UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 16, 2024

Civista Bancshares, Inc.

(Exact name of Registrant as specified in its charter)

| Ohio | 001-36192 | 34-1558688 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

( IRS Employer Identification No.) |

100 East Water Street, P.O. Box 5016, Sandusky, Ohio 44870

(Address of principle executive offices)

Registrant’s telephone number, including area code: (419) 625-4121

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common | CIVB | NASDAQ Capital Market |

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure |

On April 16, 2024, Civista Bancshares, Inc. held its Annual Meeting of shareholders. The presentation material is attached hereto as Exhibit 99.1

The information in this Current Report on Form 8-K is being furnished under Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Civista Bancshares, Inc., is a $3.9 billion financial holding company headquartered in Sandusky, Ohio. Its primary subsidiary, Civista Bank, was founded in 1884 and provides full-service banking, commercial lending, mortgage, and wealth management services. Today, Civista Bank operates 43 locations across Ohio, Southeastern Indiana and Northern Kentucky. Civista Leasing & Finance, a division of Civista Bank, offers commercial equipment leasing services for businesses nationwide. Civista Bancshares’ common shares are traded on the NASDAQ Capital Market under the symbol “CIVB”. Learn more at www.civb.com.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibit 99.1 Annual Meeting presentation material

Exhibit 104 Cover Page Interactive File-the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Civista Bancshares, Inc. |

||

| (Registrant) | ||

| Date: April 17, 2024 | /s/ Todd A. Michel |

|

| Todd A. Michel, | ||

| Senior Vice President and Controller | ||

Annual Shareholder Meeting April 16, 2024 NASDQ: CIVB WELCOME Exhibit 99.1

Forward-looking statementS Forward‐Looking Statements. This presentation may contain “forward‐looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward‐looking statements express management’s current expectations, estimates or projections of future events, results or long‐term goals, and are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this material speak only as of the date they are made, and we undertake no obligation to update any statement except to the extent required by law. Forward‐looking statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause actual results or performance to differ materially from those expressed in or implied by the forward‐looking statements. Factors that could cause actual results or performance to differ from those discussed in the forward‐looking statements include the risks identified from time to time in our public filings with the SEC, including those risks identified in “Item 1A. Risk Factors” of Part I of the Company’s Annual Report on Form 10‐K for the fiscal year ended December 31, 2023, as supplemented by any additional risks identified in the Company’s subsequent Form 10‐Qs. These risks and uncertainties should be considered in evaluating forward‐looking statements and undue reliance should not be placed on such statements. Use of Non‐GAAP Financial Measures. This presentation contains certain financial information determined by methods other than in accordance with accounting principals generally accepted in the United States (“GAAP”). These non‐GAAP financial measures include “Net Income” and “Efficiency Ratio.” The company believes that these non‐GAAP financial measures provide both management and investors a more complete understanding of the Company’s profitability. These non‐GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP Measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided at the end of this presentation. Sources of Information: Company Management and S&P Global Market Intelligence

DENNIS E. MURRAY, JR. Chairman of Civista Bancshares, Inc. and Civista Bank Welcome & INTRODUCTIONS

Dennis shaffer Lance morrison KAREN TERENZI President & Chief Executive Officer, Civista Bancshares, Inc. Corporate Secretary, Civista Bancshares, Inc. Recording Secretary , Civista Bancshares, Inc.

BRIAN MISCHEL TONY WEIS KIMBERLEE KOSKIEWICZ FORVIS, LLP Vorys, Sater, Seymour and Pease, LLP EQUINITI Trust Company

2024 Annual meeting NOTICE OF MEETING AFFIDAVIT 2023 MEETING MINUTES

Proposal presentation PROPOSAL NO. 1: Election of Directors PROPOSAL NO. 2: Compensation of Executive Officers PROPOSAL NO. 3: Appointment of FORVIS, LLP as the independent public accounting firm of the Corporation for fiscal year ending December 31, 2024 PROPOSAL NO. 4: 2024 Incentive Plan Approval

Management presentation DENNIS shaffer President & Chief Executive Officer, Civista Bancshares, Inc.

