UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 9, 2025

MP MATERIALS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39277 | 84-4465489 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 1700 S. Pavilion Center Drive, Suite 800 Las Vegas, Nevada 89135 |

(702) 844-6111 | |

| (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) |

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

| Common Stock, par value of $0.0001 per share | MP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

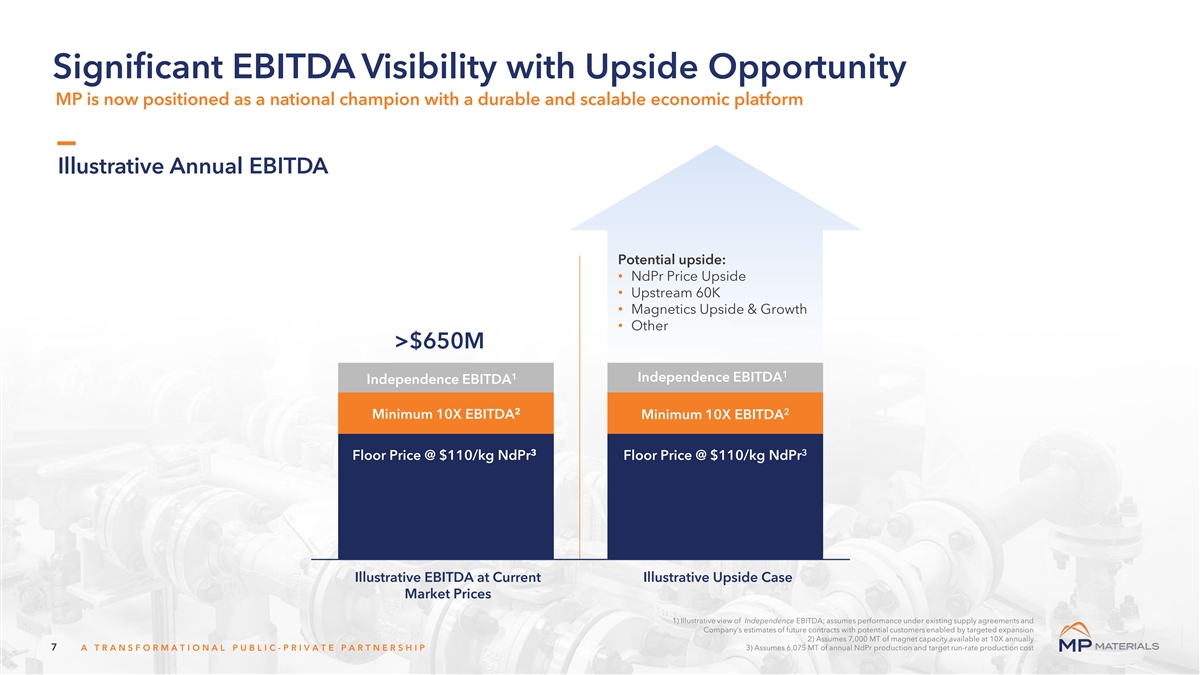

On July 10, 2025, MP Materials Corp. (the “Company,” “we,” “us” or “our”) announced that it has entered into definitive agreements establishing a transformational public-private partnership with the United States Department of Defense (“Department of Defense” or “DoD”) to dramatically accelerate the build-out of an end-to-end U.S. rare earth magnet supply chain and reduce foreign dependency. The arrangements include a multibillion-dollar package of investments and long-term commitments from DoD, and provide for, among other things, the Company’s construction of its second domestic magnet manufacturing facility (the “10X Facility”) and the addition of samarium production capabilities at its Mountain Pass, California facility where high-purity rare earth materials are extracted, refined, and separated. The strategic investments and commitments from the U.S. government will allow the Company to accelerate its work to build out an end-to-end domestic rare earth magnet supply chain in the U.S.

Rare earth permanent magnets are one of the most strategically important components in advanced technology systems spanning commercial, industrial, and defense applications. However, global production of rare earth permanent magnets is highly concentrated in China. The strategic partnership builds on MP Materials’ operational foundation to catalyze domestic production, strengthen industrial resilience, and secure critical supply chains for high-growth industries and future dual use applications.

The agreements include a $400 million equity investment by the Department of Defense in newly authorized and issued Series A Preferred Stock (as defined below), a commitment for up to $350 million in additional funding in the form of additional Series A Preferred Stock, a commitment for a $150 million loan to support expansion of heavy rare earth separation to be extended by the DoD within 30 days following the Closing (as defined below), subject to certain mutually agreed extensions, a 10-year price floor commitment by DoD for NdPr products, a 10-year offtake agreement for the purchase by DoD of magnet production from the 10X Facility, and a warrant issued by the Company to DoD. In connection with the transactions, the Company has obtained a debt commitment letter from JPMorgan Chase Funding Inc. (acting through such of its affiliates and branches as it deems appropriate, “JPMorgan”) and Goldman Sachs Bank USA (acting through such of its affiliates and branches as it deems appropriate, “Goldman Sachs”).

| Item 1.01 | Entry into a Material Definitive Agreement |

On July 9, 2025 (the “Effective Date”), the Company entered into a Transaction Agreement (the “Transaction Agreement,” and the transactions contemplated thereby, the “Transactions”) with the Department of Defense. The Transaction Agreement contemplates the concurrent execution of a number of additional agreements, and the Transaction Agreement and the additional agreements entered into are each described herein.

Price Protection Agreement

On the Effective Date, the Company entered into an NdPr price floor protection agreement (the “PPA”) with the Department of Defense. Pursuant to the terms of the PPA, the Department of Defense will pay to the Company at the end of each quarter a quarterly payment per kilogram (kg) of Neodymium-Praseodymium (“NdPr”) produced by the Company equal to the shortfall between $110 per kg and the Benchmark Quarterly Average Volume Weighted Price (as defined in the PPA). If, after the 10X Facility reaches full production capacity, the Benchmark Quarterly Average Volume Weighted Price for the prior quarter exceeds $110 per kg, the Department of Defense will be entitled to receive 30% of the NdPr sales price which exceeds $110 per kg. The term of the PPA will commence on the first day of the first full calendar quarter following closing (the “Start Date”) and will continue for 10 years and will apply to all of the Company’s products that contain NdPr (i.e., concentrate, oxide and metal).

The PPA provides that the Company will prioritize the supply of NdPr first to magnet manufacturing, with excess volumes remaining available for sale to commercial customers, subject to a prohibition on sales to certain Restricted Buyers and certain other obligations.

Offtake Agreement

On the Effective Date, a special purpose vehicle (the “Project Company”), established to develop the 10X Facility, entered into a magnet offtake agreement (the “Offtake Agreement”) with the Department of Defense. Pursuant to the terms of the Offtake Agreement, the Project Company will sell and deliver to the Department of Defense the entire amount of magnets produced at the 10X Facility; provided however, that at the Department of Defense’s request, or the Project Company’s request, and with the Department of Defense’s consent, the Project Company may syndicate up to 100% of magnet production to commercial and other customers.

