UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March 2025

Commission File Number 001-16139

Wipro Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Karnataka, India

(Jurisdiction of incorporation or organization)

Doddakannelli

Sarjapur Road

Bangalore, Karnataka 560035, India +91-80-2844-0011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DISCLOSURE OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Wipro Limited, a company organized under the laws of the Republic of India (the “Company”), hereby furnishes the Commission with the following information concerning its public disclosures regarding its results of operations for the quarter and year ended March 31, 2025. The following information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

On April 16, 2025, the Company announced its results of operations for the quarter and year ended March 31, 2025. The Company issued a press release announcing its results under International Financial Reporting Standards (“IFRS”), a copy of which is attached to this Form 6-K as Item 99.1.

The Company placed advertisements in certain Indian newspapers concerning its results of operations for the quarter and year ended March 31, 2025, under IFRS. A copy of the form of this advertisement is attached to this Form 6-K as Item 99.2.

The Company made available on its website the Condensed Consolidated Interim Financial Statements for the quarter and year ended March 31, 2025, under IFRS. A copy of such financial statements is attached to this Form 6-K as Item 99.3.

The Company filed with stock exchanges in India a statement of statutorily audited consolidated financial results for the quarter and year ended March 31, 2025, under IFRS. A copy of such financial statements is attached to this Form 6-K as Item 99.4.

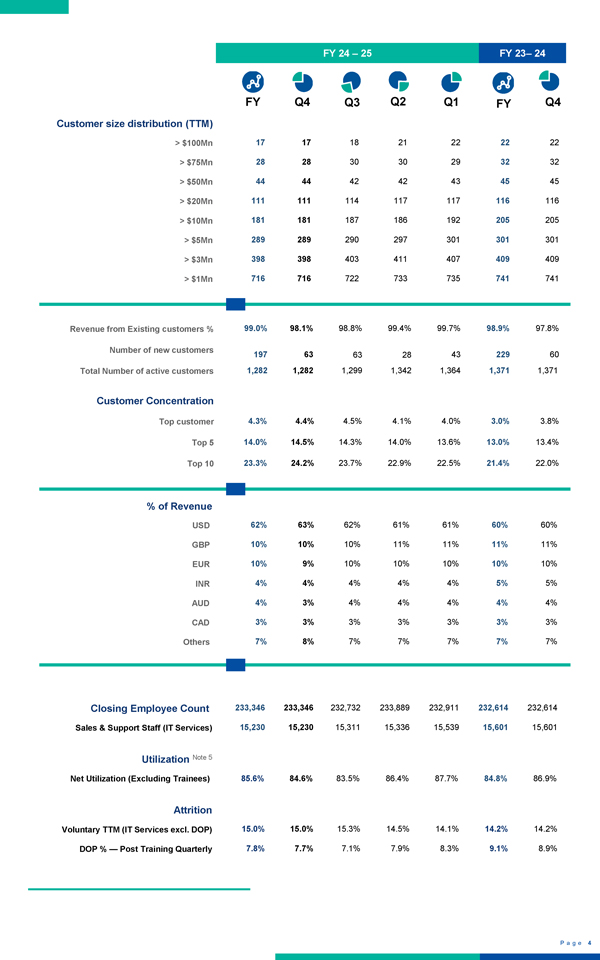

The Company filed with stock exchanges in India a data sheet containing operating metrics for the quarter and year ended March 31, 2025. A copy of such data sheet is attached to this Form 6-K as Item 99.5.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly organized.

| WIPRO LIMITED |

| By: /s/ Aparna Chandrashekar Iyer |

| Aparna Chandrashekar Iyer |

| Chief Financial Officer |

| Dated: April 21, 2025 |

INDEX TO EXHIBITS

Exhibit 99.1

| FOR IMMEDIATE RELEASE |

|

Wipro announces results for the Quarter and Year ended March 31, 2025

Net income grew 6.4% QoQ in Q4’25 and grew 18.9% YoY for FY’25

FY’25 margin at 17.1%, expands 0.9%, Q4 margin at 17.5%, expands 1.1% YoY

Large deal booking grew 48.5% YoY in Q4’25 and grew 17.5% YoY for FY’25

Operating cash flow at 104.4% of net income for Q4’25 and 128.2% for FY’25

EAST BRUNSWICK, N.J. | BANGALORE, India – Apr 16, 2025: Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO), a leading technology services and consulting company, announced financial results under International Financial Reporting Standards (IFRS) for the quarter and year ended March 31, 2025.

Highlights of the Results

Results for the Quarter ended March 31, 2025:

| 1. | Gross revenue at ₹225.0 billion ($2,634.2 million1), an increase of 0.8% QoQ and 1.3% YoY. |

| 2. | IT services segment revenue was at $2,596.5 million, decrease of 1.2% QoQ and 2.3% YoY. |

| 3. | Non-GAAP2 constant currency IT Services segment revenue decreased 0.8% QoQ and 1.2% YoY. |

| 4. | Total bookings3 was at $3,955 million, up by 13.4% QoQ in constant currency2. Large deal bookings4 was at $1,763 million, an increase of 48.5% YoY in constant currency2. |

| 5. | IT services operating margin5 for Q4’25 was at 17.5%, flat QoQ and expansion of 1.1% YoY. |

| 6. | Net income for the quarter was at ₹35.7 billion ($417.8 million1), an increase of 6.4% QoQ and 25.9% YoY. |

| 7. | Earnings per share for the quarter at ₹3.4 ($0.041), an increase of 6.2% QoQ and 25.8% YoY. |

| 8. | Operating cash flows of ₹37.5 billion ($438.5 million1), decrease of 28.2% YoY and at 104.4% of Net Income for the quarter. |

| 9. | Voluntary attrition was at 15.0% on a trailing 12-month basis. |

Results for the Year ended March 31, 2025:

| 1. | Gross revenue reached ₹890.9 billion ($10.4 billion1), a decrease of 0.7% YoY. |

| 2. | IT services segment revenue was at $10,511.5 million, a decrease of 2.7% YoY. |

| 3. | Non-GAAP2 constant currency IT Services segment revenue decreased 2.3% YoY. |

| 4. | Large deal bookings4 was at $5.4 billion, up by 17.5% YoY. Total bookings3 was at $14.3 billion, decrease of 3.8% YoY. |

| 5. | IT services operating margin5 for the year was at 17.1%, up by 0.9% YoY. |

| 6. | Net income for the year was at ₹131.4 billion ($1,537.0 million1), an increase of 18.9% YoY. |

| 7. | Earnings per share for the year was at ₹12.6 ($0.151), an increase of 20.3% YoY. |

| 8. | Operating cash flows of ₹169.4 billion ($1,983.0 million1), decrease of 3.9% YoY and at 128.2% of Net Income for the year. |

1

Outlook for the Quarter ending June 30, 2025

We expect revenue from our IT Services business segment to be in the range of $2,505 million to $2,557 million*. This translates to sequential guidance of (-)3.5% to (-)1.5% in constant currency terms.

*Outlook for the Quarter ending June 30, 2025, is based on the following exchange rates: GBP/USD at 1.26, Euro/USD at 1.05, AUD/USD at 0.63, USD/INR at 86.60 and CAD/USD at 0.70

Performance for the Quarter and Year ended March 31, 2025

Srini Pallia, CEO and Managing Director, said “We closed FY25 with two mega deal wins, an increase in large deal bookings, and growth in our top accounts. Client satisfaction scores improved, reflecting strong execution and engagement. We also continued to invest in our global talent and in strengthening our consulting and AI capabilities. As clients remain cautious in the face of macroeconomic uncertainty, we’re focused on partnering closely with them while staying committed to consistent and profitable growth.”

