UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2025

I-80 GOLD CORP.

(Exact name of registrant as specified in its charter)

British Columbia |

001-41382 |

Not Applicable |

||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

5190 Neil Road, Suite 460 Reno, Nevada, United States |

89502 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (775) 525-6450

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Shares | IAUX | NYSE American LLC | ||

| Common Shares | IAU | The Toronto Stock Exchange | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure |

The Company has prepared the following technical report summaries which are attached hereto as exhibits 99.1, 99.2, 99.3, and 99.4, respectively:

| • | S-K 1300 Initial Assessment & Technical Report Summary, Ruby Hill Complex, Eureka County, Nevada dated March 27, 2025 |

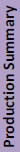

| • | S-K 1300 Initial Assessment & Technical Report Summary, Lone Tree Deposit, Nevada dated February 24, 2025 |

| • | S-K 1300 Initial Assessment & Technical Report Summary, Granite Creek Mine, Humboldt County, Nevada dated March 27, 2025 |

| • | S-K 1300 Initial Assessment & Technical Report Summary for the Cove Project, Lander County, Nevada dated March 26, 2025 |

The information in this Item 7.01 and exhibits attached hereto are being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | S-K 1300 Technical Report Summary, Initial Assessment for the Ruby Hill Complex, Eureka County, Nevada effective December 31, 2024 | |

| 99.2 | S-K 1300 Technical Report Summary, Initial Assessment for the Lone Tree Deposit, Nevada effective December 31, 2024 | |

| 99.3 | S-K 1300 Technical Report Summary, Initial Assessment for the Granite Creek Mine, Humboldt County, Nevada effective December 31, 2024 | |

| 99.4 | S-K 1300 Technical Report Summary, Initial Assessment for the Cove Project, Lander County, Nevada effective December 31, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 31, 2025 |

||||||

| i-80 GOLD CORP. | ||||||

By: |

/s/ Ryan Snow |

|||||

Name: |

Ryan Snow |

|||||

Title: |

Chief Financial Officer |

|||||

Exhibit 99.1

S-K 1300 Technical Report Summary Initial Assessment of the Ruby Hill Project, Eureka County NV i-80 Gold Corp. Prepared by: FORTE DYNAMICS, INC 120 Commerce Drive, Units 3 & 4 Fort Collins, Colorado 80524 Prepared for: i-80 Gold Corp. 5190 Neil Road, Suite 460 Reno, Nevada 89502 Others: Practical Mining LLC TR Raponi Consulting Ltd. Effective Date: December 31, 2024 Issue Date: March 29, 2025 QP Firms: Practical Mining LLC TR Raponi Consulting Ltd. Forte Dynamics, Inc.

|

|

March 29, 2025 | |

VERSION CONTROL

| Rev. No | Date | Status | Prepared By | Checked By | Approved By | |||||

|

REV A |

3/19/2025 | DRAFT | K. Ollila | J. Heiner | A. Amoroso | |||||

|

REV B |

3/25/2025 | DRAFT | K. Ollila | J. Heiner | A. Amoroso | |||||

|

REV C |

3/29/2025 | FINAL | K. Ollila | J. Heiner | A. Amoroso | |||||

| FORTE DYNAMICS, INC. |

P a g e | 2 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

DATE AND SIGNATURE PAGE

S-K 1300 Initial Assessment and Technical Report Summary, Ruby Hill Complex, Eureka County, Nevada

Prepared for: i-80 Gold Corporation

Report Date: March 29, 2025

Prepared by the following Firms:

| QP Firm | Responsibilities/Contributions | Signature | Date | |||

|

Practical Mining LLC |

1-9, 11.1, 11.2, 12, 13.1, 15.1, 16, 17, 18.1, 19.1, 20-25 | March 28, 2025 | ||||

|

TR Raponi Consulting Ltd. |

1, 10, 14.1, 14.2, 22-24 | March 28, 2025 | ||||

|

Forte Dynamics, Inc. |

1, 2, 11.1, 11.3, 11.4, 12, 13.2, 13.3, 14.3, 15.2, 18.2, 19.2, 21-25 | March 28, 2025 | ||||

| FORTE DYNAMICS, INC. |

P a g e | 3 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

Table of Contents

| Date and Signature Page |

3 | |||

| 1. Executive Summary |

17 | |||

| 1.1 Introduction |

17 | |||

| 1.2 Property Description |

19 | |||

| 1.3 Geology and Mineral Deposits |

20 | |||

| 1.3.1 Distal Disseminated |

20 | |||

| 1.3.2 Carlin Type |

20 | |||

| 1.3.3 CRD and Skarn |

21 | |||

| 1.4 Metallurgical Testing and Processing |

22 | |||

| 1.4.1 Archimedes Underground |

22 | |||

| 1.4.2 Mineral Point Open Pit |

22 | |||

| 1.5 Mineral Resources |

23 | |||

| 1.5.1 Archimedes Underground |

23 | |||

| 1.5.2 Archimedes Open Pit |

24 | |||

| 1.5.3 Mineral Point Open Pit |

25 | |||

| 1.6 Mining, Infrastructure, and Project Schedule |

26 | |||

| 1.6.1 Archimedes Underground |

26 | |||

| 1.6.2 Archimedes Open Pit |

26 | |||

| 1.6.3 Mineral Point Open Pit |

26 | |||

| 1.7 Economic Analysis |

27 | |||

| 1.7.1 Archimedes Underground |

27 | |||

| 1.7.2 Mineral Point Open Pit |

28 | |||

| 1.8 Conclusions |

30 | |||

| 1.8.1 Archimedes Underground |

30 | |||

| 1.8.2 Archimedes Open Pit |

31 | |||

| 1.8.3 Mineral Point Open Pit |

31 | |||

| 1.9 Recommendations |

32 | |||

| 1.9.1 Archimedes Underground |

32 | |||

| 1.9.2 Archimedes Open Pit |

32 | |||

| 1.9.3 Mineral Point Open Pit |

32 | |||

| 1.9.4 Work Programs |

34 | |||

| 2. Introduction |

36 | |||

| 2.1 Registrant for Whom the Technical Report Summary was Prepared |

36 | |||

| 2.2 Terms of Reference and Purpose of this Technical Report |

36 | |||

| 2.3 Qualified Persons |

36 | |||

| 2.4 Details of Personal Inspection by Qualified Persons |

37 | |||

| 2.5 Report Version Update |

37 | |||

| 2.6 Units of Measure |

37 | |||

| 2.7 Coordinate System |

38 | |||

| 2.8 Mineral Resource and Mineral Reserve Definitions |

39 | |||

| 3. Property Description |

40 | |||

| 3.1 Property Description |

40 | |||

| 3.2 Status of Mineral Titles |

40 | |||

| 3.3 Royalties |

47 | |||

| 3.4 Environmental Liabilities |

49 | |||

| 3.5 Permits/Licenses |

49 | |||

| FORTE DYNAMICS, INC. |

P a g e | 4 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 4. Accessibility, Climate, Local Resources, Infrastructure, and Physiography |

50 | |||

| 4.1 Accessibility |

50 | |||

| 4.2 Climate |

50 | |||

| 4.3 Local Resources |

50 | |||

| 4.4 Infrastructure |

50 | |||

| 4.5 Physiography |

50 | |||

| 5. History |

52 | |||

| 5.1 Historic Ownership |

52 | |||

| 5.2 Historic Mining |

54 | |||

| 5.3 Historic Exploration |

55 | |||

| 6. Geologic Setting, Mineralization and Deposit Types |

60 | |||

| 6.1 Regional Geology |

60 | |||

| 6.2 Project Geology |

62 | |||

| 6.3 Stratigraphy |

65 | |||

| 6.3.1 Lower Cambrian |

65 |

|||

| 6.3.2 Middle Cambrian |

65 |

|||

| 6.3.3 Upper Cambrian |

66 |

|||

| 6.3.4 Lower-Middle Ordovician |

66 |

|||

| 6.3.5 Cretaceous |

67 |

|||

| 6.3.6 Tertiary/Quaternary |

68 |

|||

| 6.4 Structure |

69 |

|||

| 6.4.1 Archimedes Deposit Structure |

70 |

|||

| 6.4.2 Mineral Point Trend Structure |

71 |

|||

| 6.4.3 Historic Ruby Hill and FAD Structure |

73 |

|||

| 6.5 Alteration |

74 |

|||

| 6.5.1 Archimedes Deposit Alteration |

74 |

|||

| 6.5.2 Mineral Point Trend Alteration |

74 |

|||

| 6.5.3 Historic Ruby Hill and FAD Alteration |

75 |

|||

| 6.6 Mineralization |

75 |

|||

| 6.6.1 Archimedes Deposit Mineralization |

78 |

|||

| 6.6.2 Mineral Point Trend Mineralization |

79 |

|||

| 6.6.3 Historic Ruby Hill and FAD Mineralization |

79 |

|||

| 6.7 Deposit Types |

80 |

|||

| 6.7.1 Characteristics of Polymetallic Carbonate Replacement Deposits |

80 |

|||

| 6.7.2 Characteristics of Skarn Deposits |

80 |

|||

| 6.7.3 Characteristics of Carlin-Type Gold Deposits |

80 |

|||

| 6.7.4 Distal-disseminated Mineralization at Ruby Hill |

81 |

|||

| 7. Exploration |

82 | |||

| 7.1 Geophysical |

82 | |||

| 7.1.1 Archimedes Area |

82 |

|||

| 7.1.2 FAD Area |

83 |

|||

| 7.2 Drilling |

85 | |||

| 7.2.1 Historic Drilling at Ruby Hill |

85 |

|||

| 7.2.2 Drilling Methods |

89 |

|||

| 7.2.3 Geological Logging |

91 |

|||

| 7.2.4 Sample Recovery |

91 |

|||

| 7.2.5 Collar Surveys |

91 |

|||

| 7.2.6 Downhole Surveys |

91 |

|||

| 7.2.7 Metallurgical Drilling |

92 |

|||

| FORTE DYNAMICS, INC. |

P a g e | 5 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 7.2.8 Sample Length/True Thickness |

94 | |||

| 7.2.9 Potential Downhole Contamination |

94 | |||

| 7.2.10 Summary and Interpretation of All Relevant Drilling Results |

94 | |||

| 7.2.11 i-80 Drilling |

94 | |||

| 7.3 Hydrogeology |

95 | |||

| 7.3.1 Sampling Methods and Laboratory Determinations |

95 | |||

| 7.3.2 Hydrogeology Investigations |

95 | |||

| 7.3.3 Hydrogeologic Description |

96 | |||

| 7.3.4 Mine Dewatering |

101 | |||

| 7.3.5 Dewatering Discharge |

101 | |||

| 7.3.6 Groundwater Flow Model |

102 | |||

| 7.3.7 Model Results |

105 | |||

| 8. Sample Preparation, Analysis and Security |

111 | |||

| 8.1 Sampling Methods |

111 | |||

| 8.2 Analytical and Test Laboratories |

111 | |||

| 8.3 Density Determinations |

111 | |||

| 8.4 Sample Preparation and Analysis |

113 | |||

| 8.4.1 Barrick |

113 | |||

| 8.4.2 Homestake |

114 | |||

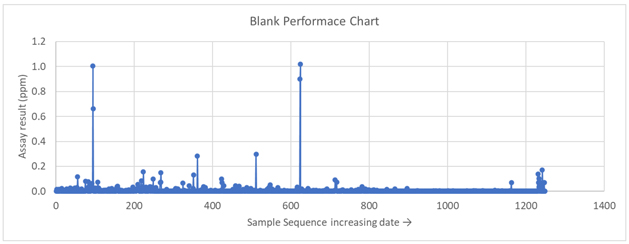

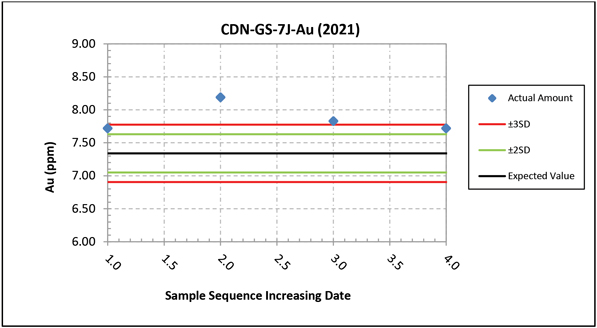

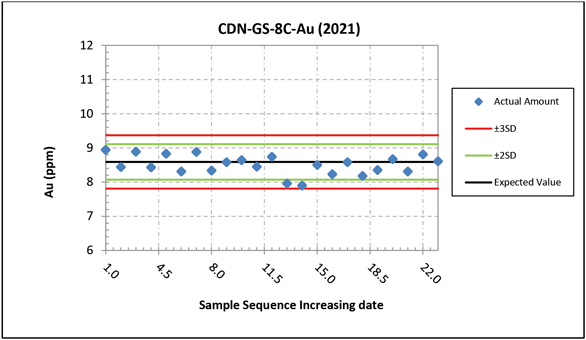

| 8.5 Quality Assurance and Quality Control (QA/QC) |

115 | |||

| 8.5.1 Barrick QA/QC Program |

115 | |||

| 8.6 Historical Databases |

121 | |||

| 8.7 Historical Sample Security |

121 | |||

| 8.8 Comments on Historic Ruby Hill Data |

121 | |||

| 8.9 i-80 Sample Preparation, Laboratory Analysis, Security, and Quality Control Procedures |

122 |

|||

| 8.9.1 i-80 Sample Preparation Procedures |

122 | |||

| 8.10 i-80 Standards and Blanks |

123 | |||

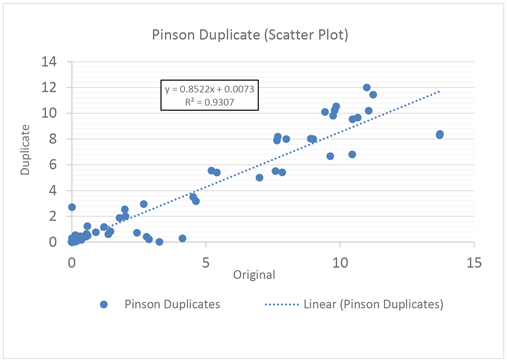

| 8.11 i-80 Duplicate Assays |

123 | |||

| 8.12 QP Opinion |

124 | |||

| 9. Data Verification |

126 | |||

| 9.1 Historical Data Review |

126 | |||

| 9.2 Wood Data Verification 2021 |

126 | |||

| 9.3 Practical Mining Data Verification 2023 |

126 | |||

| 10. Mineral Processing and Metallurgical Testing |

128 | |||

| 10.1 Archimedes Underground |

128 | |||

| 10.1.1 Refractory Testing Programs |

128 | |||

| 10.1.2 Deleterious Elements |

133 | |||

| 10.1.3 Recovery Estimates |

134 | |||

| 10.2 Mineral Point Open Pit |

135 | |||

| 10.2.1 Historical Operations |

135 | |||

| 10.2.2 Historical Test Work |

135 | |||

| 10.2.3 Mineral Point Leach Cycle Times |

141 | |||

| 10.2.4 Mineral Point Reagent Consumptions |

141 | |||

| 10.2.5 Deleterious Elements |

141 | |||

| 10.2.6 Recovery Estimates |

142 | |||

| 11. Mineral Resource Estimates |

144 | |||

| 11.1 Introduction |

144 | |||

| FORTE DYNAMICS, INC. |

P a g e | 6 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 11.2 Archimedes Underground |

145 | |||

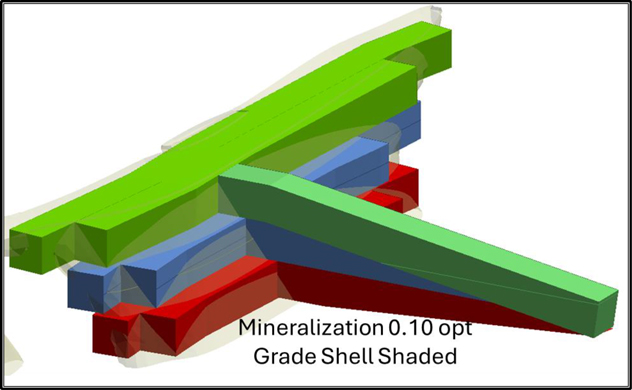

| 11.2.1 Grade Shells |

146 | |||

| 11.2.2 Density |

146 | |||

| 11.2.3 Statistics |

148 | |||

| 11.2.4 Grade Capping |

152 | |||

| 11.2.5 Block Model |

153 | |||

| 11.2.6 Model Validation |

153 | |||

| 11.2.7 Resource Classification |

159 | |||

| 11.2.8 Factors That May Affect Mineral Resources |

159 | |||

| 11.2.9 Reasonable Prospects for Eventual Economic Extraction |

159 | |||

| 11.2.10 Archimedes Underground Mineral Resource Statement |

159 | |||

| 11.2.11 QP Opinion |

161 | |||

| 11.3 Archimedes Open Pit |

161 | |||

| 11.3.1 Summary Workflow |

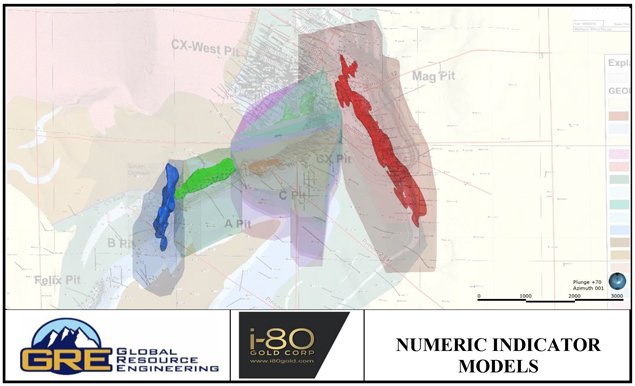

161 | |||

| 11.3.2 Exploratory Data Analysis (EDA) |

161 | |||

| 11.3.3 Resource Estimation |

165 | |||

| 11.3.4 Model Validation |

166 | |||

| 11.3.5 Mineral Resource Classification |

170 | |||

| 11.3.6 Reasonable Prospects for Eventual Economic Extraction |

170 | |||

| 11.3.7 Archimedes Open Pit Mineral Resource Statement |

170 | |||

| 11.3.8 QP Opinion |

171 | |||

| 11.4 Mineral Point Open Pit |

171 | |||

| 11.4.1 Summary Workflow |

172 | |||

| 11.4.2 Geological Modeling |

172 | |||

| 11.4.3 Exploratory Data Analysis |

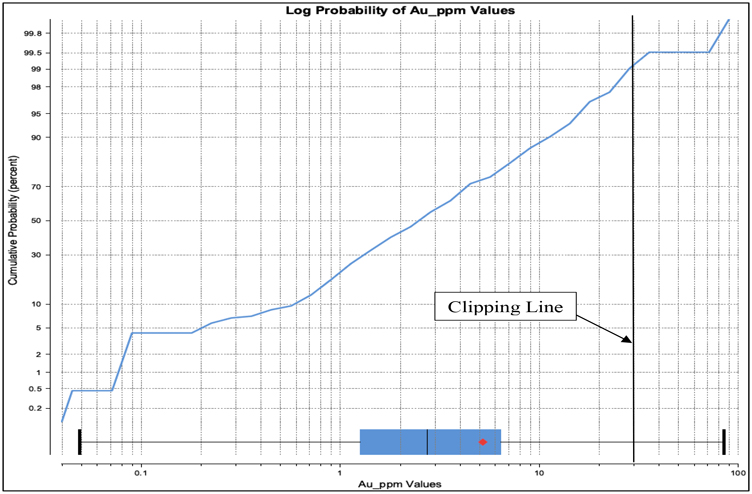

174 | |||

| 11.4.4 Grade Estimation |

177 | |||

| 11.4.5 Resource Model Validation |

180 | |||

| 11.4.6 Bulk Density |

183 | |||

| 11.4.7 Mineral Resource Classification |

183 | |||

| 11.4.8 Reasonable Prospects for Eventual Economic Extraction |

184 | |||

| 11.4.9 Mineral Point Open Pit Mineral Resource Statement |

185 | |||

| 11.4.10 Factors that may Affect Mineral Resources |

185 | |||

| 11.4.11 QP Opinion |

186 | |||

| 12. Mineral Reserve Estimates |

187 | |||

| 13. Mining Methods |

188 | |||

| 13.1 Archimedes Underground |

188 | |||

| 13.1.1 Mine Development |

188 | |||

| 13.1.2 Mining Methods |

189 | |||

| 13.1.3 Geotechnical and Ground Support |

191 | |||

| 13.1.4 Cemented Rock Fill |

200 | |||

| 13.1.5 Staffing and Underground Equipment Requirements |

200 | |||

| 13.1.6 Mine Plan |

201 | |||

| 13.2 Archimedes Open Pit |

206 | |||

| 13.3 Mineral Point Open Pit |

206 | |||

| 13.3.1 Initial Pit Limit Evaluations |

206 | |||

| 13.3.2 Open Pit Economic Parameters |

207 | |||

| 13.3.3 Pit Designs |

215 | |||

| 13.3.4 Haul Road Design |

227 | |||

| 13.3.5 Economic Evaluation |

228 | |||

| 13.3.6 Cutoff Grade |

228 | |||

| 13.3.7 Pit Design Inventories |

228 | |||

| 13.3.8 Drilling and Blasting |

229 | |||

| 13.3.9 Production Schedules |

229 | |||

| FORTE DYNAMICS, INC. |

P a g e | 7 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 13.3.10 Mine Fleet |

231 | |||

| 13.3.11 Dewatering |

231 | |||

| 14. Recovery Methods |

232 | |||

| 14.1 Archimedes Underground |

232 | |||

| 14.1.1 Introduction |

232 | |||

| 14.1.2 Refractory Mineralization Processing |

232 | |||

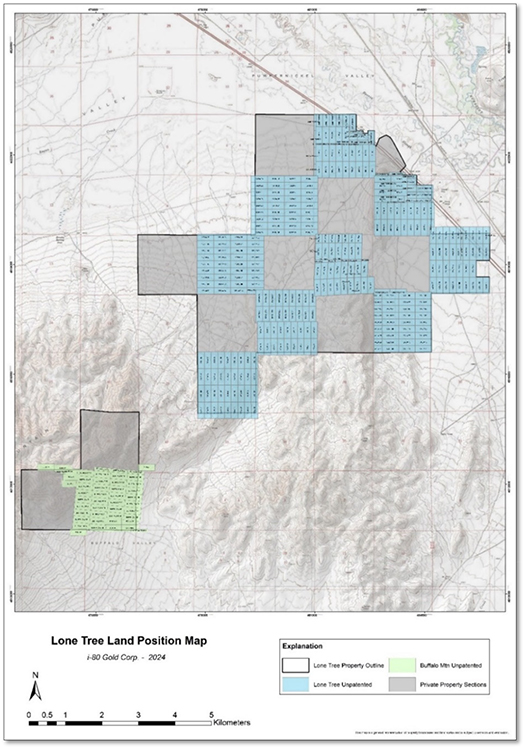

| 14.2 Lone Tree Pressure Oxidation Facility |

234 | |||

| 14.2.1 Lone Tree Mill Historic Processing |

234 | |||

| 14.2.2 Lone Tree Facility Block Flow Diagram |

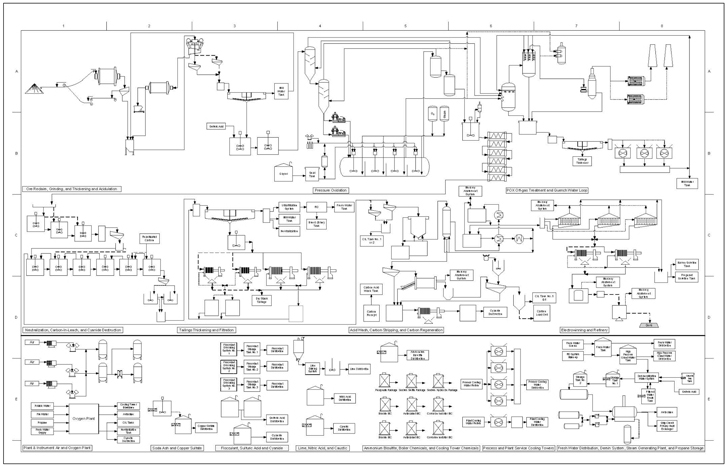

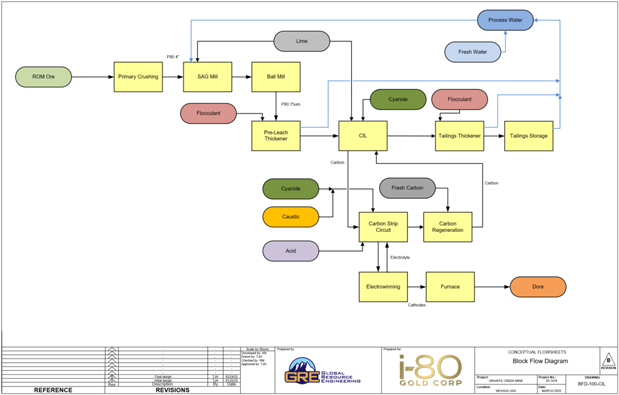

235 | |||

| 14.2.3 Key Design Criteria |

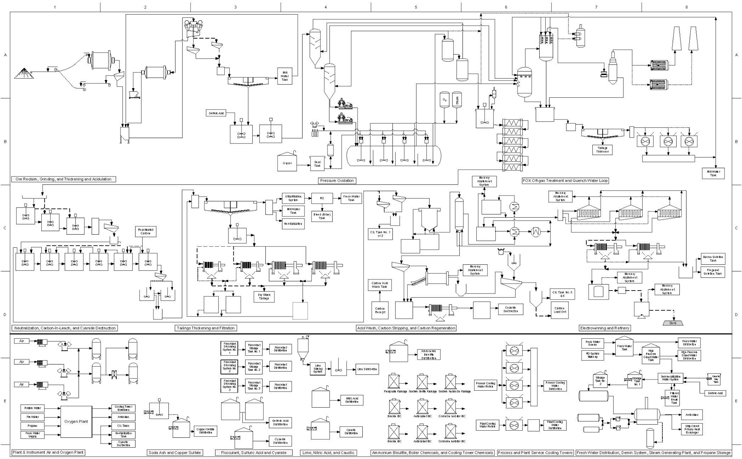

237 | |||

| 14.2.4 Lone Tree Facility Description |

237 | |||

| 14.2.5 Utilities Consumption |

241 | |||

| 14.3 Mineral Point Open Pit |

243 | |||

| 14.3.1 Summary Process Design Criteria |

243 | |||

| 14.3.2 Process Descriptions |

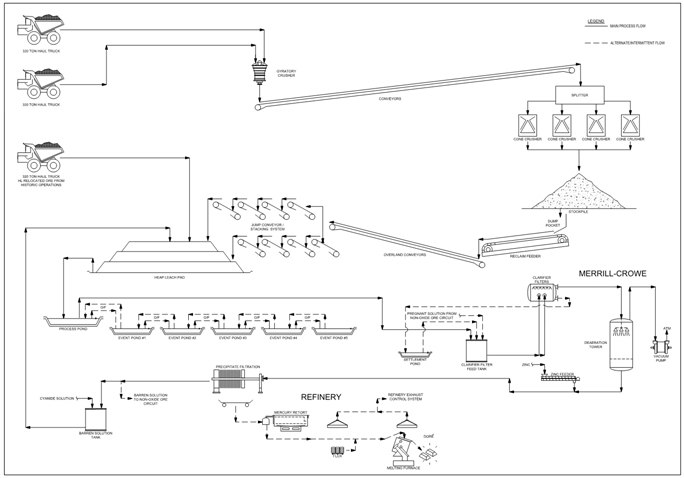

245 | |||

| 14.3.3 Process Water |

247 | |||

| 14.3.4 Process Flowsheet |

247 | |||

| 15. Infrastructure |

249 | |||

| 15.1 Archimedes Underground |

249 | |||

| 15.1.1 Operations Dewatering |

249 | |||

| 15.1.2 Operations Monitoring Wells and VWPs |

249 | |||

| 15.1.3 Operations RIBs |

249 | |||

| 15.1.4 Operations Water Supply |

249 | |||

| 15.1.5 Electrical Power |

249 | |||

| 15.1.6 Underground Mine Facilities |

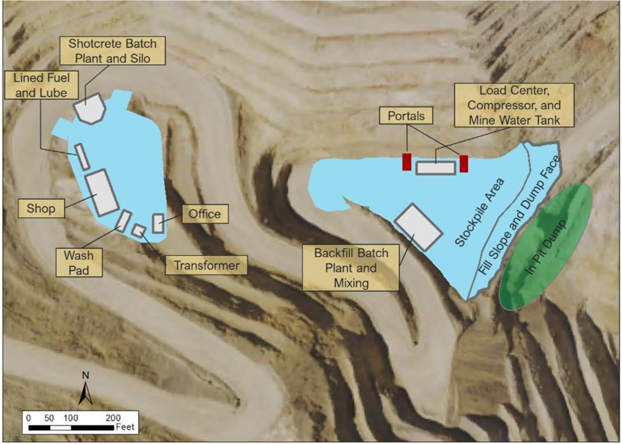

249 | |||

| 15.1.7 Backfill |

250 | |||

| 15.2 Mineral Point Open Pit |

256 | |||

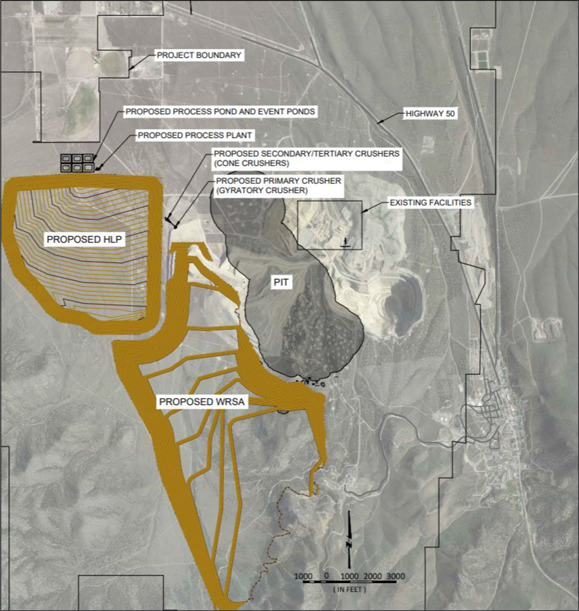

| 15.2.1 Site Layout |

256 | |||

| 15.2.2 Existing Infrastructure |

258 | |||

| 15.2.3 Planned Infrastructure |

259 | |||

| 15.2.4 Operations Dewatering |

264 | |||

| 15.2.5 Operations Monitoring |

267 | |||

| 15.2.6 Water Supply |

267 | |||

| 16. Market Studies and Contracts |

268 | |||

| 16.1 Precious Metal Markets |

268 | |||

| 16.2 Contracts |

269 | |||

| 16.2.1 Financing Agreements |

269 | |||

| 16.3 Refractory Mineralized Material Sale Agreement |

271 | |||

| 16.4 Other Contracts |

271 | |||

| 17. Environmental Studies, Permitting and Social or Community Impact |

272 | |||

| 17.1 Closure and Reclamation Requirements |

272 | |||

| 17.2 Social or Community Impacts |

272 | |||

| 17.3 Permits |

273 | |||

| 17.4 Water Use Permits |

274 | |||

| 17.5 QP Opinion |

274 | |||

| 18. Capital and Operating Costs |

275 | |||

| 18.1 Archimedes Underground |

275 | |||

| FORTE DYNAMICS, INC. |

P a g e | 8 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 18.1.1 Capital Costs |

