UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 4, 2024

ONKURE THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40315 | 47-2309515 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 6707 Winchester Circle, Suite 400 | ||

| Boulder, Colorado | 80301 | |

| (Address of principal executive offices) | (Zip code) |

(720) 307-2892

(Registrant’s telephone number, including area code)

Reneo Pharmaceuticals, Inc.

18575 Jamboree Road, Suite 275-S

Irvine, CA 92612

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading |

Name of each exchange |

||

| Class A Common Stock, par value $0.0001 per share | OKUR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

On October 4, 2024 (the “Closing Date”), Reneo Pharmaceuticals, Inc., a Delaware corporation and our predecessor company (“Reneo”), consummated the previously announced merger pursuant to the terms of the Agreement and Plan of Merger, dated as of May 10, 2024 (the “Merger Agreement”), by and among Reneo, Radiate Merger Sub I, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of Reneo (“Merger Sub I”), Radiate Merger Sub II, LLC, a Delaware limited liability company and a direct, wholly-owned subsidiary of Reneo (“Merger Sub II”), and OnKure, Inc., a Delaware corporation (“Legacy OnKure”).

Pursuant to the Merger Agreement, on the Closing Date, (i) Reneo effected a reverse stock split of Reneo’s issued common stock at a ratio of 1:10 (the “Reverse Stock Split”), (ii) Reneo changed its name to “OnKure Therapeutics, Inc.”, (iii) Reneo reclassified all of its common stock as Class A Common Stock, and (iv) Radiate Merger Sub I merged with and into Legacy OnKure (the “Merger”), with Legacy OnKure as the surviving company in the Merger and, after giving effect to such Merger, Legacy OnKure became a wholly-owned subsidiary of OnKure Therapeutics, Inc. (together, the “Combined Company”). Pursuant to the terms of the Merger Agreement, OnKure determined that the Merger would qualify for the intended tax treatment even if only the merger with Merger Sub I was consummated, and therefore the parties determined not to consummate the second merger with Merger Sub II contemplated by the Merger Agreement.

Unless the context otherwise requires, “OnKure,” “we,” “us,” “our,” and the “Company” refer to the Combined Company. All references herein to the “Board” refer to the board of directors of the Combined Company. All references herein to the “Closing” refer to the closing of the transactions contemplated by the Merger Agreement (the “Transactions”), including the Merger and the transactions contemplated by the subscription agreement (the “Subscription Agreement”) entered into by Reneo and certain investors (the “PIPE Investors”) pursuant to which the PIPE Investors collectively subscribed for and purchased shares of Class A Common Stock of the Company, par value $0.0001 per share (the “Class A Common Stock”) for an aggregate purchase price of approximately $65.0 million (the “Concurrent PIPE Investments”).

Item 2.01. Completion of Acquisition or Disposition of Assets.

As previously reported, on September 26, 2024, Reneo held a special meeting (the “Special Meeting”) at which the Reneo stockholders considered and approved, among other matters, (i) for purposes of Nasdaq Listing Rule 5635(a) and (b), the issuance of shares of Class A Common Stock pursuant to the terms of the Merger Agreement and the change of control of Reneo resulting from the Merger, (ii) for purposes of Nasdaq Listing Rule 5635(d), the issuance of shares of Class A Common Stock to the PIPE Investors, which shares represented more than 20% of the shares of the Combined Company’s common stock outstanding as of the date of the execution of the Subscription Agreement, (iii) the amended and restated certificate of incorporation of the Company, (iv) an amendment to the Company’s certificate of incorporation to effect the Reverse Stock Split, (v) the adoption of the Company’s 2024 Equity Incentive Plan (the “2024 Plan”), and (vi) the adoption of the Company’s 2024 Employee Stock Purchase Plan (the “2024 ESPP”).

On October 4, 2024, the parties to the Merger Agreement completed the Merger and the other transactions contemplated thereby in accordance with the terms of the Merger Agreement. Effective at 4:01 p.m. eastern time on October 4, 2024, the Company effected the Reverse Stock Split at a ratio of 1:10; effective at 4:02 p.m. eastern time on October 4, 2024, the Company changed its name to “OnKure Therapeutics, Inc.” and reclassified each share of Reneo common stock to Class A Common Stock; and effective at 4:15 p.m. eastern time on October 4, 2024 (the “Effective Time”), the parties to the Merger Agreement consummated the Merger.

In accordance with the terms and subject to the terms and conditions of the Merger Agreement, at the Effective Time, (i) (a) each then-outstanding share of Legacy OnKure common stock was converted into the right to receive 0.023596 shares of Class A Common Stock based on an exchange ratio (the “Common Exchange Ratio”), and (b) each then-outstanding share of Legacy OnKure preferred stock was converted into the right to receive 0.144794 shares of Class A Common Stock based on an exchange ratio (the “Preferred Exchange Ratio”); provided that a holder of Legacy OnKure preferred stock chose to receive 686,527 shares that it would otherwise have received in the form of Class A Common Stock in an equal number of shares of a new series of non-voting common stock of the Company designated Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”), (ii) each then-outstanding option to purchase shares of Legacy OnKure common stock was assumed by the Company and converted into an option to purchase Class A Common Stock based on the Common Exchange Ratio, subject to adjustments set forth in the Merger Agreement, and (iii) all then-outstanding awards of restricted stock units (“RSUs”) covering shares of Legacy OnKure preferred stock were assumed by the Company and converted into RSUs covering Class A Common Stock based on the Preferred Exchange Ratio, subject to adjustments set forth in the Merger Agreement.

2

Each share of Reneo common stock, each option to purchase shares of Reneo common stock, and each RSU award covering shares of Reneo common stock that was issued and outstanding as of immediately prior to the Effective Time remained issued and outstanding in accordance with their terms and such shares, options and RSUs were unaffected by the Merger, subject to the Reverse Stock Split and reclassification to Class A Common Stock; provided that, to the extent not previously vested, all such options and RSUs held by Reneo’s directors and executive officers vested at the Effective Time.

Upon the closing of the Transactions, (i) an aggregate of 6,470,281 shares of Class A Common Stock and 686,527 shares of Class B Common Stock were issued in exchange for the shares of Legacy OnKure capital stock outstanding as of immediately prior to the Effective Time, (ii) outstanding shares of Reneo common stock were reclassified into an aggregate of 3,343,525 shares of Class A Common Stock, and (iii) an aggregate of 2,839,005 shares of Class A Common Stock were issued to the PIPE Investors in the Concurrent PIPE Investments. Immediately after giving effect to the Transactions, there were approximately 12,652,811 shares of Class A Common Stock outstanding, 686,527 shares of Class B Common Stock outstanding, and 905,204 shares of Class A Common Stock subject to outstanding options and RSUs under the Combined Company’s equity incentive plans. The Reneo common stock, which was previously listed on The Nasdaq Stock Market LLC (“Nasdaq”) and traded under the ticker symbol “RPHM” through the close of business on October 4, 2024, commenced trading on Nasdaq as Class A Common Stock of the Combined Company under the ticker symbol ‘OKUR” on October 7, 2024.

