UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 18, 2024

Blackstone Inc.

(Exact name of Registrant as specified in its charter)

| Delaware |

001-33551 |

20-8875684 |

||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| 345 Park Avenue New York, New York |

10154 (Zip Code) |

|

| (Address of principal executive offices) |

(212) 583-5000

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock | BX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On April 18, 2024, Blackstone Inc. issued a press release and detailed presentation announcing financial results for its first quarter ended March 31, 2024.

The press release is attached hereto as Exhibit 99.1. All information in the press release is furnished but not filed.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description |

|

| 99.1 | Press release of Blackstone Inc. dated April 18, 2024. | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | |

i

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 18, 2024

| Blackstone Inc. | ||

| By: | /s/ Michael S. Chae | |

| Name: | Michael S. Chae | |

| Title: | Chief Financial Officer |

ii

Exhibit 99.1

|

|

Blackstone Reports First Quarter 2024 Results

New York, April 18, 2024: Blackstone (NYSE:BX) today reported its first quarter 2024 results.

Stephen A. Schwarzman, Chairman and Chief Executive Officer, said, “Blackstone reported strong first-quarter

results, highlighted by accelerating momentum in our private credit and private wealth businesses. We are seeing a

strengthening transaction environment and attractive opportunities to deploy capital. We are well positioned to

navigate today’s dynamic market landscape, with a portfolio concentrated in compelling sectors and nearly

$200 billion of dry powder available to invest.”

Blackstone issued a full detailed presentation of its first quarter 2024 results, which can be viewed at

www.blackstone.com.

Dividend

Blackstone has declared a quarterly dividend of $0.83 per share to record holders of common stock at the close of

business on April 29, 2024. This dividend will be paid on May 6, 2024.

Quarterly Investor Call Details

Blackstone will host its first quarter 2024 investor conference via public webcast on April 18, 2024 at 9:00 a.m. ET.

To register, please use the following link:

https://event.webcasts.com/viewer/event.jsp?ei=1662836&tp_key=79511c5e2b. For those unable to listen to the

|

Blackstone 345 Park Avenue, New York, NY 10154 T 212 583 5000 www.blackstone.com |

||

live broadcast, there will be a webcast replay on the Shareholders section of Blackstone’s website at

https://ir.blackstone.com/.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We seek to deliver compelling returns for institutional

and individual investors by strengthening the companies in which we invest. Our more than $1 trillion in assets

under management include global investment strategies focused on real estate, private equity, infrastructure, life

sciences, growth equity, credit, real assets, secondaries and hedge funds. Further information is available at

www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter), and Instagram.

Forward-Looking Statements

This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our

current views with respect to, among other things, our operations, taxes, earnings and financial performance, share

repurchases and dividends. You can identify these forward-looking statements by the use of words such as

“outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,”

“approximately,” “predicts,” “intends,” “plans,” “scheduled,” “estimates,” “anticipates,” “opportunity,” “leads,”

“forecast” or the negative version of these words or other comparable words. Such forward-looking statements are

subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause

actual outcomes or results to differ materially from those indicated in these statements. We believe these factors

include but are not limited to those described under the section entitled “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2023, as such factors may be updated from time to time in our periodic

filings with the United States Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s

website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction

with the other cautionary statements that are included in this report and in our other periodic filings. The forward-

looking statements speak only as of the date of this report, and we undertake no obligation to publicly update or

review any forward-looking statement, whether as a result of new information, future developments or otherwise.

|

2 |

||

This presentation does not constitute an offer of any Blackstone Fund.

Investor and Media Relations Contacts

| Weston Tucker Blackstone Tel: +1 (212) 583-5231 tucker@blackstone.com |

Christine Anderson Blackstone Tel: +1 (212) 583-5182 christine.anderson@blackstone.com |

|

3 |

||

Blackstone’s First

Quarter 2024 Earnings

APRIL 18, 2024

BLACKSTONE’S FIRST QUARTER 2024 GAAP RESULTS

| § |

GAAP Net Income was $1.6 billion for the quarter and $3.8 billion over the last twelve months (“LTM”). GAAP Net Income Attributable to Blackstone Inc. was $847 million for the quarter and $2.2 billion over the LTM. |

| ($ in thousands, except per share data) (unaudited) | 1Q’23 | 1Q’24 | 1Q’23 LTM | 1Q’24 LTM | |||||||||||||||||||||

| Revenues |

|||||||||||||||||||||||||

| Management and Advisory Fees, Net |

$ | 1,658,315 | $ | 1,727,148 | $ | 6,485,694 | $ | 6,740,093 | |||||||||||||||||

| Incentive Fees |

142,876 | 179,341 | 563,514 | 731,636 | |||||||||||||||||||||

| Performance Allocations |

(112,318 | ) | 1,098,460 | (1,225,170 | ) | 1,742,951 | |||||||||||||||||||

| Principal Investments |

(383,359 | ) | 540,220 | (1,455,946 | ) | 624,248 | |||||||||||||||||||

| Interest and Dividend Revenue |

90,485 | 97,839 | 307,612 | 523,851 | |||||||||||||||||||||

| Other |

(14,154 | ) | 44,820 | 97,534 | (33,955 | ) | |||||||||||||||||||

| Total Revenues |

$ | 1,381,845 | $ | 3,687,828 | $ | 4,773,238 | $ | 10,328,824 | |||||||||||||||||

| Expenses |

|||||||||||||||||||||||||

| Compensation and Benefits |

763,111 | 1,308,304 | 2,408,156 | 3,858,163 | |||||||||||||||||||||

| General, Administrative and Other |

273,394 | 369,950 | 1,125,391 | 1,213,861 | |||||||||||||||||||||

| Interest Expense |

104,441 | 108,203 | 354,919 | 435,630 | |||||||||||||||||||||

| Fund Expenses |

48,399 | 3,950 | 76,882 | 74,538 | |||||||||||||||||||||

| Total Expenses |

$ | 1,189,345 | $ | 1,790,407 | $ | 3,965,348 | $ | 5,582,192 | |||||||||||||||||

| Other Income (Loss) |

$ | 65,856 | $ | (17,767 | ) | $ | (68,640 | ) | $ | (167,620 | ) | ||||||||||||||

| Income Before Provision for Taxes |

$ | 258,356 | $ | 1,879,654 | $ | 739,250 | $ | 4,579,012 | |||||||||||||||||

| Provision for Taxes |

47,675 | 283,671 | 37,274 | 749,457 | |||||||||||||||||||||

| Net Income |

$ | 210,681 | $ | 1,595,983 | $ | 701,976 | $ | 3,829,555 | |||||||||||||||||

| Redeemable NCI in Consolidated Entities |

(6,700 | ) | (39,669 | ) | (154,642 | ) | (278,487 | ) | |||||||||||||||||

| Non-Redeemable NCI in Consolidated Entities |

131,569 | 788,266 | 240,049 | 1,955,588 | |||||||||||||||||||||

| Net Income Attributable to Blackstone Inc. (‘‘BX’’) |

$ | 85,812 | $ | 847,386 | $ | 616,569 | $ | 2,152,454 | |||||||||||||||||

| Net Income Per Share of Common Stock, Basic |

$ | 0.12 | $ | 1.12 | $ | 0.83 | $ | 2.84 | |||||||||||||||||

| Net Income Per Share of Common Stock, Diluted |

$ | 0.11 | $ | 1.11 | $ | 0.83 | $ | 2.84 | |||||||||||||||||

| Throughout this presentation, all current period amounts are preliminary and unaudited. Totals may not add due to rounding. See pages 36-38, Definitions and Dividend Policy, for definitions of terms used throughout this presentation. NCI means non-controlling interests. |

Blackstone | 1 |

|

BLACKSTONE’S FIRST QUARTER 2024 HIGHLIGHTS

| Financial Measures |

§ Fee Related Earnings (“FRE”) of $1.2 billion ($0.95/share) in the quarter

– FRE was $4.5 billion over the LTM ($3.67/share)

§ Distributable Earnings (“DE”) of $1.3 billion ($0.98/share) in the quarter

– DE was $5.1 billion over the LTM ($3.96/share)

§ Net Accrued Performance Revenues of $6.1 billion ($5.00/share)

|

|

| Capital Metrics |

§ Total Assets Under Management (“AUM”) of $1,061.3 billion

– Fee-Earning AUM of $781.4 billion

– Perpetual Capital AUM of $408.1 billion

§ Inflows of $34.0 billion in the quarter and $142.2 billion over the LTM

§ Deployment of $24.5 billion in the quarter and $87.5 billion over the LTM

§ Realizations of $15.0 billion in the quarter and $62.8 billion over the LTM

|

|

| Capital Returned to Shareholders |

§ Dividend of $0.83 per common share payable on May 6, 2024

– Dividends of $3.36 per common share over the LTM

§ Repurchased 0.7 million common shares in the quarter and 3.4 million common shares over the LTM

