UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2025

POPULAR, INC.

(Exact name of registrant as specified in its charter)

| Puerto Rico | 001-34084 | 66-0667416 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 209 Muñoz Rivera Avenue | ||

| Hato Rey, Puerto Rico | 00918 | |

| (Address of principal executive offices) | (Zip code) |

(787) 765-9800

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock ($0.01 par value) | BPOP | The NASDAQ Stock Market | ||

| 6.125% Cumulative Monthly Income Trust Preferred Securities | BPOPM | The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On July 23, 2025, Popular, Inc. (the “Corporation”) issued a press release announcing its unaudited financial results for the quarter ended June 30, 2025, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any of the Corporation’s filings under the Securities Act of 1933, as amended, unless otherwise expressly stated in such filing.

| Item 7.01. | Regulation FD Disclosure. |

The Corporation is furnishing information regarding its conference call to discuss its financial results for the quarter ended June 30, 2025. A copy of the presentation to be used by the Corporation on the conference call is attached hereto as Exhibit 99.2.

The information furnished pursuant to this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any of the Corporation’s filings under the Securities Act of 1933, as amended, unless otherwise expressly stated in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

Exhibits 99.1 and 99.2 shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended.

| 99.1 | Press Release dated July 23, 2025 – Second Quarter 2025 Financial Results. | |

| 99.2 | Popular, Inc. Conference Call Presentation – Second Quarter 2025 Financial Results. | |

| 101 | Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). | |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| POPULAR, INC. (Registrant) |

||||||

| Date: July 23, 2025 | By: | /s/ Denissa M. Rodríguez |

||||

| Denissa M. Rodríguez | ||||||

| Senior Vice President and Corporate Comptroller | ||||||

3

Exhibit 99.1

Popular, Inc. Announces Second Quarter 2025 Financial Results

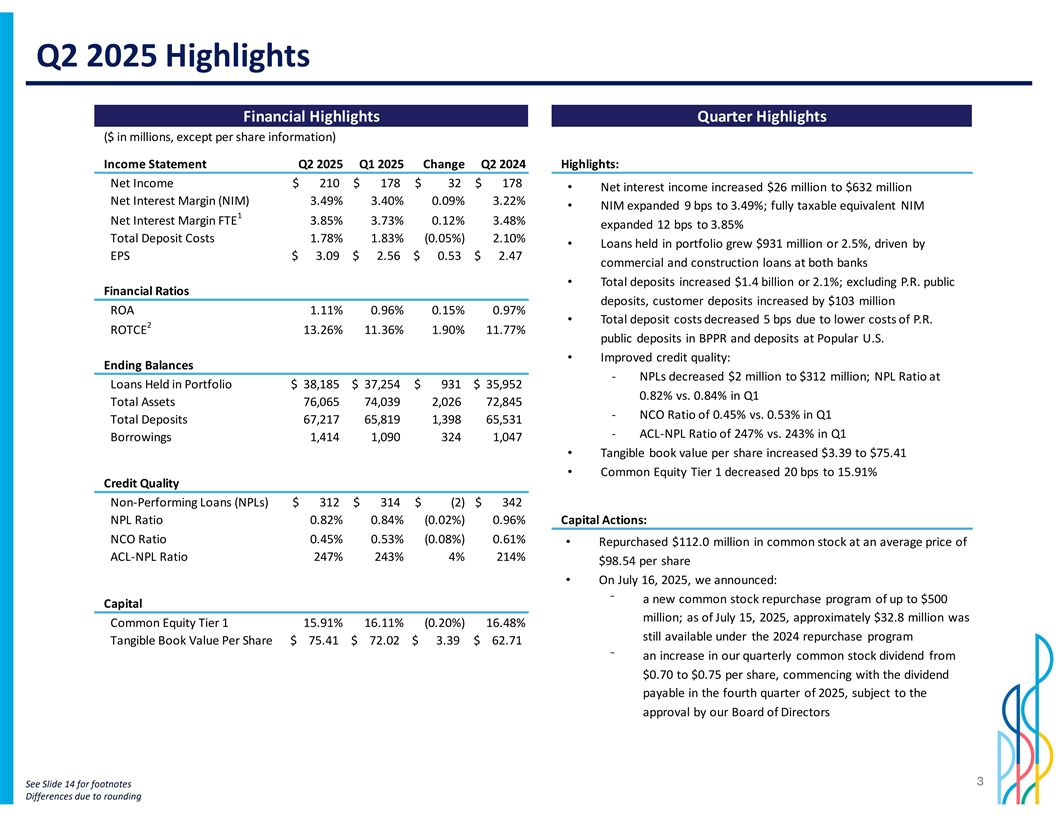

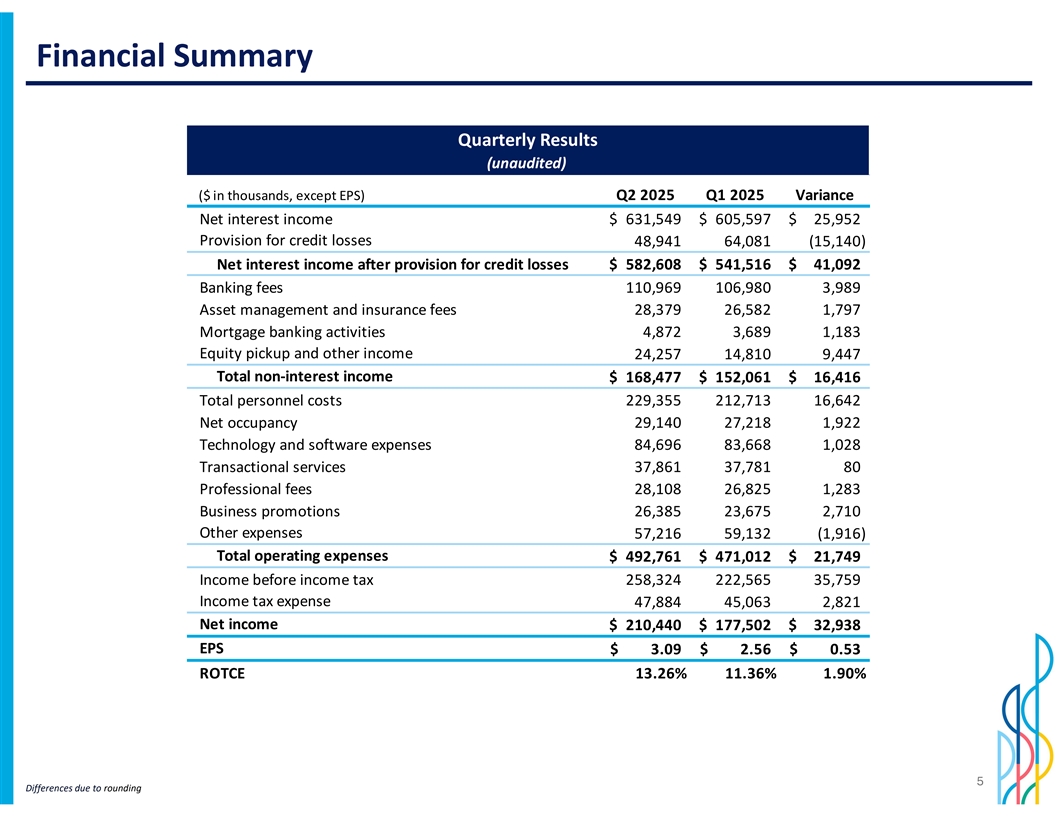

| • | Net income of $210.4 million in Q2 2025, compared to net income of $177.5 million in Q1 2025. |

| • | Earnings per share (“EPS”) of $3.09 in Q2 2025 vs. $2.56 in Q1 2025. |

| • | Net interest income of $631.5 million in Q2 2025, an increase of $25.9 million when compared to Q1 2025. |

| • | Net interest margin of 3.49% in Q2 2025, compared to 3.40% in Q1 2025; net interest margin on a taxable equivalent basis of 3.85% in Q2 2025, compared to 3.73% in Q1 2025. |

| • | Non-interest income of $168.5 million in Q2 2025, compared to $152.1 million in Q1 2025. |

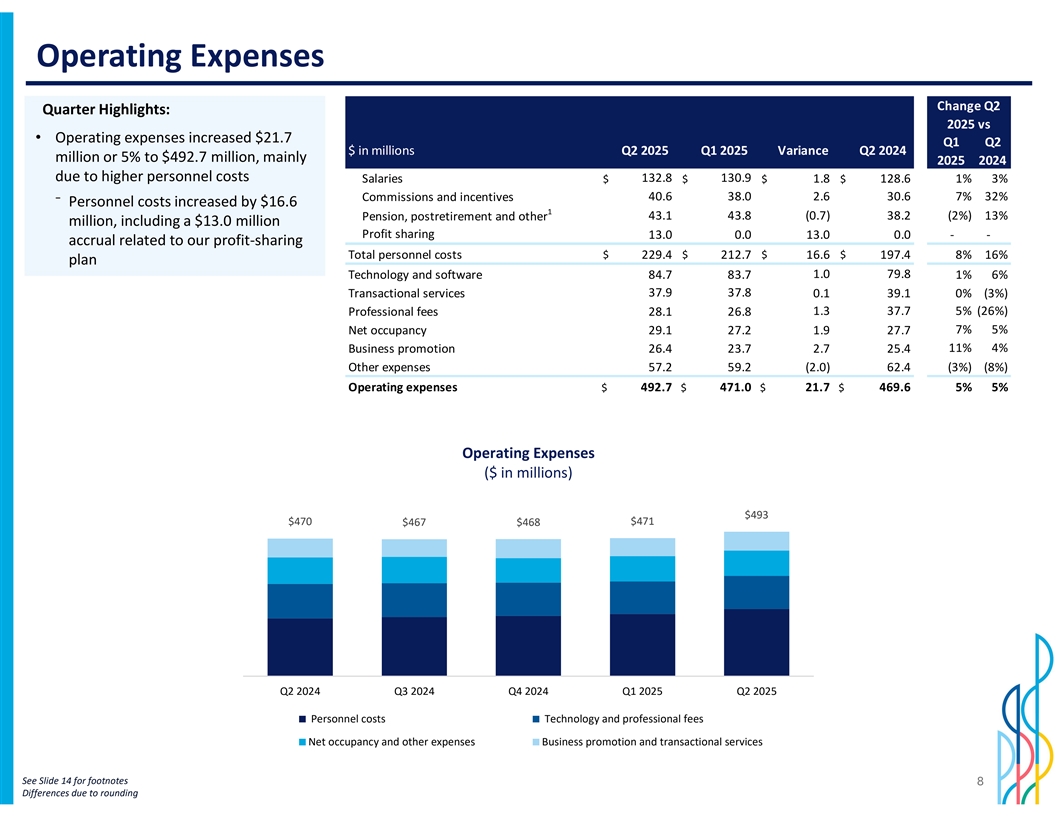

| • | Operating expenses amounted to $492.8 million, compared to $471.0 million in Q1 2025. |

