EXHIBIT 99.1

Cameco Corporation

2024 Annual Information Form

March 21, 2025

Cameco Corporation

2024 Annual information form

March 21, 2025

Contents

| Important information about this document |

3 | |||

| Our business |

7 | |||

| Our values and strategy |

13 | |||

| Operations, projects and investments |

28 | |||

| Uranium – Tier-one operations |

29 | |||

| Uranium – Tier-two operations |

79 | |||

| Uranium – Advanced projects |

81 | |||

| Uranium – Exploration |

83 | |||

| Fuel services |

84 | |||

| Westinghouse Electric Company |

87 | |||

| Other nuclear fuel cycle investments |

95 | |||

| Mineral reserves and resources |

96 | |||

| Our sustainability principles and practices |

102 | |||

| The regulatory environment |

105 | |||

| Risks that can affect our business |

115 | |||

| 1 – Operational risks |

116 | |||

| 2 – Financial risks |

123 | |||

| 3 – Governance and compliance risks |

130 | |||

| 4 – Social risks |

132 | |||

| 5 – Environmental risks |

133 | |||

| 6 – Strategic risks |

134 | |||

| Legal proceedings |

144 | |||

| Investor information |

144 | |||

| Governance |

149 | |||

| Appendix A |

154 | |||

Important information about this document

This annual information form (AIF) for the year ended December 31, 2024 provides important information about Cameco Corporation. It describes our history, our markets, our operations and projects, our mineral reserves and resources, our approach to sustainability matters, our regulatory environment, the risks we face in our business and the market for our shares, among other things.

It also incorporates by reference:

| • our management’s discussion and analysis for the year ended December 31, 2024 (2024 MD&A), which is available on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) as an exhibit to our Annual Report on Form 40-F; and |

Throughout this document, the terms we, us, our, the company and Cameco mean Cameco Corporation and its subsidiaries. |

|

|

• our audited consolidated financial statements for the year ended December 31, 2024 (2024 financial statements), which are also available on SEDAR+ and on EDGAR as an exhibit to our Annual Report on Form 40-F. |

We have prepared this document to meet the requirements of Canadian securities laws, which are different from what United States (US) securities laws require.

The information contained in this AIF is presented as at December 31, 2024, the last day of our most recently completed financial year, and is based on what we knew as of March 17, 2025, except as otherwise stated.

Reporting currency and financial information

Unless we have specified otherwise, all dollar amounts are in Canadian dollars. Any references to $(US) mean US dollars.

The financial information in this AIF has been presented in accordance with International Financial Reporting Standards (IFRS).

Caution about forward-looking information

Our AIF and the documents incorporated by reference include statements and information about our expectations for the future. When we discuss our strategy, plans and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under Canadian and US securities laws. We refer to them in this AIF as forward-looking information. In particular, the discussions under the headings Market overview and developments, Building a balanced portfolio, and Westinghouse Electric Company in this AIF contain forward-looking information.

Key things to understand about the forward-looking information in this AIF:

| • | It typically includes words and phrases about the future, such as anticipate, believe, estimate, expect, plan, will, intend, goal, target, forecast, project, strategy and outlook (see examples on page 4). |

| • | It represents our current views and can change significantly. |

| • | It is based on a number of material assumptions, including those we have listed below on pages 6 and 7, which may prove to be incorrect. |

| • | Actual results and events may be significantly different from what we currently expect, due to the risks associated with our business. We list a number of these material risks below. We recommend you also review other parts of this document, including Risks that can affect our business starting on page 115, and our 2024 MD&A, which includes a discussion of other material risks that could cause actual results to differ significantly from our current expectations. |

Forward-looking information is designed to help you understand management’s current views of our near- and longer-term prospects, and it may not be appropriate for other purposes. We will not necessarily update this information unless we are required to by Canadian or US securities laws.

2024 ANNUAL INFORMATION FORM Page 3

Examples of forward-looking information in this AIF

| • | our expectations about 2025 and future global uranium supply, consumption, contracting, demand, geopolitical issues and the market, including the discussion under the headings Market overview and developments and Building a balanced portfolio |

| • | the discussion under the heading Our strategy, including the role of nuclear energy in the world’s shift to a low-carbon, climate-resilient economy, our expectation that our strategy will allow us to increase long-term value, our intention to execute our strategy with an emphasis on safety, people and the environment, our ability to address risks and opportunities that we believe may have a significant impact on our ability to add long-term value for our stakeholders, and our expected financial capacity to execute our strategy, invest in new opportunities and self-manage risk |

| • | the discussion of our expectations relating to our 49% interest in Westinghouse, including our investment expanding our participation in the nuclear fuel value chain and providing a platform for further growth and various factors and drivers for Westinghouse’s business segments |

| • | our expectations relating to our Canada Revenue Agency (CRA) transfer pricing dispute, including our confidence that the courts would reject any attempt by CRA to utilize the same or similar positions for other tax years currently in dispute, and our belief that CRA should return the full amount of cash and security that has been paid or otherwise secured by us |

| • | our view that we have the strengths to take advantage of the world’s rising demand for safe, clean, secure, reliable, affordable, and carbon-free energy |

| • | that we will continue to focus on delivering our products responsibly and addressing the sustainability risks and opportunities that we believe will make our business sustainable and will build long-term value |

| • | our expectations about 2025 and future consumption of conversion services |

| • | our expectations for the future of the nuclear industry and the potential for new enrichment technology, including that nuclear power must be a central part of the solution to the world’s shift to a low-carbon climate-resilient economy while helping provide energy security and that our investment in enrichment technology, if successful, will allow us to participate in the entire nuclear fuel value chain |

| • | our expectations relating to care and maintenance costs |

| • | our expectations of executing major supply contracts |

| • | our expectations regarding the amount of security we will need to provide to CRA in connection with the tax debts CRA considers us owing for 2018 |

| • | our ability to capitalize on the current backlog of long-term contracting as a proven and reliable supplier with tier-one productive capacity and a record of honouring supply commitments, and to increase value throughout these price cycles |

| • | future plans and expectations for our uranium properties, advanced projects, and fuel services operating sites, including production levels and the suspension of production at certain properties, pace of advancement and expansion capacity, and carbon reduction targets |

| • | estimates of operating and capital costs and mine life for our tier-one uranium operations |

| • | our expectations regarding our licences for McArthur River, Key Lake and Crow Butte |

| • | our ability to successfully negotiate a new collective agreement for the unionized employees at McArthur River |

| • | estimated decommissioning and reclamation costs for uranium properties and fuel services operating sites |

| • | Kazatomprom’s planned production levels and timing for JV Inkai |

| • | our mineral reserve and resource estimates |

| • | our expectations that the price of uranium, production costs, and recovery rates will allow us to operate or develop a particular site or sites |

| • | estimates of metallurgical recovery and other production parameters for each uranium property |

| • | production estimates at the McArthur River/Key Lake, Cigar Lake and Inkai operations, and fuel services |

| • | our discussion of the ongoing conflict between Russia and Ukraine |

| • | our views on our ability to align our production with market opportunities and our contract portfolio |

| • | our expectation regarding opportunities to improve operational effectiveness and to reduce our impact on the environment, including through the use of digital and automation technologies |

| • | our expectations about when future reactors will come online |

| • | our efforts to participate in the commercialization and deployment of small modular reactors (SMRs) and contribute to the mitigation of global climate change and help to provide energy security and affordability by exploring SMRs and other emerging opportunities within the fuel cycle |

| • | our expectations about future demand for SMRs |

| • | our expectation that the US Department of Energy (DOE) will make available a portion of its excess uranium inventory over the next two decades |

2024 ANNUAL INFORMATION FORM Page 4

| • | the discussion under the heading Our Sustainability principles and practices, including our belief there is a significant opportunity for us to be part of the solution to combat climate change while helping provide energy security and that we are well positioned to deliver significant long-term business value |

Material risks

| • | actual sales volumes or market prices for any of our products or services are lower than we expect, or cost of sales is higher than we expect, for any reason, including changes in market prices, loss of market share to a competitor, tariffs, trade restrictions or geopolitical issues |

| • | we are adversely affected by changes in currency exchange rates, interest rates, royalty rates, tax rates, tariffs, or inflation |

| • | our production costs are higher than planned, or necessary supplies are not available or not available on commercially reasonable terms |

| • | our strategies may change, be unsuccessful or have unanticipated consequences, or we may not be able to achieve anticipated operational flexibility and efficiency |

| • | changing views of governments regarding the pursuit of carbon reduction strategies or that our view on the role of nuclear power in pursuit of those strategies may prove to be inaccurate |

| • | risks relating to the development and use of new technology or lack of appropriate technology needed to achieve our 30% GHG emissions reduction target or advance our ambition to reach net-zero GHG emissions |

| • | our estimates and forecasts prove to be inaccurate, including production, purchases, deliveries, cash flow, revenue, costs, decommissioning, reclamation expenses, or timing or receipt of future dividends from JV Inkai |

| • | that we may not realize expected benefits from our interest in Westinghouse or any of our other joint venture investments |

| • | that Westinghouse fails to generate sufficient cash flow to fund its approved annual operating budget or make distributions to the partners |

| • | the risk that we and Westinghouse may not be able to meet sales commitments for any reason |