§ $1.2 billion to be distributed to shareholders with respect to the first quarter and $4.7 billion over the LTM through dividends and share repurchases

|

|

Blackstone | 2 |

||

BLACKSTONE’S FIRST QUARTER 2024 SEGMENT EARNINGS

|

% Change |

% Change |

||||||||||||||||||||||||||

| ($ in thousands, except per share data) | 1Q’23 | 1Q’24 | vs. 1Q’23 | 1Q’23 LTM | 1Q’24 LTM | vs. 1Q’23 LTM | |||||||||||||||||||||

| Management and Advisory Fees, Net |

$ |

1,652,387 |

$ |

1,707,571 |

|

3% |

|

$ |

6,461,965 |

$ |

6,718,428 |

4% |

|||||||||||||||

| Fee Related Performance Revenues |

|

148,244 |

|

295,501 |

|

99% |

|

|

1,039,676 |

|

1,005,784 |

(3)% |

|||||||||||||||

| Fee Related Compensation |

|

(508,971 |

) |

|

(554,077 |

) |

|

9% |

|

|

(2,169,275 |

) |

|

(2,133,216 |

) |

(2)% |

|||||||||||

| Other Operating Expenses |

|

(251,648 |

) |

|

(288,978 |

) |

|

15% |

|

|

(1,026,573 |

) |

|

(1,121,663 |

) |

9% |

|||||||||||

| Fee Related Earnings |

$ |

1,040,012 |

$ |

1,160,017 |

|

12% |

|

$ |

4,305,793 |

$ |

4,469,333 |

4% |

|||||||||||||||

|

|

|||||||||||||||||||||||||||

| Realized Performance Revenues |

|

641,526 |

|

536,393 |

|

(16)% |

|

|

3,790,054 |

|

1,955,969 |

(48)% |

|||||||||||||||

| Realized Performance Compensation |

|

(296,024 |

) |

|

(253,024 |

) |

|

(15)% |

|

|

(1,591,001 |

) |

|

(853,017 |

) |

(46)% |

|||||||||||

| Realized Principal Investment Income |

|

43,691 |

|

9,938 |

|

(77)% |

|

|

282,852 |

|

77,179 |

(73)% |

|||||||||||||||

| Net Realizations |

|

389,193 |

|

293,307 |

|

(25)% |

|

|

2,481,905 |

|

1,180,131 |

(52)% |

|||||||||||||||

| Total Segment Distributable Earnings |

$ |

1,429,205 |

$ |

1,453,324 |

|

2% |

|

$ |

6,787,698 |

$ |

5,649,464 |

(17)% |

|||||||||||||||

|

|

|||||||||||||||||||||||||||

| Distributable Earnings |

$ |

1,249,092 |

$ |

1,266,378 |

|

1% |

|

$ |

5,943,992 |

$ |

5,078,241 |

(15)% |

|||||||||||||||

|

|

|||||||||||||||||||||||||||

| Additional Metrics: |

|||||||||||||||||||||||||||

| Net Income Per Share of Common Stock, Basic |

$ |

0.12 |

$ |

1.12 |

|

833% |

|

$ |

0.83 |

$ |

2.84 |

242% |

|||||||||||||||

| FRE per Share |

$ |

0.86 |

$ |

0.95 |

|

10% |

|

$ |

3.56 |

$ |

3.67 |

3% |

|||||||||||||||

| DE per Common Share |

$ |

0.97 |

$ |

0.98 |

|

1% |

|

$ |

4.59 |

$ |

3.96 |

(14)% |

|||||||||||||||

| Total Segment Revenues |

$ |

2,485,848 |

$ |

2,549,403 |

|

3% |

|

$ |

11,574,547 |

$ |

9,757,360 |

(16)% |

|||||||||||||||

| Total Assets Under Management |

$ |

991,293,596 |

$ |

1,061,262,748 |

|

7% |

|

$ |

991,293,596 |

$ |

1,061,262,748 |

7% |

|||||||||||||||

|

Fee-Earning Assets Under Management |

$ |

731,973,409 |

$ |

781,397,555 |

|

7% |

|

$ |

731,973,409 |

$ |

781,397,555 |

7% |

|||||||||||||||

| Fee Related Earnings per Share is based on end of period DE Shares Outstanding (see page 24, Share Summary). DE per Common Share is based on DE Attributable to Common Shareholders (see page 23, Shareholder Dividends) and end of period Participating Common Shares outstanding. LTM FRE per Share and DE per Common Share amounts represent the sum of the last four quarters. See pages 32-33 for the Reconciliation of GAAP to Total Segment Measures. |

Blackstone | 3 |

|

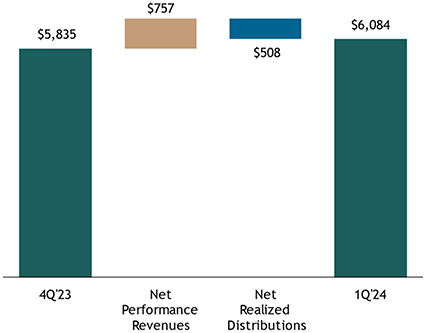

INVESTMENT PERFORMANCE AND NET ACCRUED PERFORMANCE REVENUES

| § |

Appreciation across strategies led to higher Net Accrued Performance Revenues quarter-over-quarter of $6.1 billion ($5.00/share). |

Investment Performance

(appreciation / gross returns)

| 1Q’24 | 1Q’24 LTM | |||||||||||

| Real Estate |

||||||||||||

| Opportunistic |

0.3% | (5.6)% | ||||||||||

| Core+ |

1.2% | (1.5)% | ||||||||||

| Private Equity |

||||||||||||

| Corporate Private Equity |

3.4% | 12.7% | ||||||||||

| Tactical Opportunities |

2.1% | 6.8% | ||||||||||

| Secondaries |

2.2% | 3.4% | ||||||||||

| Infrastructure |

4.8% | 18.9% | ||||||||||

| Credit & Insurance |

||||||||||||

| Private Credit |

4.1% | 17.2% | ||||||||||

| Liquid Credit |

2.5% | 12.4% | ||||||||||

| Multi-Asset Investing |

||||||||||||

| Absolute Return Composite |

4.6% | 11.7% | ||||||||||

Net Accrued Performance Revenues

($ in millions)

| Investment Performance represents fund appreciation for Real Estate and Private Equity and gross returns for Credit & Insurance and Multi-Asset Investing. Private Credit net returns were 3.1% and 12.6% for 1Q’24 and 1Q’24 LTM, respectively. Liquid Credit net returns were 2.3% and 11.8% for 1Q’24 and 1Q’24 LTM, respectively. Absolute Return Composite net returns were 4.3% and 10.7% for 1Q’24 and 1Q’24 LTM, respectively. See notes on page 34 for additional details on investment performance. Effective 1Q’24, the Hedge Fund Solutions segment was renamed “Multi-Asset Investing” (“BXMA”) and the BPS Composite was renamed “Absolute Return Composite”. |

Blackstone | 4 |

|

CAPITAL METRICS – ADDITIONAL DETAIL

| § | Inflows were $34.0 billion in the quarter, bringing LTM inflows to $142.2 billion. |

| § | Deployed $24.5 billion in the quarter and $87.5 billion over the LTM. |

| – | Committed an additional $11.0 billion that was not yet deployed in the quarter. |

| § | Realizations were $15.0 billion in the quarter and $62.8 billion over the LTM. |

| Inflows | Capital Deployed | Realizations | ||||||||||||||||||||||||||

| ($ in millions) | 1Q’24 | 1Q’24 LTM | 1Q’24 | 1Q’24 LTM | 1Q’24 | 1Q’24 LTM | ||||||||||||||||||||||

| Real Estate |

$ |

8,089 |

|

$ |

44,966 |

|

$ |

4,797 |

|

$ |

17,795 |

|

$ |

3,847 |

|

$ |

18,168 |

|

||||||||||

| Opportunistic |

|

2,321 |

|

|

9,062 |

|

|

819 |

|

|

6,807 |

|

|

470 |

|

|

3,271 |

|

||||||||||

| Core+ |

|

2,208 |

|

|

11,289 |

|

|

1,420 |

|

|

3,440 |

|

|

2,166 |

|

|

10,955 |

|

||||||||||

| BREDS |

|

3,560 |

|

|

24,615 |

|

|

2,558 |

|

|

7,547 |

|

|

1,211 |

|

|

3,941 |

|

||||||||||

| Private Equity |

|

7,360 |

|

|

26,601 |

|

|

7,341 |

|

|

28,250 |

|

|

5,219 |

|

|

19,826 |

|

||||||||||

| Corporate Private Equity |

|

3,394 |

|

|

12,332 |

|

|

3,418 |

|

|

12,939 |

|

|

2,508 |

|

|

11,158 |

|

||||||||||

| Tactical Opportunities |

|

1,130 |

|

|

4,800 |

|

|

1,523 |

|

|

3,783 |

|

|

1,484 |

|

|

3,086 |

|

||||||||||

| Secondaries |

|

1,108 |

|

|

6,043 |

|

|

2,080 |

|

|

6,483 |

|

|

1,122 |

|

|

4,861 |

|

||||||||||

| Infrastructure |

|

1,729 |

|

|

3,426 |

|

|

319 |

|

|

5,046 |

|

|

104 |

|

|

721 |

|

||||||||||

| Credit & Insurance |

|

17,194 |

|

|

63,103 |

|

|

11,956 |

|

|

38,135 |

|

|

5,543 |

|

|

21,335 |

|

||||||||||

| Multi-Asset Investing |

|

1,398 |

|

|

7,530 |

|

|

433 |

|

|

3,315 |

|

|

436 |

|

|

3,455 |

|

||||||||||

| Total Blackstone |

$ |

34,042 |

|

$ |

142,200 |

|

$ |

24,526 |

|

$ |

87,495 |

|

$ |

15,045 |

|

$ |

62,784 |

|

||||||||||

| Corporate Private Equity also includes Life Sciences, Blackstone Growth (effective 1Q’24 with prior periods recast), BTAS, and BXPE. AUM and related capital metrics are reported in the segment where the assets are managed. See note on page 34 for additional details on segment organizational updates. |

