UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 11, 2025

ALLISON TRANSMISSION HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35456 | 26-0414014 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| One Allison Way, Indianapolis, Indiana (Address of principal executive offices) |

46222 (Zip Code) |

Registrant’s telephone number, including area code: (317) 242-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, $0.01 par value | ALSN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On June 11, 2025, Allison Transmission Holdings, Inc. (“Allison” or the “Company”) issued a press release announcing its entry into a definitive agreement to acquire the off-highway business of Dana Incorporated for approximately $2.7 billion. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

On June 12, 2025, Allison will hold an investor conference call to discuss the transaction. A copy of the presentation materials that will be used for the call is attached as Exhibit 99.2 hereto and is incorporated herein by reference.

The information contained in this Item 7.01 and in Exhibits 99.1 and 99.2 hereto is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 | Press release dated June 11, 2025. | |

| 99.2 | Investor presentation materials dated June 11, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Allison Transmission Holdings, Inc. | ||||||

| Date: June 11, 2025 | By: | /s/ Eric C. Scroggins |

||||

| Name: | Eric C. Scroggins | |||||

| Title: | Vice President, General Counsel and Assistant Secretary | |||||

Exhibit 99.1

|

|

Allison Transmission Announces Acquisition of Dana’s Off-Highway Business, Strengthening its Global Powertrain Capabilities

INDIANAPOLIS, June 11, 2025 – Allison Transmission Holdings Inc. (NYSE: ALSN) today announced it has entered into a definitive agreement to acquire the Off-Highway business of Dana Incorporated, a leading provider of drivetrain and propulsion solutions, for approximately $2.7 billion.

This acquisition aligns with Allison’s strategic priorities to expand its emerging markets footprint, enhance core technologies and deliver strong financial results. Upon completion of the transaction, Allison will be able to offer a wider range of commercial-duty powertrain and industrial solutions to more customers and end users worldwide.

“This acquisition marks a transformative milestone in our commitment to empowering our current and future customers with propulsion and drivetrain solutions that Improve the Way the World Works,” said David Graziosi, Allison Transmission Chair and CEO. “We look forward to harnessing this momentum to increase value for all of our stakeholders worldwide.”

Dana’s Off-Highway business operates in over 25 countries and serves a global customer base supported by approximately 11,000 employees. Providing solutions for a wide range of applications in construction, forestry, agriculture, specialty, aftermarket, industrial and mining segments, this business is recognized for its industry-leading powertrain technologies, encompassing axles, propulsion solutions and drivetrain components. Additionally, it specializes in hybrid and electric drive systems tailored to customer needs and is further distinguished by its global network of manufacturing facilities and technical centers.

“Dana’s off-highway business has long been committed to delivering innovative solutions for off-highway applications, and we are confident that under Allison’s ownership, the team will be well-positioned to continue that legacy,” said R. Bruce McDonald, Dana Chair and CEO. “This agreement represents a strategic opportunity to ensure the ongoing success of the business, while allowing Dana to focus on our core priorities. We look forward to seeing the off-highway business thrive under Allison’s leadership.”

The combined company will utilize its expanded global presence and technical expertise to realize new growth opportunities and develop differentiated solutions that meet customers’ evolving wants and needs. Allison will deploy a transition and integration process across the business that continues to support customers, employees, suppliers and partners.

Transaction Details

The acquisition of the Dana off-highway business is expected to be immediately accretive to Allison’s diluted earnings per share and is anticipated to generate annual run-rate synergies of approximately $120 million. Allison intends to finance the transaction using a combination of cash on the company’s balance sheet and debt. The acquisition was approved by both companies’ Boards of Directors, and it is expected to close late in the fourth quarter of 2025, pending customary regulatory approvals.

BofA Securities and KPMG LLP are serving as Allison’s financial and transaction advisors respectively, and Latham & Watkins LLP is serving as legal advisor. Barclays, BofA Securities and Citigroup provided committed financing in connection with the transaction. Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC are serving as Dana’s financial advisors. Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as Dana’s legal counsel. EY Corporate Finance is serving as Dana’s transaction advisor.

