UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-42020

MAREX GROUP PLC

(Translation of registrant’s name into English)

155 Bishopsgate

London EC2M 3TQ

United Kingdom

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXPLANATORY NOTE

Earnings Results

On May 16, 2024, Marex Group plc (the “Company”) issued a press release titled “Marex Group plc Full Year 2023 Results and Q1 2024 Update.” A copy of the press release is furnished as Exhibit 99.1 herewith.

UK Annual Report to Shareholders

On May 16, 2024, the Company published its UK Annual Report 2023 to Shareholders. The UK Annual Report 2023 to Shareholders is furnished as Exhibit 99.2 herewith.

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

| Exhibit No. |

Description | |

| 99.1 | Press release dated May 16, 2024 titled “Marex Group plc Full Year 2023 Results and Q1 2024 Update” | |

| 99.2 | UK Annual Report 2023 to Shareholders | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Marex Group plc | ||||||

| Date: May 16, 2024 | By: | /s/ Robert Irvin |

||||

| Robert Irvin | ||||||

| Chief Financial Officer | ||||||

Exhibit 99.1

Press Release

Marex Group plc Announces Full Year 2023 Results and Q1 2024 Update

| • | Transformational year thanks to successful organic growth and the benefit of acquisitions |

| • | First quarter profit at the top end of range for preliminary results shows continued strong performance |

| • | Positive momentum continued into the second quarter with good performance in April |

NEW YORK, May 16, 2024 (GLOBE NEWSWIRE) — Marex Group plc (‘Marex’ or the ‘Group’), a diversified global financial services platform, announces strong results for the twelve months ended December 31, 2023, and a positive update for the first three months ended March 31, 2024.

Ian Lowitt, Group Chief Executive Officer, commented:

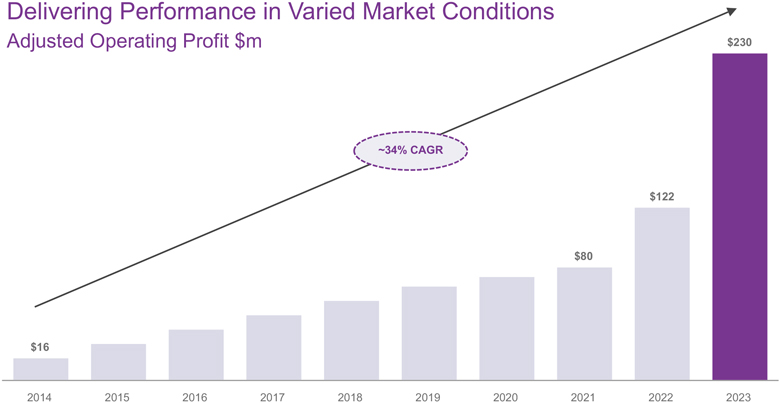

“2023 was another exceptional year where we transformed the scale and scope of the firm and maintained our record of delivering sequential growth over each of the last nine years, with an Adjusted Operating Profit compound annual growth of 34%. We continued to deliver on our strategy to expand our capabilities and our geographic reach, providing our growing client base with essential market connectivity, liquidity and hedging solutions.

We also delivered strong performance in the first quarter of 2024, reflecting the strength and scalability of the diversified global platform we have built. We are pleased to report profit at the top end of the range of the preliminary results in our IPO registration statement and significantly higher than the fourth quarter of 2023. We are delighted to have successfully launched our IPO in April and are grateful for the strong investor engagement and support. As we look to the second quarter, we have seen continued positive momentum.

The outlook for Marex remains positive. We have strong momentum in our core businesses bolstered by supportive macro-economic conditions. We continue to consider potential inorganic growth opportunities that will supplement our strong organic growth initiatives, which are proceeding well. We expect to continue to deliver sustainable growth and build an even more diversified and resilient business.”

Financial Highlights:

| 12 months ended Dec 31, 2023 |

12 months ended Dec 31, 2022 |

% Change2 |

3 months ended Mar 31, 2024 (unaudited) |

3 months ended Dec 31, 2023 (unaudited) |

% Change2 | |||||||||||||||||||

| $m |

||||||||||||||||||||||||

| Reported |

||||||||||||||||||||||||

| Revenue |

1,245 | 711 | 75% | 366 | 326 | 12% | ||||||||||||||||||

| Profit before tax |

197 | 122 | 62% | 59 | 29 | 104% | ||||||||||||||||||

| Profit before tax Margin (%) |

16% | 17% | (1ppt) | 16% | 9% | 7ppt | ||||||||||||||||||

| Profit after tax |

141 | 98 | 44% | 44 | 18 | 141% | ||||||||||||||||||

| Return on Equity (%) |

19% | 17% | 2ppt | 23% | 9% | 14ppt | ||||||||||||||||||

| Adjusted1 |

||||||||||||||||||||||||

| Operating Profit1 |

230 | 122 | 89% | 68 | 53 | 29% | ||||||||||||||||||

| Operating Profit Margin (%)1 |

18% | 17% | 1ppt | 19% | 16% | 3ppt | ||||||||||||||||||

| Operating Profit after tax Attributable to Common Equity1 |

163 | 93 | 75% | 49 | 39 | 26% | ||||||||||||||||||

| Return on Operating Profit after tax Attributable to Common Equity (%)1 |

26% | 18% | 8ppt | 29% | 23% | 6ppt | ||||||||||||||||||

| 1. | These are non-IFRS financial measures. See Appendix 1 “Non-IFRS Financial Measures and Key Performance Indicators” for additional information and for a reconciliation of each such IFRS measure to its most directly comparable non-IFRS measure. |

| 2. | % change is calculated on numbers presented to the nearest tenth of a million. |

For this quarterly update we are providing a comparison to the fourth quarter 2023, the most recent quarter. There are no comparable numbers from the first quarter in 2023 because as a private company we were not required to do a substantive close. We started this process from June 2023 in preparation for our US listing. Therefore, we will provide comparisons for the first half of 2023 as well as the third and fourth quarter.

1

Full Year 2023 Highlights:

| • | We have delivered on our strategy to grow our capabilities, our geographic reach, and our clients, through organic growth and selective acquisitions, benefiting from the integration of the ED&F Man Capital Markets division and completing the acquisition of Cowen’s prime broking business in December 2023. |

| • | Our diversified and resilient business delivered increased client activity as we benefited from organic and inorganic growth. |

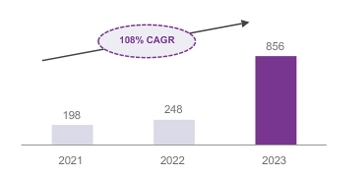

| ○ | Total trades executed were up 122% to 129 million and contracts cleared were up 245% to 856 million in 2023. |

| ○ | Average client balances were up 45% to $13.2 billion at December 31, 2023, from $9.1 billion at the end of 2022. |

| • | Results benefited from a supportive macro-economic environment, characterised by high interest rates. |

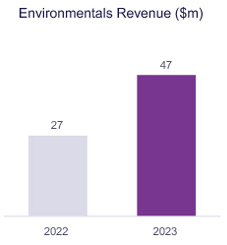

| • | Marex’s environmentals business generated strong revenue growth, up 74% to $47 million in 2023, as we continue to help our clients to navigate the energy transition. |

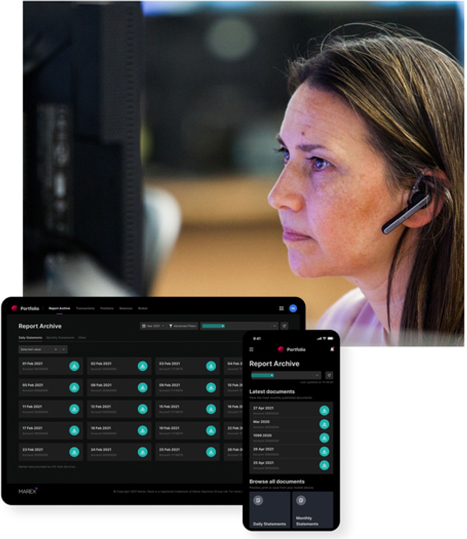

| • | We continue to invest in our proprietary technology portal Neon, which delivers a high-quality user experience to clients and now has approximately 16,000 users. |

| • | Successful issuance of €300 million in unsecured 5-year senior notes, further strengthening our liquidity. Through retained earnings we also strengthened the balance sheet and capital position to support continued growth. |

