U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of July 2024

Commission File Number: 1-15270

NOMURA HOLDINGS, INC.

(Translation of registrant’s name into English)

13-1, Nihonbashi 1-chome

Chuo-ku, Tokyo 103-8645

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Information furnished on this form:

EXHIBIT

| Exhibit Number | ||

| 4.14. | Form of $500,000,000 Senior Floating Rate Notes due 2027 | |

| 4.15. | Form of $500,000,000 5.594% Senior Fixed Rate Notes due 2027 | |

| 4.16. | Form of $1,000,000,000 5.783% Senior Fixed Rate Notes due 2034 | |

| 5.11. | Opinion of Sullivan & Cromwell LLP | |

| 5.12. | Opinion of Anderson Mori & Tomotsune | |

The registrant hereby incorporates Exhibits 4.14, 4.15, 4.16, 5.11 and 5.12 to this report on Form 6-K by reference in the prospectus that is part of the Registration Statement on Form F-3 (Registration No. 333-261756) of the registrant, filed with the Securities and Exchange Commission on December 20, 2021.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NOMURA HOLDINGS, INC. | ||||||

| Date: July 3, 2024 | By: | /s/ Kenichiro Asano | ||||

| Kenichiro Asano | ||||||

| Managing Director Treasury Department |

||||||

Exhibit 4.14

[FORM OF $500,000,000 SENIOR FLOATING RATE NOTES DUE 2027]

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERENCED AND REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN DEFINITIVE FORM IN ACCORDANCE WITH THE PROVISIONS OF THE INDENTURE AND THE TERMS OF THIS SECURITY, THIS SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE TO NOMINEES OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE. TRANSFER OF A PORTION OF THIS SECURITY SHALL BE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE INDENTURE. IN THE EVENT THAT THIS GLOBAL SECURITY IS EXCHANGED IN WHOLE OR IN PART FOR THE INDIVIDUAL SECURITIES REPRESENTED HEREBY, ALL SUCH INDIVIDUAL SECURITIES IN THE FORM OF DEFINITIVE CERTIFICATES SHALL CONTAIN THE BELOW LEGEND WITH RESPECT TO JAPANESE TAXATION.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF DTC, TO NOMURA HOLDINGS, INC. (THE “COMPANY”) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IN EXCHANGE FOR THIS CERTIFICATE OR ANY PORTION HEREOF IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

INTEREST PAYMENTS ON THIS SECURITY WILL BE SUBJECT TO JAPANESE WITHHOLDING TAX UNLESS IT IS ESTABLISHED THAT THIS SECURITY IS HELD BY OR FOR THE ACCOUNT OF A BENEFICIAL OWNER THAT IS (I) FOR JAPANESE TAX PURPOSES, NEITHER (X) AN INDIVIDUAL RESIDENT OF JAPAN OR A JAPANESE CORPORATION, NOR (Y) AN INDIVIDUAL NON-RESIDENT OF JAPAN OR A NON-JAPANESE CORPORATION THAT IN EITHER CASE IS A PERSON HAVING A SPECIAL RELATIONSHIP WITH THE COMPANY AS DESCRIBED IN ARTICLE 6, PARAGRAPH 4 OF THE ACT ON SPECIAL MEASURES CONCERNING TAXATION OF JAPAN (ACT NO. 26 OF 1957, AS AMENDED) (THE “SPECIAL TAXATION MEASURES ACT” AND, EACH SUCH PERSON, A “SPECIALLY-RELATED PERSON OF THE COMPANY”), (II) A JAPANESE DESIGNATED FINANCIAL INSTITUTION AS DESCRIBED IN ARTICLE 6, PARAGRAPH 11 OF THE SPECIAL TAXATION MEASURES ACT WHICH COMPLIES WITH THE REQUIREMENT FOR TAX EXEMPTION UNDER THAT PARAGRAPH OR (III) A JAPANESE PUBLIC CORPORATION, FINANCIAL INSTITUTION, FINANCIAL INSTRUMENTS BUSINESS OPERATOR OR CERTAIN OTHER ENTITY WHICH HAS RECEIVED SUCH PAYMENTS THROUGH A JAPANESE PAYMENT HANDLING AGENT, AS PROVIDED IN ARTICLE 3-3, PARAGRAPH 6 OF THE SPECIAL TAXATION MEASURES ACT, IN COMPLIANCE WITH THE REQUIREMENT FOR TAX EXEMPTION UNDER THAT PARAGRAPH.

INTEREST PAYMENTS ON THIS SECURITY TO AN INDIVIDUAL RESIDENT OF JAPAN, TO A JAPANESE CORPORATION, OR TO AN INDIVIDUAL NON-RESIDENT OF JAPAN OR A NON-JAPANESE CORPORATION THAT IN EITHER CASE IS A SPECIALLY-RELATED PERSON OF THE COMPANY (EXCEPT FOR THE JAPANESE DESIGNATED FINANCIAL INSTITUTION AND THE JAPANESE PUBLIC CORPORATION, FINANCIAL INSTITUTION, FINANCIAL INSTRUMENTS BUSINESS OPERATOR AND CERTAIN OTHER ENTITY DESCRIBED IN THE PRECEDING PARAGRAPH) WILL BE SUBJECT TO DEDUCTION IN RESPECT OF JAPANESE INCOME TAX AT A RATE OF 15.315% OF THE AMOUNT OF SUCH INTEREST.

NOMURA HOLDINGS, INC.

GLOBAL SECURITY

Senior Floating Rate Notes Due 2027

| No. [ ] | CUSIP No.: 65535HBQ1 | |

| ISIN No.: US65535HBQ11 | ||

| Common Code: 285212766 | ||

| $[ ] |

NOMURA HOLDINGS, INC., a joint stock corporation incorporated with limited liability under the laws of Japan (the “Company”, which term includes any successor corporation), for value received promises to pay to CEDE & CO., or registered assigns, the principal sum of $[ ] (the “Principal”) on July 2, 2027 (the “Maturity Date”) (subject to adjustments as set forth below) and to pay interest thereon from July 3, 2024 or from the most recent interest payment date to which interest has been paid or duly provided for, quarterly in arrears on January 2, April 2, July 2 and October 2 in each year (each, along with the Maturity Date or the date fixed for redemption, an “Interest Payment Date”) commencing October 2, 2024 at an interest rate equal to Compounded Daily SOFR plus a margin (the “Margin”) of 1.25% per annum, until the principal hereof is paid or made available for payment, all subject to and in accordance with the terms of the Indenture referred to herein.

The term “Business Day” means a day that is a U.S. Government Securities Business Day (as defined below) and that is not a day on which banking institutions in New York City, London or Tokyo are authorized or obligated by law, regulation or executive order to close.

If any Interest Payment Date (other than the Maturity Date or any redemption date for taxation reasons as provided for on the reverse of this Security) falls on a day that is not a Business Day, such Interest Payment Date will be adjusted in accordance with the Modified Following Business Day Convention. The term “Modified Following Business Day Convention” means that the relevant date shall be postponed to the first following day that is a Business Day (and interest will continue to accrue to, but excluding, such succeeding Business Day), unless that day falls in the next calendar month in which case that date will be the first preceding day that is a Business Day (and interest will accrue to, but excluding, such preceding Business Day).

