UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 1-9059

Barrick Gold Corporation

(Registrant’s name)

| Brookfield Place, TD Canada Trust Tower, Suite 3700 161 Bay Street, P.O. Box 212 Toronto, Ontario Canada M5J 2S1 (800) 720-7415 |

310 South Main Street Suite 1150 Salt Lake City, Utah 84101 (801) 990-3745 |

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 19, 2025 | BARRICK GOLD CORPORATION | |||||

| By: | /s/ Poupak Bahamin |

|||||

| Name: | Poupak Bahamin | |||||

| Title: | General Counsel | |||||

EXHIBIT INDEX

| Exhibit | Description |

|

| 99.1 | NI 43-101 Technical Report on the Reko Diq Project, Balochistan, Pakistan |

Exhibit 99.1

NI 43-101 Technical Report on the Reko

Diq Project, Balochistan, Pakistan

February 19, 2025

Effective Date: December 31, 2024

Simon Bottoms, CGeol, FGS, FAusIMM

Peter Jones, MAIG

Mike Saarelainen, FAusIMM

Daniel Nel, MIMMM

David Morgan, MIEAust, CPEng, IntPE(Aus)

Ashley Price, FAusIMM

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Cautionary Statement on Forward-Looking Information

This Technical Report contains forward-looking statements. All statements, other than statements of historical fact regarding Reko Diq Mining Company (Private) Limited (“RDMC”), Barrick Gold Corporation (“Barrick”), or the Reko Diq Project, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “project”, “continue”, “budget”, “estimate”, “potential”, “may”, “will”, “can”, “could” and similar expressions identify forward-looking statements. In particular, this Technical Report contains forward-looking statements with respect to: an economic analysis of the Reko Diq Project, including forecasted net present value, internal rate of return and cash flow forecasts; projected capital; operating and exploration expenditure; mine life and production rates; potential mineralization and metal or mineral recoveries; anticipated timelines and plans for project development, operation and closure; the ability and timeline to secure all relevant rights, licenses, permits and authorizations; RDMC’s strategy, plans, targets and goals in respect of environmental and social issues and sustainability matters; stakeholder engagement; the power strategy for the Reko Diq Project including renewable energy sources; sufficiency of infrastructure, systems and consultants and personnel; operating or technical challenges in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities, and the maintenance or provision of required infrastructure and information technology systems; and information pertaining to potential improvements to financial and operating performance and mine life are necessarily based on opinions and estimates made as of the date such statements are made and are subject to important risk factors and uncertainties, many of which cannot be controlled or predicted. Material assumptions regarding forward-looking statements are discussed in this Technical Report, where applicable. In addition to such assumptions, the forward-looking statements are inherently subject to significant business, economic, political, security and competitive uncertainties, and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include, but are not limited to: fluctuations in the spot and forward price of commodities (including gold, copper, diesel fuel, natural gas and electricity); the speculative nature of mineral exploration and development; risks associated with projects in the early stages of evaluation and development and for which additional technical, engineering and other analysis is required; disruption of supply routes which may cause delays in development, construction and mining activities; changes in mineral production performance, exploitation and exploration successes; diminishing quantities or grades of reserves; increased costs, delays, suspensions, and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to RDMC’s, or Barrick’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the handling of environmental matters or dealings with community groups, whether true or not; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; uncertainty whether the Reko Diq Project will meet RDMC’s or Barrick’s capital allocation objectives; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation; fluctuations in the currency markets; changes in interest rates; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; expropriation or nationalization of property and political or economic developments in the Islamic Republic of Pakistan or the Province of Balochistan; the possibility of political instability in the Islamic Republic of Pakistan or the Province of Balochistan; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; litigation; contests over title to properties or over access to water, power and other required infrastructure; increased costs and physical risks including extreme weather events and resource shortages, related to climate change; risks associated with working with partners in jointly controlled assets; and availability and increased costs associated with mining inputs and labour. In addition, there are risks and hazards associated with the business of mineral exploration, development, and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, ground conditions, pressures, cave-ins, flooding and gold and copper ore losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect RDMC’s actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, RDMC. All of the forward-looking statements made in this Technical Report are qualified by these cautionary statements. RDMC, Barrick, and the Qualified Persons who authored this Technical Report undertake no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

|

February 19, 2025 |

Page 2 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Table of Contents

| 1 | Summary | 15 | ||||||

| 1.1 | Description, Location, and Ownership | 15 | ||||||

| 1.2 | Geology and Mineralisation | 16 | ||||||

| 1.3 | Exploration Status | 17 | ||||||

| 1.4 | Mineral Resource Estimate | 17 | ||||||

| 1.5 | Mineral Reserve Estimate | 20 | ||||||

| 1.6 | Mining Methods | 22 | ||||||

| 1.7 | Mineral Processing | 22 | ||||||

| 1.8 | Project Infrastructure | 23 | ||||||

| 1.9 | Market Studies and Contracts | 24 | ||||||

| 1.10 | Environmental, Permitting and Social Considerations | 24 | ||||||

| 1.11 | Capital and Operating Costs | 25 | ||||||

| 1.12 | Economic Analysis | 25 | ||||||

| 1.13 | Interpretations and Conclusions | 26 | ||||||

| 1.14 | Recommendations | 32 | ||||||

| 2 | Introduction | 34 | ||||||

| 2.1 | Effective Date | 36 | ||||||

| 2.2 | Qualified Persons | 36 | ||||||

| 2.3 | Site Visits of Qualified Persons | 37 | ||||||

| 2.4 | Information Sources | 37 | ||||||

| 2.5 | List of Abbreviations | 38 | ||||||

| 3 | Reliance on Other Experts | 39 | ||||||

| 4 | Property Description and Location | 40 | ||||||

| 4.1 | Project Location | 40 | ||||||

| 4.2 | Property Rights and Ownership | 42 | ||||||

| 4.3 | Royalties, Payments, and Other Obligations | 46 | ||||||

| 4.4 | Permits | 48 | ||||||

| 4.5 | Environmental Liabilities | 49 | ||||||

| 4.6 | QP Comment on Property Description and Location | 49 | ||||||

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 51 | ||||||

| 5.1 | Accessibility | 51 | ||||||

| 5.2 | Climate and Physiography | 51 | ||||||

|

February 19, 2025 |

Page 3 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 5.3 | Seismicity | 52 | ||||||

| 5.4 | Local Resources and Infrastructure | 52 | ||||||

| 5.5 | Sufficiency of Surface Rights | 52 | ||||||

| 6 |

History | 53 | ||||||

| 6.1 | Project Development | 53 | ||||||

| 6.2 | Previous Mineral Resources | 55 | ||||||

| 6.3 | Production History | 55 | ||||||

| 7 |

Geological Setting and Mineralization | 56 | ||||||

| 7.1 | Regional Geology | 56 | ||||||

| 7.2 | Structure | 57 | ||||||

| 7.3 | Local Geology | 58 | ||||||

| 7.4 | Property Geology | 60 | ||||||

| 7.5 | QP Comment on Geological Setting and Mineralization | 64 | ||||||

| 8 |

Deposit Types | 65 | ||||||

| 9 |

Exploration | 67 | ||||||

| 9.1 | Exploration Concept | 67 | ||||||

| 9.2 | BHP 1996 – 1997 | 67 | ||||||

| 9.3 | TCC 2000 – 2006 | 69 | ||||||

| 9.4 | TCC 2006 -2010 | 69 | ||||||

| 9.5 | TCC 2010 – 2022 | 70 | ||||||

| 9.6 | RDMC Post 2022 | 70 | ||||||

| 9.7 | Exploration Potential | 71 | ||||||

| 9.8 | QP Comment on Exploration | 72 | ||||||

| 10 |

Drilling | 73 | ||||||

| 10.1 | Drilling Summary | 73 | ||||||

| 10.2 | Drill Methods | 74 | ||||||

| 10.3 | Collar Surveys | 81 | ||||||

| 10.4 | Down Hole Surveys | 81 | ||||||

| 10.5 | Drill Planning | 82 | ||||||

| 10.6 | Internal and External Audits | 82 | ||||||

| 10.7 | QP Comments on Drilling | 87 | ||||||

| 11 |

Sample Preparation, Analyses and Security | 88 | ||||||

| 11.1 | Sample Analysis | 90 | ||||||

| 11.2 | Sample Security | 92 | ||||||

|

February 19, 2025 |

Page 4 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 11.3 | Quality Assurance and Quality Control | 92 | ||||||

| 11.4 | QP Comments on Sample Preparation, Analyses, and Security | 105 | ||||||

| 12 | Data Verification | 106 | ||||||

| 12.1 | Internal Reviews and Audits | 106 | ||||||

| 12.2 | External Reviews and Audits | 107 | ||||||

| 12.3 | QP Comments on Data Verification | 108 | ||||||

| 13 | Mineral Processing and Metallurgical Testing | 109 | ||||||

| 13.1 | Metallurgical Testwork | 109 | ||||||

| 13.2 | Metallurgical Projections | 119 | ||||||

| 13.3 | Blending | 124 | ||||||

| 13.4 | QP Comments on Mineral Processing and Metallurgical Testing | 125 | ||||||

| 14 | Mineral Resource Estimate | 126 | ||||||

| 14.1 | Introduction | 126 | ||||||

| 14.2 | Resource Database | 126 | ||||||

| 14.3 | Area of Mineral Resources | 127 | ||||||

| 14.4 | Western Porphyries | 128 | ||||||

| 14.5 | Tanjeel | 161 | ||||||

| 14.6 | Resource Classification | 177 | ||||||

| 14.7 | Resource Reporting | 180 | ||||||

| 14.8 | Mineral Resource Statement | 183 | ||||||

| 14.9 | 2024 Versus 2022 Model Comparison | 185 | ||||||

| 14.10 | QP Comments on Mineral Resource Estimate | 186 | ||||||

| 15 | Mineral Reserve Estimate | 187 | ||||||

| 15.1 | Summary | 188 | ||||||

| 15.2 | Mineral Reserves Estimation Process | 189 | ||||||

| 15.3 | Open Pit Optimization | 189 | ||||||

| 15.4 | Sensitivities | 200 | ||||||

| 15.5 | Reconciliation | 201 | ||||||

| 15.6 | Mineral Reserve Statement | 202 | ||||||

| 15.7 | QP Comments on Mineral Reserve Estimate | 205 | ||||||

| 16 | Mining Methods | 206 | ||||||

| 16.1 | Mining Methods | 206 | ||||||

| 16.2 | Geotechnical and Hydrogeological Considerations | 207 | ||||||

| 16.3 | Mine Design | 212 | ||||||

|

February 19, 2025 |

Page 5 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 16.4 | Mining Equipment | 231 | ||||||

| 16.5 | Mining Workforce | 232 | ||||||

| 16.6 | LOM Production Schedule | 233 | ||||||

| 16.7 | QP Comments on Mining Methods | 237 | ||||||

| 17 |

Recovery Methods | 238 | ||||||

| 17.1 | Design Basis | 238 | ||||||

| 17.2 | Process Plant Description | 240 | ||||||

| 17.3 | Power, Water, and Process Reagents Requirements | 246 | ||||||

| 17.4 | QP Comments on Recovery Methods | 248 | ||||||

| 18 |

Project Infrastructure | 249 | ||||||

| 18.1 | Overview | 249 | ||||||

| 18.2 | Logistical Infrastructure | 251 | ||||||

| 18.3 | Power Supply | 254 | ||||||

| 18.4 | Water Supply | 256 | ||||||

| 18.5 | Water Management | 258 | ||||||

| 18.6 | Site Common Purpose Infrastructure | 261 | ||||||

| 18.7 | Tailings Storage Facilities | 268 | ||||||

| 18.8 | Waste Rock Storage | 274 | ||||||

| 18.9 | Stockpiles | 275 | ||||||

| 18.10 | QP Comments on Project Infrastructure | 275 | ||||||

| 19 |

Market Studies and Contracts | 276 | ||||||

| 19.1 | Market Studies | 276 | ||||||

| 19.2 | Reko Diq Concentrates | 277 | ||||||

| 19.3 | Commodity Price Assumptions | 277 | ||||||

| 19.4 | Contracts | 278 | ||||||

| 19.5 | QP Comment on Market Studies and Contracts | 278 | ||||||

| 20 |

Environmental Studies, Permitting, and Social or Community Impact | 279 | ||||||

| 20.1 | Summary | 279 | ||||||

| 20.2 | Environmental Assessment and Studies | 280 | ||||||

| 20.3 | Environmental Considerations | 283 | ||||||

| 20.4 | Permitting | 287 | ||||||

| 20.5 | Social and Community Requirements | 288 | ||||||

| 20.6 | Mine Closure and Reclamation | 292 | ||||||

| 20.7 | Environmental and Social Related Risks | 294 | ||||||

|

February 19, 2025 |

Page 6 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 20.8 | QP Comments on Environmental and Social | 295 | ||||||

| 21 | Capital and Operating Costs | 296 | ||||||

| 21.1 | Basis and Sources of Cost Estimates | 296 | ||||||

| 21.2 | Capital Costs | 296 | ||||||

| 21.3 | Operating Costs | 299 | ||||||

| 21.4 | QP Comments on Capital and Operating Costs | 300 | ||||||

| 22 | Economic Analysis | 301 | ||||||

| 22.1 | Assumptions and Inputs | 301 | ||||||

| 22.2 | Taxes and Royalties | 302 | ||||||

| 22.3 | Financial Model Summary | 303 | ||||||

| 22.4 | Sensitivity | 312 | ||||||

| 22.5 | QP Comments on Economic Analysis | 314 | ||||||

| 23 | Adjacent Properties | 315 | ||||||

| 24 | Other Relevant Data and Information | 316 | ||||||

| 25 | Interpretation and Conclusions | 317 | ||||||

| 25.1 | Mineral Tenure, Rights, Royalties and Agreements | 317 | ||||||

| 25.2 | Geology and Mineral Resources | 317 | ||||||

| 25.3 | Mining and Mineral Reserves | 318 | ||||||

| 25.4 | Mineral Processing | 318 | ||||||

| 25.5 | Infrastructure | 319 | ||||||

| 25.6 | Environment and Social Aspects | 319 | ||||||

| 25.7 | Market Studies and Contracts | 319 | ||||||

| 25.8 | Capital and Operating Costs | 320 | ||||||

| 25.9 | Project Economics | 320 | ||||||

| 25.10 | Risks | 321 | ||||||

| 26 | Recommendations | 324 | ||||||

| 26.1 | Mineral Tenure, Rights, Royalties and Agreements | 324 | ||||||

| 26.2 | Geology and Mineral Resources | 324 | ||||||

| 26.3 | Mining and Mineral Reserves | 324 | ||||||

| 26.4 | Mineral Processing | 325 | ||||||

| 26.5 | Infrastructure | 325 | ||||||

| 26.6 | Environmental, Permitting, and Social Aspects | 325 | ||||||

| 26.7 | Market Studies and Contracts | 325 | ||||||

| 26.8 | Capital and Operating Costs | 326 | ||||||

|

February 19, 2025 |

Page 7 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 26.9 | Risks | 326 | ||||||