Blackstone | 5 |

|

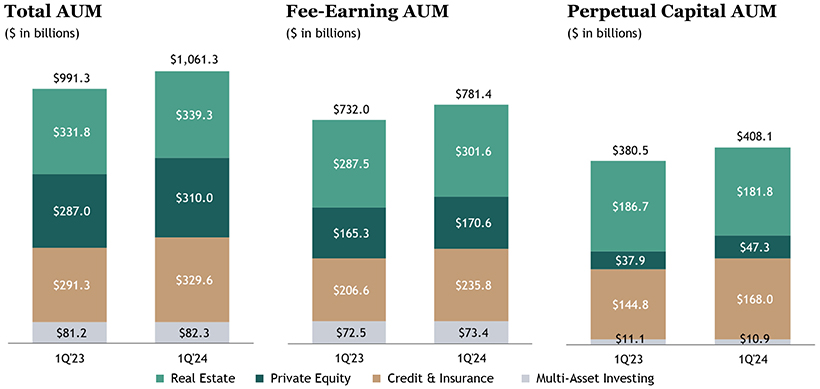

ASSETS UNDER MANAGEMENT

| § |

Total AUM increased to $1,061.3 billion, up 7% year-over-year, with $34.0 billion of inflows in the quarter and $142.2 billion over the LTM. |

| § |

Fee-Earning AUM of $781.4 billion was up 7% year-over-year, with $29.0 billion of inflows in the quarter and $116.4 billion over the LTM. |

| § |

Perpetual Capital AUM reached $408.1 billion, up 7% year-over-year. |

| – | Fee-Earning Perpetual Capital AUM increased to $351.7 billion, representing 45% of Fee-Earning AUM. |

|

Blackstone | 6 |

||

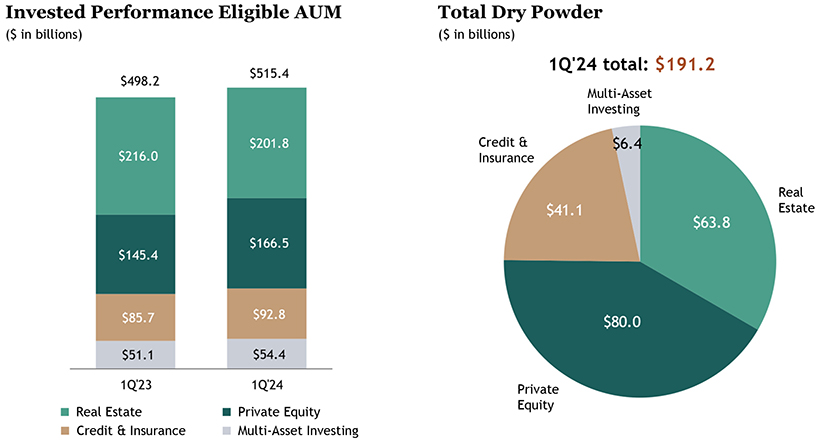

ADDITIONAL CAPITAL DETAIL

| § |

Invested Performance Eligible AUM reached $515.4 billion at quarter end. |

| § |

Undrawn capital (“Total Dry Powder”) available for investment of $191.2 billion. |

| Invested Performance Eligible AUM represents the fair value of invested assets that are eligible to earn performance revenues. |

Blackstone | 7 |

|

Segment Highlights

|

Blackstone | 8 |

||

SEGMENT DISTRIBUTABLE EARNINGS COMPOSITION

| § |

1Q’24 Total Segment Distributable Earnings were $1.5 billion. |

| § |

LTM Total Segment Distributable Earnings were $5.6 billion. |

| Segment Distributable Earnings

($ in millions) |

||

|

|

|

|

|

Blackstone | 9 |

||

REAL ESTATE

| § | Total AUM: Increased 2% to $339.3 billion with inflows of $8.1 billion in the quarter and $45.0 billion over the LTM. |

| – | Inflows in the quarter included $2.5 billion in BREDS Insurance SMAs, $2.2 billion in the seventh European opportunistic fund, $807 million of capital raised in BREIT, and $606 million in the fifth real estate debt strategies fund. |

| § | Capital Deployed: $4.8 billion in the quarter and $17.8 billion over the LTM. |

| – | Committed an additional $2.9 billion in the quarter, including the privatization of Tricon Residential by BREP and BREIT. |

| – | Subsequent to quarter end, BREP committed to the privatization of Apartment Income REIT Corp. |

| § | Realizations: $3.8 billion in the quarter and $18.2 billion over the LTM. |

| – | Realizations in the quarter included the sale by BREIT of its remaining interest in Phoenix Tower International, the sale of Arc Place Korean Office by BPP, and the sale of U.S. industrial assets across BREP and Core+. |

| § | Appreciation: Opportunistic funds appreciated 0.3% in the quarter and declined (5.6)% over the LTM; Core+ funds appreciated 1.2% in the quarter and declined (1.5)% over the LTM. |

| % Change | % Change | |||||||||||||||||||||||

| ($ in thousands) | 1Q’23 | 1Q’24 | vs. 1Q’23 | 1Q’23 LTM | 1Q’24 LTM | vs. 1Q’23 LTM | ||||||||||||||||||

| Management Fees, Net |

$ |

715,491 |

$ |

720,439 |

1% |

$ |

2,718,845 |

$ |

2,848,306 |

5% |

||||||||||||||

| Fee Related Performance Revenues |

|

20,748 |

|

129,958 |

526% |

|

604,655 |

|

403,450 |

(33)% |

||||||||||||||

| Fee Related Compensation |

|

(137,610 |

) |

|

(174,569 |

) |

27% |

|

(831,893 |

) |

|

(712,839 |

) |

(14)% |

||||||||||

| Other Operating Expenses |

|

(74,181 |

) |

|

(89,762 |

) |

21% |

|

(323,509 |

) |

|

(340,631 |

) |

5% |

||||||||||

| Fee Related Earnings |

$ |

524,448 |

$ |

586,066 |

12% |

$ |

2,168,098 |

$ |

2,198,286 |

1% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Realized Performance Revenues |

|

11,096 |

|

49,967 |

350% |

|

2,193,893 |

|

283,229 |

(87)% |

||||||||||||||

| Realized Performance Compensation |

|

(3,165 |

) |

|

(21,863 |

) |

591% |

|

(881,179 |

) |

|

(141,997 |

) |

(84)% |

||||||||||

| Realized Principal Investment Income |

|

2,224 |

|

2,193 |

(1)% |

|

99,039 |

|

7,597 |

(92)% |

||||||||||||||

| Net Realizations |

|

10,155 |

|

30,297 |

198% |

|

1,411,753 |

|

148,829 |

(89)% |

||||||||||||||

| Segment Distributable Earnings |

$ |

534,603 |

$ |

616,363 |

15% |

$ |

3,579,851 |

$ |

2,347,115 |

(34)% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Segment Revenues |

$ |

749,559 |

$ |

902,557 |

20% |

$ |

5,616,432 |

$ |

3,542,582 |

(37)% |

||||||||||||||

| Total AUM |

$ |

331,797,338 |

$ |

339,332,420 |

2% |

$ |

331,797,338 |

$ |

339,332,420 |

2% |

||||||||||||||

| Fee-Earning AUM |

$ |

287,497,306 |

$ |

301,583,557 |

5% |

$ |

287,497,306 |

$ |

301,583,557 |

5% |

||||||||||||||

|

Blackstone | 10 |

||

PRIVATE EQUITY

| § | Total AUM: Increased 8% to $310.0 billion with inflows of $7.4 billion in the quarter and $26.6 billion over the LTM. |

| – | Inflows in the quarter included $1.7 billion in Infrastructure and $1.4 billion for the ninth flagship private equity fund. |

| – | $2.7 billion of capital raised in Blackstone Private Equity Strategies Fund Program (“BXPE”), including amounts allocated to other segments. |

| § | Capital Deployed: $7.3 billion in the quarter, including Rover and 7 Brew, and $28.3 billion over the LTM. |

| – | Committed an additional $2.8 billion in the quarter, including Life Sciences’ transaction with Moderna, Inc. |

| § | Realizations: $5.2 billion in the quarter, including in Refinitiv, Phoenix Tower International, and Beacon Offshore Energy, and $19.8 billion over the LTM. |

| § | Appreciation: Corporate Private Equity appreciated 3.4% in the quarter and 12.7% over the LTM. |

| – | Tactical Opportunities appreciated 2.1% in the quarter and 6.8% over the LTM; Secondaries appreciated 2.2% in the quarter and 3.4% over the LTM; Infrastructure appreciated 4.8% in the quarter and 18.9% over the LTM. |

