UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File Number: 001-14946

Cemex, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida Ricardo Margáin Zozaya #325, Colonia Valle del Campestre,

San Pedro Garza García, Nuevo León 66265, México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Contents

| 1. | Press release dated April 28, 2025 announcing first quarter 2025 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). | |||

| 2. | First quarter 2025 results for Cemex. | |||

| 3. | Presentation regarding first quarter 2025 results for Cemex. | |||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Cemex, S.A.B. de C.V. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Cemex, S.A.B. de C.V. |

||||||||

| (Registrant) |

||||||||

| Date: April 28, 2025 | By: | /s/ Rafael Garza Lozano |

||||||

| Name: | Rafael Garza Lozano | |||||||

| Title: | Chief Comptroller | |||||||

3

EXHIBIT INDEX

| EXHIBIT NO. |

DESCRIPTION |

|

| 1. | Press release dated April 28, 2025 announcing first quarter 2025 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). | |

| 2. | First quarter 2025 results for Cemex. | |

| 3. | Presentation regarding first quarter 2025 results for Cemex. | |

4

Exhibit 1

Cemex reports record First Quarter Net Income;

new CEO with strong commitment to bolster shareholder return

| • | Net Income of US$734 million, reaching a recent record high. |

| • | 2025 full-year EBITDA guidance confirmed. |

| • | Operational excellence, streamlined corporate transformation and disciplined capital allocation as key priorities to drive shareholder return. |

Monterrey, Mexico. April 28, 2025 – Cemex reported its first-quarter results today as new CEO Jaime Muguiro outlined his vision for the company to the financial community for the first time. As he ushers the company into an era of sustainable and profitable growth, Muguiro’s focus lies on achieving operational excellence, increasing free cash flow and enhancing shareholder returns. The company’s growth strategy remains focused on accretive small to mid-size acquisitions in the U.S., with full commitment to disciplined capital allocation.

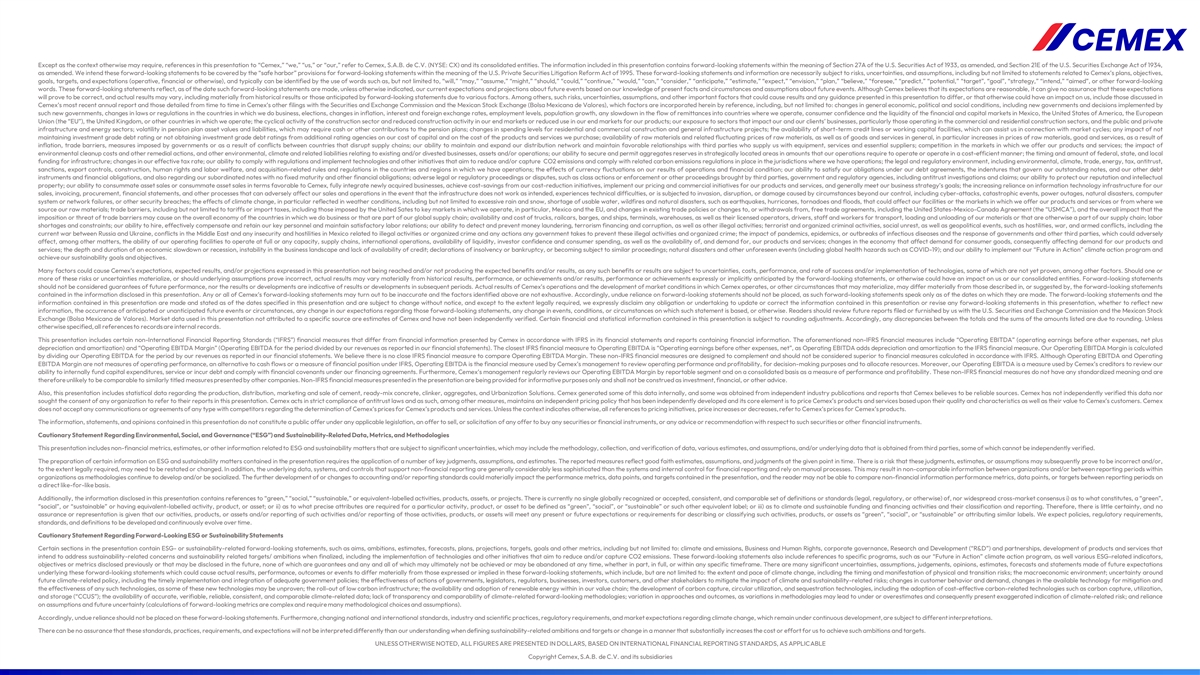

For the quarter, Cemex achieved a record Net Income of US$734 million. Net Sales stood at US$3,649 million, driven by higher consolidated prices, partially offsetting the effect from lower volumes in Mexico. EBITDA reached US$601 million, in line with expectations underlying full year 2025 EBITDA guidance, which remained unchanged.

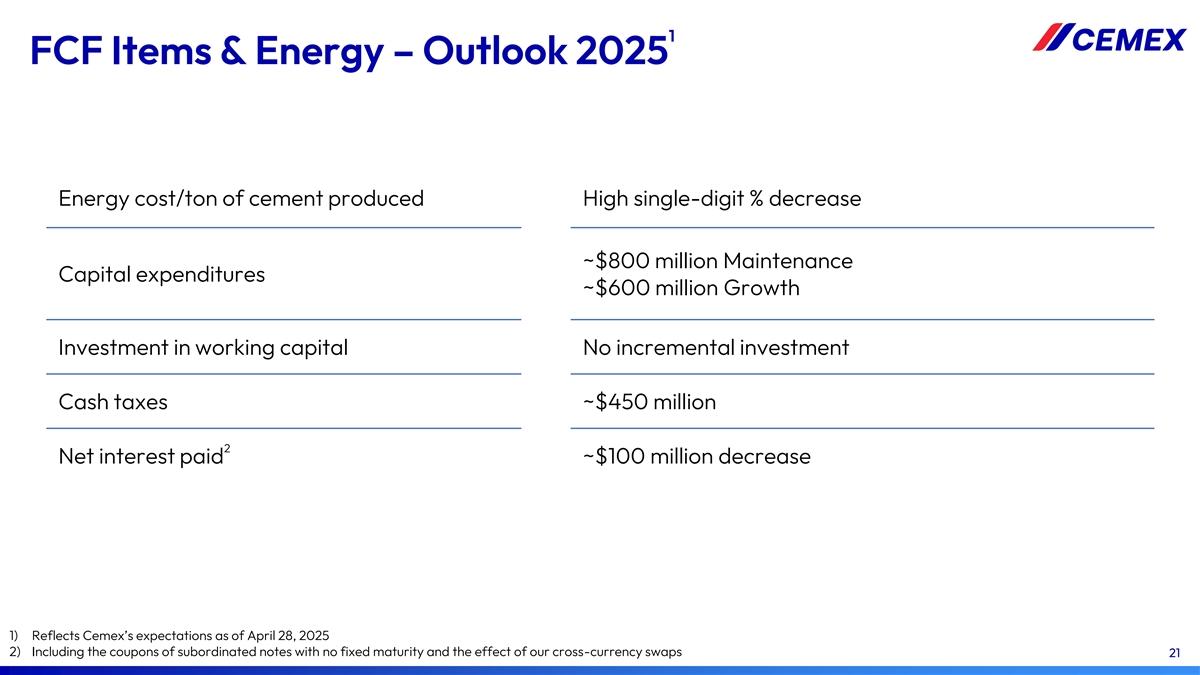

Free cash flow from operations reflected typical seasonal working capital trends in the quarter. EBITDA Margin was supported by stronger pricing and reduced energy and freight costs, which helped offset lower volumes and weather-related maintenance activity.

“I am committed to providing the highest possible returns to our shareholders by being the best partner to our customers, having a laser-like focus on operational efficiency, and following a disciplined capital allocation strategy,” said Jaime Muguiro. “I am confident we have the right management team to accomplish this.”

Under Muguiro’s leadership, Cemex intends to use its previously announced “Project Cutting Edge” cost savings initiative, as the foundation to drive a streamlined organizational transformation, to simplify and empower regional operations and deliver profitable growth. Cemex is targeting recurrent yearly EBITDA savings of at least $150 million in 2025 and US$350 million by 2027.

Cemex’s Consolidated 2025 First Quarter Highlights (millions of US Dollars)

| January - March | ||||||||||||||||

| 2025 | 2024 | % var |

l-t-l % var |

|||||||||||||

| Sales |

3,649 | 3,942 | (7 | %) | (1 | %) | ||||||||||

| Operating EBITDA |

601 | 731 | (18 | %) | (10 | %) | ||||||||||

| Operating EBITDA margin |

16.5 | % | 18.5 | % | (2.0 | pp) | ||||||||||

| Controlling interest net income (loss) |

734 | 254 | 189 | % | ||||||||||||

1

Regional 2025 First Quarter Highlights (millions of US Dollars)

| January - March | ||||||||||||||||

| Mexico |

2025 | 2024 | % var |

l-t-l % var |

||||||||||||

| Sales |

981 | 1,314 | (25 | %) | (9 | %) | ||||||||||

| Operating EBITDA |

308 | 420 | (27 | %) | (10 | %) | ||||||||||

| Operating EBITDA margin |

31.4 | % | 31.9 | % | (0.5 | pp) | ||||||||||

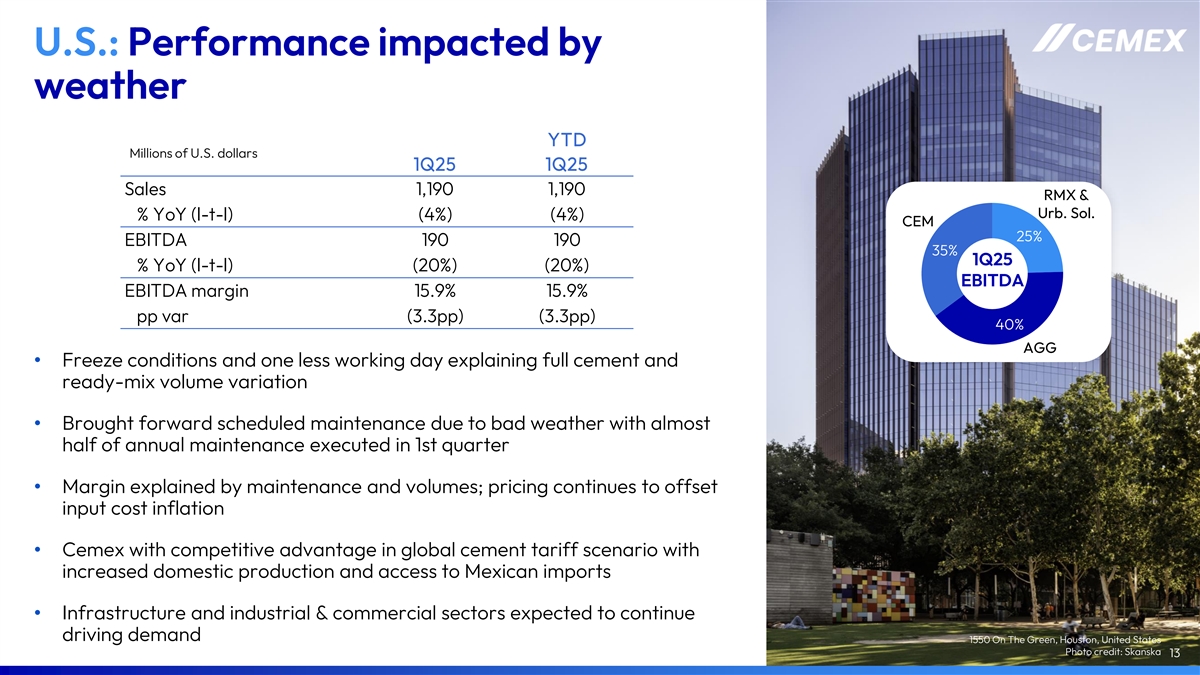

| United States |

||||||||||||||||

| Sales |

1,190 | 1,234 | (4 | %) | (4 | %) | ||||||||||

| Operating EBITDA |

190 | 237 | (20 | %) | (20 | %) | ||||||||||

| Operating EBITDA margin |

15.9 | % | 19.2 | % | (3.3 | pp) | ||||||||||

| Europe, Middle East and Africa |

||||||||||||||||

| Sales |

1,070 | 1,045 | 2 | % | 5 | % | ||||||||||

| Operating EBITDA |

117 | 83 | 40 | % | 49 | % | ||||||||||

| Operating EBITDA margin |

10.9 | % | 8.0 | % | 2.9 | pp | ||||||||||

| South, Central America and the Caribbean |

||||||||||||||||

| Sales |

314 | 306 | 2 | % | 5 | % | ||||||||||

| Operating EBITDA |

61 | 63 | (3 | %) | (2 | %) | ||||||||||

| Operating EBITDA margin |

19.6 | % | 20.7 | % | (1.1 | pp) | ||||||||||

Note: All references to EBITDA mean Operating EBITDA.

