UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

|

|

CURRENT REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| Date of Report (Date of earliest event reported): July 16, 2025 |

||

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-14965

| Delaware | 13-4019460 | |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

|

| 200 West Street, New York, N.Y. | 10282 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 902-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol |

Exchange on which registered |

||

| Common stock, par value $.01 per share | GS | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series A | GS PrA | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series C | GS PrC | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series D | GS PrD | NYSE | ||

| 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II | GS/43PE | NYSE | ||

| Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III | GS/43PF | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due March 2031 of GS Finance Corp. | GS/31B | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due May 2031 of GS Finance Corp. | GS/31X | NYSE | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 16, 2025, The Goldman Sachs Group, Inc. (Group Inc. and, together with its consolidated subsidiaries, the firm) reported its earnings for the second quarter ended June 30, 2025. A copy of Group Inc.’s press release containing this information is attached as Exhibit 99.1 to this Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On July 16, 2025, at 9:30 a.m. (ET), the firm will hold a conference call to discuss the firm’s financial results, outlook and related matters. A copy of the presentation for the conference call is attached as Exhibit 99.2 to this Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 |

Exhibit 99.1 shall be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (Exchange Act).

| 99.2 | Presentation of Group Inc. dated July 16, 2025, for the conference call on July 16, 2025. |

Exhibit 99.2 is being furnished pursuant to Item 7.01 of Form 8-K and the information included therein shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the Securities Act of 1933 or the Exchange Act.

| 101 | Pursuant to Rule 406 of Regulation S-T, the cover page information is formatted in iXBRL (Inline eXtensible Business Reporting Language). |

| 104 | Cover Page Interactive Data File (formatted in iXBRL in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE GOLDMAN SACHS GROUP, INC. |

||||||||

| (Registrant) |

||||||||

| Date: July 16, 2025 |

By: |

/s/ Denis P. Coleman III |

||||||

| Name: Denis P. Coleman III |

||||||||

| Title: Chief Financial Officer |

||||||||

Exhibit 99.1

|

Second Quarter 2025

Earnings Results

Media Relations: Tony Fratto 212-902-5400 Investor Relations: Jehan Ilahi 212-902-0300

|

||

|

The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282

|

Second Quarter 2025 Earnings Results

Goldman Sachs Reports Second Quarter Earnings Per Common Share of $10.91 and Increases the Quarterly Dividend to $4.00 Per Common Share in the Third Quarter

|

Financial Summary

|

|

|

|

|

|

|||||||||

|

Net Revenues

|

Net Earnings

|

EPS

|

||||||||||

|

2Q25 $14.58 billion

|

2Q25 $3.72 billion

|

2Q25 $10.91

|

||||||||||

|

2Q25 YTD $29.65 billion

|

2Q25 YTD $8.46 billion

|

2Q25 YTD $25.07

|

||||||||||

|

Annualized ROE1

|

Book Value Per Share

|

|||||||||||||

|

2Q25 12.8%

|

2Q25 $349.74

|

|||||||||||||

|

2Q25 YTD 14.8%

|

YTD Growth 3.9%

|

|||||||||||||

NEW YORK, July 16, 2025 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $14.58 billion and net earnings of $3.72 billion for the second quarter ended June 30, 2025. Net revenues were $29.65 billion and net earnings were $8.46 billion for the first half of 2025.

Diluted earnings per common share (EPS) was $10.91 for the second quarter of 2025 compared with $8.62 for the second quarter of 2024 and $14.12 for the first quarter of 2025, and was $25.07 for the first half of 2025 compared with $20.21 for the first half of 2024.

Annualized return on average common shareholders’ equity (ROE)1 was 12.8% for the second quarter of 2025 and 14.8% for the first half of 2025.

Book value per common share increased by 1.6% during the second quarter of 2025 and by 3.9% during the first half of 2025 to $349.74.

1

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

Net Revenues

| Net revenues were $14.58 billion for the second quarter of 2025, 15% higher than the second quarter of 2024 and 3% lower than the first quarter of 2025. The increase compared with the second quarter of 2024 reflected significantly higher net revenues in Global Banking & Markets, partially offset by slightly lower net revenues in Asset & Wealth Management. |

|

Net Revenues

|

||

|

$14.58 billion

|

||||

| Global Banking & Markets |

| Net revenues in Global Banking & Markets were $10.12 billion for the second quarter of 2025, 24% higher than the second quarter of 2024 and 5% lower than the first quarter of 2025.

Investment banking fees were $2.19 billion, 26% higher than the second quarter of 2024, due to significantly higher net revenues in Advisory, reflecting strength in the Americas and EMEA. Net revenues in Debt underwriting were slightly lower, driven by a decrease in leveraged finance activity, while net revenues in Equity underwriting were essentially unchanged. The firm’s Investment banking fees backlog2 was higher compared with both the end of the first quarter of 2025 and the end of 2024.

Net revenues in Fixed Income, Currency and Commodities (FICC) were $3.47 billion, 9% higher than the second quarter of 2024, primarily reflecting significantly higher net revenues in FICC financing, primarily driven by mortgages and structured lending. Net revenues in FICC intermediation were slightly higher, reflecting significantly higher net revenues in currencies, higher net revenues in credit products and slightly higher net revenues in interest rate products, largely offset by significantly lower net revenues in both mortgages and commodities.

Net revenues in Equities were $4.30 billion, 36% higher than the second quarter of 2024, due to significantly higher net revenues in Equities intermediation (driven by both cash products and derivatives) and in Equities financing (primarily driven by portfolio financing).

Net revenues in Other were $161 million, compared with $102 million for the second quarter of 2024, primarily reflecting higher net gains from direct investments. |

Global Banking & Markets

|

|||||

|

$10.12 billion

|

||||||

| Advisory |

$ 1.17 billion |

|||||

| Equity underwriting |

$ 428 million |

|||||

| Debt underwriting |

$ 589 million |

|||||

| Investment banking fees |

$ 2.19 billion |

|||||

|

FICC intermediation |

$ 2.42 billion |

|||||

| FICC financing |

$ 1.04 billion |

|||||

| FICC |

$ 3.47 billion |

|||||

|

Equities intermediation |

$ 2.60 billion |

|||||

| Equities financing |

$ 1.71 billion |

|||||

| Equities |

$ 4.30 billion |

|||||

|

Other |

$ 161 million |

|||||

2

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

| Asset & Wealth Management |

| Net revenues in Asset & Wealth Management were $3.78 billion for the second quarter of 2025, 3% lower than the second quarter of 2024 and 3% higher than the first quarter of 2025. The decrease compared with the second quarter of 2024 reflected significantly lower net revenues in both Equity investments and Debt investments, partially offset by higher Management and other fees. Net revenues in Private banking and lending and Incentive fees were also higher.

The decrease in Equity investments net revenues reflected significantly lower net gains from investments in private equities. The decrease in Debt investments net revenues reflected significantly lower net interest income due to a reduction in the debt investments balance sheet and net losses from hedges compared with net gains in the prior year period. The increase in Management and other fees primarily reflected the impact of higher average assets under supervision. The increase in Private banking and lending net revenues primarily reflected higher net interest income from lending. The increase in Incentive fees was primarily driven by harvesting. |

Asset & Wealth Management

|

|||

|

$3.78 billion

|

||||

|

Management and other fees |

$ 2.81 billion |

|||

|

Incentive fees |

$ 102 million |

|||

|

Private banking and lending |

$ 789 million |

|||

|

Equity investments |

$ (1) million |

|||

|

Debt investments |

$ 83 million |

|||

| Platform Solutions |

| Net revenues in Platform Solutions were $685 million for the second quarter of 2025, 2% higher than the second quarter of 2024 and essentially unchanged compared with the first quarter of 2025.

Consumer platforms net revenues were slightly higher compared with the second quarter of 2024, while Transaction banking and other net revenues were lower. |

Platform Solutions

|

|||||

|

$685 million

|

||||||

|

Consumer platforms |

$623 million | |||||

|

Transaction banking and other

|

$ 62 million | |||||

Provision for Credit Losses

| Provision for credit losses was $384 million for the second quarter of 2025, compared with $282 million for the second quarter of 2024 and $287 million for the first quarter of 2025. Provisions for the second quarter of 2025 primarily reflected net charge-offs related to the credit card portfolio and growth in the credit card and wholesale portfolios. Provisions for the second quarter of 2024 reflected net provisions related to the credit card portfolio (driven by net charge-offs). |

Provision for Credit Losses

|

|||||

|

$384 million

|

||||||

3

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

Operating Expenses

| Operating expenses were $9.24 billion for the second quarter of 2025, 8% higher than the second quarter of 2024 and essentially unchanged compared with the first quarter of 2025. The firm’s efficiency ratio2 was 62.0% for the first half of 2025, compared with 63.8% for the first half of 2024.

