SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April, 2024

PRUDENTIAL PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

1 Angel Court,

London EC2R 7AG, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

NOTICE OF ANNUAL GENERAL MEETING AND EXPLANATION OF BUSINESS PRUDENTIOL PLC TO BE HELD ON 23 MAY 2024

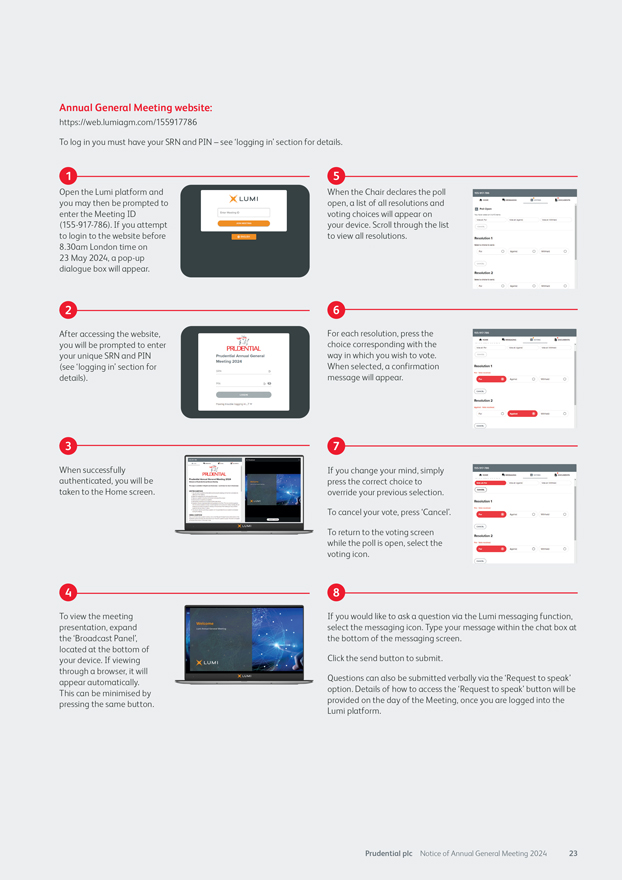

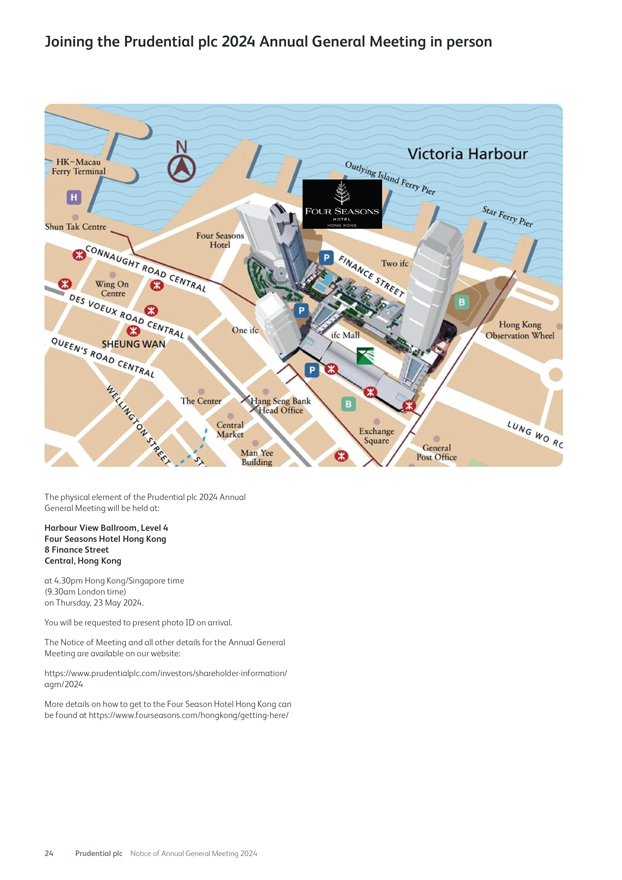

Dear Shareholder, I am pleased to write to you with details of this year’s Annual General Meeting (the ‘Meeting’) of Prudential plc (the ‘Company’). This year’s Meeting will again be held in hybrid form. The physical meeting will take place for the first time in Hong Kong, where our headquarters and management of the Group are based and where the Board regularly meets. Shareholders will also be able to join and participate in the Meeting electronically via the Lumi platform. The Meeting will be held at 4.30pm Hong Kong/Singapore time (9.30am London time) on Thursday, 23 May 2024. The physical meeting will be held at the Harbour View Ballroom, Level 4, Four Seasons Hotel Hong Kong, 8 Finance Street, Central, Hong Kong. A step-by-step guide on how to join the Meeting online, ask questions and vote can be found on pages 22 and 23. Whilst the Board is delighted to be able to welcome shareholders to join us in person in Hong Kong, we appreciate that some shareholders who are accustomed to attending the Annual General Meeting in person in London may be disappointed that they will be unable to physically attend the Meeting this year. We will continue to ensure that all shareholders are able to participate in the Meeting fully online and, in addition, there will be an opportunity for UK-based shareholders to meet with myself, the CEO and management at an additional, informal shareholder event on 27 September 2024, with further details provided separately.Shareholders attending the Meeting will receive a small corporate souvenir. Light refreshments will be offered at the Four Seasons Hotel.Shareholder engagement and questionsThe Meeting is an important event in the Company’s corporate calendar and provides a valuable opportunity for shareholders to engage directly with the Board, whether in person or online, via the Lumi platform. The Meeting will be conducted in English and a simultaneous Cantonese interpretation will be provided. In addition to the opportunity to ask questions during the Meeting, shareholders may also submit questions in advance of the Meeting by email to secretariat@prudentialplc.com When submitting questions via email, shareholders are kindly requested to include their shareholder reference number. We will consider all questions received and endeavour to provide answers during the Meeting where appropriate. Should shareholders wish to follow up on any responses provided to questions asked at the Meeting, they are encouraged to do so by emailing secretariat@prudentialplc.com 2 Prudential plc Notice of Annual General Meeting 2024