The material terms and conditions of the Merger Agreement are described in the definitive proxy statement/prospectus (the “Proxy Statement/Prospectus”) included in Reneo’s Registration Statement on Form S-4 (File No. 333-280369), filed with and declared effective by the Securities and Exchange Commission (the “SEC”) on August 26, 2024, in the section titled “Merger Agreement” beginning on page 167 of the Proxy Statement/Prospectus, which is incorporated herein by reference.

FORM 10 INFORMATION

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K and the information incorporated herein by reference may constitute “forward-looking statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to the Transactions and their expected benefits; the Combined Company’s performance following the Transactions; our plans relating to the clinical development of our product candidates, including the size, number and areas to be evaluated; our plans relating to commercializing our product candidates, if approved, including the geographic areas of focus and strategy; and the Combined Company’s ability to obtain funding for its operations. Forward-looking statements include statements relating to our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, including those relating to the Transactions. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting us will be those that we have anticipated. Forward-looking statements include, but are not limited to, statements concerning the following:

| • | risks associated with the possible failure to realize certain anticipated benefits of the Transactions, including with respect to future financial and operating results; |

| • | unexpected costs, charges or expenses resulting from the Transactions; |

3

| • | the potential for, and uncertainty associated with the outcome of, legal proceedings instituted against the Combined Company or its directors or officers related to the Transactions; |

| • | risks related to OnKure’s early stage of development; the uncertainties associated with OnKure’s product candidates, as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in the completion of clinical trials; |

| • | the significant net losses each of Reneo and Legacy OnKure has incurred since inception; |

| • | the Combined Company’s ability to initiate and complete ongoing and planned preclinical studies and clinical trials and advance its product candidates through clinical development; |

| • | the timing of the availability of data from the Combined Company’s clinical trials; |

| • | the outcome of preclinical testing and clinical trials of the Combined Company’s product candidates, including the ability of those trials to satisfy relevant governmental or regulatory requirements; |

| • | the Combined Company’s plans to research, develop and commercialize its current and future product candidates; |

| • | the clinical utility, potential benefits and market acceptance of the Combined Company’s product candidates; |

| • | the requirement for additional capital to continue to advance these product candidates, which may not be available on favorable terms or at all; |

| • | the Combined Company’s ability to attract, hire, and retain skilled executive officers and employees; |

| • | the Combined Company’s ability to protect its intellectual property and proprietary technologies; |

| • | the Combined Company’s reliance on third parties, contract manufacturers, and contract research organizations; |

| • | the possibility that the Combined Company may be adversely affected by other economic, business, or competitive factors; risks associated with changes in applicable laws or regulations; |

| • | the risks and uncertainties identified from time to time in documents filed or to be filed with the SEC by the Combined Company; and |

| • | other risks. |

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, including but not limited to those described under the heading “Risk Factors” beginning on page 36 of the Proxy Statement/Prospectus, which is incorporated herein by reference, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. There may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Business

OnKure Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the discovery and development of precision medicines that target biologically validated drivers of cancers underserved by available therapies. Using a structure- and computational chemistry-driven drug design platform, we are committed to improving clinical outcomes for patients by building a robust pipeline of small molecule drugs designed to selectively target specific mutations thought to be key drivers of cancer. By improving selectivity for the oncogenic and mutated form of these cancer-driver proteins, we aim to discover and develop drugs with improved safety and efficacy by sparing toxicity that arises from non-selective inhibition of the non-mutated (or wild-type) version of the protein. We believe that inhibiting target proteins with specific mutations instead of wild-type variants should enable precise patient selection that will, in turn, improve the probability of clinical success. We designed our current product candidates utilizing x-ray crystallography and computational chemistry to inhibit specified mutated versions of phosphoinositide 3 kinase alpha (“PI3Kα”), a key mediator in cancer growth signaling. Our lead product candidate, OKI-219, is a highly selective inhibitor of PI3Kα harboring the H1047R mutation (“PI3KαH1047R”) that has a much smaller impact on wild-type PI3Kα (“PI3KαWT”). We plan to initially focus on the development of OKI-219 in patients with advanced breast cancer of genetic subtypes that are (a) both hormone receptor positive (“HR+”) and human epidermal growth factor receptor 2 negative (“HER2-”); and (b) human epidermal growth factor receptor 2 positive (“HER2+”).

4

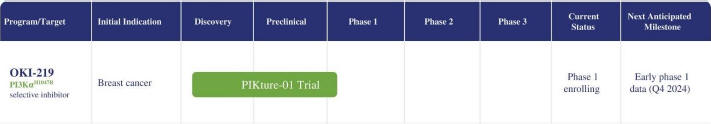

We believe that we can potentially expand the application of OKI-219 by conducting appropriate clinical trials in earlier lines of treatment within breast cancer, other subtypes of breast cancer, and potentially in other solid tumors. OKI-219 is currently in a first-in-human Phase 1 monotherapy dose-escalation trial in H1074R-mutated advanced solid tumors including breast cancer. Early clinical data are anticipated in the fourth quarter of 2024.

Genetic analysis of tumors has become standard of care in oncology and has enabled oncologists to characterize tumors much more precisely than simple segmentation based on the tissue of origin. A more precise understanding of the genetic alterations driving the growth of specific tumors has also created an opportunity for the industry to develop drugs that are intended to target mutated or oncogenic forms of proteins that drive cancer growth and survival. In a number of notable cases, this approach has profoundly changed how these tumors are treated and has significantly improved outcomes for patients with cancers that depend on these oncogenes for survival. However, in many cases, it has been challenging to effectively target the mutated oncogenic form of a target protein. In particular, non-selective inhibition of the wild-type protein in normal tissues often leads to toxic effects that can limit effective target inhibition of the intended oncogenic protein in cancers and, therefore, offers suboptimal clinical benefit. One such challenging target is the oncogene PI3Kα.

PI3Kα is an attractive target for cancer drugs because it is one of the most commonly mutated oncogenes in cancers and is a key mediator of abnormal cell growth. Furthermore, PI3Kα kinase mutations are clinically correlated with drug resistance and poor clinical outcomes. Single amino acid mutations such as E542K, E545K, H1047R, H1047L, and H1047Y account for over 70% of PI3Kα mutations. Notably, the PI3KαH1047R mutation is very common in breast cancer, being identified in approximately 13% of breast cancer cases. The PI3Kα inhibitor alpelisib has been approved to treat patients with advanced breast cancers harboring PI3Kα mutations. Alpelisib is non-selective for the key mutations, and its inhibition of not only mutant but also wild-type PI3Kα leads to significant toxicities in patients, such as hyperglycemia, rash and diarrhea. These toxicities can present significant challenges to optimal dosing and use in this patient population. OnKure is focused on addressing the shortcomings of alpelisib and other first-generation PI3Kα inhibitors by developing product candidates that target these genetic alterations selectively while sparing the wild-type PI3Kα.

We have shown preclinical data supporting the selectivity of its lead product candidate, OKI-219. OKI-219 targets the H1047R mutated PI3Kα with approximately 80-fold selectivity over the wild-type PI3Kα. OnKure designed this mutant-specific approach in order to minimize or eliminate potential toxicities and enable potentially higher and more continuous target coverage than has been achievable with drugs that also inhibit wild-type PI3Kα. OnKure is currently conducting a Phase 1 dose-escalation trial to test the efficacy and tolerability of OKI-219 in patients with solid tumors harboring the H1047R mutation.

