UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2025

Commission File Number: 001-37384

GALAPAGOS NV

(Translation of registrant’s name into English)

Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

First Half-Year 2025 Results

On July 23, 2025, the Registrant announced its unaudited first half-year results for 2025 in a press release and half year-report, copies of which are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

| Exhibit |

Description |

|

| 99.1 | Press Release dated July 23, 2025 | |

| 99.2 | H1 Report 2025 | |

The information contained in this Report on Form 6-K, including Exhibits 99.1 and 99.2, except for the quotes of Mr. Henry Gosebruch and Mr. Aaron Cox included in Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Form S-8 (File Nos. 333-204567, 333-208697, 333-211834, 333-215783, 333-218160, 333-225263, 333-231765, 333-249416, 333-260500, 333-268756, 333-275886, and 333-283361).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GALAPAGOS NV | ||||||

| (Registrant) | ||||||

| Date: July 24, 2025 | /s/ Annelies Denecker | |||||

| Annelies Denecker | ||||||

| Company Secretary | ||||||

Exhibit 99.1

Galapagos Reports Half-Year 2025 Financial Results and Provides Second Quarter Business Update

Appointments of new CEO, CFO, and seasoned business development leaders with proven track records of executing strategic transactions will position the Company to drive shareholder value and advance pipeline expansion

Strategic alternatives for the cell therapy business, including a potential divestiture, are being evaluated; CAR-T programs maintain positive momentum with recently presented clinical data

Strong balance sheet with €3.1 billion in cash and financial investments as of June 30, 2025

Mechelen, Belgium; July 23, 2025, 22:01 CET; regulated information – inside information – Galapagos NV (Euronext & NASDAQ: GLPG) today announced its half-year 2025 financial results and provided a second quarter and post-period business update. These results are further detailed in the half-year 2025 financial report available on the financial reports section of the corporate website.

“We have commenced a bold new chapter in our transformation journey,” said Henry Gosebruch, Galapagos’ CEO. “Our priorities are clear: pursue and execute on transformational transactions to build a pipeline of innovative clinical programs and maximize the cash available for this new business development activity, all with the goal of delivering meaningful impact to patients. I am delighted that Aaron, Sooin and Dan have joined our senior team, as they will bring relevant experience to help us achieve these goals. Further, we are making solid progress in evaluating strategic alternatives for our cell therapy business and we look forward to updating shareholders at the appropriate time.”

Aaron Cox, Galapagos’ CFO, said: “I am very pleased to join Galapagos at such a pivotal time in the Company’s evolution. We closed the first half of 2025 with a strong cash position of €3.1 billion, providing a solid foundation for our next phase of growth. We remain committed to disciplined capital allocation as we pursue business development opportunities to build a pipeline of innovative programs. Following recent leadership changes and as we assess strategic alternatives for the cell therapy business, we plan to provide an updated 2025 cash outlook at the time of our third-quarter results.”

SECOND QUARTER 2025 AND RECENT BUSINESS UPDATE

Strategic and Corporate Update

| • | On May 13, 2025, Galapagos announced that the Board of Directors decided, following regulatory and market developments, to re-evaluate the previously proposed separation. As a result, strategic alternatives for the cell therapy business, including a potential divestiture, are being evaluated, with the goal of maximizing shareholder value: |

| • | To facilitate this process, Galapagos has established Galapagos Cell Therapeutics as a standalone entity within the Galapagos Group for consolidating all cell therapy activities. |

| • | An update on the strategic process is expected to be provided in conjunction with the third-quarter 2025 results. |

| • | Morgan Stanley is acting as financial advisor to Galapagos in connection with this process. |

| • | The remaining Galapagos business is focused on establishing a robust and novel pipeline of innovative medicines through transformational transactions. In recent months, the Company has taken decisive steps to advance this strategy by strengthening leadership and aligning internal capabilities to deliver on its goals: |

1

| • | Executive leadership has been reinforced with the appointment of Henry Gosebruch as Chief Executive Officer, succeeding Dr. Paul Stoffels1, and Aaron Cox as Chief Financial Officer, succeeding Thad Huston. |

| • | Ms. Sooin Kwon was appointed as Chief Business Officer (CBO) and Mr. Dan Grossman as Chief Strategy Officer (CStO), effective August 4, 2025. Recruitment for additional key leadership roles to further strengthen the management team is ongoing. |

| • | Dawn Svoronos and Jane Griffiths have been appointed as Non-Executive Independent Directors by way of co-optation, effective July 28, 2025, replacing Peter Guenter and Simon Sturge, who will be stepping down. |

| • | Gilead and Galapagos have entered into a cell therapy royalty and waiver agreement, giving Galapagos full global development and commercialization rights to its cell therapy business. Effective immediately, these programs are no longer subject to Gilead’s opt-in rights under the Option, License and Collaboration Agreement (OLCA). The procedure for related party transactions under Belgian law was applied in connection with this amendment. More details are provided in the legal disclosure in the appendix to this press release. |

| • | Galapagos has transferred certain small molecule programs in oncology and immunology to Onco3R Therapeutics and in return, Galapagos will receive equity and future milestone-based considerations. |

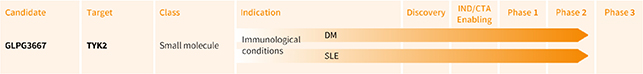

| • | Galapagos is actively exploring partnership opportunities for GLPG3667, a small molecule TYK2 inhibitor currently in Phase 3-enabling studies for systemic lupus erythematosus (SLE) and dermatomyositis (DM). Topline results from ongoing studies with GLPG3667 are expected during the first half of 2026. |

Advancing the Cell Therapy Pipeline and Platform Under Current Planning, Subject to Ongoing Strategic Review

| • | Galapagos presented new promising safety, efficacy and manufacturing data for GLPG5101 (CD19 CAR-T) from the completely enrolled cohort in relapsed/refractory (R/R) indolent non-Hodgkin lymphoma (iNHL) (Cohort 3) of the ongoing ATALANTA-1 Phase 1/2 study at ICML. As of the October 14, 2024 data cut-off, 34 patients with R/R iNHL (follicular lymphoma, FL, n=29; marginal zone lymphoma, MZL, n=5) underwent leukapheresis, of whom 32 (94%) received an infusion of GLPG5101. GLPG5101 demonstrated promising efficacy with robust and durable CAR-T cell expansion. A complete response (CR) rate of 97% (31/32) was observed with 100% of evaluable patients (10/10) being MRD negative at time of CR and the 12-month progression free survival (PFS) rate was 97%. GLPG5101 showed a favorable safety profile, with low rates of severe cytokine release syndrome (CRS) and immune effector cell-associated neurotoxicity syndrome (ICANS) observed and no deaths reported. |

| • | Galapagos presented new promising pooled safety and manufacturing data from the ongoing ATALANTA-1 Phase 1/2 study for GLPG5101 in 64 patients with R/R NHL at EHA. As of the October 14, 2024 data cut-off date, of the 64 patients enrolled, 61 received treatment, resulting in a 5% attrition rate, significantly lower than industry benchmarks. 95% of patients were infused with fresh, stem-like early memory CD19 CAR-T cells, with 89% receiving treatment within seven days, avoiding the need for cryopreservation and cytotoxic bridging therapy. The data showed that GLPG5101 was well-tolerated with only a single case of Grade 3 CRS and Grade 3 ICANS reported in this heavily pretreated population. |

| 1 | Dr. Paul Stoffels, acting via Stoffels IMC BV |

2

| • | GLPG5101 is being advanced toward pivotal development in mantle cell lymphoma (MCL), with enrollment expected to start in 2026. Following updates to the clinical study design, the Biologics License Application (BLA) filing is anticipated in 2028 with approval now expected in 2029. |

| • | Galapagos recently signed a collaboration agreement with CELLforCURE by Seqens to support the decentralized manufacturing of GLPG5101 for clinical development in Paris and the broader France area. |

| • | The Company’s other cell therapy programs continue to progress including GLPG5301, a BCMA CAR-T candidate for relapsed/refractory multiple myeloma; uza-cel, a MAGE A4 TCR-T candidate in head and neck cancer, in collaboration with Adaptimmune; and the early-stage next-generation CAR-T assets. |