Allison will hold a call with analysts and investors at 8:45 a.m. EDT tomorrow, June 12, 2025 to discuss the benefits of this transaction. Participating in that call will be Dave Graziosi, Chair and CEO of Allison, Fred Bohley, Allison’s Chief Operating Officer, and Scott Mell, Allison’s Chief Financial Officer.

The dial-in phone number for the conference call is +1-877-425-9470, and the international dial-in number is +1-201-389-0878. A live webcast of the conference call will also be available online at https://ir.allisontransmission.com. Prior to the conference call, a slide presentation will be available in the Investors section of the Allison website. For those unable to participate in the conference call, a replay will be available from 1:00 p.m. EDT on June 12 until 11:59 p.m. EDT on June 26. The replay dial-in phone number is +1-844-512-2921, and the international replay dial-in number is +1-412-317-6671. The replay passcode is 13754279.

About Allison Transmission

Allison Transmission (NYSE: ALSN) is a leading designer and manufacturer of propulsion solutions for commercial and defense vehicles and the largest global manufacturer of medium- and heavy-duty fully automatic transmissions that Improve the Way the World Works. Allison products are used in a wide variety of applications, including on-highway vehicles (distribution, refuse, construction, fire and emergency), buses (school, transit and coach), motorhomes, off-highway vehicles and equipment (energy, mining, construction and agriculture applications) and defense vehicles (tactical wheeled and tracked). Founded in 1915, the company is headquartered in Indianapolis, Indiana, USA. With a presence in more than 150 countries, Allison has regional headquarters in the Netherlands, China and Brazil, manufacturing facilities in the USA, Hungary and India, as well as global engineering resources, including electrification engineering centers in Indianapolis, Indiana, Auburn Hills, Michigan and London in the United Kingdom. Allison also has approximately 1,600 independent distributor and dealer locations worldwide. For more information, visit allisontransmission.com.

Forward-Looking Statements

This press release contains forward-looking statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “will” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: risks relating to the pending acquisition of the Off-Highway business of Dana Incorporated, including: that the acquisition may not be completed in a timely manner or at all; delays, unanticipated costs or restrictions resulting from regulatory review of the acquisition, including the risk that Allison may be unable to obtain governmental and regulatory approvals required for the acquisition or that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the acquisition; uncertainties associated with the acquisition may cause a loss of both companies’ management personnel and other key employees, and cause disruptions to both companies’ business relationships; the purchase agreement subjects Allison and Dana to restrictions on business activities prior to the effective time of the acquisition; Allison is expected to incur significant costs in connection with the acquisition and integration; litigation risks relating to the acquisition; the business and operations of the Off-Highway business of Dana may not be integrated successfully in the expected time frame; the acquisition may result in a loss of customers, vendors, and other business counterparties; and the combined company may fail to realize all of the anticipated benefits of the acquisition or fail to effectively manage its expanded operations; our participation in markets that are competitive; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; increases in cost, disruption of supply or shortage of labor, freight, raw materials, energy or components used to manufacture or transport our products or those of our customers or suppliers, including as a result of geopolitical risks, wars and pandemics; global economic volatility; general economic and industry conditions, including the risk of recession; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers or suppliers; the highly cyclical industries in which certain of our end users operate; uncertainty in the global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; the failure of markets outside North America to increase adoption of fully automatic transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending; risks associated with our international operations, including acts of war and increased trade protectionism; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; risks related to our indebtedness; and other risks and uncertainties associated with our business described in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. All information is as of the date of this press release and we undertake no obligation to update any forward-looking statement to conform the statement to actual results or changes in expectations and risks related to our indebtedness.

