UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

July 17, 2024

(Date of report; date of

earliest event reported)

Commission file number: 1-3754

ALLY FINANCIAL INC.

(Exact name of registrant as specified in its charter)

| Delaware | 38-0572512 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Ally Detroit Center

500 Woodward Ave.

Floor 10, Detroit, Michigan

48226

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act (listed on the New York Stock Exchange):

Title of each class |

Trading symbols |

|

| Common Stock, par value $0.01 per share | ALLY |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operation and Financial Condition. |

On July 17, 2024, Ally Financial Inc. issued a press release announcing preliminary operating results for the second quarter ended June 30, 2024. The press release is attached hereto and incorporated by reference as Exhibit 99.1. Charts furnished to securities analysts are attached hereto and incorporated by reference as Exhibit 99.2. In addition, supplemental financial data furnished to securities analysts is attached hereto and incorporated by reference as Exhibit 99.3.

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit No. | Description |

|

| 99.1 | Press Release, Dated July 17, 2024 | |

| 99.2 | Charts Furnished to Securities Analysts | |

| 99.3 | Supplemental Financial Data Furnished to Securities Analysts | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALLY FINANCIAL INC. | ||

| (Registrant) | ||

| Dated: July 17, 2024 | /s/ David J. DeBrunner |

|

| David J. DeBrunner | ||

| Vice President, Controller, and Chief Accounting Officer | ||

Exhibit 99.1

News release: IMMEDIATE RELEASE

Ally Financial Reports Second Quarter 2024 Financial Results

| $0.86 | 9.3% | $257 million | $2.0 billion | |||

| GAAP EPS | RETURN ON COMMON EQUITY | PRE-TAX INCOME | GAAP TOTAL NET REVENUE | |||

| $0.97 | 14.0% | $299 million | $2.0 billion | |||

| ADJUSTED EPS1 | CORE ROTCE1 | CORE PRE-TAX INCOME1 | ADJUSTED TOTAL NET REVENUE1 | |||

|

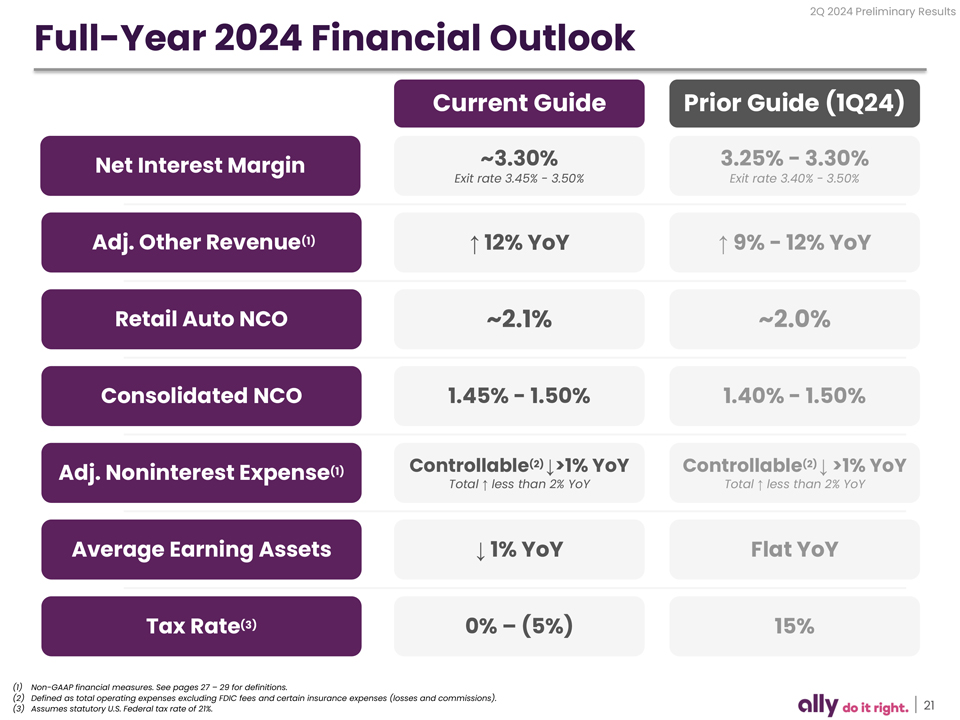

• Strong quarter over quarter improvement in net interest margin and earnings following 1Q 2024 trough

• NIM ex. OID1 of 3.30% is up 14 bps quarter over quarter as deposit costs have stabilized; well-positioned for various rate scenarios

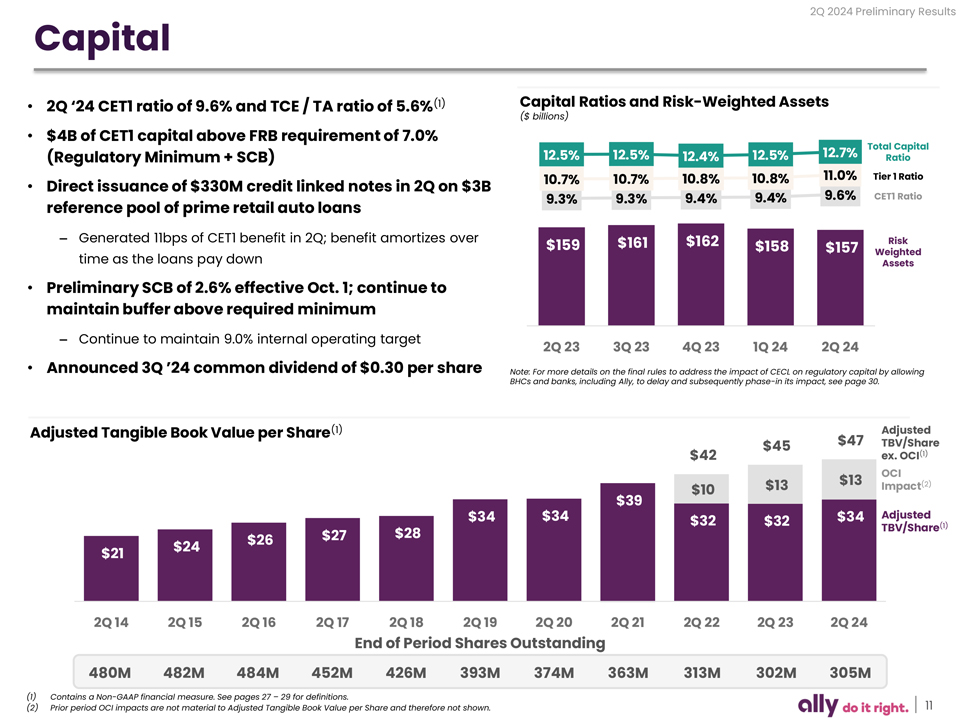

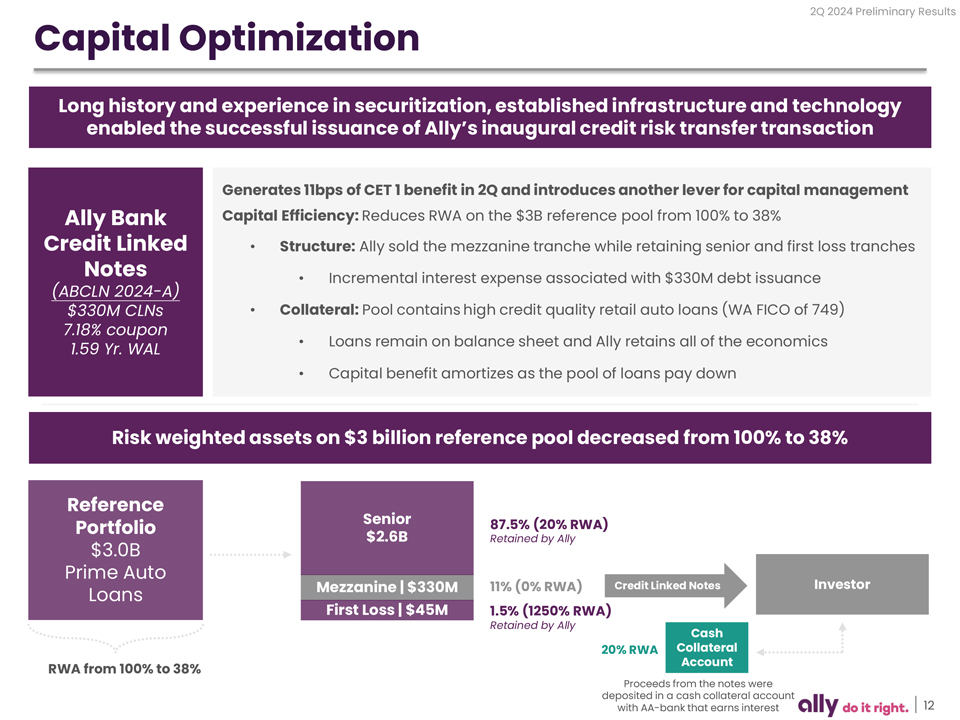

• Common equity tier 1 ratio of 9.6% increased 18 bps quarter over quarter; executed first credit risk transfer transaction in 2Q

• $4 billion of excess CET1 above required minimums; preliminary stress capital buffer of 2.6% up from 2.5%, effective October 1st |

|

|

• 3.7 million consumer auto applications and $9.8 billion of consumer auto origination volume

• Retail auto originated yield1 of 10.59% with 44% of volume within highest credit quality tier

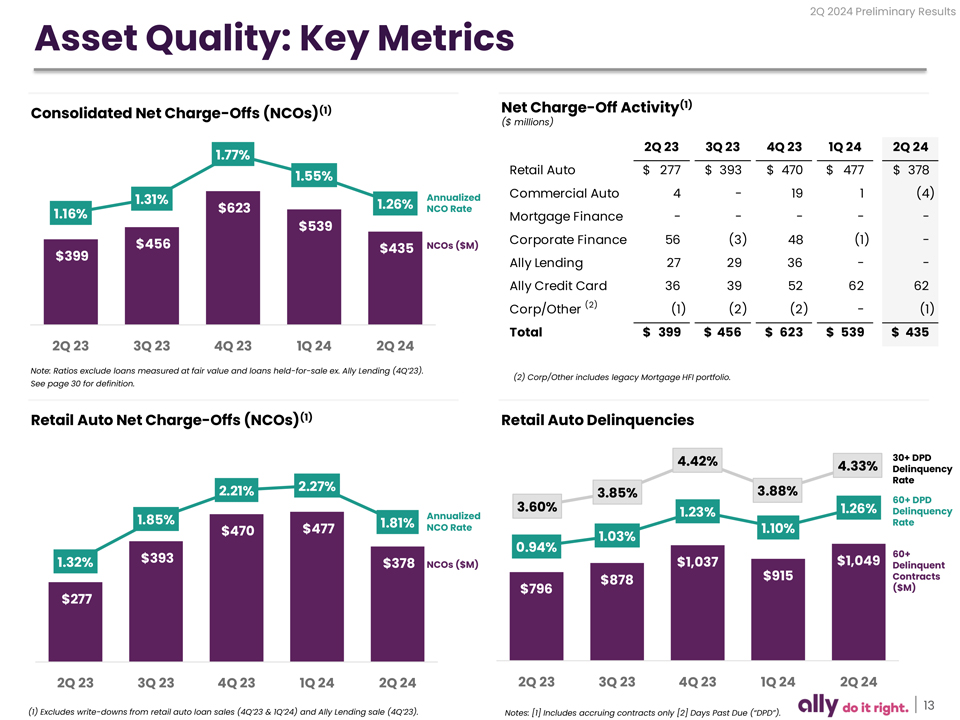

• 181 bps retail auto net charge-offs, down 46 bps quarter over quarter due to seasonal trends

• Insurance written premiums of $344 million, up 15% year over year; solid momentum in P&C and F&I

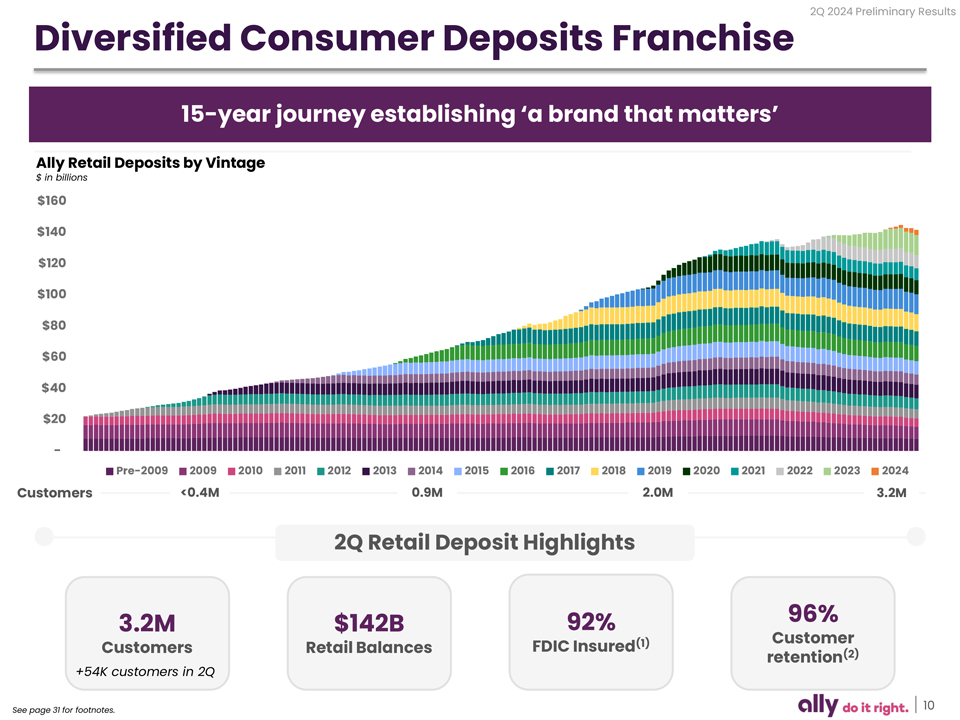

• $142 billion of retail deposits, down $3 billion quarter over quarter from seasonal tax outflows

• 61 consecutive quarters of retail deposit customer growth, up 54 thousand in 2Q; 3.2 million customers

• 1.2 million active credit cardholders; balanced approach to growth

• Corporate Finance HFI portfolio of $9.7 billion; criticized and non-performing assets near historic lows |

|

|

“In the second quarter, Ally delivered strong financial and operating results. We continue to execute within our market leading franchises, creating value for our customers by embracing our ‘Do It Right’ culture,” said Chief Executive Officer, Michael Rhodes.

“The strength of our Dealer Financial Services franchise is evident in our scale. We decisioned 3.7 million consumer applications, a second quarter record, and originated nearly $10 billion retail loan and lease volume across the credit spectrum. Insurance written premiums of $344 million demonstrate our unique ability to provide comprehensive, all-in value to our dealer customers.

At Ally Bank, we have established a model of banking through transparency and trust with our over three million customers that hold $142 billion of retail deposits. Our differentiated, all-digital approach provides value that extends beyond rates proven by our 61st consecutive quarter of deposit customer growth and over one million engaged savings customers.