| 27 | References | 327 | ||||||

| 28 | Date and Signature Page | 329 | ||||||

| 29 | Certificates of Qualified Persons | 331 | ||||||

| 29.1 | Simon Bottoms | 331 | ||||||

| 29.2 | Peter Jones | 333 | ||||||

| 29.3 | Mike Saarelainen | 335 | ||||||

| 29.4 | Daniel Nel | 337 | ||||||

| 29.5 | David Morgan | 339 | ||||||

| 29.6 | Ashley Price | 341 | ||||||

|

February 19, 2025 |

Page 8 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

List of Tables

| Table 1-1 |

Reko Diq Mineral Resources Summary, 100% Basis, as of December 31, 2024 |

19 | ||||

| Table 1-2 |

Reko Diq Mineral Reserves Statement, December 31, 2024 |

21 | ||||

| Table 1-3 |

Copper Price Impact on Free Cash, NPV8, IRR and Payback Period |

26 | ||||

| Table 1-4 |

Risk Analysis Summary |

30 | ||||

| Table 2-1 |

QP Responsibilities |

36 | ||||

| Table 2-2 |

Table of Abbreviations |

38 | ||||

| Table 4-1 |

Mining Leases Details |

43 | ||||

| Table 4-2 |

Mining Leases Coordinates |

43 | ||||

| Table 4-3 |

Exportation License Coordinates |

44 | ||||

| Table 4-4 |

Surface Lease Coordinates |

46 | ||||

| Table 4-5 |

Summary of Taxes and Other Obligations |

47 | ||||

| Table 6-1 |

Reko Diq Development History |

53 | ||||

| Table 10-1 |

Tabulation of Drilling by Year and Area |

73 | ||||

| Table 10-2 |

Downhole Survey Methods by Drilling Type |

81 | ||||

| Table 10-3 |

Twin Hole Analysis - Copper, 15m Bench Composites |

84 | ||||

| Table 10-4 |

Twin Hole Analysis - Gold, 15m Bench Composite |

86 | ||||

| Table 11-1 |

Rotary Divider Set-up |

90 | ||||

| Table 11-2 |

CRM’s Utilized in the 2003 to 2009 Exploration |

94 | ||||

| Table 11-3 |

Summary of CRM, by Types by Assay Method and Laboratory |

95 | ||||

| Table 11-4 |

In-House CRM Values and Parameters |

96 | ||||

| Table 11-5 |

Summary Results of In-House CRM’s |

98 | ||||

| Table 11-6 |

Statistics for Field Blanks Results Reported by ALS |

99 | ||||

| Table 11-7 |

Drill campaigns 1996-1997 and 2003-2009: Field Duplicates Summary Results |

101 | ||||

| Table 11-8 |

Summary of Umpire Sampling program (2003-2009) |

105 | ||||

| Table 13-1 |

Metallurgical Testwork Samples |

109 | ||||

| Table 13-2 |

Metallurgical Testwork Summary |

110 | ||||

| Table 13-3 |

Ore Properties for Comminution Circuit Design |

116 | ||||

| Table 13-4 |

Key Criteria Derived from Testwork |

118 | ||||

| Table 13-5 |

Metso HSC Sim Metal Plan Simulation Results |

122 | ||||

| Table 13-6 |

Expected Elemental and Chemical Grade of Final Concentrate |

124 | ||||

| Table 14-1 |

Drill Summary by Company and Year at the Western Porphyries and Tanjeel |

127 | ||||

| Table 14-2 |

Lithological Units and Grouping Applied |

130 | ||||

| Table 14-3 |

Hydrothermal Alteration Assemblages, Mineralogy and Codes |

131 | ||||

| Table 14-4 |

Univariate Statistics for Cu (%) by Lithology |

133 | ||||

| Table 14-5 |

Univariate Statistics for Cu % Assays by Alteration Codes |

134 | ||||

| Table 14-6 |

Univariate Statistics for Assay Au Grades (g/t) by Lithology |

135 | ||||

| Table 14-7 |

Univariate Statistics for Au (g/t) Assays by Alteration Codes |

136 | ||||

| Table 14-8 |

Metals Correlations |

136 | ||||

| Table 14-9 |

Copper and Gold Domains by Lithology and Alteration Code |

137 | ||||

| Table 14-10 |

Univariate Statistics - Density by Lithology |

139 | ||||

| Table 14-11 |

Boundary Types for Copper |

140 | ||||

| Table 14-12 |

Boundary Types for Gold |

140 | ||||

| Table 14-13 |

Copper High-Grade Cut Per Domain |

141 | ||||

| Table 14-14 |

Gold High-Grade Cut Per Domain |

142 | ||||

| Table 14-15 |

Variogram Models for Copper Domains |

143 | ||||

| Table 14-16 |

Modelled Correlograms |

145 | ||||

| Table 14-17 |

Block Model Geometric Parameters |

146 | ||||

| Table 14-18 |

Seach Ellipse Parameters Per Domain |

148 | ||||

| Table 14-19 |

Gold Estimate - First Pass Estimation parameters |

149 |

|

February 19, 2025 |

Page 9 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| Table 14-20 |

Comparison of OK. IDW and NN estimates - Copper |

150 | ||||

| Table 14-21 |

Comparison of OK, IDW and NN Estimates - Gold |

150 | ||||

| Table 14-22 |

Univariate Statistics - S and S2 Assays |

156 | ||||

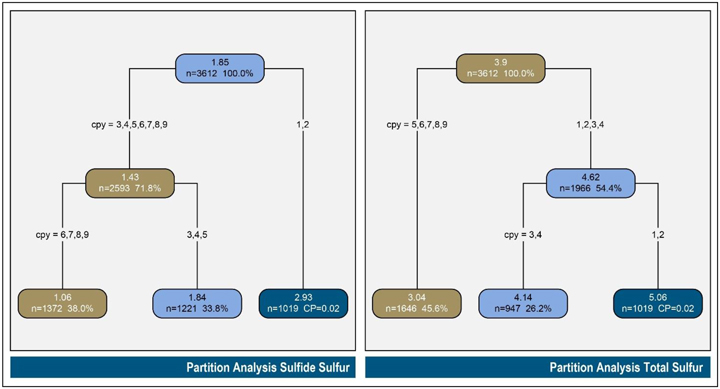

| Table 14-23 |

Partition Analysis - Total and Sulfide Sulfur |

159 | ||||

| Table 14-24 |

Univariate Statistics - Total Sulfur by Domain |

160 | ||||

| Table 14-25 |

Univariate Statistics - Sulfide Sulfur by Domain |

160 | ||||

| Table 14-26 |

S/S2 Regression Formulas |

160 | ||||

| Table 14-27 |

S Estimation Parameters |

160 | ||||

| Table 14-28 |

Lithological Grouping for Tanjeel |

162 | ||||

| Table 14-29 |

Hydrothermal Alteration Assemblages, Mineralogy and Codes |

164 | ||||

| Table 14-30 |

Initial Mineral Zone Model |

165 | ||||

| Table 14-31 |

Univariate Statistics for Cu % |

166 | ||||

| Table 14-32 |

Univariate Statistics - S and S2 Assays |

167 | ||||

| Table 14-33 |

Univariate Statistics by Lithology |

168 | ||||

| Table 14-34 |

Boundary Types for Copper |

169 | ||||

| Table 14-35 |

Copper High-Grade Cut Applied Per Domain |

171 | ||||

| Table 14-36 |

Variogram Models for Copper Domains |

172 | ||||

| Table 14-37 |

Block Model Parameters |

173 | ||||

| Table 14-38 |

Seach Ellipse Parameters Per Domain |

173 | ||||

| Table 14-39 |

Multipliers for CuCN Estimation in Un-estimated Blocks |

174 | ||||

| Table 14-40 |

Estimation Parameters for Copper and Cyanide Soluble Copper |

174 | ||||

| Table 14-41 |

Comparison of OK. IDW and NN estimates – Copper |

175 | ||||

| Table 14-42 |

Estimation Parameters for Total Sulphur and Co-estimated Sulphide Sulphur |

176 | ||||

| Table 14-43 |

Total and Sulphide Sulphur Assigned Values |

177 | ||||

| Table 14-44 |

Mineral Resources Classification Criteria |

177 | ||||

| Table 14-45 |

Pit Optimization and NSR Input Parameters |

180 | ||||

| Table 14-46 |

Reko Diq Mineral Resources Statement, 100% Basis, as of December 31, 2024 |

184 | ||||

| Table 15-1 |

Pit Optimization and NSR Input Parameters |

190 | ||||

| Table 15-2 |

Metal Prices for Pit Optimization |

191 | ||||

| Table 15-3 |

Western Porphyries Metal Recoveries and Cu Concentrate Grade |