| • | the risk that Westinghouse may not achieve the expected growth in its business |

| • | the risk to Westinghouse’s business associated with potential production disruptions, including those related to global supply chain disruptions, global economic uncertainty, political volatility, labour relations issues, and operating risks |

| • | the possibility of a materially different outcome in disputes with CRA for other tax years |

| • | our ability to implement and execute our overarching low carbon transition strategy |

| • | our investments allowing us to participate in the entire nuclear fuel value chain; fuel fabrication; reactor maintenance; development of new reactors; and nuclear sustainability services |

| • | the risk that Westinghouse may not be able to implement its business objectives in a manner consistent with its or our sustainability principles and practices and other values |

| • | the risk that Westinghouse’s strategies may change, be unsuccessful, or have unanticipated consequences |

| • | the risk that Westinghouse may be unsuccessful in respect of its new business |

| • | the risk that Westinghouse may fail to comply with nuclear licence and quality assurance requirements at its facilities |

| • | the risk that Westinghouse may lose protections against liability for nuclear damage, including discontinuation of global nuclear liability regimes and indemnities |

| • | the risk that increased trade barriers may adversely impact our business, or the business of any of the joint ventures in which we have invested |

| • | the risk that Westinghouse may default under its credit facilities, impacting adversely Westinghouse’s ability to fund its ongoing operations and to make distributions |

| • | the risk that liabilities at Westinghouse may exceed our estimates and the discovery of unknown or undisclosed liabilities |

| • | the risk that occupational health and safety issues may arise at Westinghouse’s operations |

| • | the risk that there may be disputes between us and Brookfield (as defined below) regarding our strategic partnership, or disputes between us and any of our other joint venture partners |

| • | the risk that we may default under the governance agreement with Brookfield, including us losing some or all of our interest in Westinghouse |

| • | the risk that we are unable to enforce our legal rights under our agreements, permits or licences |

| • | disruption or delay in the transportation of our products |

| • | that we are subject to litigation or arbitration that has an adverse outcome |

| • | that the courts may accept the same, similar or different positions and arguments advanced by CRA to reach decisions that are adverse to us for other tax years currently in dispute |

| • | a major accident at a nuclear power plant |

2024 ANNUAL INFORMATION FORM Page 5

| • | that CRA does not agree that the court rulings for the years that have been resolved in Cameco’s favour should apply to subsequent tax years |

| • | that CRA will not return all or substantially all of the cash and security that has been paid or otherwise secured in a timely manner, or at all |

| • | there are defects in, or challenges to, title to our properties |

| • | our mineral reserve and resource estimates are not reliable, or there are unexpected or challenging geological, hydrological or mining conditions |

| • | we are affected by environmental, safety and regulatory risks, including workforce health and safety or increased regulatory burdens or delays |

| • | necessary permits or approvals from government authorities cannot be obtained or maintained |

| • | we are affected by political risks, including developments in US foreign policy, global conflicts, sanctions, or any potential future unrest in Kazakhstan |

| • | we may be affected by crime, corruption, making improper payments or providing benefits that may violate Canadian or US laws relating to foreign corrupt practices or sanctions |

| • | we are affected by war, terrorism, cyber-attacks, sabotage, blockades, civil unrest, social or political activism, outbreak of illness (such as a pandemic like COVID-19), accident or a deterioration in political support for, or demand for, nuclear energy |

| • | operations are disrupted due to problems with our own or our joint venture partners’, suppliers’ or customers’ facilities, the unavailability of reagents, equipment, operating parts and supplies critical to production, equipment failure, lack of tailings capacity, labour shortages, labour relations issues, strikes or lockouts, fires, underground floods, cave-ins, ground movements, tailings dam failures, transportation disruptions or accidents, aging infrastructure, or other development and operating risks |

Material assumptions

| • | our expectations regarding sales and purchase volumes and prices for uranium and fuel services, cost of sales, trade restrictions, inflation, and that counterparties to our sales and purchase agreements will honour their commitments |

| • | our expectations for the nuclear industry, including its growth profile, market conditions, geopolitical issues, and the demand for and supply of uranium |

| • | the continuing pursuit of carbon reduction and energy security strategies by governments and the role of nuclear in the pursuit of those strategies |

| • | we are impacted by changes in the regulation or public perception of the safety of nuclear power plants, which adversely affect the construction of new plants, the relicensing of existing plants and the demand for uranium |

| • | government laws, regulations, policies or decisions that adversely affect us, including tax and trade laws, tariffs and sanctions, including changes in mining laws or regulations |

| • | our uranium suppliers or purchasers fail to fulfil their commitments |

| • | our McArthur River development, mining or production plans are delayed or do not succeed for any reason |

| • | our Key Lake mill production plan is delayed or does not succeed for any reason |

| • | our Cigar Lake development, mining or production plans are delayed or do not succeed for any reason |

| • | JV Inkai’s development, mining or production plans are delayed or do not succeed for any reason or JV Inkai is unable to transport and deliver its production |

| • | our production plan for our fuel services division is delayed or does not succeed for any reason, including due to the availability of production supplies |

| • | our expectations relating to care and maintenance costs prove to be inaccurate |

| • | we are affected by natural phenomena, such as forest fires, floods or earthquakes as well as shifts in temperature, precipitation, and the impact of more frequent severe weather conditions on our operations as a result of climate change |

| • | the risks that generally apply to all our operations and advanced uranium projects that are discussed under the heading Risks that can affect our business in this AIF and under the heading Managing the risks in our 2024 MD&A |

| • | that the construction of new nuclear power plants and the relicensing of existing nuclear power plants will not be adversely affected by changes in regulation or in the public perception of the safety of nuclear power plants |

| • | our ability to continue to supply our products and services in the expected quantities and at the expected times |

| • | our expected production levels for Cigar Lake, McArthur River/Key Lake, JV Inkai and our fuel services operating sites |

| • | plans to transport our products succeed, including the shipment of our share of JV Inkai production to our Blind River refinery |

2024 ANNUAL INFORMATION FORM Page 6

| • | the availability or development of technologies needed to achieve our 30% GHG emissions reduction target or advance our net-zero GHG emission ambition |

| • | the success of our plans and strategies relating to Westinghouse |

| • | our cost expectations, including production costs, operating costs, and capital costs |

| • | our expectations regarding tax payments, tax rates, tariffs, royalty rates, currency exchange rates, interest rates and inflation |

| • | in our dispute with CRA, that courts will reach consistent decisions for other tax years that are based upon similar positions and arguments |

| • | that CRA will not successfully advance different positions and arguments that may lead to different outcomes for other tax years |

| • | our expectation that we will recover all or substantially all of the amounts paid or secured in respect of the CRA dispute to date |

| • | our expectations regarding spot prices and realized prices for uranium |

| • | our decommissioning and reclamation estimates, including the assumptions upon which they are based, are reliable |

| • | our mineral reserve and resource estimates, and the assumptions upon which they are based, are reliable |

| • | our understanding of the geological, hydrological and other conditions at our uranium properties |

| • | Westinghouse’s ability to generate cash flow and fund its approved annual operating budget and make distributions to the partners |

| • | our Key Lake mill production plans succeed |

| • | our ability to mitigate adverse consequences of production shortfalls or delays in the shipment of our share of JV Inkai production to our Blind River refinery |

| • | our ability to compete for additional business opportunities so as to generate additional revenue for us as a result of our interest in Westinghouse |

| • | market conditions and other factors upon which we based our forecasts for Westinghouse will be as expected |

| • | Westinghouse’s production, purchases, sales, deliveries, and costs |

| • | Westinghouse’s ability to mitigate adverse consequences of delays in production and construction |

| • | the absence of new and adverse laws, government regulations, policies or decisions, including with respect to changes in mining laws or regulations |

| • | that there will not be any significant adverse consequences to Westinghouse’s business resulting from business disruptions, including those relating to supply disruptions, economic or political uncertainty and volatility, labour relation issues, and operating risks |

| • | Westinghouse will comply with the covenants in its credit agreement |

| • | Westinghouse will comply with nuclear licence and quality assurance requirements at its facilities |

| • | Westinghouse maintaining protections against liability for nuclear damage, including continuation of global nuclear liability regimes and indemnities |

| • | our McArthur River and Cigar Lake development, mining and production plans succeed |

| • | JV Inkai’s development, mining and production plans succeed, and that JV Inkai will be able to deliver its production |

