UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2025

HERC HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33139 | 20-3530539 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

27500 Riverview Center Blvd.

Bonita Springs, Florida 34134

(Address of principal executive offices and zip code)

(239) 301-1000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, par value $0.01 per share | HRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

On May 12, 2025, Herc Holdings Inc. (the “Company”), will use a lender presentation (the “Lender Presentation”) in connection with meetings with prospective lenders to discuss a proposed term loan financing in connection with the Company’s previously announced proposed acquisition (the “Acquisition”) of H&E Equipment Services, Inc. (“H&E”) pursuant to the Agreement and Plan of Merger, dated February 19, 2025, by and among the Company, HR Merger Sub Inc., a direct wholly owned subsidiary of the Company, and H&E (the “Merger Agreement”).

A copy of the relevant portions of the Lender Presentation are furnished herewith pursuant to Regulation FD, in the general form presented in the Lender Presentation, as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished under this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

| Exhibit |

Description |

|

| 99.1 | Excerpts from Lender Presentation, dated May 12, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

Cautionary Note Regarding Forward-Looking Statements

This communication includes “forward-looking statements,” within the meaning of Section 21E of the Securities Exchange Act, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements related to the Company, H&E and the proposed Acquisition of H&E by the Company that involve substantial risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed or implied by such statements. Forward-looking statements in this communication include, among other things, statements about the potential benefits of the proposed transaction, the Company’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of each of the Company and H&E, expected valuation and re-rating opportunities for the combined company, and the anticipated timing of closing of the proposed transaction. Forward-looking statements are generally identified by the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” “looks,” and future or conditional verbs, such as “will,” “should,” “could” or “may,” as well as variations of such words or similar expressions. All forward-looking statements are based upon our current expectations and various assumptions and apply only as of the date of this communication. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that our expectations, beliefs and projections will be achieved or that the completion and anticipated benefits of the proposed transaction can be guaranteed, and actual results may differ materially from those projected. You should not place undue reliance on forward-looking statements.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from those suggested by our forward-looking statements, including, but not limited to, (i) the possibility that the sufficient number of H&E’s shares are not validly tendered into the tender offer to meet the minimum condition; (ii) the Company’s ability to implement its plans, forecasts and other expectations with respect to H&E’s business after the completion of the proposed transaction and realized expected synergies; (iii) the ability to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; (iv) the Company and H&E may be unable to obtain regulatory approvals required for the proposed transaction or may be required to accept conditions that could reduce the anticipated benefits of the proposed transaction as a condition to obtaining regulatory approvals; (v) the length of time necessary to consummate the proposed transaction may be longer than anticipated; (vi) problems may arise in successfully integrating the businesses of the Company and H&E, including, without limitation, problems associated with the potential loss of any key employees, customers, suppliers and other counterparties of H&E; (vii) the proposed transaction may involve unexpected costs, including, without limitation, the exposure to any unrecorded liabilities or unidentified issues during the due diligence investigation of H&E or that are not covered by insurance, as well as potential unfavorable accounting treatment and unexpected increases in taxes; (viii) the Company’s business may suffer as a result of uncertainty surrounding the proposed transaction, any adverse effects on our ability to maintain relationships with customers, employees and suppliers; (ix) the occurrence of any event, change to other circumstances that could give rise to the termination of the Merger Agreement, the failure of the closing conditions included in the Merger Agreement to be satisfied, or any other failure to consummate the proposed transaction; (x) any negative effects of the announcement of the proposed transaction of the financing thereof on the market price of the Company common stock or other securities; (xi) the industry may be subject to future risks including those set forth in the “Risk Factors” section in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and in the other filings with the SEC by each of the Company and H&E; and (xii) Herc may not achieve its valuation or re-rating opportunities. The foregoing list of factors is not exhaustive. Investors should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of the Company and H&E, including those described in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and in the other filings with the SEC by each of the Company and H&E. All forward-looking statements are expressly qualified in their entirety by such cautionary statements. We undertake no obligation to update or revise forward-looking statements that have been made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, except as may be required by applicable securities laws.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| HERC HOLDINGS INC. | ||