If the Maturity Date or redemption date for taxation reasons as provided for on the reverse of this Security would fall on a day that is not a Business Day, then any interest, principal or Additional Amounts, if any, as the case may be, will be paid on the next succeeding Business Day. Payments postponed to the next succeeding Business Day in such situations will be treated under the Indenture as if they were made on the original due date. Postponement of this kind will not result in a default under this Security or the Indenture, and no interest will accrue on the postponed amount from the original due date to the next succeeding Business Day.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the person in whose name this Security is registered as at 5:00 p.m. (New York time) on the day five Business Days immediately preceding such Interest Payment Date. If and to the extent the Company shall default in the payment of the interest due on such Interest Payment Date, such defaulted interest shall be paid to the person in whose name this Security is registered at the close of business on a subsequent record date, which shall be not less than five Business Days prior to the payment of such defaulted interest, established by notice given by mail or in accordance with clearing system procedures by or on behalf of the Company to the Holder of this Security not less than 15 days preceding such subsequent record date. Interest on this Security will accrue from the date of original issuance or, if interest has already been paid, from the date it was most recently paid.

As further described on the reverse of this Security, on each Interest Determination Date, the Calculation Agent (each as defined below) will calculate the amount of accrued interest payable on this Security on the related Interest Payment Date by multiplying (i) the outstanding principal amount of this Security by (ii) the product of (a) the interest rate for the relevant Interest Period (as defined below) multiplied by (b) the number of days in the relevant Interest Period divided by 360 (actual/360 day count convention). Interest will be calculated per each $1,000 in nominal amount of the Securities and rounded to the nearest cent (half a cent being rounded upwards). In no event shall the rate of interest for this Security be less than 0% for any Interest Period.

The principal of, and interest and Additional Amounts on, this Security will be payable in U.S. dollars. The Company will cause the Trustee, or the paying agent, if any, to pay such amounts, on the dates payment is to be made, directly to The Depository Trust Company (“DTC”).

The Company will pay the Holder hereof Additional Amounts with respect to withholding taxes as are provided for, and subject to the conditions stated, on the reverse of this Security.

This Security is being deposited with DTC acting as depositary, and registered in the name of Cede & Co., a nominee of DTC. As Holder of record of this Security, Cede & Co. shall be entitled to receive payments of principal and interest. Payments of principal and interest, including any Additional Amounts, on this Security shall be made in the manner specified on the reverse hereof and, to the extent not inconsistent with the provisions set forth herein, in the Indenture referred to herein.

This Security constitutes the direct, unconditional, unsubordinated and unsecured obligations of the Company and shall at all times rank pari passu and without preference among themselves and with all other unsecured obligations, other than subordinated obligations of the Company (except for statutorily preferred exceptions) from time to time outstanding. This Security is not redeemable prior to maturity, except as set forth on the reverse of this Security and will not be subject to any sinking fund.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been manually executed by or on behalf of the Trustee under the Indenture, by Citibank, N.A., London Branch, as authenticating agent, this Security shall not be entitled to any benefits under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this Security to be signed manually or by facsimile by its duly authorized signatory.

| NOMURA HOLDINGS, INC. | ||

| By: |

|

|

| Name: | Kentaro Okuda | |

| Title: | Representative Executive Officer, President and Group Chief Executive Officer | |

[Signature Page to 3-Year Floating Rate Global Note]

Certificate of Authentication

This is one of the series designated herein and referred to in the within-mentioned Indenture.

Date:

| CITIBANK, N.A., LONDON BRANCH | ||

| as Authenticating Agent | ||

| By: |

|

|

| Name: | ||

| Title: | ||

[Signature Page to 3-Year Floating Rate Global Note]

REVERSE OF SECURITY

NOMURA HOLDINGS, INC.

$500,000,000 SENIOR FLOATING RATE NOTES DUE 2027

This Security is one of a duly authorized issue of unsecured debentures, notes or other evidences of indebtedness of Nomura Holdings, Inc., a joint stock corporation incorporated with limited liability under the laws of Japan (herein called the “Company”, which term includes any successor person under the Indenture hereinafter referred) designated as its $500,000,000 Senior Floating Rate Notes due July 2, 2027 (herein called the “Securities”), issued under and pursuant to a senior debt indenture dated as of January 16, 2020 (hereinafter called the “Indenture”), between the Company and Citibank, N.A., as trustee (herein called the “Trustee”, which term includes any successor trustee under the Indenture), to which Indenture and any other indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee and any agent of the Trustee, any paying agent, the Calculation Agent, the Company and the Holders of the Securities and of the terms upon which the Securities are issued and are to be authenticated and delivered.

This Security is one of the series designated on the face hereof. By the terms of the Indenture, additional Securities of this series and of other separate series, which may vary as to denomination, date, amount, stated maturity (if any), interest rate or method of calculating the interest rate and in other respects as therein provided, may be issued in an unlimited amount.

The principal of and interest (and any Additional Amounts) on the Securities shall be payable in U.S. dollars or in such other coin or currency of the United States of America as at the time of payment is legal tender for the payment of public and private debts. So long as any of the Securities are held in global form, payments of principal and interest on such Securities shall be made by wire transfer in immediately available funds in U.S. dollars to a bank account in New York City designated by the Holder of this Registered Global Security. Otherwise, (i) the principal amount of the Securities will be payable by check, drawn on a bank in New York City, upon the presentation and surrender of the Securities at the Specified Corporate Trust Office of the Trustee or at any office or agency maintained by the Company for such purpose and (ii) interest on the Securities will be payable by wire transfer or check, drawn on a bank in New York City, mailed to the persons in whose names the Securities are registered as of 5:00 p.m. (New York time) on the fifth Business Day immediately preceding the applicable Interest Payment Date (or the subsequent record date in the case of a defaulted interest payment) at the addresses of such persons as shall appear in the Security register of the Company; provided, however, that at the option of a Holder in whose name at least $1,000,000 principal amount of Securities are registered, all payments in respect of the Securities may be received by electronic funds transfer of immediately available funds to a U.S. dollar account maintained by the payee, provided such registered Holder so elects by giving written notice to the Trustee designating such account, no later than fifteen days immediately preceding the relevant date for payment (or such other date as the Trustee may accept in its discretion).