| • | Investment grade credit ratings affirmed by S&P Global and Fitch. |

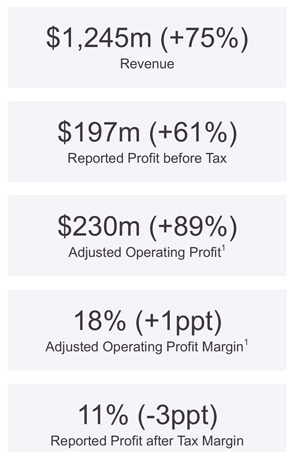

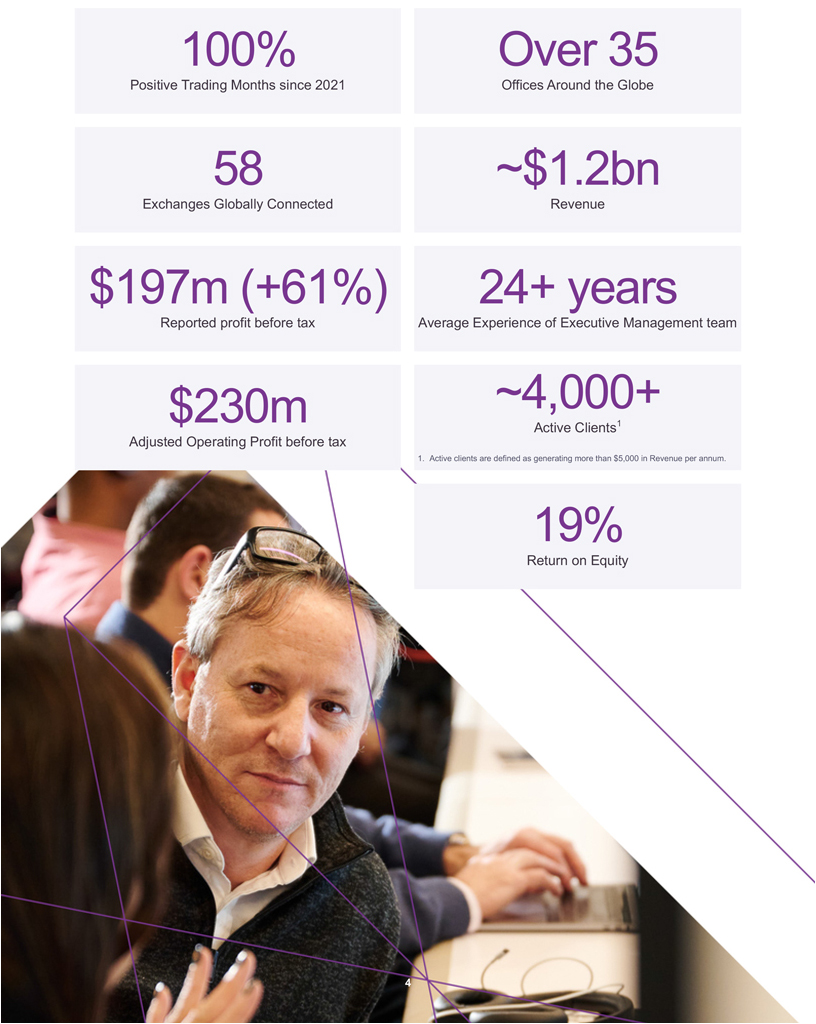

Performance was strong across the Group. Revenue rose 75% to $1,245 million and Reported Profit before tax was up 62% to $197 million and Adjusted Operating Profit rose 89% to $230 million. This was driven by performance across our segments as follows:

| • | Clearing provides connectivity between clients, exchanges and clearing houses across four principal asset classes: metals, agriculture, energy and financial products. Revenue for the twelve months ended December 31, 2023 was $373.6 million, up 87% from $200 million in 2022. This includes $236.2 million in net commission income, up 63% from the year before. |

| • | Agency and Execution acts as an agent matching buyers and sellers thereby facilitating access to market liquidity in energy and financial securities. Revenue for the twelve months ended December 31, 2023 was $541.5 million, up 135% from $230.7 million in 2022, reflecting positive conditions in the energy markets and the benefits of acquisitions that increased our capabilities in financial securities. |

| • | Market Making operates within four principal markets: metals, agriculture, energy and financial securities. Revenue for the twelve months ended December 31, 2023 of $153.9 million, down 11% from $172.6 million in 2022 reflecting a return to more normalised levels of volatility following exceptionally high levels in 2022, and higher costs of liquidity. |

| • | Hedging and Investment Solutions provides high-quality bespoke hedging and investment solutions to our clients. Revenue for the twelve months ended December 31, 2023 was $128.1 million, up by 28% from $100 million the year earlier. |

| • | Corporate revenue is primarily net interest income on house cash balances placed at banks and exchanges. Revenue for the twelve months ended December 31, 2023 was $47.5 million, up 509% from $7.8 million in 2022. |

First Quarter Year 2024 Highlights:

| • | Strong start to the year with increased client activity on our platform and the full benefit of the Cowen acquisition which was completed in December 2023: |

| ○ | Contracts cleared were 264 million, up 16% from Q4 2023. |

| • | All four segments saw a solid first quarter with a particularly strong performance from Hedging and Investment Solutions. |

| • | Recently acquired Cowen prime brokerage and outsourced trading business performing well, with good progress made onboarding new clients. |

| • | Prudent approach to capital and liquidity management, with significant headroom maintained above regulatory requirements. |

| • | Supportive market conditions and strong business performance continue into the second quarter. Well positioned, building on our expanded global footprint and client-centric growth strategy. |

First quarter performance continued to improve across the Group as compared to the fourth quarter of 2023. We generated $365.8 million in revenue for the three months ended March 31, 2024, up 12% from the three months ended December 31, 2023, driven by performance across our segments as follows:

2

First Quarter Year 2024 Highlights (continued):

| • | Clearing saw revenue for the three months ended March 31, 2024 of $100.7 million, up 22% from $82.7 million in the fourth quarter of 2023. Revenue in Q1 included $69.5 million in commission income, as well as $30.2 million net interest income reflecting average balances for the period of $13.2 billion, up from $12.7 billion in Q4 2023. |

| • | Agency and Execution saw revenue for the three months ended March 31, 2024 at $168.1 million, up 6% from $157.9 million in Q4 2023. Revenue in the first quarter consisted of $73.2 million from energy and $94.9 million from financial securities. |

| • | Market Making benefited from relatively benign conditions in the first quarter, with 94% positive trading days. Revenue

for the three months ended March 31, 2024 rose 8% to $41.8 million from $38.8 million in Q4 2023, consisting of |

| • | Hedging and Investment Solutions delivered strong performance in the first quarter, with good demand from clients in both parts of the business. Revenue for the three months ended March 31, 2024 was $41.3 million, up 24% from $33.2 million in Q4 2023, consisting of $19.5 million from hedging solutions and $21.8 million from financial products. |

| • | Corporate revenue for the three months ended March 31, 2024 was $13.9 million up 8% from $12.9 million in Q4 2023. |

As at March 31, 2024, the Group’s balance sheet was broadly in line with December 31, 2023. Total assets increased 2% to $18.0 billion.

The following table presents summary consolidated financial and other data as of the dates and for the periods indicated:

| 12 months ended Dec 31, 2023 |

12 months ended Dec 31, 2022 |

% Change |

3 months ended Mar 31, 2024 (unaudited) |

3 months ended Dec 31, 2023 (unaudited) |

% Change |

|||||||||||||||||||

| $m |

||||||||||||||||||||||||

| Revenue |

1,244.6 | 711.1 | 75.0% | 365.8 | 325.5 | 12.4% | ||||||||||||||||||

| Front Office Costs |

(690.4) | (400.0) | 72.6% | (210.1) | (186.0) | 13.0% | ||||||||||||||||||

| Control & Support Costs |

(294.2) | (168.6) | 74.5% | (80.6) | (79.3) | 1.6% | ||||||||||||||||||

| Provision for Credit Losses |

(7.1) | (9.5) | (25.3)% | 0.3 | (2.4) | (112.5)% | ||||||||||||||||||

| Depreciation & Amortisation |

(27.1) | (13.8) | 96.4% | (7.8) | (6.1) | 27.9% | ||||||||||||||||||

| Other income and share of results of associates |

4.2 | 2.5 | 68.0% | 0.1 | 0.9 | (88.9)% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Operating Profit |

230.0 | 121.7 | 89.0% | 67.7 | 52.6 | 28.7% | ||||||||||||||||||

| Non-Operating adjustments |

(33.5) | (0.1) | n.m. | (8.8) | (23.8) | (63.0)% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Reported Profit before tax |

196.5 | 121.6 | 61.6% | 58.9 | 28.8 | 104.5% | ||||||||||||||||||

| Tax |

(55.2) | (23.4) | 135.9% | (15.3) | (10.7) | 43.0% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Reported Profit after tax |

141.3 | 98.2 | 43.9% | 43.6 | 18.1 | 140.9% | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Front office costs represent staff, systems and infrastructure costs associated with running our revenue generating operations. Control and Support costs primarily reflect staff and property-related costs, along with professional fees and other administrative expenses associated with the support functions.

Conference Call Information:

Marex’s management will host a conference call to discuss its financial results today, May 16, 2024, at 9am Eastern Time. A live webcast of the call can be accessed from Marex’s Investor Relations website. An archived version will be available on the website after the call. To participate in the Conference Call, please register at the link here https://edge.media-server.com/mmc/p/t4uh5at8.

About Marex plc:

Marex is a diversified global financial services platform providing essential liquidity, market access and infrastructure services to clients across energy, commodities and financial markets.

3

About Marex plc (continued)

The Group provides comprehensive breadth and depth of coverage across four core services: Clearing, Agency and Execution, Market Making and Hedging and Investment Solutions. It has a leading franchise in many major metals, energy and agricultural products, executing around 129 million trades and clearing 856 million contracts in 2023. The Group provides access to the world’s major commodity markets, covering a broad range of clients that include some of the largest commodity producers, consumers and traders, banks, hedge funds and asset managers.

Headquartered in London with more than 35 offices worldwide, the Group has over 2,000 employees across Europe, Asia and the Americas. For more information visit www.marex.com.

