| ☐ | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

| ☒ | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended October 31, 2024 | Commission File Number 001-13354 |

Title Of Each Class |

Trading Symbol |

Name Of Each Exchange On Which Registered |

||

Common Shares |

BMO |

New York Stock Exchange |

Common Shares |

729,585,048 | |||

Class B Preferred Shares Series 31 (Non-Viability Contingent Capital (NVCC))1

|

12,000,000 | |||

Class B Preferred Shares Series 33 (Non-Viability Contingent Capital (NVCC)) |

8,000,000 | |||

Class B Preferred Shares Series 44 (Non-Viability Contingent Capital (NVCC)) |

16,000,000 | |||

Class B Preferred Shares Series 48 (Non-Viability Contingent Capital (NVCC)) |

1,250,000 | |||

Class B Preferred Shares Series 49 (Non-Viability Contingent Capital (NVCC)) |

750,000 | |||

Class B Preferred Shares Series 50 (Non-Viability Contingent Capital (NVCC)) |

500,000 | |||

Class B Preferred Shares Series 51 (Non-Viability Contingent Capital (NVCC)) |

1,000,000 | |||

Class B Preferred Shares Series 52 (Non-Viability Contingent Capital (NVCC)) |

650,000 | |||

Class B Preferred Shares Series 53 (Non-Viability Contingent Capital (NVCC)) 2

|

1,000,000 | |||

Class B Preferred Shares Series 54 (Non-Viability Contingent Capital (NVCC)) 3

|

750,000 |

DISCLOSURE CONTROLS AND PROCEDURES |

||

INTERNAL CONTROL OVER FINANCIAL REPORTING |

||

AUDIT AND CONDUCT REVIEW COMMITTEE FINANCIAL EXPERT |

||

CODE OF ETHICS |

||

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

||

OFF-BALANCE SHEET ARRANGEMENTS |

||

CONTRACTUAL AND OTHER OBLIGATIONS |

||

IDENTIFICATION OF THE AUDIT AND CONDUCT REVIEW COMMITTEE |

||

SUMMARY OF SIGNIFICANT CORPORATE GOVERNANCE DIFFERENCES |

||

NOTE ON CERTAIN ACTIVITIES |

||

UNDERTAKING |

||

SIGNATURES |

||

EXHIBIT INDEX |

||

Bank of Montreal Clawback and Recoupment Policy |

||

Annual Information Form |

||

Management’s Discussion and Analysis for the Fiscal Year Ended October 31, 2024 |

||

Consolidated Financial Statements for the Fiscal Year Ended October 31, 2024 |

||

Consent of Independent Registered Public Accounting Firm dated December 5, 2024 |

||

Section 302 Certifications of Chief Executive Officer |

||

Section 302 Certifications of Chief Financial Officer |

||

Section 906 Certifications |

||

Code of Conduct |

||

Inline Interactive Data File |

||

Cover Page Interactive Data File |

||

By: |

/s/ Tayfun Tuzun |

|

Tayfun Tuzun |

||

Chief Financial Officer |

||

Date: December 5, 2024 |

||

Exhibits |

Description |

|

97.1 |

||

99.1 |

||

99.2 |

||

99.3 |

||

99.4 |

||

99.5 |

||

99.6 |

||

99.7 |

||

99.8 |

||

101 |

Inline Interactive Data File |

|

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

|

Exhibit 99.1

BANK OF MONTREAL

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED OCTOBER 31, 2024

Dated December 5, 2024

| Annual Information Form |

2024 Financial Statements1 |

2024 MD&A1 | ||||

| EXPLANATORY NOTES AND CAUTIONS |

2 | |||||

| Caution Regarding Forward-Looking Statements |

2 | 15 | ||||

| CORPORATE STRUCTURE |

2 | Note 27 | ||||

| GENERAL DEVELOPMENT OF THE BUSINESS |

3 | 16, 33-52 | ||||

| Three-Year History |

3 | |||||

| DESCRIPTION OF THE BUSINESS |

3 | |||||

| Business |

3 | Note 26 | 16, 33-52 | |||

| Supervision and Regulation in Canada |

4 | 60-62, 70, 104-106 | ||||

| Supervision and Regulation in the United States |

4 | 60-62, 70, 104-106, 114 | ||||

| International Supervision and Regulation |

5 | 60-62, 70, 104-106 | ||||

| Competition |

5 | |||||

| Environmental, Social and Governance Issues |

6 | 70, 107-109 | ||||

| Risk Factors |

6 | 68-109 | ||||

| DIVIDENDS |

6 | Note 17 | 65-66 | |||

| DESCRIPTION OF CAPITAL STRUCTURE |

6 | Notes 17 and 20 | 62-66 | |||

| Description of Common Shares |

6 | Note 17 | ||||

| Description of Preferred Shares |

6 | Note 17 | ||||

| Certain Conditions of the Class A Preferred Shares as a Class |

7 | Note 17 | ||||

| Certain Conditions of the Class B Preferred Shares as a Class |

7 | Note 17 | ||||

| Description of Other Equity Instruments – Subordinated Capital Notes |

8 | Note 17 | ||||

| Certain Provisions of the Subordinated Capital Notes |

8 | |||||

| Description of Other Equity Instruments – Limited Recourse Capital Notes |

9 | Note 17 | ||||

| Certain Provisions of the Limited Recourse Capital Notes |

9 | |||||

| Restraints on Bank Shares under the Bank Act |

11 | |||||

| Ratings |

11 | Note 8 | 95 | |||

| MARKET FOR SECURITIES |

12 | |||||

| Trading Price and Volume |

12 | |||||

| Prior Sales |

12 | Notes 16 and 17 | 58-59 | |||

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER |

13 | |||||

| DIRECTORS AND EXECUTIVE OFFICERS |

13 | |||||

| Board of Directors |

13 | |||||

| Board Committee Members |

14 | |||||

| Executive Officers |

14 | |||||

| Shareholdings of Directors and Executive Officers |

14 | |||||

| Additional Disclosure for Directors and Executive Officers |

15 | |||||

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

15 | Note 25 | ||||

| TRANSFER AGENT AND REGISTRAR |

15 | |||||

| INTERESTS OF EXPERTS |

15 | |||||

| AUDIT AND CONDUCT REVIEW COMMITTEE INFORMATION |

16 | |||||

| Composition of the Audit and Conduct Review Committee |

16 | |||||

| Shareholders’ Auditors Pre-Approval Policies and Procedures and Fees |

16 | 115 | ||||

| ADDITIONAL INFORMATION |

16 | |||||

| APPENDIX I: BANK OF MONTREAL AUDIT AND CONDUCT REVIEW COMMITTEE CHARTER |

I-1 | |||||

| APPENDIX II: CREDIT RATING CATEGORIES |

II-1 | |||||

1 As indicated, parts of the Bank’s Consolidated Financial Statements (2024 Financial Statements) and Management’s Discussion and Analysis (2024 MD&A) for the fiscal year ended October 31, 2024 are incorporated by reference into this Annual Information Form. The 2024 Financial Statements and the 2024 MD&A are available on SEDAR+ (www.sedarplus.ca).

1

EXPLANATORY NOTES AND CAUTIONS

Unless specifically stated otherwise in this Annual Information Form:

| ● | all amounts are in Canadian dollars |

| ● | BMO Financial Group, the Bank, BMO, we, or our means Bank of Montreal and, as applicable, its subsidiaries |

| ● | information is as at October 31, 2024 |

Caution Regarding Forward-Looking Statements

Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements in this document may include, but are not limited to, statements with respect to our objectives and priorities for fiscal 2025 and beyond, our strategies or future actions, our targets and commitments (including with respect to net zero emissions), expectations for our financial condition, capital position, the regulatory environment in which we operate, the results of, or outlook for, our operations or the Canadian, U.S. and international economies, and include statements made by our management. Forward-looking statements are typically identified by words such as “will”, “would”, “should”, “believe”, “expect”, “anticipate”, “project”, “intend”, “estimate”, “plan”, “goal”, “commit”, “target”, “may”, “might”, “schedule”, “forecast”, “outlook”, “timeline”, “suggest”, “seek” and “could” or negative or grammatical variations thereof.

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, both general and specific in nature. There is significant risk that predictions, forecasts, conclusions or projections will not prove to be accurate, that our assumptions may not be correct, and that actual results may differ materially from such predictions, forecasts, conclusions or projections. We caution readers of this document not to place undue reliance on our forward-looking statements, as a number of factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements.

The future outcomes that relate to forward-looking statements may be influenced by many factors, including, but not limited to: general economic and market conditions in the countries in which we operate, including labour challenges and changes in foreign exchange and interest rates; changes to our credit ratings; cyber and information security, including the threat of data breaches, hacking, identity theft and corporate espionage, as well as the possibility of denial of service resulting from efforts targeted at causing system failure and service disruption; technology resilience, innovation and competition; failure of third parties to comply with their obligations to us; political conditions, including changes relating to, or affecting, economic or trade matters; disruptions of global supply chains; environmental and social risk, including climate change; the Canadian housing market and consumer leverage; inflationary pressures; changes in laws, including tax legislation and interpretation, or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance, and the effect of such changes on funding costs and capital requirements; changes in monetary, fiscal or economic policy; weak, volatile or illiquid capital or credit markets; the level of competition in the geographic and business areas in which we operate; exposure to, and the resolution of, significant litigation or regulatory matters, the appeal of favourable outcomes and our ability to successfully appeal adverse outcomes of such matters and the timing, determination and recovery of amounts related to such matters; the accuracy and completeness of the information we obtain with respect to our customers and counterparties; our ability to execute our strategic plans, complete proposed acquisitions or dispositions and integrate acquisitions, including obtaining regulatory approvals, and realize any anticipated benefits from such plans and transactions; critical accounting estimates and judgments, and the effects of changes in accounting standards, rules and interpretations on these estimates; operational and infrastructure risks, including with respect to reliance on third parties; global capital markets activities; the emergence or continuation of widespread health emergencies or pandemics, and their impact on local, national or international economies, as well as their heightening of certain risks that may affect our future results; the possible effects on our business of war or terrorist activities; natural disasters, such as earthquakes or flooding, and disruptions to public infrastructure, such as transportation, communications, power or water supply; and our ability to anticipate and effectively manage risks arising from all of the foregoing factors.