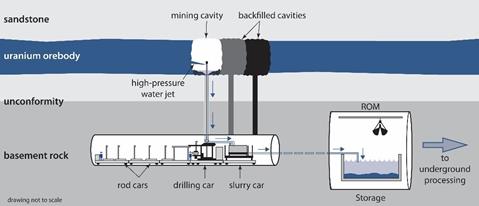

Our business

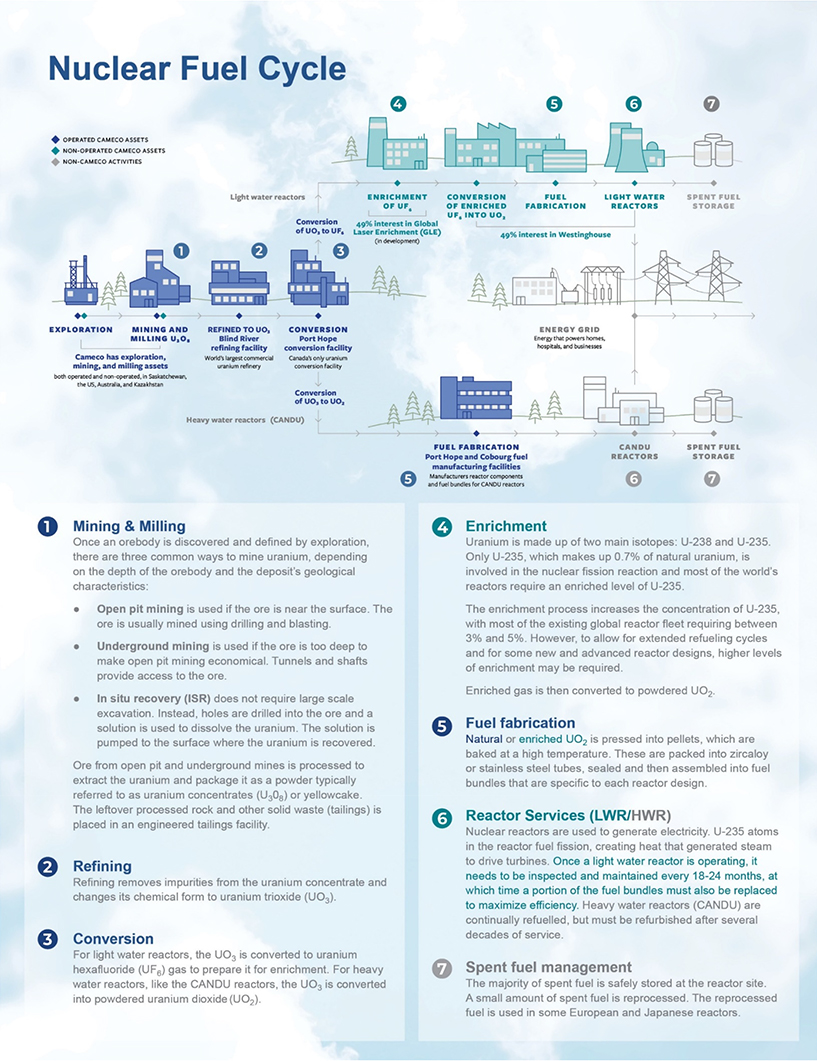

| Our operations span the nuclear fuel cycle from exploration to fuel services, which include uranium production, refining, uranium dioxide (UO2) and uranium hexafluoride (UF6) conversion services and CANDU fuel manufacturing for heavy water reactors. We have also further enhanced our ability to meet our customers’ growing demand for reliable and secure nuclear fuel supplies, services and technologies by investing in Westinghouse. Westinghouse’s assets augment the core of our business, providing operating plant services to the installed global base of reactors, the design fabrication and supply of fuel assemblies and the design, development, engineering and procurement of equipment for new reactors. We also have made an investment in a third-generation enrichment technology, that if successful we expect will allow us to participate in the entire nuclear fuel value chain. | Cameco Corporation 2121 – 11th Street West Saskatoon, Saskatchewan Canada S7M 1J3 Telephone: 306.956.6200

This is our head office, registered office and principal place of business.

We are publicly listed on the Toronto and New York stock exchanges, and had a total of 2,884 employees at December 31, 2024. |

With extraordinary assets, a proven operating track record, long-term contract portfolio, strong sustainability commitment, employee expertise, comprehensive industry knowledge, and a strong balance sheet, the company is making investments that it expects will create a platform for strategic growth. We are confident in our ability to increase long-term value by positioning the company as an industry leader at a time when the world’s prioritization of energy security, national security and increasing

2024 ANNUAL INFORMATION FORM Page 7

electrification is driving growth in demand and when geopolitics are creating concerns about the origin and security of supplies across the nuclear fuel cycle.

Business segments

| URANIUM | ||

| Our uranium production capacity is among the world’s largest. In 2024, our tier-one production accounted for 18% of world production. We have controlling ownership of the world’s largest high-grade mineral reserves.

Product

• uranium concentrates (U3O8)

Mineral reserves and resources

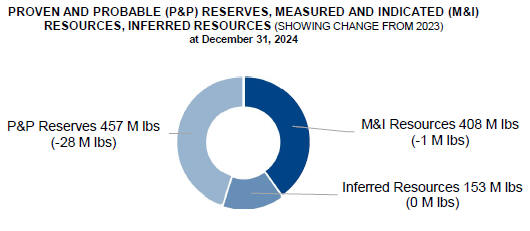

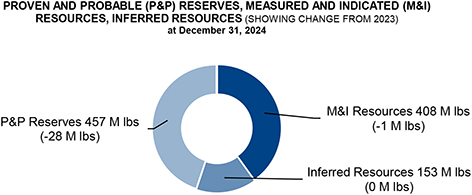

Mineral reserves

• approximately 457 million pounds proven and probable

Mineral resources

• approximately 408 million pounds measured and indicated

• approximately 153 million pounds inferred |

Tier-one operations

• McArthur River and Key Lake, Saskatchewan

• Cigar Lake, Saskatchewan

• Inkai, Kazakhstan

Tier-two operations

• Rabbit Lake, Saskatchewan

• Smith Ranch-Highland, Wyoming

• Crow Butte, Nebraska

Advanced projects

• Millennium, Saskatchewan

• Yeelirrie, Australia

• Kintyre, Australia

Exploration

• focused on North America

• approximately 0.75 million hectares of land |

|

| FUEL SERVICES | ||

| We are an integrated uranium fuel supplier, offering refining, conversion, and fuel manufacturing services.

Products

• uranium trioxide (UO3)

• UF6 for light-water reactors (we have about 20% of world primary conversion capacity)

• UO2 for CANDU heavy-water reactors

• fuel bundles, reactor components and monitoring equipment used by CANDU heavy-water reactors |

Operations

• Blind River refinery, Ontario

• Port Hope conversion facility, Ontario

• Cameco Fuel Manufacturing Inc. (CFM), Ontario (manufactures fuel bundles and reactor components for CANDU heavy-water reactors) |

|

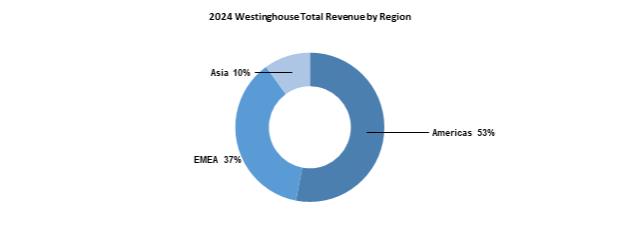

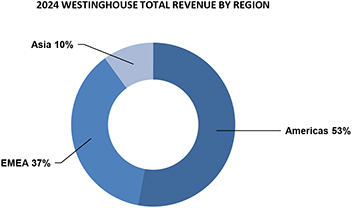

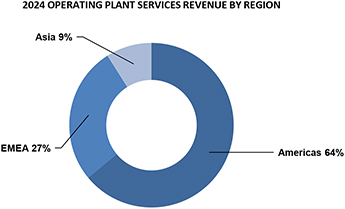

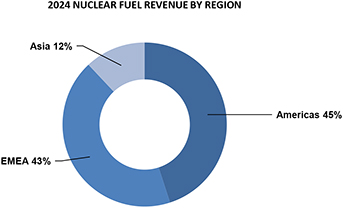

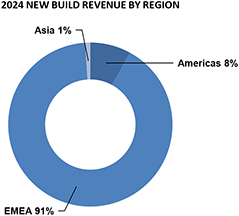

| WESTINGHOUSE ELECTRIC COMPANY (Westinghouse) | ||

| We own a 49% interest in Westinghouse in a strategic partnership with Brookfield.

Products

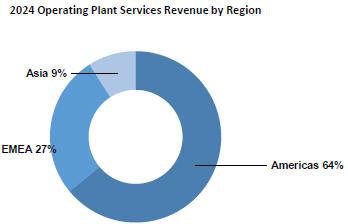

• Operating plant services (core business) – Provides outage and maintenance services, engineering support, instrumentation and controls equipment, plant modifications, and components and parts to nuclear reactors

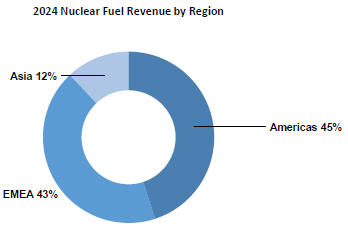

• Nuclear fuel (core business) – designs and manufactures nuclear fuel supplies and services for light water reactors

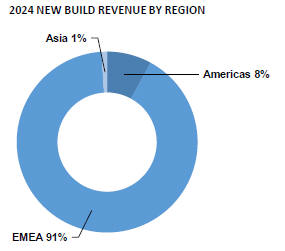

• New build – designs, develops and procures equipment for new nuclear plant projects |

Operations

• Columbia, South Carolina (fuel fabrication)

• Springfields, United Kingdom (fuel fabrication)

• Västerås, Sweden (fuel fabrication) |

|

2024 ANNUAL INFORMATION FORM Page 8

For information about the financial performance of our segments for the years ended December 31, 2024 and 2023, see our 2024 MD&A as follows:

| • | uranium – page 57 |

| • | fuel services – page 59 |

| • | Westinghouse – page 59 |

OTHER NUCLEAR FUEL CYCLE INVESTMENTS

Enrichment

We have a 49% interest in Global Laser Enrichment LLC (GLE) which is testing third-generation enrichment technology that, if successful, will use lasers to commercially enrich uranium. GLE is the exclusive licensee of the proprietary SILEX laser enrichment technology, that is in the development phase.