Ally has consistently demonstrated its commitment to our customers, employees, and communities through living out our purpose-driven ‘Do It Right’ culture of customer obsession and innovation – this will remain our blueprint for success in the years ahead. I’ve long admired Ally from a distance – I’m energized to lead this great company and l am looking forward to launching the next chapter of Ally’s evolution with my 11 thousand plus teammates.” |

|

Second Quarter 2024 Financial Results |

||||||||||

| Increase / (Decrease) vs. | ||||||||||||||||||||

| ($ millions except per share data) |

2Q 24 | 1Q 24 | 2Q 23 | 1Q 24 | 2Q 23 | |||||||||||||||

| GAAP Net Income Attributable to Common Shareholders |

$ | 266 | $ | 129 | $ | 301 | 106 | % | (12 | ) % | ||||||||||

|

Core Net Income Attributable to Common Shareholders1 |

$ | 299 | $ | 139 | $ | 291 | 116 | % | 3 | % | ||||||||||

| GAAP Earnings per Common Share |

$ | 0.86 | $ | 0.42 | $ | 0.99 | 105 | % | (13 | ) % | ||||||||||

|

Adjusted EPS1 |

$ | 0.97 | $ | 0.45 | $ | 0.96 | 115 | % | 1 | % | ||||||||||

| Return on GAAP Shareholder’s Equity |

9.3 | % | 4.5 | % | 10.8 | % | 105 | % | (14 | ) % | ||||||||||

|

Core ROTCE1 |

14.0 | % | 6.5 | % | 13.9 | % | 117 | % | 1 | % | ||||||||||

| GAAP Common Shareholder’s Equity per Share |

$ | 37.84 | $ | 37.28 | $ | 37.16 | 1 | % | 2 | % | ||||||||||

|

Adjusted Tangible Book Value per Share1 |

$ | 33.51 | $ | 32.89 | $ | 32.08 | 2 | % | 4 | % | ||||||||||

| GAAP Total Net Revenue |

$ | 2,000 | $ | 1,986 | $ | 2,079 | 1 | % | (4 | ) % | ||||||||||

|

Adjusted Total Net Revenue1 |

$ | 2,042 | $ | 1,989 | $ | 2,066 | 3 | % | (1 | ) % | ||||||||||

1 The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Adjusted Total Net Revenue, Core Pre-Tax Income, Core Net Income Attributable to Common Shareholders, Core OID, Core Return on Tangible Common Equity (Core ROTCE), Estimated Retail Auto Originated Yield, Tangible Common Equity, Net Financing Revenue (excluding Core OID) and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this release.

| Discussion of Second Quarter 2024 Results | ||||

|

Net income attributable to common shareholders was $266 million in the quarter, compared to $301 million in the second quarter of 2023. The decrease was driven by lower net financing revenue, higher provision for credit losses, and higher noninterest expenses.

Net financing revenue was $1.5 billion, down $78 million year over year primarily driven by higher funding costs, partially offset by the strength in retail auto loan pricing and continued expansion of earning asset yields.

Other revenue decreased $1 million year over year to $505 million including a $28 million decrease in fair value of equity securities in the quarter compared to a $25 million increase in the second quarter of 2023. Adjusted other revenueA, excluding the change in fair value of equity securities, of $533 million increased $52 million year over year, driven by momentum within Insurance and diversified fee revenue from SmartAuction and Passthrough platforms.

Net interest margin (“NIM”) of 3.27% decreased 11 bps year over year. Excluding Core OIDA, NIM of 3.30% was also down 11 bps year over year, due to higher funding costs, partially offset by continued strength in new origination yields.

Provision for credit losses increased $30 million year over year to $457 million, reflecting higher net charge-offs.

Noninterest expense increased $37 million year over year primarily driven by higher weather losses in Insurance and higher servicing expense within Auto.

A tax benefit of $37 million resulted from an effective tax rate of (14%) in the quarter driven by strong EV lease originations. |

||||

| A | Represents a non-GAAP financial measure. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release. |

| Second Quarter 2024 Financial Results | ||||

| Increase/(Decrease) vs. | ||||||||||||||||||||

| ($ millions except per share data) | 2Q 24 | 1Q 24 | 2Q 23 | 1Q 24 | 2Q 23 | |||||||||||||||

| (a) Net Financing Revenue |

$ | 1,495 | $ | 1,456 | $ | 1,573 | $ | 39 | $ | (78) | ||||||||||

| Core OID1 |

14 | 13 | 12 | 1 | 2 | |||||||||||||||

| Net Financing Revenue (excluding Core OID)1 |

1,509 | 1,469 | 1,585 | 40 | (76) | |||||||||||||||

| (b) Other Revenue |

505 | 530 | 506 | (25) | (1) | |||||||||||||||

| Change in Fair Value of Equity Securities2 |

28 | (11) | (25) | 39 | 53 | |||||||||||||||

| Adjusted Other Revenue1 |

533 | 519 | 481 | 14 | 52 | |||||||||||||||

| (c) Provision for Credit Losses |

457 | 507 | 427 | (50) | 30 | |||||||||||||||

| (d) Noninterest Expense |

1,286 | 1,308 | 1,249 | (22) | 37 | |||||||||||||||

| Repositioning3 |

- | (10) | - | 10 | - | |||||||||||||||

| Noninterest Expense (excluding Repositioning)1 |

1,286 | 1,298 | 1,249 | (12) | 37 | |||||||||||||||

| Pre-Tax Income (a+b-c-d) |

$ | 257 | $ | 171 | $ | 403 | $ | 86 | $ | (146) | ||||||||||

| Income Tax Expense (Benefit) |

(37) | 14 | 74 | (51) | (111) | |||||||||||||||

| Net Loss from Discontinued Operations |

- | - | - | - | - | |||||||||||||||

| Net Income |

$ | 294 | $ | 157 | $ | 329 | $ | 137 | $ | (35) | ||||||||||

| Preferred Dividends |

28 | 28 | 28 | - | - | |||||||||||||||

| Net Income Attributable to Common Shareholders |

$ | 266 | $ | 129 | $ | 301 | $ | 137 | $ | (35) | ||||||||||

| GAAP EPS (diluted) |

$ | 0.86 | $ | 0.42 | $ | 0.99 | $ | 0.44 | $ | (0.13) | ||||||||||

| Core OID, Net of Tax1 |

0.04 | 0.03 | 0.03 | 0.00 | 0.00 | |||||||||||||||

| Change in Fair Value of Equity Securities, Net of Tax3 |

0.07 | (0.03) | (0.06) | 0.10 | 0.14 | |||||||||||||||

| Repositioning, Discontinued Ops., and Other, Net of Tax3 |

- | 0.02 | - | (0.02) | - | |||||||||||||||

| Adjusted EPS1 |

$ | 0.97 | $ | 0.45 | $ | 0.96 | $ | 0.52 | $ | 0.01 | ||||||||||

| (1) | Represents a non-GAAP financial measure. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release. |

| (2) | Impacts the Insurance, Corporate Finance and Corporate and Other segments. The change reflects fair value adjustments to equity securities that are reported at fair value. Management believes the change in fair value of equity securities should be removed from select financial measures because it enables the reader to better understand the business’s ongoing ability to generate revenue and income. |

| (3) | Contains non-GAAP financial measures and other financial measures. See pages 5 and 6 for definitions. |

Note: Repositioning items represent costs associated with the FDIC Special Assessment in 1Q'24.

2

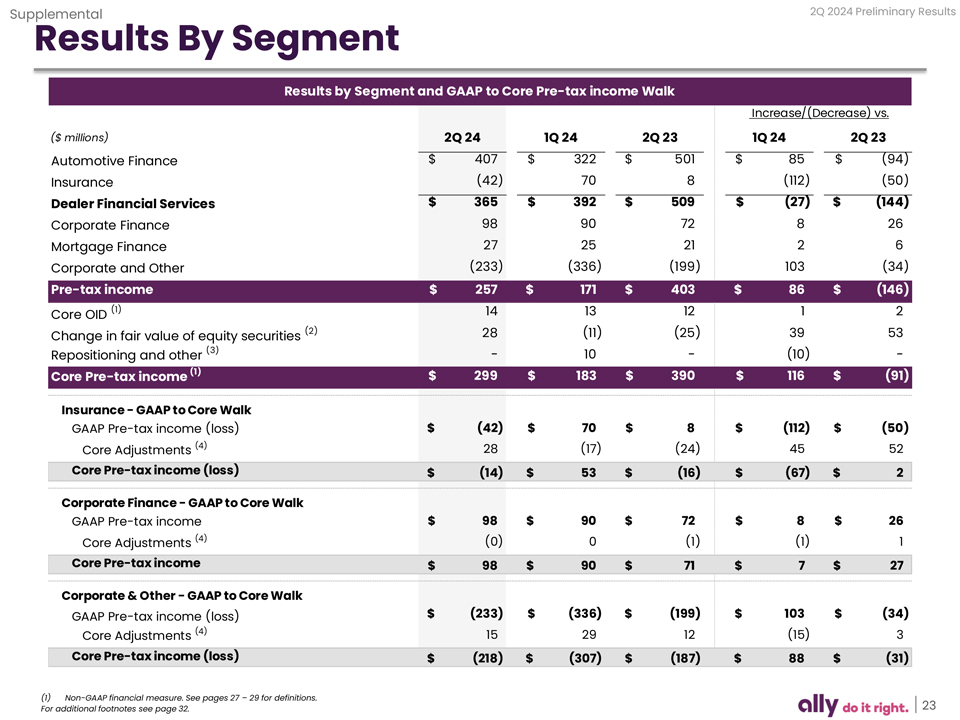

| Pre-Tax Income by Segment | ||||

| Increase/(Decrease) vs. | ||||||||||||||||||||

| ($ millions) | 2Q 24 | 1Q 24 | 2Q 23 | 1Q 24 | 2Q 23 | |||||||||||||||

| Automotive Finance |

$ | 407 | $ | 322 | $ | 501 | $ | 85 | $ | (94) | ||||||||||

| Insurance |

(42) | 70 | 8 | (112) | (50) | |||||||||||||||

| Dealer Financial Services |

$ | 365 | $ | 392 | $ | 509 | $ | (27) | $ | (144) | ||||||||||

| Corporate Finance |

98 | 90 | 72 | 8 | 26 | |||||||||||||||

| Mortgage Finance |

27 | 25 | 21 | 2 | 6 | |||||||||||||||

| Corporate and Other |

(233) | (336) | (199) | 103 | (34) | |||||||||||||||

| Pre-Tax Income from Continuing Operations |

$ | 257 | $ | 171 | $ | 403 | $ | 86 | $ | (146) | ||||||||||

| Core OID1 |

14 | 13 | 12 | 1 | 2 | |||||||||||||||

| Change in Fair Value of Equity Securities2,3 |

28 | (11) | (25) | 39 | 53 | |||||||||||||||

| Repositioning and Other3 |

- | 10 | - | (10) | - | |||||||||||||||

| Core Pre-Tax Income1 |

$ | 299 | $ | 183 | $ | 390 | $ | 116 | $ | (91) | ||||||||||

| (1) | Represents a non-GAAP financial measure. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release. |

| (2) | Change in fair value of equity securities primarily impacts the Insurance, Corporate Finance, and Corporate and Other segments. Reflects equity fair value adjustments which requires change in the fair value of equity securities to be recognized in current period net income. |

| (3) | Contains non-GAAP financial measures and other financial measures. See pages 5 and 6 for definitions. |

| Discussion of Segment Results | ||||

|

Auto Finance Pre-tax income of $407 million was down $94 million year over year, primarily driven by higher net charge-offs and noninterest expense.

Net financing revenue of $1,314 million was down $35 million year over year, driven by elevated funding costs. Ally’s retail auto portfolio yield, excluding the impact from hedges, increased 99 bps year over year to 8.86% as the portfolio turns over and reflects higher originated yields from recent periods.

Provision for credit losses of $383 million increased $52 million year over year, driven by higher retail auto net charge-offs. The retail auto net charge-off rate was 1.81%.

Noninterest expense of $617 million was up $17 million year over year primarily driven by servicing-related expenses.

Consumer auto originations of $9.8 billion included $6.1 billion of used retail volume, or 62% of total originations, $2.8 billion of new retail volume, and $0.9 billion of leases. Estimated retail auto originated yieldB was 10.59% in the quarter with 44% of originations in the highest credit quality tier.

End-of-period auto earning assets increased $1.9 billion year over year from $115.4 billion to $117.3 billion. End-of-period consumer auto earning assets of $92.1 billion decreased $2.6 billion year over year, driven by retail auto loan sales in recent periods. End-of-period commercial earning assets of $25.2 billion were $4.5 billion higher year over year, driven by higher new vehicle inventory.

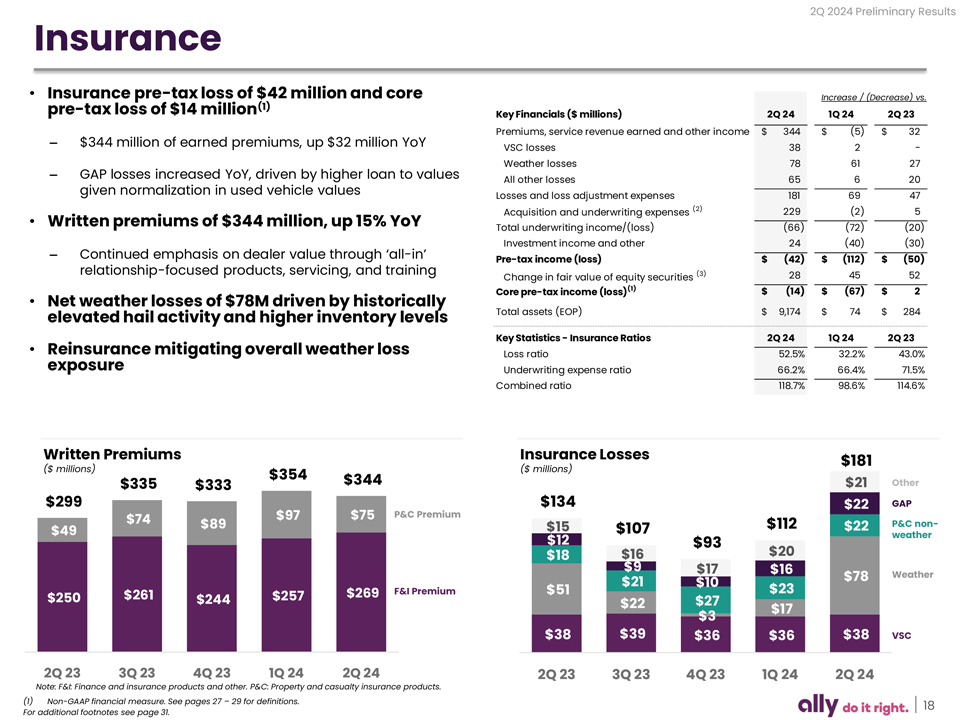

Insurance Pre-tax loss of $42 million was $50 million unfavorable year over year. Results reflect a $52 million decrease in the change in fair value of equity securities. Core pre-tax lossC of $14 million increased $2 million year over year, which was supported by $344 million of earned premiums in the quarter.

Insurance losses of $181 million were up $47 million year over year, driven by higher weather losses and higher GAP losses due to higher loan-to-values given normalization in used vehicle values.

Written premiums of $344 million, up 15% year over year, driven by growth in both P&C and F&I premiums.

Total investment income, excluding the change in fair value of equity securitiesD, was $52 million, up $22 million year over year driven by higher realized investment gains.

|

BEstimated Retail Auto Originated Yield is a forward-looking non-GAAP financial measure determined by calculating the estimated average annualized yield for loans originated during the period. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release.

CRepresents a non-GAAP financial measure. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release.

DChange in the fair value of equity securities to be recognized in current period net income. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms and Reconciliation to GAAP later in this press release.

3

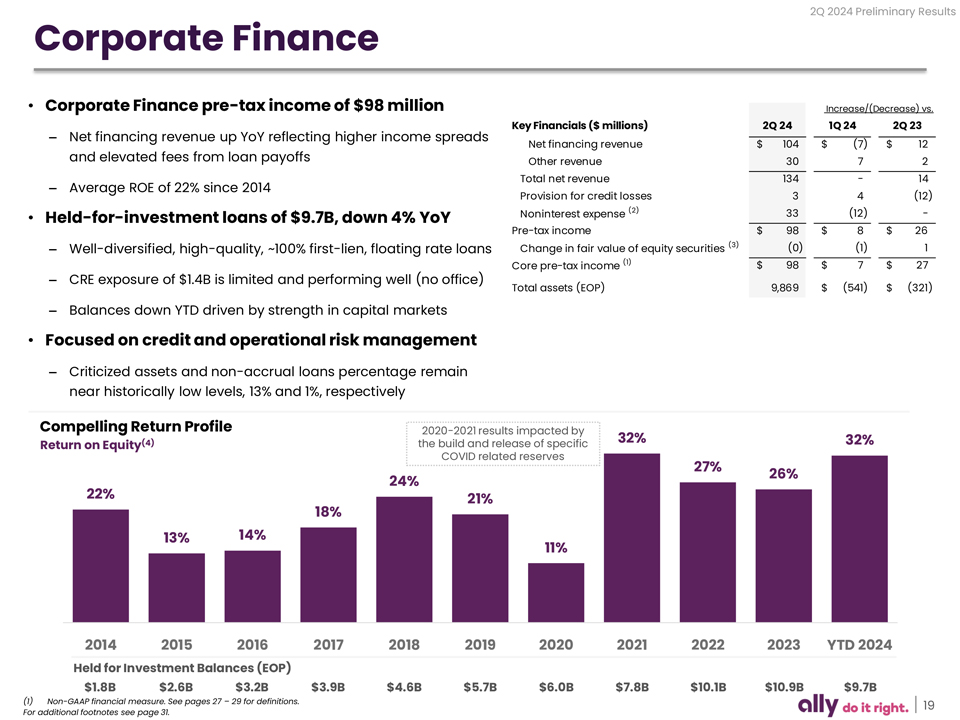

| Corporate Finance Pre-tax income of $98 million was up $26 million year over year driven by higher net financing revenue and lower provision expense.

