| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| American Depositary Shares *Common Stock ** |

TM |

The New York Stock Exchange |

| * | Each American Depositary Share representing ten shares of the registrant’s Common Stock. |

| ** | No par value. Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the U.S. Securities and Exchange Commission. |

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ | ||

| Emerging growth company ☐ | ||||

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Page |

||||||

10.D |

EXCHANGE CONTROLS | 130 | ||||

10.E |

TAXATION | 135 | ||||

10.F |

DIVIDENDS AND PAYING AGENTS | 141 | ||||

10.G |

STATEMENT BY EXPERTS | 141 | ||||

10.H |

DOCUMENTS ON DISPLAY | 141 | ||||

10.I |

SUBSIDIARY INFORMATION | 141 | ||||

10.J |

ANNUAL REPORT TO SECURITY HOLDERS | 141 | ||||

ITEM 11. |

141 | |||||

ITEM 12. |

142 | |||||

12.A |

DEBT SECURITIES | 142 | ||||

12.B |

WARRANTS AND RIGHTS | 142 | ||||

12.C |

OTHER SECURITIES | 142 | ||||

12.D |

AMERICAN DEPOSITARY SHARES | 142 | ||||

ITEM 13. |

144 | |||||

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 144 | ||||

ITEM 15. |

144 | |||||

ITEM 16. |

145 | |||||

ITEM 16A. |

145 | |||||

ITEM 16B. |

145 | |||||

ITEM 16C. |

146 | |||||

ITEM 16D. |

147 | |||||

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 147 | ||||

ITEM 16F. |

148 | |||||

ITEM 16G. |

148 | |||||

ITEM 16H. |

152 | |||||

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 152 | ||||

ITEM 16J. |

153 | |||||

ITEM 16K. |

153 | |||||

ITEM 17. |

156 | |||||

ITEM 18. |

156 | |||||

ITEM 19. |

157 | |||||

Yen in millions |

||||||||||||

Year Ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Automotive |

28,531,993 | 33,776,870 | 41,080,731 | |||||||||

Financial Services |

2,306,079 | 2,786,679 | 3,447,195 | |||||||||

All Other |

541,436 | 590,749 | 567,399 | |||||||||

Yen in millions |

||||||||||||

Year Ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Japan |

8,214,740 | 9,122,282 | 10,193,556 | |||||||||

North America |

10,897,946 | 13,509,027 | 17,624,268 | |||||||||

Europe |

3,692,214 | 4,097,537 | 5,503,738 | |||||||||

Asia |

5,778,115 | 7,076,922 | 7,604,269 | |||||||||

Other* |

2,796,493 | 3,348,530 | 4,169,494 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

| • | social, political and economic conditions; |

| • | introduction of new vehicles and technologies; |

| • | vehicle prices, costs incurred by customers to purchase and operate automobiles; and |

| • | the availability of parts and components that Toyota needs to manufacture its products. |

|

MISSION |

Producing Happiness for All Using our technology, we work towards a future of convenience and happiness, available to all |

||||

| VISION |

Creating Mobility for All Toyota strives to raise the quality and availability of mobility so that individuals, businesses, municipalities and communities can do more, while achieving a sustainable relationship with our planet |

|||||

| VALUE |

We unite our three strengths (Software, Hardware and Partnerships) to create new and unique value that comes from the Toyota Way |

|||||

| * | Governance Risk Management and Compliance. |

Thousands of Units |

||||||||||||||||||||||||

Year Ended March 31, |

||||||||||||||||||||||||

2022 |

2023 |

2024 |

||||||||||||||||||||||

Units |

% |

Units |

% |

Units |

% |

|||||||||||||||||||

Market |

||||||||||||||||||||||||

Japan |

1,924 | 23.4 | % | 2,069 | 23.5 | % | 1,993 | 21.1 | % | |||||||||||||||

North America |

2,394 | 29.1 | 2,407 | 27.3 | 2.816 | 29.8 | ||||||||||||||||||

Europe |

1,017 | 12.4 | 1,030 | 11.7 | 1,192 | 12.6 | ||||||||||||||||||

Asia |

1,543 | 18.7 | 1,751 | 19.8 | 1,804 | 19.1 | ||||||||||||||||||

Other* |

1,352 | 16.4 | 1,565 | 17.7 | 1,638 | 17.4 | ||||||||||||||||||

Total |

8,230 |

100.0 |

% |

8,822 |

100.0 |

% |

9,443 |

100.0 |

% |

|||||||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East, etc. |

Thousands of Units |

||||||||||||

Year Ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Japan |

||||||||||||

Total market sales (excluding mini-vehicles) |

2,664 |

2,696 |

2,906 |

|||||||||

Toyota sales (retail basis, excluding mini-vehicles) |

1,361 | 1,377 | 1,506 | |||||||||

Toyota market share |

51.1 | % | 51.1 | % | 51.8 | % | ||||||

Thousands of Units |

||||||||||||

Year Ended December 31, |

||||||||||||

2021 |

2022 |

2023 |

||||||||||

North America |

||||||||||||

Total market sales |

17,861 |

16,597 |

18,762 |

|||||||||

Toyota sales (retail basis) |

2,681 | 2,445 | 2,617 | |||||||||

Toyota market share |

15.0 | % | 14.7 | % | 13.9 | % | ||||||

Europe |

||||||||||||

Total market sales |

16,870 |

14,897 |

17,456 |

|||||||||

Toyota sales (retail basis) |

1,076 | 1,081 | 1,174 | |||||||||

Toyota market share |

6.4 | % | 7.3 | % | 6.7 | % | ||||||

Asia (excluding China) |

||||||||||||

Total market sales |

9,224 |

10,757 |

10,714 |

|||||||||

Toyota sales (retail basis) |

1,189 | 1,382 | 1,407 | |||||||||

Toyota market share |

12.9 | % | 12.8 | % | 13.1 | % | ||||||

Thousands of Units |

||||||||||||

Year Ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Japan |

3,738 | 3,789 | 4,042 | |||||||||

North America |

1,751 | 1,768 | 1,976 | |||||||||

Europe |

707 | 771 | 846 | |||||||||

Asia |

1,499 | 1,859 | 1,876 | |||||||||

Other* |

463 | 507 | 523 | |||||||||

Total |

8,158 | 8,694 | 9,263 | |||||||||

| * | “Other” consists of Central and South America and Africa. |

Dealers |

||||||

Channel |

Toyota Owned |

Independent |

Outlets |

|||

Toyota brand |

1 company | 232 companies | 4,353 outlets | |||

Lexus brand |

23 outlets | 164 outlets | 187 outlets | |||

Country/Region |

Number of Countries |

Number of Distributors |

||||||

North America |

3 | 5 | ||||||

Europe |

53 | 29 | ||||||

China |

1 | 4 | ||||||

Asia (excluding China) |

19 | 13 | ||||||

Oceania |

17 | 15 | ||||||

Middle East |

16 | 14 | ||||||

Africa |

56 | 48 | ||||||

Central and South America |

39 | 40 | ||||||

| Developed countries |

In parallel with the preparation of a next-generation BEVs scheduled for launch in 2026, with a focus on the bZ series and with further refined performance, Toyota plans to greatly expand its product lineup. |

|

| The United States |

In 2025, Toyota plans to start the local production of a

3-row SUV equipped with batteries to be produced in North Carolina. |

|

| China |

In addition to the bZ4X and bZ3, Toyota debuted new BEV models, the bZ3C and the bZ3X, locally developed and fit to local needs, in April 2024, and Toyota plans to continue increase the number of models in the following years. |

|

| Asia and other emerging markets (Global South) |

In order to respond to the growing demand for BEVs, Toyota started local production of BEV pickup trucks by the end of 2023 and plans to also launch a small BEV model. |

| • | Toyota Finance Corporation in Japan; |

| • | Toyota Credit Canada Inc. in Canada; |

| • | Toyota Finance Australia Ltd. in Australia; |

| • | Toyota Kreditbank GmbH in Germany; |

| • | Toyota Financial Services (UK) PLC in the United Kingdom; |

| • | Toyota Leasing (Thailand) Co., Ltd. in Thailand; and |

| • | Toyota Motor Finance (China) Co., Ltd. in China. |

| • | Adopting a resolution at the Board of Directors meeting to invest in securing the required supply of batteries for electric vehicles by 2030 to achieve carbon neutrality. |

| • | Granting approval to engage in research and development on powertrains (evolution of combustion technology) as a multi-pathway approach to realizing a carbon-neutral society. |

