UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2025

Fidelity National Information Services, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Georgia | 1-16427 | 37-1490331 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 347 Riverside Avenue | ||

| Jacksonville, Florida | 32202 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrants’ Telephone Number, including Area Code: (904) 438-6000

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.01 per share | FIS | New York Stock Exchange | ||

| 0.625% Senior Notes due 2025 | FIS25B | New York Stock Exchange | ||

| 1.500% Senior Notes due 2027 | FIS27 | New York Stock Exchange | ||

| 1.000% Senior Notes due 2028 | FIS28 | New York Stock Exchange | ||

| 2.250% Senior Notes due 2029 | FIS29 | New York Stock Exchange | ||

| 2.000% Senior Notes due 2030 | FIS30 | New York Stock Exchange | ||

| 3.360% Senior Notes due 2031 | FIS31 | New York Stock Exchange | ||

| 2.950% Senior Notes due 2039 | FIS39 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition |

In connection with the execution of the Transaction Agreement described under Item 7.01 below, Fidelity National Information Services, Inc. (“FIS” or the “Company”) is providing certain preliminary estimates of its financial results for the first quarter ended March 31, 2025. In addition, the Company is re-affirming the guidance for the year ending December 31, 2025 previously furnished in the press release on Exhibit 99.1 of Form 8-K on February 11, 2025. As the Transaction described under Item 7.01 below is not anticipated to close until 2026, no impacts of the Transaction have been included in the 2025 guidance for the year ending December 31, 2025.

The Company expects to report its first quarter financial results on May 6, 2025.

First quarter ended March 31, 2025 preliminary estimated unaudited financial results

Set forth below are certain preliminary estimated unaudited financial results for the first quarter ended March 31, 2025. These results are based only on currently available information as of the date hereof and are subject to change. The Company’s financial closing procedures for the quarter ended March 31, 2025, are not yet complete and, as a result, the final results upon completion of the closing procedures may vary from the preliminary estimated unaudited financial results set forth below.

FIS’s consolidated financial statements for the first quarter ended March 31, 2025, are not yet complete. Accordingly, FIS is presenting certain preliminary estimated unaudited financial results for the first quarter ended March 31, 2025, based on information available as of the date of this release. These anticipated results are not a comprehensive statement of FIS’s results for such period, and FIS’s actual results may differ from these preliminary estimated unaudited results. These preliminary estimated unaudited financial results are inherently uncertain and subject to change as FIS completes the preparation of its consolidated financial statements for the quarter ended March 31, 2025. During the course of the preparation of FIS’s consolidated financial statements and related notes, and completion of FIS’s financial close procedures for the quarter ended March 31, 2025, adjustments to the preliminary estimated unaudited financial results may be identified, and such adjustments may be material. These preliminary estimated unaudited financial results should not be viewed as a substitute for full financial statements prepared in accordance with GAAP, and they should not be viewed as indicative of FIS’s results for any future period. Therefore, you should not place undue reliance upon this information. FIS’s independent registered accounting firm has not audited, reviewed, compiled or performed any procedures with respect to this preliminary estimated unaudited financial information and, accordingly, does not express an opinion or any other form of assurance with respect thereto.

For the quarter ended March 31, 2025:

| METRICS ($ millions, except per share data) |

1Q 2025 Outlook |

1Q 2025 Preliminary Results |

Operational Highlights |

|||

| REVENUE |

$2,485 - $2,510 | $2,532 | • Total company recurring revenue growth of 4% • Banking recurring revenue growth of 3% • Capital Markets recurring revenue growth of 6% • Adjusted EBITDA and Adjusted EPS both toward high-end of outlook range |

|||

| ADJUSTED REVENUE GROWTH |

2.5%-3.5% | 4% | ||||

| Banking |

0.5%-1.5% | 2% | ||||

| Capital Markets |

7.0%-8.0% | 9% | ||||

| ADJUSTED EBITDA |

$940-$960 | $958 | ||||

| Adjusted EBITDA Margin |

37.8%-38.2% | ~37.8% | ||||

| ADJUSTED EPS |

$1.17 - $1.22 | $1.21 |

Full-Year 2025 Outlook

The Company previously provided full-year outlook on February 11, 2025 and is re-affirming the guidance for the metrics below:

| ($ millions, except share data) | FY 2025 | |

| Revenue |

$10,435 - $10,495 | |

| Adjusted EBITDA (Non-GAAP)1 |

$4,305 - $4,335 | |

| Adjusted EPS (Non-GAAP)1 |

$5.70 - $5.80 |

The Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items, and the information is not available without unreasonable effort.

The information contained in Item 2.02 of this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), except as expressly provided by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure. |

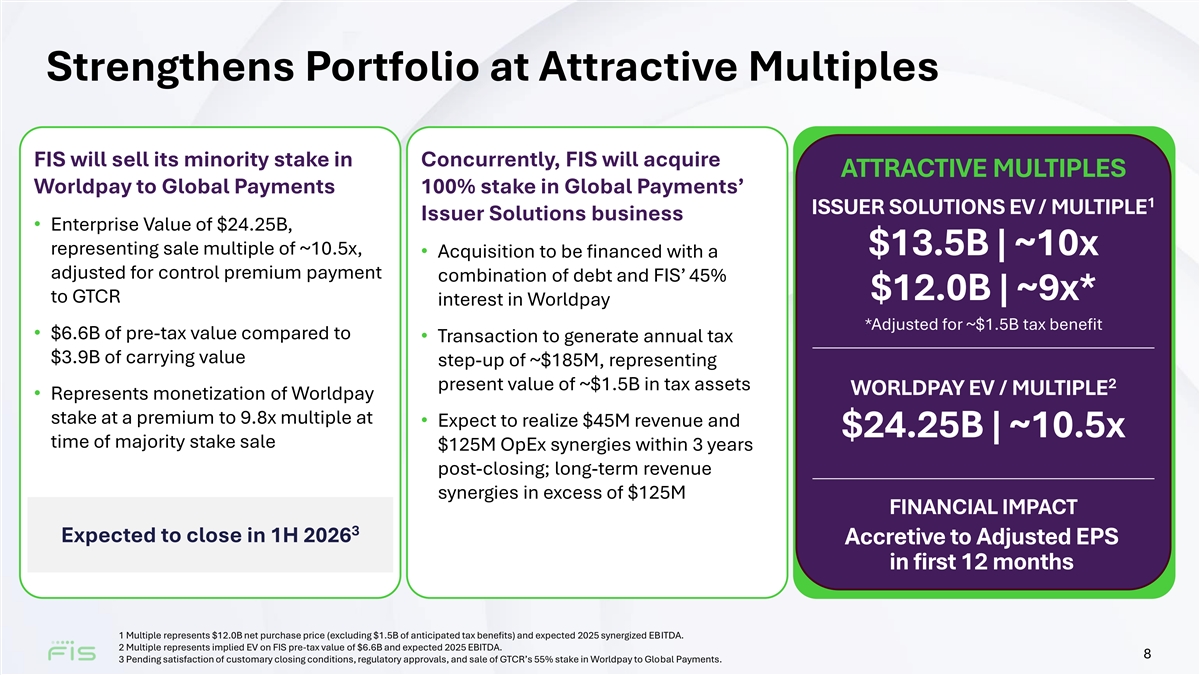

On April 17, 2025, FIS issued a press release announcing that it had entered into a transaction agreement (the “Transaction Agreement”), pursuant to which FIS has agreed to (i) buy the Issuer Solutions business from Global Payments Inc. (“Global Payments”) at a valuation of approximately $13.5 billion, subject to customary adjustments, and (ii) sell, together with affiliates of GTCR, Worldpay Holdco, LLC to Global Payments at a valuation of approximately $24.25 billion, subject to customary adjustments, in each case, subject to the receipt of required regulatory approvals and other customary closing conditions (the “Transaction”).

A copy of the press release is furnished with this Current Report as Exhibit 99.1 and is incorporated by reference herein and posted a presentation relating to the entry into the Transaction agreement on the investor relations section of its website (a copy of which is furnished herewith as Exhibit 99.2 and is incorporated by reference herein).

The information contained in Item 7.01 of this Current Report shall not be deemed “filed” for purposes of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as expressly provided by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description |

|

| 99.1 | Press Release dated April 17, 2025 | |

| 99.2 | Investor Presentation, dated April 17, 2025. | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). | |

| * | Schedules and similar attachments have been omitted from this filing pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule or similar attachment will be furnished to the Securities and Exchange Commission upon request. |

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about anticipated financial outcomes, including any earnings guidance or projections, projected revenue or expense synergies or dis-synergies, business and market conditions, outlook, foreign currency exchange rates, deleveraging plans, expected dividends and share repurchases of the Company, the Company’s sales pipeline and anticipated profitability and growth, plans, strategies and objectives for future operations, strategic value creation, risk profile and investment strategies, any statements regarding future economic conditions or performance and any statements with respect to the proposed acquisition of an Issuer Solutions business, the expected financial and operational results of the Company, and expectations regarding the Company’s business or organization after the Transaction, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, are forward-looking statements. These statements may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or guidance, statements of outlook and various accruals and estimates. These statements relate to future events and our future results and involve a number of risks and uncertainties. In addition, the amount of the goodwill impairment charge announced today is based in part on estimates of future performance, so this announcement should also be considered a forward-looking statement. Forward-looking statements are based on management’s beliefs as well as assumptions made by, and information currently available to, management.