| % Change | % Change | |||||||||||||||||||||||

| ($ in thousands) | 1Q’23 | 1Q’24 | vs. 1Q’23 | 1Q’23 LTM | 1Q’24 LTM | vs. 1Q’23 LTM | ||||||||||||||||||

| Management and Advisory Fees, Net |

$ |

465,084 |

$ |

476,165 |

2% |

$ |

1,886,833 |

$ |

1,919,445 |

2% |

||||||||||||||

| Fee Related Compensation |

|

(161,626 |

) |

|

(157,392 |

) |

(3)% |

|

(585,770 |

) |

|

(591,435 |

) |

1% |

||||||||||

| Other Operating Expenses |

|

(76,763 |

) |

|

(86,879 |

) |

13% |

|

(313,196 |

) |

|

(326,857 |

) |

4% |

||||||||||

| Fee Related Earnings |

$ |

226,695 |

$ |

231,894 |

2% |

$ |

987,867 |

$ |

1,001,153 |

1% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Realized Performance Revenues |

|

499,322 |

|

446,455 |

(11)% |

|

1,240,112 |

|

1,215,616 |

(2)% |

||||||||||||||

| Realized Performance Compensation |

|

(232,934 |

) |

|

(218,938 |

) |

(6)% |

|

(570,460 |

) |

|

(544,649 |

) |

(5)% |

||||||||||

| Realized Principal Investment Income |

|

32,889 |

|

22,208 |

(32)% |

|

107,218 |

|

56,452 |

(47)% |

||||||||||||||

| Net Realizations |

|

299,277 |

|

249,725 |

(17)% |

|

776,870 |

|

727,419 |

(6)% |

||||||||||||||

| Segment Distributable Earnings |

$ |

525,972 |

$ |

481,619 |

(8)% |

$ |

1,764,737 |

$ |

1,728,572 |

(2)% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Segment Revenues |

$ |

997,295 |

$ |

944,828 |

(5)% |

$ |

3,234,163 |

$ |

3,191,513 |

(1)% |

||||||||||||||

| Total AUM |

$ |

287,048,441 |

$ |

309,999,029 |

8% |

$ |

287,048,441 |

$ |

309,999,029 |

8% |

||||||||||||||

| Fee-Earning AUM |

$ |

165,343,505 |

$ |

170,604,390 |

3% |

$ |

165,343,505 |

$ |

170,604,390 |

3% |

||||||||||||||

|

Blackstone | 11 |

||

CREDIT & INSURANCE

| § | Total AUM: Increased 13% to $329.6 billion with inflows of $17.2 billion in the quarter and $63.1 billion over the LTM. |

| – | Inflows in the quarter included $7.3 billion for the global direct lending strategy, inclusive of $2.9 billion of equity raised for BCRED, and $5.3 billion for the infrastructure and asset based credit strategies. |

| – | Closed 3 new U.S. CLOs for $1.4 billion. |

| § | Capital Deployed: $12.0 billion in the quarter and $38.1 billion over the LTM driven by U.S. direct lending as well as infrastructure and asset based credit strategies. |

| – | Committed an additional $5.3 billion that was not yet deployed in the quarter. |

| § | Realizations: $5.5 billion in the quarter and $21.3 billion over the LTM. |

| § | Returns: Private Credit gross return of 4.1% (3.1% net) and Liquid Credit gross return of 2.5% (2.3% net) in the quarter. |

| – | Private Credit gross return of 17.2% (12.6% net) and Liquid Credit gross return of 12.4% (11.8% net) over the LTM. |

| % Change | % Change | |||||||||||||||||||||||

| ($ in thousands) | 1Q’23 | 1Q’24 | vs. 1Q’23 | 1Q’23 LTM | 1Q’24 LTM | vs. 1Q’23 LTM | ||||||||||||||||||

| Management Fees, Net |

$ |

334,129 |

$ |

379,896 |

14% |

$ |

1,293,808 |

$ |

1,421,828 |

10% |

||||||||||||||

| Fee Related Performance Revenues |

|

127,496 |

|

165,543 |

30% |

|

435,021 |

|

602,334 |

38% |

||||||||||||||

| Fee Related Compensation |

|

(163,999 |

) |

|

(181,337 |

) |

11% |

|

(566,439 |

) |

|

(657,528 |

) |

16% |

||||||||||

| Other Operating Expenses |

|

(74,238 |

) |

|

(85,530 |

) |

15% |

|

(281,252 |

) |

|

(339,026 |

) |

21% |

||||||||||

| Fee Related Earnings |

$ |

223,388 |

$ |

278,572 |

25% |

$ |

881,138 |

$ |

1,027,608 |

17% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Realized Performance Revenues |

|

125,181 |

|

15,120 |

(88)% |

|

241,851 |

|

207,699 |

(14)% |

||||||||||||||

| Realized Performance Compensation |

|

(56,772 |

) |

|

(5,445 |

) |

(90)% |

|

(107,232 |

) |

|

(89,163 |

) |

(17)% |

||||||||||

| Realized Principal Investment Income |

|

6,009 |

|

3,597 |

(40)% |

|

64,221 |

|

19,485 |

(70)% |

||||||||||||||

| Net Realizations |

|

74,418 |

|

13,272 |

(82)% |

|

198,840 |

|

138,021 |

(31)% |

||||||||||||||

| Segment Distributable Earnings |

$ |

297,806 |

$ |

291,844 |

(2)% |

$ |

1,079,978 |

$ |

1,165,629 |

8% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Segment Revenues |

$ |

592,815 |

$ |

564,156 |

(5)% |

$ |

2,034,901 |

$ |

2,251,346 |

11% |

||||||||||||||

| Total AUM |

$ |

291,268,846 |

$ |

329,636,429 |

13% |

$ |

291,268,846 |

$ |

329,636,429 |

13% |

||||||||||||||

| Fee-Earning AUM |

$ |

206,622,922 |

$ |

235,826,905 |

14% |

$ |

206,622,922 |

$ |

235,826,905 |

14% |

||||||||||||||

| See note on page 34 for additional details on infrastructure and asset based credit strategies. |

Blackstone | 12 |

|

MULTI-ASSET INVESTING

| § | Total AUM: Increased 1% to $82.3 billion with inflows of $1.4 billion in the quarter and $7.5 billion over the LTM. |

| § | Returns: Absolute Return Composite gross return of 4.6% in the quarter (4.3% net), outperforming the HFRX Global Hedge Fund Index, which was 2.5%. |

| – | Absolute Return benefited from performance across strategies, including quantitative, equities, macro, and credit during the quarter. |

| – | Gross returns of 11.7% over the LTM (10.7% net), with significantly less volatility than the broader markets, compared to 5.7% return for the HFRX Global Hedge Fund Index. |

| % Change | % Change | |||||||||||||||||||||||

| ($ in thousands) | 1Q’23 | 1Q’24 | vs. 1Q’23 | 1Q’23 LTM | 1Q’24 LTM | vs. 1Q’23 LTM | ||||||||||||||||||

| Management Fees, Net |

$ |

137,683 |

$ |

131,071 |

(5)% |

$ |

562,479 |

$ |

528,849 |

(6)% |

||||||||||||||

| Fee Related Compensation |

|

(45,736 |

) |

|

(40,779 |

) |

(11)% |

|

(185,173 |

) |

|

(171,414 |

) |

(7)% |

||||||||||

| Other Operating Expenses |

|

(26,466 |

) |

|

(26,807 |

) |

1% |

|

(108,616 |

) |

|

(115,149 |

) |

6% |

||||||||||

| Fee Related Earnings |

$ |

65,481 |

$ |

63,485 |

(3)% |

$ |

268,690 |

$ |

242,286 |

(10)% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Realized Performance Revenues |

|

5,927 |

|

24,851 |

319% |

|

114,198 |

|

249,425 |

118% |

||||||||||||||

| Realized Performance Compensation |

|

(3,153 |

) |

|

(6,778 |

) |

115% |

|

(32,130 |

) |

|

(77,208 |

) |

140% |

||||||||||

| Realized Principal Investment Income (Loss) |

|

2,569 |

|

(18,060 |

) |

n/m |

|

12,374 |

|

(6,355 |

) |

n/m |

||||||||||||

| Net Realizations |

|

5,343 |

|

13 |

(100)% |

|

94,442 |

|

165,862 |

76% |

||||||||||||||

| Segment Distributable Earnings |

$ |

70,824 |

$ |

63,498 |

(10)% |

$ |

363,132 |

$ |

408,148 |

12% |

||||||||||||||

|

|

||||||||||||||||||||||||

| Segment Revenues |

$ |

146,179 |

$ |

137,862 |

(6)% |

$ |

689,051 |

$ |

771,919 |

12% |

||||||||||||||

| Total AUM |

$ |

81,178,971 |

$ |

82,294,870 |

1% |

$ |

81,178,971 |

$ |

82,294,870 |

1% |

||||||||||||||

| Fee-Earning AUM |

$ |

72,509,676 |

$ |

73,382,703 |

1% |

$ |

72,509,676 |

$ |

73,382,703 |

1% |

||||||||||||||

|

Blackstone | 13 |

||

Supplemental Details

|

Blackstone | 14 |

||

TOTAL SEGMENTS

| ($ in thousands) | 1Q’23 | 2Q’23 | 3Q’23 | 4Q’23 | 1Q’24 | 1Q’23 LTM | 1Q’24 LTM | ||||||||||||||||||||||||||||