Forward looking statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including expected financial results, expected growth and business plans. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation: subdued commodity market activity or pricing levels; the effects of geopolitical events, terrorism and wars, such as the effect of Russia’s military action in Ukraine, on market volatility, global macroeconomic conditions and commodity prices; changes in interest rate levels; the risk of our clients and their related financial institutions defaulting on their obligations to us; regulatory, reputational and financial risks as a result of our international operations; software or systems failure, loss or disruption of data or data security failures; an inability to adequately hedge our positions and limitations on our ability to modify contracts and the contractual protections that may be available to us in OTC derivatives transactions; market volatility, reputational risk and regulatory uncertainty related to commodity markets, equities, fixed income, foreign exchange and cryptocurrency; the impact of climate change and the transition to a lower carbon economy on supply chains and the size of the market for certain of our energy products; the impact of changes in judgments, estimates and assumptions made by management in the application of our accounting policies on our reported financial condition and results of operations; lack of sufficient financial liquidity; if we fail to comply with applicable law and regulation, we may be subject to enforcement or other action, forced to cease providing certain services or obliged to change the scope or nature of our operations; significant costs, including adverse impacts on our business, financial condition and results of operations, and expenses associated with compliance with relevant regulations; and if we fail to remediate the material weaknesses we identified in our internal control over financial reporting or prevent material weaknesses in the future, the accuracy and timing of our financial statements may be impacted, which could result in material misstatements in our financial statements or failure to meet our reporting obligations and subject us to potential delisting, regulatory investments or civil or criminal sanctions, and other risks discussed under the caption “Risk Factors” in our final prospectus filed pursuant to 424(b)(4) with the Securities and Exchange Commission (the “SEC”) on April 26, 2024 and our other reports filed with the SEC.

The forward-looking statements made in this press release relate only to events or information as of the date on which the statements are made in this press release. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

4

| Appendix 1 – Supplementary Financial Information

Statutory Condensed Consolidated Income |

12 months | 12 months | 3 months ended Mar |

3 months ended Dec |

||||||||||||

| ended Dec | ended Dec | 31, 2024 | 31, 2023 | |||||||||||||

| 31, 2023 | 31, 2022 | (unaudited) | (unaudited) | |||||||||||||

| $m | $m | $m | $m | |||||||||||||

| Commission and fee income |

1,342.4 | 651.0 | 400.6 | 318.6 | ||||||||||||

| Commission and fee expense |

(637.5) | (299.2) | (181.7) | (137.2) | ||||||||||||

| Net commission income |

704.9 | 351.8 | 218.9 | 181.4 | ||||||||||||

| Net trading income |

411.4 | 325.3 | 106.2 | 111.5 | ||||||||||||

| Interest income |

591.8 | 194.4 | 163.2 | 144.5 | ||||||||||||

| Interest expense |

(470.2) | (165.0) | (127.6) | (114.4) | ||||||||||||

| Net interest income |

121.6 | 29.4 | 35.6 | 30.1 | ||||||||||||

| Net physical commodities income |

6.7 | 4.6 | 5.1 | 2.5 | ||||||||||||

| Revenue |

1,244.6 | 711.1 | 365.8 | 325.5 | ||||||||||||

| Expenses: |

||||||||||||||||

| Compensation and benefits |

(770.3) | (438.6) | (229.9) | (206.9) | ||||||||||||

| Depreciation and amortisation |

(27.1) | (13.8) | (7.8) | (6.1) | ||||||||||||

| Impairment of goodwill |

(10.7) | (53.9) | — | (10.7) | ||||||||||||

| Other expenses |

(237.4) | (147.8) | (69.6) | (71.5) | ||||||||||||

| Provision for credit losses |

(7.1) | (9.5) | 0.3 | (2.4) | ||||||||||||

| Bargain purchase gain on acquisitions |

0.3 | 71.6 | — | — | ||||||||||||

| Other income |

3.4 | 2.8 | 0.1 | 0.9 | ||||||||||||

| Share of results of associates and joint ventures . |

0.8 | (0.3) | — | — | ||||||||||||

| Profit before tax |

196.5 | 121.6 | 58.9 | 28.8 | ||||||||||||

| Tax |

(55.2) | (23.4) | (15.3) | (10.7) | ||||||||||||

| Profit after tax |

141.3 | 98.2 | 43.6 | 18.1 | ||||||||||||

| Attributable to: |

||||||||||||||||

| Ordinary shareholders of the Company |

128.0 | 91.6 | 40.3 | 14.8 | ||||||||||||

| Other equity holders |

13.3 | 6.6 | 3.3 | 3.3 | ||||||||||||

5

Appendix 1 – Supplementary Financial Information (continued)

Revenue

| Agency | Hedging and | |||||||||||||||||||||||||||||||||||

| and | Market | Investments | ||||||||||||||||||||||||||||||||||

| Clearing | Execution | Making | Solutions | Corporate | Total | |||||||||||||||||||||||||||||||

| 12 months ended December 31, 2023 | $m | $m | $m | $m | $m | $m | ||||||||||||||||||||||||||||||

| Net commission income/(expense) |

236.2 | 473.4 | (4.7) | — | — | 704.9 | ||||||||||||||||||||||||||||||

| Net trading income/(expense) |

1.2 | 62.1 | 182.8 | 165.7 | (0.4) | 411.4 | ||||||||||||||||||||||||||||||

| Net interest income/(expense) |

136.2 | 6.0 | (30.9) | (37.6) | 47.9 | 121.6 | ||||||||||||||||||||||||||||||

| Net physical commodities income |

— | — | 6.7 | — | — | 6.7 | ||||||||||||||||||||||||||||||

| Revenue |

373.6 | 541.5 | 153.9 | 128.1 | 47.5 | 1,244.6 | ||||||||||||||||||||||||||||||

| Agency | Hedging and | |||||||||||||||||||||||||||||||||||

| and | Market | Investments | ||||||||||||||||||||||||||||||||||

| Clearing | Execution | Making | Solutions | Corporate | Total | |||||||||||||||||||||||||||||||

| 12 months ended December 31, 2022 | $m | $m | $m | $m | $m | $m | ||||||||||||||||||||||||||||||

| Net commission income/(expense) |

144.7 | 207.1 | — | — | — | 351.8 | ||||||||||||||||||||||||||||||

| Net trading income/(expense) |

— | 18.4 | 179.1 | 128.2 | (0.4) | 325.3 | ||||||||||||||||||||||||||||||

| Net interest income/(expense) |

55.3 | 5.2 | (11.1) | (28.2) | 8.2 | 29.4 | ||||||||||||||||||||||||||||||

| Net physical commodities income |

— | — | 4.6 | — | — | 4.6 | ||||||||||||||||||||||||||||||

| Revenue |

200.0 | 230.7 | 172.6 | 100.0 | 7.8 | 711.1 | ||||||||||||||||||||||||||||||

| Agency | Hedging and | |||||||||||||||||||||||||||||||||||

| and | Market | Investments | ||||||||||||||||||||||||||||||||||

| 3 months ended March 31, 2024 (Unaudited) |

Clearing |

Execution | Making | Solutions | Corporate | Total | ||||||||||||||||||||||||||||||

|

$m |

$m | $m | $m | $m | $m | |||||||||||||||||||||||||||||||

| Net commission income/(expense) |

69.5 | 150.5 | (1.1) | — | — | 218.9 | ||||||||||||||||||||||||||||||

| Net trading income |

1.0 | 9.1 | 44.2 | 51.9 | — | 106.2 | ||||||||||||||||||||||||||||||

| Net interest income/(expense) |

30.2 | 8.0 | (5.9) | (10.6) | 13.9 | 35.6 | ||||||||||||||||||||||||||||||

| Net physical commodities income |

— | 0.5 | 4.6 | — | — | 5.1 | ||||||||||||||||||||||||||||||

| Revenue |

100.7 | 168.1 | 41.8 | 41.3 | 13.9 | 365.8 | ||||||||||||||||||||||||||||||

6

Appendix 1 – Supplementary Financial Information (continued)

Revenue (continued)

| Agency | Hedging and | |||||||||||||||||||||||

| and | Market | Investments | ||||||||||||||||||||||

| 3 months ended December 31, 2023 (Unaudited) |

Clearing |

Execution | Making | Solutions | Corporate | Total | ||||||||||||||||||

|

$m |

$m | $m | $m | $m | $m | |||||||||||||||||||

| Net commission income/(expense) |

52.6 | 131.2 | (2.4) | — | — | 181.4 | ||||||||||||||||||

| Net trading income |

0.4 | 23.2 | 45.7 | 42.3 | (0.2) | 111.5 | ||||||||||||||||||

| Net interest income/(expense) |

29.6 | 3.5 | (7.0) | (9.1) | 13.1 | 30.1 | ||||||||||||||||||

| Net physical commodities income |

— | — | 2.5 | — | — | 2.5 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Revenue |

82.7 | 157.9 | 38.8 | 33.2 | 12.9 | 325.5 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

Reconciliation of Adjusted Operating Profit and Adjusted Operating Profit After Tax Attributable to Common Equity to Reported Profit before tax per the income statement:

| 3 months | 3 months | |||||||||||||||

| 12 months | 12 months | ended Mar | ended Dec | |||||||||||||

| ended Dec | ended Dec | 31, 2024 | 31, 2023 | |||||||||||||

| 31, 2023 | 31, 2022 | (unaudited) | (unaudited) | |||||||||||||

| Profit Before Tax |

196.5 | 121.6 | 58.9 | 28.8 | ||||||||||||

| Goodwill impairment charges(a) |

10.7 | 53.9 | — | 10.7 | ||||||||||||

| Bargain purchase gains(b) |

(0.3) | (71.6) | — | — | ||||||||||||

| Acquisition costs(c) |

1.8 | 11.5 | 0.2 | 1.2 | ||||||||||||

| Amortisation of acquired brands and customer lists(d) |

2.1 | 1.7 | 0.8 | 0.8 | ||||||||||||

| Activities relating to shareholders(e) |

3.1 | 0.5 | 2.4 | 2.2 | ||||||||||||

| Owner fees(f) |

6.0 | 3.4 | 1.7 | 1.0 | ||||||||||||

| IPO preparation costs(g) |

10.1 | 0.7 | 3.7 | 7.9 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Adjusted Operating Profit |

230.0 | 121.7 | 67.7 | 52.6 | ||||||||||||

| Adjusted Operating Tax |

(57.3) | (23.9) | (16.3) | (11.4) | ||||||||||||

|

|

|

|||||||||||||||

| Adjusted Operating Profit after tax |

172.7 | 97.8 | 51.4 | 41.2 | ||||||||||||

| Profit attributable to AT1 note holders(h) |

(10.1) | (5.1) | (2.5) | (2.5) | ||||||||||||

|

|

|

|||||||||||||||

| Adjusted Operating Profit after tax Attributable to Common Equity |

162.6 | 92.7 | 48.9 | 38.7 | ||||||||||||

|

|

|

|||||||||||||||

7

Appendix 1 – Supplementary Financial Information (continued)

(a) Goodwill impairment charges in 2023 relates to the impairment recognised for goodwill relating to the Volatility Performance Fund S.A. CGU (‘VPF’) largely due to declining projected revenue. Goodwill impairment changes in 2022 relates to the impairment charge recognised for the OTC Energy CGU largely due to declining budgeted performance and macroeconomic factors, such as high inflation and interest rates.