Aparna Iyer, Chief Financial Officer, said “For Q4 operating margins expanded 110 basis points year on year and for the full financial year margin expanded by 90 basis points. Our focus on execution rigour has ensured that our margins have steadily expanded even in a softening revenue environment. Our endeavor will be to maintain the margin in a narrow band in the coming quarters. Our net income grew 6.4% sequentially in Q4 and 18.9% for the full financial year. Cash flow continued to be robust in Q4 resulting in net operating cash flow generation of almost $ 2 Bn for FY’25, which is 128.2% of our net income.”

Capital Allocation:

The interim dividend of ₹ 6 declared by the Board at its meeting held on January 17th, 2025, shall be considered as final dividend for the financial year 2024-25.

| 1. | For the convenience of the readers, the amounts in Indian Rupees in this release have been translated into United States Dollars at the certified foreign exchange rate of US$1 = ₹85.43, as published by the Federal Reserve Board of Governors on March 31, 2025. However, the realized exchange rate in our IT Services business segment for the quarter ended March 31, 2025, was US$1= ₹86.44 |

| 2. | Constant currency for a period is the product of volumes in that period times the average actual exchange rate of the corresponding comparative period. |

| 3. | Total Bookings refers to the total contract value of all orders that were booked during the period including new orders, renewals, and increases to existing contracts. Bookings do not reflect subsequent terminations or reductions related to bookings originally recorded in prior fiscal periods. Bookings are recorded using then-existing foreign currency exchange rates and are not subsequently adjusted for foreign currency exchange rate fluctuations. The revenues from these contracts accrue over the tenure of the contract. For constant currency growth rates, refer note 2. |

| 4. | Large deal bookings consist of deals greater than or equal to $30 million in total contract value. |

| 5. | IT Services Operating Margin refers to Segment Results Total as reflected in IFRS financials. |

2

Highlights of Strategic Deal Wins

In the fourth quarter, Wipro continued to win large and strategic deals across industries. Key highlights include:

| 1. | Phoenix Group, the UK’s largest long-term savings and retirement business, has selected Wipro to deliver life and pension business administration for their ReAssure business and accelerate the Group’s operational transformation. Under the terms of the 10-year deal, Wipro’s FCA-regulated entity, Wipro Financial Services Outsourcing Limited (WFOSL), will deliver comprehensive life and pension administration services that will encompass Policy Administration, Claims Processing, Customer Service Support, Data Management and Reporting, and Compliance and Regulatory Support. As part of the engagement, Wipro will also assume management of the client’s core policy administration ALPHA platform, modernizing it with AI, Automation, Cloud, and digital transformation technologies. This engagement aligns with our strategic big bet of setting up an Insurance Third Party Administration (TPA) business that will open doors for us to target large, multi-year platform, deals encompassing operations and technology. |

| 2. | A prominent North America-based financial institution has selected Wipro to enhance its technology infrastructure, delivery and operations. The Wipro team will consolidate the client’s existing technology vendors, thereby providing improved visibility into their technological delivery. Wipro will implement a global delivery model across the client’s entire business to streamline processes, optimize resource allocation, and significantly boost efficiency. This comprehensive approach will enable the client to achieve substantial cost savings, heightened productivity, and superior service delivery. |

| 3. | A manufacturer of premium household appliances headquartered in Europe has selected Wipro to manage and transform its IT landscape. The Wipro team will future-proof the client’s IT infrastructure by harnessing its AI-driven Smart-Operations Solution that includes conversational virtual service desk AI agents providing seamless support in multiple languages. Wipro will consolidate all business applications, infrastructure, and cyber security tracks onto a unified monitoring platform to provide better visibility into the client’s technology ecosystem. From this project, the client can expect to see enhanced operational efficiency and robust cyber-risk management. |

| 4. | One of the largest health insurers in the U.S has extended its engagement with Wipro to automate and streamline its financial and membership reconciliation. Wipro will deploy its industry leading Medicare platform, “Payer-in-a-box”, to support the client’s growing business. The SaaS based solution will provide the client with increased flexibility to handle membership growth, optimized financial control, and assured compliance with Centre for Medicare & Medicaid Services regulations. Additionally, the solution will also ensure data security, platform stability, and seamless business continuity for the client. |

| 5. | A Fortune 100 global healthcare payer, experiencing significant business growth, has entrusted Wipro to manage its increased operational demands. Wipro will leverage its deep expertise and AI tools to scale the client’s Medicare, Medicaid, and ACA operations. This will enable the client to focus on their core strategic priorities, optimize operational costs, and significantly improve efficiency in member services. Wipro will support the client in improving user experience and driving exceptional business outcomes. |

3

| 6. | A US-based payment card services company has expanded its relationship with Wipro to modernize and maintain its business applications portfolio. The Wipro team will undertake a transformation and optimization program across the client’s payment ecosystem. From this project, the client will see significantly improved transaction security for their end-customers, as well as enhanced scalability and cost efficiency. |

| 7. | A leading American multinational energy corporation has extended their relationship with Wipro to provide Application Management Services across their entire Oil & Gas value chain. Leveraging Wipro’s AI-powered NextGen AMS solution, the team will modernize and manage an expanded scope of business applications that power critical functions across the client’s end-to-end business value chain. Through this engagement, the client will see a significant increase in AI-enabled operational efficiency, improved resilience in automation, enhanced service levels, as well as stronger alignment with their competitive performance goals. |

| 8. | A North American parcel delivery company has extended its relationship with Wipro to provide private Cloud solutions, which comprise Cloud Server, Storage, Network, Security, and Scheduling services. Leveraging AI-Ops tools, the Wipro team will help the client achieve improved ticket resolution and reduction in planned outages. Further, the client will realize enhanced business agility and scalability, as well as cost predictability, data sovereignty, and resiliency. |

| 9. | A Europe-based international food wholesaler has extended its partnership with Wipro to provide comprehensive business application management, cloud, and IT support services. In the initial phase of the partnership, Wipro assisted the customer in accelerating their cloud strategy by migrating 80% of their on-premises infrastructure to the cloud and contributing to the modernization of their store infrastructure. The second phase will focus on enhancing cloud security through modernization and optimization of the client’s cloud environment. The Wipro team will also continue to manage and modernize the client’s business applications, utilizing GenAI-powered solutions to swiftly detect and resolve incidents, ensuring uninterrupted operations. Additionally, Wipro will leverage data-driven business insights to improve strategic decision-making, leading to enhanced operational efficiency and greater visibility into the client’s business segments. |

| 10. | A large Australian engineering and construction company has strengthened its strategic, long-standing partnership with Wipro by expanding into a Managed Services contract. Wipro will leverage automation and AI ops to improve user experience, deliver faster and higher quality issue resolution, as well as to optimize IT costs, and streamline operations. Wipro will also transform the client’s IT service delivery across multiple business units to create a modern, secure, and sustainable environment. |

| 11. | A multinational engineering corporation has selected Wipro to implement AI-powered comprehensive managed infosec services solution to enhance their network, endpoint, cloud, and identity security. Integrating AI solutions from the WeGA studio, Wipro will automate processes, efficiently resolve alerts, and provide contextual resolutions for the client. Wipro will enhance agent productivity by 15-20%, resulting in significant efficiency gains and improved overall performance. |

4

| 12. | Wipro has partnered with a US-based utility company to set up a GenAI Center of Excellence to spearhead AI innovation. Through the CoE, Wipro will create a comprehensive GenAI strategy for the client’s AI and data lifecycle. Wipro is developing an end-to-end resource planning platform for logistics, power management, and asset health monitoring, to streamline operations. The AI & data CoE will facilitate better risk governance, accelerated adoption and measurable ROI. The client will also see enhanced decision-making, regulatory alignment, as well as reusable and faster deployment of AI models. |