275 | |||

| 18.1.2 Operating Costs |

275 | |||

| 18.1.3 Cutoff Grade |

276 | |||

| 18.2 Mineral Point Open Pit |

277 | |||

| 18.2.1 Capital Cost Estimate |

277 | |||

| 18.2.2 Operating Cost Estimate |

279 | |||

| 19. Economic Analysis |

281 | |||

| 19.1 Archimedes Underground |

281 | |||

| 19.1.1 Taxes |

281 | |||

| 19.1.2 Cash Flow |

281 | |||

| 19.1.3 Sensitivity |

291 | |||

| 19.2 Mineral Point Open Pit |

293 | |||

| 19.2.1 Principal Assumptions |

293 | |||

| 19.2.2 Operating Cost |

293 | |||

| 19.2.3 Capital Costs |

293 | |||

| 19.2.4 Cost Summary |

294 | |||

| 19.2.5 Economic Model |

294 | |||

| 19.2.6 Economic Analysis Without Inferred Resources |

301 | |||

| 20. Adjacent Properties |

302 | |||

| 21. Other Relevant Data and Information |

303 | |||

| 22. Interpretation and Conclusions |

304 | |||

| 22.1 Conclusions |

304 | |||

| 22.1.1 Archimedes Underground |

304 | |||

| 22.1.2 Archimedes Open Pit |

305 | |||

| 22.1.3 Mineral Point Open Pit |

305 | |||

| 22.2 Risks and Opportunities |

305 | |||

| 23. Recommendations |

309 | |||

| 23.1 Archimedes Underground |

309 | |||

| 23.1.1 Metallurgical Testing |

309 | |||

| 23.1.2 Permitting and Mine Development |

309 | |||

| 23.1.3 Resource Conversion and Exploration Drilling |

309 | |||

| 23.1.4 Dewatering |

309 | |||

| 23.2 Archimedes Open Pit |

309 | |||

| 23.2.1 Mineral Resources |

309 | |||

| 23.3 Mineral Point Open Pit |

309 | |||

| 23.3.1 Mineral Resources |

309 | |||

| 23.3.2 Mining and Infrastructure |

310 | |||

| 23.3.3 Metallurgical Testing |

310 | |||

| 23.4 Work Program |

311 | |||

| 23.4.1 Archimedes Underground |

311 | |||

| 23.4.2 Archimedes Open Pit |

312 | |||

| 23.4.3 Mineral Point Open Pit |

312 | |||

| 24. References |

313 | |||

| 25. Reliance on Information Provided by the Registrant |

320 | |||

| FORTE DYNAMICS, INC. |

P a g e | 9 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

Figures

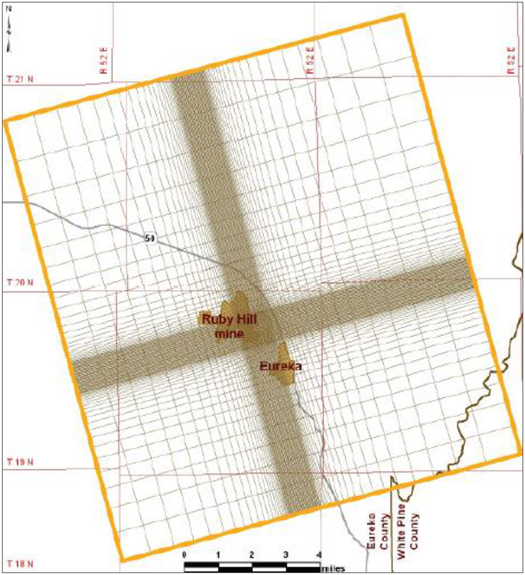

| Figure 1-1: Ruby Hill Complex Overview | 18 | |||

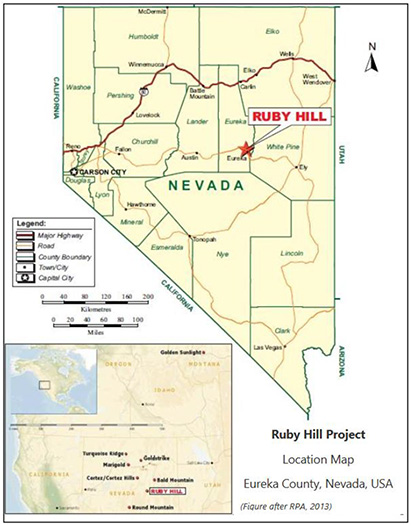

| Figure 3-1: Ruby Hill Complex Location Map | 40 | |||

| Figure 3-2: Ruby Hill Complex Land Position | 41 | |||

| Figure 3-3: Ruby Hill Royalty Map | 48 | |||

| Figure 5-1: Geophysical Surveys in the Ruby Hill Project Area | 57 | |||

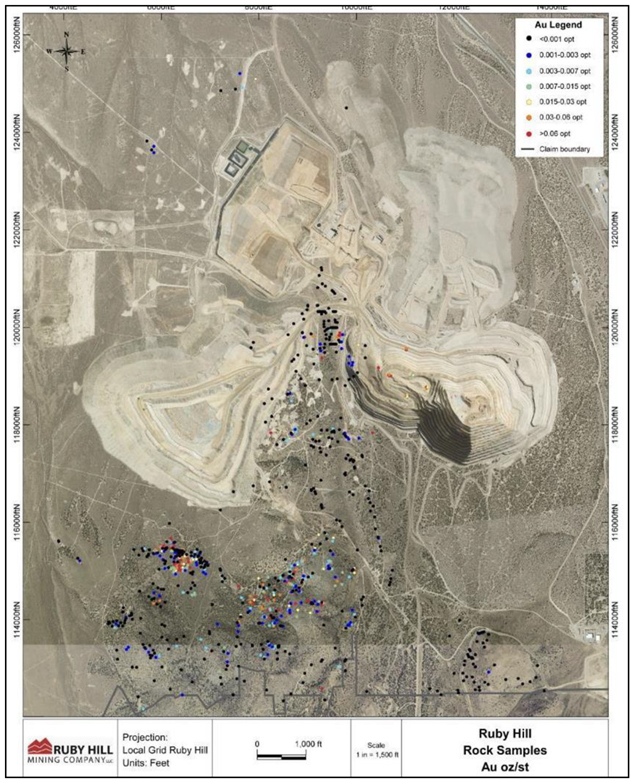

| Figure 5-2: Rock Samples with Gold Grade (opt) within the Ruby Hill Claim Block | 58 | |||

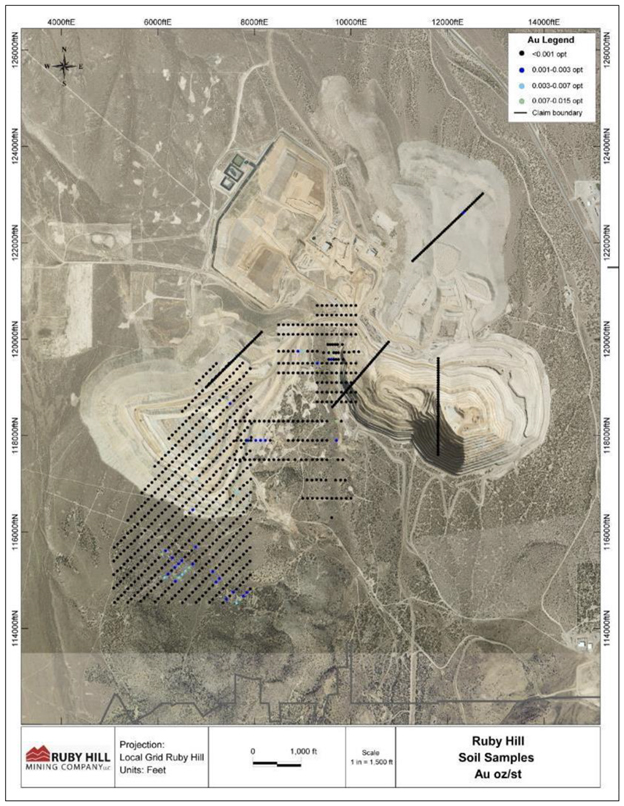

| Figure 5-3: Soil Samples with Gold Grade (opt) within the Ruby Hill Claim Block | 59 | |||

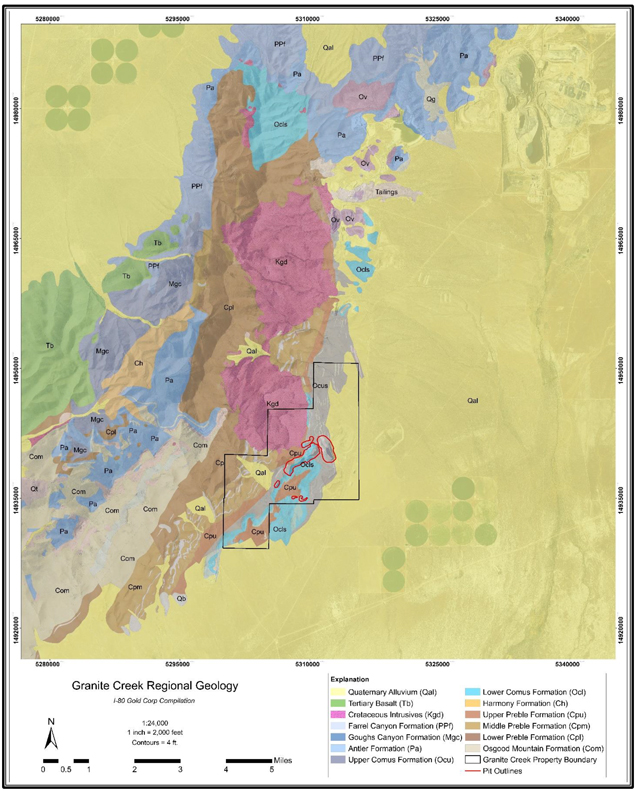

| Figure 6-1: Regional Geologic Map | 61 | |||

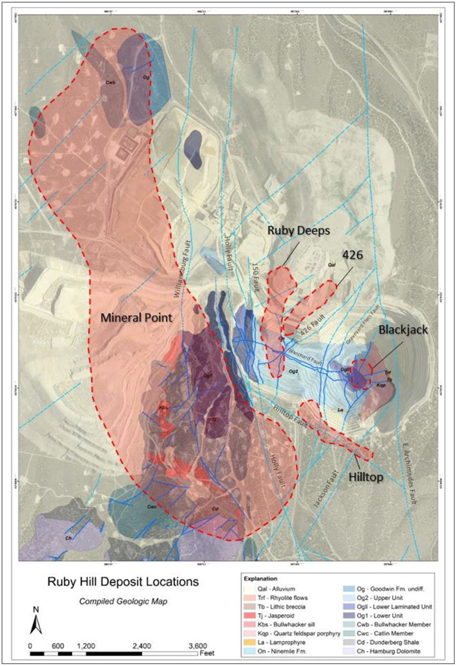

| Figure 6-2: Ruby Hill Project Geology and Deposit Locations | 64 | |||

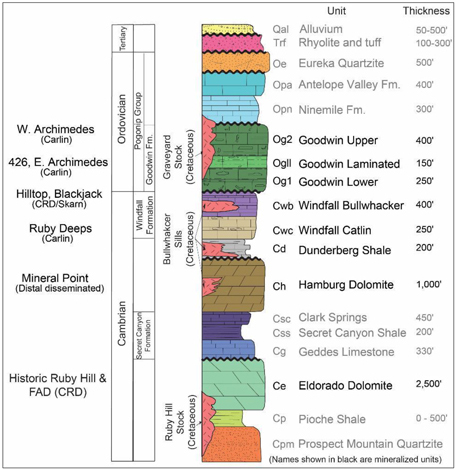

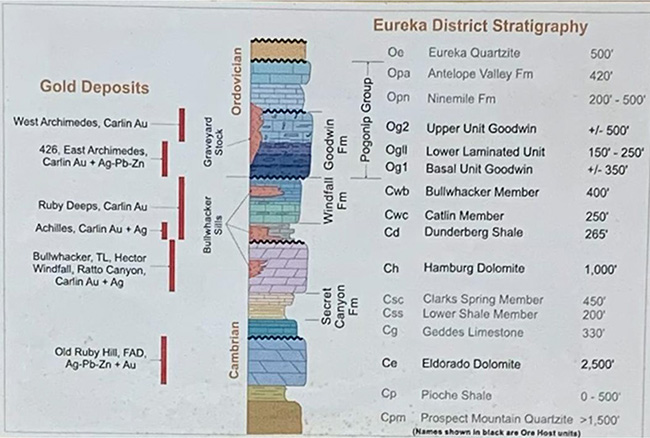

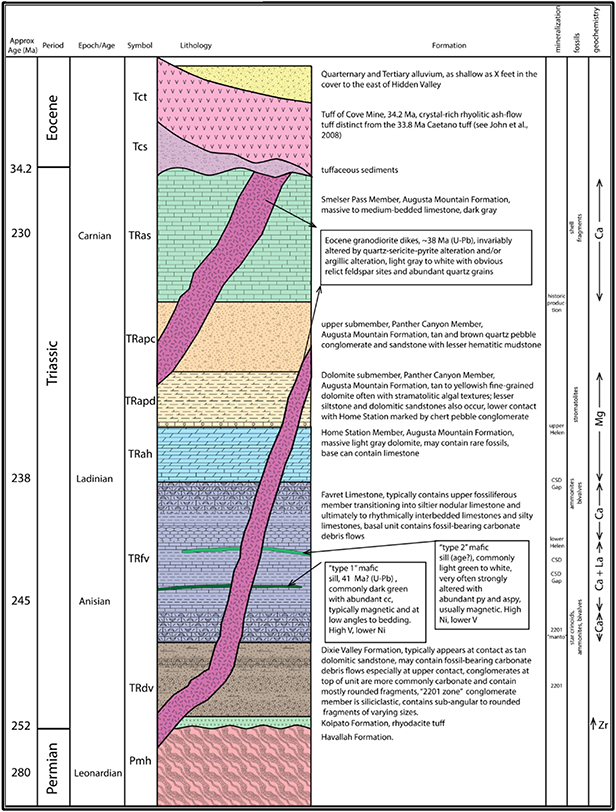

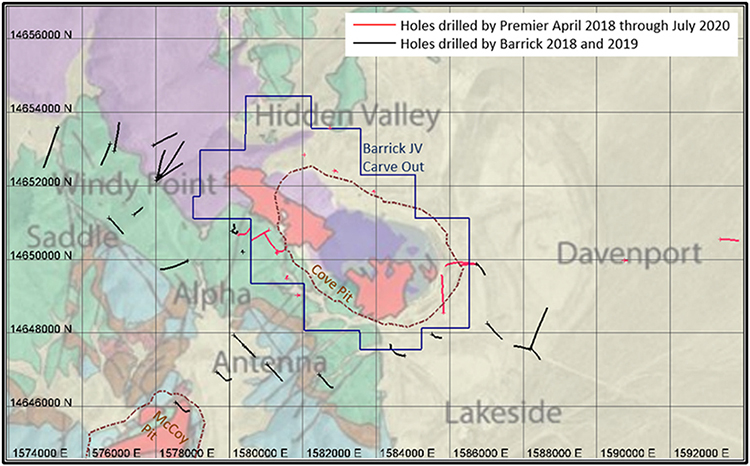

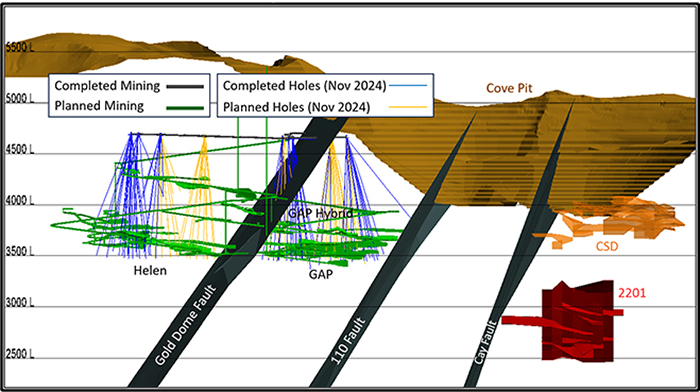

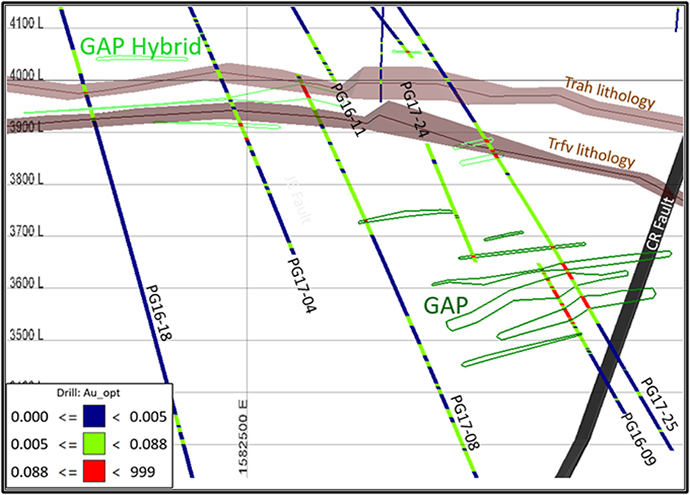

| Figure 6-3: Ruby Hill Stratigraphic Column | 68 | |||

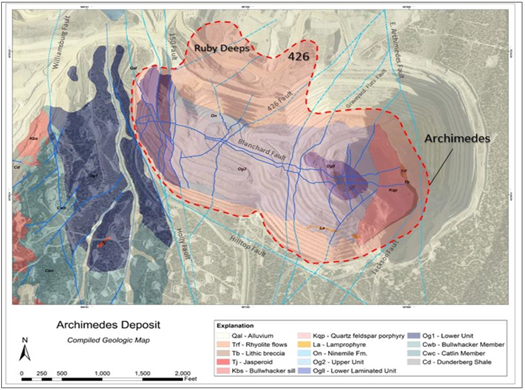

| Figure 6-4: Geology of East Archimedes, West Archimedes and Archimedes Underground Including 426, and Ruby Deeps Zones | 71 | |||

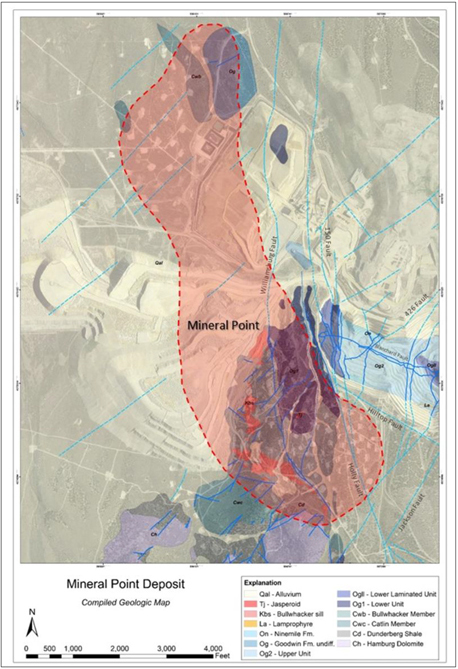

| Figure 6-5: Mineral Point Trend Geology | 72 | |||

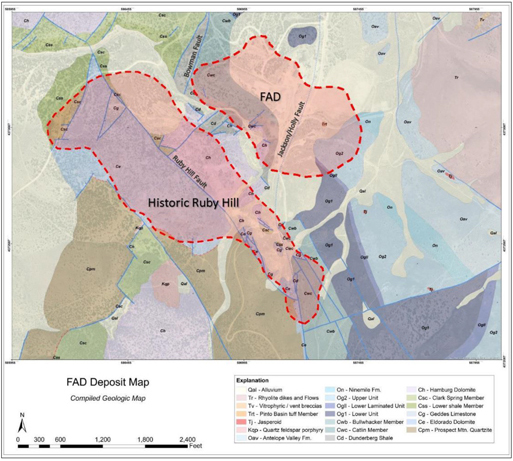

| Figure 6-6: Historic Ruby Hill and FAD Deposit Geology | 73 | |||

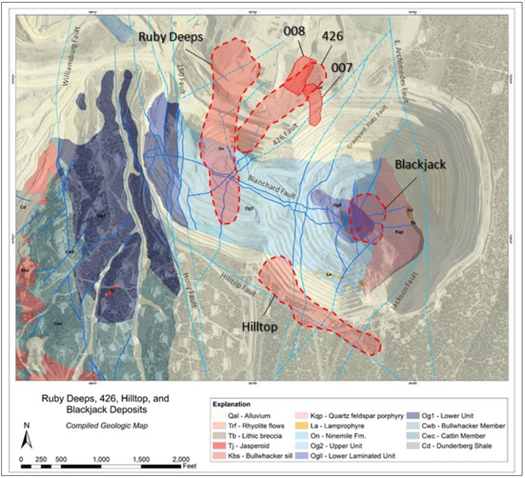

| Figure 6-7: Plan View of Ruby Deeps, 426, 007, 008, Blackjack, and Hilltop Zones | 76 | |||

| Figure 6-8: Plan View of Mineral Point Trend and Archimedes Deposits | 77 | |||

| Figure 6-9: Fence Section of Mineral Point Trend and Archimedes Deposits | 78 | |||

| Figure 7-1: Exploration Targets at Ruby Hill | 84 | |||

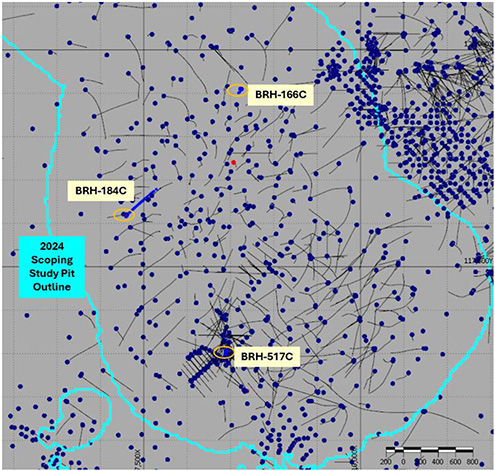

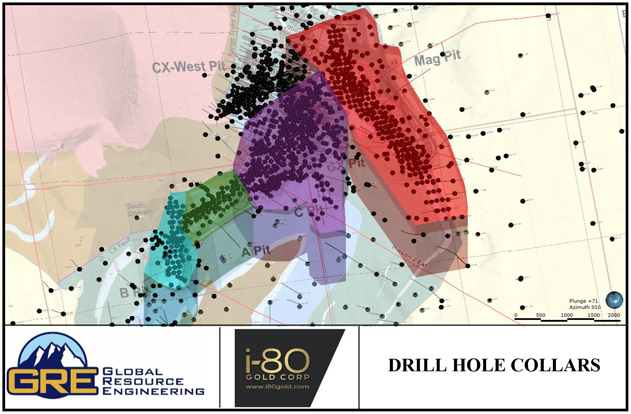

| Figure 7-2: Drill Hole Collar Locations | 86 | |||

| Figure 7-3: Distribution of Drill Types Included in the 2021 Ruby Hill Project Mineral Resource Estimate | 87 | |||

| Figure 7-4: Plan View of Drilling by Campaign | 88 | |||

| Figure 7-5: Fence Section of Drilling by Campaign (Looking North) | 89 | |||

| Figure 7-6: Diamond Valley Hydrographic Basin and Ruby Hill Mine Permit Area | 98 | |||

| Figure 7-7: Surface Geology and Pre-Mining Groundwater Level Contours | 99 | |||

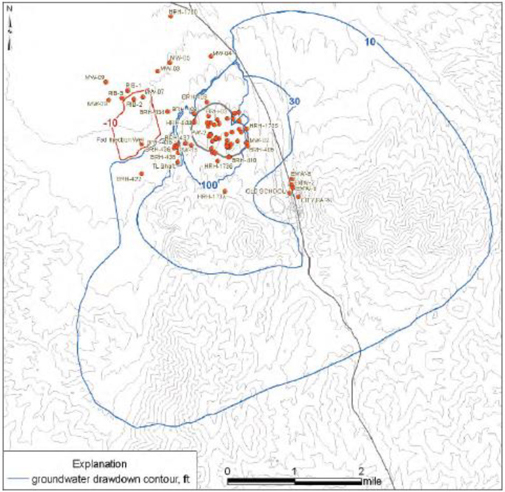

| Figure 7-8: Dewatering Well and Groundwater Monitoring Locations | 102 | |||

| Figure 7-9: Property Overview showing Plan Operations Boundary, Existing Mine Operations Boundary, and Existing Archimedes Pit with Planned UGWs for the 426 and Blackjack Deposits | 103 | |||

| Figure 7-10: Schematic Section through the Archimedes Pit Area | 104 | |||

| Figure 7-11: Ground Water Flow Model Boundary | 106 | |||

| Figure 7-12: Ground Water Flow Model Grid | 107 | |||

| Figure 7-13: Mine-Area Hydrogeologic Zones and Flow Barriers, Layer 2 | 108 | |||

| Figure 7-14: Projected Changes in Groundwater Level, End of Mining | 109 | |||

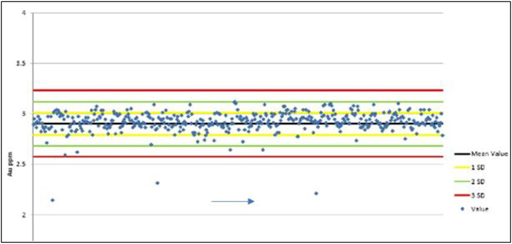

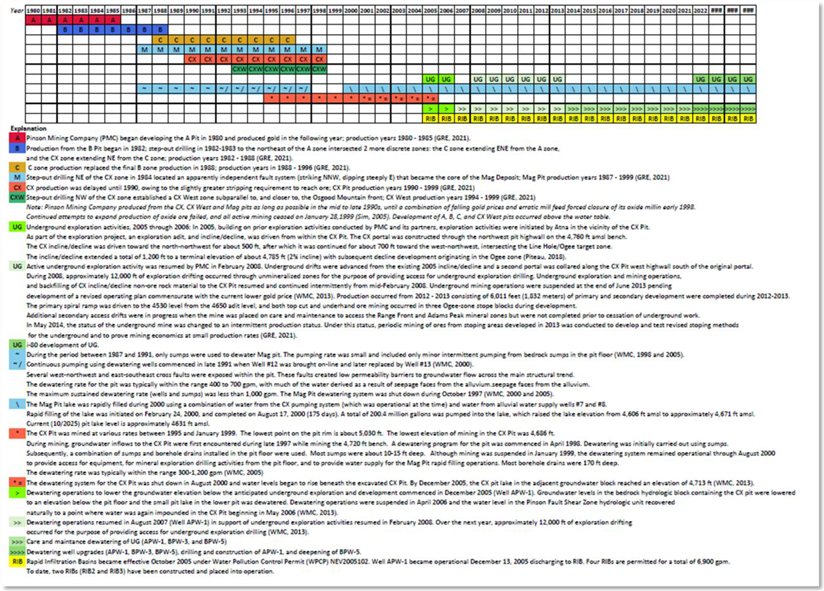

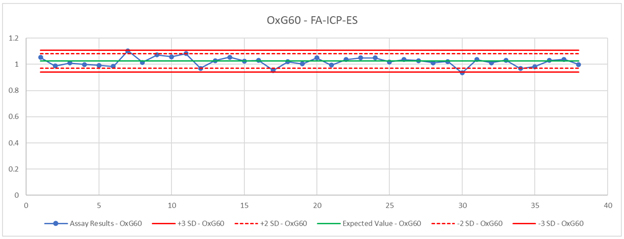

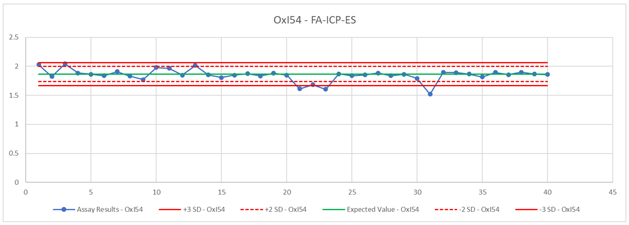

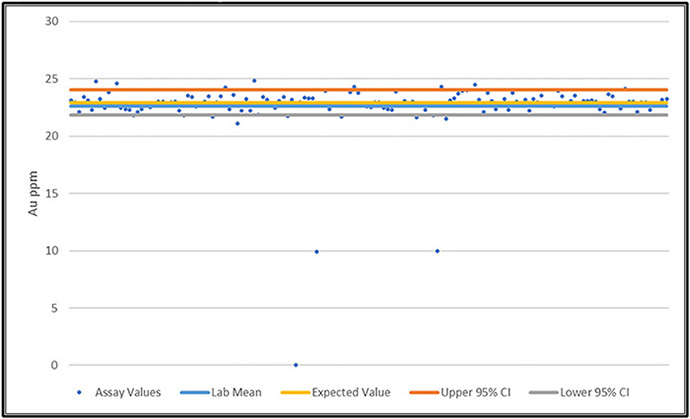

| Figure 8-1: Control Chart for Standard OREAS 54PA | 116 | |||

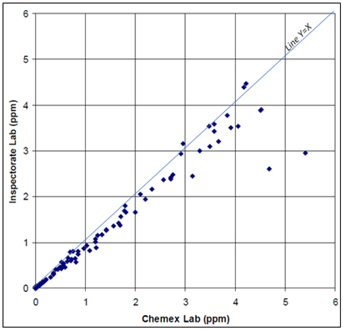

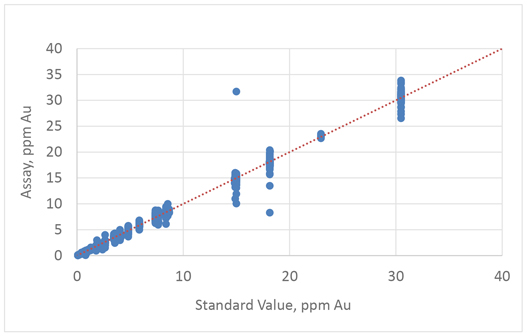

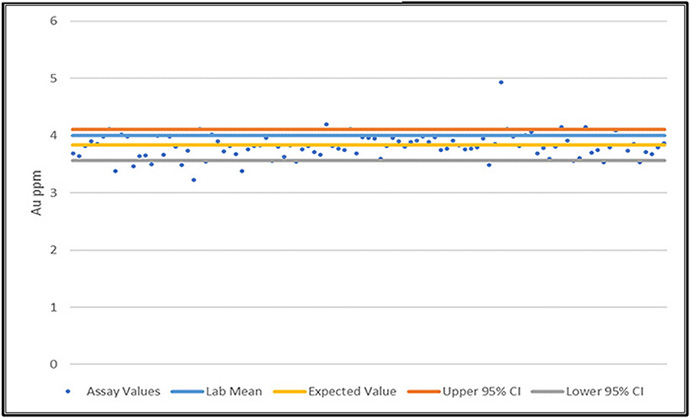

| Figure 8-2: ALS Global (Chemex) Pulps Checked at Inspectorate | 118 | |||

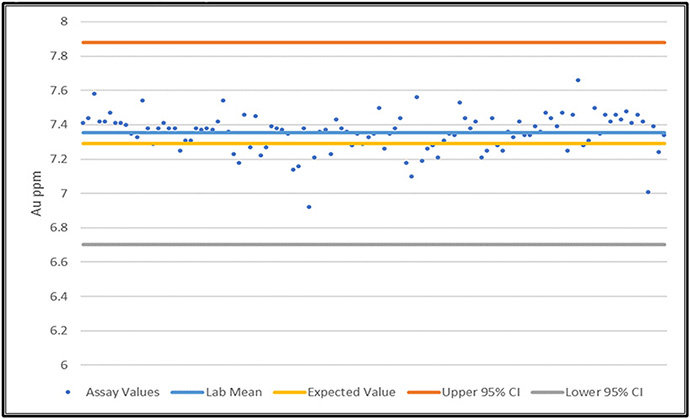

| Figure 8-3: Mean Versus Half Relative Difference for Field Duplicates | 119 | |||

| Figure 8-4: Scatter Plot of all Lab Duplicates | 120 | |||

| Figure 8-5: Mean Versus Half Relative Difference for Pulp Duplicates | 120 | |||

