| For the fiscal year ended: | December 31, 2024 | Commission File Number: | 1-8481 | ||||||||

| Melanie Schweizer Senior Vice-President, Corporate Services and Corporate Secretary BCE Inc. 1, carrefour Alexander-Graham-Bell Building A, 7th Floor Verdun, Québec H3E 3B3 Canada Tel: (514) 786-8424 |

Mario Schollmeyer Sullivan & Cromwell LLP 125 Broad Street New York, New York 10004-2498 Tel: (212) 558-4000 |

||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||

|

Common shares

|

BCE

|

New York Stock Exchange

|

||||||

| Common Shares | 912,283,103 | ||||

| First Preferred Shares | |||||

| Series R | 7,610,500 | ||||

| Series S | 2,001,167 | ||||

| Series T | 5,175,533 | ||||

| Series Y | 5,958,652 | ||||

| Series Z | 2,658,031 | ||||

| Series AA | 11,171,231 | ||||

| Series AB | 6,399,439 | ||||

| Series AC | 6,312,874 | ||||

| Series AD | 11,722,138 | ||||

| Series AE | 5,827,613 | ||||

| Series AF | 8,820,587 | ||||

| Series AG | 8,316,930 | ||||

| Series AH | 4,655,070 | ||||

| Series AI | 8,972,840 | ||||

| Series AJ | 3,827,260 | ||||

| Series AK | 21,391,312 | ||||

| Series AL | 1,724,288 | ||||

| Series AM | 9,951,978 | ||||

| Series AN | 1,004,422 | ||||

| Series AQ | 8,102,214 | ||||

| Total First Preferred Shares | 141,604,079 | ||||

| – | update the section entitled Protecting Confidential Information to clarify and update its language; |

||||

| – | create a new section entitled Supplier Relations – Foreign Jurisdictions to clarify that Bell Canada must abide by applicable sanctions and export controls laws, and address the establishment of supplier relationships in foreign jurisdictions; |

||||

| – | update the sections entitled Safeguarding Bell Assets, Workplace and Environmental Leadership to reorganize and update the information contained in these sections; and |

||||

| – | create a new section entitled Development and Use of Artificial Intelligence Technologies to reflect the adoption of Bell Canada’s Responsible Artificial Intelligence (AI) Policy. |

||||

|

BCE Inc.

|

|||||

| By: | (signed) Curtis Millen | ||||

| Curtis Millen Executive Vice-President and Chief Financial Officer |

|||||

| Date: | March 7, 2025 | ||||

| LIST OF EXHIBITS TO FORM 40-F | |||||

| BCE Inc. Policy for the recovery of erroneously awarded incentive-based compensation from executive officers | Exhibit 97 | ||||

| Annual Information Form of BCE Inc. for the year ended December 31, 2024 | Exhibit 99.1 | ||||

| Management's Discussion and Analysis of BCE Inc. for the year ended December 31, 2024 | Exhibit 99.2 | ||||

| Annual audited consolidated financial statements of BCE Inc. for the year ended December 31, 2024 | Exhibit 99.3 | ||||

| Management’s report on internal control over financial reporting and the Report of Independent Registered Public Accounting Firm thereon | Exhibit 99.4 | ||||

| Consent of Independent Registered Public Accounting Firm | Exhibit 99.5 | ||||

| Bell Canada Unaudited Selected Summary Financial Information | Exhibit 99.6 | ||||

| Earnings Coverage | Exhibit 99.7 | ||||

| Certifications of the Chief Executive Officer and the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | Exhibit 99.31 | ||||

| Certification of the Chief Executive Officer and the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | Exhibit 99.32 | ||||

| Interactive Data File (formatted as Inline XBRL) | Exhibit 101 | ||||

| Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | Exhibit 104 | ||||

Exhibit 97

BCE INC. POLICY FOR THE

RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE-BASED COMPENSATION

FROM EXECUTIVE OFFICERS

I. BACKGROUND

BCE Inc. (the “Company”) has adopted this policy (this “Policy”) to provide for the recovery or “clawback” of certain incentive compensation in the event of a Restatement (as defined below). This Policy is intended to comply with, and will be interpreted to be consistent with, the requirements of Section 303A.14 of the New York Stock Exchange (“NYSE”) Listed Company Manual (the “Listing Standard”).

II. STATEMENT OF POLICY

The Company shall recover reasonably promptly the amount of erroneously awarded Incentive-Based Compensation in the event that the Company is required to prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under applicable securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (a “Restatement”).

The Company shall recover erroneously awarded Incentive-Based Compensation in compliance with this Policy except to the extent provided under the section entitled “V. Exceptions” herein.

III. SCOPE OF POLICY

A. Covered Persons and Recovery Period. This Policy applies to all Incentive-Based Compensation received by a person:

| ● | after beginning service as an Executive Officer, |

| ● | who served as an Executive Officer at any time during the performance period for that Incentive-Based Compensation, |

| ● | while the Company has a class of securities listed on NYSE, and |

| ● | during the three completed fiscal years immediately preceding the date that the Company is required to prepare a Restatement (the “Recovery Period”). |

Notwithstanding this look-back requirement, the Company is only required to apply this Policy to Incentive-Based Compensation received on or after October 2, 2023.

For purposes of this Policy, Incentive-Based Compensation shall be deemed “received” in the Company’s fiscal period during which the Financial Reporting Measure (as defined herein) specified in the Incentive-Based Compensation award is attained, even if the payment or grant of the Incentive-Based Compensation occurs after the end of that period.

B. Transition Period. In addition to the Recovery Period, this Policy applies to any transition period (that results from a change in the Company’s fiscal year) within or immediately following the Recovery Period (a “Transition Period”), provided that a Transition Period between the last day of the Company’s previous fiscal year end and the first day of the Company’s new fiscal year that comprises a period of nine to 12 months will be deemed a completed fiscal year. For clarity, the Company’s obligation to recover erroneously awarded Incentive-Based Compensation under this Policy is not dependent on if or when a Restatement is filed.

-1-

C. Determining Recovery Period. For purposes of determining the relevant Recovery Period, the date that the Company is required to prepare the Restatement is the earlier to occur of:

| ● | the date the board of directors of the Company (the “Board”), a committee of the Board, or the officer or officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare a Restatement, and |

| ● | the date a court, regulator, or other legally authorized body directs the Company to prepare a Restatement. |

IV. AMOUNT SUBJECT TO RECOVERY

A. Recoverable Amount. The amount of Incentive-Based Compensation subject to recovery under this Policy is the amount of Incentive-Based Compensation received that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts, computed without regard to any taxes paid.

B. Covered Compensation Based on the Company’s Common Share Price or TSR. For Incentive-Based Compensation based on the price of the Company’s common shares or total shareholder return (“TSR”), where the amount of erroneously awarded Incentive-Based Compensation is not subject to mathematical recalculation directly from the information in a Restatement, the recoverable amount shall be based on a reasonable estimate of the effect of the Restatement on the share price or TSR upon which the Incentive-Based Compensation was received. In such event, the Company shall maintain documentation of the determination of that reasonable estimate and provide such documentation to the NYSE.

V. EXCEPTIONS

The Company shall recover erroneously awarded Incentive-Based Compensation in compliance with this Policy except to the extent that the conditions set out below are met and the Management Resources and Compensation Committee (the “Committee”) has made a determination that recovery would be impracticable:

A. Direct Expense Exceeds Recoverable Amount. The direct expense paid to a third party to assist in enforcing this Policy would exceed the amount to be recovered; provided, however, that before concluding it would be impracticable to recover any amount of erroneously awarded Incentive-Based Compensation based on the anticipated expense of enforcement, the Company shall make a reasonable attempt to recover such erroneously awarded Incentive-Based Compensation, document such reasonable attempt(s) to recover, and provide that documentation to the NYSE.