193 | ||||

| Table 15-4 |

Tanjeel Metal Recoveries and Cu Concentrate Grade |

194 | ||||

| Table 15-5 |

Open Pit Overall Slope Angles for Whittle |

194 | ||||

| Table 15-6 |

Sustaining Capital |

195 | ||||

| Table 15-7 |

Offsite Concentrate Costs |

196 | ||||

| Table 15-8 |

Royalties |

196 | ||||

| Table 15-9 |

Taxes on Operating Costs for Pit Optimization |

196 | ||||

| Table 15-10 |

Mine Closure Cost |

196 | ||||

| Table 15-11 |

Operating Costs for Pit Optimization |

197 | ||||

| Table 15-12 |

Whittle Pit Shell Results – Western Porphyries |

198 | ||||

| Table 15-13 |

Whittle Pit Shell Results – Tanjeel Porphyries |

199 | ||||

| Table 15-14 |

Reko Diq Mineral Reserves Statement, December 31, 2024 |

204 | ||||

| Table 16-1 |

Summary of RMR89 Data for Western Porphyries Rock Mass Units |

208 | ||||

| Table 16-2 |

Reko Diq Western Porphyries FS Slope Design Base Case |

209 | ||||

| Table 16-3 |

Reko Diq Tanjeel FS Slope Design Base Case |

210 | ||||

| Table 16-4 |

Estimated Groundwater Ingress into Western Porphyries and Tanjeel Pits |

211 | ||||

| Table 16-5 |

WP Ultimate Pit Design and Whittle Shell Comparison |

214 | ||||

| Table 16-6 |

Western Porphyries Phase Design Volumetrics |

216 | ||||

| Table 16-7 |

Tanjeel Ultimate Pit Design and Whittle Shell Comparison |

219 | ||||

| Table 16-8 |

Tanjeel Phase Design Volumetrics |

219 | ||||

| Table 16-9 |

Waste Rock Classification |

222 | ||||

| Table 16-10 |

Ultimate Pit by Waste Classification |

223 |

|

February 19, 2025 |

Page 10 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| Table 16-11 |

Destinations for Waste Materials |

223 | ||||

| Table 16-12 |

Waste Totals by Type and Destination |

223 | ||||

| Table 16-13 |

Waste Dump & Stockpile Design Parameters |

225 | ||||

| Table 16-14 |

Waste Dump Design Capacity |

225 | ||||

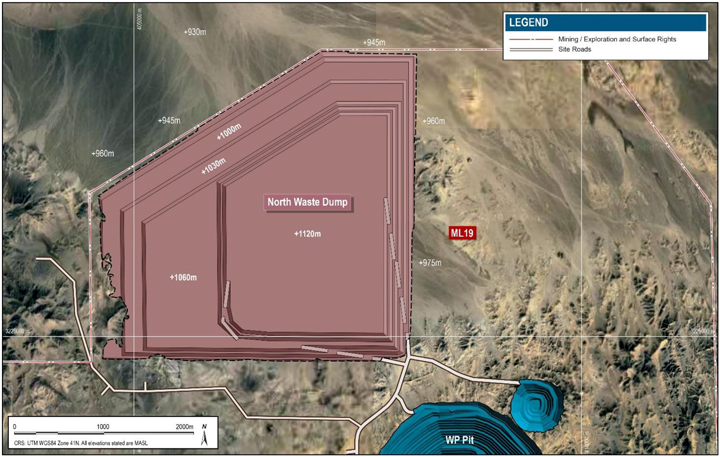

| Table 16-15 |

North Waste Dump Design Volume |

226 | ||||

| Table 16-16 |

South Waste Dump Design Volume |

227 | ||||

| Table 16-17 |

Tanjeel Waste Dump Design Volume |

228 | ||||

| Table 16-18 |

Stockpile Design Capacities |

229 | ||||

| Table 16-19 |

Fleet Requirements for Reko Diq |

232 | ||||

| Table 16-20 |

Peak Mining Workforce Numbers |

233 | ||||

| Table 16-21 |

LOM Mine and Plant Feed Schedule |

236 | ||||

| Table 17-1 |

Key Design Criteria |

239 | ||||

| Table 17-2 |

Primary Equipment |

242 | ||||

| Table 17-3 |

Phase 1 Reagent Requirements |

248 | ||||

| Table 18-1 |

Rail Project Rolling Stock Key Requirements |

252 | ||||

| Table 18-2 |

Reko Diq Power Demand Summary |

255 | ||||

| Table 18-3 |

Raw Water Demand – Phase 1 Production |

258 | ||||

| Table 21-1 |

Capital Cost Estimate Summary |

296 | ||||

| Table 21-2 |

Initial and Expansion Project Capital Expenditure Summary |

297 | ||||

| Table 21-3 |

Sustaining Capital Expenditure Summary |

298 | ||||

| Table 21-4 |

Operating Costs Summary |

299 | ||||

| Table 22-1 |

Estimated Tax Payable |

302 | ||||

| Table 22-2 |

Reko Diq Project Case Financial Model Summary |

305 | ||||

| Table 22-3 |

Annual Cashflow Summary - Feasibility Study Case |

306 | ||||

| Table 22-4 |

Annual Cashflow Summary - Reserve Case |

309 | ||||

| Table 22-5 |

Copper Price Impact on Free Cash, NPV8, IRR and Payback Period |

312 | ||||

| Table 25-1 |

Risk Analysis Summary |

322 |

|

February 19, 2025 |

Page 11 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

List of Figures

| Figure 1-1 |

On-site Infrastructure |

24 | ||||

| Figure 2-1 |

Holding Structure of the Reko Diq Project |

35 | ||||

| Figure 4-1 |

Property Location |

41 | ||||

| Figure 4-2 |

Reko Diq Mining Company Leases |

45 | ||||

| Figure 6-1 |

Tabulation of Drilling by Year and Company |

55 | ||||

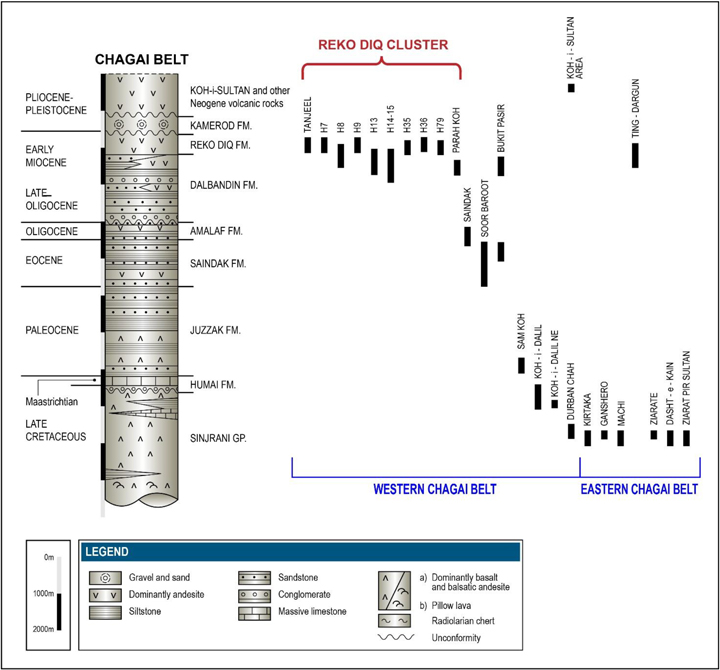

| Figure 7-1 |

Regional Geology and Structure of Chagai Belt |

57 | ||||

| Figure 7-2 |

Location of Porphyry Surface Expressions in the Reko Diq Area |

58 | ||||

| Figure 7-3 |

Regional Chagai Stratigraphy |

59 | ||||

| Figure 7-4 |

Local Geology Surface Map |

60 | ||||

| Figure 7-5 |

Host Rocks to Chagai Belt Porphyry Cu Systems |

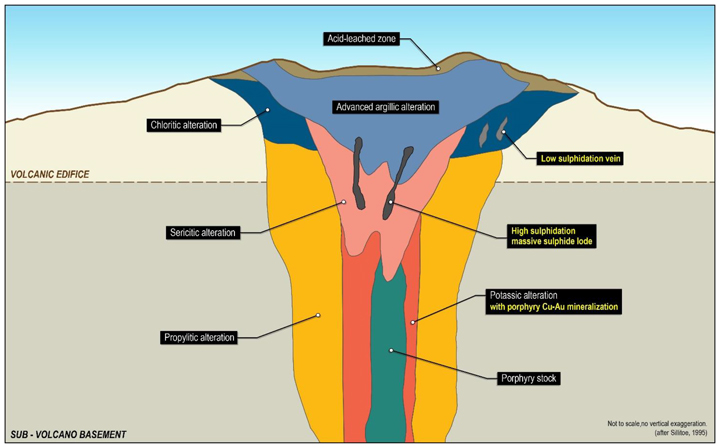

62 | ||||

| Figure 8-1 |

Conceptual Porphyry Cu-Au Deposit Model |

66 | ||||

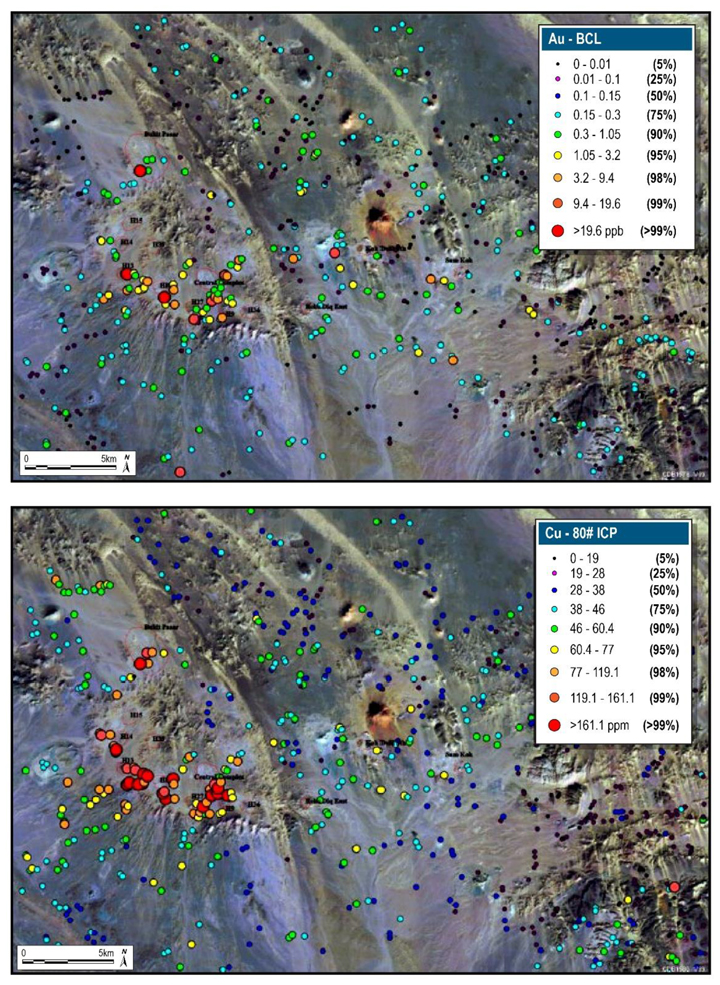

| Figure 9-1 |

Satellite Image with Sediment Sampling Results for Gold and Copper |

68 | ||||

| Figure 9-2 |

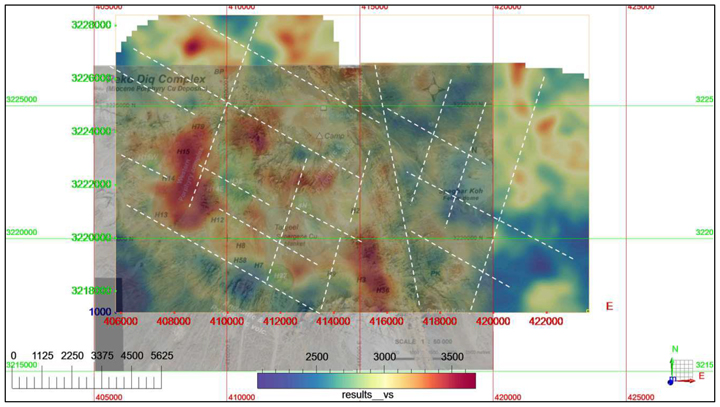

Plan view of the Reko Diq Velocity Model at N900 m depth, |

71 | ||||

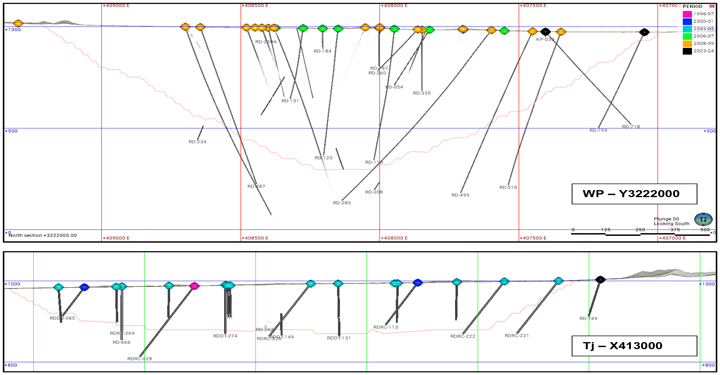

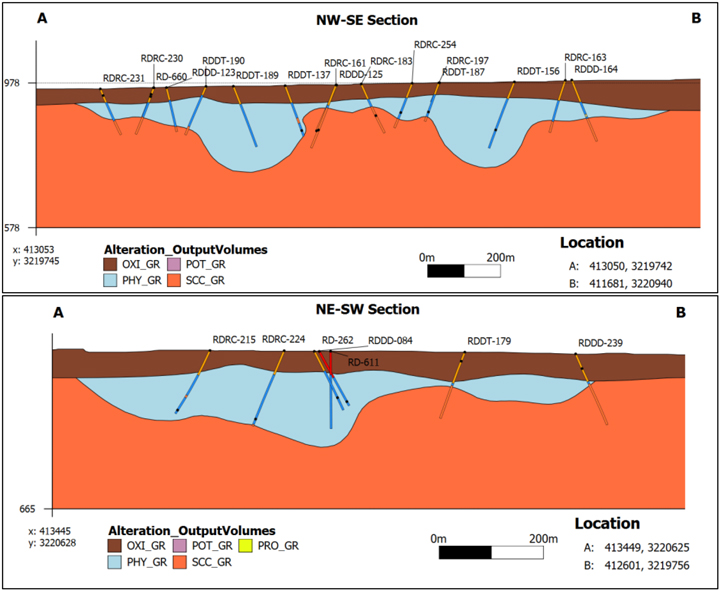

| Figure 10-1 |

Typical Drilling Cross Sections – Western Porphyries (Top), Tanjeel (Bottom) |

74 | ||||

| Figure 10-2 |

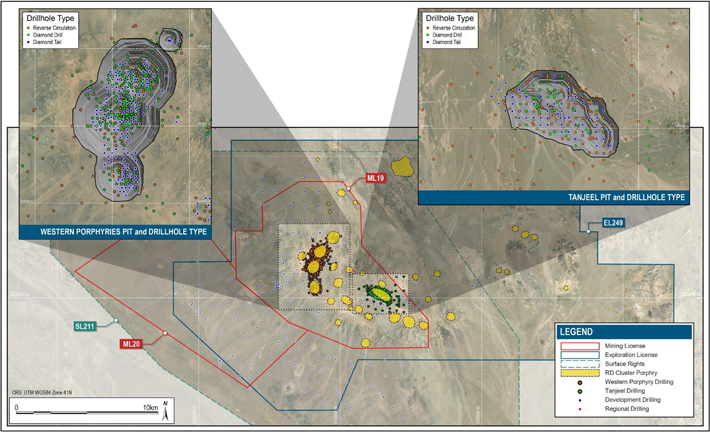

Plan of Drilling Locations |

75 | ||||

| Figure 10-3 |

Flow Chart Summary of RC Sample Preparation |

79 | ||||

| Figure 10-4 |

Location of Twinned Holes within 10-year Mining Pit |

83 | ||||

| Figure 10-5 |

Scatter Plot of Copper Grades |

85 | ||||

| Figure 10-6 |

Scatter Plot of Gold Grades |

87 | ||||

| Figure 11-1 |

Diamond Drill Core and Reverse Circulation Sample Flowchart |

89 | ||||

| Figure 11-2 |

Example of Commercial CRM Graph |

96 | ||||

| Figure 11-3 |

Example of In-House Standard Graph |

99 | ||||

| Figure 11-4 |

Blank Assays Results |

100 | ||||

| Figure 11-5 |

ANALABS Duplicate Plots 1996-1997 Au assays (Left), Cu Assay (Right) |

101 | ||||

| Figure 11-6 |

2003 to 2010 ALS Duplicates Au (left), Cu (Right) |

102 | ||||

| Figure 11-7 |

2003 to 2010 SGS-KAR Duplicates Au (left), Cu (Right) |

102 | ||||

| Figure 11-8 |

Re-assayed Pulps Location and 10-year Mining Pit |

103 | ||||

| Figure 11-9 |

Scatter Plots Cu (Top) Au (Bottom) of Grades in Historic and Re-assayed Pulps |

104 | ||||

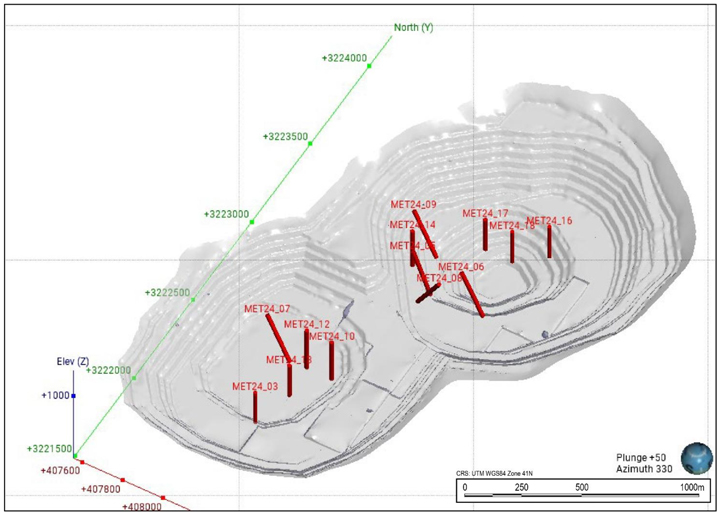

| Figure 13-1 |

Isometric View of the Zone 2 (Left) and Zone 3 (right) composite Holes |

113 | ||||

| Figure 13-2 |

Isometric View H4 Composite Sample |

113 | ||||

| Figure 13-3 |

Spatial Distribution of All of the Metallurgical Samples (Isometric View), Western Porphyries (Top) and Tanjeel (Bottom) |

