UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2024

Commission File Number: 001-38648

BRP INC.

(Translation of registrant’s name into English)

726 Saint-Joseph Street

Valcourt, Quebec, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

Exhibit 99.1, 99.2, and 99.3 to this report of a Foreign Private Issuer on Form 6-K are deemed filed for all purposes under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended.

| Exhibit No. |

Description |

|

| 99.1 | Notice of Annual Meeting of Shareholders, dated April 25, 2024 | |

| 99.2 | Management Proxy Circular, dated April 25, 2024 | |

| 99.3 | Form of Proxy | |

| 99.4 | Press Release of BRP Inc., dated April 25, 2024 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BRP Inc. | ||||||

| Date: April 25, 2024 | By: | /s/ Tara Mandjee |

||||

| Name: | Tara Mandjee | |||||

| Title: | Assistant Secretary | |||||

Exhibit 99.1

BRP INC.

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the “Meeting”) of the holders of subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple Voting Shares” and, together with the Subordinate Voting Shares, the “Shares”) of BRP Inc. (the “Company”) will be held at 11:00 a.m. (Eastern time) on May 31, 2024, via live webcast, to consider and take action on the following matters:

| (1) | to receive the audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto and the report issued by an independent registered public accounting firm (the “Report of Independent Registered Public Accounting Firm”) thereon (see page 20 of the attached management proxy circular dated April 25, 2024 (the “Circular”)); |

| (2) | to elect the 12 directors named in the Circular who will serve until the next annual meeting of shareholders or until their successors are elected or appointed (see page 20 of the Circular); |

| (3) | to appoint the independent auditor of the Company (see page 34 of the Circular); |

| (4) | to consider an advisory non-binding resolution on the Company’s approach to executive compensation, as more particularly described in the Circular (see page 36 of the Circular); and |

| (5) | to transact such other businesses as may properly be brought before the Meeting or any postponement or adjournment thereof. |

The Company is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast, where all shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate in order to maximize shareholder attendance. Shareholders will not be able to attend the Meeting in person, but they may attend by conference call, in which case they may not participate nor vote. Registered shareholders and validly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiagm.com/489499147. Non-registered shareholders (being shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxyholder will be able to attend the Meeting only as guests. Guests will be able to listen to the Meeting but will not be able to vote or ask questions.

Registered shareholders and validly appointed proxyholders will also be entitled to submit questions to the Company in advance of the Meeting by e-mail at BRPAGA@brp.com, and during the Meeting through the platform available at https://web.lumiagm.com/489499147, which questions will, subject to certain verifications by the Company, be addressed at the Meeting.

Questions provided in advance by e-mail must be provided by no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays and holidays).

Following the Meeting, the webcast of the Meeting will also be accessible on the Company’s website at www.brp.com until next year’s annual meeting of shareholders.

The Company is using the notice-and-access procedures permitted by Canadian securities laws for the delivery of the Circular, the audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto, the independent auditor’s report thereon and the related management’s discussion and analysis, and other related materials of the Meeting (the “Proxy Materials”) to both its registered and non-registered shareholders. Under the notice-and-access procedures, instead of receiving paper copies of the Proxy Materials, shareholders will receive a notice of availability of proxy materials (the “Notice-and-Access Letter”) (which provides information on how to access copies of the Proxy Materials, how to request a paper copy of the Proxy Materials and details about the Meeting). The Notice-and-Access Letter and voting instruction form or form of proxy have been sent to both registered and non-registered shareholders. Notice-and-access substantially reduces the Company’s printing and mailing costs and is more environmentally friendly as it reduces paper and energy consumption.

As a shareholder of the Company, it is very important that you read the Circular and other Proxy Materials carefully. The Circular, which may be accessed on the Company’s website at ir.brp.com and under its profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov, contains important information with respect to voting your Shares and the matters to be dealt with at the Meeting. Also enclosed is a form of proxy for the Meeting. The audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto, the independent auditor’s report thereon and the related management’s discussion and analysis, may also be accessed on the Company’s website at ir.brp.com and under its profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

The Company’s board of directors has fixed the close of business on April 18, 2024, as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting, or any postponement or adjournment thereof. No person who becomes a shareholder after that time will be entitled to vote at the Meeting or any postponement or adjournment thereof.

As a shareholder of the Company, it is very important that you vote your Shares. If you wish that a person other than the management nominees identified in the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your Shares, including if you are a non-registered shareholder and wish to appoint yourself as proxyholder to participate and vote at the Meeting, you MUST first insert such person’s name in the blank space provided in the form of proxy or voting instruction form or complete another proper form of proxy, and, in either case, return the completed form of proxy by following the instructions described therein. After having submitted your form of proxy or voting instruction form identifying such proxyholder, you MUST also register such proxyholder by visiting www.computershare.com/BRP and providing Computershare Investor Services Inc. with your proxyholder’s contact information, so that Computershare Investor Services Inc. may provide the proxyholder with a control number via e-mail. Failure to register the proxyholder by no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays, and holidays), will result in the proxyholder not receiving a control number to participate in the Meeting. Without a control number, proxyholders will not be able to participate nor vote at the Meeting, but will be able to attend as guests. If you are a non-registered shareholder located in the United States and wish to be able to participate and vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above, you must obtain a valid legal proxy from your intermediary and submit such legal proxy to Computershare.

For more details, please refer to section “General Information—Voting Information—Appointment of a Third Party as Proxy” of the Circular.

Proxies must be submitted to Computershare Investor Services Inc. no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays, and holidays). Non-registered shareholders should carefully follow the instructions of their intermediaries to ensure that their Shares are voted at the Meeting in accordance with such shareholder’s instructions.

Shareholders are invited to attend the Meeting remotely via live webcast at 11:00 a.m. (Eastern time) on May 31, 2024, by following the instructions above.

Dated at Valcourt, Québec, this 25th day of April 2024.

By order of the board of directors,

Martin Langelier

Chief Legal Officer & Corporate Services

Exhibit 99.2

BRP INC.

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

AND

MANAGEMENT PROXY CIRCULAR

Annual meeting of shareholders will be held

at 11:00 a.m. (Eastern time)

on May 31, 2024

Letter from the Chair of the Board of Directors and

the President and Chief Executive Officer

April 25, 2024

Dear Shareholders:

On behalf of the Board of Directors, the management, and all employees of BRP Inc. (“BRP”), I am pleased to inform you that our annual meeting of shareholders will be held on May 31, 2024, at 11:00 a.m. (Eastern time) in a virtual-only format. BRP believes that the use of technology-enhanced shareholder communications makes the meeting more accessible and engaging for all involved by permitting a broader base of shareholders to participate in the meeting and maximize shareholder attendance, which is consistent with the goals of regulators, stakeholders, and others invested in the corporate governance process.

In Fiscal 2024, we delivered solid financial results despite a challenging macroeconomic environment, with revenues reaching a record $10.4 billion. Our performance was driven by good retail momentum that led to further market share gains in the North American Powersports industry, reflecting the quality and diversity of our line-ups. In the second half of the year, we have observed softening consumer demand like the rest of the industry. As a result, we have proactively adjusted production and deliveries to manage network inventory and protect our dealer value proposition. We also combined the powersports and marine groups under one leadership to ensure stronger alignment and focus, create synergies, and leverage functional expertise from both businesses. To sustain our leadership, we will keep positioning BRP for long-term success by investing in development and introducing market-shaping products such as the new mid cc Outlander ATV platform introduced this year, which was BRP’s most important launch of the past ten years.