Compounded Daily SOFR

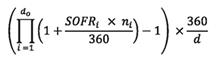

The term “Compounded Daily SOFR” means, in respect of each Interest Period, the rate of return on a daily compounded interest investment during the relevant SOFR Observation Period (with the daily SOFR reference rate as the reference rate for the calculation of interest) and will be determined by the Calculation Agent on the relevant Interest Determination Date in accordance with the following formula:

with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 per cent. being rounded upwards (e.g., 9.876541 per cent. (or 0.09876541) being rounded down to 9.87654 per cent. (or 0.0987654) and 9.876545 per cent. (or 0.09876545) being rounded up to 9.87655 per cent. (or 0.0987655)) and where:

“SOFRi” for any U.S. Government Securities Business Day “i” in the relevant SOFR Observation Period, is equal to the SOFR reference rate for that U.S. Government Securities Business Day “i”;

“d” means the number of calendar days in the relevant SOFR Observation Period;

“do” means the number of U.S. Government Securities Business Days in the relevant SOFR Observation Period;

“i” means a series of whole numbers ascending from one to do, representing each U.S. Government Securities Business Day in chronological order from (and including) the first U.S. Government Securities Business Day in the relevant SOFR Observation Period (each, a “U.S. Government Securities Business Day “i””);

“ni”, for any U.S. Government Securities Business Day “i”, means the number of calendar days from (and including) such U.S. Government Securities Business Day “i” up to (but excluding) the following U.S. Government Securities Business Day;

“Interest Determination Date” means the date that is five U.S. Government Securities Business Days before the related Interest Payment Date;

“Interest Period” means each period beginning from (and including) July 3, 2024 to (but excluding) the first Interest Payment Date, or from (and including) any Interest Payment Date to (but excluding) the next Interest Payment Date; provided, however, that, in the case of any Interest Period during which any Securities become due and payable on a date other than an Interest Payment Date, in respect of such Securities that become due and payable only, such Interest Period will end on (but exclude) such date on which such Securities have become due and payable;

“SOFR” means, in respect of a U.S. Government Securities Business Day, the reference rate determined by the Calculation Agent in accordance with the following provision:

| (i) | the Secured Overnight Financing Rate published for such U.S. Government Securities Business Day at the SOFR Determination Time on the SOFR Administrator’s Website; or |

| (ii) | if the reference rate specified in (i) above does not appear, unless both a Benchmark Transition Event and its related Benchmark Replacement Date (each as defined below) have occurred, the Secured Overnight Financing Rate published on the SOFR Administrator’s Website for the most recent preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the SOFR Administrator’s Website; |

“SOFR Administrator’s Website” means the website of the Federal Reserve Bank of New York, or any successor source;

“SOFR Determination Time” means 3:00 p.m. (New York City time) on the immediately following U.S. Government Securities Business Day;

“SOFR Observation Period” means in respect of each Interest Period, the period from, and including, the date five U.S. Government Securities Business Days preceding the first date in such Interest Period to, but excluding, the date five U.S. Government Securities Business Days preceding the Interest Payment Date for such Interest Period or in the case of any Interest Period during which the Securities become due and payable on a date other than an Interest Payment Date, the period from, and including, the date that is five U.S. Government Securities Business Days preceding the first date in such Interest Period, but excluding, the date that is five U.S. Government Securities Business Days before such date on which the Securities have become due and payable; and “U.S.

Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Notwithstanding anything to the contrary in the Indenture or the Securities, if the Company or its designee determines on or prior to the relevant Reference Time (as defined below) that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to determining Compounded Daily SOFR or the then-current Benchmark (as defined below), then the benchmark replacement provisions set forth below (“Benchmark Transition Provisions”) will thereafter apply to all determinations of the rate of interest payable on the Securities.

For the avoidance of doubt, in accordance with the Benchmark Transition Provisions, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the interest payable for each Interest Period on this Security will be an annual rate equal to the sum of the Benchmark Replacement (as defined below) and the Margin.

Subject to and in accordance with its appointment and acceptance of such appointment under a calculation agency agreement with the Company (the “Calculation Agency Agreement”), Citibank, N.A., London Branch, will serve as calculation agent (in such capacity together with any successor, the “Calculation Agent”) for the Securities. The Calculation Agent’s determination of Compounded Daily SOFR and its calculation of the applicable interest rate for each Interest Period will be conclusive and binding on the Company and the Holders of the Securities absent manifest error. Upon written request, the Calculation Agent will make available the interest rates for current (once determined) and preceding Interest Periods by delivery of such notice through such medium as is available to participants in DTC, Euroclear and Clearstream, or any successor thereof, and in accordance with such applicable rules and procedures as long as the Securities are held in global form. The Company has the right to remove the Calculation Agent at any time, which removal will take effect on the date of the appointment by the Company of a successor Calculation Agent. The Calculation Agent may resign at any time by giving not less than sixty (60) days prior written notice thereof to the Company. Pursuant to the terms of the Calculation Agency Agreement, a successor Calculation Agent will be appointed.

Benchmark Transition

Notwithstanding anything to the contrary in the Indenture or the Securities, if the Company or its designee determines on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Securities in respect of all determinations on such date and for all determinations on all subsequent dates.

In connection with the implementation of a Benchmark Replacement, the Company or its designee will have the right to make Benchmark Replacement Conforming Changes (as defined below) from time to time without the consent of the Holders.

Any determination, decision or election that may be made by the Company or its designee pursuant to these Benchmark Transition Provisions, including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection (i) will be conclusive and binding on the Company, the Trustee, the paying agent, the Calculation Agent and any other agents and the Holders of the Securities absent manifest error, (ii) if made by the Company, will be made in the Company’s sole discretion, (iii) if made by the Company’s designee, will be made after consultation with the Company, and the designee will not make any such determination, decision or election to which the Company objects and (iv) notwithstanding anything to the contrary in the Indenture or the Securities, shall become effective without consent from the Holders of the Securities or any other party.

Any determination, decision or election pursuant to these Benchmark Transition Provisions not made by the Company’s designee will be made by the Company on the basis as described above. Each Securityholder agrees that the designee shall have no liability for not making any such determination, decision or election. In addition, the Company may designate an entity (which may be its affiliate) to make any determination, decision or election that the Company has the right to make in connection with the Benchmark Transition Provisions set forth herein. Each Securityholder agrees (i) that none of the Trustee, the Calculation Agent, the Paying Agent, the Registrar, the Authenticating Agent, nor the Transfer Agent shall have any duty or liability in connection with the determination of any Benchmark Transition Event, Benchmark Replacement, Benchmark Replacement Conforming Changes, or any other related matter as provided in this section, and (ii) to waive any and all claims arising out of such matters against such persons. Each Securityholder agrees that none of the Trustee, the Calculation Agent, the Paying Agent, the Registrar, the Authenticating Agent, nor the Transfer Agent shall be under any obligation to (i) monitor, determine or verify the unavailability or cessation of any Benchmark, or whether or when there has occurred, or to give notice to any other transaction party of the occurrence of, any Benchmark Transition Event or Benchmark Replacement Date, (ii) select, determine or designate any Benchmark Replacement, or other successor or replacement benchmark index, or whether any conditions to the designation of such a rate have been satisfied, or (iii) select, determine or designate any Benchmark Replacement Adjustment, or other modifier to any replacement or successor index, if any, in connection with any of the foregoing. Each Securityholder agrees that none of the Trustee, the Calculation Agent, the Paying Agent, the Registrar, the Authenticating Agent, nor the Transfer Agent shall be liable for any inability, failure or delay on its part to perform any of its duties as a result of the unavailability of any Benchmark and absence of a designated replacement Benchmark, including as a result of any inability, delay, error or inaccuracy on the part of any other transaction party in providing any required or contemplated direction, instruction, notice or information and reasonably required for the performance of such duties.

The Company will promptly give written notice of the determination of the Benchmark Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement Conforming Changes to the Trustee, the paying agent, the Calculation Agent and the Holders of the Securities; provided that failure to give such notice will have no impact on the effectiveness of, or otherwise invalidate, any such determination.

