UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

|

|

CURRENT REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| Date of Report (Date of earliest event reported): January 15, 2025 |

||

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-14965

| Delaware | 13-4019460 | |

| (State or other jurisdiction of incorporation) |

(IRS Employer Identification No.) |

|

| 200 West Street, New York, N.Y. | 10282 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 902-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol |

Exchange on which registered |

||

| Common stock, par value $.01 per share | GS | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series A | GS PrA | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series C | GS PrC | NYSE | ||

| Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series D | GS PrD | NYSE | ||

| 5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II | GS/43PE | NYSE | ||

| Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III | GS/43PF | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due March 2031 of GS Finance Corp. | GS/31B | NYSE | ||

| Medium-Term Notes, Series F, Callable Fixed and Floating Rate Notes due May 2031 of GS Finance Corp. | GS/31X | NYSE | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 15, 2025, The Goldman Sachs Group, Inc. (Group Inc. and, together with its consolidated subsidiaries, the firm) reported its earnings for the fourth quarter and year ended December 31, 2024. A copy of Group Inc.’s press release containing this information is attached as Exhibit 99.1 to this Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On January 15, 2025, at 9:30 a.m. (ET), the firm will hold a conference call to discuss the firm’s financial results, outlook and related matters. A copy of the presentation for the conference call is attached as Exhibit 99.2 to this Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 |

The quotation on page 1 of Exhibit 99.1 and the information under the caption “Annual Highlights” on the following page (Excluded Sections) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (Exchange Act) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the Securities Act of 1933 or the Exchange Act. The information included in Exhibit 99.1, other than in the Excluded Sections, shall be deemed “filed” for purposes of the Exchange Act.

| 99.2 | Presentation of Group Inc. dated January 15, 2025, for the conference call on January 15, 2025. |

Exhibit 99.2 is being furnished pursuant to Item 7.01 of Form 8-K and the information included therein shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the Securities Act of 1933 or the Exchange Act.

| 101 | Pursuant to Rule 406 of Regulation S-T, the cover page information is formatted in iXBRL (Inline eXtensible Business Reporting Language). |

| 104 | Cover Page Interactive Data File (formatted in iXBRL in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE GOLDMAN SACHS GROUP, INC. |

||||||||||

| (Registrant) |

||||||||||

| Date: January 15, 2025 |

By: |

/s/ Denis P. Coleman III |

||||||||

| Name: Denis P. Coleman III |

||||||||||

| Title: Chief Financial Officer |

||||||||||

Exhibit 99.1

|

Full Year and

Fourth Quarter 2024

Earnings Results

Media Relations: Tony Fratto 212-902-5400 Investor Relations: Jehan Ilahi 212-902-0300

|

||

|

The Goldman Sachs Group, Inc. 200 West Street | New York, NY 10282

|

Full Year and Fourth Quarter 2024 Earnings Results

Goldman Sachs Reports Earnings Per Common Share of $40.54 for 2024

Fourth Quarter Earnings Per Common Share was $11.95

|

“We are very pleased with our strong results for the quarter and the year. I’m encouraged that we have met or exceeded almost all of the targets we set in our strategy to grow the firm five years ago, and as a result, have both grown our revenues by nearly 50% and enhanced the durability of our franchise. With an improving operating backdrop and growing CEO confidence, we are harnessing the power of One Goldman Sachs to continue to serve our clients with excellence and create further value for our shareholders.” |

|

- David Solomon, Chairman and Chief Executive Officer

|

Financial Summary

|

|

|

|||||||

|

Net Revenues

|

Net Earnings

|

EPS

|

||||||

|

2024 $53.51 billion

4Q24 $13.87 billion

|

2024 $14.28 billion

4Q24 $4.11 billion

|

2024 $40.54

4Q24 $11.95

|

||||||

|

ROE1

|

ROTE1

|

Book Value Per Share

|

||||||

|

2024 12.7%

4Q24 14.6%

|

2024 13.5%

4Q24 15.5%

|

2024 $336.77

2024 Growth 7.4%

|

||||||

NEW YORK, January 15, 2025 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $53.51 billion and net earnings of $14.28 billion for the year ended December 31, 2024. Net revenues were $13.87 billion and net earnings were $4.11 billion for the fourth quarter of 2024.

Diluted earnings per common share (EPS) was $40.54 for the year ended December 31, 2024 compared with $22.87 for the year ended December 31, 2023, and was $11.95 for the fourth quarter of 2024 compared with $5.48 for the fourth quarter of 2023 and $8.40 for the third quarter of 2024.

Return on average common shareholders’ equity (ROE)1 was 12.7% for 2024 and annualized ROE was 14.6% for the fourth quarter of 2024. Return on average tangible common shareholders’ equity (ROTE)1 was 13.5% for 2024 and annualized ROTE was 15.5% for the fourth quarter of 2024.

1

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

Annual Highlights

| ◾ | During the year, the firm supported clients and continued to execute on strategic priorities, which contributed to net revenues of $53.51 billion, net earnings of $14.28 billion and diluted EPS of $40.54, the second highest results for each. |

| ◾ | Global Banking & Markets generated net revenues of $34.94 billion, driven by record net revenues in Equities and strong performances in Investment banking fees and Fixed Income, Currency and Commodities (FICC). These results included record net revenues in each of Equities financing and FICC financing. |

| ◾ | The firm ranked #1 in worldwide announced and completed mergers and acquisitions for the year.2 |

| ◾ | Asset & Wealth Management generated net revenues of $16.14 billion, including record Management and other fees and record Private banking and lending net revenues. |

| ◾ | Assets under supervision3 increased 12% during the year to a record $3.14 trillion. |

| ◾ | Book value per common share increased by 7.4% during the year to $336.77. |

Net Revenues

|

Full Year |

||||

| Net revenues were $53.51 billion for 2024, 16% higher compared with 2023, primarily reflecting higher net revenues in Global Banking & Markets and Asset & Wealth Management. |

|

2024 Net Revenues

|

||

|

$53.51 billion

|

||||

|

Fourth Quarter |

||||

| Net revenues were $13.87 billion for the fourth quarter of 2024, 23% higher than the fourth quarter of 2023 and 9% higher than the third quarter of 2024. The increase compared with the fourth quarter of 2023 reflected higher net revenues across all segments, with significant growth in Global Banking & Markets. |

4Q24 Net Revenues

|

|||

|

$13.87 billion

|

||||

2

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

|

|

Global Banking & Markets |

|

| Full Year |

||||||

| Net revenues in Global Banking & Markets were $34.94 billion for 2024, 16% higher than 2023.

Investment banking fees were $7.73 billion, 24% higher than 2023, primarily reflecting significantly higher net revenues in Debt underwriting, primarily driven by leveraged finance activity, and in Equity underwriting, primarily driven by secondary and initial public offerings. In addition, net revenues in Advisory were higher, reflecting an increase in completed mergers and acquisitions transactions. The firm’s Investment banking fees backlog3 increased compared with the end of 2023.

Net revenues in FICC were $13.20 billion, 9% higher than 2023, primarily reflecting significantly higher net revenues in FICC financing, primarily driven by mortgages and structured lending. Net revenues in FICC intermediation were slightly higher, driven by significantly higher net revenues in currencies, mortgages and credit products, largely offset by lower net revenues in interest rate products and significantly lower net revenues in commodities.

Net revenues in Equities were $13.43 billion, 16% higher than 2023, reflecting significantly higher net revenues in Equities intermediation, primarily driven by derivatives, and higher net revenues in Equities financing, driven by prime financing.

Net revenues in Other were $576 million compared with $171 million for 2023, primarily reflecting significantly lower net losses on hedges.

|

2024 Global Banking & Markets

|

|||||

|

$34.94 billion

|

||||||

|

Advisory |

$ 3.53 billion |

|||||

|

Equity underwriting |

$ 1.68 billion |

|||||

|

Debt underwriting |

$ 2.52 billion |

|||||

|

Investment banking fees |

$ 7.73 billion |

|||||

|

FICC intermediation |

$ 9.56 billion |

|||||

|

FICC financing |

$ 3.64 billion |

|||||

|

FICC |

$13.20 billion |

|||||

|

Equities intermediation |

$ 7.94 billion |

|||||

|

Equities financing |

$ 5.49 billion |

|||||

|

Equities |

$13.43 billion |

|||||

|

Other |

$ 576 million |

|||||

|

Fourth Quarter |

||||||

| Net revenues in Global Banking & Markets were $8.48 billion for the fourth quarter of 2024, 33% higher than the fourth quarter of 2023 and essentially unchanged compared with the third quarter of 2024.