The increase in operating expenses compared with the second quarter of 2024 primarily reflected higher compensation and benefits expenses (reflecting improved operating performance) and higher transaction based expenses, partially offset by lower net provisions for litigation and regulatory proceedings (included in other expenses).

Net provisions for litigation and regulatory proceedings were $1 million for the second quarter of 2025, compared with $104 million for the second quarter of 2024.

Headcount decreased 2% compared with the end of the first quarter of 2025. |

Operating Expenses

|

|||||

|

$9.24 billion

|

||||||

|

YTD Efficiency Ratio

|

||||||

|

62.0%

|

||||||

Provision for Taxes

| The effective income tax rate for the first half of 2025 was 20.2%, up from 16.1% for the first quarter of 2025, primarily due to a decrease in the impact of tax benefits on the settlement of employee share-based awards.3 |

YTD Effective Tax Rate

|

|||

|

20.2%

|

||||

Other Matters

| ◾ On July 14, 2025, the Board of Directors of The Goldman Sachs Group, Inc. increased the quarterly dividend to $4.00 per common share from $3.00 per common share. The dividend will be paid on September 29, 2025 to common shareholders of record on August 29, 2025.

◾ During the quarter, the firm returned $3.96 billion of capital to common shareholders, including $3.00 billion of common share repurchases (5.3 million shares at an average cost of $564.57) and $957 million of common stock dividends.2

◾ Global core liquid assets2 averaged $462 billion for the second quarter of 2025, compared with an average of $441 billion for the first quarter of 2025. |

Declared Quarterly Dividend Per Common Share

|

|||

|

$4.00

|

||||

|

Common Share Repurchases

|

||||

|

5.3 million shares for $3.00 billion

|

||||

|

Average GCLA

|

||||

|

$462 billion

|

||||

4

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

| Cautionary Note Regarding Forward-Looking Statements |

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2024.

Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements.

Statements about the firm’s Investment banking fees backlog and future results also may constitute forward-looking statements. Such statements are subject to the risk that transactions may be modified or may not be completed at all, and related net revenues may not be realized or may be materially less than expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, changes in international trade policies, including the imposition of tariffs, an outbreak or worsening of hostilities, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. For information about other important factors that could adversely affect the firm’s Investment banking fees, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2024.

| Conference Call |

A conference call to discuss the firm’s financial results, outlook and related matters will be held at 9:30 am (ET). The call will be open to the public. Members of the public who would like to listen to the conference call should dial 1-800-289-0459 (in the U.S.) or 1-323-794-2095 (outside the U.S.) passcode number 7042022. The number should be dialed at least 10 minutes prior to the start of the conference call. The conference call will also be accessible as an audio webcast through the Investor Relations section of the firm’s website, www.goldmansachs.com/investor-relations. There is no charge to access the call. For those unable to listen to the live broadcast, a replay will be available on the firm’s website beginning approximately three hours after the event. Please direct any questions regarding obtaining access to the conference call to Goldman Sachs Investor Relations, via e-mail, at gs-investor-relations@gs.com.

5

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

JUNE 30, 2024 |

MARCH 31, 2025 |

JUNE 30, 2024 |

||||||||||||||||||

|

GLOBAL BANKING & MARKETS |

||||||||||||||||||||||

|

Advisory

|

|

$ 1,174

|

|

|

$ 792

|

|

|

$ 688

|

|

|

48 %

|

|

|

71 %

|

|

|||||||

| Equity underwriting

|

|

428

|

|

|

370

|

|

|

423

|

|

|

16

|

|

|

1

|

|

|||||||

| Debt underwriting

|

|

589

|

|

|

752

|

|

|

622

|

|

|

(22)

|

|

|

(5)

|

|

|||||||

| Investment banking fees

|

|

2,191

|

|

|

1,914

|

|

|

1,733

|

|

|

14

|

|

|

26

|

|

|||||||

| FICC intermediation

|

|

2,423

|

|

|

3,390

|

|

|

2,330

|

|

|

(29)

|

|

|

4

|

|

|||||||

| FICC financing

|

|

1,044

|

|

|

1,014

|

|

|

850

|

|

|

3

|

|

|

23

|

|

|||||||

| FICC

|

|

3,467

|

|

|

4,404

|

|

|

3,180

|

|

|

(21)

|

|

|

9

|

|

|||||||

| Equities intermediation

|

|

2,595

|

|

|

2,547

|

|

|

1,786

|

|

|

2

|

|

|

45

|

|

|||||||

| Equities financing

|

|

1,706

|

|

|

1,645

|

|

|

1,383

|

|

|

4

|

|

|

23

|

|

|||||||

| Equities

|

|

4,301

|

|

|

4,192

|

|

|

3,169

|

|

|

3

|

|

|

36

|

|

|||||||

| Other

|

|

161

|

|

|

197

|

|

|

102

|

|

|

(18)

|

|

|

58

|

|

|||||||

|

Net revenues |

|

10,120

|

|

|

10,707 |

|

|

8,184 |

|

|

(5) |

|

|

24 |

|

|||||||

|

ASSET & WEALTH MANAGEMENT |

||||||||||||||||||||||

|

Management and other fees

|

|

2,805

|

|

|

2,703

|

|

|

2,536

|

|

|

4

|

|

|

11

|

|

|||||||

| Incentive fees

|

|

102

|

|

|

129

|

|

|

46

|

|

|

(21)

|

|

|

122

|

|

|||||||

| Private banking and lending

|

|

789

|

|

|

725

|

|

|

707

|

|

|

9

|

|

|

12

|

|

|||||||

| Equity investments

|

|

(1)

|

|

|

(5)

|

|

|

292

|

|

|

80

|

|

|

N.M.

|

|

|||||||

| Debt investments

|

|

83

|

|

|

127

|

|

|

297

|

|

|

(35)

|

|

|

(72)

|

|

|||||||

|

Net revenues |

|

3,778 |

|

|

3,679 |

|

|

3,878 |

|

|

3 |

|

|

(3) |

|

|||||||

|

PLATFORM SOLUTIONS |

||||||||||||||||||||||

|

Consumer platforms

|

|

623

|

|

|

611

|

|

|

599

|

|

|

2

|

|

|

4

|

|

|||||||

| Transaction banking and other

|

|

62

|

|

|

65

|

|

|

70

|

|

|

(5)

|

|

|

(11)

|

|

|||||||

|

Net revenues |

|

685 |

|

|

676 |

|

|

669 |

|

|

1 |

|

|

2 |

|

|||||||

|

Total net revenues

|

|

$ 14,583

|

|

|

$ 15,062

|

|

|

$ 12,731

|

|

|

(3) |

|

|

15 |

|

|||||||

|

Geographic Net Revenues (unaudited)2 |

||||||||||||||||||||||

| $ in millions | ||||||||||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

JUNE 30, 2024 |

||||||||||||||||||||

|

Americas

|

|

$ 8,982

|

|

|

$ 9,866

|

|

|

$ 8,125

|

|

|||||||||||||

| EMEA

|

|

3,811

|

|

|

3,491

|

|

|

2,931

|

|

|||||||||||||

| Asia

|

|

1,790

|

|

|

1,705

|

|

|

1,675

|

|

|||||||||||||

|

Total net revenues |

|

$ 14,583 |

|

|

$ 15,062 |

|

|

$ 12,731 |

|

|||||||||||||

| Americas

|

|

62%

|

|

|

66%

|

|

|

64%

|

|

|||||||||||||

| EMEA

|

|

26%

|

|

|

23%

|

|

|

23%

|

|

|||||||||||||

| Asia

|

|

12%

|

|

|

11%

|

|

|

13%

|

|

|||||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

|

100%

|

|

|||||||||||||

6

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| SIX MONTHS ENDED | % CHANGE FROM | |||||||||||||||