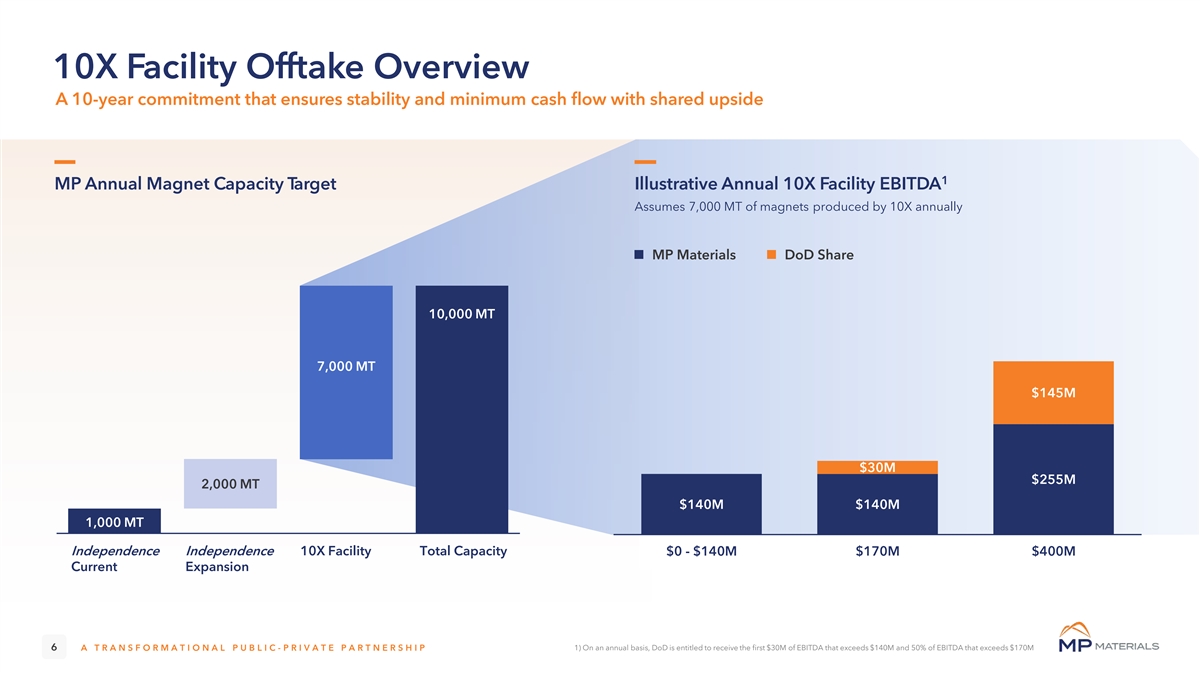

The Offtake Agreement has a term of ten years following the Commercial Operation Date (as defined in the Offtake Agreement) of the 10X Facility. In accordance with the Offtake Agreement, the 10X Facility will generate at least $140,000,000 of EBITDA on an annual basis after reaching full production capacity, adjusted annually in each calendar year following 2025 for inflation at a rate equal to 2% (the “Threshold EBITDA Amount”). The Department of Defense will also acquire magnets from the Project Company at a price equal to the Project Company’s production costs incurred in connection with the production of magnets at the 10X Facility.

Under the Offtake Agreement, the Department of Defense will make quarterly “magnet facilitation payments” to the Project Company in an amount equal to 25% of the applicable Threshold EBITDA Amount each quarter. Once the 10X Facility begins producing magnets at target levels, in the event that any portion of the magnet production from the 10X Facility in an applicable year is syndicated to third party purchasers, the Department of Defense will be entitled to receive, (i) the first $30,000,000 of EBITDA attributed to the 10X Facility magnet production that exceeds the Threshold EBITDA Amount (the “Initial Excess Amount”) and (ii) 50% of the EBITDA attributable to the 10X Facility magnet production that exceeds the Initial Excess Amount on an annual basis in that year. The Department of Defense will also make payments in respect of certain incremental costs incurred by Project Company including in connection with the engineering, development and start up of the Commercial Plant and for designing magnets to the Department of Defense’s specifications, with such payments being capped at $30,000,000 in any calendar year.

The Offtake Agreement prohibits magnet sales to certain Restricted Buyers (as defined in the PPA) and imposes certain other obligations.

Description of Securities and Certain Related Rights

Series A Preferred Stock

On July 11, 2025 (the “Closing Date”), pursuant to the terms of a subscription agreement (the “Subscription Agreement”) entered into with the Department of Defense on the Effective Date, the Company will issue and sell to the Department of Defense 400,000 shares of the Company’s Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), and file the related Certificate of Designations (the “Certificate of Designations”) with the Secretary of State of the State of Delaware to establish and fix the terms thereof. The Series A Preferred Stock has an initial stated value of $1,000 per share. Shares of Series A Preferred Stock accrue cumulative dividends at a rate of 7.0% per year (the “Dividend Rate”), compounding quarterly and payable solely in-kind through an increase to the stated value of each share of Series A Preferred Stock (each such Dividend, a “PIK Dividend”). The terms of the Series A Preferred Stock do not restrict the payment of cash dividends by the Company. However, within the first 15 business days of each new fiscal year, the Company will pay to the holder of each share of Series A Preferred Stock, on an as-converted basis, cash per share of Common Stock representing the amount, if any, by which the annual yield of the aggregate cash dividends paid by the Company on each share of Common Stock in the prior fiscal year exceeded the Dividend Rate.

The Series A Preferred Stock is convertible by the initial holder thereof at any time and from time to time after the date that is 45 days after the Closing Date (subject to certain extensions) into shares of Common Stock. The number of shares of Common Stock issuable upon conversion of each share of Preferred Stock is equal to the initial stated value of the share of Preferred Stock (without giving effect to any PIK Dividends added thereto) divided by the initial conversion price of $30.03 per share (the “Conversion Price”), representing the last-reported sale price of the Common Stock on the last trading day prior to execution of the Subscription Agreement and consistent with the New York Stock Exchange “Minimum Price” requirement. The Conversion Price is subject to adjustment in connection with certain transactions, including payments of stock dividends on its Common Stock, stock splits and combinations of the Common Stock.

At any time after the five year anniversary of the Closing Date, if the closing price per share of Common Stock exceeds 150% of the then-current Conversion Price for at least 20 trading days in any period of 30 consecutive trading days, the Company will have the option to require all or any portion of the then-outstanding shares of Series A Preferred Stock be converted into Common Stock at the then-current Conversion Price, subject to certain liquidity and other conditions.

In the event of a bankruptcy, liquidation, winding up or dissolution of the Company, holders of the Series A Preferred Stock will be entitled to be paid out of the Company’s assets legally available therefor and to the extent permitted by Delaware law, a cash amount per share of Series A Preferred Stock equal to the then-current stated value, plus any accrued and unpaid dividends, to, but not including, the date of such liquidation, winding up or dissolution.

Warrant

On the Closing Date, as required under the Transaction Agreement, the Company will issue a warrant (the “Warrant”) to the Department of Defense. The Warrant is exercisable by the initial holder thereof at any time and from time to time after the date that is 45 days after the Closing Date (subject to certain extensions) for a period of 10 years from the Closing Date for up to 11,201,659 shares of Common Stock, at an initial exercise price of $30.03 per share, representing the last-reported sale price of the Common Stock on the last trading day prior to execution of the Subscription Agreement and consistent with the New York Stock Exchange “Minimum Price” requirement. The ultimate number of shares of Common Stock to be issued under the terms of the Warrant, and the exercise price of the Warrant, are subject to adjustment in connection with certain transactions, including payments of stock dividends on the Common Stock, stock splits and combinations of the Common Stock.

Common Stock Underlying Series A Preferred Stock and Warrant

Pursuant to the terms of the Transaction Agreement, the Subscription Agreement, the Certificate of Designations and the Warrant, the Company will not effect any conversion of Series A Preferred Stock or exercise of the Warrant to the extent the delivery of the underlying Common Stock would cause a holder’s beneficial ownership of Common Stock to exceed 19.9%. This limitation does not apply in connection with certain events relating to a change of control of the Company. Additionally, the DOD shall take commercially reasonable efforts not to sell the shares of Common Stock issued upon conversion of the Series A Preferred Stock or exercise of the Warrant to a person or group who would, after giving effect to such sale, beneficially own greater than 9.9% of the Company’s Common Stock. In the aggregate, the Common Stock into which the Series A Preferred Stock is initially convertible and for which the Warrant is initially exercisable collectively represent fifteen percent (15%) of the Company’s issued and outstanding shares of Common Stock as of the Closing Date, without giving effect to the issuance of such shares.

