UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number: 001-38336

NUTRIEN LTD.

(Name of registrant)

Suite 1700, 211 19th Street East

Saskatoon, Saskatchewan, Canada

S7K 5R6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NUTRIEN LTD. | ||||||

| Date: February 28, 2025 | By: Name: Title: |

/s/ Noralee Bradley Noralee Bradley Executive Vice President, External Affairs and Chief Sustainability and Legal Officer |

||||

Exhibit 99.1

2024

ANNUAL

REPORT

You can find this report and information on Nutrien on our website at nutrien.com.

| Overview |

||||

|

|

1 |

|

||

|

|

2 |

|

||

|

|

6 |

|

||

|

|

8 |

|

||

|

|

9 |

|

||

|

|

10 |

|

||

|

|

12 |

|

||

|

|

14 |

|

||

|

|

17 |

|

||

|

|

18 |

|

||

|

|

23 |

|

||

|

|

26 |

|

||

|

|

28 |

|

||

|

|

34 |

|

||

|

|

36 |

|

||

|

|

38 |

|

||

|

|

39 |

|

||

|

|

41 |

|

||

|

|

47 |

|

||

|

|

48 |

|

||

|

|

58 |

|

||

|

|

59 |

|

||

|

|

67 |

|

||

|

|

70 |

|

||

|

|

72 |

|

||

|

|

79 |

|

||

|

|

81 |

|

||

|

|

126 |

|

||

|

|

129 |

|

||

The Overview contains certain non-GAAP financial measures, which do not have a standard meaning under IFRS, and other financial measures including:

| • | Adjusted net earnings per share |

| • | Adjusted EBITDA |

| • | Return on invested capital (“ROIC”) |

| • | Adjusted net debt |

For definitions, further information and reconciliations of these measures to the most directly comparable measures under IFRS, see the “Non-GAAP financial measures” section. See the “Other financial measures” and “Terms and definitions” sections for definitions, abbreviations and terms used in this annual report.

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

Feeding the Future |

Nutrien’s strong and trusted relationship with farmers is at the heart of our business. In spending our days with farmers, we plan with them, walk their fields and explore ways to help them succeed. We have a comprehensive portfolio of crop inputs and services, spanning the ag value chain, and we are working together with our customers to improve on-farm productivity to meet the needs of a growing global population.

We are the largest upstream fertilizer producer globally, with extensive midstream distribution capabilities, that allow us to efficiently move millions of tonnes of products annually. Our downstream retail network provides access and insights right down to the farmer’s field. Through our advantaged position across the ag value chain, we can anticipate trends, respond faster and more effectively produce and distribute the products and services that farmers need.

Together, we are Feeding the Future.

NOBODY KNOWS FARMING BETTER THAN FARMERS.

NOBODY KNOWS FARMERS BETTER THAN US.

| Nutrien Annual Report 2024 | 1 | ||||

| Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

|||||||||||||

|

Letter from our President & CEO |

Ken Seitz

President & CEO

| 2 | Nutrien Annual Report 2024 |

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

Letter from our President & CEO |

“Our advantaged position across the ag value chain provides the opportunity to more efficiently supply the products and services farmers need to help nourish a growing world, while delivering superior value for our shareholders.”

Strategic focus

Nutrien has a world-class asset base and a resilient business model that is built to withstand economic uncertainty and geopolitical shifts and to perform in all sets of market conditions. We operate in an environment of changing policy and geopolitical conflicts that has disrupted supply chains, created inflationary pressures and impacted food security. In a world that is increasingly complex, having a clear vision and strategy is vitally important.

Our vision is to be the leading global agricultural solutions provider, delivering superior shareholder value through safe and sustainable operations. To achieve this vision, our strategy is anchored around three strategic priorities: to simplify and focus, deliver operational excellence and take a disciplined and intentional approach to capital allocation.

Taken together, this strategy is focused on strengthening our core and positioning the company to structurally grow earnings and generate free cash flow in almost any market environment. This means we need to be unwavering in our efforts to preserve the low-cost position of our upstream fertilizer assets. It includes further strengthening our midstream distribution network to ensure we can most efficiently serve our customers and deliver on our volume growth opportunities. And it requires investing in highly targeted downstream retail growth opportunities that enhance our unique relationship with the farmer.

Measuring success

To measure success against the execution of our strategy, we set 2026 performance targets that we believe provide a pathway for driving structural improvements to our earnings and free cash flow through the cycle. In 2024, we made meaningful progress towards these targets.

In our upstream businesses, we increased sales volumes by nearly one million tonnes, supplying 27 million tonnes of essential fertilizer products to customers in more than 50 countries. We celebrated 65 years of potash mining in Saskatchewan and delivered record potash sales volumes, supported by continued growth in global potash demand. We mined 35 percent of our potash ore tonnes using automation in 2024, providing efficiency, flexibility and safety benefits, while supporting our highest production levels and lower controllable cash costs per tonne. We enhanced our midstream distribution capabilities, including the opening of a new potash terminal in the US Corn Belt.

We progressed brownfield expansions at our Geismar and Redwater nitrogen sites in 2024, while reliability initiatives improved operating performance. We achieved a 15 percent reduction in GHG emissions intensity1 (Scope 1 and 2) per tonne of our products produced through investments in our nitrogen GHG abatement program and changes to our production mix.

| 1 | Compared to the 2018 base year emissions intensity. |

| Nutrien Annual Report 2024 | 3 | ||||

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

Letter from our President & CEO |

Our downstream Retail business generated adjusted EBITDA of $1.7 billion in 2024, more than $200 million higher than the previous year. This result was driven by increased product margins and lower expenses as we continue to simplify our business and execute network optimization initiatives. We accelerated a margin improvement plan in Brazil and saw green shoots in this region in the fourth quarter. We remain confident in the growth platforms that support our 2026 Retail adjusted EBITDA target of $1.9 to $2.1 billion.

During the year, we took decisive actions to simplify our portfolio. We divested assets and equity investments totaling approximately $60 million in 2024, providing incremental cash flow to allocate to high conviction priorities that are core to our long-term strategy. We accelerated the timeline for achieving $200 million in annual operational efficiency and cost savings and expect to achieve this target in 2025, one year earlier than our initial goal.

Growth outlook

Looking forward, we see opportunities for growth across our business in 2025. Global grain stocks-to-use ratios are historically low and demand remains strong, providing a supportive environment for agriculture commodity prices. Farmer balance sheets and prospective crop margins are healthy in most key regions where we operate, supporting the outlook for crop input demand. We continue to monitor the risk of tariffs and how that could impact agriculture and crop input markets. We have a resilient business model and will be prepared to respond under any scenario.

Global potash fundamentals have tightened, supported by strong demand, limited new supply and reported production challenges in key producing regions. With geopolitical uncertainty and trade restrictions impacting global energy supply and nitrogen production, our low-cost nitrogen assets remain geographically advantaged.

We expect to deliver higher upstream fertilizer sales volumes in 2025, supported by strong potash demand and improved operating rates at our nitrogen facilities. Downstream, we anticipate growth in our proprietary crop nutritional and biostimulant product lines and continued recovery in our Brazilian Retail business, supported by strategic actions related to our margin improvement plan.

We intend to further optimize capital in 2025 with planned expenditures down more than $500 million compared to 2023 levels. These actions position us to counter-cyclically deploy capital towards high-conviction opportunities and improve free cash flow.

We have committed capital to sustain safe and reliable operations and to progress a set of targeted growth investments that have a strong fit with our strategy, provide returns in excess of our hurdle rates and have a relatively low degree of execution risk. This includes investments in our proprietary products business, retail network optimization, nitrogen debottleneck projects and potash mine automation. We continue to evaluate the next phase of emissions reduction projects. At this point, these prospective investments have become less attractive within our capital allocation framework as we do not have clarity on regulatory policies or see financially material opportunities for products with a lower carbon intensity.

|

|

|

|

||||||

| Retail adjusted EBITDA |

Potash manufactured sales volumes |

Nitrogen manufactured sales volumes |

||||||

| ($ billions) | (million tonnes KCl) | (million tonnes) | ||||||

|

|

|

||||||

| 1 | Guidance provided in our news release dated February 19, 2025. |

| 2 | See the “Forward-looking statements” section. |

| 4 | Nutrien Annual Report 2024 |

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

Letter from our President & CEO |

We have a long track record of providing a stable and growing dividend as a core part of the return we deliver to our shareholders. With another increase this February, our dividend per share has grown by 36 percent since the beginning of 2018, while maintaining a total dividend payment of around $1 billion per year due to the significant reduction in share count over this time period.

