UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 23, 2024

COSTAR GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 0-24531 | 52-2091509 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 1331 L Street, NW, Washington, DC | 20005 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (202) 346-6500

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

| Common Stock ($0.01 par value) | CSGP | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On April 23, 2024, CoStar Group, Inc. (“CoStar” or the “Company”) announced its financial and operating results for the quarter ended March 31, 2024. The full text of the press release (the “Press Release”) issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 2.02 and the Press Release shall be considered “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), nor shall it be deemed incorporated by reference into any reports or filings with the Securities and Exchange Commission (the “SEC”), whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure. |

CoStar hereby furnishes the presentation (the “Investor Presentation”) that the Company intends to use from time to time on or after April 23, 2024. CoStar may use the Investor Presentation with investors, analysts, lenders, insurers, vendors, clients, employees and others. The Investor Presentation is furnished herewith as Exhibit 99.2 and also will be made available on the Company’s website at costargroup.com.

The information contained in the Investor Presentation is summary information that should be considered in the context of the Company’s filings with the SEC and other public announcements that the Company may make, by press release or otherwise, from time to time. The Investor Presentation is current as of April 23, 2024. To the extent that estimates, targets or other forward-looking statements are included in the Investor Presentation, the Company specifically disclaims any duty or obligation to publicly update or revise such information.

The information contained in this Item 7.01 and the Investor Presentation shall be considered “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act, nor shall it be deemed incorporated by reference into any reports or filings with the SEC, whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. |

Description |

|

| 99.1 | CoStar Group, Inc. Press Release Dated April 23, 2024. | |

| 99.2 | CoStar Group, Inc. Investor Presentation Dated April 23, 2024. | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COSTAR GROUP, INC. | ||||||

| By: | ||||||

| Date: April 23, 2024 | /s/ Scott T. Wheeler |

|||||

| Name: Scott T. Wheeler | ||||||

| Title: Chief Financial Officer | ||||||

Exhibit 99.1

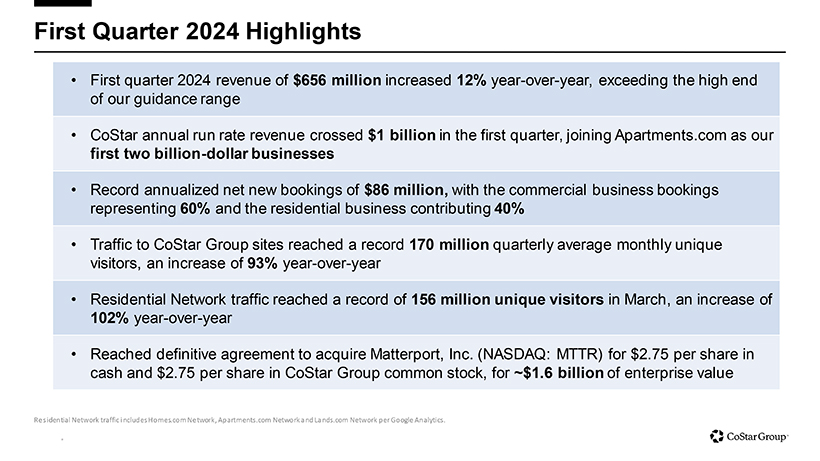

CoStar Group Successfully Launches Monetization of Homes.com in First Quarter 2024, with $39 Million of Net New Bookings Accelerating Overall Net New Bookings to a Record $86 Million

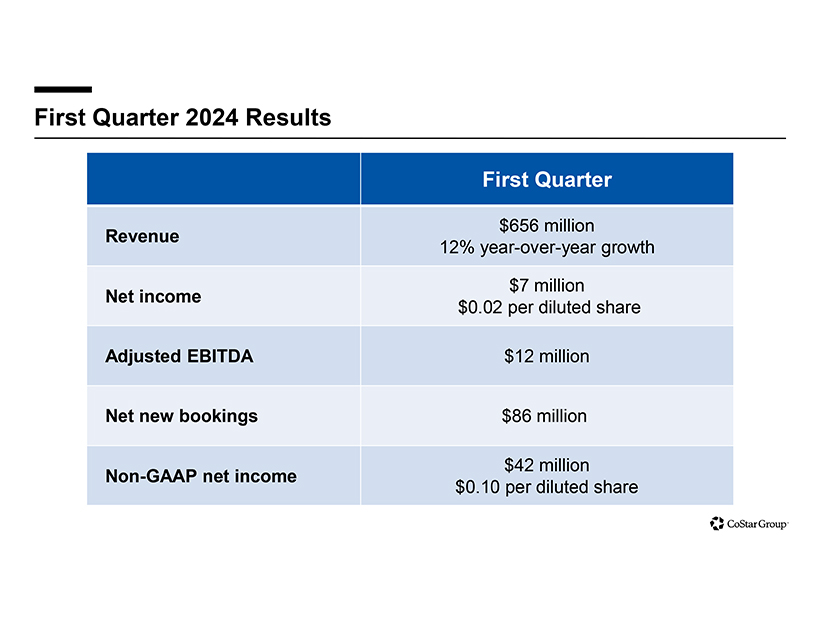

WASHINGTON – April 23, 2024 - CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the property markets, announced today that revenue for the quarter ended March 31, 2024 was $656 million, up 12% over revenue of $584 million for the quarter ended March 31, 2023. Net income was $7 million in the first quarter and net income per diluted share was $0.02 for the first quarter of 2024.

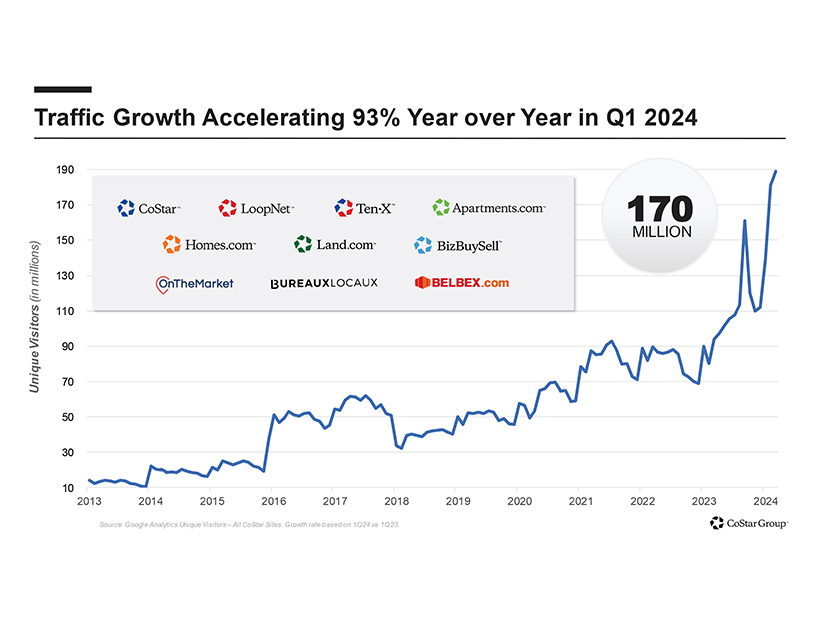

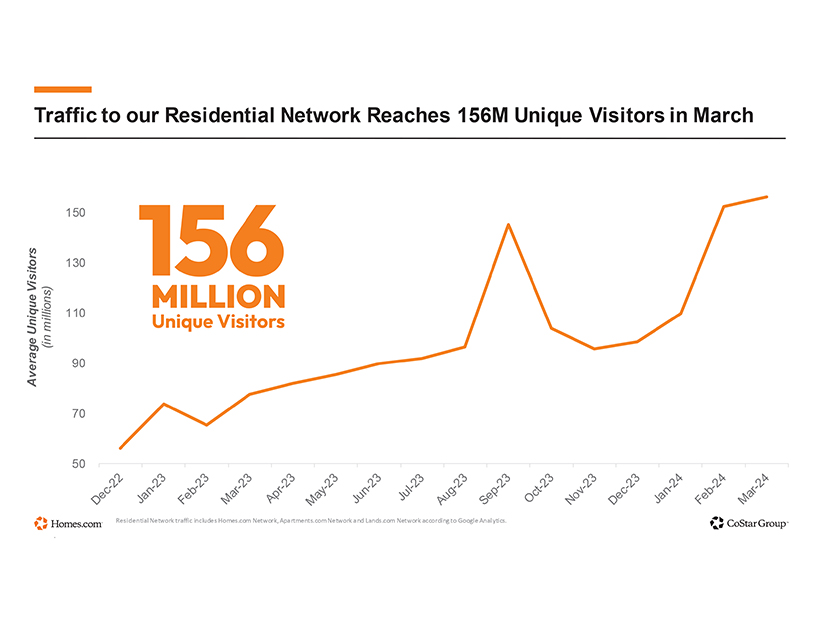

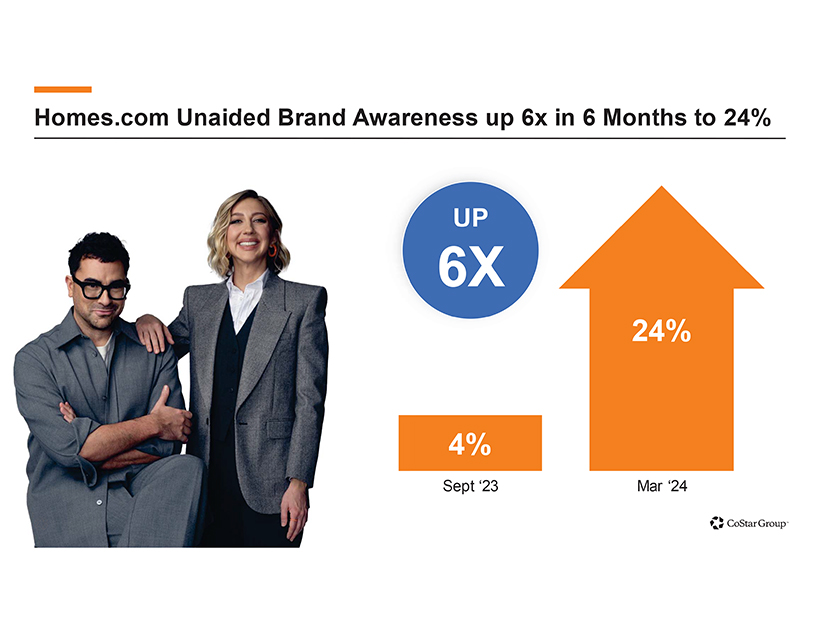

“CoStar Group delivered exceptional revenue, sales and marketplace traffic results in the first quarter of 2024, fueled by the launch of our monetization of Homes.com on February 12th of this year,” said Andy Florance, Founder and CEO of CoStar Group. “With less than two months of selling in the first quarter, Homes.com membership subscriptions reached nearly $40 million in net new bookings. This is by far the strongest sales launch of any product in the company’s history, and we are raising our sales and revenue forecast for Homes.com for the full year 2024. Sales of Homes.com memberships were supported by strong Residential Network1 traffic which reached a record 156 million monthly unique visitors in March, according to Google Analytics. We believe that Homes.com is now one of two most heavily trafficked residential marketplace portals in the U.S. Our aggressive marketing campaign successfully catapulted our unaided awareness from 4% in the fourth quarter of 2023 to 24% by the end of March 2024” said Florance.

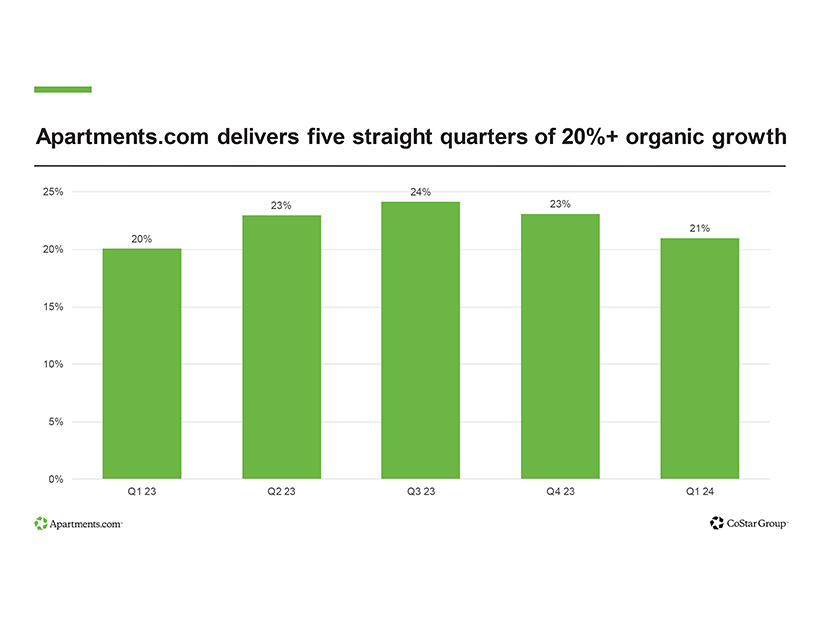

“I’m thrilled to report that our sales team delivered our highest ever quarterly net new bookings of $86 million in the first quarter of 2024,” continued Florance. “Overall revenue grew 12% year-over-year, with Apartments.com delivering over 20% revenue growth for the fifth consecutive quarter, and CoStar growing revenue 11% in the first quarter. Both Apartments.com and CoStar crossed $250 million of revenue in the first quarter to become our first and second businesses to reach $1 billion in annualized run rate revenue.”

| 1 | Our Residential Network consists of the Homes.com Network (not including OnTheMarket), the Apartments.com Network and the Land Network. |

Year 2023-2024 Quarterly Results - Unaudited

(in millions, except per share data)

| 2023 | 2024 | |||||||||||||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||

| Revenues |

$ | 584 | $ | 606 | $ | 625 | $ | 640 | $ | 656 | ||||||||||

| Net income |

87 | 101 | 91 | 96 | 7 | |||||||||||||||

| Net income per share - diluted |

0.21 | 0.25 | 0.22 | 0.24 | 0.02 | |||||||||||||||

| Weighted average outstanding shares - diluted |

406 | 407 | 407 | 408 | 407 | |||||||||||||||

| EBITDA |

98 | 105 | 89 | 98 | (13 | ) | ||||||||||||||

| Adjusted EBITDA |

123 | 127 | 112 | 130 | 12 | |||||||||||||||

| Non-GAAP net income |

118 | 127 | 120 | 133 | 42 | |||||||||||||||

| Non-GAAP net income per share - diluted |

0.29 | 0.31 | 0.30 | 0.33 | 0.10 | |||||||||||||||

2024 Outlook

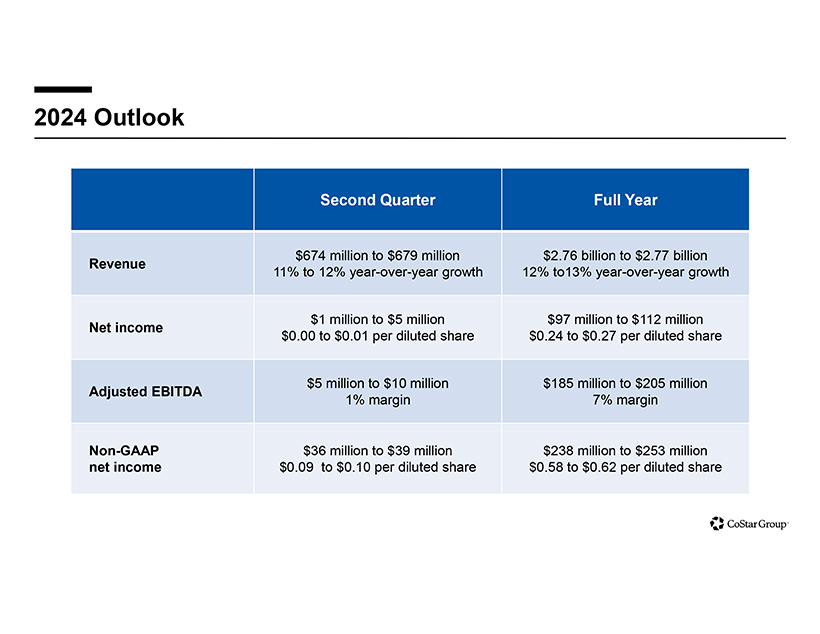

“We are off to a strong start in the first quarter of 2024 and are raising our full year revenue and adjusted EBITDA guidance,” said Scott Wheeler, CFO of CoStar Group. The Company now expects revenue in the range of $2.76 billion to $2.77 billion for the full year of 2024 representing revenue growth of approximately 13% year-over-year at the midpoint of the range. The Company expects revenue for the second quarter of 2024 in the range of $674 million to $679 million, representing revenue growth of approximately 12% year-over-year at the midpoint of the range.

