UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 19, 2025

COREWEAVE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-42563 | 82-3060021 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| 290 W Mt. Pleasant Ave., Suite 4100 Livingston, NJ |

07039 | |||

| (Address of registrant’s principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (973) 270-9737

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Class A Common Stock, $0.000005 par value per share | CRWV | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

Notes Offering

On May 19, 2025, CoreWeave, Inc. (the “Company”) announced that it intends to offer, subject to market and other customary conditions, $1,500 million in aggregate principal amount of senior notes due 2030 (the “Notes”) in a private offering (the “Notes Offering”) to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons pursuant to Regulation S under the Securities Act. The Notes will be general senior unsecured obligations of the Company and will be guaranteed on a senior unsecured basis by CoreWeave Cash Management LLC, a wholly-owned subsidiary of the Company. The Company intends to use the proceeds from the Notes Offering for general corporate purposes, including, without limitation, repayment of outstanding indebtedness, and to pay fees, costs and expenses in connection with the Notes Offering.

On May 19, 2025, the Company issued a press release announcing the commencement of the Notes Offering. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

DDTL 3.0 Facility

The Company is currently in the process of entering into a new delayed draw term loan facility (the “DDTL 3.0 Facility”), with one or more of its wholly owned subsidiaries, which is expected to provide for delayed draw term loans in an aggregate principal amount not to exceed $2.6 billion. Subject to entering into definitive documentation in connection with the DDTL 3.0 Facility, the Company intends to use borrowings under the DDTL 3.0 Facility to fund the purchase and maintenance of certain equipment, hardware, infrastructure and other systems to be utilized by the Company in order to provide a strategic customer with certain services ordered by such strategic customer. As of the date of this Current Report on Form 8-K (this “Current Report”), the Company has yet to enter into definitive documentation for the DDTL 3.0 Facility. Entry into the DDTL 3.0 Facility and negotiations thereof are subject to uncertainties and contingencies which may be beyond the Company’s control. No assurances can be given that the DDTL 3.0 Facility will be entered into in the amount indicated above or at all.

Supplemental Information

The Company is herein furnishing certain supplemental information included in Exhibit 99.2 hereto and incorporated herein by reference that is being provided to potential investors in connection with the Notes Offering.

The information contained in this Item 7.01 of this Current Report, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filings.

Cautionary Note Regarding Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, including statements regarding the Notes Offering, the DDTL 3.0 Facility and the expected use of proceeds therefrom, which statements are based on current expectations, forecasts, and assumptions and involve risks and uncertainties that could cause actual results to differ materially from expectations discussed in such statements. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors including, but not limited to, the Company’s ability to complete the Notes Offering or enter into the DDTL 3.0 Facility on favorable terms, if at all, and general market, political, economic and business conditions which might affect the Notes Offering and/or the entry into the DDTL 3.0 Facility. These factors, as well as others, are discussed in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025. All forward-looking statements contained herein are based on information available as of the date hereof and the Company does not assume any obligation to update these statements as a result of new information or future events.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description |

|

| 99.1 | Press Release of the Company Relating to the Notes Offering dated May 19, 2025. | |

| 99.2 | Supplemental Information. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 19, 2025

| COREWEAVE, INC. | ||

| By: | /s/ Michael Intrator |

|

| Name: | Michael Intrator | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

CoreWeave Announces Intention to Offer $1,500 million

of Senior Notes

LIVINGSTON, N.J., May 19, 2025 — CoreWeave, Inc. (Nasdaq: CRWV) (“CoreWeave”) announced today that it intends, subject to market and other customary conditions, to offer $1,500 million aggregate principal amount of senior notes due 2030 (the “Notes”) in a private offering. The Notes will be guaranteed on a senior unsecured basis by CoreWeave Cash Management LLC, a wholly-owned subsidiary of CoreWeave.

CoreWeave intends to use the proceeds from the offering of the Notes for general corporate purposes, including, without limitation, repayment of outstanding indebtedness, and to pay fees, costs and expenses in connection with the offering of the Notes.