About Cemex

Cemex is a global construction materials company that is building a better future through sustainable products and solutions. Cemex is committed to achieving carbon neutrality through relentless innovation and industry-leading research and development. Cemex is at the forefront of the circular economy in the construction value chain and is pioneering ways to increase the use of waste and residues as alternative raw materials and fuels in its operations with the help of new technologies. Cemex offers cement, ready-mix concrete, aggregates, and urbanization solutions in growing markets around the world, powered by a multinational workforce focused on providing a superior customer experience enabled by digital technologies. For more information, please visit: www.cemex.com

Contact information

Analyst and Investor Relations - New York

Blake Haider

+1 (212) 317-6011

ir@cemex.com

Patricio Treviño Garza

+52 (81) 8888-4327

ir@cemex.com

Media Relations

Jorge Pérez

+52 (81) 8259-6666

jorgeluis.perez@cemex.com

2

###

Except as the context otherwise may require, references in this press release to “Cemex,” ”we,” ”us,” or ”our,” refer to Cemex, S.A.B. de C.V. and its consolidated subsidiaries. This press release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Cemex intends these forward-looking statements to be covered by the “safe harbor” provisions for forward-looking statements in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Cemex’s current expectations and projections about future events based on Cemex’s knowledge of present facts and circumstances and assumptions about future events, as well as Cemex’s current plans based on such facts and circumstances, unless otherwise indicated. These statements necessarily involve risks, uncertainties, and assumptions that could cause actual results to differ materially from Cemex’s expectations, including, among others, risks, uncertainties, assumptions, and other important factors discussed in Cemex’s most recent annual report and detailed from time to time in Cemex’s other filings with the U.S. Securities and Exchange Commission and the Mexican Stock Exchange (Bolsa Mexicana de Valores), which factors are incorporated herein by reference, which if materialized could ultimately lead to Cemex’s expectations and/or expected results not producing the expected benefits and/or results. Forward-looking statements should not be considered guarantees of future performance, nor the results or developments are indicative of results or developments in subsequent periods. The forward-looking statements and the information contained in this press release are made and stated as of the dates specified in this press release and are subject to change without notice, and except to the extent legally required, we expressly disclaim any obligation or undertaking to update or correct this press release or revise any forward-looking statements contained herein, whether to reflect new information, the occurrence of anticipated or unanticipated future events or circumstances, any change in our expectations regarding those forward-looking statements, any change in events, conditions, or circumstances on which any statement is based, or otherwise. Any or all of Cemex’s forward-looking statements may turn out to be inaccurate. Accordingly, undue reliance on forward-looking statements should not be placed, as such forward-looking statements speak only as of the dates on which they are made. The content of this press release is for informational purposes only, and you should not construe any such information or other material as legal, tax, investment, financial, or other advice. All references to prices in this press release refer to Cemex’s prices for Cemex products and services. Unless otherwise specified, all references to records are internal records.

Analyst and Investor Relations - Monterrey This press release and the documents referred to herein include certain non-International Financial Reporting Standards (“IFRS”) financial measures that differ from financial information presented by Cemex in accordance with IFRS in its financial statements and reports containing financial information. The aforementioned non-IFRS financial measures include “Operating EBITDA (operating earnings before other expenses, net plus depreciation and amortization)” and “Operating EBITDA Margin”. The closest IFRS financial measure to Operating EBITDA is “Operating earnings before other expenses, net”, as Operating EBITDA adds depreciation and amortization to the IFRS financial measure. Our Operating EBITDA Margin is calculated by dividing our Operating EBITDA for the period by our revenues as reported in our financial statements. We believe there is no close IFRS financial measure to compare Operating EBITDA Margin. These non-IFRS financial measures are designed to complement and should not be considered superior to financial measures calculated in accordance with IFRS. Although Operating EBITDA and Operating EBITDA Margin are not measures of operating performance, an alternative to cash flows or a measure of financial position under IFRS, Operating EBITDA is the financial measure used by Cemex’s management to review operating performance and profitability, for decision-making purposes and to allocate resources. Moreover, our Operating EBITDA is a measure used by Cemex’s creditors to review our ability to internally fund capital expenditures, service or incur debt and comply with financial covenants under our financing agreements. Furthermore, Cemex’s management regularly reviews our Operating EBITDA Margin by reportable segment and on a consolidated basis as a measure of performance and profitability. These non-IFRS financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. Non-IFRS financial measures presented in the reports, presentations, and documents to be disclosed during Cemex’s first quarter 2025 results conference call and audio webcast presentation are being provided for informative purposes only and shall not be construed as investment, financial, or other advice.

There is currently no single globally recognized or accepted, consistent, and comparable set of definitions or standards (legal, regulatory, or otherwise) of, nor widespread cross-market consensus i) as to what constitutes, a “green”, “social”, or “sustainable” or having equivalent-labelled activity, product, or asset; or ii) as to what precise attributes are required for a particular activity, product, or asset to be defined as “green” “social”, or “sustainable” or such other equivalent label; or iii) as to climate and sustainable funding and financing activities and their classification and reporting. Therefore, there is little certainty, and no assurance or representation is given that such activities and/or reporting of those activities will meet any present or future expectations or requirements for describing or classifying funding and financing activities as “green”, “social”, or “sustainable” or attributing similar labels. We expect policies, regulatory requirements, standards, and definitions to be developed and continuously evolve over time.

3

Exhibit 2

First Quarter Results 2025

The Village, Playa del Carmen, Mexico

| Stock Listing Information | Investor Relations | |

| NYSE (ADS) | In the United States: | |

| Ticker: CX | + 1 877 7CX NYSE | |

| Mexican Stock Exchange (CPO) | In Mexico: | |

| Ticker: CEMEX.CPO | + 52 (81) 8888 4327 | |

| Ratio of CEMEXCPO to CX = 10:1 | E-Mail: ir@cemex.com | |

| Operating and financial highlights |

|

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| 2025 | 2024 | % var | l-t-l % var |

2025 | 2024 | % var | l-t-l % var |

|||||||||||||||||||||||||

| Consolidated volumes |

||||||||||||||||||||||||||||||||

| Domestic gray cement |

10,208 | 10,458 | (2 | %) | 10,208 | 10,458 | (2 | %) | ||||||||||||||||||||||||

| Ready-mix |

10,313 | 10,192 | 1 | % | 10,313 | 10,192 | 1 | % | ||||||||||||||||||||||||

| Aggregates |

30,186 | 31,601 | (4 | %) | 30,186 | 31,601 | (4 | %) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Sales |

3,649 | 3,942 | (7 | %) | (1 | %) | 3,649 | 3,942 | (7 | %) | (1 | %) | ||||||||||||||||||||

| Gross profit |

1,134 | 1,327 | (15 | %) | (6 | %) | 1,134 | 1,327 | (15 | %) | (6 | %) | ||||||||||||||||||||

| as % of Sales |

31.1 | % | 33.7 | % | (2.6pp | ) | 31.1 | % | 33.7 | % | (2.6pp | ) | ||||||||||||||||||||

| Operating earnings before other income and expenses, net |

292 | 421 | (31 | %) | (20 | %) | 292 | 421 | (31 | %) | (20 | %) | ||||||||||||||||||||

| as % of Sales |

8.0 | % | 10.7 | % | (2.7pp | ) | 8.0 | % | 10.7 | % | (2.7pp | ) | ||||||||||||||||||||

| SG&A expenses as % of Sales |

10.5 | % | 10.0 | % | 0.5pp | 10.5 | % | 10.0 | % | 0.5pp | ||||||||||||||||||||||

| Controlling interest net income (loss) |

734 | 254 | 189 | % | 734 | 254 | 189 | % | ||||||||||||||||||||||||

| Operating EBITDA |

601 | 731 | (18 | %) | (10 | %) | 601 | 731 | (18 | %) | (10 | %) | ||||||||||||||||||||

| as % of Sales |

16.5 | % | 18.5 | % | (2.0pp | ) | 16.5 | % | 18.5 | % | (2.0pp | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Free cash Flow from Operations |

(270 | ) | (159 | ) | (70 | %) | (270 | ) | (159 | ) | (70 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total debt |

6,763 | 7,844 | (14 | %) | 6,763 | 7,844 | (14 | %) | ||||||||||||||||||||||||

| Earnings (loss) of continuing operations per ADS |

0.08 | 0.16 | (50 | %) | 0.08 | 0.16 | (50 | %) | ||||||||||||||||||||||||

| Fully diluted earnings (loss) of continuing operations per ADS |

0.08 | 0.16 | (50 | %) | 0.08 | 0.16 | (50 | %) | ||||||||||||||||||||||||

| Average ADSs outstanding (1) |

1,471 | 1,469 | 0 | % | 1,471 | 1,469 | 0 | % | ||||||||||||||||||||||||

| Employees |

43,797 | 44,746 | (2 | %) | 43,797 | 44,746 | (2 | %) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | For purposes of this report, Average ADSs outstanding equals the total number of Series A shares and Series B shares outstanding as if they were all held in ADS form. |

Cement and aggregates volumes in thousands of metric tons. Ready-mix volumes in thousands of cubic meters.

In millions of U.S. dollars, except volumes, percentages, employees, and per-ADS amounts. Average ADSs outstanding are presented in millions.

