UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2024

UNITIL CORPORATION

(Exact name of registrant as specified in its charter)

| New Hampshire | 1-8858 | 02-0381573 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 6 Liberty Lane West, Hampton, New Hampshire | 03842-1720 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (603) 772-0775

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, no par value | UTL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

At 11:30 a.m. on May 1, 2024, Unitil Corporation (the “Company”) will hold its Annual Meeting of Shareholders at its offices in Hampton, New Hampshire. Following the formal business of the meeting, the Company’s Chairman and Chief Executive Officer, Thomas P. Meissner, Jr., plans to make a presentation to the Company’s shareholders. That presentation is attached as Exhibit 99.1 and will be available in the investor relations section of the Company’s website (www.unitil.com/investors) subsequent to the meeting.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Number |

Exhibit |

|

| 99.1 | Unitil Corporation’s presentation to shareholders at its Annual Meeting of Shareholders on May 1, 2024. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITIL CORPORATION

| By: | /s/ Daniel J. Hurstak |

|

| Daniel J. Hurstak | ||

| Senior Vice President, Chief Financial Officer and Treasurer | ||

| Date: | May 1, 2024 | |

Exhibit 99.1 Annual Meeting of Shareholders May 1, 2024

Forward-Looking Statements Safe harbor provision This presentation contains “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities COMPANY INFORMATION Litigation Reform Act of 1995. These forward-looking statements include statements regarding Unitil Corporation’s (“Unitil”) financial condition, results of operations, capital expenditures, business strategy, regulatory strategy, market opportunities, and other plans Unitil Corporation and objectives. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” 6 Liberty Lane West “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue”, the negative of such terms, or other Hampton, NH 03842-1720 comparable terminology. 1-888-301-7700 www.unitil.com These forward-looking statements are neither promises nor guarantees, but involve risks and uncertainties that could cause the actual results to differ materially from those set forth in the forward-looking statements. Those risks and uncertainties include: Unitil’s NYSE Ticker: UTL regulatory environment (including regulations relating to climate change, greenhouse gas emissions and other environmental matters); fluctuations in the supply of, demand for, and the prices of energy commodities and transmission capacity and Unitil’s ability Contact Information to recover energy commodity costs in its rates; customers’ preferred energy sources; severe storms and Unitil’s ability to recover Transfer Agent storm costs in its rates; general economic conditions; changes in taxation; variations in weather; long-term global climate change; Computershare catastrophic events; numerous hazards and operating risks relating to Unitil’s electric and natural gas distribution activities; Unitil’s P.O. Box 43078 ability to retain its existing customers and attract new customers; Unitil’s energy brokering customers’ performance and energy used Providence RI 02940-3078 under multi-year energy brokering contracts; increased competition; integrity and security of operational and information systems; 800-736-3001 publicity and reputational risks; and other risks detailed in Unitil's filings with the Securities and Exchange Commission, including those appearing under the caption Risk Factors in Unitil's Annual Report on Form 10-K for the year ended December 31, 2023. Investor Relations 800-999-6501 Readers should not place undue reliance on any forward looking statements, which speak only as of the date they are made. Except InvestorRelations@unitil.com as may be required by law, Unitil undertakes no obligation to update any forward-looking statements to reflect any change in Unitil’s expectations or in events, conditions, or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. PAGE 2

About Unitil Pure play New England utility creating long-term sustainable value Local distributor of electricity and natural gas in attractive service areas along the New Hampshire and Maine Seacoast • Growing customer base supported by strong regional economic growth • Significant price advantage over competing fuels Unitil Corporation is a Robust investment opportunities in electric and natural gas public utility holding infrastructure company with operations in Maine, • Grid modernization, resiliency, and renewable resources are well aligned with New Hampshire and sustainability strategies Massachusetts Together, Unitil’s operating Best-in-class operational performance and customer service utilities serve approximately 108,500 electric customers Stable long-term expected earnings growth and 88,400 natural gas • Earnings unaffected by commodity cost fluctuations customers • Distribution revenues largely decoupled from changing sales volumes due to weather or economic conditions • Strong regulatory and legislative support Strong investor value proposition • Fully regulated, low risk profile • Proven track record of financial, operating, and strategic performance unitil.com I NYSE: UTL PAGE 3