Board of directors

Welcomed to the board in 2023 Mark J. Macioce Vice President & Chief Information Officer, MASCO Corporation Darci L. Congrove CPA - Managing Director, GBQ Partners, LLC

Retiring board members Allen R. Nickles Of Counsel, Payne, Nickles & Company John O. Bacon President & CEO, The Mack Iron Works Company

Our story Founded and headquartered in Sandusky, OH since 1884 Grown from 4 to over 540 employees 43 locations across Ohio, Southeastern Indiana and Northern Kentucky Operations in Ohio’s 5 largest MSAs Diversified Revenue Streams Business & Personal Banking Wealth Management Private Banking Mortgage Equipment Leasing 43 LOCATIONS

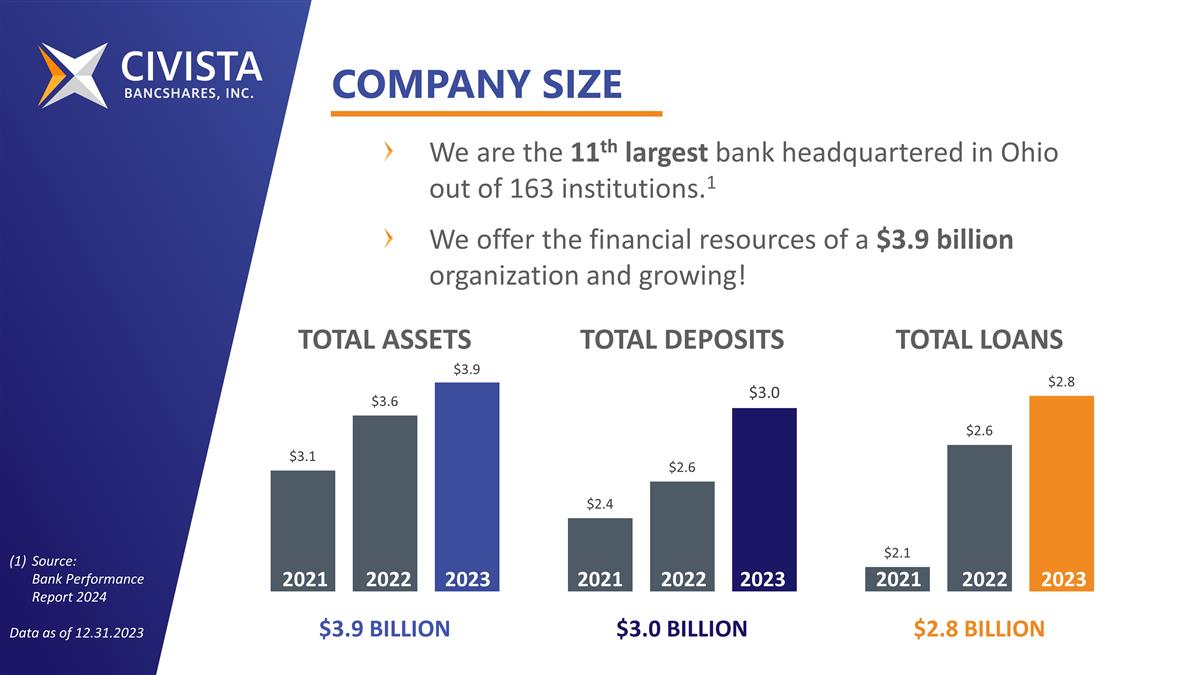

Company size Source: Bank Performance Report 2024 Data as of 12.31.2023 We are the 11th largest bank headquartered in Ohio out of 163 institutions.1 We offer the financial resources of a $3.9 billion organization and growing! TOTAL ASSETS $3.9 BILLION 2021 2022 2023 TOTAL DEPOSITS $3.0 BILLION 2021 2022 2023 TOTAL LOANS $2.8 BILLION 2021 2022 2023

2023 financial highlights Net Income increase 9% over 2022 $43 million vs $39.4 million $2.73 diluted EPS vs $2.60 in 2022 3.70% Net Interest Margin vs 3.65% in 2022 Strong organic loan growth $365 million in deposit growth primarily funded by Brokered Deposits

Civista vs. publicly traded peers Summary of Financial Data1 Source: S&P Capital IQ Pro as of 12/31/2023 (1) Data as of the most recent quarter end. Per group includes public banks with assets between $1B-$4B in Ohio and +/- 40% of CIVB's assets in contiguous states CIVB PEERS CIVB LOANS/DEPOSITS (MRQ) CIVB PEERS CIVB NET INTEREST MARGIN (LTM) CIVB PEERS CIVB COST OF DEPOSITS (MRQ)

