UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2025

Commission File Number: 001-35936

B2Gold Corp.

(Translation of registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia V6C 2X8 Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☐ Form 20-F ☒ Form 40-F

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

See the Exhibit Index hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| B2Gold Corp. | ||||||

| Date: May 7, 2025 | By: |

/s/ Randall Chatwin |

||||

| Name: Randall Chatwin |

||||||

| Title: Senior Vice President, Legal and Corporate Communications |

||||||

EXHIBIT INDEX

| Exhibit No. |

Description |

|

| 99.1 | Notice of Meeting and Information Circular | |

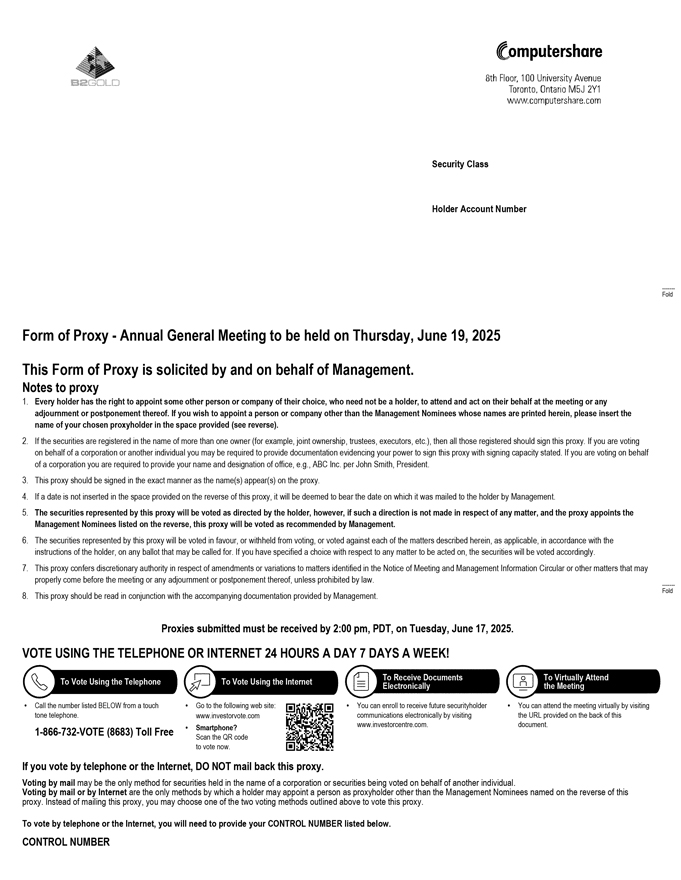

| 99.2 | Form of Proxy | |

| 99.3 | User Guide (Hybrid Meetings) | |

| 99.4 | Notice and Access | |

| 99.5 | Financial Statement Request Form | |

Exhibit 99.1

|

1

|

| NOTICE OF ANNUAL GENERAL MEETING | 02 | |||

| COMPANY OVERVIEW | 04 | |||

| 06 | ||||

| 12 | ||||

| 14 | ||||

| 17 | ||||

| NOTICE AND ACCESS | 18 | |||

| Solicitation of Proxies | 18 | |||

| Voting Procedures | 19 | |||

| 19 | ||||

| 19 | ||||

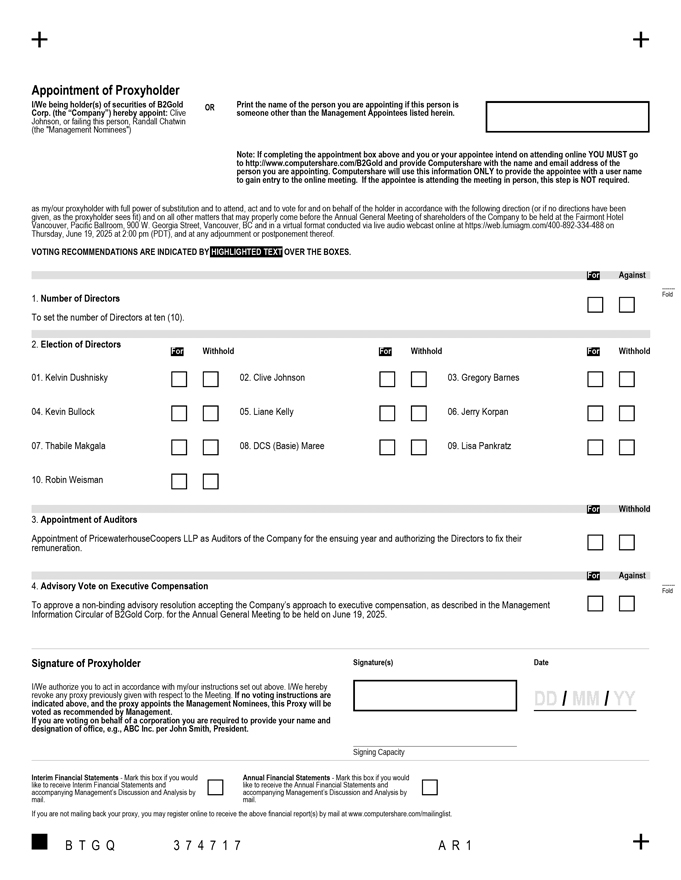

| Virtual Participation at The Meeting | 21 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| Revocability of Proxies and Change of Proxies | 22 | |||

| Voting Shares and Principal Holders Thereof | 22 | |||

| Business of The Meeting | 23 | |||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 33 | |||

| CORPORATE GOVERNANCE | 34 | |||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 42 | ||||

| 46 | ||||

| EXECUTIVE COMPENSATION | 51 | |||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 60 | ||||

| 65 | ||||

| 66 | ||||

| 69 | ||||

| Discussion regarding the Alignment of Executive Compensation with Shareholder Experience |

70 | |||

| 71 | ||||

| 73 | ||||

| 75 | ||||

| 75 | ||||

| B2GOLD | 2025 Management Information Circular |

| 2

|

GENERAL MEETING

| When |

Thursday June 19, 2025 2:00 p.m. (Vancouver time) | |

| Where |

Vancouver, British Columbia | |

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the “Meeting”) of the shareholders (“Shareholders”) of B2GOLD CORP. (“B2Gold” or the “Company”) will be held at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, Vancouver, British Columbia and in a virtual format conducted via live audio webcast online at https://web.lumiagm.com/400-892-334-488 on Thursday, June 19, 2025 (the “Meeting Date”), at 2:00 p.m. (Vancouver time) for the following purposes:

| 1. | To receive the audited annual consolidated financial statements for 2024. |

| 2. | To set number of Directors at ten. |

| 3. | To elect Directors of the Company for the ensuing year. |

| 4. | To appoint PricewaterhouseCoopers LLP as the Auditor of the Company for the ensuing year and to authorize the Directors of the Company to fix their remuneration. |

| 5. | To vote, on a non-binding advisory basis, on a resolution to accept the Company’s approach to executive compensation, as more particularly described and set forth in the accompanying Information Circular. |

| 6. | To transact such other business as may properly come before the Meeting, or any adjournment or adjournments thereof. |

The Board of Directors of the Company (the “Board” or the “Board of Directors”) has fixed the close of business on Tuesday, April 22, 2025, as the record date (the “Record Date”) for determining Shareholders who are entitled to receive notice and to vote at the Meeting or any adjournment of the Meeting. No person who becomes a Shareholder of the Company after the Record Date will be entitled to vote or act at the Meeting or any adjournment thereof.

Important Notice

The Meeting is currently scheduled to take place in person at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, Vancouver, British Columbia, and in a virtual format conducted via live audio webcast online at https:// web.lumiagm.com/400-892-334-488.

Any updates to the Meeting will be announced by news release on the Company’s website at https://www. b2gold.com and will be filed under the Company’s profile on SEDAR+ at https://www.sedarplus.ca and on EDGAR at https://www.sec.gov/. Shareholders are strongly encouraged to check the Company’s website, SEDAR+ and/or EDGAR on a regular basis to ensure that they are apprised of any and all developments with respect to the Meeting.

NOTICE AND ACCESS

This Information Circular is being sent to Shareholders using Notice and Access, the delivery procedures that allow the Company to send Shareholders paper copies of a notice of meeting and form of proxy or voting instruction form, while providing Shareholders access to electronic copies of the Information Circular over the internet or the option to receive paper copies of the Information Circular if they so request within the prescribed time periods (“Notice and Access”). For more information, please refer to the Notice and Access Notification delivered to you.

MEETING MATERIALS

Accompanying this Notice of Meeting are:

| (i) | The information circular. |

| (ii) | A form of proxy. |

| (iii) | An annual financial statement request form. |

The Information Circular provides information relating to the matters to be addressed at the Meeting. Copies of any documents to be considered, approved, ratified and adopted or authorized at the Meeting will be available for inspection at the registered and records office of the Company at 1600 – 925 West Georgia Street, Vancouver, British Columbia V6C 3L2, during normal business hours up to June 19, 2025, being the date of the Meeting, as well as at the Meeting. Shareholders are encouraged to access copies of any documents to be considered, approved, ratified and adopted or authorized at the Meeting under the Company’s profile on SEDAR+ at https://www.sedarplus.ca, on EDGAR at https://www.sec.gov/, on the Company’s website at https://www.b2gold.com or by contacting Randall Chatwin,

| B2GOLD | 2025 Management Information Circular |

|

3

|

Senior Vice President, Legal and Corporate Communications, Suite 3400, Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2X8 (Tel: 604-681-8371).

The Company is not sending proxy-related materials directly to Non-Registered Shareholders who do not object to their name being made known to the Company (“NOBOs”). Management of the Company does not intend to pay for intermediaries to forward to Non-Registered Shareholders who do object to their name being made known to the Company (“OBOs”) under National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer the proxy-related materials and Form 54-101F7 – Request for Voting Instructions Made by Intermediary. An OBO will not receive the materials unless the OBO’s intermediary assumes the cost of delivery.

VOTING

If you are a registered Shareholder, you are encouraged to vote in advance of the Meeting. To do so, you must date, execute and return the accompanying form of proxy to the Company, c/o Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 (Attn: Proxy Department), by not later than 2:00 p.m. (Vancouver time) on Tuesday, June 17, 2025, or if the Meeting is adjourned, not later than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the adjourned Meeting. You may also vote on the internet or by phone by following the instructions set out in the form of proxy.

If you are a registered Shareholder, you may attend, participate and vote at the Meeting in person at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, Vancouver, British Columbia or online via live audio webcast at https://web.lumiagm.com/400-892-334-488, provided you are connected to the internet and comply with all of the requirements set out in the Information Circular. If you plan to attend, participate and vote at the Meeting either in person or virtually, you should not vote before the Meeting.

If you are a Non-Registered Shareholder and receive these materials through your broker or another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or other intermediary. If you are a Non-Registered Shareholder and do not complete and return the materials in accordance with such instructions, you may lose the right to vote at the Meeting.