The allocation of our remaining free cash flow will continue to be focused on a narrow set of incremental growth investments such as retail tuck-in acquisitions and on share repurchases, with the goal of maximizing our risk-adjusted returns and growing free cash flow per share. We intend on repurchasing shares on a more ratable basis under our share repurchase program that is authorized until February 2026.

Commitment to safety

I want to close by addressing our Culture of Care and steadfast commitment to safety. In 2024, we achieved our lowest total recordable injury rate across our global operations but regrettably fell short of our goal for everyone to go home safe at the end of each day. We were devastated by the loss of three Nutrien employees this past year. Our deepest condolences go out to their families, friends and colleagues.

Continuous improvement is a key pillar of our safety culture and there is still more work to be done. We are taking actions to further address high-risk areas and are undertaking a third-party review by global safety experts

to identify areas of opportunity. In addition, we are revisiting our incentive plans to ensure broader alignment with our safety culture. Safety is a core value; we are making positive changes and will be relentless in our pursuits to ensure the safety of our people.

Feeding the Future

On behalf of the Board and our leadership team, I want to thank everyone who contributed to our achievements in 2024 and have positioned the company for success in the future. A special thank you goes to our 25,500 employees for their hard work and commitment to safety.

Nutrien has an extraordinary business and tremendous potential to create long-term value for our shareholders. Nobody knows farming better than farmers. Nobody knows farmers better than us. Together, we are Feeding the Future, and we will stay dedicated to that purpose.

Ken Seitz

President and Chief Executive Officer

February 20, 2025

| Nutrien Annual Report 2024 | | 5 |

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

2024 Highlights |

In 2024, Nutrien delivered higher upstream fertilizer sales volumes, accelerated operational efficiency and cost savings initiatives, increased downstream Retail earnings, achieved our lowest recordable injury rate ever across our global operations and made measurable progress against several sustainability objectives.

| Years ended December 31 |

||||||||

| ($ millions, except as otherwise noted) | 2024 | 2023 | ||||||

| Financial Results |

|

|||||||

| Sales |

25,972 | 29,056 | ||||||

| Gross margin |

7,530 | 8,474 | ||||||

| Net earnings |

700 | 1,282 | ||||||

| Diluted net earnings per share (dollars) |

1.36 | 2.53 | ||||||

| Adjusted net earnings per share (dollars)1 |

3.47 | 4.44 | ||||||

| Adjusted EBITDA1 |

5,355 | 6,058 | ||||||

| Retail adjusted EBITDA |

1,696 | 1,459 | ||||||

| Potash adjusted EBITDA |

1,848 | 2,404 | ||||||

| Nitrogen adjusted EBITDA |

1,884 | 1,930 | ||||||

| Phosphate adjusted EBITDA |

384 | 470 | ||||||

| Cash provided by operating activities |

3,535 | 5,066 | ||||||

| Cash used in investing activities |

2,133 | 2,958 | ||||||

| Cash used for dividends and share repurchases2 |

1,244 | 2,079 | ||||||

| Return on Invested Capital (“ROIC”) (%)1 |

8 | 10 | ||||||

| Adjusted net debt to adjusted EBITDA3 |

2.2x | 1.9x | ||||||

|

Non-Financial Results4 |

|

|||||||

| Scope 1 and Scope 2 GHG emissions (Mmt CO2e) |

12.0 | 12.2 | ||||||

| CO2 captured and sold (Mmt) |

1.0 | 1.0 | ||||||

| Sustainable agriculture program acres (millions) |

4 | 2 | ||||||

| Lost-time injury frequency5 |

0.19 | 0.24 | ||||||

| Community investment |

28 | 23 | ||||||

| 1 | This is a non-GAAP financial measure. See the “Non-GAAP financial measures” section. |

| 2 | See the “Other financial measures” section. |

| 3 | This is a capital management measure that includes non-GAAP components. See the “Non-GAAP financial measures” and “Other financial measures” sections. |

| 4 | These are non-financial measures. See the “Terms and definitions” section. |

| 5 | Frequency based on every 200,000 hours worked. |

| 6 | Nutrien Annual Report 2024 | ||||

|

Overview

|

MD&A |

Five-year highlights |

Financial statements and notes |

||||||||||

|

2024 Highlights |

| $3.5B | $2.2B | 16% | ||

| cash provided by operating activities |

capital expenditures, approximately $450M reduction from 2023 levels |

growth in Retail adjusted EBITDA |

||

| 27Mmt | 8% | 35% | ||

| upstream fertilizer manufactured sales volumes |

growth in proprietary crop nutritional and biostimulants gross margin |

potash ore tonnes mined using automation |

||

| 15% | 20+ | >$300M | ||

| reduction in GHG emissions intensity (Scope 1 and 2) per tonne of product produced1 |

water improvement projects completed and reduced freshwater use by 13Mm3 since 2018 | $CAD local spend with direct Indigenous economic impact |

|

|

|

Sustainability Report

|

||

| For an update on our approach to sustainability please refer to our 2024 Sustainability Report expected to be published in March 2025, available on our website at nutrien.com.

|

||||

| 1 On an intensity basis vs 2018 base year emissions intensity. |

||||

| Nutrien Annual Report 2024 | 7 | ||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Management’s discussion & analysis (“MD&A”) |

MANAGEMENT’S DISCUSSION & ANALYSIS (“MD&A”)

The following management’s discussion and analysis (“MD&A”) is the responsibility of management and is dated as of February 20, 2025.

The Board of Directors (“Board”) of Nutrien carries out its responsibility for review of this disclosure principally through its Audit Committee, comprised exclusively of independent directors. The Audit Committee reviews and, prior to its publication, recommends approval of this disclosure to the Board. The Board has approved this disclosure. The term “Nutrien” refers to Nutrien Ltd. and the terms “we”, “us”, “our”, “Nutrien” and “the Company” refer to Nutrien and, as applicable, Nutrien and its direct and indirect subsidiaries on a consolidated basis. This MD&A should be read together with the Company’s audited consolidated financial statements for the year ended December 31, 2024 (“consolidated financial statements”) prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, unless otherwise stated.

This MD&A contains certain non-GAAP financial measures and ratios, which do not have a standard meaning under IFRS and, therefore, may not be comparable to similar measures presented by other issuers. Such non-GAAP financial measures and ratios include

| • | Adjusted EBITDA |

| • | Adjusted net earnings and adjusted net earnings per share |

| • | Effective tax rate on adjusted net earnings guidance |

| • | Gross margin excluding depreciation and amortization per tonne – manufactured product |

| • | Potash controllable cash cost of product manufactured per tonne |

| • | Ammonia controllable cash cost of product manufactured per tonne |

| • | Retail adjusted average working capital to sales and Retail adjusted average working capital to sales excluding Nutrien Financial |

| • | Nutrien Financial adjusted net interest margin |

| • | Retail cash operating coverage ratio |

| • | Return on invested capital (“ROIC”) |

| • | Adjusted net debt |

For definitions, further information and reconciliations of these measures to the most directly comparable measures under IFRS, see the “Non-GAAP Financial Measures” and “Other Financial Measures” sections.

This MD&A also contains forward-looking information and forward-looking statements. See the “Forward-Looking Statements” section.

All references to per share amounts pertain to diluted net earnings (loss) per share. Financial data in this MD&A is stated in millions of US dollars, which is the functional currency of Nutrien and the majority of its subsidiaries, unless otherwise noted. Information that is not meaningful is indicated by n/m. Information that is not applicable is indicated by n/a. See the “Other Financial Measures” and “Terms and Definitions” sections for definitions, abbreviations, measures and terms used in this MD&A.

Additional information relating to Nutrien (which, except as otherwise noted, is not incorporated by reference herein), including our Annual Information Form for the year ended December 31, 2024 can be found on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov. The Company is a foreign private issuer under the rules and regulations of the US Securities and Exchange Commission (the “SEC”).

The information contained on or accessible from our website or any other website is not incorporated by reference into this MD&A or any other report or document we file with or furnish to applicable Canadian or US securities regulatory authorities.