The Notes and related guarantees are being offered only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or to persons other than “U.S. persons” in compliance with Regulation S under the Securities Act. The Notes and related guarantees have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.

This press release is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Any offers of the Notes will be made only by means of a private offering memorandum.

About CoreWeave

CoreWeave, the AI Hyperscaler™, delivers a cloud platform of cutting-edge software powering the next wave of AI. The company’s technology provides enterprises and leading AI labs with cloud solutions for accelerated computing. Since 2017, CoreWeave has operated a growing footprint of data centers across the US and Europe.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, including statements regarding the Notes offering and the expected use of proceeds therefrom, which statements are based on current expectations, forecasts, and assumptions and involve risks and uncertainties that could cause actual results to differ materially from expectations discussed in such statements. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors including, but not limited to, CoreWeave’s ability to complete the offering on favorable terms, if at all, and general market, political, economic and business conditions which might affect the offering. These factors, as well as others, are discussed in CoreWeave’s filings with the Securities and Exchange Commission, including the sections titled “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in CoreWeave’s Prospectus dated March 27, 2025, filed on March 31, 2025 pursuant to Rule 424(b) under the Securities Act of 1933, as amended, relating to the Registration Statement on Form S-1, as amended (File No. 333-285512) and CoreWeave’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025. All forward-looking statements contained herein are based on information available as of the date hereof and CoreWeave does not assume any obligation to update these statements as a result of new information or future events.

Media Contact

press@coreweave.com

Investor Relations Contact

investor-relations@coreweave.com

EXHIBIT 99.2 Disclaimer This presentation contains “forward-looking” statements based on the beliefs and assumptions of CoreWeave, Inc. (the “Company” or “we”) and on information currently available to the Company. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including information or predictions concerning the future of the Company’s business or financial performance, including expectations regarding revenue, remaining performance obligations, cost of revenue, operating margin, operating expenses, and the ability to achieve and maintain future profitability, anticipated events and trends, particularly as they relate to AI compute, potential growth and expansion plans and opportunities, competitive position, technological and market trends, industry environment, potential market and revenue opportunities, the Company’s ability to successfully consummate the offering of the notes, relationships with third parties, including business partners and suppliers, the expected timing for completion, benefits, and impacts of the Company's recent acquisition of Weights & Biases, Inc., access to alternative financing structures, macroeconomic conditions and other future conditions. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions. Moreover, the Company operates in a very competitive and rapidly changing environment, and new risks emerge from time to time. The Company may not actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements, and the Recipient should not place undue reliance on these forward- looking statements. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in these forward-looking statements. In addition, the forward-looking statements included in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation. In addition, this presentation contains certain projected financial information with respect to the Company’s future results. Such projected financial information was not prepared with a view to public disclosure or compliance with the guidelines established by the Public Company Accounting Oversight Board, published guidance or rules of the United States Securities and Exchange Commission (the SEC ) or U.S. generally accepted accounting principles ( GAAP ). Such projected financial information constitutes forward‐looking information, is presented for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The projected financial information is based on estimates and assumptions that the management of the Company believed to be reasonable at the time they were made and that are inherently subject to significant uncertainties and contingencies, many of which are beyond the Company’s control, that could cause actual results to differ materially from the projected financial information. The projected financial information also does not reflect future changes in general business or economic conditions, or any other transaction or event that may occur and that was not anticipated at the time this information was prepared and is subject to risks, uncertainties, and other factors, including those described in the sections titled “Risk Factors” in the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2025 filed with the SEC on May 15, 2025. Further, the projected financial information relates to future years and such information by its nature becomes less predictive with each succeeding day. The inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. Neither the Company's independent auditors, nor any other independent accountants, have compiled, examined, or performed any procedures with respect to the prospective financial information contained herein, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the prospective financial information. This presentation also includes certain financial measures not presented in accordance with GAAP, including Adjusted EBITDA. Such non-GAAP measures are used by management in making operating decisions, allocating financial resources, and for internal planning and forecasting and business strategy purposes. The non-GAAP measures included in this presentation have certain limitations, and should not be construed as alternatives to financial measures determined in accordance with GAAP. The non-GAAP measures as defined by us may not be comparable to similar non-GAAP measures presented by other companies. The Company’s presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that the Company’s future results will be unaffected by other unusual or non-recurring items. Please refer to the documents filed by the Company with the SEC for more information with respect to the Company’s use of non-GAAP financial measures, including reconciliations thereof. Please refer to the Appendix for a reconciliation of each non-GAAP financial measure presented herein to the most directly comparable financial measure stated in accordance with GAAP. 1

