UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 1-9059

Barrick Gold Corporation

(Registrant’s name)

| Brookfield Place, TD Canada Trust Tower, Suite 3700 161 Bay Street, P.O. Box 212 Toronto, Ontario Canada M5J 2S1 (800) 720-7415 |

310 South Main Street Suite 1150 Salt Lake City, Utah 84101 (801) 990-3745 |

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 19, 2025 | BARRICK GOLD CORPORATION | |||||

| By: | /s/ Poupak Bahamin |

|||||

| Name: | Poupak Bahamin | |||||

| Title: | General Counsel | |||||

EXHIBIT INDEX

| Exhibit |

Description |

|

| 99.1 | NI 43-101 Technical Report on the Lumwana Expansion Project, Republic of Zambia | |

Exhibit 99.1

NI 43-101 Technical Report on the

Lumwana Expansion Project, Republic of

Zambia

February 19, 2025

Effective Date: December 31, 2024

Qualified Persons:

Simon P. Bottoms, CGeol, FAusIMM

Richard Peattie, FAusIMM

Derek Holm, FAusIMM

Marius Swanepoel, Pr.Eng.

Graham E. Trusler, Pr.Eng.

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Cautionary Statement on Forward-Looking Information: This Technical Report contains forward-looking statements. All statements, other than statements of historical fact regarding Lumwana Mining Company Limited (“LMC”), Barrick Gold Corporation (“Barrick”) or the Lumwana Mine, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “project”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could” and similar expressions identify forward-looking statements. In particular, this Technical Report contains forward-looking statements with respect to: an economic analysis of the Lumwana Expansion Project, including forecasted net present value, internal rate of return and cash flow forecasts; projected capital; operating and exploration expenditure; mine life and production rates; potential mineralization and metal or mineral recoveries; anticipated timelines and plans for project development, operation and closure; the ability and timeline to secure all relevant rights, licenses, permits and authorizations; LMC’s and Barrick’s strategy, plans, targets and goals in respect of environmental and social issues and sustainability matters; stakeholder engagement; sufficiency of infrastructure, systems and consultants and personnel; operating or technical challenges in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities, and the maintenance or provision of required infrastructure and information technology systems; and information pertaining to potential improvements to financial and operating performance and mine life are necessarily based on opinions and estimates made as of the date such statements are made and are subject to important risk factors and uncertainties, many of which cannot be controlled or predicted. Material assumptions regarding forward-looking statements are discussed in this Technical Report, where applicable. In addition to such assumptions, the forward-looking statements are inherently subject to significant business, economic, political, security and competitive uncertainties, and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: fluctuations in the spot and forward price of commodities (including gold, copper, diesel fuel, natural gas and electricity); the speculative nature of mineral exploration and development; risks associated with projects in the early stages of evaluation and development and for which additional technical, engineering and other analysis is required; disruption of supply routes which may cause delays in development, construction and mining activities; changes in mineral production performance, exploitation and exploration successes; diminishing quantities or grades of reserves; increased costs, delays, suspensions, and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to LMC’s or Barrick’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the handling of environmental matters or dealings with community groups, whether true or not; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; uncertainty whether capital projects, including the Lumwana Expansion Project, will meet Barrick’s capital allocation objectives; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation; fluctuations in the currency markets; changes in interest rates; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; expropriation or nationalization of property and political or economic developments in Zambia; the possibility of political instability in Zambia; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; litigation; contests over title to properties or over access to water, power and other required infrastructure; increased costs and physical risks including extreme weather events and resource shortages, related to climate change; risks associated with working with partners in jointly controlled assets; and availability and increased costs associated with mining inputs and labour. In addition, there are risks and hazards associated with the business of mineral exploration, development, and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, ground conditions, pressures, cave-ins, flooding and gold and copper ore losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect LMC’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, LMC. All of the forward-looking statements made in this Technical Report are qualified by these cautionary statements. LMC, Barrick, and the Qualified Persons who authored this Technical Report undertake no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. Many of these uncertainties and contingencies can affect LMC’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, LMC. All of the forward-looking statements made in this Technical Report are qualified by these cautionary statements. LMC, Barrick, and the Qualified Persons who authored this Technical Report undertake no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

|

February 19, 2025 |

Page i |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Table of Contents

| 1 | Summary | 1 | ||||||

| 1.1 | Description, Location, and Ownership | 1 | ||||||

| 1.2 | Geology and Mineralisation | 2 | ||||||

| 1.3 | Exploration Status | 3 | ||||||

| 1.4 | Mineral Resource Estimate | 3 | ||||||

| 1.5 | Mineral Reserve Estimate | 6 | ||||||

| 1.6 | Mining Methods | 9 | ||||||

| 1.7 | Mineral Processing | 11 | ||||||

| 1.8 | Project Infrastructure | 12 | ||||||

| 1.9 | Market Studies and Contracts | 13 | ||||||

| 1.10 | Environmental, Permitting and Social Considerations | 13 | ||||||

| 1.11 | Capital and Operating Costs | 15 | ||||||

| 1.12 | Economic Analysis | 15 | ||||||

| 1.13 | Interpretations and Conclusions | 16 | ||||||

| 1.14 | Recommendations | 24 | ||||||

| 2 | Introduction | 26 | ||||||

| 2.1 | Effective Date | 27 | ||||||

| 2.2 | Qualified Persons | 27 | ||||||

| 2.3 | Site Visits of Qualified Persons | 27 | ||||||

| 2.4 | Information Sources | 28 | ||||||

| 2.5 | Abbreviations and Acronyms | 29 | ||||||

| 3 | Reliance on Other Experts | 30 | ||||||

| 4 | Property Description and Location | 31 | ||||||

| 4.1 | Project Location | 31 | ||||||

| 4.2 | Mineral Rights | 32 | ||||||

| 4.3 | Surface Rights | 34 | ||||||

| 4.4 | Royalties, Payments, and Other Obligations | 35 | ||||||

| 4.5 | Permits | 35 | ||||||

| 4.6 | Environmental Liabilities | 36 | ||||||

| 4.7 | Other Significant Factors and Risks | 36 | ||||||

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 38 | ||||||

| 5.1 | Accessibility | 38 | ||||||

|

February 19, 2025 |

Page i |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 5.2 | Climate and Physiography | 38 | ||||||

| 5.3 | Local Resources and Infrastructure | 40 | ||||||

| 5.4 | Sufficiency of Surface Rights | 40 | ||||||

| 6 |

History | 42 | ||||||

| 6.1 | Ownership | 42 | ||||||

| 6.2 | Development and Operations | 42 | ||||||

| 6.3 | Historical Mineral Resources and Mineral Reserves | 43 | ||||||

| 6.4 | Past Production | 43 | ||||||

| 7 |

Geological Setting and Mineralisation | 45 | ||||||

| 7.1 | Regional Geology | 45 | ||||||

| 7.2 | Local Geology | 47 | ||||||

| 7.3 | Property Geology | 48 | ||||||

| 7.4 | QP Comment on Geological Setting and Mineralisation | 54 | ||||||

| 8 |

Deposit Types | 55 | ||||||

| 8.1 | Deposit Type | 55 | ||||||

| 9 |

Exploration | 56 | ||||||

| 9.1 | Previous Exploration | 56 | ||||||

| 9.2 | Current Exploration | 57 | ||||||

| 9.3 | Planned Exploration | 64 | ||||||

| 9.4 | QP Comment on Exploration | 64 | ||||||

| 10 |

Drilling | 65 | ||||||

| 10.1 | Drilling Summary | 65 | ||||||

| 10.2 | Drilling Methods | 74 | ||||||

| 10.3 | QP Comments on Drilling | 76 | ||||||

| 11 |

Sample Preparation, Analyses, and Security | 77 | ||||||

| 11.1 | Sample Preparation | 77 | ||||||

| 11.2 | Sample Analysis | 78 | ||||||

| 11.3 | Sample Security | 78 | ||||||

| 11.4 | Quality Assurance and Quality Control | 79 | ||||||

| 11.5 | QP Comments on Sample Preparation, Analyses, and Security | 87 | ||||||

| 12 |

Data Verification | 88 | ||||||

| 12.1 | Historical Data | 88 | ||||||

| 12.2 | Current Data | 88 | ||||||

| 12.3 | Internal Reviews and Audits | 88 | ||||||

|

February 19, 2025 |

Page ii |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 12.4 | External Reviews and Audits | 89 | ||||||

| 12.5 | QP Comments on Data Verification | 90 | ||||||

| 13 |

Mineral Processing and Metallurgical Testing | 91 | ||||||

| 13.1 | Recent Metallurgical Test Work | 91 | ||||||

| 13.2 | Existing Processing Plant Performance | 102 | ||||||

| 13.3 | Recovery Estimates | 107 | ||||||

| 13.4 | Deleterious Elements | 109 | ||||||

| 13.5 | QP Comments on Mineral Processing and Metallurgical Testing | 109 | ||||||