FINANCIAL PERFORMANCE

First half-year 2025 key figures (consolidated)

(€ millions, except basic & diluted earnings/loss (-) per share)

| Six months ended June 30 |

% Change | |||||||||||

| 2025 | 2024 | |||||||||||

| Supply revenues |

18.5 | 19.1 | -3 | % | ||||||||

| Collaboration revenues |

121.8 | 121.2 | +1 | % | ||||||||

|

|

|

|

|

|||||||||

| Total net revenues |

140.3 | 140.3 | — | |||||||||

|

|

|

|

|

|||||||||

| Cost of sales |

(18.4 | ) | (19.1 | ) | -4 | % | ||||||

| R&D expenses |

(278.0 | ) | (145.2 | ) | +91 | % | ||||||

| G&Ai and S&Mii expenses |

(74.5 | ) | (63.9 | ) | +23 | % | ||||||

| Other operating income |

14.9 | 16.6 | -10 | % | ||||||||

|

|

|

|

|

|||||||||

| Operating loss |

(215.7 | ) | (71.3 | ) | +209 | % | ||||||

|

|

|

|

|

|||||||||

| Fair value adjustments and net exchange differences |

(66.2 | ) | 49.5 | |||||||||

| Net other financial result |

21.2 | 48.9 | ||||||||||

| Income taxes |

1.7 | 1.1 | ||||||||||

|

|

|

|

|

|||||||||

| Net profit/loss (-) from continuing operations |

(259.0 | ) | 28.2 | |||||||||

|

|

|

|

|

|||||||||

| Net profit/loss (-) from discontinued operations, net of tax |

(0.1 | ) | 71.0 | |||||||||

| Net profit/loss (-) of the period |

(259.1 | ) | 99.2 | |||||||||

| Basic and diluted earnings/loss (-) per share (€) |

(3.93 | ) | 1.51 | |||||||||

|

|

|

|

|

|||||||||

| Financial investments, cash & cash equivalents |

3,091.5 | 3,430.4 | ||||||||||

|

|

|

|

|

|||||||||

DETAILS OF THE FINANCIAL RESULTS OF THE FIRST HALF YEAR OF 2025

On May 13, 2025, Galapagos announced a strategic update regarding the Company’s intention to separate into two publicly traded entities. Since the initial announcement on January 8, 2025, the Company made significant progress in reorganizing its business towards the separation, which was expected by mid-2025, subject to shareholder approval and other customary conditions. However, following regulatory and market developments, the Board of Directors of Galapagos decided to re-evaluate the previously proposed separation, and the Company is exploring all strategic alternatives for the existing businesses, including the cell therapy business, with a focus on maximizing resources available for transformative business development transactions.

Total operating loss from continuing operations for the six months ended June 30, 2025, amounted to €215.7 million, compared to an operating loss of €71.3 million for the six months ended June 30, 2024. This operating loss was negatively impacted by the planned strategic reorganization and separation, for a total of €131.6 million. This is reflected in severance costs of €47.5 million, costs for early termination of collaborations of €45.7 million, impairment on fixed assets related to small molecules activities of €12.0 million, deal costs of €16.6 million, €8.0 million accelerated non-cash cost recognition for subscription right plans and €1.8 million other expenses.

3

| • | Total net revenues for the six months ended June 30, 2025 amounted to €140.3 million, compared to €140.3 million for the six months ended June 30, 2024. The revenue recognition related to the exclusive access rights granted to Gilead for Galapagos’ drug discovery platform amounted to €115.1 million for the first six months of both 2025 and 2024. The deferred income balance at June 30, 2025 includes €1.0 billion allocated to the Company’s drug discovery platform that will be recognized linearly over the remaining term of the Option, License and Collaboration Agreement (OLCA) with Gilead. |

| • | Cost of sales for the six months ended June 30, 2025 amounted to €18.4 million, compared to €19.1 million for the six months ended June 30, 2024, and related to the supply of Jyseleca® to Alfasigma under the transition agreement. The related revenues are reported in total net revenues. |

| • | R&D expenses in the first six months of 2025 amounted to €278.0 million, compared to €145.2 million for the first six months of 2024. Increased personnel expenses (mainly related to severance costs), impairment on fixed assets (related to small molecules programs), costs for early termination of collaboration agreements and higher cost related to cell therapy programs in oncology lead to this increase in R&D expenses. |

| • | G&A and S&M expenses amounted to €74.5 million in the first six months of 2025, compared to €63.9 million in the first six months of 2024. This increase was predominantly due to higher personnel costs (primarily severance costs) and higher legal and professional fees (deal costs). |

| • | Other operating income amounted to €14.9 million in the first six months of 2025, compared to €16.6 million for the same period last year, mainly driven by a reduction of recharges to Alfasigma. |

Net financial loss in the first six months of 2025 amounted to €45.0 million, compared to net financial income of €98.4 million for the first six months of 2024.

| • | Fair value adjustments and net currency exchange results in the first six months of 2025 amounted to a negative amount of €66.2 million, compared to fair value adjustments and net currency exchange gains of €49.5 million for the first six months of 2024, and were primarily attributable to €37.9 million of unrealized currency exchange losses on our cash and cash equivalents and current financial investments at amortized cost in U.S. dollars, and €27.2 million of negative changes in fair value of current financial investments. |

| • | Net other financial income in the first six months of 2025 amounted to €21.2 million, compared to net other financial income of €48.9 million for the first six months of 2024. Net interest income amounted to €21.5 million for the six months ended June 30, 2025, compared to €49.3 million of net interest income for the six months ended June 30, 2024, due to a decrease in the interest rates. |

The Company reported a net loss from continuing operations for the first six months of 2025 of €259.0 million, compared to a net profit from continuing operations of €28.2 million for the first six months of 2024.

Net loss from discontinued operations related to Jyseleca® amounted to €0.1 million for the first six months of 2025, compared to a net profit amounting to €71.0 million for the first six months of 2024. The operating profit from discontinued operations for the six months ended June 30, 2024, was mainly related to the gain on the sale of the Jysecela® business to Alfasigma of €52.3 million.

Galapagos reported a net loss for the six months ended June 30, 2025, of €259.1 million, compared to a net profit of €99.2 million for the six months ended June 30, 2024.

4

Cash, cash equivalents and financial investments totaled €3,091.5 million as of June 30, 2025, as compared to €3,317.8 million as of December 31, 2024.

On June 30, 2025, cash and cash equivalents and current financial investments included $2,156.2 million held in U.S. dollars (compared to $726.9 million on December 31, 2024) which could generate foreign exchange gains or losses in the financial results in accordance with the fluctuation of the EUR/U.S. dollar exchange rate as the functional currency of Galapagos is EUR.

Total net decrease in cash and cash equivalents and financial investments amounted to €226.3 million during the first six months of 2025, compared to a net decrease of €254.1 million during the first six months of 2024. This net decrease was composed of (i) €91.5 million of operational cash burn, (ii) €122.7 million of negative exchange rate differences, negative changes in fair value of current financial investments and variation in accrued interest income, (iii) €20.0 million loans and advances given to third parties, and (iv) €7.9 million of net cash in related to the sale/acquisition of subsidiaries.

FINANCIAL GUIDANCE

As of June 30, 2025, Galapagos had approximately €3.1 billion in cash and financial investments. Following recent leadership changes and as the Company assesses strategic alternatives for the cell therapy business, Galapagos plans to provide an updated 2025 cash outlook at the time of its third-quarter 2025 results.

About Galapagos

Galapagos is a biotechnology company with operations in Europe, the U.S., and Asia, dedicated to transforming patient outcomes through life-changing science and innovation for more years of life and quality of life. Focusing on high unmet medical needs, we synergize compelling science, technology, and collaborative approaches to create a deep pipeline of best-in-class medicines. With capabilities from lab to patient, including a decentralized cell therapy manufacturing platform, we are committed to challenging the status quo and delivering results for our patients, employees, and shareholders. Our goal is to meet current medical needs, and anticipate and shape the future of healthcare, ensuring that our innovations reach those who need them most. For additional information, please visit www.glpg.com or follow us on LinkedIn or X.

This press release contains inside information within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of April 16, 2014 on market abuse (market abuse regulation).