| Base Management Fees |

$ | 1,619,547 | $ | 1,620,609 | $ | 1,619,743 | $ | 1,605,948 | $ | 1,644,730 | $ | 6,225,436 | $ | 6,491,030 | |||||||||||||||||||||

| Transaction, Advisory and Other Fees, Net |

45,710 | 92,735 | 44,611 | 52,836 | 66,938 | 291,818 | 257,120 | ||||||||||||||||||||||||||||

| Management Fee Offsets |

(12,870 | ) | (10,158 | ) | (10,514 | ) | (4,953 | ) | (4,097 | ) | (55,289 | ) | (29,722 | ) | |||||||||||||||||||||

| Total Management and Advisory Fees, Net |

1,652,387 | 1,703,186 | 1,653,840 | 1,653,831 | 1,707,571 | 6,461,965 | 6,718,428 | ||||||||||||||||||||||||||||

| Fee Related Performance Revenues |

148,244 | 266,738 | 274,551 | 168,994 | 295,501 | 1,039,676 | 1,005,784 | ||||||||||||||||||||||||||||

| Fee Related Compensation |

(508,971 | ) | (568,808 | ) | (539,923 | ) | (470,408 | ) | (554,077 | ) | (2,169,275 | ) | (2,133,216 | ) | |||||||||||||||||||||

| Other Operating Expenses |

(251,648 | ) | (257,366 | ) | (264,445 | ) | (310,874 | ) | (288,978 | ) | (1,026,573 | ) | (1,121,663 | ) | |||||||||||||||||||||

| Fee Related Earnings |

$ | 1,040,012 | $ | 1,143,750 | $ | 1,124,023 | $ | 1,041,543 | $ | 1,160,017 | $ | 4,305,793 | $ | 4,469,333 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

| Realized Performance Revenues |

641,526 | 388,423 | 337,940 | 693,213 | 536,393 | 3,790,054 | 1,955,969 | ||||||||||||||||||||||||||||

| Realized Performance Compensation |

(296,024 | ) | (178,370 | ) | (133,995 | ) | (287,628 | ) | (253,024 | ) | (1,591,001 | ) | (853,017 | ) | |||||||||||||||||||||

| Realized Principal Investment Income (Loss) |

43,691 | (7,461 | ) | 55,500 | 19,202 | 9,938 | 282,852 | 77,179 | |||||||||||||||||||||||||||

| Total Net Realizations |

$ | 389,193 | $ | 202,592 | $ | 259,445 | $ | 424,787 | $ | 293,307 | $ | 2,481,905 | $ | 1,180,131 | |||||||||||||||||||||

| Total Segment Distributable Earnings |

$ | 1,429,205 | $ | 1,346,342 | $ | 1,383,468 | $ | 1,466,330 | $ | 1,453,324 | $ | 6,787,698 | $ | 5,649,464 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

| Distributable Earnings |

$ | 1,249,092 | $ | 1,212,072 | $ | 1,211,611 | $ | 1,388,180 | $ | 1,266,378 | $ | 5,943,992 | $ | 5,078,241 | |||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

| Additional Metrics: |

|||||||||||||||||||||||||||||||||||

| Total Segment Revenues |

$ | 2,485,848 | $ | 2,350,886 | $ | 2,321,831 | $ | 2,535,240 | $ | 2,549,403 | $ | 11,574,547 | $ | 9,757,360 | |||||||||||||||||||||

| Total Assets Under Management |

$ | 991,293,596 | $ | 1,001,355,959 | $ | 1,007,353,458 | $ | 1,040,192,447 | $ | 1,061,262,748 | $ | 991,293,596 | $ | 1,061,262,748 | |||||||||||||||||||||

| Fee-Earning Assets Under Management |

$ | 731,973,409 | $ | 731,145,065 | $ | 734,541,603 | $ | 762,607,902 | $ | 781,397,555 | $ | 731,973,409 | $ | 781,397,555 | |||||||||||||||||||||

|

Blackstone | 15 |

||

ASSETS UNDER MANAGEMENT – ROLLFORWARD

Total AUM Rollforward

($ in millions)

| Three Months Ended March 31, 2024 | Twelve Months Ended March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real

Estate |

Private

Equity |

Credit &

Insurance |

Multi-Asset

Investing |

Total | Real

Estate |

Private

Equity |

Credit &

Insurance |

Multi-Asset

Investing |

Total | ||||||||||||||||||||||||||||||||||||||||||||||

| Beginning Balance |

$ |

336,940 |

$ |

304,038 |

$ |

318,916 |

$ |

80,298 |

$ |

1,040,192 |

$ |

331,797 |

$ |

287,048 |

$ |

291,269 |

$ |

81,179 |

$ |

991,294 |

|||||||||||||||||||||||||||||||||||

| Inflows |

|

8,089 |

|

7,360 |

|

17,194 |

|

1,398 |

|

34,042 |

|

44,966 |

|

26,601 |

|

63,103 |

|

7,530 |

|

142,200 |

|||||||||||||||||||||||||||||||||||

| Outflows |

|

(3,233 |

) |

|

(1,805 |

) |

|

(4,350 |

) |

|

(1,694 |

) |

|

(11,082 |

) |

|

(14,847 |

) |

|

(4,258 |

) |

|

(16,813 |

) |

|

(10,068 |

) |

|

(45,985 |

) |

|||||||||||||||||||||||||

| Net Flows |

|

4,856 |

|

5,555 |

|

12,845 |

|

(296 |

) |

|

22,959 |

|

30,119 |

|

22,343 |

|

46,290 |

|

(2,538 |

) |

|

96,215 |

|||||||||||||||||||||||||||||||||

| Realizations |

|

(3,847 |

) |

|

(5,219 |

) |

|

(5,543 |

) |

|

(436 |

) |

|

(15,045 |

) |

|

(18,168 |

) |

|

(19,826 |

) |

|

(21,335 |

) |

|

(3,455 |

) |

|

(62,784 |

) |

|||||||||||||||||||||||||

| Market Activity |

|

1,383 |

|

5,625 |

|

3,420 |

|

2,728 |

|

13,156 |

|

(4,416 |

) |

|

20,434 |

|

13,413 |

|

7,108 |

|

36,538 |

||||||||||||||||||||||||||||||||||

| Ending Balance |

$ |

339,332 |

$ |

309,999 |

$ |

329,636 |

$ |

82,295 |

$ |

1,061,263 |

$ |

339,332 |

$ |

309,999 |

$ |

329,636 |

$ |

82,295 |

$ |

1,061,263 |

|||||||||||||||||||||||||||||||||||

| % Change |

|

1% |

|

|

2% |

|

|

3% |

|

|

2% |

|

|

2% |

|

|

2% |

|

|

8% |

|

|

13% |

|

|

1% |

|

|

7% |

|

|||||||||||||||||||||||||

Fee-Earning AUM Rollforward

($ in millions)

| Three Months Ended March 31, 2024 | Twelve Months Ended March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real

Estate |

Private

Equity |

Credit &

Insurance |

Multi-Asset

Investing |

Total | Real

Estate |

Private

Equity |

Credit &

Insurance |

Multi-Asset

Investing |

Total | ||||||||||||||||||||||||||||||||||||||||||||||

| Beginning Balance |

$ |

298,889 |

$ |

168,621 |

$ |

223,844 |

$ |

71,254 |

$ |

762,608 |

$ |

287,497 |

$ |

165,344 |

$ |

206,623 |

$ |

72,510 |

$ |

731,973 |

|||||||||||||||||||||||||||||||||||

| Inflows |

|

9,026 |

|

2,277 |

|

16,428 |

|

1,315 |

|

29,046 |

|

53,715 |

|

8,852 |

|

47,064 |

|

6,800 |

|

116,431 |

|||||||||||||||||||||||||||||||||||

| Outflows |

|

(3,175 |

) |

|

(218 |

) |

|

(2,120 |

) |

|

(1,287 |

) |

|

(6,800 |

) |

|

(17,610 |

) |

|

(811 |

) |

|

(11,788 |

) |

|

(9,327 |

) |

|

(39,535 |

) |

|||||||||||||||||||||||||

| Net Flows |

|

5,852 |

|

2,060 |

|

14,307 |

|

28 |

|

22,246 |

|

36,105 |

|

8,041 |

|

35,277 |

|

(2,527 |

) |

|

76,896 |

||||||||||||||||||||||||||||||||||

| Realizations |

|

(4,104 |

) |

|

(1,455 |

) |

|

(4,039 |

) |

|

(385 |

) |

|

(9,982 |

) |

|

(19,876 |

) |

|

(7,205 |

) |

|

(14,262 |

) |

|

(3,246 |

) |

|

(44,589 |

) |

|||||||||||||||||||||||||

| Market Activity |

|

946 |

|

1,379 |

|

1,714 |

|

2,486 |

|

6,526 |

|

(2,143 |

) |

|

4,425 |

|

8,189 |

|

6,647 |

|

17,118 |

||||||||||||||||||||||||||||||||||

| Ending Balance |

$ |

301,584 |

$ |

170,604 |

$ |

235,827 |

$ |

73,383 |

$ |

781,398 |

$ |

301,584 |

$ |

170,604 |

$ |

235,827 |

$ |

73,383 |

$ |

781,398 |

|||||||||||||||||||||||||||||||||||

| % Change |

|

1% |

|

|

1% |

|

|

5% |

|

|

3% |

|

|

2% |

|

|

5% |

|

|

3% |

|

|

14% |

|

|

1% |

|

|

7% |

|

|||||||||||||||||||||||||

| Inflows include contributions, capital raised, other increases in available capital (recallable capital and increased side-by-side commitments), purchases, inter-segment allocations and acquisitions. Outflows represent redemptions, client withdrawals and decreases in available capital (expired capital, expense drawdowns and decreased side-by-side commitments). Realizations represent realization proceeds from the disposition or other monetization of assets, current income or capital returned to investors from CLOs. Market Activity includes realized and unrealized gains (losses) on portfolio investments and the impact of foreign exchange rate fluctuations. AUM is reported in the segment where the assets are managed. |

