Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

Common shares, par value EUR 0.12 per share |

AEG |

New York Stock Exchange |

||

5.500% Fixed-to-Floating Subordinated Notes due 2048 |

AG48 |

New York Stock Exchange |

||

5.100% Subordinated Notes due 2049 issued by Aegon Funding Company LLC |

AEFC |

New York Stock Exchange |

||

Helping people live their best lives annual report on Form 20-F 2024

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Cross reference table Form 20-F

| 1 | Identity of Directors, Senior Management and Advisers | n.a. | ||

| 2 | Offer Statistics and Expected Timetable | n.a. | ||

| 3 | Key Information | |||

| 3A | Selected financial data | 100-101 | ||

| 3B | Capitalization and indebtedness | n.a. | ||

| 3C | Reasons for the offer and use of proceeds | n.a. | ||

| 3D | Risk factors | 332-355 | ||

| 4 | Information on the Company | |||

| 4A | History and development of the Company | 8-11, 17-21, 91-92, 127, 277-278, 483-484 |

||

| 4B | Business overview | 8-9, 314-331 | ||

| 4C | Organizational structure | 278-279 | ||

| 4D | Property, plants and equipment | 357 | ||

| 4A | Unresolved Staff Comments | n.a. | ||

| 5 | Operating and Financial Review and Prospects | |||

| 5A | Operating results | 102-106, 111-118, 180-181 | ||

| 5B | Liquidity and capital resources | 85-90, 203-205, 228, 250-251, 259-261, 271-273, 359 |

||

| 5C | Research and development, patent and licenses etc. | n.a. | ||

| 5D | Trend information | 13-21, 41-42, 100-106 | ||

| 5E | Critical Accounting Estimates | 149-151, 242-247 | ||

| 6 | Directors, Senior Management and Employees | |||

| 6A | Directors and senior management | 53-59, 61 | ||

| 6B | Compensation | 66-77, 198-200, 280-281 |

||

| 6C | Board practices | 47-51, 60-65, 72 | ||

| 6D | Employees | 358 | ||

| 6E | Share ownership | 73-77, 199-200, 280-281 |

||

| 6F | Disclosure of a registrant’s action to recover erroneously awarded compensation | n.a. | ||

| 7 | Major Shareholders and Related Party Transactions | |||

| 7A | Major shareholders | 49, 298-301 | ||

| 7B | Related party transactions | 280-282 | ||

| 7C | Interest of experts and counsel | n.a. | ||

| 8 | Financial Information | |||

| 8A | Consolidated Statements and Other Financial Information | 120-126, 302-307, 359 |

||

| 8B | Significant Changes | n.a. | ||

| 9 | The Offer and Listing | |||

| 9A | Offer and listing details | 360 | ||

| 9B | Plan of distribution | n.a. | ||

| 9C | Markets | 360 | ||

| 9D | Selling shareholders | n.a. | ||

| 9E | Dilution | n.a. | ||

| 9F | Expenses of the issue | n.a. | ||

| 10 | Additional Information | |||

| 10A | Share capital | n.a. | ||

| 10B | Memorandum and articles of association | 361-363 | ||

| 10C | Material contracts | 365 | ||

| 10D | Exchange controls | 366 | ||

| 10E | Taxation | 367-370 | ||

| 10F | Dividends and paying agents | n.a. | ||

| 10G | Statement by experts | n.a. | ||

| 10H | Documents on display | 484 | ||

| 10I | Subsidiary Information | n.a. | ||

| 10J | Annual report to security holders | n.a. | ||

| 11 | Quantitative and Qualitative Disclosures About Market Risk | 78-84, 88-90, 151-178, 242-249 | ||

| 12 | Description of Securities Other than Equity Securities | n.a. | ||

| 13 | Defaults, Dividend Arrearages and Delinquencies | n.a. | ||

| 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | n.a. | ||

| 15 | Controls and Procedures | 94-95 | ||

| 16A | Audit committee financial expert | 63 | ||

4 | Annual Report on Form 20-F 2024

| 16B | Code of Ethics | 93 | ||

| 16C | Principal Accountant Fees and Services | 371 | ||

| 16D | Exemptions from the Listing Standards for Audit Committees | n.a. | ||

| 16E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 372 | ||

| 16F | Change in Registrant’s Certifying Accountant | 61 | ||

| 16G | Corporate Governance | 47-51, 364 | ||

| 16H | Mine Safety Disclosure | n.a. | ||

| 16I | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | n.a. | ||

| 16J | Insider Trading Policies | 374 | ||

| 16K | Cybersecurity | 373 | ||

| 17 | Financial Statements | n.a. | ||

| 18 | Financial Statements | 120-296, 302-307 | ||

| 19 | Exhibits | 485 | ||

| Annual Report on Form 20-F 2024 | 5 |

Contents

Our purpose

People are living for longer, and at Aegon we welcome the possibilities that this brings. We see increased longevity and the resulting changing life patterns as opportunities for our customers, our employees, and society.

As recently as the late 20th century, life consisted of three stages: approximately 20 years of education, 40 years of work, and a short retirement of 15 to 20 years. Since then, life expectancy has increased around the world. This means we need to rethink what a life should look like: when we study, work, take career breaks, and switch careers. The idea of a standard path no longer applies: there are as many options as there are lives.

Longer lives bring new challenges. But the old associations with aging – of frailty and inactivity – are often being replaced by the expectation that the years after 60 can be the most rewarding.

Across all our markets, people are looking for companies that will support them in living longer, more varied lives, while also contributing towards a better world. At Aegon, we aim to do this by offering products and services through our various businesses that support society’s transition from the traditional three-stage life to a multi-stage one, so that people from all walks of life can make the most of their lives. That is why we are guided and united by a single, clear purpose: Helping people live their best lives.

| About Aegon |

||||

Welcome to Aegon’s Annual Report on Form 20-F

Welcome to Aegon’s Annual Report on Form 20-F for the year ended December 31, 2024. This report gives an overview of how we managed our business over the past year. The report outlines our business environment and material topics and how we address these through our purpose, vision, and strategy to steer our business and create long-term value for our stakeholders. The report also contains the 2024 consolidated financial statements and standalone financial statements of Aegon Ltd.

This document contains Aegon’s Annual Report as filed on Form 20-F (also referred to in this document as “Annual Report”) with the United States Securities and Exchange Commission (SEC).

We have prepared the Annual Report on Form 20-F in accordance with the requirements of the U.S. Securities and Exchange Commission and the International Financial Reporting Standards, as issued by the IASB.

Aegon prepares its consolidated financial statements in accordance with IFRS and with Part 9 of Book 2 of the Dutch Civil Code for purposes of reporting with the SEC, including financial information contained in this Annual Report. Aegon’s accounting policies and its use of various options under IFRS are described in note 2 to the consolidated financial statements.

The report also contains the 2024 sustainability statement prepared in accordance with the European Sustainability Reporting Standards, as referred to in the EU Accounting Directive, and with the specifications adopted pursuant to Article 8(4) of the EU Taxonomy Regulation.

Due to the completion of the sale of Aegon the Netherlands as per July 4, 2023, the EU “carve out”, related to fair value hedge accounting for portfolio hedges of interest rate risk (fair value macro hedges), is no longer applied by Aegon as of that date.

This Annual Report includes the following non-IFRS financial measures: operating result and addressable expenses. The reconciliation of operating result to the most comparable IFRS measure is presented in note 5 ‘Segment information’ of the consolidated financial statements. Operating result is calculated by consolidating on a proportionate basis

Aegon’s joint ventures and associated companies, except for its associate a.s.r. Note 5 ‘Segment information’ also includes information on the non-IFRS financial measure operating result after tax. This is the after-tax equivalent of operating result. The reconciliation of addressable expenses to operating expenses, the most comparable IFRS measure, is presented in the section Expenses under Results of Operations. Operating expenses are all expenses associated with selling and administrative activities (excluding commissions). Addressable expenses are calculated by excluding the following items from operating expenses: amounts attributable to insurance acquisition cash flows, restructuring expenses (including expenses related to the operational improvement plan), expenses in joint ventures and associates and expenses related to acquisitions and disposals. Addressable expenses are reported on a constant currency basis.