We caution that the foregoing list is not exhaustive of all possible factors. Other factors and risks could adversely affect our results. For more information, please refer to the discussion in the Risks That May Affect Future Results section, and the sections related to credit and counterparty, market, insurance, liquidity and funding, operational non-financial, legal and regulatory, strategic, environmental and social, and reputation risk in the Enterprise-Wide Risk Management section of the 2024 MD&A, as may be updated by quarterly reports, all of which outline certain key factors and risks that may affect our future results. Investors and others should carefully consider these factors and risks, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. We do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by the organization or on its behalf, except as required by law. The forward-looking information contained or incorporated by reference in this document is presented for the purpose of assisting shareholders and analysts in understanding our financial position as at and for the periods ended on the dates presented, as well as our strategic priorities and objectives, and may not be appropriate for other purposes.

Material economic assumptions underlying the forward-looking statements contained or incorporated by reference in this document include those set out in the Economic Developments and Outlook section of the 2024 MD&A as well as in the Allowance for Credit Losses section of the 2024 MD&A, each as may be updated by quarterly reports. Assumptions about the performance of the Canadian and U.S. economies, as well as overall market conditions and their combined effect on our business, are material factors we consider when determining our strategic priorities, objectives and expectations for our business. In determining our expectations for economic growth, we primarily consider historical economic data, past relationships between economic and financial variables, changes in government policies, and the risks to the domestic and global economy.

CORPORATE STRUCTURE

Bank of Montreal started business in Montreal in 1817 and was incorporated in 1821 by an Act of Lower Canada as the first Canadian chartered bank. Since 1871, the Bank has been a chartered bank under the Bank Act (Canada) (the Bank Act) and is named in Schedule I of the Bank Act. The Bank Act is the charter of the Bank and governs its operations.

2

The Bank’s head office is 129 rue Saint Jacques, Montreal, Québec, H2Y 1L6. Its executive offices are 100 King Street West, 1 First Canadian Place, Toronto, Ontario, M5X 1A1.

Bank of Montreal brands the organization’s member companies as BMO Financial Group. Note 27 of the 2024 Financial Statements lists the intercorporate relationships among Bank of Montreal and its significant subsidiaries. The Bank incorporates this Note herein by reference. These subsidiaries are incorporated or organized under the laws of the state or country of their principal office, except for: BMO Financial Corp. and BMO Capital Markets Corp., which are incorporated under the laws of the state of Delaware, United States.

GENERAL DEVELOPMENT OF THE BUSINESS

Three-Year History

During the first fiscal quarter of 2022, BMO completed the sale of its EMEA Asset Management business, as well as the transfer of certain U.S. asset management clients, to Ameriprise Financial, Inc.

On December 20, 2021, BMO announced a definitive agreement with BNP Paribas (BNP) to acquire Bank of the West and its subsidiaries. On February 1, 2023, we completed the acquisition of Bank of the West and its subsidiaries from BNP for a cash purchase price of US$13.8 billion. The conversion of the Bank of the West customer accounts and systems to our respective BMO platforms was completed in September 2023.

On June 8, 2022, BMO announced the appointment of Piyush Agrawal as Deputy Chief Risk Officer effective July 1, 2022 and, after a transition period with Patrick Cronin, became Chief Risk Officer effective November 1, 2022.

On February 15, 2023, BMO announced the appointment of Nadim Hirji as Group Head, BMO Commercial Bank, North America and Co-Head, Personal and Commercial Banking, effective March 1, 2023.

On April 20, 2023, BMO announced the appointment of Darrel Hackett as U.S. Chief Executive Officer of BMO Financial Group, President & CEO of BMO Bank N.A., and CEO of BMO’s U.S. holding company, BMO Financial Corp., effective June 1, 2023.

On June 1, 2023, BMO completed the acquisition of the AIR MILES Reward Program (AIR MILES) business of LoyaltyOne Co. for a cash purchase price of US$160 million. The AIR MILES business operates as a wholly-owned subsidiary of BMO.

On August 30, 2023, BMO announced the appointment of Hazel Claxton, former Executive Vice-President and Chief Human Resources Officer of Morneau Shepell Inc. (now part of TELUS Health), to its Board of Directors, effective August 30, 2023.

On October 10, 2023, BMO announced the appointment of Alan Tannenbaum as Chief Executive Officer & Group Head, BMO Capital Markets, effective November 1, 2023.

On October 29, 2024, BMO announced the appointment of Diane L. Cooper and Brian McManus to its Board of Directors, effective October 28, 2024. Ms. Cooper was formerly President and CEO of GE Capital’s Commercial Distribution business and an officer of GE Company. Mr. McManus is the Executive Chair of Polycor Inc., a global leader in the natural stone industry.

During the years ended October 31, 2022, 2023 and 2024, the Bank did not have share buyback programs in place and did not repurchase any of its common shares for cancellation.

For additional information on the general development of BMO’s business and its strategies for the upcoming year, see pages 16 and 33 to 52 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

This Three-Year History section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

DESCRIPTION OF THE BUSINESS

Business

BMO Financial Group is a highly diversified financial services provider based in North America, providing a broad range of personal and commercial banking, wealth management, global markets and investment banking products and services directly and through Canadian and non-Canadian subsidiaries, offices, and branches. As at October 31, 2024, BMO had approximately 54,000 full-time equivalent employees. The Bank has more than 1,800 bank branches and approximately 5,800 BMO automated banking machines, as well as online and mobile digital banking platforms. It operates in Canada, the United States and select markets globally through its offices in a number of jurisdictions around the world. BMO Financial Corp. (BFC) is based in Chicago and wholly-owned by Bank of Montreal. BFC operates primarily through its subsidiary BMO Bank N.A. (BBNA), formerly BMO Harris Bank N.A., which provides banking, financing, investing, and cash management services in the United States. BMO provides a range of investment dealer services through entities, including BMO Nesbitt Burns Inc., a major fully integrated Canadian investment dealer, and BMO Capital Markets Corp., Bank of Montreal’s wholly-owned registered broker dealer in the United States.