Actual results, performance or achievement could differ materially from these forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include the following, without limitation:

| • | changes in general economic, business and political conditions, including those resulting from COVID-19 or other pandemics, a recession, intensified international hostilities, acts of terrorism, increased rates of inflation or interest, changes in either or both the United States and international lending, capital and financial markets or currency fluctuations; |

| • | the risk that acquired businesses will not be integrated successfully or that the integration will be more costly or more time-consuming and complex than anticipated; |

| • | the risk that cost savings and synergies anticipated to be realized from acquisitions may not be fully realized or may take longer to realize than expected; |

| • | the risks of doing business internationally; |

| • | the risk of unforeseen liabilities of the Company or the Issuer Solutions business may exist; |

| • | unexpected costs, liabilities, charges or expenses resulting from the Transaction; |

| • | dependence on key personnel; |

| • | the effect of legislative initiatives or proposals, statutory changes, governmental or applicable regulations and/or changes in industry requirements, including privacy and cybersecurity laws and regulations; |

| • | the risks of reduction in revenue from the elimination of existing and potential customers due to consolidation in, or new laws or regulations affecting, the banking, retail and financial services industries or due to financial failures or other setbacks suffered by firms in those industries; |

| • | changes in the growth rates of the markets for our solutions; |

| • | the amount, declaration and payment of future dividends is at the discretion of our Board of Directors and depends on, among other things, our investment opportunities, results of operations, financial condition, cash requirements, future prospects, and other factors that may be considered relevant by our Board of Directors, including legal and contractual restrictions; |

| • | the amount and timing of any future share repurchases is subject to, among other things, our share price, our other investment opportunities and cash requirements, our results of operations and financial condition, our future prospects and other factors that may be considered relevant by our Board of Directors and management; |

| • | failures to adapt our solutions to changes in technology or in the marketplace; |

| • | internal or external security breaches of our systems, including those relating to unauthorized access, theft, corruption or loss of personal information and computer viruses and other malware affecting our software or platforms, and the reactions of customers, card associations, government regulators and others to any such events; |

| • | the risk that implementation of software, including software updates, for customers or at customer locations or employee error in monitoring our software and platforms may result in the corruption or loss of data or customer information, interruption of business operations, outages, exposure to liability claims or loss of customers; |

| • | uncertainties as to the timing of the consummation of the Transaction or whether it will be completed; |

| • | the risk that partners and third parties who may fail to satisfy their legal obligations and risks associated with managing pension cost; cybersecurity issues, IT outages and data privacy; |

| • | risks associated with the impact, timing or terms of the Transaction; |

| • | risks associated with the expected benefits and costs of the Transaction, including the risk that the expected benefits of the Transaction or any contingent purchase price will not be realized within the expected timeframe, in full or at all; |

| • | the risk that conditions to the Transaction will not be satisfied and/or that the Transaction will not be completed within the expected timeframe, on the expected terms or at all; |

| • | the risk that any consents or regulatory or other approvals required in connection with the Transaction will not be received or obtained within the expected timeframe, on the expected terms or at all; |

| • | the risk that the financing intended to fund the Transaction may not be obtained; |

| • | the risk that the costs of restructuring transactions and other costs incurred in connection with the Transaction will exceed our estimates or otherwise adversely affect our business or operations; |

| • | the impact of the Transaction on our businesses and the risk that the Transaction may be more difficult, time-consuming or costly than expected, including the impact on our resources, systems, procedures and controls, diversion of management’s attention and the impact on relationships with customers, governmental authorities, suppliers, employees and other business counterparties; |

| • | the reaction of current and potential customers to communications from us or regulators regarding information security, risk management, internal audit or other matters; |

| • | the risk that policies and resulting actions of the current administration in the U.S. may result in additional regulations and executive orders, as well as additional regulatory and tax costs; |

| • | competitive pressures on pricing related to the decreasing number of community banks in the U.S., the development of new disruptive technologies competing with one or more of our solutions, increasing presence of international competitors in the U.S. market and the entry into the market by global banks and global companies with respect to certain competitive solutions, each of which may have the impact of unbundling individual solutions from a comprehensive suite of solutions we provide to many of our customers; |

| • | the failure to innovate in order to keep up with new emerging technologies, which could impact our solutions and our ability to attract new, or retain existing, customers; |

| • | an operational or natural disaster at one of our major operations centers; |

| • | failure to comply with applicable requirements of payment networks or changes in those requirements; |

| • | fraud by bad actors; and |

| • | other risks detailed in the “Risk Factors” and other sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, in our quarterly reports on Form 10-Q, in our current reports on Form 8-K and in our other filings with the Securities and Exchange Commission. |

Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. There can be no assurance that the Transaction will in fact be completed in the manner described or at all. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: April 17, 2025 | Fidelity National Information Services, Inc. | |||||

| (Registrant) | ||||||

| By: | /s/ James Kehoe |

|||||

| Name: | James Kehoe | |||||

| Title: | Chief Financial Officer | |||||

| By: | /s/ Alexandra Brooks |

|||||

| Name: | Alexandra Brooks | |||||

| Title: |

Chief Accounting Officer |

|||||

Exhibit 99.1

News Release

FIS Announces Sale of Worldpay Stake and Strategic Acquisition of Global Payments’ Issuer Solutions Business

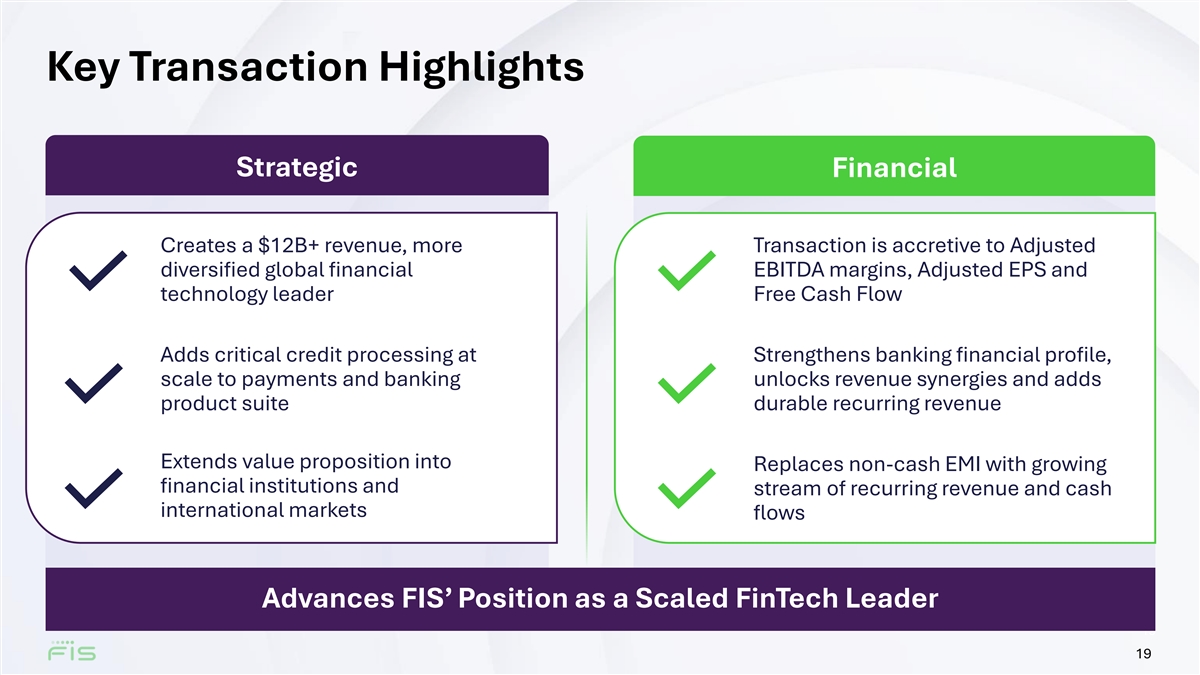

| • | Acquisition of Global Payments’ Issuer Solutions business (Issuer Solutions) strengthens FIS’ position as a scaled fintech leader with global reach and a best-of-breed product suite |

| • | Issuer Solutions’ credit processing offering will extend FIS’ value proposition and drive long-term expected revenue synergies in excess of $125 million annually |

