UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella 17

35017 Piombino Dese – Padua

Italy

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Stevanato Group S.p.A. | ||||||

| Date: May 14, 2024 | By: | /s/ Franco Moro |

||||

| Name: | Franco Moro | |||||

| Title: | Chief Executive Officer | |||||

Exhibit 99.1

Published on April 11, 2024

Convening Notice

to the Ordinary General Meeting of Shareholders

On May 22, 2024

Shareholders of Stevanato Group S.p.A. (“Stevanato” or the “Company”) are invited to attend the ordinary shareholders’ meeting (the “Shareholders’ Meeting”) which will be held - in compliance with Articles 10 and 11 of the Company’s bylaws (the “Bylaws”) - solely via teleconference, on May 22, 2024 at 4 p.m. CEST (10 a.m.- EDT), on single call, to discuss and resolve on the following

Agenda

| 1. | Approval of the financial statements for the financial year ended on December 31, 2023; presentation of the reports of the Board of Directors and of the external auditor PricewaterhouseCoopers S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2023; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2023; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

| 3. | Appointment of the members of the Board of Directors for the period elapsing from the date of the Shareholders’ Meeting to the date of approval of the financial statements for the financial year ending on December 31, 2024; determination of the number of members of the Board of Directors; appointment of the Chairman of the Board of Directors; related resolutions. |

| 4. | Compensation of the members of the Board of Directors and of the members of the Audit Committee; related resolutions. |

| 5. | Adjustment of the compensation granted to PricewaterhouseCoopers S.p.A. in relation to the auditing of the Company’s financial statements and consolidated financial statements, and the performance of the further tasks and activities to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions. |

| 6. | Authorization for the purchase and disposal of ordinary and class A treasury shares; related resolutions. |

* * *

I. Right to attend and vote at the Shareholders’ Meeting

Pursuant to Article 2355 of the Italian Civil Code and Articles 7.1, 7.6 and 11 of the Bylaws, the right to attend and/or vote at the Shareholders’ Meeting is regulated as follows:

| (i) | persons, other than Stevanato itself, being registered on the Company’s Shareholders’ Book (Libro Soci) as holders of class A shares on the Shareholders’ Meeting date (such persons, the “Class A Shareholders”) are entitled to attend and vote at the Shareholders’ Meeting according to the modalities set out in paragraph II.1 below; |

| (ii) | persons, other than Stevanato itself, being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) as holders of ordinary shares at the closing of the trading day (according to the New York time zone) falling on the twenty-fifth day preceding the Shareholders’ Meeting date (or, in case such day is not a trading day, on the preceding trading day), i.e. on April 26, 2024, at 4 p.m. EDT (10 p.m. CEST) (such date, the “Record Date”; such persons, the “Registered Shareholders”) are entitled to attend and vote at the Shareholders’ Meeting according to the modalities set out in paragraph II.1 below; |

| (iii) | persons, other than Stevanato itself, holding, directly or through brokers or other intermediaries, the beneficial ownership of the ordinary shares deposited at the Depositary Trust Company and registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) in the name of Cede & Co. (the “Holder of Record”) at the Record Date (such persons, the “Beneficial Shareholders”) are entitled to vote at the Shareholders’ Meeting collectively, through the Holder of Record, by giving voting instructions to Computershare S.p.A. (“Computershare IT”), in its capacity as substitute proxy specifically appointed by the Holder of Record, in relation to all or part of the items on the agenda, according to the modalities set out in paragraph II.2 below. |

For the sake of clarity, persons being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) as holders of ordinary shares, or persons acquiring the beneficial ownership of the ordinary shares, after the Record Date shall not be entitled to attend and vote at the Shareholders’ Meeting.

Persons being registered on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) after the Record Date but prior to the opening of the Shareholders’ Meeting shall be regarded, respectively, as absent from the Shareholders’ Meeting and not voting in favor of the resolutions approved by the shareholders at the Shareholders’ Meeting for the purpose of challenging such resolutions pursuant to Article 2377 of the Italian Civil Code. However, Beneficial Shareholders being such on the Record Date and obtaining registration on both the Company’s US Shareholders’ Register and the Company’s Shareholders’ Book (Libro Soci) prior to the Shareholders’ Meeting date shall be entitled to challenge the resolutions approved by the Shareholders’ Meeting pursuant to Article 2377 of the Italian Civil Code subject to providing proof not to have voted in favor of the relevant resolutions as Beneficial Shareholders.

II. Modalities of attendance and voting at the Shareholders’ Meeting

II.1 Class A Shareholders and Registered Shareholders

Class A Shareholders and Registered Shareholders have the right to attend and vote at the Shareholders’ Meeting either in person, via teleconference, or by a representative appointed, according to the provisions of Article 2372 of the Italian Civil Code, by means of a proxy granted in writing or through a document electronically signed pursuant to Italian Legislative Decree no. 82 of March 7, 2005 (such representative, the “Proxy”).

Computershare IT is available to serve as Proxy for class A Shareholders and Registered Shareholders and vote at the Shareholders’ Meeting on their behalf, in relation to all or part of the items on the agenda, according to the instructions received, at no costs or expenses for Class A Shareholders and Registered Shareholders.

Without prejudice to the shareholders’ rights set forth by the applicable law, Class A Shareholders and Registered Shareholders are requested to inform the Company in advance of their intention to attend personally (or, if legal entities, by the legal representative or other attorney) the Shareholders’ Meeting via teleconference, to appoint a Proxy, or to give voting instructions to Computershare IT.

To this end, the holders of class A shares as of the Record Date and Registered Shareholders will receive, respectively, from the Company or the Transfer Agent and Registrar Computershare Inc.

(“Computershare US”), at the address resulting from the Shareholders’ Book (Libro Soci), (i) this notice, (ii) a form to be completed by the Class A Shareholders and Registered Shareholders intending to attend personally (or, if legal entities, by the legal representative or other attorney) the Shareholders’ Meeting to provide the participants’ relevant personal information (the “Participant Information Form”), and (iii) a form to be completed by the Class A Shareholders and Registered Shareholders in order to appoint Computershare IT or another Proxy to attend and vote at the Shareholders’ Meeting on their behalf and provide it with voting instructions on the items on the agenda (the “Proxy Card”). Instructions for completing and returning, as applicable, the Participant Information Form or the Proxy Card to the Company or Computershare US and joining the Shareholders’ Meeting via teleconference shall be included therein.

Class A Shareholders shall return, as applicable, the Participant Information Form or the Proxy Card, together with the required attachments, to the Company (or, in case Computershare IT is appointed as Proxy, to Computershare IT) preferably by May 17, 2024, at 4.30 p.m. EDT (10.30 p.m. CEST).

Registered Shareholders shall return, as applicable, the Participant Information Form or the Proxy Card, together with the required attachments, to Computershare US by May 17, 2024, at 4.30 p.m. EDT (10.30 p.m. CEST).

Stevanato will provide Class A Shareholders and Registered Shareholders or Proxies attending personally the Shareholders’ Meeting with the teleconference access link no later than May 21, 2024, at 4 p.m. EDT (10 p.m. CEST), by notice sent to the e-mail address included to this purpose in the Participant Information Form or in the Proxy Card submitted by each Class A Shareholder and Registered Shareholder.

In order to be admitted to attend the Shareholders’ Meeting, if so requested by the Chairman of the Shareholders’ Meeting, Class A Shareholders, Registered Shareholders and Proxies shall identify themselves by presenting an identity document. Proxies shall also present, if so requested by the Chairman of the Shareholders’ Meeting, a copy of the Proxy Card or other proxy issued by the relevant Class A Shareholders and Registered Shareholders.

II.2 Beneficial Shareholders

Beneficial Shareholders have the right to give voting instructions to Computershare IT, in its capacity as substitute proxy specifically appointed by the Holder of Record, in relation to all or part of the items on the agenda of the Shareholders’ Meeting, at no costs or expenses for them.

To this end, Beneficial Shareholders shall receive by the respective brokers/intermediaries or by the voting service providers appointed by the latter the form to be used to provide Computershare IT with voting instructions in relation to the matters on the agenda at the Shareholders’ Meeting (the “Voting Instruction Form”), as well as instructions regarding the completion and transmission of the Voting Instruction Form.

| III. | Item 3 of the Agenda – Modalities for the submission of slates of candidate directors for the appointment of the Board of Directors |

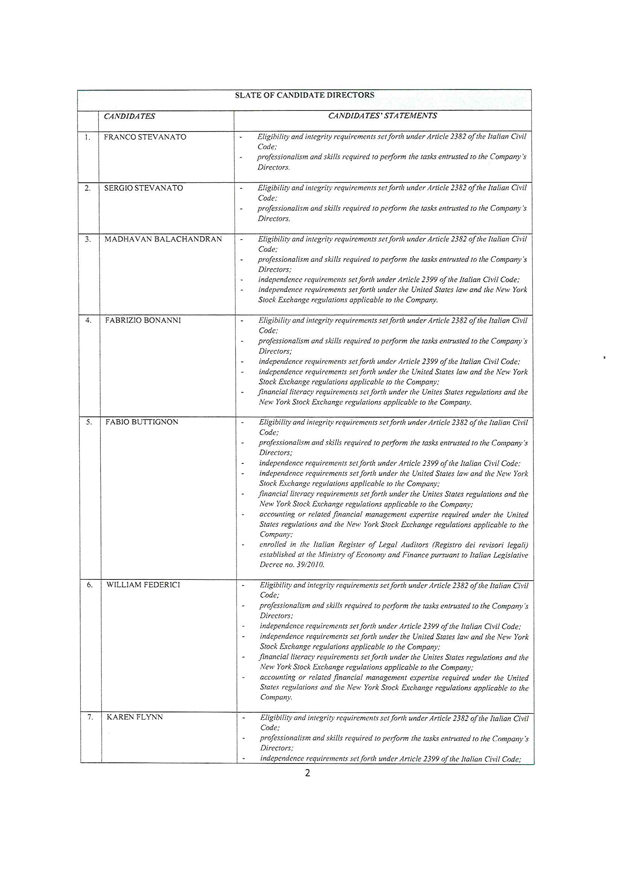

In relation to item no. 3 of the Agenda, please note that, pursuant to Article 16 of the Bylaws, the Shareholders’ Meeting shall appoint the members of the Company’s Board of Directors based on slates of candidate directors submitted by shareholders.