| (Registrant) | ||

| By: | /s/ Mark Humphrey |

|

| Name: | Mark Humphrey | |

| Title: | Senior Vice President and Chief Financial Officer | |

Date: May 12, 2025

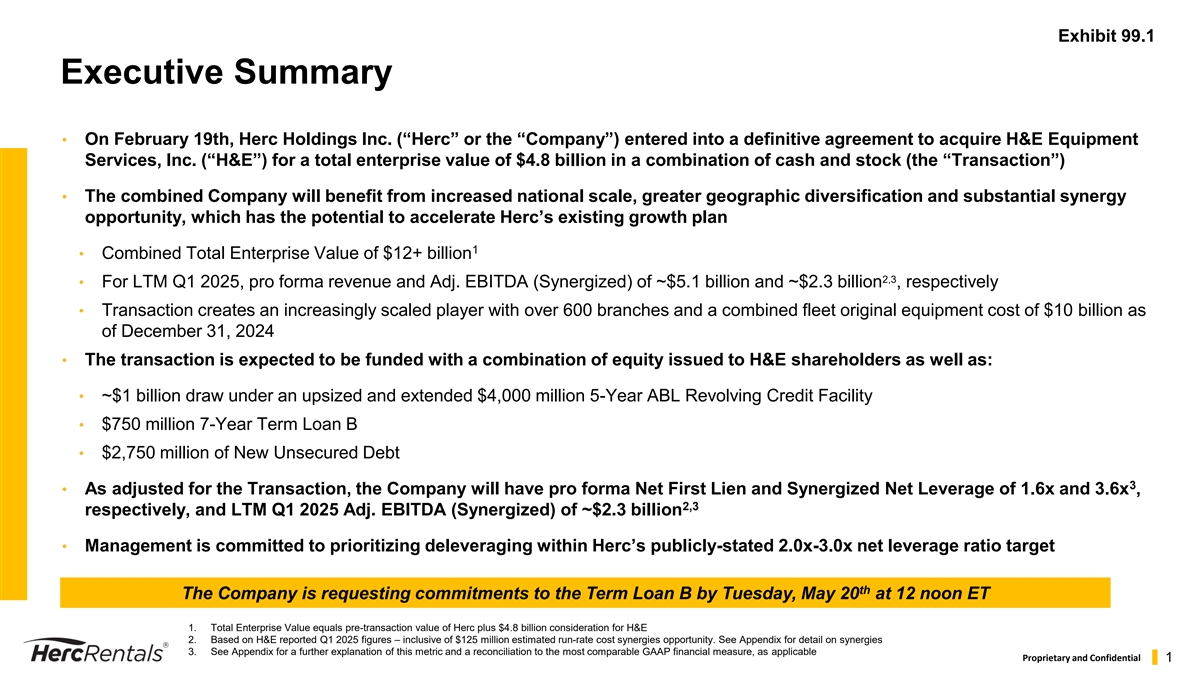

Exhibit 99.1 Executive Summary • On February 19th, Herc Holdings Inc. (“Herc” or the “Company”) entered into a definitive agreement to acquire H&E Equipment Services, Inc. (“H&E”) for a total enterprise value of $4.8 billion in a combination of cash and stock (the “Transaction”) • The combined Company will benefit from increased national scale, greater geographic diversification and substantial synergy opportunity, which has the potential to accelerate Herc’s existing growth plan 1 • Combined Total Enterprise Value of $12+ billion 2,3 • For LTM Q1 2025, pro forma revenue and Adj. EBITDA (Synergized) of ~$5.1 billion and ~$2.3 billion , respectively • Transaction creates an increasingly scaled player with over 600 branches and a combined fleet original equipment cost of $10 billion as of December 31, 2024 • The transaction is expected to be funded with a combination of equity issued to H&E shareholders as well as: • ~$1 billion draw under an upsized and extended $4,000 million 5-Year ABL Revolving Credit Facility • $750 million 7-Year Term Loan B • $2,750 million of New Unsecured Debt 3 • As adjusted for the Transaction, the Company will have pro forma Net First Lien and Synergized Net Leverage of 1.6x and 3.6x , 2,3 respectively, and LTM Q1 2025 Adj. EBITDA (Synergized) of ~$2.3 billion • Management is committed to prioritizing deleveraging within Herc’s publicly-stated 2.0x-3.0x net leverage ratio target th The Company is requesting commitments to the Term Loan B by Tuesday, May 20 at 12 noon ET 1. Total Enterprise Value equals pre-transaction value of Herc plus $4.8 billion consideration for H&E 2. Based on H&E reported Q1 2025 figures – inclusive of $125 million estimated run-rate cost synergies opportunity. See Appendix for detail on synergies 3. See Appendix for a further explanation of this metric and a reconciliation to the most comparable GAAP financial measure, as applicable Proprietary and Confidential 1