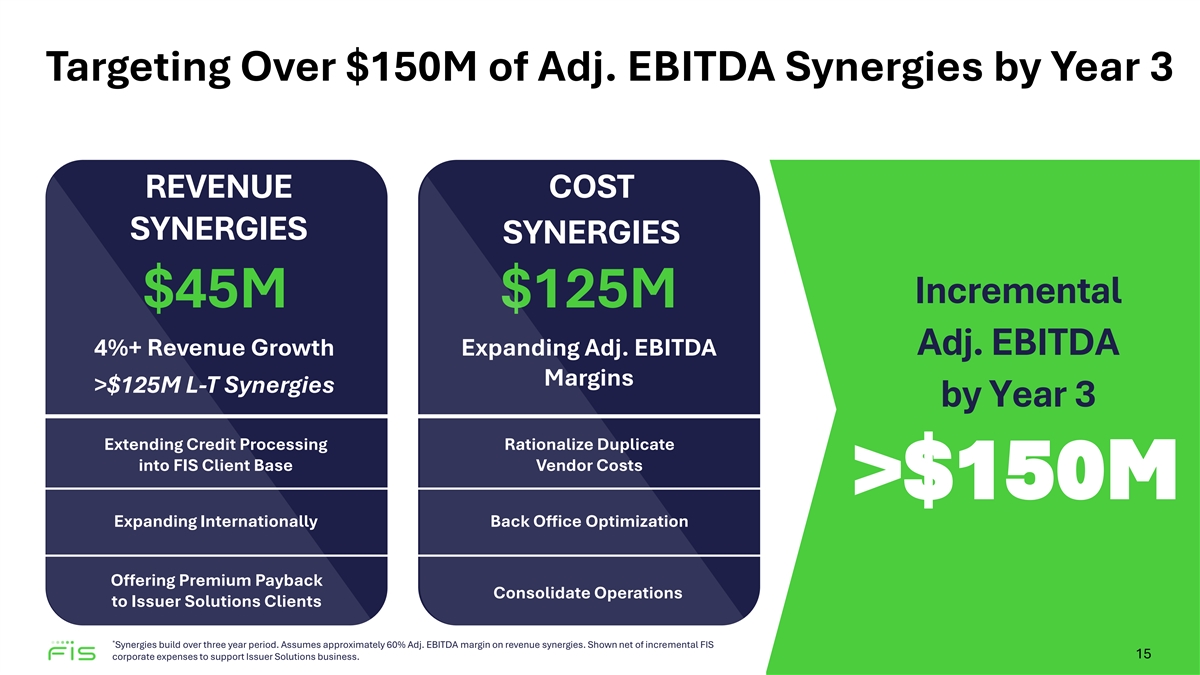

| • | Acquisition is expected to be accretive to Adjusted EBITDA margins, Adjusted EPS and Adjusted Free Cash Flow in the first 12 months, and unlock net EBITDA synergies of more than $150 million by year three |

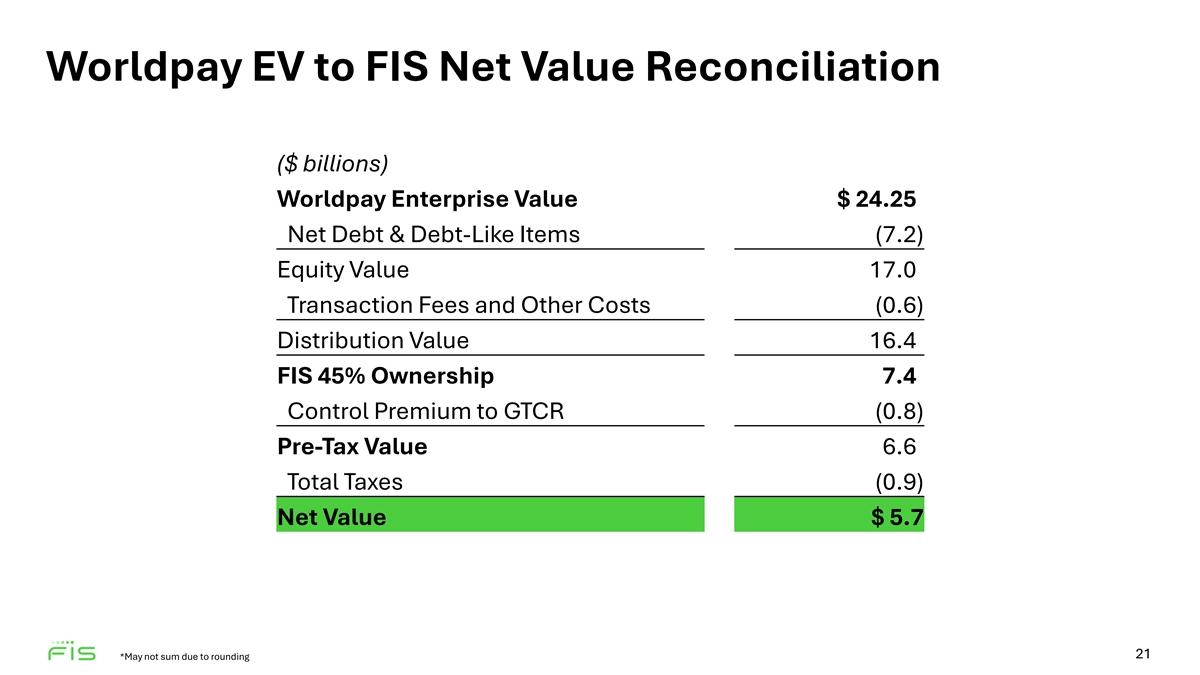

| • | Transaction accelerates monetization of Worldpay stake with sale to Global Payments for $6.6 billion in pre-tax value |

| • | Sale of Worldpay and acquisition of Issuer Solutions replaces non-cash generating minority interest with growing recurring revenues, EBITDA and free cash flow |

| • | Company provides preliminary results for the first quarter of 2025, reiterates prior full year 2025 outlook and will host an investor conference call to discuss transactions at 8:30 a.m. (EDT) |

Jacksonville, FL– Thursday, April 17, 2025 – FIS® (NYSE: FIS), (the “Company”) a global leader in financial technology, today announced it has entered into a definitive agreement to acquire 100% of Global Payments’ (NYSE: GPN) Issuer Solutions business for an enterprise value of $13.5 billion, or a net purchase price of $12 billion including $1.5 billion of anticipated net present value of tax assets.

Concurrently, FIS has entered into a definitive agreement to sell its stake in Worldpay to Global Payments for $6.6 billion in pre-tax value. This transaction accelerates the monetization of the Company’s minority stake in Worldpay.

Issuer Solutions Strengthens FIS’ Position as Globally Scaled Fintech Leader to Large Financial Institutions

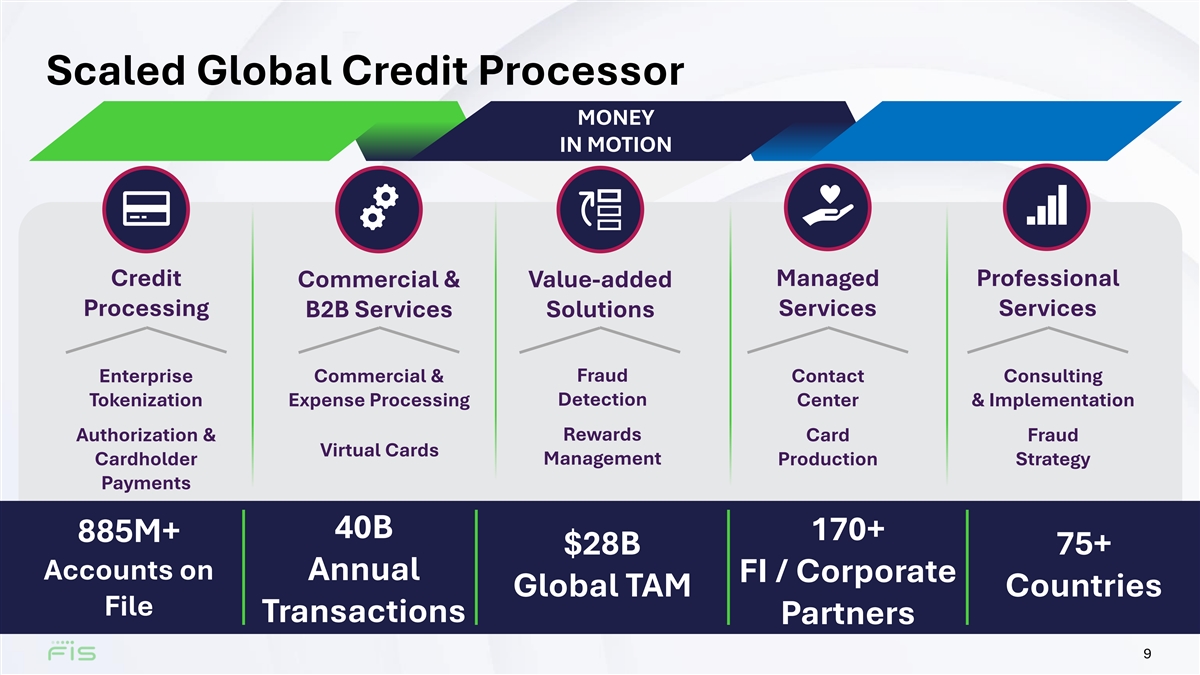

Issuer Solutions is a global market leader in credit processing, with a client presence in over 75 countries. The business processes more than 40 billion transactions annually and maintains strong partnerships with over 170 financial institutions and corporates.

“The acquisition of Issuer Solutions is a strategic and accretive transaction that will expand FIS’ payment product suite and deepen our relationships with financial institutions and corporate clients,” said Stephanie Ferris, Chief Executive Officer and President of FIS. “Issuer Solutions’ globally scaled credit processing capabilities are highly complementary to FIS’ established debit processing capabilities, strengthening our broader banking and capital markets offering.”

Ferris continued, “We are pleased to fully monetize our Worldpay stake at an attractive valuation. The transaction enhances FIS’ financial profile and replaces our non-cash generating minority stake in Worldpay with a growing stream of recurring high-margin revenues and cash flows.”