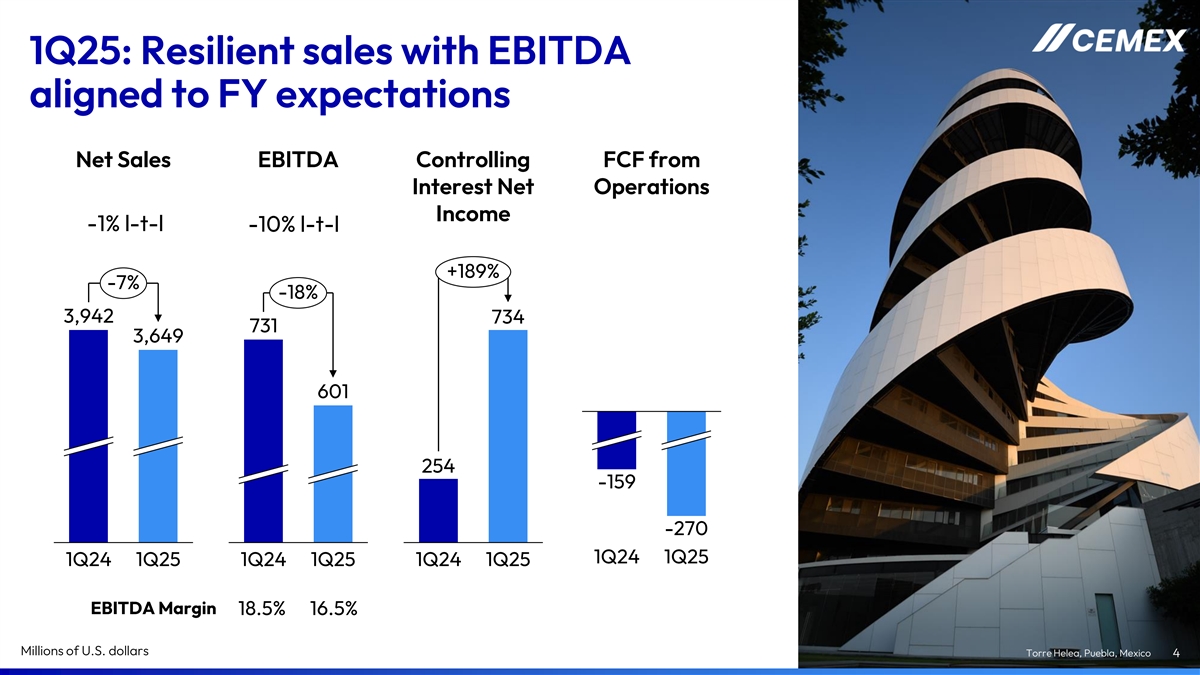

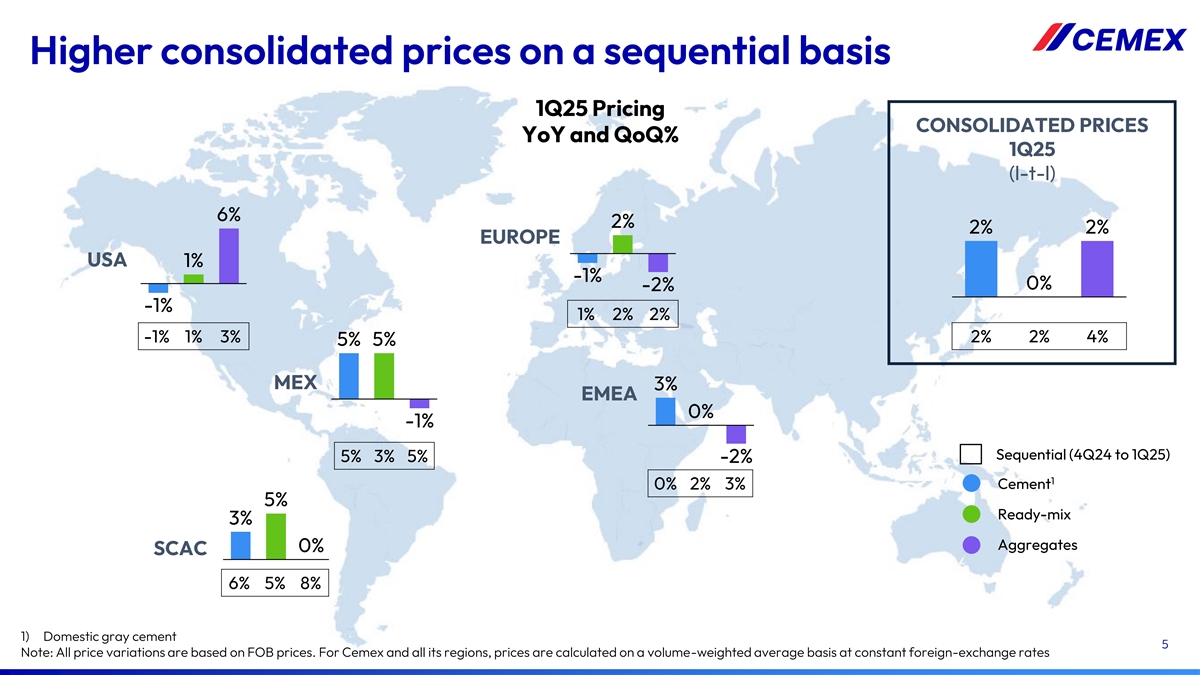

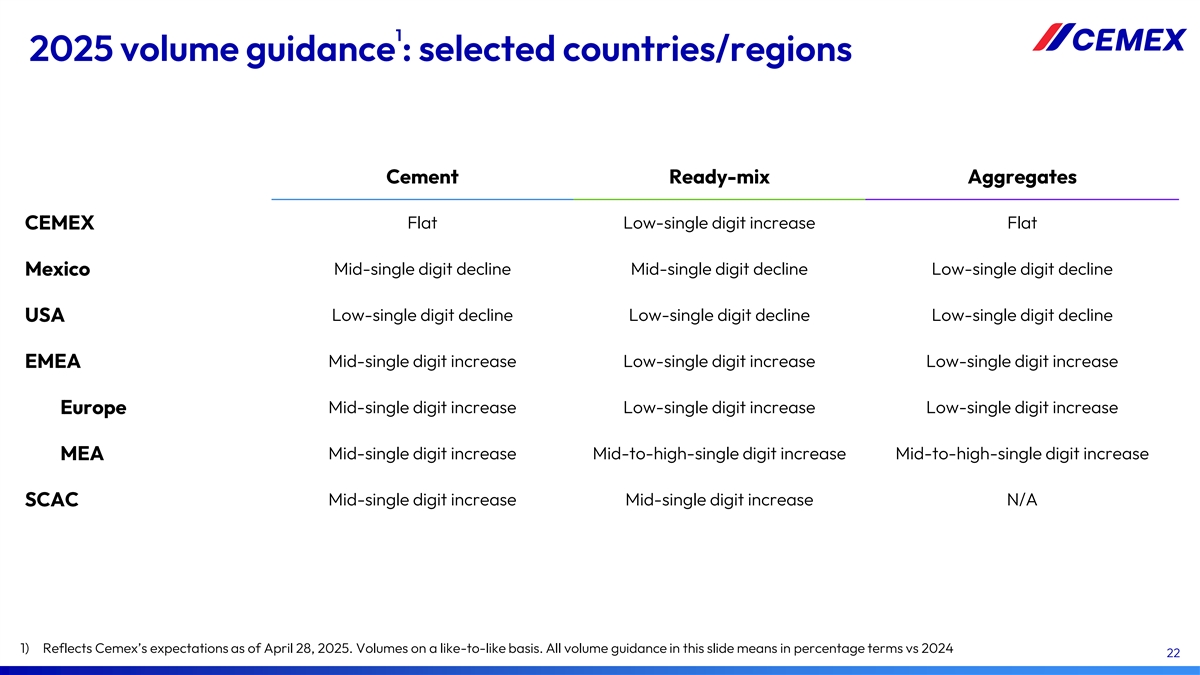

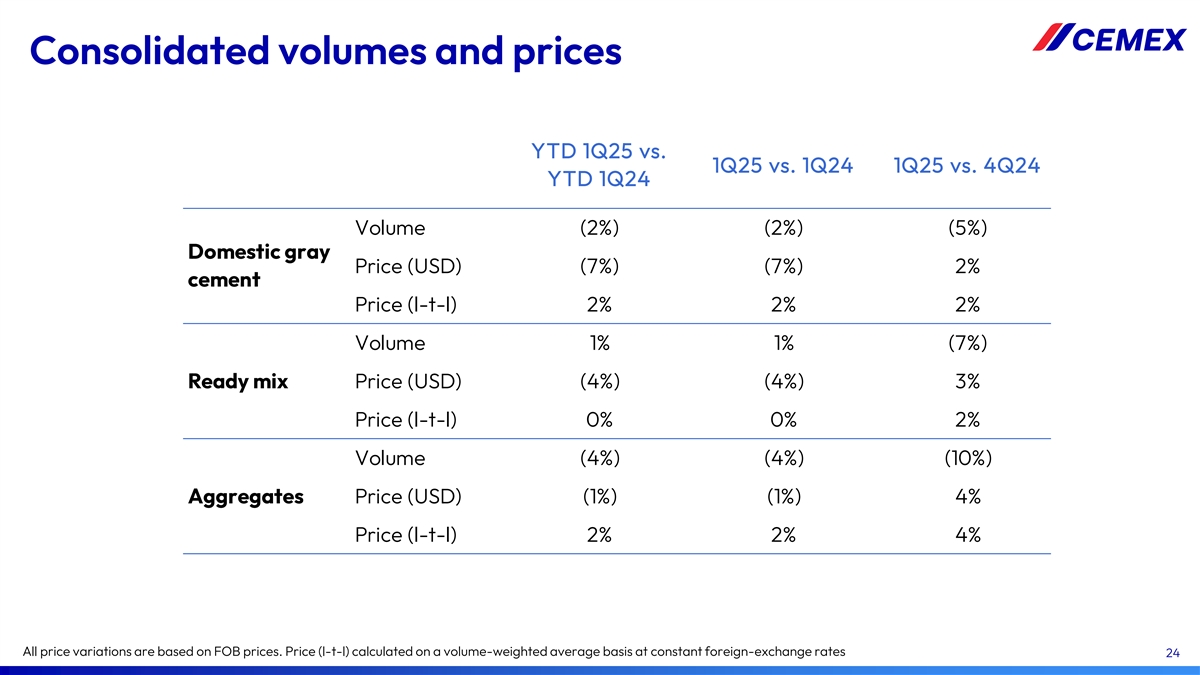

First-quarter 2025 consolidated Net Sales were US$3.6 billion, down 1% from Q1 2024 on a like-to-like basis. Higher prices were offset by lower volumes. Sales rose in EMEA and SCAC but fell in Mexico and the U.S.

Cost of sales, as a percentage of Net Sales, increased by 2.6pp to 68.9% in the first quarter of 2025, driven mainly by maintenance work brought forward in the U.S., along with a decrease in Net Sales. However, we continued to experience energy tailwinds, both in fuels and electricity for cement production.

Operating expenses, as a percentage of Net Sales, remained relatively stable in the first quarter of 2025 compared with the same period last year, as lower freight and logistics were offset by higher SG&A expense.

Operating EBITDA in the first quarter 2025 reached US$601 million, decreasing 10% on a like-to-like basis, mainly due to volumes, operating leverage and maintenance. On a regional basis, Operating EBITDA performance was largely explained by our Mexican operations, with peso depreciation resulting in a $65 million dollar headwind, coupled with volumes impacted by a strong prior year pre-election base and the usual seasonality of the first year of a new government.

Operating EBITDA margin in the first quarter 2025 decreased 2.0pp from 18.5% in the first quarter 2024 to 16.5% this quarter, with approximately half of this variation explained by regional mix. Operating EBITDA margin was supported by higher prices, lower energy and freight costs, which partially offset the impact from volumes, higher labor costs and maintenance work brought forward in the U.S.

Controlling interest net income was US$734 million in the first quarter of 2025, driven mainly by the gain in the sale of our Dominican Republic operations.

| 2025 First Quarter Results | Page 2 |

| Operating results |

|

Mexico

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| 2025 | 2024 | % var | l-t-l % var |

2025 | 2024 | % var | l-t-l % var |

|||||||||||||||||||||||||

| Sales |

981 | 1,314 | (25 | %) | (9 | %) | 981 | 1,314 | (25 | %) | (9 | %) | ||||||||||||||||||||

| Operating EBITDA |

308 | 420 | (27 | %) | (10 | %) | 308 | 420 | (27 | %) | (10 | %) | ||||||||||||||||||||

| Operating EBITDA margin |

31.4 | % | 31.9 | % | (0.5pp | ) | 31.4 | % | 31.9 | % | (0.5pp | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

In millions of U.S. dollars, except percentages.