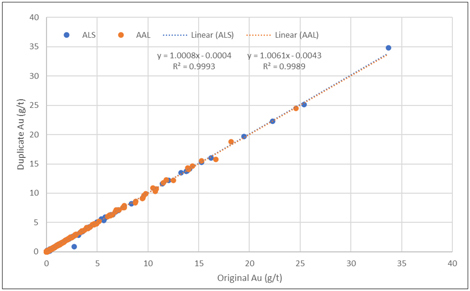

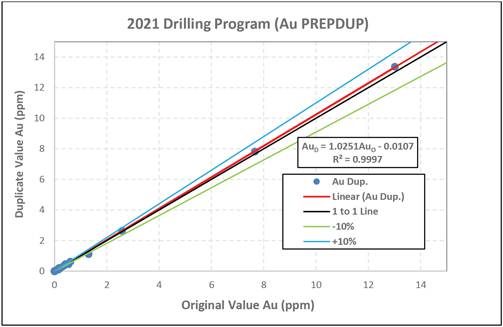

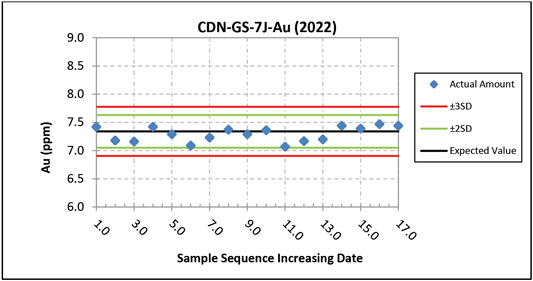

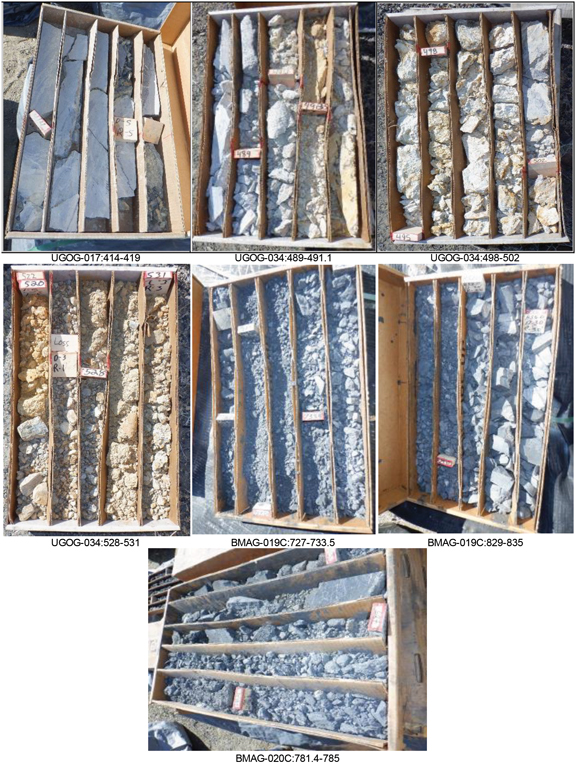

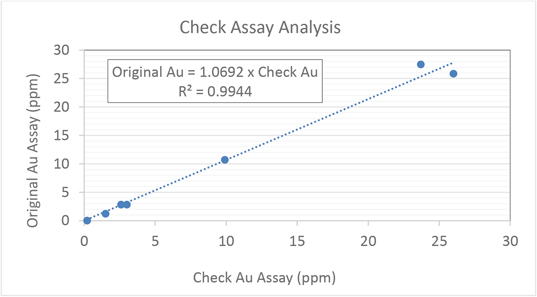

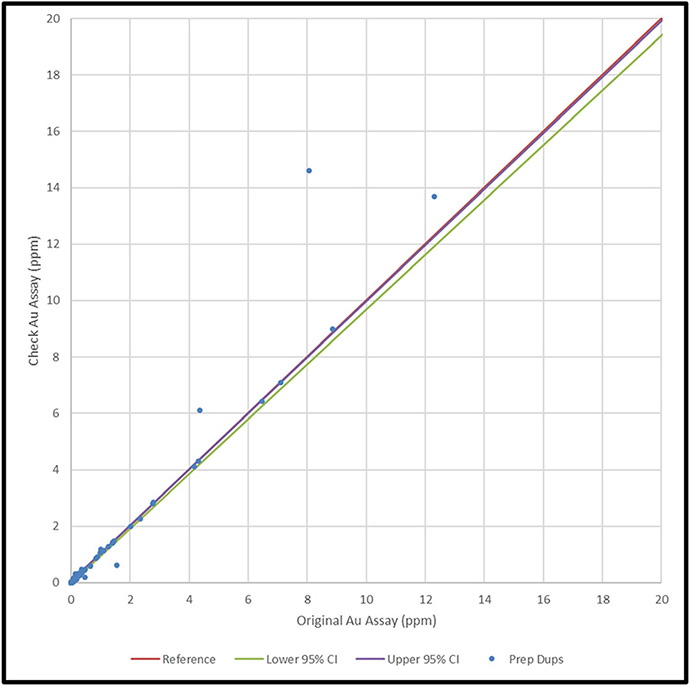

| Figure 8-6: i-80 Lab Duplicates | 124 | |||

| Figure 8-7: i-80 Prep Duplicates | 125 | |||

| Figure 10-1: 2024 FLSmidth Program Preg-Robbing as a Function of Organic Carbon Concentration | 131 | |||

| Figure 11-1: Block Model Extents | 145 | |||

| Figure 11-2: Underound Model Extents and Drill Hole Traces | 146 | |||

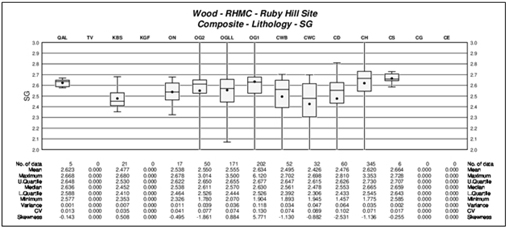

| Figure 11-3: Density Box and Whisker Plot by Lithology Formation | 147 | |||

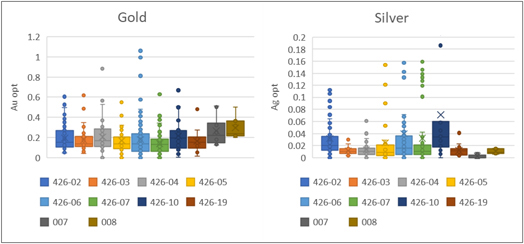

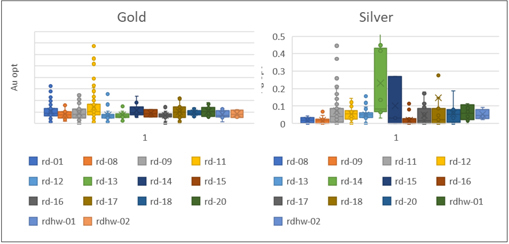

| Figure 11-4: 426 0.1 Au opt Box and Whisker Plots | 148 | |||

| Figure 11-5: Ruby Deeps 0.1 Au opt Box and Whisker Plots | 149 | |||

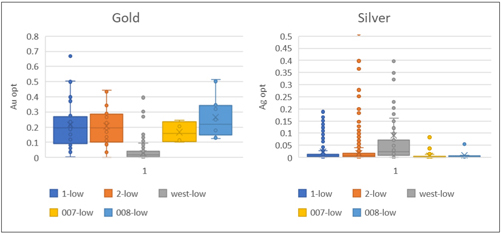

| Figure 11-6: 0.002 Au opt Box and Whisker Plots |

151 |

| FORTE DYNAMICS, INC. |

P a g e | 10 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

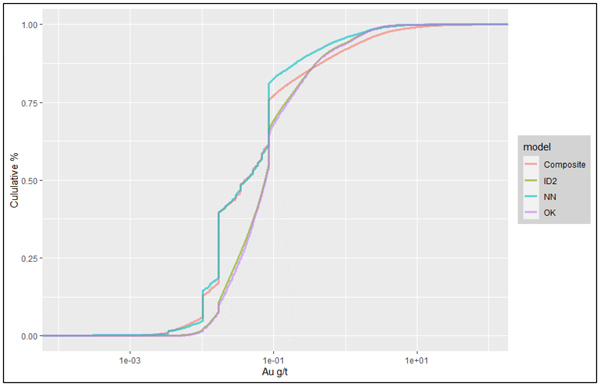

| Figure 11-7: Gold Cumulative Frequency | 152 | |||

| Figure 11-8: Silver Grade Shells Cumulative Frequency | 152 | |||

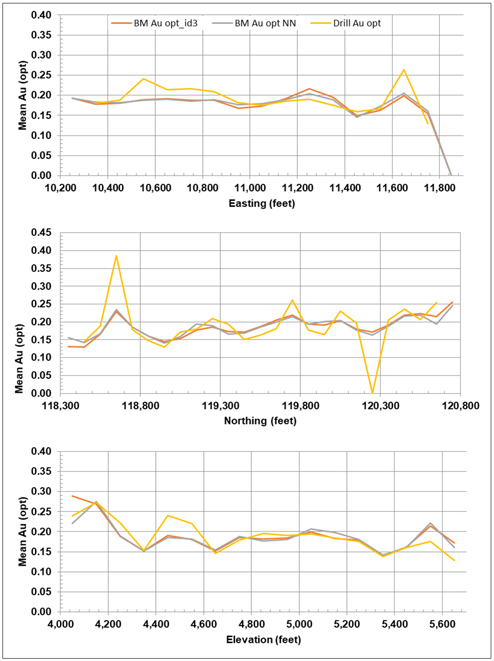

| Figure 11-9: 426 Deposit Comparison of Composite and Block Grades | 155 | |||

| Figure 11-10: Ruby Deeps Deposit Comparison of Composite and Block Grades 120450N | 156 | |||

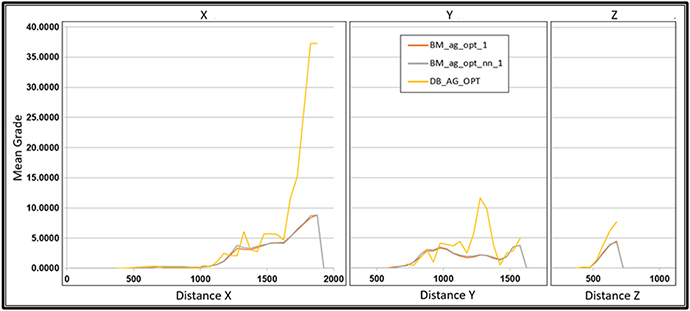

| Figure 11-11: Drift Analysis Gold | 157 | |||

| Figure 11-12: Drift Analysis Silver | 158 | |||

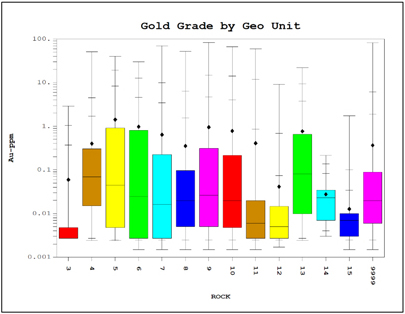

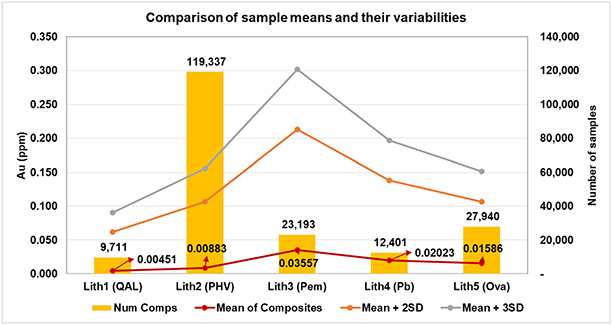

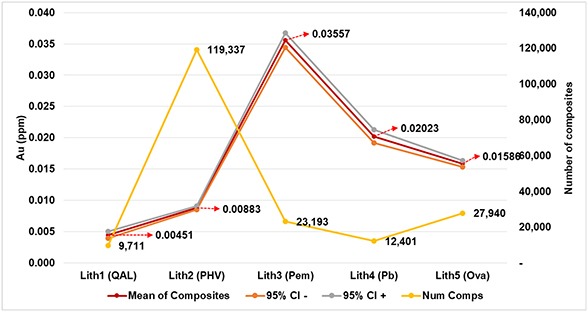

| Figure 11-13: Graphical Statistical Comparison of Rock Units | 162 | |||

| Figure 11-14: Statistics for Key Geological Units | 163 | |||

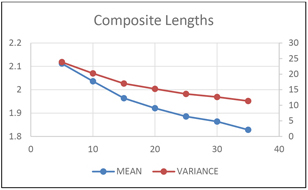

| Figure 11-15: Composite Study Results | 164 | |||

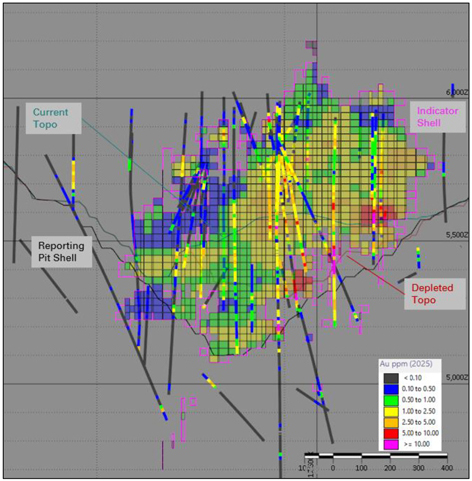

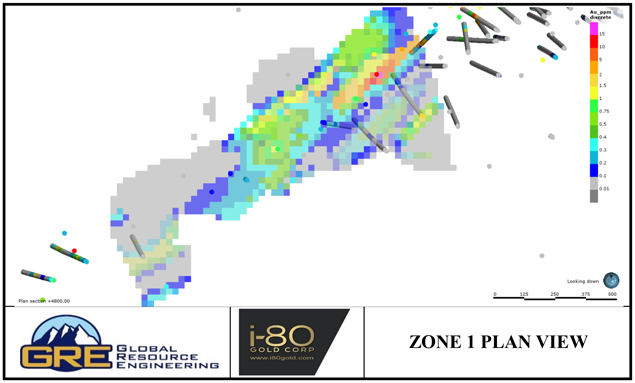

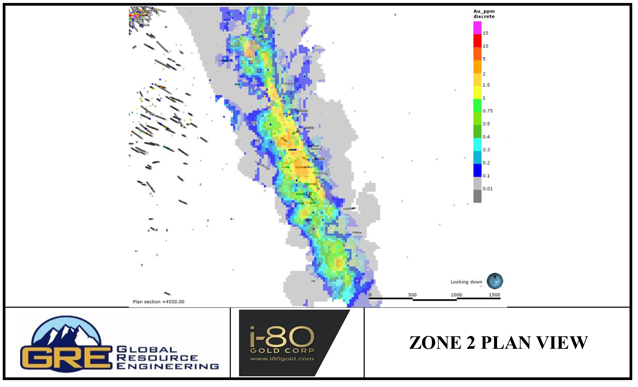

| Figure 11-16: Gold and Silver Composite Samples within the Indicator Shell | 165 | |||

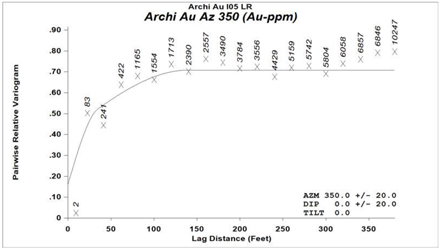

| Figure 11-17: Example Gold Variogram | 165 | |||

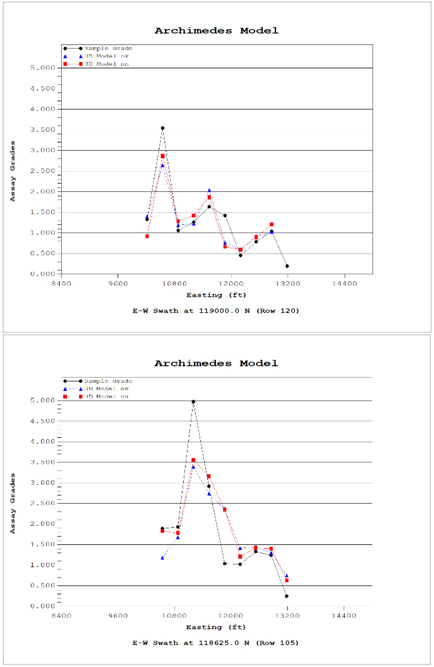

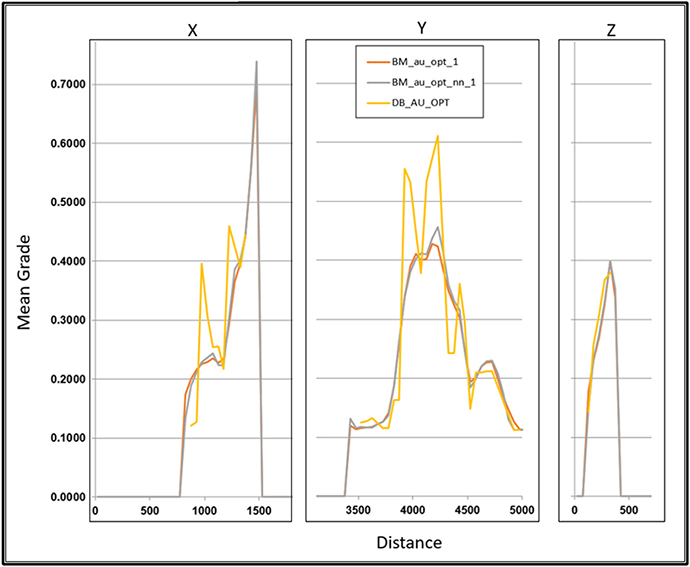

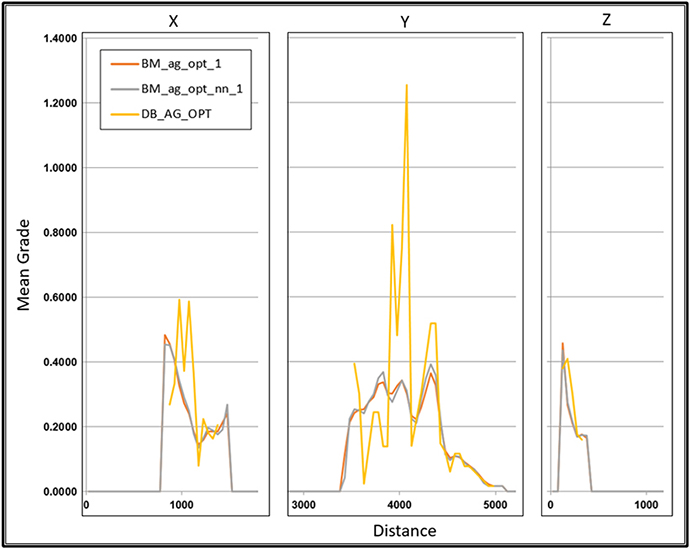

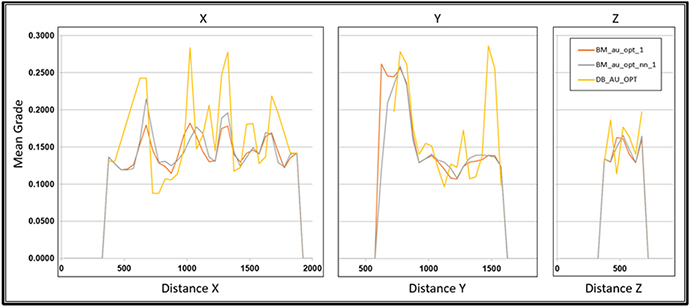

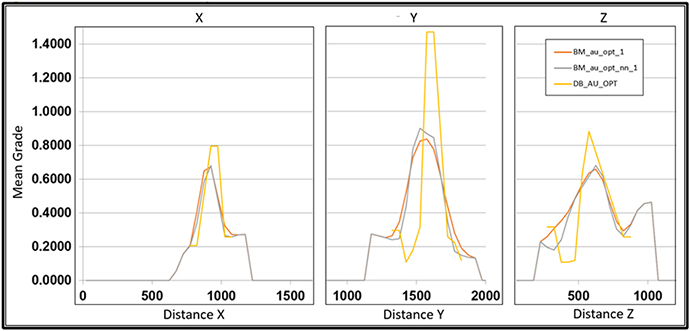

| Figure 11-18: Cross Section of Estimated Block Model and Composites | 167 | |||

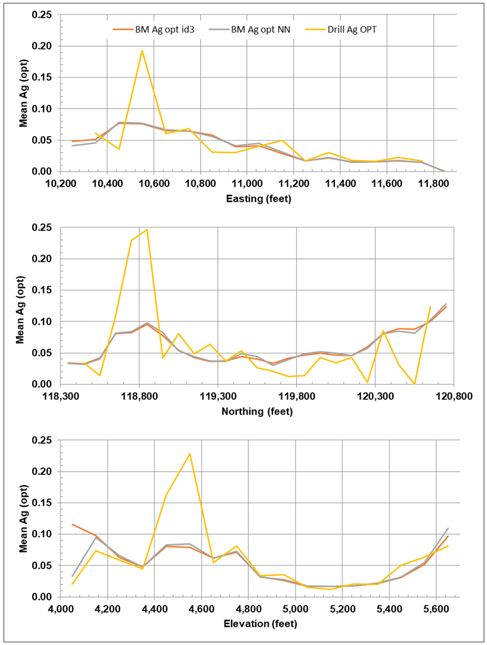

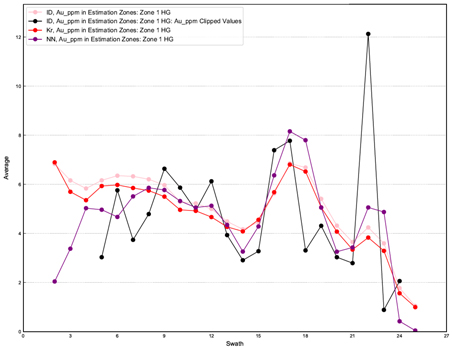

| Figure 11-19: Example Swath Plots | 168 | |||

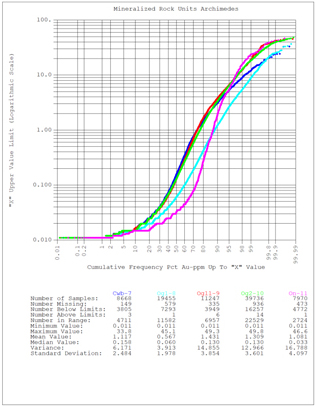

| Figure 11-20: Comparison of Cumulative Frequency | 169 | |||

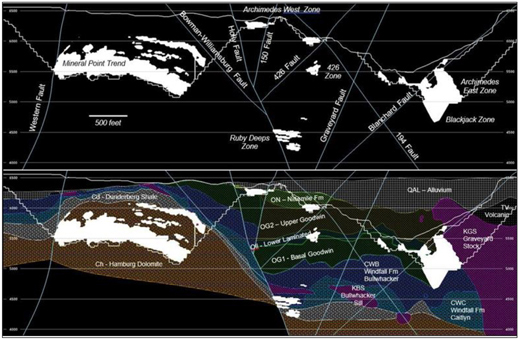

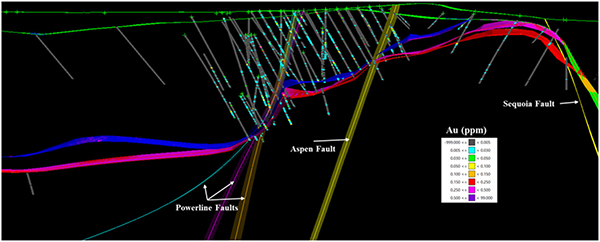

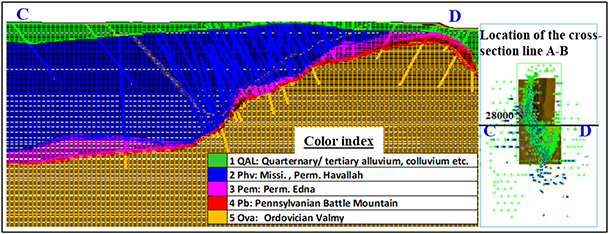

| Figure 11-21: Fence Section Looking North Showing Main Faults and Stratigraphic Units for the Ruby Hill Project | 173 | |||

| Figure 11-22: Example Cross Section Showing Modeled Sulfide Domain and Redox Codes in the Drillhole Database | 174 | |||

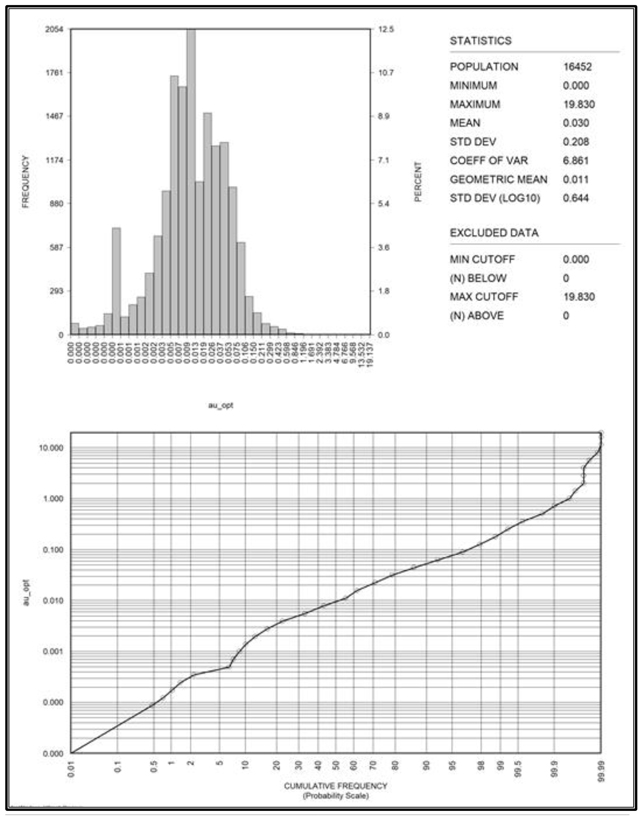

| Figure 11-23: Gold and Silver Raw Assay Sample Grade Histograms and Probability Plots | 175 | |||

| Figure 11-24: Example Cross Section of the Mineral Point Trend Showing Raw Assays (Right of Trace) and Downhole 10 ft. Composites (Left Trace) with the Optimized Pit Shell | 176 | |||

| Figure 11-25: Box and Whisker Plot for Assay Sample Grades and 10 ft. Composites for Gold and Silver | 177 | |||

| Figure 11-26: Indicator Threshold Selection – CV of Gold and Silver Assay Composite Grades | 178 | |||

| Figure 11-27: Au Estimation – Implementation of a Soft Boundary Between LG and HG Composites | 179 | |||

| Figure 11-28: Area of Au High-Grade Blow-out and Eureka Corp Underground Drilling | 180 | |||

| Figure 11-29: Estimated Block Grades and 10 Foot Composite Grades for Gold - Section 121200 N Looking N | 181 | |||

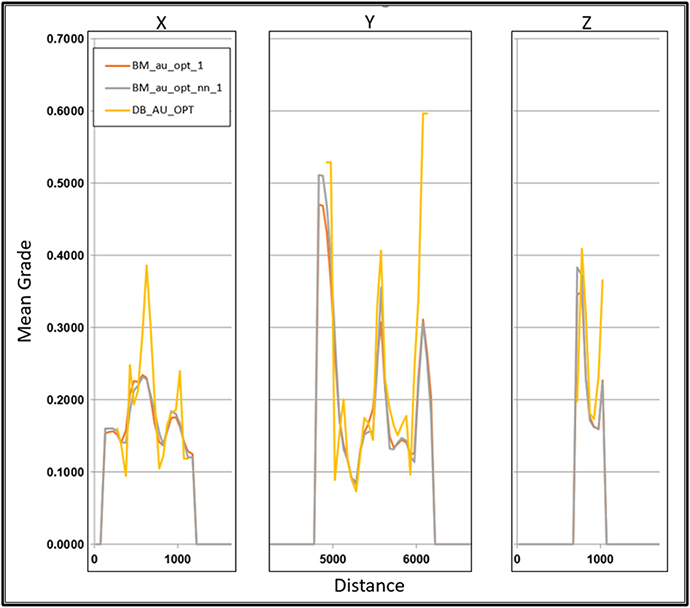

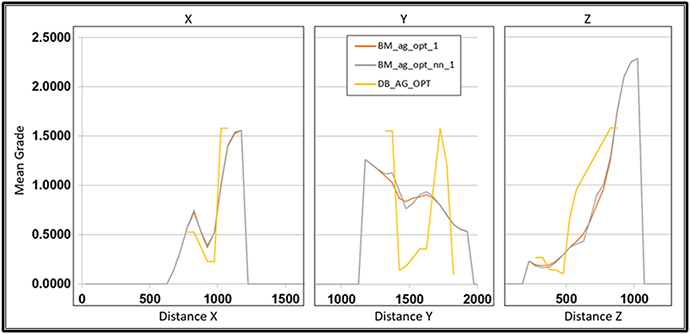

| Figure 11-30: Swath Plots – Gold – Indicated Blocks | 182 | |||

| Figure 11-31: Bulk Density Values by Lithology | 183 | |||

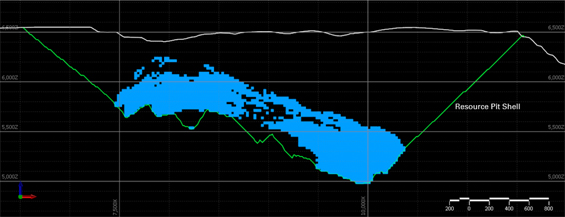

| Figure 11-32: Cross Section Showing the Mineral Point Resource, Resource Pit Shell, and Topo | 184 | |||

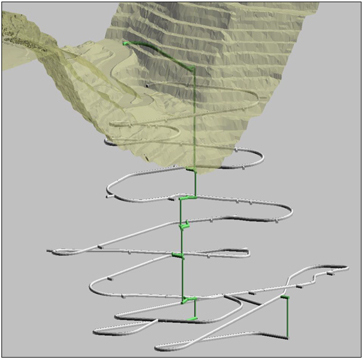

| Figure 13-1: Archimedes Underground Isometric View Showing Portals, Main Ramp and Ventilation Development | 188 | |||