Consistency of Execution Strong operational and financial results; continued execution of key strategies Record Financial Results ü Achieved Record Results • 2023 Net Income of $45.2 million or $2.82 per share – $0.23 per share increase compared to 2022; 8.9% year-over-year EPS growth • GAAP ROE of 9.5% ü Exceeded LT Guidance Expected Long-Term EPS Growth of 5% - 7% • Reaffirmed long-term guidance of 5% - 7% growth in earnings per share • Solid investment outlook supports long-term rate base growth of 6.5% - 8.5% ü Accelerated Dividend Accelerating Dividend Growth Growth • Increased dividend to $1.70 on an annualized basis • Dividend payout ratio firmly within target range of 55% - 65% ü Maintained Investment Comparatively Lower Risk Than Peers Grade Credit Ratings • Stable credit outlook; S&P assesses business risk profile as “excellent” • Credit metrics well above peer averages Operational Excellence ü Delivered Exceptional • Best-in-class operational performance and top-tier customer service Service to Customers • #2 in Business NH Magazine’s 2023 ‘Best Companies to Work For’ PAGE 4

Exceptional Customer Service Customer satisfaction remains well above regional and national peers Northeast Utilities st 1 Customer Satisfaction Ranking OUT OF 8 87% CUSTOMER Eastern Utilities SATISFACTION rd 2023 RESULTS 3 Customer Satisfaction Ranking OUT OF 23 Exceeded National, Eastern & Northeast Region Results Overall Customer Satisfaction NORTHEAST EASTERN NATIONAL Ratings UNITIL UTLITIES UTILITIES UTILITIES 72% 79% 87% 83% PAGE 5

Operational Excellence Consecutive years of outstanding electric reliability and gas emergency response Top Quartile Electric Reliability 40% improvement in average service reliability over 10 years Best-in-Class Gas Emergency Response Responded to >91% of emergency Electric Reliability Gas Emergency Response calls in 30 minutes or less (Average annual outage time in minutes) (Average response time in minutes) 20.0 150 5-Year 5-Year Exceptional Storm Average Average 125 Response 19.0 100 Restored power to 99% of affected 75 customers within 48 hours following 18.0 multiple major winter storms 50 25 17.0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 PAGE 6

Engaged Employees Unitil has established itself as a highly desirable “workplace of choice” ü High Levels of Pride and Engagement ü “Unitil University” Development Programs ü Outstanding Benefits ü Flexible Workplace ü Diversity, Equity & Inclusion ü Robust Succession Planning PAGE 7

Corporate Sustainability and Responsibility Advancing the clean energy transition and ensuring the long-term sustainability of our company Energy and the Environment We are committed to environmental stewardship and minimizing our impact on the environment while supporting the transition to a clean energy future People We are committed to creating a workplace that embraces differences and attracts talented people from a broad spectrum of backgrounds and experiences Customer and Communities We are committed to affordable energy and superior service, and partnerships supporting the economic growth and prosperity of the communities we serve Safety and Reliability We are committed to the delivery of dependable and resilient energy services, and to the health and safety We are transforming the way people meet their evolving of our customers, employees, and the general public energy needs to create a clean and sustainable future PAGE 8

Significant Investment Opportunities The energy transition offers robust long-term investment opportunities (1) (2) Actual and Forecast Capital Investment Consolidated Rate Base $1,200 Five-year capital investment of approximately $910 million 7.3% CAGR ~47% higher than prior five years $1,000 $200 $800 $180 $600 1,068 1,002 $160 935 900 835 $400 752 $140 $200 $120 $- 2018 2019 2020 2021 2022 2023 $100 200 187 180 176 168 (3) $80 Consolidated ROACE 141 10.0% 122 $60 $40 9.5% $20 9.0% 9.6% $- 9.5% 9.5% 2022 2023 2024F 2025F 2026F 2027F 2028F 8.5% 9.0% 8.6% 8.4% (1) Forecast investment includes capitalized non-service retirement benefit costs which aren’t reflected as investing activity for GAAP 8.0% (2) Rate Base figures include estimates and approximations that are typically settled or litigated in rate cases 2018 2019 2020 2021 2022 2023 (3) Return on Average Common Equity; excludes one-time gain from Usource divestiture in 2019 PAGE 9 $ in millions $ in millions

Balance Sheet Strength and Capitalization (3) Maintaining a strong balance remains a top objective Long-Term Financing Sources Responsible Financing Plan Equity, 13% • Capital investments funded principally by Cash Flow From Operations • Limited refinancing risk and no variable rate long-term debt CFFO, Less Debt, 25% Dividends, Investment Grade Rating 62% • S&P issuer rating of BBB+ • Moody’s issuer rating of Baa1 for distribution subsidiaries – Baa2 for Granite State Gas and Unitil Corporation Balanced Capital Structure Comparatively Lower Risk than Peers Forward Looking Unitil Peer Average Expectation (1) FFO / Debt 19.1% 15.9% Mid – High Teens Long- (1) Debt / EBITDA 4.3x 5.3x <5.0x Term Equity, Debt, 49% 51% (2) Equity Ratio ~49% ~45% 45% - 50% (1) Most recent data per S&P Ratings 360; includes S&P rating adjustments (2) Unitil data as of 12/31/2023; peer data most recent available per S&P Capital IQ (3) Equity includes internally generated funds such as the Dividend Reinvestment Program PAGE 10