Non-Registered Shareholders will be able to attend, participate in and vote at the Meeting in person at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, Vancouver, British Columbia or online via live audio webcast at https://web.lumiagm.com/400-892-334-488 if they duly appoint themselves as proxy holder through the method specified by their intermediary and comply with all of the requirements set out in the Information Circular relating to that appointment and registration. If a Non-Registered Shareholder does not comply with these requirements, that Non-Registered Shareholder may be able to attend the Meeting as a guest but will not be able to vote or ask questions at the Meeting.

Voting is Easy. Vote Well in Advance of the Proxy Deadline on Tuesday, June 17, 2025 at 2:00 p.m. (Vancouver Time).

| Registered Shareholders | Non-Registered Shareholders | |||

| Common Shares held in own name and represented by a physical certificate or DRS. | Common Shares held with a broker, bank or other intermediary. | |||

| Internet | www.investorvote.com | www.proxyvote.com | ||

| Telephone | 1-866-732-8683 | Dial the applicable number listed on the voting instruction form. | ||

| Return the voting instruction form in the enclosed postage paid envelope. | Return the voting instruction form in the enclosed postage paid envelope. | |||

SHAREHOLDER QUESTIONS

For more detailed information and instructions on voting, please refer to the Information Circular.

Shareholders who have questions, including with respect to Notice and Access, or need assistance with voting their shares should contact Laurel Hill Advisory Group, the proxy solicitation agent, by telephone at 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Outside North America); or by email at assistance@laurelhill.com.

DATED at Vancouver, British Columbia, this 2nd day of May, 2025.

BY ORDER OF THE BOARD

Clive Johnson

President, CEO, Founder and Director

| B2GOLD | 2025 Management Information Circular |

|

|

|

|

5

|

| B2GOLD | 2025 Management Information Circular |

| 6

|

| Fellow Shareholders, It is my pleasure to provide you with this report on B2Gold’s activities in 2024, which was both a transitional and challenging year, but also a rewarding year in many ways for our Company. Despite the challenges faced, I am incredibly proud of our global team for safely and responsibly delivering over 800,000 ounces of consolidated gold production. Beyond this achievement, we continued our track record of strategic growth, advancing the construction and development of our Goose Project in Nunavut, Canada, closer to completion and the first gold pour, which we anticipate in June 2025 - an exciting step forward for B2Gold.

|

| OPERATIONAL AND FINANCIAL PERFORMANCE

We successfully navigated a transitional year during 2024, while maintaining our commitment to responsible mining with industry-leading health, safety, environmental and social responsibility accomplishments, in large part due to the dedication of our global workforce and the strong leadership of our executive and management teams. Our total consolidated gold production for 2024 of 804,778 ounces, including 19,644 ounces of attributable production from Calibre Mining Corp., was near the low end of our 2024 guidance, with all in sustaining costs (“AISC”) of US$1,465 per ounce sold remaining within our annual guidance range of between $1,420 and $1,480 per gold ounce.

In addition to the operational challenges that we encountered in Mali, one of the more demanding aspects overshadowing our corporate performance in 2024 centred on complex negotiations with the Malian government following the introduction of the 2023 Mining Code. However, due to the strong relationship that we have formed with the Government of Mali over the past nine years, the negotiations were conducted in a constructive and collaborative manner, evidenced by the global settlement agreement that B2Gold |

reached with the State of Mali in September 2024. We continue to build on a strong working relationship with the Malian Government and our long-standing commitment and contributions to the country, and the desire to expand Fekola by developing and commencing production from the Fekola Regional licenses has been recognized by the government. We are also pleased to see relations between the Government of Mali and the mining sector are now stabilizing and we look forward to many more years of a successful partnership with the State of Mali at the Fekola Complex.

Despite strong operational years at both our Masbate and Otjikoto mines, a challenging year at the Fekola Mine resulted in lower than expected consolidated gold production. Production at Fekola was impacted by damage to an excavator and the subsequent need for replacement equipment affected equipment availability for the first nine months of 2024, reducing tonnes mined. This continued to affect the availability of high-grade ore from the Fekola Phase 7 pit, resulting in less higher-grade ore processed in 2024. However, mining and processing of these higher-grade tonnes is now occurring in 2025 as equipment availability had returned to full capacity and mining rates were at expected levels at the end of 2024. For the full year 2024, the Fekola Mine produced 392,946 ounces |

|

|

|

| B2GOLD | 2025 Management Information Circular |

|

7

|

of gold, below the low-end of its revised annual guidance range of between 420,000 and 450,000 ounces. Our Otjikoto Mine produced 198,142 ounces of gold, near the mid-point of its revised guidance range of between 185,000 and 205,000 ounces, and Masbate Mine produced 194,046 ounces of gold, at the upper end of its revised guidance range of between 175,000 and 195,000 ounces in 2024. Consolidated revenue from gold sales was US$1.9 billion, and consolidated cash flow from operations for 2024 was US$877 million.

RETURN OF CAPITAL AND LIQUIDITY

Even with the completion of significant construction activities at the Goose Project in 2024, and continued investment at the Fekola Complex, we ended the year in a strong financial position with a cash balance of US$337 million and working capital of US$321 million. We supplemented our cash position in January 2024 with a US$500 million gold prepay arrangement with several members of our existing lending syndicate, further bolstering the balance sheet as we continue to fund sustaining, development, and growth projects across the operating portfolio. To further supplement our balance sheet, on January 28, 2025, we issued an aggregate principal amount of $460 million of 2.75% convertible senior unsecured notes due 2030. The proceeds of the offering were used to pay down the outstanding amounts under our revolving credit facility. As a result, we have access to a fully undrawn US$800 million revolving credit facility with an additional US$200 million accordion feature.

During 2024, even through a challenging operational year, specifically at the Fekola mine, we were able to return $211 million to our shareholders by way of dividends. On January 13, 2025, we announced an amendment to our shareholder returns strategy to increase financial flexibility as we complete the current phase of our organic growth. Under the amended framework, the proforma dividend yield as of December 31, 2024, would be 3.3%, remaining one of the highest dividend yields among the global precious metal producers. We also announced our intention to implement a normal course issuer bid (“NCIB”), which we launched on April 3, 2025. The NCIB is reflective of our belief that the market may undervalue our common shares occasionally and that the shares may trade in a price range which may not adequately reflect their value in relation to the business, assets, and prospects of B2Gold from time to time and that purchases of the shares pursuant to the NCIB may represent an appropriate and desirable use of the Company’s capital.

| B2GOLD | 2025 Management Information Circular |

| 8

|

Message from the CEO

CONTINUED FOCUS ON GROWTH

Construction of our Goose Project, the most advanced project in our 100%-owned Back River Gold District, located in Nunavut, Canada, continued on schedule in 2024. We recognize that respect and collaboration with the Kitikmeot Inuit Association (“KIA”) is central to the license to operate in the Back River Gold District and we will continue to prioritize developing the project in a manner that recognizes Inuit priorities, addresses concerns, and brings long-term socio-economic benefits to the Kitikmeot Region. We look forward to continuing to build on our strong collaboration with the KIA and Kitikmeot communities.

All planned construction activities for 2024 at the Goose Project were successfully completed, with overall project development progressing on schedule. We are excited to share with you that the first gold pour remains on track for June 2025, followed by a ramp-up to commercial production in the third quarter of 2025. Gold production for calendar year 2025 is estimated to range between 120,000 and 150,000 ounces. Open pit and underground mining activities are already underway, aimed at building high-grade stockpiles in preparation for mill commissioning. From 2026 to 2031, average annual production is expected to be approximately 300,000 ounces, supported by the latest published Mineral Reserves. Our internal view and the current substantial Mineral Resource inventory indicate a long mine life, establishing the Goose Project as a significant contributor to B2Gold’s long-term gold production.

On June 18, 2024, we announced the results of a positive Preliminary Economic Assessment (“PEA”) for our 100%-owned Gramalote Project, located in Antioquia, Colombia. The PEA outlines a strong production profile, with projected annual gold production of 234,000 ounces during the first five years of

operation, and an average of 185,000 ounces per year over a 12.5-year project life. The study also highlights a low-cost operating structure and favourable metallurgical characteristics, reinforcing the project’s potential as a robust and economically attractive asset. We are progressing well on a feasibility study for the Gramalote Project and expect to be able to release the results by the middle of 2025.

SAFETY FIRST

B2Gold continues to lead the industry in health and safety, environmental, and social initiatives across our operations, guided by our core principles of fairness, respect, transparency, and accountability. Our commitment to responsible mining will be detailed in our upcoming Responsible Mining Report, set for release in May 2025 and I encourage you to explore it. The report showcases our 2024 milestones and achievements, including an impressive ninth consecutive year without an on-site fatality across all operations, while upholding one of the industry’s lowest injury rates. We maintained our Lost Time Injury Frequency Rate (“LTIFR”) and Total Recordable Injury Frequency Rate (“TRIFR”) at mining industry lows of 0.05 and 0.28, respectively. Most notably, our team at Masbate surpassed an outstanding six years (39.3 million hours) without a Lost Time Injury (“LTI”).

