UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2024

VIRIDIAN THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36483 | 47-1187261 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 221 Crescent Street, Suite 103A Waltham, MA |

02453 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 272-4600

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered |

||

| Common Stock, $0.01 par value | VRDN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On November 12, 2024, Viridian Therapeutics, Inc. (the “Company”) issued a press release reporting financial results for the quarter ended September 30, 2024.

The press release is attached hereto as Exhibit 99.1, which is furnished under Item 2.02 of this Current Report on Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

| Item 7.01 | Regulation FD Disclosure |

On November 12, 2024, the Company began utilizing a new corporate presentation (the “Corporate Presentation”). A copy of the Corporate Presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K, which includes pharmacokinetic and pharmacodynamic updates for VRDN-008, the Company’s next-generation bispecific neonatal Fc receptor (FcRn) inhibitor, demonstrating a potential best-in-class pharmacokinetic and pharmacodynamic profile.

The information in this Item 7.01 (including Exhibit 99.2 attached hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| Exhibit |

Exhibit Description |

|

| 99.1 | Press release, dated November 12, 2024 | |

| 99.2 | Corporate Presentation, dated November 12, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Viridian Therapeutics, Inc. | ||||||

| Date: November 12, 2024 | By: | /s/ Stephen Mahoney |

||||

| Stephen Mahoney | ||||||

| President, Chief Executive Officer, and Director | ||||||

Exhibit 99.1

Viridian Therapeutics Reports Third Quarter 2024 Financial Results and Recent Progress Including New FcRn Data

- Reported positive topline phase 3 data for veligrotug from THRIVE in patients with active thyroid eye

disease (TED); on track to report topline data from THRIVE-2 in chronic patients in December 2024 -

- Initiated two global phase 3 clinical trials of subcutaneous VRDN-003, REVEAL-1 and REVEAL-2 in

August, in active and chronic TED, respectively; topline data anticipated in the first half of 2026 -

- New non-human primate (NHP) data for VRDN-008, a next-generation bispecific neonatal Fc receptor

(FcRn) inhibitor, demonstrates a potential best-in-class pharmacokinetic (PK) and pharmacodynamic (PD)

profile; Investigational New Drug (IND) submission is planned for year-end 2025 and proof-of-concept IgG reduction data in healthy volunteers is anticipated in the second half of 2026 -

- VRDN-006, a Fc fragment inhibitor of FcRn, remains on track for Investigational New Drug (IND)

submission by year-end 2024; proof-of-concept IgG reduction data in healthy volunteers anticipated in the

second half of 2025 -

- Net proceeds of $243.2 million from public offering in September 2024 extends cash runway into

the second half of 2027; cash, cash equivalents, and short-term investments of $753.2 million as of

September 30, 2024 -

WALTHAM, Mass., November 12, 2024 — Viridian Therapeutics, Inc. (NASDAQ: VRDN), a biotechnology company focused on discovering and developing potential best-in-class medicines for serious and rare diseases, today reported recent business highlights and financial results for the third quarter ending September 30, 2024.

“We had another exceedingly strong quarter of execution across our TED and FcRn portfolios,” said Steve Mahoney, Viridian’s President and Chief Executive Officer. “In TED, we reported highly-compelling and positive phase 3 data for veligrotug and eagerly anticipate the readout of THRIVE-2 in December. We also initiated both pivotal phase 3 clinical trials for VRDN-003, our next-generation subcutaneous IGF-1R inhibitor. For our FcRn inhibitor portfolio, we are thrilled today to share VRDN-008 NHP data for the first time, demonstrating a potential best-in-class pharmacokinetic and pharmacodynamic profile for this half-life extended bispecific FcRn inhibitor. Together with our Fc fragment approach with VRDN-006, we believe these programs in our FcRn portfolio will bring differentiated options for patients and each contribute to an exciting pipeline beyond TED. This quarter, we also further strengthened our cash position with a financing that allows us to accelerate our R&D pipeline and extend our cash runway into the second half of 2027.”

RECENT TED PORTFOLIO PROGRESS

Veligrotug is an intravenously delivered anti-insulin-like growth factor-1 receptor (IGF-1R) antibody in phase 3 development for thyroid eye disease.

| • | Achieved All Primary and Secondary Endpoints in THRIVE: In September, Viridian announced positive topline results for veligrotug in THRIVE, a global phase 3 clinical trial in patients with active TED. Veligrotug met all of its primary and secondary endpoints after five infusions with high statistical significance (p < 0.0001) and was generally well-tolerated. |

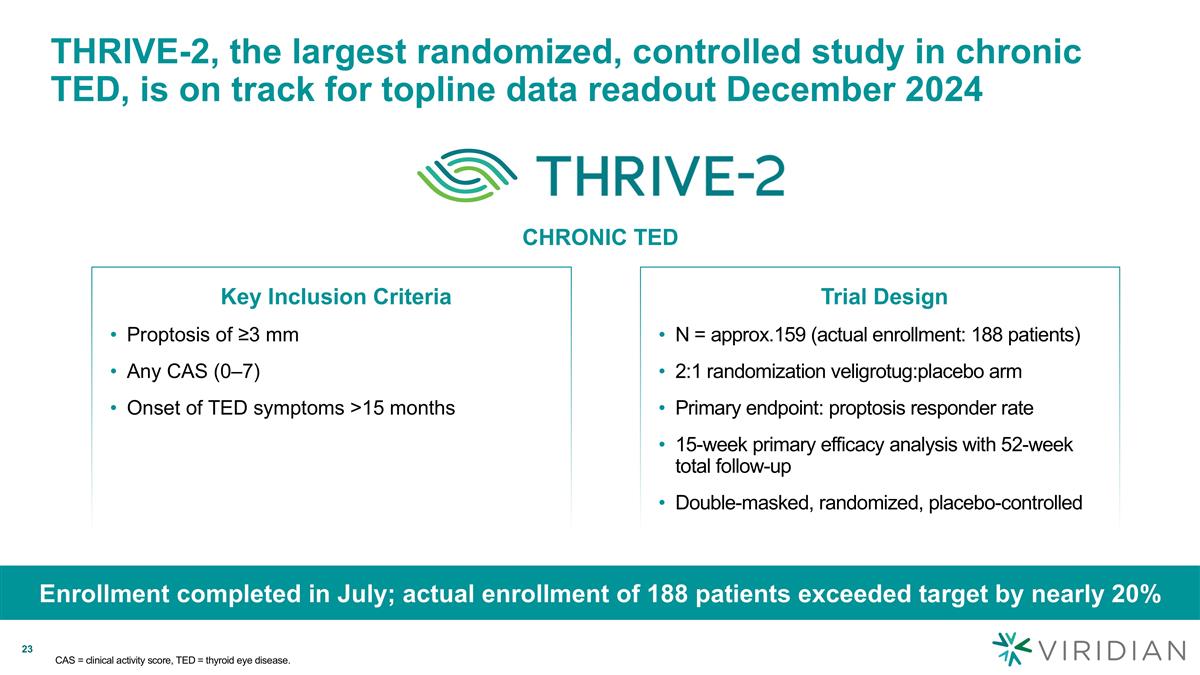

| • | THRIVE-2 Topline Data Readout on Track for December 2024: THRIVE-2 is a global phase 3 clinical trial assessing the efficacy and safety of veligrotug after five infusions in patients with chronic TED. THRIVE-2 completed enrollment in July 2024 with a total of 188 patients, exceeding the enrollment target of 159 patients due to patient demand, and is on track for topline readout of the 15-week primary efficacy analysis in December. |

1

| • | Veligrotug BLA on Track for Second Half 2025: Viridian anticipates submitting a Biologics License Application (BLA) in the second half of 2025, pending data, and expects that its data package will support a marketing authorization application in Europe. |

VRDN-003 is a potential best-in-class, subcutaneous, half-life extended anti-IGF-1R antibody with the same binding domain as veligrotug.

| • | REVEAL-1 and REVEAL-2 Initiated in August 2024: REVEAL-1 and REVEAL-2 are designed to evaluate VRDN-003 in patients with active and chronic TED, respectively, via a subcutaneous administration every four weeks or every eight weeks. Viridian believes the THRIVE topline results provide strong evidence to support the profile of VRDN-003 as a potential best-in-class subcutaneous anti-IGF-1R antibody in a low-volume, infrequent, self-administered, subcutaneous injection designed for patients to use at home. |

| • | Topline Data and BLA in 2026: Viridian anticipates topline data from both REVEAL-1 and REVEAL-2 in the first half of 2026, with a BLA submission planned by year-end 2026. The company plans to launch VRDN-003 with a commercially available low-volume autoinjector for at-home administration. |

FCRN PORTFOLIO UPDATE WITH NEW VRDN-008 NHP DATA

VRDN-006 is a highly selective Fc fragment which inhibits FcRn, and is designed to be a convenient subcutaneous and self-administered option for patients.

| • | IND on Track for Year-End 2024: Viridian is on track to submit an IND application for VRDN-006 by year-end 2024. Viridian anticipates starting a phase 1 clinical trial for VRDN-006 in healthy volunteers in early 2025 and proof-of-concept IgG reductions from that study in the second half of 2025. |

VRDN-008 is a half-life extended bispecific FcRn inhibitor comprising an Fc fragment and an albumin-binding domain designed to prolong IgG suppression and provide a potentially best-in-class subcutaneous option for patients.

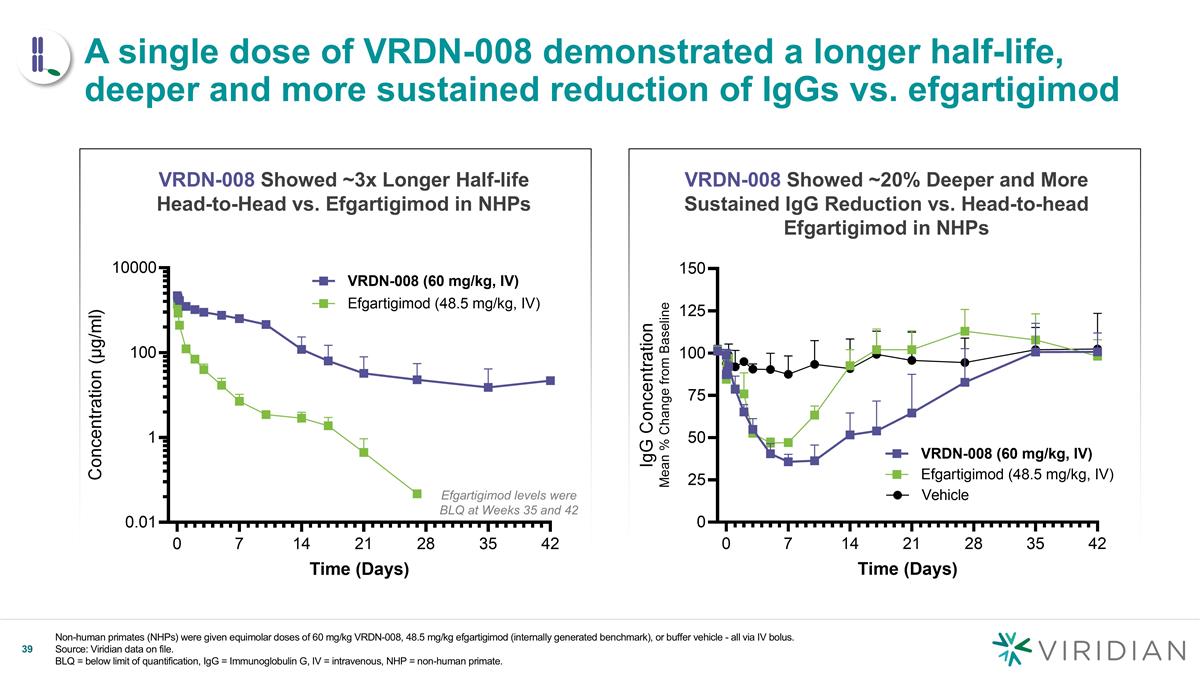

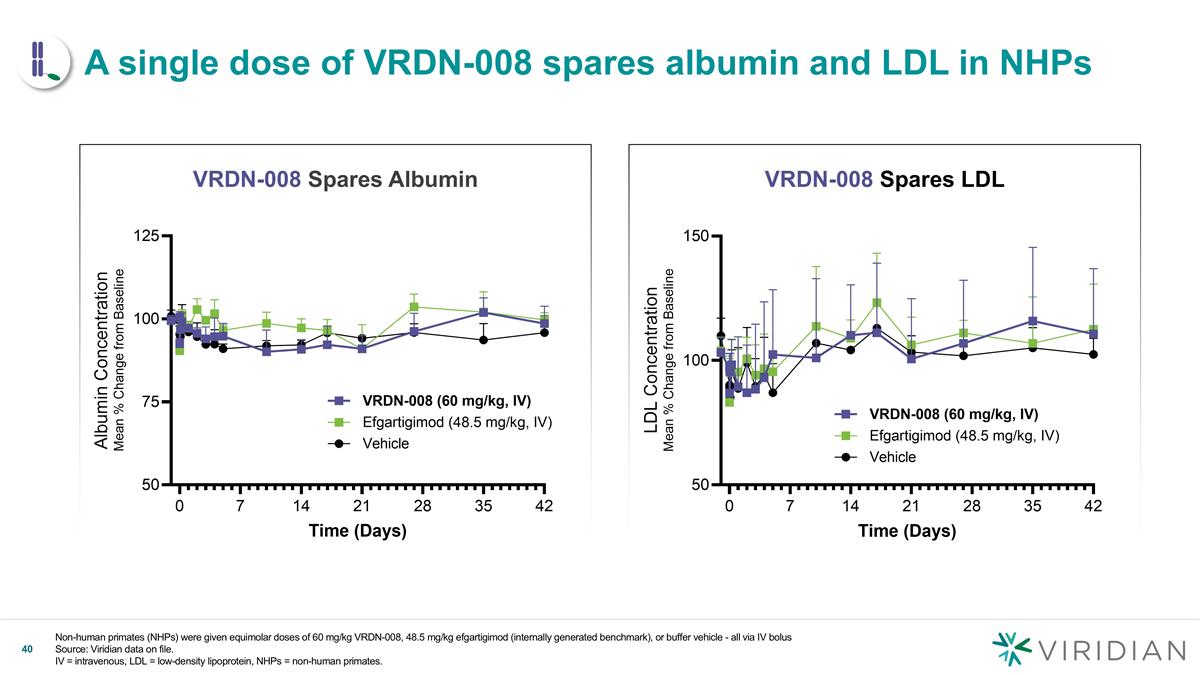

| • | Positive New NHP Data Confirms Half-Life Extension: In a head-to-head study, single doses of VRDN-008 demonstrated 3x the half-life of efgartigimod and showed a deeper and more sustained IgG reduction in NHPs with peak IgG reductions that were 20% deeper than efgartigimod. IgG levels returned to baseline 35 days after VRDN-008 dosing, more than twice as long as efgartigimod, which returned to baseline 14 days after dosing. VRDN-008 spared albumin and low-density lipoprotein (LDL), consistent with efgartigimod. Given that NHP data for FcRn inhibitors have been highly translatable to humans, Viridian believes this data shows the potential for VRDN-008 to be a best-in-class, extended half-life FcRn inhibitor for patients. |

| • | IND Submission Expected Year-End 2025: With these positive proof-of-concept data for VRDN-008, Viridian plans to further advance IND-enabling activities and submit an IND by year-end 2025. Viridian anticipates proof-of-concept IgG reduction data in healthy volunteers in the second half of 2026. |

2

FINANCIAL RESULTS

| • | Cash Position: Cash, cash equivalents, and short-term investments were $753.2 million as of September 30, 2024, compared with $571.4 million as of June 30, 2024. The company completed a public offering in September 2024 with net proceeds of $243.2 million and believes that its current cash, cash equivalents, and short-term investments will be sufficient to fund its operations into the second half of 2027. |

| • | R&D Expenses: Research and development expenses were $69.2 million during the quarter ended September 30, 2024, compared to $30.4 million during the quarter ended September 30, 2023. The increase in research and development expenses was driven by increased clinical trials costs associated with our ongoing THRIVE and THRIVE-2 pivotal clinical trials, as well as increased personnel costs to support our pipeline development. |

| • | G&A Expenses: General and administrative expenses were $14.4 million during the quarter ended September 30, 2024, compared to $20.9 million during the quarter ended September 30, 2023. The decrease in general and administrative expenses was driven by a decrease in personnel-related costs, including share-based compensation expenses. |

| • | Net Loss: The company’s net loss was $76.7 million for the third quarter ended September 30, 2024, compared with $47.7 million for the same period last year. |

| • | Shares Outstanding: As of September 30, 2024, Viridian had 97,850,645 shares of common stock outstanding on an as-converted basis, which included 79,181,445 shares of common stock and an aggregate 18,669,200 shares of common stock issuable upon the conversion of 134,864 and 145,160 shares of Series A and Series B preferred stock, respectively. |

About Viridian Therapeutics

Viridian is a biopharmaceutical company focused on engineering and developing potential best-in-class medicines for patients with serious and rare diseases. Viridian’s expertise in antibody discovery and protein engineering enables the development of differentiated therapeutic candidates for previously validated drug targets in commercially established disease areas.

