UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File Number: 001-41404

Woodside Energy Group Ltd

(ABN 55 004 898 962)

(Registrant’s name)

Woodside Energy Group Ltd

Mia Yellagonga, 11 Mount Street

Perth, Western Australia 6000

Australia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

| Exhibit No. |

Description |

|

| 99.1 | A copy of the registrant’s ASX Announcement, dated April 3, 2025, entitled “Sustainability Briefing 2025”. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: April 3, 2025

| WOODSIDE ENERGY GROUP LTD | ||

| By: | /s/ Damien Gare |

|

| Damien Gare Corporate Secretary |

||

Exhibit 99.1

| Announcement |

|

|

| Thursday, 3 April 2025 | Woodside Energy Group Ltd. ACN 004 898 962 Mia Yellagonga 11 Mount Street Perth WA 6000 Australia T +61 8 9348 4000 www.woodside.com

ASX: WDS NYSE: WDS |

|

SUSTAINABILITY BRIEFING 2025 – MEETING ENERGY DEMAND SUSTAINABLY

Woodside CEO Meg O’Neill will brief investors on Woodside’s sustainability strategy and performance today at 09:30 AEDT / 06:30 AWST (17:30 CDT on Wednesday, 2 April 2025). Woodside’s Sustainability Report (released as part of the Annual Report), 2024 Climate Update and sustainability disclosures were released on 25 February 2025.

A live webcast of the briefing will be available at https://webcast.openbriefing.com/wds-mu-2025/ and a presentation is attached.

Ms O’Neill said the briefing continues Woodside’s structured program to engage with investors and incorporate their feedback in the company’s approach to climate and other sustainability topics.

She said strong sustainability performance was a key pillar of Woodside’s business strategy and an important driver of long-term shareholder value.

“As we position Woodside to capitalise on growing global demand for LNG and other energy products, we know our investors want to understand how we combine this growth and value with strong sustainability performance.

“Against a backdrop of market and geopolitical uncertainty, and given the complexity of the energy transition, it is more important than ever that investors can rely on us to do what we say.

“We are responding on climate change, being on track to meet our net equity Scope 1 and 2 emissions reduction targets and making material progress towards our Scope 3 investment and abatement targets. We are also demonstrating strong performance across a range of other environmental, social and governance areas.

“This adds to Woodside’s strong investment case as a reliable, responsible energy provider focused on sustaining shareholder value through the energy transition.”

| INVESTORS

Marcela Louzada M: +61 456 994 243 E: investor@woodside.com |

MEDIA

Christine Forster M: +61 484 112 469 E: christine.forster@woodside.com |

|

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Page 1

Forward-looking statements

This announcement contains forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements regarding future production, emissions performance, performance against investment and abatement targets, production rates, cashflow, capital expenditure, transactions (including statements concerning the timing and completion of the transaction, the expected benefits of transactions, the timing of transactions, transaction partners and other future arrangements between Woodside and others), the timing of completion of Woodside’s projects, the financial performance of Woodside’s projects and expectations and guidance regarding production, capital and exploration expenditure, gas hub exposure and future results of projects. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘strategy’, ‘forecast’, ‘outlook’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly, statements that describe the objectives, plans, goals or expectations of Woodside are forward-looking statements.

Forward-looking statements in this announcement are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of aspirational targets that Woodside has set for itself and its management of the business. Those statements and any assumptions on which they are based are only opinions, are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective officers, directors, employees, advisers or representatives.

Details of the key risks relating to Woodside and its business can be found in the “Risk” section of Woodside’s most recent Annual Report released to the Australian Securities Exchange and Woodside’s most recent Annual Report on Form 20-F filed with the United States Securities and Exchange Commission and available on the Woodside website at https://www.woodside.com/investors/reports-investor-briefings. You should review and have regard to these risks when considering the information contained in this announcement.

Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements.

All information included in this announcement, including any forward-looking statements, speak only as of the date of this announcement and, except as required by law or regulation, Woodside does not undertake to update or revise any information or forward-looking statements contained in this announcement, whether as a result of new information, future events, or otherwise.

Other important information

All references to dollars, cents or $ in this announcement are to US currency, unless otherwise stated. References to “Woodside” may be references to Woodside Energy Group Ltd and/or its applicable subsidiaries (as the context requires).