2024 ANNUAL INFORMATION FORM Page 9

2024 ANNUAL INFORMATION FORM Page 10

Major developments

| 2022 | 2023 | 2024 | ||

| January

• We announce plans to transition McArthur River and Key Lake from care and maintenance to planned production of 15 million pounds per year (100% basis) by 2024, 40% below its annual licensed capacity, and to reduce production at Cigar Lake in 2024 to 13.5 million pounds per year (100% basis), 25% below its annual licensed capacity starting in 2024.

May

• We acquire an additional 4.522% interest in Cigar Lake increasing our interest to 54.547%.

October

• We announce our plans to form a strategic partnership with Brookfield Renewable Partners L.P., together with its institutional partners (Brookfield), to acquire Westinghouse, a global provider of nuclear services, from Brookfield Business Partners. Brookfield will own a 51% interest and we will own a 49% interest in Westinghouse. We are responsible to contribute approximately $2.2 billion (US) in respect of the acquisition.

• We issue 34,057,250 common shares at a price of $21.95 (US) per share for gross proceeds to us of approximately $747.6 million (US) pursuant to a bought deal. The net offering proceeds are intended to partially fund our share of the acquisition of Westinghouse.

November

• We announce that the first pounds of uranium ore from the McArthur River mine have now been milled and packaged at the Key Lake mill, marking the achievement of initial production as these facilities transition back to normal operations. |

March

• We sign a major supply contract to provide sufficient volumes of natural uranium hexafluoride, or UF6 (consisting of uranium and conversion services), to meet Ukraine’s full nuclear fuel needs through 2035.

• CRA issues revised assessments for the 2007 through 2013 tax years, which result in a refund of $297 million, consisting of $86 million in cash and $211 million in letters of credit, which are returned in the second quarter. CRA continued to hold $483 million that we had remitted or secured based on prior reassessments CRA had issued in our longstanding tax dispute.

November

• We announce that the acquisition of Westinghouse in a strategic partnership with Brookfield closed on November 7, 2023. |

May

• We issue $500 million of debentures, bearing interest at 4.94%, maturing in 2031.

June

• We redeem $500 million of debentures, bearing interest at 4.19%, maturing in June 2024.

December

• 2024 packaged production of

|

||

2024 ANNUAL INFORMATION FORM Page 11

Updates for 2025

Production at Inkai was suspended in January 2025 for approximately three weeks. Cameco and Kazatomprom (KAP) continue to work with JV Inkai to determine the impact of the production suspension on the operation’s 2025 production plans. Any estimates of Inkai’s 2025 and subsequent production will be tentative and uncertain. JV Inkai is experiencing procurement and supply chain issues, most notably related to the stability of sulfuric acid deliveries, as well as challenges related to construction delays and acidification of new wellfields.

Additionally, on January 13, 2025, we repaid in full the remaining principal of $200 million (US) on the term loan debt incurred in connection with the Westinghouse acquisition.

How Cameco was formed

Cameco was incorporated under the Canada Business Corporations Act on June 19, 1987.

We were formed when two crown corporations were privatized and their assets merged:

| • | Saskatchewan Mining Development Corporation (SMDC) (uranium mining and milling operations); and |

| • | Eldorado Nuclear Limited (uranium mining, refining and conversion operations) (now Canada Eldor Inc.) |

There are constraints and restrictions on ownership of shares in the capital of Cameco (common shares) set out in our company articles, and a related requirement to maintain offices in Saskatchewan. These are requirements of the Eldorado Nuclear Limited Reorganization and Divestiture Act (Canada), as amended, and The Saskatchewan Mining Development Corporation Reorganization Act, as amended, and are described on pages 145 and 146.

We have made the following amendments to our articles:

| 2002 | • increased the maximum share ownership for individual non-residents to 15% from 5%

• increased the limit on voting rights of non-residents to 25% from 20% |

|

| 2003 | • allowed the board to appoint new directors between shareholder meetings as permitted by the Canada Business Corporations Act, subject to certain limitations

• eliminated the requirement for the chair of the board to be ordinarily resident in the province of Saskatchewan |

|

| We have two main subsidiaries:

• Cameco Europe Ltd., a company incorporated under the laws of Switzerland, which we have 100% ownership of through subsidiaries.

• Cameco U.S. Holdings, Inc., a company incorporated under the laws of the state of Nevada, in which we have 100% direct ownership.

At January 1, 2025, we do not have any other subsidiaries that are material, either individually or collectively. |

For more information

You can find more information about Cameco on SEDAR+ (sedarplus.ca), EDGAR (sec.gov) and on our website (cameco.com).

See our most recent management proxy circular for additional information, including how our directors and officers are compensated and any loans to them, principal holders of our securities, and securities authorized for issue under our equity compensation plans. We expect the circular for our May 9, 2025 annual meeting of shareholders to be available on April 3, 2025.

See our 2024 financial statements and 2024 MD&A for additional financial information. |

2024 ANNUAL INFORMATION FORM Page 12

Our values and strategy

We believe we have the right strategy to add long-term value and we will do so in a manner that reflects our values. For over 35 years, we have been delivering our products responsibly. Building on that strong foundation, we remain committed to our efforts to operate in a responsible and sustainable manner, identifying and addressing the risks and opportunities that we believe may have a significant impact on our ability to add long-term value for our stakeholders.

Committed to our values

Our values are discussed below. They define who we are as a company, are at the core of everything we do and help to embed sustainability principles and practices as we execute on our strategy. They are:

| • | safety and environment |

| • | people |

| • | integrity |

| • | excellence |

Safety and Environment

The safety of people and protection of the environment are the foundations of our work. All of us share in the responsibility of continually improving the safety of our workplace and the quality of our environment.

We are committed to keeping people safe and conducting our business with respect and care for both the local and global environment.

People

We value the contribution of every employee and we treat people fairly by demonstrating our respect for individual dignity, creativity and cultural diversity. By being open and honest, we achieve the strong relationships we seek.

We are committed to developing and supporting a flexible, skilled, stable and diverse workforce, in an environment that:

| • | attracts and retains talented people and inspires them to be fully productive and engaged |

| • | encourages relationships that build the trust, credibility and support we need to grow our business |

Integrity

Through personal and professional integrity, we lead by example, earn trust, honour our commitments and conduct our business ethically.

We are committed to acting with integrity in every area of our business, wherever we operate.

Excellence

We pursue excellence in all that we do. Through leadership, collaboration and innovation, we strive to achieve our full potential and inspire others to reach theirs.

Our strategy

We are a pure-play investment in the growing demand for nuclear energy, focused on taking advantage of the near-, medium-, and long-term growth occurring in our industry. We provide nuclear fuel and nuclear power products, services, and technologies across the fuel cycle, complemented by our investment in Westinghouse, that support the generation of carbon-free, reliable, secure, and affordable energy. Our strategy is set within the context of what we believe is a transitioning market environment. Increasing populations, a growing focus on electrification and decarbonization, and concerns about energy security and affordability are driving a global focus on tripling nuclear power capacity by 2050, which is expected to durably strengthen the long-term fundamentals for our industry. Nuclear energy must be a central part of the solution to the world’s shift to a low-carbon, secure energy economy. It is an option that can provide the power needed, not only reliably, but also safely and affordably, and in a way that will help achieve climate, energy and national security objectives.

Our strategy is to capture full-cycle value by:

| • | remaining disciplined in our contracting activity, building a balanced portfolio in accordance with our contracting framework |

2024 ANNUAL INFORMATION FORM Page 13

| • | profitably producing from our tier-one assets and aligning our production decisions in all segments of the fuel cycle with contracted demand and customer needs |

| • | being financially disciplined to allow us to: |

| • | execute our strategy |

| • | invest in new opportunities that are expected to add long-term value |

| • | self-manage risk |

| • | exploring other emerging opportunities within the nuclear power value chain, which align with our commitment to manage our business responsibly and sustainably, contribute to decarbonization, and help to provide secure and affordable energy |

We continually evaluate investment opportunities within the nuclear fuel value chain, which align well with our commitment to manage our business responsibly and sustainably, and allow us to contribute to energy security solutions. Expanding our participation in the fuel cycle is expected to complement our tier-one uranium and fuel services assets, creating new revenue opportunities, and enhancing our ability to meet the increasing needs of existing and new customers for secure, reliable nuclear fuel supplies, services and technologies.

We have signed a number of non-binding arrangements to explore several areas of cooperation to advance the commercialization and deployment of SMRs in Canada and around the world.

We will make an investment decision when an opportunity is available at the right time and the right price. We strive to pursue corporate development initiatives that will leave us and our stakeholders in a fundamentally stronger position. As such, an investment opportunity is never assessed in isolation. Investments must compete for investment capital with our own internal growth opportunities. They are subject to our capital allocation process described in our 2024 MD&A under Capital Allocation – Disciplined Financial Management, starting on page 29.