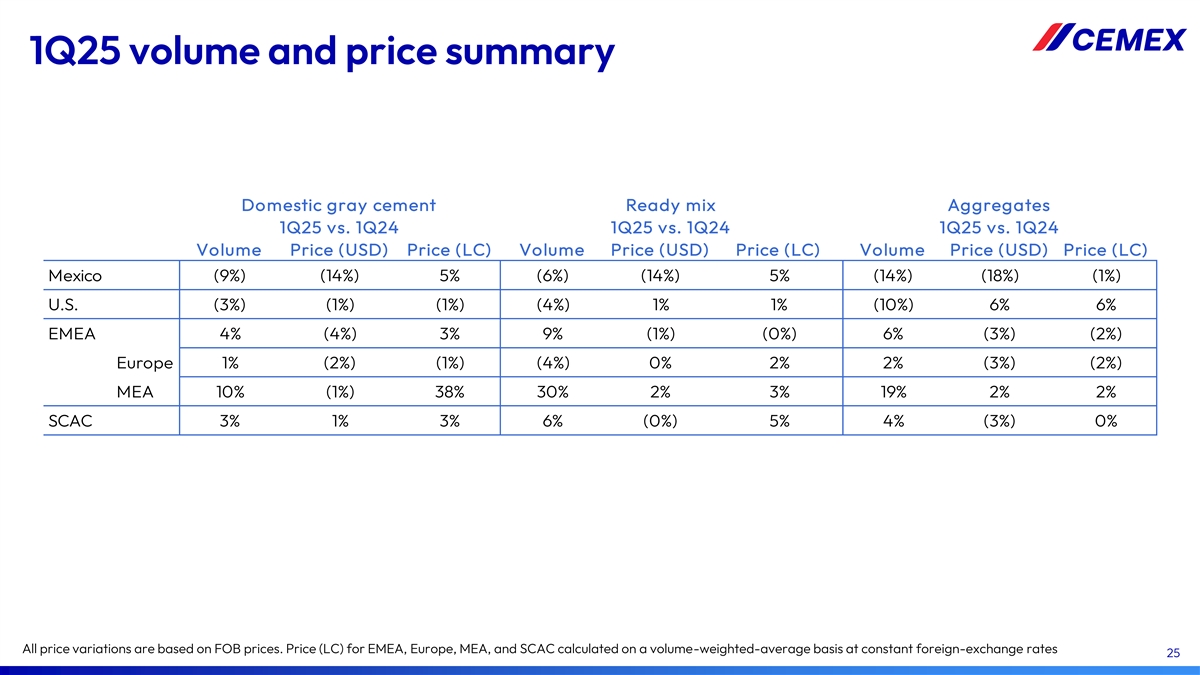

| Domestic gray cement | Ready-mix | Aggregates | ||||||||||||||||||||||

| Year-over-year percentage variation | January - March | First Quarter | January - March | First Quarter | January - March | First Quarter | ||||||||||||||||||

| Volume |

(9 | %) | (9 | %) | (6 | %) | (6 | %) | (14 | %) | (14 | %) | ||||||||||||

| Price (USD) |

(14 | %) | (14 | %) | (14 | %) | (14 | %) | (18 | %) | (18 | %) | ||||||||||||

| Price (local currency) |

5 | % | 5 | % | 5 | % | 5 | % | (1 | %) | (1 | %) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In Mexico Operating EBITDA decreased 10% on a like-to-like basis in the first quarter of 2025 due to typical seasonality associated with the first year of a new government and, a strong prior year comparison base driven by pre-electoral spending. Operating EBITDA margin was supported by favorable pricing and lower energy and freight costs offsetting most of the volume effect.

The pre-electoral spending in infrastructure and rural roads last year explained ~50% of the decline in cement volumes in the first quarter of 2025 compared to the first quarter of 2024. Ready-mix volumes remained supported by industrial projects and state-level infrastructure works in the northeast region in Mexico. The decline in aggregates volumes is attributed to the timing of several large low margin infrastructure projects in the prior year. Adjusting for these volumes, our aggregates volumes declined by 1% with a significant expansion in Operating EBITDA margin.

Our cement and aggregates prices increased 5% sequentially, while ready-mix increased 3% in local currency terms.

United States

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| 2025 | 2024 | % var | l-t-l % var |

2025 | 2024 | % var | l-t-l % var |

|||||||||||||||||||||||||

| Sales |

1,190 | 1,234 | (4 | %) | (4 | %) | 1,190 | 1,234 | (4 | %) | (4 | %) | ||||||||||||||||||||

| Operating EBITDA |

190 | 237 | (20 | %) | (20 | %) | 190 | 237 | (20 | %) | (20 | %) | ||||||||||||||||||||

| Operating EBITDA margin |

15.9 | % | 19.2 | % | (3.3pp | ) | 15.9 | % | 19.2 | % | (3.3pp | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

In millions of U.S. dollars, except percentages.

| Domestic gray cement | Ready-mix | Aggregates | ||||||||||||||||||||||

| Year-over-year percentage variation | January - March | First Quarter | January - March | First Quarter | January - March | First Quarter | ||||||||||||||||||

| Volume |

(3 | %) | (3 | %) | (4 | %) | (4 | %) | (10 | %) | (10 | %) | ||||||||||||

| Price (USD) |

(1 | %) | (1 | %) | 1 | % | 1 | % | 6 | % | 6 | % | ||||||||||||

| Price (local currency) |

(1 | %) | (1 | %) | 1 | % | 1 | % | 6 | % | 6 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In the United States, Operating EBITDA in the first quarter of 2025 declined 20% year-over-year due to unusually cold weather in many of our key markets. Operating EBITDA margin in the quarter adjusted for maintenance spend and volume loss, would have remained stable, with pricing offsetting input cost inflation.

Freeze conditions in January and 1-less working days explain the entirety of our cement and ready-mix volume decline. In aggregates, approximately half of the volume variation is explained by inclement weather, fewer shipping days and the previously announced closure of several depleted quarries.

Cement and ready-mix prices were stable sequentially. Aggregates prices remained strong with prices adjusted for product and geographic mix increasing 3% sequentially and 7% year-over-year.

| 2025 First Quarter Results | Page 3 |

| Operating results |

|

Europe, Middle East, and Africa

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| 2025 | 2024 | % var | l-t-l % var |

2025 | 2024 | % var | l-t-l % var |

|||||||||||||||||||||||||

| Sales |

1,070 | 1,045 | 2 | % | 5 | % | 1,070 | 1,045 | 2 | % | 5 | % | ||||||||||||||||||||

| Operating EBITDA |

117 | 83 | 40 | % | 49 | % | 117 | 83 | 40 | % | 49 | % | ||||||||||||||||||||

| Operating EBITDA margin |

10.9 | % | 8.0 | % | 2.9pp | 10.9 | % | 8.0 | % | 2.9pp | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

In millions of U.S. dollars, except percentages.

| Domestic gray cement | Ready-mix | Aggregates | ||||||||||||||||||||||

| Year-over-year percentage variation | January - March | First Quarter | January - March | First Quarter | January - March | First Quarter | ||||||||||||||||||

| Volume |

4 | % | 4 | % | 9 | % | 9 | % | 6 | % | 6 | % | ||||||||||||

| Price (USD) |

(4 | %) | (4 | %) | (1 | %) | (1 | %) | (3 | %) | (3 | %) | ||||||||||||

| Price (local currency) (*) |

3 | % | 3 | % | (0 | %) | (0 | %) | (2 | %) | (2 | %) | ||||||||||||

In EMEA, the recovery trend continued in the first quarter, with our operations in Europe marking the third consecutive quarter of Operating EBITDA growth, on a year-over-year basis. For the full region, Operating EBITDA in the first quarter of 2025 grew by +49% on a like-to-like basis, with Operating EBITDA margin expansion of 2.9pp. This was driven by higher volumes, prices and operating leverage, as well as higher efficiencies in relation to Project Cutting Edge.

In Europe, while we continued to see an improving volume trend in most markets in Western Europe, harsh winter conditions in February affected dynamics in our Eastern European operations. Growth in these countries resumed in March with better weather.

On Climate Action, our operations in Europe continued making progress on profitable decarbonization with net CO2 emissions declining by 1.2% in the quarter compared to first quarter of 2024.

In Middle East & Africa, Operating EBITDA improved due to strong volume growth as conditions began to stabilize.

| (*) | Calculated on a volume-weighted-average basis at constant foreign exchange rates. |

| 2025 First Quarter Results | Page 4 |

| Operating results |

|

South, Central America and the Caribbean

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| 2025 | 2024 | % var | l-t-l % var |

2025 | 2024 | % var | l-t-l % var |

|||||||||||||||||||||||||

| Sales |

314 | 306 | 2 | % | 5 | % | 314 | 306 | 2 | % | 5 | % | ||||||||||||||||||||

| Operating EBITDA |

61 | 63 | (3 | %) | (2 | %) | 61 | 63 | (3 | %) | (2 | %) | ||||||||||||||||||||

| Operating EBITDA margin |

19.6 | % | 20.7 | % | (1.1pp | ) | 19.6 | % | 20.7 | % | (1.1pp | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

In millions of U.S. dollars, except percentages.

| Domestic gray cement | Ready-mix | Aggregates | ||||||||||||||||||||||

| Year-over-year percentage variation | January - March | First Quarter | January - March | First Quarter | January - March | First Quarter | ||||||||||||||||||

| Volume |

3 | % | 3 | % | 6 | % | 6 | % | 4 | % | 4 | % | ||||||||||||

| Price (USD) |

1 | % | 1 | % | (0 | %) | (0 | %) | (3 | %) | (3 | %) | ||||||||||||

| Price (local currency) (*) |

3 | % | 3 | % | 5 | % | 5 | % | 0 | % | 0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In South, Central America and the Caribbean, Operating EBITDA decreased by 2%, on a like-to-like basis in the first quarter of 2025, compared to the prior year. Prices posted a solid performance, with volumes growing 3% in cement and 6% in ready-mix.

The formal sector continues driving demand, with our ready-mix volumes in Colombia and Panama increasing by 8% and 10% respectively.

On the operations front, increased kiln efficiency along with lower clinker factor continued to support profitability.

