UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 11, 2025

CHIMERA INVESTMENT CORPORATION

(Exact name of registrant as specified in its charter)

| Maryland | 001-33796 | 26-0630461 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| 630 Fifth Avenue, Suite 2400 New York, New York |

10111 | |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (888) 895-6557

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.01 per share | CIM | New York Stock Exchange | ||

| 8.00% Series A Cumulative Redeemable Preferred Stock | CIM PRA | New York Stock Exchange | ||

| 8.00% Series B Cumulative Fixed-to-Floating Rate Redeemable Preferred Stock | CIM PRB | New York Stock Exchange | ||

| 7.75% Series C Cumulative Fixed-to-Floating Rate Redeemable Preferred Stock | CIM PRC | New York Stock Exchange | ||

| 8.00% Series D Cumulative Fixed-to-Floating Rate Redeemable Preferred Stock | CIM PRD | New York Stock Exchange | ||

| 9.000% Senior Notes due 2029 | CIMN | New York Stock Exchange | ||

| 9.250% Senior Notes due 2029 | CIMO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

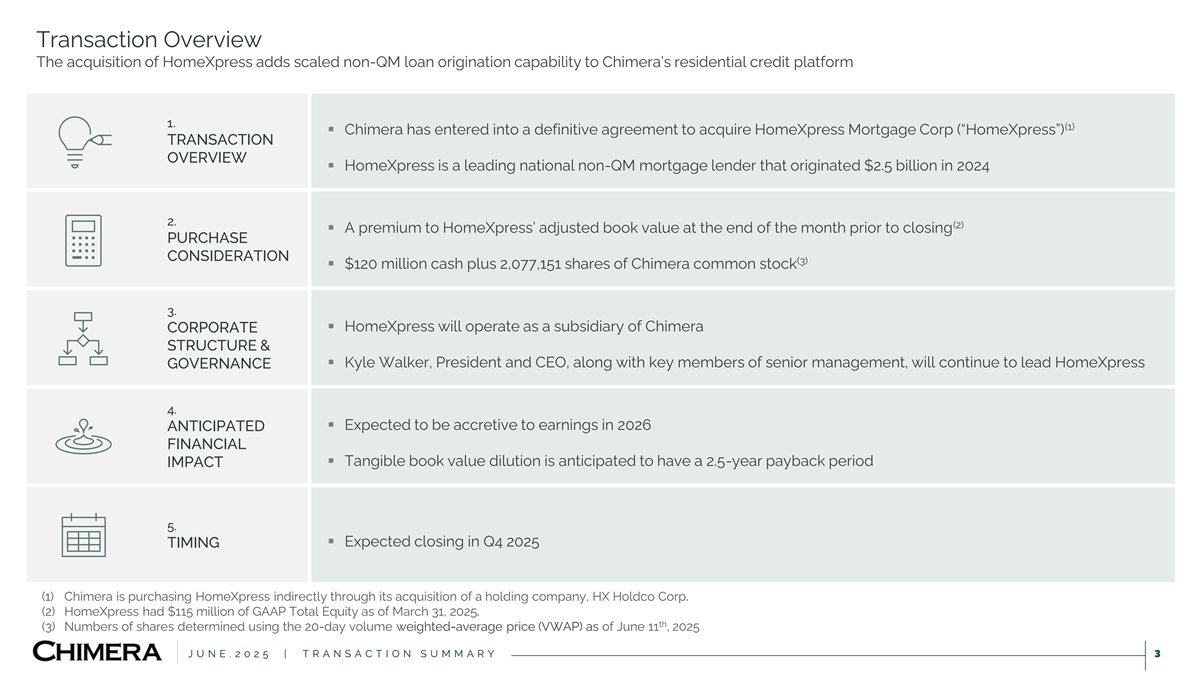

On June 11, 2025, Chimera Investment Corporation (“Chimera”), a Maryland corporation, entered into a Stock Purchase Agreement to acquire (the “Acquisition”) HomeXpress Mortgage Corp. (“HomeXpress”), a Delaware corporation. Pursuant to the Stock Purchase Agreement, Chimera will acquire (i) all of the outstanding equity interests in HX Holdco Corp. (“Holdco”), a Delaware corporation and parent of HomeXpress, from the Holdco Sellers as defined in the Stock Purchase Agreement, and (ii) certain equity interests in HomeXpress held by the Management Sellers as defined in the Stock Purchase Agreement (the Management Sellers and the Holdco Sellers are collectively referred to as the “Sellers”). Upon consummation of the Acquisition, Chimera will own, directly and indirectly through Holdco, 100% equity interest in HomeXpress. Immediately following the execution of the Stock Purchase Agreement, Chimera will assign the Stock Purchase Agreement to its taxable REIT subsidiary, Chimera Funding TRS LLC, a Delaware limited liability company, to acquire HomeXpress.