Analyst Recognition

| 1. | Wipro was positioned as a Horizon 3 – Market Leader in the HFS Horizons: Generative Enterprise Services, 2025 report |

| 2. | Wipro was ranked as a Leader in Avasant’s Life Sciences Digital Services 2025 RadarView™ |

| 3. | Wipro was positioned as a Leader in Everest Group’s Managed Detection and Response (MDR) Services PEAK Matrix® Assessment 2025 |

| 4. | Wipro was positioned as a Leader in ISG Provider Lens™ - Power & Utilities Industry Services and Solutions 2024 – North America & Europe (multiple quadrants) |

| 5. | Wipro was rated as a Leader in ISG Provider Lens™ - Oil and Gas Industry Services and Solutions 2024 - North America (all quadrants) |

| 6. | Wipro was recognized as a Leader in ISG Provider Lens™ - Telecom, Media and Entertainment Industry Services 2024 – North America (multiple quadrants) |

| 7. | Wipro was featured as a Leader in ISG Provider Lens™ - Advanced Analytics and AI Services 2024 - US (all quadrants) |

| 8. | Wipro was recognized as a Leader in ISG Provider Lens™ - Healthcare Digital Services 2024 - US (all quadrants) |

| 9. | Wipro was recognized as a Leader and Star Performer in Everest Group’s SAP Business Application Services PEAK Matrix® Assessment 2025 |

| 10. | Wipro was positioned as a Leader in ISG Provider Lens™ - Oracle Cloud and Technology Ecosystem 2024 - US & Europe (all quadrants) |

| 11. | Wipro was rated as a Leader in ISG Provider Lens™ - Sustainability and ESG 2024 - US & Europe (all quadrants) |

| 12. | Wipro was positioned as a Leader in the 2025 Gartner® Magic Quadrant™ for Outsourced Digital Workplace Services |

| 13. | Wipro was recognized as a Leader in Everest Group’s Application Management Services PEAK Matrix® Assessment 2025 |

Source & Disclaimer: *Gartner, “Magic Quadrant for Outsourced Digital Workplace Services”, Karl Rosander, et al, 24 March 2025.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product, or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner’s research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

The Gartner content described herein (the “Gartner Content”) represents research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and is not a representation of fact. Gartner Content speaks as of its original publication date (and not as of the date of this press release, and the opinions expressed in the Gartner Content are subject to change without notice.

5

IT Products

1. IT Products segment revenue for the quarter was ₹0.8 billion ($9.5 million1)

2. IT Products segment results for the quarter were ₹0.03 billion ($0.3million1)

3. IT Products segment revenue for the year was ₹2.7 billion ($31.5 million1)

4. IT Products segment results for the year were (₹(-)0.2 billion) ($(-)2.0 million1)

Please refer to the table on page 12 for reconciliation between IFRS IT Services Revenue and IT Services Revenue on a non-GAAP constant currency basis.

About Key Metrics and Non-GAAP Financial Measures

This press release contains key metrics and non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. Such non-GAAP financial measures are measures of our historical or future performance, financial position or cash flows that are adjusted to exclude or include amounts that are excluded or included, as the case may be, from the most directly comparable financial measure calculated and presented in accordance with IFRS.

The table on page 12 provides IT Services Revenue on a constant currency basis, which is a non-GAAP financial measure that is calculated by translating IT Services Revenue from the current reporting period into U.S. dollars based on the currency conversion rate in effect for the prior reporting period. We refer to growth rates in constant currency so that business results may be viewed without the impact of fluctuations in foreign currency exchange rates, thereby facilitating period-to-period comparisons of our business performance. Further, in the normal course of business, we may divest a portion of our business which may not be strategic. We refer to the growth rates in both reported and constant currency adjusting for such divestments in order to represent the comparable growth rates.

Our key metrics and non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, the most directly comparable financial measure calculated in accordance with IFRS and may be different from non-GAAP measures used by other companies. Our key metrics and non-GAAP financial measures are not comparable to, nor should be substituted for, an analysis of our revenue over time and involve estimates and judgments. In addition to our non-GAAP measures, the financial statements prepared in accordance with IFRS and the reconciliation of these non-GAAP financial measures with the most directly comparable IFRS financial measure should be carefully evaluated.

Results for the Quarter and Year ended March 31, 2025, prepared under IFRS, along with individual business segment reports, are available in the Investors section of our website www.wipro.com/investors/

Quarterly Conference Call

We will hold an earnings conference call today at 07:00 p.m. Indian Standard Time (8:30 a.m. U.S. Eastern Time) to discuss our performance for the quarter. The audio from the conference call will be available online through a webcast and can be accessed at the following link- https://links.ccwebcast.com/?EventId=WIP160425 An audio recording of the management discussions and the question-and-answer session will be available online and will be accessible in the Investor Relations section of our website at www.wipro.com

6

About Wipro Limited

Wipro Limited (NYSE: WIT, BSE: 507685, NSE: WIPRO) is a leading technology services and consulting company focused on building innovative solutions that address clients’ most complex digital transformation needs. Leveraging our holistic portfolio of capabilities in consulting, design, engineering, and operations, we help clients realize their boldest ambitions and build future-ready, sustainable businesses. With over 230,000 employees and business partners across 65 countries, we deliver on the promise of helping our clients, colleagues, and communities thrive in an ever-changing world. For additional information, visit us at www.wipro.com

| Contact for Investor Relations |

Contact for Media & Press |

|||

| Dipak Kumar Bohra |

Abhishek Jain |

Dinesh Joshi |

||

| Phone: +91-80-6142 7201 |

Phone: +91-80-6142 6143 |

Phone: +91 92052-64001 |

||

|

dipak.bohra@wipro.com |

abhishek.jain2@wipro.com |

media-relations@wipro.com |

||

Forward-Looking Statements

The forward-looking statements contained herein represent Wipro’s beliefs regarding future events, many of which are by their nature, inherently uncertain and outside Wipro’s control. Such statements include, but are not limited to, statements regarding Wipro’s growth prospects, its future financial operating results, the benefits its customers experience and its plans, expectations and intentions. Wipro cautions readers that the forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results to differ materially from the results anticipated by such statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties regarding fluctuations in our earnings, revenue and profits, our ability to generate and manage growth, complete proposed corporate actions, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which we make strategic investments, withdrawal of fiscal governmental incentives, political instability, war, legal restrictions on raising capital or acquiring companies outside India, unauthorized use of our intellectual property and general economic conditions affecting our business and industry.

Additional risks that could affect our future operating results are more fully described in our filings with the United States Securities and Exchange Commission, including, but not limited to, Annual Reports on Form 20-F. These filings are available at www.sec.gov. We may, from time to time, make additional written and oral forward-looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statement that may be made from time to time by us or on our behalf.