B. Violation of Home Country Law. Recovery would violate applicable Canadian federal or provincial law (“Canadian law”) where that law was adopted prior to November 28, 2022; provided, however, that before concluding it would be impracticable to recover any amount of erroneously awarded Incentive-Based Compensation based on violation of Canadian law, the Company shall obtain an opinion of Canadian counsel, acceptable to the NYSE, that recovery would result in such a violation, and shall provide such opinion to NYSE.

-2-

C. Recovery from Certain Tax-Qualified Retirement Plans. Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder.

VI. PROHIBITION AGAINST INDEMNIFICATION

The Company shall not indemnify any Executive Officer or former Executive Officer against the loss of erroneously awarded Incentive-Based Compensation.

VII. DISCLOSURE

The Company shall file all disclosures with respect to recoveries under this Policy in accordance with the requirements of all applicable Canadian and U.S. Federal securities laws, including the disclosure required to be included in applicable Securities and Exchange Commission (“SEC”) filings.

VIII. DEFINITIONS

Unless the context otherwise requires, the following definitions apply for purposes of this Policy:

“Executive Officer” means the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policymaking functions for the Company. Executive officers of the Company’s subsidiaries are deemed Executive Officers of the Company if they perform such policy making functions for the Company. Policy-making function is not intended to include policymaking functions that are not significant. Identification of an Executive Officer for purposes of this Policy will include at a minimum executive officers identified pursuant to 17 CFR 229.401(b).

“Financial Reporting Measures” means any of the following: (i) measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measures that are derived wholly or in part from such measures, (ii) stock price and (iii) TSR. A Financial Reporting Measure need not be presented within the Company’s financial statements or included in a filing with the SEC.

“Incentive-Based Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure.

-3-

IX. ADMINISTRATION; AMENDMENT; TERMINATION.

All determinations under this Policy will be made by the Committee, including determinations regarding how any recovery under this Policy is effected. Any determinations of the Committee will be final, binding and conclusive and need not be uniform with respect to each individual covered by this Policy.

The Committee may amend this Policy from time to time and may terminate this Policy at any time, in each case in its sole discretion.

X. EFFECTIVENESS; OTHER RECOUPMENT RIGHTS

This Policy shall be effective as of December 1, 2023. Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company and its subsidiaries and affiliates under applicable law or pursuant to the terms of any similar policy or similar provision in any employment agreement, equity award agreement or similar agreement.

-4-

In this Annual Information Form, we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

Each section of BCE’s 2022, 2023 and 2024 management’s discussion and analysis (BCE 2022 MD&A, BCE 2023 MD&A and BCE 2024 MD&A, respectively) and each section of BCE’s 2024 consolidated financial statements referred to in this Annual Information Form is incorporated by reference herein. No other document shall be considered to be incorporated by reference in this Annual Information Form. The BCE 2022 MD&A, BCE 2023 MD&A, BCE 2024 MD&A and BCE 2024 consolidated financial statements have been filed with the Canadian provincial securities regulatory authorities (available at sedarplus.ca) and with the United States (U.S.) Securities and Exchange Commission (SEC) as exhibits to BCE’s annual reports on Form 40-F (available at sec.gov). They are also available on BCE’s website at BCE.ca.

Unless otherwise indicated herein, documents and other information contained in BCE’s website or in any other site referred to in BCE’s website or in this Annual Information Form are not part of this Annual Information Form and are not incorporated by reference herein.

All dollar figures are in Canadian dollars, unless stated otherwise. The information in this Annual Information Form is as of March 6, 2025, unless stated otherwise, and except for information in documents incorporated by reference that have a different date.

Trademarks in this Annual Information Form which are owned or used under licence by BCE Inc., Bell Canada or their subsidiaries include, without limitation, BCE, BELL Design, BELL MOBILITY and BELL MEDIA. This Annual Information Form also includes trademarks of other parties. The trademarks referred to in this Annual Information Form may be listed without the ® and TM symbols.

© BCE Inc., 2025. All rights reserved.

| 2 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

| |

Annual information form |

|

|

Parts of MD&A and financial statements incorporated by reference (references are to pages of the BCE 2024 Annual financial report, except where otherwise indicated) |

|

|||

| 4 | 30-31; 38; 59; 64; 88-99 | |||||||

| 7 | ||||||||

| 7 | ||||||||

| 7 | ||||||||

| 8 | ||||||||

| 8 | 13-16; 45; 53; 58-59; 64; 81 | |||||||

| 9 | 32-36 | |||||||

| 9 | ||||||||

| 10 | 34 | |||||||

| 17 | ||||||||

| 19 | ||||||||

| 23 | ||||||||

| 24 | 21-31 | |||||||

| 25 | 39-40; 56-58; 59; 62-63; 65 | |||||||

| 26 | 82-87 | |||||||

| 26 | ||||||||

| 27 | ||||||||

| 27 | ||||||||

| 30 | 17-21; 32-36; 18-23(1); 35-38(1); 18-21(2); 33-36(2) | |||||||

| 30 | 82-87; 83-87(1); 86-90(2) | |||||||

| 31 | ||||||||

| 31 | 158-159 | |||||||

| 32 | 146-147 | |||||||

| 34 | ||||||||

| 38 | ||||||||

| 40 | 18-21; 104-108 | |||||||

| 43 | ||||||||

| 43 | ||||||||

| 45 | ||||||||

| 45 | ||||||||

| 46 | ||||||||

| 9 Interest of management and others in material transactions |

49 | |||||||

| 49 | ||||||||

| 49 | ||||||||

| 50 | ||||||||

| 51 | ||||||||

| 54 | ||||||||

| (1) | References to parts of the BCE 2023 MD&A contained in BCE’s annual financial report for the year ended December 31, 2023 (BCE 2023 Annual Financial Report). |

| (2) | References to parts of the BCE 2022 MD&A contained in BCE’s annual financial report for the year ended December 31, 2022 (BCE 2022 Annual Financial Report). |

| 3 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

| 1 | Caution regarding |

| forward-looking statements |

Certain statements made in this Annual Information Form are forward-looking statements. These statements include, without limitation, statements relating to the proposed acquisition by Bell Canada of Northwest Fiber Holdco, LLC (doing business as Ziply Fiber (Ziply Fiber)), the expected timing and completion thereof, the sources of liquidity we expect to use to fund the proposed acquisition, certain potential benefits expected to result from the proposed acquisition including the combined Bell Canada and Ziply Fiber target number of fibre locations to be reached by the end of 2028, Bell Canada’s growth prospects and strategic positioning, the proposed disposition of BCE’s ownership stake in Maple Leaf Sports and Entertainment Ltd. (MLSE), the expected timing and completion thereof, the intended use by BCE of the net proceeds from the proposed disposition and the planned access by Bell Media to content rights for the Toronto Maple Leafs and Toronto Raptors for the next 20 years, the proposed disposition of Northwestel Inc. (Northwestel), the expected timing and completion thereof, the intended use by Bell Canada of the proceeds from the proposed disposition and the planned continuation of a Bell Canada partnership with Northwestel beyond transaction close, BCE’s common share dividend, expected dividend payout ratio level in 2025 and dividend payout policy target, the reduction of BCE’s net debt leverage ratio, BCE’s anticipated reductions in capital expenditures, BCE’s network deployment plans, the status of the Shareholder Dividend Reinvestment and Stock Purchase Plan (DRP) and the time period during which the discount thereunder will be maintained by BCE, our transformation initiatives, the successful development and implementation of artificial intelligence (AI) solutions, either by us or pursuant to certain partnerships entered into by BCE, the intended use of the net proceeds of Bell Canada’s offering of debt securities, BCE’s business, outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target, commitment and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, estimate, expect, intend, may, plan, seek, should, strive, will and would. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the U.S. Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this Annual Information Form describe our expectations as at March 6, 2025 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this Annual Information Form for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook, as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