The right to submit a slate of candidate directors to the Shareholders’ Meeting for the appointment of the Board of Directors is reserved to Class A Shareholders, Registered Shareholders, and Beneficial Shareholders holding, individually or jointly with other shareholders submitting each slate, shares carrying at least 5 per cent of the total voting rights attached to all the shares issued by the Company (the “Qualified Shareholders”).

Pursuant to Article 7.6 of the Bylaws, Beneficial Shareholders may submit slates of candidate directors to the Shareholders’ Meeting through the Holder of Record (in which case the Holder of Record shall submit the slate to the Shareholders’ Meeting together with the relevant documentation on behalf of the Beneficial Shareholders) or based on a specific authorization and/or delegation from the Holder of Record (in which case the Beneficial Shareholders shall attach such authorization and/or delegation to the slate submitted to the Shareholders’ Meeting).

Each slate of candidate directors submitted by Qualified Shareholders shall include a number of candidate directors ranging from 9 (nine) and 15 (fifteen). Candidate directors shall meet the eligibility and integrity requirements set forth by Article 2382 of the Italian Civil Code and possess adequate skills and expertise to perform the tasks entrusted upon them, as provided for by Article 15.3 of the Bylaws.

Each slate shall also include: (a) at least one third of the candidate directors, rounded up to the higher unit in case of fractional number, meeting the independence requirements provided for in Article 15.4 of the Bylaws (i.e., the independence requirements set forth in Article 2399 of the Italian Civil Code); (b) at least 3 (three) candidate directors meeting the independence and competence requirements provided for in Articles 23.3 and 23.5 of the Bylaws (i.e., the independence requirements set forth in article 2399 of the Italian Civil Code and the additional requirements of independence and financial expertise set forth in United States law and NYSE regulations applicable to the Company from time to time); and (c) at least 1 (one) candidate director meeting the additional professionalism requirement provided for in Article 23.4 of the Bylaws (i.e., enrollment in the Italian register of legal auditors).

Each candidate director may only be included in one slate, under penalty of ineligibility.

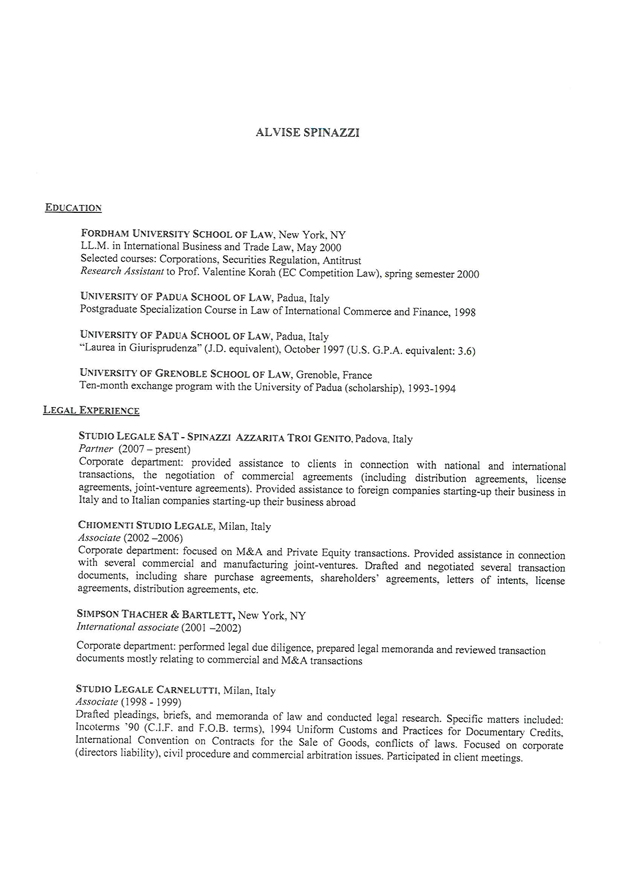

The following must be attached to each slate of candidate directors, under penalty of inadmissibility: (i) a curriculum vitae of each of the candidate directors; (ii) the statements by which each candidate director accepts his/her candidacy and certifies, under his/her own responsibility, that he/she possesses the eligibility and integrity requirements provided for in Article 15.3 of the Bylaws, the independence requirements provided for in Article 15.4 of the Bylaws, as well as the independence, expertise and competence requirements provided for by Articles 23.3, 23.4 and 23.5 of the Bylaws; (iii) an indication of the identity of the Class A Shareholders, Registered Shareholders or Beneficial Shareholders submitting the slates and the percentage of the Company’s voting rights pertaining to the shares held by them.

The slates of candidate directors submitted to the Shareholders’ Meeting must be signed by the Qualified Shareholders submitting them or, if legal persons, by their legal representatives or other attorneys.

Qualified Shareholders may submit slates of candidate directors for the appointment of the Board of Directors no later than April 23, 2024 (third day before the Record Date), at 11:59 p.m. CEST (17:59 p.m. EDT), by: (i) filing the above documentation at the Company’s registered office at Via Molinella, 17, Piombino Dese - Padova, Italy (for this purpose, please note that submission is permitted on days between Monday and Friday, from 9:00 a.m. CEST (3:00 a.m. EDT) to 5.00 p.m. CEST (11:00 a.m. EDT)); (ii) sending the above documents by mail or courier to the Company, at the address Via Molinella, 17, 35017, Piombino Dese - Padova, Italy, to the attention of the Legal Department; or (iii) sending the above documentation by certified electronic mail (PEC) to the address stevanatogroup@pec.stevanatogroup.com.

For the sake of completeness, please note that slates of candidate directors received by the Company after April 23, 2024, at 11:59 p.m. CEST (5:59 p.m. EDT), or by other means than those indicated above will be considered as not received.

Please also note that if no slate of candidate directors is submitted by Qualified Shareholders, directors will be appointed by the Shareholders’ Meeting with no application of the slate voting system.

IV. Shareholders’ Meeting materials

In accordance with the applicable law provisions, the following documents will be made available, by the Record Date, to Class A Shareholders and Registered Shareholders, at the Company’s registered office, at Via Molinella, 17, 35017 Piombino Dese – Padua (Italy), and, also to Beneficial Shareholders and the public, on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2024: https://ir.stevanatogroup.com/shareholders-meetings?year=2024.

| ● | this Convening Notice; |

| ● | Explanatory Report on the matters on the agenda of the Shareholders’ Meeting, including full texts of the resolutions to be proposed to the Shareholders’ Meeting; |

| ● | Stevanato’s draft financial statements for the financial year ended on December 31, 2023; |

| ● | Stevanato’s consolidated financial statements for the financial year ended on December 31, 2023; |

| ● | Directors’ Report for the financial year ended on December 31, 2023; |

| ● | Report of the external auditor PricewaterhouseCoopers S.p.A. on the Stevanato’s draft financial statements for the financial year ended on December 31, 2023; |

| ● | Sustainability Report for the financial year ended on December 31, 2023; |

| ● | Reports of the Audit Committee, of the Compensation Committee, and of the Nominating and Corporate Governance Committee for the financial year ended on December 31, 2023; |

| ● | Substantiated proposal of the Audit Committee on the adjustment of the compensation granted to PricewaterhouseCoopers S.p.A. in relation to the auditing of the Company’s financial statements and consolidated financial statements, and the performance of the further tasks and activities to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025. |

The aforementioned documents may be examined at the Company’s registered office only if so permitted by the applicable laws.

* * *

| The Executive Chairman of the Board of Directors | ||||

| Franco Stevanato | ||||

Exhibit 99.2

Stevanato Group S.p.A.

Ordinary Shareholders’ Meeting

on May 22, 2024

Explanatory report on the items on the agenda

This report (the “Explanatory Report”) was drafted by the board of directors of Stevanato Group S.p.A. (respectively, the “Board of Directors” and “Stevanato” or the “Company”) in relation to the ordinary meeting of the Company’s shareholders convened, on single call, on May 22, 2024, at 4:00 p.m. CEST (10:00 a.m. EDT), by notice published on April 11, 2024 (the “Convening Notice”), to discuss and resolve on the following agenda:

| 1. | Approval of the financial statements for the financial year ended on December 31, 2023; presentation of the reports of the Board of Directors and of the external auditor PricewaterhouseCoopers S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2023; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2023; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

| 3. | Appointment of the members of the Board of Directors for the period elapsing from the date of the Shareholders’ Meeting to the date of approval of the financial statements for the financial year ending on December 31, 2024; determination of the number of members of the Board of Directors; appointment of the Chairman of the Board of Directors; related resolutions. |

| 4. | Compensation of the members of the Board of Directors and of the members of the Audit Committee; related resolutions. |

| 5. | Adjustment of the compensation granted to PricewaterhouseCoopers S.p.A. in relation to the auditing of the Company’s financial statements and consolidated financial statements, and the performance of the further tasks and activities to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions. |

| 6. | Authorization for the purchase and disposal of ordinary and Class A treasury shares; related resolutions. |

(the “Agenda” and the “Shareholders’ Meeting”).

This Explanatory Report was drafted to the benefit of (i) the holders of Class A shares and of ordinary shares registered on the Company’s US Shareholders’ Register and/or on the Company’s Shareholders’ Book (Libro Soci) in the shareholders’ name, being entitled to attend and vote at the Shareholders’ Meeting as specified in the Convening Notice (respectively, the “Class A Shareholders” and the “Registered Shareholders”), and of (ii) the holders of the beneficial ownership of the ordinary shares deposited with the Depositary Trust Company and registered on the Company’s US Shareholders’ Register and on the Company’s Shareholders’ Book (Libro Soci) in the name of Cede&Co. (the “Holder of Record”), being entitled to give voting instructions to Computershare S.p.A., in its capacity as substitute proxy specifically appointed by the Holder of Record, in relation to all or part of the items on the Agenda, as specified by the Convening Notice (the “Beneficial Shareholders”), and includes certain information concerning the items on the Agenda and the proposals submitted to the Shareholders’ Meeting.

In particular, this Explanatory Report aims at providing Class A Shareholders, Registered Shareholders and Beneficial Shareholders with the information necessary - together with the reports of the Board of Directors, of the Committees and of the external auditor PricewaterhouseCoopers S.p.A.

1

(“PwC”) referred to below – to fully and effectively exercise the respective voting rights.

Please note that Stevanato’s ordinary shares are exempt from the proxy rules of the United States Securities Exchange Act of 1934, as amended, and that this Explanatory Report does not constitute a proxy statement or a solicitation of proxies.