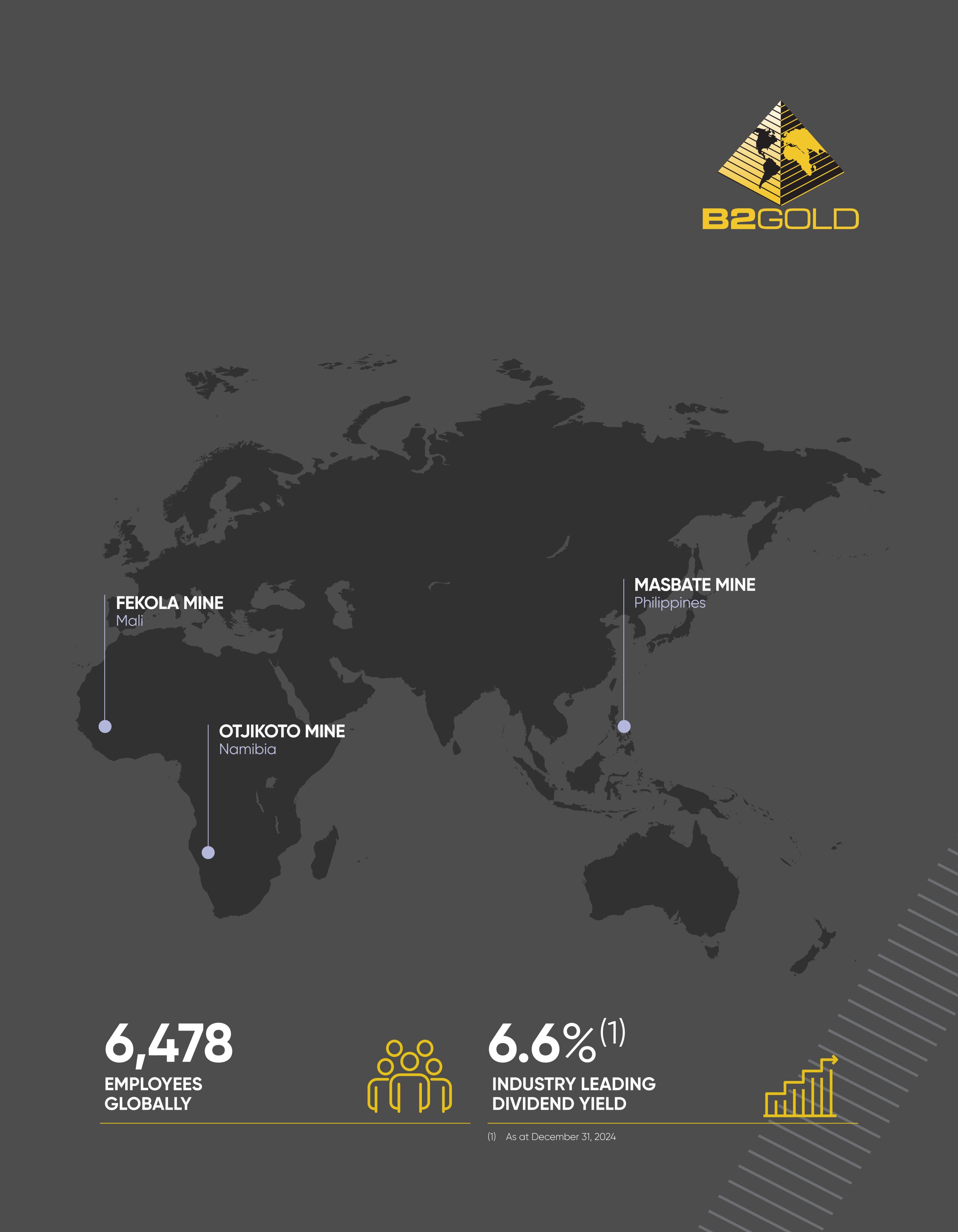

These safety achievements are made possible by our dedicated and diverse global workforce. Of our 6,478 employees globally, approximately 97% are national employees and 13.3% of employees are female.

We remain dedicated to creating inclusive and accessible work environments that support individuals from diverse backgrounds, abilities, cultures, and identities.

| B2GOLD | 2025 Management Information Circular |

|

9

|

As a responsible mining company, B2Gold is committed to developing resources in a way that mitigates environmental and biodiversity impacts. We implement a Global Water Strategy aligned with the International Council on Mining and Metal’s (“ICMM”) Water Stewardship Framework, aiming to minimize water-related risks and enhance water management across our operations. Each site has developed its own Operational Water Management Plan tailored to address the specific water risks unique to its location. In addition, we will publish in May our 2024 Climate Strategy Update, aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures. The Climate Strategy Update outlines our efforts to assess and mitigate physical and transition climate-related risks and reduce our carbon footprint in support of our target to reduce Scope 1 and 2 greenhouse gas (“GHG”) emissions by 30% by 2030 against a 2021 baseline.

B2Gold is committed to reducing GHG emissions through a structured decarbonization pathway. Our approach prioritizes expanding renewable energy, electrification, enhancing energy efficiency, and adopting emerging carbon reduction technologies. With the completion of the 22 megawatt (“MW”) Fekola solar plant expansion in January 2025, the site now sources approximately 30% of its electricity from solar power, reducing emissions by an estimated 63,000 tonnes of carbon dioxide equivalent (“CO2 e”) annually. At Masbate, we are advancing two solar initiatives, a rooftop solar panel project with a total capacity of approximately 1 MW, and a 8.2-MW solar plant set for installation in 2025. This solar plant is expected to reduce GHG emissions by approximately 8,800 tonnes of CO2e per year and reduce heavy fuel oil (“HFO”) consumption by 3.4 million liters per year. Meanwhile, at Otjikoto, a newly commissioned 9.6-MW third-party solar plant will boost solar energy to approximately 35% of the site’s total electricity demand.

COMMITMENT TO COMMUNITIES

We remain committed to the well-being of the communities where we operate, implementing management approaches that drive positive, sustainable outcomes for both our business and stakeholders. We extend our gratitude to all levels of government and the communities in the countries where we operate for fostering strong, trusting relationships with us. In 2024, we contributed approximately US$564 million in taxes, royalties, and dividend payments to governments in Mali, Namibia, the Philippines, Colombia, and Canada, along with approximately US$13 million in community investments.

A stand out initiative at Fekola is the 70-hectare Goungoubato Agricultural Project, which supports households affected by resettlement. With an initial investment of approximately $1 million, B2Gold has provided land clearing, cultivation preparation, specialized technical support and training, agricultural inputs, and essential infrastructure, creating opportunities for smallholder farmers.

Masbate’s current community investment initiatives focus on job creation and local content development as key drivers of sustainable growth. A key highlight is the Digital Hub, a co-working space designed to connect community members with digital employment opportunities, including roles in virtual assistance, web development, and e-commerce.

B2Gold Namibia’s community investment efforts focus on meeting critical needs, fostering sustainable growth, and ensuring long-term community resilience beyond mine operations. Through strategic investments, B2Gold Namibia is building a lasting legacy that strengthens healthcare, water security, and education in the region. In 2024, the Ombili Clinic was completed ahead of schedule and successfully handed over to local authorities and marks a major advancement in regional healthcare. This facility will provide primary health services to the residents of the Ombili settlement.

| B2GOLD | 2025 Management Information Circular |

| 10

|

Message from the CEO

In memory of the late Managing Director and Country Manager of B2Gold Namibia, B2Gold was honoured to launch the Mark Dawe Legacy Fund in 2025 which will support the Nakayale Private Academy with US$100,000 annually for as long as B2Gold has a footprint in Namibia. This legacy reflects Mark’s enduring belief in the power of education to transform lives.

At our Back River Gold District in Nunavut, we uphold our long-term commitment to Kitikmeot Inuit through the Inuit Impact Benefit Agreement (“IIBA”) with the Kitikmeot Inuit Association (“KIA”), signed in 2018. This renewable 20-year agreement ensures land tenure security while maximizing benefits for Kitikmeot Inuit. The IIBA is designed to mitigate potential impacts of mining operations while fostering training, employment, and business opportunities, ensuring a sustainable and mutually beneficial partnership. In 2024, B2Gold Nunavut strengthened its partnership with the Cambridge Bay-based Redfish Arts Society, an initiative focused on delivering skilled trades training to at-risk Inuit youth. In 2024, this collaboration created 15 Inuit employment opportunities, including 14 student roles and one assistant instructor, generating 15,340 hours of employment for students, trainers, and support staff.

B2Gold Nunavut also launched its Emergency Response Team Preparation School (“ERT Prep School”) at the Back River Gold District – a new training platform designed to prepare Inuit employees interested in joining the Emergency Response Team. This self-paced learning environment, supported by experienced Inuit ERT members and ERT coordinators, equips participants with essential emergency response skills in preparation for the Workers’ Safety and Compensation Commission (“WSCC”) Mines Rescue Course. Upon completing the ERT Prep School, participants can choose to pursue full ERT certification or serve as associate members.

As a proud Canadian company, B2Gold remains dedicated to making a positive impact in the Vancouver area, through our More Than Mining Fund. This fund supports programs addressing poverty, mental health, addiction, violence, and abuse by partnering with local charities that provide essential social services to vulnerable and at-risk individuals. In 2024, B2Gold allocated approximately $1 million to community organizations through this initiative.

CONTINUED FOCUS ON EXPLORATION

We executed another year of aggressive exploration in 2024, incurring US$61 million in exploration expenditures, predominantly at the Back River Gold District, with the goal of enhancing and growing the significant resource base at the Goose Project and surrounding regional targets. In Namibia, the exploration program at the Otjikoto Mine was the largest since 2012 with a focus on drilling the recently discovered Antelope deposit. In Mali, the exploration program was directed at a more strategic search for near-mine, near-surface sources of additional sulphide-related gold mineralization. In the Philippines, the exploration program at Masbate focused on drilling targets immediately south of mine infrastructure. In 2025, we continue to invest heavily in exploration, with a budget of $64 million being allocated among brownfield and greenfield opportunities, with approximately 50% being committed to the Back River Gold District. In addition, the search for new joint ventures and strategic investment opportunities will continue, building on existing equity investments in Snowline Gold Corp., Founders Metals Inc., AuMEGA Metals Ltd., and Prospector Metals Corp.

LOOKING AHEAD

For the balance of 2025 and beyond, we continue to raise the bar on our previous sustainability performance and remain committed to continuing to execute on our strategic objectives: maximize profitable production from our mines; grow as a profitable and responsible gold producer through further advancement of our pipeline of development and exploration projects; evaluate new exploration, development and production opportunities; and continue to pay an industry competitive dividend yield. We are dedicated to delivering on these objectives while continuing to drive positive outcomes for all stakeholders, ensuring that our growth is both profitable and responsible.

In closing, I want to express my heartfelt gratitude to our dedicated employees, whose track record of safe production, excellence and unwavering professionalism has been the driving force behind our continued success. Their resilience and determination over the past few years have been truly remarkable. I would also like to thank our Board of Directors for their steadfast support and guidance, and to acknowledge our exceptional executive team - your leadership, adaptability, innovation, and ability to execute continue to inspire and impress.

| B2GOLD | 2025 Management Information Circular |

|

11

|

And finally, to you, our Shareholders - thank you. Your trust and support over the past 18 years have been instrumental in our journey to becoming a safe, responsible, and profitable senior gold producer. None of this would have been possible without you.

