☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Ordinary Participation Certificates ( Certificados de Participación Ordinarios ), or CPOs, each CPO representing two Series A shares and one Series B share, traded in the form of American Depositary Shares, or ADSs, each ADS representing ten CPOs. |

CX | New York Stock Exchange |

| Large accelerated filer | ☑ |

Accelerated filer | ☐ |

Non-accelerated filer |

☐ |

|||||

| Emerging growth company | ☐ |

|||||||||

U.S. GAAP ☐

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☑

|

Other ☐

|

|

|

||||

TABLE OF CONTENTS

| PART I | 11 | |||

| Item 1—Identity of Directors, Senior Management and Advisors |

11 | |||

| 11 | ||||

| 11 | ||||

| 56 | ||||

| 165 | ||||

| 167 | ||||

| 272 | ||||

| 314 | ||||

| 317 | ||||

| 318 | ||||

| 320 | ||||

| Item 11—Quantitative and Qualitative Disclosures About Market Risk |

334 | |||

| Item 12—Description of Securities Other Than Equity Securities |

334 | |||

| PART II | 336 | |||

| 336 | ||||

| Item 14—Material Modifications to the Rights of Security Holders and Use of Proceeds |

336 | |||

| 336 | ||||

| 337 | ||||

| 337 | ||||

| 337 | ||||

| 339 | ||||

| Item 16D—Exemptions from the Listing Standards for Audit Committees |

340 | |||

| Item 16E—Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

340 | |||

| 340 | ||||

| 340 | ||||

| 346 | ||||

| Item 16I—Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

346 | |||

| 346 | ||||

| 346 | ||||

| Part III | III-1 | |||

| III-1 | ||||

| III-1 | ||||

| III-1 | ||||

| INTRODUCTION |

||||

INTRODUCTION

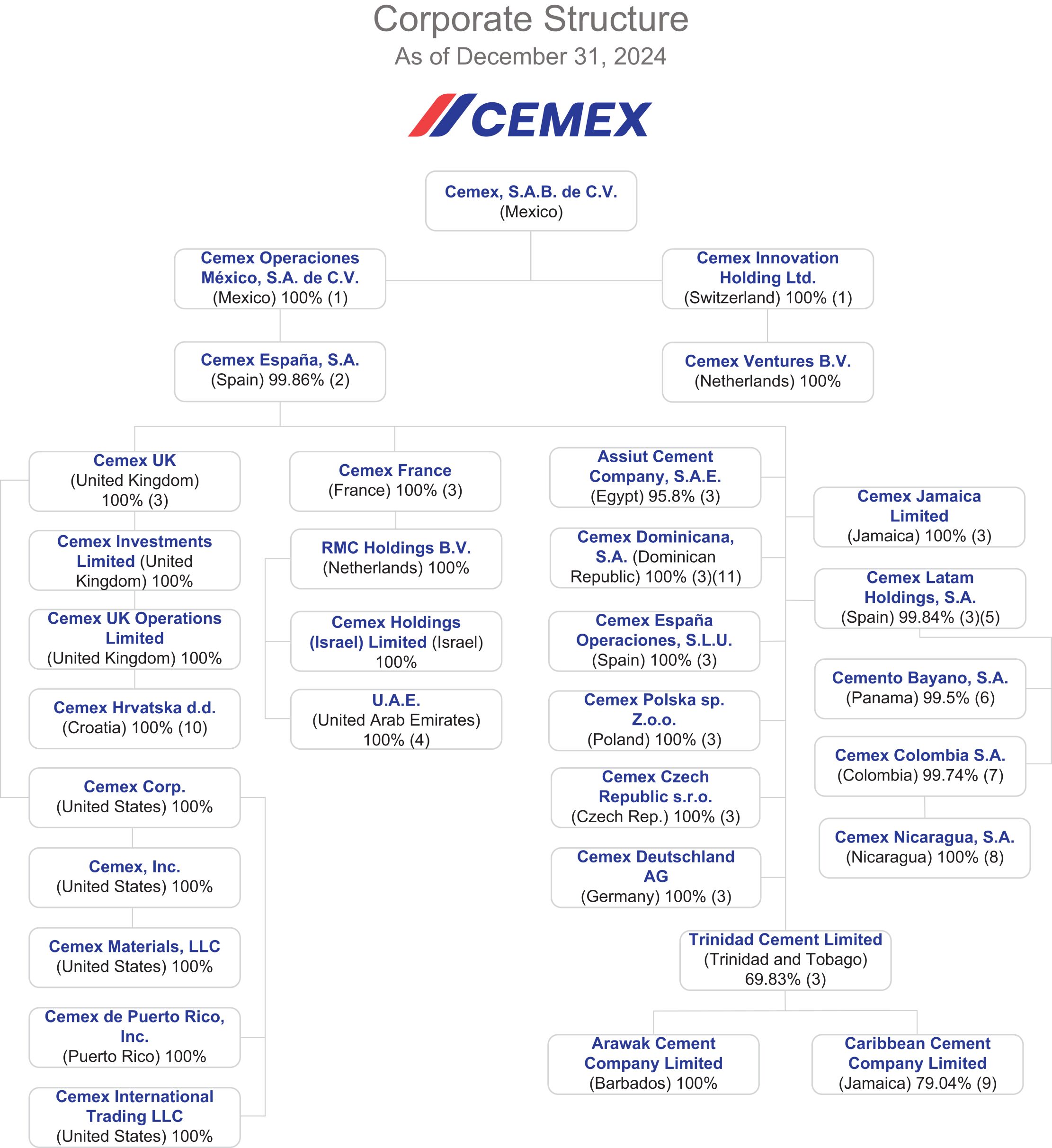

Cemex, S.A.B. de C.V. is incorporated as a publicly traded variable stock corporation (sociedad anónima bursátil de capital variable) organized under the laws of the United Mexican States (“Mexico”). Except as the context otherwise may require, references in this annual report to “Cemex,” the “Company,” “we,” “us” or “our” refer to Cemex, S.A.B. de C.V. and its consolidated entities. See note 1 to our 2024 audited consolidated financial statements included elsewhere in this annual report.

Presentation of Financial Information

The audited consolidated financial statements of Cemex, S.A.B. de C.V. included elsewhere in this annual report have been prepared in accordance with IFRS Accounting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

The regulations of the U.S. Securities and Exchange Commission (the “SEC”) do not require foreign private issuers that prepare their financial statements based on IFRS (as issued by the IASB) to reconcile such financial statements to United States Generally Accepted Accounting Principles (“U.S. GAAP”).

Unless otherwise indicated, references in this annual report to “$” and “Dollars” are to United States Dollars, references to “€” are to Euros, references to “£,” “Pounds Sterling” and “Pounds” are to British Pounds, and references to “Ps,” “Mexican Pesos” and “Pesos” are to Mexican Pesos. References to “billion” mean one thousand million. References in this annual report to “CPOs” are to Cemex, S.A.B. de C.V.’s Ordinary Participation Certificates (Certificados de Participación Ordinarios), each CPO represents two Series A shares (as defined below) and one Series B share (as defined below) of Cemex, S.A.B. de C.V. References to “ADSs” are to American Depositary Shares of Cemex, S.A.B. de C.V., each ADS represents 10 CPOs.

Unless otherwise indicated, all information in this annual report excludes (i) our operations in Guatemala and the Philippines, which we disposed of in September 2024 and December 2024, respectively, and (ii) our operations in the Dominican Republic, which we entered into a definitive agreement to dispose of in August 2024. For the years ended December 31, 2023 and 2022 and for the period from January 1 to September 10, 2024, our operations in Guatemala are reported in the statements of income, net of income tax, in the single line item “Discontinued operations.” For the years ended December 31, 2023 and 2022 and for the period from January 1 to December 2, 2024, our operations in the Philippines are reported in the statements of income, net of income tax, in the single line item “Discontinued operations.” As of December 31, 2024, the assets and liabilities related to our operations in the Dominican Republic are presented in the line items “Assets held for sale” and “Liabilities related to assets held for sale,” respectively. For the years ended December 31, 2022, 2023 and 2024, our operations in the Dominican Republic are reported in the statements of income, net of income tax, in the single line item “Discontinued operations.” For the period from January 1 to October 25, 2022 our Neoris’ operations are reported in the statements of income, net of income tax, in the single line item “Discontinued operations.” For the period from January 1 to August 31, 2022, our operations in Costa Rica and El Salvador are reported in the statements of income, net of income tax, in the single line item “Discontinued operations.” See “Item 5—Operating and Financial Review and Prospects—Results of Operations—Significant Transactions” and “Item 5—Operating and Financial Review and Prospects—Results of Operations—Discontinued Operations” for more information. Also see note 28 to Cemex, S.A.B. de C.V.’s 2024 audited consolidated financial statements included elsewhere in this annual report and “Item 5—Operating and Financial Review and Prospects—Recent Developments—Recent Developments Relating to Our Business and Operations—Divestment of our Operations in the Dominican Republic” for information related to the closing divestiture of our Dominican Republic operations.

CEMEX • 2024 20-F REPORT • 1

| INTRODUCTION |

||||

See notes 17.1, 17.2 and 29.4 to Cemex, S.A.B. de C.V.’s 2024 audited consolidated financial statements included elsewhere in this annual report for a detailed description of our debt and other financial obligations. Total debt plus other financial obligations differs from the calculation of debt under our main credit agreements, dated as of October 29, 2021 (as last amended on October 30, 2023 and as further amended and/or restated from time to time, the “Amended 2021 Credit Agreement”); dated as of December 20, 2021 (as last amended on December 6, 2023 and as further amended and/or restated from time to time, the “Mexican Peso Banorte Agreement”); and dated as of October 7, 2022 (as last amended on April 11, 2024 and as further amended and/or restated from time to time, the “2022 EUR Credit Agreement,” and collectively with the Amended 2021 Credit Agreement and the Mexican Peso Banorte Agreement, the “Credit Agreements”). See “Item 5—Operating and Financial Review and Prospects—Liquidity and Capital Resources—Our Indebtedness” for more information. In Cemex, S.A.B. de C.V.’s 2024 audited consolidated financial statements included elsewhere in this annual report, we refer to the Amended 2021 Credit Agreement as the 2023 Credit Agreement.