* * *

| 1. | Approval of the financial statements for the financial year ended on December 31, 2023; presentation of the reports of the Board of Directors and of the external auditor PricewaterhouseCoopers S.p.A.; presentation of the consolidated financial statements for the financial year ended on December 31, 2023; presentation of the consolidated non-financial statements (Sustainability Report) for the financial year ended on December 31, 2023; presentation of the reports of the Audit Committee, of the Compensation Committee, of the Nominating and Corporate Governance Committee; related resolutions. |

Pursuant to Italian law and to the Company’s by-laws (the “By-laws”), Stevanato’s shareholders shall annually resolve, at the ordinary shareholders’ meeting, on the approval of the Company’s individual financial statements for the previous financial year, within a six months term from its ending.

Therefore, we submit to Stevanato’s shareholders, for their examination and approval at the Shareholders’ Meeting, the Company’s draft financial statements for the financial year ended on December 31, 2023, approved by the Board of Directors on April 10, 2024, which show net profits amounting to Euro 35,343,941.00.

Moreover, in compliance with the applicable Italian law provisions, we present to Stevanato’s shareholders, for their examination and acknowledgment, the following documents containing more information on the Company’s draft financial statements, as well as on the Company’s current and prospective situation and on the activities carried out by Stevanato, individually and through its controlled companies, in the financial year ended on December 31, 2023:

| - | Stevanato’s consolidated financial statements for the financial year ended on December 31, 2023, approved by the Board of Directors on April 10, 2024; |

| - | Sustainability Report for the financial year ended on December 31, 2023, approved by the Board of Directors on April 10, 2024; |

| - | Directors’ Report for the financial year ended on December 31, 2023, approved by the Board of Directors on April 10, 2024; and |

| - | Report of the external auditor, to be issued by PwC by April 26, 2024 (i.e., the Record Date). |

As provided for by the Charters of the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, we also present to Stevanato’s shareholders, for their examination and acknowledgment, the following documents containing more information on the activities carried out by the mentioned Committees, as well as on the current directors’ and managers’ compensation structure and policy and on the current corporate governance system of the Company:

| - | Report of the Audit Committee for the financial year ended on December 31, 2023, approved by the Audit Committee on April 9, 2024; |

| - | Report of the Compensation Committee for the financial year ended on December 31, 2023, approved by the Compensation Committee on April 4, 2024; |

| - | Report of the Nominating and Corporate Governance Committee for the financial year ended on December 31, 2023, approved by the Nominating and Corporate Governance Committee on April 5, 2024. |

2

Stevanato’s draft financial statements for the financial year ended on December 31, 2023, together with the other above mentioned documents, will be made available to Class A Shareholders and Registered Shareholders, at the Company’s registered office, at Via Molinella, 17, 35017 Piombino Dese – Padua (Italy), and, also to Beneficial Shareholders and the public, on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2024, at the address https://ir.stevanatogroup.com/shareholders-meetings?year=2024, in accordance with applicable legal provisions (and, in any case, by the Record Date of April 26, 2024).

Based on the above, Stevanato’s shareholders are asked to approve the following resolution:

“The Shareholders’ Meeting

| - | having examined Stevanato’s financial statements for the financial year ended on December 31, 2023, in the draft presented by the Board of Directors, which show net profits amounting to Euro 35,343,941.00; |

| - | having examined the Directors’ Report; |

| - | having examined the Report of the external auditor PricewaterhouseCoopers S.p.A.; |

| - | having examined Stevanato’s consolidated financial statements for the financial year ended on December 31, 2023; |

| - | having examined Stevanato’s Sustainability Report for the financial year ended on December 31, 2023; |

| - | having examined the Reports presented by the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee, |

resolves

| 1. | to approve Stevanato’s financial statements for the financial year ended on December 31, 2023, which report net profits amounting to Euro 35,343,941.00; |

| 2. | to acknowledge the Directors’ Report presented by the Board of Directors; |

| 3. | to acknowledge Stevanato’s consolidated financial statements for the financial year ended on December 31, 2023 presented by the Board of Directors; |

| 4. | to acknowledge Stevanato’s Sustainability Report for the financial year ended on December 31, 2023 presented by the Board of Directors; |

| 5. | to acknowledge the Reports presented by the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee”. |

| 2. | Allocation of annual net profits and distribution of dividends to the shareholders; related resolutions. |

Pursuant to Italian law, Stevanato’s shareholders shall resolve, at the Shareholders’ Meeting, on the allocation of the Company’s net profits resulting from the financial statements for the financial year ended on December 31, 2023, within the applicable limitations of law.

In addition, the Shareholders’ Meeting may resolve to distribute to shareholders all or part of the reserves the distribution of which is not prohibited by Italian law.

As indicated in paragraph 1 above, based on the financial statements for the financial year ended on December 31, 2023, the Company’s operations resulted in net profits of Euro 35,343,941.00.

In light of the foregoing, we propose to the shareholders to:

| - | earmark for distribution to the shareholders an amount of the Company’s net profits, as resulting from the Company’s financial statements for the financial year ended on December 31, 2023, corresponding to a gross dividend in cash of Euro 0.053 for each outstanding Class A and ordinary share of the Company, net |

3

| of the treasury shares that will be held by the Company as of the Dividend Record Date (as defined hereinafter); |

| - | earmark the residual amount of the Company’s net profits, as resulting from the Company’s financial statements for the financial year ended on December 31, 2023, to the reserve named “extraordinary reserve”. |

Therefore, assuming that the Company continues to hold the current number of 30,073,093 treasury Class A shares at the Dividend Record Date, the amount of net profits to be used for distribution of dividends to shareholders would be equal to Euro 14,456,748.48.

In such connection, based on the resolution of the Board of Directors of April 10, 2024, and pursuant to Article 28.4 of the By-laws, we propose to set on June 4, 2024, the date for identifying the holders of the Class A shares of the Company and the registered holders and the beneficial holders of the ordinary shares of the Company entitled to receive payment of the dividends which the Shareholders’ Meeting should resolve to distribute (the “Dividend Record Date”).

Therefore, assuming that the Shareholders’ Meeting approves the proposals set out above, the ex-dividend date will fall on June 3, 2024 (Ex-Date), whereas it is expected that the dividends will be paid to the holders of Class A and ordinary shares as from July 15, 2024 (Payment Date).

Dividends will be paid to registered holders and beneficial holders of ordinary shares through the Transfer Agent and Registrar Computershare, Inc., in US dollars, based on the ECB daily foreign exchange reference rate as of the date of the Shareholders’ Meeting, i.e. May 22, 2024.

Based on the above, Stevanato’s shareholders are asked to approve the following resolution:

“The Shareholders’ Meeting

resolves

| 1. | to earmark for distribution to the shareholders an amount of the Company’s net profits, as resulting from the Company’s financial statements for the financial year ended on December 31, 2023, corresponding to a gross dividend in cash of Euro 0.053 (zero point zero fifty-three) for each outstanding Class A and ordinary share of the Company, net of the treasury shares that will be held by the Company as of the Dividend Record Date; |

| 2. | to earmark the residual amount of the Company’s net profits, as resulting from the Company’s financial statements for the financial year ended on December 31, 2023, to the reserve named “extraordinary reserve”; |

| 3. | to set the date for identifying the holders of the Class A shares of the Company and the registered holders and the beneficial holders of the ordinary shares of the Company entitled to receive payment of the aforementioned dividends on June 4, 2024 (Dividend Record Date), with the ex-dividend date (Ex-Date) falling on June 3, 2024; |

| 4. | to set the date for payment of the dividends, before withholding tax, if any, in execution of the resolutions no. 1 and 3 above, as from July 15, 2024 (Payment Date); |

| 5. | to provide that dividends will be paid to registered holders and beneficial holders of ordinary shares of the Company as of the Dividend Record Date in US dollars, based on the ECB daily foreign exchange reference rate as of the date of the Shareholders’ Meeting, i.e. May 22, 2024; |

| 6. | to grant mandate to the Board of Directors and, on behalf of the latter, severally, to each of its members to carry out all the activities related, consequent to or connected with the implementation of the resolutions no. 4 and 5 above”. |

4

| 3. | Appointment of the members of the Board of Directors for the period elapsing from the date of the Shareholders’ Meeting to the date of approval of the financial statements for the financial year ending on December 31, 2024; determination of the number of members of the Board of Directors; appointment of the Chairman of the Board of Directors; related resolutions. |

As provided for under Italian law and the By-laws, at the Shareholders’ Meeting, Stevanato’s shareholders shall appoint the members of the Company’s Board of Directors and determine their number and term of office.

Pursuant to Article 15 of the By-Laws, the Board of Directors is composed of a number of members ranging from a minimum of 9 and a maximum of 15. Directors shall remain in office for a period not exceeding three financial years and their term of office shall expire on the date of the shareholders’ meeting convened to approve the financial statements for the last financial year of their office.

Directors shall meet eligibility and integrity requirements set forth in Article 2382 of the Italian Civil Code and possess the skills and expertise to perform the tasks entrusted to them. Furthermore, one third of the members of the Board of Directors, rounded up to the higher unit in case of fractional number, must possess the independence requirements set forth in Article 2399 of the Italian Civil Code.

Pursuant to Article 23 of the By-laws, members of the Audit Committee must meet the independence requirements set forth in Article 2399 of the Italian Civil Code and the additional requirements of independence and financial expertise set forth in US laws and New York Stock Exchange (“NYSE”) regulations applicable to the Company. At least one member of the Audit Committee must be enrolled in the Italian register of legal auditors.

In light of the above, in consideration of the common practice of companies listed on the NYSE, the Board of Directors deemed it appropriate to propose to the shareholders to appoint the new members of the Board of Directors for the period of one financial year, i.e. for the period elapsing from the date of the Shareholders’ Meeting to the date of approval of the Company’s financial statements for the financial year ending on December 31, 2024.

In any event, at the Shareholders’ Meeting, Class A Shareholders and Registered Shareholders shall have the right to propose the appointment of the members of the Board of Directors for the period of two or three financial years and vote accordingly.

Pursuant to Article 16 of the By-laws, the Shareholders’ Meeting shall appoint the members of the Board of Directors on the basis of slates of candidates submitted by shareholders.

The right to submit a slate of candidate directors to the Shareholders’ Meeting for the appointment of the Board of Directors is reserved to shareholders holding, individually or jointly with other shareholders submitting each slate, shares carrying at least 5 per cent of the total voting rights attached to all the shares issued by the Company.