Page 2

INVESTOR BRIEFING: APRIL 2025 Meeting energy demand sustainably

Disclaimer, important notes and assumptions • The purpose of this presentation is to enable readers to obtain a high-level understanding of Woodside’s climate • This presentation has been prepared without reference to the investment objectives, financial and taxation situation or strategy and the progress it has made in 2024 towards achieving its plans, strategies, objectives, targets and particular needs of any Woodside shareholder or any other person. The information contained in this presentation aspirations. does not constitute, and should not be taken as, financial product or investment advice. Woodside encourages you to seek independent legal, financial, taxation and other professional advice before making any investment decision. • This presentation contains extracts of some of the key climate strategy and 2024 progress information from Woodside's Climate Transition Action Plan and 2023 Progress Report (CTAP), Woodside's 2024 Climate Update and • This presentation and the information contained herein may not be taken or transmitted, in, into or from and may not section 3.8.5 of Woodside’s 2024 Annual Report. be copied, forwarded, distributed or transmitted in or into any jurisdiction in which such release, publication or distribution would be unlawful. The release, presentation, publication or distribution of this presentation, in whole or in • It also includes extracts of broader market analysis relating to the potential demand for Woodside’s products and part, in certain jurisdictions may be restricted by law or regulation, and persons into whose possession this services and other information. presentation comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of the relevant jurisdiction. Woodside does not accept liability • This presentation does not contain all of the underlying context and detail that is included in the full CTAP, 2024 to any person in relation to the distribution or possession of this document in or from any such jurisdiction. Climate Update or section 3.8.5 of Woodside’s 2024 Annual Report. This presentation should be read in conjunction with the CTAP, 2024 Climate Update and section 3.8.5 of Woodside’s 2024 Annual Report which includes more Forward-looking statements fulsome explanation of the underpinning assumptions, uncertainties, and context relevant to the information in this presentation. • This presentation contains forward looking statements with respect to Woodside’s business and operations and market conditions, including, for example, but not limited to, statements regarding development, completion and Information execution of Woodside’s projects, operating activities, new energy products, expectations and plans for production capacity and investments in, and development of, renewables and new energy projects, and expectations regarding • This presentation has been prepared by Woodside Energy Group Ltd (“Woodside”). the achievement of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions targets and aspiration, emissions intensity performance or Woodside’s Scope 3 targets; and the performance or future position of Woodside’s balance • All information included in this presentation, including any forward-looking statements, reflects Woodside’s views held sheet, dividends, shareholder outcomes, offtake arrangements, safety outcomes, and decarbonisation, abatement or as at the date of this presentation and, except as required by applicable law, neither Woodside, its related bodies sustainability initiatives. corporate, nor any of their respective officers, directors, employees, advisers or representatives (“Beneficiaries”) intends to, undertakes to, or assumes any obligation to, provide any additional information or update or revise any • Statements that describe the objectives, plans, goals or expectations of Woodside are forward looking statements. information or forward-looking statements in this presentation after the date of this presentation, either to make them • Forward looking statements in this presentation are not guidance, forecasts, guarantees or predictions of future conform to actual results or as a result of new information, future events, changes in Woodside’s expectations or events or performance. No representation or warranty, express or implied, is given as to the accuracy, completeness otherwise. or correctness, likelihood of achievement or reasonableness of any forward looking information in this document. Readers should not place undue reliance on any forward looking statements contained in this document, particularly • This presentation may contain industry, market and competitive position data that is based on industry publications in light of the long time horizon this document discusses and inherent uncertainty in policy, market and technological and studies conducted by third parties as well as Woodside’s internal estimates and research. While Woodside believes developments in the future. that each of these publications and third-party studies is reliable and has been prepared by a reputable source, Woodside has not independently verified the market and industry data obtained from these third-party sources and • Forward looking information in this presentation may be affected by variables and changes in underlying assumptions which could cause actual results to differ materially from those expressed in this document. In addition to the risks cannot guarantee the accuracy or completeness of such data. Accordingly, undue reliance should not be placed on any referenced above these include price fluctuations, actual demand, currency fluctuations, drilling and production of the industry, market and competitive position data contained in this presentation. results, reserve estimates, loss of market, industry competition, environmental risks, transition risks, physical risks, legislative, policy, fiscal and regulatory developments, changes in accounting standards, economic and financial • To the maximum extent permitted by law, neither Woodside, its related bodies corporate, nor any of their respective market conditions in various countries and regions, political risks, abatement able to be delivered through Beneficiaries, assume any liability (including liability for equitable, statutory or other damages) in connection with, any engineering or operational changes, project delay or advancement, approvals and cost estimates. Some matters are responsibility for, or make any representation or warranty (express or implied) as to, the fairness, currency, accuracy, subject to approval of joint venture participants. adequacy, reliability or completeness of the information or any opinions expressed in this presentation or the reasonableness of any underlying assumptions. • Targets, aspirations and opportunities described in this presentation may also change materially if Woodside changes its strategic aim set out in the 2024 Annual Report and the CTAP. No offer or advice • Woodside does not undertake to provide ongoing market updates on forward looking information, including plans to • This presentation is not intended to and does not constitute, form part of, or contain an offer or invitation to sell to achieve strategic aims or targets, or on performance against its plans or targets, except to the extent it has a legal Woodside shareholders (or any other person), or a solicitation of an offer from Woodside shareholders (or any other obligation to do so. Past performance is not a guide to future performance. person), or a solicitation of any vote or approval from Woodside shareholders (or any other person) in any jurisdiction. 2

Disclaimer, important notes and assumptions (continued) Climate strategy and emissions data • All greenhouse gas emissions data in this presentation are estimates, due to the inherent uncertainty and limitations in measuring or quantifying greenhouse gas emissions, and our methodologies for measuring or quantifying greenhouse gas emissions may evolve as best practices continue to develop and data quality and quantity continue to improve. • Woodside “greenhouse gas” or “emissions” information reported are net equity Scope 1 greenhouse gas emissions, Scope 2 greenhouse gas emissions, and/or Scope 3 greenhouse gas emissions, unless otherwise stated. • For more information on Woodside's climate strategy and performance, including further details regarding Woodside's targets, aspirations and goals and the underlying methodology, judgements, assumptions and contingencies, refer to Woodside's Climate Transition Action Plan 2023 (CTAP) available on the Woodside website at https://www.woodside.com/sustainability/climate-change and section 3.8.5 of Woodside’s 2024 Annual Report . The glossary, footnotes and endnotes to this presentation provide clarification regarding the use of terms such as lower- carbon under Woodside's climate strategy. A full glossary of terms used in connection with Woodside's climate strategy is contained in the CTAP. Other important information • All references to dollars, cents or $ in this presentation are to US currency, unless otherwise stated. • References to “Woodside” may be references to Woodside Energy Group Ltd and/or its applicable subsidiaries (as the context requires). • This presentation does not include any express or implied prices at which Woodside will buy or sell financial products. • A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. 3

Agenda Marcela Louzada, Welcome Vice President Investor Relations Richard Goyder AO, Message from Chair Chair of the Board Meg O’Neill, CEO presentation CEO & Managing Director Meg O’Neill & Q&A Marcela Louzada 4

Video Message from Chair Richard Goyder AO, Chair of the Board 5 5

SSTTR RA AT TE EG GY Y A AN ND D O OU UT TLLO OO OK K CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Executing our strategy, delivering on commitments • High-quality assets and world-class reliability driving record annual production • Safe execution of major growth projects Providing energy • Growing energy demand (global GDP to almost double by 2050) supports 1 portfolio growth • Strong balance sheet supporting dividends during investment period Creating and • Fully franked dividends at the top of the target payout range returning value • Disciplined and clear capital allocation driving long-term shareholder value • Focus on safety and environmental, social and governance performance Conducting our business • Delivering on net equity Scope 1 and 2 emissions targets sustainably • Material progress towards Scope 3 investment and abatement targets All footnotes on this page will be displayed on page 28 as endnotes 6

