Immatics Corporate Presentation August 13, 2025 Exhibit 99.3

Forward-Looking Statement This presentation (“Presentation”) is provided by Immatics N.V. (“Immatics” or the “Company”) for informational purposes only. The information contained herein does not purport to be all-inclusive and none of Immatics, any of its affiliates, any of its or their respective control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. Forward-Looking Statements. Certain statements in this presentation may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance. For example, statements concerning timing of data read-outs for product candidates, the timing, outcome and design of clinical trials, the nature of clinical trials (including whether such clinical trials will be registration-enabling), the timing of IND or CTA filing for pre-clinical stage product candidates, the timing of BLA filings for clinical stage product candidates, estimated market opportunities of product candidates, manufacturing timetables, capacity and success rates, the Company’s focus on partnerships to advance its strategy, and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “plan”, “target”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Immatics and its management, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management's control including general economic conditions and other risks, uncertainties and factors set forth in the Company’s Annual Report on Form 20-F and other filings with the Securities and Exchange Commission (SEC). Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no duty to update these forward-looking statements. No Offer or Solicitation. This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or in an offering exempt from registration. Certain information contained in this Presentation relates to or is based on studies, publications, surveys and the Company’s own internal estimates and research. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its internal research is reliable, such research has not been verified by any independent source. All the scientific and clinical data presented within this presentation are – by definition prior to completion of the clinical trial and a clinical study report – preliminary in nature and subject to further quality checks including customary source data verification.

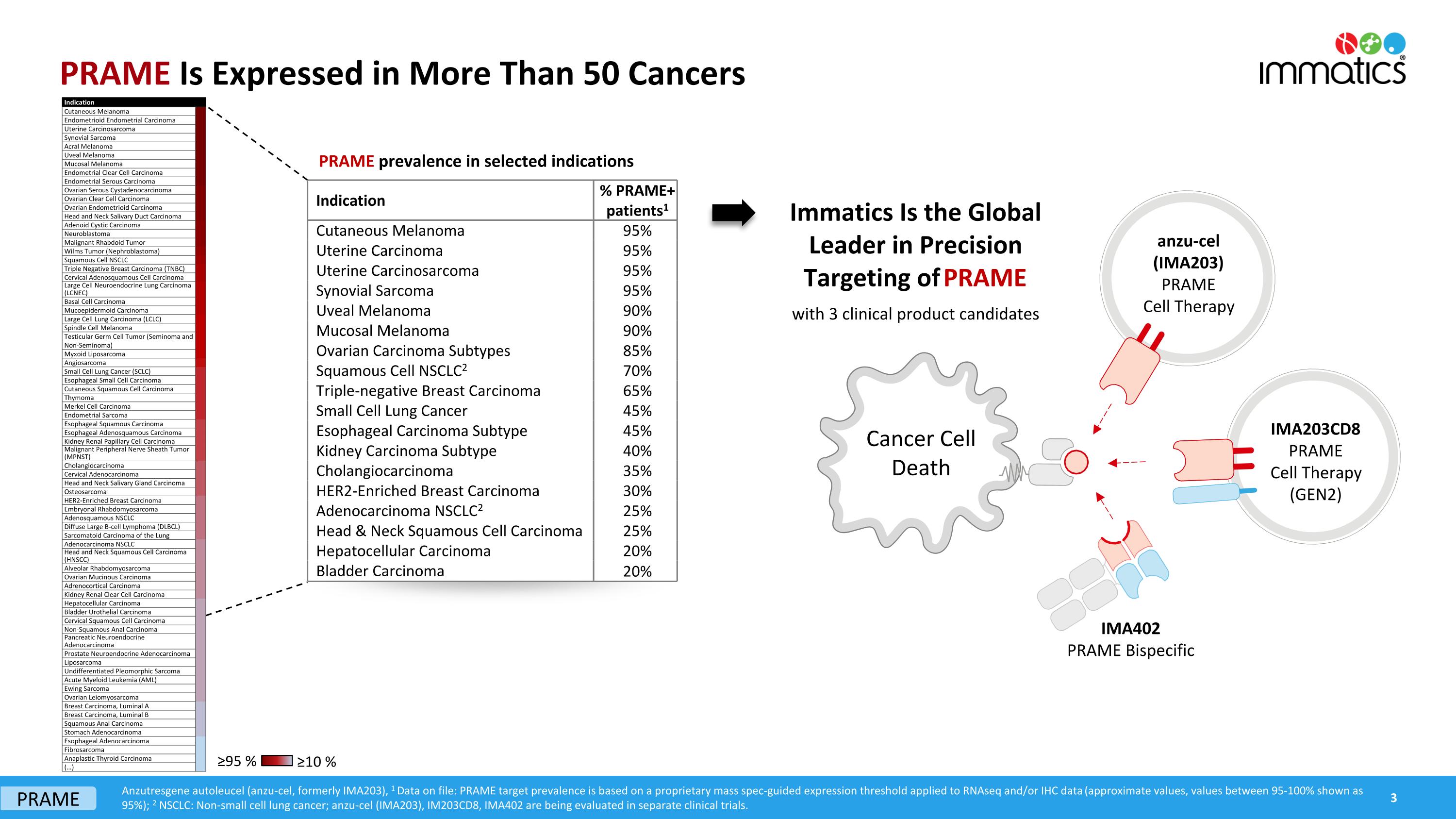

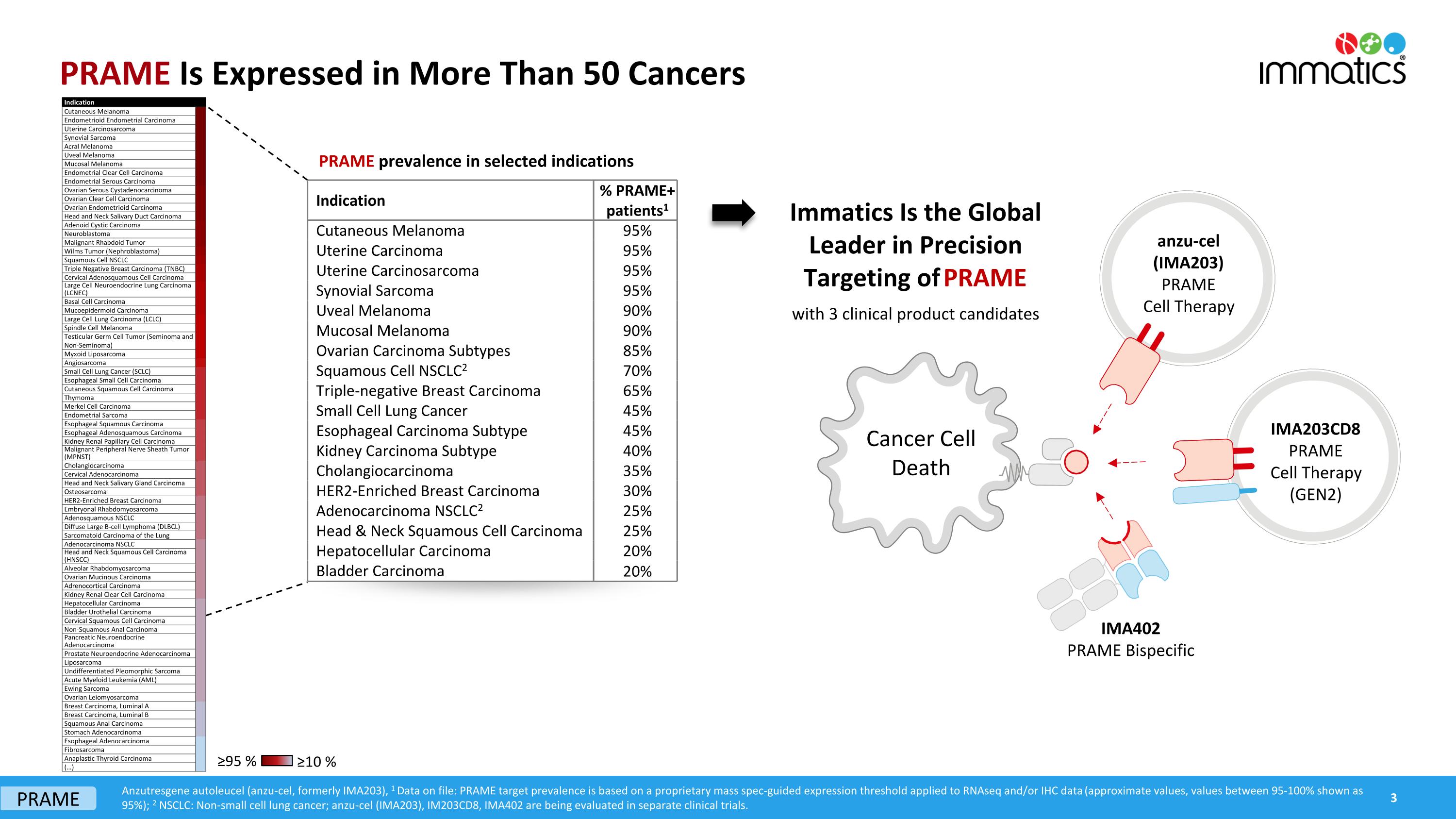

PRAME Is Expressed in More Than 50 Cancers Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Data on file: PRAME target prevalence is based on a proprietary mass spec-guided expression threshold applied to RNAseq and/or IHC data (approximate values, values between 95-100% shown as 95%); 2 NSCLC: Non-small cell lung cancer; anzu-cel (IMA203), IM203CD8, IMA402 are being evaluated in separate clinical trials. ≥95 % ≥10 % Cancer Cell Death IMA402 PRAME Bispecific anzu-cel (IMA203) PRAME Cell Therapy IMA203CD8 PRAME Cell Therapy (GEN2) Immatics Is the Global Leader in Precision Targeting of PRAME with 3 clinical product candidates PRAME prevalence in selected indications Indication % PRAME+ patients1 Cutaneous Melanoma 95% Uterine Carcinoma 95% Uterine Carcinosarcoma 95% Synovial Sarcoma 95% Uveal Melanoma 90% Mucosal Melanoma 90% Ovarian Carcinoma Subtypes 85% Squamous Cell NSCLC2 70% Triple-negative Breast Carcinoma 65% Small Cell Lung Cancer 45% Esophageal Carcinoma Subtype 45% Kidney Carcinoma Subtype 40% Cholangiocarcinoma 35% HER2-Enriched Breast Carcinoma 30% Adenocarcinoma NSCLC2 25% Head & Neck Squamous Cell Carcinoma 25% Hepatocellular Carcinoma 20% Bladder Carcinoma 20% 3 PRAME Indication Cutaneous Melanoma Endometrioid Endometrial Carcinoma Uterine Carcinosarcoma Synovial Sarcoma Acral Melanoma Uveal Melanoma Mucosal Melanoma Endometrial Clear Cell Carcinoma Endometrial Serous Carcinoma Ovarian Serous Cystadenocarcinoma Ovarian Clear Cell Carcinoma Ovarian Endometrioid Carcinoma Head and Neck Salivary Duct Carcinoma Adenoid Cystic Carcinoma Neuroblastoma Malignant Rhabdoid Tumor Wilms Tumor (Nephroblastoma) Squamous Cell NSCLC Triple Negative Breast Carcinoma (TNBC) Cervical Adenosquamous Cell Carcinoma Large Cell Neuroendocrine Lung Carcinoma (LCNEC) Basal Cell Carcinoma Mucoepidermoid Carcinoma Large Cell Lung Carcinoma (LCLC) Spindle Cell Melanoma Testicular Germ Cell Tumor (Seminoma and Non-Seminoma) Myxoid Liposarcoma Angiosarcoma Small Cell Lung Cancer (SCLC) Esophageal Small Cell Carcinoma Cutaneous Squamous Cell Carcinoma Thymoma Merkel Cell Carcinoma Endometrial Sarcoma Esophageal Squamous Carcinoma Esophageal Adenosquamous Carcinoma Kidney Renal Papillary Cell Carcinoma Malignant Peripheral Nerve Sheath Tumor (MPNST) Cholangiocarcinoma Cervical Adenocarcinoma Head and Neck Salivary Gland Carcinoma Osteosarcoma HER2-Enriched Breast Carcinoma Embryonal Rhabdomyosarcoma Adenosquamous NSCLC Diffuse Large B-cell Lymphoma (DLBCL) Sarcomatoid Carcinoma of the Lung Adenocarcinoma NSCLC Head and Neck Squamous Cell Carcinoma (HNSCC) Alveolar Rhabdomyosarcoma Ovarian Mucinous Carcinoma Adrenocortical Carcinoma Kidney Renal Clear Cell Carcinoma Hepatocellular Carcinoma Bladder Urothelial Carcinoma Cervical Squamous Cell Carcinoma Non-Squamous Anal Carcinoma Pancreatic Neuroendocrine Adenocarcinoma Prostate Neuroendocrine Adenocarcinoma Liposarcoma Undifferentiated Pleomorphic Sarcoma Acute Myeloid Leukemia (AML) Ewing Sarcoma Ovarian Leiomyosarcoma Breast Carcinoma, Luminal A Breast Carcinoma, Luminal B Squamous Anal Carcinoma Stomach Adenocarcinoma Esophageal Adenocarcinoma Fibrosarcoma Anaplastic Thyroid Carcinoma (…)

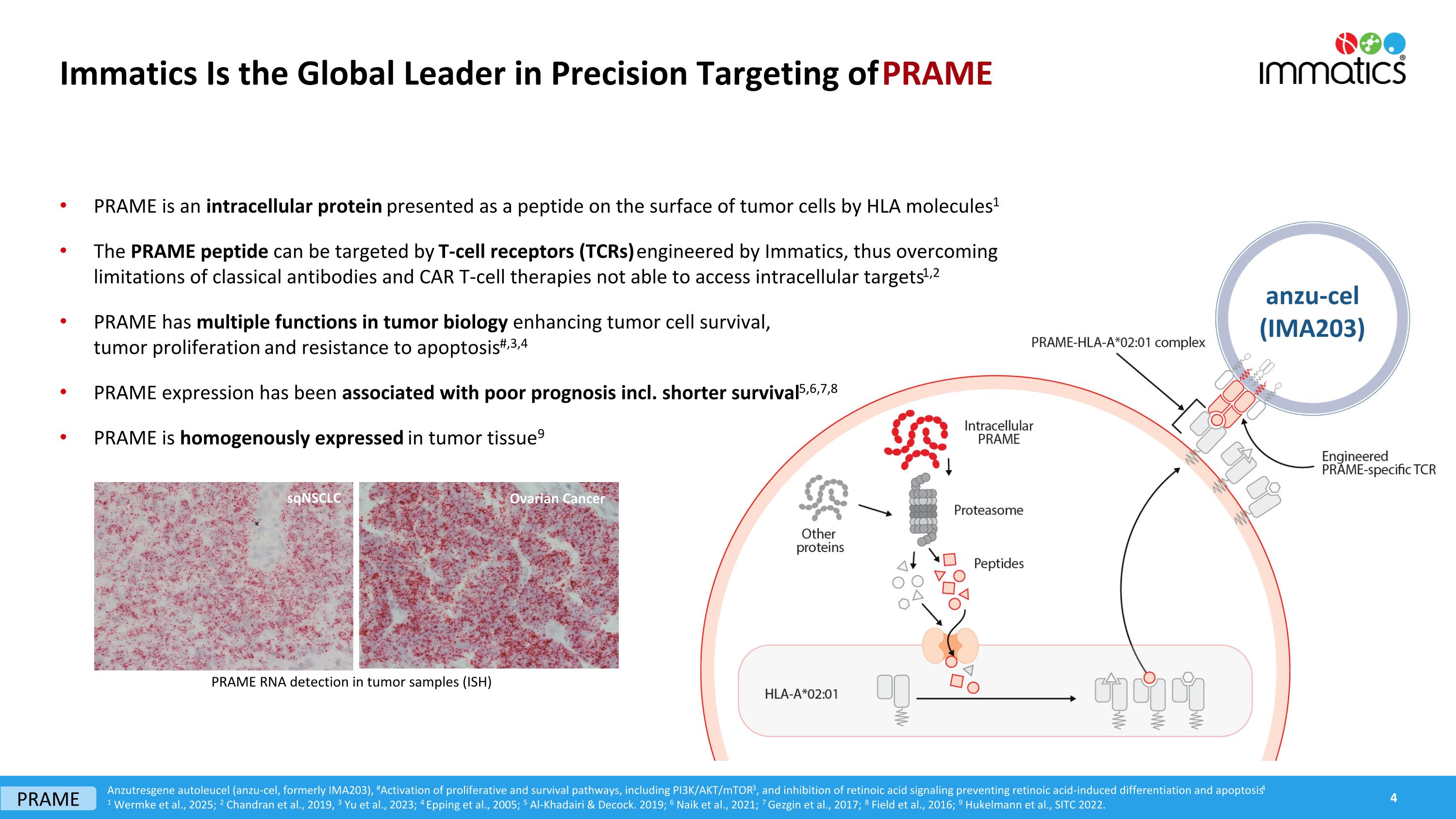

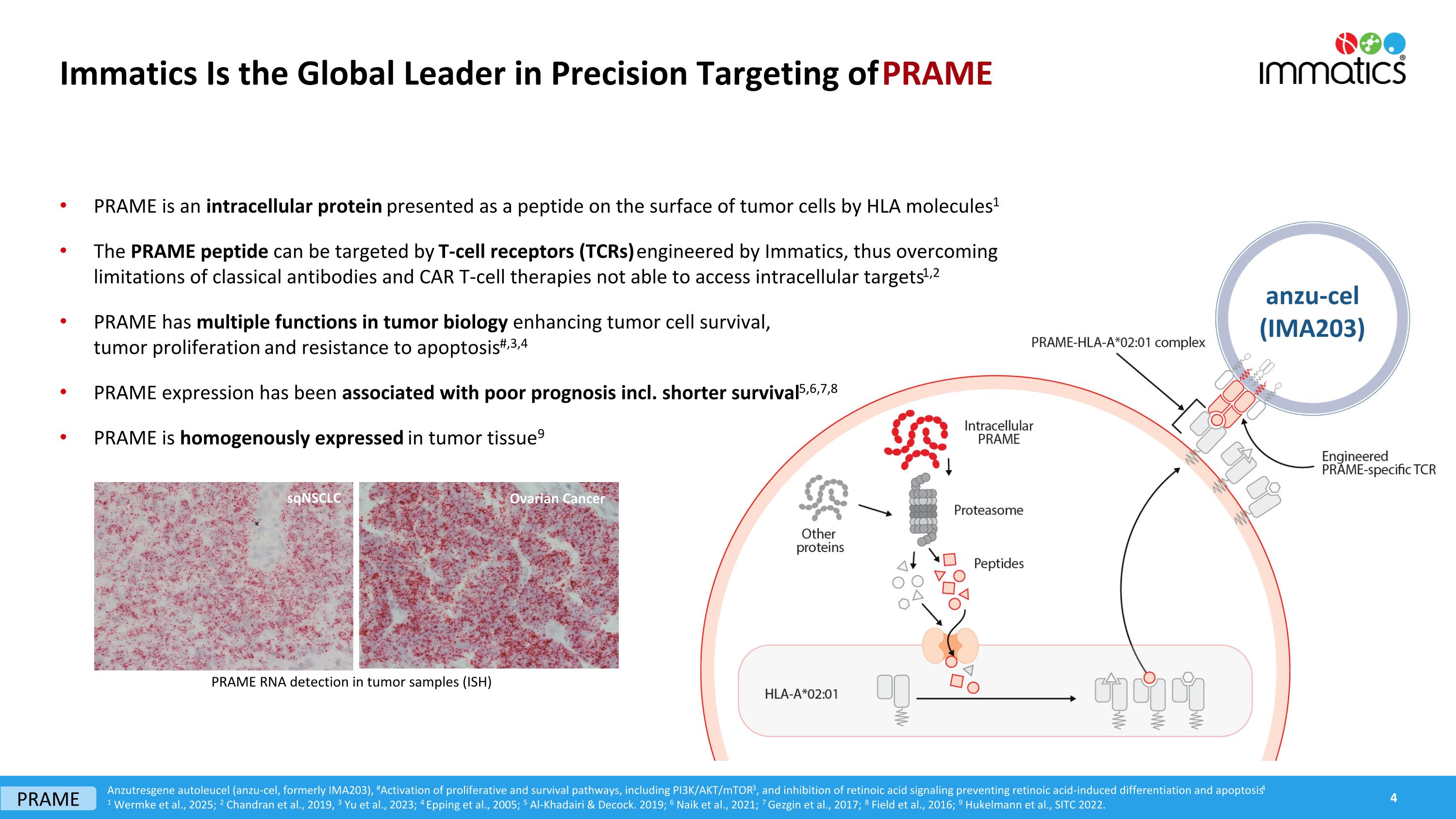

Immatics Is the Global Leader in Precision Targeting of PRAME PRAME is an intracellular protein presented as a peptide on the surface of tumor cells by HLA molecules1 The PRAME peptide can be targeted by T-cell receptors (TCRs) engineered by Immatics, thus overcoming limitations of classical antibodies and CAR T-cell therapies not able to access intracellular targets1,2 PRAME has multiple functions in tumor biology enhancing tumor cell survival, tumor proliferation and resistance to apoptosis#,3,4 PRAME expression has been associated with poor prognosis incl. shorter survival5,6,7,8 PRAME is homogenously expressed in tumor tissue9 sqNSCLC Ovarian Cancer PRAME RNA detection in tumor samples (ISH) Anzutresgene autoleucel (anzu-cel, formerly IMA203), #Activation of proliferative and survival pathways, including PI3K/AKT/mTOR3, and inhibition of retinoic acid signaling preventing retinoic acid-induced differentiation and apoptosis4 1 Wermke et al., 2025; 2 Chandran et al., 2019, 3 Yu et al., 2023; 4 Epping et al., 2005; 5 Al-Khadairi & Decock. 2019; 6 Naik et al., 2021; 7 Gezgin et al., 2017; 8 Field et al., 2016; 9 Hukelmann et al., SITC 2022. PRAME anzu-cel (IMA203)

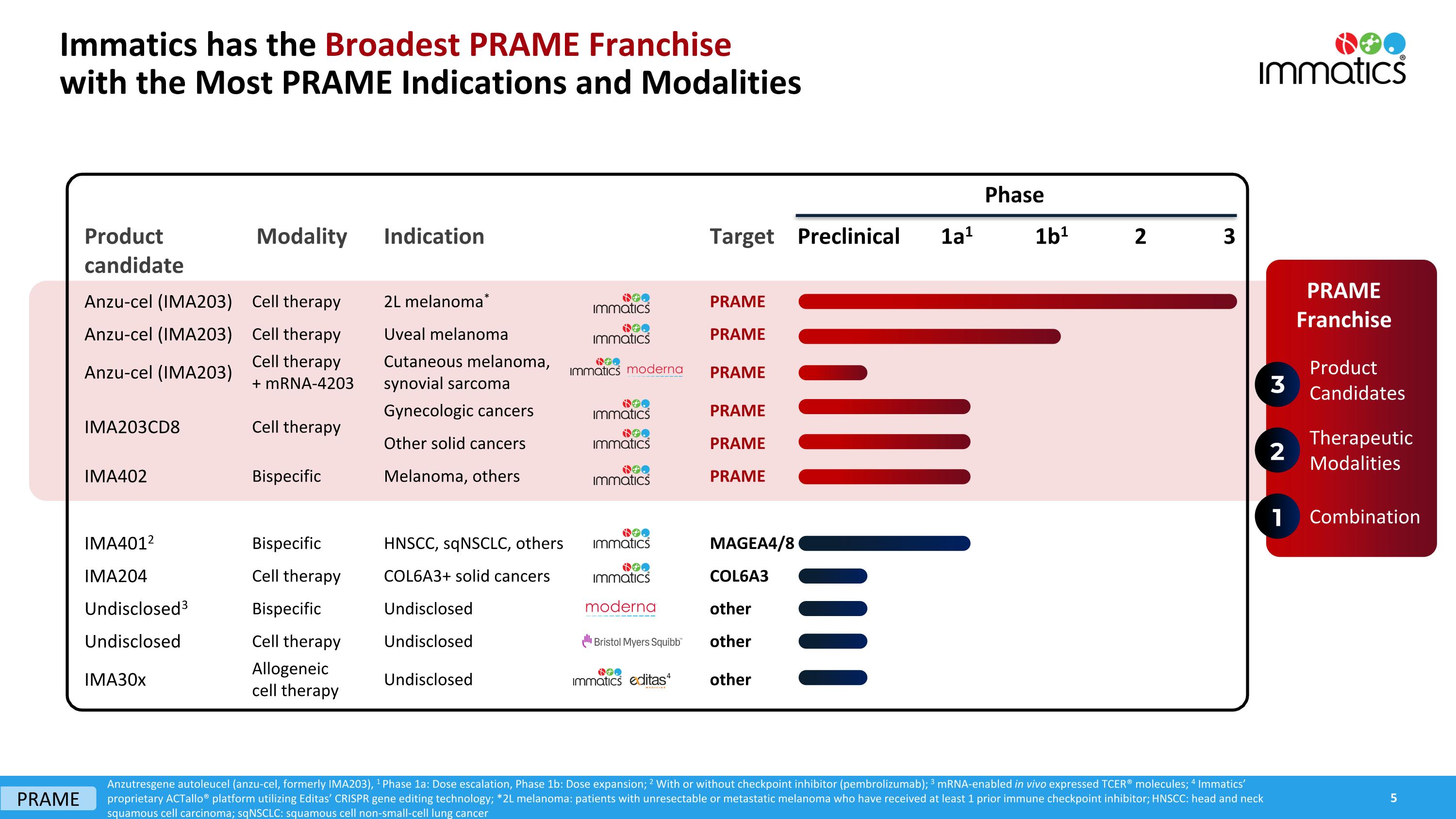

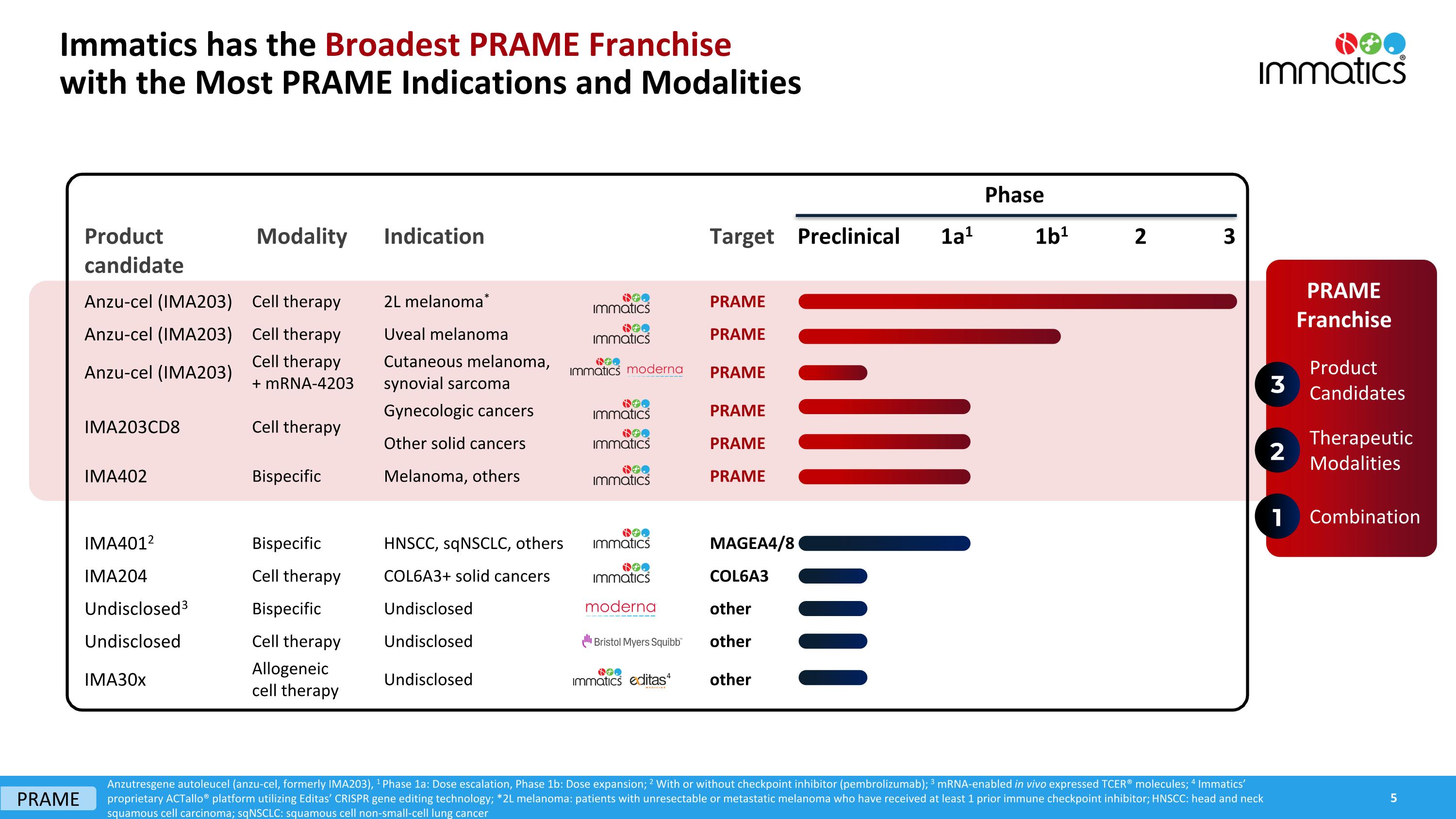

Product candidate Modality Indication Target Anzu-cel (IMA203) Cell therapy 2L melanoma* PRAME Anzu-cel (IMA203) Cell therapy Uveal melanoma PRAME Anzu-cel (IMA203) Cell therapy + mRNA-4203 Cutaneous melanoma, synovial sarcoma PRAME IMA203CD8 Cell therapy Gynecologic cancers PRAME Other solid cancers PRAME IMA402 Bispecific Melanoma, others PRAME IMA4012 Bispecific HNSCC, sqNSCLC, others MAGEA4/8 IMA204 Cell therapy COL6A3+ solid cancers COL6A3 Undisclosed3 Bispecific Undisclosed other Undisclosed Cell therapy Undisclosed other IMA30x Allogeneic cell therapy Undisclosed other Preclinical 1a1 1b1 2 3 Phase 4 Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Phase 1a: Dose escalation, Phase 1b: Dose expansion; 2 With or without checkpoint inhibitor (pembrolizumab); 3 mRNA-enabled in vivo expressed TCER® molecules; 4 Immatics’ proprietary ACTallo® platform utilizing Editas’ CRISPR gene editing technology; *2L melanoma: patients with unresectable or metastatic melanoma who have received at least 1 prior immune checkpoint inhibitor; HNSCC: head and neck squamous cell carcinoma; sqNSCLC: squamous cell non-small-cell lung cancer Product Candidates Therapeutic Modalities 3 2 PRAME Franchise 1 Combination PRAME Immatics has the Broadest PRAME Franchisewith the Most PRAME Indications and Modalities

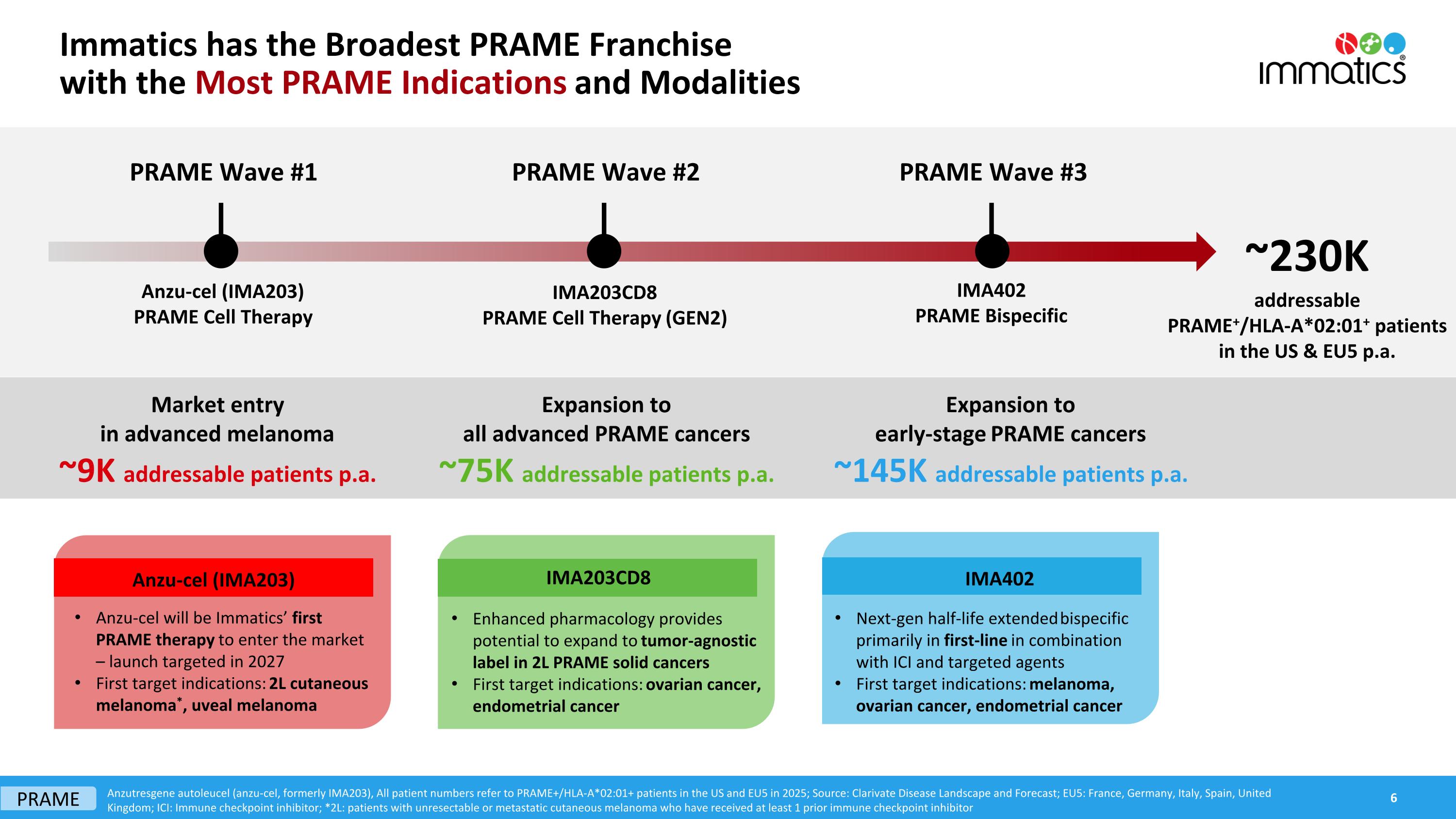

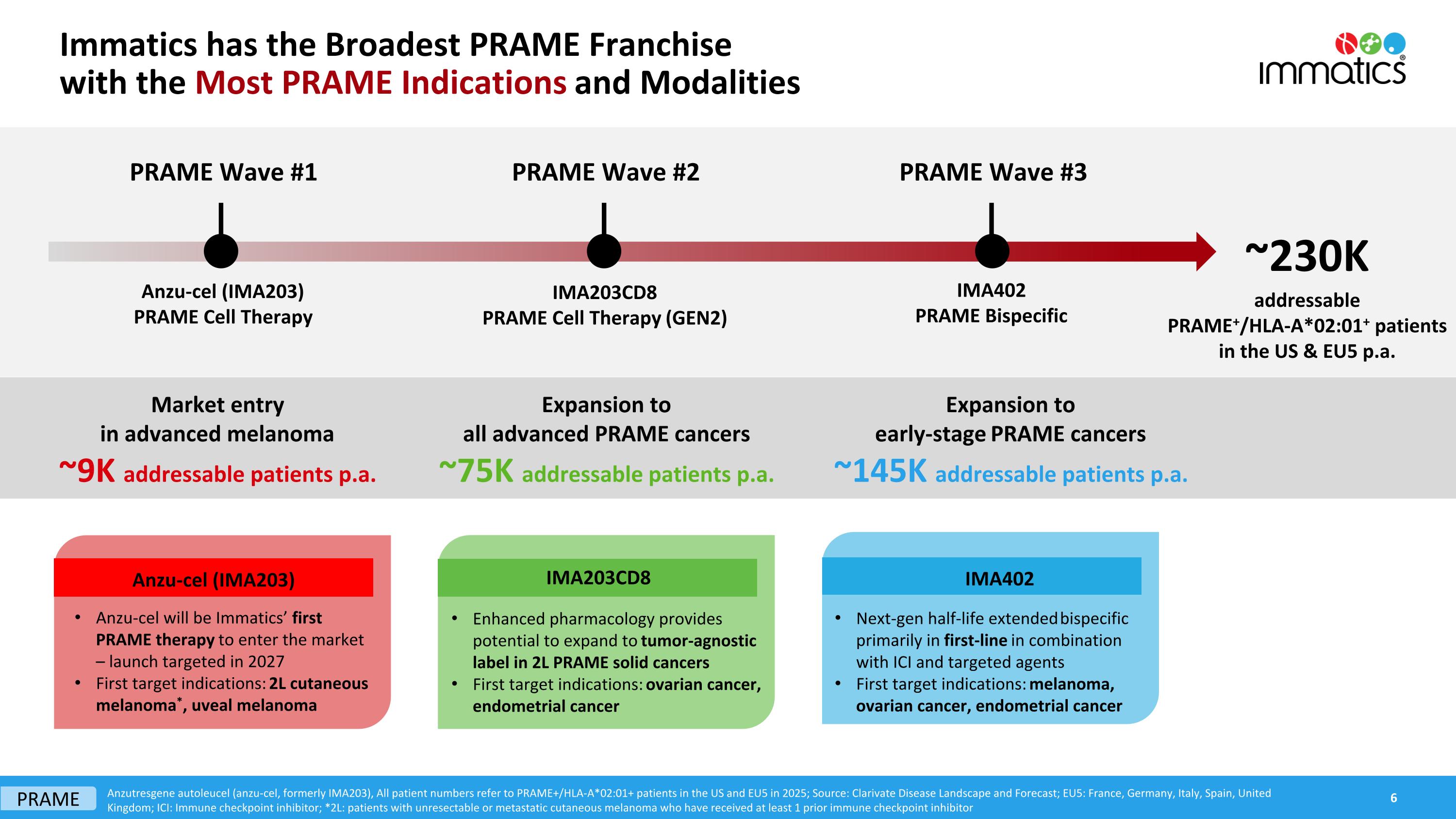

Immatics has the Broadest PRAME Franchisewith the Most PRAME Indications and Modalities PRAME Wave #2 PRAME Wave #3 Anzutresgene autoleucel (anzu-cel, formerly IMA203), All patient numbers refer to PRAME+/HLA-A*02:01+ patients in the US and EU5 in 2025; Source: Clarivate Disease Landscape and Forecast; EU5: France, Germany, Italy, Spain, United Kingdom; ICI: Immune checkpoint inhibitor; *2L: patients with unresectable or metastatic cutaneous melanoma who have received at least 1 prior immune checkpoint inhibitor ~230K addressable PRAME+/HLA-A*02:01+ patients in the US & EU5 p.a. IMA203CD8 PRAME Cell Therapy (GEN2) IMA402 PRAME Bispecific Market entryin advanced melanoma ~9K addressable patients p.a. Expansion toall advanced PRAME cancers ~75K addressable patients p.a. Expansion toearly-stage PRAME cancers ~145K addressable patients p.a. Enhanced pharmacology provides potential to expand to tumor-agnostic label in 2L PRAME solid cancers First target indications: ovarian cancer, endometrial cancer IMA203CD8 Next-gen half-life extended bispecific primarily in first-line in combination with ICI and targeted agents First target indications: melanoma, ovarian cancer, endometrial cancer IMA402 Anzu-cel will be Immatics’ first PRAME therapy to enter the market – launch targeted in 2027 First target indications: 2L cutaneous melanoma*, uveal melanoma Anzu-cel (IMA203) PRAME Wave #1 Anzu-cel (IMA203) PRAME Cell Therapy PRAME