On June 5, 2023, we fully redeemed the 7.375% Dollar-denominated notes due 2027 (the “June 2027 Dollar Notes”). During the year ended December 31, 2023, the difference between the amount paid for such notes and the notional amount redeemed, net of transactional cost, generated a repurchase loss of $38 million, recognized in the statement of income. During the year ended December 31, 2022, pursuant to tender offers and other market transactions, we partially repurchased different series of our notes for an aggregate notional amount of $1,172 million. The difference between the amount paid for such notes and the notional amount redeemed, net of transactional costs, generated a repurchase gain of $104 million, recognized in the statement of income for the year ended December 31, 2022.

Under IAS 32, Financial Instruments: Presentation (“IAS 32”), we concluded that our outstanding Subordinated Notes (as defined below) do not meet the definition of financial liability, and consequently are classified in controlling interest stockholders’ equity within Other equity reserves. See note 21.2 to Cemex, S.A.B. de C.V.’s 2024 audited consolidated financial statements included elsewhere in this annual report for a detailed description of the Subordinated Notes.

We also refer in various places within this annual report to non-IFRS measures, including “Operating EBITDA.” “Operating EBITDA” equals operating earnings before other expenses, net, plus depreciation and amortization expenses, as more fully explained in “Item 5—Operating and Financial Review and Prospects—Results of Operations—Selected Consolidated Financial Information.” Additionally, we refer to “Operating EBITDA Margin,” which is calculated by dividing our “Operating EBITDA” by our revenues. The presentation of these non-IFRS measures is not meant to be considered in isolation or as a substitute for Cemex, S.A.B. de C.V.’s 2024 audited consolidated financial results prepared in accordance with IFRS as issued by the IASB.

We have approximated certain numbers in this annual report to their closest round numbers or a given number of decimal places. Due to rounding, figures shown as totals in tables may not be arithmetic aggregations of the figures preceding them.

CEMEX • 2024 20-F REPORT • 2

| INTRODUCTION |

||||

Certain Technical Terms

When used in this annual report, the terms set forth below mean the following:

| • | Additives refer to any material (primarily inorganic) that is added to either cement/binders or concrete to achieve a specific target (e.g., alter flow properties, substitute clinker/cement, etc.). In the United States, these materials are often referred to as “inorganic processing additions,” while in Europe, these materials are commonly known as “other constituents.” |

| • | Admixtures refer to any chemical product (primarily organic molecules) that is added or applied to (our core business products) cement/binders, concrete, or aggregates to achieve a targeted performance. |

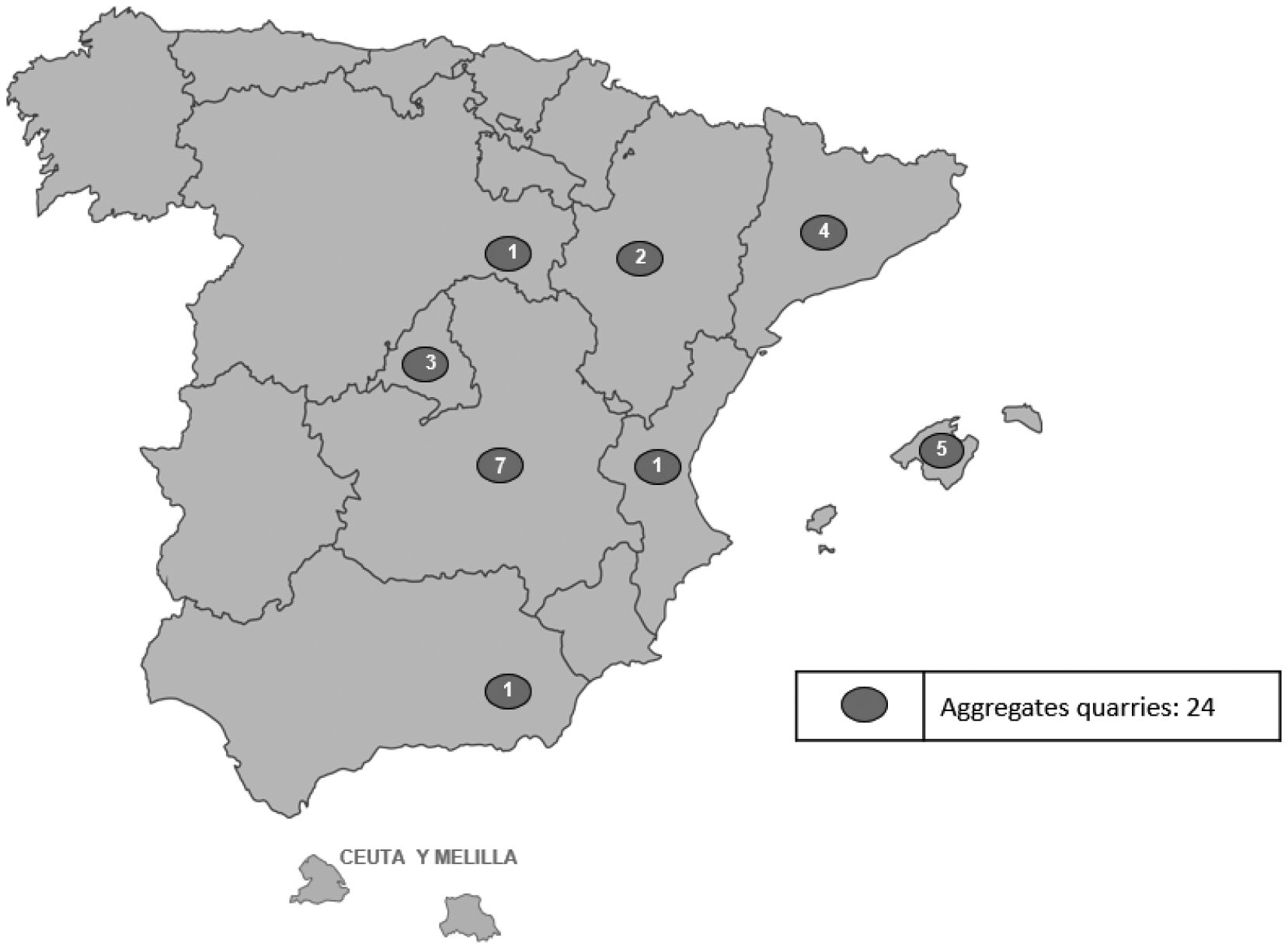

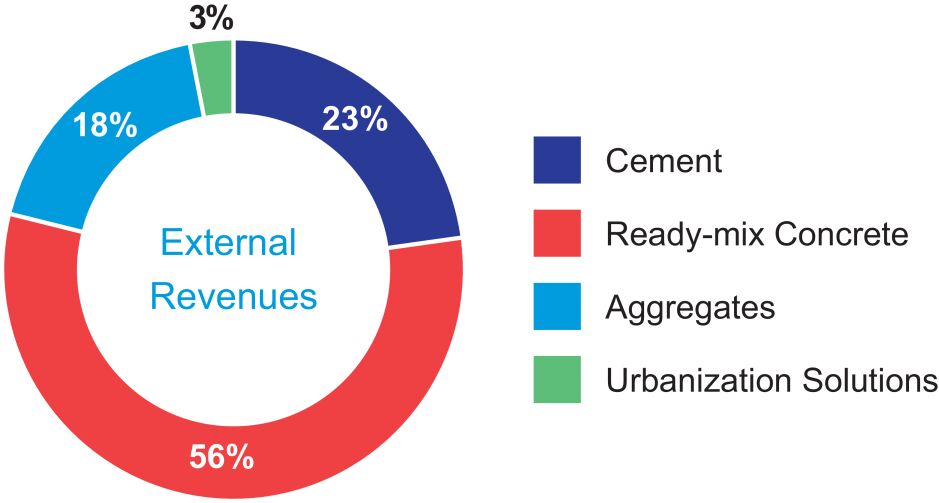

| • | Aggregates are inert granular materials, such as stone, sand, and gravel, which are obtained from land-based sources (mainly mined from quarries) or by dredging marine deposits. While they can influence concrete’s strength, aggregates play a key role in optimizing the mix by occupying volume and reducing the amount of cement needed, allowing the concrete to achieve the required strength more efficiently and cost-effectively. |

| • | Cement is a glue, acting as a hydraulic binder, meaning it hardens when water is added. Cement’s central use is to bind together the ingredients of concrete – sand and aggregates. Cement itself is a fine powder that is made by first crushing and then heating limestone or chalk, with a few other natural materials, including clay or shale, added. The ground base materials are heated in a rotating kiln to a temperature of up to 1,450 degree Celsius, or as hot as volcanic lava. |

| • | Concrete is a mixture of cement, water and aggregates (e.g., sand and gravel, crushed stone or recycled concrete) and often includes small amounts of admixtures. The exact ratios and mix, and type of aggregate use depends on the intended use. Concrete is an extremely strong, durable and resilient material that can be used in a variety of ways (i.e., shelter, housing, providing clean water and sanitation, transport, business and commerce). |

| • | Cement mill (also called “finish mill” in the United States) is a piece of equipment used to reduce the size of the materials needed for cement production, usually to microns size (1 micron is equal to 0.001 millimeters). Traditionally, cement mills have adopted the form of ball mills. Vertical roller mills, which are more effective in terms of energy consumption compared to ball mills, are being gradually introduced to our operations in the United States, Mexico, Europe, the Middle East, and other regions in which we operate. |

| • | Clinker is the main raw material used to produce portland cement, consisting of at least two-thirds by mass of calcium silicates. It is formed through a high-temperature solid-state reaction known as “clinkering,” in which a mix typically composed of limestone, clay, and iron oxide is heated in a rotary kiln at around 1,450 degrees Celsius. One ton of clinker is used to produce approximately 1.32 tons of gray portland cement. |

| • | CO2, or carbon dioxide, is a chemical compound with the chemical formula CO2. It is a greenhouse gas, which means it contributes to the warming of the Earth’s atmosphere by trapping heat that would otherwise escape into space. |

| • | CO2 emissions refer to the release of CO2 into the atmosphere as a result of our direct and indirect activities. These activities, which are responsible for most of our CO2 that is released, include the burning of fossil fuels (such as coal, gas, diesel or alternative fuels), and emissions derived from the decarbonization of limestone (process emissions). |

| • | Fly ash is a combustion residue from coal-fired power plants with cementitious capabilities when mixed with Clinker and can be used as a supplementary cementitious material. |

| • | Gray Ordinary Portland Cement or Gray Cement, is a hydraulic binding agent with a traditional composition by weight of approximately 90% to 95% clinker and up to 5% of a minor component (usually calcium sulfate and |