114 | ||||

| Figure 13-4 |

Rougher Mass Pull as a Function of Cu:S2- Ratio |

119 | ||||

| Figure 13-5 |

Units of copper recovered as a function of copper head grade |

120 | ||||

| Figure 13-6 |

Copper Concentrate Grade as a function of Cu:S2- Ratio |

121 | ||||

| Figure 13-7 |

Simulation Results: Rougher Mass Pull Over LOM |

122 | ||||

| Figure 13-8 |

Simulation Results: Metal Recovery Over LOM |

123 | ||||

| Figure 13-9 |

Simulation Results: Final Cu Concentrate Grade and Mass Pull Over LOM |

123 | ||||

| Figure 14-1 |

Location of the Resource Areas |

128 | ||||

| Figure 14-2 |

General Plan- Interpreted Faults and Drilling Data |

129 | ||||

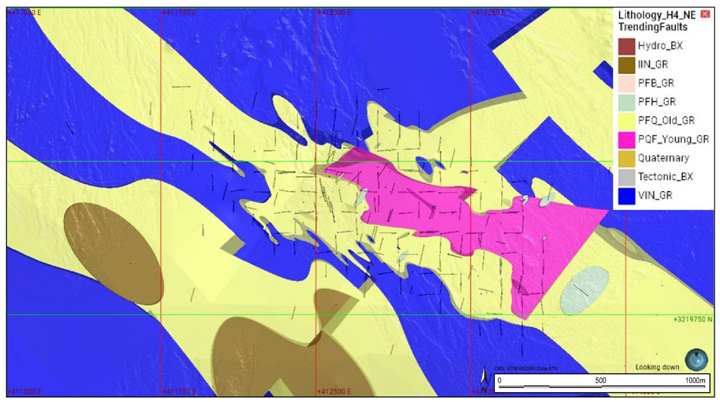

| Figure 14-3 |

Lithology Model and Drilling Cross Section (+/-50m) |

130 | ||||

| Figure 14-4 |

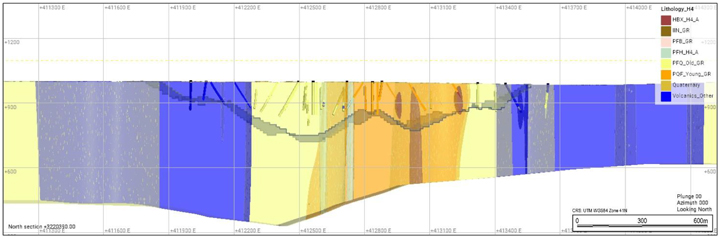

Alteration Model and Drilling Cross Section (+/-50m) |

131 | ||||

| Figure 14-5 |

Oblique View Looking Northeast – Density Determinations |

138 | ||||

| Figure 14-6 |

Histogram of Raw Density |

138 | ||||

| Figure 14-7 |

Example Variogram Model (Domain: pfb1_scc_in) |

144 | ||||

| Figure 14-8 |

Example Sage Output (Domain: volc_pot_in) |

145 | ||||

| Figure 14-9 |

Example Planes through Ellipsoids (Domain: pfb_2_3_in) |

146 | ||||

| Figure 14-10 |

Left: Plan View LVA Input Meshes. Right: Block Model Slice LVA at Block Scale |

147 | ||||

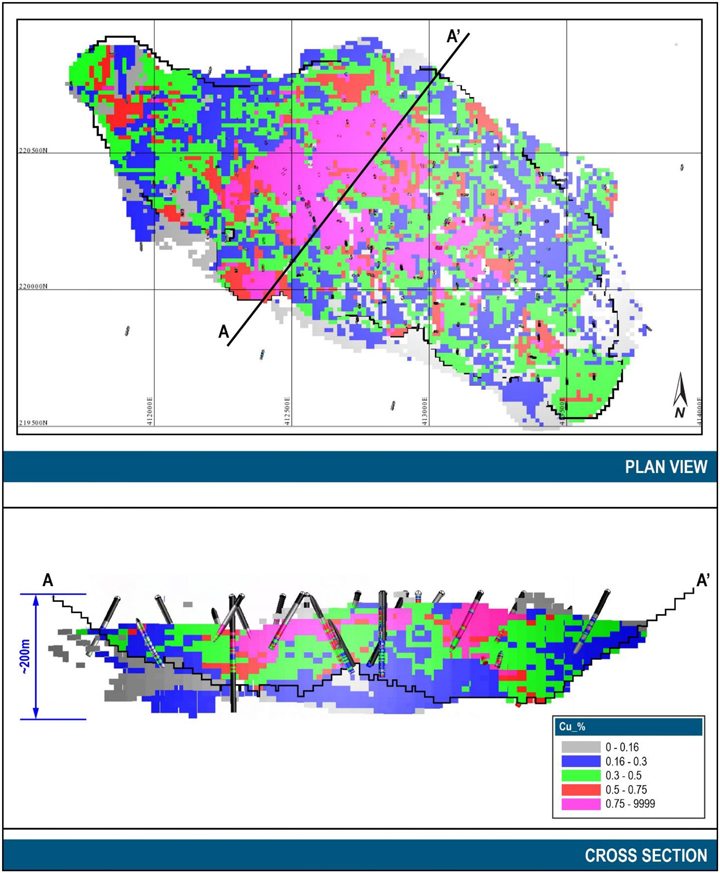

| Figure 14-11 |

Copper Block Estimates |

151 |

|

February 19, 2025 |

Page 12 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

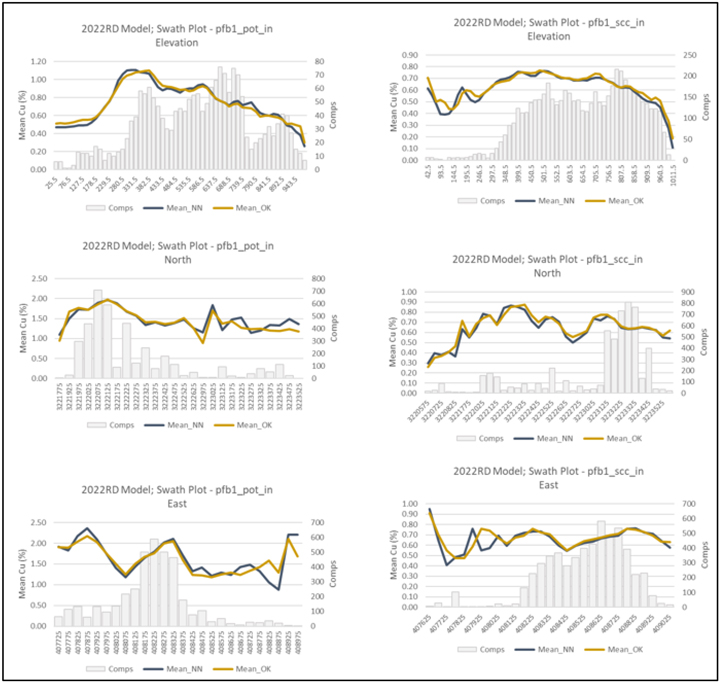

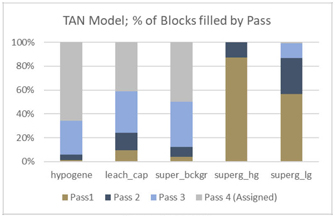

| Figure 14-12 |

Gold distribution in Block Model and composites |

152 | ||||

| Figure 14-13 |

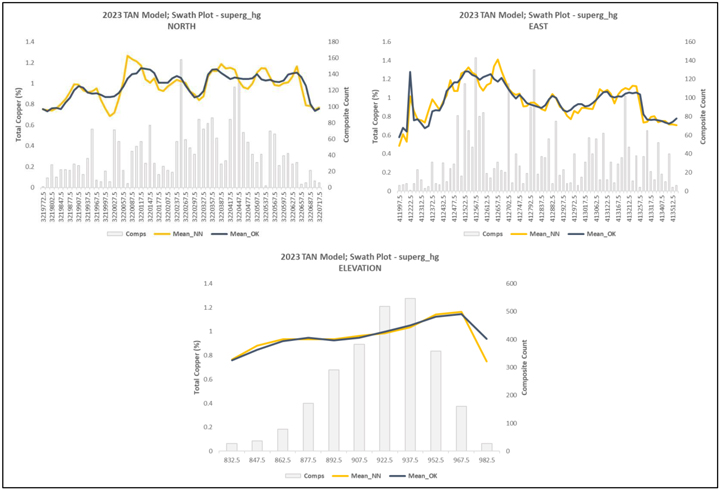

Example Copper Estimate Swath Plots |

153 | ||||

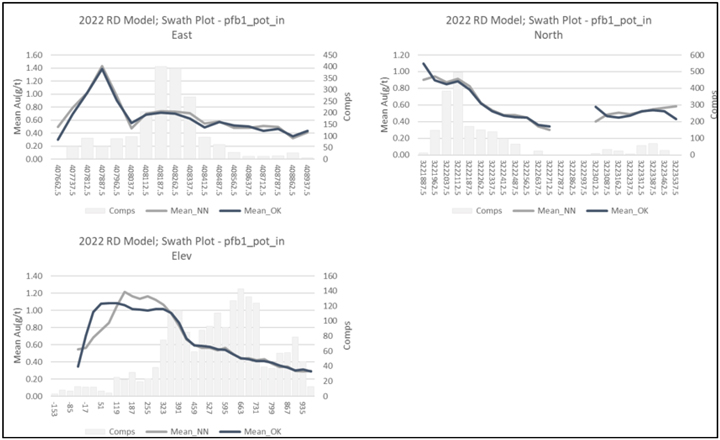

| Figure 14-14 |

Example Gold Swath Plots |

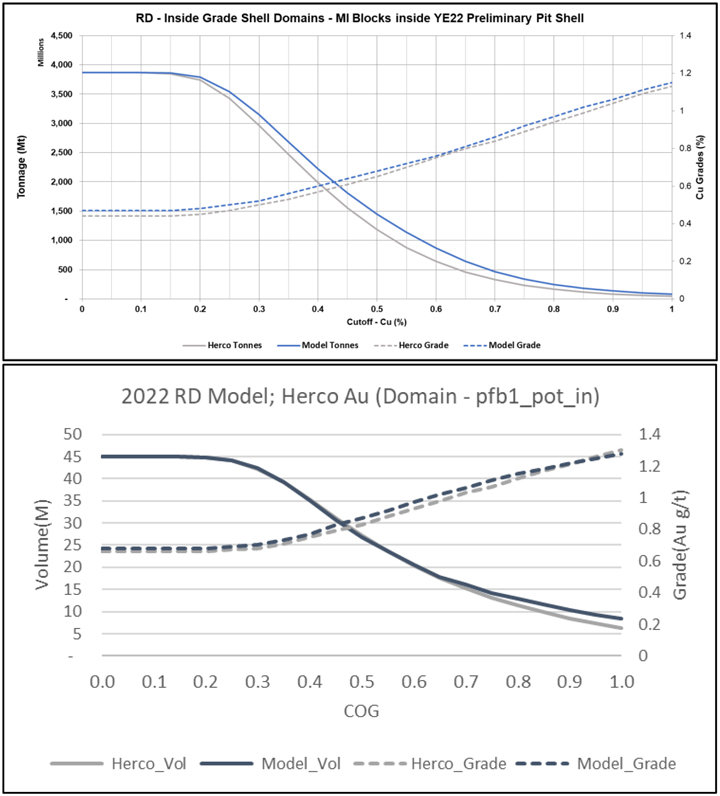

154 | ||||

| Figure 14-15 |

Tonnage-Grade and Change of Support Curves (Top Cu, Bottom Au) |

155 | ||||

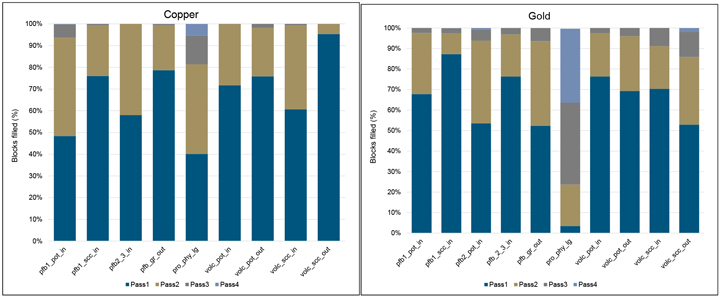

| Figure 14-16 |

Pass Percentage by Domain |

156 | ||||

| Figure 14-17 |

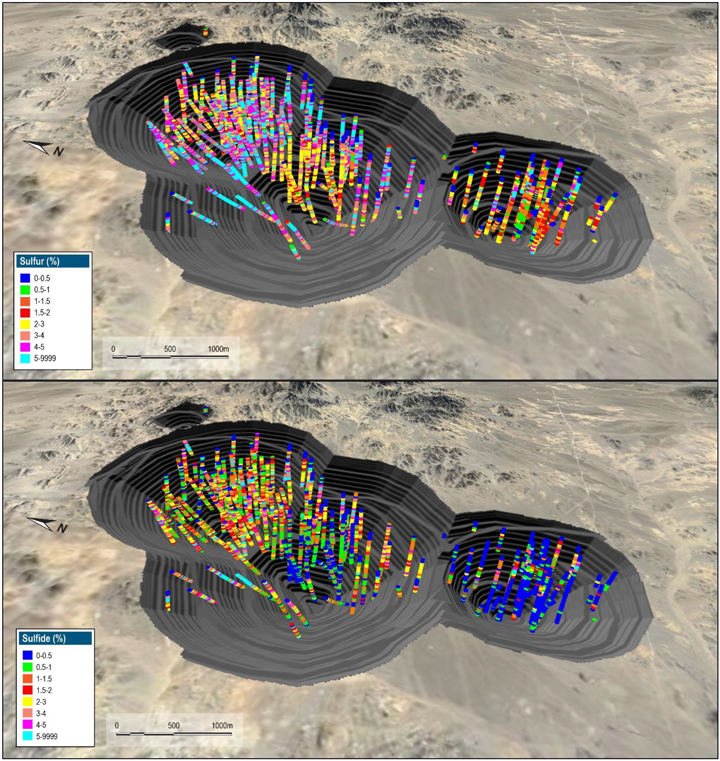

Oblique View - Sulfur (Top) and Sulphide (Right) Assays |

157 | ||||

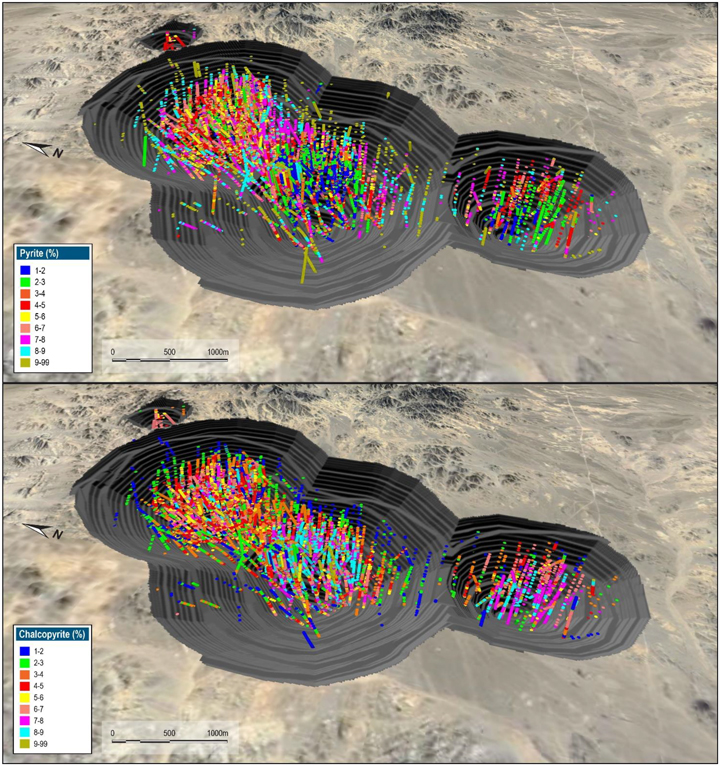

| Figure 14-18 |

Plan View - Logged Pyrite (Top) and Chalcopyrite (Bottom) |

158 | ||||

| Figure 14-19 |

Partition Analysis - Sulfide Sulfur (Left), Total Sulfur (Right) |

159 | ||||

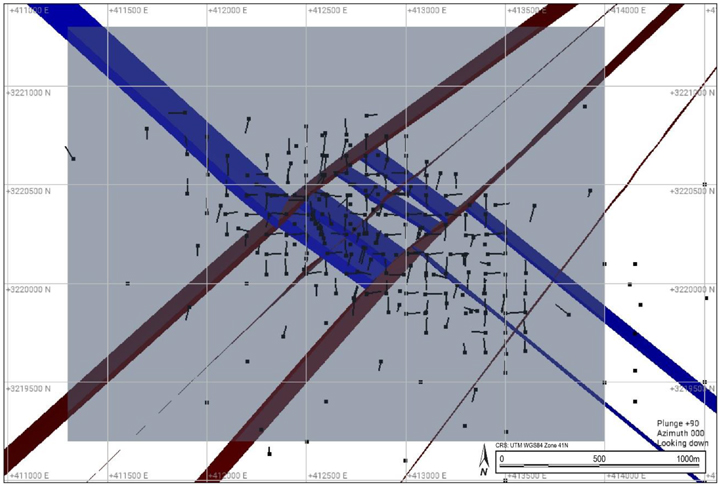

| Figure 14-20 |

Example Structural Plan View |

162 | ||||

| Figure 14-21 |

Lithology Plan View |

163 | ||||

| Figure 14-22 |

Lithology Model and Drilling Vertical Section (+/-50 m) |

163 | ||||

| Figure 14-23 |

Typical Alteration Cross-Section |

164 | ||||

| Figure 14-24 |

Tanjeel Min Zone Model Section |

165 | ||||

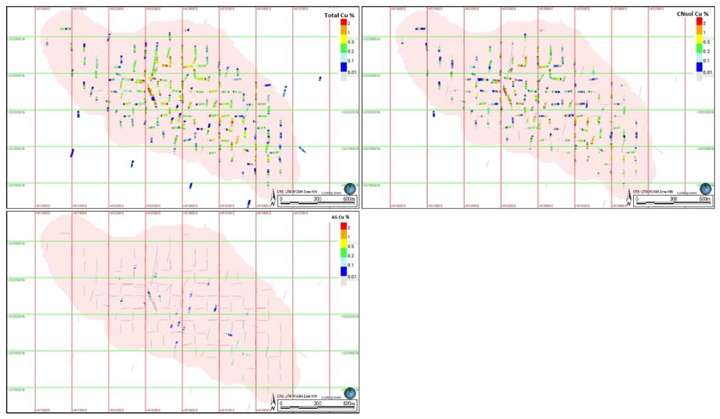

| Figure 14-25 |

Top Left – TCu (%), Top Right – CSCu (%), Bottom – ASCu (%) |

166 | ||||

| Figure 14-26 |

Plan View – Total Sulfur (%) |

167 | ||||

| Figure 14-27 |

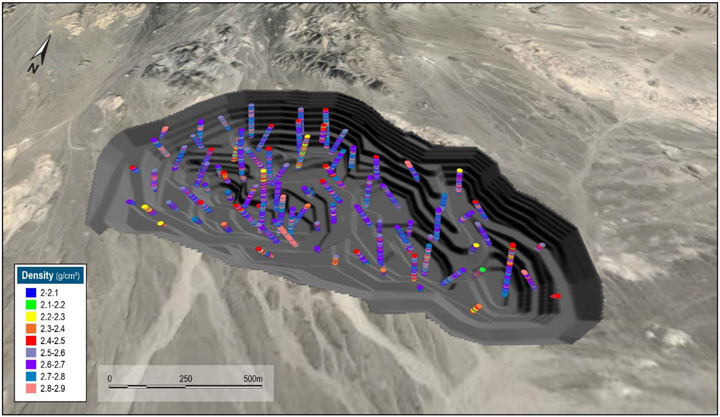

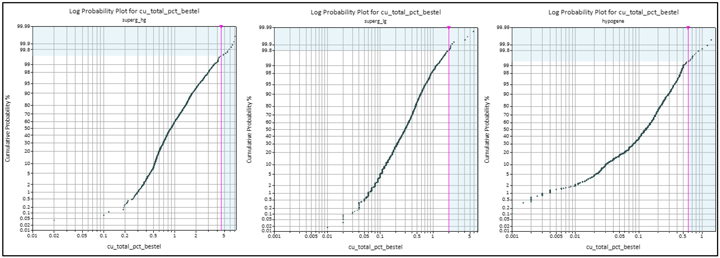

Oblique View Showing Density Determinations |

168 | ||||

| Figure 14-28 |

Histogram of Raw Density |

169 | ||||

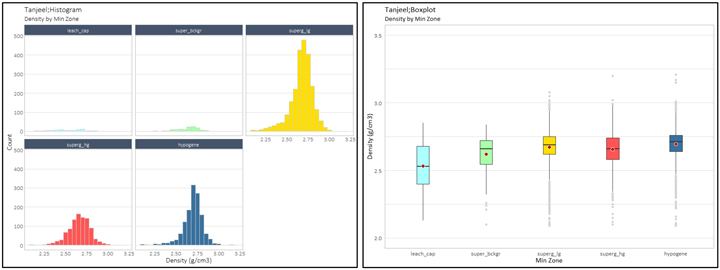

| Figure 14-29 |

Example Contact Analysis Plot |

170 | ||||

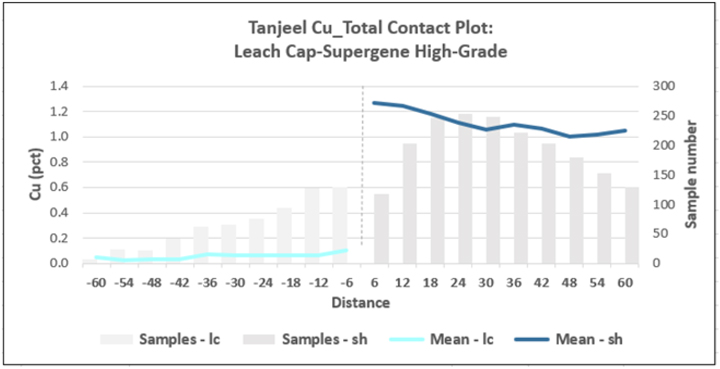

| Figure 14-30 |

Probability Plots for Supergene High Grade (left), Supergene Low Grade (middle)and Hypogene (right) |