Viridian is advancing multiple candidates in the clinic for the treatment of patients with thyroid eye disease (TED). The company is conducting a pivotal program for veligrotug (VRDN-001), including two global phase 3 clinical trials (THRIVE and THRIVE-2), to evaluate its efficacy and safety in patients with active and chronic TED. Viridian is also advancing VRDN-003 as a potential best-in-class subcutaneous therapy for the treatment of TED, including two ongoing global phase 3 pivotal clinical trials, REVEAL-1 and REVEAL-2, to evaluate the efficacy and safety of VRDN-003 in patients with active and chronic TED.

In addition to its TED portfolio, Viridian is advancing a novel portfolio of neonatal Fc receptor (FcRn) inhibitors, including VRDN-006 and VRDN-008, which has the potential to be developed in multiple autoimmune diseases.

Viridian is based in Waltham, Massachusetts. For more information, please visit www.viridiantherapeutics.com. Follow Viridian on LinkedIn and X.

3

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “on track,” “plan,” “potential,” “predict,” “project,” “design,” “should,” “target,” “will,” or “would” or other similar terms or expressions that concern our expectations, plans and intentions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations, and assumptions. Forward-looking statements include, without limitation, statements regarding: preclinical and clinical development of Viridian’s product candidates veligrotug (formerly VRDN-001), VRDN-003, VRDN-006 and VRDN-008; anticipated start dates of studies, including the initiation date of the phase 1 clinical trial for VRDN-006; milestones; timelines; anticipated data results and timing of their disclosure, including topline results; regulatory interactions and anticipated timing of regulatory submissions, including the anticipated IND submissions for VRDN-006 and VRDN-008 and the anticipated BLA submissions for veligrotug and VRDN-003; Viridian’s expectation that its data package will support a BLA submission for veligrotug in the second half of 2025, pending data; Viridian’s expectation that its data package will support a marketing authorization application in Europe for veligrotug; clinical trial designs, including the REVEAL-1 and REVEAL-2, global phase 3 clinical trials for VRDN-003; Viridian’s plans to launch VRDN-003 with a commercially available auto-injector pen, if approved; the potential utility, efficacy, potency, safety, clinical benefits, clinical response, convenience and number of indications of veligrotug, VRDN-003, VRDN-006 and VRDN-008; potential dosing regimen for VRDN-008; Viridian’s product candidates potentially being best-in-class; and that Viridian’s cash, cash equivalents and short-term investments will be sufficient to fund its operations into the second half of 2027.

New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to: potential utility, efficacy, potency, safety, clinical benefits, clinical response and convenience of Viridian’s product candidates; that results or data from completed or ongoing clinical trials may not be representative of the results of ongoing or future clinical trials; that preliminary data may not be representative of final data; the timing, progress and plans for our ongoing or future research, preclinical and clinical development programs; changes to trial protocols for ongoing or new clinical trials; expectations and changes regarding the timing for regulatory filings; regulatory interactions expectations and changes regarding the timing for enrollment and data; uncertainty and potential delays related to clinical drug development; the duration and impact of regulatory delays in our clinical programs; the timing of and our ability to obtain and maintain regulatory approvals for our therapeutic candidates; manufacturing risks; competition from other therapies or products; estimates of market size; other matters that could affect the sufficiency of existing cash, cash equivalents and short-term investments to fund operations; our financial position and projected cash runway; our future operating results and financial performance; Viridian’s intellectual property position; the timing of preclinical and clinical trial activities and reporting results from same; and those risks set forth under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on August 8, 2024 and other subsequent disclosure documents filed with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither the company, nor its affiliates, advisors, or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing the company’s views as of any date subsequent to the date hereof.

4

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(amounts in thousands, except share and per share data)

(unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue: |

||||||||||||||||

| Collaboration Revenue - related party |

$ | 86 | $ | 72 | $ | 230 | $ | 242 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

86 | 72 | 230 | 242 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Expenses: |

||||||||||||||||

| Research and development |

69,158 | 30,385 | 166,294 | 121,208 | ||||||||||||

| General and administrative |

14,408 | 20,911 | 45,499 | 62,006 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

83,566 | 51,296 | 211,793 | 183,214 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(83,480 | ) | (51,224 | ) | (211,563 | ) | (182,972 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income (expense) |

||||||||||||||||

| Interest and other income |

7,795 | 4,164 | 23,527 | 13,029 | ||||||||||||

| Interest and other expense |

(1,004 | ) | (600 | ) | (2,188 | ) | (931 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(76,689 | ) | (47,660 | ) | (190,224 | ) | (170,874 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in unrealized gain on investments |

1,475 | 109 | 594 | 326 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive loss |

$ | (75,214 | ) | $ | (47,551 | ) | $ | (189,630 | ) | $ | (170,548 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (76,689 | ) | $ | (47,660 | ) | $ | (190,224 | ) | $ | (170,874 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted |

$ | (1.15 | ) | $ | (1.09 | ) | $ | (2.98 | ) | $ | (3.97 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares used to compute basic and diluted loss per share |

66,420,063 | 43,654,577 | 63,800,798 | 43,057,658 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Viridian Therapeutics, Inc.

Selected Financial Information

Condensed Consolidated Balance Sheets

(amounts in thousands)

(unaudited)

| September 30, 2024 |

December 31, 2023 |

|||||||

| Cash, cash equivalents and short-term investments |

$ | 753,240 | $ | 477,370 | ||||

| Other assets |

18,660 | 13,054 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 771,900 | $ | 490,424 | ||||

|

|

|

|

|

|||||

| Total liabilities |

64,404 | 48,402 | ||||||

| Total stockholders’ equity |

707,496 | 442,022 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 771,900 | $ | 490,424 | ||||

|

|

|

|

|

|||||

Contacts

Anabel Chan, 617-458-8725

Vice President, Investor Relations & Communications

IR@viridiantherapeutics.com

Louisa Stone, 617-272-4604

Manager, Investor Relations

IR@viridiantherapeutics.com

Source: Viridian Therapeutics, Inc.

5

Corporate Presentation November 2024 Exhibit 99.2

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements. These statements may be identified by the use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or other similar terms or expressions that concern our expectations, plans and intentions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations, and assumptions. Forward-looking statements include, without limitation, statements regarding: preclinical and clinical development of Viridian’s product candidates veligrotug (formerly VRDN-001), VRDN-006 and VRDN-008, including Viridian's view that the THRIVE data provides strong support for VRDN-003's clinical profile; anticipated data results and timing of their disclosure, including topline results from the THRIVE-2 trial and REVEAL trials; regulatory interactions and anticipated timing of regulatory submissions, including anticipated BLA submissions and IND submissions; clinical trial designs, including the REVEAL-1 and REVEAL-2, global phase 3 clinical trials for VRDN-003; the potential utility, efficacy, potency, safety, clinical benefits, clinical response, convenience and number of indications of veligrotug, VRDN-003, VRDN-006 and VRDN-008; potential market sizes and market opportunities, including for Viridian’s product candidates; Viridian’s product candidates potentially being best-in-class; and Viridian’s anticipated cash runway. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to: potential utility, efficacy, potency, safety, clinical benefits, clinical response and convenience of Viridian’s product candidates; that results or data from completed or ongoing clinical trials may not be representative of the results of ongoing or future clinical trials; that preliminary data may not be representative of final data; the timing, progress and plans for our ongoing or future research, preclinical and clinical development programs; changes to trial protocols for ongoing or new clinical trials, including adjustments that we may make to the VRDN-003 clinical trial designs as a result of the veligrotug data; expectations and changes regarding the timing for regulatory filings; regulatory interactions expectations and changes regarding the timing for enrollment and data; uncertainty and potential delays related to clinical drug development; the duration and impact of regulatory delays in our clinical programs; the timing of and our ability to obtain and maintain regulatory approvals for our therapeutic candidates; manufacturing risks; competition from other therapies or products; other matters that could affect the sufficiency of existing cash, cash equivalents and short-term investments to fund operations; our future operating results and financial performance; and those risks set forth under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q for the quarter ended June 30, 2024, filed with the Securities and Exchange Commission (SEC) on August 8, 2024 and other subsequent disclosure documents filed with the SEC. The forward-looking statements in this presentation represent our views as of the date of this presentation. Neither we, nor our affiliates, advisors, or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

First-generation product establishes significant opportunity for next-generation strategy Identify market opportunities with clear remaining unmet need Determine key areas of potential product differentiation Engineer potential best-in-class antibodies and therapeutic proteins Rapidly advance programs to patients Viridian is building upon proven first market entrants to develop differentiated next-generation products that benefit patients

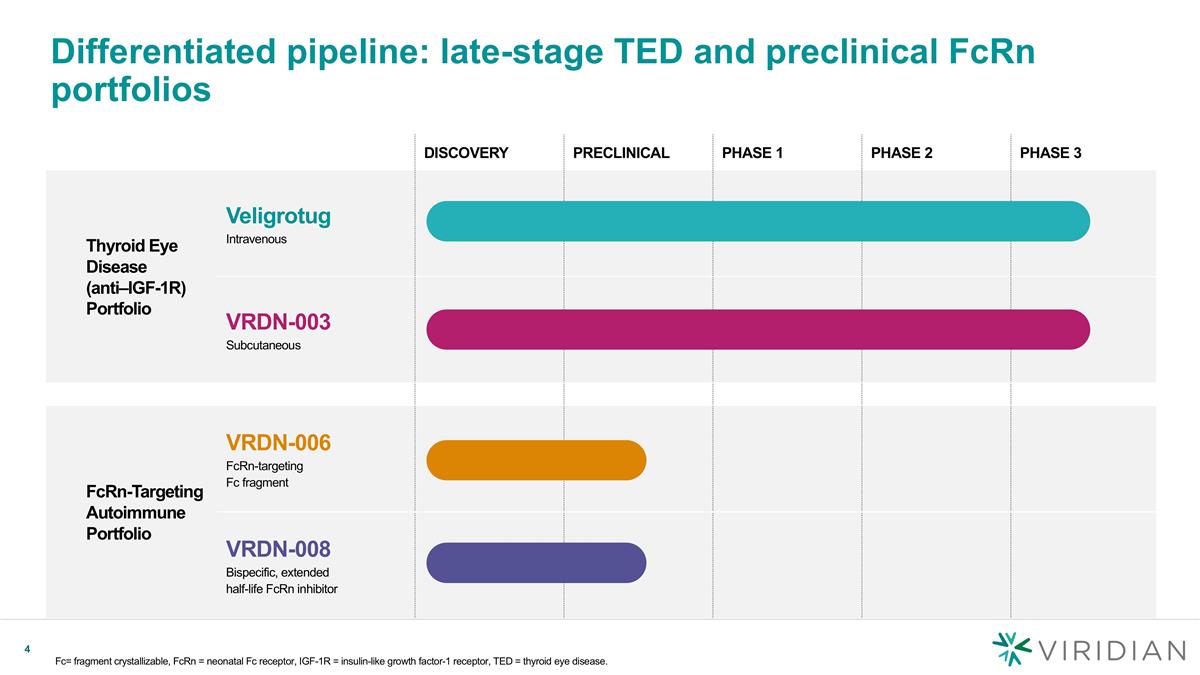

DISCOVERY PRECLINICAL PHASE 1 PHASE 2 PHASE 3 Thyroid Eye Disease (anti–IGF-1R) Portfolio Veligrotug Intravenous VRDN-003 Subcutaneous FcRn-Targeting Autoimmune Portfolio VRDN-006 FcRn-targeting Fc fragment VRDN-008 Bispecific, extended half-life FcRn inhibitor Differentiated pipeline: late-stage TED and preclinical FcRn portfolios Fc= fragment crystallizable, FcRn = neonatal Fc receptor, IGF-1R = insulin-like growth factor-1 receptor, TED = thyroid eye disease.

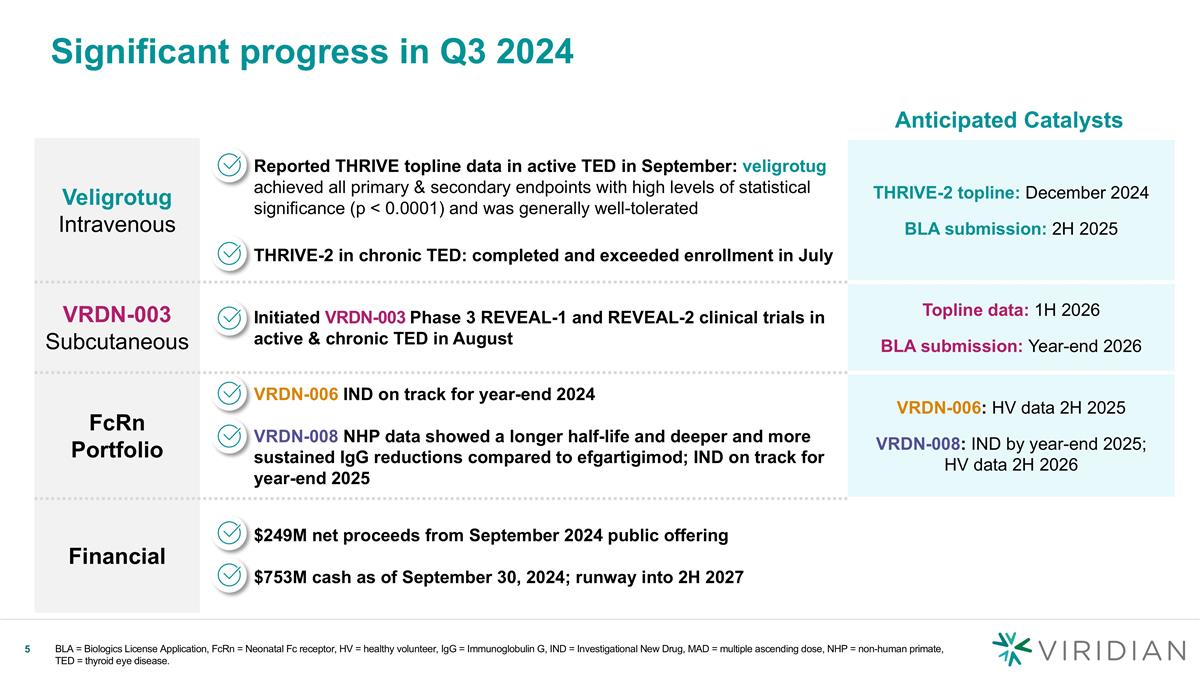

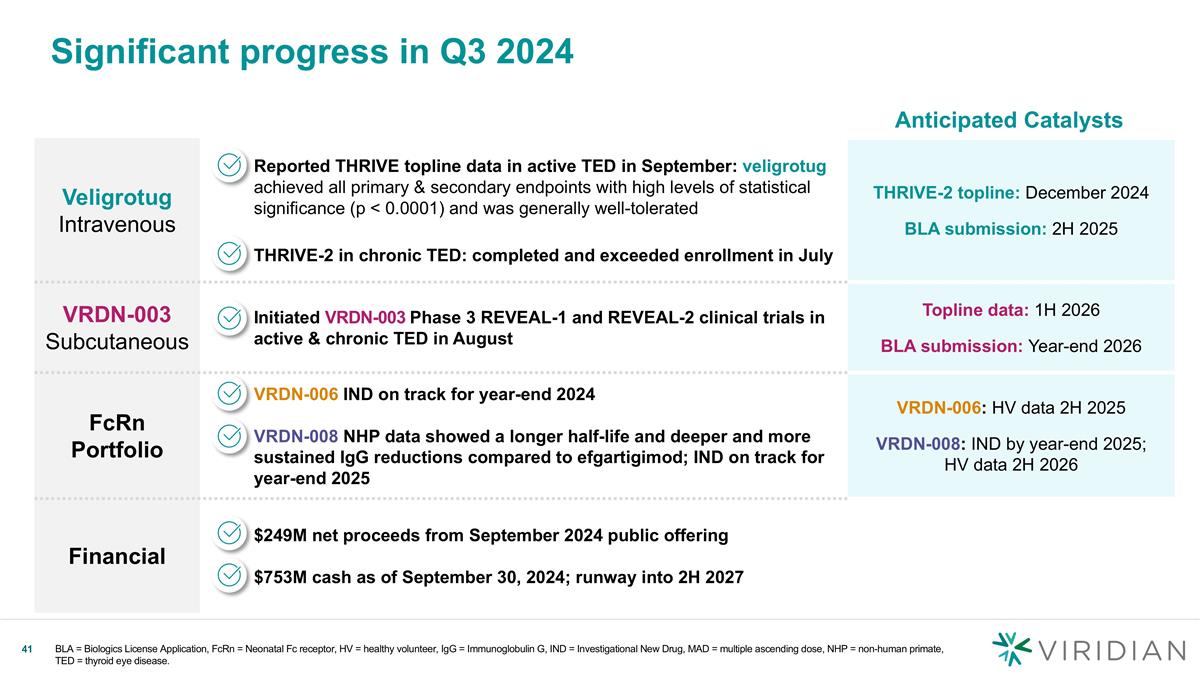

Significant progress in Q3 2024 Veligrotug Intravenous Reported THRIVE topline data in active TED in September: veligrotug achieved all primary & secondary endpoints with high levels of statistical significance (p < 0.0001) and was generally well-tolerated THRIVE-2 in chronic TED: completed and exceeded enrollment in July THRIVE-2 topline: December 2024 BLA submission: 2H 2025 VRDN-003 Subcutaneous Initiated VRDN-003 Phase 3 REVEAL-1 and REVEAL-2 clinical trials in active & chronic TED in August Topline data: 1H 2026 BLA submission: Year-end 2026 FcRn Portfolio VRDN-006 IND on track for year-end 2024 VRDN-008 NHP data showed a longer half-life and deeper and more sustained IgG reductions compared to efgartigimod; IND on track for year-end 2025 VRDN-006: HV data 2H 2025 VRDN-008: IND by year-end 2025; HV data 2H 2026 Financial $249M net proceeds from September 2024 public offering $753M cash as of September 30, 2024; runway into 2H 2027 Anticipated Catalysts BLA = Biologics License Application, FcRn = Neonatal Fc receptor, HV = healthy volunteer, IgG = Immunoglobulin G, IND = Investigational New Drug, MAD = multiple ascending dose, NHP = non-human primate, TED = thyroid eye disease.