Contacts

Jackie Bolles

Executive Director, Treasury and Investor Relations

jacalyn.bolles@allisontransmission.com

(317) 242-7073

Media Relations

Media@allisontransmission.com

(317) 694-2065

Acquisition of Dana Off-Highway Business June 11, 2025 Dave Graziosi, Chair & CEO Fred Bohley, COO Scott Mell, CFO & Treasurer Exhibit 99.2

Safe Harbor Statement The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “will” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: risks relating to the pending acquisition of the Off-Highway business of Dana Incorporated, including: that the acquisition may not be completed in a timely manner or at all; delays, unanticipated costs or restrictions resulting from regulatory review of the acquisition, including the risk that Allison may be unable to obtain governmental and regulatory approvals required for the acquisition or that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the acquisition; uncertainties associated with the acquisition may cause a loss of both companies' management personnel and other key employees, and cause disruptions to both companies' business relationships; the purchase agreement subjects Allison and Dana to restrictions on business activities prior to the effective time of the acquisition; Allison is expected to incur significant costs in connection with the acquisition and integration; litigation risks relating to the acquisition; the business and operations of the Off-Highway business of Dana may not be integrated successfully in the expected time frame; the acquisition may result in a loss of customers, vendors, and other business counterparties; and the combined company may fail to realize all of the anticipated benefits of the acquisition or fail to effectively manage its expanded operations; our participation in markets that are competitive; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; increases in cost, disruption of supply or shortage of labor, freight, raw materials, energy or components used to manufacture or transport our products or those of our customers or suppliers, including as a result of geopolitical risks, natural disasters, extreme weather events, wars and public health crises such as pandemics; global economic volatility; general economic and industry conditions, including the risk of prolonged inflation and recession; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers or suppliers; the highly cyclical industries in which certain of our end users operate; uncertainty in the global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; cybersecurity risks to our operational systems, security systems or infrastructure owned by us or our third-party vendors and suppliers; the failure of markets outside North America to increase adoption of fully automatic transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending; risks associated with our international operations, including acts of war and increased trade protectionism and tariffs; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; and risks related to our indebtedness. Allison Transmission cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial goals will be realized. All forward-looking statements included in this presentation speak only as of the date made, and Allison Transmission undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events, or otherwise. In particular, Allison Transmission cautions you not to place undue weight on certain forward-looking statements pertaining to potential growth opportunities or long-term financial goals set forth herein. Actual results may vary significantly from these statements. Allison Transmission’s business is subject to numerous risks and uncertainties, which may cause future results of operations to vary significantly from those presented herein. Important factors that could cause actual results to differ materially are discussed in Allison Transmission’s Annual Report on Form 10-K for the year ended December 31, 2024.

June 12, 2025 Call Agenda Transaction Overview Dave Graziosi Business Overview / Strategic Rationale Fred Bohley Acquisition Benefits Scott Mell

Shared core competencies Complementary propulsion categories Accelerates product innovation and enhances alternative propulsion capabilities Expands global leadership and end-market expertise Enlarges local IR&D, engineering and manufacturing footprint outside North America Broadens customer base Acquires mature alternative propulsion capabilities and technologies in early adopting end-markets Significant value creation with ~$120mm of expected annual run-rate synergies Global platform for operational excellence and adjacent growth Industry-leading adjusted EBITDA margin Strong adjusted free cash flow with modest capex Prudent leverage and capital allocation flexibility Transaction Rationale Capabilities Extension Growth Opportunity Value Creation Premier Financial Profile Opens adjacent, diverse and attractive end-markets Extends applications of existing and combined product portfolio Expands platform for future growth Accelerates Allison’s Growth and Innovation as a Global Commercial-Duty Work Solutions Provider to On-Highway, Off-Highway and Defense End-Markets with Complementary Core Capabilities and Product Portfolio Global Platform

