UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 30, 2024

SIRIUSPOINT LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 001-36052 | 98-1599372 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

Point Building

3 Waterloo Lane

Pembroke HM 08, Bermuda

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: +1 441 542-3300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange |

||

| Common Shares, $0.10 par value | SPNT | New York Stock Exchange | ||

| 8.00% Resettable Fixed Rate Preference Shares, Series B, $0.10 par value, $25.00 liquidation preference per share | SPNT PB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On December 30, 2024, SiriusPoint Ltd. (“SiriusPoint”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with CM Bermuda Limited (the “Seller”). The Securities Purchase Agreement provides that, subject to the satisfaction or waiver of certain customary conditions set forth therein, SiriusPoint will repurchase all common shares of SiriusPoint, par value $0.10 per share held by the Seller (the “Common Shares”), and all warrants to purchase Common Shares held by the Seller (the “Warrants” and, together with the Common Shares, the “Securities”).

Upon the terms and subject to the conditions in the Securities Purchase Agreement, SiriusPoint will repurchase (i) 20,991,337 Warrants at $3.56 per warrant (the “Warrant Purchase”) and (ii) 45,720,732 Common Shares at $14.25 per Common Share (together with the Warrant Purchase, the “Purchase”). The aggregate amount payable by SiriusPoint under the Securities Purchase Agreement will be approximately $733.0 million, including certain costs and expenses. Following the closing of the Purchase, the Seller will have no remaining ownership interest in SiriusPoint. The Common Shares will be purchased into treasury and the Warrants will be cancelled at the closing of the Purchase. The Securities Purchase Agreement contains customary representations, warranties and covenants of the parties. Consummation of the Purchase is subject only to the representations and warranties of each party being true and correct as of the closing date.

The closing of the Purchase is expected to be completed on or before February 28, 2025. The Securities Purchase Agreement contemplates that payment thereunder be made in two tranches. The first payment of $250.0 million was made concurrently with the execution of the Securities Purchase Agreement. At the closing of the Purchase, SiriusPoint will pay an additional $483.0 million to the Seller.

Under the terms of the Securities Purchase Agreement, SiriusPoint will acquire all Securities at the closing. SiriusPoint has placed, and the Seller has consented to, a stop transfer order on all of the Securities during the pendency of the transaction. The Seller has also placed executed transfer delivery instructions and lien releases in respect of the Securities into escrow. In addition, the Securities Purchase Agreement provides that, prior to closing, in the event that the board of directors of SiriusPoint (the “Board”) has made a good faith determination that the Seller or China Construction Bank Corporation (“CCB”) (i) has transferred any Securities to anyone other than SiriusPoint, (ii) has instructed, or sought to cause the transfer of, any Securities to anyone other than SiriusPoint or (iii) has authorized or directed any lien to be placed on any of the Securities that would not be released by the terms of the escrowed lien releases or automatically upon consummation of the Purchase without any additional action of the Seller or SiriusPoint (any of the foregoing an “Impermissible Transfer Event”), SiriusPoint can unilaterally direct the transfer of 17,070,147 Common Shares (the “Covered Securities”) to its treasury. The Seller and CCB have agreed to pay SiriusPoint an aggregate of $250.0 million under certain circumstances where an Impermissible Transfer Event has occurred and the Securities Purchase Agreement is subsequently terminated. If the conditions to closing of the Purchase are satisfied and SiriusPoint fails to make the second $483.0 million payment to the Seller by February 28, 2025, the Securities Purchase Agreement may be terminated by the Seller and SiriusPoint will forfeit (A) the $250.0 million paid to the Seller on the date hereof and (B) the right to acquire any of the Securities (and, if applicable, must return any Covered Securities that have been acquired by SiriusPoint).

In connection with the transactions contemplated by the Securities Purchase Agreement, the parties have agreed that, effective and contingent upon the closing of the Purchase: (i) Meng Tee Saw will resign from the Board and each committee of the Board of which he is a member; and (ii) SiriusPoint and the Seller will terminate that certain Investor Rights Agreement, dated as of February 26, 2021, by and between SiriusPoint and the Seller (the “IRA”). The Seller has similarly placed an executed resignation letter and IRA termination agreement into escrow. Via the termination of the IRA, the Seller will no longer have observer rights on the Board.

For more information on the Seller’s and its affiliate, CMIG International Holding Pte. Ltd.’s relationship to SiriusPoint, please refer to SiriusPoint’s Definitive Proxy Statement filed on April 9, 2024.

The above description of the Securities Purchase Agreement is qualified in its entirety by reference to the full text of the Securities Purchase Agreement, a copy of which is expected to be filed as an exhibit to SiriusPoint’s Annual Report on Form 10-K for the year ended December 31, 2024.

