UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 4, 2025

COGENT BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38443 | 46-5308248 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 275 Wyman Street, 3rd Floor Waltham, Massachusetts |

02451 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 945-5576

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common stock, $0.001 Par Value | COGT | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On Wednesday, June 4, 2025, Cogent Biosciences, Inc., a Delaware corporation (the “Company”), held its 2025 Annual Meeting of Stockholders (the “Annual Meeting”) at 9:00 a.m., Eastern Time. As of the close of business on April 14, 2025, the record date for the Annual Meeting, there were 113,856,454 shares of common stock, par value 0.001 per share (the “Common Stock”), entitled to vote at the meeting.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

At the Annual Meeting, the Company’s stockholders approved an amendment to the Company’s Third Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to provide for exculpation from liability for officers of the Company, as described in more detail in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 22, 2025 (the “Amendment”).

On June 4, 2025, the Company filed a Certificate of Amendment to the Certificate of Incorporation (the “Certificate of Amendment”) with the Secretary of State of the State of Delaware to effect the Amendment, which became effective immediately upon such filing. On the same day, the Company subsequently filed a Fourth Restated Certificate of Incorporation of the Company (the “Restated Certificate”) with the Secretary of State of the State of Delaware, which incorporated the Amendment and became effective immediately upon such filing.

The foregoing description of the Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the Certificate of Amendment and the Restated Certificate, copies of which are attached hereto as Exhibit 3.1 and Exhibit 3.2, respectively, and are incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

At the Annual Meeting, each of the Company’s director nominees was elected and each of the other proposals voted on were approved. The final voting results are set forth below.

| Votes For |

Votes Withheld |

Broker Non-Votes |

||||||||||

| Proposal 1. Election of Directors |

||||||||||||

| • Dr. Karen Ferrante |

68,418,781 | 22,231,564 | 10,575,051 | |||||||||

| • Matthew E. Ros |

77,274,345 | 13,376,000 | 10,575,051 | |||||||||

| Votes For |

Votes Against |

Abstentions | Broker Non-Votes | |||||||||||||

| Proposal 2. Ratification of PricewaterhouseCoopers LLP as Independent Registered Public Accounting Firm |

101,115,649 | 104,268 | 5,479 | 0 | ||||||||||||

| Votes For |

Votes Against |

Abstentions | Broker Non-Votes | |||||||||||||

| Proposal 3. Advisory Vote on Executive Compensation |

89,797,699 | 808,715 | 43,931 | 10,575,051 | ||||||||||||

| Votes For |

Votes Against |

Abstentions | Broker Non-Votes | |||||||||||||

| Proposal 4. Approval of an Amendment to the Certificate of Incorporation to Provide for Officer Exculpation |

86,181,373 | 4,422,462 | 46,510 | 10,575,051 | ||||||||||||

Item 7.01. Regulation FD Disclosure.

On June 5, 2025, the Company will make a presentation at the Jefferies Global Healthcare Conference. A copy of the corporate presentation is furnished hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 3.1 | Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation of Cogent Biosciences, Inc. | |

| 3.2 | Fourth Restated Certificate of Incorporation of Cogent Biosciences, Inc. | |

| 99.1 | Cogent Biosciences, Inc. Corporate Presentation | |

| 104 | The cover page from the Company’s Current Report on Form 8-K formatted in Inline XBRL. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 5, 2025 | COGENT BIOSCIENCES, INC. | |||||

| By: | /s/ Evan Kearns |

|||||

| Evan Kearns | ||||||

| Chief Legal Officer and Corporate Secretary | ||||||

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE THIRD

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

COGENT BIOSCIENCES, INC.

Cogent Biosciences, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify that:

| (1) | The name of the Corporation is Cogent Biosciences, Inc. |

| (2) | The Third Amended and Restated Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on April 3, 2018 (the “Certificate of Incorporation”). |

| (3) | This Certificate of Amendment to the Certificate of Incorporation was duly authorized and adopted by the Corporation’s Board of Directors and stockholders in accordance with Section 242 of the DGCL and adds a new provision to the Certificate of Incorporation. |

| (4) | The amendment to the existing Certificate of Incorporation being effected hereby is to add a new Article X to the Certificate of Incorporation that reads as follows: |

ARTICLE X

LIMITATION OF LIABILITY OF OFFICERS

An officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as an officer except to the extent such exemption from liability, or limitation thereof, is not permitted under the DGCL.

If the DGCL is hereafter amended to authorize the further elimination or limitation of the liability of an officer, then the liability of an officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended.

Any amendment, repeal or modification of this Article X by either of (i) the stockholders of the Corporation or (ii) an amendment to the DGCL, shall not adversely affect any right or protection existing at the time of such amendment, repeal or modification with respect to any acts or omissions occurring before such amendment, repeal or modification of a person serving as an officer at the time of such amendment, repeal or modification.

| (5) | This Certificate of Amendment to the Certificate of Incorporation shall be effective immediately upon filing with the Secretary of State of the State of Delaware. |

1

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to the Certificate of Incorporation to be executed by its duly authorized officer this 4th day of June, 2025.

| COGENT BIOSCIENCES, INC. | ||

| By: | /s/ Andrew Robbins |

|

| Name: | Andrew Robbins | |

| Title: | President and Chief Executive Officer | |

2

Exhibit 3.2

FOURTH RESTATED

CERTIFICATE OF INCORPORATION

OF

COGENT BIOSCIENCES, INC.

Cogent Biosciences, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify that:

| (1) | The name of the Corporation is Cogent Biosciences, Inc. |

| (2) | The original name of the corporation was Unum Therapeutics Inc. |

| (3) | The original Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on March 10, 2014. |

| (4) | The Third Amended and Restated Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on April 3, 2018 (the “Prior Restated Certificate”). |

| (5) | Pursuant to Section 245 of the DGCL, this Fourth Restated Certificate of Incorporation only restates and integrates and does not further amend the provisions of the Prior Restated Certificate. |

| (6) | The Board of Directors of the Corporation has duly adopted resolutions approving the restatement of the Prior Restated Certificate and has declared said restatement to be advisable and in the best interests of the Corporation and its stockholders. |

| (7) | The text of the Prior Restated Certificate is hereby restated in its entirety to provide as herein set forth in full: |

ARTICLE I

The name of the Corporation is Cogent Biosciences, Inc.