Net financing revenue increased $12 million year over year to $104 million primarily driven by higher income spreads and elevated fees from loan payoffs. Other revenue of $30 million was up $2 million year over year.

Provision expense of $3 million was down $12 million year over year primarily driven by prior period specific reserve build.

The held-for-investment loan portfolio of $9.7 billion is effectively all first lien. Loans secured by commercial real estate of $1.4B continue to perform well.

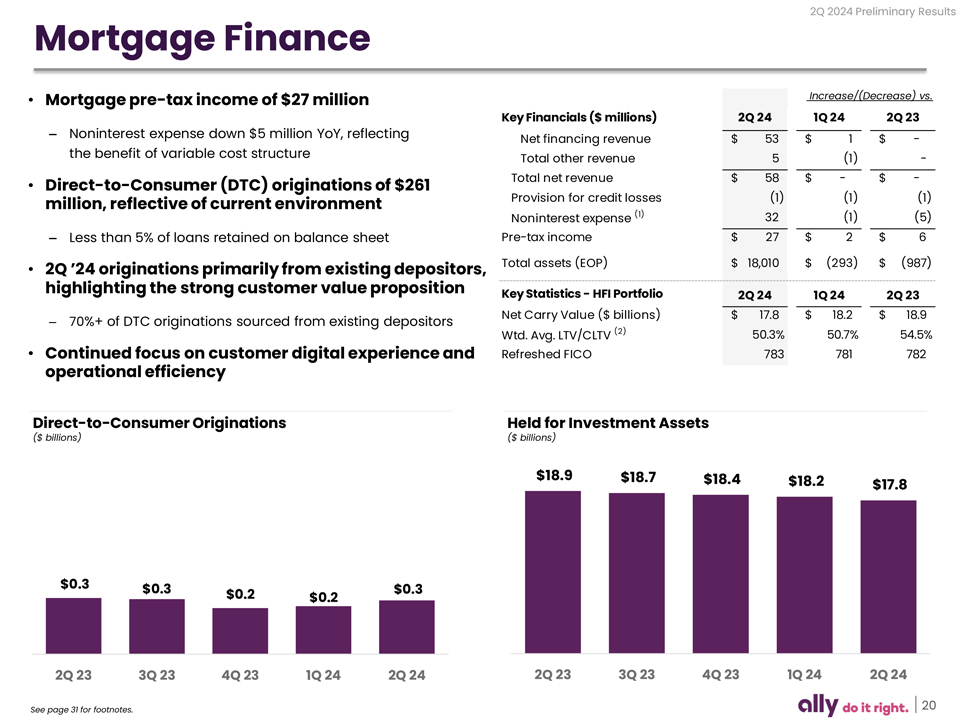

Mortgage Finance Pre-tax income of $27 million was up $6 million year over year, primarily driven by lower noninterest expense reflecting the benefit of the variable cost direct-to-consumer partnership model.

Net financing revenue and other revenue were both flat year over year at $53 million and $5 million, respectively.

Direct-to-consumer originations totaled $261 million in the quarter, predominantly held-for-sale.

Existing Ally Bank deposit customers accounted for more than 70% of the quarter’s direct-to-consumer origination volume, continuing to highlight the strong customer value proposition. |

| Capital, Liquidity & Deposits | ||||

| Capital Ally paid a $0.30 per share quarterly common dividend, which was unchanged year over year. Ally’s board of directors approved a $0.30 per share common dividend for the third quarter of 2024. Ally did not repurchase any shares on the open market during the quarter.

Ally’s common equity tier 1 (CET1) capital ratio was 9.6%, and risk weighed assets (RWA) decreased from $158.3 billion in the first quarter to $157.5 billion. Within the quarter, Ally closed a credit risk transfer transaction, which generated 11 bps of CET1 and reduced RWA on the $3 billion reference pool from 100% to 38%.

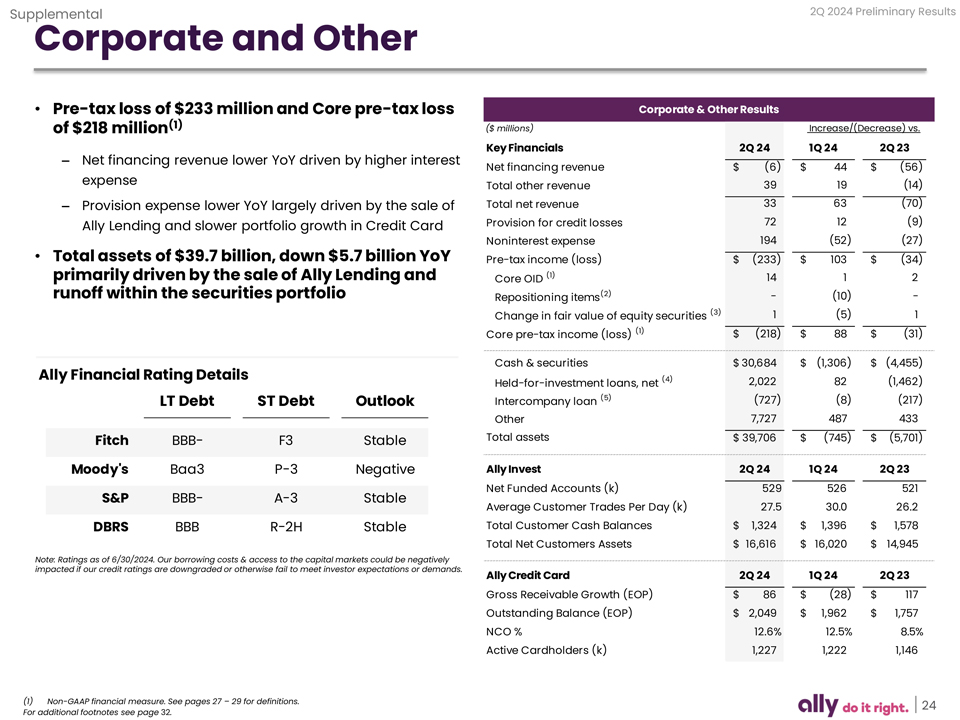

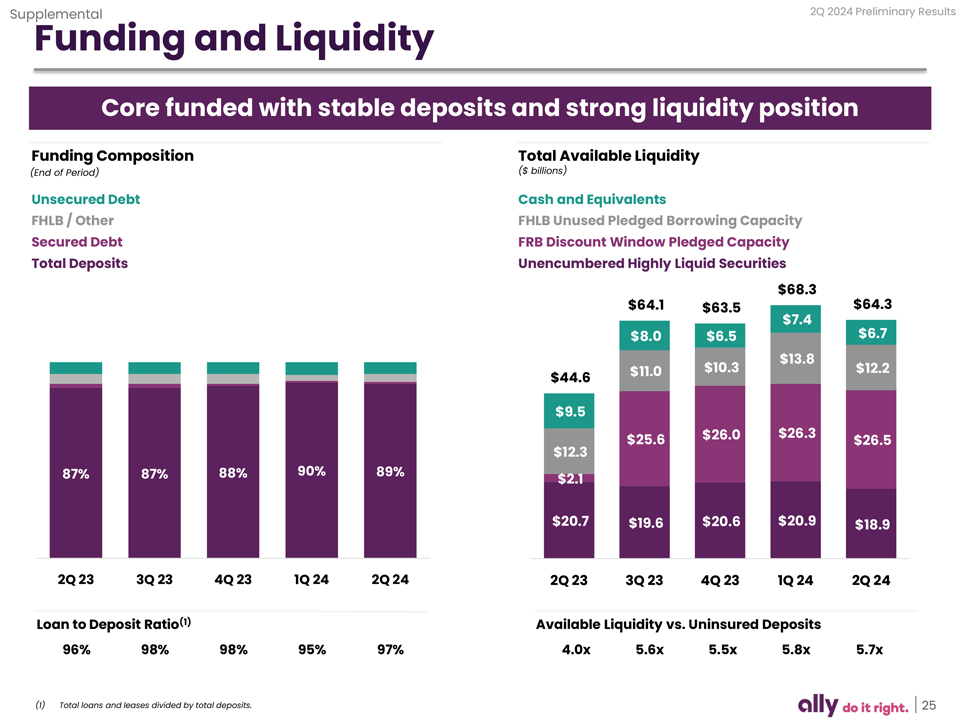

Liquidity & Funding Liquid cash and cash equivalentsE totaled $6.7 billion, down from $7.4 billion at the end of the first quarter. Highly liquid securities were $18.9 billion and unused pledged borrowing capacity at the FHLB and FRB was $12.2 billion and $26.5 billion, respectively. Total current available liquidityF was $64.3 billion, equal to 5.7x uninsured deposit balances.

|

|

Deposits represented 89% of Ally’s funding portfolio.

Deposits Retail deposits of $142.1 billion were up $3.1 billion year over year, and down $3.1 billion quarter over quarter driven by seasonal tax outflows. Total deposits were $152.2 billion and Ally maintained industry-leading customer retentionG at 96%.

The average retail portfolio deposit rate was 4.18%, up 50 bps year over year and down 7 bps quarter over quarter.

Ally Bank continues to demonstrate strong customer acquisition with 54 thousand net new deposit customers, now totaling 3.2 million customers, up 11% year over year. Millennials and younger customers continue to comprise the largest generation segment of new customers, accounting for 74% of new customers in the quarter. Approximately 10% or 323 thousand deposit customers maintained an Ally Invest, Ally Home or Ally Credit Card relationship. |

ECash & cash equivalents may include the restricted cash accumulation for retained notes maturing within the following 30 days and returned to Ally on the distribution date. See page 18 of the Financial F Supplement for more details.

FTotal liquidity includes cash & cash equivalents, highly liquid securities and current unused borrowing capacity at the FHLB, and FRB Discount Window. See page 18 of the Financial Supplement for more G details.

GSee definitions of non-GAAP financial measures and other key terms later in this document for more details.

4

| Definitions of Non-GAAP Financial Measures and Other Key Terms | ||||

Ally believes the non-GAAP financial measures defined here are important to the reader of the Consolidated Financial Statements, but these are supplemental to and not a substitute for GAAP measures. See Reconciliation to GAAP below for calculation methodology and details regarding each measure.

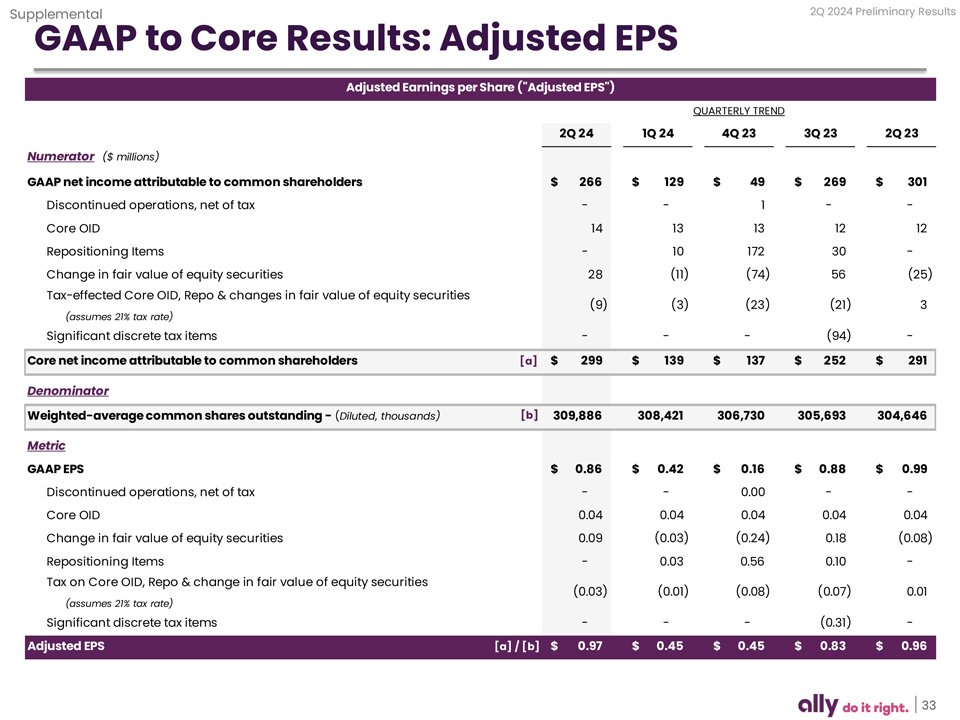

Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income attributable to common shareholders is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash Core OID, (3) adjusts for tax-effected repositioning and other which are primarily related to the extinguishment of high-cost legacy debt, strategic activities and significant other one-time items, (4) change in fair value of equity securities, (5) excludes significant discrete tax items that do not relate to the operating performance of the core businesses, and adjusts for preferred stock capital actions that have been taken by the company to normalize its capital structure, as applicable for respective periods. See page 6 for calculation methodology and details.

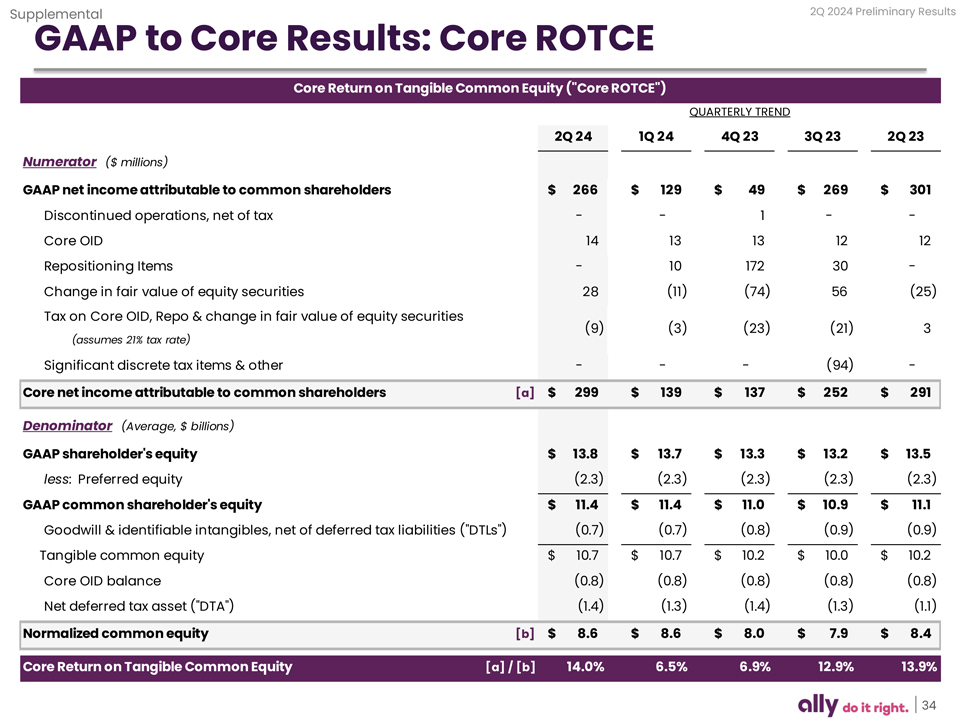

Core Return on Tangible Common Equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and net DTA. Ally’s Core net income attributable to common shareholders for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for significant discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted earnings per share.

| (1) | In the numerator of Core ROTCE, GAAP net income attributable to common shareholders is adjusted for discontinued operations net of tax, tax-effected Core OID, tax-effected repositioning and other which are primarily related to the extinguishment of high-cost legacy debt, strategic activities and significant other one-time items, change in fair value of equity securities, significant discrete tax items, and preferred stock capital actions, as applicable for respective periods. |

| (2) | In the denominator, GAAP shareholder’s equity is adjusted for goodwill and identifiable intangibles net of DTL, Core OID balance, and net DTA. |