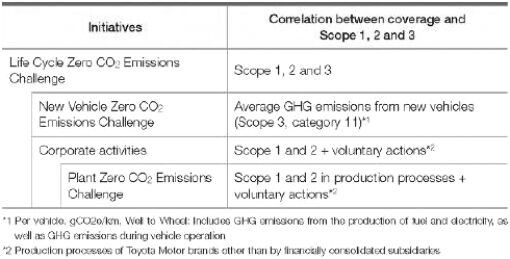

| • | 1.5ºC scenario (IEA *1 NZE*2 , APS*3 scenario, etc.) |

| • | 4ºC scenario (SSP5-8.5) |

| *1 | International Energy Agency |

| *2 | Net Zero Emissions by 2050 Scenario |

| *3 | Announced Pledges Scenario |

Period |

Reasons for adoption |

|||

| Long term | By 2050 | Target year for Toyota Environmental Challenge 2050 |

||

| Medium term | By 2030 | 2030 Milestone, in line with SBTi criteria *4

|

||

| Short term | Between now and 2025 | 7th Toyota Environmental Action Plan | ||

| *4 | Refers to Scope 1 and 2 emissions reduction targets being in line with the science-based criteria established by SBTi to limit the global average temperature increase to 1.5 degrees Celsius above pre-industrial levels, as well as Scope 3 Category 11 emissions (gCO2e/km) reduction targets also being in line with the science-based criteria to hold the increase in the global average temperature to well below 2 degrees Celsius above pre-industrial levels. |

| • | Long-term strategy (2050 Target): Toyota Environmental Challenge 2050 |

| • | Medium-term strategy (2030 Target): 2030 Milestone, in line with SBTi criteria |

| • | Short-term strategy (2025 Target): 7th Toyota Environmental Action Plan |

| *3 | Scope 1 and 2 emissions reduction targets are in line with the science-based criteria established by SBTi to limit the global average temperature increase to 1.5 degrees Celsius above pre-industrial levels. Scope 3 Category 11 emissions (gCO2e/km) reduction targets are in line with the science-based criteria to hold the increase in the global average temperature to well below 2 degrees Celsius above pre-industrial levels. |

Basic research |

Phase to discover development theme Research on basic vehicle-related technology |

|

Forward-looking and leading-edge technology development |

Phase requiring technological breakthroughs such as components and systems Development of leading-edge components and systems that are more advanced than those of competitors |

|

Product development |

Phase mainly for development of new models Development of

all-new models and existing-model upgrades |

| • | further improvements in hybrid technologies, including in functions and cost, and contributions to the environment through advancements; |

| • | improvement in internal combustion engine fuel economy technology as well as improvement in technology in connection with more stringent emission standards; |

| • | development of BEVs, FCEVs and other alternative fuel vehicles; |

| • | development of advanced safety technology designed to promote driving and vehicle safety; |

| • | development of automated driving technologies; |

| • | connected car technologies; and |

| • | development of technology to bring about more comfortable movement. |

Description of Activity |

Total Cost (Yen in billions) |

Location |

Primary Method of Financing |

|||||

Japan |

||||||||

Investment primarily in technology and products by Toyota Motor Corporation |

|

1,334.6 |

|

Japan |

Internal funds, financing from issuance of bonds, etc. |

|||

Investment primarily in technology and products by Prime Planet Energy & Solutions, Inc. |

88.7 | Japan | Internal funds | |||||

Investment primarily in technology and products by Toyota Auto Body Co., Ltd. |

84.6 | Japan | Internal funds | |||||

Investment primarily in technology and products by Toyota Motor Kyushu, Inc. |

78.6 | Japan | Internal funds | |||||

Investment primarily in technology and products by Primearth EV Energy Co., Ltd. |

69.0 | Japan | Internal funds | |||||

Investment primarily in technology and products by Hino Motors, Ltd. |

65.4 | Japan | Internal funds | |||||

Outside of Japan |

||||||||

Investment primarily to promote localization by Toyota Battery Manufacturing, Inc. |

307.9 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing de Guanajuato, S.A. de C.V. |

196.0 | Mexico | Internal funds | |||||

Description of Activity |

Total Cost (Yen in billions) |

Location |

Primary Method of Financing |

|||||

Investment primarily to promote localization by Toyota Motor Manufacturing Canada, Inc. |

168.4 | Canada | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing, Indiana, Inc. |

168.3 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing, Kentucky, Inc. |

156.0 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Manufacturing Texas, Inc. |

138.1 | United States | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Thailand Co., Ltd. |

87.4 | Thailand | Internal funds | |||||

Investment primarily to promote localization by Toyota Motor Europe NV/SA |

66.3 | Belgium | Internal funds | |||||

Investment primarily in leased automobiles by Toyota Motor Credit Corporation |

|

5,236.0 |

|

United States |

Internal funds, financing from issuance of bonds, etc. |

|||

Description of Activity |

Total Cost (Yen in billions) |

Location |

Primary Method of Financing |

|||||

Japan |

||||||||

Investment primarily in manufacturing facilities by Toyota Motor Corporation |

630.0 | Japan | Internal funds | |||||

Investment primarily in manufacturing facilities by Prime Planet Energy & Solutions, Inc. |

87.6 | Japan | Capital increase | |||||

Outside of Japan |

||||||||

Investment primarily in manufacturing facilities by Toyota Battery Manufacturing, Inc. |

467.5 | United States | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Technical Center (China) Co., Ltd. |

87.8 | China | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Europe NV/SA. |

86.4 | Belgium | Internal funds | |||||

Investment primarily in manufacturing facilities by Toyota Motor Manufacturing, Kentucky, Inc. |

82.3 | United States | Internal funds | |||||

Name of Subsidiary |

Country of Incorporation |

Percentage Ownership Interest |

Percentage Voting Interest |

|||||||||

| % | % | |||||||||||

Toyota Financial Services Corporation |

Japan | 100.00 | 100.00 | |||||||||

Hino Motors, Ltd. |

Japan | 50.11 | 50.19 | |||||||||

Daihatsu Motor Co., Ltd. |

Japan | 100.00 | 100.00 | |||||||||

TOYOTA Mobility Tokyo Inc. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Finance Corporation |

Japan | 100.00 | 100.00 | |||||||||

Toyota Mobility Parts Co., Ltd. |

Japan | 54.08 | 54.08 | |||||||||

Toyota Auto Body Co., Ltd. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Motor Kyushu, Inc. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Motor East Japan, Inc. |

Japan | 100.00 | 100.00 | |||||||||

Toyota Motor Engineering & Manufacturing North America, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Kentucky, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor North America, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Credit Corporation |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Indiana, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing, Texas, Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Sales, U.S.A., Inc. |

United States | 100.00 | 100.00 | |||||||||

Toyota Financial Savings Bank |

United States | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Canada Inc. |

Canada | 100.00 | 100.00 | |||||||||

Toyota Credit Canada Inc. |

Canada | 100.00 | 100.00 | |||||||||

Toyota Canada Inc. |

Canada | 51.00 | 51.00 | |||||||||

Toyota Motor Manufacturing de Baja California, S. de R.L. de C.V. |

Mexico | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing de Guanajuato, S.A.de C.V. |

Mexico | 100.00 | 100.00 | |||||||||

Toyota Motor Europe NV/SA |

Belgium | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing France S.A.S. |

France | 100.00 | 100.00 | |||||||||

Toyota Motor Italia S.p.A. |

Italy | 100.00 | 100.00 | |||||||||

Toyota France S.A.S. |

France | 100.00 | 100.00 | |||||||||

Toyota Motor Finance (Netherlands) B.V. |

Netherlands | 100.00 | 100.00 | |||||||||

Toyota Central Europe Sp. z o.o. |

Poland | 100.00 | 100.00 | |||||||||

Name of Subsidiary |

Country of Incorporation |

Percentage Ownership Interest |

Percentage Voting Interest |

|||||||||

Toyota Motor Manufacturing (UK) Ltd. |

United Kingdom | 100.00 | 100.00 | |||||||||

Toyota Financial Services (UK) PLC |

United Kingdom | 100.00 | 100.00 | |||||||||

Toyota (GB) PLC |

United Kingdom | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Czech Republic, s.r.o. |