As consideration for the Acquisition, Chimera will pay to the Sellers a purchase price consisting of (i) cash in an amount that equals the adjusted book value of Holdco and its subsidiaries, including HomeXpress, as of the closing of the Acquisition (the “Closing”), subject to certain adjustments in accordance with the terms of the Stock Purchase Agreement, plus (ii) a premium consisting of (a) $120 million in cash and (b) 2,077,151 shares of the common stock, par value $0.01 per share, of Chimera. Chimera expects to file with the SEC a registration statement on Form S-4 to cover the issuance of the common stock portion of the purchase price.

In addition, concurrently with the execution of the Stock Purchase Agreement, Kyle Walker, HomeXpress’ current President and Chief Executive Officer, has executed an employment agreement (the “Key Employee Agreement”) to continue serving as President and Chief Executive Officer of HomeXpress following the Closing.

The Stock Purchase Agreement contains customary representations, warranties and covenants of the parties and a representations and warranties insurance policy is the primary source of recourse for breaches of representations and warranties that do not relate to mortgage loans sold or held for sale by HomeXpress (for which recourse is provided through an indemnity that is limited to an escrowed amount of $5,000,000). Closing is subject to customary closing conditions (including as related to the filing of the Form S-4 and the Key Employee Agreement that is being executed in connection with the signing of the Stock Purchase Agreement remaining in full force and effect) and is expected to occur in the fourth quarter of 2025.

The Stock Purchase Agreement may be terminated by Chimera or the Sellers under certain circumstances, including, among others: (i) if the Closing has not occurred on or before December 31, 2025 (unless extended by the parties in accordance with the terms of the Stock Purchase Agreement); (ii) upon an uncured breach by the other party that would result in a failure of the conditions to the Closing to be satisfied; or (iii) certain circumstances relating to governmental and regulatory matters.

The foregoing description of the Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Stock Purchase Agreement, a copy of which will be filed by amendment on Form 8-K/A to this Current Report on Form 8-K within four business days of the date hereof as Exhibit 2.1 and is incorporated herein by reference.

Cautionary Statement Concerning Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, including as related to the expected timing of the closing of Chimera’s acquisition of HomeXpress and the expected impact (including as related to Chimera’s future earnings) of the transaction. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal,” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “would,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” or similar expressions are intended to identify such forward-looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: delays and/or unforeseen events that could cause the proposed acquisition of HomeXpress to be delayed or not consummated; the potential that Chimera may not fully realize the expected benefits of the acquisition of HomeXpress, including the potential financial impact; our ability to obtain funding on favorable terms and access the capital markets; our ability to achieve optimal levels of leverage and effectively manage our liquidity; changes in inflation, the yield curve, interest rates and mortgage prepayment rates; our ability to manage credit risk related to our investments and comply with the Dodd-Frank Act and related laws and regulations relating to credit risk retention for securitizations; rates of default, delinquencies, forbearance, deferred payments or decreased recovery rates on our investments; the concentration of properties securing our securities and residential loans in a small number of geographic areas; our ability to execute on our business and investment strategy; our ability to determine accurately the fair market value of our assets; changes in our industry, the general economy or geopolitical conditions; our ability to successfully integrate and realize the anticipated benefits of any acquisitions, including the acquisition of The Palisades Group in 2024 and the proposed acquisition of HomeXpress; our ability to operate our investment management and advisory services and manage any regulatory rules and conflicts of interest; the degree to which our hedging strategies may or may not be effective; our ability to effect our strategy to securitize residential mortgage loans; our ability to compete with competitors and source target assets at attractive prices; our ability to find and retain qualified executive officers and key personnel; the ability of servicers and other third parties to perform their services at a high level and comply with applicable law and expanding regulations; our dependence on information technology and its susceptibility to cyber-attacks; our ability to comply with extensive government regulation; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; our ability to maintain our classification as a real estate investment trust for U.S. federal income tax purposes; the volatility of the market price and trading volume of our shares; and our ability to make distributions to our stockholders in the future.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these, and other risk factors, is contained in Chimera’s most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are advised that any financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by Chimera’s independent auditors.

| Item 7.01. | Regulation FD Disclosure. |

A copy of Chimera’s press release (the “Press Release”) announcing the matters described under Item 1.01 above is attached hereto and furnished as Exhibit 99.1.

A copy of Chimera’s investor presentation information (the “Investor Presentation”) related to the matters described under Item 1.01 above is attached here to and furnished as Exhibit 99.2.