Investment banking fees were $2.05 billion, 24% higher than the fourth quarter of 2023, reflecting significantly higher net revenues in Equity underwriting, primarily driven by secondary and initial public offerings and private placements, and in Debt underwriting, primarily driven by leveraged finance activity. Net revenues in Advisory were slightly lower. The firm’s Investment banking fees backlog3 increased compared with the end of the third quarter of 2024.

Net revenues in FICC were $2.74 billion, 35% higher than the fourth quarter of 2023, primarily reflecting significantly higher net revenues in FICC intermediation, driven by significantly higher net revenues in currencies and mortgages and higher net revenues in credit products, partially offset by lower net revenues in commodities. Net revenues in interest rate products were essentially unchanged. Net revenues in FICC financing were also significantly higher, primarily driven by mortgages and structured lending.

Net revenues in Equities were $3.45 billion, 32% higher than the fourth quarter of 2023, due to significantly higher net revenues in Equities intermediation, primarily driven by cash products, and in Equities financing, driven by significantly higher net revenues in prime financing and portfolio financing.

Net revenues in Other were $235 million compared with $61 million for the fourth quarter of 2023, reflecting significantly lower net losses on hedges. |

4Q24 Global Banking & Markets

|

|||||

|

$8.48 billion

|

||||||

|

Advisory |

$ 960 million |

|||||

|

Equity underwriting |

$ 499 million |

|||||

|

Debt underwriting |

$ 595 million |

|||||

|

Investment banking fees |

$ 2.05 billion |

|||||

|

FICC intermediation |

$ 1.75 billion |

|||||

|

FICC financing |

$ 989 million |

|||||

|

FICC |

$ 2.74 billion |

|||||

|

Equities intermediation |

$ 1.95 billion |

|||||

|

Equities financing |

$ 1.50 billion |

|||||

|

Equities |

$ 3.45 billion |

|||||

|

Other

|

$ 235 million

|

|||||

3

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

|

|

Asset & Wealth Management |

|

| Full Year |

||||||

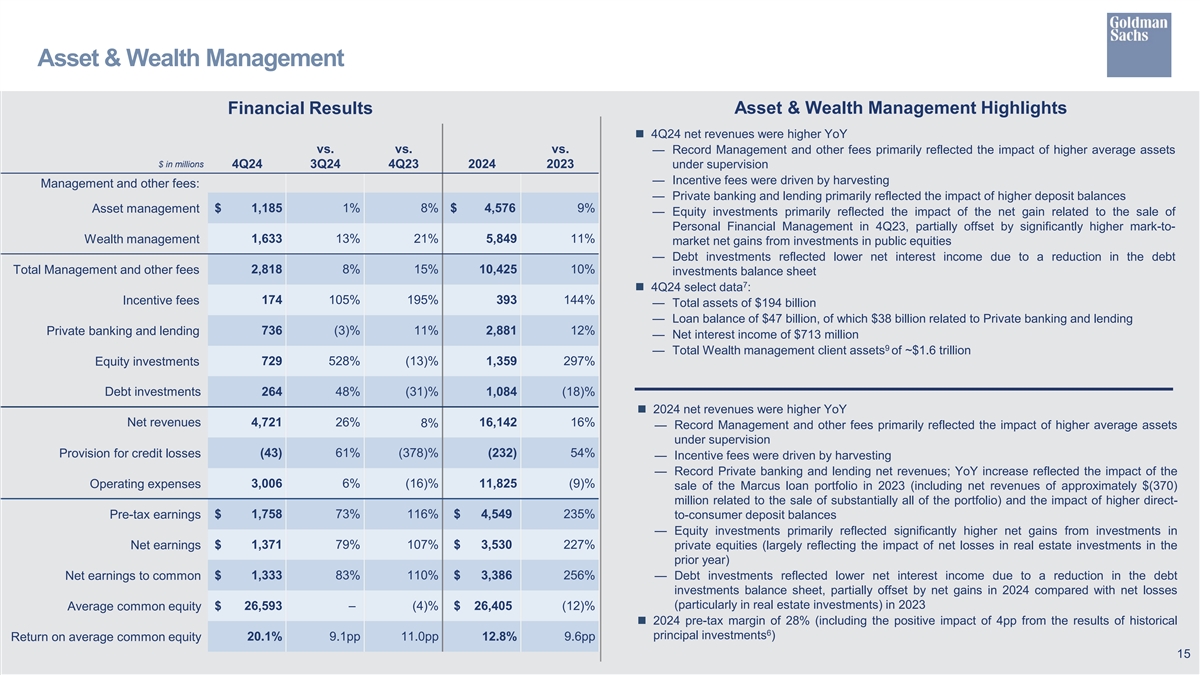

| Net revenues in Asset & Wealth Management were $16.14 billion for 2024, 16% higher than 2023, primarily reflecting significantly higher net revenues in Equity investments and higher Management and other fees. In addition, net revenues in Private banking and lending and Incentive fees were higher, while net revenues in Debt investments were lower.

The increase in Equity investments net revenues primarily reflected significantly higher net gains from investments in private equities (largely reflecting the impact of net losses in real estate investments in the prior year). The increase in Management and other fees primarily reflected the impact of higher average assets under supervision. The increase in Private banking and lending net revenues primarily reflected the impact of the sale of the Marcus loan portfolio in 2023 (including net revenues of approximately $(370) million related to the sale of substantially all of the portfolio) and the impact of higher direct-to-consumer deposit balances. The increase in Incentive fees was driven by harvesting. The decrease in Debt investments net revenues reflected lower net interest income due to a reduction in the debt investments balance sheet, partially offset by net gains in the current year compared with net losses (particularly in real estate investments) in the prior year.

|

2024 Asset & Wealth Management |

|||||

|

$16.14 billion |

||||||

|

Management and other fees |

$10.43 billion | |||||

| Incentive fees |

$ 393 million | |||||

| Private banking and lending |

$ 2.88 billion | |||||

| Equity investments |

$ 1.36 billion | |||||

|

|

Debt investments

|

$ 1.08 billion

|

||||

| Fourth Quarter |

||||||

| Net revenues in Asset & Wealth Management were $4.72 billion for the fourth quarter of 2024, 8% higher than the fourth quarter of 2023 and 26% higher than the third quarter of 2024. The increase compared with the fourth quarter of 2023 primarily reflected higher Management and other fees, significantly higher Incentive fees and higher net revenues in Private banking and lending, partially offset by significantly lower net revenues in Debt investments and lower net revenues in Equity investments.

The increase in Management and other fees primarily reflected the impact of higher average assets under supervision. The increase in Incentive fees was driven by harvesting. The increase in Private banking and lending net revenues primarily reflected the impact of higher deposit balances. The decrease in Debt investments net revenues reflected lower net interest income due to a reduction in the debt investments balance sheet. The decrease in Equity investments net revenues primarily reflected the impact of the net gain related to the sale of Personal Financial Management in the prior year period, partially offset by significantly higher mark-to-market net gains from investments in public equities. |

4Q24 Asset & Wealth Management |

|||||

|

$4.72 billion

|

||||||

|

Management and other fees |

$ 2.82 billion | |||||

|

Incentive fees |

$ 174 million | |||||

|

Private banking and lending |

$ 736 million | |||||

|

Equity investments |

$ 729 million | |||||

|

Debt investments

|

$ 264 million |

|||||

4

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

|

|

Platform Solutions |

|

| Full Year |

|

|||||

| Net revenues in Platform Solutions were $2.43 billion for 2024, 2% higher than 2023, reflecting slightly higher net revenues in Consumer platforms.

The increase in Consumer platforms net revenues reflected higher average credit card balances and higher average deposit balances, largely offset by the impact of the planned transition of the General Motors (GM) credit card program to another issuer. Transaction banking and other net revenues were lower, primarily reflecting lower net revenues related to the seller financing loan portfolio. |

2024 Platform Solutions

|

|||||

|

$2.43 billion

|

||||||

|

Consumer platforms |

$ 2.15 billion | |||||

| Transaction banking and other

|

$280 million

|

|||||

|

Fourth Quarter |

||||||

| Net revenues in Platform Solutions were $669 million for the fourth quarter of 2024, 16% higher than the fourth quarter of 2023 and 71% higher than the third quarter of 2024. The increase compared with the fourth quarter of 2023 reflected higher net revenues in Consumer platforms.