Civista vs. publicly traded peers Summary of Financial Data1 Source: S&P Capital IQ Pro as of 12/31/2023 (1) Data as of the most recent quarter end. Per group includes public banks with assets between $1B-$4B in Ohio and +/- 40% of CIVB's assets in contiguous states (2) Efficiency ratio for CIVB excludes operating leases depreciation that CIVB inherited as a part of its acquisition of Vision Financial Group CIVB PEERS CIVB EFFICIENCY RATIO2 (LTM) CIVB PEERS CIVB CORE ROAA (LTM) CIVB PEERS CIVB CORE ROAE (LTM)

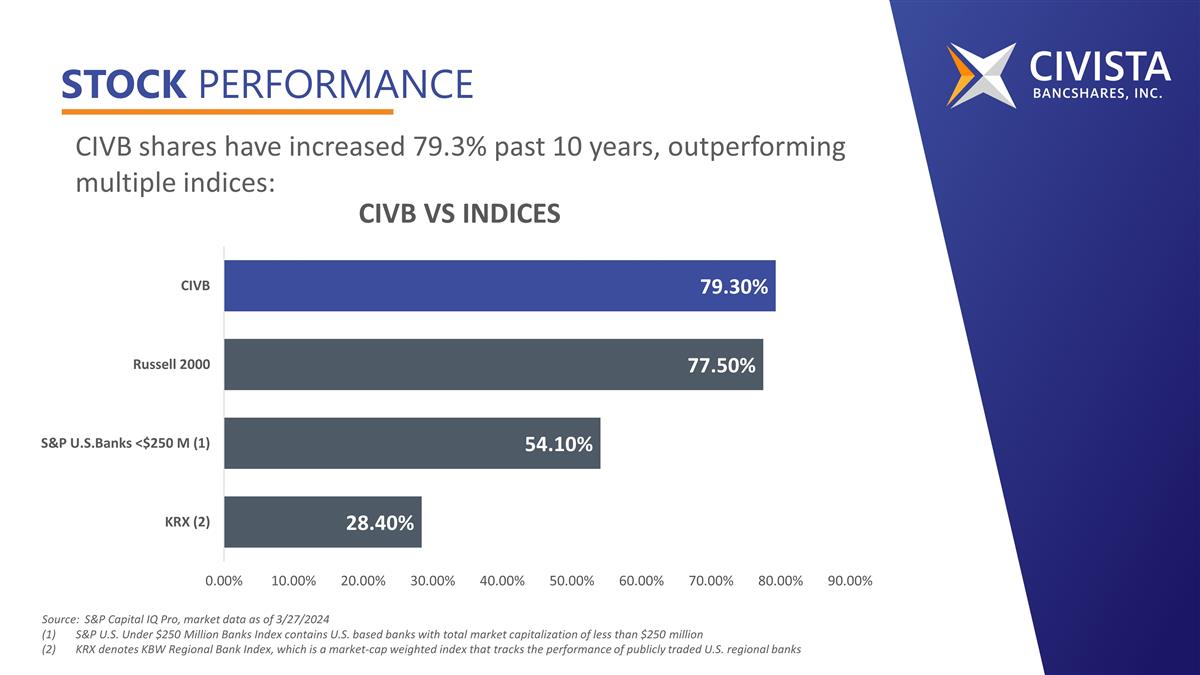

Stock performance CIVB shares have increased 79.3% past 10 years, outperforming multiple indices: Source: S&P Capital IQ Pro, market data as of 3/27/2024 S&P U.S. Under $250 Million Banks Index contains U.S. based banks with total market capitalization of less than $250 million KRX denotes KBW Regional Bank Index, which is a market-cap weighted index that tracks the performance of publicly traded U.S. regional banks