Sustainable Dividend Growth A sustainable growing dividend is a key element of Unitil’s investor proposition Historical Dividend and Payout Ratio $1.75 100% Long-term dividend growth should approximate long-term earnings growth 88% 77% $1.65 74% 80% 73% 70% 70% 65% 65% 64% 60% 57% Payout Ratio 60% $1.55 Dividends per Share $1.70 $1.45 40% $1.62 $1.56 $1.52 $1.50 $1.48 $1.46 $1.35 20% $1.44 $1.42 $1.40 $1.38 $1.38 $1.25 0% (1) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024F (2) (3) Annualized Dividend $1.70 Per Share 2023 Payout Ratio 57% Payout Ratio Target 55% - 65% Steady, Predictable Shareholder Return Supports Continued Dividend Growth Long-Term Outlook (1) 2019 payout ratio excludes one-time gain of $0.66 per share from Usource divestiture (2) Quarterly dividends are subject to approval by Unitil’s Board of Directors (3) Reflects 2023 annualized dividend of $1.62 divided by 2023 EPS of $2.82 PAGE 11

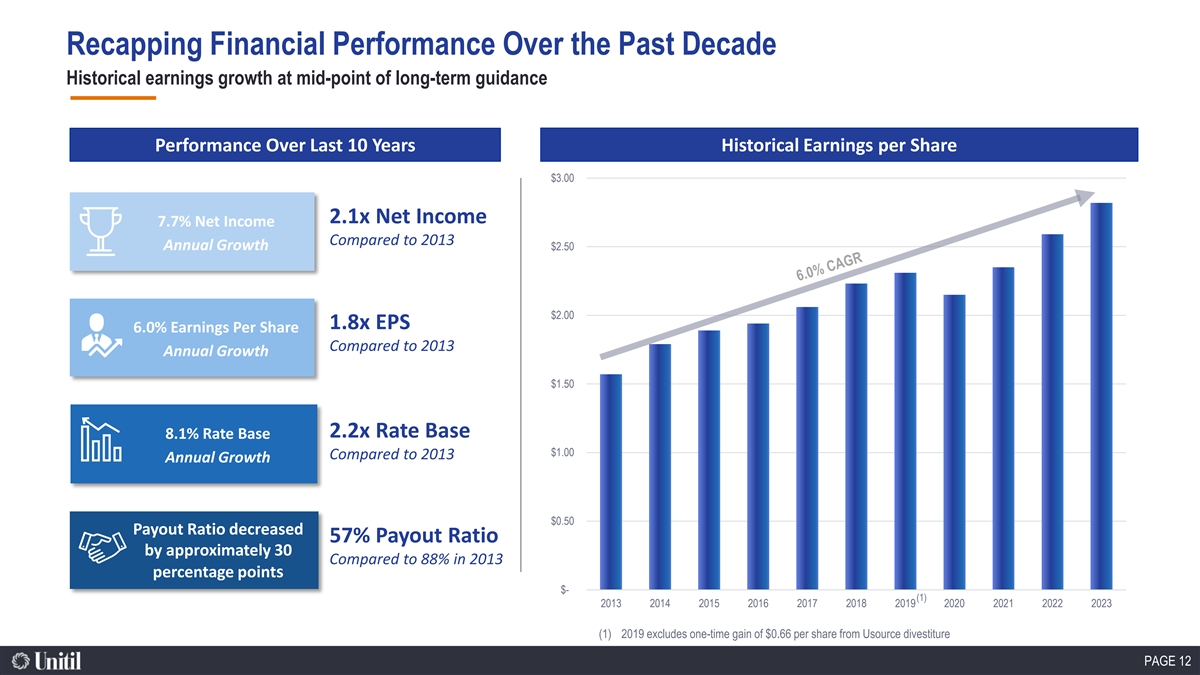

Recapping Financial Performance Over the Past Decade Historical earnings growth at mid-point of long-term guidance Performance Over Last 10 Years Historical Earnings per Share $3.00 2.1x Net Income 7.7% Net Income Compared to 2013 Annual Growth $2.50 $2.00 1.8x EPS 6.0% Earnings Per Share Compared to 2013 Annual Growth $1.50 2.2x Rate Base 8.1% Rate Base $1.00 Compared to 2013 Annual Growth $0.50 Payout Ratio decreased 57% Payout Ratio by approximately 30 Compared to 88% in 2013 percentage points $- (1) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 (1) 2019 excludes one-time gain of $0.66 per share from Usource divestiture PAGE 12

