UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 27, 2025

|

Commission File Number |

Name of Registrant, Address of Principal Executive Offices and Telephone Number |

State of Incorporation |

IRS Employer Identification No. |

|||

| 1-16681 | Spire Inc. | Missouri | 74-2976504 | |||

| 700 Market Street | ||||||

| St. Louis, MO 63101 | ||||||

| 314-342-0500 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act (only applicable to Spire Inc.):

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock $1.00 par value | SR | New York Stock Exchange LLC | ||

| Depositary Shares, each representing a 1/1,000th interest in a share of 5.90% Series A Cumulative Redeemable Perpetual Preferred Stock, par value $25.00 per share | SR.PRA | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

On July 27, 2025, Spire Inc. (“Spire”) entered into an Asset Purchase Agreement (the “Purchase Agreement”) by and between Piedmont Natural Gas Company, Inc., a North Carolina corporation (“Piedmont”) and wholly owned subsidiary of Duke Energy Corporation (“Duke Energy”) and Spire, pursuant to which Spire has agreed to acquire Piedmont’s Tennessee natural gas local distribution company business (the “Business” and such transaction, the “Transaction”).

The purchase price for the Business is $2.48 billion and subject to adjustment as set forth in the Purchase Agreement, including adjustments based on net working capital, regulatory assets and liabilities and capital expenditures at closing.

The completion of the Transaction is subject to customary closing conditions, including (i) the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (ii) approval of the Tennessee Public Utility Commission, (iii) no Material Adverse Effect (as defined in the Purchase Agreement) having occurred since the date of the Purchase Agreement, and (iv) customary conditions regarding the accuracy of the representations and warranties and compliance by the parties with their respective obligations under the Purchase Agreement. The Transaction is not subject to a financing condition and is expected to close in the first quarter of 2026, subject to satisfaction of the foregoing conditions. Spire has obtained debt financing commitments in connection with the financing of the Transaction and Spire expects the permanent financing to consist of a combination of long-term debt and/or equity.

The Purchase Agreement contains customary representations, warranties and covenants related to the Business and the Transaction. Between the date of the Purchase Agreement and the completion of the Transaction, Piedmont has agreed to cause the Business to operate in the ordinary course of business and has agreed to certain other operating covenants with respect to the Business as set forth in the Purchase Agreement. The Purchase Agreement includes customary termination provisions, including if the closing of the Transaction has not occurred by April 27, 2026 (or within three months thereafter if the only remaining closing conditions relate to regulatory approval), and provides for a termination fee payable by Spire in certain circumstances as set forth in the Purchase Agreement.

The foregoing summary of the Purchase Agreement and the transactions contemplated thereby is subject to, and is qualified in its entirety by, the full terms of the Purchase Agreement, which will be filed with Spire’s Annual Report on Form 10-K for the year ended September 30, 2025.

| Item 7.01. | Regulation FD Disclosure. |

On July 29, 2025, Spire issued a press release announcing the Transaction, which is furnished as Exhibit 99.1 hereto and is incorporated herein by reference. In addition, Spire released an investor presentation providing additional detail on the Transaction, which is furnished as Exhibit 99.2 hereto and is incorporated herein by reference.

The information provided in this Item 7.01 (including Exhibit 99.1 and Exhibit 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 8.01. | Other Events. |

Spire owns certain assets associated with its Midstream segment, more specifically identified as Spire Storage, which consist of assets and operations physically located at 4003 Clear Creek Road, Evanston, Wyoming (Spire Storage West LLC) and 78413 Osage Road, Manchester, Oklahoma (Spire Storage Salt Plains LLC) (collectively “Storage Assets”). Spire intends to explore the possible sale of the Storage Assets to offset the other financing arrangements related to the Transaction.

A related news release is attached as Exhibit 99.1 and incorporated by reference in Items 1.01 and 8.01.

