UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2025

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-38747 | 46-0306862 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices, and Zip Code)

(605) 692-0200

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, $0.00001 Par Value | DAKT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

| Item 2.02. | Results of Operations and Financial Condition. |

On June 25, 2025, Daktronics, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter and full year ended April 26, 2025 and related material information (the “Release”). A copy of the Release is attached to this Current Report on Form 8-K (this “Report”) as Exhibit 99.1 and incorporated herein by reference.

The information in Item 2.02 of this Report, including the Release, is being furnished under Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Section 5 – Corporate Governance and Management

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) On June 23, 2025, the Board of Directors of the Company (the “Board”) approved an executive compensation program for fiscal year 2026 (the “Compensation Program”). The central purposes of the Compensation Program are to: (i) support the recruitment and retention of high-performing executives; (ii) encourage leadership to drive transformational corporate performance; (iii) strengthen the alignment between executive compensation and the Company’s performance; and (iv) align executives’ interests with the best interests of the Company and its stockholders.

The Compensation Program currently applies to all of the “Covered NEOs” (as defined below). It does not apply to the Company’s Interim Chief Executive Officer, Bradley T. Wiemann, or the Acting Chief Financial Officer, Howard I. Atkins, whose compensation arrangements are set forth in their respective offer letters and equity award agreements. A summary of the material compensation terms for fiscal year 2026 for each of Messrs. Wiemann and Atkins was previously disclosed in a Current Report on Form 8-K filed with the Securities and Exchange Commission on March 5, 2025.

Annual Incentive Awards

Under the Compensation Program, the Covered NEOs will be eligible to earn annual incentive awards (the “Annual Incentive”) based on three performance measures: (i) the Company’s revenue for the 2026 fiscal year (the “Annual Incentive Performance Period”) (weighted at 30%); (ii) the Company’s operating margin for the Annual Incentive Performance Period (weighted at 50%); and (iii) performance measures specific to each Covered NEO (weighted at 20%). The Chief Executive Officer of the Company will recommend for approval by the Compensation Committee of the Board the individual performance objectives for each Covered NEO under the Annual Incentive, including but not limited to strategic initiatives, operational goals, and non-financial factors, and will evaluate each Covered NEO’s performance against those objectives.

Annual Incentive payouts to the Covered NEOs will be made in cash and range from 25% of target (threshold performance) to 150% of target (maximum performance). No Annual Incentive payout will be made for a given performance goal if the attainment for such goal falls below the threshold level. For individual performance results between threshold and target levels, and between target and maximum levels, the Annual Incentive payouts will be determined by linear interpolation.

Annual Incentive award opportunities under the Program for each of the following named executive officers of the Company (the “Covered NEOs”), expressed as a percentage of such Covered NEO’s base salary, are listed below:

| Name | Title | Target Percentage | ||

| Sheila M. Anderson | Chief Data and Analytics Officer | 55% | ||

| Matthew J. Kurtenbach | Vice President, Manufacturing | 55% | ||

| Carla S. Gatzke | Vice President, Human Resources | 45% | ||

Long-Term Incentive Awards

Under the Compensation Program, the values of the long-term incentive awards have been adjusted to more closely align with market practice. In addition, performance stock units (“PSUs”) that vest based on the attainment of certain financial performance measures of the Company during a three-year performance period (the “PSU Performance Period”) have been introduced to strengthen the connection between executive compensation and long-term stockholder value. For the fiscal 2026 long-term incentive awards, each Covered NEO will receive an award with a target value equal to 50% of the Covered NEO’s base salary, with 25% of such award in the form of PSUs and 75% in the form of time-based restricted stock units (“RSUs”). This allocation ratio is subject to adjustment by the Board from time to time.

PSUs are earned based on the Company’s profit growth (weighted at 60%) and revenue growth (weighted at 40%) during the PSU Performance Period. Earned PSUs cliff vest, if at all, on the third anniversary of the date of grant, and if earned, the number of PSUs earned range from 25% (threshold performance) to 150% (maximum performance) of the Covered NEO’s target opportunity. RSUs awarded under the Compensation Program vest pro rata over a three-year period beginning on the grant date, so long as the recipient remains continuously employed by the Company or a subsidiary of the Company through each such vesting date. The terms and conditions of RSU awards under the Compensation Program are materially consistent with those previously disclosed and set forth in the Company’s standard form of RSU award agreement.

Amended and Restated Employee Retention and Protection Plan

On June 23, 2025, the Board approved the Amended and Restated Employee Retention and Protection Plan (the “Amended Plan”), which amends and restates the previous Employee Retention and Protection Plan applicable to the Covered NEOs (the “Original Plan”). Under the Amended Plan, the Severance Multiplier (as defined in the Amended Plan) used to calculate the cash severance payment for each Covered NEO is: (i) if a Qualifying Termination (as defined in the Amended Plan) of the Covered NEO occurs within 18 months following the start date of a new Chief Executive Officer of the Company, 1.5x of the Covered NEO’s base salary plus target annual bonus; (ii) if a Qualifying Termination of the Covered NEO occurs within 12 months following a Change in Control (as defined in the Amended Plan), 2x of the Covered NEO’s base salary plus target annual bonus; and (iii) in all other cases, 1.0x of the Covered NEO’s base salary plus target annual bonus. In addition, in the event of a Qualifying Termination: (a) all RSUs and Options (as defined in the Amended Plan) held by the Covered NEOs as of the date of the Qualifying Termination (the “Termination Date”) will immediately become fully vested as of the Termination Date; (b) any Options that become vested pursuant to the Amended Plan will become exercisable as of the Termination Date, subject to the terms and conditions of the applicable award agreement; and (c) all outstanding and unvested PSUs held by the Covered NEOs as of the Termination Date will vest pro rata on the Termination Date based on the number of days remaining in the applicable PSU Performance Period, with the actual number of PSUs that vest to be determined based on actual performance levels after the end of such PSU Performance Period.

Except for the foregoing amendments disclosed in this Item 5.02(e) of this Report, the Amended Plan does not contain any other material changes to the Original Plan. The foregoing description of the Amended Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended Plan, a copy of which is filed as Exhibit 10.1 to this Report and incorporated herein by reference.

Section 7 – Regulation FD

| Item 7.01 | Regulation FD Disclosure. |

On June 25, 2025, the Company posted to its website at https://investor.daktronics.com/ an investor presentation used in connection with the Release (the “Investor Presentation”). A copy of the Investor Presentation is furnished as Exhibit 99.2 to this Report.

The information in Item 7.01 of this Current Report, including the Investor Presentation, is being furnished under Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to liability under that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Section 8 – Other Events

| Item 8.01 | Other Events. |

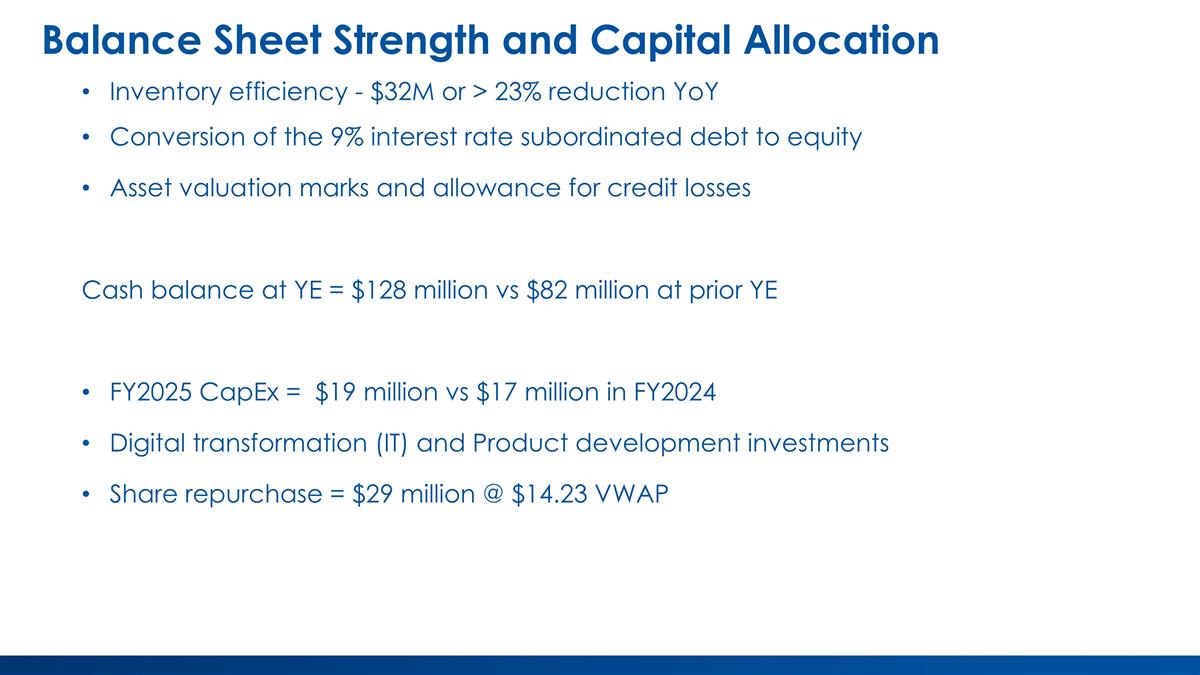

On June 23, 2025, the Board voted to authorize an additional $10 million of repurchases of outstanding shares of the Company’s common stock (“Share Repurchases”) under the Company’s stock repurchase program (the “Repurchase Program”). As of date of this Report, approximately $20 million of the $60 million authorized by the Board remained available for Share Repurchases under the Repurchase Program.

Share Repurchases may occur from time to time in open market purchases, private transactions, or other transactions. The timing, volume, and nature of Share Repurchases will be at the sole discretion of the Company’s management and will be dependent on market conditions, applicable securities laws and other legal requirements, business considerations, and other factors. The Repurchase Program does not have a fixed expiration date and may be suspended, discontinued, or terminated at any time. Under the Repurchase Program, the Company may conduct Share Repurchases in accordance with all applicable securities laws and regulations, including Rule 10b5-1 and Rule 10b-18 under the Exchange Act. No assurance can be given that any particular number of shares of common stock will be repurchased.

Section 9 – Financial Statements and Exhibits

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| Exhibit |

Description |

|

| 10.1 | Daktronics, Inc. Amended and Restated Employee Retention and Protection Plan, effective as of June 23, 2025 (constitutes a compensatory plan or arrangement). | |

| 99.1 | Press Release dated June 25, 2025, issued by Daktronics, Inc. regarding fourth quarter and fiscal year 2025 results. | |

| 99.2 | Daktronics, Inc. Investor Presentation dated June 25, 2025. | |

| 104 | Cover page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DAKTRONICS, INC. | ||||||

| By: |

/s/ Howard I. Atkins |

|||||

| Howard I. Atkins |

||||||

| Acting Chief Financial Officer (Principal Financial Officer) |

||||||

| Date: June 25, 2025 |

||||||

Exhibit 10.1

DAKTRONICS, INC.

AMENDED AND RESTATED

EMPLOYEE RETENTION AND PROTECTION PLAN

ARTICLE I

PURPOSE

This Daktronics, Inc. Employee Retention and Protection Plan has been established by the Company to promote retention and to ensure Participants of their valued status by obligating the Daktronics, Inc. (the “Company”) to provide significant severance protections in the event of Participant’s employment termination by the Company without cause or by the Participant for “good reason” such as reassignment to a lesser responsibility. The Plan was originally adopted by the Company on March 3, 2025 (the “Effective Date”), and is amended and restated effective as of June 23, 2025 (the “Amendment Effective Date”).