We expect our strategy will allow us to increase long-term value, and we will execute it with an emphasis on safety, people and the environment.

For more information on our strategy, see our 2024 MD&A under Our values and strategy, starting on page 22.

Market overview and developments

A market in transition

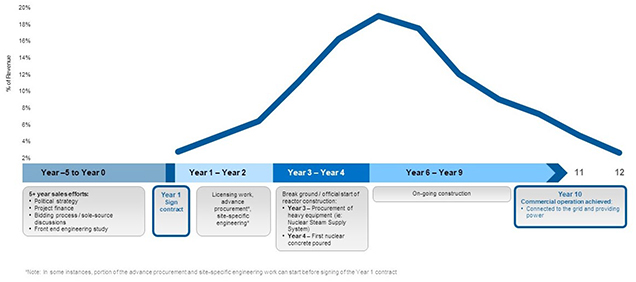

In 2024, geopolitical uncertainty and heightened concerns about energy security, national security, and climate change continued to improve the demand and supply fundamentals for the nuclear power industry and the fuel cycle that is required to support it. Increasingly, countries and companies around the globe are recognizing the critical role nuclear power must play in providing carbon-free and secure baseload power. This was evidenced at the 29th Conference of Parties (COP29), where a total of 31 countries have now signed the declaration to triple nuclear energy capacity by 2050. This growing support has led to a rise in demand as closed reactors are returning to service, reactors are being saved from retirement, life extensions are being sought and approved for existing reactor fleets, and numerous commitments and plans are advancing for the construction of new nuclear generating capacity. In addition, there is increasing interest in SMRs, including smaller versions of existing technology and advanced technology designs, with companies in energy intensive sectors looking to nuclear to help achieve their decarbonization plans. The potential expansion of the markets and use cases for nuclear energy could add significant demand in the decades to come, with a growing number of agreements being signed and several projects already underway.

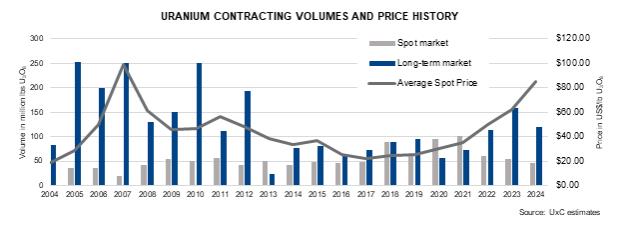

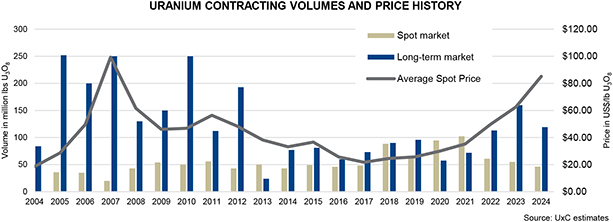

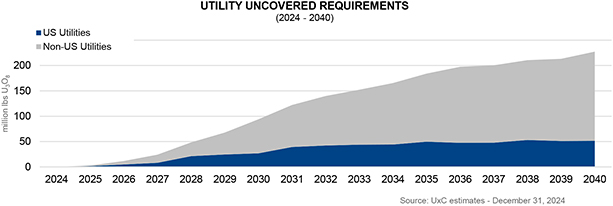

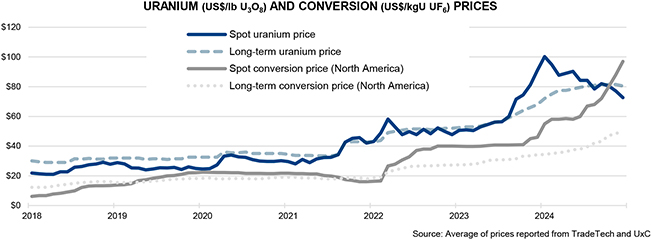

While demand for uranium and nuclear fuel continues to increase, future supply is not keeping pace. Heightened supply risk caused by growing geopolitical uncertainty, shrinking secondary supplies and a lack of investment in new capacity over the past decade has motivated utilities to evaluate their near-, mid- and long-term nuclear fuel supply chains. The uncertainty about where nuclear fuel supplies will come from to satisfy growing demand has led to significant long-term contracting activity in recent years. In 2024, about 119 million pounds of uranium was placed under long-term contracts by utilities. While the volume remains below replacement rate, this potentially increases the cumulative level of uncovered requirements in the future, when primary supply is expected to be limited, and secondary supply stocks have been drawn down. Prices across the nuclear fuel cycle continued to trend higher in 2024, reaching historic highs in conversion, where spot price increased 111% and term price rose 46% compared to 2023, and in enrichment, where spot and term prices rose over 23% and 10% respectively compared to 2023. At the front end of the cycle, uranium spot prices experienced volatility and averaged $85 (US) per pound for 2024, while the long-term uranium price increased 19% over the prior year, ending 2024 above $80 (US) per

2024 ANNUAL INFORMATION FORM Page 14

pound. We expect continued competition to secure uranium, conversion services and enrichment services under long-term contracts with proven sustainable producers and suppliers who have a diversified portfolio of assets in geopolitically attractive jurisdictions, and on terms that help ensure a reliable supply is available to satisfy demand.

Durable demand growth

The benefits of nuclear energy have come clearly into focus, supporting a level of durability that we believe has not been previously seen. The durability is being driven not only by the geopolitical realignment in energy markets but also by a global focus on achieving the net-zero carbon targets set by countries and companies around the world. Geopolitical uncertainty has deepened concerns about energy security and national security, highlighting the role of energy policy in balancing three main objectives: providing a reliable and secure baseload profile; providing an affordable, levelized cost profile; and providing a clean emissions profile. Net-zero carbon targets are also turning global attention to a broader triple challenge: about one-third of the global population must be lifted out of energy poverty by improving access to clean and reliable baseload electricity; approximately 80% of the current global electricity grids that run on carbon-emitting sources of thermal power must be replaced with a carbon-free, reliable alternative; and global power grids must grow by electrifying industries, such as private and commercial transportation, and home and industrial heating, which today are largely powered with carbon-emitting sources of thermal energy. There is increasing recognition that nuclear power meets these objectives and has a key role to play in achieving energy security and decarbonization goals. The growth in demand is not just long-term and in the form of new builds, but medium-term in the form of reactor restarts and life extensions, and near-term with early reactor retirement plans being deferred or cancelled and new markets continuing to emerge. Long-term momentum remains very supportive with the installed base of nuclear capacity and an increasing focus on large-scale new build and the development of SMRs.

Demand and energy policy highlights

| • | The inaugural Nuclear Energy Summit was held in Brussels in March, jointly organized by Belgium and the International Atomic Energy Agency (IAEA) with representatives from 32 countries in attendance. The leaders backed supportive measures in areas including financing, regulatory cooperation, technological innovation and workforce training to enable the expansion of nuclear power to help address climate change and boost energy security. |

| • | At COP29, the 2024 United Nations Climate Change Conference held in Baku, Azerbaijan, six new countries were added to the declaration to triple nuclear energy capacity by 2050, bringing the total to 31. It was recognized that financing mechanisms will play a key role in meeting targets, and the increased interest and investment from some of the world’s largest and advanced technology companies could help support future nuclear deployment. |

| • | The International Energy Agency’s (IEA) 2024 World Energy Outlook report was released in October. The projections for global electricity demand in the Stated Policies Scenario (SPS) increased 6%, or 2,200 terawatt-hours (TWh) higher in 2035, driven primarily by light industrial consumption, cooling, mobility, and data centers and AI. Nuclear generation showed a modest increase in the SPS while the Net Zero Scenario (NZE) shows a 16% increase to 7,000 TWh by 2050, compared to 6,000 TWh in the previous report. |

| • | In China, China National Nuclear Corporation (CNNC) started construction at Zhangzhou unit 3 in early 2024, a domestically designed Hualong One (HPR1000), with plans for six more units at the site. CNNC also commenced construction at the Jinqimen nuclear project where it has plans for six HPR1000s. Additionally, China General Nuclear announced that Fangchenggang unit 4, an HPR1000, began loading fuel in February and began operating on April 1. Finally, in August, four new CAP1400 reactors that use Westinghouse technology were approved, bringing the total number of approved reactors in China to 16. |

| • | In Japan, Onagawa unit 2 restarted in October, becoming the first boiling water reactor (BWR) to return to operation under the post-2011 Japanese Nuclear Regulatory Authority (NRA) safety regime. Additionally, Chugoku Electric Power Company successfully restarted Shimane unit 2 in December, bringing the total number of restarted reactors to 14. Finally, the NRA approved a 10-year life extension for two of Kansai’s reactors, Ohi units 3 and 4, from 30 years to 40 years, allowing them to operate until 2061 and 2063, respectively. |

| • | In South Korea, Korea Hydro & Nuclear Power (KHNP) announced that Shin Hanul unit 2 entered commercial operation, while units 3 and 4 are proceeding toward construction. In addition, Saeul units 3 and 4 are progressing through construction, which upon completion will mark 30 units operating in the country. KHNP also initiated the process to extend the lives of Wolsong units 2, 3 and 4. |

| • | In India, the Atomic Energy Commission reaffirmed the country’s plan to triple nuclear power generation by 2030 from current output of 7.5 gigawatt-electric (GWe), with an additional nine reactors currently under construction and additional units planned at various sites, which could potentially include SMRs. The most recent activity has been at Rajasthan unit 7, which is expected to be fully operational in early 2025, and Rajasthan unit 8 which is expected to come online in early 2026. |