Company Overview 2 2

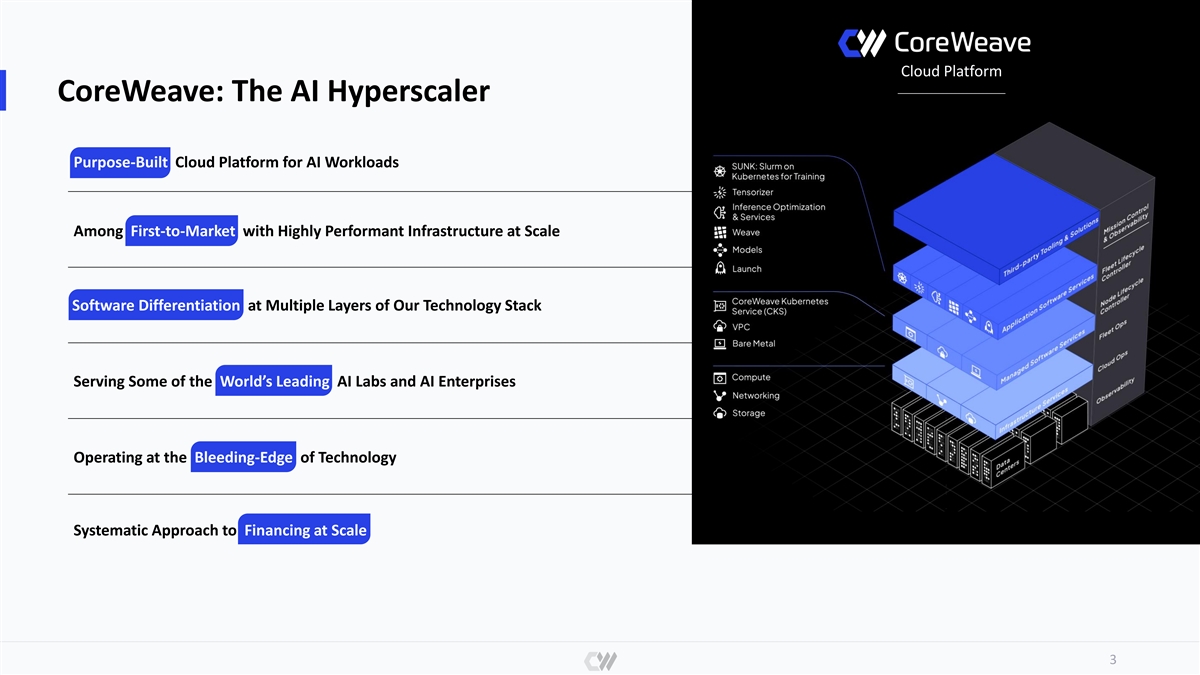

Cloud Platform CoreWeave: The AI Hyperscaler Purpose-Built Cloud Platform for AI Workloads Among First-to-Market with Highly Performant Infrastructure at Scale Software Differentiation at Multiple Layers of Our Technology Stack Serving Some of the World’s Leading AI Labs and AI Enterprises Operating at the Bleeding-Edge of Technology Systematic Approach to Financing at Scale 3

Parallelized Workloads are Fundamentally Different Today’s traditional cloud compute platforms are not optimized for the parallelized workloads of AI Serialized Workloads Parallelized Workloads SaaS Generative and VFX and High-Frequency Website Hosting Databases Email Systems Drug Discovery Applications Agentic AI Rendering Trading Single Chip Failure Single Chip Failure If… If… Simple Tasks Offloaded to Other Processors Entire Job Fails, Massive Waste of Compute Resources Then Then 4