Thyroid Eye Disease (TED) Portfolio

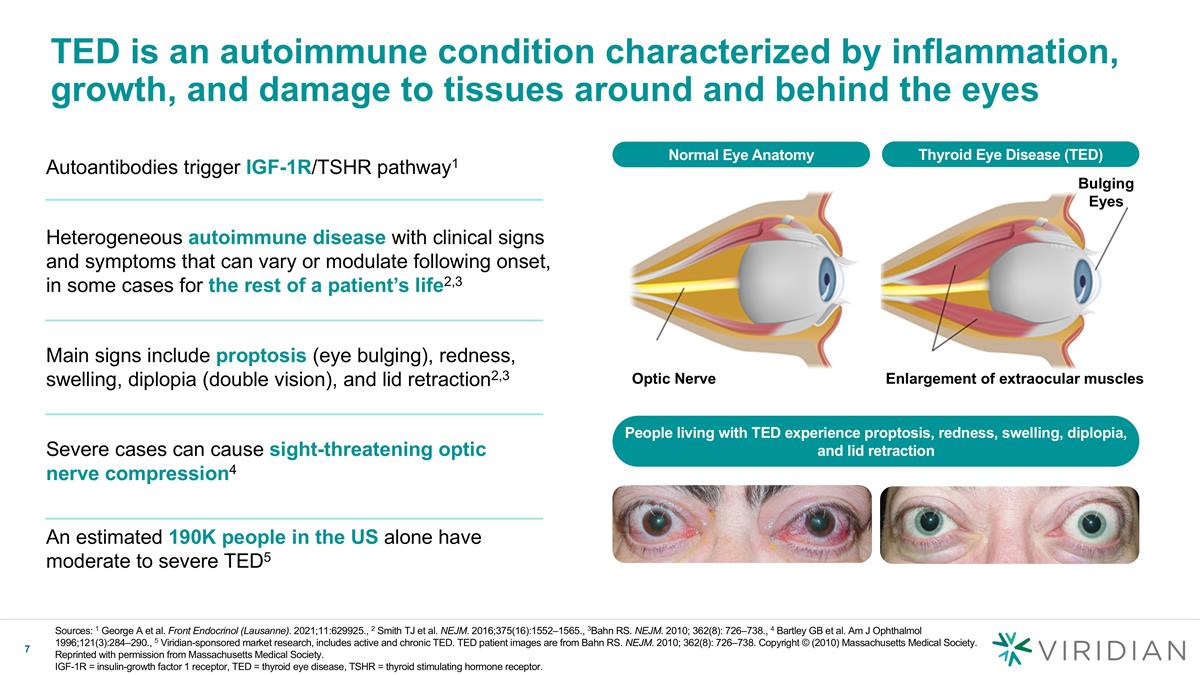

TED is an autoimmune condition characterized by inflammation, growth, and damage to tissues around and behind the eyes Normal Eye Anatomy Bulging Eyes Enlargement of extraocular muscles Optic Nerve Autoantibodies trigger IGF-1R/TSHR pathway1 Heterogeneous autoimmune disease with clinical signs and symptoms that can vary or modulate following onset, in some cases for the rest of a patient’s life2,3 Main signs include proptosis (eye bulging), redness, swelling, diplopia (double vision), and lid retraction2,3 Severe cases can cause sight-threatening optic nerve compression4 An estimated 190K people in the US alone have moderate to severe TED5 People living with TED experience proptosis, redness, swelling, diplopia, and lid retraction Thyroid Eye Disease (TED) Sources: 1 George A et al. Front Endocrinol (Lausanne). 2021;11:629925., 2 Smith TJ et al. NEJM. 2016;375(16):1552–1565., 3Bahn RS. NEJM. 2010; 362(8): 726–738., 4 Bartley GB et al. Am J Ophthalmol 1996;121(3):284–290., 5 Viridian-sponsored market research, includes active and chronic TED. TED patient images are from Bahn RS. NEJM. 2010; 362(8): 726–738. Copyright © (2010) Massachusetts Medical Society. Reprinted with permission from Massachusetts Medical Society. IGF-1R = insulin-growth factor 1 receptor, TED = thyroid eye disease, TSHR = thyroid stimulating hormone receptor.

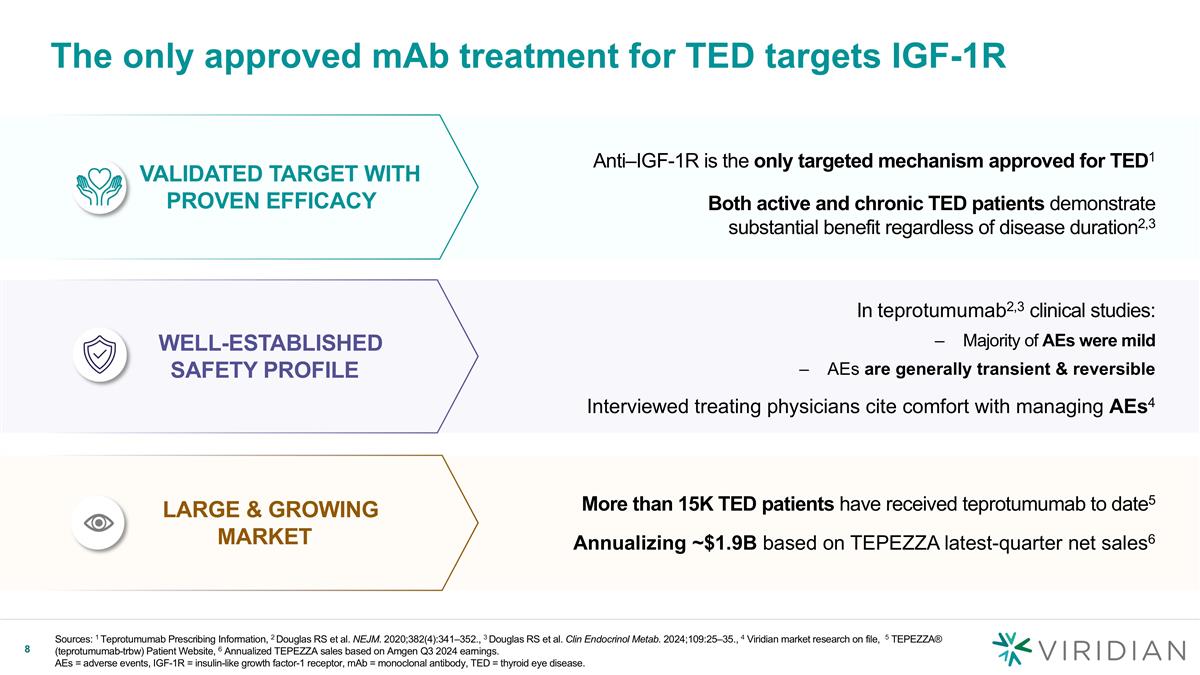

In teprotumumab2,3 clinical studies: Majority of AEs were mild AEs are generally transient & reversible Interviewed treating physicians cite comfort with managing AEs4 The only approved mAb treatment for TED targets IGF-1R Sources: 1 Teprotumumab Prescribing Information, 2 Douglas RS et al. NEJM. 2020;382(4):341–352., 3 Douglas RS et al. Clin Endocrinol Metab. 2024;109:25–35., 4 Viridian market research on file, 5 TEPEZZA® (teprotumumab-trbw) Patient Website, 6 Annualized TEPEZZA sales based on Amgen Q3 2024 earnings. AEs = adverse events, IGF-1R = insulin-like growth factor-1 receptor, mAb = monoclonal antibody, TED = thyroid eye disease. Anti–IGF-1R is the only targeted mechanism approved for TED1 Both active and chronic TED patients demonstrate substantial benefit regardless of disease duration2,3 Validated target with Proven Efficacy WELL-ESTABLISHED SAFETY PROFILE More than 15K TED patients have received teprotumumab to date5 Annualizing ~$1.9B based on TEPEZZA latest-quarter net sales6 LARGE & GROWING MARKET

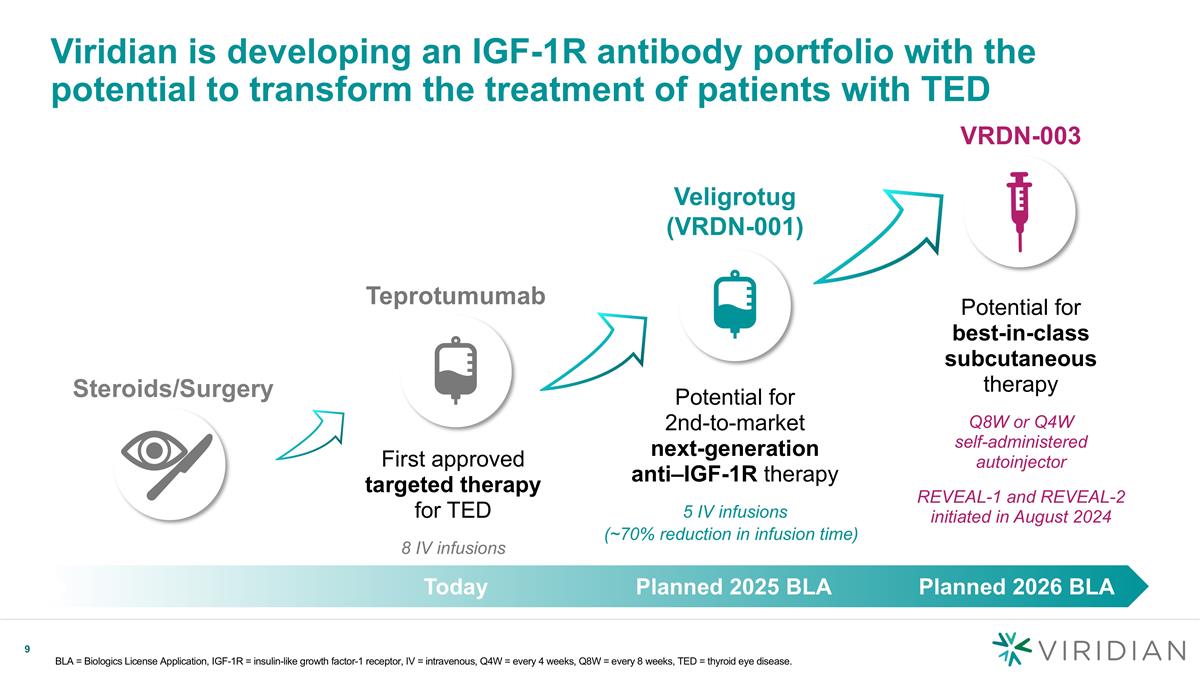

Viridian is developing an IGF-1R antibody portfolio with the potential to transform the treatment of patients with TED BLA = Biologics License Application, IGF-1R = insulin-like growth factor-1 receptor, IV = intravenous, Q4W = every 4 weeks, Q8W = every 8 weeks, TED = thyroid eye disease. Steroids/Surgery Veligrotug (VRDN-001) VRDN-003 Today Planned 2025 BLA Planned 2026 BLA Potential for 2nd-to-market next-generation anti–IGF-1R therapy 5 IV infusions Potential for best-in-class subcutaneous therapy Q8W or Q4W self-administered autoinjector REVEAL-1 and REVEAL-2 initiated in August 2024 First approved targeted therapy for TED 8 IV infusions Teprotumumab (~70% reduction in infusion time)

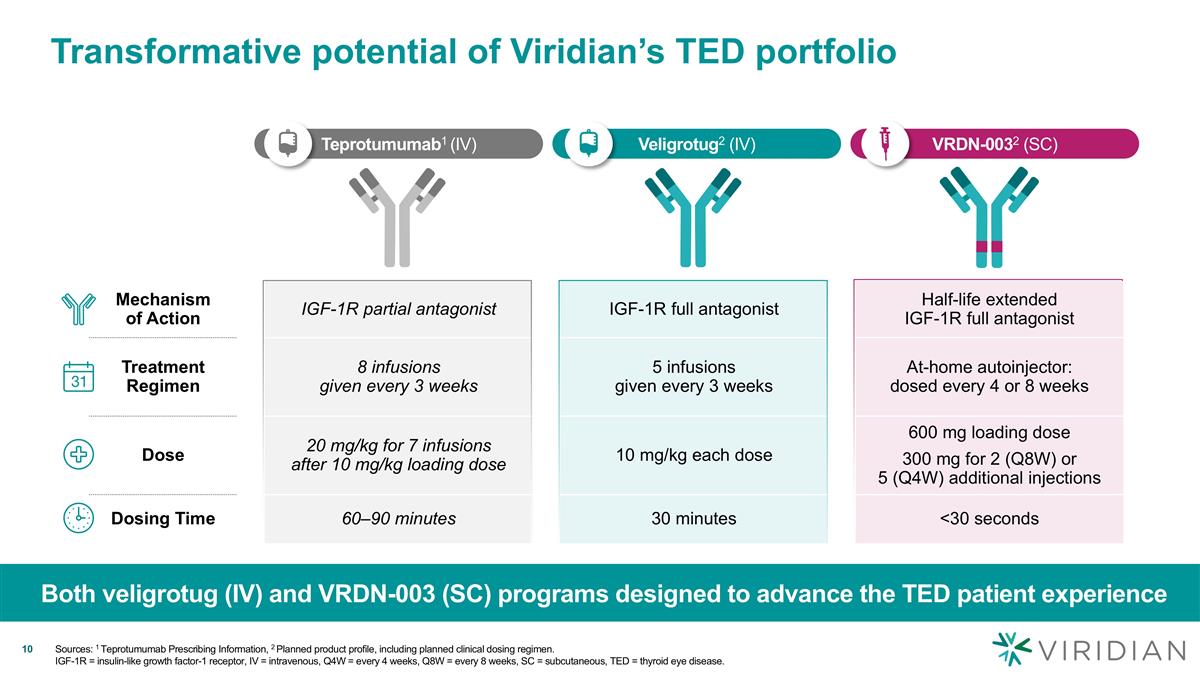

Veligrotug2 (IV) Teprotumumab1 (IV) VRDN-0032 (SC) Mechanism of Action IGF-1R partial antagonist IGF-1R full antagonist Half-life extended IGF-1R full antagonist Treatment Regimen 8 infusions given every 3 weeks 5 infusions given every 3 weeks At-home autoinjector: dosed every 4 or 8 weeks Dose 20 mg/kg for 7 infusions after 10 mg/kg loading dose 10 mg/kg each dose 600 mg loading dose 300 mg for 2 (Q8W) or 5 (Q4W) additional injections Dosing Time 60–90 minutes 30 minutes <30 seconds Transformative potential of Viridian’s TED portfolio Both veligrotug (IV) and VRDN-003 (SC) programs designed to advance the TED patient experience v v Sources: 1 Teprotumumab Prescribing Information, 2 Planned product profile, including planned clinical dosing regimen. IGF-1R = insulin-like growth factor-1 receptor, IV = intravenous, Q4W = every 4 weeks, Q8W = every 8 weeks, SC = subcutaneous, TED = thyroid eye disease.