Transaction Overview Sources Uses • Proposed debt financing will consist of : 1 ABL Draw $919 Common Stock $525 • $919 million draw under upsized and extended New Term Loan B due 2032 750 Repayment of H&E Debt 1,364 5-year ABL Revolver New Unsecured Debt 2,750 Cash Consideration Paid 2,877 1 Equity Issuance to H&E Shareholders 525 Debt Issuance Costs 73 • New $750 million 7-year Term Loan B 2 Breakage Costs 35 Cash to Balance Sheet 70 • $2,750 million of New Unsecured Debt Total Sources $4,944 Total Uses $4,944 1 • Term Loan B will be pari passu with the ABL Based on 5/2/2025 5-day VWAP of $110.91 2 Includes accrued and unpaid interest and additional costs Revolver As of 3/31/2025 Pro Forma Cum. Mult. Cum. Mult. • Both facilities will share in combined borrowing 1 2 3 $ of EBITDA Transaction Adj. $ of EBITDA base valued at $5.2 billion as of February 2025 Cash and Cash Equivalents $48 $70 $118 $4,000 million Upsized and Extended ABL due 2030 $1,620 $919 $2,539 • Net proceeds from the transaction will be used to AR Securitization Facility due 2025 359 359 finance the acquisition, to repay H&E Equipment New Term Loan B due 2032 -- 750 750 Services debt and to pay transaction-related fees Finance Lease Liabilities 75 4 79 1n Total Secured Debt $2,054 1.3x $3,727 1.6x and expenses (excluding breakup fee of $64 Net Secured Debt $2,006 1.3x $3,609 1.6x million to United Rentals paid in Q1 2025) 5.500% Senior Unsecured Notes due 2027 1,200 1,200 6.625% Senior Unsecured Notes due 2029 800 800 • As adjusted for the Transaction, the Company will New Unsecured Debt -- 2,750 2,750 have pro forma Net First Lien and Net Total Total Debt $4,054 2.6x $8,477 3.6x Net Debt $4,006 2.5x $8,359 3.6x Leverage of 1.6x and 3.6x*, respectively, and 5 4 Market Capitalization $3,463 $525 $3,988 LTM Q1 2025 Adj. EBITDA (Synergized) of ~$2.3 Total Capitalization $7,517 $12,465 * billion* ¹ Based on Herc Holdings Inc. LTM 3/31/25 Adj. EBITDA of: $1,583 * * * ** ² Based on pro forma LTM 3/31/25 Adj. EBITDA of: $2,199 • $8,738 million of cushion supporting Term Loan B * Plus expected cost synergies of: $125 * between Unsecured Debt and Equity (i.e. Market ³ Based on pro forma LTM 3/31/25 Adj. EBITDA (Synergized) of: $2,324* Capitalization) ⁴ Based on 5/9/2025 closing share price of $121.52 and 28.5 million shares outstanding ⁵ Based on 5/2/2025 5-day VWAP of $110.91 * For reconciliation to the most comparable GAAP financial measure, see the Appendix. See Appendix for detail on synergies Note: This slide sets forth the estimated sources and uses of funds in connection with the Transaction and related transactions, assuming they occurred on March 31, 2025 and based on estimated amounts outstanding on that date. Actual amounts will vary from the estimated amounts shown below depending on several factors, including, among others, the amount of cash and cash equivalents balances, net working capital, indebtedness (including accrued interest on such indebtedness), in each case, of us or H&E, changes made to the sources of the contemplated financings, the number of shares of capital stock and equity awards outstanding on the closing date of the Transaction and differences from our estimated fees and expenses. Proprietary and Confidential 2

