| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023 |

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Nevada |

84-1018684 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Common Stock, $0.0001 par value |

OMEX |

Nasdaq Capital Market |

||

(Title of each class) |

(Trading symbol) |

(Name of each exchange on which registered) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

|

Non-accelerated filer |

☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ | |||||

TABLE OF CONTENTS

As used in this Comprehensive Annual Report on Form 10-K, “we,” “us,” “our company” and “Odyssey” mean Odyssey Marine Exploration, Inc. and our subsidiaries, unless the context indicates otherwise.

Explanatory Note

As previously disclosed in the Current Report on Form 8-K filed by the company with the Securities and Exchange Commission (the “SEC”) on February 26, 2024, the Company’s Audit Committee of the Board of Directors concluded that we would restate certain of our previously issued consolidated financial statements.

This comprehensive Annual Report on Form 10-K (this “Comprehensive Form 10-K”) for the year ended December 31, 2023, includes the following information in lieu of separate annual reports on Form 10-K and quarterly reports on Form 10-Q for the following periods:

| • | restated audited consolidated financial statements for the year ended December 31, 2022 (the “2022 Restatement”); |

| • | restated unaudited consolidated financial statements for the interim periods as contained in the company’s Quarterly Reports on Form 10-Q for the fiscal periods ended March 31, 2022 and 2023, June 30, 2022 and 2023, and September 30, 2022 (collectively, the “Interim Period Restatements” and, together with the 2022 Restatement, the “Restatement”); |

| • | unaudited consolidated financial statements for the interim period ended September 30, 2023; and |

| • | amended Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) as it relates to the year ended December 31, 2022. |

We did not file our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and we include the unaudited consolidated financial statements for that period in this Comprehensive Form 10-K.

Our delay in the filing of our quarterly report on Form 10-Q for the period ended September 30, 2023, and our Annual Report for the year ended December 31, 2023, was primarily due to the time required to (a) complete the preparation of the restatement of certain of our previously issued consolidated financial statements; (b) prepare the consolidated financial statements for the quarter ended September 30, 2023; and (c) prepare other disclosures contained herein.

For a more detailed description of the financial impact of the restatements referenced above, see NOTE 2 – Restatement of Consolidated Financial Statements, and “Restatement of Previously Issued Financial Statements” under Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this Comprehensive Form 10-K. For the impact of these adjustments on the unaudited quarterly financial data, see NOTE 20 – Quarterly Financial Data (Unaudited). All amounts in this Comprehensive Form 10-K affected by the Restatement adjustments reflect such amounts as restated.

This Comprehensive Form 10-K also includes amendments or updates to Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 8 — Financial Statements, and Item 9A Controls and Procedures.

PART I

This Comprehensive Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. The statements regarding Odyssey Marine Exploration, Inc. and its subsidiaries contained in this report that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes,” “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.

Important factors known to us that could cause such material differences are identified in our “RISK FACTORS” in Item 1A and elsewhere in this Comprehensive Form 10-K. Accordingly, readers of this Comprehensive Form 10-K should consider these factors in evaluating an investment in our securities and are cautioned not to place undue reliance on the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information or future events unless otherwise specifically indicated, except as required by law.

ITEM 1. BUSINESS

Overview

Odyssey Marine Exploration, Inc. discovers, validates and develops high-value seafloor mineral resources in an environmentally responsible manner, providing access to critical resources that can transform societies and economies for generations to come.

The company has a diversified mineral portfolio that includes projects controlled by us and other projects in which we are a minority owner and service provider. In addition, our team is continually working to add new projects to the portfolio by identifying potential new assets through a proprietary Global Prospectivity Program leading to the acquisition of appropriate rights. Our development focus is on projects that can meet stringent standards for environmental responsibility and sustainability while unlocking benefits for the host country. Environmental protection remains at the forefront of the strategic and tactical decision-making processes in all our work.

Each project in the portfolio is advanced along a defined development path, decreasing risk and increasing value along the way. These steps may include, but are not limited to, verification and quantification of the mineral asset, collection of baseline environmental data essential for environmental permitting, environmental impact studies and reports, design and verification of extraction systems and definition and verification of commercial programs. Odyssey may elect to sell equity in individual projects to fund continued advancement of the project.

For nearly 30 years, we have deployed cutting-edge ocean technology and processes at depths up to 6,000 meters, under the direction of some of the industry’s most skilled and successful ocean exploration professionals, scientists, and environmental specialists.

Importance of Seabed Mineral Exploration

There is growing global demand for critical mineral resources to power the green economy, feed the world’s growing population and provide vital infrastructure. Land based deposits of cobalt, manganese, rare earth minerals, phosphorite, gold, silver, copper and zinc are being depleted. As the worldwide population continues to grow, it is necessary to explore additional and alternative sources of these much-needed materials to meet increasing forecasted demand.

Climate change and the global transition to a lower carbon economy presents opportunities for Odyssey given the increased demand for raw materials for the future green economy, including those required for renewable energy generation and storage. Furthermore, as the worldwide population continues to grow, it is necessary to explore additional and alternative sources of these much-needed materials.

Subsea mineral deposits can provide these critical resources with less adverse social and environmental impact. We have the expertise and technology to find and access these deposits and to prepare the project for extraction in an economically feasible and environmentally sensitive way.

Benefits of Ocean Mineral Resource Development

Some of the benefits of ocean mineral resource development include:

| • | Infrastructure Expense: No site-specific infrastructure and generally low capital expenditures – ship-based extraction systems provide the ability to redeploy, repurpose or increase equipment productivity through cost/tonne or ship charter financing options. |

| • | Overburden: Compared to terrestrial projects, overburden to be removed in most proposed seafloor mining projects is less, which contributes to operational efficiencies. |

1

| • | Flexibility: Extraction ships can move to different types of deposits/minerals or projects to suit market conditions without infrastructure loss at minimal costs. |

| • | Social Displacement: No people are displaced, no disruption of society or property. |

| • | Environmental Impact: Seafloor mining can be done responsibly with limited biological impact and a manageable carbon footprint. No forested lands will be impacted, and freshwater systems are not affected. Seafloor dredging, aggregate and diamond mining have been carried out for many years in shallow waters around the world and with appropriate mitigation programs have posed minimal adverse impact to marine ecosystems. |

| • | Transshipment: Shipping logistics are efficient as ore and materials are extracted and moved directly to bulk carriers, lowering the number of steps in the delivery process thus reducing time and costs. |

Considering the benefits of subsea mineral resource extraction, we are convinced that ocean mining will be the best practice for responsible provision of critical resources required worldwide. Odyssey is taking the lead in preparing for this future through the validation and development of environmentally and socially responsible seafloor mineral projects.