171 | ||||

| Figure 14-31 |

Example Variogram Model (Domain pfb1_scc_in as shown in purple) |

172 | ||||

| Figure 14-32 |

Pass Percentage by Domain |

174 | ||||

| Figure 14-33 |

Example Copper Estimates Swath Plots |

176 | ||||

| Figure 14-34 |

Mineral Resource Classification – Western Porphyries |

178 | ||||

| Figure 14-35 |

Mineral Classification - Tanjeel |

179 | ||||

| Figure 14-36 |

Section Views through H14 of Resource Pit and Copper Distribution in WP |

181 | ||||

| Figure 14-37 |

Section Views of Resource Pit and Copper Distribution in Tanjeel |

182 | ||||

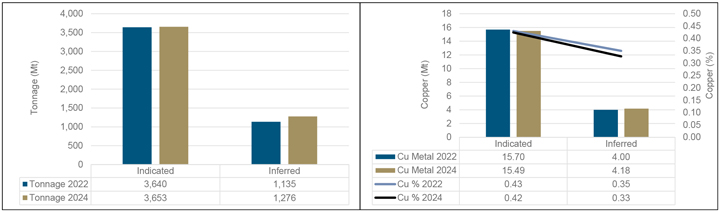

| Figure 14-38 |

Comparison of 2022 and 2024 Western Porphyries models |

185 | ||||

| Figure 14-39 |

Comparison of 2022 and 2024 Tanjeel models |

186 | ||||

| Figure 15-1 |

WP Pit Shell Contained Metal by Revenue Factor |

198 | ||||

| Figure 15-2 |

Tanjeel Pit Shell Contained Metal by Revenue Factor |

199 | ||||

| Figure 15-3 |

WP Pit Shell Sensitivity to Economic Inputs – Cu Mt (Left), Au Moz (Right) |

201 | ||||

| Figure 15-4 |

Tanjeel Pit Shell Sensitivity to Economic Inputs – Cu Mt |

201 | ||||

| Figure 16-1 |

Diversion Concept for the Pit (2032) |

212 | ||||

| Figure 16-2 |

Typical Dual Haulage Ramp Cross-Section |

213 | ||||

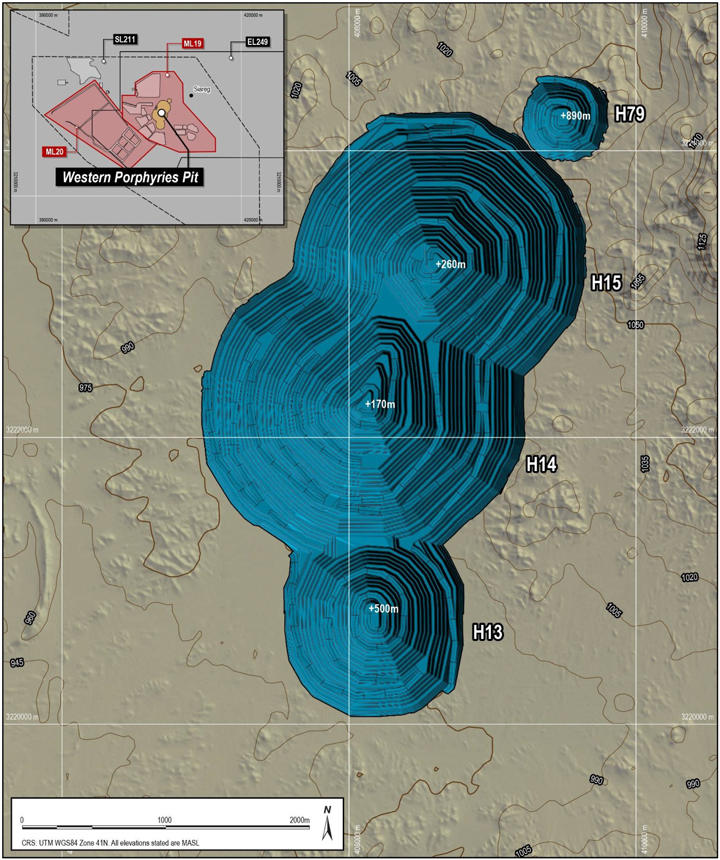

| Figure 16-3 |

WP Ultimate Pit Design |

215 | ||||

| Figure 16-4 |

Western Porphyries Phase Designs |

217 | ||||

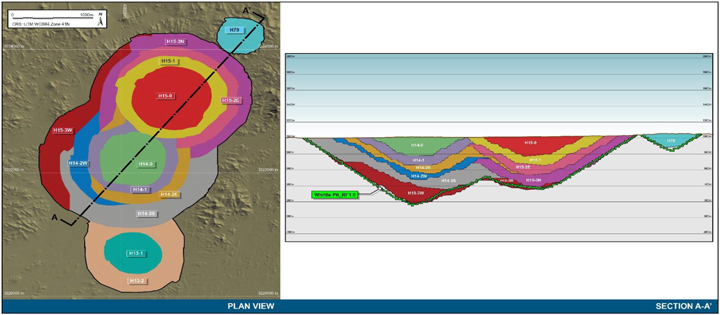

| Figure 16-5 |

Tanjeel Ultimate Pit Design |

218 | ||||

| Figure 16-6 |

Tanjeel Phase Designs |

220 | ||||

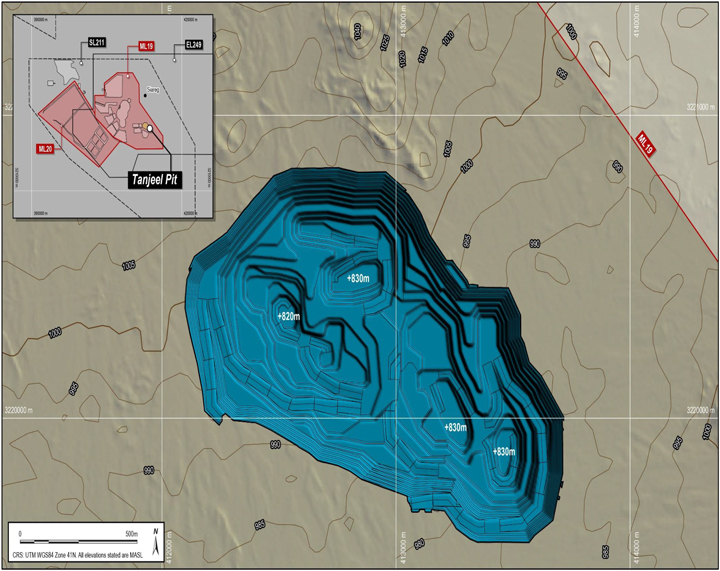

| Figure 16-7 |

Site Waste Dump and Stockpile Layout |

221 | ||||

| Figure 16-8 |

North Waste Dump Design |

226 | ||||

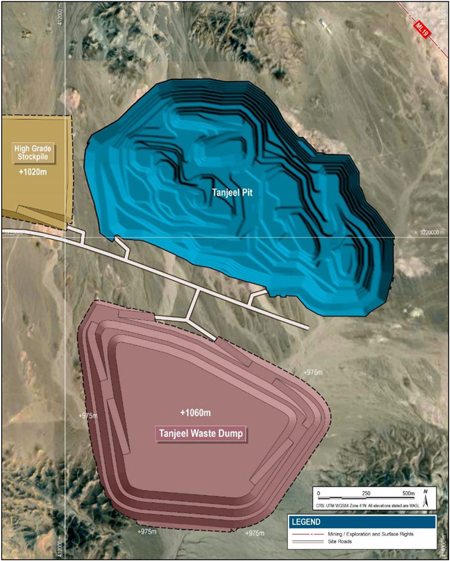

| Figure 16-9 |

South Waste Dump Design |

227 | ||||

| Figure 16-10 |

Tanjeel Waste Dump Design |

228 | ||||

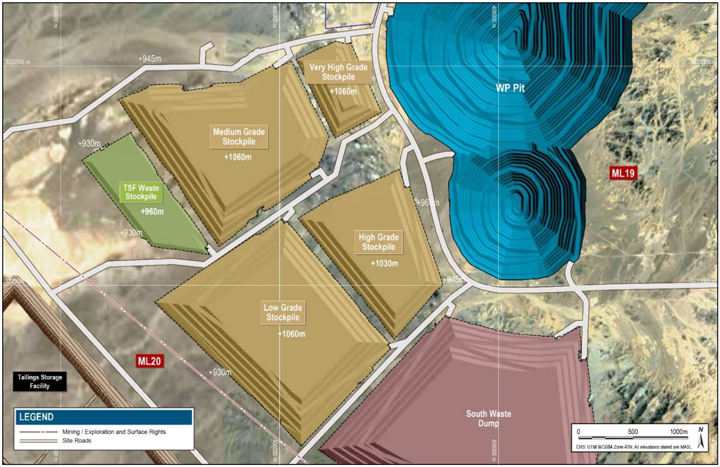

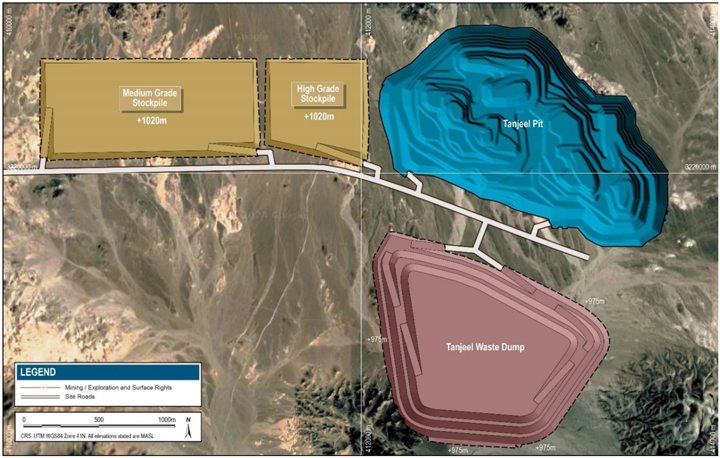

| Figure 16-11 |

Western Porphyries Stockpile Layout |

230 | ||||

| Figure 16-12 |

Tanjeel Stockpile Layout |

230 | ||||

| Figure 16-13 |

LOM Production Schedule – Mined Tonnes |

235 | ||||

| Figure 16-14 |

LOM Production Schedule – Mill Feed Tonnes |

235 | ||||

| Figure 17-1 |

Block Flow Diagram – Reko Diq Process Plant |

241 | ||||

| Figure 18-1 |

Regional Logistical Infrastructure |

249 | ||||

| Figure 18-2 |

On-Site Infrastructure |

250 | ||||

| Figure 18-3 |

PIBT Option |

254 |

|

February 19, 2025 |

Page 13 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| Figure 18-4 |

Water NOC Location Plan |

257 | ||||

| Figure 18-5 |

Basic Flow Diagram Outlining Main Flows and Planned Water Infrastructure |

260 | ||||

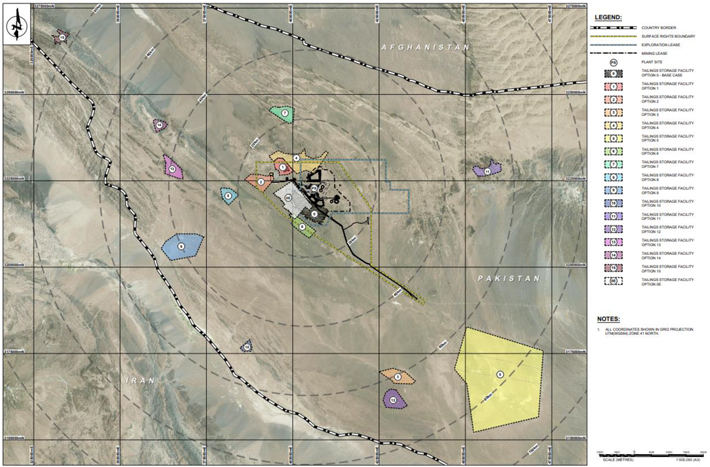

| Figure 18-6 |

Potential Tailings Storage Sites |

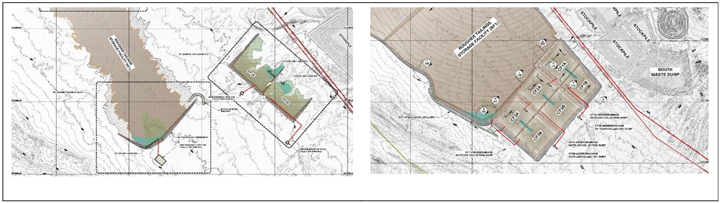

269 | ||||

| Figure 18-7 |

TSF Stage 1 (Left) and TSF Stage Final (Right) General Arrangement |

272 | ||||

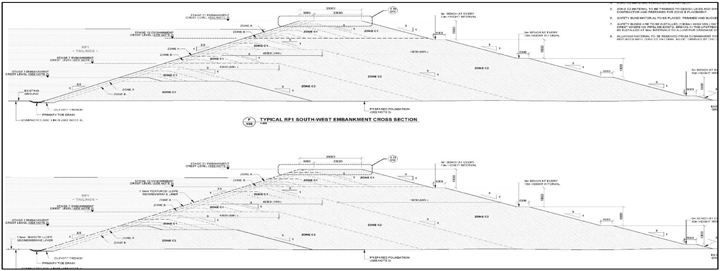

| Figure 18-8 |

RF1 and RF2 - Typical Embankment Cross-Sections |

272 | ||||

| Figure 18-9 |

Cleaner TSF Stage 1 and TSF Stage Final (Right) General Arrangement |

273 | ||||

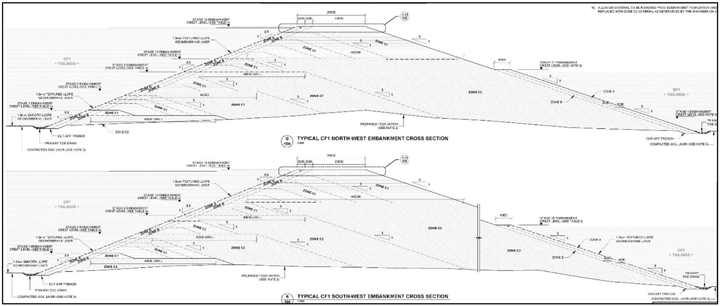

| Figure 18-10 |

Cleaner TSF Typical Embankment Cross-Sections |

273 | ||||

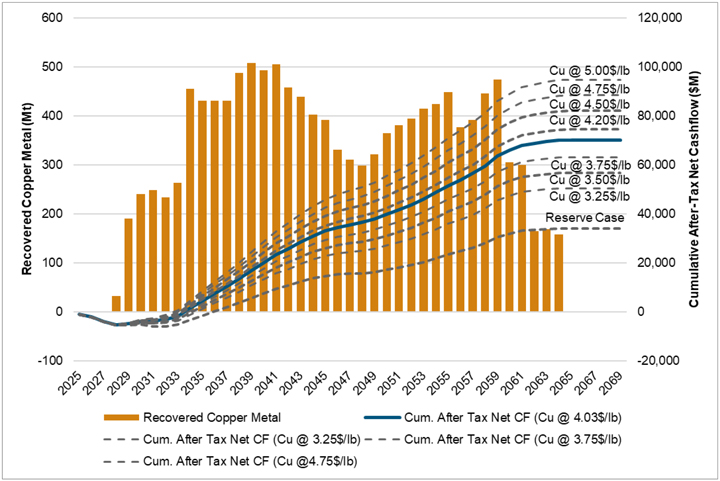

| Figure 22-1 |

Copper Price Impact on Post Tax Cash Flow (Undiscounted) |

304 | ||||

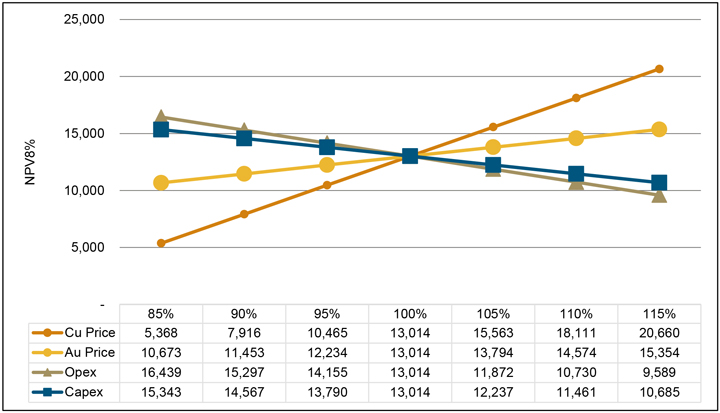

| Figure 22-2 |

Sensitivity Chart: NPV8 |

313 | ||||

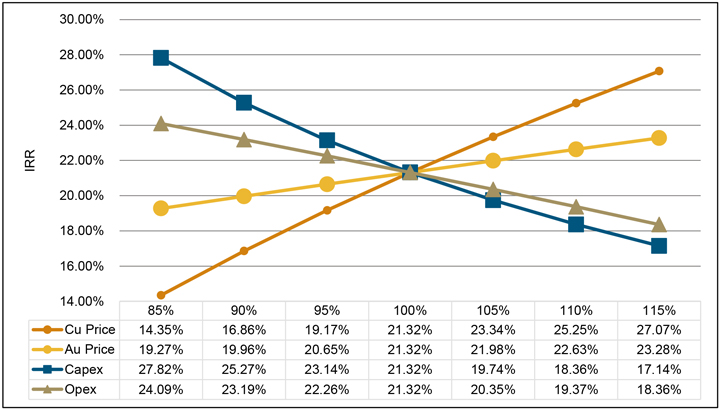

| Figure 22-3 |

Sensitivity Chart: IRR |

313 |

|

February 19, 2025 |

Page 14 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

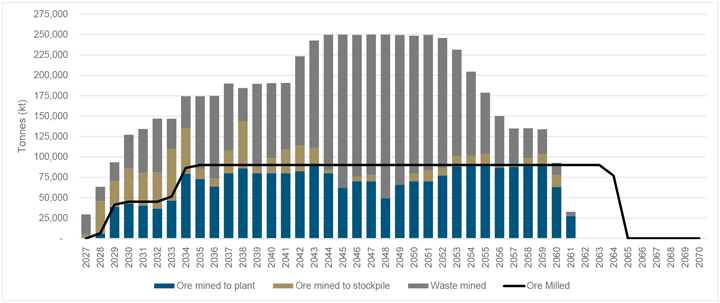

| 1 | Summary |

This Technical Report on the Reko Diq Project (the Project), located in the Balochistan Province of Pakistan has been prepared by Barrick Gold Corporation (Barrick). The purpose of this Technical Report is to support public disclosure of Mineral Resource, maiden Mineral Reserve estimate and a Feasibility Study at the Project as of December 31, 2024.

Barrick is a Canadian publicly traded mining company with a portfolio of operating mines and advanced exploration and development projects. Barrick is the issuer of this Technical Report and indirectly owns 50% of the Project, and is the operator on behalf of Reko Diq Mining Company (Private) Limited (RDMC).

The recently completed Feasibility Study details two phases of project development:

| ● | Phase 1 – Initial throughput of 45 Mtpa of ore that commences production in 2028; and |

| ● | Phase 2 – Expansion to a total throughput of 90 Mtpa that is planned to occur from 2034 onwards. |

The Project will comprise of two open pit mines, the main open pit at Western Porphyries and a satellite pit at Tanjeel, and a processing plant, together with other associated mine operation and regional infrastructure. The Project will produce copper concentrate which includes gold for smelting by third-party operated smelters.

All costs presented in this document are in USD (US$ or $) unless otherwise noted.

| 1.1 | Description, Location, and Ownership |

| 1.1.1 | Location |

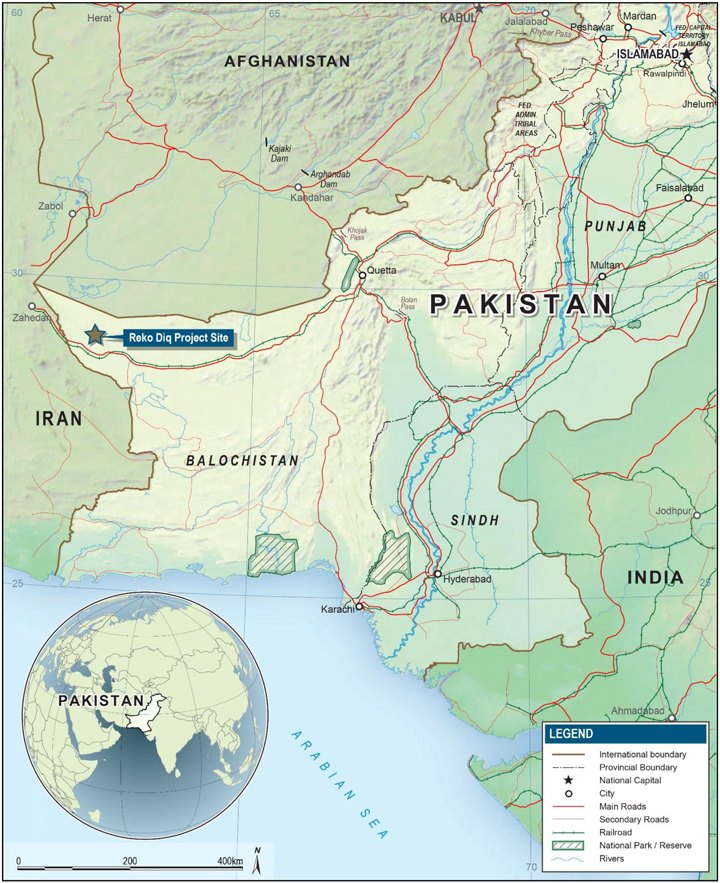

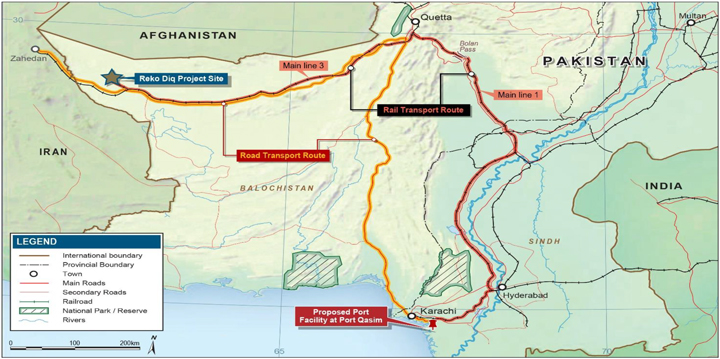

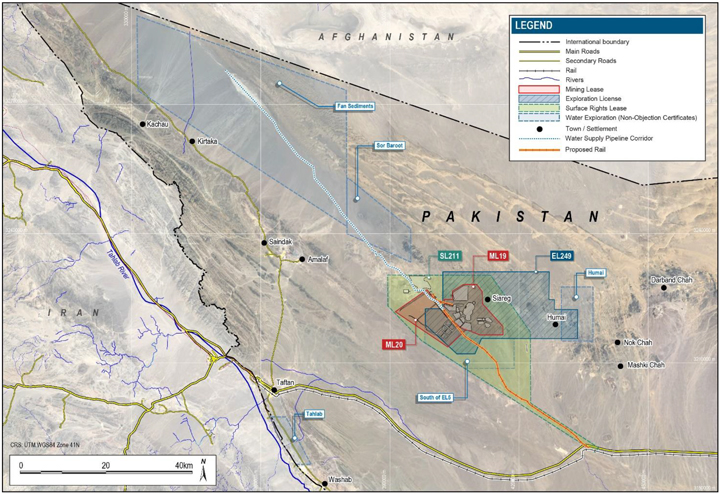

The Project is located in the north-western corner of the Balochistan Province of Pakistan (Figure 4-1). Balochistan borders Iran to the west, Afghanistan to the north, the Punjab and Sindh Provinces of Pakistan to the east, and the Arabian Sea to the south. The population of Balochistan is approximately 6.5 million people and the capital city is Quetta.

| 1.1.2 | Ownership |

RDMC is indirectly owned 50% by Barrick and 50% by Pakistani stakeholders.

|

February 19, 2025 |

Page 15 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Barrick is a Canadian publicly traded gold and copper mining company with a portfolio of operating mines and projects across North America, Africa, South America, and Asia.

