| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Japan |

13-1, Nihonbashi 1-chome

Chuo-ku, Tokyo 103-8645

Japan |

|

(Jurisdiction of incorporation or organization) |

(Address of principal executive offices) |

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange On Which Registered |

||

|

American Depositary Shares Common Stock *

|

NMR |

New York Stock Exchange |

| * | No t for trading, but only in connection with the registration of the American Depositary Shares, each representing one share of Common Stock. |

|

Large accelerated file r ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Emerging growth company ☐ |

| U.S. GAAP ☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

|

Other ☐ |

Page |

||||

PART I |

||||

Item 1. |

2 | |||

Item 2. |

2 | |||

Item 3. |

2 | |||

Item 4. |

21 | |||

Item 4A. |

55 | |||

Item 5. |

55 | |||

Item 6. |

92 | |||

Item 7. |

119 | |||

Item 8. |

119 | |||

Item 9. |

120 | |||

Item 10. |

120 | |||

Item 11. |

128 | |||

Item 12. |

143 | |||

PART II |

||||

Item 13. |

145 | |||

Item 14. |

145 | |||

Item 15. |

145 | |||

Item 16A. |

146 | |||

Item 16B. |

146 | |||

Item 16C. |

146 | |||

Item 16D. |

147 | |||

Item 16E. |

147 | |||

Item 16F. |

148 | |||

Item 16G. |

148 | |||

Item 16H. |

150 | |||

Item 16I. |

150 | |||

Item 16J. |

150 | |||

Item 16K. |

150 | |||

PART III |

||||

Item 17. |

152 | |||

Item 18. |

152 | |||

Item 19. |

152 | |||

F-1 |

||||

|

·

|

Risks Relating to the Business Environment |

1 |

Our business may be materially affected by financial markets, economic conditions and market fluctuations in Japan and elsewhere around the world, including the ones caused by geopolitical events |

| (1) | Governmental fiscal and monetary policy changes in Japan, or in any other countries or regions where we conduct business may affect our business, financial condition and results of operations |

| (2) | Extended market declines and decreases in market participants can reduce liquidity and lead to material losses |

| (3) | Natural disaster, terrorism, military dispute and infectious disease could adversely affect our business |

2 |

The financial services industry faces intense competition |

| (1) | Competition with other financial firms and financial services by non-financial companies is increasing |

| (2) | Increased consolidation, business alliance and cooperation in the financial services industry mean increased competition for us |

| (3) | Our global business continues to face intense competition and may require further revisions to its business model |

3 |

Event risk, including the ones caused by geopolitical events, may cause losses in our trading and investment assets as well as market and liquidity risk |

4 |

Sustainability factors including climate change and broader associated policy changes in each jurisdiction could adversely affect our business |

|

·

|

Risks Relating to Our Businesses |

5 |

Our business may incur losses due to various factors in the conduct of its operations |

| (1) | We may incur significant losses from our trading and investment activities |

| (2) | Holding large and concentrated positions of securities and other assets may expose us to significant losses |

| (3) | Our hedging strategies may not prevent losses |

| (4) | Our risk management policies and procedures may not be fully effective in managing risk |

| (5) | Market risk may increase other risks that we face |

| (6) | Our brokerage and asset management revenues may decline |

| (7) | Our investment banking revenues may decline |

6 |

We may be exposed to losses when third parties do not perform their obligations to us |

| (1) | Defaults by a large financial institution could adversely affect the financial markets generally and us specifically |

| (2) | There can be no assurance as to the accuracy of the information about our credit risk, or the sufficiency of the collateral we use in managing it |

| (3) | Our clients and counterparties may be unable to perform their obligations to us as a result of political or economic conditions |

7 |

We are exposed to model risk, i.e., risk of financial loss, incorrect decision making, or damage to our credibility arising from model errors or incorrect or inappropriate model application |

8 |

NHI is a holding company and depends on payments from its subsidiaries |

9 |

We may not be able to realize gains we expect, and may even suffer losses, on our investments in equity securities and non-trading debt securities |

10 |

We may face an outflow of clients’ assets due to losses incurred within cash reserve funds or debt securities we offer to clients |

|

·

|

Risks Relating to Our Financial Position |

11 |

We may have to recognize impairment losses with regard to the amount of goodwill, tangible and intangible assets recognized on our consolidated balance sheets |

12 |

Liquidity risk could impair our ability to fund operations and jeopardize our financial condition |

| (1) | We may be unable to access unsecured or secured funding |

| (2) | We may be unable to sell assets |

| (3) | Lowering of our credit ratings could impact our funding |

13 |

Equity investments in affiliates and other investees accounted for under the equity method in our consolidated financial statements may decline significantly over a period of time and result in us recognizing impairment losses |

|

·

|

Risks Relating to Legal, Compliance and Other Operational Issues |

14 |

Operational risk could adversely affect our business |

15 |

We identified a material weakness in our internal control over financial reporting and, despite our efforts to remediate, may identify further material weaknesses in the future |

16 |

Misconduct or fraud by an employee, director or officer, or any third party, could occur, and our reputation in the market and our relationships with clients could be harmed |

17 |

A failure to identify and appropriately address conflicts of interest could adversely affect our business |

18 |

Our business is subject to substantial legal, regulatory and reputational risks |

| (1) | Legal liability related to our business may occur and could adversely affect our business, financial condition and results of operations |

| (2) | Extensive regulation of our businesses limits our activities and may subject us to significant penalties and losses |

| (3) | Tightening of regulations applicable to the financial system and financial industry could adversely affect our business, financial condition and results of operations |

| (4) | Deferred tax assets may be impacted due to a change in business condition or in laws and regulations, resulting in an adverse effect on our operating results and financial condition |

| (5) | Defects in our anti-money laundering and counter-terrorism financing measures could have serious consequences such as, administrative penalties or punitive fines |

19 |

Unauthorized disclosure or misuse of personal information held by us may adversely affect our business |

20 |

System failure, information leakage and cost of maintaining sufficient cybersecurity could adversely affect our business, financial condition and results of operations |

21 |

Our business may be adversely affected if we are unable to hire, retain and develop qualified personnel |

|

·

|

Risks Related to Holding or Trading of our Shares and ADSs |

22 |

Because of daily price range limitations under Japanese stock exchange rules, you may not be able to sell your shares of the Company’s common stock at a particular price on any particular trading day, or at all |

23 |

Under Japan’s unit share system, holders of shares of the Company’s common stock constituting less than one unit are subject to transfer, voting and other restrictions |

24 |

As a holder of ADSs, you will have fewer rights than a shareholder has and you will have to act through the depositary to exercise these rights |

25 |

Rights of shareholders under Japanese law may be more limited than under the laws of other jurisdictions |

26 |

The Company’s shareholders of record on a record date may not receive the dividend they anticipate |

27 |

It may not be possible for investors to secure personal jurisdiction within the U.S. over the Company or the Company’s directors or executive officers, or to enforce against the Company or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the U.S. |

|

·

|

Special Note Regarding Forward-looking Statements |

|

·

|

Risks Relating to the Business Environment |

1. |

Our business may be materially affected by financial markets, economic conditions and market fluctuations in Japan and elsewhere around the world, including the ones caused by geopolitical events |

2. |

The financial services industry faces intense competition |

3. |

Event risk, including the ones caused by geopolitical events, may cause losses in our trading and investment assets as well as market and liquidity risk |

| • | sudden and significant reductions in credit ratings with regard to financial instruments held by our trading and investment businesses by major rating agencies, |

| • | sudden changes in trading, tax, accounting, regulatory requirements, laws and other related rules which may make our trading strategy obsolete, less competitive or no longer viable, or |

| • | an unexpected failure in a corporate transaction in which we participate resulting in us not receiving the consideration we should have received, as well as bankruptcy, deliberate acts of fraud, and administrative penalty with respect to the issuers of our trading and investment assets. |

4. |

Sustainability factors including climate change and broader associated policy changes in each jurisdiction could adversely affect our business |

|

·

|

Risks Relating to Our Businesses |

5. |

Our business may incur losses due to various factors in the conduct of its operations. |

6. |

We may be exposed to losses when third parties do not perform their obligations to us |

7. |

We are exposed to model risk, i.e., risk of financial loss, incorrect decision making, or damage to our credibility arising from model errors or incorrect or inappropriate model application |

8. |

NHI is a holding company and depends on payments from its subsidiaries |

9. |

We may not be able to realize gains we expect, and may even suffer losses, on our investments in equity securities and non-trading debt securities |

10. |

We may face an outflow of clients’ assets due to losses incurred within cash reserve funds or debt securities we offer to clients |

|

·

|

Risks Relating to Our Financial Position |

11. |

We may have to recognize impairment losses with regard to the amount of goodwill, tangible and intangible assets recognized on our consolidated balance sheets |