Czech Republic | 100.00 | 100.00 | |||||||||

Toyota Motor Manufacturing Turkey Inc. |

Turkey | 90.00 | 90.00 | |||||||||

Guangqi Toyota Engine Co., Ltd. |

China | 70.00 | 70.00 | |||||||||

Toyota Motor (China) Investment Co., Ltd. |

China | 100.00 | 100.00 | |||||||||

Toyota Motor Finance (China) Co., Ltd. |

China | 100.00 | 100.00 | |||||||||

Toyota Kirloskar Motor Private Ltd. |

India | 89.00 | 89.00 | |||||||||

P.T. Astra Daihatsu Motor |

Indonesia | 61.75 | 61.75 | |||||||||

PT. Toyota Motor Manufacturing Indonesia |

Indonesia | 95.00 | 95.00 | |||||||||

Toyota Motor Asia Pacific Pte Ltd.* 1

|

Singapore | 100.00 | 100.00 | |||||||||

Toyota Leasing (Thailand) Co., Ltd. |

Thailand | 87.44 | 87.44 | |||||||||

Toyota Motor Thailand Co., Ltd. |

Thailand | 86.43 | 86.43 | |||||||||

Toyota Daihatsu Engineering & Manufacturing Co., Ltd.* 2

|

Thailand | 100.00 | 100.00 | |||||||||

Toyota Motor Corporation Australia Ltd. |

Australia | 100.00 | 100.00 | |||||||||

Toyota Finance Australia Ltd. |

Australia | 100.00 | 100.00 | |||||||||

Toyota Argentina S.A. |

Argentina | 100.00 | 100.00 | |||||||||

Toyota do Brasil Ltda. |

Brazil | 100.00 | 100.00 | |||||||||

Toyota South Africa Motors (Pty) Ltd. |

South Africa | 100.00 | 100.00 | |||||||||

| *1 | Toyota Motor Asia Pacific Pte Ltd. was renamed Toyota Motor Asia (Singapore) Pte Ltd. on June 4, 2024. |

| *2 | Toyota Daihatsu Engineering & Manufacturing Co., Ltd. was renamed Toyota Motor Asia (Thailand) Co., Ltd. on June 4, 2024. |

Facility or Subsidiary Name |

Location |

Land Area (thousands of square meters) |

Number of Employees |

Principal Products or Functions |

||||||||

Japan (Toyota Motor Corporation) |

||||||||||||

Toyota Technical Center Shimoyama |

Toyota City, Aichi Pref. | 5,573 | 1,648 | Research and Development | ||||||||

Tahara Plant |

Tahara City, Aichi Pref. | 4,032 | 6,419 | Automobiles | ||||||||

Toyota Head Office and Technical Center |

Toyota City, Aichi Pref. | 2,733 | 22,393 | Research and Development | ||||||||

Higashi-Fuji Technical Center |

Susono City, Shizuoka Pref. | 2,719 | 2,407 | Research and Development | ||||||||

Motomachi Plant |

Toyota City, Aichi Pref. | 1,575 | 7,908 | Automobiles | ||||||||

Facility or Subsidiary Name |

Location |

Land Area (thousands of square meters) |

Number of Employees |

Principal Products or Functions |

||||||||

Takaoka Plant |

Toyota City, Aichi Pref. | 1,315 | 4,173 | Automobiles | ||||||||

Tsutsumi Plant |

Toyota City, Aichi Pref. | 1,004 | 4,776 | Automobiles | ||||||||

Kamigo Plant |

Toyota City, Aichi Pref. | 895 | 3,383 | Automobile parts | ||||||||

Kinu-ura Plant |

Hekinan City, Aichi Pref. | 808 | 2,709 | Automobile parts | ||||||||

Honsha Plant |

Toyota City, Aichi Pref. | 623 | 1,810 | Automobile parts | ||||||||

Japan (Subsidiaries) |

||||||||||||

Daihatsu Motor Co., Ltd. |

Ikeda City, Osaka, etc. | 7,739 | 10,842 | Automobiles | ||||||||

Hino Motors, Ltd. |

Hino City, Tokyo, etc. | 5,952 | 12,175 | Automobiles | ||||||||

Toyota Auto Body Co., Ltd. |

Kariya City, Aichi Pref., etc. | 2,141 | 11,581 | Automobiles | ||||||||

TOYOTA Mobility Tokyo Inc. |

Minato-ku, Tokyo, etc. |

398 | 6,577 | Sales facilities | ||||||||

Prime Planet Energy & Solutions, Inc. |

Chuo-ku, Tokyo, etc. |

192 | 3,733 | Automobiles | ||||||||

Outside Japan (Subsidiaries) |

||||||||||||

Toyota Motor Manufacturing, Texas, Inc. |

Texas, U.S.A. | 8,094 | 2,937 | Automobiles | ||||||||

Toyota Motor Manufacturing, de Guanajuato, S.A. de C.V. |

Guanajuato, Mexico | 6,091 | 2,810 | Automobiles | ||||||||

Toyota Motor Manufacturing, Kentucky, Inc. |

Kentucky, U.S.A. | 5,161 | 9,750 | Automobiles | ||||||||

Toyota Motor Manufacturing Canada, Inc. |

Ontario, Canada | 4,752 | 8,025 | Automobiles | ||||||||

Toyota Motor Manufacturing, Indiana, Inc. |

Indiana, U.S.A. | 4,359 | 6,392 | Automobiles | ||||||||

Thousands of units |

||||||||||||

Year Ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Japan |

1,924 | 2,069 | 1,993 | |||||||||

North America |

2,394 | 2,407 | 2,816 | |||||||||

Europe |

1,017 | 1,030 | 1,192 | |||||||||

Asia |

1,543 | 1,751 | 1,804 | |||||||||

Other* |

1,352 | 1,565 | 1,638 | |||||||||

Overseas total |

6,306 | 6,753 | 7,450 | |||||||||

Total |

8,230 | 8,822 | 9,443 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East, etc. |

| • | vehicle unit sales volumes, |

| • | the mix of vehicle models and options sold, |

| • | the level of parts and service sales, |

| • | the levels of price discounts and other sales incentives and marketing costs, |

| • | the cost of customer warranty claims and other customer satisfaction actions, |

| • | the cost of research and development and other fixed costs, |

| • | the prices of raw materials, |

| • | the ability to control costs, |

| • | the efficient use of production capacity, |

| • | the adverse effect on production due to such factors as the reliance on various suppliers for the provision of supplies, or the general scarcity of certain supplies, |

| • | climate change risk, including both physical risks as well as transition risks, |

| • | the adverse effect on market, sales and productions of natural calamities as well as the outbreak and spread of epidemics and interruptions of social infrastructure, and |

| • | changes in the value of the Japanese yen and other currencies in which Toyota conducts business. |

Yen in millions |

||||||||||||

Year ended March 31, |

||||||||||||

2022 |

2023 |

2024 |

||||||||||

Japan |

8,214,740 | 9,122,282 | 10,193,556 | |||||||||

North America |

10,897,946 | 13,509,027 | 17,624,268 | |||||||||

Europe |

3,692,214 | 4,097,537 | 5,503,738 | |||||||||

Asia |

5,778,115 | 7,076,922 | 7,604,269 | |||||||||

Other* |

2,796,493 | 3,348,530 | 4,169,494 | |||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Japan |