The Calculation Agent is not required to determine any interest rate if such determination would require access to any reference rate to which it does not have access. In the event of any conflict or ambiguity relating to the prevailing interest rate on the Securities, the Calculation Agent has the right to request written direction and/or clarification from the Company, refrain from acting unless and until such written direction and/or clarification is received by it and resolves such ambiguity to its satisfaction, and conclusively rely upon such direction without limitation. For any circumstances under the ISDA Definitions where the Calculation Agent would be required to exercise any discretion, including the selection of any reference banks and seeking quotations from reference banks, when calculating the relevant Rate of Interest, the relevant determination(s) which require the Calculation Agent to exercise its discretion shall instead be made by the Company or its designee.

For purposes of these Benchmark Transition Provisions:

“Benchmark” means, initially, Compounded Daily SOFR; provided that if the Company or its designee determines on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded Daily SOFR (including any daily published component used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement;

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

| (i) | the sum of: |

| (a) | the alternate reference rate that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark (including any daily published component used in the calculation thereof) for the Corresponding Tenor; and |

| (b) | the Benchmark Replacement Adjustment; |

| (ii) | the sum of: |

| (a) | the ISDA Fallback Rate; and |

| (b) | the Benchmark Replacement Adjustment; or |

| (iii) | the sum of: |

| (a) | the alternate reference rate that has been selected by the Company or its designee as the replacement for the then-current Benchmark (including any daily published component used in the calculation thereof) for the applicable Corresponding Tenor giving due consideration to any industry-accepted reference rate as a replacement for the then-current Benchmark (including any daily published component used in the calculation thereof) for U.S. dollar-denominated floating rate notes at such time; and |

| (b) | the Benchmark Replacement Adjustment; |

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or its designee as of the Benchmark Replacement Date:

| (i) | the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement; |

| (ii) | if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or |

| (iii) | the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark (including any daily published component used in the calculation thereof) with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time; |

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions or interpretations of “Interest Period,” changes to the timing and frequency of determining rates and making payments of interest, rounding of amounts or tenors, and other administrative matters) the Company or its designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its designee decides that adoption of any portion of such market practice is not administratively feasible or if the Company or its designee determine that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its designee determines is reasonably practicable);

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including any daily published component used in the calculation thereof):

| (i) | in the case of sub-paragraph (i) or (ii) of the definition of “Benchmark Transition Event”, the later of: |

| (a) | the date of the public statement or publication of information referenced therein; and |

| (b) | the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark (or such component); or |

| (ii) | in the case of sub-paragraph (iii) of the definition of “Benchmark Transition Event”, the date of the public statement or publication of information referenced therein. |

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark (including any daily published component used in the calculation thereof):

| (i) | a public statement or publication of information by or on behalf of the administrator of the Benchmark (or such component) announcing that such administrator has ceased or will cease to provide the Benchmark (or such component), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); |

| (ii) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark (or such component), the central bank for the currency of the Benchmark (or such component), an insolvency official with jurisdiction over the administrator for the Benchmark (or such component), a resolution authority with jurisdiction over the administrator for the Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark (or such component) has ceased or will cease to provide the Benchmark (or such component) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark (or such component); or |

| (iii) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative; |

“Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding business day adjustment) as the applicable tenor for the then-current Benchmark;

“designee” means a designee as selected and separately appointed by the Company in writing;

“ISDA Definitions” means the 2021 ISDA Interest Rate Derivatives Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time;

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor;

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark (including any daily published component used in the calculation thereof) for the applicable tenor excluding the applicable ISDA Fallback Adjustment;

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is the Compounded Daily SOFR, the SOFR Determination Time, or (2) if the Benchmark is not the Compounded Daily SOFR, the time determined by the Company or its designee after giving effect to the Benchmark Replacement Conforming Changes; “Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto; and

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

All payments of principal (and premium, if any) or interest in respect of the Securities will be made without withholding or deduction for or on account of any present or future taxes, duties, assessments or governmental charges of whatever nature imposed or levied by or on behalf of Japan or any authority thereof or therein having power to tax (“Japanese Taxes”), unless such withholding or deduction of such Japanese Taxes is required by law. In that event, the Company shall pay to the Securityholder such additional amounts (“Additional Amounts”) as will result in the receipt by or on behalf of the Holders or beneficial owners of such amounts as would have been received by them had no such withholding or deduction been required, provided that, no Additional Amounts shall be payable with respect to this Security:

| (a) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security who is an individual non-resident of Japan or a non-Japanese corporation and is liable for such Japanese Taxes in respect of such Security by reason of its (1) having some connection with Japan other than the mere holding of such Security, or (2) being a person having a special relationship with the Company as described in Article 6, paragraph 4 of the Act on Special Measures Concerning Taxation of Japan (Act No. 26 of 1957, as amended) (the “Special Taxation Measures Act”) (a “Specially-Related Person of the Company”); or |

| (b) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security (A) who would otherwise be exempt from any such withholding or deduction but who fails to comply with any applicable requirement to provide Interest Recipient Information (as defined below) or to submit a Written Application for Tax Exemption (as defined below) to the Paying Agent to whom the relevant Security is presented (where presentation is required), or (B) whose Interest Recipient Information is not duly communicated through the Participant (as defined below) and the relevant Clearing Organization to such Paying Agent; or |

| (c) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security who is for Japanese tax purposes treated as an individual resident of Japan or a Japanese corporation (except for (A) a Designated Financial Institution (as defined below) which complies with the requirement to provide Interest Recipient Information or to submit a Written Application for Tax Exemption and (B) an individual resident of Japan or a Japanese corporation who duly notifies (directly or through the Participant or otherwise) the relevant Paying Agent of its status as not being subject to Japanese Taxes to be withheld or deducted by the Company, by reason of such individual resident of Japan or Japanese corporation receiving interest on the relevant Security through a payment handling agent in Japan appointed by it); or |

| (d) | where such Security is presented for payment (where presentation is required) more than 30 days after the date on which such payment first becomes due or after the date on which the full amount payable is duly provided for, whichever occurs later, except to the extent that the Holder of the Security would have been entitled to such Additional Amounts on presenting the same for payment on the last day of such 30-day period; or |

| (e) | any combination of (a) through (d) above; |

nor shall Additional Amounts be paid with respect to any payment on this Security to or on behalf of a Securityholder who is a fiduciary or partnership or other than the sole beneficial owner of such payment to the extent such payment would be required by the laws of Japan to be included in the income, for tax purposes, of a beneficiary or settlor with respect to such fiduciary or a member of such partnership or a beneficial owner who, in each case, would not have been entitled to the Additional Amounts had such beneficiary, settlor, member or beneficial owner been the Securityholder. The obligation to pay Additional Amounts with respect to any taxes, duties, assessments or governmental charges shall not apply to (i) any estate, inheritance, gift, sales, transfer, personal property or any similar tax, duty, assessment or governmental charge or (ii) any tax, duty, assessment or governmental charge which is payable otherwise than by deduction or withholding from payments of principal of (and premium, if any) or interest on this Security. References to principal (and premium, if any) and interest in respect of this Security will be deemed to include any Additional Amounts due which may be payable in respect of the principal (or premium, if any) or interest.