Mineral and Offshore Services

We provide specialized mineral exploration, project development and marine services to clients (subsidiary companies, other companies and/or governments). As our business is focused on the development of a diversified portfolio of subsea resources, we may elect to receive equity for the provision of our services on select mineral projects. We have an extensive history conducting deep-ocean projects down to 6,000 meters in depth including deep-ocean resource explorations, ship and airplane wreck explorations, archaeological recovery and conservation and insurance documentation. We also apply this experience and expertise to advance our project portfolio.

Operational Projects and Status

We focus on projects that can meet stringent standards for environmental responsibility while unlocking benefits for the host community and country.

Our subsea project portfolio contains multiple projects in various stages of development throughout the world and across different mineral resources. We are regularly evaluating new projects through the development of new deposits, acquisition of mineral rights/deposits and through a leveraged contracting model, which allows the company to earn equity in deep-sea mineral projects.

With respect to mineral deposits, Subpart 1300 of Regulations S-K outlines the Securities and Exchange Commission’s (“SEC”) basic mining disclosure policy and what information may be disclosed in public filings. See Item 2 Properties.

Although Odyssey has a variety of projects in various stages of development, only projects with material activity in the past 12 months are included below.

ExO Phosphate Project:

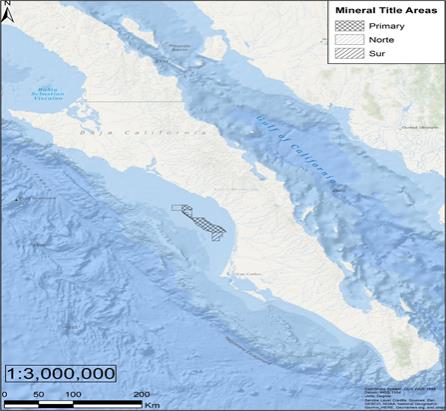

The “Exploraciones Oceánicas” Phosphate Project is a rich deposit of phosphate sands located 70-90 meters deep within Mexico’s Exclusive Economic Zone (“EEZ”). This deposit contains a large amount of high-grade phosphate ore that can be extracted on a financially attractive basis (essentially a standard dredging operation). The product will be attractive to Mexican and other world producers of fertilizers and can provide important benefits to Mexico’s agricultural development.

The deposit lies within an exclusive mining concession licensed to the Mexican company Exploraciones Oceánicas S. de R.L. de CV (“ExO”). Oceanica Resources, S. de R.L., a Panamanian company (“Oceanica”) owns 99.99% of ExO, and Odyssey owns 56.04% of Oceanica through Odyssey Marine Enterprises, Ltd., a wholly owned Bahamian company (“Enterprises”).

In 2012, ExO was granted a 50-year mining license by Mexico (extendable for another 50 years at ExO’s option) for the deposit that lies 25-40 km offshore in Baja California Sur.

We spent more than three years preparing an environmentally sustainable development plan with the assistance of experts in marine dredging and leading environmental scientists from around the world. Key features of the environmental plan included:

| • | No chemicals would be used in the dredging process or released into the sea. |

| • | A specialized return down pipe that exceeds international best practices to manage the return of dredged sands close to the seabed, limiting plume or impact to the water column and marine ecosystem (including primary production). |

| • | The seabed would be restored after dredging in such a way as to promote rapid regeneration of seabed organisms in dredged areas. |

2

| • | Ecotoxicology tests demonstrated that the dredging and return of sediment to the seabed would not have toxic effects on organisms. |

| • | Sound propagation studies concluded that noise levels generated during dredging would be similar to whale-watching vessels, merchant ships and fisherman’s ships that already regularly transit this area, proving the system is not a threat to marine mammals. |

| • | Dredging is limited to less than one square kilometer each year, which means the project would operate in only a tiny proportion of the concession area each year. |

| • | Proven turtle protection measures were incorporated, even though the deposit and the dredging activity are much deeper and colder than where turtles feed and live, making material harm to the species highly remote. |

| • | There will be no material impact on local fisheries as fishermen have historically avoided the water column directly above the deposit due to the naturally low occurrence of fish there. |

| • | The project would not be visible from the shoreline and would not impact tourism or coastal activities. |

| • | Precautionary mitigation measures were incorporated into the development plan in line with best-practice global operational standards. |

| • | The technology proposed to recover the phosphate sands has been safely used in Mexican waters for over 20 years on more than 200 projects. |

Notwithstanding the factors stated above, in April 2016 the Mexican Ministry of the Environment and Natural Resources (“SEMARNAT”) unlawfully rejected the permit to move forward with the project.

ExO challenged the decision in Mexican federal court and in March 2018, the Tribunal Federal de Justicia Administrativa (“TFJA”), an 11-judge panel, ruled unanimously that SEMARNAT denied the application in violation of Mexican law and ordered the agency to re-take its decision. Just prior to the change in administration later in 2018, SEMARNAT denied the permit a second time in defiance of the court. ExO is once again challenging the unlawful decision of the Peña Nieto administration before the TFJA. In addition, in April 2019, we filed a claim under the North American Free Trade Agreement (“NAFTA”) against Mexico to protect our shareholders’ interests and significant investment in the project.

Our claim seeks compensation of over $2 billion on the basis that SEMARNAT’s wrongful repeated denial of authorization has destroyed the value of our investment and is in violation of the following provisions of NAFTA:

| • | Article 1102. National Treatment. |

| • | Article 1105. Minimum Standard of Treatment; and |

| • | Article 1110. Expropriation and Compensation. |

We filed our First Memorial in the NAFTA case in September 2020. It is supported by documentary evidence and 20 expert reports and witness statements. In summary, this evidence includes:

| • | MERITS: Testimony from independent environmental experts that the environmental impact of ExO’s phosphate project is minimal and readily mitigated by the mitigation measures proposed by ExO. Witnesses also testified that Mexico’s denial of environmental approval by the prior administration was politically motivated and not justified on environmental grounds, and that Mexico granted environmental permits to similar dredging projects in areas that are considered more environmentally sensitive than ExO’s project location. |

| • | RESOURCE: An independent certified marine geologist testified as to the size and character of the resource. |

| • | OPERATIONAL VIABILITY: Engineering experts testified that the project uses established dredging and processing technology, and the project’s anticipated CAPEX and OPEX was reasonable. |

| • | VALUE: A phosphate market analyst testified that the project’s projected CAPEX and OPEX would make the project one of the lowest costs producing phosphate ore resources in the world, and damages experts testified the project would be commercially viable and profitable. |

3

Odyssey filed its First Memorial in the case on September 4, 2020. Mexico filed its Counter-Memorial on February 23, 2021. On June 29, 2021, we filed our reply to Mexico’s Counter-Memorial. Mexico filed its Rejoinder on October 19, 2021. The NAFTA Tribunal hearing took place in early 2022. In accordance with the procedural calendar, written post-hearing briefs were filed in September 2022. Information on the case can be found at www.odysseymarine.com/nafta. The procedural calendar and case filings are available on the International Centre for Settlement of Investment Disputes (“ICSID”) website, Case Details | ICSID (worldbank.org). The evidentiary phase of the case is now closed and the Tribunal has begun its deliberations. On October 6, 2023, Odyssey received a letter from ICSID advising that the Tribunal is well advanced in the drafting of the Award and expects to issue the Award in the first quarter of 2024. ICSID also advised that Odyssey would be duly notified of any change to the timing estimate provided. Odyssey cannot otherwise predict the length of these deliberations or when a ruling will be issued, but we remain confident in the merits of our case. On March 8, 2024, Odyssey received a letter from ICSID advising that the Tribunal “has continued to make progress in finalizing its determinations” and that it “expects to render the Award in the second quarter of this year.”