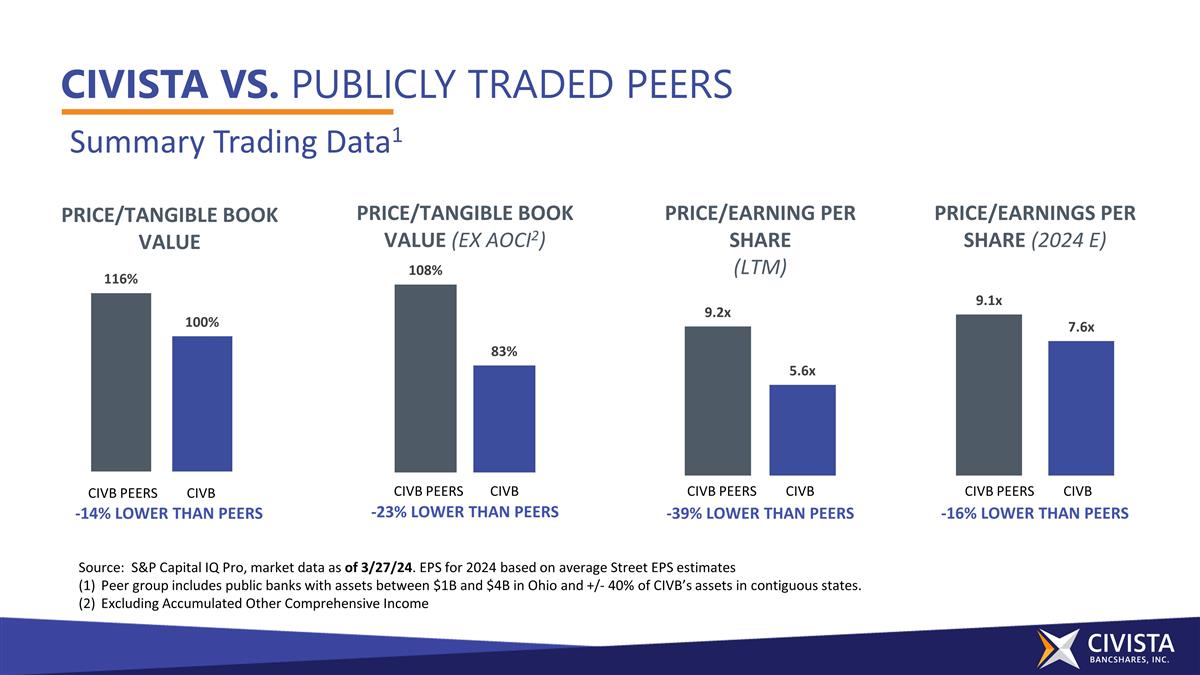

Civista vs. publicly traded peers Summary Trading Data1 Source: S&P Capital IQ Pro, market data as of 3/27/24. EPS for 2024 based on average Street EPS estimates Peer group includes public banks with assets between $1B and $4B in Ohio and +/- 40% of CIVB’s assets in contiguous states. Excluding Accumulated Other Comprehensive Income -14% LOWER THAN PEERS CIVB PEERS CIVB PRICE/TANGIBLE BOOK VALUE -39% LOWER THAN PEERS CIVB PEERS CIVB PRICE/EARNING PER SHARE (LTM) -16% LOWER THAN PEERS CIVB PEERS CIVB PRICE/EARNINGS PER SHARE (2024 E) -23% LOWER THAN PEERS PRICE/TANGIBLE BOOK VALUE (EX AOCI2) CIVB PEERS CIVB