For further information, please contact:

| Media inquiries: Marieke Vermeersch +32 479 490 603 |

Investor inquiries: Glenn Schulman +1 412 522 6239 |

|

| media@glpg.com | ir@glpg.com |

|

Forward-looking statements

This press release contains forward-looking statements, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “believe,” “anticipate,” “plan,” “upcoming,” “future,” “estimate,” “may,” “will,” “could,” “would,” “potential,” “forward,” “goal,” “next,” “continue,” “should,” “encouraging,” “aim,” “progress,” “remain,” “advance,” “ambition,” “outlook,” “further,” as well as similar expressions. These statements include, but are not limited to, the guidance from management regarding our financial results (including guidance regarding the expected operational use of cash for the fiscal year 2025), statements regarding our regulatory outlook, statements regarding the amount and timing of potential future milestones, including potential milestone payments,

5

statements regarding our R&D plans, strategy and outlook, including progress on our oncology or immunology portfolio, and potential changes of such plans, statements regarding our pipeline and complementary technology platforms facilitating future growth, statements regarding our product candidates and partnered programs, statements regarding the expected timing, design and readouts of ongoing and planned clinical trials, including but not limited to (i) GLPG3667 in SLE and DM, (ii) GLPG5101 in R/R NHL, CLL, MCL and other hematological malignancies, and (iii) GLPG5301 in R/R MM, including recruitment for trials and interim or topline results for trials and studies in our portfolio, statements regarding the potential attributes and benefits of our product candidates, statements regarding our commercialization efforts for our product candidates and any of our future approved products, if any, statements about potential future commercial manufacturing of T-cell therapies, statements regarding our expectations on commercial sales of any of our product candidates (if approved), statements related to the anticipated timing for submissions to regulatory agencies, including any INDs or CTAs, statements relating to the development of our distributed manufacturing capabilities on a global basis, and statements related to our review of strategic alternatives, including the potential divestiture of our cell therapy business, anticipated leadership changes, potential partnering opportunities and anticipated changes to, our portfolio, goals and business plans. . Galapagos cautions the reader that forward-looking statements are based on our management’s current expectations and beliefs and are not guarantees of future performance. Forward-looking statements may involve known and unknown risks, uncertainties and other factors which might cause our actual results, financial conditions and liquidity, performance or achievements, or the industry in which we operate, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if Galapagos’ results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Such risks include, but are not limited to, the risk that our expectations and management’s guidance regarding our 2025 operating expenses, cash burn and other financial estimates may be incorrect (including because one or more of our assumptions underlying our revenue and expense expectations may not be realized), risks related to our ability to effectively transfer knowledge, risks associated with Galapagos’ product candidates and partnered programs, including GLPG5101 and uza-cel, the risk that ongoing and future clinical trials may not be completed in the currently envisaged timelines or at all, the inherent risks and uncertainties associated with competitive developments, clinical trials, recruitment of patients, product development activities and regulatory approval requirements (including the risk that data from our ongoing and planned clinical research programs in DM, SLE, R/R NHL, R/R CLL, R/R MM and other oncologic indications or any other indications or diseases, may not support registration or further development of our product candidates due to safety or efficacy concerns or other reasons), the risk that the preliminary and topline data from our studies, including the ATALANTA-1 study, may not be reflective of the final data, risks related to our reliance on collaborations with third parties (including, but not limited to, our collaboration partners Gilead, Lonza, and Adaptimmune), the risk that the transfer of the Jyseleca® business will not have the currently expected results for our business and results of operations, the risk that we will not be able to continue to execute on our currently contemplated business plan and/or will revise our business plan, including the risk that our plans with respect to CAR-T may not be achieved on the currently anticipated timeline or at all, the risk that our estimates of the commercial potential of our product candidates (if approved) or expectations regarding the costs and revenues associated with any commercialization rights may be inaccurate, the risks related to our strategic transformation, including the risk that we may not achieve the anticipated benefits of such exercise on the currently envisaged timeline or at all and the risks related to geopolitical conflicts and macro-economic events. A further list and description of these risks, uncertainties and other risks can be found in our filings and reports with the Securities and Exchange Commission (SEC), including in our most recent annual report on Form 20-F filed with the SEC and our subsequent filings and reports filed with the SEC. Given these risks and uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. In addition, even if the result of our operations, financial condition and liquidity, or the industry in which we operate are consistent with such forward-looking statements, they may not be predictive of results, performance or achievements in future periods. These forward-looking statements speak only as of the date of publication of this release. We expressly disclaim any obligation to update any such forward-looking statements in this release to reflect any change in our expectations or any change in events, conditions or circumstances, unless specifically required by law or regulation.

| i | General and administrative |

| ii | Sales and marketing |

The operational cash burn (or operational cash flow if this liquidity measure is positive) is equal to the increase or decrease in the cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus:

| • | the net proceeds, if any, from share capital and share premium increases included in the net cash flows generated from/used in (-) financing activities |

| • | the net proceeds or cash used, if any, related to the acquisitions or disposals of businesses; the acquisition of financial assets held at fair value through other comprehensive income; the movement in restricted cash and movement in financial investments, if any, the cash advances and loans given to third parties, if any, included in the net cash flows generated from/used in (-) investing activities |

| • | the cash used for other liabilities related to the acquisition or disposal of businesses, if any, included in the net cash flows generated from/used in (-) operating activities. |

This alternative liquidity measure is in the view of the Company an important metric for a biotech company in the development stage. The operational cash burn for the six months ended June 30, 2025, amounted to €91.5 million and can be reconciled to the cash flow statement by considering the increase in cash and cash equivalents of €10.5 million, adjusted by (i) the net sale of financial investments amounting to €114.0 million, (ii) the cash-in related to the sale/acquisition of subsidiaries of €8.0 million, and (iii) the loans and advances given to third parties of €20.0 million.

6

APPENDIX TO THE PRESS RELEASE

Announcement in application of Article 7:97, §4/1 of the BCAC (regulated information – inside information)

The Board of Directors of Galapagos NV (“Galapagos” or the “Company”) has approved the entering into of a royalty and waiver agreement with Gilead (the “Royalty Agreement”) (the “Transaction”).

Gilead Sciences Inc., as the ultimate parent company of Gilead Therapeutics A1 Unlimited Company, reference shareholder of the Company (“Gilead”), the counterparty to the Royalty Agreement, is a related party to the Company within the meaning of IAS 24. The transaction contemplated under this agreement is therefore subject to completion of the procedure provided for under Article 7:97 of the BCAC.

Details of the Transaction

The Transaction provides the Company with a release from the obligations it entered into under the option, license and collaboration agreement between the Company and Gilead Sciences dated 14 July 2019 (the “OLCA”) as regards the Company’s cell therapy business, which gives the Company full global development and commercialisation rights to its cell therapy business effective immediately.

In consideration for this release, the Company agreed to pay Gilead a single digit royalty on (i) all annual net sales on relevant products within the cell therapies business and (ii) the divestment proceeds received by the Company in the context of a divestment of (part of the) Company’s cell therapy business.

Conclusion of the Committee and assessment of the Company’s statutory auditor

A committee of three independent members of Galapagos’ Board of Directors (the “Committee”) has reviewed the terms and conditions of the transaction document and has issued a written, reasoned advice to the Board of Directors. The Committee was assisted by Lazard as an independent expert (the “Expert”) and Allen Overy Shearman Sterling (Belgium) LLP.

In its advice, the Committee concluded that: “In light of article 7:97 of the BCAC, the Committee has performed, with the assistance of the Expert, a thorough analysis of the Proposed Resolution.

This assessment included a detailed analysis of the Transaction embedded in this Proposed Resolution, an analysis of the financial impact and other consequences thereof, an identification of the advantages and disadvantages as well as an assessment how these fit in the Company’s strategy.

Based on such assessment, the Committee believes that the Proposed Resolution and the Transaction embedded therein are in the interest of the Company, given the balance between benefits and disadvantages that the transaction represents and the potential to accelerate value creation for all shareholders.”