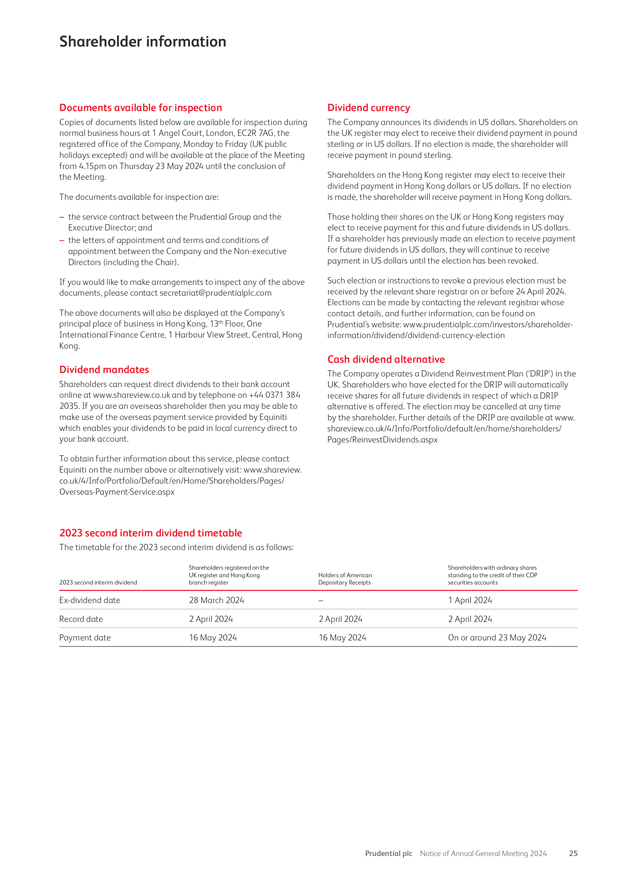

Voting All shareholders are encouraged to vote either in advance or on the This document, for which the Directors of the Company day of the Meeting. Votes can be cast: collectively and individually accept full responsibility, includes 1. in person, at the Meeting; particulars given in compliance with the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong 2. via the Lumi platform (available on the day of the Meeting); Limited for the purpose of giving information with regard to 3. via Equiniti Limited (‘Equiniti’) Sharevote website; the Company. 4. by completing and returning a paper ‘Form of Proxy’; or The Directors, having made all reasonable enquiries, confirm 5. if you are an institutional investor, you may be able to appoint that, to the best of their knowledge and belief, the a proxy electronically via CREST or the Proxymity platform. information contained in this document is accurate and As in previous years, I intend to call a poll on each resolution put to complete in all material respects and not misleading or the Meeting. This will ensure that we are able to engage with the deceptive, and there are no other matters the omission of greatest number of shareholders by including the votes cast by which would make any statement herein or this document shareholders who choose to vote ahead of the Meeting. misleading. A Chinese translation of this document is available on the Notice and Annual Report Company’s website or, on request, from Computershare Hong The formal Notice of Meeting (the ‘Notice’) together with the Kong Investor Services Limited, 17M Floor, Hopewell Centre, explanatory notes are set out on pages 4 to 17. This Notice is 183 Queen’s Road East, Wan Chai, Hong Kong. provided to shareholders on the UK register or the Hong Kong register, and any person with shares of the Company standing to the credit of their securities account held with The Central Depository (Pte) Limited (‘CDP’) in Singapore. Should you wish to view the 2023 Annual Report or this Notice online, they are available on our website at www.prudentialplc.com Dividend The Company pays all dividends as interim dividends. Interim dividends do not require shareholder approval and no resolution on a dividend payment is included in the Notice. On 20 March 2024, the Company announced a dividend of 14.21 US cents per share. Shareholders on the UK and Hong Kong registers will continue to receive their dividend payments in pounds sterling or Hong Kong dollars respectively unless they have elected to receive US dollars. The dividend rate in pounds sterling and Hong Kong dollars will be announced on or around 2 May 2024. Details of the Company’s dividends, including currency election options and payment dates, can be found on our website at www.prudentialplc.com/en/investors/ shareholder-information/dividend/cash-dividend and on page 25. Recommendation The Directors consider that all resolutions set out in this Notice to be put to the Meeting are in the best interests of the Company and its shareholders as a whole and unanimously recommend shareholders vote in favour of all proposed resolutions. The Directors intend to vote, in respect of their own beneficial shareholdings, in favour of all proposed resolutions (with the exception of resolution 17, as in accordance with Rule 7.19A(1) of the Hong Kong Listing Rules (‘HKLR’), the Chair, the Executive Director and their respective associates will abstain from voting on resolution 17 for the reasons set out on page 13 of this Notice). Yours sincerely Shriti Vadera Chair 22 April 2024 Prudential plc Notice of Annual General Meeting 2024 3

Notice of Annual General Meeting and explanatory notesNotice is hereby given that the 2024 Annual General Meeting of Prudential plc will be held on Thursday, Election and re-election of Directors23 May 2024 at 4.30pm Hong Kong/Singapore time (9.30am London time) at the Harbour View Ballroom, Explanatory notesLevel 4, Four Seasons Hotel Hong Kong, 8 Finance Street, In accordance with Provision 18 of the UK Corporate Governance Central, Hong Kong and simultaneously online, via the Code, all Directors other than those retiring at the conclusion of the Meeting will offer themselves for re-election or, in the case of Mark Lumi platform. Shareholders will be asked to consider Saunders, for election for the first time. David Law will retire at the and, if thought fit, pass the resolutions set out below. conclusion of the Meeting and will not stand for re-election. Resolutions 1 to 19 (inclusive) and resolution 23 will be proposed as All Directors in office during 2023 were subject to a formal and ordinary resolutions; resolutions 20, 21, 22 and 24 will be proposed rigorous performance evaluation. The Board considers that each of as special resolutions. For each ordinary resolution to be passed, the Directors continues to discharge their duties and responsibilities more than half of the votes cast must be in favour of the resolution. effectively, demonstrates commitment to their role, and continues to For each special resolution to be passed, at least three-quarters of make a strong contribution to the work of the Board and to the the votes cast must be in favour of the resolution. long-term sustainable success of the Company. Each Director brings valuable skills and experience to the Board and its Committees, and their individual contribution to Prudential is detailed in their Annual report and accounts biographies. The Board has determined that each Non-executive Director (with the exception of the Chair, whose independence is Resolution 1. only assessed on appointment) continues to be independent and To receive and consider the Accounts for the financial year that there are no circumstances likely to impair their judgement in ended 31 December 2023 together with the Strategic Report, relation to Prudential Board matters. Directors’ Remuneration Report, Directors’ Report and the When considering the independence of the Non-executive Directors, Auditor’s Report on those Accounts (the ‘2023 Annual Report’). the Board took into account that both Jeremy Anderson and Explanatory notes Jeanette Wong serve as non-executive directors of UBS Group AG and that Chua Sock Koong and Jeanette Wong serve as members of The formal business of the Meeting will begin with a resolution to lay the Singapore Securities Industry Council. The Board has determined before shareholders the 2023 Annual Report. Shareholders will have that these relationships do not affect the independence of those the opportunity to put questions about the 2023 Annual Report and Non-executive Directors. Based on their contributions to Board other business to be conducted at the Meeting to the Directors discussions to date, the Board is confident that they can be expected before this resolution is voted on. to continue to demonstrate objectivity and independence of The 2023 Annual Report is available to view on the Company’s judgement. website www.prudentialplc.com Each independent Non-executive Director has confirmed their independence under the criteria set out in Rule 3.13 of the Hong Directors’ Remuneration Report Kong Listing Rules. The Board, supported by the work carried out by the Nomination & Resolution 2. Governance Committee, is actively engaged in an ongoing cycle of To approve the Directors’ Remuneration Report for the year succession planning to support the Company’s strategic objectives ended 31 December 2023. and is satisfied that it continues to maintain an appropriate level of diversity and balance of skills and experience. All Directors standing Explanatory notes for election or re-election are recommended by the Nomination & As in previous years, shareholders will have the opportunity to cast Governance Committee. More detailed information about the an advisory vote on the Directors’ Remuneration Report for the year activities of the Nomination & Governance Committee in 2023 can ended 31 December 2023. be found in the Company’s 2023 Annual Report. The Directors’ Remuneration Report is set out in full on pages 200 to The Board recommends that shareholders approve the election of 225 of the 2023 Annual Report. The 2023 Annual Report is available Mark Saunders and re-election of all the Directors standing for to view on the Company’s website www.prudentialplc.com re-election. The full version of the current Directors’ Remuneration Policy, approved by shareholders on 25 May 2023, is also available on the Company’s website www.prudentialplc.com4 Prudential plc Notice of Annual General Meeting 2024

Election of Directors who joined the Board since the last Meeting Resolution 3. To elect Mark Saunders as a Director of the Company.Career Membership of committees From April 2014 to December 2022, Mark Audit Committee (since April 2024) was the Group Chief Strategy and Risk Committee (since April 2024) Corporate Development Officer and a member of the executive committee of AIA Relevant skills and experience for Group Ltd. Mark started his actuarial career Prudential in 1988 at UK headquartered insurance – Extensive knowledge of the insurance business Clerical Medial Investment Group, industry and Asia markets having been relocating to Hong Kong in 1994. He joined employed in the industry for 35 years Tillinghast (now Willis Towers Watson) in – Commercial insight gained as a senior 1997 and during his 16-year tenure he led executive of AIA and significant actuarial actuarial appraisal value assessments of skills and experience insurers across 20 markets in Asia Pacific, ultimately becoming leader of the Hong Key appointments Kong business. – Blackstone Inc (Senior Advisor) Mark is a Fellow of the Faculty of Actuaries – Bain International Inc (External Advisor) Independent Non-executive Director of the UK and the Actuarial Society of Hong Kong and holds an honours degree in Age: 60 Mathematics from the University of Manchester.Appointed to the Board: April 2024 Annual re-election of Directors Resolution 4. To re-elect Shriti Vadera as a Director of the Company. Career Membership of committeesShriti was Chair of Santander UK Group Nomination & Governance Committee Holdings, Senior Independent Director at (since May 2020, appointed Chair January BHP and a Non-executive Director of Astra 2021) Zeneca. Between 2009 and 2014, she Shriti is a standing attendee of the Audit, undertook a wide range of assignments, Risk and Remuneration Committees and the such as advising the South Korean Chair of Responsibility & Sustainability Working the G20, two European countries on the Group. She will join the Remuneration Eurozone and banking crisis, the African Committee from May 2024.Development Bank on infrastructure financing and a number of global investors Relevant skills and experience for and sovereign wealth funds on strategy and economic and market developments. Prudential – Senior boardroom experience and From 2007 to 2009, Shriti was a minister in leadership skills at complex organisations, the UK Government, serving in the Cabinet including extensive experience in the Office, Business Department and financial services sector, with Chair, Non-executive Director International Development Department. international operations and at the (independent: on appointment) She led on the UK Government’s response highest levels of international to the global financial crisis and its negotiations between governments and Age: 61 Presidency of the G20. From 1999 to 2007 in multinational organisations she was a member of HM Treasury’s Council Appointed to the Board: – Wide-ranging and global experience in of Economic Advisers. Shriti’s career began May 2020 (Chair since January 2021) economics, public policy and strategy, as with 15 years in investment banking with SG well as deep understanding and insight Warburg/UBS, where she had a strong focus into global and emerging markets and on emerging markets. the macro-political and economic Shriti holds a Bachelor’s Degree in environment Philosophy, Politics and Economics from Oxford University. Key appointments – The Royal Shakespeare Company (Chair)– Institute of International Finance (Board Member)– World Bank Private Sector Investment Lab (Co-Chair)Prudential plc Notice of Annual General Meeting 2024 5