Unitil’s Value Proposition Attractive risk-adjusted long-term total shareholder return (1) 8%-10% Expected Annual Total Shareholder Return 5%-7% 6.5%-8.5% $910 million 55%-65% 15%-19% Cost Net Zero Expected Annual Expected Annual Utility Planned Electric and Gas TargetedAnnual Long-term FFO/ Control by 2050 EPSGrowth Rate Base Growth System Investments over Dividend Payout Debt Target Anticipate O&M With 2030 goal of 50% the next 5 years Ratio growth less than or reduction in GHG equal to inflation emissions Constructive Strong financial 100% regulated Operational Key regulatory position operations excellence Considerations jurisdictions Driving sustainable growth with competitive returns and a low risk profile (1) Total Shareholder Return proposition at constant Price-to-Earnings ratio PAGE 13

STRATEGIC UPDATE Supporting the transition to a clean energy future

National Context – Carbon Intensity vs Affordability Per capita energy-related carbon dioxide emissions and average electricity costs by state CO2 Emissions (total) Average Retail Electricity Price Legend MMT % of U.S. Total Cents/kWh % of U.S. Avg State Carbon Emissions Per Person (metric tons) Massachusetts 56.1 1.14% 21.3 172% Average Retail Electricity Rate (cents/kWh) 100 45.0 Maine 14.4 0.29% 17.4 141% 90 40.0 New Hampshire 13.3 0.27% 21.7 170% United States 4,911.2 100% 12.4 100% 80 35.0 70 30.0 Carbon Emissions Avg Electricity Prices 60 High Electricity Prices 25.0 50 20.0 40 15.0 30 U.S. Average Retail Electricity Price (12.36 cents/kWh) 10.0 20 5.0 10 0 0.0 Sources: • U.S. Energy Information Administration (EIA), Table 4. Per capita energy-related carbon dioxide emissions by state (1970–2021) https://www.eia.gov/environment/emissions/state/ • EIA State Electricity Profiles (2022) https://www.eia.gov/electricity/state/ PAGE 15 Metric Tons Per Person Retail Electricity Rate (cents/kWh)