| 14 |

Mineral Resource Estimates | 110 | ||||||

| 14.1 | Resource Database | 113 | ||||||

| 14.2 | Geological Modelling | 115 | ||||||

| 14.3 | Bulk Density | 117 | ||||||

| 14.4 | Compositing | 119 | ||||||

| 14.5 | Capping and Outliers | 121 | ||||||

| 14.6 | Block Model | 121 | ||||||

| 14.7 | Variography | 125 | ||||||

| 14.8 | Resource Estimation | 128 | ||||||

| 14.9 | Block Model Validation | 132 | ||||||

| 14.10 | Resource Classification | 136 | ||||||

| 14.11 | Stockpiles | 141 | ||||||

| 14.12 | Cut-off Grade | 141 | ||||||

| 14.13 | Mineral Resource Statement | 142 | ||||||

| 14.14 | 2024 Versus 2023 End of Year Comparison | 144 | ||||||

| 14.15 | External Review | 145 | ||||||

| 14.16 | QP Comments on Mineral Resource Estimates | 146 | ||||||

| 15 |

Mineral Reserve Estimate | 147 | ||||||

| 15.1 | Mineral Reserve Estimation Process | 149 | ||||||

| 15.2 | Open Pit Optimisation | 149 | ||||||

| 15.3 | Sensitivities | 160 | ||||||

| 15.4 | Mine Design and Pit Shell Comparison | 165 | ||||||

| 15.5 | Mineral Reserve Statement | 165 | ||||||

| 15.6 | 2024 Versus 2023 End of Year Comparison | 168 | ||||||

| 15.7 | External Reviews | 169 | ||||||

| 15.8 | QP Comments on Mineral Reserve Estimates | 170 | ||||||

|

February 19, 2025 |

Page iii |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 16 |

Mining Methods | 171 | ||||||

| 16.1 | Mining Methods | 171 | ||||||

| 16.2 | Geotechnical and Hydrogeological Considerations | 173 | ||||||

| 16.3 | Mine Design | 181 | ||||||

| 16.4 | Mining Equipment | 196 | ||||||

| 16.5 | LOM Production Schedule | 197 | ||||||

| 16.6 | External Reviews | 202 | ||||||

| 16.7 | QP Comments on Mining Methods | 203 | ||||||

| 17 |

Recovery Methods | 204 | ||||||

| 17.1 | Process Plant Description | 204 | ||||||

| 17.2 | Metallurgical Accounting | 215 | ||||||

| 17.3 | Power, Water, and Process Reagents Requirements | 216 | ||||||

| 17.4 | QP Comments on Recovery Methods | 217 | ||||||

| 18 |

Project Infrastructure | 219 | ||||||

| 18.1 | Access and Roads | 221 | ||||||

| 18.2 | Power Supply | 221 | ||||||

| 18.3 | Water Management | 223 | ||||||

| 18.4 | Supply Chain | 227 | ||||||

| 18.5 | Site Common Purpose Infrastructure | 228 | ||||||

| 18.6 | Tailings Storage Facilities | 234 | ||||||

| 18.7 | QP Comments on Infrastructure | 239 | ||||||

| 19 |

Market Studies and Contracts | 240 | ||||||

| 19.1 | Markets | 240 | ||||||

| 19.2 | Lumwana Concentrates | 241 | ||||||

| 19.3 | Commodity Price Assumptions | 241 | ||||||

| 19.4 | Contracts | 241 | ||||||

| 19.5 | QP Comment on Market Studies and Contracts | 242 | ||||||

| 20 |

Environmental Studies, Permitting, and Social or Community Impact | 243 | ||||||

| 20.1 | Permitting | 244 | ||||||

| 20.2 | Environmental Assessment and Studies | 245 | ||||||

| 20.3 | Environmental Considerations | 251 | ||||||

| 20.4 | Water Management | 252 | ||||||

| 20.5 | Costs | 254 | ||||||

| 20.6 | Social and Community Requirements | 255 | ||||||

|

February 19, 2025 |

Page iv |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 20.7 | Mine Closure and Reclamation | 258 | ||||||

| 20.8 | QP Comments on Environmental and Social | 260 | ||||||

| 21 |

Capital and Operating Costs | 261 | ||||||

| 21.1 | Basis and Sources of Cost Estimates | 261 | ||||||

| 21.2 | Capital Costs | 262 | ||||||

| 21.3 | Operating Costs | 265 | ||||||

| 21.4 | QP Comments on Capital and Operating Costs | 267 | ||||||

| 22 |

Economic Analysis | 269 | ||||||

| 22.1 | Assumptions and Inputs | 269 | ||||||

| 22.2 | Taxes and Royalties | 270 | ||||||

| 22.3 | Financial Model Summary | 271 | ||||||

| 22.4 | Sensitivity | 280 | ||||||

| 22.5 | QP Comments on Economic Analysis | 282 | ||||||

| 23 |

Adjacent Properties | 283 | ||||||

| 24 |

Other Relevant Data and Information | 284 | ||||||

| 25 |

Interpretation and Conclusions | 285 | ||||||

| 25.1 | Mineral Tenure, Rights, Royalties and Agreements | 285 | ||||||

| 25.2 | Geology and Mineral Resources | 285 | ||||||

| 25.3 | Mineral Reserves | 286 | ||||||

| 25.4 | Mining | 286 | ||||||

| 25.5 | Mineral Processing | 287 | ||||||

| 25.6 | Infrastructure | 287 | ||||||

| 25.7 | Environment and Social Aspects | 288 | ||||||

| 25.8 | Capital and Operating Costs | 289 | ||||||

| 25.9 | Project Economics | 289 | ||||||

| 25.10 | Risks | 290 | ||||||

| 26 |

Recommendations | 293 | ||||||

| 26.1 | Mineral Tenure, Rights, Royalties and Agreements | 293 | ||||||

| 26.2 | Geology and Mineral Resources | 293 | ||||||

| 26.3 | Mining and Mineral Reserves | 293 | ||||||

| 26.4 | Mineral Processing | 294 | ||||||

| 26.5 | Infrastructure | 294 | ||||||

| 26.6 | Environmental, Permitting and Social Aspects | 294 | ||||||

| 26.7 | Capital and Operating Costs | 294 | ||||||

|

February 19, 2025 |

Page v |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 26.8 | Risks | 294 | ||||||

| 27 |

References | 295 | ||||||

| 28 |

Date and Signature Page | 297 | ||||||

| 29 |

Certificates of Qualified Persons | 298 | ||||||

| 29.1 | Simon P. Bottoms | 298 | ||||||

| 29.2 | Richard Peattie | 300 | ||||||

| 29.3 | Derek Holm | 302 | ||||||

| 29.4 | Marius Swanepoel | 303 | ||||||

| 29.5 | Graham E. Trusler | 305 | ||||||

List of Tables

| Table 1-1 |

Lumwana Mineral Resource Estimate as of December 31, 2024 |

5 | ||||

| Table 1-2 |

Summary of Lumwana Mineral Reserve Estimate as of December 31, 2024 |

8 | ||||

| Table 1-3 |

After-Tax Copper Price Sensitivity Analysis Results |

15 | ||||

| Table 1-4 |

Expansion Project Risk Summary |

22 | ||||

| Table 2-1 |

QP Responsibilities |

27 | ||||

| Table 2-2 |

Table of Abbreviations |

29 | ||||

| Table 4-1 |

Summary of Lumwana Mining Licences |

32 | ||||

| Table 4-2 |

Royalty Charge Relation to Copper Price |

35 | ||||

| Table 4-3 |

Summary of major required permitting |

36 | ||||

| Table 5-1 |

Annual Average Climatic Conditions in North-Western Province, Zambia |

39 | ||||

| Table 6-1 |

Summary of Lumwana Ownership |

42 | ||||

| Table 6-2 |

Summary of Lumwana Project Development |

42 | ||||

| Table 6-3 |

Past Production Records for Lumwana |

43 | ||||

| Table 10-1 |

Lumwana Drilling Summary to June 2024 |

65 | ||||

| Table 11-1 |

Summary of Laboratories and Analytical Methods |

77 | ||||

| Table 11-2 |

QA/QC Sample Insertion Rates for DD Samples Submitted between January 2022 and June 2024 |