This report also conforms to Bermuda laws and regulations. As Aegon qualifies as a non-resident company under the Dutch Act on Non-Resident Companies, this report has been drawn up in line with the applicable requirements laid down in Part 9 of Book 2 of the Dutch Civil Code. In line with these requirements, the Board Report consists of the chapters “About Aegon” and “Governance and risk management”, the information in “Financial information” prior to the financial statements, and the “Sustainability statement”. Throughout this document, Aegon Ltd. is also referred to as either “Aegon”, “the Holding”, or “the company”. For the purposes of this report, “member companies” shall mean, with respect to Aegon Ltd., those companies consolidated in accordance with applicable Dutch and Bermuda legislation relating to consolidated accounts.

References to “NYSE” and “SEC” relate to the New York Stock Exchange and the U.S. Securities and Exchange Commission respectively. Aegon uses “EUR” and “euro” when referring to the lawful currency of European Monetary Union member states; “USD” and “US dollar” when referring to the lawful currency of the United States, and “GBP”, “UK pound”, and “pound sterling” when referring to the lawful currency of the United Kingdom. If you have comments or suggestions regarding this report, please contact our headquarters in The Hague, the Netherlands. Contact details can be found at www.aegon.com.

| Annual Report on Form 20-F 2024 | 7 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Who we are

Aegon is an international financial services group whose origins date back to the first half of the 19th century. Our ambition is to build leading businesses that offer their customers investment, protection, and retirement solutions, always with a clear purpose: Helping people live their best lives.

This ambition requires a sustainable, future-oriented business that actively considers all stakeholders, including our customers, employees, investors, business partners, and society at large. Our headquarters are located in The Hague, the Netherlands, while the legal seat of the holding company, Aegon Ltd., is located in Hamilton, Bermuda.

Business overview

Aegon’s portfolio includes fully owned businesses in the Americas and the United Kingdom, a global asset manager, and a life insurer that serves affluent and high-net-worth individuals predominantly in Asia. Aegon also has insurance joint ventures in Spain & Portugal, China, and Brazil, and asset management partnerships in France and China, as well as an almost 30% strategic shareholding in the Dutch insurance company a.s.r.

Aegon allocates capital towards profitable opportunities across these markets and leverages the talent, knowledge, processes, and technologies of its different businesses. Aegon derives its revenue and earnings from insurance premiums, investment returns, fees, and commissions. Aegon is growing its direct and affiliated distribution capabilities to engage directly with customers.

| Customers 1

24.4 million |

Women in senior management 1, 3

39% |

|

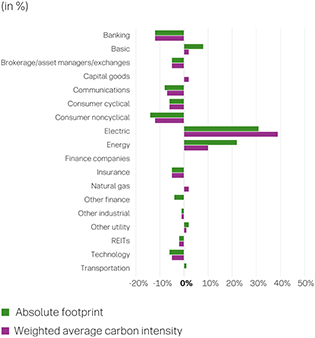

| Weighted average carbon intensity 4 (tCO2e/EURm revenue)

222 |

Annual employee engagement score 3

79% |

|

| Operating result 2, 5

EUR 1,485 million |

Free cash flow 2

EUR 759 million |

|

| Cash Capital at Holding 1

EUR 1.7 billion |

Revenue-generating investments 1

EUR 897 billion |

|

| 1 | At year end. |

| 2 | Full year result. |

| 3 | Refer to the Creating Sustainable Value chapter in the Employees section and onward for further information. |

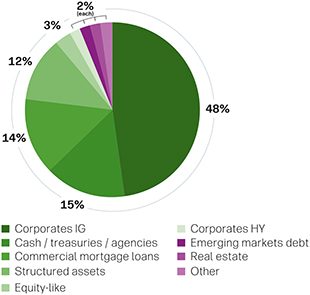

| 4 | Metric tons CO2e/EURm revenue of corporate fixed income and listed equity general account assets. For details on the methodology used, see our TCFD disclosure (Methodology). |

| 5 | Non-IFRS financial measure. For reconciliation to the most directly comparable IFRS measure, see note 5 Segment information. |

8 | Annual Report on Form 20-F 2024

| About Aegon |

||||

Our businesses

In the Americas, Aegon operates primarily under two brands. The first, Transamerica, is a leading provider of life insurance, retirement, and investment solutions, which serves millions of customers with a strong track record of making financial services available to the many, not just the few. The second, World Financial Group (WFG), is an affiliated insurance distribution network of over 86,000 independent agents who primarily serve middle-income households across the United States and Canada.

In the United Kingdom, Aegon aims to become a leading digital savings and retirement platform provider in the workplace and advisor markets. The company offers a broad range of solutions to individuals, advisors, and employers. Aegon UK serves its customers through a combination of workplace and retail financial advisors.

In Spain & Portugal, Aegon has a strategic partnership with Banco Santander to distribute life, health, and non-life insurance products through the bank’s branches, with Aegon owning a 51% stake in the joint venture. Aegon Spain’s own distribution channel offers life insurance, health insurance, and pension products.

In China, Aegon owns a 50% stake in Aegon THTF Life Insurance Company, which offers life insurance solutions through a network of branches.

In Brazil, Aegon has a 59.2% economic interest and 50% of voting common shares in Mongeral Aegon Group (MAG Seguros), the country’s third-largest independent life insurer. MAG Seguros offers individual protection solutions. Together with Banco Cooperativo do Brasil (Bancoob), MAG Seguros also operates a joint venture company dedicated to providing life insurance and pension products within the Sicoob, Brazil’s largest cooperative financial system.

Transamerica Life (Bermuda) provides life insurance products and services to affluent and high-net-worth individuals predominantly in Asia. The company writes business out of Hong Kong and Singapore.

Aegon Asset Management (Aegon AM) is an active global investment management business with EUR 332 billion of assets under management for a global client base, including Aegon’s subsidiaries and partnerships. Aegon owns 49% of Aegon-Industrial Fund Management Company, a Shanghai-based asset manager offering mutual funds, segregated accounts, and advisory services in China. In France, Aegon AM owns 25% of La Banque Postal Asset Management.

Following the transaction to combine Aegon’s Dutch pension, life and non-life insurance, banking, and mortgage origination activities with a.s.r., Aegon owns a strategic shareholding of close to 30% in a.s.r., a leading Dutch insurance company.

Further information about our businesses can be found in the business overview section of this report.

| Annual Report on Form 20-F 2024 | 9 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Milestones

Q1

| ◾ | The transfer of Nationwide Building Society’s financial planning service to Aegon UK was completed, which expanded the scope of Aegon UK’s Advice offering. |

| ◾ | Aegon announced that it would exercise its right to redeem EUR 700 million of 4% fixed-to-floating subordinated notes. |

| ◾ | Aegon UK signed the Finance for Biodiversity Pledge, a global initiative which brings together 163 financial institutions that jointly represent EUR 21.7 trillion of assets. |

| ◾ | The sale of Aegon’s 56% stake in its partnership in India, Aegon Life Insurance Company, to Bandhan Financial Holdings Limited, an Indian financial services company, was completed. |

Q2

| ◾ | The company’s Annual General Meeting of Shareholders approved all resolutions on its agenda, which included the re-election of Lard Friese as CEO, the election of Albert Benchimol to the Board, and the adoption of a new remuneration policy. |

| ◾ | Aegon presented its plans to accelerate the transformation of Aegon UK into a leading digital savings and retirement platform at a teach-in hosted from London. |

| ◾ | The EUR 1.535 billion share buyback program, mainly related to the transaction to combine Aegon the Netherlands with a.s.r., was completed. |

| ◾ | USD 760 million of senior unsecured notes with a fixed coupon of 5.5% and a tenor of three years was successfully priced. |

10 | Annual Report on Form 20-F 2024

| About Aegon |

||||

Q3

| ◾ | Duncan Russell succeeded Matt Rider as Aegon’s Chief Financial Officer. |

| ◾ | Aegon’s brand refresh program continued with the roll-out of updated brand identities for Aegon Spain, Aegon UK, and Aegon Asset Management. |

| ◾ | A EUR 200 million share buyback program, which was announced on May 16, 2024, began. |

| ◾ | The appointment of Shawn C.D. Johnson as CEO of Aegon Asset Management and a member of Aegon’s Executive Committee was announced. |

| ◾ | The appointment of Michele Bareggi as Chief Strategy, Transformation & Growth Officer and a member of Aegon’s Executive Committee was announced. |

| ◾ | Aegon UK completed the sale of its UK individual protection book to Royal London, transferring legal ownership to Royal London through a Part VII transfer. |

Q4

| ◾ | The EUR 200 million share buyback program that was announced on May 16, 2024, was completed on December 13, 2024. |

| ◾ | A new planned EUR 150 million share buyback was announced, which began in January 2025. |

| ◾ | Aegon published interim climate targets for 2030 as a step towards its 2050 net-zero ambition. |

| Annual Report on Form 20-F 2024 | 11 |

| About Aegon |

||||

Continuing on our journey of transformation

Following the structural changes the company implemented in previous years, in 2024, Aegon focused on building leading businesses offering retirement, pensions and investment solutions.

