UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 8, 2025 (January 7, 2025)

FLOWERS FOODS, INC.

(Exact name of registrant as specified in its charter)

| Georgia | 1-16247 | 58-2582379 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 1919 Flowers Circle, Thomasville, GA | 31757 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (229) 226-9110

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.01 per share | FLO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 7, 2025, Flowers Foods, Inc., a Georgia corporation (the “Company”), Daffodil Acquisition Sub, LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Company (“Purchaser”), and Daffodil Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Purchaser (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), with Purposeful Foods Holdings, Inc., a Delaware corporation (“Purposeful Foods”), the parent company of Simple Mills, Inc.

Pursuant to the Merger Agreement, the Company will acquire Purposeful Foods for a purchase price of $795 million in cash and Merger Sub will merge with and into Purposeful Foods, with Purposeful Foods being the surviving corporation (“Surviving Corporation”). After the consummation of the merger, Purchaser will be the sole stockholder of the Surviving Corporation.

The Merger Agreement contains customary representations and warranties made by each of the parties. The parties have also agreed to various covenants in the Merger Agreement, including agreements by Purposeful Foods to conduct its operations in the ordinary course of business consistent with past practice.

The closing of the merger is subject to customary closing conditions, including (i) the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (ii) the continued accuracy of the representations and warranties of the parties (subject to specified materiality standards) and (iii) the absence of a material adverse effect with respect to Purposeful Foods.

In connection with entering into the Merger Agreement, the Company entered into a commitment letter, pursuant to which, among other things, Royal Bank of Canada has committed to provide debt financing for consummation of the merger, consisting of a $795.0 million 364-day senior unsecured term loan credit facility (the “Term Loan Facility”), on the terms and subject to the conditions set forth in the commitment letter. The Term Loan Facility will be subject to reduction or prepayment upon the completion of certain debt and equity financings, as applicable, and upon other specified events. The obligations of the commitment party to provide this debt financing is subject to a number of customary conditions, including, without limitation, execution and delivery of definitive documentation. Pursuant to the Merger Agreement, Purposeful Foods has agreed to cooperate with the Company’s efforts in connection with these financings.

The closing of the merger is expected to be consummated during the first quarter of 2025, subject to receipt of regulatory and other approvals and customary closing conditions.

The foregoing description of the Merger Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Merger Agreement, a copy of which will be filed with the Company’s next Annual Report on Form 10-K.

Item 7.01 Regulation FD Disclosure

On January 8, 2025, the Company issued a press release announcing the proposed acquisition, a copy of which is furnished herewith as Exhibit 99.1 and incorporated herein by reference. Also on January 8, 2025, the Company posted on its website at https://www.flowersfoods.com an investor presentation regarding the proposed acquisition, a copy of which is furnished herewith as Exhibit 99.2 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description |

|

| 99.1 | Press Release, dated January 8, 2025. | |

| 99.2 | Investor Presentation, dated January 8, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FLOWERS FOODS, INC. | ||||||

| Date: January 8, 2025 | By: | /s/ R. Steve Kinsey |

||||

| Name: | R. Steve Kinsey | |||||

| Title: | Chief Financial Officer | |||||

Exhibit 99.1

| January 8, 2025 |

Flowers Foods (NYSE: FLO) |

Company Press Release

FLOWERS FOODS, INC. TO ACQUIRE SIMPLE MILLS

Premium brand of better-for-you crackers, cookies, snack bars, and baking mixes expected to spur growth and diversify revenue base

| • | Enhances Flowers’ growth by adding a scaled, better-for-you snacking platform that is successfully penetrating mainstream consumers and offers significant white space for future growth |

| • | Diversifies category exposure, bolstering Flowers’ exposure to better-for-you and attractive snacking segments through the addition of Simple Mills’ market-leading products, which are meaningfully outpacing category growth |

| • | Strengthens Flowers’ financial profile with the transaction expected to be immediately accretive to net sales1 and adjusted EBITDA2 growth and adjusted EBITDA margins3 on a proforma basis4 |

| • | The company will discuss the transaction during a conference call today at 8:30 a.m. Eastern Time |

THOMASVILLE, Ga. and CHICAGO, Ill. – Flowers Foods, Inc. (NYSE: FLO) today announced that it has entered into a definitive agreement to acquire Simple Mills for $795 million in cash. The addition of Simple Mills expands Flowers’ exposure to better-for-you and attractive snacking segments and enhances the company’s growth and margin prospects.

Founded in 2012 by Katlin Smith, Simple Mills is a market-leading natural brand offering premium better-for-you crackers, cookies, snack bars, and baking mixes. Built upon the belief that food has the power to spark impactful change, Simple Mills’ mission is to revolutionize the way food is made to positively impact people and the planet. The brand’s stunningly simple ingredients, pioneering use of nutrient-dense nut, seed, and vegetable flours, and exceptional taste have cultivated unmatched brand love and loyalty among natural and mainstream consumers alike. Simple Mills products are available nationwide across more than 30,000 natural and conventional stores. Simple Mills is estimated to have generated 2024 net sales of $240 million, representing 14% growth compared to the prior year.