Our Urbanization Solutions business is expanding rapidly in the region, posting an Operating EBITDA growth of 16% with a margin expansion of more than 4pp during the first quarter of 2025, compared to the same period last year.

| (*) | Calculated on a volume-weighted-average basis at constant foreign-exchange rates. |

| 2025 First Quarter Results | Page 5 |

| Operating results |

|

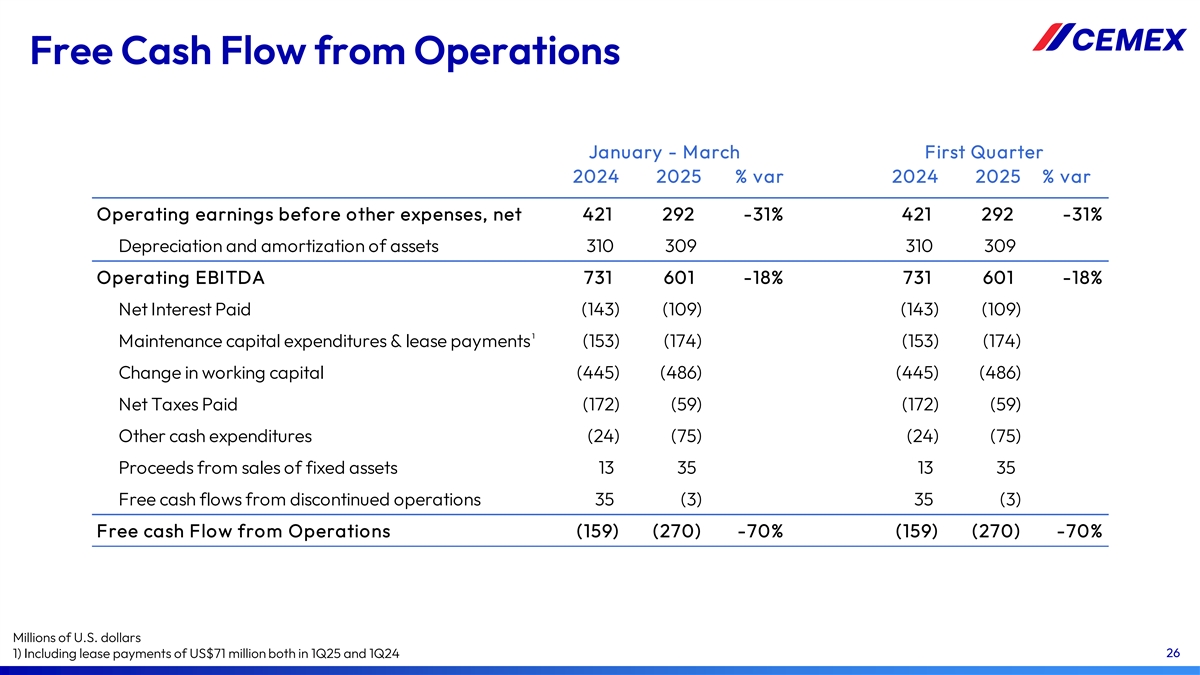

Operating EBITDA and free cash flow

| January - March | First Quarter | |||||||||||||||||||||||

| 2025 | 2024 | % var | 2025 | 2024 | % var | |||||||||||||||||||

| Operating earnings before other expenses, net |

292 | 421 | (31 | %) | 292 | 421 | (31 | %) | ||||||||||||||||

| Depreciation and amortization of assets |

309 | 310 | 309 | 310 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Operating EBITDA |

601 | 731 | (18 | %) | 601 | 731 | (18 | %) | ||||||||||||||||

| Net Interest Paid |

(109 | ) | (143 | ) | (109 | ) | (143 | ) | ||||||||||||||||

| Maintenance capital expenditures & lease payments1 |

(174 | ) | (153 | ) | (174 | ) | (153 | ) | ||||||||||||||||

| Change in working capital |

(486 | ) | (445 | ) | (486 | ) | (445 | ) | ||||||||||||||||

| Net Taxes Paid |

(59 | ) | (172 | ) | (59 | ) | (172 | ) | ||||||||||||||||

| Other cash expenditures |

(75 | ) | (24 | ) | (75 | ) | (24 | ) | ||||||||||||||||

| Proceeds from sale of fixed assets |

35 | 13 | 35 | 13 | ||||||||||||||||||||

| Free cash flow from discontinued operations |

(3 | ) | 35 | (3 | ) | 35 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Free Cash Flow from Operations |

(270 | ) | (159 | ) | (70 | %) | (270 | ) | (159 | ) | (70 | %) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

In millions of U.S. dollars, except percentages.

| (1) | Including lease payments of US$71 million both in 1Q25 and 1Q24 |

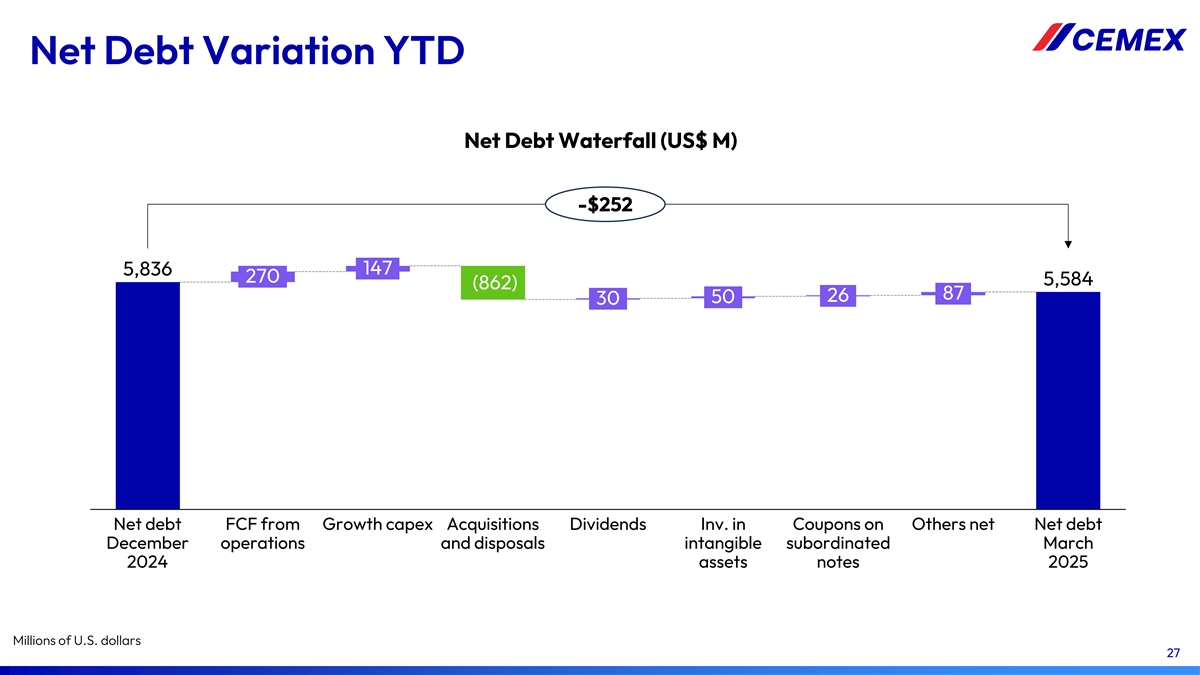

| Net Debt variation: Amounts below are presented in terms of their effect on Net Debt |

|

|||

| Net Debt 4Q24 |

5,836 | |||

|

|

|

|||

| Free Cash Flow from Operations (effect on Net Debt) |

270 | |||

| Growth capital expenditures |

147 | |||

| Acquisitions and disposals |

(862 | ) | ||

| Dividends |

30 | |||

| Investments in intangible assets |

50 | |||

| Coupons on subordinated notes |

26 | |||

| Others net |

87 | |||

|

|

|

|||

| Net debt variation 1Q25 |

(252 | ) | ||

|

|

|

|||

| Net debt 1Q25 |

5,584 | |||

|

|

|

|||

In millions of U.S. dollars.

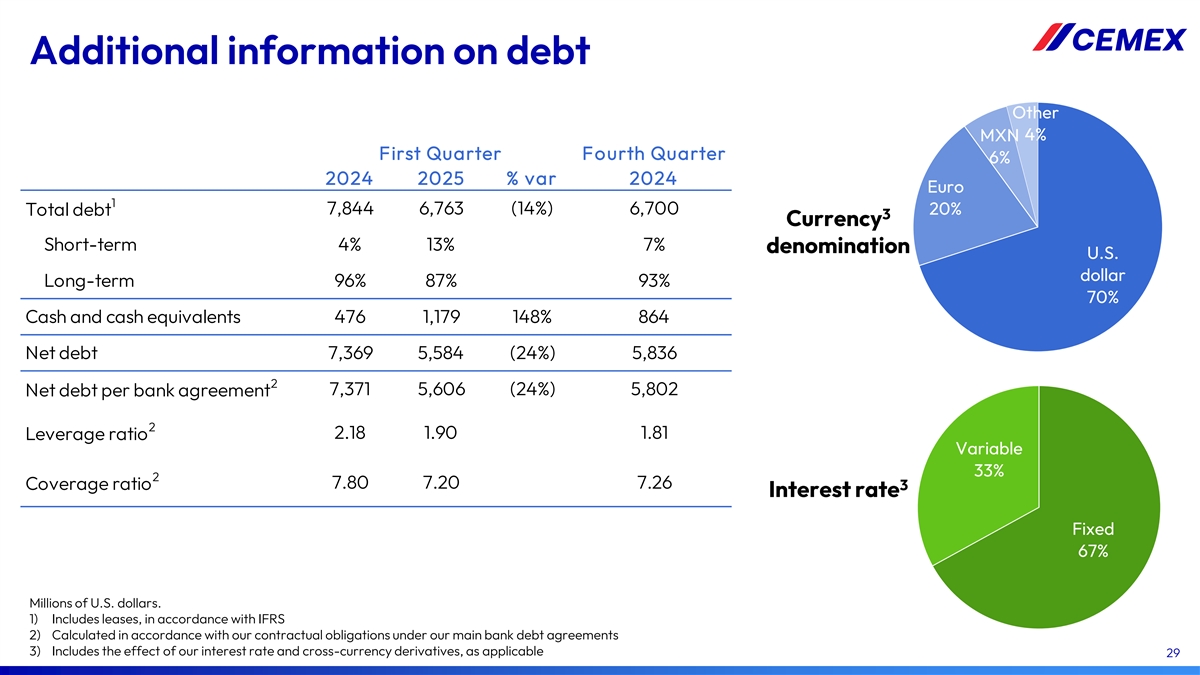

Information on debt

| First Quarter | Fourth Quarter |

First Quarter |

||||||||||||||||||||||||

| 2025 | 2024 | % var | 2024 | 2025 | 2024 | |||||||||||||||||||||

| Total debt (1) |

6,763 | 7,844 | (14 | %) | 6,700 | Currency denomination | ||||||||||||||||||||

| Short-term |

13 | % | 4 | % | 7 | % | U.S. dollar | 70 | % | 76 | % | |||||||||||||||

| Long-term |

87 | % | 96 | % | 93 | % | Euro | 20 | % | 14 | % | |||||||||||||||

| Cash and cash equivalents |

1,179 | 476 | 148 | % | 864 | Mexican peso | 6 | % | 5 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net debt |

5,584 | 7,369 | (24 | %) | 5,836 | Other | 4 | % | 5 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Consolidated net debt (2) |

5,606 | 7,371 | 5,802 | Interest rate (3) | ||||||||||||||||||||||

| Consolidated leverage ratio (2) |

1.90 | 2.18 | 1.81 | Fixed | 67 | % | 70 | % | ||||||||||||||||||

| Consolidated coverage ratio (2) |

7.20 | 7.80 | 7.26 | Variable | 33 | % | 30 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

In millions of U.S. dollars, except percentages and ratios.

| (1) | Includes leases, in accordance with International Financial Reporting Standards (IFRS). |

| (2) | Calculated in accordance with our contractual obligations under our main bank debt agreements |

| (3) | Includes the effect of our interest rate derivatives, as applicable. |

| 2025 First Quarter Results | Page 6 |

| Operating results |

|

Consolidated Statement of Operations & Statement of Financial Position

Cemex, S.A.B. de C.V. and Subsidiaries

(Thousands of U.S. dollars, except per ADS amounts)

