UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 1-14942

MANULIFE FINANCIAL CORPORATION

(Translation of registrant’s name into English)

200 Bloor Street East

North Tower 10

Toronto, Ontario, Canada M4W 1E5

(416) 926-3000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☑

DOCUMENTS FILED AS PART OF THIS FORM 6-K

The following documents, filed as exhibits to this Form 6-K, are incorporated by reference as part of this Form 6-K:

| Exhibit |

Description of Exhibit |

|

| 99.1 | 2024 Annual Report | |

| 99.2 | Notice of Annual Meeting of Shareholders | |

| 99.3 | Management Information Circular | |

| 99.4 | Shareholder Proxy Form | |

| 99.5 | Notice of Availability of Management Information Circular | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MANULIFE FINANCIAL CORPORATION | ||

| By: | /s/ James D. Gallagher |

|

| Name: | James D. Gallagher | |

| Title: | General Counsel | |

Date: March 21, 2025

Exhibit 99.2

| Notice of annual meeting of common shareholders

|

| You are invited to attend our 2025 annual meeting of common shareholders |

||||||

|

|

||||||

| When May 8, 2025 11 a.m. (Eastern time)

Where Manulife Head Office 200 Bloor Street East Toronto, Canada

How to attend Our 2025 annual meeting will be held in person at the address above and by live webcast online at https://meetings.

Please read the voting section starting on page 7 for detailed information about how to attend the meeting, vote and ask questions. More information and updates on how to attend the meeting will be made available on our website (www.manulife.com/

|

Four items of business • Receiving the consolidated financial statements and auditors’ reports for the year ended December 31, 2024 • Electing directors • Appointing the auditors • Having a say on executive pay

|

|||||

| Other matters that are properly brought before the meeting will be considered, but we are not aware of any at this time. The annual meeting for The Manufacturers Life Insurance Company will be held at the same time and will also be held in person and by live webcast.

|

||||||

| You need to register as a shareholder or proxyholder to vote or ask questions. |

||||||

|

By order of the board of directors,

Antonella Deo Corporate Secretary

March 12, 2025

|

||||||

Exhibit 99.3

Manulife 2025 Management information circular Manulife Financial Corporation Annual Meeting May 8, 2025 Notice of annual meeting of shareholders Your participation is important. Please read this document and vote.manulife.com

| Notice of annual meeting of common shareholders

|

| You are invited to attend our 2025 annual meeting of common shareholders |

||||||

|

|

||||||

| When May 8, 2025 11 a.m. (Eastern time)

Where Manulife Head Office 200 Bloor Street East Toronto, Canada

How to attend Our 2025 annual meeting will be held in person at the address above and by live webcast online at https://meetings.

Please read the voting section starting on page 7 for detailed information about how to attend the meeting, vote and ask questions. More information and updates on how to attend the meeting will be made available on our website (www.manulife.com/

|

Four items of business • Receiving the consolidated financial statements and auditors’ reports for the year ended December 31, 2024 • Electing directors • Appointing the auditors • Having a say on executive pay

|

|||||

| Other matters that are properly brought before the meeting will be considered, but we are not aware of any at this time. The annual meeting for The Manufacturers Life Insurance Company will be held at the same time and will also be held in person and by live webcast.

|

||||||

| You need to register as a shareholder or proxyholder to vote or ask questions. |

||||||

|

By order of the board of directors,

Antonella Deo Corporate Secretary

March 12, 2025

|

||||||

Message to shareholders

|

Don Lindsay

Chair of the Board |

Dear fellow shareholders,

On behalf of the board of directors, we are pleased to invite you to the annual meeting of common shareholders of Manulife Financial Corporation on May 8, 2025. As a holder of common shares, you have the right to receive our financial statements and vote your shares at the meeting.

Our 2025 management information circular, which starts on page 3, includes important information about the business of the meeting and the items you will be voting on, as well as information about our corporate governance practices and executive compensation program. Please read the circular before you vote your shares.

Thanks to our strategy, diverse business mix and geographic footprint, and our disciplined focus on execution, Manulife is a transformed company from the one it was in 2017. Today we are delivering market-leading shareholder return, we have a team and culture which is a competitive advantage, and we are continuing to make lives better for our more than 35 million customers around the world. At our Investor Day in 2024, we raised the bar with new financial targets, illustrating our ambition, unique business footprint, and strong momentum.

This success and the momentum we have built is a result of the vision and drive of our President and CEO, Roy Gori, and Manulife’s Executive Leadership Team. In 2024, after leading Manulife through the significant transformation that drove these results, Roy shared his intention to retire in May of 2025. On behalf of the board of directors and the entire Manulife team, we would like to thank Roy for his transformational, values-based leadership. His vision, passion, and drive have left a lasting legacy at Manulife.

We would also like to congratulate Phil Witherington, who we will welcome into the role of President and CEO in May. Following the board’s deliberate, thoughtful execution of our well-established succession planning process, the board was unanimous in our selection of Phil, who embodies the leadership qualities critical to the next chapter of our journey. His values-based approach, deep knowledge and understanding of our business and industry, experience in both developed and emerging markets, and his key role in Manulife’s transformation make him the right choice to serve as the next leader of Manulife.

In 2024, the board of directors continued our focus on board succession planning. We are delighted to welcome Nancy Carroll and John Montalbano to the board. These accomplished executives bring significant financial services, insurance, and wealth and asset management experience, and we are fortunate to have them join the board.

On behalf of the board and Manulife’s shareholders, customers, and colleagues, I would like to thank Sue Dabarno and Jim Prieur, who are retiring after the meeting and Vanessa Kanu who retired at the end of 2024, for their dedicated service and contributions to Manulife and the board.

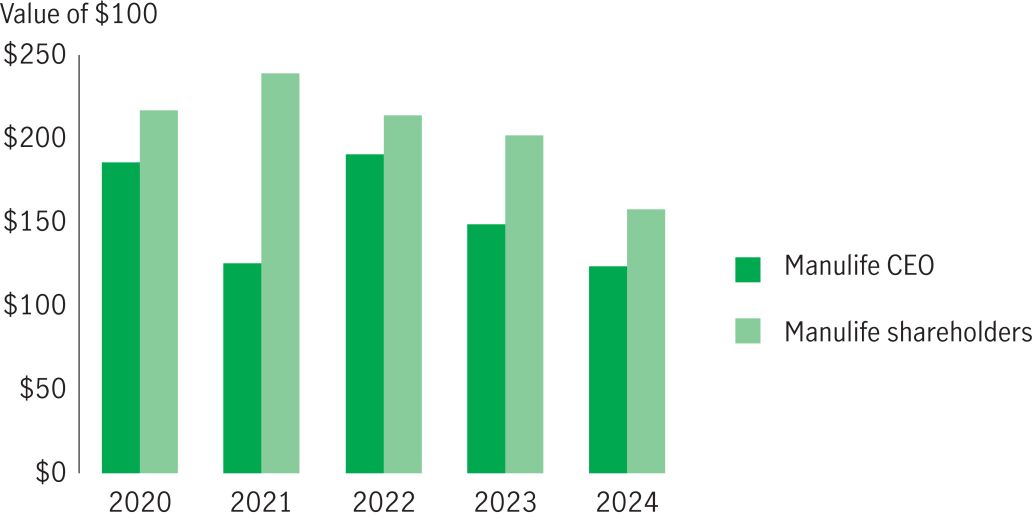

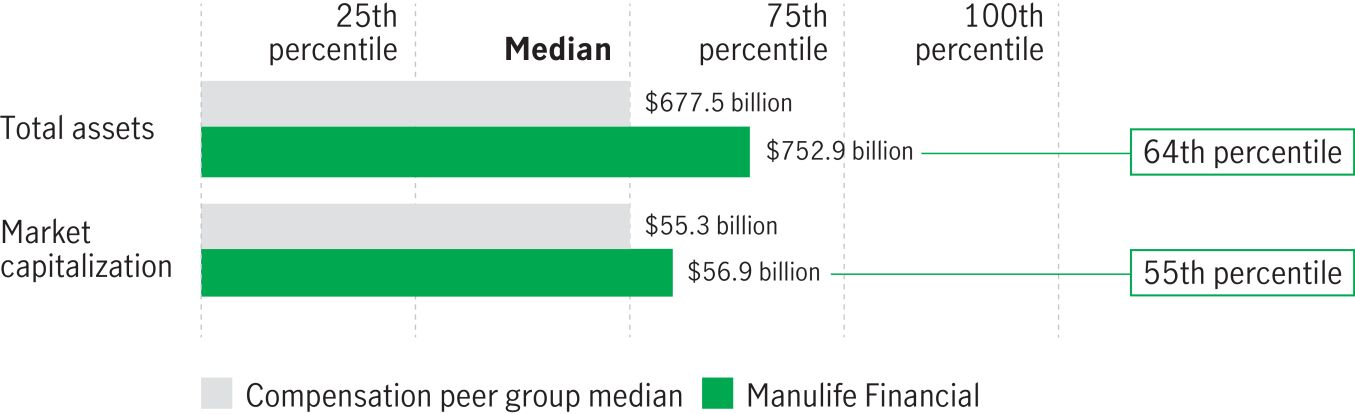

You can read about Manulife’s performance in 2024 and its impact on executive pay beginning on page 44. You will also find a more detailed discussion of the year’s performance and Manulife’s strategic progress in our 2024 annual report – available at manulife.com.