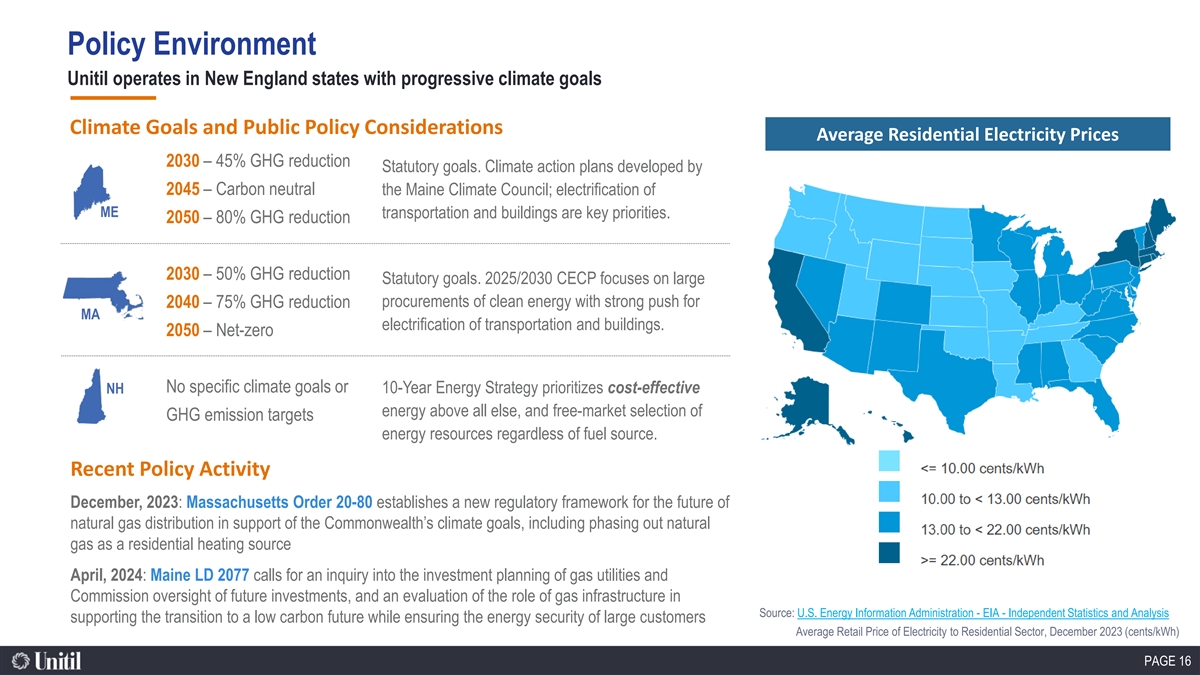

Policy Environment Unitil operates in New England states with progressive climate goals Climate Goals and Public Policy Considerations Average Residential Electricity Prices 2030 – 45% GHG reduction Statutory goals. Climate action plans developed by 2045 – Carbon neutral the Maine Climate Council; electrification of ME transportation and buildings are key priorities. 2050 – 80% GHG reduction 2030 – 50% GHG reduction Statutory goals. 2025/2030 CECP focuses on large procurements of clean energy with strong push for 2040 – 75% GHG reduction MA electrification of transportation and buildings. 2050 – Net-zero No specific climate goals or NH 10-Year Energy Strategy prioritizes cost-effective energy above all else, and free-market selection of GHG emission targets energy resources regardless of fuel source. Recent Policy Activity December, 2023: Massachusetts Order 20-80 establishes a new regulatory framework for the future of natural gas distribution in support of the Commonwealth’s climate goals, including phasing out natural gas as a residential heating source April, 2024: Maine LD 2077 calls for an inquiry into the investment planning of gas utilities and Commission oversight of future investments, and an evaluation of the role of gas infrastructure in Source: U.S. Energy Information Administration - EIA - Independent Statistics and Analysis supporting the transition to a low carbon future while ensuring the energy security of large customers Average Retail Price of Electricity to Residential Sector, December 2023 (cents/kWh) PAGE 16

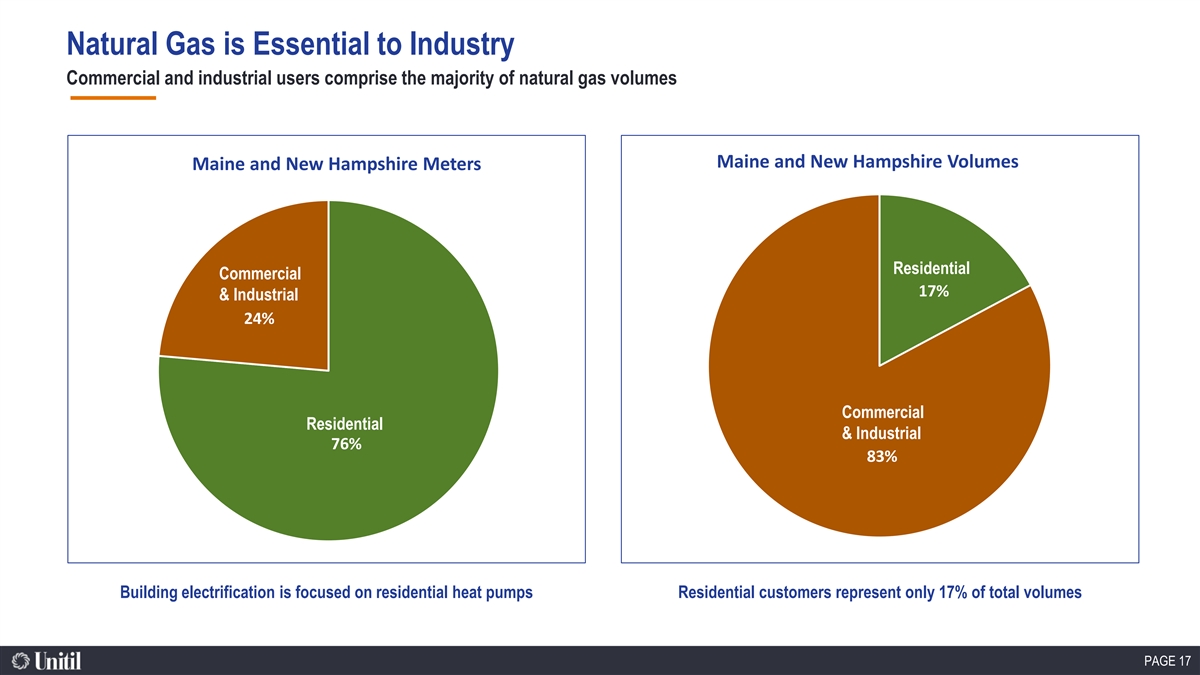

Natural Gas is Essential to Industry Commercial and industrial users comprise the majority of natural gas volumes Maine and New Hampshire Volumes Maine and New Hampshire Meters Hydro Wind Commercial Residential Commercial Residential & Industrial 17% & Industrial 24% Commercial Commercial Residential Residential & Industrial & Industrial 76% 83% Building electrification is focused on residential heat pumps Residential customers represent only 17% of total volumes PAGE 17