“We now expect adjusted EBITDA for the full year of 2024 in the range of $185 million to $205 million, an increase of $15 million at the midpoint of the range from our previous guidance. For the second quarter of 2024, we expect adjusted EBITDA in the range of $5 million to $10 million.”

The Company expects full year 2024 non-GAAP net income per diluted share in a range of $0.58 to $0.62 based on 409 million shares. For the second quarter of 2024, the Company expects non-GAAP net income per diluted share in a range of $0.09 to $0.10 based on 409 million shares. These ranges include an estimated non-GAAP tax rate of 26% for the full year and the second quarter of 2024.

The preceding forward-looking statements reflect CoStar Group’s expectations as of April 23, 2024, including forward-looking non-GAAP financial measures on a consolidated basis, based on current estimates, expectations, observations, and trends. Given the risk factors, rapidly evolving economic environment, and uncertainties and assumptions discussed in this release and in our quarterly reports on Form 10-Q and annual reports on Form 10-K, actual results may differ materially. Other than in publicly available statements, the Company does not intend to update its forward-looking statements until its next quarterly results announcement.

Reconciliations of EBITDA, adjusted EBITDA, non-GAAP net income and non-GAAP net income per diluted share to the most directly comparable GAAP measures are shown in detail below, along with definitions for those terms. A reconciliation of forward-looking non-GAAP guidance to the most directly comparable GAAP measure, net income, can be found within the tables included in this release.

Non-GAAP Financial Measures

For information regarding the purpose for which management uses the non-GAAP financial measures disclosed in this release and why management believes they provide useful information to investors regarding the Company’s financial condition and results of operations, please refer to the Company’s latest periodic report.

EBITDA is a non-GAAP financial measure that represents GAAP net income attributable to CoStar Group before interest income or expense, net and other income or expense, net; loss on debt extinguishment; income taxes and depreciation and amortization expense.

Adjusted EBITDA is a non-GAAP financial measure that represents EBITDA before stock-based compensation expense, acquisition- and integration-related costs, restructuring costs, and settlements and impairments incurred outside the Company’s ordinary course of business. Adjusted EBITDA margin represents adjusted EBITDA divided by revenues for the period.

Non-GAAP net income is a non-GAAP financial measure determined by adjusting GAAP net income attributable to CoStar Group for stock-based compensation expense, acquisition- and integration-related costs, restructuring costs, settlement and impairment costs incurred outside the Company’s ordinary course of business and loss on debt extinguishment, as well as amortization of acquired intangible assets and other related costs, and then subtracting an assumed provision for income taxes. In 2024, the Company is assuming a 26% tax rate in order to approximate its statutory corporate tax rate excluding the impact of discrete items.

Non-GAAP net income per diluted share is a non-GAAP financial measure that represents non-GAAP net income divided by the number of diluted shares outstanding for the period used in the calculation of GAAP net income per diluted share. For periods with GAAP net losses and non-GAAP net income, the weighted average outstanding shares used to calculate non-GAAP net income per share includes potentially dilutive securities that were excluded from the calculation of GAAP net income per share as the effect was anti-dilutive.

Operating Metrics

Net new bookings is calculated based on the annualized amount of change in the Company’s sales bookings resulting from new subscription-based contracts, changes to existing subscription-based contracts and cancellations of subscription-based contracts for the period reported. Information regarding net new bookings is not comparable to, nor should it be substituted for, an analysis of the Company’s revenues over time.

Earnings Conference Call

Management will conduct a conference call to discuss the first quarter 2024 results and the Company’s outlook at 5:00 PM ET on Tuesday, April 23, 2024. A live audio webcast of the conference will be available in listen-only mode through the Investors section of the CoStar Group website: https://investors.costargroup.com. A replay of the webcast audio will also be available in the Investors section of our website for a period of time following the call.

CoStar Group, Inc.

Condensed Consolidated Statements of Operations - Unaudited

(in millions, except per share data)

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Revenues |

$ | 656.4 | $ | 584.4 | ||||

| Cost of revenues |

141.2 | 119.2 | ||||||

|

|

|

|

|

|||||

| Gross profit |

515.2 | 465.2 | ||||||

| Operating expenses: |

||||||||

| Selling and marketing (excluding customer base amortization) |

366.1 | 226.3 | ||||||

| Software development |

82.4 | 66.6 | ||||||

| General and administrative |

98.5 | 89.5 | ||||||

| Customer base amortization |

11.0 | 10.6 | ||||||

|

|

|

|

|

|||||

| 558.0 | 393.0 | |||||||

|

|

|

|

|

|||||

| (Loss) income from operations |

(42.8 | ) | 72.2 | |||||

| Interest income, net |

56.2 | 43.5 | ||||||

| Other (expense) income, net |

(1.9 | ) | 0.6 | |||||

|

|

|

|

|

|||||

| Income before income taxes |

11.5 | 116.3 | ||||||

| Income tax expense |

4.8 | 29.2 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 6.7 | $ | 87.1 | ||||

|

|

|

|

|

|||||

| Net income per share - basic |

$ | 0.02 | $ | 0.22 | ||||

|

|

|

|

|

|||||

| Net income per share - diluted |

$ | 0.02 | $ | 0.21 | ||||

|

|

|

|

|

|||||

| Weighted-average outstanding shares - basic |

405.6 | 404.5 | ||||||

| Weighted-average outstanding shares - diluted |

407.3 | 406.2 | ||||||

CoStar Group, Inc.

Reconciliation of Non-GAAP Financial Measures - Unaudited

(in millions, except per share data)

Reconciliation of Net Income to Non-GAAP Net Income

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Net income |

$ | 6.7 | $ | 87.1 | ||||

| Income tax expense |

4.8 | 29.2 | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

11.5 | 116.3 | ||||||

| Amortization of acquired intangible assets |

19.8 | 17.7 | ||||||

| Stock-based compensation expense |

22.8 | 20.0 | ||||||

| Acquisition and integration related costs |

2.3 | 1.7 | ||||||

| Restructuring and related costs |

— | 3.4 | ||||||

| Settlements and impairments |

— | (0.1 | ) | |||||

|

|

|

|

|

|||||

| Non-GAAP income before income taxes |

56.4 | 159.0 | ||||||

|

|

|

|

|

|||||

| Assumed rate for income tax expense(1) |

26.0 | % | 26.0 | % | ||||

| Assumed provision for income tax expense |

(14.7 | ) | (41.3 | ) | ||||

|

|

|

|

|

|||||

| Non-GAAP net income |

$ | 41.7 | $ | 117.7 | ||||

|

|

|

|

|

|||||

| Net income per share - diluted |

$ | 0.02 | $ | 0.21 | ||||

|

|

|

|

|

|||||

| Non-GAAP net income per share - diluted |

$ | 0.10 | $ | 0.29 | ||||

|

|

|

|

|

|||||

| Weighted average outstanding shares - basic |

405.6 | 404.5 | ||||||

| Weighted average outstanding shares - diluted |

407.3 | 406.2 | ||||||

| (1) | The assumed tax rate approximates our statutory federal and state corporate tax rate for the applicable period. |

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Net income |

$ | 6.7 | $ | 87.1 | ||||

| Amortization of acquired intangible assets in cost of revenues |

8.8 | 7.1 | ||||||

| Amortization of acquired intangible assets in operating expenses |

11.0 | 10.6 | ||||||

| Depreciation and other amortization |

10.3 | 7.9 | ||||||

| Interest income, net |

(56.2 | ) | (43.5 | ) | ||||

| Other expense (income), net1 |

1.9 | (0.6 | ) | |||||

| Income tax expense |

4.8 | 29.2 | ||||||

|

|

|

|

|

|||||

| EBITDA |

$ | (12.7 | ) | $ | 97.8 | |||

|

|

|

|

|

|||||

| Stock-based compensation expense |

22.8 | 20.0 | ||||||

| Acquisition and integration related costs |

2.3 | 1.7 | ||||||

| Restructuring and related costs |

— | 3.4 | ||||||

| Settlements and impairments |

— | (0.1 | ) | |||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 12.4 | $ | 122.8 | ||||

|

|

|

|

|

|||||

| 1 | Includes $3.6 million of amortization and depreciation expense associated with lessor income |

CoStar Group, Inc.

Condensed Consolidated Balance Sheets - Unaudited

(in millions)

| March 31, 2024 |

December 31, 2023 |

|||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 4,951.6 | $ | 5,215.9 | ||||

| Accounts receivable |

218.7 | 213.2 | ||||||

| Less: Allowance for credit losses |

(21.3 | ) | (23.2 | ) | ||||

|

|

|

|

|

|||||

| Accounts receivable, net |

197.4 | 190.0 | ||||||

| Prepaid expenses and other current assets |

67.2 | 70.2 | ||||||

|

|

|

|

|

|||||

| Total current assets |

5,216.2 | 5,476.1 | ||||||

| Deferred income taxes, net |

4.3 | 4.3 | ||||||

| Property and equipment, net |

791.1 | 472.2 | ||||||

| Lease right-of-use assets |

74.8 | 79.8 | ||||||

| Goodwill |

2,383.7 | 2,386.2 | ||||||

| Intangible assets, net |

365.0 | 313.7 | ||||||

| Deferred commission costs, net |

179.0 | 167.7 | ||||||

| Deposits and other assets |

18.4 | 17.7 | ||||||

| Income tax receivable |

2.0 | 2.0 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 9,034.5 | $ | 8,919.7 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 113.6 | $ | 23.1 | ||||

| Accrued wages and commissions |

90.7 | 117.8 | ||||||

| Accrued expenses and other current liabilities |

195.5 | 163.0 | ||||||

| Income taxes payable |

12.9 | 7.7 | ||||||

| Lease liabilities |

44.0 | 40.0 | ||||||

| Deferred revenue |

117.1 | 104.2 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

573.8 | 455.8 | ||||||

| Long-term debt, net |

990.8 | 990.5 | ||||||

| Deferred income taxes, net |

33.8 | 36.7 | ||||||

| Income taxes payable |

18.4 | 18.2 | ||||||

| Lease and other long-term liabilities |

75.1 | 79.9 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

$ | 1,691.9 | $ | 1,581.1 | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

7,342.6 | 7,338.6 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 9,034.5 | $ | 8,919.7 | ||||

|

|

|

|

|

|||||

CoStar Group, Inc.

Condensed Consolidated Statements of Cash Flows - Unaudited

(in millions)

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Operating activities: |

||||||||

| Net income |

$ | 6.7 | $ | 87.1 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

33.3 | 25.6 | ||||||

| Amortization of deferred commissions costs |

27.2 | 21.9 | ||||||

| Amortization of Senior Notes discount and issuance costs |

0.6 | 0.6 | ||||||

| Non-cash lease expense |

8.3 | 6.8 | ||||||

| Stock-based compensation expense |

22.8 | 20.0 | ||||||

| Deferred income taxes, net |

(2.8 | ) | (2.9 | ) | ||||

| Credit loss expense |

7.9 | 4.7 | ||||||

| Other operating activities, net |

0.1 | 0.3 | ||||||

| Changes in operating assets and liabilities, net of acquisitions: |

||||||||

| Accounts receivable |

(15.6 | ) | (32.2 | ) | ||||

| Prepaid expenses and other current assets |

2.2 | (5.7 | ) | |||||

| Deferred commissions |

(38.7 | ) | (32.3 | ) | ||||

| Accounts payable and other liabilities |

77.2 | (13.7 | ) | |||||

| Lease liabilities |

(8.1 | ) | (10.0 | ) | ||||

| Income taxes payable, net |

5.4 | 39.6 | ||||||

| Deferred revenue |

13.1 | 13.8 | ||||||

| Other assets |

— | (0.4 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

139.6 | 123.2 | ||||||

| Investing activities: |

||||||||

| Purchases of property, equipment and other assets for new campuses |

(376.7 | ) | (15.7 | ) | ||||

| Purchases of property and equipment and other assets |

(3.6 | ) | (3.9 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(380.3 | ) | (19.6 | ) | ||||

| Financing activities: |

||||||||

| Repurchase of restricted stock to satisfy tax withholding obligations |

(26.0 | ) | (21.6 | ) | ||||

| Proceeds from exercise of stock options and employee stock purchase plan |

4.6 | 5.7 | ||||||

| Other financing activities |

(1.1 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(22.5 | ) | (15.9 | ) | ||||

| Effect of foreign currency exchange rates on cash and cash equivalents |

(1.1 | ) | — | |||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(264.3 | ) | 87.7 | |||||

| Cash and cash equivalents at the beginning of period |

5,215.9 | 4,968.0 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at the end of period |

$ | 4,951.6 | $ | 5,055.7 | ||||

|

|

|

|

|

|||||

CoStar Group, Inc.

Disaggregated Revenues - Unaudited

(in millions)

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||

| North America | International | Total | North America | International | Total | |||||||||||||||||||

| CoStar |

$ | 235.7 | $ | 14.6 | $ | 250.3 | $ | 215.8 | $ | 9.2 | $ | 225.0 | ||||||||||||

| Information Services |

27.4 | 5.6 | 33.0 | 32.1 | 9.5 | 41.6 | ||||||||||||||||||

| Multifamily |

254.8 | — | 254.8 | 210.7 | — | 210.7 | ||||||||||||||||||

| LoopNet |

66.4 | 2.7 | 69.1 | 61.2 | 2.1 | 63.3 | ||||||||||||||||||

| Residential |

8.4 | 10.2 | 18.6 | 13.2 | — | 13.2 | ||||||||||||||||||

| Other Marketplaces |

30.6 | — | 30.6 | 30.6 | — | 30.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

$ | 623.3 | $ | 33.1 | $ | 656.4 | $ | 563.6 | $ | 20.8 | $ | 584.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

CoStar Group, Inc.

Results of Segments - Unaudited

(in millions)

| Three Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| EBITDA |

||||||||

| North America |

$ | 3.2 | $ | 96.6 | ||||

| International |

(15.9 | ) | 1.2 | |||||

|

|

|

|

|

|||||

| Total EBITDA |

$ | (12.7 | ) | $ | 97.8 | |||

|

|

|

|

|

|||||

CoStar Group, Inc.

Reconciliation of Non-GAAP Financial Measures with Quarterly Results - Unaudited

(in millions, except per share data)

Reconciliation of Net Income to Non-GAAP Net Income

| 2023 | 2024 | |||||||||||||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||

| Net income |

$ | 87.1 | $ | 100.5 | $ | 90.6 | $ | 96.4 | $ | 6.7 | ||||||||||

| Income tax expense |

29.2 | 31.1 | 29.9 | 36.3 | 4.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

116.4 | 131.7 | 120.5 | 132.7 | 11.5 | |||||||||||||||

| Amortization of acquired intangible assets |

17.7 | 18.0 | 18.7 | 19.3 | 19.8 | |||||||||||||||

| Stock-based compensation expense |

20.0 | 21.8 | 21.9 | 21.2 | 22.8 | |||||||||||||||

| Acquisition and integration related costs |

1.7 | (0.2 | ) | 0.8 | 10.7 | 2.3 | ||||||||||||||

| Restructuring and related costs |

3.4 | (0.1 | ) | 0.5 | 0.2 | — | ||||||||||||||

| Settlements and impairments |

(0.1 | ) | — | — | — | — | ||||||||||||||

| Other income, net |

— | — | — | (3.8 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-GAAP income before income taxes(1) |

159.1 | 171.2 | 162.4 | 180.3 | 56.4 | |||||||||||||||

| Assumed rate for income tax expense (2) |

26 | % | 26 | % | 26 | % | 26 | % | 26 | % | ||||||||||

| Assumed provision for income tax expense |

(41.4 | ) | (44.5 | ) | (42.2 | ) | (46.9 | ) | (14.7 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-GAAP net income(1) |

$ | 117.7 | $ | 126.7 | $ | 120.2 | $ | 133.4 | $ | 41.7 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-GAAP net income per share - diluted |

$ | 0.29 | $ | 0.31 | $ | 0.30 | $ | 0.33 | $ | 0.10 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average outstanding shares - basic |

404.5 | 405.4 | 405.6 | 405.8 | 405.6 | |||||||||||||||

| Weighted average outstanding shares - diluted |

406.2 | 406.8 | 407.2 | 407.5 | 407.3 | |||||||||||||||

| (1) | Totals may not foot due to rounding. |

| (2) | The assumed tax rate approximates our statutory federal and state corporate tax rate for the applicable period. |

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

| 2023 | 2024 | |||||||||||||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||

| Net income |

$ | 87.1 | $ | 100.5 | $ | 90.6 | $ | 96.4 | $ | 6.7 | ||||||||||

| Amortization of acquired intangible assets |

17.7 | 18.0 | 18.7 | 19.3 | 19.8 | |||||||||||||||

| Depreciation and other amortization |

7.9 | 8.1 | 8.4 | 9.4 | 10.3 | |||||||||||||||

| Interest income, net |

(43.5 | ) | (51.9 | ) | (58.4 | ) | (59.7 | ) | (56.2 | ) | ||||||||||

| Other (income) expense, net |

(0.6 | ) | (0.6 | ) | (0.5 | ) | (3.7 | ) | 1.9 | |||||||||||

| Income tax expense |

29.2 | 31.1 | 29.9 | 36.3 | 4.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA(1) |

$ | 97.8 | $ | 105.2 | $ | 88.7 | $ | 98.0 | $ | (12.7 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Stock-based compensation expense |

20.0 | 21.8 | 21.9 | 21.2 | 22.8 | |||||||||||||||

| Acquisition and integration related costs |

1.7 | (0.2 | ) | 0.8 | 10.7 | 2.3 | ||||||||||||||

| Restructuring and related costs |

3.4 | (0.1 | ) | 0.5 | 0.2 | — | ||||||||||||||

| Settlements and impairments |

(0.1 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA(1) |

$ | 122.9 | $ | 126.8 | $ | 111.9 | $ | 130.1 | $ | 12.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Totals may not foot due to rounding. |

CoStar Group, Inc.