| JUNE 30, 2025 |

JUNE 30, 2024 |

JUNE 30, 2024 |

||||||||||||||

|

GLOBAL BANKING & MARKETS |

||||||||||||||||

|

Advisory

|

|

$ 1,966

|

|

|

$ 1,699

|

|

|

16 %

|

|

|||||||

| Equity underwriting |

798 | 793 | 1 | |||||||||||||

|

Debt underwriting |

1,341 | 1,321 | 2 | |||||||||||||

|

Investment banking fees |

4,105 | 3,813 | 8 | |||||||||||||

|

FICC intermediation |

5,813 | 5,801 | – | |||||||||||||

|

FICC financing |

2,058 | 1,702 | 21 | |||||||||||||

|

FICC |

7,871 | 7,503 | 5 | |||||||||||||

| Equities intermediation |

5,142 | 3,775 | 36 | |||||||||||||

|

Equities financing |

3,351 | 2,705 | 24 | |||||||||||||

|

Equities

|

|

8,493

|

|

|

6,480

|

|

|

31

|

|

|||||||

|

Other

|

|

358

|

|

|

114

|

|

|

214

|

|

|||||||

|

Net revenues

|

|

20,827

|

|

|

17,910

|

|

|

16

|

|

|||||||

|

ASSET & WEALTH MANAGEMENT |

||||||||||||||||

|

Management and other fees |

5,508 | 4,988 | 10 | |||||||||||||

|

Incentive fees |

231 | 134 | 72 | |||||||||||||

|

Private banking and lending |

1,514 | 1,389 | 9 | |||||||||||||

|

Equity investments |

(6) | 514 | N.M. | |||||||||||||

|

Debt investments

|

|

210

|

|

|

642

|

|

|

(67)

|

|

|||||||

|

Net revenues

|

|

7,457

|

|

|

7,667

|

|

|

(3)

|

|

|||||||

|

PLATFORM SOLUTIONS |

||||||||||||||||

|

Consumer platforms

|

|

1,234

|

|

|

1,217

|

|

|

1

|

|

|||||||

| Transaction banking and other

|

|

127

|

|

|

150

|

|

|

(15)

|

|

|||||||

|

Net revenues

|

|

1,361

|

|

|

1,367

|

|

|

–

|

|

|||||||

|

Total net revenues

|

|

$ 29,645

|

|

|

$ 26,944

|

|

|

10

|

|

|||||||

|

Geographic Net Revenues (unaudited)2 $ in millions

|

|

|||||||||||||||

| SIX MONTHS ENDED | ||||||||||||||||

| JUNE 30, 2025 |

JUNE 30, 2024 |

|||||||||||||||

| Americas |

$ 18,848 | $ 17,306 | ||||||||||||||

|

EMEA |

7,302 | 6,401 | ||||||||||||||

|

Asia

|

|

3,495

|

|

|

3,237

|

|

||||||||||

|

Total net revenues |

|

$ 29,645

|

|

|

$ 26,944

|

|

||||||||||

| Americas |

63% | 64% | ||||||||||||||

|

EMEA |

25% | 24% | ||||||||||||||

|

Asia

|

|

12%

|

|

|

12%

|

|

||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

||||||||||

7

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)2

In millions, except per share amounts and headcount

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

JUNE 30, 2024 |

MARCH 31, 2025 |

JUNE 30, 2024 |

||||||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||||||||

| Investment banking |

$ 2,194 | $ 1,916 | $ 1,733 | 15 % | 27 % | |||||||||||||||||||||

|

Investment management |

2,837 | 2,759 | 2,533 | 3 | 12 | |||||||||||||||||||||

|

Commissions and fees |

1,201 | 1,226 | 1,051 | (2) | 14 | |||||||||||||||||||||

|

Market making |

4,733 | 5,723 | 4,336 | (17) | 9 | |||||||||||||||||||||

|

Other principal transactions

|

|

514

|

|

|

543

|

|

|

1,088

|

|

|

(5)

|

|

|

(53)

|

|

|||||||||||

|

Total non-interest revenues

|

|

11,479

|

|

|

12,167

|

|

|

10,741

|

|

|

(6)

|

|

|

7

|

|

|||||||||||

| Interest income |

19,789 | 19,383 | 20,440 | 2 | (3) | |||||||||||||||||||||

|

Interest expense

|

|

16,685

|

|

|

16,488

|

|

|

18,450

|

|

|

1

|

|

|

(10)

|

|

|||||||||||

|

Net interest income

|

|

3,104

|

|

|

2,895

|

|

|

1,990

|

|

|

7

|

|

|

56

|

|

|||||||||||

|

Total net revenues

|

|

14,583

|

|

|

15,062

|

|

|

12,731

|

|

|

(3)

|

|

|

15

|

|

|||||||||||

|

Provision for credit losses

|

|

384

|

|

|

287

|

|

|

282

|

|

|

34

|

|

|

36

|

|

|||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||||||||||

| Compensation and benefits

|

4,685 | 4,876 | 4,240 | (4) | 10 | |||||||||||||||||||||

| Transaction based

|

1,955 | 1,850 | 1,654 | 6 | 18 | |||||||||||||||||||||

| Market development

|

167 | 156 | 153 | 7 | 9 | |||||||||||||||||||||

| Communications and technology

|

530 | 506 | 500 | 5 | 6 | |||||||||||||||||||||

| Depreciation and amortization

|

618 | 506 | 646 | 22 | (4) | |||||||||||||||||||||

| Occupancy

|

234 | 233 | 244 | – | (4) | |||||||||||||||||||||

| Professional fees

|

440 | 424 | 393 | 4 | 12 | |||||||||||||||||||||

| Other expenses

|

612 | 577 | 703 | 6 | (13) | |||||||||||||||||||||

|

Total operating expenses

|

|

9,241

|

|

|

9,128

|

|

|

8,533

|

|

|

1

|

|

|

8

|

|

|||||||||||

| Pre-tax earnings

|

4,958 | 5,647 | 3,916 | (12) | 27 | |||||||||||||||||||||

| Provision for taxes

|

1,235 | 909 | 873 | 36 | 41 | |||||||||||||||||||||

|

Net earnings

|

|

3,723

|

|

|

4,738

|

|

|

3,043

|

|

|

(21)

|

|

|

22

|

|

|||||||||||

| Preferred stock dividends

|

|

250

|

|

|

155

|

|

|

152

|

|

|

61

|

|

|

64

|

|

|||||||||||

|

Net earnings applicable to common shareholders

|

|

$ 3,473

|

|

|

$ 4,583

|

|

|

$ 2,891

|

|

|

(24)

|

|

|

20

|

|

|||||||||||

|

EARNINGS PER COMMON SHARE

|

||||||||||||||||||||||||||

|

Basic2 |

$ 11.03 | $ 14.25 | $ 8.73 | (23)% | 26 % | |||||||||||||||||||||

| Diluted |

$ 10.91 | $ 14.12 | $ 8.62 | (23) | 27 | |||||||||||||||||||||

|

AVERAGE COMMON SHARES

|

||||||||||||||||||||||||||

| Basic |

313.7 | 320.8 | 329.8 | (2) | (5) | |||||||||||||||||||||

| Diluted |

318.3 | 324.5 | 335.5 | (2) | (5) | |||||||||||||||||||||

|

SELECTED DATA AT PERIOD-END

|

||||||||||||||||||||||||||

| Common shareholders’ equity |

$ 108,943 | $ 109,147 | $ 106,710 | – | 2 | |||||||||||||||||||||

|

Basic shares2 |

311.5 | 317.1 | 326.2 | (2) | (5) | |||||||||||||||||||||

|

Book value per common share |

$ 349.74 | $ 344.20 | $ 327.13 | 2 | 7 | |||||||||||||||||||||

| Headcount

|

|

45,900

|

|

|

46,600

|

|

|

44,300

|

|

|

(2)