ARTICLE II

The address of the Corporation’s registered office in the State of Delaware is Registered Agent Solutions, Inc., 838 Walker Road, Suite 21-2, Dover, Delaware 19904, County of Kent. The name of its registered agent at such address is Registered Agent Solutions, Inc.

ARTICLE III

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the DGCL.

ARTICLE IV

CAPITAL STOCK

The total number of shares of capital stock which the Corporation shall have authority to issue is Three Hundred Ten Million (310,000,000), of which (i) Three Hundred Million (300,000,000) shares shall be a class designated as Common Stock, par value $0.001 per share (the “Common Stock”), and (ii) ten million (10,000,000) shares shall be a class designated as undesignated preferred stock, par value $0.001 per share (the “Undesignated Preferred Stock”).

Except as otherwise provided in any certificate of designations of any series of Undesignated Preferred Stock, the number of authorized shares of the class of Common Stock or Undesignated Preferred Stock may from time to time be increased or decreased (but not below the number of shares of such class outstanding) by the affirmative vote of the holders of a majority in voting power of the outstanding shares of capital stock of the Corporation irrespective of the provisions of Section 242(b)(2) of the DGCL.

The powers, preferences and rights of, and the qualifications, limitations and restrictions upon, each class or series of stock shall be determined in accordance with, or as set forth below in, this Article IV.

A. COMMON STOCK

Subject to all the rights, powers and preferences of the Undesignated Preferred Stock and except as provided by law or in this Certificate (or in any certificate of designations of any series of Undesignated Preferred Stock):

(a) the holders of the Common Stock shall have the exclusive right to vote for the election of directors of the Corporation (the “Directors”) and on all other matters requiring stockholder action, each outstanding share entitling the holder thereof to one vote on each matter properly submitted to the stockholders of the Corporation for their vote; provided, however, that, except as otherwise required by law, holders of Common Stock, as such, shall not be entitled to vote on any amendment to this Certificate (or on any amendment to a certificate of designations of any series of Undesignated Preferred Stock) that alters or changes the powers, preferences, rights or other terms of one or more outstanding series of Undesignated Preferred Stock if the holders of such affected series of Undesignated Preferred Stock are entitled to vote, either separately or together with the holders of one or more other such series, on such amendment pursuant to this Certificate (or pursuant to a certificate of designations of any series of Undesignated Preferred Stock) or pursuant to the DGCL;

(b) dividends may be declared and paid or set apart for payment upon the Common Stock out of any assets or funds of the Corporation legally available for the payment of dividends, but only when and as declared by the Board of Directors or any authorized committee thereof; and

(c) upon the voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the net assets of the Corporation shall be distributed pro rata to the holders of the Common Stock.

B. UNDESIGNATED PREFERRED STOCK

The Board of Directors or any authorized committee thereof is expressly authorized, to the fullest extent permitted by law, to provide by resolution or resolutions for, out of the unissued shares of Undesignated Preferred Stock, the issuance of the shares of Undesignated Preferred Stock in one or more series of such stock, and by filing a certificate of designations pursuant to applicable law of the State of Delaware, to establish or change from time to time the number of shares of each such series, and to fix the designations, powers, including voting powers, full or limited, or no voting powers, preferences and the relative, participating, optional or other special rights of the shares of each series and any qualifications, limitations and restrictions thereof.

ARTICLE V

STOCKHOLDER ACTION

1. Action without Meeting. Any action required or permitted to be taken by the stockholders of the Corporation at any annual or special meeting of stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders and may not be taken or effected by a written consent of stockholders in lieu thereof. Notwithstanding anything herein to the contrary, the affirmative vote of not less than two thirds (2/3) of the outstanding shares of capital stock entitled to vote thereon, and the affirmative vote of not less than two thirds (2/3) of the outstanding shares of each class entitled to vote thereon as a class, shall be required to amend or repeal any provision of this Article V, Section 1.

2. Special Meetings. Except as otherwise required by statute and subject to the rights, if any, of the holders of any series of Undesignated Preferred Stock, special meetings of the stockholders of the Corporation may be called only by the Board of Directors acting pursuant to a resolution approved by the affirmative vote of a majority of the Directors then in office, and special meetings of stockholders may not be called by any other person or persons. Only those matters set forth in the notice of the special meeting may be considered or acted upon at a special meeting of stockholders of the Corporation.

ARTICLE VI

DIRECTORS

1. General. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors except as otherwise provided herein or required by law.

2. Election of Directors. Election of Directors need not be by written ballot unless the By-laws of the Corporation (the “By-laws”) shall so provide.

3. Number of Directors; Term of Office. The number of Directors of the Corporation shall be fixed solely and exclusively by resolution duly adopted from time to time by the Board of Directors. The Directors, other than those who may be elected by the holders of any series of Undesignated Preferred Stock, shall be classified, with respect to the term for which they severally hold office, into three classes. The initial Class I Directors of the Corporation shall be Liam Ratcliffe and Robert Perez; the initial Class II Directors of the Corporation shall be Bruce Booth and Karen Ferrante; and the initial Class III Directors of the Corporation shall be Jörn Aldag and Charles Wilson. The initial Class I Directors shall serve for a term expiring at the annual meeting of stockholders to be held in 2019, the initial Class II Directors shall serve for a term expiring at the annual meeting of stockholders to be held in 2020, and the initial Class III Directors shall serve for a term expiring at the annual meeting of stockholders to be held in 2021. At each annual meeting of stockholders, Directors elected to succeed those Directors whose terms expire shall be elected for a term of office to expire at the third succeeding annual meeting of stockholders after their election. Notwithstanding the foregoing, the Directors elected to each class shall hold office until their successors are duly elected and qualified or until their earlier resignation, death or removal.

Notwithstanding the foregoing, whenever, pursuant to the provisions of Article IV of this Certificate, the holders of any one or more series of Undesignated Preferred Stock shall have the right, voting separately as a series or together with holders of other such series, to elect Directors at an annual or special meeting of stockholders, the election, term of office, filling of vacancies and other features of such directorships shall be governed by the terms of this Certificate and any certificate of designations applicable to such series.

Notwithstanding anything herein to the contrary, the affirmative vote of not less than two thirds (2/3) of the outstanding shares of capital stock entitled to vote thereon, and the affirmative vote of not less than two thirds (2/3) of the outstanding shares of each class entitled to vote thereon as a class, shall be required to amend or repeal any provision of this Article VI, Section 3.