On June 14, 2019, Odyssey and ExO executed an agreement that provided up to $6.5 million in funding for prior, current and future costs of the NAFTA action. On January 31, 2020, this agreement was amended and restated, as a result of which the availability increased to $10.0 million. In December 2020, Odyssey announced it secured an additional $10 million from the funder to aid in our NAFTA case. On June 14, 2021, the funder agreed to fund up to an additional $5.0 million for arbitration costs. The funder will not have any right of recourse against us unless the environmental permit is awarded or proceeds are received (See NOTE 12 Fair Value Financial Instruments – Litigation Financing).

CIC Project:

CIC Limited (“CIC”) is a deep-sea mineral exploration company. CIC is supported by a consortium of companies providing expertise and financial contributions in support of development of the project. Odyssey is a member of the consortium, which also includes Royal Boskalis Westminster N.V.

In February 2022, the Cook Islands Seabed Minerals Authority (“SBMA”) awarded CIC a five-year exploration license beginning June 2022. Offshore explorations and research commenced in the third quarter of 2022 with positive results in early sampling, which tested vessel and equipment functions and performance, and provided information and data further defining the requirements for viable operational functions as the basis for a longer-term operation over the license period. The early operations also resulted in preliminary resource sampling, which will ultimately accrue to the resource evaluation and regional environmental assessment and ongoing operations.

Through a wholly owned subsidiary, we have earned and now hold approximately 14.99% of the current outstanding equity units of CIC issued in exchange for provision of services by the Company.

We have the ability to earn up to an aggregate of 20.0 million equity units over the next several calendar years, which represents an approximate 16.00% interest in CIC, based upon the currently outstanding equity units. This means we can earn approximately 1.5 million additional equity units in CIC under our current services agreement. We achieved our current equity position through the provision of services rendered to CIC (see NOTE 7 Investment in Unconsolidated Entities).

Ocean Minerals, LLC Project:

Ocean Minerals, LLC (“OML”) is a deepwater critical metals exploration and development company incorporated in the Cayman Islands. Moana Minerals Limited (“Moana Minerals”) is a wholly owned subsidiary of OML and is a deepwater critical metals exploration and development company incorporated in the Cook Islands with offices and operations based in Rarotonga, Cook Islands. In 2022, the SBMA awarded Moana Minerals a five-year exploration license (“EL3”) for a 23,630 square kilometer area in the Cook Islands’ EEZ.

Moana Minerals has discovered polymetallic nodules in its exploration license area and, in compliance with SBMA’s regulations, standards and guidelines, it is conducting further exploration activities to increase confidence in the reported mineral resource and size of the reported mineral resources and to secure environmental approvals to perform commercial operations. OML and its project partners are also advancing work to develop recovery systems to harvest and process these high-quality seafloor polymetallic nodules commercially.

On June 4, 2023, Odyssey entered into a purchase agreement to acquire an approximately 13% interest in OML in exchange for a contribution by Odyssey of its interest in its then wholly owned subsidiary, ORI, whose sole asset is a 6,000-meter remotely operated vehicle (“ROV”), cash contributions of up to $10 million in a series of transactions over the following year, a Contribution Agreement and an Equity Exchange Agreement (the “OML Put Option”). On July 3, 2023, the parties consummated the initial closing of the purchase agreement, pursuant to which Odyssey’s wholly owned subsidiary obtained approximately 6.28% of OML’s outstanding equity interests. The purchase agreement allows Odyssey to acquire up to 40% of OML over the next 18 months at Odyssey’s discretion.

4

The 6,000-meter rated ROV contributed to OML by Odyssey provides OML with an additional tool to advance the project toward eventual applications for an environmental permit and harvesting license when exploration and feasibility studies are completed and demonstrate how harvesting can be done without serious environmental harm. Over the next year, OML expects to advance its current Joint Ore Reserve Committee (“JORC”) compliant report, substantially increasing resources reporting to indicated and measured confidence levels and completing its preliminary Feasibility Study, among other important project milestones.

LIHIR Gold Project:

The exploration license for the Lihir Gold Project covers a subsea area that contains several prospective gold exploration targets in two different mineralization types: seamount-related epithermal and modern placer gold. Two subaqueous debris fields within the area are adjacent to the terrestrial Ladolam Gold Mine and are believed to have originated from the same volcanogenic source. The resource lies 500-2,000 meters deep in the Papua New Guinea Exclusive Economic Zone off the coast of Lihir Island, adjacent to the location of one of the world’s largest know terrestrial gold deposits. We have an 85.6% interest in Bismarck Mining Corporation, Ltd, the Papua New Guinea company that holds the exploration license (the “Bismarck Exploration License”) for the project.

Previous exploration expeditions in the license area, including research conducted by Odyssey, indicate it is highly prospective for commercially viable gold content.

In November 2023, Papua New Guinea issued a permit extension allowing Odyssey to continue with our exploration program. We have developed an exploration program for the Lihir Gold Project to validate and quantify the precious and base metal content of the prospective resource. The Company met with local regulatory authorities, specialists in local mining, environmental legal experts, and logistics support service companies in Papua New Guinea to establish baseline business functions essential for a successful program to support upcoming marine exploration operations in the license area. This offshore work began in late 2021 and is ongoing. Bismarck and Odyssey value the environment and respect the interests and people of Papua New Guinea and Lihir and are committed to transparent sharing of all environmental data collected during the exploration program.

Offshore survey and mapping operations commenced in December 2021 in the Papua New Guinea, Lihir license area and was completed in 2022. This work produced a high-resolution acoustic terrain model of the seafloor in the area, as well as acquiring acoustic images of subseafloor sediments and lithology. This allowed characterization of the geologic setting of the area and essentially created a “snapshot” of the environment. These activities will help us to further characterize the value of this project and allow informed decision making on how to proceed with environmentally sensitive direct geologic sampling. In the first half of 2023, a comprehensive project plan was designed identifying specific target areas for geological and environmental samples to be collected in future offshore operations. No timetable has been set for operations to commence, as operational plans are currently being developed. On November 13, 2023, Bismarck received a further renewal of the Bismarck Exploration License.