12. |

Liquidity risk could impair our ability to fund operations and jeopardize our financial condition |

| • | We incur large trading losses, |

| • | The level of our business activity decreases due to a market downturn, |

| • | Regulatory authorities take significant action against us, or |

| • | Our credit rating is downgraded. |

13. |

Equity investments in affiliates and other investees accounted for under the equity method in our consolidated financial statements may decline significantly over a period of time and result in us recognizing impairment losses |

|

·

|

Risks Relating to Legal, Compliance and Other Operational Issues |

14. |

Operational risk could adversely affect our business |

15. |

We identified a material weakness in our internal control over financial reporting and, despite our efforts to remediate, may identify further material weaknesses in the future |

16. |

Misconduct or fraud by an employee, director or officer, or any third party, could occur, and our reputation in the market and our relationships with clients could be harmed |

17. |

A failure to identify and appropriately address conflicts of interest could adversely affect our business |

18. |

Our business is subject to substantial legal, regulatory and reputational risks |

19. |

Unauthorized disclosure or misuse of personal information held by us may adversely affect our business |

20. |

System failure, information leakage and cost of maintaining sufficient cybersecurity could adversely affect our business, financial condition and results of operations |

21. |

Our business may be adversely affected if we are unable to hire, retain and develop qualified personnel |

|

·

|

Risks Related to Holding or Trading of our Shares and ADSs |

22. |

Because of daily price range limitations under Japanese stock exchange rules, you may not be able to sell your shares of the Company’s common stock at a particular price on any particular trading day, or at all |

23. |

Under Japan’s unit share system, holders of shares of the Company’s common stock constituting less than one unit are subject to transfer, voting and other restrictions |

24. |

As a holder of ADSs, you will have fewer rights than a shareholder has and you will have to act through the depositary to exercise these rights |

25. |

Rights of shareholders under Japanese law may be more limited than under the laws of other jurisdictions |

26. |

The Company’s shareholders of record on a record date may not receive the dividend they anticipate |

27. |

It may not be possible for investors to secure personal jurisdiction within the U.S. over the Company or the Company’s directors or executive officers, or to enforce against the Company or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the U.S. |

|

·

|

Special Note Regarding Forward-looking Statements |

|

* |

The Retail Division has been renamed the “Wealth Management Division”, effective April 1, 2024. |

|

Purpose We aspire to create a better world by harnessing the power of financial markets |

| • | the quality, range and prices of our products and services, |

| • | our ability to originate and develop innovative client solutions, |

| • | our ability to maintain and develop client relationships, |

| • | our ability to access and commit capital resources, |

| • | our ability to retain and attract qualified employees, and |

| • | our general reputation. |

| • | the monetary and fiscal policies of national governments and international economic organizations, |

| • | economic, political and social developments both within and between Japan, the U.S., Europe and other major industrialized and developing countries and regions, and |

| • | increasing digitalization beyond the traditional financial sector |

| (i) | significantly reduce the number of instruments in scope of full transparency by trading venues and investment firms to those instruments considered most liquid (Category 1 instruments), with only venues responsible for providing transparency on other non-equity instruments (Category 2 instruments) when these are traded on venue; and |

| (ii) | streamline pre-trade waivers and post-trade deferrals, as well as allowing venues to calibrate these themselves for Category 2 instruments (applying specified criteria). |

• |

Wealth Management Division |

| • | Investment Management Division |

| • | Wholesale Division |

| • | Risk Management and Compliance, etc. |

| • | Supporting the sustainability efforts of our clients and stakeholders through business activities as a leading financial institution |

| • | The Company’s efforts to continue being a sustainable corporate group |

| • | Risk that clients will not adequately respond to climate change, resulting in financial damage, decline in creditworthiness and inability to fulfil their contractual obligations |

| • | Risk that climate change causes market fluctuations and losses are incurred due to fluctuations in the market price of Nomura’s financial assets |

| • | Risk of reputational damage if Nomura and counterparties fail to respond appropriately to climate change |

| • | Risk of financial losses or reputational damage due to inadequate or failed internal processes and employee response to climate change |

| • | Risk of inadequate strategies or failed execution of strategies as compared with competitors, and risk of gap between strategies and resources |

| (1) | Absenteeism: The impact of absenteeism is measured by financial losses due to absence from work coursed by injury or illness, calculated by multiplying the average compensation of employees for such financial year by the number of employees and the utilization rate of sick leave. |

| (2) | Presenteeism: A condition in which individuals go to work despite being ill or experiencing symptoms of illness, with negative impacts on business execution and productivity. The figure is calculated based on responses to the SPQ (Single-Item Presenteeism Question, Tokyo University 1-Item Version). |

| (3) | Work Engagement: A positive, fulfilling, work-related state of mind. This is measured based on deviation from the results of the national average of annual stress assessment, which is an annual mandatory workplace program in Japan to screen for mental health issues in workers. |

Name |

Country/Region |

Ownership Interest |

||||

(%) |

||||||

Nomura Holdings, Inc. |

Japan | — | ||||

Nomura Securities Co., Ltd. (1)

|

Japan | 100 | ||||

Nomura Asset Management Co., Ltd. |

Japan | 100 | ||||

The Nomura Trust & Banking Co., Ltd. |

Japan | 100 | ||||

Nomura Babcock & Brown Co., Ltd. |

Japan | 100 | ||||

Nomura Capital Investment Co., Ltd. |

Japan | 100 | ||||

Nomura Investor Relations Co., Ltd. |

Japan | 100 | ||||

Nomura Fiduciary Research & Consulting Co., Ltd. |

Japan | 100 | ||||

Nomura Research & Advisory Co., Ltd. |

Japan | 100 | ||||

Nomura Business Services Co., Ltd. |

Japan | 100 | ||||

Nomura Properties, Inc. |

Japan | 100 | ||||

Nomura Institute of Capital Markets Research |

Japan | 100 | ||||

Nomura Healthcare Co., Ltd. (1)

|

Japan | 100 | ||||

Nomura Agri Planning & Advisory Co., Ltd. (1)

|

Japan | 100 | ||||

Nomura Financial Products & Services, Inc. |

Japan | 100 | ||||

Nomura Institute of Estate Planning |

Japan | 100 | ||||

Nomura Capital Partners Co., Ltd. |

Japan | 100 | ||||

Nomura Mezzanine Partners Co., Ltd. |

Japan | 100 | ||||

Corporate Design Partners Co., Ltd. |

Japan | 100 | ||||

Nomura Kagayaki Co., Ltd. |

Japan | 100 | ||||

Nomura IM Investment LLC |

Japan | 100 | ||||

Nomura Asia Pacific Holdings Co., Ltd. |

Japan | 100 | ||||

Nomura International (Hong Kong) Limited |

Hong Kong | 100 | ||||

Nomura Singapore Limited |

Singapore | 100 | ||||

Nomura Securities Singapore Pte. Ltd. |

Singapore | 100 | ||||

Nomura Australia Limited |

Australia | 100 | ||||

Nomura Asia Investment (Fixed Income) Pte. Ltd. |

Singapore | 100 | ||||

Name |

Country/Region |

Ownership Interest |

||||

(%) |

||||||

Nomura Asia Investment (Singapore) Pte. Ltd. |

Singapore | 100 | ||||

Nomura Financial Advisory and Securities (India) Private Limited |

India | 100 | ||||

Nomura Holding America Inc. |

U.S. | 100 | ||||

Nomura Securities International, Inc. |

U.S. | 100 | ||||

Nomura Corporate Research and Asset Management Inc. |

U.S. | 100 | ||||

Nomura America Mortgage Finance, LLC |

U.S. | 100 | ||||

Nomura Global Financial Products, Inc. |

U.S. | 100 | ||||

Instinet Incorporated |

U.S. | 100 | ||||

Nomura Europe Holdings plc |

U.K. | 100 | ||||

Nomura International plc |

U.K. | 100 | ||||

Nomura Bank International plc |

U.K. | 100 | ||||

Nomura Financial Products Europe GmbH |

Germany | 100 | ||||

Banque Nomura France |

France | 100 | ||||

Nomura Bank (Luxembourg) S.A. |

Luxemburg | 100 | ||||

Nomura Bank (Switzerland) Ltd. |

Switzerland | 100 | ||||

Nomura Europe Finance N.V. |

The Netherlands | 100 | ||||

Nomura European Investment Limited |

U.K. | 100 | ||||

Laser Digital Group Holdings AG |

Switzerland | 100 | ||||

Nomura Asia Investment (India Powai) Pte. Ltd. |

Singapore | 100 | ||||

Nomura Services India Private Limited |

India | 100 | ||||

Nomura International Funding Pte. Ltd. |

Singapore | 100 | ||||

Nomura Orient International Securities Co., Ltd. |

China | 51 | ||||

| (1) | Nomura Securities Co., Ltd. (“NSC”), Nomura Healthcare Co., Ltd. (“NHSA”) and Nomura Agri Planning & Advisory Co., Ltd. (“NAPA”), merged effective on May 1, 2024. NSC is a surviving entity and NHSA and NAPA are absorbed entities. |