Where this Security is held through a participant of a Clearing Organization or a financial intermediary, in each case, as prescribed by the Special Taxation Measures Act (each, a “Participant”), in order to receive payments free of withholding or deduction by the Company for, or on account of, Japanese Taxes, if the relevant beneficial owner of this Security is (1) an individual non-resident of Japan or a non-Japanese corporation (other than a Specially-Related Person of the Company) or (2) a Japanese financial institution or financial instruments business operator falling under certain categories prescribed by the cabinet order under Article 6, paragraph 11 of the Special Taxation Measures Act (a “Designated Financial Institution”), such beneficial owner of this Security shall, at the time of entrusting a Participant with the custody of this Security, provide certain information prescribed by the Special Taxation Measures Act and the cabinet order and other regulations thereunder to enable the Participant to establish that such beneficial owner of this Security is exempted from the requirement for Japanese Taxes to be withheld or deducted (the “Interest Recipient Information”) and advise the Participant if the beneficial owner of this Security ceases to be so exempted (including where the beneficial owner of this Security who is an individual non-resident of Japan or a non-Japanese corporation becomes a Specially-Related Person of the Company).

Where this Security is not held by a Participant, in order to receive payments free of withholding or deduction by the Company for, or on account of, Japanese Taxes, if the relevant beneficial owner of this Security is (i) an individual non-resident of Japan or a non-Japanese corporation (other than a Specially-Related Person of the Company) or (ii) a Designated Financial Institution, such beneficial owner of this Security shall, prior to each time at which it receives interest, submit to the relevant Paying Agent a written application for tax exemption (hikazei tekiyo shinkokusho) (a “Written Application for Tax Exemption”) in a form obtainable from the Paying Agent stating, inter alia, the name and address of the beneficial owner of this Security, the title of the Security, the relevant Interest Payment Date, the amount of interest and the fact that the beneficial owner of this Security is qualified to submit the Written Application for Tax Exemption, together with documentary evidence regarding its identity and residence.

No Additional Amounts will be payable for or on account of any deduction or withholding imposed pursuant to Sections 1471-1474 of the U.S. Internal Revenue Code, the U.S. Treasury regulations thereunder and any other official guidance thereunder (“FATCA”), any intergovernmental agreement entered into with respect to FATCA, or any law, regulation or other official guidance enacted in any jurisdiction implementing, or relating to, FATCA, similar legislation under the laws of any other jurisdiction, or any such intergovernmental agreement.

If there is any withholding or deduction for or on account of Japanese Taxes with respect to payments on this Security, the Company will use reasonable efforts to obtain certified copies of tax receipts evidencing the payment of such Japanese Taxes from the Japanese taxing authority imposing such Japanese Taxes, and if certified copies are not available, the Company will use reasonable efforts to obtain other evidence of payment satisfactory to the Trustee. The Trustee shall make such certified copies or other evidence available to the Holders or the beneficial owners of this Security upon reasonable request to the Trustee.

The Company will pay all stamp, court or documentary taxes or any excise or property taxes, charges or similar levies and other duties, if any, which may be imposed by Japan, the United States or any political subdivision or any taxing authority thereof or therein, with respect to the Indenture or any indenture supplemental thereto, or as a consequence of the initial issuance, execution, delivery, registration or enforcement of the Securities.

The Company may, subject to prior confirmation of the FSA (if such confirmation is required under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended) (the “Financial Instruments and Exchange Act”) or any other applicable laws and regulations then in effect), on giving at least 45 days’, but not more than 60 days’, notice to the Trustee (which notice shall be irrevocable), redeem all, but not less than all, of the Securities at a redemption price equal to the principal amount of the Securities (or if the Securities are Original Issue Discount Securities, such amount as determined as contemplated by Section 2.03 of the Indenture) plus any accrued but unpaid interest through but not including the date fixed for redemption and any related Additional Amounts, in each case with respect to the Securities being redeemed, in the event that the Company determines that, as a result of any change in or amendment to the laws or treaties (or any regulations or rulings promulgated thereunder) of Japan or any political subdivision or authority thereof or therein having power to tax, or any change in official position regarding the application or interpretation of such laws, treaties, regulations or rulings (including a holding, judgment or order by a court of competent jurisdiction), which change or amendment becomes effective on or after the date of the final offering document for the Securities, the Company has or will become obligated to pay Additional Amounts with respect to the Securities (and such obligation cannot be avoided through the taking of reasonable measures available to the Company). The Trustee will notify the Holders at least 30 days prior to the date fixed for any such redemption. Prior to the Company’s giving of any notice of redemption for tax reasons as described in this paragraph, the Company shall deliver to the Trustee (i) an Officer’s Certificate stating that the Company is entitled to effect such redemption and setting forth a statement of facts showing that the conditions precedent to the right of the Company to so redeem have occurred and (ii) an Opinion of Counsel to such effect based on such statement of facts; provided that no such notice of redemption shall be given earlier than 60 days prior to the earliest date on which the Company would be obligated to pay such Additional Amounts if a payment in respect of the Securities were then due.

Notice of redemption to the Holders of Securities to be redeemed as a whole or in part at the option of the Company shall be given by mailing notice of such redemption by first-class mail, postage prepaid, at not less than 30 days and not more than 60 days prior to the date fixed for redemption to such Securityholders at their last addresses as they shall appear upon the Register. Any notice which is mailed in the manner herein provided shall be conclusively presumed to have been duly given, whether or not the Securityholder receives the notice. Failure to give notice by mail, or any defect in the notice to the Holder of the Security designated for redemption as a whole or in part shall not affect the validity of the proceedings for the redemption of any other Security of such series.

Notwithstanding anything to the contrary in the Indenture or this Security, each Securityholder and the Trustee acknowledge, accept, consent and agree, for a period of 30 days from and including the date upon which the Prime Minister of Japan confirms that specified item 2 measures (tokutei dai nigō sochi), which are the measures set forth in Article 126-2, Paragraph 1, Item 2 of the Deposit Insurance Act of Japan (Act No. 34 of 1971, as amended, the “Deposit Insurance Act”) (or any successor provision thereto), need to be applied to the Company, not to initiate any action to attach any of the assets of the Company, the attachment of which has been prohibited by designation of the Prime Minister of Japan pursuant to Article 126-16 of the Deposit Insurance Act (or any successor provision thereto).

Subject to applicable law, each Securityholder agrees, by the acceptance of any interest in this Security, that, if (a) the Company shall institute proceedings seeking adjudication of its bankruptcy or seeking reorganization under the Bankruptcy Act, the Civil Rehabilitation Act, the Corporate Reorganization Act, the Companies Act or any other similar applicable law of Japan, and as long as such proceedings shall have continued, or a decree or order by any court having jurisdiction shall have been issued adjudging the Company bankrupt or insolvent or approving a petition seeking reorganization under any such laws, and as long as such decree or order shall have continued undischarged or unstayed, or (b) the liabilities of the Company exceed, or may exceed, the Company’s assets, or the Company suspends, or may suspend, repayment of its obligations, the Securityholder will not, and waives its right to, exercise, claim or plead any right of set off, compensation or retention in respect of any amount owed to such Securityholder by the Company arising under, or in connection with, this Security or the Indenture.