| 2025 Management information circular | 1 |

Please read the circular and vote your shares

The meeting will be held in person and by live webcast on May 8, 2025 at 11:00 a.m. (Eastern time). You can find information about how to attend the meeting on page 7.

Your vote is important to us – we encourage you to consider the information set out in the circular and exercise your voting rights. See page 8 for details about how to vote.

The meeting will cover four items of business: (1) receiving our financial statements; (2) voting to elect directors; (3) voting to appoint the auditors; and (4) voting to have a ‘say on executive pay’. You will vote on all items except for the financial statements. The board recommends you vote FOR items 2 to 4.

We look forward to welcoming you at the meeting.

Don Lindsay

Chair of the Board

March 12, 2025

| 2 | Manulife Financial Corporation |

About this Management

Information Circular

This management information circular is being made available to you because you owned common shares of Manulife Financial Corporation as of the close of business on March 12, 2025. It includes important information about the meeting, the items of business to be covered and how to vote your shares.

You are entitled to receive notice of, and vote these shares at, our 2025 annual meeting of common shareholders.

Management is soliciting your proxy for the meeting, which means we are contacting you to encourage you to vote. This will be done mainly by mail, but you may also be contacted by phone, including in connection with the use of the Broadridge QuickVote™ service. We have retained Kingsdale Advisors (Kingsdale), and they may assist us with this process. We pay the costs of the engagement with Kingsdale, which we expect to be approximately $50,000.

In this document:

| • | we, us, our, company and Manulife mean Manulife Financial Corporation |

| • | you, your and shareholder refer to holders of Manulife common shares |

| • | circular means the Manulife management information circular |

| • | meeting means our annual meeting of common shareholders on May 8, 2025 |

| • | common shares or shares means common shares of Manulife Financial Corporation |

| • | Manufacturers Life means The Manufacturers Life Insurance Company |

Information in this circular is as at February 28, 2025 and in Canadian dollars, unless indicated otherwise. Any information contained in, or otherwise accessible through, websites mentioned in this circular does not form a part of this document.

For more information

You can find financial information about Manulife in our 2024 annual report, which includes our audited consolidated financial statements and management’s discussion and analysis (MD&A) for the year ended December 31, 2024. The audit committee section of our annual information form has information about the audit committee, including the committee charter.

These documents are available on manulife.com, on SEDAR+ (sedarplus.ca), and on EDGAR (sec.gov/edgar). You can also ask us for a copy of our 2024 annual report – simply email us at shareholder_services@manulife.com.

Important information about your shares

Third parties may contact you with unsolicited offers to buy your shares, often at prices below market value. Securities administrators in Canada and the U.S. have expressed serious concerns about these types of offers, including the possibility that investors might tender to such offers without understanding the offer price relative to the actual market price of their securities. Investors should exercise caution with these types of offers.

Manulife is not associated with these offers and does not endorse or approve them. If you are contacted with an offer to buy your Manulife shares or have any questions about your shares, please speak with your investment advisor or contact our transfer agent TSX Trust Company (TSX Trust) at 1-800-783-9495 (Canadian residents), 1-800-249-7702 (U.S. residents) or 1-416-682-3864 (rest of world).

| 2025 Management information circular | 3 |

Delivery of the 2025 management information circular

As permitted by the Canadian Securities Administrators and pursuant to an exemption from the proxy solicitation requirement received from the Office of the Superintendent of Financial Institutions Canada (OSFI), we are using notice and access to deliver this circular to both our registered and non-registered (beneficial) shareholders.

What is notice and access?

Instead of receiving a paper copy of the circular, a package was sent to shareholders with a notice explaining how to access the circular online and how to request a paper copy. A form of proxy for registered shareholders and ownership statement holders, or a voting instruction form for non-registered (beneficial) shareholders, was included with the notice with instructions so you can vote your shares.

How to access the circular online

Our website: www.manulife.com/annualmeeting

Our transfer agent’s website: www.meetingdocuments.com/TSXT/mfc

On SEDAR+: www.sedarplus.ca

How to request a paper copy of the circular

Shareholders may request a paper copy of the circular up to one year from the date the circular was filed on SEDAR+. If you would like to receive a paper copy prior to the meeting, please follow the instructions provided in the notice or make a request by going to www.meetingdocuments.com/TSXT/mfc or contacting our transfer agent, TSX Trust, via telephone at 1-888-433-6443 (toll free in Canada and the United States) or 1-416-682-3801 (rest of world), or via email at tsxt-fulfilment@tmx.com. If you have questions about notice and access, please call TSX Trust.

| Sign up for e-delivery

We want to provide you with

information the way you want to receive it. You can choose to receive

Non-registered (beneficial) shareholders Visit proxyvote.com and enter the control number from your voting instruction form. Select “Delivery

Registered shareholders and non-registered ownership statement holders Visit tsxtrust.com/MFCdigital and follow the instructions. |

| 4 | Manulife Financial Corporation |

|

|

| 7 | ||||

| 8 | ||||

| 13 | ||||

| 18 | ||||

| 20 | ||||

| 33 | ||||

| 39 | ||||

| 44 | ||||

| 47 | ||||

| 47 | ||||

| 51 | ||||

| 56 | ||||

| 72 | ||||

| 86 | ||||

| 88 | ||||

| 88 | ||||

| 90 | ||||

| 94 | ||||

| 100 | ||||

| 105 | ||||

| 109 | ||||

| 109 | ||||

|

This symbol tells you where you can find more information |

| 2025 Management information circular | 5 |

This year’s annual meeting is on May 8, 2025.

Read this section to find out who can vote, how you can vote and what you will be voting on.

| Questions?

Call our transfer agent in your region if you have any questions about the meeting. Registered holders can also call our transfer agent to get information about options for managing your share account. |

||

| Canada | 1-800-783-9495 | |

| United States | 1-800-249-7702 | |

| Hong Kong | 852-2980-1333 | |

| Philippines | 632-5318-8567 | |

| Rest of world | 1-416-682-3864 | |

|

|

||||||||

| 7 |

||||||||

| 8 |

||||||||

| 13 |

||||||||

| 6 | Manulife Financial Corporation |

About the Meeting

| If you held Manulife common shares as of 5 p.m. (Eastern time) on March 12, 2025 (the record date), you are entitled to receive notice of, and vote at, our 2025 annual meeting. We had 1,722,408,874 common shares outstanding as of this date and each share carries one vote.

|

||||||

| About quorum Before the meeting can go ahead, at least two shareholders have to be present at the meeting, in person or by proxy. |

||||||

|

|

We must receive a simple majority of votes cast for an item to be approved.

Voting restrictions

Shares beneficially owned by the following entities and persons cannot be voted (except in circumstances approved by the Minister of Finance (Canada)):

| • | the Government of Canada or any of its political subdivisions or agencies |

| • | the government of a province or any of its political subdivisions or agencies |

| • | the government of a foreign country or any foreign government’s political subdivisions or agencies |

| • | any person who has acquired more than 10% of any class of shares of Manulife. |

Also, if any person, an entity controlled by any person, or any person together with an entity that person controls, beneficially owns more than 20% of the shares that can be voted, that person or entity cannot vote unless the Minister of Finance (Canada) allows it.

We are not aware of any person who beneficially owns or exercises control or direction (directly or indirectly) over more than 10% of the voting rights attached to Manulife common shares.