Name |

Location |

Segment |

Nature of the plan |

Estimate of the amount of expenditures (Millions of yen) |

Amount of expenditures already paid (Millions of yen) |

Method of financing |

Date of start of the activity |

Estimated date of completion of the activity |

||||||||||||

NHI |

Tokyo |

Other |

Nihonbashi 1-Chome Naka Area Type 1 Urban Area Redevelopment Project |

149,200 | 17,233 | Own funds |

December 2021 |

March 2026 |

||||||||||||

|

1. |

Diluted net income attributable to NHI shareholders per share. |

Year ended March 31 (Trillions of yen) |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Recurring revenue assets |

¥ | 19.6 | ¥ | 18.7 | (4.6 | )% | ¥ | 23.0 | 23.0 | % | ||||||||||

Year ended March 31 (Billions of yen) |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Net inflows of recurring revenue assets |

¥ | 555.5 | ¥ | 333.7 | (39.9 | )% | ¥ | 317.4 | (4.9 | )% | ||||||||||

Year ended March 31 (Thousands) |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Flow business clients |

1,505 | 1,446 | (3.9 | )% | 1,692 | 17.0 | % | |||||||||||||

Services for salaried employees |

3,357 | 3,489 | 3.9 | % | 3,627 | 4.0 | % | |||||||||||||

(Trillions of yen) |

||||||||||||||||||||

March 31, 2022 |

March 31, 2023 |

% Change from previous year |

March 31, 2024 |

% Change from previous year |

||||||||||||||||

The balance of assets under management |

¥ | 67.9 | ¥ | 67.3 | (0.9 | )% | ¥ | 89.0 | 32.2% | |||||||||||

Year ended March 31 (Billions of yen) |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Net inflow |

¥ | 2,066 | ¥ | (760 | ) | — | % | ¥ | 3,760 | — % | ||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Cost-to-income |

89 | % | 96 | % | 7 | % | 94 | % | (2 | )% | ||||||||||

Revenue/modified RWA |

7.0 | % | 6.5 | % | (0.5 | )% | 6.8 | % | 0.3 | % | ||||||||||

Millions of yen, except percentages |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Non-interest revenues: |

||||||||||||||||||||

Commissions |

¥ | 332,344 | ¥ | 279,857 | (15.8 | )% | ¥ | 364,095 | 30.1 | % | ||||||||||

Fees from investment banking |

149,603 | 113,208 | (24.3 | ) | 173,265 | 53.1 | ||||||||||||||

Asset management and portfolio service fees |

269,985 | 271,684 | 0.6 | 310,154 | 14.2 | |||||||||||||||

Net gain on trading |

368,799 | 563,269 | 52.7 | 491,611 | (12.7 | ) | ||||||||||||||

Gain on private equity and debt investments |

30,768 | 14,504 | (52.9 | ) | 11,877 | (18.1 | ) | |||||||||||||

Gain (loss) on investments in equity securities |

5,446 | (1,426 | ) | — | 9,612 | — | ||||||||||||||

Other |

152,832 | 130,940 | (14.3 | ) | 175,824 | 34.3 | ||||||||||||||

Total Non-interest revenues |

1,309,777 | 1,372,036 | 4.8 | 1,536,438 | 12.0 | |||||||||||||||

Net interest revenue |

54,113 | (36,459 | ) | — | 25,562 | — | ||||||||||||||

Net revenue |

1,363,890 | 1,335,577 | (2.1 | ) | 1,562,000 | 17.0 | ||||||||||||||

Non-interest expenses |

1,137,267 | 1,186,103 | 4.3 | 1,288,150 | 8.6 | |||||||||||||||

Income before income taxes |

226,623 | 149,474 | (34.0 | ) | 273,850 | 83.2 | ||||||||||||||

Income tax expense |

80,090 | 57,798 | (27.8 | ) | 96,630 | 67.2 | ||||||||||||||

Net income |

¥ | 146,533 | ¥ | 91,676 | (37.4 | )% | ¥ | 177,220 | 93.3 | % | ||||||||||

Less: Net income (loss) attributable to noncontrolling interests |

3,537 | (1,110 | ) | — | 11,357 | — | ||||||||||||||

Net income attributable to NHI shareholders |

¥ | 142,996 | ¥ | 92,786 | (35.1 | )% | ¥ | 165,863 | 78.8 | % | ||||||||||

Return on equity |

5.1 | % | 3.1 | % | 5.1 | % | ||||||||||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Non-interest revenue |

¥ | 324,642 | ¥ | 297,496 | (8.4 | )% | ¥ | 395,900 | 33.1 | % | ||||||||||

Net interest revenue |

3,343 | 2,695 | (19.4 | ) | 6,461 | 139.7 | ||||||||||||||

Net revenue |

327,985 | 300,191 | (8.5 | ) | 402,361 | 34.0 | ||||||||||||||

Non-interest expenses |

268,745 | 266,695 | (0.8 | ) | 279,682 | 4.9 | ||||||||||||||

Income before income taxes |

¥ | 59,240 | ¥ | 33,496 | (43.5 | )% | ¥ | 122,679 | 266.2 | % | ||||||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Commissions |

¥ | 138,525 | ¥ | 112,455 | (18.8 | )% | ¥ | 173,461 | 54.2 | % | ||||||||||

Brokerage commissions |

67,419 | 50,901 | (24.5 | ) | 80,239 | 57.6 | ||||||||||||||

Commissions for distribution of investment trusts |

43,537 | 30,183 | (30.7 | ) | 54,857 | 81.7 | ||||||||||||||

Other commissions |

27,569 | 31,371 | 13.8 | 38,365 | 22.3 | |||||||||||||||

Net gain on trading |

43,981 | 44,171 | 0.4 | 55,919 | 26.6 | |||||||||||||||

Fees from investment banking |

19,003 | 16,184 | (14.8 | ) | 23,066 | 42.5 | ||||||||||||||

Asset management fees |

109,300 | 108,085 | (1.1 | ) | 124,446 | 15.1 | ||||||||||||||

Others |

13,833 | 16,601 | 20.0 | 19,008 | 14.5 | |||||||||||||||

Non-interest revenues |

¥ | 324,642 | ¥ | 297,496 | (8.4 | )% | ¥ | 395,900 | 33.1 | % | ||||||||||

Trillions of yen |

||||||||||||||||||||

Year ended March 31, 2023 |

||||||||||||||||||||

|

Balance at beginning of year |

Gross inflows |

Gross outflows |

Market appreciation / (depreciation) |

Balance at end of year |

||||||||||||||||

Equities |

¥ | 77.5 | ¥ | 21.4 | ¥ | (18.6 | ) | ¥ | (2.3 | ) | ¥ | 78.0 | ||||||||

Debt securities |

17.7 | 15.5 | (22.9 | ) | 8.2 | 18.5 | ||||||||||||||

Equity investment trusts |

10.8 | 2.8 | (2.6 | ) | (0.8 | ) | 10.2 | |||||||||||||

Debt investment trusts |

7.5 | 0.1 | (0.7 | ) | (0.1 | ) | 6.8 | |||||||||||||

Overseas mutual funds |

1.3 | 0.1 | (0.1 | ) | (0.1 | ) | 1.2 | |||||||||||||

Others |

7.3 | 1.0 | (0.5 | ) | (0.3 | ) | 7.5 | |||||||||||||

Total |

¥ | 122.1 | ¥ | 40.9 | ¥ | (45.4 | ) | ¥ | 4.6 | ¥ | 122.2 | |||||||||

Trillions of yen |

||||||||||||||||||||

Year ended March 31, 2024 |

||||||||||||||||||||

|

Balance at beginning of year |

Gross inflows |

Gross outflows |

Market appreciation / (depreciation) |

Balance at end of year |

||||||||||||||||

Equities |

¥ | 78.0 | ¥ | 31.1 | ¥ | (27.0 | ) | ¥ | 20.4 | ¥ | 102.5 | |||||||||

Debt securities |

18.5 | 13.6 | (18.4 | ) | 6.4 | 20.1 | ||||||||||||||

Equity investment trusts |

10.2 | 3.8 | (3.6 | ) | 2.9 | 13.3 | ||||||||||||||

Debt investment trusts |

6.8 | 0.8 | (0.3 | ) | 0.0 | 7.3 | ||||||||||||||

Overseas mutual funds |

1.2 | 0.5 | (0.1 | ) | 0.2 | 1.8 | ||||||||||||||

Others |

7.5 | 1.8 | (0.8 | ) | 0.1 | 8.6 | ||||||||||||||

Total |

¥ | 122.2 | ¥ | 51.6 | ¥ | (50.2 | ) | ¥ | 30.0 | ¥ | 153.6 | |||||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Non-interest revenue |