17,583,196 | 21,020,721 | 3,437,525 | 19.6 | % | |||||||||||

North America |

13,843,901 | 17,943,072 | 4,099,172 | 29.6 | ||||||||||||

Europe |

4,273,735 | 5,681,764 | 1,408,028 | 32.9 | ||||||||||||

Asia |

8,044,906 | 8,730,749 | 685,843 | 8.5 | ||||||||||||

Other* |

3,472,193 | 4,389,785 | 917,592 | 26.4 | ||||||||||||

Intersegment elimination/unallocated amount |

(10,063,633 | ) | (12,670,767 | ) | (2,607,133 | ) | — | |||||||||

Total |

37,154,298 | 45,095,325 | 7,941,027 | 21.4 | % | |||||||||||

Operating income (loss): |

||||||||||||||||

Japan |

1,901,463 | 3,484,270 | 1,582,808 | 83.2 | ||||||||||||

North America |

(74,736 | ) | 506,319 | 581,056 | — | |||||||||||

Europe |

57,460 | 388,096 | 330,636 | 575.4 | ||||||||||||

Asia |

714,451 | 865,591 | 151,140 | 21.2 | ||||||||||||

Other* |

231,362 | 198,345 | (33,017 | ) | (14.3 | ) | ||||||||||

Intersegment elimination/unallocated amount |

(104,974 | ) | (89,687 | ) | 15,286 | — | ||||||||||

Total |

2,725,025 | 5,352,934 | 2,627,909 | 96.4 | % | |||||||||||

Operating margin |

7.3 | % | 11.9 | % | 4.6 | % | ||||||||||

Income before income taxes |

3,668,733 | 6,965,085 | 3,296,352 | 89.8 | ||||||||||||

Net margin from income before income taxes |

9.9 | % | 15.4 | % | 5.5 | % | ||||||||||

Net income attributable to Toyota Motor Corporation |

2,451,318 | 4,944,933 | 2,493,615 | 101.7 | ||||||||||||

Net margin attributable to Toyota Motor Corporation |

6.6 | % | 11.0 | % | 4.4 | % | ||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Vehicles |

28,394,256 | 35,249,865 | 6,855,609 | 24.1 | % | |||||||||||

Parts and components for production |

1,710,422 | 1,596,111 | (114,311 | ) | (6.7 | ) | ||||||||||

Parts and components for after service |

2,866,196 | 3,166,586 | 300,390 | 10.5 | ||||||||||||

Other |

805,995 | 1,068,169 | 262,174 | 32.5 | ||||||||||||

Total Automotive |

33,776,870 | 41,080,731 | 7,303,861 | 21.6 | ||||||||||||

All Other |

590,749 | 567,399 | (23,350 | ) | (4.0 | ) | ||||||||||

Total sales of products |

34,367,619 | 41,648,130 | 7,280,511 | 21.2 | ||||||||||||

Financial services |

2,786,679 | 3,447,195 | 660,516 | 23.7 | ||||||||||||

Total sales revenues |

37,154,298 | 45,095,325 | 7,941,027 | 21.4 | % | |||||||||||

Number of financing contracts in thousands |

||||||||||||||||

As of March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Japan |

2,767 | 2,781 | 14 | 0.5 | % | |||||||||||

North America |

5,500 | 5,589 | 89 | 1.6 | ||||||||||||

Europe |

1,647 | 1,784 | 137 | 8.3 | ||||||||||||

Asia |

2,034 | 2,133 | 99 | 4.9 | ||||||||||||

Other* |

938 | 981 | 43 | 4.6 | ||||||||||||

Total |

12,886 | 13,268 | 382 | 3.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales* |

3,703 | 4,014 | 311 | 8.4 | % | |||||||||||

|

* including number of exported vehicle unit sales |

||||||||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

17,271,451 | 20,679,979 | 3,408,528 | 19.7 | % | |||||||||||

Financial services |

311,744 | 340,742 | 28,998 | 9.3 | ||||||||||||

Total |

17,583,196 | 21,020,721 | 3,437,525 | 19.6 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

2,407 | 2,816 | 409 | 17.0 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

11,965,050 | 15,705,804 | 3,740,754 | 31.3 | % | |||||||||||

Financial services |

1,878,850 | 2,237,268 | 358,418 | 19.1 | ||||||||||||

Total |

13,843,901 | 17,943,072 | 4,099,171 | 29.6 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,030 | 1,192 | 162 | 15.7 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

4,003,043 | 5,255,395 | 1,252,352 | 31.3 | % | |||||||||||

Financial services |

270,693 | 426,369 | 155,676 | 57.5 | ||||||||||||

Total |

4,273,735 | 5,681,764 | 1,408,028 | 32.9 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,751 | 1,804 | 53 | 3.0 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

7,832,020 | 8,485,219 | 653,199 | 8.3 | % | |||||||||||

Financial services |

212,886 | 245,529 | 32,643 | 15.3 | ||||||||||||

Total |

8,044,906 | 8,730,749 | 685,843 | 8.5 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,565 | 1,638 | 73 | 4.6 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

3,225,962 | 4,037,260 | 811,298 | 25.1 | % | |||||||||||

Financial services |

246,232 | 352,525 | 106,293 | 43.2 | ||||||||||||

Total |

3,472,193 | 4,389,785 | 917,592 | 26.4 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Operating costs and expenses |

||||||||||||||||

Cost of products sold |

29,128,561 | 33,600,612 | 4,472,051 | 15.4 | % | |||||||||||

Cost of financing services |

1,712,721 | 2,126,395 | 413,674 | 24.2 | ||||||||||||

Selling, general and administrative |

3,587,990 | 4,015,383 | 427,393 | 11.9 | ||||||||||||

Total |

34,429,273 | 39,742,390 | 5,313,117 | 15.4 | % | |||||||||||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating costs and expenses: |

||||

Effect of changes in vehicle unit sales and sales mix |

3,880,000 | |||

Effect of changes in exchange rates |

635,000 | |||

Effect of increase of cost of financial services |

270,000 | |||

Effect of cost reduction efforts |

(120,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

380,000 | |||

Other |

268,117 | |||

Total |

5,313,117 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

2,000,000 | |||

Effect of cost reduction efforts |

120,000 | |||

Effect of changes in exchange rates |

685,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(380,000 | ) | ||

Other |

202,909 | |||

Total |

2,627,909 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

1,130,000 | |||

Effect of cost reduction efforts |

(110,000 | ) | ||

Effect of changes in exchange rates |

625,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(140,000 | ) | ||

Other |

77,808 | |||

Total |

1,582,808 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

455,000 | |||

Effect of cost reduction efforts |

125,000 | |||

Effect of changes in exchange rates |

60,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(190,000 | ) | ||

Other |

131,056 | |||

Total |

581,056 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

180,000 | |||

Effect of cost reduction efforts |

75,000 | |||

Effect of changes in exchange rates |

(5,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

10,000 | |||

Other |

70,636 | |||

Total |

330,636 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

115,000 | |||

Effect of cost reduction efforts |

35,000 | |||

Effect of changes in exchange rates |

(35,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

5,000 | |||

Other |

31,140 | |||

Total |

151,140 | |||

Yen in millions |

||||

2024 v. 2023 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

125,000 | |||

Effect of cost reduction efforts |

(5,000 | ) | ||

Effect of changes in exchange rates |

40,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(80,000 | ) | ||

Other |

(113,017 | ) | ||

Total |

(33,017 | ) | ||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2024 v. 2023 Change |

|||||||||||||||

2023 |

2024 |

Amount |

Percentage |

|||||||||||||

Automotive: |

||||||||||||||||

Sales revenues |

33,820,000 | 41,266,204 | 7,446,204 | 22.0 | % | |||||||||||

Operating income |

2,180,637 | 4,621,475 | 2,440,838 | 111.9 | ||||||||||||

Financial Services: |

||||||||||||||||

Sales revenues |

2,809,647 | 3,484,198 | 674,551 | 24.0 | ||||||||||||

Operating income |

437,516 | 570,023 | 132,507 | 30.3 | ||||||||||||

All Other: |

||||||||||||||||

Sales revenues |

1,224,943 | 1,368,164 | 143,221 | 11.7 | ||||||||||||

Operating income |

103,451 | 175,241 | 71,789 | 69.4 | ||||||||||||

Intersegment elimination/unallocated amount: |

||||||||||||||||

Sales revenues |

(700,293 | ) | (1,023,242 | ) | (322,949 | ) | — | |||||||||

Operating income |

3,420 | (13,805 | ) | (17,226 | ) | — | ||||||||||

Total |

||||||||||||||||

Sales revenues |

37,154,298 | 45,095,325 | 7,941,027 | 21.4 | % | |||||||||||

Operating income |

2,725,025 | 5,352,934 | 2,627,909 | 96.4 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Japan |