Forward-Looking Information

This document contains “forward looking statements” that are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as, but not limited to: “estimates,” “expects,” “projects,” “anticipates,” “intends,” “targets,” “plans,” “forecasts,” “may,”, “likely,” “would,” “should”, “anticipated” and similar expressions.

Actual outcomes or results could differ materially from the forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and other factors, including but not limited to, conditions to the completion of the Transaction, such as receipt of required regulatory clearances, not being satisfied; closing of the Transaction being delayed or not occurring at all; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Purchase Agreement; the inability of Spire to obtain financing as currently contemplated; Spire being unable to achieve the anticipated benefits of the Transaction; the acquired assets not performing as expected; Spire assuming unexpected risks, liabilities and obligations of the acquired assets; significant transaction costs associated with the Transaction; the risk that disruptions from the Transaction will harm the businesses, including current plans and operations; the ability to retain and/or hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Transaction; and other factors relating to the operations and financial performance discussed in Spire’s filings with the SEC.

Although the forward-looking statements contained in this document are based on estimates and assumptions that management believes are reasonable, various uncertainties and risk factors may cause future performance or results to be different than those anticipated. More complete descriptions and listings of these uncertainties and risk factors can be found in Spire’s Annual Report on Form 10-K for the year ended September 30, 2024 and in subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Spire cannot guarantee that the future results reflected in or implied by any such forward-looking statement will be realized or, even if substantially realized, will have the forecasted or expected consequences and effects for or on Spire’s operations or financial performance. Such forward-looking statements are made based on information available as of the date of this document, and Spire undertakes no obligation to revise or update such statements to reflect subsequent events or circumstances, except as otherwise required by securities and other applicable laws.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are filed as part of this report:

| 99.1 |

| 99.2 |

| 104 | Cover page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Spire Inc. | ||||||

| Date: July 29, 2025 | By: | /s/ Courtney M. Vomund |

||||

|

Courtney M. Vomund Senior Vice President, Chief Administrative |

||||||

Exhibit 99.1

|

|

Investor Contact: Megan L. McPhail 314-309-6563 Megan.McPhail@SpireEnergy.com

Media Contact: Jason Merrill 314-342-3300 Jason.Merrill@SpireEnergy.com |

For Immediate Release

Spire to acquire Tennessee Piedmont Natural Gas business from Duke Energy

ST. LOUIS (July 29, 2025) – Spire Inc. (NYSE: SR) today announced it has entered into an agreement with Piedmont Natural Gas, a wholly-owned subsidiary of Duke Energy (NYSE: DUK), to acquire its Tennessee local distribution company business that serves more than 200,000 customers in the Nashville area.

Spire is acquiring the business for total consideration of $2.48 billion on a cash-free, debt-free basis, representing a purchase price multiple of 1.5× estimated rate base in 2026. The purchase will be accretive to adjusted earnings per share and supportive of long-term 5-7% adjusted earnings per share growth. The transaction is expected to close in the first quarter of calendar 2026, pending Tennessee Public Utility Commission approval, Hart-Scott-Rodino review and other customary closing conditions.

After closing, Nashville area Piedmont Natural Gas customers will be served by a new Spire business unit, Spire Tennessee.

The acquisition significantly increases Spire’s scale of its regulated business. With nearly 3,800 miles of distribution and transmission pipelines, Piedmont Natural Gas serves as the largest investor-owned natural gas utility in Tennessee and operates in the Nashville metro area, one of the fastest-growing regions in the U.S. The integration of the Piedmont Natural Gas business in Tennessee expands Spire’s utility footprint, adding to existing operations in Missouri, Alabama and Mississippi.

“This acquisition is a natural fit for Spire, allowing us to expand our core utility business and increase our utility customer base to nearly two million homes and businesses,” said Scott Doyle, president and chief executive officer of Spire. “We look forward to serving customers in the Nashville area and safely delivering the energy they need.”

Doyle said Duke Energy and Piedmont Natural Gas share Spire’s core value of safety and a commitment to serving and supporting the community.