The increase in Consumer platforms net revenues primarily reflected the mark-downs related to the GreenSky held for sale loan portfolio in the prior year period. Transaction banking and other net revenues were essentially unchanged. |

4Q24 Platform Solutions

|

|||||

|

$669 million

|

||||||

|

Consumer platforms |

$ 597 million | |||||

| Transaction banking and other

|

$72 million | |||||

Provision for Credit Losses

| Full Year |

|

|||||

| Provision for credit losses was $1.35 billion for 2024, compared with $1.03 billion for 2023. Provisions for 2024 reflected net provisions related to the credit card portfolio (primarily driven by net charge-offs). Provisions for 2023 reflected net provisions related to both the credit card portfolio (primarily driven by net charge-offs) and wholesale loans (primarily driven by impairments), partially offset by reserve reductions of $637 million related to the transfer of the GreenSky loan portfolio to held for sale and $442 million related to the sale of substantially all of the Marcus loan portfolio. |

2024 Provision for Credit Losses |

|||||

|

$1.35 billion

|

||||||

|

Fourth Quarter |

||||||

| Provision for credit losses was $351 million for the fourth quarter of 2024, compared with $577 million for the fourth quarter of 2023 and $397 million for the third quarter of 2024. Provisions for the fourth quarter of 2024 reflected net provisions related to the credit card portfolio (primarily driven by net charge-offs). Provisions for the fourth quarter of 2023 reflected net provisions related to both the credit card portfolio (primarily driven by net charge-offs and portfolio growth, partially offset by a reserve reduction of $160 million related to the transfer of the GM credit card portfolio to held for sale) and wholesale loans (driven by impairments). |

4Q24 Provision for Credit Losses

|

|||||

|

$351 million

|

||||||

5

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

Operating Expenses

| Full Year |

||||

| Operating expenses were $33.77 billion for 2024, 2% lower than 2023. The firm’s efficiency ratio3 was 63.1% for 2024, compared with 74.6% for 2023.

Operating expenses, compared with 2023, reflected decreases driven by significantly lower expenses, including impairments, related to commercial real estate in consolidated investment entities (CIEs) (largely in depreciation and amortization) and other significant expenses recognized in the prior year, including the write-down of intangibles related to GreenSky and an impairment of goodwill related to Consumer platforms (both in depreciation and amortization), and the FDIC special assessment fee (in other expenses). These decreases were partially offset by higher compensation and benefits expenses (reflecting improved operating performance) and higher transaction based expenses.

Net provisions for litigation and regulatory proceedings were $166 million for 2024 compared with $115 million for 2023.

Headcount increased 3% during 2024. |

|

2024 Operating Expenses

|

||

|

$33.77 billion

|

||||

|

2024 Efficiency Ratio

|

||||

|

63.1%

|

||||

|

Fourth Quarter |

||||

| Operating expenses were $8.26 billion for the fourth quarter of 2024, 3% lower than the fourth quarter of 2023 and essentially unchanged compared with the third quarter of 2024.

The decrease in operating expenses compared with the fourth quarter of 2023 primarily reflected the FDIC special assessment fee (in other expenses) in the prior year period and significantly lower expenses, including impairments, related to commercial real estate in CIEs (largely in depreciation and amortization), partially offset by higher transaction based expenses.

Net provisions for litigation and regulatory proceedings were $(2) million for the fourth quarter of 2024 compared with $9 million for the fourth quarter of 2023. |

4Q24 Operating Expenses

|

|||

|

$8.26 billion

|

||||

Provision for Taxes

| The effective income tax rate for 2024 was 22.4%, down from 22.6% for the first nine months of 2024, primarily due to changes in the geographic mix of earnings. The 2024 effective income tax rate increased from 20.7% for 2023, primarily due to a decrease in the impact of permanent tax benefits for 2024 compared with 2023, partially offset by changes in the geographic mix of earnings. |

2024 Effective Tax Rate

|

|||

|

22.4%

|

||||

6

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

Other Matters

| ◾ On January 14, 2025, the Board of Directors of The Goldman Sachs Group, Inc. declared a dividend of $3.00 per common share to be paid on March 28, 2025 to common shareholders of record on February 28, 2025.

◾ During the year, the firm returned $11.80 billion of capital to common shareholders, including $8.00 billion of common share repurchases (17.5 million shares at an average cost of $457.82) and $3.80 billion of common stock dividends. This included $2.97 billion of capital returned to common shareholders during the fourth quarter, including $2.00 billion of common share repurchases (3.5 million shares at an average cost of $566.27) and $965 million of common stock dividends.3

◾ Global core liquid assets3 averaged $429 billion for 2024, compared with an average of $407 billion for 2023. Global core liquid assets averaged $422 billion for the fourth quarter of 2024, compared with an average of $447 billion for the third quarter of 2024. |

Declared Quarterly Dividend Per Common Share

|

|||

|

$3.00

|

||||

|

2024 Capital Returned

|

||||

|

$11.80 billion

|

||||

|

2024 Average GCLA

|

||||

|

$429 billion

|

||||

7

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

|

|

Cautionary Note Regarding Forward-Looking Statements |

|

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2023.

Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements.

Statements about the firm’s Investment banking fees backlog and future results also may constitute forward-looking statements. Such statements are subject to the risk that transactions may be modified or may not be completed at all, and related net revenues may not be realized or may be materially less than expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak or worsening of hostilities, including those in Ukraine and the Middle East, volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. For information about other important factors that could adversely affect the firm’s Investment banking fees, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2023.

|

|

Conference Call |

|

A conference call to discuss the firm’s financial results, outlook and related matters will be held at 9:30 am (ET). The call will be open to the public. Members of the public who would like to listen to the conference call should dial 1-800-289-0459 (in the U.S.) or 1-323-794-2095 (outside the U.S.) passcode number 7042022. The number should be dialed at least 10 minutes prior to the start of the conference call. The conference call will also be accessible as an audio webcast through the Investor Relations section of the firm’s website, www.goldmansachs.com/investor-relations. There is no charge to access the call. For those unable to listen to the live broadcast, a replay will be available on the firm’s website beginning approximately three hours after the event. Please direct any questions regarding obtaining access to the conference call to Goldman Sachs Investor Relations, via e-mail, at gs-investor-relations@gs.com.

8

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| YEAR ENDED | % CHANGE FROM | |||||||||||||||

| DECEMBER 31, 2024 |

DECEMBER 31, 2023 |

DECEMBER 31, 2023 |

||||||||||||||

|

GLOBAL BANKING & MARKETS

|

||||||||||||||||

|

Advisory

|

|

$ 3,534

|

|

|

$ 3,299

|

|

|

7 %

|

|

|||||||

| Equity underwriting

|

|

1,677

|

|

|

1,153

|

|

|

45

|

|

|||||||

| Debt underwriting |

|

2,521

|

|

|

1,764

|

|

|

43

|

|

|||||||

|

Investment banking fees |

7,732 | 6,216 | 24 | |||||||||||||

| FICC intermediation

|

|

9,564

|

|

|

9,318

|

|

|

3

|

|

|||||||

| FICC financing |

|

3,640

|

|

|

2,742

|

|

|

33

|

|

|||||||

|

FICC |

13,204 | 12,060 | 9 | |||||||||||||

| Equities intermediation

|

|

7,937

|

|

|

6,489

|

|

|

22

|

|

|||||||

| Equities financing |

|

5,494

|

|

|

5,060

|

|

|

9

|

|

|||||||

|

Equities |

13,431 | 11,549 | 16 | |||||||||||||

| Other

|

576 | 171 | 237 | |||||||||||||

|

Net revenues

|

|

34,943

|

|

|

29,996

|

|

|

16

|

|

|||||||

|

ASSET & WEALTH MANAGEMENT

|

||||||||||||||||

|

Management and other fees

|

|

10,425

|

|

|

9,486

|

|

|

10

|

|

|||||||

| Incentive fees

|

|

393

|

|

|

161

|

|

|

144

|

|

|||||||

| Private banking and lending

|

|

2,881

|

|

|

2,576

|

|

|

12

|

|

|||||||

| Equity investments

|

|

1,359

|

|

|

342

|

|

|

297

|

|

|||||||

| Debt investments

|

|

1,084

|

|

|

1,315

|

|

|

(18)

