UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

| For the month of March, 2025 | Commission File Number: 1-14678 |

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

CIBC Square, 81 Bay Street

Toronto, Ontario

Canada M5J 0E7

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☑

The information contained in this Form 6-K is incorporated by reference into the Registration Statements on Form S-8 File Nos. 333-130283, 333-09874 and 333-218913 and Form F-3 File Nos. 333-219550, 333-220284, 333-272447, and 333-282307.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CANADIAN IMPERIAL BANK OF COMMERCE |

||||||

| Date: March 4, 2025 |

By: |

/s/ Natalie Biderman |

|

|||

|

|

Name: |

Natalie Biderman |

|

|||

|

|

Title: |

Vice-President, Corporate Secretary | ||||

Exhibits

| Exhibit | Description of Exhibit | |

| 99.1 | Management Proxy Circular (including Notice of Meeting) | |

| 99.2 | Annual Report | |

| 99.3 | Notice-and-Access Notice | |

| 99.4 | Proxy Form | |

| 99.5 | News Release - CIBC’s 2025 Annual and Special Meeting of Shareholders Meeting Materials Now Available | |

| 99.6 | Marked Copy of the Proposed Amendments to by-Law No. 1 | |

Exhibit 99.1

Management Proxy Circular

Notice of Annual and Special Meeting of Shareholders April 3, 2025

Your participation is important. Please read this document and vote.

Notice of Annual and Special Meeting of Shareholders

| When: |

Thursday, April 3, 2025, 9:30 a.m. Eastern Daylight Time (EDT) |

|

| Where: |

By live webcast at https://cibcvirtual.com/agm2025 |

|

| Enter password: cibc2025 (case sensitive) |

||

| In person at CIBC Square, 81 Bay Street, Toronto, Ontario |

||

You may also listen to our meeting by phone at 416 340-2217 (local) or 1 800 806-5484 (toll-free in Canada and the United States), passcode 7053922# (English) or 514 392-1587 (local) or 1 800 898-3989 (toll free in Canada and the United States), passcode 9040336# (French).

At the meeting you will be asked to:

| 1. | receive our consolidated financial statements for the fiscal year ended October 31, 2024 and the auditors’ report on the statements; |

| 2. | elect directors; |

| 3. | appoint auditors; |

| 4. | vote on an advisory resolution regarding our executive compensation approach; |

| 5. | confirm by special resolution an amendment to By-Law No. 1 regarding directors’ remuneration; |

| 6. | confirm by ordinary resolution amendments to By-Law No. 1 regarding administrative matters; |

| 7. | vote on shareholder proposals; and |

| 8. | consider any other business properly brought before the meeting. |

Voting instructions start on page 5 of our 2025 Management Proxy Circular (the Circular). Please read our Circular carefully.

Eligibility to vote

There were 940,057,664 common shares outstanding on February 3, 2025, our record date. Holders of common shares on that date are eligible to vote at our meeting (subject to Bank Act (Canada) restrictions).

Your vote is important

Please read the Circular and vote before the meeting. For more information on how you can vote or appoint someone else to vote for you, see “Voting” starting on page 5 of the Circular. Please vote as early as possible so that your shares are represented at the meeting. TSX Trust Company (TSX Trust) must receive your vote no later than 1:00 p.m. (EDT) on April 1, 2025.

You may also vote online or in person at the meeting, provided you follow certain steps. These steps are set out on pages 5 to 9 of the Circular.

Questions

If you have questions about notice-and-access or accessing our meeting online, you may contact TSX Trust at 1 888 433-6443 (toll-free in Canada and the United States) or 416 682-3801 (other countries).

Our Board of Directors (Board) and management would like to answer as many shareholder questions as possible during the meeting. Please send your questions in advance to the Corporate Secretary at Corporate.Secretary@cibc.com or to CIBC Corporate Secretary Division, 81 Bay Street, CIBC Square, 20th Floor, Toronto, Ontario M5J 0E7.

Natalie Biderman

Vice-President, Corporate Secretary

February 12, 2025

Dear fellow shareholder,

By Order of the Board We are pleased to invite you to CIBC’s Annual and Special Meeting of Shareholders on April 3, 2025, at 9:30 a.m. (EDT). Please review this Circular for information on how to participate in our meeting, voting instructions, the business to be conducted, as well as our approach to executive compensation and our governance practices. Information on the meeting is also available on our Annual Meeting webpage on our Investor Relations website at www.cibc.com.

In 2024, we delivered strong financial results, built our capital strength, and delivered positive operating leverage. These achievements were grounded in our deep client relationships and in our commitment to the disciplined and consistent execution of our client focused strategy. These efforts are reflected in continued improvements to our robust client experience scores and solid employee engagement, all of which contributed to industry leading total shareholder returns this year.

We also remained steadfast in our support for the communities we serve. As the title sponsor of the Canadian Cancer Society’s Run for the Cure, Team CIBC raised $2.8 million in 2024 to fund cancer research and provide vital support to those affected by the disease. CIBC Miracle Day raised $6 million to empower children and families through essential charitable programs.

The foundation of CIBC’s success is the strength of our people and their dedication to helping our clients make their ambitions a reality.

We thank you for your ongoing support and look forward to your participation at this year’s Annual and Special Meeting.

Sincerely,

|

|

|

| Katharine B. Stevenson | Victor G. Dodig | |

| Chair of the Board | President and Chief Executive Officer | |

Management Proxy Circular

The information in this Circular is current as of February 6, 2025 and all dollar figures are in Canadian currency, unless indicated otherwise. ‘You’, ‘your’ and ‘shareholder’ mean common shareholders of CIBC.

Table of Contents

| 1 | Business of the Meeting | |||

| 4 | Meeting Materials | |||

| 5 | Voting | |||

| 11 | Directors | |||

| 11 |

Director Nominees |

|||

| 26 |

Director Compensation |

|||

| 30 | Board Committee Reports | |||

| 38 | Statement of Corporate Governance Practices | |||

| 58 | Message from the Chair of the Board and the Chair of the Management Resources and Compensation Committee | |||

| 63 | Compensation Discussion and Analysis | |||

| 63 |

Compensation Philosophy, Practices and Governance |

|||

| 65 |

Approach to Executive Compensation |

|||

| 73 |

2024 Performance and Compensation |

|||

| 74 |

Talent and Succession Planning |

|||

| 75 |

Inclusion |

|||

| 76 |

2024 NEO Compensation |

|||

| 90 | Compensation Disclosure | |||

| 103 | Shareholder Proposals | |||

| 114 | Other Information | |||

| 114 |

Indebtedness of Directors and Executive Officers |

|||

| 115 |

Directors’ and Officers’ Liability Insurance |

|||

| 115 |

Information about CIBC |

|||

| 115 |

Vote Results and Minutes of Meeting |

|||

| 115 |

Contacting our Board of Directors |

|||

| 115 |

Board of Directors’ Approval |

|||

Glossary

| BPF | Business Performance Factor |

|

| CEO | Chief Executive Officer |

|

| CFO | Chief Financial Officer |

|

| CRO | Chief Risk Officer |

|

| CSA | Canadian Securities Administrators |

|

| CX | Client Experience |

|

| DSU | Deferred Share Unit |

|

| EDT | Eastern Daylight Time |

|

| EPS | Earnings per Share |

|

| ESG | Environmental, Social and Governance |

|

| ESOP | Employee Stock Option Plan |

|

| EY | Ernst & Young LLP |

|

| FSB | Financial Stability Board |

|

| GAAP | Generally Accepted Accounting Principles |

|

| GPS | Goals, Performance, Success |

|

| IFRS | International Financial Reporting Standards |

|

| MD&A | Management’s Discussion and Analysis |

|

| MRCC | Management Resources and Compensation Committee |

|

| NEO | Named Executive Officer |

|

| NYSE | New York Stock Exchange |

|

| OSFI | Office of the Superintendent of Financial Institutions Canada |

|

| PCAOB | Public Company Accounting Oversight Board (United States) |

|

| PSU | Performance Share Unit |

|

| RMC | Risk Management Committee |

|

| ROE | Return on Equity |

|

| RSA | Restricted Share Award |

|

| S&P | Standard & Poor’s |

|

| SBU | Strategic Business Unit |

|

| SEC | US Securities and Exchange Commission |

|

| SERP | Supplemental Executive Retirement Plan |

|

| SEVP | Senior Executive Vice-President |

|

| TDC | Total Direct Compensation |

|

| TSR | Total Shareholder Return |

|

| TSX | Toronto Stock Exchange |

|

Senior Management includes the Chief Executive Officer (CEO) and individuals who are directly accountable to the CEO.