The Plan, as a “severance pay arrangement” within the meaning of Section 3(2)(B)(i) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), is intended to be and shall be administered and maintained as an unfunded welfare benefit plan under Section 3(1) of ERISA. This document constitutes both the formal Plan document and a summary of the Plan, called a Summary Plan Description (“SPD”), and describes the provisions of the Plan that are in effect as of the Amendment Effective Date. The Company urges all Participants to read this SPD carefully so that Participants will understand the Plan as it applies to the Participants and their family. The Company suggests that all Participants keep this document in a safe place for future reference.

Capitalized terms used but not otherwise defined herein have the meanings set forth in Article 9.

ARTICLE II

PARTICIPATION

The Administrator shall designate and provide written notice to each Eligible Employee chosen by the Administrator to participate in the Plan (each, a “Participant”). Updates to Appendix A shall not require an amendment of the Plan and the Administrator has the ability to amend or modify Appendix A at any time without Participant consent.

ARTICLE III

SEVERANCE BENEFITS

Section 3.01 Severance Benefits. If a Participant has a Qualifying Termination, whether or not in connection with a Change in Control, then, subject to Article 4, the Company will provide the Participant with the following:

(a) A cash severance payment calculated by multiplying the Participant’s applicable Severance Multiplier by the aggregate amount of the Participant’s base salary plus target annual bonus award for the fiscal year in which the applicable termination occurs (the “Severance”). The Severance will be divided into substantially equal installments over the period of time that equals the number of months of base salary applicable to the Participant’s Severance Multiplier, paid in accordance with the Company’s regularly schedule payroll process, beginning no later than the Company’s first regularly scheduled pay date that occurs on or after the Release Expiration Date, and less applicable withholding. For purposes of calculating the Severance amount, a Participant’s target annual bonus award will be the target amount communicated to the Participant in writing by the Company with respect to the applicable year, whether in an Individual Employment Contract or otherwise.

(b) During the portion, if any, of the period equal to the number of months within the Participant’s Severance Benefits Period that the Participant elects to continue coverage for the Participant and the Participant’s spouse and eligible dependents, if any, under the Company’s group health plans pursuant to COBRA, the Company shall promptly reimburse the Participant on a monthly basis for the difference between the amount the Participant pays to effect and continue such coverage and the employee contribution amount that similarly-situated employees of the Company pay for the same or similar coverage under such group health plans (the “COBRA Benefit”).

(i) The COBRA Benefit shall be paid to the Participant in accordance with the Company’s regular process and payroll procedure for providing such benefits.

(ii) Notwithstanding the foregoing, the Participant shall only be eligible to receive such reimbursement payments until the earliest of: (i) the last day of the Participant’s Severance Benefits Period; (ii) the date the Participant is no longer eligible to receive COBRA continuation coverage; or (iii) the date on which the Participant becomes eligible to receive coverage under a group health plan sponsored by another employer (and any such eligibility shall be promptly reported to the Company by the Participant); provided, however, that the election of COBRA continuation coverage and the payment of any premiums due with respect to such COBRA continuation coverage shall remain the Participant’s sole responsibility, and the Company shall not assume any obligation for payment of any such premiums relating to such COBRA continuation coverage.

(iii) Notwithstanding the foregoing, if the Company’s provision of the COBRA Benefit under this Section 3.01(c) would violate the nondiscrimination rules applicable to non-grandfathered plans, or would result in the imposition of penalties under the Patient Protection and Affordable Care Act of 2010, as amended by the Health Care and Education Reconciliation Act of 2010, and the related regulations and guidance promulgated thereunder (the “ACA”), the Company shall reform this Section 3.01(c) in a manner as is necessary to comply with the ACA.

(c) Payment or reimbursement, as applicable, of (i) earned but unpaid base salary as of the date of the applicable termination; (ii) all incurred but unreimbursed expenses for which the Participant is entitled to reimbursement; and (iii) benefits to which Employee is entitled under the terms of any applicable Company benefit plan or program (collectively, the “Accrued Benefits”). Any amounts due to the Participant pursuant to clause (i) of this paragraph shall be paid in a lump sum within sixty (60) days following the applicable termination date; amounts due pursuant to clauses (ii) or (iii) will be paid in accordance with the terms of the applicable plan, policy, or arrangement to which they relate.

Section 3.02 LTIP Awards. Notwithstanding anything to the contrary within any LTIP or in any individual LTIP award agreement, and subject to Article 4, upon a Qualifying Termination, all outstanding RSUs and Options held by the Participant as of the date of the Qualifying Termination shall immediately become fully vested as of such date. Any Options that become vested pursuant to this provision shall also become exercisable as of the date of the Qualifying Termination, subject to the terms and conditions of the applicable LTIP and award agreement. All outstanding and unvested PSUs held by the Participant as of the date of the Qualifying Termination shall vest on a pro-rata basis as of the date of the Qualifying Termination, with the pro-ration calculated based on the number of days within the applicable performance period that have elapsed up to and including the date of the Qualifying Termination. The actual number of PSUs that vest will be determined after the end of the applicable performance period, based on actual performance levels as measured in accordance with the LTIP and the relevant LTIP award agreement. All other terms regarding the exercise or settlement of any such LTIP awards, including but not limited to timing, exercise procedures, form of payment, release requirements, and any other applicable restrictions or conditions to settlement, shall be governed by the applicable governing documents.

ARTICLE IV

CONDITIONS

Section 4.01 Required Conditions. A Participant’s entitlement to any Severance Benefits under this Plan, or the right to continue receiving such Severance Benefits, will be subject to:

(a) the Participant executing on or before the Release Expiration Date and not revoking within any time provided by the Company to do so, a release of all claims in a form acceptable to the Company (the “Release”), which Release shall release the Company’s respective shareholders, members, partners, officers, managers, directors, fiduciaries, employees, representatives, agents, and benefit plans (and fiduciaries of such plans) from any and all claims, including any and all causes of action arising out of the Participant’s employment with the Company or the termination of such employment, but excluding all claims to Severance Benefits the Participant may have under Article 3; provided, however, that if the Release is not executed and returned to the Company on or before the Release Expiration Date, and the required revocation period has not fully expired without revocation of the Release by the Participant, then the Participant shall not be entitled to any portion of the Severance Benefits under Article 3; (b) if applicable, the Participant must be in compliance with, and remain in compliance with, restrictive covenant agreement that exists between the Participant and the Company; and

(c) with respect to the COBRA Benefit only, the Participant timely and properly electing continuation coverage under COBRA.

Section 4.02 Contingent Conditions. A Participant’s entitlement to any Severance Benefits under this Plan, or the right to continue receiving such Severance Benefits, may be subject to additional conditions to those set forth in Section 4.01 above, as determined at the sole discretion of the Company and communicated to each individual Participant, as applicable, including:

(a) the Participant executing and delivering to the Company his or her Participation Agreement in accordance with the terms thereof; or

(b) the Participant entering into a restrictive covenant agreement with the Company, with the terms and conditions of such agreement(s) to be determined in good faith by the Company.

ARTICLE V

280G MATTERS

Notwithstanding anything to the contrary in the Plan, if a Participant is a “disqualified individual” (as defined in Section 280G(c) of the Code), and the payments and benefits provided for in the Plan, together with any other payments and benefits which such Participant has the right to receive from the Company or any of its Affiliates, would constitute a “parachute payment” (as defined in Section 280G(b)(2) of the Code), then the payments and benefits provided for in the Plan shall be either:

(a) reduced (but not below zero) so that the present value of such total amounts and benefits received by such Participant from the Company will be one dollar ($1.00) less than three (3) times such Participant’s “base amount” (as defined in Section 280G(b)(3) of the Code) and so that no portion of such amounts and benefits received by such Participant shall be subject to the excise tax imposed by Section 4999 of the Code; or

(b) paid in full,

whichever produces the better net after-tax position to such Participant (taking into account any applicable excise tax under Section 4999 of the Code and any other applicable taxes). The reduction of payments and benefits hereunder, if applicable, shall be made by reducing, first, payments or benefits to be paid in cash hereunder in the order in which such payment or benefit would be paid or provided (beginning with such payment or benefit that would be made last in time and continuing, to the extent necessary, through to such payment or benefit that would be made first in time) and, second, reducing any benefit to be provided in-kind hereunder in a similar order.

The determination as to whether any such reduction in the amount of the payments and benefits provided hereunder is necessary shall be made by the Company in good faith. If a reduced payment or benefit is made or provided and through error or otherwise that payment or benefit, when aggregated with other payments and benefits from the Company used in determining if a “parachute payment” exists, exceeds one dollar ($1.00) less than three (3) times such Participant’s base amount, then such Participant shall be required to immediately repay such excess to the Company upon notification that an overpayment has been made. Nothing in this Article 5 shall require the Company to be responsible for, or have any liability or obligation with respect to, such Participant’s excise tax liabilities under Section 4999 of the Code.

ARTICLE VI

ADMINISTRATION, AMENDMENT AND TERMINATION

Section 6.01 Administration. The Administrator has the exclusive right, power, and authority, in its sole and absolute discretion, to administer and interpret the Plan. The Administrator has all powers reasonably necessary to carry out its responsibilities under the Plan including (but not limited to) the sole and absolute discretionary authority to:

(a) administer the Plan according to its terms and to interpret Plan policies and procedures;

(b) resolve and clarify inconsistencies, ambiguities, and omissions in the Plan, and among and between the Plan and other related documents;

(c) take all actions and make all decisions regarding questions of eligibility and entitlement to benefits, and benefit amounts;

(d) make, amend, interpret, and enforce all appropriate rules and regulations for the administration of the Plan;

(e) process and approve or deny all claims for benefits; and

(f) decide or resolve any and all questions, including benefit entitlement determinations and interpretations of the Plan, as may arise in connection with the Plan.

The decision of the Administrator on any disputes arising under the Plan, including (but not limited to) questions of construction, interpretation and administration shall be final, conclusive and binding on all persons having an interest in or under the Plan. Any determination made by the Administrator shall be given deference in the event the determination is subject to judicial review and shall be overturned by a court of law only if it is arbitrary and capricious.

Section 6.02 Amendment and Termination. The Company reserves the right to amend or terminate the Plan at any time, by providing at least ninety (90) days advance written notice to each Participant; provided that no such amendment or termination that has the effect of reducing or diminishing the right of any Participant will be effective without the written consent of such Participant.

ARTICLE VII

GENERAL PROVISIONS

Section 7.01 At-Will Employment. The Plan does not alter the status of each Participant as an at-will employee of the Company. Nothing contained herein shall be deemed to give any Participant the right to remain employed by the Company or to interfere with the rights of the Company to terminate the employment of any Participant at any time, with or without Cause.

Section 7.02 Other Plans, Agreements and Benefits.

(a) In the event that an Eligible Employee is a party to an Individual Employment Contract and the Company, in its sole discretion, determines that the severance payments or benefits provided within any Individual Employment Contract are subject to Section 409A, this Plan will not be used to terminate, replace, substitute, enhance or otherwise impermissibly modify the applicable provisions of the Individual Employment Contract in a manner that would subject the individual employee or the Company to any excise, penalty or other taxes pursuant to Section 409A.

(b) Any Severance Benefits payable to a Participant under the Plan will not be counted as compensation for purposes of determining benefits under any other benefit policies or plans of the Company, except to the extent expressly provided therein.