The Press Release and the Investor Presentation are each being furnished pursuant to Item 7.01, and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits |

| (d) | Exhibits |

| Exhibit |

Description | |

| 2.1* | Stock Purchase Agreement, dated June 11, 2025, by and among Chimera Investment Corporation and the Sellers and their Representatives, each as defined therein. | |

| 99.1 | Press Release, dated June 12, 2025. | |

| 99.2 | Overview of Definitive Agreement to Acquire HomeXpress Mortgage Corp, dated June 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

| * | To be filed by amendment. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CHIMERA INVESTMENT CORPORATION | ||||||

| Date: June 12, 2025 | By: | /s/ Phillip J. Kardis II |

||||

| Phillip J. Kardis II | ||||||

| President and Chief Executive Officer | ||||||

Exhibit 99.1

Chimera Investment Corporation (NYSE: CIM) (“Chimera”) Announces Definitive Agreement to Acquire HomeXpress Mortgage Corp.

Transaction Broadens Chimera’s Residential Credit Platform and Expected to Be Accretive to Earnings in 2026

NEW YORK, June 12th, 2025—(BUSINESS WIRE)—Chimera Investment Corporation (NYSE: CIM) (“Chimera”) today announced that on June 11, 2025, it entered into a definitive agreement to acquire HomeXpress Mortgage Corp. (“HomeXpress”) from certain affiliates of Seer Capital Management’s credit fund business (“Seer”) and certain management sellers (together with Seer, the “Sellers”). HomeXpress is a leading originator of consumer non-QM, investor business purpose, and other non-Agency mortgage loan products, as well as an originator of Agency mortgage loans with a nationwide presence across 46 states and D.C.

“We are thrilled to welcome HomeXpress to the Chimera team,” said Phillip J. Kardis II, President and Chief Executive Officer of Chimera. “We believe that the transaction is the natural next step in the transformation of Chimera. Bringing together Chimera’s strong history of loan securitization, structured finance, and third-party loan management and advisory services with HomeXpress’ loan origination platform is expected to create a powerful combination and enhance our enterprise value. HomeXpress has an excellent management team with experienced origination professionals that have a long history of serving broker and correspondent partners across the U.S. We expect this acquisition to be accretive to Chimera’s earnings in 2026.”

Strategic Rationale and Benefits to Chimera Shareholders

| • | Highly Synergistic with Chimera’s Platform |

| • | The combination of HomeXpress’ non-QM origination platform and our loan management and advisory services is expected to create a tremendous cross-selling opportunity. |

| • | Provides opportunity for Chimera to acquire and securitize loans on a direct basis. |

| • | Supports Chimera’s efforts to build an MSR portfolio. |

| • | Presents an opportunity to create enterprise value at the platform level. |

| • | Attractive and Diverse Returns |

| • | Existing net operating losses at Chimera are expected to cover a substantial amount of the acquisition premium. |

| • | Continues the diversification of Chimera’s income streams to include origination fees and gain on sale income. |

HomeXpress Highlights

| • | A leading national non-QM originator |

| • | Approximately 300 employees and lending in 46 states and D.C. |

| • | $2.5 billion UPB of funded origination volume in 2024 |

| • | $3.5 billion UPB of estimated origination volume for the full year 2025, with $1.2 billion UPB of year-to-date funded origination volume through May 2025 |

| • | Made first loan in 2016 and has been profitable every year since |

| • | 2024 pre-tax net income of $47 million |

| • | $115 million of GAAP Total Equity as of March 31, 2025 |

| • | Partner of choice for brokers and correspondent lenders across U.S. |

| • | Experienced management team |

Key Transaction Details

Under the terms of the agreement, Chimera will cause its taxable REIT subsidiary, Chimera Funding TRS, to acquire HomeXpress from the Sellers for a combination of cash and 2,077,151 shares of Chimera common stock. The purchase price will be equal to the adjusted book value of HomeXpress as of the end of the month prior to the closing, plus a premium consisting of $120 million in cash plus 2,077,151 shares of Chimera common stock. HomeXpress will operate as a subsidiary of Chimera and Kyle Walker, the current President and CEO, along with key members of the senior management team will continue to manage HomeXpress. Chimera expects to close the transaction during the fourth quarter of 2025, subject to the satisfaction of customary closing conditions.

Advisors

Wells Fargo acted as the exclusive financial advisor to Chimera. Hunton Andrews Kurth LLP served as legal counsel and Alston & Bird LLP served as regulatory counsel to Chimera. Piper Sandler & Co. acted as the exclusive financial advisor to HomeXpress and Seer. Mayer Brown LLP served as legal counsel to Seer. Sheppard, Mullin, Richter & Hampton LLP served as legal counsel to HomeXpress management.

Investor Presentation and FAQs

A supplemental investor presentation, which includes FAQs on the transaction, will be available on Chimera’s website www.chimerareit.com.

About HomeXpress

HomeXpress, headquartered in Santa Ana, California, offers a wide array of consumer non-QM loans, investor business purpose loans, and other Agency and non-Agency mortgage loan products. HomeXpress has approximately 300 employees and actively lends in 46 states and D.C. HomeXpress originated approximately $2.5 billion of mortgage loans in 2024 and approximately $1.2 billion of mortgage loans year-to-date through May 2025, making it one of the largest wholesale non-QM originators in the U.S. and bringing its lifetime origination volume to over $10.7 billion.