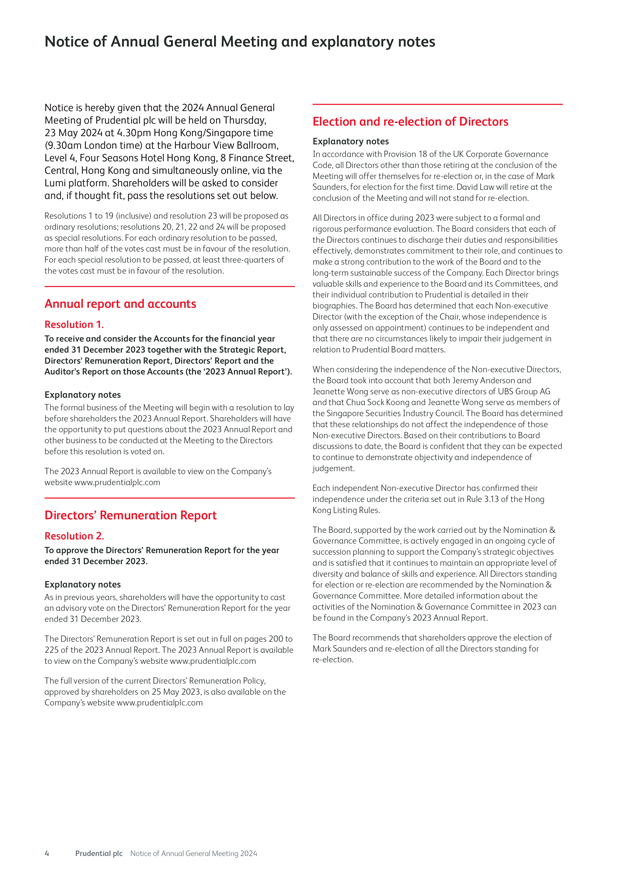

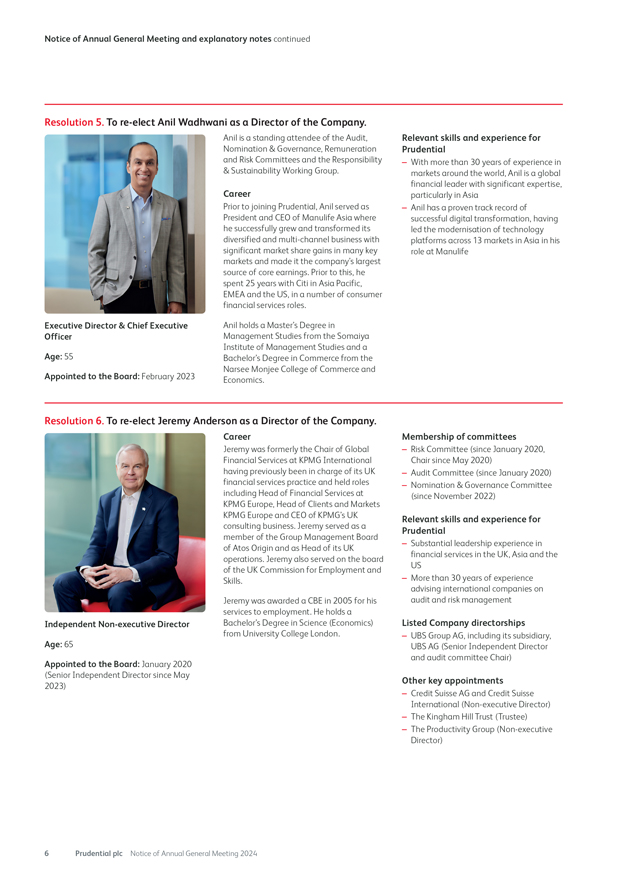

Notice of Annual General Meeting and explanatory notes continuedResolution 5. To re-elect Anil Wadhwani as a Director of the Company. Anil is a standing attendee of the Audit, Relevant skills and experience for Nomination & Governance, Remuneration Prudential and Risk Committees and the Responsibility – With more than 30 years of experience in & Sustainability Working Group. markets around the world, Anil is a global Career financial leader with significant expertise, particularly in Asia Prior to joining Prudential, Anil served as – Anil has a proven track record of President and CEO of Manulife Asia where successful digital transformation, having he successfully grew and transformed its led the modernisation of technology diversified and multi-channel business with platforms across 13 markets in Asia in his significant market share gains in many key role at Manulife markets and made it the company’s largest source of core earnings. Prior to this, he spent 25 years with Citi in Asia Pacific, EMEA and the US, in a number of consumer financial services roles.Executive Director & Chief Executive Anil holds a Master’s Degree in Officer Management Studies from the Somaiya Age: 55 Institute of Management Studies and a Bachelor’s Degree in Commerce from the Narsee Monjee College of Commerce and Appointed to the Board: February 2023 Economics.Resolution 6. To re-elect Jeremy Anderson as a Director of the Company. Career Membership of committees Jeremy was formerly the Chair of Global – Risk Committee (since January 2020, Financial Services at KPMG International Chair since May 2020) having previously been in charge of its UK – Audit Committee (since January 2020) financial services practice and held roles – Nomination & Governance Committee including Head of Financial Services at (since November 2022) KPMG Europe, Head of Clients and Markets KPMG Europe and CEO of KPMG’s UK Relevant skills and experience for consulting business. Jeremy served as a Prudential member of the Group Management Board – Substantial leadership experience in of Atos Origin and as Head of its UK financial services in the UK, Asia and the operations. Jeremy also served on the board US of the UK Commission for Employment and Skills. – More than 30 years of experience advising international companies on Jeremy was awarded a CBE in 2005 for his audit and risk management services to employment. He holds a Independent Non-executive Director Bachelor’s Degree in Science (Economics) Listed Company directorships from University College London. – UBS Group AG, including its subsidiary, Age: 65 UBS AG (Senior Independent Director and audit committee Chair)Appointed to the Board: January 2020 (Senior Independent Director since May Other key appointments2023)– Credit Suisse AG and Credit Suisse International (Non-executive Director)– The Kingham Hill Trust (Trustee)– The Productivity Group (Non-executive Director)6 Prudential plc Notice of Annual General Meeting 2024

Resolution 7. To re-elect Arijit Basu as a Director of the Company. Career Membership of committees Arijit retired as the Managing Director of – Audit Committee (since September 2022) State Bank of India (SBI) in September – Responsibility & Sustainability Working 2020 concluding a 40-year career, having Group (since September 2022) joined in 1983. During his career, he held a number of senior positions at the bank, Relevant skills and experience for across retail, corporate and international Prudential banking, business process re-engineering, IT – Extensive experience in India’s banking and risk management. He was Managing and insurance industries spanning nearly Director and Chief Executive Officer of SBI 40 years Life Insurance Company (a subsidiary of – Held high-profile leadership roles and SBI), one of India’s leading life insurers, gained broad operational experience from 2014 until 2018 and took it public in from various senior positions within SBI 2017.Since his retirement from SBI, Arijit has Key appointments worked as a consultant, including advising – HDB Financial Services Ltd (Chair) Independent Non-executive Director the Life Insurance Corporation of India on – Academic Council of the Reserve Bank of its 2022 IPO. India (Chair) Age: 63 Arijit is a certified associate of the Indian – Peerless Hospitex Hospital and Research Center Ltd (Non-executive Director) Appointed to the Board: September 2022 Institute of Bankers. He holds a Master’s Degree in History and a Bachelor’s Degree in Economics from the University of Delhi.Resolution 8. To re-elect Chua Sock Koong as a Director of the Company. Career Membership of committees From 2007 to 2020, Sock Koong was Chief – Remuneration Committee (since May Executive Officer of Singapore 2021, Chair since May 2022) Telecommunications Limited (Singtel), – Nomination & Governance Committee Asia’s leading communications technology (since May 2022) group, having previously held a number of – Sock Koong served on the Audit senior roles at the firm, including Treasurer, Committee from May 2021 until May Chief Executive Officer International and 2022. Group Chief Financial Officer, where she was responsible for Singtel’s financial Relevant skills and experience for functions, including treasury, tax, insurance, Prudential risk management and capital management. – More than 30 years’ experience working From April 2018 until March 2024, Sock in business leadership and operations Koong was a Non-executive Director of Cap with significant experience in the Asia Vista Pte Ltd and from March 2018 until market March 2024, she was a Non-executive Director of the Defence Science and – Significant boardroom experience, having Independent Non-executive Director Technology Agency. served in several C-suite roles throughout her career Age: 66 Sock Koong is a Fellow Member of the Institute of Singapore Chartered Listed company directorships Appointed to the Board: May 2021 Accountants and a Chartered Financial – Bharti Airtel Limited (Non-executive Analyst. She holds a Bachelor’s Degree in Director) Accountancy from the University of – Royal Philips NV (Non-executive Director) Singapore. – Ayala Corporation (Non-executive Director)Other key appointments– The Singapore Public Service Commission (Deputy Chair)– The Singapore Council of Presidential Advisers (Member) – Singapore Securities Industry Council (Member)Prudential plc Notice of Annual General Meeting 2024 7

