UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File Number: 001-41404

Woodside Energy Group Ltd

(ABN 55 004 898 962)

(Registrant’s name)

Woodside Energy Group Ltd

Mia Yellagonga, 11 Mount Street

Perth, Western Australia 6000

Australia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| Exhibit No. | Description |

|

| 99.1 | A copy of the registrant’s Announcement, dated April 29, 2025, entitled “Woodside approves Louisiana LNG development”. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: April 29, 2025

| WOODSIDE ENERGY GROUP LTD | ||

| By: | /s/ Damien Gare |

|

| Damien Gare Corporate Secretary |

||

Exhibit 99.1

| Announcement

Tuesday, 29 April 2025 |

Woodside Energy Group Ltd. ACN 004 898 962 Mia Yellagonga 11 Mount Street Perth WA 6000 Australia T +61 8 9348 4000 www.woodside.com

ASX: WDS NYSE: WDS |

WOODSIDE APPROVES LOUISIANA LNG DEVELOPMENT

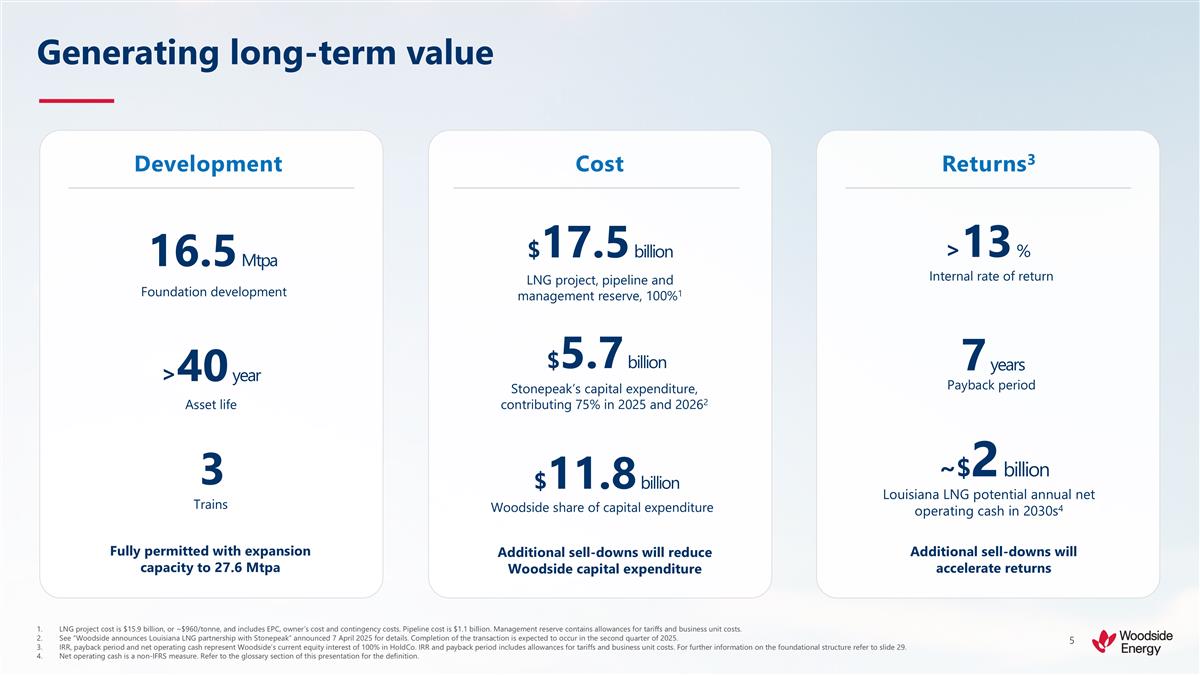

Woodside has made a final investment decision to develop the three-train, 16.5 million tonne per annum (Mtpa) Louisiana LNG development. Woodside is targeting first LNG in 2029.

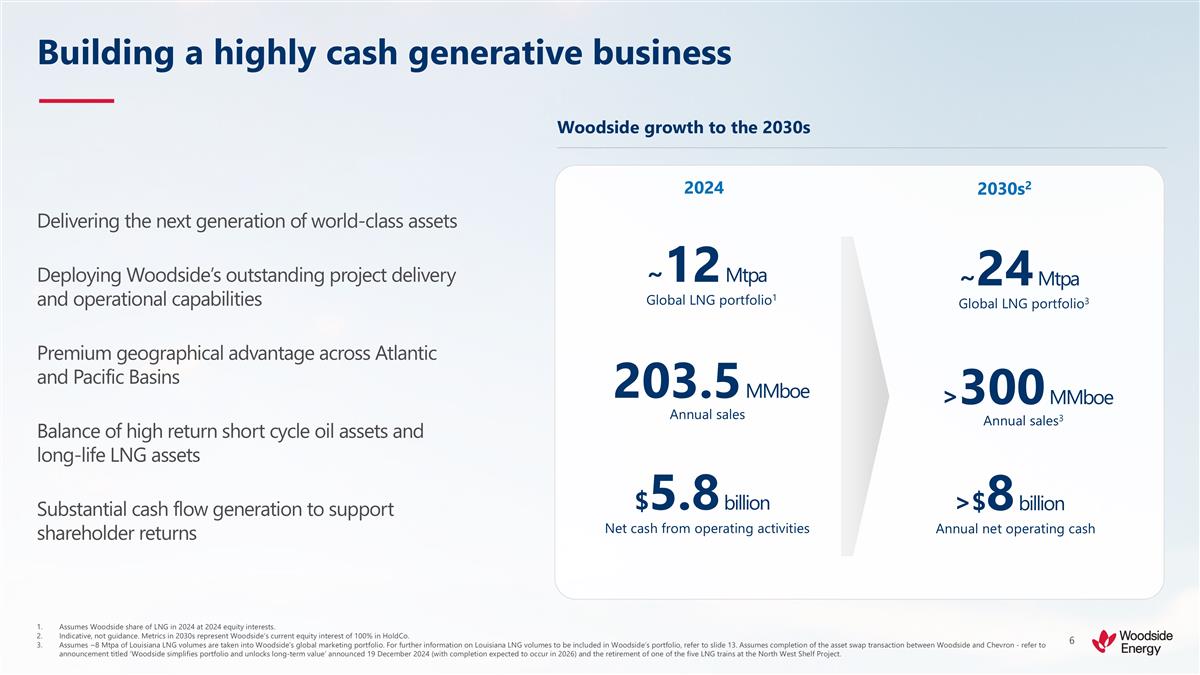

Development of Louisiana LNG will position Woodside as a global LNG powerhouse, enabling the company to deliver approximately 24 Mtpa from its global LNG portfolio in the 2030s, and operating over 5% of global LNG supply.1 The development has expansion capacity for two additional LNG trains and is fully permitted for a total capacity of 27.6 Mtpa.

Louisiana LNG represents a compelling investment that will deliver significant cash flow and create long-term value for Woodside shareholders. It exceeds Woodside’s capital allocation targets, delivering an internal rate of return (IRR) above 13% and a payback period of seven years.

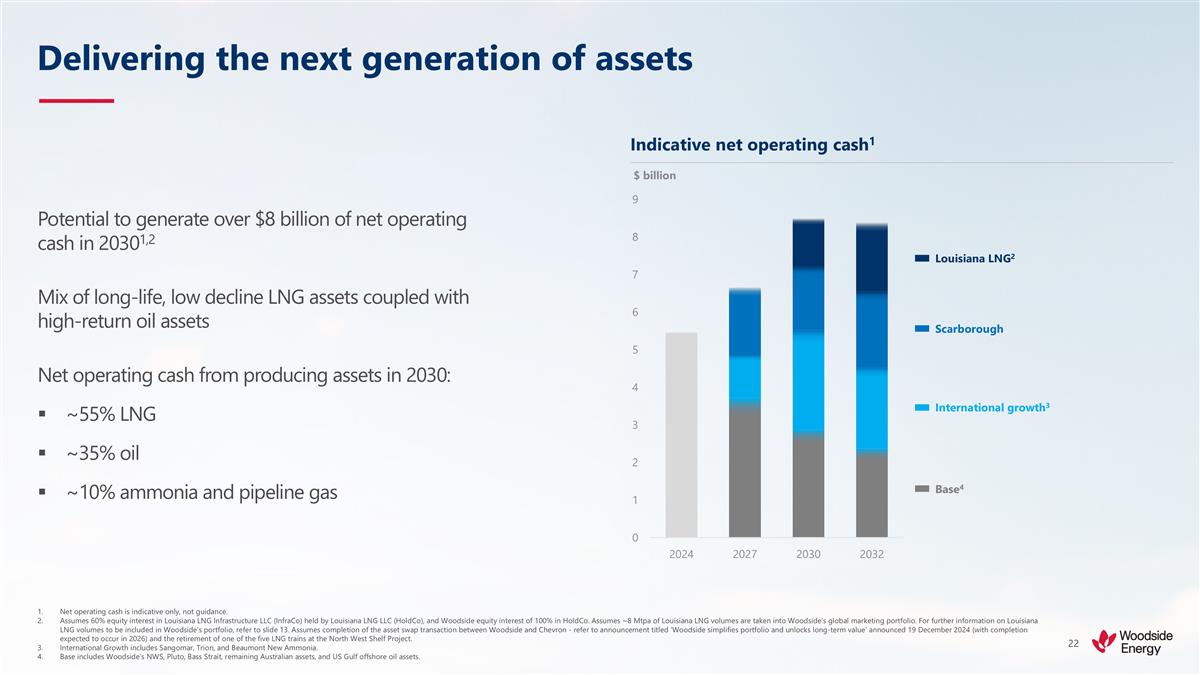

At full capacity, the foundation project is expected to generate approximately $2 billion of annual net operating cash in the 2030s. It will drive Woodside’s next chapter of value creation, giving the company’s global portfolio the potential to generate over $8 billion of annual net operating cash in the 2030s.2

The forecast total capital expenditure for the LNG project, pipeline and management reserve is US$17.5 billion (100%).3 Stonepeak, as an investor in Louisiana LNG Infrastructure LLC, will provide $5.7 billion towards the expected capital expenditure for the LNG project on an accelerated basis, contributing 75% of capital expenditure in both 2025 and 2026.4 Woodside’s share of forecast total capital expenditure is $11.8 billion.

Woodside’s greenhouse gas emissions reduction targets remain unchanged by the final investment decision on Louisiana LNG. The starting base for the emissions reduction target will not be adjusted as a result of the final investment decision.5

Woodside CEO Meg O’Neill said the final investment decision on Louisiana LNG was an historic moment for the company.

“Louisiana LNG is a game-changer for Woodside, set to position our company as a global LNG powerhouse and enable us to deliver enduring shareholder returns.

| 1 | Source: Wood Mackenzie. |

| 2 | At Woodside’s current equity interest of 100% in HoldCo (and assumes completion of the asset swap transaction between Woodside and Chevron - refer to announcement titled ‘Woodside simplifies portfolio and unlocks long-term value’ announced 19 December 2024. Completion of the transaction is expected to occur in 2026). |

| 3 | Louisiana LNG project cost is $15.9 billion, or $960/tonne, and includes EPC, owner’s cost and contingency costs. Pipeline cost is $1.1 billion. Management reserve contains allowances for tariffs and business unit costs. |

| 4 | See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Completion of the transaction is expected to occur in the second quarter of 2025. |

| 5 | Refer to “Woodside’s greenhouse gas emissions reduction targets” at the end of this announcement. |

Page 1 of 3

“This world-class project is a compelling and de-risked investment. It leverages Woodside’s proven strengths in project execution, operational excellence, marketing and customer relationships to offer significant cash generation and drive long-term shareholder value.

“We have secured quality partners and are now ready to take a final investment decision.6 This decision is another demonstration of Woodside’s disciplined investment approach, with the project delivering returns that exceed our capital allocation framework.

“Adding Louisiana LNG to our established Australian LNG business provides Woodside with a balanced and resilient portfolio, combining long-life, flexible LNG assets with high-return oil assets.

“The project benefits from access to abundant low-cost gas resources in the United States and boasts an asset lifespan of more than 40 years. It also has access to well-established interstate and intrastate gas supply networks.

“The marketing opportunities Louisiana LNG offers across the Pacific and Atlantic Basins leverages Woodside’s proven LNG marketing capabilities and complements our established position in Asia. This will position Woodside to even better serve global customers and meet growing energy demand.

“This supply can target strong and sustained demand for LNG expected in both Asia and Europe, as those markets pursue energy security and decarbonisation aspirations.

“We are pleased with the strong level of interest from potential strategic partners and are advancing discussions targeting further equity sell-downs. This will further reduce Woodside’s capital and accelerate the value of Louisiana LNG and is consistent with the approach we have taken with our Scarborough Energy Project in Australia.

“As the largest single foreign direct investment in Louisiana’s history, Louisiana LNG will also be the first greenfield US LNG project to go to final investment decision since July 2023.

“Louisiana LNG will support approximately 15,000 national jobs during construction. Woodside appreciates the support Louisiana LNG has received from both the US Federal and Louisiana State governments.”

Teleconference

A teleconference providing an overview of the Louisiana LNG development and a question-and-answer session will be hosted by CEO and Managing Director, Meg O’Neill, today at 08:00 AWST / 10:00 AEST (19:00 CDT Monday, 28 April 2025).

We recommend participants pre-register 5 to 10 minutes prior to the event with one of the following links:

| • |

https://webcast.openbriefing.com/wds-ann-2025/ to view the presentation and listen to a live stream of the question-and-answer session |

| • | https://s1.c-conf.com/diamondpass/10047000-ixhubr.html to participate in the question-and-answer session. Following pre-registration, participants will receive the teleconference details and a unique access passcode. |

An investor presentation follows this announcement and will be referred to during the conference call. It will also be made available on the Woodside website (www.woodside.com).

| 6 | See “Woodside signs LNG supply agreements with Uniper” announced 17 April 2025 for details. See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Completion of the transaction is expected to occur in the second quarter of 2025. |

Page 2 of 3

| INVESTORS

Sarah Peyman M: +61 457 513 249 E: investor@woodside.com |

MEDIA

Christine Forster M: +61 484 112 469 E: christine.forster@woodside.com |

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Forward-looking statements

This announcement contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding timing and completion of Louisiana LNG and related sell-down transactions, construction costs and capital expenditures, the expected benefits, cash flow and rates of return and other future arrangements relating to Louisiana LNG, expectations regarding future expenditures and future results of projects. All forward-looking statements contained in this announcement reflect Woodside’s views held as at the date of this announcement. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘position’, ‘enable’, ‘plan’, ‘forecast’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions.