Pursuant to Article 7.6 of the By-laws, Beneficial Shareholders may submit slates of candidate directors to the Shareholders’ Meeting through the Holder of Record (in which case the Holder of Record shall submit the slate to the Shareholders’ Meeting together with the relevant documentation on behalf of the Beneficial Shareholders) or based on a specific authorization and/or delegation from the Holder of Record (in which case the Beneficial Shareholders shall attach such authorization and/or delegation to the slate submitted to the Shareholders’ Meeting).

Contents and modalities for submission of slates of candidate directors are set out in the Convening Notice.

Following the deadline for submission of slates of candidate directors for the appointment of the Board of Directors as of April 23, 2024 and, in any case, by the Record Date of April 26, 2024, all the slates submitted by the shareholders in compliance with Article 16 of the By-laws and the provisions of the Convening Notice will be made available to the shareholders on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2024 at the address https://ir.stevanatogroup.com/shareholders-meetings?year=2024.

5

At the Shareholders’ Meeting, each shareholder shall have the right to vote for one of the slates of candidate directors submitted by the shareholders in compliance with Article 16 of the By-laws and the provisions of the Convening Notice.

Upon completion of the voting process, all candidate directors indicated in the slate obtaining the highest number of votes will be elected to the Board of Directors. In case more slates obtain the same number of votes, a new vote on the slates obtaining the same number of votes will be held at the Shareholders’ Meeting.

The number of members of the Board of Directors shall be determined in the same number of candidates indicated in the slate of candidate directors that will obtain the highest number of votes.

If, upon completion of the voting process, one or more candidate directors who do not meet the eligibility and integrity requirements set forth in Article 15.3 of the By-laws are elected as directors, such candidates will be excluded.

Moreover, if, upon completion of the voting process, a number of candidate directors meeting the independence requirements set forth in Article 15.4 of the By-laws and/or the independence, professionalism and competence requirements set forth in Articles 23.3, 23.4 and 23.5 of the By-laws that are at least equal to the minimum number provided for in said Articles are not elected to the Board of Directors, the candidates who do not comply with said requirements and are indicated as last in the slates from which they are taken will be excluded.

In the event (a) no slates of candidate directors are submitted by the shareholders to the Shareholders’ Meeting, (b) only one slate of candidate directors is submitted and such slate does not obtain the relative majority of votes, (c) the number of directors elected on the basis of the slates submitted by the shareholders, also due to subsequent exclusions, is less than 9, directors will be appointed by the Shareholders’ Meeting without applying the slate voting mechanism, without prejudice to the obligation to ensure the correct composition of the Board of Directors pursuant to the Article 15 of the By-laws and of the Audit Committee pursuant to Article 23 of the By-laws.

Pursuant to Article 17.3 of the By-laws, at the Shareholders’ Meeting, shareholders may also appoint the Chairman of the Board of Directors from among the directors elected as indicated above, provided that, unless so appointed, the Chairman of the Board of Directors shall be appointed by the members of the Board of Directors.

Therefore, shareholders submitting a slate of candidate directors for the appointment of the Board of Directors shall have also the right to propose to appoint one of the candidate directors indicated therein as Chairman of the Board of Directors. In this case, shareholders voting for the slate will be voting also for the appointment of the candidate director indicated therein as Chairman of the Board of Directors.

In any event, at the Shareholders’ Meeting, Class A Shareholders and Registered Shareholders shall have the right to propose the appointment of the Chairman of the Board of Directors from among the directors being elected and vote accordingly.

4. Compensation of the members of the Board of Directors and of the members of the Audit Committee; related resolutions.

Pursuant to Italian law and Article 19 of the Company’s By-laws, Stevanato’s shareholders shall establish the compensation of the directors to be appointed by the Shareholders’ Meeting for their office as members of the Board of Directors and/or members of the Audit Committee.

It should be noted that, without prejudice to the remuneration that will be established by the Shareholders’ Meeting, the Board of Directors may provide an additional compensation for directors entrusted with specific functions, which may consist of a fixed part and/or a variable part, related to the achievement of certain objectives, or of the right to subscribe for ordinary shares or other financial instruments of the Company at a given price.

6

Alternatively, shareholders may determine an aggregate amount for the compensation of all directors, including those entrusted with specific functions, to be allocated by the Board of Directors.

In any event, the members of the Board of Directors shall also be entitled to reimbursement of expenses incurred in the performance of their duties.

Therefore, at the Shareholders’ Meeting, following appointment of the members of the Board of Directors for the period elapsing from the date of the Shareholders’ Meeting to the date of approval of the Company’s financial statements for the financial year ending on December 31, 2024, Stevanato’s shareholders shall establish the compensation of the Company’s directors for their office as members of the Board of Directors and/or members of the Audit Committee, for the entire term of office.

In such respect, upon recommendation of the Compensation Committee, we propose to the shareholders to establish for all directors (with the exception of Mr. Franco Moro, for the reasons detailed below), as remuneration for their office as members of the Board of Directors, a fixed compensation to be paid partially in cash and partially in Company’s shares, as specified below, determined – consistently with the Company’s past practice – in consideration of the market standards, of the practices of the Company’s main competitors, and of the Board of Directors members’ professional skills and experience.

In particular, without prejudice to the right of the Board of Directors to establish an additional compensation for the directors entrusted with specific functions, we propose to establish for each director (with the exception of Mr. Franco Moro), for the period elapsing from the date of the Shareholders’ Meeting to the date of the Company’s shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024, a gross total compensation of Euro 148,000.00, to be paid as follows:

| - | as to the gross amount of Euro 74,000.00 (i.e., 50% of the total proposed compensation), in cash, in twelve equal monthly instalments; |

| - | as to the residual gross amount of Euro 74,000.00 (i.e., 50% of the total proposed compensation), in kind, through the assignment of a number of Company’s ordinary shares to be determined by the Board of Directors by dividing such amount by the average closing market price of the Company’s ordinary shares during the 30 calendar day period preceding the Shareholders’ Meeting, based on the average Euro/USD exchange rate during such period; provided that (i) such compensation in kind shall not be paid to directors ceasing for any reason to hold office before expiration of the relevant term (i.e., the date of the shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024 or, and (ii) the number of ordinary shares so determined shall be transferred to the directors on the business day following the date of the shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024, within the limits of the authorization to the disposal of such ordinary shares which shall be granted to the Board of Directors pursuant to the resolution envisaged in the next item 6 of this Explanatory Report. |

As to Mr. Franco Moro, since his current remuneration package as manager is intended to cover all services performed to the benefit of the Company, we propose not to establish any further remuneration for Mr. Moro’s service as member of the Board of Directors.

Moreover, upon recommendation of the Compensation Committee, we propose to the shareholders to grant to the directors that will be appointed by the Board of Directors, following the Shareholders’ Meeting, as members of the Audit Committee, pursuant to Article 19.4 of the Company’s By-laws, an additional compensation in the gross total amount of Euro 25,000.00 for the Chairman of the Audit Committee and of Euro 15,000.00 for each other member of the Audit Committee, to be paid in twelve equal monthly instalments.

Based on the above, Stevanato’s shareholders are asked to approve the following resolution:

7

“The Shareholders’ Meeting

resolves

| 1. | to establish for each Company’s director – with the exception of Mr. Franco Moro and without prejudice to the right of the Board of Directors to establish an additional compensation for the directors entrusted with specific functions under Article 2389 of the Italian Civil Code and Article 19.1 of the Company’s By-laws -, for the period elapsing from the date of this meeting to the date of the Company’s shareholders meeting approving the financial statements for the financial year ending on December 31, 2024, a gross total compensation of Euro 148,000.00, to be paid as follows: |

| - | as to the gross amount of Euro 74,000.00 (seventy-four thousand/00) (i.e., 50% of the total proposed compensation), in cash, in twelve equal monthly instalments; |

| - | as to the residual gross amount of Euro 74,000.00 (seventy-four thousand/00) (i.e., 50% of the total proposed compensation), in kind, through the assignment of a number of Company’s ordinary shares to be determined by the Board of Directors by dividing such amount by the average closing market price of the Company’s ordinary shares during the 30 calendar day period preceding the date of this meeting, based on the average Euro/USD exchange rate during such period; provided that: (i) such compensation in kind shall not be paid to directors ceasing for any reason to hold office before expiration of the relevant term (i.e., the date of the shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024) and (ii) the number of ordinary shares so determined shall be transferred to the directors on the business day following the date of the shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024, within the limits of the authorization to the disposal of such ordinary shares which shall be granted to the Board of Directors pursuant to the resolution adopted in relation to the next item 6 of the Agenda; |

| 2. | to grant to the directors that will be appointed by the Board of Directors as members of the Audit Committee, pursuant to Article 19.4 of the Company’s By-laws, an additional compensation in the gross total amount of Euro 25,000.00 (twenty five thousand/00) for the Chairman of the Audit Committee and of Euro 15,000.00 (fifteen thousand/00) for each other member of the Audit Committee, to be paid in twelve equal monthly instalments”. |

| 5. | Adjustment of the compensation granted to PricewaterhouseCoopers S.p.A. in relation to the auditing of the Company’s financial statements and consolidated financial statements, and the performance of the further tasks and activities to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025; related resolutions. |

Stevanato is required to appoint an external auditor to carry out the various tasks and activities provided for by Italian and US laws and regulations for a period of three financial years.

These tasks and activities include: (i) auditing and quarterly review of the Company’s consolidated financial statements, prepared in accordance with International Financial Reporting Standards (IFRS) (as issued by the International Accounting Standards Board (IASB)), to be conducted according to the International Standards of Auditing (ISA Italia) (as issued by the International Auditing and Assurance Standards Board (IAASB)); (ii) review of the financial statements included in Form 20-F prepared in accordance with SEC regulations to be conducted in accordance with the auditing standards set out by the Public Company Accounting Oversight Board (PCAOB); (iii) auditing of the financial statements of Stevanato and of the Italian companies controlled by Stevanato; (iv) verification of the proper keeping of the company accounts and the correct recording of operating events in the accounting records of Stevanato and of its Italian controlled companies; (v) auditing of the financial statements of the non-Italian companies controlled by Stevanato prepared in accordance with local regulations, when required; (vi) auditing of the reporting packages prepared for the purpose of the opinion on the Company’s consolidated financial statements; (vii) activities preparatory to the signing of tax returns in accordance with Italian law; (viii) review and full auditing of the Company’s internal control system in compliance with US law (Sarbanes-Oxley Act (SOX)) requirements.