Total transaction value of ~$2.7bn Represents 6.8x Adjusted EBITDA (LTM 12/31/24) of ~$400mm(1) and 5.2x including estimated run-rate synergies of ~$120mm 100% cash consideration, financed with new debt and cash on-hand, pursuant to a carve-out transaction involving the sale of certain stock and assets Expected annual run-rate synergies of ~$120mm Cost savings primarily driven by operations, procurement, IR&D and SG&A Fully committed debt financing $753 million of cash and $744 million available under the revolving credit facility as of March 31, 2025 Approved by Allison’s and Dana’s Boards of Directors; subject to customary regulatory approvals Anticipated closing in late Q4 2025 Purchase Price Transaction Highlights Expected net leverage of less than 3.0x at close with near-term target of less than 2.0x Anticipated to be immediately accretive to diluted earnings per share Combined company cash flow expected to preserve capital allocation flexibility Financial Highlights Synergies Financing Timing / Closing ____________________ Represents Adjusted EBITDA associated with the acquired portions of the Dana Off-Highway business.

Business Overview / Strategic Rationale

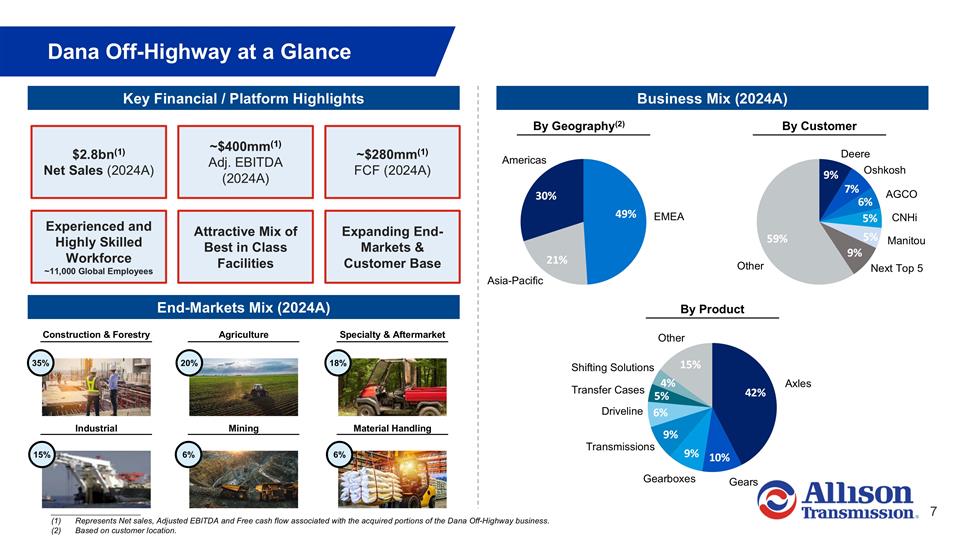

Dana Off-Highway at a Glance Key Financial / Platform Highlights Business Mix (2024A) EMEA Asia-Pacific Americas $2.8bn(1) Net Sales (2024A) ~$400mm(1) Adj. EBITDA (2024A) Experienced and Highly Skilled Workforce ~11,000 Global Employees Expanding End-Markets & Customer Base ~$280mm(1) FCF (2024A) Attractive Mix of Best in Class Facilities End-Markets Mix (2024A) Construction & Forestry Other Axles Gears Gearboxes Transmissions Driveline Transfer Cases Shifting Solutions By Geography(2) By Customer By Product Mining Agriculture 35% Specialty & Aftermarket Material Handling Industrial Deere Oshkosh AGCO CNHi Manitou Next Top 5 Other 20% 6% 18% 6% 15% ____________________ Represents Net sales, Adjusted EBITDA and Free cash flow associated with the acquired portions of the Dana Off-Highway business. Based on customer location.