“We are incredibly excited to welcome the Simple Mills team to Flowers,” said Ryals McMullian, chairman and CEO of Flowers Foods. “With leading market positions and abundant white space for future growth, Simple Mills perfectly fits our strategy of adding compelling brands in better-for-you segments that complement and diversify our existing portfolio. Equally important, the brand’s mission aligns with Flowers’ values centered on honesty and integrity, respect and inclusion, and sustainability. Katlin and the Simple Mills team have built a remarkable business, and we look forward to collaborating with them to generate continued growth while preserving the brand’s integrity and staying true to its unmatched quality and taste.”

Katlin Smith, founder and CEO of Simple Mills, commented, “This transaction marks the beginning of a new phase of growth for Simple Mills and we are thrilled to join the Flowers family. I am extremely proud of our talented team and the strong brand we’ve built with the support of our valued partners and loyal customers. With Flowers’ resources, we will be well positioned to broaden distribution, accelerate innovation, and amplify brand awareness, while advancing our mission. Flowers has a strong track record of fostering growth in its acquired companies while stewarding and protecting their brand promise. I cannot imagine a better partner for Simple Mills and the team, and I look forward to working alongside Flowers to build upon our strong history of growth.”

Compelling Strategic Rationale:

Enhances growth prospects

| – | Adds a scaled, better-for-you snacking platform, led by a seasoned management team, that is successfully penetrating mainstream consumers and offers significant white space for future growth |

| – | Enables future growth of the Simple Mills brand by expanding distribution, accelerating innovation, increasing velocities, and gaining access to new segments and categories |

| – | Leverages Flowers’ demonstrated ability to grow acquired companies in the better-for-you space |

Diversifies category exposure

| – | Bolsters Flowers’ growing position in better-for-you and attractive snacking categories through the addition of Simple Mills’ market-leading products, which are meaningfully outpacing category growth |

| – | Enhances portfolio strategy, increasing Flowers’ proforma 2024 branded retail sales as a percentage of total net sales to approximately 66% |

| – | Simple Mills authenticity and brand strength provide opportunity to extend across multiple snacking categories |

Attractive financial profile

| – | Expected to be immediately accretive to net sales and adjusted EBITDA2 growth and adjusted EBITDA margins3 on a proforma basis4 |

| – | Expected to be accretive to Flowers’ earnings per share in 2026 |

Transaction Details:

| – | Flowers has entered into a definitive agreement to acquire Simple Mills for $795 million in cash from Katlin Smith, Simple Mills management, Vestar Capital Partners (the largest individual shareholder), and initial angel investors |

| – | Flowers has entered into a binding commitment letter for a $795 million term loan from Royal Bank of Canada to help fund the transaction as required. Proforma total net debt5 estimated at the closing date will be approximately $1.9 billion and the proforma total net debt-to-EBITDA ratio is expected to be in the range of 3.1x to 3.3x.6 Flowers intends to maintain its balanced capital deployment model, along with a commitment to its investment grade debt rating. |

| – | The transaction is subject to customary regulatory approval and closing conditions and is anticipated to close in the first quarter of 2025 |

| – | Upon closing, Simple Mills will operate as an independent subsidiary of Flowers Foods and continue to be led by founder and CEO Katlin Smith and her leadership team. Simple Mills will maintain its operations in Chicago, Illinois and Mill Valley, California. |

| – | RBC Capital Markets LLC acted as exclusive financial advisor and Jones Day acted as legal counsel to Flowers Foods in this transaction. Piper Sandler and Centerview Partners served as the financial advisors and Ropes & Gray LLP served as legal counsel to Simple Mills in this transaction. Royal Bank of Canada is acting as administrative agent and sole bookrunner on the term loan. |

Transaction Webcast:

The company will host a live webcast to discuss the transaction today at 8:30 a.m. Eastern Time. Access to the webcast, along with this press release and a supporting slide presentation, will be available and archived on the investors page of flowersfoods.com.

About Flowers Foods

Headquartered in Thomasville, Ga., Flowers Foods, Inc. (NYSE: FLO) is one of the largest producers of packaged bakery foods in the United States with 2023 net sales of $5.1 billion. Flowers operates bakeries across the country that produce a wide range of bakery products. Among the company’s top brands are Nature’s Own, Dave’s Killer Bread, Wonder, Canyon Bakehouse, and Tastykake. Learn more at www.flowersfoods.com.