Reconciliation of Forward-Looking Guidance - Unaudited

(in millions, except per share data)

Reconciliation of Forward-Looking Guidance, Net Income to Non-GAAP Net Income

| Guidance Range For the Three Months Ending June 30, 2024 |

Guidance Range For the Year Ending December 31, 2024 |

|||||||||||||||

| Low | High | Low | High | |||||||||||||

| Net income |

$ | 1.0 | $ | 5.0 | $ | 97.0 | $ | 112.0 | ||||||||

| Income tax expense |

3.0 | 4.0 | 52.0 | 57.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

4.0 | 9.0 | 149.0 | 169.0 | ||||||||||||

| Amortization of acquired intangible assets |

17.0 | 17.0 | 71.0 | 71.0 | ||||||||||||

| Stock-based compensation expense |

25.0 | 25.0 | 98.0 | 98.0 | ||||||||||||

| Acquisition and integration related costs |

2.0 | 2.0 | 4.0 | 4.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP income before income taxes |

48.0 | 53.0 | 322.0 | 342.0 | ||||||||||||

| Assumed rate for income tax expense(1) |

26 | % | 26 | % | 26 | % | 26 | % | ||||||||

| Assumed provision for income tax expense |

(12.5 | ) | (13.8 | ) | (83.7 | ) | (88.9 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP net income |

35.5 | 39.2 | 238.3 | 253.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share - diluted |

$ | — | $ | 0.01 | $ | 0.24 | $ | 0.27 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-GAAP net income per share - diluted |

$ | 0.09 | $ | 0.10 | $ | 0.58 | $ | 0.62 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average outstanding shares - diluted |

409.0 | 409.0 | 408.8 | 408.8 | ||||||||||||

| (1) | The assumed tax rate approximates our statutory federal and state corporate tax rate for the applicable period. |

Reconciliation of Forward-Looking Guidance, Net Income to Adjusted EBITDA

| Guidance Range For the Three Months Ending June 30, 2024 |

Guidance Range For the Year Ending |

|||||||||||||||

| Low | High | Low | High | |||||||||||||

| Net income |

$ | 1.0 | $ | 5.0 | $ | 97.0 | $ | 112.0 | ||||||||

| Amortization of acquired intangible assets |

17.0 | 17.0 | 71.0 | 71.0 | ||||||||||||

| Depreciation and other amortization |

14.0 | 14.0 | 54.0 | 54.0 | ||||||||||||

| Interest income, net |

(51.0 | ) | (51.0 | ) | (198.0 | ) | (198.0 | ) | ||||||||

| Other (income) expense, net |

(6.0 | ) | (6.0 | ) | 7.0 | 7.0 | ||||||||||

| Income tax expense |

3.0 | 4.0 | 52.0 | 57.0 | ||||||||||||

| Stock-based compensation expense |

25.0 | 25.0 | 98.0 | 98.0 | ||||||||||||

| Acquisition and integration related costs |

2.0 | 2.0 | 4.0 | 4.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | 5.0 | $ | 10.0 | $ | 185.0 | $ | 205.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Investor Relations:

Cyndi Eakin

Senior Vice President

CoStar Group Investor Relations

(202) 346-6784

ceakin@costar.com

News Media:

Matthew Blocher

Vice President

CoStar Group Corporate Marketing & Communications

(202) 346-6775

mblocher@costar.com

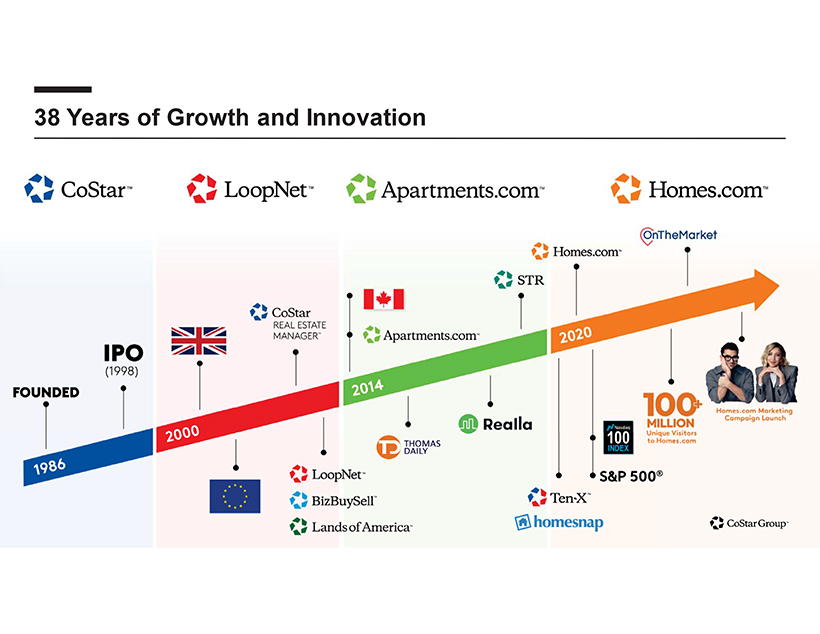

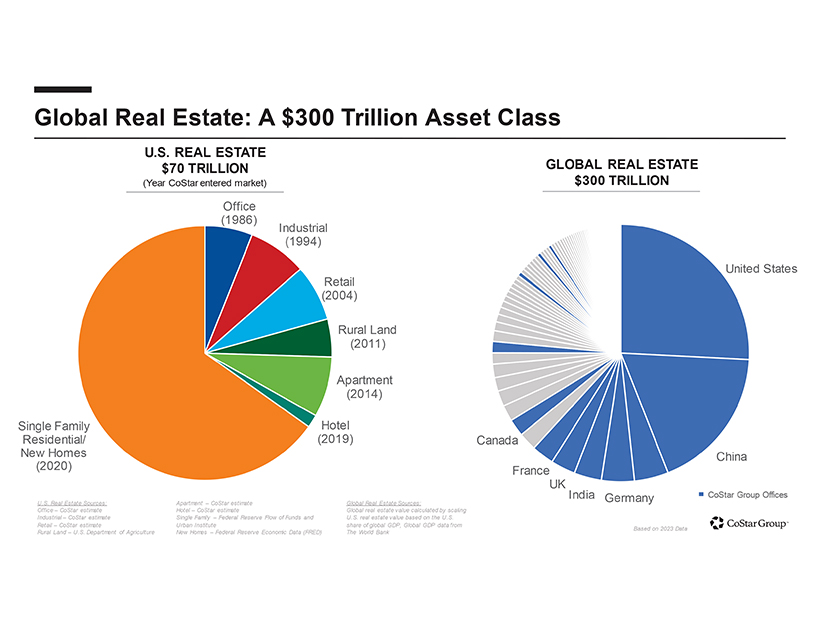

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attracted over 160 million unique monthly visitors in September 2023. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release and the Company’s earnings conference call contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about CoStar Group’s plans, objectives, expectations, beliefs and intentions and other statements including words such as “hope,” “anticipate,” “may,” “believe,” “expect,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology. Such statements are based upon the current beliefs and expectations of management of CoStar Group and are subject to many risks and uncertainties. Actual results may differ materially from the results anticipated in the forward-looking statements and the assumptions and estimates used as a basis for the forward-looking statements. The following factors, among others, could cause or contribute to such differences: risks associated with the ability to consummate the proposed transaction with Matterport, Inc. (“Matterport”) and the timing of the closing of the proposed transaction; the ability to successfully integrate operations and employees; the ability to realize anticipated benefits and synergies of the proposed mergers as rapidly or to the extent anticipated by financial analysts or investors; the potential impact of announcement of the proposed mergers or consummation of the proposed Matterport transaction on business relationships, including with employees, customers, suppliers and competitors; unfavorable outcomes of any legal proceedings that have been or may be instituted against CoStar or Matterport; the ability to retain key personnel; costs, fees, expenses and charges related to the proposed Matterport transaction; the risk that the trends stated or implied by this release or in the earnings conference call cannot or will not be sustained at the current pace or may increase or decrease, including trends and expectations related to revenue, revenue growth, net income, non-GAAP net income, EBITDA, adjusted EBITDA, adjusted EBITDA margin, sales, net new bookings, site traffic and visitors, leads, and renewal rates; the risk that the Company is unable to sustain current Company-wide or Homes.com net new bookings; the risk that revenues for the second quarter and full year 2024 will not be as stated in this press release; the risk that net income for the second quarter and full year 2024 will not be as stated in this press release; the risk that EBITDA for the second quarter and full year 2024 will not be as stated in this press release; the risk that adjusted EBITDA for the second quarter and full year 2024 will not be as stated in this press release; the risk that non-GAAP net income and non-GAAP net income per diluted share for the second quarter and full year 2024 will not be as stated in this press release; the risk that we may not successfully integrate acquired businesses or assets and may not achieve anticipated benefits of an acquisition, including expected synergies; the risk that the tax rate estimates stated in this press release may change and the risk that we may experience declines in our revenues, revenue growth rates and profitability due to the impact of economic conditions on the real estate industry and our core customer base. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar Group’s filings from time to time with the Securities and Exchange Commission (the “SEC”), including in CoStar Group’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar Group’s other filings with the SEC (including Current Reports on Form 8-K) available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar Group on the date hereof, and CoStar Group assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit 99.2

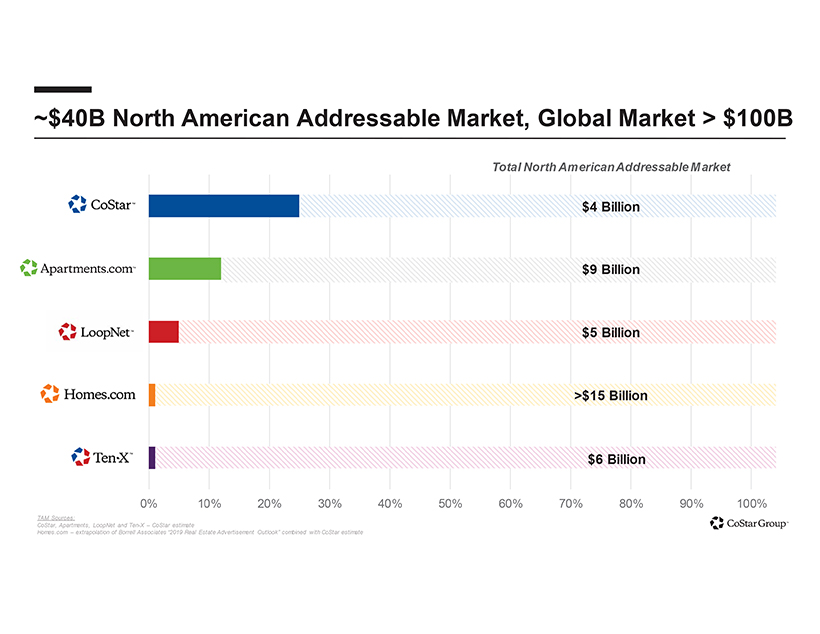

~$40B North American Addressable Market, Global Market > $100B Total North American Addressable Market $4 Billion $9 Billion $5 Billion >$15 Billion $6 Billion 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% TAM Sources: CoStar, Apartments, LoopNet and Ten-X – CoStar estimate Homes.com – extrapolation of Borrell Associates “2019 Real Estate Advertisement Outlook” combined with CoStar estimate

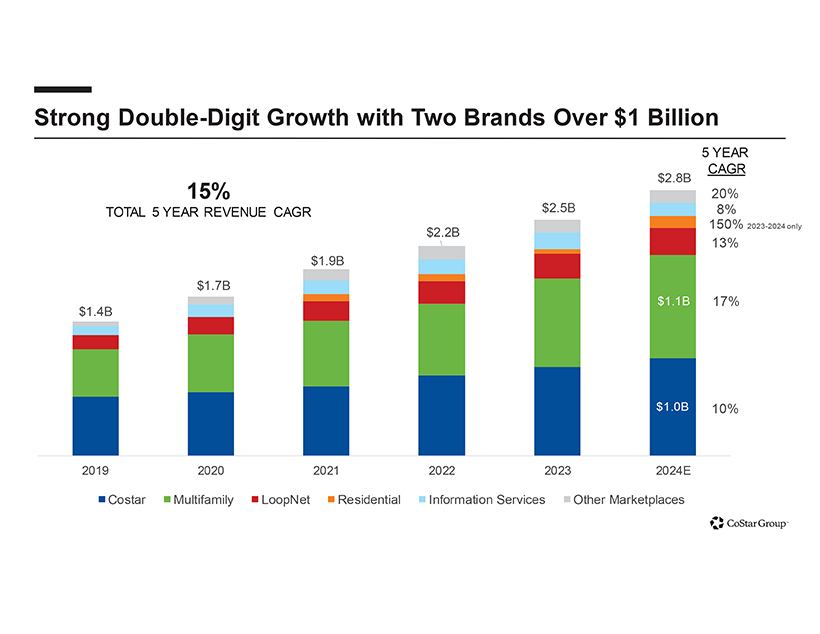

Strong Double-Digit Growth with Two Brands Over $1 Billion 5 YEAR CAGR $2.8B 15% 20% TOTAL 5 YEAR REVENUE CAGR $2.5B 8% 150% 2023-2024 only $2.2B 13% $1.9B $1.7B $1.1B 17% $1.4B $1.0B 10% 2019 2020 2021 2022 2023 2024E Costar Multifamily LoopNet Residential Information Services Other Marketplaces

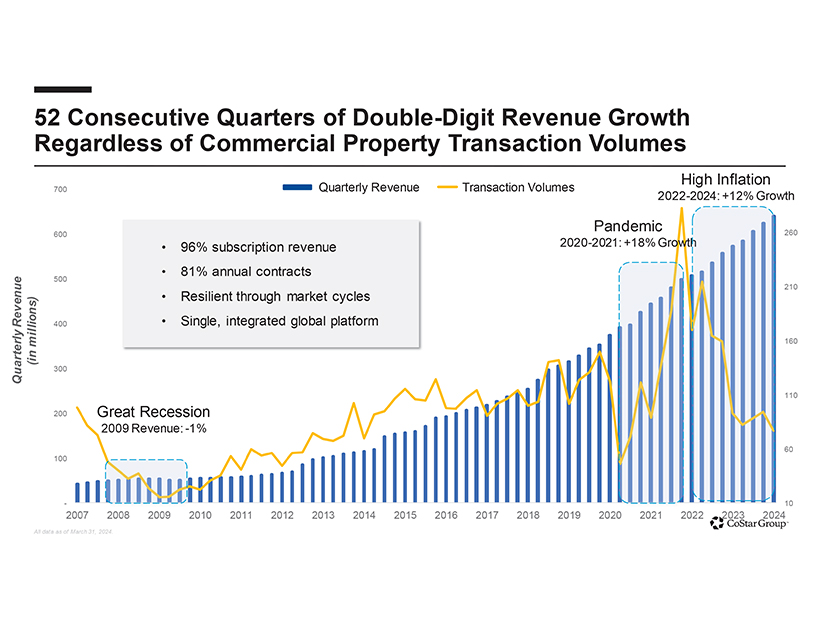

52 Consecutive Quarters of Double-Digit Revenue Growth Regardless of Commercial Property Transaction Volumes High Inflation 700 Quarterly Revenue Transaction Volumes 2022-2024: +12% Growth Pandemic 600 2020-2021: +18% Growth 260 • 96% subscription revenue • 81% annual contracts 500 210 • Resilient through market cycles Revenue 400 • Single, integrated global platform millions) 160 (in Quarterly 300 110 200 Great Recession 2009 Revenue: -1% 60 100 —10 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 20222023 2024 All data as of March 31, 2024.