Heads of Oversight Functions includes the Chief Auditor, Chief Compliance Officer, Chief Anti-Money Laundering Officer, Chief Financial Officer (captured as part of Senior Management), and Chief Risk Officer (captured as part of Senior Management).

Business of the Meeting

1. Financial Statements

The consolidated financial statements for the fiscal year ended October 31, 2024 are in our 2024 Annual Report available at www.cibc.com.

| 2. Election of Directors

You will be asked to elect 13 director nominees to serve on our Board until the earlier of the next Annual Meeting of Shareholders or the director’s retirement from the Board. The Board recommends that you vote FOR each director nominee. |

See pages 11 to 24 for information about our director nominees.

|

| 3. Appointment of Auditors

You will be asked to appoint Ernst & Young LLP (EY) as auditors of CIBC. EY has served as the auditors of CIBC since December 2002. The Board recommends that you vote FOR EY as our auditors. |

See pages 31 and 32 for information on the Audit Committee’s annual assessment of EY’s independence, audit quality, effectiveness and service quality and a description of fees paid to the auditors.

|

4. Advisory Resolution regarding our Executive Compensation Approach

|

You can have a “say on pay” by voting on our approach to executive compensation. Last year, 96.6% of shareholder votes were for our executive compensation approach. We consider the vote an important part of our shareholder engagement process as it offers valuable feedback to our Board. This vote is advisory under applicable law and does not diminish the Board’s role and responsibilities. Even though the resolution is not binding, the Board and the Management Resources and Compensation Committee (MRCC) consider the results of the vote in making future executive compensation decisions. |

See pages 58 to 102 for Message to our Fellow Shareholders and Compensation Discussion and Analysis.

|

In evaluating our executive compensation strategy, the MRCC takes into account feedback from shareholders as well as any concerns that have been expressed. If a concern is deemed significant by the MRCC, we will provide details about the MRCC’s review process and the results of that review in our next Circular.

We welcome your questions or feedback regarding our approach to executive compensation by writing to us at Corporate.Secretary@cibc.com, or CIBC Corporate Secretary Division, 81 Bay Street, CIBC Square, 20th Floor, Toronto, Ontario M5J 0E7.

|

The Board recommends that you vote FOR the following advisory resolution.

RESOLVED on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in CIBC’s management proxy circular for the 2024 Annual Meeting of Shareholders.

|

5. Special Resolution to Amend By-Law No. 1 Regarding Directors’ Remuneration

Under the Bank Act (Canada), CIBC’s by-laws must include a provision that establishes the aggregate amount directors can receive for their services as directors of the bank during a fixed time period. Currently, Section 2.6 of By-Law No. 1 sets this amount at $5,000,000 for each fiscal year. This amount was approved by shareholders at our annual and special meeting held on April 5, 2016.

On December 12, 2024, the Board passed a resolution to amend Section 2.6 of By-Law No. 1 to increase the aggregate amount that directors can be paid for a fiscal year from $5,000,000 to $6,000,000. To be effective, the proposed by-law change requires confirmation by a special resolution of shareholders, approved by at least two-thirds of the votes cast in person or by proxy at our 2025 Annual and Special Meeting of Shareholders.

| C I B C P R O X Y C I R C U L A R | 1 |

The increase in the aggregate amount that can be paid to directors provides flexibility to compensate additional directors who may be appointed in the future, as part of a planned approach to Board renewal. This change allows CIBC to continue to attract and retain strong candidates with the necessary skills and experiences to serve as directors. By electing additional directors alongside longer-serving members, we can leverage the expertise of seasoned peers to help orient new directors to the Board’s responsibilities, especially in the face of growing complexity in the banking industry and evolving global regulations. Moreover, the increase allows CIBC to respond to any unforeseen events that may require an ad-hoc committee of the Board or additional ad-hoc or committee meetings for which compensation is payable, as well as to account for any increase in director compensation approved by the Board in future years.

|

The Board recommends that shareholders vote FOR the following special resolution:

“RESOLVED BY SPECIAL RESOLUTION THAT:

The amendment of Section 2.6 of By-Law No. 1 to delete the reference to ‘$5,000,000’ and replace it with ‘$6,000,000’, so that section 2.6 reads as follows, be and is hereby confirmed: “2.6 Remuneration

To remunerate the directors for their services as such, there may be paid in each fiscal year from the funds of CIBC to and among the directors such amounts, not exceeding in the aggregate $6,000,000, and in such proportions between them as may be determined from time to time by the board of directors.””

|

6. Ordinary Resolution to Amend By-Law No. 1 Regarding Administrative Matters

On December 12, 2024, the Board passed a resolution to amend certain administrative provisions of By- Law No. 1, effective only upon confirmation by shareholders, to reflect regulatory changes, best governance practices and to make certain other changes of a “house-keeping” nature (the “Amended By-Law No. 1”). A description of key matters covered by these changes is set out below. A complete copy of the Amended By-Law No. 1, reflecting all of the proposed changes, can be found on our website at www.cibc.com, on SEDAR+ at www.sedarplus.com and on the SEC website at www.sec.gov/edgar.shtml.

| Proposed Amendments |

Amended or New Sections |

|

| Virtual director meetings – allowing director meetings to be conducted by virtual means upon unanimous consent. |

2.3 | |

| Annual meetings – providing flexibility, in extenuating circumstances, for the annual meeting to be delayed if permitted by the Bank Act (Canada), applicable laws and applicable stock exchange requirements. |

4.1 | |

| Quorum for shareholder meetings – clarifying the definition of quorum for shareholder meetings and that the quorum requirements do not apply to shareholder meetings where the class or share provisions otherwise provide for quorum requirements. |

4.3 | |

| Adjournment and Termination – adding section setting out authority of the chair of the shareholder meeting to adjourn and terminate the meeting. |

4.4 (new) | |

| No second or casting vote – removing the ability of the chair of the shareholder meeting to have a second or casting vote if there is an equality of votes. |

4.4 (old) | |

| Acceptance of proxy – providing authority to the chair of the shareholder meeting to make determinations on the acceptability of proxies. |

4.6 | |

| Renumbering – adding new section 4.4 and renumbering old sections 4.4, 4.5 and 4.6 as sections 4.5, 4.6 and 4.7, respectively. |

4.4 (old), 4.5, 4.6 |

|

| Electronic notices – adding ability to provide notices or documents by electronic means in accordance with the Bank Act (Canada). |

5.3 | |

| Use of gender-neutral language |

Throughout | |

To be effective, each by-law change requires the confirmation of shareholders by ordinary resolution approved by a majority of the votes cast in person or by proxy at the 2025 Annual and Special Meeting of Shareholders. If you do not specify in your proxy form or voting instruction form how you want to vote your shares and do not appoint a different proxyholder, the persons designated by management in the form will vote for the ordinary resolution to confirm the amendments to the Amended By-Law No. 1.

| 2 | C I B C P R O X Y C I R C U L A R |

|

The Board recommends that shareholders vote FOR the following ordinary resolution:

“RESOLVED THAT:

The amendments to By-Law No. 1 of the bank in the form filed on SEDAR+ (www.sedarplus.com) and on the SEC website (www.sec.gov/edgar.shtml) on or about March 4, 2025, other than in respect of Section 2.6 thereof, be and are hereby confirmed.”

|

| 7. Shareholder Proposals

You will be asked to vote on 7 shareholder proposals set out on pages 103 to 110 of the Circular. The Board recommends that you vote AGAINST these proposals and explains why following each proposal.