1

Issuer Solutions Offers Compelling Strategic and Financial Rationale

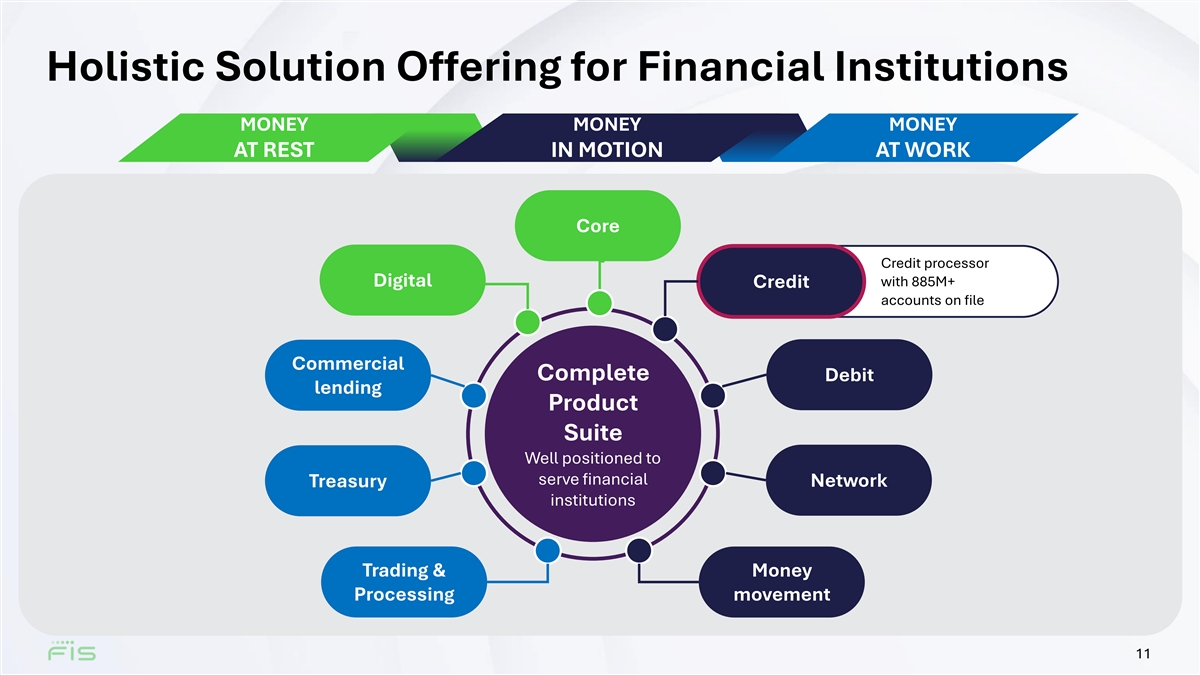

| • | Highly Complementary to FIS’ Banking and Payments Business: The acquisition adds a strong product suite in credit processing, fraud, loyalty and other value-added services to FIS’ portfolio of debit processing, network services, payments processing, loyalty solutions and AR/AP banking services, creating a best-in-class end-to-end offering for financial institutions and corporates. |

| • | Significantly Expands Market Opportunity for Banking Segment: Issuer Solutions enables FIS to tap into a global issuer market opportunity of $28 billion, including the highly attractive $15 billion U.S. issuer market opportunity. |

| • | Strengthens Financial Profile: The acquisition is expected to be accretive to Adjusted EBITDA margins, Adjusted EPS and Adjusted Free Cash Flow. FIS expects to generate over $500 million in incremental Adjusted Free Cash Flow in the first 12 months after the closing of the transaction. |

| • | Delivers Robust Revenue & Cost Synergies: The acquisition is expected to deliver $45 million in incremental revenue synergies within three years, with over $125 million of revenue synergies longer-term, and more than $150 million in net EBITDA synergies within three years. |

FIS and Global Payments have established a long-term collaboration and commercial agreements.

Issuer Solutions Transaction Details

The acquisition of Issuer Solutions for a net purchase price of $12 billion (total value of $13.5 billion excluding $1.5 billion of anticipated net present value of tax assets) represents a multiple of approximately 9x expected 2025 synergized EBITDA.

FIS will fund the acquisition through a combination of $8 billion of new debt and the value from the sale of its minority stake in Worldpay. Following the closing of the transactions, the Company expects pro forma gross leverage to be approximately 3.4x, deleveraging to its target gross leverage of 2.8x within 18 months.

This transaction is expected to close in the first half of 2026, subject to regulatory approvals, the closing of the Worldpay transaction, and other customary closing conditions.

Worldpay Transaction Details

The sale of 45% of Worldpay for $6.6 billion represents a multiple of approximately 10.5x expected 2025 EBITDA, a premium to the 9.8x valuation of FIS’ February 2024 sale of its 55% stake in Worldpay.

This transaction is expected to close in the first half of 2026, subject to regulatory approvals, the closing of the Issuer Solutions transaction, and other customary closing conditions.

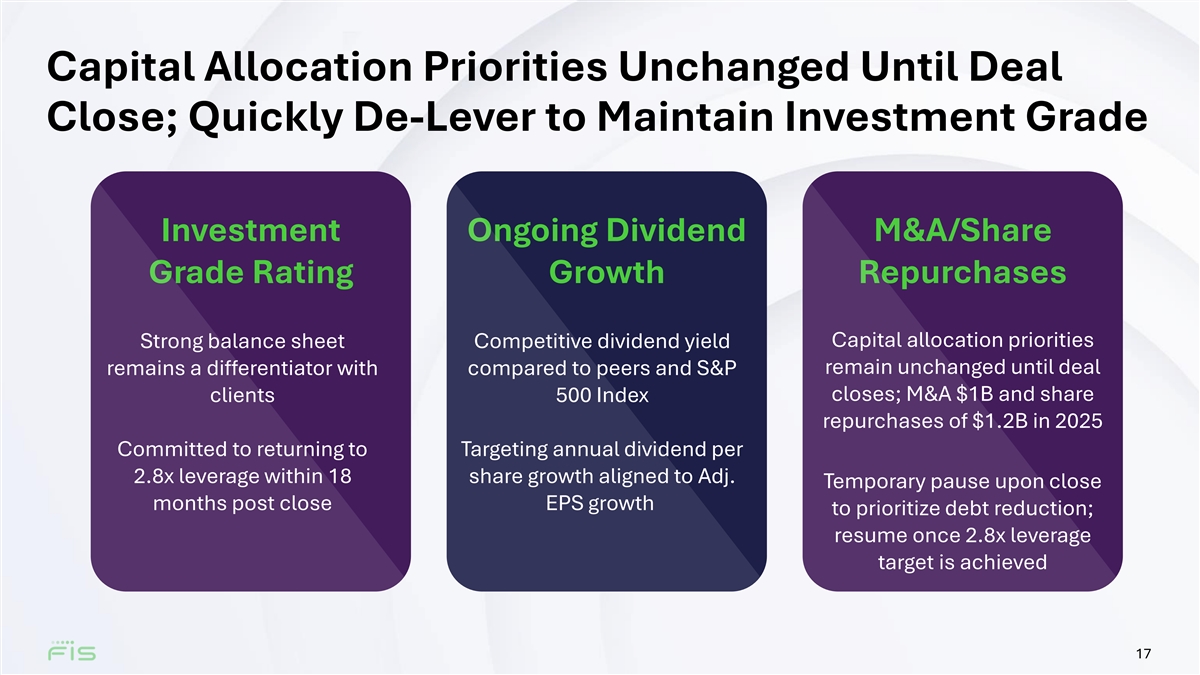

Capital Allocation Updates

The Company will continue to execute against its existing capital allocation priorities in 2025, including an M&A spend of up to $1 billion and share repurchases of $1.2 billion. The Company expects to maintain its dividend policy of annual dividend per share growth consistent with Adjusted EPS growth. Post closing the transaction, the Company expects to temporarily pause share repurchases and tuck-in M&A to accelerate deleveraging. The Company will resume its existing capital allocation priorities once it has achieved its target gross leverage of 2.8x.

2

1Q 2025 Financial Update

FIS expects to report first quarter 2025 financial results on May 6, 2025. At this time, the Company is providing certain preliminary unaudited financial results and metrics for the three months ended March 31, 2025, based on currently available information.

| • | Total company revenue of $2.5 billion, with adjusted revenue growth and recurring revenue growth of approximately 4% |

| • | Banking adjusted revenue growth of approximately 2%, which was above the high-end of the outlook; recurring revenue grew approximately 3% |

| • | Capital Markets adjusted revenue growth of approximately 9%, which was also above the high-end of the outlook; recurring revenue growth was approximately 6% |

| • | Adjusted EBITDA of approximately $958 million, toward the high-end of our outlook |

| • | Adjusted EPS of approximately $1.21, which was also toward the high-end of our outlook |

The Company is reaffirming its prior full year 2025 outlook for Adjusted Revenue Growth, Adjusted EBITDA and Adjusted EPS.

Webcast

FIS will host a live webcast about this announcement with the investment community beginning at 8:30 a.m. (EDT) on Thursday, April 17, 2025. To access the webcast, go to the Investor Relations section of FIS’ homepage, www.fisglobal.com. A replay will be available after the conclusion of the live webcast.

About FIS

FIS is a financial technology company providing solutions to financial institutions, businesses, and developers. We unlock financial technology to the world across the money lifecycle underpinning the world’s financial system. Our people are dedicated to advancing the way the world pays, banks and invests, by helping our clients to confidently run, grow, and protect their businesses. Our expertise comes from decades of experience helping financial institutions and businesses of all sizes adapt to meet the needs of their customers by harnessing where reliability meets innovation in financial technology. Headquartered in Jacksonville, Florida, FIS is a member of the Fortune 500® and the Standard & Poor’s 500® Index. To learn more, visit fisglobal.com. Follow FIS on LinkedIn, Facebook and X.

FIS Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in the United States. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, we have provided certain non-GAAP financial measures.