|

|

|||||||

|

Net revenues

|

|

16,142

|

|

|

13,880

|

|

|

16

|

|

|||||||

|

PLATFORM SOLUTIONS

|

||||||||||||||||

|

Consumer platforms

|

|

2,147

|

|

|

2,072

|

|

|

4

|

|

|||||||

| Transaction banking and other

|

|

280

|

|

|

306

|

|

|

(8)

|

|

|||||||

|

Net revenues

|

|

2,427

|

|

|

2,378

|

|

|

2

|

|

|||||||

|

Total net revenues

|

|

$ 53,512

|

|

|

$ 46,254

|

|

|

16

|

|

|||||||

|

Geographic Net Revenues (unaudited)3 $ in millions

|

|

|||||||||||||||

| YEAR ENDED | ||||||||||||||||

| DECEMBER 31, 2024 |

DECEMBER 31, 2023 |

|||||||||||||||

| Americas |

$ 34,448 | $ 29,335 | ||||||||||||||

| EMEA |

12,250 | 11,744 | ||||||||||||||

| Asia

|

|

6,814

|

|

|

5,175

|

|

||||||||||

|

Total net revenues

|

|

$ 53,512

|

|

|

$ 46,254

|

|

||||||||||

| Americas |

64% | 64% | ||||||||||||||

| EMEA |

23% | 25% | ||||||||||||||

| Asia

|

|

13%

|

|

|

11%

|

|

||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

||||||||||

9

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Segment Net Revenues (unaudited)

$ in millions

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||||

|

GLOBAL BANKING & MARKETS

|

||||||||||||||||||||||||

| Advisory

|

$ 960 | $ 875 | $ 1,005 | 10 % | (4) % | |||||||||||||||||||

| Equity underwriting

|

|

499

|

|

|

385

|

|

|

252

|

|

|

30

|

|

|

98

|

|

|||||||||

| Debt underwriting

|

|

595

|

|

|

605

|

|

|

395

|

|

|

(2)

|

|

|

51

|

|

|||||||||

| Investment banking fees |

2,054 | 1,865 | 1,652 | 10 | 24 | |||||||||||||||||||

| FICC intermediation

|

|

1,750

|

|

|

2,013

|

|

|

1,295

|

|

|

(13)

|

|

|

35

|

|

|||||||||

| FICC financing

|

|

989

|

|

|

949

|

|

|

739

|

|

|

4

|

|

|

34

|

|

|||||||||

| FICC |

2,739 | 2,962 | 2,034 | (8) | 35 | |||||||||||||||||||

| Equities intermediation |

|

1,953

|

|

|

2,209

|

|

|

1,502

|

|

|

(12)

|

|

|

30

|

|

|||||||||

| Equities financing

|

|

1,498

|

|

|

1,291

|

|

|

1,105

|

|

|

16

|

|

|

36

|

|

|||||||||

| Equities

|

|

3,451

|

|

|

3,500

|

|

|

2,607

|

|

|

(1)

|

|

|

32

|

|

|||||||||

| Other

|

|

235

|

|

|

227

|

|

|

61

|

|

|

4

|

|

|

285

|

|

|||||||||

|

Net revenues

|

|

8,479

|

|

|

8,554

|

|

|

6,354

|

|

|

(1)

|

|

|

33

|

|

|||||||||

|

ASSET & WEALTH MANAGEMENT

|

||||||||||||||||||||||||

|

Management and other fees

|

2,818 | 2,619 | 2,445 | 8 | 15 | |||||||||||||||||||

| Incentive fees

|

|

174

|

|

|

85

|

|

|

59

|

|

|

105

|

|

|

195

|

|

|||||||||

| Private banking and lending

|

|

736

|

|

|

756

|

|

|

661

|

|

|

(3)

|

|

|

11

|

|

|||||||||

| Equity investments

|

729 | 116 | 838 | 528 | (13) | |||||||||||||||||||

| Debt investments

|

|

264

|

|

|

178

|

|

|

384

|

|

|

48

|

|

|

(31)

|

|

|||||||||

|

Net revenues

|

|

4,721

|

|

|

3,754

|

|

|

4,387

|

|

|

26

|

|

|

8

|

|

|||||||||

|

PLATFORM SOLUTIONS

|

||||||||||||||||||||||||

| Consumer platforms |

597 | 333 | 504 | 79 | 18 | |||||||||||||||||||

| Transaction banking and other

|

|

72

|

|

|

58

|

|

|

73

|

|

|

24

|

|

|

(1)

|

|

|||||||||

|

Net revenues

|

|

669

|

|

|

391

|

|

|

577

|

|

|

71

|

|

|

16

|

|

|||||||||

|

Total net revenues

|

|

$ 13,869

|

|

|

$ 12,699

|

|

|

$ 11,318

|

|

|

9

|

|

|

23

|

|

|||||||||

|

Geographic Net Revenues (unaudited)3 |

|

|||||||||||||||||||||||

| $ in millions | ||||||||||||||||||||||||

| THREE MONTHS ENDED | ||||||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||||||

|

Americas |

$ 9,097 | $ 8,045 | $ 7,770 | |||||||||||||||||||||

| EMEA

|

2,773 | 3,076 | 2,481 | |||||||||||||||||||||

| Asia

|

|

1,999

|

|

|

1,578

|

|

|

1,067

|

|

|||||||||||||||

|

Total net revenues

|

|

$ 13,869

|

|

|

$ 12,699

|

|

|

$ 11,318

|

|

|||||||||||||||

| Americas

|

66% | 63% | 69% | |||||||||||||||||||||

| EMEA

|

20% | 24% | 22% | |||||||||||||||||||||

| Asia

|

|

14%

|

|

|

13%

|

|

|

9%

|

|

|||||||||||||||

|

Total

|

|

100%

|

|

|

100%

|

|

|

100%

|

|

|||||||||||||||

10

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)4

In millions, except per share amounts

| YEAR ENDED | % CHANGE FROM | |||||||||||||||||||

| DECEMBER 31, 2024 |

DECEMBER 31, 2023 |

DECEMBER 31, 2023 |

||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||

| Investment banking

|

|

$ 7,738

|

|

|

$ 6,218

|

|

|

24 %

|

|

|||||||||||

| Investment management

|

|

10,596

|

|

|

9,532

|

|

|

11

|

|

|||||||||||

| Commissions and fees

|

|

4,086

|

|

|

3,789

|

|

|

8

|

|

|||||||||||

| Market making

|

|

18,390

|

|

|

18,238

|

|

|

1

|

|

|||||||||||

| Other principal transactions

|

|

4,646

|

|

|

2,126

|

|

|

119

|

|

|||||||||||

|

Total non-interest revenues

|

|

45,456

|

|

|

39,903

|

|

|

14

|

|

|||||||||||

| Interest income

|

|

81,397

|

|

|

68,515

|

|

|

19

|

|

|||||||||||

| Interest expense

|

|

73,341

|

|

|

62,164

|

|

|

18

|

|

|||||||||||

|

Net interest income

|

|

8,056

|

|

|

6,351

|

|

|

27

|

|

|||||||||||

|

Total net revenues

|

|

53,512

|

|

|

46,254

|

|

|

16

|

|

|||||||||||

|

Provision for credit losses

|

|

1,348

|

|

|

1,028

|

|

|

31

|

|

|||||||||||

|

OPERATING EXPENSES

|

||||||||||||||||||||

| Compensation and benefits

|

|

16,706

|

|

|

15,499

|

|

|

8

|

|

|||||||||||

| Transaction based

|

|

6,724

|

|

|

5,698

|

|

|

18

|

|

|||||||||||

| Market development

|

|

646

|

|

|

629

|

|

|

3

|

|

|||||||||||

| Communications and technology

|

|

1,991

|

|

|

1,919

|

|

|

4

|

|

|||||||||||

| Depreciation and amortization

|

|

2,392

|

|

|

4,856

|

|

|

(51)

|

|

|||||||||||

| Occupancy

|

|

973

|

|

|

1,053

|

|

|

(8)

|

|

|||||||||||

| Professional fees

|

|

1,652

|

|

|

1,623

|

|

|

2

|

|

|||||||||||

| Other expenses

|

|

2,683

|

|

|

3,210

|

|

|

(16)

|

|

|||||||||||

|

Total operating expenses

|

|

33,767

|

|

|

34,487

|

|

|

(2)

|

|

|||||||||||

| Pre-tax earnings

|

|

18,397

|

|

|

10,739

|

|

|

71

|

|

|||||||||||

| Provision for taxes

|

|

4,121

|

|

|

2,223

|

|

|

85

|

|

|||||||||||

|

Net earnings

|

|

14,276

|

|

|

8,516

|

|

|

68

|

|

|||||||||||

| Preferred stock dividends

|

|

751

|

|

|

609

|

|

|

23

|

|

|||||||||||

|

Net earnings applicable to common shareholders

|

|

$ 13,525

|

|

|

$ 7,907

|

|

|

71

|

|

|||||||||||

|

EARNINGS PER COMMON SHARE

|

||||||||||||||||||||

| Basic3

|

|

$ 41.07

|

|

|

$ 23.05

|

|

|

78 %

|

|

|||||||||||

| Diluted |

$ 40.54 | $ 22.87 | 77 | |||||||||||||||||

|

AVERAGE COMMON SHARES

|

||||||||||||||||||||

| Basic

|

328.1 | 340.8 | (4) | |||||||||||||||||

| Diluted

|

|

333.6

|

|

|

345.8

|

|

|

(4)

|

|

|||||||||||

11

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Consolidated Statements of Earnings (unaudited)4