Odyssey’s multi-year exploration program is planned to focus on robust environmental surveys and studies that will accrue to environmental permitting in compliance with Papua New Guinea’s requirements as well as the development of an Environmental Impact Assessment (“EIA”). During the exploration phase, steps to validate and quantify the precious and base metal content of the prospective resource would also be carried out. Once completed, if the data shows extraction can be carried out responsibly, Odyssey will apply for a mining license.

Further development of this project is dependent on the characterization of any present resources during exploration and license approvals.

Legal and Political Issues

Odyssey works with several leading international maritime lawyers and policy experts to constantly monitor international legal initiatives that might affect our projects.

To the extent that we engage in mineral exploration or marine activities in the territorial, contiguous or exclusive economic zones of countries, we work to comply with verifiable applicable regulations and treaties.

We believe there will be increased interest in the recovery of subsea minerals throughout the oceans of the world. We are uniquely qualified to provide governments and international agencies with knowledge and skills to help manage these resources.

Related to mineral exploration, we evaluate the political climate and specific legal requirements of any areas in which we plan to work or are currently working. We may partner with third parties who have unique industry experience in specific geographical areas to assist with navigation of the regulatory landscape.

5

Competition

We conduct mineral exploration on both shallow and deep-sea terrains. There are several companies that publicly identify themselves as engaged in aspects of deep-ocean mineral exploration or mining, including Deep Sea Mining Finance Limited, OML, The Metals Company, Global Sea Mineral Resources , and Chatham Rock Phosphate, Ltd., as well as countries that are evaluating options to mine deep-ocean mineralized materials. As our mineral exploration business plan includes partnering with others in the industry, we view these entities as potential partners rather than pure competitors. As mineral rights are generally granted on an exclusive basis for a specific area or tenement, once licenses are granted, we do not anticipate any competitive intrusion on those areas. It is possible that one of these companies or some currently unknown group may secure licenses on an area desired by us or one of our partners; but since exploration work does not start until licenses are secured, we do not believe that competition from one or more of these entities, known or unknown, would materially affect our operating plan or alter our current business strategy. For offshore mineral exploration, there are providers of vessels and equipment that could be competitors or partners for certain projects. These companies generally service the oil, gas, wind and telecom industries with survey capabilities. We view these companies as potential strategic partners or services providers for our projects.

Cost of Environmental Compliance

With the exception of marine operations, our general business operations do not expose us to environmental risks or hazards. We carry insurance that provides a layer of protection in the event of an environmental exposure resulting from the operation of vessels we may utilize. The cost of such coverage is not material on an annual basis. Our seabed mineral business is currently in the exploration and validation phase and has thus not exposed us to any significant environmental risks or hazards, other than those which are standard to basic marine operations.

Executive Officers of the Registrant

The names, ages and positions of all the executive officers of the Company as of March 1, 2024, are listed below.

Mark D. Gordon (age 63) has served as Chief Executive Officer since October 1, 2014, and was appointed to the Board of Directors in January 2008. Mr. Gordon also served as President from October 2007 to June 2019, when he was appointed Chairman of the Board. Previously, Mr. Gordon served as Chief Operating Officer since October 2007 and as Executive Vice President of Sales and Business Development since January 2007 after joining Odyssey as Director of Business Development in June 2005. Prior to joining Odyssey, Mr. Gordon owned and managed four different ventures.

John D. Longley, Jr. (age 57) has served as Chief Operating Officer since October 1, 2014, and was appointed President in June 2019. Previously Mr. Longley served as Executive Vice President of Sales and Business Development since February 2012. Mr. Longley was originally the Director of Sales and Business Operations when he joined the Company in May 2006. Prior to joining Odyssey, Mr. Longley served as Vice President of Sales and Marketing for Public Imagery from 2003 to 2005 and Director of Retail Marketing for Office Depot North American stores from 1998 to 2003.

Human Capital Management

We believe our success has always been dependent on our team of professionals in various fields who are passionate about the ocean, discovery, and making a difference. Therefore, we invest in our people and cultivate a dynamic, engaging, safe and welcoming workplace that drives innovation, encourages collaboration, and helps our people thrive.

As of December 31, 2023, we had 11 full-time employees, most working from our corporate offices in Tampa, Florida. Additionally, we contract with specialized technicians to perform technical marine survey and recovery operations and from time to time hire subcontractors and consultants to perform specific services.

Recruitment, Retention, Training and Development

Odyssey has a long-tenured team that continues to attract world class experts. We believe this is a testament to our culture of treating our employees with respect, providing them with the tools and setting to be productive and innovative, and providing benefits that allow employees to maintain a healthy home and work life. To foster their and our success, we have made the recruitment, retention and development of dedicated and experienced professionals a cornerstone of our corporate strategy.

A key contributing factor to our historically high employee retention rates is our ability to rescale and upscale them through internal and external training and development programs. These include seminars, educational courses and webinars, degree programs, professional organization memberships, scholarly journal subscriptions, books and computer-based resources.

6

Compensation, Benefits and Well-being

Odyssey strives to support our employees in various ways and provide compensation and benefits that reflect our vested interest in them and their families. We offer generous health, dental and vision insurance coverage, company funded Health Reimbursement Accounts, as well as zero cost short-term disability, long-term disability and life insurance coverage for all full-time employees. We recognize that our team’s needs are varied and changing and that our benefits should be as well. Our Beyond Benefits program provides other, non-traditional assistance to employees to help them maintain their unique needs.

Diversity, Equity and Inclusion

Our ability to retain and recruit employees with diverse backgrounds and perspectives is critical to driving innovation and adapting to future challenges. As we grow our employee base and expand our work in other countries with diverse local communities, we strive to foster an inclusive company culture through increased training and awareness programs.

To date, our primary focus has been on improving gender diversity. Currently, 50% of our employees are female.

Enhancing gender and racial/ethnic diversity in management and our broader workforce is among Odyssey’s priorities for the coming years. When recruiting for senior leadership roles, we aspire to have at least 50% of candidates represent diverse backgrounds.

Health and Safety

Odyssey is committed to maintaining an incident-free, healthy work environment for employees and contractors. Our focus on responsible seafloor exploration includes complying with applicable laws and regulations in all material respects and adhering to international best practices in occupational health and safety. We require that any contracted vessel, ship management agency, ship company, and staffed crew be in good standing with various national, international and trade association codes.

To measure progress towards our safety goals outlined in our Quality, Health, Safety and Environment policies and procedures, we track several key performance indicators (“KPIs”). These include recordable medical incidents, lost workdays, first aid cases, restricted workdays, and the frequency of safety meetings. We also implement additional risk control measures such as safety drills and management visits. KPIs and control measures continue to evolve as our organization and project requirements change.

Internet Access

Odyssey’s Forms 10-K, 10-Q, 8-K and all amendments to those reports are available without charge through Odyssey’s web site on the Internet as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission, www.sec.gov. They may be accessed as follows: www.odysseymarine.com (Investors/Financial Information Link).