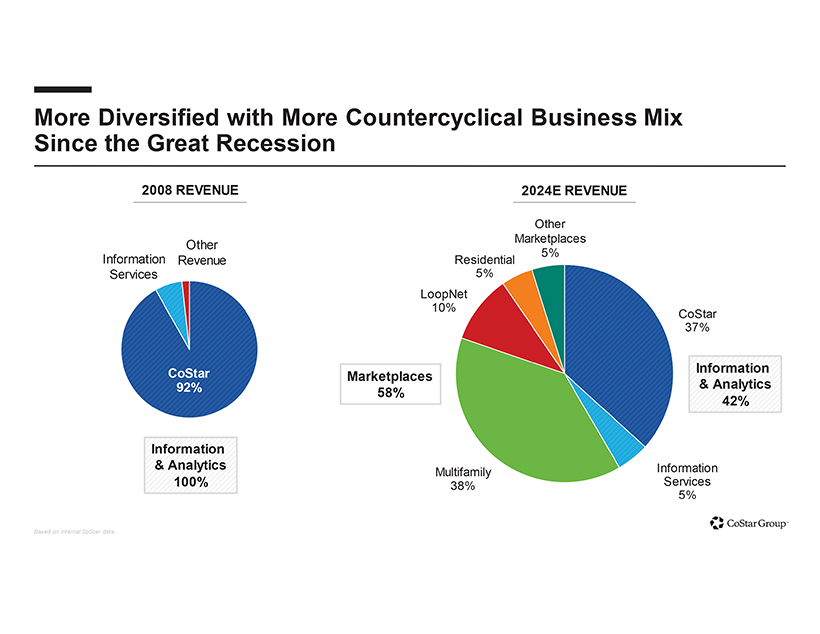

More Diversified with More Countercyclical Business Mix Since the Great Recession 2008 REVENUE 2024E REVENUE Other Marketplaces Other 5% Information Revenue Residential Services 5% LoopNet 10% CoStar 37% CoStar Information Marketplaces 92% & Analytics 58% 42% Information & Analytics Information Multifamily 100% 38% Services 5% Based on internal CoStar data.

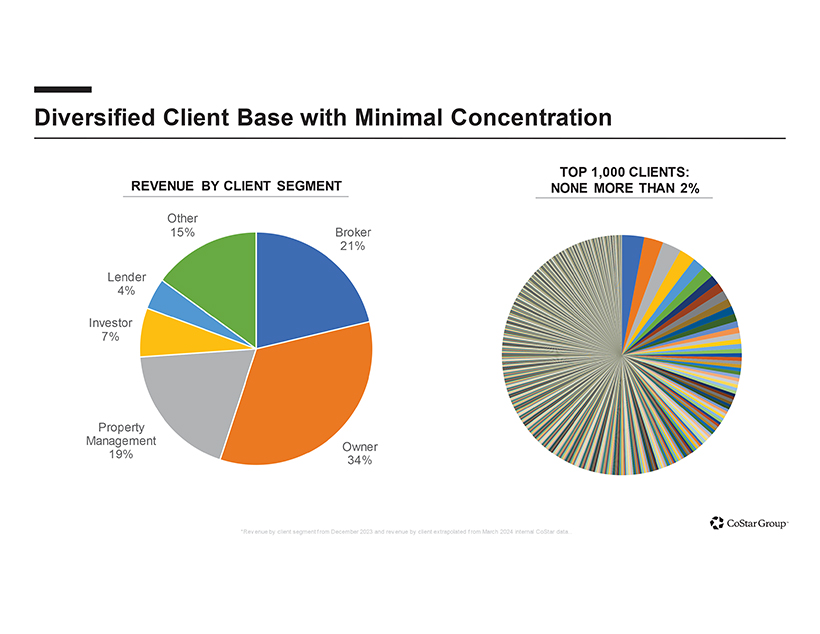

Diversified Client Base with Minimal Concentration TOP 1,000 CLIENTS: REVENUE BY CLIENT SEGMENT NONE MORE THAN 2% Other 15% Broker 21% Lender 4% Investor 7% Property Management Owner 19% 34% *Rev enue by client segment f rom December 2023 and rev enue by client extrapolated f rom March 2024 internal CoStar data.

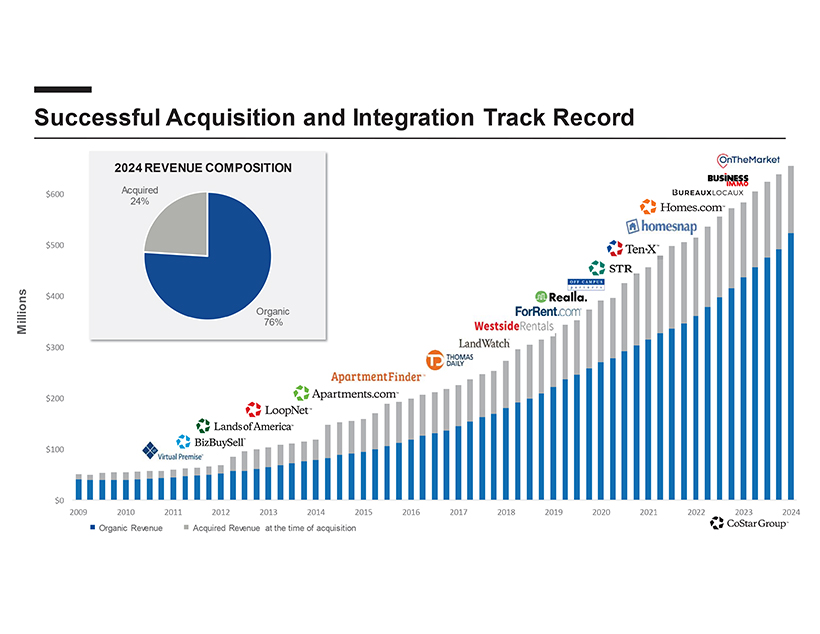

Successful Acquisition and Integration Track Record 2024 REVENUE COMPOSITION Acquired 24% Organic Millions 76% Organic Revenue Acquired Revenue at the time of acquisition

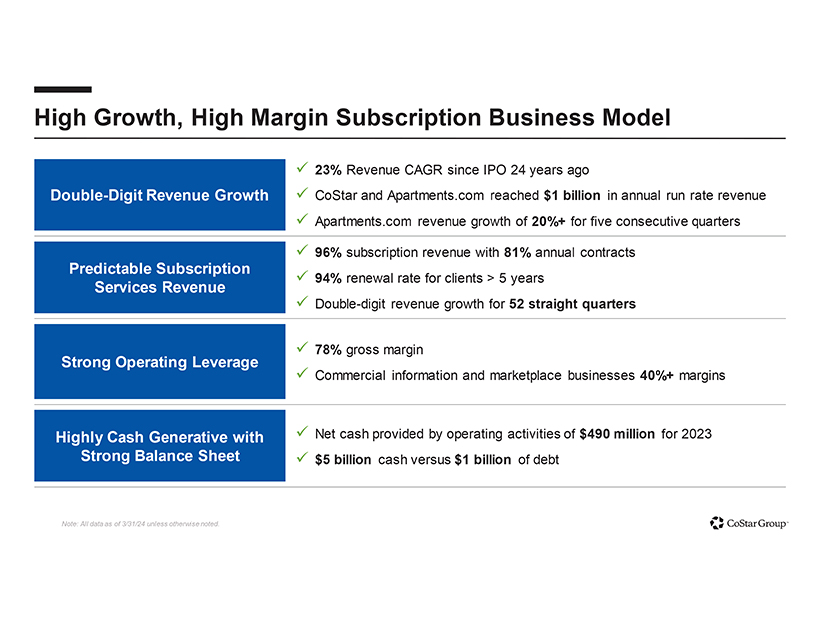

High Growth, High Margin Subscription Business Model 9 23% Revenue CAGR since IPO 24 years ago Double-Digit Revenue Growth 9 CoStar and Apartments.com reached $1 billion in annual run rate revenue 9 Apartments.com revenue growth of 20%+ for five consecutive quarters 9 96% subscription revenue with 81% annual contracts Predictable Subscription 9 94% renewal rate for clients > 5 years Services Revenue 9 Double-digit revenue growth for 52 straight quarters 9 78% gross margin Strong Operating Leverage 9 Commercial information and marketplace businesses 40%+ margins Highly Cash Generative with 9 Net cash provided by operating activities of $490 million for 2023 Strong Balance Sheet 9 $5 billion cash versus $1 billion of debt Note: All data as of 3/31/24 unless otherwise noted.

The fastest growing U.S. residential marketplace

Our Vision Establish Homes.com as the #1 residential real estate marketplace

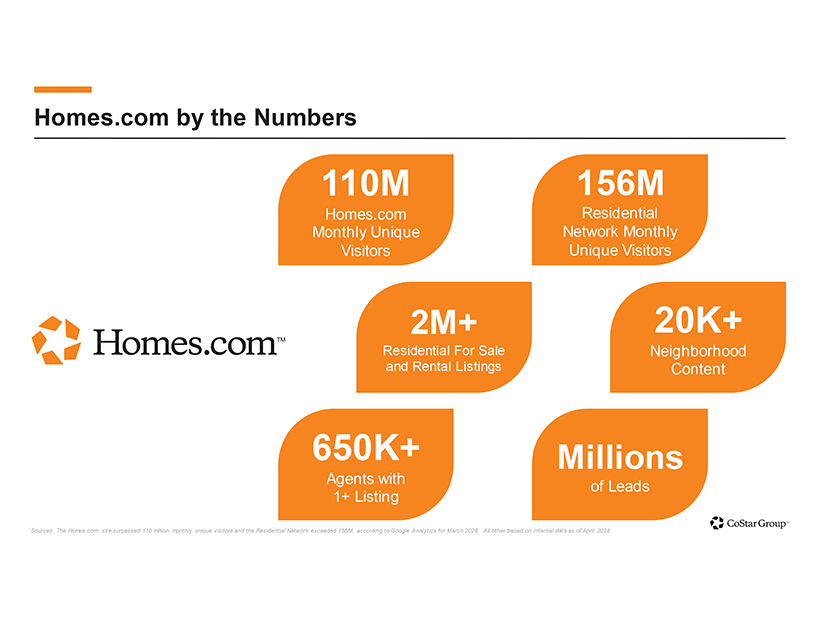

Homes.com by the Numbers 110M 156M Homes.com Residential Monthly Unique Network Monthly Visitors Unique Visitors 2M+ 20K+ Residential For Sale Neighborhood and Rental Listings Content 650K+ Millions Agents with of Leads 1+ Listing * Sources: The Homes.com site surpassed 110 million monthly unique visitors and the Residential Network exceeded 156M, according to Google Analytics for March 2024. All other based on Internal data as of April 2024.

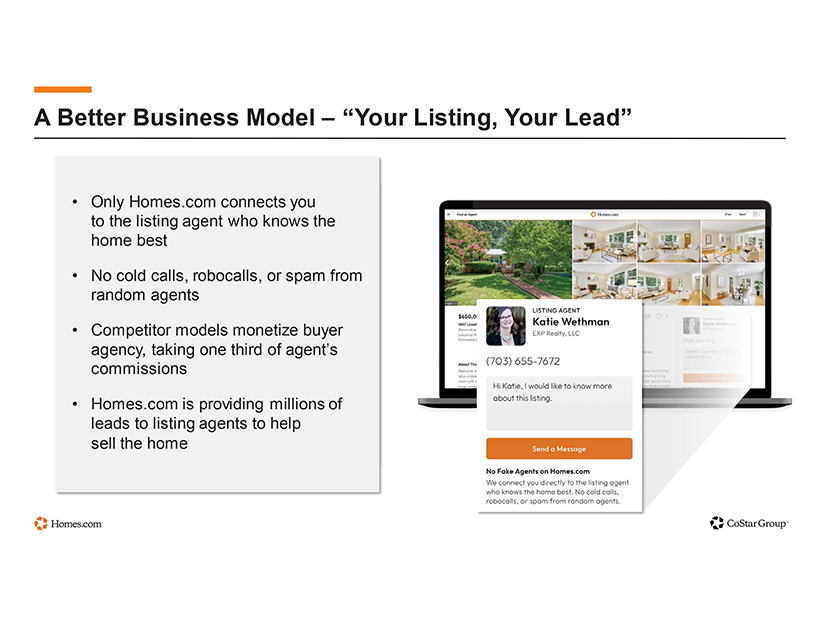

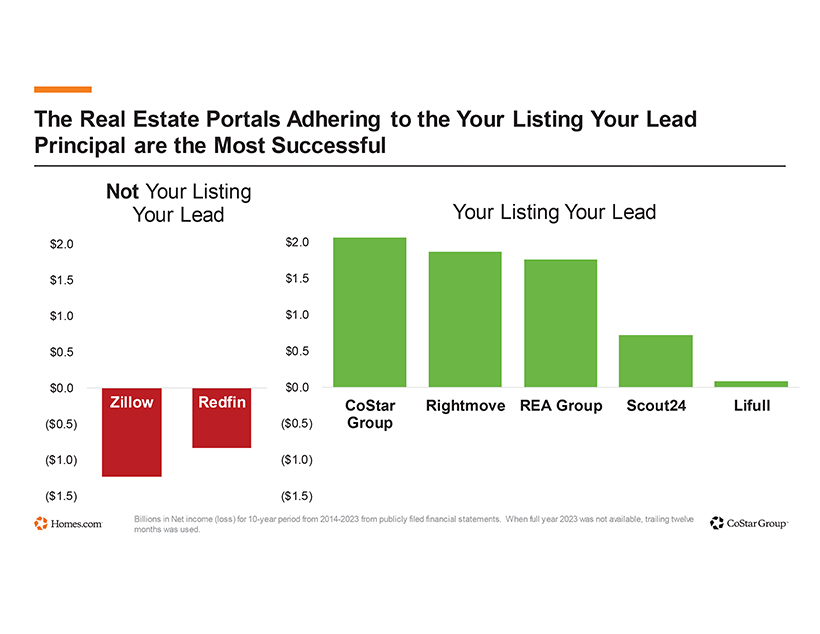

A Better Business Model – “Your Listing, Your Lead” • Only Homes.com connects you to the listing agent who knows the home best • No cold calls, robocalls, or spam from random agents • Competitor models monetize buyer agency, taking one third of agent’s commissions • Homes.com is providing millions of leads to listing agents to help sell the home

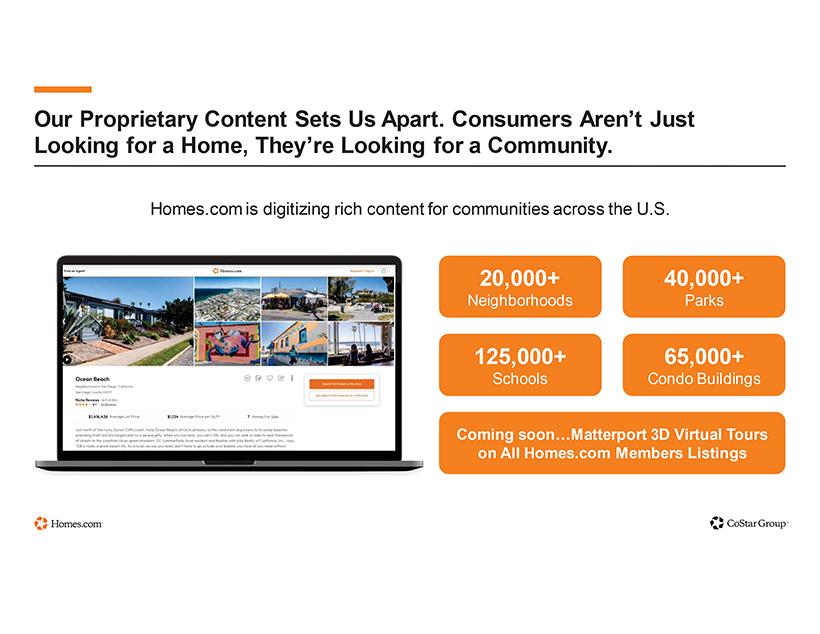

Our Proprietary Content Sets Us Apart. Consumers Aren’t Just Looking for a Home, They’re Looking for a Community. Homes.com is digitizing rich content for communities across the U.S. 20,000+ 40,000+ Neighborhoods Parks 125,000+ 65,000+ Schools Condo Buildings Coming soon…Matterport 3D Virtual Tours on All Homes.com Members Listings

The Real Estate Portals Adhering to the Your Listing Your Lead Principal are the Most Successful Not Your Listing Your Lead Your Listing Your Lead $2.0 $2.0 $1.5 $1.5 $1.0 $1.0 $0.5 $0.5 $0.0 $0.0 Zillow Redfin CoStar Rightmove REA Group Scout24 Lifull ($0.5) ($0.5) Group ($1.0) ($1.0) ($1.5) ($1.5) Billions in Net income (loss) for 10-year period from 2014-2023 from publicly filed financial statements. When full year 2023 was not available, trailing twelve months was used.