Yours sincerely,

Clive Johnson

President, CEO, Founder and Director

| B2GOLD | 2025 Management Information Circular |

|

|

|

| B2GOLD | 2025 Management Information Circular |

| 14

|

| Operational Highlights |

B2Gold continued its strong performance in 2024 across all of its operations while maintaining its long-standing commitment to safety and continuous improvement with industry leading safety and lost time performance.

| ~$211M | 0.05 | GOOSE CONSTRUCTION |

||||||

| IN DIVIDENDS PAID TO SHAREHOLDERS |

LOST TIME INJURY(1) FREQUENCY RATE |

ON TARGET FOR GOLD POUR Q2 2025 |

||||||

| MALI MOU | ~22% | $800M + $200M | ||||||

| MALI MINING CODE NEGOTIATED AND ENTERED INTO MEMORANDUM OF UNDERSTANDING WITH THE MALIAN GOVERNMENT |

OF TOTAL ELECTRICITY CONSUMED AT OPERATIONS WAS FROM RENEWABLE SOURCES |

RENEWED AND EXPANDED CREDIT FACILITY TO $800M PLUS A $200M ACCORDION FEATURE. |

||||||

| • | Our industry-leading lost time injury frequency rate and goal of sending everyone home safe continues to be a core focus, with the Masbate Gold Project in the Philippines leading the way with now over six years (39 million hours worked) without a lost time incident. |

| • | Due to our strong operating results and cash position, we have continued to pay one of the highest dividend yields in the gold sector with approximately $211 million distributed to Shareholders in 2024. |

Governance Highlights

A summary of our key governance practices is below and further details can be found under Corporate Governance beginning on page 34.

| • | The number of females as managers remains consistent across the organization at 20.0% for 2024. |

| • | The inaugural offering of B2Gold’s Global Mentorship Program was completed; 20 mentees were paired with 20 mentors with representation from all levels and locations of B2Gold’s operations. The program took place from May to December 2024. |

Note:

| (1) | Injury frequency and severity rates are based on 200,000 work hours. |

| B2GOLD | 2025 Management Information Circular |

|

15

|

Executive Summary

Sustainability Highlights

Sustainability and maintaining high standards of responsible mining has always been a key part of B2Gold’s business strategy. During 2024, the Company continued activities in support of its social and environmental commitments. Highlights of our activities include:

| • | The continued implementation of the Goungoubato Agricultural Project in Mali, which provides livelihood opportunities for over 250 smallholder farmers, among them 59 women and 70 vulnerable persons. This project has the potential to expand and accommodate up to 1,000 economically-displaced households. |

| • | Following the completion of the Fekola solar plant expansion, the site will generate approximately 30% of its electricity with solar power. The expanded solar facility is expected to reduce GHG emissions by approximately 63 thousand tonnes of CO2e per year. |

| • | B2Gold Namibia is also implementing the Otavi Water Project, aimed at enhancing water access through a new tower and distribution system, ensuring a sustainable water supply for the community. As part of its commitment to education, B2Gold continues its support of the EduVision Project, equipping Khorab Primary School in Otavi and Ombili Primary School in Otjiwarongo with interactive SMARTboards. These cutting-edge tools, supported by a dedicated satellite link, allow students to access high-quality remote learning. The handover ceremonies celebrated the transformative impact of this initiative, ensuring lasting educational opportunities for future generations. |

| • | As highlighted by our CEO in his letter to Shareholders, B2Gold Nunavut launched its ERT Prep School, and while its associate members are not mine rescue certified, they receive similar training to ensure they can apply emergency response knowledge and skills in their home communities, helping build resilience and preparedness beyond the mine site. In addition, since the launch in 2023 of the skilled trades training for at-risk Inuit youth, the initiative has contributed over 16,000 employment hours, reinforcing our commitment to community development and workforce readiness in this region. |

| • | Our commitment to local economies remained strong, with over US$600 million spent on goods and services from local and host country businesses. Notably, in Mali, on-shore purchasing saw a significant increase, rising to 70% of total purchasing in 2024, compared to 63% in 2023. In the Philippines, on-shore purchasing remained high at 71% in 2024, slightly down from 74% in 2023. Namibia maintained a steady rate, with approximately 63% of total purchasing in 2024, up from 62% in the previous year. |

| B2GOLD | 2025 Management Information Circular |

| 16

|

Executive Compensation Highlights

| B2GOLD | 2025 Management Information Circular |

|

17

|

Information Circular

Important Notice

The Annual General Meeting (the “Meeting”) of the shareholders (“Shareholders”) of B2Gold Corp. (“B2Gold” or the “Company”) is currently scheduled to take place in person at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, British Columbia and in a virtual format conducted via live audio webcast online at https:// web.lumiagm.com/400-892-334-488 on Thursday, June 19, 2025 (the “Meeting Date”) at 2:00 p.m. (Vancouver time).

Only registered Shareholders, Non-Registered Shareholders who have followed the procedures described in this management information circular (the “Information Circular”) and their respective proxy holders will be entitled to attend the Meeting physically in person.

If you attend the Meeting online, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. Even if you plan to attend the Meeting, you should consider voting your shares in advance so that your vote will be counted even in the event that you later decide not to attend the Meeting, you experience any technical difficulties, or are unable to access the Meeting for any reason.

The contents and the sending of this Information Circular have been approved by the Board. The Company reports its financial results in United States dollars. All references to “$” or “dollars” in this Information Circular refer to Canadian dollars unless otherwise indicated. References to “US$” are used to indicate United States dollar values.

This Information Circular includes certain forward-looking information. Please refer to “Cautionary Note Regarding Forward- Looking Information” attached as Schedule “B” hereto.

| B2GOLD | 2025 Management Information Circular |

| 18

|

This Information Circular is being sent to both Registered Shareholders and Non-Registered Shareholders (as defined below) of common shares in the capital of the Company (“Common Shares”) using Notice and Access, the delivery procedures that allow the Company to send Shareholders paper copies of a notice of meeting and form of proxy or voting instruction form (“VIF”), while providing Shareholders access to electronic copies of the Information Circular over the internet or the option to receive paper copies of the Information Circular if they so request within the prescribed time periods. For more information, please refer to the Notice and Access Notification delivered to you.

Non-Registered Shareholders who have previously provided the Company with standing instructions that they wish to receive paper copies of the Information Circular will continue to be mailed a paper copy of the Information Circular.

This Information Circular is furnished in connection with the solicitation of proxies by the Management of the Company for use at the Meeting to be held on the Meeting Date, being Thursday, June 19, 2025, at 2:00 p.m. (Vancouver time) at the Fairmont Hotel Vancouver, Pacific Ballroom, 900 West Georgia Street, Vancouver, British Columbia and in a virtual format conducted via live audio webcast online at https://web.lumiagm.com/400-892-334-488 or at any adjournment thereof for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation of proxies will be primarily by mail, proxies may also be solicited personally or by telephone by the Directors, officers and regular employees of the Company at a nominal cost to the Company.

Laurel Hill Advisory Group (“Laurel Hill”) is acting as the Company’s proxy solicitation agent. If you have any questions or require assistance in voting your proxy, please contact Laurel Hill at 1-877-452-7184 toll free in North America, or 416-304-0211 (outside North America); or by e-mail at assistance@laurelhill.com. The Company will be paying Laurel Hill a fee of $45,000, plus reasonable out-of-pocket expenses.

The cost of solicitation will be borne by the Company. Except as required by statute, regulation or policy thereunder, the Company does not reimburse Shareholders, nominees or agents (including brokers holding shares on behalf of clients) for the cost incurred in obtaining from their principals an authorization to execute each form of proxy.

| B2GOLD | 2025 Management Information Circular |

|

19

|

Please carefully review and follow the voting instructions below based on whether you are a Registered or Non-Registered Shareholder of the Company:

| • | You are a “Registered Shareholder” if you have a share certificate or a DRS statement registered in your name representing the Common Shares. |

| • | You are a “Non-Registered Shareholder” if you hold Common Shares through a broker, agent, nominee or other intermediary (for example, a bank, trust company, investment dealer, clearing agency, or other institution). |

Voting is Easy. Vote Well in Advance of the Proxy Deadline on Tuesday, June 17, 2025 at 2:00 p.m. Vancouver Time (the “proxy cut-off time”). Late proxies may be accepted by the Chair of the Meeting in their discretion, with or without notice, and the Chair is under no obligation to accept or reject any particular late proxy.

A proxy will not be valid unless it is signed by the Registered Shareholder, or by the Registered Shareholder’s attorney with proof that they are authorized to sign. If you represent a Registered Shareholder that is a corporation or an association, your proxy should have the seal of the corporation or association and must be executed by an officer or an attorney who has written authorization. If you execute a proxy as an attorney for an individual Registered Shareholder, or as an officer or attorney of a Registered Shareholder that is a corporation or association, you must include the original or notarized copy of the written authorization for the officer or attorney with your proxy form.

If the instructions in a form of proxy given to the proxy nominee are certain, the Common Shares represented by proxy will be voted or withheld from voting on any poll in accordance with the instructions of the Shareholder as specified in the proxy with respect to the matter to be acted on. If a choice is not so specified with respect to any such matter, the Common Shares represented by a proxy given to the proxy nominee will be voted in favour of the resolutions referred to in the form of proxy accompanying this Information Circular, including, for the election of the nominees of management for Directors, approval of certain matters relating to the Stock Option Plan, and for the appointment of the Auditor.

The form of proxy accompanying this Information Circular confers discretionary authority upon the proxy nominee with respect to any amendments or variations to matters identified in the Notice of Meeting and any other matters that may properly come before the Meeting. As at the date of this Information Circular, Management is not aware of any such amendments or variations, or of other matters to be presented for action at the Meeting.

A Shareholder has the right to appoint a person (who need not be a Shareholder) to attend and act for such Shareholder on such Shareholder’s behalf at the Meeting other than the persons designated in the form of proxy, and may exercise such right by inserting the name in full of the desired person in the blank space provided in the form of proxy.

Registered Shareholders who have duly appointed a proxy holder to attend and vote at the Meeting MUST register the appointed proxy holder with Computershare by visiting http://www.computershare.com/B2Gold before the proxy cut-off time. Computershare will ask for the appointed proxy holder’s contact information and will send such appointed proxy holder a user ID number or username via email shortly after this deadline and then may proceed with the steps above to log into the virtual Meeting.

Registered Shareholders should note that if they participate and vote on any matter at the Meeting they will revoke any previously submitted proxy.

NON-REGISTERED SHAREHOLDER VOTING

If Common Shares are listed in an account statement provided to a Shareholder by a broker, then, in almost all cases, those Common Shares will not be registered in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of an intermediary, typically the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc.), which company acts as a nominee for many Canadian brokerage firms. Common Shares held by brokers (or their agents or nominees) on behalf of a broker’s client may only be voted (for or against resolutions) in accordance with instructions received from the Non-Registered Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for Non-Registered Shareholders.

Securities regulatory policies require brokers and other intermediaries to seek voting instructions from Non-Registered Shareholders in advance of Shareholders’ meetings. Each broker or intermediary has its own mailing procedures and provides their own return instructions to clients, which should be carefully followed by Non-Registered Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often the form of proxy or VIF supplied to a Non-Registered Shareholder by its broker is identical to the form of proxy provided by the Company to the Registered Shareholders. However, its purpose is limited to instructing the Registered Shareholder (i.e., the broker or intermediary) how to vote on behalf of the Non-Registered Shareholder.

| B2GOLD | 2025 Management Information Circular |

| 20

|

Notice & Access

Most brokers delegate responsibility for obtaining instructions from clients to Broadridge in the United States and Canada. Broadridge mails a VIF in lieu of a proxy provided by the Company. The VIF will name the same persons as the Company’s proxy to represent your Common Shares at the Meeting. Non-Registered Shareholders may call a toll-free number or go online to www.proxyvote.com to vote. Alternatively, the completed VIF must be returned by mail (using the return envelope provided). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of the Common Shares to be represented at the Meeting and the appointment of any Shareholder’s representative.