15,991,436 | 17,583,196 | 1,591,760 | 10.0 | % | |||||||||||

North America |

11,166,479 | 13,843,901 | 2,677,421 | 24.0 | ||||||||||||

Europe |

3,867,847 | 4,273,735 | 405,888 | 10.5 | ||||||||||||

Asia |

6,530,566 | 8,044,906 | 1,514,340 | 23.2 | ||||||||||||

Other* |

2,928,183 | 3,472,193 | 544,011 | 18.6 | ||||||||||||

Intersegment elimination/unallocated amount |

(9,105,004 | ) | (10,063,633 | ) | (958,629 | ) | — | |||||||||

Total |

31,379,507 | 37,154,298 | 5,774,791 | 18.4 | % | |||||||||||

Operating income (loss): |

||||||||||||||||

Japan |

1,423,445 | 1,901,463 | 478,018 | 33.6 | ||||||||||||

North America |

565,784 | (74,736 | ) | (640,520 | ) | — | ||||||||||

Europe |

162,973 | 57,460 | (105,513 | ) | (64.7 | ) | ||||||||||

Asia |

672,350 | 714,451 | 42,101 | 6.3 | ||||||||||||

Other* |

238,169 | 231,362 | (6,807 | ) | (2.9 | ) | ||||||||||

Intersegment elimination/unallocated amount |

(67,024 | ) | (104,974 | ) | (37,950 | ) | — | |||||||||

Total |

2,995,697 | 2,725,025 | (270,672 | ) | (9.0 | )% | ||||||||||

Operating margin |

9.5 | % | 7.3 | % | (2.2 | )% | ||||||||||

Income before income taxes |

3,990,532 | 3,668,733 | (321,799 | ) | (8.1 | ) | ||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Net margin from income before income taxes |

12.7 | % | 9.9 | % | (2.8 | )% | ||||||||||

Net income attributable to Toyota Motor Corporation |

2,850,110 | 2,451,318 | (398,792 | ) | (14.0 | ) | ||||||||||

Net margin attributable to Toyota Motor Corporation |

9.1 | % | 6.6 | % | (2.5 | )% | ||||||||||

| * | “Other” consists of Central and South America, Oceania, Africa and the Middle East. |

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Vehicles |

23,739,442 | 28,394,256 | 4,654,814 | 19.6 | % | |||||||||||

Parts and components for production |

1,504,215 | 1,710,422 | 206,208 | 13.7 | ||||||||||||

Parts and components for after service |

2,407,143 | 2,866,196 | 459,053 | 19.1 | ||||||||||||

Other |

881,193 | 805,995 | (75,198 | ) | (8.5 | ) | ||||||||||

Total Automotive |

28,531,993 | 33,776,870 | 5,244,877 | 18.4 | ||||||||||||

All Other |

541,436 | 590,749 | 49,314 | 9.1 | ||||||||||||

Total sales of products |

29,073,428 | 34,367,619 | 5,294,191 | 18.2 | ||||||||||||

Financial services |

2,306,079 | 2,786,679 | 480,600 | 20.8 | ||||||||||||

Total sales revenues |

31,379,507 | 37,154,298 | 5,774,791 | 18.4 | % | |||||||||||

Number of financing contracts in thousands |

||||||||||||||||

As of March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Japan |

2,745 | 2,767 | 22 | 0.8 | % | |||||||||||

North America |

5,549 | 5,500 | (49 | ) | (0.9 | ) | ||||||||||

Europe |

1,507 | 1,647 | 140 | 9.3 | ||||||||||||

Asia |

2,070 | 2,034 | (36 | ) | (1.7 | ) | ||||||||||

Other* |

895 | 938 | 43 | 4.8 | ||||||||||||

Total |

12,766 | 12,886 | 120 | 0.9 | % | |||||||||||

| * | “Other” consists of Central and South America, Oceania and Africa. |

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales* |

3,640 | 3,703 | 62 | 1.7 | % | |||||||||||

|

* including number of exported vehicle unit sales |

||||||||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

15,706,514 | 17,271,451 | 1,564,938 | 10.0 | % | |||||||||||

Financial services |

284,922 | 311,744 | 26,822 | 9.4 | ||||||||||||

Total |

15,991,436 | 17,583,196 | 1,591,760 | 10.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

2,394 | 2,407 | 13 | 0.5 | % | |||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

9,578,534 | 11,965,050 | 2,386,516 | 24.9 | % | |||||||||||

Financial services |

1,587,945 | 1,878,850 | 290,905 | 18.3 | ||||||||||||

Total |

11,166,479 | 13,843,901 | 2,677,421 | 24.0 | % | |||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,017 |

1,030 |

13 |

1.3 |

% |

|||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

3,671,205 |

4,003,043 |

331,838 |

9.0 |

% |

|||||||||||

Financial services |

196,642 |

270,693 |

74,050 |

37.7 |

||||||||||||

Total |

3,867,847 |

4,273,735 |

405,888 |

10.5 |

% |

|||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,543 |

1,751 |

208 |

13.5 |

% |

|||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

6,345,172 |

7,832,020 |

1,486,848 |

23.4 |

% |

|||||||||||

Financial services |

185,394 |

212,886 |

27,492 |

14.8 |

||||||||||||

Total |

6,530,566 |

8,044,906 |

1,514,340 |

23.2 |

% |

|||||||||||

Thousands of units |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Toyota’s consolidated vehicle unit sales |

1,352 |

1,565 |

213 |

15.8 |

% |

|||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Sales revenues: |

||||||||||||||||

Sales of products |

2,756,840 |

3,225,962 |

469,122 |

17.0 |

% |

|||||||||||

Financial services |

171,343 |

246,232 |

74,889 |

43.7 |

||||||||||||

Total |

2,928,183 |

3,472,193 |

544,011 |

18.6 |

% |

|||||||||||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Operating costs and expenses |

||||||||||||||||

Cost of products sold |

24,250,784 | 29,128,561 | 4,877,778 | 20.1 | % | |||||||||||

Cost of financing services |

1,157,050 | 1,712,721 | 555,671 | 48.0 | ||||||||||||

Selling, general and administrative |

2,975,977 | 3,587,990 | 612,014 | 20.6 | ||||||||||||

Total |

28,383,811 | 34,429,273 | 6,045,462 | 21.3 | % | |||||||||||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating costs and expenses: |