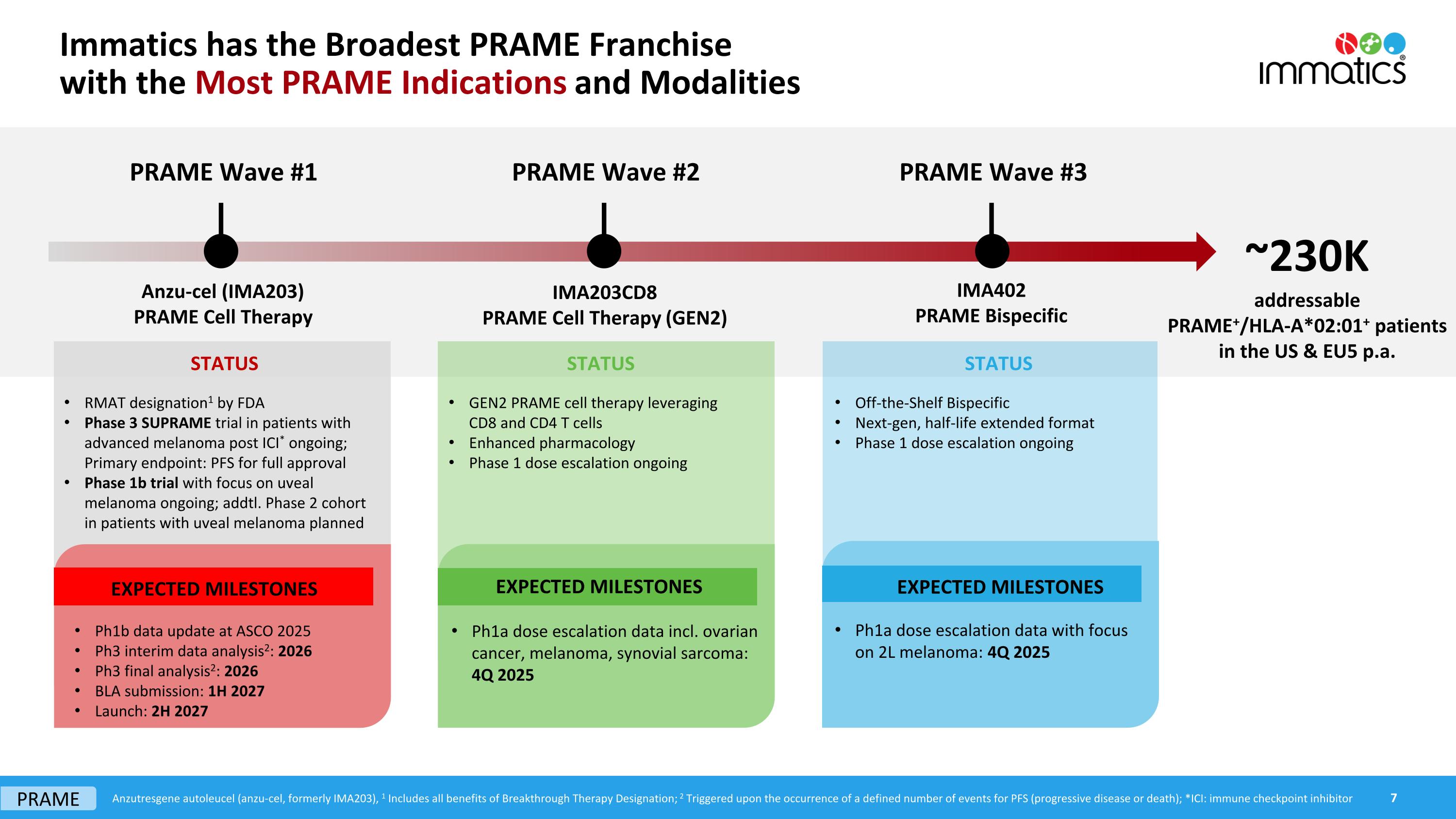

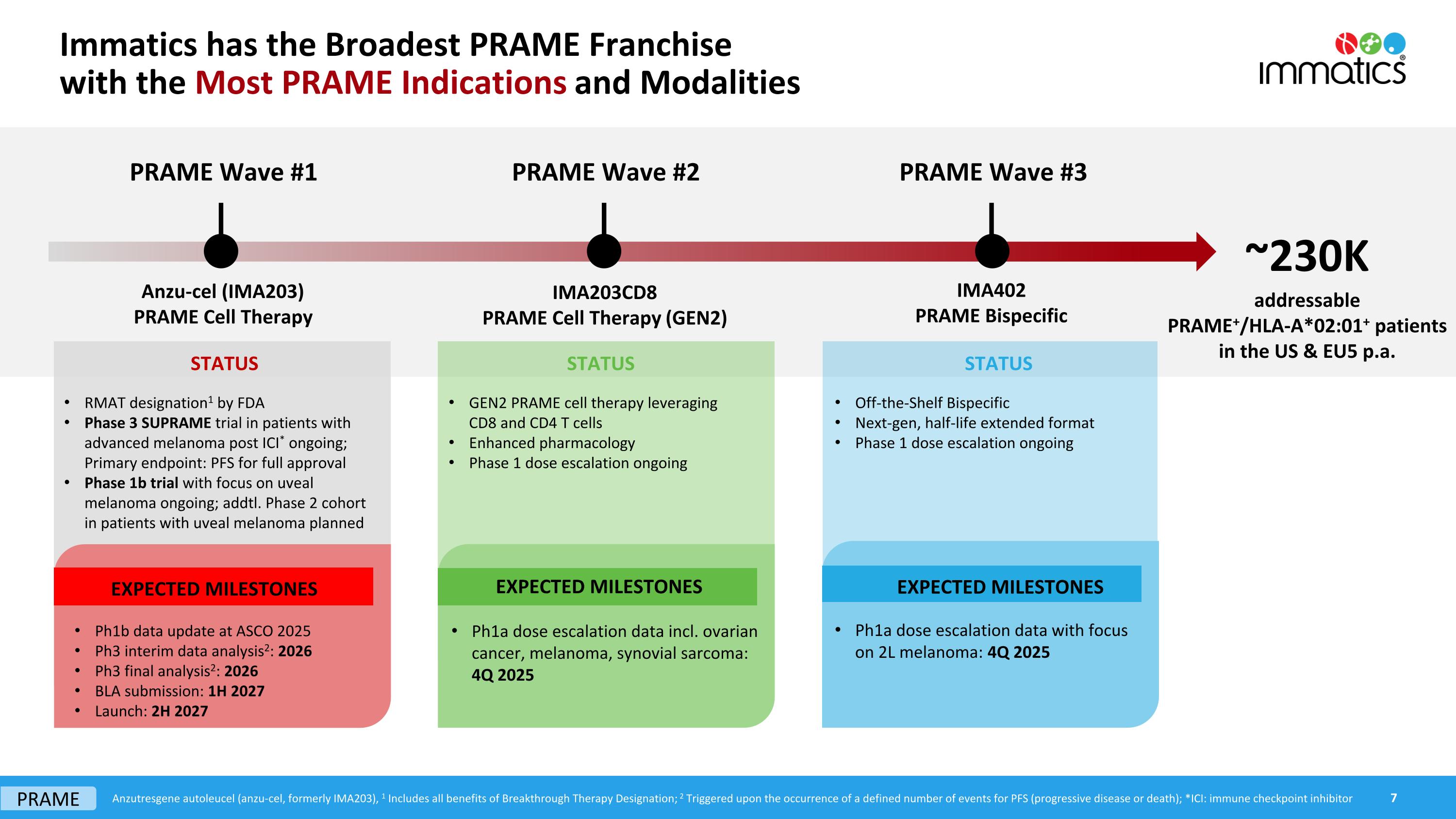

Immatics has the Broadest PRAME Franchisewith the Most PRAME Indications and Modalities PRAME Wave #1 PRAME Wave #2 PRAME Wave #3 ~230K addressable PRAME+/HLA-A*02:01+ patients in the US & EU5 p.a. Anzu-cel (IMA203) PRAME Cell Therapy IMA203CD8 PRAME Cell Therapy (GEN2) IMA402 PRAME Bispecific Ph1a dose escalation data incl. ovarian cancer, melanoma, synovial sarcoma: 4Q 2025 EXPECTED MILESTONES Ph1a dose escalation data with focus on 2L melanoma: 4Q 2025 EXPECTED MILESTONES Ph1b data update at ASCO 2025 Ph3 interim data analysis2: 2026 Ph3 final analysis2: 2026 BLA submission: 1H 2027 Launch: 2H 2027 EXPECTED MILESTONES STATUS STATUS STATUS GEN2 PRAME cell therapy leveraging CD8 and CD4 T cells Enhanced pharmacology Phase 1 dose escalation ongoing Off-the-Shelf Bispecific Next-gen, half-life extended format Phase 1 dose escalation ongoing RMAT designation1 by FDA Phase 3 SUPRAME trial in patients with advanced melanoma post ICI* ongoing; Primary endpoint: PFS for full approval Phase 1b trial with focus on uveal melanoma ongoing; addtl. Phase 2 cohort in patients with uveal melanoma planned Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Includes all benefits of Breakthrough Therapy Designation; 2 Triggered upon the occurrence of a defined number of events for PFS (progressive disease or death); *ICI: immune checkpoint inhibitor PRAME

PRAME 1 Target product profile (TPP) in monotherapy in 2L or later settings post SOC at recommended phase 2 dose (“RP2D”). Other factors such as mPFS (median progression free survival) and mOS (median overall survival) may also be considered. LYMPHODEPLETION & INFUSION Tumor cell HLA PRAME peptide ADMINISTRATION TO PATIENT LEUKAPHERESIS GENETIC ENGINEERING & EXPANSION TCER® PRODUCTION “OFF-THE-SHELF” PRODUCT PRAME Bispecific Modality: Half-life extended (HLE) bispecificT cell engager (TCER®) Application: Repeat dose Positioning: Primarily frontline (+ adjuvant) combination setting Deployment: Outpatient administration, hospitals and community centers TPP at RP2D1: ≥20% cORR, ≥6 months mDOR(monotherapy, last line) PRAME Cell Therapy Modality: Autologous TCR T-cell Therapy Application: Single dose (“one and done”)(no tumor surgery, no high-dose IL-2) Positioning: Primarily second line and later monotherapy setting Deployment : Administered in specialized hospitals and medical centers; potential for outpatient administration TPP at RP2D1: ≥40% cORR, ≥6 months mDOR(monotherapy, last line) Cell Therapy TCER® Immatics has the Broadest PRAME Franchisewith the Most PRAME Indications and Modalities

Anzu-cel (IMA203) PRAME Cell Therapy Market Entry in Advanced Melanoma PRAME Wave #1 9 Anzutresgene autoleucel (anzu-cel, formerly IMA203)

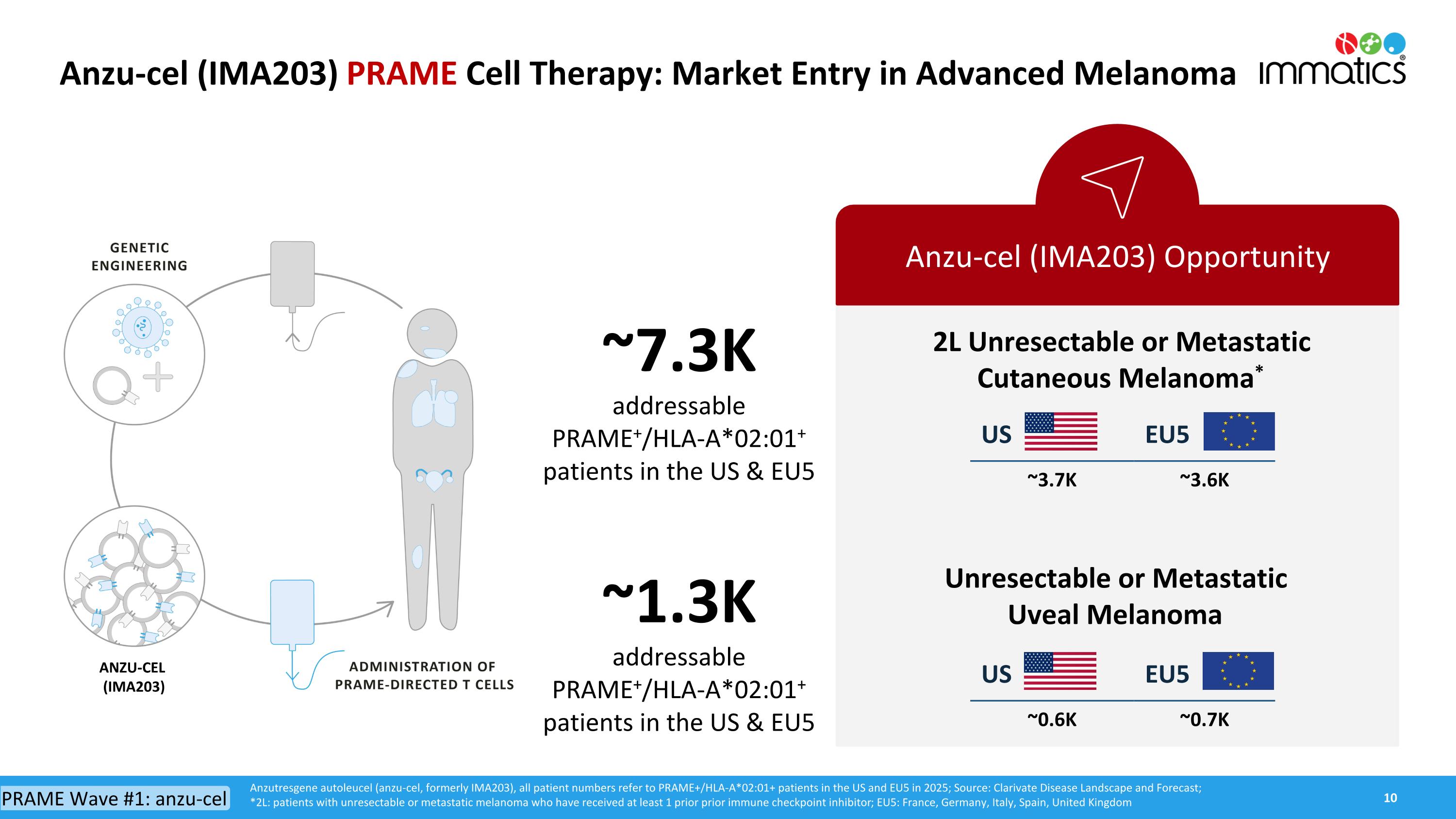

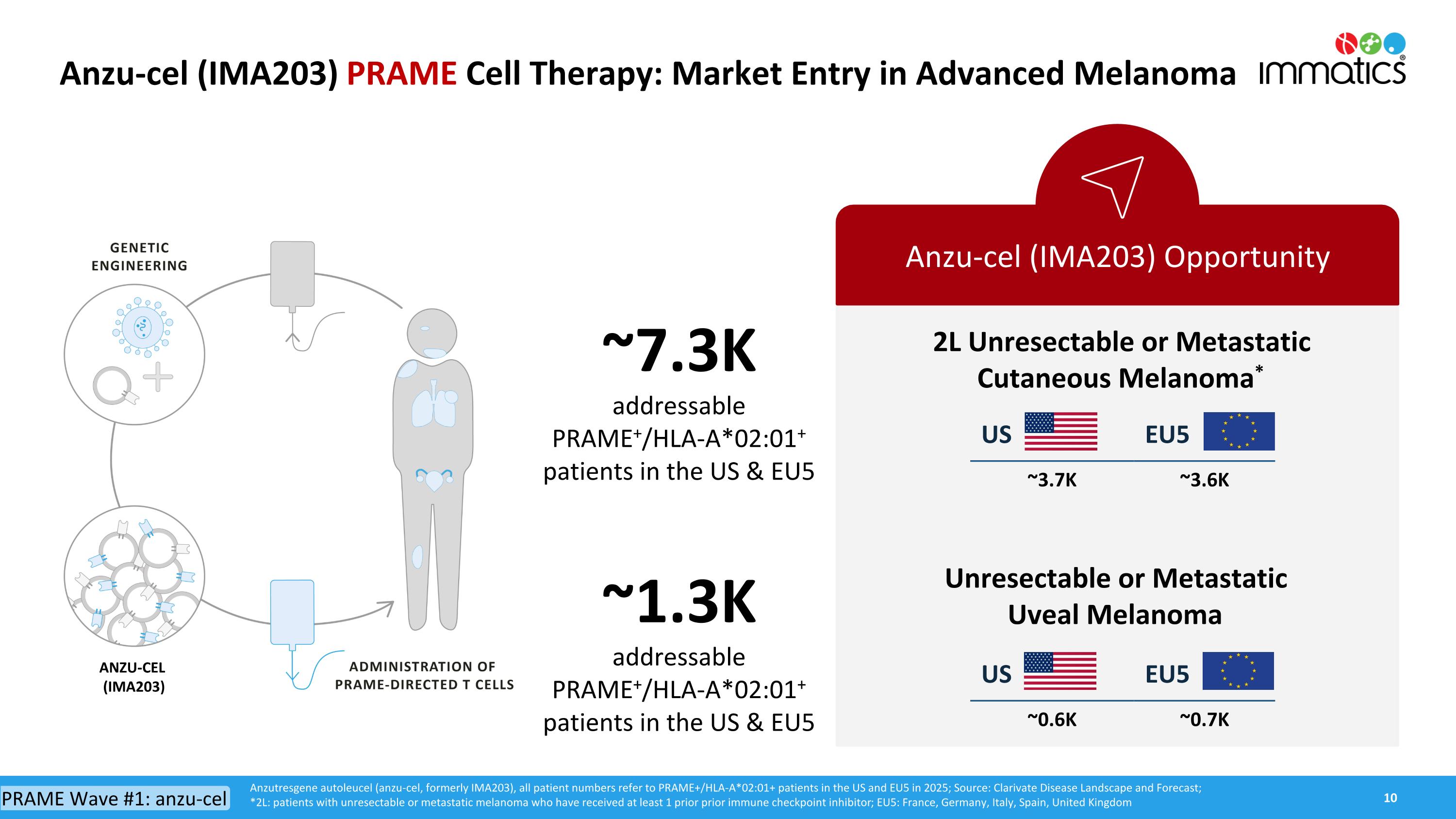

Anzu-cel (IMA203) PRAME Cell Therapy: Market Entry in Advanced Melanoma Anzu-cel (IMA203) Opportunity 2L Unresectable or MetastaticCutaneous Melanoma* ~7.3K addressable PRAME+/HLA-A*02:01+ patients in the US & EU5 ~1.3Kaddressable PRAME+/HLA-A*02:01+ patients in the US & EU5 Anzutresgene autoleucel (anzu-cel, formerly IMA203), all patient numbers refer to PRAME+/HLA-A*02:01+ patients in the US and EU5 in 2025; Source: Clarivate Disease Landscape and Forecast; *2L: patients with unresectable or metastatic melanoma who have received at least 1 prior prior immune checkpoint inhibitor; EU5: France, Germany, Italy, Spain, United Kingdom PRAME Wave #1: anzu-cel US EU5 ~3.7K ~3.6K Unresectable or Metastatic Uveal Melanoma US EU5 ~0.6K ~0.7K ANZU-CEL (IMA203)

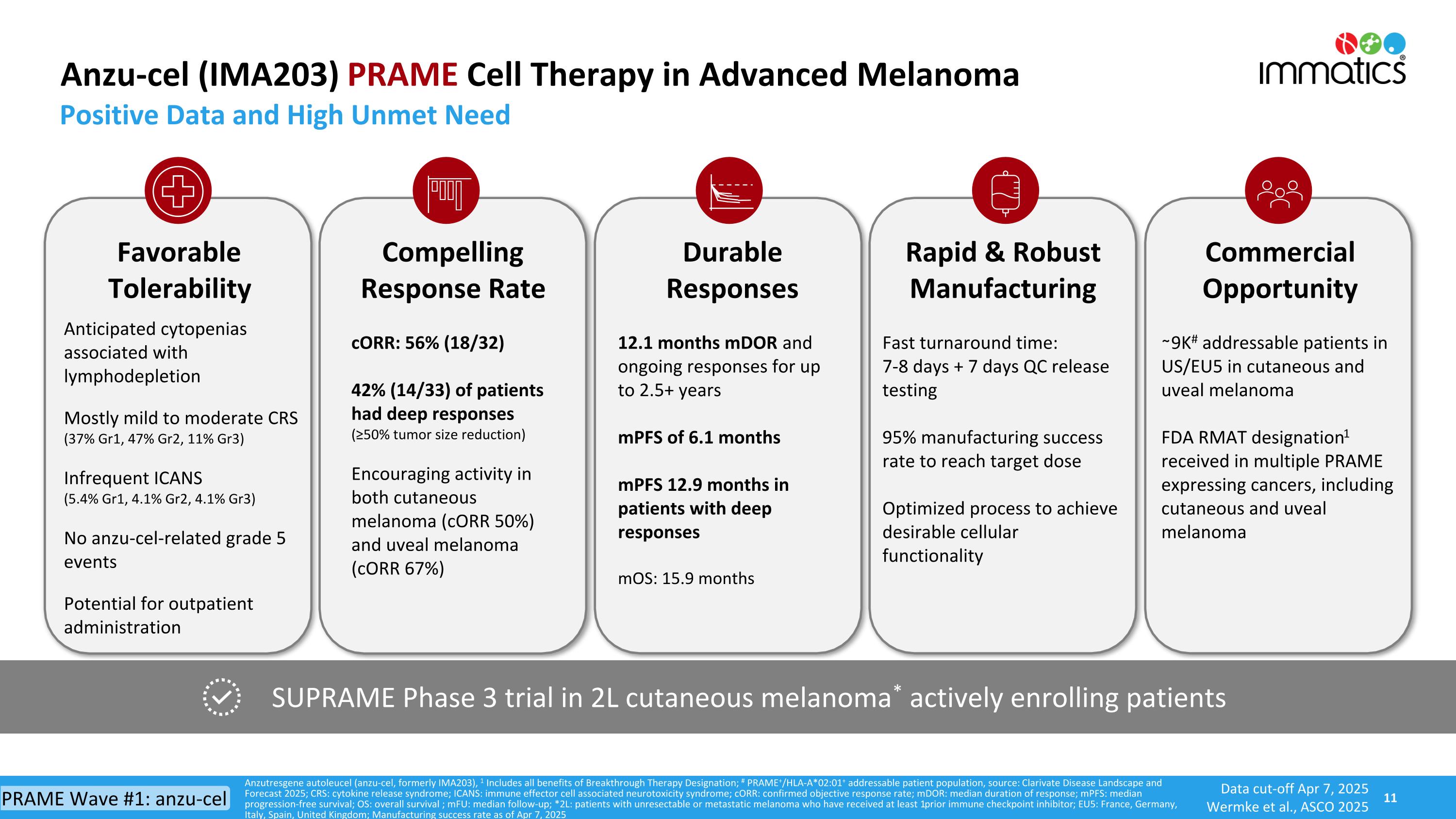

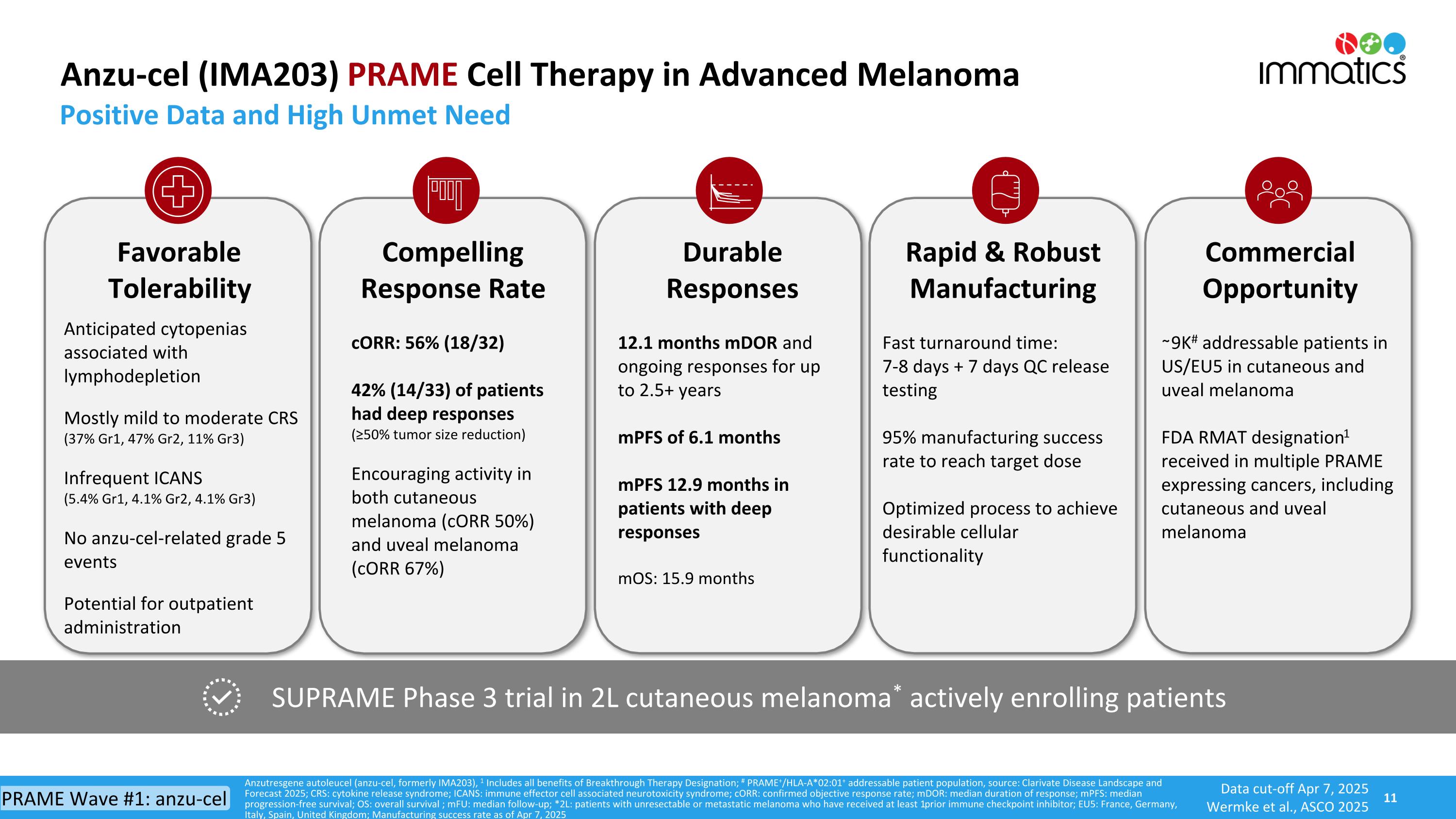

Positive Data and High Unmet Need SUPRAME Phase 3 trial in 2L cutaneous melanoma* actively enrolling patients Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Includes all benefits of Breakthrough Therapy Designation; # PRAME+/HLA-A*02:01+ addressable patient population, source: Clarivate Disease Landscape and Forecast 2025; CRS: cytokine release syndrome; ICANS: immune effector cell associated neurotoxicity syndrome; cORR: confirmed objective response rate; mDOR: median duration of response; mPFS: median progression-free survival; OS: overall survival ; mFU: median follow-up; *2L: patients with unresectable or metastatic melanoma who have received at least 1 prior immune checkpoint inhibitor; EU5: France, Germany, Italy, Spain, United Kingdom; Manufacturing success rate as of Apr 7, 2025 Anzu-cel (IMA203) PRAME Cell Therapy in Advanced Melanoma Favorable Tolerability Anticipated cytopenias associated with lymphodepletion Mostly mild to moderate CRS (37% Gr1, 47% Gr2, 11% Gr3) Infrequent ICANS(5.4% Gr1, 4.1% Gr2, 4.1% Gr3) No anzu-cel-related grade 5 events Potential for outpatient administration Compelling Response Rate cORR: 56% (18/32) 42% (14/33) of patients had deep responses(≥50% tumor size reduction) Encouraging activity in both cutaneous melanoma (cORR 50%) and uveal melanoma (cORR 67%) Durable Responses 12.1 months mDOR and ongoing responses for up to 2.5+ years mPFS of 6.1 months mPFS 12.9 months in patients with deep responses mOS: 15.9 months Rapid & Robust Manufacturing Fast turnaround time: 7-8 days + 7 days QC release testing 95% manufacturing success rate to reach target dose Optimized process to achieve desirable cellular functionality Commercial Opportunity ∼9K# addressable patients in US/EU5 in cutaneous and uveal melanoma FDA RMAT designation1 received in multiple PRAME expressing cancers, including cutaneous and uveal melanoma Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

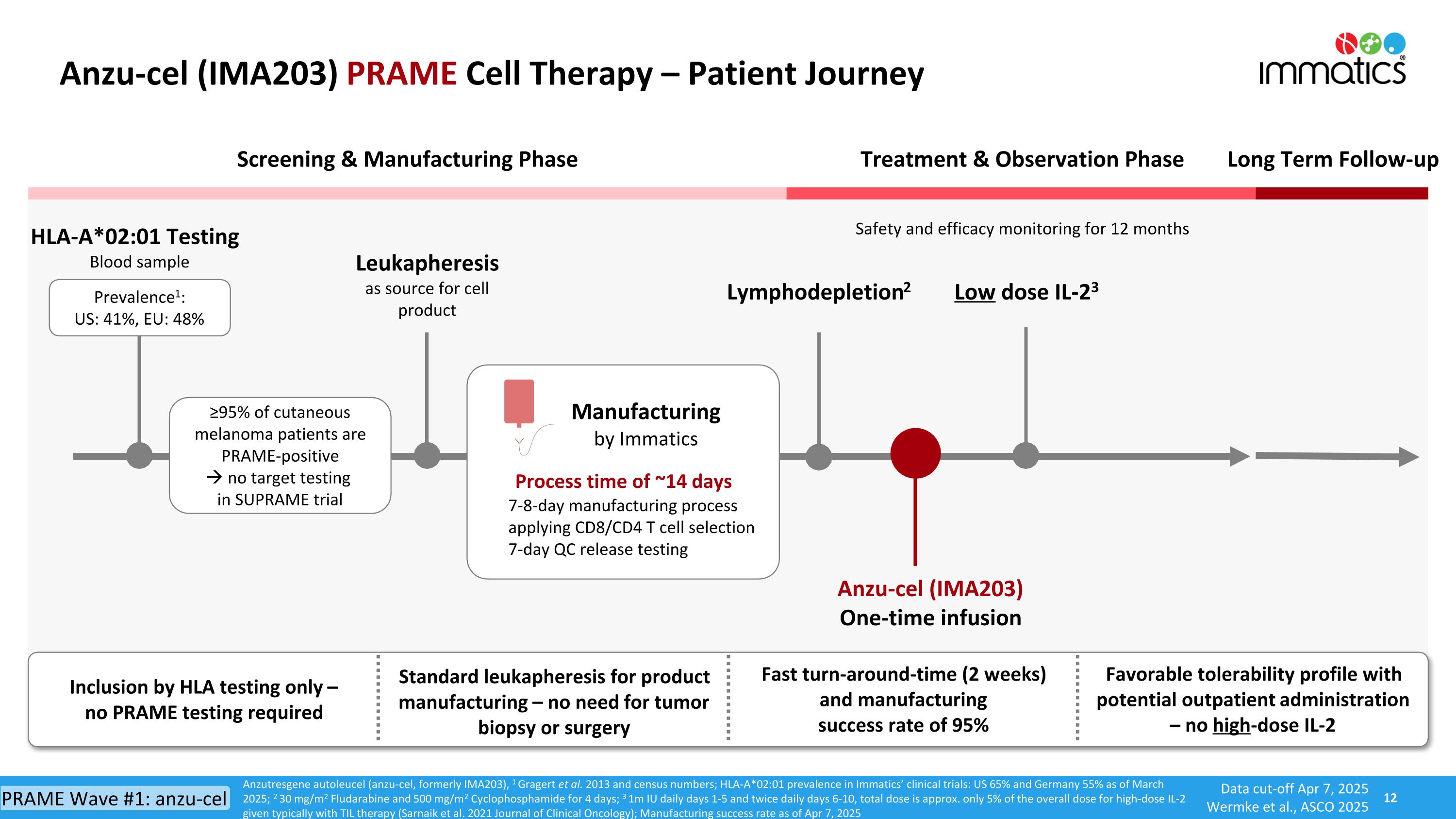

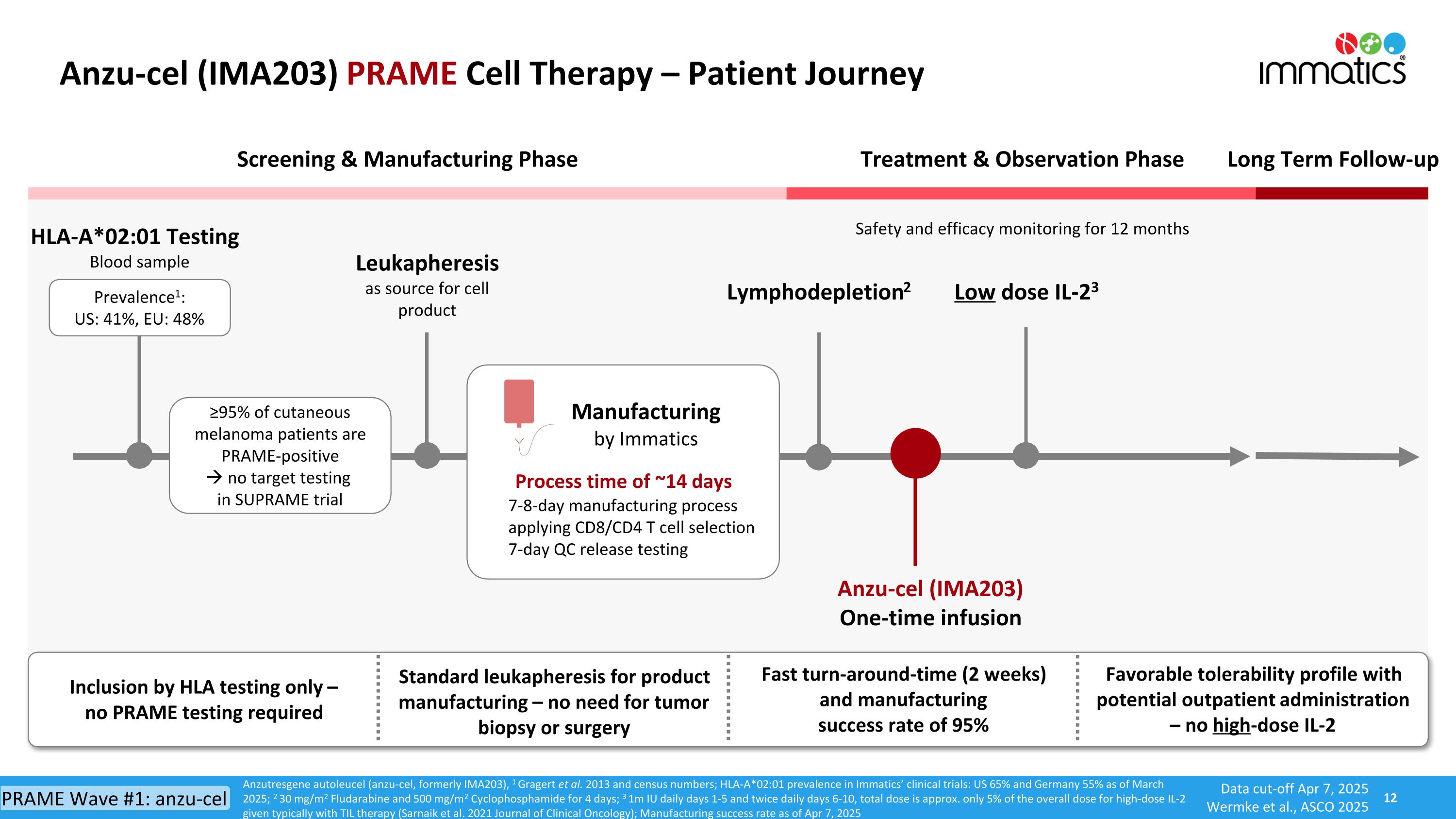

Anzu-cel (IMA203) PRAME Cell Therapy – Patient Journey Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Gragert et al. 2013 and census numbers; HLA-A*02:01 prevalence in Immatics’ clinical trials: US 65% and Germany 55% as of March 2025; 2 30 mg/m2 Fludarabine and 500 mg/m2 Cyclophosphamide for 4 days; 3 1m IU daily days 1-5 and twice daily days 6-10, total dose is approx. only 5% of the overall dose for high-dose IL-2 given typically with TIL therapy (Sarnaik et al. 2021 Journal of Clinical Oncology); Manufacturing success rate as of Apr 7, 2025 HLA-A*02:01 Testing Blood sample Treatment & Observation Phase Long Term Follow-up Screening & Manufacturing Phase Manufacturing by Immatics Anzu-cel (IMA203) One-time infusion Lymphodepletion2 Low dose IL-23 Safety and efficacy monitoring for 12 months Leukapheresis as source for cell product Process time of ~14 days 7-8-day manufacturing process applying CD8/CD4 T cell selection 7-day QC release testing ≥95% of cutaneous melanoma patients are PRAME-positive no target testing in SUPRAME trial Inclusion by HLA testing only – no PRAME testing required Fast turn-around-time (2 weeks) and manufacturing success rate of 95% Favorable tolerability profile with potential outpatient administration – no high-dose IL-2 Standard leukapheresis for product manufacturing – no need for tumor biopsy or surgery Prevalence1: US: 41%, EU: 48% Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

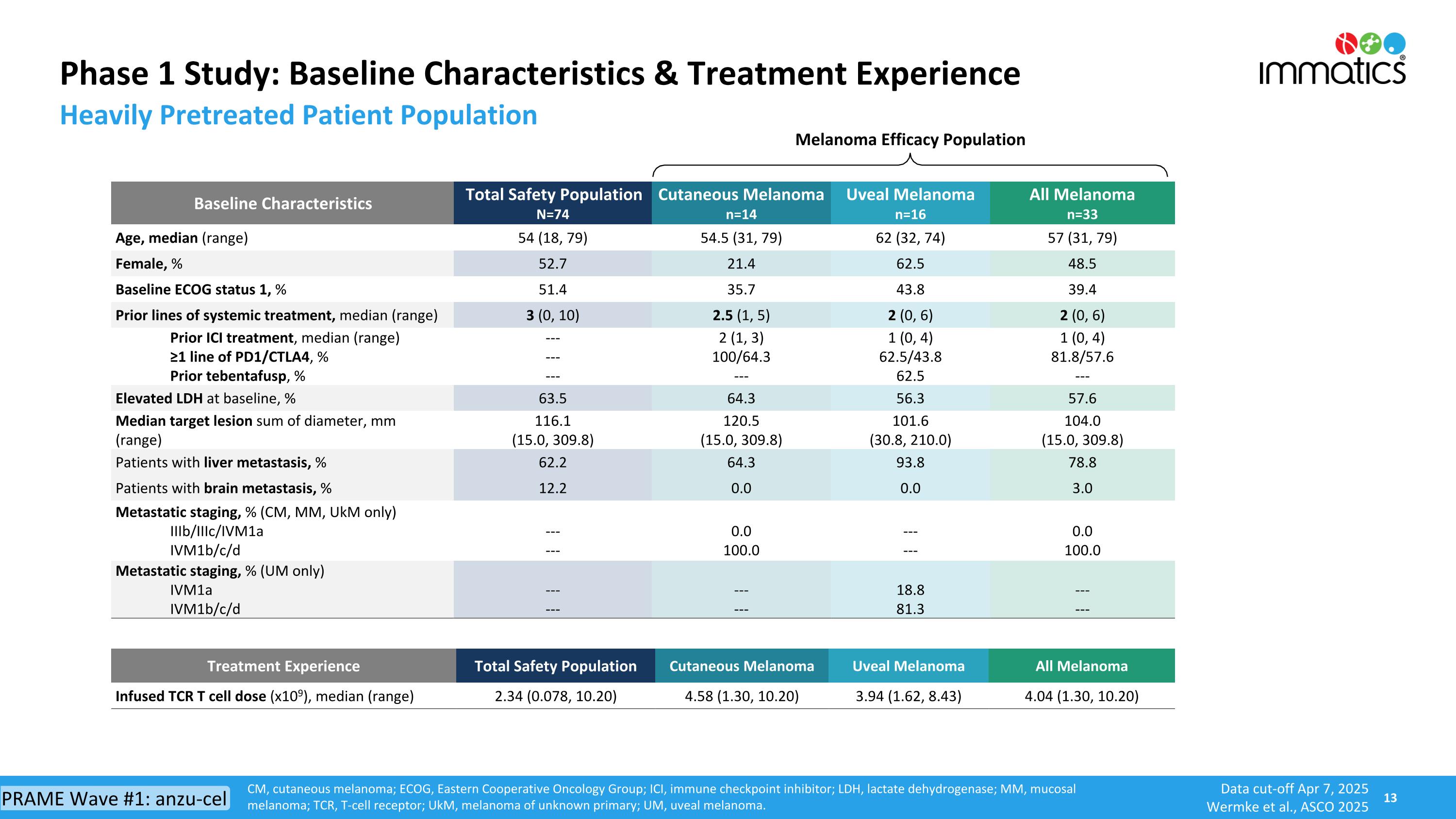

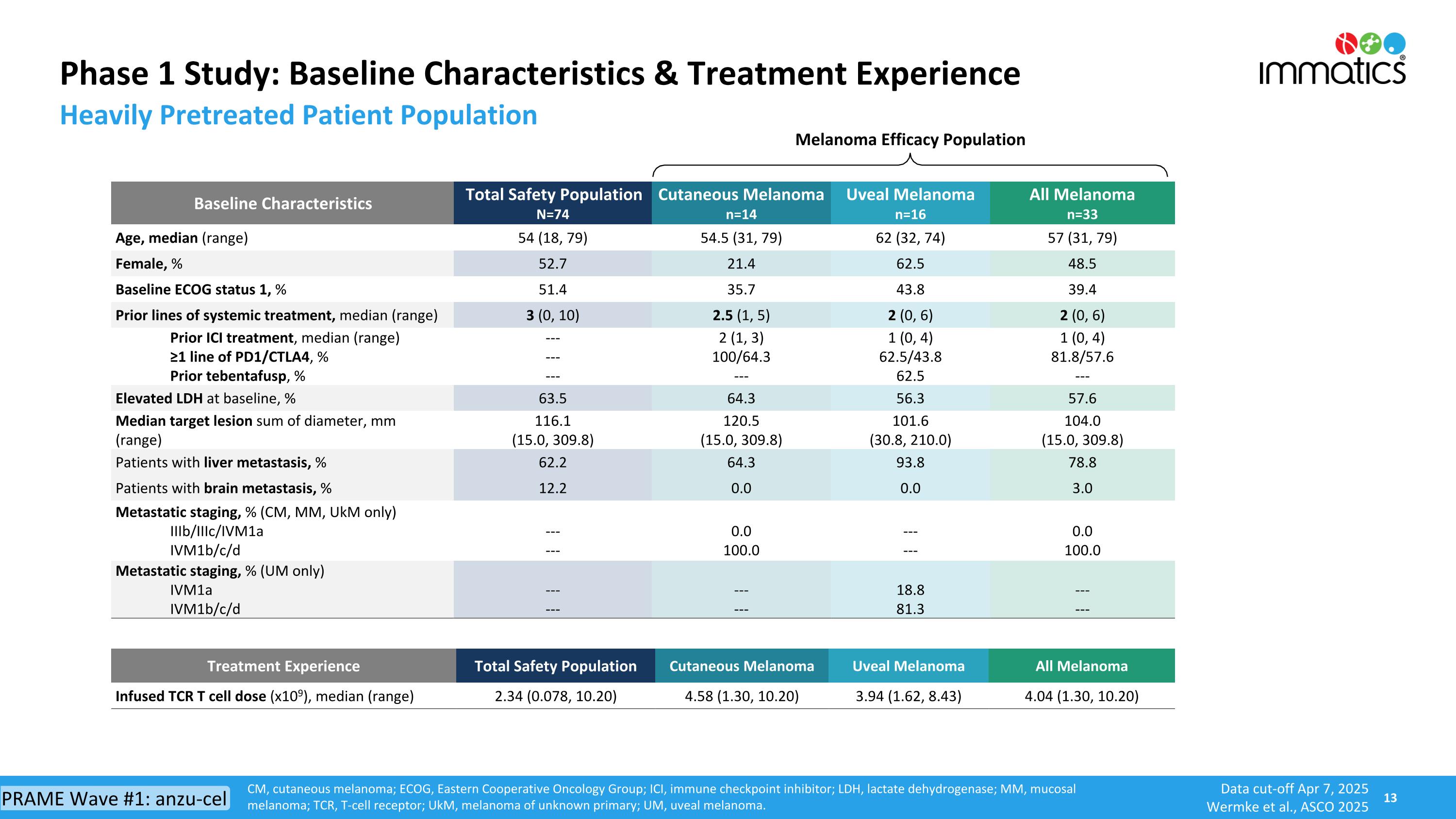

Phase 1 Study: Baseline Characteristics & Treatment Experience CM, cutaneous melanoma; ECOG, Eastern Cooperative Oncology Group; ICI, immune checkpoint inhibitor; LDH, lactate dehydrogenase; MM, mucosal melanoma; TCR, T-cell receptor; UkM, melanoma of unknown primary; UM, uveal melanoma. Baseline Characteristics Total Safety Population N=74 Cutaneous Melanoma n=14 Uveal Melanoma n=16 All Melanoma n=33 Age, median (range) 54 (18, 79) 54.5 (31, 79) 62 (32, 74) 57 (31, 79) Female, % 52.7 21.4 62.5 48.5 Baseline ECOG status 1, % 51.4 35.7 43.8 39.4 Prior lines of systemic treatment, median (range) 3 (0, 10) 2.5 (1, 5) 2 (0, 6) 2 (0, 6) Prior ICI treatment, median (range) ≥1 line of PD1/CTLA4, % Prior tebentafusp, % --- --- --- 2 (1, 3) 100/64.3 --- 1 (0, 4) 62.5/43.8 62.5 1 (0, 4) 81.8/57.6 --- Elevated LDH at baseline, % 63.5 64.3 56.3 57.6 Median target lesion sum of diameter, mm (range) 116.1 (15.0, 309.8) 120.5 (15.0, 309.8) 101.6 (30.8, 210.0) 104.0 (15.0, 309.8) Patients with liver metastasis, % 62.2 64.3 93.8 78.8 Patients with brain metastasis, % 12.2 0.0 0.0 3.0 Metastatic staging, % (CM, MM, UkM only) IIIb/IIIc/IVM1a IVM1b/c/d --- --- 0.0 100.0 --- --- 0.0 100.0 Metastatic staging, % (UM only) IVM1a IVM1b/c/d --- --- --- --- 18.8 81.3 --- --- Treatment Experience Total Safety Population Cutaneous Melanoma Uveal Melanoma All Melanoma Infused TCR T cell dose (x109), median (range) 2.34 (0.078, 10.20) 4.58 (1.30, 10.20) 3.94 (1.62, 8.43) 4.04 (1.30, 10.20) Melanoma Efficacy Population Heavily Pretreated Patient Population Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