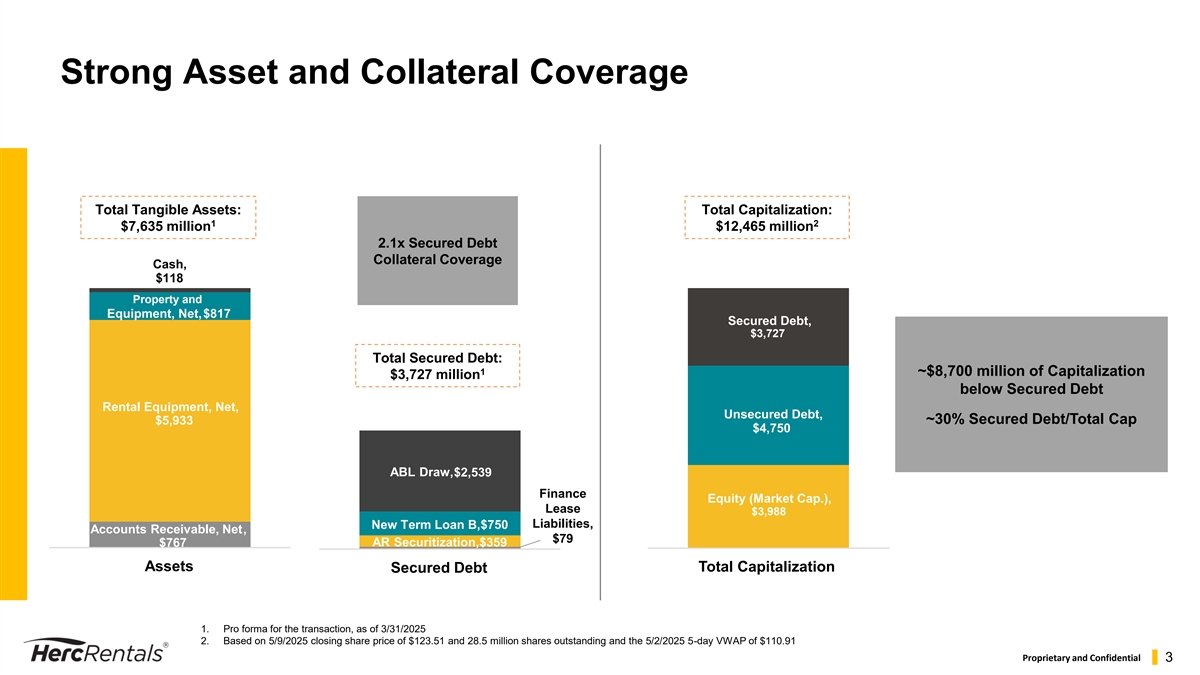

Strong Asset and Collateral Coverage Total Tangible Assets: Total Capitalization: 1 2 $7,635 million $12,465 million 2.1x Secured Debt Collateral Coverage Cash, $118 Property and Equipment, Net,$817 Secured Debt, $3,727 Total Secured Debt: 1 ~$8,700 million of Capitalization $3,727 million below Secured Debt Rental Equipment, Net, Unsecured Debt, ~30% Secured Debt/Total Cap $5,933 $4,750 ABL Draw,$2,539 Finance Equity (Market Cap.), Lease $3,988 Liabilities, New Term Loan B,$750 Accounts Receivable, Net, $79 AR Securitization,$359 $767 Assets Total Capitalization Secured Debt 1. Pro forma for the transaction, as of 3/31/2025 2. Based on 5/9/2025 closing share price of $123.51 and 28.5 million shares outstanding and the 5/2/2025 5-day VWAP of $110.91 Proprietary and Confidential 3