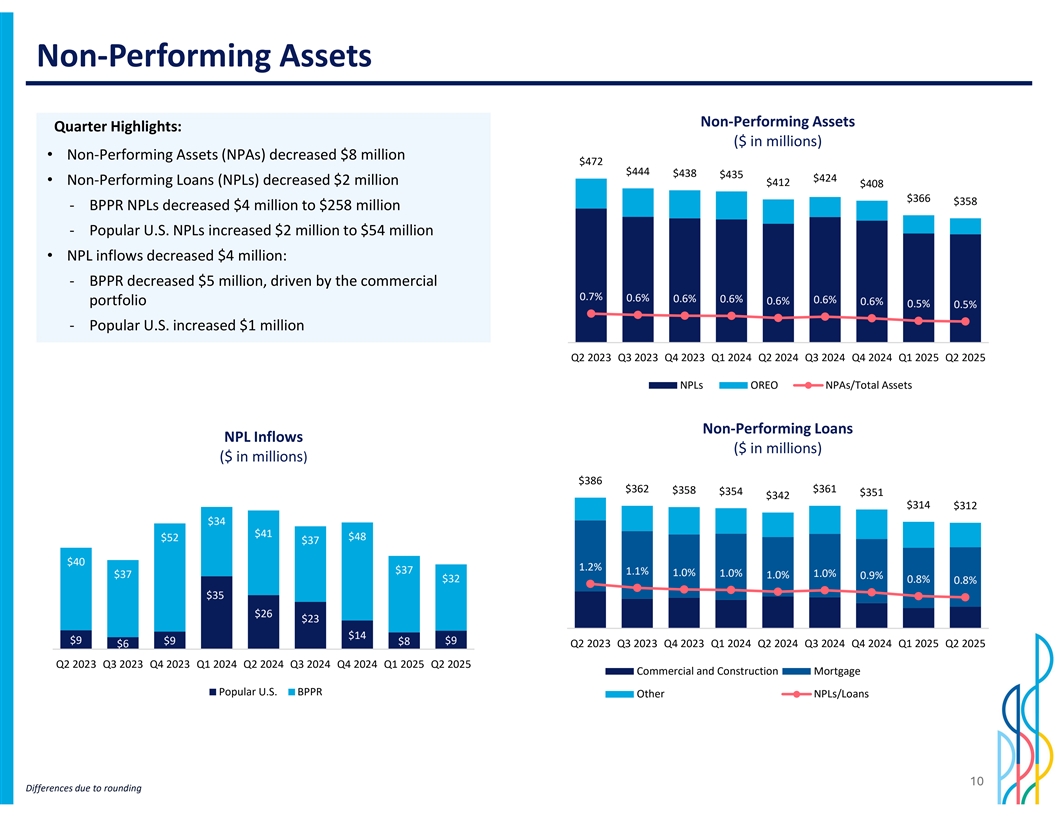

| • | Credit quality metrics improved: |

| • | Non-performing loans held-in-portfolio (“NPLs”) decreased by $2.4 million from Q1 2025; NPLs to loans ratio decreased two basis points to 0.82%; |

| • | Net charge-offs (“NCOs”) decreased by $6.9 million from Q1 2025; annualized NCOs to average loans held-in-portfolio at 0.45% vs. 0.53% in Q1 2025. |

| • | Allowance for credit losses (“ACL”) to loans held-in-portfolio at 2.02% vs. 2.05% in Q1 2025; and |

| • | ACL to NPLs at 246.9% vs. 242.7% in Q1 2025. |

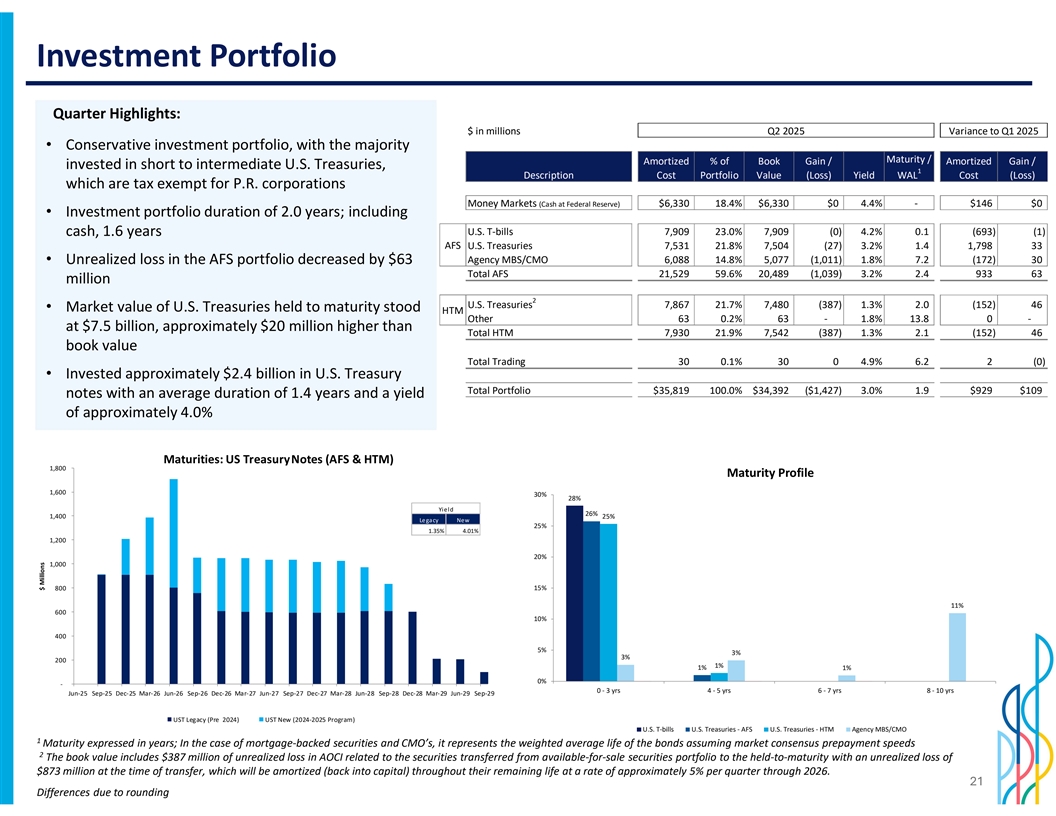

| • | Money market and investment securities increased by $1.1 billion from Q1 2025; average quarterly balances increased by $261.9 million. |

| • | Loans held in portfolio, excluding loans held-for-sale, amounted to $38.2 billion, up $931.1 million from Q1 2025; average quarterly loan balances higher by $579.0 million. |

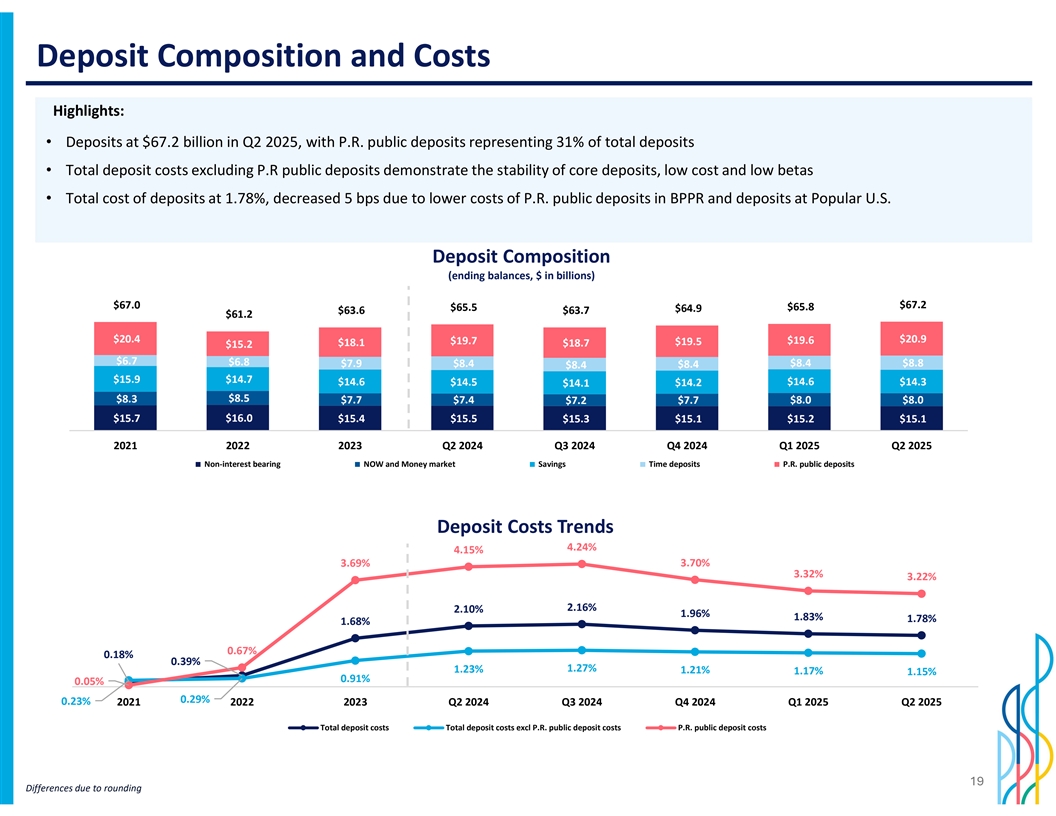

| • | Deposit balances amounted to $67.2 billion, an increase of $1.4 billion from Q1 2025; average quarterly deposits higher by $498.6 million. |

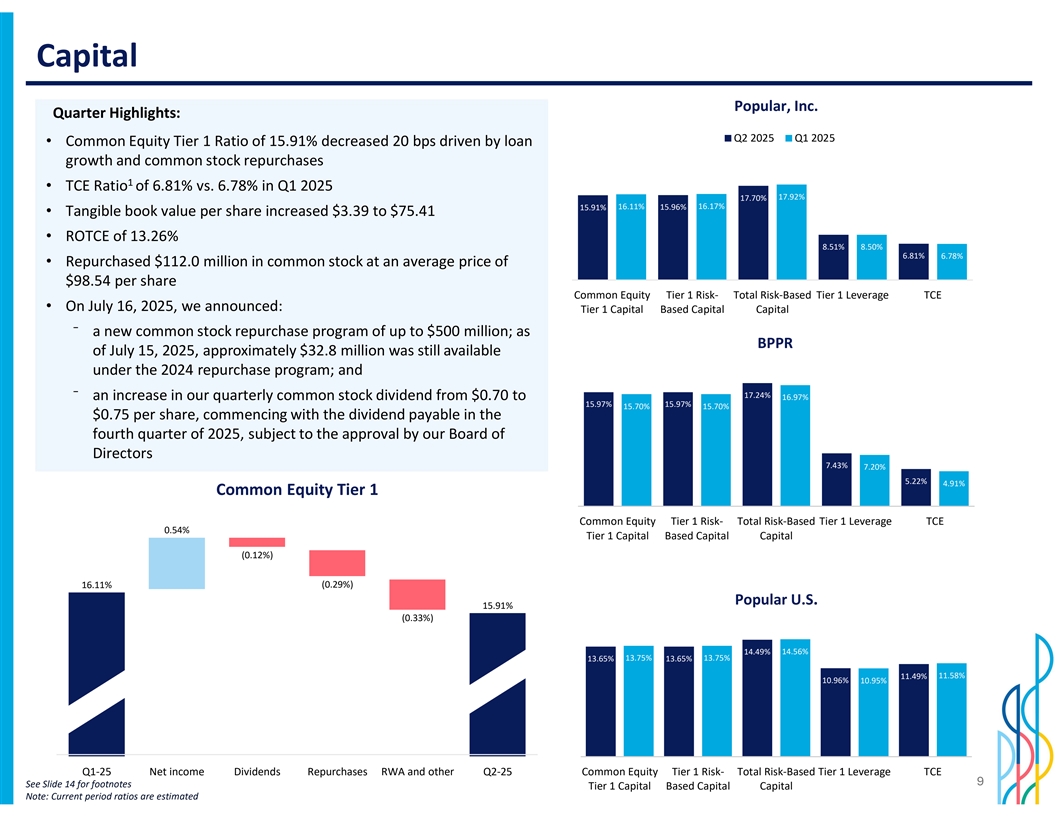

| • | Common Equity Tier 1 ratio of 15.91%, Common Equity per share of $87.31 and Tangible Book Value per share increase of $3.39 to $75.41 at June 30, 2025. |

| • | Capital actions during the quarter ended June 30, 2025 included the repurchase of 1,136,390 shares of common stock for $112.0 million at an average price of $98.54 per share. As of June 30, 2025, a total of $451.5 million had been repurchased under a common stock repurchase authorization of up to $500 million announced in Q3 2024. |

SAN JUAN, Puerto Rico – (BUSINESS WIRE) – Popular, Inc. (the “Corporation,” “Popular,” “we,” “us,” “our”) (NASDAQ:BPOP) reported net income of $210.4 million for the quarter ended June 30, 2025, compared to net income of $177.5 million for the quarter ended March 31, 2025.