2024 ANNUAL INFORMATION FORM Page 15

| • | In the Czech Republic, the government announced KHNP as the preferred bid for the construction of two additional units at the existing Dukovany nuclear site and two at the Temelin site. |

| • | Energoatom saw first concrete poured in the construction of Khmelnitski units 5 and 6. The new reactors will be the first built in Ukraine using Westinghouse’s AP1000® technology. |

| • | Italy is moving towards a reversal of the country’s current ban on nuclear power production with plans to finalize a nuclear reintroduction strategy by the end of 2027. |

| • | In Poland, the government approved a plan to build an SMR based on designs from Rolls-Royce. Additionally, Polskie Elektrownie Jądrowe announced it has received a Letter of Interest for $1.5 billion (US) in potential financing from Export Development Canada to support Poland’s AP1000 project, which aims to be the country’s first nuclear power plant. |

| • | In Romania, the US Exim Bank approved a $98 million (US) loan commitment for the financing of an SMR project utilizing NuScale technology, with additional funding announcements at the G7 leaders’ summit, totaling up to $275 million (US). The project aims for 462 MWe of capacity at a retired coal plant in the country, with a total of six 77 MWe modules to be constructed. |

| • | In Egypt, the fourth and final VVER-1200 unit at El Dabba began construction. Unit 1 is expected to begin commercial operation in 2029 with the remaining three to follow in the early to mid-2030s. |

| • | Following a lengthy legal battle, Brazilian utility Electronuclear was successful in appealing the government ordered suspension of activity at Angra unit 3, a 1,350 MWe reactor, allowing it to continue construction. |

| • | In the US, Southern Company announced that Vogtle unit 4, a Westinghouse AP1000, moved into commercial operation, making it the second new reactor to come online in the US in over 28 years. |

| • | The US Nuclear Regulatory Commission (NRC) approved Dominion’s North Anna units 1 and 2 for an extension of their operating licences from 60 to 80 years, keeping the reactors online until the 2050s, while Vistra received approval to operate Comanche Peak units 1 and 2 for up to 60 years. Additionally, approval was received to extend Pacific Gas & Electric’s two-unit Diablo Canyon plant operation until 2030, while filings have already been made to extend the operating lives of the units a further 20 years, until the mid-2040s. |

| • | The DOE released its Advanced Nuclear Commercial Liftoff report, outlining the need to add 200 GWe of new generating capacity in order to triple US nuclear capacity by 2050, as part of their net-zero emissions target. Starting in 2030, the report calls for a 13 GWe annual increase in output for 15 years to reach 300 GWe by 2050. This increase is expected to come from extending reactor operating licences, uprating of capacity, and restarting shutdown reactors, along with new large scale and advanced reactors. The report also calls for a significant increase in capacity across the nuclear fuel supply chain and notably, a secure supply of uranium from the US, allies, and partners. |

| • | The US DOE announced plans to finance $900 million (US) for deployment of light-water SMRs, with $800 million (US) of the funding for two of the “first-mover teams” which can include utilities, SMR producers, vendors, and other end-users. In addition, former President Biden signed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act into law, which builds on prior legislation to modernize licensing, speed up the licensing process and reduce fees, while simplifying the environmental review process. |

| • | Numerous utilities made positive progress towards restarting shutdown nuclear plants in 2024. Holtec International announced their intention to restart the Palisades 800 MWe pressurized water reactor in Michigan, with both state and federal governments backing the effort, which would mark the first US reactor to restart after being shut down for decommissioning. Additionally, NextEra Energy announced they have initiated the regulatory process to restart the Duane Arnold plant, which could see the reactor returning to operation as early as 2028. Finally, Constellation Energy announced their $1.6 billion (US) plan to restart the 835 MWe Crane Clean Energy Center (formerly Three Mile Island Unit 1) in Pennsylvania. The restart is planned for 2028 with Microsoft agreeing to a 20-year power purchase agreement to support the investments in restarting the plant. |

| • | With the rapid expansion of artificial intelligence and data center demand, numerous other technology companies also made commitments to nuclear for both large scale and SMR projects. Notably, Google announced a deal with Kairos Power to buy the output from at least six first-of-a-kind fluoride salt-cooled, high-temperature reactors. Additionally, Amazon and Energy Northwest announced an agreement for Amazon to fund the development of SMRs, with the right to purchase power from the first four Xe-100 units (320 MWe) and an option for Energy Northwest to build up to eight additional units (640 MWe). Finally, Sabey, a US data center developer, is working with TerraPower to explore the deployment of Natrium SMRs at current and future data center sites. |

2024 ANNUAL INFORMATION FORM Page 16

| • | In Canada, Bruce Power submitted plans for its Bruce C Project, planning to add 4.8 GWe of new generation to complement 6.5 GWe of existing generation. In early 2025, the Ontario government announced plans for Ontario Power Group (OPG) to construct a 10 GWe nuclear plant near Port Hope. In addition, OPG is proceeding with refurbishments of Pickering B’s four units, expected to be completed by the mid-2030s and extending the plants’ operating lives by 30 years. OPG also successfully completed initial site preparation at the Darlington plant for the first of four GE-Hitachi BWRX-300 SMRs, with the nuclear portion of construction for the first unit set to start in early 2025, with planned commercial operation in 2029. |

| • | Westinghouse opened a new nuclear engineering hub in Kitchener, Ontario, where 50 engineers will be stationed. In addition, SaskPower, Westinghouse, and Cameco signed a Memorandum of Understanding to evaluate Saskatchewan’s carbon-free energy needs involving discussions on the AP1000, AP300™ and eVinci™ reactors. The province will be evaluating the suitability of its infrastructure for a nuclear fuel supply chain through SaskNuclear, a newly formed subsidiary of SaskPower. |

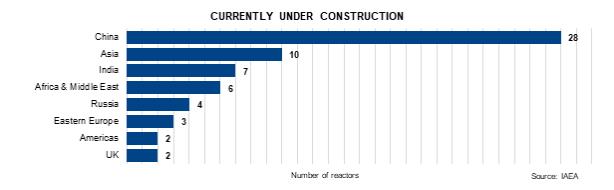

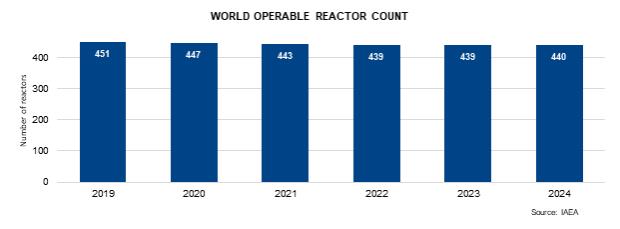

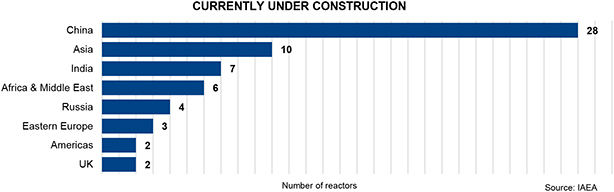

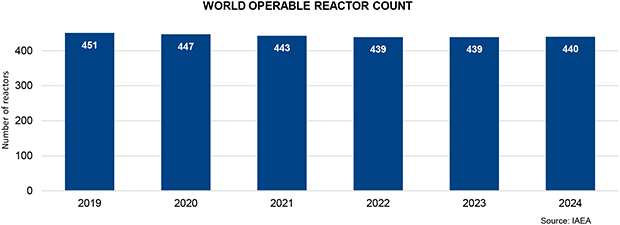

According to the IAEA, globally there are currently 440 operable reactors and 62 reactors under construction. Several nations are appreciating the energy security and carbon-free energy benefits of nuclear power and have reaffirmed their commitment with plans underway to support existing reactor units and review policies to encourage more nuclear generation. Several other non-nuclear countries have emerged as candidates for new nuclear capacity. In some countries where phase-out policies have been in place, policy reversals and decisions have been made to keep reactors running, with public opinion polls showing increasing support. With a number of reactor construction projects recently approved and many more planned, demand for uranium continues to improve. There is growing recognition of the role nuclear must play in providing safe, affordable, carbon-free baseload electricity to achieve a low-carbon economy, with geopolitical uncertainty causing some utilities to move away from Russian energy supplies and seek nuclear fuel suppliers whose values are aligned with their own, or whose origin of supply better protects them from potential interruptions.

2024 ANNUAL INFORMATION FORM Page 17

Supply uncertainty

Geopolitical uncertainty, energy security, and national security remained the most notable factors impacting security of supply in 2024. Driven by the Russian invasion of Ukraine, the mine suspension in Niger, and supply chain challenges, particularly in Kazakhstan, many governments and utilities are re-examining procurement strategies that rely on nuclear fuel supplies from these jurisdictions. In addition, sanctions on Russia and import/export restrictions added to the delivery risks for nuclear fuel supplies coming out of Central Asia. Several uranium projects restarted in 2024 in support of increased demand, though delays and higher-than-expected production costs were a common theme. Despite the positive price trend in 2024, the deepening geopolitical uncertainty, sanctions and trade policy restrictions, and years of underinvestment in new uranium and fuel cycle service capacities has shifted risk from producers to utilities.