3

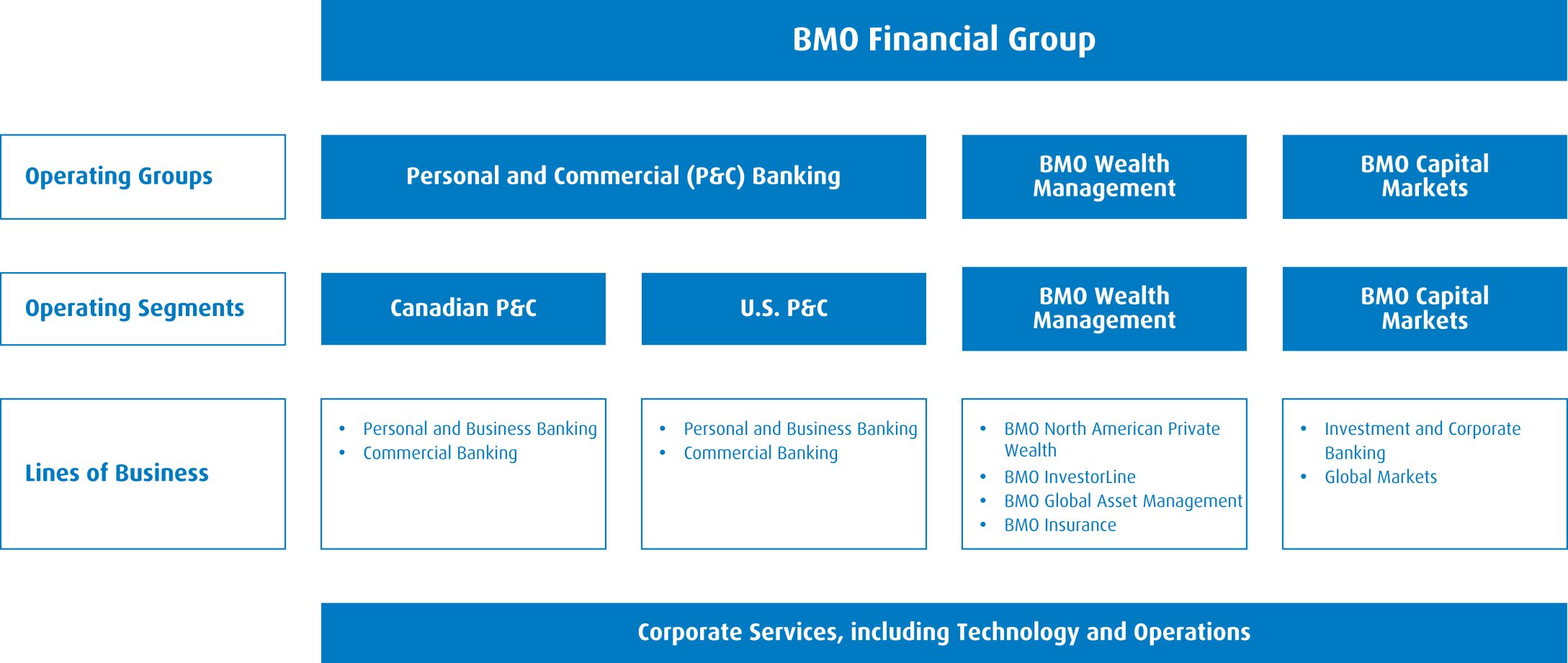

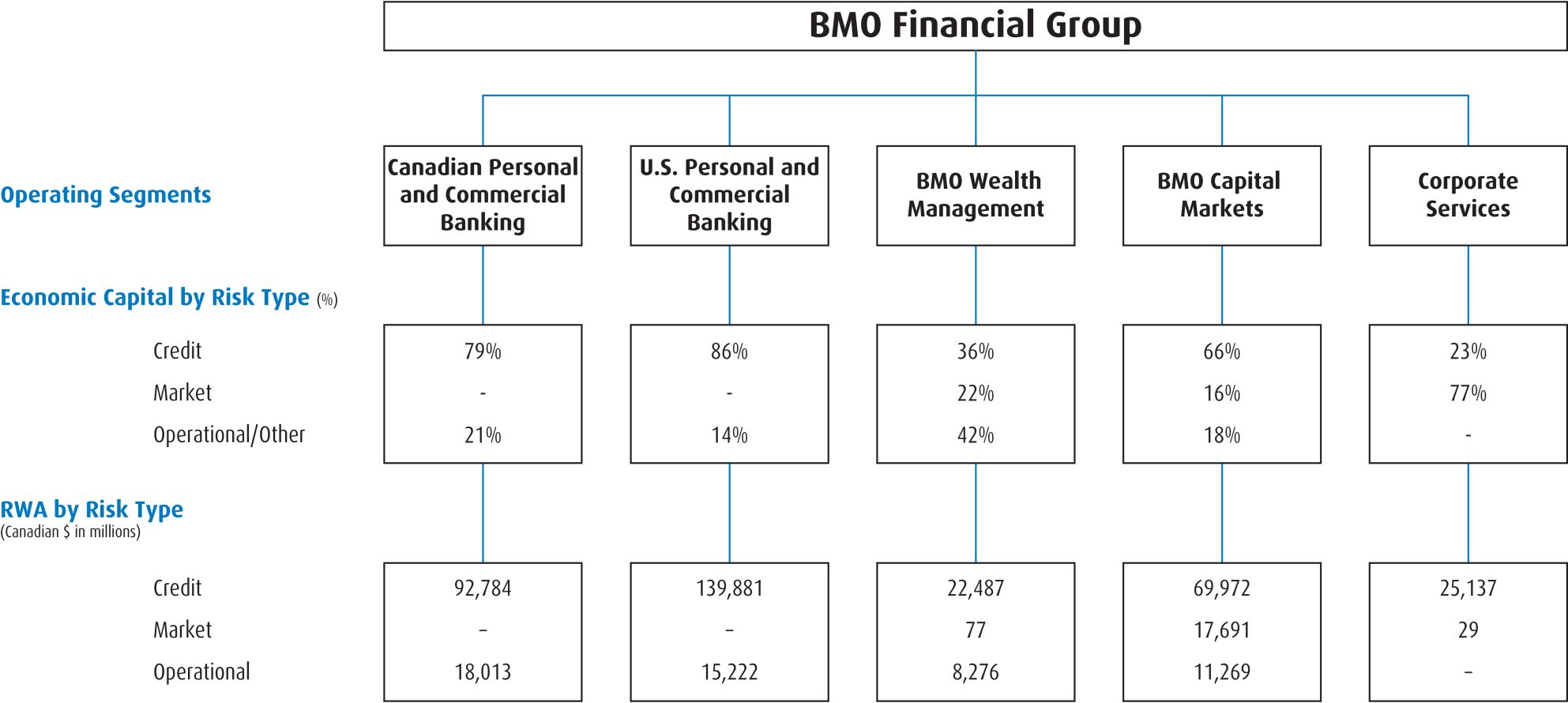

BMO conducts business through three operating groups: Personal and Commercial Banking (P&C), comprising the Canadian P&C and U.S. P&C operating segments; BMO Wealth Management; and BMO Capital Markets; supported by Corporate Services.

For additional information regarding BMO’s businesses, see pages 16 and 33 to 52 of the 2024 MD&A and Note 26 of the 2024 Financial Statements. The Bank incorporates these pages and Note herein by reference.

This Business section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

Supervision and Regulation in Canada

Bank of Montreal’s activities in Canada are governed by the Bank Act.

Under the Bank Act, a bank can operate its regular banking business as well as some additional activities, such as dealing with real property and various financial technology and information services. A bank is restricted when it undertakes certain activities, including fiduciary activities, dealing in securities, insurance activities, and personal property leasing. For example, other than for authorized types of insurance, a bank may not offer insurance products through its branch system or bank website.

The Bank Act grants a bank broad power to invest in the securities of other corporations and entities, but limits substantial investments. Under the Bank Act, a bank generally has a substantial investment in a body corporate when (1) the bank and entities controlled by the bank beneficially own more than 10% of the voting shares of the body corporate or (2) the bank and entities controlled by the bank beneficially own shares representing more than 25% of the total shareholders’ equity of the body corporate. A bank can have a substantial investment in entities that meet the substantial investment requirements as set out in Part IX of the Bank Act. In certain cases, the Minister of Finance or the Superintendent of Financial Institutions (Canada) (the Superintendent) must approve before a bank can make an investment.

The Superintendent is responsible to the Minister of Finance for administering the Bank Act. The Superintendent provides guidelines for disclosing a bank’s financial information. The Superintendent must also examine each bank annually to ensure compliance with the Bank Act and that each bank is in sound financial condition and has adequate policies and procedures to protect itself against threats to its integrity or security. The Superintendent’s examination report is submitted to the Minister of Finance.

The Bank’s Canadian trust, loan and insurance subsidiaries are federally regulated financial institutions governed by the Trust and Loan Companies Act (Canada) and the Insurance Companies Act (Canada), respectively, and under provincial laws in respect of their activities in the provinces. The Bank and its Canadian trust, loan and insurance subsidiaries are also subject to regulation by the Financial Consumer Agency of Canada (the FCAC). The FCAC enforces consumer-related provisions of the federal statutes which govern these financial institutions. Certain activities of the Bank and its subsidiaries acting as securities brokers, dealers, underwriters, advisors and investment fund managers are regulated in Canada under provincial securities legislation and, in some cases, by a self-regulatory organization (Canadian Investment Regulatory Organization).

Under Canadian bank resolution powers, the Canada Deposit Insurance Corporation (CDIC) may, in circumstances where the Bank has ceased, or is about to cease, to be viable, assume temporary control or ownership of the Bank and may be granted broad powers by one or more orders of the Governor in Council (Canada), including the power to sell or dispose of all or a part of the assets of the Bank, and the power to carry out or cause the Bank to carry out a transaction or a series of transactions the purpose of which is to restructure the business of the Bank. As part of the Canadian bank resolution powers, certain provisions of, and regulations under the Bank Act, the Canada Deposit Insurance Corporation Act (CDIC Act) and certain other Canadian federal statutes pertaining to banks (collectively, the “Bail-in Regime”) provide for a bank recapitalization regime for banks designated by the Superintendent as domestic systemically important banks. Effective September 23, 2018, under the Bail-in Regime, subject to an order of the Governor in Council (Canada) having been issued, CDIC may, having assumed temporary control or ownership of the Bank, amongst other actions, carry out a conversion, by converting or causing the Bank to convert, in whole or in part – by means of a transaction or series of transactions and in one or more steps – the shares and liabilities of the Bank that are subject to the Bail-in Regime into common shares of the Bank or any of its affiliates. For a more detailed description of Canadian bank resolution powers and the consequent risk factors attaching to certain liabilities of the Bank, reference is made to https://www.bmo.com/ir/files/F18%20Files/Bail_In_TLAC_Disclosure.pdf. The information on the Bank’s website does not form a part of this Annual Information Form.

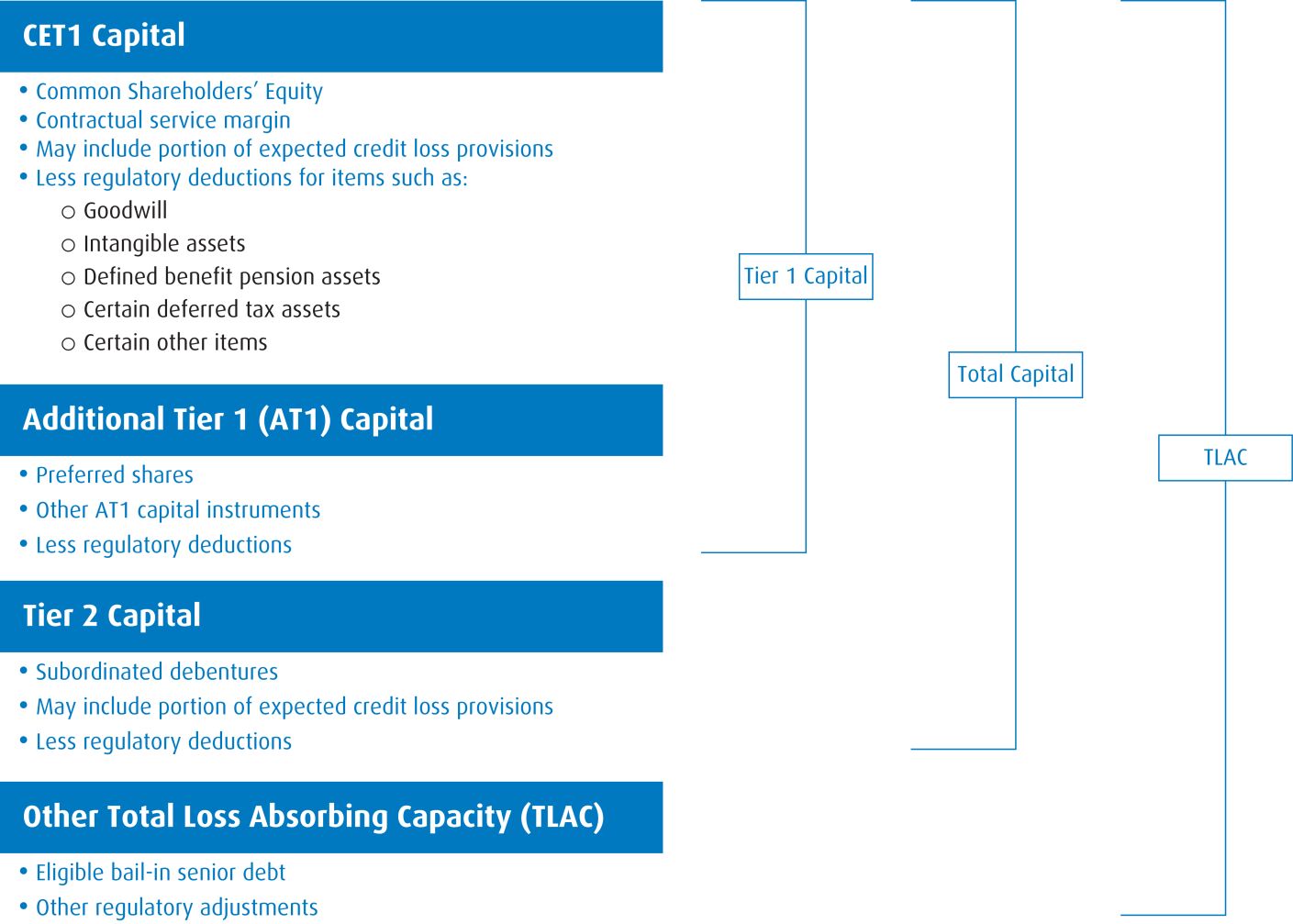

Additional information about supervision and regulation in Canada is found under the headings “Regulatory Capital Requirements”, “Regulatory Capital and Total Loss Absorbing Capacity Ratios”, “Regulatory Capital and Total Loss Absorbing Capacity Elements” and “Regulatory Capital Developments” in the Enterprise-Wide Capital Management section on pages 60 to 62, “Regulatory Environment and Changes” in the Risks That May Affect Future Results section on page 70, and “Legal and Regulatory Risk” on pages 104 to 106 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