¥ | 129,848 | ¥ | 120,096 | (7.5 | )% | ¥ | 149,575 | 24.5 | % | ||||||||||

Net interest revenue |

18,145 | 8,463 | (53.4 | ) | 4,568 | (46.0 | ) | |||||||||||||

Net revenue |

147,993 | 128,559 | (13.1 | ) | 154,143 | 19.9 | ||||||||||||||

Non-interest expenses |

76,478 | 85,064 | 11.2 | 93,945 | 10.4 | |||||||||||||||

Income before income taxes |

¥ | 71,515 | ¥ | 43,495 | (39.2 | )% | ¥ | 60,198 | 38.4 | % | ||||||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Business revenue (1)

|

¥ | 119,920 | ¥ | 120,664 | 0.6 | % | ¥ | 137,249 | 13.7 | % | ||||||||||

Investment gain/ loss (2)

|

28,073 | 7,895 | (71.9 | ) | 16,894 | 114.0 | ||||||||||||||

Net revenue |

¥ | 147,993 | ¥ | 128,559 | (13.1 | )% | ¥ | 154,143 | 19.9 | % | ||||||||||

| (1) | Consists of divisional revenue, other than investment gain/loss, including revenue generated by our asset management business (excluding gains and losses related to our investment in American Century Investments), revenues generated by Nomura Babcock & Brown Co., Ltd.’s aircraft leasing-related businesses and management fee revenues generated from our private equity and other investment businesses |

| (2) | Consists of divisional revenue attributable to investments (including fair value fluctuations, funding cost and dividends), including gains and losses related to our investment in American Century Investments, our investments held in our private equity and other investment businesses. |

Billions of yen |

||||||||||||||||||||

Year ended March 31, 2023 |

||||||||||||||||||||

|

Balance at beginning of year |

Gross inflows |

Gross outflows |

Market appreciation / (depreciation) |

Balance at end of year |

||||||||||||||||

Nomura Asset Management Co., Ltd . |

¥ | 69,592 | ¥ | 23,168 | ¥ | (24,762 | ) | ¥ | 1,094 | ¥ | 69,092 | |||||||||

Nomura Corporate Research and Asset Management Inc. etc |

3,867 | 1,040 | (1,074 | ) | 35 | 3,868 | ||||||||||||||

Combined total |

73,459 | 24,208 | (25,836 | ) | 1,129 | 72,960 | ||||||||||||||

Shared across group companies |

(5,546 | ) | (1,409 | ) | 1,382 | (115 | ) | (5,688 | ) | |||||||||||

Total |

¥ | 67,913 | ¥ | 22,799 | ¥ | (24,454 | ) | ¥ | 1,014 | ¥ | 67,272 | |||||||||

Billions of yen |

||||||||||||||||||||

Year ended March 31, 2024 |

||||||||||||||||||||

|

Balance at beginning of year |

Gross inflows |

Gross outflows |

Market appreciation / (depreciation) |

Balance at end of year |

||||||||||||||||

Nomura Asset Management Co., Ltd . |

¥ | 69,092 | ¥ | 31,019 | ¥ | (28,614 | ) | ¥ | 19,514 | ¥ | 91,011 | |||||||||

Nomura Corporate Research and Asset Management Inc. etc |

3,868 | 1,799 | (1,098 | ) | 1,019 | 5,588 | ||||||||||||||

Combined total |

72,960 | 32,818 | (29,712 | ) | 20,533 | 96,599 | ||||||||||||||

Shared across group companies |

(5,688 | ) | (2,061 | ) | 1,680 | (1,529 | ) | (7,598 | ) | |||||||||||

Total |

¥ | 67,272 | ¥ | 30,757 | ¥ | (28,032 | ) | ¥ | 19,004 | ¥ | 89,001 | |||||||||

March 31 |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Total of publicly offered investment trusts |

27 | % | 27 | % | 26 | % | ||||||

Equity investment trusts |

25 | % | 25 | % | 25 | % | ||||||

Debt investment trusts |

44 | % | 44 | % | 44 | % | ||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Non-interest revenue |

¥ | 617,227 | ¥ | 809,681 | 31.2 | % | ¥ | 875,664 | 8.1 | % | ||||||||||

Net interest revenue |

85,828 | (37,301 | ) | — | (9,517 | ) | — | |||||||||||||

Net revenue |

703,055 | 772,380 | 9.9 | 866,147 | 12.1 | |||||||||||||||

Non-interest expenses |

628,563 | 743,011 | 18.2 | 812,236 | 9.3 | |||||||||||||||

Income before income taxes |

¥ | 74,492 | ¥ | 29,369 | (60.6 | )% | ¥ | 53,911 | 83.6 | % | ||||||||||

Millions of yen |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2022 |

2023 |

% Change from previous year |

2024 |

% Change from previous year |

||||||||||||||||

Wholesale net revenue: |

||||||||||||||||||||

Global Markets net revenue |

¥ | 556,417 | ¥ | 656,298 | 18.0 | % | ¥ | 707,113 | 7.7 | % | ||||||||||

Investment Banking net revenue |

146,638 | 116,082 | (20.8 | ) | 159,034 | 37.0 | ||||||||||||||

Net revenue |

¥ | 703,055 | ¥ | 772,380 | 9.9 | % | ¥ | 866,147 | 12.1 | % | ||||||||||

Millions of yen, except per share data and percentages |

||||||||||||||||||||

Year ended March 31 |

||||||||||||||||||||

2020 |

2021 |

2022 |

2023 |

2024 |

||||||||||||||||

Statement of income data: |

||||||||||||||||||||

Revenue |

¥ | 1,952,482 | ¥ | 1,617,235 | ¥ | 1,593,999 | ¥ | 2,486,726 | ¥ | 4,157,294 | ||||||||||

Interest expense |

664,653 | 215,363 | 230,109 | 1,151,149 | 2,595,294 | |||||||||||||||

Net revenue |

1,287,829 | 1,401,872 | 1,363,890 | 1,335,577 | 1,562,000 | |||||||||||||||

Non-interest expenses |

1,039,568 | 1,171,201 | 1,137,267 | 1,186,103 | 1,288,150 | |||||||||||||||

Income before income taxes |

248,261 | 230,671 | 226,623 | 149,474 | 273,850 | |||||||||||||||

Income tax expense |

28,894 | 70,274 | 80,090 | 57,798 | 96,630 | |||||||||||||||

Net income |

¥ | 219,367 | ¥ | 160,397 | ¥ | 146,533 | ¥ | 91,676 | ¥ | 177,220 | ||||||||||

Less: Net income (loss) attributable to noncontrolling interests |

2,369 | 7,281 | 3,537 | (1,110 | ) | 11,357 | ||||||||||||||

Net income attributable to NHI shareholders |

¥ | 216,998 | ¥ | 153,116 | ¥ | 142,996 | ¥ | 92,786 | ¥ | 165,863 | ||||||||||

Balance sheet data (period end): |

||||||||||||||||||||

Total assets |

¥ | 43,999,815 | ¥ | 42,516,480 | ¥ | 43,412,156 | ¥ | 47,771,802 | ¥ | 55,147,203 | ||||||||||

Total NHI shareholders’ equity |

2,653,467 | 2,694,938 | 2,914,605 | 3,148,567 | 3,350,189 | |||||||||||||||

Total equity |

2,731,264 | 2,756,451 | 2,972,803 | 3,224,142 | 3,448,513 | |||||||||||||||

Common stock |

594,493 | 594,493 | 594,493 | 594,493 | 594,493 | |||||||||||||||

Per share data: |

||||||||||||||||||||

Net income attributable to NHI shareholders—basic |

¥ | 67.76 | ¥ | 50.11 | ¥ | 46.68 | ¥ | 30.86 | ¥ | 54.97 | ||||||||||

Net income attributable to NHI shareholders—diluted |

66.20 | 48.63 | 45.23 | 29.74 | 52.69 | |||||||||||||||

Total NHI shareholders’ equity (1)

|

873.26 | 879.79 | 965.80 | 1,048.24 | 1,127.72 | |||||||||||||||

Cash dividends (1)

|

20.00 | 35.00 | 22.00 | 17.00 | 23.00 | |||||||||||||||

Cash dividends in USD (2)

|

$ | 0.19 | $ | 0.32 | $ | 0.18 | $ | 0.13 | $ | 0.15 | ||||||||||

Weighted average number of shares outstanding (in thousands) (3)

|

3,202,370 | 3,055,526 | 3,063,524 | 3,006,744 | 3,017,128 | |||||||||||||||

Return on equity (4) : |

8.2 | % | 5.7 | % | 5.1 | % | 3.1 | % | 5.1 | % | ||||||||||

| (1) | Calculated using the number of shares outstanding at year end. |

| (2) | Calculated using the Japanese Yen—U.S. Dollar exchange rate as of the respective fiscal year end date, the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. |

| (3) | The number shown is used to calculate basic earnings per share. |

| (4) | Calculated as net income attributable to NHI shareholders divided by total NHI shareholders’ equity. |