These non-GAAP measures include constant currency revenue, adjusted revenue growth, adjusted EBITDA, adjusted EBITDA margin, adjusted net earnings, adjusted EPS, and adjusted free cash flow. These non-GAAP measures may be used in this release and/or in the attached supplemental financial information.

We believe these non-GAAP measures help investors better understand the underlying fundamentals of our business. As further described below, the non-GAAP revenue and earnings measures presented eliminate items management believes are not indicative of FIS’ operating performance. The constant currency revenue and adjusted revenue growth measures adjust for the effects of exchange rate fluctuations and exclude discontinued operations, while adjusted revenue growth also excludes revenue from Corporate and Other, giving investors further insight into our performance. Finally, adjusted free cash flow provides further information about the ability of our business to generate cash. For these reasons, management also uses these non-GAAP measures in its assessment and management of FIS’ performance.

3

Constant currency revenue represents reported segment revenue excluding the impact of fluctuations in foreign currency exchange rates in the current period.

Adjusted revenue growth reflects the percentage change in constant currency revenue for the current period as compared to the prior period. Constant currency revenue is calculated by applying prior-year period foreign currency exchange rates to current-period revenue. When referring to adjusted revenue growth, revenue from our Corporate and Other segment is excluded.

Adjusted EBITDA reflects net earnings (loss) before interest, other income (expense), taxes, equity method investment earnings (loss), and depreciation and amortization, and excludes certain costs that do not constitute normal, recurring, cash operating expenses necessary to operate our business. This measure is reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For this reason, adjusted EBITDA, as it relates to our segments, is presented in conformity with Accounting Standards Codification 280, Segment Reporting, and is excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission’s Regulation G and Item 10(e) of Regulation S-K.

Adjusted EBITDA margin reflects adjusted EBITDA, as defined above, divided by revenue.

Adjusted net earnings excludes the effect of purchase price amortization, as well as certain costs that do not constitute normal, recurring, cash operating expenses necessary to operate our business. For purposes of calculating Adjusted net earnings, our equity method investment earnings (loss) (“EMI”) from Worldpay is also adjusted to exclude certain costs and other transactions in a similar manner.

Adjusted EPS reflects adjusted net earnings, as defined above, divided by weighted average diluted shares outstanding.

Adjusted free cash flow reflects net cash provided by operating activities, adjusted for the net change in settlement assets and obligations and excluding certain transactions that are closely associated with non-operating activities or are otherwise non-operational in nature and not indicative of future operating cash flows, less capital expenditures. Adjusted free cash flow does not represent our residual cash flow available for discretionary expenditures since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from the measure. Adjusted free cash flow as presented in this earnings release excludes cash flow from discontinued operations, which our management cannot freely access following the Worldpay separation.

Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP measures. Further, FIS’ non-GAAP measures may be calculated differently from similarly titled measures of other companies. Reconciliations of these non-GAAP measures to related GAAP measures, including footnotes describing the adjustments, are provided in the attached schedules and in the Investor Relations section of the FIS website, www.fisglobal.com.

Forward-Looking Statements

This release and today’s webcast contain “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements that are not historical facts, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, are forward-looking statements. Forward-looking statements include statements about anticipated financial outcomes, including any earnings outlook or projections, projected revenue or expense synergies or dis-synergies, business and market conditions, outlook, foreign currency exchange rates, deleveraging plans, expected dividends and share repurchases of the Company, the Company’s sales pipeline and anticipated profitability and growth, plans, strategies and objectives for future operations, strategic value creation, risk profile and investment strategies, any statements regarding future economic conditions or performance and any statements with respect to the future impacts of the Worldpay Sale or any agreements or arrangements entered into in connection with such transaction.

4

These statements may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or outlook, statements of outlook and various accruals and estimates. These statements relate to future events and our future results and involve a number of risks and uncertainties. Forward-looking statements are based on management’s beliefs as well as assumptions made by, and information currently available to, management.

Actual results, performance or achievement could differ materially from these forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include the following, without limitation:

| • | changes in general economic, business and political conditions, a recession, intensified or expanded international hostilities, acts of terrorism, increased rates of inflation or interest, changes in either or both the United States and international lending, capital and financial markets or currency fluctuations; |

| • | the risk that acquired businesses will not be integrated successfully or that the integration will be more costly or more time-consuming and complex than anticipated; |

| • | the risk that cost savings and synergies anticipated to be realized from acquisitions may not be fully realized or may take longer to realize than expected or that costs may be greater than anticipated; |

| • | the risks of doing business internationally; |

| • | the effect of legislative initiatives or proposals, statutory changes, governmental or applicable regulations and/or changes in industry requirements, including privacy, data protection, cybersecurity, cyber resilience and AI laws and regulations; |

| • | our ability to comply with climate change legal and regulatory requirements and to maintain practices that meet our stakeholders’ evolving expectations; |

| • | the risks of reduction in revenue from the elimination of existing and potential customers due to consolidation in, or new laws or regulations affecting, the banking, retail and financial services industries or due to financial failures or other setbacks suffered by firms in those industries; |

| • | changes in the growth rates of the markets for our solutions; |

| • | the amount, declaration and payment of future dividends is at the discretion of our Board of Directors and depends on, among other things, our investment opportunities, results of operations, financial condition, cash requirements, future prospects, and other factors that may be considered relevant by our Board of Directors, including legal and contractual restrictions; |

| • | the amount and timing of any future share repurchases is subject to, among other things, our share price, our other investment opportunities and cash requirements, our results of operations and financial condition, our future prospects and other factors that may be considered relevant by our Board of Directors and management; |

| • | failures to adapt our solutions to changes in technology or in the marketplace; |

| • | internal or external security or privacy breaches of our systems, including those relating to unauthorized access, theft, corruption or loss of personal information and computer viruses and other malware affecting our software or platforms, and the reactions of customers, card associations, government regulators and others to any such events; |

| • | the risk that implementation of software, including software updates, for customers or at customer locations or employee error in monitoring our software and platforms may result in the corruption or loss of data or customer information, interruption of business operations, outages, exposure to liability claims or loss of customers; |

| • | the risk that partners and third parties may fail to satisfy their legal obligations to us; |

| • | risks associated with managing pension cost, cybersecurity issues, IT outages experienced by us or by third parties and data privacy; |

| • | our ability to navigate the opportunities and risks associated with using and/or incorporating AI technologies into our business; |

| • | the reaction of current and potential customers to communications from us or regulators regarding information security, risk management, internal audit or other matters; |

5

| • | competitive pressures on pricing related to the decreasing number of community banks in the U.S., the development of new disruptive technologies competing with one or more of our solutions, increasing presence of international competitors in the U.S. market and the entry into the market by global banks and global companies with respect to certain competitive solutions, each of which may have the impact of unbundling individual solutions from a comprehensive suite of solutions we provide to many of our customers; |

| • | the failure to innovate in order to keep up with new emerging technologies, which could impact our solutions and our ability to attract new, or retain existing, customers; |

| • | an operational or natural disaster at one of our major operations centers; |

| • | failure to comply with applicable requirements of payment networks or changes in those requirements; |

| • | fraud by bad actors; and |

| • | other risks detailed elsewhere in the “Risk Factors” section and other sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and in our other filings with the SEC. |

Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise.

For More Information

| Ellyn Raftery, 904.438.6083 | George Mihalos, 904.438.6438 | |

| Chief Marketing & Communications Officer | Senior Vice President | |

| FIS Global Marketing & Corporate Communications | FIS Investor Relations | |

| Ellyn.Raftery@fisglobal.com | Georgios.Mihalos@fisglobal.com |

6

Exhibit 99.2 FIS Announces Strategic Transactions April 17, 2025

Disclosures Forward-looking Statements Our discussions today, including this presentation and any comments made by management, contain “forward-looking statements” within the meaning of the U.S. federal securities laws. Any statements that refer to future events or circumstances, including our future strategies or results, or that are not historical facts, are forward-looking statements. Actual results could differ materially from those projected in forward-looking statements due to a variety of factors, including the risks and uncertainties set forth in our press release dated April 17, 2025, our annual report on Form 10-K for 2024 and our other filings with the SEC. We undertake no obligation to update or revise any forward-looking statements. Non-GAAP Measures This presentation will reference certain non-GAAP financial information. For a description of non-GAAP measures presented in this document, please visit the Investor Relations section of the FIS website at www.fisglobal.com. 2