The Company may utilize Broadridge’s QuickVoteTM system to assist Shareholders with voting their Common Shares. Certain Non-Registered Shareholders who have not objected to the Company knowing who they are (non-objecting beneficial owners) may be contacted by Laurel Hill, which is soliciting proxies on behalf of management of the Company, to conveniently obtain a vote directly over the phone.

| B2GOLD | 2025 Management Information Circular |

|

21

|

Virtual Participation at the Meeting

The Company believes that the ability to participate in the Meeting in a meaningful way, including asking questions, remains important despite the decision to also offer virtual participation at this year’s Meeting. It is anticipated that Registered Shareholders and proxy holders (including Non-Registered Shareholders who have appointed themselves as proxy holder) attending virtually will have substantially the same opportunity to ask questions on matters of business before the Meeting as those Shareholders and proxy holders attending in person. Upon Shareholders logging into the virtual meeting platform, they will have the opportunity to start submitting questions prior to the Meeting and will continue to have the opportunity to submit questions during the Meeting. Questions may be sent to the Chair of the Meeting using the online Q&A tool on the meeting portal. Only Registered Shareholders and duly appointed proxy holders will be able to submit questions. Guests will not be able to submit questions.

To ask a question, please follow the steps outlined below:

| (1) | Tap on the icon and then type your question. |

| (2) | Compose your question and then press the send to deliver your question to the Chair. |

| (3) | Once you have pressed the send icon in Step 2, confirmation that your question has been received by the Chair will appear. |

Questions will be read by the Chair of the Meeting or a designee of the Chair and responded to by a representative of the Company. To ensure fairness for all attendees, the Chair of the Meeting will decide on the amount of time allocated to each question and will have the right to limit or consolidate questions and to reject questions that do not relate to the business of the Meeting or which are determined to be inappropriate or otherwise out of order.

After the formal business of the Meeting, the Company will hold a Q&A session during which the Chair and the Company’s senior management intend to answer questions submitted during the Meeting.

DIFFICULTIES ACCESSING THE VIRTUAL MEETING

Shareholders with questions regarding the virtual meeting portal or requiring assistance accessing the Meeting website may visit the website https://www.lumiglobal.com/faq prior to the meeting.

If you attend the Meeting online, it is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. Note that if you lose connectivity once the Meeting has commenced, there may be insufficient time to resolve your issue before ballot voting is completed. Even if you plan to attend the Meeting, you should consider voting your shares in advance so that your vote will be counted even in the event that you later decide not to attend the Meeting or in the event that you experience any technical difficulties and are unable to access the Meeting for any reason.

If you experience technical difficulties during the registration process or if you encounter difficulties while accessing and attending the Meeting, please contact Lumi, the provider of the virtual meeting interface, at support-ca@lumiglobal.com.

Shareholders who need assistance with voting their shares should contact Laurel Hill Advisory Group, the proxy solicitation agent, by telephone at 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Outside North America) or by email at assistance@laurelhill.com.

| B2GOLD | 2025 Management Information Circular |

| 22

|

Notice & Access

Revocability of Proxies and Change of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a proxy may revoke it by an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing or, where the Shareholder is a corporation, by a duly authorized officer or attorney of the corporation. To be valid, an instrument of revocation must be received by the registered office of the Company by fax at (604) 669-1620 or by mail at Lawson Lundell LLP, 1600 – 925 West Georgia Street, Vancouver, British Columbia V6C 3L2, at any time up to and including the last business day preceding the Meeting Date or any adjournment thereof, or provided to the Chair of the Meeting on the day fixed for the Meeting or any adjournment thereof by not later than the time fixed for commencement of such Meeting. Further, Registered Shareholders may change the way they have voted by proxy by sending a new proxy prior to the proxy cut-off time to revoke their previous vote. The latest proxy received by Computershare will be the only one that is valid.

A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation. Registered Shareholders may attend and vote in person or virtually at the Meeting, and if they do so, any voting instructions they previously gave for such Common Shares will be revoked.

Only Registered Shareholders have the right to revoke a proxy. Non-Registered Shareholders can change their vote by contacting their broker or intermediary in sufficient time prior to the Meeting, and prior to their broker’s or intermediary’s cut-off time, to arrange to change the vote and, if necessary, revoke the proxy.

Shareholders who have questions or need assistance with voting their shares should contact Laurel Hill Advisory Group, the proxy solicitation agent, by telephone at 1-877-452-7184 (North American Toll Free) or 416-304-0211 (Outside North America) or by email at assistance@laurelhill.com.

All references to Shareholders in this Information Circular and the accompanying form of proxy and Notice of Meeting are to Shareholders as of the Record Date unless specifically stated otherwise.

Voting Shares and Principal Holders Thereof

The Board of Directors has fixed the close of business on Tuesday, April 22, 2025 as the Record Date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting or at any adjournment thereof. As at the Record Date, 1,321,372,840 Common Shares were issued and outstanding. Each Common Share outstanding on the Record Date carries the right to one vote. The Company will arrange for the preparation of a list of the Registered Shareholders on such Record Date. Each Registered Shareholder named in the list will be entitled to one vote at the Meeting for each Common Share shown opposite such Shareholder’s name. Registered Shareholders holding Common Shares for the benefit of Non-Registered Shareholders are required to vote such shares as directed by the Non-Registered Shareholders, as more particularly described above.

The quorum for the transaction of business at the Meeting is two persons present at the Meeting who hold, or represent by proxy, in aggregate at least 5% of the issued and outstanding Common Shares entitled to be voted at the Meeting.

To the knowledge of the Directors and Executive Officers of the Company, as at the Record Date, only Van Eck Associates Corp. beneficially owns, controls or directs, directly or indirectly, Common Shares carrying 10% or more of the voting rights attached to all outstanding shares of the Company, which holds 149,899,817 Common Shares representing 11.3% of the voting rights attached to all outstanding Common Shares of the Company.

| B2GOLD | 2025 Management Information Circular |

|

23

|

1) Set the Number of Directors at Ten (10)

The Company’s Articles provide that the number of Directors to be elected will be the number determined by ordinary resolution.

The Board of Directors presently consists of ten Directors (the “Current Directors”). Each of the Current Directors is nominated by the Board of Directors for election as a Director of the Company to serve until the next annual general meeting of the Company or until such person otherwise ceases to hold office (the “Director Nominees”).

MAJORITY VOTING FOR DIRECTORS

The Company has a policy (the “Majority Voting Policy”) which requires, unless there is a contested election, any nominee for election as a Director who receives a greater number of votes “withheld” than votes “for” such Director Nominee’s election to tender his or her resignation to the Chair of the Board of Directors immediately following the Meeting, effective on acceptance by the Board.

The Corporate Governance and Nominating Committee (“Governance Committee”) will consider the resignation and make a recommendation to the Board. No Director who has tendered his or her offer to resign will attend any meetings of the Governance Committee or the Board where his or her resignation is discussed, or a related resolution is voted upon. Absent exceptional circumstances, the Board will accept the resignation. The Board of Directors will make its final decision and announce the decision in a news release within 90 days following the Meeting. The applicable Director will not participate in any deliberations regarding such Director’s resignation offer.

ADVANCE NOTICE OF DIRECTOR NOMINATIONS

The Company has adopted an advance notice policy (the “Advance Notice Policy”), which was approved by the Board on April 22, 2014, and ratified, confirmed and approved by the Shareholders on June 13, 2014. The Advance Notice Policy was subsequently amended by the Board on March 13, 2018 to implement certain non-material, clarifying amendments of a housekeeping nature. On February 23, 2021 and April 28, 2021, as part of its continuous review of the Company’s corporate governance practices, the Board approved certain additional amendments to the Advance Notice Policy, which amendments were ratified by the Shareholders at the Company’s annual general and special meeting on June 11, 2021.

| B2GOLD | 2025 Management Information Circular |

| 24

|

Business of the Meeting

Through the Advance Notice Policy, the Directors of the Company are committed to:

| (i) | Facilitating an orderly and efficient annual general or, where the need arises, special meeting, process. |

| (ii) | Ensuring that all Shareholders receive adequate notice of the Director nominations and sufficient information with respect to all nominees. |

| (iii) | Allowing Shareholders to register an informed vote having been afforded reasonable time for appropriate deliberation. The purpose of the Advance Notice Policy is to provide Shareholders, Directors and management of the Company with a clear framework for nominating Directors. |

The Advance Notice Policy fixes a deadline by which holders of record of Common Shares must submit Director nominations to the Company prior to any annual general and/or special meeting of Shareholders and sets forth the information that a Shareholder must include in the notice to the Company for the notice to be in proper written form in order for any Director nominee to be eligible for election at any annual general and/or special meeting of Shareholders.

No Director nominations have been made by the Shareholders in connection with the Meeting under the terms of the Advance Notice Policy as at the date of this Information Circular.

DIRECTOR NOMINEES

Information regarding each of the Director Nominees can be found beginning on page 26.

Each Director elected will hold office until the next annual general meeting of the Company or until such Director’s successor is elected or appointed, unless such Director’s office is earlier vacated in accordance with the Articles of the Company or with the provisions of the Business Corporations Act (British Columbia) (the “BCBCA”). Management does not contemplate that any of the Director Nominees will be unable to serve as a Director; however, if for any reason any of the Director Nominees do not stand for election or are unable to serve as such, the Common Shares represented by properly executed proxies given in favour of management’s nominee(s) may be voted by the management proxyholder, in such person’s discretion, in favour of another nominee.

Management proposes the appointment of PricewaterhouseCoopers LLP as Auditor of the Company to hold office until the next annual meeting of the Company and will also propose that the Directors of the Company be authorized to fix the remuneration to be paid to the Auditor.