Section 7.03 Mitigation and Offset. If a Participant obtains other employment, then such other employment will not affect the Participant’s rights or the Company’s obligations under the Plan. The Company may reduce the amount of any Severance Benefits otherwise payable to or on behalf of a Participant by the amount of any obligation of the Participant to the Company, and the Participant shall be deemed to have consented to such reduction.

Section 7.04 Severability. The invalidity or unenforceability of any other provision of the Plan shall not affect the validity or enforceability of any other provision of the Plan. If any other provision of the Plan is held by a court of competent jurisdiction to be illegal, invalid, void, or unenforceable, such provision shall be deemed modified, amended, and narrowed to the extent necessary to render such provision legal, valid, and enforceable, and the other remaining provisions of the Plan shall not be affected but shall remain in full force and effect.

Section 7.05 Headings and Subheadings. Headings and subheadings contained in the Plan are intended solely for convenience and no provision of the Plan is to be construed by reference to the heading or subheading of any section or paragraph.

Section 7.06 Unfunded Obligations. The amounts to be paid to Participants under the Plan are unfunded obligations of the Company. The Company is not required to segregate any monies or other assets from its general funds with respect to these obligations. Participants shall not have any preference or security interest in any assets of the Company other than as a general unsecured creditor.

Section 7.07 Successors. The Plan will be binding upon any successor to the Company, its assets, its businesses, or its interest (whether as a result of the occurrence of a Change in Control or otherwise), in the same manner and to the same extent that the Company would be obligated under the Plan if no succession had taken place. In the case of any transaction in which a successor would not by the foregoing provision or by operation of law be bound by the Plan, the Company shall require any successor to the Company to expressly and unconditionally assume the Plan in writing and honor the obligations of the Company hereunder, in the same manner and to the same extent that the Company would be required to perform if no succession had taken place. All payments and benefits that become due to a Participant under the Plan will inure to the benefit of his or her heirs, assigns, designees, or legal representatives.

Section 7.08 Transfer and Assignment. Neither a Participant nor any other person shall have any right to sell, assign, transfer, pledge, anticipate, or otherwise encumber, transfer, hypothecate, or convey any amounts payable under the Plan prior to the date that such amounts are paid, except that, in the case of a Participant’s death, such amounts shall be paid to the Participant’s beneficiaries.

Section 7.09 Waiver. Any party’s failure to enforce any provision or provisions of the Plan will not in any way be construed as a waiver of any such provision or provisions, nor prevent any party from thereafter enforcing each and every other provision of the Plan.

Section 7.10 Governing Law. To the extent not pre-empted by federal law, the Plan shall be construed in accordance with and governed by the laws of South Dakota without regard to conflicts of law principles. Any action or proceeding to enforce the provisions of the Plan will be brought only in a state or federal court located in the state of South Dakota, and each party consents to the venue and jurisdiction of such court. The parties hereby irrevocably submit to the exclusive jurisdiction of such courts and waive the defense of inconvenient forum to the maintenance of any such action or proceeding in such venue.

Section 7.11 Clawback. Any amounts payable under the Plan are subject to any policy (whether in existence as of the Effective Date or later adopted) established by the Company providing for clawback or recovery of amounts that were paid to the Participant. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with any applicable law, regulation or Company policy, as applicable.

Section 7.12 Withholding. The Company shall have the right to withhold from any amount payable hereunder any Federal, state and local taxes in order for the Company to satisfy any withholding tax obligation it may have under any applicable law or regulation.

Section 7.13 Section 409A.

(a) The Plan is intended to comply with Section 409A or an exemption thereunder and shall be construed and administered in accordance with Section 409A. Notwithstanding any other provision of the Plan, payments provided under the Plan may only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any payments under the Plan that may be excluded from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded from Section 409A to the maximum extent possible.

For purposes of Section 409A, each installment payment provided under the Plan shall be treated as a separate payment. Any payments to be made under the Plan upon a termination of employment shall only be made upon a “separation from service” under Section 409A. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under the Plan comply with Section 409A and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by a Participant on account of non-compliance with Section 409A.

(b) Notwithstanding any other provision of the Plan, if any payment or benefit provided to a Participant in connection with his or her Qualifying Termination is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and the Participant is determined to be a “specified employee” as defined in Section 409A(a)(2)(b)(i) of the Code, then such payment or benefit shall not be paid until the first payroll date to occur following the six (6)-month anniversary of the Qualifying Termination or, if earlier, on the Participant’s death (the “Specified Employee Payment Date”). The aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date and interest on such amounts calculated based on the applicable federal rate published by the Internal Revenue Service for the month in which the Participant’s separation from service occurs shall be paid to the Participant in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their original schedule. Notwithstanding any other provision of the Plan, if any payment or benefit is conditioned on the Participant’s execution of a Release, then the first payment shall include all amounts that would otherwise have been paid to the Participant during the period beginning on the date of the Qualifying Termination and ending on the payment date if no delay had been imposed.

(c) To the extent required by Section 409A, each reimbursement or in-kind benefit provided under the Plan shall be provided in accordance with the following: (i) the amount of expenses eligible for reimbursement, or in-kind benefits provided, during each calendar year cannot affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year; and (ii) any right to reimbursements or in-kind benefits under the Plan shall not be subject to liquidation or exchange for another benefit.

ARTICLE VIII

CLAIMS PROCEDURES

Section 8.01 Additional Information for SPD.

(a) Name and Number of the Plan. The Plan name is the “Daktronics Inc. Employee Retention and Protection Plan,” which is a component program of the Daktronics, Inc. Welfare Benefits Plan, plan no. 555.

(b) Type of Plan. The Plan is a severance pay welfare benefit plan and is not a pension benefit plan.

(c) Plan Sponsor. The name of the sponsor of the Plan and its federal taxpayer identification number (“EIN”) are:

Daktronics Inc.

21 Daktronics Drive

Brookings, SD 57006

Phone number: 605-692-0200

EIN: 46-0306862

(d) Plan Administrator. The Plan is administered by the Compensation Committee of the Board. Communications and all claims may be directed and addressed to the Administrator through the Vice President of Human Resources, who may be contacted at the following email address: benefits@daktronics.com.

Section 8.02 Initial Claims. A Participant who believes he or she is entitled to a payment under the Plan that has not been received may submit a written claim for benefits to the Plan within sixty (60) days after the Participant’s Qualifying Termination. Claims should be addressed and sent to the Administrator using the contact information above.

If the Participant’s claim is denied, in whole or in part, the Participant will be furnished with written notice of the denial within ninety (90) days after the Administrator’s receipt of the Participant’s written claim, unless special circumstances require an extension of time for processing the claim, in which case a period not to exceed 180 days will apply. If such an extension of time is required, then written notice of the extension will be furnished to the Participant before the termination of the initial ninety (90)-day period and will describe the special circumstances requiring the extension, and the date on which a decision is expected to be rendered. Written notice of the denial of the Participant’s claim will contain the following information:

(a) The specific reason or reasons for the denial of the Participant’s claim;

(b) References to the specific Plan provisions on which the denial of the Participant’s claim was based;

(c) A description of any additional information or material required by the Administrator to reconsider the Participant’s claim (to the extent applicable) and an explanation of why such material or information is necessary; and

(d) A description of the Plan’s review procedures and time limits applicable to such procedures, including a statement of the Participant’s right to bring a civil action under Section 502(a) of ERISA following a benefit claim denial on review.

Section 8.03 Appeal of Denied Claims. If the Participant’s claim is denied and he or she wishes to submit a request for a review of the denied claim, then the Participant, or his or her authorized representative, must follow the procedures described below:

(a) Upon receipt of the denied claim, the Participant (or his or her authorized representative) may file a request for review of the claim in writing with the Administrator. This request for review must be filed no later than sixty (60) days after the Participant has received written notification of the denial.

(b) The Participant has the right to submit in writing to the Administrator any comments, documents, records, and other information relating to his or her claim for benefits.

(c) The Participant has the right to be provided with, upon request and free of charge, reasonable access to and copies of all pertinent documents, records, and other information that is relevant to his or her claim for benefits.

(d) The review of the denied claim will take into account all comments, documents, records, and other information that the Participant submitted relating to his or her claim, without regard to whether such information was submitted or considered in the initial denial of his or her claim.

Section 8.04 Administrator’s Response to Appeal. The Administrator will provide the Participant with written notice of its decision within sixty (60) days after the Administrator’s receipt of the Participant’s written claim for review. There may be special circumstances which require an extension of this sixty (60)-day period. In any such case, the Administrator will notify the Participant in writing within the sixty (60)-day period and the final decision will be made no later than 120 days after the Administrator’s receipt of the Participant’s written claim for review. The Administrator’s decision on the Participant’s claim for review will be communicated to the Participant in writing and will clearly state:

(a) The specific reason or reasons for the denial of the Participant’s claim;

(b) Reference to the specific Plan provisions on which the denial of the Participant’s claim is based;

(c) A statement that the Participant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, the Plan and all documents, records, and other information relevant to his or her claim for benefits; and

(d) A statement describing the Participant’s right to bring an action under Section 502(a) of ERISA.

Section 8.05 ERISA Rights. Eligible Employees are entitled to certain rights and protections under ERISA. ERISA provides that all Eligible Employees are entitled to:

(a) Examine, without charge, at the Company’s office, all Plan documents and copies of all documents governing the Plan, a copy of the latest annual report (Form 5500 Series) filed by the Plan with the U.S. Department of Labor and available at the Public Disclosure Room of the Employee Benefits Security Administration.

(b) Obtain, upon written request to the Company, copies of all documents governing the Plan, including copies of the latest annual report (Form 5500 series) and updated summary plan description upon written request to the Company. The Company may charge the Eligible Employee a reasonable amount for the copies.

In addition to creating rights for Eligible Employees, ERISA imposes duties upon the people who are responsible for the operation of the Plan. The people who operate the Plan, called “fiduciaries” of the Plan, have a duty to do so prudently and in the interest of the Eligible Employees. No one, including the Company, may fire an Eligible Employee or otherwise discriminate against an Eligible Employee in any way to prevent such Eligible Employee from obtaining a benefit or exercising his or her rights under ERISA.

If a claim for a benefit is denied or ignored, in whole or in part, the claimant has a right to know why this was done, to obtain copies of documents relating to the decision without charge and to have the denial reviewed and reconsidered, all within certain time schedules. Under ERISA, there are steps claimants can take to enforce the above rights. For instance, if a claimant requests a copy of the Plan document or the latest annual report from the Plan and does not receive them within 30 days, the claimant may file suit in a federal court.

In such a case, the court may require the Company to provide the materials and pay the claimant up to $110 a day until the claimant receives the materials, unless the materials were not sent because of reasons beyond the control of the Company. If a claim for benefits is denied or ignored, in whole or in part, the claimant may file suit in a state or federal court after he or she exhausts the Plan’s claims procedures as outlined in this Article 8.

If it should happen that Plan fiduciaries misuse the Plan’s money, or if a claimant is discriminated against for asserting his or her rights, the claimant may seek assistance from the U.S. Department of Labor, or the claimant may file suit in a federal court. The court will decide who should pay court costs and legal fees. If the claimant is successful, the court may order the person sued to pay these costs and fees. If the claimant loses, the court may order the claimant to pay these costs and fees, for example, if it finds the claim is frivolous.

If an Eligible Employee has any questions about the Plan, such Eligible Employee should contact the Company. If an Eligible Employee has any questions about this statement or about his or her rights under ERISA, or if he or she needs assistance in obtaining documents from the Company, such Eligible Employee should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in the telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue N.W., Washington, D.C. 20210. An Eligible Employee may also obtain certain publications about his or her rights and responsibilities under ERISA by calling the publications hotline of the Employee Benefits Security Administration.