Millions of yen |

||||||||||||

March 31, 2024 |

||||||||||||

Funded |

Unfunded |

Total |

||||||||||

Europe |

¥ | 16,707 | ¥ | 168,259 | ¥ | 184,966 | ||||||

Americas |

27,951 | 287,623 | 315,574 | |||||||||

Asia and Oceania |

21,616 | 29,870 | 51,486 | |||||||||

Total |

¥ | 66,274 | ¥ | 485,752 | ¥ | 552,026 | ||||||

Millions of yen |

||||

March 31, 2024 |

||||

Deferred tax assets |

||||

Depreciation, amortization and valuation of fixed assets |

¥ | 41,883 | ||

Investments in subsidiaries and affiliates |

7,364 | |||

Valuation of financial instruments |

136,834 | |||

Accrued pension and severance costs |

11,837 | |||

Other accrued expenses and provisions |

83,418 | |||

Operating losses |

477,358 | |||

Lease liabilities |

48,951 | |||

Other |

20,811 | |||

Gross deferred tax assets |

828,456 | |||

Less—Valuation allowances |

(595,668 | ) | ||

Total deferred tax assets |

232,788 | |||

Deferred tax liabilities |

||||

Investments in subsidiaries and affiliates |

109,611 | |||

Valuation of financial instruments |

111,175 | |||

Undistributed earnings of foreign subsidiaries |

2,257 | |||

Valuation of fixed assets |

22,945 | |||

Right-of-use |

43,443 | |||

Other |

4,404 | |||

Total deferred tax liabilities |

293,835 | |||

Net deferred tax assets (liabilities) |

¥ | (61,047 | ) | |

Billions of yen |

||||||||||||||||

|

Average for year ended March 31, 2023 |

March 31, 2023 |

Average for year ended March 31, 2024 |

March 31, 2024 |

|||||||||||||

Cash, cash equivalents and time deposits (1)

|

¥ | 3,155.5 | ¥ | 3,229.3 | ¥ | 3,741.8 | ¥ | 3,629.9 | ||||||||

Government debt securities |

4,073.8 | 3,984.0 | 4,029.4 | 4,348.6 | ||||||||||||

Others (2)

|

416.9 | 441.0 | 423.4 | 439.5 | ||||||||||||

Total liquidity portfolio |

¥ | 7,646.2 | ¥ | 7,654.3 | ¥ | 8,194.6 | ¥ | 8,418.0 | ||||||||

| (1) | Cash, cash equivalents, and time deposits include nostro balances and deposits with both central banks and market counterparties that are readily available to support the liquidity position of Nomura. |

| (2) | Others include other liquid financial assets such as money market funds and U.S. agency securities. |

Billions of yen |

||||||||||||||||

|

Average for year ended March 31, 2023 |

March 31, 2023 |

Average for year ended March 31, 2024 |

March 31, 2024 |

|||||||||||||

Japanese Yen |

¥ | 1,613.6 | ¥ | 1,852.0 | ¥ | 1,964.8 | ¥ | 1,702.3 | ||||||||

U.S. Dollar |

4,326.0 | 3,953.3 | 4,341.1 | 4,601.7 | ||||||||||||

Euro |

869.3 | 964.5 | 933.2 | 1,023.5 | ||||||||||||

British Pound |

505.7 | 522.4 | 549.4 | 659.8 | ||||||||||||

Others (1)

|

331.6 | 362.1 | 406.1 | 430.7 | ||||||||||||

Total liquidity portfolio |

¥ | 7,646.2 | ¥ | 7,654.3 | ¥ | 8,194.6 | ¥ | 8,418.0 | ||||||||

| (1) | Includes other currencies such as the Australian Dollar, the Canadian Dollar and the Swiss Franc. |

Billions of yen |

||||||||

March 31, 2023 |

March 31, 2024 |

|||||||

NHI and NSC (1)

|

¥ | 1,806.4 | ¥ | 1,495.2 | ||||

Major broker-dealer subsidiaries |

3,012.6 | 3,592.5 | ||||||

Bank subsidiaries (2)

|

1,178.6 | 1,319.9 | ||||||

Other affiliates |

1,656.7 | 2,010.4 | ||||||

Total liquidity portfolio |

¥ | 7,654.3 | ¥ | 8,418.0 | ||||

| (1) | NSC, a broker-dealer located in Japan, holds an account with the Bank of Japan (“BOJ”) and has direct access to the BOJ Lombard facility through which same day funding is available for our securities pool. Any liquidity surplus at NHI is lent to NSC via short-term intercompany loans, which can be unwound immediately when needed. |

| (2) | Includes Nomura Bank International plc (“NBI”), Nomura Singapore Limited and Nomura Bank Luxembourg S.A. |

Billions of yen |

||||||||

March 31, 2023 |

March 31, 2024 |

|||||||

Net liquidity value of other unencumbered assets |

¥ | 2,842.5 | ¥ | 3,175.6 | ||||

Liquidity portfolio |

7,654.3 | 8,418.0 | ||||||

Total |

¥ | 10,496.8 | ¥ | 11,593.6 | ||||

Billions of yen |

||||||||

March 31, 2023 |

March 31, 2024 |

|||||||

Short-term bank borrowings |

¥ | 203.3 | ¥ | 177.5 | ||||

Other loans |

256.8 | 356.0 | ||||||

Commercial paper |

300.0 | 224.8 | ||||||

Deposits at banking entities |

1,705.0 | 1,880.9 | ||||||

Certificates of deposit |

224.2 | 232.4 | ||||||

Debt securities maturing within one year |

721.9 | 1,089.8 | ||||||

Total short-term unsecured debt |

¥ | 3,411.2 | ¥ | 3,961.4 | ||||

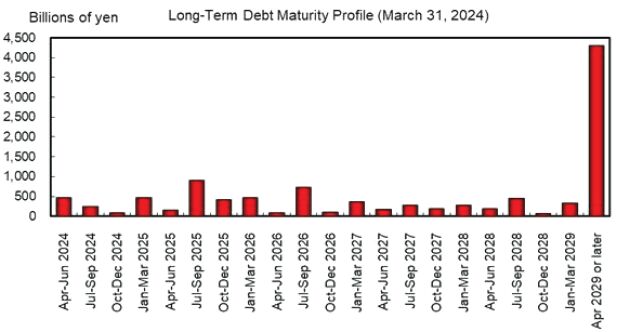

Billions of yen |

||||||||

March 31, 2023 |

March 31, 2024 |

|||||||

Long-term deposits at banking entities |

¥ | 208.8 | ¥ | 243.0 | ||||

Long-term bank borrowings |

3,004.9 | 3,408.4 | ||||||

Other loans |

265.5 | 292.3 | ||||||

Debt securities (1)

|

5,291.5 | 6,311.2 | ||||||

Total long-term unsecured debt |

¥ | 8,770.7 | ¥ | 10,254.9 | ||||

| (1) | Excludes long-term debt securities issued by consolidated special purpose entities and similar entities that meet the definition of variable interest entities under Accounting Standard Codification (“ASC”) 810 “ Consolidation Long-term borrowings Transfers and Servicing. |

| • | Stressed scenario—To maintain adequate liquidity during a severe market-wide liquidity event without raising funds through unsecured financing or through the liquidation of assets for a year; and |

| • | Acute stress scenario—To maintain adequate liquidity during a severe market-wide liquidity event coupled with credit concerns regarding Nomura’s liquidity position, without raising funds through unsecured funding or through the liquidation of assets for 30 days. |

| • | No liquidation of assets; |

| • | No ability to issue additional unsecured funding; |

| • | Upcoming maturities of unsecured debt (maturities less than one year); |

| • | Potential buybacks of our outstanding debt; |

| • | Loss of secured funding lines particularly for less liquid assets; |

| • | Fluctuation of funding needs under normal business circumstances; |

| • | Cash deposits and free collateral roll-off in a stress event; |

| • | Widening of haircuts on outstanding repo funding; |

| • | Additional collateralization requirements of clearing banks and depositories; |

| • | Drawdown on loan commitments; |

| • | Loss of liquidity from market losses; |

| • | Assuming a two-notch downgrade of our credit ratings, the aggregate fair value of assets that we would be required to post as additional collateral in connection with our derivative contracts; and |

| • | Legal and regulatory requirements that can restrict the flow of funds between entities in the Nomura Group. |

Billions of yen |

||||||||

Year Ended March 31 |

||||||||

2023 |

2024 |

|||||||

Net cash provided by (used in) operating activities |

¥ | (694.8 | ) | ¥ | 132.6 | |||

Net income |

91.7 | 177.2 | ||||||

Trading assets and private equity and debt investments |

(1,623.0 | ) | (386.5 | ) | ||||

Trading liabilities |

467.3 | (411.8 | ) | |||||

Securities purchased under agreements to resell, net of securities sold under agreements to repurchase |

(590.4 | ) | 290.8 | |||||

Securities borrowed, net of securities loaned |

834.4 | (324.1 | ) | |||||

Other net operating cash flow reconciling items |

125.2 | 787.0 | ||||||

Net cash used in investing activities |

(233.2 | ) | (887.9 | ) | ||||

Net cash outflows from time deposits |

(59.4 | ) | (83.0 | ) | ||||

Net cash outflows from loans |

(299.8 | ) | (791.7 | ) | ||||

Net cash inflows from non-trading debt securities |

159.6 | 23.3 | ||||||

Other net investing cash outflows |

(33.6 | ) | (36.5 | ) | ||||

Net cash provided by financing activities |

1,283.9 | 1,012.9 | ||||||

Net cash inflows from long-term borrowings |

1,093.3 | 962.9 | ||||||

Net cash inflows / (outflows) from short-term borrowings |

(64.5 | ) | 98.0 | |||||

Net cash inflows from deposits received at banks |

328.9 | 107.5 | ||||||

Other net financing cash outflows |

(73.8 | ) | (155.5 | ) | ||||

Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents |

148.6 | 220.6 | ||||||

Net increase in cash, cash equivalents, restricted cash and restricted cash equivalents |