Forward-looking statements in this announcement are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of aspirational targets that Woodside has set for itself and its management of the business. Those statements and any assumptions on which they are based are only opinions, are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective officers, directors, employees, advisers or representatives.

Details of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review and have regard to these risks when considering the information contained in this announcement.

Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements.

All information included in this announcement, including any forward-looking statements, speak only as of the date of this announcement and, except as required by law or regulation, Woodside does not undertake to update or revise any information or forward-looking statements contained in this announcement, whether as a result of new information, future events, or otherwise.

Woodside’s greenhouse gas emissions reduction targets

Net equity Scope 1 and 2 greenhouse gas emissions reduction target of 30% by 2030 and net zero aspiration by 2050 or sooner. Target is for net equity Scope 1 and 2 greenhouse gas emissions, relative to a starting base representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021.

Page 3 of 3

Woodside approves Louisiana LNG development www.woodside.com investor@woodside.com 29 April 2025 Creating a global LNG powerhouse

Information This presentation has been prepared by Woodside Energy Group Ltd (“Woodside”). All information included in this presentation, including any forward-looking statements, reflects Woodside’s views held as at the date of this presentation and, except as required by applicable law or regulation, neither Woodside, its related bodies corporate, nor any of their respective officers, directors, employees, advisers or representatives (“Beneficiaries”) intends to, undertakes to, or assumes any obligation to, provide any additional information or update or revise any information or forward-looking statements in this presentation after the date of this presentation, either to make them conform to actual results or as a result of new information, future events, changes in Woodside’s expectations or otherwise. This presentation may contain industry, market and competitive position data that is based on industry publications and studies conducted by third parties as well as Woodside’s internal estimates and research. While Woodside believes that each of these publications and third party studies is reliable and has been prepared by a reputable source, Woodside has not independently verified the market and industry data obtained from these third party sources and cannot guarantee the accuracy or completeness of such data. Accordingly, undue reliance should not be placed on any of the industry, market and competitive position data contained in this presentation. To the maximum extent permitted by law, neither Woodside, its related bodies corporate, nor any of their respective Beneficiaries, assume any liability (including liability for equitable, statutory or other damages) in connection with, any responsibility for, or make any representation or warranty (express or implied) as to, the fairness, currency, accuracy, adequacy, reliability or completeness of the information or any opinions expressed in this presentation or the reasonableness of any underlying assumptions. No offer or advice This presentation is not intended to and does not constitute, form part of, or contain an offer or invitation to sell to Woodside shareholders or to any other person, or a solicitation of an offer from Woodside shareholders or from any other person, or a solicitation of any vote or approval from Woodside shareholders or from any other person in any jurisdiction. This presentation has been prepared without reference to the investment objectives, financial and taxation situation or particular needs of any Woodside shareholder or of any other person. The information contained in this presentation does not constitute, and should not be taken as, financial product or investment advice. Woodside encourages you to seek independent legal, financial, taxation and other professional advice before making any investment decision. This presentation and the information contained herein may not be taken or transmitted, in, into or from and may not be copied, forwarded, distributed or transmitted in or into any jurisdiction in which such release, publication or distribution would be unlawful. The release, presentation, publication or distribution of this presentation, in whole or in part, in certain jurisdictions may be restricted by law or regulation, and persons into whose possession this presentation comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of the relevant jurisdiction. Woodside does not accept liability to any person in relation to the distribution or possession of this document in or from any such jurisdiction. Forward-looking statements This presentation contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding outcomes of transactions, undertakings, arrangements and agreements which Woodside has entered into, statements regarding long-term demand for Woodside’s products, development, completion and execution of Woodside’s projects, expectations regarding future capital expenditures, the payment of future dividends and the amount thereof, future results of projects, operating activities and new energy products, expectations and plans for renewables production capacity and investments in, and development of, renewable projects expectations and guidance with respect to production, capital and exploration expenditure and gas hub exposure, and expectations regarding the achievement of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions reduction and new energy investment targets and other climate and sustainability goals. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ’aspire’, ‘estimate, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ’forecast’, ‘indicative’, ‘outlook’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly, statements that describe the objectives, plans, goals or expectations of Woodside are forward-looking statements. Forward-looking statements in this presentation are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of future expectations that are based on management’s current expectations and assumptions. Those statements and any assumptions on which they are based are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective Beneficiaries. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, fluctuations in commodity prices, actual demand for Woodside’s products, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results, engineering estimates, reserve and resource estimates, loss of market, industry competition, environmental risks, climate related risks, physical risks, legislative, fiscal and regulatory developments, changes in accounting standards, economic and financial markets conditions in various countries and regions, political risks, the actions of third parties, project delay or advancement, regulatory approvals, the impact of armed conflict and political instability (such as the ongoing conflict in Ukraine and in the Middle East) on economic activity and oil and gas supply and demand, cost estimates, the effect of future regulatory or legislative actions on Woodside or the industries in which it operates, including potential changes to tax laws and tariffs, construction costs, the impact of general economic conditions, inflationary conditions, prevailing exchange rates and interest rates and conditions in financial markets, and risks associated with acquisitions, mergers and joint ventures, including difficulties integrating businesses, uncertainty associated with financial projections, restructuring, increased costs and adverse tax consequences, and uncertainties and liabilities associated with acquired and divested properties and businesses. Details of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission (SEC) and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review and have regard to these risks when considering the information contained in this presentation. If any of the assumptions on which a forward-looking statement is based were to change or be found to be incorrect, this would likely cause outcomes to differ from the statements made in this presentation. Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements. Disclaimer, important notes and assumptions

All forward-looking statements contained in this presentation reflect Woodside’s views held as at the date of this presentation and, except as required by applicable law or regulation, Woodside does not intend to, undertake to, or assume any obligation to, provide any additional information or update or revise any of these statements after the date of this presentation, either to make them conform to actual results or as a result of new information, future events, changes in Woodside’s expectations or otherwise. Disclosure of reserve information and cautionary note to US investors Woodside is an Australian company listed on the Australian Securities Exchange and the New York Stock Exchange. Woodside estimates and reports its Proved (1P) Reserves in accordance with the SEC regulations, which are also compliant with SPE-PRMS guidelines, and estimates and reports its Proved plus Probable (2P) Reserves and Best Estimate (2C) Contingent Resources in accordance with SPE-PRMS guidelines. Woodside reports all of its petroleum resource estimates using definitions consistent with SPE-PRMS. The SEC prohibits oil and gas companies, in their filings with the SEC, from disclosing estimates of oil or gas resources other than ‘reserves’ (as that term is defined by the SEC). In this presentation, Woodside includes estimates of quantities of oil and gas using certain terms, such as ‘proved plus probable (2P) reserves’, ‘best estimate (2C) contingent resources’, ‘reserves and contingent resources’, ‘proved plus probable’, ‘developed and undeveloped’, ‘probable developed’, ‘probable undeveloped’, ‘contingent resources’ or other descriptions of volumes of reserves, which terms include quantities of oil and gas that may not meet the SEC’s definitions of proved, probable and possible reserves, and which the SEC’s guidelines strictly prohibit Woodside from including in filings with the SEC. These types of estimates do not represent, and are not intended to represent, any category of reserves based on SEC definitions, and may differ from and may not be comparable to the same or similarly-named measures used by other companies. These estimates are by their nature more speculative than estimates of proved reserves and would require substantial capital spending over a significant number of years to implement recovery, and accordingly are subject to substantially greater risk of not being recovered by Woodside. In addition, actual locations drilled and quantities that may be ultimately recovered from Woodside’s properties may differ substantially. Woodside has made no commitment to drill, and likely will not drill, all drilling locations that have been attributable to these quantities. US investors are urged to consider closely the disclosures in Woodside’s most recent Annual Report on Form 20-F filed with the SEC and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings and its other filings with the SEC, which are available at www.sec.gov. Assumptions Unless otherwise indicated, the targets set out in this presentation have been estimated on the basis of a variety of economic assumptions including: (1) US$75/bbl Brent long-term oil price, US$10/MMBtu long term JKM price, US$9/MMBtu long-term TTF price, US$3.50 long-term Henry Hub price (2024 real terms) and a long-term inflation rate of 2.0%; (2) currently sanctioned projects being delivered in accordance with their current project schedules; and (3) applicable growth opportunities being sanctioned and delivered in accordance with the target schedules provided in this presentation. These growth opportunities are subject to relevant project participant approvals, commercial arrangements with third parties and regulatory approvals being obtained in the timeframe contemplated or at all. Woodside expresses no view as to whether project participants will agree with and support Woodside’s current position in relation to these opportunities, or such commercial arrangements and regulatory approvals will be obtained. Additional assumptions relevant to particular targets or other statements in this presentation may be set out in the relevant slides. Any such additional assumptions are in addition to the assumptions and qualifications applicable to the presentation as a whole. Climate strategy and emissions data All greenhouse gas emissions data in this presentation are estimates, due to the inherent uncertainty and limitations in measuring or quantifying greenhouse gas emissions, and our methodologies for measuring or quantifying greenhouse gas emissions may evolve as best practices continue to develop and data quality and quantity continue to improve. Woodside “greenhouse gas” or “emissions” information reported are net equity Scope 1 greenhouse gas emissions, Scope 2 greenhouse gas emissions, and/or Scope 3 greenhouse gas emissions, unless otherwise stated. For more information on Woodside's climate strategy and performance, including further details regarding Woodside’s targets, aspirations and goals and the underlying methodology, judgements, assumptions and contingencies, refer to Woodside's Climate Transition Action Plan 2023 (CTAP) and the 2024 Climate Update, each available on the Woodside website at https://www.woodside.com/sustainability/climate-change and section 3.85 of Woodside’s 2024 Annual Report. The glossary and footnotes to this presentation provide clarification regarding the use of terms such as "lower-carbon“ under Woodside's climate strategy. A full glossary of terms used in connection with Woodside's climate strategy is contained in the CTAP. Non-IFRS Financial Measures Throughout this presentation, a range of financial and non-financial measures are used to assess Woodside’s performance, including a number of financial measures that are not defined in, and have not been prepared in accordance with, International Financial Reporting Standards (IFRS) and are not recognised measures of financial performance or liquidity under IFRS (Non-IFRS Financial Measures). These measures include Cash Margin, Gearing, Capital and Exploration expenditure and Liquidity. Net operating cash describes net cash from operating activities adjusted to remove the Louisiana LNG non-controlling interest (NCI) to present net cash from operating activities attributable to Woodside (i.e. not on a consolidated basis) and also reflects the impact of lease repayments. These Non-IFRS Financial Measures are defined in the glossary section of this presentation. A quantitative reconciliation of these measures to the most directly comparable financial measure calculated and presented in accordance with IFRS can be found in Woodside’s Full Year Report for the period ended 31 December 2024. Net operating cash is defined in the glossary of this presentation and was not used in Woodside’s Full Year Report for the period ended 31 December 2024. Woodside’s management uses these measures to monitor Woodside’s financial performance alongside IFRS measures to improve the comparability of information between reporting periods and business units and Woodside believes that the Non-IFRS Financial Measures it presents provide a useful means through which to examine the underlying performance of its business. Undue reliance should not be placed on the Non-IFRS Financial Measures contained in this presentation and these Non-IFRS Financial Measures should be considered in addition to, and not as a substitute for, or as superior to, measures of financial performance, financial position or cash flows reported in accordance with IFRS. Non-IFRS Financial Measures are not uniformly defined by all companies, including those in Woodside’s industry. Accordingly, they may not be comparable with similarly titled measures and disclosures by other companies. Other important information All references to dollars, cents or $ in this presentation are to US currency, unless otherwise stated. References to “Woodside” may be references to Woodside Energy Group Ltd and/or its applicable subsidiaries (as the context requires). This presentation does not include any express or implied prices at which Woodside will buy or sell financial products. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Disclaimer, important notes and assumptions (continued)

Louisiana LNG development approved Develops world-class asset Compelling investment Generates long-term value Three-train 16.5 Mtpa development at fully permitted site, leveraging best-in-class technology De-risked low-cost development, benefits from foreign trade zone Targeting first LNG 2029 Exceeds Woodside’s capital allocation targets Reduced capital commitment through infrastructure sell-down to high-quality partner Significant cash generation to support shareholder distributions Complementary LNG presence in the Atlantic Basin enabling greater portfolio value enhancement

Generating long-term value LNG project cost is $15.9 billion, or ~$960/tonne, and includes EPC, owner’s cost and contingency costs. Pipeline cost is $1.1 billion. Management reserve contains allowances for tariffs and business unit costs. See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Completion of the transaction is expected to occur in the second quarter of 2025. IRR, payback period and net operating cash represent Woodside’s current equity interest of 100% in HoldCo. IRR and payback period includes allowances for tariffs and business unit costs. For further information on the foundational structure refer to slide 29. Net operating cash is a non-IFRS measure. Refer to the glossary section of this presentation for the definition. Development Returns3 Cost 16.5 Mtpa Foundation development Asset life >40 year $17.5 billion LNG project, pipeline and management reserve, 100%1 Trains 3 Payback period 7 years Stonepeak’s capital expenditure, contributing 75% in 2025 and 20262 $5.7 billion Woodside share of capital expenditure $11.8 billion ~$2 billion Louisiana LNG potential annual net operating cash in 2030s4 >13 % Internal rate of return Additional sell-downs will reduce Woodside capital expenditure Additional sell-downs will accelerate returns Fully permitted with expansion capacity to 27.6 Mtpa

Building a highly cash generative business Assumes Woodside share of LNG in 2024 at 2024 equity interests. Indicative, not guidance. Metrics in 2030s represent Woodside’s current equity interest of 100% in HoldCo. Assumes ~8 Mtpa of Louisiana LNG volumes are taken into Woodside’s global marketing portfolio. For further information on Louisiana LNG volumes to be included in Woodside’s portfolio, refer to slide 13. Assumes completion of the asset swap transaction between Woodside and Chevron - refer to announcement titled ‘Woodside simplifies portfolio and unlocks long-term value’ announced 19 December 2024 (with completion expected to occur in 2026) and the retirement of one of the five LNG trains at the North West Shelf Project. Delivering the next generation of world-class assets Deploying Woodside’s outstanding project delivery and operational capabilities Premium geographical advantage across Atlantic and Pacific Basins Balance of high return short cycle oil assets and long-life LNG assets Substantial cash flow generation to support shareholder returns Annual net operating cash >$8 billion Annual sales3 >300 MMboe Woodside growth to the 2030s ~24 Mtpa Global LNG portfolio3 Net cash from operating activities $5.8 billion Annual sales 203.5 MMboe ~12 Mtpa Global LNG portfolio1 2024 2030s2