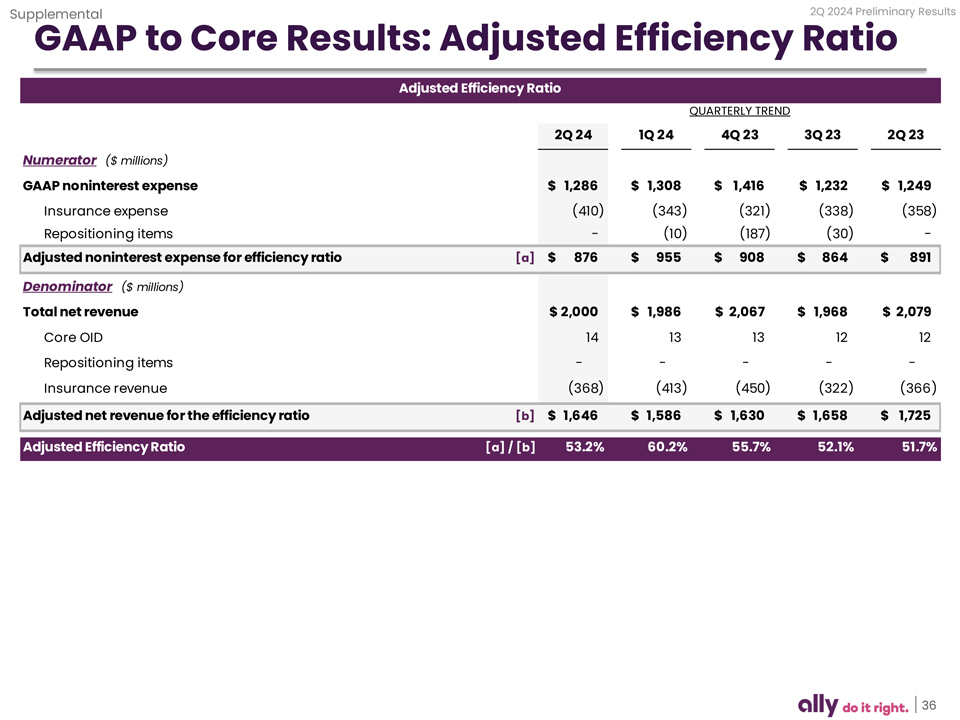

Adjusted Efficiency Ratio is a non-GAAP financial measure that management believes is helpful to readers in comparing the efficiency of its core banking and lending businesses with those of its peers. In the numerator of Adjusted Efficiency Ratio, total noninterest expense is adjusted for Rep and warrant expense, Insurance segment expense, and repositioning and other which are primarily related to the extinguishment of high-cost legacy debt, strategic activities and significant other one-time items, as applicable for respective periods. In the denominator, total net revenue is adjusted for Core OID and Insurance segment revenue. See Reconciliation to GAAP on page 7 for calculation methodology and details.

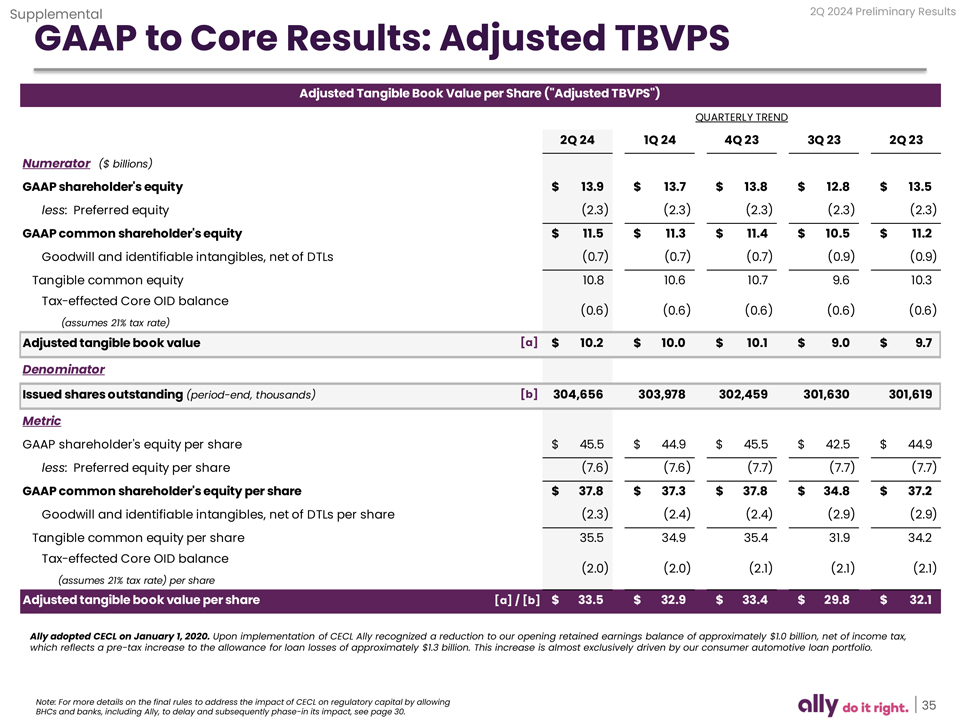

Adjusted Tangible Book Value per Share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. Adjusted TBVPS generally adjusts common equity for: (1) goodwill and identifiable intangibles, net of DTLs, and (2) tax-effected Core OID balance to reduce tangible common equity in the event the corresponding discounted bonds are redeemed/tendered, as applicable for respective periods.

Core Net Income Attributable to Common Shareholders is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. Core Net Income Attributable to Common Shareholders adjusts GAAP net income attributable to common shareholders for discontinued operations net of tax, tax-effected Core OID expense, tax-effected repositioning and other primarily related to the extinguishment of high-cost legacy debt and strategic activities and significant other, preferred stock capital actions, significant discrete tax items and tax-effected changes in equity investments measured at fair value, as applicable for respective periods. See Reconciliation to GAAP on page 6 for calculation methodology and details.

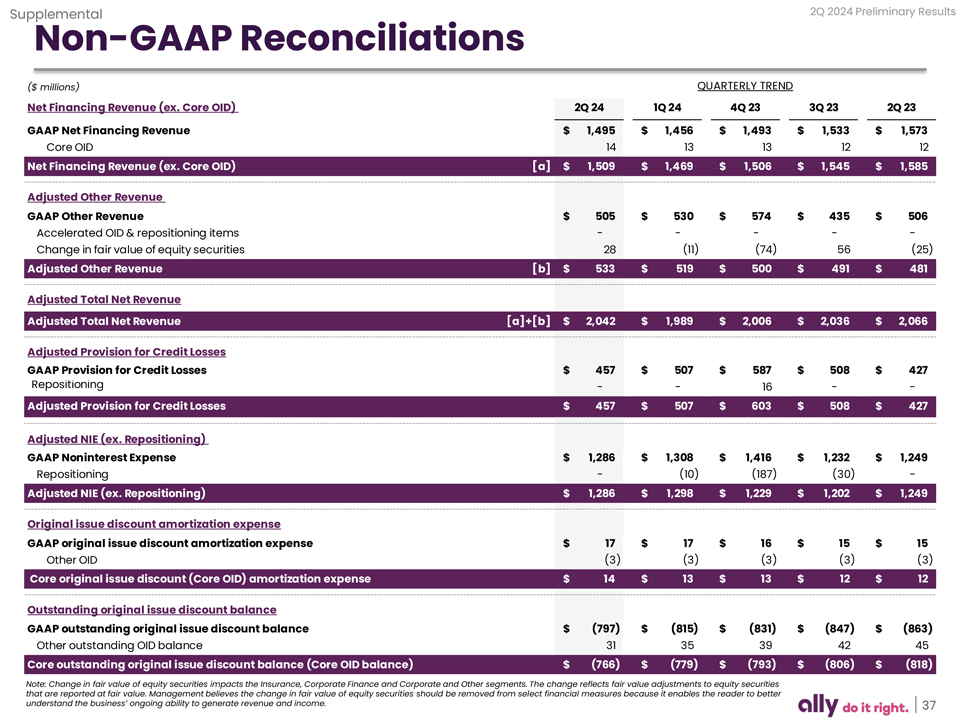

Core Original Issue Discount (Core OID) Amortization Expense is a non-GAAP financial measure for OID, and is believed by management to help the reader better understand the activity removed from: Core pre-tax income (loss), Core net income (loss) attributable to common shareholders, Adjusted EPS, Core ROTCE, Adjusted efficiency ratio, Adjusted total net revenue, and Net financing revenue (excluding Core OID). Core OID is primarily related to bond exchange OID which excludes international operations and future issuances. See page 7 for calculation methodology and details.

Core Outstanding Original Issue Discount Balance (Core OID balance) is a non-GAAP financial measure for outstanding OID and is believed by management to help the reader better understand the balance removed from Core ROTCE and Adjusted TBVPS. Core OID balance is primarily related to bond exchange OID which excludes international operations and future issuances. See page 7 for calculation methodology and details.

Core Pre-Tax Income is a non-GAAP financial measure that adjusts pre-tax income from continuing operations by excluding (1) Core OID, and (2) change in fair value of equity securities (change in fair value of equity securities impacts the Insurance and Corporate Finance segments), and (3) Repositioning and other which are primarily related to the extinguishment of high-cost legacy debt, strategic activities and significant other one-time items, as applicable for respective periods or businesses. Management believes core pre-tax income can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See the Pre-Tax Income by Segment Table on page 3 for calculation methodology and details.

Tangible Common Equity is a non-GAAP financial measure that is defined as common stockholders’ equity less goodwill and identifiable intangible assets, net of deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including Tangible Common Equity. Ally believes that Tangible Common Equity is important because we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to compare certain aspects of our capital adequacy on the same basis to other companies in the industry. For purposes of calculating Core Return on Tangible Common Equity (Core ROTCE), Tangible Common Equity is further adjusted for Core OID balance and net deferred tax asset. See page 6 for calculation methodology & details.

Net Interest Margin (excluding Core OID) is calculated using a non-GAAP measure that adjusts net interest margin by excluding Core OID. The Core OID balance is primarily related to bond exchange OID which excludes international operations and future issuances. Management believes net interest margin ex. Core OID is a helpful financial metric because it enables the reader to better understand the business’ profitability and margins.

Net Financing Revenue (excluding Core OID) is calculated using a non-GAAP measure that adjusts net financing revenue by excluding Core OID. The Core OID balance is primarily related to bond exchange OID which excludes international operations and future issuances. Management believes net financing revenue ex. Core OID is a helpful financial metric because it enables the reader to better understand the business’ ability to generate revenue.

Adjusted Other Revenue is a non-GAAP financial measure that adjusts GAAP other revenue for OID expenses, repositioning, and change in fair value of equity securities. Management believes adjusted other revenue is a helpful financial metric because it enables the reader better understand the business’ ability to generate other revenue.

Adjusted Total Net Revenue is a non-GAAP financial measure that management believes is helpful for readers to understand the ongoing ability of the company to generate revenue. For purposes of this calculation, GAAP net financing revenue is adjusted by excluding Core OID to calculate net financing revenue ex. core OID. GAAP other revenue is adjusted for OID expenses, repositioning, and change in fair value of equity securities to calculate adjusted other revenue. Adjusted total net revenue is calculated by adding net financing revenue ex. core OID to adjusted other revenue.

Adjusted Noninterest Expense is a non-GAAP financial measure that adjusts GAAP noninterest expense for repositioning items. Management believes adjusted noninterest expense is a helpful financial metric because it enables the reader better understand the business’ expenses excluding nonrecurring items.

Adjusted Provision for Credit Losses is a non-GAAP financial measure that adjusts GAAP provision for credit losses for repositioning items. Management believes adjusted provision for credit losses is a helpful financial metric because it enables the reader to better understand the business’s expenses excluding nonrecurring items.

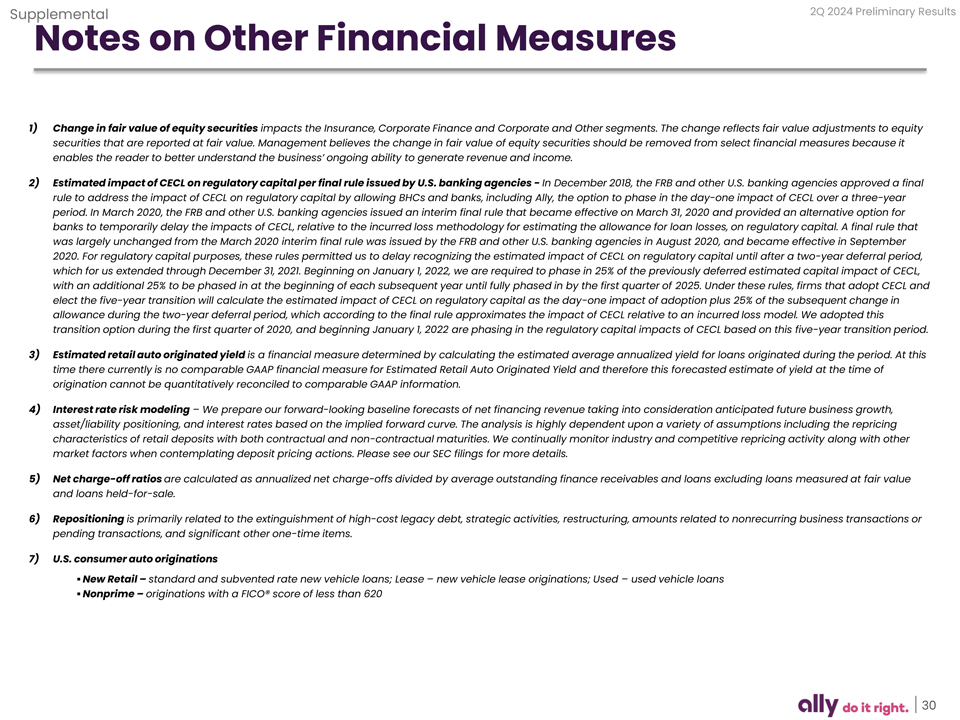

Estimated Retail Auto Originated Yield is a financial measure determined by calculating the estimated average annualized yield for loans originated during the period. At this time there currently is no comparable GAAP financial measure for Estimated Retail Auto Originated Yield and therefore this forecasted estimate of yield at the time of origination cannot be quantitatively reconciled to comparable GAAP information.

Net Charge-Off Ratios are annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair value and loans held-for-sale.

Accelerated issuance expense (Accelerated OID) is the recognition of issuance expenses related to calls of redeemable debt.

Customer retention rate is the annualized 3-month rolling average of 1 minus the monthly attrition rate; excludes escheatment.

Repositioning is primarily related to the extinguishment of high-cost legacy debt, strategic activities, restructuring, and significant other one-time items.

Corporate and Other primarily consists of activity related to centralized corporate treasury activities such as management of the cash and corporate investment securities and loan portfolios, short- and long-term debt, retail and brokered deposit liabilities, derivative instruments, the amortization of the discount associated with new debt issuances and bond exchanges, and the residual impacts of our corporate FTP and treasury ALM activities. Corporate and Other also includes certain equity investments, the management of our legacy mortgage portfolio, and reclassifications and eliminations between the reportable operating segments. Subsequent to June 1, 2016, the revenue and expense activity associated with Ally Invest was included within the Corporate and Other segment. Subsequent to October 1, 2019, the revenue and expense activity associated with Ally Lending was included within the Corporate and Other segment. Ally Lending was moved to Assets of Operations Held for Sale on December 31, 2023. The sale of Ally Lending closed on March 1, 2024. Subsequent to December 1, 2021, the revenue and expense activity associated with Ally Credit Card was included within the Corporate and Other segment.

5

Change in fair value of equity securities impacts the Insurance, Corporate Finance and Corporate and Other segments. The change reflects fair value adjustments to equity securities that are reported at fair value. Management believes the change in fair value of equity securities should be removed from select financial measures because it enables the reader to better understand the business’ ongoing ability to generate revenue and income.