About Simple Mills

Founded in 2012, Simple Mills is a leading provider of better-for-you crackers, cookies, snack bars, and baking mixes made with simple and nutritious high-quality ingredients that deliver extraordinary taste. The Company has disrupted center-aisle grocery categories to become the leading cracker, cookie, and baking mix brand in the natural channel, and the leading natural cracker brand in MULO with distribution in over 30,000 stores nationwide. Its mission is to revolutionize the way food is made to nourish people and planet. For more information, visit www.simplemills.com.

| (1) | Any reference to sales refers to net sales inclusive of allowances and deductions against gross sales. |

| (2) | Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability. |

| (3) | Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability, as a percentage of net sales. |

| (4) | No reconciliation of expected adjusted EBITDA to net income or the expected adjusted EBITDA margin to net income margin is included in this presentation because the company is unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors. |

| (5) | Net debt excludes lease liabilities; net debt equals Total Debt, less cash and cash equivalents. |

| (6) | No reconciliation of net debt to Total Debt is included in this presentation because the company is unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors. |

Contacts

Flowers Foods

Investor Contact: Eric Jacobson, InvestorRelations@flocorp.com

Media Contact: http://flowersfoods.com/contact/

Simple Mills

Media Contact: Edelman Smithfield, SimpleMills@EdelmanSmithfield.com

Forward-Looking Statements

Statements contained in this press release and certain other written or oral statements made from time to time by Flowers Foods, Inc. (the “company”, “Flowers Foods”, “Flowers”, “us”, “we”, or “our”) and its representatives that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to current expectations regarding our and Simple Mills’ business and our and Simple Mills’ future financial condition and results of operations, and include statements regarding the anticipated timing and financial and other benefits of the proposed acquisition, and are often identified by the use of words and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “is likely to,” “is expected to” or “will continue,” or the negative of these terms or other comparable terminology. These forward-looking statements are based upon assumptions we believe are reasonable. Forward-looking statements are based on current information and are subject to risks and uncertainties that could cause our actual results to differ materially from those projected. Certain factors that may cause actual results, performance, liquidity, and achievements to differ materially from those projected are discussed in our Annual Report on Form 10-K for the year ended December 30, 2023 (the “Form 10-K”) and our Quarterly Reports on Form 10-Q (the “Form 10-Qs”) filed with the Securities and Exchange Commission (“SEC”) and may include, but are not limited to, (a) our ability to satisfy the conditions precedent to the consummation of the proposed acquisition on the expected timeline or at all, (b) our ability to achieve the anticipated timing and financial and other benefits of the proposed acquisition, including anticipated synergies, (c) our ability to integrate the businesses following the acquisition, (d) our management team’s ability to focus on ongoing business operations and not be distracted by the proposed acquisition, (e) expectations regarding Simple Mills’ strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash and capital expenditures, (f) unexpected changes in any of the following: (1) general economic and business conditions; (2) the competitive setting in which we operate, including advertising or promotional strategies by us or our competitors, as well as changes in consumer demand; (3) interest rates and other terms available to us on our borrowings; (4) supply chain conditions and any related impact on energy and raw materials costs and availability and hedging counter-party risks; (5) relationships with or increased costs related to our employees and third-party service providers; (6) laws and regulations (including environmental and health-related issues); and (7) accounting standards or tax rates in the markets in which we operate, (g) the loss or financial instability of any significant customer(s), including as a result of product recalls or safety concerns related to our products, (h) changes in consumer behavior, trends and preferences, including health and whole grain trends, and the movement toward less expensive store branded products, (i) the level of success we achieve in developing and introducing new products and entering new markets, (j) our ability to implement new technology and customer requirements as required, (k) our ability to operate existing, and any new, manufacturing lines according to schedule, (l) our ability to implement and achieve our corporate responsibility goals in accordance with regulatory requirements and expectations of stakeholders, suppliers, and customers; (m) our ability to execute our business strategies which may involve, among other things, (1) the ability to realize the intended benefits of completed, planned or contemplated acquisitions, dispositions or joint ventures, (2) the deployment of new systems (e.g., our enterprise resource planning (“ERP”) system), distribution channels and technology, and (3) an enhanced organizational structure (e.g., our sales and supply chain reorganization), (n) consolidation within the baking industry and related industries, (o) changes in pricing, customer and consumer reaction to pricing actions (including decreased volumes), and the pricing environment among competitors within the industry, (p) our ability to adjust pricing to offset, or partially offset, inflationary pressure on the cost of our products, including ingredient and packaging costs; (q) disruptions in our direct-store-delivery distribution model, including litigation or an adverse ruling by a court or regulatory or governmental body that could affect the independent contractor classifications of the independent distributor partners, and changes to our direct-store-delivery distribution model in California, (r) increasing legal complexity and legal proceedings that we are or may become subject to, (s) labor shortages and turnover or increases in employee and employee-related costs, (t) the credit, business, and legal risks associated with independent distributor partners and customers, which operate in the highly competitive retail food and foodservice industries, (u) any business disruptions due to political instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East), incidents of terrorism, natural disasters, labor strikes or work stoppages, technological breakdowns, product contamination, product recalls or safety concerns related to our products, or the responses to or repercussions from any of these or similar events or conditions and our ability to insure against such events, (v) the failure of our information technology systems to perform adequately, including any interruptions, intrusions, cyber-attacks or security breaches of such systems or risks associated with the implementation of the upgrade of our ERP system; and (w) the potential impact of climate change on the company, including physical and transition risks, availability or restriction of resources, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms.