4. Vacancies. Subject to the rights, if any, of the holders of any series of Undesignated Preferred Stock to elect Directors and to fill vacancies in the Board of Directors relating thereto, any and all vacancies in the Board of Directors, however occurring, including, without limitation, by reason of an increase in the size of the Board of Directors, or the death, resignation, disqualification or removal of a Director, shall be filled solely and exclusively by the affirmative vote of a majority of the remaining Directors then in office, even if less than a quorum of the Board of Directors, and not by the stockholders. Any Director appointed in accordance with the preceding sentence shall hold office for the remainder of the full term of the class of Directors in which the new directorship was created or the vacancy occurred and until such Director’s successor shall have been duly elected and qualified or until his or her earlier resignation, death or removal. Subject to the rights, if any, of the holders of any series of Undesignated Preferred Stock to elect Directors, when the number of Directors is increased or decreased, the Board of Directors shall, subject to Article VI.3 hereof, determine the class or classes to which the increased or decreased number of Directors shall be apportioned; provided, however, that no decrease in the number of Directors shall shorten the term of any incumbent Director. In the event of a vacancy in the Board of Directors, the remaining Directors, except as otherwise provided by law, shall exercise the powers of the full Board of Directors until the vacancy is filled.

5. Removal. Subject to the rights, if any, of any series of Undesignated Preferred Stock to elect Directors and to remove any Director whom the holders of any such series have the right to elect, any Director (including persons elected by Directors to fill vacancies in the Board of Directors) may be removed from office (i) only with cause and (ii) only by the affirmative vote of the holders of two thirds (2/3) of the outstanding shares of capital stock then entitled to vote at an election of Directors. At least forty-five (45) days prior to any annual or special meeting of stockholders at which it is proposed that any Director be removed from office, written notice of such proposed removal and the alleged grounds thereof shall be sent to the Director whose removal will be considered at the meeting.

ARTICLE VII

LIMITATION OF LIABILITY

A Director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a Director, except for liability (a) for any breach of the Director’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) under Section 174 of the DGCL or (d) for any transaction from which the Director derived an improper personal benefit. If the DGCL is amended after the effective date of this Certificate to authorize corporate action further eliminating or limiting the personal liability of Directors, then the liability of a Director of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended.

Any amendment, repeal or modification of this Article VII by either of (i) the stockholders of the Corporation or (ii) an amendment to the DGCL, shall not adversely affect any right or protection existing at the time of such amendment, repeal or modification with respect to any acts or omissions occurring before such amendment, repeal or modification of a person serving as a Director at the time of such amendment, repeal or modification.

Notwithstanding anything herein to the contrary, the affirmative vote of not less than two thirds (2/3) of the outstanding shares of capital stock entitled to vote thereon, and the affirmative vote of not less than two thirds (2/3) of the outstanding shares of each class entitled to vote thereon as a class, shall be required to amend or repeal any provision of this Article VII.

ARTICLE VIII

AMENDMENT OF BY-LAWS

1. Amendment by Directors. Except as otherwise provided by law, the By-laws of the Corporation may be amended or repealed by the Board of Directors by the affirmative vote of a majority of the Directors then in office.

2. Amendment by Stockholders. Except as otherwise provided therein, the By-laws of the Corporation may be amended or repealed at any annual meeting of stockholders, or special meeting of stockholders called for such purpose, by the affirmative vote of a majority of the outstanding shares of capital stock entitled to vote on such amendment or repeal, voting together as a single class.

ARTICLE IX

AMENDMENT OF CERTIFICATE OF INCORPORATION

The Corporation reserves the right to amend or repeal this Certificate in the manner now or hereafter prescribed by statute and this Certificate, and all rights conferred upon stockholders herein are granted subject to this reservation. Except as otherwise required by this Certificate or by law, whenever any vote of the holders of capital stock of the Corporation is required to amend or repeal any provision of this Certificate, such amendment or repeal shall require the affirmative vote of the majority of the outstanding shares of capital stock entitled to vote on such amendment or repeal, and the affirmative vote of the majority of the outstanding shares of each class entitled to vote thereon as a class, at a duly constituted meeting of stockholders called expressly for such purpose.

ARTICLE X

LIMITATION OF LIABILITY OF OFFICERS

An officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as an officer except to the extent such exemption from liability, or limitation thereof, is not permitted under the DGCL.

If the DGCL is hereafter amended to authorize the further elimination or limitation of the liability of an officer, then the liability of an officer of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended.

Any amendment, repeal or modification of this Article X by either of (i) the stockholders of the Corporation or (ii) an amendment to the DGCL, shall not adversely affect any right or protection existing at the time of such amendment, repeal or modification with respect to any acts or omissions occurring before such amendment, repeal or modification of a person serving as an officer at the time of such amendment, repeal or modification.

[End of Text]

THIS FOURTH RESTATED CERTIFICATE OF INCORPORATION is executed as of this 4th day of June, 2025.