Blackstone | 16 |

|

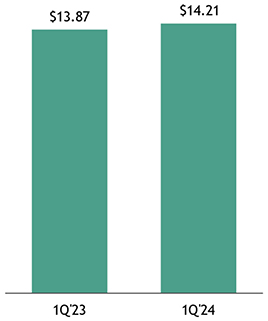

DECONSOLIDATED BALANCE SHEET HIGHLIGHTS

| § |

At March 31, 2024, Blackstone had $8.4 billion in total cash, cash equivalents, corporate treasury, and other investments and $17.3 billion of cash and net investments, or $14.21 per share. |

| § |

Blackstone has a $4.3 billion credit revolver and maintains A+/A+ ratings. |

| ($ in millions) |

1Q’24 | |||

| Cash and Cash Equivalents |

$ | 2,504 | ||

| Corporate Treasury and |

|

5,906

|

|

|

| GP/Fund Investments |

2,793 | |||

| Net Accrued Performance |

|

6,084

|

|

|

| Cash and Net Investments |

$ | 17,287 | ||

| Outstanding Debt (at par) |

10,698 | |||

Cash and Net Investments

(per share)

A+ / A+

rated by S&P and Fitch

$4.3B

credit revolver with

December 2028 maturity

$8.4B

total cash, corporate

treasury and other

| Balance Sheet Highlights exclude the consolidated Blackstone Funds. Other Investments was $5.0 billion as of March 31, 2024, which was comprised of $4.6 billion of liquid investments and $353 million of illiquid investments. See notes on pages 31 and 34 for additional details on non-GAAP balance sheet measures. |

Blackstone | 17 |

|

| NET ACCRUED PERFORMANCE REVENUES – ADDITIONAL DETAIL

|

| ($ in millions, except per share data) | 1Q’23 | 4Q’23 | 1Q’24 | 1Q’24 | ||||||||||||

| Per Share | ||||||||||||||||

| Real Estate |

||||||||||||||||

| BREP IV |

$ |

6 |

|

$ |

2 |

|

$ |

4 |

|

$ |

0.00 |

|

||||

| BREP V |

|

4 |

|

|

4 |

|

|

4 |

|

|

0.00 |

|

||||

| BREP VI |

|

19 |

|

|

1 |

|

|

2 |

|

|

0.00 |

|

||||

| BREP VII |

|

86 |

|

|

- |

|

|

- |

|

|

- |

|

||||

| BREP VIII |

|

717 |

|

|

572 |

|

|

585 |

|

|

0.48 |

|

||||

| BREP IX |

|

1,015 |

|

|

744 |

|

|

730 |

|

|

0.60 |

|

||||

| BREP Europe IV |

|

43 |

|

|

5 |

|

|

3 |

|

|

0.00 |

|

||||

| BREP Europe V |

|

28 |

|

|

- |

|

|

- |

|

|

- |

|

||||

| BREP Europe VI |

|

68 |

|

|

104 |

|

|

113 |

|

|

0.09 |

|

||||

| BREP Asia I |

|

104 |

|

|

92 |

|

|

89 |

|

|

0.07 |

|

||||

| BREP Asia II |

|

37 |

|

|

- |

|

|

- |

|

|

- |

|

||||

| BPP |

|

518 |

|

|

129 |

|

|

73 |

|

|

0.06 |

|

||||

| BREDS |

|

6 |

|

|

32 |

|

|

30 |

|

|

0.02 |

|

||||

| BTAS |

|

22 |

|

|

2 |

|

|

- |

|

|

- |

|

||||

| Real Estate |

$ |

2,672 |

|

$ |

1,687 |

|

$ |

1,632 |

|

$ |

1.34 |

|

||||

| Private Equity |

||||||||||||||||

| BCP IV |

|

6 |

|

|

- |

|

|

- |

|

|

- |

|

||||

| BCP V |

|

31 |

|

|

17 |

|

|

14 |

|

|

0.01 |

|

||||

| BCP VI |

|

407 |

|

|

340 |

|

|

335 |

|

|

0.28 |

|

||||

| BCP VII |

|

854 |

|

|

839 |

|

|

845 |

|

|

0.69 |

|

||||

| BCP VIII |

|

276 |

|

|

366 |

|

|

398 |

|

|

0.33 |

|

||||

| BCP Asia I |

|

95 |

|

|

149 |

|

|

140 |

|

|

0.11 |

|

||||

| BCP Asia II |

|

- |

|

|

32 |

|

|

40 |

|

|

0.03 |

|

||||

| BEP I |

|

26 |

|

|

25 |

|

|

29 |

|

|

0.02 |

|

||||

| BEP II |

|

2 |

|

|

78 |

|

|

138 |

|

|

0.11 |

|

||||

| BEP III |

|

158 |

|

|

203 |

|

|

227 |

|

|

0.19 |

|

||||

| BCEP |

|

213 |

|

|

234 |

|

|

230 |

|

|

0.19 |

|

||||

| Tactical Opportunities |

|

223 |

|

|

229 |

|

|

158 |

|

|

0.13 |

|

||||

| Secondaries |

|

511 |

|

|

478 |

|

|

501 |

|

|

0.41 |

|

||||

| Infrastructure |

|

158 |

|

|

333 |

|

|

389 |

|

|

0.32 |

|

||||

| Life Sciences |

|

29 |

|

|

82 |

|

|

85 |

|

|

0.07 |

|

||||

| BTAS/BXPE |

|

172 |

|

|

173 |

|

|

187 |

|

|

0.15 |

|

||||

| Private Equity |

$ |

3,161 |

|

$ |

3,581 |

|

$ |

3,717 |

|

$ |

3.05 |

|

||||

| Credit & Insurance |

$ |

239 |

|

$ |

286 |

|

$ |

355 |

|

$ |

0.29 |

|

||||

| Multi-Asset Investing |

$ |

300 |

|

$ |

281 |

|

$ |

380 |

|

$ |

0.31 |

|

||||

| Net Accrued Performance Revenues |

$ |

6,372 |

|

$ |

5,835 |

|

$ |

6,084 |

|

$ |

5.00 |

|

||||

1Q’24 QoQ Rollforward

($ in millions)

| Net | Net | |||||||||||||||||||

| Performance | Realized | |||||||||||||||||||

| 4Q’23 | Revenues | Distributions | 1Q’24 | |||||||||||||||||

| Real Estate |

$ | 1,687 | $ | 101 | $ | (156 | ) | $ | 1,632 | |||||||||||

| Private Equity |

3,581 | 364 | (228 | ) | 3,717 | |||||||||||||||

| Credit & |

286 | 175 | (106 | ) | 355 | |||||||||||||||

| Multi-Asset |

281 | 117 | (18 | ) | 380 | |||||||||||||||

| Total |

$ | 5,835 | $ | 757 | $ | (508 | ) | $ | 6,084 | |||||||||||

| QoQ Change |

4% | |||||||||||||||||||

1Q’24 LTM Rollforward

($ in millions)

| Net | Net | |||||||||||||||||||

| Performance | Realized | |||||||||||||||||||

| 1Q’23 | Revenues | Distributions | 1Q’24 | |||||||||||||||||

| Real Estate |

$ | 2,672 | $ | (527 | ) | $ | (513 | ) | $ | 1,632 | ||||||||||

| Private Equity |

3,161 | 1,226 | (671 | ) | 3,717 | |||||||||||||||

| Credit & |

239 | 590 | (473 | ) | 355 | |||||||||||||||

| Multi-Asset |

300 | 252 | (172 | ) | 380 | |||||||||||||||

| Total |

$ | 6,372 | $ | 1,542 | $ | (1,830 | ) | $ | 6,084 | |||||||||||

| YoY Change |

(5)% | |||||||||||||||||||

| Net Accrued Performance Revenues (“NAPR”) are presented net of performance compensation and excludes Performance Revenues realized but not yet distributed as of the reporting date and clawback amounts, if any, which are disclosed in the 10-K/Q. Real Estate and Private Equity include co-investments, as applicable. Per Share calculations are based on end of period DE Shares Outstanding (see page 24, Share Summary). |