“We delivered strong performance in the second quarter, highlighted by higher net interest income, an expanding net interest margin, healthy loan and deposit growth, and improved credit quality,” said Javier D. Ferrer, President and Chief Executive Officer of Popular, Inc. “I would like to recognize our colleagues, whose hard work made these achievements possible. I assume the role of CEO with a deep sense of responsibility and genuinely honored by the privilege of leading such a talented and dedicated team.

We recently announced an increase in our quarterly common stock dividend, from $0.70 to $0.75 per share, and a new common stock repurchase program of up to $500 million — actions that reflect the strength of our capital position and our continued commitment to delivering value to shareholders.

Our focus continues to be on executing our Transformation, ensuring we are the #1 bank for our customers while simplifying our operations to improve efficiency. With the progress we are making, we are optimistic about our future and confident in our ability to drive sustained performance.”

4

Significant Events

Capital actions

On July 16, 2025, the Corporation announced the following capital actions:

| • | an increase in the Corporation’s quarterly common stock dividend from $0.70 to $0.75 per share, commencing with the dividend payable in the fourth quarter of 2025, subject to the approval by the Corporation’s Board of Directors; and |

| • | a new common stock repurchase program of up to $500 million. |

This new common stock repurchase program is in addition to the $500 million common stock repurchase program announced by the Corporation on July 24, 2024 (the “2024 Repurchase Program”). As of July 15, 2025, approximately $32.8 million remained available for common stock repurchases under the 2024 Repurchase Program.

The Corporation’s planned common stock repurchases may be executed in open market transactions, privately negotiated transactions, block trades or any other manner determined by the Corporation. The timing, quantity and price of such repurchases will be subject to various factors, including market conditions, the Corporation’s capital position and financial performance, the capital impact of strategic initiatives and regulatory and tax considerations. The common stock repurchase program does not require the Corporation to acquire a specific dollar amount or number of shares and may be modified, suspended or terminated at any time without prior notice.

Earnings Highlights

| (Unaudited) |

Quarters ended | Six months ended | ||||||||||||||||||

| (Dollars in thousands, except per share information) |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | 30-Jun-25 | 30-Jun-24 | |||||||||||||||

| Net interest income |

$ | 631,549 | $ | 605,597 | $ | 568,312 | $ | 1,237,146 | $ | 1,119,056 | ||||||||||

| Provision for credit losses |

48,941 | 64,081 | 46,794 | 113,022 | 119,392 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for credit losses |

582,608 | 541,516 | 521,518 | 1,124,124 | 999,664 | |||||||||||||||

| Other non-interest income |

168,477 | 152,061 | 166,306 | 320,538 | 330,124 | |||||||||||||||

| Operating expenses |

492,761 | 471,012 | 469,576 | 963,773 | 952,689 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax |

258,324 | 222,565 | 218,248 | 480,889 | 377,099 | |||||||||||||||

| Income tax expense |

47,884 | 45,063 | 40,459 | 92,947 | 96,027 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 210,440 | $ | 177,502 | $ | 177,789 | $ | 387,942 | $ | 281,072 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income applicable to common stock |

$ | 210,087 | $ | 177,149 | $ | 177,436 | $ | 387,236 | $ | 280,366 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per common share-basic |

$ | 3.09 | $ | 2.56 | $ | 2.47 | $ | 5.64 | $ | 3.90 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per common share-diluted |

$ | 3.09 | $ | 2.56 | $ | 2.46 | $ | 5.64 | $ | 3.90 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

5

Non-GAAP Financial Measures

This press release contains financial information prepared under accounting principles generally accepted in the United States (“U.S. GAAP”) and non-GAAP financial measures. Management uses non-GAAP financial measures when it has determined that these measures provide more meaningful information about the underlying performance of the Corporation’s ongoing operations. Non-GAAP financial measures used by the Corporation may not be comparable to similarly named non-GAAP financial measures used by other companies.

Net interest income on a taxable equivalent basis

Net interest income, on a taxable equivalent basis, is presented with its different components in Tables D, E and F for the quarter ended June 30, 2025. Net interest income on a taxable equivalent basis is a non-GAAP financial measure. Management believes that this presentation provides meaningful information since it facilitates the comparison of revenues arising from taxable and tax-exempt sources.

Tangible Common Equity

Tangible common equity, the tangible common equity ratio, tangible assets and tangible book value per common share are non-GAAP financial measures. The tangible common equity ratio and tangible book value per common share are commonly used by banks and analysts in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase accounting method for mergers and acquisitions. Neither tangible common equity nor tangible assets or related measures should be used in isolation or as a substitute for stockholders’ equity, total assets or any other measure calculated in accordance with GAAP.

Refer to Table R for a reconciliation of total stockholders’ equity to tangible common equity and total assets to tangible assets.

6

Net Interest Income and Net Interest Margin

The Corporation’s net interest income for the second quarter of 2025 was $631.5 million, an increase of $25.9 million compared to $605.6 million in the previous quarter. The net interest margin (“NIM”) for the quarter was 3.49%, compared to 3.40% in the first quarter of 2025, an increase of nine basis points. Net interest income was positively impacted by one additional day when compared to the previous quarter, resulting in higher net interest income by $4.9 million.

During the period, average deposits increased by $498.6 million, including $143.2 million in average non-interest bearing deposits, compared to the first quarter of 2025, which enabled NIM expansion as a result of the increase in U.S. Treasuries at higher rates. NIM expansion was also driven by loan growth in the commercial, construction, mortgage and auto portfolios, as well as a favorable repricing of P.R. public deposits in Banco Popular de Puerto Rico (“BPPR”) and Popular Bank (“PB”, or “Popular U.S.”) deposits.

Net Interest Income and Net Interest Margin Taxable Equivalent (Non-GAAP)

Net interest income on a taxable equivalent basis for the second quarter of 2025 was $697.2 million, an increase of $33.3 million. Net interest margin on a taxable equivalent basis for the second quarter of 2025 was 3.85%, an increase of 12 basis points.

The main drivers of net interest income on a taxable equivalent basis were:

| • | higher income from investment securities by $15.9 million or 15 basis points due to investment activity of U.S. Treasuries at higher yields, largely attributed to higher average deposits as described above; |

| • | higher interest income from loans by $19.0 million, or two basis points, attributable to higher average loan balances and robust growth across most portfolios. Higher yields were noted across the majority of the loan portfolios which contributed to the increase during the period when compared to the first quarter of 2025, most notably in commercial by two basis points, in mortgage by seven basis points and in auto by two basis points; and |

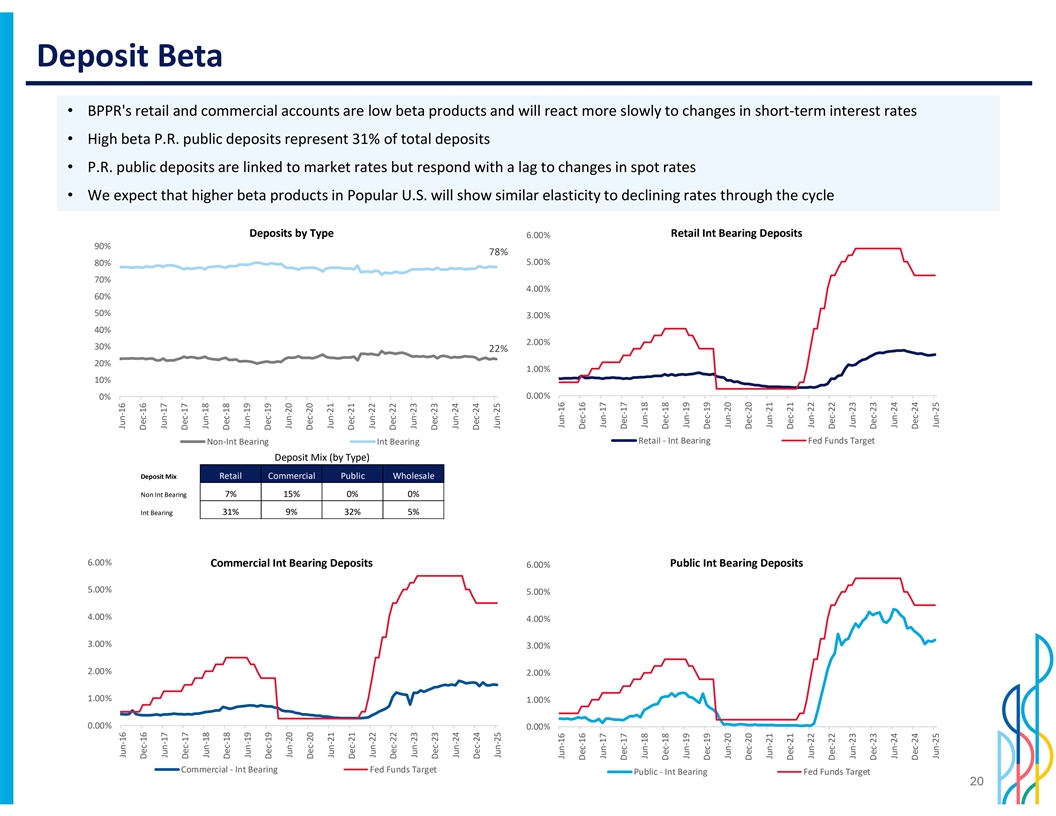

| • | lower interest expense on interest-bearing deposits by $2.8 million, or seven basis points, driven primarily by a reduction in the cost of market-linked P.R. public deposits by 10 basis points and the cost of deposits in PB by 14 basis points, partially offset by an increase in the cost of interest-bearing deposits, excluding P.R. public deposits in BPPR. Total deposit costs decreased by five basis points to 1.78% quarter-over-quarter; excluding P.R. public deposits, total deposit costs were lower by two basis points to 1.15%; |

partially offset by:

| • | higher interest expense in other short-term borrowings by $3.8 million driven by FHLB advances in Popular Bank. |

Net Interest Income and Net Interest Margin (Banco Popular de Puerto Rico Segment)

For the BPPR segment, net interest income for the second quarter of 2025 was $538.5 million, representing an increase of $16.6 million over the previous quarter. Net interest margin increased by five basis points to 3.68%. Higher interest income was primarily attributed to:

| • | $9.5 million, or eight basis points increase in investment securities, mainly U.S. Treasuries, driven by higher average deposits, which increased by $485.3 million, including $93.4 million in average non-interest bearing deposits; and |

7

| • | $8.5 million increase in income from loans due to higher average balances, mainly in the mortgage portfolio with an increase in average portfolio balance of $154.6 million, higher yields in the auto portfolio, and one additional day in the period compared to the previous quarter. |

While the cost of P.R public deposits went down by 10 basis points, total deposit costs in BPPR decreased by three basis points to 1.52% quarter-over-quarter. The cost of new or renewed retail time deposits and commercial interest-bearing deposits at BPPR partially offset the positive impact from the repricing of P.R. public deposits.

Net Interest Income and Net Interest Margin (Popular Bank Segment)

In the PB segment, net interest income was $102.2 million, $9.3 million higher when compared to the previous quarter. Net interest margin in the PB segment expanded by 19 basis points to 2.93%.

| • | During the period, interest income from loan portfolios increased by $9.4 million, or 14 basis points, compared to the previous quarter, primarily due to higher average balances and higher yields in the commercial and construction loan portfolios. |

| • | The total cost of deposits decreased by $3.7 million, or 13 basis points, largely as a result of repricing across all deposit products and lower average balances, except for the higher average balances of time deposits captured through PB’s online channel. The average balance of short-term borrowings at Popular Bank increased by $339.2 million during the period, resulting in an increase in interest expense of $3.8 million and partially offsetting the benefit of reduced deposit costs on total interest expense. Nevertheless, PB’s NIM benefited from a seven-basis point reduction in the total cost of funds, driven by the decrease in deposit costs. |

Refer to tables D and E for more details on the components of net interest income and net interest margin on a taxable equivalent basis.