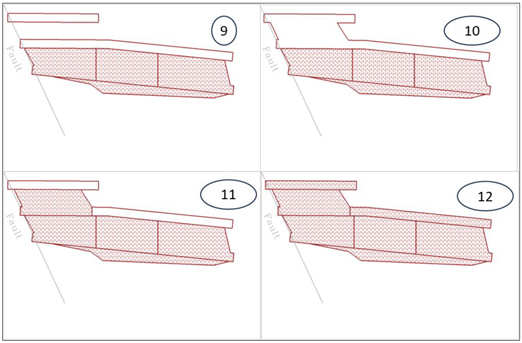

| Figure 13-2: Stope Mining Sequence Part A | 190 | |||

| Figure 13-3: Stope Mining Sequence Part B | 191 | |||

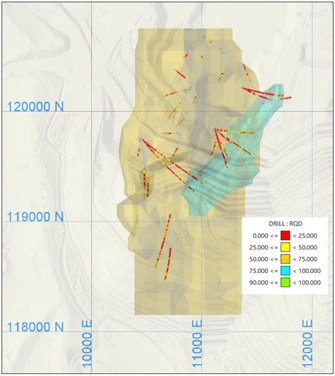

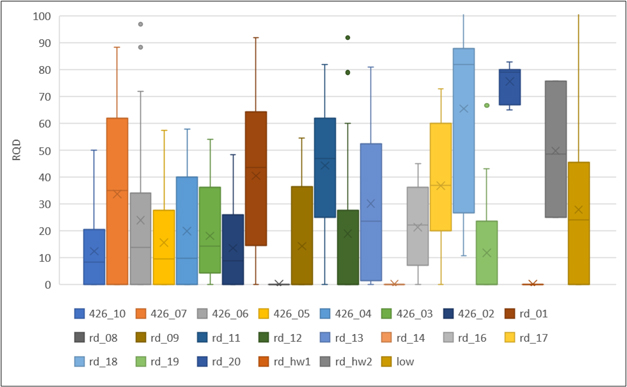

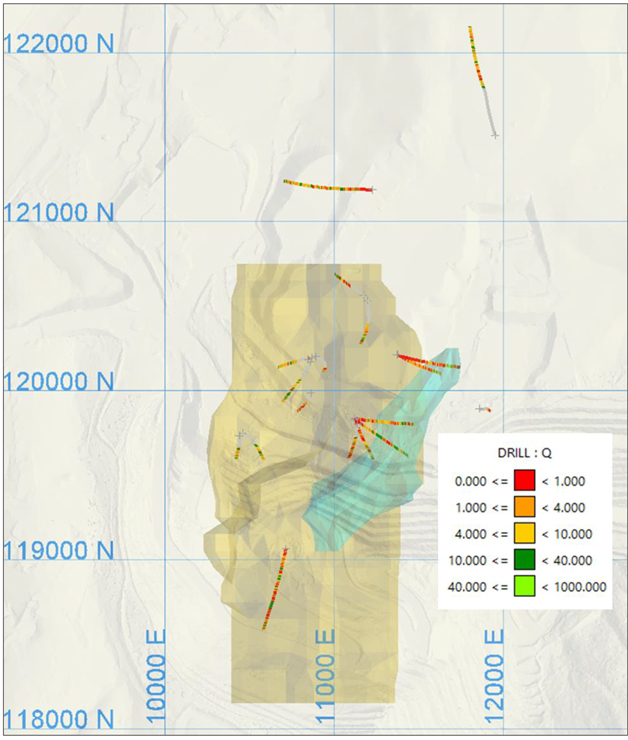

| Figure 13-4: RQD Logged Drill Holes (426 - Turquoise, Ruby Deeps - Gold) | 192 | |||

| Figure 13-5: Cross Section 119625N Showing RQD Values (426 - Turquoise, 426 Fault - Gray, Ruby Deeps - Gold, Holly Fault - Red) | 193 | |||

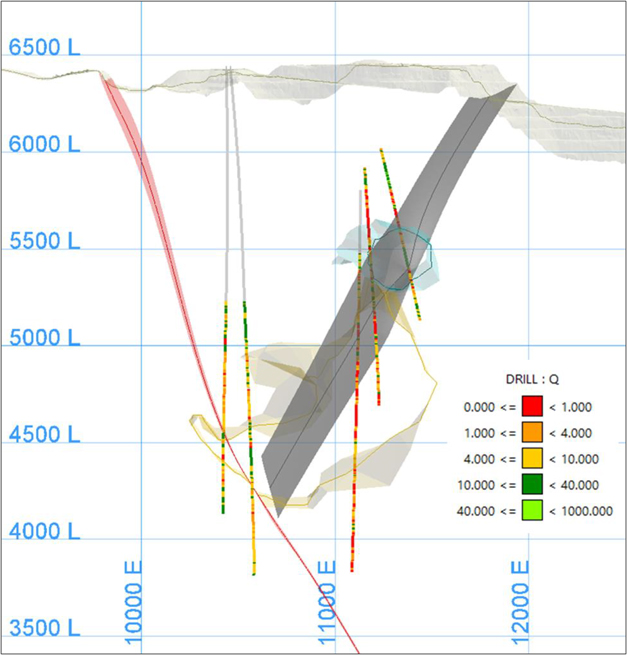

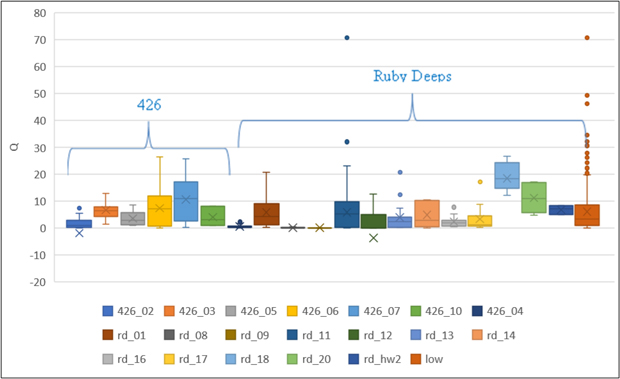

| Figure 13-6: RQD Box and Whisker Plot | 194 | |||

| Figure 13-7: Q-system Support Recommendations | 196 | |||

| Figure 13-8: Q Logged Drill Holes (426 - Blue, Ruby Deeps - Gold) | 197 | |||

| Figure 13-9: Cross Section 119625N Showing Q Values (426 - Blue, 426 Fault - Gray, Ruby Deeps - Gold, Holly Fault - Red) | 198 | |||

| Figure 13-10: Q Value Box and Whisker Plot | 199 | |||

| Figure 13-11: Permitting Development and Initial Production Schedule | 202 | |||

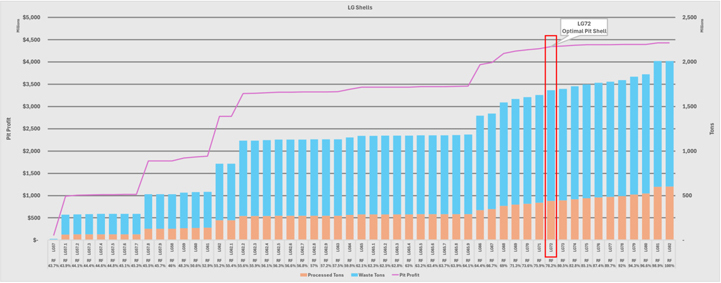

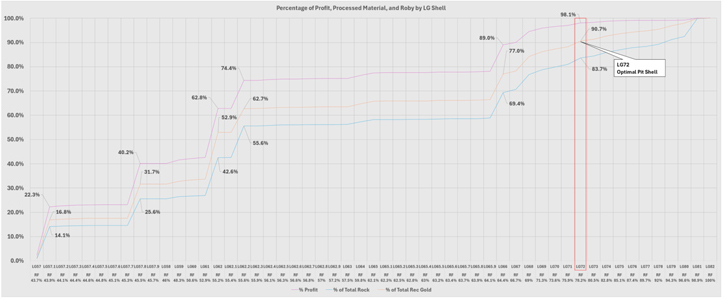

| Figure 13-12: LG Shells by Revenue Factor | 209 | |||

| Figure 13-13: Percentage of Profit, Processed Material, and Recoverable Gold by LG Shell | 211 | |||

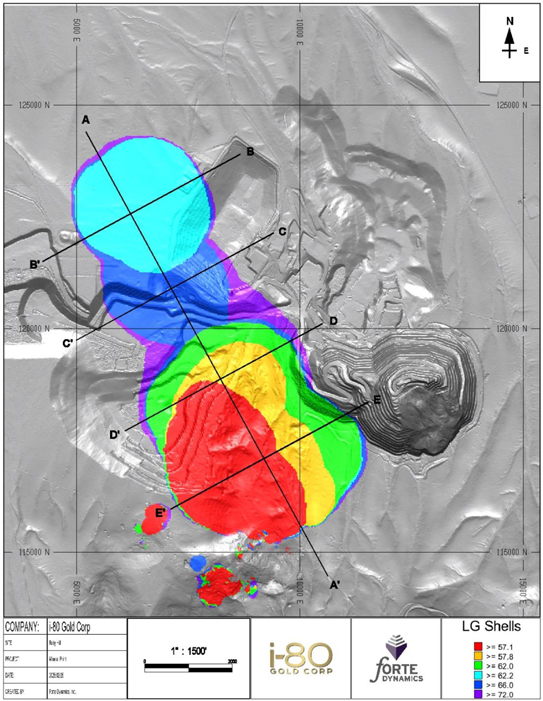

| Figure 13-14: Plan View of LG Pit Shells and Cross Section Locations |

212 |

| FORTE DYNAMICS, INC. |

P a g e | 11 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| Figure 13-15: Pit Optimization Looking West (Section A’ – A) |

213 | |||

| Figure 13-16: Pit Optimization Looking North (Section B’ – B) |

213 | |||

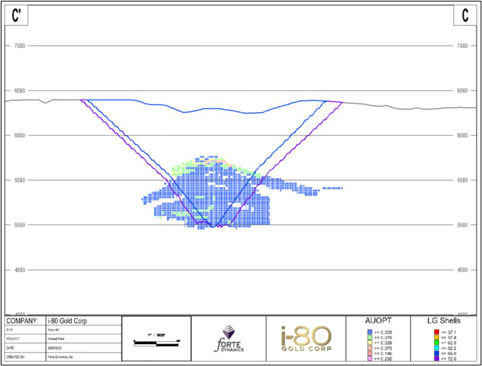

| Figure 13-17: Pit Optimization Looking North (Section C’ – C) |

214 | |||

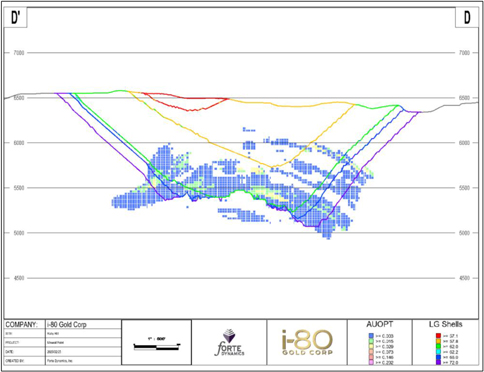

| Figure 13-18: Pit Optimization Looking North (Section D’ – D) |

214 | |||

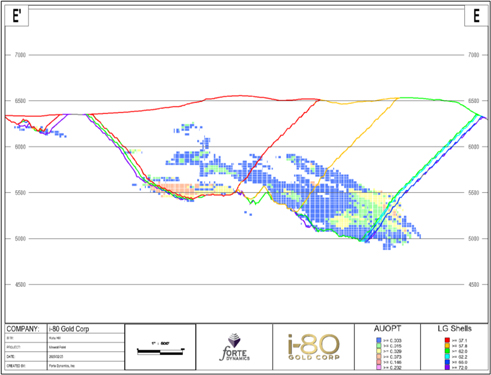

| Figure 13-19: Pit Optimization Looking North (Section E’ – E) |

215 | |||

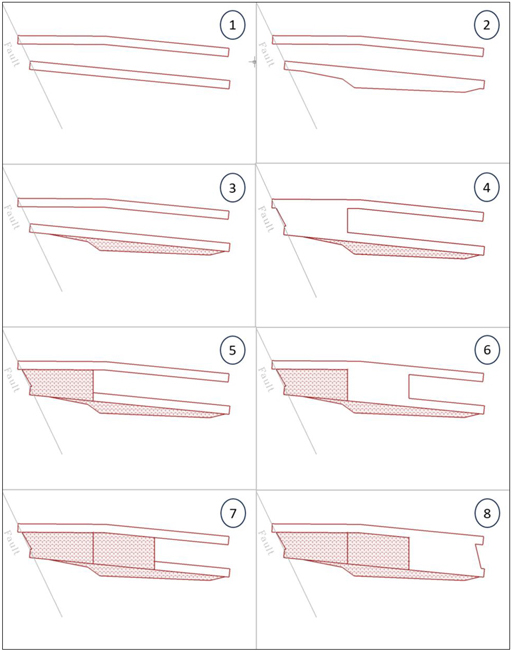

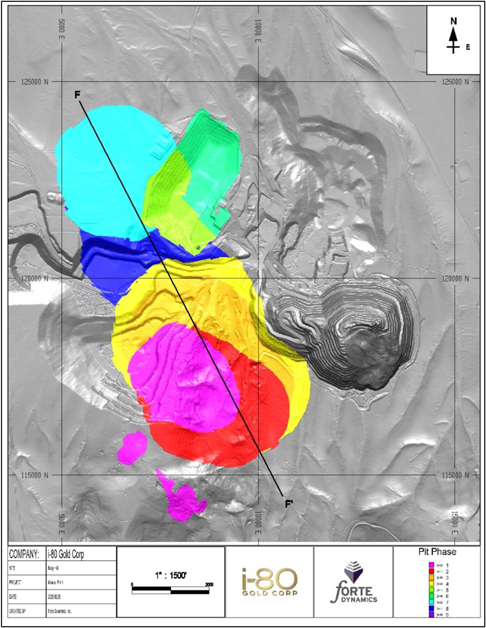

| Figure 13-20: Pit Phasing and Section Line |

216 | |||

| Figure 13-21: Cross Section F’ to F of Pit Phasing |

217 | |||

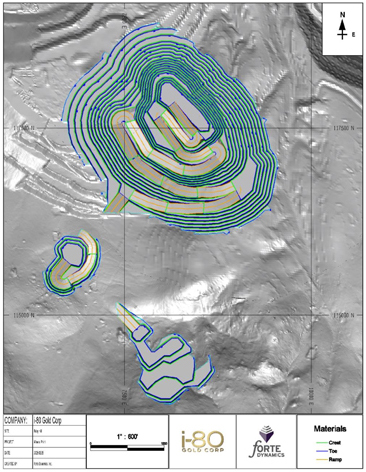

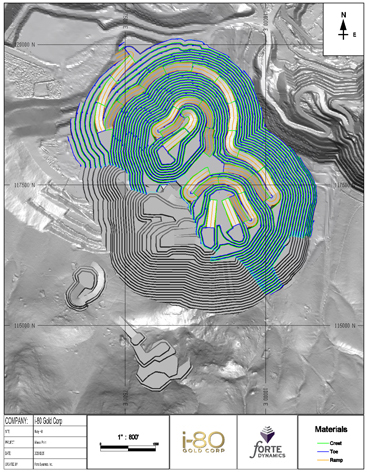

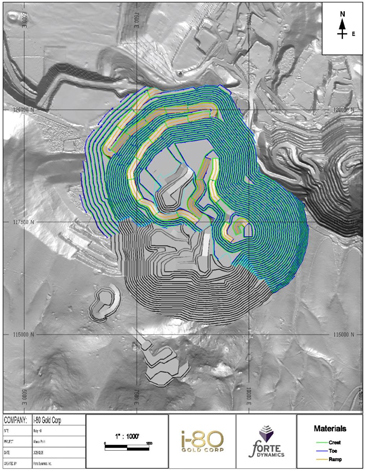

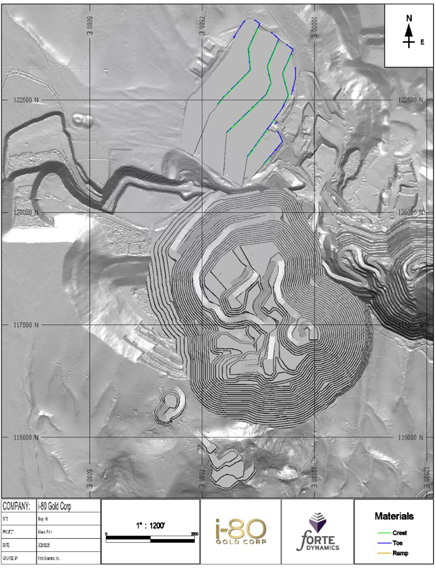

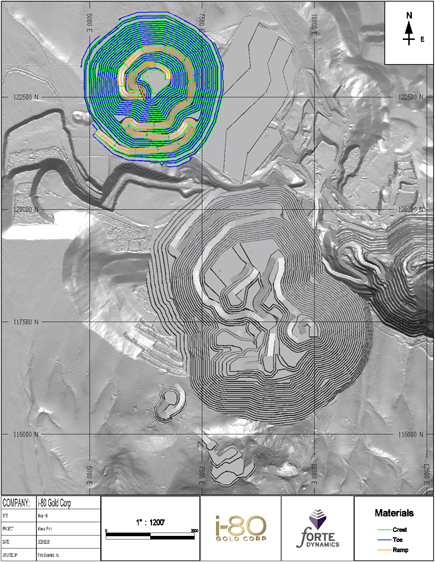

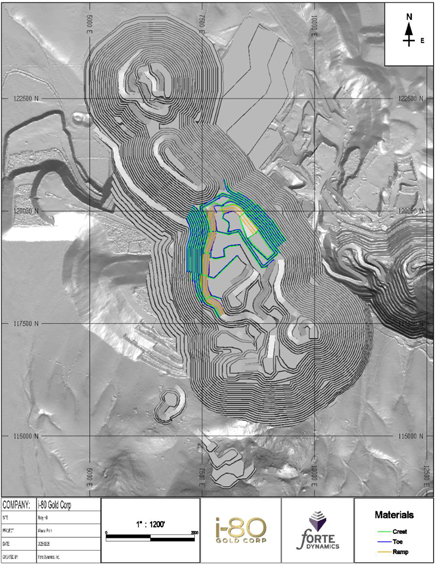

| Figure 13-22: Phase 1 Design |

218 | |||

| Figure 13-23: Phase 2 Design |

219 | |||

| Figure 13-24: Phase 3 Design |

220 | |||

| Figure 13-25: Phase 4 Design |

221 | |||

| Figure 13-26: Phase 5 Design (First Phase of Heap Leach Relocation) |

222 | |||

| Figure 13-27: Phase 6 Design (Second Phase of Heap Leach Relocation) |

223 | |||

| Figure 13-28: Phase 7 Design |

224 | |||

| Figure 13-29: Phase 8 Design |

225 | |||

| Figure 13-30: Phase 9 Design |

226 | |||

| Figure 13-31: Final Pit and Estimated Block Model in Orthogonal View Looking Northwest |

227 | |||

| Figure 13-32: LOM Annual Production Schedule |

230 | |||

| Figure 14-1: Third Party POX Facility Simplified Flowsheet |

233 | |||

| Figure 14-2: Loan Tree Block Flow Diagram |

236 | |||

| Figure 14-3: Mineral Point Process Flowsheet |

248 | |||

| Figure 15-1: Portal Surface Facilities Conceptual Layout |

250 | |||

| Figure 15-2: Site Layout Map |

257 | |||

| Figure 15-3: Existing Infrastructure |

258 | |||

| Figure 15-4: Hydrologic Blocks of Mineral Point |

265 | |||

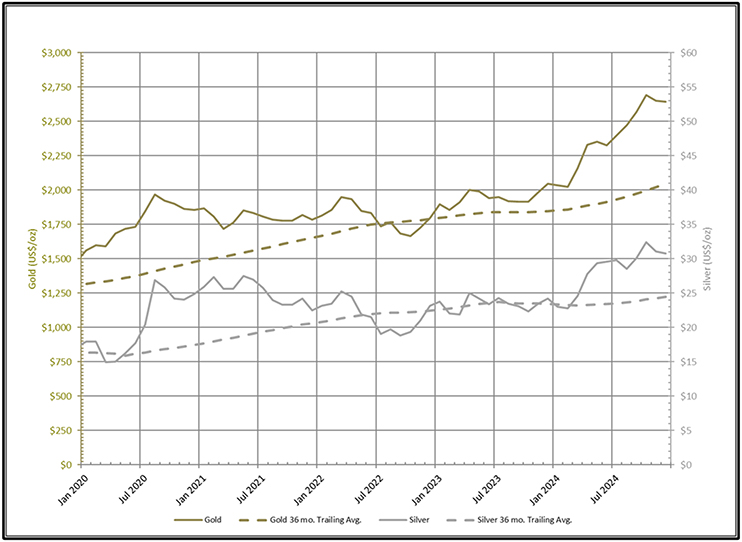

| Figure 16-1: Historical Monthly Average Gold and Silver Prices and 36 Month Trailing Average |

268 | |||

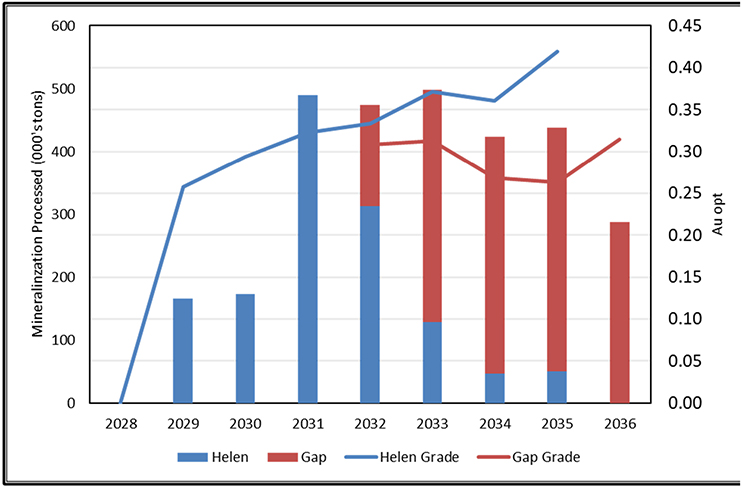

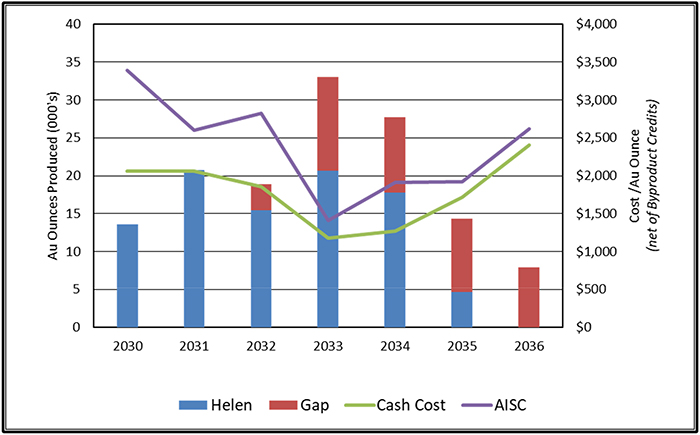

| Figure 19-1: Mineralization Mined and Processed with Inferred |

286 | |||

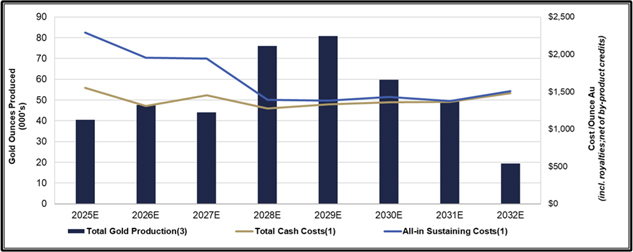

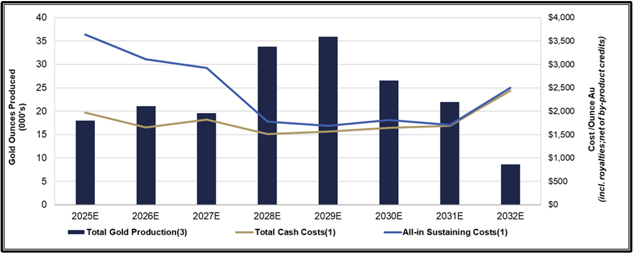

| Figure 19-2: Gold Production and Unit Costs with Inferred |

286 | |||

| Figure 19-3: Mineralization Mined and Processed without Inferred |

287 | |||

| Figure 19-4: Gold Production and Unit Costs without Inferred |

287 | |||

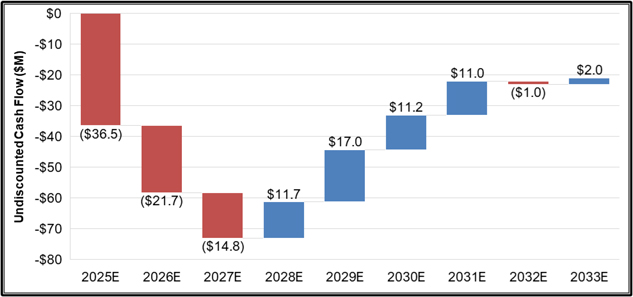

| Figure 19-5: Cash Flow Waterfall Chart with Inferred |

289 | |||

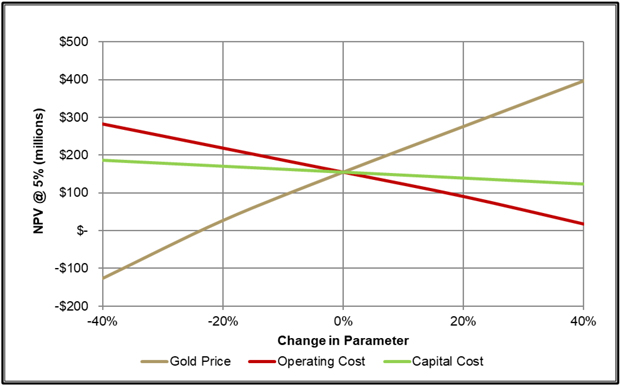

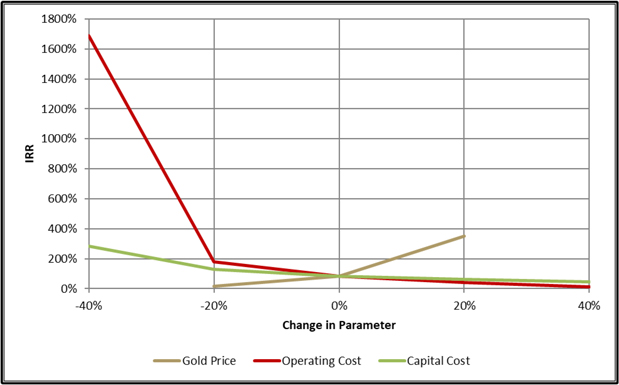

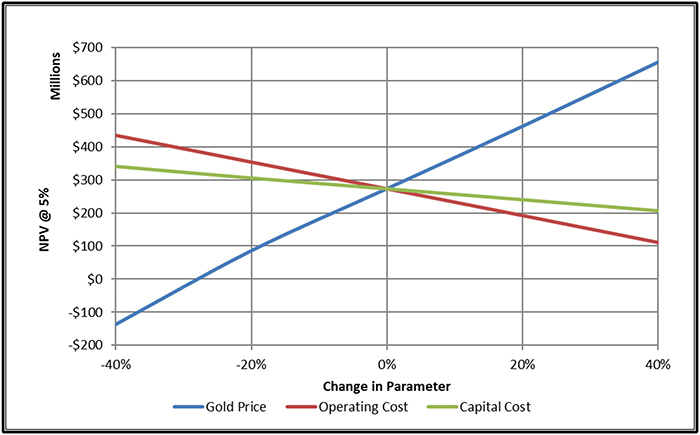

| Figure 19-6: NPV 5% Sensitivity with Inferred |

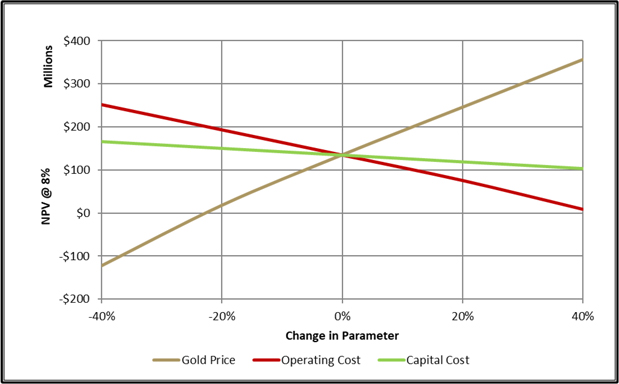

291 | |||

| Figure 19-7: NPV 8% Sensitivity with Inferred |

291 | |||

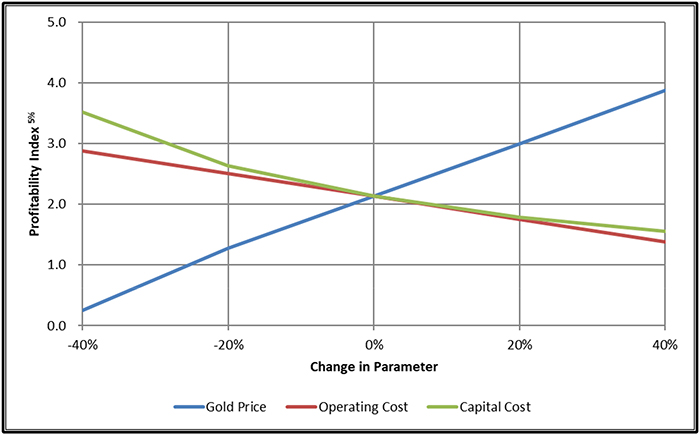

| Figure 19-8: IRR Sensitivity with Inferred |

292 | |||

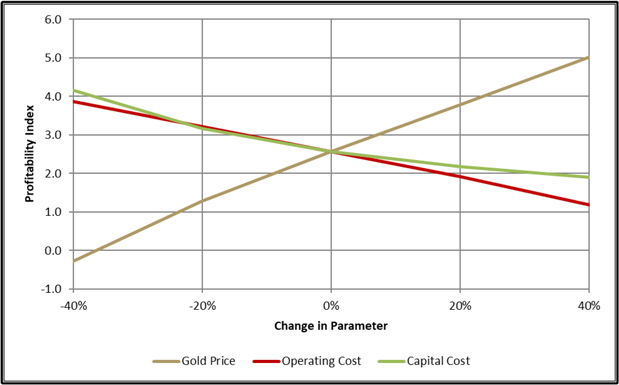

| Figure 19-9: Profitability Index Sensitivity with Inferred |

292 | |||

| Figure 19-10: Pre-Tax LOM Annual Cash Flow |

295 | |||

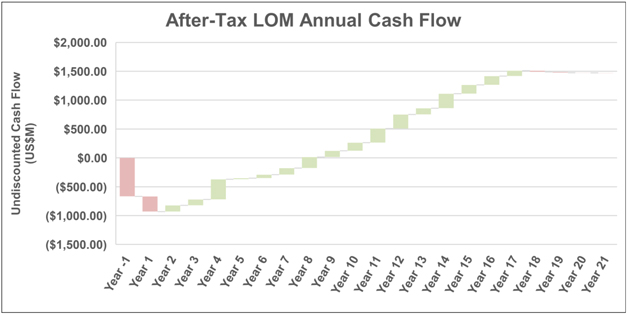

| Figure 19-11: After-Tax LOM Annual Cash Flow |

296 | |||

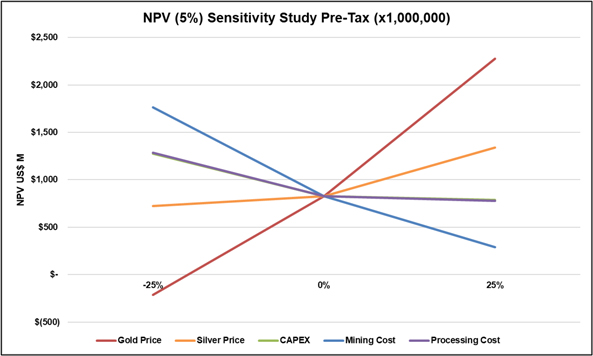

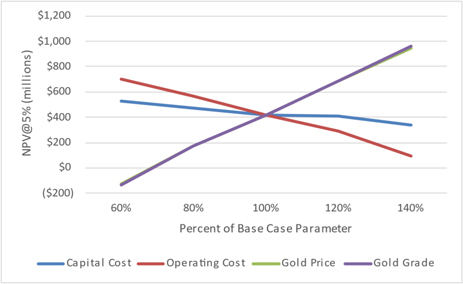

| Figure 19-12: Pre-Tax Sensitivity NPV @5% |

298 | |||

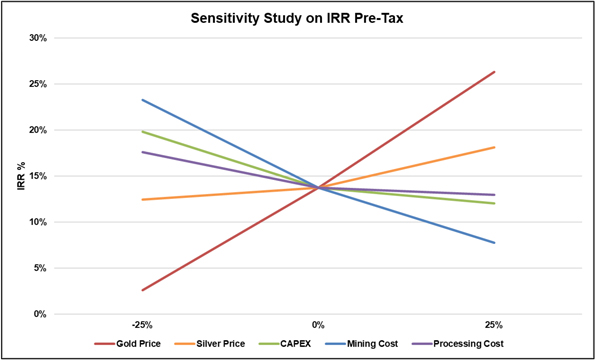

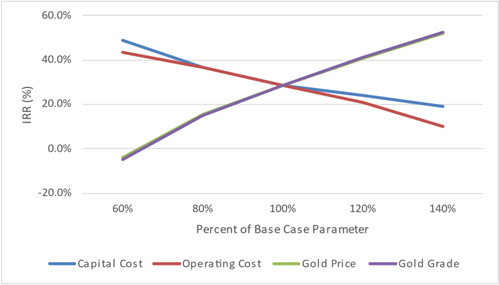

| Figure 19-13: Pre-Tax Sensitivity IRR |

298 | |||

| Figure 19-14: After-Tax Sensitivity NPV @5% |

299 | |||

| Figure 19-15: After-Tax Sensitivity IRR |

299 |

| FORTE DYNAMICS, INC. |

P a g e | 12 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

Tables

| Table 1-1: Summary of Archimedes Underground Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 23 | |||