We are also developing next-generation product candidates designed to selectively target not just H1047R, but also to inhibit H1047L and H1047K mutations, providing an opportunity to potentially broaden the patient population and address possible resistance mechanisms. Additional programs at the Combined Company include targeting other highly prevalent PI3Kα mutations such as E542K and E545K. Over time, the Combined Company aims to design and develop product candidates that effectively target all of the key oncogenic mutations in PI3Kα.

Our Team

We have assembled a leadership team with extensive experience in drug discovery and development, with particular strengths in the discovery of small molecule protein kinase inhibitors. We believe that the team’s shared history at prior successful drug development organizations provides a promising opportunity for driving efficient drug development, especially for this class of drugs.

Nicholas Saccomano, Ph.D., the Combined Company’s President and Chief Executive Officer (“CEO”), joined Legacy OnKure as a member of the board of directors in 2021 and became CEO in September 2023, and has nearly 35 years of experience leading pharmaceutical research and development across multiple therapeutic areas. Prior to OnKure, he was the Chief Science Office at Pfizer’s Boulder facility (previously Array BioPharma), leading a team of 170 research scientists focused on small molecule drug programs. Dr. Saccomano oversaw the discovery and progression of multiple central nervous system drugs, including ziprasidone, marketed by Pfizer as Geodon®; donepezil, marketed by Eisai and Pfizer as Aricept®; and varenicline, marketed by Pfizer as Chantix®.

5

Dylan Hartley, Ph.D. is the Combined Company’s Chief Scientific Officer, and joined Legacy OnKure in July 2024. Dr. Hartley has over 20 years of experience in drug research and development, including expertise in pharmacology, toxicology, drug metabolism and pharmacokinetics. Most recently, Dr. Hartley served as Vice President, Head of Research at Pfizer’s Boulder facility (previously Array BioPharma) from September 2021 to July 2024. Dr. Hartley held roles of increasing responsibility at Array BioPharma, Inc. since 2011.

Samuel Agresta, M.D. is the Combined Company’s Chief Medical Officer and has over 15 years of experience in global oncology drug development. Dr. Agresta has played key roles in the development of ivosidenib, marketed by Servier as TIBSOVO®; endasidenib, marketed by BMS and Servier as IDHIFA®; and ado-trastuzumab emtansine, marketed by Genentech as KADCYLA®.

Jason Leverone, C.P.A. is the Combined Company’s Chief Financial Officer. He brings over 25 years of strategic finance and operational experience across multiple industries, including the last 16 years in life sciences. Prior to joining Legacy OnKure, Mr. Leverone served as the Chief Financial Officer and Secretary of miRagen Therapeutics, Inc., a publicly traded biotechnology company which merged with Viridian Therapeutics, Inc. in 2021. During his tenure at miRagen, he held roles of increasing responsibility in operations, corporate finance and strategic planning, including key roles in the company’s public offering, strategic license transactions, and mergers and acquisitions. Prior to joining miRagen, Mr. Leverone served as Senior Director of Finance and Controller for Replidyne, Inc., a publicly traded biotechnology company acquired by Cardiovascular Systems in 2008. He also served as Corporate Controller for CreekPath Systems, Inc., a private international software development company. Mr. Leverone began his professional career in public accounting at Ernst and Young LLP and continued with Arthur Andersen LLP. He is a Certified Public Accountant and holds a B.S. in Business Administration from Bryant University.

The Combined Company is supported by both a scientific advisory board and a board of directors with extensive experience in drug development and building public companies.

The Combined Company’s Clinical Pipeline

The Combined Company is focused on the discovery and development of precision oncology therapies that target biologically validated drivers of cancers underserved by available therapies. The Combined Company is currently advancing OKI-219 in a Phase 1 clinical trial and has two other programs targeting PI3Kα in the early stages of development.

Our business is further described in the Proxy Statement/Prospectus in the section titled “OnKure Business” beginning on page 224 of the Proxy Statement/Prospectus and that information is incorporated herein by reference.

Risk Factors

The risk factors related to the Combined Company’s business and operations and the Transactions are set forth in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 36 of the Proxy Statement/Prospectus and that information is incorporated herein by reference.

Audited Financial Statements

The audited financial statements as of and for the years ended December 31, 2023 and 2022 of Legacy OnKure set forth in Exhibit 99.1 hereto are incorporated herein by reference and have been prepared in accordance with U.S. generally accepted accounting principles and pursuant to the regulations of the SEC.

6

These audited financial statements should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included herein.

Unaudited Financial Statements

The unaudited financial statements as of and for the three and six months ended June 30, 2024 of Legacy OnKure set forth in Exhibit 99.2 hereto are incorporated herein by reference.

These unaudited financial statements should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included herein.

Unaudited Pro Forma Condensed Combined Financial Information

The unaudited pro forma condensed combined financial information of the Combined Company for the three and six months ended June 30, 2024 and year ended December 31, 2023 is set forth in Exhibit 99.3 hereto and is incorporated herein by reference.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Reference is made to the disclosure in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in (i) Reneo’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 28, 2024 (as amended by Amendment No. 1 on Form 10-K/A, filed with the SEC on April 26, 2024), beginning on page 88 of the Annual Report on Form 10-K, which is incorporated herein by reference, and (ii) Reneo’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024, filed with the SEC on August 13, 2024, beginning on page 18 of the Quarterly Report on Form 10-Q, which is incorporated herein by reference.

Management’s discussion and analysis of the financial condition and results of operation of Legacy OnKure as of and for the year ended December 31, 2023 and the three and six months ended June 30, 2024 is set forth below.

The following discussion and analysis provides information that the Combined Company’s management believes is relevant to an assessment and understanding of the Combined Company’s results of operations and financial condition. The discussion should be read together with the audited financial statements and related notes and unaudited pro forma condensed financial information that are included elsewhere in this Current Report on Form 8-K. This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. The Combined Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 36 of the Proxy Statement/Prospectus or in other parts of this Current Report on Form 8-K. Unless the context otherwise requires, references in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” to “Legacy OnKure” refer to the business and operations of OnKure, Inc. prior to the Merger and “OnKure,” “the Company,” “we,” “us” and “our” refer to the business and operations of OnKure, Inc. prior to the Merger and to the Combined Company and its consolidated subsidiary following the Closing.

Overview

OnKure Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the discovery and development of precision medicines designed to target biologically validated drivers of cancers underserved by available therapies. Using a structure- and computational chemistry-driven drug design platform, we are committed to improving clinical outcomes for patients by building a robust pipeline of small molecule drugs designed to selectively target specific mutations thought to be key drivers of cancer. Our lead product candidate, OKI-219, is a highly selective inhibitor of 3 kinase alpha (“PI3Kα”), a key mediator in cancer growth signaling, harboring the H1047R mutation (“PI3KαH1047R”) that has a much smaller impact on non-mutated (or wild-type) PI3Kα (“PI3KαWT”). OKI-219 is currently in a first-in-human Phase 1 monotherapy dose-escalation trial in H1074R-mutated advanced solid tumors including breast cancer. Early clinical data are anticipated in the fourth quarter of 2024. In addition to OKI-219, we are also pursuing programs designed to selectively target the other specific mutations of PI3Kα.