“We’ve done your home work.” 2024 Supercharged

BIGGEST Real Estate Campaign Ever Working on behalf of the industry to help agents sign more buyer and seller agreements, drive demand for their listings and close more transactions. Over a 80 Reaching BILLION 90% DOLLARS BILLION invested impressions of households

Homes.com is EVERYWHERE. No other competitors come close to our investment to drive leads to all agents

Homes.com Unaided Brand Awareness up 6x in 6 Months to 24% UP 6X 24% 4% Sept ‘23 Mar ‘24

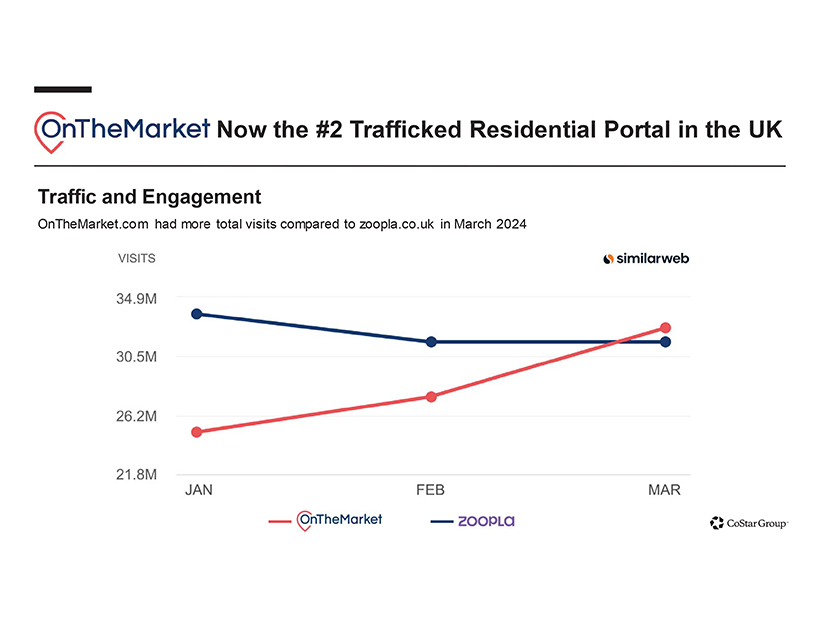

Investing to Create the #1 Residential Portal in the UK ?Average monthly unique visitors up 107% year-over-year ?Listings up 40% year-over-year ?Agent advertisers now over 15k ?Leads have grown 50% year-over-year

Now the #2 Trafficked Residential Portal in the UK Traffic and Engagement OnTheMarket.com had more total visits compared to zoopla.co.uk in March 2024

Discover your new home. Helping 100 million renters find their perfect fit.

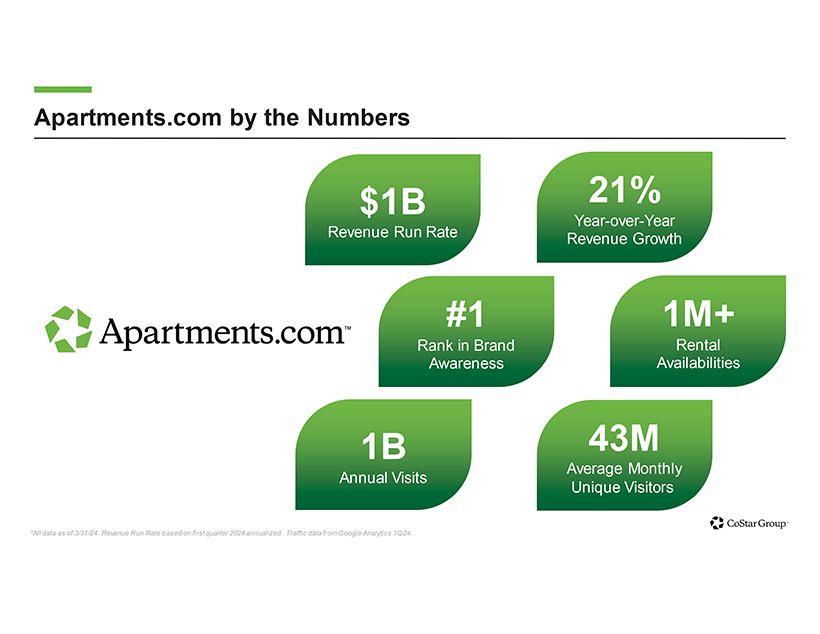

Apartments.com by the Numbers $1B 21% Year-over-Year Revenue Run Rate Revenue Growth #1 1M+ Rank in Brand Rental Awareness Availabilities 1B 43M Average Monthly Annual Visits Unique Visitors *All data as of 3/31/24. Revenue Run Rate based on first quarter 2024 annualized. Traffic data from Google Analytics 1Q24.

Apartments.com delivers five straight quarters of 20%+ organic growth 25% 24% 23% 23% 21% 20% 20% 15% 10% 5% 0% Q1 23 Q2 23 Q3 23 Q4 23 Q1 24

Our Biggest Customer Count Ever! ~73,000 APARTMENT COMMUNITIES now advertise on Apartments.com

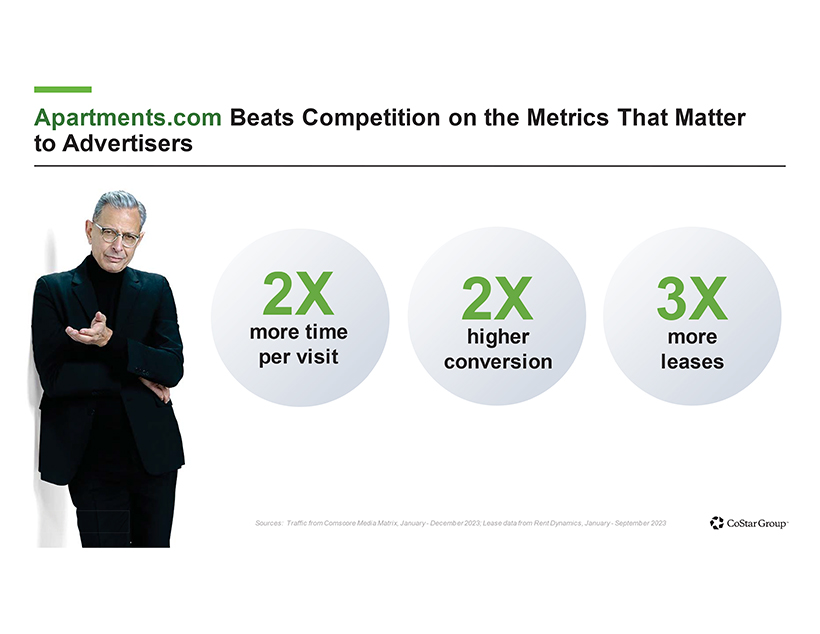

Apartments.com Beats Competition on the Metrics That Matter to Advertisers 2X 2X 3X more time higher more per visit conversion leases Sources: Traffic from Comscore Media Matrix, January—December 2023; Lease data from Rent Dynamics, January—September 2023

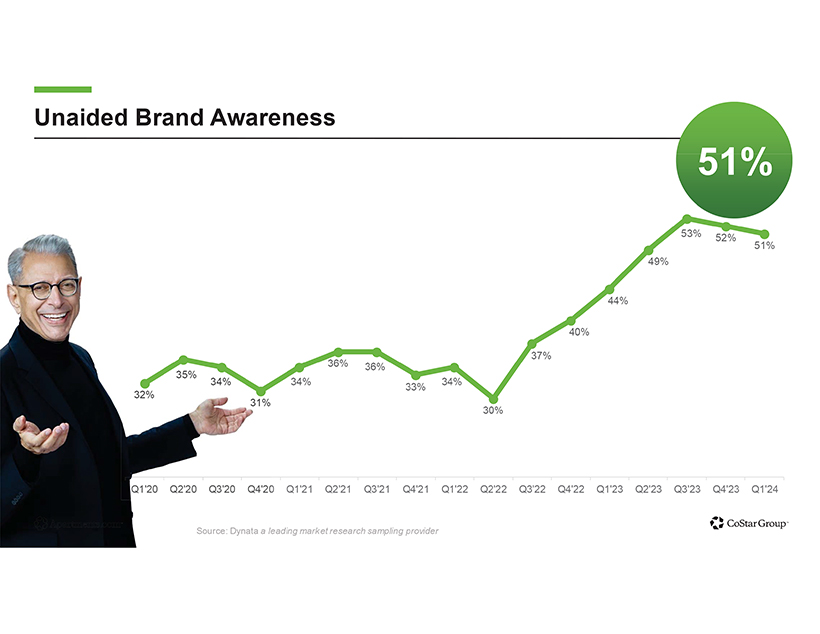

Unaided Brand Awareness 51% 53% 52% 51% 49% 44% 40% 37% 36% 36% 35% 34% 34% 34% 33% 32% 31% 30% Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Source: Dynata a leading market research sampling provider

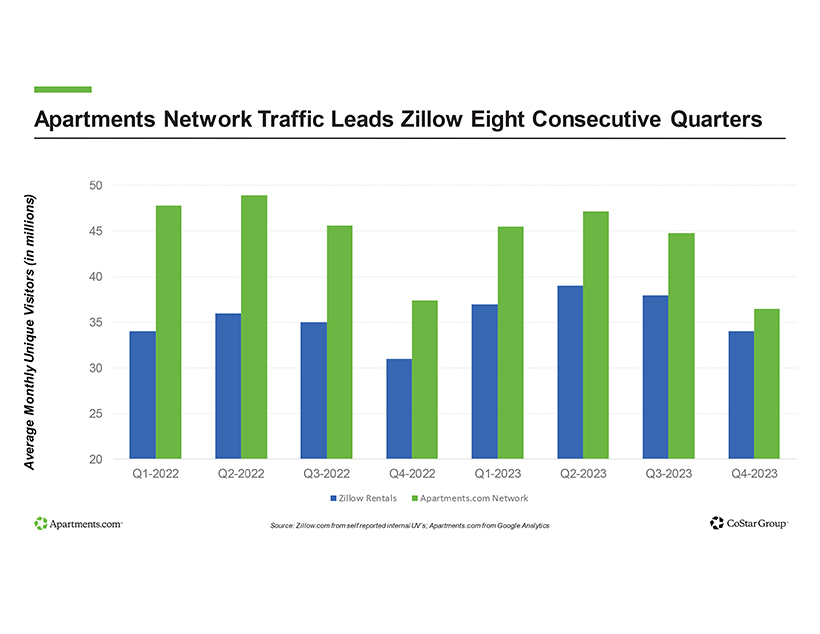

Apartments Network Traffic Leads Zillow Eight Consecutive Quarters 50 millions) 45 (in 40 Visitors Unique 35 Monthly 30 25 Average 20 Q1-2022 Q2-2022 Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 Q4-2023 Ž Z Ž E Ž Source: Zillow.com from self reported internal UV’s; Apartments.com from Google Analytics

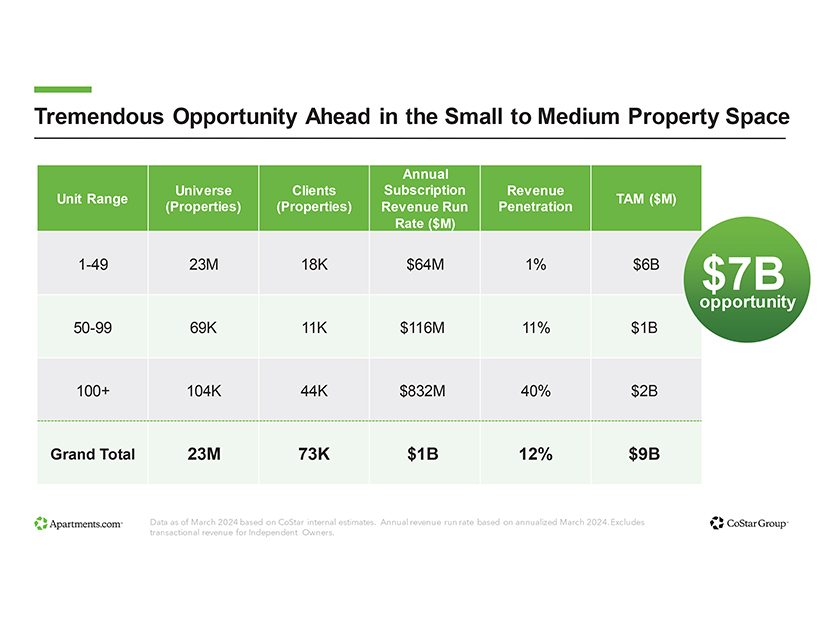

Tremendous Opportunity Ahead in the Small to Medium Property Space Annual Universe Clients Subscription Revenue Unit Range TAM ($M) (Properties) (Properties) Revenue Run Penetration Rate ($M) 1-49 23M 18K $64M 1% $6B $7B opportunity 50-99 69K 11K $116M 11% $1B 100+ 104K 44K $832M 40% $2B Grand Total 23M 73K $1B 12% $9B Data as of March 2024 based on CoStar internal estimates. Annual revenue run rate based on annualized March 2024. Excludes transactional revenue for Independent Owners.

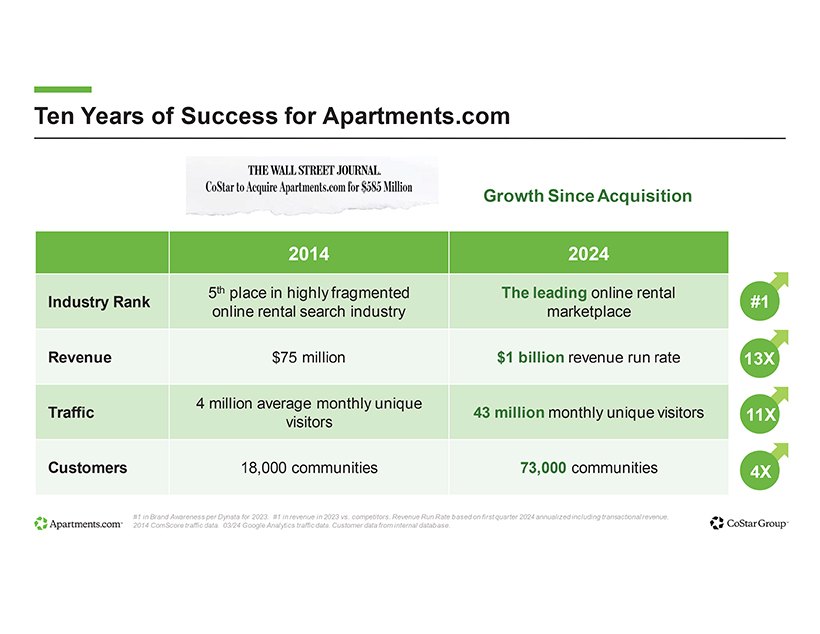

Ten Years of Success for Apartments.com Growth Since Acquisition 2014 2024 Industry Rank 5th place in highly fragmented The leading online rental #1 online rental search industry marketplace Revenue $75 million $1 billion revenue run rate 13X 4 million average monthly unique Traffic 43 million monthly unique visitors 11X visitors Customers 18,000 communities 73,000 communities 4X #1 in Brand Awareness per Dynata for 2023. #1 in revenue in 2023 vs. competitors. Revenue Run Rate based on first quarter 2024 annualized including transactional revenue. 2014 ComScore traffic data. 03/24 Google Analytics traffic data. Customer data from internal database.