About Chimera Investment Corporation

Chimera is a publicly traded real estate investment trust, or REIT, that is primarily engaged in the business of investing for itself and for unrelated third parties through its investment management and advisory services in a diversified portfolio of real estate assets, including residential mortgage loans, Non-Agency RMBS, Agency RMBS, business purpose and investor loans, including RTLs, MSRs, and other real estate-related assets such as Agency CMBS, junior liens and HELOCs, equity appreciation rights, and reverse mortgages.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, including as related to the expected timing of the closing of Chimera’s acquisition of HomeXpress and the expected impact (including as related to Chimera’s future earnings) of the transaction. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal,” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “would,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” or similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: delays and/or unforeseen events that could cause the proposed acquisition of HomeXpress to be delayed or not consummated; the potential that Chimera may not fully realize the expected benefits of the acquisition of HomeXpress, including the potential financial impact; our ability to obtain funding on favorable terms and access the capital markets; our ability to achieve optimal levels of leverage and effectively manage our liquidity; changes in inflation, the yield curve, interest rates and mortgage prepayment rates; our ability to manage credit risk related to our investments and comply with the Dodd-Frank Act and related laws and regulations relating to credit risk retention for securitizations; rates of default, delinquencies, forbearance, deferred payments or decreased recovery rates on our investments; the concentration of properties securing our securities and residential loans in a small number of geographic areas; our ability to execute on our business and investment strategy; our ability to determine accurately the fair market value of our assets; changes in our industry, the general economy or geopolitical conditions; our ability to successfully integrate and realize the anticipated benefits of any acquisitions, including the acquisition of the Palisades Group in 2024 and the proposed acquisition of HomeXpress; our ability to operate our investment management and advisory services and manage any regulatory rules and conflicts of interest; the degree to which our hedging strategies may or may not be effective; our ability to effect our strategy to securitize residential mortgage loans; our ability to compete with competitors and source target assets at attractive prices; our ability to find and retain qualified executive officers and key personnel; the ability of servicers and other third parties to perform their services at a high level and comply with applicable law and expanding regulations; our dependence on information technology and its susceptibility to cyber-attacks; our ability to comply with extensive government regulation; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; our ability to maintain our classification as a real estate investment trust for U.S. federal income tax purposes; the volatility of the market price and trading volume of our shares; and our ability to make distributions to our stockholders in the future.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

Readers are advised that any financial information in this press release is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by Chimera’s independent auditors.

Chimera Investor Contact

Chimera Investment Corporation

Investor Relations

888-895-6557

www.chimerareit.com

Exhibit 99.2 P R O P R I E T A R Y & CO N F I D E N T I A L O v e r v i e w o f D e f i n i t i v e A g r e e m e n t t o A c q u i r e H o m e X p r e s s M o r t g a g e C o r p J U N E | 2 0 2 5