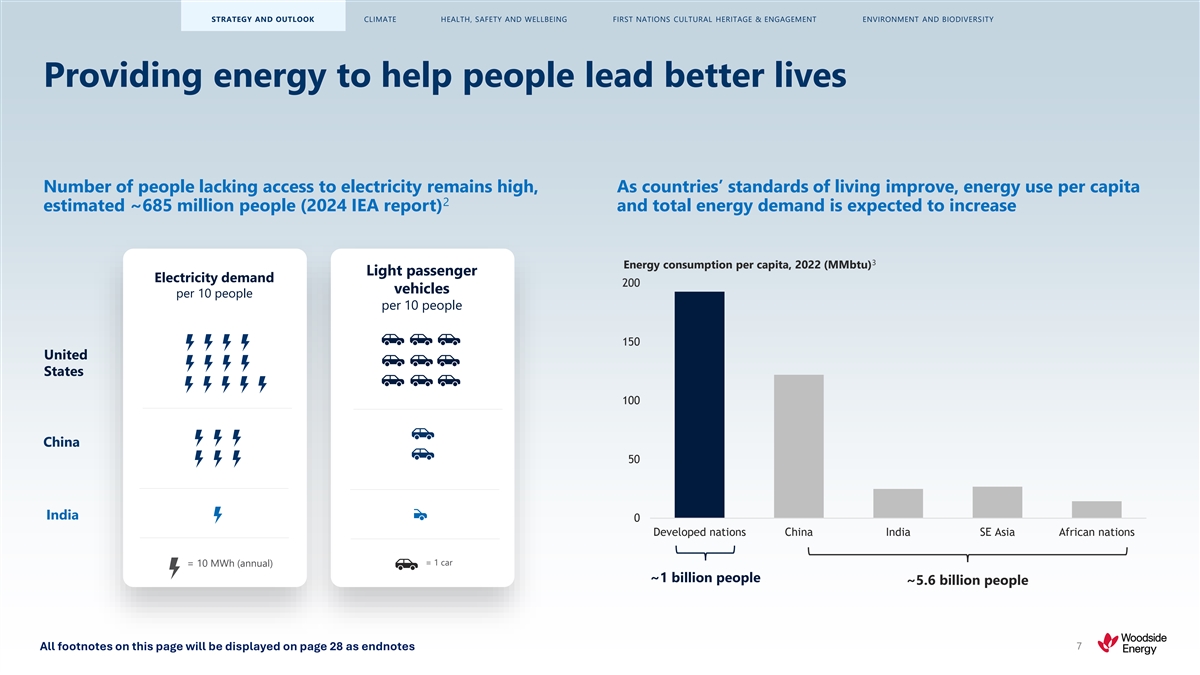

SSTTR RA AT TE EG GY Y A AN ND D O OU UT TLLO OO OK K CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Providing energy to help people lead better lives Number of people lacking access to electricity remains high, As countries’ standards of living improve, energy use per capita 2 estimated ~685 million people (2024 IEA report) and total energy demand is expected to increase 3 Energy consumption per capita, 2022 (MMbtu) Light passenger Electricity demand 200 vehicles per 10 people per 10 people 150 United States 100 China 50 India 0 Developed nations China India SE Asia African nations = 1 car = 10 MWh (annual) ~1 billion people ~5.6 billion people All footnotes on this page will be displayed on page 28 as endnotes 7

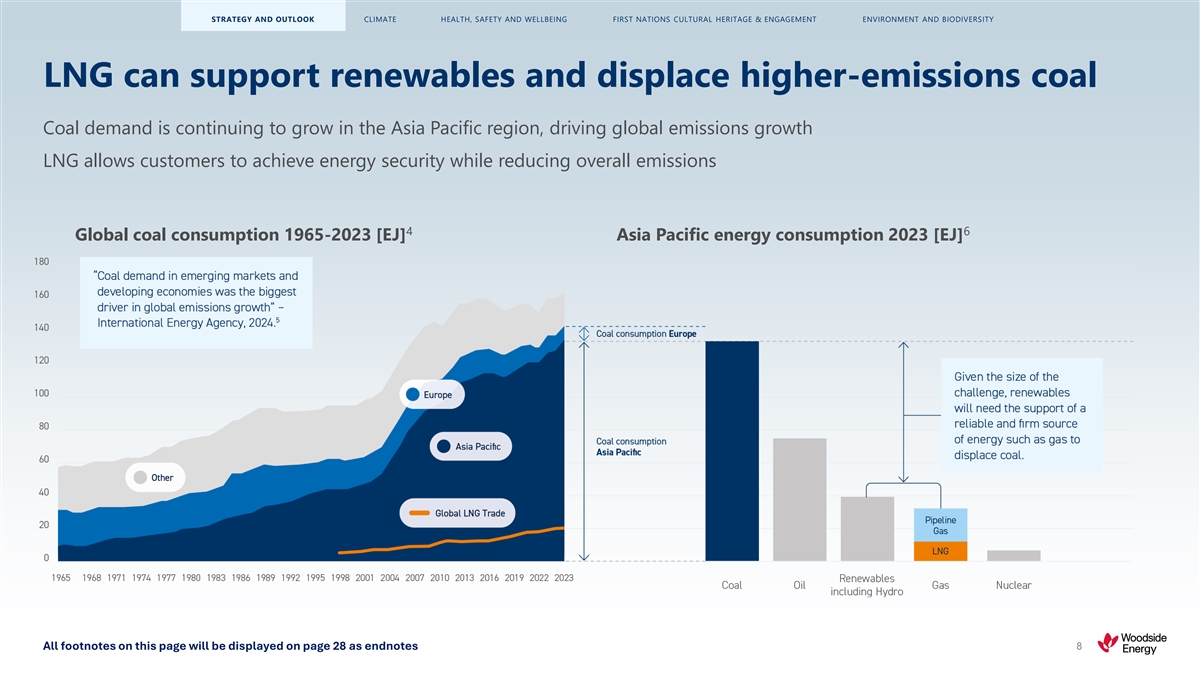

SSTTR RA AT TE EG GY Y A AN ND D O OU UT TLLO OO OK K CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY LNG can support renewables and displace higher-emissions coal Coal demand is continuing to grow in the Asia Pacific region, driving global emissions growth LNG allows customers to achieve energy security while reducing overall emissions 4 6 Global coal consumption 1965-2023 [EJ] Asia Pacific energy consumption 2023 [EJ] All footnotes on this page will be displayed on page 28 as endnotes 8

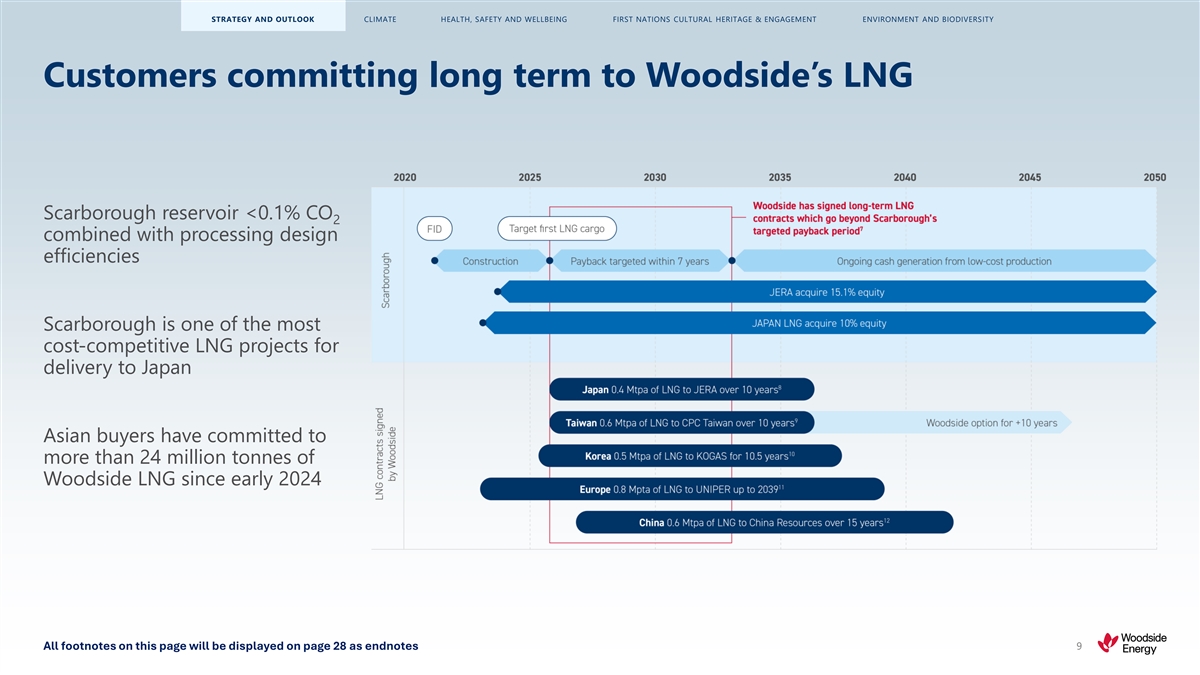

SSTTR RA AT TE EG GY Y A AN ND D O OU UT TLLO OO OK K CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Customers committing long term to Woodside’s LNG Scarborough reservoir <0.1% CO 2 combined with processing design efficiencies Scarborough is one of the most cost-competitive LNG projects for delivery to Japan Asian buyers have committed to more than 24 million tonnes of Woodside LNG since early 2024 All footnotes on this page will be displayed on page 28 as endnotes 9