2

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In connection with transactions contemplated by the Securities Purchase Agreement, Meng Tee Saw notified the Board of his resignation from the Board and each committee of the Board on which he is a member effective and contingent upon the closing. The resignation was not the result of any disagreement with SiriusPoint on any matter relating to its operations, policies or practices. If the closing does not occur, Meng Tee Saw’s resignation will not be effective and he will remain on the Board.

| Item 8.01 | Other Events. |

On December 30, 2024, SiriusPoint issued a press release that included the announcement of the transactions contemplated by the Securities Purchase Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Forward-Looking Statements

We make statements in this Current Report that are forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. federal securities laws. These statements involve risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. These risks and uncertainties include, but are not limited to, the impact of general economic conditions and conditions affecting the insurance and reinsurance industry; the adequacy of our reserves; fluctuation in the results of operations; pandemic or other catastrophic event; uncertainty of success in investing in early-stage companies, such as the risk of loss of an initial investment, highly variable returns on investments, delay in receiving return on investment and difficulty in liquidating the investment; our ability to assess underwriting risk, trends in rates for property and casualty insurance and reinsurance, competition, investment market and investment income fluctuations; trends in insured and paid losses; regulatory and legal uncertainties; and other risk factors described in SiriusPoint’s Annual Report on Form 10-K for the period ended December 31, 2023. Additionally, the transactions contemplated by the Securities Purchase Agreement are subject to risks and uncertainties and factors that could cause SiriusPoint’s actual results to differ from those statements herein including, but not limited to: that SiriusPoint may be unable to complete the proposed transactions because, among other reasons, conditions to the closing of the proposed transactions are not be satisfied or waived; the occurrence of any event, change or other circumstance that could give rise to the termination of the Securities Purchase Agreement; one or more third parties could seek to acquire the Common Shares or Warrants owned by the Seller prior to the closing of the Purchase; obligations or capital requirements of our subsidiaries could delay or impair SiriusPoint’s access to available sources of liquidity and ability to fund the second payment; and the outcome of any legal proceedings to the extent initiated against SiriusPoint or others following the announcement of the proposed transaction, as well as SiriusPoint’s response to any of the aforementioned factors.

Except as required by applicable law or regulation, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events, or other circumstances after the date of this Current Report.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description |

|

| 99.1 | Press Release, dated December 30, 2024, issued by SiriusPoint Ltd. announcing the Purchase | |

| 99.2 | SiriusPoint Ltd. Presentation to Investors, dated December 30, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 30, 2024

| /s/ Linda Lin |

||

| Name: | Linda Lin | |

| Title: | Chief Legal Officer | |

4

Exhibit 99.1

PRESS RELEASE

SiriusPoint Announces Full Repurchase of CM Bermuda Shares

HAMILTON, Bermuda. December 30, 2024 – SiriusPoint Ltd. (“SiriusPoint”) (NYSE: SPNT), a global specialty insurer and reinsurer, announced today it has entered into an agreement to repurchase all SiriusPoint common shares and warrants held by CM Bermuda Limited (“CM Bermuda”) for an aggregate purchase price of $733 million.

Following the closing of the repurchase transaction, CM Bermuda will have no remaining ownership interest in SiriusPoint and will cease to have any representation on, or observer rights with respect to, SiriusPoint’s board of directors. The payment will be made by SiriusPoint in two tranches with the first payment of $250 million made today. The closing of the transaction is expected to complete on or before February 28, 2025 at such time as SiriusPoint makes a second payment of $483 million to CM Bermuda.