Registration Rights Agreement

On the Closing Date, as required under the Transaction Agreement, the Company will enter into the Registration Rights Agreement”) with the Department of Defense. The Registration Rights Agreement provides that the Company will, among other things, prepare and file with the Securities and Exchange Commission (the “SEC”) a resale registration statement (a “Shelf Registration Statement”) on Form S-3, or if not available to the Company, on another appropriate form, including Form S-1, or an amendment or supplement to an existing registration statement on Form S-3, for the shares of Common Stock into which the Series A Preferred Stock is convertible and for which the Warrant is exercisable. The deadline for the Company to file the Shelf Registration Statement with the SEC is 45 days after the Closing Date (subject to certain extensions).

Under the Registration Rights Agreement, the Department of Defense will have certain “demand” and “piggyback” registration rights and indemnification rights customary for transactions of this type, and the Company will under certain circumstances have the right to defer the registration and/or suspend the use of a registration statement or prospectus.

Transaction Agreement

The Transaction Agreement provides for the entry into the PPA, Offtake Agreement, Subscription Agreement, Registration Rights Agreement and Warrant. The Transaction Agreement also provides for the entry into the Promissory Note (as defined below) at the time the DoD extends the Samarium Project Loan (as defined below) to the Company in accordance with the Transaction Agreement.

The Transaction Agreement further provides for the Company to use reasonable best efforts to build the 10X Facility to produce sintered Neodymium-iron boron (NdFeB) permanent magnet blocks and / or other finished magnets. Under the terms of the Transaction Agreement, the Company has agreed to use reasonable best efforts to (i) expand heavy rare earth elements (“HREE”) refining capacity at the Mountain Pass Rare Earth Mine and Processing Facility located near Mountain Pass, San Bernardino County, California (“Mountain Pass Facility”), which, after the Department of Defense extends the Samarium Project Loan to the Company in accordance with the Transaction Agreement, will include separation of samarium oxide, (ii) recommission hydrochloric acid facilities at the Mountain Pass Facility and (iii) expand capacity at the Company’s “Independence” magnet facility (the “Independence Facility”) to a projected 3,000 tons of magnets annually. The Company has also agreed to use up to $600,000,000 of its existing cash to fund the above projects. In connection with the Transactions, JPMorgan and Goldman Sachs have agreed to provide committed secured financing, subject to customary terms and conditions, in an amount equal to, in the aggregate, at least $1,000,000,000 (the “10X Facility Funding”), $650,000,000 of which will, pursuant to the terms of the committed secured financing, be specifically allocated to the construction of the 10X Facility; provided that such $1,000,000,000 may be reduced on a dollar for dollar basis for certain equity and/or debt raises and certain unrestricted cash that is not segregated or otherwise earmarked for use as contemplated by the Transaction Documents (as defined below).

So long as (i) the Department of Defense owns more than 75% of the Series A Preferred Stock or the Warrant or any Common Stock resulting from the conversion or exercise thereof as of the Closing Date, (ii) the Offtake Agreement or PPA (as described below) remains in place, or (iii) the Promissory Note (if entered into in connection with the extension of the Samarium Project Loan by the DoD) has not been repaid in full (clauses (i), (ii) and (iii), the “Specified Period”), the Company’s Nominating and Corporate Governance Committee will not nominate individuals to the Company’s Board of Directors (the “Company Board”) who are not U.S. citizens without the Department of Defense’s consent, and will oppose the election of any shareholder nominee who is not a U.S. citizen. Furthermore, during the Specified Period, the Company is not permitted to, without the Department of Defense’s consent, (i) consummate a Fundamental Event (i.e., a transaction involving the sale of 15% or more of the Company’s voting stock, the sale of all or a material portion of the equity or assets of the Project Company (defined below) (or any other subsidiary of the Company to which the 10X Facility is assigned) or all or substantially all of the consolidated assets of the Company and its subsidiaries (other than to a wholly owned subsidiary of the Company)) other than to person(s) from certain permitted jurisdictions, (ii) sell any equity or material assets of Project Company, (iii) sell assets or products identified by the Department of Defense as a priority to U.S. national security interests, (iv) knowingly issue more than 14.9% of the Common Stock to person(s) from foreign jurisdictions other than certain permitted jurisdictions or (v) consummate a Fundamental Event subject to the jurisdiction of the Committee on Foreign Investment in the United States (“CFIUS”) without obtaining CFIUS clearance prior to consummation.

So long as the Department of Defense holds any Series A Preferred Stock, Warrant or Common Stock, the Department of Defense will be subject to a customary standstill (in its capacity as an equity holder). The Department of Defense must vote any shares of Common Stock held by it in favor of the Company Board’s nominees and any proposals recommended by the Company Board so long as the Department of Defense holds any Common Stock, except with respect to any vote (i) regarding the Company or its subsidiaries taking actions in violation of any Transaction Document (as defined below), (ii) seeking to reject, disclaim, unwind, terminate or otherwise materially and adversely impact the Company’s or its subsidiaries’ relationship with the Department of Defense, (iii) which would materially and adversely impact the ability of the Company or any of its subsidiaries to comply with its obligations under any Transaction Document or (iv) which is inconsistent with applicable laws.

Pursuant to the Company’s obligations under the Transaction Agreement, the Company has agreed to (i) terminate its existing share repurchase program and (ii) cease making sales under the Offtake Agreement, dated as of March 4, 2022, between MP Mine Operations LLC and Shenghe Resources (Singapore) International Trading PTE LTD, which expires in January 2026, and will not be renewed.

The Transaction Agreement also provides that the Company shall select and fund from available alternatives on or prior to the date that is 45 days after the Closing Date, additional financing with net proceeds of at least $350,000,000 (the “Funding Allocation”) in addition to the initial proceeds to be received on the Closing Date and the 10X Facility Funding (as described below), with the Company’s alternatives including having a right to fund up to the full $350,000,000 of such additional proceeds by selling to DoD additional shares of Series A Preferred Stock on the same terms as the initial purchase or otherwise electing to obtain $350,000,000 under the terms and conditions of the committed financing provided by JPMorgan and Goldman Sachs.

The Transaction Agreement also provides that, no later than 30 days after the Effective Date (subject to extension if mutually agreed between the Department of Defense and the Company), the Department of Defense will extend a loan to the Company in the aggregate principal amount of $150,000,000 (the “Samarium Project Loan”), pursuant to an unsecured promissory note (the “Promissory Note”) to be entered into by the Company with the Department of Defense and maturing 12 years after issuance of the Promissory Note. Interest will accrue on the Samarium Project Loan at a rate equal to the 10-year U.S. Treasury constant maturity rate (as determined two U.S. government securities business days before issuance of the Promissory Note) plus 1.00% and will be payable in cash quarterly in arrears. The Company’s obligations with respect to expanding HREE refining capacity at its Mountain Pass Facility to include separation of samarium oxide are contingent upon the DoD extending the Samarium Project Loan in accordance with the Transaction Agreement.