2 Combined Fleet Portfolio Presents Opportunity 1 2 Current Combined Company OEC growth of ~93% and increase of Current OEC mix at H&E presents large specialty mix of ~6% since 2016 opportunity for cross-selling in specialty Specialty Specialty Aerial Aerial 24% 17% 24% 27% 47 Acquisition of Months Fleet Avg. Age ~$6.9B ~$10B Rental OEC Rental OEC Other Other Earthmoving 22% 19% 11% Earthmoving 15% Material Handling Material Handling 19% 22% ~$3.6B ~$1.6B 4 Revenue Adj. EBITDA ~$2.3B ~$5.1B 3,4 Pro forma Adj. EBITDA (Synergized) Pro forma Revenue ~8% 43.7% LTM Q1 2024 – LTM Q1 2025 4 Adj. EBITDA Margin Revenue Growth 45.7% Pro forma Adj. EBITDA (Synergized) 453 ~7,600 3,4 Margin Branches Team Members 1. Current refers to LTM Q1 2025. Fleet mix percentages are based on company filings 2. Combined Company financials refer to Q1 2025 pro forma financials 3. Includes run-rate cost synergies of ~$125 million, see Appendix for detail on synergies; we present the potential run-rate revenue and cost synergies because they are permitted as an adjustment to EBITDA under the indenture that will govern the notes, and they should not be viewed as a projection of future performance. Proprietary and Confidential 4. For reconciliation to the most comparable GAAP financial measure, see the Appendix 4

2 Extended Customer Diversification 1 H&E Herc Rentals 9% Non-Res • Strong Construction customer base with 36% 9% Industrial of FY 2024 Revenues H&E successfully shifted the portfolio towards Non- • Electrical, General Contractors, Mechanical, Residential $1,517M 9% Residential Construction, which directly reinforces Herc’s Remediation & Environmental, Residential O&G core end-market 69% • New verticals since 2016: Restoration and Other Specialty Contractors 4% • Solid Industrial customer base with 26% of FY 9% Non-Res 2024 Revenues 9% Industrial H&E has blue-chip customers in Industrials and Oil and • Agriculture, Chemicals. Industrial Manufacturing, Residential $1,517M Gas market allowing Herc to add to those 9% Metals & Minerals, Oil & Gas, Pharmaceutical strategic end-markets O&G • New verticals since 2016: Aerospace, 69% Automotive/EV, Energy/Renewables, Food & Other Beverage 9% Non-Res • Other diversified customer base with 7% of FY 9% Industrial 2024 Revenues Diversified customer base in other industries with the aim Residential $1,517M 9% • Sporting Events, Theater, TV, Film & Radio, of being more recession resilient O&G Homeowners 69% • New verticals since 2016: Live Events Other 1. H&E public filings, with percentages based on December 31, 2024 revenue ($ in millions) Proprietary and Confidential 5