A global leader in commercial real estate information, analytics, and data-driven news

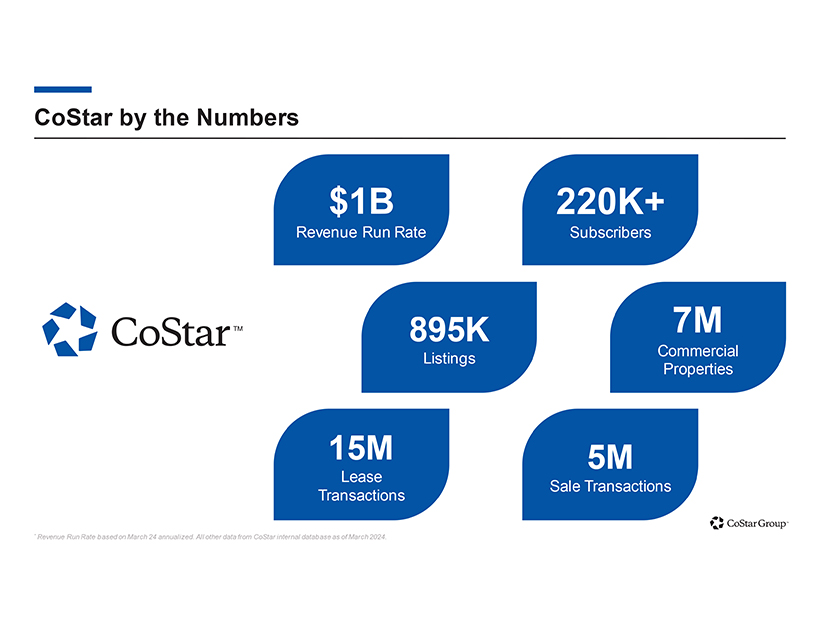

CoStar by the Numbers $1B 220K+ Revenue Run Rate Subscribers 895K 7M Commercial Listings Properties 15M 5M Lease Sale Transactions Transactions * Revenue Run Rate based on March 24 annualized. All other data from CoStar internal database as of March 2024.

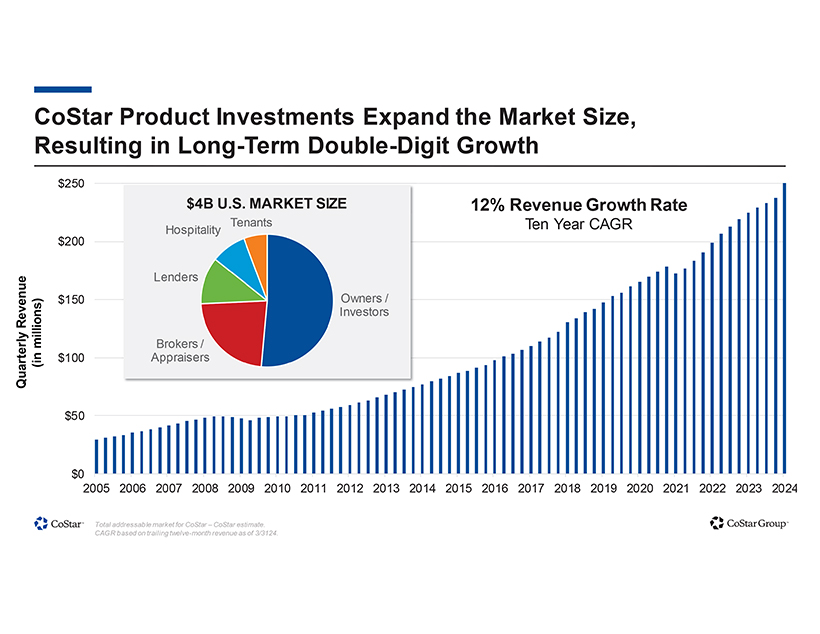

CoStar Product Investments Expand the Market Size, Resulting in Long-Term Double-Digit Growth $250 $4B U.S. MARKET SIZE 12% Revenue Growth Rate Tenants Ten Year CAGR $200 Hospitality Lenders $150 Owners / Revenue Investors millions) Brokers / Appraisers Quarterly (in $100 $50 $0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Total addressable market for CoStar – CoStar estimate. CAGR based on trailing twelve-month revenue as of 3/3124.

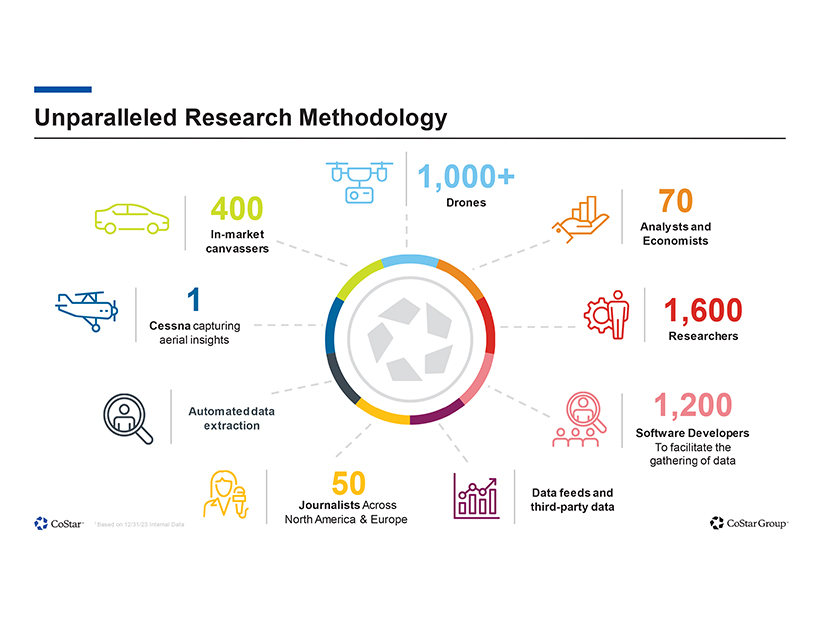

Unparalleled Research Methodology 1,000+ 400 Drones 70 Analysts and In-market Economists canvassers 1 1,600 Cessna capturing Researchers aerial insights Automated data 1,200 extraction Software Developers To facilitate the gathering of data 50 Data feeds and Journalists Across third-party data 1 North America & Europe Based on 12/31/23 Internal Data

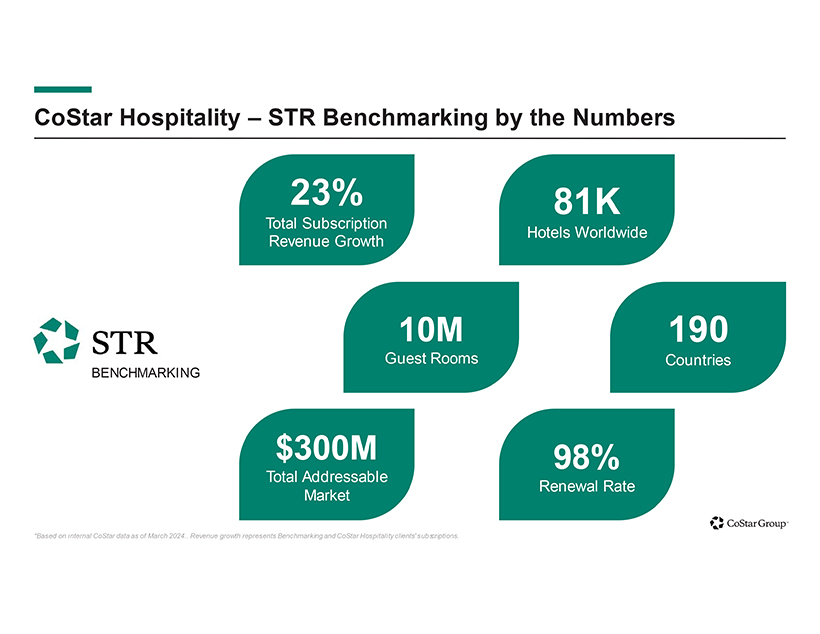

CoStar Hospitality – STR Benchmarking by the Numbers 23% 81K Total Subscription Hotels Worldwide Revenue Growth 10M 190 Guest Rooms Countries BENCHMARKING $300M 98% Total Addressable Renewal Rate Market *Based on internal CoStar data as of March 2024. Revenue growth represents Benchmarking and CoStar Hospitality clients' subscriptions.

STR Data Includes 81,000+ Hotels Across ~190 Countries

The #1 global commercial real estate marketplace

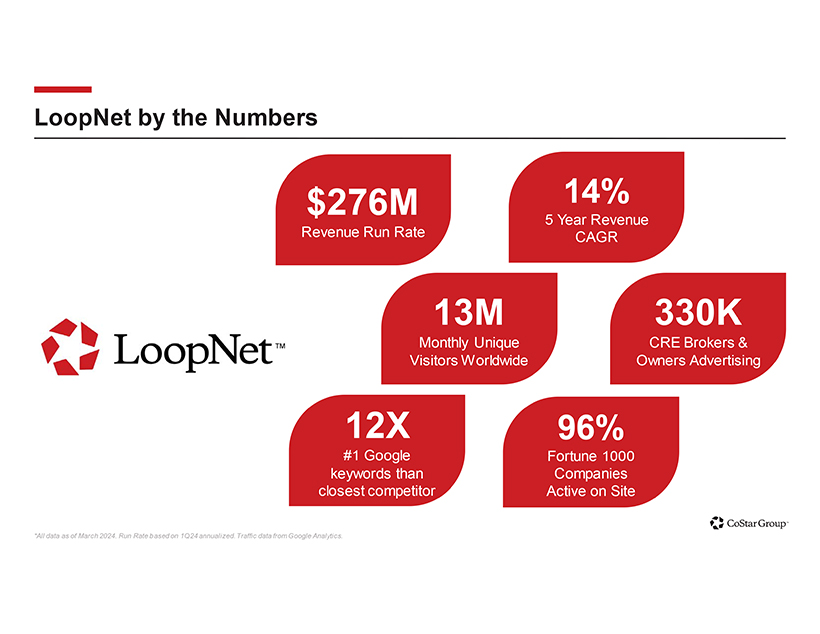

LoopNet by the Numbers $276M 14% 5 Year Revenue Revenue Run Rate CAGR 13M 330K Monthly Unique CRE Brokers & Visitors Worldwide Owners Advertising 12X 96% #1 Google Fortune 1000 keywords than Companies closest competitor Active on Site *All data as of March 2024. Run Rate based on 1Q24 annualized. Traffic data from Google Analytics.

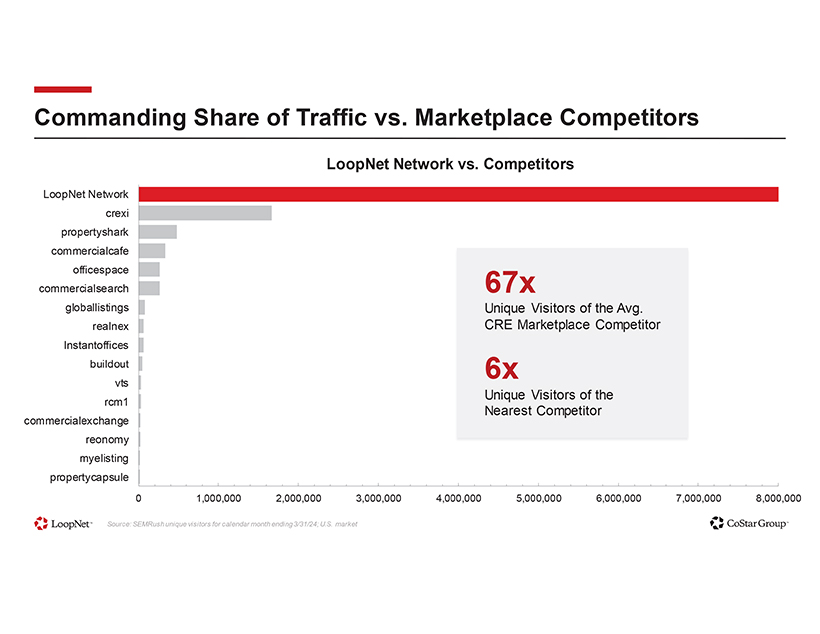

Commanding Share of Traffic vs. Marketplace Competitors LoopNet Network vs. Competitors LoopNet Network crexi propertyshark commercialcafe officespace commercialsearch 67x globallistings Unique Visitors of the Avg. realnex CRE Marketplace Competitor Instantoffices buildout 6x vts Unique Visitors of the rcm1 Nearest Competitor commercialexchange reonomy myelisting propertycapsule 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 Source: SEMRush unique visitors for calendar month ending 3/31/24; U.S. market

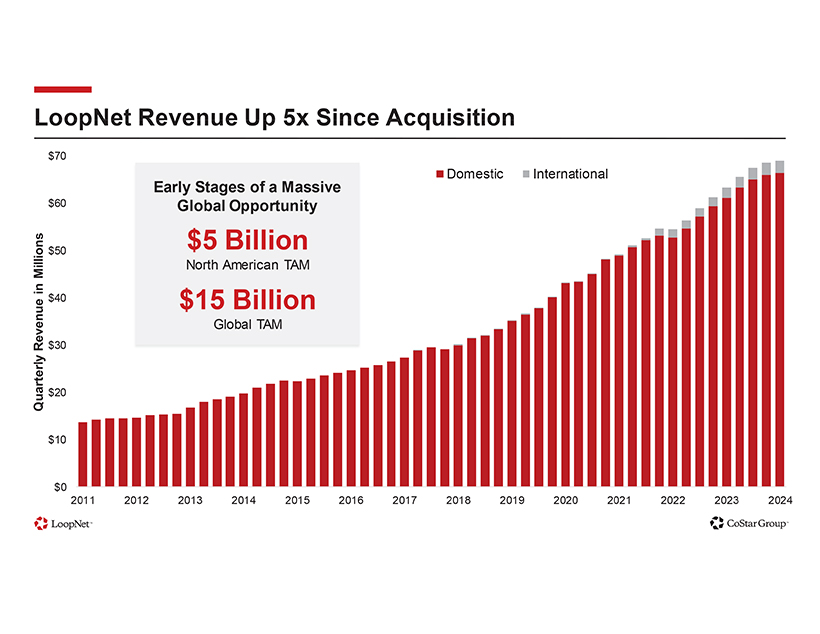

LoopNet Revenue Up 5x Since Acquisition $70 Early Stages of a Massive Domestic International $60 Global Opportunity $50 $5 Billion Millions North American TAM in $40 $15 Billion Global TAM Revenue $30 Quarterly $20 $10 $0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

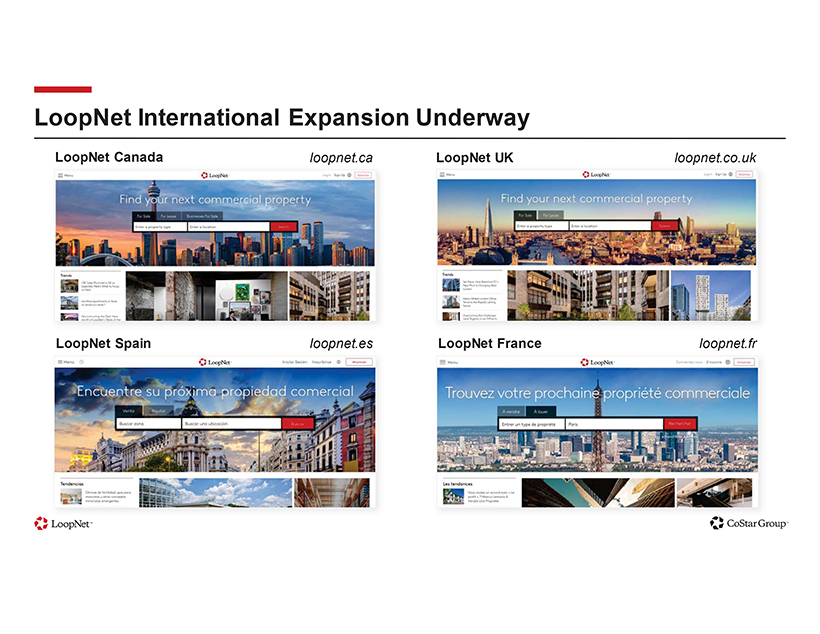

LoopNet International Expansion Underway LoopNet Canada loopnet.ca LoopNet UK loopnet.co.uk LoopNet Spain loopnet.es LoopNet France loopnet.fr

The leading platform for lease accounting and management

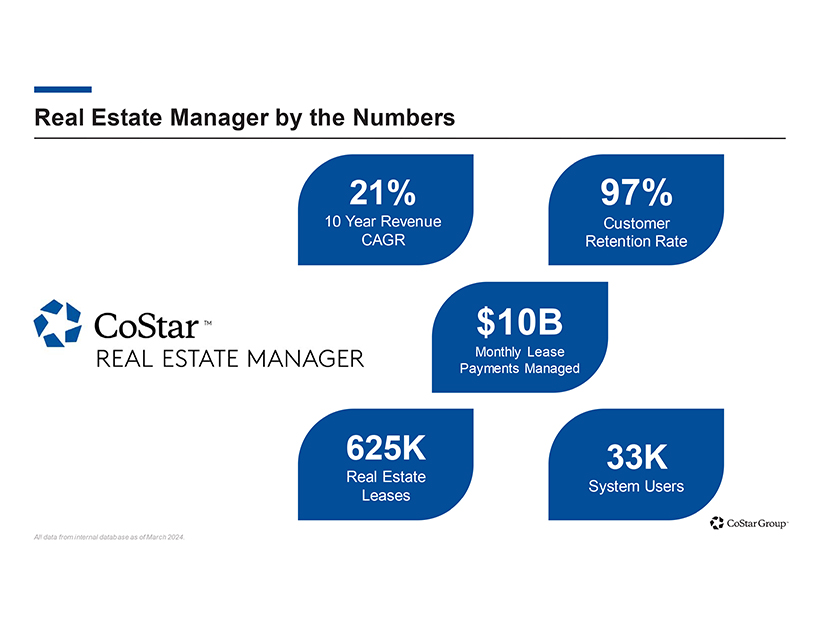

Real Estate Manager by the Numbers 21% 97% 10 Year Revenue Customer CAGR Retention Rate $10B Monthly Lease Payments Managed 625K 33K Real Estate System Users Leases All data from internal database as of March 2024.