The foregoing descriptions of the Certificate of Designations, the Transaction Agreement, the Subscription Agreement, the Warrant, the Registration Rights Agreement, the Offtake Agreement, the PPA and the Promissory Note, the transactions contemplated thereby and the securities issued or issuable pursuant thereto are only summaries and do not purport to be complete and are qualified in their entirety by reference to the full text of the relevant agreements, copies of which are attached to this Current Report on Form 8-K as Exhibit 3.1 and Exhibits 10.1-10.7 (collectively, the “Transaction Documents”), respectively, and which are incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On the Closing Date, the Department of Defense agreed to extend the Samarium Project Loan to the Company and the Company agreed to accept such loan no later than 30 days after the Effective Date (subject to extension if mutually agreed between the Department of Defense and the Company). The Samarium Project Loan will be in the aggregate principal amount of $150,000,000, pursuant to an unsecured Promissory Note to be entered into by the Company with the Department of Defense. The applicable interest rate upon incurrence will be based on the 10-year treasury bond yield plus 1.0%, payable on the first calendar day of each quarter. The Company may repay the Samarium Project Loan at any time, and the term of the Promissory Note is 12 years. A detailed description of the Samarium Project Loan is included in, and incorporated into this Item 2.03 by reference to, Item 1.01.

| Item 3.02 | Unregistered Sale of Equity Securities. |

On the Closing Date, the Company will issue 400,000 shares of Series A Preferred Stock and the Warrant to the Department of Defense. The offer and sale of the shares of Series A Preferred Stock pursuant to the Subscription Agreement, and the issuance of the Warrant pursuant to the Transaction Agreement, will each be made in reliance upon an exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof. Any shares of Common Stock deliverable upon conversion of the Series A Preferred Stock or upon exercise of the Warrant will be issued in reliance upon the exemption from registration in Section 3(a)(9) or Section 4(a)(2) of the Securities Act, respectively. Detailed descriptions of the Series A Preferred Stock and the Warrant are included in, and are incorporated into this Item 3.02 by reference to, Item 1.01.

| Item 3.03. | Material Modification to Rights of Security Holders. |

On the Closing Date, the Company will issue 400,000 shares of Series A Preferred Stock to the Department of Defense. Holders of the Series A Preferred Stock will have preferential rights on the distribution of the Company’s assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company over holders of Common Stock and any other series of preferred stock issued by the Company in the future. A more detailed description of the Series A Preferred Stock is included in, and is incorporated into this Item 3.03 by reference to, Item 1.01.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On the Closing Date, the Company will file the Certificate of Designations with the Secretary of State of the State of Delaware to establish and fix the terms of the Series A Preferred Stock. The Certificate of Designations will become effective upon filing. A more detailed description of the terms of the Series A Preferred Stock as set forth in the Certificate of Designations is included in, and is incorporated into this Item 3.02 by reference to, Item 1.01.

| Item 7.01. | Regulation FD Information. |

Press Release and Investor Presentation

On July 10, 2025, the Company issued a press release announcing the Transactions. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Attached hereto as Exhibit 99.2 and incorporated by reference herein is an investor presentation.

The information contained in the investor presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

The information furnished in Item 7.01 of this Current Report on Form 8-K under the heading “Press Release and Investor Presentation,” as well as Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act or the Exchange Act.

Risk Factors

The Company’s business, prospects, financial condition and results of operations, as well as the price of the Common Stock, can be affected by a number of factors, whether currently known or unknown, including those described in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”) and Part II, Item 1A. “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended March 31, 2025 (the “Form 10-Q”). When any one or more of these risks materializes from time to time, the Company’s business, prospects, financial condition and results of operations, as well as the price of the Common Stock, can be materially and adversely affected.

The Company is supplementing the risk factors previously disclosed in the Company’s Form 10-K and Form 10-Q with the risk factors relating to the Transactions set forth below.

Risks Related to the Transactions

While we have executed the Transaction Documents with the Department of Defense and received funding thereunder, there can be no assurances that the authorization of and continued support for the transactions contemplated by the Transaction Documents will not be modified, challenged or impaired in the future, which would have a material adverse effect on our business, prospects, financial condition and results of operations.

On the Effective Date, the Company and the Department of Defense executed the Transaction Documents and satisfied all conditions required thereunder, other than the receipt by the Company of the proceeds from the sale of the Series A Preferred Stock, which will be received on the Closing Date. We have received assurances from the Department of Defense that it has, pursuant to Title III of the Defense Production Act (“DPA”), 50 U.S.C. § 4531 et seq., as well as other authorities, all requisite authority to enter into the Transaction Documents and to consummate its obligations thereunder, including with respect to appropriation of the funds that will be used to purchase the Series A Preferred Stock on the Closing Date and to fund the Samarium Project Loan within 30 days following the Effective Date (subject to certain mutually agreed extensions). However, given the unconventional use of DPA Title III authority, the need for the Department of Defense to secure additional funds in the future in order to meets its obligations in these Transaction Documents, as well as the heightened sensitivity and complexity of contracting with a government entity, particularly in a high profile industry implicating national security, there can be no assurances that the authorization of and continued support for the Transactions will not be modified, challenged or impaired in the future, which could have a material adverse effect on our business, prospects, financial condition and results of operations.

We believe there are multiple factors that may contribute to this uncertainty, including, but not limited to, the interpretation of current and future, and enactment of future, federal and international laws, regulations, administrative actions and rulings, and interpretations and changes to interpretations thereof, whether by a court or within the legislative or executive branches of the federal government; our ability to comply with any conditions or other requirements imposed by such laws, regulations, actions and rulings, and changes thereto; a determination by the legislative, judicial, or executive branches of the federal government that any aspect of Transaction Documents was unauthorized, void, or voidable; future changes in federal administration and related executive and legislative priorities; the continued availability of Congressional appropriations and Department of Defense funding; geopolitical developments; and the legal and strategic challenges associated with enforcing the obligations of and seeking performance from a government counterparty, especially in conjunction with the unique defenses and remedies available to the federal government. Furthermore, while the Department of Defense is contractually bound under the Transaction Documents, no other agency, office or branch of the federal government has made any assurances or has any obligations under the Transaction Documents to actively support, accede to or refrain from challenging, investigating or otherwise impeding the commitments and obligations of the parties to the Transaction Documents, whether now or in the future. The Transactions may also be challenged by other third parties and are subject to the risk of litigation, both the cost and result of which could materially adversely affect our business, prospects, financial condition and results of operations. The Transaction Documents contain affirmative covenants requiring us to take certain actions and negative covenants restricting our ability to take certain actions, which the failure to comply with could give rise to an event of default under the applicable Transaction Documents and if any such event of default is not waived by the Department of Defense, the Department of Defense would have the right to exercise certain remedies or damages including but not limited to termination of one or more of the Transaction Documents and/or acceleration of maturity of the Samarium Project Loan any of which could materially adversely affect our business, results of operations and financial position.

The Transaction Documents require the Company to make substantial investments in and commitments to specific aspects of our business, namely the expansion of our midstream separation capabilities and development of our 10X facility. Furthermore, under the terms of the Offtake Agreement, we anticipate that the Department of Defense will become our largest customer of magnets and that the obligations of the Department of Defense under the PPA and Offtake Agreement will represent a significant source of our revenue. As such, we will be heavily reliant upon the continued availability of financing provided by the Department of Defense (including its ability to secure sufficient funding from the legislative branch), as well as the Department of Defense’s long-term pricing and offtake commitments in planning our operations and formulating our strategic plan. If for any reason contractually agreed to (but currently unavailable) funding is not timely appropriated by the legislative branch or otherwise becomes unavailable, reduced, restricted, or delayed, we may need to seek alternate financing arrangements, and there can be no assurance that we would be able to secure replacement financing on acceptable terms, at favorable pricing, in a timely manner or at all. If we are not successful in generating alternate financing from operations or in equity or debt capital raising transactions, we may need to reduce our costs, which measures could include selling or consolidating certain operations or assets, and delaying, canceling or scaling back our development projects. Further, historically, market prices for rare earth metals and their downstream products have been subject to a high degree of volatility. If the Department of Defense were to fail to meet its obligations with respect to its pricing and offtake commitments, or to be delayed in doing so, our products may not be cost-optimized to compete in the market, and our profitability may be materially adversely impacted if we choose to offer our products at a reduced price. Additionally, because many of our products may be designed to satisfy Department of Defense specifications and requirements, our products may not find customers in the commercial marketplace, and our profitability may be materially adversely impacted if we are unable to identify alternative sales channels. Failure by either or both of the Company and the Department of Defense to perform its obligations under the PPA and Offtake Agreement would have a material adverse impact on our business, prospects, financial condition and results of operations.

