UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 24, 2025

THE MACERICH COMPANY

(Exact name of registrant as specified in its charter)

| Maryland | 1-12504 | 95-4448705 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

401 Wilshire Boulevard, Suite 700, Santa Monica, California 90401

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code (310) 394-6000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange |

||

| Common stock of The Macerich Company, $0.01 par value per share | MAC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

On June 24, 2025, The Macerich Company (the “Company”) made available on the Investor Relations section of its website, investing.macerich.com, an investor presentation describing the Company’s acquisition of the Crabtree Mall located in Raleigh, NC. A copy of the presentation is attached hereto as Exhibit 99.1. The Company also issued a press release relating to the acquisition on June 24, 2025. A copy of the press release is attached hereto as Exhibit 99.2. The information set forth in this Item 7.01, in the presentation attached hereto as Exhibit 99.1 and in the press release attached hereto as Exhibit 99.2, is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

| ITEM 8.01 | OTHER EVENTS. |

As noted above, on June 24, 2025 the Company announced the acquisition of Crabtree Mall, a Class A mall totaling approximately 1.3 million square feet in Raleigh, NC for a purchase price of $290 million. The Company funded the acquisition with cash on hand and $100.0 million of borrowings under its revolving credit facility.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

| EXHIBIT NUMBER |

DESCRIPTION |

|

| 99.1 | Investor Presentation | |

| 99.2 | Press Release dated June 24, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, The Macerich Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE MACERICH COMPANY | ||

| By: Daniel E. Swanstrom II | ||

| June 24, 2025 | /s/ Daniel E. Swanstrom II |

|

| Date | Senior Executive Vice President, Chief Financial Officer and Treasurer | |

Exhibit 99.1 MACERICH CRABTREE MALL ACQUISITION June 2025 NYSE: MAC | Macerich.com

LEGAL DISCLAIMER Note: This document contains statements that constitute forward-looking statements, which can be identified by the use of words, such as “will,” “expects,” “pro forma,” “anticipates,” “assumes,” “believes,” “estimated,” “guidance,” “potential,” “target,” “projects,” “scheduled” and similar expressions that do not relate to historical matters, and includes expectations regarding the Company’s future operational results, including in connection with the acquisition of the Crabtree Mall and the Path Forward Plan and its ability to meet the established goals under such Plan, including de-leveraging targets, growth rates and acquisition and disposition goals, as well as development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, as well as global, national, regional and local economic and business conditions, including the impact of tariffs and elevated interest rates and inflation, which will, among other things, affect demand for retail space or retail goods, availability and creditworthiness of current and prospective tenants, anchor or tenant bankruptcies, closures, mergers or consolidations, lease rates, terms and payments, elevated interest rates and its impact on the financial condition and results of operations of the Company, including as a result of any increased borrowing costs on the Company's outstanding floating-rate debt and defaults on mortgage loans, availability, terms and cost of financing and operating expenses; adverse changes in the real estate markets including, among other things, competition from other companies, retail formats and technology, risks of real estate development and redevelopment (including elevated inflation, supply chain disruptions and construction delays), acquisitions and dispositions; adverse impacts from any pandemic, epidemic or outbreak of any highly infectious disease on the U.S., regional and global economies and the financial condition and results of operations of the Company and its tenants; the liquidity of real estate investments; governmental actions and initiatives (including legislative and regulatory changes); environmental and safety requirements; and terrorist activities or other acts of violence, which could adversely affect all of the above factors. The reader is directed to the Company’s various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2024, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events unless required by law to do so. 2 Copyright © 2025 Macerich