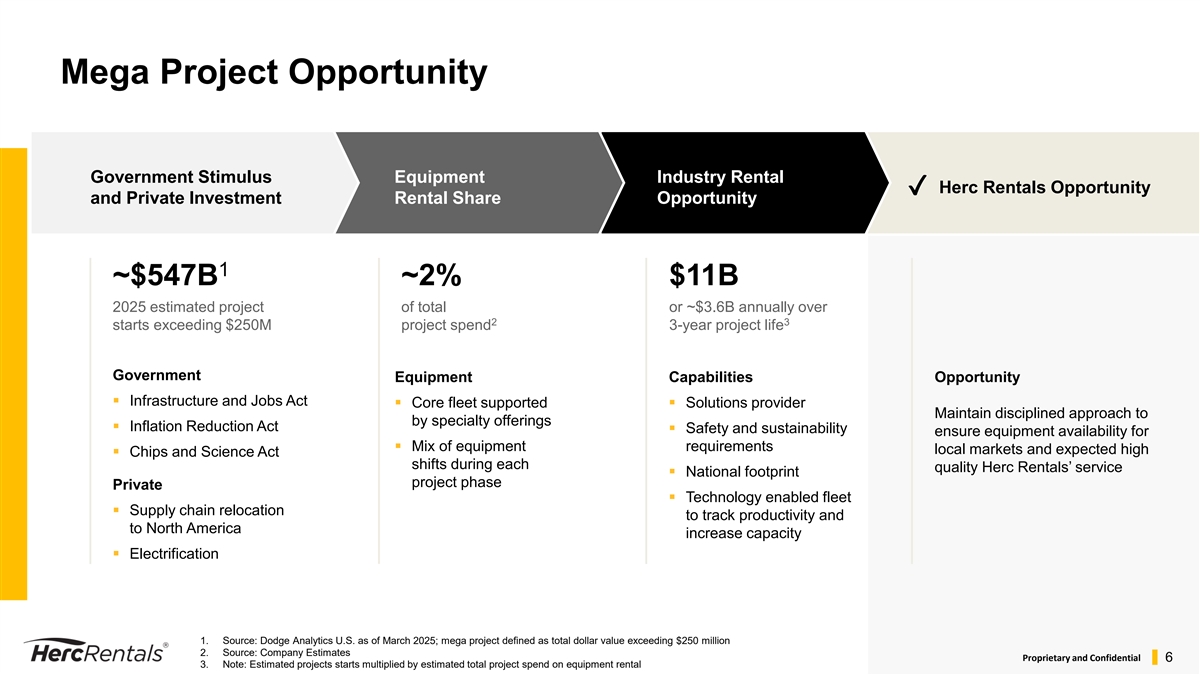

Mega Project Opportunity Government Stimulus Equipment Industry Rental Herc Rentals Opportunity and Private Investment Rental Share Opportunity 1 ~$547B ~2% $11B 2025 estimated project of total or ~$3.6B annually over 2 3 starts exceeding $250M project spend 3-year project life Government Equipment Capabilities Opportunity ▪ Infrastructure and Jobs Act ▪ Core fleet supported▪ Solutions provider Maintain disciplined approach to by specialty offerings ▪ Inflation Reduction Act ▪ Safety and sustainability ensure equipment availability for ▪ Mix of equipment requirements local markets and expected high ▪ Chips and Science Act shifts during each quality Herc Rentals’ service ▪ National footprint project phase Private ▪ Technology enabled fleet ▪ Supply chain relocation to track productivity and to North America increase capacity ▪ Electrification 1. Source: Dodge Analytics U.S. as of March 2025; mega project defined as total dollar value exceeding $250 million 2. Source: Company Estimates Proprietary and Confidential 6 3. Note: Estimated projects starts multiplied by estimated total project spend on equipment rental