The foregoing list of important factors does not include all such factors, nor does it necessarily present them in order of importance. In addition, you should consult other disclosures made by the company (such as in our other filings with the SEC or in company press releases) for other factors that may cause actual results to differ materially from those projected by the company. Refer to Part I, Item 1A., Risk Factors, of the Form 10-K, Part II, Item 1A., Risk Factors, of Forms 10-Q and subsequent filings with the SEC for additional information regarding factors that could affect the company’s results of operations, financial condition and liquidity. We caution you not to place undue reliance on forward-looking statements, as they speak only as of the date made and are inherently uncertain. The company undertakes no obligation to publicly revise or update such statements, except as required by law. You are advised, however, to consult any further public disclosures by the company (such as in our filings with the SEC or in company press releases) on related subjects.

Information Regarding Non-GAAP Financial Measures

The company prepares its consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP). However, from time to time, the company may present in its public statements, press releases and SEC filings, non-GAAP financial measures such as, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense, adjusted selling, distribution and administrative expenses (SD&A), gross margin excluding depreciation and amortization, and net debt. The company’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP.

The company defines EBITDA as earnings before interest, taxes, depreciation and amortization. Earnings are net income. The company believes that EBITDA is a useful tool for managing the operations of its business and is an indicator of the company’s ability to incur and service indebtedness and generate free cash flow. The company also believes that EBITDA measures are commonly reported and widely used by investors and other interested parties as measures of a company’s operating performance and debt servicing ability because EBITDA measures assist in comparing performance on a consistent basis without regard to depreciation or amortization, which can vary significantly depending upon accounting methods and non-operating factors (such as historical cost). EBITDA is also a widely-accepted financial indicator of a company’s ability to incur and service indebtedness.

EBITDA should not be considered an alternative to (a) income from operations or net income (loss) as a measure of operating performance; (b) cash flows provided by operating, investing and financing activities (as determined in accordance with GAAP) as a measure of the company’s ability to meet its cash needs; or (c) any other indicator of performance or liquidity that has been determined in accordance with GAAP.

The company defines adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense and adjusted SD&A, respectively, to exclude additional costs that the company considers important to present to investors to increase the investors’ insights about the company’s core operations. These costs include, but are not limited to, the costs of closing a plant or costs associated with acquisition-related activities, restructuring activities, certain impairment charges, legal settlements, costs to implement an enterprise resource planning system and enhance bakery digital capabilities (business process improvement costs) to provide investors direct insight into these costs, and other costs impacting past and future comparability. The company believes that these measures, when considered together with its GAAP financial results, provides management and investors with a more complete understanding of its business operating results, including underlying trends, by excluding the effects of certain charges. Adjusted EBITDA is used as the primary performance measure in the company’s 2014 Omnibus Equity and Incentive Compensation Plan (Amended and Restated Effective May 25, 2023).

Presentation of gross margin includes depreciation and amortization in the materials, supplies, labor and other production costs according to GAAP. Our method of presenting gross margin excludes the depreciation and amortization components, as discussed above.

The company defines net debt as total debt less cash and cash equivalents. Net debt to EBITDA is used as a measure of financial leverage employed by the company.

Exhibit 99.2

Flowers FOODS

ACQUISITION OF SIMPLE MILLS

January 8, 2025

REGARDING FORWARD-LOOKING STATEMENTS

Statements

contained in this presentation and certain other written or oral statements made from time to time by Flowers Foods, Inc. (the “company”, “Flowers Foods”, “Flowers”, “us”, “we”, or “our”)

and its representatives that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to current expectations regarding our and Simple Mills’

business and our and Simple Mills’ future financial condition and results of operations, and include statements regarding the anticipated timing and financial and other benefits of the proposed acquisition, and are often identified by the use

of words and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “should,” “will,” “would,” “is likely to,” “is expected to” or

“will continue,” or

the negative of these terms or other comparable terminology. These forward-looking statements are based upon assumptions we believe are reasonable. Forward-looking statements are based on current information and are subject to risks and

uncertainties that could cause our actual results to differ materially from those projected. Certain factors that may cause actual results, performance, liquidity, and achievements to differ materially from those projected are discussed in our

Annual Report on Form 10-K for the year ended December 30, 2023 (the “Form 10-K”) and our Quarterly Reports on Form

10-Q (the “Form 10-Qs”) filed with the Securities and Exchange Commission (“SEC”) and may include, but are not limited to, (a) our ability to

satisfy the conditions precedent to the consummation of the proposed acquisition on the expected timeline or at all, (b) our ability to achieve the anticipated timing and financial and other benefits of the proposed acquisition, including

anticipated synergies, (c) our ability to integrate the businesses following the acquisition, (d) our management team’s ability to focus on ongoing business operations and not be distracted by the proposed acquisition,