Dividend growth

Net income & earnings per share

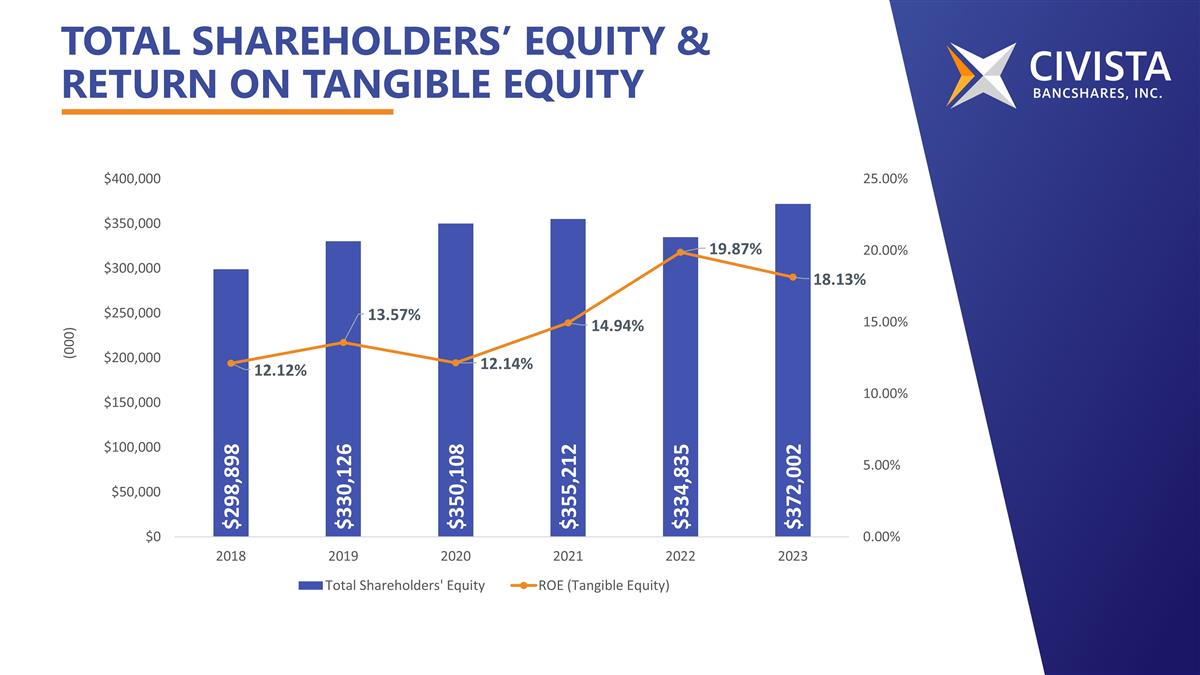

Total shareholders’ equity & return on tangible equity

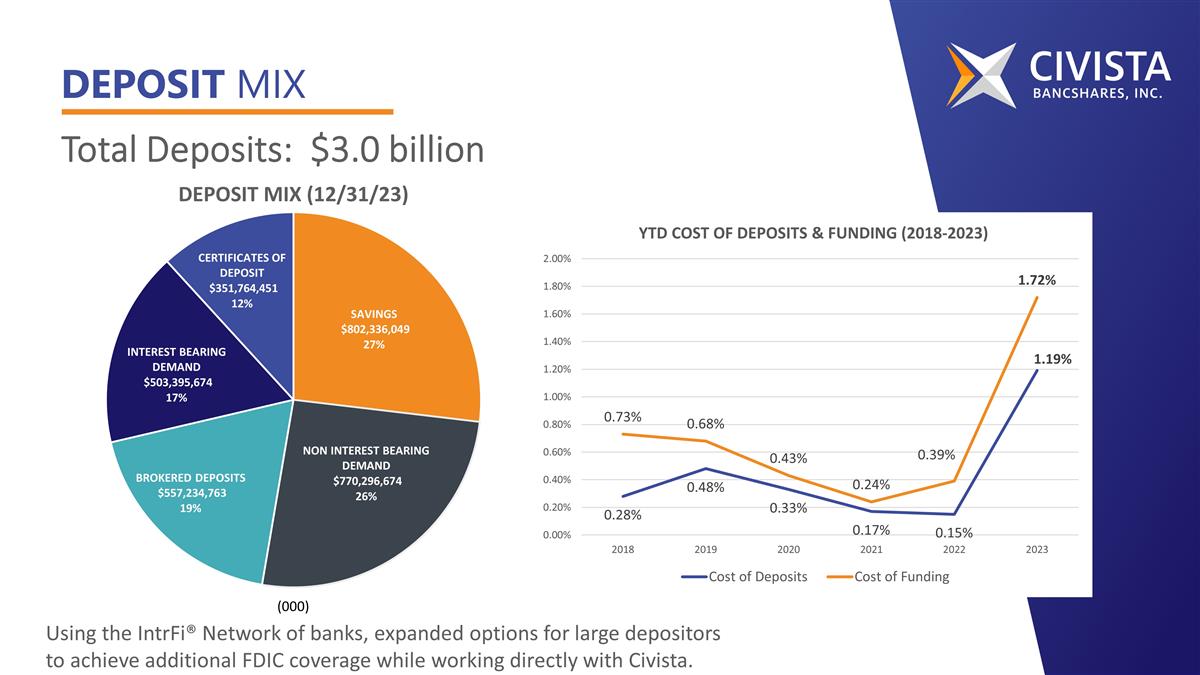

Over 83% of deposits insured Average deposit account balance is $25,000, excluding Certificates of Deposit At year-end 2023, Civista had no deposit concentration, excluding $336.5 million of Public Funds Deposit base: Strong, Insured, Stable. CIVB SIVB SBNY

Deposit mix Total Deposits: $3.0 billion Using the IntrFi® Network of banks, expanded options for large depositors to achieve additional FDIC coverage while working directly with Civista. Deposit mix (12/31/23) (000)