8 | Nutrien Annual Report 2024

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Our approach to annual reporting |

OUR APPROACH TO ANNUAL REPORTING

Through our annual report, we aim to communicate how we assess opportunities and challenges, which guide our strategy, risk management and governance. Our stakeholders’ priorities influence our approach to creating long-term value.

|

Our company

Outlines who we are as a company, where we operate, and our competitive advantages

12 | Nutrien’s advantage

14 | Global profile |

|

Operating environment

Defines factors and trends that influence the environment we operate in and our outlook for 2025

18 | Market fundamentals and outlook

23 | Megatrends |

|||||

|

Strategy

Describes our vision and strategy across three strategic priorities

28 | Nutrien’s strategy

29 | Simplify and focus

|

|

Governance

Describes our key corporate governance principles and risk management process

36 | Corporate governance

37 | Board and executive leadership

38 | Risk governance

|

|||||

|

Key enterprise risks

Outlines the key risks that could affect our performance and our future operations

42 | Key enterprise risks |

|

Profile and results

Describes each of our operating segments, highlights our current financial results and provides guidance

48 | Operating segment performance

58 | 2025 Guidance and sensitivities

|

| Nutrien Annual Report 2024 | 9 | ||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s advantage |

Nutrien is a leading global provider of crop inputs and services. We operate a world-class network of production, distribution and ag retail facilities that positions us to efficiently serve the needs of farmers. We focus on creating long-term value by prioritizing investments that strengthen the advantages of our business across the ag value chain and by maintaining access to the resources and relationships with stakeholders needed to achieve our goals.

| 10 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Nutrien’s advantage Global profile |

| Nutrien Annual Report 2024 | 11 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Nutrien’s advantage |

Our leading position across the ag value chain offers key competitive advantages and differentiation from our competitors. We focus on enhancing our relationships with farmers, driving efficiencies across our network and strengthening our financial position and resilience.

|

UNIQUE RELATIONSHIP WITH THE FARMER

The farmer is at the heart of everything we do and our connection with our customers is unlike any other. Together we are working to improve on-farm productivity and foster innovation to address the demands of a growing global population. |

|

|

ADVANTAGED POSITION ACROSS THE AG VALUE CHAIN

Our global reach provides competitive advantages to support higher upstream sales of manufactured fertilizer and proprietary products, drive supply chain efficiencies, optimize transportation and logistics and efficiently supply our customers. |

|

|

PROVEN FINANCIAL STRENGTH AND STABILITY

Our business is diversified, which enhances our earnings profile. Our downstream Nutrien Ag Solutions (“Retail”) business provides greater stability to our earnings base and counter-cyclical cash flow, while our low-cost upstream fertilizer production assets are positioned to generate significant cash flow, providing the ability to invest in our business and consistently return capital to our shareholders. |

| 12 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||||

| Nutrien’s advantage |

|

|

1. UNIQUE RELATIONSHIP WITH THE FARMER

|

|||||

| >4,500 |

>600,000 |

4M |

||||

| crop consultants |

customer accounts |

sustainable agriculture program acres1 |

||||

|

|

2. ADVANTAGED POSITION ACROSS THE AG VALUE CHAIN

|

|||||

| World-class production assets | Global supply chain excellence | Leading ag retail network | ||||

| 27Mmt |

~660 |

>1,900 |

||||

| upstream fertilizer manufactured sales volumes |

midstream fertilizer distribution points |

Retail locations |

||||

| ~2,000 |

5 |

~1,500 |

||||

| proprietary products |

specialized marine terminals2 |

crop input suppliers |

||||

|

|

3. PROVEN FINANCIAL STRENGTH AND STABILITY

|

|||||

| Substantial cash generation | Balanced approach to capital allocation (2020–2024) (percent) |

|||||

| $4.8B

annual average cash provided by operating activities (2020–2024) |

|

|||||

| 1 | This is a non-financial measure. See the “Terms and definitions” section. |

| 2 | Owned or accessed through Canpotex. |

| 3 | This is a supplementary financial measure. See the “Other financial measures” section. |

| Nutrien Annual Report 2024 | 13 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

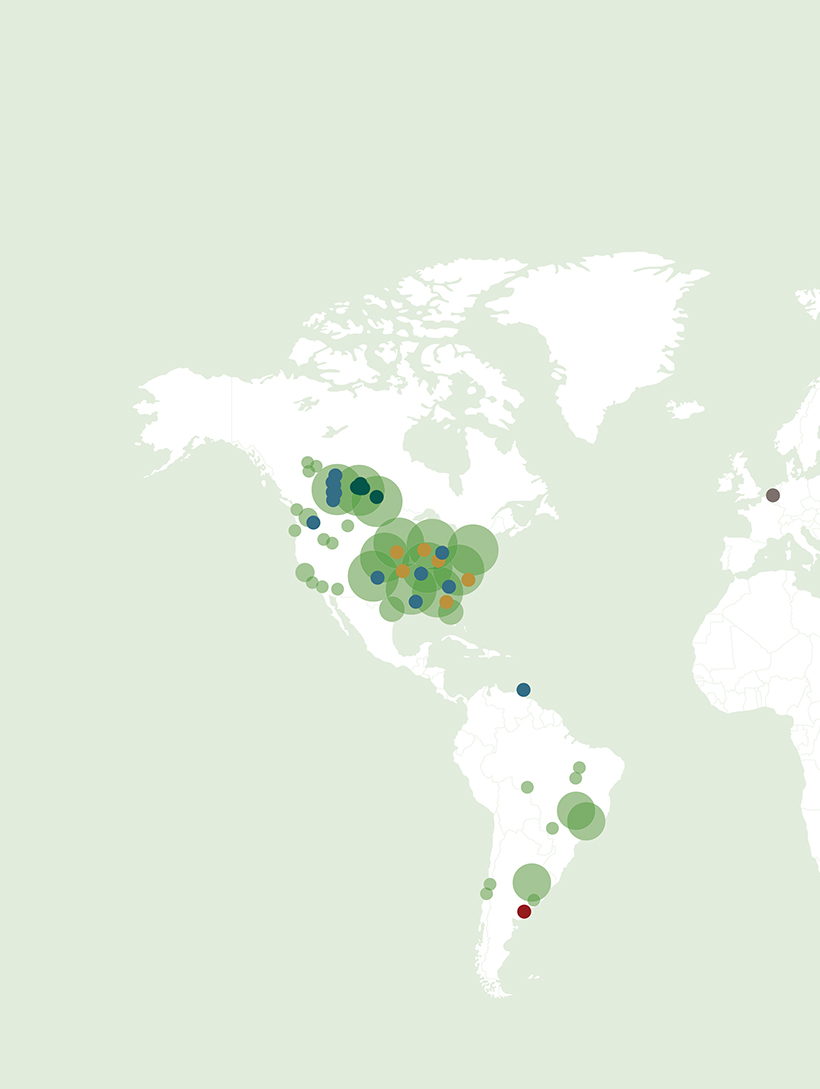

Global profile |

|

Our upstream fertilizer manufacturing assets are primarily located in North America, with access to high-quality resources, lower cost inputs and an extensive midstream distribution network to efficiently supply our customers. Our downstream Retail business serves farmers in key agricultural markets in North America, Australia and South America.

|

||

| 13

Nitrogen production and upgrade facilities in North America and Trinidad and Tobago |

6

Potash mines in Canada |

|

| 1,300

Retail locations in North America |

6

Phosphate production and upgrade facilities in the US |

|

|

200

Retail locations in South America |

||

| 14 | Nutrien Annual Report 2024

|

||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Global profile |

| Retail | Nitrogen | Joint venture and investments | ||||

| Potash | Phosphate | European distribution | ||||

| 400

Retail locations in Australia |

| Nutrien Annual Report 2024 | 15 | ||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Market fundamentals and

outlook |

||||||||||||||

| 16 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Market fundamentals and

outlook |

||||||||||||||

We operate in a rapidly changing world and must anticipate and adapt to our environment. We seek to understand the specific markets where we operate as well as the broader trends that influence and shape our operational landscape. This understanding helps us to seize new opportunities as they emerge and better identify the risks that could impact our ability to deliver on our strategy.

| Nutrien Annual Report 2024 | 17 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Market fundamentals and outlook | ||||||||||||||

MARKET FUNDAMENTALS AND OUTLOOK

Agriculture and retail markets

$125B

2024 total global

crop input sales1

Crop nutrients

72.5Mmt

2024 global potash

(KCl) demand

~159Mmt

2024 global nitrogen

(N) demand

~51Mmt

2024 global phosphate

(P2O5) demand

| 1 | Represents total market sales of seed, fertilizer and crop protection products in the US, Canada, Australia and Brazil. |

18 | Nutrien Annual Report 2024

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Market fundamentals and outlook | ||||||||||||||

AGRICULTURE AND RETAIL MARKETS

Market fundamentals

Total crop protection, seed and fertilizer sales in our Retail operating regions equated to approximately $125 billion in 2024. As the world’s population increases, farmers are challenged to increase yields from a finite arable land base. This drives growth in demand for crop inputs and agronomic services.