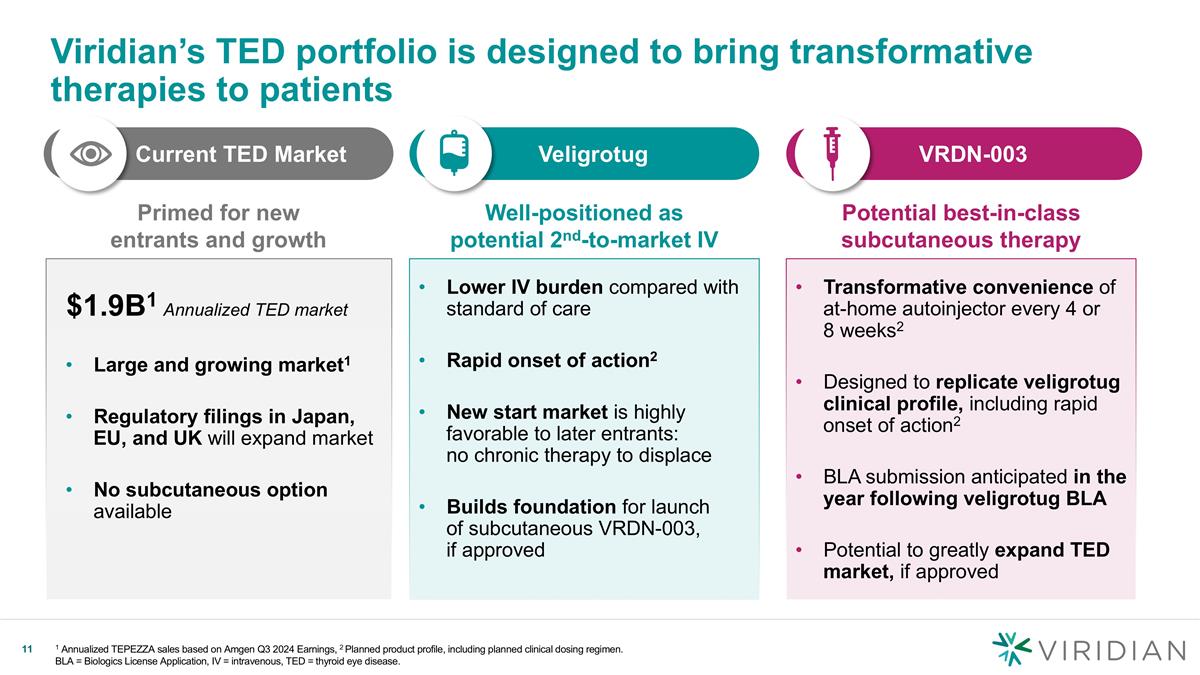

Current TED Market Transformative convenience of at-home autoinjector every 4 or 8 weeks2 Designed to replicate veligrotug clinical profile, including rapid onset of action2 BLA submission anticipated in the year following veligrotug BLA Potential to greatly expand TED market, if approved Lower IV burden compared with standard of care Rapid onset of action2 New start market is highly favorable to later entrants: no chronic therapy to displace Builds foundation for launch of subcutaneous VRDN-003, if approved Viridian’s TED portfolio is designed to bring transformative therapies to patients 1 Annualized TEPEZZA sales based on Amgen Q3 2024 Earnings, 2 Planned product profile, including planned clinical dosing regimen. BLA = Biologics License Application, IV = intravenous, TED = thyroid eye disease. VRDN-003 Veligrotug v Primed for new entrants and growth Large and growing market1 Regulatory filings in Japan, EU, and UK will expand market No subcutaneous option available Well-positioned as potential 2nd-to-market IV Potential best-in-class subcutaneous therapy $1.9B1 Annualized TED market

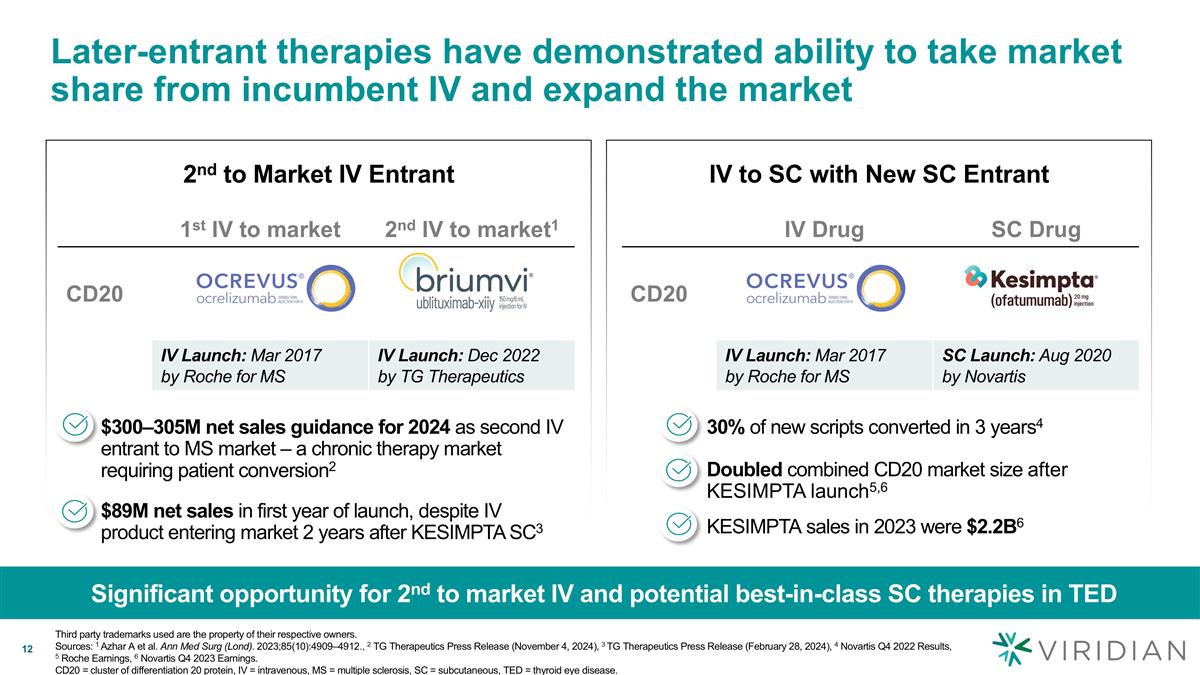

Later-entrant therapies have demonstrated ability to take market share from incumbent IV and expand the market Significant opportunity for 2nd to market IV and potential best-in-class SC therapies in TED Third party trademarks used are the property of their respective owners. Sources: 1 Azhar A et al. Ann Med Surg (Lond). 2023;85(10):4909–4912., 2 TG Therapeutics Press Release (November 4, 2024), 3 TG Therapeutics Press Release (February 28, 2024), 4 Novartis Q4 2022 Results, 5 Roche Earnings, 6 Novartis Q4 2023 Earnings. CD20 = cluster of differentiation 20 protein, IV = intravenous, MS = multiple sclerosis, SC = subcutaneous, TED = thyroid eye disease. IV to SC with New SC Entrant 2nd to Market IV Entrant 30% of new scripts converted in 3 years4 IV Drug SC Drug CD20 IV Launch: Mar 2017 by Roche for MS SC Launch: Aug 2020 by Novartis Doubled combined CD20 market size after KESIMPTA launch5,6 1st IV to market 2nd IV to market1 CD20 IV Launch: Mar 2017 by Roche for MS IV Launch: Dec 2022 by TG Therapeutics $300–305M net sales guidance for 2024 as second IV entrant to MS market – a chronic therapy market requiring patient conversion2 $89M net sales in first year of launch, despite IV product entering market 2 years after KESIMPTA SC3 KESIMPTA sales in 2023 were $2.2B6

Veligrotug Intravenous anti–IGF-1R

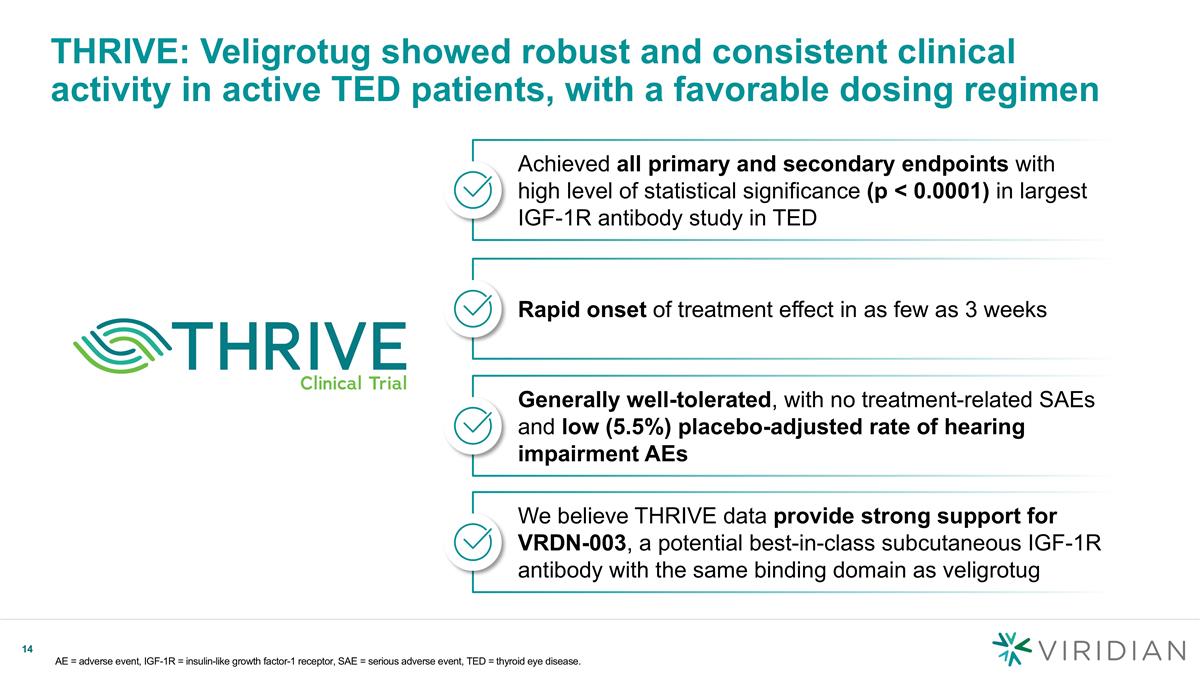

THRIVE: Veligrotug showed robust and consistent clinical activity in active TED patients, with a favorable dosing regimen AE = adverse event, IGF-1R = insulin-like growth factor-1 receptor, SAE = serious adverse event, TED = thyroid eye disease. Achieved all primary and secondary endpoints with high level of statistical significance (p < 0.0001) in largest IGF-1R antibody study in TED Rapid onset of treatment effect in as few as 3 weeks Generally well-tolerated, with no treatment-related SAEs and low (5.5%) placebo-adjusted rate of hearing impairment AEs We believe THRIVE data provide strong support for VRDN-003, a potential best-in-class subcutaneous IGF-1R antibody with the same binding domain as veligrotug

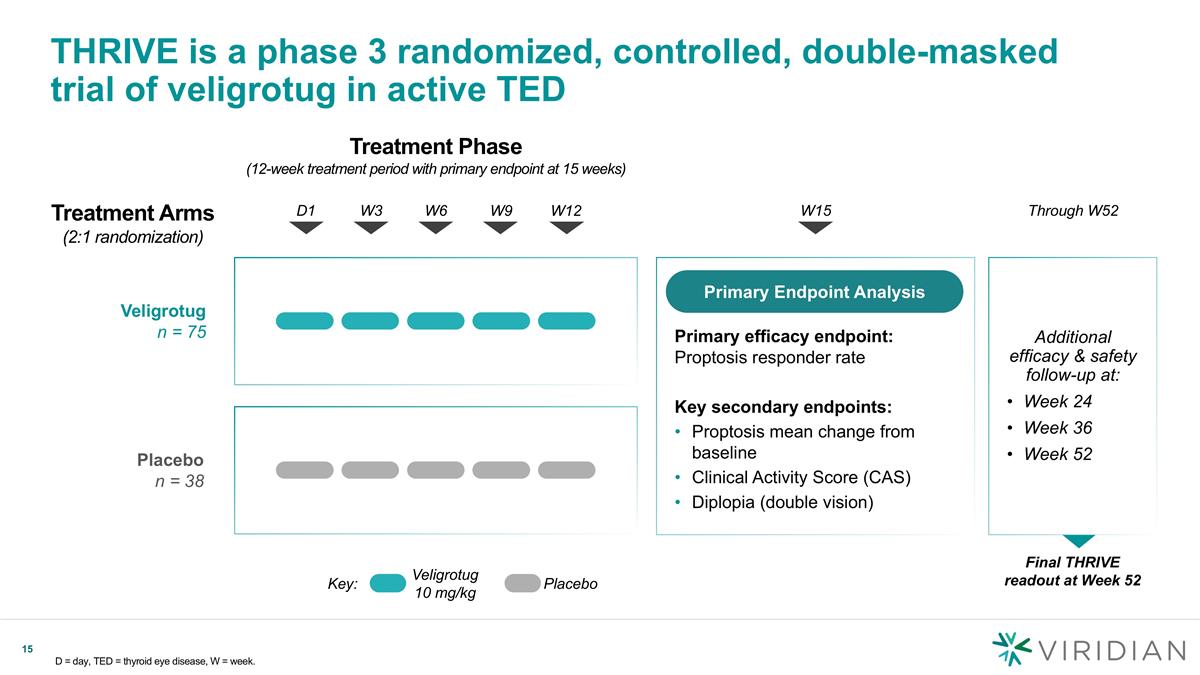

Treatment Phase (12-week treatment period with primary endpoint at 15 weeks) Veligrotug n = 75 THRIVE is a phase 3 randomized, controlled, double-masked trial of veligrotug in active TED D = day, TED = thyroid eye disease, W = week. D1 W3 W6 W9 W12 Placebo n = 38 Key: Veligrotug 10 mg/kg Placebo W15 Treatment Arms (2:1 randomization) Through W52 Additional efficacy & safety follow-up at: Week 24 Week 36 Week 52 Primary efficacy endpoint: Proptosis responder rate Key secondary endpoints: Proptosis mean change from baseline Clinical Activity Score (CAS) Diplopia (double vision) Primary Endpoint Analysis Final THRIVE readout at Week 52

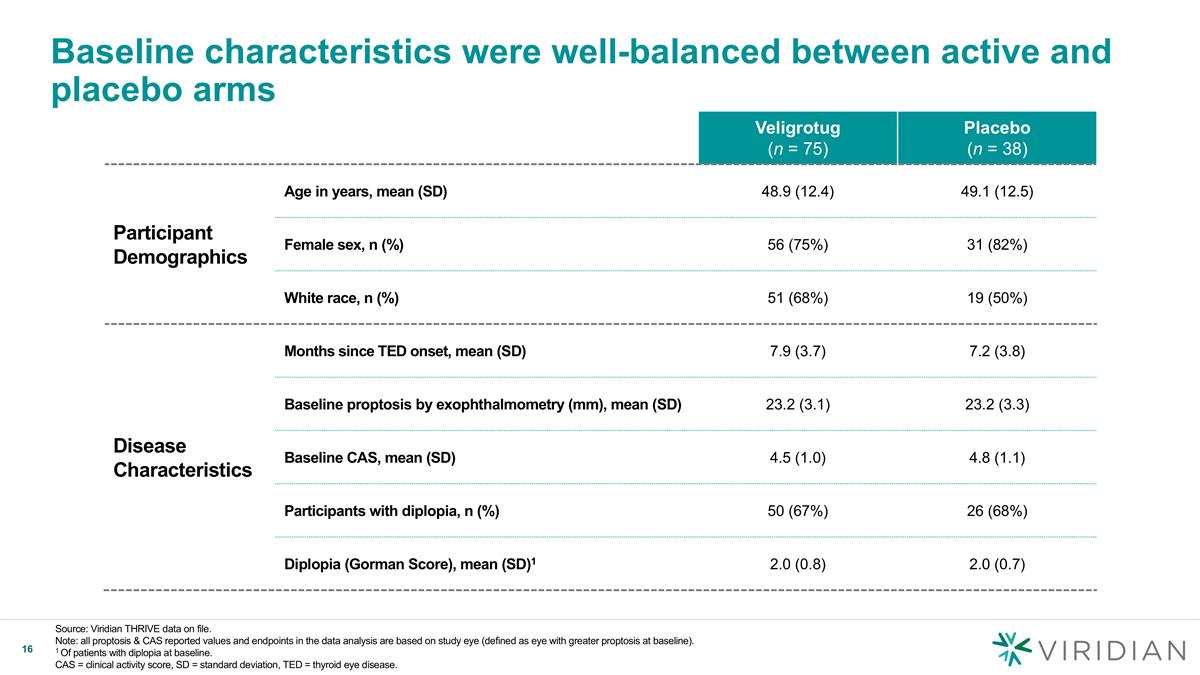

Baseline characteristics were well-balanced between active and placebo arms Veligrotug (n = 75) Placebo (n = 38) Participant Demographics Age in years, mean (SD) 48.9 (12.4) 49.1 (12.5) Female sex, n (%) 56 (75%) 31 (82%) White race, n (%) 51 (68%) 19 (50%) Disease Characteristics Months since TED onset, mean (SD) 7.9 (3.7) 7.2 (3.8) Baseline proptosis by exophthalmometry (mm), mean (SD) 23.2 (3.1) 23.2 (3.3) Baseline CAS, mean (SD) 4.5 (1.0) 4.8 (1.1) Participants with diplopia, n (%) 50 (67%) 26 (68%) Diplopia (Gorman Score), mean (SD)1 2.0 (0.8) 2.0 (0.7) Source: Viridian THRIVE data on file. Note: all proptosis & CAS reported values and endpoints in the data analysis are based on study eye (defined as eye with greater proptosis at baseline). 1 Of patients with diplopia at baseline. CAS = clinical activity score, SD = standard deviation, TED = thyroid eye disease.