(e) expectations regarding Simple Mills’ strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities, revenues, products and services, pricing,

operating expenses, market trends, liquidity, cash flows and uses of cash and capital expenditures, (f) unexpected changes in any of the following: (1) general economic and business conditions; (2) the competitive setting in which we

operate, including advertising or promotional strategies by us or our competitors, as well as changes in consumer demand; (3) interest rates and other terms available to us on our borrowings; (4) supply chain conditions and any related

impact on energy and raw materials costs and availability and hedging counter-party risks; (5) relationships with or increased costs related to our employees and third-party service providers; (6) laws and regulations (including

environmental and health-related issues); and (7) accounting standards or tax rates in the markets in which we operate, (g) the loss or financial instability of any significant customer(s), including as a result of product recalls or

safety concerns related to our products, (h) changes in consumer behavior, trends and preferences, including health and whole grain trends, and the movement toward less expensive store branded products, (i) the level of success we achieve

in developing and introducing new products and entering new markets, (j) our ability to implement new technology and customer requirements as required, (k) our ability to operate existing, and any new, manufacturing lines according to

schedule, (l) our ability to implement and achieve our corporate responsibility goals in accordance with regulatory requirements and expectations of stakeholders, suppliers, and customers; (m) our ability to execute our business strategies

which may involve, among other things, (1) the ability to realize the intended benefits of completed, planned or contemplated acquisitions, dispositions or joint ventures, (2) the deployment of new systems

(e.g., our enterprise resource planning (“ERP”) system), distribution channels and technology, and (3) an enhanced organizational structure (e.g., our sales and

supply chain reorganization), (n) consolidation within the baking industry and related industries, (o) changes in pricing, customer and consumer reaction to pricing actions (including decreased volumes), and the pricing environment among

competitors within the industry, (p) our ability to adjust pricing to offset, or partially offset, inflationary pressure on the cost of our products, including ingredient and packaging costs; (q) disruptions in our direct-store-delivery

distribution model, including litigation or an adverse ruling by a court or regulatory or governmental body that could affect the independent contractor classifications of the independent distributor partners, and changes to our

direct-store-delivery distribution model in California, (r) increasing legal complexity and legal proceedings that we are or may become subject to, (s) labor shortages and turnover or increases in employee and employee-related costs,

(t) the credit, business, and legal risks associated with independent distributor partners and customers, which operate in the highly competitive retail food and foodservice industries, (u) any business disruptions due to political

instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East), incidents of terrorism, natural disasters, labor strikes or work stoppages, technological breakdowns, product

contamination, product recalls or safety concerns related to our products, or the responses to or repercussions from any of these or similar events or conditions and our ability to insure against such events, (v) the failure of our information

technology systems to perform adequately, including any interruptions, intrusions, cyber-attacks or security breaches of such systems or risks associated with the implementation of the upgrade of our ERP system; and (w) the potential impact of

climate change on the company, including physical and transition risks, availability or restriction of resources, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms. The foregoing list of

important factors does not include all such factors, nor does it necessarily present them in order of importance. In addition, you should consult other disclosures made by the company (such as in our other filings with the SEC or in company press

releases) for other factors that may cause actual results to differ materially from those projected by the company. Refer to Part I, Item 1A., Risk Factors, of the Form 10-K, Part II, Item 1A., Risk Factors,

of Forms 10-Q and subsequent filings with the SEC for additional information regarding factors that could affect the company’s results of operations, financial condition and liquidity. We caution you not

to place undue reliance on forward-looking statements, as they speak only as of the date made and are inherently uncertain. The company undertakes no obligation to publicly revise or update such statements, except as required by law. You are

advised, however, to consult any further public disclosures by the company (such as in our filings with the SEC or in company press releases) on related subjects.

COMPBELLING STRATEGIC RATIONALE

ENHANCES GROWTH

PROSPECTS

Adds a scaled, better-for-you snacking platform, led by a seasoned

management team, that is successfully penetrating mainstream consumers and offers significant white space for future growth Enables future growth of the Simple Mills brand by expanding distribution, accelerating innovation, increasing velocities,

and gaining access to new segments and categories Leverages Flowers’ demonstrated ability to grow acquired companies in the better-for-you space DIVERSIFIES

CATEGORY EXPOSURE - Bolsters Flowers’ growing position in better-for-you and attractive snacking categories through the addition of Simple Mills’

market-leading products, which are meaningfully outpacing category growth Enhances portfolio strategy, increasing proforma 2024 branded retail sales as a percentage of total net sales¹ to approximately 66% Simple Mills’ authenticity and

brand strength provide opportunity to extend across multiple snacking categories ATTRACTIVE FINANCIAL PROFILE Expected to be immediately accretive to net sales and adjusted EBITDA² growth and adjusted EBITDA margins³ on a proforma

basis¹ Expected to be accretive to Flowers’ earnings per share in 2026

(1) Any reference to sales refers to net sales inclusive of allowances and

deductions against gross sales.

(2) Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability.

(3) Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability, as a percentage of net sales.

(4) No reconciliation of expected adjusted EBITDA to net income or the expected adjusted EBITDA margin to net income margin is included in this presentation because the company is

unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading

to investors.