Last December, we celebrated our 20th anniversary as a standalone company. Over this period, we became the leading OEM in the industry, and our manufacturing footprint has grown from 7 to 14 sites and to nearly 3,000 dealers that sell BRP’s products in 130 countries. Today, one out of every three powersports product sold in the world carries BRP’s logo. I am very proud of this lasting success which reflects the relentless work and dedication of our employees, the strong support of our distributors, dealers and suppliers and the loyalty of our customers. I thank them all for making BRP the leader in the industry.

The enclosed notice of the annual meeting of shareholders and management proxy circular provide information on all matters to be acted upon by the shareholders, including information on directors nominated for election, the appointment of the Company’s independent auditor and the Company’s approach to executive compensation. The management proxy circular also provides information on our corporate governance practices.

For more information, please contact Investor Relations by e-mail at ir@brp.com.

Your vote and participation are very important to us. As holders of our shares, please take the time to review the management proxy circular and provide your vote on the business items of the meeting. Although it will be possible to vote your shares during the virtual meeting, we encourage you to vote your shares in advance of the meeting via the Internet, by phone or by signing, dating and returning the proxy form or voting instruction form which were made available to you, and by following the instructions provided in the management proxy circular.

In closing, we thank you for your support and we look forward to your participation at our 2024 annual meeting of shareholders and to continuing to report on our progress.

Sincerely,

José Boisjoli

Chair of the Board of Directors, President and Chief Executive Officer

BRP INC.

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the “Meeting”) of the holders of subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple Voting Shares” and, together with the Subordinate Voting Shares, the “Shares”) of BRP Inc. (the “Company”) will be held at 11:00 a.m. (Eastern time) on May 31, 2024, via live webcast, to consider and take action on the following matters:

| (1) | to receive the audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto and the report issued by an independent registered public accounting firm (the “Report of Independent Registered Public Accounting Firm”) thereon (see page 20 of the attached management proxy circular dated April 25, 2024 (the “Circular”)); |

| (2) | to elect the 12 directors named in the Circular who will serve until the next annual meeting of shareholders or until their successors are elected or appointed (see page 20 of the Circular); |

| (3) | to appoint the independent auditor of the Company (see page 34 of the Circular); |

| (4) | to consider an advisory non-binding resolution on the Company’s approach to executive compensation, as more particularly described in the Circular (see page 36 of the Circular); and |

| (5) | to transact such other businesses as may properly be brought before the Meeting or any postponement or adjournment thereof. |

The Company is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast, where all shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate in order to maximize shareholder attendance. Shareholders will not be able to attend the Meeting in person, but they may attend by conference call, in which case they may not participate nor vote. Registered shareholders and validly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiagm.com/489499147. Non-registered shareholders (being shareholders who hold their Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxyholder will be able to attend the Meeting only as guests. Guests will be able to listen to the Meeting but will not be able to vote or ask questions.

Registered shareholders and validly appointed proxyholders will also be entitled to submit questions to the Company in advance of the Meeting by e-mail at BRPAGA@brp.com, and during the Meeting through the platform available at https://web.lumiagm.com/489499147, which questions will, subject to certain verifications by the Company, be addressed at the Meeting. Questions provided in advance by e-mail must be provided by no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays and holidays).

Following the Meeting, the webcast of the Meeting will also be accessible on the Company’s website at www.brp.com until next year’s annual meeting of shareholders.

The Company is using the notice-and-access procedures permitted by Canadian securities laws for the delivery of the Circular, the audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto, the independent auditor’s report thereon and the related management’s discussion and analysis, and other related materials of the Meeting (the “Proxy Materials”) to both its registered and non-registered shareholders. Under the notice-and-access procedures, instead of receiving paper copies of the Proxy Materials, shareholders will receive a notice of availability of proxy materials (the “Notice-and-Access Letter”) (which provides information on how to access copies of the Proxy Materials, how to request a paper copy of the Proxy Materials and details about the Meeting). The Notice-and-Access Letter and voting instruction form or form of proxy have been sent to both registered and non-registered shareholders. Notice-and-access substantially reduces the Company’s printing and mailing costs and is more environmentally friendly as it reduces paper and energy consumption.

As a shareholder of the Company, it is very important that you read the Circular and other Proxy Materials carefully. The Circular, which may be accessed on the Company’s website at ir.brp.com and under its profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov, contains important information with respect to voting your Shares and the matters to be dealt with at the Meeting. Also enclosed is a form of proxy for the Meeting. The audited annual consolidated financial statements of the Company for the fiscal year ended January 31, 2024, together with the notes thereto, the independent auditor’s report thereon and the related management’s discussion and analysis, may also be accessed on the Company’s website at ir.brp.com and under its profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

The Company’s board of directors has fixed the close of business on April 18, 2024, as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting, or any postponement or adjournment thereof. No person who becomes a shareholder after that time will be entitled to vote at the Meeting or any postponement or adjournment thereof.

As a shareholder of the Company, it is very important that you vote your Shares. If you wish that a person other than the management nominees identified in the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your Shares, including if you are a non-registered shareholder and wish to appoint yourself as proxyholder to participate and vote at the Meeting, you MUST first insert such person’s name in the blank space provided in the form of proxy or voting instruction form or complete another proper form of proxy, and, in either case, return the completed form of proxy by following the instructions described therein. After having submitted your form of proxy or voting instruction form identifying such proxyholder, you MUST also register such proxyholder by visiting www.computershare.com/BRP and providing Computershare Investor Services Inc. with your proxyholder’s contact information, so that Computershare Investor Services Inc. may provide the proxyholder with a control number via e-mail. Failure to register the proxyholder by no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays, and holidays), will result in the proxyholder not receiving a control number to participate in the Meeting. Without a control number, proxyholders will not be able to participate nor vote at the Meeting, but will be able to attend as guests. If you are a non-registered shareholder located in the United States and wish to be able to participate and vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above, you must obtain a valid legal proxy from your intermediary and submit such legal proxy to Computershare. For more details, please refer to section “General Information—Voting Information—Appointment of a Third Party as Proxy” of the Circular.

Proxies must be submitted to Computershare Investor Services Inc. no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays, and holidays). Non-registered shareholders should carefully follow the instructions of their intermediaries to ensure that their Shares are voted at the Meeting in accordance with such shareholder’s instructions.

Shareholders are invited to attend the Meeting remotely via live webcast at 11:00 a.m. (Eastern time) on May 31, 2024, by following the instructions above.

Dated at Valcourt, Québec, this 25th day of April 2024.

By order of the board of directors,

Martin Langelier

Chief Legal Officer & Corporate Services

BRP INC.