CEMEX • 2024 20-F REPORT • 3

| INTRODUCTION |

||||

| limestone). Blended portland cement has lower clinker factor, usually below 90%, which results in lower CO2 emissions. Both traditional and blended portland cement, when mixed with sand, stone or other aggregates and water, produce concrete. |

| • | Ground Granulated Blast Furnace Slag is a by-product generated in blast furnaces used for smelting to produce pig-iron. When mixed with clinker, it exhibits cementitious properties and can be used as a supplementary cementitious material. |

| • | Petroleum coke or pet coke is a by-product of the oil refining coking process that can be incorporated into the cement production process as fuel, in substitution of other primary fuels such as natural gas or coal. |

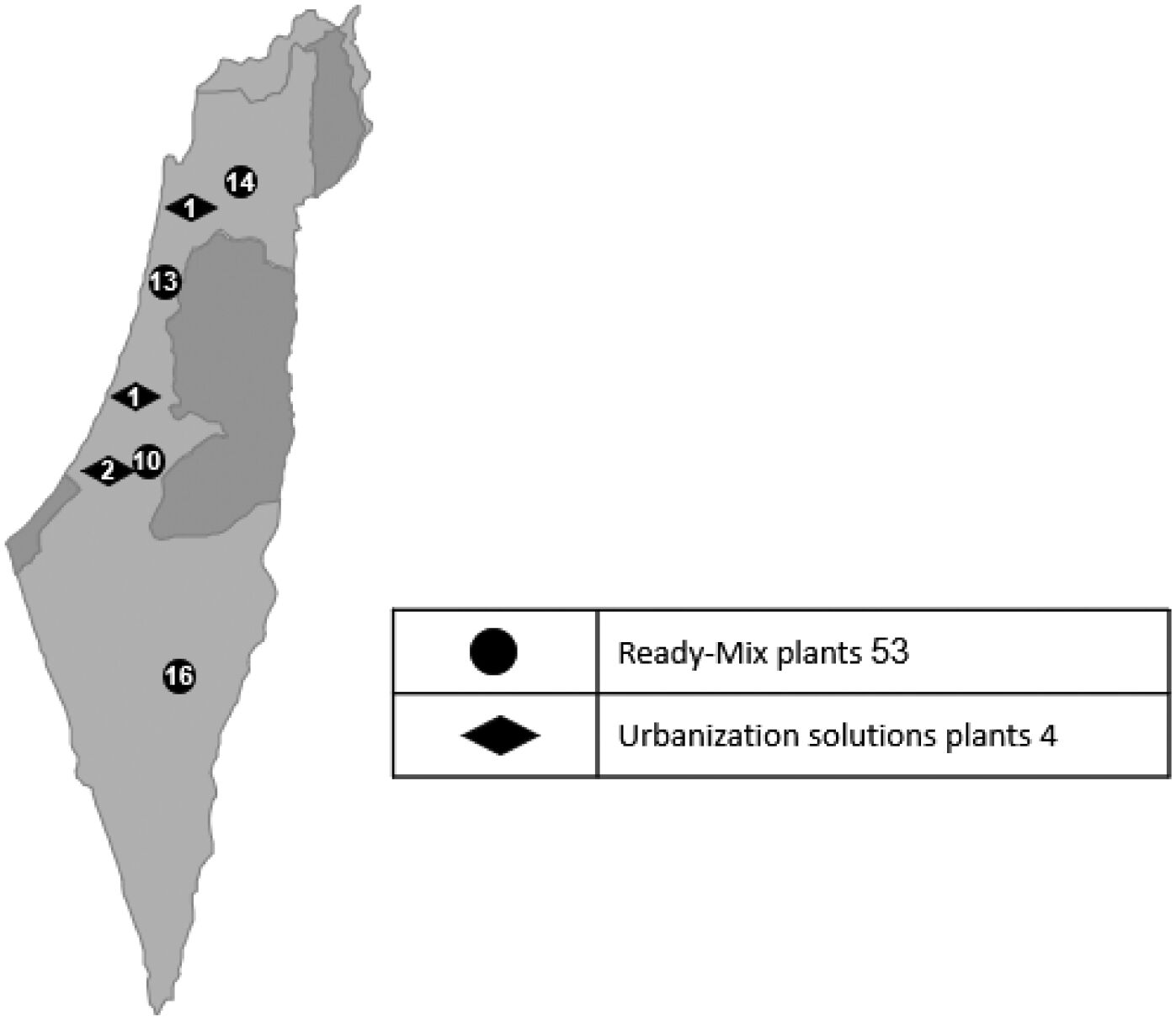

| • | Ready-mix concrete is a mixture of cement, aggregates, admixtures and water that is produced through a central batching process and transferred to a ready-mix truck for delivery or is mixed directly in the ready-mix truck and produced through a dry batching process. |

| • | Tons means metric tons. One metric ton equals 1.102 short tons. |

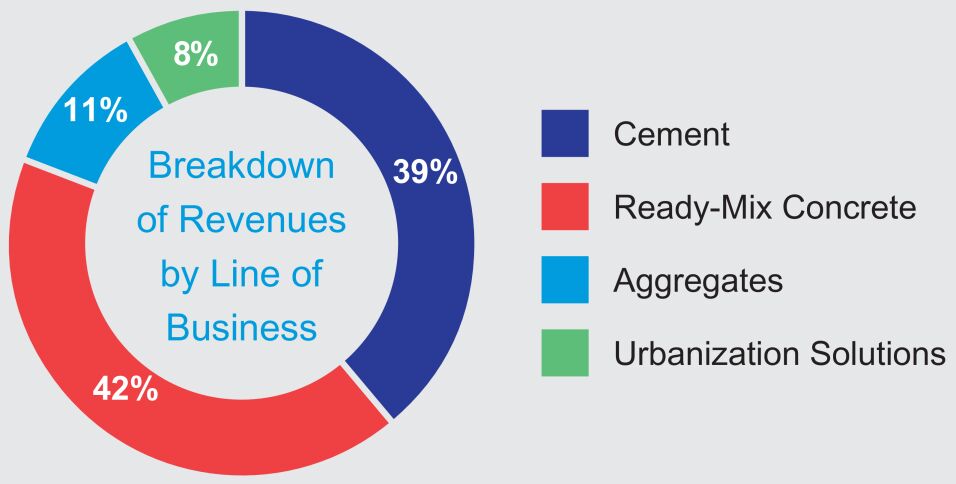

| • | Urbanization Solutions is one of our four core businesses. It is a business that complements our value offering of products and solutions, looking to connect with the broader metropolis ecosystem, address urbanization challenges, and provide means to all stakeholders in the construction value chain to enable sustainable urbanization by focusing on four market segments: performance materials, circularity, industrialized construction, and related services. |

| • | White cement is a special portland cement used primarily for decorative purposes with the same or higher performance of gray portland cement. The white color of the cement is typically, but not always, achieved by reducing the iron-bearing phases in clinker to a minimum. |

CEMEX • 2024 20-F REPORT • 4

| INTRODUCTION |

||||

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains, and the reports we will file or furnish in the future may contain, forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We intend these forward-looking statements to be covered by the “safe harbor” provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, these statements can be identified by the use of forward-looking words such as, but not limited to, “will,” “may,” “assume,” “might,” “should,” “could,” “continue,” “would,” “can,” “consider,” “anticipate,” “estimate,” “expect,” “envision,” “plan,” “believe,” “foresee,” “predict,” “potential,” “target,” “goal,” “strategy,” “intend,” “aimed,” or other forward-looking words. These forward-looking statements reflect, as of the date such forward-looking statements are made, unless otherwise indicated, our expectations and projections about future events based on our knowledge of present facts and circumstances, and assumptions about future events. These forward-looking statements and information are necessarily subject to risks, uncertainties, and assumptions, including but not limited to statements related to our plans, objectives, goals, targets and expectations (operative, financial or otherwise). Although we believe that our expectations are reasonable, we can give no assurance that these expectations will prove to be correct, and actual results may vary, including materially, from historical results or results anticipated by forward-looking statements due to various factors. Some of the risks, uncertainties, assumptions, and other important factors that could cause results to differ, or that otherwise could have an impact on us or our consolidated entities, include, but are not limited to:

| • | changes in general economic, political and social conditions, including new governments and decisions implemented by such new governments, changes in laws or regulations in the countries in which we do business, elections, changes in inflation, interest and foreign exchange rates, employment levels, population growth, any slowdown in the flow of remittances into countries where we operate, consumer confidence, and the liquidity of the financial and capital markets in Mexico, the United States, the European Union (the “EU”), the United Kingdom or other countries in which we operate; |

| • | the cyclical activity of the construction sector and reduced construction activity in our end markets or reduced use in our end markets for our products; |

| • | our exposure to sectors that impact our and our clients’ businesses, particularly those operating in the commercial and residential construction sectors, and the public and private infrastructure and energy sectors; |