Supply and trade policy highlights

| • | The Prohibiting Russian Uranium Imports Act (H.R. 1042) went into effect in August with the intent to prohibit the imports of Russian low-enriched uranium (LEU) into the US until 2040. It contains a US DOE waiver process available until 2028, where utilities can apply through a public process for an exception to the import ban in situations concerning energy and national security. In November, the Russian government issued a decree to immediately limit the export of LEU to the US, which was meant to be symmetrical to the trade actions taken by the US earlier in the year. This resulted in two ships departing from St. Petersburg to Baltimore without any of their intended enriched uranium product cargo onboard. |

| • | The DOE approved funding of up to $2.7 billion (US) to support domestic production of LEU and high-assay low-enriched uranium (HALEU) by creating a guaranteed buyer of US produced nuclear fuel to restore US nuclear fuel production capabilities. Initial awards were granted for HALEU in October and LEU in December. |

| • | In January 2025, KAP announced that 2024 production increased 10% from the prior year to 60.5 million pounds U3O8. No update was provided on 2025 production guidance beyond its previous announcement from August 2024, where it lowered its 2025 guidance range to 65 million to 68.9 million pounds U3O8 (previously 79.3 million to 81.9 million pounds U3O8), citing project delays and continued sulfuric acid shortages. A significant portion of the reduced 2025 guidance resulted from production delays at Appak LLP, as well as JV Budenovskoye LLP. Additionally, KAP reduced production guidance for JV KATCO LLP below annual production capacity until at least 2026. |

| • | In July, the government of Kazakhstan introduced amendments to the Tax Code of the Republic of Kazakhstan which involved changes to the Mineral Extraction Tax (MET) rate for uranium. The MET rate will increase from 6% in 2024, to 9% in 2025, with the introduction of a progressive system based on actual annual production volumes under each subsoil use agreement, starting in 2026, where the highest rate is 18% for operations producing over 10.4 million pounds. An additional MET of up to 2.5% based on the spot market price of uranium, will also be added in 2026. The MET is incurred and paid by the mining entities, impacting both KAP and different JVs and subsidiaries. |

| • | In October, Orano Canada Inc. (Orano) announced plans to temporarily suspend operations at their SOMAIR mine in Niger due to growing financial difficulties resulting from the coup d’état in July 2023 and the subsequent closure of the main supply and export route in Niger. Orano confirmed in December that the Nigerien authorities have taken operational control of the project, resulting from escalating conflicts between the company and the country’s ruling military junta. Earlier in the year, Orano also reported that the Nigerien government revoked their operating permit for their undeveloped Imouraren deposit. Further in the region, GoviEx Uranium Inc. (GoviEx) was informed by the Nigerien government that they no longer have rights over the perimeter of the Madaouela mining permit. In December, both Orano and GoviEx initiated arbitration proceedings against the Republic of Niger for the Imouraren and Madaouela projects respectively. |

| • | In March, Paladin Energy Ltd. (Paladin) announced the restart of its Langer Heinrich mine in Namibia which has an annual production capacity of 5.2 million pounds U3O8 and had been in care and maintenance since 2018. In November, Paladin updated their 2025 production guidance from 4.0-4.5 million pounds U3O8 to 3.0-3.6 million pounds U3O8 due to ongoing challenges and operational variability in ramping up production. |

| • | In 2024, several other uranium projects also restarted production including Boss Energy’s Honeymoon ISR project in Australia, Uranium Energy Corp.’s Christensen Ranch ISR operations in Wyoming, enCore Energy’s Alta Mesa Uranium Central Processing Plant and Wellfield in Texas, and Peninsula Energy Ltd.’s Lance ISR project in Wyoming. In June, Terrafame also reported it officially started recovering natural uranium at its industrial site in Sotkamo, Finland. |

| • | Sprott Physical Uranium Trust (SPUT) purchased about three million pounds U3O8 in 2024, bringing total purchases since inception to nearly 48 million pounds U3O8, and a total physical position of 66.2 million pounds U3O8. Volatility in the equity market impacts SPUT’s ability to raise funds to purchase uranium based on its share price trading at a discount or a premium to the net asset value (NAV) of the uranium it holds; in 2024 SPUT was at a discount to NAV for most of the year, negatively impacting its ability to buy uranium. |

2024 ANNUAL INFORMATION FORM Page 18

| • | Following 2023 announcements from both Urenco and Orano to proceed with enrichment capacity expansion projects, 2024 saw advancements with the first new centrifuges being installed at Urenco USA and Orano starting construction at its Georges Besse II (GBII) expansion in France. A total capacity expansion of 1.8 million separative work units (SWU) is planned across three Urenco facilities including in Germany and the Netherlands, which represents a 10% capacity increase, whereas Orano seeks to grow GBII’s enrichment capacity, by approximately 2.5 million SWU annually, a 30% increase. |

Long-term contracting creates full-cycle value for proven productive assets

Like other commodities, the demand for uranium is cyclical. However, unlike other commodities, uranium is not traded in meaningful quantities on a commodity exchange. The uranium market is principally based on bilaterally negotiated long-term contracts covering the annual run-rate requirements of nuclear power plants, with a small spot market to serve discretionary demand. History demonstrates that in general, when prices are rising and high, uranium is perceived as scarce, and more contracting activity takes place with proven and reliable suppliers. The higher demand discovered during this contracting cycle drives investment in higher-cost sources of production, which due to lengthy development timelines, tend to miss the contracting cycle and ramp up after demand has already been won by proven producers. When prices are declining and low, there is no perceived urgency to contract, and contracting activity and investment in new supply dramatically decreases. After years of low prices, and a lack of investment in supply, and as the uncommitted material available in the spot market begins to thin, security-of-supply tends to overtake price concerns. Utilities typically re-enter the long-term contracting market to ensure they have a reliable future supply of uranium to run their reactors.

UxC reports that over the last five years approximately 534 million pounds U3O8 equivalent have been locked-up in the long-term market, while approximately 798 million pounds U3O8 equivalent have been consumed in reactors. We remain confident that utilities have a growing gap to fill.

We believe the current backlog of long-term contracting presents a substantial opportunity for proven and reliable suppliers with tier-one productive capacity and a record of honouring supply commitments. As a low-cost producer, we manage our operations to increase value throughout these price cycles.

2024 ANNUAL INFORMATION FORM Page 19

In our industry, customers do not come to the market right before they need to load nuclear fuel into their reactors. To operate a reactor that could run for more than 60 years, natural uranium and the downstream services have to be purchased years in advance, allowing time for a number of processing steps before a finished fuel bundle arrives at the power plant. At present, we believe there is a significant amount of uranium that needs to be contracted to keep reactors running into the next decade.

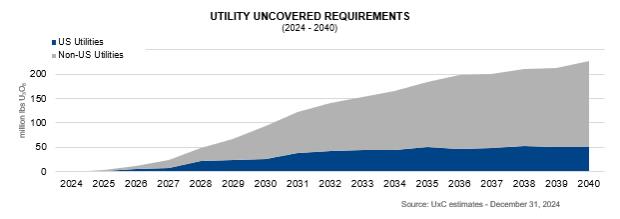

UxC estimates that cumulative uncovered requirements are about 2.1 billion pounds to the end of 2040. With the lack of investment over the past decade, there is growing uncertainty about where uranium will come from to satisfy growing demand, and utilities are becoming increasingly concerned about the availability of material to meet their long-term needs. In addition, secondary supplies have diminished, and the material available in the spot market has thinned as producers and financial funds continue to purchase material. Furthermore, geopolitical uncertainty is causing some utilities to seek nuclear fuel suppliers whose values are aligned with their own or whose origin of supply better protects them from potential interruptions, including from transportation challenges or the possible imposition of formal sanctions.

We will continue to take the actions we believe are necessary to position the company for long-term success. Therefore, we will continue to align our production decisions with our customers’ needs under our contract portfolio. We will undertake contracting activity which is intended to ensure we have adequate protection while maintaining exposure to the benefits that come from having uncommitted, low-cost supply to place into a strengthening market.

Building a balanced portfolio

The purpose of our contracting framework is to deliver value. Our approach is to secure a solid base of earnings and cash flow by maintaining a balanced contract portfolio that optimizes our realized price.