8

Currently, the above tasks and activities are carried out by PwC and other audit firms within PwC’s international network, based on separate appointments made by Stevanato and other relevant Stevanato’s subsidiaries (Stevanato and its subsidiaries, jointly, the “Stevanato Group”).

As regards Stevanato, on May 24, 2023, the shareholders’ meeting of the Company appointed PwC as Company’s external auditor for the auditing of the Company’s financial statements and consolidated financial statements, and the performance of the further tasks and activities relevant to Stevanato to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years ending on December 31, 2023, December 31, 2024, and December 31, 2025, at the terms and conditions of the offer submitted by PwC on February 7, 2023.

In particular, the mentioned offer envisaged an annual compensation amounting, as far as the Company alone is concerned, to: Euro for 591,000.00 the financial year 2023; Euro 595,000.00 for the financial year 2024; and Euro 621,000.00 for the financial year 2025, plus any applicable VAT and expenses.

Such compensation covers the auditing and verification activities that PwC is required to carry out, pursuant to Sec. 404 of the Sarbanes-Oxley Act, on the internal controls over the financial reporting process for the consolidated financial statements with respect to different companies belonging to the Stevanato Group.

Subsequently, it seemed to be more appropriate, on grounds of relevance and in light of the companies within PwC’s network that actually carry out the above auditing and verification activities, that part of such costs are borne by the Stevanato’s subsidiaries to which they relate, instead of by Stevanato, without prejudice to the scope of the overall audit activities carried out to the benefit of the Stevanato Group.

To this end, on December 11, 2023, PwC submitted an offer to the Company to amend the terms and conditions of the current audit appointment (the “PwC Updated Offer”).

In particular, the PwC Updated Offer envisaged an annual compensation amounting, as far as the Company alone is concerned and as a result of the different allocation of costs mentioned above, to: Euro for 538,000.00 the financial year 2023; Euro 437,000.00 for the financial year 2024; and Euro 383,000.00 for the financial year 2025, plus any applicable VAT and expenses.

On April 9, 2024, the Audit Committee issued a favorable opinion on the PwC Updated Offer and the consequent amendment of the economic terms and conditions of the current audit appointment in the terms stated therein.

More details on tasks and activities to be performed by the external auditor, on the terms and conditions of the PwC Updated Offer, as well as on the assessment carried out by the Audit Committee are included in substantiated proposal of the Audit Committee, available on the Company’s website, section Corporate Governance – Shareholders’ Meeting 2024 at the address https://ir.stevanatogroup.com/shareholders-meetings?year=2024.

Based on the above, Stevanato’s shareholders are asked to approve, upon substantiated proposal presented by Audit Committee, the following resolution:

“The Shareholders’ Meeting

| - | pursuant to Article 13, par. 1, of Legislative Decree no. 39 of 27 January 2010; |

| - | based on the offer presented by PricewaterhouseCoopers S.p.A on December 11, 2023 amending the offer submitted by PricewaterhouseCoopers S.p.A. on February 7, 2023, and on the substantiated proposal presented by the Audit Committee; |

resolves

9

| 1. | to amend the terms and conditions of the appointment granted to PricewaterhouseCoopers S.p.A. by resolution of the shareholders’ meeting of the Company on May 24, 2023, for the auditing of the Company’s financial statements and consolidated financial statements, as well as the performance of the further tasks and activities to be conducted by the external auditor in compliance with Italian and US laws and regulations, for the financial years 2023, 2024 and 2025, as provided for by the offer submitted by PricewaterhouseCoopers S.p.A. on December 11, 2023 and summarized above; and |

| 2. | to adjust the annual compensation granted to PricewaterhouseCoopers S.p.A. by resolution of the shareholders’ meeting of the Company on May 24, 2023, by granting to PricewaterhouseCoopers S.p.A., in consideration for the performance of the activities indicated above, an overall compensation amounting to Euro 538,000.00 for the financial year 2023, Euro 437,000.00 for the financial year 2024, and Euro 383,000.00 for the financial year 2025, plus any applicable VAT and expenses, as further detailed in the offer submitted by PricewaterhouseCoopers S.p.A. on December 11, 2023 and summarized above”. |

| 6. | Authorization for the purchase and disposal of ordinary and Class A treasury shares; related resolutions. |

Pursuant to Italian law, the purchase of treasury Class A and ordinary shares must be authorized by Stevanato’s shareholders, who shall establish the methods, the maximum number of shares to be purchased, the duration (not exceeding eighteen months) for which the authorization is granted, and the minimum and maximum purchase price.

In any case, Stevanato may not purchase treasury Class A and ordinary shares for a consideration exceeding the limits of the distributable net profits and reserves resulting from the latest Company’s financial statements approved by the shareholders’ meeting, provided that the nominal value of the treasury shares to be purchased shall not exceed one fifth (i.e., 20 per cent) of the Company’s share capital, taking into account also any Stevanato’s shares held by the subsidiaries.

Furthermore, it is provided that, upon purchase of treasury shares, (i) a negative reserve shall be entered and maintained in the Company’s financial statements for an amount equal to the value attributed to the treasury shares, (ii) the voting rights connected to such shares shall be suspended as long as they are held in treasury and (iii) the dividends and reserves distributions pertaining to such treasury shares shall be allocated proportionally to the other shares.

Similarly, the Board of Directors may dispose of the shares held in treasury only upon authorization of the shareholder’s meeting, which shall also establish the relevant modalities of such dispositions.

Upon resolution of the shareholders’ meeting of May 24, 2023, the Board of Directors was authorized, pursuant to Articles 2357 and 2357-ter of the Italian Civil Code, for the period elapsing from the date of that shareholder meeting to the date of the shareholders meeting approving the Company’s financial statements for the financial year ending on December 31, 2023, to:

| - | purchase up to a maximum number of Class A and ordinary shares equal to one per cent (1%) of the shares into which Stevanato’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than ten per cent (10%) higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or NYSE law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last financial statements approved by the shareholders’ meeting of the Company; and |

10

| - | dispose of a maximum number of 1.000.000 Class A or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests. |

As of the date of this Explanatory Report, Stevanato holds in treasury no. 30,073,093 Class A shares, equal to approximately 9.93 per cent of the Company’s share capital.

In light of the above and, especially, of the time-limits to which the aforementioned authorizations are subject and of the Company’s interest that the Board of Directors be at any time vested with the authority to purchase Stevanato’s shares and dispose of the shares held in treasury with flexibility and for all transactions and purposes deemed to be advantageous for the Company, in consideration of the foreseeable necessities of the latter, we propose to the shareholders to grant to the Board of Directors a new authorization to purchase Company’s shares and dispose of the shares in treasury, at the same terms and conditions set forth by the shareholders’ meeting of May 24, 2023, for another period of one financial year.

Therefore, we submit to the Shareholders’ Meeting the request to authorize the Board of Directors, for the period elapsing from the date of the Shareholders’ Meeting to the date of the shareholders’ meeting approving the Company’s financial statements for the financial year ending on December 31, 2024, to:

| - | purchase, within the time period referred to above, up to a maximum number of Class A and ordinary shares equal to one per cent (1%) of the shares into which Stevanato’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than ten per cent (10%) higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or NYSE law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last financial statements approved by the shareholders’ meeting of the Company; and |

| - | dispose, within the time period referred to above, of a maximum number of 1,000,000 Class A or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests. |

The requested authorizations shall be granted to the Board of Directors for the purposes of (i) carrying out extraordinary transactions (such as the transfer, exchange, contribution or other act of disposal of such shares for, inter alia, the acquisition of shareholdings in other companies, of business operations, of real estate assets or other transactions instrumental to the pursuit of industrial projects or, in any event, of the corporate purpose of the Company), (ii) fulfilling the obligations deriving from option contracts or other agreements concerning the Company’s shares, (iii) assigning the shares to directors or employees of the Company or of its subsidiaries as compensation in kind or as benefit, bonus or other premium or incentive, without limitations (also in execution of the “Restricted Stock Grant Plan Stevanato Group S.p.A. 2023 - 2027” and of the “Performance Stock Grant Plan Stevanato Group S.p.A. 2023 - 2027” approved by the Board of Directors on December 15, 2022, or any other stock option or incentives plans which should be approved by the Board of Directors), and (iv) supporting the market liquidity of the Company’s shares.

Upon purchase of Company’s shares and as long as such shares are held in treasury, the Company shall enter and maintain in its financial statements a negative reserve for an amount equal to the value attributed to the treasury shares and shall not be allowed, in its capacity as holder of such shares, to vote at the shareholders’ meeting and to receive dividends, reserves or other rights being distributed, which shall be allocated proportionally to the other shares.

11

Based on the foregoing, Stevanato’s shareholders are invited to resolve as follows:

“The Shareholders’ Meeting

| - | having examined the proposal presented by the Board of Directors under point 6 of the Explanatory Report; |

resolves

| 1. | to authorize the Board of Directors, pursuant to Articles 2357 and 2357-ter of the Italian Civil Code, for the period elapsing from the date of this meeting to the date of the Company’s shareholders’ meeting approving the financial statements for the financial year ending on December 31, 2024, for the purposes referred to under point 6 of the Explanatory Report, to: |

| - | purchase up to a maximum number of Class A and ordinary shares equal to 1% (one per cent) of the shares into which Stevanato’s share capital is divided (including the treasury shares at any time held by the Company), through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that from time to time the Board of Directors deems more appropriate in the Company’s interests, provided that (i) the purchases shall be made at a price not being more than ten per cent (10%) higher or lower than the closing market price of the ordinary shares on the trading day preceding the day of each relevant transaction, (ii) the relevant transactions must be carried out in compliance with all applicable Italian and US or NYSE law and regulatory provisions, and, following any such purchases, (iii) the overall value of the shares held in treasury shall not exceed the amount of the distributable net profits and reserves resulting, from time to time, from the last financial statements approved by the shareholders’ meeting of the Company; and |

| - | dispose of a maximum number of 1,000,000 (one million) Class A or ordinary shares held in treasury (prior, where appropriate, conversion of the Class A shares into ordinary shares), in compliance with all applicable Italian and US or NYSE law and regulatory provisions, through one or more transactions to be executed on or off market at the price, terms and conditions, and according to the modalities, that the Board of Directors deems more appropriate in the Company’s interests; |

| 2. | to grant the Board of Directors with all powers needed or useful in order to execute the resolutions as per the points above and carrying out all the activities that may be necessary, instrumental or otherwise connected thereto”. |