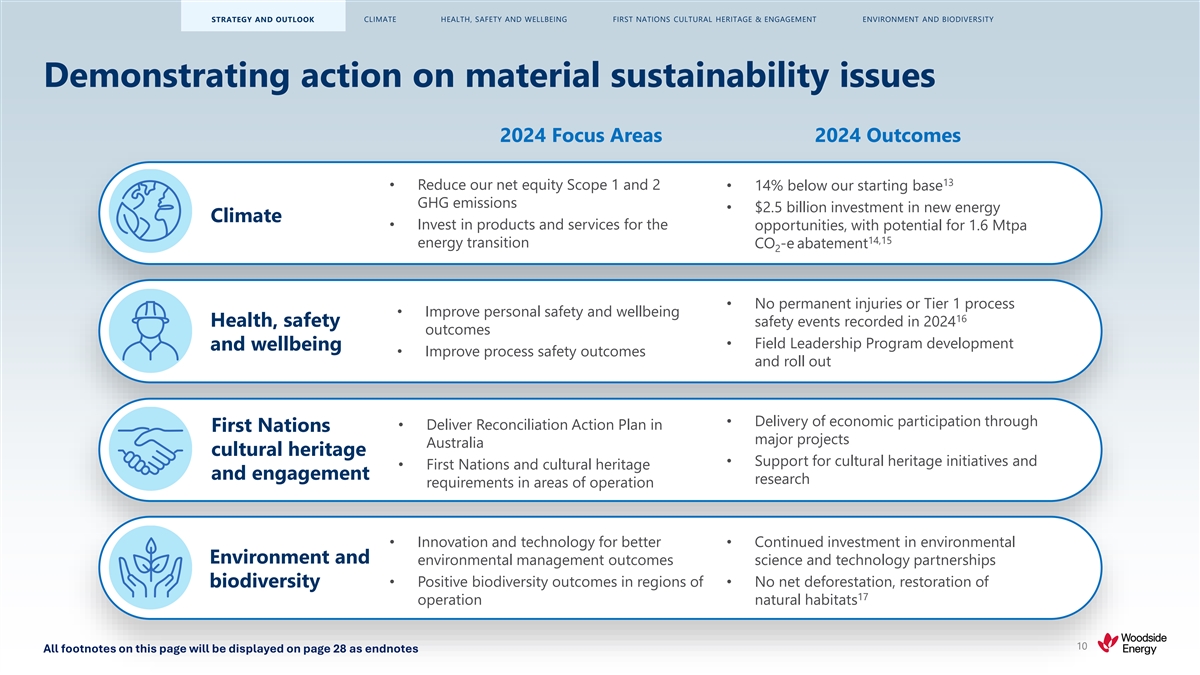

STS R ST A TR R TA A ET G TE E YG G A Y Y N A AD N N D D G O O O V U U E T T R LLN O OA O ON K KCE CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Demonstrating action on material sustainability issues 2024 Focus Areas 2024 Outcomes 13 • Reduce our net equity Scope 1 and 2 • 14% below our starting base GHG emissions • $2.5 billion investment in new energy Climate • Invest in products and services for the opportunities, with potential for 1.6 Mtpa 14,15 energy transition CO -e abatement 2 • No permanent injuries or Tier 1 process • Improve personal safety and wellbeing 16 safety events recorded in 2024 Health, safety outcomes • Field Leadership Program development and wellbeing • Improve process safety outcomes and roll out • Delivery of economic participation through • Deliver Reconciliation Action Plan in First Nations major projects Australia cultural heritage • Support for cultural heritage initiatives and • First Nations and cultural heritage and engagement research requirements in areas of operation • Innovation and technology for better • Continued investment in environmental Environment and environmental management outcomes science and technology partnerships biodiversity• Positive biodiversity outcomes in regions of • No net deforestation, restoration of 17 operation natural habitats 10 All footnotes on this page will be displayed on page 28 as endnotes

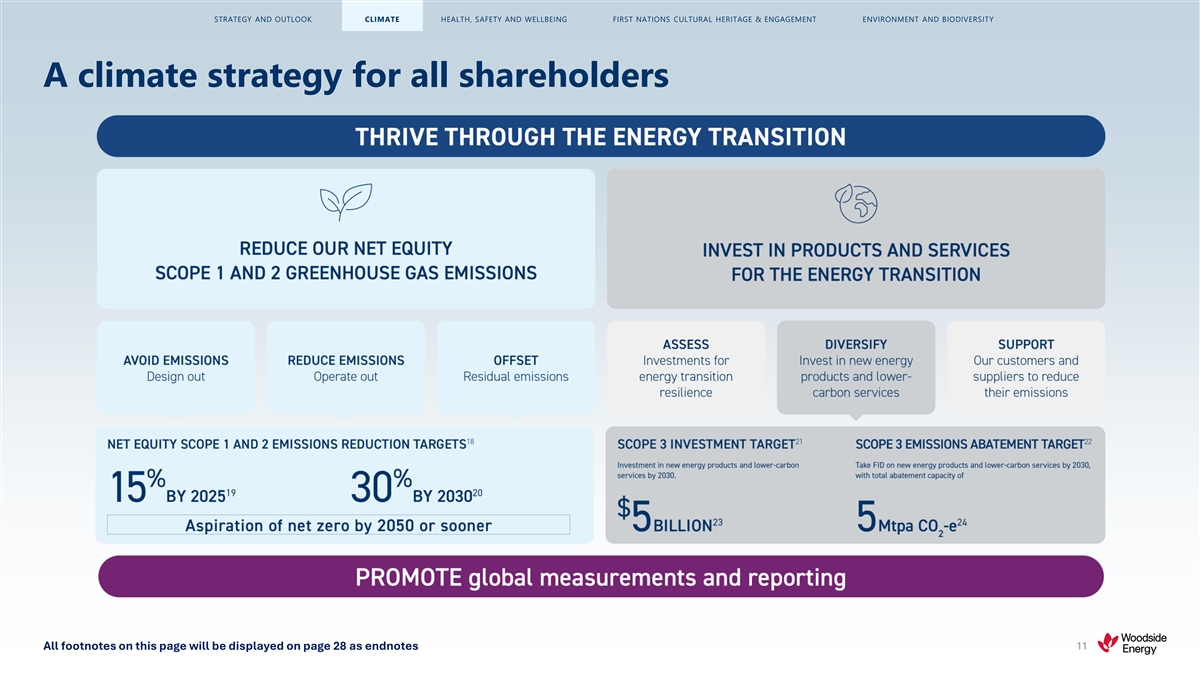

STRATEGY AND OUTLOOK C CL LIIM MA A TT EE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY A climate strategy for all shareholders All footnotes on this page will be displayed on page 28 as endnotes 11