Section 8.06 Exhaustion of Administrative Remedies. The exhaustion of these claims procedures is mandatory for resolving every claim and dispute arising under the Plan. As to such claims and disputes:

(a) No claimant shall be permitted to commence any legal action to recover benefits or to enforce or clarify rights under the Plan under Section 502 or Section 510 of ERISA or under any other provision of law, whether or not statutory, until these claims procedures have been exhausted in their entirety; and

(b) In any such legal action, all explicit and implicit determinations by the Administrator (including, but not limited to, determinations as to whether the claim, or a request for a review of a denied claim, was timely filed) shall be afforded the maximum deference permitted by law.

Section 8.07 Attorney’s Fees. The Company and each Participant shall bear their own attorneys’ fees incurred in connection with any disputes between them.

ARTICLE IX

DEFINITIONS

Section 9.01 “2020 LTIP” means the Company’s 2020 Stock Incentive Plan, as amended, or any successor or replacement plan

Section 9.02 “Administrator” means the Compensation Committee of the Board or any other person or committee appointed by the Board to administer the Plan.

Section 9.03 “Amendment Effective Date” has the meaning set forth in Article 1.

Section 9.04 “Affiliate” means any person that directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, the Company and any predecessors to such entity; provided, however, that a natural person shall not be considered an Affiliate.

Section 9.05 “Board” means the Board of Directors of the Company.

Section 9.06 “Cause” shall have the meaning set forth within the Participant’s Individual Employment Contract. In the absence of such a contract or definition, the term “Cause” shall have the same meaning given to such term within the 2020 LTIP.

Section 9.07 “Change in Control” shall have the same meaning given to such term within the Company’s 2020 LTIP.

Section 9.08 “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985.

Section 9.09 “Code” means the Internal Revenue Code of 1986, as amended. Any reference to a section of the Code shall be deemed to include a reference to any regulations promulgated thereunder.

Section 9.10 “Disability” shall have the meaning set forth within the Participant’s Individual Employment Contract. In the absence of such a contract or definition, the term “Disability” shall have the same meaning given to such term within the 2020 LTIP.

Section 9.11 “Effective Date” has the meaning set forth in Article 1.

Section 9.12 “Eligible Employee” means, subject to Section 7.02 of this Plan, any employee that the Board has designated as eligible for this Plan.

Section 9.13 “ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

Section 9.14 “Good Reason” shall have the meaning set forth within the Participant’s Individual Employment Contract. In the absence of such a contract or definition, the term “Good Reason” shall have the meaning set forth below:

Good Reason means the Participant has provided written notice to the Company within 90 days following the occurrence of any of the following events, provided the events results in a materially negative change to the Participant, which notice describes the event in reasonable detail and the facts and circumstances claimed by the Participant to constitute Good Reason: (a) the assignment of the Participant without the Participant’s consent to a position with material responsibilities or duties of a lesser status or degree than the then current position of the Participant with the Company: (b) the relocation of the Participant’s work location as of the date immediately prior to the applicable termination date; (c) a material reduction, in the aggregate, in base salary, variable pay opportunities or the employee benefits in which the Participant is entitled to participate irrespective of any standard waiting periods with respect to the same, unless such material reduction is generally applicable to all employees of the Company with a similar ranking to the Participant; or (d) a material breach or a material adverse modification by the Company of an Individual Employment Contract or any other employment or service agreement with the Company without the Participant’s consent.

Section 9.15 “Individual Employment Contract” means an individual offer letter, employment agreement, service agreement or other individual compensation arrangement with the Company or its affiliates.

Section 9.16 “LTIP” or “LTIPs” means, singularly or together, as the context requires, the (a) 2020 LTIP or (b) the Company’s 2015 Stock Incentive Plan, each as amended, or any successor or replacement plan.

Section 9.17 “Options” means an award of options to purchase shares of stock in the Company, granted pursuant to an LTIP.

Section 9.18 “Participant” has the meaning set forth in Section 2.01.

Section 9.19 “Participation Agreement” means a participation agreement delivered by the Company to a Participant containing any terms and conditions that may be applicable to the Eligible Employee in addition to or contrary to the terms of this Plan. In the event that an Eligible Employee does not receive a Participation Agreement, that individual will have his or her rights to Severance Benefits governed solely by the provisions of this Plan.

Section 9.20 “Plan” means this Daktronics, Inc. Amended and Restated Employee Retention and Protection Plan, as may be amended and/or restated from time to time.

Section 9.21 “PSUs” or “Performance Share Units” means an award of RSUs subject to the attainment of specified performance goals over a specified performance period granted pursuant to an LTIP.

Section 9.22 “Qualifying Termination” means the termination of a Participant’s employment either:

(a) by the Company without Cause; or

(b) by the Participant for Good Reason.

For purposes of clarity, a termination due to death or Disability shall not be deemed to be a Qualifying Termination pursuant to this Plan.

Section 9.23 “Release” has the meaning set forth in Section 4.01(b).

Section 9.24 “Release Expiration Date” means that date that is twenty-one (21) days following the date upon which the Company delivers the Release to the Employee (which shall occur no later than seven (7) days after the Participant’s Termination Date) or, in the event that such termination of employment is “in connection with an exit incentive or other employment termination program” (as such phrase is defined in the Age Discrimination in Employment Act of 1967), the date that is forty-five (45) days following such delivery date.

Section 9.25 “RSUs” means an award of restricted stock units granted pursuant to an LTIP.

Section 9.26 “Section 409A” means Section 409A of the Code, and all regulations promulgated thereunder.

Section 9.27 “Severance” has the meaning set forth in Section 3.01(a).

Section 9.28 “Severance Benefits” shall mean, as the context requires, the amounts to be paid pursuant to Article 3.

Section 9.29 “Severance Benefits Period” shall mean the number of months assigned to each Eligible Employee on Appendix A attached herein in order to calculate his or her COBRA Benefit.

Section 9.30 “Severance Multiplier” shall be the number assigned to each Eligible Person on Appendix A attached hereto in order to calculate his or her Severance.

Section 9.31 “Specified Employee Payment Date” has the meaning set forth in Section 7.13(b).

APPENDIX A

Eligible Employees and Applicable Multipliers

| Name/Title or Position |

Severance Multiplier |

Severance Benefits Period |

||

| Executive Officers | 1.0x upon a Qualifying Termination

1.5x if a Qualifying Termination occurs within eighteen (18) months following the start date of a new Chief Executive Officer of the Company

2.0x if a Qualifying Termination occurs within the twelve (12) months following a Change in Control |

12 months | ||

| Other Non-Executive Officer Participants | To be set forth within a Participation Agreement | To be set forth within a Participation Agreement | ||

A-1

Exhibit 99.1

Daktronics, Inc. Announces Fiscal Year and Fourth Quarter 2025 Results

FY2025 Operating Profit of $33 million; Adjusted Operating Profit of $50 million

FQ4 Operating Loss of $2 million; Adjusted Operating Income of $6 million

FQ4 Orders +29% Sequentially and +17% YoY; Year-end Product Backlog of $342 million up 8%

FY2025 Operating Cash Flow +55% to $98 million; Year-end Cash Balance of $128 million

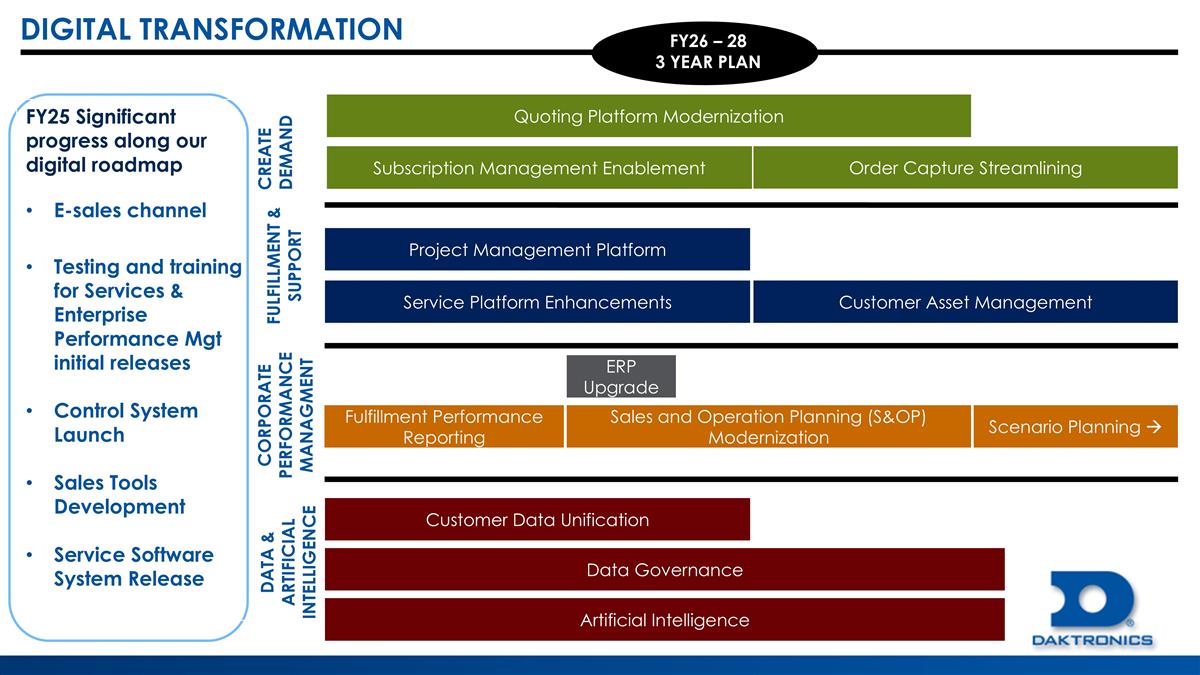

Business and Digital Transformation on Track; Reconfirming Three Year Forward Objectives of 7-10% Sales Growth, 10-12% operating margin, 17-20% ROIC

BROOKINGS, S.D., June 25, 2025—Daktronics, Inc. (NASDAQ:DAKT) (“Daktronics,” the “Company,” “we,” “our,” or “us”), the leading U.S.-based designer and manufacturer of best-in-class dynamic video communication displays and control systems for customers worldwide, today reported results for its fiscal year and fourth quarter ended April 26, 2025.