The 50% Pakistan stakeholder interests comprise a 10% free-carried, non-contributing share held directly by the Government of Balochistan (the GoB), an additional 15% held by the GoB indirectly through Balochistan Mineral Resources Limited (BMRL) a special purpose company wholly owned by the GoB and 25% indirectly owned by the Government of Pakistan (the GoP) through three Pakistani state-owned enterprises (the SOEs), Oil & Gas Development Company Limited (OGDCL), Government Holdings (Private) Ltd. (GHPL) and Pakistan Petroleum Ltd. (PPL). The SOEs hold their interests (in equal thirds) through Pakistan Minerals (Private) Ltd. (PMPL).

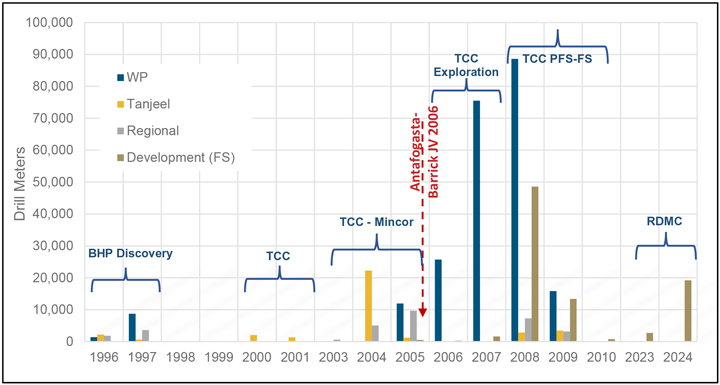

| 1.1.3 | History |

Several companies have held interests in the Project since 1996 with approximately 360 km of drilling being undertaken to date within the Exploration License. Exploration commenced in 1996 with several campaigns of drilling being completed, culminating with the latest drilling to support the Mineral Resources finishing in 2009. The project was put on hold in 2010 after disputes arose with the GoB and the GoP.

In November 2011, Tethyan Copper Company Pty. Limited (TCC, which is now known as RDMC) filed for arbitration against the Government of Pakistan and the Government of Balochistan in respect of contractual and treaty investment claims relating to the Reko Diq Project. By July 2019, arbitration tribunals ruled in favour of TCC and, among other things, rendered a multi-billion-dollar damages award against the GoP (the Award). Barrick, Antofagasta, the GoB, and the GoP subsequently engaged in discussions regarding alternatives for the resolution of the Award that maximally satisfied the objectives of each party and all related stakeholders. Ultimately, these negotiations resulted in the reconstitution of the Project. The Project was formally reconstituted in December 2022. The reconstitution was approved by the Government of Balochistan, the Government of Pakistan and the Supreme Court which issued a favourable opinion in respect of the legality of the agreements concluded as part of the reconstitution under Pakistan law. The agreements include the Project Joint Venture Agreement and Mineral Agreement which respectively form the basis for the governance of the Project and the applicable royalty and tax regime, including fiscal stabilisation.

The process above is referred to as the “Reconstitution”. The Agreements above are referred to in the Report collectively as “Project Agreements”.

| 1.2 | Geology and Mineralisation |

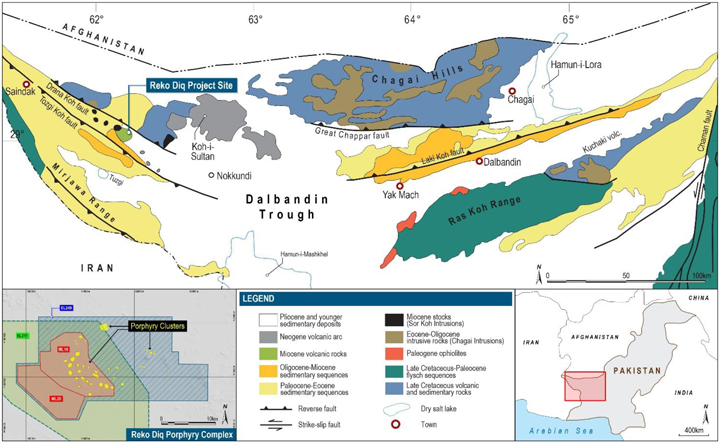

Copper and gold mineralization is associated with a regional-scale porphyry system primarily contained within a series of diorite to quartz-diorite bodies that have intruded the Dalbandin and

|

February 19, 2025 |

Page 16 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Reko Diq formations. These intrusions are fine to medium-grained displaying porphyritic textures with alteration halos radiating outwards. Mineralization is primarily within the intrusives, however, also occurs in the adjacent altered wall rock. The intrusions occur as stocks, dykes, sills, and dyke swarms, with bodies typically ranging in size, but have diameters less than 3 km.

The Western Porphyries display a minor (<50 m) leach cap with primary mineralization occurring at surface. The limited leach cap formed when the system was uplifted quickly during deformation resulting in the minor development of a supergene system. Mineralization at the Western Porphyries is primary hypogene with chalcopyrite dominant near surface with bornite abundance increasing at depth. Extensive pyrite has been identified (generally less than 4%) with minimal oxide mineralization identified.

Tanjeel is a supergene system with mineralization occurring as a moderately well developed, sub-horizontal, copper enrichment blanket. The system is relatively small compared to Western Porphyries (representing approximately 6% of the total recovered copper for the life of the Project) and contains an upper pyrite-chalcocite system with a pyrite-chalcopyrite hypogene underlying system. Copper oxide is common and occurs as malachite, copper wad, as well as chalcanthite where exposed chalcocite has oxidized. The pyrite content can reach 12% accounting for the required generation of sulphur to mobilize copper in the supergene system.

| 1.3 | Exploration Status |

Significant exploration and resource drilling has been undertaken on the Project resulting in the Mineral Resources and Mineral Reserve reported in this Report. The Project is a development asset, with early construction works underway, as well as ongoing development, infill, and exploration drilling to support detailed design and initial operations.

| 1.4 | Mineral Resource Estimate |

The Mineral Resource estimate has been prepared according to the Canadian Institute of Mining, Metallurgy and Petroleum 2014 Definition Standards for Mineral Resources and Mineral Reserves dated 10 May 2014 (CIM (2014) Standards) as incorporated in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). Mineral Resource estimate was also prepared using the guidance outlined in CIM Estimation of Mineral Resources and Mineral Reserves (MRMR) Best Practice Guidelines 2019 (CIM (2019) MRMR Best Practice Guidelines).

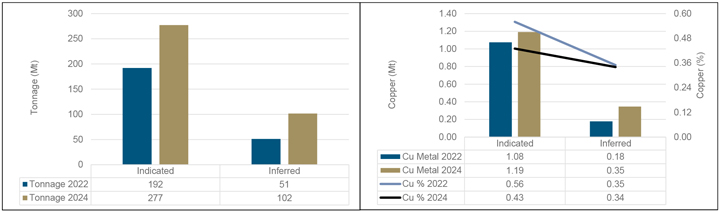

Since the Statement of Mineral Resources reported by Barrick as of December 31, 2022, there have been minor changes to the Resource estimate. The main drivers were changes in the operating costs

|

February 19, 2025 |

Page 17 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

and processing recoveries which underpin the cut off grade and pit shell determinations used for reporting. No additional drilling is included in the updated Mineral Resource estimate.

Mineral Resources considered amenable to open pit mining methods were constrained within a Lerchs-Grossmann pit shell that used a copper price of $4.00/lb, and a gold price of $1,900/oz. Value-based routing was used in generating the cost and cash value of each block to determine reasonable prospects for economic extraction. This is demonstrated in the results of the pit optimization process based on the processing recoveries, and mining costs outlined below. Within the pit optimization, the Mineral Resources were reported using an NSR approach based on the same parameters.

The estimate was reviewed internally as well as externally and approved by the Qualified Person and Barrick prior to release.

The QP is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors which could materially affect the Mineral Resource estimate.

Table 1-1 summarises the Reko Diq Mineral Resources, inclusive of Mineral Reserves, as of December 31, 2024.

|

February 19, 2025 |

Page 18 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Table 1-1 Reko Diq Mineral Resources Summary, 100% Basis, as of December 31, 2024

|

Location |

Measured | Indicated | Measured + Indicated | Inferred | ||||||||||||||||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | |||||||||||||

| (Mt) |

Cu (%) |

Cu (M)t |

(Mt) |

Cu (%) |

Cu (Mt) |

(Mt) |

Cu (%) |

Cu (Mt) |

(Mt) |

Cu (%) |

Cu (Mt) |

|||||||||||||

| Western Porphyries | - | - | - | 3,653 | 0.42 | 15 | 3,653 | 0.42 | 15 | 1,276 | 0.3 | 4.2 | ||||||||||||

| Tanjeel | - | - | - | 277 | 0.45 | 1.3 | 277 | 0.45 | 1.3 | 102 | 0.3 | 0.3 | ||||||||||||

| Reko Diq Total | 3,930 | 0.43 | 17 | 3,930 | 0.43 | 17 | 1,378 | 0.3 | 4.5 | |||||||||||||||

|

Location |

Measured | Indicated | Measured + Indicated | Inferred | ||||||||||||||||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | |||||||||||||

| (Mt) |

Au (g/t) |

Au (Moz) |

(Mt) |

Au (g/t) |

Au (Moz) |

(Mt) |

Au (g/t) |

Au (Moz) |

(Mt) |

Au (g/t) |

Au (Mg/t) |

|||||||||||||

| Western Porphyries | - | - | - | 3,653 | 0.25 | 29 | 3,653 | 0.25 | 29 | 1,276 | 0.2 | 7.8 | ||||||||||||

| Reko Diq Total | 3,653 | 0.25 | 29 | 3,653 | 0.25 | 29 | 1,276 | 0.2 | 7.8 | |||||||||||||||

Notes:

| ● | Mineral Resources are reported on 100% basis. Barrick’s attributable share of the Mineral Resource is based on its 50% interest in Reko Diq. |

| ● | The Mineral Resource estimate has been prepared according to CIM (2014) Standards and using CIM (2019) MRMR Best Practice Guidelines. |

| ● | Mineral Resources are reported based on an economic pit shell. |

| ● | Mineral Resources are reported using a long-term price of US$4.00/lb Cu and US$1,900/oz Au. |

| ● | NSR calculation considers smelting, refining and treatment charges, and payment terms, concentrate transport, metallurgical recoveries and royalties. |

| ● | Mineral Resources are inclusive of Mineral Reserves. |

| ● | Contained metal is reported in millions of tonnes of copper and million troy ounces of gold. |

| ● | Numbers may not add due to rounding. |

| ● | The QP responsible for this Mineral Resource Estimate is Peter Jones (MAIG). |

|

February 19, 2025 |

Page 19 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 1.5 | Mineral Reserve Estimate |

The Mineral Reserve estimate has been prepared according to the Canadian Institute of Mining, Metallurgy and Petroleum 2014 Definition Standards for Mineral Resources and Mineral Reserves dated 10 May 2014 (CIM (2014) Standards) as incorporated with National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101). Mineral Reserve estimate was also prepared using the guidance outlined in CIM Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines 2019 (CIM (2019) MRMR Best Practice Guidelines).

The Mineral Reserves have been estimated from the Indicated Mineral Resources (as shown in Table 1-1 above, there are currently no Measured Mineral Resources) and do not include any Inferred Mineral Resources. Mineral Reserves include material that will be mined by open pit.

The estimate uses economic assumptions, the Mineral Resource and geological models (as described in Section 14), and modifying factors including geotechnical, and metallurgical recovery parameters. The Qualified Person responsible for estimating the Mineral Reserves has performed an independent verification of the block model tonnes and grade, and in their opinion the process has been carried out to industry standards.

The final pit limit selection and design process is outlined in Section 16. A site-specific financial model was populated and reviewed which demonstrates that the Mineral Reserves are economically viable.

A summary of the Mineral Reserves is shown in Table 1-2. Mineral Reserves are estimated:

| ● | As of December 31, 2024. |

| ● | Using a copper price of $3.00/lb. |

| ● | Using a gold price of $1,400/ oz. |

| ● | As ROM grades and tonnage delivered to the primary crushing facility. |

|

February 19, 2025 |

Page 20 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Table 1-2 Reko Diq Mineral Reserves Statement, December 31, 2024

| Location | Proven | Probable | Proven and Probable | |||||||||||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | ||||||||||

| (Mt) | Cu (%) |

Cu (Mt) |

(Mt) | Cu (%) |

Cu (M)t |

(Mt) | Cu (%) |

Cu (Mt) |

||||||||||

|

Western Porphyries |

- | - | - | 2,861 | 0.48 | 14 | 2,861 | 0.48 | 14 | |||||||||

|

Tanjeel |

- | - | - | 147 | 0.62 | 1 | 147 | 0.62 | 1 | |||||||||

|

Reko Diq Total |

3,008 | 0.48 | 15 | 3,008 | 0.48 | 15 | ||||||||||||

| Location | Proven | Probable | Proven and Probable | |||||||||||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | ||||||||||

| (Mt) | Au (g/t) |

Au (Moz) |

(Mt) | Au (g/t) |

Au (Moz) |

(Mt) | Au (g/t) |

Au (Moz) |

||||||||||

|

Western Porphyries |

- | - | - | 2,861 | 0.28 | 26 | 2,861 | 0.28 | 26 | |||||||||

|

Reko Diq Total |

2,861 | 0.28 | 26 | 2,861 | 0.28 | 26 | ||||||||||||

Notes:

| ● | Proven and Probable Mineral Reserves are reported on 100% basis. Barrick’s attributable share of the Mineral Resource is based on its 50% interest in Reko Diq. |

| ● | The Mineral Reserve estimate has been prepared according to CIM (2014) Standards and using CIM (2019) MRMR Best Practice Guidelines. |

| ● | Mineral Reserves are reported at a copper price of US$3.00/lb and a gold price of US$1,400/oz. |

| ● | Pit optimizations were run at US$3.00/lb Cu and US$1,300/oz Au. The additional material as a result of US$1,400/oz Au represented no material change to the Mineral Reserve. |

| ● | Mineral Reserves are estimated based on an economic pit design applying appropriate costs and modifying factors. |

| ● | Mineral Reserves are based on a NSR cut-off considering smelting, refining and treatment charges, and payment terms, concentrate transport, metallurgical recoveries and royalties. |

| ● | All reported metal is contained before process recovery; metal recoveries are variable based on material type |

| ● | Contained metal is reported in millions of tonnes of copper and million troy ounces of gold. |

| ● | Numbers may not add due to rounding. |

| ● | The QP responsible for the Mineral Reserve Estimate is Mike Saarelainen, FAusIMM. |

|

February 19, 2025 |

Page 21 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 1.6 | Mining Methods |

The Reko Diq mine has been designed as two large-scale open pit operations. The Western Porphyries will be mined with electric rope and hydraulic shovels while Tanjeel will utilize hydraulic shovels. Both operations will utilize 360-t haul trucks. Mining will be carried out year-round, 24 hours per day using conventional drill, blast, and load and haul methods. At peak production the Western Porphyries pit is forecast to reach a total material movement rate of 250 Mtpa while Tanjeel will achieve 40 Mtpa.

Haul trucks will deliver run-of-mine (ROM) ore from the open pits directly to the primary crushers or nearby ROM pad, or to temporary longer-term ore stockpiles. Waste rock will be placed in one of three onsite waste rock dumps or used for tailings storage facility construction.

Over the life-of-mine, an estimated 3,008 million tonnes of ore will be delivered to the plant at an average grade of 0.48% copper and 0.26 g/t gold. There is an estimated total of 3,205 million tonnes of waste rock mined, resulting in an average strip ratio of 1.07 waste to ore. The strip ratio in the first 10 years of production is 0.64 waste to ore. The total mine life is expected to be approximately 37 years from commissioning of the plant in 2028. Mining is forecast to finish in 2061 followed by three years of processing of stockpiles to 2064.

| 1.7 | Mineral Processing |

The process flowsheet was selected based on metallurgical testwork conducted from 2023 to 2024 which built upon previous work conducted between 2007 and 2009.

The 2007 to 2009 testwork program was undertaken in three phases and included flotation and comminution variability samples, bench testing and pilot plant testwork, and High Pressure Grinding Roll testwork.

The primary goal of the 2023 to 2024 testwork program was intended to ensure suitability of the process flowsheet and forecast recoveries to underpin the LOM plan and focused on the initial 10 years of production. The program included comminution testwork, conventional, high-shear and coarse particle flotation testwork, and ancillary vendor testwork in line with industry standards for the level of study.

The expected average recovery is 89.9% copper, and 69.9% gold based on the current life-of-mine plan and testwork completed to date. Copper recovery in the first 10 years is forecasted at 90.1%.

|

February 19, 2025 |

Page 22 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

The process flowsheet is based on industry standard proven technology that will comprise feed preparation using two-stage crushing and high-pressure grinding rolls followed by a closed-circuit ball milling circuit. Product from the comminution circuit will feed a bulk sulphide rougher flotation circuit with rougher concentrate reground and upgraded to final concentrate grade in a two stage cleaner circuit. The final concentrate handling circuit will consist of concentrate thickening and filtration, with filter cake stored on site before being transported to the port via rail.