| COGENT BIOSCIENCES, INC. | ||

| By: | /s/ Andrew Robbins |

|

| Name: | Andrew Robbins | |

| Title: | President and Chief Executive Officer | |

Exhibit 99.1 Jefferies Global Healthcare Conference June 5, 2025

Forward-Looking Statements and Risk Factors The information contained in this presentation has been prepared by Cogent Biosciences, Inc. (“Cogent” or the “Company”) and contains information pertaining to the business and operations of the Company. The information contained in this presentation: (a) is provided as at the date hereof, is subject to change without notice, and is based on publicly available information, internally developed data as well as third party information from other sources; (b) does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in the Company; (c) is not to be considered as a recommendation by the Company that any person make an investment in the Company; (d) is for information purposes only and shall not constitute an offer to buy, sell, issue or subscribe for, or the solicitation of an offer to buy, sell or issue, or subscribe for any securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful. Where any opinion or belief is expressed in this presentation, it is based on certain assumptions and limitations and is an expression of present opinion or belief only. This presentation should not be construed as legal, financial or tax advice to any individual, as each individual’s circumstances are different. This document is for informational purposes only and should not be considered a solicitation or recommendation to purchase, sell or hold a security. This presentation and the accompanying oral commentary contain forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, any statements of the plans, strategies, and objectives of management for future operations, including our clinical development and commercialization plans; any projections of financial information; any statement about historical results that may suggest trends for our business; any statement of expectation or belief regarding future events; potential markets or market size, technology developments, our clinical product pipeline, clinical and pre-clinical data or the implications thereof, enforceability of our intellectual property rights, competitive strengths or our position within the industry; any statements regarding the anticipated benefits of our collaborations or other strategic transactions; and any statements of assumptions underlying any of the items mentioned. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from our current expectations as a result of many risks and uncertainties, including but not limited to, risks associated with: the potential impacts of raising additional capital, including dilution to our existing stockholders, restrictions on our operations or requirements that we relinquish rights to our technologies or product candidates; the success, cost, and timing of our product development activities and clinical trials; the timing of our planned regulatory submissions to the FDA for our product candidate bezuclastinib and feedback from the FDA as to our plans; our ability to obtain and maintain regulatory approval for our bezuclastinib product candidate and any other product candidates we may develop, and any related restrictions, limitations, and/or warnings in the label of an approved product candidate; the potential for our identified research priorities to advance our bezuclastinib product candidate; the ability to license additional intellectual property relating to our product candidates from third parties and to comply with our existing license agreements and collaboration agreements; the ability and willingness of our third-party research institution collaborators to continue research and development activities relating to our product candidates; our ability to commercialize our products in light of the intellectual property rights of others; our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates; the scalability and commercial viability of our manufacturing methods and processes; the commercialization of our product candidates, if approved; our plans to research, develop, and commercialize our product candidates; our ability to attract collaborators with development, regulatory, and commercialization expertise; our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates; business interruptions resulting from public health crises, which could cause a disruption of the development of our product candidates and adversely impact our business; and the fact that interim clinical data may not be indicative of future results, among others. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to our business in general, see our periodic filings filed from time to time with the Securities and Exchange Commission. Unless as required by law, we assume no obligation and do not intend to update these forward-looking statements or to conform these statements to actual results or to changes in our expectations. All of Cogent’s product candidates are investigational product candidates and their safety and efficacy have not yet been established. Cogent has not obtained marketing approval for any product, and there is no certainty that any marketing approvals will be obtained or as to the timelines on which they will be obtained. Any data pertaining to Cogent product candidates is interim data and may include investigator-reported interim data for which Cogent has not yet independently reviewed the source data. The interim data may not be representative of the final results that may be obtained in the corresponding trials and results from earlier trials may not be representative of results obtained in later trial or pivotal trials. 2

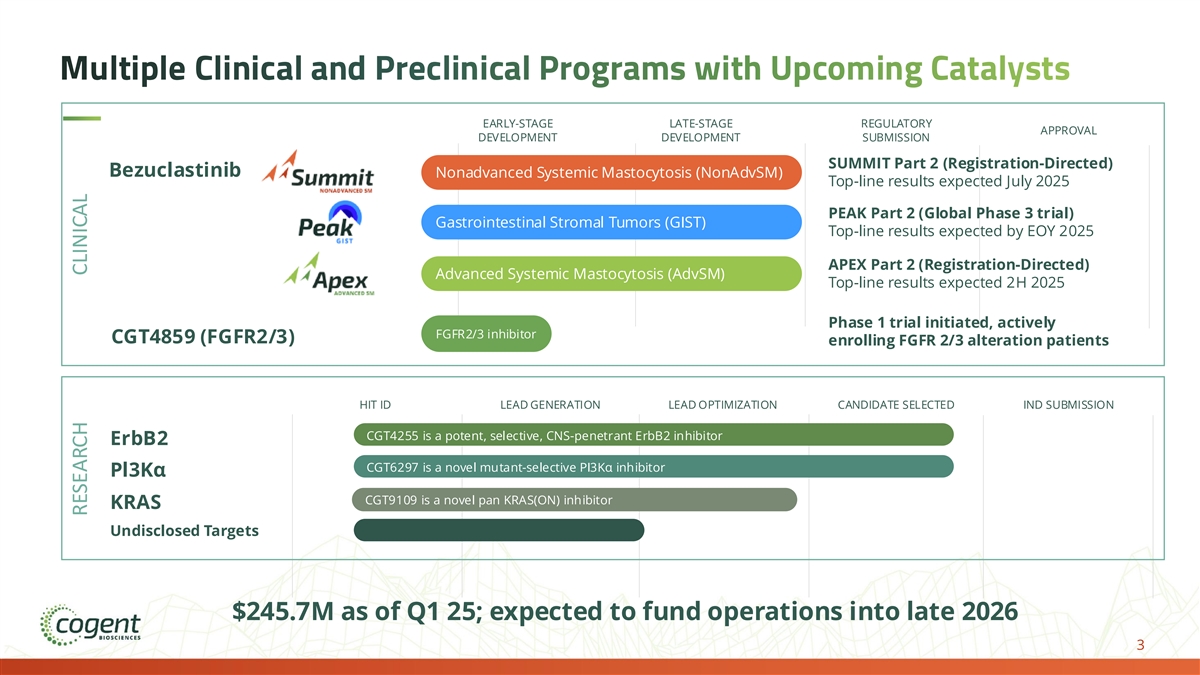

Multiple Clinical and Preclinical Programs with Upcoming Catalysts EARLY-STAGE LATE-STAGE REGULATORY APPROVAL DEVELOPMENT DEVELOPMENT SUBMISSION SUMMIT Part 2 (Registration-Directed) Bezuclastinib Nonadvanced Systemic Mastocytosis (NonAdvSM) Top-line results expected July 2025 PEAK Part 2 (Global Phase 3 trial) Gastrointestinal Stromal Tumors (GIST) Top-line results expected by EOY 2025 APEX Part 2 (Registration-Directed) Advanced Systemic Mastocytosis (AdvSM) Top-line results expected 2H 2025 Phase 1 trial initiated, actively FGFR2/3 inhibitor CGT4859 (FGFR2/3) enrolling FGFR 2/3 alteration patients HIT ID LEAD GENERATION LEAD OPTIMIZATION CANDIDATE SELECTED IND SUBMISSION CGT4255 is a potent, selective, CNS-penetrant ErbB2 inhibitor ErbB2 CGT6297 is a novel mutant-selective PI3Kα inhibitor Pl3Kα CGT9109 is a novel pan KRAS(ON) inhibitor KRAS Undisclosed Targets $245.7M as of Q1 25; expected to fund operations into late 2026 3 RESEARCH CLINICAL