Fiscal Q4 and full year 2025 financial highlights:

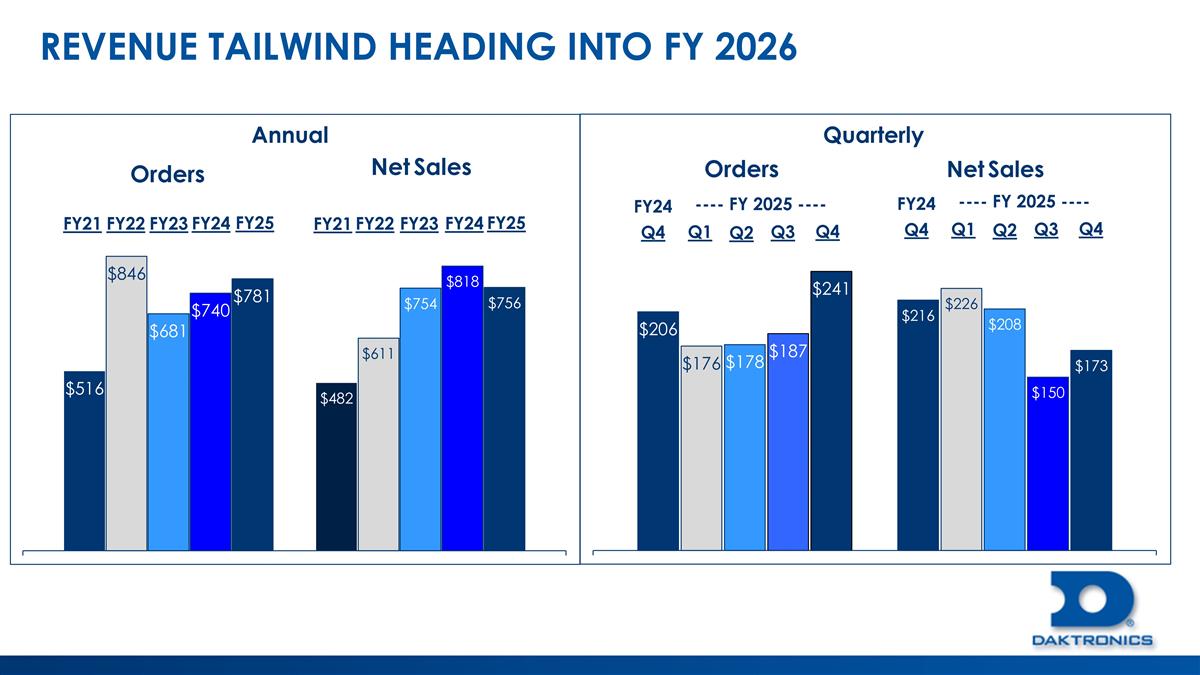

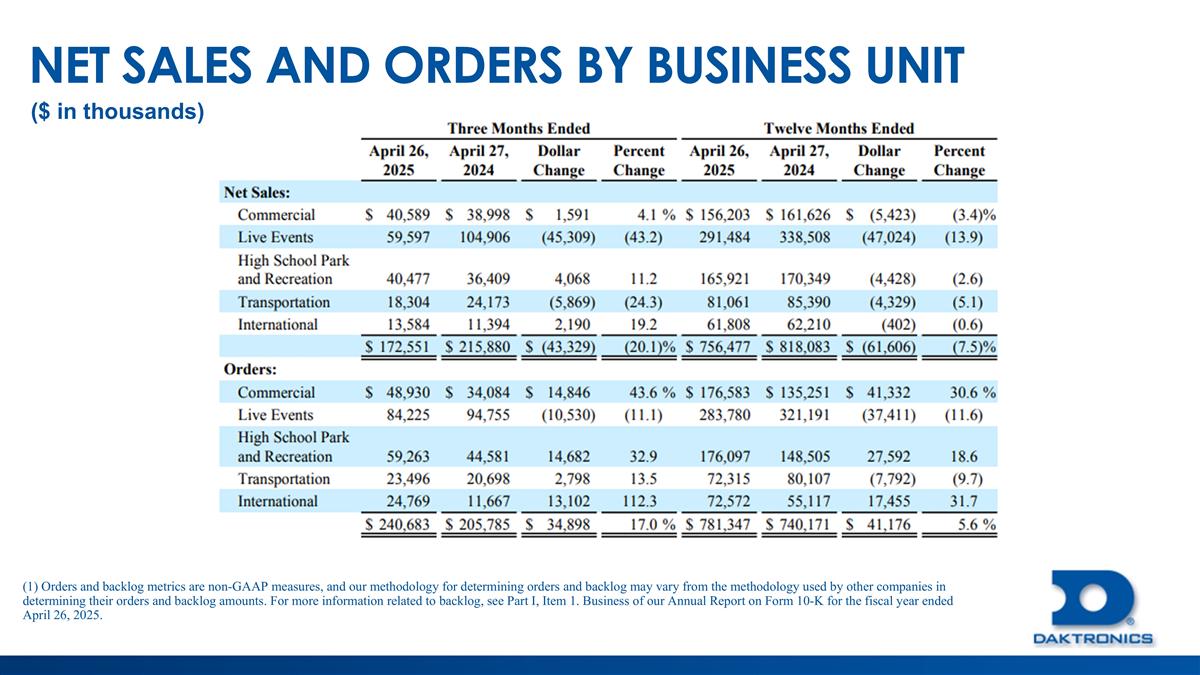

| • | Q4 sales of $172.6 million and full year 2025 sales of $756.5 million compared to $215.9 million and record sales of $818.1 million at the end of Q4 and full year 2024, respectively. On a sequential basis from the seasonally slower Q3, Q4 sales rose 15.4% |

| • | Q4 gross profit as a percentage of sales of 25.0% compared to 25.7% in the year-earlier period; full year gross profit as a percentage of net sales of 25.8% decreased as compared to 27.2% for fiscal 2024 |

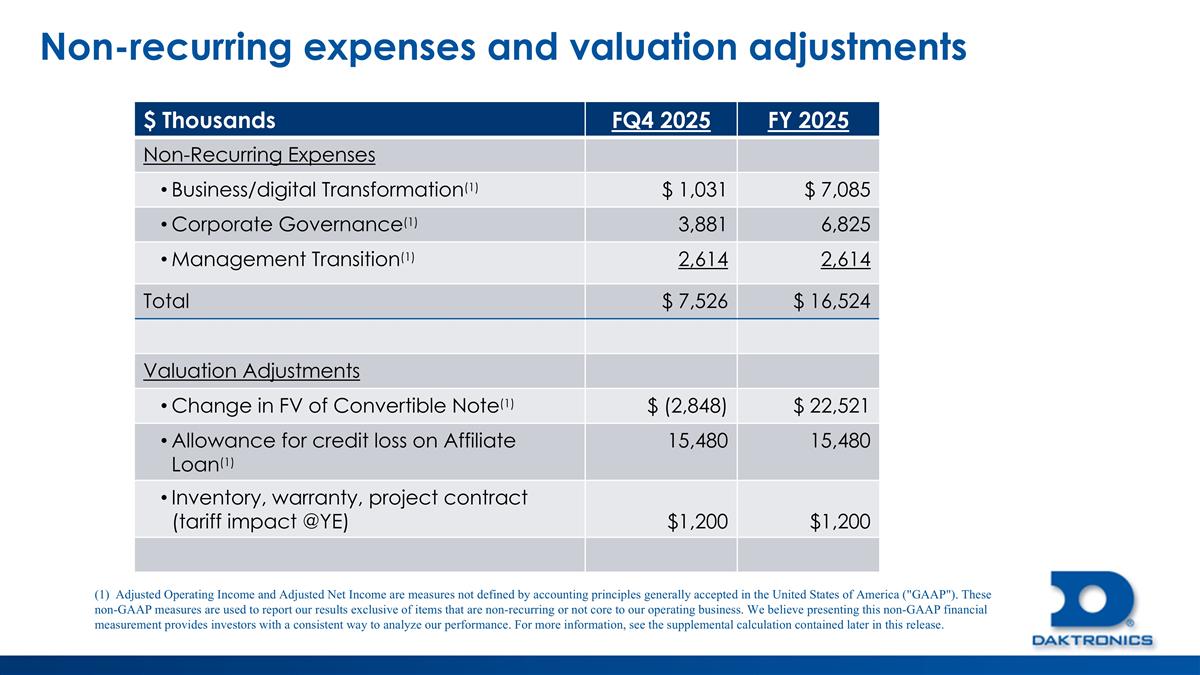

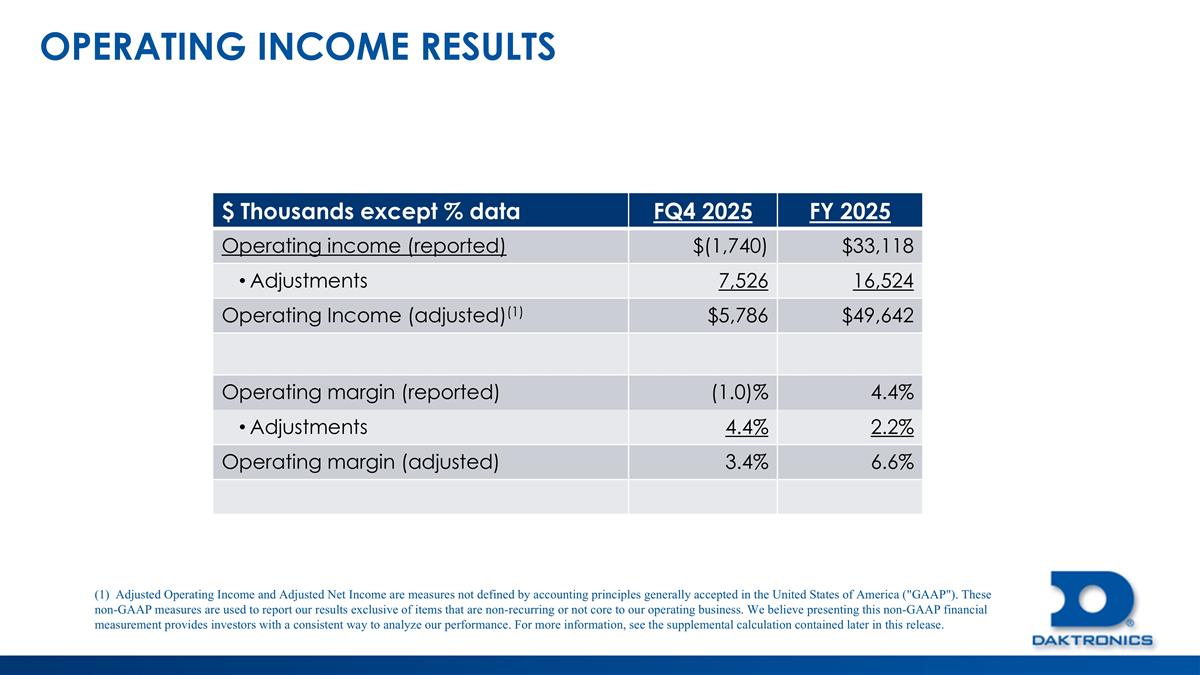

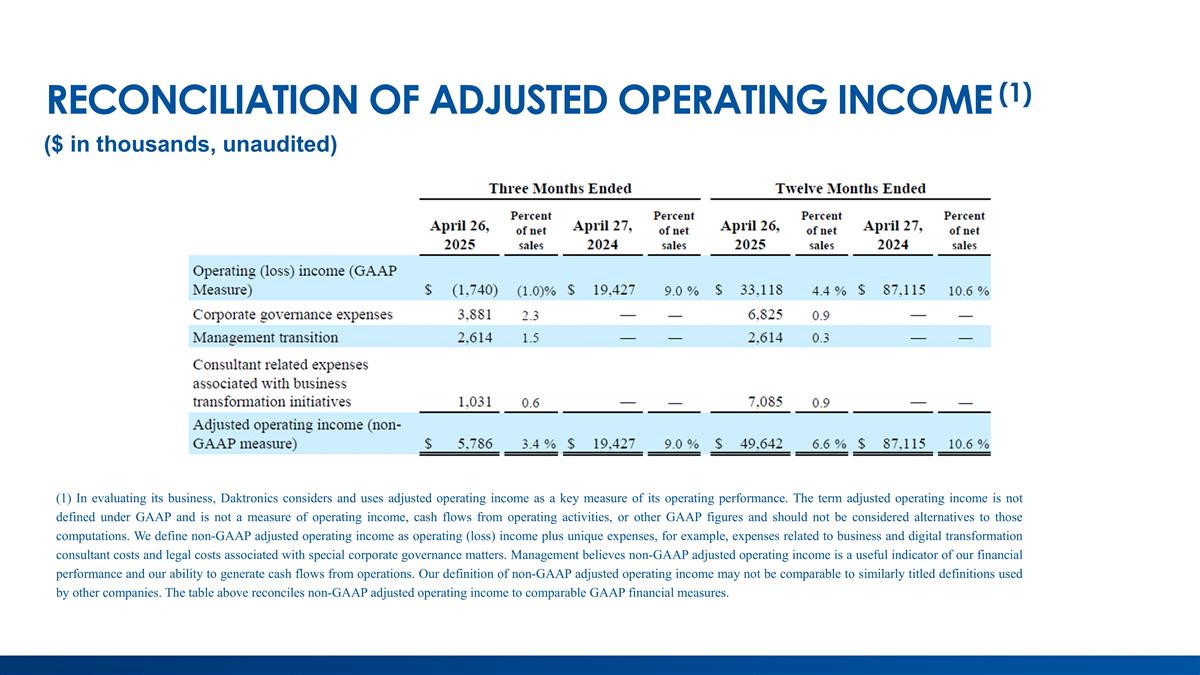

| • | Q4 operating loss of $1.7 million compared to a profit of $19.4 million in the year-earlier period; adjusted operating income(1) was $5.8 million after excluding $7.5 million related to business and digital transformation consultant costs, legal costs associated with special corporate governance matters, and management transition costs; full-year operating income was $33.1 million compared to a record $87.1 million in fiscal 2024; full-year adjusted operating income was $49.6 million(1) after excluding $16.5 million related to business and digital transformation consultant costs, legal costs associated with special corporate governance matters, and management transition costs |