Blackstone | 18 |

|

INVESTMENT RECORDS AS OF MARCH 31, 2024(a)

|

($/€ in thousands, except where noted)

Fund (Investment Period Beginning Date / Ending Date)

|

Committed Capital |

Available Capital (b) |

Unrealized Investments |

Realized Investments |

Total Investments |

Net IRRs (d) |

||||||||||||||||||||||||

| Value | MOIC (c) | Value | MOIC (c) | Value | MOIC (c) | Realized | Total | |||||||||||||||||||||||

| Real Estate |

||||||||||||||||||||||||||||||

| Pre-BREP |

$ |

140,714 |

|

$ |

- |

|

$ |

- |

|

n/a |

$ |

345,190 |

|

2.5x |

$ |

345,190 |

|

2.5x |

33% |

33% |

||||||||||

| BREP I (Sep 1994 / Oct 1996) |

|

380,708 |

|

|

- |

|

|

- |

|

n/a |

|

1,327,708 |

|

2.8x |

|

1,327,708 |

|

2.8x |

40% |

40% |

||||||||||

| BREP II (Oct 1996 / Mar 1999) |

|

1,198,339 |

|

|

- |

|

|

- |

|

n/a |

|

2,531,614 |

|

2.1x |

|

2,531,614 |

|

2.1x |

19% |

19% |

||||||||||

| BREP III (Apr 1999 / Apr 2003) |

|

1,522,708 |

|

|

- |

|

|

- |

|

n/a |

|

3,330,406 |

|

2.4x |

|

3,330,406 |

|

2.4x |

21% |

21% |

||||||||||

| BREP IV (Apr 2003 / Dec 2005) |

|

2,198,694 |

|

|

- |

|

|

3,170 |

|

n/a |

|

4,666,129 |

|

1.7x |

|

4,669,299 |

|

1.7x |

12% |

12% |

||||||||||

| BREP V (Dec 2005 / Feb 2007) |

|

5,539,418 |

|

|

- |

|

|

6,226 |

|

n/a |

|

13,463,448 |

|

2.3x |

|

13,469,674 |

|

2.3x |

11% |

11% |

||||||||||

| BREP VI (Feb 2007 / Aug 2011) |

|

11,060,122 |

|

|

- |

|

|

5,324 |

|

n/a |

|

27,760,883 |

|

2.5x |

|

27,766,207 |

|

2.5x |

13% |

13% |

||||||||||

| BREP VII (Aug 2011 / Apr 2015) |

|

13,503,329 |

|

|

1,225,034 |

|

|

1,956,790 |

|

0.6x |

|

28,403,367 |

|

2.3x |

|

30,360,157 |

|

1.9x |

20% |

14% |

||||||||||

| BREP VIII (Apr 2015 / Jun 2019) |

|

16,602,804 |

|

|

2,106,760 |

|

|

12,551,757 |

|

1.5x |

|

22,034,929 |

|

2.3x |

|

34,586,686 |

|

2.0x |

24% |

14% |

||||||||||

| BREP IX (Jun 2019 / Aug 2022) |

|

21,346,305 |

|

|

3,387,974 |

|

|

24,901,917 |

|

1.4x |

|

8,634,759 |

|

2.2x |

|

33,536,676 |

|

1.5x |

59% |

15% |

||||||||||

| *BREP X (Aug 2022 / Feb 2028) |

|

30,480,299 |

|

|

28,079,177 |

|

|

2,795,029 |

|

1.2x |

|

- |

|

n/a |

|

2,795,029 |

|

1.2x |

n/m |

n/m |

||||||||||

| Total Global BREP |

$ |

103,973,440 |

|

$ |

34,798,945 |

|

$ |

42,220,213 |

|

1.3x |

$ |

112,498,433 |

|

2.3x |

$ |

154,718,646 |

|

1.9x |

17% |

15% |

||||||||||

| BREP Int’l (Jan 2001 / Sep 2005) |

€ |

824,172 |

|

€ |

- |

|

€ |

- |

|

n/a |

€ |

1,373,170 |

|

2.1x |

€ |

1,373,170 |

|

2.1x |

23% |

23% |

||||||||||

| BREP Int’l II (Sep 2005 / Jun 2008) (e) |

|

1,629,748 |

|

|

- |

|

|

- |

|

n/a |

|

2,583,032 |

|

1.8x |

|

2,583,032 |

|

1.8x |

8% |

8% |

||||||||||

| BREP Europe III (Jun 2008 / Sep 2013) |

|

3,205,420 |

|

|

395,780 |

|

|

156,697 |

|

0.3x |

|

5,856,192 |

|

2.4x |

|

6,012,889 |

|

2.0x |

18% |

13% |

||||||||||

| BREP Europe IV (Sep 2013 / Dec 2016) |

|

6,676,581 |

|

|

1,098,498 |

|

|

1,253,628 |

|

0.8x |

|

10,027,832 |

|

1.9x |

|

11,281,460 |

|

1.7x |

19% |

12% |

||||||||||

| BREP Europe V (Dec 2016 / Oct 2019) |

|

7,981,358 |

|

|

1,097,156 |

|

|

4,576,200 |

|

0.9x |

|

6,757,417 |

|

3.8x |

|

11,333,617 |

|

1.6x |

41% |

9% |

||||||||||

| BREP Europe VI (Oct 2019 / Sep 2023) |

|

9,922,660 |

|

|

3,320,479 |

|

|

8,093,104 |

|

1.2x |

|

3,439,595 |

|

2.6x |

|

11,532,699 |

|

1.4x |

72% |

15% |

||||||||||

| *BREP Europe VII (Sep 2023 / Mar 2029) |

|

7,073,413 |

|

|

6,525,856 |

|

|

631,994 |

|

1.2x |

|

- |

|

n/a |

|

631,994 |

|

1.2x |

n/a |

n/a |

||||||||||

| Total BREP Europe |

€ |

37,313,352 |

|

€ |

12,437,769 |

|

€ |

14,711,623 |

|

1.0x |

€ |

30,037,238 |

|

2.3x |

€ |

44,748,861 |

|

1.6x |

17% |

11% |

||||||||||

| BREP Asia I (Jun 2013 / Dec 2017) |

$ |

4,262,075 |

|

$ |

898,228 |

|

$ |

1,614,155 |

|

1.6x |

$ |

7,023,539 |

|

1.9x |

$ |

8,637,694 |

|

1.9x |

16% |

12% |

||||||||||

| BREP Asia II (Dec 2017 / Mar 2022) |

|

7,354,811 |

|

|

1,310,691 |

|

|

6,618,861 |

|

1.2x |

|

1,707,204 |

|

1.9x |

|

8,326,065 |

|

1.3x |

31% |

5% |

||||||||||

| *BREP Asia III (Mar 2022 / Sep 2027) |

|

8,209,660 |

|

|

6,869,378 |

|

|

1,217,283 |

|

0.9x |

|

- |

|

n/a |

|

1,217,283 |

|

0.9x |

n/a |

(21)% |

||||||||||

| Total BREP Asia |

$ |

19,826,546 |

|

$ |

9,078,297 |

|

$ |

9,450,299 |

|

1.2x |

$ |

8,730,743 |

|

1.9x |

$ |

18,181,042 |

|

1.5x |

17% |

8% |

||||||||||

| BREP Co-Investment (f) |

|

7,387,496 |

|

|

101,066 |

|

|

910,970 |

|

1.9x |

|

15,226,653 |

|

2.2x |

|

16,137,623 |

|

2.2x |

16% |

16% |

||||||||||

| Total BREP |

$ |

174,923,872 |

|

$ |

57,481,967 |

|

$ |

69,149,508 |

|

1.2x |

$ |

173,164,628 |

|

2.3x |

$ |

242,314,136 |

|

1.8x |

17% |

14% |

||||||||||

| *BREDS High-Yield (Various) (g)