The Board of Directors has, in its decision-making, not deviated from the conclusion of the Committee. The Company’s statutory auditor has carried out its assessment in accordance with article 7:97, §4 of the BCAC, the conclusion of which provides as follows: “Based on our review, nothing has come to our attention that causes us to believe that the financial and accounting data reported in the advice of the Ad hoc committee of the independent members of the Board of Directors dated on July 22, 2025 and in the

7

minutes of the Board of Directors dated on July 22, 2025, which justify the proposed transaction, are not consistent, in all material respects, compared to the information we possess in the context of our mission.

Our mission is solely executed for the purposes described in article 7:97 CCA and therefore our report may not be used for any other purpose.”

8

Exhibit 99.2

ABOUT THIS REPORT

About This Report

This report contains information required under Belgian law. Galapagos NV is a limited liability company organized under the laws of Belgium, having its registered office at Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium and registered with the Crossroads Enterprise Database (RPR Antwerp – division Mechelen) under number 0466.460.429.

Throughout this report, the term “Galapagos NV” refers solely to the non-consolidated Belgian company, and references to “we,” “our,” “the group” or “Galapagos” include Galapagos NV together with its subsidiaries.

This report is published in Dutch and in English. Galapagos will use reasonable efforts to ensure the translation and conformity between the Dutch and English versions. In case of inconsistency between the Dutch and the English version, the Dutch version shall prevail.

This report is available free of charge and upon request addressed to:

Galapagos NV

Investor Relations

Generaal De Wittelaan L11 A3 2800 Mechelen, Belgium

Tel: +32 15 34 29 00

Email: ir@glpg.com

A digital version of this report is available on our website, www.glpg.com.

We will use reasonable efforts to ensure the accuracy of the digital version, but we do not assume responsibility if inaccuracies or inconsistencies with the printed or PDF document arise as a result of any electronic transmission. Other information on our website or on other websites does not form a part of this report.

With the exception of filgotinib’s approval as Jyseleca® (which was transferred to Alfasigma in early 2024) for the treatment of moderate-to-severe rheumatoid arthritis and ulcerative colitis by the European Commission, Great Britain’s Medicines and Healthcare products Regulatory Agency, and the Japanese Ministry of Health, Labour and Welfare, our drug candidates mentioned in this report are investigational; their efficacy and safety have not been fully evaluated by any regulatory authority.

2

Galapagos NV Half-Year Financial Report 2025

TABLE OF CONTENTS

Table of Contents

| Management Report |

||||

| Main Events in the First Six Months of 2025 |

5 | |||

| Financial Highlights |

8 | |||

| The Galapagos Share |

12 | |||

| Related Party Transactions |

13 | |||

| Risk Factors |

13 | |||

| Financial Statements |

||||

| Unaudited Condensed Consolidated Interim |

||||

| Financial Statements |

15 | |||

| Notes |

22 | |||

| Other Information |

||||

| Forward-Looking Statements |

35 | |||

| Glossary |

37 | |||

| Financial Calendar |

45 | |||

| Other Information |

46 | |||

| Contact |

47 |

3

Galapagos NV Half-Year Financial Report 2025

Management Report

MANAGEMENT REPORT

Main Events in the First Six Months of 2025

Portfolio

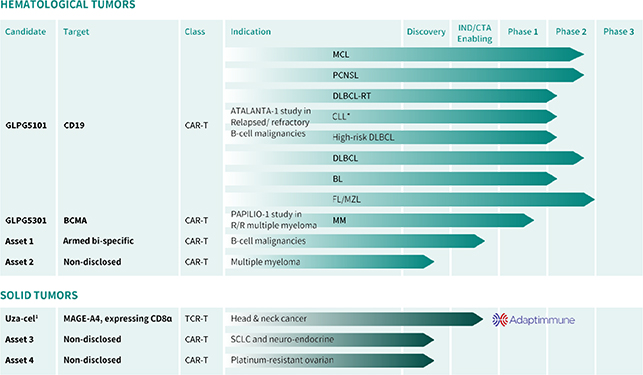

The charts below provide an overview of our R&D pipeline in oncology and immunology comprising our product candidates that are in development as of the date of this report’s publication.

Oncology

Robust Best-in-Class Pipeline

| * | GLPG5101 protocol being amended to include CLL. BIC, best-in-class; BL, Burkitt lymphoma; CLL, chronic lymphocytic leukemia; DLBCL, diffuse large B- cell lymphoma; FL, follicular lymphoma; High-risk DLBCL with International Prognostic Index 3-5 or double/triple-hit lymphoma, primary refractory disease, defined as subjects failing to achieve a complete response to first-line anti-CD20 and anthracycline-based chemoimmunotherapy after ≥2 cycles at the interim disease assessment; MCL, mantle cell lymphoma; MM, multiple myeloma; MZL, marginal zone lymphoma; PCNSL, primary central nervous system lymphoma; R/R relapsed/refractory; RT, Richter transformation; SCLC, small-cell lung cancer; 1Collaboration with ADAP |

Immunology

DM, dermatomyositis; SLE, systemic lupus erythematosus See our Q1 2025 press release.

5

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

First Quarter 2025

Second Quarter 2025 and Post-Period Update

Strategic and Corporate Update

| • | On May 13, 2025, we announced that the Board of Directors decided, following regulatory and market developments, to re-evaluate the previously proposed separation. As a result, strategic alternatives for the cell therapy business, including a potential divestiture, are being evaluated, with the goal of maximizing shareholder value: |

| • | To facilitate this process, we established Galapagos Cell Therapeutics as a standalone entity within the Galapagos Group for consolidating all cell therapy activities. |

| • | An update on the strategic process is expected to be provided in conjunction with the third-quarter 2025 results. |

| • | Morgan Stanley is acting as financial advisor in connection with this process. |

| • | Our remaining business is focused on establishing a robust and novel pipeline of innovative medicines through transformational transactions. In recent months, we have taken decisive steps to advance this strategy by strengthening leadership and aligning internal capabilities to deliver on our goals: |

| • | Executive leadership has been reinforced with the appointment of Henry Gosebruch as Chief Executive Officer, succeeding Dr. Paul Stoffels1, and Aaron Cox as Chief Financial Officer, succeeding Thad Huston. |

| • | Ms. Sooin Kwon was appointed as Chief Business Officer (CBO) and Mr. Dan Grossman as Chief Strategy Officer (CStO), effective August 4, 2025. Recruitment for additional key leadership roles to further strengthen our management team is ongoing. |

| • | Dawn Svoronos and Jane Griffiths have been appointed as Non-Executive Independent Directors by way of co- optation, effective July 28, 2025, replacing Peter Guenter and Simon Sturge, who will be stepping down. |

| • | We transferred certain small molecule programs in oncology and immunology to Onco3R Therapeutics and in return, we will receive equity and future milestone-based considerations. |

| • | We are actively exploring partnership opportunities for GLPG3667, a small molecule TYK2 inhibitor currently in Phase 3-enabling studies for systemic lupus erythematosus (SLE) and dermatomyositis (DM). Topline results from ongoing studies with GLPG3667 are expected during the first half of 2026. |

| 1 | Dr. Paul Stoffels, acting via Stoffels IMC BV |

6

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

Advancing the Cell Therapy Pipeline and Platform Under Current Planning, Subject to Ongoing Strategic Review

| • | We presented new promising safety, efficacy and manufacturing data for GLPG5101 (CD19 CAR-T) from the completely enrolled cohort in relapsed/refractory (R/R) indolent non-Hodgkin lymphoma (iNHL) (Cohort 3) of the ongoing ATALANTA-1 Phase 1/2 study at ICML. As of the October 14, 2024 data cut-off, 34 patients with R/R iNHL (follicular lymphoma, FL, n=29; marginal zone lymphoma, MZL, n=5) underwent leukapheresis, of whom 32 (94%) received an infusion of GLPG5101. GLPG5101 demonstrated promising efficacy with robust and durable CAR-T cell expansion. A complete response (CR) rate of 97% (31/32) was observed with 100% of evaluable patients (10/10) being MRD negative at time of CR and the 12-month progression free survival (PFS) rate was 97%. GLPG5101 showed a favorable safety profile, with low rates of severe cytokine release syndrome (CRS) and immune effector cell-associated neurotoxicity syndrome (ICANS) observed, and no deaths reported. |