| • | volatility in pension plan asset values and liabilities, which may require cash or other contributions to the pension plans; |

| • | changes in spending levels for residential and commercial construction and general infrastructure projects; |

| • | the availability of short-term credit lines or working capital facilities, which can assist us in connection with market cycles; |

| • | any impact of not maintaining investment grade debt rating or not obtaining investment grade debt ratings from additional rating agencies on our cost of capital and on the cost of the products and services we purchase; |

| • | availability of raw materials and related fluctuating prices of raw materials, as well as of goods and services in general, in particular increases in prices of raw materials, good and services, as a result of inflation, trade barriers, measures imposed by governments or as a result of conflicts between countries that disrupt supply chains; |

| • | our ability to maintain and expand our distribution network and maintain favorable relationships with third parties who supply us with equipment, services and essential suppliers; |

| • | competition in the markets in which we offer our products and services; |

CEMEX • 2024 20-F REPORT • 5

| INTRODUCTION |

||||

| • | the impact of environmental cleanup costs and other remedial actions, and other environmental, climate and related liabilities relating to existing and/or divested businesses, assets and/or operations; |

| • | our ability to secure and permit aggregates reserves in strategically located areas in amounts that our operations require to operate or operate in a cost-efficient manner; |

| • | the timing and amount of federal, state, and local funding for infrastructure; |

| • | changes in our effective tax rate; |

| • | our ability to comply with regulations and implement technologies and other initiatives that aim to reduce and/or capture CO2 emissions and comply with related carbon emissions regulations in place in the jurisdictions where we have operations; |

| • | the legal and regulatory environment, including environmental, climate, trade, energy, tax, antitrust, sanctions, export controls, construction, human rights, and labor welfare, and acquisition-related rules and regulations in the countries and regions in which we operate; |

| • | the effects of currency fluctuations on our results of operations and financial condition; |

| • | our ability to satisfy our obligations under our debt agreements, the indentures that govern our outstanding Notes (as defined herein) and our other debt instruments and financial obligations, and also regarding our subordinated notes with no fixed maturity and other financial obligations; |

| • | adverse legal or regulatory proceedings or disputes, such as class actions or enforcement or other proceedings brought by third parties, government and regulatory agencies, including antitrust investigations and claims; |

| • | our ability to protect our reputation and intellectual property; |

| • | our ability to consummate asset sales or consummate asset sales in terms favorable to us, fully integrate newly acquired businesses, achieve cost-savings from our cost-reduction initiatives, implement our pricing and commercial initiatives for our products and services, and generally meet our business strategy’s goals; |

| • | the increasing reliance on information technology infrastructure for our sales, invoicing, procurement, financial statements, and other processes that can adversely affect our sales and operations in the event that the infrastructure does not work as intended, experiences technical difficulties, or is subjected to invasion, disruption, or damage caused by circumstances beyond our control, including cyber-attacks, catastrophic events, power outages, natural disasters, computer system or network failures, or other security breaches; |

| • | the effects of climate change, in particular reflected in weather conditions, including but not limited to excessive rain and snow, shortage of usable water, wildfires and natural disasters, such as earthquakes, hurricanes, tornadoes and floods, that could affect our facilities or the markets in which we offer our products and services or from where we source our raw materials; |

| • | trade barriers, including but not limited to tariffs or import taxes, including those imposed by the United States to key markets in which we operate, in particular, Mexico and the EU, and changes in existing trade policies or changes to, or withdrawals from, free trade agreements, including the United States-Mexico-Canada Agreement (the “USMCA”), and the overall impact that the imposition or threat of trade barriers may cause on the overall economy of the countries in which we do business or that are part of our global supply chain; |

| • | availability and cost of trucks, railcars, barges, and ships, terminals, warehouses, as well as their licensed operators, drivers, staff and workers, for transport, loading and unloading of our materials or that are otherwise a part of our supply chain; |

| • | labor shortages and constraints; |

CEMEX • 2024 20-F REPORT • 6

| INTRODUCTION |

||||

| • | our ability to hire, effectively compensate and retain our key personnel and maintain satisfactory labor relations; |

| • | our ability to detect and prevent money laundering, terrorism financing and corruption, as well as other illegal activities; |

| • | terrorist and organized criminal activities, social unrest, as well as geopolitical events, such as hostilities, war, and armed conflicts, including the current war between Russia and Ukraine, conflicts in the Middle East, and any insecurity and hostilities in Mexico related to illegal activities or organized crime and any actions any government takes to prevent these illegal activities and organized crime; |

| • | the impact of pandemics, epidemics, or outbreaks of infectious diseases and the response of governments and other third parties, which could adversely affect, among other matters, the ability of our operating facilities to operate at full or any capacity, supply chains, international operations, availability of liquidity, investor confidence and consumer spending, as well as the availability of, and demand for, our products and services; |

| • | changes in the economy that affect demand for consumer goods, consequently affecting demand for our products and services; |

| • | the depth and duration of an economic slowdown or recession, instability in the business landscape and lack of availability of credit; |

| • | declarations of insolvency or bankruptcy, or becoming subject to similar proceedings; |

| • | natural disasters and other unforeseen events (including global health hazards such as COVID-19); |

| • | our ability to implement our “Future in Action” climate action program and achieve our sustainability goals and objectives; and |

| • | the other risks and uncertainties described under “Item 3—Key Information—Risk Factors” and elsewhere in this annual report. |

Many factors could cause our expectations, expected results, and/or projections expressed in this annual report not being reached and/or not producing the expected benefits and/or results, as any such benefits or results are subject to uncertainties, costs, performance, and rate of success and/or implementation of technologies, some of which are not yet proven, among other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from historical results, performance, or achievements and/or results, performance, or achievements expressly or implicitly anticipated by the forward-looking statements, or otherwise could have an impact on us or our consolidated entities. Forward-looking statements should not be considered guarantees of future performance, nor the results or developments are indicative of results or developments in subsequent periods. Actual results of our operations and the development of market conditions in which we operate, or other circumstances or assumptions that may materialize, may differ materially from those described in, or suggested by, the forward-looking statements contained herein. Any or all of our forward-looking statements may turn out to be inaccurate and the factors identified above are not exhaustive. Accordingly, readers should not place undue reliance on forward-looking statements, as such forward-looking statements speak only as of the date on which they are made. The forward-looking statements and information contained in this annual report are made as of the date of this annual report and are subject to change without notice, and except to the extent legally required, we expressly disclaim any obligation or undertaking to update or revise any forward-looking statements in this annual report, whether to reflect new information, any change in our expectations regarding those forward-looking statements, any change in events, conditions, or circumstances on which any such statement is based, or otherwise. Readers should review future reports filed or furnished by us with the SEC, the Mexican Banking and Securities Commission (Comisión Nacional Bancaria y de Valores) (the “CNBV”) and the Mexican Stock Exchange (Bolsa Mexicana de Valores) (the “MSE”).

CEMEX • 2024 20-F REPORT • 7

| INTRODUCTION |

||||

This annual report contains statistical data regarding, but not limited to, the production, distribution, marketing, and sale of cement, ready-mix concrete, clinker, aggregates, and Urbanization Solutions. We generated some of this data internally, and some was obtained from independent industry publications and reports, available as of the date of this annual report, that we believe to be reliable sources. We have not independently verified this data nor sought the consent of any organizations to refer to their reports in this annual report.

We act in strict compliance with antitrust laws and as such, among other measures, maintain an independent pricing policy that has been independently developed. Our core element is to price our products and services based on their quality and characteristics as well as their value to our customers. We do not accept any communications or agreements with competitors concerning the determination of its prices for products or services. Unless otherwise indicated, all references to prices, pricing initiatives, price increases or decreases pertain solely to our prices for our products.

This annual report includes certain non-IFRS financial measures that differ from financial information presented by Cemex in accordance with IFRS in its financial statements and reports containing financial information. These non-IFRS financial measures include “Operating EBITDA (operating earnings before other expenses, net plus depreciation and amortization)” and “Operating EBITDA Margin” (Operating EBITDA for the period divided by our revenues as reported in our financial statements). We consider the closest financial measure to Operating EBITDA in our financial statements under IFRS to be the line item of “Operating earnings before other expenses, net,” as Operating EBITDA adds depreciation and amortization to this line item. Our Operating EBITDA Margin is calculated by dividing our Operating EBITDA for the period by our revenues as reported in our financial statements. We believe there is no close IFRS financial measure to compare Operating EBITDA Margin. These non-IFRS financial measures are designed to complement and should not be considered superior to financial measures calculated in accordance with IFRS. Although Operating EBITDA and Operating EBITDA Margin are not measures of operating performance, an alternative to cash flows or a measure of financial position under IFRS, Operating EBITDA is the financial measure used by our management to review operating performance and profitability, for decision-making purposes and to allocate resources. Moreover, our Operating EBITDA is a measure used by our creditors to review our ability to internally fund capital expenditures, to service or incur debt and to comply with financial covenants under our financing agreements. Furthermore, our management regularly reviews our Operating EBITDA Margin by reportable segment and on a consolidated basis as a measure of performance and profitability. These non-IFRS financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. Non-IFRS financial measures presented in this annual report are being provided for informative purposes only and shall not be construed as investment, financial, or other advice.

The information, statements, and opinions contained in this annual report do not constitute a public offer under any applicable legislation, an offer to sell, or solicitation of any offer to buy any securities or financial instruments, or any advice or recommendation with respect to such securities or other financial instruments.

Cautionary Statement Regarding Environmental, Social, and Governance (“ESG”) and Sustainability-Related Data, Metrics, and Methodologies

This annual report includes non-financial metrics, estimates, or other information related to ESG and sustainability matters that are subject to significant uncertainties, which may include the methodology, collection, and verification of data, various estimates, and assumptions, and/or underlying data that is obtained from third parties, some of which cannot be independently verified.