Shareholder proposals that were withdrawn are set out on pages 111 to 113 of the Circular with supporting statements and the Board’s response.

|

See pages 103 to 113 for shareholder proposals and the Board’s responses. |

|||

| Shareholder proposals for next year’s Annual Meeting of Shareholders must be submitted by November 14, 2025. | ||||

| C I B C P R O X Y C I R C U L A R | 3 |

Meeting Materials

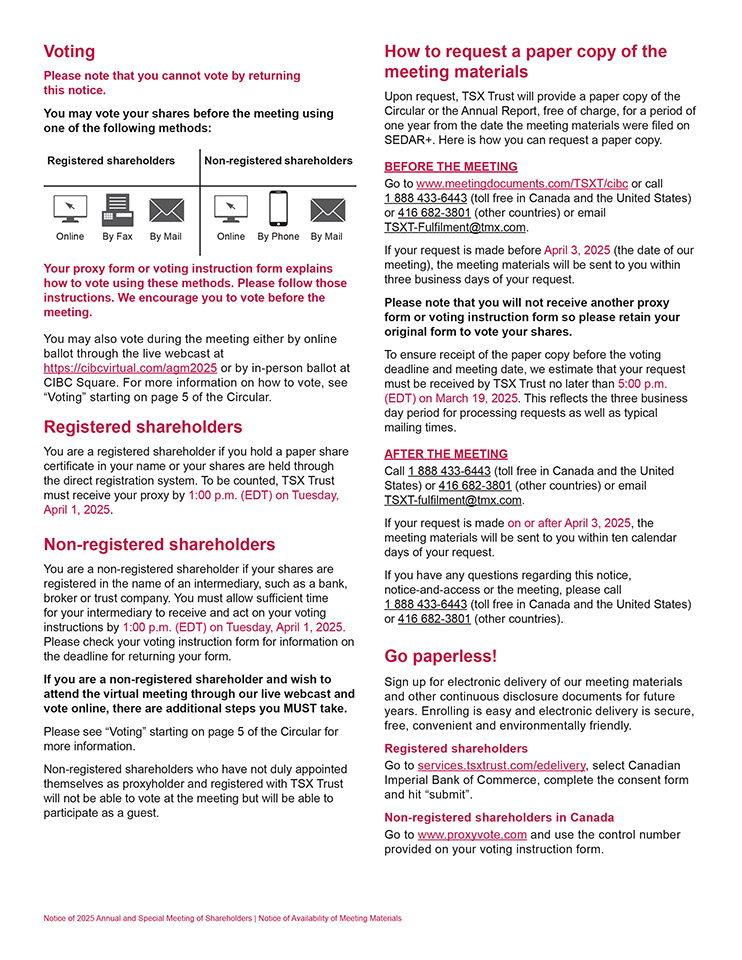

Delivery of meeting materials by notice-and-access

Management Proxy Circular – We are using notice-and-access to send our registered and non-registered shareholders our Circular as permitted by the Canadian Securities Administrators (CSA) and with the authorization of the Office of the Superintendent of Financial Institutions Canada (OSFI). This means that our Circular is posted online for you to access, rather than being printed and mailed to you. Reducing the amount of paper we send to shareholders helps reduce the environmental impact associated with paper. You will receive a proxy form or a voting instruction form by mail, so that you can vote your shares, as well as a notice with information about how you can access our Circular online or request a paper copy.

Annual Financial Statements and Management’s Discussion and Analysis – The way we send you our annual financial statements and Management’s Discussion and Analysis (MD&A) depends on whether you are a registered shareholder or a non-registered shareholder.

You are a registered shareholder if you hold a paper share certificate in your name or your shares are held through the direct registration system. You are a non-registered shareholder if your shares are registered in the name of an intermediary, such as a bank, broker or trust company.

If you are a registered shareholder and you did not sign up for e-delivery or opt out of receiving our annual financial statements, we are required to send you our annual financial statements and you will receive a paper copy of our Annual Report with the notice.

If you are a non-registered shareholder, we will use notice-and-access to provide you access to our annual financial statements and MD&A as permitted by securities law, so that you can access this material online the same way as our Circular. We will send shareholders the notice-and-access notification on or about March 4, 2025.

Our Circular and Annual Report (the meeting materials) are available on the website of our transfer agent, TSX Trust (www.meetingdocuments.com/TSXT/cibc), on our website (www.cibc.com), on SEDAR+ (www.sedarplus.com) and on the SEC website (www.sec.gov/edgar.shtml).

How to request a paper copy of the meeting materials

You may request a paper copy of the meeting materials, free of charge, for up to one year from the date the meeting materials were filed on SEDAR+.

To make your request before the meeting, contact TSX Trust at www.meetingdocuments.com/TSXT/cibc or 1 888 433-6443 (toll-free in Canada and the United States) or 416 682-3801 (other countries) or email TSXT-fulfilment@tmx.com. Please follow TSX Trust’s instructions. A paper copy of the requested documents will be sent to you within three business days of your request. Please note that you will not receive another proxy form or voting instruction form so please retain your original form to vote your shares.

To ensure receipt of the paper copy of the meeting materials before the voting deadline and meeting date, we estimate that your request must be received no later than 5:00 p.m. (EDT) on March 19, 2025. This estimate reflects a three business day period for processing requests as well as typical mailing times.

To make your request on or after the date of the meeting, call TSX Trust at 1 888 433-6443 (toll-free in Canada and the United States) or 416 682-3801 (other countries) or email TSXT-fulfilment@tmx.com. The requested documents will be sent to you within 10 calendar days of your request.

Attending the Meeting

This year, the meeting will take place by live webcast at https://cibcvirtual.com/agm2025 and in person at CIBC Square, 81 Bay Street, Toronto, Ontario. Either way, you can take part, vote and ask your questions during the meeting. For the most current information about our meeting please visit our Annual Meeting webpage on our Investor Relations website at www.cibc.com.

| 4 | C I B C P R O X Y C I R C U L A R |

Voting

Shareholder approval

Each matter you are being asked to vote on requires the approval of a simple majority (more than 50%) of the votes cast, except the special resolution to amend By-Law No. 1 regarding the aggregate remuneration of directors, which requires approval of at least two-thirds (66.67%) of the votes cast, in each case, by proxy or during the meeting, by either online ballot through the live webcast or in person ballot at CIBC Square.

Who can vote

You are entitled to one vote for each common share you own on February 3, 2025, our record date. There were 940,057,664 outstanding common shares eligible to vote on that date.

In accordance with Bank Act (Canada) restrictions, shares cannot be voted if they are beneficially owned by:

| ◾ | the government of Canada or any of its agencies; |

| ◾ | the government of a province or territory or any of its agencies; |

| ◾ | the government of a foreign country, any political subdivision of a foreign country or any of its agencies; |

| ◾ | a person who has acquired more than 10% of any class of our shares without Minister of Finance approval; or |

| ◾ | a person or entity controlled by a person that, in aggregate, is more than 20% of the eligible votes that may be cast in respect of that vote, unless permitted by the Minister of Finance. |

Our directors and officers are not aware of any person or company that beneficially owns, directly or indirectly, or exercises control or direction over, more than 10% of the votes attached to any class of CIBC shares.

How to Vote

You may vote your shares before the meeting by proxy or voting instruction form, or during the meeting either by online ballot through the live webcast or in person ballot at CIBC Square. The voting process depends on whether you are a registered shareholder or a non-registered shareholder.

You are a registered shareholder if you hold a paper share certificate in your name or your shares are held through the direct registration system. You would have received a proxy form with a 13-digit control number. See voting instructions beginning on page 6.

You are non-registered shareholder if your shares are registered in the name of an intermediary, such as a bank, broker or trust company and you would have received a voting instruction form with a 16-digit control number. See voting instructions beginning on page 8.

| C I B C P R O X Y C I R C U L A R | 5 |

Voting

|

REGISTERED SHAREHOLDERS

|

||

|

REGISTERED SHAREHOLDERS – You are a registered shareholder if you hold a paper share certificate in your name or your shares are held through the direct registration system. If you are a registered shareholder, you should have received a proxy form with a 13-digit control number. If you did not receive this form, please contact TSX Trust at 1 800 387-0825 (toll-free in Canada and the United States) or 416 682-3860 (other countries).

|

||

|

If you want to vote by proxy before the meeting

Return your completed proxy to CIBC’s transfer agent, TSX Trust, by 1:00 p.m. (EDT) on April 1, 2025 to ensure your vote is counted. We encourage you to vote your shares early.