In millions, except per share amounts and headcount

| THREE MONTHS ENDED | % CHANGE FROM | |||||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||||

|

REVENUES

|

||||||||||||||||||||||||

| Investment banking

|

|

$ 2,056

|

|

|

$ 1,864

|

|

|

$ 1,653

|

|

|

10 %

|

|

|

24 %

|

|

|||||||||

| Investment management

|

|

2,923

|

|

|

2,649

|

|

|

2,478

|

|

|

10

|

|

|

18

|

|

|||||||||

| Commissions and fees

|

|

1,085

|

|

|

873

|

|

|

925

|

|

|

24

|

|

|

17

|

|

|||||||||

| Market making

|

|

3,833

|

|

|

4,127

|

|

|

3,496

|

|

|

(7)

|

|

|

10

|

|

|||||||||

| Other principal transactions

|

|

1,627

|

|

|

839

|

|

|

1,427

|

|

|

94

|

|

|

14

|

|

|||||||||

|

Total non-interest revenues |

11,524 | 10,352 | 9,979 | 11 | 15 | |||||||||||||||||||

| Interest income

|

|

19,954

|

|

|

21,448

|

|

|

18,484

|

|

|

(7)

|

|

|

8

|

|

|||||||||

| Interest expense |

17,609 | 19,101 | 17,145 | (8) | 3 | |||||||||||||||||||

|

Net interest income |

2,345 | 2,347 | 1,339 | – | 75 | |||||||||||||||||||

|

Total net revenues |

13,869 | 12,699 | 11,318 | 9 | 23 | |||||||||||||||||||

|

Provision for credit losses |

351 | 397 | 577 | (12) | (39) | |||||||||||||||||||

|

OPERATING EXPENSES |

||||||||||||||||||||||||

| Compensation and benefits

|

|

3,759

|

|

|

4,122

|

|

|

3,602

|

|

|

(9)

|

|

|

4

|

|

|||||||||

| Transaction based

|

|

1,872

|

|

|

1,701

|

|

|

1,456

|

|

|

10

|

|

|

29

|

|

|||||||||

| Market development

|

|

181

|

|

|

159

|

|

|

175

|

|

|

14

|

|

|

3

|

|

|||||||||

| Communications and technology

|

|

523

|

|

|

498

|

|

|

503

|

|

|

5

|

|

|

4

|

|

|||||||||

| Depreciation and amortization

|

|

498

|

|

|

621

|

|

|

780

|

|

|

(20)

|

|

|

(36)

|

|

|||||||||

| Occupancy

|

|

240

|

|

|

242

|

|

|

268

|

|

|

(1)

|

|

|

(10)

|

|

|||||||||

| Professional fees

|

|

475

|

|

|

400

|

|

|

471

|

|

|

19

|

|

|

1

|

|

|||||||||

| Other expenses

|

|

713

|

|

|

572

|

|

|

1,232

|

|

|

25

|

|

|

(42)

|

|

|||||||||

|

Total operating expenses |

8,261 | 8,315 | 8,487 | (1) | (3) | |||||||||||||||||||

| Pre-tax earnings

|

|

5,257

|

|

|

3,987

|

|

|

2,254

|

|

|

32

|

|

|

133

|

|

|||||||||

| Provision for taxes |

1,146 | 997 | 246 | 15 | 366 | |||||||||||||||||||

|

Net earnings |

4,111 | 2,990 | 2,008 | 37 | 105 | |||||||||||||||||||

| Preferred stock dividends |

188 | 210 | 141 | (10) | 33 | |||||||||||||||||||

|

Net earnings applicable to common shareholders |

$ 3,923 | $ 2,780 | $ 1,867 | 41 | 110 | |||||||||||||||||||

|

EARNINGS PER COMMON SHARE |

||||||||||||||||||||||||

| Basic3

|

|

$ 12.13

|

|

|

$ 8.52

|

|

|

$ 5.52

|

|

|

42 %

|

|

|

120 %

|

|

|||||||||

| Diluted |

$ 11.95 | $ 8.40 | $ 5.48 | 42 | 118 | |||||||||||||||||||

|

AVERAGE COMMON SHARES |

||||||||||||||||||||||||

| Basic |

322.4 | 324.8 | 335.7 | (1) |

|

(4)

|

|

|||||||||||||||||

| Diluted |

328.4 | 330.8 | 340.9 | (1) | (4) | |||||||||||||||||||

|

SELECTED DATA AT PERIOD-END |

||||||||||||||||||||||||

| Common shareholders’ equity

|

|

$ 108,743

|

|

|

$ 107,947

|

|

|

$ 105,702

|

|

|

1

|

|

|

3

|

|

|||||||||

| Basic shares3

|

|

322.9

|

|

|

324.2

|

|

|

337.1

|

|

|

–

|

|

|

(4)

|

|

|||||||||

| Book value per common share |

$ 336.77 | $ 332.96 | $ 313.56 | 1 | 7 | |||||||||||||||||||

| Headcount

|

|

46,500

|

|

|

46,400

|

|

|

45,300

|

|

|

–

|

|

|

3

|

|

|||||||||

12

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (unaudited)3

$ in billions

| AS OF | ||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||

| Cash and cash equivalents

|

$ 182 | $ 155 | $ 242 | |||||||||||||||||

| Collateralized agreements

|

369 | 417 | 423 | |||||||||||||||||

| Customer and other receivables

|

134 | 145 | 132 | |||||||||||||||||

| Trading assets

|

571 | 601 | 478 | |||||||||||||||||

| Investments

|

185 | 183 | 147 | |||||||||||||||||

| Loans

|

196 | 192 | 183 | |||||||||||||||||

| Other assets

|

|

34

|

|

|

35

|

|

|

37

|

|

|||||||||||

|

Total assets

|

|

$ 1,671

|

|

|

$ 1,728

|

|

|

$ 1,642

|

|

|||||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||||||||||||||

| Deposits

|

$ 433 | $ 445 | $ 428 | |||||||||||||||||

| Collateralized financings

|

353 | 347 | 324 | |||||||||||||||||

| Customer and other payables

|

223 | 251 | 231 | |||||||||||||||||

| Trading liabilities

|

203 | 215 | 200 | |||||||||||||||||

| Unsecured short-term borrowings

|

70 | 76 | 76 | |||||||||||||||||

| Unsecured long-term borrowings

|

243 | 250 | 242 | |||||||||||||||||

| Other liabilities

|

|

24

|

|

|

23

|

|

|

24

|

|

|||||||||||

|

Total liabilities

|

|

1,549

|

|

|

1,607

|

|

|

1,525

|

|

|||||||||||

| Shareholders’ equity

|

|

122

|

|

|

121

|

|

|

117

|

|

|||||||||||

|

Total liabilities and shareholders’ equity

|

|

$ 1,671

|

|

|

$ 1,728

|

|

|

$ 1,642

|

|

|||||||||||

|

Capital Ratios and Supplementary Leverage Ratio (unaudited)3 $ in billions

|

|

|||||||||||||||||||

| AS OF | ||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||

| Common equity tier 1 capital |

$ 103.0 | $ 102.3 | $ 99.4 | |||||||||||||||||

|

STANDARDIZED CAPITAL RULES

|

||||||||||||||||||||

| Risk-weighted assets

|

$ 686 | $ 698 | $ 693 | |||||||||||||||||

| Common equity tier 1 capital ratio |

15.0% | 14.6% | 14.4% | |||||||||||||||||

|

ADVANCED CAPITAL RULES

|

||||||||||||||||||||

| Risk-weighted assets

|

$ 671 | $ 658 | $ 665 | |||||||||||||||||

| Common equity tier 1 capital ratio |

15.4% | 15.5% | 14.9% | |||||||||||||||||

|

SUPPLEMENTARY LEVERAGE RATIO

|

||||||||||||||||||||

| Supplementary leverage ratio

|

|

5.5%

|

|

|

5.5%

|

|

|

5.5%

|

|

|||||||||||

|

Average Daily VaR (unaudited)3 $ in millions

|

|

|||||||||||||||||||

| THREE MONTHS ENDED | YEAR ENDED | |||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