Subject to various factors, we believe that the assumptions on which the forward-looking statements made in this Annual Information Form are based were reasonable as at March 6, 2025. Refer in particular to the sub-sections of the BCE 2024 MD&A entitled Assumptions on pages 30 to 31, 38, 59, and 64 of BCE’s annual financial report for the year ended December 31, 2024 (BCE 2024 Annual Financial Report) for a discussion of certain key economic, market, operational and other assumptions we have made in preparing forward-looking statements. If our assumptions turn out to be inaccurate, actual results or events could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously mentioned forward-looking statements and other forward-looking statements contained in this Annual Information Form include, but are not limited to: the negative effect of adverse economic conditions, including trade wars resulting from the imposition of U.S. tariffs on imports from Canada and retaliatory tariffs by the Canadian government on goods coming from the U.S., recessions, reductions in immigration levels, high housing support costs relative to income, and financial and capital market

| 4 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

volatility, and the resulting negative impact on customer spending and the demand for our products and services; the negative effect of adverse conditions associated with geopolitical events; the intensity of competitive activity and the failure to effectively respond to evolving competitive dynamics; the level of technological substitution and the presence of alternative service providers contributing to disruptions and disintermediation in each of our business segments; changing customer behaviour and the expansion of cloud-based, over-the-top (OTT) and other alternative solutions; advertising market pressures from economic conditions, fragmentation and non-traditional/global digital services; rising content costs and challenges in our ability to acquire or develop key content; high Canadian Internet and smartphone penetration; regulatory initiatives, proceedings and decisions, government consultations and government positions that negatively affect us and influence our business including, without limitation, concerning mandatory access to networks, spectrum auctions, the imposition of consumer-related codes of conduct, approval of acquisitions, broadcast and spectrum licensing, foreign ownership requirements, privacy and cybersecurity obligations and control of copyright piracy; the inability to implement enhanced compliance frameworks and to comply with legal and regulatory obligations; unfavourable resolution of legal proceedings; the failure to evolve and transform our networks, systems and operations using next-generation technologies while lowering our cost structure, including the failure to meet customer expectations of product and service experience; the inability to drive a positive customer experience; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to implement an effective security and data governance framework; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; service interruptions or outages due to network failures or slowdowns; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, information technology (IT) systems, equipment and other facilities; the failure by other telecommunications carriers on which we rely to provide services to complete planned and sufficient testing, maintenance, replacement or upgrade of their networks, equipment and other facilities, which could disrupt our operations including through network or other infrastructure failures; the complexity of our operations and IT systems and the failure to implement, maintain or manage highly effective processes and IT systems; in-orbit and other operational risks to which the satellites used to provide our satellite television (TV) services are subject; the failure to attract, develop and retain a talented team capable of furthering our strategic imperatives and high-tech transformation; the potential deterioration in employee morale and engagement resulting from staff reductions, cost reductions or reorganizations and the de-prioritization of transformation initiatives due to staff reductions, cost reductions or reorganizations; the failure to adequately manage health and safety concerns; labour disruptions and shortages; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether our dividend payout policy will be maintained or achieved, or that the dividend on common shares will be maintained or dividends on any of BCE’s outstanding shares will be declared by BCE’s board of directors (BCE Board); the failure to reduce costs and adequately assess investment priorities, as well as unexpected increases in costs; the inability to manage various credit, liquidity and market risks; the failure to evolve practices to effectively monitor and control fraudulent activities; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the impact on our financial statements and estimates from a number of factors; pension obligation volatility and increased contributions to post-employment benefit plans; the expected timing and completion of the proposed disposition of Northwestel are subject to closing conditions, termination rights and other risks and uncertainties, including, without limitation, the purchaser securing financing and the completion of confirmatory due diligence, which may affect its completion, terms or timing and, as such, there can be no assurance that the proposed disposition will occur, or that it will occur on the terms and conditions, or at the time, currently contemplated, or that the potential benefits expected to result from the proposed disposition will be realized; the expected timing and completion of the proposed disposition of BCE’s ownership stake in MLSE and the planned access by Bell Media to content rights for the Toronto Maple Leafs and Toronto Raptors for the next 20 years through a long-term agreement with Rogers Communications Inc. (Rogers) are subject to closing conditions, termination rights and other risks and uncertainties, including, without limitation, relevant sports league and other customary approvals, which may affect its completion, terms or timing, and the intended use of proceeds by BCE from the proposed disposition may vary based on timing of closing of the disposition and other factors and, as such, there can be no assurance that the proposed disposition, the anticipated use of proceeds and the potential benefits expected to result from the proposed disposition will occur or be realized, or that they will occur or be realized on the terms and conditions, or at the time, currently contemplated; the expected timing and completion of the proposed acquisition of Ziply Fiber are subject to customary closing conditions, termination rights and other risks and uncertainties, including, without limitation, relevant regulatory approvals, such as approval by the Federal Communications Commission and approvals by state Public Utilities Commissions, which may affect its completion, terms or timing and, as such, there can be no assurance that the proposed acquisition will occur, or that it will occur on the terms and conditions, or at the time, currently contemplated, or that the potential benefits expected to result from the proposed

| 5 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

acquisition will be realized; reputational risks and the inability to meaningfully integrate environmental, social and governance (ESG) considerations into our business strategy, operations and governance; the adverse impact of various internal and external factors on our ability to achieve our ESG targets, including, without limitation, those related to greenhouse gas emissions reduction; the failure to take appropriate actions to adapt to current and emerging environmental impacts, including climate change; the failure to develop and implement sufficient corporate governance practices; the inability to adequately manage social issues; health risks, including pandemics, epidemics and other health concerns, such as radio frequency emissions from wireless communications devices and equipment; our dependence on third-party suppliers, outsourcers and consultants to provide an uninterrupted supply of the products and services we need; the failure of our vendor selection, governance and oversight processes, including our management of supplier risk in the areas of security, data governance and responsible procurement; the quality of our products and services and the extent to which they may be subject to defects or fail to comply with applicable government regulations and standards.

These and other risk factors that could cause actual results or events to differ materially from our expectations expressed in, or implied by, our forward-looking statements are discussed in this Annual Information Form and the BCE 2024 MD&A and, in particular, in section 9, Business risks of the BCE 2024 MD&A, on pages 88 to 99, of the BCE 2024 Annual Financial Report.

Forward-looking statements contained in this Annual Information Form for periods beyond 2025 involve longer-term assumptions and estimates than forward-looking statements for 2025 and are consequently subject to greater uncertainty. Forward-looking statements for periods beyond 2025 further assume, unless otherwise indicated, that the risks described above and in section 9, Business risks of the BCE 2024 MD&A will remain substantially unchanged during such periods.