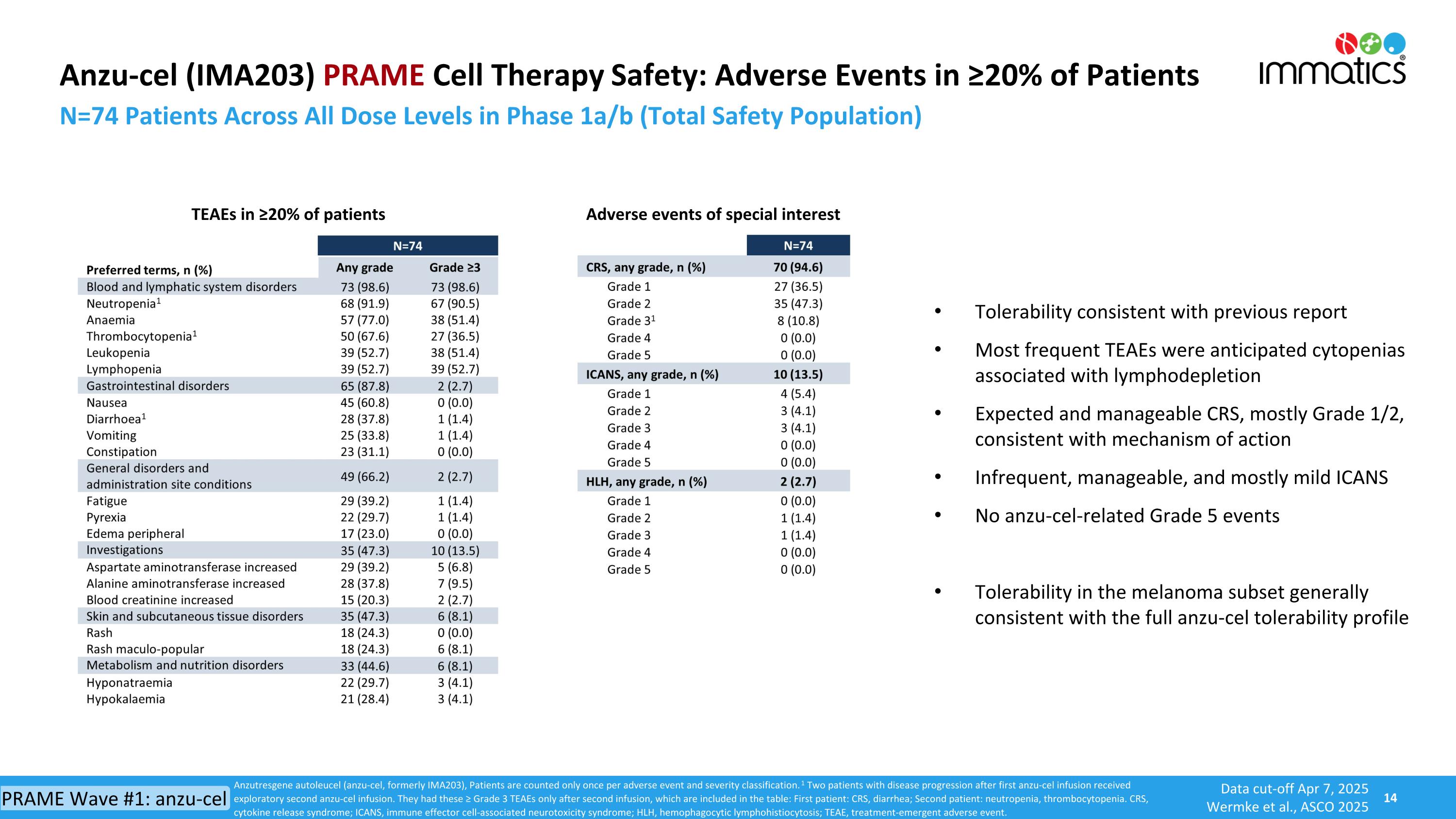

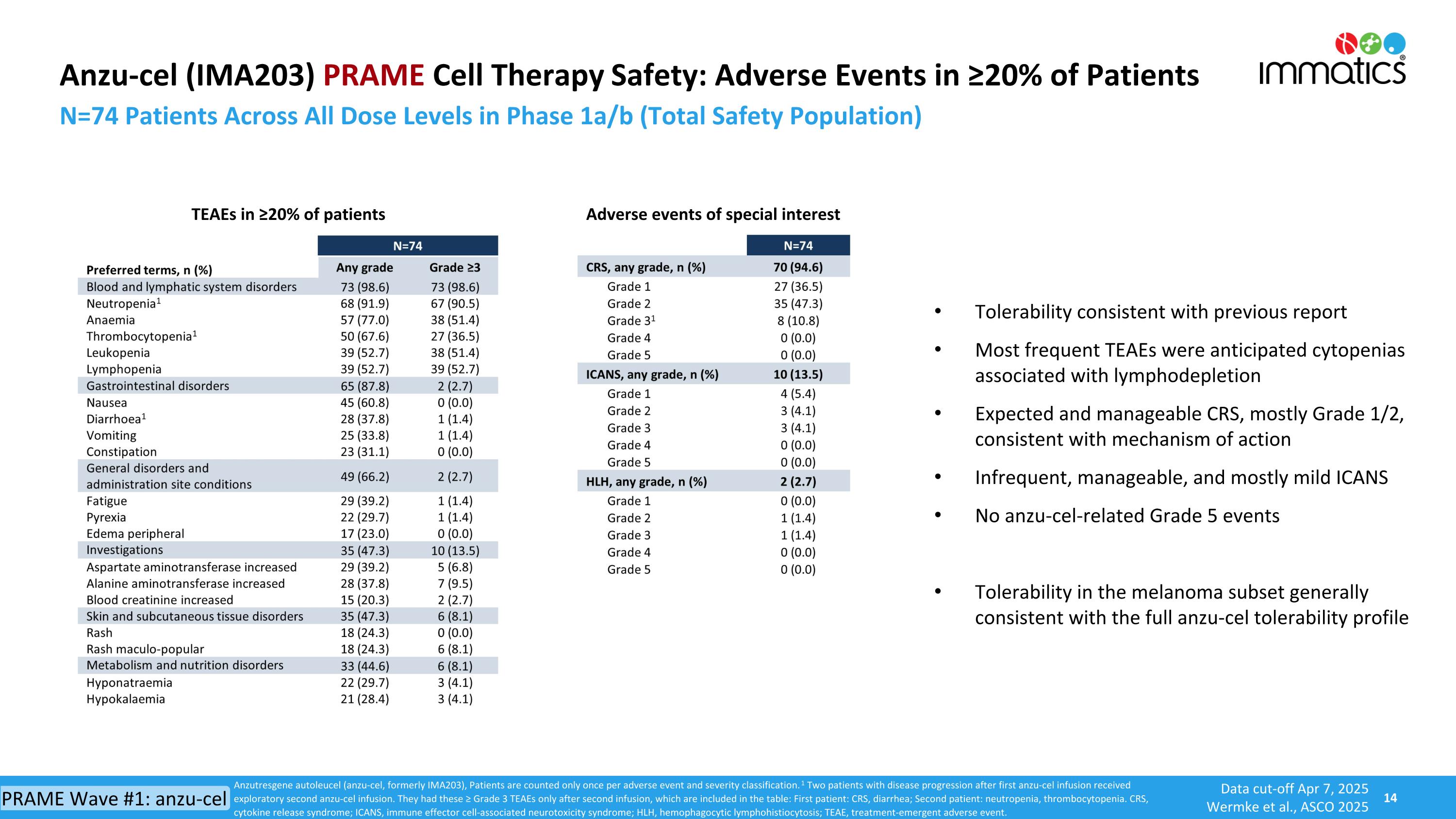

Anzu-cel (IMA203) PRAME Cell Therapy Safety: Adverse Events in ≥20% of Patients N=74 Patients Across All Dose Levels in Phase 1a/b (Total Safety Population) Anzutresgene autoleucel (anzu-cel, formerly IMA203), Patients are counted only once per adverse event and severity classification. 1 Two patients with disease progression after first anzu-cel infusion received exploratory second anzu-cel infusion. They had these ≥ Grade 3 TEAEs only after second infusion, which are included in the table: First patient: CRS, diarrhea; Second patient: neutropenia, thrombocytopenia. CRS, cytokine release syndrome; ICANS, immune effector cell-associated neurotoxicity syndrome; HLH, hemophagocytic lymphohistiocytosis; TEAE, treatment-emergent adverse event. Tolerability consistent with previous report Most frequent TEAEs were anticipated cytopenias associated with lymphodepletion Expected and manageable CRS, mostly Grade 1/2, consistent with mechanism of action Infrequent, manageable, and mostly mild ICANS No anzu-cel-related Grade 5 events Tolerability in the melanoma subset generally consistent with the full anzu-cel tolerability profile Adverse events of special interest TEAEs in ≥20% of patients Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

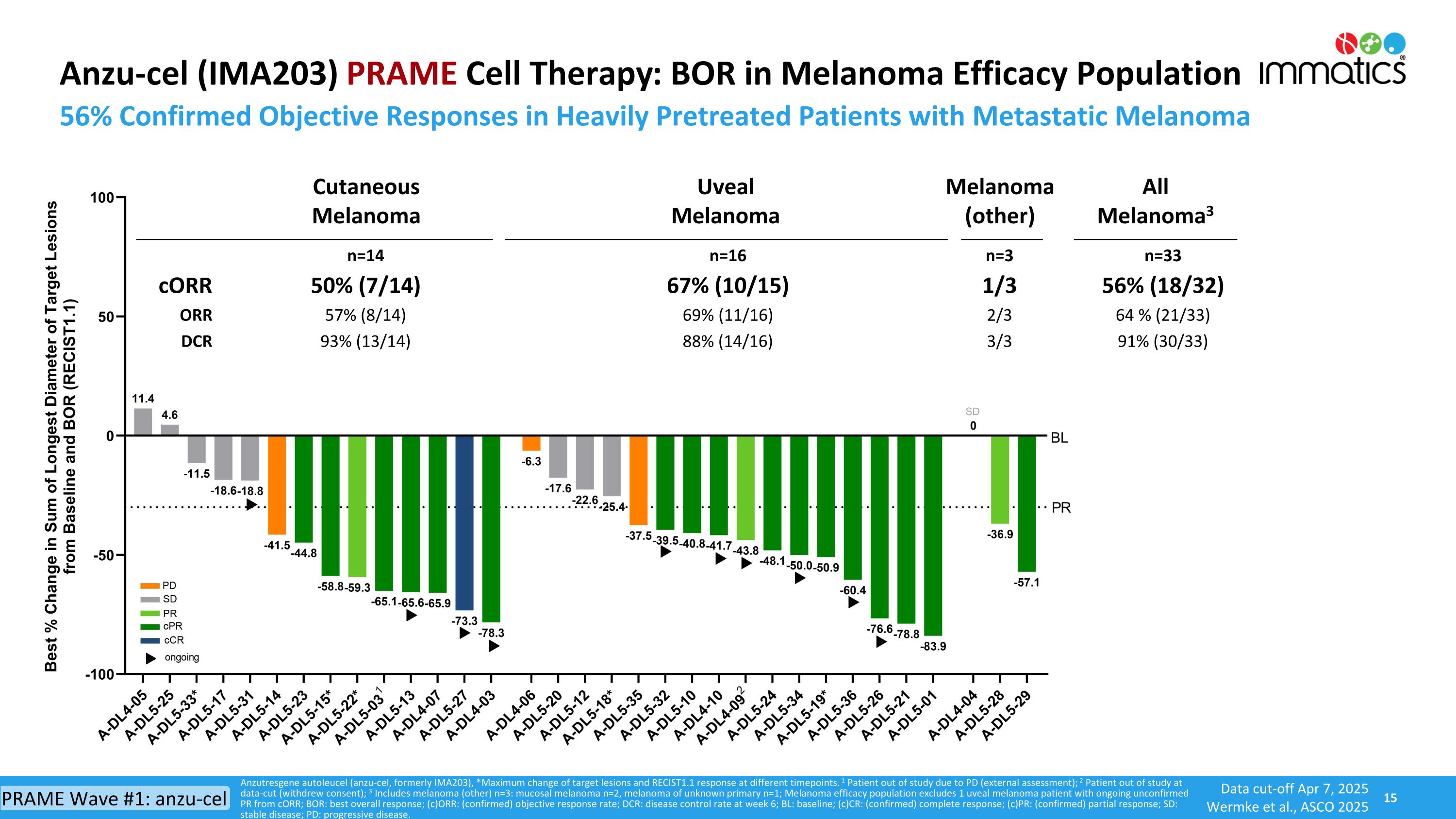

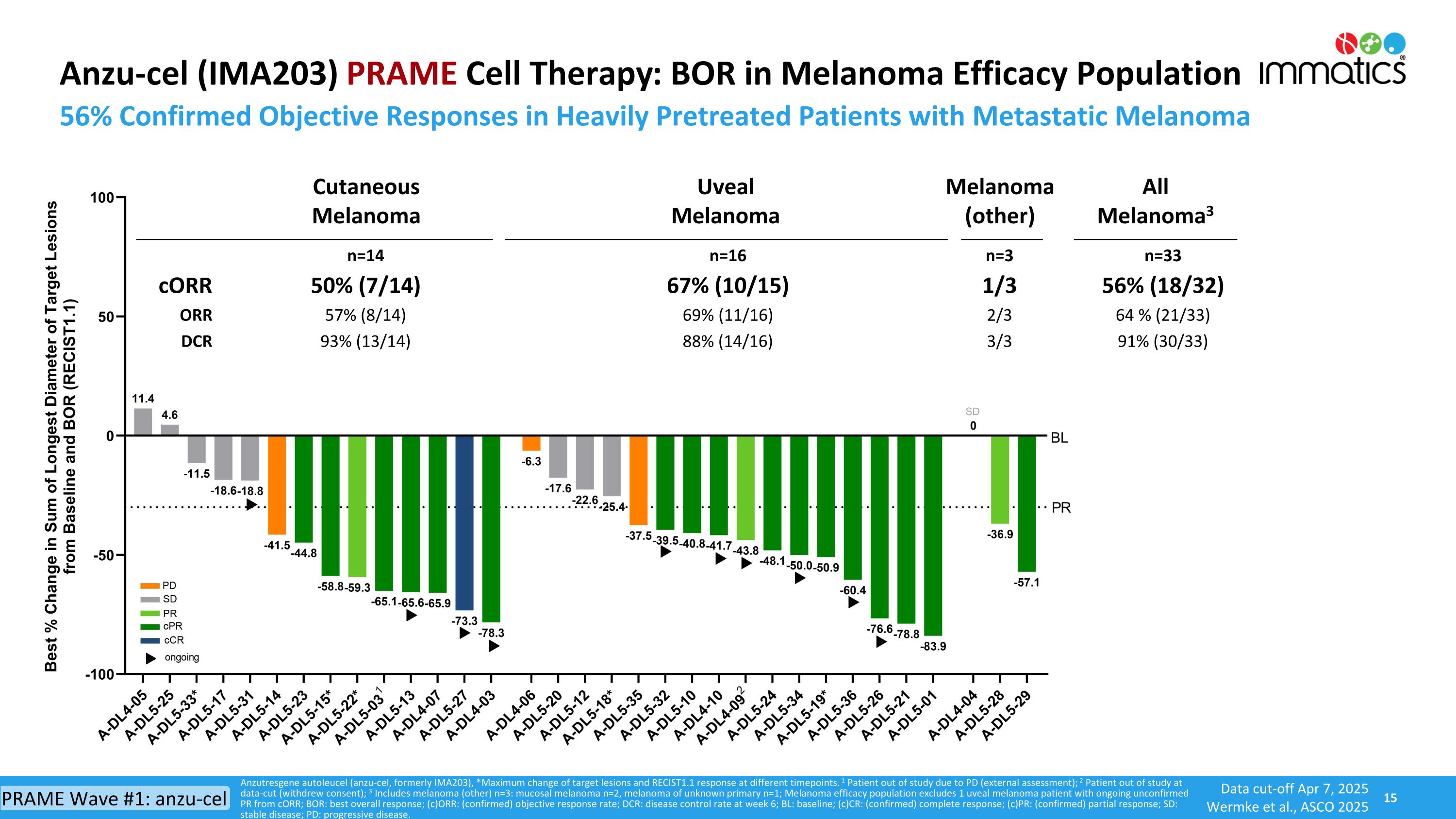

Anzu-cel (IMA203) PRAME Cell Therapy: BOR in Melanoma Efficacy Population 56% Confirmed Objective Responses in Heavily Pretreated Patients with Metastatic Melanoma Anzutresgene autoleucel (anzu-cel, formerly IMA203), *Maximum change of target lesions and RECIST1.1 response at different timepoints. 1 Patient out of study due to PD (external assessment); 2 Patient out of study at data-cut (withdrew consent); 3 Includes melanoma (other) n=3: mucosal melanoma n=2, melanoma of unknown primary n=1; Melanoma efficacy population excludes 1 uveal melanoma patient with ongoing unconfirmed PR from cORR; BOR: best overall response; (c)ORR: (confirmed) objective response rate; DCR: disease control rate at week 6; BL: baseline; (c)CR: (confirmed) complete response; (c)PR: (confirmed) partial response; SD: stable disease; PD: progressive disease. n=14 n=16 n=3 n=33 cORR 50% (7/14) 67% (10/15) 1/3 56% (18/32) ORR 57% (8/14) 69% (11/16) 2/3 64 % (21/33) DCR 93% (13/14) 88% (14/16) 3/3 91% (30/33) Cutaneous Melanoma Uveal Melanoma Melanoma (other) All Melanoma3 Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

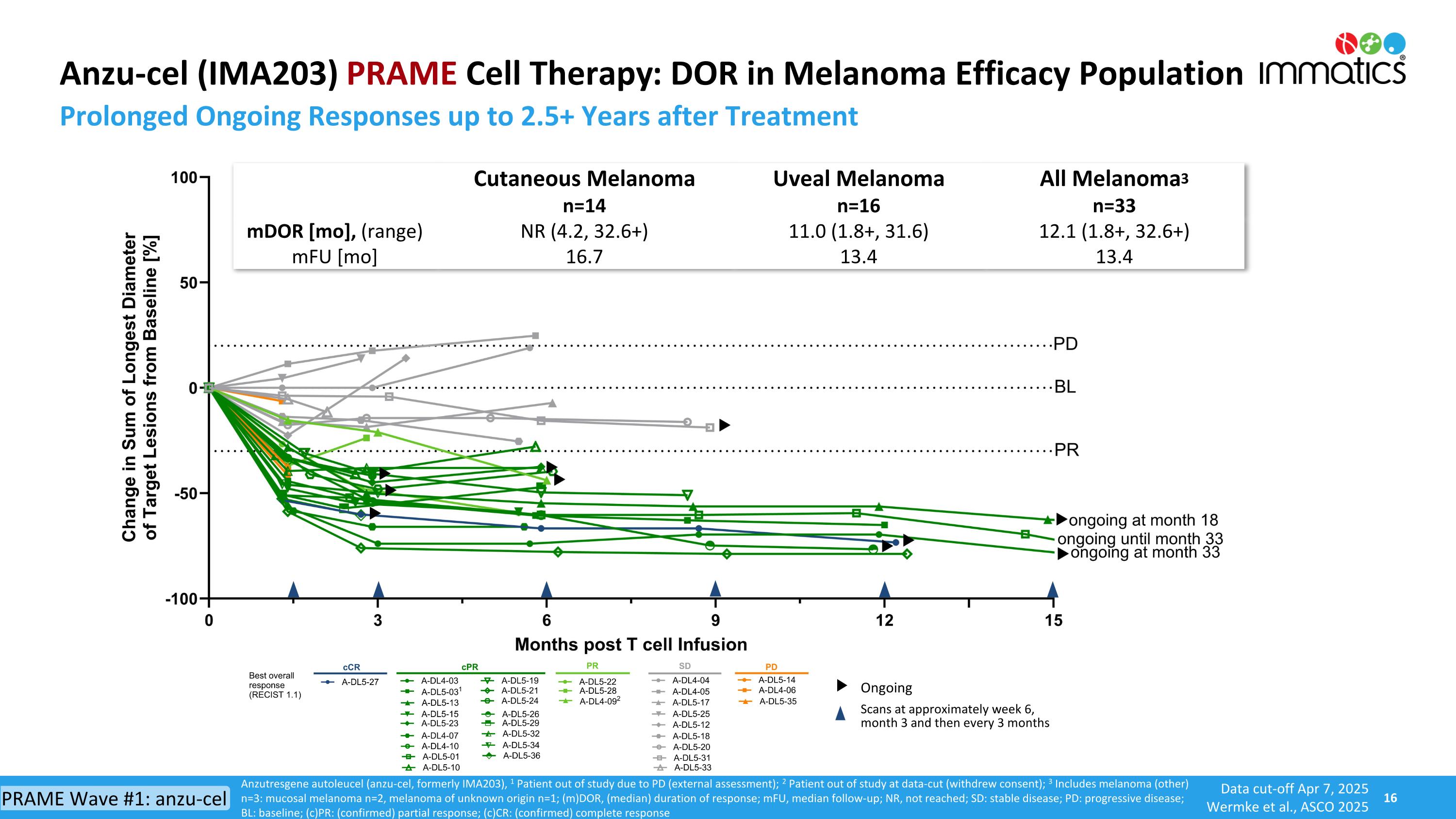

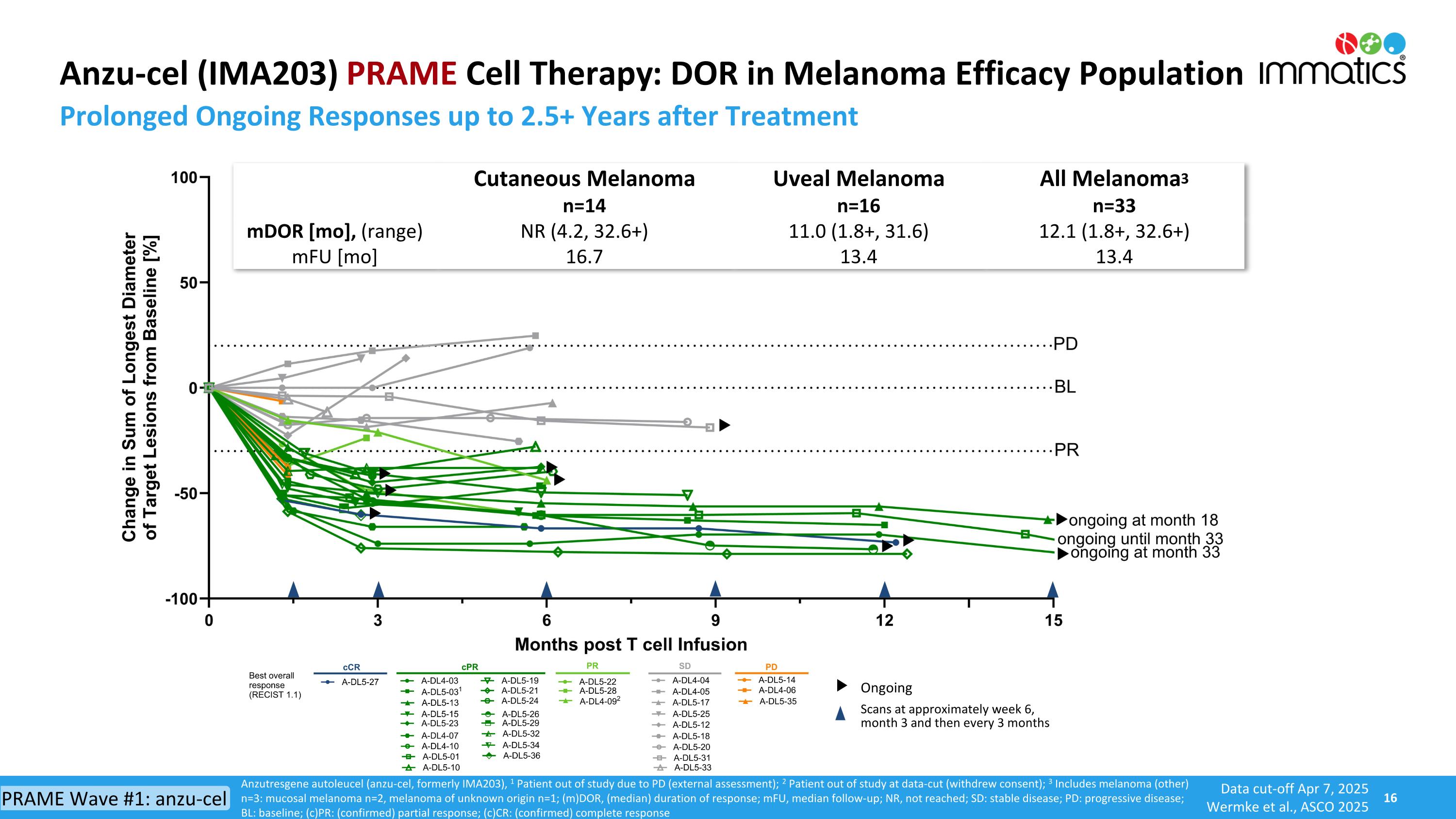

Anzu-cel (IMA203) PRAME Cell Therapy: DOR in Melanoma Efficacy Population Prolonged Ongoing Responses up to 2.5+ Years after Treatment Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Patient out of study due to PD (external assessment); 2 Patient out of study at data-cut (withdrew consent); 3 Includes melanoma (other) n=3: mucosal melanoma n=2, melanoma of unknown origin n=1; (m)DOR, (median) duration of response; mFU, median follow-up; NR, not reached; SD: stable disease; PD: progressive disease; BL: baseline; (c)PR: (confirmed) partial response; (c)CR: (confirmed) complete response Scans at approximately week 6, month 3 and then every 3 months Ongoing Cutaneous Melanoma n=14 Uveal Melanoma n=16 All Melanoma3 n=33 mDOR [mo], (range) mFU [mo] NR (4.2, 32.6+) 16.7 11.0 (1.8+, 31.6) 13.4 12.1 (1.8+, 32.6+) 13.4 Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

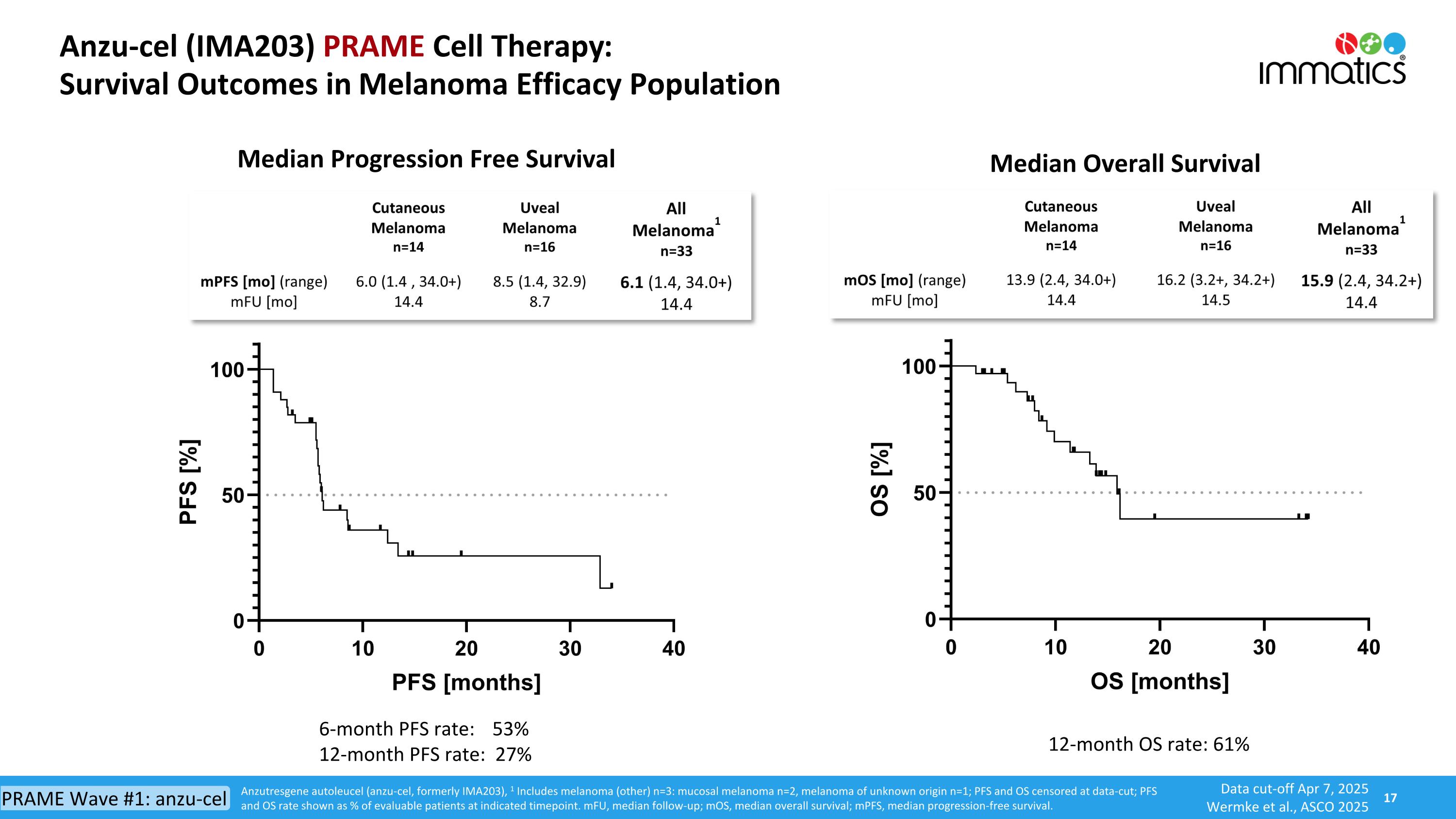

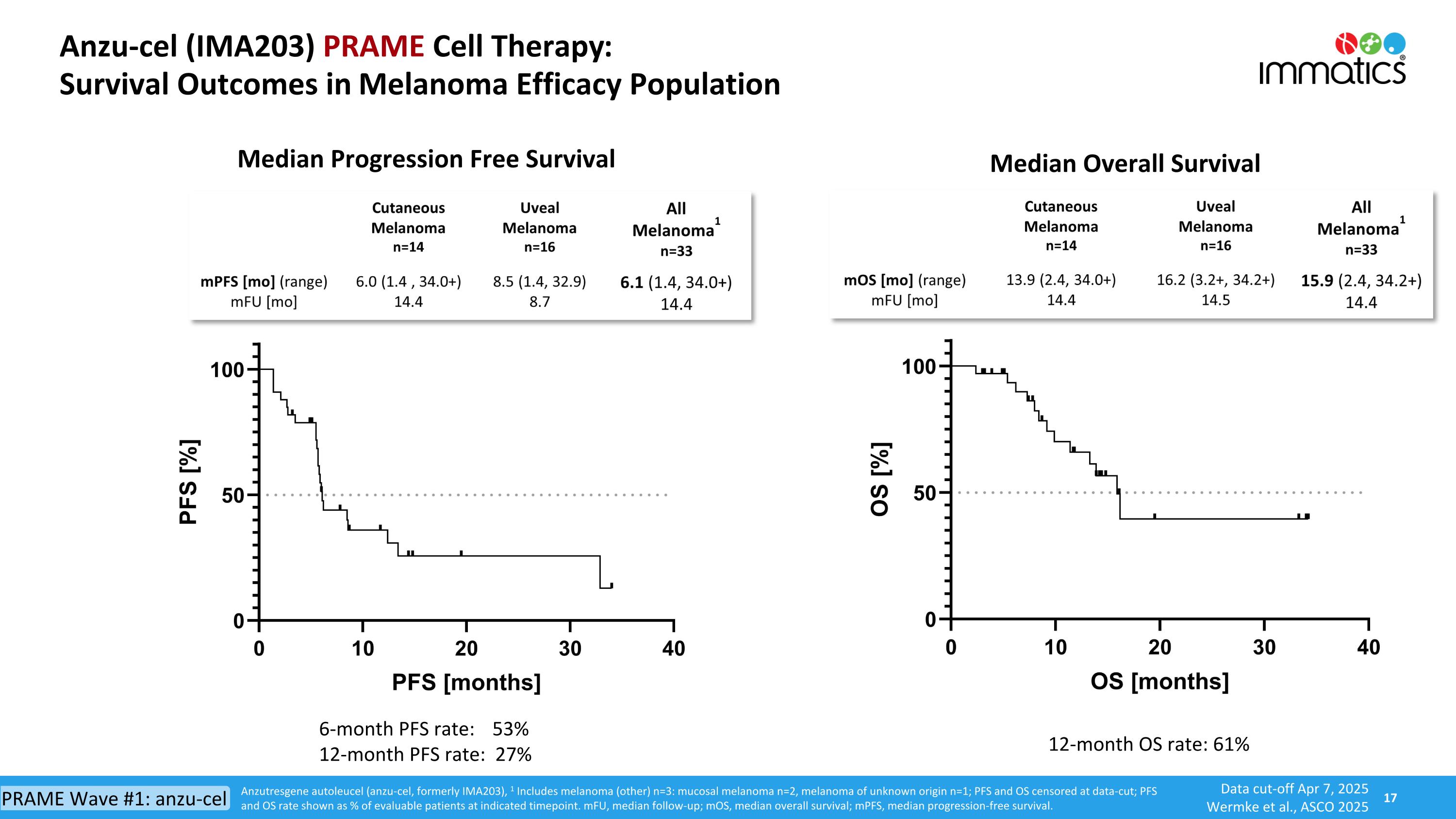

Anzu-cel (IMA203) PRAME Cell Therapy: Survival Outcomes in Melanoma Efficacy Population Median Progression Free Survival Median Overall Survival 12-month OS rate: 61% 6-month PFS rate: 53% 12-month PFS rate: 27% Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Includes melanoma (other) n=3: mucosal melanoma n=2, melanoma of unknown origin n=1; PFS and OS censored at data-cut; PFS and OS rate shown as % of evaluable patients at indicated timepoint. mFU, median follow-up; mOS, median overall survival; mPFS, median progression-free survival. Data cut-off Apr 7, 2025 Wermke et al., ASCO 2025 PRAME Wave #1: anzu-cel

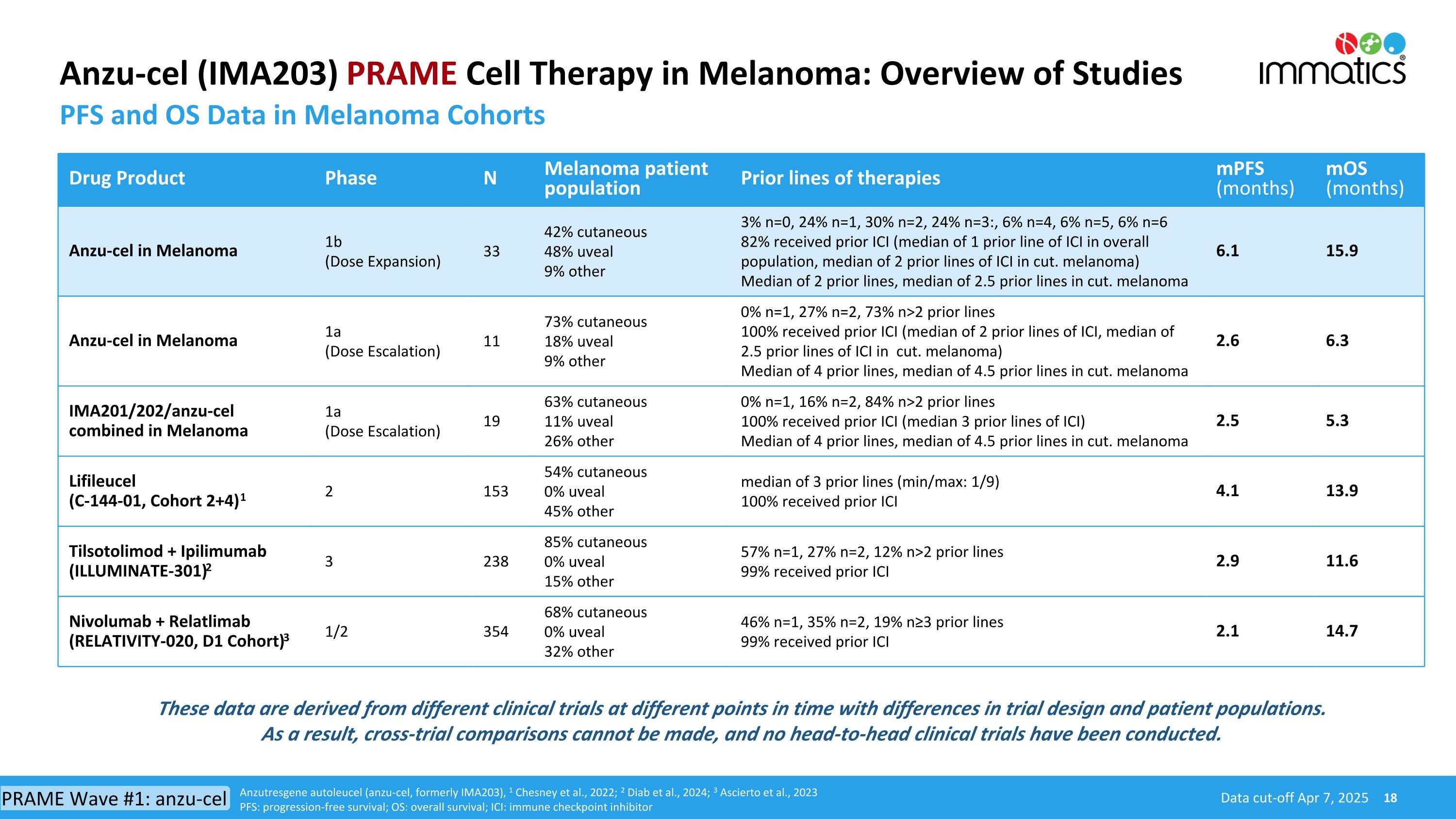

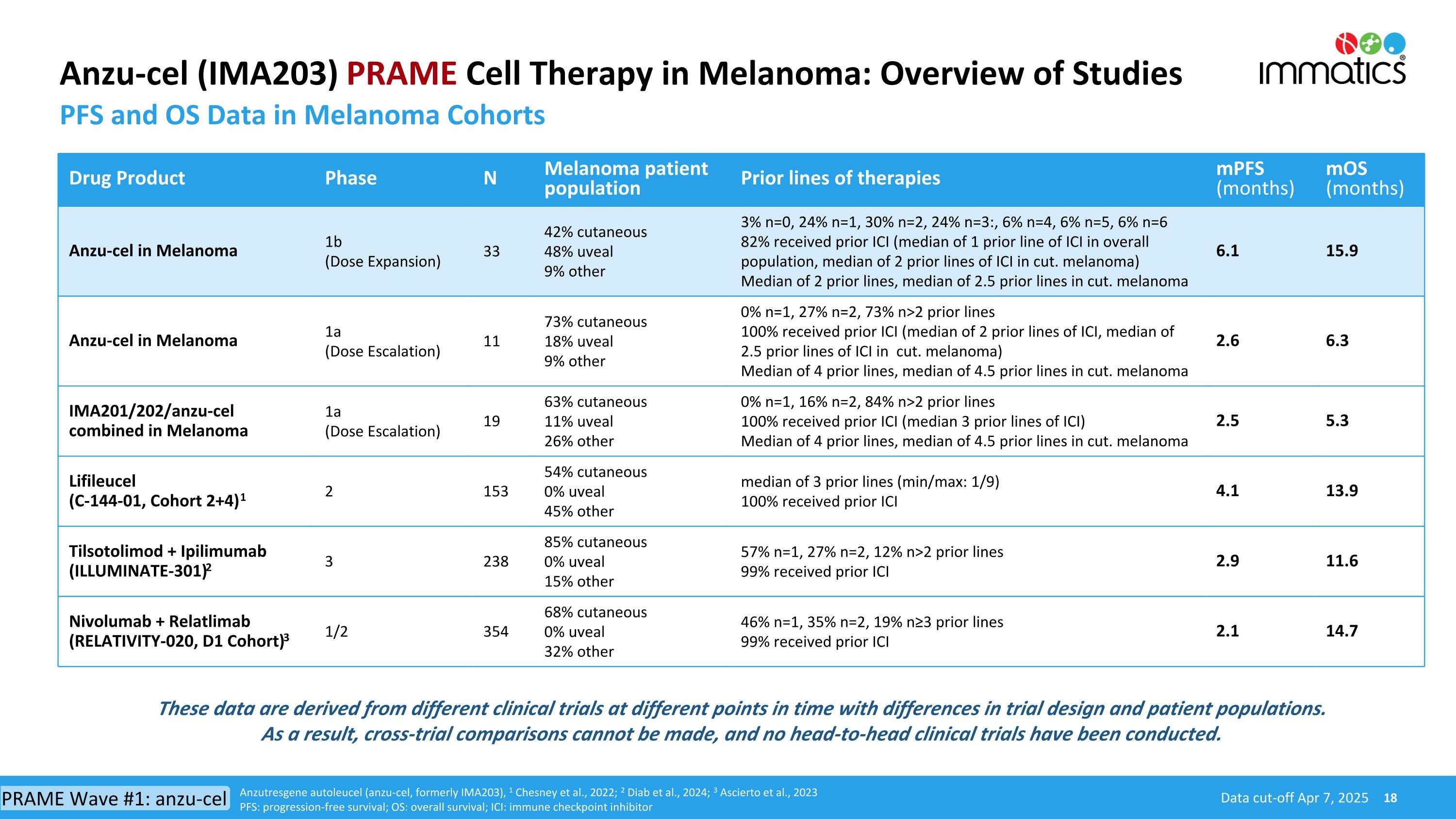

Anzu-cel (IMA203) PRAME Cell Therapy in Melanoma: Overview of Studies PFS and OS Data in Melanoma Cohorts Drug Product Phase N Melanoma patient population Prior lines of therapies mPFS (months) mOS (months) Anzu-cel in Melanoma 1b (Dose Expansion) 33 42% cutaneous 48% uveal 9% other 3% n=0, 24% n=1, 30% n=2, 24% n=3:, 6% n=4, 6% n=5, 6% n=6 82% received prior ICI (median of 1 prior line of ICI in overall population, median of 2 prior lines of ICI in cut. melanoma) Median of 2 prior lines, median of 2.5 prior lines in cut. melanoma 6.1 15.9 Anzu-cel in Melanoma 1a (Dose Escalation) 11 73% cutaneous 18% uveal 9% other 0% n=1, 27% n=2, 73% n>2 prior lines 100% received prior ICI (median of 2 prior lines of ICI, median of 2.5 prior lines of ICI in cut. melanoma) Median of 4 prior lines, median of 4.5 prior lines in cut. melanoma 2.6 6.3 IMA201/202/anzu-cel combined in Melanoma 1a (Dose Escalation) 19 63% cutaneous 11% uveal 26% other 0% n=1, 16% n=2, 84% n>2 prior lines 100% received prior ICI (median 3 prior lines of ICI) Median of 4 prior lines, median of 4.5 prior lines in cut. melanoma 2.5 5.3 Lifileucel (C-144-01, Cohort 2+4)1 2 153 54% cutaneous 0% uveal 45% other median of 3 prior lines (min/max: 1/9) 100% received prior ICI 4.1 13.9 Tilsotolimod + Ipilimumab (ILLUMINATE-301)2 3 238 85% cutaneous 0% uveal 15% other 57% n=1, 27% n=2, 12% n>2 prior lines 99% received prior ICI 2.9 11.6 Nivolumab + Relatlimab (RELATIVITY-020, D1 Cohort)3 1/2 354 68% cutaneous 0% uveal 32% other 46% n=1, 35% n=2, 19% n≥3 prior lines 99% received prior ICI 2.1 14.7 Data cut-off Apr 7, 2025 Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Chesney et al., 2022; 2 Diab et al., 2024; 3 Ascierto et al., 2023 PFS: progression-free survival; OS: overall survival; ICI: immune checkpoint inhibitor These data are derived from different clinical trials at different points in time with differences in trial design and patient populations. As a result, cross-trial comparisons cannot be made, and no head-to-head clinical trials have been conducted. PRAME Wave #1: anzu-cel