|

|

|

4

|

|

|||||||||||

8

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)2

In millions, except per share amounts

| SIX MONTHS ENDED | % CHANGE FROM | |||||||||||||||||

| JUNE 30, 2025 |

JUNE 30, 2024 |

JUNE 30, 2024 |

||||||||||||||||

|

REVENUES

|

||||||||||||||||||

| Investment banking

|

$ 4,110 | $ 3,818 | 8 % | |||||||||||||||

| Investment management

|

5,596 | 5,024 | 11 | |||||||||||||||

| Commissions and fees

|

2,427 | 2,128 | 14 | |||||||||||||||

| Market making

|

10,456 | 10,430 | – | |||||||||||||||

| Other principal transactions

|

1,057 | 2,180 | (52) | |||||||||||||||

|

Total non-interest revenues

|

23,646 | 23,580 | – | |||||||||||||||

| Interest income

|

39,172 | 39,995 | (2) | |||||||||||||||

| Interest expense

|

33,173 | 36,631 | (9) | |||||||||||||||

|

Net interest income

|

5,999 | 3,364 | 78 | |||||||||||||||

|

Total net revenues

|

29,645 | 26,944 | 10 | |||||||||||||||

|

Provision for credit losses

|

671 | 600 | 12 | |||||||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||

| Compensation and benefits

|

9,561 | 8,825 | 8 | |||||||||||||||

| Transaction based

|

3,805 | 3,151 | 21 | |||||||||||||||

| Market development

|

323 | 306 | 6 | |||||||||||||||

| Communications and technology

|

1,036 | 970 | 7 | |||||||||||||||

| Depreciation and amortization

|

1,124 | 1,273 | (12) | |||||||||||||||

| Occupancy

|

467 | 491 | (5) | |||||||||||||||

| Professional fees

|

864 | 777 | 11 | |||||||||||||||

| Other expenses

|

1,189 | 1,398 | (15) | |||||||||||||||

|

Total operating expenses

|

18,369 | 17,191 | 7 | |||||||||||||||

| Pre-tax earnings

|

10,605 | 9,153 | 16 | |||||||||||||||

| Provision for taxes

|

2,144 | 1,978 | 8 | |||||||||||||||

|

Net earnings

|

|

8,461 |

|

|

7,175 |

|

|

18 |

|

|||||||||

| Preferred stock dividends

|

405 | 353 | 15 | |||||||||||||||

|

Net earnings applicable to common shareholders

|

$ 8,056 | $ 6,822 | 18 | |||||||||||||||

|

EARNINGS PER COMMON SHARE

|

||||||||||||||||||

|

Basic2

|

$ 25.32 | $ 20.44 | 24 % | |||||||||||||||

| Diluted |

$ 25.07 | $ 20.21 | 24 | |||||||||||||||

|

AVERAGE COMMON SHARES

|

||||||||||||||||||

| Basic

|

317.2 | 332.6 | (5) | |||||||||||||||

| Diluted

|

321.4 | 337.5 | (5) | |||||||||||||||

9

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (unaudited)2

$ in billions

| AS OF | ||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

|||||||||||||||||||||

| ASSETS

|

||||||||||||||||||||||

| Cash and cash equivalents |

$ 153 | $ 167 | ||||||||||||||||||||

|

Collateralized agreements

|

367 | 398 | ||||||||||||||||||||

| Customer and other receivables

|

182 | 165 | ||||||||||||||||||||

| Trading assets

|

628 | 596 | ||||||||||||||||||||

| Investments

|

202 | 196 | ||||||||||||||||||||

| Loans

|

217 | 210 | ||||||||||||||||||||

| Other assets

|

|

36

|

|

|

34

|

|

||||||||||||||||

|

Total assets

|

|

$ 1,785

|

|

|

$ 1,766

|

|

||||||||||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||||||||||||||||

| Deposits

|

$ 466 | $ 471 | ||||||||||||||||||||

| Collateralized financings

|

311 | 330 | ||||||||||||||||||||

| Customer and other payables

|

259 | 254 | ||||||||||||||||||||

| Trading liabilities

|

253 | 233 | ||||||||||||||||||||

| Unsecured short-term borrowings

|

69 | 71 | ||||||||||||||||||||

| Unsecured long-term borrowings

|

280 | 263 | ||||||||||||||||||||

| Other liabilities

|

|

23

|

|

|

20

|

|

||||||||||||||||

|

Total liabilities

|

|

1,661

|

|

|

1,642

|

|

||||||||||||||||

| Shareholders’ equity

|

|

124

|

|

|

124

|

|

||||||||||||||||

|

Total liabilities and shareholders’ equity |

|

$ 1,785

|

|

|

$ 1,766

|

|

||||||||||||||||

|

Capital Ratios and Supplementary Leverage Ratio (unaudited)2 $ in billions |

|

|||||||||||||||||||||

| AS OF | ||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

|||||||||||||||||||||

|

Common equity tier 1 capital |

$ 102.5 | $ 102.7 | ||||||||||||||||||||

|

STANDARDIZED CAPITAL RULES

|

||||||||||||||||||||||

| Risk-weighted assets

|

$ 708 | $ 693 | ||||||||||||||||||||

| Common equity tier 1 capital ratio |

14.5% | 14.8% | ||||||||||||||||||||

|

ADVANCED CAPITAL RULES

|

||||||||||||||||||||||

| Risk-weighted assets |

$ 669 | $ 662 | ||||||||||||||||||||

| Common equity tier 1 capital ratio |

15.3% | 15.5% | ||||||||||||||||||||

|

SUPPLEMENTARY LEVERAGE RATIO

|

||||||||||||||||||||||

| Supplementary leverage ratio

|

5.3% | 5.5% | ||||||||||||||||||||

|

Average Daily VaR (unaudited)2 $ in millions |

|

|||||||||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

|||||||||||||||||||||

|

RISK CATEGORIES

|

||||||||||||||||||||||

| Interest rates

|

$ 79 | $ 70 | ||||||||||||||||||||

| Equity prices

|

48 | 42 | ||||||||||||||||||||

| Currency rates

|

23 | 36 | ||||||||||||||||||||

| Commodity prices

|

15 | 15 | ||||||||||||||||||||

| Diversification effect

|

(67) | (72) | ||||||||||||||||||||

|

Total

|

|

$ 98

|

|

|

$ 91

|

|

||||||||||||||||

10

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Assets Under Supervision (unaudited)2

$ in billions

| AS OF | ||||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

JUNE 30, 2024 |

||||||||||||||||||||||

|

ASSET CLASS

|

||||||||||||||||||||||||

| Alternative investments

|

|

$ 355

|

|

|

$ 341

|

|

|

$ 314

|

|

|||||||||||||||

| Equity

|

|

857

|

|

|

771

|

|

|

735

|

|

|||||||||||||||

| Fixed income

|

|

1,253

|

|

|

1,221

|

|

|

1,147

|

|

|||||||||||||||

|

Total long-term AUS

|

|

2,465

|

|

|

2,333

|

|

|

2,196

|

|

|||||||||||||||

| Liquidity products

|

|

828

|

|

|

840

|

|

|

738

|

|

|||||||||||||||

|

Total AUS

|

|

$ 3,293

|

|

|

$ 3,173

|

|

|

$ 2,934

|

|

|||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||||

| JUNE 30, 2025 |

MARCH 31, 2025 |

JUNE 30, 2024 |

||||||||||||||||||||||

|

Beginning balance

|

$ 3,173 | $ 3,137 | $ 2,848 | |||||||||||||||||||||

| Net inflows / (outflows):

|

||||||||||||||||||||||||

| Alternative investments

|

9 | 4 | 18 | |||||||||||||||||||||

| Equity

|

|

8

|

|

|

11

|

|

|

6

|

|

|||||||||||||||

| Fixed income

|

|

–

|

|

|

14

|

|

|

7

|

|

|||||||||||||||

|

Total long-term AUS net inflows / (outflows)

|

|

17

|

|

|

29

|

|

|

31

|

|

|||||||||||||||

|

Liquidity products

|

|

(12)

|

|

|

(5)

|

|

|

40

|

|

|||||||||||||||

|

Total AUS net inflows / (outflows)

|

|

5

|

|

|

24

|

|

|

71

|

|

|||||||||||||||

| Net market appreciation / (depreciation)

|

|

115

|

|

|

12

|

|

|

15

|

|

|||||||||||||||

|

Ending balance

|

|

$ 3,293

|

|

|

$ 3,173

|

|

|

$ 2,934

|

|

|||||||||||||||

11

Goldman Sachs Reports

Second Quarter 2025 Earnings Results

|

Footnotes |

|

|

| 1. | Annualized ROE is calculated by dividing annualized net earnings applicable to common shareholders by average monthly common shareholders’ equity. The table below presents average common shareholders’ equity: |

|

AVERAGE FOR THE |

||||||||||||||

| Unaudited, $ in millions

|

THREE MONTHS ENDED JUNE 30, 2025

|

SIX MONTHS ENDED

|

||||||||||||

|

Total shareholders’ equity

|

|

$ 123,849

|

|

|

$ 123,502

|

|

||||||||

| Preferred stock

|

|

(15,153)

|

|

|

(14,882)

|

|

||||||||

|

Common shareholders’ equity

|

|

$ 108,696

|

|

|

$ 108,620

|

|

||||||||

| 2. | For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2025: (i) Investment banking fees backlog – see “Results of Operations – Global Banking & Markets,” (ii) assets under supervision – see “Results of Operations – Asset & Wealth Management – Assets Under Supervision,” (iii) efficiency ratio – see “Results of Operations – Operating Expenses,” (iv) share repurchase program – see “Capital Management and Regulatory Capital – Capital Management,” (v) global core liquid assets – see “Risk Management – Liquidity Risk Management,” (vi) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” and (vii) VaR – see “Risk Management – Market Risk Management.” |

For information about the following items, see the referenced sections in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2025: (i) risk-based capital ratios and the supplementary leverage ratio – see Note 20 “Regulation and Capital Adequacy,” (ii) geographic net revenues – see Note 25 “Business Segments” and (iii) unvested share-based awards that have non-forfeitable rights to dividends or dividend equivalents in calculating basic EPS – see Note 21 “Earnings Per Common Share.”