Legacy OnKure was incorporated in the State of Delaware in 2011 and we are headquartered in Boulder, Colorado. Since our inception, we have devoted substantially all of our resources to research and development activities, business planning, establishing and maintaining our intellectual property portfolio, hiring personnel, raising capital, and providing general and administrative support for these activities.

7

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We rely, and expect to continue to rely, on third parties for the manufacture of our product candidates for preclinical and clinical testing, and expect that we will rely on third parties for commercial manufacturing should any of our product candidates obtain marketing approval. We believe that this strategy allows us to maintain a more efficient infrastructure by eliminating the need to invest in our own manufacturing facilities, equipment and personnel while also enabling us to focus our expertise and resources on the development of our product candidates. In addition, we generally expect to rely on third parties for the manufacture of any companion diagnostics we may develop.

To date, OnKure has funded its operations primarily through private placements of OnKure common stock, OnKure preferred stock and convertible debt. As of June 30, 2024, OnKure had cash and cash equivalents of $18.6 million. After giving effect to the Merger and the Concurrent PIPE Investments, we believe the resulting cash resources are sufficient to fund our planned operations into the fourth quarter of 2026.

As of June 30, 2024, OnKure had an accumulated deficit of $125.7 million. OnKure incurred losses and negative cash flows from operations since inception, including net losses of $35.3 million and $29.5 million for the years ended December 31, 2023 and 2022, respectively. OnKure’s net losses for the periods ended June 30, 2024 and 2023 were $23.7 million and $16.9 million, respectively. We expect that our operating losses and negative operating cash flows will continue for the foreseeable future as we develop our product candidates.

Our net losses may fluctuate significantly from quarter to quarter and year to year, depending on a variety of factors including the timing and scope of its research and development activities. We expect our expenses and capital requirements will increase substantially in connection with our ongoing activities as we:

| • | advance the OKI-219 program through clinical development; |

| • | advance the development of other small-molecule research-stage programs; |

| • | expand our pipeline of product candidates through our own research and development efforts; |

| • | seek to discover and develop additional product candidates; |

| • | seek regulatory approvals for any product candidates that successfully complete clinical trials; |

| • | establish a sales, marketing and distribution infrastructure to commercialize any approved product candidates; |

| • | contract to manufacture any approved product candidates; |

| • | expand our clinical, scientific, management and administrative teams; |

| • | maintain, expand, protect and enforce our intellectual property portfolio, including patents, trade secrets and know-how; |

| • | implement operational, financial and management systems; and |

| • | operate as a public company. |

We do not have any products approved for commercial sale, have not generated any revenue from product sales or other sources and cannot provide assurance that we will ever generate positive cash flows from operating activities. Our ability to generate product revenue sufficient to achieve and maintain profitability will depend upon the successful development and eventual commercialization of one or more of OnKure’s product candidates, which is uncertain and expected to take many years.

8

We will therefore require substantial additional capital to develop these product candidates and support our continuing operations. Accordingly, until such time that we can generate a sufficient amount of revenue from product sales or other sources, if ever, we expect to finance our operations through private or public equity or debt financings, loans or other capital sources, which could include income from collaborations, partnerships or other marketing, distribution, licensing or other strategic arrangements with third parties. However, we may be unable to raise additional capital from these sources on favorable terms, or at all. Our failure to obtain sufficient capital on acceptable terms when needed could have a material adverse effect on our business, results of operations or financial condition, including requiring us to delay, reduce or curtail our research, product development or future commercialization efforts. We may also be required to license rights to product candidates at an earlier stage of development or on less favorable terms than we would otherwise choose.

Recent Developments

The Merger and Concurrent PIPE Investments

On May 10, 2024, we entered into the Merger Agreement, pursuant to which Legacy OnKure merged with and into Radiate Merger Sub I at the Effective Time on October 4, 2024, with Legacy OnKure continuing after the Merger as the surviving company and a wholly-owned subsidiary of the Company. At the Effective Time, each outstanding share of Legacy OnKure capital stock was converted into the right to receive shares of Class A Common Stock or Class B Common Stock, as set forth in the Merger Agreement. Upon closing of the Merger, the Company was renamed “OnKure Therapeutics, Inc.” and will continue to be listed on Nasdaq.

Under the exchange ratio formulas in the Merger Agreement, immediately following the Effective Time, (i) (a) each then-outstanding share of Legacy OnKure common stock was converted into the right to receive 0.023596 shares of Class A Common Stock based on the Common Exchange Ratio, and (b) each then-outstanding share of Legacy OnKure preferred stock was converted into the right to receive 0.144794 shares of Class A Common Stock based on the Preferred Exchange Ratio; provided that a holder of Legacy OnKure preferred stock chose to receive 686.527 shares that it would otherwise have received in the form of Class A Common Stock in an equal number of shares of Class B Common Stock, (ii) each then-outstanding option to purchase shares of Legacy OnKure common stock was assumed by the Company and converted into an option to purchase Class A Common Stock based on the Common Exchange Ratio, subject to adjustments set forth in the Merger Agreement, and (iii) each then-outstanding RSU of Legacy OnKure corresponding to shares of Legacy OnKure preferred stock was assumed by the Company and converted into RSUs of the Company covering 213,254 shares of Class A Common Stock based on the Preferred Exchange Ratio, subject to adjustments set forth in the Merger Agreement. Each share of Reneo common stock, each option to purchase shares of Reneo common stock and each RSU award covering shares of Reneo common stock that was issued and outstanding as of immediately prior to the Effective Time remained issued and outstanding in accordance with its terms and such shares, options and RSUs, subject to the Reverse Stock Split, were reclassified as Class A Common Stock but were otherwise unaffected by the Merger; provided that, to the extent not previously vested, all such options and RSUs held by Reneo’s directors and executive officers vested at the Effective Time.

Concurrently with the execution of the Merger Agreement, Reneo entered into the Subscription Agreement with the PIPE Investors, pursuant to which the PIPE Investors subscribed for and purchased an aggregate of 2,839,005 shares of Class A Common Stock at a price of approximately $22.895 per share for aggregate gross proceeds of approximately $65.0 million.

Basis of Presentation

The following discussion highlights OnKure’s results of operations and the principal factors that have affected its financial condition as well as its liquidity and capital resources for the periods described and provides information that management believes is relevant for an assessment and understanding of the balance sheets and statements of operations and comprehensive loss presented herein. The following discussion and analysis are based on OnKure’s audited financial statements and related notes and unaudited interim financial statements and related notes contained in this Current Report on Form 8-K, which OnKure has prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). You should read the discussion and analysis together with such audited financial statements and the related notes thereto and unaudited interim financial statements and related notes thereto.

9

Components of Statements of Operations and Comprehensive Loss

Revenue

To date, OnKure has not generated any revenue and it does not expect to generate any revenue from the sale of products or from other sources in the foreseeable future.

Operating Expenses

Research and Development

Research and development expenses account for a significant portion of OnKure’s operating expenses and consist primarily of expenses incurred in connection with the discovery and development of its product candidates.