To vote your shares by proxy, you may provide your voting instructions in one of these ways:

|

||

|

Online – go to http://www.meeting-vote.com/, enter the 13-digit control number located on your proxy form and follow the instructions on the screen; or

– scan both sides of your proxy form and email it to proxyvote@tmx.com.

|

|

|

Fax – complete your proxy form and fax both sides to TSX Trust at 416 595-9593.

|

|

|

|

Mail – complete your proxy form and return it in the envelope provided. |

|

|

If you want to vote through the live webcast

To vote your shares at our meeting through the live webcast, do not complete or return your proxy form. You will be able to vote in real time by completing an online ballot through the live webcast. You must be connected to the internet and follow these steps:

1. Log in at https://cibcvirtual.com/agm2025 at least 15 minutes before the meeting starts and check browser compatibility. There must be internet connectivity for the duration of the meeting to vote.

2. Select “Vote” and a separate browser will open. Enter the 13-digit control number from your proxy form as your user name. Enter “cibc2025” (case sensitive) as your password. Any vote you cast at the meeting will revoke any proxy you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote during the meeting.

|

||

|

If you want to vote in person at CIBC Square

To vote your shares in person at CIBC Square, do not complete or return the proxy form, but bring it with you to the meeting. You will be able to vote at the meeting by completing a paper ballot. When you arrive at the meeting, please check in at the registration table.

|

||

| 6 | C I B C P R O X Y C I R C U L A R |

Voting

|

REGISTERED SHAREHOLDERS

|

||

|

If you want to appoint a proxyholder to vote during the meeting for you You may appoint a proxyholder, other than management’s nominees, Katharine B. Stevenson, Chair of the Board, and Victor G. Dodig, President and Chief Executive Officer, to attend, vote and act on your behalf at the meeting and any continuation or adjournment of the meeting. You should be certain your proxyholder is attending the meeting and is aware they have been appointed by you to vote your shares. To appoint a proxyholder you must follow these steps:

|

||||

|

1. Insert your proxyholder’s name in the space provided on your proxy form and return it online, by fax or mail, as described on the previous page. The person you appoint as your proxyholder does not need to be a CIBC shareholder. You may leave the voting section blank, or you may provide voting instructions that your proxyholder must follow.

If your proxyholder is attending the meeting through the live webcast, you and your proxyholder must follow these additional steps:

2. You must register your proxyholder by calling TSX Trust at 1 866 751-6315 (within North America) or 1 416 682-3860 (outside North America) or by completing an online form at https://www.tsxtrust.com/control-number-request by 1:00 p.m. on April 1, 2025. TSX Trust will provide your proxyholder with a control number to vote during the meeting. If you do not take this additional step of registering your proxyholder with TSX Trust, your proxyholder will not be able to vote your shares through the live webcast during the meeting.

3. Your proxyholder should log in at https://cibcvirtual.com/agm2025 at least 15 minutes before the meeting starts and check browser compatibility. There must be internet connectivity for the duration of the meeting to vote.

4. Your proxyholder should select “Vote” and a separate browser will open. Your proxyholder will enter their user name and password. The user name is the control number emailed to your proxyholder after you registered them with TSX Trust. The password is “cibc2025” (case sensitive).

If your proxyholder is attending the meeting in person, your proxyholder will need to register with our transfer agent, TSX Trust, at the registration table when they arrive at the meeting.

|

||||

|

If you want to change your vote If you change your mind on the voting instructions you sent, you may revoke your proxy in one of these ways:

◾ If you returned your proxy form by fax or mail, you should sign a written statement that you revoke your proxy, provide your new instructions and send it to CIBC Corporate Secretary Division, 81 Bay Street, CIBC Square, 20th Floor, Toronto, Ontario M5J 0E7. It must be received before 1:00 p.m. (EDT) on April 1, 2025.

◾ If you voted online, you may vote online again before 1:00 p.m. (EDT) on April 1, 2025, using the control number on your proxy form.

◾ You can also change your vote by voting through the live webcast described under If you want to vote through the live webcast on the previous page. Any vote you cast at the meeting will revoke any votes you previously submitted. If you do not wish to revoke previously submitted votes, you should not vote during the meeting.

|

||||

| C I B C P R O X Y C I R C U L A R | 7 |

Voting

|

NON-REGISTERED SHAREHOLDERS

|

|

NON-REGISTERED SHAREHOLDERS – You are a non-registered shareholder if your shares are registered in the name of an intermediary, such as a bank, broker or trust company. If you are a non-registered shareholder, you should have received a voting instruction form with a 16-digit control number. If you did not receive this form, please contact the intermediary where your shares are registered. You may vote by proxy before the meeting using the voting instruction form that was sent to you or you may vote during the meeting either by online ballot through the live webcast or in person ballot at the meeting provided you follow the steps below to register yourself as a proxyholder.

We may not have records of your shareholding as a non-registered shareholder. Please make sure you follow the voting instructions on your voting instruction form to vote.

|

|

If you want to vote by proxy before the meeting

You must allow sufficient time for your intermediary to receive and act on your instructions. Please check your voting instruction form for information on the deadline for returning your form. We encourage you to vote your shares early.

To vote your shares by proxy, you may provide your voting instructions in one of these ways

|

||

|

|

Online – go to www.proxyvote.com, enter the 16-digit control number located on your voting instruction form and follow the instructions on the screen.

|

|

|

Mail – complete your voting instruction form and return it in the envelope provided.

|

|

|

Phone – call 1 800 474-7493 (English) or 1 800 474-7501 (French) and follow the prompts.

|

|

|

If you want to vote in person at CIBC Square during the meeting or appoint a proxyholder to attend in person to vote for you

If you plan to attend the meeting and vote in person, you should appoint yourself as proxyholder by writing your name in the space provided on the voting instruction form and returning it in the envelope provided. Do not complete the voting section because your vote will be taken at the meeting. When you arrive at the meeting, please check in at the registration table.

If you want to appoint someone as your proxyholder to attend the meeting and vote your shares for you, insert the person’s name in the blank space provided on your voting instruction form, and return it in the envelope provided. The person you choose does not have to be a CIBC shareholder. You should confirm this person is attending the meeting and is aware that they have been appointed to vote your shares. If you do not insert a name in the blank space, then Katharine B. Stevenson, Chair of the Board or Victor G. Dodig, President and Chief Executive Officer, will be appointed as your proxyholder.

Your proxyholder is authorized to vote and act for you at the meeting or any continuation or adjournment of the meeting. You can indicate on your voting instruction form how you want your proxyholder to vote your shares and your proxyholder must follow your instructions.

|

| 8 | C I B C P R O X Y C I R C U L A R |

Voting

|

NON-REGISTERED SHAREHOLDERS

|

If you want to vote through the live webcast or appoint a proxyholder to attend the live webcast to vote for you

To attend and vote at our meeting through the live webcast or appoint a proxyholder to attend and vote for you, you or your proxyholder will be able to vote in real time by completing an online ballot through the live webcast as long as you, or your proxyholder, are connected to the internet and follow these steps:

| 1. | If you want to appoint someone other than yourself, or management’s nominees, Katharine B. Stevenson and Victor G. Dodig, as your proxyholder, to attend, vote and act for you at the meeting and any continuation or adjournment of the meeting, you must insert their name in the space provided on your voting instruction form and return it by mail in the envelope provided. You may leave the voting section blank, or you may provide voting instructions that your proxyholder must follow. You should be certain your proxyholder is attending the live webcast and is aware they have been appointed by you to vote your shares. The person you appoint as your proxyholder does not need to be a CIBC shareholder. |

| 2. | You must register yourself, or your proxyholder, by calling TSX Trust at 1 866 751-6315 (within North America) or 1 416 682-3860 (outside North America) or by completing an online form at https://www.tsxtrust.com/control-number-request by 1:00 p.m. (EDT) on April 1, 2025. TSX Trust will provide you, or your proxyholder, with a control number to vote during the meeting. If you do not take the additional step of registering with TSX Trust, you or your proxyholder, as applicable, will not receive a control number to vote your shares at our meeting through the live webcast. |

|

If you are a non-registered shareholder in the United States and want to vote at the meeting through the live webcast, you must obtain a legal proxy form from your intermediary by following the steps on the voting instruction form sent to you, or if you have not received one, contact your intermediary to request a legal proxy form. After obtaining the legal proxy form, appoint yourself or someone else as proxyholder. For instructions on how to appoint yourself or someone else as proxyholder, see Step 1 above, then follow Step 2 above to register yourself or your proxyholder with TSX Trust.