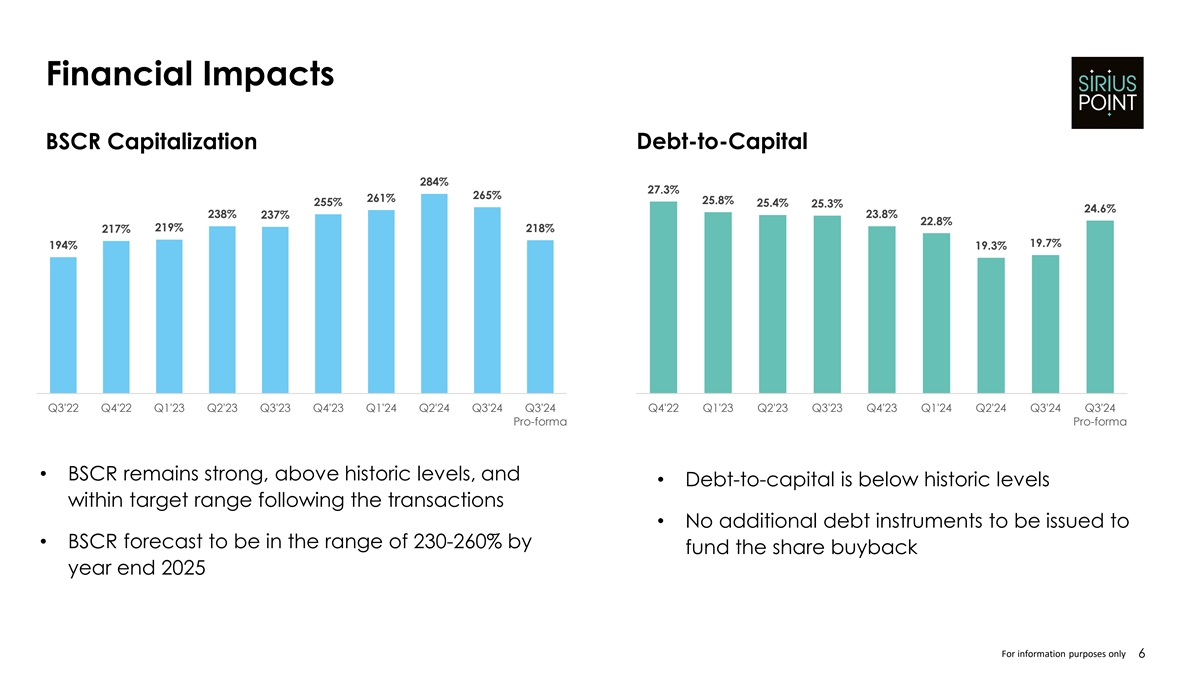

SiriusPoint has financed the transaction entirely through its existing capital. Its proforma Bermuda Solvency Capital Ratio at the end of Q3 remains strong at 218% after the payments.

The Company has agreed to repurchase 45.7 million common shares at $14.25 per share. It also agreed to repurchase and surrender 21 million warrants at $3.56 per warrant (strike price of $11 per warrant). As of September 30, 2024, SiriusPoint’s diluted book value per common share was $14.73, and the 30-day volume-weighted average common share price was $15.16 as of December 27, 2024.

SiriusPoint CEO, Scott Egan, said: “Today’s announcement to repurchase all shares and warrants owned by CM Bermuda is a significant development for SiriusPoint. Our financial position, driven by our strengthening profitability and performance, has empowered us to execute this transaction.

“The transaction will be meaningfully accretive to earnings per share and return on equity, and accretive to book value per share. The closing of the transaction positions SiriusPoint well for the future. We enter 2025 with great momentum and remain focused on driving further value creation for all shareholders.”

BofA Securities, Inc. acted as financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP provided legal counsel to SiriusPoint in connection with the transaction.

ENDS

About SiriusPoint

SiriusPoint is a global underwriter of insurance and reinsurance providing solutions to clients and brokers around the world. Bermuda-headquartered with offices in New York, London, Stockholm and other locations, we are listed on the New York Stock Exchange (SPNT). We have licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. Our offering and distribution capabilities are strengthened by a portfolio of strategic partnerships with Managing General Agents and Program Administrators within our Insurance & Services segment. With over $3.0 billion total capital, SiriusPoint’s operating companies have a financial strength rating of A- (Excellent) from AM Best, S&P and Fitch, and A3 from Moody’s. For more information, please visit www.siriuspt.com.

Forward-Looking Statements

We make statements in this press release that are forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. federal securities laws. These statements involve risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. These risks and uncertainties include, but are not limited to, the impact of general economic conditions and conditions affecting the insurance and reinsurance industry; the adequacy of our reserves; fluctuation in the results of operations; pandemic or other catastrophic event; uncertainty of success in investing in early-stage companies, such as the risk of loss of an initial investment, highly variable returns on investments, delay in receiving return on investment and difficulty in liquidating the investment; our ability to assess underwriting risk, trends in rates for property and casualty insurance and reinsurance, competition, investment market and investment income fluctuations; trends in insured and paid losses; regulatory and legal uncertainties; and other risk factors described in SiriusPoint’s Annual Report on Form 10-K for the period ended December 31, 2023. Additionally, the transactions contemplated by the securities purchase agreement are subject to risks and uncertainties and factors that could cause SiriusPoint’s actual results to differ from those statements herein including, but not limited to: that SiriusPoint may be unable to complete the proposed transactions because, among other reasons, conditions to the closing of the proposed transactions are not be satisfied or waived; the occurrence of any event, change or other circumstance that could give rise to the termination of the securities purchase agreement; one or more third parties could seek to acquire the common shares and warrants owned by CM Bermuda prior to the closing of the repurchase transaction; obligations or capital requirements of our subsidiaries could delay or impair SiriusPoint’s access to available sources of liquidity and ability to fund the second payment; and the outcome of any legal proceedings to the extent initiated against SiriusPoint or others following the announcement of the proposed transaction, as well as SiriusPoint’s response to any of the aforementioned factors.

Except as required by applicable law or regulation, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events, or other circumstances after the date of this press release.