79 | ||||

| Table 13-1 |

Metallurgical Test Work Samples |

92 | ||||

| Table 13-2 |

Summary of Phase 1 Comminution Test Work Results |

97 | ||||

| Table 13-3 |

Summary of Phase 2 Comminution Test Work Results |

97 | ||||

| Table 13-4 |

Locked Cycle Test Work Results (Phase 2) |

100 | ||||

| Table 14-1 |

Lumwana Mineral Resource Estimate as of December 31, 2024 |

112 | ||||

| Table 14-2 |

Summary of Mineral Resource Drilling and Model Dates |

113 | ||||

| Table 14-3 |

Drilling in the Mineral Resource Database |

114 | ||||

| Table 14-4 |

Modelled Geological Domains |

116 | ||||

| Table 14-5 |

Ratios Used to Define Oxidation Zones |

117 | ||||

| Table 14-6 |

Dry Bulk Density Assignment |

118 | ||||

| Table 14-7 |

Chimiwungo Mineralised Domain Assay and Composite Comparison |

120 | ||||

| Table 14-8 |

Malundwe Mineralised Domain Assay and Composite Comparison |

120 | ||||

| Table 14-9 |

Kamisengo Fresh Mineralised Domain Assay and Composite Comparison |

120 | ||||

| Table 14-10 |

Kababisa Mineralised Domain Assay and Composite Comparison |

120 | ||||

| Table 14-11 |

Chimiwungo Copper Top-cut and High-grade Yield Summary |

122 | ||||

| Table 14-12 |

Kababisa Copper Top-cut and High-grade Yield Summary |

122 |

|

February 19, 2025 |

Page vi |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| Table 14-13 |

Malundwe Copper Top-cut and High-grade Yield Summary |

123 | ||||

| Table 14-14 |

Kamisengo Copper Top-cut and High-grade Yield Summary |

123 | ||||

| Table 14-15 |

Block Model Parameters |

124 | ||||

| Table 14-16 |

Chimiwungo ‘Geol = 21’ Fresh Copper Estimation Parameters |

129 | ||||

| Table 14-17 |

Malundwe ‘Geol = 3’ Fresh Copper Estimation Parameters |

129 | ||||

| Table 14-18 |

Kamisengo ‘Geol = 10 and 20’ Mineralised Fresh Copper Estimation Parameters |

130 | ||||

| Table 14-19 |

Kababisa Mineralised Fresh Copper Estimation Parameters |

130 | ||||

| Table 14-20 |

Comparison of Sample and Estimated Grades in the Chimiwungo Main Mineralisation Domains (RC Area) |

132 | ||||

| Table 14-21 |

Comparison of Sample and Estimated Grades in the Malundwe Main Mineralisation Domains (RC Area) |

133 | ||||

| Table 14-22 |

Comparison of Sample and Estimated Grades in the Kamisengo Mineralisation Domains (Inferred Area) |

133 | ||||

| Table 14-23 |

Comparison of Sample and Estimated Grades in the Kababisa Mineralisation Domains (Inferred Area) |

133 | ||||

| Table 14-24 |

Lumwana Mineral Resource Classification Criteria |

136 | ||||

| Table 14-25 |

Resource Cut-off Grade Calculations |

141 | ||||

| Table 14-26 |

Lumwana Mineral Resource Estimate as of December 31, 2024 |

143 | ||||

| Table 14-27 |

Chimiwungo 2024 vs. 2023 Mineral Resource Comparison |

144 | ||||

| Table 14-28 |

Malundwe 2024 vs. 2023 Mineral Resource Comparison |

144 | ||||

| Table 14-29 |

Kamisengo 2024 vs 2023 Mineral Resource Comparison |

145 | ||||

| Table 15-1 |

Summary of Lumwana Mineral Reserve Estimate as of December 31, 2024 |

148 | ||||

| Table 15-2 |

Summary of Lumwana Pit Optimisation Parameters |

151 | ||||

| Table 15-3 |

Minimum Block Size |

152 | ||||

| Table 15-4 |

GCO Dilution and Recovery Summary |

152 | ||||

| Table 15-5 |

Lumwana 2024 Year-End Reconciliation Performance |

153 | ||||

| Table 15-6 |

Historic Reconciliation Performance |

154 | ||||

| Table 15-7 |

Overall Slope Angles for Pit Optimisation |

155 | ||||

| Table 15-8 |

Chimiwungo Pit Optimisation Results |

157 | ||||

| Table 15-9 |

Malundwe Pit Optimisation Results |

158 | ||||

| Table 15-10 |

Kamisengo Pit Optimisation Results |

159 | ||||

| Table 15-11 |

Kababisa Pit Optimisation Results |

159 | ||||

| Table 15-12 |

Comparison of Optimised Pit Shells and Final Pit Designs |

165 | ||||

| Table 15-13 |

Summary of Lumwana Mineral Reserve Estimate as of December 31, 2024 |

167 | ||||

| Table 15-14 |

Comparison to 2023 Mineral Reserve Statement |

169 | ||||

| Table 16-1 |

Length of Geotechnical Logged Core |

173 | ||||

| Table 16-2 |

Chimiwungo Slope Design Parameters |

176 | ||||

| Table 16-3 |

Malundwe Slope Design Parameters |

178 | ||||

| Table 16-4 |

Kamisengo Slope Design Parameters |

179 | ||||

| Table 16-5 |

Kababisa Slope Design Domains |

179 | ||||

| Table 16-6 |

Dump Design Parameters |

180 | ||||

| Table 16-7 |

In-Pit Dump Design Parameters |

180 | ||||

| Table 16-8 |

Waste Dump Design Summary |

190 | ||||

| Table 16-9 |

Long-term Stockpile Summary |

195 | ||||

| Table 16-10 |

Life of Mine Equipment Requirement Summary |

196 | ||||

| Table 16-11 |

Equipment Availability and Utilisation Inputs |

197 | ||||

| Table 16-12 |

Equipment Productivity Assumptions |

197 | ||||

| Table 16-13 |

Summary of LOM Production Schedule |

200 | ||||

| Table 17-1 |

Estimated Annual Power Consumption of Major Process Equipment Following the Completion of the Expansion Project |

216 |

|

February 19, 2025 |

Page vii |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| Table 17-2 |

Summary of Annual Reagents for the Process Plant Following the Expansion Project |

217 | ||||

| Table 17-3 |

Summary of Annual Consumables for the Process Plant Following the Expansion Project |

217 | ||||

| Table 20-1 |

Key E&S Impact Summary |

248 | ||||

| Table 20-2 |

Annual Costs Included in G&A Costing for Environmental Management |

254 | ||||

| Table 21-1 |

Exchange Rates and Exposure |

261 | ||||

| Table 21-2 |

Capital Cost Estimate Summary – Including Non-Expansion Capital Items |

262 | ||||

| Table 21-3 |

Construction Capital Expenditure Summary by Area (2025 to 2028) |

263 | ||||

| Table 21-4 |

Growth Capital Expenditure Summary |

263 | ||||

| Table 21-5 |

Sustaining Capital Expenditure Summary |

264 | ||||

| Table 21-6 |

LOM Average Unit Operating Costs Summary |

265 | ||||

| Table 22-1 |

Sliding Scale of the Applicable Royalty Rates |

270 | ||||

| Table 22-2 |

Lumwana Expansion Before and After-Tax Annual Cash Flow Summary at Barrick Reserve Case Price (3.00$/lb Cu) |

273 | ||||

| Table 22-3 |

Lumwana Expansion Before and After-Tax Annual Cash Flow Summary at 3-year trailing average Cu price ($4.03/lb Cu) |

276 | ||||

| Table 22-4 |

Lumwana Expansion Case Financial Model Summary at Barrick Reserve Price ($3.00/lb Cu), and 3 year trailing average Cu price ($4.03/lb) |

279 | ||||

| Table 22-5 |

After-Tax Copper Price Sensitivity Analysis Results |

280 | ||||

| Table 25-1 |

Expansion Project Risk Summary |

291 |

List of Figures

| Figure 1-1 |

Layout of Expansion Project Planned Infrastructure |

14 | ||||

| Figure 4-1 |

Lumwana Location Map |

31 | ||||

| Figure 4-2 |

Lumwana Mining Licences and Surface Rights |

33 | ||||

| Figure 5-1 |

Monthly Average Temperature and Precipitation for North-Western Province, Zambia |

39 | ||||

| Figure 5-2 |

Lumwana Mine Existing Infrastructure |

41 | ||||

| Figure 7-1 |

Geological Map of the Central African Copperbelt highlighting Key Geological Features and Lithological Boundaries |

46 | ||||

| Figure 7-2 |

Local Geology of the Kabompo and Mwombezhi Domes Area |

47 | ||||

| Figure 7-3 |

Lumwana Property Geology |

49 | ||||

| Figure 7-4 |

Chimiwungo Geological Cross-section 378600mE (Looking East) |

50 | ||||

| Figure 7-5 |

Malundwe Geological Cross-section 8644975mN (Looking South) |

51 | ||||

| Figure 7-6 |

Kamisengo Geological Cross-section 8656100mN (Looking North) |

52 | ||||

| Figure 7-7 |

Kababisa Geological Cross-section 8652500mN (Looking North) |

54 | ||||

| Figure 9-1 |

Lumwana Main Deposits and Exploration Prospects |

58 | ||||

| Figure 9-2 |

Lumwana Regolith Map: Residual Soils (Rp), Erosional (Eo & Ep), Ferruginous (Fp), Possible Thin Duricrust, Depositional (Da & Dc) |

60 | ||||

| Figure 9-3 |

Kamisengo Soil Samples and Regolith Map: Residual Soils (Rp), Erosional (Eo & Ep), Ferruginous (Fp), Possible Thin Duricrust, Depositional (Da & Dc) |