Research and development expenses consist of costs incurred for the research and development of OnKure’s programs and product candidates, which include:

| • | employee-related expenses, including salaries, severance, retention, benefits, insurance and share-based compensation expense; |

| • | expenses incurred under agreements with contract research organizations (“CROs”), which are companies that assist in managing OnKure’s clinical trials, other clinical trial-related vendors and clinical consultants; |

| • | the costs of acquiring, developing, and manufacturing and testing clinical and preclinical materials, including costs incurred under agreements with contract manufacturing organizations (“CMOs”); |

| • | costs associated with non-clinical activities and regulatory operations; and |

| • | facilities, depreciation, market research and other expenses, which include allocated expenses for rent and maintenance of facilities, depreciation of leasehold improvements and equipment, and laboratory supplies. |

OnKure makes non-refundable advance payments for goods and services that will be used in future research and development activities. These payments are recorded as expenses in the period in which OnKure receives or takes ownership of the goods or when the services are performed. At any one time, OnKure is working on multiple research or drug discovery programs and internal resources. Employees and infrastructure are not directly tied to any one program and are typically deployed across multiple programs; therefore, OnKure does not track its research and development expenses on a program-specific basis.

Conducting preclinical studies and clinical trials necessary to obtain regulatory approval is costly and time-consuming. As OnKure initiates new clinical trials, its research and development expenses may increase. Product candidates in later stages of development generally have higher development costs than those in earlier stages. As a result, OnKure expects that its research and development expenses will increase substantially over the next several years as it advances product candidates through preclinical studies into and through clinical trials, continues to discover and develop additional product candidates, undertakes activities to expand, maintain, protect and enforce its intellectual property portfolio, and hires additional research and development personnel.

Successful development of product candidates is highly uncertain and may not result in approved products. The probability of success for each product candidate may be affected by numerous factors, including clinical data, preclinical data, competition, manufacturability and commercial viability. Completion dates and completion costs can vary significantly for each product candidate and are difficult to predict. OnKure anticipates that it will make determinations as to which programs to pursue and how much funding to direct to each program on an ongoing basis in response to its ability to enter strategic alliances with respect to each program or product candidate, the scientific and clinical success of each product candidate and ongoing assessments as to each product candidate’s commercial potential. OnKure will need to raise additional capital and may seek strategic alliances in the future to advance its various programs.

Selling, General and Administrative

General and administrative expenses consist primarily of salaries, bonuses and related benefits, share-based compensation and severance and retention benefits related to OnKure’s executive, finance and administrative functions, professional fees for auditing, tax, consulting and legal services, as well as insurance, board of director compensation, consulting and other administrative expenses. OnKure recognizes general and administrative expenses in the periods in which they are incurred.

10

OnKure expects that its general and administrative expenses will increase over the next several years as it hires additional personnel to support the growth of its business. In addition, the Combined Company will incur significant additional expenses associated with being a public company, including expenses related to accounting, audit, legal, regulatory, public company reporting and compliance, director and officer insurance, investor and public relations and other administrative and professional services.

Other Income

Interest Income

Interest income primarily consists of interest income generated from OnKure’s cash equivalents in interest-bearing money market accounts.

Interest Expense

Interest expense consists of interest expense generated from OnKure’s convertible notes payable.

Results of Operations

Comparison of the Three Months Ended June 30, 2024 and 2023

The following table summarizes OnKure’s results of operations for the periods indicated:

| Three Months Ended June 30, |

||||||||||||

| 2024 | 2023 | $ Change | ||||||||||

| (in thousands) | ||||||||||||

Operating expenses: |

||||||||||||

Research and development |

$ | 10,752 | $ | 7,514 | $ | 3,238 | ||||||

General and administrative |

3,591 | 1,120 | 2,471 | |||||||||

|

|

|

|

|

|

|||||||

Total operating expenses |

14,343 | 8,634 | 5,709 | |||||||||

Loss from operations |

(14,343 | ) | (8,634 | ) | (5,709 | ) | ||||||

Other income (expense), net |

||||||||||||

Interest income |

230 | 451 | (221 | ) | ||||||||

Interest expense |

(26 | ) | — | (26 | ) | |||||||

|

|

|

|

|

|

|||||||

Total other income (expense), net |

204 | 451 | (247 | ) | ||||||||

|

|

|

|

|

|

|||||||

Net loss and comprehensive loss |

$ | (14,139 | ) | $ | (8,183 | ) | $ | (5,956 | ) | |||

Research and Development Expenses

Research and development expenses were $10.8 million for the three months ended June 30, 2024 compared to $7.5 million for the three months ended June 30, 2023, an increase of $3.2 million. This increase was primarily due to an increase in research and development costs, consisting of a $0.9 million increase in clinical trial and manufacturing expenses and a $2.7 million increase in personnel-related costs due to an increase in headcount, severance and share-based compensation charges. These increases were partially offset by a decrease of $0.5 million in outsourced research.

General and Administrative Expenses

General and administrative expenses were $3.6 million for the three months ended June 30, 2024 compared to $1.1 million for the three months ended June 30, 2023, an increase of $2.5 million. The increase was primarily due to an increase in personnel-related and consulting costs of $0.6 million and an increase in legal service costs of $1.8 million.

11

Other Income (Expense), net

Other income (expense), net was $0.2 million for the three months ended June 30, 2024 compared to $0.5 million for the three months ended June 30, 2023, a decrease of $0.3 million. The decrease was primarily due to a decrease in cash and cash equivalents available during the quarter ended June 30, 2024.

Comparison of the Six Months Ended June 30, 2024 and 2023

The following table summarizes OnKure’s results of operations for the periods indicated:

| Six Months Ended June 30, |

||||||||||||

| 2024 | 2023 | $ Change | ||||||||||

| (in thousands) | ||||||||||||

Operating expenses: |

||||||||||||

Research and development |

$ | 19,318 | $ | 15,037 | $ | 4,281 | ||||||

General and administrative |

4,857 | 2,349 | 2,508 | |||||||||

|

|

|

|

|

|

|||||||

Total operating expenses |

24,175 | 17,386 | 6,789 | |||||||||

Loss from operations |

(24,175 | ) | (17,386 | ) | (6,789 | ) | ||||||

Other income (expense), net |

||||||||||||

Interest income |

526 | 524 | 2 | |||||||||

Interest expense |

(26 | ) | — | (26 | ) | |||||||

|

|

|

|

|

|

|||||||

Total other income (expense), net |

500 | 524 | (24 | ) | ||||||||

|

|

|

|

|

|

|||||||

Net loss and comprehensive loss |

$ | (23,675 | ) | $ | (16,862 | ) | $ | (6,813 | ) | |||

|

|

|

|

|

|

|||||||

Research and Development Expenses

Research and development expenses were $19.3 million for the six months ended June 30, 2024 compared to $15.0 million for the six months ended June 30, 2023, an increase of $4.3 million. This increase was primarily due to an increase in research and development costs, consisting of a $1.9 million increase in clinical trial and manufacturing expenses and a $3.5 million increase in personnel-related costs due to an increase in headcount, severance and share-based compensation charges. These increases were partially offset by a decrease of $1.2 million in outsourced research.

General and Administrative Expenses

General and administrative expenses were $4.9 million for the six months ended June 30, 2024 compared to $2.3 million for the six months ended June 30, 2023, an increase of $2.5 million. The increase was primarily due to an increase in personnel-related and consulting costs of $0.6 million and an increase in legal service costs of $1.8 million.

Other Income (Expense), net

Other income (expense), net was $0.5 million for each of the six months ended June 30, 2024 and June 30, 2023.