For information about net interest income and total non-interest revenues, see the firm’s Form 8-K dated January 15, 2025.

Represents a preliminary estimate for the second quarter of 2025 for the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR. These may be revised in the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2025.

| 3. | The impact of the tax benefits related to employee share-based awards was a reduction to provision for taxes for the first half of 2025 of approximately $600 million, which increased diluted EPS by $1.85 and annualized ROE by 1.1 percentage points. |

12

Exhibit 99.2 Second Quarter 2025 Earnings Results Presentation July 16, 2025

Results Snapshot “Our strong results for the quarter reflected healthy client activity levels across our businesses, our differentiated franchise positions and the talent and commitment of our people. At this time, the economy and markets are generally responding positively to the evolving policy environment. But as developments rarely unfold in a straight line, we remain very focused on risk management. Given the strategic decisions and investments we’ve made, we continue to believe that the firm is well positioned to perform for our shareholders.” — David Solomon, Chairman and Chief Executive Officer Net Revenues Net Earnings EPS 2Q25 $14.58 billion 2Q25 $3.72 billion 2Q25 $10.91 $8.46 billion $29.65 billion $25.07 2Q25 YTD 2Q25 YTD 2Q25 YTD 1 1 Annualized ROE Annualized ROTE Book Value Per Share 13.6% 2Q25 12.8% 2Q25 2Q25 $349.74 14.8% 15.8% 3.9% 2Q25 YTD 2Q25 YTD YTD Growth 4 Quarterly Highlights Selected Items #1 in announced and completed M&A; $ in millions, except per share amounts 2Q25 2Q25 YTD 2 #2 in equity & equity-related, high-yield debt and leveraged loan offerings Pre-tax earnings: 5 $ (136) $ (196) AWM historical principal investments Record Equities net revenues and strong Advisory net revenues; Record financing net revenues in both Equities and FICC General Motors (GM) Card / Seller financing (1) (35) (137) (231) Total impact to pre-tax earnings $ $ 3 Record AUS of $3.29 trillion; th 30 consecutive quarter of long-term fee-based net inflows Impact to net earnings $ (104) $ (184) (0.33) (0.57) Impact to EPS $ $ Increased quarterly dividend by 33% to $4.00 per common share in 3Q25 (0.4)pp (0.4)pp Impact to ROE 1

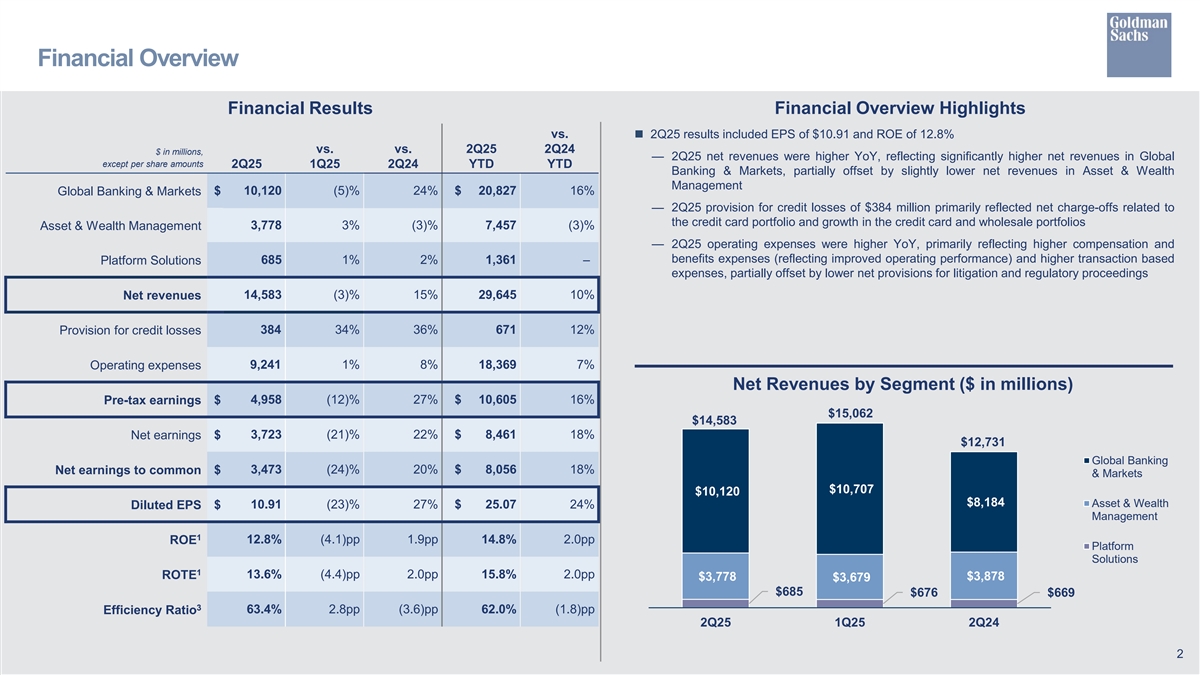

Financial Overview Financial Results Financial Overview Highlights vs.n 2Q25 results included EPS of $10.91 and ROE of 12.8% vs. vs. 2Q25 2Q24 $ in millions, — 2Q25 net revenues were higher YoY, reflecting significantly higher net revenues in Global except per share amounts 2Q25 1Q25 2Q24 YTD YTD Banking & Markets, partially offset by slightly lower net revenues in Asset & Wealth Management $ 10,120 (5)% 24% $ 20,827 16% Global Banking & Markets — 2Q25 provision for credit losses of $384 million primarily reflected net charge-offs related to the credit card portfolio and growth in the credit card and wholesale portfolios Asset & Wealth Management 3,778 3% (3)% 7,457 (3)% — 2Q25 operating expenses were higher YoY, primarily reflecting higher compensation and benefits expenses (reflecting improved operating performance) and higher transaction based 685 1% 2% 1,361 – Platform Solutions expenses, partially offset by lower net provisions for litigation and regulatory proceedings 14,583 (3)% 15% 29,645 10% Net revenues 384 34% 36% 671 12% Provision for credit losses 9,241 1% 8% 18,369 7% Operating expenses Net Revenues by Segment ($ in millions) 4,958 (12)% 27% $ 10,605 16% Pre-tax earnings $ $15,062 $14,583 $ 3,723 (21)% 22% $ 8,461 18% Net earnings $12,731 Global Banking $ 3,473 (24)% 20% $ 8,056 18% Net earnings to common & Markets $10,707 $10,120 $8,184 Asset & Wealth $ 10.91 (23)% 27% $ 25.07 24% Diluted EPS Management 1 ROE 12.8% (4.1)pp 1.9pp 14.8% 2.0pp Platform Solutions 1 ROTE 13.6% (4.4)pp 2.0pp 15.8% 2.0pp $3,878 $3,778 $3,679 $685 $676 $669 3 63.4% 2.8pp (3.6)pp 62.0% (1.8)pp Efficiency Ratio 2Q25 1Q25 2Q24 2