We caution readers that the risks described above are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. We regularly consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after March 6, 2025. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way or in the same way we present known risks affecting our business.

| 6 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

| 2 | Corporate structure |

| 2.1 | Incorporation and registered office |

BCE Inc. was incorporated in 1970 and was continued under the Canada Business Corporations Act in 1979. It is governed by a certificate and articles of amalgamation dated August 1, 2004, as amended by: (a) a certificate and articles of arrangement dated July 10, 2006 to implement a plan of arrangement providing for the distribution by BCE Inc. to its shareholders of units in the Bell Aliant Regional Communications Income Fund and to consolidate outstanding BCE Inc. common shares; (b) a certificate and articles of amendment dated January 25, 2007 to implement a plan of arrangement providing for the exchange of Bell Canada preferred shares for BCE Inc. preferred shares; (c) a certificate and articles of amendment dated June 29, 2011 to create two additional series of BCE Inc. Cumulative Redeemable First Preferred Shares (first preferred shares); and (d) certificates and articles of amendment dated September 22, 2014 and November 11, 2014 to create six additional series of BCE Inc. first preferred shares. BCE Inc.’s head and registered offices are located at 1, Carrefour Alexander-Graham-Bell, Building A, Verdun, Québec H3E 3B3.

| 2.2 | Subsidiaries |

The table below shows BCE Inc.’s main subsidiaries at December 31, 2024, which are all incorporated in Canada, and the percentage of voting securities that BCE Inc. directly or indirectly held in such subsidiaries on that date. BCE Inc. has other subsidiaries that have not been included in the table since each represented 10% or less of our total consolidated assets and 10% or less of our total consolidated operating revenues at December 31, 2024. These other subsidiaries together represented 20% or less of our total consolidated assets and 20% or less of our total consolidated operating revenues at December 31, 2024.

|

Subsidiary |

Percentage of voting securities held by BCE Inc. at December 31, 2024(1) |

|

| Bell Canada |

100% | |

| Bell Mobility Inc. |

100% | |

| Bell Media Inc. |

100% | |

| (1) | At December 31, 2024, BCE Inc. directly held 94.1% of the voting securities of Bell Canada and indirectly held the remaining 5.9% through its wholly-owned subsidiary, Bell MTS Inc. (Bell MTS). BCE Inc. indirectly held all the voting securities of: (i) Bell Mobility Inc. (Bell Mobility) through Bell Canada, which in turn indirectly held all the voting securities of Bell Mobility through its wholly-owned subsidiary, Bell Mobility Holdings Inc.; and (ii) Bell Media Inc. (Bell Media) through Bell Canada. |

| 7 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

| 3 | Description of our business |

This section contains forward-looking statements, including, but not limited to, statements relating to our anticipated capital expenditures and network deployment plans, our transformation initiatives and the benefits expected to result therefrom, the successful development and implementation of artificial intelligence (AI) solutions, either by us or pursuant to certain partnerships entered into by BCE, our proposed acquisitions and dispositions, and our business outlook, objectives, plans and strategic priorities. Refer to section 1, Caution regarding forward-looking statements in this Annual Information Form.

| 3.1 | General summary |

BCE is Canada’s largest communications company,(1) providing residential, business and wholesale customers with a wide range of solutions for all their communications needs.

Our results are reported in two segments: Bell Communication and Technology Services (Bell CTS) and Bell Media.

Bell CTS provides a wide range of communication products and services to consumer, business and government customers across Canada. Wireless products and services include mobile data and voice plans, streaming services, and devices and are available nationally. Wireline products and services comprise data (including Internet access, Internet protocol television (IPTV), cloud-based services and business solutions), voice, and other communication services and products, which are available to our residential, small and medium-sized business and large enterprise customers primarily in Ontario, Québec, the Atlantic provinces and Manitoba, while satellite TV service and connectivity to business customers are available nationally across Canada. In addition, this segment includes our wholesale business, which buys and sells local telephone, long distance, data and other services from or to resellers and other carriers as well as the results of operations of our national consumer electronics retailer, The Source (Bell) Electronics Inc. (The Source). In 2024, Bell Canada announced a strategic partnership with Best Buy Canada to operate 167 The Source consumer electronics retail stores in Canada, which have been rebranded as Best Buy Express and offer the latest in consumer electronics from Best Buy along with exclusive telecommunications services from Bell.

Our Bell Media segment provides a portfolio of assets in premium video, audio, out-of-home (OOH) advertising, and digital media to customers nationally across Canada. Revenues are derived primarily from advertising and subscriber fees.

Additional information regarding our business operations and the products and services we provide can be found in section 1.2, About BCE of the BCE 2024 MD&A, on pages 13 to 16 of the BCE 2024 Annual Financial Report. Additional information regarding the business outlook of our Bell CTS and Bell Media segments can be found in the sections entitled Business outlook and assumptions of the BCE 2024 MD&A, on pages 58 to 59, and 64 of the BCE 2024 Annual Financial Report.

In addition to our operating segments, we also hold investments in a number of other assets, including:

| • | a 37.5% indirect equity interest in MLSE(2); |

| • | a 50% indirect equity interest in Glentel Inc. (Glentel); |

| • | a 20.2% indirect equity interest in entities that operate the Montréal Canadiens Hockey Club, evenko and the Bell Centre in Montréal, Québec, as well as Place Bell in Laval, Québec. |

A discussion of the key transactions completed by BCE since 2022 can be found in section 4.1, Transactions of this Annual Information Form.

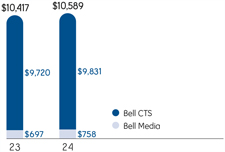

For the years ended December 31, 2024 and 2023, we generated consolidated operating revenues of $24,409 million and $24,673 million, respectively, and consolidated net earnings of $375 million and $2,327 million, respectively. For the year ended December 31, 2024, Bell CTS’ operating revenues totaled $21,619 million ($21,592 million external revenues) and Bell Media’s operating revenues totaled $3,151 million ($2,817 million external revenues). For the year ended December 31, 2023, Bell CTS’ operating revenues totaled $21,926 million ($21,897 million external revenues) and Bell Media’s operating revenues totaled $3,117 million ($2,776 million external revenues). A table showing the operating revenues that each segment contributed to total operating revenues for the years ended December 31, 2024 and 2023 can be found in section 4.3, Operating revenues of the BCE 2024 MD&A, on page 45 of the BCE 2024 Annual Financial Report. A table showing the operating revenues of our Bell CTS segment

| (1) | Based on total revenue and total combined customer connections. |

| (2) | On September 18, 2024, BCE announced that it has reached an agreement to sell its ownership stake in MLSE for $4.7 billion to Rogers, subject to relevant sports league and other customary approvals. The transaction is expected to close in mid-2025. |

| 8 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

by category of products and services can be found in section 5.1, Bell CTS of the BCE 2024 MD&A, on page 53 of the BCE 2024 Annual Financial Report.

Some of our segments’ revenues vary slightly by season. For more information, refer to section 7.2, Quarterly financial information – Seasonality considerations of the BCE 2024 MD&A, on page 81 of the BCE 2024 Annual Financial Report.

| 3.2 | Strategic imperatives |

BCE’s purpose is to advance how Canadians connect with each other and the world. Our strategy builds on our long-standing strengths in networks, service innovation and content creation, and positions the company for continued growth and innovation leadership. Our primary business objectives are to grow our subscriber base profitably and to maximize revenues, operating profit, free cash flow and return on invested capital by further enhancing our position as the foremost provider in Canada of comprehensive communications services to residential, business and wholesale customers, and as Canada’s leading media and entertainment company. We seek to take advantage of opportunities to leverage our networks, infrastructure, sales channels, and brand and marketing resources across our various lines of business to create value for our customers and other stakeholders.