| Table 1-2: Summary of Archimedes Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 24 | |||

| Table 1-3: Summary of Mineral Point Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 25 | |||

| Table 1-4: Capital and Operating Cost Summary | 27 | |||

| Table 1-5: Financial Statistics | 28 | |||

| Table 1-6: Unit and Total Operating Costs With and Without Inferred Resources | 29 | |||

| Table 1-7: After-Tax NPV Comparison of With and Without Inferred Resources | 30 | |||

| Table 1-8: Archimedes Underground Work Program | 34 | |||

| Table 1-9: Mineral Point Work Program | 35 | |||

| Table 2-1: Personal Inspections by Qualified Persons | 37 | |||

| Table 2-2: Units and Abbreviations | 38 | |||

| Table 3-1: Ruby Hill Project Owned Patented Claims | 42 | |||

| Table 3-2: Ruby Hill Project Owned Unpatented Claims | 43 | |||

| Table 3-3: Ruby Hill Project Leased Unpatented Claims | 44 | |||

| Table 3-4: Golden Hill FAD Property Owned Patented Claims | 44 | |||

| Table 3-5: Golden Hill FAD Property Leased Patented Claims | 45 | |||

| Table 3-6: Golden Hill FAD Property Owned Unpatented Claims | 46 | |||

| Table 3-7: Golden Hill FAD Property Leased Unpatented Claims | 46 | |||

| Table 3-8: Ruby Hill Complex Property Holding Costs | 47 | |||

| Table 3-9: Ruby Hill Royalties | 47 | |||

| Table 3-10: Golden Hill Royalties | 47 | |||

| Table 5-1: Historic Regional Ownership and Activities | 52 | |||

| Table 5-2: Production History Summary | 55 | |||

| Table 5-3: Historic Exploration | 56 | |||

| Table 6-1: Major Structural Features and Orientations within the Property Area | 69 | |||

| Table 7-1: Drilling Statistics for Drillholes Included in the 2021 Ruby Hill Project Mineral Resource Estimate | 87 | |||

| Table 7-2: Distribution of Drilling by Campaign | 87 | |||

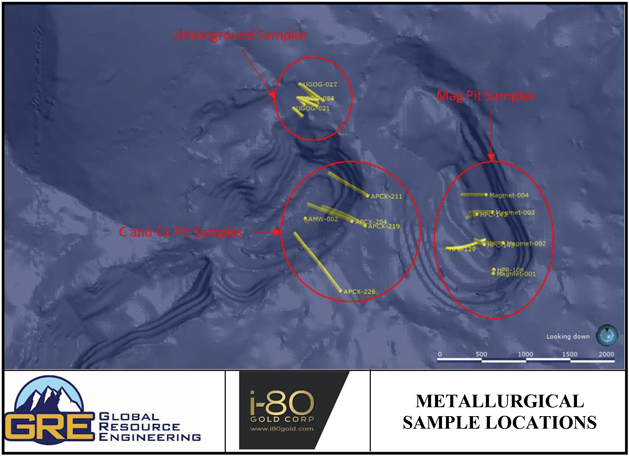

| Table 7-3: 2004 Barrick Metallurgical Holes | 92 | |||

| Table 7-4: 2009 Metallurgical Holes | 93 | |||

| Table 7-5: 2010 and 2011 Metallurgical Holes | 93 | |||

| Table 7-6: 2011 Metallurgical Holes | 93 | |||

| Table 7-7: Summary of Hydrogeological Surveys Since 2004 (Wood 2021) | 96 | |||

| Table 8-1: Assay, Density and Metallurgical Laboratories | 112 | |||

| Table 8-2: Barrick Rock Type Density Values | 113 | |||

| Table 8-3: ALS Global Gold Analytical Parameters | 114 | |||

| Table 8-4: Count and Description of QA/QC Samples by Year | 116 | |||

| Table 8-5: SRM Performance | 117 | |||

| Table 8-6: Selected i-80 Blank and Standard Reference Results | 123 | |||

| Table 9-1: Drill Holes in 426 and Ruby Deeps Zones | 127 | |||

| Table 9-2: Drillhole Data Fields Reviewed | 127 | |||

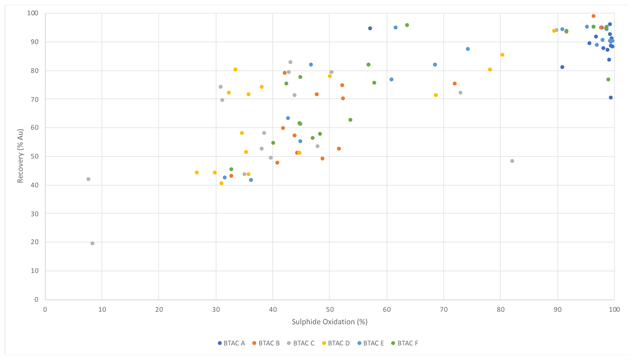

| Table 10-1: Ruby Hill Project Refractory Testing Programs | 128 | |||

| Table 10-2: January 2008 426 Zone Barrick Technology Centre Test Results Summary |

129 |

| FORTE DYNAMICS, INC. |

P a g e | 13 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| Table 10-3: November 2011 426 Zone Barrick Technology Centre Test Results Summary | 130 | |||

| Table 10-4: 2024 FLSmidth Program Assays Summary | 130 | |||

| Table 10-5: FLSmidth Program BTAC Conditions Summary | 132 | |||

| Table 10-6: FLSmidth Program BTAC and Roasting CIL Recovery Summary | 132 | |||

| Table 10-7: November 2011 426 Zone Barrick Technology Centre Refractory Sample Assays Summary | 134 | |||

| Table 10-8: Ruby Hill (Archimedes) Summary of Estimated Gold Recoveries | 134 | |||

| Table 10-9: Ruby Hill Project Historical Metallurgical Testing Programs | 135 | |||

| Table 10-10: June 2004 KCA Archimedes Column Test Results Summary | 136 | |||

| Table 10-11: May 2005 KCA Archimedes Column Test Results Summary | 136 | |||

| Table 10-12: January 2009 426 Zone KCA Column Leach Test Results Summary | 137 | |||

| Table 10-13: November 2011 426 Zone KCA Column Leach Test Results Summary | 137 | |||

| Table 10-14: February 2011 Mineral Point Deposit KCA Bottle Rolls Test Results Summary | 138 | |||

| Table 10-15: February 2011 Mineral Point Deposit KCA Column Leach Test Results Summary | 138 | |||

| Table 10-16: July 2012 Mineral Point Deposit KCA Bottle Rolls Test Results Summary | 139 | |||

| Table 10-17: July 2012 Mineral Point Deposit KCA Column Leach Test Results Summary | 139 | |||

| Table 10-18: February 2014 Mineral Point Deposit KCA Bottle Rolls Test Results Summary | 140 | |||

| Table 10-19: February 2014 Mineral Point Deposit KCA Column Leach Test Results Summary | 141 | |||

| Table 10-20: Summary of Column Leach Test Results | 142 | |||

| Table 10-21: Mineral Point Summary of Estimated Gold and Silver Recoveries | 143 | |||

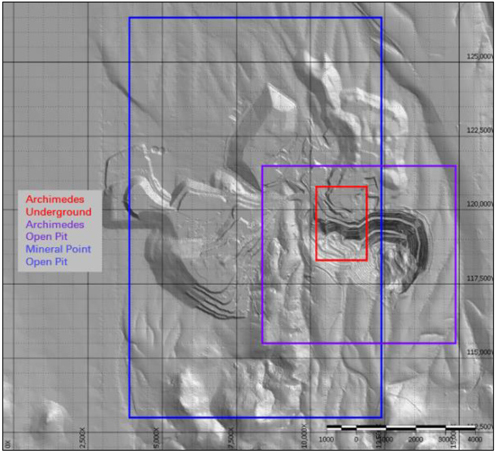

| Table 11-1: Univariate Density Statistics by Lithology Formation (tonnes/m3) | 147 | |||

| Table 11-2: Gold Univariate Statistics for 426 0.1 Au opt Composites | 148 | |||

| Table 11-3: Silver Univariate Statistics for 426 0.1 Au opt Composites | 149 | |||

| Table 11-4: Gold Univariate Statistics for Ruby Deeps 0.01 Au opt Composites | 150 | |||

| Table 11-5: Silver Univariate Statistics for Ruby Deeps 0.01 Au opt Composites | 150 | |||

| Table 11-6: Gold Univariate Statistics for 0.002 Au opt Composites | 151 | |||

| Table 11-7: Silver Univariate Statistics for 0.002 Au opt Composites | 151 | |||

| Table 11-8: Gold and Silver Grade Caps | 153 | |||

| Table 11-9: Estimation Search Distances and Sample Requirements | 153 | |||

| Table 11-10: Ellipsoid Search Parameters for each Grade Shell | 153 | |||

| Table 11-11: Comparison of Composite and Block Model Statistics | 154 | |||

| Table 11-12: Mineral Resource Classification Scheme | 159 | |||

| Table 11-13: Summary of Archimedes Underground Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 160 | |||

| Table 11-14: Summary Sample Statistics - Archimedes | 162 | |||

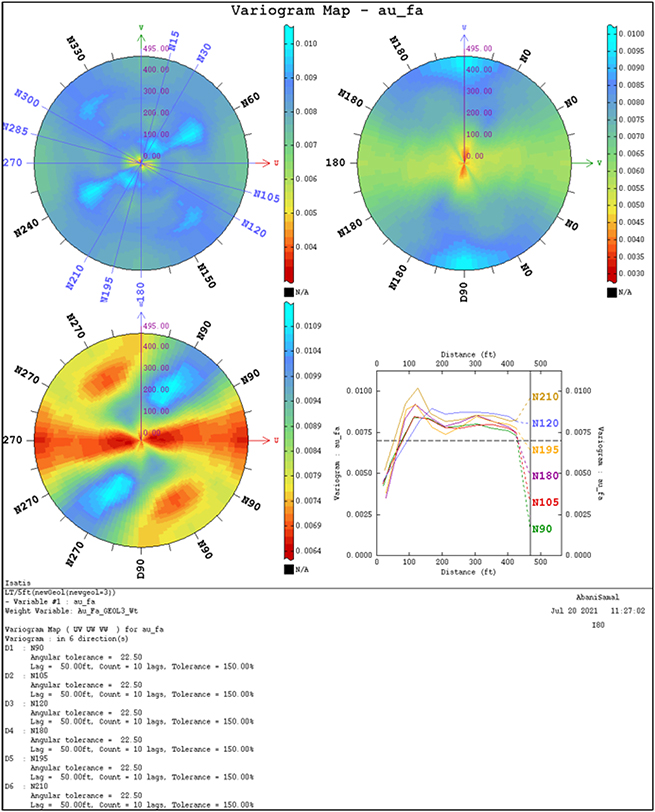

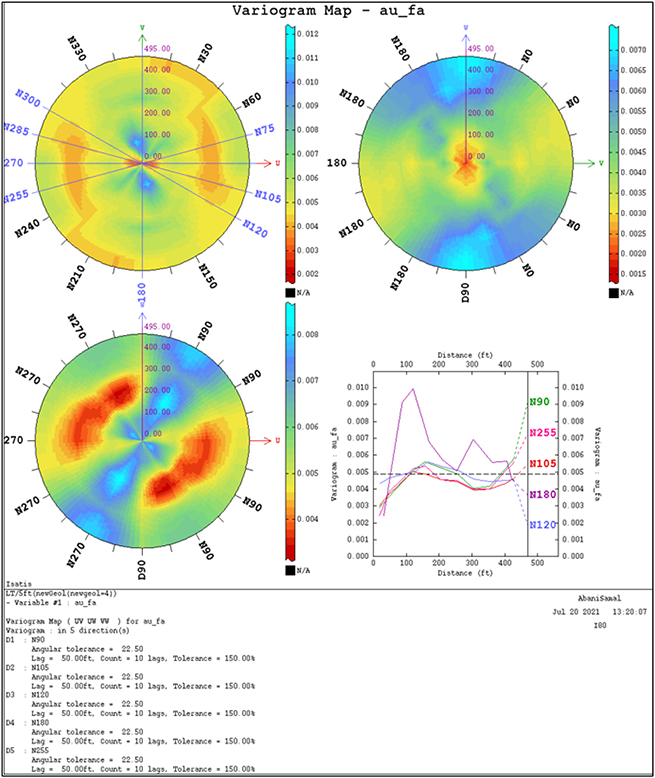

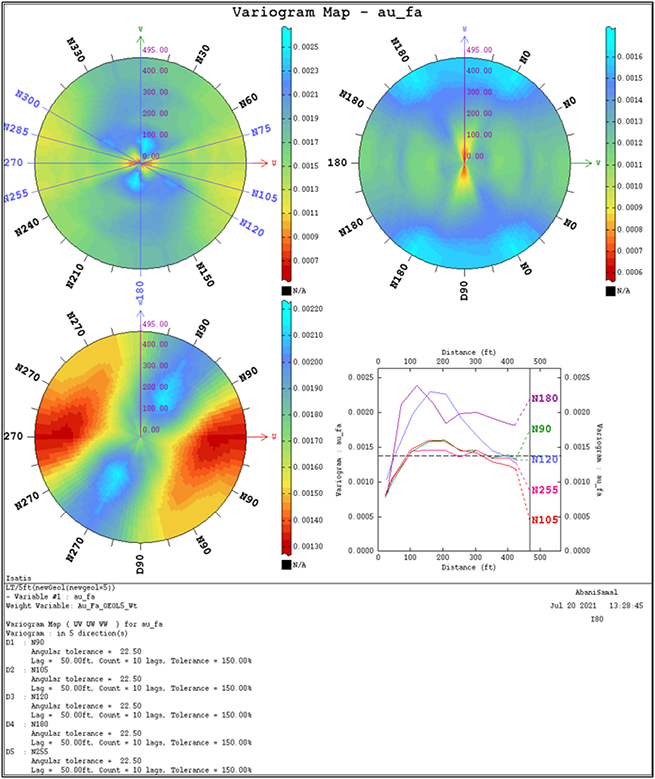

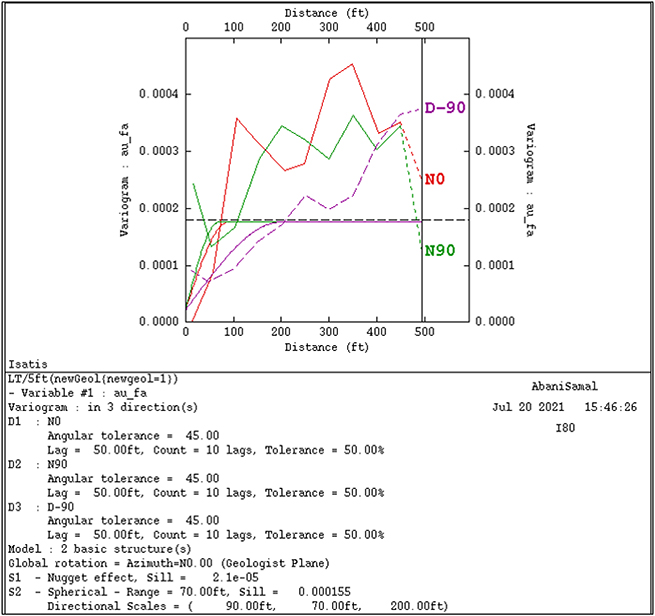

| Table 11-15: Variogram for 0.05 Au ppm Indicator | 164 | |||

| Table 11-16: Variograms for Au and Ag | 166 | |||

| Table 11-17: Gold and Silver Search Parameters | 166 | |||

| Table 11-18: Resource Classification by Sample Density | 170 | |||

| Table 11-19: Summary of Archimedes Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 171 | |||

| Table 11-20: Estimation Parameters | 179 | |||

| Table 11-21: Global Bias Check within Indicated Resources | 181 | |||

| Table 11-22: Parameters for Mineral Resource Pit Shell Construction | 184 | |||

| Table 11-23: Summary of Mineral Point Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024 | 185 | |||

| Table 13-1: Guidelines for the Selection of Primary Support for 20-foot to 40-foot Tunnels in Rock | 192 | |||

| Table 13-2: RQD Univariate Statistics by Grade Shell |

194 |

| FORTE DYNAMICS, INC. |

P a g e | 14 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| Table 13-3: Q Value Univariate Statistics by Grade Shell | 199 | |||

| Table 13-4: Personnel Requirements | 200 | |||

| Table 13-5: Equipment Requirements | 201 | |||

| Table 13-6: i-80 Support Equipment | 201 | |||

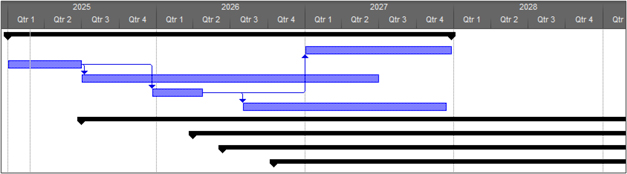

| Table 13-7: Ruby Hill Development Schedule | 202 | |||

| Table 13-8: Archimedes Production Mining Plan (Includes Inferred Mineral Resource) | 203 | |||

| Table 13-9: Mine Production Rates by Excavation Type | 203 | |||

| Table 13-10: Ruby Hill Processing Plan (Includes Inferred Mineral Resource) | 204 | |||

| Table 13-11: Ruby Hill Processing Plan (Without Inferred Mineral Resource) | 205 | |||

| Table 13-12: Pit Slope by Lithology Unit | 207 | |||

| Table 13-13: Pit Optimization Parameters | 207 | |||

| Table 13-14: Profit Factor for Optimization Results | 210 | |||

| Table 13-15: Pit Design Parameters | 215 | |||

| Table 13-16: Design Metal Prices, Costs, and Recoveries | 228 | |||

| Table 13-17: In-Pit Mineral Resources by Pit Phase | 229 | |||

| Table 13-18: LOM Production Schedule | 230 | |||

| Table 13-19: Mining Equipment List | 231 | |||

| Table 14-1: Summary of Key Process Statistics | 237 | |||

| Table 14-2: Lone Tree Facility Water Consumption by Type | 242 | |||

| Table 14-3: Lone Tree Facility Energy Usage by Area | 242 | |||

| Table 14-4: Mineral Point Design Criteria | 243 | |||

| Table 15-1: Ruby Hill Active Dewatering Wells (LRE 2025) | 251 | |||

| Table 15-2: Summary of Locations, Construction Information, and Water Levels for Dewatering Wells, VWPs, Monitoring Wells, and Piezometers | 252 | |||

| Table 15-3: Existing Infrastructure Plans | 259 | |||

| Table 15-4: Heap Leach Pad Phases | 260 | |||

| Table 15-5: WRSA Parameters | 261 | |||

| Table 15-6: Ruby Hill Pumping Wells | 266 | |||

| Table 17-1: Ruby Hill Project Significant Permits | 273 | |||

| Table 18-1: Mine Development Unit Costs | 275 | |||

| Table 18-2: Project Capital Costs ($M) | 275 | |||

| Table 18-3: Underground Mine Operating Costs | 276 | |||

| Table 18-4: Resource Cutoff Grades by Process | 276 | |||

| Table 18-5: Mineral Point Project Capital Cost Summary | 277 | |||

| Table 18-6: Mineral Point Mining Equipment LOM CAPEX | 278 | |||

| Table 18-7: Mineral Point Process Infrastructure LOM CAPEX | 278 | |||

| Table 18-8: Mineral Point Pre-Production and Facilities LOM CAPEX | 279 | |||

| Table 18-9: Mineral Point Owner’s Costs LOM CAPEX | 279 | |||

| Table 18-10: Mineral Point LOM Operating Cost Summary | 280 | |||

| Table 18-11: Mineral Point Processing Costs | 280 | |||

| Table 19-1: Income Statement with Inferred | 282 | |||

| Table 19-2: Cash Flow Statement with Inferred | 283 | |||

| Table 19-3: Income Statement without Inferred | 284 | |||

| Table 19-4: Cash Flow Statement without Inferred | 285 | |||

| Table 19-5: Capital and Operating Cost Summary With Inferred | 288 | |||

| Table 19-6: Capital and Operating Cost Summary Without Inferred | 288 | |||

| Table 19-7: Financial Statistics | 290 | |||

| Table 19-8: Economic Model Parameters | 293 |

| FORTE DYNAMICS, INC. |

P a g e | 15 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| Table 19-9: Cost Summary | 294 | |||

| Table 19-10: Pre-Tax NPV Summary | 295 | |||

| Table 19-11: After-Tax NPV Summary | 295 | |||

| Table 19-12: Sensitivity Summary | 297 | |||

| Table 19-13: Gold and Silver Price Sensitivity After-Tax Analysis | 300 | |||

| Table 19-14: Economic Model Parameters Comparison of With and Without Inferred Resources | 301 | |||

| Table 19-15: After-Tax NPV Comparison of With and Without Inferred Resources | 301 | |||

| Table 22-1: Risks and Uncertainties | 307 | |||

| Table 22-2: Opportunities | 308 | |||

| Table 23-1: Archimedes Underground Work Program | 311 | |||

| Table 23-2: Mineral Point Work Program | 312 |

Appendices

Appendix A – Site Visit Report

Appendix B – Mineral Point Open Pit Economic Model with Inferred Resources

| FORTE DYNAMICS, INC. |

P a g e | 16 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 1. | EXECUTIVE SUMMARY |

| 1.1 | Introduction |

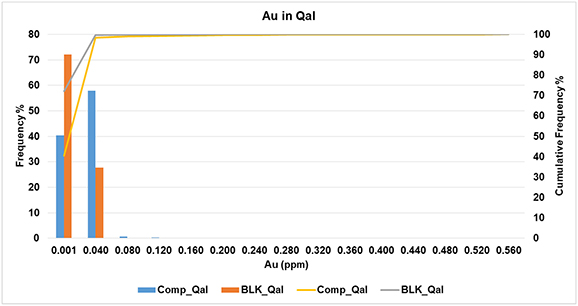

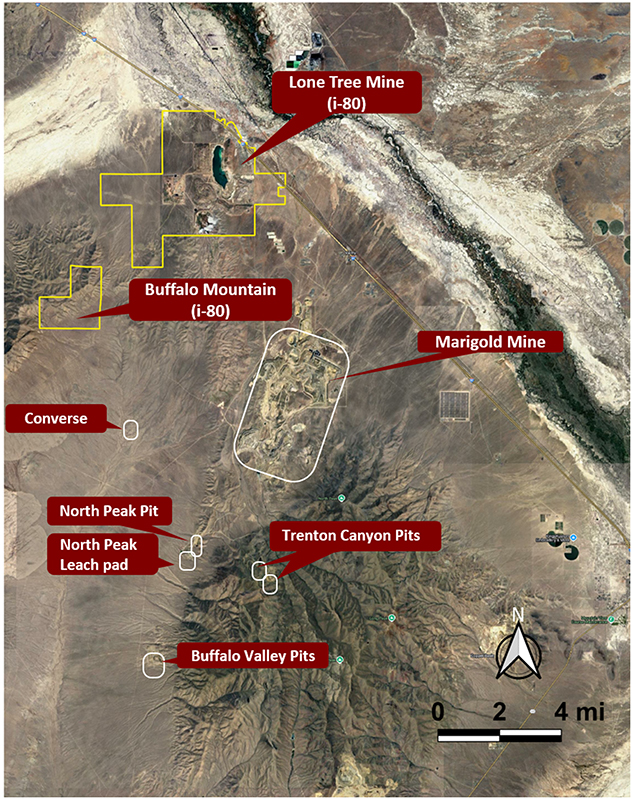

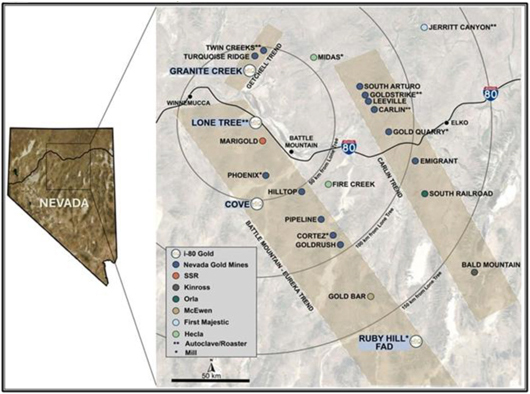

This Technical Report Summary (“TRS”) dated the 29th day of March, 2025 with an effective date of December 31, 2024 provides an updated statement of Mineral Resources for Ruby Hill Mining Company LLC’s Ruby Hill Complex. This Technical Report Summary provides an Initial Assessment (“IA”) for the Archimedes Underground, Archimedes Open Pit, and Mineral Point Open Pit Resource areas at Ruby Hill.

The mining contemplated for each of these areas is independent of the other and there is no interaction between them. Exploitation of one area does not preclude exploitation of the other. This report considers each to be a stand-alone operation, and there has not been any shared benefit assigned to operating or capital costs.