Notice of Annual General Meeting and explanatory notes continuedResolution 9. To re-elect Ming Lu as a Director of the Company. Career Membership of committees Ming is the Executive Chairman, Asia Pacific – Nomination & Governance Committee at KKR Asia Limited and a partner of (since May 2021) Kohlberg Kravis Roberts & Co. L.P. He also – Remuneration Committee (since May serves as a member of the KKR Asian 2022) Private Equity Investment Committee and – Ming served on the Risk Committee from the KKR Asian Portfolio Management May 2021 until May 2022. Committee. Since 2018 he has played an important role in KKR’s Asia growth and Relevant skills and experience for expansion. He has served as a member of Prudential the Asia Infrastructure Investment – More than 30 years of experience Committee and Asia Real Estate investing in and developing businesses Investment Committee. throughout the Asia Pacific region Ming previously worked for CITIC, China’s – Brings deep knowledge and up-to-date largest direct investment firm, before insights on China and other key markets moving to Kraft Foods International Inc. He Independent Non-executive Director was President of Asia Pacific at Lucas Varity, Key appointments and a partner at CCMP Capital Asia – KKR Asia Ltd (Executive Chair, Asia Age: 66 (formerly J.P. Morgan Partners Asia), where Pacific) he was responsible for investment in the – Goodpack Pte Limited, a KKR portfolio Appointed to the Board: May 2021 automotive, consumer and industrial company (Director) sectors across several countries throughout Asia. Ming has also held directorships at Ma San Consumer Corporation, Unisteel Technology International Limited, Weststar Aviation Service Sdn Bhd and MMI Technologies Pte Ltd. He was a Non-executive Director of Jones Lang LaSalle Inc from 2009 to 2021. Ming holds a Master’s Degree in Business Administration from the University of Leuven and a Bachelor’s Degree in Arts (Economics) from the Wuhan University of Hydroelectrical Engineering. 8 Prudential plc Notice of Annual General Meeting 2024

Resolution 10. To re-elect George Sartorel as a Director of the Company. Career Membership of committees From 2014 to 2019 George was the regional – Responsibility & Sustainability Working Chief Executive Officer of Allianz’s Asia Group, Chair (since May 2022) Pacific business, having previously held a – Nomination & Governance Committee range of senior roles within the company, (since May 2022) including Chief Executive of both Allianz – Risk Committee (since May 2022) Italy and Allianz Turkey, Global Head of – Remuneration Committee (since May Change Programmes for Allianz Group, and 2023) General Manager of Allianz Malaysia and Allianz Australia and New Zealand. George Relevant skills and experience for also sat on the Financial Advisory Panel of Prudential the Monetary Authority of Singapore from 2015 to 2019. George’s career began at – Considerable operational expertise in the Manufacturers Mutual Insurance in insurance industry gained over a 40-year Australia in 1973, before its acquisition by career, including experience of digital Allianz in 1998. transformation– A range of senior leadership roles, Independent Non-executive Director George holds a Master’s Degree in including as regional Chief Executive International Business Studies from Officer of Allianz AG’s Asia Pacific Age: 66 Heriot-Watt University. business and several country-head positions prior to thatAppointed to the Board: January 2022Listed company directorships– Insurance Australia Group Limited (Non-executive Director)Resolution 11. To re-elect Claudia Suessmuth Dyckerhoff as a Director of the Company. Career Membership of committees Claudia joined the global consultancy firm – Risk Committee (since January 2023) McKinsey & Partners in 1995 and worked in – Responsibility & Sustainability Working several senior roles. She was responsible for Group (since January 2023) helping to build the firm’s healthcare services and systems sector in Asia Pacific, Relevant skills and experience for including working with the Chinese Ministry Prudential of Health to help develop their views on – Considerable experience in the China’s national healthcare systems. From healthcare services and technology March 2021 until October 2023, Claudia sectors across China and the broader was also a Non-executive Director of Huma Asia-Pacific region. Her board experience Therapeutics Ltd, a global health has helped her develop valuable insights technology company. around the implementation of Claudia holds a PhD in Business transformation through technology, Administration from the University of St. digital and data Gallen in Switzerland and a Master’s Degree – Knowledge of Asian markets, particularly Independent Non-executive Director in Business Administration from CEMS/ China, having been based in Shanghai for ESADE in Barcelona. nearly 15 years and Hong Kong for a Age: 57 further two yearsAppointed to the Board: January 2023 Listed company directorships– Ramsay Health Care Ltd (Non-executive Director)– Clariant AG (Non-executive Director)– Roche Holding AG (Non-executive Director)Other key appointments– QuEST Global Services Private Ltd (Non-executive Director)Prudential plc Notice of Annual General Meeting 2024 9

Notice of Annual General Meeting and explanatory notes continuedResolution 12. To re-elect Jeanette Wong as a Director of the Company. Career Membership of committees From 2008 to 2019, Jeanette led DBS – Appointed Chair of the Audit Committee: Group’s institutional banking business, March 2024 (member since May 2021) where she was responsible for corporate – Risk Committee (since May 2021) banking, global transaction services, – Responsibility & Sustainability Working strategic advisory, and mergers and Group (since November 2021) acquisitions. Prior to this, she was the DBS – Jeanette Wong succeeded David Law as Group’s Chief Financial Officer from 2003 to Audit Committee Chair from 20 March 2024. 2008, having previously been Chief Administrative Officer. As part of her role at Relevant skills and experience for DBS Group, Jeanette held Non-executive PrudentialDirector positions with ASEAN Finance Corporation, TMB Bank and the Bank of the – Over 35 years of operational experience in Philippine Islands. Jeanette began her financial services career in Singapore at Banque Paribas – Extensive knowledge and experience of before moving to Citibank and then J.P. ASEAN markets as well as significant Morgan in Singapore, where she held senior boardroom experience gained from a Independent Non-executive Director pan-Asian roles. She has previously served number of non-executive roles as a Non-executive Director of Fullerton Age: 64 Fund Management Ltd and Neptune Orient Listed company directorships Lines Limited. – UBS Group AG, including its subsidiary, Appointed to the Board: May 2021UBS AG (Non-executive Director and audit Jeanette is a member of the UBS Board, committee member) where she has served as a member of the – Singapore Airlines Limited (Non-executive audit committee since 2019.Director) Jeanette holds a Master’s Degree in Business Administration from the University Other key appointments of Chicago and a Bachelor’s Degree in – Council of CareShield Life (Chair) Business Administration from the National – GIC Pte Ltd (Non-executive Director) University of Singapore. – PSA International Pte Ltd (Non-executive Director)– Singapore Securities Industry Council (Member)Resolution 13. To re-elect Amy Yip as a Director of the Company. Career Membership of committees Amy was formerly a Non-executive Director – Audit Committee (since March 2021) of Deutsche Brse AG, Temenos Group AG, – Amy served on the Remuneration Fidelity Funds, and Vita Green (Hong Kong) Committee from September 2019 until and an executive director of Reserves March 2021.Management at the Hong Kong Monetary Authority. Relevant skills and experience for PrudentialFrom 2006 to 2010, Amy was Chief Executive Officer of DBS Bank (Hong Kong) – Extensive skills and experience in asset Limited, where she was also head of its management, banking, insurance, and wealth management group and Chair of regulation following a career spanning DBS asset management. From 1996 to more than 40-years 2006, Amy held various senior positions at – Substantial experience of China and the Hong Kong Monetary Authority. Amy South-east Asian markets having occupied began her career at the Morgan Guaranty roles across these regions for much of her Trust Company of New York, going on to career Independent Non-executive Director hold senior appointments at Rothschild Listed company directorships Asset Management and Citibank Private Age: 72 Bank. – EFG International AG (including its subsidiary, EFG Bank AG) (Non-executive Appointed to the Board: September 2019 Amy has a Master’s Degree in Business Director) Administration from Harvard Business – TP ICAP Group plc (Non-executive School and a Bachelor’s Degree in Arts Director) (History) from Brown University.Other key appointments– AIG Insurance Hong Kong Limited (Non-executive Director)10 Prudential plc Notice of Annual General Meeting 2024

Reappointment of auditor Resolution 14. To re-appoint Ernst & Young LLP (‘EY’) as the Company’s auditor until the conclusion of the next general meeting at which the Company’s accounts are laid. Explanatory note Following the recommendation of the Company’s Audit Committee and Board, shareholders will be asked to approve the appointment of EY as the Company’s auditor, to hold office until the conclusion of the Company’s 2025 Annual General Meeting. Remuneration of auditor Resolution 15. To authorise the Company’s Audit Committee, on behalf of the Board, to determine the amount of the auditor’s remuneration. Explanatory note Shareholders will be asked to grant authority to the Company’s Audit Committee to determine the remuneration of EY. Political donations Resolution 16. That the Company, and all companies that are its subsidiaries at any time during the period for which this resolution is effective, be and are hereby generally and unconditionally authorised for the purposes of Sections 366 and 367 of the Companies Act 2006 (the ‘2006 Act’), in aggregate, to: i. make political donations to political parties and/or independent election candidates not exceeding Ł50,000 in total; ii. make political donations to political organisations other than political parties not exceeding Ł50,000 in total; and iii. incur political expenditure not exceeding Ł50,000 in total, (as such terms are defined in Sections 363 to 365 of the 2006 Act) provided that the aggregate of such donations and expenditure shall not exceed Ł50,000 during the period beginning with the date of passing this resolution and expiring at the earlier of 30 June 2025 and the conclusion of the Annual General Meeting of the Company to be held in 2025, unless such authority has been previously renewed, revoked or varied by the Company at a general meeting. The Company may enter into a contract or undertaking under this authority prior to its expiry, which contract or undertaking may be performed wholly or partly after such expiry, and may make donations to political organisations other than political parties and incur political expenditure in pursuance of such contracts or undertakings as if the said authority had not expired. Explanatory notes The 2006 Act restricts companies from making donations to political parties, other political organisations or independent election candidates and from incurring political expenditure without shareholders’ consent. Prudential has a clear policy not to make political donations (no political donations were made in the year ended 31 December 2023). However, although the Company intends to continue to adhere to its policy of not making donations to political parties or to independent election candidates (and will not do so without the specific endorsement of its shareholders) the broad definitions used in the 2006 Act make it possible for normal business activities of the Company, which might not be thought of as political expenditure or donations to political organisations in the usual sense, to be caught. The Company does not believe there is a material risk of it inadvertently making such donations. In accordance with established best practice, it is the Company’s intention to seek renewal of this resolution on an annual basis. Renewal of authority to allot ordinary shares Resolution 17. That the Directors be and are hereby authorised, generally and unconditionally, pursuant to Section 551 of the 2006 Act, to exercise all the powers of the Company to allot shares in the Company and to grant rights to subscribe for or to convert any security into shares in the Company for a period expiring at the earlier of 30 June 2025 and the conclusion of the Annual General Meeting of the Company to be held in 2025 (save that the Company may make offers and enter into agreements under this authority prior to its expiry which would, or might, require shares to be allotted or rights to subscribe for or to convert securities into shares to be granted after such expiry, and the Board may allot shares or grant rights to subscribe for or to convert securities into shares under any such offer or agreement as if the said authority had not expired) and for a maximum aggregate nominal amount of: A. Ł27,496,701 (such amount to be reduced by any allotments or grants made under paragraph (B) or (C) of this resolution 17 so that in total no more than Ł45,782,008 can be allotted under paragraphs (A) and (B) of this resolution 17, and no more than Ł91,564,017 can be allotted under paragraphs (A), (B) and (C)); B. Ł45,782,008 (such amount to be reduced by any allotments or grants made under paragraph (A) or (C) of this resolution 17 so that in total no more than Ł45,782,008 can be allotted under paragraphs (A) and (B) of this resolution 17, and no more than Ł91,564,017 can be allotted under paragraphs (A), (B) and (C)) in connection with an offer or invitation: Prudential plc Notice of Annual General Meeting 2024 11