MANAGEMENT PROXY CIRCULAR

TABLE OF CONTENTS

| Page | ||||

| GENERAL INFORMATION |

8 | |||

| Forward-Looking Statements |

8 | |||

| IFRS and Non-IFRS Measures |

9 | |||

| Voting Information |

10 | |||

| Voting Shares Outstanding and Principal Shareholders |

18 | |||

| BUSINESS OF THE MEETING |

20 | |||

| Election of Directors |

20 | |||

| Appointment of Independent Auditor |

34 | |||

| Say-on-Pay Advisory Resolution on Approach to Executive Compensation |

36 | |||

| COMPENSATION OF DIRECTORS |

37 | |||

| Fees Earned by Directors who are not Employees of the Company |

38 | |||

| Share Ownership Guidelines for Non-Employee Directors |

39 | |||

| EXECUTIVE COMPENSATION—DISCUSSION AND ANALYSIS |

40 | |||

| Executive Compensation Philosophy and Objectives |

40 | |||

| Role and Accountabilities of the Human Resources and Compensation Committee |

40 | |||

| Compensation Consulting Services |

42 | |||

| Market Positioning and Benchmarking |

42 | |||

| Compensation Philosophy and Elements of Compensation |

44 | |||

| Share Ownership Requirements |

51 | |||

| Hedging / Anti-Hedging Policy |

52 | |||

| Compensation Risk Management |

52 | |||

| Performance Results |

53 | |||

| Summary Compensation Table |

54 | |||

| Incentive Plan Awards |

55 | |||

| Securities Authorized for Issuance under Equity Compensation Plans |

56 | |||

| Stock Option Plan |

57 | |||

| Pension Plan Benefits |

61 | |||

| Termination and Change of Control Benefits |

63 | |||

| Clawback Policy |

65 | |||

| DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES |

67 | |||

| Board of Directors |

67 | |||

| Position Descriptions |

70 | |||

| Board of Directors Committees |

71 | |||

| Shareholder Engagement |

76 | |||

| Orientation and Continuing Education |

77 | |||

| Ethical Business Conduct |

79 | |||

| Diversity, Equity and Inclusion |

81 | |||

| CSR25 Program |

84 | |||

| Nomination Rights Agreement |

85 | |||

| Majority Voting Policy |

86 | |||

| Advance Notice Requirements for Director Nominations |

86 | |||

| Indemnification and Insurance |

86 | |||

| ADDITIONAL INFORMATION |

87 | |||

| Indebtedness of Directors and Executive Officers |

87 | |||

| Interest of Certain Persons and Companies in Matters to be Acted Upon |

87 | |||

| Interest of Informed Persons in Material Transactions |

87 | |||

| Reimbursement to Bombardier Inc., a company related to Beaudier Group |

87 | |||

| Normal Course Issuer Bid |

87 | |||

| Available Information |

88 | |||

| Shareholder Proposals for Next Annual Meeting of Shareholders |

88 | |||

| Approval by Directors |

88 | |||

| SCHEDULE A |

A-1 | |||

|

GENERAL INFORMATION

|

This management proxy circular (the “Circular”) is furnished in connection with the solicitation by management of BRP Inc. (“BRP” or the “Company”) of proxies for use at the annual meeting of shareholders of the Company (the “Meeting”) to be held on May 31, 2024, at 11:00 a.m. (Eastern time), or any postponements or adjournments thereof, and for the purposes set forth in the accompanying notice of 2024 annual meeting of shareholders (the “Notice of Meeting”).

The Company has decided to hold the Meeting virtually via live webcast in order to maximize shareholder attendance for those who would be unable to attend in person and because it also is a very effective way of holding shareholders’ meetings. As such, shareholders will not be able to attend the Meeting in person. A summary of the information shareholders will need to join the Meeting online is provided below.

Unless otherwise noted or the context otherwise requires, all information provided in this Circular is given as at April 18, 2024, and references to the “Company” and “BRP” refer to BRP Inc., its direct and indirect subsidiaries, predecessors and other entities controlled by them. Unless otherwise indicated, all references to “$” or “dollars” in this Circular refer to Canadian dollars.

No person has been authorized to give any information or to make any representation in connection with any other matters to be considered at the Meeting other than those contained in this Circular and, if given or made, any such information or representation must not be relied upon as having been authorized.

Forward-Looking Statements

Certain statements in this Circular about the Company’s current and future plans, including statements relating to the expected impact of the organizational changes to further improve the Company’s position for its long-term growth, including changes combining the Powersports and Marine groups under one leadership, prospects, expectations, anticipations, estimates and intentions, results, levels of activity, performance, objectives, targets, goals or achievements, including the Company’s environmental, social and governance (“ESG”) targets, goals and initiatives set forth under the Company’s CSR25 Program, including targeted reductions in CO2 emissions, and those related to its electrification journey, priorities and strategies, including proactively managing network inventory, financial position, market position, capabilities, competitive strengths and beliefs, the prospects and trends of the industries in which the Company operates, the expected demand for products and services in the markets in which the Company competes, research and product development activities, including projected design, characteristics, capacity or performance of future products and their expected scheduled entry to market and the anticipated impact of such product introductions, or any other future events or developments and other statements in this Circular that are not historical facts constitute forward-looking statements within the meaning of applicable securities laws. The words “may,” “will,” “would,” “should,” “could,” “expects,” “forecasts,” “plans,” “intends,” “trends,” “indications,” “anticipates,” “believes,” “estimates,” “outlook,” “predicts,” “projects,” “likely” or “potential” or the negative or other variations of these words or other comparable words or phrases, are intended to identify forward-looking statements.

Forward-looking statements are presented for the purpose of assisting readers in understanding certain key elements of the Company’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of the Company’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes; readers should not place undue reliance on forward-looking statements contained herein. Forward-looking statements, by their very nature, involve inherent risks and uncertainties and are based on a number of assumptions, both general and specific. The Company cautions that its assumptions may not materialize and that the currently challenging macroeconomic and geopolitical environments in which it evolves may render such assumptions, although believed reasonable at the time they were made, subject to greater uncertainty.

8

2024 Proxy Circular

Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results or performance of the Company or the industry to be materially different from the outlook or any future results or performance implied by such statements.

In addition, many factors could cause the Company’s actual results, level of activity, performance or achievements or future events, or developments to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the following factors, which are discussed in greater detail under the “Risk Factors” section of the Company’s management’s discussion and analysis (the “2024 MD&A”) for the fiscal year ended on January 31, 2024 (“Fiscal 2024”) and in other continuous disclosure materials filed from time to time with Canadian securities regulatory authorities and the Securities and Exchange Commission: the impact of adverse economic conditions including in the context of recent significant increases of interest and inflation rates; any decline in social acceptability of the Company and its products, including in connection with the broader adoption of electrical or low-emission products; high levels of indebtedness; any unavailability of additional capital; any supply problems, termination or interruption of supply arrangements or increases in the cost of materials, including as a result of the ongoing military conflict between Russia and Ukraine; the inability to attract, hire and retain key employees, including members of the Company’s management team or employees who possess specialized market knowledge and technical skills; any failure of information technology systems, security breach or cyber-attack, or difficulties with the implementation of new systems, including the difficulties in the continued implementation of its ERP system; the Company’s reliance on international sales and operations; the Company’s inability to successfully execute its growth strategy; fluctuations in foreign currency exchange rates; unfavourable weather conditions and climate change more generally; the seasonal nature of the Company’s business and some of its products; the Company’s reliance on a network of independent dealers and distributors; any inability of dealers and distributors to secure adequate access to capital; any inability to comply with product safety, health, environmental and noise pollution laws; the Company’s large fixed cost base; any failure to compete effectively against competitors or any failure to meet consumers’ evolving expectations; any failure to maintain an effective system of internal control over financial reporting and to produce accurate and timely financial statements; any inability to maintain and enhance the Company’s reputation and brands; any significant product liability claim; any significant product repair and/or replacement due to product warranty claims or product recalls; any failure to carry proper insurance coverage; the Company’s inability to successfully manage inventory levels; any intellectual property infringement and litigation; the Company’s inability to successfully execute its manufacturing strategy or to meet customer demand as a result of manufacturing capacity constraints; increased freight and shipping costs or disruptions in transportation and shipping infrastructure; any failure to comply with covenants in financing and other material agreements; any changes in tax laws and unanticipated tax liabilities; any impairment in the carrying value of goodwill and trademarks; any deterioration in relationships with employees; pension plan liabilities; natural disasters; volatility in the market price for the Subordinate Voting Shares; the Company’s conduct of business through subsidiaries; the significant influence of Beaudier Group and BCI (both defined below); and future sales of Subordinate Voting Shares by Beaudier Group, BCI, directors, officers or senior management of the Company. These factors are not intended to represent a complete list of the factors that could affect the Company; however, these factors should be considered carefully.