Louisiana LNG DEVELOPMENT

Advantaged and de-risked US greenfield project Equipment and materials comprise ~25% of the Bechtel EPC cost. Assumes 60% equity interest in Louisiana LNG Infrastructure LLC (InfraCo) held by Louisiana LNG LLC (HoldCo) and Woodside equity interest of 100% in HoldCo. Real terms 2024. Cost and schedule certainty Bechtel EPC contract with high technical maturity 95% of Bechtel EPC pricing is lump sum or fixed rate Benefits from operating in a designated foreign trade zone, <15% of EPC spend is sourced outside the US1 Advanced construction Competitively advantaged Pilings for Train 1 and LNG tanks complete, with foundation work underway for LNG tanks Quality Tier 1 partners in Bechtel, Baker Hughes and Chart >90% of high value orders have been placed, locking in price and schedule >12% returns generated with gulf coast net back above 100% Henry Hub plus ~$3.40/MMBtu2 Ability to leverage price volatility across Atlantic and Pacific Basins Future expansion expected to lower unit costs and enhance returns

Leveraging best-in-class technology Integrated compression line = ICL. Zero-emissions during operation and pressurised stand by. Being an electrical driven compressor, emissions are proportional to electrical grid power generation emissions. In the case of green electrical power, ICL is reducing up to 99% of emissions compared to gas-fired solutions. As defined by Baker Hughes. Approved foundation project Future phases Buildings Jetty 1 Jetty 2 Tank 1 and 2 Flare 1 and 2 Liquefaction Gas pretreatment Pipeline Trains 1-3 (5.5 Mtpa each) Bechtel engineering, procurement and construction (EPC) contract Chart IPSMR® liquefaction technology 12 high efficiency LM6000PF+ aeroderivative gas turbines for refrigerant compressor drivers (four per train) Baker Hughes mixed refrigerant compressors and control units Flareless restart without gas recycle Two large 235,000 m3 LNG storage tanks to enable operational flexibility Two jetties with capacity for large LNG carriers (up to 216,000m3) Storage tanks and berths Fully permitted 37-mile (~60 km) pipeline Permitted interconnections provide flexibility in gas supply Baker Hughes electric drive ICL zero-emissions compressors1 Woodside Louisiana LNG site Expansion potential for two additional trains totaling 11 Mtpa Fully permitted for 27.6 Mtpa to support expansion Potential returns for future phases benefit from foundation development common infrastructure Future expansion

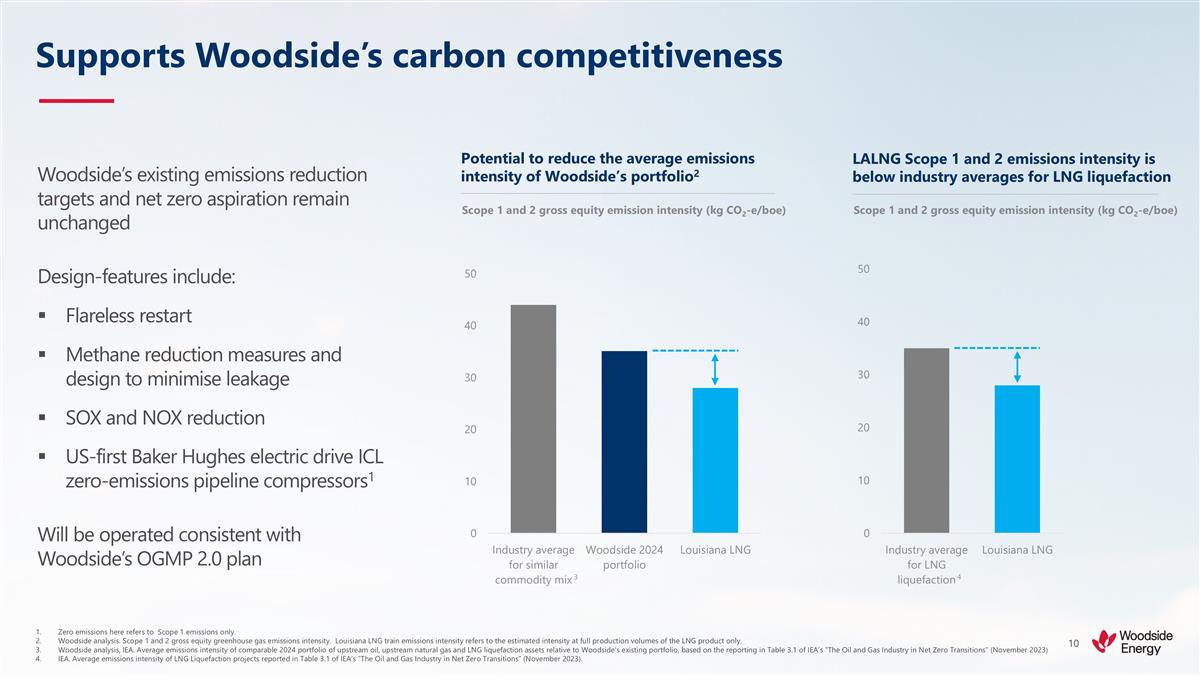

Supports Woodside’s carbon competitiveness Zero emissions here refers to Scope 1 emissions only. Woodside analysis. Scope 1 and 2 gross equity greenhouse gas emissions intensity. Louisiana LNG train emissions intensity refers to the estimated intensity at full production volumes of the LNG product only. Woodside analysis, IEA. Average emissions intensity of comparable 2024 portfolio of upstream oil, upstream natural gas and LNG liquefaction assets relative to Woodside's existing portfolio, based on the reporting in Table 3.1 of IEA’s “The Oil and Gas Industry in Net Zero Transitions” (November 2023) IEA. Average emissions intensity of LNG Liquefaction projects reported in Table 3.1 of IEA’s “The Oil and Gas Industry in Net Zero Transitions” (November 2023). Woodside’s existing emissions reduction targets and net zero aspiration remain unchanged Design-features include: Flareless restart Methane reduction measures and design to minimise leakage SOX and NOX reduction US-first Baker Hughes electric drive ICL zero-emissions pipeline compressors1 Will be operated consistent with Woodside’s OGMP 2.0 plan Potential to reduce the average emissions intensity of Woodside’s portfolio2 Scope 1 and 2 gross equity emission intensity (kg CO2-e/boe) LALNG Scope 1 and 2 emissions intensity is below industry averages for LNG liquefaction Scope 1 and 2 gross equity emission intensity (kg CO2-e/boe) 3 4

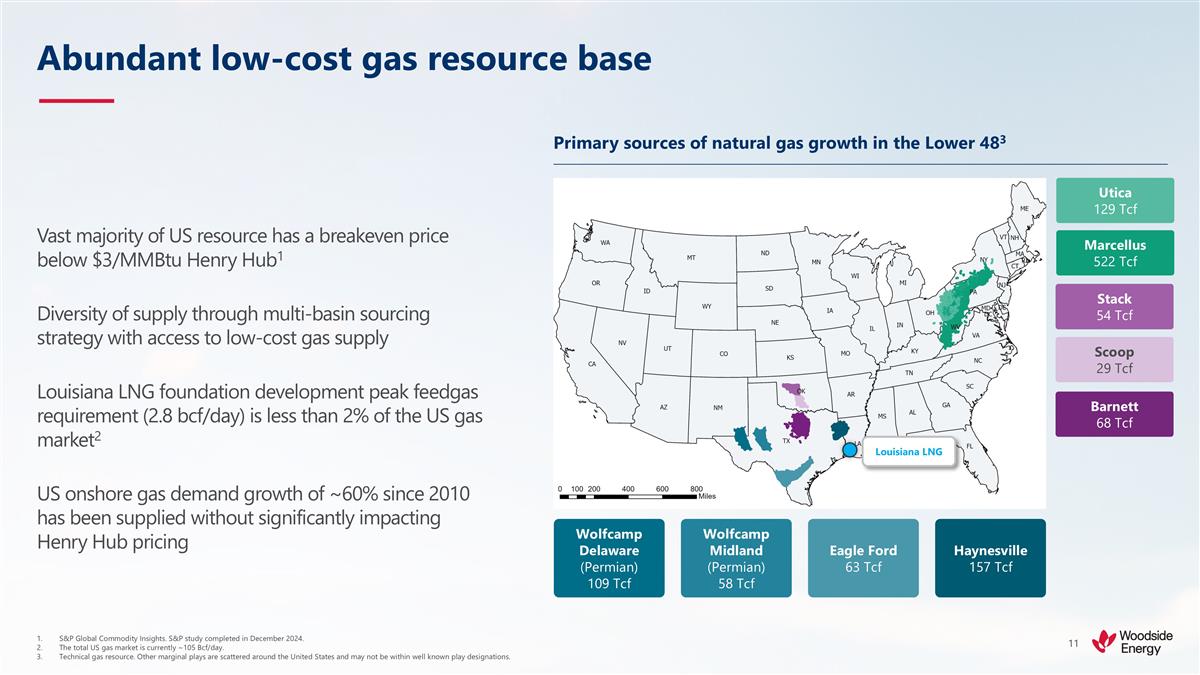

Abundant low-cost gas resource base S&P Global Commodity Insights. S&P study completed in December 2024. The total US gas market is currently ~105 Bcf/day. Technical gas resource. Other marginal plays are scattered around the United States and may not be within well known play designations. Vast majority of US resource has a breakeven price below $3/MMBtu Henry Hub1 Diversity of supply through multi-basin sourcing strategy with access to low-cost gas supply Louisiana LNG foundation development peak feedgas requirement (2.8 bcf/day) is less than 2% of the US gas market2 US onshore gas demand growth of ~60% since 2010 has been supplied without significantly impacting Henry Hub pricing Primary sources of natural gas growth in the Lower 483 Utica 129 Tcf Marcellus 522 Tcf Stack 54 Tcf Scoop 29 Tcf Barnett 68 Tcf Wolfcamp Midland (Permian) 58 Tcf Wolfcamp Delaware (Permian) 109 Tcf Eagle Ford 63 Tcf Haynesville 157 Tcf Louisiana LNG

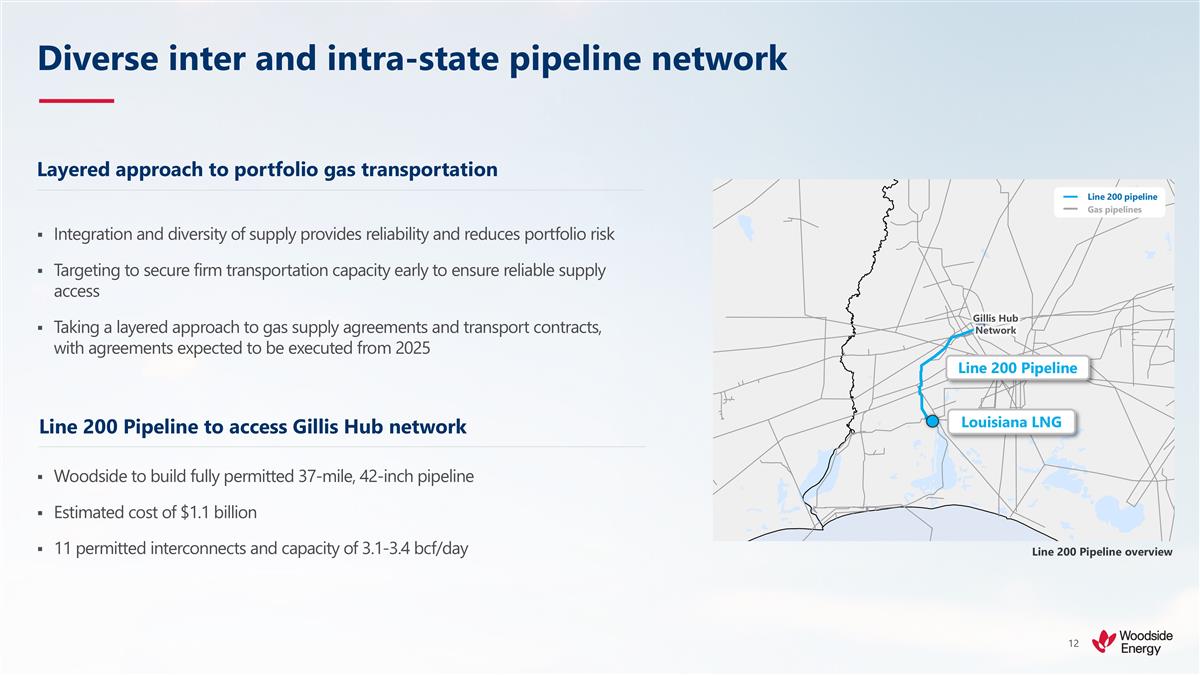

Diverse inter and intra-state pipeline network Layered approach to portfolio gas transportation Line 200 Pipeline to access Gillis Hub network Integration and diversity of supply provides reliability and reduces portfolio risk Targeting to secure firm transportation capacity early to ensure reliable supply access Taking a layered approach to gas supply agreements and transport contracts, with agreements expected to be executed from 2025 Woodside to build fully permitted 37-mile, 42-inch pipeline Estimated cost of $1.1 billion 11 permitted interconnects and capacity of 3.1-3.4 bcf/day Line 200 Pipeline overview Line 200 Pipeline Louisiana LNG Gillis Hub Network Line 200 pipeline Gas pipelines