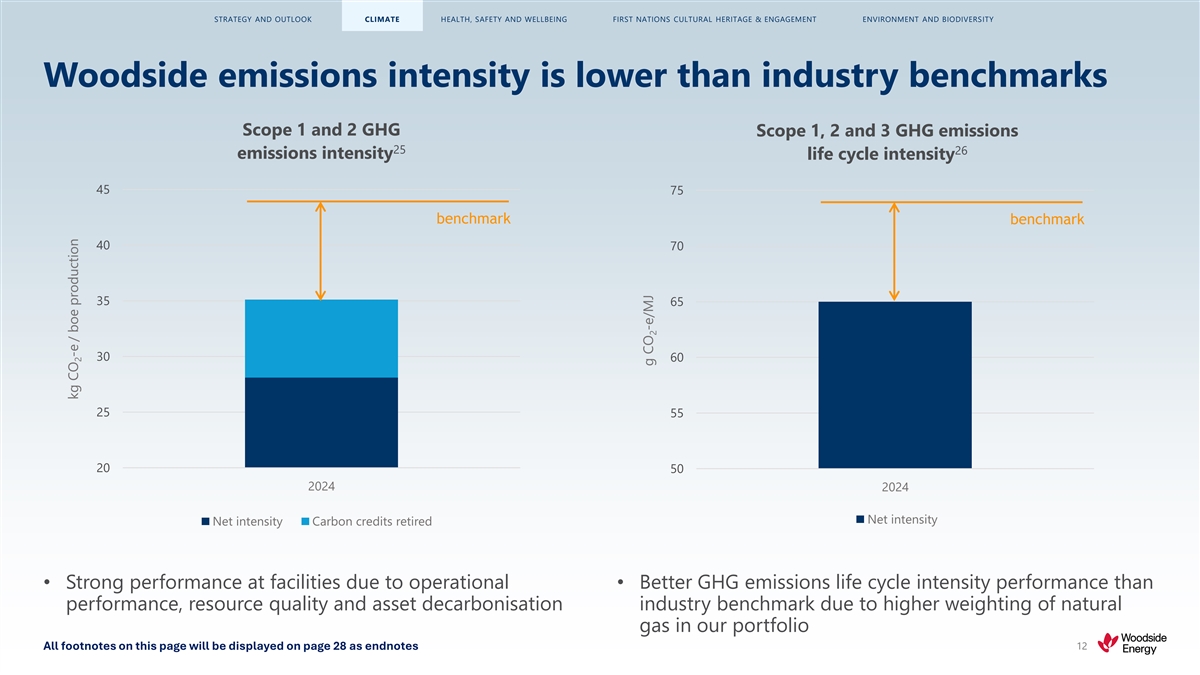

STRATEGY AND OUTLOOK C CL LIIM MA A TT EE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Woodside emissions intensity is lower than industry benchmarks Scope 1 and 2 GHG Scope 1, 2 and 3 GHG emissions 25 26 emissions intensity life cycle intensity 45 75 benchmark benchmark 40 70 35 65 30 60 25 55 20 50 2024 2024 Net intensity Net intensity Carbon credits retired • Strong performance at facilities due to operational • Better GHG emissions life cycle intensity performance than performance, resource quality and asset decarbonisation industry benchmark due to higher weighting of natural gas in our portfolio All footnotes on this page will be displayed on page 28 as endnotes 12 kg CO -e / boe production 2 g CO -e/MJ 2

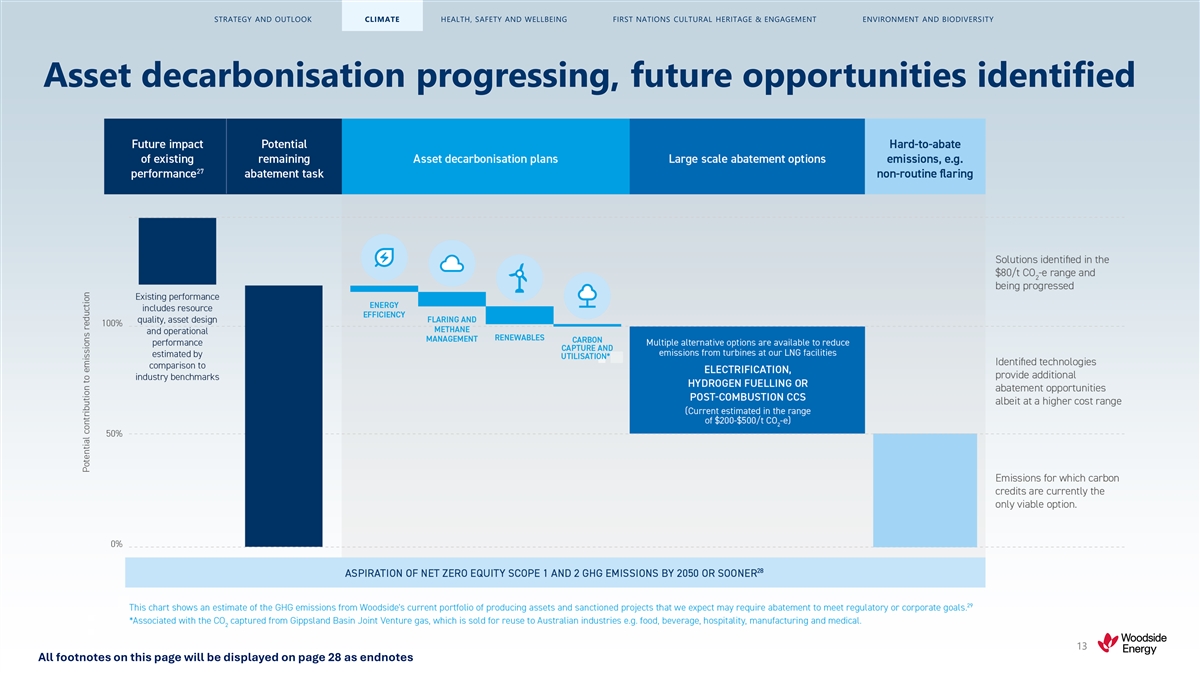

STRATEGY AND OUTLOOK C CL LIIM MA A TT EE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Asset decarbonisation progressing, future opportunities identified 13 All footnotes on this page will be displayed on page 28 as endnotes

STRATEGY AND OUTLOOK C CL LIIM MA A TT EE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Creating value and delivering on our Scope 3 targets 30 31 $2.5billion 1.6Mtpa investment in new of potential CO -e 2 energy and lower- customer emissions carbon services abatement Strategic, responsible diversification of our portfolio aligned with customer needs and capital allocation framework Focused on delivery of Beaumont New Ammonia – targeting first production from H2 2025 Strong and immediate cashflow generation at current ammonia pricing Beaumont New Ammonia Project under construction All footnotes on this page will be displayed on page 28 as endnotes 14