Unless otherwise stated, the forward-looking statements contained in this Circular are made as of the date of this Circular, and the Company has no intention and undertakes no obligation to update or revise any forward-looking statements, including to reflect future events, changes in circumstances, or changes in beliefs, unless required by applicable securities regulations. In the event that the Company does update any forward-looking statements contained in this Circular, no inference should be made that the Company will make additional updates with respect to that statement, related matters or any other forward-looking statement.

IFRS and Non-IFRS Measures

The Company’s financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), and this Circular makes reference to certain non-IFRS financial measures.

9

2024 Proxy Circular

These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS.

The Company believes non-IFRS measures are important supplemental measures of financial performance because they eliminate items that have less bearing on the Company’s financial performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS measures. The Company also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of companies, many of which present similar metrics when reporting their results. Management also uses non-IFRS measures in order to facilitate financial performance comparisons from period to period, prepare annual operating budgets, assess the Company’s ability to meet its future debt service, capital expenditure and working capital requirements, and also, as a component in the determination of the short-term incentive compensation for the Company’s employees. A detailed description of the usefulness of each non-IFRS measure can be found in the 2024 MD&A. Because other companies may calculate these non-IFRS measures differently than the Company does, these metrics are not comparable to similarly titled measures reported by other companies. “Normalized EBITDA” is defined as net income before financing costs, financing income, income tax expense, depreciation expense and normalized elements, as described in the 2024 MD&A, such as transaction costs, gain on normal course issuer bid (“NCIB”) and depreciation of intangible assets related to business combinations. “Normalized net income” is defined as net income before normalized elements described in the 2024 MD&A, such as foreign exchange gain on long-term debt and lease liabilities, transaction costs and past service costs, and adjusted to reflect the tax effect on these elements. “Normalized earnings per share—diluted” (“Normalized diluted EPS”) is obtained, by dividing the Normalized net income by the weighted average number of shares—diluted. The Company refers the reader to the “Non-IFRS Measures” and “Selected Consolidated Financial Information” sections of the 2024 MD&A, which are incorporated by reference herein, for definitions and reconciliations of Normalized EBITDA, Normalized net income and Normalized diluted EPS presented by the Company to the most directly comparable IFRS measure. The Company’s 2024 MD&A, financial statements and annual information form dated March 27, 2024 (“2024 AIF”), are available under the Company’s profiles on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

Voting Information

The following questions and answers provide guidance on how to vote your subordinate voting shares (the “Subordinate Voting Shares”) and/or multiple voting shares (the “Multiple Voting Shares” and, together with the Subordinate Voting Shares, the “Shares”) of the Company.

How do I access Meeting materials?

All Meeting materials have been posted on the Company’s website at ir.brp.com and are also available under the Company’s profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Who is soliciting my proxy?

Management of the Company is soliciting your proxy. It is expected that the solicitation will be made primarily by mail and by Internet, but proxies may also be solicited by telephone, in writing or in person, by directors, officers or employees of the Company and its subsidiaries who will receive no other compensation therefore other than their regular remuneration. The Company may also reimburse brokers and other persons holding Shares in their name or in the name of nominees for the costs incurred in sending Proxy Materials to their principals in order to obtain their proxies. Such costs are expected to be nominal.

10

2024 Proxy Circular

Who can vote?

Only persons registered as holders of Subordinate Voting Shares and/or Multiple Voting Shares on the books of the Company as of the close of business on April 18, 2024 (the “Record Date”) are entitled to receive notice of, and to vote at, the Meeting or any postponement or adjournment thereof, and no person becoming a shareholder after the Record Date shall be entitled to receive notice of, and to vote at, the Meeting or any postponement or adjournment thereof. The failure of any shareholder to receive notice of the Meeting does not deprive the shareholder of the right to vote at the Meeting to which the shareholder would have otherwise been entitled.

What will I be voting on?

Holders of Shares will be voting:

| ● | to elect the directors of the Company who will serve until the next annual meeting of shareholders or until their successors are elected or appointed (see page 22 of the Circular); |

| ● | to appoint the independent auditor of the Company (see page 34); |

| ● | to consider an advisory non-binding resolution on the Company’s approach to executive compensation, as more particularly described in the Circular (see page 36 of the Circular); and |

| ● | to transact such other businesses as may properly be brought before the Meeting or any postponement or adjournment thereof. |

How will these matters be decided at the Meeting?

A simple majority of the votes cast (50% plus one), in person or by proxy, by the holders of Subordinate Voting Shares and Multiple Voting Shares, voting together as a single class, will constitute approval of each of the matters specified in this Circular.

For further details on majority voting rules as provided by the Canada Business Corporations Act (“CBCA”), please refer to section “Disclosure of Corporate Governance Practices—Majority Voting Policy” of this Circular.

What is the necessary quorum for the Meeting?

A quorum of shareholders is present at a meeting of shareholders if the holders of not less than 25% of the shares entitled to vote at the meeting are present online or represented by proxy.

How many votes do I have?

The Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws in that they do not carry equal voting rights with the Multiple Voting Shares.

Each Multiple Voting Share carries the right to six votes and each Subordinate Voting Share carries the right to one vote. In the aggregate, all of the voting rights associated with the Subordinate Voting Shares represented, as at April 18, 2024, 13.6% of the voting rights attached to all of the issued and outstanding Shares.

The Subordinate Voting Shares are not convertible into any other class of shares. Each outstanding Multiple Voting Share may at any time, at the option of the holder, be converted into one Subordinate Voting Share. Upon the first date that any Multiple Voting Share shall be held other than by a Permitted Holder (as such term is defined in the Company’s articles), such holder, without any further action, shall automatically be deemed to have exercised his, her or its rights to convert all of the Multiple Voting Shares held by such holder into fully paid and non-assessable Subordinate Voting Shares, on a share for share basis.

11

2024 Proxy Circular

In addition, all Multiple Voting Shares, regardless of the holder thereof, will convert automatically into Subordinate Voting Shares at such time as Permitted Holders that hold Multiple Voting Shares no longer hold and own, collectively, directly or indirectly, more than 15% of the beneficial ownership interests in the aggregate number of outstanding Multiple Voting Shares and Subordinate Voting Shares (it being understood that the number of Multiple Voting Shares shall be added to the number of Subordinate Voting Shares for the purposes of such calculation).