Estimated impact of CECL on regulatory capital per final rule issued by U.S. banking agencies - In December 2018, the FRB and other U.S. banking agencies approved a final rule to address the impact of CECL on regulatory capital by allowing BHCs and banks, including Ally, the option to phase in the day-one impact of CECL over a three-year period. In March 2020, the FRB and other U.S. banking agencies issued an interim final rule that became effective on March 31, 2020 and provided an alternative option for banks to temporarily delay the impacts of CECL, relative to the incurred loss methodology for estimating the allowance for loan losses, on regulatory capital. A final rule that was largely unchanged from the March 2020 interim final rule was issued by the FRB and other U.S. banking agencies in August 2020, and became effective in September 2020. For regulatory capital purposes, these rules permitted us to delay recognizing the estimated impact of CECL on regulatory capital until after a two-year deferral period, which for us extended through December 31, 2021. Beginning on January 1, 2022, we are required to phase in 25% of the previously deferred estimated capital impact of CECL, with an additional 25% to be phased in at the beginning of each subsequent year until fully phased in by the first quarter of 2025. Under these rules, firms that adopt CECL and elect the five-year transition will calculate the estimated impact of CECL on regulatory capital as the day-one impact of adoption plus 25% of the subsequent change in allowance during the two-year deferral period, which according to the final rule approximates the impact of CECL relative to an incurred loss model. We adopted this transition option during the first quarter of 2020, and beginning January 1, 2022, are phasing in the regulatory capital impacts of CECL based on this five-year transition period.

| Reconciliation to GAAP | ||||

| Adjusted Earnings per Share |

||||||||||||||

| Numerator ($ millions) | 2Q 24 | 1Q 24 | 2Q 23 | |||||||||||

| GAAP Net Income Attributable to Common Shareholders |

$ | 266 | $ | 129 | $ | 301 | ||||||||

| Discontinued Operations, Net of Tax |

- | - | - | |||||||||||

| Core OID |

14 | 13 | 12 | |||||||||||

| Repositioning and Other |

- | 10 | - | |||||||||||

| Change in the Fair Value of Equity Securities |

28 | (11 | ) | (25 | ) | |||||||||

| Tax on: Core OID & Change in Fair Value of Equity Securities (21% tax rate) |

(9 | ) | (3 | ) | 3 | |||||||||

| Core Net Income Attributable to Common Shareholders |

[a] |

$ | 299 | $ | 139 | $ | 291 | |||||||

| Denominator |

||||||||||||||

| Weighted-Average Common Shares Outstanding - (Diluted, thousands) |

[b] |

309,886 | 308,421 | 304,646 | ||||||||||

| Adjusted EPS |

[a] ÷ [b] |

$ | 0.97 | $ | 0.45 | $ | 0.96 | |||||||

| Core Return on Tangible Common Equity (ROTCE) | ||||||||||||||

| Numerator ($ millions) | 2Q 24 | 1Q 24 | 2Q 23 | |||||||||||

| GAAP Net Income Attributable to Common Shareholders |

$ | 266 | $ | 129 | $ | 301 | ||||||||

| Discontinued Operations, Net of Tax |

- | - | - | |||||||||||

| Core OID |

14 | 13 | 12 | |||||||||||

| Repositioning and Other |

- | 10 | - | |||||||||||

| Change in Fair Value of Equity Securities |

28 | (11 | ) | (25 | ) | |||||||||

| Tax on: Core OID & Change in Fair Value of Equity Securities (21% tax rate) |

(9 | ) | (3 | ) | 3 | |||||||||

| Core Net Income Attributable to Common Shareholders |

[a] |

$ | 299 | $ | 139 | $ | 291 | |||||||

| Denominator (Average, $ millions) |

||||||||||||||

| GAAP Shareholder’s Equity |

$ | 13,754 | $ | 13,712 | $ | 13,455 | ||||||||

| Preferred Equity |

(2,324 | ) | (2,324 | ) | (2,324 | ) | ||||||||

| GAAP Common Shareholder’s Equity |

$ | 11,430 | 11,388 | $ | 11,131 | |||||||||

| Goodwill & Identifiable Intangibles, Net of Deferred Tax Liabilities (DTLs) |

(717 | ) | (723 | ) | (891 | ) | ||||||||

| Tangible Common Equity |

$ | 10,713 | $ | 10,664 | $ | 10,240 | ||||||||

| Core OID Balance |

(773 | ) | (786 | ) | (824 | ) | ||||||||

| Net Deferred Tax Asset (DTA) |

(1,388 | ) | (1,278 | ) | (1,060 | ) | ||||||||

| Normalized Common Equity | [b] | $ | 8,553 | $ | 8,600 | $ | 8,357 | |||||||

| Core Return on Tangible Common Equity |

[a] ÷ [b] |

14.0 | % | 6.5 | % | 13.9 | % | |||||||

6

| Adjusted Tangible Book Value per Share |

||||||||||||||||

| Numerator ($ millions) | 2Q 24 | 1Q 24 | 2Q 23 | |||||||||||||

| GAAP Shareholder’s Equity |

$ | 13,851 | $ | 13,657 | $ | 13,532 | ||||||||||

| Preferred Equity |

(2,324 | ) | (2,324 | ) | (2,324 | ) | ||||||||||

| GAAP Common Shareholder’s Equity |

$ | 11,527 | $ | 11,333 | $ | 11,208 | ||||||||||

| Goodwill and Identifiable Intangible Assets, Net of DTLs |

(713 | ) | (720 | ) | (887 | ) | ||||||||||

| Tangible Common Equity |

10,814 | 10,613 | 10,321 | |||||||||||||

| Tax-effected Core OID Balance (21% tax rate) |

(605 | ) | (616 | ) | (646 | ) | ||||||||||

| Adjusted Tangible Book Value |

[a] | $ | 10,209 | $ | 9,997 | $ | 9,675 | |||||||||

| Denominator |

||||||||||||||||

| Issued Shares Outstanding (period-end, thousands) | [b] | 304,656 | 303,978 | 301,619 | ||||||||||||

| Metric |

||||||||||||||||

| GAAP Common Shareholder’s Equity per Share |

$ | 37.84 | $ | 37.28 | $ | 37.16 | ||||||||||

| Goodwill and Identifiable Intangible Assets, Net of DTLs per Share |

(2.34 | ) | (2.37 | ) | (2.94 | ) | ||||||||||

| Tangible Common Equity per Share |

$ | 35.50 | $ | 34.91 | $ | 34.22 | ||||||||||

| Tax-effected Core OID Balance (21% tax rate) per Share |

(1.99 | ) | (2.03 | ) | (2.14 | ) | ||||||||||

| Adjusted Tangible Book Value per Share |

[a] ÷ [b] | $ | 33.51 | $ | 32.89 | $ | 32.08 | |||||||||

| Adjusted Efficiency Ratio | ||||||||||||||||

| Numerator ($ millions) | 2Q 24 | 1Q 24 | 2Q 23 | |||||||||||||

| GAAP Noninterest Expense |

$ | 1,286 | $ | 1,308 | $ | 1,249 | ||||||||||

| Insurance Expense |

(410 | ) | (343 | ) | (358 | ) | ||||||||||

| Repositioning and Other |

- | (10 | ) | - | ||||||||||||

| Adjusted Noninterest Expense for Adjusted Efficiency Ratio |

[a] | $ | 876 | $ | 955 | $ | 891 | |||||||||

| Denominator ($ millions) |

||||||||||||||||

| Total Net Revenue |

$ | 2,000 | $ | 1,986 | $ | 2,079 | ||||||||||

| Core OID |

14 | 13 | 12 | |||||||||||||

| Insurance Revenue |

(368 | ) | (413 | ) | (366 | ) | ||||||||||

| Adjusted Net Revenue for Adjusted Efficiency Ratio |

[b] | $ | 1,646 | $ | 1,586 | $ | 1,725 | |||||||||

| Adjusted Efficiency Ratio |

[a] ÷ [b] | 53.2 | % | 60.2 | % | 51.7 | % | |||||||||

| Original Issue Discount Amortization Expense ($ millions) | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Original Issue Discount Amortization Expense |

$ | 17 | $ | 17 | $ | 15 | ||||||||||

| Other OID |

(3 | ) | (3 | ) | (3 | ) | ||||||||||

| Core Original Issue Discount (Core OID) Amortization Expense |

$ | 14 | $ | 13 | $ | 12 | ||||||||||

| Outstanding Original Issue Discount Balance ($ millions) | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Outstanding Original Issue Discount Balance |

$ | (797 | ) | $ | (815 | ) | $ | (863 | ) | |||||||

| Other Outstanding OID Balance |

31 | 35 | 45 | |||||||||||||

| Core Outstanding Original Issue Discount Balance (Core OID Balance) |

$ | (766 | ) | $ | (779 | ) | $ | (818 | ) | |||||||

7

| ($ millions) |

||||||||||||||||

| Net Financing Revenue (Excluding Core OID) |

||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Net Financing Revenue |

[w] | $ | 1,495 | $ | 1,456 | $ | 1,573 | |||||||||

| Core OID |

14 | 13 | 12 | |||||||||||||

| Net Financing Revenue (Excluding Core OID) |

[a] | $ | 1,509 | $ | 1,469 | $ | 1,585 | |||||||||

| Adjusted Other Revenue | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Other Revenue |

[x] | $ | 505 | $ | 530 | $ | 506 | |||||||||

| Change in Fair Value of Equity Securities |

28 | (11 | ) | (25 | ) | |||||||||||

| Adjusted Other Revenue |

[b] | $ | 533 | $ | 519 | $ | 481 | |||||||||

| Adjusted Total Net Revenue | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| Adjusted Total Net Revenue |

[a]+[b] | $ | 2,042 | $ | 1,989 | $ | 2,066 | |||||||||

| Adjusted Provision for Credit Losses | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Provision for Credit Losses |

[y] | $ | 457 | $ | 507 | $ | 427 | |||||||||

| Adjusted Provision for Credit Losses |

[c] | $ | 457 | $ | 507 | $ | 427 | |||||||||

| Adjusted NIE (Excluding Repositioning) | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| GAAP Noninterest Expense |

[z] | $ | 1,286 | $ | 1,308 | $ | 1,249 | |||||||||

| Repositioning |

- | (10 | ) | - | ||||||||||||

| Adjusted NIE (Excluding Repositioning) |

[d] | $ | 1,286 | $ | 1,298 | $ | 1,249 | |||||||||

| Core Pre-Tax Income | ||||||||||||||||

| 2Q 24 | 1Q 24 | 2Q 23 | ||||||||||||||

| Pre-Tax Income |

[w]+[x]-[y]-[z] | $ | 257 | $ | 171 | $ | 403 | |||||||||

| Core Pre-Tax Income |

[a]+[b]-[c]-[d] | $ | 299 | $ | 183 | $ | 390 | |||||||||

| Insurance Non-GAAP Walk to Core Pre-Tax Income |

|

|||||||||||||||||||||||

| 2Q 2024 | 2Q 2023 | |||||||||||||||||||||||

| ($ millions)

Insurance |

GAAP |

|

Change in the fair value of equity

|

|

|

Non-GAAP1 |

|

GAAP |

|

Change in the fair value of equity

|

|

|

Non-GAAP1 |

|

||||||||||

| Premiums, Service Revenue Earned and Other |

$ | 344 | $ | - | $ | 344 | $ | 312 | $ | - | $ | 312 | ||||||||||||

| Losses and Loss Adjustment Expenses |

181 | - | 181 | 134 | - | 134 | ||||||||||||||||||

| Acquisition and Underwriting Expenses |

229 | - | 229 | 224 | - | 224 | ||||||||||||||||||

| Investment Income and Other |

24 | 28 | 52 | 54 | (24 | ) | 30 | |||||||||||||||||

| Pre-Tax Income from Continuing Operations |

$ | (42 | ) | $ | 28 | $ | (14 | ) | $ | 8 | $ | (24 | ) | $ | (16 | ) | ||||||||

1Non-GAAP line items walk to Core Pre-Tax Income, a non-GAAP financial measure that adjusts Pre-Tax Income.

8

| Additional Financial Information | ||||

For additional financial information, the second quarter 2024 earnings presentation and financial supplement are available in the Events & Presentations section of Ally’s Investor Relations Website at http://www.ally.com/about/investor/events-presentations/.

About Ally Financial Inc.

Ally Financial Inc. (NYSE: ALLY) is a financial services company with the nation’s largest all-digital bank and an industry-leading auto financing business, driven by a mission to “Do It Right” and be a relentless ally for customers and communities. The company serves approximately 11 million customers through a full range of online banking services (including deposits, mortgage, and credit card products) and securities brokerage and investment advisory services. The company also includes a robust corporate finance business that offers capital for equity sponsors and middle-market companies, as well as auto financing and insurance offerings. For more information, please visit www.ally.com.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures.

For further images and news on Ally, please visit http://media.ally.com.

Forward-Looking Statements

This earnings release and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the release or related communication.

This earnings release and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts — such as statements about the outlook for financial and operating metrics and performance and future capital allocation and actions. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future.

Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings.

This earnings release and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable GAAP financial measures are reconciled in the release.

Unless the context otherwise requires, the following definitions apply. The term “loans” means the following consumer and commercial products associated with our direct and indirect financing activities: loans, retail installment sales contracts, lines of credit, and other financing products excluding operating leases. The term “operating leases” means consumer- and commercial-vehicle lease agreements where Ally is the lessor and the lessee is generally not obligated to acquire ownership of the vehicle at lease-end or compensate Ally for the vehicle’s residual value. The terms “lend,” “finance,” and “originate” mean our direct extension or origination of loans, our purchase or acquisition of loans, or our purchase of operating leases as applicable. The term “consumer” means all consumer products associated with our loan and operating-lease activities and all commercial retail installment sales contracts. The term “commercial” means all commercial products associated with our loan activities, other than commercial retail installment sales contracts. The term “partnerships” means business arrangements rather than partnerships as defined by law.

| Contacts: | ||

| Sean Leary | Peter Gilchrist | |

| Ally Investor Relations | Ally Communications (Media) | |

| 704-444-4830 | 704-644-6299 | |

| sean.leary@ally.com | peter.gilchrist@ally.com |

9

Exhibit 99.2

Ally Financial Inc. 2Q 2024 Earnings Review July 17, 2024 Contact Ally Investor Relations at (866) 710-4623 or investor.relations@ally.com

2Q 2024 Preliminary Results Forward-Looking Statements and Additional Information This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the presentation or related communication. This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as statements about the outlook for financial and operating metrics and performance and future capital allocation and actions. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings. This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation. Unless the context otherwise requires, the following definitions apply. The term “loans” means the following consumer and commercial products associated with our direct and indirect financing activities: loans, retail installment sales contracts, lines of credit, and other financing products excluding operating leases. The term “operating leases” means consumer- and commercial-vehicle lease agreements where Ally is the lessor and the lessee is generally not obligated to acquire ownership of the vehicle at lease-end or compensate Ally for the vehicle’s residual value. The terms “lend,” “finance,” and “originate” mean our direct extension or origination of loans, our purchase or acquisition of loans, or our purchase of operating leases, as applicable. The term “consumer” means all consumer products associated with our loan and operating-lease activities and all commercial retail installment sales contracts. The term “commercial” means all commercial products associated with our loan activities, other than commercial retail installment sales contracts. The term “partnerships” means business arrangements rather than partnerships as defined by law. 2