Contacts

Investor Relations

Liam Blackledge, SiriusPoint

Liam.Blackledge@siriuspt.com

+44 203 772 3082

Media

Sarah Hills, Rein4ce

sarah.hills@rein4ce.co.uk

+44 7718 882011

Exhibit 99.2 CM Bermuda Investor Agreement December 30, 2024

Disclaimer Basis of Presentation and Non-GAAP Financial Measures: Unless the context otherwise indicates or requires, as used in this presentation references to we, our, us, the Company, and SiriusPoint refer to SiriusPoint Ltd. and directly and indirectly owned subsidiaries, as a combined entity, except where otherwise stated or where it is clear that the terms mean only SiriusPoint Ltd. exclusive of its subsidiaries. We have made rounding adjustments to reach some of the figures included in this presentation and, unless otherwise indicated, percentages presented in this presentation are approximate. In presenting SiriusPoint's results, management has included financial measures that are not calculated under standards or rules that comprise accounting principles generally accepted in the United States ( GAAP ). SiriusPoint's management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of SiriusPoint's financial performance, identifying trends in our results and providing meaningful period-to-period comparisons. Core combined ratio is a non-GAAP financial measure. Management believes it is useful to review Core results as it better reflects how management views the business and reflects the Company's decision to exit the runoff business. Underlying annualized return on equity on average common shareholders' equity ( ROE ) is also a non-GAAP financial measure. Underlying ROE is calculated by dividing annualized underlying net income available to SiriusPoint common shareholders for the period by the average common shareholders' equity, excluding accumulated other comprehensive income (loss). A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measure is contained in our earnings release and our Form 10-K for the fiscal year ended December 31, 2023. Safe Harbor Statement Regarding Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond the Company's control. The Company cautions you that the forward-looking information presented in this presentation is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as believes, intends, seeks, anticipates, aims, plans, targets, estimates, expects, assumes, continues, guidance, should, could, will, may and the negative of these or similar terms and phrases. Specific forward- looking statements in this press release include, but not limited to, statements regarding the trend of our performance as compared to the previous guidance, the current insurtech market trends, our ability to generate shareholder value and whether we will continue to have momentum in our business in the future. Actual events, results and outcomes may differ materially from the Company's expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: our ability to execute on our strategic transformation, including re-underwriting to reduce volatility and improving underwriting performance, de-risking our investment portfolio, and transforming our business; the impact of unpredictable catastrophic events such as uncertainties with respect to COVID-19 losses across many classes of insurance business and the amount of insurance losses that may ultimately be ceded to the reinsurance market, supply chain issues, labor shortages and related increased costs, changing interest rates and equity market volatility; inadequacy of loss and loss adjustment expense reserves, the lack of available capital, and periods characterized by excess underwriting capacity and unfavorable premium rates; the performance of financial markets, impact of inflation and interest rates, and foreign currency fluctuations; our ability to compete successfully in the insurance and reinsurance market and the effect of consolidation in the insurance and reinsurance industry; technology breaches or failures, including those resulting from a malicious cyber-attack on us, our business partners or service providers; the effects of global climate change, including increased severity and frequency of weather-related natural disasters and catastrophes and increased coastal flooding in many geographic areas; geopolitical uncertainty, and ongoing conflicts in Europe and the Middle East; our ability to retain key senior management and key employees; a downgrade or withdrawal of our financial ratings; fluctuations in our results of operations; legal restrictions on certain of SiriusPoint's insurance and reinsurance subsidiaries' ability to pay dividends and other distributions to SiriusPoint; the outcome of legal and regulatory proceedings and regulatory constraints on our business; reduced returns or losses in SiriusPoint's investment portfolio; our exposure or potential exposure to corporate income tax in Bermuda and the E.U., U.S. federal income and withholding taxes and our significant deferred tax assets, which could become devalued if we do not generate future taxable income or applicable corporate tax rates are reduced; risks associated with delegating authority to third party managing general agents, managing general underwriters and/or program administrators; future strategic transactions such as acquisitions, dispositions, investments, mergers or joint ventures; SiriusPoint's response to any acquisition proposal that may be received from any party, including any actions that may be considered by the Company's Board of Directors or any committee thereof; and other risks and factors listed under Risk Factors in the Company's most recent Annual Report on Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. Additionally, the transactions contemplated by the securities repurchase agreement with CM Bermuda Limited are subject to risks and uncertainties and factors that could cause SiriusPoint’s actual results to differ from those statements herein including, but not limited to: that SiriusPoint may be unable to complete the proposed transactions because, among other reasons, conditions to the closing of the proposed transactions are not be satisfied or waived; the occurrence of any event, change or other circumstance that could give rise to the termination of the securities repurchase agreement; one or more third parties could seek to acquire the common shares and warrants owned by CM Bermuda prior to the closing of the repurchase transaction; obligations or capital requirements of our subsidiaries could delay or impair SiriusPoint’s access to available sources of liquidity and ability to fund the second payment; and the outcome of any legal proceedings to the extent initiated against SiriusPoint or others following the announcement of the proposed transaction, as well as SiriusPoint’s response to any of the aforementioned factors. All forward-looking statements speak only as of the date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. For information purposes only 2