Our operations are subject to extensive regulatory requirements enforced in part by the federal government. If government regulations are interpreted or enforced in a manner adverse to us, we may be subject to enforcement actions, penalties, exclusion, and other material limitations on our operations. Any change in our relationship with the federal government could impair our ability to operate our existing business and pursue our strategic plans. Furthermore, many of the potential opportunities presented by our strategic relationship with the Department of Defense cannot be replaced, including the government’s unique position to assist and facilitate our sourcing of heavy rare earth feedstock and securing necessary environmental permits and approvals, and with respect to the designation with the highest priority DX Rating under the Defense Priorities and Allocations System (DPAS) of our contracts relating to the Transactions.

In the event of any termination or frustration of the Transaction Documents, in full or in part, we may have limited recourse and remedies available against the Department of Defense and the federal government.

The Company’s agreement to the Transaction Documents also subjects it to various laws, regulations, and other policies and considerations that may constrain our future business or otherwise have a material adverse impact on future financial results. We may be subject to heightened scrutiny of our business activities with both government and non-government customers, government audits, investigations, congressional scrutiny, inquiries about conflicts of interest, civil or criminal enforcement by the Department of Justice (including actions under the False Claims Act), exclusion or limitation on future government-funded opportunities, suspension, debarment, and other administrative remedies.

The Transaction Documents contain affirmative and negative covenants that may restrict our ability and the ability of our subsidiaries to take actions management believes are important to our long-term strategy, and therefore could have a material adverse effect on our business, prospects, financial condition, or results of operations.

The Transaction Documents contain affirmative covenants requiring us to take certain actions and negative covenants restricting our ability to take certain actions. The affirmative covenants impose obligations on us with respect to, among other things, (i) constructing and developing the 10X Facility, (ii) expanding HREE refining capacity at the Mountain Pass Facility, to include, after the Department of Defense extends the Samarium Project Loan to the Company in accordance with the Transaction Agreement, the separation of samarium oxide, (iii) expanding/recommissioning hydrochloric acid facilities at the Mountain Pass Facility, (iv) expanding capacity at the Independence Facility to a projected 3,000 tons of magnets annually and (v) selecting and funding from available alternatives on or prior to the date that is 45 days after the Closing Date at least $350,000,000 of net proceeds. The negative covenants in the Transaction Documents restrict us with respect to, among other things, (i) consummating a Fundamental Event other than to person(s) from certain permitted jurisdictions, (ii) selling any equity or material assets of the Project Company, (iii) selling assets or products identified by the Department of Defense as a priority to U.S. national security interests, (iv) knowingly issuing more than 14.9% of the Common Stock to person(s) from foreign jurisdictions other than certain permitted jurisdictions, (v) consummating a Fundamental Event subject to the jurisdiction of the Committee on Foreign Investment in the United States (“CFIUS”) without obtaining CFIUS clearance prior to consummation and (vi) selling NdPr or magnets to any customer that is a Restricted Buyer or permitting any customer to resell NdPr or magnets to a Restricted Buyer (other than any NdPr or magnets that are included in another finished product sold by such customer).

Compliance with the affirmative and negative covenants contained in the Transaction Documents could restrict our ability to take actions that management believes are important to our long-term strategy. If strategic transactions we wish to undertake are prohibited by the Transaction Documents, our ability to execute our long-term strategy could be materially adversely affected, which could in turn have a material adverse effect on our business, prospects, financial condition, or results of operations.

The conversion or exercise of the Series A Preferred Stock and the Warrant into shares of Common Stock would dilute the ownership position of existing common stockholders, and the subsequent sale of a substantial number of such shares of Common Stock in the public market, or the perception of such sales, could cause our stock price to decline.

The shares of Common Stock into which the shares of Series A Preferred Stock to be issued on the Closing Date will be initially convertible and for which the Warrant will be initially exercisable collectively represent 15% of the Company’s issued and outstanding Common Stock as of the Closing Date, without giving effect to the issuance of such shares. The Series A Preferred Stock and the Warrant are convertible and exercisable at any time and from time to time after the date that is 45 days after the Closing Date (subject to certain extensions), and the initial conversion price and exercise price are equal to the last-reported sale price of the Common Stock on the last trading day prior to execution of the Subscription Agreement and Transaction Agreement. Additionally, depending on the manner in which the Company determines to fund the Funding Allocation, the Funding Allocation could result in further significant issuances of our Common Stock, or of Common Stock underlying other securities, relating to the Transactions.

At any time after the five year anniversary of the Closing Date, if the closing price of our Common Stock exceeds 150% of the then-current conversion price for at least 20 trading days in any period of 30 consecutive trading days, we will have the option to require all or any portion of the then-outstanding Series A Preferred Stock be converted into Common Stock at the then-current conversion price, subject to certain liquidity and other conditions. As such, existing common stockholders may experience substantial dilution of their ownership positions.

Furthermore, the sale of a substantial number of shares of our Common Stock in the public market, or the perception that these sales might occur, including of the shares issuable upon conversion and exercise of the Series A Preferred Stock and the Warrant, could depress the market price of our Common Stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that sales may have on the prevailing market price of our Common Stock.

The financial, tax and accounting treatment of the Transactions contemplated by the Transaction Documents remains uncertain and subject to change.

Given both the novelty and complexity of the Transactions, the Company’s initial analysis of the financial, tax and accounting implications of its commitments and obligations under the Transaction Documents has not been completed and may take considerable time and require significant attention from management. Additionally, no assurance can be provided that this initial assessment will not require adjustment or amendment over time due to changes in tax law or regulations, accounting practices and requirements and unforeseen developments in the course of providing services and receiving cash flows relating to the Transactions, particularly with respect to the Offtake Agreement and PPA, including with respect to the timing and characterization of payments received from the Department of Defense, among other considerations. The Transaction Documents are also highly integrated, and certain of the obligations under each Transaction Document are contingent upon or impacted by the terms and obligations of the others. If one or more of the Transaction Documents, or one or more elements of the Transactions, were to be altered, amended or terminated, management would need to assess the financial, tax and accounting implications of such changes, which could be significant, together with any related remedies available to the Company and the present condition of its business and operations. We are unable to predict, and may not be able to anticipate, either these changes or the impact thereof. Any of the foregoing may have a material adverse effect on our business, prospects, financial condition and results of operations, including, but not limited to, material changes to our financial outlook, recharacterizations, restatements or other modifications of our financial statements or adjustments to previously provided estimates or guidance.

Inability to perform the obligations under our customer supply agreements could have a material adverse effect on our business, prospects, financial condition and results of operations.