Our strategy is centred on our disciplined focus and execution of six strategic imperatives that position us to deliver continued success in a fast-changing communications marketplace. The six strategic imperatives that underlie BCE’s business plan are:

|

|

|

||

| Build the best networks |

Drive growth with innovative services |

Deliver the most compelling content |

||

|

|

|

||

| Champion customer experience |

Operate with agility and cost efficiency |

Engage and invest in our people and create a sustainable future |

||

Additional information regarding our strategic imperatives can be found in section 2, Strategic imperatives of the BCE 2024 MD&A, on pages 32 to 36 of the BCE 2024 Annual Financial Report.

| 3.3 | Our operational transformation(1) |

We are continuing our journey to modernize our operations, increase productivity, build tech talent and materially right-size our cost base.

Innovation is driving customer expectations for enhanced user experiences, improved customer service, and faster market responses, all of which are improved by our operational transformation.

Our transformation reinforces a customer-first approach and specifically sets out to deliver incremental value to our customers as indicated in the following examples:

| • | Ability for customers to enjoy our products, services, and content on any device in any location; |

| • | Enable customers to be served on their timeline through simple sales and support interactions across the channel of their choosing (e.g., online, call centre, store); and |

| • | Access to new and better products, services and solutions on an accelerated basis tailored to meet customers’ evolving needs and expectations. |

| (1) | Also referred to as our transformation from a traditional telecommunications company to a technology services and digital media company. |

| 9 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

| 3.4 | Competitive strengths |

Canada’s largest communications company

We are Canada’s largest communications company(1), providing residential, business and wholesale customers with a wide range of solutions for all their communications needs, as described below:

| • | We are the largest local exchange carrier in Canada. BCE operates an extensive local access network in Ontario, Québec, the Atlantic provinces and Manitoba, as well as in Canada’s Northern Territories(2). We provide an expansive suite of wireless communications, wireline voice and data, including Internet access and TV, product and service offerings to residential, business and wholesale customers. We also own Bell Media, Canada’s leading media and entertainment company with a portfolio of assets in premium video, audio, OOH advertising and digital media, monetized through traditional and digital platforms. |

| • | We also offer competitive local exchange carrier services in Alberta and British Columbia. |

| • | At December 31, 2024, BCE was one of the largest wireless operators in Canada based on number of subscribers, providing 10,288,574 mobile phone subscribers with nationwide mobile voice and data services. We also had 3,043,430 mobile connected device subscribers at December 31, 2024. |

| • | BCE is the largest Internet service provider (ISP) in Canada based on number of subscribers, providing 4,490,896 retail customers at December 31, 2024 with high-speed Internet access through fibre-optic, wireless-to-the-premise (WTTP) and digital subscriber line (DSL) technology. |

| • | BCE is one of the largest TV providers in Canada based on number of subscribers, nationally broadcasting a wide range of domestic and international programming to 2,132,953 IPTV retail subscribers at December 31, 2024 through its IPTV services, namely Fibe TV, the Fibe TV app and Virgin Plus TV, as well as its satellite TV service. |

| • | BCE operated 1,834,191 retail residential network access service voice lines at December 31, 2024. |

| • | Our business markets team maintains a leadership position, having established relationships with a majority of Canada’s largest 100 corporations. |

Our large customer base, our wireline and wireless network reach, and our ability to sell through a variety of distribution channels, as discussed in more detail in section 3.5, Marketing and distribution channels in this Annual Information Form, give us scale that supports the execution of our six strategic imperatives. With a wireless network service footprint that encompasses more than 99% of Canada’s population, a coast-to-coast national fibre transport network and a local exchange carrier footprint from Manitoba to the Atlantic provinces, BCE is well positioned to take advantage of integrated wireless and wireline solutions in the future.

Technologically advanced wireless networks and services

Through our Bell CTS segment, we provide wireless services over technologically advanced wireless networks that are available to virtually all Canadians. We offer a broad range of wireless voice and data communication products and services to residential and business customers through our Bell brand, as well as our Virgin Plus and Lucky Mobile brands, which enhance our competitive market position by allowing us to compete more effectively with the Canadian industry’s other discount brands, as well as regional facilities-based wireless service providers.

We are focused on maintaining our market share of national operators’ postpaid mobile phone net customer activations, growing our prepaid mobile phone subscriber base, improving sales execution and customer retention, and introducing new devices and data services. We also believe our priorities for improved customer experience at all touch points, enhanced network quality and performance driven by effective spectrum deployment and carrier aggregation that support bandwidth and speeds, as well as a broad device offering, should continue to improve our ability to attract and retain wireless customers. With our fifth-generation (5G) and 5G+ wireless networks, fourth-generation (4G) long-term evolution (LTE) wireless network, LTE Advanced (LTE-A) network and

| (1) | Based on total revenue and total combined customer connections. |

| (2) | In June 2024, Bell Canada entered into an agreement for the sale of Northwestel to Sixty North Unity, a consortium of Indigenous communities from the Yukon, the Northwest Territories and Nunavut. The transaction is expected to close in 2025 subject to certain closing conditions, including securing financing by Sixty North Unity and the completion of confirmatory due diligence and, as such, there can be no assurance that the transaction will ultimately be consummated. The Competition Bureau’s approval was received in the fourth quarter of 2024. |

| 10 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

our high-speed packet access plus (HSPA+) network, we are able to offer one of the broadest ranges of choice in wireless smartphones in Canada, along with extensive North American and international coverage. Bell also offers a LTE, Category M1 (LTE-M) network, which is a subset of our LTE network supporting low-power Internet of Things (IoT) applications with enhanced coverage, longer device battery life and enabling lower costs for IoT devices connecting to Bell’s national network.

Through our 5G and 5G+ wireless service, Bell offers enhanced mobile data speeds and the latest 5G and 5G+-capable smartphones. Bell is working with multiple equipment suppliers for its 5G rollout, including Nokia Corporation (Nokia) and Telefonaktiebolaget LM Ericsson (Ericsson). In 2021, Bell acquired significant additional mid-band, flexible-use 3500 megahertz (MHz) wireless spectrum in the auction by Innovation, Science and Economic Development Canada (ISED) and on May 19, 2023, Bell obtained the right to use, through subordination, certain of Xplore Inc.’s 3500 MHz spectrum licences in Québec after receiving approval from ISED. On November 30, 2023, Bell also announced having secured the right to acquire 939 wireless spectrum licences in the 3800 MHz spectrum auction, covering 1.77 billion MHz per population (MHz-Pop) for $518 million. On May 29, 2024, Bell acquired the 3800 MHz spectrum licences. Essential to Canada’s ongoing transition to 5G communications, these high-capacity airwaves support Bell’s delivery of enhanced 5G digital experiences to Canadian consumers and businesses in urban, rural and remote communities. Refer to section 4.1, Transactions in this Annual Information Form for more details.

Bell’s 5G network covered 87% of Canada’s population at December 31, 2024, a significant increase from the 26% of Canada’s population covered at the end of 2020, attributable in part to our capital expenditure acceleration program, which provided for $1.7 billion in additional network funding in 2021 and 2022, in addition to the approximately $4 billion that Bell typically spent each year in network expansion and enhancement prior to 2020. This $1.7 billion in accelerated capital expenditures advanced the rollout of our broadband fibre, 5G wireless and rural networks and helped drive Canada’s recovery from the COVID-19 pandemic. In 2022, Bell launched its 5G+ network, a faster and more responsive service allowing for a superior mobile experience, and which covered 60% of Canada’s population at December 31, 2024. Refer to section 3.6, Networks – Wireless in this Annual Information Form for more details concerning our wireless networks.