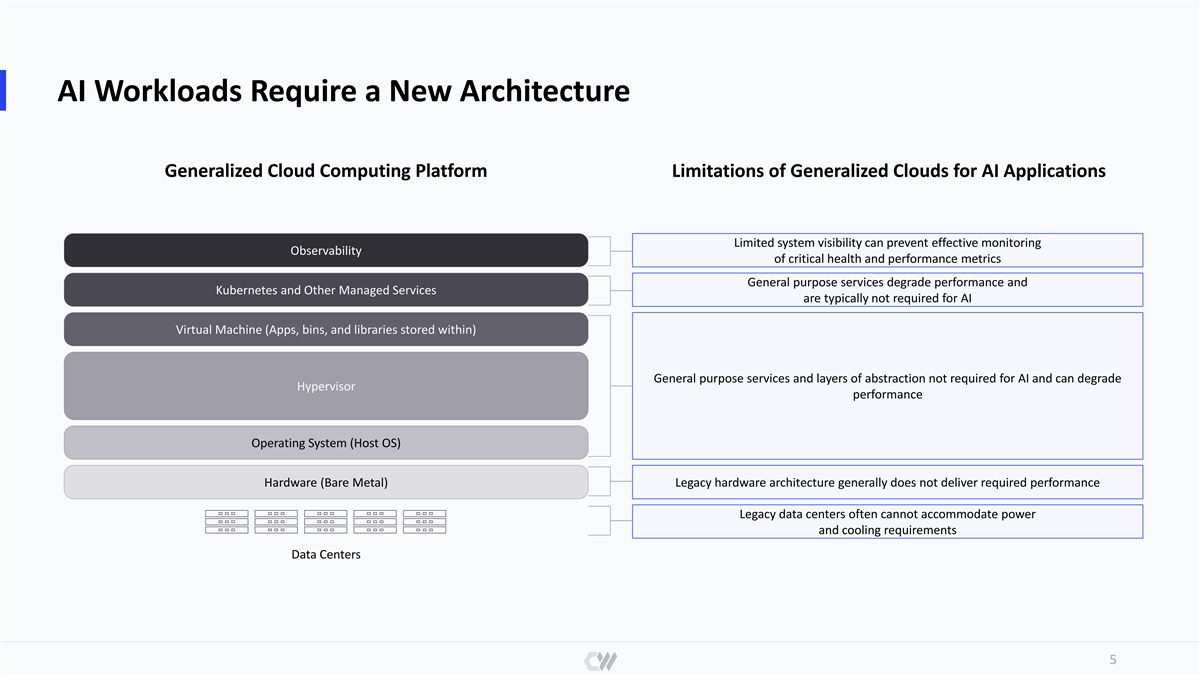

AI Workloads Require a New Architecture Generalized Cloud Computing Platform Limitations of Generalized Clouds for AI Applications Limited system visibility can prevent effective monitoring Observability of critical health and performance metrics General purpose services degrade performance and Kubernetes and Other Managed Services are typically not required for AI Virtual Machine (Apps, bins, and libraries stored within) General purpose services and layers of abstraction not required for AI and can degrade Hypervisor performance Operating System (Host OS) Hardware (Bare Metal) Legacy hardware architecture generally does not deliver required performance Legacy data centers often cannot accommodate power and cooling requirements Data Centers 5