| • | We presented new promising pooled safety and manufacturing data from the ongoing ATALANTA-1 Phase 1/2 study for GLPG5101 in 64 patients with R/R NHL at EHA. As of the October 14, 2024 data cut-off date, of the 64 patients enrolled, 61 received treatment, resulting in a 5% attrition rate, significantly lower than industry benchmarks. 95% of patients were infused with fresh, stem-like early memory CD19 CAR-T cells, with 89% receiving treatment within seven days, avoiding the need for cryopreservation and cytotoxic bridging therapy. The data showed that GLPG5101 was well-tolerated with only a single case of Grade 3 CRS and Grade 3 ICANS reported in this heavily pretreated population. |

| • | GLPG5101 is being advanced toward pivotal development in mantle cell lymphoma (MCL), with enrollment expected to start in 2026. Following updates to the clinical study design, the Biologics License Application (BLA) filing is anticipated in 2028 with approval now expected in 2029. |

| • | We recently signed a collaboration agreement with CELLforCURE, by Seqens, to support the decentralized manufacturing of GLPG5101 for clinical development in Paris and the broader France area. |

| • | Our other cell therapy programs continue to progress including GLPG5301, a BCMA CAR-T candidate for relapsed/ refractory multiple myeloma; uza-cel, a MAGE A4 TCR-T candidate in head and neck cancer, in collaboration with Adaptimmune; and the early-stage next-generation CAR-T assets. |

Financial Guidance

As of June 30, 2025, we had approximately €3.1 billion in cash and financial investments. Following recent leadership changes and as we are assessing strategic alternatives for the cell therapy business, we plan to provide an updated 2025 cash outlook at the time of our third-quarter 2025 results.

7

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

Financial Highlights

Consolidated Key Figures

| (thousands of €, if not stated otherwise) |

Six months ended June 30, 2025 |

Six months ended June 30, 2024 |

Year ended December 31, 2024 |

|||||||||

| Income statement |

||||||||||||

| Supply revenues |

18,486 | 19,105 | 34,863 | |||||||||

| Collaboration revenues |

121,779 | 121,200 | 240,786 | |||||||||

| Total net revenues |

140,265 | 140,305 | 275,649 | |||||||||

| Cost of sales |

(18,435 | ) | (19,105 | ) | (34,863 | ) | ||||||

| R&D expenses |

(278,027 | ) | (145,225 | ) | (335,459 | ) | ||||||

| S&M, G&A expenses |

(74,470 | ) | (63,925 | ) | (134,438 | ) | ||||||

| Other operating income |

14,932 | 16,638 | 40,773 | |||||||||

| Operating loss |

(215,735 | ) | (71,312 | ) | (188,338 | ) | ||||||

| Net financial results |

(45,056 | ) | 98,337 | 185,253 | ||||||||

| Taxes |

1,788 | 1,139 | 1,803 | |||||||||

| Net profit/loss (–) from continuing operations |

(259,003 | ) | 28,164 | (1,282 | ) | |||||||

| Net profit/loss (–) from discontinued operations, net of tax |

(148 | ) | 71,041 | 75,364 | ||||||||

| Net profit/loss (–) |

(259,151 | ) | 99,205 | 74,082 | ||||||||

| Income statement from discontinued operations |

||||||||||||

| Product net sales |

— | 11,264 | 11,475 | |||||||||

| Collaboration revenues |

— | 26,041 | 26,041 | |||||||||

| Total net revenues |

— | 37,305 | 37,516 | |||||||||

| Cost of sales |

— | (2,012 | ) | (1,693 | ) | |||||||

| R&D expenses |

(12,516 | ) | (11,279 | ) | (8,152 | ) | ||||||

| S&M, G&A expenses |

(620 | ) | (10,320 | ) | (12,607 | ) | ||||||

| Other operating income |

11,599 | 54,601 | 56,180 | |||||||||

| Operating profit/loss (–) |

(1,537 | ) | 68,295 | 71,244 | ||||||||

| Net financial results |

1,921 | 2,844 | 4,218 | |||||||||

| Taxes |

(532 | ) | (98 | ) | (98 | ) | ||||||

| Net profit/loss (–) from discontinued operations, net of tax |

(148 | ) | 71,041 | 75,364 | ||||||||

8

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

| (thousands of €, if not stated otherwise) |

Six months ended June 30, 2025 |

Six months ended June 30, 2024 |

Year ended December 31, 2024 |

|||||||||

| Balance sheet |

||||||||||||

| Cash and cash equivalents |

71,669 | 72,328 | 64,239 | |||||||||

| Financial investments |

3,019,835 | 3,358,092 | 3,253,516 | |||||||||

| R&D incentives receivables |

147,672 | 172,139 | 172,611 | |||||||||

| Assets |

3,818,224 | 4,290,367 | 4,135,719 | |||||||||

| Shareholders’ equity |

2,643,819 | 2,910,295 | 2,896,939 | |||||||||

| Deferred income |

954,066 | 1,186,822 | 1,071,352 | |||||||||

| Other liabilities |

220,339 | 193,250 | 167,428 | |||||||||

| Cash flow |

||||||||||||

| Operational cash burn |

(91,529 | ) | (250,041 | ) | (373,961 | ) | ||||||

| Cash flow used in operating activities |

(147,388 | ) | (188,867 | ) | (320,026 | ) | ||||||

| Cash flow generated from investing activities |

159,452 | 95,678 | 220,597 | |||||||||

| Cash flow used in financing activities |

(1,611 | ) | (2,232 | ) | (4,924 | ) | ||||||

| Increase/decrease (–) in cash and cash equivalents |

10,453 | (95,421 | ) | (104,353 | ) | |||||||

| Effect of currency exchange rate fluctuation on cash and cash equivalents |

(3,023 | ) | 939 | 1,782 | ||||||||

| Cash and cash equivalents at the end of the period |

71,669 | 72,328 | 64,239 | |||||||||

| Financial investments at the end of the period |

3,019,835 | 3,358,092 | 3,253,516 | |||||||||

| Total financial investments and cash and cash equivalents at the end of the period |

3,091,504 | 3,430,420 | 3,317,755 | |||||||||

| Financial ratios |

||||||||||||

| Number of shares issued at the end of the period |

65,897,071 | 65,897,071 | 65,897,071 | |||||||||

| Basic and diluted earnings/loss (–) per share |

(3.93 | ) | 1.51 | 1.12 | ||||||||

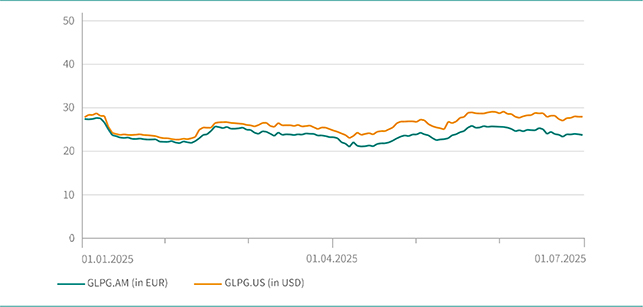

| Share price at the end of the period (in €) |

23.76 | 23.34 | 26.52 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total group employees at the end of the period (number) |

558 | 683 | 704 | |||||||||

|

|

|

|

|

|

|

|||||||

9

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

First-Half 2025 Financial Results

On May 13, 2025, we announced a strategic update regarding the company’s intention to separate into two publicly traded entities. Since the initial announcement on January 8, 2025, we made significant progress in reorganizing our business towards the separation, which was expected by mid-2025, subject to shareholder approval and other customary conditions. However, following regulatory and market developments, our Board of Directors decided to re-evaluate the previously proposed separation. As such, we are exploring all strategic alternatives for the existing businesses, including the cell therapy business, with a focus on maximizing resources available for transformative business development transactions.