12

Comparison of the Years Ended December 31, 2024 and 2023

The following table summarizes OnKure’s results of operations for the periods indicated:

| Year Ended December 31, | ||||||||

| 2023 | 2022 | |||||||

| (in thousands) | ||||||||

Operating expenses: |

||||||||

Research and development |

$ | 32,115 | $ | 25,862 | ||||

General and administrative |

4,819 | 3,904 | ||||||

|

|

|

|

|||||

Total operating expenses |

36,934 | 29,766 | ||||||

|

|

|

|

|||||

Loss from operations |

(36,934 | ) | (29,766 | ) | ||||

Other income (expense), net |

||||||||

Interest income |

1,623 | 254 | ||||||

|

|

|

|

|||||

Total other income (expense), net |

1,623 | 254 | ||||||

|

|

|

|

|||||

Net loss and comprehensive loss |

$ | (35,311 | ) | $ | (29,512 | ) | ||

|

|

|

|

|||||

Research and Development Expenses

Research and development expenses were $32.1 million for the year ended December 31, 2023 compared to $25.9 million for the year ended December 31, 2022, an increase of $6.2 million. The increase was primarily due to an increase in manufacturing costs of $3.4 million, an increase in clinical trial costs of $2.0 million, as well as an increase in personnel-related costs of $1.9 million related to an increase in headcount. These increases were partially offset by a decrease in outsourced research costs of $1.3 million.

General and Administrative Expenses

General and administrative expenses were $4.8 million for the year ended December 31, 2023 compared to $3.9 million for the year ended December 31, 2022, an increase of $0.9 million. The increase was primarily due to an increase of $0.6 million in personnel-related costs and an increase of $0.4 million in legal service costs.

Other Income (Expense), net

Other income (expense), net was $1.6 million for the year ended December 31, 2023 compared to $0.3 million for the year ended December 31, 2022, an increase of $1.4 million. The increase was primarily due to an increase in cash and cash equivalents available during 2023.

Liquidity and Capital Resources

Sources of Liquidity

Since inception, OnKure has not generated any revenue from product sales and has incurred significant operating losses and negative cash flows from its operations. OnKure expects to continue to incur significant expenses and operating losses for the foreseeable future as it advances the clinical development of its product candidates. OnKure expects that its research and development and general and administrative costs will continue to increase significantly, including in connection with conducting clinical trials and manufacturing its product candidates to support commercialization and providing general and administrative support for its operations, including the costs associated with operating as a public company following the Closing. As a result, OnKure will need additional capital to fund its operations, which OnKure may seek to obtain from equity or debt financings, collaborations, licensing arrangements or other sources.

OnKure has funded its operations primarily through private placements of common stock, convertible preferred stock and convertible debt, for cumulative gross proceeds of approximately $122 million as of June 30, 2024. However, OnKure has incurred significant recurring losses, including net losses of $23.7 million and $35.3 million for the six months ended June 30, 2024 and the year ended December 31, 2023, respectively.

13

OnKure had an accumulated deficit of $125.7 million as of June 30, 2024.

Going Concern

As of June 30, 2024, OnKure had cash and cash equivalents of $18.6 million. These factors raised substantial doubt about OnKure’s ability to continue as a going concern prior to the completion of the Merger and the Concurrent PIPE Investments. After giving effect to the completion of the Merger and the Concurrent PIPE Investments, OnKure believes the resulting cash resources will be sufficient to fund its planned for at least the next twelve months.

Future Capital Requirements

OnKure’s primary uses of cash to date have been to fund its research and development activities, including with respect to its PI3Kα and other programs, business planning, establishing and maintaining its intellectual property portfolio, hiring personnel, raising capital and providing general and administrative support for these activities.

OnKure has never generated any revenue from product sales. Management does not expect to generate any meaningful product revenue unless and until OnKure obtains regulatory approval for its product candidates, and management does not know when, or if, that will occur. Until OnKure can generate significant revenue from product sales, if ever, it will continue to require substantial additional capital to develop its product candidates and fund operations for the foreseeable future. OnKure is subject to all the risks inherent in the development of new biopharmaceutical products, and OnKure may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may harm its business.

In order to complete the development of OnKure’s product candidates and to build the sales, marketing and distribution infrastructure that management believes will be necessary to commercialize product candidates, if approved, OnKure will require substantial additional capital. Accordingly, until such time that OnKure can generate a sufficient amount of revenue from product sales or other sources, management expects to seek to raise any necessary additional capital through equity financings, debt financings or other capital sources, which could include income from collaborations, partnerships, licensing or other strategic arrangements with third parties. To the extent that OnKure raises additional capital through equity financings or convertible debt securities, the ownership interest of its stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of its stockholders. Debt financing and equity financing, if available, may involve agreements that include covenants limiting or restricting OnKure’s ability to take specific actions, including restricting its operations and limiting its ability to incur liens, issue additional debt, pay dividends, repurchase its own common stock, make certain investments or engage in merger, consolidation, licensing or asset sale transactions. If OnKure raises capital through collaborations, partnerships and other similar arrangements with third parties, it may be required to grant rights to develop and market product candidates that OnKure would otherwise prefer to develop and market itself. OnKure may be unable to raise additional capital from these sources on favorable terms, or at all.

OnKure’s ability to secure capital is dependent upon a number of factors, including its success in developing its product candidates. The failure to obtain sufficient capital on acceptable terms when needed could have a material adverse effect on OnKure’s business, results of operations or financial condition, including requiring OnKure to delay, reduce or curtail its research, product development or future commercialization efforts. OnKure may also be required to license rights to product candidates at an earlier stage of development or on less favorable terms than OnKure would otherwise choose. Management cannot provide assurance that OnKure will ever generate positive cash flow from operating activities.

OnKure’s future funding requirements will depend on many factors, including:

| • | the scope, timing, progress, results and costs of researching and developing OKI-219, and conducting preclinical studies and clinical trials; |

| • | the scope, timing, progress, results and costs of researching and developing other product candidates that OnKure may pursue; |

14

| • | the costs, timing and outcome of regulatory review of OnKure’s product candidates; |

| • | the costs of future activities, including product sales, medical affairs, marketing, manufacturing and distribution for OnKure’s product candidates for which it receives marketing approval; |

| • | the costs of manufacturing commercial-grade products and producing sufficient inventory to support commercial launch; |

| • | the revenue, if any, received from commercial sales of OnKure’s products, should its product candidates receive marketing approval; |

| • | the cost and timing of attracting, hiring and retaining skilled personnel to support OnKure’s operations and continued growth; |

| • | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing OnKure’s intellectual property rights and defending intellectual property-related claims; |

| • | OnKure’s ability to establish, maintain and derive value from collaborations, partnerships or other marketing, distribution, licensing or other strategic arrangements with third parties on favorable terms, if at all; |

| • | the extent to which OnKure acquires or in-licenses other product candidates and technologies, if any; and |

| • | the costs associated with operating as a public company. |

A change in the outcome of any of these or other factors with respect to the development of OKI-219 or any of OnKure’s future product candidates could significantly change the costs and timing associated with the development of that product candidate. Furthermore, OnKure’s operating plans may change in the future, and OnKure may need additional capital to meet the capital requirements associated with such operating plans.