Supervision and Regulation in the United States

In the United States, the operations of Bank of Montreal and its subsidiaries are supervised, regulated, and examined by regulatory and government agencies at the federal and state level. As a foreign bank, Bank of Montreal is subject to various U.S. laws and regulations, including the United States International Banking Act of 1978, the United States Bank Holding Company Act of 1956, and related regulations. The Board of Governors of the Federal Reserve System, including the Federal Reserve Banks (the Federal Reserve), and state banking regulators oversee Bank of Montreal’s branch and office operations in the United States. The U.S. Securities and Exchange Commission (the SEC), the Financial Industry Regulatory Authority, and state securities regulators regulate Bank of Montreal’s broker-dealer subsidiaries. The SEC and state securities regulators regulate Bank of Montreal’s registered investment advisor subsidiaries.

Bank of Montreal and its subsidiaries own two Federal Deposit Insurance Corporation (FDIC) insured depository institutions in the United States, BBNA and BMO Harris Central N.A. (BHC). BBNA provides banking, financing, investing, and cash management services across the United States. BHC provides limited cash management services. They are both supervised and regulated by the Office of the Comptroller of the Currency (OCC). The Federal Reserve generally needs to approve acquiring (a) more than 5% of voting shares, (b) control, or (c) all (or substantially all) of the assets of a bank holding company, bank, or savings association.

The Bank is also subject to the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) and related regulations. Dodd-Frank provides for consumer protections, regulation of over-the-counter derivatives markets, restrictions on proprietary trading and the ownership and sponsorship of private investment funds by banks and their affiliates (referred to as the Volcker Rule), imposition of heightened prudential standards, and broader application of leverage and risk-based capital requirements.

Bank of Montreal is subject to the Federal Reserve’s rule regarding the supervision and regulation of foreign banking organizations (FBO Rule), promulgated to implement Dodd Frank’s requirements for enhanced prudential standards for the U.S. operations of non-U.S. banks, such as BMO. The rule establishes requirements relating to an intermediate holding company structure, risk-based capital and leverage requirements, capital stress testing requirements, U.S. risk management and risk governance, liquidity risk management and liquidity stress testing frameworks.

4

In May 2018, the U.S. enacted the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCP), which made reforms to Dodd-Frank, including raising the threshold for heightened prudential standards from US$50 billion to US$250 billion in total consolidated assets. The Federal Reserve in October 2019 issued final rules that modify capital and liquidity requirements, single counterparty credit limits, and enhanced prudential standards for bank holding companies and foreign banking organizations.

OCC guidelines establish heightened standards for large national banks with average total consolidated assets of US$50 billion or more, including BBNA. The guidelines set out minimum standards for the design and implementation of a bank’s risk governance framework and minimum standards for oversight of that framework by a bank’s board of directors. The framework must ensure the bank’s risk profile is easily distinguished and separate from that of its parent for risk management purposes. A bank’s board of directors is responsible for informed oversight of, and providing credible challenge to, management’s risk management recommendations and decisions. We comply with these guidelines.

Additional information about supervision and regulation in the United States is found under the headings “Regulatory Capital Requirements”, “Regulatory Capital Developments” and “Regulatory Capital and Total Loss Absorbing Capacity Review” in the Enterprise-Wide Capital Management section on pages 60 to 62, “Regulatory Environment and Changes” in the Risks That May Affect Future Results section on page 70, “Legal and Regulatory Risk” on pages 104 to 106, and “Other Regulatory Developments” on page 114 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

This Supervision and Regulation in the United States section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

International Supervision and Regulation

Outside Canada and the U.S., each of Bank of Montreal’s branches, agencies and subsidiaries must comply with the regulatory requirements of the country or jurisdiction where it conducts business. These include the Basel Committee on Banking Supervision capital, liquidity and prudential rules (Basel III), or local variations on Basel III, which are intended to strengthen the banking sector’s capital and liquidity frameworks. Since the first quarter of 2013, regulatory capital requirements for Bank of Montreal have been determined on a Basel III basis. Additional information about international supervision and regulation is found under the headings “Regulatory Capital Requirements”, “Regulatory Capital and Total Loss Absorbing Capacity Ratios”, “Regulatory Capital and Total Loss Absorbing Capacity Elements” and “Regulatory Capital Developments” in the Enterprise-Wide Capital Management section on pages 60 to 62, “Regulatory Environment and Changes” in the Risks That May Affect Future Results section on page 70, and “Legal and Regulatory Risk” on pages 104 to 106 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

Competition

Canada’s financial services industry is highly competitive. It includes domestic banks and foreign bank subsidiaries, branches, and lending branches, as well as trust companies, credit unions, online and full-service brokerages, investment dealers, insurance companies, mutual fund dealers, and large monoline financial institutions, as well as non-bank competitors, among others. Bank of Montreal competes with most of these companies in some form across its businesses. However, the Bank’s range of services compares most directly to those of the other five major Canadian banks, and they are direct competitors in almost all the Bank’s businesses and markets in Canada. Bank of Montreal is the fourth largest chartered bank in Canada as measured by assets and equity, and the third largest as measured by market capitalization, as at October 31, 2024. In North America, the Bank is the eighth largest bank as measured by assets, ninth largest as measured by equity, and ninth largest as measured by market capitalization, as at October 31, 2024. BMO is the third largest Canadian bank, as measured by global retail branches, as at October 31, 2024.

The six major banks play a prominent role in the Canadian banking system, each maintaining an extensive branch network, augmented by automated banking machines, dedicated contact centres and digital and mobile banking platforms. The industry is considered mature with moderate growth. Although the major banks offer similar products and services, they compete on product offerings, pricing, service models, digital capabilities and customer experience, with a goal of attracting and retaining customers, gaining a strategic advantage and growing market share and scale. The financial services industry continues to operate in a rapidly changing environment as the advancement of technological capabilities is shaping the future of everyday banking for individuals and businesses.

The financial services landscape in the United States remains highly competitive. As a top 10 full-service U.S. bank1, BMO offers Personal, Commercial, Private Wealth and Capital Markets services with offices in 32 U.S. states and national digital platforms, competing with large U.S. banks, regional banks as well as community banks and non-bank financial service providers.

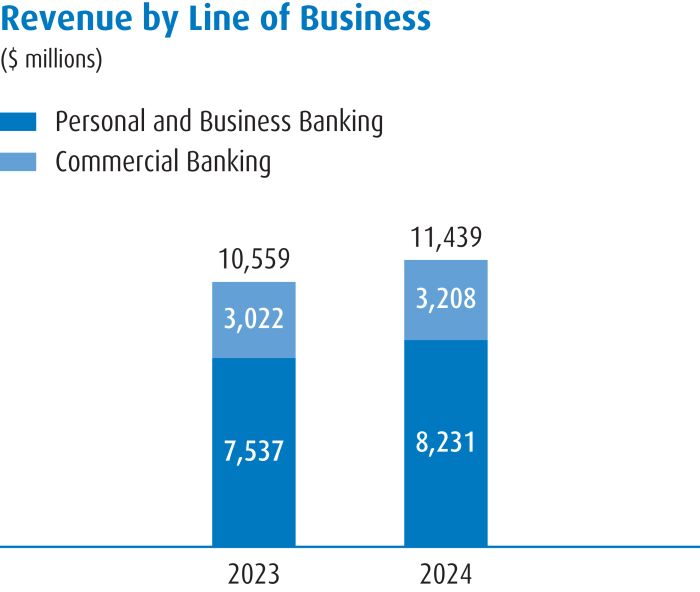

In Personal and Commercial banking, BMO serves millions of customers across Canada and the United States. Personal and Business Banking (P&BB) offers a range of everyday banking products and services including deposits, home lending, consumer credit, small business lending, credit cards, cash management, everyday financial and investment advice and other banking services. In Canada, P&BB serves customers through a network of almost 900 branches, over 3,200 automated banking machines, customer contact centres and digital banking platforms. In the United States, P&BB’s core branch footprint spans twenty-two states, serving customers through a network of nearly 1,000 branches as well as nationwide access to a digital banking platform and access to more than 40,000 BMO and Allpoint® automated banking machines. Commercial Banking offers a range of commercial banking products and services, including a variety of financing options, treasury and payment solutions and risk management products to customers across Canada and the United States with strong market share positions.

BMO Wealth Management serves a range of clients from individuals and families to business owners and institutions, and offers a wide spectrum of wealth, asset management and insurance products and services. BMO competes with domestic banks, insurance companies, trust companies, global private banks, investment counselling and advisory firms, and investment fund and asset management companies, among others. BMO North American Private Wealth provides full-service investing, banking and wealth advisory services to mass affluent, high net worth and ultra-high net worth clients in Canada and the United States. BMO InvestorLine provides a range of digital investment services that compete with online brokerages and digital advice providers in Canada. BMO Global Asset Management provides investment management services in Canada to institutional, retail and high net worth investors, offering a range of innovative, client-focused solutions and strategies to help clients meet their investment objectives. BMO Insurance competes with Canadian insurance companies in providing individual life and annuity products as well as pension de-risking solutions.