| • | Total operating loss from continuing operations for the six months ended June 30, 2025, was €215.7 million, compared to an operating loss of €71.3 million for the six months ended June 30, 2024. This operating loss was negatively impacted by the strategic reorganization and intended separation, for a total of €131.6 million. This is reflected in severance costs of €47.5 million, costs for early termination of collaborations of €45.7 million, impairment on fixed assets related to small molecules activities of €12.0 million, deal costs of €16.6 million, €8.0 million accelerated non- cash cost recognition for subscription right plans related to good leavers and €1.8 million other expenses. |

| • | Total net revenues for the six months ended June 30, 2025, amounted to €140.3 million, compared to €140.3 million for the six months ended June 30, 2024. The revenue recognition related to the exclusive access rights granted to Gilead for our drug discovery platform amounted to €115.1 million for the first six months of both 2025 and 2024. Our deferred income balance at June 30, 2025 includes €1.0 billion allocated to our drug discovery platform that will be recognized linearly over the remaining term of the Option, License and Collaboration Agreement (OLCA) with Gilead. We have recognized royalty income from Gilead for Jyseleca® for €5.6 million in the first six months of 2025 (compared to €6.1 million in the same period last year). |

| • | Cost of sales for the six months ended June 30, 2025, amounted to €18.4 million, compared to €19.1 million in the same period last year, and related to the supply of Jyseleca® to Alfasigma under the transition agreement. The related revenues are reported in total net revenues. |

| • | R&D expenses in the first six months of 2025 amounted to €278.0 million, compared to €145.2 million for the first six months of 2024. This increase was primarily explained by an increase in subcontracting cost from €64.6 million in the first half-year of 2024 to €141.0 million in the first half-year of 2025 due to increased costs for CAR-T and small molecule programs in oncology, and costs for early termination of collaborations. Personnel costs increased from €42.0 million in the first half of 2024 to €82.3 million for the same period this year due to severance costs. Depreciation and impairment expenses increased from €13.3 million in the first six months of 2024 to €32.2 million in the first six months of 2025 due to impairments on fixed assets related to small molecules activities. |

| • | S&M expenses amounted to €1.6 million in the first six months of 2025, compared to €7.1 million in the first six months of 2024. The decrease related to the reversal of a bad debt provision on Alfasigma receivables, a decrease in professional fees and other operating expenses. |

| • | G&A expenses amounted to €72.9 million in the first six months of 2025, compared to €56.8 million in the first six months of 2024. The increase in legal and professional fees, from €15.6 million in the first six months of 2024 to €20.8 million in the first six months of 2025 mainly related to deal costs, while the increase in personnel expenses of €11.7 million (from €25.4 million in the first six months of 2024 to €37.1 million in the same period this year) was due to higher severance costs. |

| • | Other operating income amounted to €14.9 million in the first six months of 2025, compared to €16.6 million for the same period last year, mainly driven by a reduction of recharges to Alfasigma. |

Net financial loss in the first six months of 2025 amounted to €45.0 million (as compared to net financial income of €98.3 million in the same period last year) and consisted mainly of €21.8 million interest income (as compared to €49.4 million interest income in the same period last year) due to the decreased interest rates. Net financial loss in the first six months of 2025 also included €37.9 million of unrealized currency exchange loss on our cash and cash equivalents and current financial investments at amortized cost in U.S. dollar (as compared to €18.2 million unrealized currency exchange gain on cash and cash equivalents and current financial investments in the first six months of 2024), as a result of the fluctuation of the U.S. dollar, and €27.2 million negative changes in fair value of current financial investments (€31.2 million positive changes in the same period last year).

10

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

We had €1.8 million of tax income for the first six months of 2025 (as compared to €1.1 million tax income for the same period last year).

Net loss from continuing operations for the first six months of 2025 was €259.0 million, compared to a net profit from continuing operations of €28.2 million for the same period last year.

Net loss from discontinued operations related to Jyseleca® amounted to €0.1 million for the first six months of 2025, compared to a net profit amounting to €71.0 million for the first six months of 2024. The operating profit from discontinued operations for the six months ended June 30, 2024, was mainly related to the gain on the sale of the Jyseleca® business to Alfasigma of €52.3 million.

We reported a net loss for the six months ended June 30, 2025, of €259.1 million, as compared to a net profit of €99.2 million for the six months ended June 30, 2024.

Cash, Cash Equivalents and Financial Investments

Cash and cash equivalents and financial investments totaled €3,091.5 million as of June 30, 2025 (€3,317.8 million as of 31 December 2024).

On June 30, 2025, our cash and cash equivalents and current financial investments included $2,156.2 million held in U.S. dollars ($726.9 million on December 31, 2024) which could generate foreign exchange gains or losses in our financial results in accordance with the fluctuation of the EUR/U.S. dollar exchange rate as our functional currency is EUR.

A net decrease of €226.3 million in cash and cash equivalents and financial investments was recorded during the first six months of 2025, compared to a net decrease of €254.1 million during the first six months of 2024.

This net decrease was composed of (i) €91.5 million of operational cash burn, (ii) €122.7 million of negative exchange rate differences, negative changes in fair value of current financial investments and variation in accrued interest income, (iii) €20.0 million loans and advances given to third parties, partly offset by (iv) €7.9 million of net cash in related to the sale/ acquisition of subsidiaries.

The operational cash burn (or operational cash flow if this liquidity measure is positive) is a financial measure that is not calculated in accordance with IFRS. Operational cash burn/cash flow is defined as the increase or decrease in our cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus:

| 1. | the net proceeds, if any, from share capital and share premium increases included in the net cash flows generated from/used in (–) financing activities. |

| 2. | the net proceeds or cash used, if any, in acquisitions or disposals of businesses; the acquisition of equity investments held at fair value; the movement in restricted cash and movement in financial investments, if any, the loans and advances given to third parties, if any, included in the net cash flows generated from/used in (–) investing activities. |

| 3. | the cash used for other liabilities related to the acquisition of businesses, if any, included in the net cash flows generated from/used in (–) operating activities. |

This alternative liquidity measure is in our view an important metric for a biotech company in the development stage.

11

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

The following table provides a reconciliation of the operational cash burn:

| Six months ended June 30 | ||||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Increase/decrease (–) in cash and cash equivalents (excluding effect of exchange differences) |

10,453 | (95,421 | ) | |||||

| Less: |

||||||||

| Convertible loan issued to third party |

20,000 | — | ||||||

| Net sale of financial investments |

(114,041 | ) | (200,307 | ) | ||||

| Acquisition of equity investments held at fair value |

— | 36,880 | ||||||

| Cash in/cash out (–) from the disposal of subsidiaries, net of cash disposed of |

(9,733 | ) | 5,209 | |||||

| Cash used for other liabilities related to the disposal of subsidiaries |

— | 3,598 | ||||||

| Cash used for other liabilities related to the acquisition of subsidiaries |

1,792 | — | ||||||

|

|

|

|

|

|||||

| Total operational cash burn |

(91,529 | ) | (250,041 | ) | ||||

|

|

|

|

|

|||||

The Galapagos Share

Galapagos NV (ticker: GLPG) has been listed on Euronext Amsterdam and Brussels since May 6, 2005 and on the Nasdaq Global Select Market since May 14, 2015.

Performance of the Galapagos share on Euronext and Nasdaq

12

Galapagos NV Half-Year Financial Report 2025

MANAGEMENT REPORT

Related Party Transactions

We refer to the statements included under the heading “Related party transactions” in the “Notes to the unaudited condensed consolidated interim financial statements for the first six months of 2025” part of this report.

Risk Factors

We refer to the description of risk factors in our 2024 annual report, pp. 141–158, as supplemented by the description of risk factors in our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, pp. 3–61. In summary of the foregoing, the principal risks and uncertainties faced by us relate to and include, but are not limited to: product development and regulatory approval, commercialization, our financial position and need for additional capital, our reliance on third parties, our intellectual property, our competitive position, our organization, structure and operation, and market risks relating to our shares and ADSs.

We also refer to the description of the group’s financial risk management given in the 2024 annual report, pp. 223–225, which remains valid and unaltered.