* * *

Piombino Dese, April 10, 2024

| The Executive Chairman of the Board of Directors | ||

| Franco Stevanato | ||

12

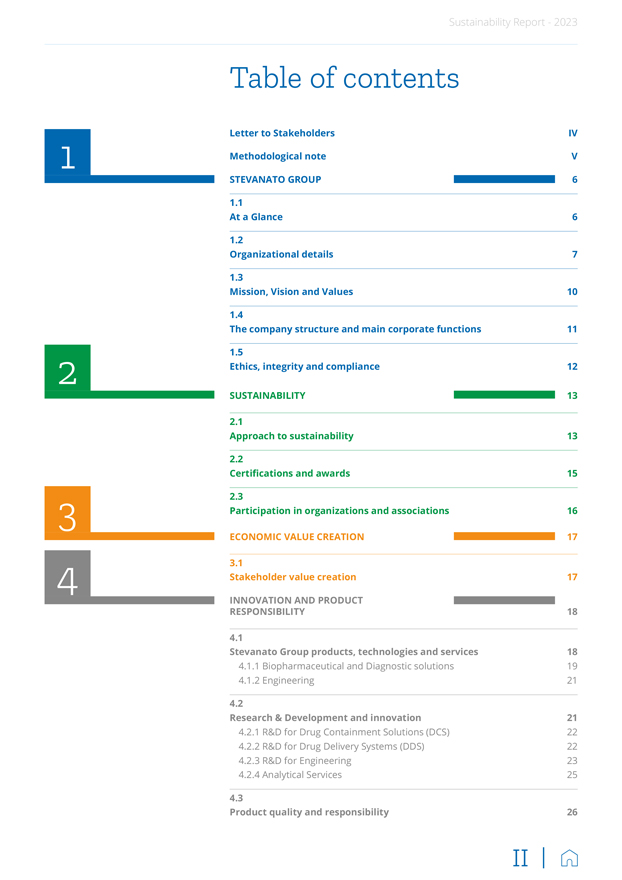

Exhibit 99.3

SUSTAINABILITY REPORT 2023

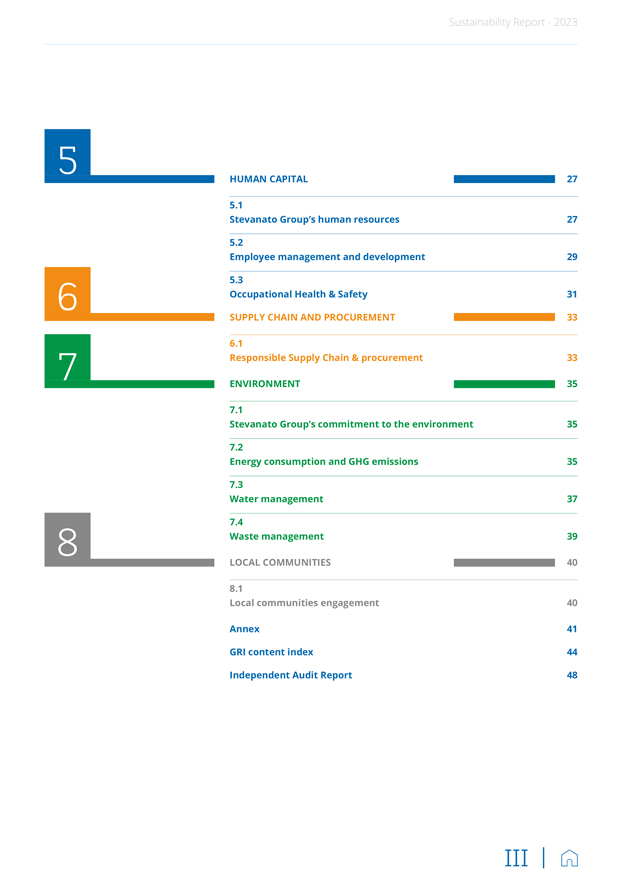

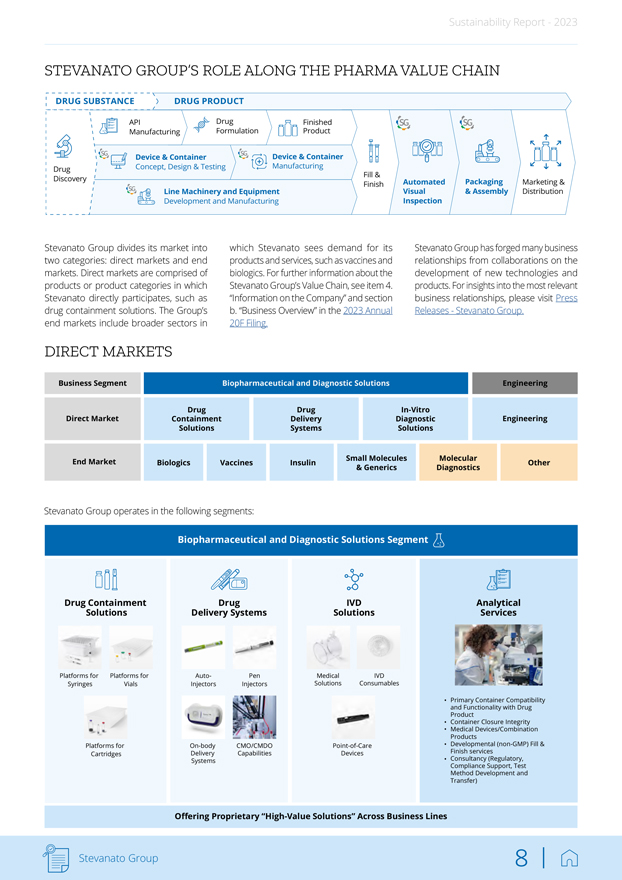

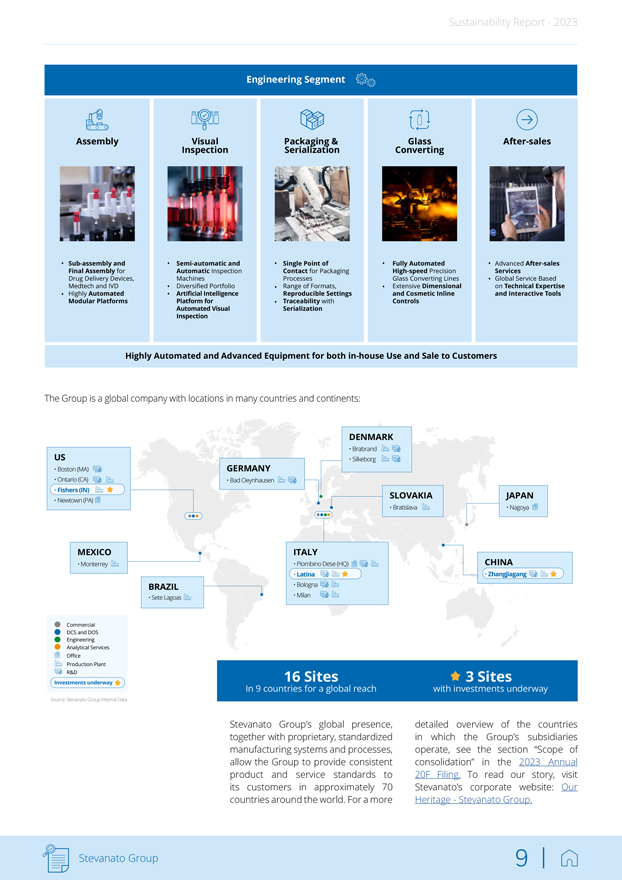

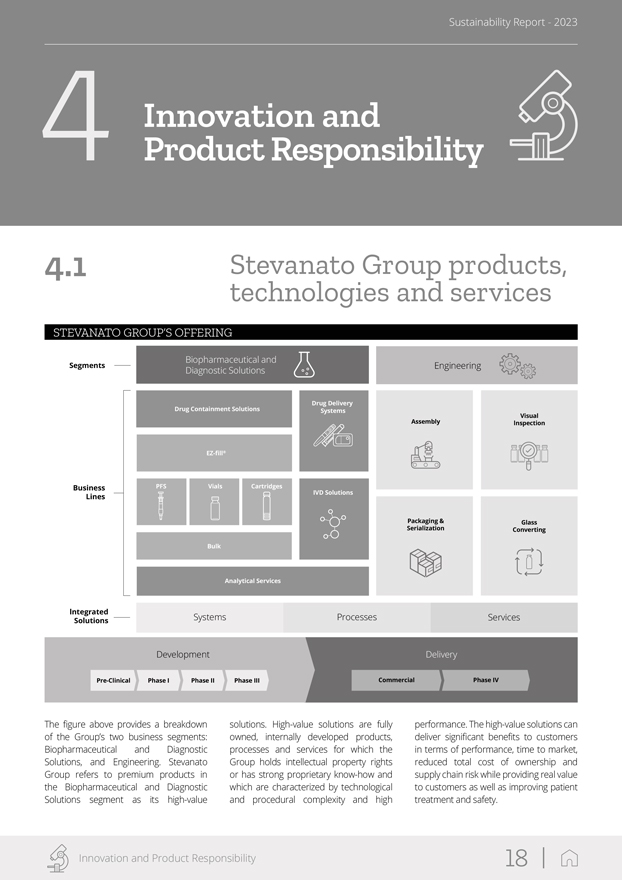

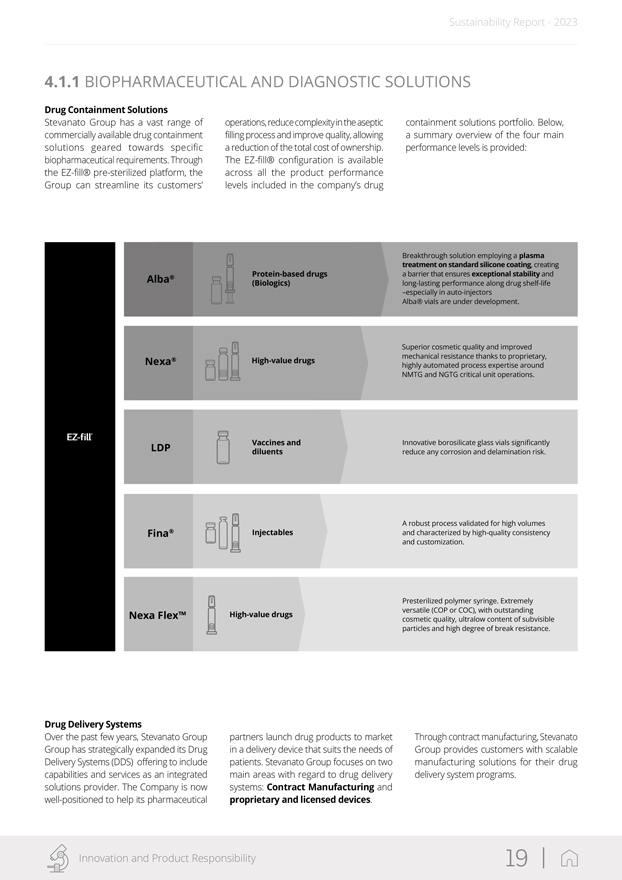

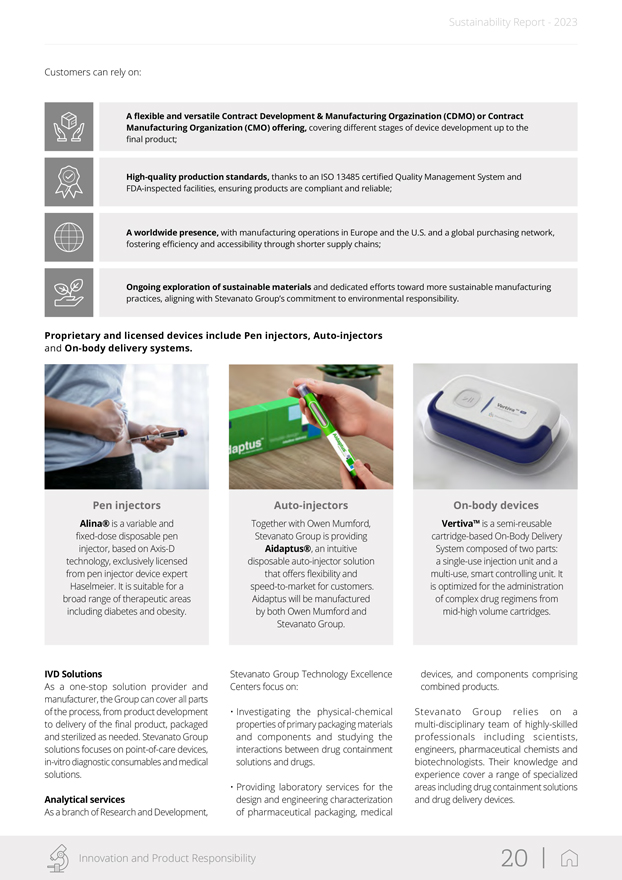

Table of contents Letter to Stakeholders IV 1 Methodological note V STEVANATO GROUP 6 1.1 At a Glance 6 1.2 Organizational details 7 1.3 Mission, Vision and Values 10 1.4 The company structure and main corporate functions 11 1.5 2 Ethics, integrity and compliance 12 SUSTAINABILITY 13 2.1 Approach to sustainability 13 2.2 Certifications and awards 15 2.3 3 Participation in organizations and associations 16 ECONOMIC VALUE CREATION 17 3.1 4 Stakeholder value creation 17 INNOVATION AND PRODUCT RESPONSIBILITY 18 4.1 Stevanato Group products, technologies and services 18 4.1.1 Biopharmaceutical and Diagnostic solutions 19 4.1.2 Engineering 21 4.2 Research & Development and innovation 21 4.2.1 R&D for Drug Containment Solutions (DCS) 22 4.2.2 R&D for Drug Delivery Systems (DDS) 22 4.2.3 R&D for Engineering 23 4.2.4 Analytical Services 25 4.3 Product quality and responsibility 26 II |

5 HUMAN CAPITAL 27 5.1 Stevanato Group’s human resources 27 5.2 Employee management and development 29 5.3 6 Occupational Health & Safety 31 SUPPLY CHAIN AND PROCUREMENT 33 6.1 7 Responsible Supply Chain & procurement 33 ENVIRONMENT 35 7.1 Stevanato Group’s commitment to the environment 35 7.2 Energy consumption and GHG emissions 35 7.3 Water management 37 7.4 8 Waste management 39 LOCAL COMMUNITIES 40 8.1 Local communities engagement 40 Annex 41 GRI content index 44 Independent Audit Report 48 III |

Letter to Stakeholders At Stevanato Group, we are part of over a 70-year history delivering exceptional performance to meet market and customer needs, thanks to our unique value proposition of integrating our core competencies across our business lines. The passion and commitment of all of us led our Group to become a leading provider of mission-critical containment, delivery, and diagnostic solutions for the pharmaceutical, biotechnology, and life sciences industries. The delivery of innovation and value has always characterized our Group, since its establishment and we embed science and technology in what we do every day to bring life-changing medicines to patients. Our goal is to be the global partner of choice to biopharma customers for the full spectrum of end-to-end solutions, from drug development through life-cycle management. Our commitment is to cooperate deeply with our partners all over the world, providing our extensive know-how, resources and enthusiasm to achieve the most successful result possibile for the customer in everything we do. We want to create a reliable ecosystem to empower our customers and their ability to produce safe, easy-to-use and cost-effective treatments to improve patients’ lives. We strive to support our stakeholders and we are committed to embedding sustainability in our strategic plan, policies and practices. We’re committed to a more sustainable and equitable future for our employees, customers, and communities which we serve. To accomplish this, we’ve developed a sustainability strategy structured in three pillars: • Sustainable processes and products, to minimize any potential negative environmental impact; • Sustainable value chain, to collaborate with partners on improving societal and environmental impacts: • People and governance, to establish and maintain a sustainable and transparent corporate model. The main goal is to pursue a regenerative business innovation journey while asserting our position as an interdependent and responsible member of the community in line with the United Nations’ Sustainable Development Goals. Hence, we are pleased to share our third Sustainability Report on a voluntary basis. This report reaffirms our dedication to ethical and environmentally conscious business practices while summarizing some of the actions being undertaken to address current environmental, social, and economic challenges. In 2023, we stepped forward and progressed in our regenerative business innovation journey. In particular, with regard to environmental efforts, we advanced in developing our plan to reduce GHG emissions of our business in line with Science Based Targets and we have begun to execute this plan through efficiency-related initiatives and sourcing of renewables-based electricity. In addition, we improved our waste management practices with an increase in the amount of waste recovered and diverted from landfill. We aim to foster a culture that values Diversity, Equity & Inclusion with attitudes and behaviors which characterize us and the path we are undergoing. Thus, we confirmed our commitment for a diverse workplace with our Gender Balance program on females holding senior positions. Finally, with reference to the Governance area, we continue to strengthen our policies and procedures system. In 2023, we started activities to update our Whistleblowing system and procedure according to EU Directive 2019/1937 and we reinforced our disclosures on GRI Reporting and Rating & Indexes. This aim of these activities are to improve and to maintain a sustainable corporate model. With regard to Rating, we significantly improved our disclosure in Carbon Disclosure Project (CDP) with extension at Group level for wider transparency and, in addition, we achieved “Management level”, above the relevant benchmark. This is an achievement for the Group that values the work done and paves the way for future steps. We confirm our goal is to continue growing and supporting customers throughout our regenerative business innovation while making a positive impact everywhere we work and do business. We will continue to work to improve processes, to innovate on technologies, to eco-design products and packaging, while considering our Values and Guiding Principles as cornerstone of harmonious interactions at Stevanato Group and the roots of our leadership in excellence. Therefore, we keep on pursuing this important journey with confidence and determination towards an increasingly sustainable and responsible future. Franco Stevanato Franco Moro Executive Chairman Chief Executive Officer Stevanato Group S.p.A. Stevanato Group S.p.A. Via Molinella 17, 35017 Via Molinella 17, 35017 Piombino Dese · Padova · Italy Piombino Dese · Padova · Italy