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| like-to-like | like-to-like | |||||||||||||||||||||||||||||||

| STATEMENT OF OPERATIONS |

2025 | 2024 | % var | % var | 2025 | 2024 | % var | % var | ||||||||||||||||||||||||

| Sales |

3,649,177 | 3,942,493 | (7 | %) | (1 | %) | 3,649,177 | 3,942,493 | (7 | %) | (1 | %) | ||||||||||||||||||||

| Cost of sales |

(2,515,408 | ) | (2,615,302 | ) | 4 | % | (2,515,408 | ) | (2,615,302 | ) | 4 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Gross profit |

1,133,769 | 1,327,191 | (15 | %) | (6 | %) | 1,133,769 | 1,327,191 | (15 | %) | (6 | %) | ||||||||||||||||||||

| Operating expenses |

(841,594 | ) | (906,463 | ) | 7 | % | (841,594 | ) | (906,463 | ) | 7 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Operating earnings before other income and expenses, net |

292,175 | 420,729 | (31 | %) | (20 | %) | 292,175 | 420,729 | (31 | %) | (20 | %) | ||||||||||||||||||||

| Other expenses, net |

(45,573 | ) | (18,589 | ) | (145 | %) | (45,573 | ) | (18,589 | ) | (145 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Operating earnings |

246,603 | 402,140 | (39 | %) | 246,603 | 402,140 | (39 | %) | ||||||||||||||||||||||||

| Financial expense |

(114,699 | ) | (143,714 | ) | 20 | % | (114,699 | ) | (143,714 | ) | 20 | % | ||||||||||||||||||||

| Other financial income (expense), net |

37,196 | 6,236 | 496 | % | 37,196 | 6,236 | 496 | % | ||||||||||||||||||||||||

| Financial income |

8,328 | 9,591 | (13 | %) | 8,328 | 9,591 | (13 | %) | ||||||||||||||||||||||||

| Results from financial instruments, net |

(16,072 | ) | (4,278 | ) | (276 | %) | (16,072 | ) | (4,278 | ) | (276 | %) | ||||||||||||||||||||

| Foreign exchange results |

66,592 | 25,151 | 165 | % | 66,592 | 25,151 | 165 | % | ||||||||||||||||||||||||

| Effects of net present value on assets and liabilities and others, net |

(21,652 | ) | (24,227 | ) | 11 | % | (21,652 | ) | (24,227 | ) | 11 | % | ||||||||||||||||||||

| Equity in gain (loss) of associates |

5,417 | 8,599 | (37 | %) | 5,417 | 8,599 | (37 | %) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Income (loss) before income tax |

174,517 | 273,261 | (36 | %) | 174,517 | 273,261 | (36 | %) | ||||||||||||||||||||||||

| Income tax |

(51,308 | ) | (36,367 | ) | (41 | %) | (51,308 | ) | (36,367 | ) | (41 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Profit (loss) of continuing operations |

123,209 | 236,894 | (48 | %) | 123,209 | 236,894 | (48 | %) | ||||||||||||||||||||||||

| Discontinued operations |

618,488 | 21,593 | 2764 | % | 618,488 | 21,593 | 2764 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Consolidated net income (loss) |

741,698 | 258,486 | 187 | % | 741,698 | 258,486 | 187 | % | ||||||||||||||||||||||||

| Non-controlling interest net income (loss) |

7,739 | 4,091 | 89 | % | 7,739 | 4,091 | 89 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Controlling interest net income (loss) |

733,959 | 254,396 | 189 | % | 733,959 | 254,396 | 189 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Operating EBITDA |

601,241 | 730,837 | (18 | %) | (10 | %) | 601,241 | 730,837 | (18 | %) | (10 | %) | ||||||||||||||||||||

| Earnings (loss) of continued operations per ADS |

0.08 | 0.16 | (50 | %) | 0.08 | 0.16 | (50 | %) | ||||||||||||||||||||||||

| Earnings (loss) of discontinued operations per ADS |

0.42 | 0.01 | 2760 | % | 0.42 | 0.01 | 2760 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| As of March 31 | ||||||||||||

| STATEMENT OF FINANCIAL POSITION |

2025 | 2024 | % var | |||||||||

| Total assets |

27,974,866 | 28,602,557 | (2 | %) | ||||||||

| Cash and cash equivalents |

1,179,154 | 475,689 | 148 | % | ||||||||

| Trade receivables less allowance for doubtful accounts |

1,780,870 | 1,943,641 | (8 | %) | ||||||||

| Other accounts receivable |

717,218 | 766,660 | (6 | %) | ||||||||

| Inventories, net |

1,556,192 | 1,800,148 | (14 | %) | ||||||||

| Assets held for sale |

33,259 | 50,499 | (34 | %) | ||||||||

| Other current assets |

133,629 | 147,083 | (9 | %) | ||||||||

| Current assets |

5,400,323 | 5,183,719 | 4 | % | ||||||||

| Property, machinery and equipment, net |

11,420,036 | 12,458,810 | (8 | %) | ||||||||

| Other assets |

11,154,507 | 10,960,028 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

14,613,472 | 16,490,290 | (11 | %) | ||||||||

| Current liabilities |

6,235,905 | 6,669,742 | (7 | %) | ||||||||

| Long-term liabilities |

4,955,490 | 6,526,279 | (24 | %) | ||||||||

| Other liabilities |

3,422,077 | 3,294,269 | 4 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Total stockholder’s equity |

13,361,394 | 12,112,267 | 10 | % | ||||||||

| Common stock and additional paid-in capital |

7,699,108 | 7,699,108 | 0 | % | ||||||||

| Other equity reserves |

(2,469,656 | ) | (2,483,203 | ) | 1 | % | ||||||

| Subordinated notes |

1,985,040 | 1,985,040 | 0 | % | ||||||||

| Retained earnings |

5,850,711 | 4,562,340 | 28 | % | ||||||||

| Non-controlling interest |

296,190 | 348,982 | (15 | %) | ||||||||

|

|

|

|

|

|

|

|||||||

| 2025 First Quarter Results | Page 7 |

| Operating results |

|

Operating Summary per Country

In thousands of U.S. dollars

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| like-to-like | like-to-like | |||||||||||||||||||||||||||||||

| Sales |

2025 | 2024 | % var | % var | 2025 | 2024 | % var | % var | ||||||||||||||||||||||||

| Mexico |

981,282 | 1,314,212 | (25 | %) | (9 | %) | 981,282 | 1,314,212 | (25 | %) | (9 | %) | ||||||||||||||||||||

| U.S.A. |

1,190,296 | 1,233,975 | (4 | %) | (4 | %) | 1,190,296 | 1,233,975 | (4 | %) | (4 | %) | ||||||||||||||||||||

| Europe, Middle East and Africa |

1,069,542 | 1,045,116 | 2 | % | 5 | % | 1,069,542 | 1,045,116 | 2 | % | 5 | % | ||||||||||||||||||||

| Europe |

781,686 | 808,478 | (3 | %) | (2 | %) | 781,686 | 808,478 | (3 | %) | (2 | %) | ||||||||||||||||||||

| Middle East and Africa |

287,856 | 236,638 | 22 | % | 31 | % | 287,856 | 236,638 | 22 | % | 31 | % | ||||||||||||||||||||

| South, Central America and the Caribbean |

313,862 | 306,334 | 2 | % | 5 | % | 313,862 | 306,334 | 2 | % | 5 | % | ||||||||||||||||||||

| Others and intercompany eliminations |

94,196 | 42,856 | 120 | % | 121 | % | 94,196 | 42,856 | 120 | % | 121 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

3,649,177 | 3,942,493 | (7 | %) | (1 | %) | 3,649,177 | 3,942,493 | (7 | %) | (1 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| GROSS PROFIT |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

| Mexico |

483,267 | 662,188 | (27 | %) | (11 | %) | 482,330 | 662,188 | (27 | %) | (12 | %) | ||||||||||||||||||||

| U.S.A. |

300,856 | 341,728 | (12 | %) | (12 | %) | 300,856 | 341,728 | (12 | %) | (12 | %) | ||||||||||||||||||||

| Europe, Middle East and Africa |

238,481 | 198,001 | 20 | % | 26 | % | 238,481 | 198,001 | 20 | % | 26 | % | ||||||||||||||||||||

| Europe |

174,822 | 153,723 | 14 | % | 15 | % | 174,822 | 153,723 | 14 | % | 15 | % | ||||||||||||||||||||

| Middle East and Africa |

63,659 | 44,278 | 44 | % | 64 | % | 63,659 | 44,278 | 44 | % | 64 | % | ||||||||||||||||||||

| South, Central America and the Caribbean |

101,462 | 99,944 | 2 | % | 4 | % | 101,462 | 99,944 | 2 | % | 4 | % | ||||||||||||||||||||

| Others and intercompany eliminations |

9,703 | 25,330 | (62 | %) | (62 | %) | 10,640 | 25,330 | (58 | %) | (58 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

1,133,769 | 1,327,191 | (15 | %) | (6 | %) | 1,133,769 | 1,327,191 | (15 | %) | (6 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| OPERATING EARNINGS BEFORE OTHER EXPENSES, NET |

|

|

|

|

|

|

||||||||||||||||||||||||||

| Mexico |

259,125 | 363,097 | (29 | %) | (12 | %) | 259,125 | 363,097 | (29 | %) | (12 | %) | ||||||||||||||||||||

| U.S.A. |

63,059 | 109,813 | (43 | %) | (43 | %) | 63,059 | 109,813 | (43 | %) | (43 | %) | ||||||||||||||||||||

| Europe, Middle East and Africa |

41,843 | 10,042 | 317 | % | 378 | % | 41,843 | 10,042 | 317 | % | 378 | % | ||||||||||||||||||||

| Europe |

7,459 | (7,161 | ) | N/A | N/A | 7,459 | (7,161 | ) | N/A | N/A | ||||||||||||||||||||||

| Middle East and Africa |

34,383 | 17,203 | 100 | % | 141 | % | 34,383 | 17,203 | 100 | % | 141 | % | ||||||||||||||||||||

| South, Central America and the Caribbean |

42,205 | 43,979 | (4 | %) | (3 | %) | 42,205 | 43,979 | (4 | %) | (3 | %) | ||||||||||||||||||||

| Others and intercompany eliminations |

(114,056 | ) | (106,202 | ) | (7 | %) | (28 | %) | (114,056 | ) | (106,202 | ) | (7 | %) | (28 | %) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

292,175 | 420,729 | (31 | %) | (20 | %) | 292,175 | 420,729 | (31 | %) | (20 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 2025 First Quarter Results | Page 8 |

| Operating results |

|

Operating Summary per Country

Operating EBITDA in thousands of U.S. dollars. Operating EBITDA margin as a percentage of sales.

| January - March | First Quarter | |||||||||||||||||||||||||||||||

| like-to-like | like-to-like | |||||||||||||||||||||||||||||||

| OPERATING EBITDA |

2025 | 2024 | % var | % var | 2025 | 2024 | % var | % var | ||||||||||||||||||||||||

| Mexico |

308,234 | 419,721 | (27 | %) | (10 | %) | 308,234 | 419,721 | (27 | %) | (10 | %) | ||||||||||||||||||||

| U.S.A. |

189,745 | 237,037 | (20 | %) | (20 | %) | 189,745 | 237,037 | (20 | %) | (20 | %) | ||||||||||||||||||||

| Europe, Middle East and Africa |

116,866 | 83,246 | 40 | % | 49 | % | 116,866 | 83,246 | 40 | % | 49 | % | ||||||||||||||||||||

| Europe |

68,685 | 54,341 | 26 | % | 26 | % | 68,685 | 54,341 | 26 | % | 26 | % | ||||||||||||||||||||

| Middle East and Africa |

48,181 | 28,906 | 67 | % | 93 | % | 48,181 | 28,906 | 67 | % | 93 | % | ||||||||||||||||||||

| South, Central America and the Caribbean |

61,469 | 63,392 | (3 | %) | (2 | %) | 61,469 | 63,392 | (3 | %) | (2 | %) | ||||||||||||||||||||

| Others and intercompany eliminations |

(75,073 | ) | (72,559 | ) | (3 | %) | (34 | %) | (75,073 | ) | (72,559 | ) | (3 | %) | (34 | %) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL |

601,241 | 730,837 | (18 | %) | (10 | %) | 601,241 | 730,837 | (18 | %) | (10 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| OPERATING EBITDA MARGIN |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

| Mexico |

31.4 | % | 31.9 | % | 31.4 | % | 31.9 | % | ||||||||||||||||||||||||

| U.S.A. |

15.9 | % | 19.2 | % | 15.9 | % | 19.2 | % | ||||||||||||||||||||||||

| Europe, Middle East and Africa |

10.9 | % | 8.0 | % | 10.9 | % | 8.0 | % | ||||||||||||||||||||||||

| Europe |

8.8 | % | 6.7 | % | 8.8 | % | 6.7 | % | ||||||||||||||||||||||||

| Middle East and Africa |

16.7 | % | 12.2 | % | 16.7 | % | 12.2 | % | ||||||||||||||||||||||||

| South, Central America and the Caribbean |

19.6 | % | 20.7 | % | 19.6 | % | 20.7 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL |

16.5 | % | 18.5 | % | 16.5 | % | 18.5 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| 2025 First Quarter Results | Page 9 |

| Operating results |

|

Volume Summary

Cement and aggregates: Thousands of metric tons.