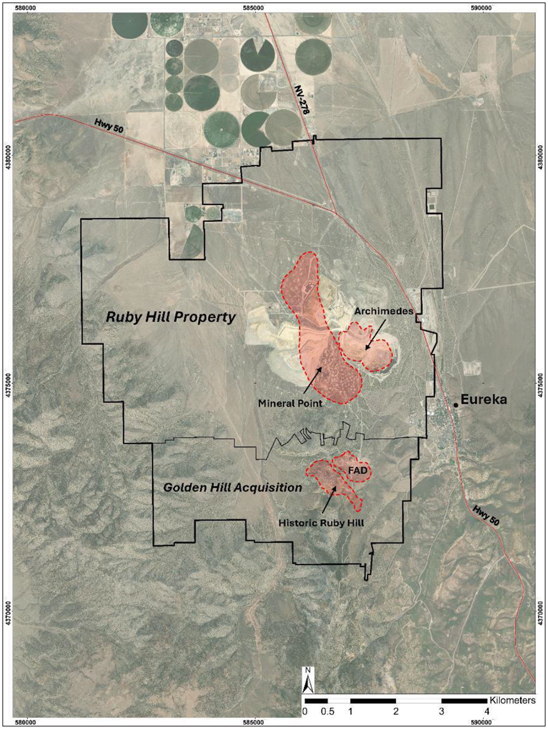

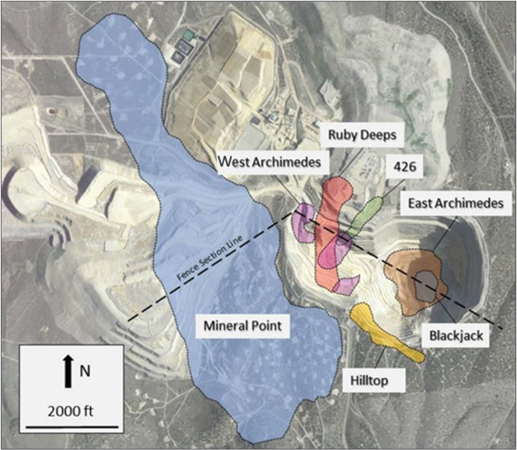

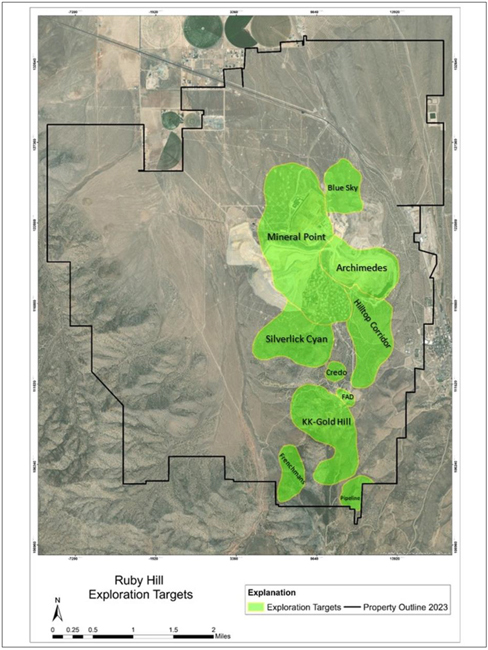

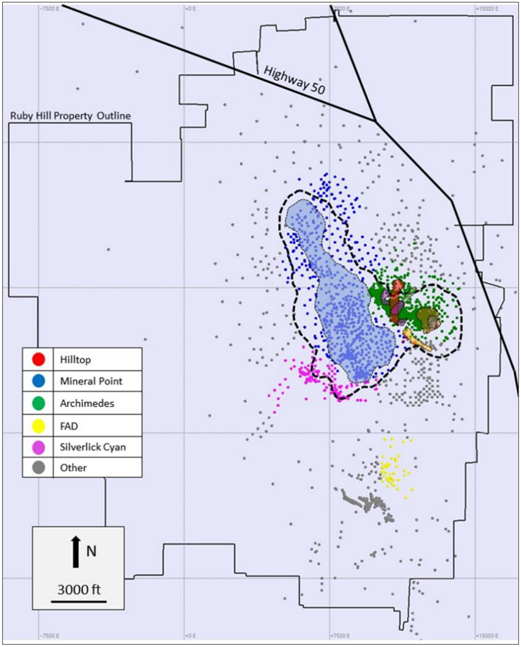

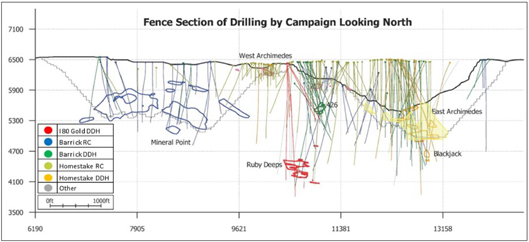

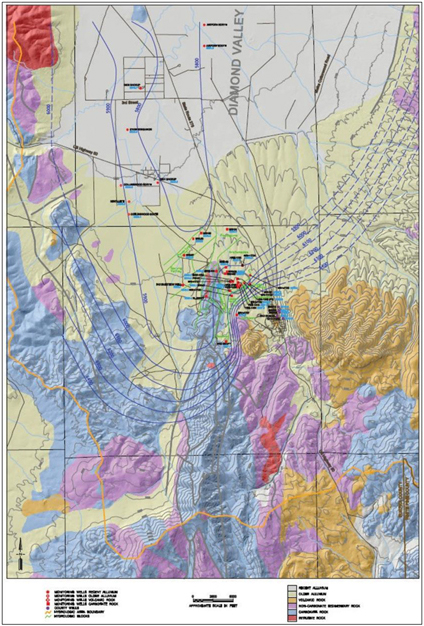

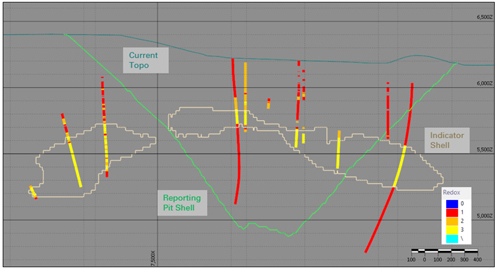

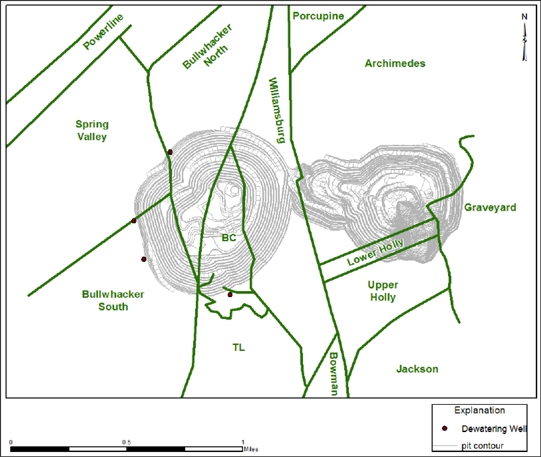

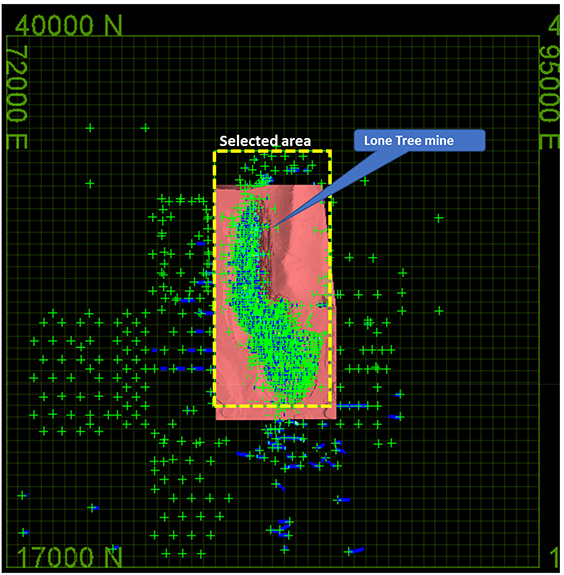

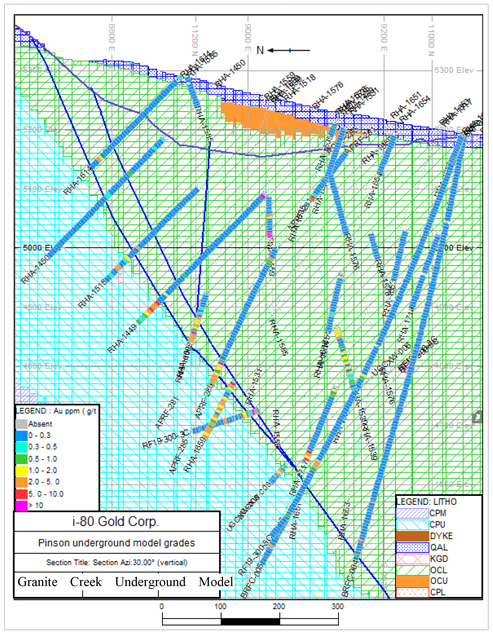

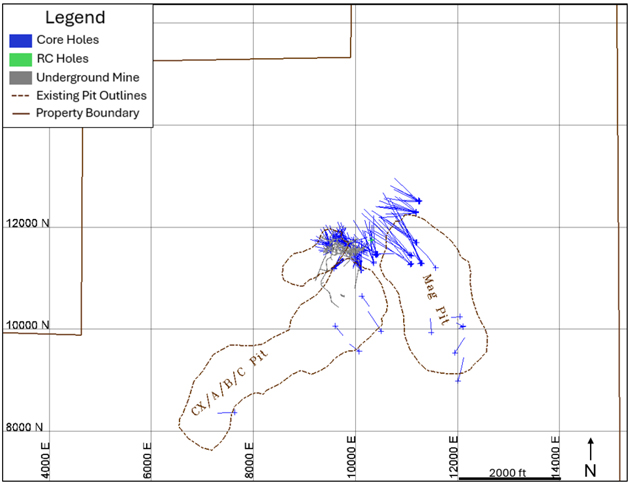

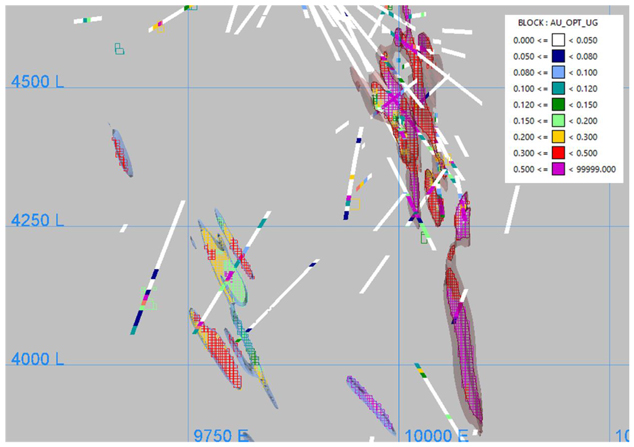

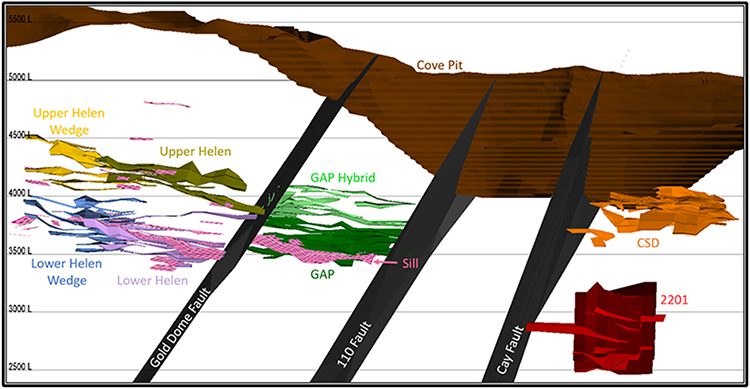

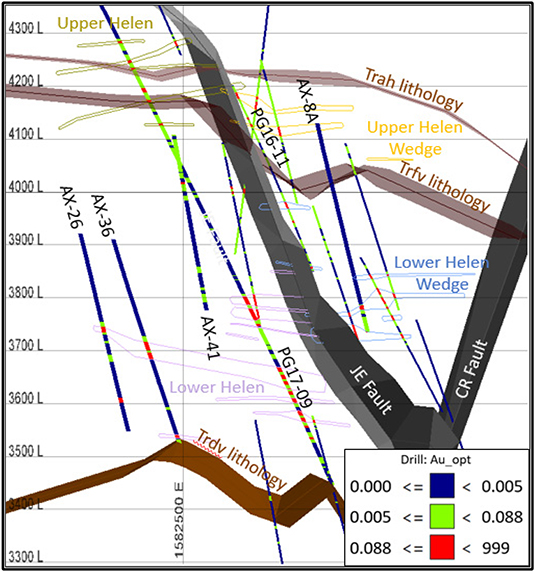

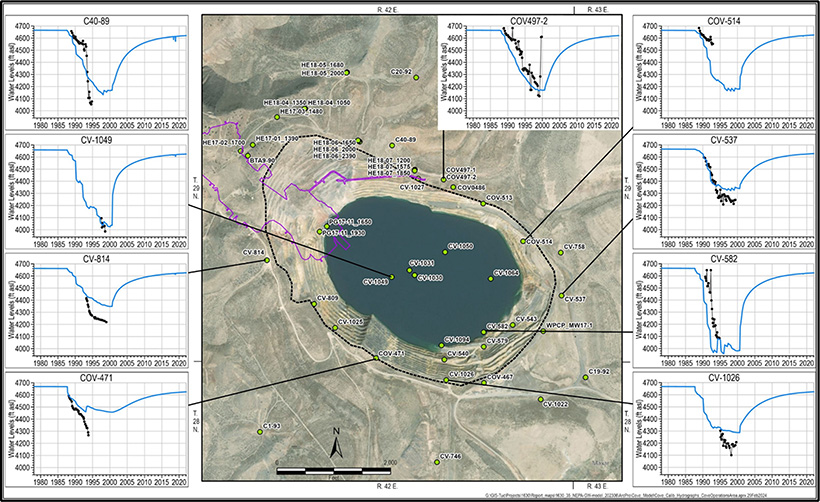

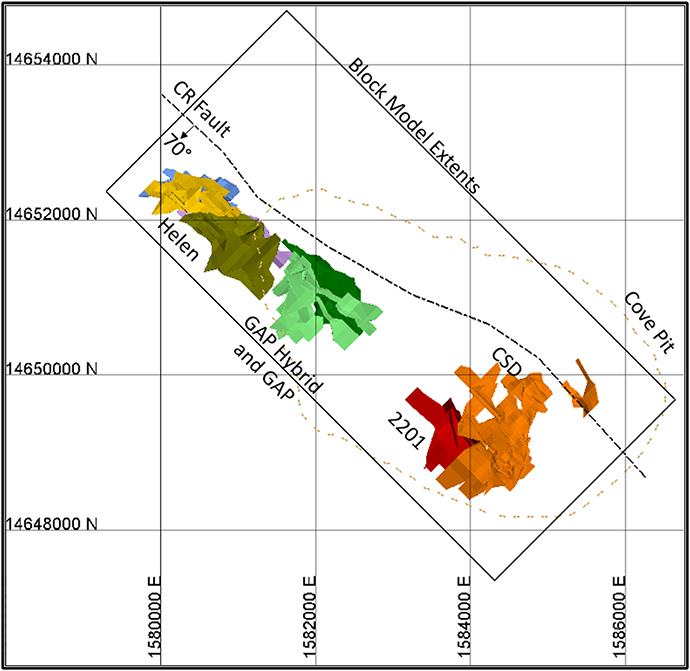

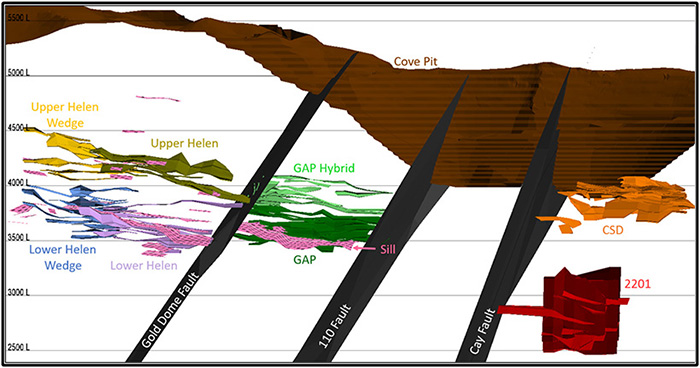

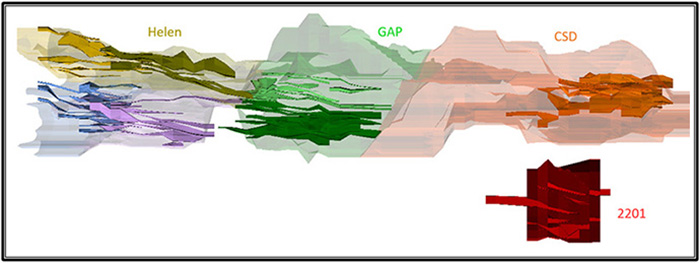

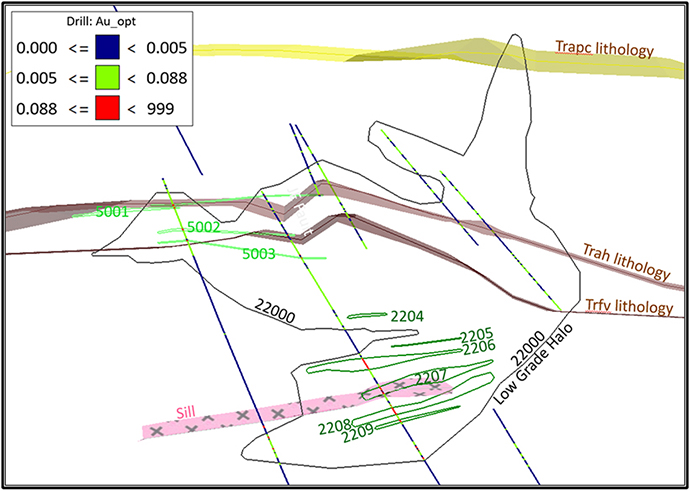

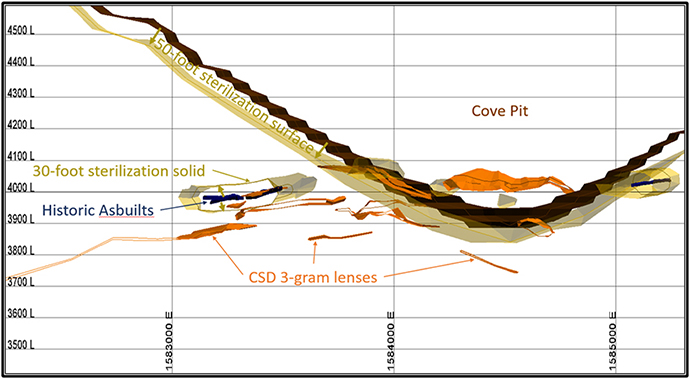

The Ruby Hill property contains several historical mines, current resources, and exploration targets (Figure 1-1). The property is endowed with multiple types of mineralization, including Carlin-style gold, distal disseminated silver-gold, carbonate replacement deposits (CRD), and skarn base metals. i-80 is currently focused on precious metal deposits. The resources considered in this report include the Archimedes Underground Carlin-style gold deposit and the Mineral Point distal disseminated silver-gold deposit.

| FORTE DYNAMICS, INC. |

P a g e | 17 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

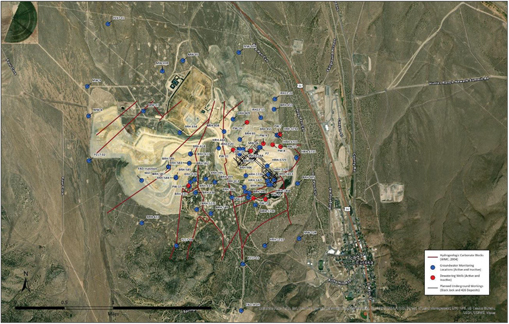

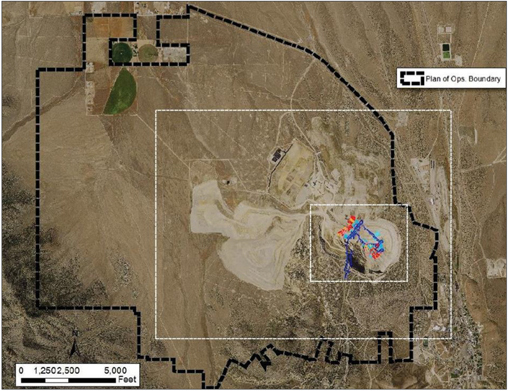

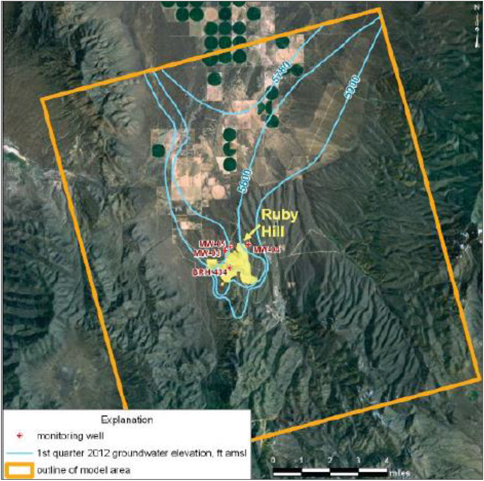

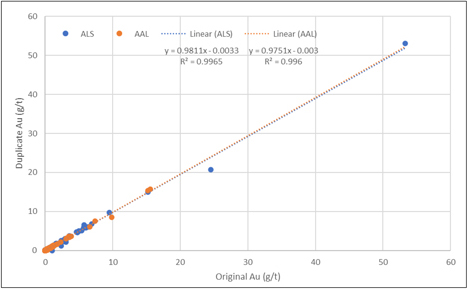

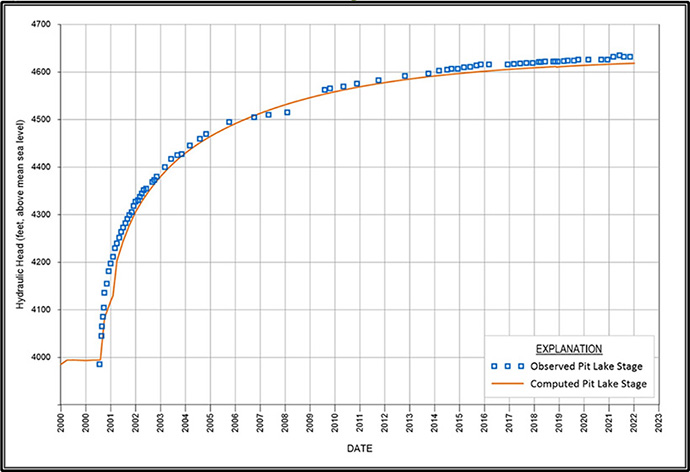

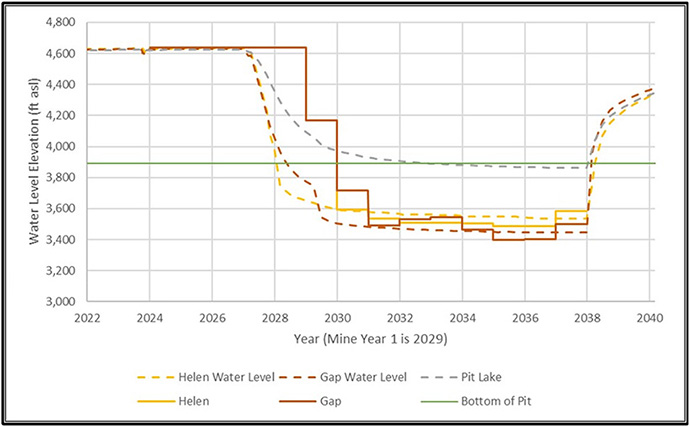

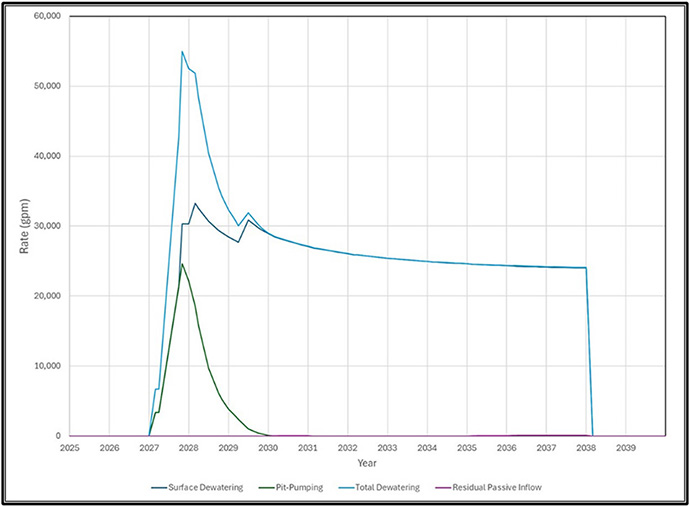

Figure 1-1: Ruby Hill Complex Overview

(Source: i-80 Gold, 2023)

Cautionary Note:

The financial analysis contains certain information that may constitute “forward-looking information” under applicable United States securities legislation. Forward-looking information includes, but is not limited to, statements regarding

| FORTE DYNAMICS, INC. |

P a g e | 18 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

the Company’s achievement of the full-year projections for ounce production, production costs, AISC costs per ounce, cash cost per ounce and realized gold/silver price per ounce, the Company’s ability to meet annual operations estimates, and statements about strategic plans, including future operations, future work programs, capital expenditures, discovery and production of minerals, price of gold and currency exchange rates, timing of geological reports and corporate and technical objectives. Forward-looking information is necessarily based upon a number of assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward looking information, including the risks inherent to the mining industry, adverse economic and market developments and the risks identified in Premier’s annual information form under the heading “Risk Factors”. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this Presentation is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Premier disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

| 1.2 | Property Description |

The Ruby Hill property is located in the historic Eureka mining district. It lies west of the town of Eureka in Eureka County, central Nevada. It is a large property containing multiple deposit types and several past-producing mines, and as such it has a long history of prior ownership and production. The property takes its name from the most significant historical mine, the Ruby Hill mine, named for the hill it lies beneath roughly 1.2 miles southwest of Eureka. Historic mining generally exploited silver and base metal mineralization with the majority of production coming from the Ruby Hill mine from 1873-1916. Sporadic exploration and production from 1916 through 1959 included discovery and mining of the TL, Holly and Helen deposits roughly 1.2 miles north of Ruby Hill as well as further attempts to re-access the Ruby Hill mine and a largely as-yet unexploited deposit interpreted as a lower offset of the Ruby Hill deposit known as FAD. The FAD and Locan shafts were sunk to target depths but were plagued by unmanageable water inflows when crosscut mining intersected water bearing structures.

Modern mining began in 1992 with the discovery of the Archimedes Carlin-style gold deposit roughly 1.5 miles NNE of Ruby Hill and one mile NNW of Eureka. Archimedes has been mined using open pit methods from 1997-2002, 2007-2013, and 2020-2021. A pit wall failure in 2013 made continued large scale open pit mining unfeasible due to the economic environment at that time, but continued exploration delineated resources exploitable using underground mining methods. These resources are collectively called Archimedes Underground.

The mineral deposits being considered for economic extraction in this TR are the Archimedes Underground and the Mineral Point deposits.

The Mineral Point deposit was delineated by previous owners between 1992 and 2015 but has not been mined with the exception of limited areas at the southern end of the deposit exploited by the historic TL, Holly and Helen underground mines.

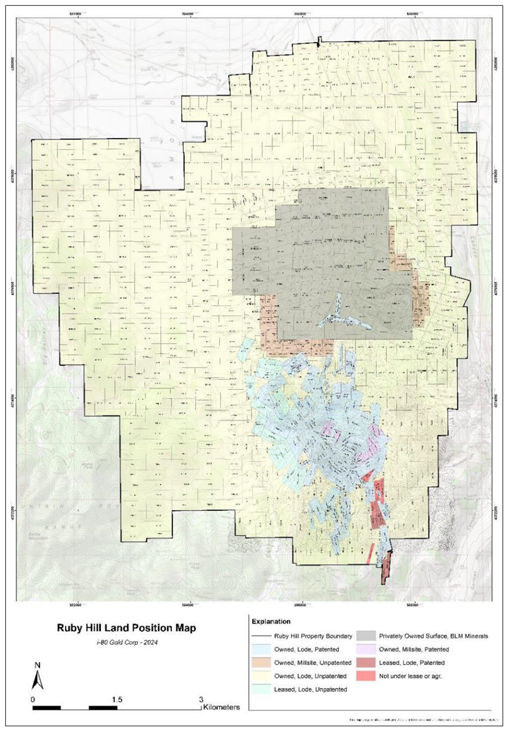

The property is located on owned fee land, owned and leased patented mining claims, and owned and leased unpatented mining claims. i-80 Gold purchased the northern portion of the Ruby Hill property, containing the Archimedes and Mineral Point deposits and small historic underground mines including TL, Holly and Helen from Waterton Global in 2021. The southern portion of the property, including the historic Ruby Hill mine and FAD deposit, was acquired by i-80 through a merger with Golden Hill Mining Corporation in 2022. The Ruby Hill complex comprises 10,608 acres from the Ruby Hill purchase and 3,229 acres from the Golden Hill Merger. i-80 differentiates the property for managerial/administrative purposes, referring to

| FORTE DYNAMICS, INC. |

P a g e | 19 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

the northern portion as Ruby Hill and the southern portion as Golden Hill. Collectively they are known as the Ruby Hill Project or the Ruby Hill Complex.

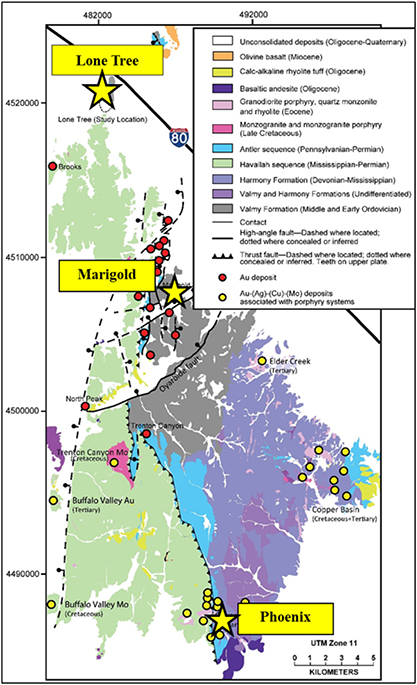

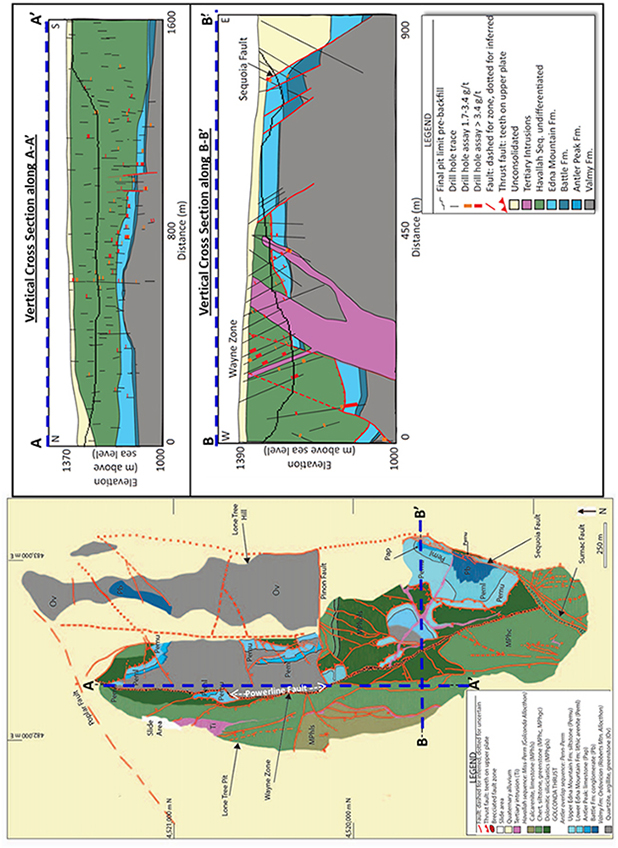

| 1.3 | Geology and Mineral Deposits |

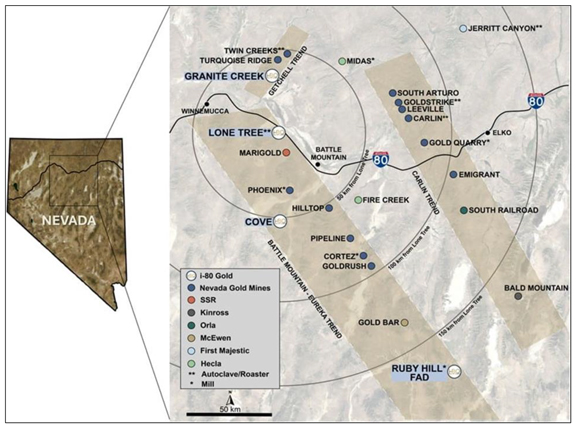

The Ruby Hill Project is located along the southeastern end of the Battle Mountain/Eureka gold trend. The Eureka gold mining district exposes a nearly continuous sequence of Cambrian and Ordovician sedimentary rocks approximately 10,000’ thick consisting primarily of carbonate units which are favorable for mineralization with subordinate shale and quartz sandstone.

Mineralization at Ruby Hill is characterized by intrusion-related distal-disseminated silver-gold, carbonate replacement base metal deposits, and skarn deposits that have been overprinted by younger Carlin-type gold mineralization. The main precious metal mineralization at Ruby Hill occurs in favorable lithostratigraphic units bound by high angle structures that are interpreted to have been conduits for hydrothermal fluids responsible for gold and silver mineralization. The earlier carbonate replacement base metal mineralization occurs in metamorphosed and skarn-altered limestone units proximal to Cretaceous intrusions.

| 1.3.1 | Distal Disseminated |

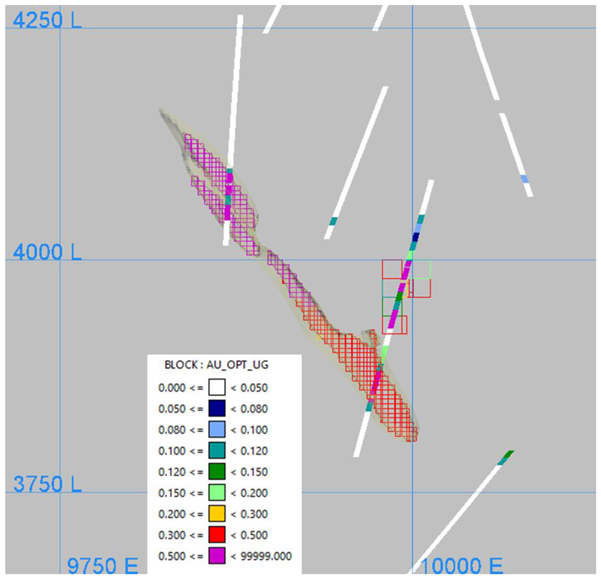

The Mineral Point deposit consists of gold and silver mineralization hosted by the Cambrian Hamburg dolomite in the nose of a broad anticline that plunges gently to the north-northwest and is bound to the east by the Holly Fault and to the west by the Spring Valley Fault. The Mineral Point Trend is 10,000 ft long, 2,400 ft wide and up to 500 ft thick. The top of the Mineral Point Trend is near surface at its south end and 500 ft below surface at its north end. The majority of the mineralization in the Mineral Point deposit is oxidized and has a high ratio of cyanide soluble to fire assay total gold. This deposit has not been mined and is the largest (and lowest grade) precious metal mineral resource in the Ruby Hill Project.

| 1.3.2 | Carlin Type |

The Archimedes deposit was discovered by Homestake Mining Company in 1992. The upper portions, called West and East Archimedes, were mined as the Archimedes open pit by Homestake followed by Barrick Gold Corporation from 1998 through 2015, and to a lesser extent by Ruby Hill Mining Company, LLC in 2020 and 2021. The Archimedes Underground remains unmined.

The West Archimedes deposit is hosted in the Ordovician Upper Goodwin limestone unit and is bound to the west by the Holly Fault. The zone strikes north-west and dips shallowly to the north-east. The deposit measures 2,000 ft along strike and 740 ft down dip and is up to 300 ft thick. The majority of West Archimedes was mined as an open pit before mining at East Archimedes. The mineralization in the West Archimedes deposit is oxidized and has a high ratio of cyanide soluble to fire assay total gold.

The East Archimedes Zone occurs east of the Graveyard Fault and proximal to the Graveyard Stock. Mineralization extends eastward from the West Archimedes Zone in the Upper Goodwin Formation and extends downward in the Lower Laminated and Lower Goodwin units along the contact with the Graveyard Stock. Silver and base metal grades are elevated in the East Archimedes zone in comparison with the other zones in the Ruby Hill Project in an envelope around the Blackjack zone replacement-style zinc mineralization described below. Mineralization in East Archimedes is roughly 1,200 ft wide and 1,200 ft long in plan and extends from surface where it is well defined by shallow drilling to several mineralized intersections over 1,800 ft below surface. The upper portion of the East Archimedes deposit, above an elevation of approximately 5,000 ft, is oxidized and transitional oxide-sulfide mineralization with a high ratio of cyanide soluble to total fire assay gold. The upper portion of the East Archimedes zone has been mined.

| FORTE DYNAMICS, INC. |

P a g e | 20 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

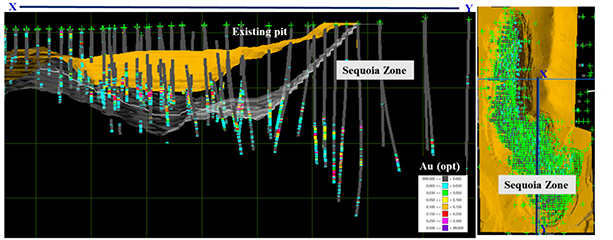

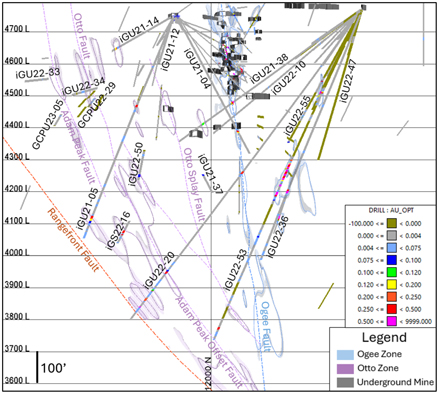

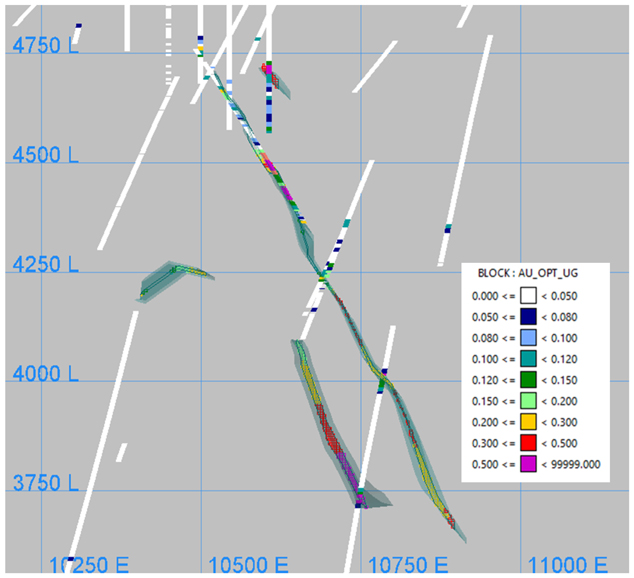

The Archimedes Underground lies below, and extends north of, the Archimedes pit. It includes multiple zones of Carlin-type mineralization characterized by mineralization controlling faults and differing lithologic units with increasing depth. Mineralization is variably oxidized and refractory.