The agriculture retail industry is highly fragmented in most of the major markets in which we operate, primarily composed of small and medium-sized competitors. Scale, reliability of supply and the ability to provide innovative products and solutions, including digital offerings, are increasingly important to farmers.

In North America, the primary crops grown include corn, soybeans, wheat, canola and cotton. It is a more mature market with farmers leveraging advanced agriculture tools and willing and able to invest in high-value products and services.

In Australia, our customers require a full suite of crop production inputs but also solutions for livestock, water and irrigation services given the more mixed nature of farm operations.

Brazil is one of the world’s largest and fastest-growing agriculture markets. It is currently the largest soybean producer and the third largest producer of corn globally. Its retail industry is highly fragmented, the supply chain is extended due to the significant reliance on imported crop inputs and there remains opportunity for adoption of more advanced products and services at the farmer level.

Market outlook

Global grain stocks-to-use ratios are historically low, and demand remains strong, providing a supportive environment for ag commodity prices in 2025. We expect US corn plantings to range between 91 and 93 million acres and soybean plantings to range from 84 to 86 million acres in 2025. The projected increase in corn acreage, combined with a shortened fall application season in 2024, supports our outlook for strong North American fertilizer demand in the first half of the year.

In Brazil, generally favorable soil moisture conditions and stronger crop prices are expected to lead to an increase in safrinha corn planted acreage of approximately five percent, supporting crop input demand in the first half of 2025.

A weaker Australian dollar and strong grain and oilseed export demand is supporting grower economics, and conditions remain positive for 2025 crop input demand.

US ag retail industry profile

(percent)

Source: Croplife

Global grains ending stocks & stocks/use ratio1

| (ending stocks Mmt) | (stocks/use ratio %) |

Source: USDA, Nutrien

| 1 | Global grains include corn, wheat, rice, barley, oats, millets, mixed grains, rye and sorghum. RoW is Rest of World excluding China and the US. |

| Nutrien Annual Report 2024 | 19 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Market fundamentals and outlook |

||||||||||||||

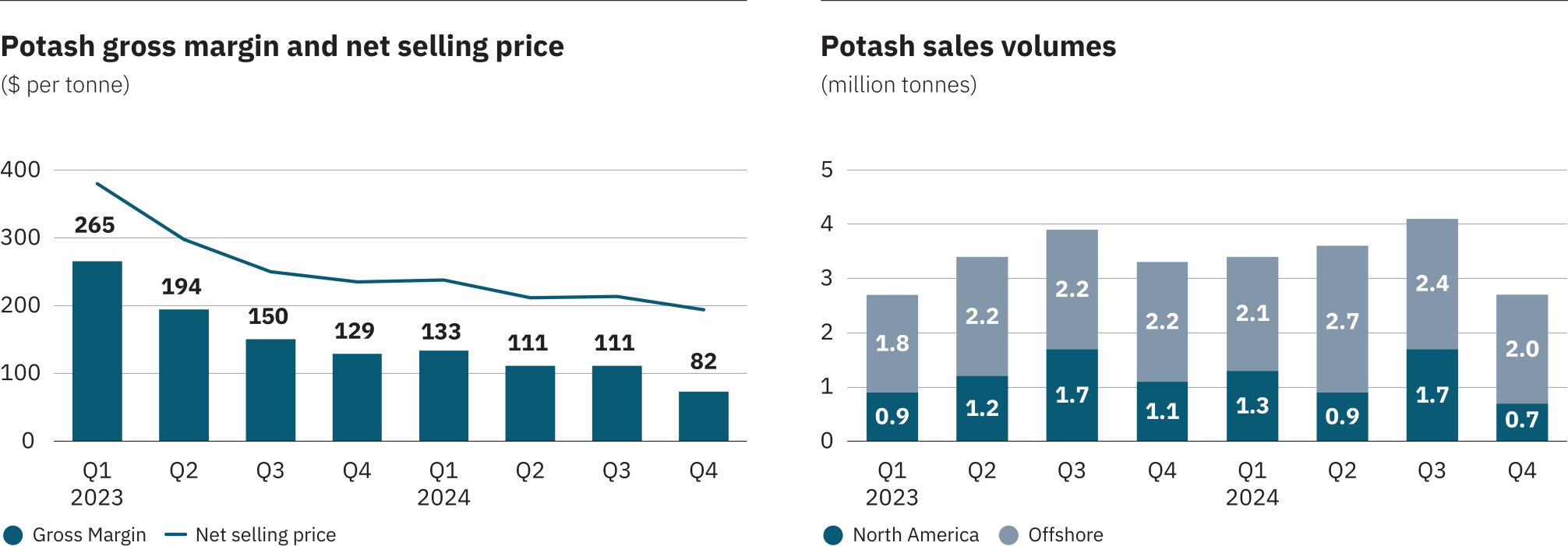

CROP NUTRIENT MARKETS: POTASH

Market fundamentals

Potash strengthens root systems supporting water uptake, drought and disease tolerance and increases the uptake of other nutrients. Potash demand growth is driven by increasing nutrient requirements of higher-yielding crops and improving soil fertility practices, particularly in emerging markets where potash has been historically under-applied and crop yields lag.

High-quality potash reserves in significant quantities are limited to a small number of countries. Canada has the largest known global potash reserves, accounting for approximately 40 percent of the total. Approximately 75 percent of the world’s potash production capacity is held by the six largest producing companies.

Building new production capacity requires significant capital and time to bring online. The expected cost for a greenfield project, including infrastructure, ranges up to $7 billion and requires a minimum of 10 years.1 Brownfield projects have a significant per-tonne capital cost advantage over greenfield projects.

Most major potash-consuming countries in Asia and Latin America have limited production capability and rely on imports to meet their needs. Trade typically accounts for approximately three-quarters of demand for potash, resulting in a globally diversified marketplace.

Inflation in operating and logistics costs has increased the short run marginal cost of potash supply and higher capital costs has also impacted the long-run margin cost.

Market outlook

Global potash shipments rebounded to approximately 72.5 million tonnes in 2024, driven by improved supply and supportive application economics that contributed to increased demand in key markets such as China, Brazil and Southeast Asia.

We forecast global potash shipments between 71 and 75 million tonnes in 2025. The high end of the range captures the potential for stronger underlying global consumption and the lower end captures the potential for reduced supply availability. We anticipate the potential for supply tightness with limited global capacity additions in 2025 and reported operational challenges and maintenance work in key producing regions.

|

|

|

|||

| Global potash demand | Delivered cash cost of potash to Brazil2,3 | |||

| (million tonnes KCl) | ($ per tonne) | |||

|

|

|||

| Source: IFA, Argus, CRU, SPGCI, Nutrien | Source: CRU, Nutrien | |||

| 1 | 3 million tonne KCl conventional potash mine in Saskatchewan, Canada. Cost includes rail, utility systems, port facilities and, if applicable, cost of deposit. |

| 2 | Based on CRU historical data and forecasts. |

| 3 | Short-run marginal cost refers to the breakeven delivered cash cost of the market-clearing high-cost production on a short-term basis. Long-run marginal cost refers to the full economic cost of new capacity. |

| 20 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Market fundamentals and outlook |

||||||||||||||

CROP NUTRIENT MARKETS: NITROGEN

Market fundamentals

Nitrogen is an essential crop nutrient and is a fundamental building block of plant proteins that improves both crop yield and quality. The necessity of nitrogen for crop yield supports a strong and growing demand source for nitrogen fertilizers. Additionally, nitrogen is used as an input in many industrial processes and has the potential to provide further value if markets for low-carbon ammonia emerge.