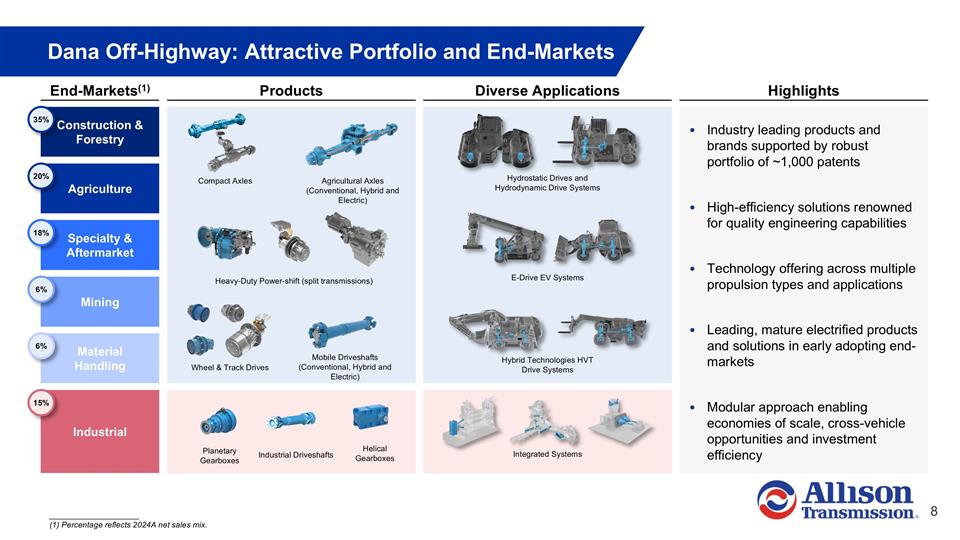

Compelling Strategic Combination Dana Off-Highway: Attractive Portfolio and End-Markets Industry leading products and brands supported by robust portfolio of ~1,000 patents High-efficiency solutions renowned for quality engineering capabilities Technology offering across multiple propulsion types and applications Leading, mature electrified products and solutions in early adopting end-markets Modular approach enabling economies of scale, cross-vehicle opportunities and investment efficiency Construction & Forestry Agriculture Specialty & Aftermarket Mining Material Handling Industrial End-Markets(1) Diverse Applications Highlights 20% 6% 35% 18% 6% 15% ____________________ (1) Percentage reflects 2024A net sales mix. Integrated Systems Mobile Driveshafts (Conventional, Hybrid and Electric) Hydrostatic Drives and Hydrodynamic Drive Systems E-Drive EV Systems Hybrid Technologies HVT Drive Systems Planetary Gearboxes Helical Gearboxes Industrial Driveshafts Wheel & Track Drives Products Agricultural Axles (Conventional, Hybrid and Electric) Heavy-Duty Power-shift (split transmissions) Compact Axles