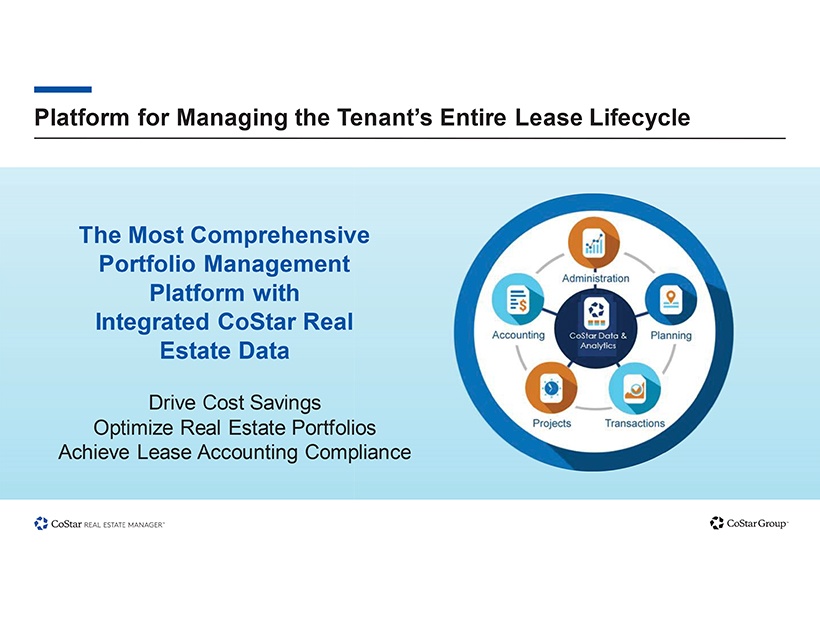

Platform for Managing the Tenant’s Entire Lease Lifecycle The Most Comprehensive Portfolio Management Platform with Integrated CoStar Real Estate Data Drive Cost Savings Optimize Real Estate Portfolios Achieve Lease Accounting Compliance

The SMARTER, BETTER, FASTER way to transact commercial real estate

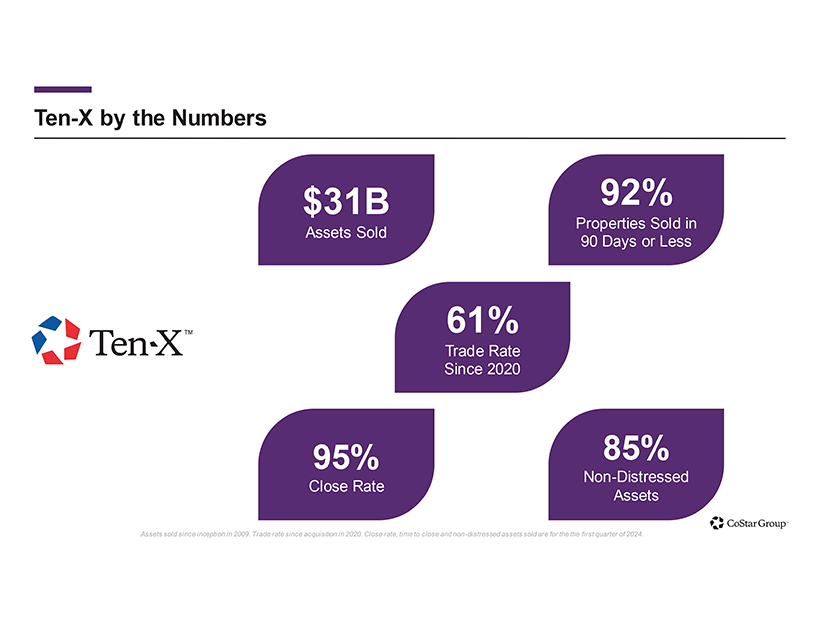

Ten-X by the Numbers $31B 92% Properties Sold in Assets Sold 90 Days or Less 61% Trade Rate Since 2020 95% 85% Non-Distressed Close Rate Assets Assets sold since inception in 2009. Trade rate since acquisition in 2020. Close rate, time to close and non-distressed assets sold are for the the first quarter of 2024.

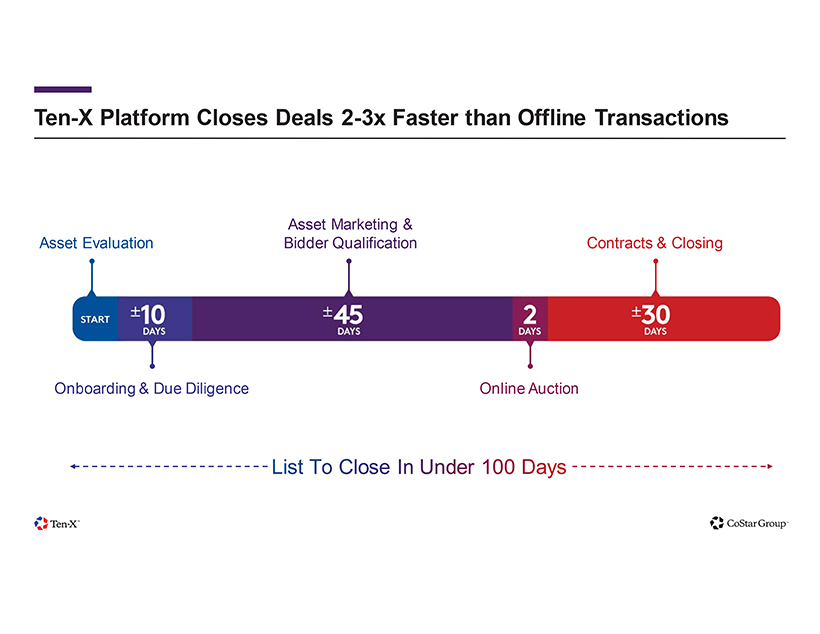

Ten-X Platform Closes Deals 2-3x Faster than Offline Transactions Asset Marketing & Asset Evaluation Bidder Qualification Contracts & Closing +—10 Days Onboarding & Due Diligence Online Auction List To Clos ose In Unde er r 100 Da ay ys

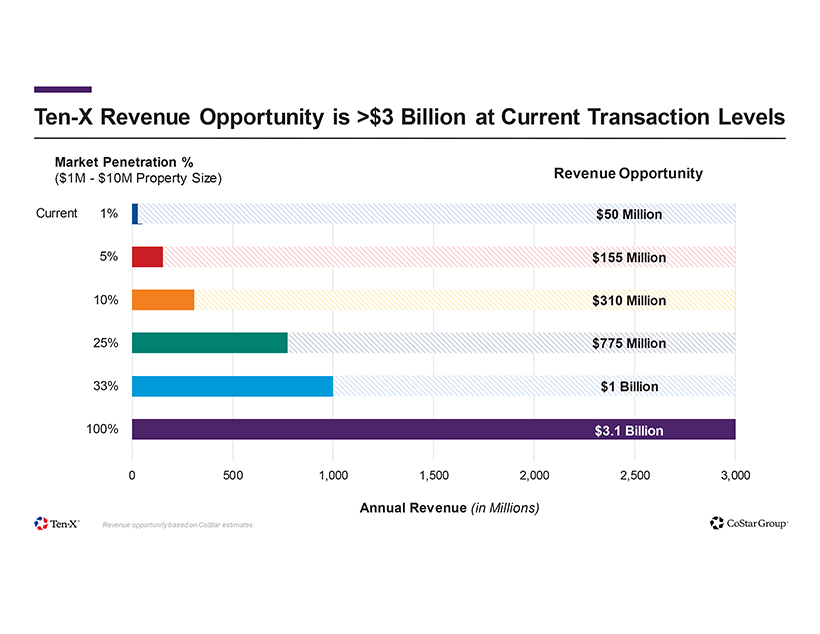

Ten-X Revenue Opportunity is >$3 Billion at Current Transaction Levels Market Penetration % ($1M—$10M Property Size) Revenue Opportunity Current 1% $50 Million 5% $155 Million 10% $310 Million 25% $775 Million 33% $1 Billion 100% $3.1 Billion 0 500 1,000 1,500 2,000 2,500 3,000 Annual Revenue (in Millions) Revenue opportunity based on CoStar estimates.

The largest rural real estate marketplace in the country

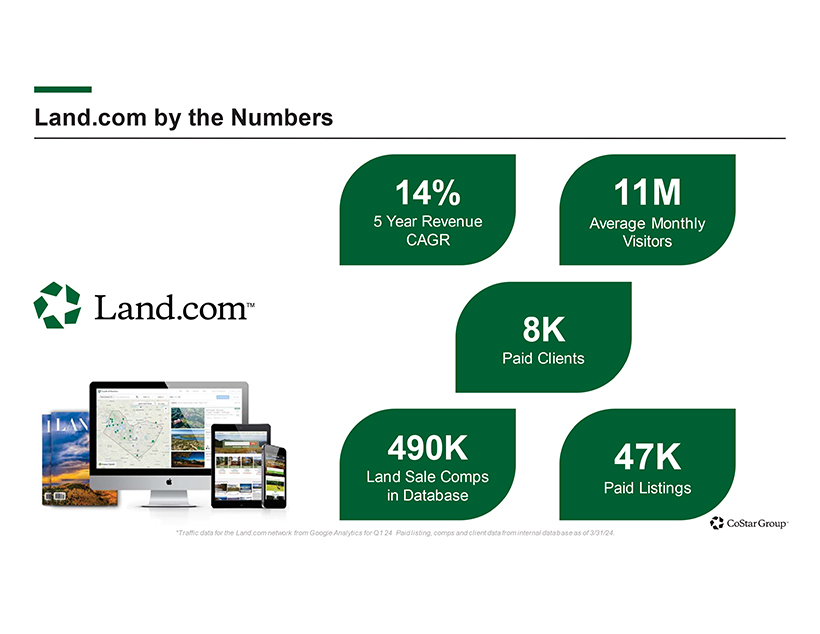

Land.com by the Numbers 14% 11M 5 Year Revenue Average Monthly CAGR Visitors 8K Paid Clients 490K 47K Land Sale Comps Paid Listings in Database *Traffic data for the Land.com network from Google Analytics for Q1 24 Paid listing, comps and client data from internal database as of 3/31/24.

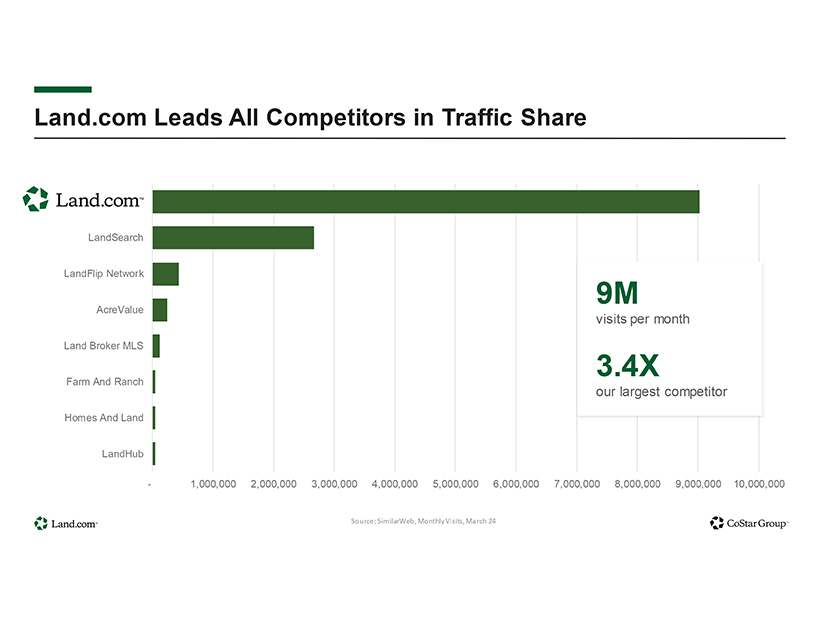

Land.com Leads All Competitors in Traffic Share LandSearch LandFlip Network AcreValue 9M visits per month Land Broker MLS Farm And Ranch 3.4X our largest competitor Homes And Land LandHub —1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 9,000,000 10,000,000 ^Ž ^ t DŽ s D

The largest business-for-sale marketplace in the U.S.

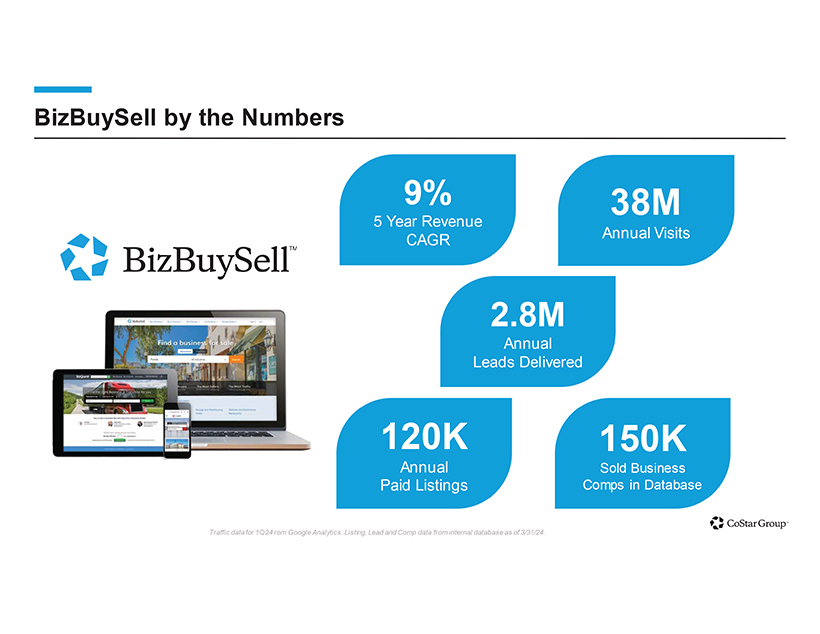

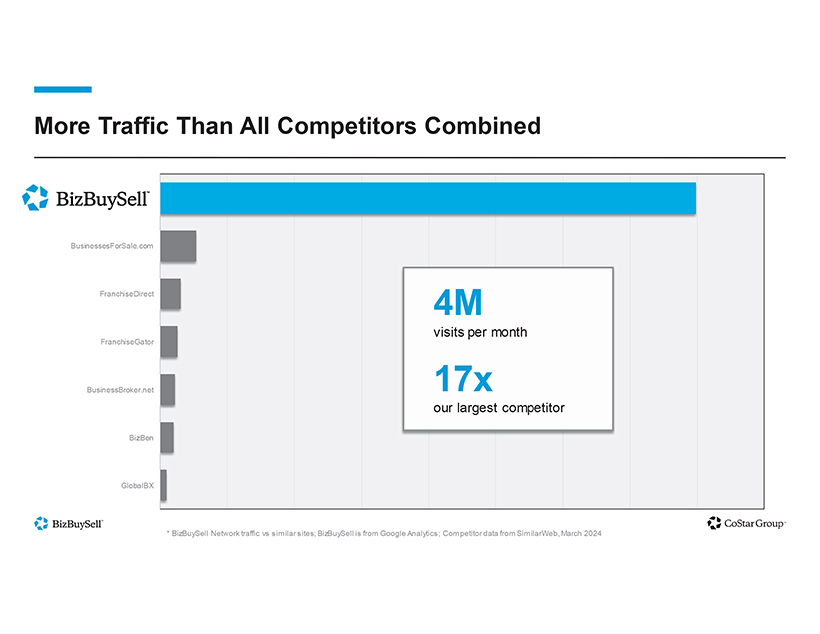

BizBuySell by the Numbers 9% 38M 5 Year Revenue CAGR Annual Visits 2.8M Annual Leads Delivered 120K 150K Annual Sold Business Paid Listings Comps in Database Traffic data for 1Q24 rom Google Analytics. Listing, Lead and Comp data from internal database as of 3/31/24.