How to attend the meeting

| In person The meeting will take place on May 8, 2025 at 11:00 a.m. (Eastern time). It will be held at our head office in Toronto at 200 Bloor Street East. Please register with our transfer agent when you arrive.

Online as a shareholder

1. Log in: https://meetings.lumiconnect.com/ The link will be accessible one hour before the meeting start time to allow you to test your connection 2. Click “I have a login”

3. Enter your control number as your username (see pages 8 to 12 for more information) 4. Enter your password: “manulife2025” (case sensitive)

Online as a guest 1. Log in: https://meetings.lumiconnect.com/400-562-297-505 2. Click “I am a guest” and then complete the required fields. Although guests can attend the meeting, they cannot vote or ask questions. |

Shareholders and their duly appointed proxyholders will be able to ask questions and vote during the meeting. For more information about how to vote during the meeting and ask questions, please see pages 8 to 11. Additional instructions will be provided at the meeting, as necessary.

Questions should be of interest to all shareholders, not personal in nature. If your question relates to a personal matter, we will contact you after the meeting to follow up on your question. If we cannot answer a question during the meeting because of timing or technical limitations, we will follow up with you as soon as practicable after the meeting.

More information and updates on how to attend the meeting will be available on our website (www.manulife.com/annualmeeting) |

|||||

| 2025 Management information circular | 7 |

Please make sure your browser is compatible before you try to access the meeting online To access the meeting online either as a shareholder or a guest you will need the latest version of Chrome, Safari, Edge or Firefox. Please do not use Internet Explorer. You should log in early to make sure your browser is compatible. Internal network security protocols including firewalls and virtual private network (VPN) connections may block access. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted by the security settings of your organization. In the event of difficulties during the registration process or with accessing and attending the meeting, please contact TSX Trust at 1-800-783-9495 (Canadian residents), 1-800-249-7702 (U.S. residents) or 1-416-682-3864 (rest of world).

There are two ways to vote – by proxy before the meeting, or during the meeting. How you vote depends on whether you are a registered shareholder, an ownership statement holder or a non-registered (beneficial) shareholder.

Shareholders are encouraged to vote their shares and submit proxies before the meeting.

|

|

See page 12 for important details about voting by proxy. |

Registered shareholders and non-registered ownership statement holders (your package includes a proxy form)

You are a registered shareholder if you have a share certificate in your name or your shares are recorded electronically in the Direct Registration System (DRS) maintained by our transfer agent.

You are an ownership statement holder if you hold a share ownership statement that was issued when Manufacturers Life demutualized. |

||||||||

| Vote by proxy You or your authorized representative must complete the proxy form. If you are a corporation or other legal entity, your authorized representative must complete the form. |

|

You can vote your shares in one of four ways: | ||||||||

|

On the internet – Go to the website indicated on your proxy form. You will need the personal identification/control number on the form. |

|||||||||

|

By phone (Canada and U.S. only) – Call the toll-free number on the proxy form and follow the instructions. You will need the personal identification/control number on the form. |

|||||||||

|

By mail – Complete your proxy form and return it in the envelope provided. |

|||||||||

|

On your smartphone – Use the QR code found on your proxy form. |

|||||||||

| Your proxy must be received by 5 p.m. (Eastern time) on May 6, 2025 for your vote to be counted. If you are mailing your proxy form, be sure to allow enough time for the envelope to be delivered. The deadline for the deposit of proxies can be waived by the Chair of the Board at his discretion, without notice.

If the meeting is adjourned, your proxy must be received by 5 p.m. (Eastern time) two business days before the meeting is reconvened. |

||||||||||

| 8 | Manulife Financial Corporation |

About the Meeting

| Registered shareholders and non-registered ownership statement holders (continued) | ||||||||

| Vote in person at the meeting You will need to bring photo identification with you to the meeting. |

|

Check in with our transfer agent when you arrive at the meeting. Do not complete the proxy form before the meeting because you will vote in person at the meeting. |

||||||||

| Vote online during the meeting You will find your control number on the proxy form included with your meeting materials.

You will need your control number to be able to vote or ask questions at the meeting. |

|

On the day of the meeting: 1. Log in https://meetings.lumiconnect.com/400-562-297-505 The link will be accessible one hour before the meeting start time to allow you to test your connection 2. Click “I have a login” 3. Enter your control number (on the proxy form included with the meeting materials) as your username 4. Enter your password: “manulife2025” (case sensitive) 5. Follow the instructions to cast your vote.

If you have already voted by proxy, your vote at the meeting, if properly cast, will automatically revoke your previous vote. |

||||||||

| Changing your vote You can revoke your proxy form if you change your mind about how you want to vote your shares. |

|

Sending new voting instructions with a later date will revoke the instructions you previously submitted.

You can send a new proxy on the internet, by phone or by mail, by following the instructions above. Or send a notice in writing, signed by you or your authorized representative to: Corporate Secretary, Manulife Financial Corporation, 200 Bloor Street East, Toronto, Canada M4W 1E5.

Your new proxy must be received by 5 p.m. (Eastern time) on May 6, 2025 for your vote to be counted. If you are mailing your new proxy form, be sure to allow enough time for the envelope to be delivered.

If the meeting is adjourned, your proxy must be received by 5 p.m. (Eastern time) two business days before the meeting is reconvened.

If you miss the deadline, you can only revoke your proxy by giving a notice in writing to the Chair of the Board before the meeting begins. The notice must be signed by you or your authorized representative. |

||||||||

| 2025 Management information circular | 9 |

|

See page 12 for important details about voting by |

Non-registered (beneficial) shareholders (your package includes a voting instruction form)

You are a non-registered shareholder if you hold your shares through an intermediary (a bank, trust company, securities broker, or other financial institution). This means the shares are registered in your intermediary’s name and you are the beneficial shareholder. |

||||||||

| Vote by proxy You or your authorized representative must complete the voting instruction form. If you are a corporation or other legal entity, your authorized representative must complete the form. |

|

|

You can vote your shares in one of four ways: | |||||||

|

On the internet – Go to the website indicated on your voting instruction form and follow the instructions on screen. |

|||||||||

|

By phone (Canada and U.S. only) – Call the toll-free number on your voting instruction form and follow the instructions. |

|||||||||

|

By mail – Complete your voting instruction form and return it in the envelope provided. |

|||||||||

|

On your smartphone – Use the QR code found on your voting instruction form. |

|||||||||

| Your intermediary must receive your voting instructions with enough time to act on your instructions. Check the form for the deadline for submitting your voting instructions. If you are mailing your voting instruction form, be sure to allow enough time for the envelope to be delivered. The deadline for the deposit of proxies can be waived by the Chair of the Board at his discretion, without notice. |

||||||||||

| Vote in person at the meeting You must appoint yourself (or another person) as proxyholder.

Then you or the person you appoint need to bring photo identification with you to the meeting. |

|

First, appoint yourself as proxyholder by printing your name in the space provided on the voting instruction form. You can also appoint someone else to be your proxyholder (see page 12 for more information). You can do this in one of two ways: • sign and return the form in the envelope provided but do not fill in your voting instructions because you will vote during the meeting (check the form for the deadline for submitting it, and make sure you allow enough time for the envelope to be delivered), or • go to the website indicated on the voting instruction form and follow the instructions.

Then, when you arrive at the meeting, check in with our transfer agent. |

||||||||

| 10 | Manulife Financial Corporation |

About the Meeting

| Non-registered (beneficial) shareholders (continued) |

||||||||

| Vote online during the meeting You must appoint yourself (or another person) as proxyholder.

Then you or the person you appoint must contact TSX Trust to get a control number.

You need a control number to be able to vote or ask questions at the meeting. |

|

First, appoint yourself as proxyholder by printing your name in the space provided on the voting instruction form. You can also appoint someone else to be your proxyholder (see page 12 for more information). You can do this in one of two ways: • sign and return the form in the envelope provided but do not fill in your voting instructions because you will vote online during the meeting (check the form for the deadline for submitting it, and make sure you allow enough time for the envelope to be delivered), or • go to the website indicated on the voting instruction form and follow the instructions.

Then get a control number by contacting TSX Trust by no later than 5 p.m. (Eastern time) on May 6, 2025. You can do this in one of two ways: • call 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America), or • go online at www.tsxtrust.com/control-number-request

If you appointed someone else to be your proxyholder, that person must contact TSX Trust to get a control number.