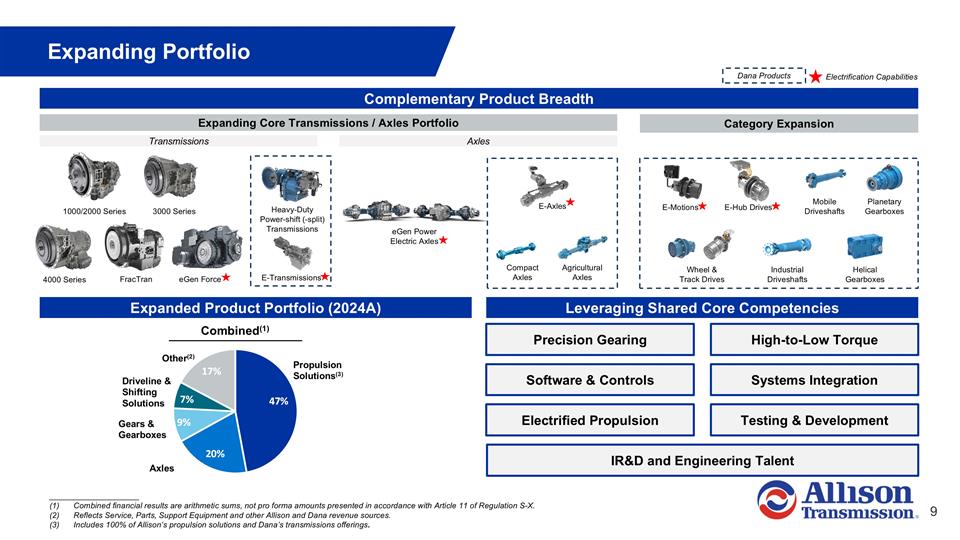

Expanding Portfolio ____________________ Combined financial results are arithmetic sums, not pro forma amounts presented in accordance with Article 11 of Regulation S-X. Reflects Service, Parts, Support Equipment and other Allison and Dana revenue sources. Includes 100% of Allison’s propulsion solutions and Dana’s transmissions offerings. Expanding Core Transmissions / Axles Portfolio Complementary Product Breadth Expanded Product Portfolio (2024A) Leveraging Shared Core Competencies Combined(1) Precision Gearing High-to-Low Torque Software & Controls Systems Integration Electrified Propulsion Testing & Development Propulsion Solutions(3) Axles Gears & Gearboxes Driveline & Shifting Solutions Other(2) Dana Products IR&D and Engineering Talent Category Expansion Electrification Capabilities Transmissions Axles Helical Gearboxes Planetary Gearboxes Wheel & Track Drives Industrial Driveshafts Mobile Driveshafts E-Transmissions 1000/2000 Series 3000 Series FracTran eGen Force eGen Power Electric Axles E-Axles E-Hub Drives E-Motions Heavy-Duty Power-shift (-split) Transmissions Compact Axles Agricultural Axles 4000 Series

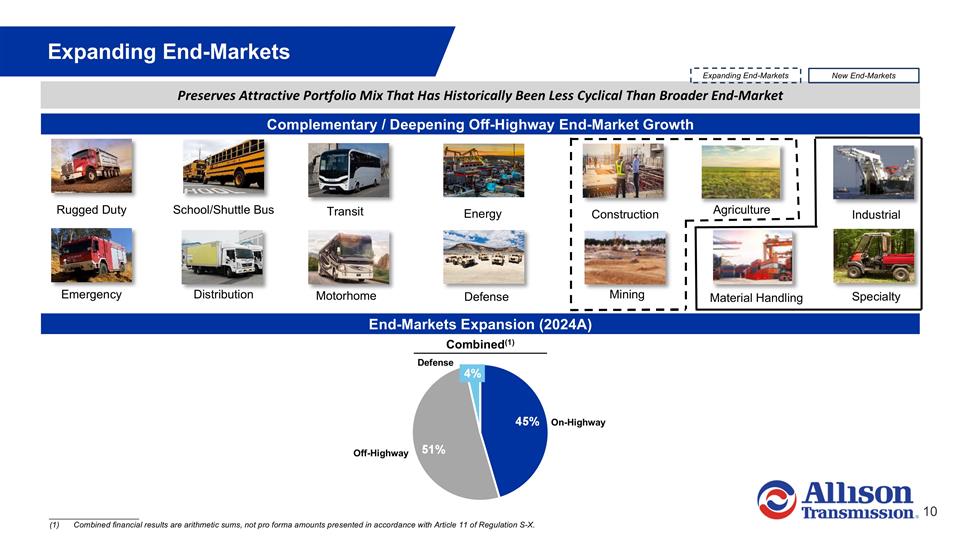

Expanding End-Markets Complementary / Deepening Off-Highway End-Market Growth End-Markets Expansion (2024A) Transit School/Shuttle Bus Rugged Duty Motorhome Distribution Emergency Construction Mining Agriculture Material Handling Industrial Specialty Combined(1) On-Highway Defense Off-Highway Preserves Attractive Portfolio Mix That Has Historically Been Less Cyclical Than Broader End-Market Energy Defense Expanding End-Markets New End-Markets ____________________ Combined financial results are arithmetic sums, not pro forma amounts presented in accordance with Article 11 of Regulation S-X.