Notice of Annual General Meeting and explanatory notes continueda. to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and b. to holders of other equity securities (as defined in section 560(1) of the 2006 Act) as required by the rights of those securities or as the Board otherwise considers necessary, and so that the Board may impose any limits or restrictions and make any arrangements which it considers necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter; C. 91,564,017 (such amount to be reduced by any allotments or grants made under paragraph (A) or (B) of this resolution 17 so that in total no more than 91,564,017 can be allotted under paragraphs (A), (B) and (C) of this resolution 17) in connection with a rights issue: a. to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and b. to holders of other equity securities (as defined in Section 560(1) of the 2006 Act) as required by the rights of those securities or as the Board otherwise considers necessary, and so that the Board may impose any limits or restrictions and make any arrangements which it considers necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter; and D. the amount allotted pursuant to the terms of any share scheme of the Company or any of its subsidiary undertakings adopted prior to or on the date of this Meeting. Explanatory notes At last year’s Annual General Meeting, shareholders renewed a resolution giving the Directors authority to allot ordinary shares or grant rights to subscribe for or convert any security into shares in the Company (referred to collectively as Allotments). That authority will expire at the conclusion of this year’s Meeting. Accordingly, the Notice includes a resolution to renew this authority and to extend the authority to make Allotments in connection with rights issues as further described below. The Company has no present plans to undertake a rights issue or to issue new shares (or grant options over such new shares) other than in connection with its employee and agent share plans. The Company may also issue new shares pursuant to any scrip dividend alternative that may be offered by the Directors in respect of any dividend (see explanatory notes to Resolution 23). This authority will give the Directors the flexibility permitted by the HKLR and corporate governance guidelines to issue shares where they believe it is for the benefit of shareholders to do so. This authority complies with UK institutional investment guidelines and will expire at the earlier of 30 June 2025 and the conclusion of the 2025 Annual General Meeting. This resolution needs to comply with the requirements of the HKLR as a result of the Company’s listing on the Hong Kong Stock Exchange (‘HKSE’). As a consequence, paragraphs (A), (B) and (C) of resolution 17 relate to different tranches of the Company’s issued ordinary share capital which, when taken together, cover an aggregate nominal amount equal to 91,564,017 representing approximately 1,831,280,349 ordinary shares. This amount is approximately 66.6 per cent of the total issued ordinary share capital of the Company as at 7 April 2024, the latest practicable date prior to publication of this Notice, which is also in line with guidance issued by the Investment Association. To protect shareholders’ interests and minimise any dilutive effects arising from the non-pre-emptive issue of shares, the total amount of Allotments which may be made under paragraphs (A), (B) and (C) of resolution 17, will cover an aggregate nominal amount equal to 91,564,017 representing approximately 1,831,280,349 ordinary shares (the ‘Allotment Limit’). The Allotment Limit is equal to approximately 66.6 per cent of the total issued ordinary share capital of the Company as at 7 April 2024, the latest practicable date prior to publication of this Notice. Paragraph (A) of resolution 17 authorises the Directors to make Allotments of an aggregate nominal amount equal to 27,496,701 (representing approximately 549,934,038 ordinary shares in the Company). This amount, which is the maximum proportion of share capital Directors may allot without pre-emption under the HKLR, represents approximately 20 per cent of the total issued ordinary share capital as at 7 April 2024. This authority will be reduced by the amount of any allotments or grants made under paragraphs (B) and (C) of resolution 17, to ensure that the total amount of Allotments which may be made under paragraphs (A) and (B) does not exceed one-third of the total issued ordinary share capital of the Company and that the total amount of Allotments which may be made under paragraphs (A), (B) and (C) of resolution 17 does not exceed the Allotment Limit. Paragraph (B) of resolution 17 authorises the Directors to make Allotments of an aggregate nominal amount equal to 45,782,008 (representing approximately 915,640,174 ordinary shares in the Company) in connection with offers to ordinary shareholders or holders of other equity securities. This amount exceeds the 20 per cent authority in paragraph (A) of resolution 17 by approximately 13 percentage points, which is in line with guidance issued by the Investment Association. This authority will be reduced by the amount of any allotments or grants made under paragraphs (A) and (C) of resolution 17 to ensure that the total amount of Allotments which may be made under paragraphs (A) and (B) of resolution 17 does not exceed one-third of the total issued ordinary share capital of the Company and that the total amount of Allotments which may be made under paragraphs (A), (B) and (C) of resolution 17 does not exceed the Allotment Limit. The HKLR does not permit the Directors to allot, on a non-preemptive basis, shares or rights to shares that would represent more than 20 per cent of the total issued ordinary share capital as at the date on which the resolution granting them a general authority to allot is passed. Accordingly, paragraph (A) of resolution 17 restricts the authority of the Directors to the 20 per cent threshold. 12 Prudential plc Notice of Annual General Meeting 2024

Paragraph (C) of resolution 17 authorises the Directors to make Paragraph (D) of resolution 17 seeks authority from shareholders Allotments of an aggregate nominal amount equal to 91,564,017 under the HKLR for the Directors to make Allotments pursuant to the (representing approximately 1,831,280,349 ordinary shares in the Company’s share schemes or those of its subsidiary undertakings. Company) in connection with only a rights issue to ordinary The Directors intend to use the authorities sought under paragraph shareholders or holders of other equity securities. This authority will (D) of resolution 17 following the exercise of options and awards be reduced by the amount of any allotments or grants made under under the Company’s share schemes adopted prior to or on the date paragraphs (A) and (B) of resolution 17 to ensure that the total of the Meeting. amount of Allotments which may be made under paragraphs (A), (B) and (C) of resolution 17 does not exceed the Allotment Limit. This amount exceeds the 20 per cent authority in paragraph (A) Extension of authority to allot ordinary of resolution 17 by approximately 46 percentage points, which is in shares to include repurchased shares line with guidance issued by the Investment Association. Resolution 18. The Directors are aware of the latest Investment Association Share Capital Management Guidelines published in February 2023, which That the authority granted to the Directors to allot shares and update the previous guidance to incorporate all fully pre-emptive to grant rights to subscribe for or to convert any security into offers, not just fully pre-emptive rights issues, in respect of the shares up to a total nominal value of 27,496,701 pursuant to authority to allot a further (one-third) of the total issued ordinary paragraph (A) of resolution 17 set out above be extended by share capital of the Company. The Directors have decided that they the addition of such number of ordinary shares of five pence will limit Paragraph (C) of the allotment authority to rights issues this each representing the nominal amount of the Company’s share year, which reflects the terms of a waiver to Rule 7.19A(1) of the capital repurchased by the Company under the authority HKLR granted by the HKSE (as further described below in this granted pursuant to resolution 22 set out below, to the extent Explanatory Note). The Directors consider the current limitation to that such extension would not result in the authority to allot rights issues provides sufficient flexibility to the Company for present shares or grant rights to subscribe for or convert securities into purposes. shares pursuant to resolution 17 exceeding 91,564,017. Under Rule 7.19A(1) of the HKLR, if a proposed rights issue would Explanatory notes increase either the number of issued shares or the market As permitted by the HKLR, resolution 18 seeks to extend the capitalisation of the Company by more than 50 per cent (on its Directors’ authority to allot shares and grant rights to subscribe for or own or when aggregated with any other rights issues or open offers convert any security into shares pursuant to paragraph (A) of announced within the previous 12 months or prior to such 12-month resolution 17 to include any shares repurchased by the Company period where dealing in respect of the shares issued pursuant under the authority to be sought by resolution 22. thereto commenced within such 12-month period), then the issue must be made conditional on approval by minority shareholders in a general meeting by a resolution on which the directors (excluding independent non-executive directors) and their associates must abstain from voting. However, the HKSE has granted a waiver to the Company on 4 May 2010 from strict compliance with the above requirements in order to place the Company on an equal footing with other UK listed companies. The waiver has been granted on the basis that: A. the directors (excluding independent non-executive directors) and their associates would abstain from voting on the relevant resolution in their capacity as shareholders at the Meeting; and B. if the Company were to do a further rights issue, the Company would not need to obtain further minority shareholder approval under Rule 7.19A(1) of the HKLR provided that: a. the market capitalisation of the Company will not increase by more than 50 per cent as a result of the proposed rights issue; and b. the votes of any new Directors appointed to the Board since the Meeting would not have made a difference to the outcome of the relevant resolution at the Meeting if they had been shareholders at the time and they had in fact abstained from voting. Prudential plc Notice of Annual General Meeting 2024 13