62 | ||||

| Figure 10-1 |

Plan View Map of Drilling at Chimiwungo |

67 | ||||

| Figure 10-2 |

Representative Cross-section Chimiwungo 378600 mE (Looking East) |

68 | ||||

| Figure 10-3 |

Plan View Map of Drilling at Malundwe |

69 | ||||

| Figure 10-4 |

Representative Cross-section at Malundwe 8645300mN (Looking North) |

70 | ||||

| Figure 10-5 |

Plan View Map of Drilling at Kamisengo |

71 | ||||

| Figure 10-6 |

Representative Cross-section at Kamisengo 8656100 mN (Looking North) |

72 | ||||

| Figure 10-7 |

Plan View Map of Drilling at Kababisa |

73 |

|

February 19, 2025 |

Page viii |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| Figure 10-8 |

Representative Cross-section at Kababisa 8652500 m N (Looking North) |

74 | ||||

| Figure 11-1 |

Copper (%) for CRMs at SGS Kalulushi |

80 | ||||

| Figure 11-2 |

Copper (%) for CRMs at SGS Lumwana Laboratory |

80 | ||||

| Figure 11-3 |

Copper (%) for CRMs at Bureau Veritas Laboratory |

81 | ||||

| Figure 11-4 |

Copper (%) for CRMs at ALS Johannesburg Laboratory |

81 | ||||

| Figure 11-5 |

Copper (%) for Blanks Submitted at SGS Kalulushi |

82 | ||||

| Figure 11-6 |

Copper (%) for Blanks Submitted at SGS Lumwana |

83 | ||||

| Figure 11-7 |

Copper (%) for Blanks Submitted at BV Laboratory |

83 | ||||

| Figure 11-8 |

Copper (%) for Blanks Submitted at ALS Laboratory |

84 | ||||

| Figure 11-9 |

HARD Plot of DD Field Duplicates Assayed by SGS Kalulushi |

85 | ||||

| Figure 11-10 |

HARD Plot of Pulp Duplicates Assayed by SGS Lumwana |

86 | ||||

| Figure 11-11 |

Log Scatter Plot of Samples Analysed at SGS Laboratories and ALS Chemex Umpire Laboratory |

87 | ||||

| Figure 13-1 |

Chimiwungo Metallurgical Test Work Sample Locations |

92 | ||||

| Figure 13-2 |

Malundwe Metallurgical Test Work Sample Locations |

93 | ||||

| Figure 13-3 |

Kamisengo Metallurgical Test Work Sample Locations |

94 | ||||

| Figure 13-4 |

Kababisa Metallurgical Test Work Sample Locations |

95 | ||||

| Figure 13-5 |

Open Circuit Flotation Test Work Flowsheet |

98 | ||||

| Figure 13-6 |

Summary of Phase 1 Open Circuit Flotation Test Work Results |

99 | ||||

| Figure 13-7 |

Summary of Existing Processing Plant Throughput, Head Grade and Tails Grade |

102 | ||||

| Figure 13-8 |

Summary of Existing Processing Plant Copper Recovery and Concentrate Grades |

103 | ||||

| Figure 13-9 |

Relationship between Concentrate Grades and Head Grades |

104 | ||||

| Figure 13-10 |

Relationship between Recovery and Head Grades |

104 | ||||

| Figure 13-11 |

Relationship between Grade and Recovery for 2019 to 2022 |

105 | ||||

| Figure 13-12 |

Variation of Mill Throughput from August 2023 to July 2024 |

105 | ||||

| Figure 13-13 |

Variation of Copper Recovery from August 2023 to July 2024 |

106 | ||||

| Figure 13-14 |

Variation of Copper Concentrate Grade from August 2023 to July 2024 |

106 | ||||

| Figure 13-15 |

Variation of Head Grade from August 2023 to July 2024 |

107 | ||||

| Figure 13-16 |

FS Test Work Recovery and Actual Plant Recoveries for Chimiwungo and Malundwe |

108 | ||||

| Figure 14-1 |

QQ Plot for DD-RC Pairs within 2 m |

115 | ||||

| Figure 14-2 |

3D Model of MS Domains and Faults at Chimiwungo (Looking North East) |

116 | ||||

| Figure 14-3 |

Chimiwungo Fresh Density for Copper Grade Bins |

118 | ||||

| Figure 14-4 |

Malundwe Fresh Density for Copper Grade Bins |

119 | ||||

| Figure 14-5 |

Experimental Semi-variograms and Semi-variogram Models for Chimiwungo Main MS |

125 | ||||

| Figure 14-6 |

Experimental Semi-variograms and Semi-variogram Models for Malundwe Main MS |

126 | ||||

| Figure 14-7 |

Experimental Normal Scores Semi-variograms and Semi-variogram Model for Kamisengo Combined MS Domains 30, 40, 50, 60 and 70 |

127 | ||||

| Figure 14-8 |

Experimental Normal Scores Semi-variograms and Semi-variogram Models for Kababisa Combined MS |

128 | ||||

| Figure 14-9 |

Chimiwungo Block Model within the Mineral Resource Pit Shell (Looking North East) |

131 | ||||

| Figure 14-10 |

Contact Profile Plot between Oxide, Transitional, and Fresh MS at Chimiwungo |

131 | ||||

| Figure 14-11 |

Contact Profile Plot between Mineralised and Waste Domains at Chimiwungo |

132 | ||||

| Figure 14-12 |

Chimiwungo Visual Validation of Assay and Estimated Copper Grades – Long Section 378600E (Looking East) |

134 |

|

February 19, 2025 |

Page ix |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| Figure 14-13 |

Chimiwungo Main Domain 11 and 89 Example Swath Plots within GC Drill Campaign |

135 | ||||

| Figure 14-14 |

Chimiwungo Mineral Resource Classification Plan View |

137 | ||||

| Figure 14-15 |

Malundwe Mineral Resource Classification Plan View |

138 | ||||

| Figure 14-16 |

Kamisengo Mineral Resource Classification Plan View |

139 | ||||

| Figure 14-17 |

Kababisa Mineral Resource Classification Plan View |

140 | ||||

| Figure 15-1 |

Chimiwungo Pit Optimisation Tonnage Grade Curve |

160 | ||||

| Figure 15-2 |

Malundwe Pit Optimisation Tonnage Grade Curve |

161 | ||||

| Figure 15-3 |

Kamisengo Pit Optimisation Tonnage Grade Curve |

161 | ||||

| Figure 15-4 |

Chimiwungo Pit Optimisation Mining Cost Sensitivity |

163 | ||||

| Figure 15-5 |

Malundwe Pit Optimisation Mining Cost Sensitivity |

163 | ||||

| Figure 15-6 |

Kamisengo Pit Optimisation Mining Cost Sensitivity |

164 | ||||

| Figure 15-7 |

Chimiwungo Super-Pit Design with Existing Open Pits and Estimated Copper Grades |