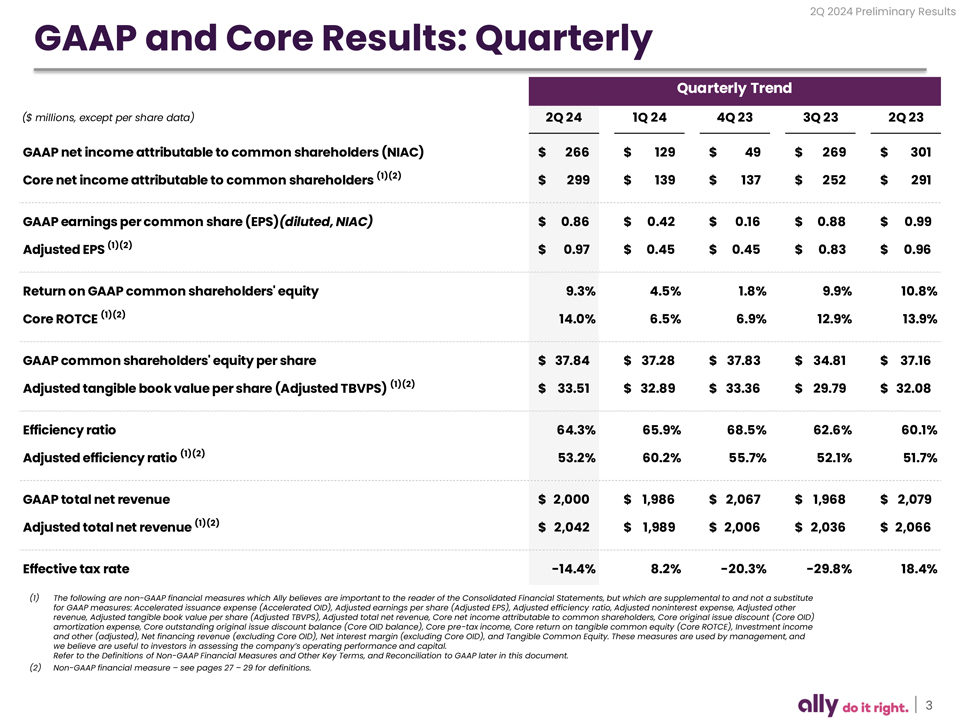

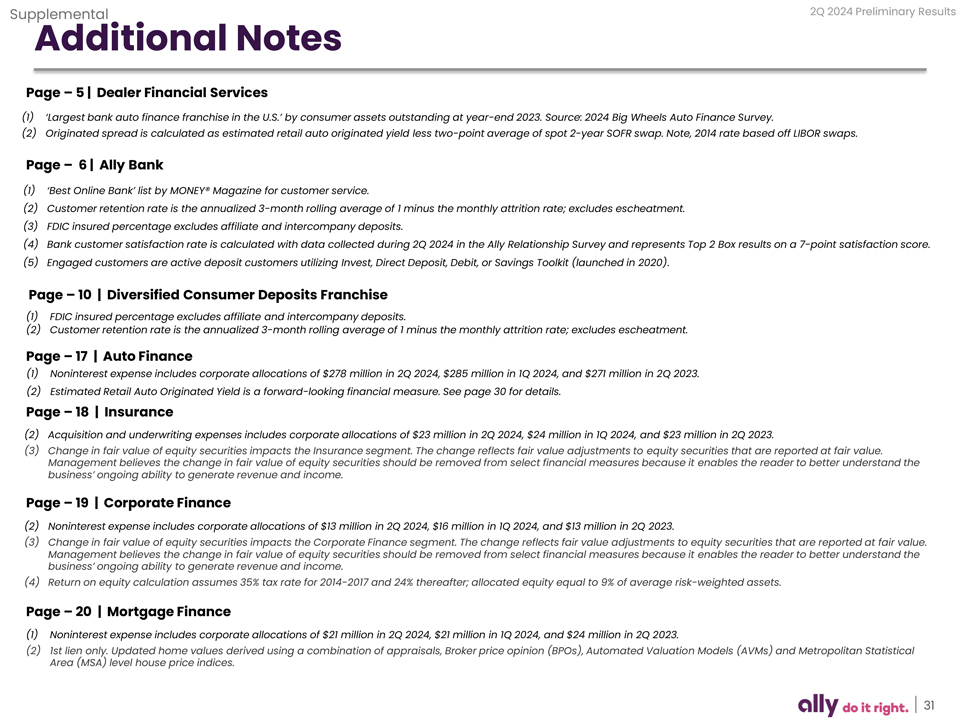

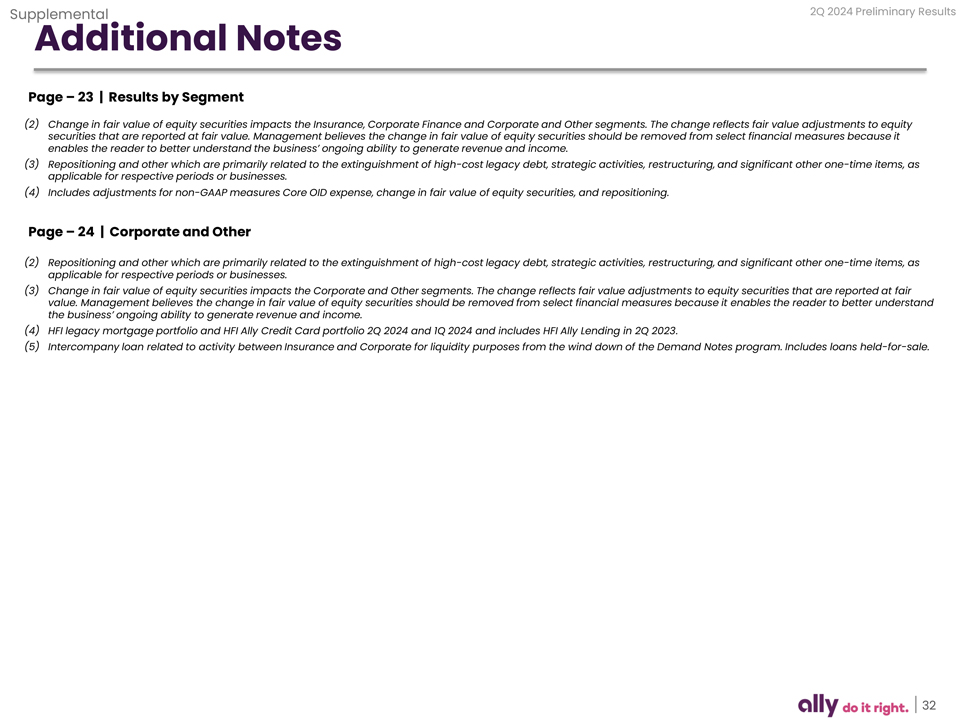

2Q 2024 Preliminary Results GAAP and Core Results: Quarterly Quarterly Trend ($ millions, except per share data) 2Q 24 1Q 24 4Q 23 3Q 23 2Q 23 GAAP net income attributable to common shareholders (NIAC) $266 $129 $49 $269 $301 Core net income attributable to common shareholders (1)(2) $299 $139 $137 $252 $291 GAAP earnings per common share (EPS)(diluted, NIAC) $0.86 $0.42 $0.16 $0.88 $0.99 Adjusted EPS (1)(2) $0.97 $0.45 $0.45 $0.83 $0.96 Return on GAAP common shareholders’ equity 9.3% 4.5% 1.8% 9.9% 10.8% Core ROTCE (1)(2) 14.0% 6.5% 6.9% 12.9% 13.9% GAAP common shareholders’ equity per share $37.84 $37.28 $37.83 $34.81 $37.16 Adjusted tangible book value per share (Adjusted TBVPS) (1)(2) $33.51 $32.89 $33.36 $29.79 $32.08 Efficiency ratio 64.3% 65.9% 68.5% 62.6% 60.1% Adjusted efficiency ratio (1)(2) 53.2% 60.2% 55.7% 52.1% 51.7% GAAP total net revenue $2,000 $1,986 $2,067 $1,968 $2,079 Adjusted total net revenue (1)(2) $2,042 $1,989 $2,006 $2,036 $2,066 Effective tax rate -14.4% 8.2% -20.3% -29.8% 18.4% (1) The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for GAAP measures: Accelerated issuance expense (Accelerated OID), Adjusted earnings per share (Adjusted EPS), Adjusted efficiency ratio, Adjusted noninterest expense, Adjusted other revenue, Adjusted tangible book value per share (Adjusted TBVPS), Adjusted total net revenue, Core net income attributable to common shareholders, Core original issue discount (Core OID) amortization expense, Core outstanding original issue discount balance (Core OID balance), Core pre-tax income, Core return on tangible common equity (Core ROTCE), Investment income and other (adjusted), Net financing revenue (excluding Core OID), Net interest margin (excluding Core OID), and Tangible Common Equity. These measures are used by management, and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. (2) Non-GAAP financial measure – see pages 27 – 29 for definitions. 3

2Q 2024 Preliminary Results Purpose-Driven Culture Powered by our “LEAD” core values and “Do it Right” approach L ook externally E xecute with excellence A ct with professionalism D eliver results Customers Communities Employees “Do It Right” culture of Impact the communities Invest in our people and customer obsession in which we live and work culture to drive purpose 4

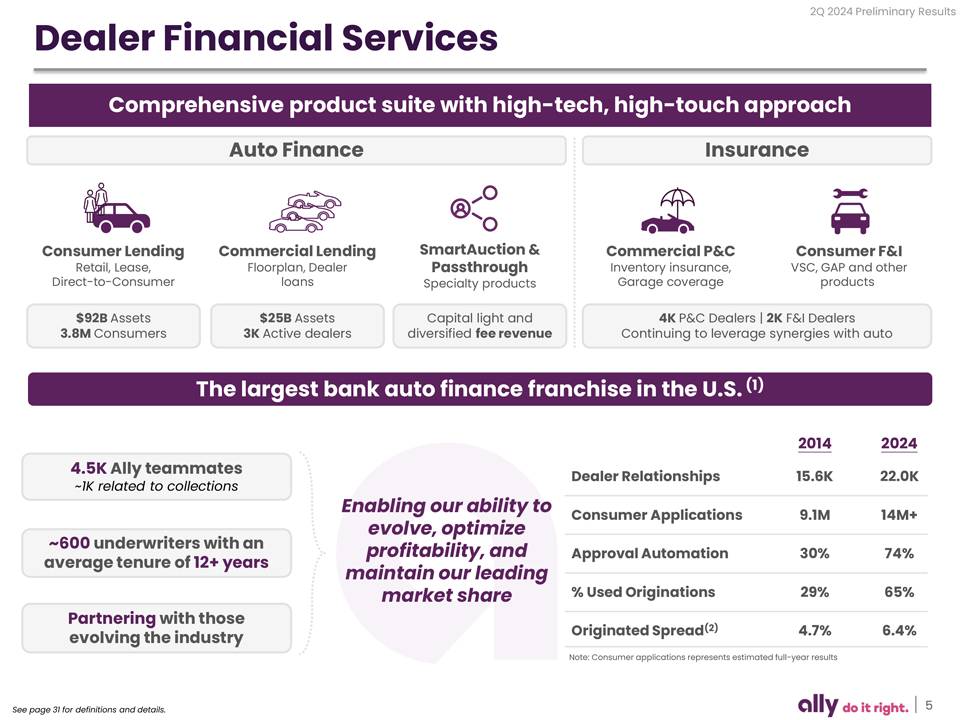

2Q 2024 Preliminary Results Dealer Financial Services Comprehensive product suite with high-tech, high-touch approach Auto Finance Insurance Consumer Lending Commercial Lending SmartAuction & Commercial P&C Consumer F&I Retail, Lease, Floorplan, Dealer Passthrough Inventory insurance, VSC, GAP and other Direct-to-Consumer loans Specialty products Garage coverage products $92B Assets $25B Assets Capital light and 4K P&C Dealers | 2K F&I Dealers 3.8M Consumers 3K Active dealers diversified fee revenue Continuing to leverage synergies with auto The largest bank auto finance franchise in the U.S.(1) 2014 2024 4.5K Ally teammates Dealer Relationships 15.6K 22.0K ~1K related tocollections Consumer Applications 9.1M 14M+ ~600 underwriters with an Approval Automation 30% 74% average tenure of 12+ years % Used Originations 29% 65% Partnering with those evolving the industry Originated Spread(2) 4.7% 6.4% Note: Consumer applications represents estimated full-year results See page 31 for definitions and details. 5

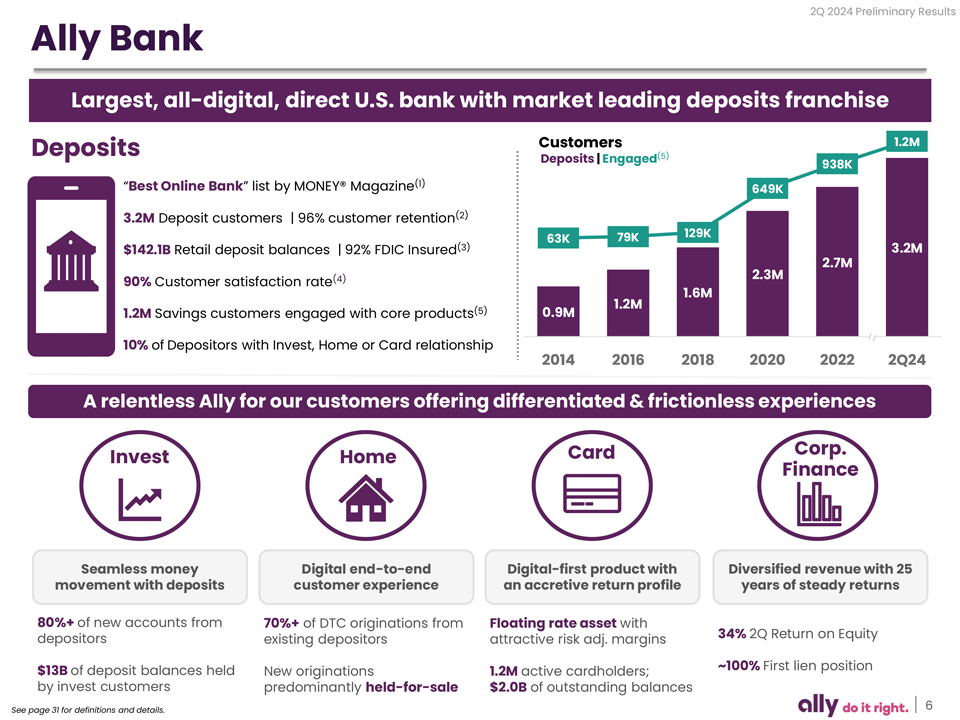

2Q 2024 Preliminary Results Ally Bank Largest, all-digital, direct U.S. bank with market leading deposits franchise Deposits Customers 1.2M Deposits | Engaged(5) 938K “Best Online Bank” list by MONEY® Magazine(1) 649K 3.2M Deposit customers | 96% customer retention(2) 63K 79K 129K $142.1B Retail deposit balances | 92% FDIC Insured(3) 3.2M 2.7M 90% Customer satisfaction rate(4) 2.3M 1.6M 1.2M 1.2M Savings customers engaged with core products(5) 0.9M 10% of Depositors with Invest, Home or Card relationship 2014 2016 2018 2020 2022 2Q24 A relentless Ally for our customers offering differentiated & frictionless experiences Invest Home Card Corp. Finance Seamless money Digital end-to-end Digital-first product with Diversified revenue with 25 movement with deposits customer experience an accretive return profile years of steady returns 80%+ of new accounts from 70%+ of DTC originations from Floating rate asset with depositors existing depositors attractive risk adj. margins 34% 2Q Return on Equity $13B of deposit balances held New originations 1.2M active cardholders; ~100% First lien position by invest customers predominantly held-for-sale $2.0B of outstanding balances See page 31 for definitions and details. 6