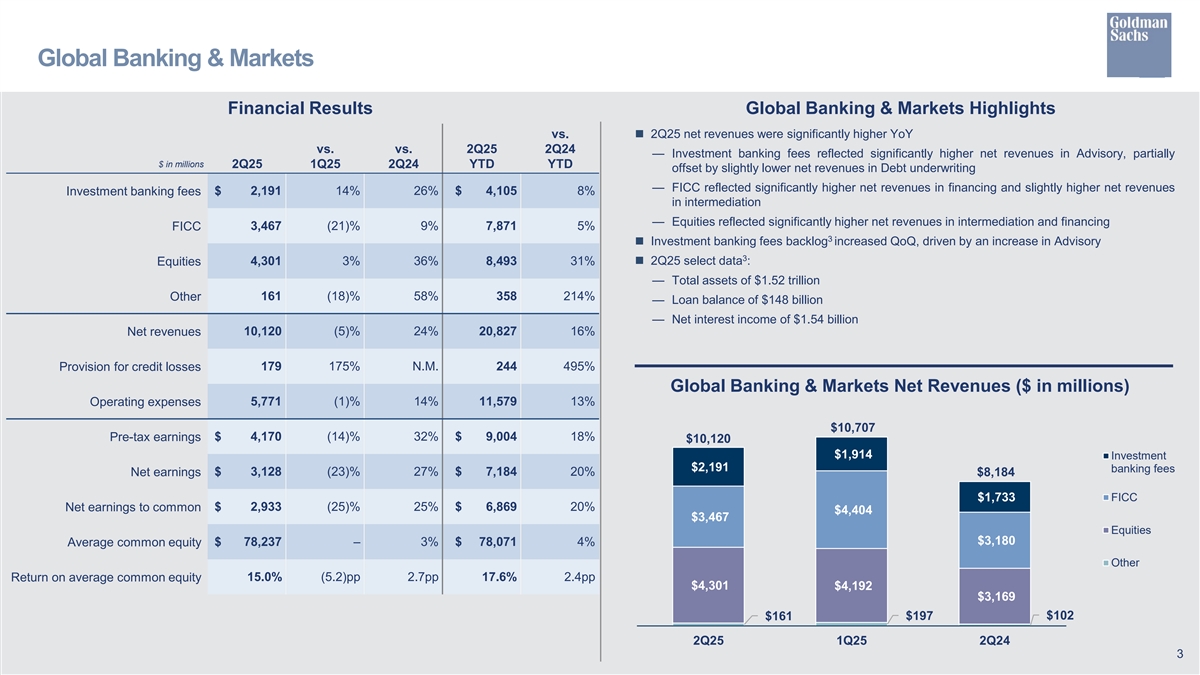

Global Banking & Markets Financial Results Global Banking & Markets Highlights vs.n 2Q25 net revenues were significantly higher YoY vs. vs. 2Q25 2Q24 — Investment banking fees reflected significantly higher net revenues in Advisory, partially $ in millions 2Q25 1Q25 2Q24 YTD YTD offset by slightly lower net revenues in Debt underwriting — FICC reflected significantly higher net revenues in financing and slightly higher net revenues $ 2,191 14% 26% $ 4,105 8% Investment banking fees in intermediation — Equities reflected significantly higher net revenues in intermediation and financing 3,467 (21)% 9% 7,871 5% FICC 3 n Investment banking fees backlog increased QoQ, driven by an increase in Advisory 3 4,301 3% 36% 8,493 31%n 2Q25 select data : Equities — Total assets of $1.52 trillion 161 (18)% 58% 358 214% Other — Loan balance of $148 billion — Net interest income of $1.54 billion 10,120 (5)% 24% 20,827 16% Net revenues Provision for credit losses 179 175% N.M. 244 495% Global Banking & Markets Net Revenues ($ in millions) Operating expenses 5,771 (1)% 14% 11,579 13% $10,707 Pre-tax earnings $ 4,170 (14)% 32% $ 9,004 18% $10,120 $1,914 Investment $2,191 banking fees Net earnings $ 3,128 (23)% 27% $ 7,184 20% $8,184 $1,733 FICC Net earnings to common $ 2,933 (25)% 25% $ 6,869 20% $4,404 $3,467 Equities $3,180 Average common equity $ 78,237 – 3% $ 78,071 4% Other Return on average common equity 15.0% (5.2)pp 2.7pp 17.6% 2.4pp $4,301 $4,192 $3,169 $161 $197 $102 2Q25 1Q25 2Q24 3

Global Banking & Markets – Net Revenues Net Revenues Global Banking & Markets Net Revenues Highlights vs.n 2Q25 Investment banking fees were significantly higher YoY vs. vs. 2Q25 2Q24 — Advisory reflected strength in the Americas and EMEA $ in millions 2Q25 1Q25 2Q24 YTD YTD — Equity underwriting was essentially unchanged $ 1,174 48% 71% $ 1,966 16% Advisory — Debt underwriting reflected a decrease in leveraged finance activity n 2Q25 FICC net revenues were higher YoY 428 16% 1% 798 1% Equity underwriting — FICC intermediation reflected significantly higher net revenues in currencies, higher net 589 (22)% (5)% 1,341 2% Debt underwriting revenues in credit products and slightly higher net revenues in interest rate products, largely offset by significantly lower net revenues in both mortgages and commodities 2,191 14% 26% 4,105 8% Investment banking fees — Record FICC financing primarily reflected significantly higher net revenues from mortgages and structured lending 2,423 (29)% 4% 5,813 – FICC intermediation n 2Q25 Equities net revenues were a record and significantly higher YoY — Equities intermediation reflected significantly higher net revenues in both cash products and FICC financing 1,044 3% 23% 2,058 21% derivatives — Record Equities financing primarily reflected significantly higher net revenues in portfolio FICC 3,467 (21)% 9% 7,871 5% financing n 2Q25 Other net revenues YoY primarily reflected higher net gains from direct investments Equities intermediation 2,595 2% 45% 5,142 36% Equities financing 1,706 4% 23% 3,351 24% Equities 4,301 3% 36% 8,493 31% Other 161 (18)% 58% 358 214% Net revenues $ 10,120 (5)% 24% $ 20,827 16% 4

Asset & Wealth Management Financial Results Asset & Wealth Management Highlights n 2Q25 net revenues were slightly lower YoY vs. vs. vs. 2Q25 2Q24 — Management and other fees primarily reflected the impact of higher average AUS $ in millions 2Q25 1Q25 2Q24 YTD YTD — Incentive fees were primarily driven by harvesting Management and other fees: — Private banking and lending net revenues primarily reflected higher net interest income from lending Asset management $ 1,213 2% 10% $ 2,404 9% — Equity investments reflected significantly lower net gains from investments in private equities — Debt investments reflected significantly lower net interest income due to a reduction in the 1,592 5% 11% 3,104 12% Wealth management debt investments balance sheet and net losses from hedges compared with net gains in 2Q24 Total Management and other fees 2,805 4% 11% 5,508 10% n 2Q25 YTD pre-tax margin of 22% and ROE of 9.4% (both including an approximate 3pp 5 102 (21)% 122% 231 72% reduction from historical principal investments ) Incentive fees 3 n 2Q25 select data : Private banking and lending 789 9% 12% 1,514 9% — Total assets of $199 billion — Loan balance of $50 billion, of which $42 billion related to Private banking and lending (1) 80% N.M. (6) N.M. Equity investments — Net interest income of $786 million 6 — Total Wealth management client assets of ~$1.7 trillion Debt investments 83 (35)% (72)% 210 (67)% Net revenues 3,778 (3)% 7,457 (3)% 3% Asset & Wealth Management Net Revenues ($ in millions) $3,878 $3,778 Provision for credit losses (102) N.M. (76)% (83) (4)% $3,679 3,035 6% – 5,907 (1)% Operating expenses Management and other fees Pre-tax earnings $ 845 7% (6)% $ 1,633 (8)% Incentive $2,536 fees $2,805 $2,703 $ 642 (3)% (8)% $ 1,303 (6)% Net earnings Private banking and lending Net earnings to common $ 596 (6)% (11)% $ 1,227 (7)% $46 Equity $129 $102 investments $707 $ 26,046 – – $ 26,087 – Average common equity $(1) $(5) Debt $725 $292 $789 investments $83 $127 Return on average common equity 9.2% (0.5)pp (1.1)pp 9.4% (0.7)pp $297 5 2Q25 1Q25 2Q24