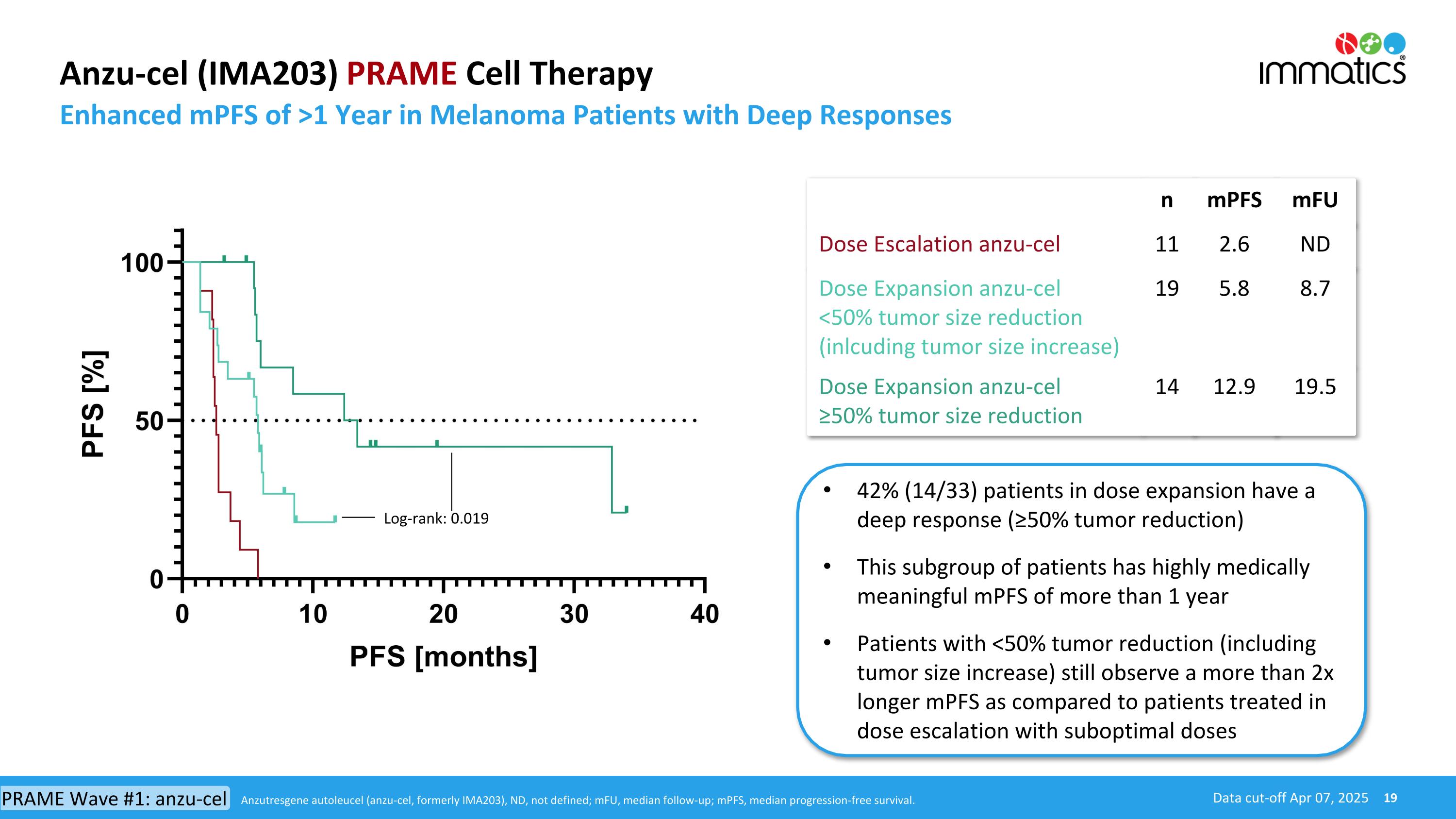

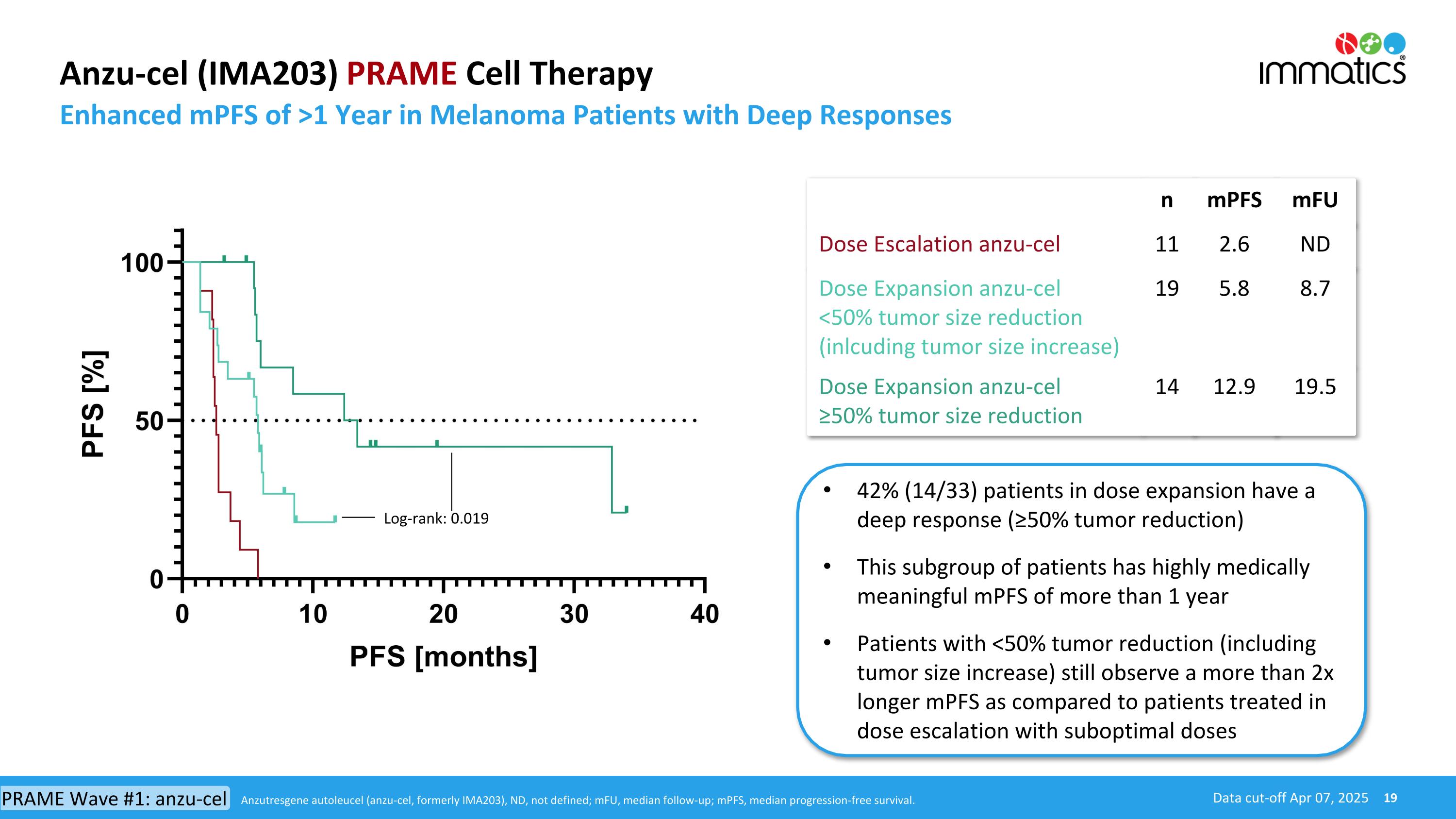

Anzu-cel (IMA203) PRAME Cell Therapy Enhanced mPFS of >1 Year in Melanoma Patients with Deep Responses Data cut-off Apr 07, 2025 42% (14/33) patients in dose expansion have a deep response (≥50% tumor reduction) This subgroup of patients has highly medically meaningful mPFS of more than 1 year Patients with <50% tumor reduction (including tumor size increase) still observe a more than 2x longer mPFS as compared to patients treated in dose escalation with suboptimal doses n mPFS mFU Dose Escalation anzu-cel 11 2.6 ND Dose Expansion anzu-cel <50% tumor size reduction (inlcuding tumor size increase) 19 5.8 8.7 Dose Expansion anzu-cel ≥50% tumor size reduction 14 12.9 19.5 Log-rank: 0.019 Anzutresgene autoleucel (anzu-cel, formerly IMA203), ND, not defined; mFU, median follow-up; mPFS, median progression-free survival. PRAME Wave #1: anzu-cel

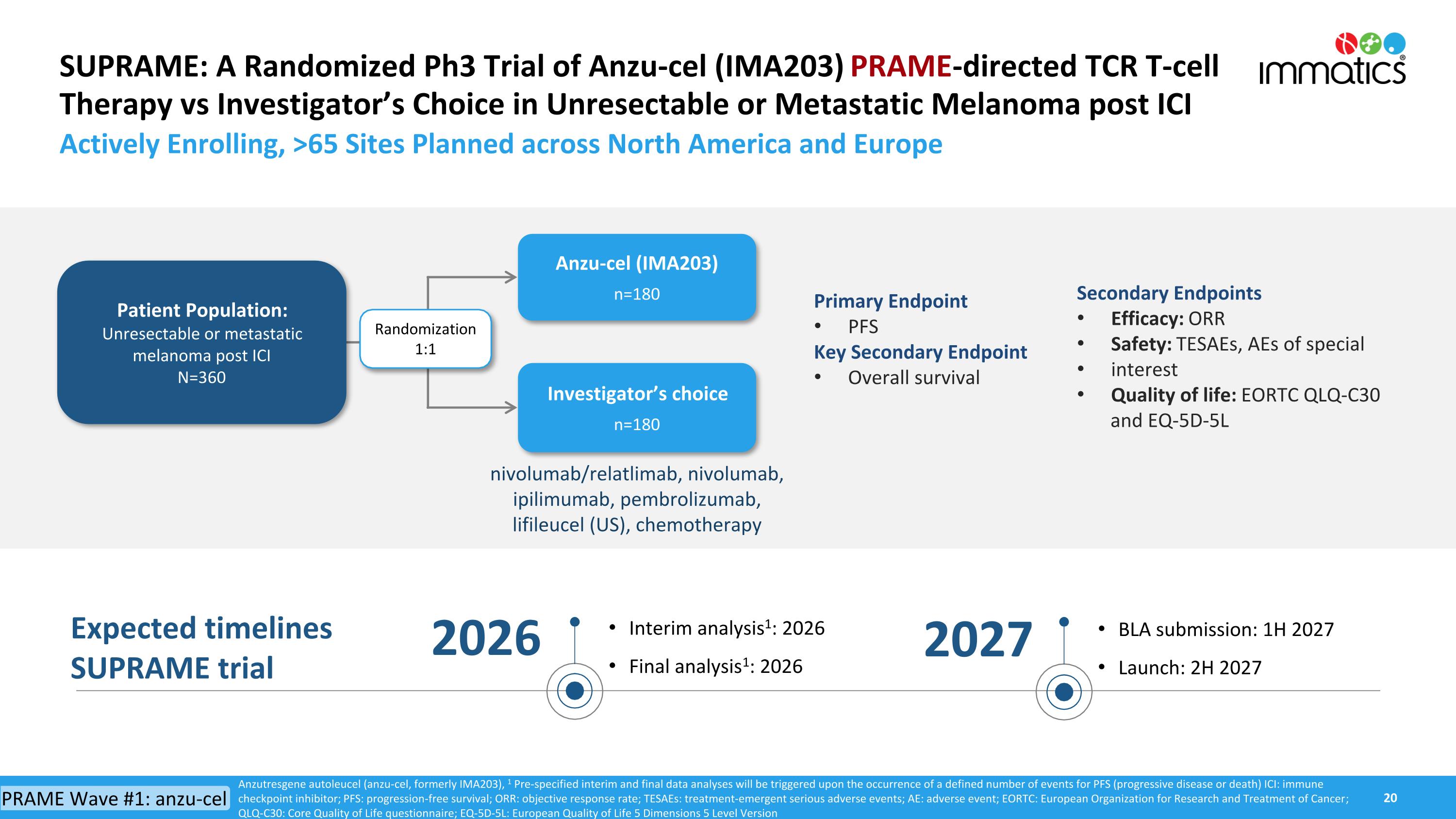

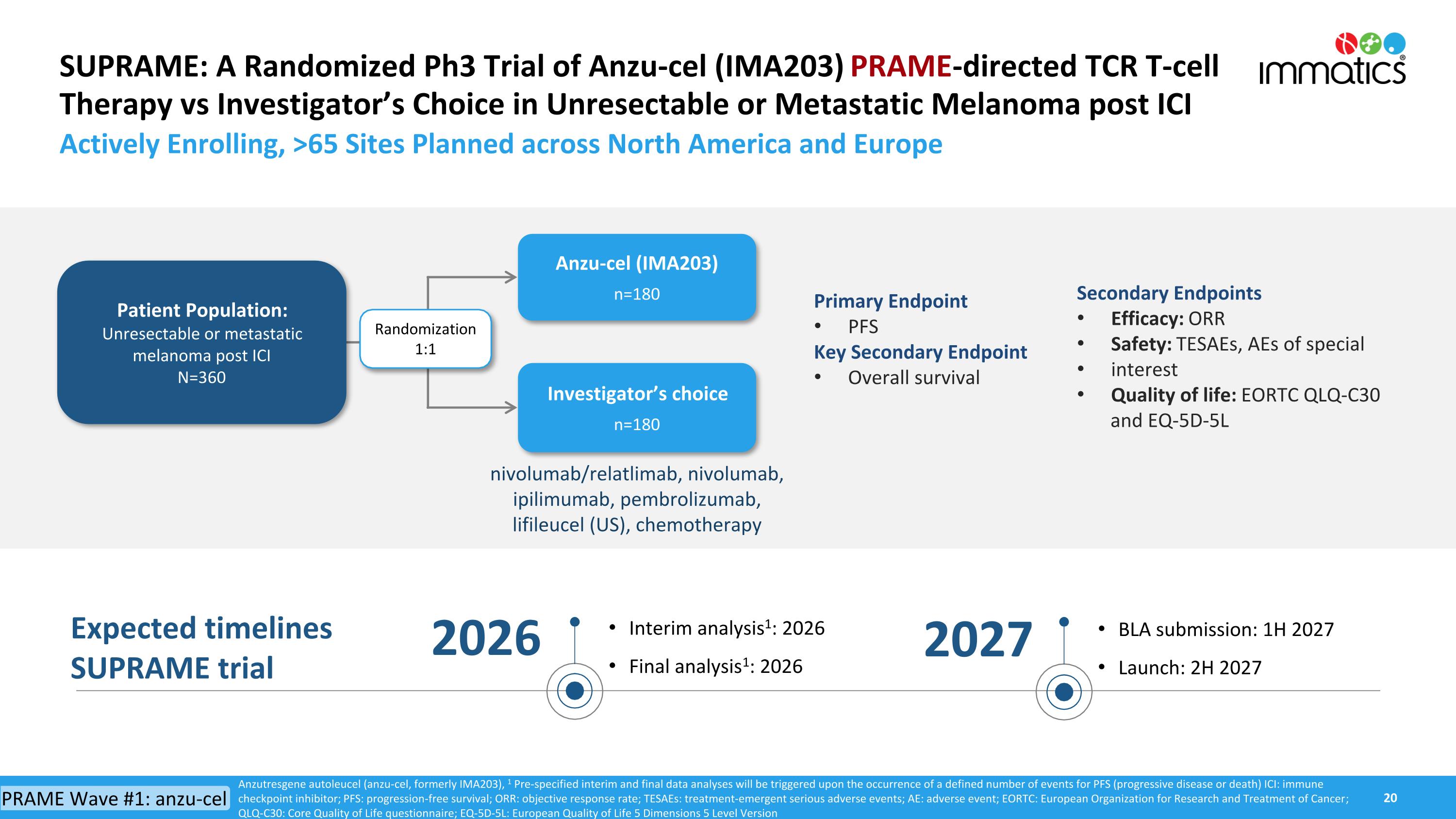

SUPRAME: A Randomized Ph3 Trial of Anzu-cel (IMA203) PRAME-directed TCR T-cell Therapy vs Investigator’s Choice in Unresectable or Metastatic Melanoma post ICI Actively Enrolling, >65 Sites Planned across North America and Europe Anzu-cel (IMA203) n=180 Investigator’s choice n=180 Primary Endpoint PFS Key Secondary Endpoint Overall survival Randomization 1:1 Patient Population: Unresectable or metastatic melanoma post ICI N=360 nivolumab/relatlimab, nivolumab, ipilimumab, pembrolizumab,lifileucel (US), chemotherapy Anzutresgene autoleucel (anzu-cel, formerly IMA203), 1 Pre-specified interim and final data analyses will be triggered upon the occurrence of a defined number of events for PFS (progressive disease or death) ICI: immune checkpoint inhibitor; PFS: progression-free survival; ORR: objective response rate; TESAEs: treatment-emergent serious adverse events; AE: adverse event; EORTC: European Organization for Research and Treatment of Cancer; QLQ-C30: Core Quality of Life questionnaire; EQ-5D-5L: European Quality of Life 5 Dimensions 5 Level Version Secondary Endpoints Efficacy: ORR Safety: TESAEs, AEs of special interest Quality of life: EORTC QLQ-C30 and EQ-5D-5L Expected timelines SUPRAME trial Interim analysis1: 2026 Final analysis1: 2026 2026 BLA submission: 1H 2027 Launch: 2H 2027 2027 PRAME Wave #1: anzu-cel

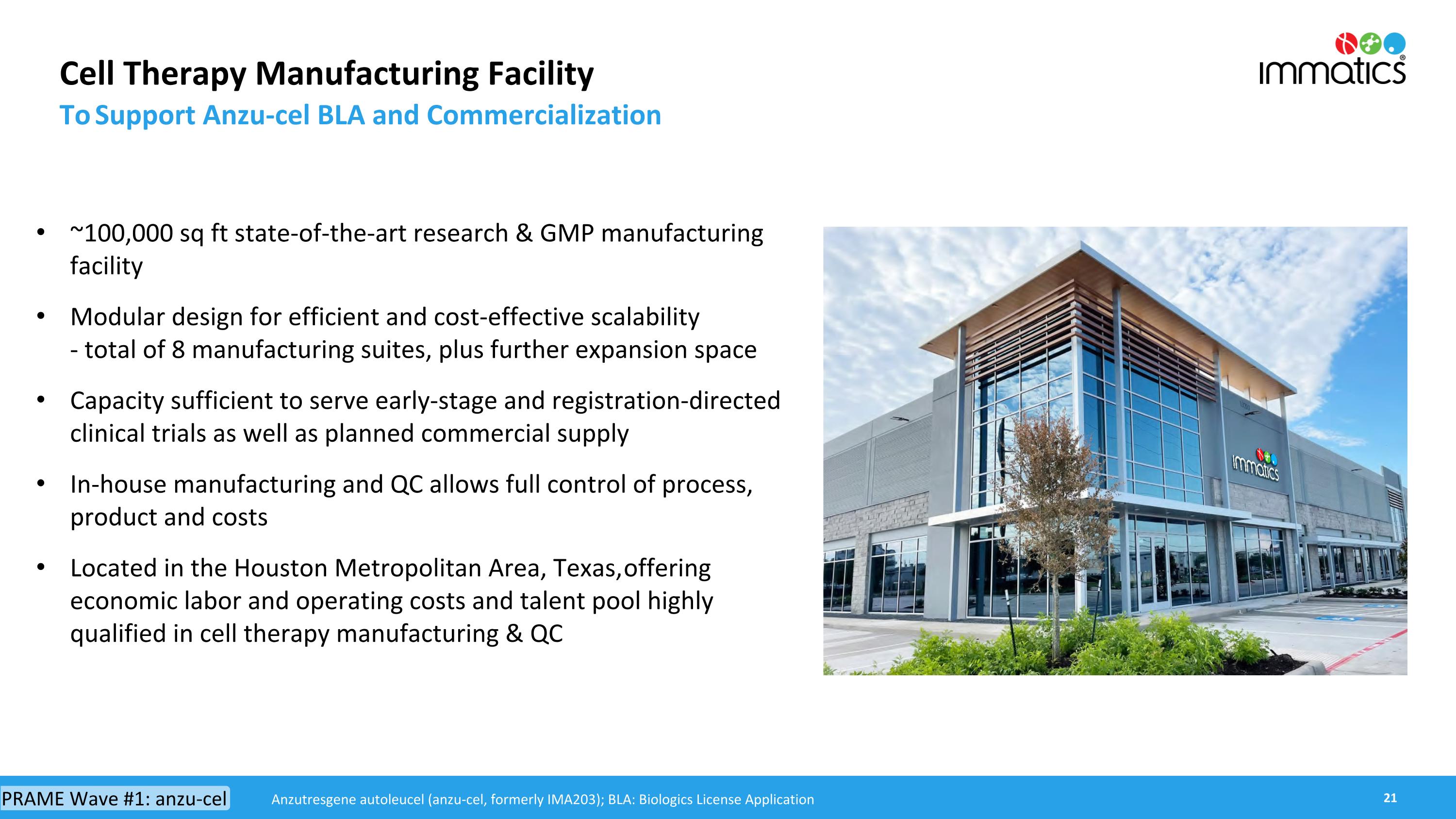

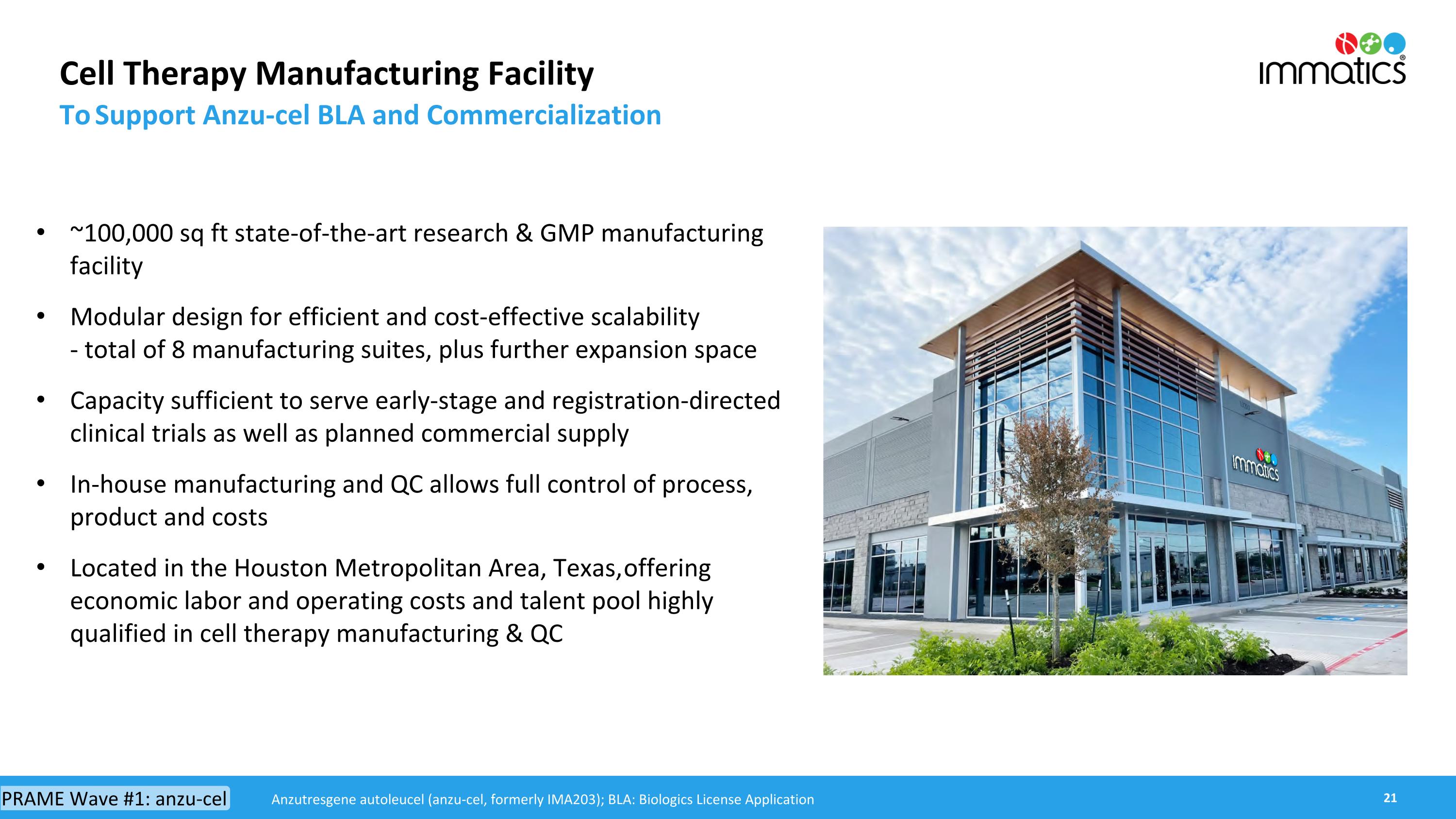

Cell Therapy Manufacturing Facility To Support Anzu-cel BLA and Commercialization ~100,000 sq ft state-of-the-art research & GMP manufacturing facility Modular design for efficient and cost-effective scalability - total of 8 manufacturing suites, plus further expansion space Capacity sufficient to serve early-stage and registration-directed clinical trials as well as planned commercial supply In-house manufacturing and QC allows full control of process, product and costs Located in the Houston Metropolitan Area, Texas, offering economic labor and operating costs and talent pool highly qualified in cell therapy manufacturing & QC Anzutresgene autoleucel (anzu-cel, formerly IMA203); BLA: Biologics License Application PRAME Wave #1: anzu-cel

IMA203CD8 PRAME Cell Therapy (GEN2) Expansion to all Advanced PRAME Cancers PRAME Wave #2 22

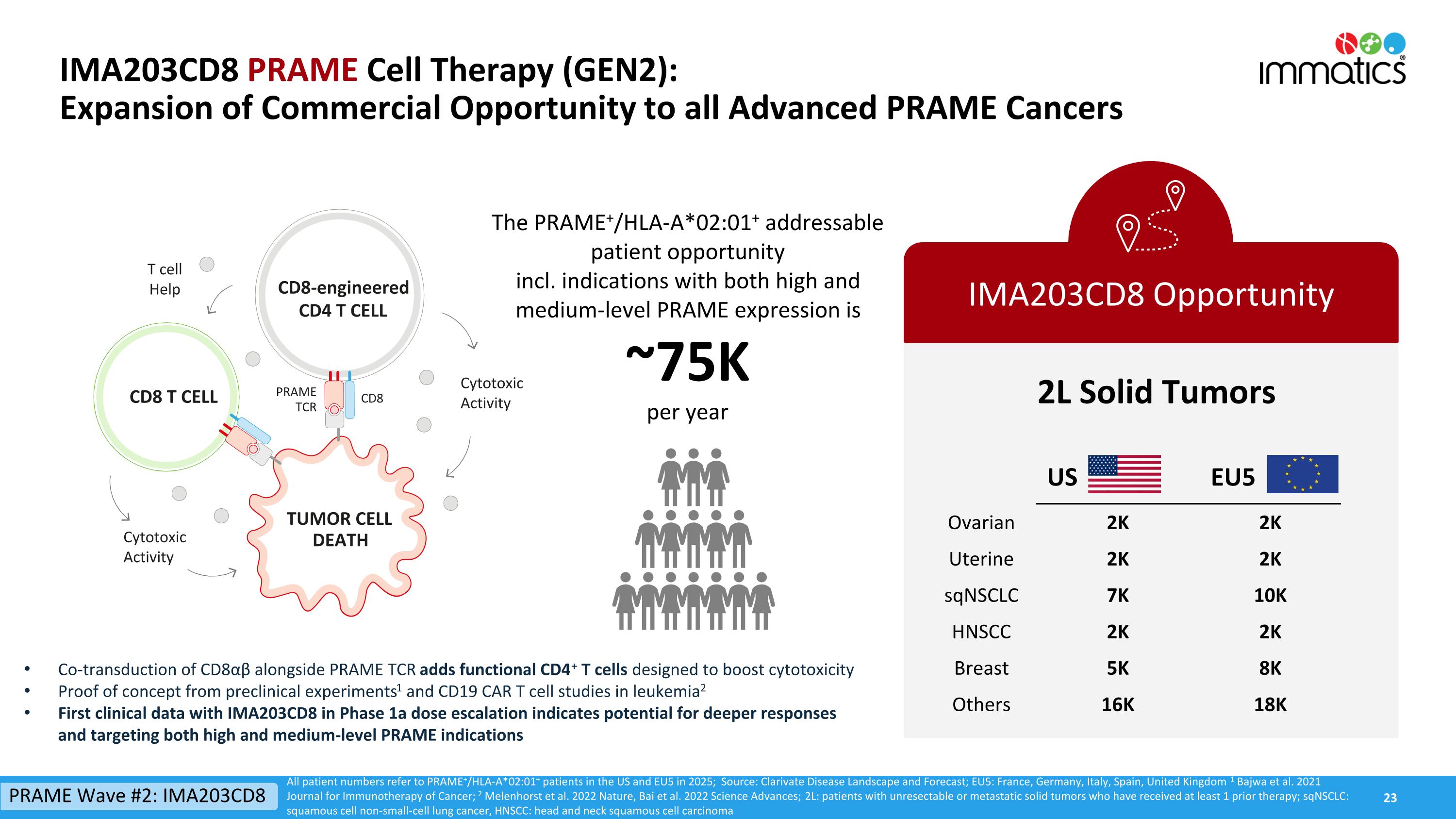

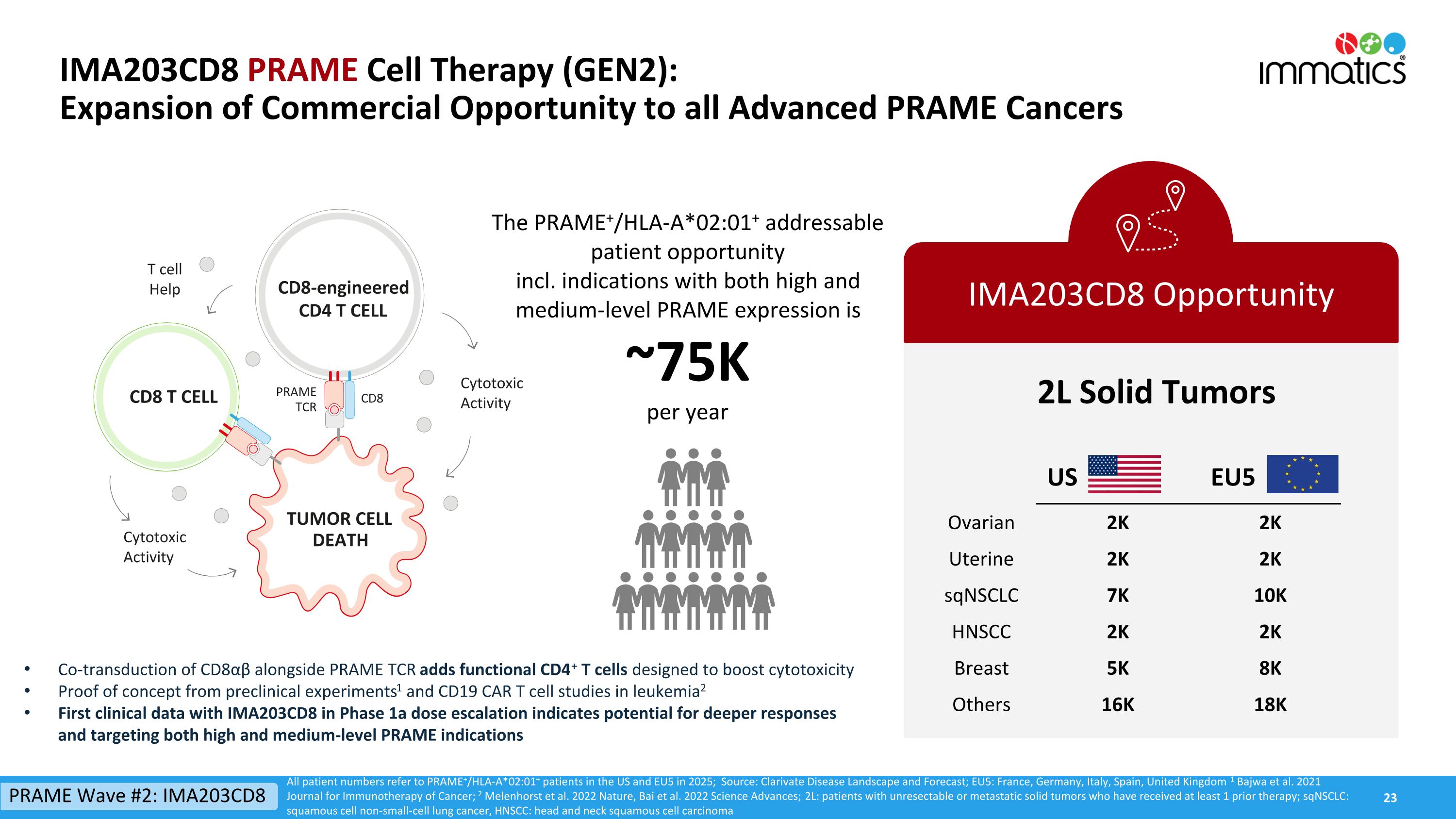

IMA203CD8 PRAME Cell Therapy (GEN2):Expansion of Commercial Opportunity to all Advanced PRAME Cancers IMA203CD8 Opportunity 2L Solid Tumors All patient numbers refer to PRAME+/HLA-A*02:01+ patients in the US and EU5 in 2025; Source: Clarivate Disease Landscape and Forecast; EU5: France, Germany, Italy, Spain, United Kingdom 1 Bajwa et al. 2021 Journal for Immunotherapy of Cancer; 2 Melenhorst et al. 2022 Nature, Bai et al. 2022 Science Advances; 2L: patients with unresectable or metastatic solid tumors who have received at least 1 prior therapy; sqNSCLC: squamous cell non-small-cell lung cancer, HNSCC: head and neck squamous cell carcinoma The PRAME+/HLA-A*02:01+ addressable patient opportunity incl. indications with both high and medium-level PRAME expression is~75Kper year Co-transduction of CD8αβ alongside PRAME TCR adds functional CD4+ T cells designed to boost cytotoxicity Proof of concept from preclinical experiments1 and CD19 CAR T cell studies in leukemia2 First clinical data with IMA203CD8 in Phase 1a dose escalation indicates potential for deeper responses and targeting both high and medium-level PRAME indications US EU5 Ovarian 2K 2K Uterine 2K 2K sqNSCLC 7K 10K HNSCC 2K 2K Breast 5K 8K Others 16K 18K TUMOR CELL DEATH CD8-engineered CD4 T CELL Cytotoxic Activity CD8 T CELL T cell Help Cytotoxic Activity CD8 PRAME TCR PRAME Wave #2: IMA203CD8

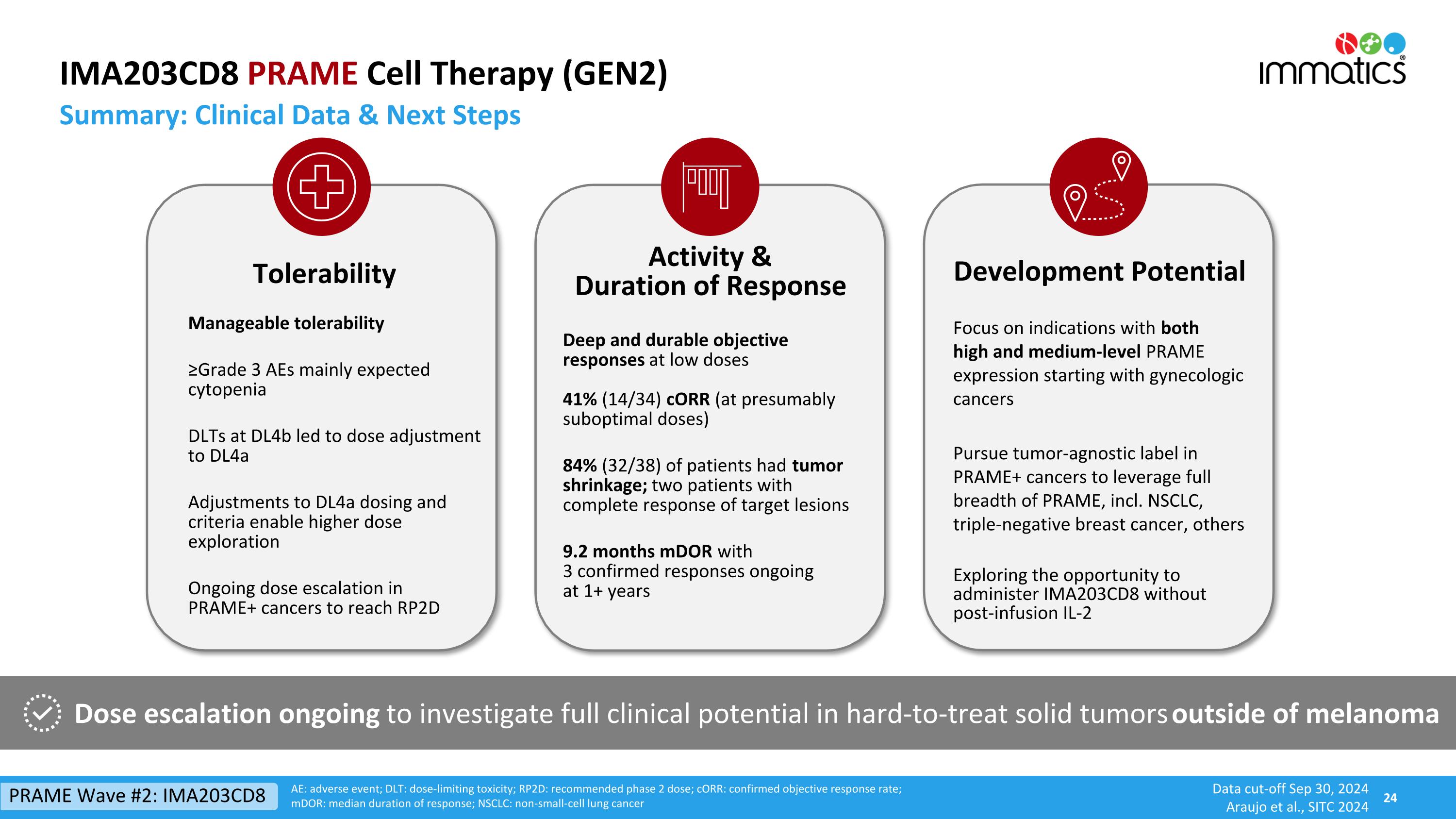

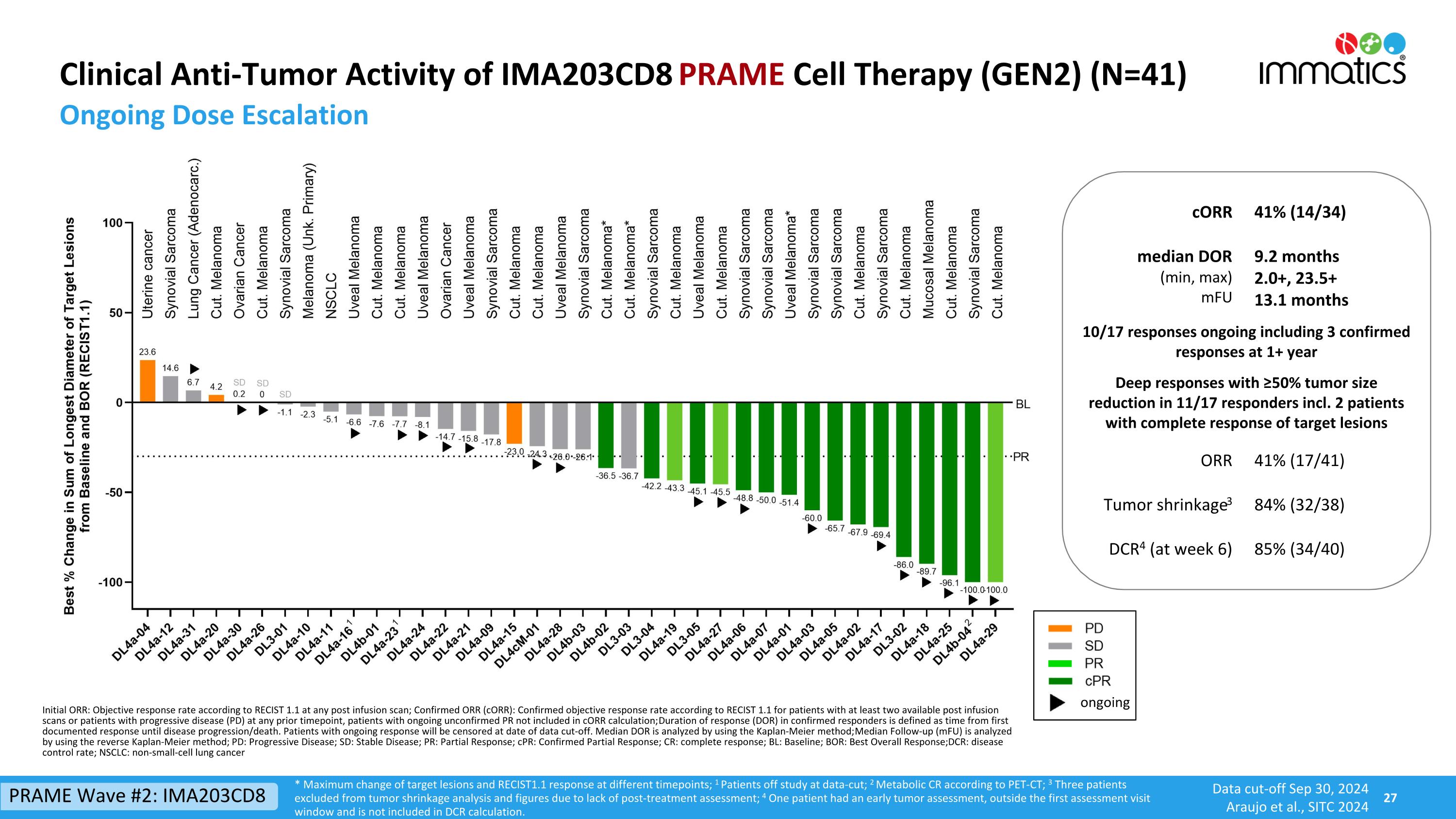

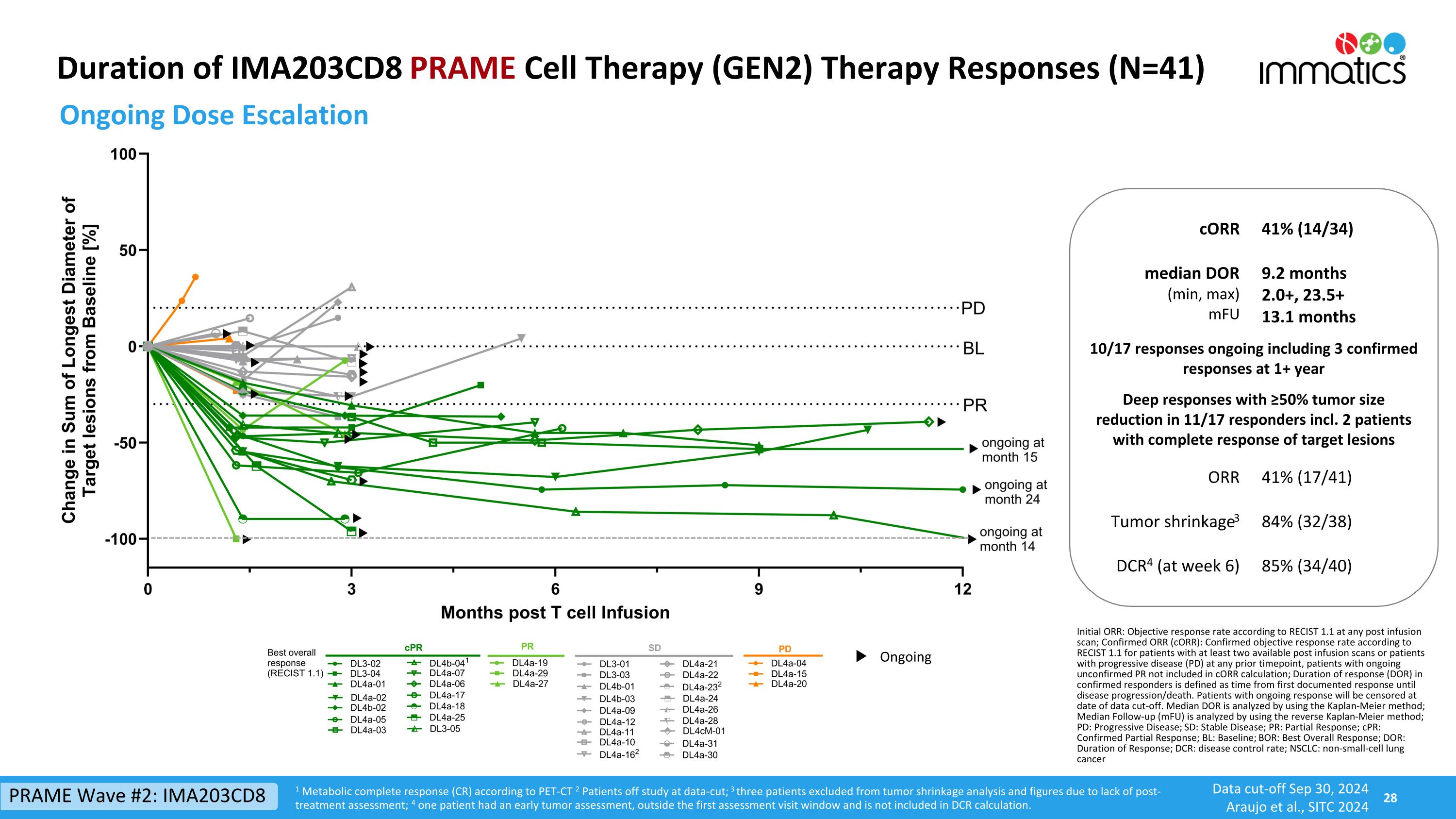

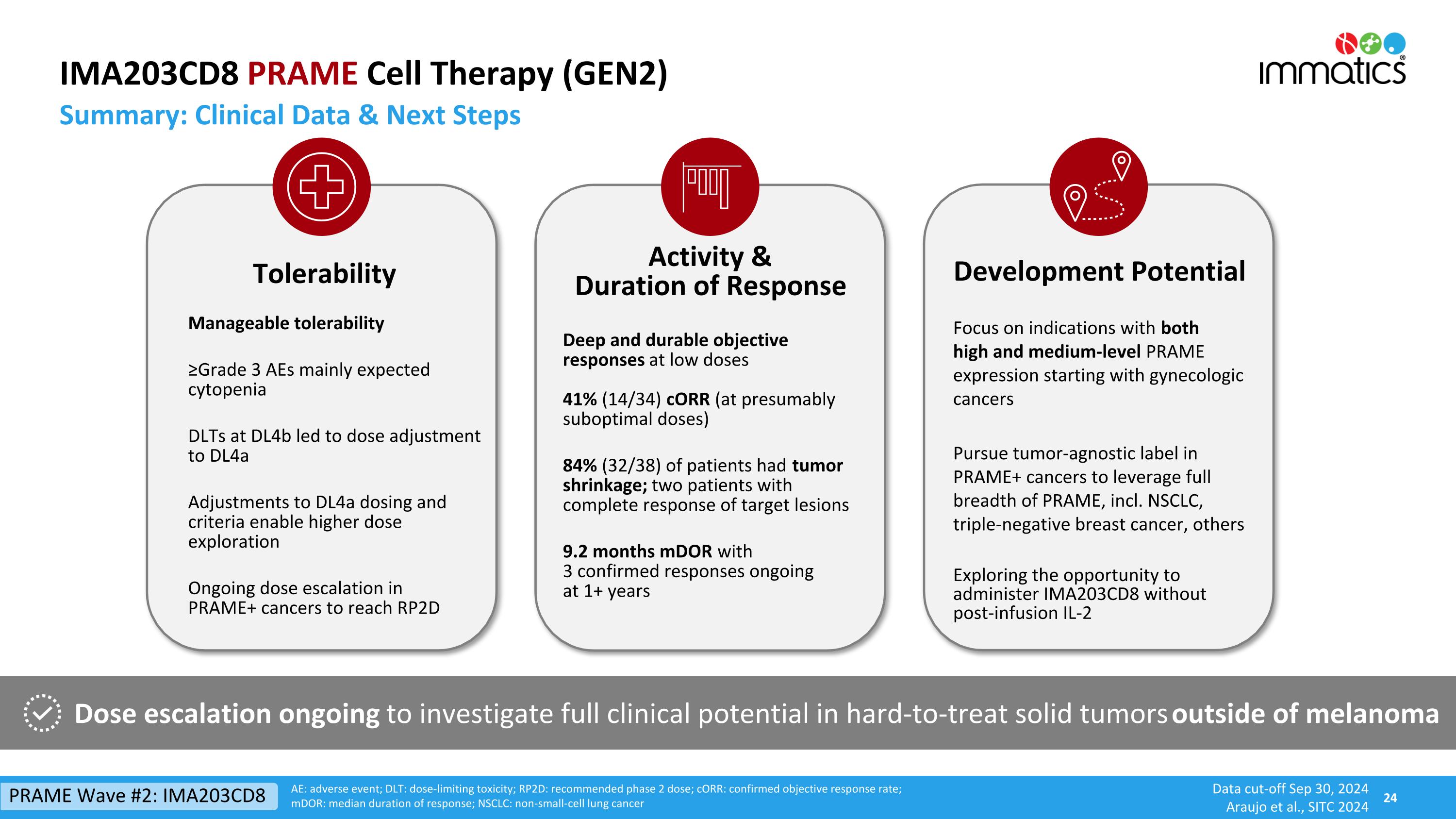

IMA203CD8 PRAME Cell Therapy (GEN2) Data cut-off Sep 30, 2024 Araujo et al., SITC 2024 Dose escalation ongoing to investigate full clinical potential in hard-to-treat solid tumors outside of melanoma Tolerability Manageable tolerability ≥Grade 3 AEs mainly expected cytopenia DLTs at DL4b led to dose adjustment to DL4a Adjustments to DL4a dosing and criteria enable higher dose exploration Ongoing dose escalation in PRAME+ cancers to reach RP2D Deep and durable objective responses at low doses 41% (14/34) cORR (at presumably suboptimal doses) 84% (32/38) of patients had tumor shrinkage; two patients with complete response of target lesions 9.2 months mDOR with 3 confirmed responses ongoing at 1+ years Activity & Duration of Response CD8 Development Potential Focus on indications with both high and medium-level PRAME expression starting with gynecologic cancers Pursue tumor-agnostic label in PRAME+ cancers to leverage full breadth of PRAME, incl. NSCLC, triple-negative breast cancer, others Exploring the opportunity to administer IMA203CD8 without post-infusion IL-2 AE: adverse event; DLT: dose-limiting toxicity; RP2D: recommended phase 2 dose; cORR: confirmed objective response rate; mDOR: median duration of response; NSCLC: non-small-cell lung cancer Summary: Clinical Data & Next Steps PRAME Wave #2: IMA203CD8