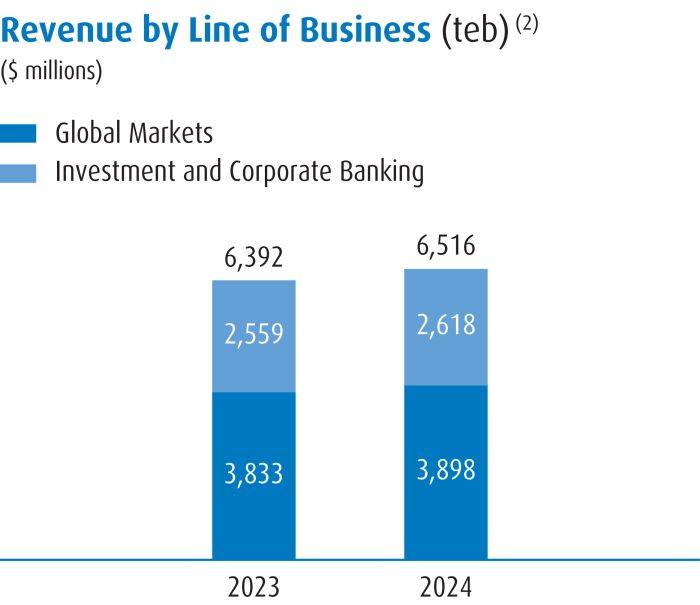

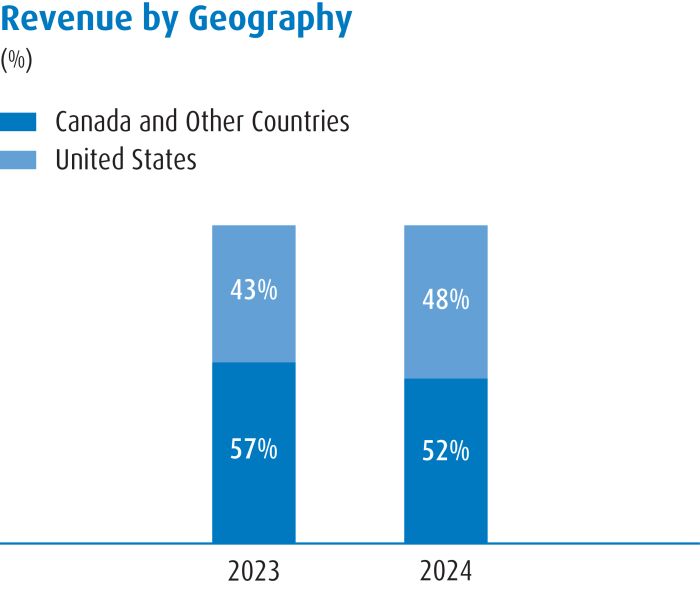

BMO Capital Markets offers a range of products and services to corporate, institutional and government clients, including investment and corporate banking services, as well as global market sales and trading solutions. It primarily focuses on the North American market and operates in 30 locations around the world in a highly competitive environment with a diverse range of competitors, including large money centre banks and boutique investment firms.

1 Top 10 U.S. Banks by assets: JP Morgan, Bank of America, Citibank, Wells Fargo, U.S. Bank, PNC Bank, Truist Bank, The Toronto-Dominion Bank, Capital One, Bank of Montreal.

5

Environmental, Social and Governance Issues

The Bank publishes a Sustainability Report and Public Accountability Statement, outlining how the Bank is addressing environmental, social, and governance issues. This report is part of a broader suite of sustainability reporting including the BMO Climate Report, and other related information that is available on the Bank’s website, www.bmo.com. The information on the Bank’s website does not form a part of this Annual Information Form. Additional information about the Bank’s environmental and social risks is under the heading “Environmental and Social Risk, including Climate Change” in the Risks That May Affect Future Results section on page 70 and “Environmental and Social Risk” in the Enterprise-Wide Risk Management section on pages 107 to 109 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

Risk Factors

A description of certain key factors and risks faced by the Bank and its businesses can be found in the “Enterprise-Wide Risk Management” section on pages 68 to 109 of the 2024 MD&A, which pages the Bank incorporates herein by reference.

DIVIDENDS

You can find information about the Bank’s dividends paid or payable per share on the common shares and each outstanding series of preferred shares in each of the three most recently completed years under the heading “Outstanding Shares and NVCC Instruments” on pages 65 to 66 of the 2024 MD&A, which pages the Bank incorporates herein by reference. Information about restrictions on the payment of dividends appears under the heading “Share Redemption and Dividend Restrictions” in Note 17 of the 2024 Financial Statements, which Note is incorporated herein by reference.

The Bank cannot (a) declare dividends on its preferred or common shares if paying those dividends would contravene the capital adequacy, liquidity, or other regulations under the Bank Act; (b) pay common share dividends unless the Bank has paid all dividends declared and payable on its preferred shares or set aside sufficient funds to do so; and (c) in certain circumstances, pay Class B Preferred Share dividends unless the Bank pays dividends on the Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) and Class B Preferred Shares Series 54 (NVCC) (each as defined below). In the event that interest due and payable on the Bank’s Subordinated Capital Notes (as defined below) is not paid in full, the Bank will not declare dividends on its common shares or preferred shares or, subject to certain exceptions, redeem, purchase or otherwise retire such shares until the month commencing after such interest payments have been made in full. The Board of Directors determines the amount and payment of future dividends. The determination by the Board of Directors depends on the Bank’s operations, financial condition, cash requirements, future regulatory restrictions on the payment of dividends, and other factors the Board of Directors finds relevant. You can find information about the Bank’s dividends and dividend payout range on page 66 of the 2024 MD&A, which page the Bank incorporates herein by reference.

Currently, these limitations do not restrict the payment of dividends on common or preferred shares.

DESCRIPTION OF CAPITAL STRUCTURE

The following summarizes certain provisions of the Bank’s common shares, preferred shares, Subordinated Capital Notes and Limited Recourse Capital Notes. This summary is qualified in its entirety by the Bank’s by-laws and the actual terms and conditions of such securities. For more detail on the Bank’s capital structure, see pages 62 to 66 of the 2024 MD&A and Notes 17 and 20 of the 2024 Financial Statements. The Bank incorporates those pages and Notes herein by reference.

Description of Common Shares

The authorized capital of the Bank includes an unlimited number of common shares without nominal or par value for unlimited consideration. The holders of common shares are entitled to:

| (i) | Vote at all Bank shareholders’ meetings, except for meetings where only holders of a specified class or series of shares are entitled to vote. |

| (ii) | Receive dividends as and when declared by the Board of Directors, subject to the preference of the Bank’s holders of preferred shares. |

| (iii) | Receive the remaining property of the Bank if it is liquidated, dissolved, or wound up, only after paying the Bank’s holders of preferred shares and paying all outstanding debt. |

Description of Preferred Shares

The authorized capital of the Bank includes an unlimited number of Class A Preferred Shares and Class B Preferred Shares without nominal or par value, in series, for unlimited consideration. Class B Preferred Shares may be issued in a foreign currency. The following describes certain general terms and conditions of the preferred shares.

6

Certain Conditions of the Class A Preferred Shares as a Class

Issuable in Series

From time to time, the Board of Directors may resolve to issue Class A Preferred Shares in one or more series with rights, privileges, restrictions, and conditions, which the Board of Directors may also decide. As at December 4, 2024, there were no outstanding Class A Preferred Shares.

The Class A Preferred Shares of each series rank equally to all other series of Class A and Class B Preferred Shares and are entitled to preference over the common shares and over any other shares ranking junior to the Class A Preferred Shares and the Class B Preferred Shares with respect to the payment of dividends and in the distribution of property in the event of the liquidation, dissolution or winding up of the Bank.

Creating and Issuing Shares

Under the Bank Act, the Bank needs approval from the holders of Class A Preferred Shares to create any other class of shares with equal or superior rank to Class A Preferred Shares. Shareholders must give this approval as set out below in “Shareholder Approvals.” The Bank Act and other laws may also require other forms of approval.

The Bank does not require shareholder approval to create or issue additional Class A Preferred Shares or shares of equal rank if, on the date they are created or issued, the Bank has declared and paid or set apart for payment all dividends payable on cumulative and non-cumulative Class A Preferred Shares, including for the most recently completed fiscal period.

Voting Rights

The holders of the Class A Preferred Shares only have voting rights as a class on certain matters (see below) or as the law requires.

Shareholder Approvals

Holders of the Class A Preferred Shares can give their approval if 66 2/3% or more holders casting vote in favour of doing so at a meeting where the majority of Class A Preferred Shares is represented, or if no quorum is present at such a meeting, at an adjourned meeting at which no quorum requirements apply.

Certain Conditions of the Class B Preferred Shares as a Class

Issuable in Series

From time to time, the Board of Directors may resolve to issue Class B Preferred Shares in one or more series with rights, privileges, restrictions, and conditions, which the Board of Directors may also decide.

The Class B Preferred Shares of each series rank equally to all the other series of Class B and Class A Preferred Shares and are entitled to preference over the common shares and any other shares ranking junior to the Class A Preferred Shares and the Class B Preferred Shares with respect to the payment of dividends and in the distribution of property in the event of the liquidation, dissolution or winding up of the Bank.

Creating and Issuing Shares

Under the Bank Act, the Bank needs approval from holders of Class B Preferred Shares to create any other class of shares with equal or superior rank to Class B Preferred Shares. The Bank Act or other laws may also require other forms of approval.

The Bank does not require shareholder approval to create or issue additional Class B Preferred Shares or shares of equal rank if, on the date they are created or issued, the Bank has declared and paid or set apart for payment all dividends payable on cumulative and non-cumulative Class B Preferred Shares, including for the most recently completed fiscal period. As at December 4, 2024, none of the outstanding Class B Preferred Shares have the right to cumulative dividends.

Voting Rights

The holders of the Class B Preferred Shares only have voting rights as a class on certain matters (see below) or as the law requires.