Bell’s 5G and 5G+ networks were ranked the fastest and best 5G in Canada by Global Wireless Solutions (GWS) in its 2024 nationwide assessment of 5G networks(3). This marks the third consecutive year Bell has earned this recognition for its 5G network and the second consecutive year for its 5G+ network.

Advancing 5G and IoT solutions

Bell is working with a range of global and domestic 5G partners, including Ericsson and Nokia, to accelerate Canada’s 5G innovation ecosystem. This includes continued investment in research and development (R&D) at Canadian institutions, such as a partnership between Western University and Bell creating an advanced centre for research into 5G applications across health (including mental health), transportation, education and other sectors. In 2022, Bell also launched a private mobile network at the Centre for Port Innovation, Engagement and Research (The PIER), an innovation hub in Halifax focused on developing innovative solutions for supply chain and logistics in the transportation industry, enabling IoT solutions that help support business-critical functions with real-time data monitoring and reporting, as well as supporting partners as they work to develop commercial opportunities seeking to benefit Canadian and global companies and their customers. On the international stage, Bell is involved in the setting of global 5G standards with our participation in the Next Generation Mobile Networks consortium and Third Generation Partnership Program.

The high capacity and near instant connections offered by 5G support new consumer and business applications, including augmented and virtual reality (AR/VR), AI and machine learning, immersive entertainment services, connected vehicles, smart cities and enhanced rural access, and IoT opportunities for business and government enterprises. In January 2023, we announced a partnership with Snap Inc. which introduced the first-ever 5G multi-user augmented reality (AR) basketball experience on Snapchat. Fans with a 5G device in attendance at four Toronto Raptors Welcome Toronto home games in early 2023 could join a shared AR experience where thousands could participate by teaming up and competing against each other, leveraging Snapchat’s AR technology and the speed, latency and bandwidth capabilities of 5G. In time for the start of the 2023-2024 hockey season, the 5G multi-user AR experience was also introduced in Winnipeg at the Canada Life Centre with the Bell 5G Slapshot Challenge AR lens. Jets fans were able to test their slapshot skills against other fans in the stadium to see who could score the most goals.

On September 25, 2023, we announced that Bell, Verizon, Vodafone and independent software vendor Matsuko successfully conducted the first live transatlantic collaborative meeting connecting multiple holographic people in Canada, the U.S. and the United Kingdom using 5G and multi-access edge computing (MEC) technology and Matsuko’s real-time software. Interacting with holograms of humans rather than avatars can provide a more personal experience for many applications such as remote

| (3) | Independent testing by GWS from February to November 2024 ranked Bell’s 5G and 5G+ networks highest among Canadian national wireless carriers. GWS OneScoreTM rankings for 5G+ performance and speeds are based on testing while actively using 3500 MHz spectrum. |

| 11 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

healthcare, collaborative working and education. The call was enabled by the speed of 5G combined with the quick response times of MEC, which moves the necessary computing closer to the edge of the network. Through its active participation in the 5G Future Forum industry body, Bell continues to support the developer community to access 5G MEC technologies and for their solutions to take advantage of Bell’s 5G network in Canada, and to interoperate globally.

On February 25, 2025, Bell Canada and Nokia announced a significant expansion of their 5G network infrastructure partnership, marking a major step forward in deploying cloud radio access network (RAN) and paving the way for future open RAN advancements. This multi-year contract extension will see Bell deploy Nokia’s commercial cloud RAN solution, built on a foundation of Red Hat OpenShift and supported by Dell Technologies infrastructure. Nokia will supply equipment from its industry-leading, energy-efficient 5G AirScale portfolio to support Bell’s Ccoud RAN deployments, ensuring feature and performance consistency throughout the network evolution. This collaboration leverages the power of cloud RAN to deliver immediate benefits to Bell’s network. The cloud-native architecture, powered by Red Hat OpenShift, provides enhanced scalability and agility, enabling Bell to rapidly adapt its network to meet fluctuating customer demands and swiftly introduce new services. This agility is further enhanced by the deployment of Dell PowerEdge servers at cell sites and data centres, providing the processing power and reliability needed for demanding 5G workloads.

Bell also provides a number of solutions in the IoT sector, which enable the interconnection of a range of devices and applications that send and receive data. Bell further offers global connectivity solutions for our IoT platforms and applications, which offer customers worldwide network access and the ability to manage all of their international devices remotely from a single web platform. Bell’s lineup of innovative IoT applications includes connected telematics services, including security, safety, diagnostics and infotainment for vehicles; fuel tank monitoring and water management solutions; fleet management solutions connecting commercial vehicles to the Internet to provide web-based analytics to manage the fleet; connected laptop solutions, enabling LTE connectivity directly from select LTE-enabled laptops; managed IoT security services that offer businesses, smart cities and other organizations employing IoT solutions a fully managed solution to detect and protect organizations from evolving cyber threats; and new solutions made available in the context of the COVID-19 pandemic, such as real-time occupancy monitoring, digital signage and sanitizer kiosks.

Next-generation high-speed Internet and TV services

Our strategic imperative to build the best networks has included the expansion of our fibre network to more homes and business locations. At December 31, 2024, our fibre-to-the-premise (FTTP) footprint covered approximately 7.8 million homes and businesses in Ontario, Québec, the Atlantic provinces and Manitoba. Our fibre network enables the delivery of Bell’s next-generation fibre-optic high-speed Internet service marketed as Fibe Internet, offering symmetrical download and upload speeds of up to 3 gigabits per second (Gbps) with FTTP through our Gigabit Fibe 3.0 service, as well as download speeds of up to 100 megabits per second (Mbps) with fibre-to-the node (FTTN). Our network also enables the delivery of our Internet service marketed as Virgin Plus Internet, offering download speeds of up to 1 Gbps. Refer to section 3.6, Networks – Wireline – High-speed fibre deployment in this Annual Information Form for more details concerning the deployment of our fibre-optic high-speed Internet services.

For the fourth consecutive time, the Ookla Q3-Q4 2024 Speedtest Awards have named Bell Pure Fibre Canada’s fastest Internet(4). Bell was also recognized by BrandSpark as Canada’s most trusted Internet provider for Wi-Fi performance/Wi-Fi connectivity for the sixth year in a row, and this year earned Most Trusted awards for TV, cellular and home phone(5).

On July 24, 2024, Bell announced the launch of its new Bell Business Wi-Fi App, designed to empower small businesses in Ontario and Québec with an enhanced Wi-Fi experience that combines improved security, customizable guest Wi-Fi, employee and customer data insights, and simplified network management. The Bell Business Wi-Fi App is available for small business owners in Ontario and Québec with Bell pure fibre Internet.

As Bell extends its direct fibre links in urban and suburban centres, we are also delivering broadband speeds to smaller towns and rural locations with our Wireless Home Internet (WHI) fixed wireless service, which is based on 5G-capable WTTP technology. With the expansion of wireless cell site coverage, deep fibre backhaul and advancements in technology, the cost to provide a fixed wireless solution became viable in rural areas where it is uneconomical to deploy FTTP. In 2021, we completed the buildout of our WHI service in smaller towns and rural communities across Ontario, Québec, the Atlantic provinces and Manitoba, reaching our target of 1 million locations one year ahead of schedule. Bell delivers Wireless Home Internet service with download speeds of up to 50 Mbps and upload speeds of 10 Mbps (50/10) to a majority of customers. In August 2021, an agreement with Casa Systems, Inc.

| (4) | Based on analysis by Ookla of Speedtest Awards® data for Q3-Q4 2024 Ookla trademarks used under license and reprinted with permission. |

| (5) | Voted and awarded Most Trusted High Speed Internet Provider for Wi-Fi Performance/Wi-Fi Connectivity, Home Phone Service Provider, TV Service Provider (in a tie), and Cellular Service Provider (in a tie) by Canadian shoppers based on the 2025 BrandSpark Canadian Trust Study. |

| 12 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

was announced for the upgrade of a portion of Bell’s WTTP network to 5G to further boost speed and capacity for WHI customers in rural regions, which was completed in June 2023.