Statement Regarding Forward-Looking Information This communication contains “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements that are not historical facts, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, or other characterizations of future events or circumstances, are forward-looking statements. Forward-looking statements include statements about anticipated financial outcomes, including any earnings outlook or projections, projected revenue or expense synergies or dis-synergies, business and market conditions, outlook, foreign currency exchange rates, deleveraging plans, expected dividends and share repurchases of the Company, the Company’s sales pipeline and anticipated profitability and growth, plans, strategies and objectives for future operations, strategic value creation, risk profile and investment strategies, any statements regarding future economic conditions or performance and any statements with respect to the future impacts of the Worldpay Sale or any agreements or arrangements entered into in connection with such transaction. These statements may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or outlook, statements of outlook and various accruals and estimates. These statements relate to future events and our future results and involve a number of risks and uncertainties. Forward-looking statements are based on management’s beliefs as well as assumptions made by, and information currently available to, management. Actual results, performance or achievement could differ materially from these forward-looking statements. The risks and uncertainties to which forward-looking statements are subject include the following, without limitation: • changes in general economic, business and political conditions, a recession, intensified or expanded international hostilities, acts of terrorism, increased rates of inflation or interest, changes in either or both the United States and international lending, capital and financial markets or currency fluctuations; • the risk that acquired businesses will not be integrated successfully or that the integration will be more costly or more time-consuming and complex than anticipated; • the risk that cost savings and synergies anticipated to be realized from acquisitions may not be fully realized or may take longer to realize than expected or that costs may be greater than anticipated; • the risks of doing business internationally; • the effect of legislative initiatives or proposals, statutory changes, governmental or applicable regulations and/or changes in industry requirements, including privacy, data protection, cybersecurity, cyber resilience and AI laws and regulations; • our ability to comply with climate change legal and regulatory requirements and to maintain practices that meet our stakeholders’ evolving expectations; • the risks of reduction in revenue from the elimination of existing and potential customers due to consolidation in, or new laws or regulations affecting, the banking, retail and financial services industries or due to financial failures or other setbacks suffered by firms in those industries; • changes in the growth rates of the markets for our solutions; • the amount, declaration and payment of future dividends is at the discretion of our Board of Directors and depends on, among other things, our investment opportunities, results of operations, financial condition, cash requirements, future prospects, and other factors that may be considered relevant by our Board of Directors, including legal and contractual restrictions; • the amount and timing of any future share repurchases is subject to, among other things, our share price, our other investment opportunities and cash requirements, our results of operations and financial condition, our future prospects and other factors that may be considered relevant by our Board of Directors and management; • failures to adapt our solutions to changes in technology or in the marketplace; • internal or external security or privacy breaches of our systems, including those relating to unauthorized access, theft, corruption or loss of personal information and computer viruses and other malware affecting our software or platforms, and the reactions of customers, card associations, government regulators and others to any such events; 3

Statement Regarding Forward-Looking Information • the risk that implementation of software, including software updates, for customers or at customer locations or employee error in monitoring our software and platforms may result in the corruption or loss of data or customer information, interruption of business operations, outages, exposure to liability claims or loss of customers; • the risk that partners and third parties may fail to satisfy their legal obligations to us; • risks associated with managing pension cost, cybersecurity issues, IT outages experienced by us or by third parties and data privacy; • our ability to navigate the opportunities and risks associated with using and/or incorporating AI technologies into our business; • the reaction of current and potential customers to communications from us or regulators regarding information security, risk management, internal audit or other matters; • competitive pressures on pricing related to the decreasing number of community banks in the U.S., the development of new disruptive technologies competing with one or more of our solutions, increasing presence of international competitors in the U.S. market and the entry into the market by global banks and global companies with respect to certain competitive solutions, each of which may have the impact of unbundling individual solutions from a comprehensive suite of solutions we provide to many of our customers; • the failure to innovate in order to keep up with new emerging technologies, which could impact our solutions and our ability to attract new, or retain existing, customers; • an operational or natural disaster at one of our major operations centers; • failure to comply with applicable requirements of payment networks or changes in those requirements; • fraud by bad actors; and • other risks detailed elsewhere in the “Risk Factors” section and other sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and in our other filings with the SEC. Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise. 4

Sale of Worldpay Stake and Strategic Acquisition of Global Payments Issuer Solutions Business

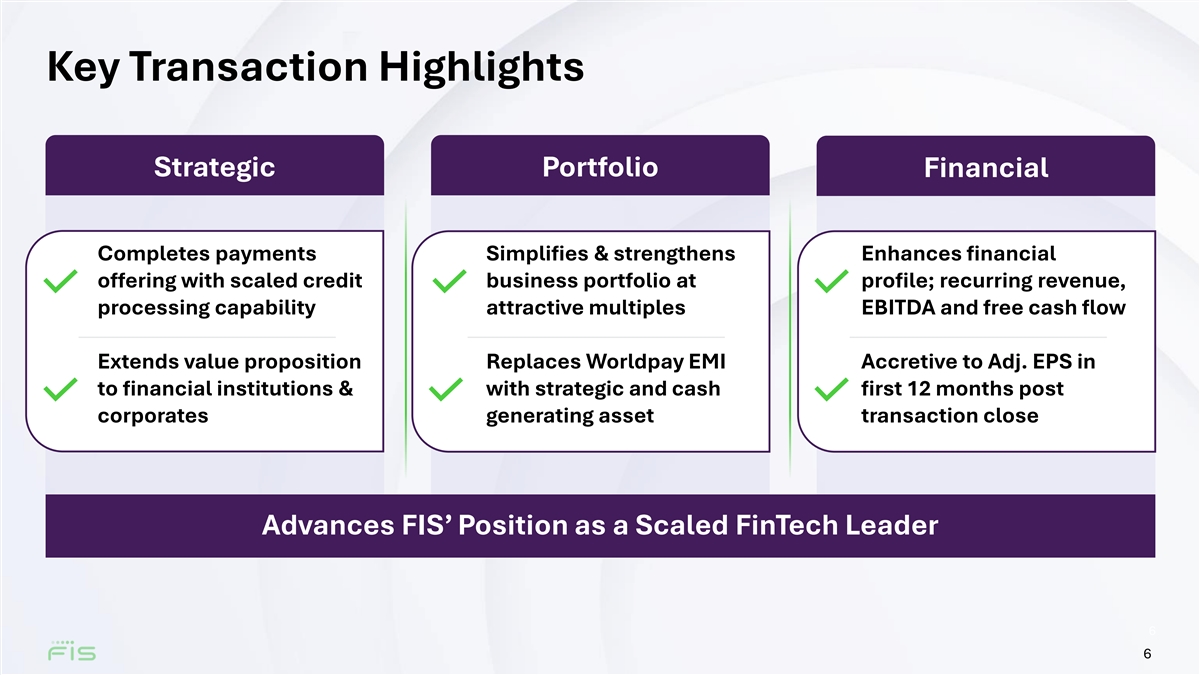

Key Transaction Highlights Strategic Portfolio Financial Completes payments Simplifies & strengthens Enhances financial offering with scaled credit business portfolio at profile; recurring revenue, processing capability attractive multiples EBITDA and free cash flow Extends value proposition Replaces Worldpay EMI Accretive to Adj. EPS in to financial institutions & with strategic and cash first 12 months post corporates generating asset transaction close Advances FIS’ Position as a Scaled FinTech Leader 6 6

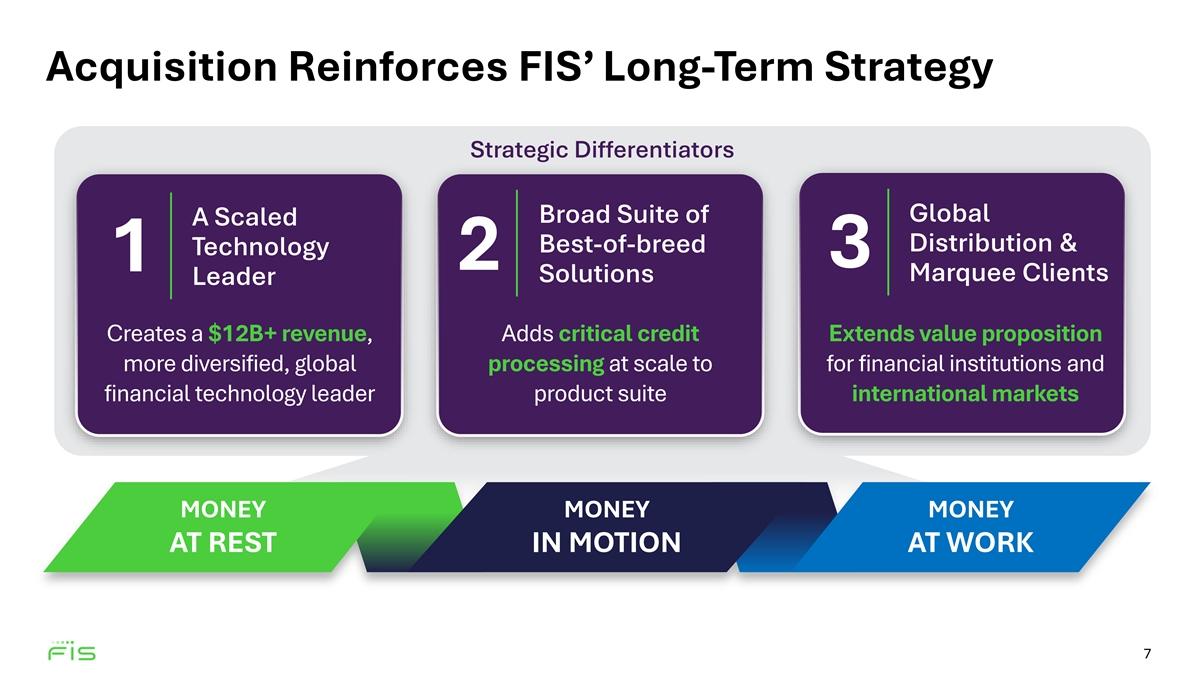

Acquisition Reinforces FIS’ Long-Term Strategy Strategic Differentiators Broad Suite of Global A Scaled Distribution & Best-of-breed Technology 3 2 1 Marquee Clients Solutions Leader Creates a $12B+ revenue, Adds critical credit Extends value proposition more diversified, global processing at scale to for financial institutions and financial technology leader product suite international markets MONEY MONEY MONEY AT REST IN MOTION AT WORK 7