Legal proxies may be returned to TSX Trust by email at proxyvote@tmx.com or by mail: TSX Trust Company, Attn: Proxy Department, P.O. Box 721, Agincourt, Ontario M1S 0A1 and must be labeled “Legal Proxy”.

Please allow sufficient time for the return of your legal proxy by the cut-off date of 1:00 p.m. (EDT) on April 1, 2025.

|

| 3. | You or your proxyholder should log in at https://cibcvirtual.com/agm2025 at least 15 minutes before the meeting starts and check browser compatibility. There must be internet connectivity for the duration of the meeting to vote. |

| 4. | You or your proxyholder should select “Vote” and a separate browser will open. You or your proxyholder will enter a user name and password. The user name is the control number emailed to you or your proxyholder after you registered yourself or your proxyholder with TSX Trust. The password is “cibc2025” (case sensitive). |

If you want to change your vote before the meeting

If you change your mind on the voting instructions you sent through your intermediary and would like to change your vote or vote during the meeting, contact your intermediary to discuss whether this is possible and what procedures you need to follow.

| C I B C P R O X Y C I R C U L A R | 9 |

Voting

Other voting information

How your proxyholder will vote — If you have given voting instructions in your proxy form or voting instruction form, your proxyholder must vote according to those instructions. If you have not given voting instructions, your proxyholder will decide how to vote. Your proxyholder will also decide how to vote on any amendment or variation to any of the matters in the notice of meeting or any matters that are properly brought before the meeting.

You can vote:

| FOR or WITHHOLD |

◾ on each director nominee ◾ on the appointment of auditors |

|

| FOR or AGAINST |

◾ the advisory resolution regarding our executive compensation approach ◾ the special resolution to amend By-Law No. 1 regarding directors’ remuneration ◾ the ordinary resolution to amend By-Law No. 1 regarding administrative matters |

|

| FOR, AGAINST or ABSTAIN | ◾ on the shareholder proposals | |

If you or your proxyholder do not give specific voting instructions, or you do not insert a name in the blank space on your proxy form or voting instruction form, then management’s nominees, Katharine B. Stevenson or Victor G. Dodig will be appointed as your proxyholder and your shares will be voted

|

FOR |

◾ each director nominee listed in the Circular ◾ the appointment of Ernst & Young LLP as auditors ◾ the advisory resolution regarding our executive compensation approach ◾ the special resolution to amend By-Law No. 1 regarding directors’ remuneration ◾ the ordinary resolution to amend By-Law No. 1 regarding administrative matters |

|||||

|

AGAINST |

◾ each shareholder proposal |

|||||

Confidentiality of your vote — To protect the confidentiality of your vote, TSX Trust counts proxies and tabulates the results independently and does not inform CIBC about how individual shareholders have voted except where required by law or where a shareholder’s comments are intended for management.

How we solicit proxies — We are soliciting proxies primarily by mail but CIBC employees may contact you by phone or in writing. CIBC pays any costs associated with proxy solicitation.

We reserve the right to accept late proxies and to waive or extend the proxy deadline with or without notice, but we are under no obligation to accept or reject a late proxy.

If you want to attend the meeting as a guest — In-person attendance at the meeting is open only to registered shareholders, non-registered shareholders and duly appointed proxyholders. All other interested guests are welcome to attend the meeting in one of these ways:

|

Online – | go to https://cibcvirtual.com/agm2025 to join the live webcast; or | ||

|

Phone – |

call 416 340-2217 (local) or 1 800 806-5484 (toll-free in Canada and the United States) passcode 7053922# (English) or 514 392-1587 (local) or 1 800 898-3989 (toll-free in Canada and the United States) passcode 9040336# (French) for an audio only experience. |

||

Go Paperless!

Sign up for electronic delivery of our meeting materials and other continuous disclosure documents

for future years. Enrolling is easy and electronic delivery is secure, free, convenient and helps reduce

the environmental impact associated with paper.

If you are a registered shareholder, go to services.tsxtrust.com/edelivery,

select Canadian Imperial Bank of Commerce, complete the consent form and hit “submit”.

If you are a non-registered shareholder, go to www.proxyvote.com and use the control number

provided on your voting instruction form.

| 10 | C I B C P R O X Y C I R C U L A R |

Directors

Director Nominees

There are 13 director nominees. Each nominee was elected at the last Annual Meeting of Shareholders held on April 4, 2024, except Mr. François Poirier who was appointed to the Board effective September 1, 2024.

Mr. Charles Brindamour is retiring at the close of our meeting. The Board would like to thank Mr. Brindamour for his years of dedicated service to the Board and to CIBC.

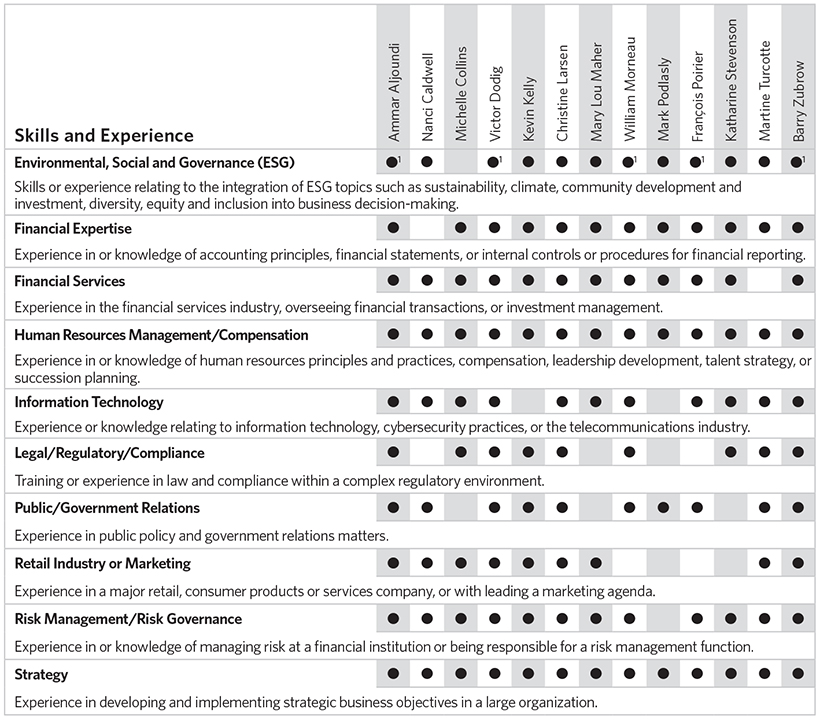

Information on each nominee starts on page 12 and is current as of February 6, 2025. Below are key highlights about CIBC’s Board composition, assuming each nominee is elected by shareholders(1). In addition, we note that none of the director nominees identify as living with disability(2). For information about the nomination process see the Statement of Corporate Governance Practices — “Director Nomination Process” and “Director Tenure” starting on page 42.