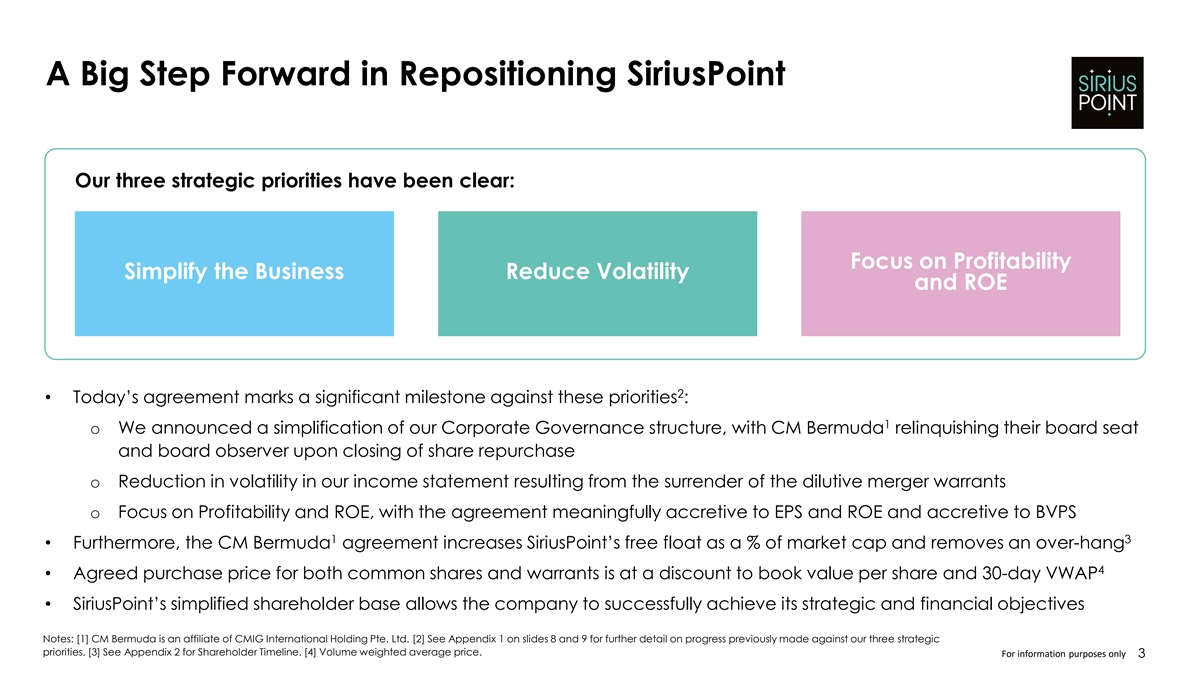

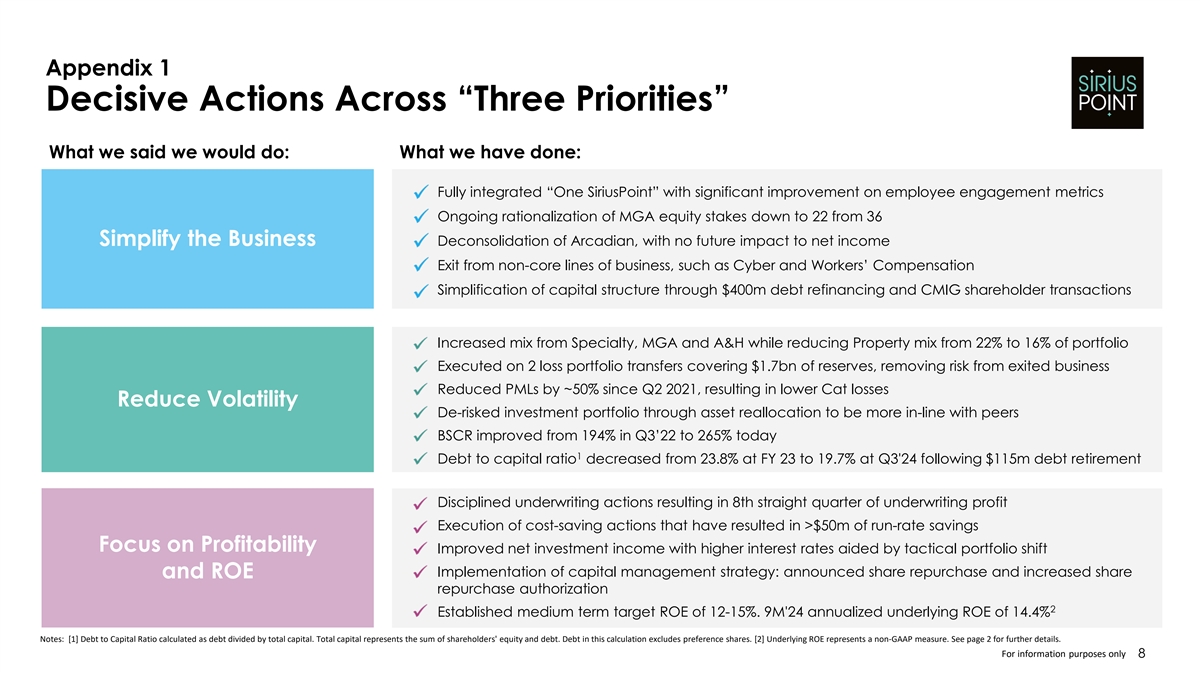

A Big Step Forward in Repositioning SiriusPoint Our three strategic priorities have been clear: Focus on Profitability Simplify the Business Reduce Volatility and ROE 2 • Today’s agreement marks a significant milestone against these priorities : 1 o We announced a simplification of our Corporate Governance structure, with CM Bermuda relinquishing their board seat and board observer upon closing of share repurchase o Reduction in volatility in our income statement resulting from the surrender of the dilutive merger warrants o Focus on Profitability and ROE, with the agreement meaningfully accretive to EPS and ROE and accretive to BVPS 1 3 • Furthermore, the CM Bermuda agreement increases SiriusPoint’s free float as a % of market cap and removes an over-hang 4 • Agreed purchase price for both common shares and warrants is at a discount to book value per share and 30-day VWAP • SiriusPoint’s simplified shareholder base allows the company to successfully achieve its strategic and financial objectives Notes: [1] CM Bermuda is an affiliate of CMIG International Holding Pte. Ltd. [2] See Appendix 1 on slides 8 and 9 for further detail on progress previously made against our three strategic priorities. [3] See Appendix 2 for Shareholder Timeline. [4] Volume weighted average price. For information purposes only 3

CM Bermuda Agreement Summary 1 Key Takeaways • Full repurchase of all CM Bermuda common shares and outstanding warrants for $733m agreed Buyback agreed for • 45.7m shares repurchased at $14.25, represents a 6% 2 45.7m outstanding shares discount to 30-day VWAP (28.2% of