# # #

(Tables to follow)

7

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(₹ in millions, except share and per share data, unless otherwise stated)

| As at March 31, 2024 | As at March 31, 2025 | |||||||||||

|

|

Convenience translation into US dollar in millions (unaudited) |

|||||||||||

| ASSETS |

||||||||||||

| Goodwill |

316,002 | 325,014 | 3,804 | |||||||||

| Intangible assets |

32,748 | 27,450 | 321 | |||||||||

| Property, plant and equipment |

81,608 | 80,684 | 944 | |||||||||

| Right-of-Use assets |

17,955 | 25,598 | 300 | |||||||||

| Financial assets |

||||||||||||

| Derivative assets |

25 | ^ | ^ | |||||||||

| Investments |

21,629 | 26,458 | 310 | |||||||||

| Trade receivables |

4,045 | 299 | 3 | |||||||||

| Other financial assets |

5,550 | 4,664 | 54 | |||||||||

| Investments accounted for using the equity method |

1,044 | 1,327 | 16 | |||||||||

| Deferred tax assets |

1,817 | 2,561 | 30 | |||||||||

| Non-current tax assets |

9,043 | 7,230 | 85 | |||||||||

| Other non-current assets |

10,331 | 7,460 | 87 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current assets |

501,797 | 508,745 | 5,954 | |||||||||

|

|

|

|

|

|

|

|||||||

| Inventories |

907 | 694 | 8 | |||||||||

| Financial assets |

||||||||||||

| Derivative assets |

1,333 | 1,820 | 21 | |||||||||

| Investments |

311,171 | 411,474 | 4,817 | |||||||||

| Cash and cash equivalents |

96,953 | 121,974 | 1,428 | |||||||||

| Trade receivables |

115,477 | 117,745 | 1,378 | |||||||||

| Unbilled receivables |

58,345 | 64,280 | 753 | |||||||||

| Other financial assets |

10,536 | 8,448 | 99 | |||||||||

| Contract assets |

19,854 | 15,795 | 185 | |||||||||

| Current tax assets |

6,484 | 6,417 | 75 | |||||||||

| Other current assets |

29,602 | 29,128 | 341 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current assets |

650,662 | 777,775 | 9,105 | |||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||||

| TOTAL ASSETS |

1,152,459 | 1,286,520 | 15,059 | |||||||||

|

|

|

|

|

|

|

|||||||

| EQUITY |

||||||||||||

| Share capital |

10,450 | 20,944 | 245 | |||||||||

| Share premium |

3,291 | 2,628 | 31 | |||||||||

| Retained earnings |

630,936 | 716,477 | 8,387 | |||||||||

| Share-based payment reserve |

6,384 | 6,985 | 82 | |||||||||

| Special Economic Zone re-investment reserve |

42,129 | 27,778 | 325 | |||||||||

| Other components of equity |

56,693 | 53,497 | 626 | |||||||||

|

|

|

|

|

|

|

|||||||

| Equity attributable to the equity holders of the Company |

749,883 | 828,309 | 9,696 | |||||||||

| Non-controlling interests |

1,340 | 2,138 | 25 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL EQUITY |

751,223 | 830,447 | 9,721 | |||||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES |

||||||||||||

| Financial liabilities |

||||||||||||

| Loans and borrowings |

62,300 | 63,954 | 749 | |||||||||

| Lease liabilities |

13,962 | 22,193 | 260 | |||||||||

| Derivative liabilities |

4 | - | - | |||||||||

| Other financial liabilities |

4,985 | 7,793 | 91 | |||||||||

| Deferred tax liabilities |

17,467 | 16,443 | 192 | |||||||||

| Non-current tax liabilities |

37,090 | 42,024 | 492 | |||||||||

| Other non-current liabilities |

12,970 | 17,119 | 200 | |||||||||

| Provisions |

- | 294 | 3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current liabilities |

148,778 | 169,820 | 1,987 | |||||||||

|

|

|

|

|

|

|

|||||||

| Financial liabilities |

||||||||||||

| Loans, borrowings and bank overdrafts |

79,166 | 97,863 | 1,146 | |||||||||

| Lease liabilities |

9,221 | 8,025 | 94 | |||||||||

| Derivative liabilities |

558 | 968 | 11 | |||||||||

| Trade payables and accrued expenses |

88,566 | 88,252 | 1,033 | |||||||||

| Other financial liabilities |

2,272 | 3,878 | 45 | |||||||||

| Contract liabilities |

17,653 | 20,063 | 235 | |||||||||

| Current tax liabilities |

21,756 | 34,481 | 404 | |||||||||

| Other current liabilities |

31,295 | 31,086 | 364 | |||||||||

| Provisions |

1,971 | 1,637 | 19 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current liabilities |

252,458 | 286,253 | 3,351 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL LIABILITIES |

401,236 | 456,073 | 5,338 | |||||||||

|

|

|

|

|

|

|

|||||||

| TOTAL EQUITY AND LIABILITIES |

1,152,459 | 1,286,520 | 15,059 | |||||||||

|

|

|

|

|

|

|

|||||||

^ Value is less than 0.5

8

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended March 31, | Year ended March 31, | |||||||||||||||||||||||

| 2024 | 2025 | 2025 | 2024 | 2025 | 2025 | |||||||||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) |

|

|

Convenience translation into US dollar in millions (unaudited) |

|||||||||||||||||||

| Revenues |

222,083 | 225,042 | 2,634 | 897,603 | 890,884 | 10,428 | ||||||||||||||||||

| Cost of revenues |

(157,219 | ) | (155,525 | ) | (1,820 | ) | (631,497 | ) | (617,802 | ) | (7,231 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

64,864 | 69,517 | 814 | 266,106 | 273,082 | 3,197 | ||||||||||||||||||

| Selling and marketing expenses |

(15,443 | ) | (15,065 | ) | (176 | ) | (69,972 | ) | (64,378 | ) | (753 | ) | ||||||||||||

| General and administrative expenses |

(13,920 | ) | (15,589 | ) | (183 | ) | (60,375 | ) | (57,465 | ) | (673 | ) | ||||||||||||

| Foreign exchange gains/(losses), net |

(128 | ) | 224 | 3 | 340 | 32 | ^ | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Results from operating activities |

35,373 | 39,087 | 458 | 136,099 | 151,271 | 1,771 | ||||||||||||||||||

| Finance expenses |

(3,308 | ) | (3,767 | ) | (44 | ) | (12,552 | ) | (14,770 | ) | (173 | ) | ||||||||||||

| Finance and other income |

6,759 | 11,819 | 138 | 23,896 | 38,202 | 447 | ||||||||||||||||||

| Share of net profit/ (loss) of associate and joint venture accounted for using the equity method |

(202 | ) | 291 | 3 | (233 | ) | 254 | 3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit before tax |

38,622 | 47,430 | 555 | 147,210 | 174,957 | 2,048 | ||||||||||||||||||

| Income tax expense |

(10,040 | ) | (11,549 | ) | (135 | ) | (36,089 | ) | (42,777 | ) | (501 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit for the period |

28,582 | 35,881 | 420 | 111,121 | 132,180 | 1,547 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit attributable to: |

||||||||||||||||||||||||

| Equity holders of the Company |

28,346 | 35,696 | 418 | 110,452 | 131,354 | 1,537 | ||||||||||||||||||

| Non-controlling interests |

236 | 185 | 2 | 669 | 826 | 10 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Profit for the period |

28,582 | 35,881 | 420 | 111,121 | 132,180 | 1,547 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per equity share: |

||||||||||||||||||||||||

| Attributable to equity holders of the Company |

||||||||||||||||||||||||

| Basic |

2.71 | 3.41 | 0.04 | 10.44 | 12.56 | 0.15 | ||||||||||||||||||

| Diluted |

2.70 | 3.39 | 0.04 | 10.41 | 12.52 | 0.14 | ||||||||||||||||||

| Weighted average number of equity shares used in computing earnings per equity share | ||||||||||||||||||||||||

| Basic |

10,444,700,646 | 10,462,328,534 | 10,462,328,534 | 10,576,571,110 | 10,456,741,552 | 10,456,741,552 | ||||||||||||||||||

| Diluted |

10,470,351,422 | 10,490,716,219 | 10,490,716,219 | 10,611,424,628 | 10,488,939,392 | 10,488,939,392 | ||||||||||||||||||