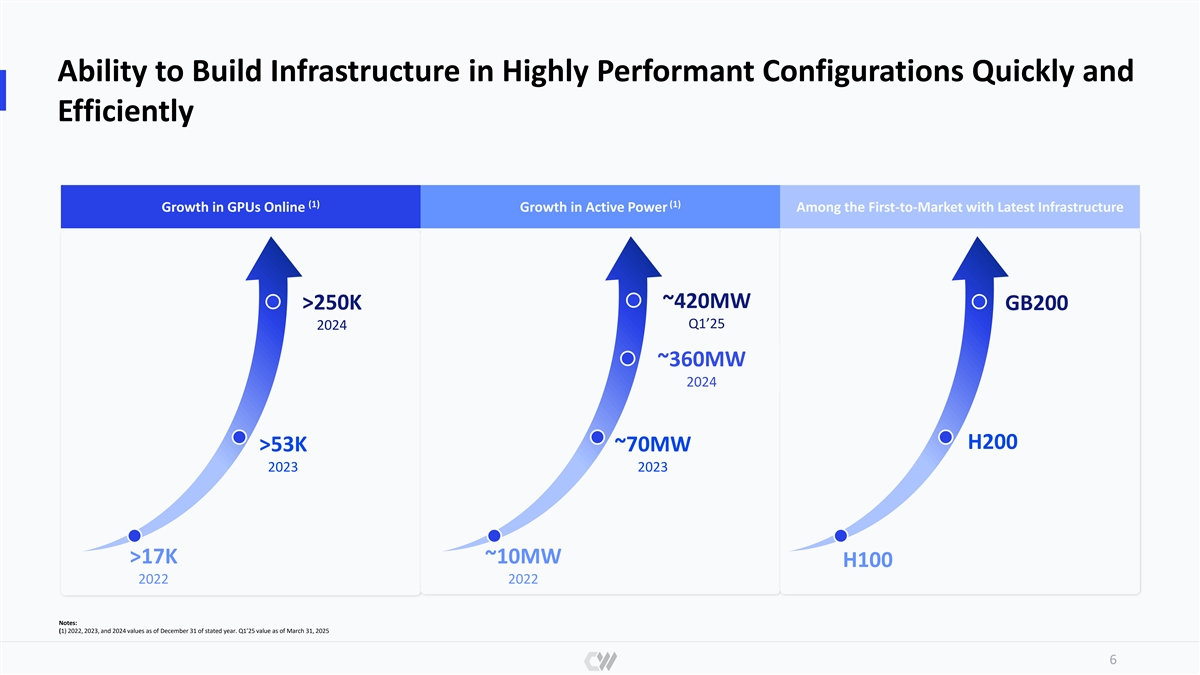

Ability to Build Infrastructure in Highly Performant Configurations Quickly and Efficiently (1) (1) Growth in GPUs Online Growth in Active Power Among the First-to-Market with Latest Infrastructure ~420MW >250K GB200 Q1’25 2024 ~360MW 2024 H200 >53K ~70MW 2023 2023 >17K ~10MW H100 2022 2022 Notes: (1) 2022, 2023, and 2024 values as of December 31 of stated year. Q1’25 value as of March 31, 2025 6