STRATEGY AND OUTLOOK C CL LIIM MA A TT EE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Video Beaumont New Ammonia Daniel Kalms, EVP and Chief Operating Officer International 15

STRATEGY AND OUTLOOK CLIMATE HE HA EL AT LH TH , ,S S AA FF EETTY Y A AN ND D W WE EL LL LB BE EIIN NG G FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Commitment to safety excellence drives performance Protecting our people Relentless focus on systematically improving safety performance SYSTEMS HABITS Consistent policies and requirements; a Simple systems Leadership common safety culture across a growing and tools Learning portfolio Lead and lag indicators Aspiration Risk management Global Wellbeing Framework to cultivate a positive work environment INNOVATION PRACTICES Best practice and Capability and capacity Focus on technology to improve performance collaboration H&S focused design, and put additional barriers between our people Data and AI maintenance and operations and hazards Technology Verification Managing risks and opportunities 16

STRATEGY AND OUTLOOK CLIMATE HE HA EL AT LH TH , ,S S AA FF EETTY Y A AN ND D W WE EL LL LB BE EIIN NG G FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Consistent safety focus in operations and projects More than 23 million exposure hours worked globally in 2024 No permanent injuries or Tier 1 process safety events 32 recorded Field leadership program building safety leadership at all levels - rolled out to more than 1200 staff Safe delivery of Sangomar Project and Pluto Train 2 modules program All footnotes on this page will be displayed on page 28 as endnotes 17

STRATEGY AND OUTLOOK CLIMATE HE HA EL AT LH TH , ,S S AA FF EETTY Y A AN ND D W WE EL LL LB BE EIIN NG G FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT ENVIRONMENT AND BIODIVERSITY Video Sangomar safety Paul Sullivan, Vice President Sangomar 18

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIFR IR SS TT N N AA TT IIO ON NS S C CU UL LT TU UR RA AL L H HE ER RIITT A A G G EE & & E E NN GG AA GG EM EM EN ET NT ENVIRONMENT AND BIODIVERSITY Respectful partnerships, meaningful engagement Established track record of partnering with First Nations communities in culturally significant areas Strategic approach focused on areas of potential impact and opportunities for positive outcomes Engagement through representative bodies with cultural authority, guided by First Nations communities on their preferred methods of consultation Focus on economic participation through our business activities and major projects 19

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIFR IR SS TT N N AA TT IIO ON NS S C CU UL LT TU UR RA AL L H HE ER RIITT A A G G EE & & E E NN GG AA GG EM EM EN ET NT ENVIRONMENT AND BIODIVERSITY Tangible actions delivering outcomes Awarded Woodside’s largest ever Traditional Owner construction contract (Pluto Train 1 modifications) Effective consultations with 18 First Nations groups to support Scarborough environment plans Established Woodside First Nations Advisory Group Support for cultural heritage initiatives and research; Murujuga World Heritage Listing 20

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIFR IR SS TT N N AA TT IIO ON NS S C CU UL LT TU UR RA AL L H HE ER RIITT A A G G EE & & E E NN GG AA GG EM EM EN ET NT ENVIRONMENT AND BIODIVERSITY Video Murujuga cultural heritage management Sharon Reynolds, Head of First Nations and Human Rights 21

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT EN EN VV IR IR OO N N M M EE N NT T A AN ND D B BIIO OD DI IV VE ER RS SIITTYY Robust environmental management approach Focus on most significant risks Established track record of operating in sensitive marine and onshore environments Systematic approach to manage potential impacts and Emissions Water risks in a consistent way across global portfolio and air quality management Strong focus on hydrocarbon spill preparedness and response, approach based on international best practice Discharge and Biodiversity and Continued investment in science, partnering with waste management protected areas government-funded research organisations to underpin approach Underpinned by credible science 22

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT EN EN VV IR IR OO N N M M EE N NT T A AN ND D B BIIO OD DI IV VE ER RS SIITTYY Strong environmental performance No hydrocarbon spills exceeding moderate impact threshold in 2024 No penalties for non-compliance with environmental regulations in 2024 33 No net deforestation across Woodside’s global operations Restoration of natural habitats to support positive biodiversity outcomes 23

STRATEGY AND OUTLOOK CLIMATE HEALTH, SAFETY AND WELLBEING FIRST NATIONS CULTURAL HERITAGE & ENGAGEMENT EN EN VV IR IR OO N N M M EE N NT T A AN ND D B BIIO OD DI IV VE ER RS SIITTYY Video Woodside whale research Dr Luke Smith, Head of Biodiversity and Science 24

Delivering long-term value for communities and economies Major economic Significant community contribution investment Local Content Employment Social Contribution $7.9 billion >4400 jobs >A$300 million spent on goods and services for Senegalese people during invested by NWS JV partners globally in 2024 Sangomar construction phase in social and community infrastructure Tax Payments Employment Local Contribution >A$22 billion >1600 jobs A$115 million paid in taxes, royalties and generated in WA on Pluto committed to WA community levies to Australian Train 2 construction in 2024 investment since 2022 governments since 2011 25 25

Executing our strategy, delivering on commitments • High-quality assets and world-class reliability driving record annual production • Safe execution of major growth projects Providing energy • Growing energy demand (global GDP to almost double by 2050) supports 34 portfolio growth • Strong balance sheet supporting dividends during investment period Creating and • Fully franked dividends at the top of the target payout range returning value • Disciplined and clear capital allocation driving long-term shareholder value • Focus on safety and environmental, social and governance performance Conducting our business • Delivering on net equity Scope 1 and 2 emissions targets sustainably • Material progress towards Scope 3 investment and abatement targets A 26 ll footnotes on this page will be displayed on page 28 as endnotes 26