Forward Looking Statements This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, including as related to the expected timing of the closing of Chimera’s acquisition of HomeXpress and the expected impact (including as related to Chimera’s future earnings) of the transaction. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal,” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “would,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” or similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: delays and/or unforeseen events that could cause the proposed acquisition of HomeXpress to be delayed or not consummated; the potential that Chimera may not fully realize the expected benefits of the acquisition of HomeXpress, including the potential financial impact; our ability to obtain funding on favorable terms and access the capital markets; our ability to achieve optimal levels of leverage and effectively manage our liquidity; changes in inflation, the yield curve, interest rates and mortgage prepayment rates; our ability to manage credit risk related to our investments and comply with the Dodd-Frank Act and related laws and regulations relating to credit risk retention for securitizations ; rates of default, delinquencies, forbearance, deferred payments or decreased recovery rates on our investments; the concentration of properties securing our securities and residential loans in a small number of geographic areas; our ability to execute on our business and investment strategy; our ability to determine accurately the fair market value of our assets; changes in our industry, the general economy or geopolitical conditions; our ability to successfully integrate and realize the anticipated benefits of any acquisitions, including the acquisition of the Palisades Group in 2024 and the proposed acquisition of HomeXpress; our ability to operate our investment management and advisory services and manage any regulatory rules and conflicts of interest; the degree to which our hedging strategies may or may not be effective; our ability to effect our strategy to securitize residential mortgage loans; our ability to compete with competitors and source target assets at attractive prices; our ability to find and retain qualified executive officers and key personnel; the ability of servicers and other third parties to perform their services at a high level and comply with applicable law and expanding regulations; our dependence on information technology and its susceptibility to cyber-attacks; our ability to comply with extensive government regulation; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; our ability to maintain our classification as a real estate investment trust for U.S. federal income tax purposes; the volatility of the market price and trading volume of our shares; and our ability to make distributions to our stockholders in the future. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these, and other risk factors, is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are advised that any financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by Chimera’s independent auditors. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. We use our website (www.chimerareit.com) as a channel of distribution of company information. The information we post on our website may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about Chimera when you enroll your email address by visiting our website, then clicking on “News and Events and selecting Email Alerts to complete the email notification form. Our website and any alerts are not incorporated into this document. 11 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Contents T R A N S A C T I O N O V E R V I E W 3 S T R A T E G I C R A T I O N A L E 4 H O M E X P R E S S A T - A - G L A N C E 5 F R E Q U E N T L Y A S K E D Q U E S T I O N S ( F A Q s ) 8 S E L E C T F O O T N O T E S 12 2 2 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Transaction Overview The acquisition of HomeXpress adds scaled non-QM loan origination capability to Chimera’s residential credit platform 1. (1) ▪ Chimera has entered into a definitive agreement to acquire HomeXpress Mortgage Corp (“HomeXpress”) TRANSACTION OVERVIEW ▪ HomeXpress is a leading national non-QM mortgage lender that originated $2.5 billion in 2024 2. (2) ▪ A premium to HomeXpress’ adjusted book value at the end of the month prior to closing PURCHASE CONSIDERATION (3) ▪ $120 million cash plus 2,077,151 shares of Chimera common stock 3. ▪ HomeXpress will operate as a subsidiary of Chimera CORPORATE STRUCTURE & ▪ Kyle Walker, President and CEO, along with key members of senior management, will continue to lead HomeXpress GOVERNANCE 4. ▪ Expected to be accretive to earnings in 2026 ANTICIPATED FINANCIAL ▪ Tangible book value dilution is anticipated to have a 2.5-year payback period IMPACT 5. ▪ Expected closing in Q4 2025 TIMING (1) Chimera is purchasing HomeXpress indirectly through its acquisition of a holding company, HX Holdco Corp. (2) HomeXpress had $115 million of GAAP Total Equity as of March 31, 2025. th (3) Numbers of shares determined using the 20-day volume weighted-average price (VWAP) as of June 11 , 2025 33 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Strategic Rationale Transaction further anchors Chimera’s position as a leader in the residential credit sector 1. ▪ HomeXpress is a leading nationwide lending platform with more than $10.7 billion of loans originated since 2016 ADDS SCALED NON-QM ▪ There are multiple growth channels identified that provide an opportunity to leverage Chimera’s permanent capital base LENDING FRANCHISE 2. ▪ Creates the ability for Chimera to retain loans in portfolio at cost and develop a programmatic securitization routine OFFERS DIRECT EXPOSURE TO ▪ Organically originated loans are expected to produce enhanced economics relative to acquiring loans in the secondary market NON-QM LOANS 3. FACILITATES ▪ HomeXpress’ lending business creates mortgage servicing rights (“MSRs”) that may be retained for investment INVESTMENT IN MSRs 4. SYNERGISTIC WITH ▪ Transaction introduces the ability to cross sell loan products and asset management services across the Chimera platform RD 3 PARTY ASSET MANAGEMENT 5. ▪ Introduces opportunities to further enhance enterprise value through platform activities STRATEGIC GROWTH ▪ Transaction provides the potential to drive value for REIT shareholders beyond net portfolio income derived from financial assets OPPORTUNITIES 6. ▪ HomeXpress generates loan origination fees and gain-on-sale income, further diversifying Chimera’s sources of earnings DIVERSIFIES EARNINGS & UTILIZATION OF NOLs▪ NOLs available to offset future income cover a substantial portion of the purchase premium 44 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

HomeXpress at-a-Glance The team’s experienced team of professionals have built a leading partner of choice for loan brokers and correspondent partners across the U.S. YEAR ESTABLISHED ▪ HomeXpress is led by Kyle Walker, President and CEO LEADERSHIP ▪ Several members of the senior management team have worked together prior to HomeXpress 2016 NATIONAL FOOTPRINT ▪ Approximately 300 FTEs PROFESSIONALS (1) (# STATES) ▪ Headquartered in Santa Ana, CA with an operations and production office in Tampa, FL 46 KEY ▪ Serving mortgage broker and correspondent lending partners nationwide CLIENTS SERVED ORIGINATIONS INCEPTION-TO-DATE ▪ Centralized underwriting and risk management functions UNDERWRITING & $10.7B RISK MANAGEMENT ▪ All loans are sourced from approved brokers and/or correspondents and underwritten in-house 2024 PRE-TAX EARNINGS ▪ Robust capital markets presence selling 20K+ loans to over 30 unique third-party institutions CAPITAL MARKETS ▪ Consistent seller of loans to a variety of aggregators, insurance companies, banks, and other investors $47MM (1) HomeXpress lends in 46 states and D.C. 5 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