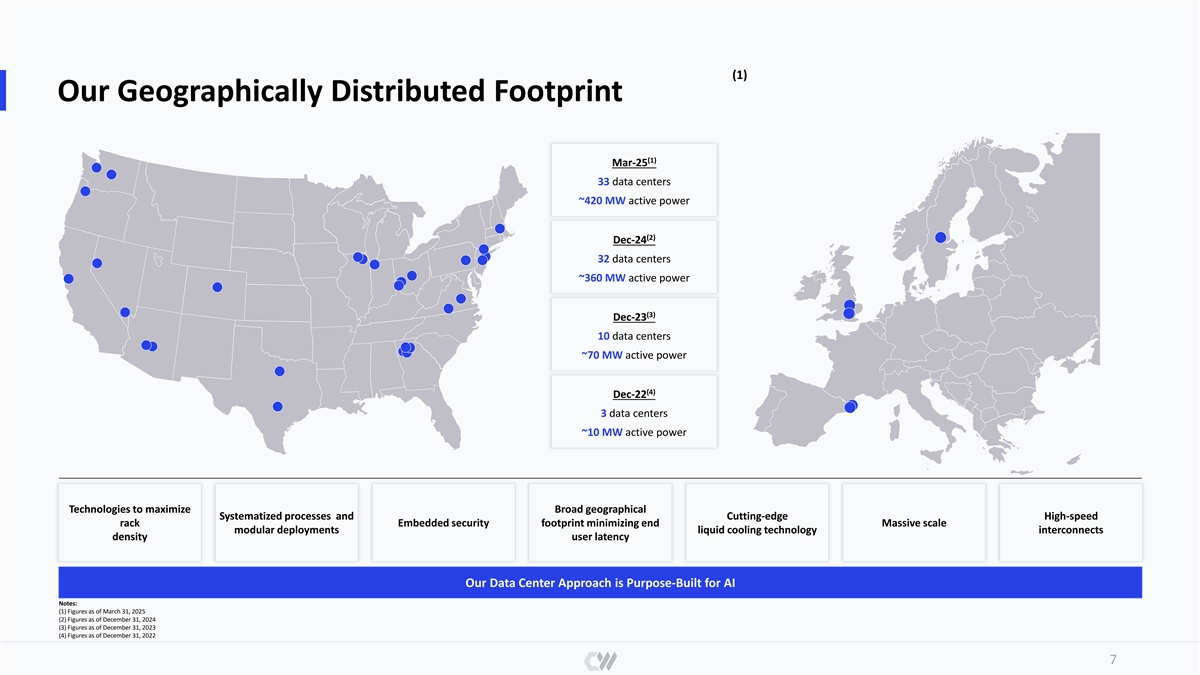

(1) Our Geographically Distributed Footprint (1) Mar-25 33 data centers ~420 MW active power (2) Dec-24 32 data centers ~360 MW active power (3) Dec-23 10 data centers ~70 MW active power (4) Dec-22 3 data centers ~10 MW active power Technologies to maximize Broad geographical Systematized processes and Cutting-edge High-speed rack Embedded security footprint minimizing end Massive scale modular deployments liquid cooling technology interconnects density user latency Our Data Center Approach is Purpose-Built for AI Notes: (1) Figures as of March 31, 2025 (2) Figures as of December 31, 2024 (3) Figures as of December 31, 2023 (4) Figures as of December 31, 2022 7