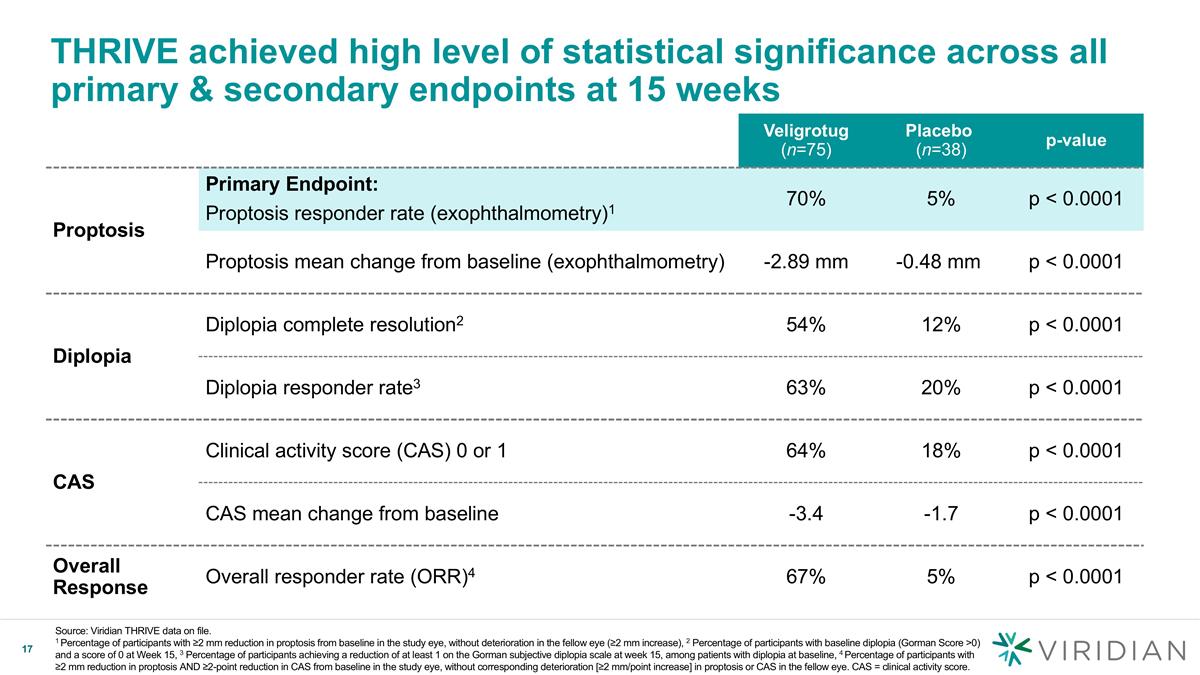

THRIVE achieved high level of statistical significance across all primary & secondary endpoints at 15 weeks Source: Viridian THRIVE data on file. 1 Percentage of participants with ≥2 mm reduction in proptosis from baseline in the study eye, without deterioration in the fellow eye (≥2 mm increase), 2 Percentage of participants with baseline diplopia (Gorman Score >0) and a score of 0 at Week 15, 3 Percentage of participants achieving a reduction of at least 1 on the Gorman subjective diplopia scale at week 15, among patients with diplopia at baseline, 4 Percentage of participants with ≥2 mm reduction in proptosis AND ≥2-point reduction in CAS from baseline in the study eye, without corresponding deterioration [≥2 mm/point increase] in proptosis or CAS in the fellow eye. CAS = clinical activity score. Veligrotug (n=75) Placebo (n=38) p-value Proptosis Primary Endpoint: Proptosis responder rate (exophthalmometry)1 70% 5% p < 0.0001 Proptosis mean change from baseline (exophthalmometry) -2.89 mm -0.48 mm p < 0.0001 Diplopia Diplopia complete resolution2 54% 12% p < 0.0001 Diplopia responder rate3 63% 20% p < 0.0001 CAS Clinical activity score (CAS) 0 or 1 64% 18% p < 0.0001 CAS mean change from baseline -3.4 -1.7 p < 0.0001 Overall Response Overall responder rate (ORR)4 67% 5% p < 0.0001

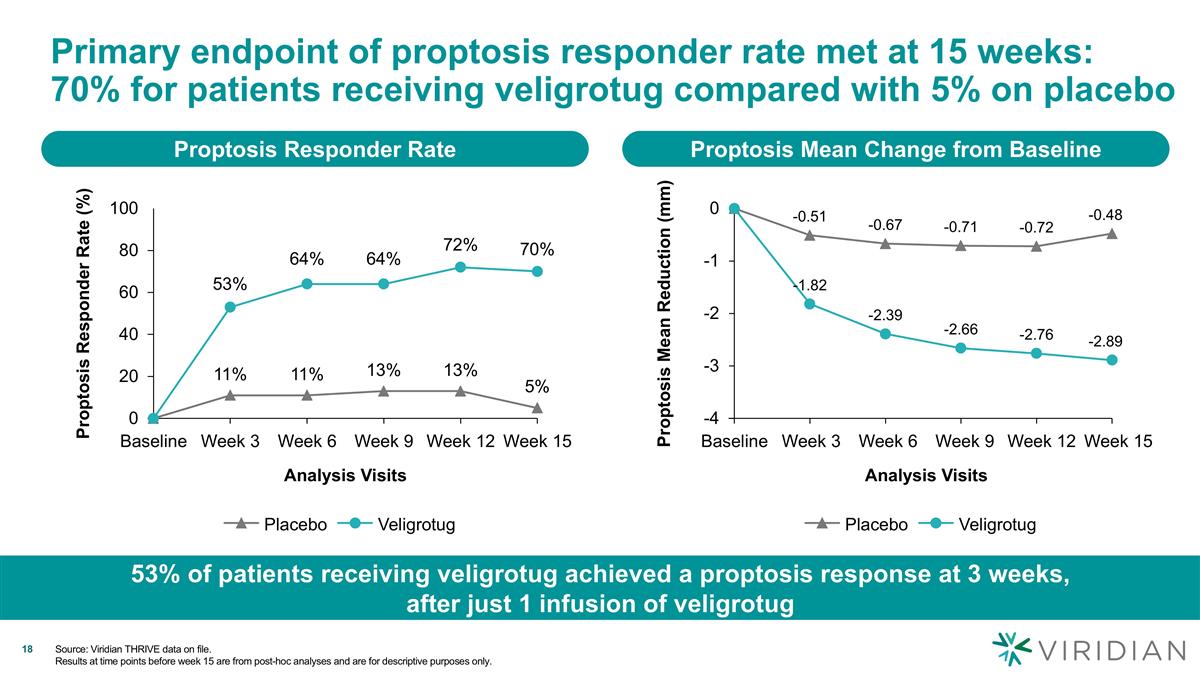

Primary endpoint of proptosis responder rate met at 15 weeks: 70% for patients receiving veligrotug compared with 5% on placebo Proptosis Responder Rate Analysis Visits Proptosis Responder Rate (%) 53% 64% 64% 72% 70% Veligrotug Proptosis Mean Change from Baseline Analysis Visits Proptosis Mean Reduction (mm) Veligrotug 53% of patients receiving veligrotug achieved a proptosis response at 3 weeks, after just 1 infusion of veligrotug Source: Viridian THRIVE data on file. Results at time points before week 15 are from post-hoc analyses and are for descriptive purposes only.

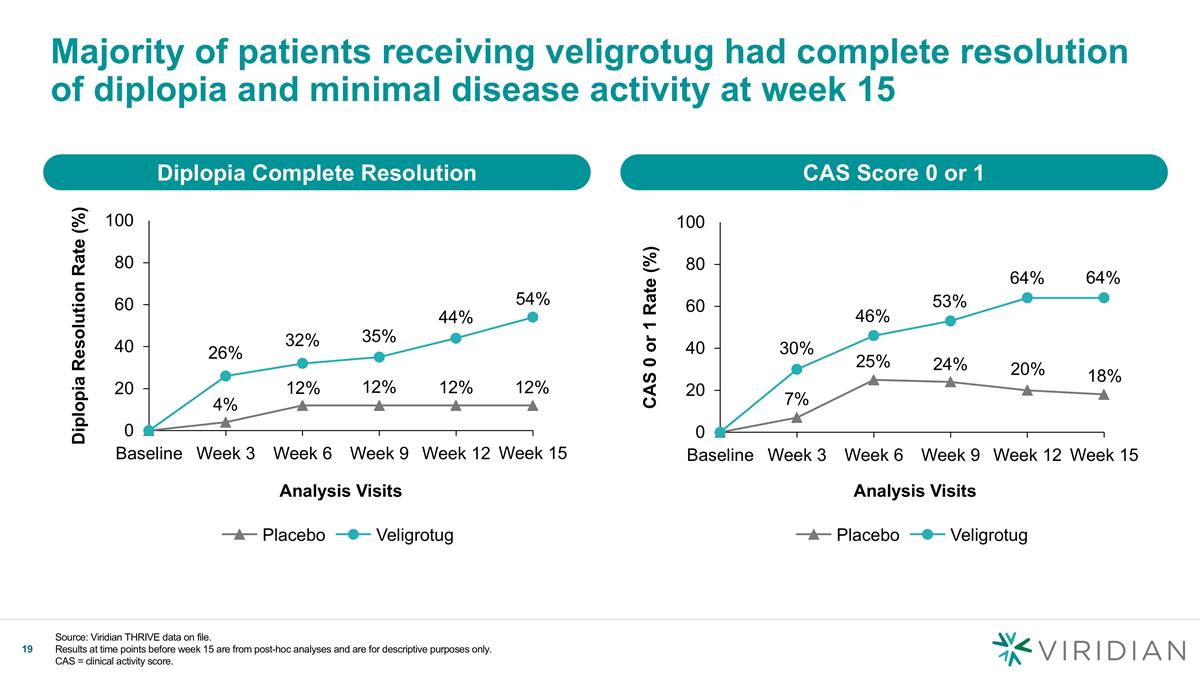

Majority of patients receiving veligrotug had complete resolution of diplopia and minimal disease activity at week 15 Diplopia Complete Resolution Analysis Visits Diplopia Resolution Rate (%) 26% 32% 54% Veligrotug CAS Score 0 or 1 CAS 0 or 1 Rate (%) 7% 25% 46% 24% 20% 64% 18% 64% Analysis Visits Veligrotug Source: Viridian THRIVE data on file. Results at time points before week 15 are from post-hoc analyses and are for descriptive purposes only. CAS = clinical activity score.

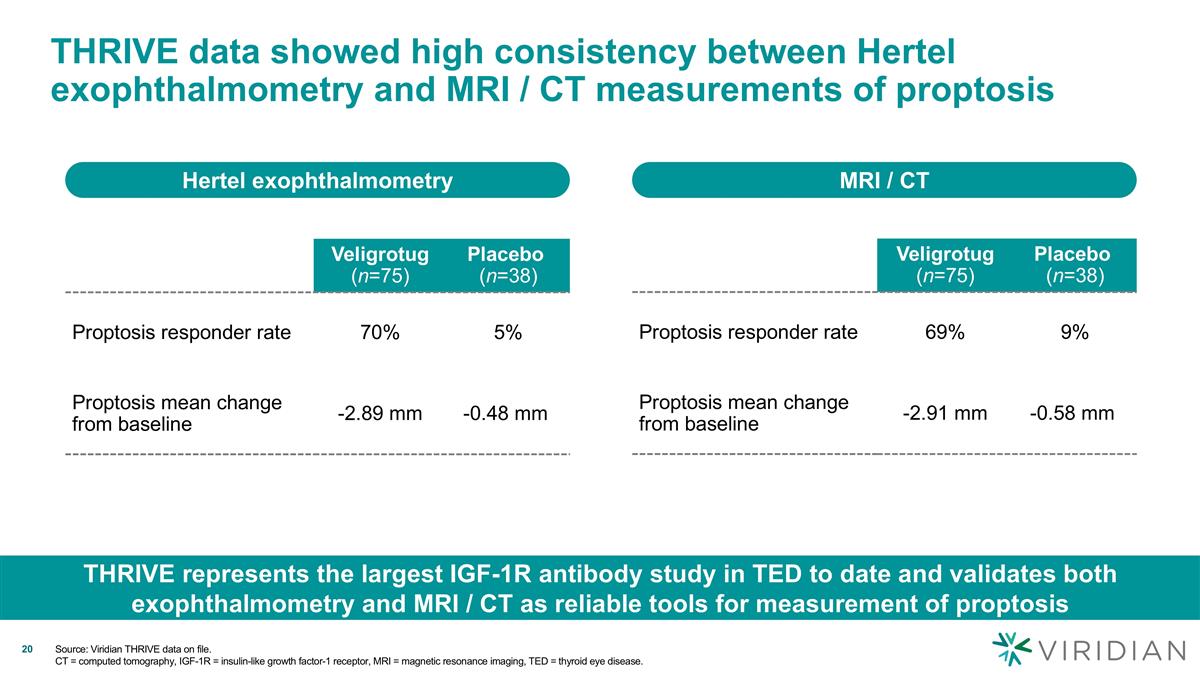

THRIVE data showed high consistency between Hertel exophthalmometry and MRI / CT measurements of proptosis Hertel exophthalmometry MRI / CT THRIVE represents the largest IGF-1R antibody study in TED to date and validates both exophthalmometry and MRI / CT as reliable tools for measurement of proptosis Veligrotug (n=75) Placebo (n=38) Proptosis responder rate 70% 5% Proptosis mean change from baseline -2.89 mm -0.48 mm Veligrotug (n=75) Placebo (n=38) Proptosis responder rate 69% 9% Proptosis mean change from baseline -2.91 mm -0.58 mm Source: Viridian THRIVE data on file. CT = computed tomography, IGF-1R = insulin-like growth factor-1 receptor, MRI = magnetic resonance imaging, TED = thyroid eye disease.

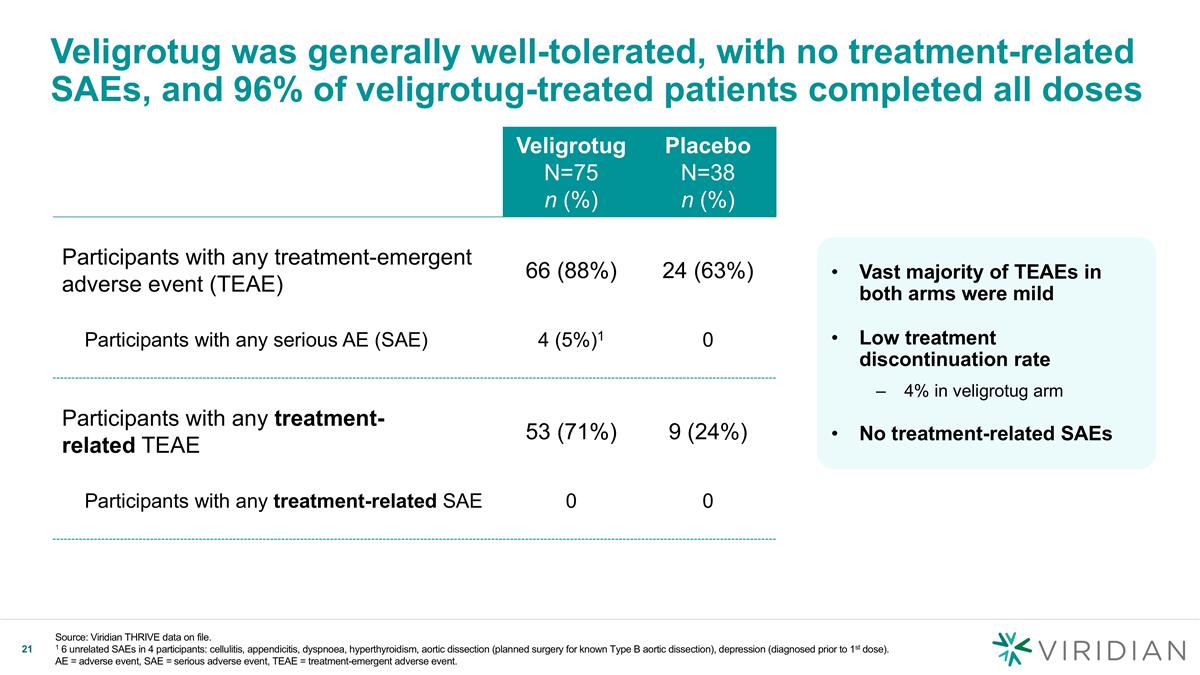

Veligrotug was generally well-tolerated, with no treatment-related SAEs, and 96% of veligrotug-treated patients completed all doses Veligrotug N=75 n (%) Placebo N=38 n (%) Participants with any treatment-emergent adverse event (TEAE) 66 (88%) 24 (63%) Participants with any serious AE (SAE) 4 (5%)1 0 Participants with any treatment- related TEAE 53 (71%) 9 (24%) Participants with any treatment-related SAE 0 0 Vast majority of TEAEs in both arms were mild Low treatment discontinuation rate 4% in veligrotug arm No treatment-related SAEs Source: Viridian THRIVE data on file. 1 6 unrelated SAEs in 4 participants: cellulitis, appendicitis, dyspnoea, hyperthyroidism, aortic dissection (planned surgery for known Type B aortic dissection), depression (diagnosed prior to 1st dose). AE = adverse event, SAE = serious adverse event, TEAE = treatment-emergent adverse event.