504.4 | 478.2 | ||||||

Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of the year |

3,316.4 | 3,820.9 | ||||||

Cash, cash equivalents, restricted cash and restricted cash equivalents at end of the year |

¥ | 3,820.9 | ¥ | 4,299.0 | ||||

Billions of yen, except ratios |

||||||||

March 31 |

||||||||

2023 |

2024 |

|||||||

NHI shareholders’ equity |

¥ | 3,148.6 | ¥ | 3,350.2 | ||||

Total assets |

47,771.8 | 55,147.2 | ||||||

Adjusted assets (1)

|

29,654.3 | 34,152.4 | ||||||

Leverage ratio (2)

|

15.2 x | 16.5 x | ||||||

Adjusted leverage ratio (3)

|

9.4 x | 10.2 x | ||||||

| (1) | Represents total assets less Securities purchased under agreements to resell Securities borrowed non-GAAP financial measure and is calculated as follows: |

| (2) | Equals total assets divided by NHI shareholders’ equity. |

| (3) | Equals adjusted assets divided by NHI shareholders’ equity. |

Billions of yen |

||||||||

March 31 |

||||||||

2023 |

2024 |

|||||||

Total assets |

¥ | 47,771.8 | ¥ | 55,147.2 | ||||

Less: |

||||||||

Securities purchased under agreements to resell |

13,834.5 | 15,621.1 | ||||||

Securities borrowed |

4,283.0 | 5,373.7 | ||||||

Adjusted assets |

¥ | 29,654.3 | ¥ | 34,152.4 | ||||

Fiscal year ended March 31, |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

Total |

|||||||||||||||

2019 |

¥ | — | ¥ | 3.00 | ¥ | — | ¥ | 3.00 | ¥ | 6.00 | ||||||||||

2020 |

— | 15.00 | — | 5.00 | 20.00 | |||||||||||||||

2021 |

— | 20.00 | — | 15.00 | 35.00 | |||||||||||||||

2022 |

— | 8.00 | — | 14.00 | 22.00 | |||||||||||||||

2023 |

— | 5.00 | — | 12.00 | 17.00 | |||||||||||||||

2024 |

— | 8.00 | — | 15.00 | 23.00 | |||||||||||||||

Billions of yen, except ratios |

||||||||

March 31 |

||||||||

2023 |

2024 |

|||||||

Common equity Tier 1 capital |

¥ | 2,828.8 | ¥ | 3,091.3 | ||||

Tier 1 capital |

3,203.7 | 3,467.8 | ||||||

Total capital |

3,204.1 | 3,468.3 | ||||||

Risk-Weighted Assets |

||||||||

Credit risk-weighted assets |

8,385.8 | 9,764.7 | ||||||

Market risk equivalent assets |

6,270.6 | 6,381.9 | ||||||

Operational risk equivalent assets |

2,667.5 | 2,828.9 | ||||||

Total risk-weighted assets |

¥ | 17,323.9 | ¥ | 18,975.5 | ||||

Consolidated Capital Adequacy Ratios |

||||||||

Common equity Tier 1 capital ratio |

16.32 | % | 16.29 | % | ||||

Tier 1 capital ratio |

18.49 | % | 18.27 | % | ||||

Consolidated capital adequacy ratio |

18.49 | % | 18.27 | % | ||||

Consolidated Leverage Ratio |

5.63 | % | 5.24 | % | ||||

External TLAC Ratios |

||||||||

Risk-weighted assets basis |

31.78 | % | 33.06 | % | ||||

Leverage ratio exposure measure basis |

10.63 | % | 10.42 | % | ||||

Nomura Holdings, Inc. |

Short-term Debt |

Long-term Debt |

||

S&P Global Ratings |

A-2 |

BBB+ | ||

Moody’s Investors Service |

— | Baa1 | ||

Fitch Ratings |

F1 | A- | ||

Rating and Investment Information, Inc. |

a-1 |

A | ||

Japan Credit Rating Agency, Ltd. |

— | AA- | ||

Nomura Securities Co., Ltd. |

Short-term Debt |

Long-term Debt |

||

S&P Global Ratings |

A-2 |

A- | ||

Moody’s Investors Service |

P-2 |

A3 | ||

Fitch Ratings |

F1 | A- | ||

Rating and Investment Information, Inc. |

a-1 |

A+ | ||

Japan Credit Rating Agency, Ltd. |

— | AA- | ||

| • | an obligation under a guarantee contract; |

| • | a retained or contingent interest in assets transferred to an off-balance sheet entity or similar arrangement that serves to provide credit, liquidity or market risk support to such entity; |

| • | any obligation, including a contingent obligation, under a contract that would be accounted for as a derivative instrument; or |

| • | any obligation, including a contingent obligation, arising out of a variable interest in an off-balance sheet entity that is held by, and material to, us, where such entity provides financing, liquidity, market risk or credit risk support to, or engages in leasing, hedging or research and development services with, us. |

| • | In connection with our banking and financing activities, we enter into various guarantee arrangements with counterparties in the form of standby letters of credit and other guarantees, which generally have fixed expiration dates. |

| • | In connection with our operating activities, we issue Japanese Yen and non-Japanese Yen denominated long-term borrowings which incur variable and fixed interest payments in accordance with our funding policy. |

| • | We lease office space, residential facilities for employees, motor vehicles, equipment and technology assets in the ordinary course of business both in Japan and overseas as lessee. These arrangements predominantly consist of operating leases. |

| • | Separately we sublease certain real estate and equipment through operating lease arrangements. |

| • | We lease certain equipment and facilities in Japan and overseas which are classified as finance lease agreements. |

| • | We have purchase obligations for goods and services which include payments for construction, advertising, and computer and telecommunications maintenance agreements. |

| • | In connection with our banking and financing activities, we enter into contractual commitments to extend credit, which generally have fixed expiration dates. |

| • | In connection with our investment banking activities, we enter into agreements with clients under which we commit to underwrite securities that may be issued by clients. |

| • | As a member of certain central clearing counterparties, Nomura is committed to provide liquidity facilities through entering into reverse repurchase transactions backed by government and government agency debt securities with those counterparties in a situation where a default of another clearing member occurs. |

| • | We have commitments to invest in interests in various partnerships and other entities and commitments to provide financing for investments related to those partnerships. |

Millions of yen |

||||||||||||||||||||

|

Total contractual amount |

Years to maturity |

|||||||||||||||||||

|

Less than 1 year |

1 to 3 years |

3 to 5 years |

More than 5 years |

|||||||||||||||||

Standby letters of credit and other guarantees |

¥ | 3,561,640 | ¥ | 3,517,487 | ¥ | 24,321 | ¥ | 16,976 | ¥ | 2,856 | ||||||||||

Long-term borrowings (1)

|

11,926,429 | 1,146,494 | 3,374,258 | 2,265,231 | 5,140,446 | |||||||||||||||

Contractual interest payments (2)

|

2,002,724 | 317,600 | 468,572 | 316,353 | 900,199 | |||||||||||||||

Operating lease commitments (3)

|

200,454 | 47,123 | 65,824 | 44,630 | 42,877 | |||||||||||||||

Purchase obligations (4)

|

94,478 | 16,124 | 74,189 | 3,049 | 1,116 | |||||||||||||||

Commitments to extend credit (5)

|

3,105,611 | 1,905,593 | 388,648 | 476,372 | 334,998 | |||||||||||||||

Commitments to invest |

31,989 | 2,305 | 3,698 | 461 | 25,525 | |||||||||||||||

Total |

¥ | 20,923,325 | ¥ | 6,952,726 | ¥ | 4,399,510 | ¥ | 3,123,072 | ¥ | 6,448,017 | ||||||||||

| (1) | The amounts disclosed within long-term borrowings exclude financial liabilities recognized within long-term borrowings as a result of transfers of financial assets that are accounted for as financings rather than sales in accordance with ASC 860. These are not borrowings issued for our own funding purposes and therefore do not represent actual contractual obligations by us to deliver cash. |

| (2) | The amounts represent estimated future interest payments related to long-time borrowings based on the period through to their maturity and applicable interest rates as of March 31, 2024. |

| (3) | The amounts of operating lease commitments are undiscounted future minimum lease payments. The amounts of finance lease contracts were immaterial. |

| (4) | The minimum contractual obligations under enforceable and legally binding contracts that specify all significant terms. Amounts exclude obligations that are already reflected on our consolidated balance sheets as liabilities or payables. Includes the commitment to purchase parts of the redeveloped real estate in Tokyo Nihonbashi district from the redevelopment association. |

| (5) | Contingent liquidity facilities to central clearing counterparties are included. |