(b) Bargain purchase gains relate to a gain of $0.3 million (2022: $71.6 million), recognised as a result of the acquisition of ED&F Man Capital Markets’ US and UK businesses in 2022.

(c) Acquisition costs are costs, such as legal fees incurred in relation to the business acquisitions of ED&F Man Capital Markets business, the OTCex group and Cowen’s Prime Services and Outsourced Trading business.

(d) This represents the amortisation charge for the year/period of acquired brands and customers lists.

(e) Activities in relation to shareholders primarily consist of dividend-like contributions made to participants within certain of our share-based payments schemes. In prior years, this balance was presented as part of amortisation of acquired brands and customer lists. Given the increase of the balance in 2023, this has been reclassified out of the line item and is now presented separately.

(f) Owner fees relate to management services to parties associated with the ultimate controlling party based on a percentage of our EBITDA in each year, presented in the income statement within other expenses. Owner fees are excluded from operating expenses as they do not form part of the operation of the business and ceased to be incurred after the completion of our offering.

(g) IPO preparation costs related to consulting, legal and audit fees, presented in the income statement within other expenses.

(h) Profit attributable to AT1 note holders includes the coupons on the AT1 which are accounted for as dividends and the tax benefit of the coupons.

Non-IFRS Financial Measures and Key Performance Indicators

Certain parts of this press release contain non-IFRS financial measures, including Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity. These non-IFRS financial measures are presented for supplemental informational purposes only and should not be considered a substitute for profit after tax, profit margin, return on equity or any other financial information presented in accordance with IFRS and may be different from similarly titled non-IFRS measures used by other companies.

We define Adjusted Operating Profit as profit after tax adjusted for (i) tax, (ii) goodwill impairment charges, (iii) acquisition costs, (iv) bargain purchase gains, (v) owner fees, (vi) amortisation of acquired brands and customer lists, (vii) activities in relation to shareholders and (viii) initial public offering (“IPO”) preparation costs. Adjusted Operating Profit is the primary measure used by our management to evaluate and understand our underlying operations and business trends, forecast future results and determine future capital investment allocations. Adjusted Operating Profit is the measure used by our executive board to assess the financial performance of our business in relation to our trading performance. The most directly comparable IFRS measure is profit after tax. We believe Adjusted Operating Profit is a useful measure as it allows management to monitor our ongoing core operations and provides useful information to investors and analysts regarding the net results of the business. The core operations represent the primary trading operations of the business.

We define Adjusted Operating Profit Margin as Adjusted Operating Profit (as defined above) divided by revenue. We believe that Adjusted Operating Profit Margin is a useful measure as it allows management to assess the profitability of our business in relation to revenue. The most directly comparable IFRS measure is profit margin, which is profit after tax divided by revenue.

8

Appendix 1 – Supplementary Financial Information (continued)

We define Adjusted Operating Profit After Tax Attributable to Common Equity as adjusted operating profit adjusting for (i) the tax effect of the adjusting items to calculate adjusted operating profit, (ii) the tax effect from the coupons on the additional tier one capital and (iii) the profit attributable to the holders of the Additional Tier 1 capital. We define common equity as being the equity belonging to the holder of the Group’s share capital. The most directly comparable IFRS measure is profit after tax.

We define the Return on Adjusted Operating Profit After Tax Attributable to Common Equity as the Adjusted Operating Profit After Tax Attributable to Common Equity, divided by the average common equity for the period. Common equity is the total equity and deducting the Additional Tier 1 capital, the average being a two point average from the beginning and end of the period. The most directly comparable IFRS measure for Adjusted Operating Profit After Tax Attributable to Common Equity is profit after tax.

We believe that these non-IFRS financial measures provide useful information to both management and investors by excluding certain items that management believes are not indicative of our ongoing operations. Our management uses these non-IFRS measures to evaluate our business strategies and to facilitate operating performance comparisons from period to period. We believe that these non-IFRS measures provide useful information to investors because they improve the comparability of our financial results between periods and provide for greater transparency of key measures used to evaluate our performance. In addition, we believe Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity are measures commonly used by investors to evaluate companies in the financial services industry. However, they are not presentations made in accordance with IFRS, and the use of the terms Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity may vary from others in our industry. Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity are frequently used by securities analysts, investors and other interested parties in their evaluation of companies comparable to us, many of which present related performance measures when reporting their results.

Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity are used by different companies for differing purposes and are often calculated in different ways that reflect the circumstances of those companies. In addition, certain judgments and estimates are inherent in our process to calculate such non-IFRS measures. You should exercise caution in comparing Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity as reported by us to Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity, and Return on Adjusted Operating Profit After Tax Attributable to Common Equity as reported by other companies.

Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under IFRS. Some of these limitations are:

| • | they do not reflect costs incurred in relation to the acquisitions that we have undertaken; |

| • | they do not reflect impairment of goodwill; |

| • | other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures; and |

| • | the adjustments made in calculating these non-IFRS measures are those that management considers to be not representative of our core operations and, therefore, are subjective in nature. |

Accordingly, prospective investors should not place undue reliance on Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Operating Profit After Tax Attributable to Common Equity and Return on Adjusted Operating Profit After Tax Attributable to Common Equity.

We also use key performance indicators (“KPIs”) such as Average Balances, Trades Executed, and Contracts Cleared to assess the performance of our business and believe that these KPIs provide useful information to both management and investors by showing the growth of our business across the periods presented.

9

Appendix 1 – Supplementary Financial Information (continued)

Our management uses these KPIs to evaluate our business strategies and to facilitate operating performance comparisons from period to period. We define certain terms used in this release as follows:

“Average balances” means the average amount of segregated and non-segregated client balances that generate interest income for us over a given period, calculated by taking the balances at the end of each quarter for the last five quarters.

“Trades executed” means the total number of trades executed on our platform in a given year.

“Contracts cleared” means the total number of contracts cleared in a given year.

10

Appendix 2 – Trading Volumes

| Marex Volumes | Market Volumes |

Marex Volumes | Market Volumes |

|||||||||||||||||||||||||||||

| (million contracts) |

12 months ended Dec 31, 2023 (Unaudited) |

12 months ended Dec 31, 2022 (Unaudited) |

Growth%1 | 2023 vs 20221 |

3 months ended Mar 31, 2024 (Unaudited) |

3 months ended Dec 31, 2023 (Unaudited) |

Growth%1 | Q1 24 vs Q4 231 |

||||||||||||||||||||||||

| Clearing |

855.5 | 247.8 | 245 | % | 4 | % | 263.5 | 228.1 | 16 | % | 4 | % | ||||||||||||||||||||

| Agency & Execution |

||||||||||||||||||||||||||||||||

| Energy |

44.7 | 30.9 | 45 | % | 13 | % | 14.9 | 13.6 | 10 | % | 9 | % | ||||||||||||||||||||

| Securities |

239.5 | 57.7 | 315 | % | 4 | % | 75.5 | 64.7 | 17 | % | 1 | % | ||||||||||||||||||||

| Market Making |

||||||||||||||||||||||||||||||||

| Agriculture |

28.1 | 24.1 | 17 | % | 16 | % | 8.9 | 7.1 | 25 | % | 8 | % | ||||||||||||||||||||

| Metals |

25.3 | 21.5 | 18 | % | 18 | % | 6.8 | 6.8 | — | % | 10 | % | ||||||||||||||||||||

| Energy |

2.1 | 2.0 | 1 | % | 13 | % | 0.5 | 0.6 | (10 | )% | 9 | % | ||||||||||||||||||||

| 1. | % change is calculated on unrounded numbers. |

Enquiries please contact:

Marex

Nicola Ratchford / Robert Coates

+44 (0) 7786548889 / +44 7880 486329 | nratchford@marex.com / RCoates@marex.com

FTI Consulting US / UK

+1 (919) 609-9423 / +44 (0) 7776 111 222 | marex@fticonsulting.com Marex is a diversified global financial services

11

Exhibit 99.2

Diversified Resilient. . Dynamic. Marex Group plc Annual report 2023

platform, providing essential liquidity, market

access and infrastructure services to clients in

the energy, commodities and financial markets.

We have over 35 offices, access to 58 exchanges,

and a client-focussed technology platform.