Contracting decisions in all segments of our business need to consider the nuclear fuel market structure, the nature of our competitors, and the current market environment. The vast majority of run-rate fuel requirements are procured under long-term contracts. The spot market is thinly-traded, where certain utilities may buy small, discretionary volumes. This market structure is reflective of the baseload nature of nuclear power and the relatively small proportion of the overall operating costs the fuel represents compared to other sources of baseload electricity. Additionally, about half of the fuel supply typically comes from state-owned entities with production volume strategies or ambitions to serve state nuclear power ambitions with low-cost fuel supplies, or from diversified mining companies that produce uranium as a by-product. We evaluate our strategy in the context of our market environment and continue to adjust our actions in accordance with our contracting framework:

| • | First, we build a long-term contract portfolio by layering in volumes over time. In addition to our committed sales, we will compete for customer demand in the market where we think we can obtain value and, in general, as part of longer-term contracts. We will take advantage of opportunities the market provides, where it makes sense from an economic, logistical, diversification and strategic point of view. Those opportunities may come in the form of spot, mid-term or long-term demand, and will be additive to our current committed sales. |

| • | Based on our portfolio of long-term contracts, we decide how to best source material to satisfy that demand, planning our production in accordance with our contract portfolio and other available sources of supply. We will not produce from our tier-one assets to sell into an oversupplied spot market. |

| • | We do not intend to build an inventory of excess uranium. Excess inventory serves to contribute to the sense that uranium is abundant and creates an overhang on the market, and it ties up working capital on our balance sheet. |

2024 ANNUAL INFORMATION FORM Page 20

| • | Depending on the timing and volume of our production, purchase commitments, and our inventory volumes, we may be active buyers in the market in order to meet our annual delivery commitments. Historically, we have generally planned our annual delivery commitments to slightly exceed the annual supply we expect to come from our annual production and our long-term purchase commitments and have therefore relied on the spot market to meet a small portion of our delivery commitments. During the time that our tier-one assets were in care and maintenance from 2018-2022, we relied more heavily on market purchases to meet our delivery obligations. In general, if we choose to purchase material to meet demand, we expect the cost of that material will be more than offset by the volume of commitments in our sales portfolio that are exposed to market prices at the time of delivery over the long-term. |

In addition to this framework, our contracting decisions always factor in who the customer is, our desire for regional diversification, the product form, and logistical factors.

Ultimately, our goal is to protect and extend the value of our contract portfolio on terms that recognize the value of our assets, including future development projects, and pricing mechanisms that provide adequate protection when prices go down and exposure to rising prices. We believe using this framework will allow us to create long-term value. Our focus will continue to be on ensuring we have the financial capacity to execute on our strategy and self-manage risk.

Long-term contracting

Uranium is not traded in meaningful quantities on a commodity exchange. Utilities have historically bought the majority of their uranium and fuel services products under long-term contracts that are bilaterally negotiated with suppliers. The spot market is discretionary and typically used for one-time volumes, not to satisfy annual demand. We sell uranium and fuel products and services directly to nuclear utilities around the world as uranium concentrates, UO2 and UF6, conversion services, or fuel fabrication and reactor components for CANDU heavy water reactors. We have a solid portfolio of long-term sales contracts that reflect our reputation as a proven, reliable supplier of geographically stable supply, and the long-term relationships we have built with our customers.

In general, we are active in the market when it is beneficial for us and in support of our long-term contract portfolio. We undertake activity in the spot and term markets prudently, looking at the prices and other business factors to decide whether it is appropriate to purchase or sell into the spot or term market. Not only is this activity a source of profit, but it also gives us insight into underlying market fundamentals.

We deliver the majority of our uranium under long-term contracts each year, some of which are tied to market-related pricing mechanisms quoted at time of delivery. Therefore, our net earnings and operating cash flows are generally affected by changes in the uranium price. Market prices are influenced by the fundamentals of supply and demand, market access and trade policy issues, geopolitical events, disruptions in planned supply and demand, and other market factors.

The objectives of our contracting strategy are to:

| • | optimize realized price by balancing exposure to future market prices while providing some certainty for our future earnings and cash flow |

| • | focus on meeting the nuclear industry’s growing annual uncovered requirements with our tier-one production |

| • | establish and grow market share with strategic and regionally diverse customers |

We have a portfolio of long-term contracts, each bilaterally negotiated with customers, that have a mix of base-escalated pricing and market-related pricing mechanisms, including provisions that provide exposure to rising market prices and also protect us when the market price is declining. This is a balanced and flexible approach that allows us to adapt to market conditions, put a floor on our average realized price and deliver the best value over the long term.

This approach has allowed our realized price to outperform the market during periods of weak uranium demand, and we expect it will enable us to realize increases linked to higher market prices in the future.

Base-escalated contracts for uranium: use a pricing mechanism based on a term-price indicator at the time the contract is accepted and escalated to the time of each delivery over the term of the contract.

Market-related contracts for uranium: are different from base-escalated contracts in that the pricing mechanism may be based on either the spot price or the long-term price, and that price is generally set a month or more prior to delivery rather than at the time the contract is accepted. These contracts may provide for discounts and typically include floor prices and/or ceiling prices, which are established at time of contract acceptance and usually escalate over the term of the contract.

2024 ANNUAL INFORMATION FORM Page 21

Fuel services contracts: the majority of our fuel services contracts use a base-escalated mechanism per kilogram of uranium (KgU) and reflect the market at the time the contract is accepted.

Optimizing our contract portfolio

We work with our customers to optimize the value of our contract portfolio. With respect to new contracting activity, there is often a lag from when contracting discussions begin and when contracts are executed. With our large pipeline of business under negotiation in our uranium segment, and a value driven strategy, we continue to be strategically patient in considering the commercial terms we are willing to accept. We layer in contracts over time, with higher commitments in the near term and declining over time in accordance with utilities growing uncovered requirements. Demand may come in the form of off-market negotiations or through on-market requests for proposals. We remain confident that we can add acceptable new sales commitments to our portfolio of long-term contracts to underpin the ongoing operation of our productive capacity and capture long-term value.

Given our view that additional long-term supply will need to be incented to meet the growing demand for safe, reliable, carbon-free nuclear energy, our preference today is to sign long-term contracts with market-related pricing mechanisms. However, we believe our customers expect prices to rise and prefer to lock-in today’s prices, with a fixed-price mechanism. Our goal is to balance all these factors, along with our desire for customer and regional diversification, with product form, and logistical factors to ensure we have adequate protection and will have exposure to rising market prices under our contract portfolio, while maintaining the benefits that come from having low-cost supply to deliver into a strengthening market.

At times, we may also look for opportunities to optimize the value of our portfolio. In cases where there is a changing policy, operating, or economic environment, including the introduction of new taxes or tariffs in certain jurisdictions, we manage risk accordingly. We have taken actions such as positioning material ahead of expected deliveries, revising our contract terms to protect us from unexpected future implementation of taxes or tariffs, and adjusting our contracts to minimize potential negative impacts while maintaining strong customer relationships, and we will continue to consider additional mitigation in the future.

Contract portfolio status

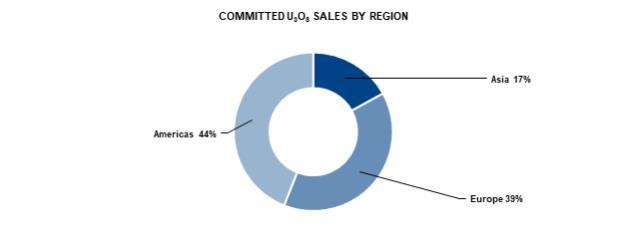

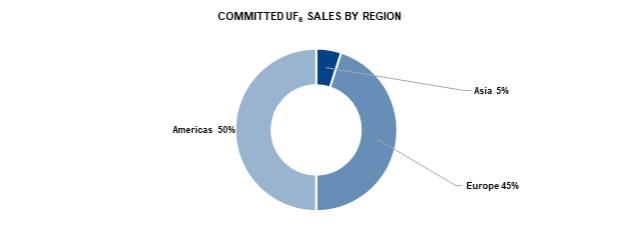

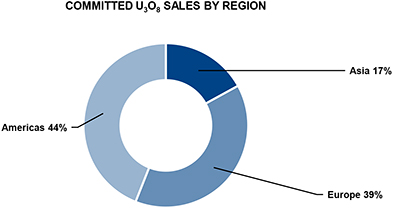

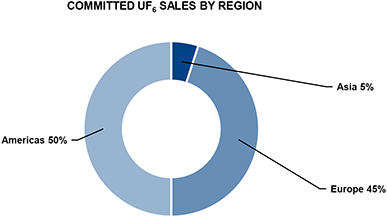

We have executed contracts to sell about 220 million pounds of U3O8 with 41 customers worldwide in our uranium segment, and about 85 million kilograms as UF6 conversion with 34 customers worldwide in our fuel services segment. We sell uranium and fuel services products to nuclear utilities in 16 countries.

Economic dependence

Customers – U3O8:

Our five largest customers account for 58% of commitments

2024 ANNUAL INFORMATION FORM Page 22

Customers – UF6 conversion:

Our five largest customers account for 59% of commitments

Managing our contract commitments

We allow sales volumes to vary year-to-year depending on:

| • | the level of sales commitments in our long-term contract portfolio |

| • | market opportunities |

| • | our sources of supply |

To meet our delivery commitments and to mitigate risk, we have access to a number of sources of supply, which includes uranium obtained from:

| • | our productive capacity |

| • | purchases under our JV Inkai agreement, under long-term agreements and in the spot market |

| • | our inventory in excess of our working requirements |

| • | product loans |

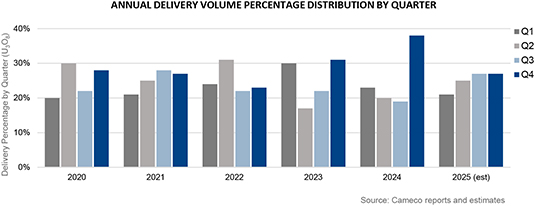

Our supply discipline