Shareholder Approvals

Holders of the Class B Preferred Shares can give their approval if 66 2/3% or more holders casting vote in favour of doing so at a meeting where the majority of Class B Preferred Shares is represented, or if no quorum is present at such meeting, at an adjourned meeting at which no quorum requirements apply.

Contingent Conversion of Certain Series of Class B Preferred Shares

Upon the occurrence of certain specified trigger events relating to the viability of the Bank, the Class B Preferred Shares Series 33 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 44 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 48 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 49 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 50 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 51 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 52 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 53 (Non-Viability Contingent Capital (NVCC)) and Class B Preferred Shares Series 54 (Non-Viability Contingent Capital (NVCC)) will immediately and automatically be converted into common shares of the Bank. The number of common shares into which such Class B Preferred Shares would be converted upon the occurrence of such a trigger event will be determined in accordance with a pre-determined conversion formula specified at the time of issuance of such Class B Preferred Shares.

7

Description of Other Equity Instruments – Subordinated Capital Notes

The Bank currently has outstanding US$500 million 4.800% Fixed Rate Resetting Non-Cumulative Subordinated Additional Tier 1 Capital Notes (Non-Viability Contingent Capital (NVCC)) (“Subordinated Capital Notes”) which are classified as equity and form part of the Bank’s additional tier 1 non-viability contingent capital. The Subordinated Capital Notes are compound financial instruments that have both equity and liability features. For more details, see “Other Equity Instruments” in Note 17 of the 2024 Financial Statements.

The Subordinated Capital Notes are direct unsecured obligations of the Bank and, in the event of the Bank’s insolvency or winding-up, will rank subordinate to all of the Bank’s subordinated indebtedness and in right of payment equally with and not prior to indebtedness that ranks equally in right of payment with, or is subordinated to, the Subordinated Capital Notes (other than indebtedness which by its terms ranks subordinate to the Subordinated Capital Notes, including but not limited to the Limited Recourse Capital Notes). The Subordinated Capital Notes will constitute subordinated indebtedness for the purposes of the Bank Act. In the event of the Bank’s insolvency or winding-up, the Subordinated Capital Notes will rank ahead of the Bank’s common shares and Preferred Shares.

Upon the occurrence of certain specified trigger events relating to the viability of the Bank, the Subordinated Capital Notes will immediately and automatically be converted into common shares of the Bank. The number of common shares into which the Subordinated Capital Notes would be converted upon the occurrence of such a trigger event will be determined in accordance with a pre-determined conversion formula specified at the time of issuance of the Subordinated Capital Notes.

Certain Provisions of the Subordinated Capital Notes

Distributions and Restrictions on Dividend and Retirement of Shares

Interest on the Subordinated Capital Notes was payable semi-annually in arrears for the initial five years, which ended on August 25, 2024 (the “First Reset Date”). Following the First Reset Date, the interest rate will reset every five years and interest will accrue at a fixed rate. While interest is payable on a semi-annual basis, the Bank may, at its discretion, with prior notice, cancel the payments. If the Bank does not pay the interest in full to the note holders, the Bank will not declare dividends on its common shares or preferred shares or redeem, purchase or otherwise retire such shares until the month commencing after the Bank resumes full interest payments on the Subordinated Capital Notes.

Maturity and Redemption

The Subordinated Capital Notes have no scheduled maturity or redemption date. Accordingly, the Bank is not required to make any repayment of the principal amount of the Subordinated Capital Notes except in the event of bankruptcy or insolvency and provided that the NVCC requirements have not been triggered. The Subordinated Capital Notes are redeemable at par on any interest payment date on or after the First Reset Date solely at the option of the Bank, or following certain regulatory or tax events, in accordance with their terms. All redemptions are subject to regulatory consent.

Purchase for Cancellation

Subject to regulatory consent, the Bank may at any time, purchase for cancellation any Subordinated Capital Notes at any price in the open market.

Events of Default

An event of default in respect of the Subordinated Capital Notes will occur only if the Bank becomes bankrupt or insolvent or becomes subject to the provisions of the Winding-up and Restructuring Act (Canada), or if the Bank goes into liquidation, either voluntarily or under an order of a court of competent jurisdiction, passes a resolution for the winding-up, liquidation or dissolution of the Bank or otherwise acknowledges its insolvency. Neither a failure to make a payment on the Subordinated Capital Notes when due (including any interest payment, whether as a result of cancellation or otherwise) nor an NVCC automatic conversion upon the occurrence of a trigger event will constitute an event of default.

Issuance of other Senior or Pari Passu Securities

The terms governing the Subordinated Capital Notes do not limit the Bank’s ability to incur additional indebtedness or issue or repurchase securities, other than the restriction on retirement of shares noted above. The Bank may incur additional indebtedness without the authorization of the holders of the Subordinated Capital Notes.

Voting Rights

The holders of Subordinated Capital Notes are not entitled to any rights of holders of common shares, including any rights of shareholders to receive notice, to attend or to vote at any meeting of the shareholders of the Bank. If the Subordinated Capital Notes are converted into common shares of the Bank under NVCC requirements, holders of the Subordinated Capital Notes will become holders of the Bank’s common shares and will only have rights as holders of common shares.

8

Description of Other Equity Instruments – Limited Recourse Capital Notes

The Bank currently has outstanding $1.25 billion 4.300% Limited Recourse Capital Notes, Series 1 (Non-Viability Contingent Capital (NVCC)) (“LRCN 1”), $750 million 5.625% Limited Recourse Capital Notes, Series 2 (Non-Viability Contingent Capital (NVCC)) (“LRCN 2”), $1 billion 7.325% Limited Recourse Capital Notes, Series 3 (Non-Viability Contingent Capital (NVCC)) (“LRCN 3”), US$1 billion 7.700% Limited Recourse Capital Notes, Series 4 (Non-Viability Contingent Capital (NVCC)) (“LRCN 4”) and US$750 million 7.300% Limited Recourse Capital Notes, Series 5 (Non-Viability Contingent Capital (NVCC)) (“LRCN 5”, collectively with the LRCN 1, LRCN 2, LRCN 3 and LRCN 4, the “Limited Recourse Capital Notes”) which are classified as equity and form part of the Bank’s additional tier 1 non-viability contingent capital. The Limited Recourse Capital Notes are compound financial instruments that have both equity and liability features. For more details, see “Other Equity Instruments” in Note 17 of the 2024 Financial Statements.

The Limited Recourse Capital Notes are direct unsecured obligations of the Bank and, in the event of the Bank’s insolvency or winding-up (prior to the occurrence of specified trigger events), will rank: (a) subordinate in right of payment to the prior payment in full of all indebtedness, including certain subordinated indebtedness (including but not limited to the Subordinated Capital Notes); and (b) in right of payment, equally with and not prior to indebtedness which by its terms ranks equally in right of payment with, or is subordinate to, the Limited Recourse Capital Notes (other than indebtedness which by its terms ranks subordinate to the Limited Recourse Capital Notes) in each case, from time to time outstanding, and will be subordinate in right of payment to the claims of the Bank’s depositors and other unsubordinated creditors. The Limited Recourse Capital Notes will constitute subordinated indebtedness for the purposes of the Bank Act. In the event of the Bank’s insolvency or winding-up, the Limited Recourse Capital Notes will rank ahead of the Bank’s common shares and Preferred Shares.

In the event of a non-payment by the Bank of the principal amount of, or interest on the Limited Recourse Capital Notes when due, while a holder of Limited Recourse Capital Notes will have a claim against the Bank for the principal amount of the Limited Recourse Capital Notes and any accrued and unpaid interest (which will then be due and payable), the sole remedy of each holder of Limited Recourse Capital Notes is the delivery of such holder’s proportionate share of the assets of a limited recourse trust. As of the date hereof, the limited recourse trust’s assets in respect of the LRCN 1 consist of 1,250,000 Class B Preferred Shares, Series 48 (Non-Viability Contingent Capital (NVCC)) (“Class B Preferred Shares Series 48 (NVCC)”), in respect of the LRCN 2 consist of 750,000 Class B Preferred Shares, Series 49 (Non-Viability Contingent Capital (NVCC)) (“Class B Preferred Shares Series 49 (NVCC)”), in respect of the LRCN 3 consist of 1,000,000 Class B Preferred Shares, Series 51 (Non-Viability Contingent Capital (NVCC)) (“Class B Preferred Shares Series 51 (NVCC)”), in respect of the LRCN 4 consist of 1,000,000 Class B Preferred Shares, Series 53 (Non-Viability Contingent Capital (NVCC)) (“Class B Preferred Shares Series 53 (NVCC)”) and in respect of the LRCN 5 consist of 750,000 Class B Preferred Shares, Series 54 (Non-Viability Contingent Capital (NVCC)) (“Class B Preferred Shares Series 54 (NVCC)”).

Upon the occurrence of certain specified trigger events relating to the viability of the Bank, the Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) and Class B Preferred Shares Series 54 (NVCC) will immediately and automatically be converted into common shares of the Bank. The number of common shares into which the Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) and Class B Preferred Shares Series 54 (NVCC) would be converted upon the occurrence of such a trigger event will be determined in accordance with a pre-determined conversion formula specified at the time of the issuance of the Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) and Class B Preferred Shares Series 54 (NVCC). Subject to certain limitations, each holder of the Limited Recourse Capital Notes would receive such holder’s proportionate share of such common shares of the Bank.

Certain Provisions of the Limited Recourse Capital Notes

Distributions and Restrictions on Dividend and Retirement of Shares

Interest on the Limited Recourse Capital Notes is paid semi-annually in arrears for the initial five years. Thereafter, the interest will reset every five years and accrue at a fixed rate.

Until revoked, the trustee of the limited recourse trust has waived its right to receive any and all dividends on the Class B Preferred Shares Series 48 (NVCC). Accordingly, until such waiver is revoked by the trustee of the limited recourse trust, no dividends are expected to be declared or paid on the Class B Preferred Shares Series 48 (NVCC). To the extent the waiver is no longer in effect and the limited recourse trust is the sole holder of the Class B Preferred Shares Series 48 (NVCC), if the Bank does not declare and pay dividends on the Class B Preferred Shares Series 48 (NVCC), it will not declare and pay dividends on any of the other outstanding series of Class B Preferred Shares of the Bank.