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 18 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 27 | ||||

| 33 | ||||

| 41 | ||||

| 61 | ||||

| 67 | ||||

| 77 | ||||

| 81 | ||||

| 86 | ||||

| 90 | ||||

| 94 | ||||

| 101 | ||||

| 103 | ||||

| Consolidated Statement of the Changes in Equity and Movements in Reserves |

105 | |||

| 106 | ||||

| 108 | ||||

| 179 | ||||

| Company Statement of the Changes in Equity and Movements in Reserves |

180 | |||

| 181 | ||||

| 182 | ||||

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Our diversified and resilient business

model delivered double digit growth in

Adjusted Operating Profit before tax

over the past nine years in a variety of

market conditions

We have delivered on our strategy to

grow our capabilities, our geographic

reach, and our clients, through organic

growth and selective acquisitions

Recent acquisitions have dramatically

transformed our scale and scope and

extended our geographic footprint

Successful issuance of €300 million

in unsecured 5-year senior notes,

funding our recent growth

Investment grade credit ratings

affirmed by S&P Global and Fitch

Strong financial performance driven

by client activity on our platform

About Marex

Marex is a diversified and global financial services platform. We are agile and entrepreneurial. Our teams are dedicated to providing excellent service to our clients across the globe, underpinned by our strong balance sheet, credit rating and robust risk controls. At the heart of our firm is our ability to connect clients to global markets for commodities, financial products and energy.

1. Marex’s KPIs include non-statutory alternative performance measures (‘APMs’) as defined by the European Securities and Markets Authority (‘ESMA’). We provide these to offer additional insights into the Group’s financial results. Where a non-statutory financial measure of performance is used, a reconciliation to the most directly related statutory measure is provided in note 6 to the financial statements.

1

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Marex’s diversified and scalable platform offers

liquidity, market access and hedging services

to clients across a broad range of asset classes.

We offer essential specialist services to

market participants.

Our values

| Integrity

We pride ourselves on our honesty and high ethical standards. We apply these values when working with all our clients, colleagues and other stakeholders. |

Respect

Our people and our clients are at the heart of our business. We always act respectfully and treat people fairly in everything we do. |

Developing our people

Our people are the basis of our competitive advantage. We look to ‘grow our own’ and make Marex the place ambitious, hardworking and talented people choose to build their career. |

||

| Adaptable and nimble

We are proactive. We embrace change as markets evolve to constantly increase our efficiency and create innovative solutions for our clients. |

Collaborative

By working together across the organisation, we foster teamwork, can better respond to challenges and successfully deliver for our clients. |

|||

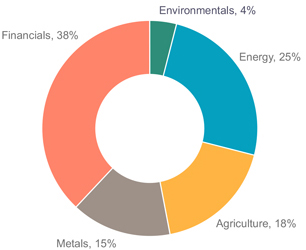

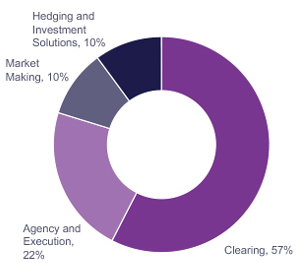

| Revenue by asset class1 | Revenue by service segment1 | |

|

|

|

| 1. | Revenue pie charts are for the 12 months ended 31 December 2023. Revenue values by service segment do not sum to 100% due to the exclusion of Corporate segment Revenue. The Corporate segment contributed $47.5 million in Revenue. |

2

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

At a Glance

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

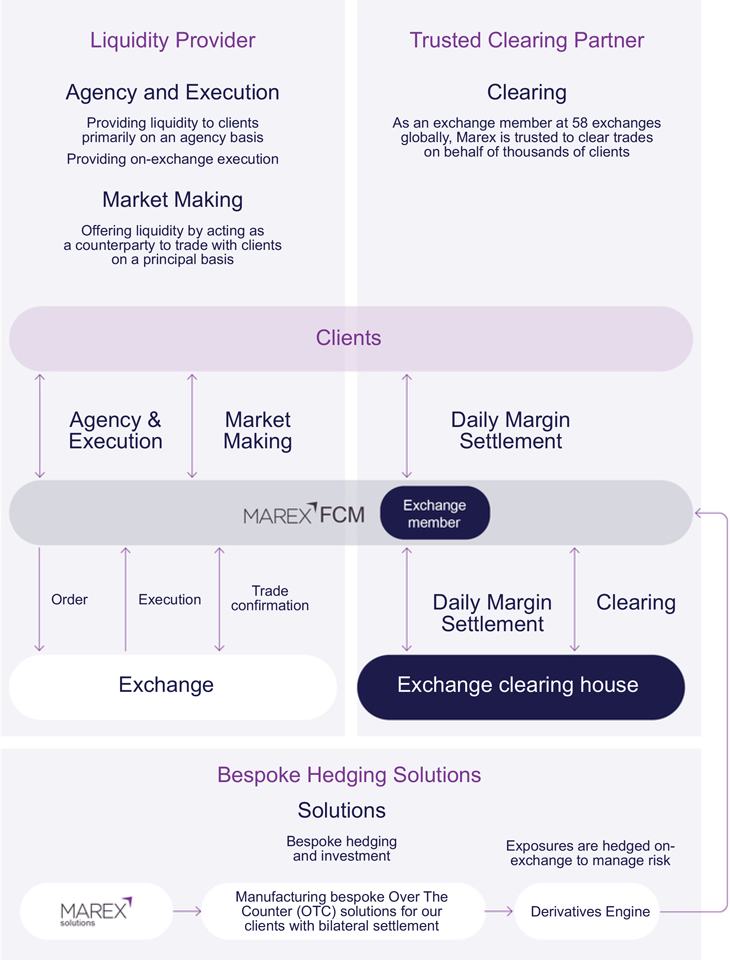

Our Value Chain

Marex Occupies a Central Position in the Value Chain Our scalable business model allows us to

5

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Market Making Provides liquidity by leveraging extensive market connectivity Acts as principal Limited market risk and overnight exposure We act as principal to provide direct market pricing to professional and wholesale counterparties in a variety of commodity and securities markets. Our Market Making business primarily generates Revenue through charging a spread between buying and selling prices, without taking significant proprietary risk. of Revenue1 12% Hedging and Investment Solutions Bespoke hedging solutions for producers, consumers and market participants Bespoke investment solutions for individuals and asset managers We offer bespoke hedging and investment solutions for our clients and generate Revenue through a return built into our product pricing. Given that we hold the principal balance of the issued notes on our balance sheet, our structured notes offering also provides a source of liquidity for our business. of Revenue1 10% 1. Revenue values by service segment do not sum to 100% due to the exclusion of Corporate segment Revenue. The Corporate segment contributed $47.5 million in Revenue. The value we create for our stakeholders Our people Our people are our most important resource, working as a team to serve our clients. We want our colleagues to feel that Marex is a great place to work. Our 2023 employee engagement survey showed that we maintained our engagement scores across the Group from the year earlier. We are pleased to see this manifest itself in strong retention, and staff turnover that is below the industry average. 17% Staff turnover (industry average 22%)1 1. 2023 Payscales Compensation Best Practice Report. Clients We have built a client-focussed business model at Marex – we strive to provide innovative products, value-added insights and high-quality service. Our growth strategy centres on attracting new clients onto our platform and increasing the business we do with all our clients over time. ~4,000+ Active clients2 2. Active clients are defined as generating more than $5,000 in Revenue per annum. Our communities and environment We are committed to cultivating positive change in the markets in which we operate. We aim to foster an environment where talent can thrive as well as to support our clients through the green transition. One of the many ways we engage with our colleagues and our communities is through charitable giving. $470k Social contribution – donated to charitable causes Investors Marex is a diversified and resilient business capable of delivering sustainable growth and strong returns over the long term. We believe this creates an attractive proposition for both debt and equity investors as we look for partners to support the future growth and evolution of the Group.

7

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Marex aims to deliver high-quality, sustainable

growth by expanding our product offering and

global reach, to deepen our client relationships.

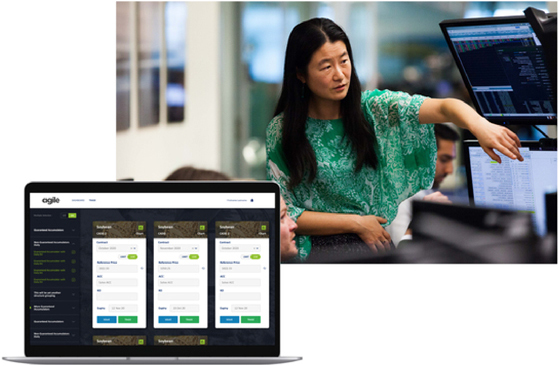

Our growth strategy is to build a diversified global platform and increase our capabilities as we look to connect clients to global markets. We continually look to expand our product coverage and geographic footprint, allowing us to bring more clients onto our platform and deepen relationships with existing clients. We have developed a scalable platform, and our people are focussed on delivering high-quality service to our clients, to differentiate us from our competitors. As our platform grows, we will continue to supplement the numerous organic growth opportunities that we see in the markets we operate in with selective, value-accretive acquisitions to accelerate our development.