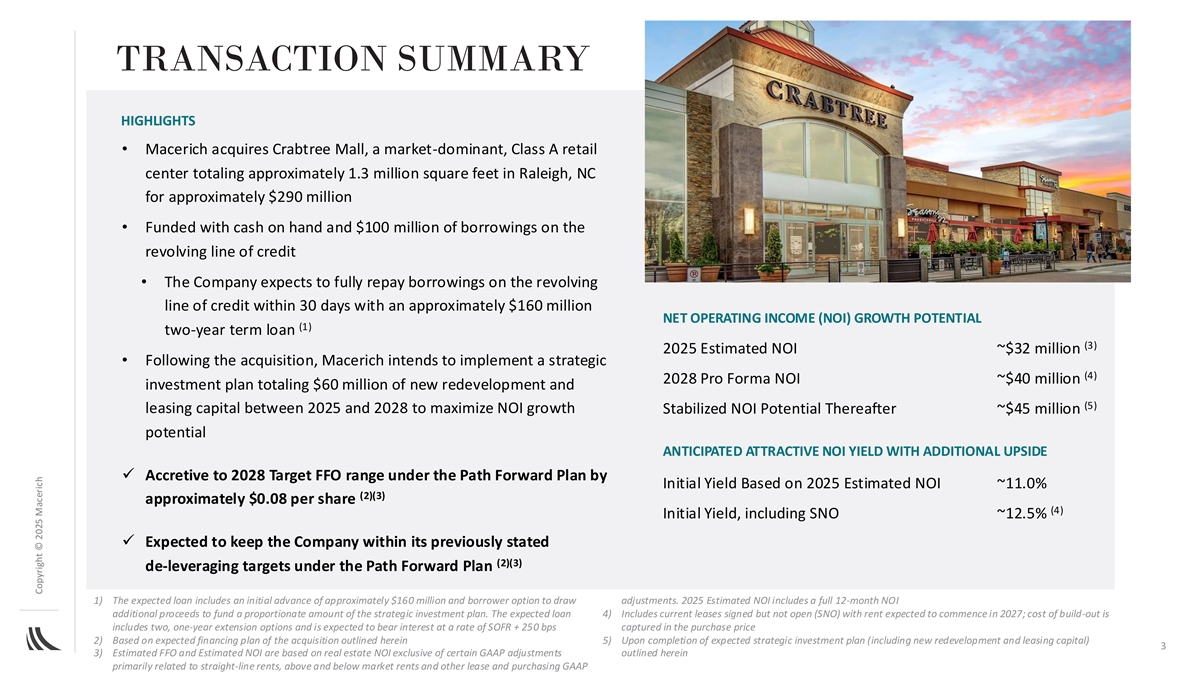

TRANSACTION SUMMARY HIGHLIGHTS • Macerich acquires Crabtree Mall, a market-dominant, Class A retail center totaling approximately 1.3 million square feet in Raleigh, NC for approximately $290 million • Funded with cash on hand and $100 million of borrowings on the revolving line of credit • The Company expects to fully repay borrowings on the revolving line of credit within 30 days with an approximately $160 million NET OPERATING INCOME (NOI) GROWTH POTENTIAL (1) two-year term loan (3) 2025 Estimated NOI ~$32 million • Following the acquisition, Macerich intends to implement a strategic (4) 2028 Pro Forma NOI ~$40 million investment plan totaling $60 million of new redevelopment and (5) leasing capital between 2025 and 2028 to maximize NOI growth Stabilized NOI Potential Thereafter ~$45 million potential ANTICIPATED ATTRACTIVE NOI YIELD WITH ADDITIONAL UPSIDE ✓ Accretive to 2028 Target FFO range under the Path Forward Plan by Initial Yield Based on 2025 Estimated NOI ~11.0% (2)(3) approximately $0.08 per share (4) Initial Yield, including SNO ~12.5% ✓ Expected to keep the Company within its previously stated (2)(3) de-leveraging targets under the Path Forward Plan 1) The expected loan includes an initial advance of approximately $160 million and borrower option to draw adjustments. 2025 Estimated NOI includes a full 12-month NOI additional proceeds to fund a proportionate amount of the strategic investment plan. The expected loan 4) Includes current leases signed but not open (SNO) with rent expected to commence in 2027; cost of build-out is includes two, one-year extension options and is expected to bear interest at a rate of SOFR + 250 bps captured in the purchase price 2) Based on expected financing plan of the acquisition outlined herein 5) Upon completion of expected strategic investment plan (including new redevelopment and leasing capital) 3 3) Estimated FFO and Estimated NOI are based on real estate NOI exclusive of certain GAAP adjustments outlined herein primarily related to straight-line rents, above and below market rents and other lease and purchasing GAAP Copyright © 2025 Macerich