On the day of the meeting: 1. Log in: https://meetings.lumiconnect.com/400-562-297-505 The link will be accessible one hour before the meeting start time to allow you to test your connection 2. Click “I have a login” 3. Enter your control number as your username 4. Enter your password: “manulife2025” (case sensitive) 5. Follow the instructions to cast your vote. If you have already voted by proxy, your vote at the meeting, if properly cast, will automatically revoke your previous vote. |

||||||

| Changing your vote You can revoke your voting instruction form if you change your mind about how you want to vote your shares. |

|

Follow the instructions on your voting instruction form or contact your intermediary for more information.

Your intermediary must receive your voting instructions with enough time to act on your instructions. Check the form for the deadline for submitting your voting instructions. If you are mailing your voting instruction form, be sure to allow enough time for the envelope to be delivered. The deadline for the deposit of proxies may be waived or extended by the Chair of the Board at his discretion, without notice. |

||||||

| 2025 Management information circular | 11 |

| More about voting by proxy

Voting by proxy is the easiest way to vote. It means you are giving someone else (your proxyholder) the authority to attend the meeting and vote for you according to your instructions.

Roy Gori, President and Chief Executive Officer or, in his place, Donald R. Lindsay, Chair of the Board (with full power of substitution) have agreed to act as Manulife proxyholders to vote your shares at the meeting according to your instructions. If you do not name a different proxyholder when you complete your form, you are authorizing Mr. Gori or Mr. Lindsay to act as your proxyholder to vote for you at the meeting according to your instructions. |

|

|||||

| About confidentiality and voting results Our transfer agent independently counts and tabulates the votes to maintain confidentiality. A proxy form or voting instruction form is only referred to us if it’s clear that a shareholder wants to communicate with the board or management, the validity of the form is in question, or the law requires it.

After the meeting the voting results will be posted on manulife.com, on SEDAR+ (sedarplus.ca), and on EDGAR (sec.gov/edgar). Voting results from past meetings are also available. |

||||||

|

|

If you do not indicate on the form how you want to vote your shares, Mr. Gori or Mr. Lindsay will vote:

| • | FOR the election of each of the nominated directors in this circular |

| • | FOR the appointment of Ernst & Young LLP as auditors |

| • | FOR the advisory vote on our approach to executive compensation |

You can also appoint someone else to be your proxyholder – that individual does not need to be a Manulife shareholder. To do so, print the person’s name in the blank space on the proxy form or voting instruction form, sign and return the form in the envelope provided but do not fill in your voting instructions because your proxyholder will vote during the meeting (check the form for the deadline for submitting it, and make sure you allow enough time for the envelope to be delivered), or go to the website indicated on the proxy form or voting instruction form and follow the instructions. Once your intermediary receives your instructions your proxyholder needs to either attend the meeting in person (please have your proxyholder bring photo ID to the meeting) or get a control number to attend the meeting online by contacting TSX Trust by no later than 5 p.m. (Eastern time) on May 6, 2025. They can do this in one of two ways:

| • | call 1-866-751-6315 (within North America) or 416-682-3860 (outside of North America), or |

| • | go online at www.tsxtrust.com/control-number-request. |

If there are amendments to the items to be voted on or any other matters that are properly brought before the meeting or any adjournment, your proxyholder can vote your shares as they see fit.

| Questions?

Call the transfer agent in your region if you have any questions or to ask for a new proxy form (see page 6 for details).

|

| 12 | Manulife Financial Corporation |

About the Meeting

The meeting will cover four items of business.

1. Financial statements (see manulife.com)

Our 2024 consolidated financial statements and the auditors’ reports on those financial statements will be presented at the meeting. You can find a copy in our 2024 annual report on manulife.com.

2. Electing directors (see page 17)

You will elect 13 directors to serve on our board until either the end of next year’s annual meeting of shareholders, or earlier if they leave the board. You can read about the nominated directors beginning on page 17. The board recommends that you vote FOR the election of each nominated director.

3. Appointing the auditors

Ernst & Young LLP (Ernst & Young) (or a predecessor) have acted as external auditors to Manulife or an entity within the Manulife group of entities since 1905. The audit committee has recommended that the board re-appoint them as our external auditors for fiscal 2025 to serve until the end of our next annual meeting.

We maintain independence from the external auditors through audit committee oversight, adherence to rigorous regulatory independence requirements in Canada and the United States, including rotation of the lead audit partner at least every five years, a robust pre-approval policy and limits on non-audit services, and Ernst & Young’s own internal independence safeguards. The audit committee also conducts a formal review of the external auditors every year and a more comprehensive review every five years. A comprehensive review was completed in 2024 and the next comprehensive review is scheduled for 2029.

External audit tender

While Manulife is not subject to mandatory auditor rotation requirements, in 2021, Manulife announced the intention to undertake an audit tender process once the first annual audit cycle following the adoption of IFRS 17 Insurance Contracts was complete, following consideration of best practice governance guidelines and shareholder feedback.

An extensive and robust evaluation process was conducted throughout 2024, resulting in a recommendation from the audit committee, endorsed by the board, to continue with Ernst & Young as the company’s external auditor. Formal appointment of Ernst & Young is submitted to shareholders for approval at the company’s annual meeting of common shareholders each year.

The decision was made following a thorough and competitive external auditor tender process. The selection process carefully considered the submissions of Ernst & Young and two other globally recognized audit firms and was independently overseen by the audit committee.

Ernst & Young was selected based on their proven ability to maintain independence, a steadfast commitment to audit quality, and the outstanding qualifications of the global engagement team that are well-suited to Manulife’s complex and evolving business.

Governance

There were three separate layers of governance, including a core audit tender team with responsibility for conducting detailed evaluations of bidding firms, an oversight committee chaired by the Chief Financial Officer (with representation from key members of senior management and the executive leadership team) accountable for leading the tender process and sharing management’s insights with the audit committee, and lastly, the audit committee with responsibility for overseeing the tender process and recommending the preferred external auditor to the board.

| 2025 Management information circular | 13 |

Invitations to qualified firms and site visits

Formal audit tender invitations were issued to three of the “Big 4” globally recognized audit firms with confirmed interest and intent to participate in the tender process. As part of the tender, the bidding firms were granted access to extensive background documentation which was followed by site visits hosted by Manulife across key functional areas to promote an equitable distribution of knowledge, and to encourage comparable and high-quality responses from each of the participants. Each bidding firm participated in over 50 site visit meetings and had the opportunity to interact with dozens of individuals representing Manulife management’s various functional areas. Education materials were provided to bidding firms in advance of each of the site visits to provide optimal conditions for rich dialogue. Site visits were hosted at Manulife’s head office locations in Toronto, Boston, and Hong Kong, with additional (virtual) meetings held across select Asia regions between regional (proposed) engagement team members and key finance and actuarial leaders from Manulife. In addition, the bidding firms met with each member of Manulife’s audit committee following the site visits with management.

Evaluations

A complete, thorough, and structured evaluation of the audit firms was conducted by the audit committee based on carefully selected criteria which considered independence, audit quality, audit approach including innovation and use of technology, quality of resources, organizational fit with Manulife, and approach for technical consultations. In order to maximize objectivity, audit fees and the effort/cost related to transition to a new external auditor, were excluded from the decision criteria.

As part of the evaluation, the audit committee considered written proposals submitted from each of the audit firms, management’s views on the firms based on site visits, oral presentations and technology demonstrations that showcased digital tools, and final oral presentations made to the audit committee. All three bidders participated in the entire process.

Following an extensive evaluation in September 2024, the audit committee recommended Ernst & Young as the preferred external auditor to the board. The audit committee considered multiple factors in their recommendation to the board, including:

| • | Delivery of high-quality audits by Ernst & Young including systems of quality assurance controls, proven audit quality results from inspections, and continuous assessment and improvement of service quality |

| • | Ernst & Young’s robust independence safeguards including objectivity and professional skepticism, partner rotations, controls over personal and firm independence, reviewing permissibility and acceptance of services, independence monitoring and remediation, with timely and transparent reporting of potential independence matters to the audit committee |

| • | Ernst & Young’s broad talent pool of global life insurance resources who have a strong track record of leadership and experience including deep technical knowledge of the insurance industry, IFRS 17 insurance and actuarial concepts, and widespread presence in Asia with capabilities to support Manulife’s growing strategic priorities in the region |

| • | Ernst & Young’s global presence and well-qualified resources across key markets where Manulife operates, with deep bench strength and expertise in the insurance and wealth and asset management sectors, and effective capabilities to share valuable insights and support complex technical consultations |

| • | Ernst & Young’s innovative audit approach incorporating advanced tools and technologies that are highly customized to audit Manulife’s business, alignment to Manulife’s evolving business requirements across the globe and application of complex accounting policies |

| • | The length of Ernst & Young’s service to Manulife, with potential impact to (perceived) independence while considering the impact of mitigants and enhanced audit quality achieved through extensive life insurance experience, expertise, and specialized skills |

Final decision

The extensive and robust evaluation process described above resulted in a recommendation from the audit committee, endorsed by the board, to continue with Ernst & Young as the company’s external

| 14 | Manulife Financial Corporation |

About the Meeting

auditor. Formal appointment of Ernst & Young is submitted to shareholders for approval at the Company’s annual meeting of common shareholders each year.