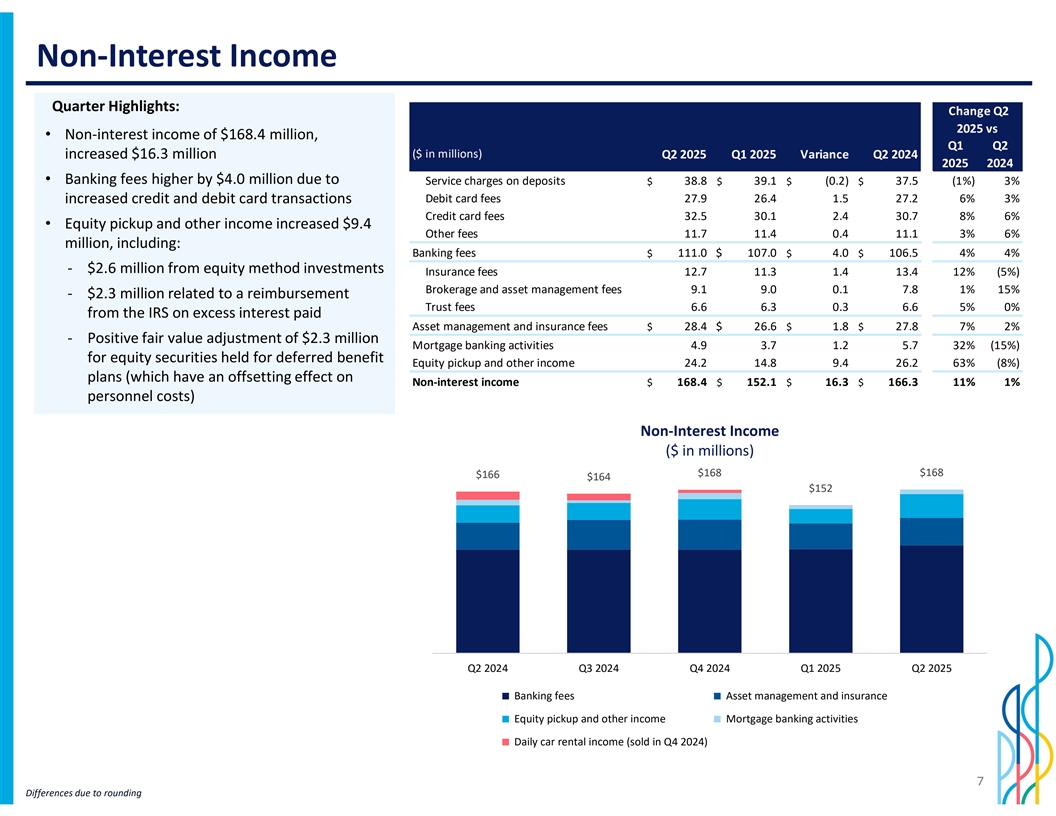

Non-interest income

Non-interest income amounted to $168.5 million for the quarter ended June 30, 2025, an increase of $16.4 million when compared to $152.1 million for the previous quarter. Non-interest income for the period was positively impacted by market-driven adjustments and certain other transactions including tax-related reimbursements and distributions from legacy investments. The service fee income for the quarter also reflects increased seasonal activity.

Refer below to a detailed breakdown of the main variances affecting non-interest income.

| • | higher other operating income by $7.2 million, mainly due to higher income from investments accounted under the equity investment method by $2.6 million, a positive variance of $2.3 million for the reimbursement of interest paid in excess to the U.S. Internal Revenue Service for late payment penalties related to tax withholdings on intercompany distributions for the years 2014-2024 previously disclosed in 2024, and a $1.2 million cash distribution from the exit of a legacy equity investment; |

| • | higher other service fees by $6.0 million mainly due to higher credit card and debit card fees by $2.4 million and $1.5 million, respectively, due to an increase in purchase volume, and higher insurance fees by $1.4 million; and |

| • | favorable fair value adjustments for an aggregate of $3.9 million, including $2.3 million for the valuation of equity securities held for deferred benefit plans, which have an offsetting effect in personnel costs, and a variance of $1.6 million in the fair value adjustment of mortgage servicing rights (“MSRs”). |

Refer to Table B for further details.

8

Operating expenses

Operating expenses for the second quarter of 2025 totaled $492.8 million, an increase of $21.7 million when compared to the first quarter of 2025. Total operating expenses are driven by personnel costs, professional fees and investment in technology and compliance.

The variance in operating expenses was driven primarily by:

| • | higher personnel costs by $16.6 million mainly due to higher incentives, including $13.0 million related to the profit-sharing plan which is tied to the Corporation’s financial performance and $4.7 million in other performance-based incentives, an increase in health insurance costs by $4.1 million, and a $2.3 million increase in the expense related to the valuation of equity securities held for deferred compensation plans, which have an offsetting effect in equity securities income; partially offset by lower other compensation by $3.7 million, and lower savings plan and payroll tax expense by $2.3 million and $1.9 million, respectively, both which are generally higher during the first quarter of the year; |

| • | higher business promotion expenses by $2.7 million, mainly due to higher volume of transactions tied to a customer reward program in our credit card business; and |

| • | higher net occupancy expenses by $1.9 million mainly due to lower rental income driven by reduced lease space, higher cleaning expenses and higher depreciation from new office remodeling. |

Full-time equivalent employees were 9,303 as of June 30, 2025, compared to 9,274 as of March 31, 2025.

For a breakdown of operating expenses by category refer to Table B.

Income taxes

For the second quarter of 2025, the Corporation recorded an income tax expense of $47.9 million, compared to an income tax expense of $45.1 million for the previous quarter. Higher income tax expense of $2.8 million is mainly driven by higher income before tax, offset in part by higher exempt income.

The effective tax rate (“ETR”) for the second quarter of 2025 was 18.5%, compared to 20.2% for the previous quarter. The ETR of the Corporation is impacted by the composition and source of its taxable income.

9

Credit Quality

The Corporation’s credit quality metrics demonstrated favorable trends in the second quarter of 2025 compared to the previous quarter, with improvements in NPLs and NCOs. The Corporation continues to closely monitor the economic landscape and borrower performance, as economic uncertainty remains a key consideration. Management believes that the improvements in risk management practices over recent years and the overall credit risk profile of the loan portfolio position the Corporation to continue to operate successfully in the current environment.

The following presents credit quality results for the second quarter of 2025:

Non-Performing Loans and Net Charge Offs

Total NPLs decreased by $2.4 million to $311.6 million compared to the previous quarter. Excluding consumer loans, inflows of NPLs held-in-the-portfolio decreased by $4.1 million in the second quarter of 2025. The ratio of NPLs to total loans held in the portfolio was 0.82% for the second quarter of 2025, compared to 0.84% for the previous quarter. NPLs variances per reporting segment include:

| • | In the BPPR segment, NPLs decreased by $4.4 million, reflected across all loan segments. Excluding consumer loans, inflows to NPLs in the BPPR segment decreased by $4.8 million compared to the previous quarter, mostly related to lower commercial NPLs inflows. |

| • | In the PB segment, NPLs increased by $1.9 million driven by higher commercial NPLs by $4.2 million. Inflows to NPLs, excluding consumer loans, remained flat quarter-over-quarter. |

Total NCOs of $42.2 million decreased by $6.9 million when compared to the first quarter of 2025. The Corporation’s ratio of annualized NCOs to average loans held-in-portfolio for the second quarter was 0.45%, compared to 0.53% in the first quarter of 2025.

NCOs variances per reporting segment include:

| • | In the BPPR segment, NCOs decreased by $6.9 million, mainly driven by lower auto and personal loans NCOs by $6.9 million and $2.6 million, respectively, partially offset by higher commercial NCOs by $2.5 million, mainly driven by a $3.8 million recovery recognized in the previous quarter. |

| • | In the PB segment, NCOs remained flat quarter-over-quarter at $2 million. |

Including OREO assets of $46.1 million, Non-performing Assets (“NPAs”) for the Corporation amounted to $357.8 million, a decrease of $8.4 million during the period driven by the sale of residential OREO properties, at a net gain, in the BPPR segment.

Refer to Table N for further information on NCOs and related ratios.

Refer to Table L for additional information on NPAs and related ratios.

Allowance for Credit Losses and Provision for Credit Losses

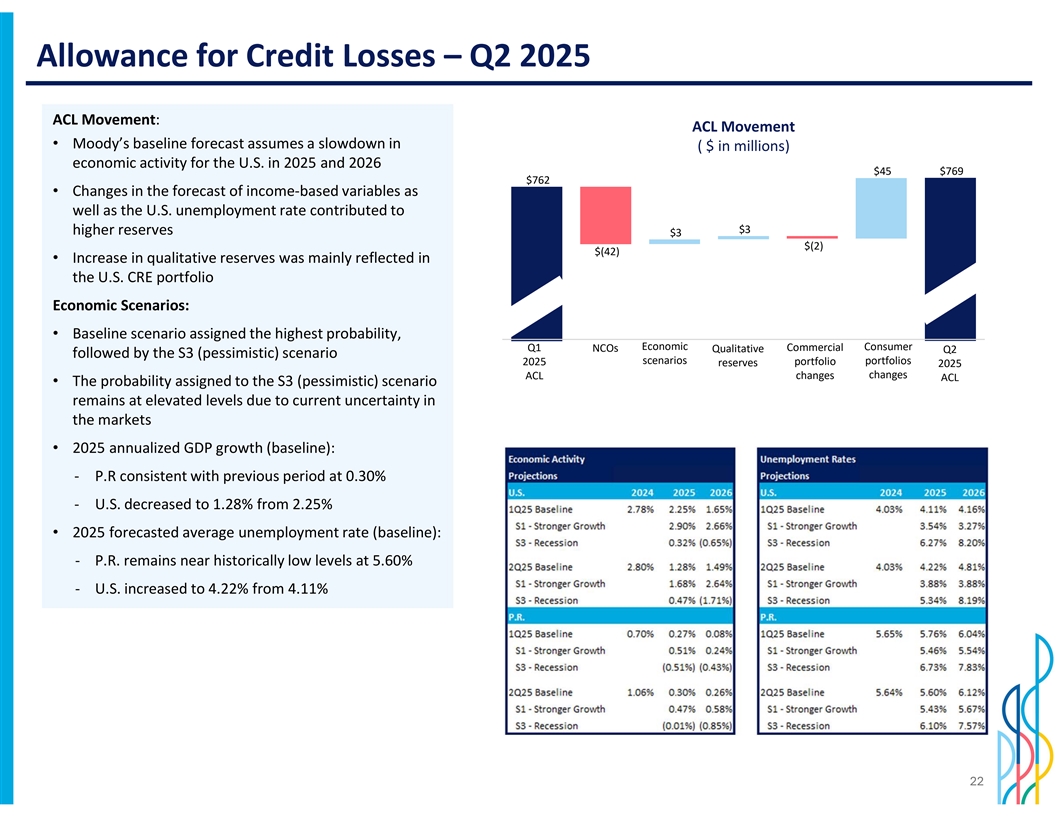

The ACL as of June 30, 2025 amounted to $769.5 million, an increase of $7.3 million when compared to the first quarter of 2025. The increase in ACL was driven by reserve build up associated with portfolio growth and unfavorable changes in the economic assumptions used in the ACL model. This increase was offset in part by the update to probability weights assigned to the economic scenarios, as further described below, and the net effect of changes in credit quality, and NCOs during the quarter.

10

The Corporation uses multiple economic scenarios to estimate its ACL. In the first quarter of 2025, management assigned equal probability weights to the baseline and pessimistic scenarios in response to economic uncertainty. In the second quarter of 2025, the probability weight for the pessimistic scenario was moderately decreased based on changes in the economic outlook and a reassessment of uncertainty compared to the previous quarter. This change resulted in a $4.5 million reduction in ACL reserve levels. The probability weight for the pessimistic scenario remains above the levels observed in 2024, given the ongoing economic uncertainty.

In the BPPR segment, the ACL increased by $3.0 million when compared to the previous quarter. This higher ACL was driven by an increase in the reserves for auto loans due to migrations between FICO score categories and changes in the economic scenarios. This increase was partially offset by lower reserves for commercial loans due to improvements in credit quality and changes in the probability weights, partially offset by ACL reserve build up due to portfolio growth.