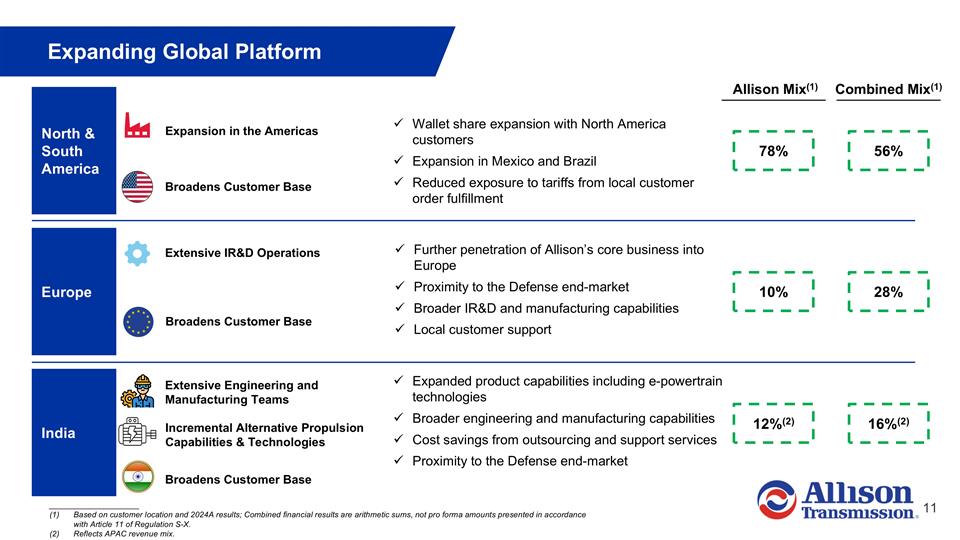

Expanding Global Platform Europe North & South America India Further penetration of Allison’s core business into Europe Proximity to the Defense end-market Broader IR&D and manufacturing capabilities Local customer support Wallet share expansion with North America customers Expansion in Mexico and Brazil Reduced exposure to tariffs from local customer order fulfillment Expanded product capabilities including e-powertrain technologies Broader engineering and manufacturing capabilities Cost savings from outsourcing and support services Proximity to the Defense end-market Extensive IR&D Operations Broadens Customer Base Expansion in the Americas Extensive Engineering and Manufacturing Teams Incremental Alternative Propulsion Capabilities & Technologies Broadens Customer Base Combined Mix(1) 28% 56% 16%(2) ____________________ Based on customer location and 2024A results; Combined financial results are arithmetic sums, not pro forma amounts presented in accordance with Article 11 of Regulation S-X. Reflects APAC revenue mix. Broadens Customer Base Allison Mix(1) 10% 78% 12%(2)