Production of nitrogen products is the most geographically diverse of the three primary crop nutrients due to the widespread availability of hydrogen sources. Access to reliable and competitively priced energy feedstock supply is an important driver of profitability, as recent geopolitical events continue to create additional volatility in certain global energy markets. North American nitrogen producers currently have an advantaged cost position due to the relatively low price of natural gas compared to competitors in Europe and Asia.

The US is the third largest nitrogen-producing country but remains one of the largest importers of nitrogen products. China and India are the largest-consuming countries of nitrogen products, accounting for approximately 40 percent of the world’s consumption.

Market outlook

Global urea and UAN prices have increased in the first quarter of 2025, driven by strengthening demand in key import markets and restricted supply, including continued Chinese urea export restrictions. Global ammonia prices have trended lower to start the year due to seasonal demand weakness and the anticipation of incremental supply in the US and export capacity from Russia. We expect North American natural gas prices to remain highly competitive compared to Europe and Asia, with Henry Hub natural gas prices projected to average between $3.25 and $3.50 per MMBtu for the year.

The US nitrogen supply and demand balance is expected to be tight ahead of the spring application season, as nitrogen fertilizer net imports in the first half of the 2024/2025 fertilizer year were down approximately 60 percent compared to the five-year average. Additionally, nitrogen demand for the spring season is expected to be strong due to the limited fall ammonia application season and higher expected corn acreage.

|

|

|

|||

| Global ammonia demand | Natural gas prices in key regions | |||

| (million tonnes NH3) | ($ per MMBtu) | |||

|

|

|||

| Source: SPGCI, CRU, Argus, Nutrien | Source: Bloomberg, SPGCI, ICE, CME, Nutrien | |||

| 1 | 2025F based on front month Europe TTF futures prices as of February 14, 2025. North American natural gas prices are based on the Nutrien 2025 forecast. |

| Nutrien Annual Report 2024 | 21 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Market fundamentals and outlook |

||||||||||||||

CROP NUTRIENT MARKETS: PHOSPHATE

Market fundamentals

Phosphorus is essential to all living things and is key to energy reactions in the plant, particularly photosynthesis, and vital to plant growth. Additionally, phosphate is used as an input in animal feed, food ingredients and for industrial processes.

Phosphate rock is found in significant quantity and quality in only a handful of geographic locations, with only 11 major phosphate-producing countries. Due to the concentration of deposits, the majority of recent capacity additions have come from existing producers in North Africa, the Middle East and China.

China is the world’s largest producer of phosphate, and its trade policy has a major impact on the global market. In 2024, Chinese DAP/MAP exports were down approximately 35 percent from 2021 levels as a result of export restrictions.

India and Brazil are the largest importers of phosphate fertilizers, with limited domestic production. In more mature markets like North America, we have seen continued demand growth for phosphate fertilizers that incorporate secondary nutrients and micronutrients like Nutrien’s MAP+MST product.

Market outlook

Phosphate fertilizer markets remain firm, particularly in North America where channel inventories were estimated to be historically low entering 2025. We expect Chinese phosphates exports similar to 2024 levels, with total DAP/MAP exports ranging between 6 and 7 million tonnes, and tight stocks in India to support demand ahead of their key planting season.

|

|

|

|||

| Global P2O5 demand | China DAP/MAP exports | |||

| (million tonnes P2O5) | (millions tonnes) | |||

|

|

|||

| Source: CRU, TFI, Industry Consultants, Nutrien | Source: CRU, Argus, Nutrien | |||

| 22 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Megatrends |

||||||||||||||

We define megatrends as macro-level long-term trends and global dynamics that are expected to shape our operating environment. A megatrend typically stems from complex interactions between policy developments, environmental changes, socio-economic shifts and technological advancements. Evaluating and monitoring megatrends helps inform Nutrien’s strategy and the related risks we look to manage. See page 28 for more information on our strategy and page 42 for our key enterprise risks.

FOOD SECURITY

Despite advances in modern agriculture, food security remains a global challenge. Producing enough nutritious food for the world’s eight billion people, and transporting it to where it is needed, is straining existing global resources. It is estimated that nearly 10 percent of the world’s population is food insecure. A rising population, expected to grow by close to two billion people by 2050, is further increasing the scale of this challenge.

The agricultural landscape continues to evolve and be influenced by climate change, biodiversity loss, water stress, geopolitical volatility, technology and digitalization, along with social trends that could impact the ability to address global food security.

| Nutrien Annual Report 2024 | 23 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Megatrends |

||||||||||||||

CLIMATE CHANGE, BIODIVERSITY

LOSS AND WATER RESOURCES

The convergence of climate change, biodiversity loss and water resource challenges forms a critical intersection that is expected to influence global environmental policy and corporate decisions in agriculture and mining for the foreseeable future. The agriculture value chain is expected to face long-term challenges related to climate change, including continued expectations for climate actions, reductions of GHG emissions and physical impacts from climate change on farmers and agriculture production.

GEOPOLITICAL

VOLATILITY

Geopolitical turmoil around the world is being driven by nationalism, polarization and economic instability. Due to globalization, regional events are having global impacts. Trade disputes, tariffs, restrictions and tensions have resulted in, and may continue to result in, supply chain disruptions and price volatility for energy and several other key commodities. Geopolitical fragmentation can lead to increased costs associated with diverging and sometimes incompatible regulations.

| 24 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Megatrends |

||||||||||||||

TECHNOLOGY AND

DIGITALIZATION

Digital technologies and access to vast amounts of data are supporting the transformation of the agriculture and mining industries. In mining operations, advances in automation and autonomous mining are improving safety by removing workers from the more hazardous areas and enabling productivity increases. Agriculture and food systems are undergoing technological changes driven by big data, digital connectivity, artificial intelligence and innovations in biotechnology.

New applications of emerging technologies, such as artificial intelligence and predictive analytics, have the potential to greatly improve operational productivity. The regulatory environment around artificial intelligence continues to evolve at a different pace than its use. Adoption of such technologies is expected to be uneven given vast differences in access and investment.

SOCIETAL

EXPECTATIONS

Stakeholders remain focused on corporate transparency and accountability. Some investors consider environmental and social principles alongside traditional financial metrics in capital allocation decisions and, along with regulators, are considering those principles in evaluating disclosure enhancements. Beyond climate-related matters, societal concerns include broad ecosystem impacts, as well as the expectation that companies operate in the best interest of stakeholders keeping public health goals in mind.

In response to these expectations, governments may impose new regulations or increase the stringency of existing ones. An inability to meet stakeholder expectations for environmental and social performance could increase stakeholder scrutiny, which could, in turn result in increased difficulty for companies as they seek to access cost-efficient capital, retain talent or deliver on their strategic priorities.

| Nutrien Annual Report 2024 | 25 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy Capital allocation |

||||||||||||||

Our vision is to be the leading global agricultural solutions provider, delivering superior shareholder value through safe and sustainable operations. We are focused on strategic initiatives that we believe will help achieve our vision: improving safety and operating performance, increasing earnings and cash flow, while generating higher risk-adjusted returns. We take a disciplined and intentional approach to capital allocation that is designed to optimize the sources and uses of our cash and prioritize sustaining safe and reliable operations, maintaining a healthy balance sheet, strategically investing in our business and providing meaningful returns to our shareholders.

| 26 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy Capital allocation |

| Nutrien Annual Report 2024 | | 27 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy |

Our strategy is focused on three priorities that span our upstream, midstream and downstream businesses.

|

SIMPLIFY AND FOCUS

Simplify our approach and focus on business activities that are core to our long-term vision and strategic direction, exploring opportunities to exit non-core activities. |

|

|

OPERATIONAL EXCELLENCE

Enhance safety, increase operational efficiency and asset utilization, maximize cost savings and improve the quality of earnings. |

|

|

|

DISCIPLINED AND INTENTIONAL CAPITAL ALLOCATION

Optimize the sources and uses of our cash and prioritize sustaining safe and reliable operations, maintaining a strong and flexible balance sheet, strategically investing in our business and providing meaningful returns to our shareholders. |

| 28 | | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy |

Simplify

| • | Pursuing divestiture of non-core Retail assets in South America |

| • | Reviewing strategic options for our 50 percent ownership stake in Profertil |

| • | Evaluating further options with regards to our ownership in Sinofert Holdings Limited (“Sinofert”) |

| • | Centralizing functions to drive efficiencies and streamline decision making |