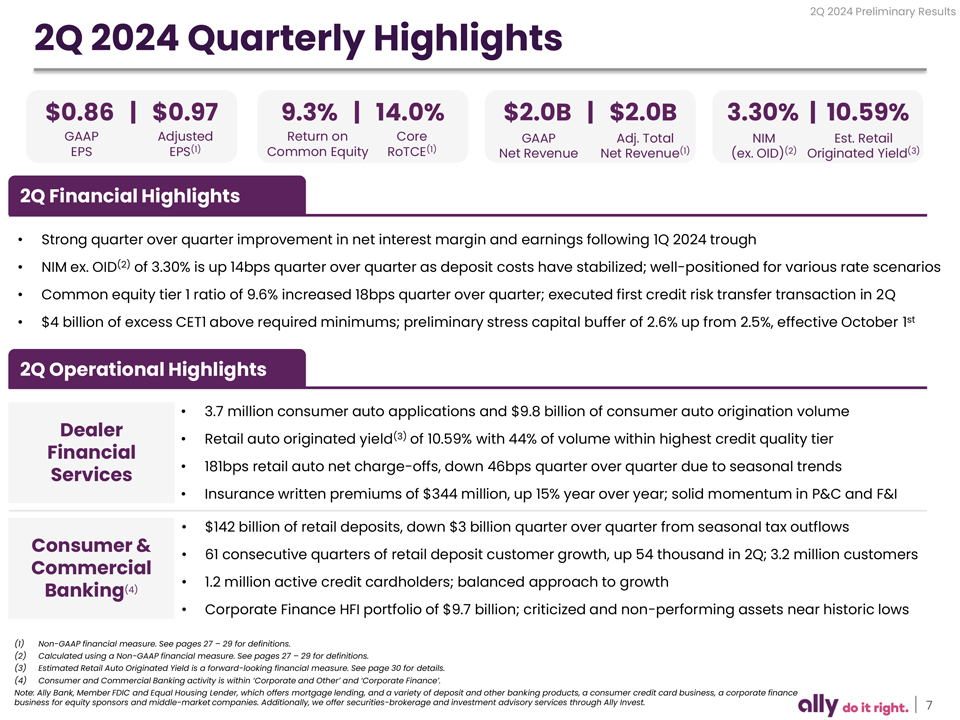

2Q 2024 Preliminary Results 2Q 2024 Quarterly Highlights $0.86 |$0.97 9.3% |14.0% $2.0B |$2.0B 3.30% 10.59% GAAP Adjusted Return on Core GAAP Adj. Total NIM Est. Retail EPS EPS(1) Common Equity RoTCE(1) Net Revenue Net Revenue(1) (ex. OID)(2) Originated Yield(3) 2Q Financial Highlights • Strong quarter over quarter improvement in net interest margin and earnings following 1Q 2024 trough • NIM ex. OID(2) of 3.30% is up 14bps quarter over quarter as deposit costs have stabilized; well-positioned for various rate scenarios • Common equity tier 1 ratio of 9.6% increased 18bps quarter over quarter; executed first credit risk transfer transaction in 2Q • $4 billion of excess CET1 above required minimums; preliminary stress capital buffer of 2.6% up from 2.5%, effective October 1st 2Q Operational Highlights Dealer • 3.7 million consumer auto applications and $9.8 billion of consumer auto origination volume Financial • Retail auto originated yield(3) of 10.59% with 44% of volume within highest credit quality tier Services • 181bps retail auto net charge-offs, down 46bps quarter over quarter due to seasonal trends • Insurance written premiums of $344 million, up 15% year over year; solid momentum in P&C and F&I Consumer & • $142 billion of retail deposits, down $3 billion quarter over quarter from seasonal tax outflows • 61 consecutive quarters of retail deposit customer growth, up 54 thousand in 2Q; 3.2 million customers Commercial • 1.2 million active credit cardholders; balanced approach to growth Banking(4) • Corporate Finance HFI portfolio of $9.7 billion; criticized and non-performing assets near historic lows (1) Non-GAAP financial measure. See pages 27 – 29 for definitions. (2) Calculated using a Non-GAAP financial measure. See pages 27 – 29 for definitions. (3) Estimated Retail Auto Originated Yield is a forward-looking financial measure. See page 30 for details. (4) Consumer and Commercial Banking activity is within ‘Corporate and Other’ and ‘Corporate Finance’. Note: Ally Bank, Member FDIC and Equal Housing Lender, which offers mortgage lending, and a variety of deposit and other banking products, a consumer credit card business, a corporate finance business for equity sponsors and middle-market companies. Additionally, we offer securities-brokerage and investment advisory services through Ally Invest. 7

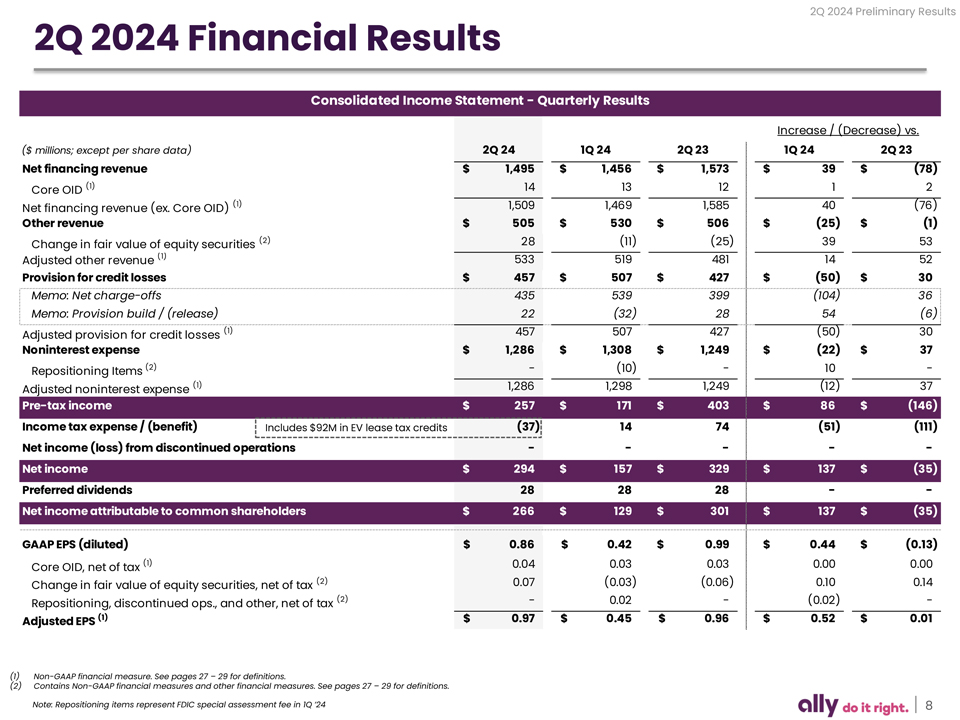

2Q 2024 Preliminary Results 2Q 2024 Financial Results Consolidated Income Statement—Quarterly Results Increase / (Decrease) vs. ($ millions; except per share data) 2Q 24 1Q 24 2Q 23 1Q 24 2Q 23 Net financing revenue $1,495 $1,456 $1,573 $39 $(78) Core OID (1) 14 13 12 1 2 Net financing revenue (ex. Core OID) (1) 1,509 1,469 1,585 40 (76) Other revenue $505 $530 $506 $(25) $(1) Change in fair value of equity securities (2) 28 (11) (25) 39 53 Adjusted other revenue (1) 533 519 481 14 52 Provision for credit losses $457 $507 $427 $(50) $30 Memo: Net charge-offs 435 539 399 (104) 36 Memo: Provision build / (release) 22 (32) 28 54 (6) Adjusted provision for credit losses (1) 457 507 427 (50) 30 Noninterest expense $1,286 $1,308 $1,249 $(22) $37 Repositioning Items (2) - (10)—10 -Adjusted noninterest expense (1) 1,286 1,298 1,249 (12) 37 Pre-tax income $257 $171 $403 $86 $(146) Income tax expense / (benefit) Includes $92M in EV lease tax credits (37) 14 74 (51) (111) Net income (loss) from discontinued operations - — —Net income $294 $157 $329 $137 $(35) Preferred dividends 28 28 28 —Net income attributable to common shareholders $266 $129 $301 $137 $(35) GAAP EPS (diluted) $0.86 $0.42 $0.99 $0.44 $(0.13) Core OID, net of tax (1) 0.04 0.03 0.03 0.00 0.00 Change in fair value of equity securities, net of tax (2) 0.07 (0.03) (0.06) 0.10 0.14 Repositioning, discontinued ops., and other, net of tax (2) - 0.02—(0.02)—Adjusted EPS (1) $0.97 $0.45 $0.96 $0.52 $0.01 (1) Non-GAAP financial measure. See pages 27 – 29 for definitions. (2) Contains Non-GAAP financial measures and other financial measures. See pages 27 – 29 for definitions. Note: Repositioning items represent FDIC special assessment fee in 1Q ’24 8

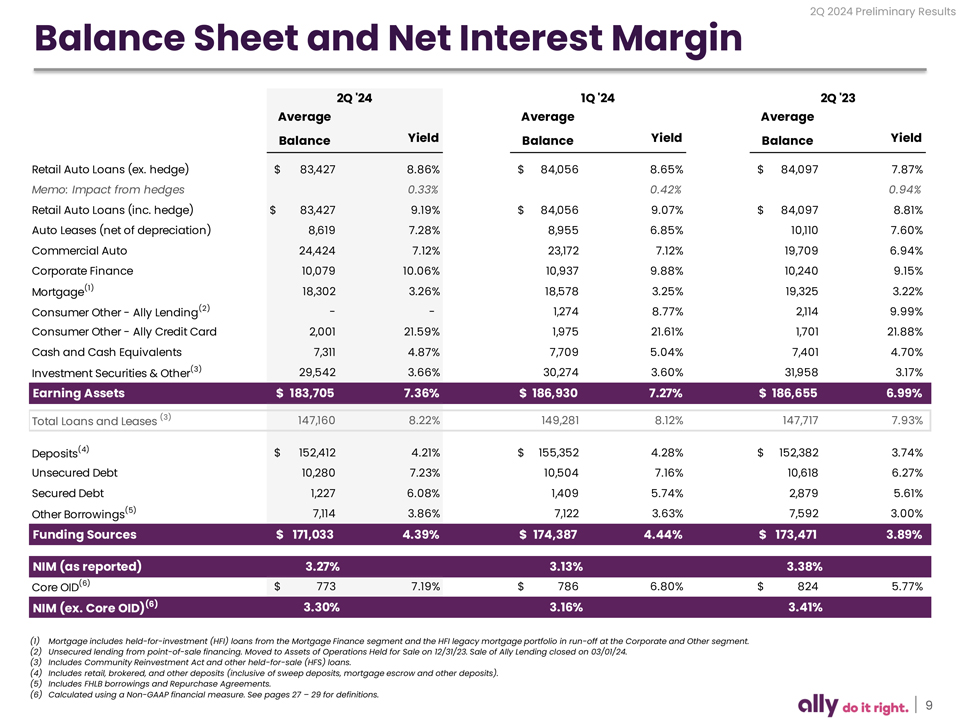

2Q 2024 Preliminary Results Balance Sheet and Net Interest Margin 2Q ‘24 1Q ‘24 2Q ‘23 Average Average Average Balance Yield Balance Yield Balance Yield Retail Auto Loans (ex. hedge) $83,427 8.86% $84,056 8.65% $84,097 7.87% Memo: Impact from hedges 0.33% 0.42% 0.94% Retail Auto Loans (inc. hedge) $83,427 9.19% $84,056 9.07% $84,097 8.81% Auto Leases (net of depreciation) 8,619 7.28% 8,955 6.85% 10,110 7.60% Commercial Auto 24,424 7.12% 23,172 7.12% 19,709 6.94% Corporate Finance 10,079 10.06% 10,937 9.88% 10,240 9.15% Mortgage(1) 18,302 3.26% 18,578 3.25% 19,325 3.22% Consumer Other—Ally Lending(2) — 1,274 8.77% 2,114 9.99% Consumer Other—Ally Credit Card 2,001 21.59% 1,975 21.61% 1,701 21.88% Cash and Cash Equivalents 7,311 4.87% 7,709 5.04% 7,401 4.70% Investment Securities & Other(3) 29,542 3.66% 30,274 3.60% 31,958 3.17% Earning Assets $183,705 7.36% $ 186,930 7.27% $ 186,655 6.99% Total Loans and Leases (3) 147,160 8.22% 149,281 8.12% 147,717 7.93% Deposits(4) $152,412 4.21% $155,352 4.28% $152,382 3.74% Unsecured Debt 10,280 7.23% 10,504 7.16% 10,618 6.27% Secured Debt 1,227 6.08% 1,409 5.74% 2,879 5.61% Other Borrowings(5) 7,114 3.86% 7,122 3.63% 7,592 3.00% Funding Sources $171,033 4.39% $174,387 4.44% $173,471 3.89% NIM (as reported) 3.27% 3.13% 3.38% Core OID(6) $773 7.19% $786 6.80% $824 5.77% NIM (ex. Core OID)(6) 3.30% 3.16% 3.41% (1) Mortgage includes held-for-investment (HFI) loans from the Mortgage Finance segment and the HFI legacy mortgage portfolio in run-off at the Corporate and Other segment. (2) Unsecured lending from point-of-sale financing. Moved to Assets of Operations Held for Sale on 12/31/23. Sale of Ally Lending closed on 03/01/24. (3) Includes Community Reinvestment Act and other held-for-sale (HFS) loans. (4) Includes retail, brokered, and other deposits (inclusive of sweep deposits, mortgage escrow and other deposits). (5) Includes FHLB borrowings and Repurchase Agreements. (6) Calculated using a Non-GAAP financial measure. See pages 27 – 29 for definitions. 9

2Q 2024 Preliminary Results Diversified Consumer Deposits Franchise 15-year journey establishing ‘a brand that matters’ Ally Retail Deposits by Vintage $ in billions $160 $140 $120 $100 $80 $60 $40 $20—Pre-2009 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Customers <0.4M 0.9M 2.0M 3.2M 2Q Retail Deposit Highlights 3.2M $142B 92% 96% FDIC Insured(1) Customer Customers Retail Balances (2) +54K customers in 2Q retention See page 31 for footnotes. 10

2Q 2024 Preliminary Results Capital • 2Q ‘24 CET1 ratio of 9.6% and TCE / TA ratio of 5.6% (1) Capital Ratios and Risk-Weighted Assets ($ billions) • $4B of CET1 capital above FRB requirement of 7.0% 12.7% Total Capital (Regulatory Minimum + SCB) 12.5% 12.5% 12.4% 12.5% Ratio 10.7% 10.7% 10.8% 10.8% 11.0% Tier 1 Ratio • Direct issuance of $330M credit linked notes in 2Q on $3B 9.3% 9.3% 9.4% 9.4% 9.6% CET1 Ratio reference pool of prime retail auto loans – Generated 11bps of CET1 benefit in 2Q; benefit amortizes over $159 $161 $162 Risk $158 $157 Weighted time as the loans pay down Assets • Preliminary SCB of 2.6% effective Oct. 1; continue to maintain buffer above required minimum – Continue to maintain 9.0% internal operating target 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 • Announced 3Q ’24 common dividend of $0.30 per share Note: For more details on the final rules to address the impact of CECL on regulatory capital by allowing BHCs and banks, including Ally, to delay and subsequently phase-in its impact, see page 30. Adjusted Tangible Book Value per Share(1) Adjusted $45 $47 TBV/Share $42 ex. OCI(1) $13 OCI $10 $13 Impact(2) $39 $34 $34 $32 $32 $34 Adjusted $27 $28 TBV/Share(1) $24 $26 $21 2Q 14 2Q 15 2Q 16 2Q 17 2Q 18 2Q 19 2Q 20 2Q 21 2Q 22 2Q 23 2Q 24 End of Period Shares Outstanding 480M 482M 484M 452M 426M 393M 374M 363M 313M 302M 305M (1) Contains a Non-GAAP financial measure. See pages 27 – 29 for definitions. (2) Prior period OCI impacts are not material to Adjusted Tangible Book Value per Share and therefore not shown. 11

2Q 2024 Preliminary Results Capital Optimization Long history and experience in securitization, established infrastructure and technology enabled the successful issuance of Ally’s inaugural credit risk transfer transaction Generates 11bps of CET 1 benefit in 2Q and introduces another lever for capital management Ally Bank Capital Efficiency: Reduces RWA on the $3B reference pool from 100% to 38% Credit Linked • Structure: Ally sold the mezzanine tranche while retaining senior and first loss tranches Notes Incremental interest issuance • expense associated with $330M debt (ABCLN 2024-A) $330M CLNs • Collateral: Pool contains high credit quality retail auto loans (WA FICO of 749) 7.18% coupon 1.59 Yr. WAL • Loans remain on balance sheet and Ally retains all of the economics • Capital benefit amortizes as the pool of loans pay down Risk weighted assets on $3 billion reference pool decreased from 100% to 38% Reference Portfolio Senior 87.5% (20% RWA) $2.6B Retained by Ally $3.0B Prime Auto Loans Mezzanine | $330M 11% (0% RWA) Credit Linked Notes Investor First Loss | $45M 1.5% (1250% RWA) Retained by Ally Cash 20% RWA Collateral RWA from 100% to 38% Account Proceeds from the notes were deposited in a cash collateral account with AA-bank that earns interest 12

2Q 2024 Preliminary Results Asset Quality: Key Metrics Net Charge-Off Activity(1) Consolidated Net Charge-Offs (NCOs)(1) ($ millions) 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 1.77% 1.55% Retail Auto $277 $393 $470 $477 $378 1.31% Annualized Commercial Auto 4—19 1 (4) $623 1.26% NCO Rate 1.16% Mortgage Finance — — -$539 Corporate Finance 56 (3) 48 (1) -$456 $435 NCOs ($M) $399 Ally Lending 27 29 36—-Ally Credit Card 36 39 52 62 62 Corp/Other (2) (1) (2) (2)—(1) 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 Total $399 $456 $623 $539 $435 Note: Ratios exclude loans measured at fair value and loans held-for-sale ex. Ally Lending (4Q’23). (2) Corp/Other includes legacy Mortgage HFI portfolio. See page 30 for definition. Retail Auto Net Charge-Offs (NCOs)(1) Retail Auto Delinquencies 4.42% 30+ DPD 4.33% Delinquency 2.27% Rate 2.21% 3.85% 3.88% 3.60% 60+ DPD 1.23% 1.26% Delinquency 1.85% Annualized 1.81% Rate $470 $477 NCO Rate 1.10% 1.03% 0.94% $393 $1,049 60+ 1.32% $378 NCOs ($M) $1,037 Delinquent $878 $915 Contracts $796 ($M) $277 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 13 (1) Excludes write-downs from retail auto loan sales (4Q’23 & 1Q’24) and Ally Lending sale (4Q’23). Notes: [1] Includes accruing contracts only [2] Days Past Due (“DPD”).