“We’re eager to build on the foundation of exceptional customer service and community engagement that Piedmont Natural Gas customers in Tennessee have enjoyed for years,” said Doyle. “We look forward to welcoming their employees and customers, and becoming an active participant in the growing Nashville business community.”

“The transaction allows us to efficiently fund accelerating investment opportunities driven by record customer growth and a deepening economic development pipeline,” said Harry Sideris, Duke Energy president and chief executive officer. “We’re confident Spire will support the continued growth and success of the Tennessee natural gas business and serve as an incredible operator for the benefit of employees, customers and communities.”

1

Sideris added, “I want to thank our customers and the Nashville community for allowing us to serve as their trusted energy partner, regional supporter and neighbor for more than 40 years. I also want to recognize the entire Piedmont Natural Gas team who support the Tennessee business for their unwavering commitment to our customers, operational excellence and industry-leading service. They have set the bar for what it means to be a best-in-class natural gas business and will continue to do so for many years to come.”

Compelling Strategic Rationale for Spire

| • | Expands regulated footprint. This transaction allows Spire to significantly expand its regulated utility footprint in high-quality jurisdictions. It significantly increases the scale of its regulated business while delivering on Spire’s commitment to growth and creating long-term shareholder value. |

| • | Diversifies and de-risks growth. The addition of Piedmont Natural Gas business in Tennessee provides robust growth driven by new customer additions and system integrity investments, aligned with Spire’s investment strategy. Tennessee’s constructive regulatory environment encourages capital investment to support its growing service territory. |

| • | Strong focus on customers, community and employees. Spire is committed to safely delivering reliable and efficient service and community engagement. Its shared services platform is well-positioned for integration. |

| • | Financial benefits. The transaction supports Spire’s long-term adjusted earnings per share growth expectations and provides meaningful investment opportunities. The acquisition generates significant cash flow to support investment in the business, shareholder returns and dividend growth. |

Financing

The transaction is supported by a fully committed bridge facility with BMO Capital Markets Corp. for the entire purchase price. Permanent financing of the acquisition will be funded through a balanced mix of debt, equity and hybrid securities. Spire is also evaluating the sale of non-utility assets, such as natural gas storage facilities, as a potential source of funds.

Timing and Approvals

This transaction is expected to close in the first quarter of calendar 2026, subject to customary closing conditions, including the approval of the Tennessee Public Utility Commission and the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act.

Advisors

BMO Capital Markets Corp. acted as exclusive financial advisor to Spire. Additional advisory support was provided by Newlin Capital Advisors. Sidley Austin LLP acted as lead legal counsel to Spire, with additional legal counsel provided by Bradley Arant Boult Cummings LLP.

Conference Call and Webcast

Spire will host a conference call and webcast today to discuss the acquisition. To access the call, please dial the applicable number approximately 5–10 minutes in advance.

| Date and Time: | Tuesday, July 29 | |||

| 7:30 a.m. CT (8:30 a.m. ET) | ||||

| Phone Numbers: | U.S. and Canada: | 844-824-3832 | ||

| International: | 412-317-5142 | |||

2

The webcast can be accessed at Investors.SpireEnergy.com under Events & Presentations. A replay of the call will be available approximately one hour following the call until August 6, 2025, by dialing 877-344-7529 (U.S.), 855-669-9658 (Canada), or 412-317-0088 (international). The replay access code is 2945605.

About Spire

At Spire Inc. (NYSE: SR) we believe energy exists to help make people’s lives better. It’s a simple idea, but one that’s at the heart of our company. Every day we serve 1.7 million homes and businesses making us one of the largest publicly traded natural gas companies in the country. We help families and business owners fuel their daily lives through our gas utilities serving Alabama, Mississippi and Missouri. Our natural gas-related businesses include Spire Marketing and Spire Midstream. We are committed to transforming our business through growing organically, investing in infrastructure, and advancing through innovation. Learn more at SpireEnergy.com.