| (1) | All nominee data is based on self-identification and voluntarily disclosed as of February 6, 2025. |

| (2) | Persons with disabilities are those who self-identify as having long-term, temporary or recurring physical, mental, sensory, psychological or learning differences. |

| (3) | Indigenous peoples refers to the original inhabitants of Canada and their descendants, including First Nations, Inuit, and Métis peoples. Reporting also includes those who self-identify as having mixed or other Indigenous ancestry, based on the aforementioned definition. |

| (4) | People of colour includes those who self-identify as visible minorities in Canada and non-white outside of Canada. Visible minorities is defined as persons - other than Indigenous peoples - who self-identify as non-white. |

| (5) | Members of the LGBTQ+ community refers to those who self-identify as lesbian, gay, bisexual, asexual, queer, two spirit, trans man, trans woman, non-binary and other. |

| C I B C P R O X Y C I R C U L A R | 11 |

Directors

AMMAR ALJOUNDI, Toronto, Ontario, Canada

Director since: 2022

Age: 60

Independent

2024 Shareholder

votes in favour: 99.5%

| Key Skills and Experiences:

|

||

| • Environmental, Social and Governance (ESG) | • Risk Management/Risk Governance | |

| • Financial Expertise

|

• Strategy | |

|

Principal occupation: President and Chief Executive Officer, Agnico Eagle Mines Limited |

||

| Experience: Mr. Aljoundi was appointed President and Chief Executive Officer of Agnico Eagle Mines Limited in February 2022. Prior to this, he was President of Agnico Eagle from 2015 to 2022. Mr. Aljoundi also served as Agnico’s Senior Vice-President and Chief Financial Officer and has over 20 years of experience in finance and business strategy. Mr. Aljoundi has extensive experience in mining, capital markets and banking. Prior to 2015 he served in various senior financial roles at Barrick Gold Corporation, including Executive Vice-President and Chief Financial Officer, Senior Vice-President of Capital Allocation and Business Strategy and Senior Vice-President of Finance. He held senior roles at Barrick South America, including Executive Director and Chief Financial Officer and was also Vice-President Structured Finance at Citibank, Canada. |

||

| Education: Mr. Aljoundi holds a Mechanical Engineering degree (with distinction) from the University of Toronto and a Master of Business Administration degree (with honours) from Western University. |

||

| Other public company board directorships during last five years | ||

| Current: | Current committee memberships: | |

| Agnico Eagle Mines Limited – since February 2022 | – | |

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

|

Overall attendance: 100%

Board: 12/12

Risk Management Committee: 13/13 |

||

| CIBC equity – Mr. Aljoundi meets the equity ownership guideline

|

||||||||||

| Year |

Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 12,000 | 11,369 | 23,369 | 2,124,943 | 2.7x | |||||

| 2024 | 12,000 | 7,553 | 19,553 | 1,247,481 | 1.6x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. |

| 12 | C I B C P R O X Y C I R C U L A R |

Directors

NANCI E. CALDWELL, Woodside, California, USA

Director since: 2015

Age: 66

Independent

2024 Shareholder

votes in favour: 99.2%

| Key Skills and Experiences: | ||||

| ◾ Environmental, Social and Governance (ESG) | ◾ Information Technology | |||

| ◾ Human Resources Management/Compensation | ◾ Strategy | |||

| Principal occupation: Corporate Director | ||||

| Experience: Ms. Caldwell was Executive Vice-President and Chief Marketing Officer for PeopleSoft, Inc. from 2002 through 2004. She held increasingly senior and executive sales and marketing roles at Hewlett Packard Company in Canada and the US from 1982 to 2001. Ms. Caldwell has served on several public and private technology company boards since 2005 and has more than 25 years of operating experience in the global technology and software industries. Ms. Caldwell has served as a director on private company boards, including JDA Software, LiveOps Inc., Sophos, plc and Network General Corporation. |

||||

| Education: Ms. Caldwell holds a Bachelor of Arts degree from Queen’s University and completed Western University’s Executive Marketing Management Program. |

||||

| Other public company board directorships during last five years |

||

| Current: |

Current committee memberships: | |

| Equinix, Inc. – since 2015

Procore Technologies Inc. – since 2020

|

Nominating and Governance (Chair);

Compensation (Chair); Nominating and Governance |

|

| Former: |

||

| Citrix Systems, Inc. – 2008 to Sept 2022 (ceased to be a public company in 2022) |

||

| Donnelley Financial Solutions Inc. – 2016 to Jun 2020 |

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings |

||

| Overall attendance: 100% |

||

| Board: 12/12 |

||

| Corporate Governance Committee (Chair): 10/10 |

||

| Management Resources and Compensation Committee: 8/8 |

||

| CIBC equity - Ms. Caldwell meets the equity ownership guideline |

||||||||||

| Year | Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 24,932 | 0 | 24,932 | 2,267,067 | 2.0x | |||||

| 2024 | 22,212 | 0 | 22,212 | 1,417,126 | 1.3x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. Directors who are US citizens and whose primary residence is in the US received their fees in US dollars and their share ownership guideline is in US dollars. For purposes of calculating US director ownership against the guideline, the US dollar amount has been converted to Canadian dollars using the WM/Reuters exchange rate of US$1.00 = C$1.3924 for 2024 and US$1.00 = C$1.3868 for 2023 reflecting the foreign exchange rate on the last trading day of the fiscal year. |

| C I B C P R O X Y C I R C U L A R | 13 |

Directors

MICHELLE L. COLLINS, Chicago, Illinois, USA

Director since: 2017

Age: 64

Independent

2024 Shareholder

votes in favour: 99.3%

| Key Skills and Experiences: | ||||

| • Financial Expertise | • Legal/Regulatory/Compliance | |||

| • Financial Services | • Strategy | |||

| Principal occupation: President, Cambium LLC | ||||

| Experience: Ms. Collins has been President of Cambium LLC since 2007. Cambium is a Chicago- based business and financial advisory firm that serves small and medium-sized businesses. She has 30 years of experience in corporate governance, investment banking, and private equity. She also has significant corporate board experience, having served as a director for several publicly traded companies across a wide range of industries. Ms. Collins is a director of CIBC Bancorp USA Inc. and CIBC Bank USA and chair of their Audit Committees. She is a member of the Global Risk Institute, the Advisory Boards of Svoboda Capital Partners, LLC, and Cedar Street Asset Management. Ms. Collins serves on several philanthropic and non-profit boards, including the Griffin Museum of Science and Industry and Navy Pier, Inc, and is the former chair of the Board of Trustees of National Louis University.

Ms. Collins received the Daniel H. Burnham Award for Distinguished Leadership in 2024 from the Chicagoland Chamber of Commerce in recognition for her remarkable accomplishments and contributions to the community. She received the Bertha Honoré Palmer Making History award for distinction in civic leadership in 2023 and is a past recipient of the Outstanding Leader Award for Business from the YWCA in recognition of her distinguished career in business, her community involvement and willingness to take on leadership positions on impacting women’s lives and racial justice. |

||||

| Education: Ms. Collins holds a Bachelor of Arts degree in Economics from Yale University and a Master of Business Administration degree from Harvard Graduate School of Business. |

||||

| Other public company board directorships during last five years |

||

| Current: |

Current committee memberships: |

|

| Ryan Specialty Group Holdings, Inc. – since 2021 |

Audit |

|

| Ulta Beauty Inc. – since 2014 |

Audit; Compensation |

|

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings |

||

| Overall attendance: 100% |

||

| Board: 12/12 |

||

| Audit Committee: 10/10 |

||

| CIBC equity – Ms. Collins meets the equity ownership guideline |

||||||||||

| Year | Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of SharesDSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 2,714 | 43,201(5) | 45,914 | 4,175,051 | 3.7x | |||||

| 2024 | 2,714 | 37,347(5) | 40,061 | 2,555,892 | 2.3x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. Directors who are US citizens and whose primary residence is in the US received their fees in US dollars and their share ownership guideline is in US dollars. For purposes of calculating US director ownership against the guideline, the US dollar amount has been converted to Canadian dollars using the WM/Reuters exchange rate of US$1.00 = C$1.3924 for 2024 and US$1.00 = C$1.3868 for 2023 reflecting the foreign exchange rate on the last trading day of the fiscal year. |

| (5) | Includes DSUs earned for serving on the Boards of CIBC Bancorp USA Inc. and CIBC Bank USA. |

| 14 | C I B C P R O X Y C I R C U L A R |

Directors

VICTOR G. DODIG, Toronto, Ontario, Canada

Director since: 2014

Age: 59

Not Independent

See “Director

Independence”

on page 40.