The preparation of certain information on ESG and sustainability matters contained in this annual report requires the application of a number of key judgments, assumptions, and estimates. The reported measures in this annual report reflect good faith estimates, assumptions, and judgments at the given point in time.

CEMEX • 2024 20-F REPORT • 8

| INTRODUCTION |

||||

There is a risk that these judgments, estimates, or assumptions may subsequently prove to be incorrect and/or, to the extent legally required, may need to be restated or changed. In addition, the underlying data, systems, and controls that support non-financial reporting are generally considerably less sophisticated than the systems and internal control for financial reporting and rely on manual processes. This may result in non-comparable information between organizations and/or between reporting periods within organizations as methodologies continue to develop and/or be socialized. The further development of or changes to accounting and/or reporting standards could materially impact the performance metrics, data points, and targets contained in this annual report, and the reader may not be able to compare non-financial information performance metrics, data points, or targets between reporting periods on a direct like-for-like basis.

There is currently no single globally recognized or accepted, consistent or comparable set of definitions or standards (legal, regulatory, or otherwise), nor widespread cross-market consensus, of (i) what constitutes, a “green,” “social,” “sustainable,” or any other similarly-labelled activity, product, or asset; (ii) the precise attributes required for a particular activity, product, or asset to be defined as “green,” “social,” “sustainable” or any other similar label; or (iii) climate and sustainable funding and financing activities and their classification and reporting.

Therefore, there is little certainty, and no assurance or representation can be given, that our activities, products, or assets and/or reporting of such activities, products, or assets will meet any present or future expectations or requirements for describing or classifying such activities, products, or assets as “green,” “social,” “sustainable,” or any other similar label. We expect policies, regulatory requirements, standards, and definitions to continuously develop and evolve over time.

Cautionary Statement Regarding Forward-Looking ESG or Sustainability Statements

Certain sections in this annual report contain ESG- or sustainability-related forward-looking statements, such as aims, ambitions, estimates, forecasts, plans, projections, targets, goals and other metrics, including but not limited to: climate and emissions, Business and Human Rights, corporate governance, Research and Development (“R&D”) and partnerships, development of products and services that intend to address sustainability-related concerns and sustainability related targets/ ambitions when finalized, including the implementation of technologies and other initiatives that aim to reduce and/or capture CO2 emissions. These forward-looking statements also include references to specific programs, such as our “Future in Action” climate action program, as well various ESG-related indicators, objectives or metrics disclosed previously or that may be disclosed in the future, none of which are guarantees and any and all of which may ultimately not be achieved or may be abandoned at any time, whether in part, in full, or within any specific timeframe. There are many significant uncertainties, assumptions, judgements, opinions, estimates, forecasts and statements made of future expectations underlying these forward-looking statements which could cause actual results, performance, outcomes or events to differ materially from those expressed or implied in these forward-looking statements, which include, but are not limited to:

| • | the extent and pace of climate change, including the timing and manifestation of physical and transition risks; |

| • | the macroeconomic environment; |

| • | uncertainty around future climate-related policy, including the timely implementation and integration of adequate government policies; |

| • | the effectiveness of actions of governments, legislators, regulators, businesses, investors, customers, and other stakeholders to mitigate the impact of climate and sustainability-related risks; |

| • | changes in customer behavior and demand, changes in the available technology for mitigation and the effectiveness of any such technologies, as some of these new technologies may be unproven; |

CEMEX • 2024 20-F REPORT • 9

| INTRODUCTION |

||||

| • | the roll-out of low carbon infrastructure; |

| • | the availability and adoption of renewable energy within in our value chain; |

| • | the development of carbon capture, circular utilization, and sequestration technologies, including the adoption of cost-effective carbon-related technologies such as carbon capture, utilization, and storage (“CCUS”); |

| • | the availability of accurate, verifiable, reliable, consistent, and comparable climate-related data; |

| • | lack of transparency and comparability of climate-related forward-looking methodologies; |

| • | variation in approaches and outcomes, as variations in methodologies may lead to under or overestimates and consequently present exaggerated indication of climate-related risk; and |

| • | reliance on assumptions and future uncertainty (calculations of forward-looking metrics are complex and require many methodological choices and assumptions). |

Accordingly, undue reliance should not be placed on these forward-looking statements. Furthermore, changing national and international standards, industry and scientific practices, regulatory requirements, and market expectations regarding climate change, which remain under continuous development, are subject to different interpretations.

There can be no assurance that these standards, practices, requirements, and expectations will not be interpreted differently than our understanding when defining sustainability-related ambitions and targets or change in a manner that substantially increases the cost or effort for us to achieve such ambitions and targets.

CEMEX • 2024 20-F REPORT • 10

| PART I |

||||

PART I

Item 1—IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

Item 2—OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Item 3—KEY INFORMATION

Accelerating a Sustainable World

In 2024, we had a strong operational and strategic performance, demonstrating resilience amid evolving global dynamics. We delivered strong results with a resilient free cash flow generation, and successfully recovered from the extraordinary inflationary pressures of the last few years. Our performance is a testament to the focus and commitment of our employees worldwide.

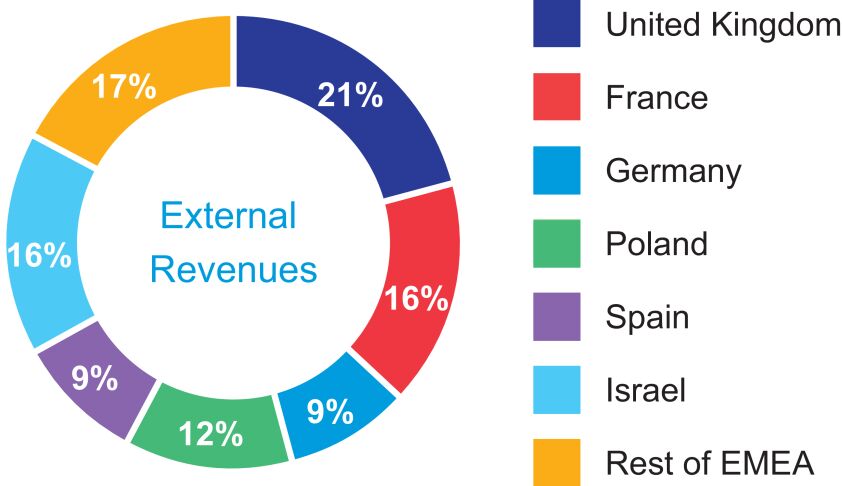

Throughout 2024, we strengthened our financial position, regaining investment-grade status and enhancing strategic flexibility. This allowed us to launch a shareholder return program, including dividends, while advancing our bolt-on growth strategy and reinforcing our capital structure. We also continued optimizing our portfolio, with a substantial part of our revenues now originating from our operations in the United States, Mexico and Europe, which we believe are markets with strong long-term potential. As part of our portfolio reallocation strategy, during the year ended December 31, 2024 we announced the divestment of, or the entry into definitive agreements for the divestment of, our operations in the Philippines, the Dominican Republic and Guatemala, as well as our remaining minority stake in Neoris N.V. (“Neoris”).

In 2024, we made significant progress in our “Future in Action” climate action program, reinforcing our industry leadership in decarbonization and resource efficiency. At the same time, we accelerated our digital transformation, enhancing customer experience through Cemex Go and leveraging artificial intelligence (“AI”)-driven solutions to improve operations. Our Urbanization Solutions business continued its profitable expansion, reinforcing our role in sustainable urban development.

Despite a challenging macroeconomic landscape throughout 2024, including elections across multiple key markets, shifting infrastructure investment priorities, and the impacts of large-scale natural phenomena, we remained agile and well-positioned to capture emerging opportunities. We believe that we played a crucial role in numerous iconic projects worldwide, including major infrastructure developments in the United States, Mexico, Europe and other countries.

For the year ended December 31, 2024, we had revenues of $16.2 billion, a slight decrease compared to our revenues for the year ended December 31, 2023. Also, during the year ended December 31, 2024, we reduced our total debt plus other financial obligations by $806 million, as compared to 2023. Our leverage ratio, as calculated under the Credit Agreements, reduced by 0.25x as compared to December 31 2023, reaching 1.81x as of December 31, 2024. As of December 31, 2024, our total debt plus other financial obligations in our statement of financial position (which does not include $2,000 million aggregate principal amount of Subordinated Notes (as defined below)) decreased to $7,358 million (principal amount $7,388 million, excluding deferred issuance costs).

CEMEX • 2024 20-F REPORT • 11

| PART I |

||||

Of relevance during the year ended December 31, 2024:

| • | On April 11, 2024, we successfully closed the refinancing of the 2022 EUR Credit Agreement, extending the maturity for the term loan facility to 2029 and setting the maturity for the new revolving credit facility to 2028. Following the refinancing, the credit facility consists of a €450 million 5-year term loan amortizing in five equal semi-annual payments starting in April 2027 and a €300 million 4-year committed revolving credit facility. The credit facility, denominated exclusively in Euros, has a floating interest rate of EURIBOR plus a leverage-based interest rate margin ranging from 1.40% to 2.15%, and maintains its previous financial covenants, consistent with an investment-grade capital structure, that allows a maximum leverage ratio of 3.75x throughout the life of the loan and a minimum interest coverage ratio of 2.75x. Cemex, S.A.B. de C.V.’s obligations thereunder are guaranteed by the Refinancing Guarantors (as defined elsewhere in this annual report). Debt under the 2022 EUR Credit Agreement was issued under the sustainability-linked financing framework (“SLFF”). |

| • | We achieved a significant portfolio rebalancing milestone with $2.2 billion in announced divestments. |

| • | We announced a progressive shareholder dividend program. |

| • | We regained our investment grade rating and achieved a leverage ratio of 1.81x as calculated under the Credit Agreements. |

Beyond exceptional financial results, we remain committed to health and safety and continue to have good results. In 2024, our employee Lost Time Injury (“LTI”) Frequency Rate was 0.6, with zero injuries across 87% of our sites globally. We believe these results demonstrate our continuous improvement commitment is producing positive outcomes as we aim toward our Zero4Life goal. We look forward to maintaining continuity and sustained growth under our renewed management team. This change comes at a time when Cemex is in a strong position, with a solid financial foundation, a clear strategic vision, and a firm commitment to innovation, sustainability and operational excellence, driving long-term value while contributing to a more resilient and sustainable environment.