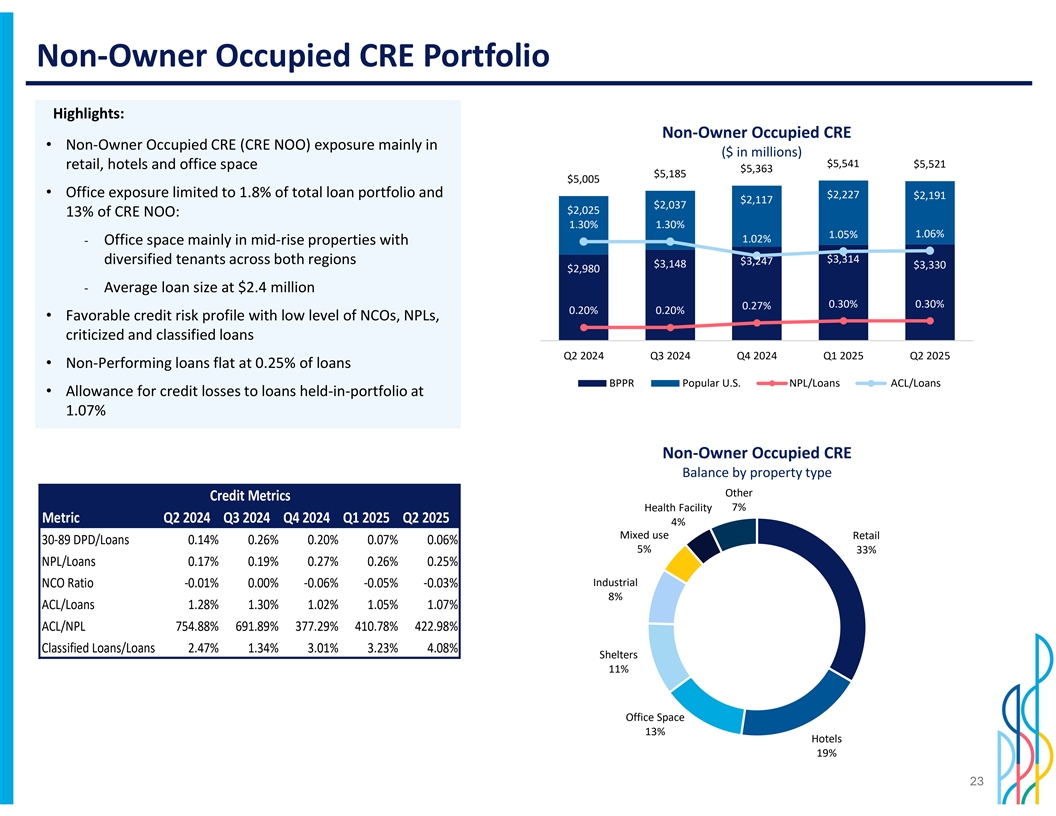

In the PB segment, the ACL increased by $4.4 million from the previous quarter. This increase was influenced by changes in the forecast of the U.S. unemployment rate as well as higher qualitative reserves for the Commercial Real Estate (“CRE”) portfolio.

The Corporation’s ratio of the ACL to loans held-in-portfolio was 2.02% in the second quarter of 2025, compared to 2.05% in the previous quarter. The ratio of the ACL to NPLs held-in-portfolio was 246.9%, compared to 242.7% in the previous quarter.

The provision for loan losses for the loan and lease portfolios for the second quarter of 2025 was $49.5 million, a decrease of $15.7 million when compared to $65.2 million in the previous quarter. The provision for loan losses for the BPPR segment amounted to $43.2 million, compared to $52.7 million in the previous quarter. This reduction was mainly driven by lower provision expense for commercial loans and leases. The provision for loan losses for the PB segment amounted to $6.4 million, compared to $12.5 million in the prior quarter. The reduction in provision expense occurred mainly within the commercial loan portfolio.

The provision for credit losses for the second quarter of $48.9 million, includes the provision for loan and lease losses, along with the $1.1 million reserve release related to unfunded loan commitments and the $0.5 million provision for the Corporation’s investment portfolio.

Refer to Table L for break-out of non-performing assets and related ratios and to Table N for allowance for credit losses, net charge-offs and related ratios.

11

Non-Performing Assets

| (Unaudited) |

||||||||||||

| (In thousands) |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | |||||||||

| Non-performing loans held-in-portfolio |

$ | 311,625 | $ | 314,069 | $ | 341,835 | ||||||

| Other real estate owned |

46,126 | 52,114 | 70,225 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-performing assets |

$ | 357,751 | $ | 366,183 | $ | 412,060 | ||||||

|

|

|

|

|

|

|

|||||||

| Net charge-offs for the quarter |

$ | 42,202 | $ | 49,103 | $ | 53,630 | ||||||

|

|

|

|

|

|

|

|||||||

| Ratios: |

||||||||||||

| Loans held-in-portfolio |

$ | 38,185,178 | $ | 37,254,032 | $ | 35,591,620 | ||||||

| Non-performing loans held-in-portfolio to loans held-in-portfolio |

0.82 | % | 0.84 | % | 0.96 | % | ||||||

| Allowance for credit losses to loans held-in-portfolio |

2.02 | 2.05 | 2.05 | |||||||||

| Allowance for credit losses to non-performing loans, excluding loans held-for-sale |

246.93 | 242.67 | 213.58 | |||||||||

Refer to Table L for additional information.

Provision for Credit Losses (Benefit)- Loan Portfolios

| (Unaudited) |

Quarters ended | Six months ended | ||||||||||||||||||

| (In thousands) |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | 30-Jun-25 | 30-Jun-24 | |||||||||||||||

| Provision for credit losses (benefit) - loan portfolios: |

||||||||||||||||||||

| BPPR |

$ | 43,150 | $ | 52,690 | $ | 48,585 | $ | 95,840 | $ | 109,593 | ||||||||||

| Popular U.S. |

6,389 | 12,528 | (4,428 | ) | 18,917 | 6,950 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total provision for credit losses (benefit) - loan portfolios |

$ | 49,539 | $ | 65,218 | $ | 44,157 | $ | 114,757 | $ | 116,543 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Credit Quality by Segment

| (Unaudited) | ||||||||||||

| (Dollars in thousands) |

Quarters ended | |||||||||||

| BPPR |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | |||||||||

| Provision for credit losses - loan portfolios |

$ | 43,150 | $ | 52,690 | $ | 48,585 | ||||||

| Net charge-offs |

40,164 | 47,102 | 49,308 | |||||||||

| Total non-performing loans held-in-portfolio |

257,648 | 262,006 | 286,887 | |||||||||

| Annualized net charge-offs to average loans held-in-portfolio |

0.61 | % | 0.72 | % | 0.79 | % | ||||||

| Allowance / loans held-in-portfolio |

2.53 | % | 2.59 | % | 2.56 | % | ||||||

| Allowance / non-performing loans held-in-portfolio |

263.63 | % | 258.11 | % | 224.34 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Quarters ended | ||||||||||||

| Popular U.S. |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | |||||||||

| Provision for credit losses (benefit) - loan portfolios |

$ | 6,389 | $ | 12,528 | $ | (4,428 | ) | |||||

| Net charge-offs |

2,038 | 2,001 | 4,322 | |||||||||

| Total non-performing loans held-in-portfolio |

53,977 | 52,063 | 54,948 | |||||||||

| Annualized net charge-offs to average loans held-in-portfolio |

0.07 | % | 0.07 | % | 0.16 | % | ||||||

| Allowance / loans held-in-portfolio |

0.79 | % | 0.77 | % | 0.83 | % | ||||||

| Allowance / non-performing loans held-in-portfolio |

167.17 | % | 164.96 | % | 157.37 | % | ||||||

|

|

|

|

|

|

|

|||||||

12

Financial Condition Highlights

| (Unaudited) |

||||||||||||

| (In thousands) |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | |||||||||

| Cash and money market investments |

$ | 6,741,417 | $ | 6,575,193 | $ | 7,211,367 | ||||||

| Investment securities |

28,283,970 | 27,375,396 | 26,742,639 | |||||||||

| Loans |

38,185,178 | 37,254,032 | 35,591,620 | |||||||||

| Total assets |

76,065,090 | 74,038,606 | 72,845,072 | |||||||||

| Deposits |

67,217,491 | 65,819,255 | 65,530,862 | |||||||||

| Borrowings |

1,414,494 | 1,090,417 | 1,047,264 | |||||||||

| Total liabilities |

70,111,072 | 68,238,911 | 67,472,394 | |||||||||

| Stockholders’ equity |

5,954,018 | 5,799,695 | 5,372,678 | |||||||||

|

|

|

|

|

|

|

|||||||

13

Total assets amounted to $76.1 billion at June 30, 2025, an increase of $2.0 billion from the first quarter of 2025, driven by:

| • | an increase in securities available-for-sale (“AFS”) of $997.0 million, mainly due to an increase in investments in U.S. Treasury securities and a decrease in the unrealized losses of AFS securities of $63.7 million, partially offset by maturities and principal paydowns; |

| • | an increase in loans held-in-portfolio by $931.1 million, driven by an increase of $680.4 million in the BPPR segment across most portfolios, particularly commercial, including the origination of a $265.0 million commercial loan which represents the Corporation’s portion of a $425.0 million issuance in which BPPR acted as the lead bank and administrative agent, and mortgage loans, coupled with an increase of $250.7 million in the PB segment, particularly commercial and construction loans; and |

| • | an increase in money market investments of $145.8 million, mainly driven by higher deposits, partially offset by the purchase of investments in U.S. Treasury securities and loan originations; |

partially offset by:

| • | a decrease in securities held-to-maturity (“HTM”) of $107.0 million driven by maturities and principal paydowns, partially offset by the amortization of $46.2 million of the discount related to U.S. Treasury securities previously reclassified from AFS to HTM. |

Total liabilities increased by $1.9 billion from the first quarter of 2025, driven by:

| • | an increase of $1.4 billion in deposits, primarily driven by an increase in P.R. public deposits of approximately $1.3 billion, mainly due to tax collections, net of reimbursements. At quarter-end, P.R. public deposits totaled $20.9 billion and represented 31% of the Corporation’s total deposit portfolio; and |

| • | an increase in other short-term borrowings of $350 million due to FHLB advances in PB. |

Stockholders’ equity increased by $154.3 million from the first quarter of 2025 mainly due to the quarter’s net income of $210.4 million, a decrease in net unrealized losses in the portfolio of AFS securities of $48.4 million and the amortization of unrealized losses from securities previously reclassified to HTM of $37.0 million, net of tax, and other changes, mainly in accumulated other comprehensive income, for $16.0 million, partially offset by an increase in Treasury Stock of $109.3 million mainly due to common stock repurchases during the quarter and common and preferred dividends declared during the quarter of $48.2 million.

During the quarter and six months ended June 30, 2025, Popular repurchased 1,136,390 shares of common stock for $112.0 million at an average price of $98.54 per share and 2,406,959 shares of common stock for $234.2 million at an average price of $97.32 per share, respectively. As of June 30, 2025, Popular had repurchased a total of approximately 4.7 million shares of common stock for $451.5 million as part of the common stock repurchase authorization of up to $500 million announced in Q3 2024.

Common Equity Tier 1 ratio (“CET1”), common equity per share and tangible book value per share were 15.91%, $87.31 and $75.41 respectively, at June 30, 2025, compared to 16.11%, $83.75 and $72.02, respectively, at March 31, 2025.

Refer to Table A for capital ratios.