ITEM 1A. RISK FACTORS

You should carefully consider the following factors, in addition to the other information in this Comprehensive Form 10-K, in evaluating our company and our business. Our business, operations and financial condition are subject to various risks. The material risks are described below and should be carefully considered in evaluating Odyssey or any investment decision relating to our securities. This section is intended only as a summary of the principal risks. If any of the following risks actually occur, our business, operating results, or financial results could suffer. If this occurs, the trading price of our common stock could decline, and you could lose all or part of the money you paid to buy our common stock.

We face risks related to the Restatement of our financial information and the material weaknesses in our internal control over financial reporting, as described in Item 9A – Controls and Procedures and Note 2- Restatement of Consolidated Financial Statements.

We are subject to various SEC reporting and other regulatory requirements. Effective internal controls over financial reporting are necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud and material errors in transactions and to fairly present financial statements. Any failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing we conduct in connection with Section 404 of the Sarbanes-Oxley Act, or the subsequent testing by our independent registered public accounting firm when required, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses or that may require prospective or retrospective changes to our consolidated financial statements or identify other areas for further attention or improvement. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our Common Stock.

7

As discussed in the Explanatory Note to this Comprehensive Form 10-K and in NOTE 2 to the restated audited annual consolidated financial statements included in this Comprehensive Form 10-K, we determined to restate certain financial information in our previously issued consolidated financial statements for the year ended December 31, 2022, and for the interim periods ended March 31, 2023 and 2022, June 30, 2023 and 2022, and September 30, 2022. The circumstances leading to the Restatement of our previously issued financial statements, and our efforts to investigate, assess and remediate those matters have resulted in substantial costs in the form of accounting, legal fees, and similar professional fees, in addition to the substantial diversion of time and attention of our senior management and members of our accounting team in preparing the Restatement.

In addition, as a result of the Restatement, we have identified material weaknesses in our internal controls over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. While we have undertaken substantial work to maintain effective internal controls and have taken action to remediate the material weaknesses identified in connection with the Restatement, we cannot be certain that we will be successful in our remediation efforts or in maintaining adequate internal controls over our financial reporting. As a result of the material weaknesses, management determined that our internal control over financial reporting and disclosure controls and procedures were ineffective as of December 31, 2023. If we fail to maintain an effective system of internal controls over financial reporting and disclosure controls and procedures, we may not be able to accurately determine our results of operations or financial conditions or to prevent fraud.

As a result of the Restatement, we have become subject to a number of additional risks and uncertainties, which may affect investor confidence in the accuracy of our financial disclosures and may raise reputational issues for our business. We expect to continue to face the risks and challenges related to the Restatement, including the following: (i) we may face potential litigation or other disputes, which may include, among others, claims invoking the federal and state securities laws, contractual claims, or other claims arising from the Restatement; (ii) the SEC may review the restatements, including the Restatement, and require further amendment of our public filings; and (iii) the processes undertaken to effect the Restatement may not have been adequate to identify and correct all errors in our historical financial statements and, as a result, we may discover additional errors and our financial statements remain subject to the risk of future restatement. We cannot provide assurance that all of the risks and challenges described above will be eliminated or that general reputational harm will not persist. If any of the foregoing risks or challenges persists, our business, operations and financial condition could be materially adversely affected.

We face risks related to being delinquent in our SEC reporting obligations.

Primarily due to the matters that led to our restatement of prior financial statements and the material weaknesses identified in connection therewith, which are more fully detailed in NOTE 2 – Restatement of Consolidated Financial Statements and Item 9A – Controls and Procedures, immediately prior to the filing of this Comprehensive Form 10-K, our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, and our Annual Report for the year ended December 31, 2023, were not timely filed. We expect to continue to face many of the risks and challenges related to the matters that led to the delay in the filing of that Quarterly Report and Annual Report, including the following:

| • | we may fail to remediate material weaknesses in our internal control over financial reporting and other material weaknesses may be identified in the future, which would adversely affect the accuracy and timing of our financial reporting; |

| • | failure to timely file our SEC reports and make our current financial information available may place downward pressure on our stock price and result in the inability of our employees to sell the shares of our common stock underlying their awards granted pursuant to our equity compensation plans, which may adversely affect hiring and employee retention; |

| • | litigation and claims, and any as regulatory examinations, investigations, proceedings and orders arising out of our failure to file SEC reports on a timely basis, including the reasons and causes for the delay in filing, could divert management attention and resources from the operation of our business; and |

| • | negative reports or actions on our commercial credit ratings would increase our costs of, or reduce our access to, future commercial credit arrangements and limit our ability to refinance existing indebtedness. |

If any of the foregoing risks or challenges persists, our business, operations and financial condition are likely to be materially and adversely affected.

8

We have identified material weaknesses in our internal control over financial reporting, which could, if not remediated, adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner.

We have concluded that our internal control over financial reporting was not effective as of December 31, 2023 and prior periods, due to the existence of material weaknesses in our internal control over financial reporting, all as described in Part II, Item 9A - Controls and Procedures of this Comprehensive Form 10-K. Although we have initiated remediation measures to address the identified material weaknesses, we cannot provide assurance that our remediation efforts will be adequate to allow us to conclude that such controls will be effective in the future. We also cannot assure that additional material weaknesses in our internal control over financial reporting will not arise or be identified in the future. We intend to continue our control remediation activities and to continue to improve our overall control environment and our operational, information technology, financial systems, and infrastructure procedures and controls, as well as to continue to train, retain and manage our personnel who are essential to effective internal controls. In doing so, we will continue to incur expenses and expend management time on compliance-related issues. If we are unable to successfully complete our remediation efforts or favorably assess the effectiveness of our internal control over financial reporting, our operating results, financial position, ability to accurately report our financial results and timely file our SEC reports, and stock price could be adversely affected.

Moreover, because of the inherent limitations of any control system, material misstatements due to error or fraud may not be prevented or detected on a timely basis, or at all. If we are unable to provide reliable and timely financial reports in the future, our business and reputation may be further harmed. Restated financial statements and failures in internal controls may also cause us to fail to meet reporting obligations, negatively affect investor and customer confidence in our management or result in adverse publicity and concerns from investors and customers, any of which could have a negative effect on the price of our common stock, subject us to further regulatory investigations, potential penalties or stockholder litigation, and have a material adverse impact on our business and financial condition.

Our business involves a high degree of risk.

An investment in Odyssey is extremely speculative and of exceptionally high risk. With respect to mineral exploration projects, there are uncertainties with respect to the quality and quantity of the material and their economic feasibility, the price we can obtain for the sale of the deposit or the ore extracted from the deposit, the granting of the necessary permits to operate, environmental safety, technology for extraction and processing, distribution of the eventual ore product, and funding of necessary equipment and facilities. In projects where Odyssey takes a minority ownership position in the company holding the mining rights, there may be uncertainty as to that company’s ability to move the project forward.

The research and data we use may not be reliable.