CEMEX • 2024 20-F REPORT • 12

| PART I |

||||

As required pursuant to the laws of Mexico, the following is a description of our debt securities listed in Mexico:

CEMEX • 2024 20-F REPORT • 13

| PART I |

||||

INFORMATION ABOUT THE LONG-TERM NOTES (CERTIFICADOS BURSÁTILES A TASA VARIABLE)

(“Long-Term Notes 1”) ISSUED BY CEMEX, S.A.B. DE C.V.

AS OF DECEMBER 31, 2024

Amount of the Issuance of Original Long-Term Notes 1: Ps1,000,000,000.00.

Amount of the Issuance of Additional Long-Term Notes 1: Ps2,000,000,000.00.

Name of the Issuer: Cemex, S.A.B. de C.V.

Ticker: “CEMEX 23L”

Issue Number under the Program: First Issuance and First Reopening of First Issuance.

Issue Date of Original Long-Term Notes 1: October 5, 2023.

Issue Date of Additional Long-Term Notes 1: February 20, 2024.

Maturity Date: October 1, 2026.

Term of Original Long-Term Notes 1: 1,092 days.

Term of Additional Long-Term Notes 1: 954 days.

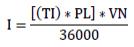

Interest Rate and Interest Calculation Method: The annual gross interest rate will be calculated by adding 0.45 percentage points to the rate known as the Mexican Interbank Equilibrium Interest Rate at a 28-day term.

Interest Payment Frequency: Every 28-days starting November 2, 2023.

Place and Form of Payment of Principal and Interest: The principal and ordinary interest accrued will be paid by electronic transfer of funds to the address of S.D. Indeval Institución para el Depósito de Valores, S.A. de C.V. (“Indeval”), or, where appropriate, at the offices of Cemex, S.A.B. de C.V.

Redemption and Early Redemption: A single payment at their nominal value or, if applicable, at their Adjusted Nominal Value (as defined in the Long-Term Notes 1).

Guarantee: The Long-Term Notes 1 will be guaranteed, initially, by the following entities (the “Long-Term Notes 1 Guarantors” or “Refinancing Guarantors”): Cemex Concretos, S.A. de C.V. (“Cemex Concretos”), Cemex Corp. (“Cemex Corp”), Cemex Operaciones México, S.A. de C.V. (“COM”), and Cemex Innovation Holding Ltd. (“CIH”), but are not secured. Cemex, S.A.B. de C.V. shall have the right to release or replace any Long-Term Notes 1 Guarantor, or add new guarantors, provided that after such release, addition or replacement takes effect, the Minimum Endorsement (as defined in the Long-Term Notes 1) is satisfied.

Rating: Standard & Poor’s, S.A. de C.V. “mxAA” (payment capacity of Cemex, S.A.B. de C.V. to satisfy its financial commitments within the obligation is very strong compared to other issuers in the domestic market). Fitch México, S.A. de C.V. “AA(mex)” (very low risk level of default compared to other issuers or obligations in the same country).

Common Representative: CIBanco, S.A., Institución de Banca Múltiple (“Cibanco”).

CEMEX • 2024 20-F REPORT • 14

| PART I |

||||

Depositary: Indeval.

Tax Regime: The applicable withholding rate with respect to interest paid under the Long-Term Notes 1 is subject: (i) for individuals or legal entities residing in Mexico for tax purposes, to the provisions of Articles 54, 55, 135, and other applicable laws of the current Income Tax Law; and (ii) for individuals and legal entities resident abroad for tax purposes, the provisions of Articles 153, 166, and other applicable laws of the current Income Tax Law. The current tax regime may be amended throughout the term of the issue.

Cemex, S.A.B. de C.V.’s policy on making decisions regarding changes of control during the term of the issue: Not applicable.

Cemex, S.A.B. de C.V.’s policy on making decisions regarding corporate restructurings, including acquisitions, mergers and spin-offs during the term of the issue: Cemex, S.A.B. de C.V. and the Long-Term Notes 1 Guarantors cannot merge, unless: (i) the merged or acquiring company assumes the obligations of the Issuer or the Long-Term Notes 1 Guarantor, as appropriate, under the Long-Term Notes 1, (ii) a Cause of Early Termination (as defined in the Long-Term Notes 1) does not occur under the Long-Term Notes 1 as a result of the merger or transfer, and (iii) the merged or acquiring company delivers to the Common Representative (as defined in the Long-Term Notes 1) a legal opinion stating that said merger or transfer complies with (i) and (ii) above.

Cemex, S.A.B. de C.V.’s policy on making decisions on the sale or creation of encumbrances on essential assets, specifying what such concept will include during the term of the issue: According to the provisions of the Long-Term Notes 1, Cemex, S.A.B. de C.V. shall not permit the constitution of any encumbrance on its assets, except (i) for Permitted Encumbrances (as defined in the Long-Term Notes 1), or (ii) where the Issuer’s obligations under the Long-Term Notes 1 are simultaneously guaranteed.

The net proceeds from the issuance of the Long-Term Notes 1 were applied towards total or partial repayment of the then-outstanding amount under the revolving credit facility of the Amended 2021 Credit Agreement.

CEMEX • 2024 20-F REPORT • 15

| PART I |

||||

INFORMATION ABOUT THE LONG-TERM NOTES (CERTIFICADOS BURSÁTILES A TASA FIJA)

(“Long-Term Notes 2”) ISSUED BY CEMEX, S.A.B. DE C.V.

AS OF DECEMBER 31, 2024

Amount of the Issuance of Original Long-Term Notes 2: Ps5,000,000,000.00.

Amount of the Issuance of Additional Long-Term Notes 2: Ps3,500,000,000.00.

Name of the Issuer: Cemex, S.A.B. de C.V.

Ticker: “CEMEX 23-2L”

Issue Number under the Program: Second Issuance and First Reopening of Second Issuance.

Issue Date of Original Long-Term Notes 2: October 5, 2023.

Issue Date of Additional Long-Term Notes 2: February 20, 2024.

Maturity Date: September 26, 2030.

Term of Original Long-Term Notes 2: 2,548 days.

Term of Additional Long-Term Notes 2: 2,410 days.

Interest Rate and Interest Calculation Method: Annual gross interest of 11.48%, which will remain fixed during the term of the issue, except in the event that such rate is substituted by the Adjusted Gross Annual Interest Rate (as defined in the Long-Term Notes 2).

Interest Payment Frequency: Every 182 days starting April 4, 2024.

Place and Form of Payment of Principal and Interest: The principal and ordinary interest accrued will be paid by electronic transfer of funds to the address of Indeval, or, where appropriate, at the offices of Cemex, S.A.B. de C.V.

Redemption and Early Redemption: A single payment at their nominal value or, if applicable, at their Adjusted Nominal Value (as defined in the Long-Term Notes 2).

Guarantee: The Long-Term Notes 2 will be guaranteed, initially, by Long-Term Notes 1 Guarantors, but are not secured. The Issuer shall have the right to release or replace any Long-Term Note 1 Guarantor, or add new guarantors, provided that after such release, addition or replacement takes effect, the Minimum Endorsement (as defined in the Long-Term Notes 2) is satisfied.

Rating: Standard & Poor’s, S.A. de C.V. “mxAA” (payment capacity of the Cemex, S.A.B. de C.V. to satisfy its financial commitments within the obligation is very strong compared to other issuers in the domestic market). Fitch México, S.A. de C.V. “AA(mex)” (very low risk level of default compared to other issuers or obligations in the same country).

Common Representative: Cibanco.

Depositary: Indeval.

CEMEX • 2024 20-F REPORT • 16

| PART I |

||||

Tax Regime: The applicable withholding rate with respect to interest paid under the Long-Term Notes 2 is subject: (i) for individuals or legal entities residing in Mexico for tax purposes, to the provisions of Articles 54, 55, 135, and other applicable laws of the current Income Tax Law; and (ii) for individuals and legal entities resident abroad for tax purposes, the provisions of Articles 153, 166, and other applicable laws of the current Income Tax Law. The current tax regime may be amended throughout the term of the issue.

Cemex, S.A.B. de C.V.’s policy on making decisions regarding changes of control during the term of the issue: Not applicable.

Cemex, S.A.B. de C.V.’s policy on making decisions regarding corporate restructurings, including acquisitions, mergers and spin-offs during the term of the issue: Cemex, S.A.B. de C.V. and the Long-Term Notes 1 Guarantors cannot merge, unless: (i) the merged or acquiring company assumes the obligations of Cemex, S.A.B. de C.V. or the Long-Term Notes 1 Guarantor, as appropriate, under the Long-Term Notes 2, (ii) a Cause of Early Termination (as defined in the Long-Term Notes 2) does not occur under the Long-Term Notes 2 as a result of the merger or transfer, and (iii) the merged or acquiring company delivers to the Common Representative (as defined in the Long-Term Notes 2) a legal opinion stating that said merger or transfer complies with (i) and (ii) above.

Cemex, S.A.B. de C.V.’s policy on making decisions on the sale or creation of encumbrances on essential assets, specifying what such concept will include during the term of the issue: According to the set forth on the Long-Term Notes 2, Cemex, S.A.B. de C.V. shall not permit the constitution of any encumbrance on its assets, except (i) for Permitted Encumbrances (as defined in the Long-Term Notes 2), or (ii) where the Issuer’s obligations under the Long-Term Notes 2 are simultaneously guaranteed.

The net proceeds from the issuance of the Long-Term Notes 2 were applied towards total or partial repayment of the then-outstanding amount under the revolving credit facility of the Amended 2021 Credit Agreement.