2024 Shareholder

votes in favour: 99.7%

| Key Skills and Experiences: | ||||

| • Financial Expertise | • Human Resources Management/Compensation | |||

| • Financial Services | • Strategy | |||

| Principal occupation: President and Chief Executive Officer, CIBC | ||||

| Experience: Mr. Dodig has been President and Chief Executive Officer of the CIBC group of companies since September 2014. He brings more than 25 years of extensive business and banking experience, including leading CIBC’s Wealth Management, Asset Management and Retail Banking businesses. Over the course of his career, Mr. Dodig has also led several businesses with UBS and Merrill Lynch in Canada and internationally, and was a management consultant with McKinsey & Company. Mr. Dodig is past Chair of the Business Council of Canada and is a Trustee of the Brookings Institution. He was President of the 2022 International Monetary Conference. Mr. Dodig is committed to inclusion, both to strengthen our social fabric and as an economic imperative. He serves as Chair of CIBC’s Inclusion Leadership Council and is past Co-Chair of the BlackNorth Initiative. He is a recipient of the 2017 Catalyst Canada Honours Champion award, past Chair of the Catalyst Canada Advisory Board, and past Chair of the 30% Club Canada. |

||||

| Education: Mr. Dodig holds a Bachelor of Commerce degree from the University of Toronto (St. Michael’s College), a Master of Business Administration degree from the Harvard Business School where he was recognized as a Baker Scholar, and a Diploma from the Institut d’études politiques in Paris. He has received an honorary Doctor of Laws degree from Toronto Metropolitan University and an honorary Doctorate from St. Michael’s College.

|

||||

| Other public company board directorships during last five years |

||

| Current: |

Current committee memberships: |

|

| TELUS Corporation – Since May 2022

|

Pension |

|

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings |

||

| Overall attendance: 100% |

||

| Board: 12/12 |

||

Mr. Dodig does not receive compensation for his services as a director. For information on Mr. Dodig’s equity ownership, see “2024 NEO compensation” on page 76 of the Circular.

| C I B C P R O X Y C I R C U L A R | 15 |

Directors

KEVIN J. KELLY, Toronto, Ontario, Canada

Director since: 2013

Age: 69

Independent

2024 Shareholder

votes in favour: 96.4%

| Key Skills and Experiences: | ||||

| • Financial Expertise | • Human Resources Management/Compensation | |||

| • Financial Services | • Strategy | |||

| Principal occupation: Corporate Director | ||||

| Experience: Mr. Kelly was Lead Director of the Ontario Securities Commission from 2010 to 2012 and Commissioner from 2006 to 2010. He has more than 30 years’ experience in wealth and asset management in Canada and the US. Mr. Kelly was President and Co-Chief Executive Officer of Wellington West Capital, Inc. from 2004 to 2005, President of Fidelity Brokerage Company in Boston from 2000 to 2003, President of Fidelity Investments Institutional Services Company from 1997 to 2000, President of Fidelity Canada from 1996 to 1997, and President and Chief Executive Officer of Bimcor Inc. from 1992 to 1996. Mr. Kelly is a director of CIBC Bancorp USA Inc., CIBC Bank USA and a director and board chair of CIBC National Trust Company. Mr. Kelly is also a member of the Canadian Public Accountability Board. |

||||

| Education: Mr. Kelly holds a Bachelor of Commerce degree from Dalhousie University. |

||||

| Other public company board directorships during last five years | ||

| None

|

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 100% | ||

| Board: 12/12 | ||

| Corporate Governance Committee (as of April 2024): 6/6 Management Resources and Compensation Committee (Chair): 8/8 |

||

| CIBC equity – Mr. Kelly meets the equity ownership guideline | ||||||||||

| Year |

Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 12,404 | 65,754 | 78,158 | 7,106,907 | 8.9x | |||||

| 2024 | 12,404 | 58,778 | 71,182 | 4,541,412 | 5.7x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. |

| 16 | C I B C P R O X Y C I R C U L A R |

Directors

CHRISTINE E. LARSEN, Montclair, New Jersey, USA

Director since: 2016

Age: 63

Independent

2024 Shareholder

votes in favour: 99.6%

| Key Skills and Experiences: | ||||

| • Financial Services | • Legal/Regulatory/Compliance | |||

| • Information Technology | • Risk Management/Risk Governance | |||

| Principal occupation: Corporate Director | ||||

| Experience: Ms. Larsen was Executive Vice-President, Chief Operations Officer of First Data Corporation from 2013 to 2018. She held various progressively senior roles in technology, operations and business management at JPMorgan Chase & Co. from 2006 to 2013. Before joining JPMorgan Chase, she held several leadership roles at Citigroup for 12 years. Ms. Larsen is a Limited Partner Advisor at NYCA Partners and Vice-Chair of the Board of Trustees of Syracuse University. |

||||

| Education: Ms. Larsen holds a Bachelor of Arts (Phi Beta Kappa) degree from Cornell College and a Master of Library Science degree from Syracuse University (University Fellow). |

||||

| Other public company board directorships during last five years | ||

| Former: | ||

| Datto Holding Corp. – 2021 to June 2022 | ||

|

Paya Holdings, Inc. – 2020 to May 2022

|

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 100% | ||

| Board: 12/12 | ||

| Management Resources and Compensation Committee: 8/8 | ||

| CIBC equity – Ms. Larsen meets the equity ownership guideline | ||||||||||

| Year |

Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 24,863 | 0 | 24,863 | 2,260,793 | 2.0x | |||||

| 2024 | 22,948 | 0 | 22,948 | 1,464,082 | 1.3x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. Directors who are US citizens and whose primary residence is in the US received their fees in US dollars and their share ownership guideline is in US dollars. For purposes of calculating US director ownership against the guideline, the US dollar amount has been converted to Canadian dollars using the WM/Reuters exchange rate of US$1.00 = C$1.3924 for 2024 and US$1.00 = C$1.3868 for 2023 reflecting the foreign exchange rate on the last trading day of the fiscal year. |

| C I B C P R O X Y C I R C U L A R | 17 |

Directors

MARY LOU MAHER, Toronto, Ontario, Canada

Director since: 2021

Age: 64

Independent

2024 Shareholder

votes in favour: 98.8%

| Key Skills and Experiences: | ||||

| • Financial Expertise | • Human Resources Management/Compensation | |||

| • Financial Services | • Risk Management/Risk Governance | |||

| Principal occupation: Corporate Director | ||||

| Experience: Ms. Maher was Canadian Managing Partner, Quality and Risk, KPMG Canada from 2017 to 2021. She was also Global Head of Inclusion and Diversity KPMG International for the same period. Ms. Maher was with KPMG since 1983, in various executive and governance roles, including Chief Financial Officer and Chief Human Resources Officer. Ms. Maher was a member of the World Economic Forum focused on Human Rights – the business perspective, and has served on other not-for-profit boards, including as Chair of Women’s College Hospital and a member of the CPA Ontario Council. She is a member of the Canadian Public Accountability Board. Ms. Maher created KPMG Canada’s first ever National Diversity Council and was the executive sponsor of pride@kpmg. Ms. Maher received the Wayne C. Fox Distinguished Alumni Award from McMaster University in recognition of her work on inclusion and diversity, was inducted into the Hall of Fame for the WXN 100 Top Most Powerful Women in Canada, received a Lifetime Achievement Award from Out on Bay Street (Proud Strong), and the Senior Leadership Award for Diversity from the Canadian Centre for Diversity and Inclusion. Ms. Maher completed the Competent Board for ESG Program. |

||||

| Education: Ms. Maher holds a Bachelor of Commerce degree from McMaster University and holds the designation of FCPA, FCA.