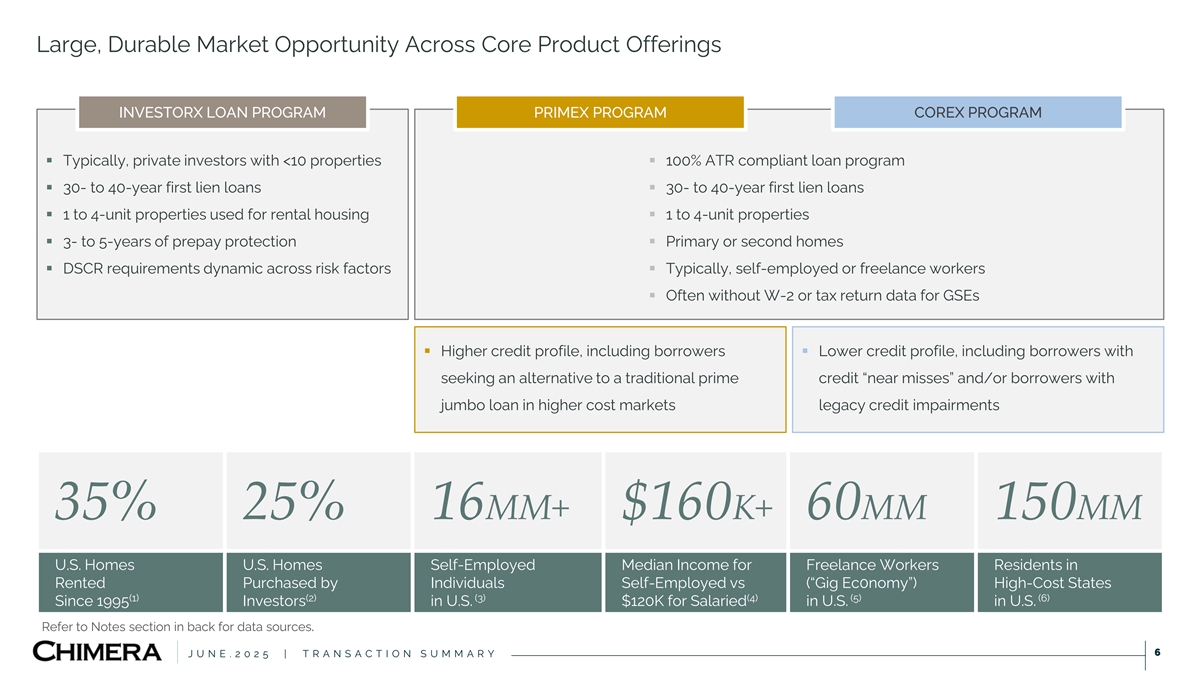

Large, Durable Market Opportunity Across Core Product Offerings INVESTORX LOAN PROGRAM PRIMEX PROGRAM COREX PROGRAM ▪ Typically, private investors with <10 properties▪ 100% ATR compliant loan program ▪ 30- to 40-year first lien loans▪ 30- to 40-year first lien loans ▪ 1 to 4-unit properties used for rental housing▪ 1 to 4-unit properties ▪ 3- to 5-years of prepay protection ▪ Primary or second homes ▪ DSCR requirements dynamic across risk factors▪ Typically, self-employed or freelance workers ▪ Often without W-2 or tax return data for GSEs ▪ Higher credit profile, including borrowers ▪ Lower credit profile, including borrowers with seeking an alternative to a traditional prime credit “near misses” and/or borrowers with jumbo loan in higher cost markets legacy credit impairments 35% 25% 16MM+ $160K+ 60MM 150MM U.S. Homes U.S. Homes Self-Employed Median Income for Freelance Workers Residents in Rented Purchased by Individuals Self-Employed vs (“Gig Ec0nomy”) High-Cost States (1) (2) (3) (4) (5) (6) Since 1995 Investors in U.S. $120K for Salaried in U.S. in U.S. Refer to Notes section in back for data sources. 6 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