14

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including without limitation those regarding Popular’s business, financial condition, results of operations, plans, objectives and future performance. These statements are not guarantees of future performance, are based on management’s current expectations and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Risks and uncertainties include, without limitation, the effect of competitive and economic factors, and our reaction to those factors, the adequacy of the allowance for loan losses, delinquency trends, market risk and the impact of interest rate changes (including on our cost of deposits), our ability to attract deposits and grow our loan portfolio, capital market conditions, capital adequacy and liquidity, the effect of legal and regulatory proceedings, new regulatory requirements or accounting standards on the Corporation’s financial condition and results of operations, the occurrence of unforeseen or catastrophic events, such as extreme weather events, pandemics, man-made disasters or acts of violence or war, as well as actions taken by governmental authorities in response thereto, and the direct and indirect impact of such events on Popular, our customers, service providers and third parties. Other potential factors include Popular’s ability to successfully execute its transformation initiative, including, but not limited to, achieving projected earnings, efficiencies and return on tangible common equity and accurately anticipating costs and expenses associated therewith, imposition of additional or special FDIC assessments, or increases thereto, changes to regulatory capital, liquidity and resolution-related requirements applicable to financial institutions in response to recent developments affecting the banking sector, the impact of bank failures or adverse developments at other banks and related negative media coverage of the banking industry in general on investor and depositor sentiment regarding the stability and liquidity of banks, and changes in and uncertainty regarding federal funding, tax and trade policies, and rulemaking, supervision, examination and enforcement priorities of the federal administration. All statements contained herein that are not clearly historical in nature, are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions, and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, are generally intended to identify forward-looking statements.

More information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Form 10-K for the year ended December 31, 2024, our Form 10-Q for the quarter ended March 31, 2025, and the Form 10-Q for the quarter ended June 30, 2025 to be filed with the Securities and Exchange Commission. Our filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements or information which speak as of their respective dates.

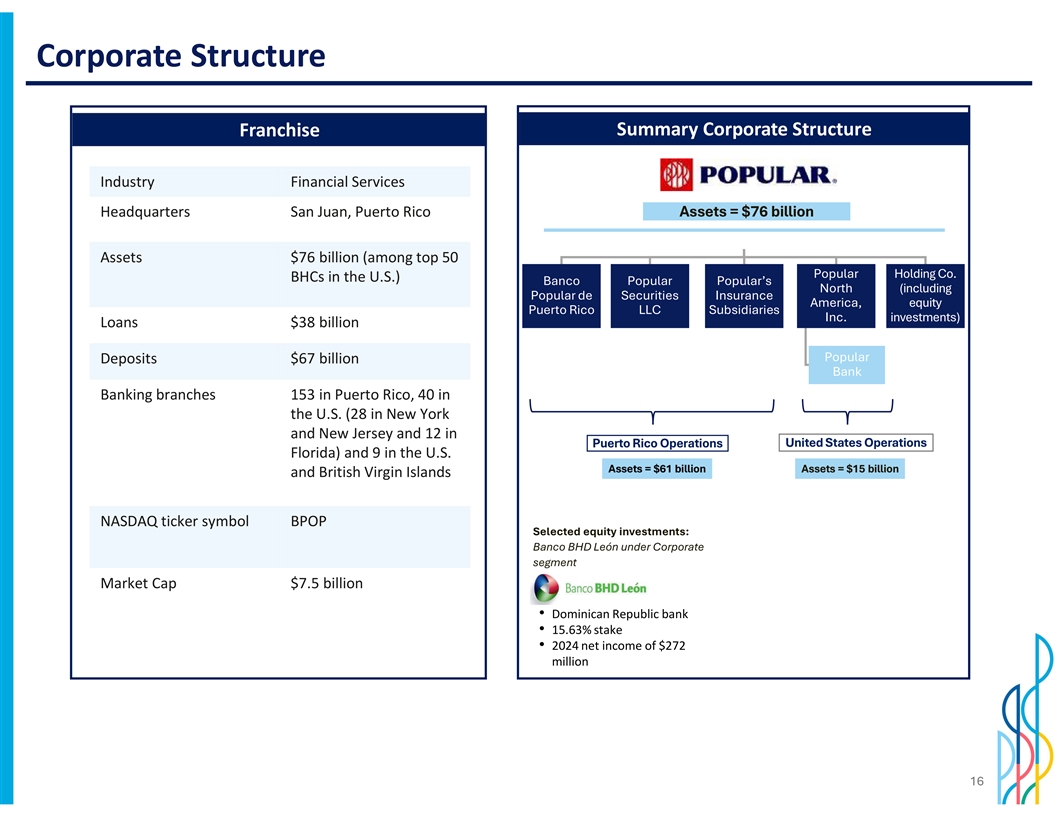

About Popular, Inc.

Popular, Inc. (NASDAQ: BPOP) is the leading financial institution in Puerto Rico, by both assets and deposits, and ranks among the top 50 U.S. bank holding companies by assets. Founded in 1893, Banco Popular de Puerto Rico, Popular’s principal subsidiary, provides retail, mortgage and commercial banking services in Puerto Rico and the U.S. and British Virgin Islands, as well as auto and equipment leasing and financing in Puerto Rico. Popular also offers broker-dealer and insurance services in Puerto Rico through specialized subsidiaries. In the mainland United States, Popular provides retail, mortgage and commercial banking services through its New York-chartered banking subsidiary, Popular Bank, which has branches located in New York, New Jersey and Florida.

Conference Call

Popular will hold a conference call to discuss its financial results today, Wednesday, July 23, 2025 at 11:00 a.m. Eastern Time. The call will be broadcast live over the Internet and can be accessed through the Investor Relations section of the Corporation’s website: www.popular.com.

Listeners are recommended to go to the website at least 15 minutes prior to the call to download and install any necessary audio software. The call may also be accessed through a dial-in telephone number 1-833-470-1428 (Toll Free) or 1-404-975-4839 (Local). The dial-in access code is 297124.

15

A replay of the webcast will be archived in Popular’s website. A telephone replay will be available one hour after the end of the conference call through Friday, August 22, 2025. The replay dial in is: 1-866-813-9403 or 1-929-458-6194. The replay passcode is 734694.

An electronic version of this press release can be found at the Corporation’s website: www.popular.com.

16

| Popular, Inc. |

| Financial Supplement to Second Quarter 2025 Earnings Release |

| Table A - Selected Ratios and Other Information |

| Table B - Consolidated Statement of Operations |

| Table C - Consolidated Statement of Financial Condition |

| Table D - Analysis of Levels and Yields on a Taxable Equivalent Basis (Non-GAAP) - QUARTER |

| Table E - Analysis of Levels and Yields on a Taxable Equivalent Basis (Non-GAAP) - QUARTER |

| Table F - Analysis of Levels and Yields on a Taxable Equivalent Basis (Non-GAAP) - YEAR-TO-DATE |

| Table G - Mortgage Banking Activities and Other Service Fees |

| Table H - Consolidated Loans and Deposits |

| Table I - Loan Delinquency - BPPR Operations |

| Table J - Loan Delinquency - Popular U.S. Operations |

| Table K - Loan Delinquency - Consolidated |

| Table L - Non-Performing Assets |

| Table M - Activity in Non-Performing Loans |

| Table N - Allowance for Credit Losses, Net Charge-offs and Related Ratios |

| Table O - Allowance for Credit Losses ‘‘ACL’’ - Loan Portfolios - BPPR Operations |

| Table P - Allowance for Credit Losses ‘‘ACL’’ - Loan Portfolios - Popular U.S. Operations |

| Table Q - Allowance for Credit Losses ‘‘ACL’’ - Loan Portfolios - Consolidated |

| Table R - Reconciliation to GAAP Financial Measures |

17

POPULAR, INC.

Financial Supplement to Second Quarter 2025 Earnings Release

Table A - Selected Ratios and Other Information

(Unaudited)

| Quarters ended | Six months ended | |||||||||||||||||||

| 30-Jun-25 | 31-Mar-25 | 30-Jun-24 | 30-Jun-25 | 30-Jun-24 | ||||||||||||||||

| Basic EPS |

$ | 3.09 | $ | 2.56 | $ | 2.47 | $ | 5.64 | $ | 3.90 | ||||||||||

| Diluted EPS |

$ | 3.09 | $ | 2.56 | $ | 2.46 | $ | 5.64 | $ | 3.90 | ||||||||||

| Average common shares outstanding |

68,050,361 | 69,280,137 | 71,970,773 | 68,661,851 | 71,920,254 | |||||||||||||||

| Average common shares outstanding - assuming dilution |

68,079,649 | 69,307,681 | 71,991,911 | 68,687,659 | 71,937,434 | |||||||||||||||

| Common shares outstanding at end of period |

67,937,468 | 68,984,148 | 72,365,926 | 67,937,468 | 72,365,926 | |||||||||||||||

| Market value per common share |

$ | 110.21 | $ | 92.37 | $ | 88.43 | $ | 110.21 | $ | 88.43 | ||||||||||

| Market capitalization - (In millions) |

$ | 7,487 | $ | 6,372 | $ | 6,399 | $ | 7,487 | $ | 6,399 | ||||||||||

| Return on average assets |

1.11 | % | 0.96 | % | 0.97 | % | 1.04 | % | 0.77 | % | ||||||||||

| Return on average common equity |

11.77 | % | 10.07 | % | 10.38 | % | 10.93 | % | 8.24 | % | ||||||||||

| Net interest margin (non-taxable equivalent basis) |

3.49 | % | 3.40 | % | 3.22 | % | 3.45 | % | 3.20 | % | ||||||||||

| Net interest margin (taxable equivalent basis) -non-GAAP |

3.85 | % | 3.73 | % | 3.48 | % | 3.80 | % | 3.44 | % | ||||||||||

| Common equity per share |

$ | 87.31 | $ | 83.75 | $ | 73.94 | $ | 87.31 | $ | 73.94 | ||||||||||

| Tangible common book value per common share (non-GAAP) [1] |

$ | 75.41 | $ | 72.02 | $ | 62.71 | $ | 75.41 | $ | 62.71 | ||||||||||

| Tangible common equity to tangible assets (non-GAAP) [1] |

6.81 | % | 6.78 | % | 6.30 | % | 6.81 | % | 6.30 | % | ||||||||||

| Return on average tangible common equity [1] |

13.26 | % | 11.36 | % | 11.77 | % | 12.32 | % | 9.35 | % | ||||||||||

| Tier 1 capital |

15.96 | % | 16.17 | % | 16.54 | % | 15.96 | % | 16.54 | % | ||||||||||

| Total capital |

17.70 | % | 17.92 | % | 18.30 | % | 17.70 | % | 18.30 | % | ||||||||||

| Tier 1 leverage |

8.51 | % | 8.50 | % | 8.53 | % | 8.51 | % | 8.53 | % | ||||||||||

| Common Equity Tier 1 capital |

15.91 | % | 16.11 | % | 16.48 | % | 15.91 | % | 16.48 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| [1] | Refer to Table R for reconciliation to GAAP financial measures. |

18

POPULAR, INC.