Critical accounting policy |

Critical accounting estimates |

Key subjective assumptions or judgments by management |

Effect of changes in estimates and assumptions during year ended March 31, 2024 |

|||

|

Fair value of financial instruments Note 2

“Fair value measurements” |

Estimating fair value for financial instruments |

A significant portion of our financial instruments are carried at fair value. The fair values of these financial instruments may not only be measured at quoted prices but also impacted by other factors, including selection of valuation techniques/ models and other assumptions that require judgment. This may affect the amount and timing of unrealized gains or losses recognized in the consolidated statements of income for a particular financial instrument. |

See Note 2

“Fair value measurements” Level 3 financial assets (net of derivative liabilities) during the year increased from ¥868 billion as of March 2023 to ¥1,041 billion as of March 2024. Total level 3 financial assets to total financial assets carried at fair value on a recurring basis ratio was 6 % as of March 31, 2024 (5 % as of March 31, 2023.) |

Critical accounting policy |

Critical accounting estimates |

Key subjective assumptions or judgments by management |

Effect of changes in estimates and assumptions during year ended March 31, 2024 |

|||

|

Selection of appropriate valuation techniques • For financial instruments measured at fair values where quoted prices are available in active markets, we typically use quoted prices as level 1 inputs for determining the fair values of these financial instruments. • For financial instruments where such quoted prices are not available, fair values of these financial instruments are measured using level 2 or level 3 inputs. Significant judgment is involved in selection of appropriate valuation techniques and validation of assumptions applied in models because the estimated fair values measured could vary depending on which models and assumptions are used. When selecting valuation techniques, various factors such as the particular circumstances and markets where these financial instruments are traded, the availability of reliable inputs, maximizing the use of relevant observable inputs and minimizing the use of unobservable inputs are considered. Significance of level 3 inputs • Fair values are more judgmental when we use level 3 inputs, which are based on significant

non-market based unobservable inputs.• For these instruments, fair value is determined based on management’s judgment about the assumption that market participant would use in pricing the instruments, including perception of liquidity, economic environment and the risks affecting the specific instruments. |

See Note 2

“Fair Value measurement” |

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Koji Nagai (Jan. 25, 1959) |

Director Chairman of the Board Directors Member of the Nomination Committee Member of the Compensation Committee Director and Chairman of Nomura Securities Co., Ltd. |

Apr. 1981 | Joined the Company | |||

| Apr. 2003 | Director of Nomura Securities Co., Ltd. | |||||

| Jun. 2003 | Executive Officer of Nomura Securities Co., Ltd. | |||||

| Apr. 2007 | Executive Officer (Executive Managing Director) of Nomura Securities Co., Ltd. | |||||

| Oct. 2008 | Senior Corporate Managing Director of Nomura Securities Co., Ltd. | |||||

| Apr. 2009 | Executive Officer and Executive Vice President of Nomura Securities Co., Ltd. | |||||

| Apr. 2011 |

Co-COO and Deputy President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2012 |

Senior Managing Director of the Company Director, Representative Executive Officer and President of Nomura Securities Co., Ltd. |

|||||

| Aug. 2012 |

Representative Executive Officer & Group CEO of the Company Director, Representative Executive Officer and President of Nomura Securities Co., Ltd. |

|||||

| Jun. 2013 |

Director, Representative Executive Officer & Group CEO of the Company Director, Representative Executive Officer and President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2017 |

Director, Representative Executive Officer, President & Group CEO of the Company Director and Chairman of Nomura Securities Co., Ltd. |

|||||

| Apr. 2020 |

Director and Chairman of the Company (Current) Director and Chairman of Nomura Securities Co., Ltd. (Current) |

|||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Kentaro Okuda (Nov. 7, 1963) |

Director, Representative Executive Officer, President and Group CEO Representative Director and President of Nomura Securities Co., Ltd. |

Apr. 1987 | Joined the Company | |||

| Apr. 2010 | Senior Managing Director of Nomura Securities Co., Ltd. | |||||

| Apr. 2012 | Senior Corporate Managing Director of Nomura Securities Co., Ltd. | |||||

| Aug. 2012 |

Senior Corporate Managing Director of the Company Senior Corporate Managing Director of Nomura Securities Co., Ltd. |

|||||

| Apr. 2013 |

Senior Managing Director of the Company Senior Corporate Managing Director of Nomura Securities Co., Ltd. |

|||||

| Apr. 2015 |

Senior Managing Director of the Company Executive Vice President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2016 |

Senior Managing Director of the Company Executive Officer and Executive Vice President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2017 |

Senior Managing Director of the Company Executive Vice President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2018 |

Executive Officer and Group

Co-COO of the CompanyDirector, Executive Officer and Deputy President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2019 | Executive Officer, Deputy President and Group Co-COO of the Company |

|||||

| Apr. 2020 |

Representative Executive Officer, President & Group CEO of the Company Representative Director of Nomura Securities Co., Ltd. |

|||||

| Jun. 2020 |

Director, Representative Executive Officer, President & Group CEO of the Company Representative Director of Nomura Securities Co., Ltd. |

|||||

| Jun. 2021 |

Director, Representative Executive Officer, President & Group CEO of the Company (Current) Representative Director and President of Nomura Securities Co., Ltd. (Current) |

|||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Yutaka Nakajima (Aug. 2, 1965) |

Director, Representative Executive Officer and Deputy President Representative Director and Deputy President of Nomura Securities Co., Ltd. |

Apr. 1988 | Joined the Company | |||

| Apr. 2011 | Senior Managing Director of Nomura Securities Co., Ltd. | |||||

| May. 2015 | Senior Managing Director of the Company | |||||

| Apr. 2016 |

Senior Managing Director of the Company Senior Corporate Managing Director of Nomura Securities Co., Ltd. |

|||||

| Apr. 2017 |

Senior Managing Director of the Company Executive Managing Director and Senior Corporate Managing Director of Nomura Securities Co., Ltd. |

|||||

| Apr. 2018 |

Senior Managing Director of the Company Executive Managing Director and Executive Vice President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2019 |

Senior Managing Director of the Company Director and Executive Vice President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2021 |

Senior Managing Director of the Company Representative Director and Deputy President of Nomura Securities Co., Ltd. |

|||||

| Apr. 2023 |

Representative Executive Officer and Deputy President of the Company Representative Director and Deputy President of Nomura Securities Co., Ltd. |

|||||

| Jun. 2023 |

Director, Representative Executive Officer and Deputy President of the Company (Current) Representative Director and Deputy President of Nomura Securities Co., Ltd. (Current) |

|||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Shoji Ogawa (Aug. 9, 1964) |

Director Member of the Audit Committee (full-time) Member of the Board Risk Committee Corporate Auditor of Nomura Asia Pacific Holdings Co., Ltd Non-Executive Director of Nomura Holding America Inc.Non-Executive Director of Instinet Incorporated |

Apr. 1987 | Joined the Company | |||

| Apr. 2007 | Head of Investment Banking Strategic Planning Dept of Nomura Securities Co., Ltd. | |||||

| Oct. 2008 | Head of Capital Markets Dept. and Capital Solutions Dept. of Nomura Securities Co., Ltd. | |||||

| Jul. 2009 | Head of Capital Markets Dept. of Nomura Securities Co., Ltd. | |||||

| Apr. 2012 | Head of Investment Banking Strategic Planning Dept. of Nomura Securities Co., Ltd. | |||||

| Jul. 2013 |

Head of Office of Audit Committee of the Company Head of Office of Audit Committee of Nomura Securities Co., Ltd. |

|||||

| Aug. 2016 |

Head of Office of

Non-Executive Directors and Audit Committee of the CompanyHead of Office of

Non-Executive Directors and Audit Committee of Nomura Securities Co., Ltd. |

|||||

| Apr. 2017 |

Senior Managing Director and Group Internal Audit of the Company Senior Managing Director and Internal Audit of Nomura Securities Co., Ltd. |

|||||

| Apr. 2021 | Advisor of the Company | |||||

| Jun. 2021 | Director of the Company (Current) | |||||

|

Laura Simone Unger (Jan. 8, 1961) |

Outside Director Chairperson of the Board Risk Committee Independent Director of Nomura Holding America Inc. Independent Director of Nomura Securities International, Inc. Independent Director of Nomura Global Financial Products Inc. Independent Director of Instinet Holdings Incorporated |

Jan. 1988 | Enforcement Attorney of the U.S. Securities and Exchange Commission (SEC) | |||

| Oct. 1990 | Counsel of the U.S. Senate Committee on Banking, Housing, and Urban Affairs | |||||

| Nov. 1997 | Commissioner of the SEC | |||||

| Feb. 2001 | Acting Chairperson of the SEC | |||||

| Jul. 2002 | Regulatory Expert of CNBC | |||||

| May 2003 | Independent Consultant of JPMorgan Chase & Co. | |||||

| Aug. 2004 | Independent Director of CA Inc. | |||||

| Jan. 2010 | Special Advisor of Promontory Financial Group | |||||

| Dec. 2010 | Independent Director of CIT Group Inc. | |||||

| Nov. 2014 | Independent Director of Navient Corporation | |||||

| Jun. 2018 | Outside Director of the Company (Current) | |||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Victor Chu (Jun. 20, 1957) |