About Duke Energy

Duke Energy is executing an ambitious energy transition, keeping customer reliability and value at the forefront as it builds a smarter energy future. The company is investing in major electric grid upgrades and cleaner generation, including natural gas, nuclear, renewables and energy storage.

More information is available at duke-energy.com and the Duke Energy News Center. Follow Duke Energy on X, LinkedIn, Instagram and Facebook, and visit illumination for stories about the people and innovations powering our energy transition.

About Piedmont Natural Gas

Piedmont Natural Gas, a subsidiary of Duke Energy, distributes natural gas to more than 1.2 million residential, commercial, industrial and power generation customers in North Carolina, South Carolina and Tennessee. Piedmont Natural Gas earned the No. 1 spot in customer satisfaction with residential natural gas service in the South among large utilities, according to the J.D. Power 2024 U.S. Gas Utility Residential Customer Satisfaction Study. More information: piedmontng.com.

Forward-Looking Statements

This release contains “forward looking statements,” including Spire Inc. (Spire) management’s guidance regarding the impact of the proposed transaction on Spire, including the potential impact on earnings per share and the return on equity and other potential economic benefits to Spire. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as, but not limited to: “estimates,” “expects,” “projects,” “anticipates,” “intends,” “targets,” “plans,” “forecasts,” “may,” “likely,” “would,” “should,” “anticipated” and similar expressions.

3

Actual outcomes or results could differ materially from the forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and other factors, including but not limited to, conditions to the completion of the transaction, such as receipt of required regulatory clearances, not being satisfied; closing of the transaction being delayed or not occurring at all; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the purchase agreement; the inability of Spire to obtain financing; Spire being unable to achieve the anticipated benefits of the transaction; the acquired assets not performing as expected; Spire assuming unexpected risks, liabilities and obligations of the acquired assets; significant transaction costs associated with the transaction; the risk that disruptions from the transaction will harm the businesses, including current plans and operations; the ability to retain and/or hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; and other factors relating to the operations and financial performance discussed in Spire’s filings with the SEC.

Although the forward-looking statements contained in this release are based on estimates and assumptions that management believes are reasonable, various uncertainties and risk factors may cause future performance or results to be different than those anticipated. More complete descriptions and listings of these uncertainties and risk factors can be found in our Annual Report on Form 10-K for the year ended September 30, 2024, and in subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K. You should consider all risks, uncertainties and other factors identified above and in those SEC reports carefully when evaluating the forward-looking statements in this release. Spire cannot assure you that the future results reflected in or implied by any such forward-looking statement will be realized or, even if substantially realized, will have the forecasted or expected consequences and effects for or on our operations or financial performance. Such forward-looking statements are made based on information available as of the date of this release, and Spire undertakes no obligation to revise or update such statements to reflect subsequent events or circumstances, except as otherwise required by securities and other applicable laws.

This release also includes references to “adjusted earnings” or “adjusted earnings per share,” which are non-GAAP measures used internally by management when evaluating Spire’s performance and results of operations. Internal non-GAAP operating metrics should not be considered as an alternative to, or more meaningful than, GAAP measures such as operating income, net income or earnings per share. Reconciliation of adjusted earnings to net income and other non-GAAP measures referenced in the presentation are contained in our SEC filings.