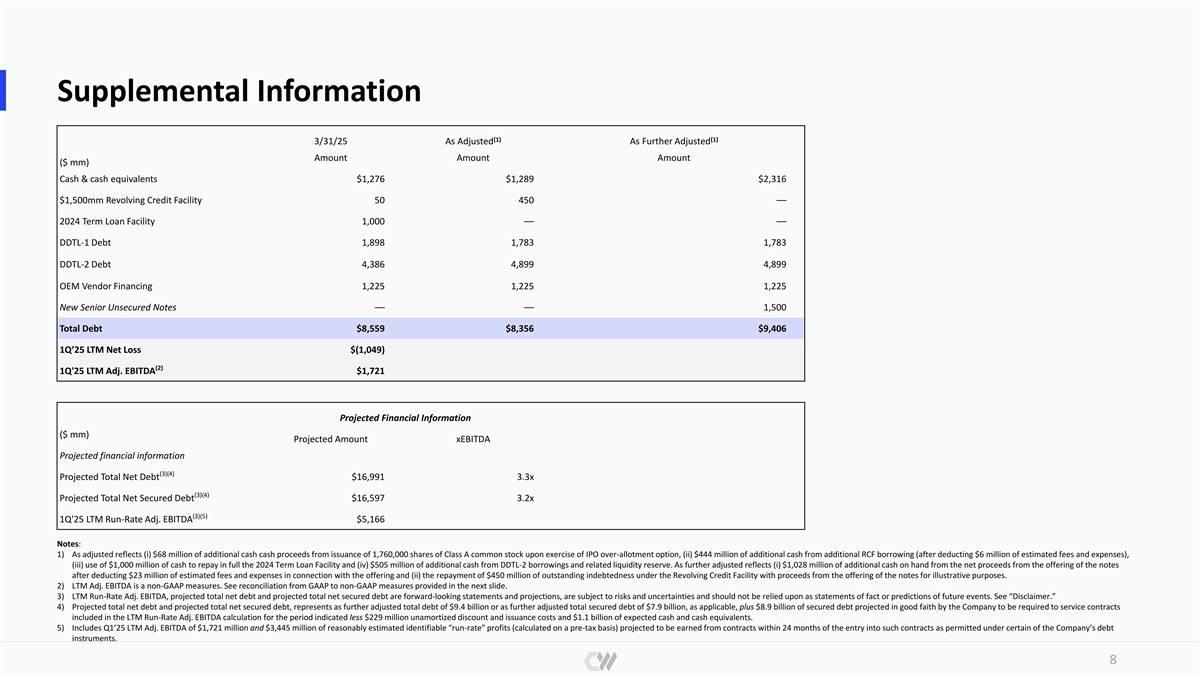

Supplemental Information (1) (1) 3/31/25 As Adjusted As Further Adjusted Amount Amount Amount ($ mm) Cash & cash equivalents $1,276 $1,289 $2,316 $1,500mm Revolving Credit Facility 50 450 –– 2024 Term Loan Facility 1,000 –– –– DDTL-1 Debt 1,898 1,783 1,783 DDTL-2 Debt 4,386 4,899 4,899 OEM Vendor Financing 1,225 1,225 1,225 New Senior Unsecured Notes –– –– 1,500 Total Debt $8,559 $8,356 $9,406 1Q’25 LTM Net Loss $(1,049) (2) 1Q'25 LTM Adj. EBITDA $1,721 Projected Financial Information ($ mm) Projected Amount xEBITDA Projected financial information (3)(4) Projected Total Net Debt $16,991 3.3x (3)(4) Projected Total Net Secured Debt $16,597 3.2x (3)(5) 1Q'25 LTM Run-Rate Adj. EBITDA $5,166 Notes: 1) As adjusted reflects (i) $68 million of additional cash cash proceeds from issuance of 1,760,000 shares of Class A common stock upon exercise of IPO over-allotment option, (ii) $444 million of additional cash from additional RCF borrowing (after deducting $6 million of estimated fees and expenses), (iii) use of $1,000 million of cash to repay in full the 2024 Term Loan Facility and (iv) $505 million of additional cash from DDTL-2 borrowings and related liquidity reserve. As further adjusted reflects (i) $1,028 million of additional cash on hand from the net proceeds from the offering of the notes after deducting $23 million of estimated fees and expenses in connection with the offering and (ii) the repayment of $450 million of outstanding indebtedness under the Revolving Credit Facility with proceeds from the offering of the notes for illustrative purposes. 2) LTM Adj. EBITDA is a non-GAAP measures. See reconciliation from GAAP to non-GAAP measures provided in the next slide. 3) LTM Run-Rate Adj. EBITDA, projected total net debt and projected total net secured debt are forward-looking statements and projections, are subject to risks and uncertainties and should not be relied upon as statements of fact or predictions of future events. See “Disclaimer.” 4) Projected total net debt and projected total net secured debt, represents as further adjusted total debt of $9.4 billion or as further adjusted total secured debt of $7.9 billion, as applicable, plus $8.9 billion of secured debt projected in good faith by the Company to be required to service contracts included in the LTM Run-Rate Adj. EBITDA calculation for the period indicated less $229 million unamortized discount and issuance costs and $1.1 billion of expected cash and cash equivalents. 5) Includes Q1’25 LTM Adj. EBITDA of $1,721 million and $3,445 million of reasonably estimated identifiable “run-rate” profits (calculated on a pre-tax basis) projected to be earned from contracts within 24 months of the entry into such contracts as permitted under certain of the Company’s debt instruments. 8