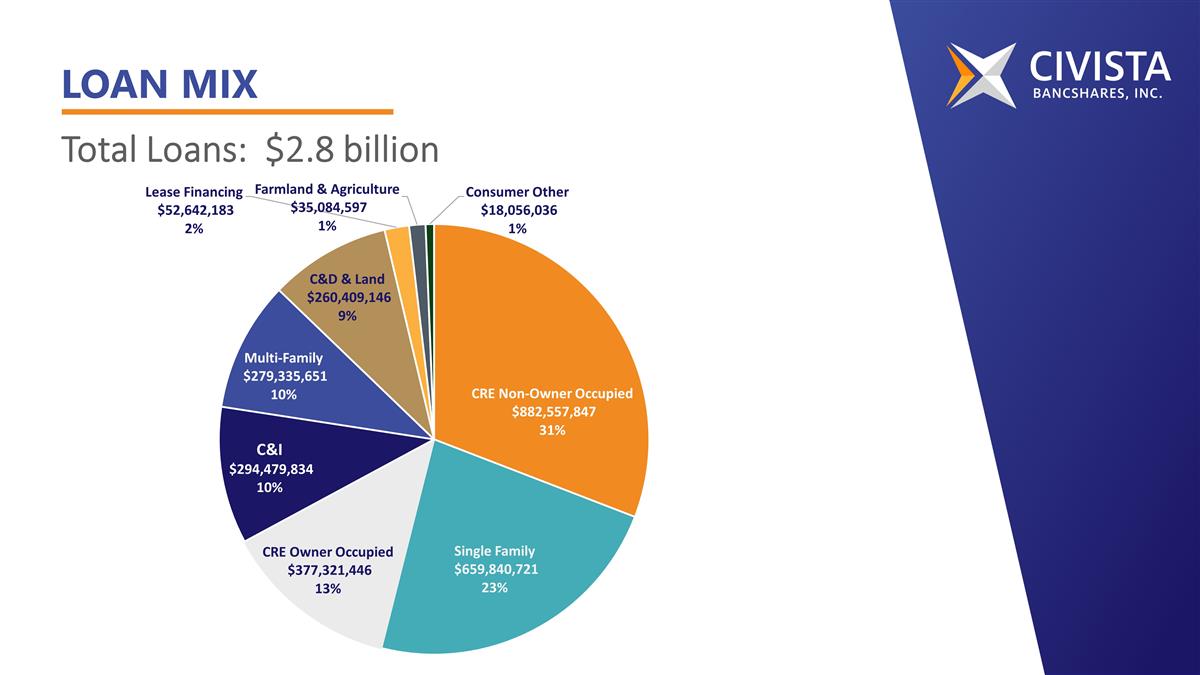

Loan mix Total Loans: $2.8 billion

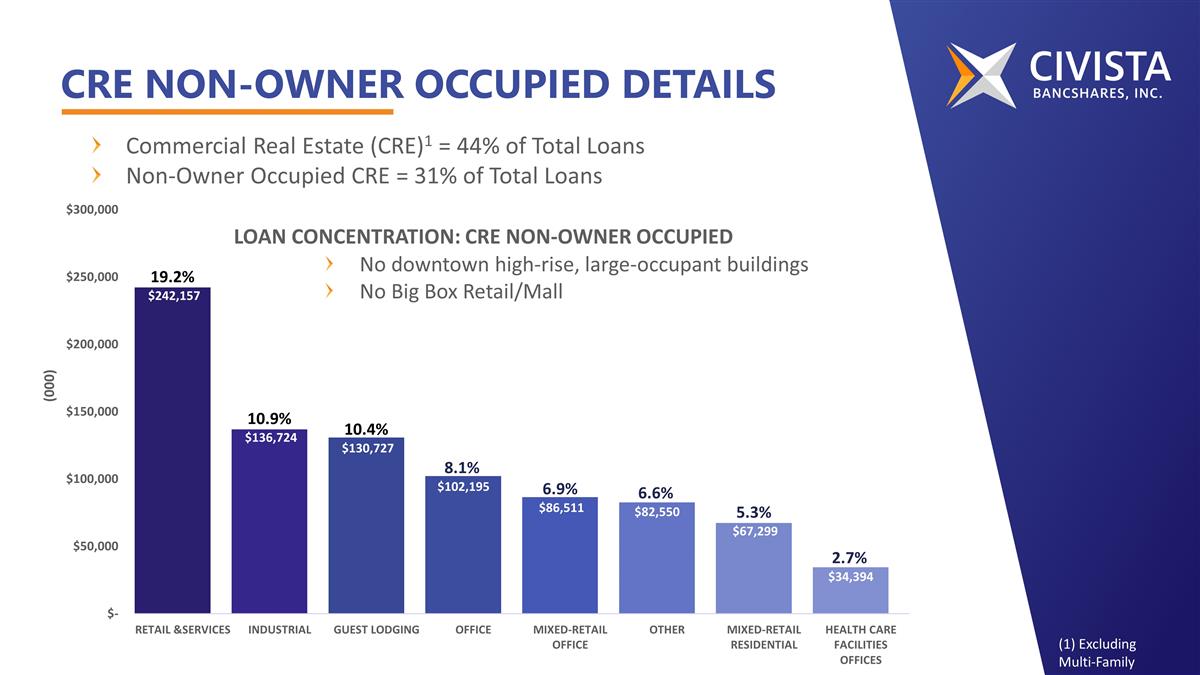

CRE Non-Owner OccuPIED Details Commercial Real Estate (CRE)1 = 44% of Total Loans Non-Owner Occupied CRE = 31% of Total Loans No downtown high-rise, large-occupant buildings