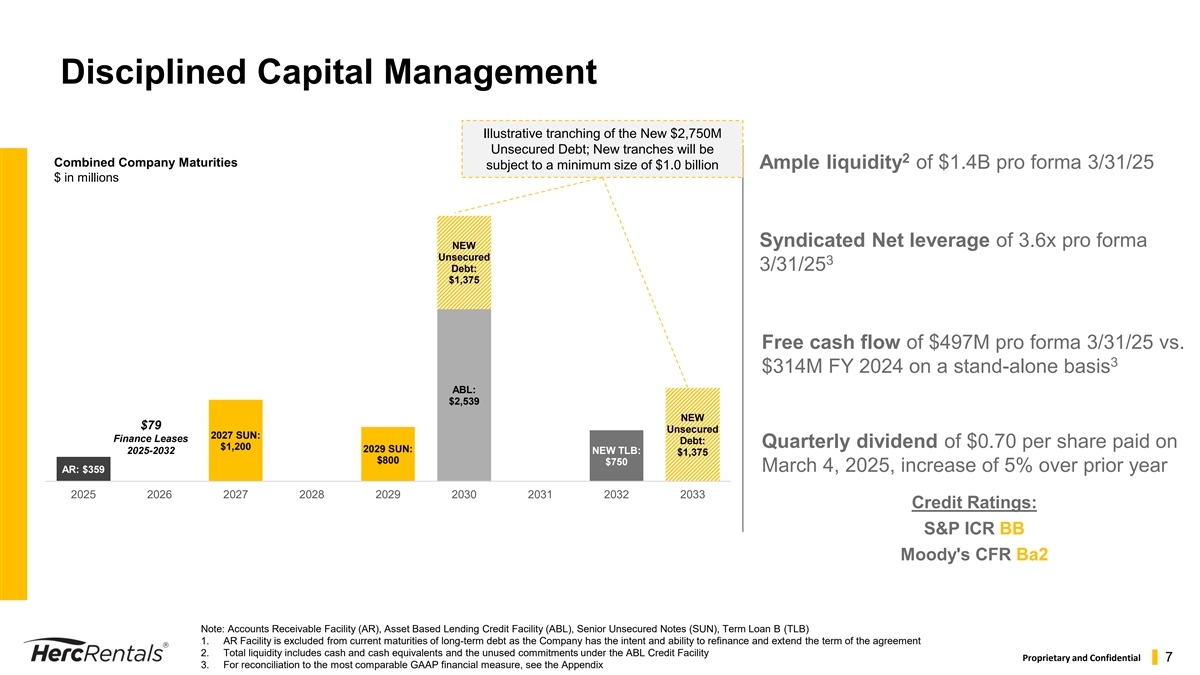

Disciplined Capital Management Illustrative tranching of the New $2,750M Unsecured Debt; New tranches will be 2 Combined Company Maturities Ample liquidity of $1.4B pro forma 3/31/25 subject to a minimum size of $1.0 billion $ in millions Syndicated Net leverage of 3.6x pro forma NEW Unsecured 3 3/31/25 Debt: $1,375 Free cash flow of $497M pro forma 3/31/25 vs. 3 $314M FY 2024 on a stand-alone basis ABL: $2,539 NEW $79 Unsecured 2027 SUN: Finance Leases Debt: Quarterly dividend of $0.70 per share paid on $1,200 2029 SUN: 2025-2032 NEW TLB: $1,375 $800 $750 AR: $359 March 4, 2025, increase of 5% over prior year 2025 2026 2027 2028 2029 2030 2031 2032 2033 Credit Ratings: S&P ICR BB Moody's CFR Ba2 Note: Accounts Receivable Facility (AR), Asset Based Lending Credit Facility (ABL), Senior Unsecured Notes (SUN), Term Loan B (TLB) 1. AR Facility is excluded from current maturities of long-term debt as the Company has the intent and ability to refinance and extend the term of the agreement 2. Total liquidity includes cash and cash equivalents and the unused commitments under the ABL Credit Facility Proprietary and Confidential 7 3. For reconciliation to the most comparable GAAP financial measure, see the Appendix

Appendix 40

Reconciliation of Herc Net Income to Adj. EBITDA and Adj. EBITDA Margin $ in millions 2020 2021 2022 2023 2024 LTM 3/31/2025 Net income $ 74 $ 224 $ 330 $ 347 $ 211 $ 128 Income tax provision 20 67 104 100 80 74 Interest expense, net 93 86 122 224 260 261 Depreciation of rental equipment 403 420 536 643 679 691 Non-rental depreciation and amortization 63 68 95 112 127 131 EBITDA 653 865 1,187 1,426 1,357 1,285 Non-cash stock-based compensation charges 16 23 27 18 17 18 Restructuring 1 — — — — — Impairment 15 3 3 — — — Transaction related costs — 4 7 8 11 82 Loss on assets held for sale / disposal of business 3 — — — 194 194 Other 1 — 3 — 4 4 Adjusted EBITDA 689 895 1,227 1,452 1,583 1,583 Total revenues $ 1,780 $ 2,073 $ 2,740 $ 3,282 $ 3,568 $ 3,625 Adjusted EBITDA Margin 38.7 % 43.2 % 44.8 % 44.2 % 44.4 % 43.7 % 9

Reconciliation of Net Income to Pro Forma Adj. EBITDA and Pro Forma Adj. EBITDA Margin and Pro Forma Free Cash Flow $ in millions Pro Forma FYE 12/31/2024 Pro Forma LTM 3/31/2025 Net income $93 $9 Income tax provisions 39 33 Interest expense, net 605 589 Depreciation of rental equipment 978 997 Non-rental depreciation and amortization 261 266 EBITDA 1,976 1,894 Non-cash stock-based compensation charges 40 11 Transaction related costs 15 96 Loss on assets held for sale 194 194 Other 4 4 Adj. EBITDA 2,229 2,199 Run-rate cost synergies N/A 125 Adj. EBITDA (Synergized) $2,324 N/A Revenue 5,085 5,090 Adj. EBITDA Margin 43.8% 43.2% Adj. EBITDA Margin (Synergized) N/A 45.7% Net cash provided by operating activities 1,721 1,666 Non-rental capital expenditures (268) (248) Rental equipment expenditures (1,393) (1,381) Proceeds from disposal of property and equipment 21 24 Proceeds from disposal of rental equipment 427 436 Net capex 1,213 1,169 Free cash flow $508 $497 10