Outside Director Member of the Audit Committee Chairman and Chief Executive Officer of First Eastern Investment Group Chair of Council, University College London Co-Chair, International Business Council of the World Economic ForumIndependent Director of Airbus SE |

Dec. 1982 | Solicitor of the Supreme Court, Hong Kong | |||

| Jan. 1988 | Chairman and Chief Executive Officer of First Eastern Investment Group (Current) | |||||

| Oct. 1988 | Director and Council Member of the Hong Kong Stock Exchange | |||||

| Jun. 1992 | Advisory Committee Member of the Securities and Futures Commission, Hong Kong | |||||

| Aug. 2003 | Foundation Board Member of the World Economic Forum | |||||

| Apr. 2018 | Independent Director of Airbus SE (Current) | |||||

| Jun. 2021 | Outside Director of the Company (Current) | |||||

|

J.Christopher Giancarlo (May 12, 1959) |

Outside Director Member of the Board Risk Committee Senior Counsel of Willkie Farr & Gallagher LLP Chair of the Board of Directors of Digital Dollar Project Independent Director of Digital Asset Holdings, LLC Independent Director of Nomura Securities International, Inc. Independent Director of Nomura Global Financial Products Inc. |

Sep. 1984 | Associate Attorney of Mudge Rose Guthrie Alexander & Ferdon | |||

| Oct. 1985 | Associate Attorney of Curtis, Mallet-Prevost, Colt & Mosle | |||||

| Jan. 1992 | Attorney, Founding Partner of Giancarlo & Gleiberman | |||||

| Sep. 1997 | Attorney, (Equity) Partner of Thelen Reid Brown Raysman & Steiner | |||||

| Apr. 2000 | Vice President and Legal Counsel of Fenics Software | |||||

| Apr. 2001 | Executive Vice President of GFI Group Inc. | |||||

| Jun. 2014 | Commissioner of the U.S. Commodity Futures Trading Commission | |||||

| Jan. 2017 | Chairman of the U.S. Commodity Futures Trading Commission | |||||

| Oct. 2019 | Independent Director of the American Financial Exchange | |||||

| Jan. 2020 | Senior Counsel of Willkie Farr & Gallagher LLP (Current) | |||||

| Jun. 2021 | Outside Director of the Company (Current) | |||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Patricia Mosser (Feb. 14, 1956) |

Outside Director Member of the Board Risk Committee Senior Research Scholar* Director of the MPA Program in Economic Policy Management* Director of Central Banking and Financial Policy* *Positions at Columbia University, School of International and Public Affairs Independent Director of Nomura Holding America Inc. |

Jul. 1986 | Assistant Professor, Economics Department, Columbia University | |||

| Jan. 1991 | Economist and Vice President of the Federal Reserve Bank of New York (FRBNY) | |||||

| Nov. 2006 | Senior Vice President, FRBNY, Member of the FX Forum, Executive Meeting of East Asia and Pacific (EMEAP) Central Banks, Bank for International Settlements | |||||

| Jan. 2007 | Board Member of the American Economic Association’s Committee on the Status of Women in the Economics Profession | |||||

| Jun. 2007 | Member of the Markets Committee, Bank for International Settlements | |||||

| Jan 2009 | Acting Systemic Open Market Account Manager for the Federal Open Market Committee (FOMC) | |||||

| Oct. 2013 | Deputy Director of the Office of Financial Research (OFR), U.S. Treasury Department | |||||

| Oct. 2013 | Member of the Deputies Committee of the Financial Stability Oversight Council (FSOC) | |||||

| Jun. 2015 | Senior Research Scholar and Director of Central Banking and Financial Policy at Columbia University’s School of International and Public Affairs (Current) | |||||

| Jun. 2021 | Outside Director of the Company (Current) | |||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Takahisa Takahara (Jul. 12, 1961) |

Outside Director Member of the Nomination Committee Member of the Compensation Committee Representative Director, President & CEO of Unicharm Corporation Outside Director of Sumitomo Corporation |

Apr. 1986 | Joined The Sanwa Bank, Ltd. (currently MUFG Bank, Ltd.) | |||

| Apr. 1991 | Joined Unicharm Corporation | |||||

| Jun. 1995 | Director of Unicharm Corporation | |||||

| Apr. 1996 | Director, General Manager of Procurement Division and Deputy General Manager of International Division of Unicharm Corporation | |||||

| Jun. 1997 | Senior Director of Unicharm Corporation | |||||

| Apr. 1998 | Senior Director, General Manager of Feminine Hygiene Business Division of Unicharm Corporation | |||||

| Oct. 2000 | Senior Director, Responsible for Management Strategy of Unicharm Corporation | |||||

| Jun. 2001 | Representative Director, President of Unicharm Corporation | |||||

| Jun. 2004 | Representative Director, President & CEO of Unicharm Corporation (Current) | |||||

| Jun. 2021 | Outside Director of the Company (Current) | |||||

|

Miyuki Ishiguro (Oct. 26, 1964) |

Outside Director Member of the Board Risk Committee Partner of Nagashima Ohno & Tsunematsu President of the Inter-Pacific Bar Association (IPBA) Outside Audit & Supervisory Board Member, Lasertec Corporation |

Apr. 1991 | Registered as an Attorney-at-Law |

|||

| Jan. 1999 | Partner of Tsunematsu Yanase & Sekine | |||||

| Jan. 2000 | Partner of Nagashima Ohno & Tsunematsu(Current) | |||||

| Oct. 2004 | Visiting Professor, Columbia Law School | |||||

| May. 2015 | Secretary General of the Inter-Pacific Bar Association (IPBA) | |||||

| Feb. 2016 | Council Member of the Radio Regulatory Council (Ministry of Internal Affairs and Communications) | |||||

| Apr. 2016 | Council Member of the Management Council of Hitotsubashi University | |||||

| Apr. 2018 | Vice President of the Tokyo Bar Association | |||||

| Jun. 2023 | Outside Director of the Company (Current) | |||||

| Apr. 2024 | President of the Inter-Pacific Bar Association (IPBA) (Current) | |||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Masahiro Ishizuka (Apr. 21, 1960) |

Outside Director Chairman of the Audit Committee Director of Nomura Securities Co., Ltd. |

Oct. 1984 | Joined Deloitte Haskins and Sells International (*) | |||

| Apr. 1988 | Registered as a Certified Public Accountant | |||||

| Jun. 1997 | Partner of Tohmatsu & Co. (*) | |||||

| Jan. 1998 | Deloitte & Touche LLP based in New York | |||||

| Oct. 2004 | Head of Audit and Technology Dept. of Business Administrative Division, of Tohmatsu & Co. (*) | |||||

| Aug. 2010 | Vice Chairman of the Audit Standards Committee of the Japanese Institute of Certified Public Accountants | |||||

| Oct. 2010 | Head of Office of Manual, of Quality Administrative Division, of Deloitte Touche Tohmatsu LLC | |||||

| Nov. 2015 | The Board Member of Deloitte Tohmatsu LLC | |||||

| Jun. 2017 | Executive Officer, General Manager of the Reputation Quality Risk Management Division of Deloitte Tohmatsu LLC and Deloitte Touche Tohmatsu LLC | |||||

| Jun. 2022 | Ethics Officer of Deloitte Tohmatsu Group | |||||

| Jun. 2023 | Outside Director of the Company (Current) | |||||

| Apr. 2024 | Director of Nomura Securities Co., Ltd. (Current) | |||||

| *Each of the corporations is currently Deloitte Touche Tohmatsu LLC | ||||||

|

Taku Oshima (Jul. 14, 1956) |

Outside Director Chairman of the Nomination Committee Chairman of the Compensation Committee Chairman and Representative Director of NGK INSULATORS, LTD. Outside Director of Central Japan Railway Company Chairman of Aichi Employers’ Association Outside Director of Toho Gas |

Mar. 1980 | Joined NGK INSULATORS, LTD. | |||

| Jun. 2007 | Corporate Officer of NGK INSULATORS, LTD. | |||||

| Jun. 2011 | Corporate Executive Officer of NGK INSULATORS, LTD. | |||||

| Jun. 2014 | President and Representative Director of NGK INSULATORS, LTD. | |||||

| Apr. 2021 | Chairman and Representative Director of NGK INSULATORS, LTD. (Current) | |||||

| Jun. 2024 | Outside Director of the Company (Current) | |||||

|

Name (Date of Birth) |

Responsibilities and Status within Nomura/ Other Principal Business Activities |

Business Experience |

||||

|

Kentaro Okuda (Nov. 7, 1963) |

See “ Directors |

See “ Directors |

||||

|

Yutaka Nakajima (Aug. 2, 1965) |