shares outstanding) • 21.0m warrants surrendered, with proceeds of $3.56 per warrant ($11.00 strike price) • First payment of $250m paid December 30, 2024. Final 21.0m of dilutive merger payment of $483m to be paid on or before February 28, 2025 warrants surrendered and retired • Shares will remain legally outstanding until final payment, but under US GAAP rules they will no longer be 3 considered outstanding as of December 30, 2024 • Deal to be financed through existing excess capital, no Agreement is accretive to increase in debt issuance Q3’24 EPS, ROE and BVPS • BSCR and debt-to-capital levels remain within target ranges Notes: [1] CM Bermuda is an affiliate of CMIG International Holding Pte. Ltd. [2] Volume weighted average price as of 12/27/24. [3] December 31, 2024 GAAP balance sheet will reflect fully reduced Shareholders’ Equity and shares outstanding. For information purposes only 4

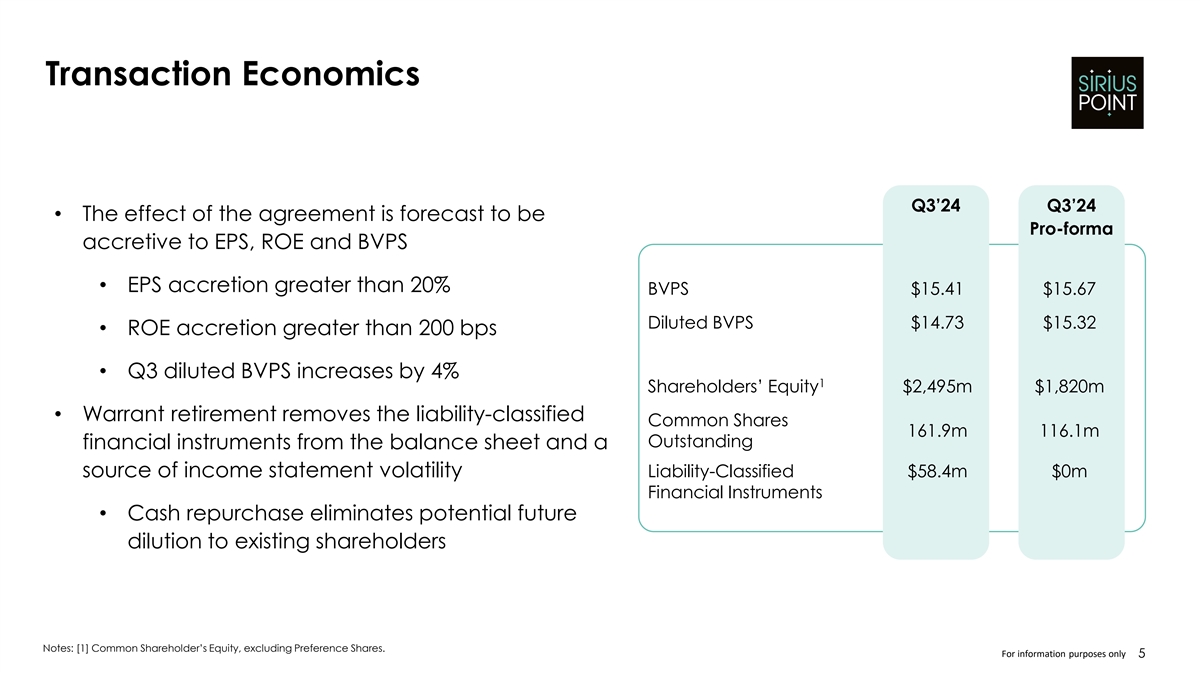

Transaction Economics Q3’24 Q3’24 • The effect of the agreement is forecast to be Pro-forma accretive to EPS, ROE and BVPS • EPS accretion greater than 20% BVPS $15.41 $15.67 Diluted BVPS $14.73 $15.32 • ROE accretion greater than 200 bps • Q3 diluted BVPS increases by 4% 1 Shareholders’ Equity $2,495m $1,820m • Warrant retirement removes the liability-classified Common Shares 161.9m 116.1m Outstanding financial instruments from the balance sheet and a source of income statement volatility Liability-Classified $58.4m $0m Financial Instruments • Cash repurchase eliminates potential future dilution to existing shareholders Notes: [1] Common Shareholder’s Equity, excluding Preference Shares. For information purposes only 5