4

July 29, 2025 Acquisition of the Piedmont Natural Gas Tennessee LDC business Exhibit 99.2

This presentation contains “forward looking statements,” including Spire Inc. (“Spire”) management’s guidance regarding the impact of the proposed transaction on Spire, including the potential impact on earnings per share and the return on equity and other potential economic benefits to Spire. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as, but not limited to: “estimates,” “expects,” “projects,” “anticipates,” “intends,” “targets,” “plans,” “forecasts,” “may,” “likely,” “would,” “should,” “anticipated,” and similar expressions. Actual outcomes or results could differ materially from the forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and other factors, including but not limited to, conditions to the completion of the transaction, such as receipt of required regulatory clearances not being satisfied; closing of the transaction being delayed or not occurring at all; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the purchase agreement; the inability of Spire to obtain financing; Spire being unable to achieve the anticipated benefits of the transaction; the acquired assets not performing as expected; Spire assuming unexpected risks, liabilities and obligations of the acquired assets; significant transaction costs associated with the transaction; the risk that disruptions from the transaction will harm the businesses, including current plans and operations; the ability to retain and/or hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; and other factors relating to the operations and financial performance discussed in Spire’s filings with the SEC. Although the forward-looking statements contained in this presentation are based on estimates and assumptions that management believes are reasonable, various uncertainties and risk factors may cause future performance or results to be different than those anticipated. More complete descriptions and listings of these uncertainties and risk factors can be found in our Annual Report on Form 10-K for the year ended September 30, 2024, and in subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K. You should consider all risks, uncertainties and other factors identified above and in those SEC reports carefully when evaluating the forward-looking statements in this release. Spire cannot assure you that the future results reflected in or implied by any such forward-looking statement will be realized or, even if substantially realized, will have the forecasted or expected consequences and effects for or on our operations or financial performance. Such forward-looking statements are made based on information available as of the date of this presentation, and Spire undertakes no obligation to revise or update such statements to reflect subsequent events or circumstances, except as otherwise required by securities and other applicable laws. This presentation also includes references to “adjusted earnings” or “adjusted earnings per share,” which are non-GAAP measures used internally by management when evaluating Spire’s performance and results of operations. Internal non-GAAP operating metrics should not be considered as an alternative to, or more meaningful than, GAAP measures such as operating income, net income or earnings per share. Reconciliation of adjusted earnings to net income and other non-GAAP measures referenced in the presentation are contained in our SEC filings. Note: Years shown in this presentation are fiscal years ended September 30. Investor Relations contact: Megan L. McPhail Managing Director, Investor Relations 314-309-6563 | Megan.McPhail@SpireEnergy.com Forward-looking statements and use of non-GAAP measures Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Acquisition summary Acquisition of the Piedmont Natural Gas Tennessee LDC business from Duke Energy for $2.48 billion on a cash-free, debt-free basis; represents 1.5´ 2026E rate base Strategic acquisition that expands regulated utility footprint Diversifies and de-risks