No Big Box Retail/Mall (1) Excluding Multi-Family

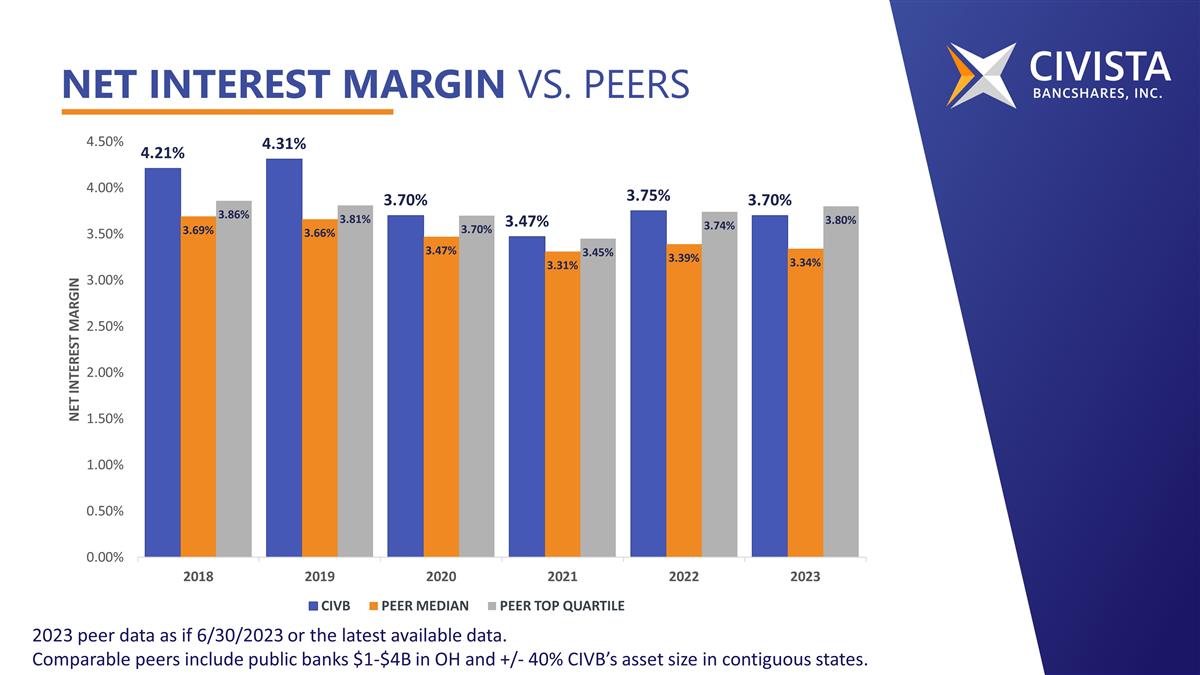

Net interest margin vs. peers 2023 peer data as if 6/30/2023 or the latest available data. Comparable peers include public banks $1-$4B in OH and +/- 40% CIVB’s asset size in contiguous states.