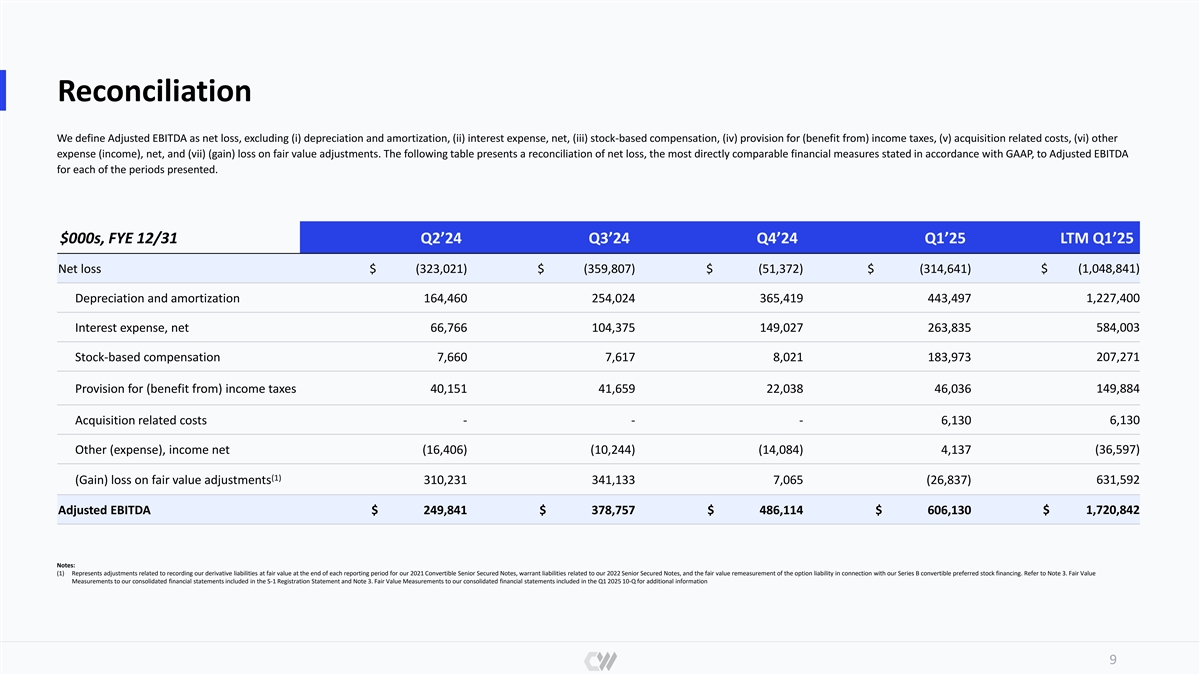

Reconciliation We define Adjusted EBITDA as net loss, excluding (i) depreciation and amortization, (ii) interest expense, net, (iii) stock-based compensation, (iv) provision for (benefit from) income taxes, (v) acquisition related costs, (vi) other expense (income), net, and (vii) (gain) loss on fair value adjustments. The following table presents a reconciliation of net loss, the most directly comparable financial measures stated in accordance with GAAP, to Adjusted EBITDA for each of the periods presented. $000s, FYE 12/31 Q2’24 Q3’24 Q4’24 Q1’25 LTM Q1’25 Net loss $ (323,021) $ (359,807) $ (51,372) $ (314,641) $ (1,048,841) Depreciation and amortization 164,460 254,024 365,419 443,497 1,227,400 Interest expense, net 66,766 104,375 149,027 263,835 584,003 Stock-based compensation 7,660 7,617 8,021 183,973 207,271 Provision for (benefit from) income taxes 40,151 41,659 22,038 46,036 149,884 Acquisition related costs - - - 6,130 6,130 (36,597) Other (expense), income net (16,406) (10,244) (14,084) 4,137 (1) (Gain) loss on fair value adjustments 310,231 341,133 7,065 (26,837) 631,592 Adjusted EBITDA $ 249,841 $ 378,757 $ 486,114 $ 606,130 $ 1,720,842 Notes: (1) Represents adjustments related to recording our derivative liabilities at fair value at the end of each reporting period for our 2021 Convertible Senior Secured Notes, warrant liabilities related to our 2022 Senior Secured Notes, and the fair value remeasurement of the option liability in connection with our Series B convertible preferred stock financing. Refer to Note 3. Fair Value Measurements to our consolidated financial statements included in the S-1 Registration Statement and Note 3. Fair Value Measurements to our consolidated financial statements included in the Q1 2025 10-Q for additional information 9