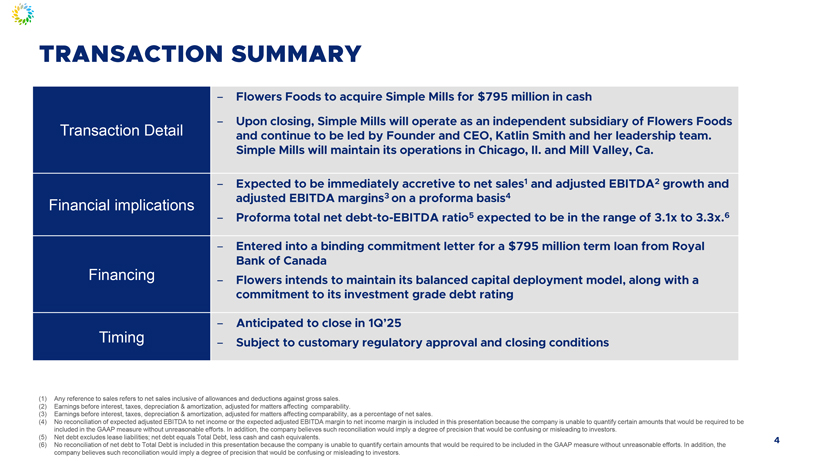

Transaction Detail Financial implications Financing Timing

Transaction Detail Financial implications Financing Timing - Flowers Foods to acquire Simple Mills for $795 million in cash Upon closing, Simple Mills will operate as an

independent subsidiary of Flowers Foods and continue to be led by Founder and CEO, Katlin Smith and her leadership team. Simple Mills will maintain its operations in Chicago, II. and Mill Valley, Ca. Expected to be immediately accretive to net

sales¹ and adjusted EBITDA² growth and adjusted EBITDA margins³ on a proforma basis4 Proforma total net debt-to-EBITDA ratio5 expected to be in the range

of 3.1x to 3.3x.6 Entered into a binding commitment letter for a $795 million term loan from Royal Bank of Canada Flowers intends to maintain its balanced capital deployment model, along with a commitment to its investment grade debt rating

Anticipated to close in 1Q’25 Subject to customary regulatory approval and closing conditions

(1) Any reference to sales refers to net sales inclusive of

allowances and deductions against gross sales. (2) Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability.

(3) Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability, as a percentage of net sales.

(4) No reconciliation of expected adjusted EBITDA to net income or the expected adjusted EBITDA margin to net income margin is included in this presentation because the company is

unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading

to investors.

(5) Net debt excludes lease liabilities; net debt equals Total Debt, less cash and cash equivalents.

(6) No reconciliation of net debt to Total Debt is included in this presentation because the company is unable to quantify certain amounts that would be required to be included in

the GAAP measure without unreasonable efforts. In addition, the company believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors.