^ Value is less than 0.5

9

Information on reportable segments for the three months ended March 31, 2025, December 31, 2024, March 31, 2024, and year ended March 31, 2025 and March 31, 2024 are as follows:

| Particulars | Three months ended | Year ended | ||||||||||||||||||

| March 31, 2025 |

December 31, 2024 |

March 31, 2024 |

March 31, 2025 |

March 31, 2024 |

||||||||||||||||

| Audited | Audited | Audited | Audited | Audited | ||||||||||||||||

| Segment revenue | ||||||||||||||||||||

| IT Services | ||||||||||||||||||||

| Americas 1 |

73,721 | 72,010 | 67,229 | 281,824 | 268,230 | |||||||||||||||

| Americas 2 |

68,582 | 68,120 | 67,724 | 271,972 | 269,482 | |||||||||||||||

| Europe |

58,552 | 59,282 | 61,344 | 240,077 | 253,927 | |||||||||||||||

| APMEA |

23,598 | 23,439 | 24,499 | 94,351 | 102,177 | |||||||||||||||

| Total of IT Services | 224,453 | 222,851 | 220,796 | 888,224 | 893,816 | |||||||||||||||

| IT Products |

813 | 747 | 1,159 | 2,692 | 4,127 | |||||||||||||||

|

Total segment revenue |

225,266 | 223,598 | 221,955 | 890,916 | 897,943 | |||||||||||||||

| Segment result |

||||||||||||||||||||

| IT Services |

||||||||||||||||||||

| Americas 1 |

16,195 | 14,966 | 14,081 | 58,186 | 59,364 | |||||||||||||||

| Americas 2 |

15,513 | 15,275 | 15,791 | 61,326 | 59,163 | |||||||||||||||

| Europe |

8,140 | 7,600 | 7,933 | 29,434 | 33,354 | |||||||||||||||

| APMEA |

3,672 | 3,667 | 3,401 | 12,850 | 12,619 | |||||||||||||||

| Unallocated |

(4,250 | ) | (2,518 | ) | (5,011 | ) | (10,157 | ) | (20,304 | ) | ||||||||||

| Total of IT Services |

39,270 | 38,990 | 36,195 | 151,639 | 144,196 | |||||||||||||||

| IT Products |

28 | 29 | 143 | (173 | ) | (371 | ) | |||||||||||||

|

Reconciling Items |

(211 | ) | (53 | ) | (965 | ) | (195 | ) | (7,726 | ) | ||||||||||

|

Total segment result |

39,087 | 38,966 | 35,373 | 151,271 | 136,099 | |||||||||||||||

| Finance expenses |

(3,767 | ) | (4,146 | ) | (3,308 | ) | (14,770 | ) | (12,552 | ) | ||||||||||

| Finance and other income |

11,819 | 9,708 | 6,759 | 38,202 | 23,896 | |||||||||||||||

| Share of net profit/ (loss) of associate and joint venture accounted for using the equity method | 291 | 5 | (202 | ) | 254 | (233 | ) | |||||||||||||

|

Profit before tax |

47,430 | 44,533 | 38,622 | 174,957 | 147,210 | |||||||||||||||

10

Additional Information:

The Company is organized into the following operating segments: IT Services and IT Products.

IT Services: The IT Services segment primarily consists of IT services offerings to customers organized by four Strategic Market Units (“SMUs”) - Americas 1, Americas 2, Europe and Asia Pacific Middle East and Africa (“APMEA”). Americas 1 and Americas 2 are primarily organized by industry sector, while Europe and APMEA are organized by countries.

Americas 1 includes the entire business of Latin America (“LATAM”) and the following industry sectors in the United States of America: Communications, media and information services, Software and gaming, New age technology, Consumer goods, medical devices and life sciences, Healthcare, and Technology products and services. Americas 2 includes the entire business in Canada and the following industry sectors in the United States of America: Banking and financial services, Energy, Manufacturing and resources, Capital markets and insurance, and Hi-tech.

Europe consists of the United Kingdom and Ireland, Switzerland, Germany, Northern Europe and Southern Europe.

APMEA consists of Australia and New Zealand, India, Middle East, South-East Asia, Japan and Africa.

Revenue from each customer is attributed to the respective SMUs based on the location of the customer’s primary buying center of such services. With respect to certain strategic global customers, revenue may be generated from multiple countries based on such customer’s buying centers, but the total revenue related to these strategic global customers are attributed to a single SMU based on the geographical location of key decision makers.

IT Products: The Company is a value-added reseller of security, packaged and SaaS software for leading international brands. In certain total outsourcing contracts of the IT Services segment, the Company delivers hardware, software products and other related deliverables. Revenue relating to these items is reported as revenue from the sale of IT Products.

11

Reconciliation of selected GAAP measures to Non-GAAP measures

| 1. | Reconciliation of Non-GAAP Constant Currency IT Services Revenue to IT Services Revenue as per IFRS ($Mn) |

| Three Months ended March 31, 2025 | ||

| IT Services Revenue as per IFRS |

$2,596.5 | |

| Effect of Foreign currency exchange movement |

$11.4 | |

|

Non-GAAP Constant Currency IT Services Revenue based on previous quarter exchange rates |

$2,607.9 | |

|

|

||

| Three Months ended March 31, 2025 | ||

| IT Services Revenue as per IFRS |

$2,596.5 | |

| Effect of Foreign currency exchange movement |

$29.8 | |

|

Non-GAAP Constant Currency IT Services Revenue based on exchange rates of comparable period in previous year |

$2,626.3 | |

|

|

||

| Year ended March 31, 2025 | ||

| IT Services Revenue as per IFRS |

$10,511.5 | |

| Effect of Foreign currency exchange movement |

$45.0 | |

|

Non-GAAP Constant Currency IT Services Revenue based on previous year exchange rates |

$10,556.6 | |

12

| 2. | Reconciliation of Free Cash Flow for three months and twelve months ended March 31, 2025 |

| Amount in INR Mn | ||||

| Three months ended March 31, 2025 |

Twelve months ended March 31, 2025 |

|||

|

Net Income for the period [A] |

35,881 | 132,180 | ||

|

Computation of Free Cash Flow |

||||

| Net cash generated from operating activities [B] |

37,465 | 169,426 | ||

| Add/ (deduct) cash inflow/ (outflow)on: |

||||

| Purchase of property, plant and equipment |

(6,875) | (14,737) | ||

| Proceeds from sale of property, plant and equipment |

306 | 1,822 | ||

|

Free Cash Flow [C] |

30,896 | 156,511 | ||

|

Operating Cash Flow as percentage of Net Income [B/A] |

104.4% | 128.2% | ||

| Free Cash Flow as percentage of Net Income [C/A] |

86.1% | 118.4% | ||

-------------------------------

13

Exhibit 99.2

Exhibit 99.3

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS UNDER IFRS

AS AT AND FOR THE THREE MONTHS AND YEAR ENDED MARCH 31, 2025

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(₹ in millions, except share and per share data, unless otherwise stated)

| Notes | As at March 31, 2024 | As at March 31, 2025 | ||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

||||||||||||

| ASSETS |

||||||||||||||

| Goodwill |

6 | 316,002 | 325,014 | 3,804 | ||||||||||

| Intangible assets |

6 | 32,748 | 27,450 | 321 | ||||||||||

| Property, plant and equipment |

4 | 81,608 | 80,684 | 944 | ||||||||||

| Right-of-Use assets |

5 | 17,955 | 25,598 | 300 | ||||||||||

| Financial assets |

||||||||||||||

| Derivative assets |

18 | 25 | ^ | ^ | ||||||||||

| Investments |

8 | 21,629 | 26,458 | 310 | ||||||||||

| Trade receivables |

4,045 | 299 | 3 | |||||||||||

| Other financial assets |

11 | 5,550 | 4,664 | 54 | ||||||||||

| Investments accounted for using the equity method |

1,044 | 1,327 | 16 | |||||||||||

| Deferred tax assets |

1,817 | 2,561 | 30 | |||||||||||

| Non-current tax assets |

9,043 | 7,230 | 85 | |||||||||||

| Other non-current assets |

12 | 10,331 | 7,460 | 87 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total non-current assets |