As our platform grows, we have expanded into adjacent products and regions, organically and through acquisition, in the following ways:

| – | Firstly, by increasing the number of clients we service on our platform by continually developing new client relations and deepening the relationships we have with existing clients by leveraging our full-service offering. |

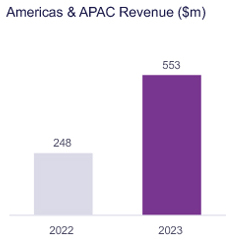

| – | Secondly, by extending our geographic coverage by building out our presence in the Americas, APAC and also the Middle East. |

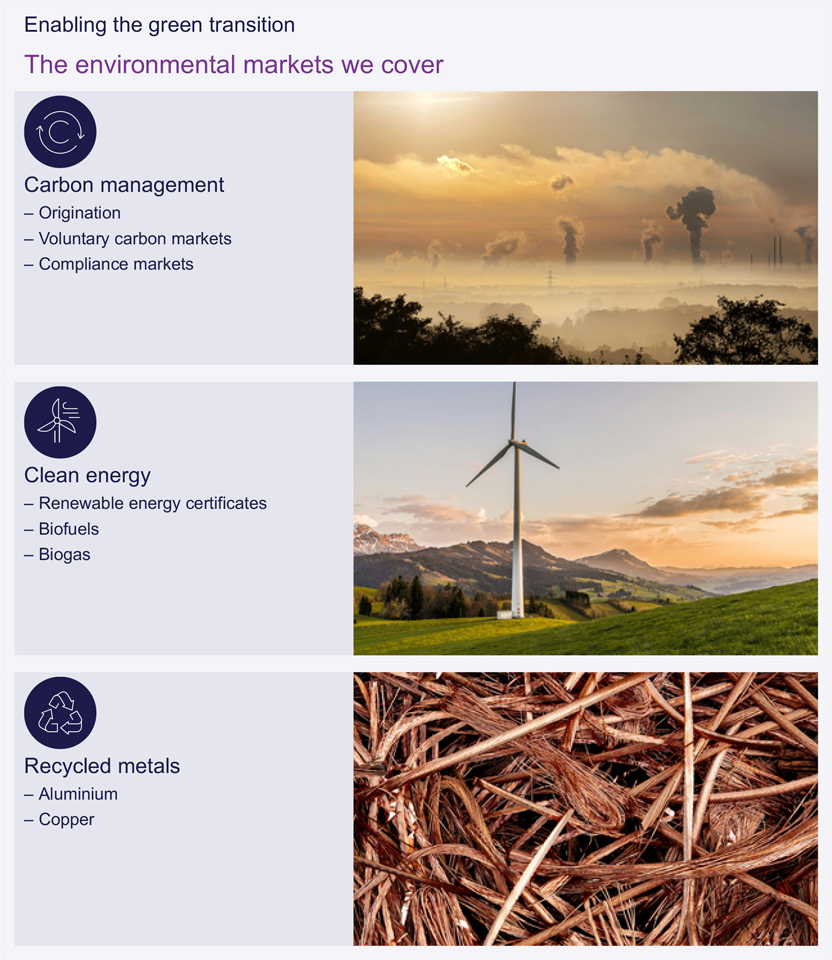

| – | Thirdly, by expanding our product offering by adding adjacent asset classes. Most notably this includes building full service capabilities in renewables and environmentals, to support our clients in the transition to a lower carbon economy, and by increasing our coverage of the financial securities markets in both Clearing and Agency & Execution, diversifying away from the commodities markets which were historically the focus of the Group. |

Successful execution of this strategy over the last five years has created a business with a track record of delivering sustainable growth across both strong and weak macroeconomic environments.

8

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Products

Focusing on our four core services, we look to expand our product coverage into adjacent markets or asset classes to increase our relevance to a broader client base.

Clients

We provide services that are essential for our clients to run their businesses effectively. We look to add new clients to our platform and deepen relationships with our existing clients through cross-selling.

Geography

We have an extensive global presence across 17 countries and are actively increasing our presence in the Middle East, the Americas and Asia Pacific, which are growth markets for us.

Recent progress

Over the last few years, we have gradually built out our product offering and expanded the asset classes we cover through both organic and inorganic investments. The acquisition of ED&F Man Capital Markets increased our capabilities in clearing, as well as financial securities in agency and execution. Acquiring OTCex also bolstered our broking capabilities in financial markets. In late 2023, we acquired Cowen’s prime and outsourced trading businesses, creating opportunities to provide additional services to our growing asset manager client base.

Recent progress

We have been highly successful in bringing new clients to our platform, with the total number of active clients exceeding 4,000 at the end of 2023, while increasing average balances from less than $1 billion in 2018 to $13.2 billion at the end of 2023. We have also increased the amount of business we do with our largest clients, increasing our share of wallet, seeing an increase in the number of clients that generate over $1 million of Revenue from 43 in 2018 to 234 in 2023, with Revenue generated from our Top 10 clients increasing to $137 million in 2023.

Recent progress

By expanding our global footprint we have seen the Revenue generated from the Americas and APAC regions grow from $248 million in 2022 to $553 million in 2023. In fact, Revenue from these regions now accounts for 45% of the Group’s total Revenue. We have achieved our extensive global presence through both organic growth and strategic acquisitions. For example, the acquisition of ED&F Man Capital Markets has significantly increased our U.S. and Middle East capabilities while our acquisition of Cowen’s prime brokerage business enabled us to diversify our product offering in financial securities in the U.S.

Looking ahead

We see opportunities to develop in Market Making in certain commodities and also to develop further in Clearing in the Americas. There is also a significant opportunity to develop more environmental products, particularly ‘green’ contracts, pairing carbon certificates with underlying commodities.

Looking ahead

We continue to add clients through organic and inorganic growth and increase Revenue generated from our smaller clients. There is a significant opportunity to cross-sell additional services to existing clients, especially for those clients who are newer to our platform.

Looking ahead

We see opportunities for growth in the securities and commodities markets in the United States and in the broader Americas region. In Asia Pacific we seek to capitalise on numerous structural growth opportunities and recent new exchange memberships on SGX and ASX. In the Middle East we see opportunities to expand in energy and environmentals, metals and financial securities.

9

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Unlocking Opportunities

Through Diversification

At Marex, we believe that diversity in our operations and services

is the key to unlocking opportunities, mitigating risk, and ensuring

our resilience in an ever-evolving market landscape.

Diversified

The combination of our global footprint and broad range of products and services means we have a scalable platform that can serve the evolving needs of our clients. New services include prime brokerage and outsourced trading, and we have bolstered our renewable metals offering and extended our range of financial products.

Our geographic expansion has also yielded benefits. We have seen significant Revenue growth in the U.S. and have expanded activities in APAC and in the Middle East. The Americas now account for 37% of Revenue and 43% of our Adjusted Operating Profit.

| Adjusted Operating Profit by service segment1 | Adjusted Operating Profit by geography1 | |

|

|

| 1. | Adjusted Operating Profit pie charts are for the 12 months ended 31 December 2023. Adjusted Operating Profit values by service segment do not sum to 100% due to exclusion of Corporate segment. Adjusted Operating Profit is a non-IFRS measure. Please see note 6 for a reconciliation to the nearest IFRS measure. |

10

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

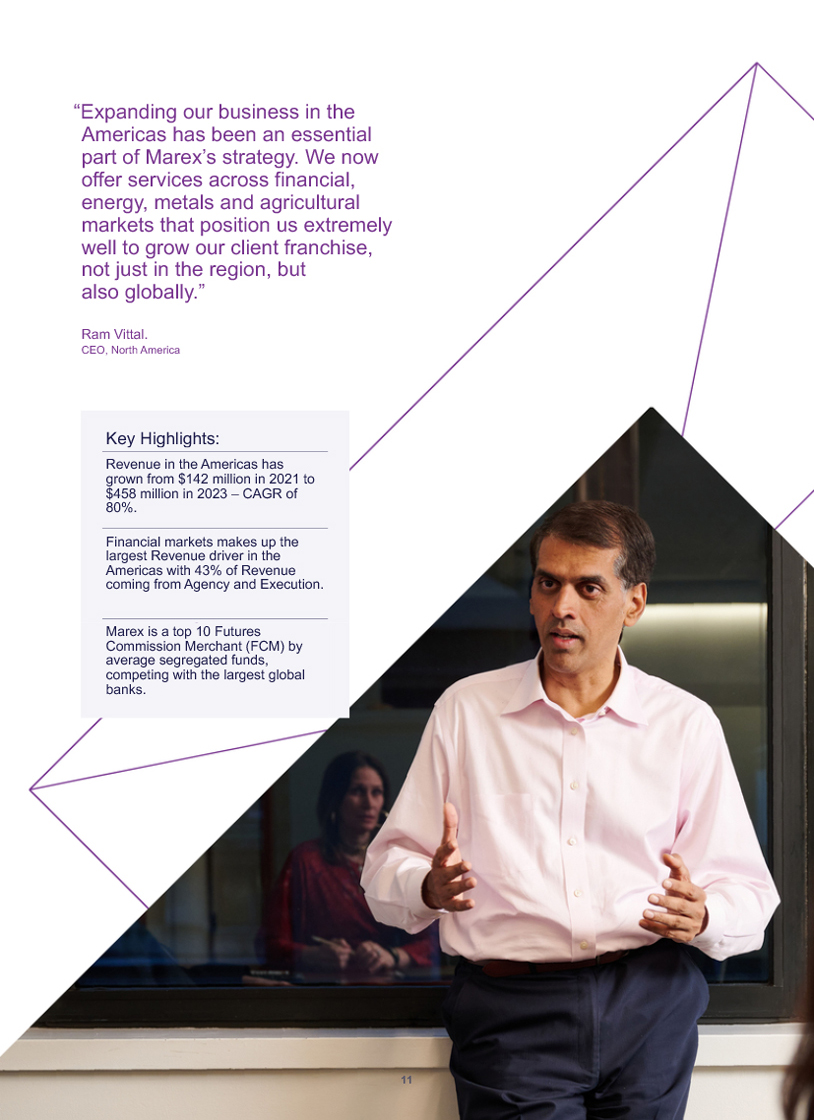

“Expanding our business in the Americas has been an essential part of Marex’s strategy. We now offer services across financial, energy, metals and agricultural markets that position us extremely well to grow our client franchise, not just in the region, but also globally.” Ram Vittal. CEO, North America Key Highlights: Revenue in the Americas has grown from $142 million in 2021 to $458 million in 2023 – CAGR of 80%. Financial markets makes up the largest Revenue driver in the Americas with 43% of Revenue coming from Agency and Execution. Marex is a top 10 Futures Commission Merchant (FCM) by average segregated funds, competing with the largest global banks.