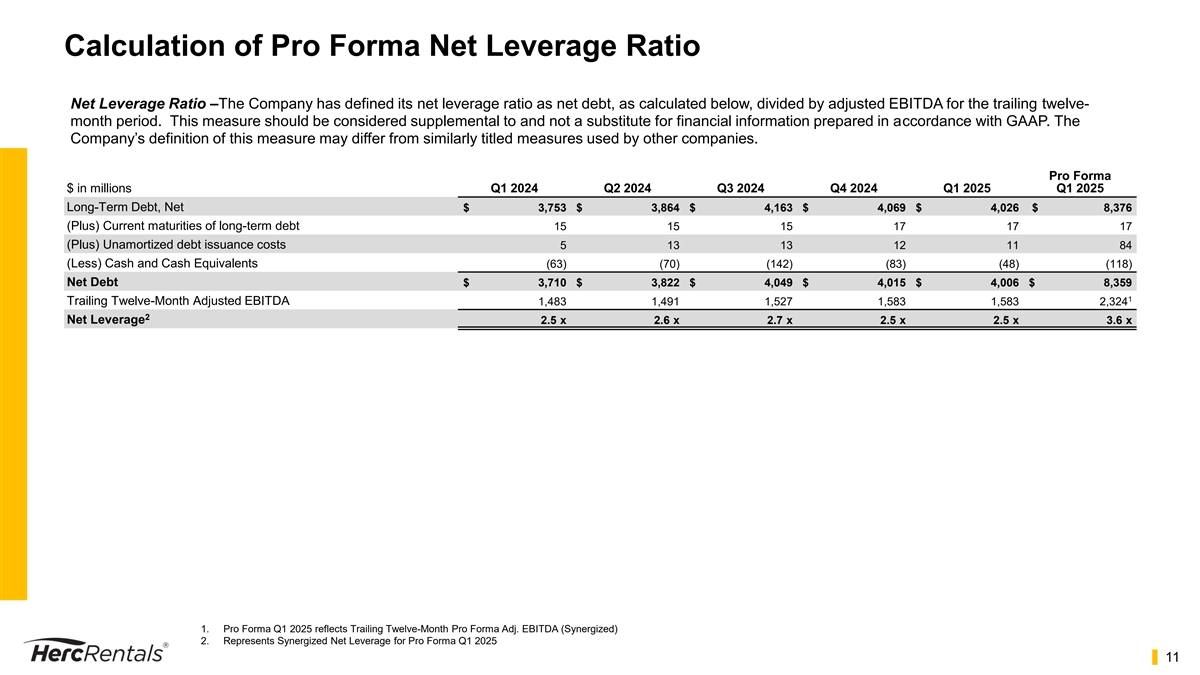

Calculation of Pro Forma Net Leverage Ratio Net Leverage Ratio –The Company has defined its net leverage ratio as net debt, as calculated below, divided by adjusted EBITDA for the trailing twelve- month period. This measure should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of this measure may differ from similarly titled measures used by other companies. Pro Forma $ in millions Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q1 2025 Long-Term Debt, Net $ 3,753 $ 3,864 $ 4,163 $ 4,069 $ 4,026 $ 8,376 (Plus) Current maturities of long-term debt 15 15 15 17 17 17 (Plus) Unamortized debt issuance costs 5 13 13 12 11 84 (Less) Cash and Cash Equivalents (63) (70) (142) (83) (48) (118) Net Debt $ 3,710 $ 3,822 $ 4,049 $ 4,015 $ 4,006 $ 8,359 1 Trailing Twelve-Month Adjusted EBITDA 1,483 1,491 1,527 1,583 1,583 2,324 2 Net Leverage 2.5 x 2.6 x 2.7 x 2.5 x 2.5 x 3.6 x 1. Pro Forma Q1 2025 reflects Trailing Twelve-Month Pro Forma Adj. EBITDA (Synergized) 2. Represents Synergized Net Leverage for Pro Forma Q1 2025 11