Under applicable Canadian law, an offer to purchase Multiple Voting Shares would not necessarily require that an offer be made to purchase Subordinate Voting Shares. In accordance with the rules of the Toronto Stock Exchange (the “TSX”) designed to ensure that, in the event of a takeover bid, the holders of Subordinate Voting Shares will be entitled to participate on an equal footing with holders of Multiple Voting Shares, Beaudier Inc. (“Beaudier”), 4338618 Canada Inc. (“4338618” and, together with Beaudier, the “Beaudier Group”), Bain Capital Luxembourg Investments S.à.r.l. (which subsequently assigned its rights thereunder to Bain Capital Integral Investors II, L.P. (“Bain”)) and Caisse de dépôt et placement du Québec (“CDPQ” and, together with Beaudier Group and Bain, the “Principal Shareholders”), as the holders of all the outstanding Multiple Voting Shares as at May 29, 2013, entered into a coattail agreement dated May 29, 2013, with the Company and Computershare Trust Company of Canada (the “Coattail Agreement”). The Coattail Agreement contains provisions customary for dual class, TSX-listed companies designed to prevent transactions that otherwise would deprive the holders of Subordinate Voting Shares of rights under applicable provincial takeover bid legislation to which they would have been entitled if the Multiple Voting Shares had been Subordinate Voting Shares. Additional information relating to the Coattail Agreement can be found in the 2024 AIF available on the Company’s website at ir.brp.com and under its profiles on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Whom can I call with questions?

If you have questions about the information contained in this Circular or require assistance in completing your form of proxy, please contact Computershare Investor Services Inc. (“Computershare”), the Company’s transfer agent, toll-free at 1-800-564-6253, or by mail at:

Computershare Investor Services Inc.

100 University Avenue

8th Floor

Toronto, Ontario M5J 2Y1

Registered shareholders and validly appointed proxyholders will be entitled to submit questions electronically to the Company in advance of the Meeting by e-mail at BRPAGA@brp.com, and during the Meeting through the platform available at https://web.lumiagm.com/489499147, which questions will, subject to certain verifications by the Company, be addressed at the Meeting. Questions provided in advance by e-mail must be provided by no later than 11:00 a.m. (Eastern time) on May 29, 2024, or if the Meeting is postponed or adjourned, by no later than 48 hours prior to the time of such postponed or adjourned meeting (excluding Saturdays, Sundays and holidays).

Am I a registered shareholder or non-registered shareholder?

You are a registered holder if your Shares are registered directly in your name with Computershare. Such Shares are generally evidenced by a share certificate or direct registration statement.

You are a non-registered shareholder if your Shares are held in the name of a depositary or a nominee such as a trustee, financial institution, or securities broker (each an “Intermediary”). If your common shares are listed in an account statement provided to you by your broker, those common shares are, in all likelihood, not registered in your name. Such common shares will more likely be registered under the name of an Intermediary.

12

2024 Proxy Circular

Without specific instructions, Intermediaries are prohibited from voting the common shares for their client. Pursuant to National Instrument 54–101–Communication with Beneficial Owners of Securities of a Reporting Issuer, each Intermediary is required to request voting instructions from non-registered shareholders prior to shareholders meetings. Intermediaries have their own procedures for sending materials and their own guidelines for the return of documents. Non-registered shareholders should carefully follow the instructions of their intermediaries to ensure that their Shares are voted at the Meeting in accordance with such shareholder’s instructions.

How do I attend the Meeting?

The Company is holding the Meeting virtually. Shareholders may attend the Meeting online using a smartphone, tablet or computer, or by conference call.

To attend the Meeting online:

| ● | Make sure the browser on your device is compatible. You will need the latest version of Chrome, Safari, Edge, or Firefox. Internet Explorer is not supported. |

| ● | Using your smartphone, tablet or computer, go to the following address: https://web.lumiagm.com/489499147. |

| ● | Internal network security protocols including firewalls and VPN connections may block access to the Lumi platform for your meeting. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted to security settings of your organization. |

| ● | It is important that you are connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. You should allow ample time to check into the Meeting online and complete the related procedure. The Company recommends that you log in at least one hour before the Meeting starts. The Meeting will begin promptly at 11:00 a.m. (Eastern time) on May 31, 2024, unless otherwise adjourned or postponed. |

| ● | Registered shareholders and duly appointed proxyholders: |

| o | Select “I have a login.” |

| o | Registered shareholders: Enter the control number listed on your form of proxy or in the e-mail notification you received, and the password “brp2024” (case sensitive) |

| o | Duly appointed proxyholders: Enter the control number or username provided by Computershare, and the password “brp2024” (case sensitive). Computershare will provide the proxyholder with a control number by e-mail after the deadline of May 29, 2024, has passed (or if the Meeting is postponed or adjourned, within the 48 hours prior to the time of such postponed or adjourned meeting, excluding Saturdays, Sundays and holidays) and after the proxyholder has been duly appointed AND registered as described in “Appointment of a Third Party as Proxy” below. |

| ● | Guests: |

| o | Select “I am a guest” and fill in the form. |

To attend by conference call:

| ● | French: 1-877-731-3745 |

13

2024 Proxy Circular

| ● | English: 1-888-307-2440 |

| ● | Original (without interpretation): 1-888-354-1106 |

Anyone joining the Meeting on the live webcast as a “guest” or by phone on the conference call, including non-registered shareholders who have not duly appointed themselves as their proxy, will be able to listen to the Meeting but will not be ale to vote or ask questions. Registered shareholders and duly appointed proxyholders, including non-registered shareholders who have duly appointed themselves as their proxy, who are joining the Meeting at https://web.lumiagm.com/489499147 by following the steps above, will be able to participate and ask questions in real time as well as vote at the appropriate times during the Meeting. Please refer to section “General Information—Voting Information—Appointment of a Third Party as Proxy” of this Circular below for additional information on voting at the Meeting, appointing yourself as a proxyholder and, where applicable, registering with Computershare.

Following the Meeting, the webcast of the Meeting will also be accessible on the Company’s website at www.brp.com until next year’s annual meeting of shareholders.

Submitting Questions at the Meeting

If a registered shareholder or duly appointed proxyholder (including a non-registered shareholder who has duly appointed himself or herself as proxyholder) has a question about one of the items to be voted on by the shareholders at the Meeting, such question may be submitted by selecting the messaging tab on the Lumi AGM online platform at or before the time the matters are presented at the Meeting, and by typing your question within the box at the top of the screen and clicking the send arrow. Questions will be answered on any items to be voted on by the shareholders at the Meeting before the voting is closed. General questions received during the course of the Meeting, but not on matters on the agenda, will be addressed during a live question period following the Meeting.

Only registered shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder) may submit questions at the Meeting, that are germane to the proposals and/or the Meeting. Guests will not be able to submit questions, vote or otherwise participate at the Meeting; however, they will be able to join the webcast as a guest. Shareholders voting by proxy in advance of the Meeting are welcome to join the Meeting as guests.