DECEMBER 31, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||

|

RISK CATEGORIES

|

||||||||||||||||||||

| Interest rates

|

$ 83 | $ 75 | $ 87 | $ 81 | $ 96 | |||||||||||||||

| Equity prices

|

49 | 39 | 29 | 37 | 29 | |||||||||||||||

| Currency rates

|

31 | 26 | 18 | 26 | 24 | |||||||||||||||

| Commodity prices

|

19 | 20 | 19 | 19 | 19 | |||||||||||||||

| Diversification effect

|

|

(86)

|

|

|

(68)

|

|

|

(62)

|

|

(71)

|

(69)

|

|||||||||

|

Total

|

|

$ 96

|

|

|

$ 92

|

|

|

$ 91

|

|

$ 92

|

$ 99

|

|||||||||

13

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

The Goldman Sachs Group, Inc. and Subsidiaries

Assets Under Supervision (unaudited)3

$ in billions

| AS OF | ||||||||||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||||||||||

|

ASSET CLASS

|

||||||||||||||||||||||||||||

| Alternative investments

|

|

$ 336

|

|

|

$ 328

|

|

|

$ 295

|

|

|||||||||||||||||||

| Equity

|

|

772

|

|

|

780

|

|

|

658

|

|

|||||||||||||||||||

| Fixed income

|

|

1,184

|

|

|

1,220

|

|

|

1,122

|

|

|||||||||||||||||||

|

Total long-term AUS

|

|

2,292

|

|

|

2,328

|

|

|

2,075

|

|

|||||||||||||||||||

| Liquidity products

|

|

845

|

|

|

775

|

|

|

737

|

|

|||||||||||||||||||

|

Total AUS

|

|

$ 3,137

|

|

|

$ 3,103

|

|

|

$ 2,812

|

|

|||||||||||||||||||

| THREE MONTHS ENDED | YEAR ENDED | |||||||||||||||||||||||||||

| DECEMBER 31, 2024 |

SEPTEMBER 30, 2024 |

DECEMBER 31, 2023 |

DECEMBER 31, 2024 |

DECEMBER 31, 2023 |

||||||||||||||||||||||||

|

Beginning balance

|

|

$ 3,103

|

|

|

$ 2,934

|

|

|

$ 2,680

|

|

|

$ 2,812

|

|

|

$ 2,547

|

|

|||||||||||||

| Net inflows / (outflows):

|

||||||||||||||||||||||||||||

| Alternative investments

|

|

11

|

|

|

9

|

|

|

23

|

|

|

38

|

|

|

25

|

|

|||||||||||||

| Equity

|

|

4

|

|

|

4

|

|

|

2

|

|

|

15

|

|

|

(3)

|

|

|||||||||||||

| Fixed income

|

|

7

|

|

|

16

|

|

|

26

|

|

|

53

|

|

|

52

|

|

|||||||||||||

|

Total long-term AUS net inflows / (outflows)

|

|

22

|

|

|

29

|

|

|

51

|

|

|

106

|

|

|

74

|

|

|||||||||||||

| Liquidity products

|

|

70

|

|

|

37

|

|

|

(37)

|

|

|

108

|

|

|

27

|

|

|||||||||||||

|

Total AUS net inflows / (outflows)

|

|

92

|

|

|

66

|

|

|

14

|

|

|

214

|

|

|

101

|

|

|||||||||||||

| Acquisitions / (dispositions)

|

|

–

|

|

|

–

|

|

|

(23)

|

|

|

–

|

|

|

(23)

|

|

|||||||||||||

| Net market appreciation / (depreciation)

|

|

(58)

|

|

|

103

|

|

|

141

|

|

|

111

|

|

|

187

|

|

|||||||||||||

|

Ending balance

|

|

$ 3,137

|

|

|

$ 3,103

|

|

|

$ 2,812

|

|

|

$ 3,137

|

|

|

$ 2,812

|

|

|||||||||||||

14

Goldman Sachs Reports

Full Year and Fourth Quarter 2024 Earnings Results

|

Footnotes |

|

|

| 1. | ROE is calculated by dividing net earnings (or annualized net earnings for annualized ROE) applicable to common shareholders by average monthly common shareholders’ equity. ROTE is calculated by dividing net earnings (or annualized net earnings for annualized ROTE) applicable to common shareholders by average monthly tangible common shareholders’ equity (tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets). Management believes that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally, and that tangible common shareholders’ equity is meaningful because it is a measure that the firm and investors use to assess capital adequacy. ROTE and tangible common shareholders’ equity are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. |

The table below presents a reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity:

| AVERAGE FOR THE | ||||||||||||||

| Unaudited, $ in millions

|

YEAR ENDED DECEMBER 31, 2024 |

|

THREE MONTHS ENDED DECEMBER 31, 2024 |

|

||||||||||

| Total shareholders’ equity

|

|

$ 119,204

|

|

|

$ 121,083

|

|

||||||||

| Preferred stock

|

|

(12,430)

|

|

|

(13,253)

|

|

||||||||

|

Common shareholders’ equity

|

|

106,774

|

|

|

107,830

|

|

||||||||

| Goodwill |

|

(5,895)

|

|

|

(5,880)

|

|

||||||||

| Identifiable intangible assets

|

|

(1,003)

|

|

|

(886)

|

|

||||||||

|

Tangible common shareholders’ equity

|

|

$ 99,876

|

|

|

$ 101,064

|

|

||||||||

| 2. | Dealogic – January 1, 2024 through December 31, 2024. |

| 3. | For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2024: (i) Investment banking fees backlog – see “Results of Operations – Global Banking & Markets,” (ii) assets under supervision – see “Results of Operations – Asset & Wealth Management – Assets Under Supervision,” (iii) efficiency ratio – see “Results of Operations – Operating Expenses,” (iv) share repurchase program – see “Capital Management and Regulatory Capital – Capital Management,” (v) global core liquid assets – see “Risk Management – Liquidity Risk Management,” (vi) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” and (vii) VaR – see “Risk Management – Market Risk Management.” |

| For information about the following items, see the referenced sections in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended September 30, 2024: (i) risk-based capital ratios and the supplementary leverage ratio – see Note 20 “Regulation and Capital Adequacy,” (ii) geographic net revenues – see Note 25 “Business Segments” and (iii) unvested share-based awards that have non-forfeitable rights to dividends or dividend equivalents in calculating basic EPS – see Note 21 “Earnings Per Common Share.” |

| Represents a preliminary estimate for the fourth quarter of 2024 for the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data, global core liquid assets and VaR. These may be revised in the firm’s Annual Report on Form 10-K for the year ended December 31, 2024. |

| 4. | Beginning in the fourth quarter of 2024, revenues relating to certain short-term foreign currency swaps used in connection with the firm’s funding strategy are classified within non-interest revenues to better align with the classification for similar foreign currency derivatives. Previously, such revenues were included within net interest income ($234 million for the first quarter of 2024, $252 million for the second quarter of 2024 and $276 million for the third quarter of 2024). This change has no impact to total net revenues of the firm. Amounts previously reported for the first, second and third quarters of 2024 have been conformed to the current presentation. Revenues related to such swaps were not material for 2023, and therefore no adjustments have been made to prior year amounts. |

| Net interest income for the fourth quarter of 2024 included $869 million in Global Banking & Markets, $713 million in Asset & Wealth Management and $763 million in Platform Solutions, and for 2024 included $2.41 billion in Global Banking & Markets, $2.80 billion in Asset & Wealth Management and $2.86 billion in Platform Solutions. |

15

Exhibit 99.2 Full Year and Fourth Quarter 2024 Earnings Results Presentation January 15, 2025