The 426 zone occurs in the Lower Laminated unit of the Goodwin Formation and the upper part of the underlying basal Goodwin unit of the Goodwin Formation in the nose of a fold. The mineralized zone forms a rod-shaped body plunging shallowly to the northeast that is 1,400 ft long, 200 ft wide and 200 ft thick. The top of the zone is approximately 1,000’ below surface, but it is 500’ below the bottom of the current East Archimedes pit bottom. The majority of the higher-grade mineralization occurring in the Goodwin Formation Lower Laminated unit is sulfide-style mineralization with a low ratio of cyanide soluble to total fire assay gold but the lower portion of the zone that is hosted in the basal Goodwin Unit has a moderate cyanide soluble to total fire assay gold mineralization.

The Ruby Deeps zone is a north-south striking, shallowly east dipping zone of mineralization hosted in the Windfall Formation and Dunderberg Shale in proximity to bodies of Bullwhacker Sill intrusive bound by the Graveyard Fault to the east and the Holly Fault to the west. The zone is 2,400 ft long 500 ft wide and 600 ft thick. The top of the zone is 1,600 ft below surface and 1,000 ft below the bottom of the West Archimedes pit. Within the zone there are several tabular horizons of higher-grade mineralization that are 40 ft to 100 ft thick.

The 007 Zone is an exploration target controlled by the NE trending NS Fault. Higher-grade oxide Au mineralization within the fault zone has been intersected by two holes, Barrick’s RC hole P7, 55’ @ 0.291 Au opt and i-80’s core hole iRH22-18A, 43.9’ @ 0.276 Au opt. Three more i-80 holes west of the fault zone intersect mineralization extending west into the Bullwhacker member. The zone is untested to the north and south, currently projecting about 400 ft along strike, 100 ft along dip, and ranges from 10 ft thick where stratigraphically controlled to over 40 ft thick within the NS fault zone.

The 008 Zone is an early exploration stage target. It is stratigraphically controlled, lying near the top of the Windfall Formation in the hinge of an anticline bracketed by the 426 and NS faults. The anticline appears to have formed above an intrusive lens emplaced within the upper member of the Windfall Formation, stratigraphically higher than typical Cretaceous sill material, which typically intruded along the lower contact of the Windfall Fm. The 008 Zone is not well defined but currently is about 350 ft long by 200 ft wide by 15 ft thick.

| 1.3.3 | CRD and Skarn |

Skarn and CRD mineralization are known to occur on the property but are not being considered for extraction in the current analysis.

Polymetallic (Au-Ag-Pb-Zn) skarn and carbonate replacement deposit (CRD) mineralization is lithologically and structurally controlled. Skarn occurs at Blackjack and the Hilltop Fault-Graveyard Flats stock intersection, primarily within the carbonate-rich Ordovician and mid to upper Cambrian formations adjacent to the Graveyard Flats stock. Minor skarn and CRD mineralization occur within the Cretaceous intrusive units.

Blackjack is a pod of zinc skarn mineralization hosted by the Lower Goodwin Unit proximal to the Graveyard Flats stock within the East Archimedes Zone below the Archimedes pit. It has elevated lead, copper and silver due to CRD overprinting. The base metal-rich CRD and skarn mineralization has been overprinted by later Carlin-style gold mineralization resulting in locally higher-grade gold zones. It is approximately 750 ft wide, 750 ft long and 900 ft high. The Hilltop Fault-Graveyard Flats stock intersection is an exploration stage target and has not been well defined.

| FORTE DYNAMICS, INC. |

P a g e | 21 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

CRD mineralization tends to occur in the carbonate-rich formations along WNW trending faults. Examples include the historic Ruby Hill mine, the FAD deposit and the Hilltop exploration target.

| 1.4 | Metallurgical Testing and Processing |

| 1.4.1 | Archimedes Underground |

The Ruby Hill project encompasses several deposits and mineralization types hosting both precious and base metals. Historical production dates to 1998, primarily under Homestake Mining and Barrick Gold, with intermittent operations up to the current date.

Assumptions are based on historic and current metallurgical performance and the test work reports for oxide gold heap leaching, benchmarks, and the test work reports for zinc sulfide flotation. No detailed process design or production planning has been undertaken at this stage of the Project.

Historically, there have been three destinations for treatment of mineralization from the Ruby Hill Mine: (i) run of mine (ROM) and crushed mineralization to a heap leach pad, (ii) crushing and tank leaching with agglomerated tailings routed to the heap leach pad, and (iii) higher-grade sulfide mineralization (DSO) routed to Nevada Gold Mines Goldstrike Operation for autoclave processing.

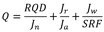

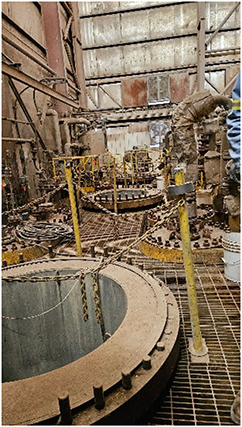

For the Archimedes Underground, production with be processed at a third party destination capable of processing refractory ore until such time that i-80 has refurbished the Lone Tree Autoclave facility. The third party destination is an autoclave circuit capable of processing 4 - 5 million tons per year and consists of primary crushing, two parallel semi-autogenous grinding (SAG) Mill-Ball Mill grinding circuits with pebble crushing, five parallel autoclaves capable of acid pressure oxidation (POX) and three of which are capable of alkaline POX, two parallel calcium thiosulphate (CaTS) leaching circuits with resin-in-leach (RIL), electrowinning for gold recovery, and a refinery producing doré bullion from both autoclave and roaster circuits.

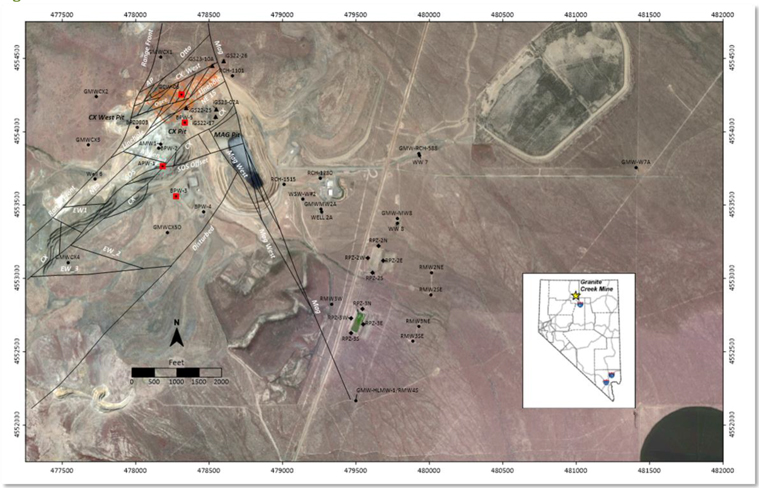

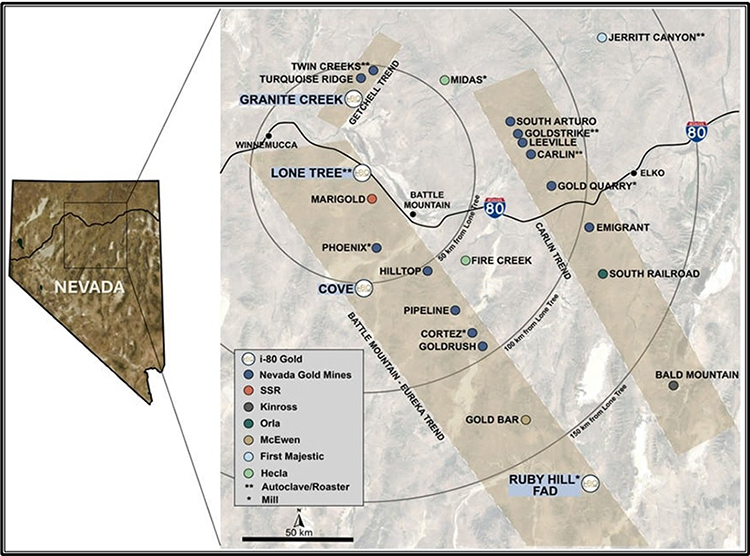

The Lone Tree Autoclave Facility is located immediately adjacent to i-80, approximately 12 miles west of Battle Mountain, 50 miles east of Winnemucca, and 120 miles west of Elko. The Lone Tree processing facilities were shut-down at the end of 2007. Since that time, the mills have been rotated on a regular basis to lubricate the bearings. In general, the facility is still in place with most of the equipment sitting idle. i-80 Gold Corp’s objective is to refurbish and restart the POX circuit and associated unit operations, including the existing oxygen plant, as it was operating before the shut-down, while meeting all new regulatory requirements. The flotation circuit is not being considered for restart. The POX circuit will have capability to operate under either acidic or basic conditions.

| 1.4.2 | Mineral Point Open Pit |

The Mineral Point project encompasses several deposits and mineralization types hosting both precious and base metals. Historical production dates to 1998, primarily under Homestake Mining and Barrick Gold, with intermittent operations up to the current date.

Generally, previous operating experience as well as the metallurgical test work confirms the amenability of oxide material to heap leaching for precious metals extraction. From 2004 to 2014, seven test work programs were carried out, by Kappes Cassiday Associates (KCA) focusing on column leaching and bottle roll leach testing of the oxide deposits, namely Archimedes, 426 and Mineral Point. Mineral Point estimated recoveries are based on alteration type ranging from 83% to 84.4% gold and 40% to 45.2% silver for oxide mineralization. The proposed process for Mineral Point Open Pit material is a two-stage crush conventional heap leach operations with a Merrill-Crowe processing facility.

| FORTE DYNAMICS, INC. |

P a g e | 22 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 1.5 | Mineral Resources |

| 1.5.1 | Archimedes Underground |

Practical Mining LLC estimated the Archimedes Underground mineral resource using all drilling and geological data available through October 31, 2022. Wood Canada Ltd. estimated and reported open pit mineral resources in the inaugural NI 43-101 Technical Report under i-80’s ownership of the Ruby Hill Project. All work, including drilling, done since the time of the inaugural report has targeted the 426, Ruby Deeps and other underground deposits and does not influence the Open Pit mineral resource reported on the October 2021 report. The open pit mineral resources reported in October 2021 are current and are restated herein.

Table 1-1: Summary of Archimedes Underground Mineral Resources at the End of the Fiscal Year Ended December 31, 2024

| Deposit |

Tonnes (000) |

Au (g/t) |

Ag (g/t) |

Au oz (000) |

Ag oz (000) |

|||||

| Indicated Mineral Resources | ||||||||||

|

426 |

899 | 6.9 | 0.8 | 199 | 22 | |||||

|

Ruby Deeps |

892 | 8.3 | 2.4 | 237 | 69 | |||||

|

Total Indicated |

1,791 | 7.6 | 1.6 | 436 | 92 | |||||

| Inferred Mineral Resources | ||||||||||

|

426 |

1,038 | 6.6 | 1.2 | 219 | 40 | |||||

|

Ruby Deeps |

3,150 | 7.6 | 2.4 | 769 | 246 | |||||

|

Total Inferred |

4,188 | 7.3 | 2.1 | 988 | 286 | |||||

Notes:

| 1. | Underground mineral resources have been estimated at a gold price of $2,175 per troy ounce and a silver price of $27.25 per ounce (Section 16.1). |

| 2. | Mineral resources have been estimated using pressure oxidation gold metallurgical recoveries of 96.8% and 89.5% for the 426 and Ruby Deeps deposits respectively. |

| 3. | Pressure oxidation cutoff grades are 5.06 and 5.48 Au g/t (0.148 and 0.160 opt) for the 426 and Ruby Deeps deposits respectively. |

| 4. | Detailed input mining, processing, and G&A costs are defined in Section 18.1. |

| 5. | Units shown are metric. |

| 6. | The contained gold ounces estimates in the mineral resource table have not been adjusted for metallurgical recoveries. |

| 7. | Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences. |

| 8. | A mineral resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| 9. | An inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. |

| 10. | Mineral resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant factors. |

| 11. | Mineral resources have an effective date of December 31, 2024. |

| 12. | The reference point for mineral resources is in situ. |

| FORTE DYNAMICS, INC. |

P a g e | 23 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 1.5.2 | Archimedes Open Pit |

The Archimedes deposit was previously mined by Homestake and Barrick for West Archimedes and East Archimedes respectively. Mining ceased after a pit wall failure. In this study an updated estimation of the Archimedes mineral resource has been developed Forte Dynamics, Inc (Forte), and the mining potential for continuing the surface exploitation of the deposit was evaluated to estimate a current open pit mineral resource estimate.

The Archimedes mineral resources are detailed in Table 1-2. Mineral resources are not Mineral Reserves and have not been demonstrated to have economic viability. There is no certainty that the mineral resource will be converted to Mineral Reserves. Inferred mineral resources do not have sufficient confidence that modifying factors can be applied to convert them to mineral reserves. The quantity and grade or quality is an estimate and is rounded to reflect the fact that it is an approximation. Quantities may not sum due to rounding.

Table 1-2: Summary of Archimedes Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024

| Deposit | Cutoff Au (g/t) |

Tonnes (000) |

Au (g/t) |

Ag (g/t) |

Au oz (000) |

Ag oz (000) |

||||||

| Indicated Mineral Resources | ||||||||||||

|

Archimedes Pit |

0.2 | 4,280 | 1.98 | 10.7 | 272 | 1,460 | ||||||

| 0.1 | 4,320 | 1.96 | 10.6 | 272 | 1,490 | |||||||

| 0.05 | 4,340 | 1.95 | 10.6 | 272 | 1,480 | |||||||

| Inferred Mineral Resources | ||||||||||||

|

Archimedes Pit |

0.2 | 820 | 1.18 | 8.9 | 31 | 230 | ||||||

| 0.1 | 870 | 1.12 | 8.5 | 31 | 250 | |||||||

| 0.05 | 880 | 1.11 | 8.5 | 31 | 250 | |||||||

Notes:

| 1. | Mineral resources have an effective date of December 31, 2024. |

| 2. | Mineral resources are the portion of Mineral Point that can be mined profitably by open pit mining method and processed by heap leaching. |

| 3. | Mineral resources are below an updated topographic surface (below Archimedes pit). |

| 4. | Mineral resources are constrained to economic material inside a conceptual open pit shell. The main parameters for pit shell construction are a gold price of $2,175/oz Au, a silver price of $26.00/oz, average gold recovery of 77%, average silver recovery of 40%, open pit mining costs of $3.31/tonne, heap leach average processing costs of $3.47/tonne, general and administrative cost of $0.83/tonne processed, gold refining cost of $1.85/oz, silver refining cost of $0.50, and a 3% royalty (Section 16.1). |

| 5. | Mineral resources are reported above a 0.1 g/t Au cutoff grade. Silver revenues were not considered in the cutoff grade. |

| 6. | Mineral resources are stated as in situ. |

| 7. | Mineral resources have not been adjusted for metallurgical recoveries. |

| 8. | Reported units are metric tonnes. |

| 9. | Reported table numbers have been rounded as required by reporting guidelines and may result in summation discrepancies. |

| FORTE DYNAMICS, INC. |

P a g e | 24 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 1.5.3 | Mineral Point Open Pit |

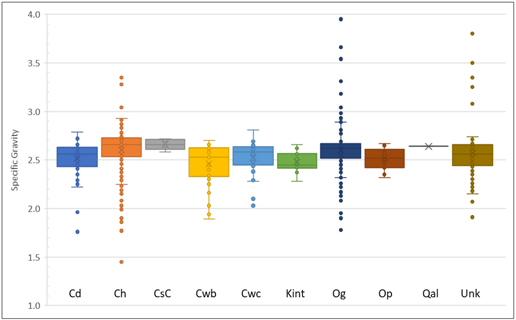

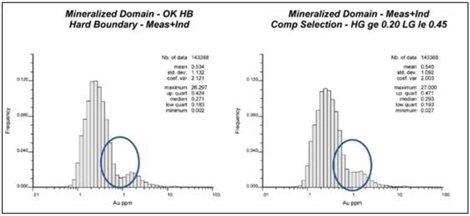

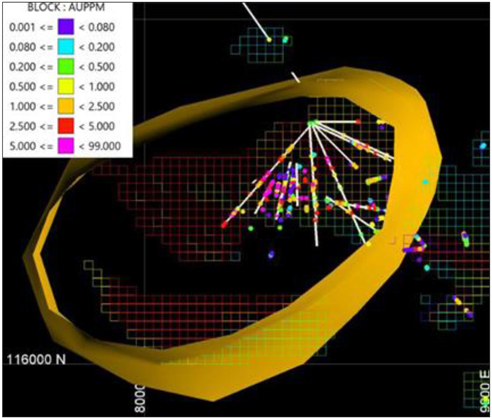

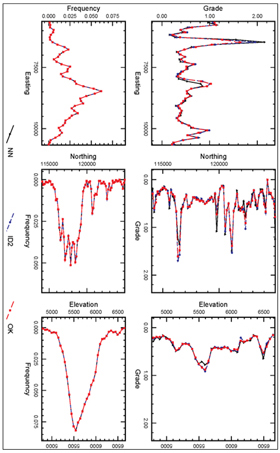

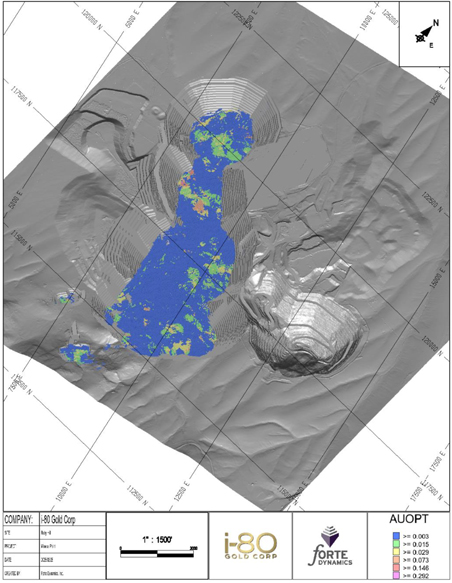

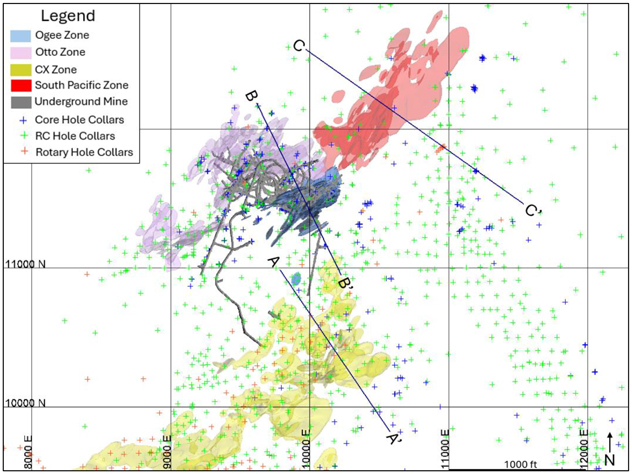

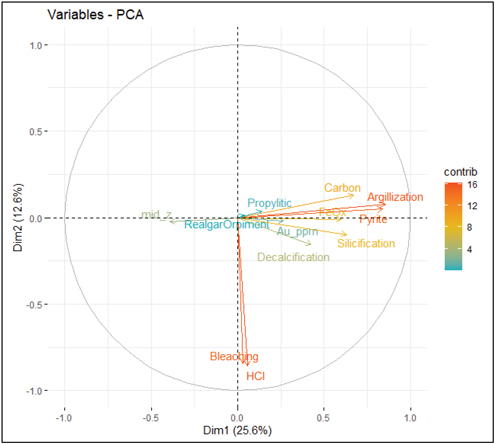

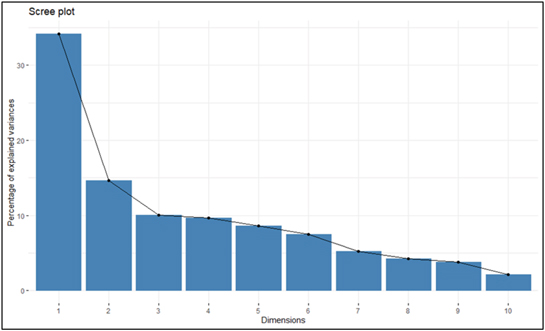

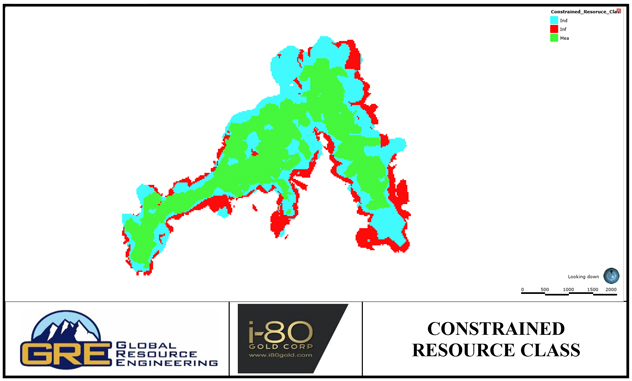

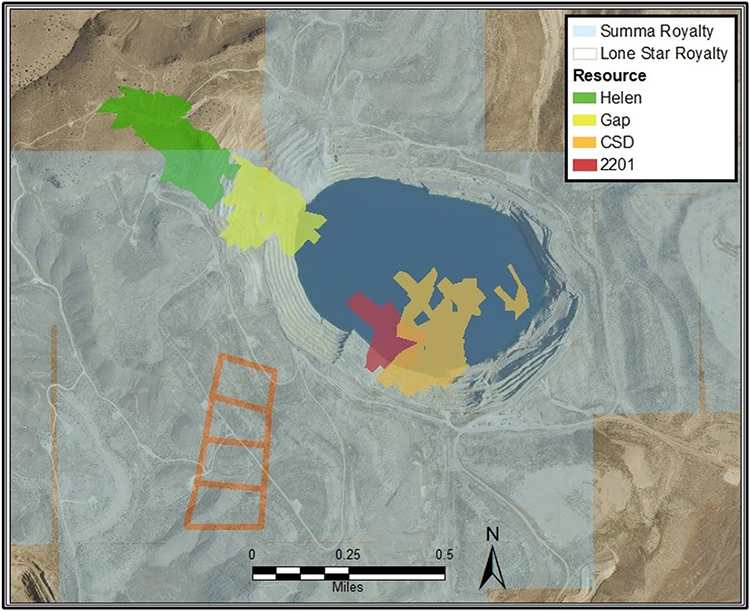

Forte reviewed the Mineral Point Open Pit mineral resource estimate completed by Wood in July 2021. The scope of the review included the informing drillhole and sample data, exploratory data analysis (EDA), input models, and the current topography. The scope also included a review of the grade estimation methodology and model validation, bulk density determination, resource classification, reasonable prospects for eventual economic extraction (RPEEE), and the statement of mineral resources.

Upon completion of the Mineral Point open pit resource review, Forte made some slight modifications to the Wood block model. Note that the estimated block grades were not altered or changed. Updates included updating the block model with the current topographic surface, recoding the Wood 2021 lithological model to the block model along with an assigned specific gravity (SG) values based on lithology code, and updated values and conversions for tonnage factor. Forte also used an updated pit shell to constrain and report the mineral resource under the requirements for RPEEE, which was based on a 2024 Scoping Study completed by Forte and used for other work completed in this Technical Report Summary.

The Mineral Point Open Pit mineral resources are detailed in Table 1-3. Mineral resources are not mineral reserves and have not been demonstrated to have economic viability. There is no certainty that the mineral resource will be converted to mineral reserves. Inferred mineral resources do not have sufficient confidence that modifying factors can be applied to convert them to mineral reserves. The quantity and grade or quality is an estimate and is rounded to reflect the fact that it is an approximation. Quantities may not sum due to rounding.

Table 1-3: Summary of Mineral Point Open Pit Mineral Resources at the End of the Fiscal Year Ended December 31, 2024

| Deposit |

Tonnes (000) |

Au (g/t) |

Ag (g/t) |

Au oz (000) |

Ag oz (000) |

|||||

| Indicated Mineral Resources | ||||||||||

|

Mineral Point |

216,982 | 0.48 | 15.0 | 3,376 | 104,332 | |||||

|

Total Indicated |

216,982 | 0.48 | 15.0 | 3,376 | 104,332 | |||||

| Inferred Mineral Resources | ||||||||||

|

Mineral Point |

194,442 | 0.34 | 14.6 | 2,117 | 91,473 | |||||

|

Total Inferred |

194,442 | 0.34 | 14.6 | 2,117 | 91,473 | |||||

Notes:

| 1. | Mineral resources have an effective date of December 31, 2024. |

| 2. | Mineral resources are the portion of Mineral Point that can be mined profitably by open pit mining method and processed by heap leaching. |

| 3. | Mineral resources are below an updated topographic surface. |

| 4. | Mineral resources are constrained to economic material inside a conceptual open pit shell. The main parameters for pit shell construction are a gold price of $2,175/oz Au, a silver price of $26.00/oz, average gold recovery of 77%, average silver recovery of 40%, open pit mining costs of $3.31/tonne, heap leach average processing costs of $3.47/tonne, general and administrative cost of $0.83/tonne processed, gold refining cost of $1.85/oz, silver refining cost of $0.50, and a 3% royalty (Section 16.1). |

| 5. | Mineral resources are reported above a 0.1 g/t Au cutoff grade. |

| 6. | Mineral resources are stated as in situ. |

| 7. | Mineral resources have not been adjusted for metallurgical recoveries. |

| 8. | Reported units are metric tonnes. |

| 9. | Reported table numbers have been rounded as required by reporting guidelines and may result in summation discrepancies. |

| FORTE DYNAMICS, INC. |

P a g e | 25 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

| 1.6 | Mining, Infrastructure, and Project Schedule |

| 1.6.1 | Archimedes Underground |

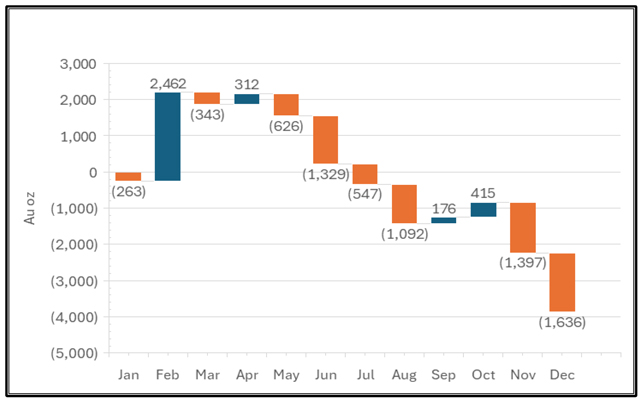

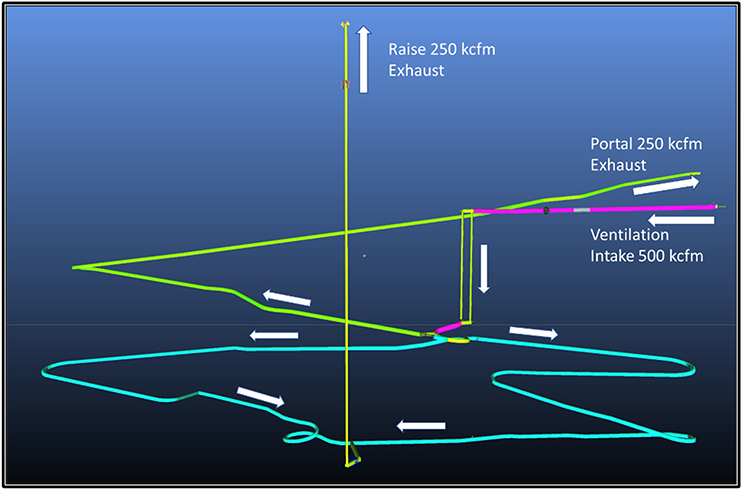

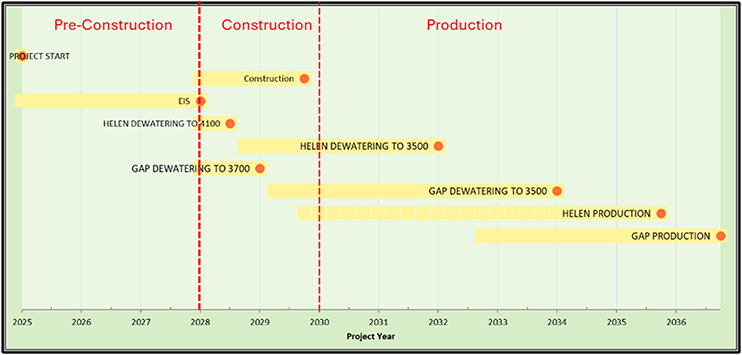

Permitting approval for development and mining above the 5100 elevation is anticipated by the end of Q2 2025 and underground development will commence immediately thereafter. This is consistent with previously approved permits for mining the Archimedes open pits. Production mining in the 426 deposit will start in 2026 and continue through 2027 with oxide material processed on site in the existing heap leach facility and refractory material sent to a third party for toll processing. Permits for mining below the 5100 elevation are anticipated in the second quarter of 2027 with development mining for the Ruby Deeps deposit beginning shortly thereafter.

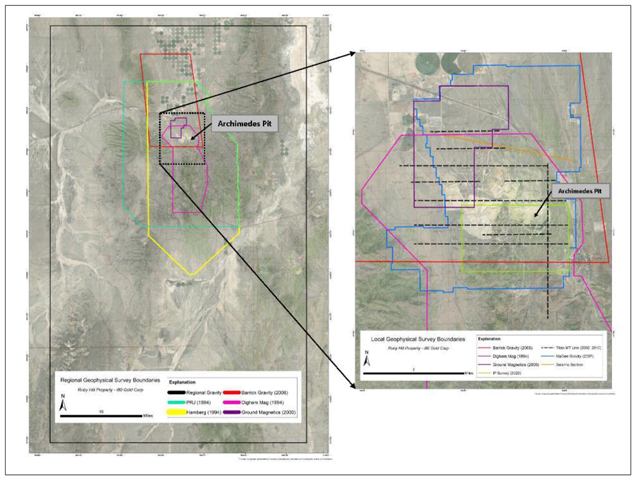

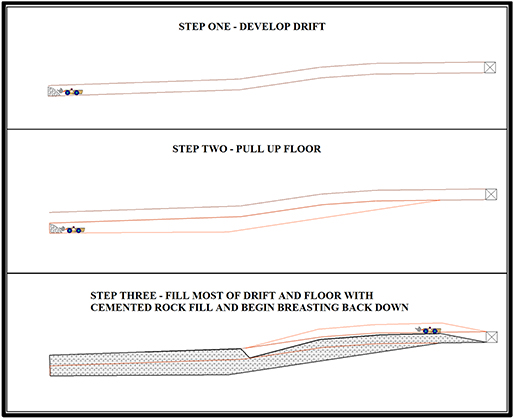

Mining conditions anticipated are typical for northern Nevada underground mines. Long hole open stoping will be the primary mining method and will be supplemented with underhand drift and fill mining where deposit geometry dictates. Mining will be undertaken by a qualified contractor, eliminating the need to recruit a workforce and purchase mining equipment.