So that as many questions as possible are answered, shareholders and proxyholders are asked to be brief and concise and to address only one topic per question. Questions from multiple shareholders on the same topic or that are otherwise related will be grouped, summarized and answered together. All shareholder questions are welcome. However, the Company does not intend to address questions that are irrelevant to the Company’s operations or to the business of the Meeting, are related to non-public information about the Company, are related to personal grievances, constitute derogatory references to individuals or that are otherwise offensive to third parties, are repetitious or have already been asked by other shareholders, are in furtherance of a shareholder’s personal or business interest, or are out of order or not otherwise appropriate as determined by the Chair of the Meeting in their reasonable judgment.

For any questions asked but not answered during the Meeting, shareholders may contact the Company’s corporate secretary at corporate.secretariat@brp.com.

In the event of technical malfunction or other significant problem that disrupts the Meeting, the Chair of the Meeting may adjourn, recess, or expedite the Meeting, or take such other action that the Chair determines is appropriate considering the circumstances.

14

2024 Proxy Circular

How do I vote?

|

1. Voting by proxy before the Meeting |

You may vote before the Meeting by completing your form of proxy or voting instruction form in accordance with the instructions provided therein. Non-registered shareholders should also carefully follow all instructions provided by their intermediaries to ensure that their Shares are voted at the Meeting.

The persons named in the form of proxy provided, namely Messrs. José Boisjoli and Martin Langelier, are respectively Chair of the Board of Directors, President and Chief Executive Officer, and Chief Legal Officer & Corporate Services of the Company. However, as further described herein, you may choose another person to act as your proxyholder, including someone who is not a holder of Shares of the Company, by inserting another person’s name in the blank space provided in the enclosed form of proxy or by completing another proper form of proxy.

Registered shareholders may vote by proxy as follows: by mail, fax, telephone, or over the Internet on Computershare’s proxy voting website.

Submitting a proxy by mail, fax, e-mail or through Computershare’s website are the only methods by which a registered shareholder may appoint a person other than the members of the management of the Company named in the form of proxy as proxyholder.

Mail or Fax

Registered shareholders electing to submit a proxy by mail or fax must complete, date and sign the form of proxy. It must then be returned to the Company’s transfer agent, Computershare, either in the postage pre-paid return envelope provided or by fax at 1-866-249-7775 (for shareholders in Canada and in the United States) or at (416) 263-9524 (for shareholders outside Canada and the United States), no later than 11:00 a.m. (Eastern time) on May 29, 2024.

Telephone

Registered shareholders electing to submit a proxy by telephone must do so by using a touchtone telephone. The telephone number to call for shareholders in Canada and in the United States is 1-866-732-VOTE (8683). For shareholders outside Canada and the United States, the telephone number to call is 312-588-4290. Shareholders must follow the instructions, use the form of proxy received from the Company and provide the 15-digit control number located on the form of proxy. Instructions are then conveyed by use of the touchtone selections over the telephone.

Internet

Registered shareholders electing to submit a proxy over the Internet must access the following website: www.investorvote.com.

Registered shareholders must then follow the instructions and refer to the form of proxy received from the Company which contains a 15-digit control number located on the form of proxy. Voting instructions are then conveyed electronically by the shareholder over the Internet.

If you are a non-registered shareholder, you should also carefully follow the instructions provided by your intermediary to ensure that your Shares are voted at the Meeting in accordance with your instructions.

15

2024 Proxy Circular

|

2. Voting at the Meeting |

Registered shareholders may vote at the Meeting by attending the Meeting online, as further described above. Please refer to section “General Information—Voting Information—How do I attend the Meeting?” of this Circular. Once voting has opened, the voting tab will appear, and resolutions and voting choices will be displayed in that tab. To vote, select one of the voting options. A confirmation message will appear once your vote has been received. The number of resolutions for which you have voted, or not yet voted, will be displayed at the top of the screen. You will be able to change your votes until the end the voting period by simply selecting another choice. You will continue to hear the meeting proceedings during this time. To return to the broadcast tab on mobile, tap on the broadcast button after having voted.

Non-registered shareholders who have not duly appointed themselves as proxyholder will not be able to participate nor vote at the Meeting, but will be able to attend as guests. This is because the Company and its transfer agent do not have a record of the non-registered shareholders of the Company, and, as a result, will have no knowledge of your shareholdings or entitlement to vote, unless you appoint yourself as proxyholder. If you are a non-registered shareholder and wish to vote at the Meeting, you have to appoint yourself as proxyholder, by inserting your own name in the space provided on the voting instruction form sent to you and must follow all of the applicable instructions provided by your intermediary. You must also register as a proxyholder by visiting www.computershare.com/BRP by 11:00 a.m. (Eastern time) on May 29, 2024, and provide Computershare with your contact information, so that Computershare may provide you with a control number via e-mail.

In addition, if you are a non-registered shareholder located in the United States and wish to vote at the Meeting, if permitted, you must also submit your legal proxy to Computershare.

Please refer to sections “General Information—Voting Information—Appointment of a Third Party as Proxy” and “General Information—Voting Information—How do I attend the Meeting?” of this Circular.

How will my proxyholder vote?

The persons named in the form of proxy provided, namely Messrs. José Boisjoli and Martin Langelier, are respectively Chair of the Board of Directors, President and Chief Executive Officer, and Chief Legal Officer & Corporate Services of the Company. However, as further described herein, you may choose another person to act as your proxyholder, including someone who is not a shareholder of the Company, by inserting another person’s name in the blank space provided in the form of proxy or voting instruction form and following the other applicable steps described in “Appointment of a Third Party as Proxy” below.

On the form of proxy, you may indicate either how you want your proxyholder to vote your Shares, or you can let your proxyholder decide for you. If you have specified in the form of proxy how you want your Shares to be voted on a particular matter (by marking FOR, AGAINST or WITHHOLD), then your proxyholder must vote your Shares accordingly.

If you have not specified in the form of proxy how you want your Shares to be voted on a particular matter, then your proxyholder can vote your Shares as he or she sees fit.

16

2024 Proxy Circular

Unless contrary instructions are provided, the voting rights attached to the Multiple Voting Shares and/or Subordinate Voting Shares represented by proxies received by the management of the Company will be voted:

| ● | FOR the election of all the nominees proposed as directors; and |

| ● | FOR the appointment of Deloitte LLP as independent auditors of the Company and authorizing the Board of Directors to fix their remuneration; and |

| ● | FOR the adoption of the advisory non-binding resolution on the Company’s approach to executive compensation (the “Say-on-Pay Advisory Resolution”). |

The enclosed form of proxy gives the persons named in it the authority to use their discretion in voting on amendments or variations to matters identified in the Notice of Meeting. As of the date of this Circular, the management of the Company is not aware of any other matter to be presented at the Meeting. If, however, other matters properly come before the Meeting, the persons named in the enclosed form of proxy will vote on them in accordance with their judgment, pursuant to the discretionary authority conferred upon them by the form of proxy with respect to such matters.

Appointment of a Third Party as Proxy

The following applies to shareholders who wish to appoint a person (a “third party proxyholder”) other than the management nominees set forth in the form of proxy or voting instruction form as proxyholder, including non-registered shareholders who wish to appoint themselves as proxyholder to be able to participate and vote at the Meeting.