We have entered into the Transaction Documents with the Department of Defense, including the Offtake Agreement, and we previously entered into a binding long-term supply agreement with the General Motors Company (“GM”). Our ability to fulfill our obligations under these long-term agreements to supply the Department of Defense and GM, as well as any other future customers, with magnets and magnet materials, are subject to a number of risks and contingencies. We are currently building the Independence Facility, the first scaled rare earth magnet manufacturing facility in the U.S. in several decades, and under the Transaction Agreements, we are required to begin planning and constructing a second rare earth magnet manufacturing facility, the 10X Facility. While we are relying, and will rely, on a number of experienced engineers and other third parties in the design, engineering and construction of the Independence Facility and the 10X Facility, we are making and will be required to make a number of judgments and assumptions on process design, equipment selection and design, and plant operations, that may or may not prove to be correct. Design, engineering or construction delays may impair our ability to perform under our long-term agreements with the Department of Defense and GM, as well as those made with any other future customers. We will also need to promptly assess the need for and to build out additional resources to support multiple novel construction projects in parallel. In addition, we need to procure the necessary equipment and materials to produce magnets and their precursor products, some of which may be difficult to obtain. There can be no assurance that such resources, equipment and materials will be procured on time or not be delayed due to both the finite time and resources of our management and employees to assess and respond to these increased demand, and to circumstances beyond our control.

Further, we need to hire a sufficient number of engineers, operators and other professionals to successfully design and operate the Independence Facility and the 10X Facility. It may be difficult for us to hire employees with the experience, education and skills needed to produce magnet materials, and we may need to hire employees from other countries if we cannot recruit employees in the U.S. We will also face competition for these employees. These challenges may be exacerbated by the need to develop multiple facilities at the same time.

There can be no assurance that we successfully produce magnet materials at the volumes and quality necessary to meet the requirements under our long-term supply agreements with the Department of Defense and GM. In the event we are not able to mitigate these risks or fail to comply with the terms of the Transaction Agreements, particularly the Offtake Agreement, and our supply agreement with GM, we may experience material adverse effects on our business, prospects, financial condition and results of operations.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. Forward-looking statements may be identified by the use of the words such as “estimate,” “plan,” “shall,” “may,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “will,” “target,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the forward-looking aspects of the Transactions, including the Funding Allocation, the intended use of proceeds of the Transactions and the Funding Allocation, the timing and consummation of future phases of the Transactions, the Company’s and the Department of Defense’s future obligations related to the Transactions, and the expected impact of the Transactions on the Company’s business and the broader industry; the availability of government appropriations, funding and support for the Transactions; the availability of additional or replacement funding for our development projects and operations; the financial, tax and accounting assessment and treatment of the various obligations and commitments under the Transaction Documents; our engagement with industry and the government and outcomes related to this engagement; the price and market for rare earth materials, the continued demand for rare earth materials and the market for rare earth materials generally; future demand for magnets; estimates and forecasts of the Company’s results of operations and other financial and performance metrics, including NdPr oxide production and shipments and expected NdPr oxide production and shipments; and the Company’s mining and magnet projects, including the Company’s ability to expand its separation capabilities to include samarium, the fact that the Company’s obligation to undertake such expansion is conditioned upon the Department of Defense extending the Samarium Project Loan in accordance with the Transaction Agreement, and to develop the 10X Facility and to achieve run rate production of separated rare earth materials and production of commercial metal and magnets. Such statements are all subject to risks, uncertainties and changes in circumstances that could significantly affect the Company’s future financial results and business.

These forward-looking statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of our management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond our control. These forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the timing and achievement of expected business milestones, including with respect to the construction of the 10X Facility and the extension of the Samarium Project Loan by the Department of Defense; the availability of appropriations from the legislative branch of the federal government and the ability of the Department of Defense to obtain funding and support for the Transactions; the determination by the legislative, judicial or executive branches of the federal government that any aspect of the Transactions was unauthorized, void or voidable; our ability to obtain additional or replacement financing, as needed; our ability to effectively assess, determine and monitor the financial, tax and accounting treatment of the Transactions, together with our and the Department of Defense’s obligations thereunder; challenges associated with identifying alternate sales channels and customers for the highly-specialized products contemplated by the Transactions should the partnership be altered or terminated; our ability to effectively use the proceeds and utilize the other anticipated benefits of the Transactions as contemplated thereby; our ability to effectively comply with the broader legal and regulatory requirements and heightened scrutiny associated with government partnerships and contracts; limitations on the Company’s ability to transact with non-U.S.

customers; changes in trade and other policies and priorities in U.S. and foreign governments, including with respect to tariffs; fluctuations, variability and uncertainty in demand and pricing in the market for rare earth products, including magnets; volatility in the price of our common stock; and those risk factors discussed in the Company’s filings with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed by the Company with the Securities and Exchange Commission.

If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that we do not presently know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect our expectations, plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. We anticipate that subsequent events and developments will cause our assessments to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, unless required by applicable law. These forward-looking statements should not be relied upon as representing our assessment as of any date subsequent to the date of this Current Report on Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| * | Certain identified information has been excluded from the exhibit because it both (i) is not material and (ii) would be competitively harmful if publicly disclosed. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 10, 2025 | MP Materials Corp. | |||||

| By: | /s/ Elliot D. Hoops |

|||||

| Elliot D. Hoops | ||||||

| General Counsel and Secretary | ||||||

Exhibit 3.1

FORM OF CERTIFICATE OF DESIGNATIONS, PREFERENCES AND RIGHTS OF SERIES A CONVERTIBLE PERPETUAL PREFERRED STOCK OF MP MATERIALS CORP.

Pursuant to Section 151 of the Delaware General Corporation Law (as amended, supplemented or restated from time to time, the “DGCL”), MP Materials Corp., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 103 of the DGCL DOES HEREBY CERTIFY

FIRST: That, the Second Amended and Restated Certificate of Incorporation of the Corporation (the “Certificate of Incorporation”) authorizes the issuance of up to Fifty Million (50,000,000) shares of Preferred Stock, par value $0.0001, of the Corporation (“Preferred Stock”) in one or more series and expressly vests the Board of Directors of the Corporation (the “Board”) with the authority to fix by resolution or resolutions the designations and the powers, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, including, without limitation, the dividend rate, conversion rights, redemption price and liquidation preference, of any series of shares of Preferred Stock, and to fix the number of shares constituting any such series, and to increase or decrease the number of shares of any such series (but not below the number of shares thereof then outstanding);

SECOND: That, pursuant to the authority vested in the Board by the Certificate of Incorporation and delegated to the Transaction Committee of the Board on June 30, 2025 (the “Transaction Committee”), the Transaction Committee on July 9, 2025, adopted the following resolution designating a new series of Preferred Stock as “Series A Convertible Perpetual Preferred Stock”:

NOW, THEREFORE, BE IT RESOLVED, that, pursuant to the authority vested in the Board in accordance with the provisions of Article IV of the Certificate of Incorporation and the provisions of Section 151 of the DGCL, and delegated to the Transaction Committee by the Board in accordance with the Certificate of Incorporation and the DGCL, a series of Preferred Stock of the Corporation designated as “Series A Convertible Perpetual Preferred Stock” is hereby authorized, and the designations, rights, preferences, powers, restrictions and limitations of the Series A Convertible Perpetual Preferred Stock shall be as follows:

Table of Contents

| 1. Designation |

1 | |||

| 2. Defined Terms |

1 | |||

| 3. Rank |

5 | |||

| 4. Dividends |

5 | |||

| 4.1 Accrual of Dividends |

5 | |||

| 4.2 Payment of Dividends |

5 | |||

| 4.3 Dividend Calculations |

6 | |||

| 4.4 Special Payments |

6 | |||

| 5. Liquidation |

6 | |||

| 5.1 Liquidation |

6 | |||

| 5.2 Insufficient Assets |

6 | |||

| 5.3 Notice Requirement |

6 | |||

| 6. Voting |

6 | |||

| 7. Conversion |

7 | |||

| 7.1 Holders’ Optional Right to Convert |

7 | |||

| 7.2 Mandatory Conversion |

7 | |||

| 7.3 Procedures for Conversion; Effect of Conversion |

7 | |||

| 7.4 Reservation of Stock |

9 | |||

| 7.5 No Charge or Payment |

10 | |||

| 7.6 Adjustment to Conversion Price and Number of Conversion Shares |

10 | |||

| 8. Reissuance of Series A Preferred Stock |

16 | |||

| 9. Notices |

16 | |||

| 10. Share Exchanges, Reclassifications, Mergers and Consolidations |

17 | |||

| 11. Amendments and Waiver |

17 | |||

| 12. Withholding |

17 | |||

| 13. Transfers and Exchanges |

17 |

i

1. Designation. There shall be a series of Preferred Stock that shall be designated as “Series A Convertible Perpetual Preferred Stock” (the “Series A Preferred Stock”) and the number of shares constituting such series (“Shares”) shall be 400,000 with an initial Stated Value (as defined below) of $1,000 per Share. The rights, preferences, powers, restrictions and limitations of the Series A Preferred Stock shall be as set forth herein. The Series A Preferred Stock shall be issued in book-entry form on the Corporation’s share ledger, subject to the rights of holders to receive certificated Shares under the DGCL.

2. Defined Terms. For purposes hereof, the following terms shall have the following meanings:

“Accumulated Stated Value” has the meaning set forth in Section 4.1.

“Affiliate” of any specified Person means any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For the purposes of this definition, “control” (including, with its correlative meanings, “controlled by” and “under common control with”), when used with respect to any specified Person means the power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. Notwithstanding anything to the contrary herein, the determination of whether one Person is an “Affiliate” of another Person for purposes of this Certificate of Designations shall be made based on the facts at the time such determination is made or required to be made, as the case may be, hereunder.

“Beneficial Ownership Limitation” has the meaning set forth in Section 7.3(e).

“Board” has the meaning set forth in the Recitals.

“Business Day” means a day other than a Saturday, Sunday or other day on which the SEC or banks in the City of New York are authorized or required by law to close.

“Certificate of Designations” means this Certificate of Designations, Preferences and Rights of Series A Convertible Perpetual Preferred Stock of MP Materials Corp., as it may be amended from time to time.

“Certificate of Incorporation” has the meaning set forth in the Recitals.

“Common Stock” means the common stock, par value $0.0001 per share, of the Corporation.

“Compounded Dividends” has the meaning set forth in Section 4.2.

“Conversion Date” has the meaning set forth in Section 7.3(d).

“Conversion Limitation Adjustment Event” means the consummation of (i) any share exchange, stock sale, consolidation or merger of the Corporation, or other transaction pursuant to which a majority of the Common Stock will be converted into cash, securities or other property or assets, or pursuant to which any Person or group of Persons will have the right to appoint a majority of the members of the Board, (ii) any issuance of Common Stock or other securities convertible into Common Stock pursuant to which any Person or group of Persons will have the right to appoint a majority of the Board, or (iii) any sale, lease or other transfer in one transaction or a series of transactions of any material portion of the consolidated assets of the Corporation and its Subsidiaries, taken as a whole, other than the transfer of assets of the Corporation to one or more of the Corporation’s wholly owned Subsidiaries.

“Conversion Price” means, initially, $30.03 per Share (the “Initial Conversion Price”), as adjusted from time to time in accordance with Section 7.6.

“Conversion Shares” means the shares of Common Stock or other capital stock of the Corporation then issuable upon conversion of the Series A Preferred Stock in accordance with the terms of Section 7.

“Corporation” has the meaning set forth in the Preamble.

“DGCL” has the meaning set forth in the Preamble.

“Dividend Payment Date” has the meaning set forth in Section 4.2.

“Dividend Rate” means 7.0% per annum.

“Dividend” has the meaning set forth in Section 4.1.

“Equity Securities” has the meaning ascribed to such term in Rule 405 promulgated under the Securities Act as in effect on the date hereof, and in any event includes any stock, any partnership interest, any limited liability company interest and any other interest, right or security convertible into, or exchangeable or exercisable for, capital stock, partnership interests, limited liability company interests or otherwise having the attendant right to vote for directors or similar representatives.

“Ex-Dividend Date” means the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive the issuance, dividend or distribution in question, from the Corporation or, if applicable, from the seller of Common Stock on such exchange or market (in the form of due bills or otherwise) as determined by such exchange or market.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Expiration Date” has the meaning set forth in Section 7.6(e).

“Governmental Authority” means any government, court, regulatory or administrative agency, commission, arbitrator (public or private) or authority or other legislative, executive or judicial governmental entity (in each case including any self-regulatory organization), whether federal, state or local, domestic, foreign or multinational.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder.

“Initial Investor” means the United States Department of Defense.

“Insolvency Event” means:

(a) any voluntary or involuntary liquidation, dissolution or winding up of the Corporation;

(b) an involuntary proceeding shall be commenced or an involuntary petition shall be filed in a court of competent jurisdiction seeking (i) relief in respect of the Corporation, or a substantial part of the property or assets of the Corporation, under Title 11 of the United States Code, as now constituted or hereafter amended, or any other federal, state or foreign bankruptcy, insolvency, receivership or similar law, (ii) the appointment of a receiver, trustee, custodian, sequestrator, conservator or similar official for the Corporation, or a substantial part of the property or assets of the Corporation, or (iii) the winding-up or liquidation of the Corporation, and such proceeding or petition shall continue undismissed for 60 days or an order or decree approving or ordering any of the foregoing shall be entered; or

(c) the Corporation shall (i) voluntarily commence any proceeding or file any petition seeking relief under Title 11 of the United States Code, as now constituted or hereafter amended, or any other federal, state or foreign bankruptcy, insolvency, receivership or similar law, (ii) consent to the institution of, or fail to contest in a timely and appropriate manner, any proceeding or the filing of any petition described in clause (b) above, (iii) apply for or consent to the appointment of a receiver, trustee, custodian, sequestrator, conservator or similar official for the Corporation, or a substantial part of the property or assets of the Corporation, (iv) file an answer admitting the material allegations of a petition filed against it in any such proceeding, (v) make a general assignment for the benefit of creditors or (vi) become unable or admit in writing its inability or fail generally to pay its debts as they become due.

2

“Junior Securities” means, collectively, the Common Stock and each other class or series of capital stock now existing or hereafter authorized, classified or reclassified, the terms of which do not expressly provide that such class or series ranks on a parity basis with or senior to the Series A Preferred Stock as to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

“Last Reported Sale Price” of the Common Stock on any date means the closing sale price per share (or if no closing sale price is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is traded. If the Common Stock is not listed for trading on a U.S. national or regional securities exchange on the relevant date, the “Last Reported Sale Price” shall be the last quoted bid price per share for the Common Stock in the over-the-counter market on the relevant date as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted, the “Last Reported Sale Price” shall be the average of the mid-point of the last bid and ask prices per share for the Common Stock on the relevant date from each of at least three nationally recognized independent investment banking firms selected by the Corporation for this purpose.

“Laws” mean all state or federal laws, common law, statutes, ordinances, codes, rules or regulations, orders, executive orders, judgments, injunctions, governmental guidelines or interpretations have the force of law, Permits, decrees, or other similar requirement enacted, adopted, promulgated, or applied by any Governmental Authority.

“Liquidation” has the meaning set forth in Section 5.1.

“Mandatory Conversion Date” has the meaning set forth in Section 7.2.