INVESTOR BRIEFING: APRIL 2025 Q&A

Endnotes 1. UN World Population Prospects 2024. 21. Scope 3 targets are subject to commercial arrangements, commercial feasibility, regulatory and Joint Venture approvals, and third party activities (which may or may not proceed). Individual investment decisions are subject to Woodside’s investment targets. Not guidance. 2. Tracking SDG 7: The Energy Progress Report 2024. Potentially includes both organic and inorganic investment. 3. Energy Institute: Statistical Review of World Energy (2024). 22. Scope 3 targets are subject to commercial arrangements, commercial feasibility, regulatory and Joint Venture approvals, and third party 4. Energy Institute: Statistical Review of World Energy (2024). activities (which may or may not proceed). Individual investment decisions are subject to Woodside’s investment targets. Not guidance. Potentially includes both organic and inorganic investment. 5. International Energy Agency (2024): CO2 Emissions in 2023. 23. Includes pre-RFSU spend on new energy products and lower-carbon services that can help our customers decarbonise by using these 6. Energy Institute: Statistical Review of World Energy (2024). products and services. It is not used to fund reductions of Woodside’s net equity Scope 1 and 2 greenhouse gas emissions which are 7. Woodside’s 2023 Climate Transition Action Plan and Progress Report, page 49. https://www.woodside.com/docs/default- managed separately through asset decarbonisation plans. source/investordocuments/major-reports-(static-pdfs)/ctap2023/climate-transition-action-plan-and-2023-progress- 24. Includes binding and non-binding opportunities in the portfolio, subject to commercial arrangements, commercial feasibility, regulatory report.pdf?sfvrsn=d6f6eed4_11 and Joint Venture approvals, and third-party activities (which may or may not proceed). Individual investment decisions are subject to 8. See announcement titled “Woodside and JERA sign agreement for long-term LNG supply”. https://www.woodside.com/docs/default- Woodside’s investment targets. Not guidance. source/media-releases/woodside-and-jera-sign-agreement-for-long-term-lng-supply.pdf?sfvrsn=1e6b022f_1 25. Gross equity basis. Woodside analysis, based on Woodside Scope 1 and 2 greenhouse gas emissions data for 2024 relative to a 9. See announcement titled “Woodside and CPC sign agreement for long-term LNG supply”. https://www.woodside.com/docs/default- comparable portfolio of upstream oil, upstream natural gas and LNG liquefaction assets, based on the average emissions intensity of source/about-us-documents/woodside-and-cpc-sign-agreement-for-long-term-lng-supply.pdf?sfvrsn=667cd731_1 these project categories reported in Table 3.1 of IEA’s “The Oil and Gas Industry in Net Zero Transitions” (November 2023). 10. See announcement titled “Woodside and Kogas sign agreement for long-term LNG supply”. woodside-and-kogas-sign-agreement- 26. Woodside analysis, based on Woodside Scope 1, 2 and 3 emissions data for 2024 relative to the Transition Pathway Initiative oil and gas for-long-term-lng-supply.pdf sector mean reported in their assessment Woodside on 9 June 2024. https://www.transitionpathwayinitiative.org/companies/woodside- petroleum. 11. See announcement titled “Woodside and Uniper sign agreement for LNG supply to Europe . Woodside and Uniper sign new LNG agreement 27. Quantification of emissions reductions associated with the continuation of existing performance is inherently uncertain. However, it is possible to provide an estimate by comparison to a benchmark of a comparable portfolio of upstream oil, upstream natural gas and LNG 12. See announcement titled “Woodside and China Resources agree long-term LNG supply”. Woodside and China Resources agree long- liquefaction assets with a similar product mix to Woodside’s forecast production between 2025 and 2050. The industry average term LNG supply emissions reported in Table 3.1 of IEA’s “The Oil and Gas Industry in Net Zero Transitions” (November 2023) has been applied to 13. Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO2-e which Woodside's forecast production between 2025 to 2050 to determine the benchmark performance used to estimate the emissions is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be reduction. Woodside's LNG projects, inclusive of upstream and liquefaction facilities, have been benchmarked based on the industry adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. average LNG liquefaction emissions intensity stated by the IEA. This is a conservative approach as does not include the average industry Net equity emissions include the utilisation of carbon credits as offsets. emissions associated with upstream production from these facilities. 14. Cumulative spend against the investment target at the end of 2024 includes 80% of the total $2,350 million for the Beaumont New 28. Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO2 -e which is Ammonia Project acquisition. The remaining 20% will be paid at Project completion. representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity 15. Scope 3 emissions abatement capacity of 1.6 Mtpa CO2 -e assumes supply of carbon abated hydrogen and CCS operational for phase emissions include the utilisation of carbon credits as offsets. 1 of the Beaumont New Ammonia Project . Woodside has made the assumption to estimate the avoided emissions through the displacement of conventional marine fuel. Actual displaced emissions may differ based on actual use case. 29. This includes Scarborough, Trion and Beaumont New Ammonia Project as well as producing assets. Emissions and abatement opportunities at future investments can be added when a FID is taken and design is complete. 16. The tragic death of an OCI contractor employee at the Beaumont New Ammonia site is not included in the Woodside statistics due to the applicable contractual arrangements. 30. Cumulative spend against the investment target at the end of 2024 includes 80% of the total $2,350 million for the Beaumont New Ammonia Project acquisition. The remaining 20% will be paid at Project completion. 17. Woodside’s Environment and Biodiversity Policy outlines our deforestation principles and definition of a forest 31. Scope 3 emissions abatement capacity of 1.6 Mtpa CO2 -e assumes supply of carbon abated hydrogen and CCS operational for phase of 18. Targets and aspiration are for net equity Scope 1 and 2 greenhouse gas emissions relative to a starting base of 6.32 Mt CO2-e which the Beaumont New Ammonia Project . Woodside has made the assumption to estimate the avoided emissions through the is representative of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and which may be displacement of conventional marine fuel. Actual displaced emissions may differ based on actual use case. adjusted (up or down) for potential equity changes in producing or sanctioned assets with a final investment decision prior to 2021. Net equity emissions include the utilisation of carbon credits as offsets. 32. The tragic death of an OCI contractor employee at the Beaumont New Ammonia site is not included in the Woodside statistics due to the applicable contractual arrangements. 19. This means net equity for the 12-month period ending 31 December 2025 are targeted to be 15% lower than the starting base. 33. Woodside’s Environment and Biodiversity Policy outlines our deforestation principles and definition of a forest. 20. This means net equity emissions for the 12-month period ending 31 December 2030 are targeted to be 30% lower than starting base. 34. UN World Population Prospects 2024. 28