Our culture and leading client franchise are the foundation of our strategy S TRA TE G I C Client Service OBJ EC T I VES Harness One GS to Serve Our Clients with Excellence Partnership Run World-Class, Differentiated, Durable Businesses Integrity Invest to Operate at Scale Excellence 1

World-class and interconnected franchises positioned to deliver mid-teens returns Leading Global Active 1 #1 M&A Advisor 3 Asset Manager One Global Banking & Asset & Wealth Goldman Top 5 Alternative 2 #1 Equities Franchise Markets Management 3 Sachs Asset Manager Leading FICC Premier Ultra High Net 2 Franchise Worth franchise 4 2024 SHAREHOLDER VALUE CREATION +48% +7% +9% +52% Growth in Book Value Growth in Quarterly Stock Price Total Shareholder Return per Share Dividend 2

Exceptional talent underpinned by a culture of excellence 875k+ ~380 Experienced hire applicants, with <1% hire rate Boomerang hires Compelling for Experienced Talent >40% <1% Aspirational Invested Selection rate from ~320k applicants for of the firm’s Partners were campus hires for Campus in Our People 2024 summer internship program Recruits 275+ Ranked #1 Unparalleled Brand of Excellence Alumni in C-suite roles (including Managing Partners) by Vault for most prestigious banking firm of organizations valued at >$1bn or with AUM >$5bn 3

Strong progress on execution priorities in 2024 Global Banking & Markets Asset & Wealth Management Exceptional client franchise Grew more durable revenues Record Management and other fees of $10.4bn in 2024, up 10% YoY; 1; #1 M&A, #3 ECM, #2 Leveraged Loans, #3 High-Yield Debt Alts management and other fees CAGR of 13% from 2019-2024 5 Top 3 with 119 of the Top 150 FICC & Equities clients in 1H24 vs. 77 in 2019 Record Private banking and lending revenues of $2.9bn in 2024, 2 +340bps wallet share gains in GBM since 2019 up 12% YoY 6,7 Increased financing revenues in FICC and Equities Positive momentum in fundraising and reduced HPI Alternatives fundraising of $72bn in 2024; $323bn since 2019YE Record financing revenues of $9.1bn in 2024 CAGR of 15% from 2019-2024 HPI reduction of $6.9bn to $9.4bn in 2024 Strong execution on narrowed strategic focus Sold GreenSky Sold seller financing loan portfolio Signed agreement to transition General Motors (GM) credit card program 4

Global Banking & Markets: Increased wallet share and financing driving attractive returns Leading diversified franchise ($bn) Forward Catalysts Advisory FICC financing Equity underwriting Equities intermediation Debt underwriting Equities financing Constructive Economic Outlook FICC intermediation Other Average revenues: $33bn Average ROE: 16% Improving CEO Confidence $37 $35 $32 $30 $30 Increasing Sponsor Activity Focus on Scale and Innovation Improving Regulatory Backdrop Financing: Capital Solutions Group 2020 2021 2022 2023 2024 5

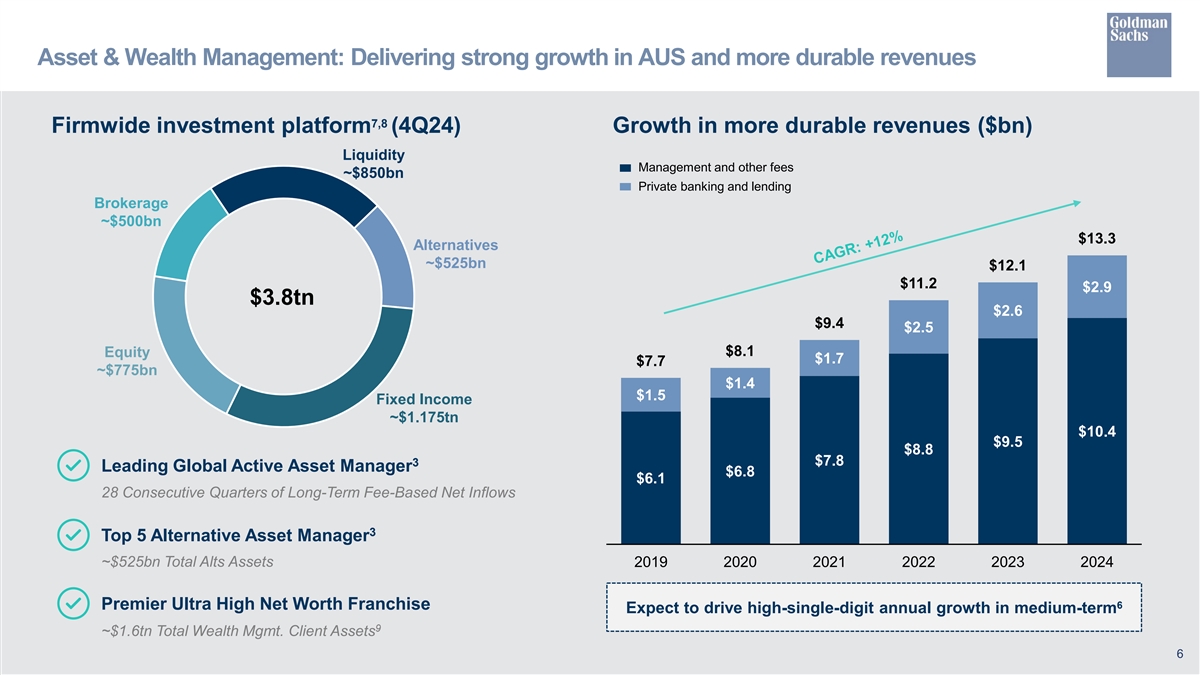

Asset & Wealth Management: Delivering strong growth in AUS and more durable revenues 7,8 Firmwide investment platform (4Q24) Growth in more durable revenues ($bn) Liquidity Management and other fees ~$850bn Private banking and lending Brokerage ~$500bn $13.3 Alternatives ~$525bn $12.1 $11.2 $2.9 $3.8tn $2.6 $9.4 $2.5 $8.1 Equity $1.7 $7.7 ~$775bn $1.4 $1.5 Fixed Income ~$1.175tn $10.4 $9.5 $8.8 3 $7.8 Leading Global Active Asset Manager $6.8 $6.1 28 Consecutive Quarters of Long-Term Fee-Based Net Inflows 3 Top 5 Alternative Asset Manager ~$525bn Total Alts Assets 2019 2020 2021 2022 2023 2024 6 Premier Ultra High Net Worth Franchise Expect to drive high-single-digit annual growth in medium-term 9 ~$1.6tn Total Wealth Mgmt. Client Assets 6