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Strategy in action

Consistent Performance Through

Our Resilient Approach

Our diversified platform, combined with our prudent approach to capital

and funding, means we are resilient in the face of market volatility,

demonstrated by our consistent performance.

Resilient

Our track record is a testament to our resilience. Our risk management procedures are central to this resilience, with a prudent risk tolerance delivering consistent profitability with limited market risk.

This has resulted in improving positive trading weeks and months since 2021, and no single negative month since 2021.

This is the result of our diligent risk assessment, proactive measures, and prudent financial management.

Investment in our business model means we are well positioned to capture structural growth within the services that we provide, off-setting any cyclical headwinds, whilst still managing our risk to a reasonable level.

12

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

“Our strategy is centered around deepening our client relationships. We can increase our relevance to clients by offering them additional services across more geographies.” Paolo Tonucci Chief Strategist and CEO of Capital Markets Key Highlights: Revenue from our top 10 clients has grown to $137 million, up 125% in 2023, as we continue to generate greater value from cross-selling services to our largest clients. 234 clients generate more than $1 million in Revenue, up from only 43 clients in 2018, evidence of our growing scale and services. In 2023, we continued to grow our active client base, a testament to our ability to cater to diverse needs.

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Strategy in action

Embracing Change Through

Our Dynamic Spirit

Change creates opportunity. Our proactive approach and

agile culture ensures that we can adapt as markets evolve

to meet our clients’ needs.

Dynamic

Marex embodies dynamism and is ready to embrace innovation and proactively adapt to shifts in the financial landscape. This means we are able not just to withstand market volatility, but also to benefit from it.

We see that volatility has become the norm, driven by macro-economic events and exacerbated by geopolitical events.

Our trading volumes tell a story of our dynamic nature, with total contracts cleared and trades executed growing 245% and 122% respectively in 2023. We are quick to respond to market demands, adjusting our strategies to seize new opportunities while staying ahead in a competitive environment.

This includes developing new products in our Environmentals business, where we see great opportunity to support our clients as they navigate the green transition.

| Contracts Cleared (m) | Trades Executed (m) | |

|

|

14

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

“We are consistently exploring new ways to support our clients as they navigate their journey to net-zero. This includes investments in expanding our green product coverage further into recycled metals and carbon certificates.” Bastien Declercq Head of Environmentals and CEO of CSC Commodities Key Highlights: Revenue from environmental products up 75% to $47 million in 2023, representing 4% of our total Revenue. We sell over 50 environmental products and services, to support our clients as they transition to a low carbon economy. In 2023, we added to our recycled metals offering by acquiring Global Metals Network (GMN) in Hong Kong.

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Case Studies

Global commodities group Since 2021, we have significantly expanded our relationship with this large global commodities group, increasing the volumes transacted, adding additional asset classes – including agriculture and metals – while also adding Clearing services which have delivered a meaningful increase in revenue over the period. Leading gas utility. We have deepened our relationship with a large energy supplier by expanding our existing relationship to include essential Clearing services. The Clearing team on boarded the client in the second half of 2022 and have increased our revenue to over $5 million in 2023. Large trading house Over recent years we have built an increasingly strong relationship with this large global cross-asset trading business and have become a trusted counterparty providing services across a variety of markets, including energy, metals, agriculture and securities.

16

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Clients

Deepening Client Relationships Through Maximising Cross-Selling The Board uses key performance indicators (‘KPIs’) to monitor our performance and track progress against our growth strategy.

17

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

| Revenue ($m) | Reported profit after tax ($m) | |

| Revenue as reported in the audited Income Statement. This metric tracks the Group’s top-line growth. |

Profit after tax as reported in the audited Income Statement. |

|

|

|

|

|

| Reported profit before tax ($m) | Adjusted Operating Profit ($m) | |

| Profit before tax as reported in the audited Income Statement. |

Adjusted Operating Profit (before tax) is a measure of the underlying profitability of the Group and excludes items that are considered to be non-operating, such as exceptional items. |

|

|

|

|

|

| Reported return on equity (%) | Adjusted Operating Profit Margin (%) | |

| The annual return the Group produces on its equity capital base, calculated as reported profit after tax divided by average total equity. |

Adjusted Operating Profit Margin is calculated as Adjusted Operating Profit divided by Revenue. This metric tracks the underlying relative profitability of the Group. |

|

|

|

|

|

| Total capital ratio (%) | Positive trading days (%) | |

| Indicates the financial strength of the business. The Group’s total capital resources as a percentage of total risk exposure calculated under the UK Investment Firms Prudential Regime (‘IFPR’) (came into force from January 2022). |

The proportion of positive trading days is a measure of the effectiveness of the Group’s risk management and of the profitability of our Market Making operations. |

|

|

|

|

|

| Number of trades executed (m) | Average number of employees

|

|

|

The number of trades (in millions) executed on behalf of our clients tracks the Group’s growth over time. |

Average full time equivalent (‘FTE’) headcount is an indication of the size of the Group and tracks our growth over time. |

|

|

|

|

|

Marex’s KPIs include non-statutory APMs as defined by ESMA. We provide these to offer additional insights into the Group’s financial results. Where a non-statutory financial measure of performance is used, a reconciliation to the most directly related statutory measure is provided in note 6 to the consolidated financial statements.

18

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Marex operates in an attractive market environment,

with a large addressable market and declining

competitive intensity, both of which support future

growth.

| Attractive market backdrop

Marex is well positioned within an attractive market environment, which supports future growth. The markets are large, growing and highly fragmented and characterised by declining competitive intensity. We remain nimble and entrepreneurial, focussed on providing excellent service to our clients, but we also have impressive scale and significant capital. This, combined with our investment grade credit rating, allows us to leverage our global footprint and broad asset class coverage to increase our market share.

These market dynamics have supported Marex’s ability to consistently deliver double digit growth, both in Revenue and Adjusted Operating Profit in recent years.

We anticipate these market dynamics will continue to be supportive for future growth. |

Large addressable market

We estimate our serviceable addressable market (‘SAM’) for our services to be around $70 billion per annum in Revenue terms. With a market share of only c. 2%, we see material opportunity to grow Revenues and gain market share in a growing market.

To increase our share, we are expanding our geographic footprint and asset class coverage, to better meet our clients’ needs.

Market growth

The energy, agriculture and metals markets that we service are large, established markets and asset classes. Our analysis suggests that the commodities market has delivered a compound annual growth rate of 9% since 2010. While the growth rate in any given year can be impacted by external events, which can impact volatility or the risk appetite of market participants and cause market conditions to evolve, we anticipate that market volumes in these core markets will continue to increase gradually. |

The consistent volume growth over the long term has resulted from demographic trends and globalisation, with the demand for energy and commodities steadily increasing.

In addition, increased demand for cleared products after the financial crisis presents a tailwind for the addressable markets in all asset classes.

This market is characterised by declining competitive intensity, with investment and commercial banks retrenching from both commodities trading as well as reducing capital intensive activities such as clearing. Smaller competitors are less able to take advantage of these opportunities given the regulatory complexity and technology investments that are required to be successful in this market. So we see material opportunity to continue gaining market share from both our larger, and smaller, competitors. |

||

| Declining competitive intensity and barriers to entry | Large serviceable addressable market |

|||

|

Large serviceable addressable market refers to revenue opportunities.

Exchange-traded energy and commodity derivatives volumes (bn)

Volumes relates to derivative contracts. |

|||

19

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Our Market Drivers

Our Core Markets Exhibit Strong Growth Well-invested scalable platform, underpinned by a highly experienced management team with a clear strategy.

20

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

2023 – a banner year for Marex as we reap

the benefits of our growth strategy

|

||||

| I am delighted to present my first report to shareholders since I was appointed Chair of the Marex Board in October. I would like to pay tribute to my predecessor, Carla Stent, who stepped down at the end of September after nine years in the role. Carla made a huge contribution in overseeing our governance arrangements and in supporting and guiding our management team as they grew the business into what it is today.

2023 proved to be a banner year for Marex as we reaped the benefits of the strategic steps implemented over the past several years. Against a background of continuing economic uncertainty and geopolitical turmoil, we grew our business across the board, delivering record results in almost |

every segment. Revenue increased by 75% to $1.2 billion while Adjusted Operating Profit before tax rose nearly 89% to $230 million. Our Adjusted Operating Profit margin grew to 18% and our reported return on equity stood at 19%.

Segments

Growth in profits was driven primarily by our Clearing, and Agency and Execution businesses. Marex’s Clearing business benefited from a full year of commission income from ED&F Man Capital Markets (‘ED&F Man’) and from additional net interest income arising from higher interest rates on larger client balances. This interest income is an integral feature of our Clearing business which requires us to hold large amounts of cash on behalf of our clients. Marex is now a major player in the clearing business globally and one of the largest non-bank futures commission merchants. In the fourth quarter of 2023, we ranked in the top five clearers by volume on the |

Chicago Mercantile Exchange (‘CME’), and in the top three on both the London Metal Exchange (‘LME’) and the Intercontinental Exchange (‘ICE’).