Bezuclastinib Offers Best-in-Class KIT Inhibitor Opportunity 2024 2025 $2 billion US annual market Enrolled ~6 months early Registration-directed study in NonAdvSM bezuclastinib vs. placebo opportunity; differentiated LPFV TLR symptom improvement would n=179, 24-week MS2D2 primary endpoint July provide path to market leadership Enrolled ~6 months early Phase 3 study in 2nd-line GIST $1 billion+ US annual market bezuclastinib +/- sunitinib LPFV TLR opportunity, limited n=413, PFS primary endpoint By EOY competition for 2nd-line GIST $300 million US annual market Patient screening complete Registration-directed study in AdvSM opportunity; differentiated bezuclastinib monotherapy LPFV TLR safety/tolerability results would n=58, ORR primary endpoint 2H provide path to market leadership Aggregate US annual sales opportunity >$3 billion with limited competition LPFV: Last patient, first visit 4 TLR: Top-line results including primary endpoint

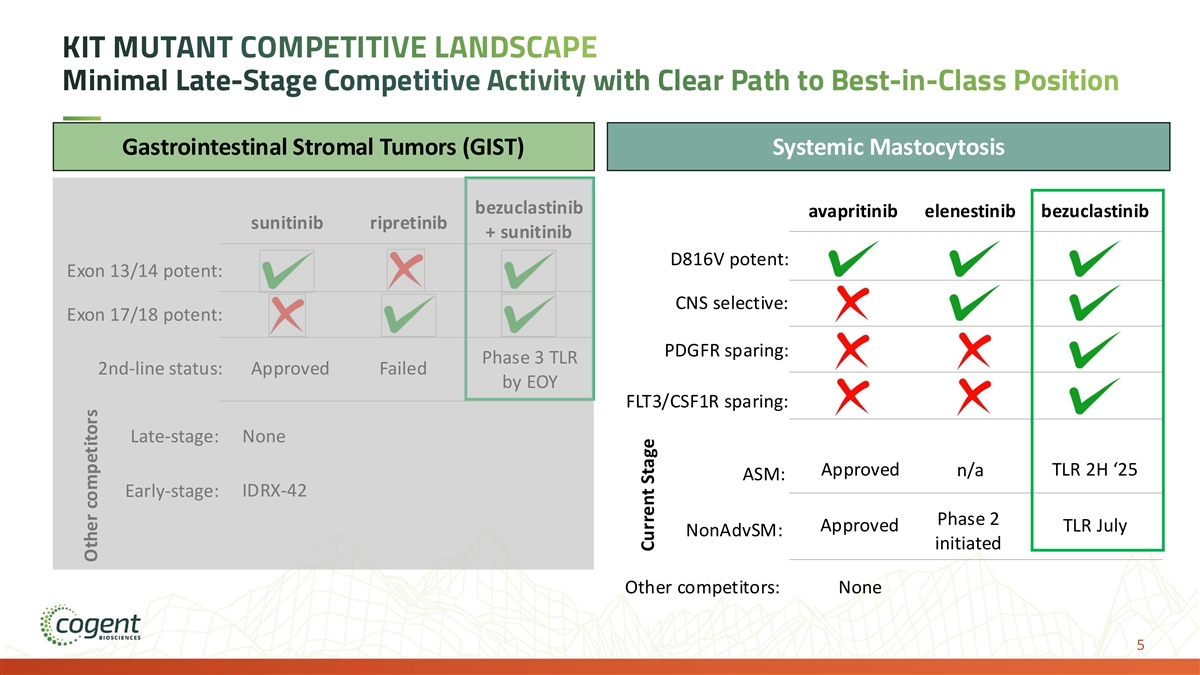

KIT MUTANT COMPETITIVE LANDSCAPE Minimal Late-Stage Competitive Activity with Clear Path to Best-in-Class Position Gastrointestinal Stromal Tumors (GIST) Systemic Mastocytosis bezuclastinib avapritinib elenestinib bezuclastinib sunitinib ripretinib + sunitinib D816V potent: Exon 13/14 potent: CNS selective: Exon 17/18 potent: PDGFR sparing: Phase 3 TLR 2nd-line status: Approved Failed by EOY FLT3/CSF1R sparing: Late-stage: None Approved n/a TLR 2H ‘25 ASM: IDRX-42 Early-stage: Phase 2 Approved TLR July NonAdvSM: initiated Other competitors: None 5 Other competitors Current Stage