2022 and 2023 saw big changes in the company. What stood out for you in 2024?

Since 2020, Aegon has embarked on a journey of fundamental transformation to improve its overall performance. We have worked at pace to focus our attention on markets where we aim to build leading businesses. As a result of the changes we have made in recent years, Aegon is now a more focused company with an improved operational performance, a strong balance sheet, and an enhanced risk profile. Following the combination of our Dutch businesses with a.s.r., which created a leading Dutch insurance company, we set out our plans to transform Transamerica into America’s leading middle-market life insurance and retirement company at our Capital Markets Day (CMD) in June 2023.

In 2024, we focused on the disciplined execution of those plans and have made good progress in strengthening both Transamerica and its affiliated insurance agency, WFG. This year, we achieved strong growth in the number of WFG agents and in net deposits of registered linked annuities. Our mid-sized Retirement Plans business continued to grow with strong written plan sales, and we grew assets in both the General Account Stable Value product and individual retirement accounts.

In June 2024, we announced our plans to accelerate the transformation of Aegon UK into a leading digital savings and retirement platform. Aegon UK is well positioned to capture opportunities in the United Kingdom’s large and growing market for long-term savings and retirement solutions. By leveraging its interconnected business model, Aegon UK aims to increase flows, combined assets under administration, and remittances to the Holding over time.

Furthermore, in 2024, we held our first Annual General Meeting in Bermuda and continued to build our team in the country, including the appointment in September of a dedicated Country Executive. Since our redomiciliation to Bermuda in late 2023, we have been actively engaging with the Bermuda Monetary Authority (BMA), and I wish to thank the BMA for the professional, courteous and efficient relationship that we have been able to build in a relatively short period of time.

How did Aegon perform during the year?

I am very pleased with the progress we made in 2024. We met all our guidance for the year, and we are on track to meet the 2025 targets we laid out at our 2023 CMD.

We delivered on our increased guidance for Operating Capital Generation (OCG) of EUR 1.2 billion for 2024, while our main business units remained well capitalized. We also generated an IFRS operating result of EUR 1.5 billion.

The progress we made in 2024 reflects our ability to adapt and grow in a changing environment. For me, this is proof that we laid the right foundations in previous years and are on the right track for our transformation. I very much appreciate the dedication and hard work of our teams over the past twelve months that made this possible.

It is great to see their efforts paying off, as we were able to propose a final dividend of 19 eurocents per share. On this basis, the total dividend paid for the full-year 2024 will be 35 eurocents per share, up 17% compared with 2023, and we are on our way to achieving our target of around 40 cents per share over 2025.

In addition, we continued to return capital to shareholders during 2024 through various share buyback programs. In May, we launched a EUR 200 million program, which was completed on December 13, 2024. In June, we completed the EUR 1.535 billion share buyback mainly related to the combination of Aegon’s Dutch businesses with a.s.r. And, in November, we announced a new EUR 150 million program, that began in January 2025.

| Annual Report on Form 20-F 2024 | 13 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

What has Aegon done to improve customer experiences across its various businesses?

Our customers are central to our business, and, in 2024, we continued to work hard to enhance their experiences across our operations.

In the United States, Transamerica took steps to improve its customer experience, bringing important functions and activities that were previously outsourced back in-house, including its customer service operations. By doing so, Transamerica took back control of critical service processes that will help to enhance its competitive position and deliver a better customer experience. These efforts were further strengthened by the creation in 2024 of Transamerica’s Customer Experience Center of Excellence which focuses on improving customers’ experiences, and uses data and client feedback to develop solutions, communications, and digital capabilities that address customer needs.

At the same time, we continued to grow WFG, which now has over 86,000 agents in the US and Canada, a 17% increase on the previous year. Many of these agents come from diverse communities, enabling them to better understand the needs of the people they serve.

In the United Kingdom, we launched the Aegon Digital Experience (ADX), a new set of online journeys that provide a smoother experience for advisors, their customers, and employers. ADX also provides improved security for customers and more sophisticated data analytics that will enable Aegon UK to further enhance customer experiences in the future.

More broadly, following the successful rebranding of the holding company in 2023, we rolled out refreshed brand identities in 2024 for Aegon Spain, Aegon UK, and Aegon Asset Management. These new identities were developed with digital experiences in mind and will support our businesses in further enhancing the digital experience they offer to customers. Furthermore, in January 2025, we completed this refresh with the launch of refreshed brand identities for Transamerica and Transamerica Life Bermuda. This refresh provides our businesses with a consistent and recognizable visual identity, while capitalizing on the strength of the various brand names in their local markets. Moreover, it underscores that our group is a family of companies united by a clear purpose of Helping people live their best lives.

Do you see any suitable opportunities for acquisition to accelerate Aegon’s transformation?

In recent years, we have concentrated on divesting companies where we felt we were not the right owner. With the completion of the sale of our stake in our partnership in India, we have completed that process. We are fully focused on building leading businesses in our chosen markets and we are ready to invest to accelerate our progress. If we see acquisition opportunities that could advance our strategy, we will evaluate them against both financial and non-financial criteria. We will only consider an acquisition if a company fits with our businesses and strategy, if we can integrate it, and if it makes sense financially. We will always behave in a disciplined and rational manner.

You continue to hold an almost 30% stake in a.s.r. How long do you plan to hold on to it?

The combination of our Dutch businesses with a.s.r., which was completed in July 2023, created a leading Dutch insurance company. Our stake in a.s.r. has an indefinite timeframe. This allows us to benefit from the unique synergies that the combination brings. We are pleased with how the integration of the businesses is progressing and are already seeing benefits from the combination. To gain as much further value as possible, we will hold our stake until the a.s.r. share price reflects its intrinsic value, or until

value-creating opportunities emerge that require capital.

How did you ensure employees remained engaged during recent changes in the company?

We continue to build a culture that allows us to attract and develop the talent that we need to transform the company. The excitement and motivation I see across our businesses to deliver on our purpose of Helping people live their best lives is heartening. This is reflected in the strong levels of engagement that we see in the results of our annual Global Employee Survey (GES). I am always inspired by how dedicated my colleagues are to serving our customers and growing our businesses.

14 | Annual Report on Form 20-F 2024

| About Aegon |

||||

2024 also brought changes to the Executive Committee.

Indeed, we bid a fond farewell to two senior colleagues and welcomed two new members to the Executive Committee (ExCo).

First, Matt Rider retired from his position as our CFO after seven years of dedicated service to Aegon. Matt has been instrumental in building and maintaining Aegon’s strong financial profile and significantly improving its financial performance. Matt has been a great partner, and I wish him all the best for his well-earned retirement. Fortunately, I will continue to work with Matt in his new role as a non-executive board member of Transamerica. Matt was succeeded by Duncan Russell, who has served as our Chief Transformation Officer and a member of the ExCo since 2020. Duncan has already played a significant role in the progress we have made so far, and I am very pleased that we had such a talented individual ready to take the reins from Matt. Duncan, in turn, has been succeeded by Michele Bareggi, whose considerable experience in M&A, transforming organizations and creating long-term growth will be incredibly valuable as we continue to transform the business.