Shareholders who wish to appoint a third party proxyholder to attend and participate at the Meeting as their proxy and vote their Shares MUST submit their proxy or voting instruction form (as applicable) appointing such third party proxyholder AND register the third party proxyholder, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a control number that is required to participate and vote at the Meeting. These two steps are further detailed below:

Step 1: Submit your proxy or voting instruction form: To appoint a third party proxyholder, insert such person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form.

Step 2: Register your proxyholder: To register a proxyholder, shareholders MUST visit www.computershare.com/BRP by 11:00 a.m. (Eastern time) on May 29, 2024, and provide Computershare with the required proxyholder contact information, so that Computershare may provide the proxyholder with a control number via e-mail. Without a control number, proxyholders will not be able to participate nor vote at the Meeting.

If you are a non-registered shareholder located in the United States and wish to be able to participate and vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above, you must obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting information form sent to you, or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Computershare. Requests for registration from non-registered shareholders located in the United States that wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by e-mail or by courier to: service@computershare.com (if by e-mail), or Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 (if by courier), and in both cases, must be labelled as “legal proxy” and received by no later than 11:00 a.m. (Eastern time) on May 29, 2024.

17

2024 Proxy Circular

How can I revoke my proxy?

If you are a registered shareholder, you may revoke your proxy at any time before it is acted upon in any manner permitted by law, including by stating clearly, in writing, that you wish to revoke your proxy and by delivering this written statement to Computershare, no later than the last business day before the day of the Meeting, or to the Chair of the Meeting on the day of the Meeting or any postponement or adjournment thereof.

If you are a non-registered shareholder and wish to revoke previously provided voting instructions, you should follow the instructions carefully provided by your intermediary.

If you have followed the process for participating and voting at the Meeting online, voting at the Meeting online will revoke your previous proxy.

Voting Shares Outstanding and Principal Shareholders

The Company’s authorized share capital consists of an unlimited number of Multiple Voting Shares and Subordinate Voting Shares and an unlimited number of preferred shares issuable in series. As of April 18, 2024, there were 36,494,011 Subordinate Voting Shares and 38,519,358 Multiple Voting Shares issued and outstanding, and no preferred shares were issued and outstanding. Under the Company’s articles, each Subordinate Voting Share carries the right to one vote and each Multiple Voting Shares carries the right to six votes.

The following table discloses the names of the persons or companies who, to the knowledge of the Company, as of April 18, 2024, beneficially owned, controlled or directed, directly or indirectly, more than 10% of any class or series of the voting securities of the Company:

| Name |

Number of Multiple Voting Shares Owned |

Percentage of Outstanding Multiple Voting Shares |

Number of Subordinate Voting Shares Owned |

Percentage of Outstanding Subordinate Voting Shares |

Percentage of Outstanding Shares |

Percentage of Total Voting Power |

||||||

| Bain Group(1) |

11,996,629 | 31.1% | 1,628,558(5) | 4.5% | 16.0% | 26.9% | ||||||

| Beaudier Group |

||||||||||||

| Beaudier(2) |

13,000,000 | 33.7% | — | — | 17.3% | 29.2% | ||||||

| 4338618(3) |

8,709,901 | 22.6% | — | — | 11.6% | 19.5% | ||||||

| CDPQ(4) |

4,812,828 | 12.5% | 977,000 | 2.7% | 6.4% | 10.8% | ||||||

| (1) | Represents shares held by Bain and its affiliates (the “Bain Group”). Bain’s general partner is Bain Capital Investors, LLC (“BCI”), which may be deemed to share voting and dispositive power with respect to the shares held by the Bain Group. The address of BCI is c/o Bain Capital Private Equity, LP, 200 Clarendon Street, Boston, MA 02116. The address of Bain is Ugland House, Church Street, Georgetown KY1-1104 Cayman Islands. |

| (2) | Beaudier is a portfolio holding company of the Beaudoin family and is controlled by Mr. Laurent Beaudoin, former director and current Chairman Emeritus of the Board of Directors, and his wife Mrs. Claire Bombardier Beaudoin, through holding companies which they control. Mr. Pierre Beaudoin, the son of Mr. Laurent Beaudoin and Mrs. Claire Bombardier Beaudoin is currently a director of the Company and will be standing for re-election at the Meeting. Ms. Élaine Beaudoin, the daughter of Mr. Laurent Beaudoin and Mrs. Claire Bombardier Beaudoin is currently a director of the Company and will be standing for re-election at the Meeting. |

| (3) | 4338618 is a portfolio holding company which is owned by Mrs. Janine Bombardier, Mrs. Huguette B. Fontaine and Mr. J.R. André Bombardier, through respective holding companies which they control and, in the case of Mrs. Janine Bombardier, a trust to her benefit and the benefit of her issue. Mr. Charles Bombardier, the son of Mr. J.R. André Bombardier is currently a director of the Company and will be standing for re-election at the Meeting. |

18

2024 Proxy Circular

| (4) | CDPQ is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. CDPQ invests these funds globally and across different asset classes namely, equity markets, private equity, infrastructure, real estate and fixed income. |

| (5) | The data published in this table is as of the Record Date. The Company announced on April 19, 2024 the closing of a bought deal secondary offering (the “April 2024 Offering”) pursuant to which Bain sold 1,500,000 SVS of the Company as of April 19, 2024. In connection with the Offering, an aggregate number of 1,628,558 MVS of the Company held by Bain were converted into 1,628,558 SVS of the Company as of April 18, 2024, which is reflected in the above table. For further details on the April 2024 Offering, please refer to the Company’s press release dated April 19, 2024, which is available on the Company’s website at www.brp.com. |

19

2024 Proxy Circular

|

BUSINESS OF THE MEETING

|

Shareholders will be asked to consider and vote on the following matters at the Meeting:

| ● | the election of the directors of the Company who will serve until the next annual meeting of shareholders or until their successors are elected or appointed (see page 20 of the Circular); |

| ● | the appointment of the independent auditor of the Company (see page 34 of the Circular); |

| ● | to consider the Say-on-Pay Advisory Resolution, as more particularly described in the Circular (see page 36 of the Circular); and |

| ● | such other business as may properly be brought before the Meeting or any adjournment thereof. |

The audited annual consolidated financial statements of the Company for Fiscal 2024, along with the notes thereto and the Report of Independent Registered Public Accounting Firm thereon, will be submitted at the Meeting, but no vote thereon is required or expected. These audited annual consolidated financial statements, together with the related management’s discussion and analysis, are available under the Company’s profiles on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov and on the Company’s website at ir.brp.com.

Election of Directors

The Company’s articles provide that its Board of Directors shall consist of not less than three and not more than fifteen directors. The Company’s directors are elected annually at the annual meeting of shareholders, except that the Board of Directors can appoint directors in certain circumstances between annual meetings. Each director is expected to hold office until the next annual meeting of shareholders or until his or her successor is elected or appointed.

The Board of Directors is currently comprised of 12 directors, and it is proposed that 12 directors be elected at the Meeting. The persons identified in the section “Business of the Meeting—Election of Directors—Description of Proposed Director Nominees” of this Circular will be nominated for election as directors at the Meeting. All such nominees are presently directors of the Company. Shareholders may vote for each proposed director nominee individually. Each of the proposed director nominees was elected at the annual meeting of the shareholders of the Company held on June 1, 2023, by at least a majority of the votes cast by proxy or at such meeting.