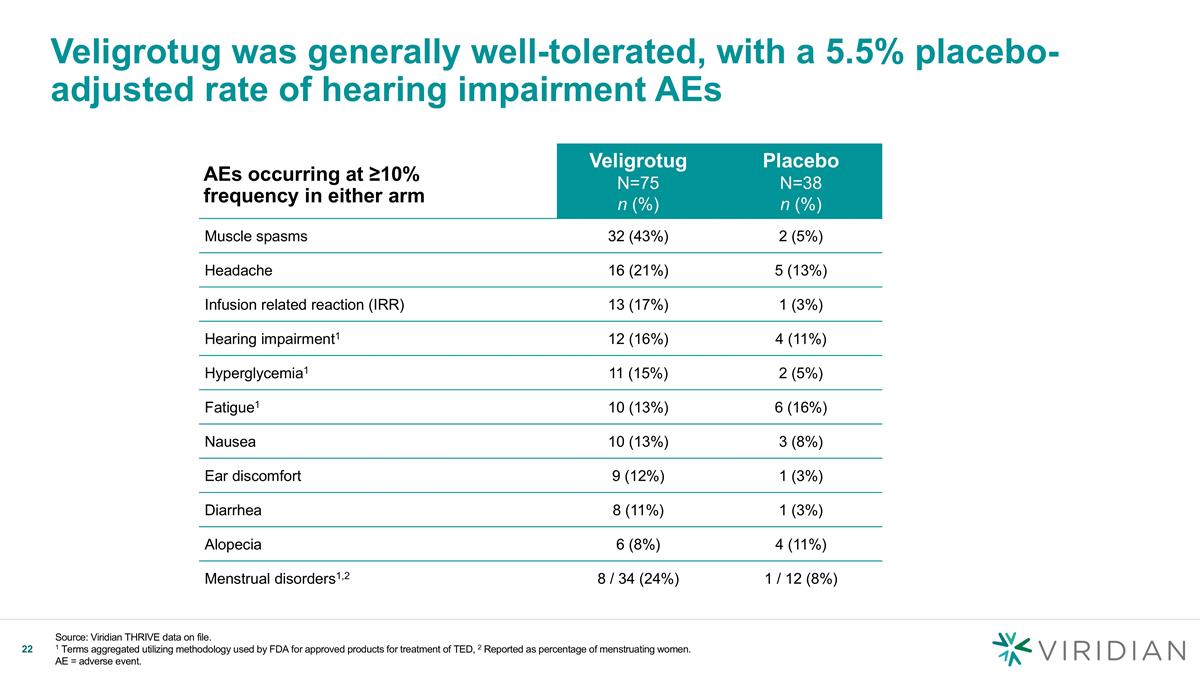

Veligrotug was generally well-tolerated, with a 5.5% placebo-adjusted rate of hearing impairment AEs Source: Viridian THRIVE data on file. 1 Terms aggregated utilizing methodology used by FDA for approved products for treatment of TED, 2 Reported as percentage of menstruating women. AE = adverse event. Veligrotug N=75 n (%) Placebo N=38 n (%) Muscle spasms 32 (43%) 2 (5%) Headache 16 (21%) 5 (13%) Infusion related reaction (IRR) 13 (17%) 1 (3%) Hearing impairment1 12 (16%) 4 (11%) Hyperglycemia1 11 (15%) 2 (5%) Fatigue1 10 (13%) 6 (16%) Nausea 10 (13%) 3 (8%) Ear discomfort 9 (12%) 1 (3%) Diarrhea 8 (11%) 1 (3%) Alopecia 6 (8%) 4 (11%) Menstrual disorders1,2 8 / 34 (24%) 1 / 12 (8%) AEs occurring at ≥10% frequency in either arm

CAS = clinical activity score, TED = thyroid eye disease. Enrollment completed in July; actual enrollment of 188 patients exceeded target by nearly 20% Key Inclusion Criteria Proptosis of ≥3 mm Any CAS (0–7) Onset of TED symptoms >15 months Trial Design N = approx.159 (actual enrollment: 188 patients) 2:1 randomization veligrotug:placebo arm Primary endpoint: proptosis responder rate 15-week primary efficacy analysis with 52-week total follow-up Double-masked, randomized, placebo-controlled THRIVE-2, the largest randomized, controlled study in chronic TED, is on track for topline data readout December 2024 CHRONIC TED

VRDN-003 Subcutaneous half-life extended anti–IGF-1R

Viridian believes veligrotug experience strongly supports REVEAL pivotal program for subcutaneous VRDN-003 dosed Q4W and Q8W Veligrotug (IV) VRDN-003 (SC) Shared pharmacology: Veligrotug & VRDN-003 have the same binding domain VRDN-003 has the potential to have a best-in-class profile Source: Viridian data on file. IV = intravenous, Q4W = every 4 weeks, Q8W = every 8 weeks, SC = subcutaneous.

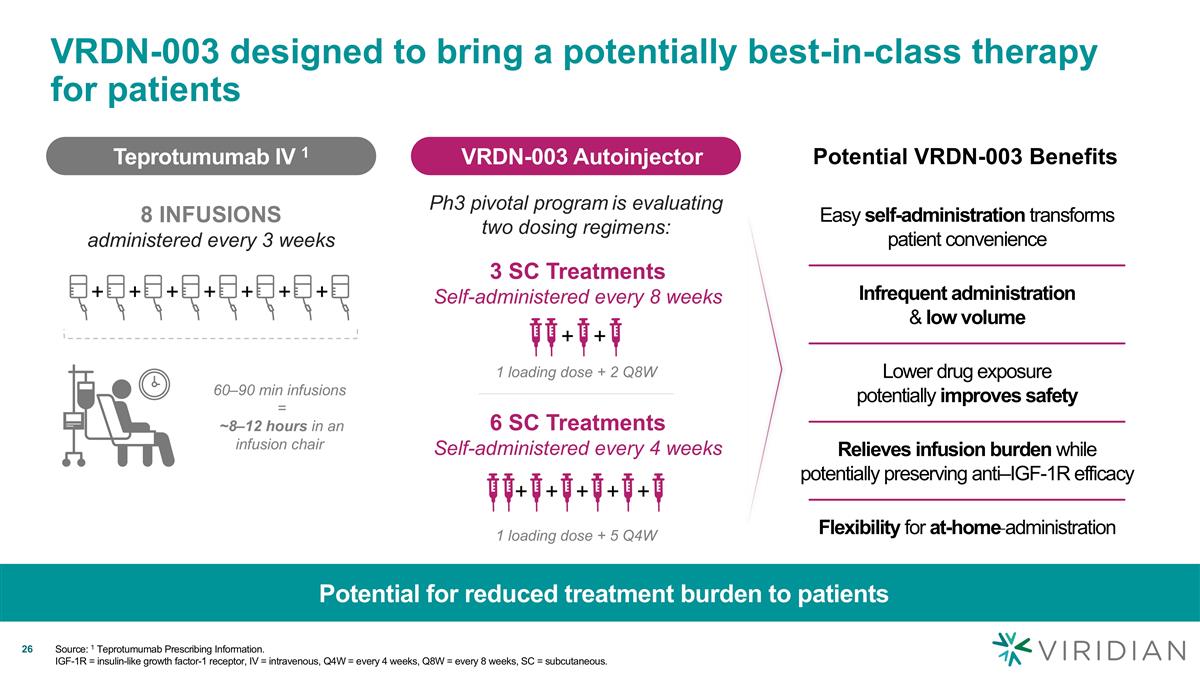

VRDN-003 designed to bring a potentially best-in-class therapy for patients Potential for reduced treatment burden to patients Source: 1 Teprotumumab Prescribing Information. IGF-1R = insulin-like growth factor-1 receptor, IV = intravenous, Q4W = every 4 weeks, Q8W = every 8 weeks, SC = subcutaneous. 6 SC Treatments Self-administered every 4 weeks + + + + + 1 loading dose + 5 Q4W 3 SC Treatments Self-administered every 8 weeks + + 1 loading dose + 2 Q8W Easy self-administration transforms patient convenience Infrequent administration & low volume Flexibility for at-home administration Relieves infusion burden while potentially preserving anti–IGF-1R efficacy Lower drug exposure potentially improves safety Teprotumumab IV 1 8 INFUSIONS administered every 3 weeks VRDN-003 Autoinjector Ph3 pivotal program is evaluating two dosing regimens: 60–90 min infusions = ~8–12 hours in an infusion chair + + + + + + + Potential VRDN-003 Benefits

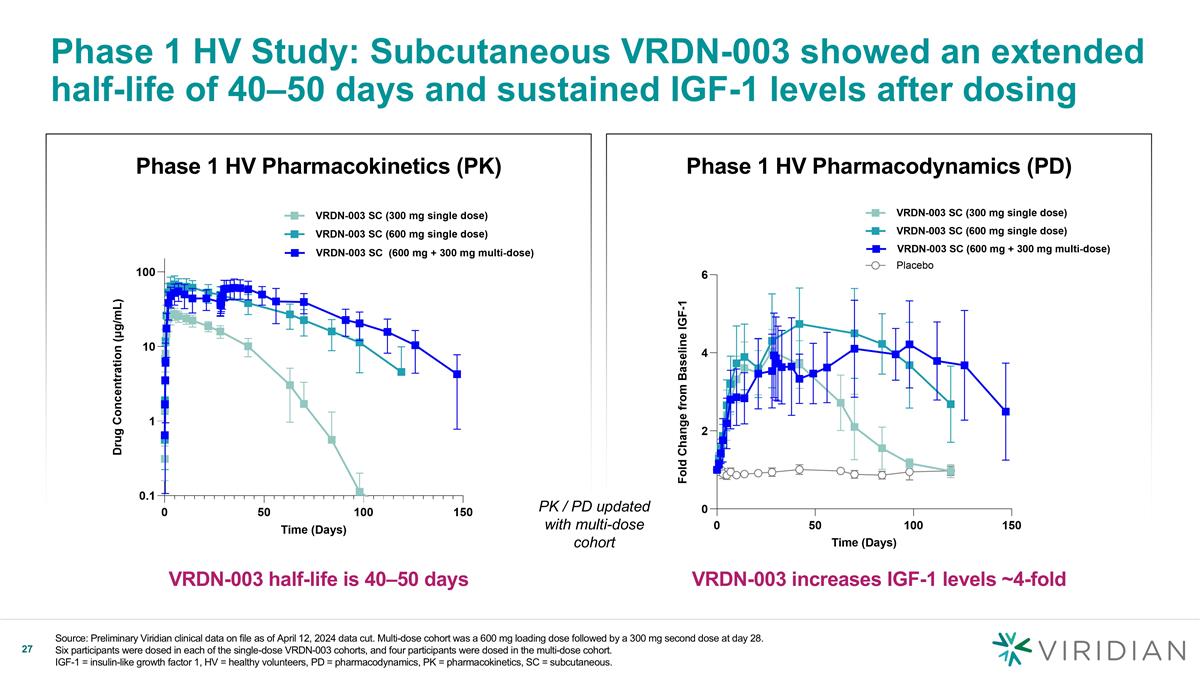

Phase 1 HV Pharmacodynamics (PD) Phase 1 HV Pharmacokinetics (PK) Phase 1 HV Study: Subcutaneous VRDN-003 showed an extended half-life of 40–50 days and sustained IGF-1 levels after dosing Source: Preliminary Viridian clinical data on file as of April 12, 2024 data cut. Multi-dose cohort was a 600 mg loading dose followed by a 300 mg second dose at day 28. Six participants were dosed in each of the single-dose VRDN-003 cohorts, and four participants were dosed in the multi-dose cohort. IGF-1 = insulin-like growth factor 1, HV = healthy volunteers, PD = pharmacodynamics, PK = pharmacokinetics, SC = subcutaneous. VRDN-003 half-life is 40–50 days VRDN-003 increases IGF-1 levels ~4-fold PK / PD updated with multi-dose cohort

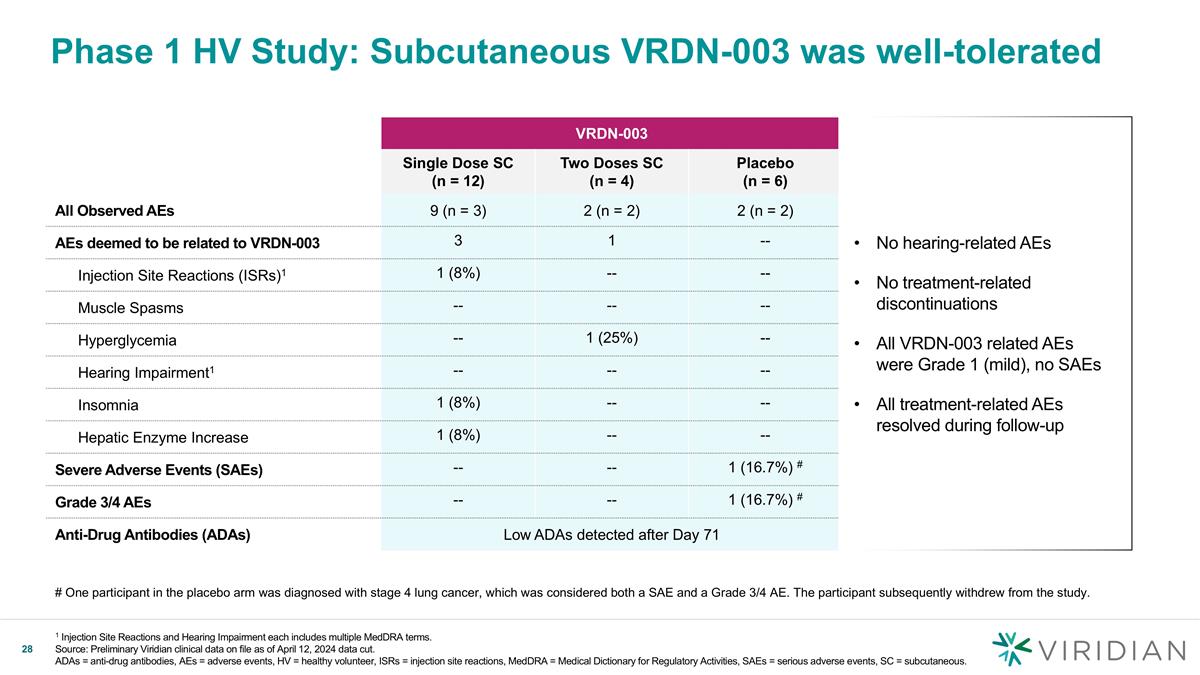

VRDN-003 Single Dose SC (n = 12) Two Doses SC (n = 4) Placebo (n = 6) All Observed AEs 9 (n = 3) 2 (n = 2) 2 (n = 2) AEs deemed to be related to VRDN-003 3 1 -- Injection Site Reactions (ISRs)1 1 (8%) -- -- Muscle Spasms -- -- -- Hyperglycemia -- 1 (25%) -- Hearing Impairment1 -- -- -- Insomnia 1 (8%) -- -- Hepatic Enzyme Increase 1 (8%) -- -- Severe Adverse Events (SAEs) -- -- 1 (16.7%) # Grade 3/4 AEs -- -- 1 (16.7%) # Anti-Drug Antibodies (ADAs) Low ADAs detected after Day 71 Phase 1 HV Study: Subcutaneous VRDN-003 was well-tolerated No hearing-related AEs No treatment-related discontinuations All VRDN-003 related AEs were Grade 1 (mild), no SAEs All treatment-related AEs resolved during follow-up # One participant in the placebo arm was diagnosed with stage 4 lung cancer, which was considered both a SAE and a Grade 3/4 AE. The participant subsequently withdrew from the study. 1 Injection Site Reactions and Hearing Impairment each includes multiple MedDRA terms. Source: Preliminary Viridian clinical data on file as of April 12, 2024 data cut. ADAs = anti-drug antibodies, AEs = adverse events, HV = healthy volunteer, ISRs = injection site reactions, MedDRA = Medical Dictionary for Regulatory Activities, SAEs = serious adverse events, SC = subcutaneous.

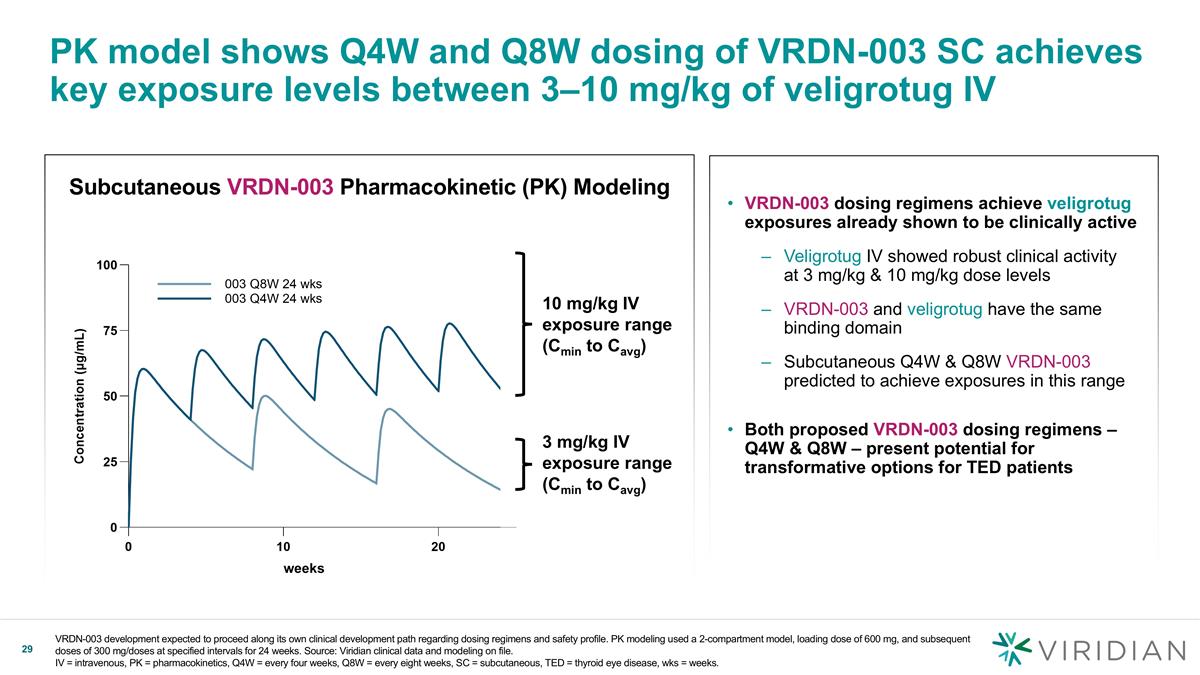

Subcutaneous VRDN-003 Pharmacokinetic (PK) Modeling PK model shows Q4W and Q8W dosing of VRDN-003 SC achieves key exposure levels between 3–10 mg/kg of veligrotug IV VRDN-003 dosing regimens achieve veligrotug exposures already shown to be clinically active Veligrotug IV showed robust clinical activity at 3 mg/kg & 10 mg/kg dose levels VRDN-003 and veligrotug have the same binding domain Subcutaneous Q4W & Q8W VRDN-003 predicted to achieve exposures in this range Both proposed VRDN-003 dosing regimens – Q4W & Q8W – present potential for transformative options for TED patients 3 mg/kg IV exposure range (Cmin to Cavg) 10 mg/kg IV exposure range (Cmin to Cavg) weeks VRDN-003 development expected to proceed along its own clinical development path regarding dosing regimens and safety profile. PK modeling used a 2-compartment model, loading dose of 600 mg, and subsequent doses of 300 mg/doses at specified intervals for 24 weeks. Source: Viridian clinical data and modeling on file. IV = intravenous, PK = pharmacokinetics, Q4W = every four weeks, Q8W = every eight weeks, SC = subcutaneous, TED = thyroid eye disease, wks = weeks.