Second, in August, Shawn C.D. Johnson was appointed CEO of Aegon AM, and a member of Aegon’s Executive Committee. I am pleased to welcome Shawn, whose extensive asset management expertise, strategic consulting skills, and leadership acumen will help him lead Aegon AM through the next phase of its transformation. Shawn takes over from Bas NieuweWeme, who over the past five years has helped shape Aegon AM into a more customer-driven organization and brought it closer to becoming a global platform.

The new members of our senior leadership team bring with them new capabilities, skills, and experience that will be key to helping drive Aegon and its businesses forward during the second phase of our transformation.

What were the most important steps you took in 2024 in terms of sustainability?

We take our commitment to sustainability seriously and I am pleased that we were able to meet all our 2025 climate targets. Of course, we still have more to do, which is why we published targets for 2030 in the last quarter of 2024. These build on our previous set of targets and include reducing the carbon impact of our operations and general account assets, investing an additional USD 1 billion in activities to help climate change mitigation and adaptation, and continuing to engage with the top 20 corporate carbon emitters in Aegon’s general account investment portfolio.

How do you support the local communities in the places where you operate?

We believe it is very important that we support our local communities. Guided by our purpose, we make direct donations to good causes and carry out volunteering through our Global Force for Good initiative. I am really proud of what we’ve accomplished in 2024: we supported almost 500 charities and good causes around the world, with a total community investment of almost EUR 10 million. I am also pleased that the Holding, together with our businesses, colleagues, and the Transamerica Foundation, stepped up to contribute important donations and support to communities affected by natural catastrophes in Spain, Brazil, and the United States.

What are you looking forward to most in 2025?

While we have achieved a lot in 2024, there is still so much more to be done. In 2025, we will remain laser focused on driving growth and building champion businesses. And I am sure that, if we maintain the pace and commitment we built up in recent years, we can increase our momentum further as we continue our journey of transformation. I am excited about Aegon’s future, and I am inspired by my colleagues around the world. Together we will help people live their best lives and deliver value for all our stakeholders.

| Annual Report on Form 20-F 2024 | 15 |

Our Strategy

| Our strategy |

||||

At Aegon, we build champion businesses that can thrive in a changing business environment and that respond to the evolving needs and expectations of our stakeholders.

We aim to give people the confidence and flexibility to live their best lives and contribute to a better world. As we work to realize our vision to create leading businesses in investment, protection, and retirement solutions, we also consider the opportunities and challenges our stakeholders face in today’s evolving financial services landscape.

Guided by our purpose

Our purpose of Helping people live their best lives guides how we engage with both our customers and our wider stakeholder community. We aim to maximize value for all stakeholders by enabling them to seize the opportunities presented by a changing demographic landscape, and to join us in helping to shape a healthy, equitable world. This approach provides the foundation for Aegon’s vision and strategy, as well as all subsequent business planning and decision-making.

Our investment, protection, and retirement solutions are designed to help our customers navigate a longer, multi-stage life and make the right choices for their future. For our workforce, we aim to foster a purpose-led, inclusive culture that leads to rewarding and fulfilling career opportunities. We seek to cultivate strong, respectful relationships with our suppliers and business partners that enable them to support our customers. And, for our investors, we focus on generating predictable, competitive returns.

In addition to addressing the needs and expectations of our immediate stakeholders, we seek to have a positive impact on the world around us through our sustainability approach. This is an important element of Aegon’s strategy for value creation, and includes our long-standing focus on responsible investing, our net-zero ambitions, and our focus on fostering a fair and inclusive company. This approach provides an overview of how we address key sustainability issues, considering the expectations and perspectives of our stakeholders, and the steps we took in 2024 to address them through our strategy and activities.

Building on our strengths

One of our most important resources at Aegon is our global workforce’s deep knowledge and expertise. Across our businesses and partnerships, we have a clearly defined workforce strategy and culture that aims to attract, retain, and develop the talent we have in our company. Where relevant, we leverage business synergies across our company and our different markets: for example, through the strong links between our growth businesses and our global asset manager. Similarly, Aegon’s asset management teams strive to deliver strong investment returns and support the sound and effective management of the large back books associated with our businesses in run-off.

At the holding level, Aegon supports this strategy by developing strategy, allocating capital, defining risk appetite, setting targets, supporting talent development, and driving performance and strategy implementation. We also take a centralized approach to determining functional mandates, setting global policies and frameworks, and providing shareholder services. In parallel, Aegon’s businesses develop local strategies and operating plans within the company’s strategic framework and ensure their implementation.

Clear strategic focus, delivered through our businesses and partnerships

Since 2020, Aegon has taken structured steps to become a more focused company with an improved operational performance, a stronger balance sheet, and an enhanced risk profile. Following the combination of Aegon’s Dutch businesses with a.s.r., Aegon completed a major step in its transformation in 2023. The company is now continuing its transformation journey and accelerating the execution of its strategy.

| Annual Report on Form 20-F 2024 | 17 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

In the Americas, Transamerica, the largest of Aegon’s businesses, is a leading provider of life insurance, retirement, and investment solutions, serving millions of customers. We aim to accelerate Transamerica’s growth and create America’s leading middle-market life insurance and retirement company. The rapidly growing middle-income market is the largest in the United States but remains relatively underserved by the financial services industry. Transamerica is well positioned to capitalize on the opportunities in this market through its three Strategic Assets business segments: Distribution, Savings & Investments, and Protection Solutions. The fourth business segment holds Financial Assets, which are running-off. Aegon intends to, over time, reduce the capital employed by Financial Assets and grow its Strategic Assets, its partnerships, and the global asset manager.

The Strategic Assets business segments offer a greater potential for an attractive return on capital and are where Aegon is well positioned for growth. We continuously evaluate and invest in growth opportunities within our Strategic Assets. This includes expanding our customer base with a focus on providing middle-income retail customers with selected life insurance and investment products, as well as growing our retirement plan and recordkeeping businesses.

The Distribution business segment is focused on the distribution of life insurance and annuity products to middle-income households and consists mainly of WFG, an affiliated insurance distribution network of over 86,000 agents. Transamerica will invest further in WFG and plans to grow the number of agents to 110,000 by the end of 2027, while at the same time improving agent productivity.

Transamerica’s Savings & Investments business segment offers retirement plans, mutual funds, and stable value solutions. In retirement plans, Transamerica strategically focuses on mid-market participants and the pooled plan solutions market in the United States. In addition to providing retirement plan recordkeeping, Transamerica is growing its offering of ancillary products and services to plans, participants, and retirement investors, such as administration and investment services, advisory services, as well as individual retirement, health, and flexible savings accounts. We aim to increase earnings on in-force from the retirement business to between USD 275 million and USD 300 million by 2027.

The Protection Solutions business segment includes Transamerica’s life insurance, health insurance (employee benefits), registered indexed annuities, and variable annuities lines of business that Transamerica aims to strategically grow. These products are distributed through WFG and other distribution channels. Transamerica is targeting approximately USD 750 million of annual new life sales in Individual Life by 2027. Transamerica is also investing in its product manufacturing capabilities and operating model to position its Protection Solutions business for further growth, with distribution through both WFG and third parties.

Financial Assets are capital-intensive blocks of business with relatively low returns on the capital employed. We aim to maximize the value of these businesses through disciplined risk management and capital management actions. These businesses include Fixed and Variable Annuities with interest rate sensitive riders, a standalone Long-Term Care insurance portfolio, as well as the legacy Universal Life portfolio, and Single Premium Group Annuities (SPGA).

In the United Kingdom, Aegon focuses on providing pension, savings, and investment solutions to approximately 3.7 million customers, working with financial advisors and employers.

In June 2024, Aegon presented its plans to accelerate the transformation of Aegon UK into a leading savings and retirement platform. Aegon UK focuses on an interconnected business model with three growth franchises: the Workplace platform, the Adviser platform, and the Advice franchise.

The transformation aims to enable Aegon UK to increase flows and grow its combined assets under administration of the combined Adviser and Workplace platforms to over GBP 135 billion by 2028. In February 2024, Aegon completed the acquisition of Nationwide Building Society’s financial planning teams, which supports Aegon’s strategy to grow its Advice franchise.