STRATEGIC RATIONALE ENHANCES GO-FORWARD PORTFOLIO AND CREATES OPPORTUNITY TO DRIVE SHAREHOLDER VALUE ✓ Accretive to Path Forward Plan 2028 target FFO range ✓ Market-dominant position in a high-growth market ✓ Strong existing traffic and sales per square foot ✓ Powerful entry point to one of the top Southeastern U.S. markets ✓ Opportunity to deploy Macerich operating, leasing and marketing platforms to reinvigorate leasing momentum, drive permanent occupancy (from approximately 78% as of March 31, 2025 to approximately 90% by 2028) and capture NOI growth upside potential 4 Copyright © 2025 Macerich

STRONG TENANT MIX DRIVING PERFORMANCE Only location First-to-Market Expanding within 15 miles Coming Soon 200+ CURRENT TENANTS Crabtree Mall is a high-performing asset we believe is primed for accelerated growth, with strong foot traffic and sales and clear market dominance in a high-growth region. Existing retailers and anchors – Macy’s, a new Dick’s House of Sport and Belk – lay a solid foundation Now, by using established leasing relationships and a targeted approach, we believe Macerich can introduce other high-performing brands that attract new shoppers, boost foot traffic and build long-term loyalty Our goal is to drive the current share of permanent to temporary occupancy (78% permanent as of March 31, 2025 to approximately 90% permanent by 2028) (1) $429M Annual Sales (2) $951 Sales Per Square Foot (3) 94% Occupancy 8.7M Total Annual Visits 3.4x Visit Frequency Sources: Placer.ai full-year 2024 as of February 21, 2025 (1) Trailing 12-month gross sales as of March 31, 2025, for all reporting tenants (2) Trailing 12-month sales as of March 31, 2025 for all permanent, reporting tenants under 10,000 SF with at least 12 5 months of reported sales (3) As of March 31, 2025; comprised of 78% permanent occupancy and 16% temporary occupancy Copyright © 2025 Macerich

CAPITAL INVESTMENT PLAN TO MAXIMIZE PERFORMANCE With the proven Macerich investment approach – rooted in deep operational expertise and long- standing industry relationships – we're positioned to unlock meaningful additional value Our plan is to reimagine the center through a more dynamic tenant mix, enhanced customer experiences and refreshed, modern environments. A series of thoughtful enhancements are planned to ensure the property continues to thrive and resonate with today’s consumer • Over 200,000 square feet of common area will be reimagined with fresh paint, a full lighting redesign, modernized handrails and a fully re-envisioned furniture package for a cohesive, elevated look • Interior signage and wayfinding will be redesigned to create a more intuitive and seamless guest journey • Updated furniture, lush greenery and curated planters will transform gathering spaces into stylish, comfortable retreats Dick’s House of Sport replacing former Sears • The food court will be revitalized with upgraded columns, contemporary furnishings and the addition of a playful family zone Dick’s House of Sport draws an average • New vertical transportation proposed to enhance accessibility and flow of ~935K annual visits per location • Parking decks will be refreshed with upgraded lighting, new paint and improved signage to ensure a brighter, cleaner and a more welcoming arrival Sources: Placer.ai full-year 2024 as of May 13, 2025 6 Copyright © 2025 Macerich

N.C. STATE UNIVERSITY (5 MILES) MARKET DOWNTOWN RALEIGH (<5 MILES) DOMINANT LOCATION Raleigh, North Carolina Two-Level Super Regional Center Retail GLA: 1,346,658 Square Feet CRABTREE MALL Conveniently located off I-440 (>100K AADT) and Glenwood Avenue (>60K AADT) Avg Household Income (3-mile radius): $150K WITHIN 1 MILE OF CRABTREE MALL: $1M+ Single Family Homes $500K+ Townhomes 1,500+ Keys in 10 Hotels 2,300+ Residential Units WITHIN 11 MILES OF CRABTREE MALL: 15.5M Raleigh-Durham International Airport Travelers in 2024 (Up 6.5% YoY) 38K N.C. State University Student Enrollment RALEIGH-DURHAM INTERNATIONAL AIRPORT in Fall 2024 (Up 7% since 2020) N (11 MILES) Sources: Esri, 2024; RDU.com; NCSU.edu 7 Copyright © 2025 Macerich