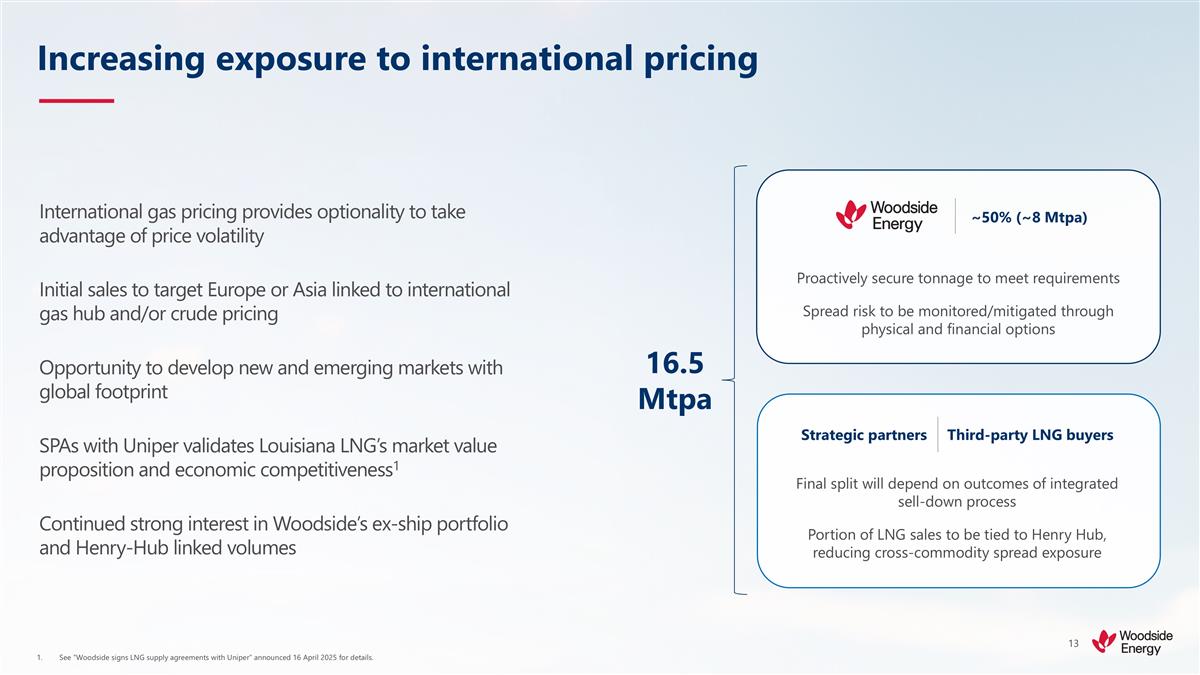

Increasing exposure to international pricing International gas pricing provides optionality to take advantage of price volatility Initial sales to target Europe or Asia linked to international gas hub and/or crude pricing Opportunity to develop new and emerging markets with global footprint SPAs with Uniper validates Louisiana LNG’s market value proposition and economic competitiveness1 Continued strong interest in Woodside’s ex-ship portfolio and Henry-Hub linked volumes Proactively secure tonnage to meet requirements Spread risk to be monitored/mitigated through physical and financial options 16.5 Mtpa See “Woodside signs LNG supply agreements with Uniper” announced 16 April 2025 for details. Strategic partners Third-party LNG buyers ~50% (~8 Mtpa) Final split will depend on outcomes of integrated sell-down process Portion of LNG sales to be tied to Henry Hub, reducing cross-commodity spread exposure

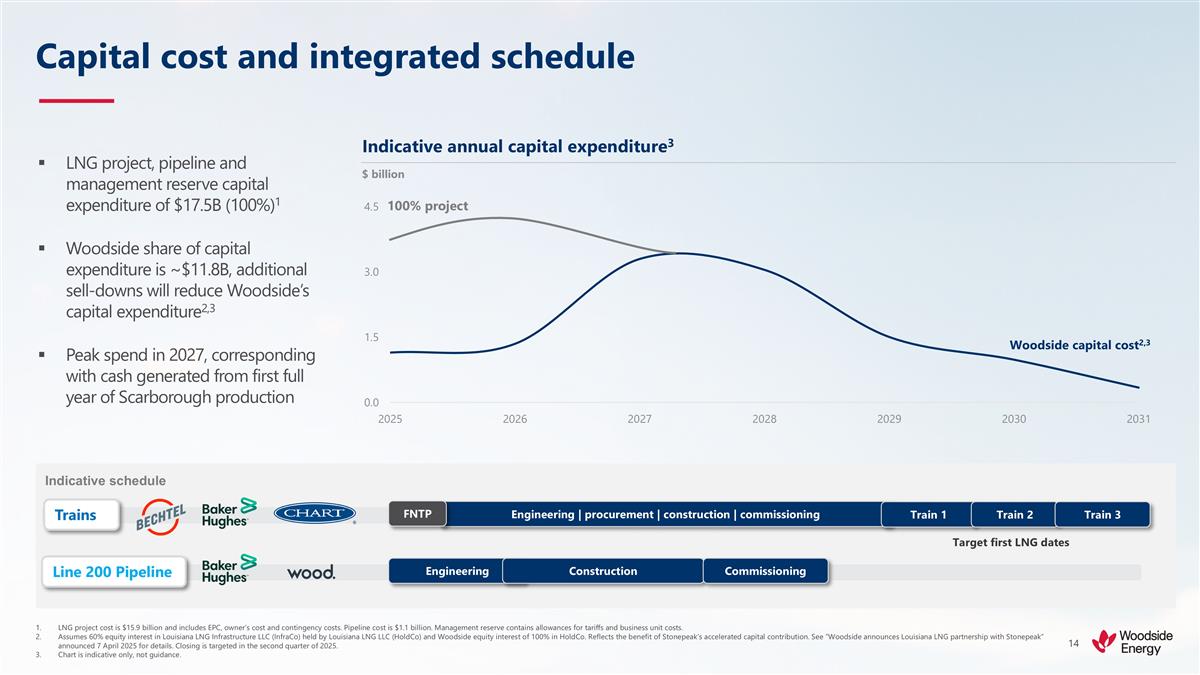

Capital cost and integrated schedule LNG project cost is $15.9 billion and includes EPC, owner’s cost and contingency costs. Pipeline cost is $1.1 billion. Management reserve contains allowances for tariffs and business unit costs. Assumes 60% equity interest in Louisiana LNG Infrastructure LLC (InfraCo) held by Louisiana LNG LLC (HoldCo) and Woodside equity interest of 100% in HoldCo. Reflects the benefit of Stonepeak’s accelerated capital contribution. See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Closing is targeted in the second quarter of 2025. Chart is indicative only, not guidance. Engineering | procurement | construction | commissioning FNTP Indicative schedule Line 200 Pipeline Engineering Trains 100% project Train 1 Train 2 Train 3 Target first LNG dates Construction Commissioning LNG project, pipeline and management reserve capital expenditure of $17.5B (100%)1 Woodside share of capital expenditure is ~$11.8B, additional sell-downs will reduce Woodside’s capital expenditure2,3 Peak spend in 2027, corresponding with cash generated from first full year of Scarborough production $ billion Indicative annual capital expenditure3 Woodside capital cost2,3

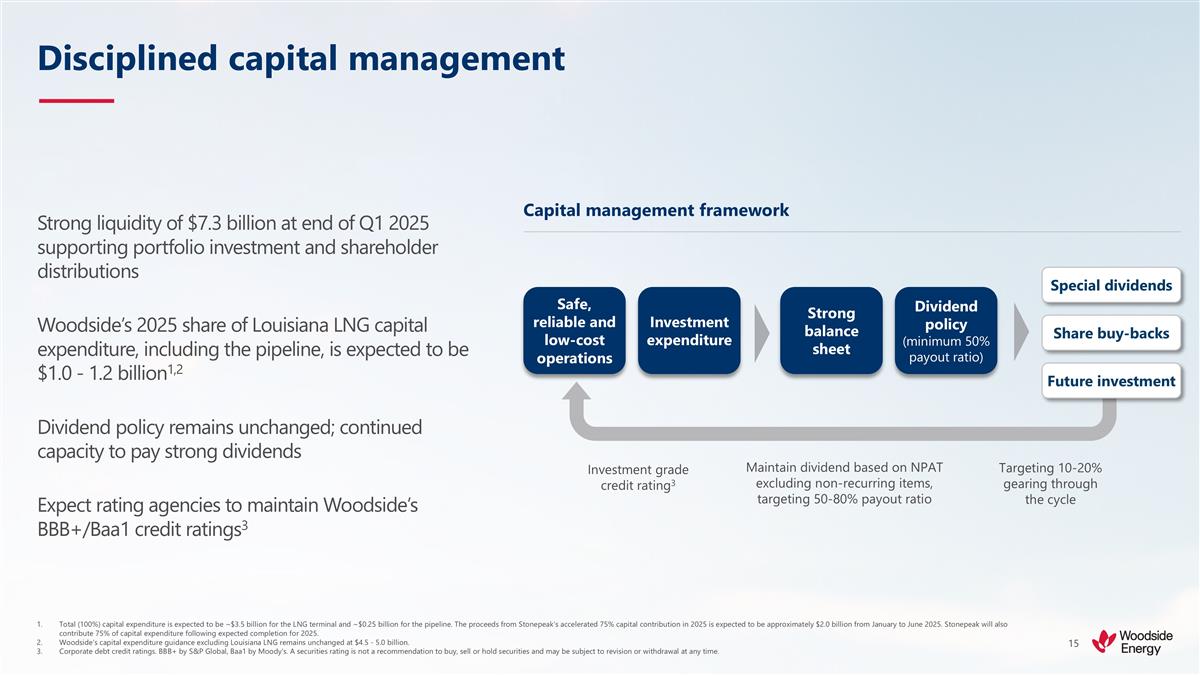

Safe, reliable and low-cost operations Investment expenditure Strong balance sheet Dividend policy (minimum 50% payout ratio) Special dividends Share buy-backs Investment grade credit rating3 Maintain dividend based on NPAT excluding non-recurring items, targeting 50-80% payout ratio Targeting 10-20% gearing through the cycle Future investment Disciplined capital management Total (100%) capital expenditure is expected to be ~$3.5 billion for the LNG terminal and ~$0.25 billion for the pipeline. The proceeds from Stonepeak’s accelerated 75% capital contribution in 2025 is expected to be approximately $2.0 billion from January to June 2025. Stonepeak will also contribute 75% of capital expenditure following expected completion for 2025. Woodside’s capital expenditure guidance excluding Louisiana LNG remains unchanged at $4.5 - 5.0 billion. Corporate debt credit ratings. BBB+ by S&P Global, Baa1 by Moody’s. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. Strong liquidity of $7.3 billion at end of Q1 2025 supporting portfolio investment and shareholder distributions Woodside’s 2025 share of Louisiana LNG capital expenditure, including the pipeline, is expected to be $1.0 - 1.2 billion1,2 Dividend policy remains unchanged; continued capacity to pay strong dividends Expect rating agencies to maintain Woodside’s BBB+/Baa1 credit ratings3 Capital management framework

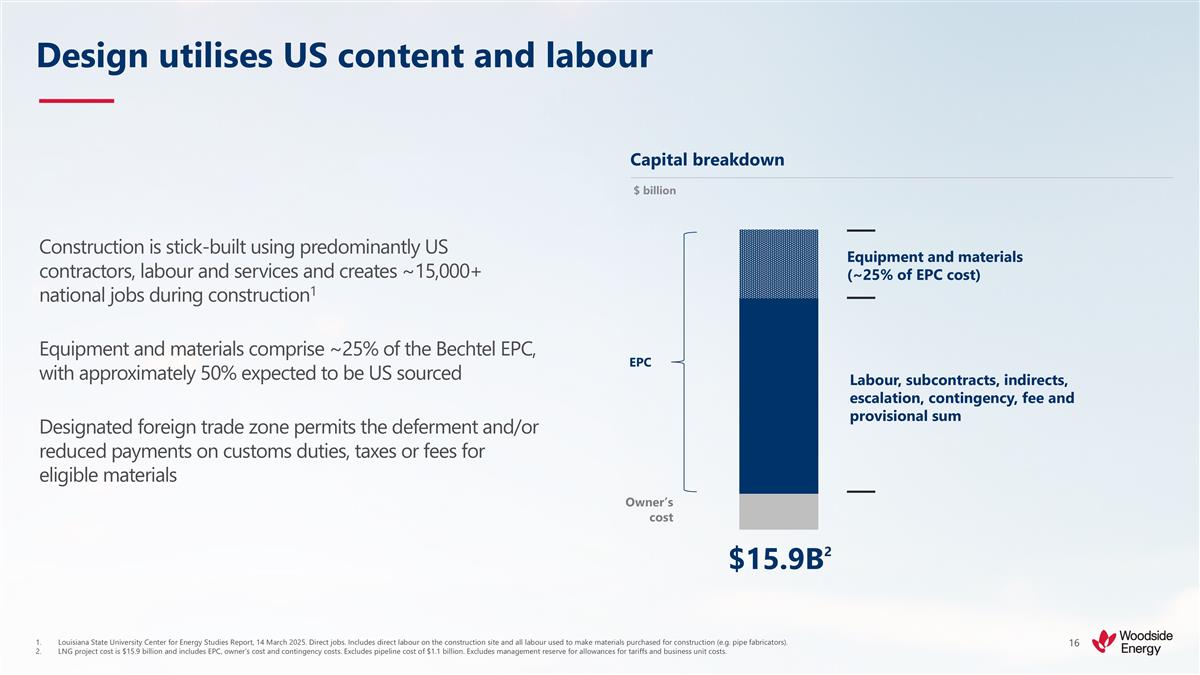

Design utilises US content and labour Louisiana State University Center for Energy Studies Report, 14 March 2025. Direct jobs. Includes direct labour on the construction site and all labour used to make materials purchased for construction (e.g. pipe fabricators). LNG project cost is $15.9 billion and includes EPC, owner’s cost and contingency costs. Excludes pipeline cost of $1.1 billion. Excludes management reserve for allowances for tariffs and business unit costs. Capital breakdown $ billion Equipment and materials (~25% of EPC cost) Construction is stick-built using predominantly US contractors, labour and services and creates ~15,000+ national jobs during construction1 Equipment and materials comprise ~25% of the Bechtel EPC, with approximately 50% expected to be US sourced Designated foreign trade zone permits the deferment and/or reduced payments on customs duties, taxes or fees for eligible materials EPC Owner’s cost $15.9B2 Labour, subcontracts, indirects, escalation, contingency, fee and provisional sum