Our fibre network also enables the delivery of Bell’s IPTV services, namely Fibe TV, the Fibe TV app and Virgin Plus TV. Bell’s Fibe TV service, built on an IPTV platform, offers a wide range of flexible programming options and innovative features to customers in Ontario, Québec, the Atlantic provinces and Manitoba, such as: the Fibe TV wireless receiver, which enables customers to enjoy the Fibe experience on up to 10 additional TVs anywhere in the home (five in Manitoba) without the hassle of running cable through the house; the Restart and Look Back features, enabling customers to rewind and watch TV shows already in progress from the beginning and up to 30 hours after they started; and the Trending feature, which lists the five most-watched shows in both English and French among Fibe TV customers at any given time and allows customers to switch to watch live or restart from the beginning. Fibe TV further allows access to Crave, Netflix, Prime Video and YouTube directly from customer TV receivers, providing a seamless experience.

In 2024, the next generation of Fibe TV was launched in Ontario, Québec and the Atlantic region, leveraging Google Android TV technology with enhanced search capabilities and voice remote. This service offers customers a consistent viewing experience on all screens with the Fibe TV app, including access to more than 500 live TV channels, on-demand content and over 10,000 apps from the Google Play Store, including Crave, Netflix, Prime Video, Apple TV and YouTube. Viewers can more easily find the content they want to watch, and explore new and exciting entertainment with a voice remote powered by Google Assistant and intuitive universal search capabilities that will find content across Fibe TV and supported subscribed streaming services. With added cloud personal video recorder (PVR) capabilities, viewers can record an unlimited number of shows simultaneously to watch at their convenience.

The Fibe TV app is available to customers in Ontario, Québec, the Atlantic provinces and Manitoba, and brings the rich Fibe TV viewing experience to tablets, smartphones, laptops, Bell Streamer, Apple TV, Amazon Fire TV, Google Chromecast and a variety of Android TV devices, with access to more than 500 live and on-demand channels at home or on the go, which allows customers to seamlessly transfer a channel being viewed from a mobile device to a TV, or resume what is being watched on TV on a mobile device. In addition, Fibe customers can download their personal video recordings with the Fibe TV app to watch on iOS and Android mobile devices without Wi-Fi network access, and customers can pause and rewind live TV on any device with the Fibe TV app.

In addition, we offer the Fibe TV app service in Ontario and Québec as a standalone app-based live TV streaming service that offers live and on-demand programming. With no traditional TV set-top box required, the Fibe TV app offers up to 500 live and on-demand channels on tablets, smartphones, laptops, Bell Streamer, Apple TV, Amazon Fire TV, Google Chromecast and a variety of Android TV devices. The standalone Fibe TV app offers access to two TV streams at a time and customers can add individual channels to build their own packages. Like Bell’s Fibe TV service, the standalone Fibe TV app operates as a licensed broadcast service on the privately managed Bell Fibe broadband network for in-home viewing, and on mobile or Wi-Fi networks outside the home.

Virgin Plus TV is an app-based service that does not require a traditional TV set-top box or installation and that lets members in Ontario and Québec watch live and on-demand TV shows and live sports on any screen they want as it works on virtually all devices – iOS and Android smartphones and tablets, laptops, Amazon Fire TV, Android TV, Apple TV and Google Chromecast. The Virgin Plus TV app lets members watch two streams at once, pause and rewind live TV, resume on-demand programs where they left off, and track all the top trending shows.

In addition, through Bell Streamer, an all-in-one 4K High Dynamic Range streaming device powered by Android TV, we offer customers in Ontario and Québec all-in-one access to the Fibe TV app, support for all major streaming services and access to thousands of apps on Google Play.

In November 2024, Bell Canada expanded its TV offering with 11 new free, ad-supported television (FAST) channels, available nationwide on the Bell TV and Virgin Plus TV apps. These channels are available with all TV packages and are seamlessly integrated into the customer’s TV guide, appearing alongside their favourite live channels.

Further, on November 4, 2024, BCE announced that Bell Canada had entered into an agreement to acquire Ziply Fiber, the leading fibre Internet provider in the Pacific Northwest of the U.S., for approximately $3.65 billion in U.S. dollars (approximately $5 billion in Canadian dollars) in cash and the assumption of outstanding net debt of approximately $1.45 billion in U.S. dollars (approximately $2 billion in Canadian dollars) to be rolled over at transaction close, representing a transaction value of approximately $5.1 billion in U.S. dollars (approximately $7 billion in Canadian dollars). This strategic acquisition is expected to grow Bell’s position as North America’s third largest fibre internet provider. Together, Bell Canada and Ziply Fiber have a goal to reach approximately 12 million fiber locations in North America by the end of 2028. This is expected to accelerate subscriber, revenue and EBITDA growth for Bell. The transaction is subject to certain customary closing conditions and the receipt of certain regulatory approvals, including the

| 13 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

Federal Communications Commission, and approvals by state Public Utilities Commissions. The proposed acquisition is expected to close in the second half of 2025. Refer to section 4.1, Transactions in this Annual Information Form for more details.

Our strong position in broadband Internet and TV and our broad suite of product offerings serve as a foundation for the other products and services we offer. This provides us with a significant number of established customer connections to drive uptake of new products and services, either through bundled offerings or on a standalone basis, and allows us to improve customer retention. In addition, our team continues to deliver network-centric business service solutions to large business and public sector clients, including cloud, security and workflow automation solutions, which are key to business communications today and increase the value of connectivity services.

Innovation in communications technology

Technological advancement plays a significant role in the success of our business. We invest in Canadian innovation and have spent $573 million in R&D capital expenditures in 2024. Our investments in R&D enable us to continue providing our customers with innovative products and services and to adopt new technologies that better support our own operations and our strategic imperatives to champion the customer experience and drive growth with innovative services. Our deployment of new and innovative networks and services is a direct result of our investment in R&D.

Over the past decades, Bell has invested in developing data analytics capabilities and AI applications in multiple areas of its operations. Providing advanced technological solutions allows us to better differentiate our product and service offerings and to seek to provide greater value to our customers. As part of Bell’s objective to remain at the forefront of technology and innovation in communications services, and encourage the development of, and expertise in, new emerging technologies in Canada, we partner with a range of global and domestic organizations.

In 2022, we announced a five-year strategic engagement with the Vector Institute, an independent, not-for-profit corporation dedicated to research in the field of AI, and announced a three-year strategic partnership with Montréal innovation centre Centech to provide tech entrepreneurs with access to the latest in Bell 5G, IoT and MEC technologies.

Bell also introduced Bell Ventures in 2022, its corporate venture capital initiative to encourage development of early-stage and growth companies that harness the power of Bell’s networks to drive growth and adoption of advanced technological solutions. Building on Bell’s history of innovation and investments, Bell Ventures is a natural extension of Bell’s purpose to advance how Canadians connect with each other and the world. Bell Ventures invests in early-stage and growth companies that provide advanced technology solutions seeking to further differentiate Bell’s 5G and fibre networks and deliver solutions for its customers, including in the areas of network, security, IoT, robotics, telematics, clean technology, data monetization and AI.