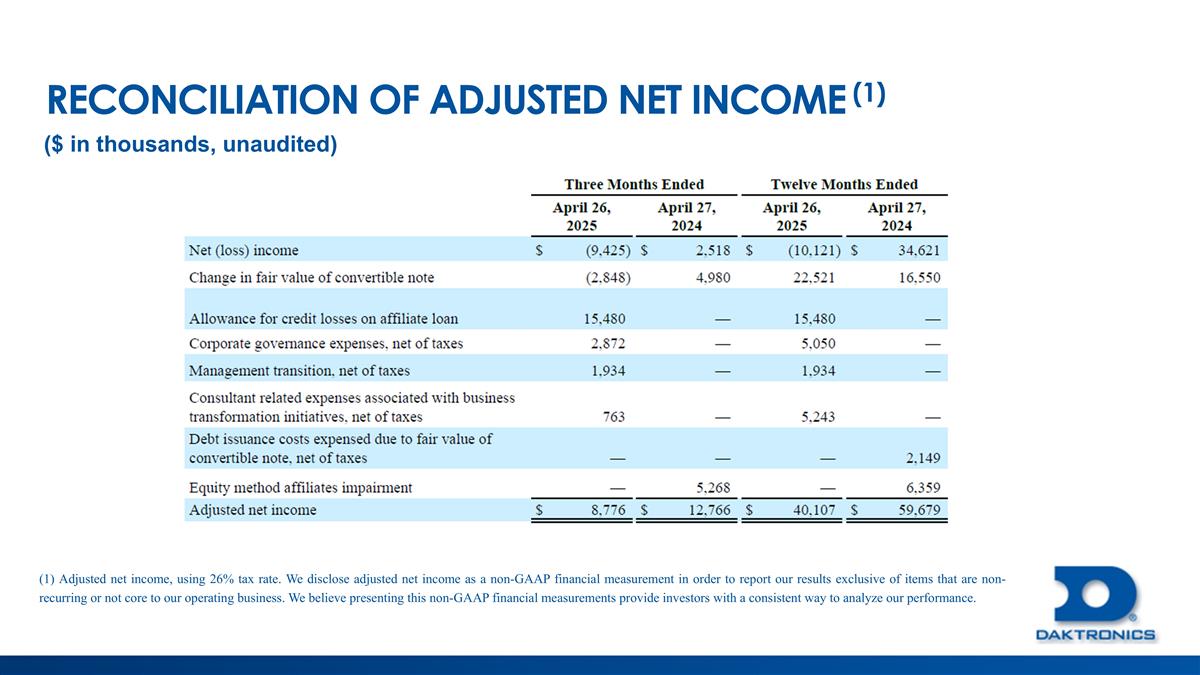

| • | Q4 net loss of $9.4 million, compared to income of $2.5 million in the year-earlier period; adjusted net income(1) was $8.8 million for the quarter after excluding a provision for credit losses on affiliate loans, the non-operating non-cash debt fair value adjustment, and tax impacted operating expense adjustments; full-year net loss was $10.1 million, compared to income of $34.6 million in fiscal 2024; adjusted net income(1) was $40.1 million for full-year fiscal 2025 after excluding a non-cash allowance for credit loss on affiliate loans, the non-operating non-cash debt fair value adjustment, and tax impacted operating expense adjustments |

| (1) | Adjusted Operating Income and Adjusted Net Income are measures not defined by accounting principles generally accepted in the United States of America (“GAAP”). These non-GAAP measures are used to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting this non-GAAP financial measurement provides investors with a consistent way to analyze our performance. For more information, see the supplemental calculation contained later in this release. |

| (2) | Orders and backlog metrics are non-GAAP measures, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 26, 2025. |

| • | Q4 product and service orders of $240.7 million(2) increased 17.0% from $205.8 million in the year-ago period; full-year product and service orders were $781.3 million(1) up 5.6% from $740.2 million in fiscal 2024 |

| • | Product order backlog was $341.6 million at April 26, 2025 compared to $316.9 million a year ago due to the robust increase in orders during Q4 of fiscal 2025(2) |

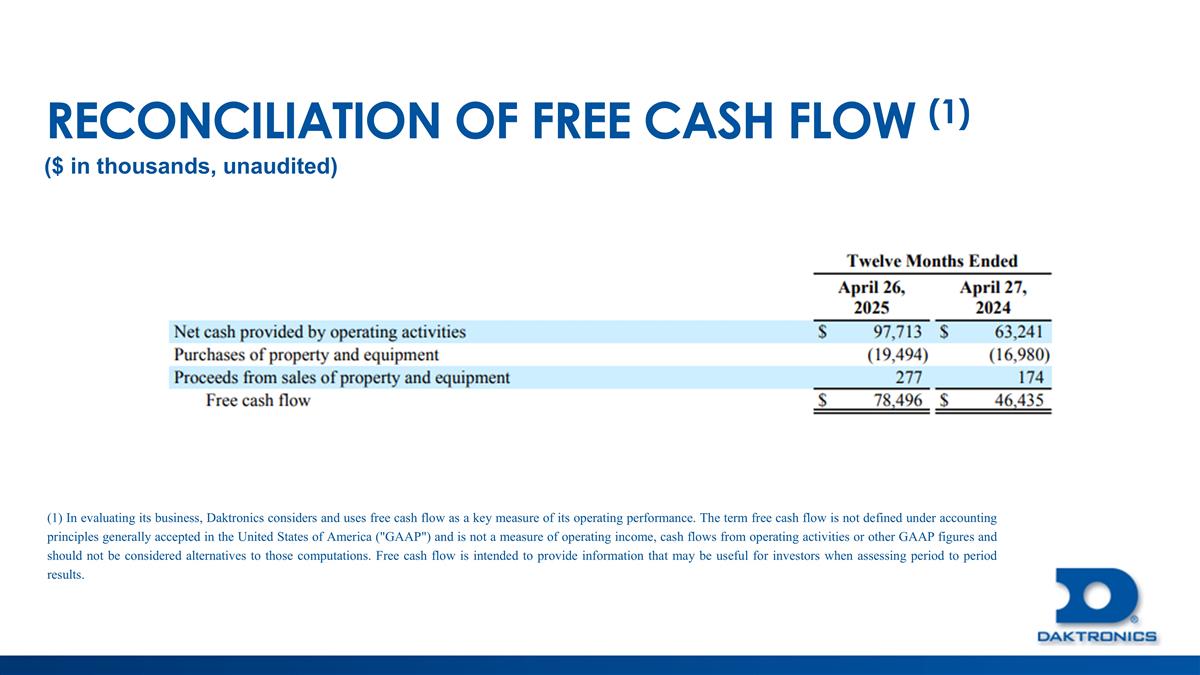

| • | Q4 cash flows from operations of $22.9 million and $97.7 million for full year fiscal 2025, compared to $9.5 million and $63.2 million in the same periods a year earlier, respectively |

Brad Wiemann, Daktronics’ Interim President and Chief Executive Officer, commented, “The Company embarked on its business transformation in fiscal 2025. A rigorous analysis and planning phase of this transformation was completed with a detailed implementation plan of action designed to support ambitious sales growth, margin improvements and top quartile ROIC targets. New orders reflect strong growth, especially in our International business unit, demonstrating continued market adoption of digital display technology and a comprehensive line of products and services. We also improved contribution margin in our Commercial and Transportation segments through better alignment of capacity to demand, lower manufacturing costs and other operating efficiencies during the year. The 54.5 percent growth in full-year cash flow generated from operations in part reflected inventory efficiency initiatives and value-based pricing increases implemented as part of the business transformation effort.”

Business Transformation Update

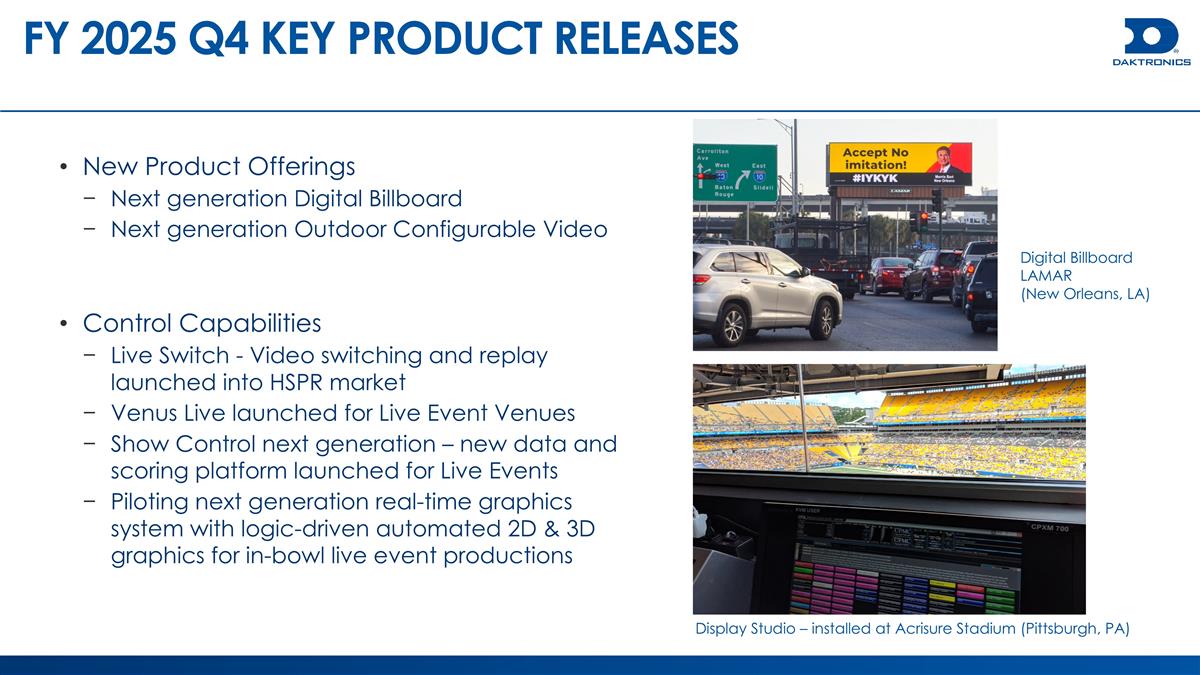

During fiscal 2025, the Company embarked on a business transformation program to achieve and sustain a higher profit growth trajectory. The investment in this program began to realize benefits in the last four months of fiscal 2025 through initiatives to reprice products to their intrinsic value to customers, raise inventory efficiency and turnover as well as leverage the Company’s purchasing power to improve input costs to get to market quicker and more efficiently. The Company’s increased focus on working capital management has additionally reduced accounts receivable and contract assets. In the first quarter fiscal 2026, Daktronics rolled out its Service software system, a major milestone, which will benefit the Company in streamlining processes and enhancing customer experiences through better service management and enablement of self-service options.