PricewaterhouseCoopers LLP was first appointed Auditor of the Company on September 18, 2007.

| B2GOLD | 2025 Management Information Circular |

|

25

|

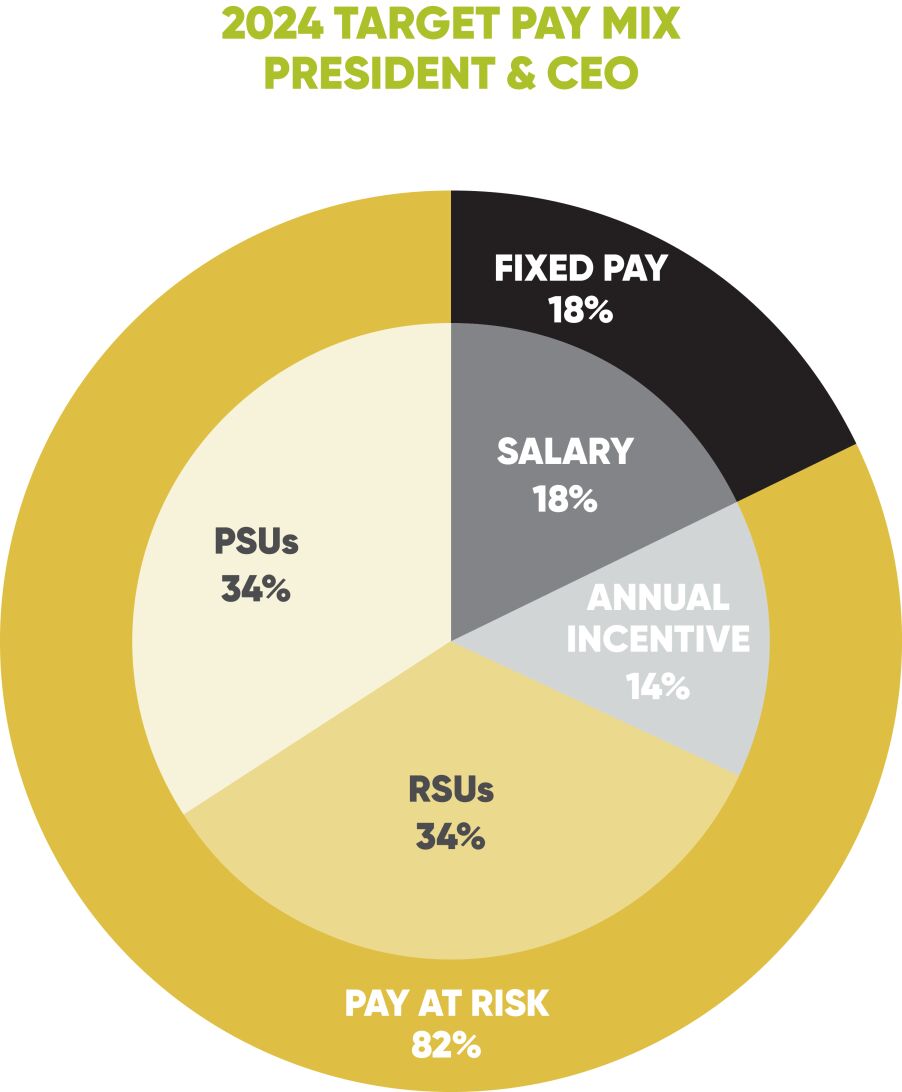

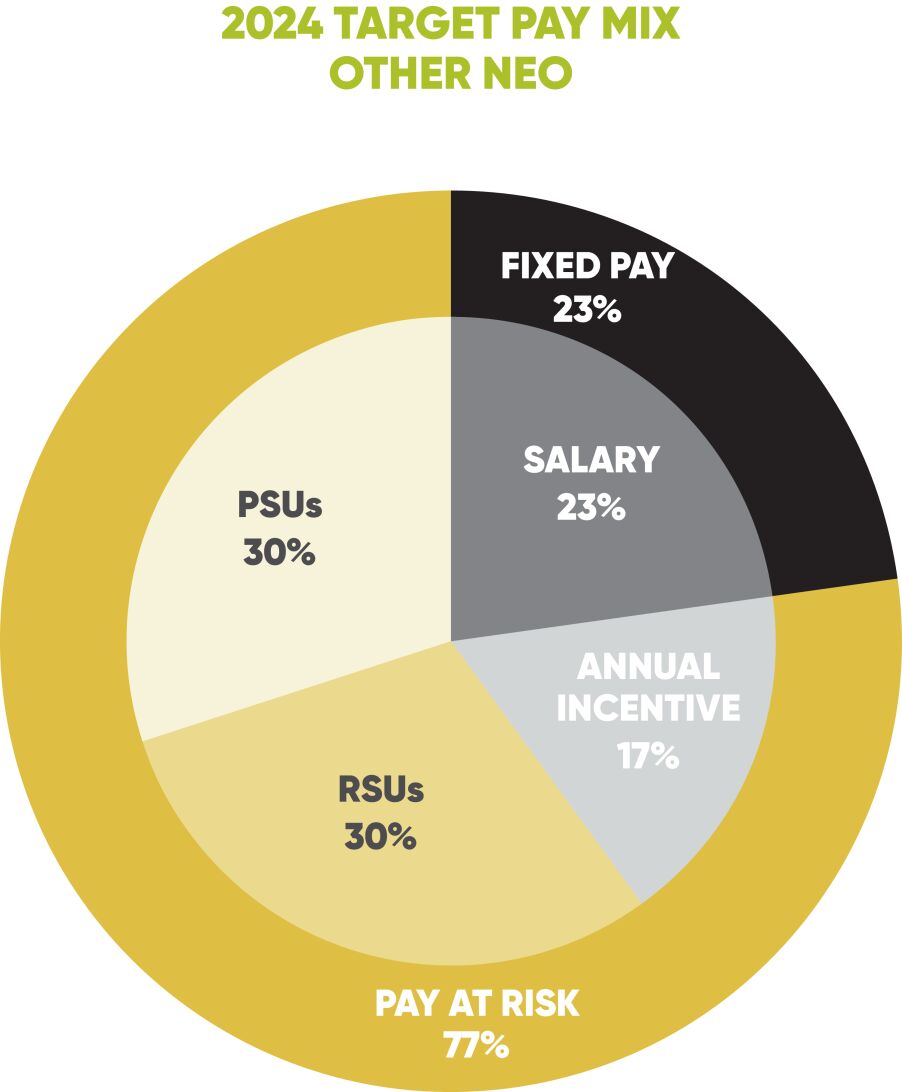

4) Advisory Vote on Executive Compensation

The Company endorses a “Pay for Performance” approach for executive compensation in order to reinforce the linkages between compensation and the Company’s strategic objectives and risk management processes. We believe that a “Pay for Performance” philosophy achieves the goal of attracting and retaining talented executives by rewarding behaviours that reinforce the Company’s values while also delivering on its corporate objectives, thereby aligning executives’ interests with those of our Shareholders. In considering its approach to executive compensation, the Board takes into account the results of the Shareholder vote for “Say on Pay”, together with feedback it receives from Shareholders. The Say on Pay advisory vote held at the 2024 annual general meeting of Shareholders (“2024 AGM”) was supported with 96.5% approval.

While this outcome was strongly supportive of the Company’s approach to the executive compensation program, Compensation Committee, in conjunction with its independent compensation consultant, continues to review current market practices regarding executive compensation and will continue to seek Shareholder feedback to discuss compensation and governance matters and provide Shareholders the opportunity to express any concerns in its review of the executive compensation program during 2024. For a detailed discussion of the Company’s executive compensation program, please see “Executive Compensation” below.

The purpose of the “Say on Pay” advisory vote is to give Shareholders a formal opportunity to provide their views on the disclosed objectives of the executive compensation plans, and on the plans themselves, by voting on the following resolution:

“IT IS RESOLVED, on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors, that the Shareholders of the Company accept the approach to executive compensation disclosed in the Information Circular delivered in advance of the Meeting.”

As this is an advisory vote, the results will not be binding upon the Board. However, the Board will take the results of the vote into account, as appropriate, when considering future compensation policies, procedures and decisions. In the event that the “Say on Pay” advisory resolution is not approved by a majority of the votes cast at the Meeting, the Board will consult with its Shareholders (particularly those who are known to have voted against it) to understand their concerns and will review the Board’s approach to compensation in the context of those concerns.

The Company will disclose the results of the Shareholder “Say on Pay” advisory vote as a part of its report on voting results for the Meeting.

| B2GOLD | 2025 Management Information Circular |

| 26

|

Business of the Meeting

5) Information Regarding the Director Nominees

The Board has determined that ten (10) Directors are to be elected to hold office until the next annual meeting of Shareholders. The following pages provide relevant information on each of the Director Nominees.

| B2GOLD | 2025 Management Information Circular |

|

|

|

| 27

|

| B2GOLD | 2025 Management Information Circular |

| 28

|

Business of the Meeting

KELVIN DUSHNISKY

Independent Director, Chair |

Kelvin Dushnisky served as Chief Executive Officer and a Director of AngloGold Ashanti Limited from 2018 to 2020. There he led the execution of the organization’s strategic priorities and oversaw a global portfolio of mining operations and projects in Africa, South America and Australia, along with exploration interests and investments in Canada and the USA. Prior to this Mr. Dushnisky had a 16-year career with Barrick Gold Corporation, ultimately as its President and as a Director. Prior to Barrick, Mr. Dushnisky held senior executive and board positions with a number of private and public companies.

Mr. Dushnisky presently serves on the boards of Directors of Lithium Americas Corporation and Doman Building Materials Group. Mr. Dushnisky holds a B.Sc. (Hon.) degree from the University of Manitoba and M.Sc. degree and Juris Doctor degree from the University of British Columbia. He is a member of the Law Society of British Columbia and the Canadian Bar Association.

Among numerous other industry and related associations, Mr. Dushnisky is past Chair of the World Gold Council and a former member of the International Council on Mining and Metals (“ICMM”) CEO Council. |

|||||||||||||||

|

Ontario Canada

Director Since: 2023

Tenure: < 2 years

Other Public Directorships:

• Lithium America Corporation

• Doman Building Materials Group

|

Voting Results of 2024 AGM 87.2% (For) |

Meetings Attended | ||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Compensation Committee | 8 of 8 | 100% | ||||||||||||||

| Governance Committee | 5 of 5 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | ✓ | 100,000 | 374,303 | |||||||||||||

| Note:

(1) As of Record Date. |

||||||||||||||||

|

Clive Johnson has served as a Director and the President of B2Gold since December 2006 and Chief Executive Officer (“CEO”) since March 2007. Mr. Johnson oversees the long-term strategy and development as well as the day-to-day activities of B2Gold. Previously, Mr. Johnson was founder of Bema Gold and its predecessor companies. He was a driving force in Bema’s transition from a junior exploration company to an international intermediate gold producer.

Mr. Johnson is currently a Director of Vanadian Energy Corp. and BeMetals Corp. In 2013, Mr. Johnson received the Pacific Entrepreneur of the Year Award for Mining and Metals, and in 2004 he received the Viola MacMillan Developer’s Award from the Prospectors and Developers Association of Canada. |

|||||||||||||||

| CLIVE JOHNSON President and CEO |

Voting Results of 2024 AGM 95.7% (For) |

Meetings Attended | ||||||||||||||

|

British Columbia, Canada

Director Since: 2006

Tenure: 18 Years

Other Public Directorships:

• Vandian Energy Corp. (formerly Uracan Resources Ltd.)