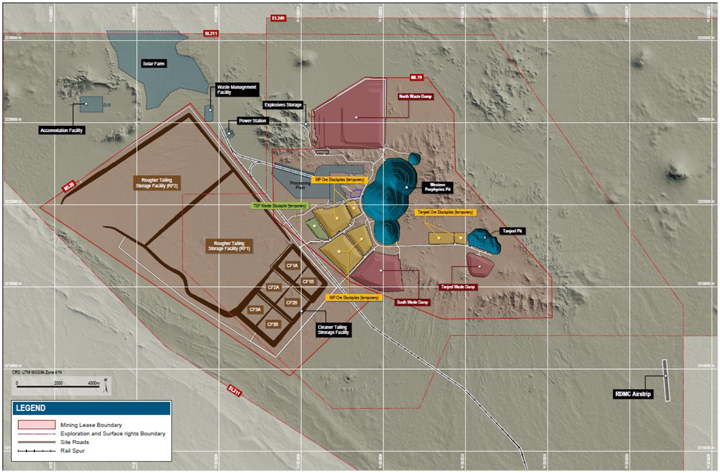

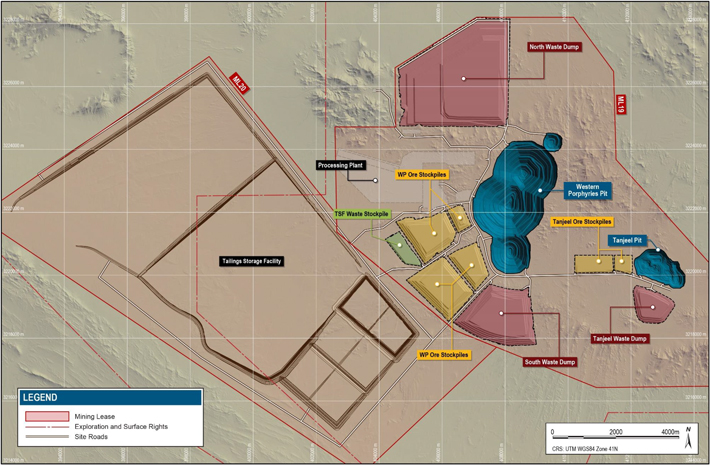

| 1.8 | Project Infrastructure |

The Project proposes to utilize rail, road, and port infrastructure throughout the region, including an existing rail network route to Port Qasim for export to international markets (for which upgrades to meet Project requirements will be required). The Project is planned to be connected to the National Highway N40 via a purpose built 45 km road. Site roads will connect the various areas within the Project and allow for haulage of mined material and other vehicle movements.

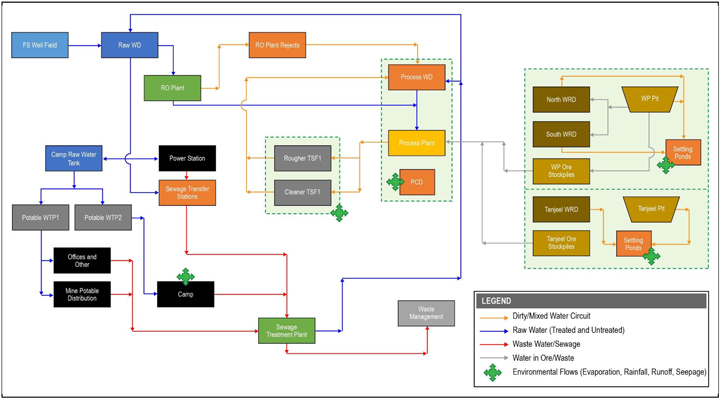

Power will be supplied by an onsite hybrid microgrid power solution, comprising heavy fuel oil power generating sets, diesel generating sets, a solar photovoltaic array, and a battery energy storage system. The base case for the Feasibility Study assumes the power supply will be sourced from the national grid from Year 15 of mining with the heavy fuel oil generating sets remaining on standby.

Groundwater is planned as the primary water supply. Water will be supplied from boreholes located north of the mine and will be supplied via a pipeline of approximately 70 km. Water demand has been calculated and based on expected water usage for both construction and operations. Water distribution will be via dedicated service lines at the required pressures and flows, to all required facilities and buildings on site.

A conventional thickened tailings storage facility will be constructed and will be sized to accommodate the anticipated life-of-mine material. The facility will be located to the southwest of the process plant.

Site infrastructure includes security facilities, airstrip, roads, accommodation village, maintenance facilities, stockpiles, and other auxiliary buildings. The site common purpose infrastructure will be initially developed to support Phase 1 with allowance for expansion where appropriate to support Phase 2.

The on-site infrastructure is shown in Figure 1-1.

|

February 19, 2025 |

Page 23 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Source: Barrick, 2024

Figure 1-1 On-site Infrastructure

| 1.9 | Market Studies and Contracts |

The planned product is a conventional copper concentrate with payable levels of gold. This product is not projected to contain deleterious elements at penalty levels and is expected to be readily marketable to smelters. As of December 31, 2024, there were no offtake contracts in place.

While there are numerous contracts in place at the Project, there are no currently executed contracts considered to be material to Barrick.

| 1.10 | Environmental, Permitting and Social Considerations |

An Early Works Environmental and Social Impact Assessment (ESIA) was produced in February 2024, which the regulators approved in May 2024. Subsequently, a Project ESIA aligned to the Feasibility Study was completed in late 2024. Approval from the regulators, the Balochistan and Sindh Environmental Protection Agencies, is expected in early 2025.

|

February 19, 2025 |

Page 24 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

These assessments were completed in line with the relevant National and Provincial Environment and Social legislative requirements, the Equator Principles 4, and the International Finance Corporation’s Environment and Social Performance Standards and Guidelines.

The work conducted for the Feasibility Study and Project ESIA identified potential environmental and social impacts. Corresponding mitigation and management measures were developed in an Environmental and Social Management and Monitoring Plan.

The Project ESIA summarises the proposed risk mitigation measures for the above identified environmental and social risks. These proposed risk mitigation measures comprise a combination of design, management, and stakeholder engagement.

| 1.11 | Capital and Operating Costs |

Cost estimates correspond with an accuracy of +/-15%. The Phase 1 project capital cost is estimated to be $5,566M in order to reach initial production of 45Mtpa. The Phase 2 project capital is estimated to be $3,264M to increase the production capacity to 90Mtpa. Sustaining capital costs are $3,825M over the life of the mine with an estimated closure cost of $72M.

Operating costs over the life-of-mine are $57,489M with unit operating costs of $25.42/t and $18.58/t for Phase 1 and Phase 2 respectively.

The portion of the Phase 1 Initial capital costs attributable to Barrick under the terms of the JVA are $3,092M on a 100% equity basis, assuming no debt.

| 1.12 | Economic Analysis |

A financial analysis was carried out using a discounted cash flow approach to support the declaration of Minerals Reserves. The model included yearly cash inflows, or revenues, and subtracted yearly cash outflows such as operating costs, capital costs, and taxes.

Financial analysis of the Project shows after-tax NPV (at a discount rate of 8%), internal rate of return (IRR), and payback periods from 2028 as shown in Table 1-3. Reko Diq Mining Company is estimated to pay a total of $7,076M in taxes across the life of the mine.

|

February 19, 2025 |

Page 25 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Table 1-3 Copper Price Impact on Free Cash, NPV8, IRR and Payback Period

|

Copper Price ($/lb) |

Gold Price ($/oz) |

Free Cash ($M) |

After Tax NPV ($M) |

Project IRR (%) |

Payback Period (yrs) |

|||||

| 3.001 |

1,4001 | 33,994 | 4,032 | 12.89% | 8.46 | |||||

| 3.25 |

2,045 | 50,376 | 8,073 | 17.01% | 7.06 | |||||

| 3.50 |

2,045 | 56,710 | 9,653 | 18.45% | 6.70 | |||||

| 3.75 |

2,045 | 63,044 | 11,234 | 19.83% | 6.42 | |||||

| 4.03 |

2,045 | 70,178 | 13,014 | 21.32% | 6.16 | |||||

| 4.13 |

2,045 | 72,672 | 13,636 | 21.82% | 6.08 | |||||

| 4.20 |

2,045 | 74,446 | 14,079 | 22.18% | 6.02 | |||||

| 4.50 |

2,045 | 82,046 | 15,975 | 23.66% | 5.78 | |||||

| 4.75 |

2,045 | 88,380 | 17,556 | 24.84% | 5.57 | |||||

| 5.00 |

2,045 | 94,714 | 19,136 | 26.00% | 5.33 |

Notes:

| 1. | Reserve Pricing Case |

| 1.13 | Interpretations and Conclusions |

The QPs note the following interpretations and conclusions in their respective areas of expertise, based on the review of data available for this Report.

The Project as a whole has been designed to utilize industry standard practices and deploy conventional technology, with many of the technologies already employed at other mines Barrick operates, reducing the implementation operational risks. Where technologies are not employed by Barrick, benchmarked sites have been visited by the Project team to validate equipment selection and adopt best practices. Though new and emerging technologies are not included in the base case, the Project has been designed to allow for the adoption of technologies during the operational phase which, if realized, may result in potential improvements in operational performance from that which is presented in this Report.

| 1.13.1 | Mineral Tenure, Rights, Royalties and Agreements |

| ● | The Mineral Agreement, applicable Statutory Regulatory Orders and the Foreign Investment Promotion and Protection Act, 2022 (FDI Act), codified an agreed-to fiscal regime and 30-year stabilization period for the Project (i.e., until December 15, 2052) with automatic renewals for incremental periods of up to 30 years, at the request of RDMC. The JVA provides for the governance of the Project while the Mineral Agreement outlines the royalties and tax regime applicable to the Project, including tax holidays, among other things. |

| ● | The various rights secured for the Project are considered sufficient to support the Mineral Resources, Mineral Reserves, and life-of-mine plan presented in this Report. |

|

February 19, 2025 |

Page 26 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| 1.13.2 | Geology and Mineral Resources |

| ● | The understanding of the deposit settings, lithologies, and geologic, structural, and alteration controls on mineralization is sufficient to support the estimation of Mineral Resources and subsequent Mineral Reserves. |

| ● | Drilling, sample collection and QA/QC procedures that support the Mineral Resources have been conducted in accordance with industry standards at the relevant time and are supported by recent verification work. Therefore, are considered sufficient to support the declaration of the Mineral Resources and the classification presented in this Report. |

| ● | Snowden Optiro was engaged to complete an independent audit of the underlying data and the Mineral Resource estimation for Western Porphyries and Tanjeel. The audit concluded that the Mineral Resource estimate and the data collected to inform them do not present any fatal flaws and are logical and well considered. |

| ● | The estimated Mineral Resources currently in consideration for mining are defined by existing drilling, however, the Western Porphyries and Tanjeel remain open at depth and there is potential to expand the Minerals Resources with further drilling. |

| ● | The Project includes several exploration targets that have the potential to add to the existing Mineral Resource base and are considered substantial enough to warrant continued investment in parallel with the Project’s development. |

| 1.13.3 | Mining and Mineral Reserves |

| ● | The mine will employ conventional open pit truck and shovel mining methods. These methods are typical at Barrick operations as well as at mines operated by others in a variety of jurisdictions globally. |

| ● | Geotechnical recommendations were based on dedicated geotechnical drilling and testwork programs which were used in the mine design parameters and included the appropriate factors of safety. Recommendations were reviewed and verified by third parties. |

| ● | Mineral Reserves were estimated at copper and gold prices that are below current spot prices for both metals and are therefore considered resilient to changes in commodity prices. All other modifying factors used in the determination of the Mineral Reserves are appropriate for the Project and style of mineralization. |

| ● | There are Inferred Resources that sits within and below the currently designed open pits. Should this material be able to be converted to Indicated Resources, there is potential to increase the size of the Mineral Reserve. |

| 1.13.4 | Mineral Processing |

| ● | The process plant design is based on sufficient metallurgical testwork for this level of study to support the development of the flowsheet, forecast recoveries, and projected concentrate characteristics. |

| ● | The selected processing technology is conventional and includes comminution, floatation, thickening, and filtration. The design is at a scale comparable to other operations in the industry. |

|

February 19, 2025 |

Page 27 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| ● | The expected average recovery is 89.9% copper, and 69.9% gold based on the current life-of-mine plan and testwork completed to date. Copper recovery in the first 10 years is forecasted at 90.1%. Changes in the feed material characteristics may impact the actual achieved recovery. |

| 1.13.5 | Infrastructure |

| ● | Regional road, rail, and port infrastructure will be used during the construction and operation of the Project. Some upgrades and increased maintenance are required to meet the needs of the Project, which have been studied, and costs are included as appropriate. |

| ● | Most of the planned site infrastructure (waste storage facilities, offices, workshops, etc.), requires construction, and once constructed, is considered sufficient to support the mining operation as planned. Some aspects of the infrastructure will require expansion during the Phase 2, for which sufficient space has been allowed, as well as potential for further expansion beyond the stated Phase 2 capacity. |

| ● | The tailings storage facility is designed using conventional tailings deposition method and will be operated in accordance with Barrick’s internal policies and industry standard practices (including GISTM). The initial construction and subsequent planned dam raises provide sufficient storage capacity to support the stated Mineral Reserves. The tailings storage facility is designed in such a way that it can handle capacity beyond the stated Mineral Reserve with additional capital investment. |

| 1.13.6 | Environment, Permitting and Social Considerations |

| ● | The Project has been scoped and is being conducted to meet the requirements of international standards (IFC Performance Standards and Equator Principals 4, which are considered benchmarks for the industry), as well as Barrick’s own policies and standards. |

| ● | The Project has been granted many of the permits to support ongoing early works. However, as of the date of this Technical Report, a number of permits and approvals are still in the process of being obtained necessary for construction and operation. The expected permitting timeline allows for the development of the Project inline with the schedule presented in this Report (detailed in item 20 of the Report). |

| 1.13.7 | Market Studies and Contracts |

| ● | Copper concentrate is freely and regularly traded by a large number of parties. Barrick is not dependent upon the sale of copper to any one customer and its product is sold to a variety of traders and smelters. |

| ● | The planned concentrate product is expected to be readily marketable to third-party smelters. |

| ● | While there are numerous contracts in place, there are no currently executed contracts considered to be material to Barrick. |

| 1.13.8 | Capital and Operating Costs |

| ● | Capital and operating costs estimates for the study were estimated at what is considered sufficient for a Feasibility Study (+/- 15%). The costs were estimated as of Q3 2024 and are |

|

February 19, 2025 |

Page 28 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| considered current for the purpose of this Technical Report and the declaration of Mineral Reserves. |

| ● | Operating cost estimates include all operational activities required for the mining, processing, general and administrative costs, and offsite costs (including freight & refining and royalties) for all of the forecasted production. |

| 1.13.9 | Project Economics |

| ● | As a result of the Reconstitution of the Project and associated agreements, obligations such as tax and royalties, are well understood and have been reflected in the economic analysis. |

| ● | The Project’s NPV is most sensitive to changes in copper price and operating costs. Changes in these parameters from those listed in this Report will impact the NPV. |

| 1.13.10 | Risk |

The QPs have examined the various risks and uncertainties known or identified that could reasonably be expected to affect reliability or confidence in the exploration information, the Mineral Resources or Mineral Reserves of the Mine, or projected economic outcomes contained in this Technical Report. They have considered the controls that are in place or proposed to be implemented and have determined the residual risk post mitigation measures. The post mitigation risk rating is evaluated consistent with guidance provided by Barrick’s Formal Risk Assessment Procedure (FRA) and considers the likelihood and consequence of the risk’s occurrence and impact.

Table 1-4 details the significant risks and uncertainties as determined by the QPs for the Expansion Project.

|

February 19, 2025 |

Page 29 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

Table 1-4 Risk Analysis Summary

| Area | Risk | Mitigation | Post Mitigation Risk Rating |

|||

| Geology and Mineral Resources | Lower than modelled grades/tonnes |

● A number of internal and third-party reviews have been undertaken to date. ● Continue with reviews/audits of models on a regular basis ● Update model with reconciliation based on production data and infill grade control drilling once available. |

Medium | |||

| Mining and Mineral Reserves | Underperformance relative to FS mine plan | ● A number of internal and third-party reviews have been undertaken to date. ● Mine designs to adhere to geotechnical guidance for pit slopes and ramps. ● Dual ramp access to mining phases where practical. ● Mine plan to build ore stockpile inventory. ● Continue with geotechnical audits and compliance to design. |

Medium | |||

| Processing | Recovery lower than modelled due to ore variability / inadequate test work | ● Use of conventional process technology. ● Significant variability and bulk pilot testwork undertaken. ● Update process recovery curves with production data once available. ● Vendor testwork completed to determine processing performance and equipment selection as part of FS and BE. |

Medium | |||

| Project Infrastructure | Inadequate to support operations / planned capacity (site and regional) | ● The Feasibility Study engineering included all project infrastructure required to support the project. ● Redundancy design in key areas (e.g., power, spares, concentrate storage at site and port facility, etc.). ● Continued engagement with regional infrastructure partners (rail/port) and monitoring/maintenance of facilities. |

Medium | |||

| Tailings | Dam failure | ● Ongoing independent tailings review board process. ● No persons working/living downstream from the facility with dam breach analysis. |

High | |||

| Environmental | Impact on regional environment/habitat | ● Variety of environmental management plans have already been developed. ● Ongoing monitoring of performance and updating of management plans. |

Medium | |||

| Supply Chain | Disruption of supply chain for supplies, spares, fuel etc. | ● Plan for mine to hold multiple months of capacity for critical items. ● Initial fills and quantities of critical spares developed with major vendors. |

Medium | |||

| Human resources | Availability of qualified construction and operational personnel (contractor and owner) | ● Participate in market surveys to identify skills and define appropriate compensation for staff. ● Operational readiness and associated training programs. |

Medium | |||

|

February 19, 2025 |

Page 30 |

|

|

NI 43-101 Technical Report on the Reko Diq Project |

|

| Area | Risk | Mitigation | Post Mitigation Risk Rating |

|||

|

Security |

Terrorism or other attack (people and/or property) |

● Security management strategy in place (physical infrastructure and management plans). ● Monitoring of in-country risk status and intelligence monitoring. |