|

|

24,667,563

|

|

|

8,606,485

|

|

|

6,016,175

|

|

1.0x

|

|

19,217,327

|

|

1.4x

|

|

25,233,502

|

|

1.3x

|

10%

|

9%

|

||||||||||

| Private Equity |

||||||||||||||||||||||||||||||

| Corporate Private Equity |

||||||||||||||||||||||||||||||

| BCP I (Oct 1987 / Oct 1993) |

$ |

859,081 |

|

$ |

- |

|

$ |

- |

|

n/a |

$ |

1,741,738 |

|

2.6x |

$ |

1,741,738 |

|

2.6x |

19% |

19% |

||||||||||

| BCP II (Oct 1993 / Aug 1997) |

|

1,361,100 |

|

|

- |

|

|

- |

|

n/a |

|

3,268,627 |

|

2.5x |

|

3,268,627 |

|

2.5x |

32% |

32% |

||||||||||

| BCP III (Aug 1997 / Nov 2002) |

|

3,967,422 |

|

|

- |

|

|

- |

|

n/a |

|

9,228,707 |

|

2.3x |

|

9,228,707 |

|

2.3x |

14% |

14% |

||||||||||

| BCOM (Jun 2000 / Jun 2006) |

|

2,137,330 |

|

|

24,575 |

|

|

194 |

|

n/a |

|

2,995,106 |

|

1.4x |

|

2,995,300 |

|

1.4x |

6% |

6% |

||||||||||

| BCP IV (Nov 2002 / Dec 2005) |

|

6,773,182 |

|

|

195,824 |

|

|

373 |

|

n/a |

|

21,720,334 |

|

2.9x |

|

21,720,707 |

|

2.9x |

36% |

36% |

||||||||||

| BCP V (Dec 2005 / Jan 2011) |

|

21,009,112 |

|

|

1,035,259 |

|

|

62,513 |

|

n/a |

|

38,806,330 |

|

1.9x |

|

38,868,843 |

|

1.9x |

8% |

8% |

||||||||||

| BCP VI (Jan 2011 / May 2016) |

|

15,195,243 |

|

|

1,341,026 |

|

|

4,571,438 |

|

2.1x |

|

28,457,325 |

|

2.2x |

|

33,028,763 |

|

2.2x |

15% |

12% |

||||||||||

| BCP VII (May 2016 / Feb 2020) |

|

18,857,108 |

|

|

1,693,906 |

|

|

18,687,754 |

|

1.6x |

|

16,827,034 |

|

2.6x |

|

35,514,788 |

|

2.0x |

27% |

13% |

||||||||||

| *BCP VIII (Feb 2020 / Feb 2026) |

|

25,907,791 |

|

|

10,984,120 |

|

|

21,094,309 |

|

1.4x |

|

1,507,061 |

|

2.5x |

|

22,601,370 |

|

1.4x |

n/m |

11% |

||||||||||

| BCP IX (TBD) |

|

19,230,289 |

|

|

19,230,289 |

|

|

- |

|

n/a |

|

- |

|

n/a |

|

- |

|

n/a |

n/a |

n/a |

||||||||||

| Energy I (Aug 2011 / Feb 2015) |

|

2,441,558 |

|

|

174,492 |

|

|

524,555 |

|

1.6x |

|

4,182,579 |

|

2.0x |

|

4,707,134 |

|

2.0x |

14% |

11% |

||||||||||

| Energy II (Feb 2015 / Feb 2020) |

|

4,914,198 |

|

|

860,834 |

|

|

3,951,409 |

|

1.8x |

|

4,229,166 |

|

1.7x |

|

8,180,575 |

|

1.8x |

12% |

8% |

||||||||||

| *Energy III (Feb 2020 / Feb 2026) |

|

4,370,396 |

|

|

1,573,733 |

|

|

5,106,767 |

|

1.9x |

|

1,314,854 |

|

2.4x |

|

6,421,621 |

|

2.0x |

55% |

33% |

||||||||||

| Energy Transition IV (TBD) |

|

3,241,333 |

|

|

3,241,333 |

|

|

- |

|

n/a |

|

- |

|

n/a |

|

- |

|

n/a |

n/a |

n/a |

||||||||||

| BCP Asia I (Dec 2017 / Sep 2021) |

|

2,437,080 |

|

|

417,503 |

|

|

3,228,733 |

|

1.8x |

|

1,790,472 |

|

4.9x |

|

5,019,205 |

|

2.3x |

95% |

26% |

||||||||||

| *BCP Asia II (Sep 2021 / Sep 2027) |

|

6,770,483 |

|

|

4,982,956 |

|

|

2,317,215 |

|

1.5x |

|

25 |

|

n/a |

|

2,317,240 |

|

1.5x |

n/a |

19% |

||||||||||

| Core Private Equity I (Jan 2017 / Mar 2021) (h) |

|

4,760,247 |

|

|

1,169,489 |

|

|

7,265,294 |

|

1.9x |

|

2,830,764 |

|

5.1x |

|

10,096,058 |

|

2.3x |

58% |

18% |

||||||||||

| *Core Private Equity II (Mar 2021 / Mar 2026) (h) |

|

8,450,914 |

|

|

5,904,921 |

|

|

3,554,718 |

|

1.5x |

|

68,770 |

|

n/a |

|

3,623,488 |

|

1.5x |

n/a |

15% |

||||||||||

| Total Corporate Private Equity |

$ |

152,683,867 |

|

$ |

52,830,260 |

|

$ |

70,365,272 |

|

1.6x |

$ |

138,968,892 |

|

2.2x |

$ |

209,334,164 |

|

2.0x |

16% |

15% |

||||||||||

| The returns presented herein represent those of the applicable Blackstone Funds and not those of Blackstone Inc. n/m represents “not meaningful” generally due to the limited time since initial investment. n/a represents “not applicable”. Notes on pages 21-22. BREP – Blackstone Real Estate Partners, BREDS – Blackstone Real Estate Debt Strategies, BCP – Blackstone Capital Partners, BCOM – Blackstone Communications. * Represents funds that are currently in their investment period. |

Blackstone | 19 |

|

INVESTMENT RECORDS AS OF MARCH 31, 2024(a) – (CONT’D)

|

($/€ in thousands, except where noted)

Fund (Investment Period Beginning Date / Ending Date)

|

Committed Capital |

Available Capital (b) |

Unrealized Investments |

Realized Investments |

Total Investments |

Net IRRs (d) |

||||||||||||||||||||||||

| Value | MOIC (c) | Value | MOIC (c) | Value | MOIC (c) | Realized | Total | |||||||||||||||||||||||

| Private Equity (continued) |

||||||||||||||||||||||||||||||

| Tactical Opportunities |

||||||||||||||||||||||||||||||

| *Tactical Opportunities (Various) |

$ |

30,791,361 |

|

$ |

14,876,161 |

|

$ |

12,797,374 |

|

1.2x |

$ |

23,350,221 |

|

1.8x |

$ |

36,147,595 |

|

1.6x |

16% |

10% |

||||||||||

| *Tactical Opportunities Co-Investment and Other (Various) |

|

10,866,176 |

|

|

1,984,203 |

|

|

3,889,626 |

|

1.3x |

|

10,343,902 |

|

1.8x |

|

14,233,528 |

|

1.6x |

20% |

16% |

||||||||||

| Total Tactical Opportunities |

$ |

41,657,537 |

|

$ |

16,860,364 |

|

$ |

16,687,000 |

|

1.2x |

$ |

33,694,123 |

|

1.8x |

$ |

50,381,123 |

|

1.6x |

17% |

12% |

||||||||||

| Growth |

||||||||||||||||||||||||||||||

| *BXG I (Jul 2020 / Jul 2025) |

|

5,117,385 |

|

|

1,229,251 |

|

|

3,490,110 |

|

1.0x |

|

509,532 |

|

2.6x |

|

3,999,642 |

|

1.0x |

n/m |

(3)% |

||||||||||

| BXG II (TBD) |

|

4,117,735 |

|

|

4,117,735 |

|

|

- |

|

n/a |

|

- |

|

n/a |

|

- |

|

n/a |

n/a |

n/a |

||||||||||

| Total Growth |

$ |

9,235,120 |

|

$ |

5,346,986 |

|

$ |

3,490,110 |

|

1.0x |

$ |

509,532 |

|

2.6x |

$ |

3,999,642 |

|

1.0x |

n/m |

(3)% |

||||||||||

| Strategic Partners (Secondaries) |

||||||||||||||||||||||||||||||

| Strategic Partners I-V (Various) (i) |

|

11,035,527 |

|

|

139,208 |

|

|

7,902 |

|

n/a |

|

16,782,783 |

|

n/a |

|

16,790,685 |

|

1.7x |

n/a |

13% |

||||||||||

| Strategic Partners VI (Apr 2014 / Apr 2016) (i) |

|

4,362,772 |

|

|

609,788 |

|

|

768,144 |

|

n/a |

|

4,292,757 |

|

n/a |

|

5,060,901 |

|

1.7x |

n/a |

14% |

||||||||||

| Strategic Partners VII (May 2016 / Mar 2019) (i) |

|

7,489,970 |

|

|

1,572,428 |

|

|

4,126,974 |

|

n/a |

|

6,722,300 |

|

n/a |

|

10,849,274 |

|

1.9x |

n/a |

17% |

||||||||||

| Strategic Partners Real Assets II (May 2017 / Jun 2020) (i) |

|

1,749,807 |

|

|

474,064 |

|

|

1,286,170 |

|

n/a |

|

1,142,630 |

|

n/a |

|

2,428,800 |

|

1.7x |

n/a |

17% |

||||||||||

| Strategic Partners VIII (Mar 2019 / Oct 2021) (i) |

|

10,763,600 |

|

|

4,085,028 |

|

|

7,924,434 |

|

n/a |

|

6,335,653 |

|

n/a |

|

14,260,087 |

|

1.8x |

n/a |

27% |

||||||||||

| *Strategic Partners Real Estate, SMA and Other (Various) (i) |

|

7,055,474 |

|

|

2,563,005 |

|

|

2,105,684 |

|

n/a |

|

2,382,194 |

|

n/a |

|

4,487,878 |

|

1.6x |

n/a |

13% |

||||||||||

| *Strategic Partners Infrastructure III (Jun 2020 / Jul 2024) (i) |

|

3,250,100 |

|

|

708,817 |

|

|

1,980,800 |

|

n/a |

|

249,542 |

|

n/a |

|

2,230,342 |

|

1.4x |

n/a |

26% |

||||||||||

| *Strategic Partners IX (Oct 2021 / Jan 2027) (i) |

|

19,542,126 |

|

|