Focus

| • | Prioritizing safety to ensure our people go home safe, every day |

| • | Enhancing low-cost upstream North American fertilizer production assets |

| • | Strengthening our global distribution network |

| • | Investing in our core Retail business with a focus on proprietary products |

| ~$200M | +$500M | ~$60M | ||

| annual consolidated cost savings expected to be achieved in 2025, ahead of our initial target of 2026 |

expected reduction in 2025 capital expenditures from 2023 levels | proceeds from divestment of non-core assets, including 13 percent of our total ownership position in Sinofert and the sale of land in Argentina | ||

| 2026 Target | 2024 Actuals | 2023 Actuals | ||||||||||

| Simplify and focus |

||||||||||||

| Consolidated cost savings1 |

~$200M | Ahead of Schedule | N/A | |||||||||

| 1 | Based on targeted reductions in operational and corporate costs. |

| Nutrien Annual Report 2024 | 29 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy |

||||||||||||||

Maintain low-cost position and enhance safety and the reliability of our upstream assets

| • Investing in Potash mine automation technology and operational excellence

• Increasing Nitrogen reliability and energy efficiency

• Improving Phosphate reliability and cost stewardship |

35% | 12% | ||

| potash ore tonnes mined using automation in 2024 |

increased gas utilization in Trinidad compared to 2023 |

|||

Drive midstream supply chain efficiencies across our network

| • Optimizing our logistics infrastructure |

• Leveraging our extensive sales and distribution capabilities |

|||

Optimize downstream Retail network to enhance margins and our ability to efficiently serve the farmer

| • Consolidating and modernizing our North American footprint

• Executing on a margin improvement plan in Brazil |

>50 | >50 | ||

| North American Retail sites consolidated into centralized locations over the past 5 years |

Retail Brazil locations closed, idled 5 blending facilities, and restructured our workforce in Brazil |

|||

| 2026 Target | 2024 Actuals | 2023 Actuals | ||||||||||

| Operational excellence |

||||||||||||

| Potash ore tonnes mined using automation |

40%—50% | 35% | 22% | |||||||||

| Ammonia operating rate1 |

92%—93% | 88% | 88% | |||||||||

|

P2O5 operating rate |

87%—90% | 78% | 83% | |||||||||

| 1 | Operating rate represents production volumes divided by production capacity (excluding Joffre and Trinidad facilities). |

| 30 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Nutrien’s strategy |

||||||||||||||

| 3. | DISCIPLINED AND INTENTIONAL CAPITAL ALLOCATION |

Safe and reliable operations

| • | Sustain our assets to support safe and reliable operations |

| • | Focus on continuous improvement initiatives and investments that enhance the utilization rates, reliability and efficiency of our assets |

| • | Monitor technology, policy and market developments that may make emissions reduction projects economically viable |

Consistent shareholder returns

| • | Return capital to shareholders through a combination of share repurchases and a stable and growing dividend per share |

| • | Consider reduction in share count in the decision criteria for future dividend per share growth |

Strong and flexible balance sheet

| • | Evaluate our assets to ensure they are generating an appropriate return |

| • | Provide sufficient and flexible access to liquidity while optimizing the cost of our capital through the cycle |

| • | Expect to maintain an average adjusted net debt to adjusted EBITDA leverage ratio below 3:1 through the cycle |

High-value growth opportunities

| • | Leverage existing assets to deliver upstream fertilizer volume and proprietary products growth |

| • | Progress targeted growth investments that have a strong fit with our strategy, provide returns in excess of our hurdle rates and have a relatively low degree of execution risk |

| 2026 Target | 2024 Actuals | 2023 Actuals | ||||||||||

| Disciplined and intentional capital allocation |

||||||||||||

| Annual average capital expenditures (2024-2026)1 |

$2.2B–$2.3B | $2.2B | $2.6B | |||||||||

| Potash manufactured sales volumes (million tonnes) |

14.0–15.0 | 13.9 | 13.2 | |||||||||

| Nitrogen manufactured sales volumes (million tonnes) |

11.5–12.0 | 10.7 | 10.4 | |||||||||

| Retail adjusted EBITDA |

$1.9B–$2.1B | $1.7B | $1.5B | |||||||||

| 1 | Comprised of sustaining capital expenditures, investing capital expenditures and mine development and pre-stripping capital expenditures that are supplementary financial measures. See the “Other financial measures” section. |

| Nutrien Annual Report 2024 | 31 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Capital allocation |

||||||||||||||

| SAFE AND RELIABLE OPERATIONS |

|

|

|

Sustaining, mine development and pre-stripping capital expenditures1 |

||

| $1.7B | ||

|

2024 |

||

| Sustaining, mine development and pre-stripping capital expenditures (percent) |

Key 2024 actions

• Completed reliability work and replaced key identified end-of-life assets across our upstream operations, including five major maintenance turnarounds and planned outages at four of our Nitrogen sites

• Received the National Safety Council’s Green Cross for Safety Innovation award in recognition of tele-remote technology in our potash mines

• Invested in maintenance and safety-related initiatives for our downstream Retail facilities |

|

|

||

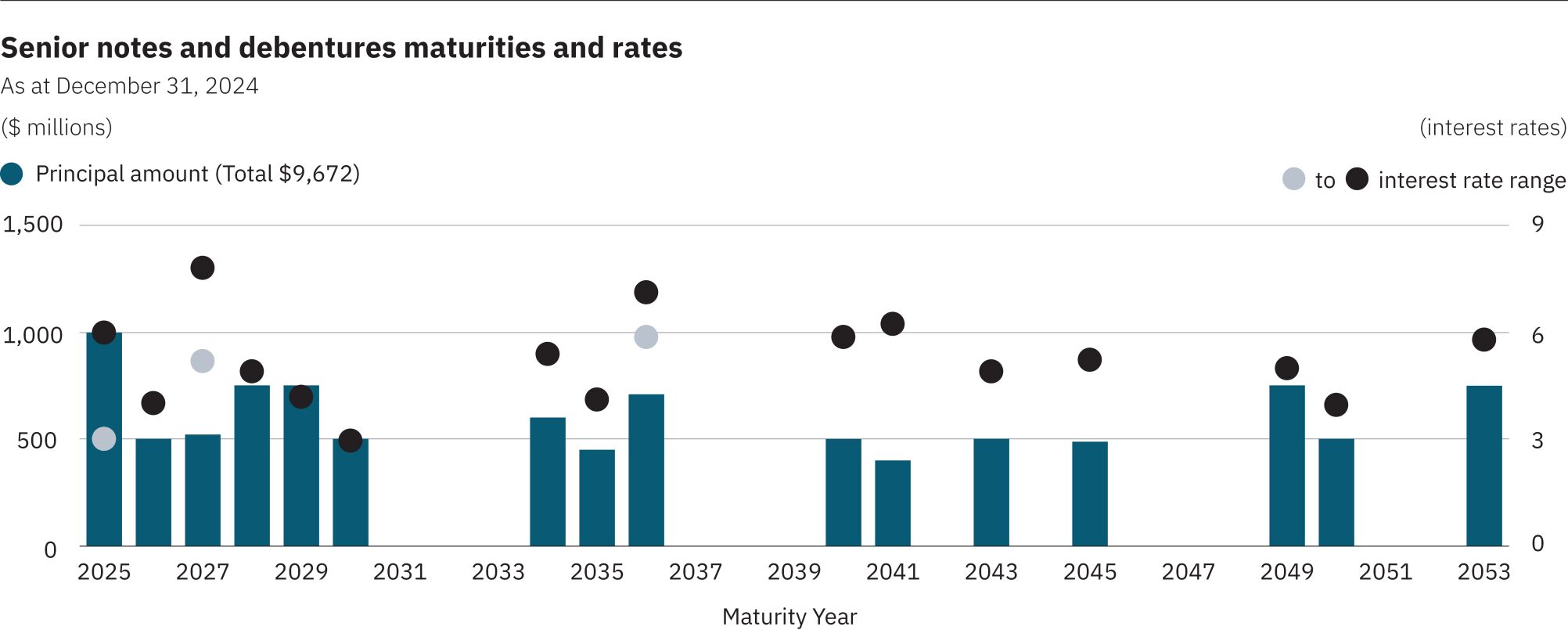

| STRONG AND FLEXIBLE BALANCE SHEET |

|

|

|

Adjusted net debt to adjusted EBITDA2 |

||

|

2.2X |

||

| 2024 | ||

| Debt and equity3,4 (percent) |

Key 2024 actions

• Maintained our Baa2/BBB investment-grade credit rating

• Repaid $500 million in senior notes that matured in 2024 and issued a total of $1.0 billion of 3-year and 10-year senior notes |