501,797 | 508,745 | 5,954 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Inventories |

9 | 907 | 694 | 8 | ||||||||||

| Financial assets |

||||||||||||||

| Derivative assets |

18 | 1,333 | 1,820 | 21 | ||||||||||

| Investments |

8 | 311,171 | 411,474 | 4,817 | ||||||||||

| Cash and cash equivalents |

10 | 96,953 | 121,974 | 1,428 | ||||||||||

| Trade receivables |

115,477 | 117,745 | 1,378 | |||||||||||

| Unbilled receivables |

58,345 | 64,280 | 753 | |||||||||||

| Other financial assets |

11 | 10,536 | 8,448 | 99 | ||||||||||

| Contract assets |

19,854 | 15,795 | 185 | |||||||||||

| Current tax assets |

6,484 | 6,417 | 75 | |||||||||||

| Other current assets |

12 | 29,602 | 29,128 | 341 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total current assets |

650,662 | 777,775 | 9,105 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL ASSETS |

1,152,459 | 1,286,520 | 15,059 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| EQUITY |

||||||||||||||

| Share capital |

10,450 | 20,944 | 245 | |||||||||||

| Share premium |

3,291 | 2,628 | 31 | |||||||||||

| Retained earnings |

630,936 | 716,477 | 8,387 | |||||||||||

| Share-based payment reserve |

6,384 | 6,985 | 82 | |||||||||||

| Special Economic Zone re-investment reserve |

42,129 | 27,778 | 325 | |||||||||||

| Other components of equity |

56,693 | 53,497 | 626 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Equity attributable to the equity holders of the Company |

749,883 | 828,309 | 9,696 | |||||||||||

| Non-controlling interests |

1,340 | 2,138 | 25 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL EQUITY |

751,223 | 830,447 | 9,721 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| LIABILITIES |

||||||||||||||

| Financial liabilities |

||||||||||||||

| Loans and borrowings |

13 | 62,300 | 63,954 | 749 | ||||||||||

| Lease liabilities |

13,962 | 22,193 | 260 | |||||||||||

| Derivative liabilities |

18 | 4 | - | - | ||||||||||

| Other financial liabilities |

15 | 4,985 | 7,793 | 91 | ||||||||||

| Deferred tax liabilities |

17,467 | 16,443 | 192 | |||||||||||

| Non-current tax liabilities |

37,090 | 42,024 | 492 | |||||||||||

| Other non-current liabilities |

16 | 12,970 | 17,119 | 200 | ||||||||||

| Provisions |

17 | - | 294 | 3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total non-current liabilities |

148,778 | 169,820 | 1,987 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Financial liabilities |

||||||||||||||

| Loans, borrowings and bank overdrafts |

13 | 79,166 | 97,863 | 1,146 | ||||||||||

| Lease liabilities |

9,221 | 8,025 | 94 | |||||||||||

| Derivative liabilities |

18 | 558 | 968 | 11 | ||||||||||

| Trade payables and accrued expenses |

14 | 88,566 | 88,252 | 1,033 | ||||||||||

| Other financial liabilities |

15 | 2,272 | 3,878 | 45 | ||||||||||

| Contract liabilities |

17,653 | 20,063 | 235 | |||||||||||

| Current tax liabilities |

21,756 | 34,481 | 404 | |||||||||||

| Other current liabilities |

16 | 31,295 | 31,086 | 364 | ||||||||||

| Provisions |

17 | 1,971 | 1,637 | 19 | ||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| Total current liabilities |

252,458 | 286,253 | 3,351 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL LIABILITIES |

401,236 | 456,073 | 5,338 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| TOTAL EQUITY AND LIABILITIES |

1,152,459 | 1,286,520 | 15,059 | |||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

| ^ Value is less than 0.5 |

|

|||||||||||||

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Srinivas Pallia | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | (DIN: 02983899) | (DIN: 00009627) | Managing Director |

|||

| (DIN: 10574442)

|

||||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer | Company Secretary | ||||

| Membership No.: 110815 | Membership No.: F4129 | |||||

|

Bengaluru |

||||||

| April 16, 2025 | ||||||

1

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended March 31, | Year ended March 31, | |||||||||||||||||||||||||||

| Notes | 2024 | 2025 | 2025 | 2024 | 2025 | 2025 | ||||||||||||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|||||||||||||||||||||||

| Revenues |

21 | 222,083 | 225,042 | 2,634 | 897,603 | 890,884 | 10,428 | |||||||||||||||||||||

| Cost of revenues |

22 | (157,219 | ) | (155,525 | ) | (1,820 | ) | (631,497 | ) | (617,802 | ) | (7,231 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

64,864 | 69,517 | 814 | 266,106 | 273,082 | 3,197 | ||||||||||||||||||||||

| Selling and marketing expenses |

22 | (15,443 | ) | (15,065 | ) | (176 | ) | (69,972 | ) | (64,378 | ) | (753 | ) | |||||||||||||||

| General and administrative expenses |

22 | (13,920 | ) | (15,589 | ) | (183 | ) | (60,375 | ) | (57,465 | ) | (673 | ) | |||||||||||||||

| Foreign exchange gains/(losses), net |

24 | (128 | ) | 224 | 3 | 340 | 32 | ^ | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Results from operating activities | 35,373 | 39,087 | 458 | 136,099 | 151,271 | 1,771 | ||||||||||||||||||||||

| Finance expenses |

23 | (3,308 | ) | (3,767 | ) | (44 | ) | (12,552 | ) | (14,770 | ) | (173 | ) | |||||||||||||||

| Finance and other income |

24 | 6,759 | 11,819 | 138 | 23,896 | 38,202 | 447 | |||||||||||||||||||||

| Share of net profit/ (loss) of associate and joint venture accounted for using the equity method |

(202 | ) | 291 | 3 | (233 | ) | 254 | 3 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit before tax |

38,622 | 47,430 | 555 | 147,210 | 174,957 | 2,048 | ||||||||||||||||||||||

| Income tax expense |

20 | (10,040 | ) | (11,549 | ) | (135 | ) | (36,089 | ) | (42,777 | ) | (501 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit for the period |

28,582 | 35,881 | 420 | 111,121 | 132,180 | 1,547 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit attributable to: |

||||||||||||||||||||||||||||

| Equity holders of the Company |

28,346 | 35,696 | 418 | 110,452 | 131,354 | 1,537 | ||||||||||||||||||||||

| Non-controlling interests |

236 | 185 | 2 | 669 | 826 | 10 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit for the period |

28,582 | 35,881 | 420 | 111,121 | 132,180 | 1,547 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per equity share: |