Financial Supplement to Second Quarter 2025 Earnings Release

Table B - Consolidated Statement of Operations

(Unaudited)

| Quarters ended |

Variance Quarter ended | Variance | Six months ended | |||||||||||||||||||||||||

| Q2 2025 | Q2 2025 | |||||||||||||||||||||||||||

| (In thousands, except per share information) |

30-Jun-25 | 31-Mar-25 | vs. Q1 2025 | 30-Jun-24 | vs. Q2 2024 | 30-Jun-25 | 30-Jun-24 | |||||||||||||||||||||

| Interest income: |

||||||||||||||||||||||||||||

| Loans |

$ | 684,587 | $ | 666,673 | $ | 17,914 | $ | 648,739 | $ | 35,848 | $ | 1,351,260 | $ | 1,287,469 | ||||||||||||||

| Money market investments |

69,532 | 70,166 | (634 | ) | 88,316 | (18,784 | ) | 139,698 | 176,832 | |||||||||||||||||||

| Investment securities |

189,753 | 180,159 | 9,594 | 184,852 | 4,901 | 369,912 | 351,747 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest income |

943,872 | 916,998 | 26,874 | 921,907 | 21,965 | 1,860,870 | 1,816,048 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Interest expense: |

||||||||||||||||||||||||||||

| Deposits |

295,058 | 297,863 | (2,805 | ) | 339,939 | (44,881 | ) | 592,921 | 669,435 | |||||||||||||||||||

| Short-term borrowings |

5,300 | 1,426 | 3,874 | 1,126 | 4,174 | 6,726 | 2,318 | |||||||||||||||||||||

| Long-term debt |

11,965 | 12,112 | (147 | ) | 12,530 | (565 | ) | 24,077 | 25,239 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest expense |

312,323 | 311,401 | 922 | 353,595 | (41,272 | ) | 623,724 | 696,992 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income |

631,549 | 605,597 | 25,952 | 568,312 | 63,237 | 1,237,146 | 1,119,056 | |||||||||||||||||||||

| Provision for credit losses |

48,941 | 64,081 | (15,140 | ) | 46,794 | 2,147 | 113,022 | 119,392 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income after provision for credit losses |

582,608 | 541,516 | 41,092 | 521,518 | 61,090 | 1,124,124 | 999,664 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Service charges on deposit accounts |

38,826 | 39,054 | (228 | ) | 37,526 | 1,300 | 77,880 | 74,968 | ||||||||||||||||||||

| Other service fees |

100,522 | 94,508 | 6,014 | 96,863 | 3,659 | 195,030 | 191,135 | |||||||||||||||||||||

| Mortgage banking activities |

4,872 | 3,689 | 1,183 | 5,723 | (851 | ) | 8,561 | 10,083 | ||||||||||||||||||||

| Net gain (loss), including impairment, on equity securities |

1,862 | (414 | ) | 2,276 | 319 | 1,543 | 1,448 | 1,422 | ||||||||||||||||||||

| Net gain on trading account debt securities |

538 | 520 | 18 | 277 | 261 | 1,058 | 638 | |||||||||||||||||||||

| Adjustments to indemnity reserves on loans sold |

120 | 173 | (53 | ) | 212 | (92 | ) | 293 | (25 | ) | ||||||||||||||||||

| Other operating income |

21,737 | 14,531 | 7,206 | 25,386 | (3,649 | ) | 36,268 | 51,903 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total non-interest income |

168,477 | 152,061 | 16,416 | 166,306 | 2,171 | 320,538 | 330,124 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Personnel costs |

||||||||||||||||||||||||||||

| Salaries |

132,752 | 130,950 | 1,802 | 128,634 | 4,118 | 263,702 | 258,018 | |||||||||||||||||||||

| Commissions, incentives and other bonuses |

40,551 | 37,986 | 2,565 | 30,626 | 9,925 | 78,537 | 69,237 | |||||||||||||||||||||

| Profit sharing |

13,000 | — | 13,000 | — | 13,000 | 13,000 | — | |||||||||||||||||||||

| Pension, postretirement and medical insurance |

18,458 | 14,566 | 3,892 | 16,619 | 1,839 | 33,024 | 34,004 | |||||||||||||||||||||

| Other personnel costs, including payroll taxes |

24,594 | 29,211 | (4,617 | ) | 21,545 | 3,049 | 53,805 | 51,542 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total personnel costs |

229,355 | 212,713 | 16,642 | 197,424 | 31,931 | 442,068 | 412,801 | |||||||||||||||||||||

| Net occupancy expenses |

29,140 | 27,218 | 1,922 | 27,692 | 1,448 | 56,358 | 55,733 | |||||||||||||||||||||

| Equipment expenses |

5,789 | 5,302 | 487 | 9,662 | (3,873 | ) | 11,091 | 19,229 | ||||||||||||||||||||

| Other taxes |

18,632 | 18,725 | (93 | ) | 15,333 | 3,299 | 37,357 | 29,708 | ||||||||||||||||||||

| Professional fees |

28,108 | 26,825 | 1,283 | 37,744 | (9,636 | ) | 54,933 | 66,662 | ||||||||||||||||||||

| Technology and software expenses |

84,696 | 83,668 | 1,028 | 79,752 | 4,944 | 168,364 | 159,214 | |||||||||||||||||||||

| Processing and transactional services |

||||||||||||||||||||||||||||

| Credit and debit cards |

13,044 | 12,926 | 118 | 13,739 | (695 | ) | 25,970 | 25,883 | ||||||||||||||||||||

| Other processing and transactional services |

24,817 | 24,855 | (38 | ) | 25,357 | (540 | ) | 49,672 | 47,407 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total processing and transactional services |

37,861 | 37,781 | 80 | 39,096 | (1,235 | ) | 75,642 | 73,290 | ||||||||||||||||||||

| Communications |

5,010 | 4,904 | 106 | 4,357 | 653 | 9,914 | 8,914 | |||||||||||||||||||||

| Business promotion |

||||||||||||||||||||||||||||

| Rewards and customer loyalty programs |

18,047 | 16,365 | 1,682 | 16,406 | 1,641 | 34,412 | 30,462 | |||||||||||||||||||||

| Other business promotion |

8,338 | 7,310 | 1,028 | 9,043 | (705 | ) | 15,648 | 15,976 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total business promotion |

26,385 | 23,675 | 2,710 | 25,449 | 936 | 50,060 | 46,438 | |||||||||||||||||||||

| Deposit insurance |

9,407 | 10,035 | (628 | ) | 10,581 | (1,174 | ) | 19,442 | 34,468 | |||||||||||||||||||

| Other real estate owned (OREO) expense (income) |

(4,124 | ) | (3,330 | ) | (794 | ) | (5,750 | ) | 1,626 | (7,454 | ) | (11,071 | ) | |||||||||||||||

| Other operating expenses |

||||||||||||||||||||||||||||

| Operational losses |

6,185 | 6,138 | 47 | 11,823 | (5,638 | ) | 12,323 | 15,384 | ||||||||||||||||||||

| All other |

15,932 | 16,761 | (829 | ) | 15,679 | 253 | 32,693 | 40,390 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other operating expenses |

22,117 | 22,899 | (782 | ) | 27,502 | (5,385 | ) | 45,016 | 55,774 | |||||||||||||||||||

| Amortization of intangibles |

385 | 597 | (212 | ) | 734 | (349 | ) | 982 | 1,529 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

492,761 | 471,012 | 21,749 | 469,576 | 23,185 | 963,773 | 952,689 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income tax |

258,324 | 222,565 | 35,759 | 218,248 | 40,076 | 480,889 | 377,099 | |||||||||||||||||||||

| Income tax expense |

47,884 | 45,063 | 2,821 | 40,459 | 7,425 | 92,947 | 96,027 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 210,440 | $ | 177,502 | $ | 32,938 | $ | 177,789 | $ | 32,651 | $ | 387,942 | $ | 281,072 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income applicable to common stock |

$ | 210,087 | $ | 177,149 | $ | 32,938 | $ | 177,436 | $ | 32,651 | $ | 387,236 | $ | 280,366 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income per common share - basic |

$ | 3.09 | $ | 2.56 | $ | 0.53 | $ | 2.47 | $ | 0.62 | $ | 5.64 | $ | 3.90 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income per common share - diluted |

$ | 3.09 | $ | 2.56 | $ | 0.53 | $ | 2.46 | $ | 0.63 | $ | 5.64 | $ | 3.90 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Dividends Declared per Common Share |

$ | 0.70 | $ | 0.70 | $ | — | $ | 0.62 | $ | 0.08 | $ | 1.40 | $ | 1.24 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

19

Popular, Inc.

Financial Supplement to Second Quarter 2025 Earnings Release

Table C - Consolidated Statement of Financial Condition

(Unaudited)

| Variance | ||||||||||||||||

| Q2 2025 vs. | ||||||||||||||||

| (In thousands) |

30-Jun-25 | 31-Mar-25 | 30-Jun-24 | Q1 2025 | ||||||||||||

| Assets: |

||||||||||||||||

| Cash and due from banks |

$ | 400,631 | $ | 380,165 | $ | 359,973 | $ | 20,466 | ||||||||

| Money market investments |

6,340,786 | 6,195,028 | 6,851,394 | 145,758 | ||||||||||||

| Trading account debt securities, at fair value |

29,643 | 28,477 | 28,045 | 1,166 | ||||||||||||

| Debt securities available-for-sale, at fair value |

20,490,212 | 19,493,180 | 18,543,279 | 997,032 | ||||||||||||

| Less: Allowance for credit losses |

— | — | 500 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Debt securities available-for-sale, net |

20,490,212 | 19,493,180 | 18,542,779 | 997,032 | ||||||||||||

| Debt securities held-to-maturity, at amortized cost |

7,541,724 | 7,648,718 | 7,975,524 | (106,994 | ) | |||||||||||

| Less: Allowance for credit losses |

5,999 | 5,481 | 6,251 | 518 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Debt securities held-to-maturity, net |

7,535,725 | 7,643,237 | 7,969,273 | (107,512 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Equity securities |

222,391 | 205,021 | 195,791 | 17,370 | ||||||||||||

| Loans held-for-sale, at lower of cost or fair value |

2,898 | 5,077 | 8,225 | (2,179 | ) | |||||||||||

| Loans held-in-portfolio |

38,611,834 | 37,675,070 | 35,978,602 | 936,764 | ||||||||||||

| Less: Unearned income |

426,656 | 421,038 | 386,982 | 5,618 | ||||||||||||

| Allowance for credit losses |

769,485 | 762,148 | 730,077 | 7,337 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total loans held-in-portfolio, net |

37,415,693 | 36,491,884 | 34,861,543 | 923,809 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Premises and equipment, net |

649,191 | 625,237 | 599,058 | 23,954 | ||||||||||||

| Other real estate |

46,126 | 52,114 | 70,225 | (5,988 | ) | |||||||||||

| Accrued income receivable |

274,867 | 262,720 | 260,162 | 12,147 | ||||||||||||

| Mortgage servicing rights, at fair value |

103,077 | 104,743 | 113,386 | (1,666 | ) | |||||||||||

| Other assets |

1,745,052 | 1,742,540 | 2,172,555 | 2,512 | ||||||||||||

| Goodwill |

802,954 | 802,954 | 804,428 | — | ||||||||||||

| Other intangible assets |

5,844 | 6,229 | 8,235 | (385 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 76,065,090 | $ | 74,038,606 | $ | 72,845,072 | $ | 2,026,484 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities and Stockholders’ Equity: |

||||||||||||||||

| Liabilities: |

||||||||||||||||

| Deposits: |

||||||||||||||||

| Non-interest bearing |

$ | 15,114,614 | $ | 15,160,801 | $ | 15,470,082 | $ | (46,187 | ) | |||||||

| Interest bearing |

52,102,877 | 50,658,454 | 50,060,780 | 1,444,423 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total deposits |

67,217,491 | 65,819,255 | 65,530,862 | 1,398,236 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Assets sold under agreements to repurchase |

56,043 | 57,268 | 105,684 | (1,225 | ) | |||||||||||

| Other short-term borrowings |

550,000 | 200,000 | — | 350,000 | ||||||||||||

| Notes payable |

808,451 | 833,149 | 941,580 | (24,698 | ) | |||||||||||

| Other liabilities |

1,479,087 | 1,329,239 | 894,268 | 149,848 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

70,111,072 | 68,238,911 | 67,472,394 | 1,872,161 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Stockholders’ equity: |

||||||||||||||||

| Preferred stock |

22,143 | 22,143 | 22,143 | — | ||||||||||||

| Common stock |

1,049 | 1,049 | 1,048 | — | ||||||||||||

| Surplus |

4,919,950 | 4,912,886 | 4,852,747 | 7,064 | ||||||||||||

| Retained earnings |

4,861,958 | 4,699,697 | 4,385,522 | 162,261 | ||||||||||||

| Treasury stock |

(2,455,425 | ) | (2,346,093 | ) | (2,010,500 | ) | (109,332 | ) | ||||||||

| Accumulated other comprehensive loss, net of tax |

(1,395,657 | ) | (1,489,987 | ) | (1,878,282 | ) | 94,330 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total stockholders’ equity |

5,954,018 | 5,799,695 | 5,372,678 | 154,323 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities and stockholders’ equity |

$ | 76,065,090 | $ | 74,038,606 | $ | 72,845,072 | $ | 2,026,484 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

20

Popular, Inc.