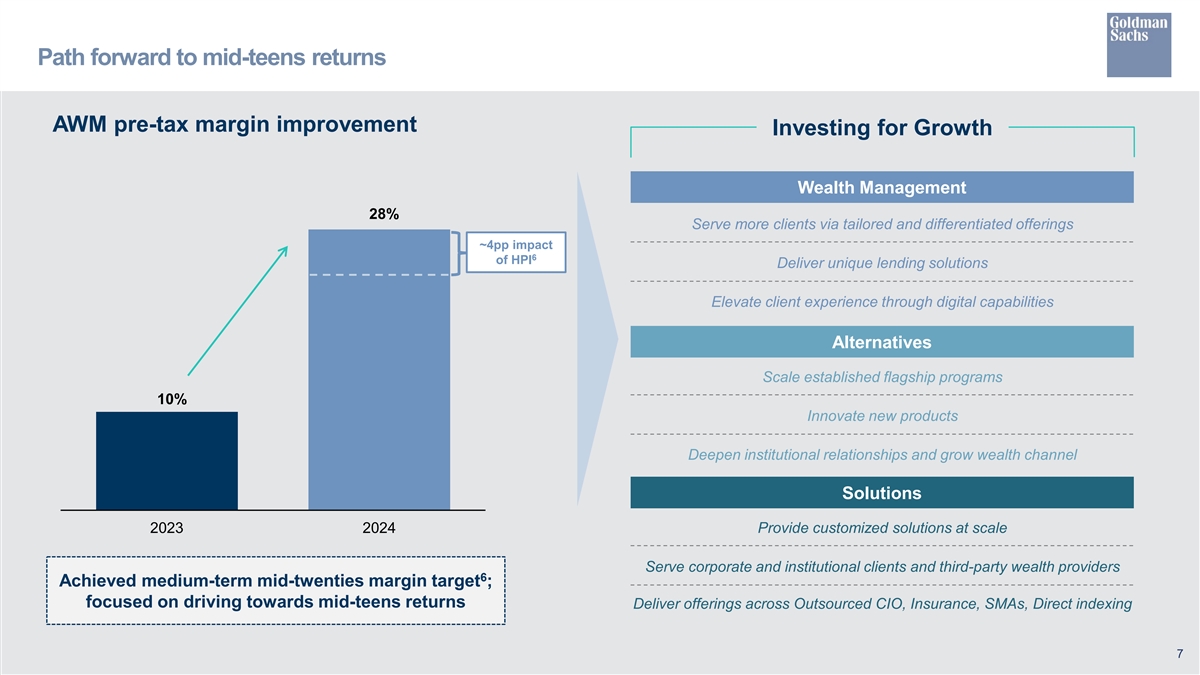

Path forward to mid-teens returns AWM pre-tax margin improvement Investing for Growth Wealth Management 28% Serve more clients via tailored and differentiated offerings ~4pp impact 6 of HPI Deliver unique lending solutions Elevate client experience through digital capabilities Alternatives Scale established flagship programs 10% Innovate new products Deepen institutional relationships and grow wealth channel Solutions 2023 2024 Provide customized solutions at scale Serve corporate and institutional clients and third-party wealth providers 6 Achieved medium-term mid-twenties margin target ; focused on driving towards mid-teens returns Deliver offerings across Outsourced CIO, Insurance, SMAs, Direct indexing 7

~70% of 2024 revenues driven from a growing baseline and more durable sources 10 GS revenue breakdown ($bn) Baseline revenues Solid foundation from More durable revenues baseline revenues with Other incremental revenues 1 opportunity for continued growth $59.3 $53.5 3 $47.4 $46.3 $44.6 $16.5 Growing contribution from $30.4 $12.3 $15.4 more durable revenue 2 $36.5 sources $19.4 2 $11.4 $22.4 $19.9 $18.4 $15.3 $12.2 $12.3 Power of diversification and 1 consistent ability to capture 3 $14.6 $14.1 $13.6 $13.6 $12.9 $12.9 upside 2019 2020 2021 2022 2023 2024 8

Investing to operate at scale with resilience and enhanced productivity O P E RATI NG E FFI CI E NCI E S 1 2 3 Organizational Spend Automation Structure Management n Expand presence in key n Optimize transaction based n Simplify and modernize strategic locations expenses technology stack n Optimize pyramid footprintn Drive efficient management n Productivity enhancements of consultants and vendors n Streamline functions and n Leverage AI solutions to processesn Reduction of expenses accelerate and transform associated with business technology consolidated investment entity (CIE) dispositions 9

Driving the firm to mid-teens returns through-the-cycle Mid-Teens Global Banking & Asset & Wealth Platform Markets Management Solutions Demonstrated mid-teens 2024 ROE of 12.8%; 12 Achieve pre-tax breakeven 11 returns clear path to mid-teens returns 12.7% 2024 ROE Through-the-Cycle 10

Results Snapshot Net Revenues Net Earnings EPS 2024 $53.51 billion 2024 $14.28 billion 2024 $40.54 4Q24 $ 1 3 . 87 billion 4Q24 $ 4 . 1 1 billion 4Q24 $11. 95 13 13 ROE ROTE Book Value Per Share 2024 12.7% 2024 13.5% 2024 $336.77 4Q24 14.6% 4Q24 15.5% 2024 Growth 7.4% 14 Annual Highlights Selected Items and FDIC Special Assessment Fee nd 2 highest net revenues, net earnings and diluted EPS $ in millions, except per share amounts 2024 4Q24 Pre-tax earnings: 1 6 #1 in announced and completed M&A $ 939 $ 472 AWM historical principal investments (668) (71) GM Card / Seller financing / GreenSky Record Equities net revenues, including record financing; (71) 9 FDIC special assessment fee Record FICC financing $ 200 $ 410 Total impact to pre-tax earnings Record Management and other fees; $ 156 $ 320 Impact to net earnings Record Private banking and lending net revenues $ 0.47 $ 0.98 Impact to EPS 7 Record AUS of $3.14 trillion; th 0.2pp 1.2pp Impact to ROE 28 consecutive quarter of long-term fee-based net inflows 11

Financial Overview Financial Results Financial Overview Highlights vs. vs. vs.n 4Q24 results included EPS of $11.95 and ROE of 14.6% $ in millions, except per share amounts 4Q24 3Q24 4Q23 2024 2023 — 4Q24 net revenues were significantly higher YoY reflecting higher net revenues across all segments, with significant growth in Global Banking & Markets $ 8,479 (1)% 33% $ 34,943 16% Global Banking & Markets — 4Q24 provision for credit losses was $351 million, reflecting net provisions related to the credit card portfolio (primarily driven by net charge-offs) Asset & Wealth Management 4,721 26% 8% 16,142 16% — 4Q24 operating expenses were slightly lower YoY primarily reflecting the FDIC special 669 71% 16% 2,427 2% assessment fee in 4Q23 and significantly lower expenses, including impairments, related to Platform Solutions commercial real estate in CIEs, partially offset by higher transaction based expenses 13,869 9% 23% 53,512 16% Net revenues 351 (12)% (39)% 1,348 31% Provision for credit losses 8,261 (1)% (3)% 33,767 (2)% Operating expenses 5,257 32% 133% $ 18,397 71% Pre-tax earnings $ n 2024 results included EPS of $40.54 and ROE of 12.7% $ 4,111 37% 105% $ 14,276 68% Net earnings — 2024 net revenues were higher YoY primarily reflecting higher net revenues in Global Banking & Markets and Asset & Wealth Management $ 3,923 41% 110% $ 13,525 71% Net earnings to common — 2024 provision for credit losses was $1.35 billion, reflecting net provisions related to the credit card portfolio (primarily driven by net charge-offs) $ 11.95 42% 118% $ 40.54 77% Diluted EPS — 2024 operating expenses were slightly lower YoY reflecting decreases driven by significantly lower expenses, including impairments, related to commercial real estate in CIEs and other 13 ROE 14.6% 4.2pp 7.5pp 12.7% 5.2pp significant expenses recognized in the prior year, including the write-down of intangibles related to GreenSky, an impairment of goodwill related to Consumer platforms and the FDIC 13 special assessment fee. These decreases were partially offset by higher compensation and ROTE 15.5% 4.4pp 7.9pp 13.5% 5.4pp benefits expenses and higher transaction based expenses 7 59.6% (5.9)pp (15.4)pp 63.1% (11.5)pp Efficiency Ratio 12

Global Banking & Markets Financial Results Global Banking & Markets Highlights n 4Q24 net revenues were significantly higher YoY vs. vs. vs. $ in millions — Investment banking fees reflected significantly higher net revenues in Equity underwriting and 4Q24 3Q24 4Q23 2024 2023 Debt underwriting Investment banking fees $ 2,054 10% 24% $ 7,732 24% — FICC reflected significantly higher net revenues in intermediation and financing — Equities reflected significantly higher net revenues in intermediation and financing FICC 2,739 (8)% 35% 13,204 9% 7 n Investment banking fees backlog increased QoQ, primarily driven by Equity underwriting 7 n 4Q24 select data : 3,451 (1)% 32% 13,431 16% Equities — Total assets of $1.41 trillion 235 4% 285% 576 237% — Loan balance of $130 billion Other — Net interest income of $869 million 8,479 (1)% 33% 34,943 16% Net revenues (55) N.M. N.M. 40 (90)% Provision for credit losses Operating expenses 4,783 (4)% 10% 19,980 11% n 2024 net revenues were higher YoY — Investment banking fees reflected significantly higher net revenues in Debt underwriting and Pre-tax earnings $ 3,751 6% 105% $ 14,923 29% Equity underwriting and higher net revenues in Advisory — FICC reflected significantly higher net revenues in financing and slightly higher net revenues Net earnings $ 2,937 11% 72% $ 11,580 26% in intermediation — Equities reflected significantly higher net revenues in intermediation and higher net revenues Net earnings to common $ 2,793 12% 75% $ 10,998 26% in financing 7 n Investment banking fees backlog increased YoY, primarily driven by Advisory Average common equity $ 76,604 1% 3% $ 75,796 5% Return on average common equity 14.6% 1.5pp 6.0pp 14.5% 2.4pp 13