• Bemetals Corp.

|

Board | 7 of 7 | 100% | |||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Salary | ✓ | 3,162,713 | Nil | |||||||||||||

| Note:

(1) As of Record Date. |

||||||||||||||||

| B2GOLD | 2025 Management Information Circular |

|

29

|

|

|

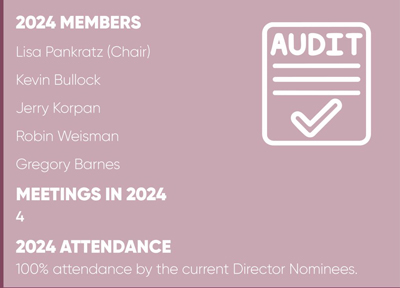

Greg Barnes has more than 30 years of experience in the global mining industry, providing industry-leading equity research on multiple M&A transactions and mining development projects. Most recently, Mr. Barnes served as Managing Director, Head of Mining Equity Research for TD Securities, joining the company in 2005, and oversaw the North American precious and base metal sectors.

Prior to joining TD Securities, Mr. Barnes was Vice President, Mining Analyst at Canaccord Capital, and also at Yorkton Securities. Before beginning his equity research career, Mr. Barnes spent two years with Kennecott Canada, a subsidiary of Rio Tinto, and three years with Falconbridge Ltd., where he was involved in corporate development and marketing. Mr. Barnes also spent several years as an exploration geologist in Northern Ontario and Newfoundland. Mr. Barnes holds a BSc in Geology from Queen’s University and a MBA from York University.

|

||||||||||

|

GREG BARNES

Independent Director

Ontario Canada

Director Since: 2024

Tenure: < 1 Year

Other Public Directorships:

• None |

Meetings Attended(1) | |||||||||||

| Board | 2 of 2 | 100% | ||||||||||

| Audit Committee | 1 of 1 | 100% | ||||||||||

| Ownership Requirement(2) | Achieved | Common Shares | DSUs | |||||||||

| 3x Annual Retainer | by 2029 | 50,000(3) | 46,798 | |||||||||

| Note:

(1) Mr. Barnes was appointed as a member of the Board and Audit Committee on November 1, 2024.

(2) As of Record Date.

(3) Mr. Barnes purchased the Common Shares in the public market in 2025. |

||||||||||||

KEVIN BULLOCK Independent Director

Ontario Canada

Director Since: 2013

Tenure: 11 Years

Other Public Directorships:

• NexGold Mining Corp. (formerly Signal Gold Inc.)

|

Kevin Bullock is a registered Professional Mining Engineer in the province of Ontario. Mr. Bullock was Volta Resources Inc.’s (“Volta”) President and Chief Executive Officer and was the founding President and CEO of Goldcrest (a Volta predecessor company) since its inception in 2002. He was instrumental in the growth of Volta from a shell company through to the ultimate sale of the company to B2Gold at the end of 2013.

Mr. Bullock has over 25 years of experience, at senior levels, in mining exploration, mine development and mine operations. Throughout his career, Mr. Bullock has been involved in projects from inception through exploration to development and production. Mr. Bullock is currently the President, Chief Executive Officer and Director of NexGold Mining Corp.

|

|||||||||||||||

| Voting Results of 2024 AGM 98.8% (For) |

Meetings Attended | |||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Audit Committee | 4 of 4 | 100% | ||||||||||||||

| Sustainability Committee | 4 of 4 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | ✓ | 68,033 | 347,991 | |||||||||||||

| Note:

(1) As of Record Date. |

||||||||||||||||

| B2GOLD | 2025 Management Information Circular |

| 30

|

Business of the Meeting

|

|

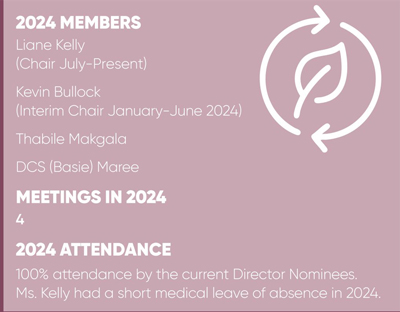

LIANE KELLY

Independent Director

Ontario Canada

Director Since: 2020

Tenure: 5 Years

Other Public Directorships:

• Amaroq Minerals Ltd. (formerly, AEX Gold Inc.) |

|

Liane Kelly is a CSR professional with extensive experience in environment, social and governance (“ESG”) oversight. Her expertise focuses on sustainability strategies, social risk management, and methodologies for effective community investment outcomes. Her professional career also includes working as an exploration geophysicist in the global mining sector. Ms. Kelly is currently a Director of Amaroq Minerals Ltd. and has worked with other boards in areas of governance, board performance and diversity, and employee ownership.

She has a BSc in Engineering Physics (Queen’s University), a postgraduate Certificate in International Development (UBC) and is a registered professional engineer in Ontario. Ms. Kelly obtained a Company Directors Diploma through the Australian Institute of Company Directors and is a member of the Institute of Corporate Directors (“ICD”) of Canada. |

|

||||||||||||||||||||

|

Voting Results of 2024 AGM 98.4% (For) |

Meetings Attended(1) | |||||||||||||||||||||||

| Board | 6 of 6 | 100% | ||||||||||||||||||||||

| Compensation Committee | 6 of 6 | 100% | ||||||||||||||||||||||

| Sustainability Committee | 3 of 3 | 100% | ||||||||||||||||||||||

| Ownership Requirement(2) | Achieved | Common Shares |

|

DSUs | ||||||||||||||||||||

| 3x Annual Retainer | ✓ | Nil |

|

359,060 | ||||||||||||||||||||

|

Note:

(1) Ms. Kelly took a short medical leave of absence in 2024.

(2) As of Record Date. |

|

|||||||||||||||||||||||

JERRY KORPAN

Independent Director

London, England

Director Since: 2007

Tenure: 17 Years

Other Public Directorships:

• None

|

Jerry Korpan has a Bachelor of Arts from the University of Alberta and a graduate degree from the University of Portland. Mr. Korpan completed financial executive education courses at the City of London Business School in 1996 where he studied accounting and financial analysis and project and infrastructure finance, among other things.

He began his career at Merrill Lynch in 1978, joined Yorkton Securities in 1988 and was Managing Director of Yorkton Securities UK until 1999. Jerry was a Director of Bema from 2002 to 2007 and Chairman of Mitra Energy until 2016. |

|||||||||||||||

|

Voting Results of 2024 AGM 96% (For)

|

Meetings Attended | |||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Audit Committee | 4 of 4 | 100% | ||||||||||||||

| Compensation Committee | 8 of 8 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | ✓ | 2,680,000 | 364,168 | |||||||||||||

|

Note:

(1) As of Record Date.

|

||||||||||||||||

| B2GOLD | 2025 Management Information Circular |

|

31

|

|

Thabile Makgala is the Vice President HSESC at Rio Tinto Minerals. Prior she was the

Mining Executive with

Ms. Makgala spent the first nine years of her career at Gold Fields Limited (from 2001-2009) in an engineering |

|||||||||||||||

| THABILE MAKGALA

Independent Director

Johannesburg, South Africa

Director Since: 2023

Tenure: < 2 year

Other Public Directorships:

• None

|

Voting Results of 2024 AGM 99.3% (For) |

Meetings Attended | ||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Sustainability Committee

|

4 of 4 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | by 2028 | Nil | 119,767 | |||||||||||||

| Notes:

(1) As of Record Date.

|

||||||||||||||||

|

DCS (Basie) Maree has more than 40 years of experience in the global mining industry, ranging from Chief Operating Officer, Chief Technical Officer, Mine General Manager (underground and open pit), and

Mr. Maree has served on

several company boards and was one of the founding members and Director of the |

|||||||||||||||

| DCS (BASIE) MAREE

Independent Director

Dubai, United Arab Emirates

Director Since: 2024

Tenure: < 1 Year

Other Public Directorships:

• None

|

Meetings Attended(1) | |||||||||||||||

| Board | 2 of 2 | 100% | ||||||||||||||

| Sustainability Committee | 1 of 1 | 100% | ||||||||||||||

| Ownership Requirement(2) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | ✓ | 111,500(3) | 46,798 | |||||||||||||

| Notes:

(1) Mr. Maree was appointed as a member of the Board and Sustainability Committee on November 1, 2024.

(2) As of Record Date.

(3) Mr. Maree purchased the Common Shares in the public market in 2025. |

||||||||||||||||

| B2GOLD | 2025 Management Information Circular |

| 32

|

Business of the Meeting

|

LISA PANKRATZ

Independent Director

British Columbia, Canada

Director Since: 2023

Tenure: 2 Years

Other Public Directorships:

• None |

Lisa Pankratz has over 30 years of experience in the investment industry and capital markets in both executive and advisory capacities, working with multinational and international companies. For over 20 years, she has served as a Board Member of corporations in the financial services, global media and mining industries. Most recently, she was Chair of the HSBC Independent Review Committee for HSBC Global Asset Management (Canada) Limited and was a member of the Board of Directors and Chair of the Audit Committee for Sherritt International Corporation.

Previously, she was Chair of the Board of Directors of UBC Investment Management Trust Inc. and served on the Boards of IA Clarington Investments, the Canadian Museum for Human Rights, Canwest Media, Inc., The Insurance Corporation of British Columbia, and was a member of the Accounting Policy and Advisory Committee advising the Ministry of Finance for the Province of British Columbia. From 2006 to 2010, she was the President of Mackenzie Cundill Investment Management Ltd., and from 2002 to 2006 was the President, Chief Compliance

Officer and Director of Cundill Investment Research Ltd. and the Chief Compliance Officer of The Cundill Group. Ms. Pankratz is a Fellow of the Institute of Chartered Professional Accountants of British Columbia and a Chartered Financial Analyst charter holder. She received an Honours Bachelor of Arts in Business Administration from the Richard Ivey School of Business at Western University. |

|||||||||||||||

|

Voting Results of 2024 AGM 98.9% (For) |

Meetings Attended | |||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Audit Committee | 4 of 4 | 100% | ||||||||||||||

| Governance Committee | 5 of 5 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | By 2028 | Nil | 149,810 | |||||||||||||

| Note:

(1) As of Record Date. |

||||||||||||||||

ROBIN WISEMAN

Independent Director

Virginia, USA

Director Since: 2017

Tenure: 7 Years

Other Public Directorships:

• None

|

Robin Weisman joined B2Gold as a continuation of her deep experience in resource sector finance, immediately following her well-respected career at International Finance Corporation (“IFC”) in Washington, D.C as a Principal Investment Officer. While at IFC, she led teams to invest debt and equity in projects valued up to USD$9 billion, and advised clients on risk mitigation strategies in developing countries. During her 22-year career at IFC, she developed a renowned sub-specialty in managing risks through effective corporate social responsibility, including a focus on advancing the role of women across the resource development sector.