168 | ||||

| Figure 16-1 |

Slope Stability Section Locations in the Chimiwungo Pit |

175 | ||||

| Figure 16-2 |

Chimiwungo Fresh Rock Design Domains |

177 | ||||

| Figure 16-3 |

Kamisengo Fresh Rock Design Domains |

178 | ||||

| Figure 16-4 |

Final Pit Design for Chimiwungo |

182 | ||||

| Figure 16-5 |

Final Pit Design for Malundwe |

183 | ||||

| Figure 16-6 |

Final Pit Design for Kamisengo |

184 | ||||

| Figure 16-7 |

Final Pit Design for Kababisa |

185 | ||||

| Figure 16-8 |

Basic Mining Layout of Chimiwungo and the Super-Pit |

187 | ||||

| Figure 16-9 |

Basic Mining Layout of Malundwe |

188 | ||||

| Figure 16-10 |

Basic Mining Layout of Kamisengo |

189 | ||||

| Figure 16-11 |

Chimiwungo Planned Waste Dumps |

191 | ||||

| Figure 16-12 |

Malundwe Planned Waste Dumps |

192 | ||||

| Figure 16-13 |

Kamisengo Planned Waste Dumps |

193 | ||||

| Figure 16-14 |

Kababisa Planned Waste Dumps |

194 | ||||

| Figure 16-15 |

Production Schedule for the LOM |

201 | ||||

| Figure 17-1 |

Process Flow Diagram of the Existing Processing Plant |

205 | ||||

| Figure 17-2 |

Process Flow Diagram for the Expansion Project |

206 | ||||

| Figure 18-1 |

Layout of Expansion Project Planned Infrastructure |

220 | ||||

| Figure 18-2 |

Layout of Existing and Planned TSF and Water Management Infrastructure |

224 | ||||

| Figure 20-1 |

Environmental and Social Impact Assessment Process Followed |

247 | ||||

| Figure 20-2 |

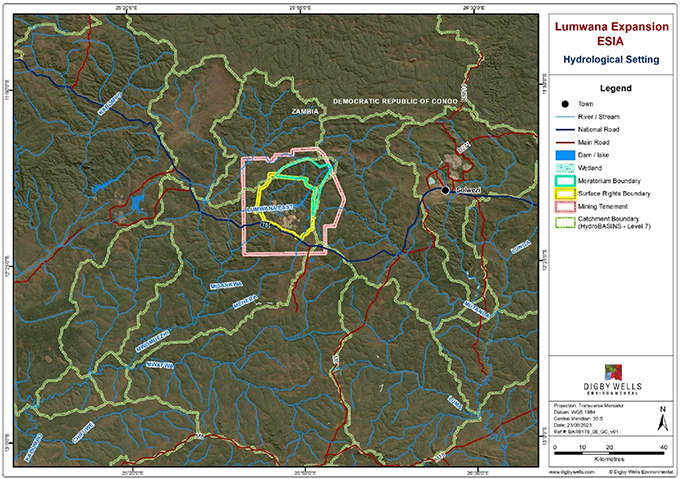

Hydrological Setting of the Expansion Project Development Area |

254 | ||||

| Figure 20-3 |

Communities and Social Infrastructure |

255 | ||||

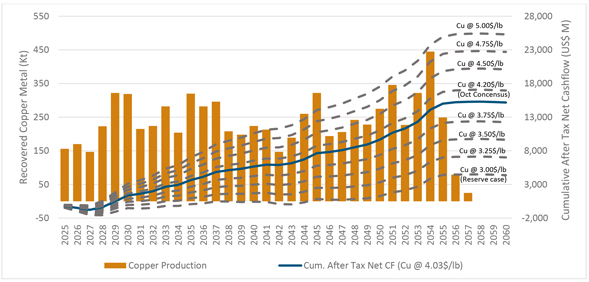

| Figure 22-1 |

Cumulative After-Tax Net Cash Flow |

271 | ||||

| Figure 22-2 |

After-Tax Sensitivity Analysis Results to NPV8% |

281 | ||||

| Figure 22-3 |

After-Tax Sensitivity Analysis Results to IRR |

281 |

|

February 19, 2025 |

Page x |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 1 | Summary |

This Technical Report on the Lumwana Open Pit Copper Mine (Lumwana, Lumwana Mine, or the Mine), located in the North-Western Province of the Republic of Zambia has been prepared by Barrick Gold Corporation (Barrick). The purpose of this Technical Report is to support public disclosure of the Feasibility Study (FS) completed on the Lumwana Expansion Project (the Expansion Project) and updated Mineral Resource and Mineral Reserve estimates as of December 31, 2024. This Technical Report conforms to National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

Barrick is a Canadian publicly traded mining company with a portfolio of operating mines and advanced exploration and development projects. Barrick is the issuer of this Technical Report and is the 100% shareholder in Zambian registered Lumwana Mining Company Limited (LMC), an exploration and mining company, and the owner of the Mine.

Lumwana is an operating mine with two open pits, Chimiwungo and Malundwe, a conventional sulphide flotation processing plant, and associated infrastructure. In 2024, Barrick completed an FS for the Expansion Project (Barrick, 2024b), which entails an expansion of the current mining operations at Chimiwungo and Malundwe, the opening of two new open pits at Kamisengo and Kababisa, the expansion of the current processing plant, tailings and water supply infrastructure, and an upgrade of existing site infrastructure. As of December 31, 2024, the total Proven and Probable Mineral Reserves are estimated to be 1,600 million tonnes (Mt) at 0.52% Cu for 8.3 Mt Cu. Proven and Probable Mineral Reserves have increased from 510 Mt in 2023 to 1,600 Mt. The increase in Mineral Reserves, presented in the FS, represents a 180% increase in contained copper since 2023. The expansion will substantially increase the mine’s production capacity, extending its operational life by 17 years to 2057, and doubling the capacity of the processing plant from 27 million tonnes per annum (Mtpa) to a peak design of 54 Mtpa, with 52 Mtpa feed targeted for the production schedule. Annual copper output will increase from the current range of 120 thousand tonnes (kt) to 140 kt, to an average of 240 kt annually over life of mine, and will bring Lumwana to the top 25 copper producers globally (CIBC, 2024).

All costs presented in this document are in USD (US$ or $) unless otherwise noted.

| 1.1 | Description, Location, and Ownership |

| 1.1.1 | Location |

The Mine is located in the North-Western Province of Zambia approximately 60 km west from the provincial capital of Solwezi and 400 km northwest of the national capital, Lusaka. The Mine is

|

February 19, 2025 |

Page 1 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

covered by six large scale mining licences (the Mining Licences) with a total area of 1,192 km2. The Mining Licences are held by LMC.

The Mine is situated within a degazetted area of the Acres National Forest 105 (National Forest), where LMC owns the surface rights. Some of the planned Expansion Project infrastructure, including the Kamisengo Inflow Control Dam (KICD) and the Kamisengo open pit, are situated in an 8,800 ha area of the National Forest, which has not been degazetted, and will require obtaining permission and a licence to operate within the National Forest. LMC is in the process of submitting an application to obtain permission and licence to operate in a National Forest, as well as acquiring surface rights, with approval expected before the end of 2025.

| 1.1.2 | Ownership |

Barrick is a Canadian publicly traded gold and copper mining company with a portfolio of operating mines and projects across North America, Africa, South America, and Asia.

LMC is 100% owned by Barrick.

| 1.1.3 | History |

Copper mineralisation was initially discovered in the 1930s with exploration and mining studies completed between the 1950s and 1990s by previous owners including Roan Selection Trust Limited (RST), Azienda General Italiana Petroli (AGIP), and Phelps Dodge Corporation (Phelps Dodge). The Mine was brought into production in 2008 by Equinox Copper Ventures (Equinox) which was acquired by Barrick in 2011.

The first commercial copper production was achieved in 2009 and total production to 2024 is 352.13 Mt milled at a 0.57% Cu head grade for 1,845 thousand tonnes (kt) Cu (91.84% recovery).

| 1.2 | Geology and Mineralisation |

The copper deposits at Lumwana are large, tabular bodies of disseminated mineralisation, which are often referred to as basement hosted copper deposits. They are hosted within the Mwombezhi Dome, which is part of the Domes Region of the Lufilian Arc. The Domes Region is part of the Central African Copperbelt, which is a metallogenic province in the border region of Zambia and the Democratic Republic of the Congo. The deposits are characterised by pyrite, chalcopyrite, and occasional bornite, which is typically associated with higher copper grades. The mineralisation is hosted within either biotite or muscovite dominant schists.

|

February 19, 2025 |

Page 2 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

There are four main deposits at Lumwana. The principal deposit is Chimiwungo, with additional deposits Malundwe (6 km northwest of Chimiwungo), Kamisengo (14 km NNE of Chimiwungo), and Kababisa (10 km NNW of Chimiwungo). The deposits generally comprise a hanging wall gneiss, a mineralised schist containing barren gneiss, and a footwall gneiss, with Kamisengo being more geometrically complex than the other three deposits. All have relatively shallow dips between 5° and 25° and extend from surface to maximum depths of between 250 m and 950 m.

| 1.3 | Exploration Status |

Significant exploration has been undertaken over the life of the Mine. This exploration has included geological mapping, soil geochemistry, ground and airborne geophysics, and exploration drilling targeting near surface mineralisation, and has led to the discovery of the four main deposits, as well as other exploration prospects.

Exploration completed since 2022 has focused on delineating mineralisation in areas where significant infrastructure is planned for the Expansion Project. Sufficient exploration has now been completed to ensure that potential mineralisation will not be impacted by planned infrastructure.

Further exploration will focus on understanding the geology and structural controls at the Greater Odile prospect located approximately 3 km west of Malundwe.

| 1.4 | Mineral Resource Estimate |

The Mineral Resource estimates have been prepared according to the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) 2014 Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) Standards) as incorporated with NI 43-101. Mineral Resource estimates were also prepared using the guidance outlined in CIM Estimation of Mineral Resources and Mineral Reserves (MRMR) Best Practice Guidelines 2019 (CIM (2019) MRMR Best Practice Guidelines).

Significant drilling, including 290,908 m of diamond drilling (DD) and 448,541 m reverse circulation (RC) drilling, has been completed to further define the extent, continuity, and structural controls on mineralisation at each of the four main deposits. Information gained from drilling, and supported by operational knowledge, has been used to produce geological models for Mineral Resource estimation.

The current Mineral Resource estimate consists of surface stockpiles and in-situ open pit material from four deposits; Chimiwungo, Malundwe, Kamisengo, and Kababisa. The open pit Mineral Resources are those that demonstrate reasonable prospects for eventual economic extraction

|

February 19, 2025 |

Page 3 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

(RPEEE). These are defined as those above the in-situ marginal cut-off grade within a pit shell using a copper price of US$4.00/lb Cu.

Since 2023 there have been changes to the Mineral Resource through exploration and drilling, including extensions to the existing Chimiwungo, Malundwe and Kamisengo deposits, and the reporting of new Mineral Resource estimates for Kababisa. There has also been depletion of the previously estimated Mineral Resources through mining at the Chimiwungo and Malundwe open pits and processing of stockpiled ore.

Table 1-1 summarises the Lumwana Mineral Resources, inclusive of Mineral Reserves, as of December 31, 2024.

The Measured and Indicated Mineral Resources have increased by 41% (2.9 Mt Cu) and the Inferred Mineral Resources have decreased by 77% (3.1 Mt Cu) since 2023.