Methodological note Sustainability Report clearly outlines Stevanato Group’s environmental, social and economic achievements in a transparent and structured manner for the 2023 financial year (January 1—December 31) aligned with the company’s financial reporting, and shows the commitment and initiatives undertaken by the Group towards its goal of sustainable development. The annual reporting cycle provides internal and external stakeholders with a representation of Stevanato Group’s business performance, results and impact in relation to the main sustainability topics in the 2023 financial year. This document represents the Sustainability Report of the companies belonging to Stevanato Group S.p.A. and its subsidiaries (hereinafter also referred to as “the Company,” “Stevanato,” the “Stevanato Group,” or “the Group”). The list of entities included in the sustainability reporting is aligned with the 2023 Annual 20F Filing1. The Sustainability Report includes data about the parent company Stevanato Group S.p.A. and its subsidiaries, which are directly or indirectly consolidated on a line-by-line basis. Note that some Group companies, such as Perugini S.r.l. which was acquired in late 2023, or plants that are not operational, have not been included in the Environmental, Health & Safety data due to the limitation of scope2. Stevanato Group has reported sustainability information with reference to the GRI Standards 2021. For more details on Global Reporting Initiative (GRI) Standards, please see section “GRI Content Index”. The contents of the Sustainability Report were selected based on the results of a materiality analysis that was revised in 2023. The Materiality Analysis confirmed the original list of material topics for the Group and its stakeholders, as published in this document and described in Chapter 2. Information on quality criteria and the reporting scope was defined following the GRI principles and encompassed positive and negative impacts, comparability, accuracy, timeliness, clarity and verifiability. Specifically, the information included in this report was taken from both the Group’s IT system and the sustainability reporting package. To properly manage the reporting process, a Sustainability Reporting Procedure was set up in 2021 and updated in 2023, in line with the GRI Standards 2021, which illustrates how to prepare the Group’s Sustainability Report, including the timing, tools, roles and responsibilities of the functions and individuals. To ensure responsiveness and proper application of the procedure, the reporting process was extensively discussed and agreed upon by the working group. The information presented in this report refers to 2023 and includes a comparison with the previous year. Any restatements of information made from previous reporting periods are appropriately indicated, when necessary, throughout the report. The information collected and reported is based on measurable data. To provide an accurate overview of the Group’s performance and help ensure data reliability, the use of estimates has been limited as much as possible. If they are provided, they have been made using the best methods available and are properly identified. The report presents both positive and negative aspects equally with a comment on the results when appropriate. This report was approved by the Board of Directors of Stevanato Group S.p.A. on April 10, 2024, and published in June 2024. The process for seeking external assurance involved a preliminary evaluation based on different providers and relative core competencies and resulted in the selection and approval of PricewaterhouseCoopers S.p.A as external auditor. Stevanato Group commissioned the external auditor to provide a limited assurance report “limited assurance engagement” in accordance with the criteria indicated by the ISAE 3000 Revised Standard, which is attached at the end of this document. It contains a description of what has been assured and on what basis, including the assurance standard used, the level of assurance obtained, any limitations of the assurance process, and the relationships between the organization and the assurance provider. For further information and suggestions regarding Stevanato Group’s Sustainability Report, please contact: sustainability@stevanatogroup.com. ¹ About the scope of consolidation as of December 31, 2023: • On December 31, 2022, the respective extraordinary shareholders’ meetings of Innoscan A/S and SVM Automatik A/S approved the merger of Innoscan A/S into SVM Automatik A/S. The transaction was effective for accounting purposes at January 1, 2022. In February 2023, the surviving company SVM Automatik A/S changed its corporate name to Stevanato Group Denmark A/S. • On November 8, 2023, the subsidiary Spami S.r.l. acquired all of the business operations of Perugini S.r.l., an Italian company specialized in the manufacturing of consumables and mechanical components for industrial machines. ² Not included: Stevanato Group International a.s., Ompi of America Inc, Ompi of Japan Co., Ltd., Medirio SA, Perugini S.r.l.,Stevanato Group N. A. S de RL de CV, and the Cisterna plant (under construction). V |