Notice of Annual General Meeting and explanatory notes continuedRenewal of authority to allot preference shares Resolution 19. That the Company be and is hereby authorised to allot and to grant rights to subscribe for or to convert securities into Sterling Preference Shares up to a maximum aggregate nominal value of Ł20 million (representing two billion Sterling Preference Shares in the Company), to allot and to grant rights to subscribe for or to convert securities into Dollar Preference Shares up to a maximum aggregate nominal value of US$20 million (representing two billion Dollar Preference Shares in the Company), and to allot and to grant rights to subscribe for or to convert securities into Euro Preference Shares up to a maximum aggregate nominal value of €20 million (representing two billion Euro Preference Shares in the Company) for a period expiring at the conclusion of the Annual General Meeting of the Company to be held in 2029, save that the Company may make offers and enter into agreements under this authority prior to its expiry which would, or might, require shares to be allotted or rights to subscribe for or to convert securities into shares to be granted after such expiry, and the Board may allot shares or grant rights to subscribe for or to convert securities into shares under any such offer or agreement as if the said authority had not expired. Explanatory notes The Company obtained shareholder approval in May 2019 to allot preference shares. This approval lasts five years and expires in May 2024. The renewal of this authority is primarily sought to preserve the Company’s ability to structure hybrid regulatory capital issues which it might decide to make based on future financing needs and market conditions. The Directors have no immediate plans to make use of this authority, which will expire in five years from the date of this resolution. Rule 13.36(2)(b) of the HKLR provides that the Company may seek a general mandate from its shareholders to allot or issue securities subject to a restriction that the aggregate number of securities allotted must not exceed the aggregate of 20 per cent of the existing issued share capital of the Company. The Company sought, and the HKSE granted, a waiver to the Company on 1 April 2014 from strict compliance with Rule 13.36(2)(b) of the HKLR such that the Company (a) was permitted to seek the five-year mandate from its shareholders for allotting preference shares in May 2014 and (b) is able to renew such five-year mandate periodically without being subject to Rule 13.36(2)(b) of the HKLR. As such, the Company is not required to seek an equivalent waiver from the HKSE in relation to the authorities sought in this resolution or any replacement authorities that may be sought in five years’ time. Renewal of authority for disapplication of pre-emption rights Resolution 20. That if resolutions 17 and/or 18 are passed the Directors be and are hereby authorised to allot equity securities (as defined in Section 560(1) of the 2006 Act) for cash pursuant to the power conferred on the Directors by resolutions 17 and/or 18 and/or to sell any ordinary shares held by the Company as treasury shares for cash as if Section 561 of that Act did not apply to such allotment or sale for a period expiring at the earlier of 30 June 2025 and the conclusion of the Annual General Meeting of the Company to be held in 2025 (save that the Company may make offers and enter into agreements under this authority prior to its expiry which would, or might, require equity securities to be allotted (or treasury shares to be sold) after such expiry, and the Board may allot equity securities (or sell treasury shares) under any such offer or agreement as if the said authority had not expired), such authority to be limited: A. to the allotment of equity securities and sale of treasury shares in connection with an offer of, or an invitation to apply for, equity securities in accordance with paragraphs (B) and (C) of resolution 17 above; and B. otherwise than under paragraph (A) above, in the case of any allotment of equity securities and sale of treasury shares the maximum aggregate nominal amount of equity securities that may be allotted or sold pursuant to this authority under the authority conferred on the Directors by paragraph (A) of resolution 17 and/or 18 and/or a sale of ordinary shares held by the Company as treasury shares for cash is Ł6,874,175.Explanatory notes At last year’s Annual General Meeting, shareholders passed a special resolution giving the Directors authority to allot equity securities for cash without first being required to offer such securities to existing shareholders in proportion to their existing holdings, by the limited disapplication of Section 561 of the 2006 Act. That power will expire at the conclusion of this year’s Meeting. Accordingly, the Notice includes a special resolution to renew this authority. This authority only extends (apart from pre-emptive issues) to the issue of equity securities, including the sale of any ordinary shares held in treasury in accordance with the provisions of Chapter 6 of Part 18 of the 2006 Act. As at 7 April 2024 the Company held no treasury shares. The authority is sought for a maximum nominal value of 6,874,175 representing approximately 137,483,509 ordinary shares in the Company, which is approximately 5 per cent of the total issued ordinary share capital of the Company as at 7 April 2024. As regards rights issues and other pre-emptive issues, the Directors believe the mechanics and delay of the procedure under Section 561 are unduly restrictive and are therefore also seeking continuation of its disapplication in these circumstances. 14 Prudential plc Notice of Annual General Meeting 2024

Annual renewal of this authority is sought in line with the Statement of Principles on Disapplying Pre-Emption Rights published by the Pre-Emption Group in 2022 (the ‘Statement of Principles 2022’). In respect of the authorities sought under resolutions 20 and 21, the Directors acknowledge the provisions of the Statement of Principles 2022 and the revised guidelines on share capital management issued by UK’s Investment Association which include an increase in the dis-application of pre-emption rights limits. However, at this time, the Directors consider it appropriate to retain the previous limits of 5 per cent of the total issued ordinary share capital of the Company in resolutions 20 and 21 and have not adopted the increased limits of 10 per cent set out in the Statement of Principles 2022, nor do the resolutions specifically provide for follow-on offers. The Directors will keep emerging market practice under review but consider that the limits of 5 per cent provide sufficient flexibility to the Company for present purposes. While there are no current plans to make use of the authority granted in resolutions 20 and 21, if the powers are used in relation to a non-pre-emptive offer, the Directors confirm their intention to follow the shareholder protections in paragraph 1 of Part 2B of the Statement of Principles 2022. While the resolutions do not specifically provide for follow-on offers, where relevant, the Directors confirm their intention to follow the expected features of a follow-on offer as set out in paragraph 3 of Part 2B of the Statement of Principles 2022.This renewed authority complies with UK institutional investment guidelines and will expire at the earlier of 30 June 2025 and the conclusion of the 2025 Annual General Meeting. Additional authority for disapplication of pre-emption rights for purposes of acquisitions or specified capital investments Resolution 21. That if resolutions 17 and 18 are passed the Directors be and are hereby authorised in addition to any authority granted under resolution 18 to allot equity securities (as defined in Section 560(1) of the 2006 Act) for cash pursuant to the power conferred on the Directors by resolutions 17 and/or 18 and/or to sell any ordinary shares held by the Company as treasury shares for cash as if Section 561 of that Act did not apply to such allotment or sale for a period expiring at the earlier of 30 June 2025 and the conclusion of the Annual General Meeting of the Company to be held in 2025 (save that the Company may make offers and enter into agreements under this authority prior to its expiry which would, or might, require equity securities to be allotted (or treasury shares to be sold) after such expiry, and the Board may allot equity securities (or sell treasury shares) under any such offer or agreement as if the said authority had not expired), such authority to be: A. limited to the allotment of equity securities and sale of treasury shares up to a nominal amount of Ł6,874,175; and B. used only for the purposes of financing (or refinancing, if the authority is to be used within twelve months after the original transaction) a transaction which the Board determines to be either an acquisition or a specified capital investment of a kind contemplated by the Statement of Principles 2022. Explanatory notes In line with the guidance in the Statement of Principles 2022, resolution 21 requests shareholder approval, by way of a separate special resolution, for the Directors to allot equity securities or sell treasury shares for cash in connection with acquisitions or capital investments without first being required to offer such securities to existing shareholders in proportion to their existing holdings, in addition to the general authority to disapply pre-emption rights sought under resolution 20. In accordance with the Statement of Principles 2022, the Directors confirm that this authority will only be used in connection with an acquisition or specified capital investment that is announced contemporaneously with the issue, or that has taken place in the preceding twelve month period and is disclosed in the announcement of the issue. This authority only extends to the issue of equity securities, including the sale of any ordinary shares held in treasury in accordance with the provisions of Chapter 6 of Part 18 of the 2006 Act. As at 7 April 2024 the Company held no treasury shares. The authority is sought for a maximum nominal value of 6,874,175 representing approximately 137,483,509 ordinary shares in the Company, which is approximately 5 per cent of the issued ordinary share capital of the Company as at 7 April 2024, the latest practicable date prior to publication of this Notice. While the Directors have no present intention of exercising this specific authority to disapply pre-emption rights, the Directors consider that the authority sought at this year’s Meeting will benefit the Company and its shareholders generally since there may be occasions in the future when the Directors need the flexibility to finance acquisitions or capital investments by issuing shares for cash without a pre-emptive offer to existing shareholders. Prudential plc Notice of Annual General Meeting 2024 15