|

|

| 1 | This is a supplementary financial measure. See the “Other financial measures” section. |

| 2 | This is a capital management measure that includes non-GAAP components. See the “Non-GAAP financial measures” and “Other financial measures” sections. |

| 3 | As at December 31, 2024. |

| 4 | Debt includes short-term debt, long-term debt and lease liabilities, including the current portions of each where applicable. |

| 32 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Capital allocation |

||||||||||||||

| CONSISTENT SHAREHOLDER RETURNS |

Key 2024 actions

• Repurchased 3.9M shares for a total of ~$190 million in the second half of 2024

• Announced a 1 percent increase to our quarterly dividend to $0.545 per share in February 2025, our seventh increase since 2018

• In February 2025, we approved the purchase of up to 5 percent of Nutrien’s outstanding common shares over a twelve-month period through a renewal of our normal course issuer bid |

|

|

Cash used for dividends and share repurchases |

||

| 4.3% | ||

|

average dividend yield in 2024 |

||

| $1.2B

returned to shareholders through dividends and share repurchases in 2024 |

| HIGH-VALUE GROWTH OPPORTUNITIES |

Key 2024 actions

• Invested in potash autonomous mining machines and technology and increased our ore tonnes mined using automation by more than 75% (vs 2023)

• Invested in low-cost nitrogen brownfield expansions and added incremental ammonium sulfate capability at our Redwater nitrogen site

• Invested in proprietary products, network optimization and digital capabilities to better serve our customers |

|

|

Targeted growth investments |

||

| $430M | ||

|

investing capital expenditures in 2024 |

||

| 8%

growth in proprietary crop nutritional and biostimulants gross margin in 2024 (vs 2023) |

| Nutrien Annual Report 2024 | 33 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Corporate governance |

We embed strong corporate governance systems and principles in our business to place the interests of our shareholders and other stakeholders at the center of every decision we make. Our governance supports value preservation and long-term value creation by ensuring our businesses’ principal risks and opportunities are being appropriately identified and addressed.

| 34 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Corporate

governance |

| Nutrien Annual Report 2024 | 35 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Corporate governance |

Nutrien’s corporate governance structure includes policies and processes that define the roles of the Board and the Executive Leadership Team (“ELT”). Our Board oversees the execution of our corporate strategy and management of risk. Below are highlights of our corporate governance practices. For more information, see our most recent Management Proxy Circular.

Board diversity

Having a mix of directors on the Board from varied backgrounds and with a diverse range of experience and skills fosters enhanced decision-making capacity and promotes strong corporate governance. Our Board Diversity Policy includes a target that women comprise no fewer than 30 percent of the Board members. As of December 31, 2024, four of our directors were women (33 percent of the total number of directors).

Executive compensation

Nutrien’s compensation framework is based on a pay-for-performance philosophy, with the majority of executive compensation being at risk. Each year, we include an advisory “say on pay” vote at our annual meeting.

Board skills

Our Board competencies and skills matrices are essential tools to evaluate whether the Board has the right skills, perspectives, experience and expertise for proper oversight and effective decision making. The Board regularly reviews the skills matrix.

Core business skills1

(percent of Board of Directors)

Core industry experience1

(percent of Board of Directors)

| 1 | As disclosed in Nutrien’s 2024 Management Proxy Circular. |

| 36 | | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Corporate governance |

||||||||||||||

|

|

|

|

|

|

|||||

| Russell Girling | Ken Seitz | Christopher Burley | Maura Clark | Michael Hennigan | Miranda Hubbs | |||||

| Chair | President and Chief Executive Officer | Director | Director | Director | Director | |||||

|

|

|

|

|

|

|

|||||

| Raj Kushwaha | Julie Lagacy | Consuelo Madere | Keith Martell | Aaron Regent | Nelson Luiz Costa Silva | |||||

| Director | Director | Director | Director | Director | Director |

EXECUTIVE LEADERSHIP TEAM

|

|

|

|

|

|||||||||

| Ken Seitz | Noralee Bradley | Andrew Kelemen | Chris Reynolds | |||||||||

| President and Chief Executive Officer | Executive Vice President, External Affairs and Chief Sustainability and Legal Officer | Executive Vice President and Chief Corporate Development and Strategy Officer | Executive Vice President and Chief Commercial Officer | |||||||||

|

|

|

|

|

|||||||||

| Jeff Tarsi | Mark Thompson | Sarah Walters | Trevor Williams | |||||||||

| Executive Vice President and President, Global Retail | Executive Vice President and Chief Financial Officer | Executive Vice President and Chief People Officer | Executive Vice President and President, Nitrogen and Phosphate |

| Nutrien Annual Report 2024 | 37 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Risk governance |

||||||||||||||

Risk management is an integral part of doing business and is governed by our Board, which has the highest level of oversight for risk governance. The Board is responsible for overseeing the execution and alignment of Nutrien’s corporate strategy and risk management processes.

Nutrien’s ELT has the responsibility of ensuring the Company’s principal risks are being appropriately identified, assessed and addressed. Management keeps the Board and each of the Board committees regularly apprised of risks and developments relevant to their mandates.

Responsibility and accountability for risk management are embedded in all levels of our organization, and we strive to integrate risk management into key decision-making processes and strategies. By considering risk throughout our business, we seek to effectively manage the risks that could have an impact on our ability to deliver on our strategy.

Role of the Board committees

While the Board as a whole oversees our strategy and risk management processes, each Board committee has oversight over business topics and certain risk areas relevant to their committee mandate. More information can be found in Nutrien’s Board and Board committee charters on our website at nutrien.com.

| Board/Board Committee

|

Oversight includes the following business topics or risk areas

|

|||

| Board of Directors |

• Corporate strategy

• Oversight of safety, health, environmental and security matters |

• Risk management

• Human resources and compensation

• Governance and compliance |

||

| Audit Committee |

• Accounting and financial reporting

• Internal controls |

• Compliance

• Financial risk management |

||

| Corporate Governance & Nominating Committee |

• Corporate governance

• Board diversity

• Director compensation |

• Director orientation and continuing education

• Board evaluation |

||

| Human Resources & Compensation Committee |

• Executive compensation

• Succession planning |

• Equity, diversity and inclusion, including the Company’s Indigenous Strategy as it relates to Indigenous employment and human resources matters with appropriate coordination with the S&S Committee

• Learning and development |

||

| Safety & Sustainability (“S&S”) Committee |

• Sustainability priorities

• Risks, strengths and opportunities related to safety and sustainability including climate-related impacts |

• Safety and sustainability performance and strategy

• Cybersecurity and data privacy

• Status of remediation projects and environmental provisions

• The Company’s Indigenous Strategy as it relates to Indigenous engagement and stakeholder relations, with appropriate coordination with the Human Resources & Compensation Committee |

||

| 38 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Risk management process |

||||||||||||||

Risk management is integrated in our strategy and business processes to facilitate informed decision making and responsible management of resources. Our Enterprise Risk Management process is overseen by our Enterprise Risk Management Team and guided by our global risk management framework. The framework promotes consistent and integrated application of risk management principles and processes across our organization and is scalable to support all levels of the business.

Nutrien’s operating segments and corporate functions use this framework to identify, assess and develop mitigation actions for key risks that could affect their strategy, operations or future performance. Assessment criteria embedded in the risk framework follow best practices and allow for comparability of different types of risks. Key criteria include the likelihood of impacting our business and the potential severity of impact.