Ernst & Young was selected as the external auditor by the board based on their commitment to audit quality, advanced technological capabilities, industry leadership and expertise in global insurance markets, rigorous independence protocols, and high-quality resources across the globe.

Each of Manulife management, the audit committee and the board found the external auditor tender process to be a valuable use of time and resources. Going forward, Manulife plans to conduct an external audit tender in line with best practice governance guidelines, which is currently every ten years.

| Audit committee review The audit committee conducts a formal review of the external auditors every year, and a more comprehensive review every five years. These reviews are based on guidelines set by the Chartered Professional Accountants of Canada (CPA Canada) and the Canadian Public Accountability Board (CPAB) to assist the audit committee in their oversight duties.

A comprehensive review was conducted in 2024, covering the five-year period ended December 31, 2023. The 2024 review included an evaluation of the engagement partner and team, their independence, objectivity and professional skepticism, and the quality of communication and audit work performed.

|

The following table lists the services Ernst & Young provided to Manulife and its subsidiaries in the last two fiscal years and the fees they charged each year.

| (in millions) | 2024 | 2023 | ||||||

| Audit fees | $39.5 | $51.4 | ||||||

| Includes the audit of our financial statements as well as the financial statements of our subsidiaries, segregated funds, audits of statutory filings, prospectus services, report on internal controls, reviews of quarterly reports and regulatory filings | ||||||||

| Audit-related fees | $3.1 | $4.0 | ||||||

| Includes consultation concerning financial accounting and reporting standards not classified as audit, due diligence in connection with proposed or consummated transactions and assurance services to report on internal controls for third parties | ||||||||

| Tax fees |

|

$0.4

|

|

|

$0.4

|

|

||

| Includes tax compliance, tax planning and tax advice services | ||||||||

| All other fees |

|

$0.2

|

|

|

$0.2

|

|

||

| Includes other advisory services | ||||||||

| Total | $43.2 | $56.0 | ||||||

Note: Total fees above exclude fees of $17.7 million in 2024 and $13.1 million in 2023 for professional services provided by Ernst & Young to certain investment funds managed by subsidiaries of Manulife. For certain funds, these fees are paid directly by the funds. For other funds, in addition to other administrative costs, the subsidiaries are responsible for the auditor’s fees for professional services, in return for a fixed administration fee. Audit fees above also include one-time fees for special projects related to the implementation of IFRS 17 and 9 of $12.8 million for 2023.

Our auditor independence policy requires the audit committee to pre-approve all audit and permitted non-audit services (including the fees and conditions) the external auditor provides.

If a new service is proposed during the year that is outside the pre-approved categories or budget, it must be pre-approved by the audit committee, or by a member that the committee has appointed to act on its behalf.

The board recommends that you vote FOR the appointment of Ernst & Young as auditors.

| 2025 Management information circular | 15 |

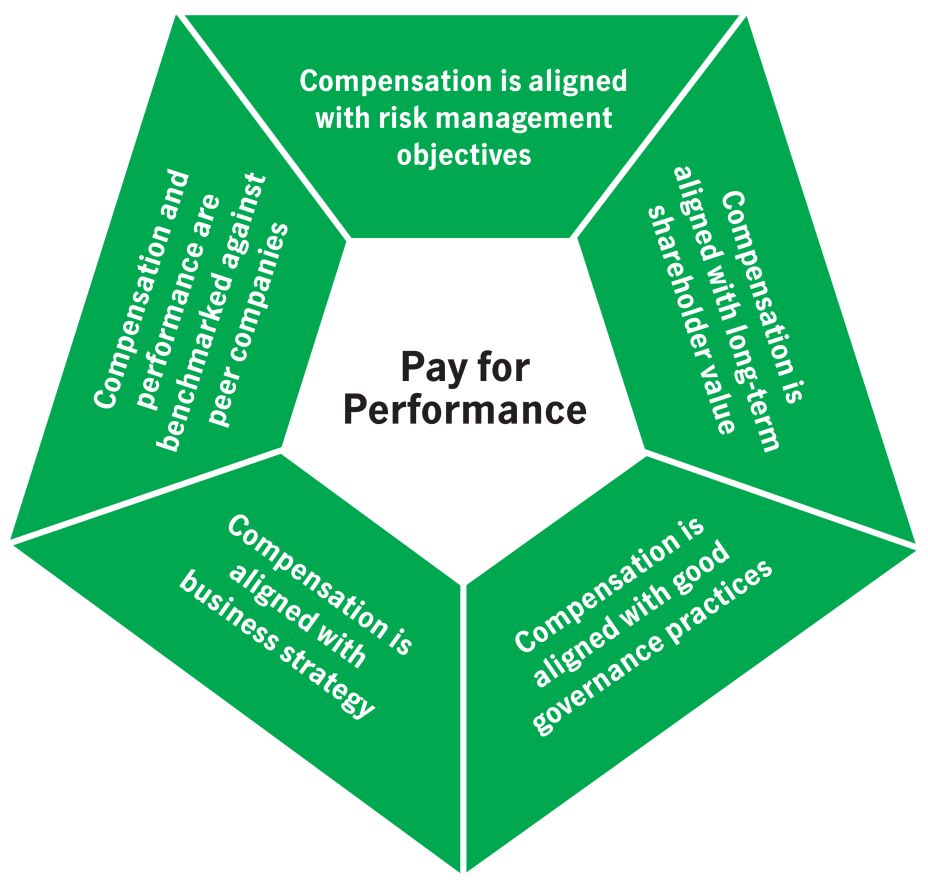

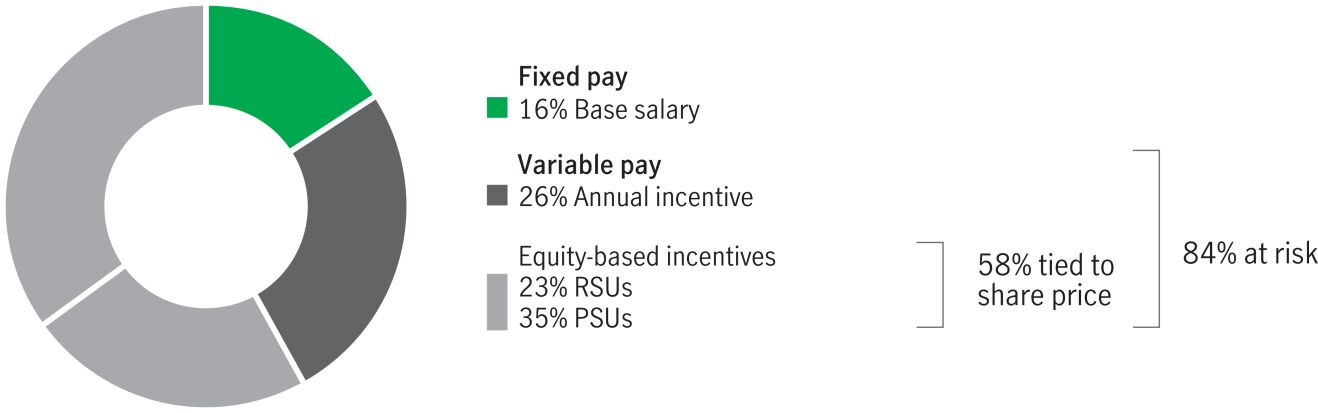

4. Having a say on executive pay (see page 43)

The board believes that executive compensation programs must be sound, fair and competitive with the market and support our strategy and progress.