Notice of Annual General Meeting and explanatory notes continuedRenewal of authority for purchase of own shares Resolution 22.That the Company be and is hereby generally and unconditionally authorised, in accordance with Section 701 of the 2006 Act, to make one or more market purchases (within the meaning of Section 693(4) of the 2006 Act) of its ordinary shares in the capital of the Company, provided that: A. Such authority be limited: i. to a maximum aggregate number of 274,967,019 ordinary shares; ii. by the condition that the minimum price which may be paid for each ordinary share is five pence and the maximum price which may be paid for an ordinary share is the highest of: a. an amount equal to 105 per cent of the average of the middle market quotations for an ordinary share as derived from the Daily Official List of the London Stock Exchange for the five business days immediately preceding the day on which the share is contracted to be purchased; and b. the higher of the price of the last independent trade and the highest current independent bid on the trading venues where the purchase is carried out, in each case exclusive of expenses; B. Such authority shall, unless renewed, varied or revoked prior to such time, expire at the earlier of 30 June 2025 and the conclusion of the Annual General Meeting of the Company to be held in 2025, save that the Company may before such expiry make a contract or contracts to purchase ordinary shares under the authority hereby conferred which would or may be executed wholly or partly after the expiry of such authority and may make a purchase of ordinary shares in pursuance of any such contract or contracts as if the power conferred hereby had not expired; and C. All ordinary shares purchased pursuant to said authority shall be either: i. cancelled immediately upon completion of the purchase; or ii. held, sold, transferred or otherwise dealt with as treasury shares in accordance with the provisions of the 2006 Act. Explanatory notes The Directors consider that there may be circumstances in which it would be desirable for the Company to purchase its own shares in the market. The Directors believe that it is an important part of the financial management of the Company to have the flexibility to repurchase issued shares in order to manage its capital base. The Company will only seek to purchase shares where the Directors believe this would be in the best interests of shareholders generally, which may include, for example, to return capital to shareholders, or to manage share dilution from the vesting of awards under its employee and agent share plans or the take-up of any scrip dividend option if a scrip dividend alternative were to be offered (see explanatory notes to resolution 23). The authority will only be used after careful consideration, taking into account market conditions prevailing at the time, other investment and financing opportunities and the overall financial position of the Company, as well as other relevant factors and circumstances at that time, for example the effect on earnings per share. No purchases of shares would be conducted on the HKSE. Accordingly, this resolution is proposed to authorise the Company to make market purchases of its ordinary shares up to a maximum nominal value of 13,748,350, representing 274,967,019 ordinary shares which is approximately 10 per cent of the Company’s issued share capital as at 7 April 2024, at prices not lower than five pence per ordinary share and not exceeding the highest of (i) 105 per cent of the average middle-market value of an ordinary share for the five business days preceding the date of purchase and (ii) the higher of the price of the last independent trade and the highest current independent bid on the trading venues where the purchase is carried out. The Company may retain any shares it purchases as treasury shares with a view to possible reissue at a future date or may cancel the shares. If the Company were to purchase any of its own ordinary shares, it would consider holding them as treasury shares pursuant to the authority conferred by this resolution. This would enable the Company to reissue such shares quickly and cost-effectively and would provide the Company with additional flexibility in the management of its capital base. This authority will expire at the earlier of 30 June 2025 and the conclusion of the 2025 Annual General Meeting. A waiver from strict compliance with Rule 10.06(5) of the HKLR was granted by the HKSE on 4 May 2010 (and updated on 24 February 2016, 29 April 2021, 21 March 2022 and 18 April 2023). Under Rule 10.06(5) of the HKLR, the listing of all shares which are purchased by the Company shall automatically be cancelled upon purchase and the Company must apply for listing of any further issues in the normal way. As a consequence of this waiver, Rule 10.06(5) of the HKLR has been amended such that shares purchased by the Company to hold as treasury shares will remain listed and the listing will not be suspended or cancelled and any subsequent sale of such treasury shares or transfer of such treasury shares pursuant to an employees’ share scheme shall not, for the purposes of the HKLR, constitute a new issue of shares and shall not require a new listing application to be made. In accordance with the terms of this waiver, the Company confirms that it complies with the applicable law and regulation in the UK in relation to the holding of shares in treasury and with the conditions of the waiver in connection with the purchase of own shares and any treasury shares it may hold. 16 Prudential plc Notice of Annual General Meeting 2024

The Company has options and awards outstanding over 3,621,701 ordinary shares, representing approximately 0.13 per cent of the Notice for general meetings Company’s ordinary issued share capital as at 7 April 2024 (the latest practicable date prior to the publication of this Notice). If the Resolution 24. existing authority given at the 2023 Annual General Meeting and That a general meeting other than an Annual General Meeting the authority sought by this resolution 22 were to be fully used these may be called on not less than 14 clear days’ notice. outstanding options and awards would represent 0.16 per cent of the Company’s ordinary issued share capital at that date. Explanatory notes Under the 2006 Act, the notice period required for general meetings Authority to allot ordinary shares instead of of the Company is 21 clear days unless shareholders approve a cash in respect of any dividend paid shorter notice period (which cannot however be less than 14 clear days). Annual General Meetings are still required to be held on at Resolution 23. least 21 ‘clear days’ notice. Approval for a shorter notice period was sought and received from shareholders at the last Annual General That the Directors be empowered, up to the conclusion of the Meeting and to preserve this ability, this resolution 24 seeks renewal Annual General Meeting of the Company to be held in 2027, to of the approval for a notice period of 14 days to apply to general exercise the powers in Article 160 of the Company’s Articles of meetings. The shorter notice period will not be used as a matter of Association (as from time to time varied), to the extent and in routine, but only where flexibility is merited by the business of the the manner determined by the Directors, to offer and allot meeting and is thought to be to the advantage of shareholders as a ordinary shares (credited as fully paid) instead of cash in whole. If used, an electronic voting facility will be provided. respect of any dividend or any part of any dividend declared or paid from time to time, or for such period as the Directors may Annual General Meetings will continue to be held on at least 21 clear determine, and for such purposes to capitalise the appropriate days’ notice. nominal amounts out of the sums standing to the credit of any The approval will be effective until the earlier of 30 June 2025 or the reserve or account of the Company, to the extent that the conclusion of the Company’s 2025 Annual General Meeting when it Directors decide, at their discretion, to offer a scrip dividend is intended that a similar resolution will be proposed. alternative in respect of any such dividend or period. Explanatory notes By order of the Board of Directors Under the Company’s Articles of Association, the Directors may operate a scrip dividend alternative which gives shareholders the right to elect to receive additional ordinary shares credited as fully paid instead of cash in respect of any dividend or any part of any Tom Clarkson dividend. The Directors would have the power to adopt an Company Secretary ‘evergreen’ scheme that allows shareholders to elect to receive 22 April 2024 additional shares for every dividend paid, until they notify the Company that their election is cancelled. This resolution empowers the Board to make a scrip dividend alternative available for a three-year period in line with the Investment Association Share Capital Management Guidelines. The Company does not currently offer a scrip dividend alternative, but shareholder approval is being sought for the flexibility it offers. The Company is exploring the use of a scrip dividend alternative which would involve issuance of relevant new ordinary shares only on the Hong Kong line. If a scrip dividend alternative were to be offered, the Company would seek to actively manage the dilutive effect of resulting share issuances (for example, by buying back shares). Prudential plc Notice of Annual General Meeting 2024 17