Financial Impacts Debt-to-Capital BSCR Capitalization 284% 27.3% 265% 261% 25.8% 255% 25.4% 25.3% 24.6% 238% 237% 23.8% 22.8% 219% 217% 218% 19.7% 194% 19.3% Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q3'24 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q3'24 Pro-forma Pro-forma • BSCR remains strong, above historic levels, and • Debt-to-capital is below historic levels within target range following the transactions • No additional debt instruments to be issued to • BSCR forecast to be in the range of 230-260% by fund the share buyback year end 2025 For information purposes only 6

Appendix For information purposes only 7

Appendix 1 Decisive Actions Across “Three Priorities” What we said we would do: What we have done: Fully integrated “One SiriusPoint” with significant improvement on employee engagement metrics Ongoing rationalization of MGA equity stakes down to 22 from 36 Simplify the Business Deconsolidation of Arcadian, with no future impact to net income Exit from non-core lines of business, such as Cyber and Workers’ Compensation Simplification of capital structure through $400m debt refinancing and CMIG shareholder transactions Increased mix from Specialty, MGA and A&H while reducing Property mix from 22% to 16% of portfolio Executed on 2 loss portfolio transfers covering $1.7bn of reserves, removing risk from exited business Reduced PMLs by ~50% since Q2 2021, resulting in lower Cat losses Reduce Volatility De-risked investment portfolio through asset reallocation to be more in-line with peers BSCR improved from 194% in Q3’22 to 265% today 1 Debt to capital ratio decreased from 23.8% at FY 23 to 19.7% at Q3'24 following $115m debt retirement Disciplined underwriting actions resulting in 8th straight quarter of underwriting profit Execution of cost-saving actions that have resulted in >$50m of run-rate savings Focus on Profitability Improved net investment income with higher interest rates aided by tactical portfolio shift Implementation of capital management strategy: announced share repurchase and increased share and ROE repurchase authorization 2 Established medium term target ROE of 12-15%. 9M'24 annualized underlying ROE of 14.4% Notes: [1] Debt to Capital Ratio calculated as debt divided by total capital. Total capital represents the sum of shareholders' equity and debt. Debt in this calculation excludes preference shares. [2] Underlying ROE represents a non-GAAP measure. See page 2 for further details. For information purposes only 8