13

Galapagos NV Half-Year Financial Report 2025

Financial Statements

FINANCIAL STATEMENTS

Unaudited Condensed Consolidated Interim Financial Statements for the First Six Months of 2025

Consolidated Statement of Income and Comprehensive Income/Loss (-) (unaudited)

Consolidated income statement

| Six months ended June 30 | ||||||||

| (thousands of €, except per share data) |

2025 | 2024 | ||||||

| Supply revenues |

18,486 | 19,105 | ||||||

| Collaboration revenues |

121,779 | 121,200 | ||||||

|

|

|

|

|

|||||

| Total net revenues |

140,265 | 140,305 | ||||||

|

|

|

|

|

|||||

| Cost of sales |

(18,435 | ) | (19,105 | ) | ||||

| Research and development expenses |

(278,027 | ) | (145,225 | ) | ||||

| Sales and marketing expenses |

(1,556 | ) | (7,092 | ) | ||||

| General and administrative expenses |

(72,914 | ) | (56,833 | ) | ||||

| Other operating income |

14,932 | 16,638 | ||||||

|

|

|

|

|

|||||

| Operating loss |

(215,735 | ) | (71,313 | ) | ||||

|

|

|

|

|

|||||

| Fair value adjustments and net currency exchange differences |

(66,228 | ) | 49,455 | |||||

| Other financial income |

22,536 | 50,015 | ||||||

| Other financial expenses |

(1,364 | ) | (1,133 | ) | ||||

|

|

|

|

|

|||||

| Profit/loss (–) before tax |

(260,791 | ) | 27,024 | |||||

|

|

|

|

|

|||||

| Income taxes |

1,788 | 1,139 | ||||||

|

|

|

|

|

|||||

| Net profit/loss (–) from continuing operations |

(259,003 | ) | 28,164 | |||||

|

|

|

|

|

|||||

| Net profit/loss (–) from discontinued operations, net of tax |

(148 | ) | 71,041 | |||||

|

|

|

|

|

|||||

| Net profit/loss (–) |

(259,151 | ) | 99,205 | |||||

|

|

|

|

|

|||||

15

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

| Six months ended June 30 | ||||||||

| (thousands of €, except per share data) |

2025 | 2024 | ||||||

| Net profit/loss (–) attributable to: |

||||||||

| Owners of the parent |

(259,151 | ) | 99,205 | |||||

| Basic and diluted earnings/loss (–) per share |

(3.93 | ) | 1.51 | |||||

| Basic and diluted earnings/loss (–) per share from continuing operations |

(3.93 | ) | 0.43 | |||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

Consolidated statement of comprehensive income/loss (–)

| Six months ended June 30 | ||||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Net profit/loss (–) |

(259,151 | ) | 99,205 | |||||

| Items that will not be reclassified subsequently to profit or loss: |

||||||||

| Re-measurement of defined benefit obligation |

— | 74 | ||||||

| Fair value adjustment financial assets held at fair value through other comprehensive income |

(6,012 | ) | 923 | |||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||

| Translation differences, arisen from translating foreign activities |

(618 | ) | 215 | |||||

| Realization of translation differences upon sale of foreign operations |

— | 4,095 | ||||||

| Other comprehensive income/loss (–), net of income tax |

(6,630 | ) | 5,307 | |||||

| Total comprehensive income/loss (–) |

||||||||

|

|

|

|

|

|||||

| Owners of the parent |

(265,781 | ) | 104,512 | |||||

| Total comprehensive income/loss (–) attributable to owners of the parent arises from: |

||||||||

|

|

|

|

|

|||||

| Continuing operations |

(265,633 | ) | 29,112 | |||||

| Discontinued operations |

(148 | ) | 75,400 | |||||

|

|

|

|

|

|||||

| Total comprehensive income/loss (–), net of income tax |

(265,781 | ) | 104,512 | |||||

|

|

|

|

|

|||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

16

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Consolidated Statement of Financial Position

(unaudited)

| June 30 | December 31 | |||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Assets |

||||||||

| Goodwill |

69,151 | 70,010 | ||||||

| Intangible assets other than goodwill |

147,427 | 164,862 | ||||||

| Property, plant and equipment |

109,686 | 122,898 | ||||||

| Deferred tax assets |

870 | 1,474 | ||||||

| Non-current R&D incentives receivables |

115,330 | 132,729 | ||||||

| Non-current contingent consideration receivable |

50,645 | 42,465 | ||||||

| Equity investments |

46,928 | 52,941 | ||||||

| Other non-current assets |

2,527 | 8,708 | ||||||

| Convertible loan |

20,348 | — | ||||||

| Non-current financial investments |

— | 200,182 | ||||||

|

|

|

|

|

|||||

| Non-current assets |

562,912 | 796,269 | ||||||

|

|

|

|

|

|||||

| Inventories |

33,794 | 51,192 | ||||||

| Trade and other receivables |

55,499 | 47,476 | ||||||

| Current R&D incentives receivables |

32,342 | 39,882 | ||||||

| Current financial investments |

3,019,835 | 3,053,334 | ||||||

| Cash and cash equivalents |

71,669 | 64,239 | ||||||

| Escrow account |

21,819 | 41,163 | ||||||

| Other current assets |

20,354 | 31,049 | ||||||

|

|

|

|

|

|||||

| Current assets from continuing operations |

3,255,312 | 3,328,335 | ||||||

|

|

|

|

|

|||||

| Assets in disposal group classified as held for sale |

— | 11,115 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,255,312 | 3,339,450 | ||||||

|

|

|

|

|

|||||

| Total assets |

3,818,224 | 4,135,719 | ||||||

|

|

|

|

|

|||||

17

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

| June 30 | December 31 | |||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Equity and liabilities |

||||||||

| Share capital |

293,937 | 293,937 | ||||||

| Share premium account |

2,736,994 | 2,736,994 | ||||||

| Other reserves |

(9,215 | ) | (3,158 | ) | ||||

| Translation differences |

2,899 | 3,472 | ||||||

| Accumulated losses |

(380,796 | ) | (134,306 | ) | ||||

|

|

|

|

|

|||||

| Total equity |

2,643,819 | 2,896,939 | ||||||

|

|

|

|

|

|||||

| Retirement benefit liabilities |

2,109 | 2,099 | ||||||

| Deferred tax liabilities |

17,877 | 20,660 | ||||||

| Non-current lease liabilities |

6,050 | 8,243 | ||||||

| Other non-current liabilities |

21,585 | 33,821 | ||||||

| Non-current deferred income |

723,830 | 838,876 | ||||||

|

|

|

|

|

|||||

| Non-current liabilities |

771,451 | 903,699 | ||||||

|

|

|

|

|

|||||

| Current lease liabilities |

2,393 | 3,479 | ||||||

| Trade and other liabilities |

133,179 | 98,877 | ||||||

| Provisions |

36,868 | — | ||||||

| Current tax payable |

278 | 249 | ||||||

| Current deferred income |

230,236 | 232,476 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

402,954 | 335,081 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,174,405 | 1,238,780 | ||||||

|

|

|

|

|

|||||

| Total equity and liabilities |

3,818,224 | 4,135,719 | ||||||

|

|

|

|

|

|||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

18

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Consolidated Cash Flow Statement

(unaudited)

| Six months ended June 30 | ||||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Net profit/loss (–) of the year |

(259,151 | ) | 99,205 | |||||

|

|

|

|

|

|||||

| Adjustment for non-cash transactions |

168,205 | (14,184 | ) | |||||

| Adjustment for items to disclose separately under operating cash flow |

(22,743 | ) | (49,814 | ) | ||||

| Adjustment for items to disclose under investing and financing cash flows |

(41,328 | ) | (62,075 | ) | ||||

| Change in working capital other than deferred income |

112,335 | (64,496 | ) | |||||

| Cash used for other liabilities related to the disposal of subsidiaries |

— | (3,598 | ) | |||||

| Cash used for other liabilities related to the acquisition of subsidiaries |

(1,792 | ) | — | |||||

| Decrease in deferred income |

(117,286 | ) | (140,038 | ) | ||||

|

|

|

|

|

|||||

| Cash used in operations |

(161,760 | ) | (235,000 | ) | ||||

|

|

|

|

|

|||||

| Interest paid |

(304 | ) | (501 | ) | ||||

| Interest received |

14,880 | 47,228 | ||||||

| Corporate taxes paid |

(204 | ) | (594 | ) | ||||

|

|

|

|

|

|||||

| Net cash flow used in operating activities |

(147,388 | ) | (188,867 | ) | ||||

|

|

|

|

|

|||||

19

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

| Six months ended June 30 | ||||||||

| (thousands of €) |

2025 | 2024 | ||||||

| Purchase of property, plant and equipment |

(9,250 | ) | (7,062 | ) | ||||

| Purchase of intangible fixed assets |

(155 | ) | (65,036 | ) | ||||

| Purchase of financial investments |

(2,087,499 | ) | (1,516,737 | ) | ||||

| Investment income received related to financial investments |

42,338 | 9,558 | ||||||

| Sale of financial investments |

2,201,540 | 1,717,044 | ||||||

| Proceeds from settlement of hedging instrument |

22,745 | — | ||||||

| Cash in/cash out (–) from the disposal of subsidiaries, net of cash disposed of |