25 | |||||||||||||||||||||||||||

| Attributable to equity holders of the Company |

||||||||||||||||||||||||||||

| Basic |

2.71 | 3.41 | 0.04 | 10.44 | 12.56 | 0.15 | ||||||||||||||||||||||

| Diluted |

2.70 | 3.39 | 0.04 | 10.41 | 12.52 | 0.14 | ||||||||||||||||||||||

| Weighted average number of equity shares used in computing earnings per equity share | ||||||||||||||||||||||||||||

| Basic |

10,444,700,646 | 10,462,328,534 | 10,462,328,534 | 10,576,571,110 | 10,456,741,552 | 10,456,741,552 | ||||||||||||||||||||||

| Diluted |

10,470,351,422 | 10,490,716,219 | 10,490,716,219 | 10,611,424,628 | 10,488,939,392 | 10,488,939,392 | ||||||||||||||||||||||

| ^ Value is less than 0.5 |

|

|||||||||||||||||||||||||||

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Srinivas Pallia | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | (DIN: 02983899) | (DIN: 00009627) | Managing Director | |||

| (DIN: 10574442)

|

||||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer |

Company Secretary | ||||

| Membership No.: 110815 | Membership No.: F4129 | |||||

|

Bengaluru |

||||||

| April 16, 2025 | ||||||

2

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(₹ in millions, except share and per share data, unless otherwise stated)

| Three months ended March 31, | Year ended March 31, | |||||||||||||||||||||||

| 2024 | 2025 | 2025 | 2024 | 2025 | 2025 | |||||||||||||||||||

|

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|

|

Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

|||||||||||||||||||

| Profit for the period | 28,582 | 35,881 | 420 | 111,121 | 132,180 | 1,547 | ||||||||||||||||||

| Other comprehensive income (OCI) | ||||||||||||||||||||||||

| Items that will not be reclassified to profit or loss in subsequent periods | ||||||||||||||||||||||||

| Remeasurements of the defined benefit plans, net |

(177 | ) | 124 | 1 | 82 | 274 | 3 | |||||||||||||||||

| Net change in fair value of investment in equity instruments measured at fair value through OCI |

(506 | ) | (2,943 | ) | (34 | ) | (473 | ) | (3,476 | ) | (41 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| (683 | ) | (2,819 | ) | (33 | ) | (391 | ) | (3,202 | ) | (38 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Items that will be reclassified to profit or loss in subsequent periods | ||||||||||||||||||||||||

| Foreign currency translation differences |

(844 | ) | 1,762 | 21 | 4,219 | 7,331 | 86 | |||||||||||||||||

| Reclassification of foreign currency translation differences on liquidation of subsidiaries to statement of income |

(2 | ) | (55 | ) | (1 | ) | (198 | ) | (41 | ) | ^ | |||||||||||||

| Net change in time value of option contracts designated as cash flow hedges, net of taxes |

271 | (94 | ) | (1 | ) | 198 | (189 | ) | (2 | ) | ||||||||||||||

| Net change in intrinsic value of option contracts designated as cash flow hedges, net of taxes |

15 | 335 | 4 | 128 | 146 | 2 | ||||||||||||||||||

| Net change in fair value of forward contracts designated as cash flow hedges, net of taxes |

355 | 810 | 9 | 1,655 | (745 | ) | (9 | ) | ||||||||||||||||

| Net change in fair value of investment in debt instruments measured at fair value through OCI, net of taxes |

261 | 352 | 4 | 1,516 | 963 | 11 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| 56 | 3,110 | 36 | 7,518 | 7,465 | 88 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Total other comprehensive income, net of taxes |

(627 | ) | 291 | 3 | 7,127 | 4,263 | 50 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Total comprehensive income for the period |

27,955 | 36,172 | 423 | 118,248 | 136,443 | 1,597 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| Total comprehensive income attributable to: |

||||||||||||||||||||||||

| Equity holders of the Company |

27,781 | 36,005 | 421 | 117,744 | 135,595 | 1,587 | ||||||||||||||||||

| Non-controlling interests |

174 | 167 | 2 | 504 | 848 | 10 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| 27,955 | 36,172 | 423 | 118,248 | 136,443 | 1,597 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

| ^ Value is less than 0.5 |

|

|||||||||||||||||||||||

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Srinivas Pallia | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W - 100018 | (DIN: 02983899) | (DIN: 00009627) | Managing Director | |||

| (DIN: 10574442)

|

||||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer |

Company Secretary | ||||

| Membership No.: 110815 | Membership No.: F4129 | |||||

|

Bengaluru |

||||||

| April 16, 2025 | ||||||

3

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(₹ in millions, except share and per share data, unless otherwise stated)

|

Special Economic Zone re- investment reserve |

Other components of equity |

Equity attributable to the equity holders of the Company |

Non- controlling interests |

Total equity | ||||||||||||||||||||||||||||||||||||||||||||

| Particulars | Number of shares (1) |

Share capital, fully paid-up |

Share premium |

Retained earnings |

Share- based payment reserve |

Foreign currency translation reserve (2) |

Cash flow hedging reserve (3) |

Other reserves (2) |

||||||||||||||||||||||||||||||||||||||||

| As at April 1, 2023 | 5,487,917,741 | 10,976 | 3,689 | 660,964 | 5,632 | 46,803 | 43,255 | (1,403 | ) | 11,248 | 781,164 | 589 | 781,753 | |||||||||||||||||||||||||||||||||||

| Comprehensive income for the year | ||||||||||||||||||||||||||||||||||||||||||||||||

| Profit for the year |

- | - | - | 110,452 | - | - | - | - | - | 110,452 | 669 | 111,121 | ||||||||||||||||||||||||||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | 4,006 | 1,981 | 1,305 | 7,292 | (165 | ) | 7,127 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income for the year | - | - | - | 110,452 | - | - | 4,006 | 1,981 | 1,305 | 117,744 | 504 | 118,248 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Issue of equity shares on exercise of options | 6,883,426 | 13 | 3,370 | - | (3,370 | ) | - | - | - | - | 13 | - | 13 | |||||||||||||||||||||||||||||||||||

| Issue of shares by controlled trust on exercise of options (1) | - | - | - | 1,462 | (1,462 | ) | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||

| Compensation cost related to employee share-based payment | - | - | - | 7 | 5,584 | - | - | - | - | 5,591 | - | 5,591 | ||||||||||||||||||||||||||||||||||||

| Transferred from Special Economic Zone re-investment reserve | - | - | - | 4,674 | - | (4,674 | ) | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||

| Buyback of equity shares, including tax thereon (4) | (269,662,921 | ) | (539 | ) | (3,768 | ) | (141,015 | ) | - | - | - | - | 539 | (144,783 | ) | - | (144,783 | ) | ||||||||||||||||||||||||||||||

| Transaction cost related to buyback of equity shares (4) | - | - | - | (390 | ) | - | - | - | - | - | (390 | ) | - | (390 | ) | |||||||||||||||||||||||||||||||||

| Financial liability on written put options (5) | - | - | - | - | - | - | - | - | (4,238 | ) | (4,238 | ) | - | (4,238 | ) | |||||||||||||||||||||||||||||||||

| Non-controlling interests on acquisition of subsidiary (5) | - | - | - | - | - | - | - | - | - | - | 472 | 472 | ||||||||||||||||||||||||||||||||||||

| Dividend | - | - | - | (5,218 | ) | - | - | - | - | - | (5,218 | ) | (322 | ) | (5,540 | ) | ||||||||||||||||||||||||||||||||

| Others | - | - | - | - | - | - | - | - | - | - | 97 | 97 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other transactions for the year | (262,779,495 | ) | (526 | ) | (398 | ) | (140,480 | ) | 752 | (4,674 | ) | - | - | (3,699 | ) | (149,025 | ) | 247 | (148,778 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As at March 31, 2024 | 5,225,138,246 | 10,450 | 3,291 | 630,936 | 6,384 | 42,129 | 47,261 | 578 | 8,854 | 749,883 | 1,340 | 751,223 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Includes 5,952,740 treasury shares held as at March 31, 2024 by a controlled trust. 3,943,096 shares have been transferred by the controlled trust to eligible employees on exercise of options during the year ended March 31, 2024. (2) Refer to Note 19 (3) Refer to Note 18 (4) Refer to Note 30 (5) Refer to Note 7 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