Until revoked, the trustee of the limited recourse trust has waived its right to receive any and all dividends on the Class B Preferred Shares Series 49 (NVCC). Accordingly, until such waiver is revoked by the trustee of the limited recourse trust, no dividends are expected to be declared or paid on the Class B Preferred Shares Series 49 (NVCC). To the extent the waiver is no longer in effect and the limited recourse trust is the sole holder of the Class B Preferred Shares Series 49 (NVCC), if the Bank does not declare and pay dividends on the Class B Preferred Shares Series 49 (NVCC), it will not declare and pay dividends on any of the other outstanding series of Class B Preferred Shares of the Bank.

Until revoked, the trustee of the limited recourse trust has waived its right to receive any and all dividends on the Class B Preferred Shares Series 51 (NVCC). Accordingly, until such waiver is revoked by the trustee of the limited recourse trust, no dividends are expected to be declared or paid on the Class B Preferred Shares Series 51 (NVCC). To the extent the waiver is no longer in effect and the limited recourse trust is the sole holder of the Class B Preferred Shares Series 51 (NVCC), if the Bank does not declare and pay dividends on the Class B Preferred Shares Series 51 (NVCC), it will not declare and pay dividends on any of the other outstanding series of Class B Preferred Shares of the Bank.

Until revoked, the trustee of the limited recourse trust has waived its right to receive any and all dividends on the Class B Preferred Shares Series 53 (NVCC). Accordingly, until such waiver is revoked by the trustee of the limited recourse trust, no dividends are expected to be declared or paid on the Class B Preferred Shares Series 53 (NVCC). To the extent the waiver is no longer in effect and the limited recourse trust is the sole holder of the Class B Preferred Shares Series 53 (NVCC), if the Bank does not declare and pay dividends on the Class B Preferred Shares Series 53 (NVCC), it will not declare and pay dividends on any of the other outstanding series of Class B Preferred Shares of the Bank.

9

Until revoked, the trustee of the limited recourse trust has waived its right to receive any and all dividends on the Class B Preferred Shares Series 54 (NVCC). Accordingly, until such waiver is revoked by the trustee of the limited recourse trust, no dividends are expected to be declared or paid on the Class B Preferred Shares Series 54 (NVCC). To the extent the waiver is no longer in effect and the limited recourse trust is the sole holder of the Class B Preferred Shares Series 54 (NVCC), if the Bank does not declare and pay dividends on the Class B Preferred Shares Series 54 (NVCC), it will not declare and pay dividends on any of the other outstanding series of Class B Preferred Shares of the Bank.

Maturity and Redemption

The LRCN 1 are scheduled to mature on November 26, 2080. The LRCN 1 are redeemable, at the option of the Bank, at their principal amount every five years after issuance, or following certain regulatory or tax events, in accordance with their terms. Upon any redemption of the Class B Preferred Shares Series 48 (NVCC) held by the limited recourse trust, the Bank shall redeem LRCN 1 with an aggregate principal amount equal to the aggregate face amount of the Class B Preferred Shares Series 48 (NVCC) redeemed by the Bank. All redemptions are subject to regulatory consent.

The LRCN 2 are scheduled to mature on May 26, 2082. The LRCN 2 are redeemable, at the option of the Bank, at their principal amount every five years after issuance, or following certain regulatory or tax events, in accordance with their terms. Upon any redemption of the Class B Preferred Shares Series 49 (NVCC) held by the limited recourse trust, the Bank shall redeem LRCN 2 with an aggregate principal amount equal to the aggregate face amount of the Class B Preferred Shares Series 49 (NVCC) redeemed by the Bank. All redemptions are subject to regulatory consent.

The LRCN 3 are scheduled to mature on November 26, 2082. The LRCN 3 are redeemable, at the option of the Bank, at their principal amount every five years after issuance, or following certain regulatory or tax events, in accordance with their terms. Upon any redemption of the Class B Preferred Shares Series 51 (NVCC) held by the limited recourse trust, the Bank shall redeem LRCN 3 with an aggregate principal amount equal to the aggregate face amount of the Class B Preferred Shares Series 51 (NVCC) redeemed by the Bank. All redemptions are subject to regulatory consent.

The LRCN 4 are scheduled to mature on May 26, 2084. The LRCN 4 are redeemable, at the option of the Bank, at their principal amount every five years after issuance, or following certain regulatory or tax events, in accordance with their terms. Upon any redemption of the Class B Preferred Shares Series 53 (NVCC) held by the limited recourse trust, the Bank shall redeem LRCN 4 with an aggregate principal amount equal to the aggregate face amount of the Class B Preferred Shares Series 53 (NVCC) redeemed by the Bank. All redemptions are subject to regulatory consent.

The LRCN 5 are scheduled to mature on November 26, 2084. The LRCN 5 are redeemable, at the option of the Bank, at their principal amount every five years after issuance, or following certain regulatory or tax events, in accordance with their terms. Upon any redemption of the Class B Preferred Shares Series 54 (NVCC) held by the limited recourse trust, the Bank shall redeem LRCN 5 with an aggregate principal amount equal to the aggregate face amount of the Class B Preferred Shares Series 54 (NVCC) redeemed by the Bank. All redemptions are subject to regulatory consent.

Purchase for Cancellation

Subject to regulatory consent, the Bank may at any time, purchase for cancellation any LRCN 1, LRCN 2, LRCN 3, LRCN 4 and LRCN 5 at any price in the open market. Prior to any such cancellation, the Bank shall, subject to regulatory consent, redeem, as applicable, a corresponding number of Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) or Class B Preferred Shares Series 54 (NVCC) (the aggregate face amount of which shall equal the aggregate principal amount of the Notes to be cancelled) then held by the limited recourse trust for cancellation.

Events of Default

An event of default in respect of the Limited Recourse Capital Notes (“Event of Default”), will occur only if the Bank becomes bankrupt or insolvent or becomes subject to the provisions of the Winding-up and Restructuring Act (Canada), or if the Bank goes into liquidation, either voluntarily or under an order of a court of competent jurisdiction, passes a resolution for the winding-up, liquidation or dissolution of the Bank or otherwise acknowledges its insolvency. Upon an Event of Default, the sole remedy of each holder of LRCN 1 is the delivery of such holder’s proportionate share of the Class B Preferred Shares Series 48 (NVCC), the sole remedy of each holder of LRCN 2 is the delivery of such holder’s proportionate share of the Class B Preferred Shares Series 49 (NVCC), the sole remedy of each holder of LRCN 3 is the delivery of such holder’s proportionate share of the Class B Preferred Shares Series 51 (NVCC), the sole remedy of each holder of LRCN 4 is the delivery of such holder’s proportionate share of the Class B Preferred Shares Series 53 (NVCC) and the sole remedy of each holder of LRCN 5 is the delivery of such holder’s proportionate share of the Class B Preferred Shares Series 54 (NVCC).

Issuance of other Senior or Pari Passu Securities

The terms governing the Limited Recourse Capital Notes do not limit the Bank’s ability to incur additional indebtedness or issue or repurchase securities. The Bank may incur additional indebtedness without the authorization of the holders of the Limited Recourse Capital Notes.

Voting Rights

The holders of the Limited Recourse Capital Notes are not entitled to any rights of holders of common shares, including any rights of shareholders to receive notice, to attend or to vote at any meeting of the shareholders of the Bank. If the Class B Preferred Shares Series 48 (NVCC), Class B Preferred Shares Series 49 (NVCC), Class B Preferred Shares Series 51 (NVCC), Class B Preferred Shares Series 53 (NVCC) or Class B Preferred Shares Series 54 (NVCC) are converted into common shares of the Bank, holders of the LRCN 1, LRCN 2, LRCN 3, LRCN 4 and LRCN 5 as applicable, will become holders of the Bank’s common shares and will only have rights as holders of common shares.

This Certain Provisions of the Limited Recourse Capital Notes section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

10

Restraints on Bank Shares under the Bank Act

The Bank Act restricts the beneficial ownership of shares of a bank. No person may be a major shareholder of a bank if the bank has equity of $12 billion or more, which applies to the Bank. A major shareholder is defined as a person, or group of persons under common control or acting jointly or in concert, that beneficially owns more than 20% of any class of voting shares or more than 30% of any class of non-voting shares of the bank.

In addition, no person may have a significant interest in any class of shares of a bank, including the Bank, unless the person first receives the approval of the Minister of Finance. A person has a significant interest in a class of shares of a bank when the person, or group of persons under common control or acting jointly or in concert, beneficially owns more than 10% of any class of shares of the bank.

Governments and their agents are also restricted from acquiring shares of a bank, except for certain cases that require the Minister of Finance’s consent.

Ratings

The credit ratings that external rating agencies assign to some of the Bank’s securities are important in the raising of both capital and funding to support the Bank’s business operations. The credit ratings and outlook that the rating agencies assigned are based on their own views and methodologies. Maintaining strong credit ratings allows the Bank to access the capital markets at competitive pricing levels. Should the Bank’s credit ratings experience a downgrade, its cost of funds would likely increase and its access to funding and capital through capital markets could be reduced. A material downgrade of the Bank’s ratings could also have other consequences, including those set out in Note 8 of the 2024 Financial Statements, which Note the Bank incorporates herein by reference. The following table sets out ratings the Bank has received for its outstanding securities from the rating agencies, which are current as at December 4, 2024.

| S&P

|

Moody’s

|

DBRS

|

Fitch

|

|||||||||||||

|

Rating

|

Rank1

|

Rating

|

Rank1

|

Rating

|

Rank1

|

Rating

|

Rank1

|

|||||||||

|

Short-term instruments

|

A-1 | 1 of 6 | P-1 | 1 of 4 | R-1 (high) | 1 of 6 | F1+ | 1 of 7 | ||||||||

|

Senior debt3 |

A- | 3 of 10 | A2 | 3 of 9 | AA (low) | 2 of 10 | AA- | 2 of 10 | ||||||||

|

Long Term Deposits / Legacy Senior Debt4 |

A+ | 3 of 10 | Aa2 | 2 of 9 | AA | 2 of 10 | AA | 2 of 10 | ||||||||

|

Subordinated debt

Subordinated debt – NVCC2 |

A-

BBB+ |

3 of 10

4 of 10 |

Baa1

Baa1(hyb) |

4 of 9

4 of 9 |

A (high)

A (low) |

3 of 10

3 of 10 |

A

A |

3 of 10

3 of 10 |

||||||||

|

Subordinated Capital Notes –NVCC2 |

BBB- | 4 of 10 | Baa3(hyb) | 4 of 9 | N/A | N/A | N/A | N/A | ||||||||

|

Limited Recourse Capital Notes –NVCC2 |

BBB- | 4 of 10 | Baa3(hyb) | 4 of 9 | BBB (high) | 4 of 10 | N/A | N/A | ||||||||

|

Preferred shares

Preferred shares –NVCC2 |

BBB

BBB- |

3 of 9

3 of 9 |

Baa3

Baa3(hyb) |

4 of 9

4 of 9 |

Pfd-2 (high)

Pfd-2 |

2 of 6

2 of 6 |

N/A

N/A |

N/A

N/A |

||||||||

|

Trend/Outlook

|

Stable | -- | Stable | -- | Stable | -- | Stable | -- | ||||||||

Notes: 1 Rank, according to each rating agency’s public website, refers to the assigned ratings ranking of all major assignable ratings for each debt or share class, 1 being the highest. Each assignable major rating may be modified further (+/-, high/low) to show relative standing within the major rating categories.