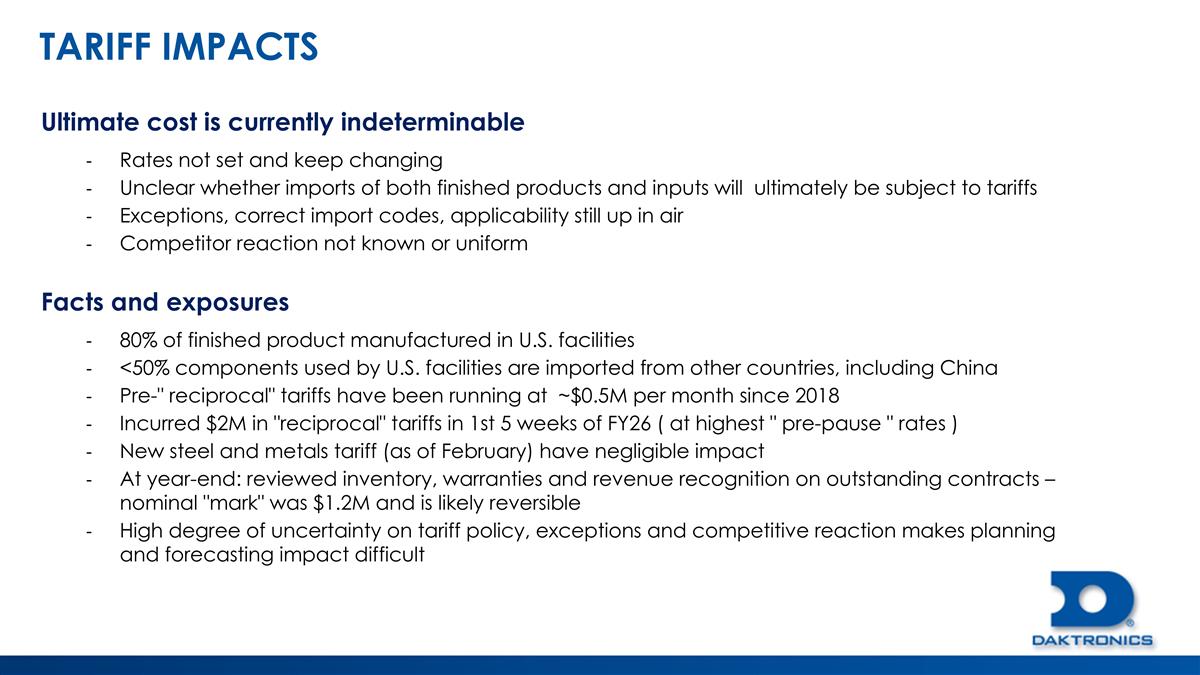

Outlook and Tariff Backdrop

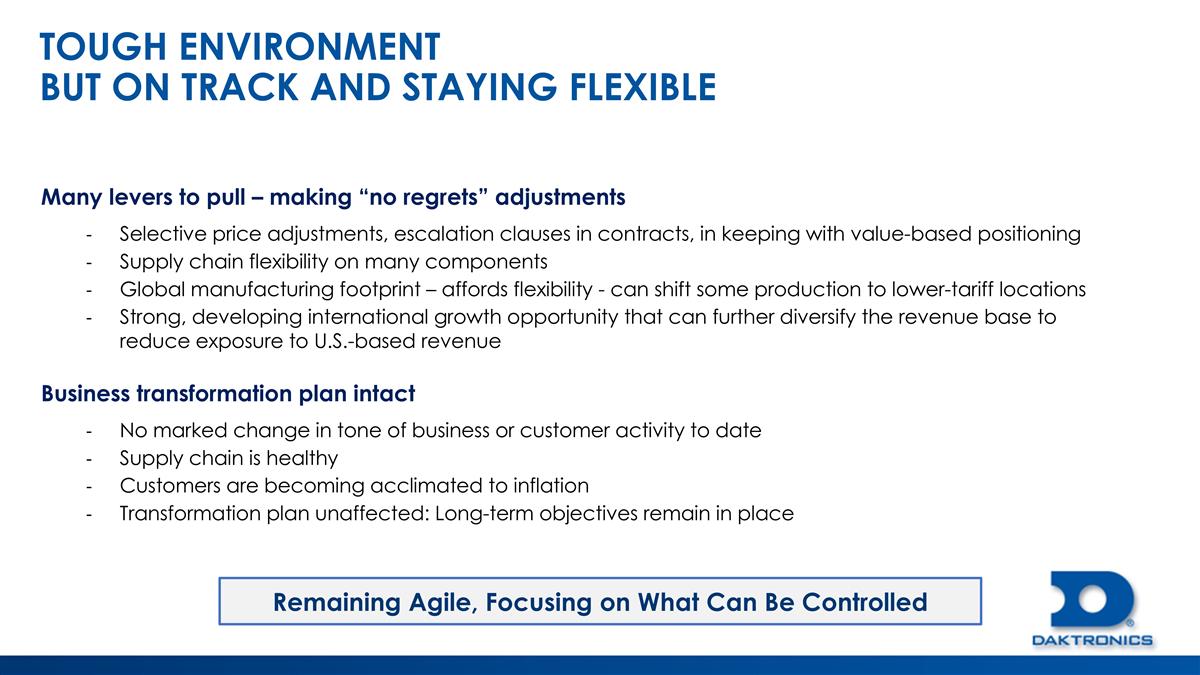

The tariff environment remains highly uncertain and fluid. Since the announcement of reciprocal tariffs on April 2, 2025, tariff rates have fluctuated, including periods of increases, reductions, and temporary suspensions. Given this high degree of uncertainty with respect to tariff rates, effectiveness, exceptions and competitive reaction, Daktronics cannot reliably determine the ultimate tariff impact at this time.

Daktronics remains agile and is able to implement certain measures to mitigate tariff impacts, though offsets may not be immediate. These measures include:

| • | Selective price adjustments and escalation clauses built into contracts |

| • | Supply chain flexibility on many components |

| • | A global manufacturing footprint that affords flexibility, including shifting production to a Daktronics lower-tariff international facility, potentially reshoring production to the U.S, or a mix of both depending on specific product cost, certainty of price or customer preference |

| • | A strong and developing international growth opportunity that can further diversify the revenue base to reduce exposure to U.S.-based revenue |

| • | The Company continues to focus on proactively managing the areas of the business within our control to generate profitable growth over the long term |

Mr. Wiemann added, “As we enter fiscal 2026, our transformation efforts ensure we are well-positioned to capitalize on increasing market demand. Our market leadership, technological superiority, and high-quality value-based selling proposition set us apart. Our tiered product offering, supply and manufacturing capabilities, supported by a strengthened balance sheet, further enhance our competitive edge.

“Additionally, our three-year transformation plan includes expanding our presence in indoor markets, enhancing the services we offer, and focusing on our highest-growth and most profitable sales channels. We are on track to meet the financial objectives tied to this plan.”

Fourth Quarter and Year to Date Results

Howard Atkins, Daktronics’ Acting Chief Financial Officer, commented, “Following a record revenue year in fiscal 2024 and then an initial softness in order flows in early fiscal 2025, our teams worked to successfully drive order growth in the second half of fiscal 2025, with Q4 orders up 17.0 percent over the comparable quarter of fiscal 2024. Although net sales were not as high as orders in Q4, the lag between order growth and net sales sets the stage for solid growth in revenue as projects begin in fiscal 2026.”

Growth in orders in the fourth quarter of fiscal 2025 was broadly led by strong demand in the Commercial, High School Park and Recreation, and International business units; on a sequential basis, orders increased 28.8 percent driven by strong demand across all business units. Orders for the full fiscal 2025 year increased 5.6 percent as compared to fiscal 2024 for the similar reasons in the same business units.

Net sales for the fourth quarter of fiscal 2025 decreased by 20.1 percent as compared to the fourth quarter of fiscal 2024; on a sequential basis, net sales increased 15.4 percent. Net sales for fiscal 2025 decreased 7.5 percent as compared to fiscal 2024. The decrease in sales was the result of lower volumes in each business unit, primarily driven by the Live Events business unit due to order timing and buildable backlog.

Gross profit as a percentage of net sales decreased to 25.0 percent for the fourth quarter of fiscal 2025 as compared to 25.7 percent in the fourth quarter of fiscal 2024. Gross profit as a percentage of net sales decreased to 25.8 percent for fiscal 2025 as compared to 27.2 percent in the prior year. The year-over-year gross profit decrease is attributable to sales mix differences between periods and a lower sales volume during fiscal 2025 as compared to fiscal 2024.

Operating expenses for the fourth quarter of fiscal 2025 were $44.9 million compared to $36.0 million for the fourth quarter of fiscal 2024, an increase of 24.8 percent. Operating expenses were $162.4 million for the full fiscal 2025 year as compared to $135.3 million for the full fiscal 2024 year, an increase of 20.0 percent. The increase in operating expenses for the year was attributable to $4.4 million related to investments in staffing resources to support information technology and digital transformation plans. Additionally, the increase is due to $16.5 million unique expenses in the year which included $7.1 million in strategic and digital transformation initiatives, $6.8 million for corporate governance matters including redomiciling and shareholder relations legal and advisory costs, and $2.6 million for management transition.

The above changes resulted in a negative operating margin of 1.0 percent for the fourth quarter of fiscal 2025 compared to a positive operating margin of 9.0 percent for the fourth quarter of fiscal 2024. Operating margin was 4.4 percent for fiscal 2025 as compared to 10.6 percent for fiscal 2024.