RALEIGH LIFESTYLE RALEIGH – CARY, NC MSA #1 Best-Performing Large City (Milken Institute, 2025) Raleigh Metro, at the center of Wake County, stands as a powerhouse of explosive growth, groundbreaking #2 Fastest Growing Cities in the U.S. (Exploding Topics, 2025) innovation, wealth and world-class talent – making it one of the most vibrant and forward-moving markets #3 Happiest City in America (SmartAsset, 2025) in the nation #4 Fastest-Growing Major U.S. Market for GDP Growth (CoStar, 2024) 1.6M $100K $1.4M 53% #5 [Cary] Best Place to Live in the Country 2024 Total Median Average Hold a Bachelor’s (U.S. News & World Report, 2025-2026) Population Household Income Net Worth Degree or Higher (Expected to grow +9% (27% above the (12% above the (43% above the 2024-2029) national average) national average) national average) RESEARCH TRIANGLE RALEIGH – DURHAM – CARY The Research Triangle Region – spanning 7,000 acres and home to three Tier-1 universities: Duke University, North Carolina State University and the University of North Carolina at Chapel Hill – is anchored by Research Triangle Park, the largest research park in North America and one of the most successful and globally recognized science parks in the world 7K 700 300 2.5% 20 Total International Headquarters Lowest Corporate Colleges & Companies Companies in the Park Alone Tax Rate in the U.S. Universities Sources: Esri 2024; Researchtriangle.org; CNBC 2024 8 Copyright © 2025 Macerich

MACERICH (NYSE: MAC) ONE OF THE NATION’S LEADING OWNERS, OPERATORS & DEVELOPERS OF MAJOR RETAIL PROPERTIES IN ATTRACTIVE U.S. MARKETS, INCLUDING CALIFORNIA, PHOENIX/SCOTTSDALE, PACIFIC NORTHWEST, GREATER NEW YORK, NORTH CAROLINA AND WASHINGTON, D.C.

Exhibit 99.2

Macerich Acquires Market-Dominant Crabtree Mall in Raleigh, NC for $290 million

Attractive Initial Yield of Approximately 11% with Upside and is Accretive to Path Forward Plan

SANTA MONICA, CA, June 24, 2025 — The Macerich Company (NYSE: MAC) (the “Company” or “Macerich”), a leading owner, operator and developer of major retail properties in top markets, today announced the acquisition of Crabtree Mall, a market-dominant, Class A retail center totaling approximately 1.3 million square feet in Raleigh, NC for $290 million.

“Crabtree checks all the boxes for pursuing opportunistic external growth with its strong traffic and sales, its market-dominant position in a high-growth market, the ability to drive improvements in permanent leasing and NOI as well as the accretion to our 2028 target FFO ranges under the Path Forward Plan,” said Jack Hsieh, President and Chief Executive Officer, Macerich. “We have successfully de-risked the execution of the Path Forward Plan with 62% of our new lease deals achieved to date, placing us well ahead of schedule to reach 70% of the Path Forward leasing target by year-end 2025. We are on track with the operational performance improvement and asset sale components of the plan as well, positioning us to create additional value with the acquisition of this irreplaceable retail property.”

Macerich expects an initial yield on the Crabtree acquisition of approximately 11% based on the property’s estimated 2025 net operating income (“NOI”) and an estimated yield of approximately 12.5% inclusive of current leases signed but not opened with rent expected to commence in 2027. Over the course of 2025 through 2028, the Company plans to implement a strategic investment plan at the property totaling approximately $60 million of new redevelopment and leasing capital to maximize the center’s performance.

Macerich has funded the acquisition with cash on hand and $100 million of borrowings on its revolving line of credit. The Company expects to repay borrowings on the revolving line of credit within 30 days with the proceeds from an expected $160 million two-year term loan with two, one-year extension options that is expected to bear interest at SOFR plus 250 basis points. The expected financing of the acquisition is expected to keep the Company within its previously stated de-leveraging targets under the Path Forward Plan.

Hsieh added, “Crabtree’s outstanding location brings Macerich a powerful entry point to the Southeastern US and is a strong addition to the Go-Forward Portfolio. Macerich’s proven leasing, management and redevelopment capabilities will reinvigorate leasing momentum at Crabtree, create a more inviting and refreshed ambiance and reinforce Crabtree’s longstanding reputation within the community.”