Glossary Abate/Abatement Decarbonisation Lower-carbon Avoidance, reduction or removal of an amount of carbon Woodside uses this term to describe activities or pathways that Woodside uses this term to describe the characteristic of dioxide or equivalent. have the effect of moving towards a state that is lower-carbon, having lower levels of associated potential GHG emissions as defined in this glossary. when compared to historical and/or current conventions or Aspiration analogues, for example relating to an otherwise similar Woodside uses this term to describe an aspiration to seek the Emissions resource, process, production facility, product or service, or achievement of an outcome but where achievement of the Emissions refers to emissions of greenhouse gases unless activity. When applied to Woodside's strategy, please see the outcome is subject to material uncertainties and contingencies otherwise stated. definition of lower-carbon portfolio. such that Woodside considers there is not yet a suitable Equity greenhouse gas emissions defined plan or pathway to achieve that outcome. Lower-carbon ammonia Woodside sets its Scope 1 and 2 greenhouse gas emissions Lower-carbon ammonia is characterised here by the use of Biodiversity reduction targets on an equity basis. This ensures that the hydrogen with emissions abated by carbon, capture, and Biological diversity means the variability among living scope of its emissions reduction targets is aligned with its storage (CCS), with an expected ammonia lifecycle (Scope 1, 2 organisms from all sources including, inter alia, terrestrial, economic interest in its investments. Equity emissions reflect and 3) carbon emissions intensity of 0.8 tCO2/tNH3 (based on marine and other aquatic ecosystems and the ecological the greenhouse gas emissions from operations according to contracted intensity threshold with Linde) relative to unabated complexes of which they are a part, thus including species Woodside’s share of equity in the operation. Its equity share of ammonia with a lifecycle (Scope 1, 2 and 3) carbon emissions within species. an operation reflects its economic interest in the operation, intensity of 2.3 tCO2/tNH3 (Hydrogen Europe, 2023). Carbon credit which is the extent of rights it has to the risks and rewards Lower-carbon portfolio A tradable financial instrument that is issued by a carbon- flowing from the operation. For Woodside, a lower-carbon portfolio is one from which the crediting program. A carbon credit represents a greenhouse FID net equity Scope 1 and 2 greenhouse gas emissions, which gas emission reduction to, or removal from, the atmosphere Final investment decision. includes the use of offsets, are being reduced towards targets, equivalent to 1 t/CO2-e, calculated as the difference in Flaring and into which new energy products and lower-carbon emissions from a baseline scenario to a project scenario. The controlled burning of gas found in oil and gas reservoirs. services are planned to be introduced as a complement to Carbon credits are uniquely serialised, issued, tracked and existing and new investments in oil and gas. Our Climate Policy retired or administratively cancelled by means of an electronic GHG or Greenhouse gas sets out the principles that we believe will assist us achieve this registry operated by an administrative body, such as a carbon- The seven greenhouse gases listed in the Kyoto Protocol are: aim. crediting program. carbon dioxide (CO2); methane (CH4); nitrous oxide (N20); hydrofluorocarbons (HFCs); nitrogen trifluoride (NF3); Lower-carbon services CCS perfluorocarbons (PFCs); and sulphur hexafluoride (SF6).50 Woodside uses this term to describe technologies, such as Carbon capture and storage. CCUS or offsets that could be used by customers to reduce Goal CCUS their net greenhouse gas emissions. Woodside uses this term to broadly encompass its targets and Carbon capture utilisation and storage. aspirations. MMBtu CO2-e Million british thermal units. Gulf of Mexico CO2 equivalent. The universal unit of measurement to indicate “Gulf of Mexico” refers to the US Continental Shelf area Net equity greenhouse gas emissions the global warming potential of each of the seven greenhouse bounded on the northeast, north, and northwest by the States Woodside’s equity share of net greenhouse gas emissions gases, expressed in terms of the global warming potential of of Texas, Louisiana, Mississippi, Alabama and Florida and which includes the utilisation of carbon credits as offsets. one unit of carbon dioxide. It is used to evaluate releasing (or extending to the seaward boundary with Mexico and Cuba. avoiding releasing) any greenhouse gas against a common 29 basis. LNG Liquefied natural gas.

Glossary (continued) Net greenhouse gas emissions Scope 1 GHG emissions refer to the data table on page 73 of the Climate Action Woodside has set its Scope 1 and 2 greenhouse gas emissions Direct GHG emissions. These occur from sources that are Transition Plan and 2023 Progress Report for further reduction targets on a net basis, allowing for both direct owned or controlled by the company, for example, emissions information on the Scope 3 emissions categories reported by emissions reductions from its operations and emissions from combustion in owned or controlled boilers, furnaces, Woodside. reduction achieved from the utilisation of carbon credits as vehicles, etc.; emissions from chemical production in owned or Starting base offsets (including credits relating to avoidance, reduction and / controlled process equipment. Woodside estimates Woodside uses a starting base of 6.32 Mt CO2-e which is or removal activities). Net greenhouse gas emissions are equal greenhouse gas emissions, energy values and global warming representative of the gross annual average equity Scope 1 and to an entity’s gross greenhouse gas emissions reduced by the potentials are estimated in accordance with the relevant 2 greenhouse gas emissions over 2016-2020 and which may number of retired carbon credits. reporting regulations in the jurisdiction where the emissions be adjusted (up or down) for potential equity changes in occur (e.g. Australian National Greenhouse and Energy Net zero producing or sanctioned assets with a final investment Reporting (NGER), US EPA Greenhouse Gas Reporting Program Net zero emissions are achieved when anthropogenic decision prior to 2021. Net equity emissions include the (GHGRP)). Australian regulatory reporting principles have been emissions of greenhouse gases to the atmosphere are utilisation of carbon credits as offsets. used for emissions in jurisdictions where regulations do not yet balanced by anthropogenic removals over a specified period. Sustainability (including sustainable and sustainably) exist. Where multiple greenhouse gases are involved, the References to sustainability (including sustainable and quantification of net zero emissions depends on the climate Scope 2 GHG emissions sustainably) are used with reference to Woodside’s metric chosen to compare emissions of different gases (such Electricity indirect GHG emissions. Scope 2 accounts for GHG Sustainability Committee and sustainability-related Board as global warming potential, global temperature change emissions from the generation of purchased electricity policies, as well as in the context of Woodside’s aim to potential, and others, as well as the chosen time horizon). consumed by the company. Purchased electricity is defined as ensure its business is sustainable from a long-term electricity that is purchased or otherwise brought into the New energy perspective, considering a range of factors including organisational boundary of the company. Scope 2 emissions Woodside uses this term to describe energy technologies, such economic (including being able to sustain our business in the physically occur at the facility where electricity is generated. as hydrogen or ammonia, that are emerging in scale but which long-term by being low-cost and profitable), environmental Woodside estimates greenhouse gas emissions, energy values are expected to grow during the energy transition due to (including considering our environmental impact and striving and global warming potentials are estimated in accordance having lower greenhouse gas emissions at the point of use for a lower-carbon portfolio), social (including supporting our with the relevant reporting regulations in the jurisdiction where than conventional fossil fuels. licence to operate), and regulatory (including ongoing the emissions occur (e.g. Australian National Greenhouse and Offsets compliance with relevant legal obligations). Use of the terms Energy Reporting (NGER), US EPA Greenhouse Gas Reporting The compensation for an entity’s greenhouse gas emissions ‘sustainability’, ‘sustainable’ and ‘sustainably’ is not Program (GHGRP)). Australian regulatory reporting principles within its scope by achieving an equivalent amount of emission intended to imply that Woodside will have no adverse impact have been used for emissions in jurisdictions where regulations reductions or removals outside the boundary or value chain of on the economy, environment, or society, or that Woodside do not yet exist. that entity. will achieve any particular economic, environmental, or Scope 3 GHG emissions social outcomes Renewables Other indirect GHG emissions. Scope 3 is a reporting category Include modern bioenergy, geothermal, hydropower, solar Target that allows for the treatment of all other indirect emissions. photovoltaics, concentrating solar power, wind, marine (tide Woodside uses this term to describe an intention to seek the Scope 3 emissions are a consequence of the activities of the and wave) energy, and renewable waste. achievement of an outcome, where Woodside considers that it company, but occur from sources not owned or controlled by has developed a suitably defined plan or pathway to achieve RFSU the company. that outcome. Ready for startup. Some examples of Scope 3 activities are extraction and 30 $, USD, US$ production of purchased materials; transportation of US dollars purchased fuels; and use of sold products and services. Please