The success of a mineral project is dependent to a substantial degree upon the research and data we or others have obtained. By its very nature, research and data regarding mineral deposits can be imprecise, incomplete, outdated, and unreliable. For mineral exploration, data is collected based on a sampling technique and available data may not be representative of the entire ore body or tenement area. Prior to conducting offshore exploration, we typically conduct onshore research, which relies heavily on third-party data and reports. There is no guarantee that the models and research conducted onshore will be representative of actual results on the seafloor. Offshore exploration typically requires significant expenditures, with no guarantee that the results will be useful or financially rewarding.

Operations may be affected by natural hazards.

Underwater exploration and extraction operations are inherently difficult and may be delayed or suspended by weather, sea conditions or other natural hazards. Further, such operations may be undertaken more reliably during certain months of the year than others. We cannot guarantee that we, or the entities we are affiliated with, will be able to conduct exploration, sampling or extractions operations during favorable periods. In addition, even though sea conditions in a particular search location may be somewhat predictable, the possibility exists that unexpected conditions may occur that adversely affect our operations. It is also possible that natural hazards may prevent or significantly delay operations. Seabed mineral extraction work may be subject to interruptions resulting from storms that adversely affect the extraction operations or the ports of delivery. Project planning considers these risks to the extent practicable.

We may be unable to establish our rights to resources or items we discover or recover.

We may discover potentially valuable seabed mineral deposits, but we may be unable to get title to the deposits or get the necessary governmental permits to commercially extract the minerals. Mineral deposits may be in controlled waters where the policies and laws of a certain government may change abruptly, thereby adversely affecting our ability to operate in those zones. We have a process for evaluating this risk in our proprietary Global Prospectivity Program which enables us to rank and prioritize projects.

The market for minerals we recover is uncertain.

During the time, measured in years, between when a mineral deposit is discovered and the first extracted minerals are sold, world and local prices for the mineral may fluctuate drastically and thereby adversely affect the economics of the mineral project.

9

We could experience delays in the disposition or sale of minerals.

It may take significant time between when a mineral deposit is discovered and the first extracted minerals are sold. Stakes in the mineral deposits can potentially be sold at an earlier date, but there is no guarantee that there will be readily available buyers at favorable competitive prices.

Legal, political or civil issues could interfere with our marine operations.

Legal, political or civil issues of governments throughout the world could restrict access to our operational marine sites or interfere with our marine operations or rights to seabed mineral deposits. In many countries, the legislation covering ocean exploration lacks clarity or certainty. As a result, when we are conducting projects in certain areas of the world for our own account or on our behalf of a contracting party, we may be subjected to unexpected delays, requests, and outcomes as we work with local governments to define and obtain the necessary permits and to assert our claims over assets on the seafloor bottom. Vessels on which we work, equipment, personnel and or cargo could be seized or detained by government authorities. We may have to work with different units of a government, and there may be a change of government representatives over time. This may result in unexpected changes or interpretations in government contracts and legislation.

Non-governmental organizations (“NGOs”) that are opposed to seafloor mineral extraction may attempt to disrupt business operations. NGOs may also use disinformation in the media to damage our reputation and the reputations of our projects. This may result in delays to project timelines and incremental costs to the company to implement strategies to mitigate and counter NGO activities.

We may be unable to get permission to conduct exploration, excavation, or extraction operations.

It is possible we will not be successful in obtaining the necessary permits to conduct exploration or excavation or extraction operations. In addition, permits we obtain may be revoked or not honored by the entities that issued them. In addition, certain governments may develop new permit requirements that could delay new operations or interrupt existing operations.

Changes in our business strategy or restructuring of our businesses may increase our costs or otherwise affect the profitability of our businesses.

As changes in our business environment occur, we may need to adjust our business strategies to meet these changes or we may otherwise find it necessary to restructure our operations or particular businesses or assets. When these changes or events occur, we may incur costs to change our business strategy and may need to write down the value of assets or sell certain assets. In any of these events our costs may increase, and we may have significant charges associated with the write-down of assets.

We may be unsuccessful in raising the necessary capital to fund operations and capital expenditures.

Our ability to generate cash inflows is dependent upon our ability to provide mineral exploration and development services to our subsidiaries and other subsea mineral companies or monetize mineral rights or monetize our investments in third-party projects. However, we cannot guarantee that the sales and other cash sources will generate sufficient cash inflows to meet our overall cash requirements. If cash inflows are not sufficient to meet our business requirements, we will be required to raise additional capital through other financing activities. Although we have been successful in raising the necessary funds in the past, there can be no assurance we can continue to do so in the future.

We depend on key employees and face competition in hiring and retaining qualified employees.

Our employees are vital to our success, and our key management and other employees are difficult to replace. We currently do not have employment contracts with the majority of our key employees. We may not be able to retain highly qualified employees in the future which could adversely affect our business.

We may continue to experience significant losses from operations.

We have experienced a net loss in every fiscal year since our inception except for 2023 and 2004. We had net income in 2023 of $1.5 million only as a result of a gain recognized on debt extinguishment. Our net losses were $23.1 million in 2022. Even if we do generate operating income in one or more quarters in the future, subsequent developments in our industry, customer base, business or cost structure or an event such as significant litigation or a significant transaction may cause us to again experience operating losses. We may not become profitable for the long-term, or even for any quarter.

10

Technological obsolescence of our marine assets or failure of critical equipment could put a strain on our capital requirements or operational capabilities.

From time to time, we employ state-of-the-art technology including but not limited to sonars, magnetometers, ROVs, vessels, and other advanced science and technology to perform seabed mineral exploration. Although we try to maintain back-ups on critical equipment and components, equipment failures may require us to delay or suspend operations. Also, while we endeavor to keep marine equipment in excellent working condition and current with all available upgrades, technological advances in new equipment may provide superior efficiencies compared to the capabilities of our existing equipment, and this could require us to purchase new equipment which would require additional capital.

We may not be able to contract with clients or customers for marine services or third-party projects.

From time to time we earn revenue by chartering out equipment and crew and providing marine services to clients or customers. Even if we do contract out our services, the revenue may not be sufficient to cover administrative overhead costs. Although the operational results of these third-party projects are generally successful, the clients or customers may not be willing or financially able to continue with third-party projects of this type in the future. Failure to secure such revenue producing contracts in the future may have a material adverse impact on our revenue and operating cash flows.

The issuance of shares at conversion prices lower than the market price at the time of conversion and the sale of such shares could adversely affect the price of our common stock.

Some of our outstanding shares may have been acquired from time to time upon conversion of convertible notes at conversion prices that are lower than the market price of our common stock at the time of conversion. In the past, Odyssey has issued debt obligations that could be converted into common shares at prices below the current market price. Conversion of the notes at conversion prices that are lower than the market price at the time of conversion and the sale of the shares issued upon conversion could have an adverse effect upon the market price of our common stock.

Investments in subsea mineral exploration companies may prove unsuccessful.