Transportation, electrical and support infrastructure already exists at Ruby Hill. Additional infrastructure requirements are limited to:

| ● | Overhead power line and transformer at the portal site. |

| ● | Backfill and shotcrete plants. |

| ● | Fuel and oil storage near the portal. |

| ● | Contractor’s maintenance facility and office. |

| ● | Mine water supply tank. |

| 1.6.2 | Archimedes Open Pit |

The Archimedes Open Pit mineral resource has not been evaluated for surface mining.

| 1.6.3 | Mineral Point Open Pit |

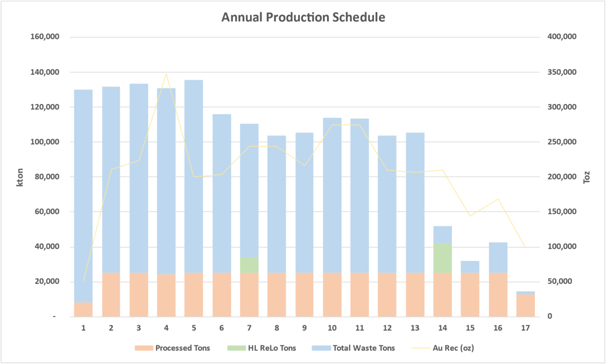

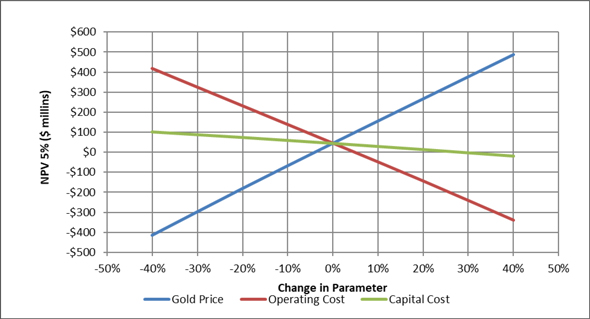

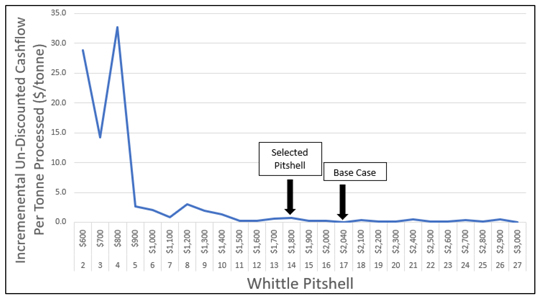

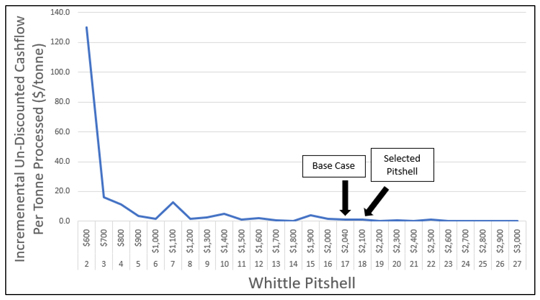

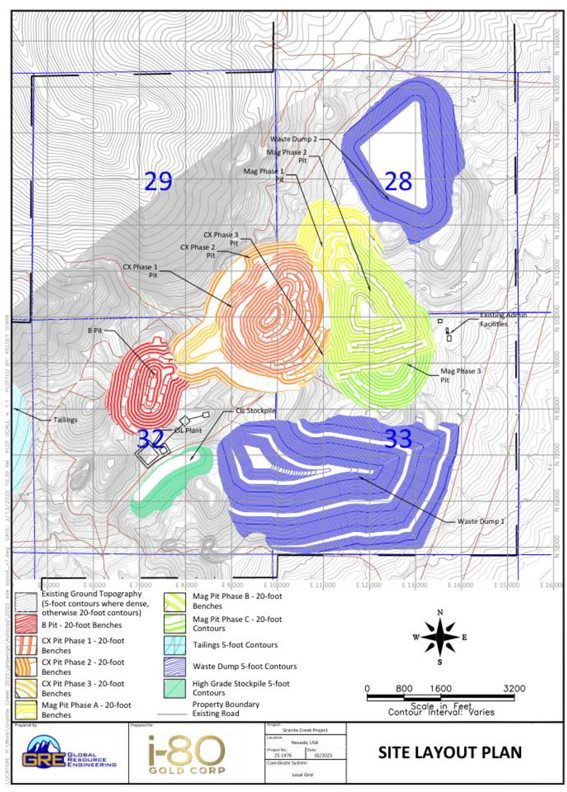

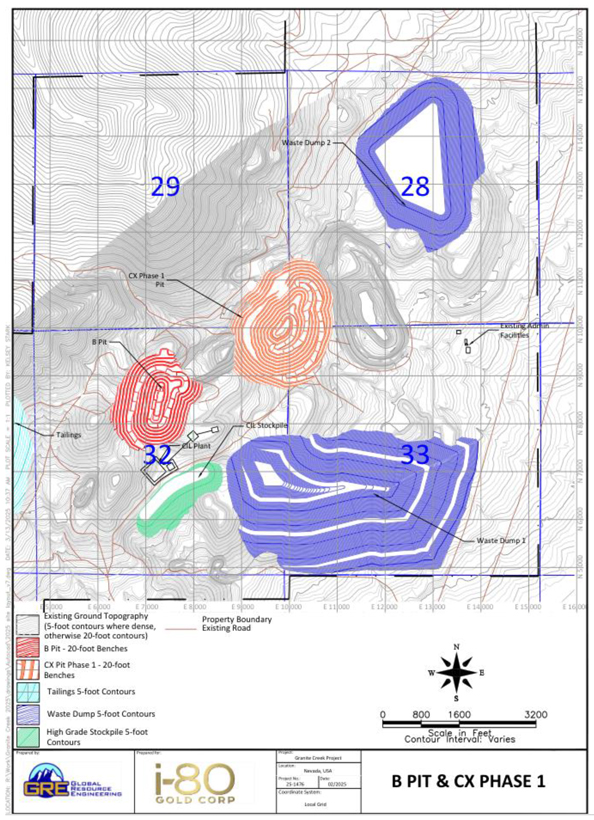

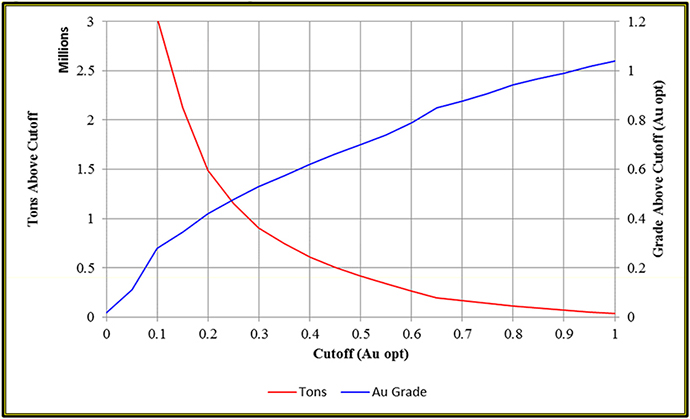

The Mineral Point Project, operated by i-80 Gold, is planned as an open pit mining operation using conventional equipment, targeting a processing rate of 68,000 tons per day. While there is currently no Mineral Reserve Estimate, the project contains indicated and inferred mineral resources. Pit optimization using Hexagon Mine Plan software identified an optimal pit shell (LG72) with a 78% revenue factor, containing 4.98 million ounces of gold and 195.5 million ounces of silver at an average stripping ratio of 2.8:1. Key economic parameters include a gold price of $2,175/toz, silver price of $27.25/toz, and heap leach average recovery rates of 78% for gold and 41% for silver. The calculated cutoff grade for gold is 0.011 oz/ton, ensuring the extraction of economically viable material.

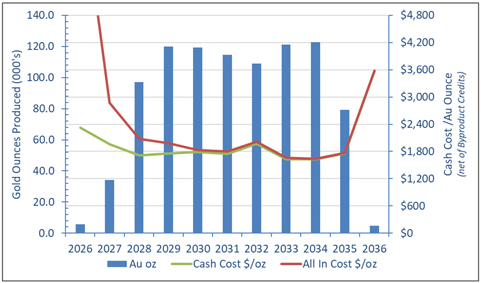

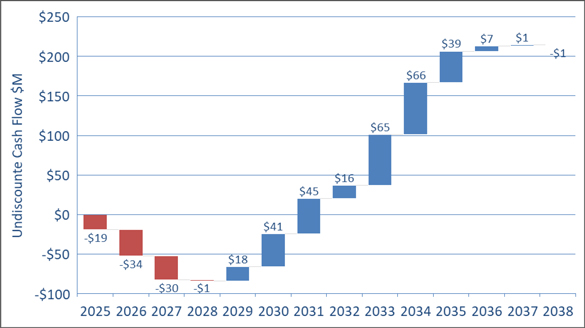

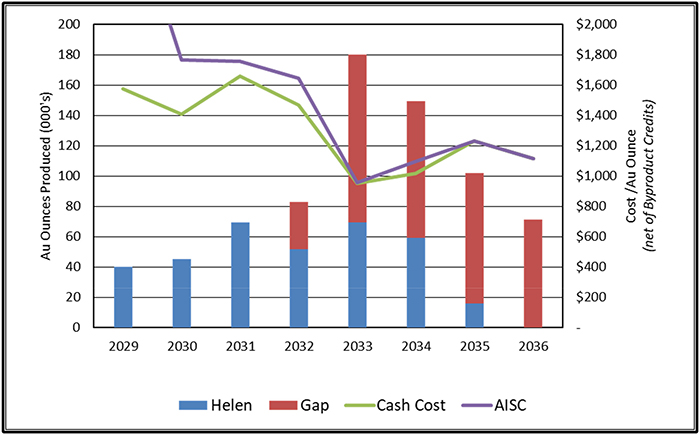

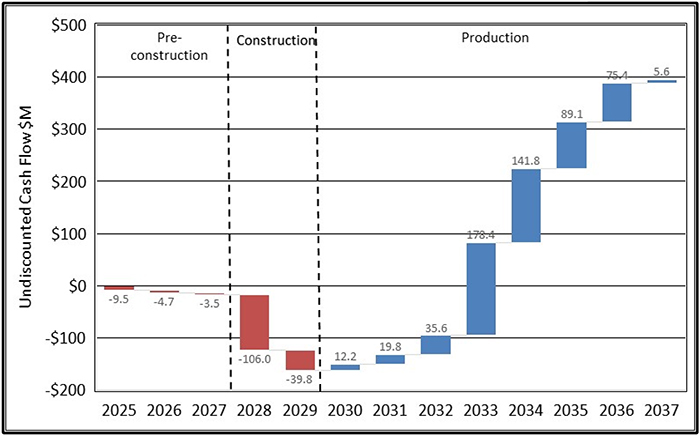

The mine design consists of nine pit phases, with mining benches at 50-foot intervals and a projected Life-of-Mine (LOM) of 17 years. The operation will rely on a mining fleet comprising two rope shovels, (2) hydraulic shovels, (26) haul trucks, and various support equipment. Annual production is expected to average 4.5 million ounces of gold and 177.3 million ounces of silver. Dewatering will be required in later mine stages, though the extent is yet to be determined.

The project will leverage existing infrastructure from previous mining activities at the Ruby Hill site, including site access, haul roads, waste rock storage, and power supply, with necessary upgrades. Key processing facilities include a crushing and stacking system, a heap leach pad, and a Merrill Crowe plant for gold and silver recovery. The heap leach facility will be developed in five phases, with a total capacity of 466.8 million

| FORTE DYNAMICS, INC. |

P a g e | 26 of 362 | i-80 Gold Corp. |

|

|

March 29, 2025 | |

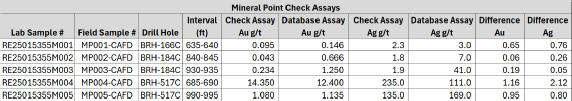

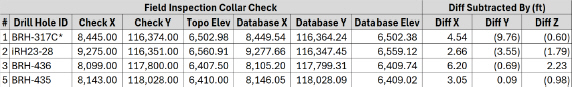

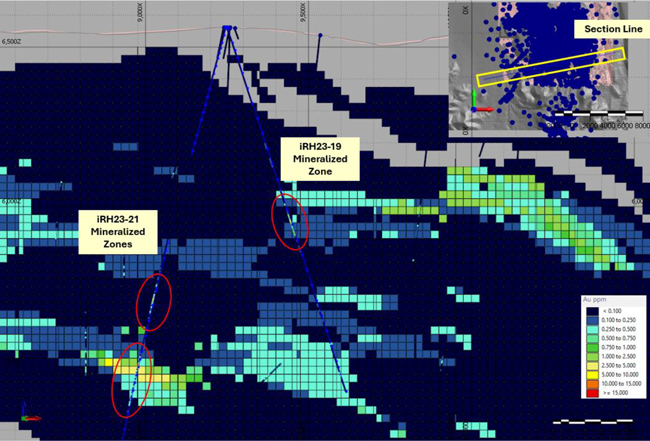

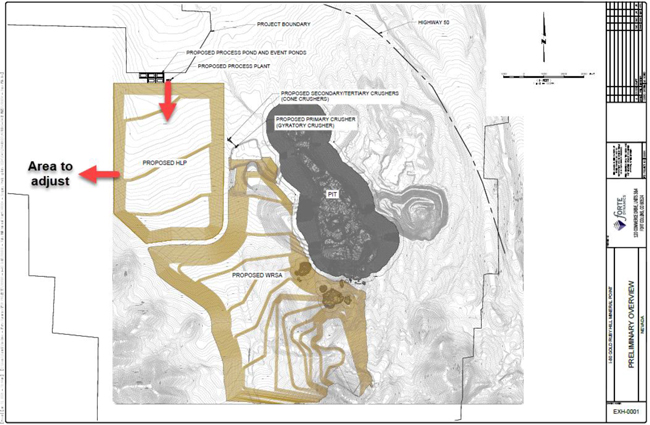

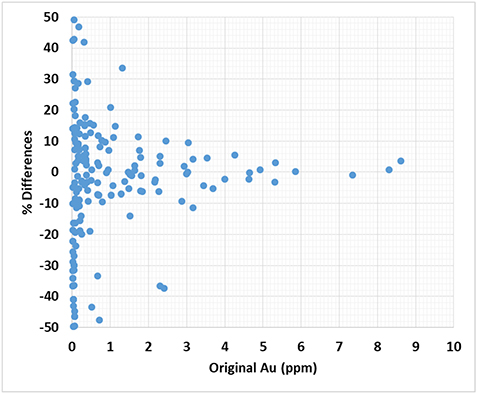

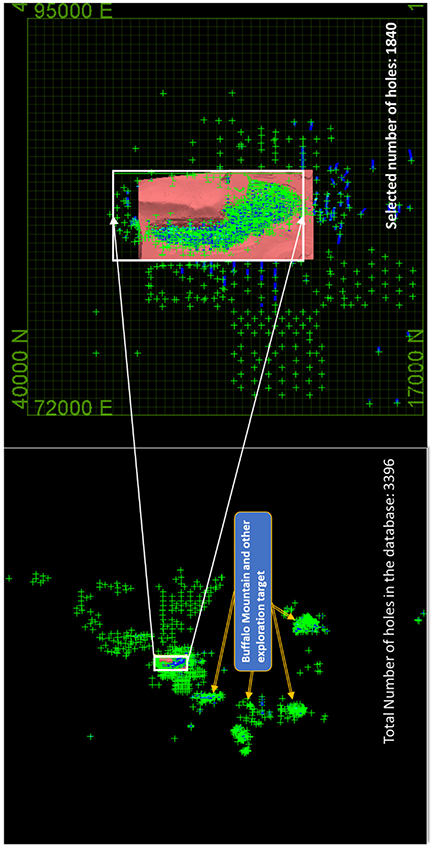

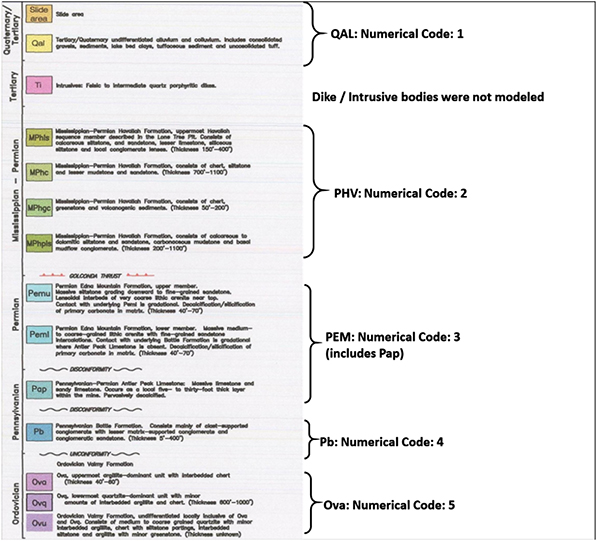

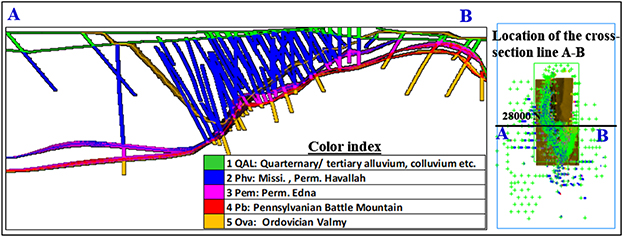

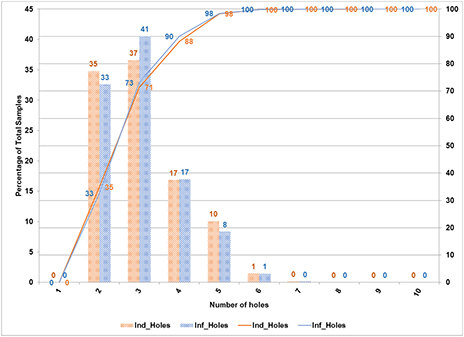

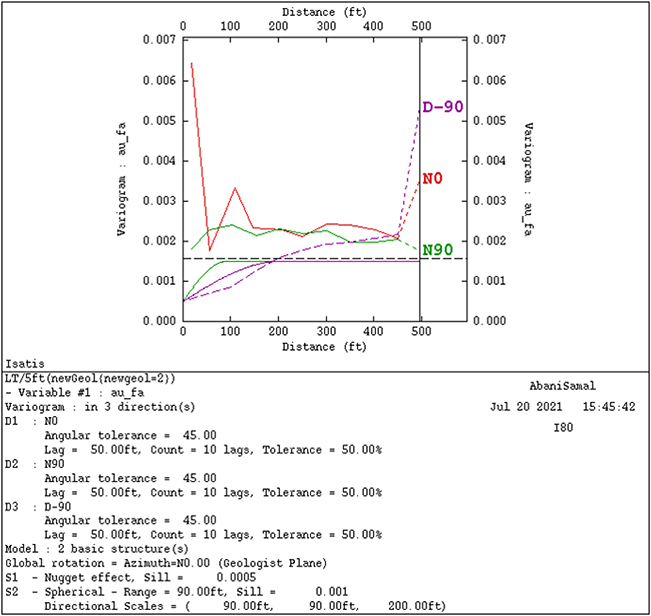

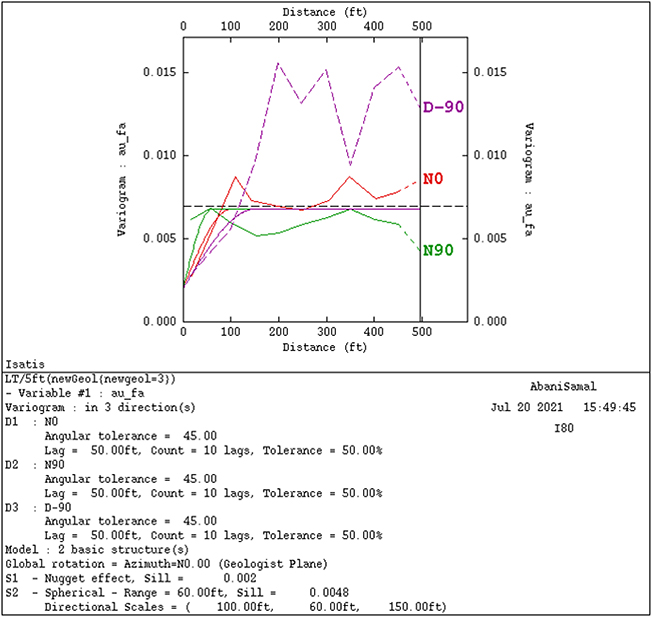

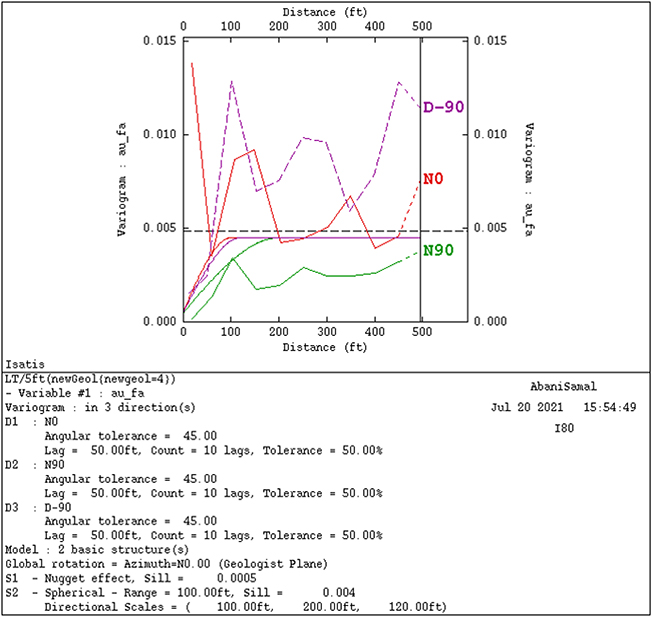

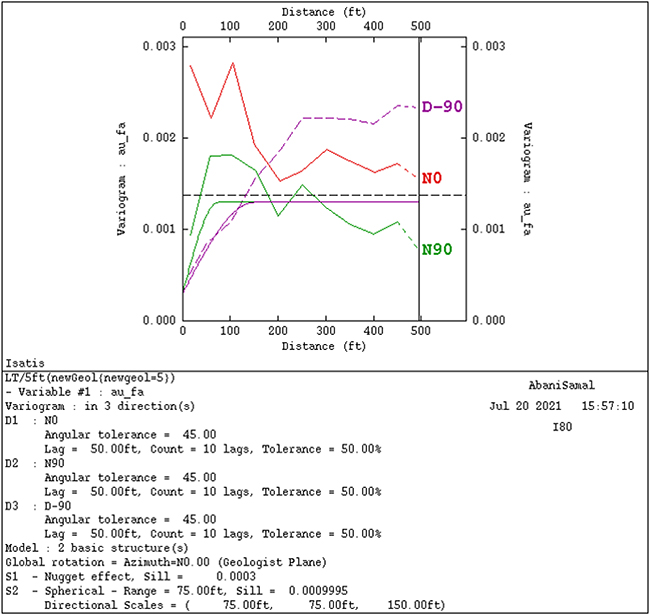

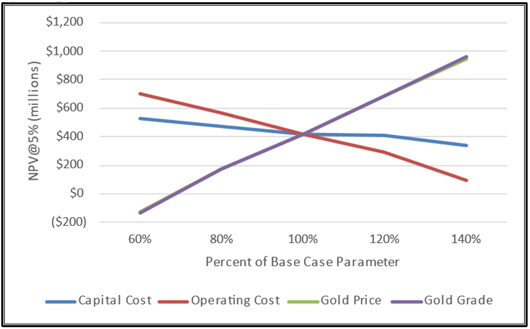

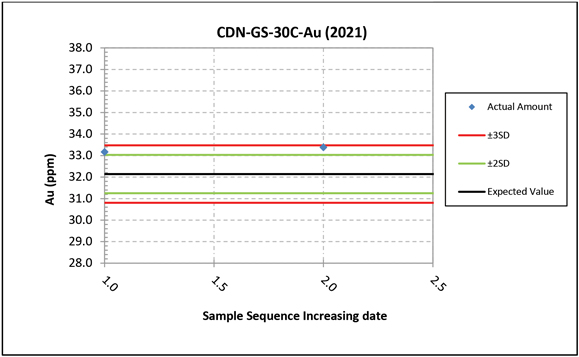

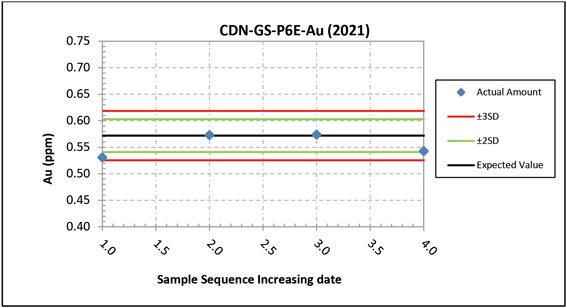

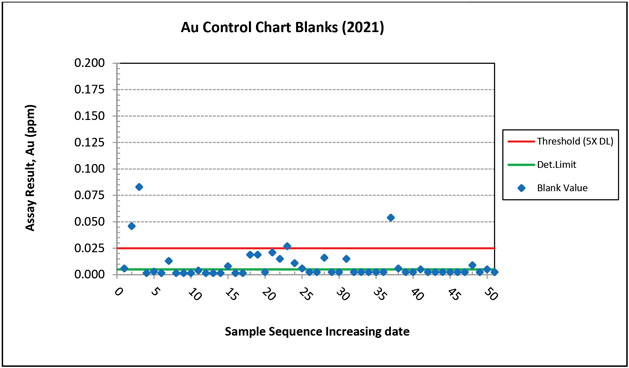

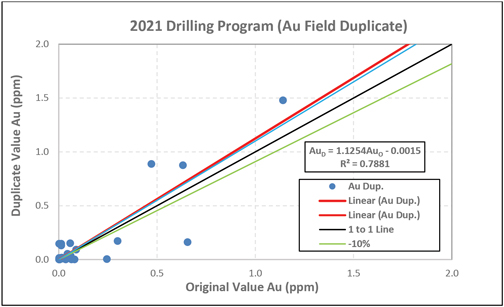

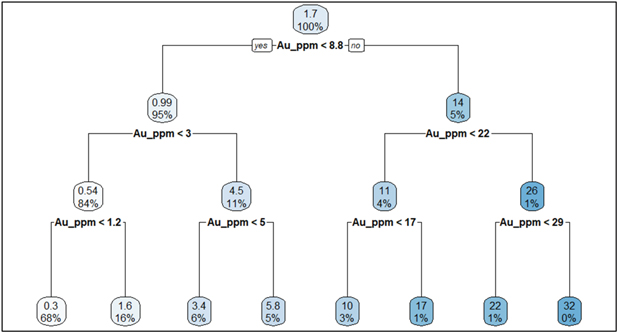

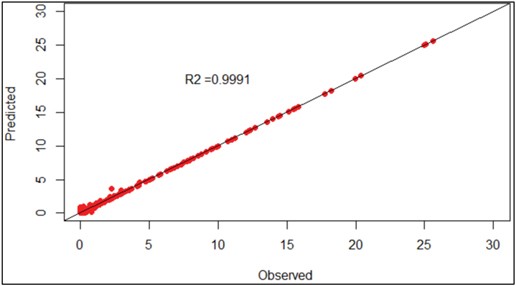

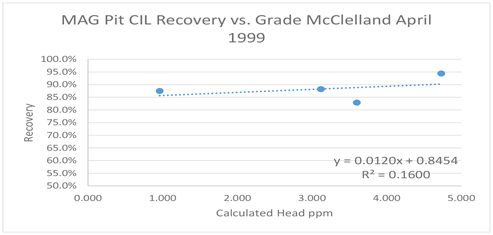

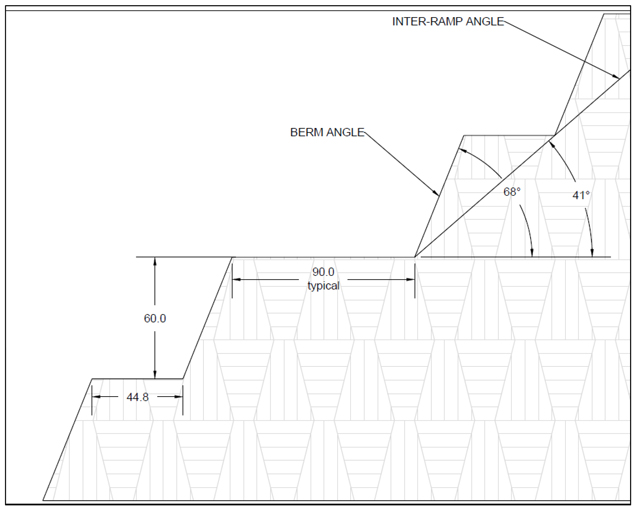

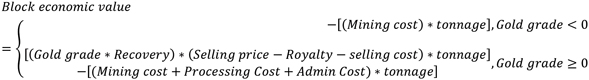

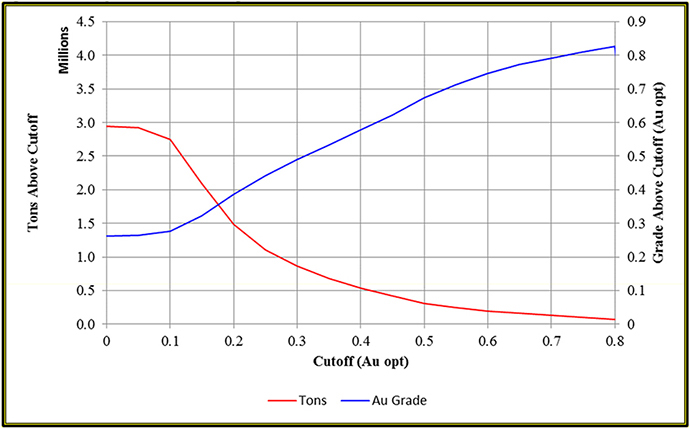

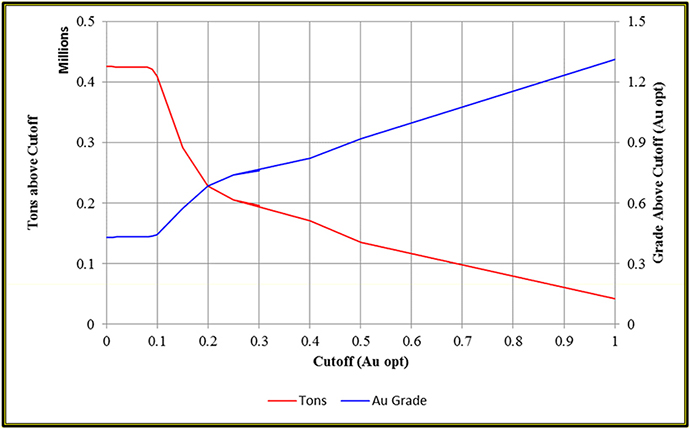

tons, while a Merrill Crowe plant will process pregnant leach solution at a rate of 11,500 gallons per minute, ultimately producing doré bars for off-site refining.