CEMEX • 2024 20-F REPORT • 17

| PART I |

||||

RISK FACTORS

We are subject to various risks mainly resulting from changing economic, environmental, political, industry, business, legal, regulatory, financial and climate conditions, as well as risks related to ongoing legal proceedings and investigations. The following risk factors are not the only risks we face, and any of the risk factors described below could significantly and adversely affect our business, liquidity, results of operations or financial condition, as well as, in certain instances, our reputation.

Risk Factor Summary

Risks Relating to Ownership of Our Securities

| • | Non-Mexicans may not hold Cemex, S.A.B. de C.V.’s Series A shares directly and must have them held in a trust at all times. |

| • | ADS holders may only indirectly vote the Series B shares represented by the CPOs deposited with the ADS depositary through the ADS depositary and are not entitled to vote the Series A shares represented by the CPOs deposited with the ADS depositary or to attend shareholders’ meetings. |

| • | Corporate rights, mainly voting rights, may not be available to any person that acquires or otherwise becomes entitled to vote 2% or more of Cemex, S.A.B. de C.V.’s shares with voting rights without the previous approval of Cemex, S.A.B. de C.V.’s Board of Directors. |

| • | Preemptive rights generally available under Mexican law may be unavailable to ADS holders. |

| • | The protections afforded to shareholders in Mexico are different from those in other countries and may be more difficult to enforce. |

Risks Relating to Our Business and Operations

| • | Economic conditions globally, including persistently elevated inflation and interest rates, particularly in countries where we operate, have affected and may continue to adversely affect our business, financial condition, liquidity, and results of operations. |

| • | Political, social, and geopolitical events, changes in public policies and other risks in some of the countries where we operate, which are inherent to the operations of an international company, could have a material adverse effect on our business, financial condition, liquidity, and results of operations. |

| • | The emergence or continued escalation of geopolitical conflicts may have a material adverse effect on our business, financial condition, liquidity, and results of operation. |

| • | Potential political, economic, and military instability in Israel and the Middle East could materially and adversely affect our business, financial condition, liquidity, and results of operation. |

| • | Complications in relationships with local communities and different stakeholder perspectives could lead to social actions against our industry or company, including legal actions, on-the-ground protests, attacks on our assets or facilities, negative media campaigns, strikes, and social unrest. All these events could disrupt our operations, affect our capacity to serve our clients, damage our assets and/or reputation and may materially and adversely affect our business continuity, reputation, liquidity, and results of operations. |

| • | Labor activism and unrest, or failure to maintain satisfactory labor relations, could materially and adversely affect our reputation and results of operations. |

CEMEX • 2024 20-F REPORT • 18

| PART I |

||||

| • | We are subject to restrictions and reputational risks resulting from non-controlling interests held by third parties in our consolidated subsidiaries. As of the date of this annual report, we control publicly listed companies in Trinidad and Tobago and in Jamaica, where this risk is heightened. |

| • | High energy and fuel costs have had and may continue to have a material adverse effect on our business, financial condition, liquidity, and results of operation. |

| • | We are increasingly dependent on information technology and our systems and infrastructure, as well as those provided by third-party service providers, face certain risks, including cyber-security risks, which if materialized, could materially and adversely affect our business, financial condition, liquidity, and results of operation. |

| • | The development and adoption of AI, including generative AI, and its use by us or use or misuse by third parties, may increase the financial and operational risks or create new financial or operational risks that we are not currently anticipating. |

| • | We may not be able to realize the expected benefits from our portfolio rebalancing or any divestments, acquisitions, investments or joint ventures, some of which may have a material impact on our reputation, business, financial condition, liquidity, and results of operations. Any failure to realize expected benefits from the bolt-on acquisitions of our business strategy heightens this risk. |

| • | We have adopted a sustainability strategy we consider to be ambitious. Our sustainability strategy includes achieving the targets of our “Future in Action” climate action program and some of these targets are replicated as key performance indicators in our sustainability-linked financing arrangements. Failure to reach these goals may expose us to certain risks that could have a material adverse effect on our reputation, business, financial condition, liquidity, and results of operations. |

| • | A substantial amount of our total assets consists of intangible assets, including goodwill. We have recognized charges for goodwill impairment in the past, nevertheless no goodwill impairment was recognized in 2024, but if market or industry conditions deteriorate in the future, additional impairment charges may be recognized. |

| • | The failure of any bank in which we deposit our funds could have an adverse effect on our financial condition. |

| • | Activities in our business can be hazardous and can cause injury to people or damage to property in certain circumstances. |

| • | The introduction of or failure to introduce construction material substitutes or alternative forms of cement, ready-mix concrete, or aggregates into the market and the development of or failure to develop new construction techniques and technologies could have a material adverse effect on our business, financial condition, liquidity, and results of operations and could have an impact in our sustainability targets. |

| • | We operate in highly competitive markets with numerous players employing different competitive strategies and if we do not compete effectively, our revenues, market share, business and results of operations may be affected. |

| • | We may fail to secure certain materials required to run our business, or could secure them at higher prices, which could have a material adverse effect on our business, financial condition, liquidity, and results of operations. |

| • | Our operations and ability to source products and materials can be affected by adverse weather conditions, hydrometeorological and geological hazards such as hurricanes, flash floods, earthquakes, and/or natural disasters, including climate change, which could have a material adverse effect on our business, financial condition, liquidity, and results of operations. |

| • | We could be materially and adversely affected by any significant or prolonged disruption to our production facilities, which could impact our business, financial condition, liquidity, and results of operations. |

CEMEX • 2024 20-F REPORT • 19

| PART I |

||||

| • | Our insurance coverage may not cover all the risks to which we, our board members, officers and employees may be exposed or may cover them to an amount that may not be sufficient to satisfy our requirements. |

| • | Our success depends largely on the strategic vision and actions of Cemex, S.A.B. de C.V.’s Board of Directors and on key members of our executive management team and the availability of a specialized workforce. |

| • | Future pandemics and epidemics could materially adversely affect our financial condition and results of operations. |

Risks Relating to Our Indebtedness and Certain Other Obligations

| • | The Credit Agreements, the indentures governing our outstanding 3.125% Euro-denominated notes due 2026 (the “March 2026 Euro Notes”), 5.450% Dollar denominated notes due 2029 (the “November 2029 Dollar Notes”), 5.200% Dollar denominated notes due 2030 (the “September 2030 Dollar Notes”), 3.875% Dollar denominated notes due 2031 (the “July 2031 Dollar Notes”), and the sustainability-linked long-term notes in the Mexican market (the “CEBURES” and, collectively with the March 2026 Euro Notes, the November 2029 Dollar Notes, the September 2030 Dollar Notes and the July 2031 Dollar Notes, the “Notes”) and our other debt agreements and/or instruments and other agreements contain several restrictions and covenants. Our failure to comply with such restrictions and covenants or any inability to capitalize on business opportunities or refinance our debt resulting from them could have a material adverse effect on our business and financial conditions. |

| • | We have a substantial amount of debt and other financial obligations. If we are unable to secure refinancing on favorable terms or at all, we may not be able to comply with our payment obligations upon their maturity. Our ability to comply with our principal maturities and financial covenants may depend on us implementing certain strategic initiatives, including, but not limited to, making asset sales, and there is no assurance that we will be able to implement any such initiatives or execute such sales, if needed, on terms favorable to us or at all. |

| • | We may not be able to generate sufficient cash to service our indebtedness or satisfy our short-term liquidity needs, and we may be forced to take other actions to do so, which may not be successful. |

| • | Our ability to repay debt and pay dividends is highly dependent on our subsidiaries’ ability to transfer income and dividends to us. As of the date of this annual report, we control publicly listed companies in Trinidad and Tobago and in Jamaica, where this risk is heightened. |

| • | We have to service part of our debt and other financial obligations denominated in Dollars and Euros with revenues generated in Mexican Pesos or other currencies, as we do not generate sufficient revenue in Dollars and Euros from our operations to service all our debt and other financial obligations denominated in Dollars and Euros. This could adversely affect our ability to service our obligations in the event of a devaluation of the Mexican Peso, or any of the other currencies of the countries in which we operate, compared to the Dollar and Euro. In addition, our consolidated reported results and outstanding indebtedness are significantly affected by fluctuations in exchange rates between the Dollar (our reporting currency) vis-à-vis the Mexican Peso and other significant currencies within our operations. |

| • | Increases in liabilities related to our pension plans could adversely affect our results of operations. |

| • | Our use of derivative financial instruments could negatively affect our net income and liquidity, especially in volatile and uncertain markets. |

Risks Relating to Regulatory and Legal Matters

| • | We are subject to the laws and regulations of the countries where we operate and do business. Non-compliance with laws and regulations and/or any material changes in such laws and regulations and/or any significant delays in assessing the impact and/ or adapting to such changes in laws and regulations may have a material adverse effect on our reputation, business, financial condition, liquidity, and results of operations. |

CEMEX • 2024 20-F REPORT • 20

| PART I |

||||

| • | We or our third-party providers may fail to maintain, obtain, or renew, or may experience material delays in obtaining, requisite governmental or other approvals, licenses, and permits for the conduct of our or their business. |

| • | We are subject to litigation proceedings, including, but not limited to, government investigations relating to corruption, antitrust, and other proceedings that could harm our business and our reputation. |

| • | We are subject to human rights, anti-corruption, anti-bribery, anti-money laundering, antitrust, anti-boycott, economic sanctions, anti-terrorism, trade embargoes, and export control laws and regulations in the countries in which we operate and do business, a considerable number of which are considered high and medium risk countries for purposes of corruption, money laundering, and other matters. Any violation of any such laws or regulations could have a material adverse impact on our reputation, results of operations, and financial condition, as well as harm our reputation. |

| • | Certain tax matters have had and may have a material adverse effect on our cash flow, financial condition, and net income, as well as on our reputation. |

| • | Our operations are subject to environmental laws and regulations, including those relating to greenhouse gas emissions, and new reporting requirements that are or could become effective and increasingly stringent. |

| • | It may be difficult to enforce civil liabilities against us or the members of Cemex, S.A.B. de C.V.’s Board of Directors, our senior management, and controlling persons. |

Risks Relating to Ownership of Our Securities

Non-Mexicans may not hold Cemex, S.A.B. de C.V.’s Series A shares directly and must have them held in a trust at all times.