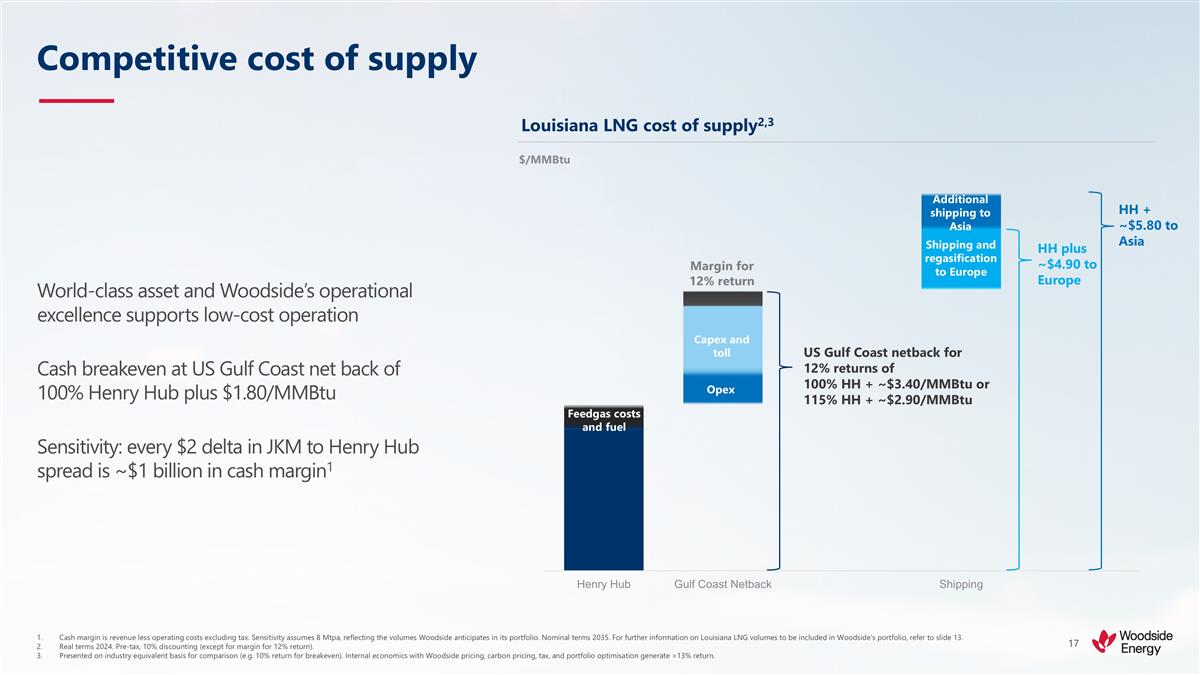

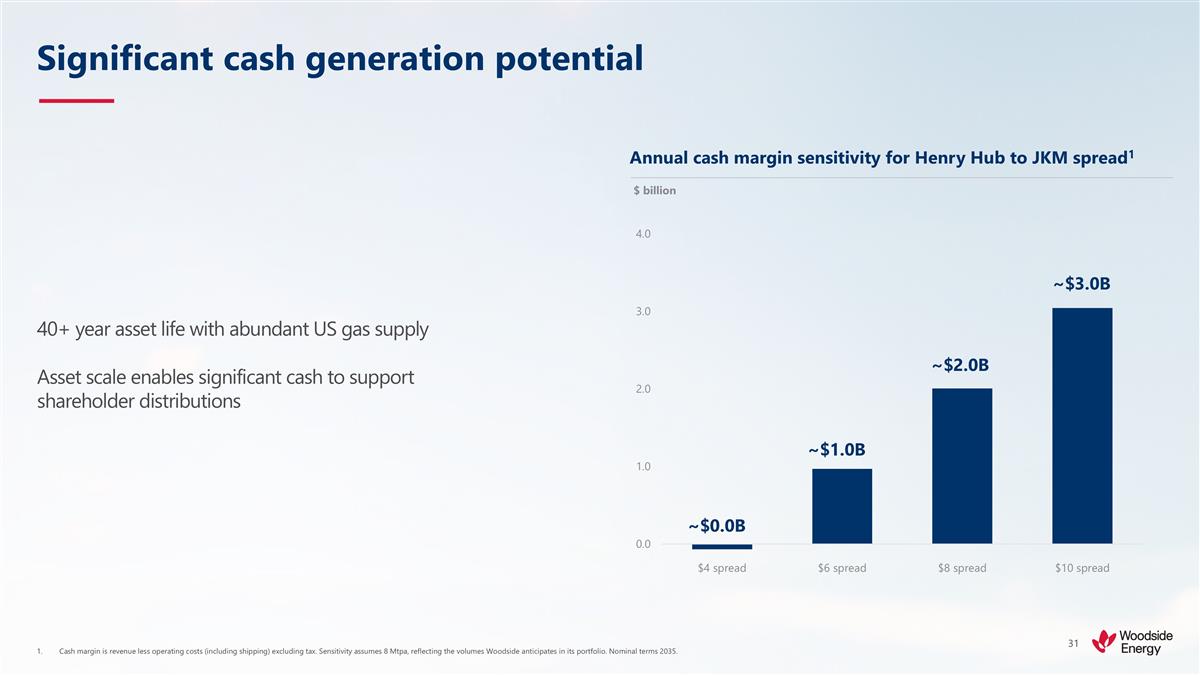

Competitive cost of supply Cash margin is revenue less operating costs excluding tax. Sensitivity assumes 8 Mtpa, reflecting the volumes Woodside anticipates in its portfolio. Nominal terms 2035. For further information on Louisiana LNG volumes to be included in Woodside’s portfolio, refer to slide 13. Real terms 2024. Pre-tax, 10% discounting (except for margin for 12% return). Presented on industry equivalent basis for comparison (e.g. 10% return for breakeven). Internal economics with Woodside pricing, carbon pricing, tax, and portfolio optimisation generate >13% return. World-class asset and Woodside’s operational excellence supports low-cost operation Cash breakeven at US Gulf Coast net back of 100% Henry Hub plus $1.80/MMBtu Sensitivity: every $2 delta in JKM to Henry Hub spread is ~$1 billion in cash margin1 Louisiana LNG cost of supply2,3 Feedgas costs and fuel Opex Capex and toll US Gulf Coast netback for 12% returns of 100% HH + ~$3.40/MMBtu or 115% HH + ~$2.90/MMBtu Margin for 12% return Additional shipping to Asia Shipping and regasification to Europe HH plus ~$4.90 to Europe $/MMBtu HH + ~$5.80 to Asia

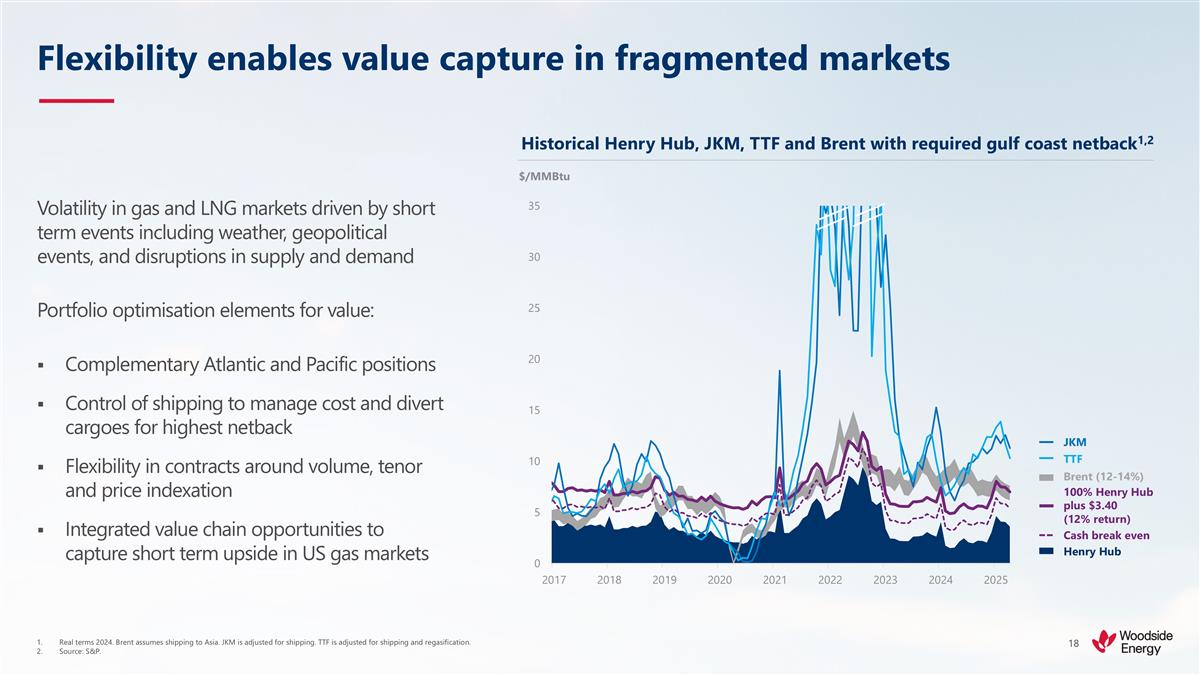

Flexibility enables value capture in fragmented markets Real terms 2024. Brent assumes shipping to Asia. JKM is adjusted for shipping. TTF is adjusted for shipping and regasification. Source: S&P. Volatility in gas and LNG markets driven by short term events including weather, geopolitical events, and disruptions in supply and demand Portfolio optimisation elements for value: Complementary Atlantic and Pacific positions Control of shipping to manage cost and divert cargoes for highest netback Flexibility in contracts around volume, tenor and price indexation Integrated value chain opportunities to capture short term upside in US gas markets $/MMBtu Historical Henry Hub, JKM, TTF and Brent with required gulf coast netback1,2 JKM TTF 100% Henry Hub plus $3.40 (12% return) Henry Hub Brent (12-14%) Cash break even

PORTFOLIO OVERVIEW

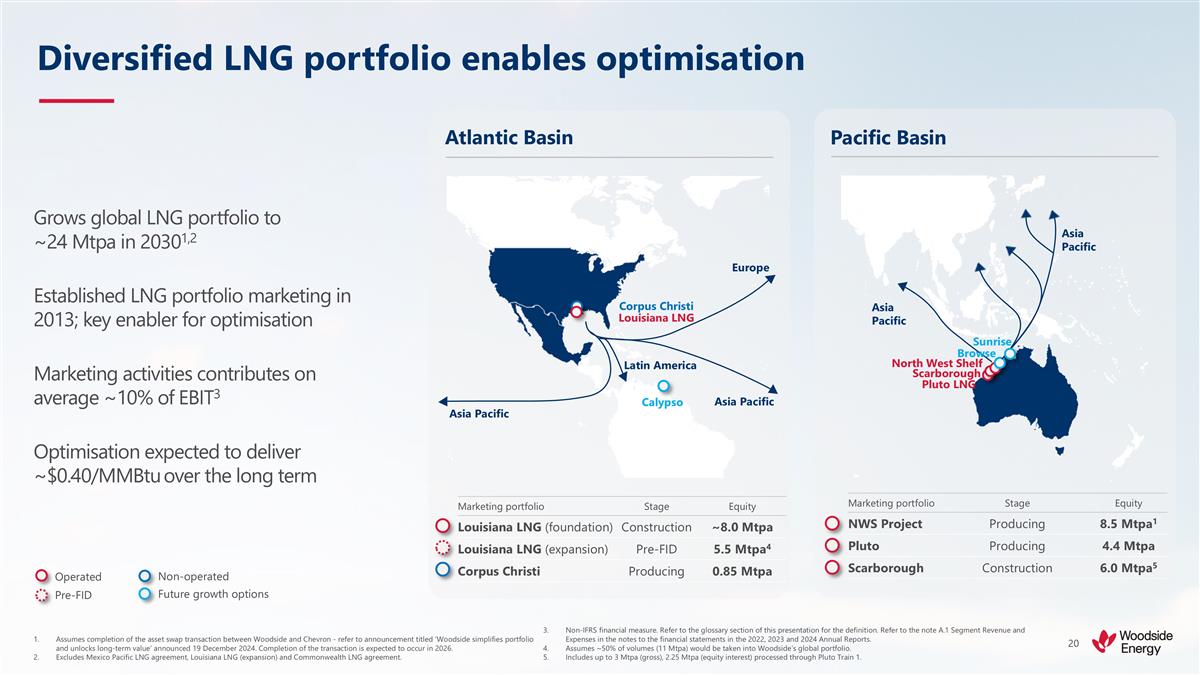

Diversified LNG portfolio enables optimisation Assumes completion of the asset swap transaction between Woodside and Chevron - refer to announcement titled ‘Woodside simplifies portfolio and unlocks long-term value’ announced 19 December 2024. Completion of the transaction is expected to occur in 2026. Excludes Mexico Pacific LNG agreement, Louisiana LNG (expansion) and Commonwealth LNG agreement. Non-IFRS financial measure. Refer to the glossary section of this presentation for the definition. Refer to the note A.1 Segment Revenue and Expenses in the notes to the financial statements in the 2022, 2023 and 2024 Annual Reports. Assumes ~50% of volumes (11 Mtpa) would be taken into Woodside’s global portfolio. Includes up to 3 Mtpa (gross), 2.25 Mtpa (equity interest) processed through Pluto Train 1. Operated Pre-FID Non-operated Atlantic Basin Marketing portfolio Stage Equity Louisiana LNG (foundation) Construction ~8.0 Mtpa Louisiana LNG (expansion) Pre-FID 5.5 Mtpa4 Corpus Christi Producing 0.85 Mtpa Asia Pacific Louisiana LNG Calypso Corpus Christi Europe Asia Pacific Latin America Pacific Basin Marketing portfolio Stage Equity NWS Project Producing 8.5 Mtpa1 Pluto Producing 4.4 Mtpa Scarborough Construction 6.0 Mtpa5 North West Shelf Pluto LNG Scarborough Asia Pacific Asia Pacific Sunrise Browse Grows global LNG portfolio to ~24 Mtpa in 20301,2 Established LNG portfolio marketing in 2013; key enabler for optimisation Marketing activities contributes on average ~10% of EBIT3 Optimisation expected to deliver ~$0.40/MMBtu over the long term Future growth options