More Traffic Than All Competitors Combined BusinessesForSale.com FranchiseDirect 4M visits per month FranchiseGator BusinessBroker.net 17x our largest competitor BizBen GlobalBX * BizBuySell Network traffic vs similar sites; BizBuySell is from Google Analytics; Competitor data from SimilarWeb, March 2024

Appendix

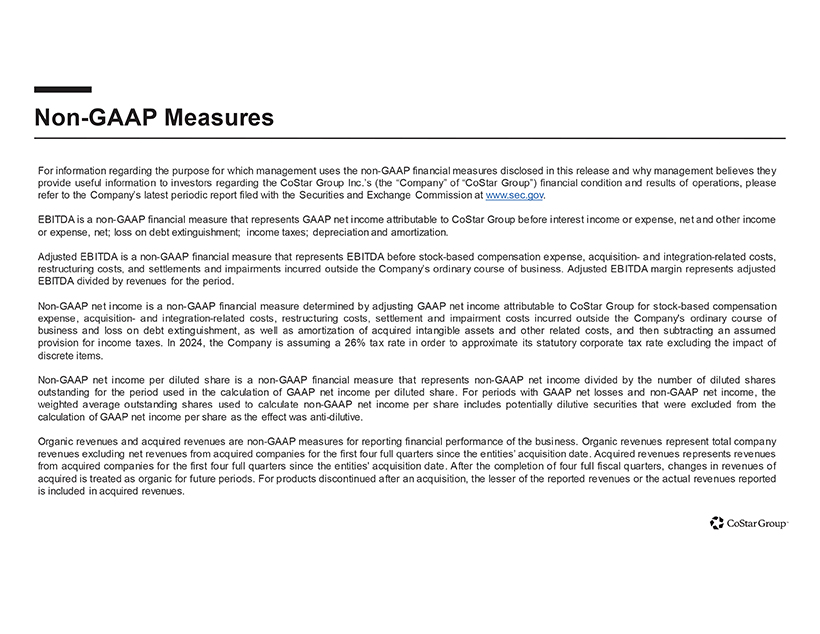

Non-GAAP Measures For information regarding the purpose for which management uses the non-GAAP financial measures disclosed in this release and why management believes they provide useful information to investors regarding the CoStar Group Inc.’s (the “Company” of “CoStar Group”) financial condition and results of operations, please refer to the Company’s latest periodic report filed with the Securities and Exchange Commission at www.sec.gov. EBITDA is a non-GAAP financial measure that represents GAAP net income attributable to CoStar Group before interest income or expense, net and other income or expense, net; loss on debt extinguishment; income taxes; depreciation and amortization. Adjusted EBITDA is a non-GAAP financial measure that represents EBITDA before stock-based compensation expense, acquisition- and integration-related costs, restructuring costs, and settlements and impairments incurred outside the Company’s ordinary course of business. Adjusted EBITDA margin represents adjusted EBITDA divided by revenues for the period. Non-GAAP net income is a non-GAAP financial measure determined by adjusting GAAP net income attributable to CoStar Group for stock-based compensation expense, acquisition- and integration-related costs, restructuring costs, settlement and impairment costs incurred outside the Company’s ordinary course of business and loss on debt extinguishment, as well as amortization of acquired intangible assets and other related costs, and then subtracting an assumed provision for income taxes. In 2024, the Company is assuming a 26% tax rate in order to approximate its statutory corporate tax rate excluding the impact of discrete items. Non-GAAP net income per diluted share is a non-GAAP financial measure that represents non-GAAP net income divided by the number of diluted shares outstanding for the period used in the calculation of GAAP net income per diluted share. For periods with GAAP net losses and non-GAAP net income, the weighted average outstanding shares used to calculate non-GAAP net income per share includes potentially dilutive securities that were excluded from the calculation of GAAP net income per share as the effect was anti-dilutive. Organic revenues and acquired revenues are non-GAAP measures for reporting financial performance of the business. Organic revenues represent total company revenues excluding net revenues from acquired companies for the first four full quarters since the entities’ acquisition date. Acquired revenues represents revenues from acquired companies for the first four full quarters since the entities’ acquisition date. After the completion of four full fiscal quarters, changes in revenues of acquired is treated as organic for future periods. For products discontinued after an acquisition, the lesser of the reported revenues or the actual revenues reported is included in acquired revenues.

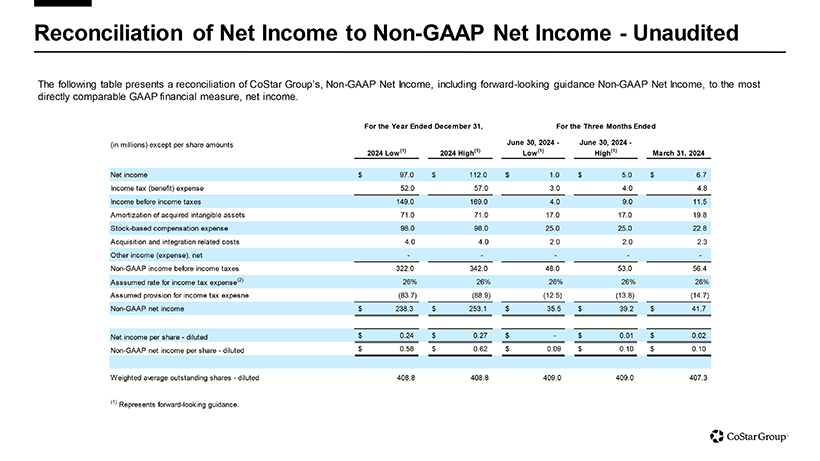

Reconciliation of Net Income to Non-GAAP Net Income—Unaudited The following table presents a reconciliation of CoStar Group’s, Non-GAAP Net Income, including forward-looking guidance Non-GAAP Net Income, to the most directly comparable GAAP financial measure, net income. For the Year Ended December 31, For the Three Months Ended (in millions) except per share amounts June 30, 2024—June 30, 2024— 2024 Low(1) 2024 High(1) Low(1) High(1) March 31, 2024 Net income $ 97.0 $ 112.0 $ 1.0 $ 5.0 $ 6.7 Income tax (benefit) expense 52.0 57.0 3.0 4.0 4.8 Income before income taxes 149.0 169.0 4.0 9.0 11.5 Amortization of acquired intangible assets 71.0 71.0 17.0 17.0 19.8 Stock-based compensation expense 98.0 98.0 25.0 25.0 22.8 Acquisition and integration related costs 4.0 4.0 2.0 2.0 2.3 Other income (expense), net — — — — — Non-GAAP income before income taxes 322.0 342.0 48.0 53.0 56.4 Asssumed rate for income tax expense(2) 26% 26% 26% 26% 26% Assumed provision for income tax expesne (83.7) (88.9) (12.5) (13.8) (14.7) Non-GAAP net income $ 238.3 $ 253.1 $ 35.5 $ 39.2 $ 41.7 Net income per share—diluted $ 0.24 $ 0.27 $ — $ 0.01 $ 0.02 Non-GAAP net income per share—diluted $ 0.58 $ 0.62 $ 0.09 $ 0.10 $ 0.10 Weighted average outstanding shares—diluted 408.8 408.8 409.0 409.0 407.3 (1) Represents forward-looking guidance.

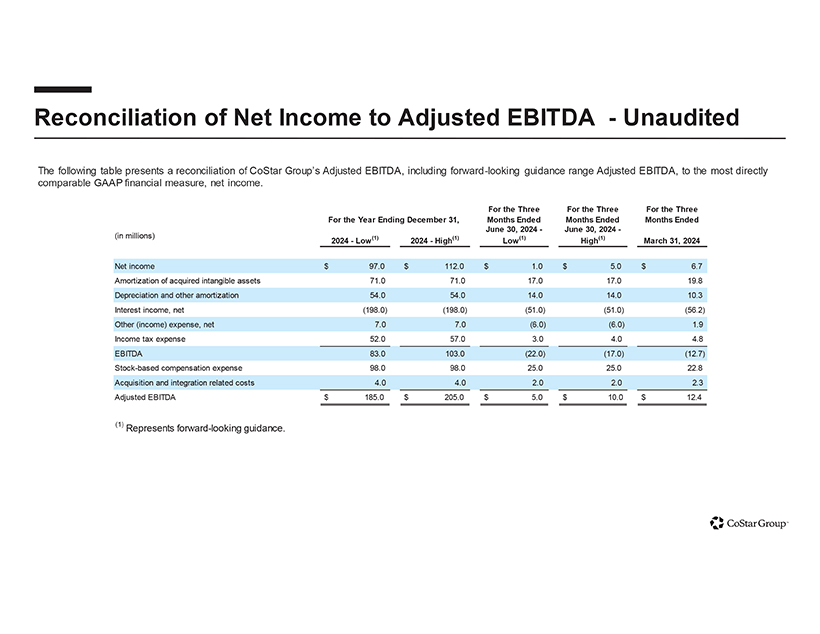

Reconciliation of Net Income to Adjusted EBITDA —Unaudited The following table presents a reconciliation of CoStar Group’s Adjusted EBITDA, including forward-looking guidance range Adjusted EBITDA, to the most directly comparable GAAP financial measure, net income. For the Three For the Three For the Three For the Year Ending December 31, Months Ended Months Ended Months Ended (in millions) June 30, 2024—June 30, 2024—2024—Low(1) 2024—High(1) Low(1) High(1) March 31, 2024 Net income $ 97.0 $ 112.0 $ 1.0 $ 5.0 $ 6.7 Amortization of acquired intangible assets 71.0 71.0 17.0 17.0 19.8 Depreciation and other amortization 54.0 54.0 14.0 14.0 10.3 Interest income, net (198.0) (198.0) (51.0) (51.0) (56.2) Other (income) expense, net 7.0 7.0 (6.0) (6.0) 1.9 Income tax expense 52.0 57.0 3.0 4.0 4.8 EBITDA 83.0 103.0 (22.0) (17.0) (12.7) Stock-based compensation expense 98.0 98.0 25.0 25.0 22.8 Acquisition and integration related costs 4.0 4.0 2.0 2.0 2.3 Adjusted EBITDA $ 185.0 $ 205.0 $ 5.0 $ 10.0 $ 12.4 (1) Represents forward-looking guidance.

Use of Operating Metrics and Other Definitions CoStar Group reviews a number of operating metrics to evaluate its business, measure performance, identify trends, formulate business plans and make strategic decisions. This presentation includes Net New Bookings. Going forward, CoStar Group expects to use these operating metrics on a periodic basis to evaluate and provide investors with insight into the performance of the Company’s subscription-based services. Net New Bookings are calculated based on the annualized amount of change in the Company’s sales bookings, resulting from new subscription-based contracts, changes to existing subscription-based contracts and cancellations of subscription-based contracts for the period reported. Information regarding net new bookings is not comparable to, nor should it be substituted for, an analysis of the Company’s revenues over time. Other Definitions References to “commercial information and marketplace businesses” refer to our consolidated financial position and results excluding the impact of our Residential brands, which are Homes.com and OnTheMarket, plc. Our “Residential Network” consists of the following list of brands: Apartments.com, ApartmentFinder, FinderSites, ApartmentHomeLiving, WestSideRentals, ForRent, After55, CorporateHousing, ForRentUniversity, Cozy.com, Off Campus Partners, Homes.com, Homesnap, CitySnap, OnTheMarket,plc (beginning in January 2024), Land.com, Landandfarm.com, and LandWatch.com

Use of Operating Metrics and Other Definitions CoStar Group reviews a number of operating metrics to evaluate its business, measure performance, identify trends, formulate business plans and make strategic decisions. This presentation includes Net New Bookings. Going forward, CoStar Group expects to use these operating metrics on a periodic basis to evaluate and provide investors with insight into the performance of the Company’s subscription-based services.Net New Bookings are calculated based on the annualized amount of change in the Company’s sales bookings, resulting from new subscription-based contracts, changes to existing subscription-based contracts and cancellations of subscription-based contracts for the period reported. Information regarding net new bookings is not comparable to, nor should it be substituted for, an analysis of the Company’s revenues over time. Other Definitions References to “commercial information and marketplace businesses” refer to our consolidated financial position and results excluding the impact of our Residential brands, which are Homes.com and OnTheMarket, plc. Our “Residential Network” consists of the following list of brands: Apartments.com, ApartmentFinder, FinderSites, ApartmentHomeLiving, WestSideRentals, ForRent, After55, CorporateHousing, ForRentUniversity, Cozy.com, Off Campus Partners, Homes.com, Homesnap, CitySnap, OnTheMarket,plc (beginning in January 2024), Land.com, Landandfarm.com, and LandWatch.com

Filed by CoStar Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Matterport, Inc.

Commission File No.: 001-39790

This filing relates to the proposed transaction between CoStar Group, Inc., a Delaware corporation (“CoStar”), and Matterport, Inc., a Delaware corporation (“Matterport”), pursuant to the terms of that certain Agreement and Plan of Merger and Reorganization, dated as of April 21, 2024, by and among CoStar, Matterport, Matrix Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of CoStar (“Merger Sub I”) and Matrix Merger Sub II LLC, a Delaware limited liability company and a wholly owned subsidiary of CoStar (“Merger Sub II”).

Forward-Looking Statements

This communication may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. All statements other than statements of historical fact, including statements regarding the proposed acquisition of Matterport, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future, may be “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements, involve a number of risks and uncertainties that could significantly affect the financial or operating results of CoStar, Matterport or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. CoStar can give no assurance that its expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks associated with the ability to consummate the proposed transaction and the timing of the closing of the proposed transaction; the ability to successfully integrate operations and employees; the ability to realize anticipated benefits and synergies of the proposed mergers as rapidly or to the extent anticipated by financial analysts or investors; the potential impact of announcement of the proposed mergers or consummation of the proposed transaction on business relationships, including with employees, customers, suppliers and competitors; unfavorable outcomes of any legal proceedings that have been or may be instituted against CoStar or Matterport; the ability to retain key personnel; costs, fees, expenses and charges related to the proposed transaction; general adverse economic conditions; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (the “SEC”) by CoStar and Matterport. Moreover, other risks and uncertainties of which CoStar or Matterport are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by CoStar or Matterport on their respective websites or otherwise. Neither CoStar nor Matterport undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, CoStar intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement of Matterport that also constitutes a prospectus of CoStar and other documents regarding the proposed transaction. The definitive proxy statement/prospectus will be delivered to stockholders of Matterport.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus (when available) and other relevant documents filed by CoStar and Matterport with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by CoStar with the SEC will also be available on CoStar’s website at https://costargroup.com, and copies of the documents filed by Matterport with the SEC are available on Matterport’s website at https://matterport.com.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

Participants in the Solicitation

CoStar, Matterport and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Matterport’s stockholders in respect of the proposed transaction. Information regarding CoStar’s directors and executive officers can be found in CoStar’s definitive proxy statement filed with the SEC on April 27, 2023. Information regarding Matterport’s directors and executive officers can be found in Matterport’s definitive proxy statement filed with the SEC on April 27, 2023.

Additional information regarding the interests of such potential participants will be included in the definitive proxy statement/prospectus when it is filed with the SEC. These documents will be available on the SEC’s website and from CoStar and Matterport, as applicable, using the sources indicated above.