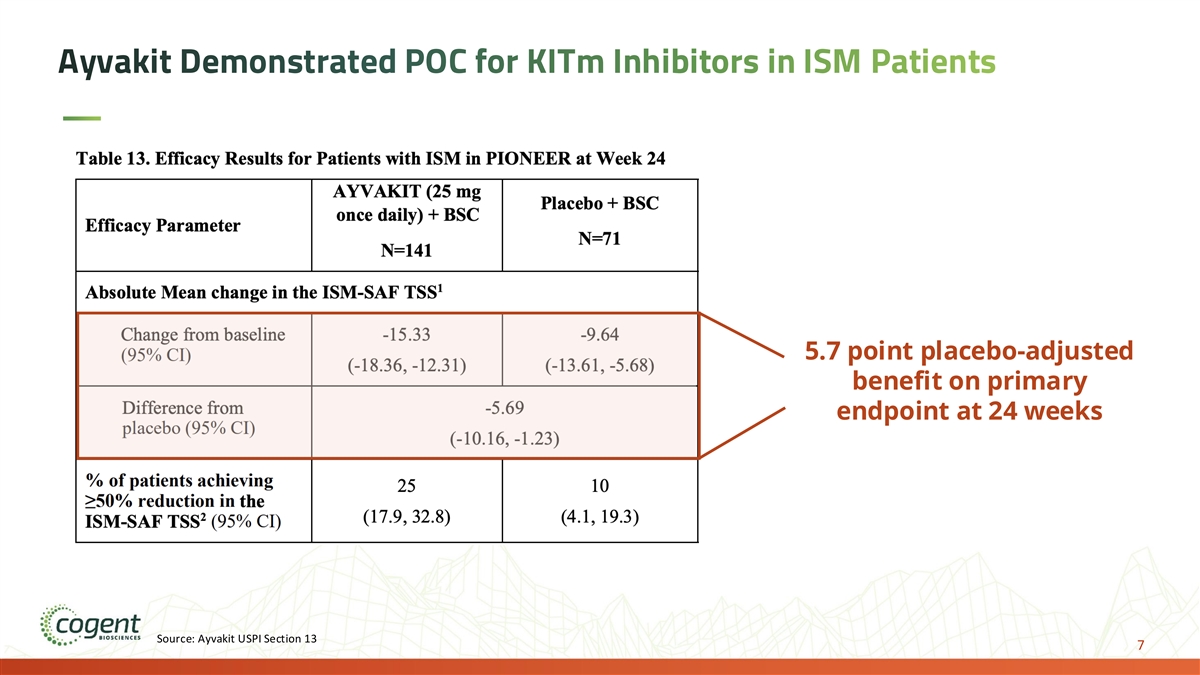

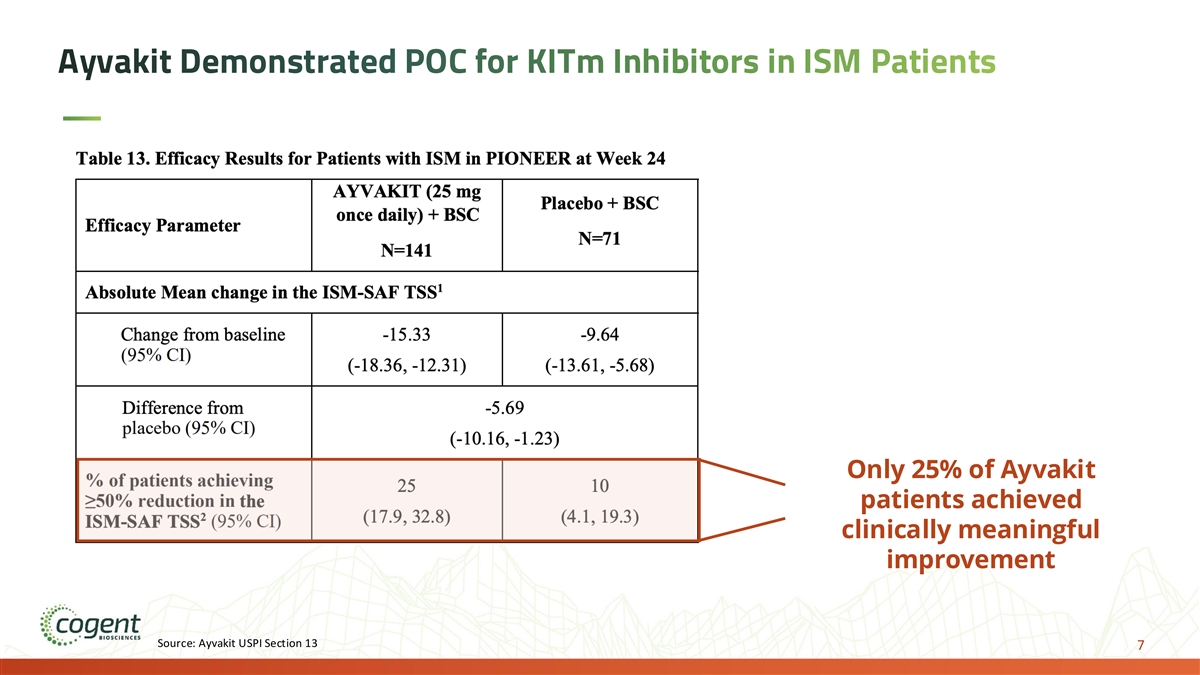

Ayvakit Demonstrated POC for KITm Inhibitors in ISM Patients 5.7 point placebo-adjusted benefit on primary endpoint at 24 weeks Source: Ayvakit USPI Section 13 7

Ayvakit Demonstrated POC for KITm Inhibitors in ISM Patients Only 25% of Ayvakit patients achieved clinically meaningful improvement Source: Ayvakit USPI Section 13 7

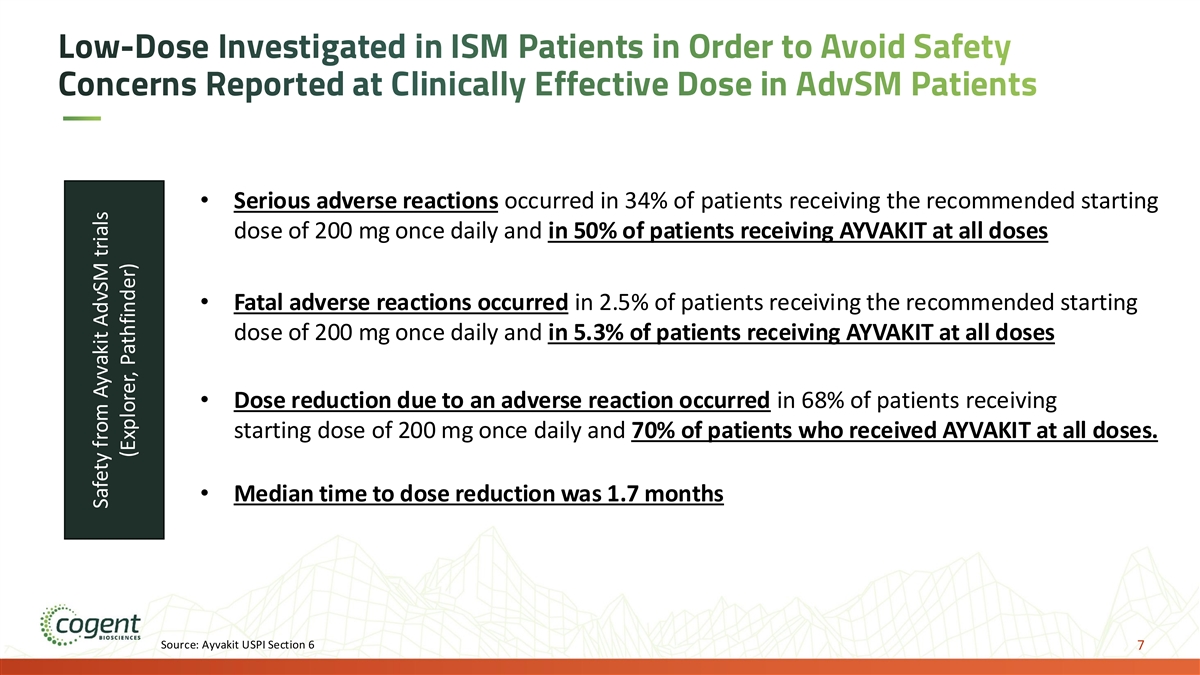

Low-Dose Ayvakit (25 mg) Associated with Improved Safety Profile Among Patients Treated with 25 mg Avapritinib on PIONEER Part 2: • 21.3% Grade 3+ AE • 9.9% Dose Modification due to AE • 5% Serious Adverse Events (SAE) Source: Ayvakit USPI Section 6 including Table 9; Gotlib, J. et al “Avapritinib versus placebo in indolent systemic mastocytosis.” NEjM Evidence, May 2023. 7