Cash Flows

The following table summarizes OnKure’s cash flows for the periods indicated, in thousands:

| Six Months Ended June 30, |

Year Ended December 31, |

|||||||||||||||

| 2024 | 2023 | 2023 | 2022 | |||||||||||||

Net cash used in operating activities |

$ | (17,102 | ) | $ | (15,646 | ) | $ | (34,546 | ) | $ | (26,953 | ) | ||||

Net cash used in investing activities |

(19 | ) | (71 | ) | (246 | ) | (1,134 | ) | ||||||||

Net cash provided by financing activities |

5,878 | 53,106 | 53,125 | 26,465 | ||||||||||||

|

|

|

|

|

|

|

|

|||||||||

Net increase (decrease) in cash and cash equivalents |

$ | (11,243 | ) | $ | 37,389 | $ | 18,333 | $ | (1,622 | ) | ||||||

Cash Flows from Operating Activities

Net cash used in operating activities during the six months ended June 30, 2024 was $17.1 million. This consisted primarily of a net loss of $23.7 million, and a net decrease in OnKure’s operating assets and liabilities of $4.4 million, partially offset by non-cash charges for share-based compensation and depreciation and amortization.

Net cash used in operating activities during the six months ended June 30, 2023 was $15.6 million. This consisted primarily of a net loss of $16.9 million, partially offset by a net increase in OnKure’s operating assets and liabilities of $0.9 million, primarily due to increases in accounts payable and accrued expenses.

Net cash used in operating activities during the year ended December 31, 2023 was $34.5 million. This consisted primarily of a net loss of $35.3 million, partially offset by the non-cash charge for share-based compensation, depreciation and amortization.

Net cash used in operating activities during the year ended December 31, 2022 was $27.0 million. This consisted primarily of a net loss of $29.5 million, partially offset by a net increase in OnKure’s operating assets and liabilities of $2.1 million, primarily due to increases in accounts payable and accrued expenses.

Cash Flows from Investing Activities

Net cash used in investing activities for the six months ended June 30, 2024 was $19 thousand and related to purchase of property and equipment.

15

Net cash used in investing activities for the three months ended June 30, 2023 was $71 thousand and related to purchase of property and equipment.

Net cash used in investing activities for the year ended December 31, 2023 was $0.2 million and related to purchase of property and equipment.

Net cash used in investing activities for the year ended December 31, 2022 was $1.1 million and related to leasehold improvements and the purchase of property and equipment.

Cash Flows from Financing Activities

Net cash provided by financing activities was $5.9 million during the six months ended June 30, 2024 and related primarily to proceeds from the issuance of convertible notes payable.

Net cash provided by financing activities was $53.1 million during the six months ended June 30, 2023. This consisted primarily of proceeds of $53.8 million resulting from the sale of shares of OnKure preferred stock, partially offset by $0.7 million of issuance costs.

Net cash provided by financing activities during the year ended December 31, 2023 was $53.1 million. This consisted primarily of proceeds of $53.8 million resulting from the sale of shares of OnKure preferred stock, partially offset by $0.7 million of issuance costs.

Net cash provided by financing activities during the year ended December 31, 2022 was $26.5 million. This consisted primarily of proceeds of $27.5 million resulting from the sale of shares of OnKure preferred stock and $0.3 million related to proceeds from the sale of shares of OnKure common stock, partially offset by $1.4 million of issuance costs.

Contractual Obligations and Commitments

OnKure leases certain office space in Boulder, Colorado pursuant to a lease which is scheduled to expire on December 31, 2026.

The following table summarizes OnKure’s contractual obligations and commitments as of June 30, 2024 (in thousands):

| Payments Due by Period | ||||||||||||||||

| Total | Remainder of 2024 |

2025-2026 | Thereafter | |||||||||||||

Operating lease obligation |

$ | 605 | $ | 118 | $ | 487 | $ | — | ||||||||

OnKure also entered into agreements in the normal course of business with certain vendors for the provision of goods and services, which includes manufacturing services with CMOs and development services with CROs. These agreements may include certain provisions for purchase obligations and termination obligations that could require payments for the cancellation of committed purchase obligations or for early termination of the agreements. The amounts of the cancellation or termination payments vary and are based on the timing of the cancellation or termination and the specific terms of the agreement. These obligations and commitments are not separately presented.

Off-Balance Sheet Arrangements

OnKure currently does not have, and did not have during the periods presented, any off-balance sheet arrangements, as defined in the rules and regulations of the SEC.

Critical Accounting Policies and Significant Judgments and Estimates

OnKure’s financial statements are prepared in accordance with U.S. GAAP. The preparation of OnKure’s financial statements and related disclosures requires OnKure to make estimates and judgments that affect the reported amounts of assets, liabilities, costs and expenses, and the disclosure of contingent assets and liabilities in its financial statements.

16

OnKure bases its estimates on historical experience, known trends and events and various other factors that OnKure believes are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. OnKure evaluates its estimates and assumptions on a periodic basis. OnKure’s actual results may differ from these estimates.

While OnKure’s significant accounting policies are described in more detail in the notes to its annual audited financial statements included as Exhibit 99.1 to this Current Report on Form 8-K, OnKure believes that the following accounting policies are critical to understanding its historical and future performance, as the policies relate to the more significant areas involving management’s judgments and estimates used in the preparation of OnKure’s financial statements.

There have been no material changes to OnKure’s significant accounting policies during the period ended June 30, 2024.

Accrued Research and Development Expense

OnKure records research and development expenses in the period in which it receives or takes ownership of the applicable goods or when the applicable services are performed. OnKure is required to estimate its expenses resulting from its obligations under contracts with vendors, consultants and CROs in connection with conducting research and development activities. The financial terms of these contracts are subject to negotiations, which vary from contract to contract and may result in payment flows that do not match the periods over which materials or services are provided under such contracts. OnKure reflects research and development expenses in its financial statements by matching those expenses with the period in which services are expended. OnKure accounts for these expenses according to the progress of the preclinical studies or clinical trials, as measured by the timing of various aspects of the study or related activities. OnKure determines accrual estimates through a review of the underlying contracts along with the preparation of financial models considering discussions with research and other key personnel as to the progress of studies, trials or other services being conducted. During a study or trial, OnKure adjusts its rate of expense recognition if actual results differ from its estimate. Nonrefundable advance payments for goods and services, including fees for process development or manufacturing and distribution of clinical supplies that will be used in future research and development activities, are deferred and recognized as an expense in the period that the related goods are consumed, or services are performed.

Share-Based Compensation

OnKure maintains equity incentive compensation plans under which incentive stock options and nonqualified stock options to purchase OnKure common stock, and RSUs, are granted to employees, members of the OnKure board of directors, and non-employee consultants. Share-based compensation cost is measured at the grant date, based on the fair value of the award, and is recognized as expense over the requisite service or performance period. The fair value of OnKure stock options granted to employees is estimated using the Black-Scholes option pricing model.

The Black-Scholes valuation method requires certain assumptions be used as inputs, such as the fair value of the underlying OnKure common stock, expected term of the option before exercise, expected volatility of OnKure common stock, the risk-free interest rate and expected dividend. OnKure stock options granted have a maximum contractual term of 10 years. OnKure has limited historical stock option activity and therefore estimates the expected term of stock options granted using the simplified method, which represents the arithmetic average of the original contractual term of the OnKure stock option and its weighted-average vesting term. The expected volatility of OnKure stock options is based on the historical volatility of several publicly traded companies in similar stages of clinical development. OnKure will continue to apply this process until enough historical information regarding the volatility of its stock price becomes available. The risk-free interest rates used are based on the U.S. Treasury yield in effect at the time of grant for zero-coupon U.S. Treasury notes with maturities approximately equal to the expected term of the applicable OnKure stock option. OnKure has historically not declared or paid any dividends and does not currently expect to do so in the foreseeable future, and therefore has estimated the dividend yield to be zero.