Pursuant to the nomination rights agreement entered into on May 29, 2013, between the Company and the Principal Shareholders (the “Nomination Rights Agreement”), each of Bain Capital Luxembourg Investments S.à.r.l. (which subsequently assigned its rights thereunder to Bain), Beaudier Group and CDPQ are entitled to designate three, three and one member(s) of the Board of Directors, respectively. The current members of the Board of Directors so designated are Messrs. Joshua Bekenstein and Nicholas Nomicos for Bain, Messrs. Pierre Beaudoin and Charles Bombardier, as well as Ms. Élaine Beaudoin for the Beaudier Group, and Ms. Estelle Métayer for CDPQ. Bain elected not to designate a third board member for election at the Meeting. Please refer to section “Disclosure of Corporate Governance Practices—Nomination Rights Agreement” of this Circular.

Unless a proxy specifies that the Shares it represents should be voted against the election of one or more directors or voted in accordance with the specification in the proxy, the persons named in the form of proxy intend to vote FOR the election of each of the nominees listed in this Circular.

Management of the Company does not expect that any of the nominees will be unable, or for any reason, will become unwilling, to stand for election as director at the Meeting.

20

2024 Proxy Circular

However, if, for any reason, at or before the time of the Meeting, any of the nominees becomes unable to serve and unless otherwise specified, it is intended that the persons designated in the form of proxy will vote in their discretion for a substitute nominee or nominees.

21

2024 Proxy Circular

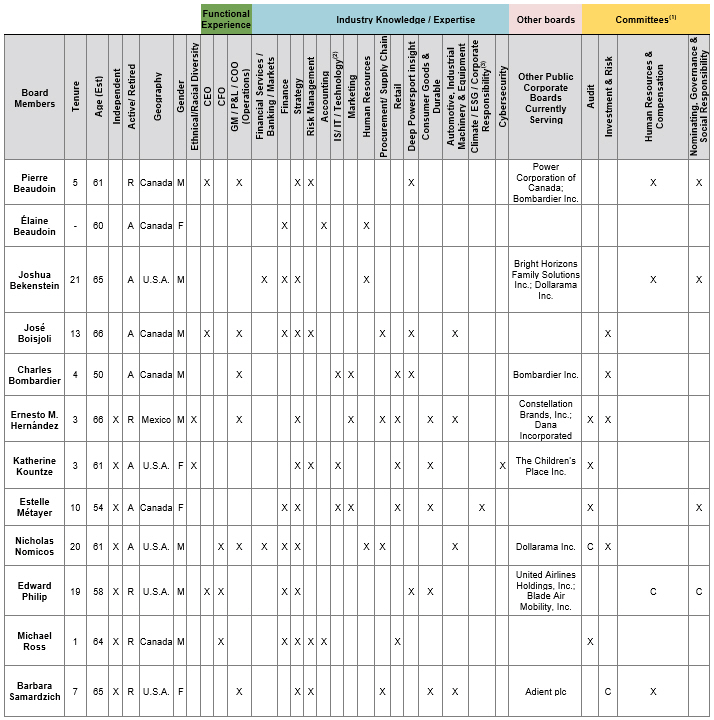

Description of Proposed Director Nominees

| ÉLAINE BEAUDOIN | Director |

|||||||||

|

|

||||||||||

|

Age: 60

Québec, Canada

Not independent(1)

Director since 2023

2023 Voting Results For: 99.43% Against: 0.57% |

Ms. Élaine Beaudoin is Vice-President and director of Beaudier, a private holding company which holds Multiple Voting Shares, since 2019. She is a member of several other boards of directors, including Armtex Inc., Hebdo-litho, Bodycad Inc. and the J.Armand Bombardier Foundation. She also sat on the board of directors of Canam Inc. from 2000 to 2017 and chaired its Human Resources Committee and served as a member of its Audit Committee. From 1989 to 1998, she acted as Chief Executive Officer of Unifix Inc., a company specializing in the manufacturing of light-weight concrete panels. Ms. Élaine Beaudoin is a graduate of McGill University and a member of the Ordre des comptables professionnels agréés du Québec (Québec CPA Order). She holds the ICD.D designation from the Institute of Corporate Directors. |

|||||||||

|

Board/Committee Membership |

Attendance | Other Public Board Membership | ||||||||

|

Board of Directors |

4/4 | Entity | Since | |||||||

| Total: 100%

|

||||||||||

|

Value of Total Compensation Received as Director(2) |

||||||||||

|

Fiscal 2024: |

$211,054 |

|||||||||

| Securities Held as of January 31, 2024(3) |

||||||||||||||||

| Subordinate Voting Shares |

Market Value of Subordinate Voting Shares ($) |

Multiple Voting Shares (#) |

Market Value of Multiple Voting Shares ($) |

Options (#) |

Value

of Money |

Deferred Share Units (#) |

Market Value of Deferred Share Units ($)(4) |

Total Market Value of Securities Held ($)(4) |

||||||||

| - | - | - | - | - | - | 1,338 | 113,482 | 113,482 | ||||||||

| Total ownership as multiple of retainer as at January 31, 2024 (Target: 5x annual base cash retainer)(5): 1.4(6) | ||||||||||||||||

| Notes

|

||||||||||||||||||

| (1) |

Ms. Élaine Beaudoin is not considered independent as she is the daughter of Claire Bombardier Beaudoin and Laurent Beaudoin, who both control Beaudier, a Principal Shareholder, through holding companies which they control. Ms. Beaudoin is also the niece of Janine Bombardier, Huguette Bombardier Fontaine and J.R. André Bombardier, who own 4338618, a Principal Shareholder, through holding companies which they control. |

|||||||||||||||||

| (2) |

For a complete itemization of the compensation, please refer to section “Compensation of Directors” of this Circular. |

|||||||||||||||||

| (3) |

Ms. Élaine Beaudoin does not personally own any voting securities of the Company. For details regarding Beaudier’s ownership of voting securities of the Company, please refer to section “General Information—Voting Shares Outstanding and Principal Shareholders” of this Circular. |

|||||||||||||||||

| (4) |

Based on the closing price of the Subordinate Voting Shares on the TSX ($84.84) on January 31, 2024, being the last trading day before the end of Fiscal 2024. |

|||||||||||||||||

| (5) |

Equity ownership was assessed as at January 31, 2024, based on the closing price of the Subordinate Voting Shares on the TSX on that date ($84.84), converted to U.S. dollars based on the daily rate of exchange published by Refinitiv on January 31, 2024, (U.S.$1.00 = $1. 3387). For further details on the share ownership guidelines applicable to non-employee directors, please refer to section “Compensation of Directors—Share Ownership Guidelines for Non-Employee Directors” of this Circular. |

|||||||||||||||||

| (6) |

Ms. Élaine Beaudoin’s transition period to meet the minimum share ownership runs until June 1, 2028. Please refer to section “Compensation of Directors—Share Ownership Guidelines for Non-Employee Directors” of this Circular. |

|||||||||||||||||

22

2024 Proxy Circular

| PIERRE BEAUDOIN | Director |

|||||||||

|

|

||||||||||

|

Age: 61

Québec, Canada

Not independent(1)

Director since 2019

2023 Voting Results For: 95.55% Against: 4.45% |