growth in a highly constructive regulatory environment Shared services platform is well-positioned to integrate business while maintaining a strong focus on customers, community and employees Accretive acquisition and supportive of long-term 5-7% adjusted earnings per share growth and long-term dividend growth Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Strategic rationale Expands regulated utility footprint Strategic acquisition that expands regulated utility footprint in a high-quality jurisdiction Significantly increases scale of regulated business, adding $1.6 billion1 of rate base and ~205,000 customers Diversifies and de-risks growth Robust growth of Tennessee Piedmont Natural Gas business driven by new customer additions and system modernization spend, complementing Spire’s existing capital plan focused on pipeline replacement Tennessee is a constructive regulatory environment with rate setting mechanisms in place to encourage investment in the system Strong focus on customers, community and employees Aligned focus on safe, reliable and efficient service Builds on shared values of active civic engagement and community support Shared services platform is well-positioned to integrate business Financial benefits Increases five-year capital plan by >25% Proven shared services model will lead to efficiencies across the Spire organization Accretive and supportive of long-term 5-7% adjusted EPS growth Cash flow supports investment, shareholder value and growing dividends 12026E. Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Transaction terms Transaction and purchase price Acquiring 100% of the Piedmont Natural Gas Tennessee business from Duke Energy $2.48 billion enterprise value on a cash-free, debt-free basis, subject to customary closing adjustments Purchase price represents 1.5´ 2026E rate base Financing plan Financing supported by bridge facility with BMO Capital Markets Corp. for entire purchase price Permanent financing plan consistent with Spire’s current credit ratings and will include a balanced mix of debt, equity and hybrid securities Evaluating the sale of non-utility assets, such as natural gas storage facilities, as a potential source of funds Required approvals Tennessee Public Utility Commission (TPUC) Hart-Scott-Rodino review Other customary closing conditions Timing Filing for TPUC approval within 45 days Acquisition expected to close in Q1 of calendar 2026 Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Nashville Gas utility territories Spire STL Pipeline Spire MoGas Pipeline St. Louis Kansas City Birmingham TENNESSEE MISSOURI MISSISSIPPI ALABAMA Hattiesburg Mobile Spire’s expanded utility footprint Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Adding a premier gas utility to Spire’s portfolio Piedmont Natural Gas serves as the largest investor-owned utility in Tennessee and operates in the Nashville metro area, one of the fastest-growing regions in the U.S. ~$1.6 billion 2026E rate base ~3,800 System miles 91% Residential customers 9.8% | 49.33% ROE1 | Equity layer1 ~11% Historical rate base CAGR (2013-2024) ~205,000 Customers1 Piedmont Natural Gas TN business territories Natural gas basin Receipt / delivery points Interstate gas pipelines Robertson Dickson Cheatham Davidson Williamson Sumner Trousdale Wilson Rutherford Nashville Nashville TENNESSEE 1As of December 31, 2024; Rates from most recent Annual Rate Review Mechanism (ARM) (filed May 2024) went into effect in October 2024. Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Piedmont Natural Gas Tennessee business Pro forma Rate base $6.3 billion1 $1.6 billion2 $7.9 billion (+25%) Five-year capital plan (2025E-2029E) $3.5 billion $0.9 billion $4.4 billion (+26%) Customers ~1,741,000 ~205,000 ~1,946,000 (+12%) Miles of pipe ~63,000 ~3,800 ~66,800 (+6%) 1Reflects MO rate base as of May 31, 2025, filed in latest rate case; other utilities reflect net plant included in 2024 commission filings. 2Reflects 2026E. Significantly enhances Spire’s scale Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