||||

Effect of changes in vehicle unit sales and sales mix |

1,110,000 | |||

Effect of changes in exchange rates |

2,300,000 | |||

Effect of increase of cost of financial services |

320,000 | |||

Effect of cost reduction efforts |

1,290,000 | |||

Increase or decrease in expenses and expense reduction efforts |

525,000 | |||

Other |

500,462 | |||

Total |

6,045,462 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

680,000 | |||

Effect of cost reduction efforts |

(1,290,000 | ) | ||

Effect of changes in exchange rates |

1,280,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(525,000 | ) | ||

Other |

(415,672 | ) | ||

Total |

(270,672 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

365,000 | |||

Effect of cost reduction efforts |

(690,000 | ) | ||

Effect of changes in exchange rates |

1,210,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(320,000 | ) | ||

Other |

(86,982 | ) | ||

Total |

478,018 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

90,000 | |||

Effect of cost reduction efforts |

(395,000 | ) | ||

Effect of changes in exchange rates |

(15,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

(135,000 | ) | ||

Other |

(185,520 | ) | ||

Total |

(640,520 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

130,000 | |||

Effect of cost reduction efforts |

(120,000 | ) | ||

Effect of changes in exchange rates |

(15,000 | ) | ||

Increase or decrease in expenses and expense reduction efforts |

(25,000 | ) | ||

Other |

(75,513 | ) | ||

Total |

(105,513 | ) | ||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

75,000 | |||

Effect of cost reduction efforts |

(25,000 | ) | ||

Effect of changes in exchange rates |

90,000 | |||

Increase or decrease in expenses and expense reduction efforts |

(45,000 | ) | ||

Other |

(52,899 | ) | ||

Total |

42,101 | |||

Yen in millions |

||||

2023 v. 2022 Change |

||||

Changes in operating income and loss: |

||||

Effect of marketing efforts |

60,000 | |||

Effect of cost reduction efforts |

(60,000 | ) | ||

Effect of changes in exchange rates |

10,000 | |||

Increase or decrease in expenses and expense reduction efforts |

0 | |||

Other |

(16,807 | ) | ||

Total |

(6,807 | ) | ||

Yen in millions |

||||||||||||||||

Year ended March 31, |

2023 v. 2022 Change |

|||||||||||||||

2022 |

2023 |

Amount |

Percentage |

|||||||||||||

Automotive: |

||||||||||||||||

Sales revenues |

28,605,738 | 33,820,000 | 5,214,263 | 18.2% | ||||||||||||

Operating income |

2,284,290 | 2,180,637 | (103,653 | ) | (4.5) | |||||||||||

Financial Services: |

||||||||||||||||

Sales revenues |

2,324,026 | 2,809,647 | 485,621 | 20.9 | ||||||||||||

Operating income |

657,001 | 437,516 | (219,485 | ) | (33.4) | |||||||||||

All Other: |

||||||||||||||||

Sales revenues |

1,129,876 | 1,224,943 | 95,067 | 8.4 | ||||||||||||

Operating income |

42,302 | 103,451 | 61,150 | 144.6 | ||||||||||||

Intersegment elimination/unallocated amount: |

||||||||||||||||

Sales revenues |

(680,133 | ) | (700,293 | ) | (20,160 | ) | — | |||||||||

Operating income |

12,104 | 3,420 | (8,684 | ) | — | |||||||||||

Total |

||||||||||||||||

Sales revenues |

31,379,507 | 37,154,298 | 5,774,791 | 18.4% | ||||||||||||

Operating income |

2,995,697 | 2,725,025 | (270,672 | ) | (9.0)% | |||||||||||

S&P |

Moody’s |

R&I |

||||

Short-term borrowing |

A-1+ |

P-1 |

— | |||

Long-term debt |

A+ | A1 | AAA |

Yen in millions |

||||||||||||||||||||

Payments Due by Period |

||||||||||||||||||||

Total |

Less than 1 year |

1 to 3 years |

3 to 5 years |

5 years and after |

||||||||||||||||

Contractual Obligations: |

||||||||||||||||||||

Short-term debt |

5,487,959 | 5,487,959 | — | — | — | |||||||||||||||

Long-term debt |

31,073,820 | 9,918,326 | 12,033,292 | 6,449,064 | 2,673,138 | |||||||||||||||

Commitments for the purchase of property, plant, other assets and services (note 30) |

4,712,085 | 474,929 | 476,834 | 986,110 | 2,774,212 | |||||||||||||||

Total |

41,273,864 | 15,881,214 | 12,510,126 | 7,435,174 | 5,447,350 | |||||||||||||||

Commercial Commitments (note 30): |

||||||||||||||||||||

Maximum potential exposure to guarantees given in the ordinary course of business |

3,310,989 | 881,967 | 1,470,118 | 834,481 | 124,423 | |||||||||||||||

Total |

3,310,989 | 881,967 | 1,470,118 | 834,481 | 124,423 | |||||||||||||||

| * | “Long-term debt” represents future principal payments. |

Facility |

Principal Activity |

|

Japan |

||

Toyota Technical Center |

Product planning, style, design, prototype production and vehicle evaluation | |

Toyota Technical Center Shimoyama |

Product planning, style, design and vehicle evaluation | |

Higashi-Fuji Technical Center |

Advanced development | |

Tokyo Design Research & Laboratory |

Advanced styling designs | |

Woven by Toyota, Inc. |

Development of artificial intelligence technology with a focus on automated driving technology Development of Woven City and software platform technologies |

|

Otemachi Office |

Development of key IT technologies, creation of new values by utilizing big data and collaboration with venture companies | |

Shibetsu Proving Ground |

Evaluation | |

Toyota Central R&D Labs., Inc. |

Basic research | |

United States |

||

Toyota Motor Engineering and Manufacturing North America, Inc. |

Product planning, design and evaluation of vehicles manufactured in North America | |

Calty Design Research, Inc. |

Design | |

Toyota Research Institute of North America (TRI-NA)

|

Advanced research relating to “energy and environment,” “safety” and “mobility infrastructure” | |

Toyota Research Institute, Inc. |

Research and development of artificial intelligence technology | |

Woven by Toyota, U.S., Inc. |

Development of automated driving technology and software | |

Europe |

||

Toyota Motor Europe NV/SA |

Planning and evaluation of vehicles manufactured in Europe | |

Facility |

Principal Activity |

|

Toyota Europe Design Development S.A.R.L. |

Design |

|

TOYOTA GAZOO Racing Europe GmbH |

Development of motor sports vehicles |

|

Woven by Toyota, U.K., Ltd. |

Development of automated driving technology and software platform technology | |

Asia Pacific |

||

Toyota Motor Asia (Thailand) Co., Ltd.* |

Planning and evaluation of vehicles manufactured in Australia and Asia | |

* Toyota Daihatsu Engineering & Manufacturing Co., Ltd. was renamed Toyota Motor Asia (Thailand) Co., Ltd. on June 4, 2024. |

||

China |

||

Intelligent Electro Mobility R&D Center by TOYOTA (China) Co., Ltd. |

Environmental technology design and evaluation in China | |

FAW Toyota Research & Development Co., Ltd. |

Design, evaluation and certification of vehicles manufactured in China | |

GAC Toyota Motor Co., Ltd. R&D Center |

Design, evaluation and certification of vehicles manufactured in China | |

BYD Toyota EV Technology Co., Ltd. |

Design and evaluation of BEVs |

|

Toyota Motor Technical Research and Service (Shanghai) Co., Ltd. |

Research of new technology, construction and system of automobiles | |

United Fuel Cell System R&D (Beijing) Co., Ltd. |

Development of FC system for commercial vehicles in China |

|

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

|

Akio Toyoda

(May 3, 1956)

|

Chairman of the Board of Directors |

1984 Joined TMC

2000 Member of the Board of Directors of TMC

2002 Managing Director of TMC

2003 Senior Managing Director of TMC

2005 Executive Vice President of TMC

2009 President of TMC

2023 Chairman of TMC (to present)

(important concurrent duties)

Chairman of TOYOTA FUDOSAN CO., LTD.

Director of DENSO Corporation

Representative Director of ROOKIE Racing, Inc.

Chairman of TOYOTA GAZOO Racing World Rally Team

|

23,466 | |||||

| Shigeru Hayakawa (September 15, 1953) | Vice Chairman of the Board of Directors |

1977 Joined Toyota Motor Sales Co., Ltd.

2007 Managing Officer of TMC

2007 Toyota Motor North America, Inc. President

2012 Senior Managing Officer of TMC

2015 Member of the Board of Directors and Senior Managing Officer of TMC

2017 Vice Chairman of TMC (to present)

(important concurrent duties)

Representative Director of Institute for International Economic Studies

|

331 | |||||

|

Koji Sato

(October 19, 1969)

|

President,

Member of the Board of Directors

|

1992 Joined TMC

2017 Executive General Manager of TMC

2020 Operating Officer of TMC

2021 Operating Officer of TMC (current system)

2023 Operating Officer and President of TMC

President of TMC (to present) (important concurrent duties)

Chairman of TOYOTA GAZOO Racing Europe GmbH

Chairman and CEO of Toyota Motor North America, Inc.

|

56 | |||||

|

Hiroki Nakajima

(April 10, 1962)

|

Member of the Board of Directors, Operating Officer, Vice President |

1987 Joined TMC

2014 Executive General Manager of TMC

2015 Managing Officer of TMC

2020 Operating Officer of TMC

2023 Operating Officer and Executive Vice President of TMC (current system)

Member of the Board of Directors, Operating Officer, Vice President of TMC (to present)

(important concurrent duties)