The estimate was reviewed internally as well as externally and approved by the Qualified Person (QP) and Barrick prior to release. The QP is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, metallurgical, fiscal, or other relevant factors that are not discussed in this Technical Report, that could materially affect the Mineral Resource estimate.

|

February 19, 2025 |

Page 4 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Table 1-1 Lumwana Mineral Resource Estimate as of December 31, 2024

| Measured | Indicated | Measured + Indicated | Inferred | |||||||||||||||||||||

|

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

|||||||||||||

| Stockpiles |

20 | 0.32 | 0.064 | - | - | - | 20 | 0.32 | 0.064 | - | - | - | ||||||||||||

| Chimiwungo |

130 | 0.43 | 0.56 | 1,300 | 0.55 | 7.1 | 1,400 | 0.53 | 7.6 | 180 | 0.4 | 0.74 | ||||||||||||

| Kababisa |

- | - | - | 7.2 | 0.39 | 0.028 | 7.2 | 0.39 | 0.028 | 0.14 | 0.4 | 0.00056 | ||||||||||||

| Kamisengo |

- | - | - | 350 | 0.32 | 1.1 | 350 | 0.32 | 1.1 | 40 | 0.3 | 0.13 | ||||||||||||

| Malundwe |

24 | 0.64 | 0.15 | 180 | 0.57 | 1.0 | 200 | 0.58 | 1.2 | 11 | 0.4 | 0.046 | ||||||||||||

|

Open Pit Subtotal |

150 | 0.46 | 0.71 | 1,800 | 0.50 | 9.2 | 2,000 | 0.50 | 9.9 | 230 | 0.4 | 0.91 | ||||||||||||

| Total |

170 | 0.45 | 0.77 | 1,800 | 0.50 | 9.2 | 2,000 | 0.50 | 10.0 | 230 | 0.4 | 0.91 | ||||||||||||

Notes:

| ● | Mineral Resources are reported on a 100% basis. |

| ● | The Mineral Resource estimate has been prepared according to CIM (2014) Standards and using CIM (2019) MRMR Best Practice Guidelines. |

| ● | All Mineral Resource tabulations are reported inclusive of that material which is then modified to form Mineral Reserves. |

| ● | Open pit Mineral Resources are those within a US$4.00/lb pit shell at a cut-off grade of 0.13% Cu for both transitional and fresh mineralisation. |

| ● | The Mineral Resource has been depleted with mined surfaces up to December 31, 2024. |

| ● | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| ● | Mineral Resources were reviewed by Richard Peattie, FAusIMM, an employee of Barrick and QP. |

| ● | Numbers may not add due to rounding. Tonnes and contained copper are rounded to 2 significant figures. All Measured and Indicated grades are reported to 2 decimal places whilst Inferred Mineral Resource grades are reported to 1 decimal place. |

|

February 19, 2025 |

Page 5 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 1.5 | Mineral Reserve Estimate |

The Mineral Reserve estimates have been prepared according to the Canadian Institute of Mining, Metallurgy and Petroleum 2014 Definition Standards for Mineral Resources and Mineral Reserves dated 10 May 2014 (CIM (2014) Standards) as incorporated with National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). Mineral Reserve estimates were also prepared using the guidance outlined in CIM Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines 2019 (CIM (2019) MRMR Best Practice Guidelines).

The Mineral Reserves have been estimated from the Measured and Indicated Mineral Resources and do not include any Inferred Mineral Resources.

Mineral Reserves were estimated following pit optimisation, pit design, and the development of a Life of Mine (LOM) schedule. The optimisation was based on the 2024 Mineral Resource models and the geotechnical and cost outputs from FS updates of the prior Pre-feasibility Study (PFS), (Barrick, 2024a). For optimisation, the Mineral Resource block model was converted into selective mining units using software that performed an economic evaluation of various combinations of resource blocks, and flagged material as ore or waste. That output allowed planned dilution and waste to be included and was used for optimisation and scheduling work. Metallurgical recoveries were based on the last five years of processing plant data and additional PFS and FS test work. Validations were performed to ensure that the difference between the final FS outputs and the early study inputs did not materially change the optimisation work.

The Mineral Reserve estimate, as of December 31, 2024 consists of surface stockpiles and in-situ open pit material from four deposits: Chimiwungo, Malundwe, Kababisa, and Kamisengo. Open pit Mineral Reserves are reported at a copper price of $3.00/lb Cu.

2024 Mineral Reserves have increased substantially from 2023. The increase was driven by the inclusion of additional Indicated Mineral Resources due to infill and resource definition drilling and changes to the pit optimisation and design at Chimiwungo and Malundwe made as part of the FS. The addition of Kamisengo and Kababisa to the Mineral Reserves also contributed to the increase.

A summary of the Mineral Reserves is shown in Table 1-2.

The total Proven and Probable Mineral Reserves are estimated to be 1,600 Mt at 0.52% Cu for 8.3 Mt Cu. Proven and Probable Mineral Reserves have increased from 510 Mt in 2023 to 1,600 Mt. This results in an increase in contained copper of 180% since 2023. Chimiwungo contains approximately 78% of the total copper processed, followed by Malundwe with 12% and Kamisengo with 10%. Kababisa contains 0.3% of the total and is considered a satellite deposit.

|

February 19, 2025 |

Page 6 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

The estimate was reviewed internally as well as externally and approved by the QP and Barrick prior to release. The QP is not aware of any mining, metallurgical, infrastructure, permitting, or other relevant factors which could materially affect the Mineral Reserve estimates.

|

February 19, 2025 |

Page 7 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Table 1-2 Summary of Lumwana Mineral Reserve Estimate as of December 31, 2024

| Source | Proven | Probable | Total | |||||||||||||||||

|

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

Tonnes (Mt) |

Grade % Cu) |

Contained Metal (Mt Cu) |

Tonnes (Mt) |

Grade (% Cu) |

Contained Metal (Mt Cu) |

||||||||||||

|

Stockpiles |

ROM Pad Chimiwungo | 18 | 0.32 | 0.057 | - | - | - | 18 | 0.32 | 0.057 | ||||||||||

| ROM Pad Malundwe | 1.6 | 0.34 | 0.0056 | - | - | - | 1.6 | 0.34 | 0.0056 | |||||||||||

| COS | 0.18 | 0.85 | 0.0015 | - | - | - | 0.18 | 0.85 | 0.0015 | |||||||||||

| Stockpile Subtotal | 20 | 0.32 | 0.064 | - | - | - | 20 | 0.32 | 0.064 | |||||||||||

| Open Pit |

Malundwe | 18 | 0.72 | 0.13 | 140 | 0.60 | 0.83 | 160 | 0.61 | 0.96 | ||||||||||

| Chimiwungo | 100 | 0.48 | 0.48 | 1,100 | 0.56 | 6 | 1,200 | 0.55 | 6.5 | |||||||||||

| Kamisengo | 240 | 0.34 | 0.82 | 240 | 0.34 | 0.82 | ||||||||||||||

| Kababisa | 5.3 | 0.43 | 0.023 | 2.3 | 0.43 | 0.023 | ||||||||||||||

| Open Pit Subtotal | 118 | 0.52 | 0.62 | 1,500 | 0.53 | 7.6 | 1,600 | 0.53 | 8.3 | |||||||||||

|

Total |

140 | 0.49 | 0.67 | 1,500 | 0.53 | 7.6 | 1,600 | 0.52 | 8.3 | |||||||||||

Notes:

| ● | Mineral Reserves are reported on a 100% basis. |

| ● | The Mineral Reserve estimate has been prepared according to CIM (2014) Standards and using CIM (2019) MRMR Best Practice Guidelines . |

| ● | Open Pit Mineral Reserves are reported at a copper price of $3.00/lb, and at a pit rim cut-off grade of 0.14% Cu |

| ● | Dilution and losses were applied through the Grade Control Optimiser (GCO) process. |

| ● | The Mineral Reserve estimate was reviewed by Derek Holm, FAusIMM, an employee of Barrick and QP. |

| ● | Numbers may not add due to rounding. Tonnes and contained metal are rounded to 2 significant figures, whilst Proven and Probable grades are reported to 2 decimal places. |

|

February 19, 2025 |

Page 8 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 1.6 | Mining Methods |

Current operations involve open pit mining of two deposits, Chimiwungo, which comprises three individual open pits; Chimiwungo West, Chimiwungo East, and Chimiwungo South, and Malundwe. Total mine production in 2024 was 141 Mt, of which 26.0 Mt was ore at a grade of 0.55% Cu.

As part of the Expansion Project, both Chimiwungo and Malundwe will be expanded, resulting in the three open pits at Chimiwungo being merged into a single large ‘Super-Pit’. Additionally, two new satellite open pits, Kababisa and Kamisengo, will be developed from 2035 and 2036 respectively.

The ramp-up from the current mining capacity of 157 million tonnes per annum (Mtpa) takes an initial step to over 200 Mtpa in 2026, then a later step to approximately 300 Mtpa in 2030. A further step up takes place in 2039, when production attains the peak rate of approximately 354 Mtpa.

The LOM, based on the FS and Mineral Reserve estimate, increases from the current 16 years to 33 years, ending in 2057, with the final two years allocated only to stockpile processing.