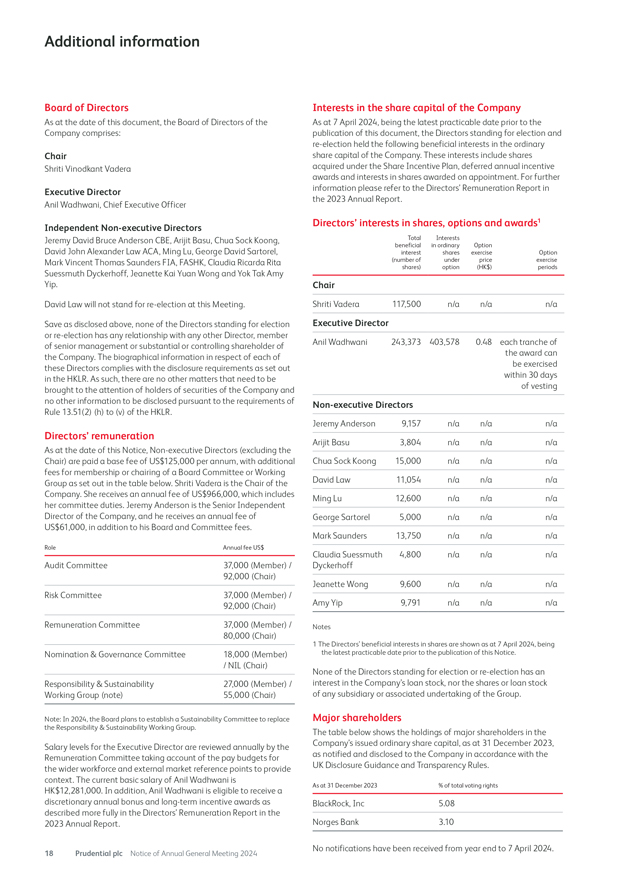

Additional information Board of Directors As at the date of this document, the Board of Directors of the Company comprises: Chair Shriti Vinodkant Vadera Executive Director Anil Wadhwani, Chief Executive Officer Independent Non-executive Directors Jeremy David Bruce Anderson CBE, Arijit Basu, Chua Sock Koong, David John Alexander Law ACA, Ming Lu, George David Sartorel, Mark Vincent Thomas Saunders FIA, FASHK, Claudia Ricarda Rita Suessmuth Dyckerhoff, Jeanette Kai Yuan Wong and Yok Tak Amy Yip. David Law will not stand for re-election at this Meeting. Save as disclosed above, none of the Directors standing for election or re-election has any relationship with any other Director, member of senior management or substantial or controlling shareholder of the Company. The biographical information in respect of each of these Directors complies with the disclosure requirements as set out in the HKLR. As such, there are no other matters that need to be brought to the attention of holders of securities of the Company and no other information to be disclosed pursuant to the requirements of Rule 13.51(2) (h) to (v) of the HKLR. Directors’ remuneration As at the date of this Notice, Non-executive Directors (excluding the Chair) are paid a base fee of US$125,000 per annum, with additional fees for membership or chairing of a Board Committee or Working Group as set out in the table below. Shriti Vadera is the Chair of the Company. She receives an annual fee of US$966,000, which includes her committee duties. Jeremy Anderson is the Senior Independent Director of the Company, and he receives an annual fee of US$61,000, in addition to his Board and Committee fees. Role Annual fee US$ Audit Committee 37,000 (Member) / 92,000 (Chair) Risk Committee 37,000 (Member) / 92,000 (Chair) Remuneration Committee 37,000 (Member) / 80,000 (Chair) Nomination & Governance Committee 18,000 (Member) / NIL (Chair) Responsibility & Sustainability 27,000 (Member) / Working Group (note) 55,000 (Chair)Note: In 2024, the Board plans to establish a Sustainability Committee to replace the Responsibility & Sustainability Working Group. Salary levels for the Executive Director are reviewed annually by the Remuneration Committee taking account of the pay budgets for the wider workforce and external market reference points to provide context. The current basic salary of Anil Wadhwani is HK$12,281,000. In addition, Anil Wadhwani is eligible to receive a discretionary annual bonus and long-term incentive awards as described more fully in the Directors’ Remuneration Report in the 2023 Annual Report. Interests in the share capital of the Company As at 7 April 2024, being the latest practicable date prior to the publication of this document, the Directors standing for election and re-election held the following beneficial interests in the ordinary share capital of the Company. These interests include shares acquired under the Share Incentive Plan, deferred annual incentive awards and interests in shares awarded on appointment. For further information please refer to the Directors’ Remuneration Report in the 2023 Annual Report. Directors’ interests in shares, options and awards1 Total Interests beneficial in ordinary Option interest shares exercise Option (number of under price exercise shares) option (HK$) periodsChair Shriti Vadera 117,500 n/a n/a n/a Executive DirectorAnil Wadhwani 243,373 403,578 0.48 each tranche of the award can be exercised within 30 days of vestingNon-executive DirectorsJeremy Anderson 9,157 n/a n/a n/a Arijit Basu 3,804 n/a n/a n/a Chua Sock Koong 15,000 n/a n/a n/a David Law 11,054 n/a n/a n/a Ming Lu 12,600 n/a n/a n/a George Sartorel 5,000 n/a n/a n/a Mark Saunders 13,750 n/a n/a n/a Claudia Suessmuth 4,800 n/a n/a n/a Dyckerhoff Jeanette Wong 9,600 n/a n/a n/a Amy Yip 9,791 n/a n/a n/a Notes 1 The Directors’ beneficial interests in shares are shown as at 7 April 2024, being the latest practicable date prior to the publication of this Notice. None of the Directors standing for election or re-election has an interest in the Company’s loan stock, nor the shares or loan stock of any subsidiary or associated undertaking of the Group. Major shareholders The table below shows the holdings of major shareholders in the Company’s issued ordinary share capital, as at 31 December 2023, as notified and disclosed to the Company in accordance with the UK Disclosure Guidance and Transparency Rules. As at 31 December 2023 % of total voting rights BlackRock, Inc 5.08 Norges Bank 3.10 No notifications have been received from year end to 7 April 2024. 18 Prudential plc Notice of Annual General Meeting 2024

Notes to Notice of Meeting Appointing a proxy 1. Members are entitled to appoint a proxy to exercise all or any of their rights to attend, speak and vote on their behalf at the Meeting. A shareholder may appoint more than one proxy in relation to the Meeting provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that shareholder. Where more than one proxy is appointed, members must specify the number of shares each proxy is entitled to exercise. A proxy need not be a shareholder of the Company. 2. Members’ attention is drawn to the Form of Proxy accompanying this Notice. A proxy may be appointed by any of the following methods: i. Completing and returning the enclosed Form of Proxy; ii. For members on the UK register, electronic proxy appointment by logging in to the website of Equiniti, the Company’s registrar, at www.sharevote.co.uk. Shareholders will need their Voting ID, Task ID and Shareholder Reference Number, which are printed on the accompanying Form of Proxy. Full details of the procedures are given on the website. If you have already registered with Equiniti’s online portfolio service Shareview, you may submit your proxy vote by logging in to your portfolio at www.shareview.co.uk using your user ID and password. Once logged in simply click ‘View’ on the ‘My Investments’ page, click on the link to vote, then follow the on-screen instructions; iii. If you are an institutional investor, you may be able to appoint a proxy electronically via the Proxymity platform, a process which has been agreed by the Company and approved by the Registrar. For further information regarding Proxymity, please go to www.proxymity.io. Your proxy must be lodged by 4.30pm Hong Kong/Singapore time (9.30am London time) on 21 May 2024 to be considered valid. Before you can appoint a proxy via this process you will need to have agreed to Proxymity’s associated terms and conditions. It is important that you read these carefully as you will be bound by them and they will govern the electronic appointment of your proxy; or iv. If you are a member of CREST, by using the CREST electronic appointment service. IMPORTANT: Whichever method you choose, your instructions or Form of Proxy must be received by the registrar no later than 4.30pm Hong Kong/Singapore time (9.30am London time) on 21 May 2024. Any person holding an interest in shares through CDP must submit the completed Form of Proxy to CDP, and should note that CDP must receive voting instructions by 5.00pm Singapore time on 13 May 2024 to allow it to collate voting instructions for onward transmission to Computershare Hong Kong Investor Services Limited (‘Computershare Hong Kong’), the Hong Kong branch share registrar, by the deadline above. 3. If you are a registered shareholder and do not have a Form of Proxy and believe that you should have one, or if you require additional forms, or would like to request a hard copy of the 2023 Annual Report, please contact Equiniti on +44 (0) 371 384 2035 or Computershare Hong Kong on +852 2862 8555. Lines at Equiniti are open from 8.30am to 5.30pm London time Monday to Friday, excluding bank holidays in England and Wales. Lines at Computershare Hong Kong are open from 9.00am to 6.00pm (Hong Kong time) Monday to Friday, excluding public holidays in Hong Kong. 4. To be valid, a Form of Proxy, or other instrument appointing a proxy, must be received by post at Equiniti Limited, Aspect House, Spencer Road, Lancing, West Sussex, BN99 6GJ no later than 9.30am London time on 21 May 2024 or at Computershare Hong Kong Investor Services Limited, 17M Floor, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong no later than 4.30pm Hong Kong/Singapore time on 21 May 2024. Any person holding an interest in shares through CDP must submit the completed Form of Proxy to CDP, and should note that CDP must receive voting instructions by 5.00pm Singapore time on 13 May 2024 to allow it to collate voting instructions for onward transmission to Computershare Hong Kong, the Hong Kong branch registrar, by the deadline above. 5. The return of a completed Form of Proxy, other such instrument or any CREST Proxy Instruction (as described in paragraph 11 below) will not prevent a shareholder attending the Meeting and voting in person, or via the Lumi platform, if they wish to do so. 6. Any person to whom this Notice is sent who is a person nominated under Section 146 of the 2006 Act to enjoy information rights (a nominated person) may, under an agreement between him/her and the shareholder by whom he/ she was nominated, have a right to be appointed (or to have someone else appointed) as a proxy for the Meeting. If a nominated person has no such proxy appointment right or does not wish to exercise it, he/she may, under any such agreement, have a right to give instructions to the shareholder as to the exercise of voting rights. 7. The statement of the rights of shareholders in relation to the appointment of proxies in paragraphs 1 to 4 above does not apply to nominated persons. The rights described in these paragraphs can only be exercised by registered shareholders of the Company. 8. CREST members who wish to appoint a proxy or proxies through the CREST electronic proxy appointment service may do so by using the procedures described in the CREST Manual. CREST personal members or other CREST sponsored members, and those CREST members who have appointed a service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf. Prudential plc Notice of Annual General Meeting 2024 19