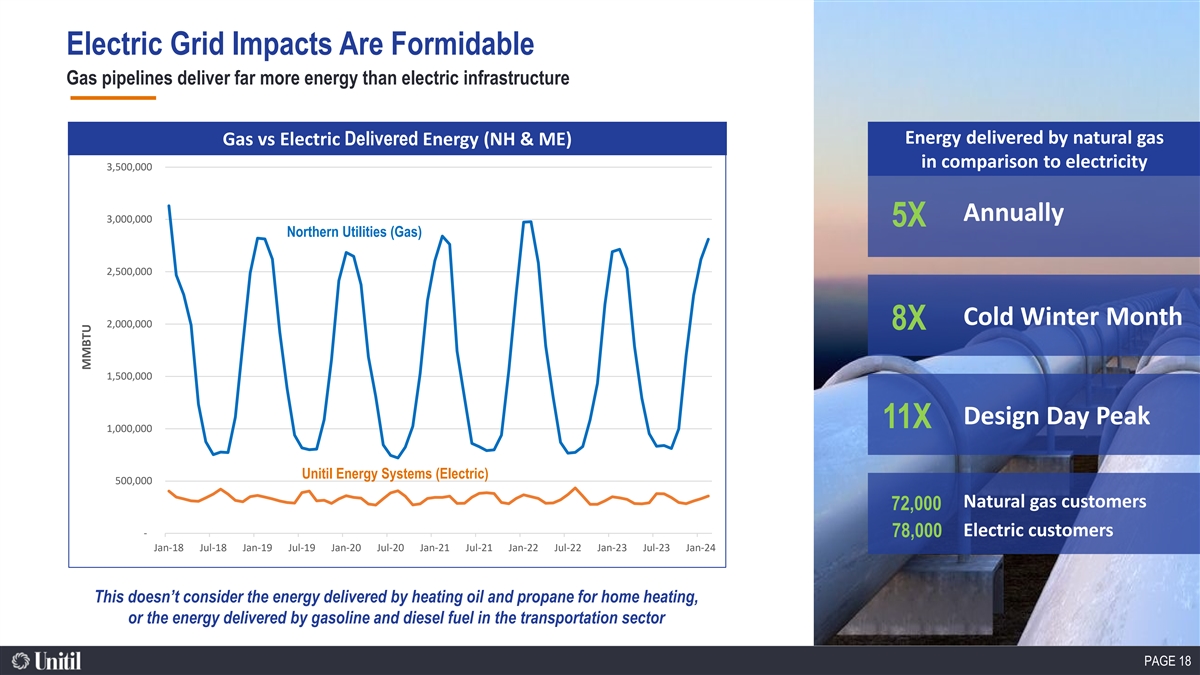

Electric Grid Impacts Are Formidable Gas pipelines deliver far more energy than electric infrastructure Energy delivered by natural gas Gas vs Electric Delivered Energy (NH & ME) in comparison to electricity 3,500,000 Annually 3,000,000 5X Northern Utilities (Gas) Nuclear Hydro Wind 2,500,000 Cold Winter Month 2,000,000 8X Renewables Solar 1,500,000 Natural Gas Design Day Peak 11X 1,000,000 Unitil Energy Systems (Electric) 500,000 Natural gas customers 72,000 - Electric customers 78,000 Jan-18 Jul-18 Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22 Jan-23 Jul-23 Jan-24 This doesn’t consider the energy delivered by heating oil and propane for home heating, or the energy delivered by gasoline and diesel fuel in the transportation sector PAGE 18 MMBTU

Resource Adequacy is a Major Concern Energy security risks and wholesale price volatility are most acute in the winter Infrastructure Constraints New England Wholesale Electricity Prices “During the last few years, inadequate infrastructure to transport natural gas has at times affected the ability of natural-gas-fired plants to get the fuel they need to perform. This energy-security risk has become a pressing concern in New England, considering the major role natural-gas-fired generation plays in keeping the lights on and setting prices for wholesale electricity.” --ISO-NE Will Reliability Be Next? Source: Monthly wholesale electricity prices and demand in New England, January 2023 - ISO Newswire PAGE 19

Electricity is Not Carbon-Free New England’s electricity has about the same carbon intensity as fuel oil Carbon Emissions Per MMBTU ISO-NE Annual Average Generator Emission Rates 1200 180 160 1000 Hydro Wind Nuclear 140 31% reduction since 2001 Wind 800 Wood 120 Wood 100 600 Renewables Solar 80 400 Natural Gas Refuse 60 Between 2000 and 2020, electricity supplied by natural gas increased from 15% of the New England energy supply to more than 50% as coal and oil-fired generation was retired 200 40 20 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 0 Natural Gas Propane Gasoline Fuel Oil Electricity CO2 CO2 with Net Imports Source: 2022 ISO New England Electric Generator Air Emissions Report Source: 2022 ISO New England Electric Generator Air Emissions Report, Table 3-1 final_2022_air_emissions_report_appendix, Table 3-5 EIA Carbon Dioxide Emissions Coefficients by Fuel PAGE 20 CO lbs per MWh 2 CO lbs per MMBTU 2