Open pit mining is carried out using conventional drill, blast, load, and haul surface mining methods, with extensive grade control drilling completed prior to mining. There will be no major changes to this method for the Expansion Project.

Mining is undertaken with two fleets, the pre-strip fleet (120 t to 200 t shovels, 91 t trucks) that mines oxide material and the smaller pits, and main ultra class fleet (700 t to 800 t shovels, 290 t trucks) that mines fresh waste and ore in the larger pits. Ore is fresh sulphide material (oxide material is sent to waste) which is currently hauled to two run-of-mine (ROM) pads.

For the Expansion Project, a new pit rim crusher is planned to the north of Chimiwungo in 2027, with a later in-pit crusher also planned in 2031 on completion of CE-4 pushback. These will allow increased volumes to be crushed and also reduce ore haulage distances and subsequent mining costs. A new crusher is also planned to be constructed at Kamisengo in 2035, and Kababisa ore will be trucked to the existing Malundwe crusher.

LMC owns and operates the pre-strip and production load and haul equipment. Explosives and blasting services are supplied through a down-the-hole contract with an explosive provider, Maxam.

| 1.6.1 | Geotechnical |

The open pits are primarily composed of fresh, stable rock, with a transitional layer above, and a soft saprolite cap at the surface. The saprolite requires dewatering to support steeper slope angles, whereas the fresh rock below is robust and generally allows for relatively steep pit walls.

|

February 19, 2025 |

Page 9 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Comprehensive geotechnical assessments, including detailed testing and stability analysis, have been conducted across all deposits. Due to the rock’s competency, slope design is primarily constrained by catch berm requirements to manage rockfall risk. However, in saprolite areas, slope angles are further constrained by the rock’s inherent low strength. Double-benching, where feasible, has been recommended and significantly increases slope angles. A programme is underway to improve blasting and therefore enable double benching, which will be increasingly required from 2027. Three-dimensional (3D) modelling work confirmed the viability of the proposed Chimiwungo ‘Super-Pit’ and waste dump designs, with only small changes required.

| 1.6.2 | Hydrogeology |

The groundwater table in the saprolite is generally shallow, with pre-mining levels averaging 2 m to 10 m below the surface. Effective depressurisation in the saprolite zones is essential for slope stability and safe mining at steeper angles. Active pumping from strategically placed perimeter wells along the pit crest has proven effective in drawing down groundwater to the targeted levels. Most water inflows are attributed to surface water infiltration from rainfall, but certain natural fractures also allow water inflow through the fresh rock.

A monitoring network with groundwater observation points has been established around the Chimiwungo open pits. Piezometers are being installed at Malundwe and the two new open pit locations, Kamisengo and Kababisa. Robust hydrogeological models are in place for Chimiwungo, and development of a similar model that will encompass Malundwe, Kamisengo, and Kababisa is underway.

| 1.6.3 | Design and Schedule |

Pit designs were based on the selected optimised pit shells. Pushbacks were kept large enough to support effective production, but small enough to produce a reasonable ore delivery profile that does not require overly large long-term stockpiles.

Waste dumps were placed as close to the pits as possible without sterilising future pushbacks, with 25% of the planned waste placed into in-pit dumps in areas where the mineralisation is completely mined out. Dumping was sequenced to follow the mining faces as closely as possible.

The expanded process plant has a peak design capacity of 54 Mtpa, with 52 Mtpa targeted for the production schedule. In 2028, the first year the expanded plant will operate, 48 Mt will be processed due to commissioning of the expanded processing plant. These ore targets are supported by a ramp-up in mining starting in 2026.

Chimiwungo is the mainstay of production and is mined for the LOM. It contains 1,164 Mt of ore at a head grade of 0.55% Cu and strip ratio of 5.0. Malundwe will continue to be mined until 2048 and

|

February 19, 2025 |

Page 10 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Kamisengo will start in 2036. Malundwe contains 157 Mt of ore at 0.61% Cu and a strip ratio of 7.0, while Kamisengo contains 244 Mt of ore at a grade of 0.34% Cu and a strip ratio of 1.7. Annual copper output will increase from the current range of 120 kt to 140 kt, to between 200 kt to 300 kt at an average of 240 kt.

Overall, 1.57 Bt of ore will be mined over the LOM at 0.53% Cu, with 7.33 Bt of waste, for an overall strip ratio of 4.7.

| 1.6.4 | Mining Equipment |

The current ultra class fleet and the split of a pre-strip and main production fleet will be retained for the Expansion Project. At peak capacity, in 2045, the plan requires 91 x 300 t trucks, 15 x 700 t shovels, and 38 x blast hole rigs, increasing from the current fleet size of 49 x 300 t trucks, 6 x 700 t shovels, and 28 x blast hole rigs. The ratio of support equipment to production equipment will be increased to sustain high volumes of production and the geographical spread of mining. Primary fleet was based on modelled cycle times and the production schedule, while support fleet was based on simpler cycle times or empirical ratios.

Future availability, utilisation, and production rates are based on benchmarked values, with a programme underway to reach those values with the existing equipment. These rates have been achieved during 2024 and will be made more consistent during a two-year transition period.

| 1.7 | Mineral Processing |

The Lumwana processing plant has been operating since 2009 and has consistently produced saleable copper concentrate. It was initially designed for a 20 Mtpa throughput but was expanded to process 27 Mtpa in 2020. The plant consists of two primary crushing facilities, one at Malundwe and one at Chimiwungo, each delivering crushed ore via overland conveyors to a single crushed ore stockpile (COS). Primary crushed ore is drawn from the stockpile and fed to a Semi-autogenous Grinding (SAG)-ball grinding circuit.

The product from the grinding circuit, following classification by cyclone clusters, is fed into two parallel rougher flotation banks. Rougher concentrate is subject to multiple cleaner flotation stages. The final cleaner flotation concentrate is dewatered using a thickener, filtered, and stockpiled to load onto road transport to off-site smelters. Rougher tailings are thickened and pumped to the Tailings Storage Facility (TSF).

To meet increased production, processing rates will be increased from the current 27 Mtpa to 52 Mtpa with peak design capacity of 54 Mtpa. This will be achieved through the construction of a parallel processing plant. The new processing plant will use a similar flowsheet to the current plant

|

February 19, 2025 |

Page 11 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

and will involve the installation of two new primary crushing and overland conveying systems in 2027, with a further in-pit crusher being installed in 2041.

For the FS, metallurgical test work was completed on samples that reflect the ore supply proportions. The test work determined plant parameters required to produce a saleable copper concentrate from the new Kamisengo and Kababisa open pits as well as the extensions to the existing Chimiwungo and Malundwe open pits. No material difference is expected in recovery and concentrate grades between currently processed mineralisation and expected mineralisation to be processed from the expansion.

The expected average recovery is 92.7% copper based on the current LOM plan and test work completed to date. Changes in the feed material characteristics may impact the actual achieved recovery.

| 1.8 | Project Infrastructure |

Lumwana is an established and mature operation that was commissioned in 2008. It has well-developed infrastructure supporting the current operations and detailed plans for additional infrastructure to support the Expansion Project.

The most significant changes to infrastructure are increases in power supply and power infrastructure, a significant increase in capacity of the TSF, and significant changes to the Water Storage Facility (WSF).

Power demand will increase from 60 MVA to 177 MVA. The current peak supply is 65 MVA and a Power Supply Agreement (PSA) with Zambia Electricity Supply Company (ZESCO) has been executed to increase the peak supply to 180 MVA.

In the short term, several upgrades to ZESCO’s network infrastructure will be completed by introducing a static synchronous compensators (STATCOM) at identified locations in close proximity to Lumwana, and constructing an additional 330 kV overhead line from Kalumbila to Lumwana. These measures will increase the available power to Lumwana, without increasing national power generation requirements. The additional available power will be sufficient for the Expansion Project requirements.

Expansion of the existing TSF capacity from 360 Mt to an ultimate capacity of 2 Bt will commence in 2025. The existing WSF will be dewatered and filled with tailings as part of the TSF expansion from 2029. A new WSF, KICD, will be constructed in 2026 upstream of Kamisengo which will divert outflow through a new diversion channel into the Malundwe Stream. The ultimate water storage capacity will be reduced from 65 Mm3 in the current WSF to 40 Mm3 in the new KICD, minimising the affected

|

February 19, 2025 |

Page 12 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

footprint, whilst maintaining the ability to supply water to the operations throughout LOM. Proposed infrastructure is shown in Figure 1-1.

| 1.9 | Market Studies and Contracts |

The Lumwana operations produce a readily saleable copper concentrate.

Zambia has several major copper smelters that process copper concentrates. Projections indicate that domestic smelting capacity will be sufficient to handle the additional concentrate expected from both the Lumwana Expansion Project and the overall increase in supply from the Zambian market.

Given the presence of multiple copper cathode and copper concentrate purchasers within the country, Barrick is not reliant on a single customer for copper sales. Additionally, the option to export concentrate remains available, with no identified barriers to export at this time outside of purely commercial factors being an export fee for which waivers can be applied for.