|

||||

| Other public company board directorships during last five years | ||

| Current: | Current committee memberships: | |

| CAE Inc. – since May 2021 | Human Resources (Chair) | |

| Magna International Inc. - since May 2021 | Audit (Chair); Technology | |

|

|

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 100% | ||

| Board: 12/12 | ||

| Audit Committee (Chair): 10/10

Corporate Governance Committee (since April 2024): 6/6 |

||

| CIBC equity - Ms. Maher meets the equity ownership guideline | ||||||||||

| Year | Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 3,356 | 14,397 | 17,753 | 1,614,280 | 2.0x | |||||

| 2024 | 3,356 | 11,288 | 14,644 | 934,287 | 1.2x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. |

| 18 | C I B C P R O X Y C I R C U L A R |

Directors

THE HONOURABLE WILLIAM F. MORNEAU, P.C., Toronto, Ontario, Canada

Director since: 2022

Age: 62

Independent

2024 Shareholder

votes in favour: 99.5%

| Key Skills and Experiences: | ||||

| • Environmental, Social and Governance (ESG) | • Public/Government Relations | |||

| • Human Resources Management/Compensation | • Strategy | |||

| Principal occupation: Corporate Director | ||||

| Experience: Mr. Morneau was Canada’s Minister of Finance, a member of Parliament for Toronto Centre, Governor at the International Monetary Fund and at the World Bank from 2015 to 2020. He was also active in international socio-economic forums including the OECD. From 1990 to 2015, Mr. Morneau led Morneau Shepell, which became the largest human resource and pension services provider in Canada during that time. Mr. Morneau previously was Senior Fellow at the Jackson Institute at Yale University and served as Chair of St. Michael’s Hospital, Covenant House, and the C.D. Howe Institute. He is currently Chair of NovaSource Power Services, Chair of the Advisory Board of Magnet at Toronto Metropolitan University, Member of The Wilson Center’s Canada Institute Advisory Board, Co-chair of the National Arts Centre’s The Next Act Campaign, Distinguished Fellow at the Munk School of Global Affairs and Public Policy at the University of Toronto and Executive in Residence at the Rotman School of Management at the University of Toronto. |

||||

| Education: Mr. Morneau holds a Bachelor of Arts degree from Western University, a Master of Science degree from London School of Economics and a Master of Business Administration degree from INSEAD.

|

||||

| Other public company board directorships during last five years | ||

| Current: | Current committee memberships: | |

| Clairvest Group Inc – since June 2022 | Audit | |

|

|

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 97% | ||

| Board: 12/12 | ||

| Corporate Governance Committee (since April 2024): 6/6 | ||

| Risk Management Committee: 12/13 | ||

| CIBC equity - Mr. Morneau meets the equity ownership guideline | ||||||||||

| Year | Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 0 | 9,998 | 9,998 | 909,118 | 1.1x | |||||

| 2024 | 0 | 5,813 | 5,813 | 370,869 | 0.5x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. |

| C I B C P R O X Y C I R C U L A R | 19 |

Directors

MARK W. PODLASLY, M.S.M., Vancouver, British Columbia, Canada

Director since: 2023

Age: 59

Independent

2024 Shareholder

votes in favour: 99.6%

| Key Skills and Experiences: | ||||

| ◾ Environmental, Social and Governance (ESG) | ◾ Public/Government Relations | |||

| ◾ Human Resources Management/Compensation | ◾ Strategy | |||

| Principal occupation: Chief Executive Officer, First Nations Major Projects Coalition | ||||

| Experience: Mr. Podlasly, a member of the Cook’s Ferry Indian Band, Nlaka’pamux Nation in British Columbia, is the Chief Executive Officer at the First Nations Major Projects Coalition, a national 170 Indigenous nation collective that seeks ownership of major projects such as pipelines, electric utilities, and mining support infrastructure. Mr. Podlasly counsels Indigenous governments across Canada on the establishment of trusts to invest revenues from resource development. He is Chair of the First Nations (Pacific Trails Pipeline) Group Limited Partnership and a Trustee of Nlaka’pamux Nation Legacy Trust. He is an Advisor to Public Matters, sits on the advisory board of Canada 2020, a Fellow at the Public Policy Forum of Canada, and a Director of the Development Partners Institute.

In 2017, Mr. Podlasly was awarded the Governor General of Canada’s Meritorious Service Medal for Indigenous leadership in establishing Teach For Canada–Gakinaamaage, a non-profit organization that works with northern First Nations to recruit and support committed teachers. He has advised many leading international companies on corporate education, strategy, leadership, and globalization programs. Mr. Podlasly is a regular speaker at global business and governance events. |

||||

| Education: Mr. Podlasly holds a Bachelor of Arts degree from Trinity Western University, a Master of Public Administration from Harvard University and is a member of the Institute of Corporate Directors with the designation ICD.D. |

||||

| Other public company board directorships during last five years | ||

| Current: | Current committee memberships: | |

| Hydro One – since June 2022 | Audit; Human Resources | |

|

|

||

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 100% | ||

| Board: 12/12 | ||

| Audit Committee: 10/10 | ||

| CIBC equity – Mr. Podlasly has until November 1, 2028 to meet the equity ownership guideline | ||||||||||

| Year |

Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 0 | 4,721 | 4,721 | 429,281 | 0.5x | |||||

| 2024 | 0 | 1,111 | 1,111 | 70,882 | 0.1x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular) and February 8, 2024 (the date of information in our 2024 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025 and February 8, 2024. |

| (3) | “Total value of Shares/DSUs” for 2025 and 2024 is calculated by multiplying “Total Shares/DSUs” by the closing price of a CIBC common share on the Toronto Stock Exchange on December 31, 2024 ($90.93) and December 29, 2023 ($63.80). |

| (4) | “Total as a multiple of share ownership guideline” was calculated by dividing “Total value of Shares/DSUs” by the equity share ownership guideline of $800,000. |

| 20 | C I B C P R O X Y C I R C U L A R |

Directors

FRANÇOIS L. POIRIER, Calgary, Alberta, Canada

Director since:

September 2024

Age: 58

Independent

2024 Shareholder

votes in favour: n/a

| Key Skills and Experiences: | ||||

| ◾ Environmental, Social and Governance (ESG) | ◾ Risk Management/Risk Governance | |||

| ◾ Financial Services | ◾ Strategy | |||

| Principal occupation: President and Chief Executive Officer, TC Energy Corp. | ||||

| Experience: Mr. Poirier became President and Chief Executive Officer of TC Energy in January 2021 after spending seven years in roles with progressively increasing responsibility, including as Chief Operating Officer and Executive Vice-President, Strategy and Corporate Development. Mr. Poirier has 35 years of professional experience in leadership, strategy, ESG, investment banking and capital markets, consulting and governance. Prior to joining TC Energy, he was the founding President of Wells Fargo Securities, Canada, after spending 17 years with JP Morgan Securities. He is a member of the board of TC Energy Corp. as well as the Business Council of Canada and the American Petroleum Institute. Mr. Poirier has acted as an independent advisor to the Government of Canada’s ministries of Finance and Natural Resources on strategic matters and lectured at York University’s Schulich School of Business in the MBA program. His community service has included serving as Chair of the North York Harvest Food Bank as well as Co-Chair of the Special Olympics Canada Winter Games, Calgary 2024. |

||||

| Education: Mr. Poirier holds a Bachelor of Operations Research (Magna Cum Laude) from the University of Ottawa and a Master of Business Administration degree (with distinction) from the Schulich School of Business at York University. He graduated from the Institute of Corporate Directors’ Directors Education Program at the University of Toronto. |

||||

| Other public company board directorships during last five years | ||

| Current: | Current committee memberships: | |

| TC Energy Corp. – since January 2021 | – | |

| Fiscal 2024 Board and standing committee membership and attendance at regular and special meetings | ||

| Overall attendance: 100% | ||

| Board (since September 2024): 2/2 | ||

| Risk Management Committee (since September 2024): 2/2 | ||

| CIBC equity – Mr. Poirier has until 2029 to meet the equity ownership guideline | ||||||||||

| Year |

Shares(1) (#) |

DSUs(2) (#) |

Total Shares/DSUs (#) |

Total value of Shares/DSUs(3) ($) |

Total as a multiple of share ownership guideline(4) |

|||||

| 2025 | 0 | 1,294 | 1,294 | 117,663 | 0.2x | |||||

| (1) | “Shares” refers to the number of CIBC common shares a nominee beneficially owned, or exercised control or direction over on February 6, 2025 (the date of information in our 2025 Circular). |

| (2) | “DSUs” refers to the number of deferred share units held by a nominee on February 6, 2025. |