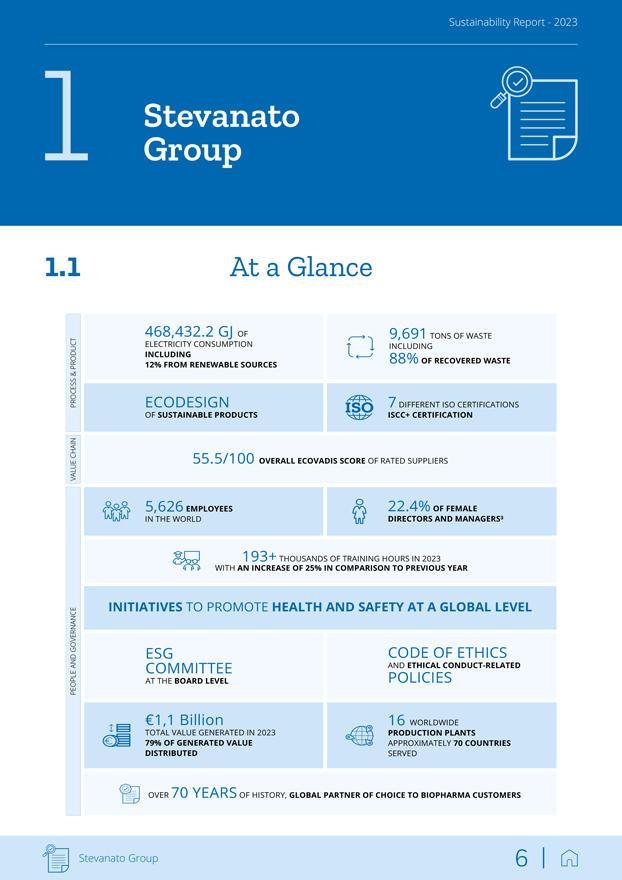

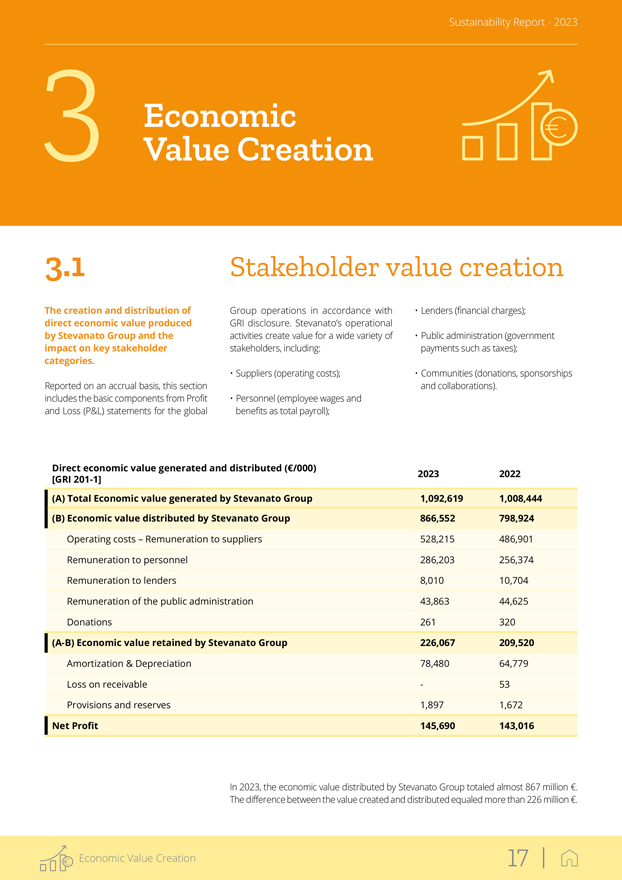

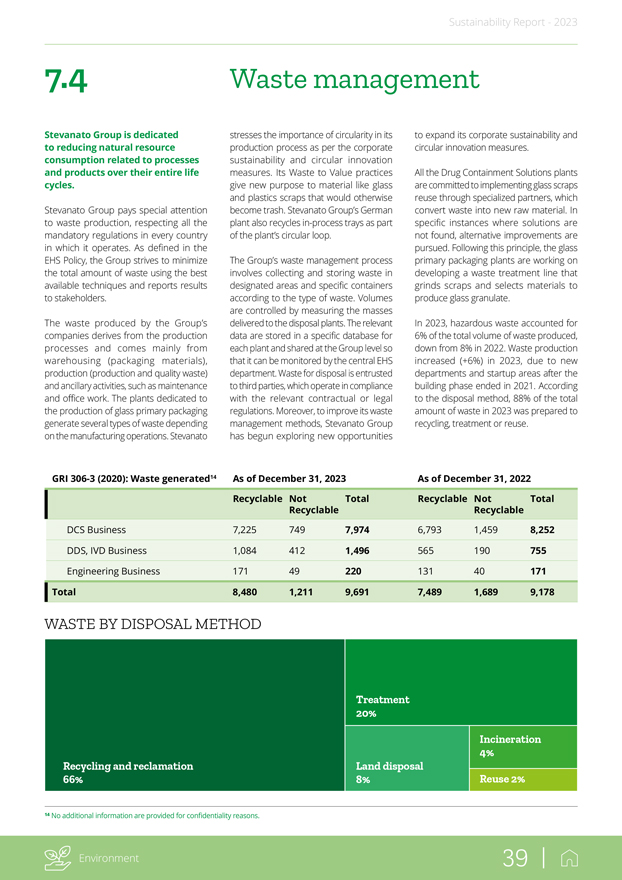

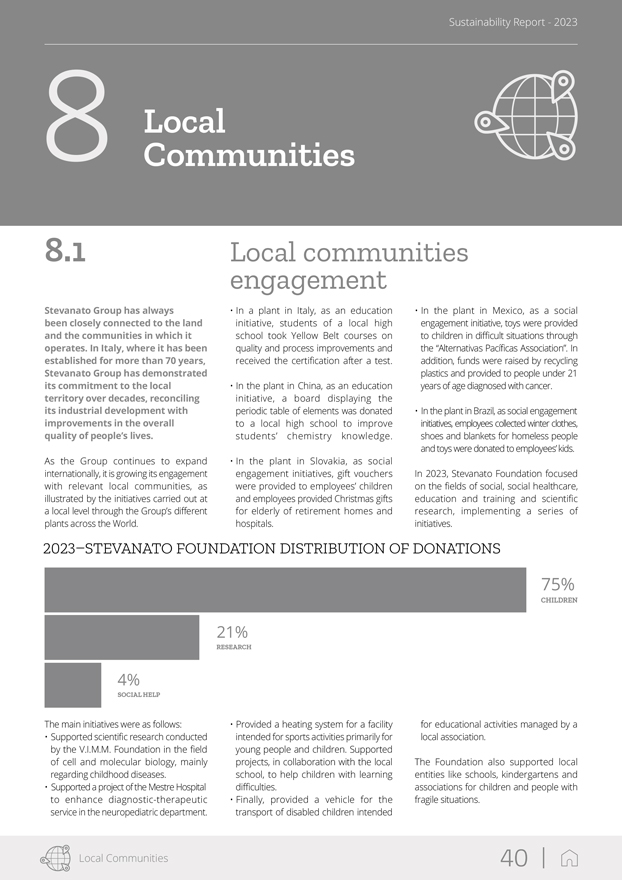

Sustainability Report—2023 Stevanato 1 Group 1.1 At a Glance 468,432.2 GJ OF 9,691 TONS OF WASTE ELECTRICITY CONSUMPTION INCLUDING INCLUDING PRODUCT 12% FROM RENEWABLE SOURCES 88% OF RECOVERED WASTE & PROCESS ECODESIGN 7 DIFFERENT ISO CERTIFICATIONS OF SUSTAINABLE PRODUCTS ISCC+ CERTIFICATION CHAIN 55.5/100 OVERALL ECOVADIS SCORE OF RATED SUPPLIERS VALUE 5,626 EMPLOYEES 22.4% OF FEMALE IN THE WORLD DIRECTORS AND MANAGERS³ 193+ THOUSANDS OF TRAINING HOURS IN 2023 WITH AN INCREASE OF 25% IN COMPARISON TO PREVIOUS YEAR INITIATIVES TO PROMOTE HEALTH AND SAFETY AT A GLOBAL LEVEL ESG CODE OF ETHICS AND COMMITTEE AND ETHICAL CONDUCT-RELATED PEOPLE AT THE BOARD LEVEL POLICIES €1,1 Billion 16 WORLDWIDE TOTAL VALUE GENERATED IN 2023 PRODUCTION PLANTS 79% OF GENERATED VALUE APPROXIMATELY 70 COUNTRIES DISTRIBUTED SERVED OVER 70 YEARS OF HISTORY, GLOBAL PARTNER OF CHOICE TO BIOPHARMA CUSTOMERS Stevanato Group 6 |