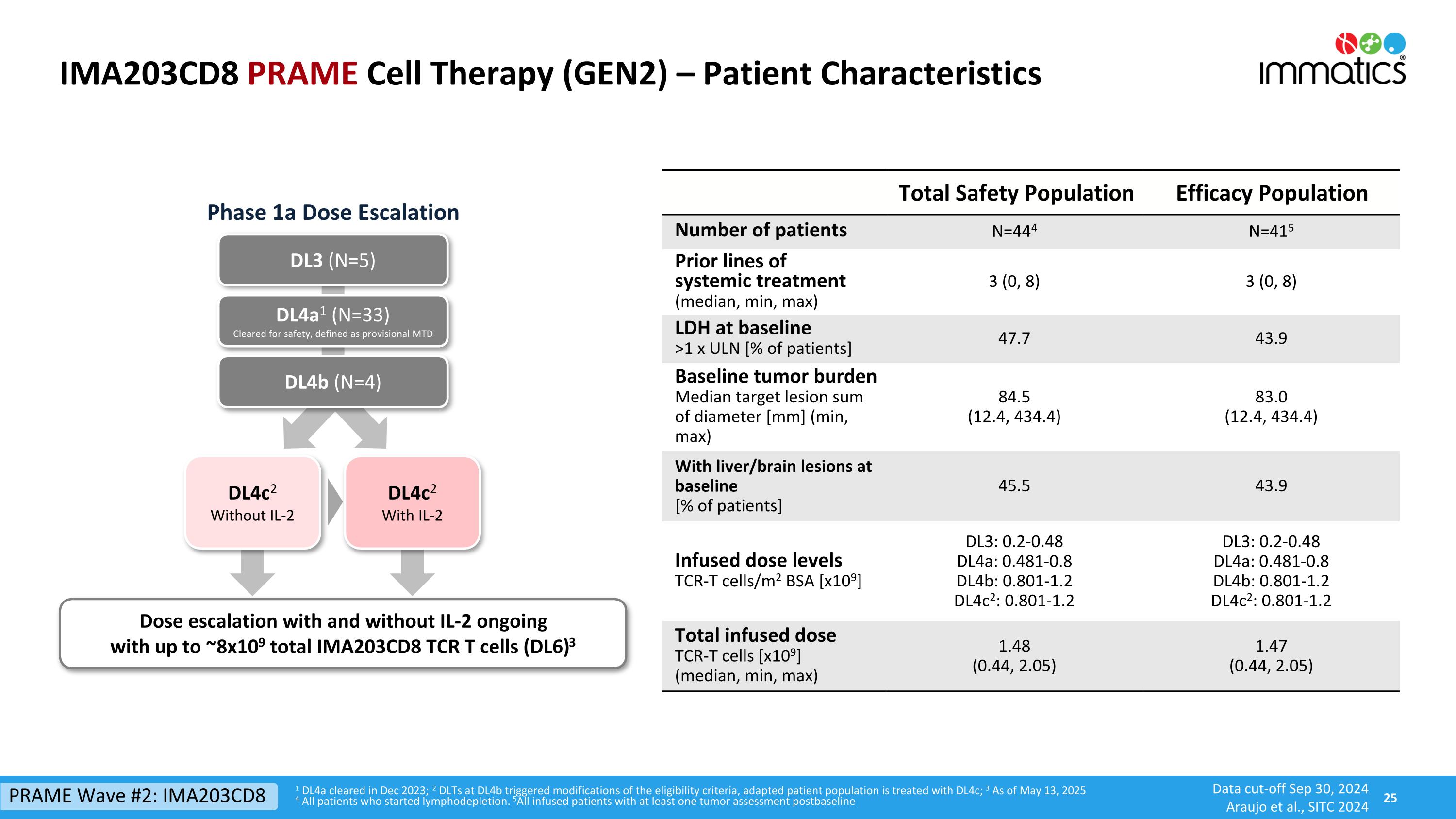

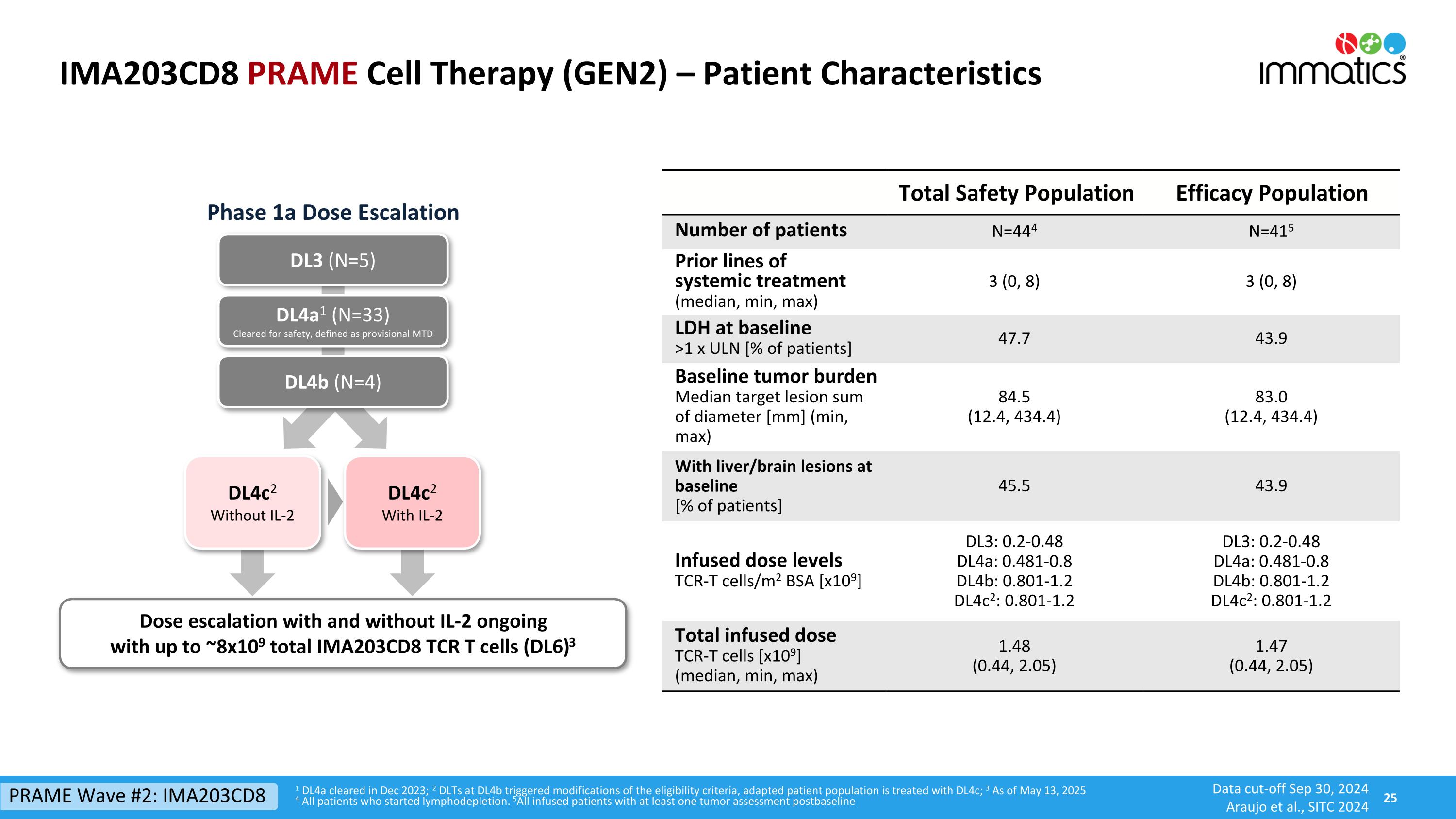

IMA203CD8 PRAME Cell Therapy (GEN2) – Patient Characteristics 1 DL4a cleared in Dec 2023; 2 DLTs at DL4b triggered modifications of the eligibility criteria, adapted patient population is treated with DL4c; 3 As of May 13, 2025 4 All patients who started lymphodepletion. 5All infused patients with at least one tumor assessment postbaseline DL3 (N=5) DL4a1 (N=33) Cleared for safety, defined as provisional MTD Dose escalation with and without IL-2 ongoing with up to ~8x109 total IMA203CD8 TCR T cells (DL6)3 DL4b (N=4) Phase 1a Dose Escalation Total Safety Population Efficacy Population Number of patients N=444 N=415 Prior lines of systemic treatment (median, min, max) 3 (0, 8) 3 (0, 8) LDH at baseline >1 x ULN [% of patients] 47.7 43.9 Baseline tumor burden Median target lesion sum of diameter [mm] (min, max) 84.5 (12.4, 434.4) 83.0 (12.4, 434.4) With liver/brain lesions at baseline [% of patients] 45.5 43.9 Infused dose levelsTCR-T cells/m2 BSA [x109] DL3: 0.2-0.48 DL4a: 0.481-0.8 DL4b: 0.801-1.2 DL4c2: 0.801-1.2 DL3: 0.2-0.48 DL4a: 0.481-0.8 DL4b: 0.801-1.2 DL4c2: 0.801-1.2 Total infused doseTCR-T cells [x109] (median, min, max) 1.48 (0.44, 2.05) 1.47 (0.44, 2.05) PRAME Wave #2: IMA203CD8 DL4c2 Without IL-2 DL4c2 With IL-2 Data cut-off Sep 30, 2024 Araujo et al., SITC 2024

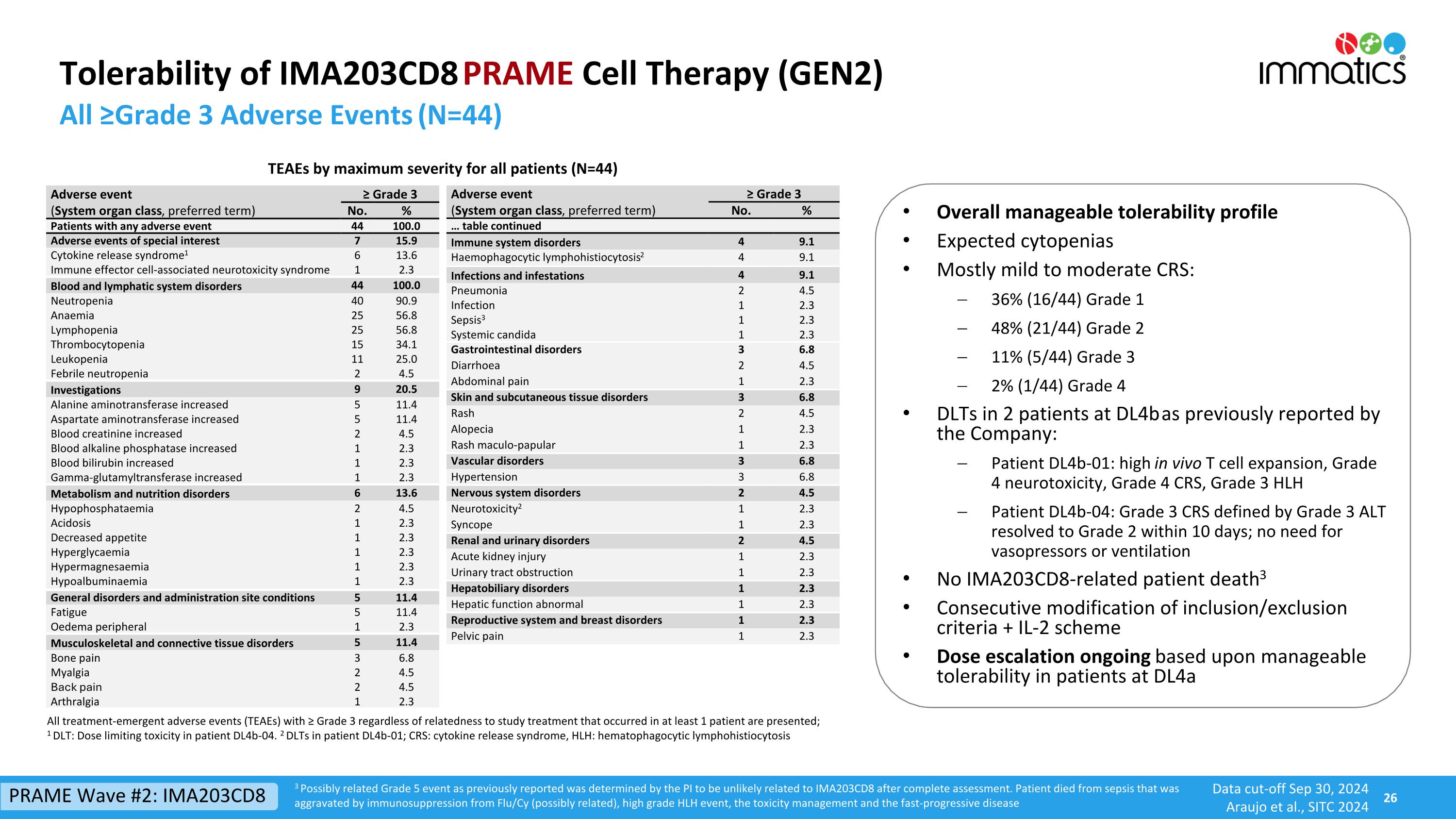

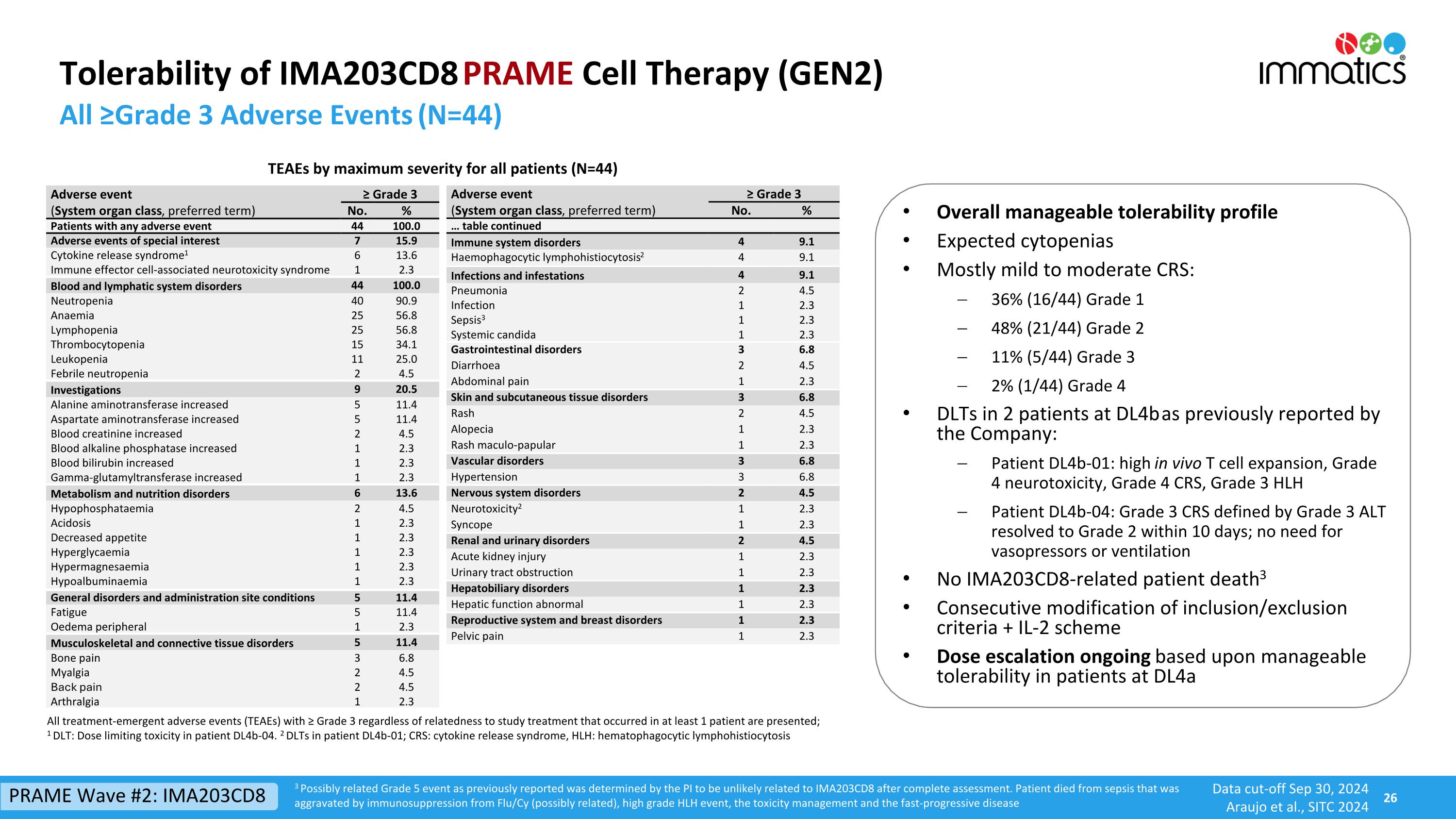

Tolerability of IMA203CD8 PRAME Cell Therapy (GEN2) All ≥Grade 3 Adverse Events (N=44) Adverse event ≥ Grade 3 (System organ class, preferred term) No. % Patients with any adverse event 44 100.0 Adverse events of special interest 7 15.9 Cytokine release syndrome1 6 13.6 Immune effector cell-associated neurotoxicity syndrome 1 2.3 Blood and lymphatic system disorders 44 100.0 Neutropenia 40 90.9 Anaemia 25 56.8 Lymphopenia 25 56.8 Thrombocytopenia 15 34.1 Leukopenia 11 25.0 Febrile neutropenia 2 4.5 Investigations 9 20.5 Alanine aminotransferase increased 5 11.4 Aspartate aminotransferase increased 5 11.4 Blood creatinine increased 2 4.5 Blood alkaline phosphatase increased 1 2.3 Blood bilirubin increased 1 2.3 Gamma-glutamyltransferase increased 1 2.3 Metabolism and nutrition disorders 6 13.6 Hypophosphataemia 2 4.5 Acidosis 1 2.3 Decreased appetite 1 2.3 Hyperglycaemia 1 2.3 Hypermagnesaemia 1 2.3 Hypoalbuminaemia 1 2.3 General disorders and administration site conditions 5 11.4 Fatigue 5 11.4 Oedema peripheral 1 2.3 Musculoskeletal and connective tissue disorders 5 11.4 Bone pain 3 6.8 Myalgia 2 4.5 Back pain 2 4.5 Arthralgia 1 2.3 TEAEs by maximum severity for all patients (N=44) Adverse event ≥ Grade 3 (System organ class, preferred term) No. % … table continued Immune system disorders 4 9.1 Haemophagocytic lymphohistiocytosis2 4 9.1 Infections and infestations 4 9.1 Pneumonia 2 4.5 Infection 1 2.3 Sepsis3 1 2.3 Systemic candida 1 2.3 Gastrointestinal disorders 3 6.8 Diarrhoea 2 4.5 Abdominal pain 1 2.3 Skin and subcutaneous tissue disorders 3 6.8 Rash 2 4.5 Alopecia 1 2.3 Rash maculo-papular 1 2.3 Vascular disorders 3 6.8 Hypertension 3 6.8 Nervous system disorders 2 4.5 Neurotoxicity2 1 2.3 Syncope 1 2.3 Renal and urinary disorders 2 4.5 Acute kidney injury 1 2.3 Urinary tract obstruction 1 2.3 Hepatobiliary disorders 1 2.3 Hepatic function abnormal 1 2.3 Reproductive system and breast disorders 1 2.3 Pelvic pain 1 2.3 All treatment-emergent adverse events (TEAEs) with ≥ Grade 3 regardless of relatedness to study treatment that occurred in at least 1 patient are presented; 1 DLT: Dose limiting toxicity in patient DL4b-04. 2 DLTs in patient DL4b-01; CRS: cytokine release syndrome, HLH: hematophagocytic lymphohistiocytosis Overall manageable tolerability profile Expected cytopenias Mostly mild to moderate CRS: 36% (16/44) Grade 1 48% (21/44) Grade 2 11% (5/44) Grade 3 2% (1/44) Grade 4 DLTs in 2 patients at DL4b as previously reported by the Company: Patient DL4b-01: high in vivo T cell expansion, Grade 4 neurotoxicity, Grade 4 CRS, Grade 3 HLH Patient DL4b-04: Grade 3 CRS defined by Grade 3 ALT resolved to Grade 2 within 10 days; no need for vasopressors or ventilation No IMA203CD8-related patient death3 Consecutive modification of inclusion/exclusion criteria + IL-2 scheme Dose escalation ongoing based upon manageable tolerability in patients at DL4a 3 Possibly related Grade 5 event as previously reported was determined by the PI to be unlikely related to IMA203CD8 after complete assessment. Patient died from sepsis that was aggravated by immunosuppression from Flu/Cy (possibly related), high grade HLH event, the toxicity management and the fast-progressive disease PRAME Wave #2: IMA203CD8 Data cut-off Sep 30, 2024 Araujo et al., SITC 2024

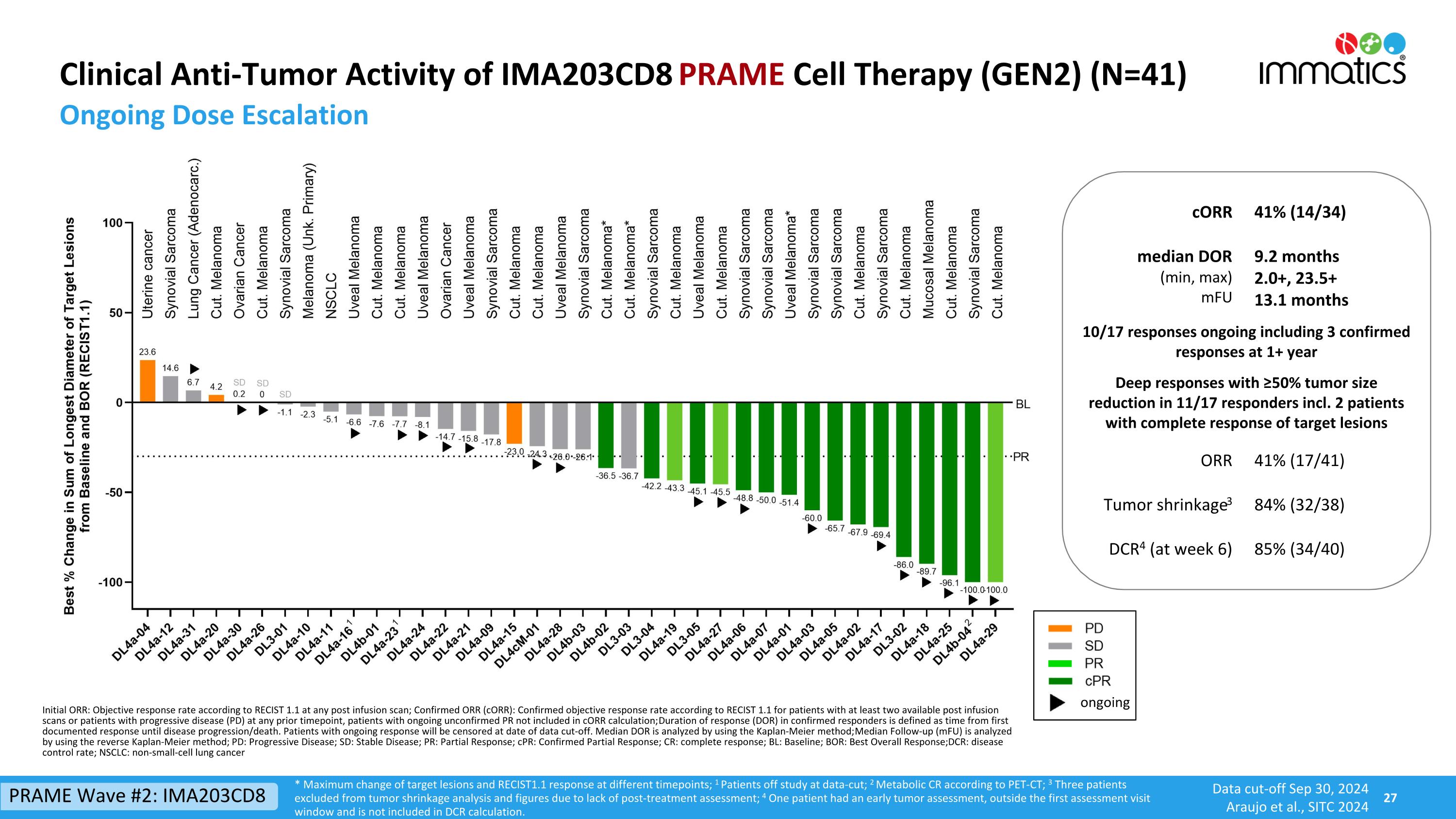

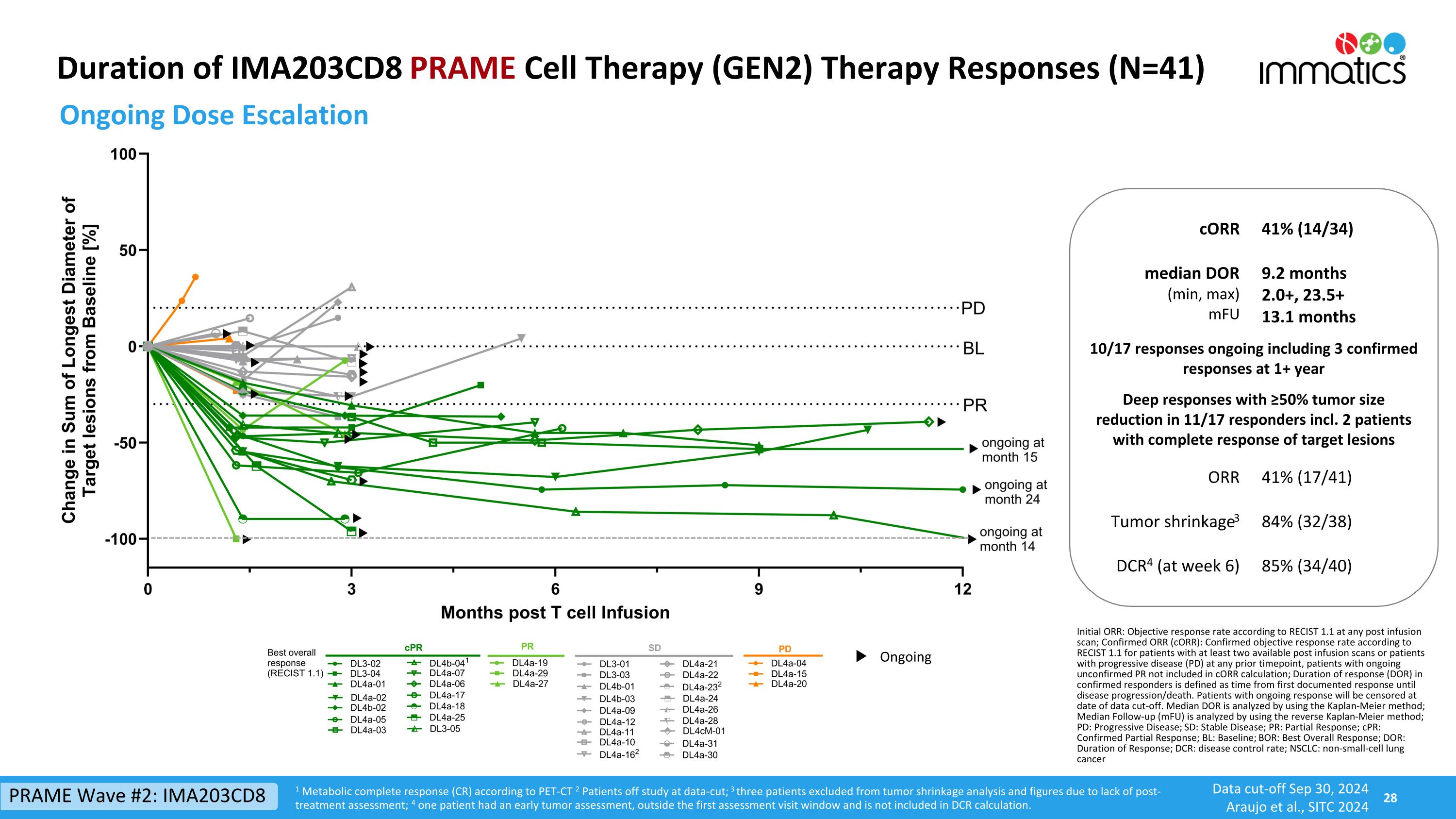

Clinical Anti-Tumor Activity of IMA203CD8 PRAME Cell Therapy (GEN2) (N=41) Ongoing Dose Escalation cORR 41% (14/34) median DOR (min, max) mFU 9.2 months 2.0+, 23.5+ 13.1 months 10/17 responses ongoing including 3 confirmed responses at 1+ year Deep responses with ≥50% tumor size reduction in 11/17 responders incl. 2 patients with complete response of target lesions ORR 41% (17/41) Tumor shrinkage3 84% (32/38) DCR4 (at week 6) 85% (34/40) ongoing * Maximum change of target lesions and RECIST1.1 response at different timepoints; 1 Patients off study at data-cut; 2 Metabolic CR according to PET-CT; 3 Three patients excluded from tumor shrinkage analysis and figures due to lack of post-treatment assessment; 4 One patient had an early tumor assessment, outside the first assessment visit window and is not included in DCR calculation. Initial ORR: Objective response rate according to RECIST 1.1 at any post infusion scan; Confirmed ORR (cORR): Confirmed objective response rate according to RECIST 1.1 for patients with at least two available post infusion scans or patients with progressive disease (PD) at any prior timepoint, patients with ongoing unconfirmed PR not included in cORR calculation; Duration of response (DOR) in confirmed responders is defined as time from first documented response until disease progression/death. Patients with ongoing response will be censored at date of data cut-off. Median DOR is analyzed by using the Kaplan-Meier method; Median Follow-up (mFU) is analyzed by using the reverse Kaplan-Meier method; PD: Progressive Disease; SD: Stable Disease; PR: Partial Response; cPR: Confirmed Partial Response; CR: complete response; BL: Baseline; BOR: Best Overall Response; DCR: disease control rate; NSCLC: non-small-cell lung cancer PRAME Wave #2: IMA203CD8 Data cut-off Sep 30, 2024 Araujo et al., SITC 2024

Duration of IMA203CD8 PRAME Cell Therapy (GEN2) Therapy Responses (N=41) Ongoing Dose Escalation 1 Metabolic complete response (CR) according to PET-CT 2 Patients off study at data-cut; 3 three patients excluded from tumor shrinkage analysis and figures due to lack of post-treatment assessment; 4 one patient had an early tumor assessment, outside the first assessment visit window and is not included in DCR calculation. cORR 41% (14/34) median DOR (min, max) mFU 9.2 months 2.0+, 23.5+ 13.1 months 10/17 responses ongoing including 3 confirmed responses at 1+ year Deep responses with ≥50% tumor size reduction in 11/17 responders incl. 2 patients with complete response of target lesions ORR 41% (17/41) Tumor shrinkage3 84% (32/38) DCR4 (at week 6) 85% (34/40) Initial ORR: Objective response rate according to RECIST 1.1 at any post infusion scan; Confirmed ORR (cORR): Confirmed objective response rate according to RECIST 1.1 for patients with at least two available post infusion scans or patients with progressive disease (PD) at any prior timepoint, patients with ongoing unconfirmed PR not included in cORR calculation; Duration of response (DOR) in confirmed responders is defined as time from first documented response until disease progression/death. Patients with ongoing response will be censored at date of data cut-off. Median DOR is analyzed by using the Kaplan-Meier method; Median Follow-up (mFU) is analyzed by using the reverse Kaplan-Meier method; PD: Progressive Disease; SD: Stable Disease; PR: Partial Response; cPR: Confirmed Partial Response; BL: Baseline; BOR: Best Overall Response; DOR: Duration of Response; DCR: disease control rate; NSCLC: non-small-cell lung cancer Ongoing PRAME Wave #2: IMA203CD8 Data cut-off Sep 30, 2024 Araujo et al., SITC 2024

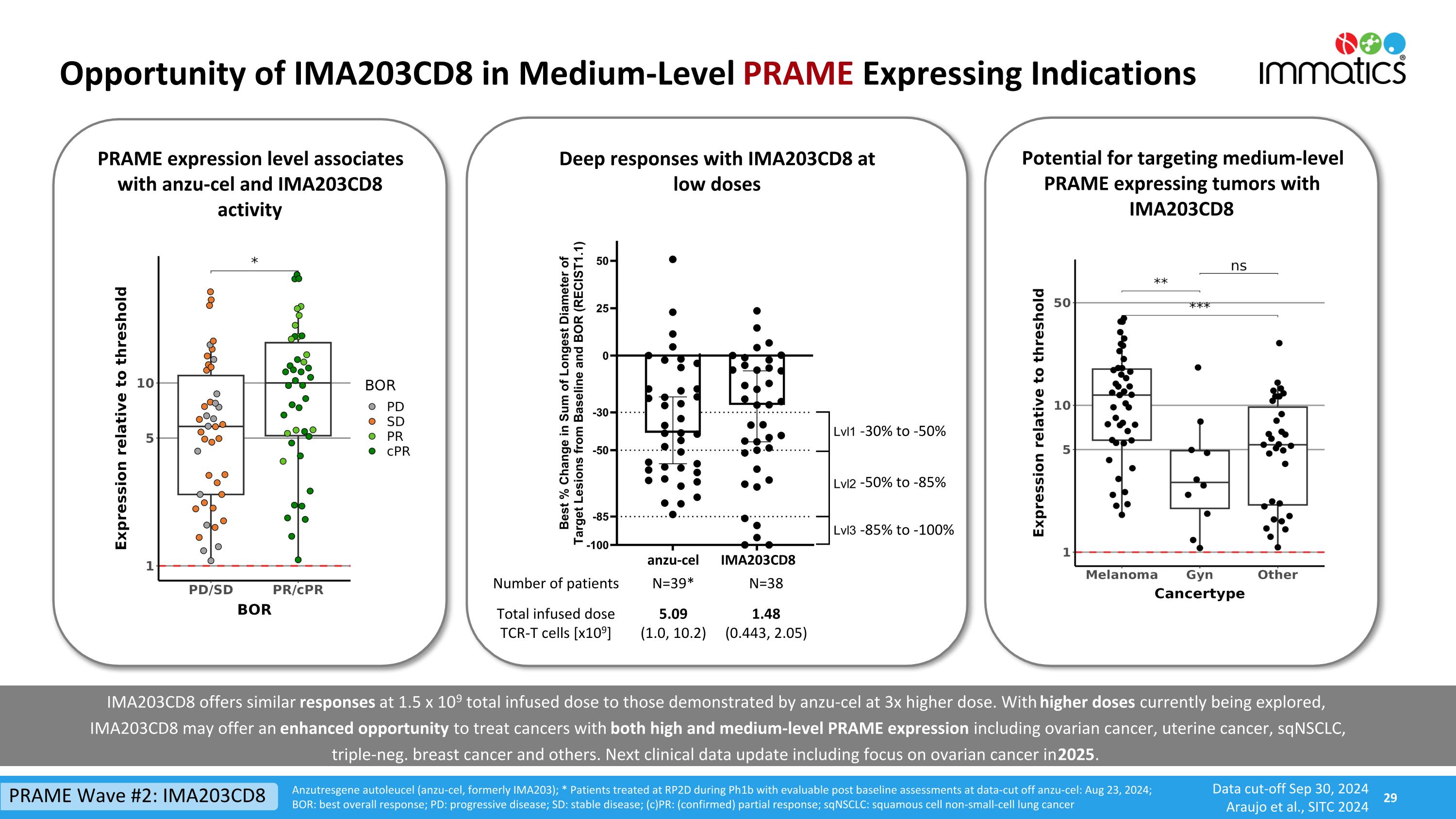

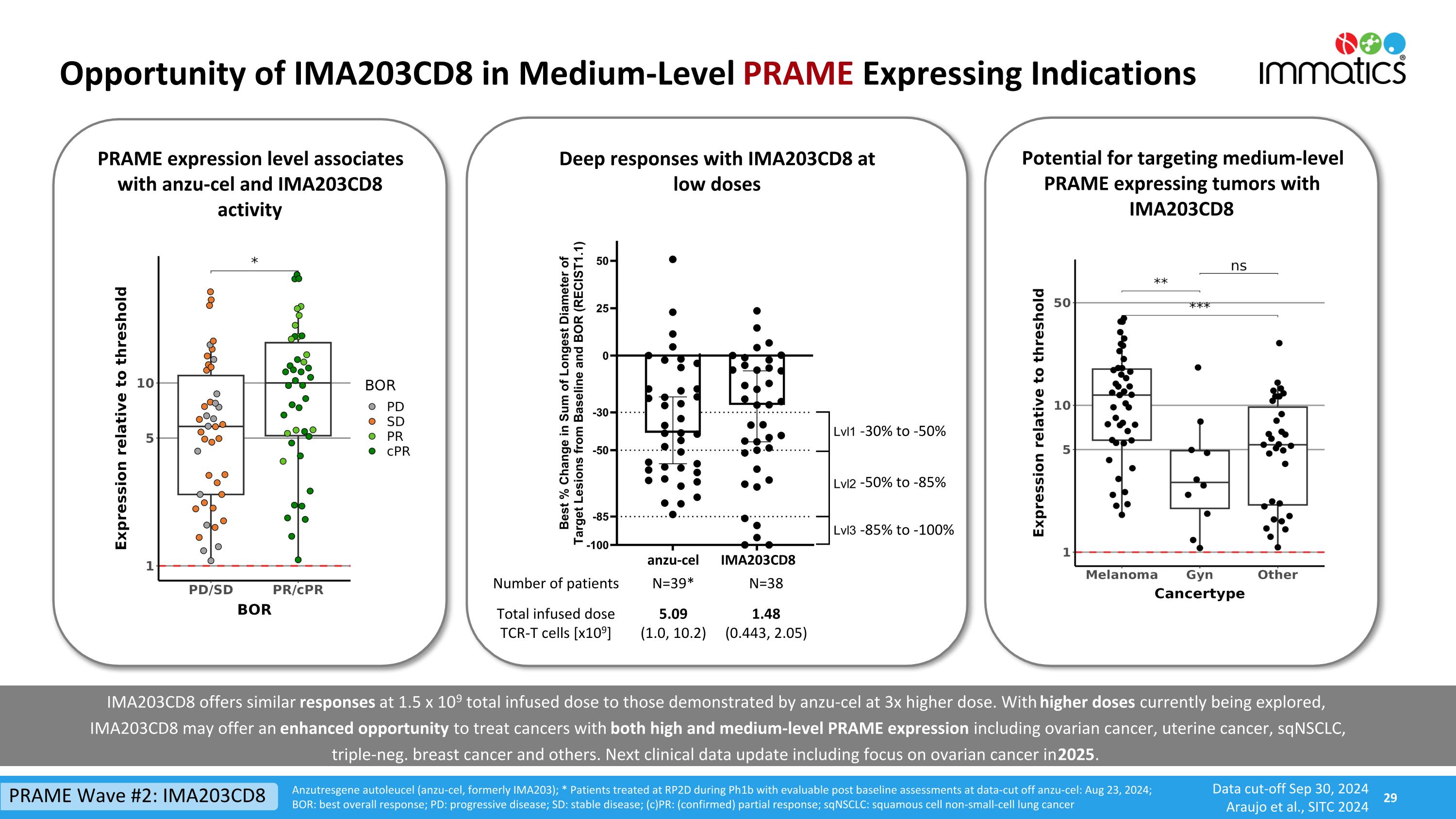

Opportunity of IMA203CD8 in Medium-Level PRAME Expressing Indications Anzutresgene autoleucel (anzu-cel, formerly IMA203); * Patients treated at RP2D during Ph1b with evaluable post baseline assessments at data-cut off anzu-cel: Aug 23, 2024; BOR: best overall response; PD: progressive disease; SD: stable disease; (c)PR: (confirmed) partial response; sqNSCLC: squamous cell non-small-cell lung cancer Number of patients N=39* N=38 Total infused doseTCR-T cells [x109] 5.09 (1.0, 10.2) 1.48 (0.443, 2.05) Deep responses with IMA203CD8 at low doses -30% to -50% -50% to -85% -85% to -100% PRAME expression level associates with anzu-cel and IMA203CD8 activity Potential for targeting medium-level PRAME expressing tumors with IMA203CD8 IMA203CD8 offers similar responses at 1.5 x 109 total infused dose to those demonstrated by anzu-cel at 3x higher dose. With higher doses currently being explored,IMA203CD8 may offer an enhanced opportunity to treat cancers with both high and medium-level PRAME expression including ovarian cancer, uterine cancer, sqNSCLC, triple-neg. breast cancer and others. Next clinical data update including focus on ovarian cancer in 2025. PRAME Wave #2: IMA203CD8 Data cut-off Sep 30, 2024 Araujo et al., SITC 2024 anzu-cel IMA203CD8