Our Agency and Execution business also grew strongly. A major turnaround in our Energy OTC business which connects market participants in oil, gas, power markets, environmentals and biofuel, led to a substantial increase in Revenue and profit, while a full year of Revenue from ED&F Man and contributions from the OTCex businesses acquired in February 2023 drove a significant increase in our capital markets Revenues. We intend our capital markets businesses in Agency and Execution to be a significant area of growth in the future as we expand them by product and geography, further diversifying our Revenues and reducing our dependence on commodity and energy markets. |

||

22

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

In December 2023, we completed the acquisition of the prime brokerage and outsourced trading businesses of Cowen, which have now been rebranded under the Marex name. This acquisition will create opportunities to provide additional services to a new set of clients.

Despite a decrease in market volatility and a changing mix of business, our Market Making Revenues marginally declined to $153.9 million in 2023. Although the Adjusted Operating Profit dropped (50%) year-on-year this represents a strong performance, as Revenues in 2022 had been boosted by the extraordinary volatility sparked by the Russian invasion of Ukraine. Many of our competitors saw considerable declines in their market making and trading businesses.

Our Hedging and Investment Solutions business (Marex Solutions), which enables clients to hedge positions in commodities, foreign exchange and rates, and also creates structured investment products which are distributed to investors via third parties, was able to grow Revenue organically by more than 28%. Marex Solutions is not just a significant contributor to our profits but is also an important source of funding for the Group as when we issue structured notes, the buyers of those notes lend money to the Group in exchange for an enhanced return.

People

The organic growth and acquisitions which have enabled us to deliver these exceptional results have also resulted in a significant increase in our headcount which now stands at more than 2,000, up from around 1,600 at the end of 2022. Management has worked hard to ensure that these businesses and individuals are integrated into Marex’s systems and culture and that all our employees understand our values and how we do business.

It is essential that, as we grow, we ensure that we understand and manage the risks which are an integral part of our business and that we maintain open, transparent and constructive relationships with the many regulators to whom we are accountable in the territories where we operate. To this end, we have invested heavily in our Control and Support functions to ensure that they keep pace with our growth, and we will continue to do so.

A prudent approach to managing our balance sheet underpins our strategy and we ensure that Marex holds sufficient surplus capital and liquidity to satisfy our regulators and to support our investment grade credit ratings. These ratings help Marex to be seen as a trusted counterparty for our clients. We continue to diversify our funding sources and, in February 2023, we successfully completed our inaugural public senior bond issuance, raising €300 million. This bond issuance further strengthens the Group’s liquidity position, diversifies its funding sources and extends its debt maturity profile.

In our Environmentals business, we continue to expand our capabilities as we help our clients transition to a lower-carbon economy. To support this, in July we acquired Global Metals Network, a recycled metals market maker in Hong Kong. We also acquired Eagle Commodities which offers carbon certificates alongside traditional energy products. Thanks to our range of services, we are well placed to help clients meet their regulatory requirements and switch to environmental products.

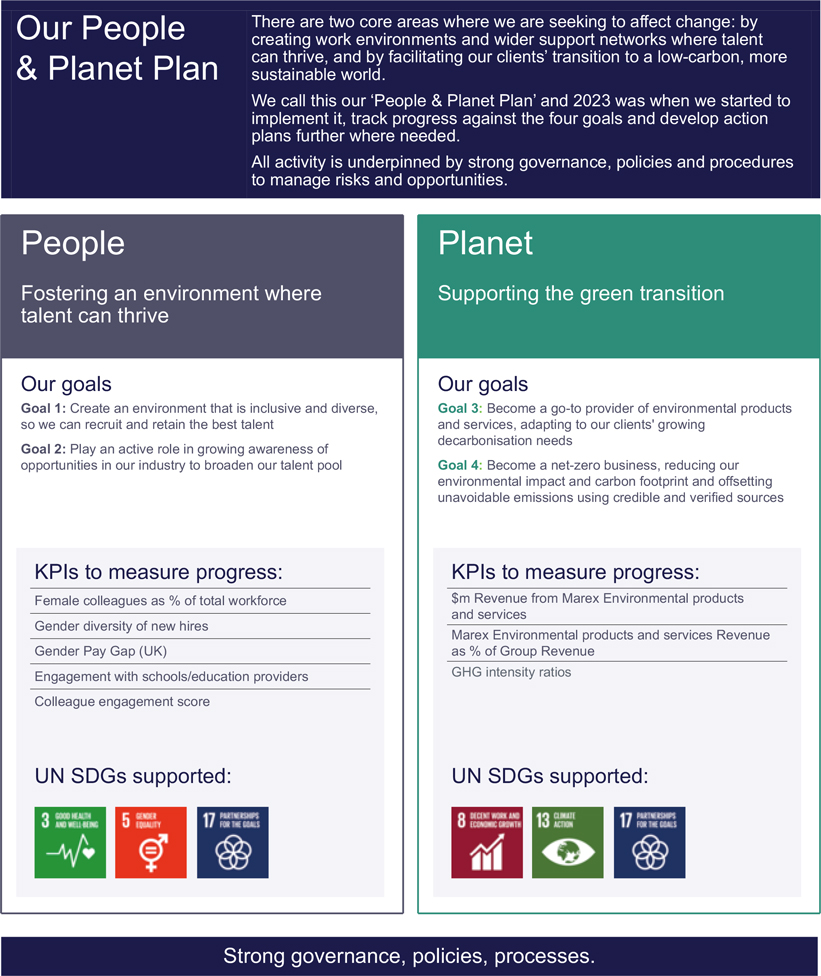

These efforts are one element of our broader People & Planet plan, which underpins our sustainability objective to cultivate positive change in the markets in which we operate. Elsewhere within Marex, we have made great strides towards meeting our climate-related reporting requirements, bringing in an advisor on our Climate Related Financial Disclosures (‘CFD’) reporting and also implementing Environmental Social and Governance (‘ESG’) carbon emission reporting software. These actions will help us meet compliance requirements and establish a baseline for a credible transition pathway to net-zero.

Governance/Leadership

In addition to Carla Stent, we also said goodbye last year to Stanley, Lord Fink, who stepped down after 13 years on the Board. Stanley was there from the beginning and we all benefited from his years of accumulated experience and wisdom.

In further Board changes, Sarah Ing stepped up to become Senior Independent Director and remains Chair of the Audit Committee. We also welcomed Linda Myers and Madelyn Antoncic, both of whom joined the Board in January 2024. Linda and Madelyn are both proven leaders with outstanding credentials in their respective fields of corporate law, and markets and risk management. In March 2024, Linda became Chair of the Remuneration Committee taking over from Jeremy Isaacs who has performed this role for the past seven years.

I am extremely grateful to our Non-Executive Directors and Committee Chairs for the support they give our management team as we strive for best in class governance, and I thank them for their efforts.

On the executive side, Rob Irvin joined us in March 2023 as Chief Financial Officer, and Graham Francis in July as Chief Operating Officer. Paolo Tonucci relinquished the role of Chief Financial Officer and stepped down from the board in May in order to concentrate full time on his new roles as Chief Executive of Capital Markets and Chief Strategist. Rob Irvin was appointed to the Board in May 2023.

I would like to thank our executive team, led with distinction by Ian Lowitt, for the enormous amount of hard work they have put in during 2023 and over the previous years, which has resulted in the impressive performance detailed in this report.

Future

The next few years will be exciting ones for Marex as we continue to build the business. We believe there will be many opportunities to grow our share of existing markets as well as to expand into adjacent areas as larger competitors retrench and leave the field. We expect to pursue these opportunities both organically and through acquisition. In parallel, we will continue to forge a distinctive Marex culture and identity as we evolve from our roots as a commodities-focussed broker and market maker into a diversified global financial services platform with market access and infrastructure at the heart of our offering. We view the future with excitement and confidence.

Robert Pickering

Chair

22 April 2024

23

| Marex Group plc Annual Report 2023 | Strategic Report | Corporate Governance | Financial Statements | |||

|

|

|

|

|

|||

Chief Executive Officer’s Review

2023 – an exceptional year in Marex’s

growth strategy

I am pleased to report that 2023 was another exceptional year when we transformed the scale and scope of the Firm. We continued to deliver on our strategy to grow our capabilities, our geographic reach, and our client base. We continued to invest in our platform and our people, and our Revenue grew 75% to $1.2 billion and our Adjusted Operating Profit was up 89% to $230 million.

The strength of our 2023 performance further demonstrates our ability to successfully navigate challenging periods in global markets. We have now increased Adjusted Operating Profit in each of the past nine years, a 34% CAGR since 2014. This sustained high performance is further confirmation of the strength of our organisation and the demand for our

services. Building on this momentum, we see a significant opportunity to capture additional market share across a total serviceable addressable market in Revenue terms exceeding $70 billion.

Macro conditions were broadly supportive through the year, with higher interest rates globally acting as a tailwind. While commodity markets showed less extreme volatility than the previous year, conditions were positive, and our business remained resilient.

We continued to add clients to our global platform in 2023, steadily increasing the amount of business we are doing with them, maintaining a strong level of organic growth. Revenue has been driven by a combination of client-driven organic growth, supplemented by selective acquisitions.

Our scalable platform has continued to demonstrate its ability to process a significant increase in levels of client activity on the platform this year, with total

trades executed up 80% (CAGR) since 2021 to 129 million trades. As we build scale in the business, so we also see an improvement in returns, with reported return on equity of 19%, up from 17% in 2022.

We have posted these record results while maintaining a strong capital and liquidity position that underpins our investment grade credit rating.