The increase in interest (expense) income, net for the fourth quarter of fiscal 2025 compared to the same period one year ago was primarily due to the increase in average cash balances on which interest was earned during the year.

| (1) | Adjusted Operating Income and Adjusted Net Income are measures not defined by accounting principles generally accepted in the United States of America (“GAAP”). These non-GAAP measures are used to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting this non-GAAP financial measurement provides investors with a consistent way to analyze our performance. For more information, see the supplemental calculation contained later in this release. |

| (2) | Orders and backlog metrics are non-GAAP measures, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 26, 2025. |

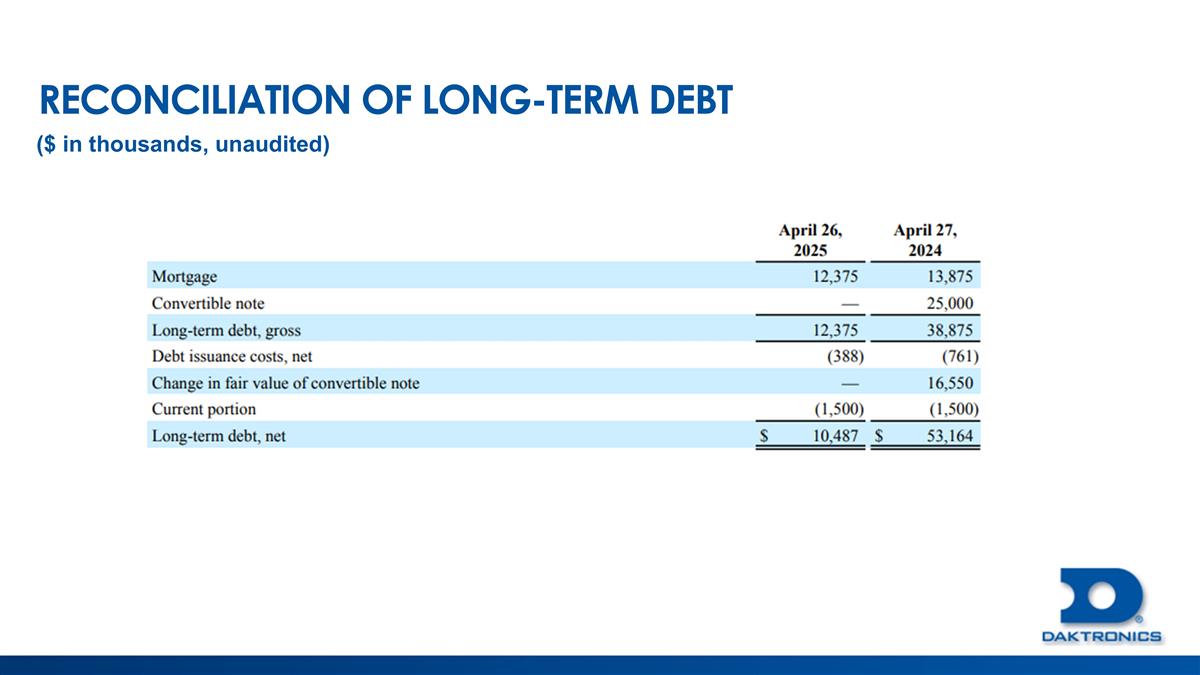

For the fourth quarter and for the fiscal 2025, the change in fair value of the convertible note was a non-cash benefit of $2.8 million and a non-cash charge of $22.5 million, respectively. In the fourth quarter and for fiscal 2024, the Company recorded non-cash charges for fair value changes of the convertible note of $5.0 million and $16.6 million, respectively. The fair value changes were primarily caused by forced conversion of the entire Convertible Note in the third and fourth quarters of fiscal 2025 and changes in stock price over the fair value measurement periods.

In fiscal 2025, the Company did not record any impairment charges for investments in affiliates, as compared to $5.3 million and $6.4 million for the fourth quarter and fiscal 2024. During the fourth quarter of fiscal 2025, a provision for possible credit losses of $15.5 million was recorded. No such loss was recorded in fiscal 2024.

The Company’s effective tax rate for fiscal 2025 was negative 73.0 percent. The effective income tax rate for fiscal 2025 was primarily impacted due to the convertible note fair value adjustment to expense that is not deductible for tax purposes. Additional other items impacting the rate were valuation allowances on equity investments, state taxes, as well as a write-down of deferred taxes related to debt issuance costs on the conversion of the convertible note. The effective tax rate for fiscal 2024 was 35.9 percent. The effective income tax rate for fiscal 2024 was primarily impacted due to the fair value adjustment to the convertible note that is not deductible for tax purposes. Additional other items impacting the rate were valuation allowances on equity investments, state taxes, as well as prior year provision to return adjustments reduced in part by tax benefits from permanent tax credits.

Balance Sheet and Cash Flow

Balance sheet quality was further strengthened in fiscal 2025. Cash, restricted cash and marketable securities totaled $127.5 million at April 26, 2025, and $12.0 million of long-term debt was outstanding as of that date. The long-term debt includes the face value of the debt of $12.4 million, net of $0.4 million of debt issuance costs. There were no draw-downs on the asset-based revolving credit facility during fiscal 2025 and $32.9 million was available to draw at April 26, 2025. We issued 4.0 million shares to convert the 9.0 percent convertible note payable and repurchased 2.1 million shares for a total of $29.5 million shares purchased at a weighted average cost of approximately $14.23 per share.

In fiscal year 2025, cash flow generated from operations was $97.7 million, of which $19.5 million was used for purchases of property and equipment and $29.5 million for stock repurchase. At the end of the fiscal 2025 fourth quarter, the working capital ratio was 2.2 to 1. Inventory levels dropped 23.3 percent since the end of the 2024 fiscal year on April 27, 2024, in part due to the business transformation initiatives to optimize inventory levels. Management’s focus remains on managing working capital to fund the expected growth of the Company with its current sources of liquidity.

Webcast Information

The Company will host a conference call and webcast to discuss its financial results today at 10:00 a.m. (Central Time). This call will be broadcast live at http://investor.daktronics.com where related presentation materials will also be posted prior to the conference call. A webcast will be available for replay shortly after the event.

About Daktronics

Daktronics has strong leadership positions in, and is the world’s largest supplier of, large-screen video displays, electronic scoreboards, LED text and graphics displays, and related control systems. The Company excels in the control of display systems, including those that require integration of multiple complex displays showing real-time information, graphics, animation, and video. Daktronics designs, manufactures, markets and services display systems for customers around the world in four domestic business units: Live Events, Commercial, High School Park and Recreation, and Transportation, and one International business unit. For more information, visit the Company’s website at: www.daktronics.com.

Safe Harbor Statement

Cautionary Notice: In addition to statements of historical fact, this news release contains forward-looking statements within the meaning of the federal securities laws and is intended to receive the protections of such laws.

All statements, other than historical facts, included or incorporated in this presentation could be deemed forward-looking statements, particularly statements that reflect the expectations or beliefs of Daktronics, Inc. (the “Company,” “Daktronics,” “we,” or “us”) concerning future events or our future financial performance. You are cautioned not to place undue reliance on forward-looking statements, which are often characterized by discussions of strategy, plans, or intentions or by the use of words such as “may,” “would,” “could,” “should,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” “plan,” “forecast,” “project,” “predict,” “potential,” “continue,” or “intend,” the negative or other variants of such terms, or other comparable terminology. The Company cautions that these forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations as a result of various factors, including, but not limited to, changes in economic and market conditions, management of growth, timing and magnitude of future contracts and orders, fluctuations in margins, the introduction of new products and technology, the impact of adverse weather conditions, increased regulation, the imposition of tariffs, trade wars, the availability and costs of raw materials, components, and shipping services, geopolitical and governmental actions, and other risks described in the Company’s Annual Report on Form 10-K for its 2024 fiscal year (the “Form 10-K”) and in other reports filed with or furnished to the U.S. Securities and Exchange Commission (the “SEC”) by the Company. You should carefully consider the trends, risks, and uncertainties described in this presentation, the Form 10-K, and other reports filed with or furnished to the SEC by the Company before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties continues or occurs, our business, financial condition, or operating results could be materially and adversely affected, the trading prices of our securities could decline, and you could lose part or all of your investment.

Forward-looking statements are made in the context of information available as of the date of this news release and are based on our current expectations, forecasts, estimates, and assumptions. The Company undertakes no obligation to update or revise such statements to reflect circumstances or events occurring after this presentation except as may be required by applicable law. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

— END —

For more information contact:

INVESTOR RELATIONS:

Howard Atkins, Acting Chief Financial Officer

Tel (605) 692-0200

Investor@daktronics.com

LHA Investor Relations

Carolyn Capaccio / Jody Burfening

DAKTIRTeam@allianceadvisors.com

| (1) | Adjusted Operating Income and Adjusted Net Income are measures not defined by accounting principles generally accepted in the United States of America (“GAAP”). These non-GAAP measures are used to report our results exclusive of items that are non-recurring or not core to our operating business. We believe presenting this non-GAAP financial measurement provides investors with a consistent way to analyze our performance. For more information, see the supplemental calculation contained later in this release. |

| (2) | Orders and backlog metrics are non-GAAP measures, and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. For more information related to backlog, see Part I, Item 1. Business of our Annual Report on Form 10-K for the fiscal year ended April 26, 2025. |

Daktronics, Inc. and Subsidiaries

Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

| Three Months Ended | Year Ended | |||||||||||||||

| April 26, 2025 | April 27, 2024 | April 26, 2025 | April 27, 2024 | |||||||||||||

| Net sales |

$ | 172,551 | $ | 215,880 | $ | 756,477 | $ | 818,083 | ||||||||

| Cost of sales |

129,406 | 160,501 | 560,990 | 595,640 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

43,145 | 55,379 | 195,487 | 222,443 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Selling |

15,200 | 15,114 | 60,011 | 56,954 | ||||||||||||

| General and administrative |

19,727 | 11,555 | 63,498 | 42,632 | ||||||||||||

| Product design and development |

9,958 | 9,283 | 38,860 | 35,742 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 44,885 | 35,952 | 162,369 | 135,328 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating (loss) income |

(1,740 | ) | 19,427 | 33,118 | 87,115 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Nonoperating income (expense): |

||||||||||||||||

| Interest income (expense), net |

637 | (466 | ) | 1,347 | (3,418 | ) | ||||||||||

| Change in fair value of convertible note |

2,848 | (4,980 | ) | (22,521 | ) | (16,550 | ) | |||||||||

| Other expense and debt issuance costs write-off, net |

(15,183 | ) | (6,814 | ) | (17,795 | ) | (13,096 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income before income taxes |

(13,438 | ) | 7,167 | (5,851 | ) | 54,051 | ||||||||||

| Income tax (benefit) expense |

(4,013 | ) | 4,649 | 4,270 | 19,430 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

$ | (9,425 | ) | $ | 2,518 | $ | (10,121 | ) | $ | 34,621 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

49,516 | 46,257 | 47,587 | 45,901 | ||||||||||||

| Diluted |

49,516 | 46,872 | 47,587 | 46,543 | ||||||||||||

| (Loss) earnings per share: |

||||||||||||||||

| Basic |

$ | (0.19 | ) | $ | 0.05 | $ | (0.21 | ) | $ | 0.75 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.19 | ) | $ | 0.05 | $ | (0.21 | ) | $ | 0.74 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

Daktronics, Inc. and Subsidiaries

Consolidated Balance Sheets

(in thousands)

(unaudited)

| April 26, 2025 |

April 27, 2024 |

|||||||

| ASSETS |

||||||||

| CURRENT ASSETS: |

||||||||

| Cash and cash equivalents |

$ | 127,507 | $ | 81,299 | ||||

| Restricted cash |

— | 379 | ||||||

| Accounts receivable, net |

92,762 | 117,186 | ||||||

| Inventories |

105,839 | 138,008 | ||||||

| Contract assets |

41,169 | 55,800 | ||||||

| Current maturities of long-term receivables |

2,437 | 298 | ||||||

| Prepaid expenses and other current assets |

8,520 | 8,531 | ||||||

| Income tax receivables |

3,217 | 448 | ||||||

|

|

|

|

|

|||||

| Total current assets |

381,451 | 401,949 | ||||||

|

|

|

|

|

|||||

| Property and equipment, net |

73,884 | 71,752 | ||||||

| Long-term receivables, less current maturities |

1,030 | 562 | ||||||

| Goodwill |

3,188 | 3,226 | ||||||

| Intangibles, net |