Acquisition Benefits

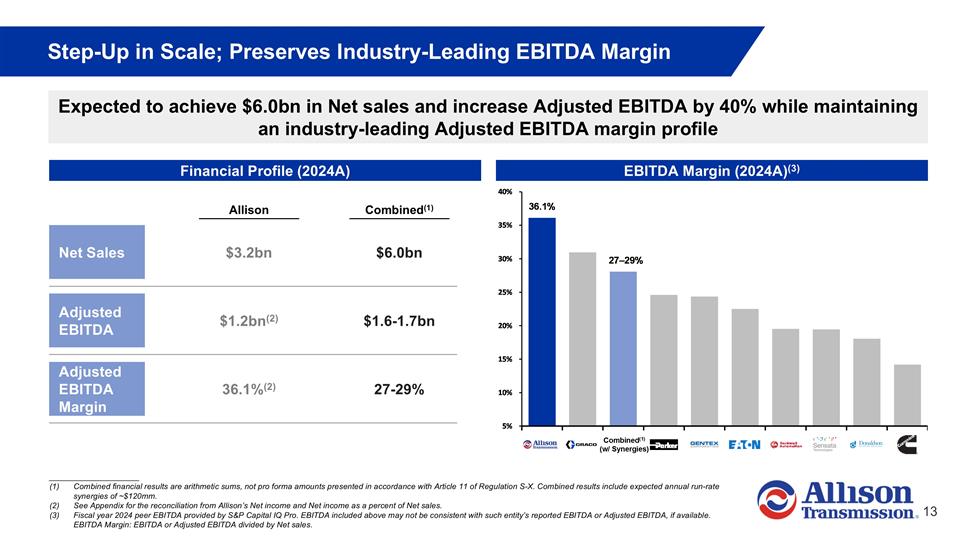

Step-Up in Scale; Preserves Industry-Leading EBITDA Margin EBITDA Margin (2024A)(3) Expected to achieve $6.0bn in Net sales and increase Adjusted EBITDA by 40% while maintaining an industry-leading Adjusted EBITDA margin profile Financial Profile (2024A) Net Sales Adjusted EBITDA Adjusted EBITDA Margin $3.2bn $1.2bn(2) 36.1%(2) $6.0bn $1.6-1.7bn 27-29% Combined(1) Allison ____________________ Combined financial results are arithmetic sums, not pro forma amounts presented in accordance with Article 11 of Regulation S-X. Combined results include expected annual run-rate synergies of ~$120mm. See Appendix for the reconciliation from Allison’s Net income and Net income as a percent of Net sales. Fiscal year 2024 peer EBITDA provided by S&P Capital IQ Pro. EBITDA included above may not be consistent with such entity’s reported EBITDA or Adjusted EBITDA, if available. EBITDA Margin: EBITDA or Adjusted EBITDA divided by Net sales. Combined(1) (w/ Synergies)

Strong Balance Sheet with Flexibility Well-Defined Capital Allocation Policy Returns on capital from completed investments in global commercial capabilities, including new product and technology development Maintain focus on returning capital to stockholders Quarterly dividend paid since initial public offering in 2012 Over 64% of shares outstanding repurchased since IPO with approximately $1.4B of remaining authorization as of March 31, 2025 Prudent balance sheet management Financing flexibility and strong cash flow expected to enable rapid deleveraging No debt maturities until 2027 Near-term net leverage target of less than 2.0x

Appendix Non-GAAP Financial Information

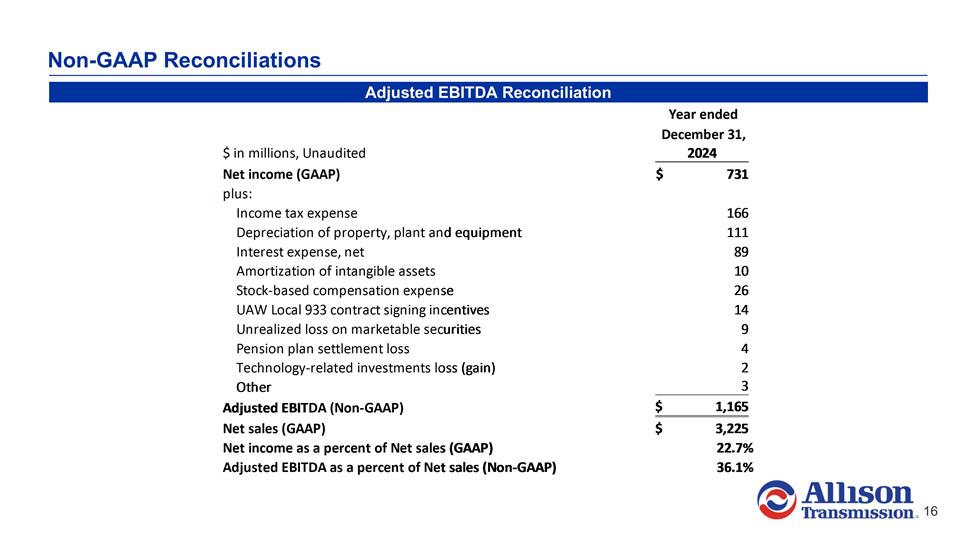

Non-GAAP Reconciliations Adjusted EBITDA Reconciliation