Risks are evaluated at the management level to fully understand Nutrien’s risk landscape and identify interdependencies between risks. A consolidated view of our risks is presented to our ELT and senior leaders for review and discussion. Nutrien’s key enterprise risks are then presented to the Board at least annually.

| Nutrien Annual Report 2024 | 39 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Key enterprise risks |

| 40 | Nutrien Annual Report 2024 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Key enterprise risks |

Nutrien characterizes a key risk as a risk or combination of risks that could threaten the effective delivery of our business model, future financial peformance, liquidity or ability to deliver on our strategy.

| Nutrien Annual Report 2024 | 41 |

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Key enterprise risks |

||||||||||||||

Our key enterprise risks are discussed below and, while these represent our significant risks, we also continue to be exposed to other important general business, financial, operational and climate-related risks. For a more detailed discussion of these key risks and other risks that may have a material effect on us, refer to Nutrien’s 2024 Annual Information Form.

| 1 |

Competition and shifting market fundamentals

|

|||

| Description

Global macroeconomic conditions and shifting market fundamentals – including trade tariffs and trade restrictions, market volatility, geopolitical conditions, increased price competition or new entrants, and/or a significant change in agriculture production or consumption trends – could lead to a sustained environment of reduced demand for our products, increased costs and/or low or volatile commodity prices, thereby negatively impacting our short- and long-term profitability. |

Risk management approach

We operate across the ag value chain and have a diversified portfolio of products and services that are designed to enable us to respond to changing economic conditions. We have a favorable cost-structure and the flexibility to make operational changes across our portfolio to help minimize the impact of changing market dynamics. We prioritize a strong and flexible balance sheet and focus on initiatives that simplify and enhance our core business, optimize our advantages across the ag value chain and allocate capital to high-value investments.

See page 18 of this report for more information on our market fundamentals. |

|||

| 2 |

Changing regulations

|

|||

| Description

Changing laws, regulations and government policies, including those relating to the environment, climate change (including regulation of GHG emissions), data privacy, health and safety, and taxes and royalties, could affect our ability to produce or sell certain products, reduce our efficiency and competitive advantage, increase our costs of raw materials, energy, transportation and compliance, or require us to make capital improvements to our operations. These and other factors could impact our strategy, operations, financial results or reputation. |

Risk management approach

Our Government & External Affairs Team maintains an active engagement strategy with governments and regulators, including participation in industry associations. These relationships allow us to keep current on regulatory developments affecting our business or industry, allowing us to anticipate new or changing laws and regulations and put us in the best position for success while leveraging our industry association allies. |

|||

| 42 | | Nutrien Annual Report 2024 | |||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

| Key enterprise risks |

||||||||||||||

| 3 |

Political, economic and social instability

|

|||

| Description

We are a global business with significant operations in Canada and the US as well as operations outside of North America, including Australia, South America, Trinidad and certain European countries.

We are subject to numerous risks and uncertainties related to international sales and operations, and wide-ranging political, economic and social instability. These risks include, but are not limited to: restrictions on monetary distributions in jurisdictions we operate, inflation and/or conditions resulting from governmental attempts to reduce inflation, currency exchange rate fluctuations between the US dollar and foreign currencies, labor disruptions, competitive restrictions, forced divestitures or changes to, or termination or nullification of, existing agreements, military or other armed conflicts, mining permits or leases, the imposition of tariffs, exchange controls, |

international sanctions, embargoes, trade barriers or other restrictions. Instability in political or regulatory regimes could also affect our ability to do business and could impact our financial results or the value of our assets.

Risk management approach

Our Government & External Affairs Team maintains an active engagement strategy with governments, regulators and other stakeholders in the countries where we operate or plan to operate and is well positioned with the US Administration. We assess capital investments and project decisions against political, country-specific and other related risk factors and avoid or reduce our exposure to jurisdictions with unacceptable risk levels. We actively monitor regulatory and political developments and global trends that may impact us. |

|||

| 4 |

Agricultural changes and trends

|

|||

| Description

The agricultural landscape continues to evolve as a result of factors including, but not limited to, farm and industry consolidation, changing farmer demographics, technology developments, sustainability practices, changing government programs and policies, climate change and shifting social trends, many of which vary from jurisdiction to jurisdiction. These factors as well as other factors affecting long-term demand for our products and services could adversely impact our strategy and our financial results. |

Risk management approach

We operate across the ag value chain and have a diversified portfolio of products and services that enable us to adapt to changes in the agriculture industry and help position us to achieve long-term value creation. Our downstream Retail network provides access and insights directly to the farmer, providing an opportunity to anticipate trends and respond faster to the needs of our customers. We are focused on bringing value-added products and services to market that address key grower challenges, including offering financing solutions through Nutrien Financial and expanding innovative proprietary product offerings.

See page 28 of this report for more information on our strategy. |

|||

| 5 |

Cybersecurity threats

|

|||

| Description

Information technology and operational control systems are embedded in our business and as we become more dependent on these systems, third-party systems and cloud-based platforms, we may become more exposed to cyberattacks, which continue to become increasingly sophisticated. Cybersecurity risks can include attacks on information technology and infrastructure by hackers, industrial espionage, terrorist attacks, viruses, ransom events, the unintended disclosure of confidential |

information and/or personally identifiable information, the misuse or loss of control over computer control systems, power outages, business and/or supply chain disruptions, and related breaches. Any of these could result in business disruptions, increased defense or insurance costs, reputational damage, personal injury or third-party claims, which could, in turn, negatively impact our operations, financial results or reputation. |

|||

| Nutrien Annual Report 2024 | 43 | ||||

|

Overview |

MD&A

|

Five-year highlights |

Financial statements and notes |

||||||||||

|

Key enterprise risks |

| 5 |

Cybersecurity threats (continued)

|

|||

| Risk management approach

Our Global Information Management and Cyber Security Team is supported by third-party specialists, oversees our network security and may assist in incident response. We promote a strong culture of cybersecurity awareness to minimize threats and vulnerabilities, which is supported by our cybersecurity framework, policies and best practices. |

Threat and risk assessments are completed for all new information technology systems, and our cybersecurity incident response processes are backstopped by external response measures. We also conduct regular simulated phishing and targeted cybersecurity training as well as incident response training. |

|||

| 6 |

Supply chain disruption

|

|||

| Description

Our ability to produce and supply our customers and markets with products can be negatively impacted by disruptions in our inbound and outbound supply chains. These disruptions can result in difficulties supplying key materials or supplies to our facilities or impair our ability (or the ability of the third parties upon which we rely) to deliver products to our customers in a timely manner. Ongoing geopolitical conflicts, regulatory instability, sanctions, tariffs, labor disputes and extreme weather events or disasters have created and could create supply chain challenges and disruptions, and/or limit our future ability to sell or distribute our products in a timely manner, any of which could negatively impact our business and financial results. |

Risk management approach

Our business structure and position across the ag value chain provides us the flexibility to optimize our operations and distribution network to be able to respond to potential supply chain disruptions. We have an extensive and diverse transportation and storage network that allows us to effectively manage and adapt to logistical challenges. We maintain a sizable and diverse network of suppliers that we regularly review to ensure we can maintain critical feedstocks for our operations. |

|||

| 7 |

Climate change

|

|||

| Description

Our business and our customers are subject to risks related to or resulting from climate change, which are commonly grouped into physical risk and transition risk categories.

Physical risks include the impacts that climate change could have on our operations, supply chains and customers. These may cause or result in, among other things, more frequent and severe weather events, diminishing biodiversity, impacts to growing seasons or crop yields and changing weather factors such as temperature, precipitation, wind and water levels, and affect freshwater availability. These risks may also result in operational or supply chain disruptions.

Transition risks relate to the risk inherent in changing strategies, policies or investments as society and industry work to reduce the reliance on carbon and its impact on the climate. Impacts from transition risks include, among other things, policy constraints on emissions, carbon pricing mechanisms, water restrictions, land use restrictions or incentives, changing consumer preferences and market demand and supply shifts. |

We are also subject to reputational risks associated with climate change, including our stakeholders’ perception of the agriculture industry and our role in the transition to a lower-carbon economy. These and other factors resulting from climate change could adversely impact our operations, financial results or liquidity.

Risk management approach

Our capital allocation framework and preventive maintenance programs help support the long-term reliability and efficiency of our assets. Additionally, our geographically diversified network of facilities and operations helps to minimize the overall impact of physical risk from climate change on our Company.