Investing for the future Continue to invest in technology that: Automates work to improve scalability & capability Enhance customer experience Upgraded AI-chatbot to a new platform Identified additional Robotic Process Automation (RPAs) Established new Small Business Lending Platform for Origination & Workflow – soft launch Upgraded fraud detection and workflow tools Expanded electronic signatures capabilities – Wire Transfer Introduced Mortgage Application Text Notifications for status updates

Investing in our people Launched Civista University, a new Learning Management System Supported Bank Management School Participants Launched Innovation Resource Group Held 2nd Annual all-employee Day of Learning

Investing in our communities Community Development Investments $2 MILLION $54 MILLION Community Development Loans $450,808 Other Donations to Community Organizations $192,721 Money Raised for United Way Campaign 490 Nonprofit Organizations Helped 2,580 Volunteer Hours 384 Employee Volunteers

State & national recognition A 2023 Best Employer in Ohio – 13th consecutive year Named among American Banker’s 2023 Best Banks to Work For Named as one of the best U.S. Banks in the country for financial performance, Bank Director Magazine

Community recognition United Way of Greater Cincinnati’s Tremendous 25 Workplaces That Care, Per Capita Giving 2023 Large Business of the Year Dearborn County (Indiana) Chamber of Commerce 2023 Business of the Month, West Liberty Business Association

Thank you We appreciate your confidence in our vision.

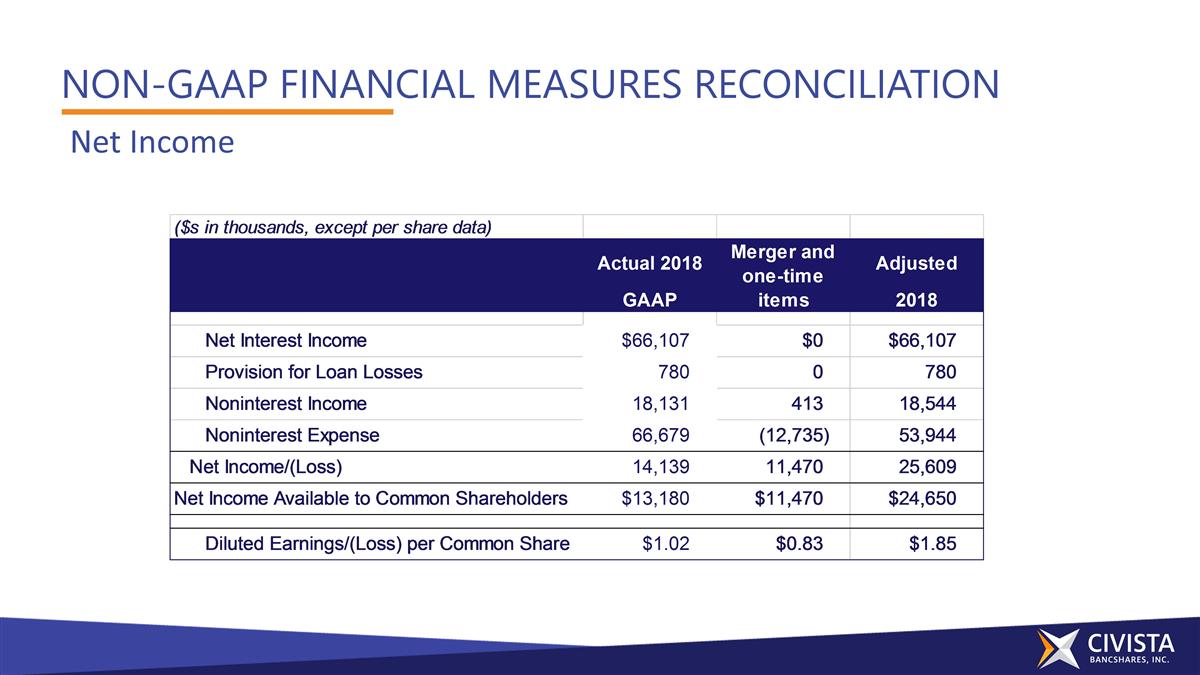

Non-GAAP Financial Measures Reconciliation Net Income

Non-GAAP Financial Measures Reconciliation Efficiency Ratio

Questions & answers

Voting results PROPOSAL NO. 1: Election of Directors PROPOSAL NO. 2: Compensation of Executive Officers PROPOSAL NO. 3: Appointment of FORVIS, LLP as the independent public accounting firm of the Corporation for fiscal year ending December 31, 2024 PROPOSAL NO. 4: 2024 Incentive Plan Approval

Your trust and investment drives our success. NASDQ: CIVB Thank you!