SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of March, 2025

Commission File Number 001-14948

Toyota Motor Corporation

(Translation of Registrant’s Name Into English)

1, Toyota-cho, Toyota City,

Aichi Prefecture 471-8571,

Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Material Contained in this Report:

| I. | English translation of a press release dated March 24, 2025 with respect to the notice concerning of introduction share-based compensation plan for employees, as filed by the registrant with the Tokyo Stock Exchange on March 24, 2025. |

SIGNATURES

| Toyota Motor Corporation |

||||

| By: | /s/ Yoshihide Moriyama |

|||

| Name: | Yoshihide Moriyama | |||

| Title: | General Manager, |

|||

| Capital Strategy & Affiliated Companies Finance Division | ||||

Date: March 24, 2025

[Reference Translation]

March 24, 2025

| Company name: | TOYOTA MOTOR CORPORATION | |||

| Representative: | Koji Sato, President (Code number:7203; TSE Prime/NSE Premier) |

|||

| Inquiries: | Yoshihide Moriyama, General Manager, Capital Strategy & Affiliated Companies Finance Div. (Telephone: 0565-28-2121) |

Notice Concerning of Introduction Share-Based Compensation Plan for Employees

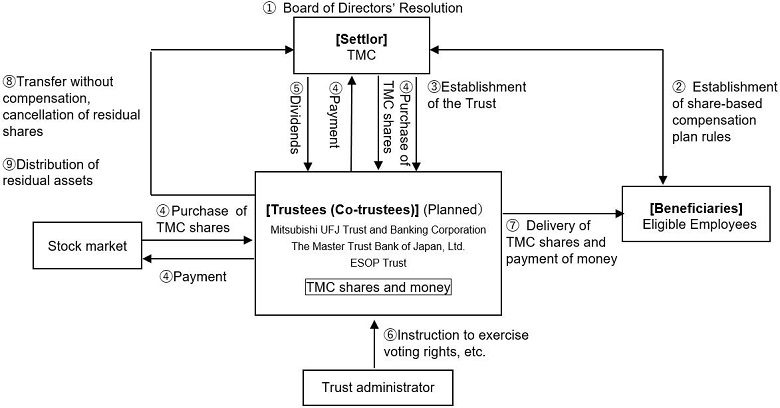

Toyota Motor Corporation (“TMC”) hereby announces that it has decided to introduce a share-based compensation plan (the “Plan”) using an ESOP1 trust structure (the “ESOP Trust”) for employees in “Senior Professional / Senior Management (Kanbushoku)” positions who satisfy certain requirements (the “Eligible Employees”), which was resolved at a meeting of the board of directors held on March 24, 2025.

Details of the acquisition of TMC shares by the ESOP trust structure will be announced as soon as it is determined.

I. Purpose of introducing the Plan

| (1) | TMC is taking on the challenge of transforming into a mobility company, in the face of a once-in-a-century transformational period of the automobile industry. TMC particularly expects our “Senior Professional / Senior Management (Kanbushoku)” employees, who lead execution teams in the genba (front lines), to drive challenges toward the future with the mission of “producing happiness for all.” |

| (2) | TMC has introduced the Plan with the aim that Eligible Employees will align with management to further accelerate these challenges and contribute to the medium- to long-term enhancement of corporate value. |

| (3) | The Plan adopts the ESOP Trust system and, based on the predetermined rule of the Plan, it will, in principle after their retirement, provide Eligible Employees with TMC shares, monetary amounts equivalent to the proceeds from the sale of TMC shares, and dividends arising from TMC shares. |

| 1 | Abbreviation of Employee Stock Ownership Plan |

II. Outline of the Plan

|

TMC shall make necessary procedures such as resolution of the board of directors regarding the introduction of the Plan. |

|

TMC shall establish share-based compensation plan rules in its company internal rules regarding the Plan. |

|

TMC shall contribute funds and set up an ESOP Trust for the Beneficiaries, defined as Eligible Employees who satisfy the relevant requirements. |

|

The ESOP Trust shall, in accordance with instructions from the trust administrator, utilize the money

contributed to the Trust in

|

|

Dividends on TMC’s shares in the ESOP Trust shall be distributed in the same manner as dividends on other TMC shares. |

|

For TMC shares in the ESOP Trust, throughout the trust period, the trust administrator will provide instructions for the exercise of shareholder rights, such as voting rights, and the ESOP Trust will exercise its shareholder rights in accordance with these instructions. |

|

During the trust period, Eligible Employees receive points based on TMC’s performance which will accumulate over time. TMC shares equivalent to a certain percentage of the points accumulated shall be awarded to Beneficiaries after their retirement who satisfy certain requirements. TMC shares equivalent to any remaining points shall be converted into cash within the ESOP Trust in accordance with the provisions of the trust agreement, and the Beneficiaries shall receive money equivalent to the liquidation value of the TMC shares. Dividends paid for the TMC shares in the ESOP Trust will also be paid to the Beneficiaries in proportion to the number of the TMC shares to be delivered from the ESOP Trust. |

|

In the event that TMC shares remain upon the expiration of the trust period, TMC may continue to use the ESOP Trust as an incentive plan similar to the Plan by revising the trust agreement and entrusting additional funds. If the ESOP Trust is instead terminated, as a means of shareholder returns, it is expected that residual shares will be transferred from the ESOP Trust to TMC at no charge, and TMC will cancel the shares so acquired. |

|

Dividends remaining in the ESOP Trust upon the expiration of the trust period shall be used as funds for purchasing shares in the event that the ESOP Trust is to be continued to be used. However, if the ESOP Trust is terminated due to the expiration of the trust period, TMC plans to donate the amount exceeding the trust expense reserve to an organization that has no conflict of interest. |

(Reference)

III. Outline of the Trust Agreement

|

|

A money trust other than an individually-operated designated money trust (third party benefit trust) | |

|

|

To provide incentives to Eligible Employees | |

|

|

TMC | |

|

|

Mitsubishi UFJ Trust and Banking Corporation (planned) (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

|

|

|

Eligible Employees satisfying the beneficiary requirements | |

|

|

A third party that does not have any interest in TMC (certified public accountant) | |

|

|

During 2025 (to be disclosed upon resolution) | |

|

|

From the trust agreement date to August 31, 2026 (planned) | |

|

|

The trustee will exercise the voting rights of TMC shares by following the instructions of the trust administrator that reflect the exercise of voting rights by the beneficiary candidates. | |

|

|

Common stock of TMC | |

|

|

1.5 billion yen (planned) (includes trust fees and trust expenses) | |

|

|

Unspecified (to be disclosed upon resolution) | |

|

|

Unspecified (to be disclosed upon resolution) | |

|

|

TMC | |

|

|

Residual assets that can be received by TMC, as the beneficiary, shall be limited to the trust expense reserve, which is calculated by deducting the cost for acquiring the shares from trust money. | |

END