High | |||

|

Regulatory |

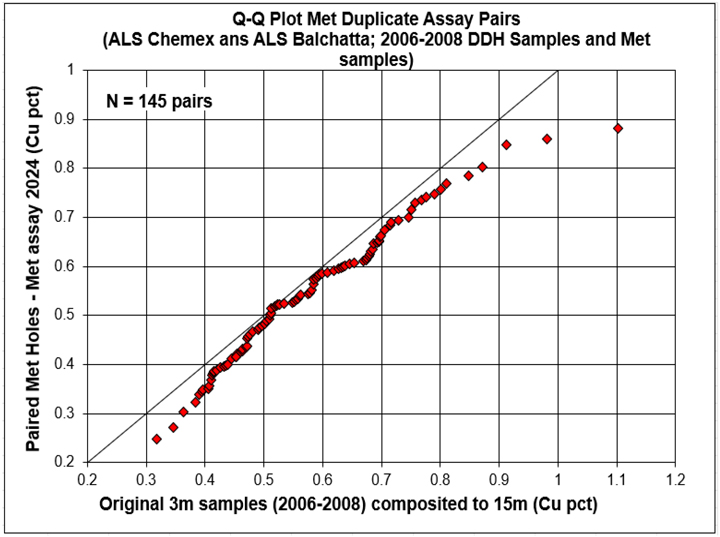

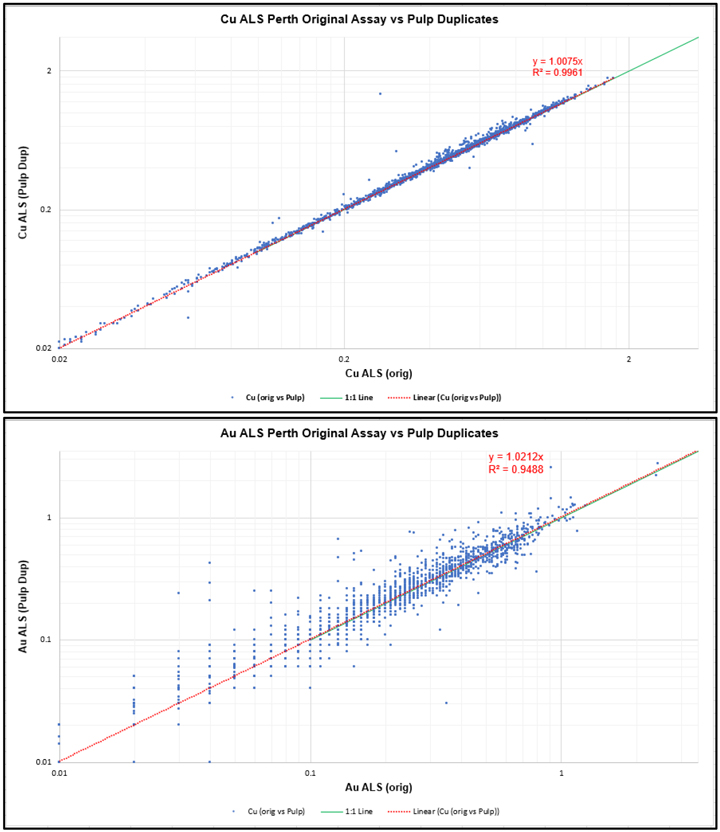

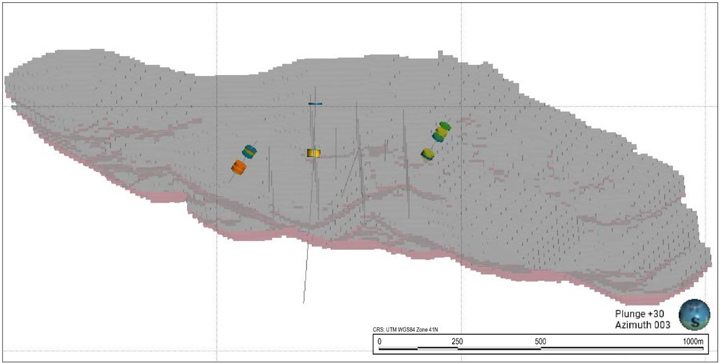

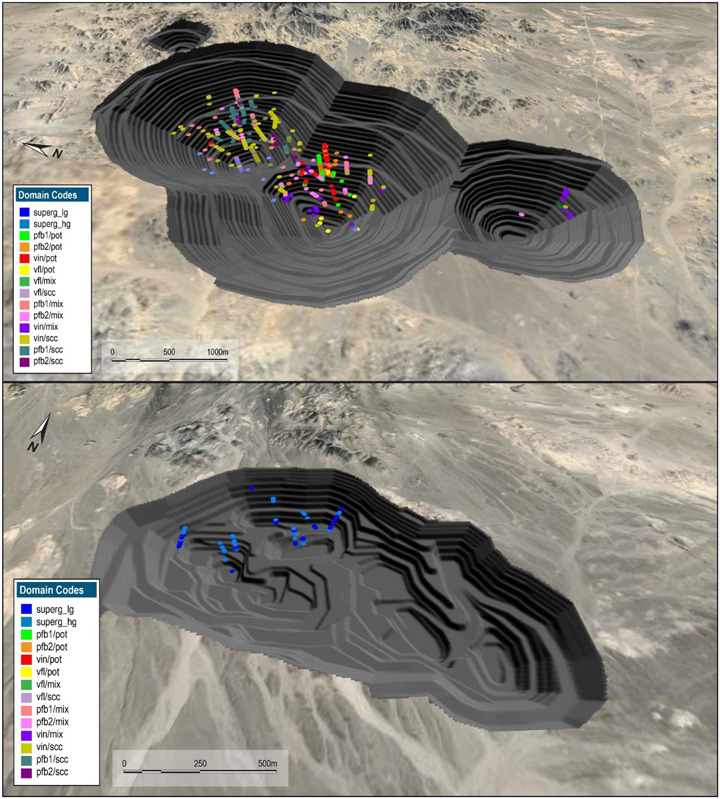

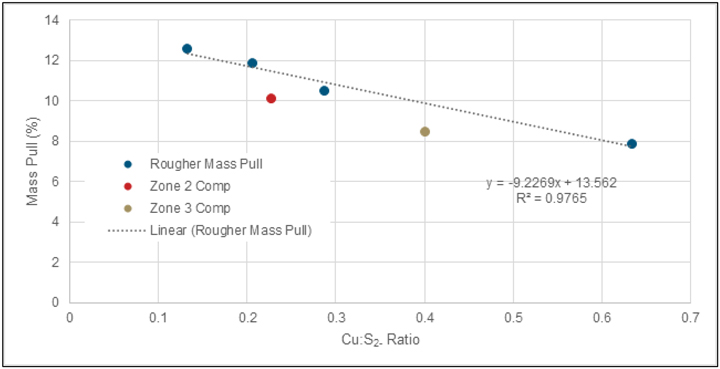

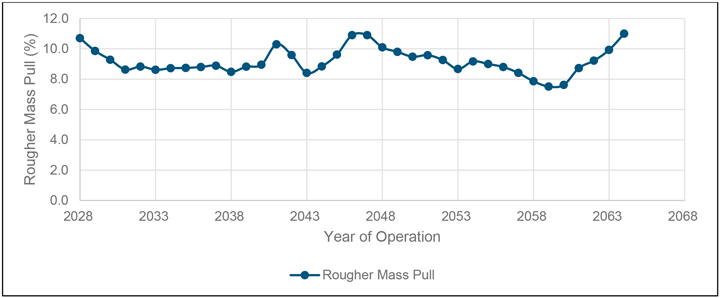

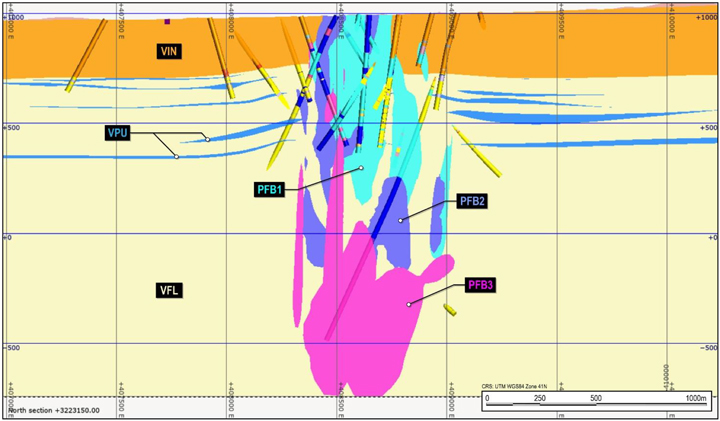

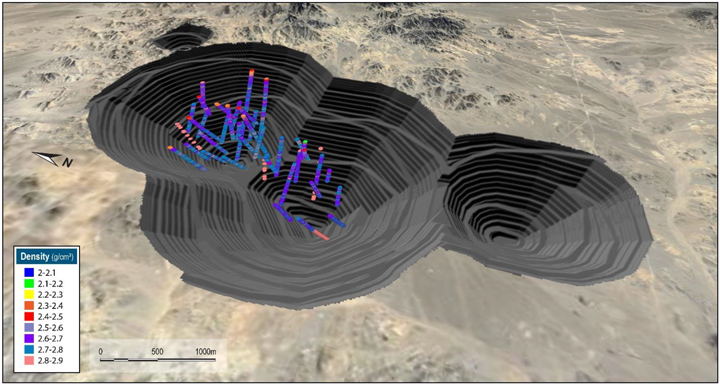

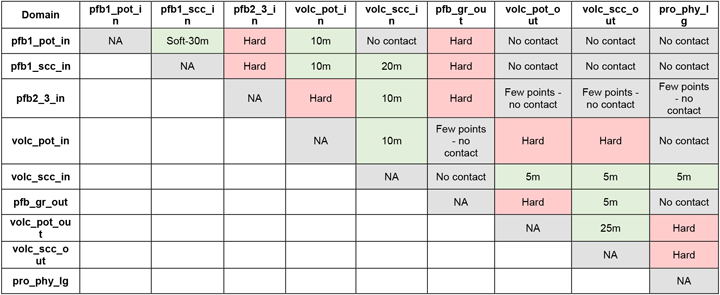

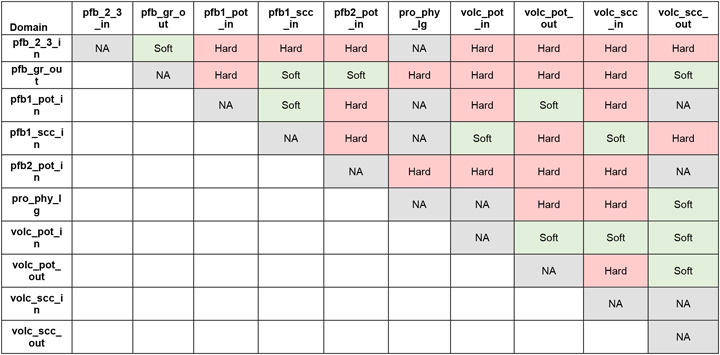

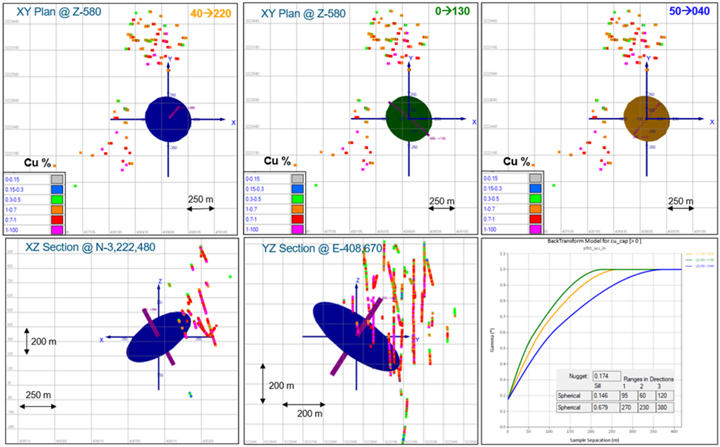

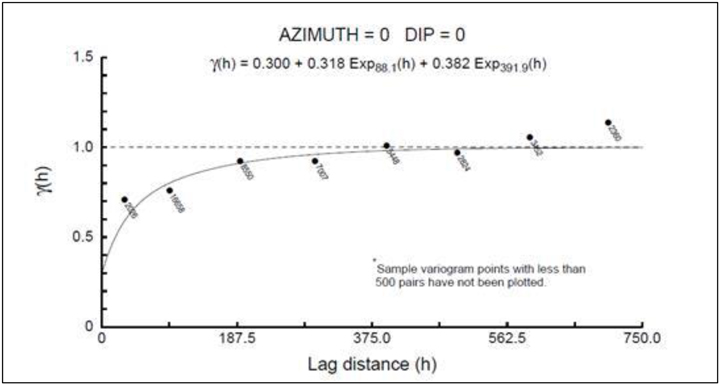

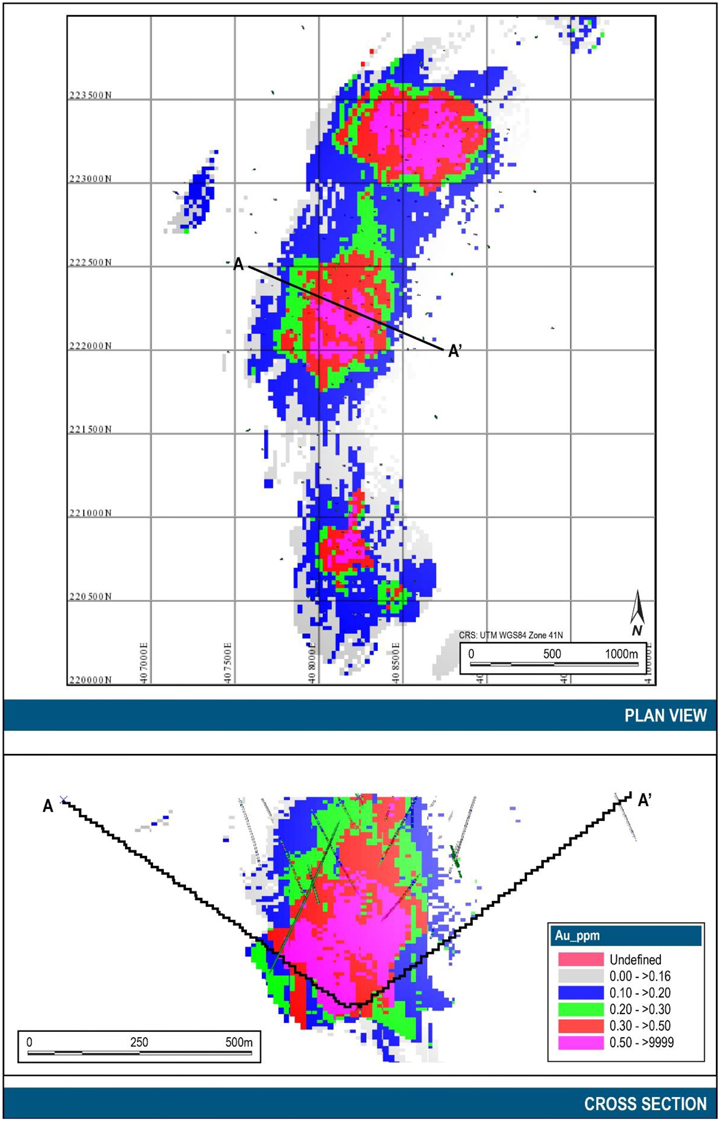

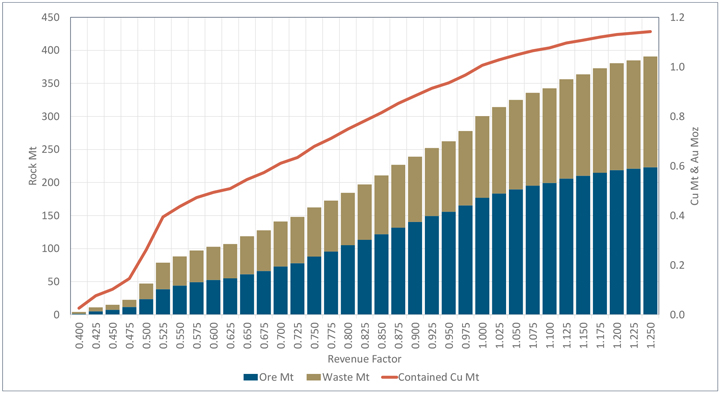

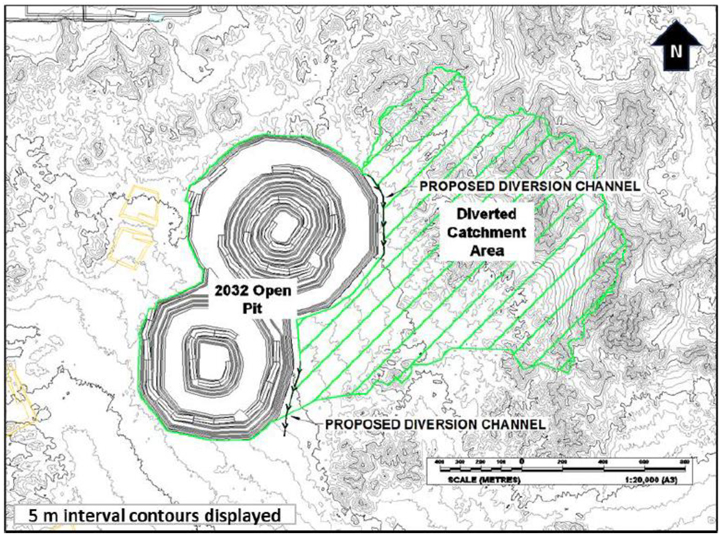

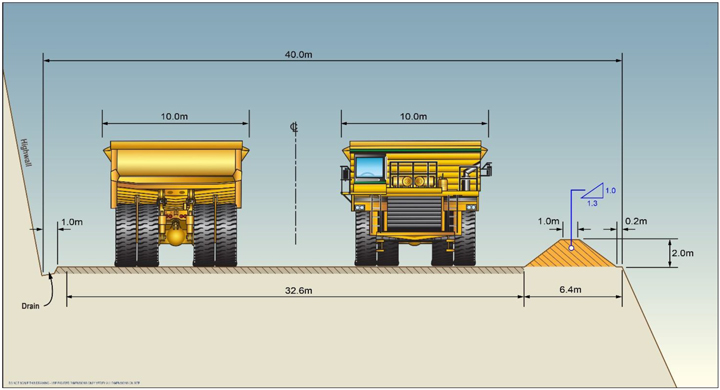

Delays in permits for construction and operation |