Our global asset manager, Aegon AM, is an important contributor to our strategy, and we aim to drive its growth and improve profitability. We are implementing a new global technology platform to reduce costs and make Aegon AM more client-focused and scalable.

18 | Annual Report on Form 20-F 2024

| Our strategy |

||||

Leveraging our global brand and a global operating platform, Aegon AM operates through Aegon’s local subsidiaries and partnerships, as well as independently in Germany and Hungary. In China, Aegon AM operates a joint venture, Aegon-Industrial Fund Management Company, of which Aegon owns 49%, and which offers mutual funds, segregated accounts, and advisory services. In France, Aegon AM owns 25% of La Banque Postal Asset Management (LBP AM). Aegon AM has an asset management partnership with a.s.r. The partnership leverages Aegon AM’s position as a provider of distinct capabilities in retirement-related investment solutions, alternative fixed-income investments, and responsible investing.

Transamerica Life (Bermuda) (TLB) provides life insurance products and services to affluent and high-net-worth individuals predominantly in Asia. Aegon is maximizing TLB’s value through active in-force management and has reinsured TLB’s universal life portfolio to Transamerica in 2022. TLB continues to make profitable sales of Indexed Universal Life products on a selective basis.

Aegon continues to expand its strong partnership businesses by making the most of their scale and untapped potential. In Spain & Portugal, we are growing the business through our long-standing bancassurance partnership with Banco Santander. In China and Brazil, we aim to generate growing volumes and earnings, including by expanding distribution.

In the Netherlands, Aegon holds a close to 30% shareholding in a.s.r. following the transaction to combine its former Dutch pension, life and non-life insurance, banking, and mortgage origination activities with a.s.r. Aegon intends to hold the stake until the a.s.r. share price reflects its intrinsic value, unless other value-creating opportunities present themselves.

A clear model for achieving our vision

We aim to create a resilient, future-fit business: a well-managed and well-respected company that delivers value for its stakeholders, including attractive capital returns to shareholders. While our strategy directly supports this vision, our ambition goes beyond operational or financial performance, as we also aim to have a positive impact on society and the environment.

Achieving this overall vision involves building on our existing strengths: first and foremost, our proven ability to operate trusted brands and leading retirement platforms in our chosen markets. Aegon provides advanced retirement and asset management solutions, and life insurance and protection products. We deliver these by leveraging our strong foundations in large established markets, as well as in underpenetrated, growing markets.

Investment proposition

With this approach, Aegon is expected to be well placed to benefit from favorable structural trends and create leading businesses in locations where demographic realities require customers to save more. In all our businesses, our customers are the starting point for the development of our financial solutions, and we proactively assess their needs and develop products and services to suit. We then estimate and price the risk to us as a provider. After branding, our products and services are distributed through intermediaries, which include brokers, banks, and financial advisors, or marketed directly to customers, or via their employers.

In exchange for Aegon’s products and services, our customers pay fees or premiums to our businesses or make deposits on certain pension, savings, and investment products. We earn returns for our customers by investing those premiums and paying out claims and benefits. For non-insurance products, such as retirement plans or saving deposits, customers make withdrawals based on pre-agreed terms and conditions. We use the remaining funds to cover our expenses, support new investments, and return profits to our shareholders.

Aegon’s 24.4 million-strong customer base provides a robust foundation from which to expand and develop the business. As a diversified international company, we have the reach to deliver our propositions to a broad range of customers, who will increasingly benefit from more sophisticated and tailored digital services and advice. Our global, integrated asset management business is also an important driver of our continued success, enabling us to grow our share of the overall Assets under Administration over time.

| Annual Report on Form 20-F 2024 | 19 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Value-creating capital allocation

Aegon operates a focused business portfolio to deliver success for the company and its stakeholders on the way to realizing its vision. Through our wholly owned businesses and partnerships, we strive to be seen as a leader that offers contemporary propositions and outstanding customer service.

In the Americas, Aegon’s capital allocation approach aims to, over time, reduce the capital employed by Financial Assets and grow its Strategic Assets. Since the end of 2022, the capital employed in Financial Assets has reduced from USD 4.1 billion by USD 0.7 billion to USD 3.4 billion, supported by run-off, favorable markets, and management actions. We aim to continue to reduce our exposure to Financial Assets and improve the quantity and quality of our capital generation in the coming years. Additional management actions and the natural run-off of the book are expected to lead to USD 2.2 billion of capital employed in Financial Assets at the end of 2027. Any financial flexibility this creates will allow Aegon to further reduce its exposure to Financial Assets.

On July 1, 2024, Aegon UK completed the sale of its individual protection book to Royal London, transferring legal ownership to Royal London through a Part VII transfer. This supported the strategy to accelerate the transformation of Aegon UK into a leading savings and retirement platform, leveraging its interconnected business model with the Workplace platform, the Adviser platform, and the Advice franchise.

In addition, as part of the strategy announced at our CMD in December 2020, Aegon has exited various small and niche markets in order to focus on markets where Aegon is well positioned to create value. This included the sale of several businesses in Central & Eastern Europe and Asia and was rounded off with the completion of the sale of its 56% stake in its partnership in India to Bandhan Financial Holdings Limited on February 23, 2024.

Strong balance sheet

Maintaining a strong balance sheet is a prerequisite for Aegon to achieve its overall vision. It allows us to build leading, advantaged businesses that can actively contribute to a healthier, more equitable society, and create value for our customers and wider stakeholder base in line with our purpose.

Moreover, we maintain a strong balance sheet in order to focus time and energy on increasing the return on capital, supporting our operating units, and the return of capital to shareholders. We have a clear capital management policy in place that informs our capital deployment decisions,

which is driven by the Cash Capital at Holding and is supported by reliable remittances from the units. Aegon has a strong and resilient balance sheet with an enhanced risk profile. Aegon’s financial position and balance sheet strength are subject to group supervision by the BMA.

Transamerica continues to take in-force management actions on its Financial Assets, which aim to reduce the capital employed in those Financial Assets to USD 2.2 billion by the end of 2027 and to limit earnings volatility from this book. In 2024, Transamerica achieved its target to purchase at least 40% of the USD 7 billion face value of institutionally owned universal life policies that were in-force at the end of 2021, locking in claims cost and reducing the mortality risk of the overall portfolio. The company purchased institutionally owned universal life policies, focusing on older age policies with large face amounts. The program achieved the targeted investment hurdles and concluded three years ahead of plan.

For its Long-Term Care Insurance portfolio, Transamerica is pursuing a rate-increase program seeking approvals for additional actuarially justified-premium rate increases with a combined value of USD 700 million. By the end of 2024, the company had received approvals for 82% of the targeted premium rate increases. In the variable annuity portfolio, the dynamic hedging program continued to perform well in 2024, with a hedge effectiveness ratio of 99% and low volatility in the capital position.

In the second quarter of 2024, Transamerica reviewed its mortality assumptions and increased its liabilities for certain life portfolios. These assumption updates are expected to reduce future negative claims experience variances, positively affecting the operating result for Transamerica’s insurance business going forward.

The execution of Transamerica’s strategic plan aims to result in an increase in the capital generation from the in-force Strategic Asset portfolio. Transamerica plans to reinvest part of its earnings on in-force from Strategic Assets in profitable new business opportunities to secure long-term growth. This is anticipated to result in a gradual increase in operating capital generation from Strategic Assets to fund growing remittances to the holding company. Transamerica is targeting mid-single-digit percentage growth in its remittances over the medium term, from a level of USD 550 million in 2023, and remitted USD 575 million in 2024. This will contribute to Aegon’s free cash flow.

Aegon is transforming Aegon UK into a leading digital savings and retirement platform. The transformation of Aegon UK will take place over the 2024 to 2027 period and will be self-funded from Aegon UK’s capital generation and own funds. During this transformation phase, we aim to grow remittances by GBP 5 million per year, starting from GBP 100 million in 2024 with potential for higher growth after the investment period, adding to free cash flow.