Low-Dose Investigated in ISM Patients in Order to Avoid Safety Concerns Reported at Clinically Effective Dose in AdvSM Patients • Serious adverse reactions occurred in 34% of patients receiving the recommended starting dose of 200 mg once daily and in 50% of patients receiving AYVAKIT at all doses • Fatal adverse reactions occurred in 2.5% of patients receiving the recommended starting dose of 200 mg once daily and in 5.3% of patients receiving AYVAKIT at all doses • Dose reduction due to an adverse reaction occurred in 68% of patients receiving starting dose of 200 mg once daily and 70% of patients who received AYVAKIT at all doses. • Median time to dose reduction was 1.7 months Source: Ayvakit USPI Section 6 7 Safety from Ayvakit AdvSM trials (Explorer, Pathfinder)

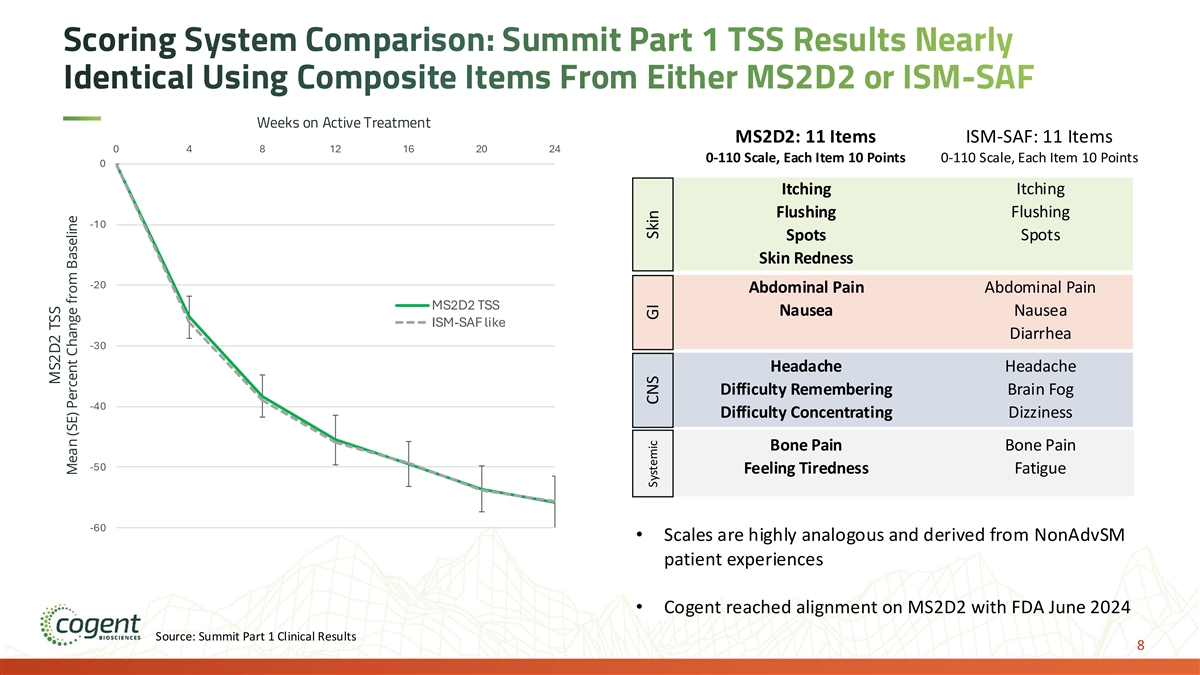

Scoring System Comparison: Summit Part 1 TSS Results Nearly Identical Using Composite Items From Either MS2D2 or ISM-SAF Weeks on Active Treatment MS2D2: 11 Items ISM-SAF: 11 Items 0 4 8 12 16 20 24 0-110 Scale, Each Item 10 Points 0-110 Scale, Each Item 10 Points 0 Itching Itching Flushing Flushing -10 Spots Spots Skin Redness -20 Abdominal Pain Abdominal Pain MS2D2 TSS Nausea Nausea ISM-SAF like Diarrhea -30 Headache Headache Difficulty Remembering Brain Fog -40 Difficulty Concentrating Dizziness Bone Pain Bone Pain -50 Feeling Tiredness Fatigue -60 • Scales are highly analogous and derived from NonAdvSM patient experiences • Cogent reached alignment on MS2D2 with FDA June 2024 Source: Summit Part 1 Clinical Results 8 MS2D2 TSS Mean (SE) Percent Change from Baseline Systemic CNS GI Skin

Preparing for SUMMIT Part 2 TLR – Defining Success Summit Part 2 Primary Endpoint <5.7 points 5.7 points 8.5 points 11.4 points (placebo-adjusted mean 24 week TSS) Competitive Positioning vs. >50% >100% Worse than Equivalency Standard of Care (SOC) “Home Run” “Grand Slam” SOC w/SOC Summit Part 2 Safety & Tolerability: - No new safety signals with transaminase elevations reported as: No cases of DILI or Hy’s Law Asymptomatic and Reversible ≤10% Gr 3; ≤10% discontinuation 11

PEAK Pending

KIT MUTANT COMPETITIVE LANDSCAPE Minimal Late-Stage Competitive Activity with Clear Path to Best-in-Class Position Gastrointestinal Stromal Tumors (GIST) Systemic Mastocytosis bezuclastinib avapritinib elenestinib bezuclastinib sunitinib ripretinib + sunitinib D816V potent: Exon 13/14 potent: CNS selective: Exon 17/18 potent: PDGFR sparing: Phase 3 TLR 2nd-line status: Approved Failed by EOY FLT3/CSF1R sparing: Late-stage: None Approved n/a TLR 2H ‘25 ASM: IDRX-42 Early-stage: Phase 2 Approved TLR July NonAdvSM: initiated Other competitors: None 13 Other competitors Current Stage