Ready-mix: Thousands of cubic meters.

| January - March | First Quarter | |||||||||||||||||||||||

| 2025 | 2024 | % var | 2025 | 2024 | % var | |||||||||||||||||||

| Consolidated cement volume (1) |

12,256 | 12,128 | 1 | % | 12,256 | 12,128 | 1 | % | ||||||||||||||||

| Consolidated ready-mix volume |

10,313 | 10,192 | 1 | % | 10,313 | 10,192 | 1 | % | ||||||||||||||||

| Consolidated aggregates volume (2) |

30,186 | 31,601 | (4 | %) | 30,186 | 31,601 | (4 | %) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Per-country volume summary

| January - March | First Quarter | First Quarter 2025 | ||||||||||

| DOMESTIC GRAY CEMENT VOLUME |

2025 vs. 2024 | 2025 vs. 2024 | vs. Fourth Quarter 2024 | |||||||||

| Mexico |

(9 | %) | (9 | %) | (9 | %) | ||||||

| U.S.A. |

(3 | %) | (3 | %) | (2 | %) | ||||||

| Europe, Middle East and Africa |

4 | % | 4 | % | (7 | %) | ||||||

| Europe |

1 | % | 1 | % | (12 | %) | ||||||

| Middle East and Africa |

10 | % | 10 | % | 3 | % | ||||||

| South, Central America and the Caribbean |

3 | % | 3 | % | 0 | % | ||||||

|

|

|

|

|

|

|

|||||||

| READY-MIX VOLUME |

|

|

|

|||||||||

| Mexico |

(6 | %) | (6 | %) | (11 | %) | ||||||

| U.S.A. |

(4 | %) | (4 | %) | (5 | %) | ||||||

| Europe, Middle East and Africa |

9 | % | 9 | % | (7 | %) | ||||||

| Europe |

(4 | %) | (4 | %) | (11 | %) | ||||||

| Middle East and Africa |

30 | % | 30 | % | (1 | %) | ||||||

| South, Central America and the Caribbean |

6 | % | 6 | % | (6 | %) | ||||||

|

|

|

|

|

|

|

|||||||

| AGGREGATES VOLUME |

|

|

|

|||||||||

| Mexico |

(14 | %) | (14 | %) | (13 | %) | ||||||

| U.S.A. |

(10 | %) | (10 | %) | (8 | %) | ||||||

| Europe, Middle East and Africa |

6 | % | 6 | % | (10 | %) | ||||||

| Europe |

2 | % | 2 | % | (13 | %) | ||||||

| Middle East and Africa |

19 | % | 19 | % | (1 | %) | ||||||

| South, Central America and the Caribbean |

4 | % | 4 | % | (6 | %) | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Consolidated cement volume includes domestic and export volume of gray cement, white cement, special cement, mortar, and clinker. |

| (2) | Consolidated aggregates volumes include aggregates from our marine business in the United Kingdom. |

| 2025 First Quarter Results | Page 10 |

| Operating results |

|

Price Summary

Variation in U.S. dollars

| January - March | First Quarter | First Quarter 2025 vs. | ||||||||||

| DOMESTIC GRAY CEMENT PRICE |

2025 vs. 2024 | 2025 vs. 2024 | Fourth Quarter 2024 | |||||||||

| Mexico |

(14 | %) | (14 | %) | 4 | % | ||||||

| U.S.A. |

(1 | %) | (1 | %) | (1 | %) | ||||||

| Europe, Middle East and Africa (*) |

(4 | %) | (4 | %) | 0 | % | ||||||

| Europe (*) |

(2 | %) | (2 | %) | 2 | % | ||||||

| Middle East and Africa (*) |

(1 | %) | (1 | %) | 10 | % | ||||||

| South, Central America and the Caribbean (*) |

1 | % | 1 | % | 7 | % | ||||||

|

|

|

|

|

|

|

|||||||

| READY-MIX PRICE |

|

|

|

|||||||||

| Mexico |

(14 | %) | (14 | %) | 2 | % | ||||||

| U.S.A. |

1 | % | 1 | % | 1 | % | ||||||

| Europe, Middle East and Africa (*) |

(1 | %) | (1 | %) | 2 | % | ||||||

| Europe (*) |

0 | % | 0 | % | 2 | % | ||||||

| Middle East and Africa (*) |

2 | % | 2 | % | 5 | % | ||||||

| South, Central America and the Caribbean (*) |

(0 | %) | (0 | %) | 10 | % | ||||||

|

|

|

|

|

|

|

|||||||

| AGGREGATES PRICE |

|

|

|

|||||||||

| Mexico |

(18 | %) | (18 | %) | 4 | % | ||||||

| U.S.A. |

6 | % | 6 | % | 3 | % | ||||||

| Europe, Middle East and Africa (*) |

(3 | %) | (3 | %) | 3 | % | ||||||

| Europe (*) |

(3 | %) | (3 | %) | 2 | % | ||||||

| Middle East and Africa (*) |

2 | % | 2 | % | 9 | % | ||||||

| South, Central America and the Caribbean (*) |

(3 | %) | (3 | %) | 11 | % | ||||||

|

|

|

|

|

|

|

|||||||

All price variations are based on FOB prices.

| (*) | Price variation in U.S. dollars calculated on a volume-weighted-average basis; price variation in local currency calculated on a volume-weighted-average basis at constant foreign-exchange rates. |

| 2025 First Quarter Results | Page 11 |

| Operating results |

|

Variation in Local Currency

| January - March | First Quarter | First Quarter 2025 vs. | ||||||||||

| DOMESTIC GRAY CEMENT PRICE |

2025 vs. 2024 | 2025 vs. 2024 | Fourth Quarter 2024 | |||||||||

| Mexico |

5 | % | 5 | % | 5 | % | ||||||

| U.S.A. |

(1 | %) | (1 | %) | (1 | %) | ||||||

| Europe, Middle East and Africa (*) |

3 | % | 3 | % | (0 | %) | ||||||

| Europe (*) |

(1 | %) | (1 | %) | 1 | % | ||||||

| Middle East and Africa (*) |

38 | % | 38 | % | 11 | % | ||||||

| South, Central America and the Caribbean (*) |

3 | % | 3 | % | 6 | % | ||||||

|

|

|

|

|

|

|

|||||||

| READY-MIX PRICE |

|

|

|

|||||||||

| Mexico |

5 | % | 5 | % | 3 | % | ||||||

| U.S.A. |

1 | % | 1 | % | 1 | % | ||||||

| Europe, Middle East and Africa (*) |

(0 | %) | (0 | %) | 2 | % | ||||||

| Europe (*) |

2 | % | 2 | % | 2 | % | ||||||

| Middle East and Africa (*) |

3 | % | 3 | % | 4 | % | ||||||

| South, Central America and the Caribbean (*) |

5 | % | 5 | % | 5 | % | ||||||

|

|

|

|

|

|

|

|||||||

| AGGREGATES PRICE |

|

|

|

|||||||||

| Mexico |

(1 | %) | (1 | %) | 5 | % | ||||||

| U.S.A. |

6 | % | 6 | % | 3 | % | ||||||

| Europe, Middle East and Africa (*) |

(2 | %) | (2 | %) | 3 | % | ||||||

| Europe (*) |

(2 | %) | (2 | %) | 2 | % | ||||||

| Middle East and Africa (*) |

2 | % | 2 | % | 8 | % | ||||||

| South, Central America and the Caribbean (*) |

0 | % | 0 | % | 8 | % | ||||||

|

|

|

|

|

|

|

|||||||

All price variations are based on FOB prices.

| (*) | Price variation in U.S. dollars calculated on a volume-weighted-average basis; price variation in local currency calculated on a volume-weighted-average basis at constant foreign-exchange rates. |

| 2025 First Quarter Results | Page 12 |

| Other Information |

|

Operating expenses

The following table shows the breakdown of operating expenses for the period presented.

| January-March | First Quarter | |||||||||||||||||||||||

| In thousands |

2025 | 2024 | % var | 2025 | 2024 | % var | ||||||||||||||||||

| General and administrative expenses |

296,460 | 300,186 | -1 | % | 296,460 | 300,186 | -1 | % | ||||||||||||||||

| Selling expenses |

88,230 | 92,195 | -4 | % | 88,230 | 92,195 | -4 | % | ||||||||||||||||

| Distribution and logistics expenses |

398,647 | 459,950 | -13 | % | 398,647 | 459,950 | -13 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating expenses before depreciation |

783,338 | 852,332 | -8 | % | 783,338 | 852,332 | -8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Depreciation in operating expenses |

58,256 | 54,131 | 8 | % | 58,256 | 54,131 | 8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating expenses |

841,594 | 906,463 | -7 | % | 841,594 | 906,463 | -7 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As % of Net Sales |

||||||||||||||||||||||||

| General and administrative expenses |

8.1 | % | 7.6 | % | 8.1 | % | 7.6 | % | ||||||||||||||||

| SG&A expenses |

10.5 | % | 10.0 | % | 10.5 | % | 10.0 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Equity-related information

As of December 31, 2024, based on our latest 20-F Annual Report, the number of outstanding CPO-equivalents was 14,507,429,244. See Cemex’s reports furnished to or filed with the U.S. Securities and Exchange Commission for information, if any, regarding repurchases of securities and other developments that may have caused a change in the number of CPO-equivalents outstanding after December 31, 2024. For the three-month period ended March 31, 2025, no CPOs were repurchased by Cemex.

One Cemex ADS represents ten Cemex CPOs. One Cemex CPO represents two Series A shares and one Series B share.

For purposes of this report, outstanding CPO-equivalents equal the total number of Series A and B shares outstanding as if they were all held in CPO form, less CPOs held by Cemex and its subsidiaries, which as of December 31, 2024, were 20,541,277. Starting 2024, employees receive restricted ADRs instead of restricted CPOs. Restricted ADRs allocated to eligible

employees as variable compensation are not included in the outstanding CPO-equivalents.