9,733 | (5,209 | ) | |||||

| Convertible loan issued to third party |

(20,000 | ) | — | |||||

| Acquisition of equity investments held at fair value |

— | (36,880 | ) | |||||

| Net cash flow generated from investing activities |

159,452 | 95,678 | ||||||

|

|

|

|

|

|||||

| Payment of lease liabilities |

(1,611 | ) | (2,232 | ) | ||||

| Net cash flow used in financing activities |

(1,611 | ) | (2,232 | ) | ||||

|

|

|

|

|

|||||

| Increase/decrease (–) in cash and cash equivalents |

10,453 | (95,421 | ) | |||||

|

|

|

|

|

|||||

| Cash and cash equivalents at beginning of the period |

64,239 | 166,810 | ||||||

|

|

|

|

|

|||||

| Increase/decrease (–) in cash and cash equivalents |

10,453 | (95,421 | ) | |||||

| Effect of exchange rate differences on cash and cash equivalents |

(3,023 | ) | 939 | |||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of the period |

71,669 | 72,328 | ||||||

|

|

|

|

|

|||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

20

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Consolidated Statement of Changes in Equity

(unaudited)

| (thousands of €) |

Share capital |

Share premium account |

Translation differences |

Other reserves |

Accumul. losses |

Total | ||||||||||||||||||

| On January 1, 2024 |

293,937 | 2,736,994 | (1,201 | ) | (5,890 | ) | (228,274 | ) | 2,795,566 | |||||||||||||||

| Net profit |

99,205 | 99,205 | ||||||||||||||||||||||

| Other comprehensive income |

4,096 | 1,211 | 5,307 | |||||||||||||||||||||

| Total comprehensive income |

4,096 | 1,211 | 99,205 | 104,512 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Share-based compensation |

10,217 | 10,217 | ||||||||||||||||||||||

| On June 30, 2024 |

293,937 | 2,736,994 | 2,895 | (4,679 | ) | (118,852 | ) | 2,910,295 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| On January 1, 2025 |

293,937 | 2,736,994 | 3,472 | (3,158 | ) | (134,306 | ) | 2,896,939 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

(259,151 | ) | (259,151 | ) | ||||||||||||||||||||

| Other comprehensive loss |

(573 | ) | (6,057 | ) | (6,630 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total comprehensive loss |

(573 | ) | (6,057 | ) | (259,151 | ) | (265,781 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Share-based compensation |

12,661 | 12,661 | ||||||||||||||||||||||

| On June 30, 2025 |

293,937 | 2,736,994 | 2,899 | (9,215 | ) | (380,796 | ) | 2,643,819 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes form an integral part of these condensed consolidated financial statements.

21

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Notes to the Unaudited Condensed Consolidated Interim Financial Statements for the First Six Months of 2025

Basis of Preparation

These condensed consolidated interim financial statements have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by the European Union. The condensed consolidated interim financial statements do not contain all information required for an annual report and should therefore be read in conjunction with our Annual Report 2024.

Material Accounting Policies

There were no significant changes in accounting policies applied by us in these condensed consolidated interim financial statements compared to those used in the most recent annual consolidated financial statements of December 31, 2024.

New standards and interpretations applicable for the annual period beginning on January 1, 2025 did not have any material impact on our condensed consolidated interim financial statements.

We have not early adopted any other standard, interpretation, or amendment that has been issued but is not yet effective. We are currently still assessing the impact of these new accounting standards and amendments that are not yet effective, but we expect no standard to have a material impact on our financial statements in the period of initial application except for the effect of IFRS 18 (effective for the period beginning January 1, 2027) as mentioned below.

IFRS 18 Presentation and disclosure in Financial Statements, which was issued by the IASB in April 2024 supersedes IAS 1 and will result in major consequential amendments to IFRS Accounting Standards including IAS8 Basis of Preparation of Financial Statements (renamed from Accounting Policies, Changes in Accounting Estimates and Errors). Even though IFRS 18 will not have any effect on the recognition and measurement of items in the condensed consolidated interim financial statements, it is expected to have a significant effect on the presentation and disclosure of certain items. These changes include categorization and sub-totals in the statement of profit or loss, aggregation/disaggregation and labelling of information, and disclosure of management-defined performance measures.

Summary of Significant Transactions

Strategic Update regarding the proposed Separation

On May 13, 2025, we announced a strategic update regarding the company’s intention to separate into two publicly traded entities. Since the initial announcement on January 8, 2025, we made significant progress in reorganizing our business towards the separation, which was expected by mid-2025, subject to shareholder approval and other customary conditions. However, following regulatory and market developments, our Board of Directors has decided to re-evaluate the previously proposed separation and will explore all strategic alternatives for the existing businesses, including the cell therapy business, with a focus on maximizing resources available for transformative business development transactions.

In the first half of 2025, we incurred costs for the strategic reorganization and intended separation, for a total of €131.6 million. This is reflected in severance costs of €47.5 million, costs for early termination of collaborations of €45.7 million, impairment on fixed assets related to small molecules activities of €12.0 million , deal costs of €16.6 million, €8.0 million accelerated non- cash cost recognition for subscription right plans related to good leavers and €1.8 million other expenses.

22

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Transfer of Assets and Financing Agreement with Onco3R Therapeutics BV

In April 2025, we and Onco3R Therapeutics (Onco3R) signed an agreement under which multiple small molecule immunology and oncology assets, including Phase 1-ready SIK3 inhibitor, have been sold to Onco3R. Under the terms of the agreement, we will participate in Onco3R’s start-up capital via a convertible loan facility of €20 million, which will convert during the next equity financing round.

Onco3R is committed to using commercially reasonable efforts to develop and commercialize these assets.

This convertible loan facility is presented in the line “Convertible loan” in our statement of financial position and is measured at fair value through profit or loss. As per June 30, 2025, the only fair value change recognized is related to the capitalized interest.

In exchange for the transfer of these assets, we are entitled to a contingent consideration. The contingent consideration is recognized as a financial asset recognized at fair value through profit or loss. On June 30, 2025, the fair value is valued by management at zero, based on the very-early stage of the transferred assets. The fair values are reviewed at each reporting date and any changes are reflected in our consolidated income statement. An impairment was recorded for assets transferred to Onco3R Therapeutics (€1.7 million).

Critical Accounting Judgements and Key Sources of Estimation Uncertainty

There were no significant changes in our critical accounting judgements and key sources of estimations uncertainty compared to those used in the most recent annual consolidated financial statements of December 31, 2024, except for the following new critical accounting judgements and key sources of estimation uncertainty.

Determination of fair value of convertible loan receivable

As there is no active market for the convertible loan and no reference share value is readily available of Onco3R, which is a very early-stage R&D organization at the moment, we establish the fair value by using other valuation techniques. The fair value has been determined mainly by reference to the initial transaction price and adjusted as necessary for impairment and revaluations with reference to capitalized interests, relevant available information and recent financing rounds.

The inputs used are categorized as Level 3 inputs.

Determination of restructuring provision

On June 30, 2025, as a result of the strategic reorganization, we recorded a provision for the early termination of collaborations. The provision is estimated based on the total amount of undelivered open purchase commitments, ongoing negotiations with collaboration partners, and confirmed potential exposure provided by our legal advisor.

23

Galapagos NV Half-Year Financial Report 2025

FINANCIAL STATEMENTS

Details of the Unaudited Condensed Consolidated Interim Results

Collaboration revenues

The following table summarizes our collaboration revenues for the six months ended June 30, 2025 and 2024:

| Six months ended June 30 |

||||||||||||||

| (thousands of €) |

Over time |

Point in time |

2025 | 2024 | ||||||||||

| Recognition of non-refundable upfront payments and license fees |

116,226 | 115,120 | ||||||||||||

|

|

|

|

|