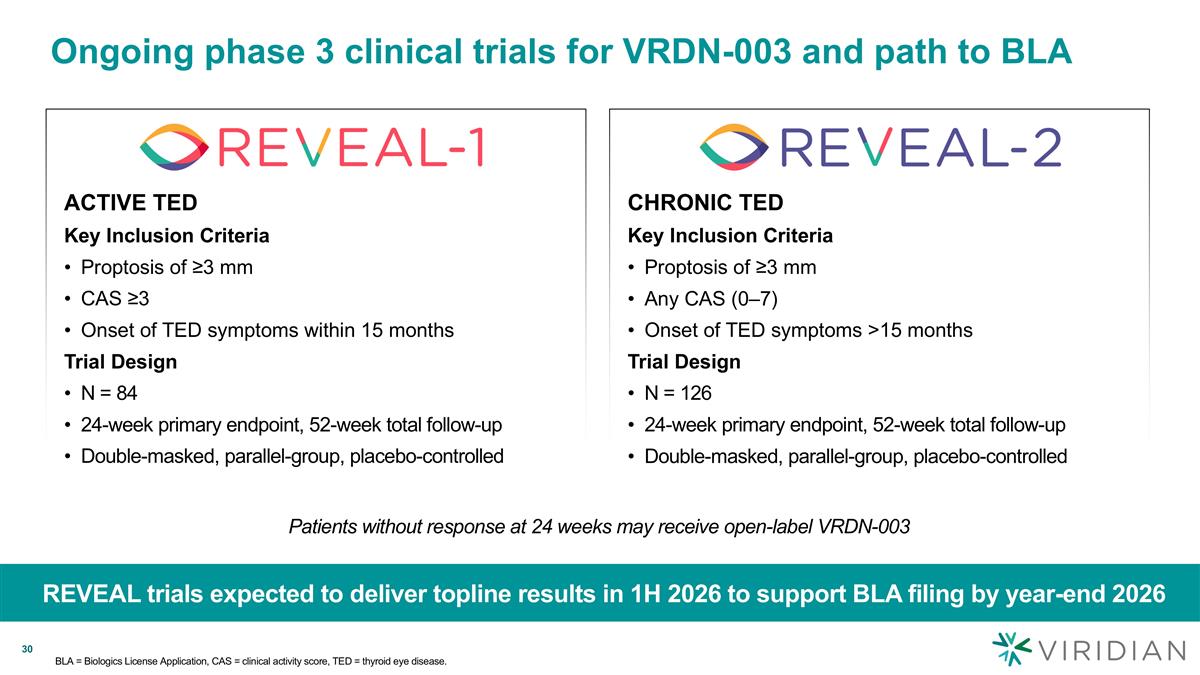

Ongoing phase 3 clinical trials for VRDN-003 and path to BLA REVEAL trials expected to deliver topline results in 1H 2026 to support BLA filing by year-end 2026 CHRONIC TED Key Inclusion Criteria Proptosis of ≥3 mm Any CAS (0–7) Onset of TED symptoms >15 months Trial Design N = 126 24-week primary endpoint, 52-week total follow-up Double-masked, parallel-group, placebo-controlled ACTIVE TED Key Inclusion Criteria Proptosis of ≥3 mm CAS ≥3 Onset of TED symptoms within 15 months Trial Design N = 84 24-week primary endpoint, 52-week total follow-up Double-masked, parallel-group, placebo-controlled Patients without response at 24 weeks may receive open-label VRDN-003 BLA = Biologics License Application, CAS = clinical activity score, TED = thyroid eye disease.

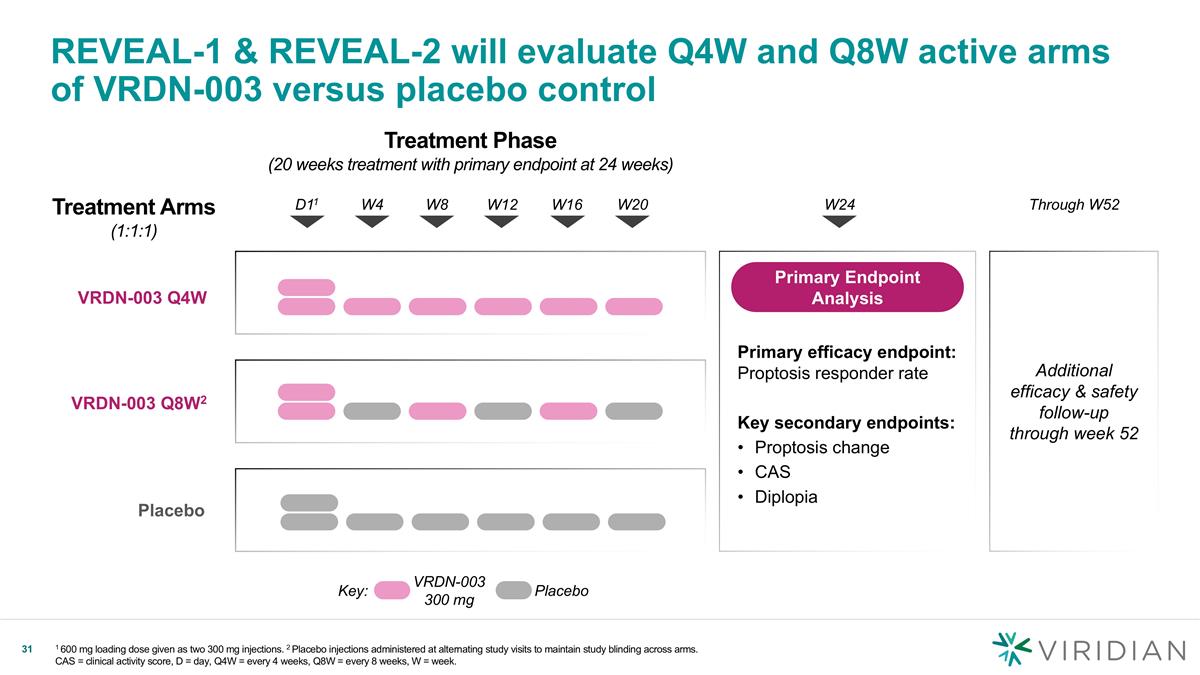

Treatment Phase (20 weeks treatment with primary endpoint at 24 weeks) VRDN-003 Q4W REVEAL-1 & REVEAL-2 will evaluate Q4W and Q8W active arms of VRDN-003 versus placebo control 1 600 mg loading dose given as two 300 mg injections. 2 Placebo injections administered at alternating study visits to maintain study blinding across arms. CAS = clinical activity score, D = day, Q4W = every 4 weeks, Q8W = every 8 weeks, W = week. D11 W4 W8 W12 W16 W20 VRDN-003 Q8W2 Placebo Key: VRDN-003 300 mg Placebo W24 Treatment Arms (1:1:1) Through W52 Additional efficacy & safety follow-up through week 52 Primary efficacy endpoint: Proptosis responder rate Key secondary endpoints: Proptosis change CAS Diplopia Primary Endpoint Analysis

FcRn Inhibitor Portfolio

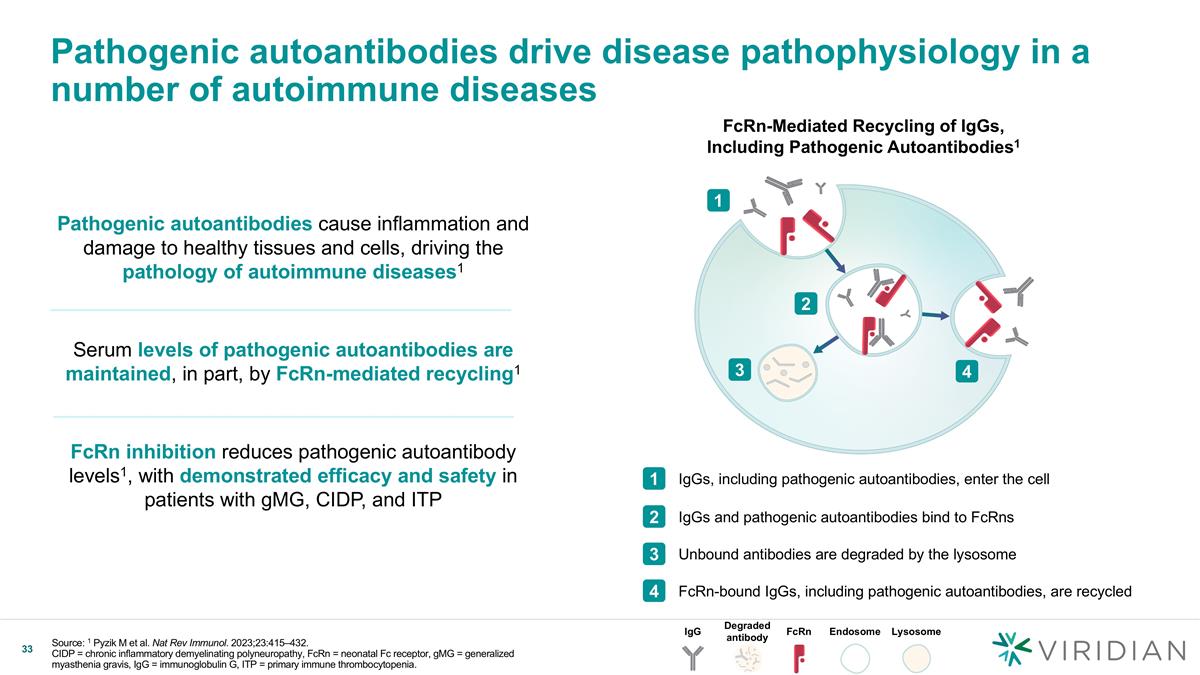

Pathogenic autoantibodies drive disease pathophysiology in a number of autoimmune diseases Pathogenic autoantibodies cause inflammation and damage to healthy tissues and cells, driving the pathology of autoimmune diseases1 Serum levels of pathogenic autoantibodies are maintained, in part, by FcRn-mediated recycling1 FcRn inhibition reduces pathogenic autoantibody levels1, with demonstrated efficacy and safety in patients with gMG, CIDP, and ITP FcRn-Mediated Recycling of IgGs, Including Pathogenic Autoantibodies1 1 2 3 4 IgGs, including pathogenic autoantibodies, enter the cell 1 IgGs and pathogenic autoantibodies bind to FcRns 2 Unbound antibodies are degraded by the lysosome 3 FcRn-bound IgGs, including pathogenic autoantibodies, are recycled 4 IgG Degraded antibody FcRn Endosome Lysosome Source: 1 Pyzik M et al. Nat Rev Immunol. 2023;23:415–432. CIDP = chronic inflammatory demyelinating polyneuropathy, FcRn = neonatal Fc receptor, gMG = generalized myasthenia gravis, IgG = immunoglobulin G, ITP = primary immune thrombocytopenia.

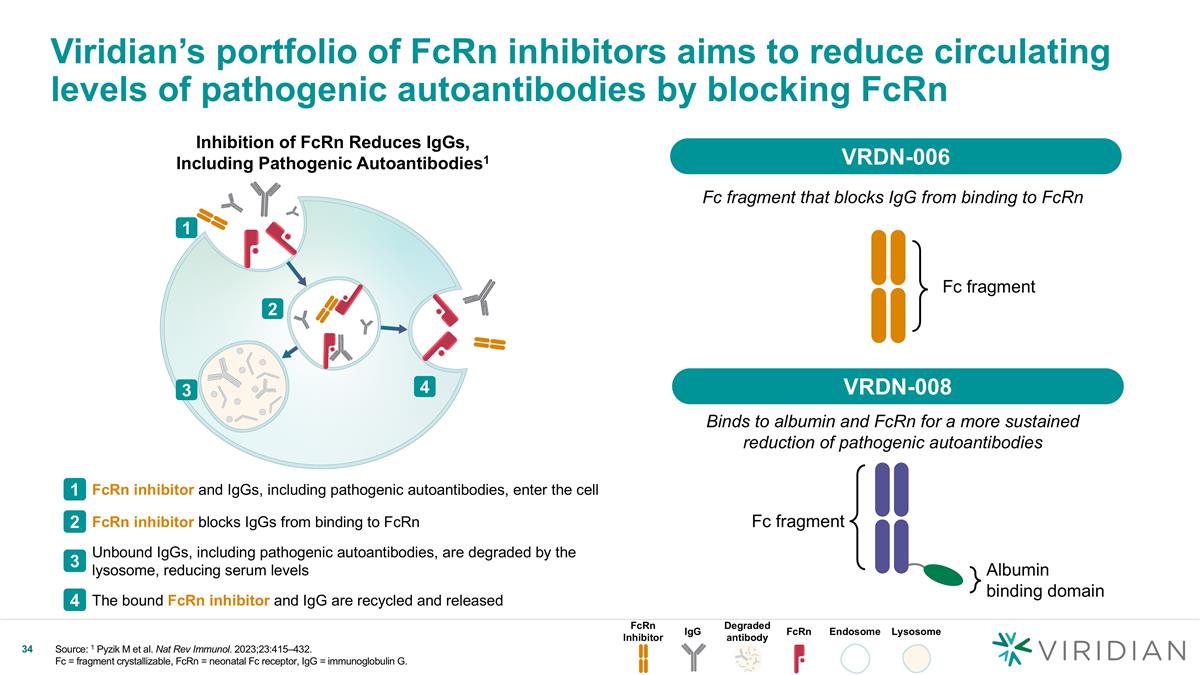

Viridian’s portfolio of FcRn inhibitors aims to reduce circulating levels of pathogenic autoantibodies by blocking FcRn Fc fragment that blocks IgG from binding to FcRn Binds to albumin and FcRn for a more sustained reduction of pathogenic autoantibodies Inhibition of FcRn Reduces IgGs, Including Pathogenic Autoantibodies1 Fc fragment Fc fragment Albumin binding domain FcRn inhibitor and IgGs, including pathogenic autoantibodies, enter the cell 1 FcRn inhibitor blocks IgGs from binding to FcRn 2 Unbound IgGs, including pathogenic autoantibodies, are degraded by the lysosome, reducing serum levels 3 The bound FcRn inhibitor and IgG are recycled and released 4 1 2 3 4 FcRn Inhibitor IgG Degraded antibody FcRn Endosome Lysosome VRDN-006 VRDN-008 Source: 1 Pyzik M et al. Nat Rev Immunol. 2023;23:415–432. Fc = fragment crystallizable, FcRn = neonatal Fc receptor, IgG = immunoglobulin G.