Any person acquiring shares, CPOs or ADSs of Cemex, S.A.B. de C.V. should be aware that non-Mexican investors and Mexican companies without a foreign investment-exclusion clause in their by-laws may not directly hold the Series A shares underlying Cemex, S.A.B. de C.V.’s CPOs or ADSs, but may hold them indirectly through Cemex, S.A.B. de C.V.’s CPO trust. Upon the early termination or expiration of the term of Cemex, S.A.B. de C.V.’s CPO trust on September 6, 2029, the Series A shares underlying the CPOs held by non-Mexican investors or by Mexican companies without a foreign investment-exclusion clause in their by-laws must be placed into a new trust similar to the current CPO trust. We cannot guarantee that a trust similar to the CPO trust will exist or that the relevant authorization for the transfer of Cemex, S.A.B. de C.V.’s Series A shares to such a trust will be obtained. In that event, such investors might be required to sell their Series A shares to a Mexican individual or corporation that has a foreign investment-exclusion clause in its by-laws, which could expose shareholders to a loss in the sale of the corresponding Series A shares and may cause the price of Cemex, S.A.B. de C.V.’s shares, CPOs and ADSs to decrease.

ADS holders may only indirectly vote the Series B shares represented by the CPOs deposited with the ADS depositary through the ADS depositary and are not entitled to vote the Series A shares represented by the CPOs deposited with the ADS depositary or to attend shareholders’ meetings.

Any person acquiring ADSs should be aware of the terms of the ADSs, the corresponding deposit agreement pursuant to which the ADSs are issued (the “Deposit Agreement”), the CPO Trust (as defined in the Deposit Agreement) and Cemex, S.A.B. de C.V.’s by-laws. Under such terms, in relation to shareholders’ meetings of Cemex, S.A.B. de C.V., a holder of an ADS has the right to instruct the ADS depositary to exercise voting rights only with respect to Series B shares represented by the CPOs deposited with the depositary, but not with respect to the Series A shares represented by the CPOs deposited with the depositary.

CEMEX • 2024 20-F REPORT • 21

| PART I |

||||

ADS holders will not be able to directly exercise their right to vote unless they withdraw the CPOs underlying their ADSs (and, in the case of non-Mexican holders, even if they do so, they may not vote the Series A shares represented by the CPOs) and may not receive voting materials in time to ensure that they are able to instruct the depositary to vote the CPOs underlying their ADSs or receive sufficient notice of a shareholders’ meeting of Cemex, S.A.B. de C.V. to permit them to withdraw their CPOs to allow them to cast their vote with respect to any specific matter. Holders of ADSs will not have the right to instruct the ADS depositary as to the exercise of voting rights in respect of Series A shares underlying CPOs held in the CPO Trust. Under the terms of the CPO Trust, Series A shares underlying CPOs held by non-Mexican nationals, including all Series A shares underlying CPOs represented by ADSs, will be voted by the CPO Trustee (as defined in the Deposit Agreement), according to the majority of all Series A shares held by Mexican nationals and Series B shares voted at a shareholders meeting of Cemex, S.A.B. de C.V. In addition, the depositary and its agents may not be able to send out voting instructions on time or carry them out in the manner an ADS holder has instructed. As a result, ADS holders may not be able to exercise their right to vote and they may lack recourse if the CPOs underlying their ADSs are not voted as they requested. ADS holders will also not be permitted to vote the CPOs underlying the ADSs directly at a shareholders’ meeting of Cemex, S.A.B. de C.V. or to appoint a proxy to do so without withdrawing the CPOs. If the ADS depositary does not receive voting instructions from a holder of ADSs in a timely manner, such holder will nevertheless be treated as having instructed the ADS depositary to give a proxy to a person the corresponding CPO trust’s technical committee, which is formed by our employees, designates, to vote the Series B shares underlying the CPOs represented by the ADSs in his/her discretion. The ADS depositary or the custodian for the CPOs on deposit may represent the CPOs at any meeting of holders of CPOs of Cemex, S.A.B. de C.V. even if no voting instructions have been received. The CPO trustee may represent the Series A shares and the Series B shares represented by the CPOs at any meeting of holders of Series A shares or Series B shares of Cemex, S.A.B. de C.V. even if no voting instructions have been received. By so attending, the ADS depositary, the custodian or the CPO trustee, as applicable, may contribute to the establishment of a quorum at a meeting of holders of CPOs, Series A shares or Series B shares, as appropriate. In addition, even though every shareholder of Cemex, S.A.B. de C.V. is entitled to attend shareholders’ meetings pursuant to Cemex, S.A.B. de C.V.’s by-laws and Mexican law, ADS holders are generally not able to attend shareholders’ meetings because they are not the registered holders of the CPOs underlying the ADSs they hold; and, consequently, they are generally unable to satisfy the procedural requirements to attend a shareholders’ meeting pursuant to Cemex, S.A.B. de C.V.’s by-laws and the CPO Trust unless they withdraw the CPOs underlying their ADSs (and, in the case of non-Mexican holders, even if they do so, they may not vote the Series A shares represented by the CPOs). Generally, as only registered holders of CPOs are able to satisfy the requirements to attend a shareholders’ meeting of Cemex, S.A.B. de C.V. pursuant to Cemex, S.A.B. de C.V.’s by-laws and the CPO Trust, only the ADS depositary (as the registered holder of the CPOs underlying ADSs) or the CPO trustee (at the direction of the ADS depositary) will be able to satisfy such requirements and attend shareholders’ meetings of Cemex, S.A.B. de C.V. to represent the CPOs underlying ADSs at a shareholders’ meeting of Cemex, S.A.B. de C.V.

Corporate rights, mainly voting rights, may not be available to any person that acquires or otherwise becomes entitled to vote 2% or more of Cemex, S.A.B. de C.V.’s shares with voting rights without the previous approval of Cemex, S.A.B. de C.V.’s Board of Directors.

Any person acquiring shares, CPOs or ADSs of Cemex, S.A.B. de C.V., must be aware that Cemex, S.A.B. de C.V.’s by-laws provide that its Board of Directors must authorize in advance any transfer of voting shares of its capital stock or other transaction that would result in any person, or group acting in concert, becoming a holder of or otherwise becoming entitled to vote 2% or more of Cemex, S.A.B. de C.V.’s shares with voting rights. In the event this requirement is not met, the persons acquiring such shares or executing such transaction will not be entitled to any corporate rights, mainly voting rights, with respect to such shares, CPOs or ADSs, and such shares, CPOs or ADSs will not be taken into account for purposes of determining a quorum for any Cemex, S.A.B. de C.V. shareholders’ meetings, Cemex, S.A.B.

CEMEX • 2024 20-F REPORT • 22

| PART I |

||||

de C.V. will not record such persons as holders of such shares in its share registry and the registry undertaken by Indeval (as defined below) shall not have any effect. See “Item 7—Major Shareholders and Related Party Transactions—Major Shareholders.”

Preemptive rights generally available under Mexican law may be unavailable to ADS holders.

ADS holders may be unable to exercise preemptive rights granted to Cemex, S.A.B. de C.V.’s shareholders, in which case ADS holders could be diluted following equity or equity-linked offerings. Under Mexican law, if Cemex, S.A.B. de C.V. issues new shares, Cemex, S.A.B. de C.V. would be generally required to grant preemptive rights to its shareholders, except in certain situations, including if such shares are issued in the context of a public offering or if such shares underlie convertible securities issued by Cemex, S.A.B. de C.V. However, ADS holders may not be able to exercise these preemptive rights to acquire new shares unless (i) Cemex, S.A.B. de C.V. files a registration statement with the SEC with respect to such shares or (ii) the offering of the shares qualifies for an exemption from registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”). We cannot assure you that Cemex, S.A.B. de C.V. would file a registration statement in the United States that would allow holders of ADSs to participate in any preemptive rights offering. Under Mexican law, preemptive rights cannot be waived in advance or be assigned or be represented by an instrument that is negotiable separately from the corresponding shares. As a result of applicable United States securities laws, holders of ADSs may be restricted in their ability to exercise preemptive rights as provided in the Deposit Agreement with the ADSs depositary, as amended. Shares subject to a preemptive rights offering, with respect to which preemptive rights have not been exercised, may be sold by Cemex, S.A.B. de C.V. to third parties on the terms and conditions previously approved by Cemex, S.A.B. de C.V.’s shareholders or its Board of Directors. See “Item 10—Additional Information—Articles of Association and By-laws.”

The protections afforded to shareholders in Mexico are different from those in other countries and may be more difficult to enforce.

Under Mexican law, the protections afforded to shareholders are different from those in the United States and countries in continental Europe. In particular, the legal framework and case law pertaining to directors’ duties and disputes between shareholders and us, the members of Cemex, S.A.B. de C.V.’s Board of Directors or our officers are less protective of shareholders under Mexican law than under U.S. and continental European law. Mexican law only permits shareholder derivative suits (i.e., suits for our benefit as opposed to the direct benefit of our shareholders) and there are procedural requirements for bringing shareholder derivative lawsuits, such as minimum holdings, which differ from those in effect in other jurisdictions. There is also a substantially less active plaintiffs’ bar dedicated to the enforcement of shareholders’ rights in Mexico than in the United States or Europe. As a result, in practice it may be more difficult for our shareholders to initiate an action against us, the members of Cemex, S.A.B. de C.V.’s Board of Directors or our officers or obtain direct remedies than it would be for shareholders of a U.S. or European company.

Risks Relating to Our Business and Operations