The board recognizes the increased scrutiny of executive compensation generally and believes that shareholders should have the opportunity to fully understand our compensation objectives, philosophy and principles, and have a say on our approach to executive compensation.

As a result, we are asking you to vote on the following resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in the management information circular delivered in advance of the 2025 annual meeting of common shareholders of Manulife Financial Corporation.

Last year shareholders voted 92.48% in favour of our approach to executive compensation. We discuss our executive compensation program for 2024 in detail starting on page 44. This disclosure has been approved by the board on the recommendation of the management resources and compensation committee. The board recommends that you vote FOR our approach to executive compensation.

This is an advisory vote, so the results are not binding. The board will, however, take the results into account, together with feedback received from other shareholder engagement activities, when making decisions about compensation policies, procedures and executive pay in the future.

If a significant number of shareholders oppose the resolution, the board will engage with shareholders (especially those who are known to have voted against it) to understand their concerns and will continue to review our approach to executive compensation in the context of those concerns.

We encourage any shareholders who are thinking of voting against the resolution to contact the board to discuss their specific issues or concerns (see page 121 for details about how to contact the board and page 129 for details about our shareholder engagement activities).

|

About shareholder proposals and proxy access

Shareholder proposals We must receive shareholder proposals or nominations under our proxy access policy for our 2026 annual meeting by 5 p.m. (Eastern time) on December 12, 2025 to consider including them in next year’s circular. Shareholder proposal submissions must be in writing and meet the requirements of the Insurance Companies Act (Canada). See page 129 for more information about our proxy access policy.

Send your proposal or nomination notice to: Manulife Financial Corporation 200 Bloor Street East Toronto, Ontario M4W 1E5 Canada email: corporate_governance@manulife.com |

| 16 | Manulife Financial Corporation |

Read about the nominated directors before you vote your shares.

This year, 13 people have been nominated for election to the board for a one-year term.

This group of directors has the mix of skills, experience and qualifications necessary for proper oversight and effective decision-making in the context of a complex, publicly traded organization.

| Appropriate size | 13 |

directors is within an appropriate range for healthy debate and effective decision-making

|

||||

| Independent | All |

nominated directors are independent, except the incoming CEO, and all board committee members are independent

|

||||

| Qualified and financially literate |

All |

directors bring a mix of the competencies and experience necessary for effective oversight, and all are financially literate

|

||||

| Attendance | 100% |

is the average overall attendance for director nominees who served on the board in 2024

|

||||

| Diversity * as defined in the Employment Equity Act (Canada) |

6 |

6 | ||||

| of the nominated independent directors (50%) are women |

of all nominated directors (46%) are women | |||||

| 2 |

2 | |||||

| of the nominated independent directors (17%) have self-identified as members of a visible minority* |

of all nominated directors (15%) have self-identified as members of a visible minority* | |||||

| Tenure and term limits | 3.4 |

3.2 | ||||

| years is the average tenure of the nominated independent directors |

years is the average tenure of all nominated directors | |||||

| The board has a 12-year term limit. The Chair of the Board can serve a term of five years, regardless of the number of years served as a director. |

||||||

| Age | 65 |

64 | ||||

| is the average age of the nominated independent directors |

is the average age of all nominated directors | |||||

|

|

||||||||

| 18 |

33 |

|||||||

| 20 |

39 |

|||||||

| 2025 Management information circular | 17 |

Diversity

| Our board recognizes the importance of diversity and is committed to fostering diversity at all levels of the organization. The board has a long history of promoting diversity and believes that having highly qualified directors from diverse backgrounds brings different perspectives and experiences to the boardroom, generating healthy discussion and debate and more effective decision-making. | ||||

| Six of the nominated independent directors (50%) are women.

Two of the nominated independent directors (17%) have self-identified as members of a visible minority as defined in the Employment Equity Act (Canada).

|

||||

Diversity is an important consideration in board succession, and you can read more about the board’s approach to diversity and its recruiting efforts on page 133.

Oversight

Our board continued to provide effective oversight and guidance to management this year through regular interactions, including:

| • | board and committee meetings, regular update calls, meetings with management, and written updates and informal communications |

| • | significant interactions with regulators and investors to better understand the evolving operational environment and stakeholder expectations |

| • | continued use of board focus groups for taking deep dives on key topics of strategic importance to the company |

| • | balanced use of in-person and virtual meeting formats to facilitate in-person interactions while maintaining the flexibility of virtual meetings given the global nature of the board to achieve optimal participation from all directors and to help attract talented directors from across the globe. |

The board’s strategic focus in 2024 included:

| • | led a robust CEO succession and transition process and the Board looks forward to welcoming Phil Witherington as the company’s CEO after the annual meeting |

| • | continued our strategic focus on board succession with the appointment of six new directors since February 2024 who bring skills and experience critical to Manulife’s strategic priorities |

| • | provided robust oversight over the strategic ambitions of the company and related activities, including the execution of two transformational reinsurance transactions |

| • | board members met with investors who collectively own approximately 27% of Manulife’s outstanding institutional shares as part of the shareholder outreach program |

| • | oversaw successful release of first set of annual financial statements under IFRS 17 and completed a thorough, competitive, and transparent tendering process for the external audit engagement. |

| 18 | Manulife Financial Corporation |

About the Directors

Majority voting

Shareholders can vote for, or withhold their vote from, each director. Directors who receive more withhold than for votes must submit their resignation.

The corporate governance and nominating committee will review the details surrounding the resignation and report to the board. The board will accept the resignation unless there are exceptional circumstances. The board will decide whether to accept the resignation within 90 days of the meeting and a news release will be issued disclosing the resignation or the reasons why the resignation was not accepted. The director will not participate in these deliberations. The resignation will be effective when it is accepted by the board.

This policy applies only in uncontested elections, where the number of nominated directors is the same as the number of directors to be elected.

Attendance

Quorum for board meetings is a majority of the directors and directors are expected to attend all meetings of the board and their respective committees.

Attendance for the nominated directors at board and committee meetings held in 2024 is set out in the director profiles starting on page 20. The average overall attendance of director nominees who served on the board in 2024 was 100%.

Equity ownership

| The director profiles that follow include the value of each director’s equity ownership. We calculated the value of equity ownership by multiplying the number of their common shares and deferred share units (DSUs) by $45.06, the closing price of our common shares on the TSX on February 28, 2025. | ||||

| Directors receive a minimum of US$127,500 (approximately 55%) of the annual board retainer in equity, and the director equity ownership requirement is six times the mandatory equity portion of the annual board retainer. |

We require all directors except the CEO to own common shares, preferred shares and/or DSUs with a total market value of at least six times the mandatory equity portion of the annual board retainer. Mr. Gori has separate equity ownership requirements as the current President and CEO, which he meets (see page 113).

Directors are expected to meet their equity ownership requirements within six years of joining the board. The minimum equity ownership as of February 28, 2025 was $1,104,507 (US$765,000, using the Bank of Canada daily exchange rate of US$1.00 = $1.4438). Fluctuations in foreign exchange rates will cause variances in the minimum ownership requirements. All directors have either met the director equity ownership requirement or are on track to meet the requirement by their sixth anniversary of joining the board.

| 2025 Management information circular | 19 |

|

Donald R. Lindsay (Chair)

Vancouver, BC, Canada/Age 66/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Risk management |

• Public company executive/Director |

|||

| • Talent management/Executive compensation |

• Environmental/Climate/Social |

|||

| • Technology/Operations |

||||

|

Mr. Lindsay’s international business experience, including over 17 years as CEO of a public company and nearly two decades of experience in senior executive roles in investment and corporate banking and global financial services, qualify him to serve as the Chair of the Board and a member of the corporate governance and nominating committee. Mr. Lindsay also has extensive environment, social and governance (ESG) experience which will be valuable as Manulife seeks to implement its Impact Agenda and drive sustained social and environmental impact through our business and our interactions with customers, communities and the environments in which we operate. |

||||

| Mr. Lindsay was previously President and CEO of Teck Resources Limited, Canada’s largest diversified mining, mineral processing and metallurgical company, a position he held since 2005 where he led Teck to achieve top rankings from ESG rating agencies such as S&P Global, MSCI and ISS ESG. His experience also includes almost two decades with CIBC World Markets Inc., where he ultimately served as President after periods as Head of Investment and Corporate Banking and Head of the Asia Pacific Region.