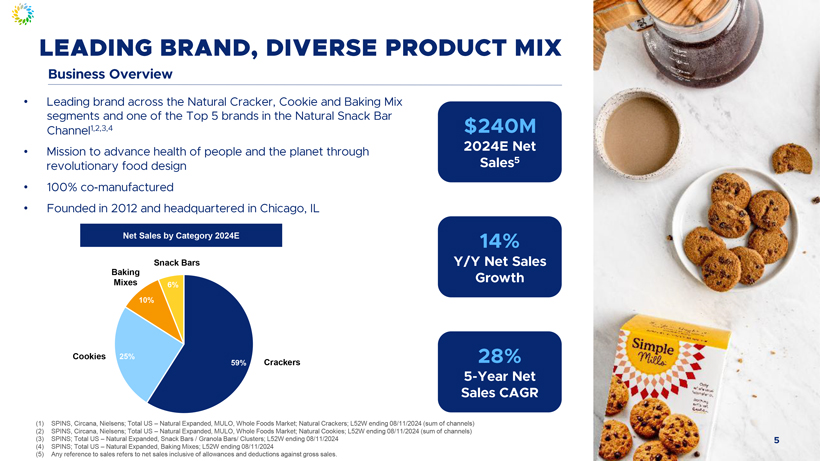

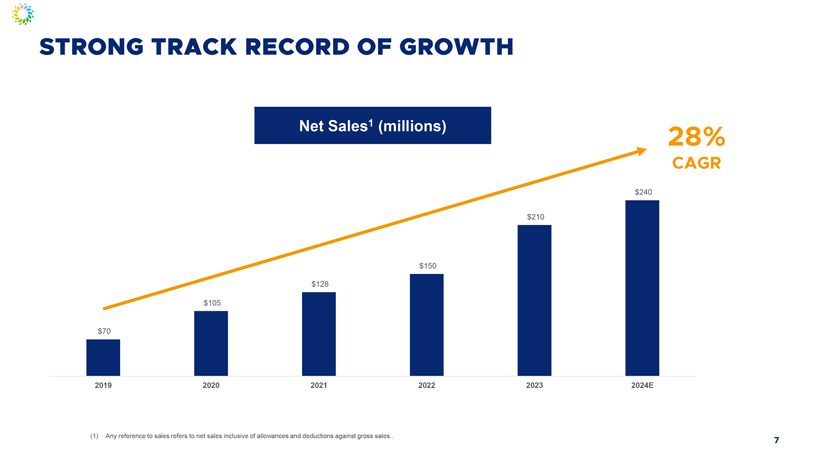

(1) SPINS, Circana, Nielsens; Total US – Natural Expanded, MULO, Whole Foods Market; Natural Crackers; L52W ending 08/11/2024 (sum of channels) (2) SPINS, Circana, Nielsens; Total US – Natural Expanded, MULO, Whole Foods Market; Natural Cookies; L52W ending 08/11/2024 (sum of channels) (3) SPINS; Total US – Natural Expanded, Snack Bars / Granola Bars/ Clusters; L52W ending 08/11/2024 (4) SPINS; Total US – Natural Expanded, Baking Mixes; L52W ending 08/11/2024 (5) Any reference to sales refers to net sales inclusive of allowances and deductions against gross sales. Net Sales1 (millions) LEADING BRAND, DIVERSE PRODUCT MIX Business Overview Leading brand across the Natural Cracker, Cookie and Baking Mix segments and one of the Top 5 brands in the Natural Snack Bar Channel1,2,3,4 Mission to advance health of people and the planet through revolutionary food design 100% co-manufactured Founded in 2012 and headquartered in Chicago, IL Net Sales by Category 2024E Baking Mixes 10% Snack Bars 6% $240M 2024E Net Sales5 14% Y/Y Net Sales Growth Cookies 25% 59% Crackers 28% 5-Year Net Sales CAGR STRONG TRACK RECORD OF GROWTH $70 $105 Net Sales¹ (millions) $128 $150 $210 $240 28% CAGR 2019 2020 2021 2022 2023 2024E (1) Any reference to sales refers to net sales inclusive of allowances and deductions against gross sales..

PIONEERING BRAND WITH MAINSTREAM APPEAL Single Cheide WEET PROTE Ñ,об Transformative Brand Unique brand that unifies delicious and nutritious in unexpected ways that drive significant consumer loyalty. Simple Mills products are not just simple and real but also purposeful and nutritious, with no compromise on taste Scaled Snacking Powerhouse Top independent snack brand with significant presence in multiple large, attractive categories and proven innovation capabilities Mainstream Appeal Diversified consumer base and channel presence with continued growth momentum Just Getting Started Sustaining impressive growth accompanied by strong profitability, with significant upside in all product categories and channels in which Simple Mills competes

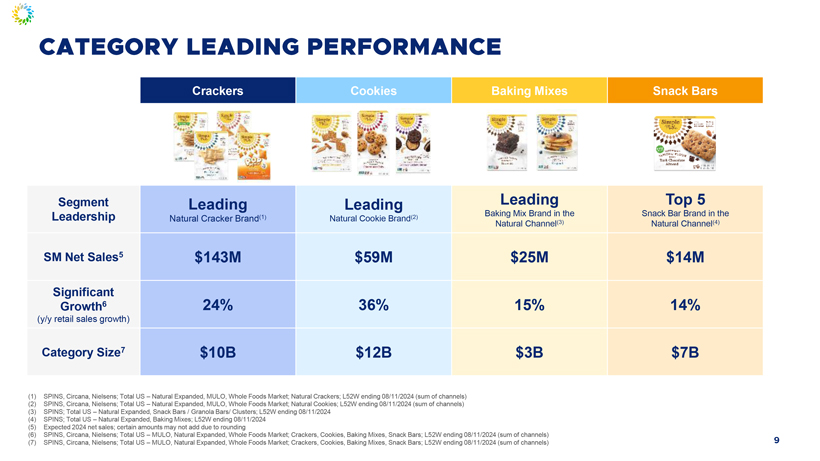

GROWTH DRIVERS Clear playbook to drive sustainable, long-term growth Expand Distribution Grow total distribution points at retailers through ACV¹ and AIC2 and add new retail customers and channels Product Innovation Enhance portfolio in existing and new snacking categories Grow Velocities Increase velocities through promotions, marketing, and retail execution (1) ACV: all commodity volume (2) AIC: average items carried Crackers Cookies Baking Mixes Snack Bars Segment Leading Leading Leading Top 5 Baking Mix Brand in the Snack Bar Brand in the Leadership Natural Cracker Brand(1) Natural Cookie Brand(2) Natural Channel(3) Natural Channel(4) SM Net Sales5 $143M $59M $25M $14M Significant Growth6 24% 36% 15% 14% (y/y retail sales growth) Category Size7 $10B $12B $3B $7B (1) SPINS, Circana, Nielsens; Total US – Natural Expanded, MULO, Whole Foods Market; Natural Crackers; L52W ending 08/11/2024 (sum of channels) (2) SPINS, Circana, Nielsens; Total US – Natural Expanded, MULO, Whole Foods Market; Natural Cookies; L52W ending 08/11/2024 (sum of channels) (3) SPINS; Total US – Natural Expanded, Snack Bars / Granola Bars/ Clusters; L52W ending 08/11/2024 (4) SPINS; Total US – Natural Expanded, Baking Mixes; L52W ending 08/11/2024 (5) Expected 2024 net sales; certain amounts may not add due to rounding (6) SPINS, Circana, Nielsens; Total US – MULO, Natural Expanded, Whole Foods Market; Crackers, Cookies, Baking Mixes, Snack Bars; L52W ending 08/11/2024 (sum of channels) (7) SPINS, Circana, Nielsens; Total US – MULO, Natural Expanded, Whole Foods Market; Crackers, Cookies, Baking Mixes, Snack Bars; L52W ending 08/11/2024 (sum of channels)