20 | Annual Report on Form 20-F 2024

| Our strategy |

||||

Growing capital distributions

Aegon aims to grow its dividends in line with its free cash flows. Any capital deployment decisions will consider our financial leverage, as well as planned management actions to further improve the risk profile of the company.

Financial leverage remained stable at EUR 5.2 billion over 2024. The redemption of a EUR 700 million subordinated bond that matured in April 2024 was refinanced by a USD 760 million senior bond during the same month.

We remain disciplined in our management of capital, and any surplus cash flow not used for value-added growth opportunities will be returned to shareholders over time, as demonstrated by the share buyback programs executed in 2024. Following the transaction with a.s.r., Aegon initiated

a EUR 1.5 billion share buyback program in July 2023 to offset the dilutive effect of the transaction on free cash flow per share. In April 2024, the share buyback program was increased by an amount of EUR 35 million in relation to obligations resulting from share-based compensation plans. The program was completed on June 28, 2024.

Subsequently, the company returned surplus cash capital to its shareholders through a EUR 200 million share buyback executed in the second half of 2024. In the fourth quarter of 2024, Aegon announced another share buyback program of EUR 150 million, which started on January 13, 2025, and is expected to be completed by June 30, 2025. This program includes an amount of about EUR 40 million to meet Aegon’s obligations resulting from the share-based compensation plans for senior management.

| Annual Report on Form 20-F 2024 | 21 |

Our sustainability approach

| Our sustainability approach |

||||

Our approach to sustainability is driven by our purpose of Helping people live their best lives.

As both an investor and a provider of financial products and services, we have a responsibility to address issues that affect a broad range of stakeholders and that will influence the future of our society and our environment, as well as the performance of our business.

Enriching and embedding our sustainability approach

This approach considers the expectations, interests, and perspectives of the company’s stakeholders. How we create value for our stakeholders through our sustainability approach is explained in the Creating Sustainable Value chapter of this report. Our approach is built on our sustainability commitments, which include pledges to the UN Global Compact (UNGC), the UN Principles for Sustainable Insurance (PSI), the Net-Zero Asset Owner Alliance (NZAOA), and the Principles for Responsible Investment (PRI). A selection of our commitments is detailed in this report and a full overview is listed on our website.

In 2024, we continued to take steps to deliver upon our commitments. One example was our efforts to increase the understanding of key sustainability issues among our workforce, which is a prerequisite for achieving our goals and for preparing for future regulations, risks, and opportunities. In addition, Aegon’s investors increasingly expect the company’s leaders to be educated on sustainability issues and to demonstrate sustainability literacy. In 2024, we made progress toward these goals through our Sustainability Academy, which provides employees with webinars and e-learnings designed to increase their awareness and understanding of sustainability to support our sustainability ambitions.

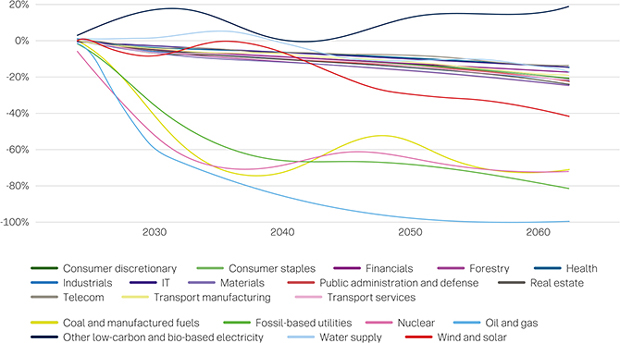

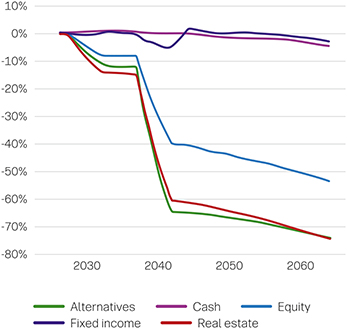

Aegon achieved several key sustainability targets and goals in 2024. These included reducing the weighted average carbon intensity (WACI) of our corporate fixed income and listed equity general account assets. We exceeded our 2025 WACI target of a 25% reduction with a result of 52% in 2024, against a 2019 baseline. We also met our 2025 target to invest USD 2.5 billion in activities to help mitigate climate change or adapt to its associated impacts, with an actual result of USD 2.7 billion. We continued to engage with the top 20 corporate carbon emitters in our portfolio, and we have also reduced the scope 1 and 2 carbon intensity of our directly held real estate investments by 51%, well above our 2025 target of a 25% reduction, against a 2019 baseline.

The next phase of our net-zero commitments covers the period from 2025 to 2030. By 2030, Aegon aims to:

| • | Reduce the weighted average carbon intensity of Aegon’s corporate fixed income and listed equity general account assets by 50%, against a 2019 baseline. |

| • | Reduce the scope 1 and 2 carbon intensity of Aegon’s directly held real estate investments by 42%, against a 2019 baseline. |

| • | Invest an additional USD 1 billion in activities to help mitigate climate change or adapt to the associated impacts. This is in addition to Aegon’s investment of USD 2.5 billion by 2025. |

| • | Continue engagements with at least the top 20 corporate carbon emitters in Aegon’s portfolio. |

| • | We also aim to reduce our operational footprint by 75% against a 2019 baseline. |

Our double materiality approach

We support our sustainability approach through regular double materiality assessments (DMAs). As part of our broader risk and strategic analysis activities, the DMA is an important tool that allows us to understand the sustainability landscape in which Aegon and its businesses operate and to identify the key issues to focus on. Undertaking regular DMAs also helps us understand our stakeholders’ perspectives on sustainability issues. We can also see where we, as a company, can have an impact on society and the environment, or where sustainability issues have a financial impact on Aegon.

In 2024, we built on the experience of previous DMAs undertaken in 2022 and 2023. The assessment took into account the European Sustainability Reporting Standards (ESRS) methodology adopted by the European Commission and the accompanying Materiality Assessment Implementation Guidance (MAIG) issued by the European Financial Reporting Advisory Group (EFRAG). For more information on Aegon’s double materiality methodology, refer to “impact, risk, and opportunity management”.

| Annual Report on Form 20-F 2024 | 23 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Our DMA topics

Five material topics, comprised of 14 sustainability matters, were identified through the 2024 DMA process (see “Aegon’s material topics” below). More information on how these topics contribute to the value we create as a company can be found in this report’s Creating Sustainable Value chapter. Further details on how these topics are embedded in our sustainability approach and where their impacts fall within Aegon’s value chain are described under each material topic (see table below). The material topic sections also detail the impacts, risks, and opportunities associated with these topics, as well as the policies and processes implemented, the actions taken to manage them, and the key metrics and targets that we have set to guide our progress on these issues.

The DMA will be reviewed regularly to reflect the views and perspectives of Aegon’s stakeholders, as well as any material changes to the sustainability and business landscape in which we operate. This will then inform the assessment of risks, opportunities, and impacts, as well as the issues we focus on in our sustainability approach.

|

Aegon’s material topics

|

||||||

| Material topic

|

Including the following sustainability

|

Link to stakeholder value

|

Link to details in “Sustainability statement”

|

|||

| Climate change |

Climate change adaption

|

Society Partners and suppliers |

Environmental Information | |||

|

Climate change mitigation

|

||||||

|

Energy management

|

||||||

| Human capital |

General working conditions

|

Employee | Social Information: Human Capital | |||

|

Social dialogue

|

||||||

|

Training and skills development

|

||||||

| Inclusion & diversity |

Gender equality and equal pay for work of equal value

|

I&D Customers |

Social Information: I&D | |||

|

Measures against violence and harassment in the workplace

|

||||||

|

Diversity

|

||||||

| Data privacy |

Information-related impacts for consumers and end users

|

Data security | Social Information: Data Privacy | |||

| Business conduct |

Responsible marketing practices |

Customers | Governance Information: Business Conduct Responsible Marketing Practices