17

Legacy OnKure Common Stock Valuation

There was no public market for Legacy OnKure common stock prior to the Merger. As such, the estimated fair value of Legacy OnKure common stock has historically been determined at each grant date by the Legacy OnKure board of directors, with input from management, based on the information known to Legacy OnKure on the grant date and upon a review of any recent events and their potential impact on the estimated per-share fair value of Legacy OnKure common stock. As part of these fair value determinations, the Legacy OnKure board of directors obtained and considered valuation reports prepared by an independent third-party valuation specialist in accordance with the guidance outlined in the American Institute of Certified Public Accountants Technical Practice Aid, Valuation of Privately-Held-Company Equity Securities Issued as Compensation. In order to determine the fair value, management considered, among other things, Legacy OnKure’s actual operating and financial performance, Legacy OnKure’s current business conditions and projections, the lack of marketability of Legacy OnKure common stock and the market performance of comparable publicly traded companies.

Each valuation methodology includes estimates and assumptions that require management’s judgment. These estimates and assumptions include a number of objective and subjective factors, including external market conditions, the prices at which Legacy OnKure sold shares of Legacy OnKure preferred stock, the superior rights and preferences of the Legacy OnKure preferred stock senior to Legacy OnKure common stock at the time, the progress of Legacy OnKure’s research and development programs, including their stages of development, Legacy OnKure’s business strategy, trends within the biotechnology industry, Legacy OnKure’s financial position, including cash on hand and its historical and forecasted performance and operating results, the lack of an active public market for Legacy OnKure common stock, the market performance of peer companies in the biopharmaceutical industry, and a probability analysis of various liquidity events, such as a public offering or sale of Legacy OnKure, under differing scenarios. Changes to the key assumptions used in the valuations could result in materially different fair values of Legacy OnKure common stock at each valuation date.

Following the closing of the Merger, the Board will determine the fair value of Class A Common Stock based on the closing price of the Class A Common Stock as reported on the date of grant on the primary stock exchange on which such common stock is traded.

See Note 6 to Legacy OnKure’s annual audited financial statements included as Exhibit 99.1 to this Current Report on Form 8-K for further details.

Legacy OnKure recorded share-based compensation expense of $1.8 million and $17 thousand for the three months ended June 30, 2024 and 2023, respectively, $1.9 million and $32 thousand for the six months ended June 30, 2024 and 2023, respectively, and $0.2 million and $48 thousand for the years ended December 31, 2023 and 2022, respectively. Legacy OnKure recorded accelerated share-based compensation expenses related to modifications of RSUs under certain separation agreements of $1.7 million during the three and six months ended June 30, 2024. As of June 30, 2024, Legacy OnKure had $0.4 million of unrecognized share-based compensation expense for unvested stock options, which it expects to recognize over an estimated weighted-average period of 2.6 years. As of June 30, 2024, Legacy OnKure had $0.3 million of unrecognized share-based compensation expense for unvested restricted stock unit awards, which it expects to recognize over an estimated weighted-average period of 2.7 years. OnKure expects to continue to grant stock options and other share-based awards in the future, and to the extent that it does, OnKure’s share-based compensation expense recognized in future periods will likely increase.

Recent Accounting Pronouncements

A description of recently issued accounting pronouncements that may potentially impact OnKure’s financial condition and results of operations is disclosed in Note 2 of OnKure’s annual audited financial statements and unaudited interim financial statements appearing elsewhere in this Current Report on Form 8-K.

Quantitative and Qualitative Disclosures About Market Risks

Interest Rate Risk

As of June 30, 2024 and December 31, 2023, OnKure’s cash and cash equivalents consisted primarily of U.S. Treasury-backed money market funds. OnKure’s primary exposure to market risk is interest income sensitivity, which is affected by changes in the general level of U.S. interest rates. However, because of the short-term maturities of OnKure’s investments, OnKure believes a hypothetical 100 basis point increase or decrease in interest rates during any of the periods presented would not have had a material impact on its financial results.

18

As of June 30, 2024, OnKure had convertible notes payable outstanding with fixed interest rates and was therefore not exposed to interest rate risk with respect to debt.

Foreign Currency Exchange Risk

OnKure’s primary operations are transacted in U.S. dollars. However, OnKure has entered into a limited number of contracts with vendors for research and development services that are denominated in foreign currencies, including the British Pound or Euros. OnKure could be subject to foreign currency transaction gains or losses on OnKure’s contracts denominated in foreign currencies. OnKure does not currently engage in any hedging activity to reduce OnKure’s potential exposure to currency fluctuations, although it may choose to do so in the future. OnKure believes a hypothetical 100 basis point increase or decrease in foreign exchange rates during any of the periods presented would not have had a material impact on its financial condition or results of operations.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of the shares of Class A Common Stock immediately after completion of the Merger and the Concurrent PIPE Investments, by:

| • | each person known by the Combined Company to be the beneficial owner of more than 5% of the Combined Company’s outstanding Class A Common Stock immediately following the consummation of the Transactions; |

| • | each of the Combined Company’s executive officers and directors; and |

| • | all of the Combined Company’s directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if such person possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes securities that such person has the right to acquire, such as through the exercise of stock options, within 60 days of the Closing Date. Shares subject to warrants and options that are currently exercisable or exercisable within 60 days of the Closing Date are considered outstanding and beneficially owned by the person holding such warrant and/or options for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Except as noted by footnote, and subject to community property laws where applicable, based on the information provided to the Combined Company, the Combined Company believes that the individuals and entities named in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise noted, the business address of each of the directors and executive officers of the Combined Company is 6707 Winchester Circle, Suite 400, Boulder, CO 80301. The percentage of beneficial ownership of the Combined Company is calculated based on 12,652,811 shares of Class A Common Stock and 686,527 shares of non-voting Class B Common Stock outstanding immediately after giving effect to the Transactions.

19

| Name of Beneficial Owner | Number of Shares of Class A Common Stock Beneficially Owned |

Percentage of Shares of Class A Common Stock Outstanding Beneficially Owned |

||||||

Greater than 5% Stockholders: |

||||||||

Acorn Bioventures, L.P. (1) |

1,439,674 | 11.4 | % | |||||

Entities affiliated with Citadel Advisors (2) |

1,062,836 | 8.4 | % | |||||

Entities affiliated with Cormorant Asset Management LP (3) |

1,837,739 | 14.5 | % | |||||

Perceptive Life Sciences Master Fund, Ltd. (4) |

1,004,439 | 7.9 | % | |||||

Samsara BioCapital, L.P. (5) |

824,155 | 6.5 | % | |||||

Named Executive Officers and Directors: |

||||||||

Nicholas A. Saccomano, Ph.D. (6) |

— | — | ||||||

Jason Leverone, CPA (7) |

— | — | ||||||

Isaac Manke, Ph.D. (1) |