Since 2022, we have also announced a number of significant milestones in our strategic cloud and technology partnerships. In February 2022, Bell announced its deployment of Google Distributed Cloud Edge in its network, enabling more efficiency, reliability and scale while also driving new business opportunities. This is the world’s first implementation of core network functions on Google Distributed Cloud Edge, a fully managed product that brings Google Cloud’s infrastructure and services closer to where data is being generated and consumed. This advancement builds on Bell and Google Cloud’s strategic partnership, announced in 2021, to combine Bell’s 5G network leadership with Google Cloud’s expertise in multi-cloud, data analytics and AI, and to enable Bell to drive operational efficiencies and deliver richer customer experiences. On February 26, 2025, Bell Canada announced its network AI Ops solution built on Google Cloud, which has been successfully deployed and is already revolutionizing how it detects, analyzes, and presents network issues. This AI-driven approach has significantly improved Bell’s mean time to resolution, enabling proactive network management that enhances reliability and optimizes the customer experience. In addition, in 2023, Bell announced the launch of the first public MEC with AWS Wavelength in Canada. Building on Bell’s agreement with Amazon Web Services (AWS), announced in 2021, together the two companies are deploying AWS Wavelength Zones throughout the country at the edge of Bell’s 5G network, starting in Toronto. Bell Public MEC with AWS Wavelength embeds AWS compute and storage services at the edge of the Bell 5G network, closer to mobile and connected devices where data is generated and consumed. This enables software developers and businesses to take full advantage of the high speed and low latency of Bell’s 5G network and the cloud with AWS to build innovative, low-latency solutions that leverage real-time visual data processing, AR/VR, AI and machine learning, advanced robotics and much more.

On March 29, 2023, Bell announced a partnership with Palo Alto Networks to better support Canadian businesses managing their cloud security with the launch of two new cloud-native application protection platform (CNAPP) solutions, Cloud Security Posture Assessment and Cloud Security Posture Protection. These cybersecurity solutions identify threats to enterprise data in the cloud and provide managed services to protect data across complex hybrid, multi-cloud environments. On December 12, 2024, Bell announced a strategic partnership with Palo Alto Networks that brings together Bell’s expertise in managed and professional

| 14 | BCE INC. | 2024 ANNUAL INFORMATION FORM |

services with Palo Alto Networks’ industry-leading, AI-powered cybersecurity platforms. Building upon the customer success and service development initiatives launched in 2023, Bell will offer a full suite of services across Palo Alto Networks’ three platforms, delivering comprehensive protection against evolving cyber threats for customers in Canada.

In addition, on June 1, 2023, Bell acquired FX Innovation, a Montréal-based provider of cloud-focused managed and professional services and workflow automation solutions for business clients. This acquisition combines FX Innovation’s agility, start-up culture, and cloud services expertise with Bell’s next-generation fibre and 5G networks, resources, and scale to deliver leading-edge technology solutions for Canadian businesses. The acquisition aims to position Bell as a technology services leader for our enterprise customers. On November 29, 2023, Bell and ServiceNow, a digital workflow company, announced a collaboration to launch Service Bridge capabilities on the ServiceNow platform, leveraging FX Innovation’s deep industry expertise to elevate the end-to-end experience for Bell customers with customized solutions and automation capabilities. On July 18, 2024, Bell and ServiceNow announced a multi-year strategic agreement to accelerate Bell’s transformation to meet the growing customer demand for tech services and digital media. The renewed commitment makes Bell one of ServiceNow’s largest communications customers with a first-of-its-kind collaboration in Canada. Bell will expand its use of the ServiceNow platform, supporting its own digital transformation while continuing to offer ServiceNow implementation expertise to support the digital transformation of its Bell Business Markets customers. On October 9, 2024, Bell announced the acquisition by FX Innovation of HGC Technologies (HGC), an Elite ServiceNow partner. HGC strengthens FX Innovation’s expertise in process automation, cloud technologies, and digital transformation, bringing strengths in business application development, HR and customer service delivery, and a strong North American talent base to support growth. HGC’s existing U.S. customer base aligns with FX Innovation’s strategic plans for expansion into the U.S. market, providing immediate access to a new and growing customer segment.

On February 1, 2024, Bell announced a partnership with SentinelOne, Inc. (SentinelOne), a global leader in AI-powered security, to provide extensive data protection services for Bell’s enterprise customers.

On February 2, 2024, Bell announced an 18-month collaborative project with Mila, a research institute in AI, to apply deep learning neural network algorithms to Bell’s systems and data. Mila researchers will work alongside Bell’s Machine Learning and AI teams to build on Bell’s previous investments by using deep learning neural network techniques to identify opportunities to improve business performance and customer experience. By advancing its understanding of deep learning AI techniques, Bell seeks to continue to enhance its customer experience and accelerate its operational transformation.

On February 6, 2024, Bell announced a collaboration with Microsoft to expand its hybrid work solutions to help Canadian enterprises modernize their communications platforms with the launch of Bell Operator Connect, pairing Bell’s high-quality voice network and Microsoft Teams. Bell is also advancing its company-wide digital transformation and workforce modernization in selecting Microsoft 365 as its cloud collaboration solution. On November 19, 2024, Bell expanded its collaboration with Microsoft by launching services for Microsoft Teams Phone Mobile to offer Canadian businesses a flexible, secure, high-performance communication solution. This innovative mobile-first solution integrates mobile numbers with Teams, enabling seamless calling and collaboration. Teams Phone Mobile provides a consistent user experience, simplifying business communication and boosting productivity and efficiency.

On April 9, 2024, Bell announced the availability of Google Cloud Contact Center AI (CCAI) from Bell for Canadian businesses – the first fully AI solution for Bell enterprise and mid-market customers. Google Cloud’s CCAI from Bell is a managed solution supported by professional services expertise that enables intelligent customer and agent experience leveraging generative AI-infused technology. Providing rich conversational experiences and analytics, Google CCAI from Bell offers scalability and flexibility that can be added to existing contact centre environments and to cloud contact centres of any size.

On June 13, 2024, Bell and Mila, the world’s largest academic research centre for deep learning, announced a new partnership to develop cutting-edge AI solutions, building on the 18-month collaborative project Mila and Bell entered into earlier in 2024 to apply deep learning neural network algorithms to Bell’s environment. This collaboration is driven by a shared vision to enhance customer experience, optimize business operations and cultivate a vibrant AI ecosystem within Québec and across Canada. In line with Bell’s significant investments in AI, this partnership reinforces Bell’s business transformation, harnessing Mila’s groundbreaking research to drive transformative improvements across Bell’s operations. From data analysis and operational efficiency to Internet-based applications, Mila’s expertise will accelerate advancements that will enhance the customer experience.

On July 9, 2024, Bell announced that it had acquired technical services companies Stratejm and CloudKettle Inc., adding professional and managed services expertise in cybersecurity and Salesforce digital workflow automation to its existing capabilities. These acquisitions will advance Bell’s strategy to be the leader in supporting medium and large organizations’ digital transformations and automation through cloud services. Combined with Bell’s pure fibre and 5G networks, enterprises will benefit from an exceptional and seamless AI-powered end-to-end customer experience.

| 15 | BCE INC. | 2024 ANNUAL INFORMATION FORM |