|

|||

|

Protection of whistleblowers

|

Society | Governance Information: Business Conduct |

||||

|

Prevention and detection of corruption and bribery – including training

|

||||||

|

Prevention and detection of corruption and bribery – incidents

|

||||||

24 | Annual Report on Form 20-F 2024

Creating sustainable value

About Aegon Governance and risk management Financial information Sustainability information How we create sustainable value for our stakeholders Our inputs Financial Shareholders’ equity at December 31: EUR 7.2 billion Gross financial leverage: EUR 5.2 billion Group Solvency Own Funds: EUR 14.3 billion Group Solvency Capital required: EUR 7.5 billion Manufactured Our product mix and digital platforms Insurance service result EUR 376 million Gross deposits: EUR 219.5 billion Fees and commissions received: EUR 937 million New business strain: EUR 776 million Revenue-generating investments at December 31: EUR 897 billion intellectual Internal processes. systems. and controls Knowledge and expertise Human Number of employees at December 31: 15.582 Amount spent on training and development: EUR 5.9 million Talent management Number of tied agents at December 31: 2.000 Social and relationship Number of customers: 24.4 million Customer experience programs Responsible sourcing and Investing philosophy Brand equity. purpose. and values Relationship with intermediaries. business partners. suppliers. and other key stakeholders (e.g. regulators and NGOs) Natural Our commitment to achieving net-zero in 2050 Total energy used by company: 26,680 MWh Solutions development and pricing Development of our financial solutions begins with our customers. We assess their needs and develop products and services to suit. We then estimate and price the risk involved for us as a provider. Distribution Our products and services are then branded and marketed. before being distributed via intermediaries that include brokers. banks. and financial advisors. We also sell to our customers directly. Investments In exchange for products and services. customers pay fees or premiums. On certain pension. savings, and investment products. customers make deposits. We earn returns for our customers by investing this money. Claims and benefits We pay out claims. benefits. and retirement plan withdrawals. We use the remaining funds to cover our expenses. support new investments. and deliver profits to our shareholders. 26 Annual Report on Form 20-F 2024

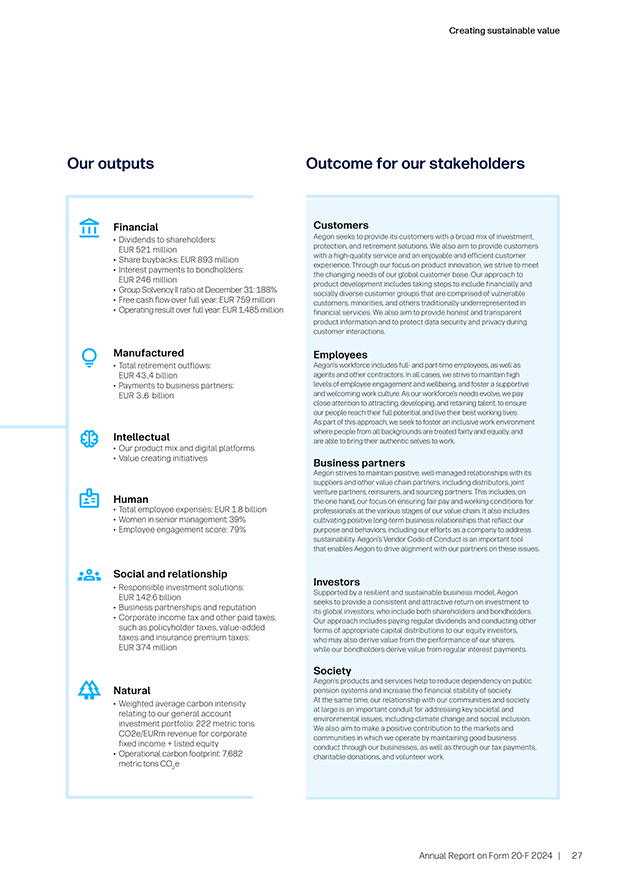

Creating sustainable value Our outputs Financial Dividends to shareholders: EUR 521 million Share buybacks: EUR 893 million Interest payments to bondholders: EUR 246 million Group Solvency II ratio at December 31: 188% Free cash flow over full year: EUR 759 million Operating result over full year: EUR 1,485 million Manufactured Total retirement outflows: EUR 47 billion Payments to business partners: EUR 2.1 billion Intellectual Our product mix and digital platforms Value creating initiatives Human Total employee expenses: EUR 1.8 billion Women in senior management: 39% Employee engagement score: 79% Social and relationship Responsible investment solutions: EUR 142.6 billion Business partnerships and reputation Corporate income tax and other paid taxes, such as policyholder taxes, value-added taxes and insurance premium taxes: EUR 374 million Natural Weighted average carbon intensity relating to our general account investment portfolio: 222 metric tons CO2e/EURm revenue for corporate fixed income + listed equity Operational carbon footprint: 7,703 metric tons CO2e Outcome for our stakeholders Customers Aegon seeks to provide its customers with a broad mix of investment, protection, and retirement solutions. We also aim to provide customers with a high-quality service and an enjoyable and efficient customer experience. Through our focus on product innovation, we strive to meet the changing needs of our global customer base. Our approach to product development includes taking steps to include financially and socially diverse customer groups that are comprised of vulnerable customers, minorities, and others traditionally underrepresented in financial services. We also aim to provide honest and transparent product information and to protect data security and privacy during customer interactions. Employees Aegon’s workforce includes full- and part-time employees, as well as agents and other contractors. In all cases, we strive to maintain high levels of employee engagement and wellbeing, and foster a supportive and welcoming work culture. As our workforce’s needs evolve, we pay close attention to attracting, developing, and retaining talent, to ensure our people reach their full potential and live their best working lives. As part of this approach, we seek to foster an inclusive work environment where people from all backgrounds are treated fairly and equally, and are able to bring their authentic selves to work. Business partners Aegon strives to maintain positive, well-managed relationships with its suppliers and other value chain partners, including distributors, joint venture partners, reinsurers, and sourcing partners. This includes, on the one hand, our focus on ensuring fair pay and working conditions for professionals at the various stages of out value chain. It also includes cultivating positive long-term business relationships that reflect our purpose and behaviors, including our efforts as a company to address sustainability. Aegon’s Vendor Code of Conduct is an important tool that enables Aegon to drive alignment with our partners on these issues Investors Supported by a resilient and sustainable business model. Aegon seeks to provide a consistent and attractive return on investment to its global investors, who include both shareholders and bondholders. Our approach includes paying regular dividends and conducting other forms of appropriate capital distributions to our equity investors, who may also derive value from the performance of our shares, while our bondholders derive value from regular interest payments. Society Aegon’s products and services help to reduce dependency on public pension systems and increase the financial stability of society. At the same time, our relationship with our communities and society at large is an important conduit for addressing key societal and environmental issues, including climate change and social inclusion. We also aim to make a positive contribution to the markets and communities in which we operate by maintaining good business conduct through our businesses, as well as through our tax payments, charitable donations, and volunteer work Annual Report on Form 20-F 2024 | 27

|

About Aegon Governance and risk management Financial information Sustainability information | |||

Creating sustainable value

for our stakeholders

Aegon seeks to generate value for a wide range of stakeholders, including its customers, employees, business partners, investors, and society.

In line with our purpose, we see our business as being inherently beneficial to society. We believe the value we generate as a company is shared through our diverse businesses and global workforce. However, we also recognize that certain decisions and actions can erode value by having a negative effect on our stakeholders or on the environment. Actively identifying and managing potential negative impacts is, therefore, an integral part of our decision-making, alongside realizing opportunities and positive impacts.

Customers

Key performance indicators (KPIs) for this stakeholder group:

| KPIs

|

Target for

|

Performance

|

||||

| Significant fines to address cases of mis-selling (EUR)* | 0 EUR | 0 EUR | ||||

| Proportion of employees who completed specific training on data privacy | 95% | 98% | ||||

| Proportion of employees who completed the annual Information Security training (%) | 95% | 98% | ||||

| * | Includes any fines for mis-selling in excess of EUR 100,000, excluding settlements. |

Providing positive experiences for customers is essential to achieving our purpose. As people live longer and their lifestyles change, we aim to provide products and services that help them to adapt to changing circumstances and secure a strong financial foundation for the future. Across our global businesses, we are implementing a series of targeted actions to support our core customer groups – individual customers, employers, and advisors and distribution partners – and closely monitor their satisfaction levels. Improving financial inclusion, including by extending our reach and promoting financial education and awareness, is also important. With innovations such as Pension Geeks, Aegon UK’s retirement education initiative, we are exploring ways to enable people to best prepare for retirement.