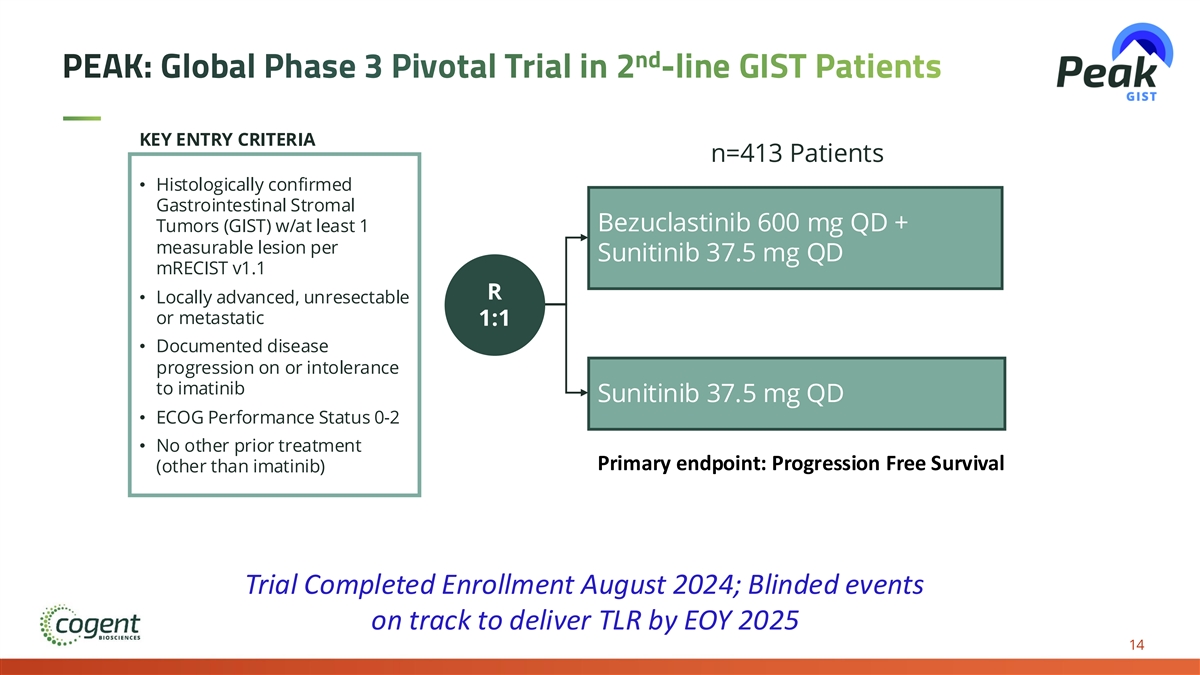

nd PEAK: Global Phase 3 Pivotal Trial in 2 -line GIST Patients KEY ENTRY CRITERIA n=413 Patients • Histologically confirmed Gastrointestinal Stromal Bezuclastinib 600 mg QD + Tumors (GIST) w/at least 1 measurable lesion per Sunitinib 37.5 mg QD mRECIST v1.1 R • Locally advanced, unresectable or metastatic 1:1 • Documented disease progression on or intolerance to imatinib Sunitinib 37.5 mg QD • ECOG Performance Status 0-2 • No other prior treatment Primary endpoint: Progression Free Survival (other than imatinib) Trial Completed Enrollment August 2024; Blinded events on track to deliver TLR by EOY 2025 14

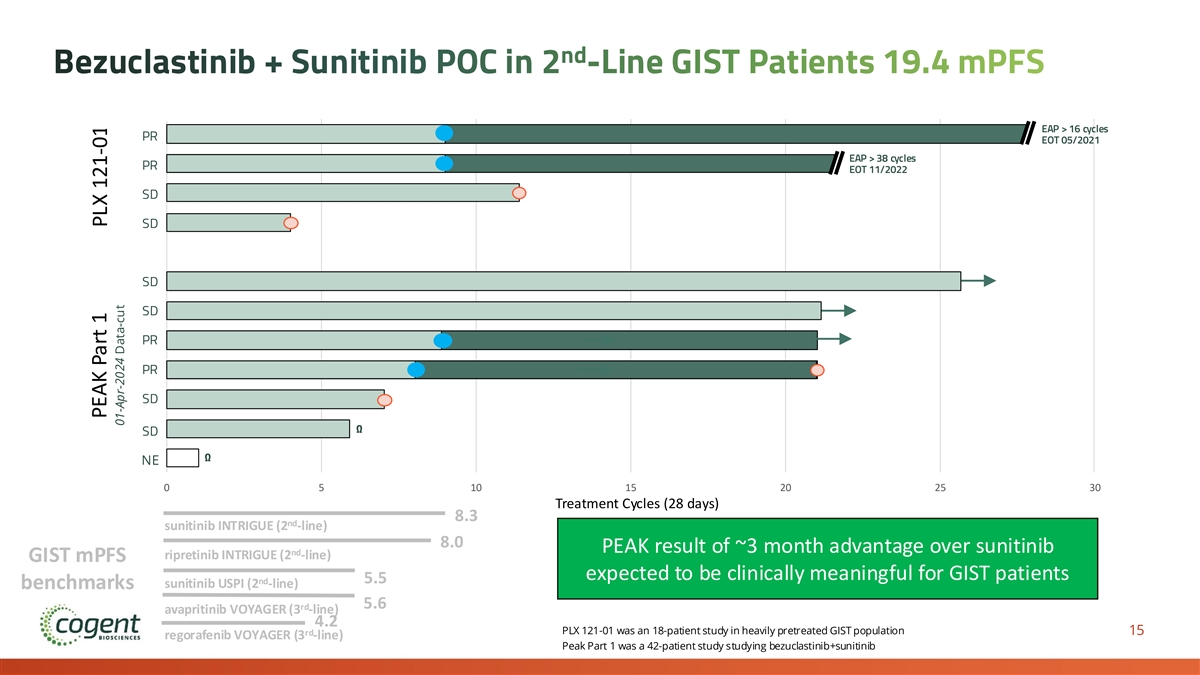

nd Bezuclastinib + Sunitinib POC in 2 -Line GIST Patients 19.4 mPFS EAP > 16 cycles PR EOT 05/2021 EAP > 38 cycles PR EOT 11/2022 SD SD SD SD PR PR SD Ω SD Ω NE 0 5 10 15 20 25 30 Treatment Cycles (28 days) 8.3 nd sunitinib INTRIGUE (2 -line) 8.0 PEAK result of ~3 month advantage over sunitinib nd ripretinib INTRIGUE (2 -line) GIST mPFS expected to be clinically meaningful for GIST patients nd 5.5 sunitinib USPI (2 -line) benchmarks 5.6 rd avapritinib VOYAGER (3 -line) 4.2 PLX 121-01 was an 18-patient study in heavily pretreated GIST population 15 rd regorafenib VOYAGER (3 -line) Peak Part 1 was a 42-patient study studying bezuclastinib+sunitinib PEAK Part 1 PLX 121-01 01-Apr-2024 Data-cut