President of Commercial Japan Partnership Technologies Corporation

|

20 | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

|

Yoichi Miyazaki (October 19, 1963) |

Member of the Board of Directors, Operating Officer, Vice President |

1986 Joined TMC 2015 Managing Officer of TMC 2019 Operating Officer of TMC 2022 Operating Officer of TMC (current system) 2023 Operating Officer and Executive Vice President of TMC Member of the Board of Directors, Operating Officer, Vice President of TMC (to present) |

44 | |||||

|

Simon Humphries (March 30, 1967) |

Member of the Board of Directors, Operating Officer |

1988 Joined DCA Design in UK. 1994 Joined TMC 2016 President of Toyota Europe Design Development S.A.R.L. 2018 Executive General Manager of TMC 2023 Operating Officer of TMC Member of the Board of Directors, Operating Officer (to present) (important concurrent duties) Executive Vice President of Calty Design Research, Inc. |

11 | |||||

|

Ikuro Sugawara (March 6, 1957) |

Outside Member of the Board of Directors |

1981 Joined Ministry of International Trade and Industry 2010 Director-General of the Industrial Science and Technology Policy and Environment Bureau, Ministry of Economy, Trade and Industry 2012 Director-General of the Manufacturing Industries Bureau, Ministry of Economy, Trade and Industry 2013 Director-General of the Economic and Industrial Policy Bureau, Ministry of Economy, Trade and Industry 2015 Vice-Minister of Ministry of Economy, Trade and Industry 2017 Retired from the Ministry of Economy, Trade and Industry 2017 Special Advisor to the Cabinet 2018 Retired from Special Advisor to the Cabinet 2018 Outside Member of the Board of Directors of TMC (to present) (important concurrent duties) Independent Director of Hitachi, Ltd. Outside Director of FUJIFILM Holdings Corporation |

— | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

|

Sir Philip Craven (July 4, 1950) |

Outside Member of the Board of Directors |

1989 President of the International Wheelchair Basketball Federation 2001 President of the International Paralympic Committee 2002 Retired as President of the International Wheelchair Basketball Federation 2017 Retired as President of the International Paralympic Committee 2018 Outside Member of the Board of Directors of TMC (to present) |

— | |||||

|

Masahiko Oshima (September 13, 1960) |

Outside Member of the Board of Directors |

1984 Joined The Mitsui Bank Limited 2012 Executive Officer of Sumitomo Mitsui Banking Corporation (SMBC) 2014 Managing Executive Officer of SMBC 2017 Director and Managing Executive Officer of SMBC Director and Senior Managing Executive Officer of SMBC 2018 Senior Managing Corporate Executive Officer of Sumitomo Mitsui Financial Group, Inc. (SMFG) Senior Managing Executive Officer of SMBC 2019 Deputy President and Executive Officer of SMFG Director and Deputy President of SMBC 2023 Deputy Chairman of SMBC Outside Member of the Board of Directors of TMC (to present) 2024 Advisor of SMBC (important concurrent duties) Advisor of SMBC |

1 | |||||

|

Emi Osono (August 8, 1965) |

Outside Member of the Board of Directors |

1988 Joined The Sumitomo Bank, Limited 1998 Visiting Professor of the Waseda Institute of Asia-Pacific Studies (WIAPS) 2000 Full-time lecturer at School of International Corporate Strategy, Hitotsubashi University Business School 2002 Assistant Professor at School of International Corporate Strategy, Hitotsubashi University Business School 2010 Professor at School of International Corporate Strategy, Hitotsubashi University Business School 2018 Professor at School of Business Administration, Hitotsubashi University Business School 2022 Dean and Professor at School of Business Administration and School of International |

0 | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

|

Corporate Strategy, Hitotsubashi University Business School (to present) 2023 Outside Member of the Board of Directors of TMC (to present) (important concurrent duties) Professor at School of Business Administration, Hitotsubashi University Business School Outside Director of Tokio Marine Holdings, Inc. |

||||||||

|

Takeshi Shirane (September 5, 1952) |

Full-time Audit & Supervisory Board Member |

1977 Joined TMC 2001 General Manager of Production Management Div. of TMC 2004 General Manager of Global Procurement Planning Div. of TMC 2005 General Manager of 1st Procurement Div. of TMC Managing Officer of TMC 2009 Senior Managing Director of TMC 2011 Senior Managing Officer of TMC Advisor of Kanto Auto Works, Ltd. 2012 President of Kanto Auto Works, Ltd. President of Toyota Motor East Japan, Inc. 2019 Chairman of the Board of Toyota Motor East Japan, Inc. 2023 Senior Executive Advisor of Toyota Motor East Japan, Inc. (to present) Audit & Supervisory Board Member of TMC (to present) |

150 | |||||

|

Masahide Yasuda (April 1, 1949) |

Full-time Audit & Supervisory Board Member |

1972 Joined TMC 2000 General Manager of Overseas Parts Division of TMC 2007 President of Toyota Motor Corporation Australia Ltd. 2014 Chairman of Toyota Motor Corporation Australia Ltd. 2017 Retired as Chairman of Toyota Motor Corporation Australia Ltd. 2018 Audit & Supervisory Board Member of TMC (to present) |

63 | |||||

| Katsuyuki Ogura (January 25, 1963) | Full-time Audit & Supervisory Board Member |

1985 Joined TMC 2015 General Manager of Affiliated Companies Finance Dept. of TMC 2018 General Manager of Audit & Supervisory Board Office of TMC 2019 Audit & Supervisory Board Member of TMC (to present) (important concurrent duties) Outside Audit & Supervisory Board Member of Aichi Steel Corporation |

30 | |||||

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares (in thousands) |

|||||

|

George Olcott (May 7, 1955) |

Outside Audit & Supervisory Board Member |

1986 Joined S.G.Warburg & Co., Ltd 1999 President of UBS Asset Management (Japan) 1999 President, Japan UBS Brinson 2000 Managing Director, Equity Capital Markets, UBS Warburg Tokyo 2001 Judge Business School, University of Cambridge 2005 FME Teaching Fellow, Judge Business School, University of Cambridge 2008 Senior Fellow, Judge Business School, University of Cambridge 2022 Outside Audit & Supervisory Board Member of TMC (to present) (important concurrent duties) Outside Director of Kirin Holdings Company, Limited |

3 | |||||

|

Catherine O’Connell (February 10, 1967) |

Outside Audit & Supervisory Board Member |

1987 Joined Japan Travel Bureau Inc. 1994 Senior Solicitor of Anderson Lloyd Barristers & Solicitors (New Zealand) 2002 In House Counsel of Olympus Corporation 2004 Senior In House Counsel of Matsushita Electric Industrial Co., Ltd. Motor Company Senior In House Counsel of Matsushita Electronic Components Co., Ltd. 2008 Hogan Lovells Horitsu Jimusho Gaikokuho Kyodo Jigyo 2012 Head of Legal of Molex Japan LLC 2017 President of O’Connell Consultants 2018 CEO of Catherine O’Connell Law (to present) 2023 Outside Audit & Supervisory Board Member of TMC (to present) (important concurrent duties) Registered foreign attorney External Audit & Supervisory Board Member of Fujitsu Limited |

— | |||||

|

Hiromi Osada (June 11, 1973) |

Outside Audit & Supervisory Board Member |

1999 Joined Chunichi Shimbun Co., Ltd. 2021 Editorial writer and Leader for reserve reporters in the Business News Department of Chunichi Shimbun Co., Ltd. 2023 Editorial Committee Member and International General Desk of Chunichi Shimbun Co., Ltd. 2024 Retired from Chunichi Shimbun Co., Ltd. 2024 Outside Audit & Supervisory Board Member of TMC (to present) |

— | |||||

| 1. | Mr. Koji Sato, who is President and Member of the Board of Directors, concurrently serves as Operating Officer (President). |

| 2. | The terms of office of the members of the board of directors commenced at the conclusion of the Ordinary General Shareholders’ Meeting held on June 18, 2024 and will expire at the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2025. |

| 3. | The terms of office of Mr. Takeshi Shirane, Mr. Katsuyuki Ogura, and Ms. Catherine O’Connell, who are all Audit & Supervisory Board Members, commenced at the conclusion of the Ordinary General Shareholders’ Meeting held on June 14, 2023 and will expire at the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2027. |

| 4. | The terms of office of Mr. Masahide Yasuda and Mr. George Olcott, who are both Audit & Supervisory Board Members, commenced at the conclusion of the Ordinary General Shareholders’ Meeting held on June 15, 2022 and will expire at the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2026. |

| 5. | The terms of office of Ms. Hiromi Osada commenced at the conclusion of the Ordinary General Shareholders’ Meeting held on June 18, 2024 and will expire at the conclusion of the Ordinary General Shareholders’ Meeting for fiscal 2028. |