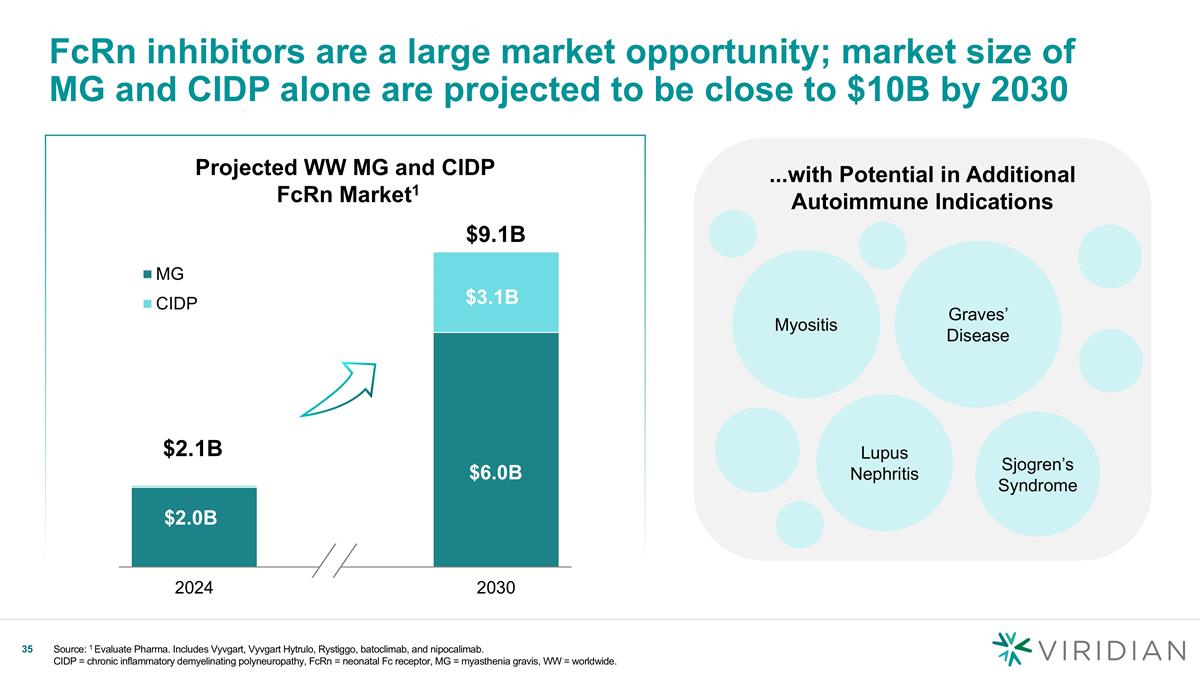

Projected WW MG and CIDP FcRn Market1 FcRn inhibitors are a large market opportunity; market size of MG and CIDP alone are projected to be close to $10B by 2030 ...with Potential in Additional Autoimmune Indications Sjogren’s Syndrome Lupus Nephritis Myositis Graves’ Disease Source: 1 Evaluate Pharma. Includes Vyvgart, Vyvgart Hytrulo, Rystiggo, batoclimab, and nipocalimab. CIDP = chronic inflammatory demyelinating polyneuropathy, FcRn = neonatal Fc receptor, MG = myasthenia gravis, WW = worldwide. $9.1B $3.1B $6.0B $2.0B $2.1B

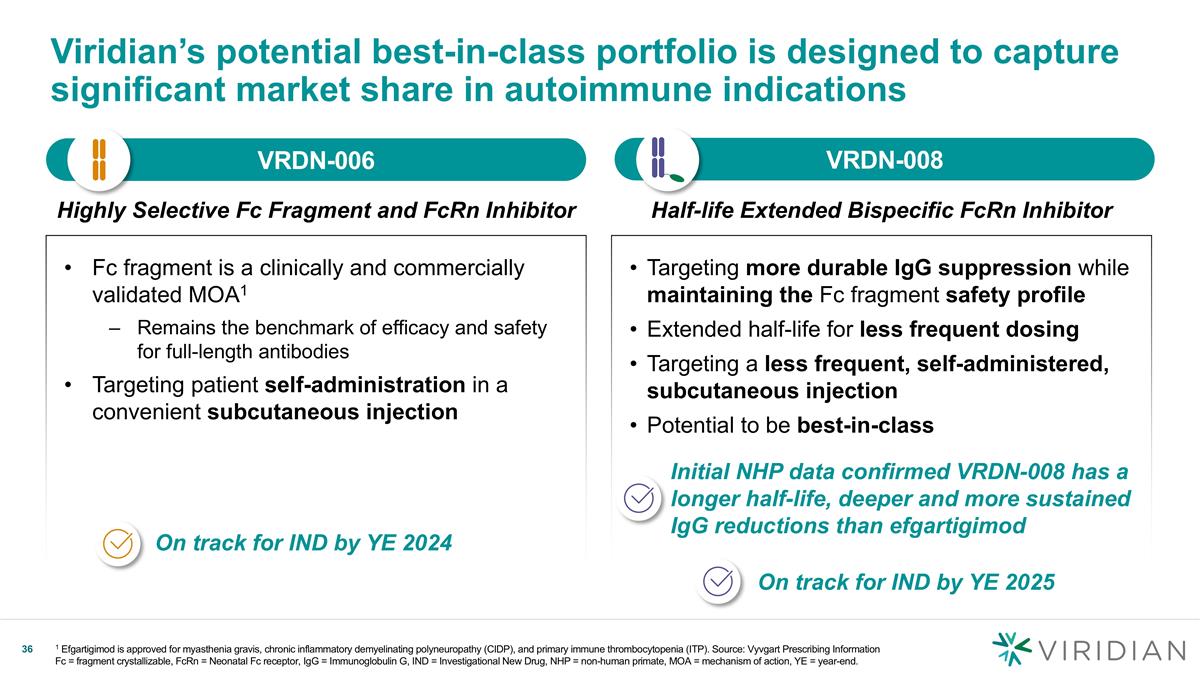

Targeting more durable IgG suppression while maintaining the Fc fragment safety profile Extended half-life for less frequent dosing Targeting a less frequent, self-administered, subcutaneous injection Potential to be best-in-class Viridian’s potential best-in-class portfolio is designed to capture significant market share in autoimmune indications Fc fragment is a clinically and commercially validated MOA1 Remains the benchmark of efficacy and safety for full-length antibodies Targeting patient self-administration in a convenient subcutaneous injection On track for IND by YE 2024 Initial NHP data confirmed VRDN-008 has a longer half-life, deeper and more sustained IgG reductions than efgartigimod VRDN-006 v VRDN-008 v Half-life Extended Bispecific FcRn Inhibitor Highly Selective Fc Fragment and FcRn Inhibitor On track for IND by YE 2025 1 Efgartigimod is approved for myasthenia gravis, chronic inflammatory demyelinating polyneuropathy (CIDP), and primary immune thrombocytopenia (ITP). Source: Vyvgart Prescribing Information Fc = fragment crystallizable, FcRn = Neonatal Fc receptor, IgG = Immunoglobulin G, IND = Investigational New Drug, NHP = non-human primate, MOA = mechanism of action, YE = year-end.

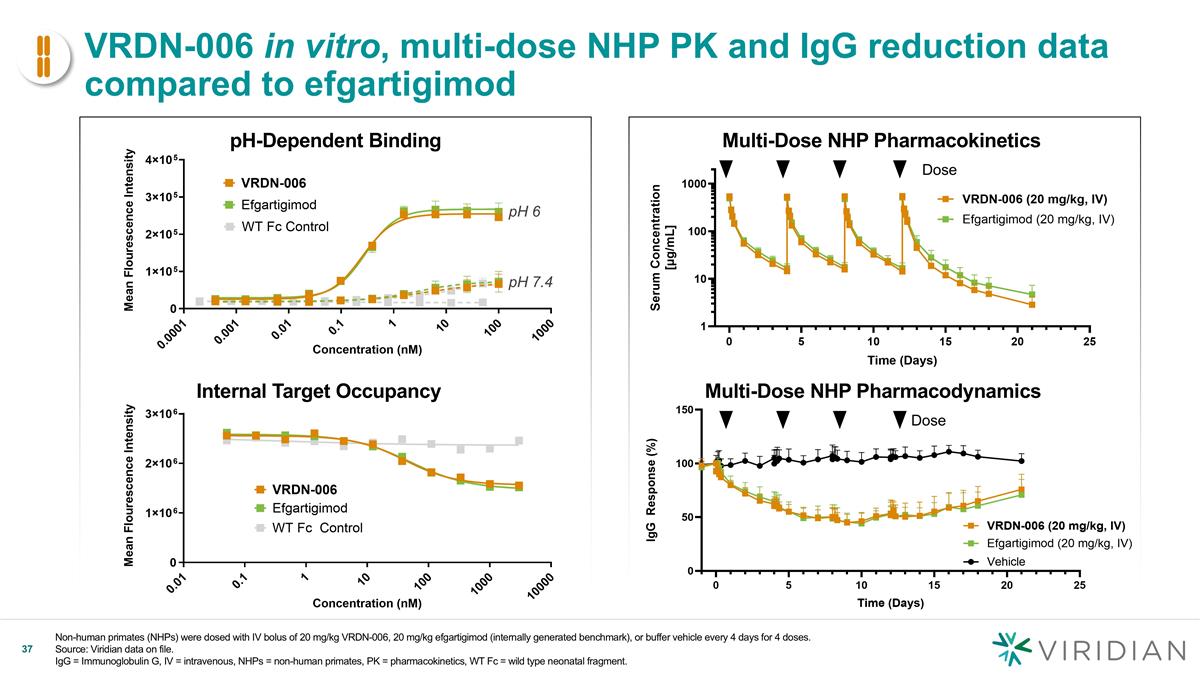

VRDN-006 in vitro, multi-dose NHP PK and IgG reduction data compared to efgartigimod Non-human primates (NHPs) were dosed with IV bolus of 20 mg/kg VRDN-006, 20 mg/kg efgartigimod (internally generated benchmark), or buffer vehicle every 4 days for 4 doses. Source: Viridian data on file. IgG = Immunoglobulin G, IV = intravenous, NHPs = non-human primates, PK = pharmacokinetics, WT Fc = wild type neonatal fragment. pH-Dependent Binding Internal Target Occupancy pH 7.4 pH 6 Multi-Dose NHP Pharmacokinetics Dose Dose v Multi-Dose NHP Pharmacodynamics

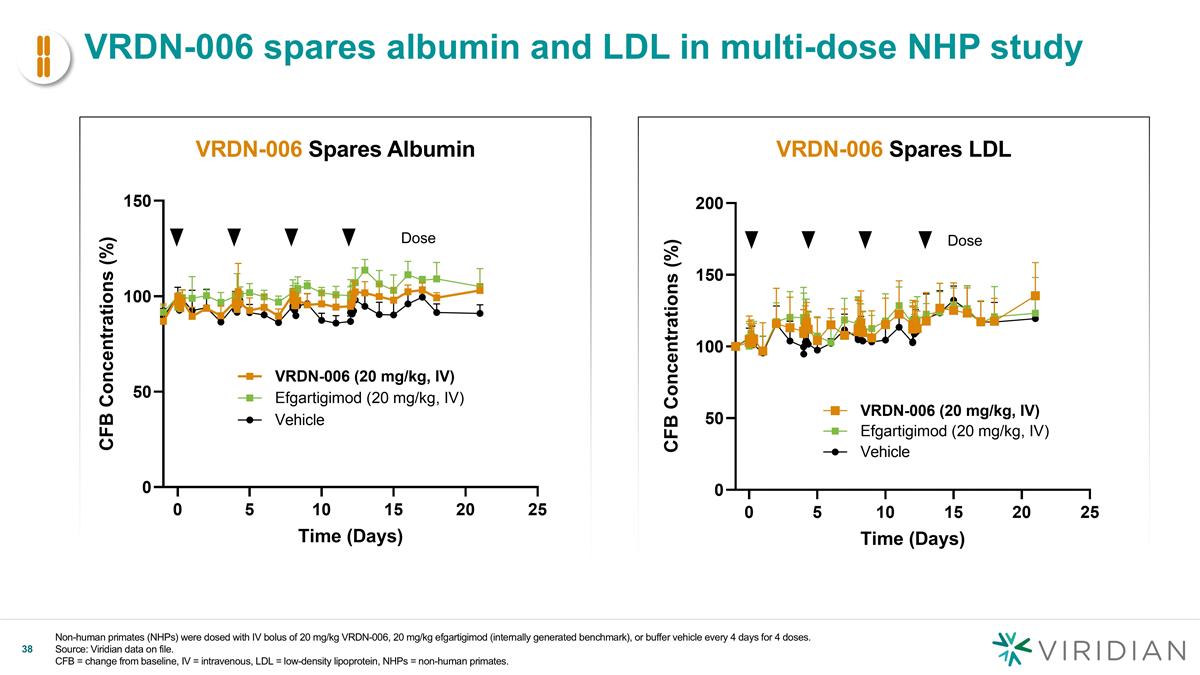

VRDN-006 spares albumin and LDL in multi-dose NHP study Non-human primates (NHPs) were dosed with IV bolus of 20 mg/kg VRDN-006, 20 mg/kg efgartigimod (internally generated benchmark), or buffer vehicle every 4 days for 4 doses. Source: Viridian data on file. CFB = change from baseline, IV = intravenous, LDL = low-density lipoprotein, NHPs = non-human primates. VRDN-006 Spares Albumin VRDN-006 Spares LDL Dose v Dose

Non-human primates (NHPs) were given equimolar doses of 60 mg/kg VRDN-008, 48.5 mg/kg efgartigimod (internally generated benchmark), or buffer vehicle - all via IV bolus. Source: Viridian data on file. BLQ = below limit of quantification, IgG = Immunoglobulin G, IV = intravenous, NHP = non-human primate. v A single dose of VRDN-008 demonstrated a longer half-life, deeper and more sustained reduction of IgGs vs. efgartigimod VRDN-008 Showed ~3x Longer Half-life Head-to-Head vs. Efgartigimod in NHPs VRDN-008 Showed ~20% Deeper and More Sustained IgG Reduction vs. Head-to-head Efgartigimod in NHPs Efgartigimod levels were BLQ at Weeks 35 and 42

Non-human primates (NHPs) were given equimolar doses of 60 mg/kg VRDN-008, 48.5 mg/kg efgartigimod (internally generated benchmark), or buffer vehicle - all via IV bolus Source: Viridian data on file. IV = intravenous, LDL = low-density lipoprotein, NHPs = non-human primates. VRDN-008 Spares Albumin VRDN-008 Spares LDL v A single dose of VRDN-008 spares albumin and LDL in NHPs

Significant progress in Q3 2024 Veligrotug Intravenous Reported THRIVE topline data in active TED in September: veligrotug achieved all primary & secondary endpoints with high levels of statistical significance (p < 0.0001) and was generally well-tolerated THRIVE-2 in chronic TED: completed and exceeded enrollment in July THRIVE-2 topline: December 2024 BLA submission: 2H 2025 VRDN-003 Subcutaneous Initiated VRDN-003 Phase 3 REVEAL-1 and REVEAL-2 clinical trials in active & chronic TED in August Topline data: 1H 2026 BLA submission: Year-end 2026 FcRn Portfolio VRDN-006 IND on track for year-end 2024 VRDN-008 NHP data showed a longer half-life and deeper and more sustained IgG reductions compared to efgartigimod; IND on track for year-end 2025 VRDN-006: HV data 2H 2025 VRDN-008: IND by year-end 2025; HV data 2H 2026 Financial $249M net proceeds from September 2024 public offering $753M cash as of September 30, 2024; runway into 2H 2027 Anticipated Catalysts BLA = Biologics License Application, FcRn = Neonatal Fc receptor, HV = healthy volunteer, IgG = Immunoglobulin G, IND = Investigational New Drug, MAD = multiple ascending dose, NHP = non-human primate, TED = thyroid eye disease.

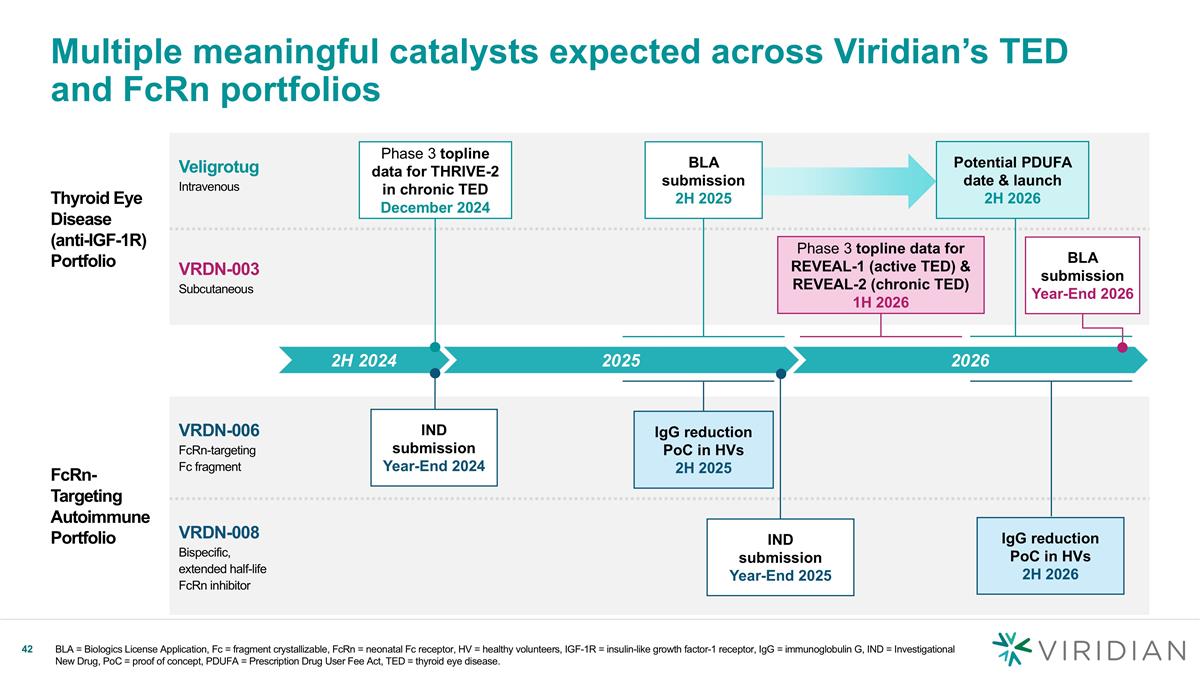

Thyroid Eye Disease (anti-IGF-1R) Portfolio Veligrotug Intravenous VRDN-003 Subcutaneous FcRn-Targeting Autoimmune Portfolio VRDN-006 FcRn-targeting Fc fragment VRDN-008 Bispecific, extended half-life FcRn inhibitor Multiple meaningful catalysts expected across Viridian’s TED and FcRn portfolios 2025 2H 2024 Phase 3 topline data for THRIVE-2 in chronic TED December 2024 IND submission Year-End 2024 IgG reduction PoC in HVs 2H 2025 2026 Phase 3 topline data for REVEAL-1 (active TED) & REVEAL-2 (chronic TED) 1H 2026 BLA = Biologics License Application, Fc = fragment crystallizable, FcRn = neonatal Fc receptor, HV = healthy volunteers, IGF-1R = insulin-like growth factor-1 receptor, IgG = immunoglobulin G, IND = Investigational New Drug, PoC = proof of concept, PDUFA = Prescription Drug User Fee Act, TED = thyroid eye disease. Potential PDUFA date & launch 2H 2026 BLA submission Year-End 2026 IND submission Year-End 2025 BLA submission 2H 2025 IgG reduction PoC in HVs 2H 2026