As of December 31, 2024, the Company had no copper derivative contracts in place. As a result, all of Barrick’s copper production is currently subject to market prices.

While there are numerous contracts in place at Lumwana, there are no contracts, apart from product sales, in place or planned which are considered to be material to Barrick.

| 1.10 | Environmental, Permitting and Social Considerations |

The Lumwana Mine has been operating successfully since 2008. All environmental permits are in place for the existing operations. The Environmental and Social Impact Assessment (ESIA) for the Expansion Project was approved in November 2024 with other permits on schedule for approval prior to commencement of construction.

The Expansion Project requires a significant increase in the footprint of the Mine. As a result, a Resettlement Action Plan (RAP) has been developed for the resettlement of 279 households in Kamisengo and has been submitted to Zambia Environmental Management Agency (ZEMA) with approval expected in Q1 2025. Household agreements for the affected households are more than 95% completed, with the remaining households expected to sign agreements in Q1 2025.

Ongoing management of Environmental and Social (E&S) impacts is completed through the environmental management system (EMS) including management plans, monitoring programmes, internal and external auditing, and implementation of the Reducing Emissions from Deforestation and Forest Degradation in Developing Countries (REDD+) Project.

|

February 19, 2025 |

Page 13 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

Source: Barrick, 2024

Figure 1-1 Layout of Expansion Project Planned Infrastructure

|

February 19, 2025 |

Page 14 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| 1.11 | Capital and Operating Costs |

Lumwana is an operational project with an extensive basis to enable accurate estimation of future capital and operating costs. Cost estimates correspond with an accuracy of +/-15%.

The estimated total capital cost over the LOM is US$14,319 M. This includes construction capital of US$1,998 M to be spent from January 1, 2025 to December 31, 2028, growth capital of US$2,013 M which relates to Expansion Project capital expected to be incurred after December 2028, sustaining capital of US$1,652 M, and capitalised stripping of US$8,656 M.

The operating costs for the LOM were developed considering mining, operating, processing, general and administrative (G&A), downstream, and closure costs. The average LOM unit operating cost is estimated at $18.23/t of processed ore.

| 1.12 | Economic Analysis |

A financial analysis was carried out using a discounted cash flow approach to support the declaration of Mineral Reserves. The model included yearly cash inflows, or revenues, and subtracting yearly cash outflows such as operating costs, capital costs, and taxes.

Financial analysis of the Lumwana Expansion Project results in after-tax net present value (NPV) at a discount rate of 8%, internal rate of return (IRR), and payback periods from 2028 as shown in Table 1-3. LMC is estimated to pay a total of $1,888 M in taxes across the LOM.

Table 1-3 After-Tax Copper Price Sensitivity Analysis Results

| Copper Price |

Cumulative After-Tax Net Cash Flow (US$ Bn) |

After- Tax Bn) |

Project IRR (%) |

Payback Period Post Ramp-up (years) |

||||

| $3.00/lb (Base Case) |

4.4 | 0.2 | 10% | 8 | ||||

| $3.25/lb |

7.0 | 1.1 | 17% | 5 | ||||

| $3.50/lb |

9.6 | 2.0 | 26% | 3 | ||||

| $3.75/lb |

12.3 | 2.9 | 36% | 2 | ||||

| $4.00/lb |

14.9 | 3.8 | 48% | 2 | ||||

| $4.03/lb (3-year trailing average) |

15.2 | 3.9 | 49% | 2 | ||||

| $4.13/lb |

16.2 | 4.3 | 55% | 2 | ||||

| $4.20/lb (Consensus) |

17.0 | 4.5 | 59% | 2 | ||||

| $4.25/lb |

17.5 | 4.7 | 63% | 2 | ||||

| $4.50/lb |

20.1 | 5.6 | 84% | 1 | ||||

| $4.75/lb |

22.7 | 6.5 | 120% | 1 |

|

February 19, 2025 |

Page 15 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| Copper Price |

Cumulative After-Tax Net Cash Flow (US$ Bn) |

After- Tax Bn) |

Project IRR (%) |

Payback Period Post Ramp-up (years) | ||||

| $5.00/lb |

25.3 | 7.4 | 219% | 1 |

Notes:

| 1. | Consensus pricing is based on the Canadian Imperial Bank of Commerce (CIBC) consensus as at August 2024. |

| 1.13 | Interpretations and Conclusions |

The QPs present the following interpretations and conclusions in their respective areas of expertise, based on the review of data available for this Technical Report.

The Project as a whole has been designed to use industry standard practices and deploy conventional technology with many of the technologies already employed by Barrick at other mines they operate, reducing the implementation and operational risks. Where technologies are not employed by Barrick, benchmarked sites have been visited by the Project team to validate equipment selection and adopt best practices. Though new and emerging technologies are not included in the base case, the Project has been designed to allow for the adoption of technologies during the operational phase which, if realised, may result in potential improvements in operational performance from that which is presented in this Technical Report.

| 1.13.1 | Mineral Tenure, Rights, Royalties and Agreements |

| ● | LMC owns the surface rights in the form of a 99 year lease covering the current operations and a majority of the planned infrastructure, including the proposed TSF and Process Plant expansions, and the Chimiwungo, Malundwe and Kababisa open pits. |

| ● | The KICD and the Kamisengo open pit are situated in an area which is within the Acres National Forest 105 and will require either degazetting or obtaining permission and licence to operate in the 8,800 ha of the Acres National Forest 105. LMC’s current surface rights area includes 28,500 ha of Acres National Forest 105 previously degazetted by the President of Zambia in 2009, and as such, subject to obtaining the necessary permission and a licence, LMC does not anticipate that there are any barriers preventing the development of aforementioned infrastructure. |

| 1.13.2 | Geology and Mineral Resources |

| ● | Significant exploration, drilling, and operational data provides a good understanding of the deposit geology as well as an understanding of the geometry, thickness, and grade continuity of the mineralisation at Chimiwungo, Malundwe, Kamisengo, and Kababisa. |

| ● | Procedures for drilling, logging, sampling, analyses, and security are in place and meet industry standards. Data validation and data verification procedures indicate that the data within the database is suitable for Mineral Resource estimation. |

|

February 19, 2025 |

Page 16 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| ● | Extensive drilling has resulted in substantial increases in Indicated Mineral Resources at Chimiwungo, Malundwe, and Kamisengo, and the addition of new Mineral Resources at Kababisa. The extensive and closer spaced drilling has resulted in increased confidence in the controls on mineralisation which has increased confidence in the geological models used for Mineral Resource estimation. The geo-metallurgical understanding of the deposit has also improved and, as a result, oxidation zones are now better-defined using ratios of acid soluble copper, total copper, and sulphur. |

| ● | In June 2024, RSC Consulting Limited (RSC) completed a site visit and external audit of the Mineral Resource and its informing data and processes. RSC concluded that the processes underlying the generation and declaration of the Mineral Resource reflected good practice. |

| 1.13.3 | Mineral Reserves |

| ● | The Mineral Reserve estimate is based on a comprehensive process of evaluation, starting with the Mineral Resource block model that was optimised using geotechnical, technical and economic parameters, after which the various pits were designed and scheduled. |

| ● | Final FS parameters for operating costs and recoveries differed slightly from the optimisation and scheduling input costs. These differences are considered usual during a project and do not materially affect the outcomes. |

| ● | The Expansion Project schedule supports the doubling of the throughput of the processing plant and extension of the LOM to 33 years. |

| ● | Dilution and loss estimates are applied to the expansion mine plan to provide realistic estimates of grade and tonnes supplied by the mining operation. Initial planned dilution is determined through software, while unplanned dilution and losses are accounted for in model adjustments following reconciliation work. |

| ● | The highest undiscounted cash flow shells were selected from the optimisation results. |

| ● | In December 2024, AMC Consultants (AMC) completed a site visit and external review of the mining portion of the FS and its informing data, modifying factors, mine planning, and scheduling processes. AMC concluded that these did not present any fatal flaws and that the requirements of an FS were met. |

| 1.13.4 | Mining |

| ● | Mining envisaged for the Expansion Project uses the same mining methods and the same types of equipment as the current operation, substantially reducing risks to the Expansion Project. |

| ● | Notable increases in output per machine are planned through changes to the equipment availability, utilisation, and productivity. The estimated operating cost and capital cost of the production fleet is based on this higher productivity rate, and in the lead up to the completion of the FS, the operations team demonstrated that the required FS output parameters could be achieved. An extensive improvement plan is underway, with a two-year transition period included in the FS. |

| ● | Double benching has been proposed for the final Chimiwungo Super-Pit walls from 2027 onwards. A programme to improve current mining practices in order to implement double benching is underway. |

|

February 19, 2025 |

Page 17 |

|

|

NI 43-101 Technical Report on the Lumwana Expansion Project |

|

| ● | In November 2024, third party geotechnical reviews were completed by Itasca (Itasca, 2024) and PSM (PSM, 2024) to validate assumptions used in the mine planning and scheduling process. The reviews concluded that there were no fatal flaws and that the geotechnical data and analysis are reasonable and the slope design parameters are suitable for the FS. |

| 1.13.5 | Mineral Processing |