Maintaining Affordability is Important Heating with natural gas is more affordable than heating with electricity Annual Heating Cost Heating System Cost of Operation $40 $4,500 $4,000 Electric $35 Nuclear Hydro Power Wind $3,500 Transportation $30 $3,000 Petroleum Products Wood (1) Electric Heat Pump ($0.2261 per kWh) Renewables Residential $2,500 $25 Solar Natural Gas $2,000 Natural Gas ($1.98 per therm) Natural Gas $20 Refuse $1,500 Commercial Industrial $1,000 $15 $500 $10 -15 -10 -5 0 5 10 15 20 25 30 35 40 45 50 55 60 $0 Natural Gas Electric Heat Fuel Oil Propane Outdoor Temperature (Fahrenheit) Pump (1) Air source heat pump with industry leading Heating System Performance Factor (HSPF) of 13.5 Energy Cost Data: Source: https://www.efficiencymaine.com/at-home/heating-cost-comparison/ • https://www.maine.gov/mpuc/regulated-utilities/electricity/delivery-rates • https://unitil.com/electric-gas-service/pricing-rates/rates PAGE 21 $ per MMBtu

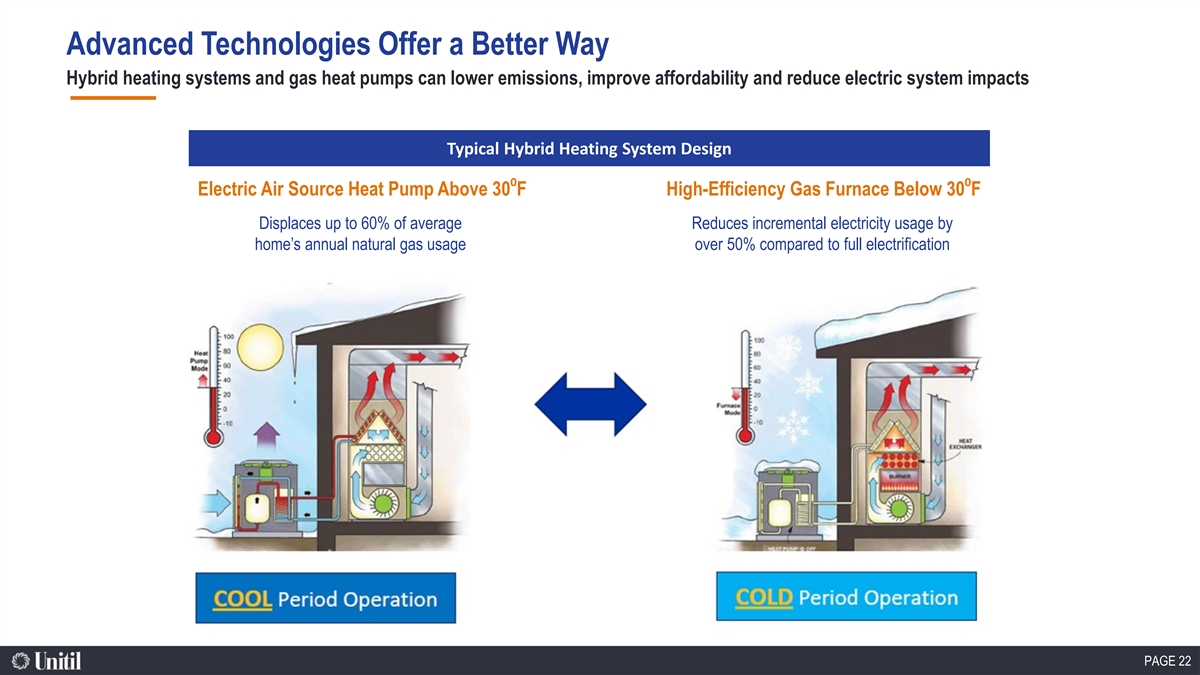

Advanced Technologies Offer a Better Way Hybrid heating systems and gas heat pumps can lower emissions, improve affordability and reduce electric system impacts Typical Hybrid Heating System Design 0 0 Electric Air Source Heat Pump Above 30 F High-Efficiency Gas Furnace Below 30 F Displaces up to 60% of average Reduces incremental electricity usage by Electric Hydro home’s annual natural gas usage over 50% compared to full electrification Power Wind Transportation Petroleum Products Wood Renewables Residential Solar Natural Gas Refuse Commercial Industrial PAGE 22