IMA402 PRAME Bispecific Expansion to Early-Stage PRAME Cancers PRAME Wave #3

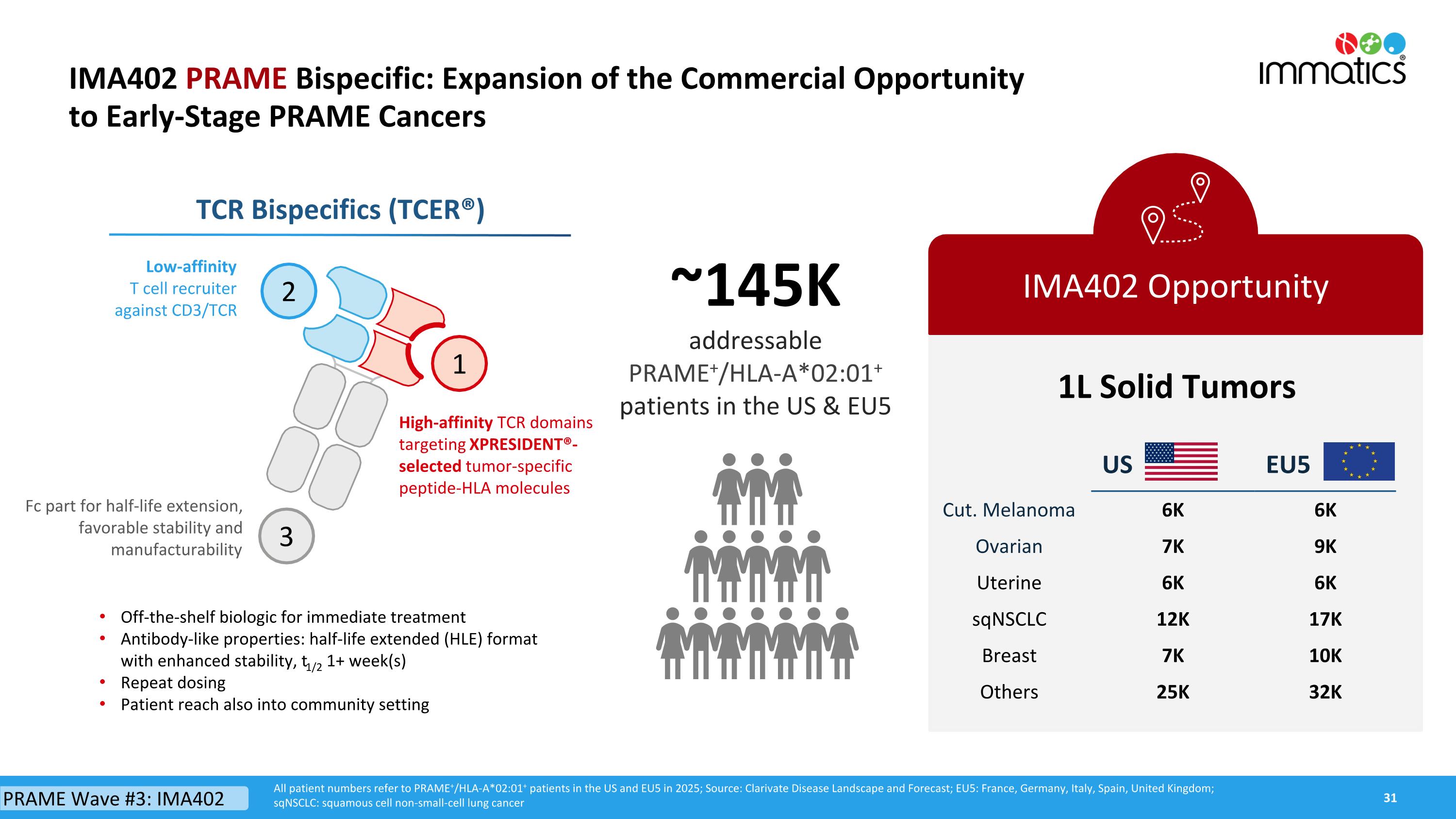

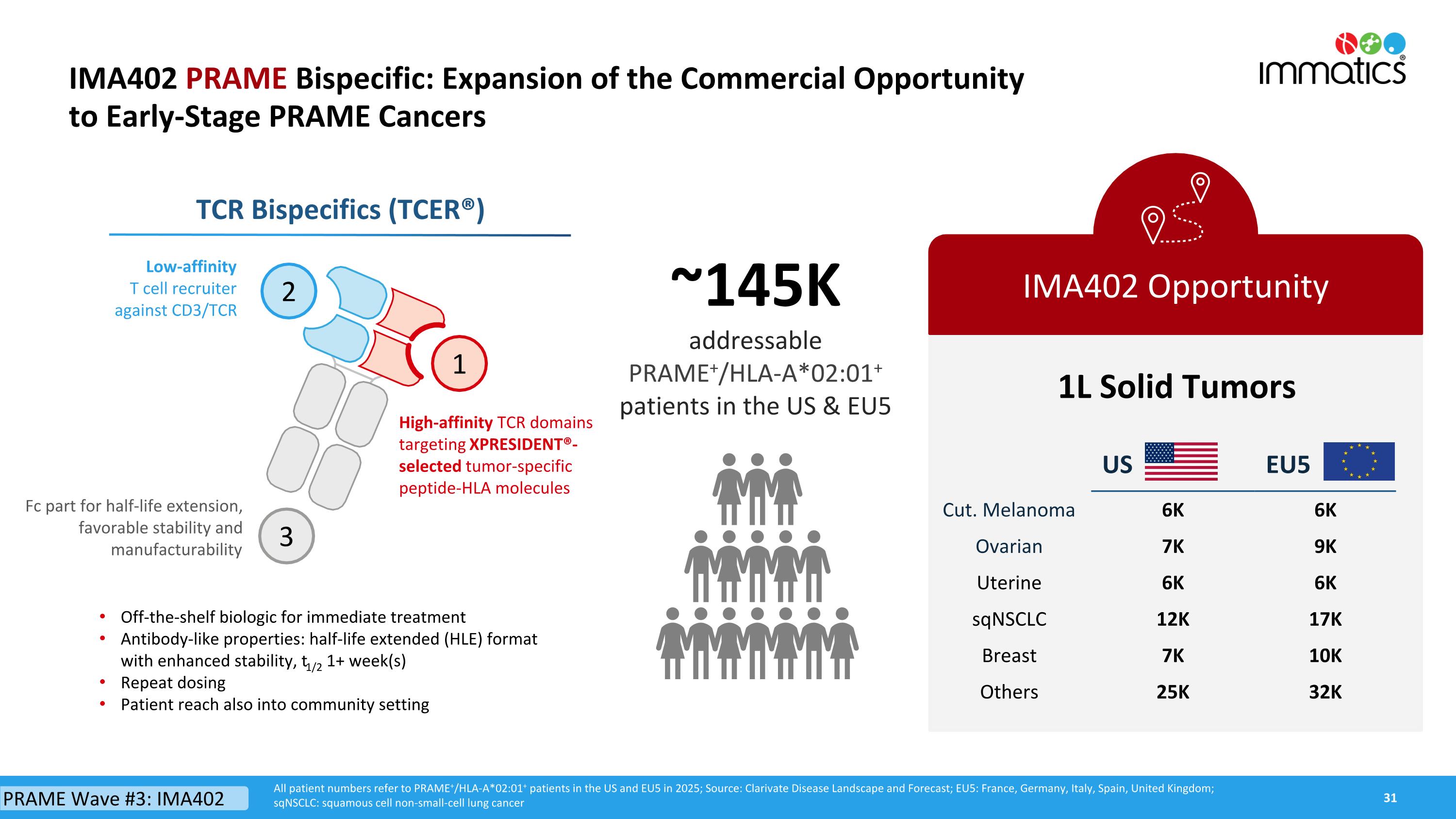

IMA402 PRAME Bispecific: Expansion of the Commercial Opportunity to Early-Stage PRAME Cancers IMA402 Opportunity All patient numbers refer to PRAME+/HLA-A*02:01+ patients in the US and EU5 in 2025; Source: Clarivate Disease Landscape and Forecast; EU5: France, Germany, Italy, Spain, United Kingdom; sqNSCLC: squamous cell non-small-cell lung cancer 1L Solid Tumors ~145Kaddressable PRAME+/HLA-A*02:01+ patients in the US & EU5 Off-the-shelf biologic for immediate treatment Antibody-like properties: half-life extended (HLE) format with enhanced stability, t1/2 1+ week(s) Repeat dosing Patient reach also into community setting TCR Bispecifics (TCER®) 2 1 3 Low-affinity T cell recruiter against CD3/TCR Fc part for half-life extension,favorable stability and manufacturability High-affinity TCR domains targeting XPRESIDENT®-selected tumor-specific peptide-HLA molecules PRAME Wave #3: IMA402 US EU5 Cut. Melanoma 6K 6K Ovarian 7K 9K Uterine 6K 6K sqNSCLC 12K 17K Breast 7K 10K Others 25K 32K

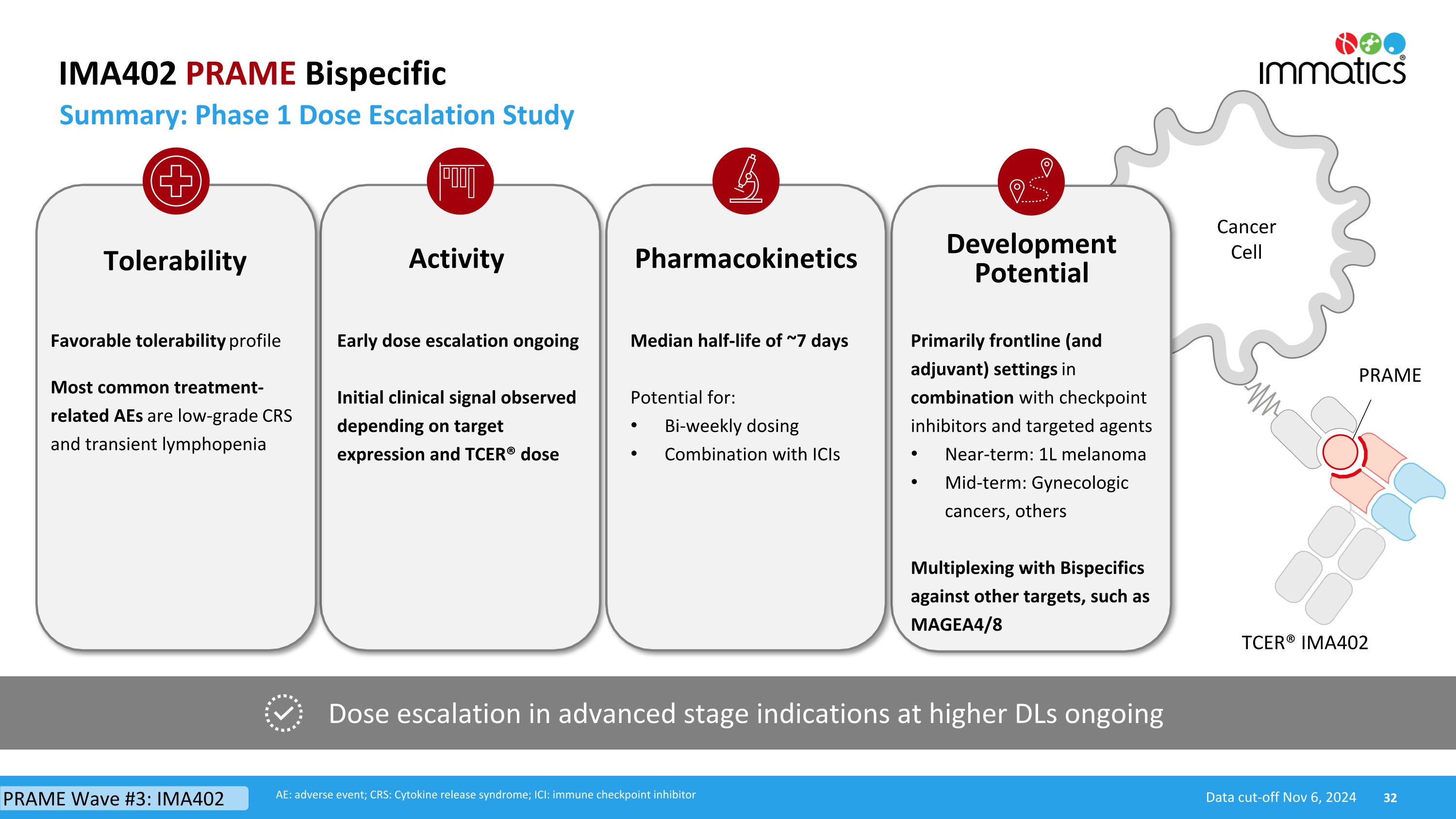

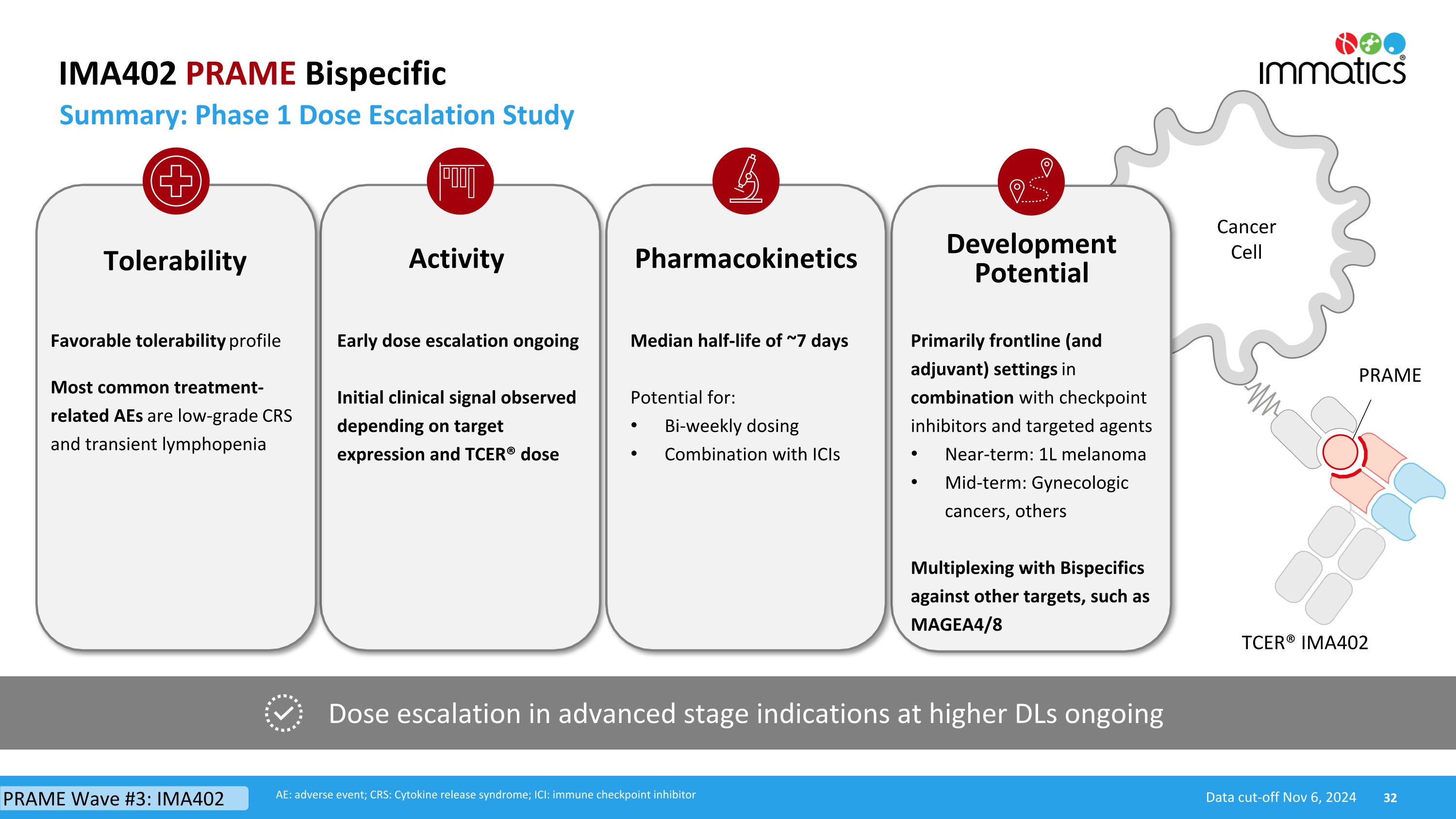

Cancer Cell IMA402 PRAME Bispecific Summary: Phase 1 Dose Escalation Study Dose escalation in advanced stage indications at higher DLs ongoing Tolerability Favorable tolerability profile Most common treatment-related AEs are low-grade CRS and transient lymphopenia Early dose escalation ongoing Initial clinical signal observed depending on target expression and TCER® dose Pharmacokinetics Median half-life of ~7 days Potential for: Bi-weekly dosing Combination with ICIs Activity Development Potential Primarily frontline (and adjuvant) settings in combination with checkpoint inhibitors and targeted agents Near-term: 1L melanoma Mid-term: Gynecologic cancers, others Multiplexing with Bispecifics against other targets, such as MAGEA4/8 AE: adverse event; CRS: Cytokine release syndrome; ICI: immune checkpoint inhibitor Data cut-off Nov 6, 2024 PRAME TCER® IMA402 PRAME Wave #3: IMA402

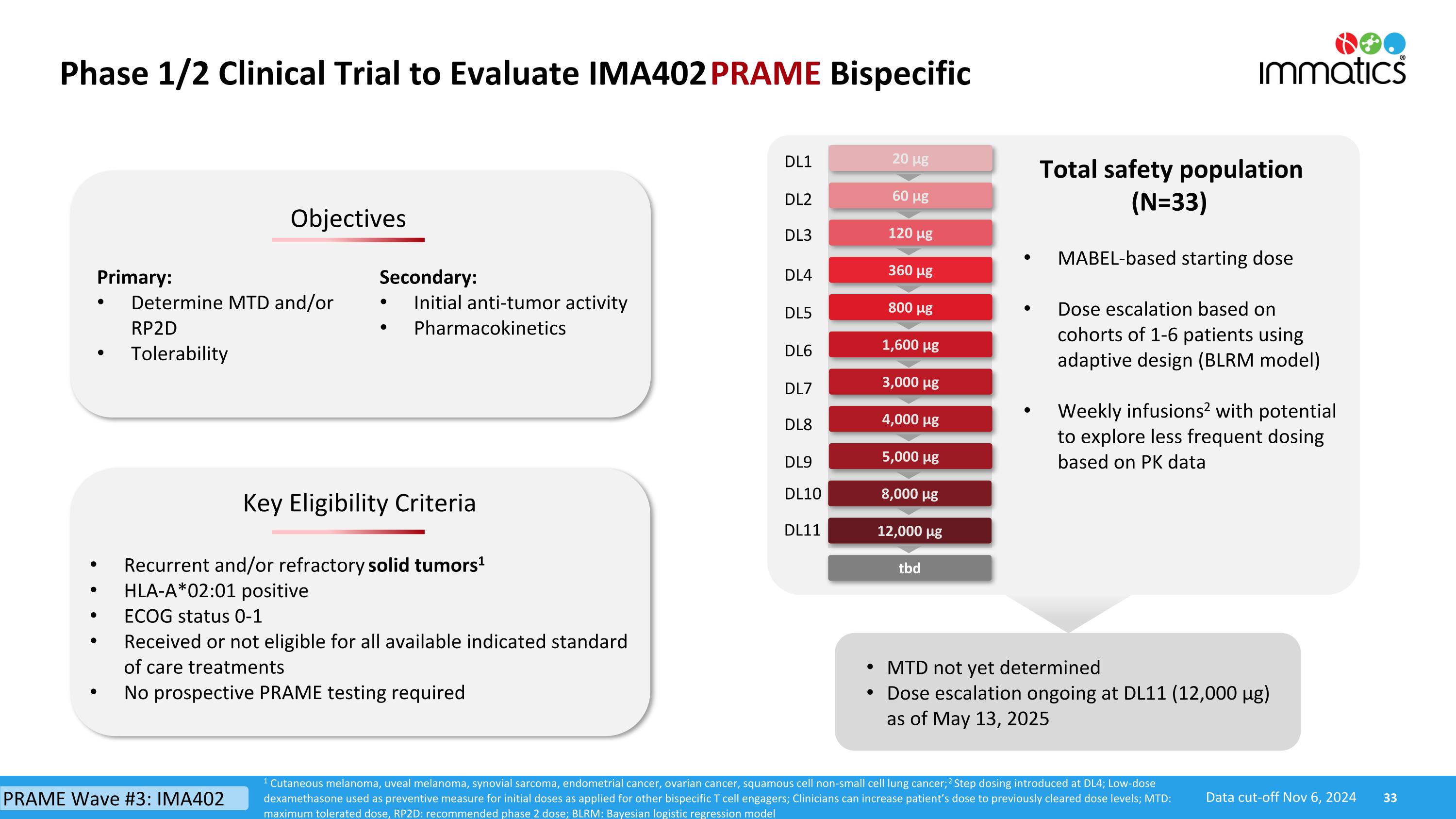

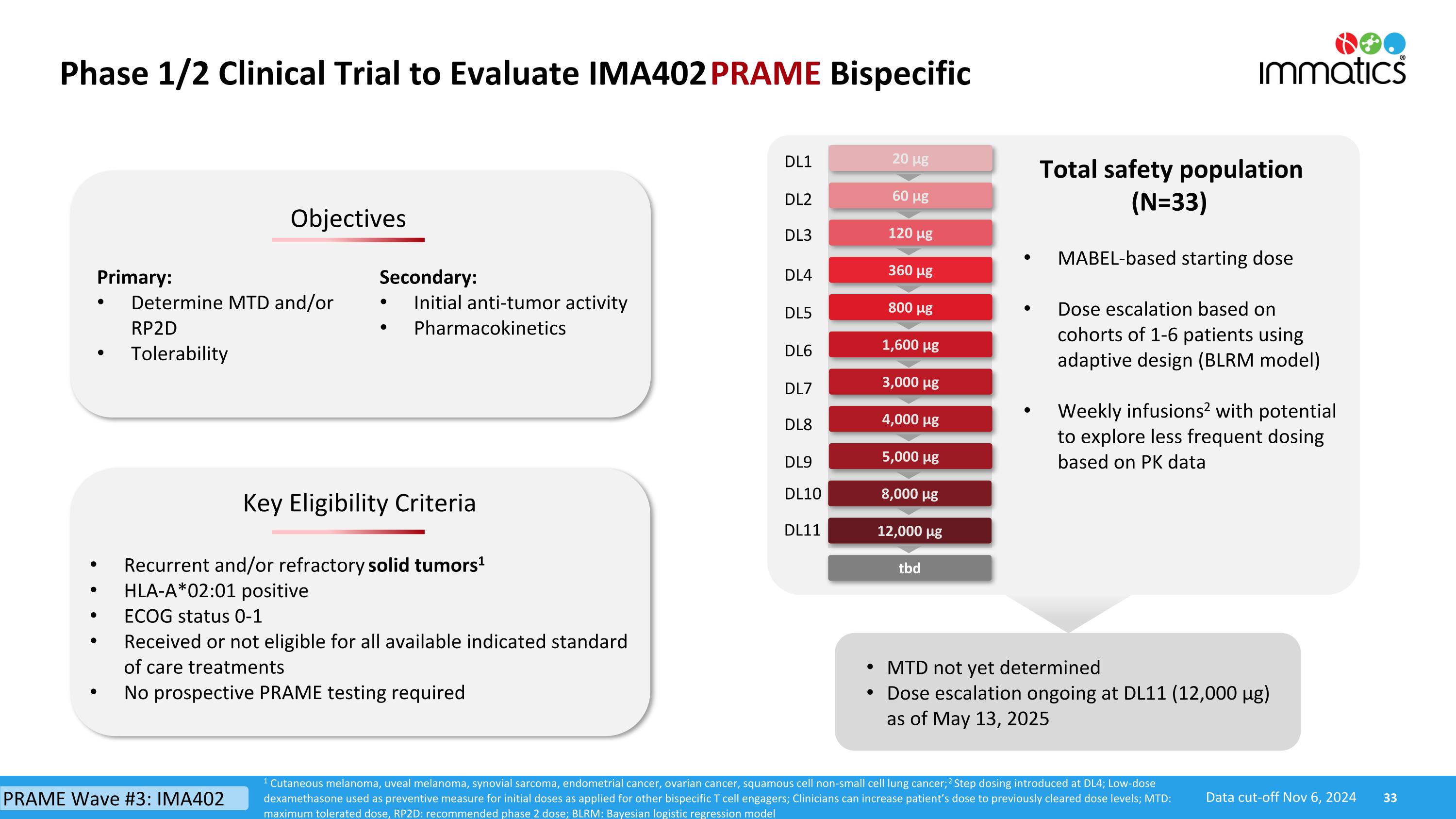

Phase 1/2 Clinical Trial to Evaluate IMA402 PRAME Bispecific 360 µg 800 µg 3,000 µg 5,000 µg 120 µg 1,600 µg 60 µg 20 µg DL1 DL2 DL3 DL4 DL5 DL7 DL9 DL6 8,000 µg 4,000 µg DL8 Key Eligibility Criteria Objectives Primary: Determine MTD and/or RP2D Tolerability Secondary: Initial anti-tumor activity Pharmacokinetics Recurrent and/or refractory solid tumors1 HLA-A*02:01 positive ECOG status 0-1 Received or not eligible for all available indicated standard of care treatments No prospective PRAME testing required Total safety population (N=33) MTD not yet determined Dose escalation ongoing at DL11 (12,000 µg) as of May 13, 2025 1 Cutaneous melanoma, uveal melanoma, synovial sarcoma, endometrial cancer, ovarian cancer, squamous cell non-small cell lung cancer; 2 Step dosing introduced at DL4; Low-dose dexamethasone used as preventive measure for initial doses as applied for other bispecific T cell engagers; Clinicians can increase patient’s dose to previously cleared dose levels; MTD: maximum tolerated dose, RP2D: recommended phase 2 dose; BLRM: Bayesian logistic regression model PRAME Wave #3: IMA402 Data cut-off Nov 6, 2024 MABEL-based starting dose Dose escalation based on cohorts of 1-6 patients using adaptive design (BLRM model) Weekly infusions2 with potential to explore less frequent dosing based on PK data DL10 12,000 µg DL11 tbd

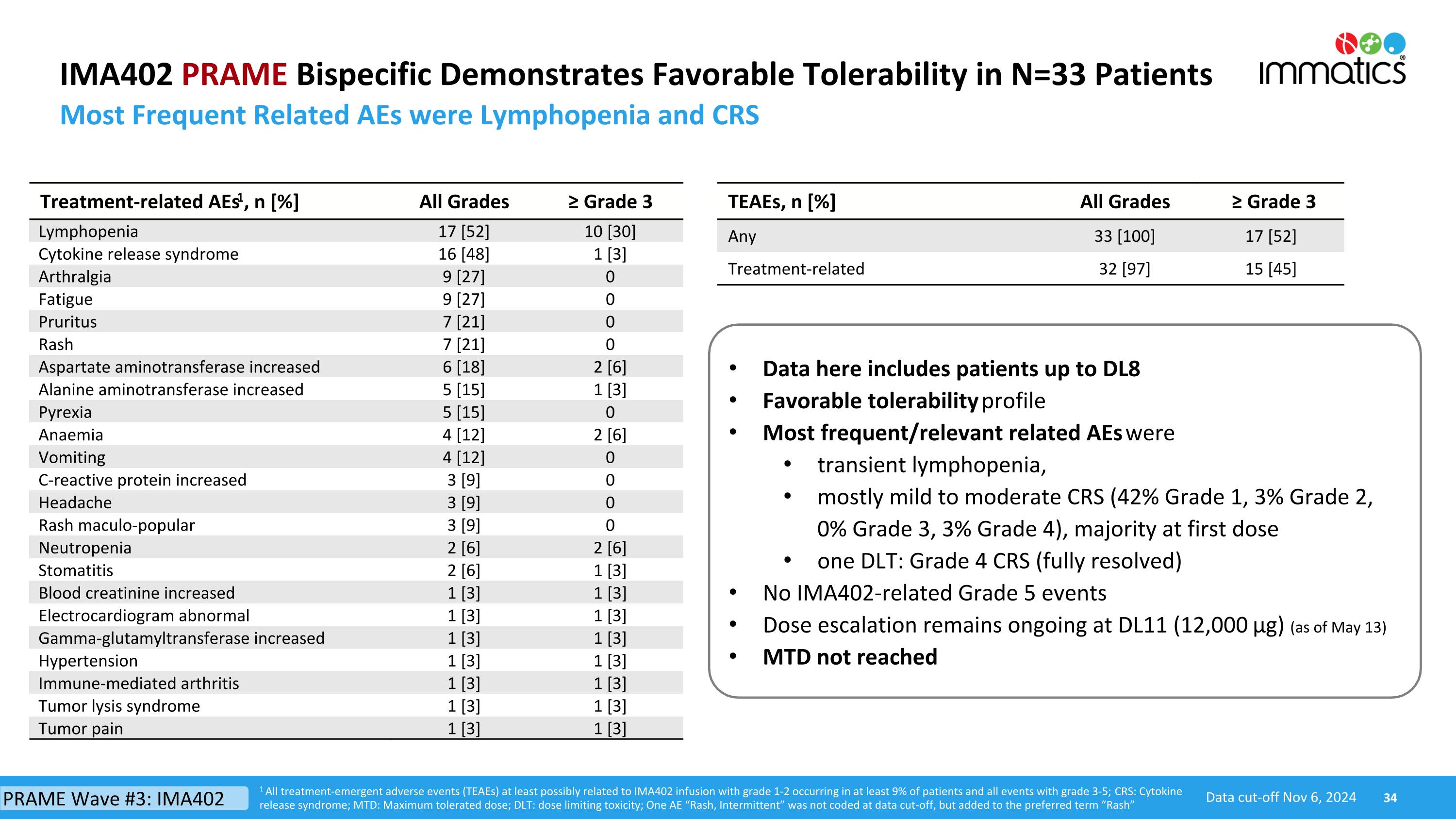

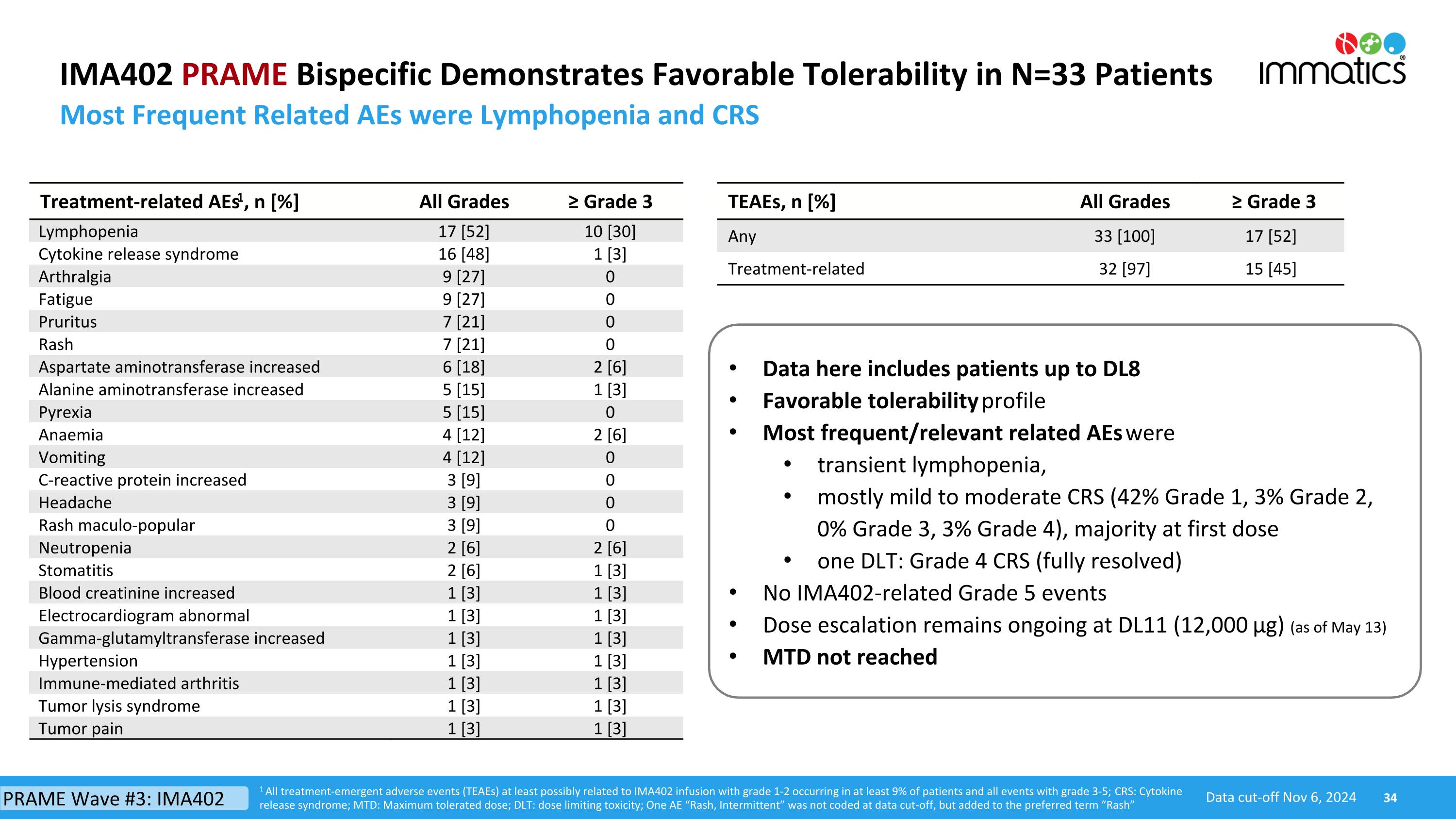

IMA402 PRAME Bispecific Demonstrates Favorable Tolerability in N=33 Patients Most Frequent Related AEs were Lymphopenia and CRS TEAEs, n [%] All Grades ≥ Grade 3 Any 33 [100] 17 [52] Treatment-related 32 [97] 15 [45] Treatment-related AEs1, n [%] All Grades ≥ Grade 3 Lymphopenia 17 [52] 10 [30] Cytokine release syndrome 16 [48] 1 [3] Arthralgia 9 [27] 0 Fatigue 9 [27] 0 Pruritus 7 [21] 0 Rash 7 [21] 0 Aspartate aminotransferase increased 6 [18] 2 [6] Alanine aminotransferase increased 5 [15] 1 [3] Pyrexia 5 [15] 0 Anaemia 4 [12] 2 [6] Vomiting 4 [12] 0 C-reactive protein increased 3 [9] 0 Headache 3 [9] 0 Rash maculo-popular 3 [9] 0 Neutropenia 2 [6] 2 [6] Stomatitis 2 [6] 1 [3] Blood creatinine increased 1 [3] 1 [3] Electrocardiogram abnormal 1 [3] 1 [3] Gamma-glutamyltransferase increased 1 [3] 1 [3] Hypertension 1 [3] 1 [3] Immune-mediated arthritis 1 [3] 1 [3] Tumor lysis syndrome 1 [3] 1 [3] Tumor pain 1 [3] 1 [3] Data here includes patients up to DL8 Favorable tolerability profile Most frequent/relevant related AEs were transient lymphopenia, mostly mild to moderate CRS (42% Grade 1, 3% Grade 2, 0% Grade 3, 3% Grade 4), majority at first dose one DLT: Grade 4 CRS (fully resolved) No IMA402-related Grade 5 events Dose escalation remains ongoing at DL11 (12,000 µg) (as of May 13) MTD not reached 1 All treatment-emergent adverse events (TEAEs) at least possibly related to IMA402 infusion with grade 1-2 occurring in at least 9% of patients and all events with grade 3-5; CRS: Cytokine release syndrome; MTD: Maximum tolerated dose; DLT: dose limiting toxicity; One AE “Rash, Intermittent” was not coded at data cut-off, but added to the preferred term “Rash” Data cut-off Nov 6, 2024 PRAME Wave #3: IMA402

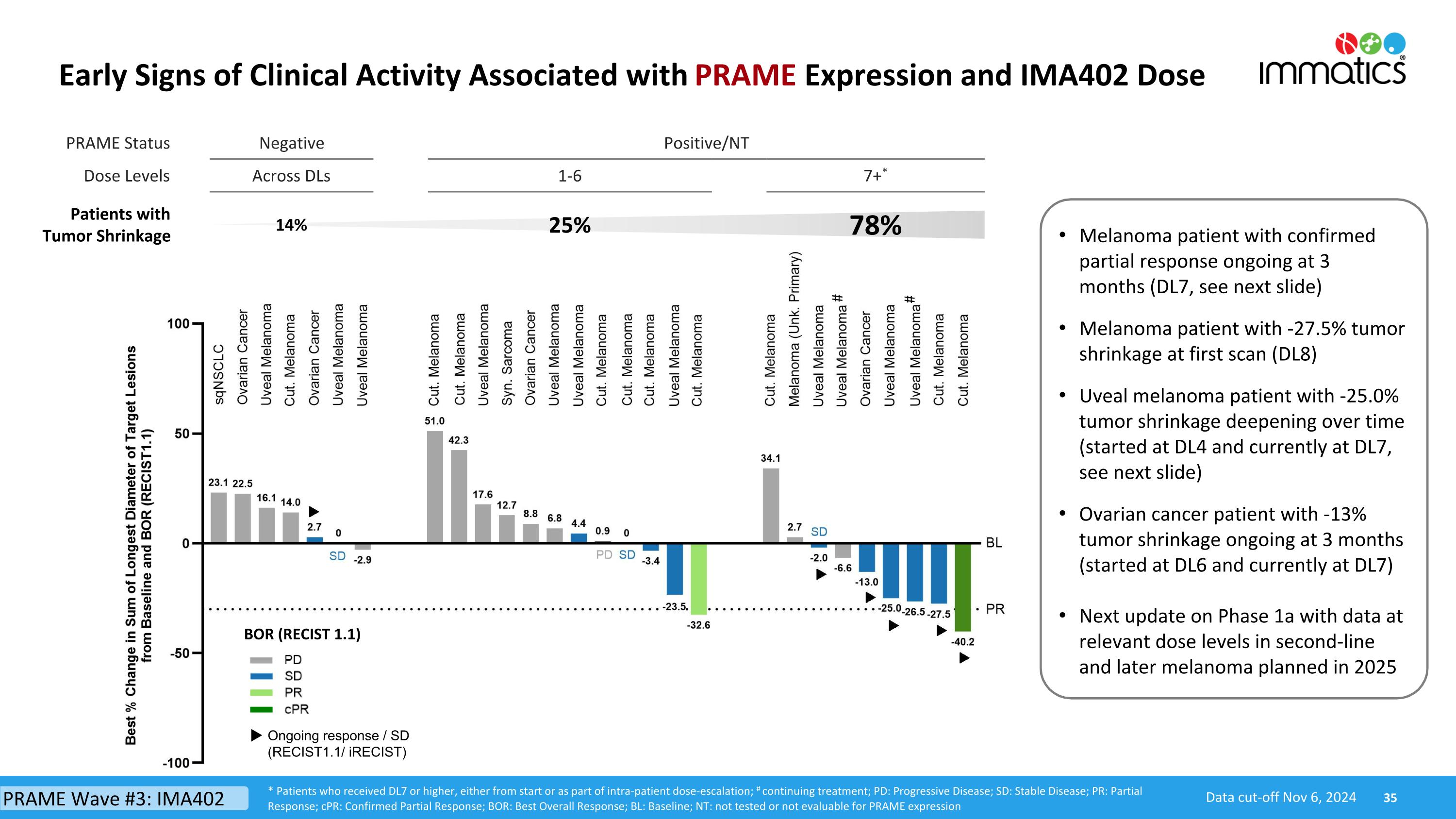

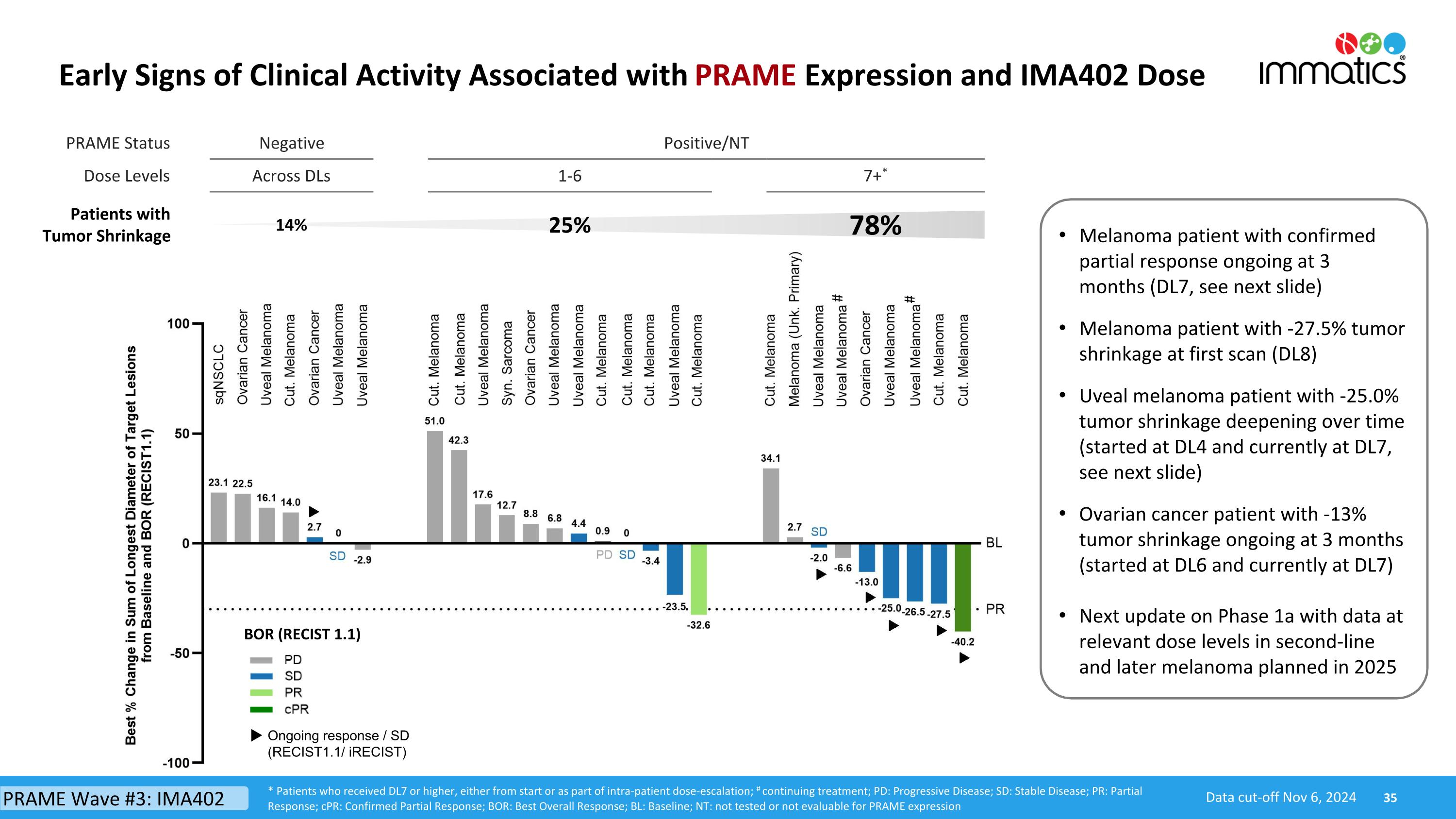

PRAME Status Negative Positive/NT Dose Levels Across DLs 1-6 7+* Patients with Tumor Shrinkage 14% 25% 78% Early Signs of Clinical Activity Associated with PRAME Expression and IMA402 Dose BOR (RECIST 1.1) Ongoing response / SD (RECIST1.1/ iRECIST) Data cut-off Nov 6, 2024 * Patients who received DL7 or higher, either from start or as part of intra-patient dose-escalation; # continuing treatment; PD: Progressive Disease; SD: Stable Disease; PR: Partial Response; cPR: Confirmed Partial Response; BOR: Best Overall Response; BL: Baseline; NT: not tested or not evaluable for PRAME expression # # Melanoma patient with confirmed partial response ongoing at 3 months (DL7, see next slide) Melanoma patient with -27.5% tumor shrinkage at first scan (DL8) Uveal melanoma patient with -25.0% tumor shrinkage deepening over time (started at DL4 and currently at DL7, see next slide) Ovarian cancer patient with -13% tumor shrinkage ongoing at 3 months (started at DL6 and currently at DL7) Next update on Phase 1a with data at relevant dose levels in second-line and later melanoma planned in 2025 PRAME Wave #3: IMA402