4

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(₹ in millions, except share and per share data, unless otherwise stated)

| Special Economic Zone re- investment |

Other components of equity |

Equity attributable to the equity holders of the Company |

Non- controlling interests |

Total equity | ||||||||||||||||||||||||||||||||||||||||||||

| Particulars | Number of shares (1) |

Share capital, fully paid-up |

Share premium |

Retained earnings |

Share- based payment reserve |

Foreign currency translation reserve (2) |

Cash flow hedging reserve (3) |

Other reserves (2) |

||||||||||||||||||||||||||||||||||||||||

| As at April 1, 2024 | 5,225,138,246 | 10,450 | 3,291 | 630,936 | 6,384 | 42,129 | 47,261 | 578 | 8,854 | 749,883 | 1,340 | 751,223 | ||||||||||||||||||||||||||||||||||||

| Comprehensive income for the year | ||||||||||||||||||||||||||||||||||||||||||||||||

| Profit for the year |

- | - | - | 131,354 | - | - | - | - | - | 131,354 | 826 | 132,180 | ||||||||||||||||||||||||||||||||||||

| Other comprehensive income |

- | - | - | - | - | - | 7,253 | (788 | ) | (2,224 | ) | 4,241 | 22 | 4,263 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income for the year | - | - | - | 131,354 | - | - | 7,253 | (788 | ) | (2,224 | ) | 135,595 | 848 | 136,443 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Issue of equity shares on exercise of options | 13,628,596 | 27 | 4,950 | - | (4,950 | ) | - | - | - | - | 27 | - | 27 | |||||||||||||||||||||||||||||||||||

| Bonus issue of equity shares (4) | 5,233,369,207 | 10,467 | (5,613 | ) | (3,193 | ) | - | - | - | - | (1,661 | ) | - | - | - | |||||||||||||||||||||||||||||||||

| Dividend (5) | - | - | - | (62,750 | ) | - | - | - | - | - | (62,750 | ) | - | (62,750 | ) | |||||||||||||||||||||||||||||||||

| Transfer from Other components of equity (2) | - | - | - | 5,754 | - | - | - | - | (5,754 | ) | - | - | - | |||||||||||||||||||||||||||||||||||

| Transfer of shares pertaining to Non-controlling interests of subsidiary | - | - | - | 25 | - | - | (14 | ) | - | (8 | ) | 3 | (3 | ) | - | |||||||||||||||||||||||||||||||||

| Compensation cost related to employee share-based payment | - | - | - | - | 5,551 | - | - | - | - | 5,551 | - | 5,551 | ||||||||||||||||||||||||||||||||||||

| Transferred from Special Economic Zone re-investment reserve | - | - | - | 14,351 | - | (14,351 | ) | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||

| Others | - | - | - | - | - | - | - | - | - | - | (47 | ) | (47 | ) | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other transactions for the year | 5,246,997,803 | 10,494 | (663 | ) | (45,813 | ) | 601 | (14,351 | ) | (14 | ) | - | (7,423 | ) | (57,169 | ) | (50 | ) | (57,219 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| As at March 31, 2025 | 10,472,136,049 | 20,944 | 2,628 | 716,477 | 6,985 | 27,778 | 54,500 | (210 | ) | (793 | ) | 828,309 | 2,138 | 830,447 | ||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) | 245 | 31 | 8,387 | 82 | 325 | 638 | (3 | ) | (9 | ) | 9,696 | 25 | 9,721 | |||||||||||||||||||||||||||||||||||

| (1) Includes 11,905,480 treasury shares held as at March 31, 2025 by a controlled trust. (2) Refer to Note 19 (3) Refer to Note 18 (4) Refer to Note 31 (5) Refer to Note 32 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes form an integral part of these interim condensed consolidated financial statements

| As per our report of even date attached | For and on behalf of the Board of Directors | |||||

| for Deloitte Haskins & Sells LLP | Rishad A. Premji | Deepak M. Satwalekar | Srinivas Pallia | |||

| Chartered Accountants | Chairman | Director | Chief Executive Officer and | |||

| Firm’s Registration No: 117366W/W -100018 | (DIN: 02983899) | (DIN: 00009627) | Managing Director | |||

| (DIN: 10574442)

|

||||||

| Anand Subramanian | Aparna C. Iyer | M. Sanaulla Khan | ||||

| Partner | Chief Financial Officer |

Company Secretary | ||||

| Membership No.: 110815 | Membership No.: F4129 | |||||

|

Bengaluru |

||||||

| April 16, 2025 | ||||||

5

WIPRO LIMITED AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(₹ in millions, except share and per share data, unless otherwise stated)

| Year ended March 31, | ||||||||||||

| 2024 | 2025 | 2025 | ||||||||||

| Convenience translation into US dollar in millions (unaudited) Refer to Note 2(iii) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||

| Cash flows from operating activities |

||||||||||||

| Profit for the year |

111,121 | 132,180 | 1,547 | |||||||||

| Adjustments to reconcile profit for the year to net cash generated from operating activities: |

||||||||||||

| Gain on sale of property, plant and equipment, net |

(2,072 | ) | (606 | ) | (7 | ) | ||||||

| Depreciation, amortization and impairment expense |

34,071 | 29,579 | 346 | |||||||||

| Unrealized exchange (gain)/loss, net |

655 | (623 | ) | (7 | ) | |||||||

| Share-based compensation expense |

5,584 | 5,551 | 65 | |||||||||

| Share of net (profit)/loss of associate and joint venture accounted for using equity method |

233 | (254 | ) | (3 | ) | |||||||

| Income tax expense |

36,089 | 42,777 | 501 | |||||||||

| Finance and other income, net of finance expenses |

(11,344 | ) | (23,432 | ) | (274 | ) | ||||||

| Change in fair value of contingent consideration |

(1,300 | ) | (169 | ) | (2 | ) | ||||||

| Lifetime expected credit loss |

640 | 324 | 4 | |||||||||

| Other non-cash items |

488 | - | - | |||||||||

| Changes in operating assets and liabilities, net of effects from acquisitions |

||||||||||||

| (Increase)/Decrease in trade receivables |

7,824 | 1,894 | 23 | |||||||||

| (Increase)/Decrease in unbilled receivables and contract assets |

5,919 | (1,331 | ) | (16 | ) | |||||||

| (Increase)/Decrease in Inventories |

287 | 213 | 2 | |||||||||

| (Increase)/Decrease in other financial assets and other assets |

8,869 | 6,609 | 78 | |||||||||

| Increase/(Decrease) in trade payables, accrued expenses, other financial liabilities, other liabilities and provisions |

(435 | ) | 548 | 6 | ||||||||

| Increase/(Decrease) in contract liabilities |

(5,053 | ) | 2,341 | 27 | ||||||||

|

|

|

|

|

|

|

|

|

|

||||

| Cash generated from operating activities before taxes |

191,576 | 195,601 | 2,290 | |||||||||

| Income taxes paid, net |

(15,360 | ) | (26,175 | ) | (307 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

||||

| Net cash generated from operating activities |

176,216 | 169,426 | 1,983 | |||||||||

|

|

|

|

|

|

|

|

|

|

||||

| Cash flows from investing activities: |

||||||||||||

| Payment for purchase of property, plant and equipment |

(10,510 | ) | (14,737 | ) | (173 | ) | ||||||

| Proceeds from disposal of property, plant and equipment |

4,022 | 1,822 | 21 | |||||||||

| Payment for purchase of investments |

(975,069 | ) | (801,582 | ) | (9,383 | ) | ||||||

| Proceeds from sale of investments |

978,598 | 706,520 | 8,270 | |||||||||