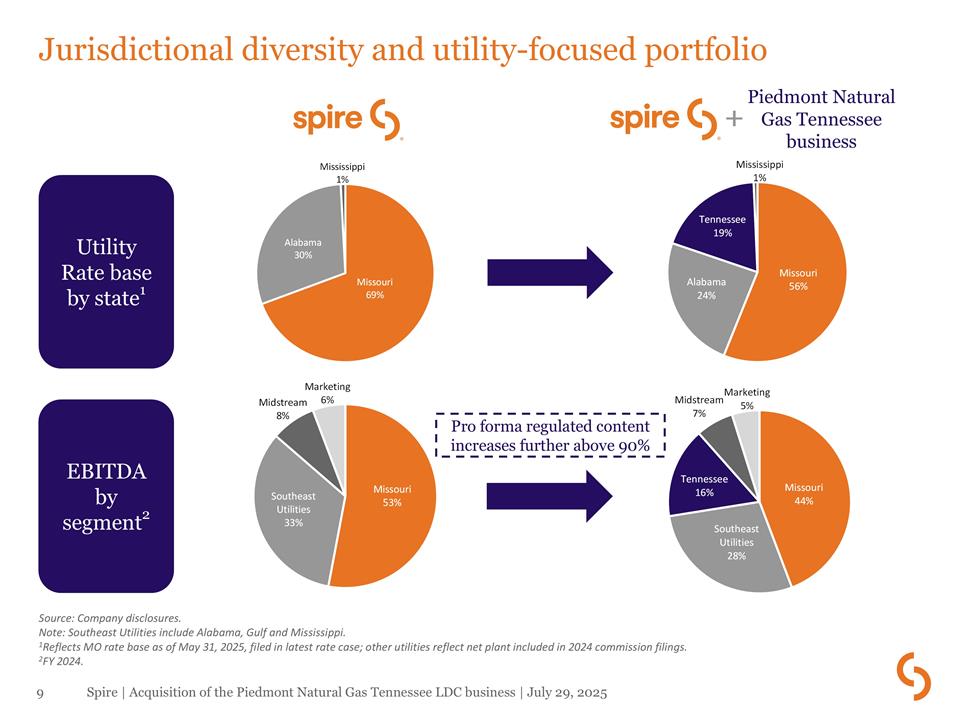

Jurisdictional diversity and utility-focused portfolio (2) Utility Rate base by state1 EBITDA by segment2 Pro forma regulated content increases further above 90% Piedmont Natural Gas Tennessee business Source: Company disclosures. Note: Southeast Utilities include Alabama, Gulf and Mississippi. 1Reflects MO rate base as of May 31, 2025, filed in latest rate case; other utilities reflect net plant included in 2024 commission filings. 2FY 2024. Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Nashville is a dynamic metropolitan area The Nashville metro area is amongst the fastest growing areas in the U.S., with steady population growth ~3´ the national average and low unemployment rates supporting continued economic development Supported by a diverse set of industries – home to corporate headquarters for HCA Healthcare, Nissan North America, Bridgestone Americas, Tractor Supply Company and Dollar General; Oracle announced it is moving its headquarters to Nashville Regional growth dynamics are supported by a strong housing market, with access to top national homebuilders that translates into a robust pipeline of new residential customers Population growth 2013-2023 CAGR Real GDP growth 2013-2023 CAGR % of households with annual income >$100k 2023A Source: St. Louis FRED Economic Data, Nashville Area Chamber of Commerce, Leidos. Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Supportive regulatory environment Constructive and highly rated regulatory environment Tennessee ranked “Above Average / 3” by Regulatory Research Associates (RRA) Strong and established regulatory framework in place to encourage investment in natural gas infrastructure Supportive business environment in Tennessee Consistently ranked among the most business-friendly environments Strong legislative support of natural gas, including law ensuring fuel choice Established Annual Rate Review Mechanism (ARM) framework supports continued growth Annual true-up mechanism allows for regular rate updates Supports capital investment to support growing service territory Protects against other changing costs Positive framework underpinned by Piedmont Natural Gas and its track record of excellence Consistently ranks as a leader in customer service by Net Promoter Score (NPS) and organizations such as J.D. Power Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

Spire Alabama and Spire Gulf Tennessee Spire Mississippi Spire Missouri RRA ranking Above Average / 1 Above Average / 3 Above Average / 3 Average / 2 Rate setting mechanism Rate stabilization and equalization (RSE) – forward test year ARM – historical, with annual true-up mechanism Rate stabilization adjustment (RSA) – formula ratemaking Historical test year – future test year after July 20261 Rate filing deadline Annual filing by Oct. RSE reset Oct. 2026 The ARM filing date shall be no later than May 20 of each year Annual filing by Sept. Filed Nov. 20242 Infrastructure rider Infrastructure System Replacement Surcharge Cost control incentive Cost Control Measure Weather normalization ü ü ü ü Purchased gas rider ü ü ü ü Pension / OPEB tracker ü Property tax tracker ü Energy efficiency tracker ü 1The passage of Senate Bill 4 in April 2025 will allow for future test year ratemaking for rate cases filed after July 2026. 2Agreement in principle reached in early July 2025. Adds to existing, constructive jurisdictions Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025

1For the five-year period of 2025-2029. Supportive of long-term 5-7% adjusted EPS growth and growing dividends ü Combined investment opportunities $4.4 billion over five years1 ü Proven track record of gas utility integration ü Shift in business mix provides diversification and lowers risk ü Increases scale and expands regulated utility footprint in a high-quality jurisdiction ü Highly strategic acquisition for Spire ü Transformative acquisition Spire | Acquisition of the Piedmont Natural Gas Tennessee LDC business | July 29, 2025