The Company shall, as soon as practicable after the Prime Minister of Japan has confirmed that specified item 2 measures (tokutei dai nigō sochi) set forth in Article 126-2, Paragraph 1, Item 2 of the Deposit Insurance Act (or any successor provision thereto) need to be applied to the Company, deliver a written notice of such event to the Trustee and the Securityholders through DTC. Any failure or delay by the Company to provide such written notice shall not change or delay the effect of the acknowledgement, acceptance, consent and agreement of the Securityholders described in the preceding paragraph or of the Trustee described in Section 4.04 of the Indenture.

Notwithstanding certain requirements under the Indenture relating to the Company’s ability to merge or consolidate with or merge into, or sell, assign, transfer, lease or convey all or substantially all of the Company’s properties or assets to any person or persons, each Securityholder and the Trustee acknowledge, accept, consent and agree to any transfer of the Company’s assets (including shares of the Company’s subsidiaries) or liabilities, or any portions thereof, with permission of a Japanese court in accordance with Article 126-13 of the Deposit Insurance Act (or any successor provision thereto), including any such transfer made pursuant to the authority of the Deposit Insurance Corporation to represent and manage and dispose of the Company’s assets under Article 126-5 of the Deposit Insurance Act (or any successor provision thereto), and that any such transfer shall not constitute a sale, assignment, transfer, lease or conveyance of the Company’s properties or assets for the purpose of Article 8 of the Indenture.

A Holder of Securities issued in definitive form may transfer or exchange Securities in accordance with the Indenture. As described in the legend on the face of this Registered Global Security, interest payments on such Securities issued in definitive form will be subject to Japanese income taxation unless the Holder establishes the matters set forth therein. Such legend concerning Japanese taxation shall also be included on the face of any Securities issued in definitive form. The Registrar and the Trustee may require a Holder, among other things, to furnish appropriate endorsements and transfer documents, and to pay any taxes and fees required by law or permitted by the Indenture. The Company will treat the registered Holder of this Security as the owner of that Security for all purposes, except as described above.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company and the Trustee with the consent of the Holders of not less than a majority in aggregate principal amount of the Securities at the time Outstanding of all series to be affected (voting as a class). The Indenture also contains provisions permitting the Holders of specified percentages in aggregate principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series, to waive compliance by the Company with certain provisions of the Indenture and certain past defaults under the Indenture and their consequences. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

As provided in the Indenture and subject to certain limitations therein set forth, the transfer of this Security is registrable, upon surrender of this Security for registration of transfer at the office or agency of the Company in any place where the principal of and interest on this Security are payable, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the Registrar duly executed by, the Holder hereof or his attorney duly authorized in writing and thereupon one or more new Securities of this series and of like tenor, of authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees.

The Securities of this series are issuable only in registered form without coupons in denominations of $200,000 and integral multiples of $1,000 in excess thereof. As provided in the Indenture and subject to certain limitations therein set forth, Securities of this series are exchangeable for a like aggregate principal amount of Securities of this series and of like tenor of a different authorized denomination, as requested by the Holder surrendering the same.

No service charge shall be made for any such registration of transfer or exchange; provided, however, the Company may require payment of a sum sufficient to cover any tax or other governmental charge that may be imposed in connection therewith.

Prior to due presentment of this Security for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may deem and treat the person in whose name this Security is registered upon the Security register as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

No reference herein to the Indenture and no provision of this Security or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Security at the times, place and rate, and in the coin or currency, herein prescribed.

This Security shall be governed by and construed in accordance with the laws of the State of New York.

All capitalized terms used and not defined herein shall have the meanings assigned to them in the Indenture.

The Company has initially appointed Citibank, N.A., London Branch, as paying agent, transfer agent, registrar, authenticating agent and calculation agent with respect to the Securities.

PAYING AGENT, TRANSFER AGENT, REGISTRAR, AUTHENTICATING AGENT AND CALCULATION AGENT

Citibank, N.A., London Branch

Citigroup Centre

Canada Square

Canary Wharf

London E14 5LB

United Kingdom

Fax: +353 1622 2210 / +353 1622 2212

Exhibit 4.15

[FORM OF $500,000,000 5.594% SENIOR FIXED RATE NOTES DUE 2027]

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERENCED AND REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN DEFINITIVE FORM IN ACCORDANCE WITH THE PROVISIONS OF THE INDENTURE AND THE TERMS OF THIS SECURITY, THIS SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE TO NOMINEES OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE. TRANSFER OF A PORTION OF THIS SECURITY SHALL BE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE INDENTURE. IN THE EVENT THAT THIS GLOBAL SECURITY IS EXCHANGED IN WHOLE OR IN PART FOR THE INDIVIDUAL SECURITIES REPRESENTED HEREBY, ALL SUCH INDIVIDUAL SECURITIES IN THE FORM OF DEFINITIVE CERTIFICATES SHALL CONTAIN THE BELOW LEGEND WITH RESPECT TO JAPANESE TAXATION.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF DTC, TO NOMURA HOLDINGS, INC. (THE “COMPANY”) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IN EXCHANGE FOR THIS CERTIFICATE OR ANY PORTION HEREOF IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

INTEREST PAYMENTS ON THIS SECURITY WILL BE SUBJECT TO JAPANESE WITHHOLDING TAX UNLESS IT IS ESTABLISHED THAT THIS SECURITY IS HELD BY OR FOR THE ACCOUNT OF A BENEFICIAL OWNER THAT IS (I) FOR JAPANESE TAX PURPOSES, NEITHER (X) AN INDIVIDUAL RESIDENT OF JAPAN OR A JAPANESE CORPORATION, NOR (Y) AN INDIVIDUAL NON-RESIDENT OF JAPAN OR A NON-JAPANESE CORPORATION THAT IN EITHER CASE IS A PERSON HAVING A SPECIAL RELATIONSHIP WITH THE COMPANY AS DESCRIBED IN ARTICLE 6, PARAGRAPH 4 OF THE ACT ON SPECIAL MEASURES CONCERNING TAXATION OF JAPAN (ACT NO. 26 OF 1957, AS AMENDED) (THE “SPECIAL TAXATION MEASURES ACT” AND, EACH SUCH PERSON, A “SPECIALLY-RELATED PERSON OF THE COMPANY”), (II) A JAPANESE DESIGNATED FINANCIAL INSTITUTION AS DESCRIBED IN ARTICLE 6, PARAGRAPH 11 OF THE SPECIAL TAXATION MEASURES ACT WHICH COMPLIES WITH THE REQUIREMENT FOR TAX EXEMPTION UNDER THAT PARAGRAPH OR (III) A JAPANESE PUBLIC CORPORATION, FINANCIAL INSTITUTION, FINANCIAL INSTRUMENTS BUSINESS OPERATOR OR CERTAIN OTHER ENTITY WHICH HAS RECEIVED SUCH PAYMENTS THROUGH A JAPANESE PAYMENT HANDLING AGENT, AS PROVIDED IN ARTICLE 3-3, PARAGRAPH 6 OF THE SPECIAL TAXATION MEASURES ACT, IN COMPLIANCE WITH THE REQUIREMENT FOR TAX EXEMPTION UNDER THAT PARAGRAPH.