Mr. Lindsay currently serves on the Board of Directors of Alpine Canada, and is an Honorary Governor of the Royal Ontario Museum. He was Chair of the International Council on Mining and Metals, Chair of the Board of Governors for Mining and Metals at the World Economic Forum, and Chair of the Business Council of Canada. He is a recent recipient of the Canadian Business Leader Lifetime Achievement Award from The Canadian Chamber of Commerce, which was presented on June 13, 2024.

Mr. Lindsay earned a Bachelor of Science in Mining Engineering from Queen’s University and holds an MBA from Harvard Business School, and has been the recipient of an Honorary Doctor of Laws from the University of Windsor and Honorary Doctorate of Technology from the British Columbia Institute of Technology.

2024 meeting attendance

|

|

Director since Chair of the Board since 2023

Term limit: 2028

2024 votes for: 98.07%

Public company boards (last five years)

• BHP Group Limited, 2024-present • Teck Resources Limited, 2005-2022 |

||||||||

| Board | 13 of 13 | 100 | % | |||||||

|

Board committees |

||||||||||

| • Audit |

5 of 5 | 100 | % | |||||||

| • Corporate governance and nominating |

4 of 4 | 100 | % | |||||||

| • Management resources and compensation |

5 of 5 | 100 | % | |||||||

| • Risk |

6 of 6 | 100 | % | |||||||

| Total | 33 of 33 | 100 | % | |||||||

| As Chair of the Board, Don Lindsay is not a member of the audit, management resources and compensation or risk committees but attends at the invitation of each committee chair. He was chair of the corporate governance and nominating committee until June 1, 2024. | ||||||||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year | Common shares |

DSUs | Total common shares and DSUs |

Total value | Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 120,000 | 158,291 | 278,291 | $12,539,792 | 11.4x | |||||||||||||||

| 2024 | 120,000 | 136,680 | 256,680 | $8,267,633 | 8.0x | |||||||||||||||

| Change | 0 | 21,611 | 21,611 | $4,272,129 | ||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 20 | Manulife Financial Corporation |

About the Directors

|

Nicole S. Arnaboldi

Greenwich, CT, U.S.A./Age 66/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Government relations/Public policy/Regulatory |

|||

| • Risk management |

• Public company executive/Director |

|||

| • Talent management/Executive compensation |

• Environmental/Climate/Social |

|||

|

Ms. Arnaboldi’s extensive experience at a major financial institution, specifically in the asset management field, qualifies her to serve on our board, as a member of the risk committee and as chair of the management resources and compensation committee. |

||||

| Nicole Arnaboldi is a partner at Oak Hill Capital Management, a private equity firm. She is a former senior executive at Credit Suisse, a global financial services company, and its predecessor Donaldson, Lufkin and Jenrette Securities Corporation, holding a number of senior roles in their wealth and asset management businesses, including Senior Advisor, and prior to that, Vice Chairman, Credit Suisse Asset Management.

Ms. Arnaboldi is a member of the boards of Commonfund and Merit Hill Capital (non-public companies). She also serves on various Harvard University advisory boards, including for HarvardX and Harvard Law School.

Ms. Arnaboldi holds a Bachelor of Arts from Harvard College, and a JD and an MBA from Harvard University.

2024 meeting attendance

|

|

Director since June 2020

Term limit: 2033

2024 votes for: 98.85%

Public company boards (last five years)

• NextEra Energy, Inc., 2022-present |

||||||

| Board | 13 of 13 | 100 | % | |||||

|

Board committees |

||||||||

| • Management resources and compensation (chair) |

5 of 5 | 100 | % | |||||

| • Risk |

6 of 6 | 100 | % | |||||

| Total | 24 of 24 | 100 | % | |||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 6,500 | 53,727 | 60,227 | $2,713,829 | 2.5x | |||||||||||||||

| 2024 | 6,500 | 46,982 | 53,482 | $1,722,655 | 1.7x | |||||||||||||||

| Change | 0 | 6,745 | 6,745 | $991,174 | ||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 2025 Management information circular | 21 |

|

Guy L.T. Bainbridge

Edinburgh, Midlothian, United Kingdom/Age 64/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Government relations/Public policy/Regulatory |

|||

| • Risk management |

• Public company executive/Director |

|||

|

Mr. Bainbridge’s extensive financial and audit experience qualifies him to serve on our board, as a member of the corporate governance and nominating committee and as chair of the audit committee. |

||||

| Guy Bainbridge is a former partner with KPMG LLP. He has acted as the key audit leader of several of the UK and world’s largest financial institutions and served on KPMG’s UK and Europe boards.

Mr. Bainbridge also serves as the audit committee chair of each of Yorkshire Building Society and ICE Clear Europe Limited (non-public companies).

Mr. Bainbridge is a member of the Institute of Chartered Accountants in England and Wales and holds a Master of Arts from the University of Cambridge.

2024 meeting attendance

|

|

Director since August 2019

Term limit: 2032

2024 votes for: 98.24%

Public company boards (last five years)

• None |

||||||

| Board | 13 of 13 | 100 | % | |||||

|

Board committees |

||||||||

| • Audit (chair) |

5 of 5 | 100 | % | |||||

| • Corporate governance and nominating |

4 of 4 | 100 | % | |||||

| Total | 22 of 22 | 100 | % | |||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 0 | 38,205 | 38,205 | $1,721,517 | 1.6x | |||||||||||||||

| 2024 | 0 | 32,111 | 32,111 | $1,034,295 | 0.99x | |||||||||||||||

| Change | 0 | 6,094 | 6,094 | $687,222 | ||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 22 | Manulife Financial Corporation |

About the Directors

|

Nancy J. Carroll

Toronto, ON, Canada/Age 67/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Government relations/Public policy/Regulatory |

|||

| • Risk management |

• Environmental/Climate/Social |

|||

|

Ms. Carroll’s experience advising boards and companies in the insurance and broader financial services sectors on legal and strategic matters qualifies her to serve on our board and as a member of the audit committee and corporate governance and nominating committee. |

||||

| Nancy Carroll is a former partner in the Financial Services Group and head of the National Insurance and Reinsurance Group of McCarthy Tétrault LLP, with over 40 years of experience as a leading legal advisor to Canadian and global insurance and reinsurance companies, banks and their boards on complex regulatory, M&A, transactional, compliance, governance and strategic matters.

Ms. Carroll sits on the board of The Princess Margaret Cancer Foundation, is a member of the Law Society of Ontario and was awarded an ICD.D designation from the Institute of Corporate Directors and the Rotman School of Business at the University of Toronto. She holds a JD from the University of Toronto, a Master of Arts in International Political Studies from Queen’s University, and a Bachelor of Arts from Mount Allison University.

2024 meeting attendance

|

|

Director since February 2025

Term limit: 2037

Public company boards (last five years)

• None |

||||||

| Board | N/A | N/A | ||||||

|

Board committees |

||||||||

| • Audit |

N/A | N/A | ||||||

| • Corporate governance and nominating |

N/A | N/A | ||||||

Equity ownership (as at February 28, 2025)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 0 | 0 | 0 | $0 | N/A | |||||||||||||||

|

Ms. Carroll joined the board on February 28, 2025. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. |

|

|||||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 2025 Management information circular | 23 |

|

Julie E. Dickson

Ottawa, ON, Canada/Age 67/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Government relations/Public policy/Regulatory |

|||

| • Insurance/Reinsurance/Investment management |

• Public company executive/Director |

|||

| • Risk management |

||||

|

Ms. Dickson’s extensive financial, risk and regulatory experience qualifies her to serve on our board and as a member of the audit committee and the corporate governance and nominating committee. |

||||

| Julie Dickson is a former Superintendent of Financial Institutions, Canada, Canada’s main financial services regulator. She currently serves on the Canadian Public Accountability Board, and the board of the Dubai Financial Services Authority.

Ms. Dickson is an Officer of the Order of Canada and holds a Bachelor of Arts from the University of New Brunswick and a Master of Economics from Queen’s University.