HomeXpress Origination Volume Shows Proven Ability to Scale into Large Non-QM Addressable Market HISTORICAL SHARE OF NON- CURRENT SHARE OF ANNUAL U.S. MORTGAGE IMPLIED ANNUAL (1) (1) (1) (1) AGENCY LOANS NON-AGENCY LOANS ORIGINATIONS ADDRESSABLE MARKET $225 $2.3 10% 3-4% BILLION TRILLION HOMEXPRESS HISTORICAL ORIGINATION VOLUME $ in Billions $4.0 $3.5 $3.5 $3.0 $2.5 $2.5 $1.8 $2.0 $1.7 $1.6 $1.5 $1.0 $0.4 $0.5 $0.0 2020 2021 2022 2023 2024 2025E Refer to Notes section in back for data sources. 7 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Frequently Asked Questions 1. Why non-QM and why HomeXpress? Chimera is a leader in acquiring, financing and securitizing non-Agency residential mortgage loans. Currently, we have nearly $1 billion of non-QM loans on our balance sheet, and with the acquisition of The Palisades Group (Palisades), we manage more than $20 billion of non-QM loans for third parties. We have significant expertise in the non-QM space. HomeXpress is a leader in non-QM origination with a national footprint, actively lending in 46 states and D.C., and a proven capability of serving broker and correspondent partners. They made their first loan in 2016, and have been profitable every year since, including during the volatile market environment of 2020 and the rising interest rate environments of 2022 and 2023. We believe combining their origination capabilities with our ability to manage, finance, and securitize non-QM loans will create a powerful platform that further anchors our position as a leader in the residential credit sector. It is the next logical step in the evolution of the Company after the acquisition of Palisades and creates additional opportunities to grow enterprise value through platform activities. 2. Why did you choose to pay a portion of the purchase price with stock? Chimera common stock is expected to represent approximately 10% of the total purchase consideration. This results in a marginal increase in dilution relative to an all-cash transaction, and the change in the payback period is de minimis. Therefore, we prioritized creating an alignment of interest with management and preserving cash for other investments, which we believe is in the best interests of our shareholders over the long term. 3. What is the breakeven period to recapture the dilution of book value due to goodwill? If HomeXpress continues to meet its projections, we estimate the payback period (defined as tangible book value dilution divided by the net incremental earnings related to the HomeXpress acquisition) to be approximately 2.5 years. It is important to note, the tax benefit of Chimera's NOLs currently available to offset future income covers a substantial portion of the purchase premium. 8 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Frequently Asked Questions 4. What is the strategic play for Chimera relative to the timing of this transaction and the current housing market environment? We believe the non-QM space has a significant runway. Historically, approximately 10% of the mortgage market has fallen outside the Agency and Prime Jumbo space. We believe that implies a large annual non-QM addressable market, with a growing base of non-QM and investor loan borrowers as evidenced by sector growth amid elevated interest rates So, it is not surprising that even in this current challenging environment, HomeXpress has shown an ability to grow originations. We also believe there are policy driven tailwinds for the non-QM sector. While the outcome of GSE reform remains uncertain, it is likely that any shifts in GSE-related mandates would refocus the agencies on their core housing mission, leaving room for private non-QM lenders to expand origination volumes across a variety of products. Also, there are several significant avenues of growth. Currently, HomeXpress sources nearly all loans by serving thousands of broker partners through its wholesale channel. They recently launched a non-delegated correspondent channel and are actively planning to launch a delegated correspondent channel to source loans, which we believe presents a significant opportunity for growth. Furthermore, they intend to expand their origination activities to four additional states, including New York. Their burgeoning Agency origination channel provides another synergistic expansion opportunity. In addition, we intend to retain some of the MSRs from their originations, start a securitization program for their loans, and expand our third-party asset management services by cross selling to their clients. We also believe that by retaining service, combined with our servicing oversight capabilities, HomeXpress would be able maintain its relationships with borrowers and present opportunities to provide additional products including second lien mortgages. In short, we see many opportunities, even in this current housing environment, to expand our platform capabilities and grow our enterprise value. 5. How much does HomeXpress currently originate? What is the product mix? What is the number of employees? How many states is HomeXpress originating in? HomeXpress originated approximately $2.5 billion of non-QM loans in 2024 and expects to originate approximately $3.5 billion in 2025. Historically, the originations have been split between consumer non-QM and investor business purpose loans, and more recently weighted toward investor business purpose loans. HomeXpress currently has approximately 300 employees and actively lends in 46 states and D.C. 9 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Frequently Asked Questions 6. Are you planning to expand into other mortgage lending products? If so, through HomeXpress? Or additional acquisitions? Currently, HomeXpress primarily originates first lien non-QM loans, but also originates a small number of Freddie, VA, and FHA loans, and is working to obtain licenses to originate Fannie Mae loans and issue Ginnie Mae securities. We are currently looking to expand that business. We also believe that by retaining servicing, combined with our servicing oversight capabilities, HomeXpress would be able to maintain its relationships with borrowers and present opportunities to provide additional products including second lien mortgages. We will continue to look for quality and complimentary businesses that fit within our core areas of expertise but are focused on making sure that the opportunity is also a cultural and operational fit. The strategic alignment with Palisades has proven to be an exceptional cultural and operational fit, and we are confident that we will enjoy similar alignment with the HomeXpress team. They have an excellent culture and outstanding values. 7. What percentage of HomeXpress mortgage originations are you planning to securitize and retain for the REIT? Depending on market conditions and our overall portfolio construction objectives, after getting through the integration process, we would expect to settle into a regular quarterly securitization program. We expect to continue to sell a significant portion of the originations to third parties. 8. Will you retain HomeXpress mortgage servicing and create your own MSRs? Yes, that is our plan. While we do not expect to retain the servicing on every loan that HomeXpress sells, the MSRs we do retain will be additive to our portfolio construction strategy and serve as an asset hedge for the balance of our loan portfolio. 9. How do these transactions diversify and improve Chimera’s income? With the acquisition of Palisades, Chimera began the process of diversifying away from relying solely on net interest income from its financial assets and expanded into fee for service income. With this acquisition, we are further diversifying into other income streams, including origination fee income and gain on sale proceeds. For the full year 2024, HomeXpress had net income before taxes of approximately $47 million, and at the current run rate, we expect net income before taxes of nearly $67 million for 2025. Our NOLs will significantly reduce HomeXpress’s tax exposure, further enhancing an important source of income for investment. In addition, as previously mentioned, we expect to retain some MSRs, securitize some of their loans, and cross-sell our asset advisory services to their clients. All of these will be additive sources of income. 10 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Frequently Asked Questions 10. What is the long-term strategic play of the acquisition as it relates to Chimera’s REIT and asset management businesses? We see this as a natural fit and tremendous cross-selling opportunity. Currently, HomeXpress sells loans to a variety of end investors, including insurance companies, REITs and other investment firms. Our third-party asset management team provides loan acquisition and management services to a similar client base. We expect to be able to enhance HomeXpress’ capital markets and distribution through cross-selling to our existing client base of non-QM investors, and similarly, we expect to be able to increase the breadth of our third-party asset management activities by cross-selling to HomeXpress’ clients. Importantly, we believe that our team will be uniquely positioned to offer a one-stop solution for new entrants seeking exposure to non-QM loans by providing both an origination source packaged with a post-closing asset management resource. In addition, our experience providing mortgage servicer oversight for owners of non-QM loans will further enhance the value of the MSRs retained by HomeXpress. 11. Are you concerned about the retention of employees? HomeXpress’ employees are its key asset. They have a very experienced senior management team that works well together and a staff of lending and operational professionals that have all contributed to building a top tier non-QM origination platform. Overall, their team is outstanding and surveyed satisfaction levels are very high. It is a very well run organization. We believe our cultures are very compatible and expect to work very well together. As with the Palisades transaction, HomeXpress will be joining the Chimera team and there will be no “us and them” only “we”. In addition, Kyle Walker has agreed to an employment agreement with a three-year term and we plan on incentivizing and rewarding HomeXpress employees appropriately. Accordingly, we do not expect to have any issues with retention and will continue to recruit and retain talented professionals across our combined business. 12. Are there any synergies between the 3 businesses (REIT/Asset Management/Origination)? Any potential cost savings? As with the Palisades acquisition, this acquisition is additive, not through reductions in personnel and other “cost” savings”, but through expanding our existing capabilities. As previously discussed, we see strong synergies between Palisades and HomeXpress. We also note that we are a leading issuer of residential mortgage loan securitizations. We have not securitized many non-QM loans, in part because we have been unable to purchase directly from originators. We believe that our ability to securitize loans we originate through HomeXpress will be very accretive to our shareholders. Retaining the MSRs from HomeXpress’ originations will be a natural hedge to our loan portfolio as well as provide another stream of income. Also, by retaining servicing, combined with our servicing oversight capabilities, we believe that HomeXpress will be able to maintain its relationships with borrowers and present opportunities to provide additional products including second mortgages. 11 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y