Unitil Corporation Thank You! 6 Liberty Lane West Hampton, NH 03842-1720 1-888-301-7700 www.unitil.com NYSE Ticker: UTL Investor Relations unitil.com/investors 800-999-6501 InvestorRelations@unitil.com

Appendix 86,600 Natural Gas Customers PAGE 24

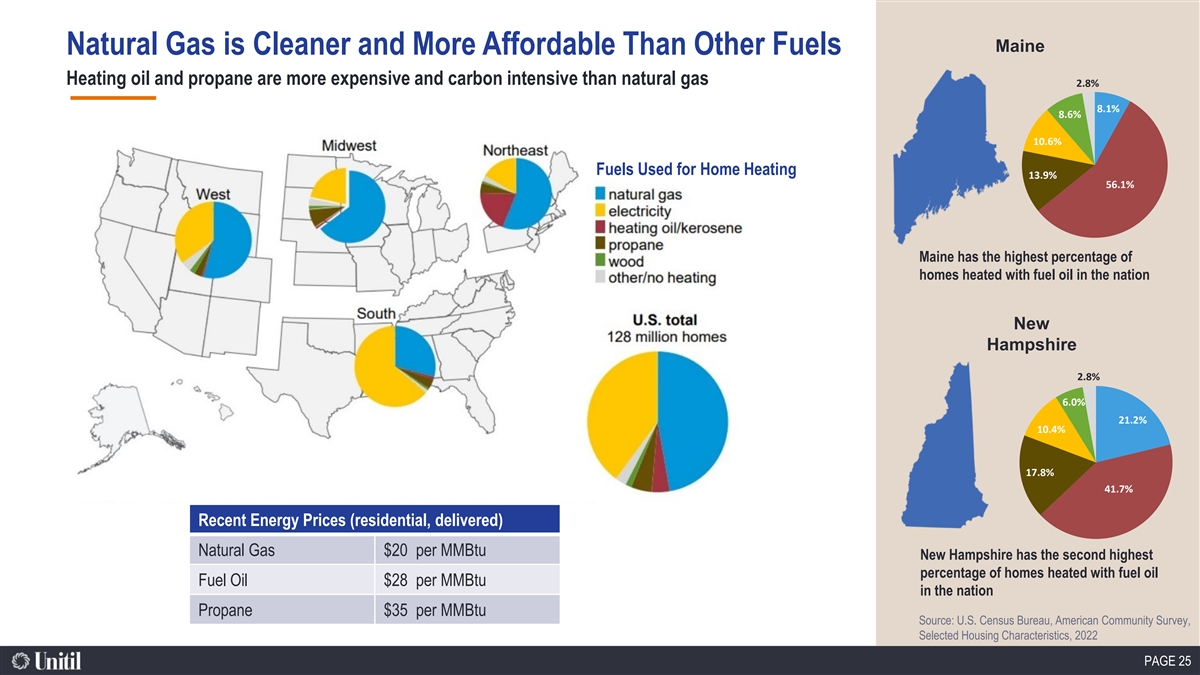

Maine Natural Gas is Cleaner and More Affordable Than Other Fuels Heating oil and propane are more expensive and carbon intensive than natural gas 2.8% 8.1% 8.6% 10.6% Fuels Used for Home Heating 13.9% 56.1% Maine has the highest percentage of homes heated with fuel oil in the nation New Hampshire 2.8% 6.0% 21.2% 10.4% 17.8% 41.7% Recent Energy Prices (residential, delivered) Natural Gas $20 per MMBtu New Hampshire has the second highest percentage of homes heated with fuel oil Fuel Oil $28 per MMBtu in the nation Propane $35 per MMBtu Source: U.S. Census Bureau, American Community Survey, Selected Housing Characteristics, 2022 PAGE 25

New England Resource Adequacy Insufficient pipeline capacity causes wholesale prices to skyrocket during periods of peak demand 2023 New England Generation Mix Winter Price Volatility Renewables 12.2% Wood Nuclear 22.9% Natural Gas 54.9% Refuse Hydro 9.5% Annual energy supply excluding net interchange Source: ISO-NE 2023 Net Energy and Peak Load by Source.xlsx File Source: Monthly wholesale electricity prices and demand in New England, January 2023 – ISO Newswire PAGE 26

Well Positioned in Massachusetts Significant gas and electric overlap; residential electrification targets about one third of total gas volumes Massachusetts Customer Mix Massachusetts Gas Volumes Gas Only Commercial Hydro 7% & Industrial Wind Commercial Residential & Industrial Residential 35% Electric Only Both Electric + Gas 50% Commercial Commercial 43% Residential & Industrial & Industrial Residential 65% Over 85% of gas customers have Unitil for electric service Residential customers represent only 35% of total volumes PAGE 27