Our products are subject to rigorous review and approval processes that are designed to keep our marketing fair and balanced and that, where applicable, the product recommendation is in the customers’ best interests and, where relevant, meets suitability requirements. Aegon also seeks to protect the wellbeing of its customers in other ways, including through robust measures to protect customer data and to minimize potential negative impacts on our customers related to data security and privacy.

In 2024, Aegon continued its efforts to deliver high-quality solutions and experiences to customers around the world. This included further investment in digital tools and platforms to make products and advice more accessible and intuitive for a growing number of financial services consumers and intermediaries. Below, we describe the approaches taken by our business in the United States, Transamerica, and our business in the United Kingdom, Aegon UK, during the year.

Transamerica

Tracking customer satisfaction

Transamerica has used Net Promoter Scores (NPS)1 for many years to measure customer satisfaction in its life and retirement businesses. In 2024, this approach was expanded to provide metrics for end-customers (policyholders and plan participants), as well as distribution agents and advisors. NPS for life customers is measured through an annual third-party study conducted by LIMRA2, the largest research association supporting the insurance industry in the United States. NPS for retirement is calculated internally, and NPS for advisors is measured on a rolling basis throughout the year. The expanded view of NPS is representative of Transamerica’s growing commitment to measure and act on customer-centricity with its key audiences.

| Net Promoter Scores: United States

|

2024

|

|||

| NPS for life customers |

36 | |||

| NPS for retirement |

72 | |||

| NPS for advisors |

55 | |||

| 1 | For more details on how NPS are calculated, refer to the Metrics section of Business Conduct - Responsible marketing practices. |

| 2 | https://www.limra.com/en/about/ |

28 | Annual Report on Form 20-F 2024

| Creating sustainable value |

||||

Optimizing Transamerica’s structure

In 2024, Transamerica took steps to improve its organizational structure by placing five business lines – Insurance, Annuities, Retirement, Life and Health (Employee Benefits), and Investment Solutions – under common leadership. The goal was to create greater alignment among the businesses, thereby ensuring the highest level of service to all of Transamerica’s customers. Transamerica kept key functional areas separate by line of business where it made sense to do so, in an effort to maximize subject matter expertise. These efforts were strengthened by the creation in 2024 of Transamerica’s Customer Experience Center of Excellence, which focuses on improving customers’ experiences and uses data and customer feedback to develop solutions, communications, and digital capabilities that address customer needs, while also helping to share best practices across the organization.

Transamerica also brought several key functions back to the organization while implementing new contracts and controls with new vendor partners to which functions were outsourced. The new “hybrid” model replaces the previous fully outsourced model. By making this adjustment, Transamerica aims to gain greater control over the products and services that potentially have the greatest reputational impact on the organization.

Enhancing customer experiences

Like other Aegon businesses around the world, Transamerica is investing in digital tools and processes to improve customer interaction with its products and services. In 2024, Transamerica launched My Life Access, a new portal for life insurance products that allows customers to better understand their policies online without having to contact a call center. For retirement products, Transamerica enhanced its rollover and individual retirement account (IRA) experience and created an improved product selection experience to help participants understand their options regarding the IRA product.

Late in the year, Transamerica released a streamlined Guided Defined Contribution plan enrollment experience to reduce the number of decisions required to enroll in the plan and to simplify the overall process for the participant. 2024 also saw the launch of a redesigned Managed Advice dashboard, which provides a consolidated view of advice to help participants improve their retirement outcomes, and better emphasizes the value of Transamerica’s guidance and advice solutions to help participants better understand how Transamerica supports their retirement goals.

Performance enhancements were also made to the Transamerica Retirement App for retirement plan participants, aimed at stabilizing the user experience and addressing customer feedback.

| Transamerica launches Agent Home Portal for WFG agents

WFG, Transamerica’s affiliated insurance distribution network of over 86,000 independent agents, is an important medium for delivering products and services to customers throughout North America. This includes groups that have traditionally been underserved by financial services, and WFG’s growing agent network is central to Transamerica’s efforts to expand its reach to middle-market customers. To that end, WFG is actively increasing the number of agents dedicated to serving the middle market, with plans to have 110,000 agents in place by the end of 2027.

In 2024, the Transamerica-WFG relationship was strengthened with the release of the Agent Home Portal, a one-stop shop for WFG agents that allows them to manage their Transamerica life insurance business, run illustrations, submit applications, and perform other tasks from the convenience of a single platform. Transamerica also launched a digital underwriting process that streamlines the application process for life insurance solutions, and introduced redesigned life insurance agent websites where customers can access relevant marketing materials. |

Together with developing its digital capabilities, Transamerica remains committed to engaging with customers in the way that works best for them. The goal is to proactively inform customers of new products and capabilities, with a focus on clear, transparent messaging that ensures awareness and understanding. To this end, in 2024 Transamerica introduced a new engagement approach for its Retirement business. The Retirement Engagement Strategy is designed to engage the right person at the right time using a combination of consumer touchpoints, including email, text messages, website promotion, and call center talking points. In 2025, Transamerica launched its redesigned Transamerica.com website, with new content to better position products across all business lines, and help consumers understand how to do business with Transamerica.

Driving inclusion – focus on middle-market customers

Building on the commitment made at Aegon’s 2023 CMD, Transamerica continued its efforts to expand its reach to diverse customer groups, with a focus on middle-market customers. The middle market is a large and highly diverse demographic market in the United States, with significant (and often unmet) protection and savings needs.

| Annual Report on Form 20-F 2024 | 29 |

|

About Aegon Governance and risk management Financial information Sustainability information | |||

A key development in 2024 was the launch of the Final Expense Express solution. This solution takes customers from quote to policy delivery in as little as ten minutes, providing easy access to affordable protection and allowing Transamerica to reach more everyday Americans. In the retirement business, a new pooled plan offering was launched through Transamerica’s distribution agreements with Edward Jones and Willis Towers Watson. Another important strategy to improve financial inclusion for middle-market customers is to leverage the distribution network of Transamerica’s affiliated insurance agency, WFG: see “Transamerica launches Agent Home Portal for WFG agents” on the previous page.

More broadly, Transamerica is focused on ensuring that its products and services reflect the diverse needs of its participants. This includes accommodating individuals with special needs by continually evaluating the business’s website and call center technology, providing capable customer service representatives, and offering customized solutions for customers with visual and hearing impairments. In 2024, Transamerica also created additional translated information and marketing materials to reach customers who prefer to do business and consume content in languages other than English.

Aegon UK

Tracking customer satisfaction

Aegon UK also measures customer satisfaction using NPS. Scores are obtained by surveying individual customers, advisors, and employers about their experiences with Aegon UK. Customer surveys are conducted throughout the year, whereas advisors are surveyed on a quarterly basis and employers every six months.

| Net Promoter Scores: United Kingdom

|

|

2024

|

|

|

| NPS for individual customers |

28 | |||

| NPS for advisors |

(8) | |||

| NPS for employers |

26 | |||

Enhancing customer experiences

Aegon UK’s initiatives to enhance customer experience took place against a backdrop of regulatory change, namely the Financial Conduct Authority’s (FCA) introduction in 2023 of the Customer Duty, a framework that aims to ensure high standards of protection for consumers of financial services.

In 2024, Aegon UK launched the Aegon Digital Experience (ADX), a new set of online journeys that provide a smoother experience for advisors, their customers, and employers. ADX also provides improved security for customers and more sophisticated data analytics that will enable Aegon UK to further enhance customer experiences in the future.

Aegon UK: Mylo among new

solutions to begin roll out in 2025

In 2025, Aegon UK plans to begin rolling out a number of innovations to further improve customer experiences across its different business lines and customer groups. A key development will be the launch of Mylo, a new app that will provide customers with a simple way to consolidate their pension schemes. The app allows customers to navigate their Aegon UK products, and focuses on key life moments. This will help customers make informed decisions, providing access to targeted education, guidance, and advice when customers need it most.