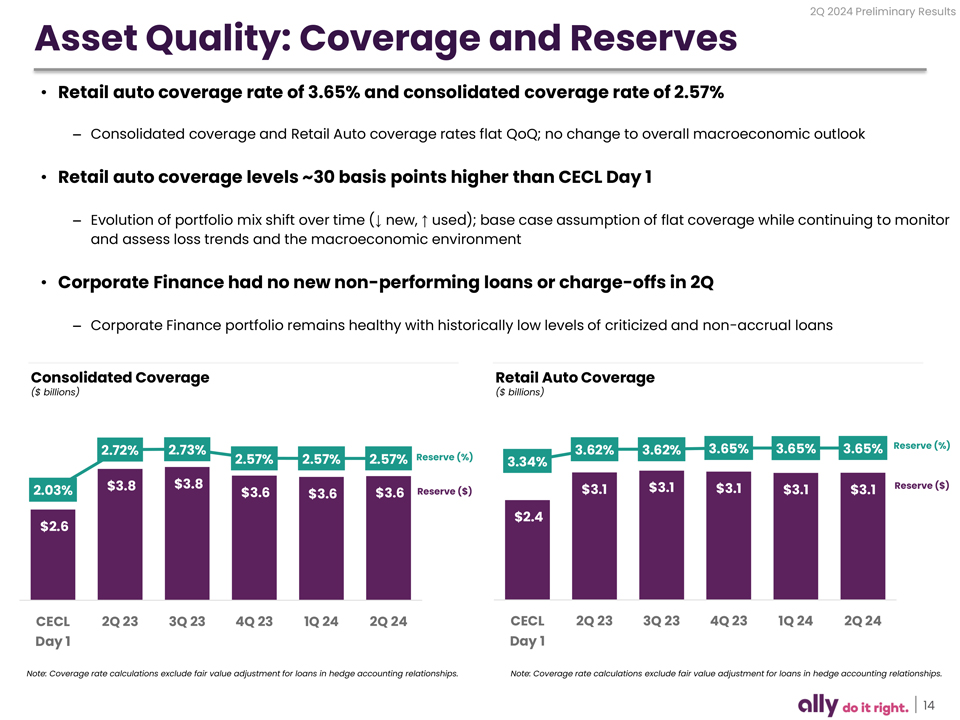

2Q 2024 Preliminary Results Asset Quality: Coverage and Reserves • Retail auto coverage rate of 3.65% and consolidated coverage rate of 2.57% – Consolidated coverage and Retail Auto coverage rates flat QoQ; no change to overall macroeconomic outlook • Retail auto coverage levels ~30 basis points higher than CECL Day 1 – Evolution of portfolio mix shift over time (↓ new, ↑ used); base case assumption of flat coverage while continuing to monitor and assess loss trends and the macroeconomic environment • Corporate Finance had no new non-performing loans or charge-offs in 2Q – Corporate Finance portfolio remains healthy with historically low levels of criticized and non-accrual loans Consolidated Coverage Retail Auto Coverage ($ billions) ($ billions) 2.72% 2.73% 3.62% 3.62% 3.65% 3.65% 3.65% Reserve (%) 2.57% 2.57% 2.57% Reserve (%) 3.34% $3.8 $3.8 $3.1 $3.1 $3.1 $3.1 $3.1 Reserve ($) 2.03% $3.6 $3.6 $3.6 Reserve ($) $2.4 $2.6 CECL 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 CECL 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 Day 1 Day 1 Note: Coverage rate calculations exclude fair value adjustment for loans in hedge accounting relationships. Note: Coverage rate calculations exclude fair value adjustment for loans in hedge accounting relationships. 14

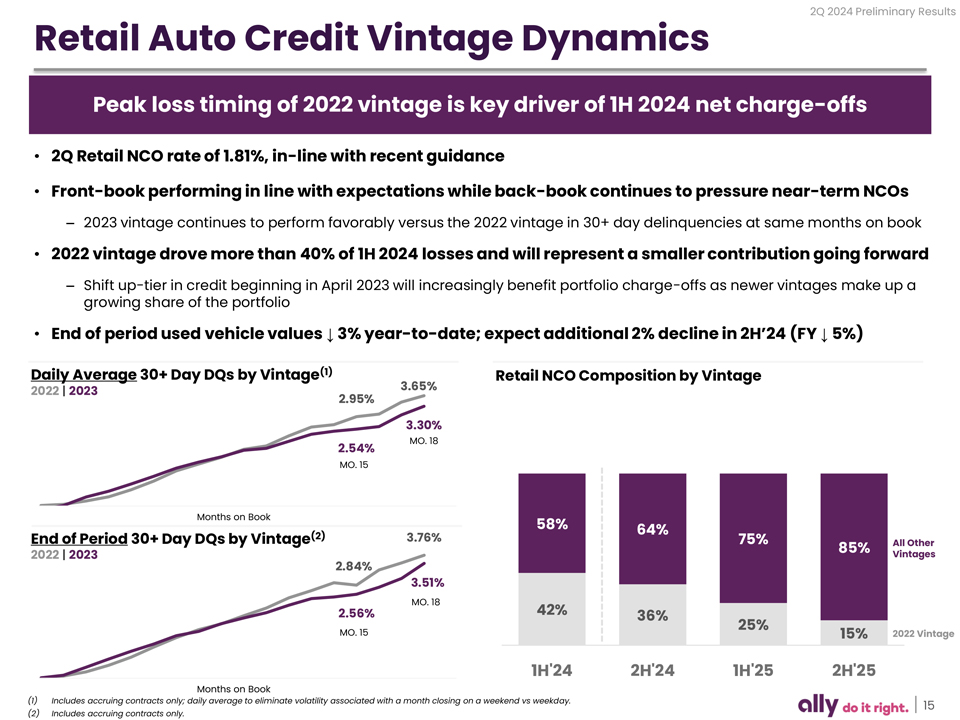

2Q 2024 Preliminary Results Retail Auto Credit Vintage Dynamics Peak loss timing of 2022 vintage is key driver of 1H 2024 net charge-offs • 2Q Retail NCO rate of 1.81%, in-line with recent guidance • Front-book performing in line with expectations while back-book continues to pressure near-term NCOs – 2023 vintage continues to perform favorably versus the 2022 vintage in 30+ day delinquencies at same months on book • 2022 vintage drove more than 40% of 1H 2024 losses and will represent a smaller contribution going forward – Shift up-tier in credit beginning in April 2023 will increasingly benefit portfolio charge-offs as newer vintages make up a growing share of the portfolio • End of period used vehicle values ↓ 3% year-to-date; expect additional 2% decline in 2H’24 (FY ↓ 5%) Daily Average 30+ Day DQs by Vintage(1) Retail NCO Composition by Vintage 2022 | 2023 2.95% 3.65% 3.30% MO. 18 2.54% MO. 15 Months on Book 58% (2) 64% End of Period 30+ Day DQs by Vintage 3.76% 75% All Other 2022 | 2023 85% Vintages 2.84% 3.51% 2.56% MO. 18 42% 36% 25% MO. 15 15% 2022 Vintage 1H’24 2H’24 1H’25 2H’25 Months on Book (1) Includes accruing contracts only; daily average to eliminate volatility associated with a month closing on a weekend vs weekday. 15 (2) Includes accruing contracts only.

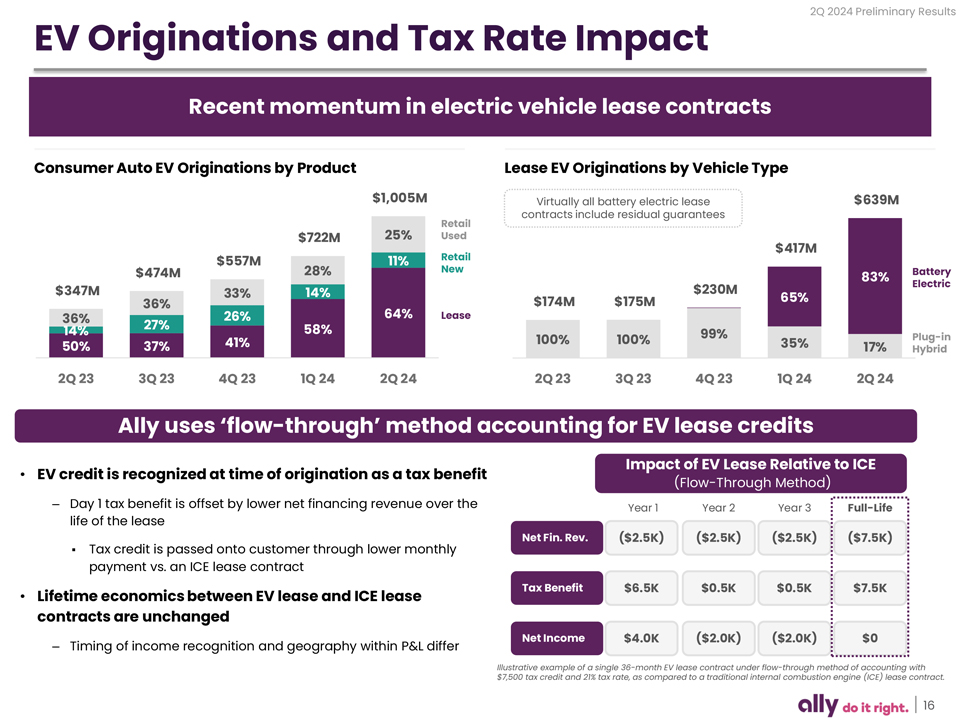

2Q 2024 Preliminary Results EV Originations and TaxRate Impact Recent momentum in electric vehicle lease contracts Consumer Auto EV Originations by Product Lease EV Originations by Vehicle Type $1,005M Virtually all battery electric lease $639M contracts include residual guarantees Retail $722M 25% Used $417M $557M 11% Retail $474M 28% New Battery 83% $347M $230M Electric 33% 14% 65% 36% $174M $175M 36% 26% 64% Lease 14% 27% 58% 100% 100% 99% Plug-in 50% 37% 41% 35% 17% Hybrid 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 Ally uses ‘flow-through’ method accounting for EV lease credits Impact of EV Lease Relative to ICE • EV credit is recognized at time of origination as a tax benefit (Flow-Through Method) – Day 1 tax benefit is offset by lower net financing revenue over the Year 1 Year 2 Year 3 Full-Life life of the lease Net Fin. Rev. ($2.5K) ($2.5K) ($2.5K) ($7.5K) ? Tax credit is passed onto customer through lower monthly payment vs. an ICE lease contract ICE lease Tax Benefit $6.5K $0.5K $0.5K $7.5K • Lifetime economics between EV lease and contracts are unchanged Net Income $4.0K ($2.0K) ($2.0K) $0 – Timing of income recognition and geography within P&L differ Illustrative example of a single 36-month EV lease contract under flow-through method of accounting with $7,500 tax credit and 21% tax rate, as compared to a traditional internal combustion engine (ICE) lease contract. 16

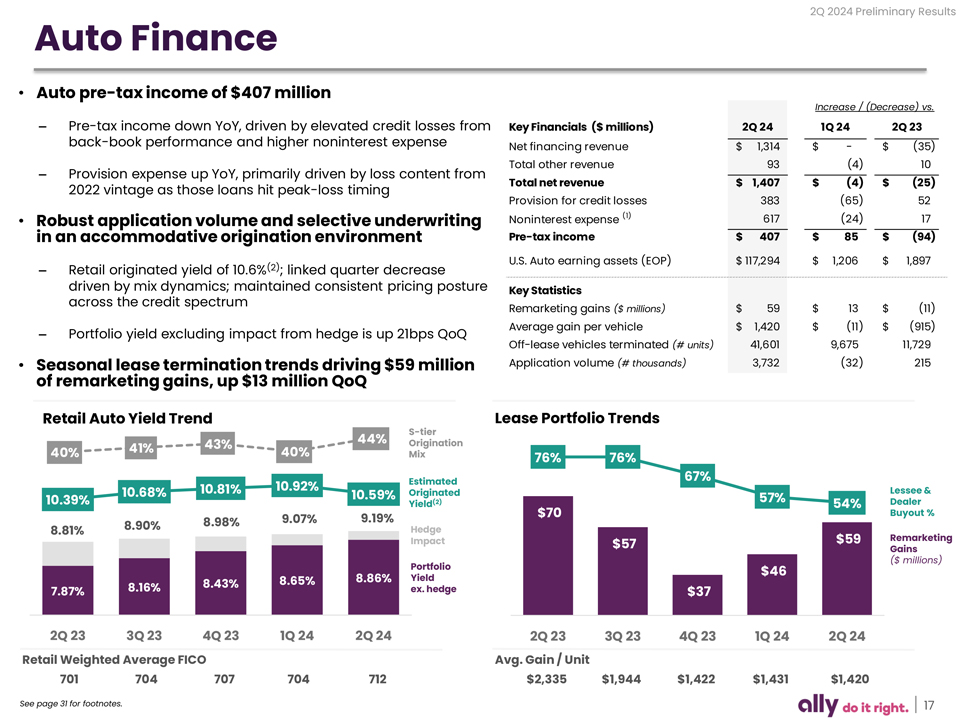

2Q 2024 Preliminary Results Auto Finance • Auto pre-tax income of $407 million Increase / (Decrease) vs. – Pre-tax income down YoY, driven by elevated credit losses from Key Financials ($ millions) 2Q 24 1Q 24 2Q 23 back-book performance and higher noninterest expense Net financing revenue $1,314 $- $(35) Total other revenue 93 (4) 10 – Provision expense up YoY, primarily driven by loss content from 2022 vintage as those loans hit peak-loss timing Total net revenue $1,407 $(4) $(25) Provision for credit losses 383 (65) 52 • Robust application volume and selective underwriting Noninterest expense (1) 617 (24) 17 in an accommodative origination environment Pre-tax income $407 $85 $(94) U.S. Auto earning assets (EOP) $ 117,294 $1,206 $1,897 – Retail originated yield of 10.6% (2); linked quarter decrease driven by mix dynamics; maintained consistent pricing posture Key Statistics across the credit spectrum Remarketing gains ($ millions) $59 $13 $(11) hedge is up 21bps QoQ Average gain per vehicle $1,420 $(11) $(915) – Portfolio yield excluding impact from Off-lease vehicles terminated (# units) 41,601 9,675 11,729 • Seasonal lease termination trends driving $59 million Application volume (# thousands) 3,732 (32) 215 of remarketing gains, up $13 million QoQ Retail Auto Yield Trend Lease Portfolio Trends 44% S-tier 41% 43% Origination 40% 40% Mix 76% 76% Estimated 67% 10.81% 10.92% Lessee & 10.68% 10.59% Originated 57% 10.39% Yield(2) 54% Dealer 9.07% 9.19% $70 Buyout % 8.90% 8.98% 8.81% Hedge Impact $57 $59 Remarketing Gains ($ millions) Portfolio $46 8.43% 8.65% 8.86% Yield 7.87% 8.16% ex. hedge $37 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 Retail Weighted Average FICO Avg. Gain / Unit 701 704 707 704 712 $2,335 $1,944 $1,422 $1,431 $1,420 See page 31 for footnotes. 17