2 Non-viability contingent capital or NVCC.

3 Subject to conversion under the Bail-In Regime.

4 Long Term Deposits / Legacy Senior Debt Includes: (a) Senior debt issued prior to September 23, 2018; and (b) Senior debt issued on or after September 23, 2018 which is excluded from the Bail-In Regime.

A definition of the categories of each rating as at December 4, 2024 from each rating agency’s website is outlined in Appendix II to this Annual Information Form. Further information may be obtained from the applicable rating agency. S&P, Moody’s, DBRS and Fitch each have a stable outlook on BMO’s long-term credit ratings.

During fiscal 2024 there were no changes to ratings assigned by S&P, Moody’s, DBRS or Fitch.

Credit ratings are not recommendations to purchase, hold, or sell securities and do not address the market price or suitability of a specific security for a particular investor. Credit ratings may not reflect the potential impact of all risks on the value of securities. In addition, real or anticipated changes in the rating assigned to a security will generally affect the market value of that security. The Bank cannot know for certain that a rating will remain in effect for any given period of time or that a rating agency will not revise or withdraw it entirely in the future.

The Bank paid fees to credit rating agencies to obtain its credit ratings. The Bank may also pay fees for other services from credit rating agencies in the ordinary course of business.

For additional information on the credit ratings assigned to the Bank’s short-term and senior-long term debt securities by external rating agencies, see page 95 of the 2024 MD&A, which page the Bank incorporates herein by reference.

This Ratings section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

11

MARKET FOR SECURITIES

Trading Price and Volume

The outstanding common shares of the Bank are listed for trading on the Toronto Stock Exchange (TSX) and on the New York Stock Exchange (NYSE) under the trading symbol BMO. The outstanding preferred shares of the Bank set out below are listed on the TSX with the following trading symbols: BMO.PR.Y for the Class B Preferred Shares Series 33 (Non-Viability Contingent Capital (NVCC)) and BMO.PR.E for the Class B Preferred Shares Series 44 (Non-Viability Contingent Capital (NVCC)).

The following table sets out the reported high and low trading prices in Canadian dollars and the trading volumes of the common and preferred shares of Bank of Montreal on the TSX for the given periods. Prices are based on the reported data from the TSX Historical Data Access.

| BMO Common |

PR.S1 Series 27 |

PR.T2 Series 29 |

PR.W3 Series 31 |

PR.Y Series 33 |

PR.E Series 44 |

PR.F4 Series 46 |

||||||||||||||||||||||

| November 2023 |

||||||||||||||||||||||||||||

| - High Price ($) |

112.49 | 19.76 | 18.55 | 18.00 | 18.57 | 24.07 | 24.50 | |||||||||||||||||||||

| - Low Price ($) |

103.40 | 18.17 | 17.00 | 16.64 | 16.20 | 22.05 | 23.27 | |||||||||||||||||||||

|

- Volume |

41,403,176 | 427,528 | 208,545 | 86,606 | 72,383 | 258,801 | 82,906 | |||||||||||||||||||||

| December 2023 |

||||||||||||||||||||||||||||

| - High Price ($) |

132.11 | 19.85 | 18.90 | 18.47 | 19.52 | 24.40 | 24.99 | |||||||||||||||||||||

| - Low Price ($) |

109.76 | 19.00 | 17.30 | 16.96 | 18.09 | 23.75 | 24.11 | |||||||||||||||||||||

|

- Volume |

48,690,950 | 174,808 | 189,153 | 121,161 | 62,814 | 357,153 | 95,149 | |||||||||||||||||||||

| January 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

131.84 | 21.53 | 20.25 | 19.61 | 20.17 | 25.15 | 24.97 | |||||||||||||||||||||

| - Low Price ($) |

125.50 | 19.50 | 18.34 | 17.77 | 18.75 | 24.24 | 24.53 | |||||||||||||||||||||

|

- Volume |

71,330,750 | 703,424 | 410,767 | 222,658 | 190,065 | 264,652 | 392,566 | |||||||||||||||||||||

| February 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

129.60 | 22.55 | 21.10 | 20.52 | 20.95 | 25.10 | 24.90 | |||||||||||||||||||||

| - Low Price ($) |

119.51 | 21.01 | 19.68 | 18.79 | 19.50 | 24.40 | 24.55 | |||||||||||||||||||||

|

- Volume |

64,569,727 | 1,001,433 | 272,673 | 295,882 | 179,289 | 347,781 | 343,302 | |||||||||||||||||||||

| March 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

132.68 | 24.45 | 24.00 | 23.99 | 23.24 | 24.99 | 25.02 | |||||||||||||||||||||

| - Low Price ($) |

122.28 | 22.46 | 20.85 | 20.31 | 20.27 | 24.58 | 24.76 | |||||||||||||||||||||

|

- Volume |

34,867,142 | 1,127,495 | 1,025,060 | 336,253 | 380,063 | 309,133 | 160,589 | |||||||||||||||||||||

| April 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

133.95 | 25.15 | 24.68 | 24.25 | 23.99 | 25.46 | 25.25 | |||||||||||||||||||||

| - Low Price ($) |

122.64 | 24.15 | 23.70 | 23.63 | 22.95 | 24.87 | 24.90 | |||||||||||||||||||||

|

- Volume |

59,584,254 | 2,217,980 | 1,337,869 | 772,576 | 444,199 | 197,894 | 394,492 | |||||||||||||||||||||

| May 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

131.40 | 25.10 | 24.61 | 24.20 | 23.94 | 25.78 | 25.02 | |||||||||||||||||||||

| - Low Price ($) |

118.71 | 24.90 | 24.00 | 23.50 | 23.52 | 25.10 | 24.91 | |||||||||||||||||||||

|

- Volume |

59,284,465 | 2,816,357 | 475,140 | 1,283,797 | 175,979 | 264,509 | 1,275,051 | |||||||||||||||||||||

| June 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

121.79 | n.a. | 24.92 | 24.40 | 23.90 | 25.70 | n.a. | |||||||||||||||||||||

| - Low Price ($) |

113.75 | n.a. | 23.77 | 22.91 | 22.70 | 25.00 | n.a. | |||||||||||||||||||||

|

- Volume |

47,549,265 | n.a. | 234,724 | 238,208 | 149,758 | 201,325 | n.a. | |||||||||||||||||||||

| July 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

121.33 | n.a. | 25.15 | 24.86 | 24.45 | 25.96 | n.a. | |||||||||||||||||||||

| - Low Price ($) |

113.75 | n.a. | 24.81 | 24.20 | 23.63 | 25.23 | n.a. | |||||||||||||||||||||

|

- Volume |

73,173,912 | n.a. | 1,565,977 | 431,459 | 219,116 | 361,992 | n.a. | |||||||||||||||||||||

| August 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

120.25 | n.a. | 25.00 | 24.88 | 24.14 | 26.14 | n.a. | |||||||||||||||||||||

| - Low Price ($) |

109.02 | n.a. | 24.92 | 23.81 | 23.81 | 25.16 | n.a. | |||||||||||||||||||||

|

- Volume |

65,226,808 | n.a. | 2,590,873 | 153,315 | 190,025 | 371,750 | n.a. | |||||||||||||||||||||

| September 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

123.47 | n.a. | n.a. | 24.78 | 24.14 | 26.26 | n.a. | |||||||||||||||||||||

| - Low Price ($) |

110.94 | n.a. | n.a. | 23.79 | 23.77 | 25.80 | n.a. | |||||||||||||||||||||

|

- Volume |

48,990,423 | n.a. | n.a. | 159,735 | 100,176 | 354,568 | n.a. | |||||||||||||||||||||

| October 2024 |

||||||||||||||||||||||||||||

| - High Price ($) |

130.17 | n.a. | n.a. | 25.17 | 24.63 | 26.72 | n.a. | |||||||||||||||||||||

| - Low Price ($) |

121.18 | n.a. | n.a. | 23.77 | 23.92 | 25.95 | n.a. | |||||||||||||||||||||

|

- Volume |

86,747,649 | n.a. | n.a. | 1,105,335 | 112,559 | 186,042 | n.a. | |||||||||||||||||||||

1 The Bank redeemed all of its outstanding Class B Preferred Shares Series 27 (Non-Viability Contingent Capital (NVCC)) on May 25, 2024.

2 The Bank redeemed all of its outstanding Class B Preferred Shares Series 29 (Non-Viability Contingent Capital (NVCC)) on August 25, 2024.

3 The Bank redeemed all of its outstanding Class B Preferred Shares Series 31 (Non-Viability Contingent Capital (NVCC)) on November 25, 2024.

4 The Bank redeemed all of its outstanding Class B Preferred Shares Series 46 (Non-Viability Contingent Capital (NVCC)) on May 25, 2024.