We have invested in marine mineral companies that to date are still in the exploration phase and have not begun to earn significant revenue from operations. We may or may not have control or input on the future development of these businesses. There can be no assurance that these companies will achieve profitability or otherwise be successful in capitalizing on the mineralized materials they intend to exploit or through other revenue-generating activities.

We may be subject to short selling strategies.

Short sellers of our stock may be manipulative and may attempt to drive down the market price of our common stock. Short selling is the practice of selling securities that the seller does not own but rather has, supposedly, borrowed from a third party with the intention of buying identical securities back later to return to the lender. The short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is therefore in the short seller’s best interests for the price of the stock to decline, many short sellers (sometime known as “disclosed shorts”) publish, or arrange for the publication of, negative opinions regarding the relevant issuer and its business prospects to create negative market momentum and generate profits for themselves after selling a stock short. Although traditionally these disclosed shorts were limited in their ability to access mainstream business media or to otherwise create negative market rumors, the availability of the Internet and technological advancements regarding document creation, videotaping and publication by weblog (“blogging”) have allowed many disclosed shorts to publicly attack a company’s credibility, strategy and veracity by means of so-called “research reports” that mimic the type of investment analysis performed by large Wall Street firms and independent research analysts. These short attacks have, in the past, led to selling of shares in the market, on occasion in large scale and broad base. Issuers who have limited trading volumes and are susceptible to higher volatility levels than large-cap stocks, can be particularly vulnerable to such short seller attacks. These short seller publications are not regulated by any governmental, self-regulatory organization or other official authority in the U.S., are not subject to certification requirements imposed by the Securities and Exchange Commission and, accordingly, the opinions they express may be based on distortions or omissions of actual facts or, in some cases, fabrications of facts. In light of the limited risks involved in publishing such information, and the enormous profit that can be made from running just one successful short attack, unless the short sellers become subject to significant penalties, it is more likely than not that disclosed short sellers will continue to issue such reports.

11

Some of our equipment or assets could be seized or we may be forced to sell certain assets.

We have pledged certain assets, such as equipment and shares of subsidiaries, as collateral under our loan agreements. Some lenders could seize some of our assets if we do not make timely payments for the loans, services, supplies, or equipment that they have provided to us. If we were unable to make payments on these obligations, the lender or supplier may seize the asset or force the sale of the asset. The loss of such assets could adversely affect our operations. The sale of the asset may be done in a manner and under circumstances that do not provide the highest cash value for the sale of the asset.

We could be delisted from the Nasdaq Capital Market.

Our common stock is listed on the Nasdaq Capital Market, which imposes, among other requirements, a minimum bid requirement. The closing bid price for our common stock must remain at or above $1.00 per share to comply with Nasdaq’s minimum bid requirement for continued listing. If the closing bid price for our common stock is less than $1.00 per share for 30 consecutive business days, Nasdaq may send us a notice stating we will be provided a period of 180 days to regain compliance with the minimum bid requirement or else Nasdaq may make a determination to delist our common stock. Another requirement for continued listing on the Nasdaq Capital Market is to maintain our market capitalization above $35.0 million.

Our failure to maintain compliance with the above-mentioned and other Nasdaq continued listing requirements, including timely filing of our periodic reports with the SEC, may lead to the delisting of our common from the Nasdaq Capital Market. Delisting from the Nasdaq Capital Market could make trading our common stock more difficult for investors, potentially leading to declines in our share price and liquidity. If our common stock is delisted by Nasdaq, our common stock may be eligible to trade on an over-the-counter quotation system, where an investor may find it more difficult to sell our stock or obtain accurate quotations as to the market value of our common stock. We cannot assure you that our common stock, if delisted from the Nasdaq Capital Market, will be listed on another national securities exchange or quoted on an over-the counter quotation system.

Our insurance coverage may be inadequate to cover all of our business risks.

Although we seek to obtain insurance for some of our main operational risks, there is no guarantee that the insurance policies that we have are sufficient, that they will be in place when needed, that we will be able to obtain insurance coverage when desired, that insurance will be available on commercially attractive terms, or that we will be able to anticipate the risks that need to be insured. For example, although we may be able to obtain War Risk coverage for a project at a specific date and location, such insurance may be unavailable at other times and locations. Although we may be able to insure our marine assets for certain risks such as certain possible loss or damage scenarios, we may lack insurance to cover against government seizure or detention of certain marine assets. Permanent loss or temporary loss of our marine assets and the associated business interruption without commensurate coverage from an insurance policy could severely impact the financial results and operational capabilities of the company.

We may be exposed to cybersecurity risks.

We depend on information technology networks and systems to process, transmit and store electronic information and to communicate among our locations around the world and among ourselves within our company. Additionally, one of our significant responsibilities is to maintain the security and privacy of our confidential and proprietary information and the personal data of our employees. Our information systems, and those of our service and support providers, are vulnerable to an increasing threat of continually evolving cybersecurity risks. Computer viruses, hackers and other external hazards, as well as improper or inadvertent staff behavior could expose confidential company and personal data systems and information to security breaches. Techniques used to obtain unauthorized access or cause system interruption change frequently and may not immediately produce signs of intrusion. As a result, we may be unable to anticipate these incidents or techniques, timely discover them, or implement adequate preventative measures. With respect to our commercial arrangements with service and support providers, we have processes designed to require third-party IT outsourcing, offsite storage and other vendors to agree to maintain certain standards with respect to the storage, protection and transfer of confidential, personal and proprietary information. However, we remain at risk of a data breach due to the intentional or unintentional non-compliance by a vendor’s employee or agent, the breakdown of a vendor’s data protection processes, or a cyber-attack on a vendor’s information systems or our information systems.

12

Subsea mineral, development and operating have inherent risks.

Mining operations generally involve a high degree of risk. The financing, exploration, development and mining of any of our properties is furthermore subject to a number of macroeconomic, legal and social factors, including commodity prices, laws and regulations, political conditions, currency fluctuations, the ability to hire and retain qualified people, the inability to obtain suitable and adequate machinery, equipment or labor and obtaining necessary services in the jurisdictions in which we may operate. Unfavorable changes to these and other factors have the potential to negatively affect our operations and business. Major expenses may be required to locate and establish mineral reserves and resources, to develop processes and to construct mining and processing facilities at a particular site. Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Unusual or infrequent weather phenomena, sabotage, government or other interference could adversely affect our operations, financial condition and results of operations. It is impossible to ensure that the exploration or development programs planned by us will result in a profitable commercial mining operation. Whether precious or base metal or mineral deposits will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as the quantity and quality of mineralization; mineral prices, which are highly volatile; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in not receiving an adequate return on invested capital. There is no certainty that the expenditures to be made by us towards the exploration and evaluation of our projects will result in discoveries or production of commercial quantities of the minerals. In addition, once in production, mineral reserves are finite and there can be no assurance that we will be able to locate additional reserves as its existing reserves are depleted.