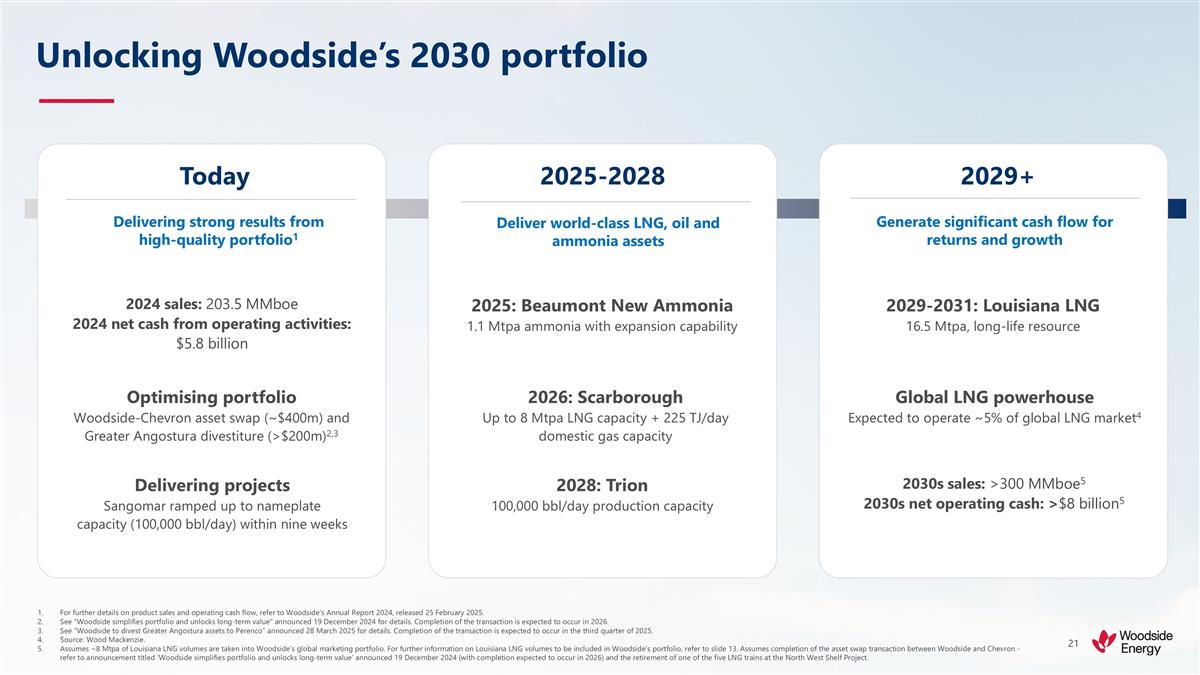

Unlocking Woodside’s 2030 portfolio For further details on product sales and operating cash flow, refer to Woodside’s Annual Report 2024, released 25 February 2025. See “Woodside simplifies portfolio and unlocks long-term value” announced 19 December 2024 for details. Completion of the transaction is expected to occur in 2026. See “Woodside to divest Greater Angostura assets to Perenco” announced 28 March 2025 for details. Completion of the transaction is expected to occur in the third quarter of 2025. Source: Wood Mackenzie. Assumes ~8 Mtpa of Louisiana LNG volumes are taken into Woodside’s global marketing portfolio. For further information on Louisiana LNG volumes to be included in Woodside’s portfolio, refer to slide 13. Assumes completion of the asset swap transaction between Woodside and Chevron - refer to announcement titled ‘Woodside simplifies portfolio and unlocks long-term value’ announced 19 December 2024 (with completion expected to occur in 2026) and the retirement of one of the five LNG trains at the North West Shelf Project. Today 2025-2028 2029+ Deliver world-class LNG, oil and ammonia assets Delivering strong results from high-quality portfolio1 2024 sales: 203.5 MMboe 2024 net cash from operating activities: $5.8 billion Generate significant cash flow for returns and growth 2030s sales: >300 MMboe5 2030s net operating cash: >$8 billion5 Optimising portfolio Woodside-Chevron asset swap (~$400m) and Greater Angostura divestiture (>$200m)2,3 Delivering projects Sangomar ramped up to nameplate capacity (100,000 bbl/day) within nine weeks Global LNG powerhouse Expected to operate ~5% of global LNG market4 2025: Beaumont New Ammonia 1.1 Mtpa ammonia with expansion capability 2026: Scarborough Up to 8 Mtpa LNG capacity + 225 TJ/day domestic gas capacity 2028: Trion 100,000 bbl/day production capacity 2029-2031: Louisiana LNG 16.5 Mtpa, long-life resource

Delivering the next generation of assets Net operating cash is indicative only, not guidance. Assumes 60% equity interest in Louisiana LNG Infrastructure LLC (InfraCo) held by Louisiana LNG LLC (HoldCo), and Woodside equity interest of 100% in HoldCo. Assumes ~8 Mtpa of Louisiana LNG volumes are taken into Woodside’s global marketing portfolio. For further information on Louisiana LNG volumes to be included in Woodside’s portfolio, refer to slide 13. Assumes completion of the asset swap transaction between Woodside and Chevron - refer to announcement titled ‘Woodside simplifies portfolio and unlocks long-term value’ announced 19 December 2024 (with completion expected to occur in 2026) and the retirement of one of the five LNG trains at the North West Shelf Project. International Growth includes Sangomar, Trion, and Beaumont New Ammonia. Base includes Woodside’s NWS, Pluto, Bass Strait, remaining Australian assets, and US Gulf offshore oil assets. Potential to generate over $8 billion of net operating cash in 20301,2 Mix of long-life, low decline LNG assets coupled with high-return oil assets Net operating cash from producing assets in 2030: ~55% LNG ~35% oil ~10% ammonia and pipeline gas Scarborough International growth3 Base4 Louisiana LNG2 Indicative net operating cash1 $ billion

CLOSE

Investing in US prosperity Estimated combined tax rate of 25.35 (21% + (5.5% x 79%)). Louisiana State University Center for Energy Studies Report, 14 March 2025. Direct jobs. Includes direct labour on the construction site and all labour used to make materials purchased for construction (e.g. pipe fabricators). NATIONAL JOBS DURING CONSTRUCTION3 15,000+ NATIONAL JOBS DURING OPERATIONS 4,000+ Largest single direct foreign investment in Louisiana’s history First greenfield US LNG project sanctioned since the lifting of the LNG pause Attractive fiscal environment for long-term investment Subject to US Federal income tax of 21% and Louisiana income tax rate of 5.5%1 Job creation2

Louisiana LNG development approved Develops world-class asset Compelling investment Generates long-term value Three-train 16.5 Mtpa development at fully permitted site, leveraging best-in-class technology De-risked low-cost development, benefits from foreign trade zone Targeting first LNG 2029 Exceeds Woodside’s capital allocation targets Reduced capital commitment through infrastructure sell-down to high-quality partner Significant cash generation to support shareholder distributions Complementary LNG presence in the Atlantic Basin enabling greater portfolio value enhancement

Q&A Meg O’Neill Chief Executive Officer and Managing Director

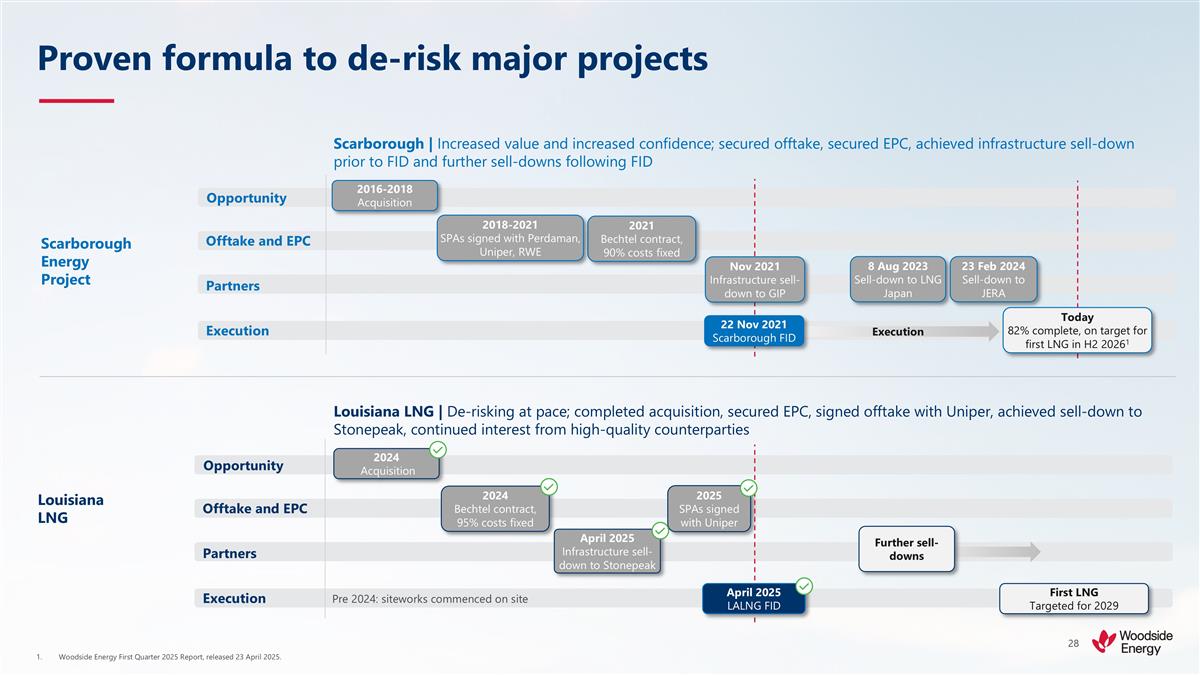

ANNEXURE

Louisiana LNG Opportunity Offtake and EPC Partners Execution 2024 Bechtel contract, 95% costs fixed 2025 SPAs signed with Uniper 2024 Acquisition First LNG Targeted for 2029 Proven formula to de-risk major projects Woodside Energy First Quarter 2025 Report, released 23 April 2025. Scarborough Energy Project Opportunity Offtake and EPC Partners Execution 2021 Bechtel contract, 90% costs fixed 2018-2021 SPAs signed with Perdaman, Uniper, RWE 2016-2018 Acquisition Scarborough | Increased value and increased confidence; secured offtake, secured EPC, achieved infrastructure sell-down prior to FID and further sell-downs following FID Nov 2021 Infrastructure sell-down to GIP 8 Aug 2023 Sell-down to LNG Japan 23 Feb 2024 Sell-down to JERA April 2025 Infrastructure sell-down to Stonepeak April 2025 LALNG FID Further sell-downs Today 82% complete, on target for first LNG in H2 20261 Louisiana LNG | De-risking at pace; completed acquisition, secured EPC, signed offtake with Uniper, achieved sell-down to Stonepeak, continued interest from high-quality counterparties Pre 2024: siteworks commenced on site Execution 22 Nov 2021 Scarborough FID

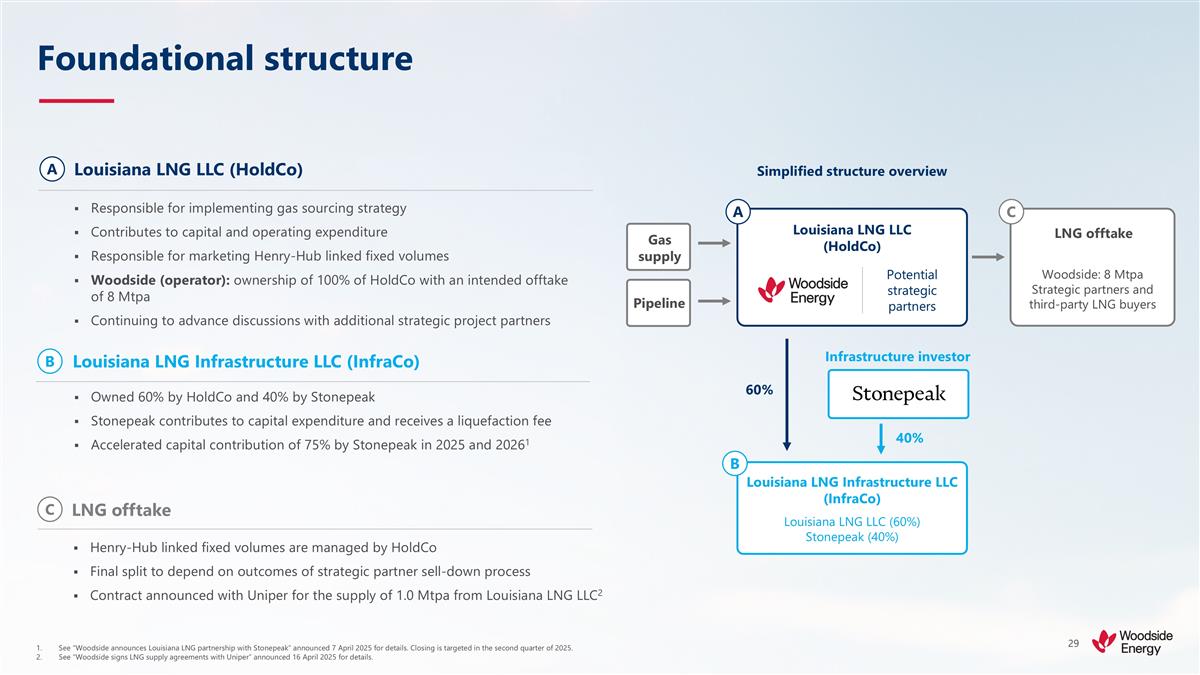

Foundational structure See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Closing is targeted in the second quarter of 2025. See “Woodside signs LNG supply agreements with Uniper” announced 16 April 2025 for details. Simplified structure overview B C A Louisiana LNG LLC (HoldCo) Responsible for implementing gas sourcing strategy Contributes to capital and operating expenditure Responsible for marketing Henry-Hub linked fixed volumes Woodside (operator): ownership of 100% of HoldCo with an intended offtake of 8 Mtpa Continuing to advance discussions with additional strategic project partners Louisiana LNG Infrastructure LLC (InfraCo) Owned 60% by HoldCo and 40% by Stonepeak Stonepeak contributes to capital expenditure and receives a liquefaction fee Accelerated capital contribution of 75% by Stonepeak in 2025 and 20261 LNG offtake Henry-Hub linked fixed volumes are managed by HoldCo Final split to depend on outcomes of strategic partner sell-down process Contract announced with Uniper for the supply of 1.0 Mtpa from Louisiana LNG LLC2 B Louisiana LNG Infrastructure LLC (InfraCo) Louisiana LNG LLC (60%) Stonepeak (40%) 60% Louisiana LNG LLC (HoldCo) Infrastructure investor 40% LNG offtake Gas supply Potential strategic partners A C Woodside: 8 Mtpa Strategic partners and third-party LNG buyers Pipeline