Name (Date of Birth) |

Position |

Brief Career Summary and Important Concurrent Duties |

Number of Common Shares |

|||

|

Kumi Fujisawa (March 15, 1967) |

Substitute Audit & Supervisory Board Member |

1995 Founder and President of IFIS Limited Ltd. 2000 Director of Think Tank SophiaBank 2011 Public Governor of the Japan Securities Dealers Association (to present) 2012 Director of Organization for Supporting the Turnaround of Businesses Damaged by the Great East Japan Earthquake 2013 President of Think Tank SophiaBank 2014 Outside Director of Toyota Tsusho Corporation 2022 Chairperson of Institute for International Socio-Economic Studies (to present) (important concurrent duties) Chairperson of Institute for International Socio-Economic Studies Outside Director of Net Protections Holdings, Inc. Outside Director (Audit & Supervisory Committee Member) of CellSource Co., Ltd. Outside Director of Shizuoka Financial Group, Inc. |

— |

| • | It should be a system that encourages members of the board of directors to work to improve the medium- to long-term corporate value of Toyota. |

| • | It should be a system that can maintain compensation levels that will allow Toyota to secure and retain talented personnel. |

| • | It should be a system that motivates members of the board of directors to promote management from the same viewpoint as our shareholders with a stronger sense of responsibility as corporate managers. |

| * | Masahiko Oshima and Emi Osono, both outside members of the Board of Directors, replaced Teiko Kudo, an outside member of the Board of Directors, as members of the Executive Compensation Meeting on June 14, 2023. Teiko Kudo, an outside member of the Board of Directors, retired as an outside member of the Board of Directors upon the conclusion of the Ordinary General Shareholders’ Meeting held on June 14, 2023. |

| • | Review of remuneration level for each position and job responsibility |

| • | Review of remuneration composition for each position and job responsibility |

| • | Review of benchmarks and evaluation of actual results of fiscal 2024 |

| • | Determination of the amount of remuneration for each member of the board of directors |

| * | Calculated by multiplying the closing price of Toyota’s common stock on the Tokyo Stock Exchange by the number of shares issued after deducting the number of shares of treasury stock |

Type of Remuneration |

% of Total Remuneration |

Remuneration Method |

Concept |

|||

Base compensation |

Around 30% | Cash compensation |

The percentage of total remuneration represented by LTI is designed to increase as an individual’s roles and duties become greater. | |||

STI (Short Term Incentive) |

Around 20% | Cash compensation |

||||

LTI (Long Term Incentive) |

Around 50% | Share compensation |

||||

STI |

Financial indicators |

(1) Consolidated operating income (single year) | Indicator for evaluating Toyota’s efforts based on short-term business performance | |||

| (2) Fluctuation of Toyota’s market capitalization | Corporate value indicator for shareholders and investors to evaluate Toyota’s efforts | |||||

LTI |

Financial indicators |

(3) Consolidated operating income (multiple years) | Indicator for evaluating Toyota’s medium- to long-term efforts based on business performance | |||

| (4) Total shareholder return | Corporate value indicator for shareholders and investors to evaluate Toyota’s medium- to long-term efforts | |||||

(5) Return on equity |

||||||

Non-financial

indicator |

(6) Progress of efforts to resolve sustainability issues | Indicator for evaluating Toyota’s medium- to long-term efforts based on the degree of corporate value enhancement | ||||

Individual performance evaluation |

Qualitative evaluation of performance of each member of the Board of Directors | |||||

STI |

Evaluation Weight |

Evaluation Method |

Reference Value |

Evaluation Result |

||||

(1) Consolidated operating income (single year) |

70% | Evaluate the degree of attainment of consolidated operating income in fiscal 2024, using the average consolidated operating income of Toyota over the last 10 fiscal years as a reference value (set in 2023) | 2.5 trillion yen | 191% | ||||

(2) Fluctuation of Toyota’s market capitalization |

30% | Comparatively evaluate the fluctuation of TMC’s market capitalization for fiscal 2024 (average from January through March), using the market capitalization of Toyota and TOPIX for fiscal 2023 (average from January through March) as reference values |

Toyota: 25.5 trillion yen TOPIX: 1,990.68 |

|||||

LTI |

Evaluation Weight |

Evaluation Method |

Reference Value |

Evaluation Result |

||||

(3) Consolidated operating income (multiple years) |

35% | Evaluate the degree of attainment of consolidated operating income for the last three fiscal years, including fiscal 2024, using the average consolidated operating income of Toyota over the last 10 fiscal years as a reference value (set in 2023) | 2.5 trillion yen | 139% | ||||

(4) Total shareholder return |

17.5% | Comparatively evaluate Toyota’s total shareholder return, using the rate of change calculated by dividing the sum of the stock price of Toyota on the last day of fiscal 2024 and the cumulative amount of dividend per share during the period from the fiscal year that is four years before fiscal 2024 through fiscal 2024 by the stock price on the last day of the fiscal year that is five years before fiscal 2024 and the rate of change in TOPIX Net Total Return calculated in the same manner as reference values | TOPIX: 196.2% | |||||

|

(5) Return on equity |

17.5% | Comparatively evaluate Toyota’s return on equity for fiscal 2024 using the levels recommended by the Ito Review *1 as reference values |

8% | |||||

|

(6) Progress of efforts to resolve sustainability issues |

30% | Evaluate the degree of contribution of business activities during fiscal 2024 in accordance with the six key issues (materiality) *2

|

Six key issues (materiality) |

|||||

| *1 | A report on corporate governance reforms released by the Ministry of Economy, Trade and Industry in 2014 |

| *2 | The six key issues identified by Toyota are: (1) Expanding the Value of Mobility; (2) Safety & Reliability; (3) Coexistence of Humanity & the Earth (including carbon neutrality); (4) Supporting the Community and Employment; (5) Active Participation for All; and (6) Strong Production and Business Operation |

Consolidated operating income |

Indicator for evaluating Toyota’s efforts based on business performance | |

Fluctuation of the market capitalization |

Corporate value indicator for shareholders and investors to evaluate Toyota’s efforts | |

Individual performance evaluation |

Qualitative evaluation of performance of each member of the board of directors | |

Evaluation Weight |

Evaluation Method |

Reference Value |

Evaluation Result for Fiscal 2022 |

|||||

Consolidated operating income |

70% | Evaluate the degree of attainment of consolidated operating income in fiscal 2024, using required income (set in 2011) for Toyota’s sustainable growth as reference value | ¥1 trillion | 330% | ||||

Fluctuation of Toyota’s market capitalization |

30% | Comparatively evaluate the fluctuation of Toyota’s market capitalization for fiscal 2024 (average of January-March), using the market capitalization of Toyota and the TOPIX of fiscal 2023 (average of January-March) as reference values |

Toyota: ¥25.5 trillion TOPIX : ¥1,990.68 |

|||||

Compensation per Type (million yen) |

||||||||||||||||||||

Performance-based Compensation |

||||||||||||||||||||

Name, Position |

Classification of Company |

Fixed Compensation |

Bonus |

Share Compensation |

Retirement Benefits |

Total Compensation (millions of yen) |

||||||||||||||

Akio Toyoda, Member of the Board of Directors |

Toyota Motor Corporation | 289 | 324 | 1,009 (280,000 shares) |

— | 1,622 | ||||||||||||||

Shigeru Hayakawa, Member of the Board of Directors |

Toyota Motor Corporation | 77 | 133 | 179 (50,000 shares) |

— | 389 | ||||||||||||||

Koji Sato*1, Member of the Board of Directors |

Toyota Motor Corporation | 87 | 187 | 349 (97,000 shares) |

— | 623 | ||||||||||||||