Derivative instruments

The following table shows the notional amount for each type of derivative instrument and the aggregate fair market value for all of Cemex’s derivative instruments as of the last day of each quarter presented.

| First Quarter | Fourth Quarter | |||||||||||||||||||||||

| 2025 | 2024 | 2024 | ||||||||||||||||||||||

| In millions of US dollars |

Notional amount |

Fair value |

Notional amount |

Fair value |

Notional amount |

Fair value |

||||||||||||||||||

| Exchange rate derivatives (1) |

1,384 | 61 | 1,422 | (88 | ) | 1,363 | 104 | |||||||||||||||||

| Interest rate swaps (2) |

1,520 | (79 | ) | 1,408 | 80 | 1,258 | (86 | ) | ||||||||||||||||

| Fuel derivatives (3) |

312 | 6 | 308 | 19 | 356 | 6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 3,216 | (12 | ) | 3,138 | 11 | 2,977 | 24 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 1) | The exchange rate derivatives are used to manage currency exposures arising from regular operations, net investment hedge and forecasted transactions. As of March 31, 2025, the derivatives related to net investment hedge represent a notional amount of US$779 million. |

| 2) | Interest-rate swap derivatives related to bank loans, include an interest rate and exchange rate swap derivatives with a notional amount of US$920 million. |

| 3) | Cemex’s derivative financial instruments portfolio includes swaps and financial options. These derivative instruments are mainly used to hedge the market price risk of certain fuels associated with certain Cemex operations, such as transportation and production. In addition, there are call spreads on Brent oil and derivatives thereof, designed to mitigate the exposure related to the cost of fuel implicit in distribution expenses. |

Under IFRS, companies are required to recognize the fair value of all derivative financial instruments on the balance sheet as financial assets or liabilities, with changes in such fair market values recorded in the income statement, except when transactions are entered into for cash-flow-hedging purposes, in such cases, changes in the fair market value of the related derivative instruments are recognized temporarily in equity and subsequently reclassified into earnings as the effects of the underlying are recognized in the income statement. Moreover, in transactions related to net investment hedges, changes in fair market value are recorded directly in equity as part of the currency translation effect and are reclassified to the income statement only in the case of a disposal of the net investment. As of March 31, 2025, in connection with the derivatives portfolio’s fair market value recognition, Cemex recognized changes in mark to market resulting in a financial liability of US$12 million.

| 2025 First Quarter Results | Page 13 |

| Other Information |

|

Discontinued operations

On January 30, 2025, Cemex completed the sale to Cementos Progreso Holdings, S.L. and its strategic partners of its operations in the Dominican Republic for a total consideration of US$928 million after adjustments for final balances of cash, debt and working capital. The divested assets consist of one cement plant in the Dominican Republic with two integrated production lines and related cement, concrete, aggregates and marine terminal assets. For the period from January 1 to January 30, 2025 and the three-month period ended March 31, 2024, Cemex’s operations in the Dominican Republic are reported in Cemex’s income statements, net of income tax, in the single line item “Discontinued operations,” including a sale on gain of US$593 million, net of the reclassification of foreign currency translation effects accrued in equity until the date of sale and goodwill write off of US$13 million.

On December 2, 2024, considering separate agreements with each counterparty and the satisfaction of closing conditions, including the approval by the Philippine Competition Commission and the fulfillment of other requirements by the purchasers to the shareholders of Cemex Holdings Philippines (“CHP”), including the non-controlling interest owned by third parties in CHP, Cemex concluded the sale of its operations and assets in the Philippines to DACON Corporation, DMCI Holdings, Inc. and Semirara Mining & Power Corporation, for a total consideration related to Cemex’s controlling interest of US$798 million including the sale of minority investments and debt assumed by the purchaser. The assets sold consisted of 2 cement plants, 18 land distribution centers and 6 marine distribution terminals. For the three-month period ended March 31, 2024, Cemex’s operations in the Philippines are reported in Cemex’s income statements, net of income tax, in the single line item “Discontinued operations.”

On September 10, 2024, Cemex sold its operations in Guatemala to Holcim Group, for a total consideration of US$212 million. The divested assets mainly consist of one grinding mill with an installed capacity of around 0.6 million metric tons per year, three ready-mix plants and five distribution centers. For the three-month period ended March 31, 2024, Cemex’s operations in Guatemala are reported in the income statements, net of income tax, in the single line item “Discontinued operations.”

Based on the disclosures above, the following table presents condensed combined information of the income statements for the three-months ended March 31, 2025 and 2024, for Cemex’s discontinued operations related to the Dominican Republic, the Philippines and Guatemala:

| INCOME STATEMENTS | Jan-Mar | First Quarter | ||||||||||||||

| (Millions of U.S. dollars) |

2025 | 2024 | 2025 | 2024 | ||||||||||||

| Sales |

26 | 195 | 26 | 195 | ||||||||||||

| Cost of sales, operating expenses, other expenses, and gain on sale, net |

595 | -168 | 595 | -168 | ||||||||||||

| Interest expense, net, and others |

0 | 3 | 0 | 3 | ||||||||||||

| Income (loss) before income tax |

621 | 30 | 621 | 30 | ||||||||||||

| Income tax |

-3 | -8 | -3 | -8 | ||||||||||||

| Net result from discontinued operations |

618 | 22 | 618 | 22 | ||||||||||||

| 2025 First Quarter Results | Page 14 |

| Operating results |

|

Methodology for translation, consolidation, and presentation of results

Under IFRS, Cemex translates the financial statements of foreign subsidiaries using exchange rates at the reporting date for the balance sheet and the exchange rates at the end of each month for the income statement.

Breakdown of regions and subregions

The South, Central America and the Caribbean region includes Cemex’s operations in Colombia, Panama, Puerto Rico, Nicaragua, Jamaica, Trinidad and Tobago, Jamaica, Guyana, Barbados, Peru and Bahamas.

The EMEA region includes Europe, Middle East and Africa.

Europe subregion includes operations in Spain, Croatia, the Czech Republic, France, Germany, Poland, and the United Kingdom.

Middle East and Africa subregion includes operations in United Arab Emirates, Egypt, and Israel.

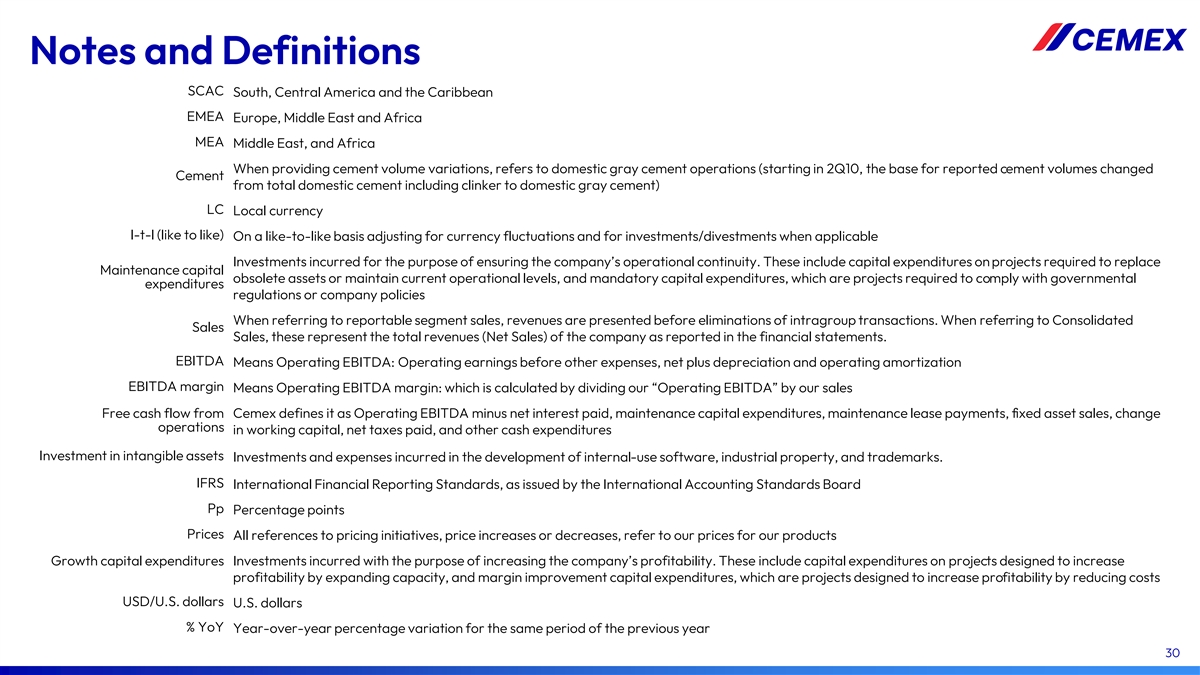

Definition of terms

Free cash flow from operations Cemex defines it as Operating EBITDA minus net interest paid, maintenance capital expenditures, maintenance lease payments, fixed asset sales, change in working capital, net taxes paid, and other cash expenditures.

l-t-l (like to like) on a like-to-like basis adjusting for currency fluctuations and for investments/divestments when applicable.

Maintenance capital expenditures equal investments incurred for the purpose of ensuring the company’s operational continuity. These include capital expenditures on projects required to replace obsolete assets or maintain current operational levels, and mandatory capital expenditures, which are projects required to comply with governmental regulations or company policies.

Net debt equals total debt (debt plus financial leases) minus cash and cash equivalents.

Sales, when referring to reportable segment sales, revenues are presented before eliminations of intragroup transactions. When referring to Consolidated Sales, these represent the total revenues (Net Sales) of the company as reported in the financial statements.

Operating EBITDA, or EBITDA equals operating earnings before other income and expenses, net, plus depreciation and amortization.

Operating EBITDA margin, or EBITDA margin, is calculated by dividing our “Operating EBITDA” by our sales.

pp equals percentage points.

Prices all reference to pricing initiatives, price increases or decreases, refer to our prices for our products and services.

SG&A expenses equal selling and administrative expenses

Growth capital expenditures equal investments incurred with the purpose of increasing the company’s profitability. These include capital expenditures on projects designed to increase profitability by expanding capacity, and margin improvement capital expenditures, which are projects designed to increase profitability by reducing costs.

Investment in intangible assets equals investments and expenses incurred in the development of internal-use software, industrial property, and trademarks.

Working capital equals operating accounts receivable (including other current assets received as payment in kind) plus historical inventories minus operating payables.

% var percentage variation

Earnings per ADS

Please refer to page 2 for the number of average ADSs outstanding used for the calculation of earnings per ADS.

According to the IAS 33 Earnings per share, the weighted-average number of common shares outstanding is determined considering the number of days during the accounting period in which the shares have been outstanding, including shares derived from corporate events that have modified the stockholder’s equity structure during the period, such as increases in the number of shares by a public offering and the distribution of shares from stock dividends or recapitalizations of retained earnings and the potential diluted shares (Stock options, Restricted Stock Options and Mandatory Convertible Shares). The shares issued because of share dividends, recapitalizations and potential diluted shares are considered as issued at the beginning of the period.

| Exchange rates | January - March | First Quarter | First Quarter | |||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Average | Average | Average | Average | End of period | End of period | |||||||||||||||||||

| Mexican peso |

20.58 | 16.95 | 20.58 | 16.95 | 20.48 | 16.57 | ||||||||||||||||||

| Euro |

0.9495 | 0.9237 | 0.9495 | 0.9237 | 0.9245 | 0.9264 | ||||||||||||||||||

| British pound |

0.7910 | 0.7898 | 0.7910 | 0.7898 | 0.7740 | 0.7921 | ||||||||||||||||||

Amounts provided in units of local currency per U.S. dollar.

| 2025 First Quarter Results | Page 15 |

| Disclaimer |

|