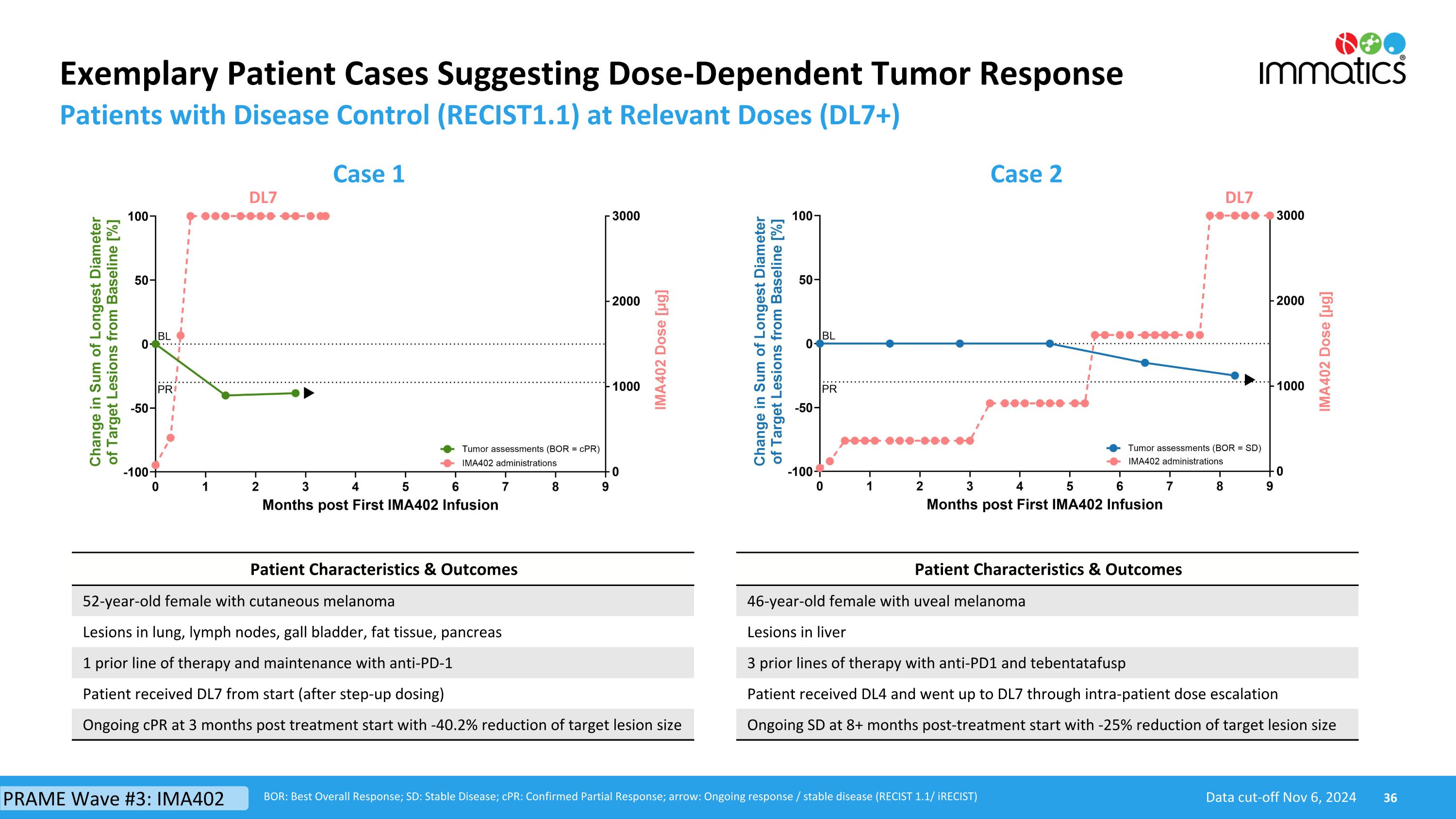

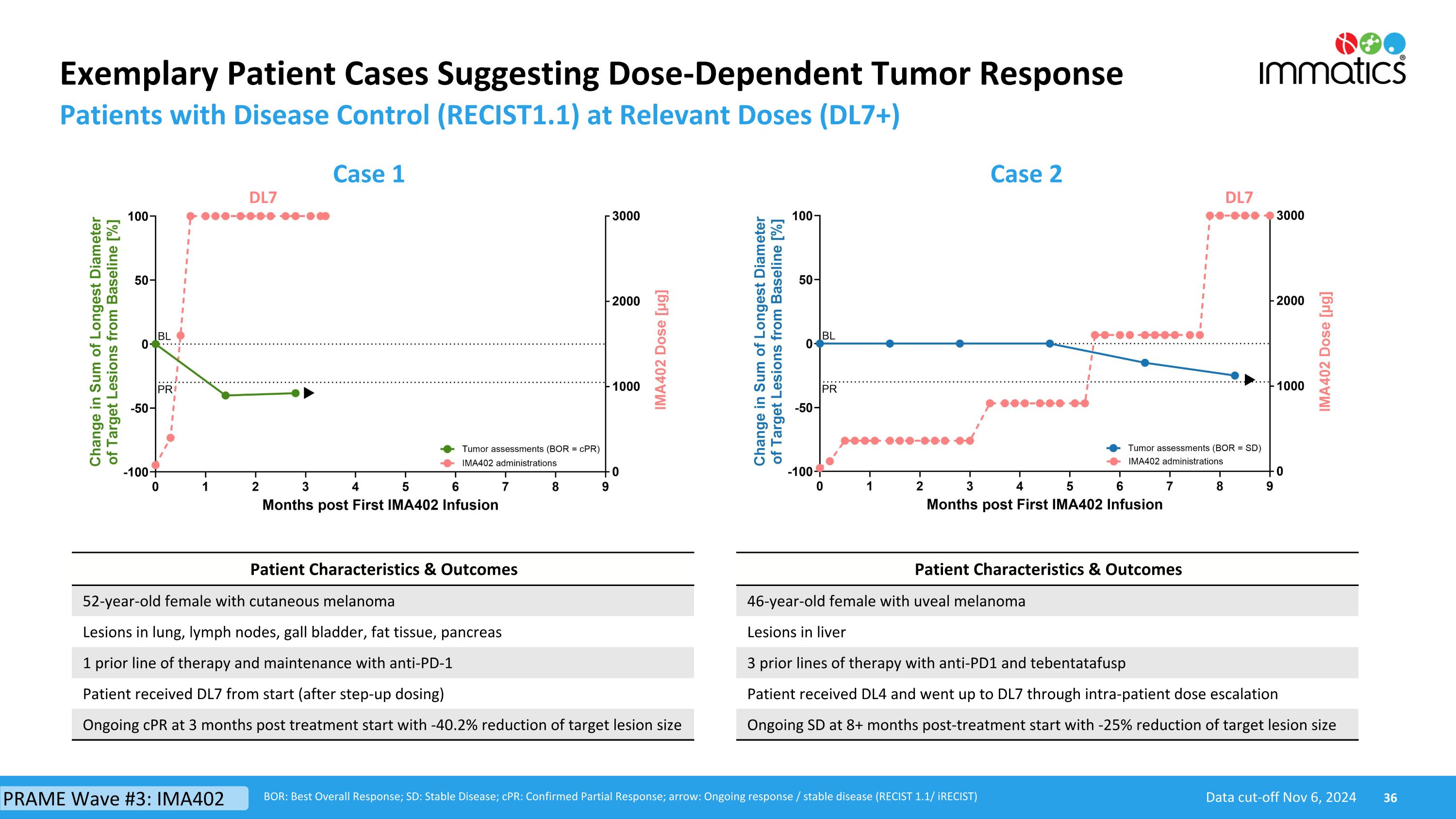

Exemplary Patient Cases Suggesting Dose-Dependent Tumor Response Patients with Disease Control (RECIST1.1) at Relevant Doses (DL7+) Data cut-off Nov 6, 2024 BOR: Best Overall Response; SD: Stable Disease; cPR: Confirmed Partial Response; arrow: Ongoing response / stable disease (RECIST 1.1/ iRECIST) Case 1 Case 2 DL7 DL7 Patient Characteristics & Outcomes 52-year-old female with cutaneous melanoma Lesions in lung, lymph nodes, gall bladder, fat tissue, pancreas 1 prior line of therapy and maintenance with anti-PD-1 Patient received DL7 from start (after step-up dosing) Ongoing cPR at 3 months post treatment start with -40.2% reduction of target lesion size Patient Characteristics & Outcomes 46-year-old female with uveal melanoma Lesions in liver 3 prior lines of therapy with anti-PD1 and tebentatafusp Patient received DL4 and went up to DL7 through intra-patient dose escalation Ongoing SD at 8+ months post-treatment start with -25% reduction of target lesion size PRAME Wave #3: IMA402

IMA401 MAGEA4/8 Bispecific Driving Innovation beyond PRAME beyond PRAME

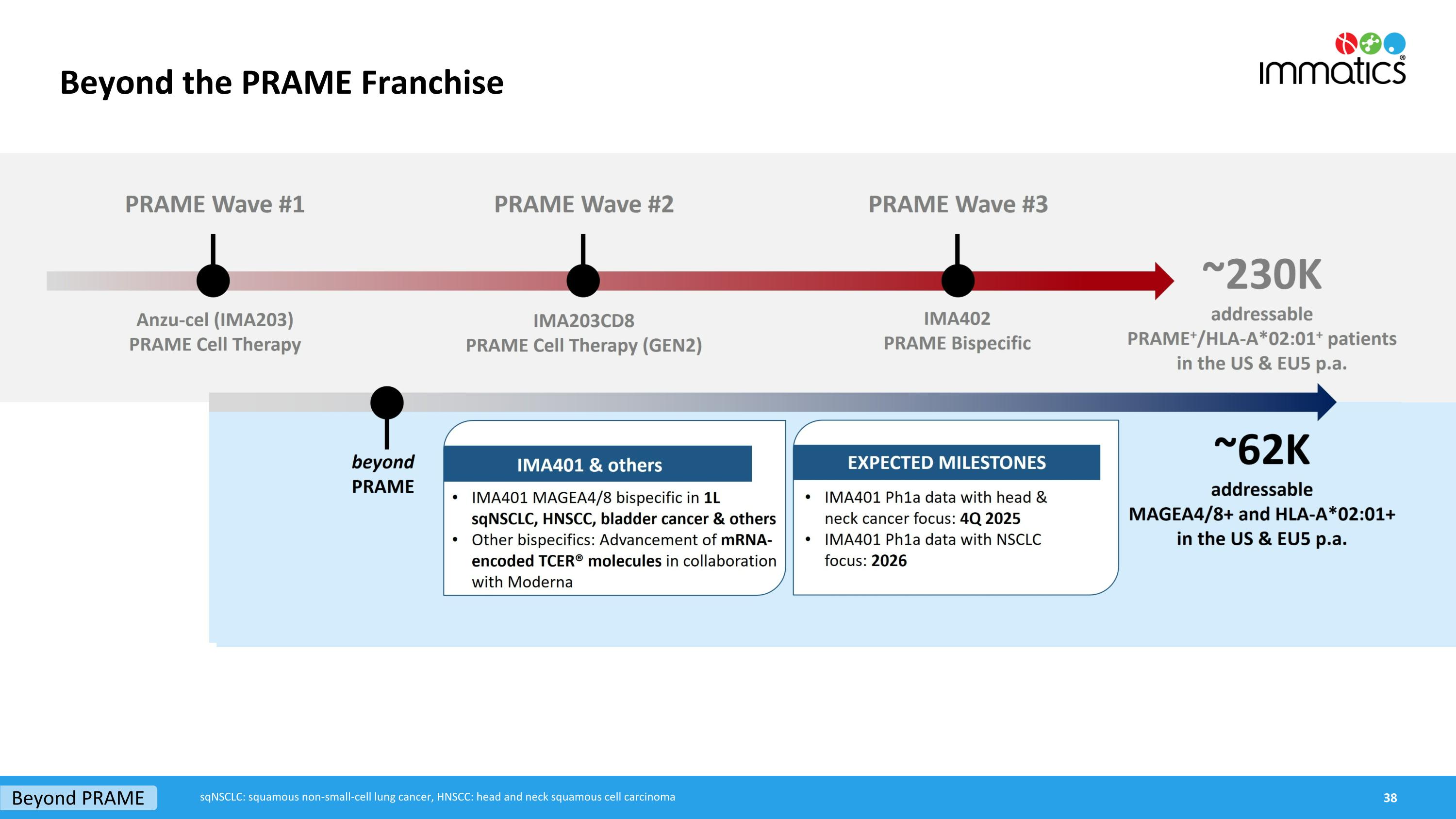

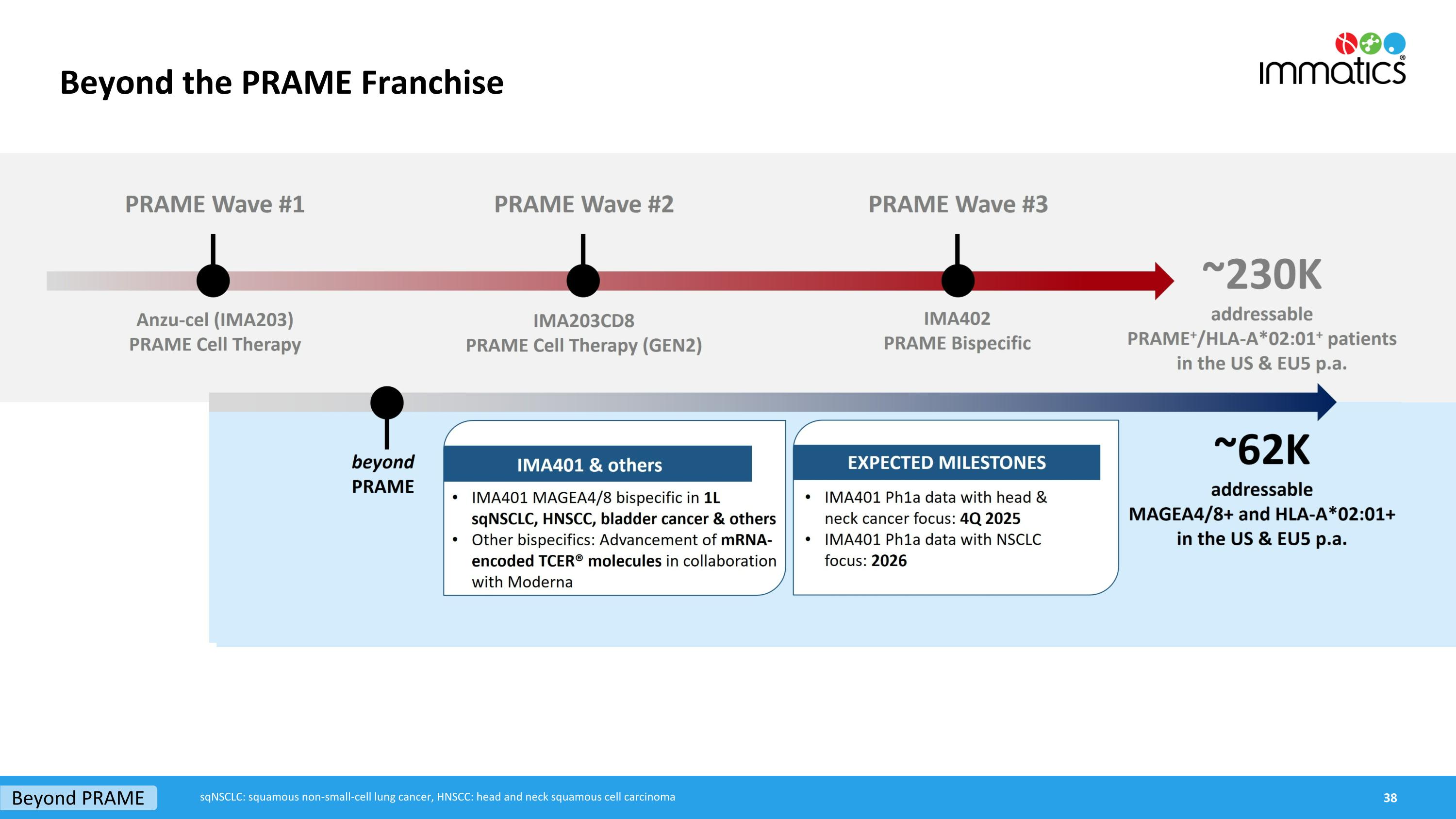

Beyond the PRAME Franchise Beyond PRAME sqNSCLC: squamous non-small-cell lung cancer, HNSCC: head and neck squamous cell carcinoma

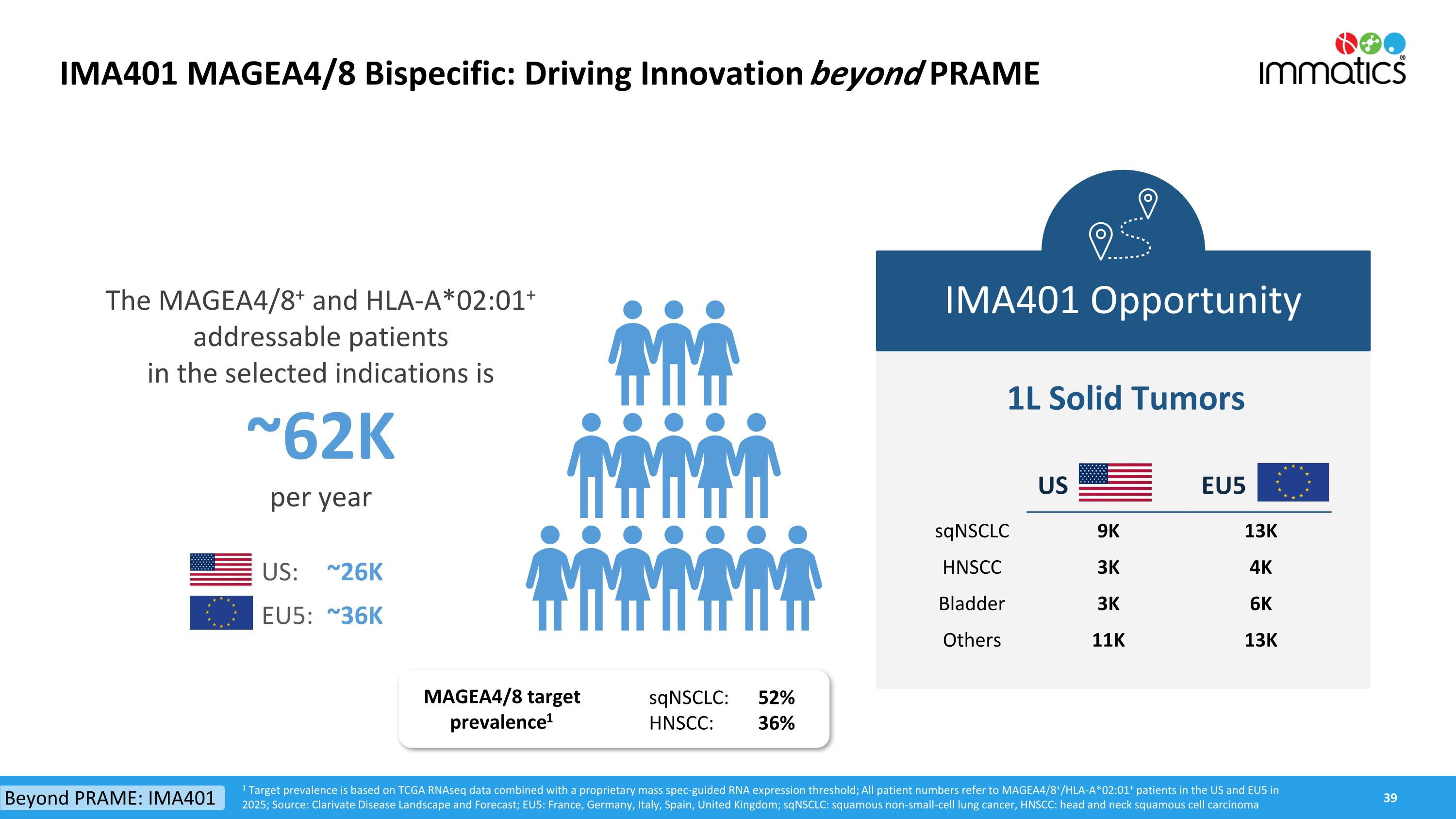

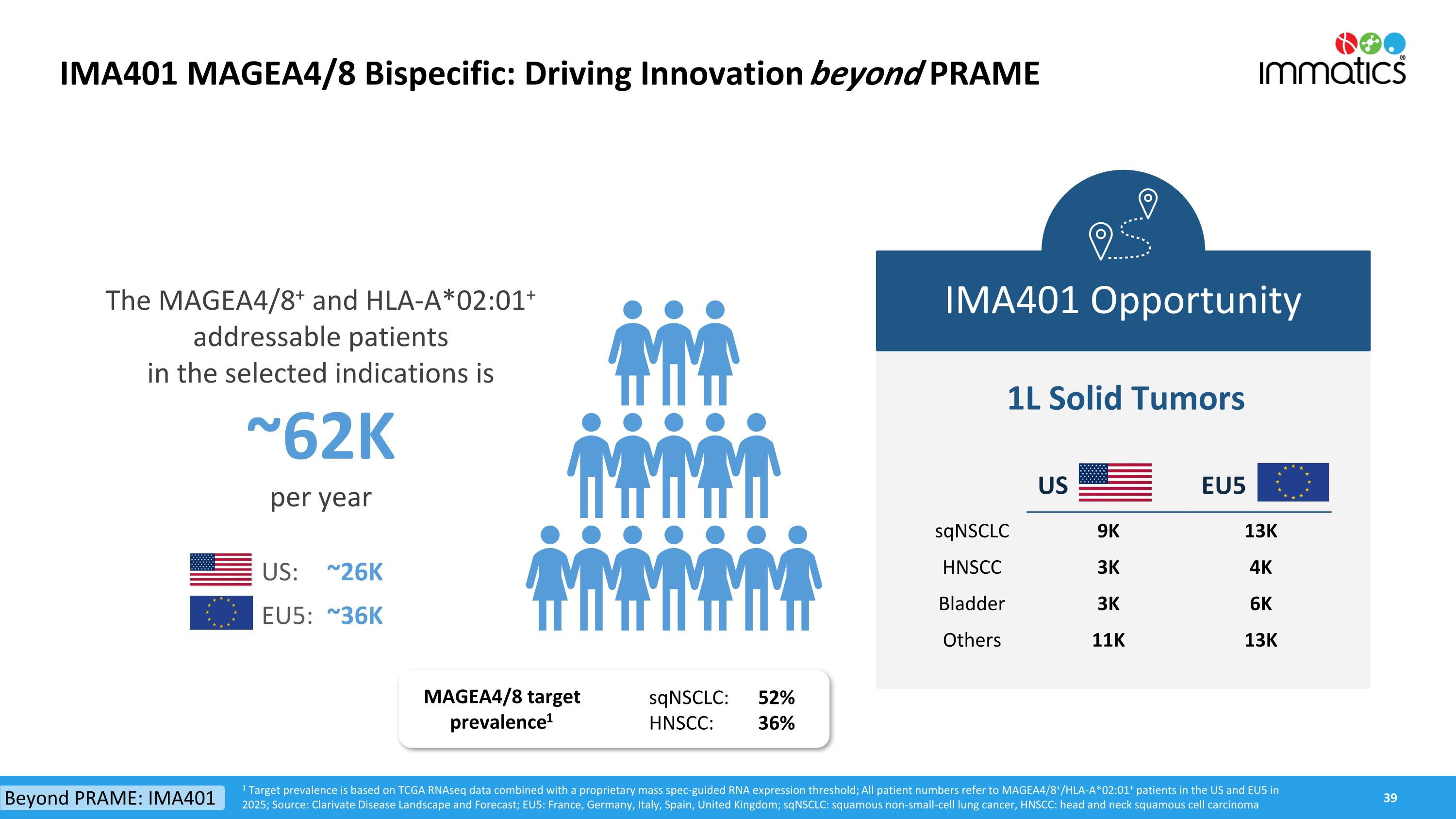

IMA401 MAGEA4/8 Bispecific: Driving Innovation beyond PRAME IMA401 Opportunity 1L Solid Tumors 1 Target prevalence is based on TCGA RNAseq data combined with a proprietary mass spec-guided RNA expression threshold; All patient numbers refer to MAGEA4/8+/HLA-A*02:01+ patients in the US and EU5 in 2025; Source: Clarivate Disease Landscape and Forecast; EU5: France, Germany, Italy, Spain, United Kingdom; sqNSCLC: squamous non-small-cell lung cancer, HNSCC: head and neck squamous cell carcinoma The MAGEA4/8+ and HLA-A*02:01+ addressable patientsin the selected indications is~62Kper year US: ~26K EU5: ~36K Beyond PRAME: IMA401 US EU5 sqNSCLC 9K 13K HNSCC 3K 4K Bladder 3K 6K Others 11K 13K MAGEA4/8 target prevalence1 sqNSCLC: 52% HNSCC: 36%

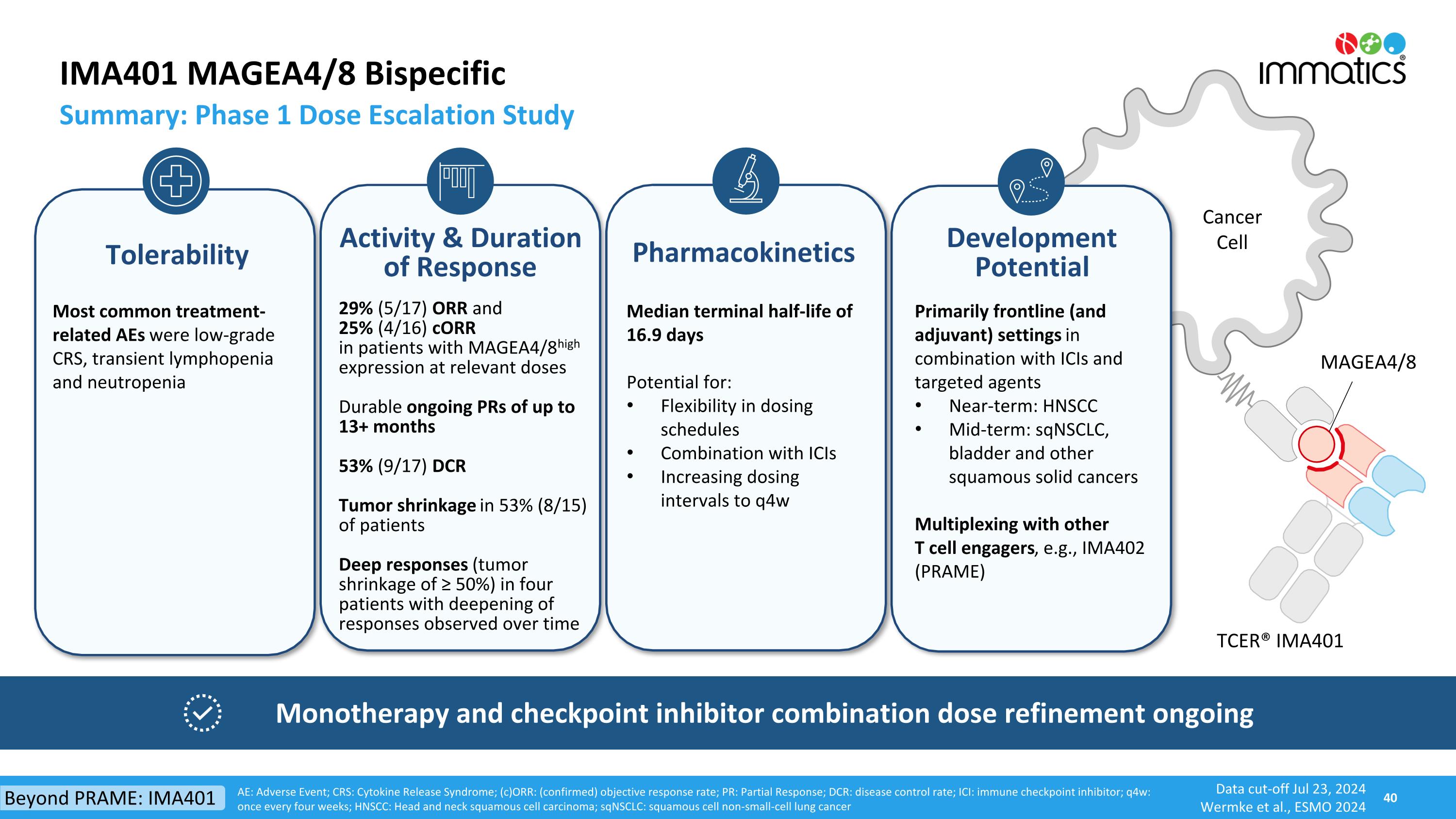

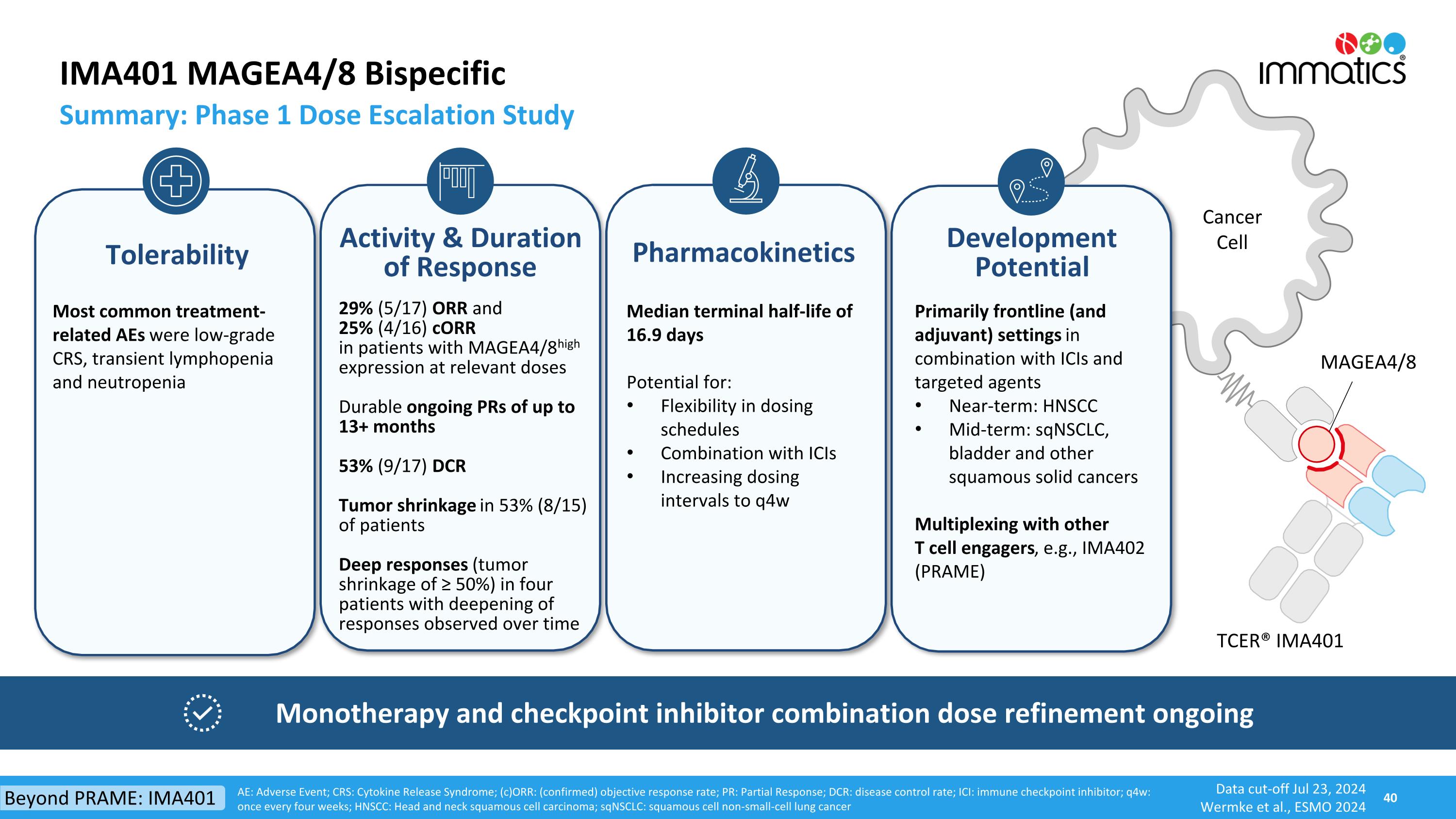

Cancer Cell MAGEA4/8 IMA401 MAGEA4/8 Bispecific Summary: Phase 1 Dose Escalation Study AE: Adverse Event; CRS: Cytokine Release Syndrome; (c)ORR: (confirmed) objective response rate; PR: Partial Response; DCR: disease control rate; ICI: immune checkpoint inhibitor; q4w: once every four weeks; HNSCC: Head and neck squamous cell carcinoma; sqNSCLC: squamous cell non-small-cell lung cancer Data cut-off Jul 23, 2024 Wermke et al., ESMO 2024 29% (5/17) ORR and 25% (4/16) cORR in patients with MAGEA4/8high expression at relevant doses Durable ongoing PRs of up to 13+ months 53% (9/17) DCR Tumor shrinkage in 53% (8/15) of patients Deep responses (tumor shrinkage of ≥ 50%) in four patients with deepening of responses observed over time Tolerability Activity & Duration of Response Primarily frontline (and adjuvant) settings in combination with ICIs and targeted agents Near-term: HNSCC Mid-term: sqNSCLC, bladder and other squamous solid cancers Multiplexing with other T cell engagers, e.g., IMA402 (PRAME) Development Potential Most common treatment-related AEs were low-grade CRS, transient lymphopenia and neutropenia Pharmacokinetics Median terminal half-life of 16.9 days Potential for: Flexibility in dosing schedules Combination with ICIs Increasing dosing intervals to q4w Monotherapy and checkpoint inhibitor combination dose refinement ongoing TCER® IMA401 Beyond PRAME: IMA401

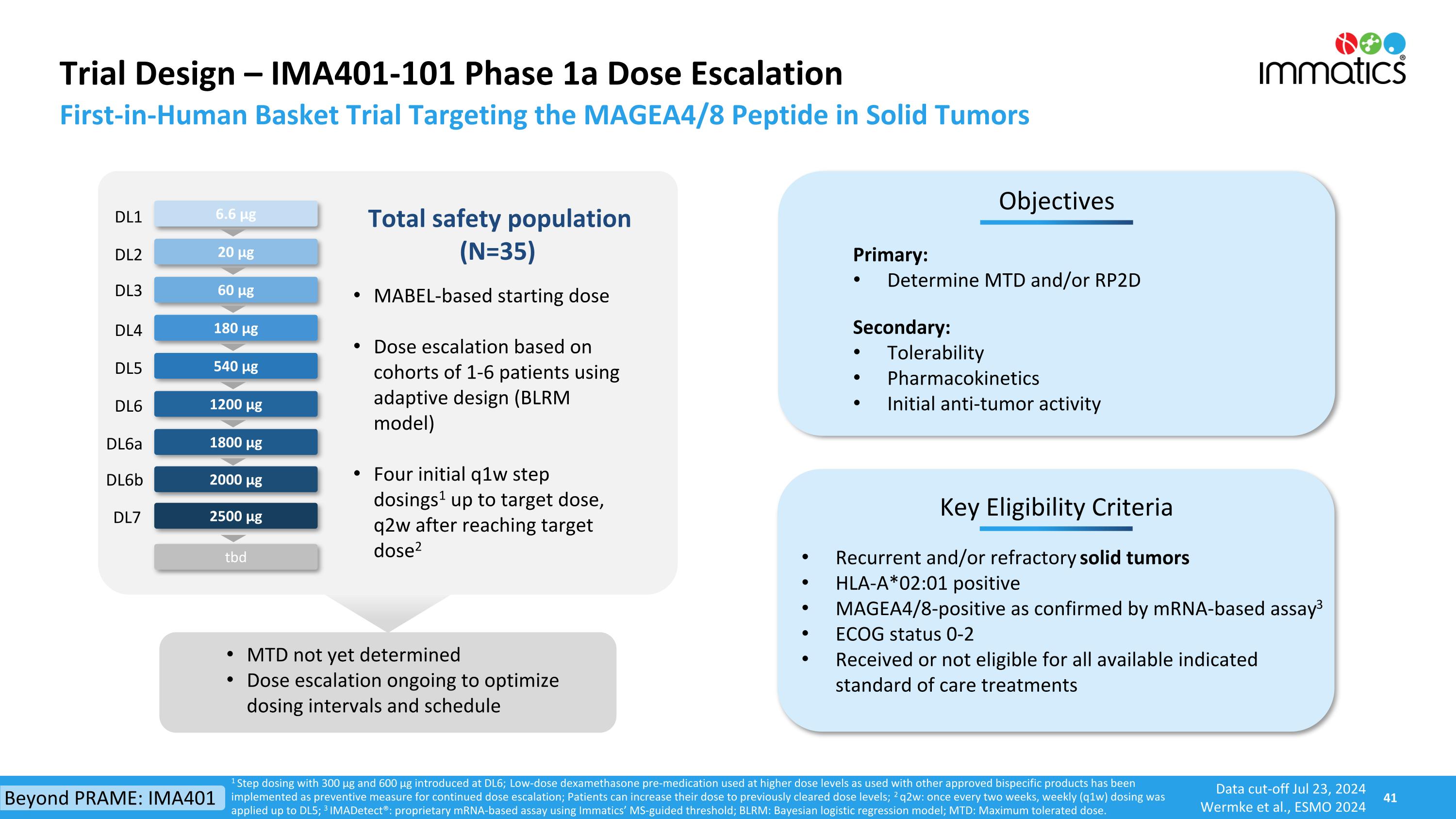

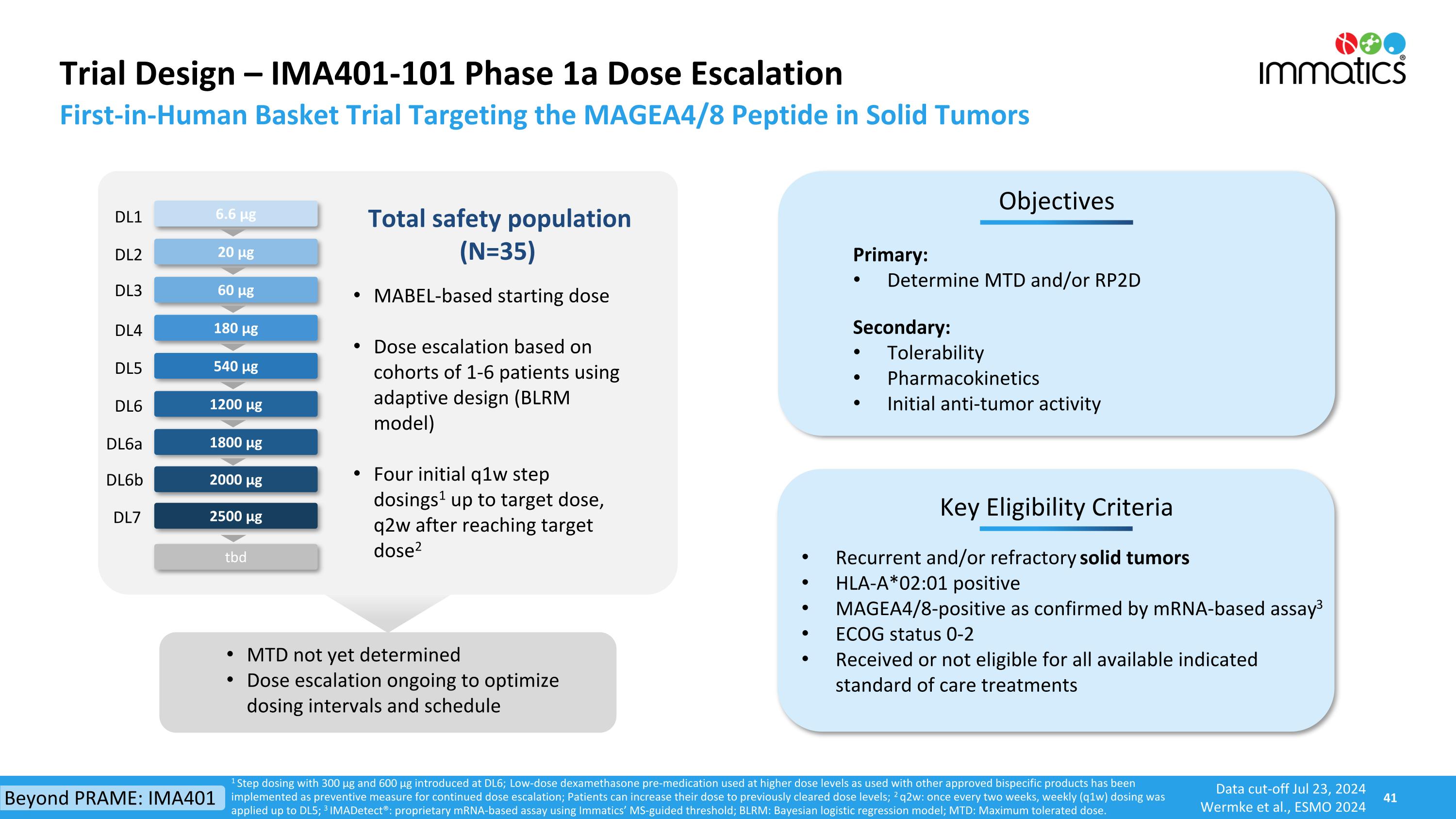

Trial Design – IMA401-101 Phase 1a Dose Escalation 180 µg 540 µg 1800 µg 2500 µg Key Eligibility Criteria Objectives Primary: Determine MTD and/or RP2D Secondary: Tolerability Pharmacokinetics Initial anti-tumor activity Recurrent and/or refractory solid tumors HLA-A*02:01 positive MAGEA4/8-positive as confirmed by mRNA-based assay3 ECOG status 0-2 Received or not eligible for all available indicated standard of care treatments 60 µg 1200 µg Total safety population (N=35) 20 µg 6.6 µg MTD not yet determined Dose escalation ongoing to optimize dosing intervals and schedule MABEL-based starting dose Dose escalation based on cohorts of 1-6 patients using adaptive design (BLRM model) Four initial q1w step dosings1 up to target dose, q2w after reaching target dose2 First-in-Human Basket Trial Targeting the MAGEA4/8 Peptide in Solid Tumors 1 Step dosing with 300 µg and 600 µg introduced at DL6; Low-dose dexamethasone pre-medication used at higher dose levels as used with other approved bispecific products has been implemented as preventive measure for continued dose escalation; Patients can increase their dose to previously cleared dose levels; 2 q2w: once every two weeks, weekly (q1w) dosing was applied up to DL5; 3 IMADetect®: proprietary mRNA-based assay using Immatics’ MS-guided threshold; BLRM: Bayesian logistic regression model; MTD: Maximum tolerated dose. DL1 DL2 DL3 DL4 DL5 DL6a DL7 DL6 tbd 2000 µg DL6b Beyond PRAME: IMA401 Data cut-off Jul 23, 2024 Wermke et al., ESMO 2024