Strengthens Portfolio at Attractive Multiples FIS will sell its minority stake in Concurrently, FIS will acquire ATTRACTIVE MULTIPLES Worldpay to Global Payments 100% stake in Global Payments’ 1 ISSUER SOLUTIONS EV / MULTIPLE Issuer Solutions business • Enterprise Value of $24.25B, representing sale multiple of ~10.5x, $13.5B | ~10x • Acquisition to be financed with a adjusted for control premium payment combination of debt and FIS’ 45% $12.0B | ~9x* to GTCR interest in Worldpay *Adjusted for ~$1.5B tax benefit • $6.6B of pre-tax value compared to • Transaction to generate annual tax $3.9B of carrying value step-up of ~$185M, representing 2 present value of ~$1.5B in tax assets WORLDPAY EV / MULTIPLE • Represents monetization of Worldpay stake at a premium to 9.8x multiple at • Expect to realize $45M revenue and $24.25B | ~10.5x time of majority stake sale $125M OpEx synergies within 3 years post-closing; long-term revenue synergies in excess of $125M FINANCIAL IMPACT 3 Expected to close in 1H 2026 Accretive to Adjusted EPS in first 12 months 1 Multiple represents $12.0B net purchase price (excluding $1.5B of anticipated tax benefits) and expected 2025 synergized EBITDA. 2 Multiple represents implied EV on FIS pre-tax value of $6.6B and expected 2025 EBITDA. 8 3 Pending satisfaction of customary closing conditions, regulatory approvals, and sale of GTCR’s 55% stake in Worldpay to Global Payments.

Scaled Global Credit Processor MONEY MONEY AT REST IN MOTION Credit Managed Professional Commercial & Value-added Processing Services Services B2B Services Solutions Enterprise Commercial & Fraud Contact Consulting Tokenization Expense Processing Detection Center & Implementation Authorization & Rewards Card Fraud Virtual Cards Cardholder Management Production Strategy Payments 40B 170+ 885M+ $28B 75+ Accounts on Annual FI / Corp Dor RAFT at – PRe IVILEGED AND CONFIDENTIAL 9 Global TAM Countries File Transactions Partners 9

Scaled High Margin Financial Profile 2024 Metrics, Issuer Solutions Strong Robust FCF Scaled Durable Margins Generation $2.5B $1.1B 45.1% $0.7B REVENUE ADJ. EBITDA ADJ. EBITDA UNLEVERED FCF MARGIN 10

Holistic Solution Offering for Financial Institutions MONEY MONEY MONEY AT REST IN MOTION AT WORK Core Credit processor Digital with 885M+ Credit accounts on file Commercial Complete Debit lending Product Suite Well positioned to serve financial Treasury Network institutions Trading & Money Processing movement 11

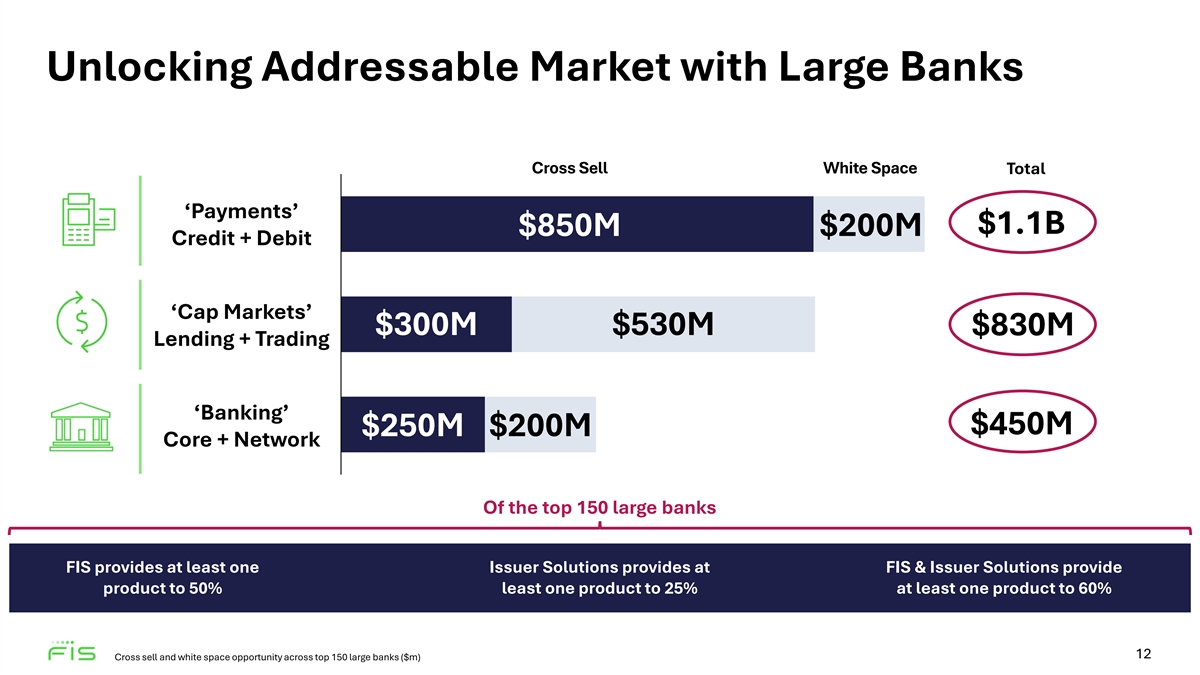

Unlocking Addressable Market with Large Banks Cross Sell White Space Total ‘Payments’ $1.1B $850M $200M Credit + Debit ‘Cap Markets’ $300M $530M $830M Lending + Trading ‘Banking’ $450M $250M $200M Core + Network Of the top 150 large banks FIS provides at least one Issuer Solutions provides at FIS & Issuer Solutions provide product to 50% least one product to 25% at least one product to 60% 12 Cross sell and white space opportunity across top 150 large banks ($m)

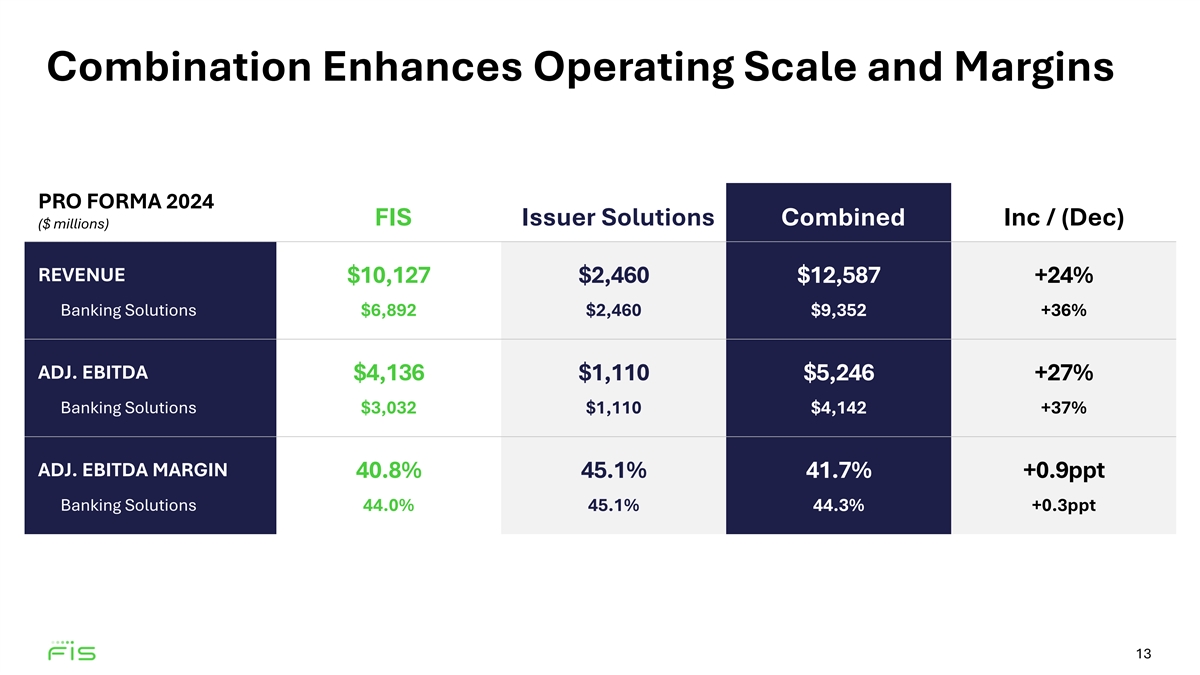

Combination Enhances Operating Scale and Margins PRO FORMA 2024 FIS Issuer Solutions Combined Inc / (Dec) ($ millions) REVENUE $10,127 $2,460 $12,587 +24% Banking Solutions $6,892 $2,460 $9,352 +36% ADJ. EBITDA $4,136 $1,110 $5,246 +27% Banking Solutions $3,032 $1,110 $4,142 +37% ADJ. EBITDA MARGIN 40.8% 45.1% 41.7% +0.9ppt Banking Solutions 44.0% 45.1% 44.3% +0.3ppt 13