INTEREST PAYMENTS ON THIS SECURITY TO AN INDIVIDUAL RESIDENT OF JAPAN, TO A JAPANESE CORPORATION, OR TO AN INDIVIDUAL NON-RESIDENT OF JAPAN OR A NON-JAPANESE CORPORATION THAT IN EITHER CASE IS A SPECIALLY-RELATED PERSON OF THE COMPANY (EXCEPT FOR THE JAPANESE DESIGNATED FINANCIAL INSTITUTION AND THE JAPANESE PUBLIC CORPORATION, FINANCIAL INSTITUTION, FINANCIAL INSTRUMENTS BUSINESS OPERATOR AND CERTAIN OTHER ENTITY DESCRIBED IN THE PRECEDING PARAGRAPH) WILL BE SUBJECT TO DEDUCTION IN RESPECT OF JAPANESE INCOME TAX AT A RATE OF 15.315% OF THE AMOUNT OF SUCH INTEREST.

NOMURA HOLDINGS, INC.

GLOBAL SECURITY

5.594% Senior Fixed Rate Notes Due 2027

| No. [ ] | CUSIP No.: 65535HBR9 | |

| ISIN No.: US65535HBR93 | ||

| Common Code: 285213088 | ||

| $[ ] |

NOMURA HOLDINGS, INC., a joint stock corporation incorporated with limited liability under the laws of Japan (the “Company”, which term includes any successor corporation), for value received promises to pay to CEDE & CO., or registered assigns, the principal sum of $[ ] (the “Principal”) on July 2, 2027 and to pay interest thereon from July 3, 2024 or from the most recent interest payment date to which interest has been paid or duly provided for, semi-annually in arrears on January 2 and July 2 in each year (each, an “Interest Payment Date”) commencing January 2, 2025 at the rate per annum of 5.594% until the principal hereof is paid or made available for payment, all subject to and in accordance with the terms of the Indenture referred to herein.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the person in whose name this Security is registered as at 5:00 p.m. (New York time) on the day five Business Days immediately preceding such Interest Payment Date. If and to the extent the Company shall default in the payment of the interest due on such Interest Payment Date, such defaulted interest shall be paid to the person in whose name this Security is registered at the close of business on a subsequent record date, which shall be not less than five Business Days prior to the payment of such defaulted interest, established by notice given by mail or in accordance with clearing system procedures by or on behalf of the Company to the Holder of this Security not less than 15 days preceding such subsequent record date. Interest on this Security will accrue from the date of original issuance or, if interest has already been paid, from the date it was most recently paid. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. If any payment is due on this Security on any Interest Payment Date, other than the maturity date, that is not a Business Day, payment will be made on the day that is the next succeeding Business Day. If the maturity date with respect to this Security falls on a day that is not a Business Day, payments of principal and interest otherwise due on such day will be made on the next succeeding Business Day. Payments postponed to the next succeeding Business Day in such situations will be treated under the Indenture as if they were made on the original due date. Postponement of this kind will not result in a default under this Security or the Indenture, and no interest will accrue on the postponed amount from the original due date to the next succeeding Business Day. The term “Business Day” means a day which is not a day on which banking institutions in New York City, London or Tokyo are authorized or obligated by law, regulation or executive order to close.

The principal of, and interest and Additional Amounts on, this Security will be payable in U.S. dollars. The Company will cause the Trustee, or the paying agent, if any, to pay such amounts, on the dates payment is to be made, directly to The Depository Trust Company (“DTC”).

The Company will pay the Holder hereof Additional Amounts with respect to withholding taxes as are provided for, and subject to the conditions stated, on the reverse of this Security.

This Security is being deposited with DTC acting as depositary, and registered in the name of Cede & Co., a nominee of DTC. As Holder of record of this Security, Cede & Co. shall be entitled to receive payments of principal and interest. Payments of principal and interest, including any Additional Amounts, on this Security shall be made in the manner specified on the reverse hereof and, to the extent not inconsistent with the provisions set forth herein, in the Indenture referred to herein.

This Security constitutes the direct, unconditional, unsubordinated and unsecured obligations of the Company and shall at all times rank pari passu and without preference among themselves and with all other unsecured obligations, other than subordinated obligations of the Company (except for statutorily preferred exceptions) from time to time outstanding. This Security is not redeemable prior to maturity, except as set forth on the reverse of this Security and will not be subject to any sinking fund.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been manually executed by or on behalf of the Trustee under the Indenture, by Citibank, N.A., London Branch, as authenticating agent, this Security shall not be entitled to any benefits under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this Security to be signed manually or by facsimile by its duly authorized signatory.

| NOMURA HOLDINGS, INC. | ||

| By: |

|

|

| Name: | Kentaro Okuda | |

| Title: | Representative Executive Officer, President and Group Chief Executive Officer | |

[Signature Page to 3-Year Fixed Rate Global Note]

Certificate of Authentication

This is one of the series designated herein and referred to in the within-mentioned Indenture.

| Date: ___________________ | ||||||

| CITIBANK, N.A., LONDON BRANCH as Authenticating Agent |

||||||

| By: |

|

|||||

| Name: | ||||||

| Title: | ||||||

[Signature Page to 3-Year Fixed Rate Global Note]

REVERSE OF SECURITY

NOMURA HOLDINGS, INC.

$500,000,000 5.594% SENIOR FIXED RATE NOTES DUE 2027

This Security is one of a duly authorized issue of unsecured debentures, notes or other evidences of indebtedness of Nomura Holdings, Inc., a joint stock corporation incorporated with limited liability under the laws of Japan (herein called the “Company”, which term includes any successor person under the Indenture hereinafter referred) designated as its $500,000,000 5.594% Senior Fixed Rate Notes due July 2, 2027 (herein called the “Securities”), issued under and pursuant to a senior debt indenture dated as of January 16, 2020 (hereinafter called the “Indenture”), between the Company and Citibank, N.A., as trustee (herein called the “Trustee”, which term includes any successor trustee under the Indenture), to which Indenture and any other indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee and any agent of the Trustee, any paying agent, the Company and the Holders of the Securities and of the terms upon which the Securities are issued and are to be authenticated and delivered.

This Security is one of the series designated on the face hereof. By the terms of the Indenture, additional Securities of this series and of other separate series, which may vary as to denomination, date, amount, stated maturity (if any), interest rate or method of calculating the interest rate and in other respects as therein provided, may be issued in an unlimited amount.

The principal of and interest (and any Additional Amounts) on the Securities shall be payable in U.S. dollars or in such other coin or currency of the United States of America as at the time of payment is legal tender for the payment of public and private debts. So long as any of the Securities are held in global form, payments of principal and interest on such Securities shall be made by wire transfer in immediately available funds in U.S. dollars to a bank account in New York City designated by the Holder of this Registered Global Security. Otherwise, (i) the principal amount of the Securities will be payable by check, drawn on a bank in New York City, upon the presentation and surrender of the Securities at the Specified Corporate Trust Office of the Trustee or at any office or agency maintained by the Company for such purpose and (ii) interest on the Securities will be payable by wire transfer or check, drawn on a bank in New York City, mailed to the persons in whose names the Securities are registered as of 5:00 p.m. (New York time) on the fifth Business Day immediately preceding the applicable Interest Payment Date (or the subsequent record date in the case of a defaulted interest payment) at the addresses of such persons as shall appear in the Security register of the Company; provided, however, that at the option of a Holder in whose name at least $1,000,000 principal amount of Securities are registered, all payments in respect of the Securities may be received by electronic funds transfer of immediately available funds to a U.S. dollar account maintained by the payee, provided such registered Holder so elects by giving written notice to the Trustee designating such account, no later than fifteen days immediately preceding the relevant date for payment (or such other date as the Trustee may accept in its discretion).