Financial Supplement to Second Quarter 2025 Earnings Release

Table D - Analysis of Levels and Yields on a Taxable Equivalent Basis (Non-GAAP)

For the quarters ended June 30, 2025 and March 31, 2025

(Unaudited)

| Variance |

||||||||||||||||||||||||||||||||||||||||||||

| Average Volume | Average Yields / Costs | Interest | Attributable to | |||||||||||||||||||||||||||||||||||||||||

| 30-Jun-25 |

31-Mar-25 | Variance | 30-Jun-25 | 31-Mar-25 | Variance | 30-Jun-25 | 31-Mar-25 | Variance | Rate | Volume | ||||||||||||||||||||||||||||||||||

| (In millions) | (In thousands) | |||||||||||||||||||||||||||||||||||||||||||

| $ 6,251 | $ | 6,379 | $ | (128 | ) | 4.46 | % | 4.46 | % | - | % | Money market investments |

$ | 69,532 | $ | 70,166 | $ | (634 | ) | $ | 789 | $ | (1,423 | ) | ||||||||||||||||||||

| 28,809 | 28,415 | 394 | 3.29 | 3.14 | 0.15 | Investment securities [1] |

236,372 | 220,435 | 15,937 | 12,117 | 3,820 | |||||||||||||||||||||||||||||||||

| 27 | 31 | (4 | ) | 5.99 | 5.82 | 0.17 | Trading securities |

407 | 440 | (33 | ) | 17 | (50 | ) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 35,087 | 34,825 | 262 | 3.50 | 3.38 | 0.12 | Total money market, investment and trading securities |

306,311 | 291,041 | 15,270 | 12,923 | 2,347 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Loans: |

||||||||||||||||||||||||||||||||||||||||||||

| 18,676 | 18,489 | 187 | 6.73 | 6.71 | 0.02 | Commercial |

313,493 | 305,968 | 7,525 | 4,414 | 3,111 | |||||||||||||||||||||||||||||||||

| 1,459 | 1,309 | 150 | 8.19 | 8.11 | 0.08 | Construction |

29,806 | 26,190 | 3,616 | 567 | 3,049 | |||||||||||||||||||||||||||||||||

| 1,963 | 1,930 | 33 | 7.18 | 7.14 | 0.04 | Leasing |

35,249 | 34,444 | 805 | 208 | 597 | |||||||||||||||||||||||||||||||||

| 8,339 | 8,168 | 171 | 5.89 | 5.82 | 0.07 | Mortgage |

122,873 | 118,917 | 3,956 | 1,452 | 2,504 | |||||||||||||||||||||||||||||||||

| 3,211 | 3,203 | 8 | 14.00 | 14.04 | (0.04 | ) | Consumer |

112,083 | 110,859 | 1,224 | 1,034 | 190 | ||||||||||||||||||||||||||||||||

| 3,937 | 3,907 | 30 | 9.14 | 9.12 | 0.02 | Auto |

89,706 | 87,850 | 1,856 | 1,170 | 686 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 37,585 | 37,006 | 579 | 7.50 | 7.48 | 0.02 | Total loans |

703,210 | 684,228 | 18,982 | 8,845 | 10,137 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| $ 72,672 | $ | 71,831 | $ | 841 | 5.57 | % | 5.49 | % | 0.08 | % | Total earning assets |

$ | 1,009,521 | $ | 975,269 | $ | 34,252 | $ | 21,768 | $ | 12,484 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Interest bearing deposits: |

||||||||||||||||||||||||||||||||||||||||||||

| $8,062 | $ | 7,964 | $ | 98 | 1.71 | % | 1.72 | % | (0.01 | )% | NOW and money market |

$ | 34,288 | $ | 33,784 | $ | 504 | $ | (567 | ) | $ | 1,071 | ||||||||||||||||||||||

| 14,605 | 14,507 | 98 | 0.83 | 0.87 | (0.04 | ) | Savings |

30,378 | 31,280 | (902 | ) | (889 | ) | (13 | ) | |||||||||||||||||||||||||||||

| 8,532 | 8,400 | 132 | 3.15 | 3.22 | (0.07 | ) | Time deposits |

67,032 | 66,681 | 351 | (393 | ) | 744 | |||||||||||||||||||||||||||||||

| 20,333 | 20,305 | 28 | 3.22 | 3.32 | (0.10 | ) | P.R. public deposits |

163,360 | 166,118 | (2,758 | ) | (2,866 | ) | 108 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 51,532 | 51,176 | 356 | 2.29 | 2.36 | (0.07 | ) | Total interest bearing deposits |

295,058 | 297,863 | (2,805 | ) | (4,715 | ) | 1,910 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 14,825 | 14,682 | 143 | Non-interest bearing demand deposits |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| 66,357 | 65,858 | 499 | 1.78 | 1.83 | (0.05 | ) | Total deposits |

295,058 | 297,863 | (2,805 | ) | (4,715 | ) | 1,910 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 470 | 121 | 349 | 4.52 | 4.77 | (0.25 | ) | Short-term borrowings |

5,300 | 1,426 | 3,874 | (54 | ) | 3,928 | |||||||||||||||||||||||||||||||

| 832 | 862 | (30 | ) | 5.79 | 5.66 | 0.13 | Other medium and long-term debt |

11,965 | 12,112 | (147 | ) | (6 | ) | (141 | ) | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 52,834 | 52,159 | 675 | 2.36 | 2.42 | (0.06 | ) | Total interest bearing liabilities (excluding demand deposits) |

312,323 | 311,401 | 922 | (4,775 | ) | 5,697 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 5,013 | 4,990 | 23 | Other sources of funds |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| $ 72,672 | $ | 71,831 | $ | 841 | 1.72 | % | 1.76 | % | (0.04 | )% | Total source of funds |

312,323 | 311,401 | 922 | (4,775 | ) | 5,697 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 3.85 | % | 3.73 | % | 0.12 | % | Net interest margin/ income on a taxable equivalent basis (Non-GAAP) |

697,198 | 663,868 | 33,330 | $ | 26,543 | $ | 6,787 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| 3.21 | % | 3.07 | % | 0.14 | % | Net interest spread Taxable equivalent adjustment |

65,649 | 58,271 | 7,378 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| 3.49 | % | 3.40 | % | 0.09 | % | Net interest margin/ income non-taxable equivalent basis (GAAP) |

$ | 631,549 | $ | 605,597 | $ | 25,952 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Note: The changes that are not due solely to volume or rate are allocated to volume and rate based on the proportion of the change in each category.

| [1] | Average balances exclude unrealized gains or losses on debt securities available-for-sale and the unrealized loss related to certain securities transferred from available-for-sale to held-to-maturity. |

21

Popular, Inc.

Financial Supplement to Second Quarter 2025 Earnings Release

Table E - Analysis of Levels and Yields on a Taxable Equivalent Basis (Non-GAAP)

For the quarters ended June 30, 2025 and June 30, 2024

(Unaudited)

| Variance | ||||||||||||||||||||||||||||||||||||||||||||

| Average Volume | Average Yields / Costs | Interest | Attributable to | |||||||||||||||||||||||||||||||||||||||||

| 30-Jun-25 |

30-Jun-24 | Variance | 30-Jun-25 | 30-Jun-24 | Variance | 30-Jun-25 | 30-Jun-24 | Variance | Rate | Volume | ||||||||||||||||||||||||||||||||||

| (In millions) | (In thousands) | |||||||||||||||||||||||||||||||||||||||||||

| $ | 6,251 | $ | 6,471 | $ | (220 | ) | 4.46 | % | 5.49 | % | (1.03 | )% | Money market investments |

$ | 69,532 | $ | 88,316 | $ | (18,784 | ) | $ | (15,866 | ) | $ | (2,918 | ) | ||||||||||||||||||

| 28,809 | 28,943 | (134 | ) | 3.29 | 3.01 | 0.28 | Investment securities [1] |

236,372 | 216,922 | 19,450 | 18,673 | 777 | ||||||||||||||||||||||||||||||||

| 27 | 26 | 1 | 5.99 | 5.69 | 0.30 | Trading securities |

407 | 367 | 40 | 21 | 19 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 35,087 | 35,440 | (353 | ) | 3.50 | 3.47 | 0.03 | Total money market, investment and trading securities |

306,311 | 305,605 | 706 | 2,828 | (2,122 | ) | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Loans: |

||||||||||||||||||||||||||||||||||||||||||||

| 18,676 | 17,707 | 969 | 6.73 | 6.86 | (0.13 | ) | Commercial |

313,493 | 302,003 | 11,490 | (4,831 | ) | 16,321 | |||||||||||||||||||||||||||||||

| 1,459 | 1,070 | 389 | 8.19 | 9.11 | (0.92 | ) | Construction |

29,806 | 24,224 | 5,582 | (2,558 | ) | 8,140 | |||||||||||||||||||||||||||||||

| 1,963 | 1,789 | 174 | 7.18 | 6.86 | 0.32 | Leasing |

35,249 | 30,697 | 4,552 | 1,467 | 3,085 | |||||||||||||||||||||||||||||||||

| 8,339 | 7,817 | 522 | 5.89 | 5.66 | 0.23 | Mortgage |

122,873 | 110,673 | 12,200 | 4,632 | 7,568 | |||||||||||||||||||||||||||||||||

| 3,211 | 3,192 | 19 | 14.00 | 13.97 | 0.03 | Consumer |

112,083 | 110,906 | 1,177 | 374 | 803 | |||||||||||||||||||||||||||||||||

| 3,937 | 3,819 | 118 | 9.14 | 8.88 | 0.26 | Auto |

89,706 | 84,268 | 5,438 | 2,780 | 2,658 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 37,585 | 35,394 | 2,191 | 7.50 | 7.52 | (0.02 | ) | Total loans |

703,210 | 662,771 | 40,439 | 1,864 | 38,575 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| $ 72,672 | $ | 70,834 | $ | 1,838 | 5.57 | % | 5.49 | % | 0.08 | % | Total earning assets |

$ | 1,009,521 | $ | 968,376 | $ | 41,145 | $ | 4,692 | $ | 36,453 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Interest bearing deposits: |

||||||||||||||||||||||||||||||||||||||||||||

| $8,062 | $ | 7,522 | $ | 540 | 1.71 | % | 1.97 | % | (0.26 | )% | NOW and money market |

$ | 34,288 | $ | 36,783 | $ | (2,495 | ) | $ | (4,611 | ) | $ | 2,116 | |||||||||||||||||||||

| 14,605 | 14,728 | (123 | ) | 0.83 | 0.92 | (0.09 | ) | Savings |

30,378 | 33,749 | (3,371 | ) | (2,862 | ) | (509 | ) | ||||||||||||||||||||||||||||

| 8,532 | 8,237 | 295 | 3.15 | 3.39 | (0.24 | ) | Time deposits |

67,032 | 69,494 | (2,462 | ) | (4,857 | ) | 2,395 | ||||||||||||||||||||||||||||||

| 20,333 | 19,364 | 969 | 3.22 | 4.15 | (0.93 | ) | P.R. public deposits |

163,360 | 199,913 | (36,553 | ) | (45,918 | ) | 9,365 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 51,532 | 49,851 | 1,681 | 2.29 | 2.74 | (0.45 | ) | Total interest bearing deposits |

295,058 | 339,939 | (44,881 | ) | (58,248 | ) | 13,367 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 14,825 | 15,176 | (351 | ) | Non-interest bearing demand deposits |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 66,357 | 65,027 | 1,330 | 1.78 | 2.10 | (0.32 | ) | Total deposits |

295,058 | 339,939 | (44,881 | ) | (58,248 | ) | 13,367 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 470 | 80 | 390 | 4.52 | 5.64 | (1.12 | ) | Short-term borrowings |

5,300 | 1,126 | 4,174 | (213 | ) | 4,387 | |||||||||||||||||||||||||||||||

| 832 | 978 | (146 | ) | 5.79 | 5.16 | 0.63 | Other medium and long-term debt |

11,965 | 12,530 | (565 | ) | 181 | (746 | ) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| 52,834 | 50,909 | 1,925 | 2.36 | 2.79 | (0.43 | ) | Total interest bearing liabilities (excluding demand deposits) |