Notes NOTES FROM SLIDE #5 1. Source: U.S. Census Bureau. Data as of June 30, 2024, Reflects inverse of published homeownership rate. 2. Source: John Burns Research and Consulting. Data as of March 31, 2024. 3. Source: Federal Reserve, U.S. Bureau of Labor Statistics. Data as of November 30, 2024. Reflects combined number of incorporated and unincorporated self-employed individuals in the U.S. 4. Source: Federal Reserve, U.S. Bureau of Labor Statistics. Reflects approximate rounded figures for illustrative purposes. 5. Source: Center for American Progress, McKinsey & Company. Reflects approximate rounded figures for illustrative purposes. 6. Source: Federal Housing Finance Administration (FHFA), U.S. Census Bureau. Reflects aggregate population (as of July 1, 2023) of states containing high-costs areas as determined by the FHFA’s conforming loans limits for 2025. NOTES FROM SLIDE #6 1. Source: Source: Inside Mortgage Finance (May 2025), Mortgage Bankers Association (May 2025), Wells Fargo. Total residential mortgage originations volume from 2009 to 2020 has ranged from $1.3 trillion to $4.4 trillion, with an average of $2.3 trillion. Market opportunity estimated at 10% of $2.25 trillion, which is average market size between 2025E & 2026E. 10% represents Private Capital’s approximate historical share of total mortgage originations. 12 J U N E . 2 0 2 5 | T R A N S A C T I O N S U M M A R Y