2024 meeting attendance

|

|

Director since August 2019

Term limit: 2032

2024 votes for: 99.47%

Public company boards (last five years)

• None |

||||||

| Board | 13 of 13 | 100 | % | |||||

|

Board committees |

||||||||

| • Management resources and compensation |

2 of 2 | 100 | % | |||||

| • Risk |

1 of 1 | 100 | % | |||||

| • Audit |

4 of 4 | 100 | % | |||||

| • Corporate governance and nominating |

3 of 3 | 100 | % | |||||

| Total | 23 of 23 | 100 | % | |||||

| On March 5, 2024, Julie Dickson joined the corporate governance and nominating committee and audit committee, and resigned from the management resources and compensation committee and the risk committee. |

|

|||||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 0 | 70,221 | 70,221 | $3,164,158 | 2.9x | |||||||||||||||

| 2024 | 0 | 59,172 | 59,172 | $1,905,930 | 1.8x | |||||||||||||||

| Change | 0 | 11,049 | 11,049 | $1,258,228 | ||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 24 | Manulife Financial Corporation |

About the Directors

|

J. Michael Durland

Toronto, ON, Canada/Age 60/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Risk management |

• Government relations/Public policy/Regulatory |

|||

| • Talent management/Executive compensation |

• Public company executive/Director |

|||

| • Technology/Operations |

||||

|

Mr. Durland’s strong financial background and extensive international experience at a major financial institution qualifies him to serve on our board and as a member of the audit committee and the corporate governance and nominating committee. |

||||

| Michael Durland is a former senior executive at The Bank of Nova Scotia, holding a number of senior roles in their capital markets division, including Group Head and CEO, Global Banking and Markets. He is currently the Chief Executive Officer of Melancthon Capital Corporation, a private company primarily focused on the provision of capital and advisory services to emerging Canadian companies. He brings a sophisticated risk taking and risk structuring capability set to the board, along with international business experience.

Mr. Durland is the Chancellor of Saint Mary’s University. He is a member of the board of the True Patriot Love Foundation (not-for-profit organization), as well as the boards of Receptiviti Inc. and LifeRaft Inc., and the former Chair of Truleaf Sustainable Agriculture (non-public companies). He is a Distinguished Fellow at the Munk School of Global Affairs and Public Policy at the University of Toronto and a former a member of the Board of the Dalhousie Medical Research Foundation, the Business Strategy Committee of the Global Risk Institute and the Advisory Boards of the Centre for Social Impact at Queen’s University and the Master of Management Analytics Program at Queen’s University.

Mr. Durland holds a Bachelor of Commerce from Saint Mary’s University and a Ph.D. in Management from Queen’s University.

2024 meeting attendance

|

|

Director since February 2024

Term limit: 2036

2024 votes for: 99.64%

Public company boards (last five years)

• None |

||||||

| Board | 12 of 12 | 100 | % | |||||

|

Board committees |

||||||||

| • Audit |

4 of 4 | 100 | % | |||||

| • Corporate governance and nominating |

3 of 3 | 100 | % | |||||

| Total | 19 of 19 | 100 | % | |||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 0 | 6,750 | 6,750 | $304,155 | 0.3x | |||||||||||||||

| 2024 | 0 | 0 | 0 | $0 | N/A | |||||||||||||||

| Change | 0 | 6,750 | 6,750 | $304,155 | ||||||||||||||||

|

Mr. Durland joined the board on March 5, 2024. Under the director equity ownership requirements, he is expected to meet the equity ownership requirements within six years of joining the board. |

|

|||||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 2025 Management information circular | 25 |

|

Donald P. Kanak

Bellevue, WA, U.S.A./Age 72/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Government relations/Public policy/Regulatory |

|||

| • Risk management |

• Public company executive/Director |

|||

| • Talent management/Executive compensation |

• Digital transformation/Sales/Marketing |

|||

| • Technology/Operations |

• Environmental/Climate/Social |

|||

|

Mr. Kanak’s extensive experience at a major insurer and asset manager, specifically in Asian markets, where he lived and worked for over 35 years, qualifies him to serve on our board and as a member of the management resources and compensation committee and the risk committee. |

||||

| Don Kanak is a former senior executive with deep insurance experience in Asia. Most recently, he held several roles with Prudential Holdings Ltd. (part of Prudential plc). He ultimately served as Chairman, Insurance Growth Markets and Chairman, Prudence Foundation, and, prior to that, Chairman, Eastspring Investments and Chairman of Prudential Corporation Asia. He served in senior executive positions at American International Group (AIG) for over 14 years before joining Prudential Holdings Ltd.

Mr. Kanak has been a Senior Fellow of The Program in International Financial Systems (PIFS) since 2007 and a director since 2017. His research has focused on solutions for achieving climate objectives and for developing capital markets in emerging economies. He currently serves as Chairman of the Board of PreachFor Foundation. Previously, he served as a trustee of the Worldwide Fund for Nature (WWF)-Hong Kong, Chairman and executive board member of the EU-ASEAN Business Council and a member of the board of the Hong Kong Financial Services Development Council (non-public entities).

Mr. Kanak holds a Bachelor of Arts from the University of North Carolina, a JD from Harvard Law School, and a MLitt from Oxford University in management studies.

2024 meeting attendance

|

|

Director since February 2024

Term limit: 2036

2024 votes for: 99.58%

Public company boards (last five years)

• None |

||||||

| Board | 12 of 12 | 100 | % | |||||

|

Board committees |

||||||||

| • Management resources and compensation |

3 of 3 | 100 | % | |||||

| • Risk |

5 of 5 | 100 | % | |||||

| Total | 20 of 20 | 100 | % | |||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 0 | 6,750 | 6,750 | $304,155 | 0.3x | |||||||||||||||

| 2024 | 0 | 0 | 0 | $0 | N/A | |||||||||||||||

| Change | 0 | 6,750 | 6,750 | $304,155 | ||||||||||||||||

|

Mr. Kanak joined the board on March 5, 2024. Under the director equity ownership requirements, he is expected to meet the equity ownership requirements within six years of joining the board. |

|

|||||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 26 | Manulife Financial Corporation |

About the Directors

|

Anna Manning

Toronto, ON, Canada/Age 66/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Government relations/Public policy/Regulatory |

|||

| • Risk management |

• Public company executive/Director |

|||

| • Talent management/Executive compensation |

• Environmental/Climate/Social |

|||

| • Technology/Operations |

||||

|

Ms. Manning’s experience leading a major health and life reinsurance institution qualifies her to serve on our board and as a member of the management resources and compensation committee and the risk committee. |

||||

| Anna Manning is the former President and Chief Executive Officer of Reinsurance Group of America, Incorporated (RGA), a global reinsurance company focusing on life and health solutions. Prior to joining RGA, she spent 19 years with the Toronto office of Towers Perrin’s Tillinghast insurance consulting service, providing consulting services to the insurance industry on mergers and acquisitions, value-added performance measurement, product development, and financial reporting.

Ms. Manning is a Fellow of the Society of Actuaries and the Canadian Institute of Actuaries and holds a B.Sc. in Actuarial Science from the University of Toronto.

2024 meeting attendance

|

|

Director since August 2024

Term limit: 2037

Public company boards (last five years)

• Reinsurance Group of America, Incorporated, 2016-2023 |

||||||

| Board | 7 of 7 | 100 | % | |||||

|

Board committees |

||||||||

| • Management resources and compensation |

2 of 2 | 100 | % | |||||

| • Risk |

4 of 4 | 100 | % | |||||

| Total | 13 of 13 | 100 | % | |||||

| Ms. Manning joined the board and the management resources and compensation committee and risk committee on August 7, 2024. |

|

|||||||

Equity ownership (as at February 28, 2025 and February 29, 2024)

| Year |

Common shares |

DSUs |

Total common shares and DSUs |

Total value |

Total value as a multiple of equity ownership guideline |

|||||||||||||||

| 2025 | 7,715 | 3,060 | 10,775 | $485,522 | 0.4x | |||||||||||||||

| 2024 | 7,715 | 0 | 7,715 | $248,500 | N/A | |||||||||||||||

| Change | 0 | 3,060 | 3,060 | $237,022 | ||||||||||||||||

|

Ms. Manning joined the board on August 7, 2024. Under the director equity ownership requirements, she is expected to meet the equity ownership requirements within six years of joining the board. |

|

|||||||||||||||||||

|

|

|

See page 39 for information about equity ownership | ||||||||||||||||||

| 2025 Management information circular | 27 |

|

John S. Montalbano

West Vancouver, BC, Canada/Age 60/Independent |

| Key competencies and experience |

||||

| • Finance/Accounting |

• Asia experience |

|||

| • Insurance/Reinsurance/Investment management |

• Public company executive/Director |

|||

| • Risk management |

• Digital transformation/Sales/Marketing |

|||

| • Talent management/Executive compensation |

• Environmental/Climate/Social |

|||

|