The Raleigh-Cary, NC MSA stands as a powerhouse of explosive growth, groundbreaking innovation, wealth and world-class talent – making it one of the most vibrant and forward-moving markets in the nation. The Research Triangle Region is anchored by Research Triangle Park (“RTP”) – the largest research park in North American and one of the most successful and globally recognized science parks in the world. RTP spans 7,000 acres and is home to 250+ businesses and three Tier-1 universities: Duke University, North Carolina State University and the University of North Carolina at Chapel Hill.

About Crabtree

With over 200 stores and dozens of restaurants, Crabtree features Apple, Banana Republic, Belk, Belk Men’s Store, Brahmin, Brooks Brothers, Build-A-Bear Workshop, Chubbies, Coach, H&M, Lego, Macy’s, Michael Kors, TAG Heuer, and Tommy Bahama, among many others. Top dining options at Crabtree today include Kanki Japanese House of Steaks & Sushi, P.F. Chang’s China Bistro, The Cheesecake Factory, Seasons 52, Brio Italian Grill, Fleming’s Prime Steakhouse & Wine Bar and more.

The largest mall in North Carolina’s high-growth Research Triangle area at 1,346,658 square feet, Crabtree today features over 200 total tenants and is anchored by Belk and Macy’s. Crabtree currently generates $429 million in annual sales, $951 in sales per square foot and over 8.7 million annual visitors.

About Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT). As a leading owner, operator, and developer of high-quality retail real estate in densely populated and attractive U.S. markets, Macerich’s portfolio is concentrated in California, the Pacific Northwest, Phoenix/Scottsdale, and the Metro New York to Washington, D.C. corridor. Developing and managing properties that serve as community cornerstones, Macerich currently owns 41 million square feet of real estate, consisting primarily of interests in 38 retail centers. Macerich is firmly dedicated to advancing environmental goals, social good, and sound corporate governance. A recognized leader in sustainability, Macerich has achieved a #1 Global Real Estate Sustainability Benchmark (GRESB) ranking for the North American retail sector for ten consecutive years (2015-2024). For more information, please visit www.Macerich.com.

The Company has posted a supplemental presentation providing additional detail on the acquisition. Macerich uses, and intends to continue to use, its Investor Relations website, which can be found at investing.macerich.com, as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD. Additional information about Macerich can be found through social media platforms such as LinkedIn. Reconciliations of non-GAAP financial measures, including NOI and FFO, to the most directly comparable GAAP measures are included in the earnings release and supplemental filed on Form 8-K with the SEC, which are posted on the Investor Relations website at investing.macerich.com.

Forward-Looking Information

This release contains statements that constitute forward-looking statements, which can be identified by the use of words, such as “will,” “expects,” “pro forma”, “anticipates,” “assumes,” “believes,” “estimated,” “guidance,” “potential,” “target,” “projects,” “scheduled” and similar expressions that do not relate to historical matters, and includes expectations regarding the Company’s future operational results, including in connection with the acquisition of the Crabtree Mall and the Path Forward Plan and its ability to meet the established goals under such Plan, including de-leveraging targets, growth rates and acquisition and disposition goals, as well as development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, as well as global, national, regional and local economic and business conditions, including the impact of tariffs and elevated interest rates and inflation, which will, among other things, affect demand for retail space or retail goods, availability and creditworthiness of current and prospective tenants, anchor or tenant bankruptcies, closures, mergers or consolidations, lease rates, terms and payments, elevated interest rates and its impact on the financial condition and results of operations of the Company, including as a result of any increased borrowing costs on the Company’s outstanding floating-rate debt and defaults on mortgage loans, availability, terms and cost of financing and operating expenses; adverse changes in the real estate markets including, among other things, competition from other companies, retail formats and technology, risks of real estate development and redevelopment (including elevated inflation, supply chain disruptions and construction delays), acquisitions and dispositions; adverse impacts from any pandemic, epidemic or outbreak of any highly infectious disease on the U.S., regional and global economies and the financial condition and results of operations of the Company and its tenants; the liquidity of real estate investments; governmental actions and initiatives (including legislative and regulatory changes); environmental and safety requirements; and terrorist activities or other acts of violence, which could adversely affect all of the above factors. The reader is directed to the Company’s various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2024, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events unless required by law to do so.

INVESTOR CONTACT: Samantha Greening, AVP Investor Relations,

Samantha.Greening@macerich.com

MEDIA CONTACT: Arun Khosla, VP Corporate Communications,

Arun.Khosla@macerich.com