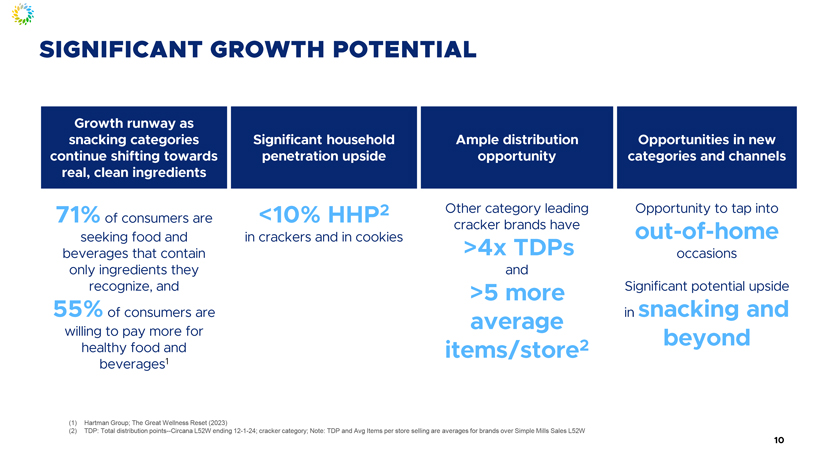

SIGNIFICANT GROWTH POTENTIAL Growth runway as snacking categories continue shifting towards real, clean ingredients 71% of consumers are seeking food and beverages that contain only ingredients they recognize, and 55% of consumers are willing to pay more for healthy food and beverages¹ Significant household penetration upside <10% HHP2 in crackers and in cookies Ample distribution opportunity Other category leading cracker brands have >4x TDPs and >5 more average items/store² Opportunities in new categories and channels Opportunity to tap into out-of-home Occasions Significant potential upside in Snacking and beyond (1) Hartman Group; The Great Wellness Reset (2023) (2) TDP: Total distribution points—Circana L52W ending 12-1-24; cracker category; Note: TDP and Avg Items per store selling are averages for brands over Simple Mills Sales L52W ATTRACTIVE FINANCIAL PROFILE Immediately accretive to multiple financial measures Net Sales1 Growth Adj EBITDA2 Growth Adj EBITDA Margin3

| (1) | Any reference to sales refers to net sales inclusive of allowances and deductions against gross sales. |

| (2) | Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability. |

| (3) | Earnings before interest, taxes, depreciation & amortization, adjusted for matters affecting comparability, as a percentage of net sales. |

KEY TAKEAWAYS Enhances growth prospects Diversifies category exposure Attractive financial profile INFORMATION REGARDING NON-GAAP FINANCIAL MEASURES The company prepares its consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP). However, from time to time, the company may present in its public statements, press releases and SEC filings, non-GAAP financial measures such as, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense, adjusted selling, distribution and administrative expenses (SD&A), gross margin excluding depreciation and amortization, and net debt. The company’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The company defines EBITDA as earnings before interest, taxes, depreciation and amortization. Earnings are net income. The company believes that EBITDA is a useful tool for managing the operations of its business and is an indicator of the company’s ability to incur and service indebtedness and generate free cash flow. The company also believes that EBITDA measures are commonly reported and widely used by investors and other interested parties as measures of a company’s operating performance and debt servicing ability because EBITDA measures assist in comparing performance on a consistent basis without regard to depreciation or amortization, which can vary significantly depending upon accounting methods and non-operating factors (such as historical cost). EBITDA is also a widely-accepted financial indicator of a company’s ability to incur and service indebtedness. EBITDA should not be considered an alternative to (a) income from operations or net income (loss) as a measure of operating performance; (b) cash flows provided by operating, investing and financing activities (as determined in accordance with GAAP) as a measure of the company’s ability to meet its cash needs; or (c) any other indicator of performance or liquidity that has been determined in accordance with GAAP. The company defines adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted diluted EPS, adjusted income tax expense and adjusted SD&A, respectively, to exclude additional costs that the company considers important to present to investors to increase the investors’ insights about the company’s core operations. These costs include, but are not limited to, the costs of closing a plant or costs associated with acquisition-related activities, restructuring activities, certain impairment charges, legal settlements, costs to implement an enterprise resource planning system and enhance bakery digital capabilities (business process improvement costs) to provide investors direct insight into these costs, and other costs impacting past and future comparability. The company believes that these measures, when considered together with its GAAP financial results, provides management and investors with a more complete understanding of its business operating results, including underlying trends, by excluding the effects of certain charges. Adjusted EBITDA is used as the primary performance measure in the company’s 2014 Omnibus Equity and Incentive Compensation Plan (Amended and Restated Effective May 25, 2023). Presentation of gross margin includes depreciation and amortization in the materials, supplies, labor and other production costs according to GAAP. Our method of presenting gross margin excludes the depreciation and amortization components, as discussed above. The company defines net debt as total debt less cash and cash equivalents. Net debt to EBITDA is used as a measure of financial leverage employed by the company.