Prior to joining IFC, she worked in increasingly senior roles including the position of vice president at Standard Chartered Bank, concentrating on structured trade financing. In her executive role at Citibank, she specialized in the currencies of emerging markets. Prior to these positions, Ms. Weisman provided financial forecasting and competitive analysis for CBS Television Network. Ms. Weisman holds a BSc from the University of Illinois and a MBA from the University of Chicago. Ms. Weisman has her ICD designate from the Institute of Corporate Directors (“ICD”) in partnership with the Rotman School of Management. Ms. Weisman is a member of the National Association of Corporate Directors.

|

|||||||||||||||

|

Voting Results of 2024 AGM 99.1% (For) |

Meetings Attended | |||||||||||||||

| Board | 7 of 7 | 100% | ||||||||||||||

| Governance Committee (Chair) | 5 of 5 | 100% | ||||||||||||||

| Audit Committee | 4 of 4 | 100% | ||||||||||||||

| Ownership Requirement(1) | Achieved | Common Shares | DSUs | |||||||||||||

| 3x Annual Retainer | ✓ | 3,274 | 364,168 | |||||||||||||

| Note:

(1) As of Record Date. |

||||||||||||||||

| B2GOLD | 2025 Management Information Circular |

|

33

|

Cease Trade Orders, Bankruptcies,

Penalties or Sanctions

| Cease Trade Orders | Director | |

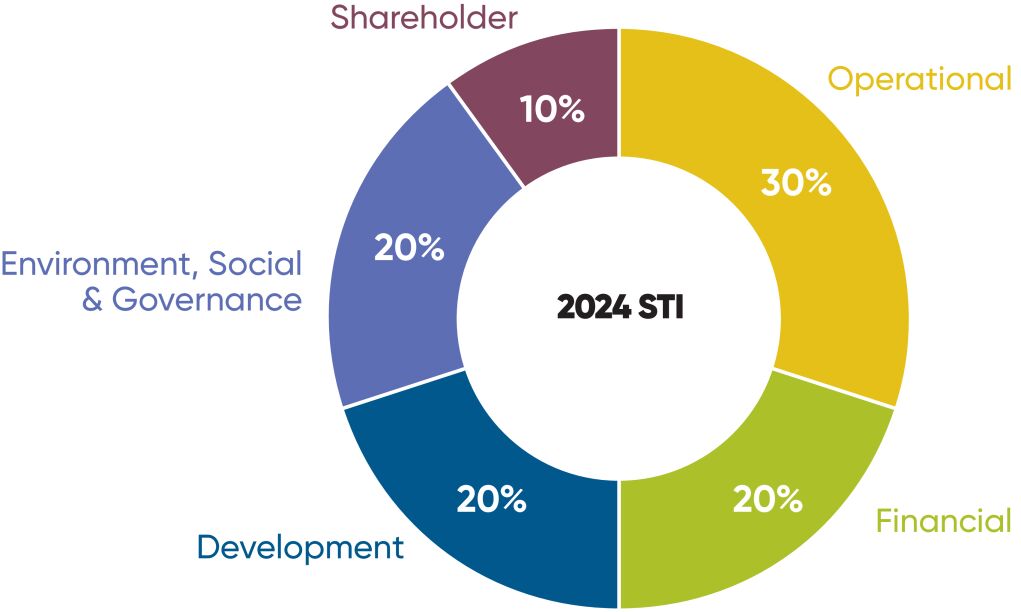

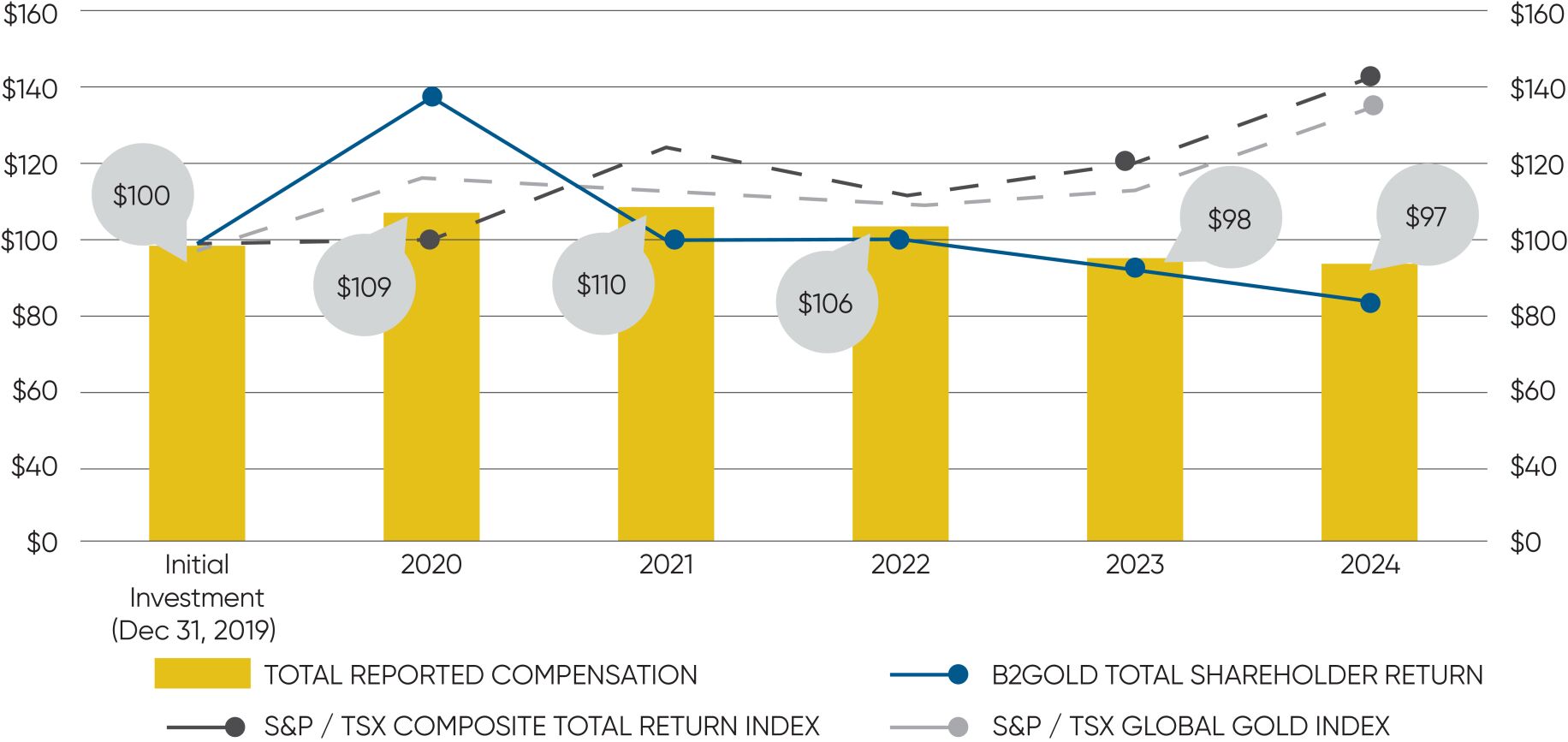

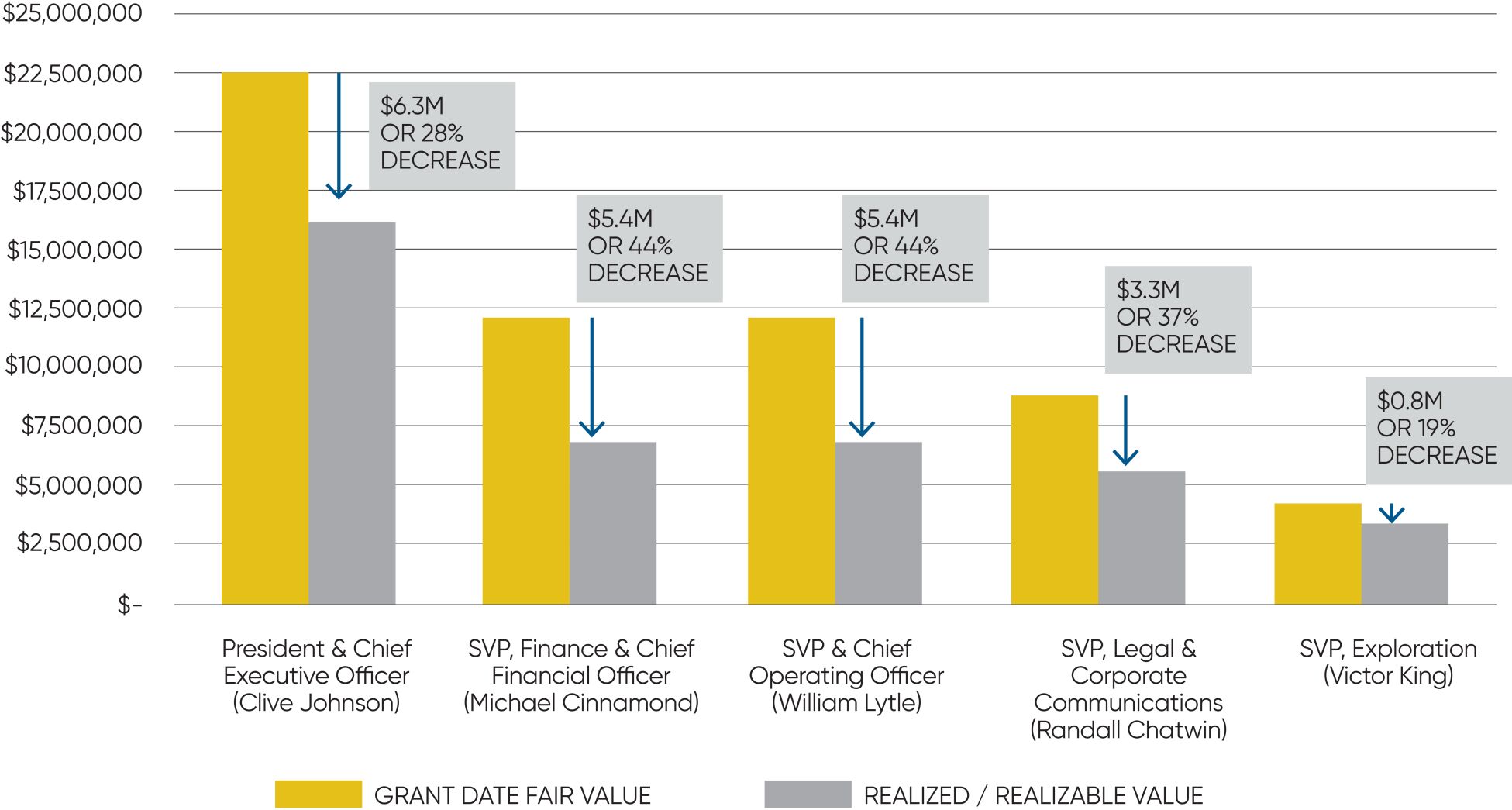

|