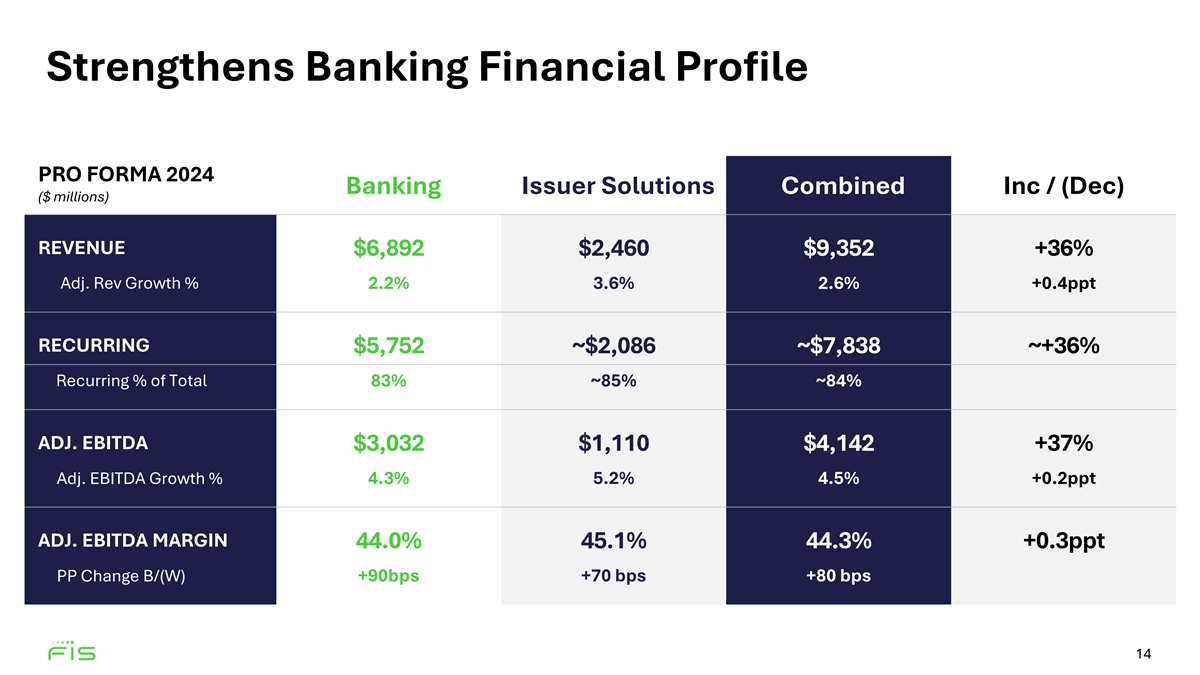

Strengthens Banking Financial Profile PRO FORMA 2024 Banking Issuer Solutions Combined Inc / (Dec) ($ millions) REVENUE $6,892 $2,460 $9,352 +36% Adj. Rev Growth % 2.2% 3.6% 2.6% +0.4ppt RECURRING $5,752 ~$2,086 ~$7,838 ~+36% Recurring % of Total 83% ~85% ~84% ADJ. EBITDA $3,032 $1,110 $4,142 +37% Adj. EBITDA Growth % 4.3% 5.2% 4.5% +0.2ppt ADJ. EBITDA MARGIN 44.0% 45.1% 44.3% +0.3ppt PP Change B/(W) +90bps +70 bps +80 bps 14

Targeting Over $150M of Adj. EBITDA Synergies by Year 3 REVENUE COST SYNERGIES SYNERGIES Incremental $45M $125M Adj. EBITDA 4%+ Revenue Growth Expanding Adj. EBITDA Margins >$125M L-T Synergies by Year 3 Extending Credit Processing Rationalize Duplicate into FIS Client Base Vendor Costs >$150M Expanding Internationally Back Office Optimization Offering Premium Payback Consolidate Operations to Issuer Solutions Clients * Synergies build over three year period. Assumes approximately 60% Adj. EBITDA margin on revenue synergies. Shown net of incremental FIS 15 corporate expenses to support Issuer Solutions business.

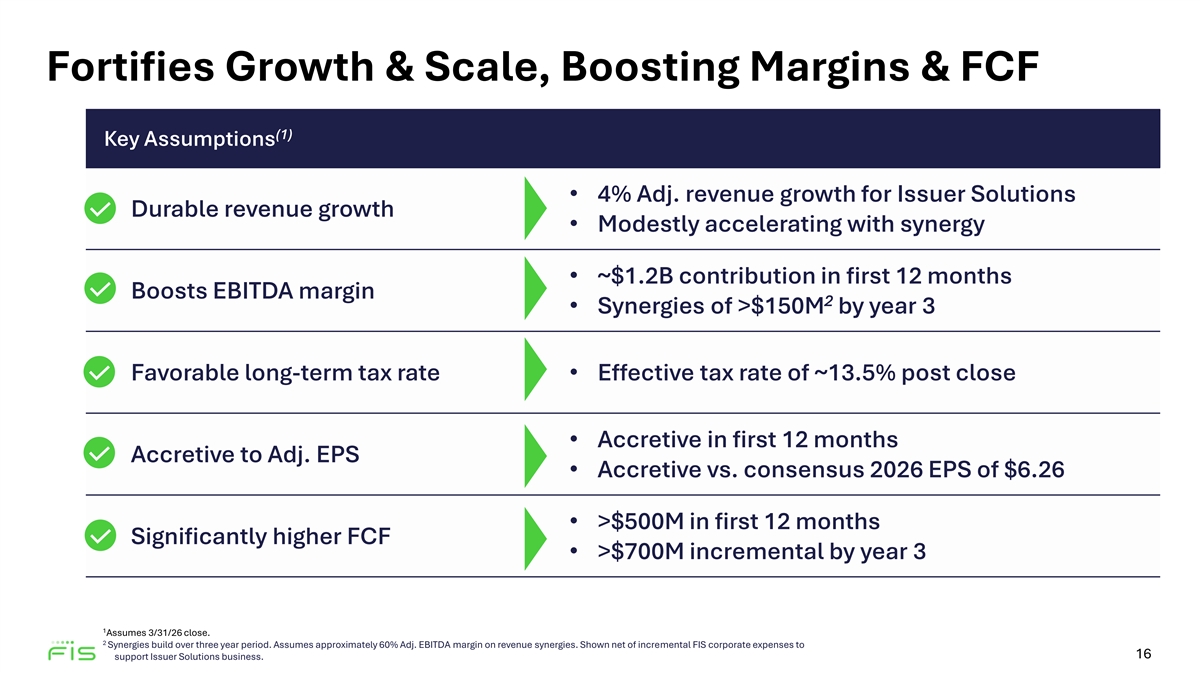

Fortifies Growth & Scale, Boosting Margins & FCF (1) Key Assumptions • 4% Adj. revenue growth for Issuer Solutions Durable revenue growth • Modestly accelerating with synergy • ~$1.2B contribution in first 12 months Boosts EBITDA margin 2 • Synergies of >$150M by year 3 Favorable long-term tax rate • Effective tax rate of ~13.5% post close • Accretive in first 12 months Accretive to Adj. EPS • Accretive vs. consensus 2026 EPS of $6.26 • >$500M in first 12 months Significantly higher FCF • >$700M incremental by year 3 1 Assumes 3/31/26 close. 2 Synergies build over three year period. Assumes approximately 60% Adj. EBITDA margin on revenue synergies. Shown net of incremental FIS corporate expenses to 16 support Issuer Solutions business.

Capital Allocation Priorities Unchanged Until Deal Close; Quickly De-Lever to Maintain Investment Grade Investment Ongoing Dividend M&A/Share Grade Rating Growth Repurchases Capital allocation priorities Strong balance sheet Competitive dividend yield remain unchanged until deal remains a differentiator with compared to peers and S&P closes; M&A $1B and share clients 500 Index repurchases of $1.2B in 2025 Committed to returning to Targeting annual dividend per 2.8x leverage within 18 share growth aligned to Adj. Temporary pause upon close months post close EPS growth to prioritize debt reduction; resume once 2.8x leverage target is achieved 17

Preliminary 1Q 2025 Results - Strong Start to 2025 METRICS 1Q 2025 1Q 2025 ($ millions, except per share data) Outlook Preliminary Results Operational Highlights • Total company recurring REVENUE $2,485 - $2,510 $2,532 revenue growth of 4% ADJ. REVENUE GROWTH 2.5% - 3.5% 4% • Banking recurring Banking 0.5% - 1.5% 2% revenue growth of 3% Capital Markets 7.0% - 8.0% 9% • Capital Markets recurring revenue growth of 6% ADJ. EBITDA $940 - $960 $958 • Adj. EBITDA & Adj. EPS Adj. EBITDA Margin 37.8% - 38.2% ~37.8% both toward high-end of outlook range ADJ. EPS $1.17 - $1.22 $1.21 Reaffirming FY 2025 Outlook 18

Key Transaction Highlights Strategic Financial Creates a $12B+ revenue, more Transaction is accretive to Adjusted diversified global financial EBITDA margins, Adjusted EPS and technology leader Free Cash Flow Adds critical credit processing at Strengthens banking financial profile, scale to payments and banking unlocks revenue synergies and adds product suite durable recurring revenue Extends value proposition into Replaces non-cash EMI with growing financial institutions and stream of recurring revenue and cash international markets flows Advances FIS’ Position as a Scaled FinTech Leader 19 19

Appendix

Worldpay EV to FIS Net Value Reconciliation ($ billions) Worldpay Enterprise Value $ 24.25) Net Debt & Debt-Like Items (7.2) Equity Value 17.0) Transaction Fees and Other Costs (0.6) Distribution Value 16.4) FIS 45% Ownership 7.4) Control Premium to GTCR (0.8) Pre-Tax Value 6.6) Total Taxes (0.9) Net Value $ 5.7 21 *May not sum due to rounding