Asset & Wealth Management – Assets Under Supervision 3 3 AUS Highlights AUS by Asset Class n During the quarter, AUS increased $120 billion to a record $3.29 trillion $ in billions 2Q25 1Q25 2Q24 — Net market appreciation primarily in equity and fixed income assets $ 355 $ 341 $ 314 Alternative investments — Net inflows in alternative investments and equity assets Equity 857 771 735 — Net outflows in liquidity products Fixed income 1,253 1,221 1,147 n Total AUS net inflows of $5 billion during the quarter, of which: Long-term AUS 2,465 2,333 2,196 — $5 billion of net inflows in Institutional client channel Liquidity products 828 840 738 — $3 billion of net inflows in Wealth management client channel 3,293 3,173 2,934 Total AUS $ $ $ — $3 billion of net outflows in Third-party distributed client channel 3 AUS by Client Channel $ in billions 2Q25 1Q25 2Q24 Institutional $ 1,140 $ 1,095 $ 1,063 3 AUS Rollforward 1,003 952 865 Wealth management $ in billions 2Q25 1Q25 2Q24 Third-party distributed 1,150 1,126 1,006 Beginning balance $ 3,173 $ 3,137 $ 2,848 Total AUS $ 3,293 $ 3,173 $ 2,934 17 29 31 Long-term AUS net inflows / (outflows) Liquidity products (12) (5) 40 3 2Q25 AUS by Region and Vehicle 5 24 71 Total AUS net inflows / (outflows) 7% Net market appreciation / (depreciation) 115 12 15 15% Ending balance $ 3,293 $ 3,173 $ 2,934 Americas Separate accounts 23% Region EMEA Vehicle Public funds 54% 31% 70% Asia Private funds and other 6

Asset & Wealth Management – Alternative Investments 3 3 Alternative Investments Highlights On-Balance Sheet Alternative Investments n 2Q25 Management and other fees from alternative investments were $589 million, up 7% $ in billions 2Q25 compared with 2Q24 Loans $ 8.2 n During the quarter, alternative investments AUS increased $14 billion to $355 billion Debt securities 8.7 n 2Q25 gross third-party alternatives fundraising across strategies was $18 billion, including: Equity securities 13.5 — $7 billion in corporate equity, $6 billion in credit, $1 billion in real estate and $4 billion in 7 Other 4.9 hedge funds and other Total On-B/S alternative investments $ 35.3 — $360 billion raised since the end of 2019 n During the quarter, on-balance sheet alternative investments increased by $0.1 billion to $35.3 billion $ in billions 2Q25 5 — Historical principal investments declined by $0.8 billion to $8.0 billion (attributed equity of Client co-invest $ 18.7 $3.5 billion) and included $1.4 billion of loans, $2.1 billion of debt securities, $3.3 billion of equity securities and $1.2 billion of CIE investments Firmwide initiatives / CRA investments 8.6 5 Historical principal investments 8.0 Total On-B/S alternative investments $ 3 35.3 Alternative Investments AUS and Effective Fees 2Q25 $ in billions Average AUS Effective Fees (bps) Historical Principal Investments Rollforward Corporate equity $ 134 75 $ in billions 2Q25 67 72 Credit Beginning balance $ 8.8 Real estate 30 57 Additions 0.1 8 78 59 Hedge funds and other Dispositions / paydowns (0.9) Funds and discretionary accounts 309 68 Net mark-ups / (mark-downs) – Net change $ (0.8) 38 18 Advisory accounts Ending balance $ 8.0 Total alternative investments AUS $ 347 62 7

Platform Solutions Financial Results Platform Solutions Highlights vs.n 2Q25 net revenues were slightly higher YoY vs. vs. 2Q25 2Q24 n 2Q25 provision for credit losses of $307 million reflected net charge-offs and growth related to the $ in millions 2Q25 1Q25 2Q24 YTD YTD credit card portfolio 3 $ 623 2% 4% $ 1,234 1% Consumer platformsn 2Q25 select data : — Total assets of $61 billion 62 (5)% (11)% 127 (15)% Transaction banking and other — Loan balance of $19 billion — Net interest income of $781 million Net revenues 685 1% 2% 1,361 – 307 51% (22)% 510 (20)% Provision for credit losses 435 (3)% 3% 883 (11)% Operating expenses Pre-tax earnings / (loss) $ (57) N.M. 61% $ (32) 88% Platform Solutions Net Revenues ($ in millions) Net earnings / (loss) $ (47) N.M. 59% $ (26) 87% Net earnings / (loss) to common $ (56) N.M. 53% $ (40) 82% $685 $676 $669 Average common equity $ 4,413 (2)% 2% $ 4,462 (2)% Consumer platforms Return on average common equity (5.1)% (6.5)pp 5.9pp (1.8)% 7.8pp Transaction $623 $611 $599 banking and other $62 $65 $70 2Q25 1Q25 2Q24 8

Loans and Net Interest Income 3 3 Loans by Segment ($ in billions) Loans and Net Interest Income Highlights n 2Q25 loans increased QoQ — Gross loans by type: $211 billion - amortized cost, $6 billion - fair value, $5 billion - held for $217 $210 sale $184 Global Banking — Average loans of $215 billion & Markets $148 $143 — Total allowance for loan losses and losses on lending commitments was $5.29 billion $123 Asset & Wealth ($4.54 billion for funded loans) Management o $2.82 billion for wholesale loans, $2.47 billion for consumer loans Platform Solutions $50 $49 $44 n Net charge-offs of $290 million for an annualized net charge-off rate of 0.6% $19 $18 $17 — 0.0% for wholesale loans, 6.1% for consumer loans 2Q25 1Q25 2Q24 n Net interest income for 2Q25 was $3.10 billion, 56% higher YoY reflecting a decrease in funding costs 3 Loans by Type — 2Q25 average interest-earning assets of $1.65 trillion Metrics $ in billions 2Q25 1Q25 2Q24 2.1% ALLL to Total Corporate $ 33 $ 32 $ 35 Gross Loans, at Commercial real estate Amortized Cost 33 32 27 Residential real estate 29 28 24 1.1% ALLL to Gross Securities-based lending 18 18 15 Wholesale Loans, at Other collateralized lending 86 82 67 Amortized Cost Credit cards 21 21 19 12.8% ALLL to Gross Other 2 2 2 Consumer Loans, at Allowance for loan losses (5) (5) (5) Amortized Cost Total loans $ $ $ 217 210 184 ~85% Gross Loans Secured 9

Expenses Financial Results Expense Highlights n 2Q25 total operating expenses were higher YoY vs. vs. vs. 2Q25 2Q24 — Compensation and benefits expenses were higher (reflecting improved operating 2Q25 1Q25 2Q24 YTD YTD $ in millions performance) — Non-compensation expenses were higher, reflecting: Compensation and benefits $ 4,685 (4)% 10% $ 9,561 8% o Higher transaction based expenses Transaction based 1,955 6% 18% 3,805 21% o Partially offset by lower net provisions for litigation and regulatory proceedings (included in other expenses) Market development 167 7% 9% 323 6% n 2Q25 YTD effective income tax rate was 20.2%, up from 16.1% for 1Q25, primarily due to a decrease in the impact of tax benefits on the settlement of employee share-based awards Communications and technology 530 5% 6% 1,036 7% 618 22% (4)% 1,124 (12)% Depreciation and amortization 3 Occupancy 234 – (4)% 467 (5)% Efficiency Ratio 63.8% Professional fees 440 4% 12% 864 11% 62.0% Other expenses 612 6% (13)% 1,189 (15)% Total operating expenses $ 9,241 1% 8% $ 18,369 7% 1,235 36% 41% $ 2,144 8% Provision for taxes $ Effective Tax Rate 20.2% (1.4)pp 2Q25 YTD 2Q24 YTD 10

Capital and Balance Sheet 3 3 Capital and Balance Sheet Highlights Selected Balance Sheet Data n Both Standardized and Advanced CET1 capital ratios decreased QoQ, primarily reflecting an increase in credit RWAs $ in billions 2Q25 1Q25 4Q24 n SLR decreased QoQ, primarily reflecting an increase in on-balance sheet assets Total assets $ 1,785 $ 1,766 $ 1, 676 n Returned $3.96 billion of capital to common shareholders during the quarter Deposits $ 466 $ 471 $ 433 — 5.3 million common shares repurchased for a total cost of $3.00 billion — $957 million of common stock dividends Unsecured long-term borrowings $ 280 $ 263 $ 243 n Increased the quarterly dividend from $3.00 to $4.00 per common share in 3Q25 Shareholders’ equity $ 124 $ 124 $ 122 n Deposits of $466 billion consisted of consumer $196 billion, private bank $94 billion, transaction banking $62 billion, brokered CDs $44 billion, deposit sweep programs $37 billion and other $33 billion Average GCLA $ 462 $ 441 $ 422 n BVPS increased 1.6% QoQ, driven by net earnings 3,9 Capital Book Value In millions, except per share amounts 2Q25 1Q25 4Q24 2Q25 1Q25 4Q24 3 Standardized CET1 capital ratio Basic shares 311.5 317.1 322.9 14.5% 14.8% 15.0% Advanced CET1 capital ratio Book value per common share $ 349.74 $ 344.20 $ 336.77 15.3% 15.5% 15.3% 1 Supplementary leverage ratio (SLR) 5.3% 5.5% 5.5% Tangible book value per common share $ 327.78 $ 322.95 $ 316.02 11

Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity and the forward-looking statements below, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2024. Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data and global core liquid assets (GCLA) consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements. Statements regarding (i) forward catalysts, estimated GDP growth or contraction, interest rate and inflation trends and volatility, (ii) the timing, profitability, benefits and other prospective aspects of business initiatives and the achievability of targets and goals, (iii) the firm’s expense savings, productivity (including the opportunities presented by artificial intelligence (AI)) and strategic location initiatives, (iv) the future state of the firm’s liquidity and regulatory capital ratios (including the firm’s stress capital buffer (SCB) requirement and G-SIB buffer, and the potential impact of changes to U.S. regulatory capital rules), (v) the firm’s prospective capital distributions (including dividends and repurchases), (vi) the firm’s future effective income tax rate, (vii) the firm’s Investment banking fees backlog and future results, (viii) the firm’s planned 2025 benchmark debt issuances, and (ix) the firm’s ability to sell, and the terms of any proposed or pending sale of, Asset & Wealth Management historical principal investments, and the firm’s ability to transition the GM credit card program are forward-looking statements. Statements regarding forward catalysts are subject to the risk that the actual operating environment may differ, possibly materially, due to, among other things, changes or the absence of changes in general economic and market conditions, CEO confidence, sponsor activity, productivity gains, and the regulatory backdrop. Statements regarding estimated GDP growth or contraction, interest rate and inflation trends and volatility are subject to the risk that actual GDP growth or contraction, interest rate and inflation trends and volatility may differ, possibly materially, due to, among other things, changes in general economic conditions and monetary, fiscal and trade policy, including tariffs. Statements about the timing, profitability, benefits and other prospective aspects of business, expense savings and productivity (including the opportunities presented by AI) and the achievability of targets and goals are based on the firm’s current expectations regarding the firm’s ability to effectively implement these initiatives and achieve these targets and goals and may change, possibly materially, from what is currently expected. Statements about the future state of the firm’s liquidity and regulatory capital ratios (including the firm’s SCB requirement and G-SIB buffer), as well as its prospective capital distributions (including dividends and repurchases), are subject to the risk that the firm’s actual liquidity, regulatory capital ratios and capital distributions may differ, possibly materially, from what is currently expected, including due to, among other things, the results of supervisory stress tests, the finalization of the outstanding proposal on SCB averaging and other potential future changes to regulatory capital rules, which may not be what the firm expects. Statements about the firm’s future effective income tax rate are subject to the risk that the firm’s future effective income tax rate may differ from the anticipated rate indicated, possibly materially, due to, among other things, changes in the tax rates applicable to the firm, the firm’s earnings mix or profitability, the entities in which the firm generates profits and the assumptions made in forecasting the firm’s expected tax rate, and potential future guidance from tax authorities. Statements about the firm’s Investment banking fees backlog and future advisory and capital market results are subject to the risk that advisory and capital market activity may not increase as the firm expects or that transactions may be modified or may not be completed at all, and related net revenues may not be realized or may be materially less than expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, changes in international trade policies, including the imposition of tariffs, an outbreak or worsening of hostilities, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. Statements regarding the firm’s planned 2025 benchmark debt issuances are subject to the risk that actual issuances may differ, possibly materially, due to changes in market conditions, business opportunities or the firm’s funding needs. Statements about the proposed or pending sales of Asset & Wealth Management historical principal investments are subject to the risks that buyers may not bid on these assets or bid at levels, or with terms, that are unacceptable to the firm, and that the performance of these investments may deteriorate as a result of the proposed and pending sales, and statements about the process to transition the GM credit card program are subject to the risk that a transaction may not close on the anticipated timeline or at all. 12

Footnotes 1. Annualized return on average common shareholders’ equity (ROE) is calculated by dividing annualized net earnings applicable to common shareholders by average monthly common shareholders’ equity. Annualized return on average tangible common shareholders’ equity (ROTE) is calculated by dividing annualized net earnings applicable to common shareholders by average monthly tangible common shareholders’ equity. Tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets. Tangible book value per common share (TBVPS) is calculated by dividing tangible common shareholders’ equity by basic shares. Management believes that tangible common shareholders’ equity and TBVPS are meaningful because they are measures that the firm and investors use to assess capital adequacy and that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally. Tangible common shareholders’ equity, ROTE and TBVPS are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. The table below presents a reconciliation of average and ending common shareholders’ equity to average and ending tangible common shareholders’ equity: AVERAGE FOR THE AS OF THREE MONTHS ENDED SIX MONTHS ENDED Unaudited, $ in millions JUNE 30, 2025 JUNE 30, 2025 JUNE 30, 2025 MARCH 31, 2025 DECEMBER 31, 2024 Total shareholders’ equity $ 123,849 $ 123,502 $ 124,096 $ 124,300 $ 121,996 Preferred stock (15,153) (14,882) (15,153) (15,153) (13,253) Common shareholders’ equity 108,696 108,620 108,943 109,147 108,743 Goodwill (5,922) (5,893) (5,952) (5,886) (5,853) Identifiable intangible assets (874) (860) (888) (854) (847) Tangible common shareholders’ equity $ 101,900 $ 101,867 $ 102,103 $ 102,407 $ 102,043 2. Dealogic – January 1, 2025 through June 30, 2025. 3. For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2025: (i) Investment banking fees backlog – see “Results of Operations – Global Banking & Markets,” (ii) assets under supervision (AUS) – see “Results of Operations – Asset & Wealth Management – Assets Under Supervision,” (iii) efficiency ratio – see “Results of Operations – Operating Expenses,” (iv) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics,” (v) share repurchase program – see “Capital Management and Regulatory Capital – Capital Management” and (vi) global core liquid assets – see “Risk Management – Liquidity Risk Management.” For information about the following items, see the referenced sections in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2025: (i) interest-earning assets – see “Statistical Disclosures – Distribution of Assets, Liabilities and Shareholders’ Equity” and (ii) risk-based capital ratios and the supplementary leverage ratio – see Note 20 “Regulation and Capital Adequacy.” Represents a preliminary estimate for the second quarter of 2025 for the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data and global core liquid assets. These may be revised in the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2025. 4. Includes selected items that the firm has sold or is selling related to the narrowing of the firm’s ambitions in consumer-related activities and related to the transitioning of Asset & Wealth Management to a less capital- intensive business. Net earnings reflects the 2Q25 and 2Q25 YTD effective income tax rate for the respective segment of each item. 13

Footnotes - Continued 5. Includes consolidated investment entities (CIEs) and other legacy investments the firm intends to exit over the medium term (medium term refers to a 3-5 year time horizon from year-end 2022). The 2Q25 YTD average attributed equity for historical principal investments was $3.8 billion. 6. Consists of AUS, brokerage assets and Marcus deposits. 7. Other on-balance sheet alternative investments include tax credit investments (accounted for under the proportional amortization method of accounting) of $3.3 billion and CIEs, which held assets (generally accounted for at historical cost less depreciation) of $1.6 billion, both as of June 30, 2025. The assets held by CIEs were funded with liabilities of $0.8 billion as of June 30, 2025, which are substantially all nonrecourse, thereby reducing the firm’s equity at risk. Substantially all of the firm’s CIEs are engaged in commercial real estate investment activities. 8. Includes approximately $0.1 billion of investments that were transferred from historical principal investments to client co-invest. 9. Following feedback from the Federal Reserve, the firm expects its SCB requirement will be 3.4%, resulting in a Standardized CET1 ratio requirement of 10.9%, effective October 1, 2025. The Federal Reserve will provide the firm’s final SCB requirement by August 31, 2025. These results and the effective date may be subject to further changes pending the finalization of the Federal Reserve’s outstanding proposal on SCB averaging. In addition, the Federal Reserve disclosed that the firm’s current SCB from the CCAR 2024 test had been reduced by 10 basis points to 6.1%, resulting in a current Standardized CET1 ratio requirement of 13.6%. 14