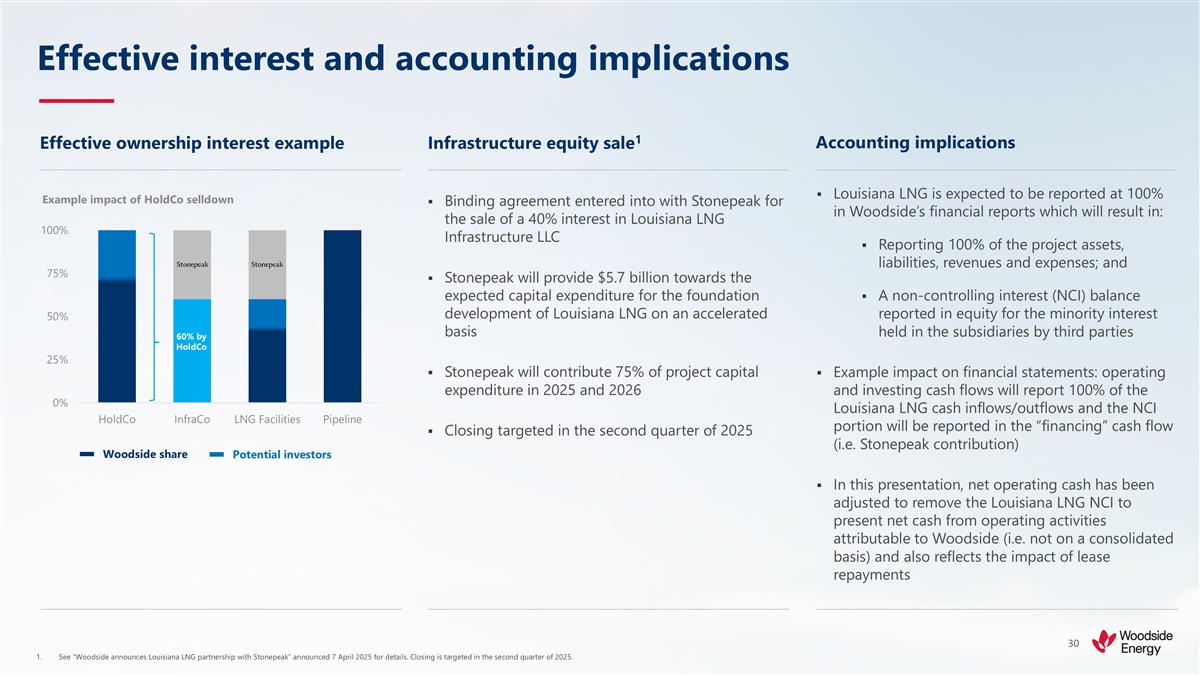

Effective interest and accounting implications Louisiana LNG is expected to be reported at 100% in Woodside’s financial reports which will result in: Reporting 100% of the project assets, liabilities, revenues and expenses; and A non-controlling interest (NCI) balance reported in equity for the minority interest held in the subsidiaries by third parties Example impact on financial statements: operating and investing cash flows will report 100% of the Louisiana LNG cash inflows/outflows and the NCI portion will be reported in the “financing” cash flow (i.e. Stonepeak contribution) In this presentation, net operating cash has been adjusted to remove the Louisiana LNG NCI to present net cash from operating activities attributable to Woodside (i.e. not on a consolidated basis) and also reflects the impact of lease repayments Effective ownership interest example Infrastructure equity sale1 Accounting implications Binding agreement entered into with Stonepeak for the sale of a 40% interest in Louisiana LNG Infrastructure LLC Stonepeak will provide $5.7 billion towards the expected capital expenditure for the foundation development of Louisiana LNG on an accelerated basis Stonepeak will contribute 75% of project capital expenditure in 2025 and 2026 Closing targeted in the second quarter of 2025 Woodside share Potential investors 60% by HoldCo Example impact of HoldCo selldown See “Woodside announces Louisiana LNG partnership with Stonepeak” announced 7 April 2025 for details. Closing is targeted in the second quarter of 2025.

Significant cash generation potential Cash margin is revenue less operating costs (including shipping) excluding tax. Sensitivity assumes 8 Mtpa, reflecting the volumes Woodside anticipates in its portfolio. Nominal terms 2035. 40+ year asset life with abundant US gas supply Asset scale enables significant cash to support shareholder distributions ~$1.0B ~$2.0B ~$3.0B ~$0.0B Annual cash margin sensitivity for Henry Hub to JKM spread1 $ billion

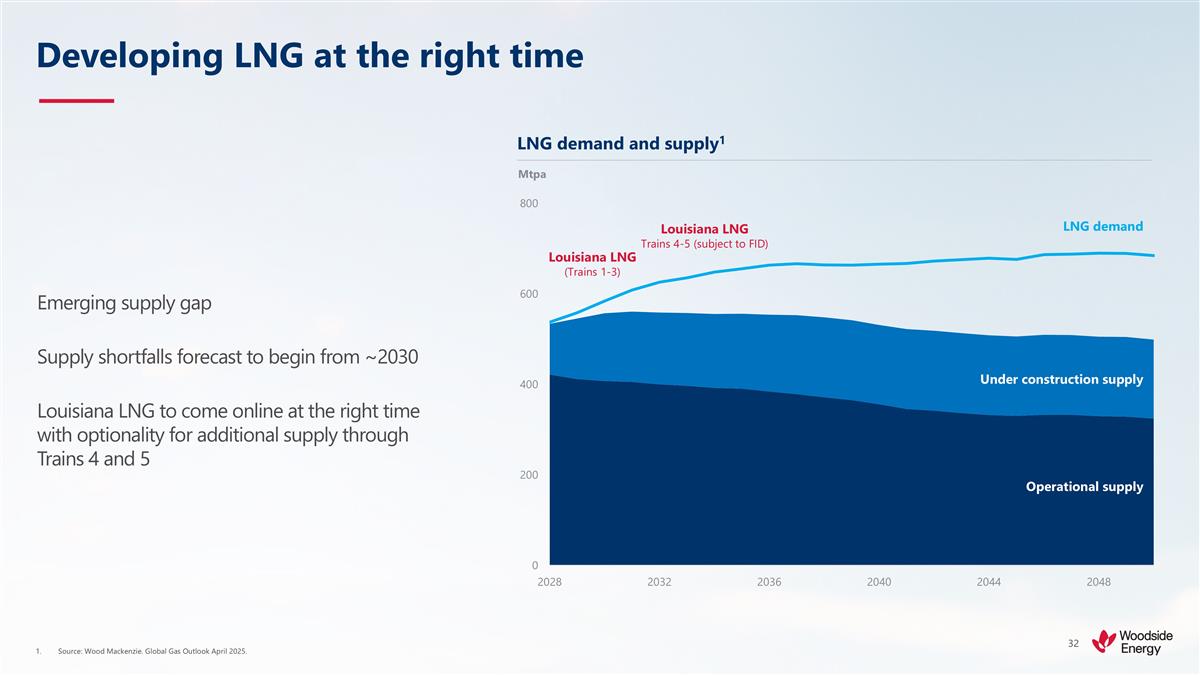

Developing LNG at the right time Source: Wood Mackenzie. Global Gas Outlook April 2025. LNG demand Under construction supply Operational supply Louisiana LNG (Trains 1-3) Louisiana LNG Trains 4-5 (subject to FID) Emerging supply gap Supply shortfalls forecast to begin from ~2030 Louisiana LNG to come online at the right time with optionality for additional supply through Trains 4 and 5 Mtpa LNG demand and supply1

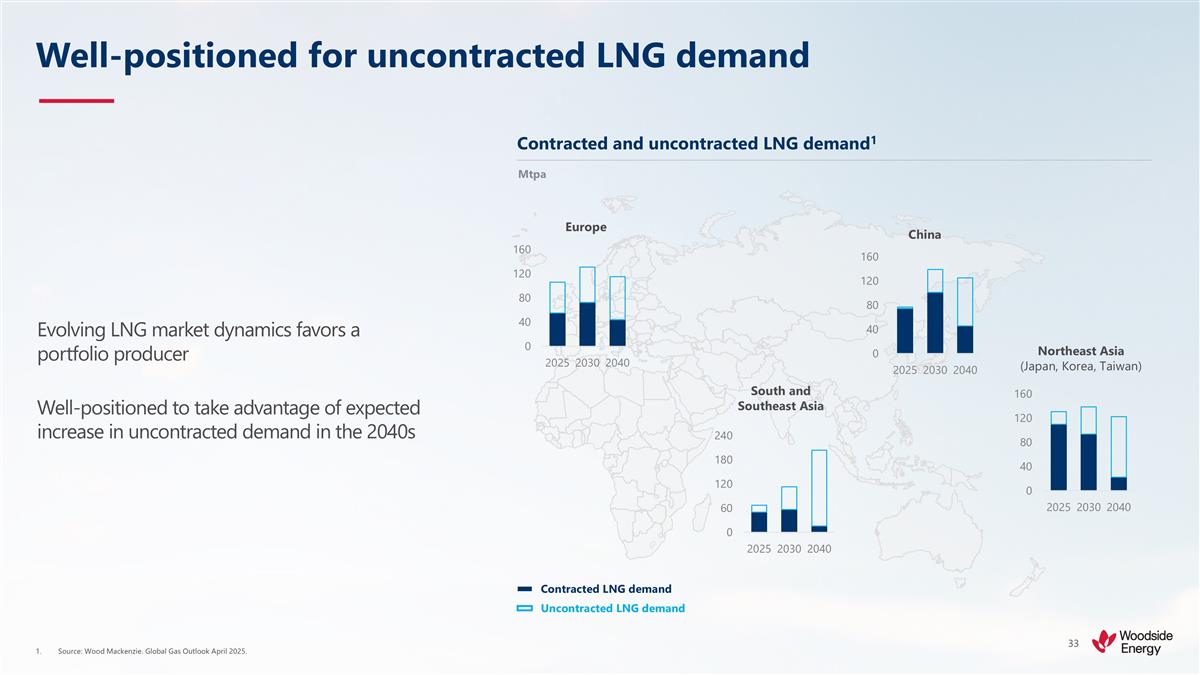

Well-positioned for uncontracted LNG demand Source: Wood Mackenzie. Global Gas Outlook April 2025. Europe Northeast Asia (Japan, Korea, Taiwan) South and Southeast Asia Contracted LNG demand Uncontracted LNG demand China Evolving LNG market dynamics favors a portfolio producer Well-positioned to take advantage of expected increase in uncontracted demand in the 2040s Mtpa Contracted and uncontracted LNG demand1

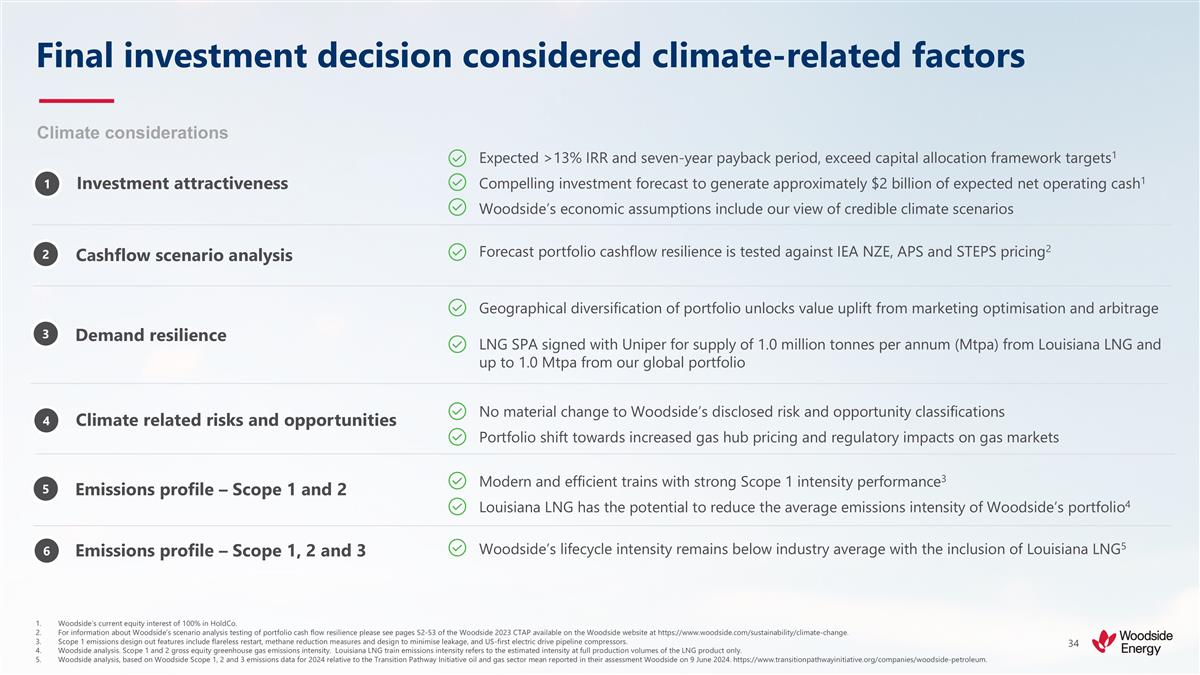

Final investment decision considered climate-related factors Woodside’s current equity interest of 100% in HoldCo. For information about Woodside’s scenario analysis testing of portfolio cash flow resilience please see pages 52-53 of the Woodside 2023 CTAP available on the Woodside website at https://www.woodside.com/sustainability/climate-change. Scope 1 emissions design out features include flareless restart, methane reduction measures and design to minimise leakage, and US-first electric drive pipeline compressors. Woodside analysis. Scope 1 and 2 gross equity greenhouse gas emissions intensity. Louisiana LNG train emissions intensity refers to the estimated intensity at full production volumes of the LNG product only. Woodside analysis, based on Woodside Scope 1, 2 and 3 emissions data for 2024 relative to the Transition Pathway Initiative oil and gas sector mean reported in their assessment Woodside on 9 June 2024. https://www.transitionpathwayinitiative.org/companies/woodside-petroleum. Climate considerations Investment attractiveness Cashflow scenario analysis Demand resilience Climate related risks and opportunities Emissions profile – Scope 1 and 2 Emissions profile – Scope 1, 2 and 3 Geographical diversification of portfolio unlocks value uplift from marketing optimisation and arbitrage No material change to Woodside’s disclosed risk and opportunity classifications Portfolio shift towards increased gas hub pricing and regulatory impacts on gas markets Modern and efficient trains with strong Scope 1 intensity performance3 Louisiana LNG has the potential to reduce the average emissions intensity of Woodside’s portfolio4 Woodside’s lifecycle intensity remains below industry average with the inclusion of Louisiana LNG5 Expected >13% IRR and seven-year payback period, exceed capital allocation framework targets1 Compelling investment forecast to generate approximately $2 billion of expected net operating cash1 Woodside’s economic assumptions include our view of credible climate scenarios 1 2 3 4 5 6 Forecast portfolio cashflow resilience is tested against IEA NZE, APS and STEPS pricing2 LNG SPA signed with Uniper for supply of 1.0 million tonnes per annum (Mtpa) from Louisiana LNG and up to 1.0 Mtpa from our global portfolio