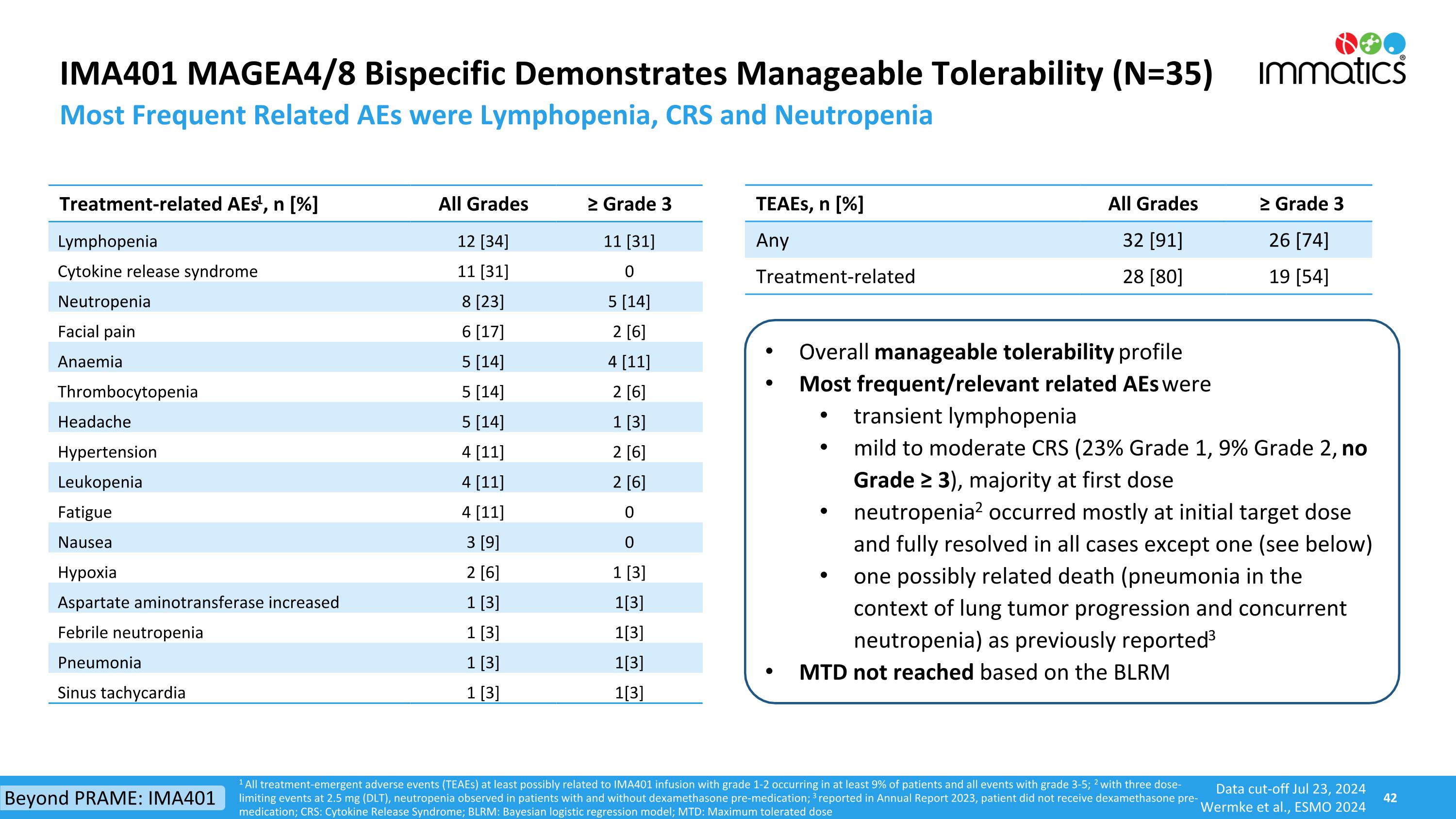

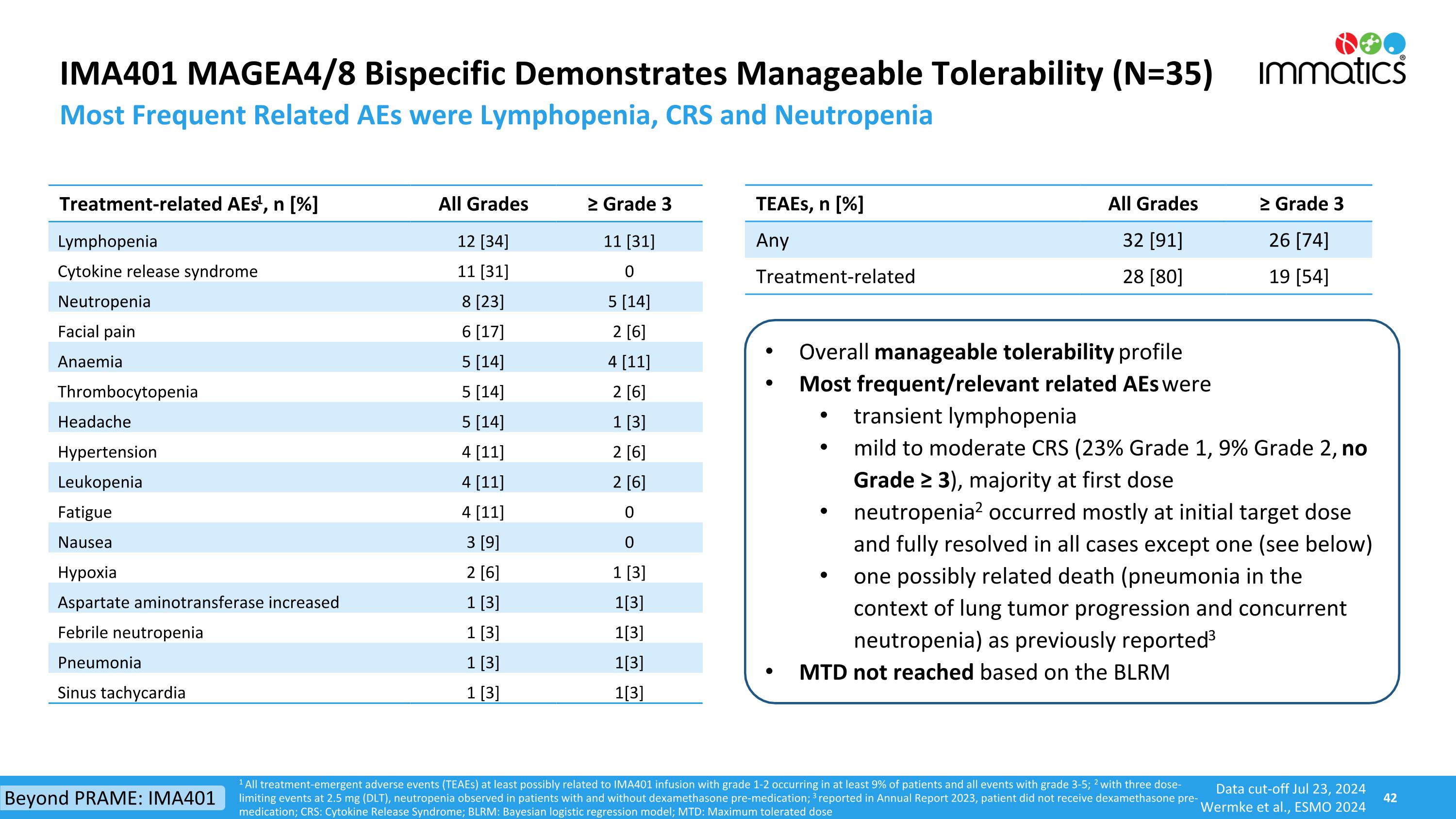

IMA401 MAGEA4/8 Bispecific Demonstrates Manageable Tolerability (N=35) Most Frequent Related AEs were Lymphopenia, CRS and Neutropenia TEAEs, n [%] All Grades ≥ Grade 3 Any 32 [91] 26 [74] Treatment-related 28 [80] 19 [54] Treatment-related AEs1, n [%] All Grades ≥ Grade 3 Lymphopenia 12 [34] 11 [31] Cytokine release syndrome 11 [31] 0 Neutropenia 8 [23] 5 [14] Facial pain 6 [17] 2 [6] Anaemia 5 [14] 4 [11] Thrombocytopenia 5 [14] 2 [6] Headache 5 [14] 1 [3] Hypertension 4 [11] 2 [6] Leukopenia 4 [11] 2 [6] Fatigue 4 [11] 0 Nausea 3 [9] 0 Hypoxia 2 [6] 1 [3] Aspartate aminotransferase increased 1 [3] 1[3] Febrile neutropenia 1 [3] 1[3] Pneumonia 1 [3] 1[3] Sinus tachycardia 1 [3] 1[3] Overall manageable tolerability profile Most frequent/relevant related AEs were transient lymphopenia mild to moderate CRS (23% Grade 1, 9% Grade 2, no Grade ≥ 3), majority at first dose neutropenia2 occurred mostly at initial target dose and fully resolved in all cases except one (see below) one possibly related death (pneumonia in the context of lung tumor progression and concurrent neutropenia) as previously reported3 MTD not reached based on the BLRM 1 All treatment-emergent adverse events (TEAEs) at least possibly related to IMA401 infusion with grade 1-2 occurring in at least 9% of patients and all events with grade 3-5; 2 with three dose-limiting events at 2.5 mg (DLT), neutropenia observed in patients with and without dexamethasone pre-medication; 3 reported in Annual Report 2023, patient did not receive dexamethasone pre-medication; CRS: Cytokine Release Syndrome; BLRM: Bayesian logistic regression model; MTD: Maximum tolerated dose Beyond PRAME: IMA401 Data cut-off Jul 23, 2024 Wermke et al., ESMO 2024

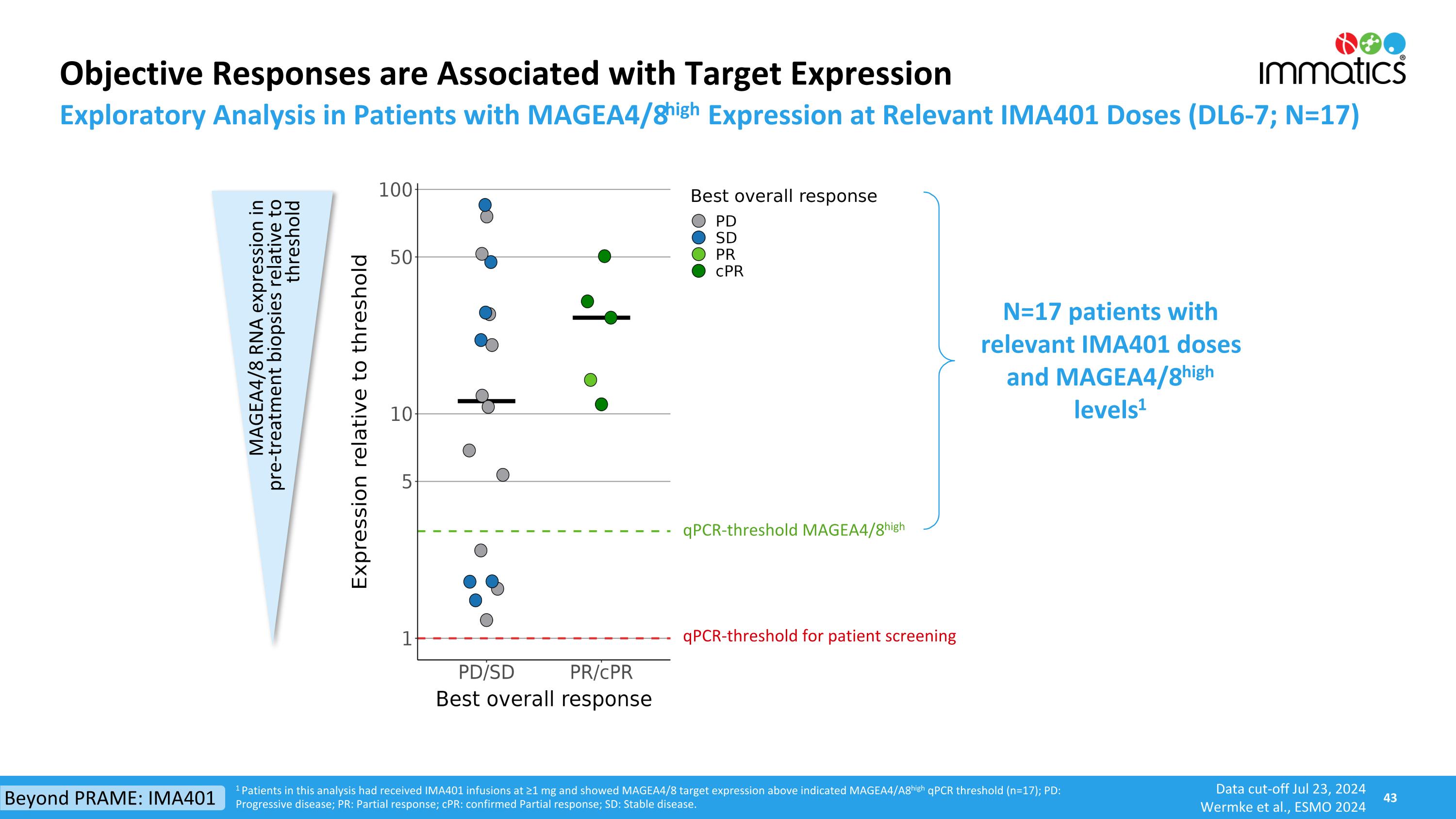

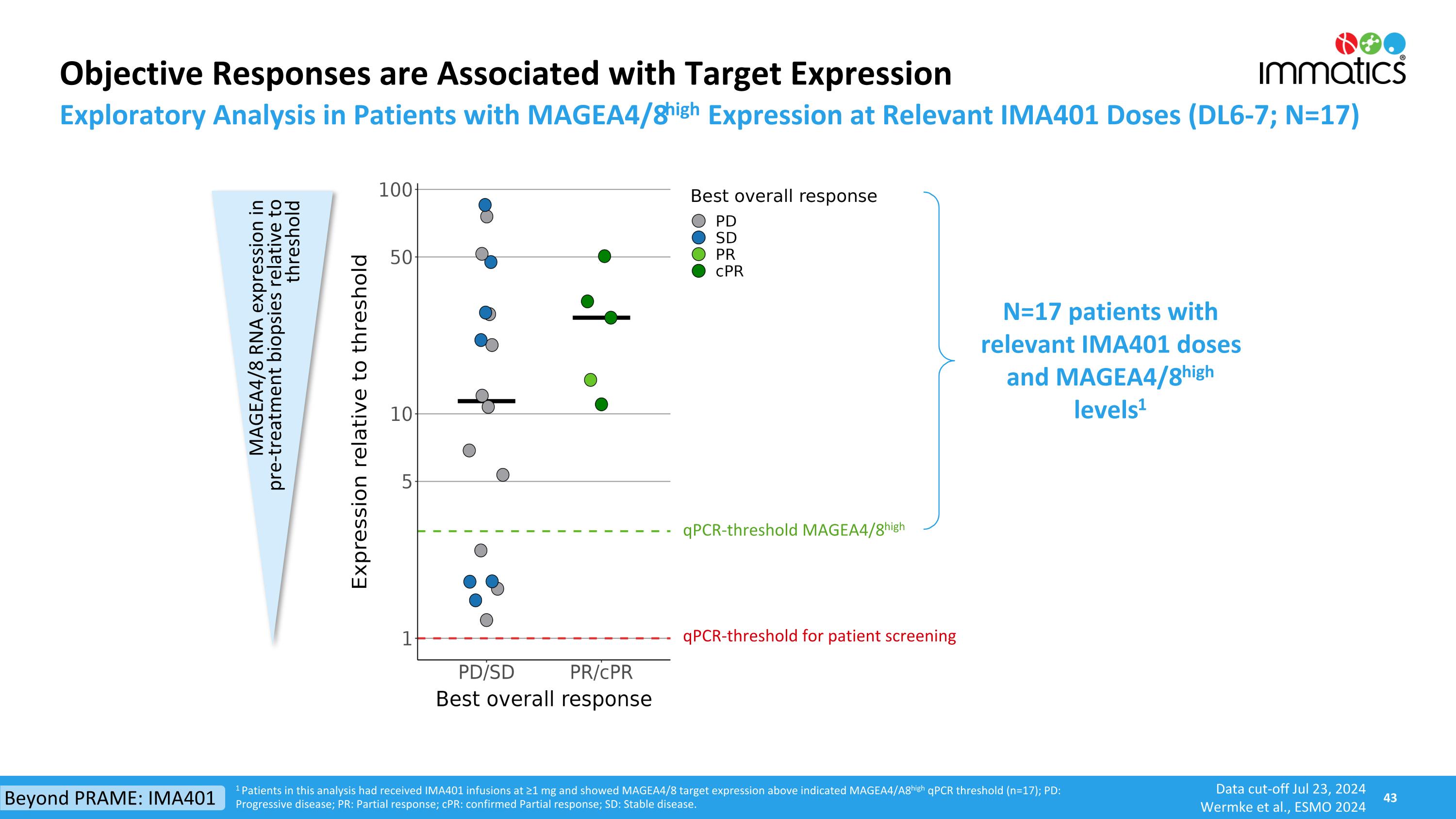

1 Patients in this analysis had received IMA401 infusions at ≥1 mg and showed MAGEA4/8 target expression above indicated MAGEA4/A8high qPCR threshold (n=17); PD: Progressive disease; PR: Partial response; cPR: confirmed Partial response; SD: Stable disease. Objective Responses are Associated with Target Expression Exploratory Analysis in Patients with MAGEA4/8high Expression at Relevant IMA401 Doses (DL6-7; N=17) qPCR-threshold MAGEA4/8high qPCR-threshold for patient screening MAGEA4/8 RNA expression in pre-treatment biopsies relative to threshold N=17 patients with relevant IMA401 doses and MAGEA4/8high levels1 Beyond PRAME: IMA401 Data cut-off Jul 23, 2024 Wermke et al., ESMO 2024

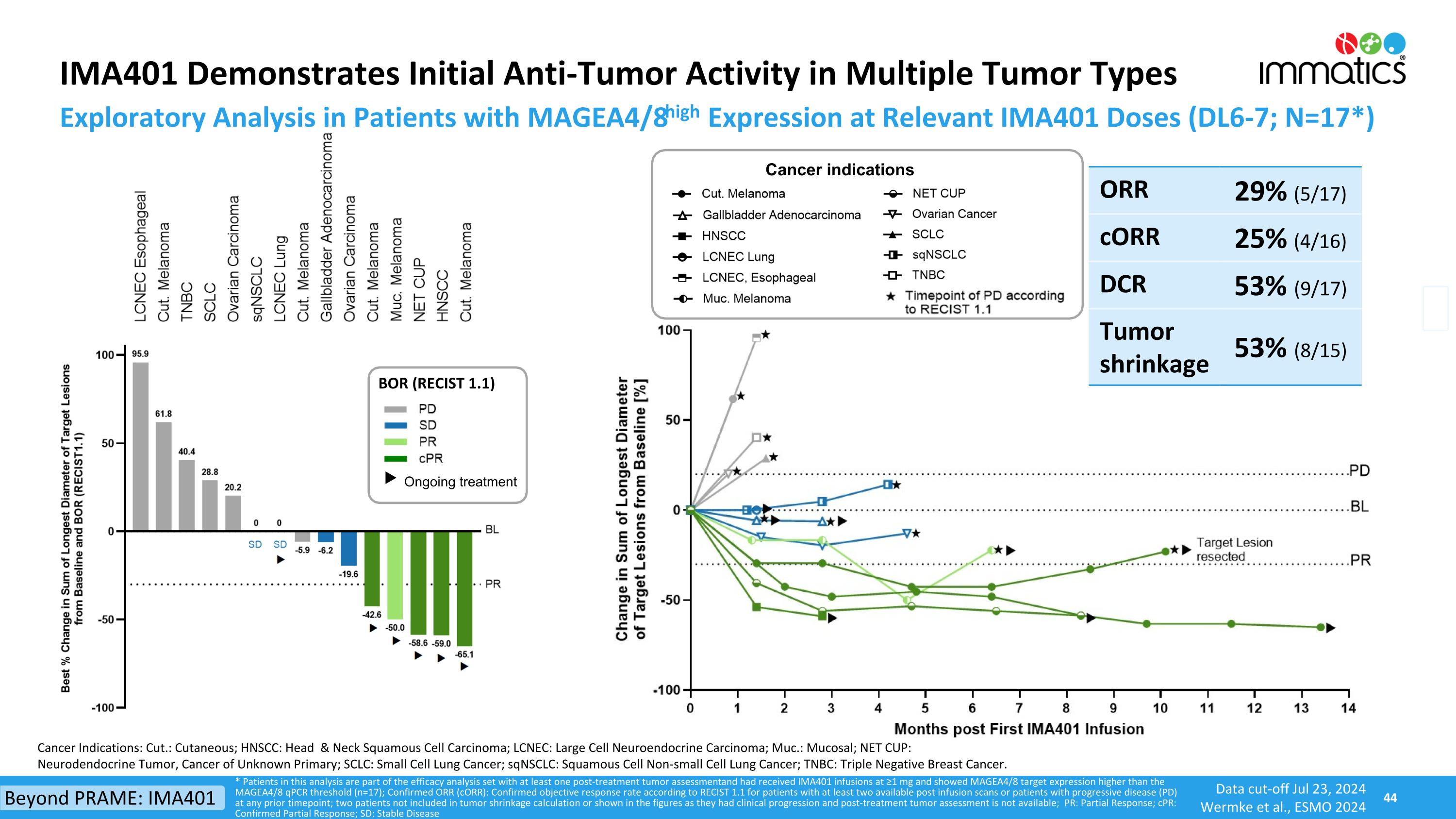

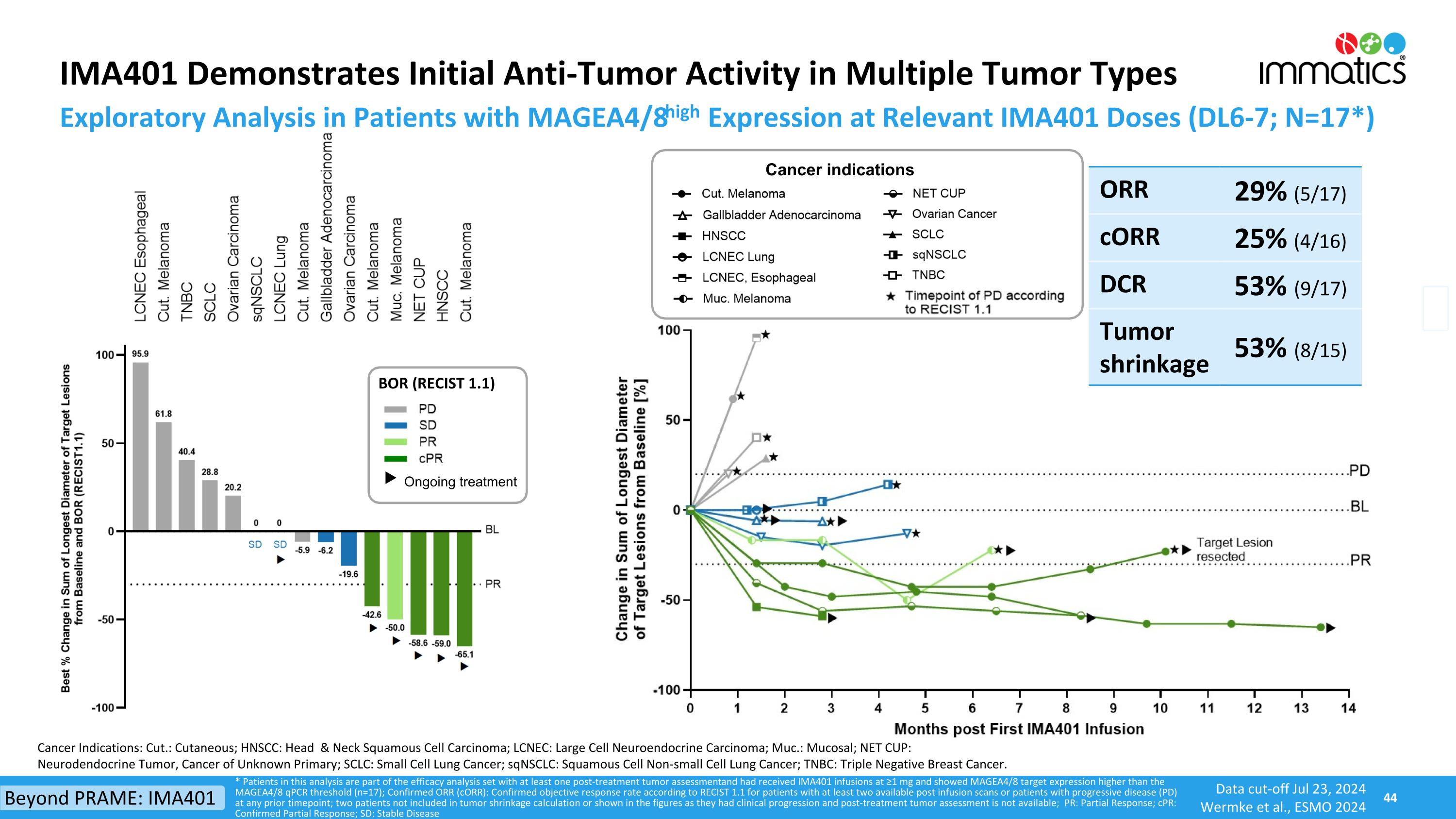

IMA401 Demonstrates Initial Anti-Tumor Activity in Multiple Tumor Types * Patients in this analysis are part of the efficacy analysis set with at least one post-treatment tumor assessment and had received IMA401 infusions at ≥1 mg and showed MAGEA4/8 target expression higher than the MAGEA4/8 qPCR threshold (n=17); Confirmed ORR (cORR): Confirmed objective response rate according to RECIST 1.1 for patients with at least two available post infusion scans or patients with progressive disease (PD) at any prior timepoint; two patients not included in tumor shrinkage calculation or shown in the figures as they had clinical progression and post-treatment tumor assessment is not available; PR: Partial Response; cPR: Confirmed Partial Response; SD: Stable Disease Exploratory Analysis in Patients with MAGEA4/8high Expression at Relevant IMA401 Doses (DL6-7; N=17*) ORR 29% (5/17) cORR 25% (4/16) DCR 53% (9/17) Tumor shrinkage 53% (8/15) Cancer Indications: Cut.: Cutaneous; HNSCC: Head & Neck Squamous Cell Carcinoma; LCNEC: Large Cell Neuroendocrine Carcinoma; Muc.: Mucosal; NET CUP: Neurodendocrine Tumor, Cancer of Unknown Primary; SCLC: Small Cell Lung Cancer; sqNSCLC: Squamous Cell Non-small Cell Lung Cancer; TNBC: Triple Negative Breast Cancer. BOR (RECIST 1.1) Ongoing treatment Cancer indications Beyond PRAME: IMA401 Data cut-off Jul 23, 2024 Wermke et al., ESMO 2024

Appendix

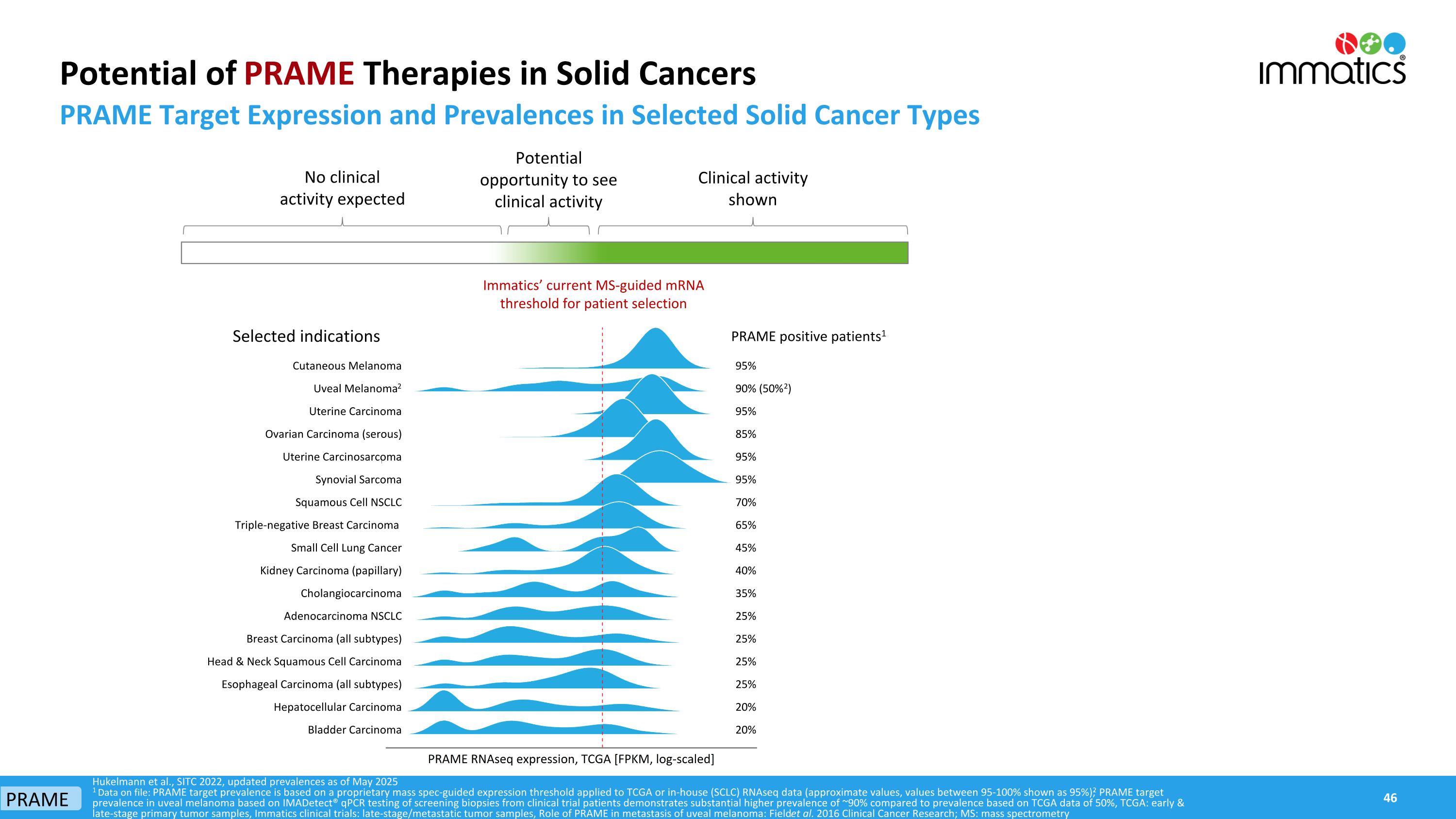

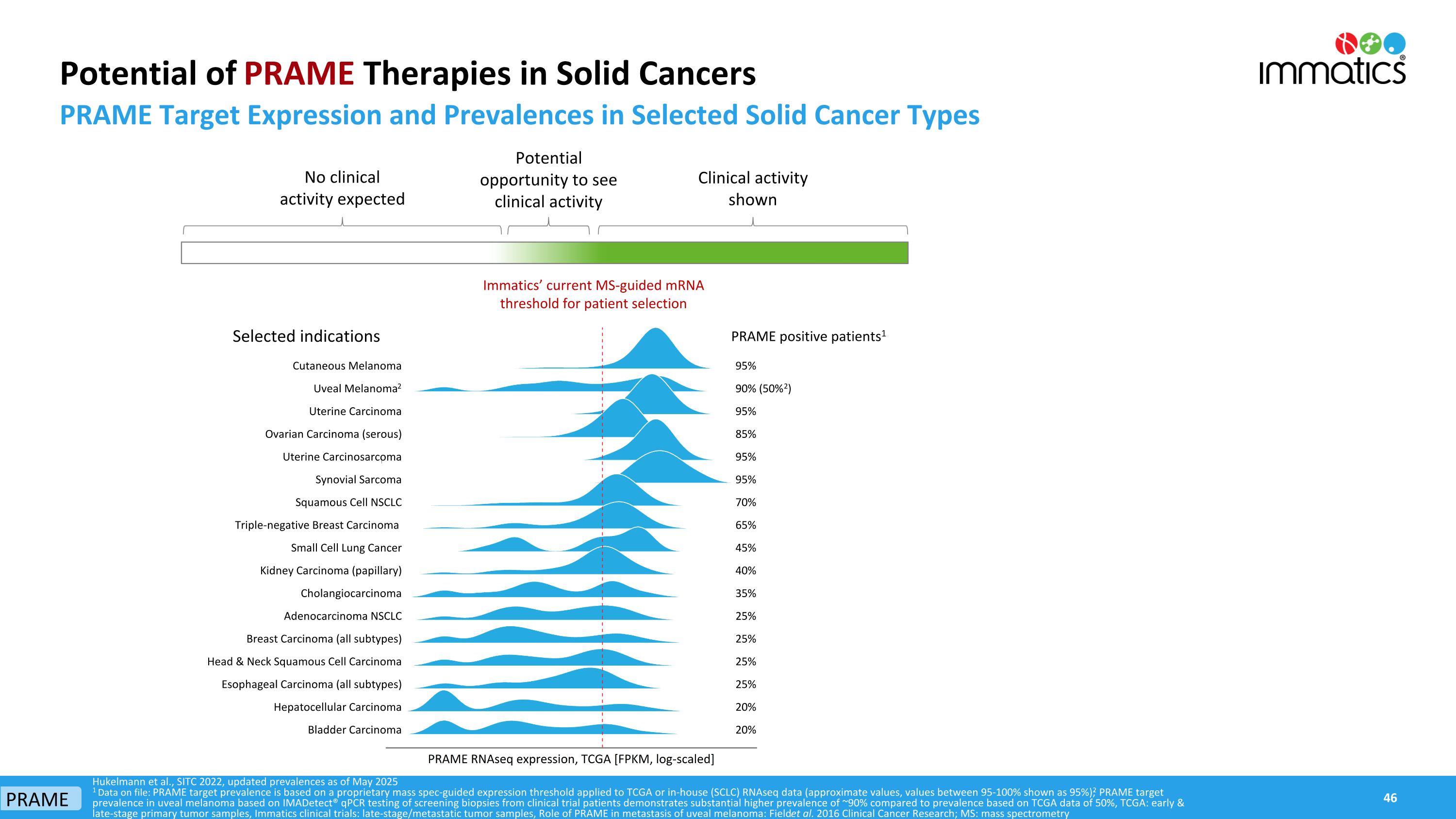

Potential of PRAME Therapies in Solid Cancers PRAME Target Expression and Prevalences in Selected Solid Cancer Types Hukelmann et al., SITC 2022, updated prevalences as of May 2025 1 Data on file: PRAME target prevalence is based on a proprietary mass spec-guided expression threshold applied to TCGA or in-house (SCLC) RNAseq data (approximate values, values between 95-100% shown as 95%); 2 PRAME target prevalence in uveal melanoma based on IMADetect® qPCR testing of screening biopsies from clinical trial patients demonstrates substantial higher prevalence of ~90% compared to prevalence based on TCGA data of 50%, TCGA: early & late-stage primary tumor samples, Immatics clinical trials: late-stage/metastatic tumor samples, Role of PRAME in metastasis of uveal melanoma: Field et al. 2016 Clinical Cancer Research; MS: mass spectrometry Immatics’ current MS-guided mRNA threshold for patient selection Selected indications Clinical activity shown No clinical activity expected Potential opportunity to see clinical activity PRAME 95% 90% (50%2) 95% 85% 95% 95% 70% 65% 45% 40% 35% 25% 25% 25% 25% 20% 20% PRAME positive patients1 Cutaneous Melanoma Uveal Melanoma2 Uterine Carcinoma Ovarian Carcinoma (serous) Uterine Carcinosarcoma Synovial Sarcoma Squamous Cell NSCLC Triple-negative Breast Carcinoma Small Cell Lung Cancer Kidney Carcinoma (papillary) Cholangiocarcinoma Adenocarcinoma NSCLC Breast Carcinoma (all subtypes) Head & Neck Squamous Cell Carcinoma Esophageal Carcinoma (all subtypes) Hepatocellular Carcinoma Bladder Carcinoma

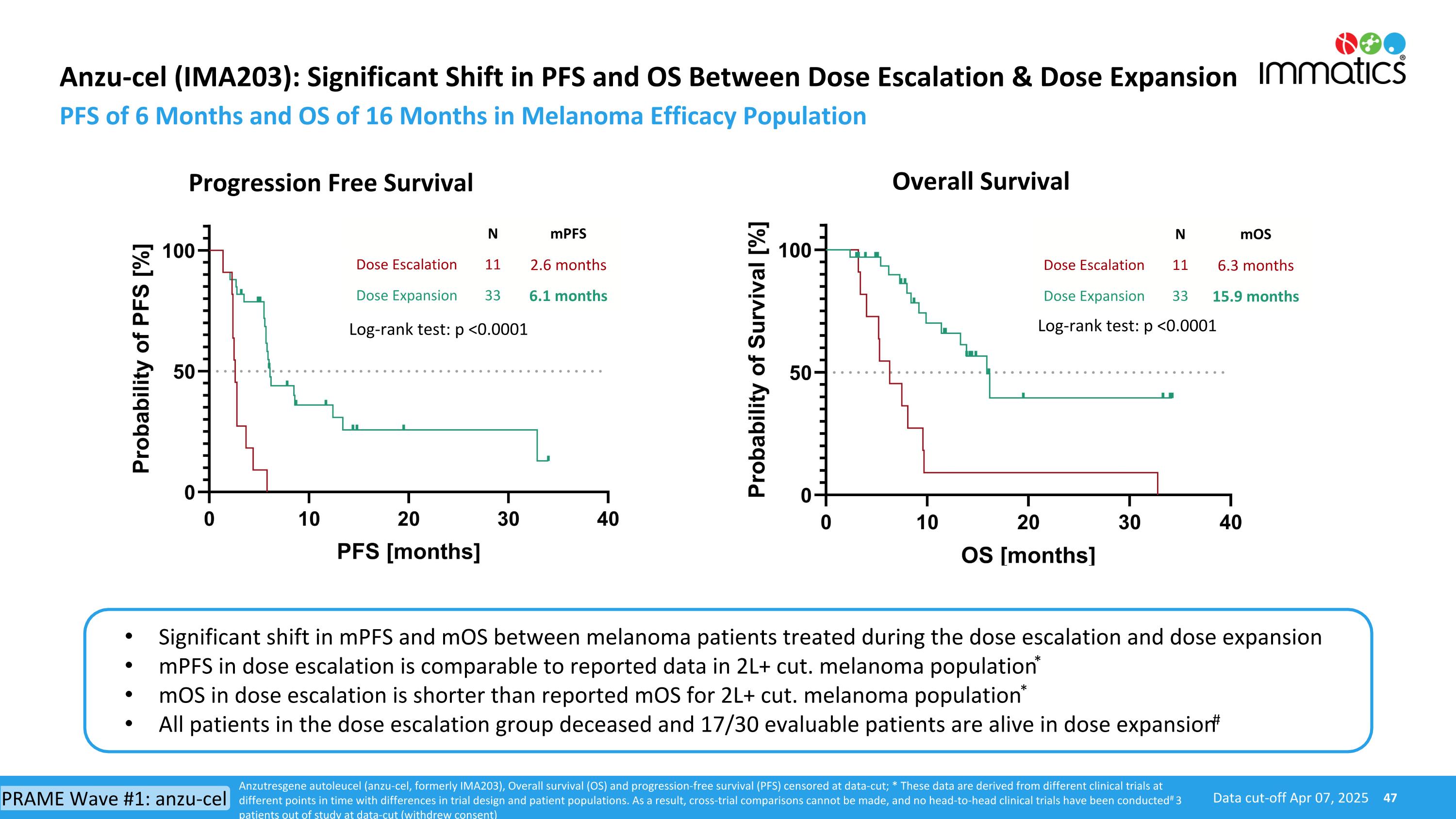

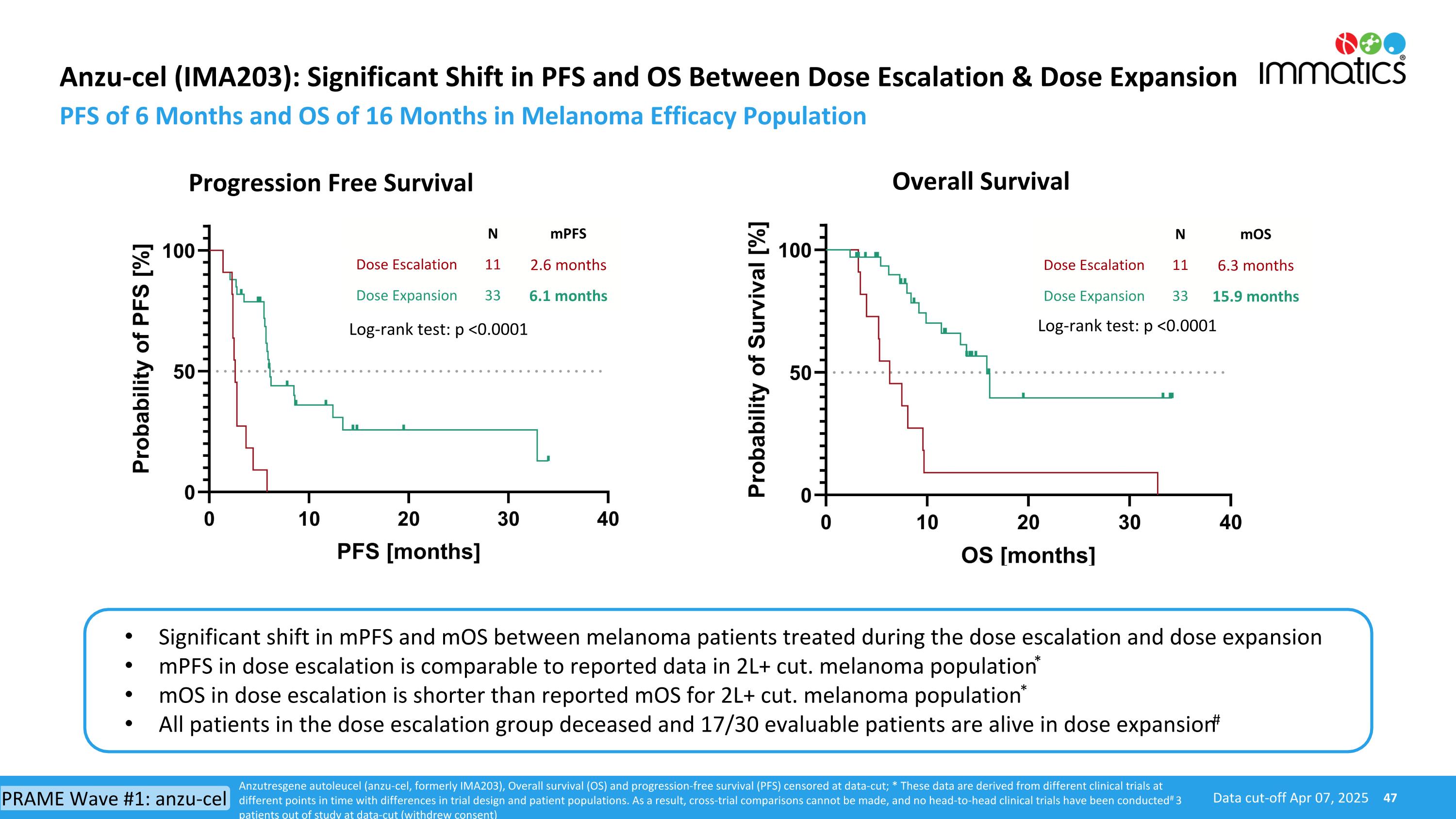

Anzu-cel (IMA203): Significant Shift in PFS and OS Between Dose Escalation & Dose Expansion PFS of 6 Months and OS of 16 Months in Melanoma Efficacy Population Progression Free Survival Data cut-off Apr 07, 2025 Overall Survival N mPFS Dose Escalation 11 2.6 months Dose Expansion 33 6.1 months N mOS Dose Escalation 11 6.3 months Dose Expansion 33 15.9 months Significant shift in mPFS and mOS between melanoma patients treated during the dose escalation and dose expansion mPFS in dose escalation is comparable to reported data in 2L+ cut. melanoma population* mOS in dose escalation is shorter than reported mOS for 2L+ cut. melanoma population* All patients in the dose escalation group deceased and 17/30 evaluable patients are alive in dose expansion# Log-rank test: p <0.0001 Log-rank test: p <0.0001 Anzutresgene autoleucel (anzu-cel, formerly IMA203), Overall survival (OS) and progression-free survival (PFS) censored at data-cut; * These data are derived from different clinical trials at different points in time with differences in trial design and patient populations. As a result, cross-trial comparisons cannot be made, and no head-to-head clinical trials have been conducted # 3 patients out of study at data-cut (withdrew consent) PRAME Wave #1: anzu-cel