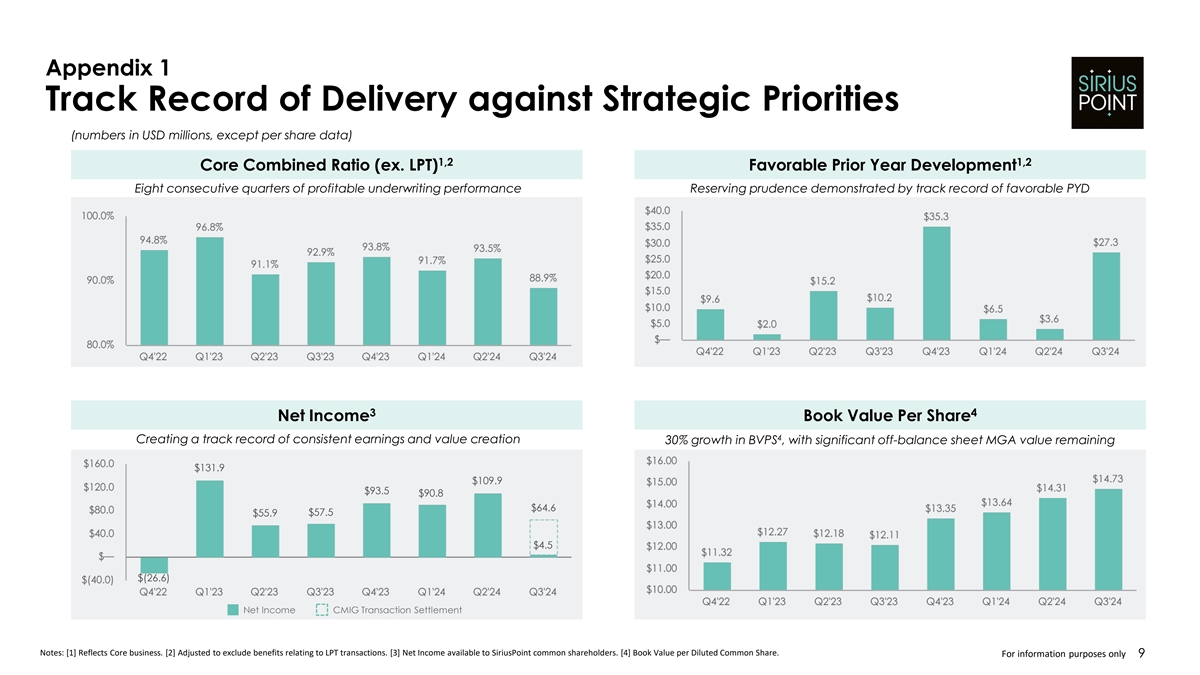

Appendix 1 Track Record of Delivery against Strategic Priorities (numbers in USD millions, except per share data) 1,2 1,2 Core Combined Ratio (ex. LPT) Favorable Prior Year Development Eight consecutive quarters of profitable underwriting performance Reserving prudence demonstrated by track record of favorable PYD 3 4 Net Income Book Value Per Share 4 Creating a track record of consistent earnings and value creation 30% growth in BVPS , with significant off-balance sheet MGA value remaining $131.9 $109.9 $93.5 $90.8 $64.6 $55.9 $57.5 $4.5 $(26.6) Net Income CMIG Transaction Settlement Notes: [1] Reflects Core business. [2] Adjusted to exclude benefits relating to LPT transactions. [3] Net Income available to SiriusPoint common shareholders. [4] Book Value per Diluted Common Share. For information purposes only 9

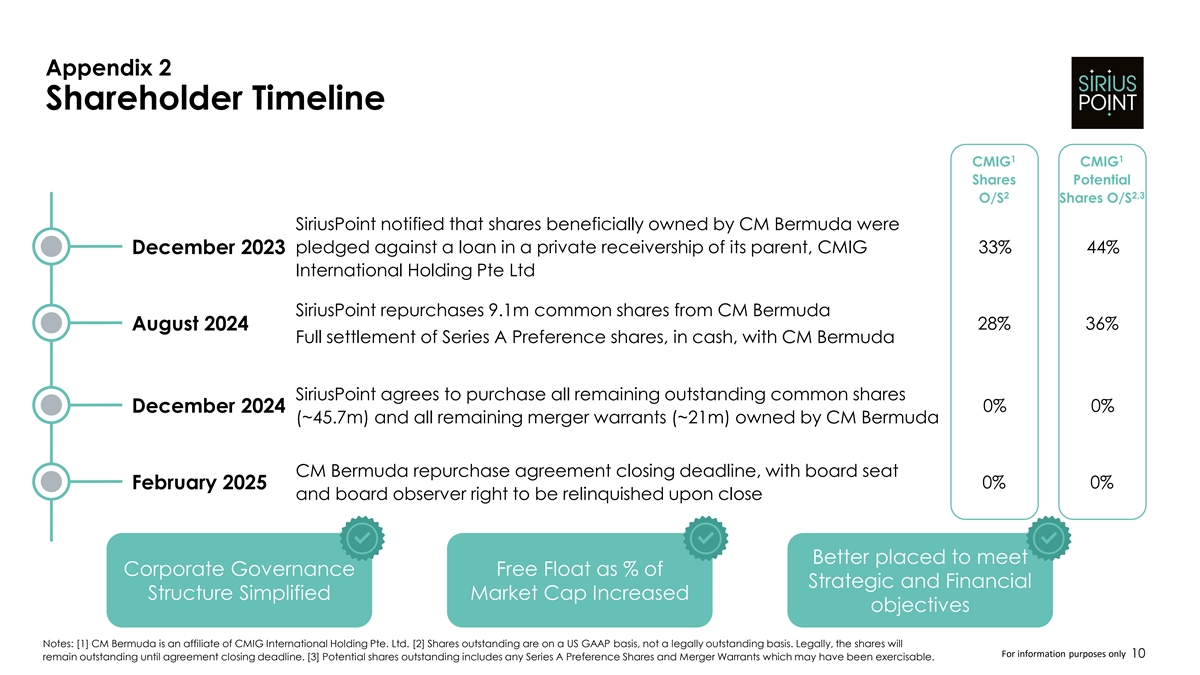

Appendix 2 Shareholder Timeline 1 1 CMIG CMIG Shares Potential 2 2,3 O/S Shares O/S SiriusPoint notified that shares beneficially owned by CM Bermuda were December 2023 pledged against a loan in a private receivership of its parent, CMIG 33% 44% International Holding Pte Ltd SiriusPoint repurchases 9.1m common shares from CM Bermuda 28% 36% August 2024 Full settlement of Series A Preference shares, in cash, with CM Bermuda SiriusPoint agrees to purchase all remaining outstanding common shares December 2024 0% 0% (~45.7m) and all remaining merger warrants (~21m) owned by CM Bermuda CM Bermuda repurchase agreement closing deadline, with board seat 0% 0% February 2025 and board observer right to be relinquished upon close Better placed to meet Corporate Governance Free Float as % of Strategic and Financial Structure Simplified Market Cap Increased objectives Notes: [1] CM Bermuda is an affiliate of CMIG International Holding Pte. Ltd. [2] Shares outstanding are on a US GAAP basis, not a legally outstanding basis. Legally, the shares will For information purposes only 10 remain outstanding until agreement closing deadline. [3] Potential shares outstanding includes any Series A Preference Shares and Merger Warrants which may have been exercisable.