We are subject to significant governmental regulations, which affect our operations and costs of conducting our business.

Our exploration operations are subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labor standards. For us to carry out our activities, various licenses and permits must be obtained and kept current. There is no guarantee that the Company’s licenses and permits will be granted, or that once granted will be maintained and extended. In addition, the terms and conditions of such licenses or permits could be changed and there can be no assurances that any application to renew any existing licenses will be approved. There can be no assurance that all permits that we require will be obtainable on reasonable terms, or at all. Delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, could have a material adverse impact on our operations. We may be required to contribute to the cost of providing the required infrastructure to facilitate the development of our properties and will also have to obtain and comply with permits and licenses that may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies and financial assurances. There can be no assurance that we will be able to comply with any such conditions and non-compliance with such conditions may result in the loss of certain of our permits and licenses on properties, which may have a material adverse effect on us. Future taxation of mining operators cannot be predicted with certainty so planning must be undertaken using present conditions and best estimates of any potential future changes. There is no certainty that such planning will be effective to mitigate adverse consequences of future taxation on us.

We may not be able to obtain all required permits and licenses to place any of our properties into production.

Our current and future operations, including development activities and commencement of production, if warranted, require permits from governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, environmental protection, mine safety and other matters. Companies engaged in mineral property exploration and the development or operation of mines and related facilities generally experience increased costs, and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. We cannot predict if all permits which we may require for continued exploration, development or construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay our planned exploration and development activities. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on our operations and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

13

Calculations of mineral resources are estimates only and subject to uncertainty.

The estimation of mineral resources is an imprecise process and the accuracy of such estimates is a function of the quantity and quality of available data, the assumptions used and judgments made in interpreting engineering and geological information and estimating future capital and operating costs. There is significant uncertainty in any reserve or resource estimate, and the economic results of mining a mineral deposit may differ materially from the estimates as additional data are developed or interpretations change.

Estimated mineral resources may be materially affected by other factors.

In addition to uncertainties inherent in estimating mineral resources, other factors may adversely affect estimated mineral resources and mineral reserves. Such factors may include but are not limited to metallurgical, environmental, permitting, legal, title, taxation, socio-economic, marketing, political, gold prices, and capital and operating costs. Any of these or other adverse factors may reduce or eliminate estimated mineral reserves and mineral resources and could have a material adverse effect on our business, prospects, results of operations, cash flows, financial condition and corporate reputation.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

Cybersecurity Risk Management and Strategy

We are dedicated to protecting the integrity, confidentiality, and availability of our data, infrastructure and operating systems. As part of our commitment to safeguarding our operations against cybersecurity threats, we employ a comprehensive strategy for the assessment, identification, and management of cybersecurity risks. We engage a third-party CIO consulting firm and a managed services provider, which work together to provide wide-ranging services including risk assessments, threat detection, monitoring and response strategies, security audits and cybersecurity services, tools and training.

Cybersecurity Processes: We conduct robust cybersecurity processes aligned with NIST and CMMC protocols. Our comprehensive approach includes:

| • | An enterprise firewall; |

| • | Implementation of Multi-Factor Authentication (MFA); |

| • | Adherence to the Zero Trust model; |

| • | Utilization of Managed Detection and Response (MDR); |

| • | Endpoint Detection and Response (EDR) technologies; |

| • | 24x7 Security Operations Center (SOC); and |

| • | Employment of Security Information and Event Management (SIEM) systems to continuously monitor our network and respond to threats in real time. |

Risk Assessment Procedures: We conduct periodic risk assessments to identify potential cybersecurity threats and vulnerabilities within our IT infrastructure. These assessments are conducted using various software tools and methodologies that enable us to evaluate our systems critically and comprehensively. Our risk assessment process includes the analysis of:

| • | Hardware and software configurations; |

| • | Network and data access protocols; |

| • | Encryption standards; and |

| • | Compliance with relevant industry and regulatory standards. |

Threat Identification: We utilize advanced threat detection tools and services that continuously monitor our network for signs of unauthorized access, anomalies, and potential breaches. Our third-party cybersecurity provider is equipped with sophisticated detection technologies that help to swiftly identify even the most subtle signs of compromise. We focus on:

| • | Real-time monitoring of our networks; |

| • | Regularly updated intrusion detection systems (IDS); |

| • | Deployment of endpoint detection and response (EDR) solutions; and |

| • | Utilization of threat intelligence platforms to stay abreast of emerging threats. |

Threat Management: Upon identification of a potential threat, our managed service provider’s dedicated incident response team takes immediate action to mitigate any adverse impacts. Our threat management procedures include:

| • | Immediate isolation of affected systems to prevent the spread of threats; |

| • | Application of appropriate remediation measures, such as patches and software updates; |

| • | Conducting a thorough investigation to understand the breach’s nature and scope; and |

| • | Implementing enhancements to prevent future occurrences. |

14

Our incident response plan provides a concise strategy of how we will respond to an incident, including who will respond and their roles and responsibilities, the facilities that are in place to help with the management of the incident, how decisions will be taken with regard to our response to an incident, how communication will be handled both internally and externally, and defining what will happen once the incident is resolved and how we can learn and improve from the situation.

Integration into Overall Risk Management: Our cybersecurity risk assessment processes are fully integrated into the broader risk management framework. Cybersecurity is positioned as a core component of our risk management strategy, with direct reporting to our President and COO, who is guided by our third-party CIO firm. The CIO firm provides strategic direction on policy, procedures and best practice. The synergy between cybersecurity and risk management ensures a resilient posture against emerging cyber threats.

Engagement of Third Parties: These providers are selected based on stringent criteria for cybersecurity expertise, particularly their capability to implement and manage NIST and CMMC protocols.

Third-Party Service Provider Oversight: Our oversight processes include comprehensive due diligence checks for any new third-party service provider and continuous monitoring of our existing managed service provider and CIO firms’ activities. We have established protocols for communication and incident response that align with our managed service provider’s operations, and industry best practice, ensuring swift action in the face of cybersecurity threats. Furthermore, a scheduled series of meetings has been established to procure updates and deliberate upon cybersecurity strategy with our contracted third-party providers.

Impact of Cybersecurity Risks

Material Effects from Cyber Threats: To date, our operations and financial condition have not been materially affected by cybersecurity threats, due in part to our proactive measures such as employee security training programs and advanced threat detection and response capabilities. Our defensive strategies have successfully mitigated the risks of cyber incidents.

Potential Risk Exposure: While we have not experienced significant disruptions from cyber threats, we recognize the evolving nature of cyber risks. We continually evaluate the likelihood of potential cybersecurity incidents that could materially impact our strategic direction, operational efficacy, and financial stability. Our investment in training, alongside our sophisticated SOC, SIEM, and Zero Trust architecture, positions us to identify and address potential cybersecurity challenges promptly.

Cybersecurity Governance