“Mandatory Conversion Determination” has the meaning set forth in Section 7.3(a).

“Mandatory Conversion Premium” means 150%.

“Mandatory Conversion Right” has the meaning set forth in Section 7.2.

“Mandatory Conversion Threshold” means the Conversion Price multiplied by the Mandatory Conversion Premium.

“Notice of Conversion” has the meaning set forth in Section 7.3(a).

“NYSE” means the New York Stock Exchange.

“Original Issue Date” means July 11, 2025. For the avoidance of doubt, any additional Series A Preferred Stock issued as contemplated by Section 6.01(b) of the Transaction Agreement shall be deemed to be issued on the Original Issue Date.

“Parity Securities” means any class or series of capital stock, the terms of which expressly provide that such class ranks pari passu with the Series A Preferred Stock as to dividend rights and rights on the distribution of assets on any voluntary or involuntary bankruptcy, liquidation, dissolution or winding up of the affairs of the Corporation.

“Permits” mean all licenses, franchises, permits, certificates, approvals and authorizations from Governmental Authorities.

3

“Person” means an individual, corporation, limited liability company, partnership, joint venture, association, trust, unincorporated organization or any other entity, including a Governmental Authority.

“Preferred Stock” has the meaning set forth in the Recitals.

“Regulatory Laws” shall mean, collectively, any Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or lessening of competition through merger or acquisition or restraint of trade or that affect foreign investment, outbound investment, foreign exchange, national security or national interest of any jurisdiction.

“Reorganization Event” has the meaning set forth in Section 7.6(f).

“Restricted Stock Legend” has the meaning set forth in Section 13(b).

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Senior Securities” means any class or series of capital stock, the terms of which expressly provide that such class ranks senior to any series of the Series A Preferred Stock, has preference or priority over the Series A Preferred Stock as to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

“Series A Preferred Stock” has the meaning set forth in Section 1.

“Shares” has the meaning set forth in Section 1.

“Special Payment” has the meaning set forth in Section 4.4.

“Special Payment Amount” means the product of (i) the number of shares of Common Stock into which a Share would be convertible, and (ii) the amount by which (x) the sum of all cash dividends declared by the Board and paid by the Corporation on each share of Common Stock during the most recently completed fiscal year (as determined by the record date for such dividend payment) exceeds (y) 7.0% of the Last Reported Sale Price, in each case, as determined on the last Trading Day of such completed fiscal year.

“Special Payment Date” has the meaning set forth in Section 4.4.

“Special Payment Record Date” has the meaning set forth in Section 4.4.

“Spin-Off” has the meaning set forth in Section 7.6(d).

“Stated Value” means, with respect to any Share on any given date, $1,000.00.

“Subsidiary” when used with respect to any Person, means any corporation, limited liability company, partnership, association, trust or other entity of which (x) securities or other ownership interests representing more than 50% of the ordinary voting power (or, in the case of a partnership, more than 50% of the general partnership interests) or (y) sufficient voting rights to elect at least a majority of the board of directors or other governing body are, as of such date, owned by such Person or one or more Subsidiaries of such Person or by such Person and one or more Subsidiaries of such Person.

“Transaction Agreement” means that Transaction Agreement, dated as of the Original Issue Date, by and between the Corporation and the Initial Investor (and any transferee that becomes party to the Transaction Agreement in accordance with its terms), as amended, modified or supplemented from time to time.

4

“Tax” and “Taxes” means any and all United States federal, state, local or non-United States taxes, fees, levies, duties, tariffs, imposts, and other similar charges (together with any and all interest, penalties and additions to tax) imposed by any Governmental Authority, including taxes or other charges in the nature of a tax on or with respect to income, franchises, windfall or other profits, gross receipts, property, sales, use, capital stock, payroll, employment, social security, workers’ compensation, unemployment compensation or net worth; other charges in the nature of excise, withholding, ad valorem, stamp, transfer, value added or gains taxes; license, registration and documentation fees; and customs duties, tariffs and similar charges.

“Trading Day” means a Business Day on which NYSE (or any other national securities exchange on which the Common Stock is listed at such time) is open for business.

“Transfer Agent” means the Corporation’s transfer agent and registrar for the Common Stock, and any successor appointed in such capacity.

3. Rank. With respect to the distribution of assets upon Liquidation of the Corporation and payment of dividends, all Shares of the Series A Preferred Stock shall rank (a) senior to all Junior Securities and (b) pari passu with any Parity Securities in issue from time to time, and (c) junior to all Senior Securities; provided, that without the prior written consent of the holders of a majority of the then-issued and outstanding Series A Preferred Stock, the Corporation shall not issue any new Equity Interests of the Corporation, or reclassify, alter or amend any existing Equity Interests of the Corporation into, or issue any Equity Interests convertible into, Equity Interests of the Corporation, in each case, ranking pari passu with, or senior to, the Series A Preferred Stock with respect to the distribution of assets upon Liquidation.

4. Dividends.

4.1 Accrual of Dividends. From and after the Original Issue Date of the Shares, cumulative dividends (each, a “Dividend”) on each such Share shall accrue, whether or not there are funds legally available for the payment of dividends, on a daily basis in arrears at the applicable Dividend Rate on the sum of (i) the Stated Value thereof plus (ii) once compounded, any Compounded Dividends thereon (the Stated Value plus accumulated Compounded Dividends, the “Accumulated Stated Value”). For the avoidance of doubt, the payment of a Special Payment with respect to a Share or any rights with respect thereto shall not reduce or otherwise affect the Accumulated Stated Value of such Share.

4.2 Payment of Dividends. All Dividends shall compound quarterly on the last day of March, June, September and December of each calendar year, and shall be automatically added to the then current Accumulated Stated Value (“Compounded Dividends”).

4.3 Dividend Calculations. Dividends on the Series A Preferred Stock shall accrue on the basis of a 360-day year, consisting of twelve (12), thirty (30) calendar day periods, and shall accrue daily commencing on the Original Issue Date, and shall be deemed to accrue from such date whether or not earned or declared and whether or not there are profits, surplus or other funds of the Corporation legally available for the payment of dividends.

4.4 Special Payments.

(a) Generally. For any completed fiscal year of the Corporation, to the extent the Special Payment Amount is greater than zero, the Corporation shall pay (a “Special Payment”), within the first 15 Business Days of the succeeding fiscal year (the date of such payment, the “Special Payment Date”), the Special Payment Amount to the holder of record of each Share as of the close of business on the last Business Day of such completed fiscal year (the “Special Payment Record Date”).

(b) Conversion Prior to or Following a Record Date. If the Conversion Date for any Shares is prior to the Special Payment Record Date, the holder of such Shares shall not be entitled to any Special Payment. If the Conversion Date for any Shares is after the Special Payment Record Date, but prior to the corresponding Special Payment Date, the holder of such Shares as of the Special Payment Record Date shall be entitled to receive such Special Payment, notwithstanding the conversion of such Shares prior to the applicable Special Payment Date.

5

5. Liquidation.

5.1 Liquidation. Upon the occurrence of any Insolvency Event of the Corporation (a “Liquidation”), the holders of Shares then outstanding shall be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders, pari passu with any payment to the holders of any Parity Securities and subject to the rights of Senior Securities and the Corporation’s creditors, but before any distribution or payment out of the assets of the Corporation shall be made to the holders of Junior Securities by reason of their ownership thereof, an amount in cash equal to the greater of (i) the Accumulated Stated Value, plus accrued and unpaid Dividends, and (ii) such amount as would have been payable had all Shares been converted into Comon Stock at the Conversion Price immediately prior to such Liquidation (such amount, the “Liquidation Price”).