All payments of principal (and premium, if any) or interest in respect of the Securities will be made without withholding or deduction for or on account of any present or future taxes, duties, assessments or governmental charges of whatever nature imposed or levied by or on behalf of Japan or any authority thereof or therein having power to tax (“Japanese Taxes”), unless such withholding or deduction of such Japanese Taxes is required by law. In that event, the Company shall pay to the Securityholder such additional amounts (“Additional Amounts”) as will result in the receipt by or on behalf of the Holders or beneficial owners of such amounts as would have been received by them had no such withholding or deduction been required, provided that, no Additional Amounts shall be payable with respect to this Security:

| (a) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security who is an individual non-resident of Japan or a non-Japanese corporation and is liable for such Japanese Taxes in respect of such Security by reason of its (1) having some connection with Japan other than the mere holding of such Security, or (2) being a person having a special relationship with the Company as described in Article 6, paragraph 4 of the Act on Special Measures Concerning Taxation of Japan (Act No. 26 of 1957, as amended) (the “Special Taxation Measures Act”) (a “Specially-Related Person of the Company”); or |

| (b) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security (A) who would otherwise be exempt from any such withholding or deduction but who fails to comply with any applicable requirement to provide Interest Recipient Information (as defined below) or to submit a Written Application for Tax Exemption (as defined below) to the Paying Agent to whom the relevant Security is presented (where presentation is required), or (B) whose Interest Recipient Information is not duly communicated through the Participant (as defined below) and the relevant Clearing Organization to such Paying Agent; or |

| (c) | to, or to a third party on behalf of, a Securityholder or beneficial owner of this Security who is for Japanese tax purposes treated as an individual resident of Japan or a Japanese corporation (except for (A) a Designated Financial Institution (as defined below) which complies with the requirement to provide Interest Recipient Information or to submit a Written Application for Tax Exemption and (B) an individual resident of Japan or a Japanese corporation who duly notifies (directly or through the Participant or otherwise) the relevant Paying Agent of its status as not being subject to Japanese Taxes to be withheld or deducted by the Company, by reason of such individual resident of Japan or Japanese corporation receiving interest on the relevant Security through a payment handling agent in Japan appointed by it); or |

| (d) | where such Security is presented for payment (where presentation is required) more than 30 days after the date on which such payment first becomes due or after the date on which the full amount payable is duly provided for, whichever occurs later, except to the extent that the Holder of the Security would have been entitled to such Additional Amounts on presenting the same for payment on the last day of such 30-day period; or |

| (e) | any combination of (a) through (d) above; |

nor shall Additional Amounts be paid with respect to any payment on this Security to or on behalf of a Securityholder who is a fiduciary or partnership or other than the sole beneficial owner of such payment to the extent such payment would be required by the laws of Japan to be included in the income, for tax purposes, of a beneficiary or settlor with respect to such fiduciary or a member of such partnership or a beneficial owner who, in each case, would not have been entitled to the Additional Amounts had such beneficiary, settlor, member or beneficial owner been the Securityholder. The obligation to pay Additional Amounts with respect to any taxes, duties, assessments or governmental charges shall not apply to (i) any estate, inheritance, gift, sales, transfer, personal property or any similar tax, duty, assessment or governmental charge or (ii) any tax, duty, assessment or governmental charge which is payable otherwise than by deduction or withholding from payments of principal of (and premium, if any) or interest on this Security. References to principal (and premium, if any) and interest in respect of this Security will be deemed to include any Additional Amounts due which may be payable in respect of the principal (or premium, if any) or interest.

Where this Security is held through a participant of a Clearing Organization or a financial intermediary, in each case, as prescribed by the Special Taxation Measures Act (each, a “Participant”), in order to receive payments free of withholding or deduction by the Company for, or on account of, Japanese Taxes, if the relevant beneficial owner of this Security is (1) an individual non-resident of Japan or a non-Japanese corporation (other than a Specially-Related Person of the Company) or (2) a Japanese financial institution or financial instruments business operator falling under certain categories prescribed by the cabinet order under Article 6, paragraph 11 of the Special Taxation Measures Act (a “Designated Financial Institution”), such beneficial owner of this Security shall, at the time of entrusting a Participant with the custody of this Security, provide certain information prescribed by the Special Taxation Measures Act and the cabinet order and other regulations thereunder to enable the Participant to establish that such beneficial owner of this Security is exempted from the requirement for Japanese Taxes to be withheld or deducted (the “Interest Recipient Information”) and advise the Participant if the beneficial owner of this Security ceases to be so exempted (including where the beneficial owner of this Security who is an individual non-resident of Japan or a non-Japanese corporation becomes a Specially-Related Person of the Company).

Where this Security is not held by a Participant, in order to receive payments free of withholding or deduction by the Company for, or on account of, Japanese Taxes, if the relevant beneficial owner of this Security is (i) an individual non-resident of Japan or a non-Japanese corporation (other than a Specially-Related Person of the Company) or (ii) a Designated Financial Institution, such beneficial owner of this Security shall, prior to each time at which it receives interest, submit to the relevant Paying Agent a written application for tax exemption (hikazei tekiyo shinkokusho) (a “Written Application for Tax Exemption”) in a form obtainable from the Paying Agent stating, inter alia, the name and address of the beneficial owner of this Security, the title of the Security, the relevant Interest Payment Date, the amount of interest and the fact that the beneficial owner of this Security is qualified to submit the Written Application for Tax Exemption, together with documentary evidence regarding its identity and residence.

No Additional Amounts will be payable for or on account of any deduction or withholding imposed pursuant to Sections 1471-1474 of the U.S. Internal Revenue Code, the U.S. Treasury regulations thereunder and any other official guidance thereunder (“FATCA”), any intergovernmental agreement entered into with respect to FATCA, or any law, regulation or other official guidance enacted in any jurisdiction implementing, or relating to, FATCA, similar legislation under the laws of any other jurisdiction, or any such intergovernmental agreement.

If there is any withholding or deduction for or on account of Japanese Taxes with respect to payments on this Security, the Company will use reasonable efforts to obtain certified copies of tax receipts evidencing the payment of such Japanese Taxes from the Japanese taxing authority imposing such Japanese Taxes, and if certified copies are not available, the Company will use reasonable efforts to obtain other evidence of payment satisfactory to the Trustee. The Trustee shall make such certified copies or other evidence available to the Holders or the beneficial owners of this Security upon reasonable request to the Trustee.

The Company will pay all stamp, court or documentary taxes or any excise or property taxes, charges or similar levies and other duties, if any, which may be imposed by Japan, the United States or any political subdivision or any taxing authority thereof or therein, with respect to the Indenture or any indenture supplemental thereto, or as a consequence of the initial issuance, execution, delivery, registration or enforcement of the Securities.