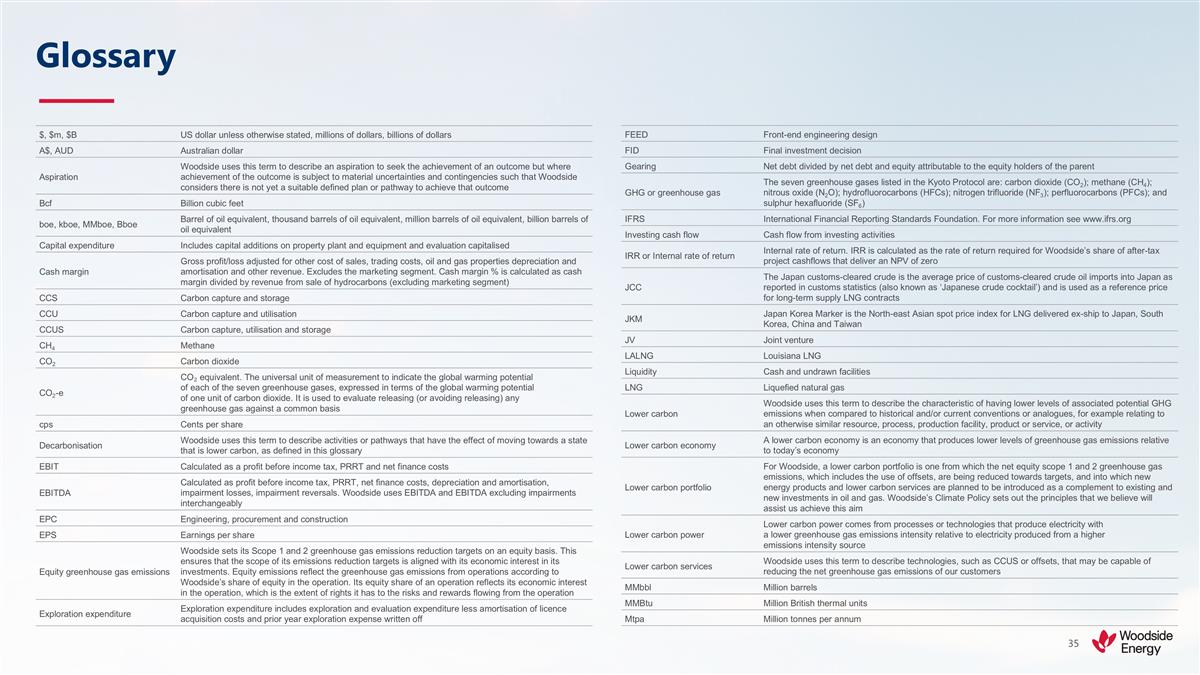

Glossary $, $m, $B US dollar unless otherwise stated, millions of dollars, billions of dollars A$, AUD Australian dollar Aspiration Woodside uses this term to describe an aspiration to seek the achievement of an outcome but where achievement of the outcome is subject to material uncertainties and contingencies such that Woodside considers there is not yet a suitable defined plan or pathway to achieve that outcome Bcf Billion cubic feet boe, kboe, MMboe, Bboe Barrel of oil equivalent, thousand barrels of oil equivalent, million barrels of oil equivalent, billion barrels of oil equivalent Capital expenditure Includes capital additions on property plant and equipment and evaluation capitalised Cash margin Gross profit/loss adjusted for other cost of sales, trading costs, oil and gas properties depreciation and amortisation and other revenue. Excludes the marketing segment. Cash margin % is calculated as cash margin divided by revenue from sale of hydrocarbons (excluding marketing segment) CCS Carbon capture and storage CCU Carbon capture and utilisation CCUS Carbon capture, utilisation and storage CH4 Methane CO2 Carbon dioxide CO2-e CO₂ equivalent. The universal unit of measurement to indicate the global warming potential of each of the seven greenhouse gases, expressed in terms of the global warming potential of one unit of carbon dioxide. It is used to evaluate releasing (or avoiding releasing) any greenhouse gas against a common basis cps Cents per share Decarbonisation Woodside uses this term to describe activities or pathways that have the effect of moving towards a state that is lower carbon, as defined in this glossary EBIT Calculated as a profit before income tax, PRRT and net finance costs EBITDA Calculated as profit before income tax, PRRT, net finance costs, depreciation and amortisation, impairment losses, impairment reversals. Woodside uses EBITDA and EBITDA excluding impairments interchangeably EPC Engineering, procurement and construction EPS Earnings per share Equity greenhouse gas emissions Woodside sets its Scope 1 and 2 greenhouse gas emissions reduction targets on an equity basis. This ensures that the scope of its emissions reduction targets is aligned with its economic interest in its investments. Equity emissions reflect the greenhouse gas emissions from operations according to Woodside’s share of equity in the operation. Its equity share of an operation reflects its economic interest in the operation, which is the extent of rights it has to the risks and rewards flowing from the operation Exploration expenditure Exploration expenditure includes exploration and evaluation expenditure less amortisation of licence acquisition costs and prior year exploration expense written off FEED Front-end engineering design FID Final investment decision Gearing Net debt divided by net debt and equity attributable to the equity holders of the parent GHG or greenhouse gas The seven greenhouse gases listed in the Kyoto Protocol are: carbon dioxide (CO2); methane (CH4); nitrous oxide (N2O); hydrofluorocarbons (HFCs); nitrogen trifluoride (NF3); perfluorocarbons (PFCs); and sulphur hexafluoride (SF6) IFRS International Financial Reporting Standards Foundation. For more information see www.ifrs.org Investing cash flow Cash flow from investing activities IRR or Internal rate of return Internal rate of return. IRR is calculated as the rate of return required for Woodside’s share of after-tax project cashflows that deliver an NPV of zero JCC The Japan customs-cleared crude is the average price of customs-cleared crude oil imports into Japan as reported in customs statistics (also known as ‘Japanese crude cocktail’) and is used as a reference price for long-term supply LNG contracts JKM Japan Korea Marker is the North-east Asian spot price index for LNG delivered ex-ship to Japan, South Korea, China and Taiwan JV Joint venture LALNG Louisiana LNG Liquidity Cash and undrawn facilities LNG Liquefied natural gas Lower carbon Woodside uses this term to describe the characteristic of having lower levels of associated potential GHG emissions when compared to historical and/or current conventions or analogues, for example relating to an otherwise similar resource, process, production facility, product or service, or activity Lower carbon economy A lower carbon economy is an economy that produces lower levels of greenhouse gas emissions relative to today’s economy Lower carbon portfolio For Woodside, a lower carbon portfolio is one from which the net equity scope 1 and 2 greenhouse gas emissions, which includes the use of offsets, are being reduced towards targets, and into which new energy products and lower carbon services are planned to be introduced as a complement to existing and new investments in oil and gas. Woodside’s Climate Policy sets out the principles that we believe will assist us achieve this aim Lower carbon power Lower carbon power comes from processes or technologies that produce electricity with a lower greenhouse gas emissions intensity relative to electricity produced from a higher emissions intensity source Lower carbon services Woodside uses this term to describe technologies, such as CCUS or offsets, that may be capable of reducing the net greenhouse gas emissions of our customers MMbbl Million barrels MMBtu Million British thermal units Mtpa Million tonnes per annum

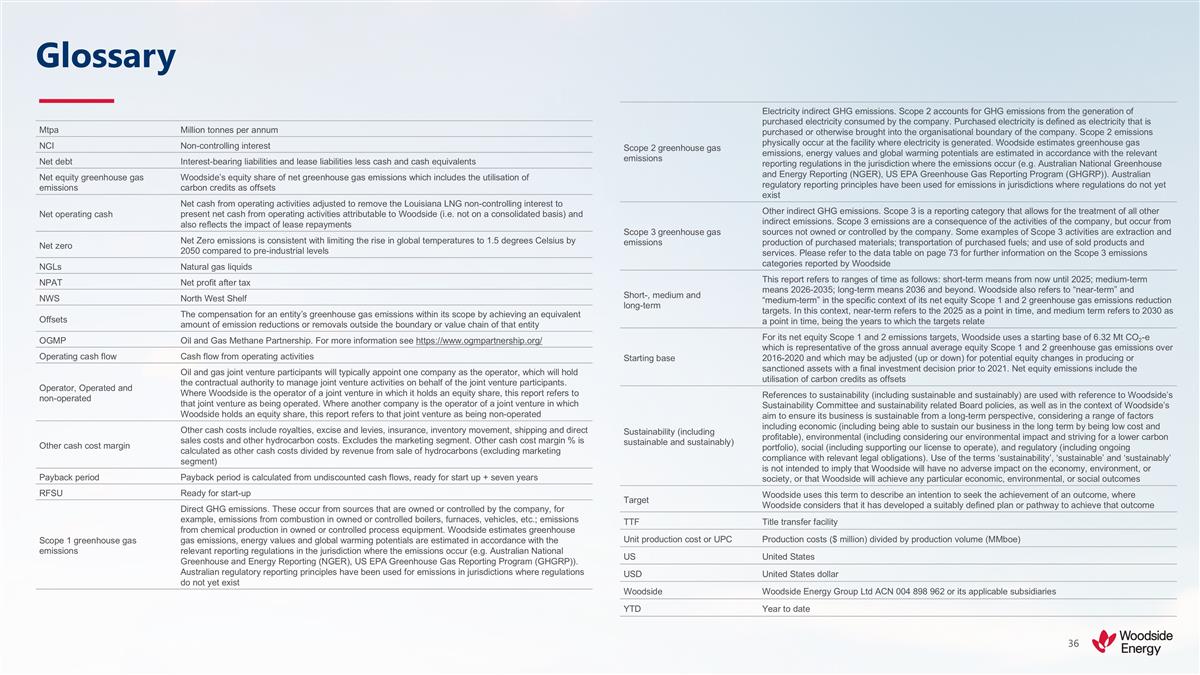

Glossary Mtpa Million tonnes per annum NCI Non-controlling interest Net debt Interest-bearing liabilities and lease liabilities less cash and cash equivalents Net equity greenhouse gas emissions Woodside’s equity share of net greenhouse gas emissions which includes the utilisation of carbon credits as offsets Net operating cash Net cash from operating activities adjusted to remove the Louisiana LNG non-controlling interest to present net cash from operating activities attributable to Woodside (i.e. not on a consolidated basis) and also reflects the impact of lease repayments Net zero Net Zero emissions is consistent with limiting the rise in global temperatures to 1.5 degrees Celsius by 2050 compared to pre-industrial levels NGLs Natural gas liquids NPAT Net profit after tax NWS North West Shelf Offsets The compensation for an entity’s greenhouse gas emissions within its scope by achieving an equivalent amount of emission reductions or removals outside the boundary or value chain of that entity OGMP Oil and Gas Methane Partnership. For more information see https://www.ogmpartnership.org/ Operating cash flow Cash flow from operating activities Operator, Operated and non-operated Oil and gas joint venture participants will typically appoint one company as the operator, which will hold the contractual authority to manage joint venture activities on behalf of the joint venture participants. Where Woodside is the operator of a joint venture in which it holds an equity share, this report refers to that joint venture as being operated. Where another company is the operator of a joint venture in which Woodside holds an equity share, this report refers to that joint venture as being non-operated Other cash cost margin Other cash costs include royalties, excise and levies, insurance, inventory movement, shipping and direct sales costs and other hydrocarbon costs. Excludes the marketing segment. Other cash cost margin % is calculated as other cash costs divided by revenue from sale of hydrocarbons (excluding marketing segment) Payback period Payback period is calculated from undiscounted cash flows, ready for start up + seven years RFSU Ready for start-up Scope 1 greenhouse gas emissions Direct GHG emissions. These occur from sources that are owned or controlled by the company, for example, emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc.; emissions from chemical production in owned or controlled process equipment. Woodside estimates greenhouse gas emissions, energy values and global warming potentials are estimated in accordance with the relevant reporting regulations in the jurisdiction where the emissions occur (e.g. Australian National Greenhouse and Energy Reporting (NGER), US EPA Greenhouse Gas Reporting Program (GHGRP)). Australian regulatory reporting principles have been used for emissions in jurisdictions where regulations do not yet exist Scope 2 greenhouse gas emissions Electricity indirect GHG emissions. Scope 2 accounts for GHG emissions from the generation of purchased electricity consumed by the company. Purchased electricity is defined as electricity that is purchased or otherwise brought into the organisational boundary of the company. Scope 2 emissions physically occur at the facility where electricity is generated. Woodside estimates greenhouse gas emissions, energy values and global warming potentials are estimated in accordance with the relevant reporting regulations in the jurisdiction where the emissions occur (e.g. Australian National Greenhouse and Energy Reporting (NGER), US EPA Greenhouse Gas Reporting Program (GHGRP)). Australian regulatory reporting principles have been used for emissions in jurisdictions where regulations do not yet exist Scope 3 greenhouse gas emissions Other indirect GHG emissions. Scope 3 is a reporting category that allows for the treatment of all other indirect emissions. Scope 3 emissions are a consequence of the activities of the company, but occur from sources not owned or controlled by the company. Some examples of Scope 3 activities are extraction and production of purchased materials; transportation of purchased fuels; and use of sold products and services. Please refer to the data table on page 73 for further information on the Scope 3 emissions categories reported by Woodside Short-, medium and long-term This report refers to ranges of time as follows: short-term means from now until 2025; medium-term means 2026-2035; long-term means 2036 and beyond. Woodside also refers to “near-term” and “medium-term” in the specific context of its net equity Scope 1 and 2 greenhouse gas emissions reduction targets. In this context, near-term refers to the 2025 as a point in time, and medium term refers to 2030 as a point in time, being the years to which the targets relate Starting base For its net equity Scope 1 and 2 emissions targets, Woodside uses a starting base of 6.32 Mt CO2-e which is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets Sustainability (including sustainable and sustainably) References to sustainability (including sustainable and sustainably) are used with reference to Woodside’s Sustainability Committee and sustainability related Board policies, as well as in the context of Woodside’s aim to ensure its business is sustainable from a long-term perspective, considering a range of factors including economic (including being able to sustain our business in the long term by being low cost and profitable), environmental (including considering our environmental impact and striving for a lower carbon portfolio), social (including supporting our license to operate), and regulatory (including ongoing compliance with relevant legal obligations). Use of the terms ‘sustainability’, ‘sustainable’ and ‘sustainably’ is not intended to imply that Woodside will have no adverse impact on the economy, environment, or society, or that Woodside will achieve any particular economic, environmental, or social outcomes Target Woodside uses this term to describe an intention to seek the achievement of an outcome, where Woodside considers that it has developed a suitably defined plan or pathway to achieve that outcome TTF Title transfer facility Unit production cost or UPC Production costs ($ million) divided by production volume (MMboe) US United States USD United States dollar Woodside Woodside Energy Group Ltd ACN 004 898 962 or its applicable subsidiaries YTD Year to date