UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number: 001-34984

First Majestic Silver Corp.

(Translation of registrant’s name into English)

Suite 1800 - 925 West Georgia Street

Vancouver, B.C. V6C 3L2

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐

DOCUMENTS INCORPORATED BY REFERENCE

Exhibit 99.3 to this Report on Form 6-K are hereby incorporated by reference (i) as Exhibits to the Registration Statement on Form F-10 of First Majestic Silver Corp. (File No. 333-273734) and (ii) into the Registration Statement on Form S-8 of First Majestic Silver Corp. (File No. 333-258124).

DOCUMENTS FILED AS PART OF THIS FORM 6-K

| Exhibit |

Description |

|

| 99.1 | Notice of Meeting | |

| 99.2 | Notice and Access Notification | |

| 99.3 | Management Information Circular | |

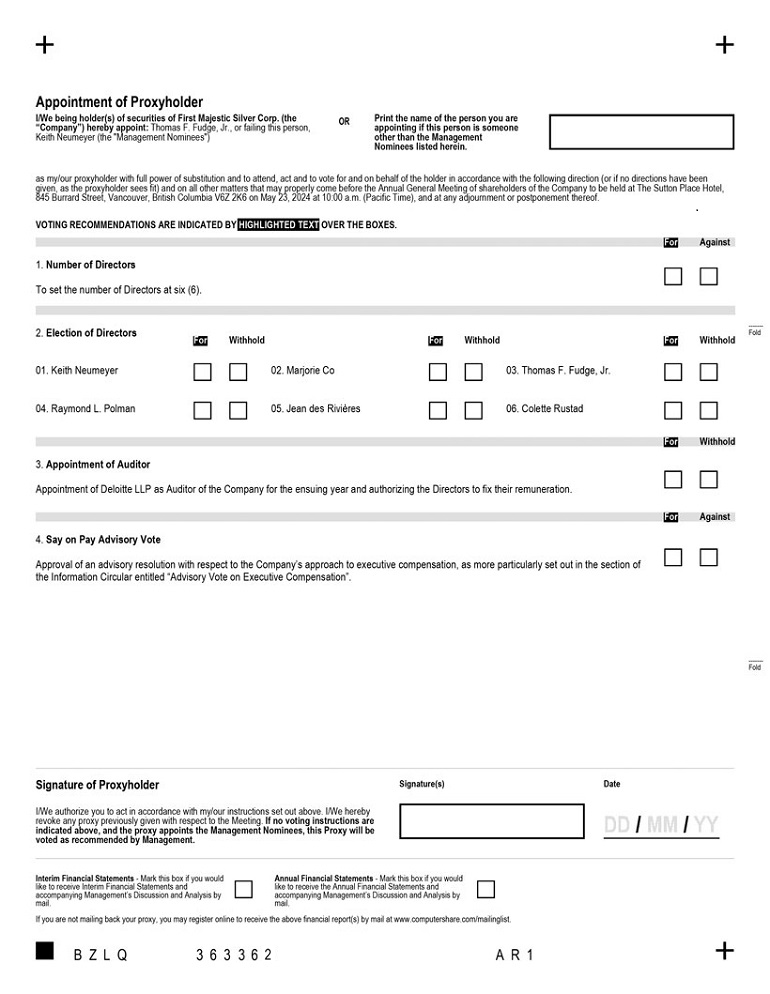

| 99.4 | Form of Proxy | |

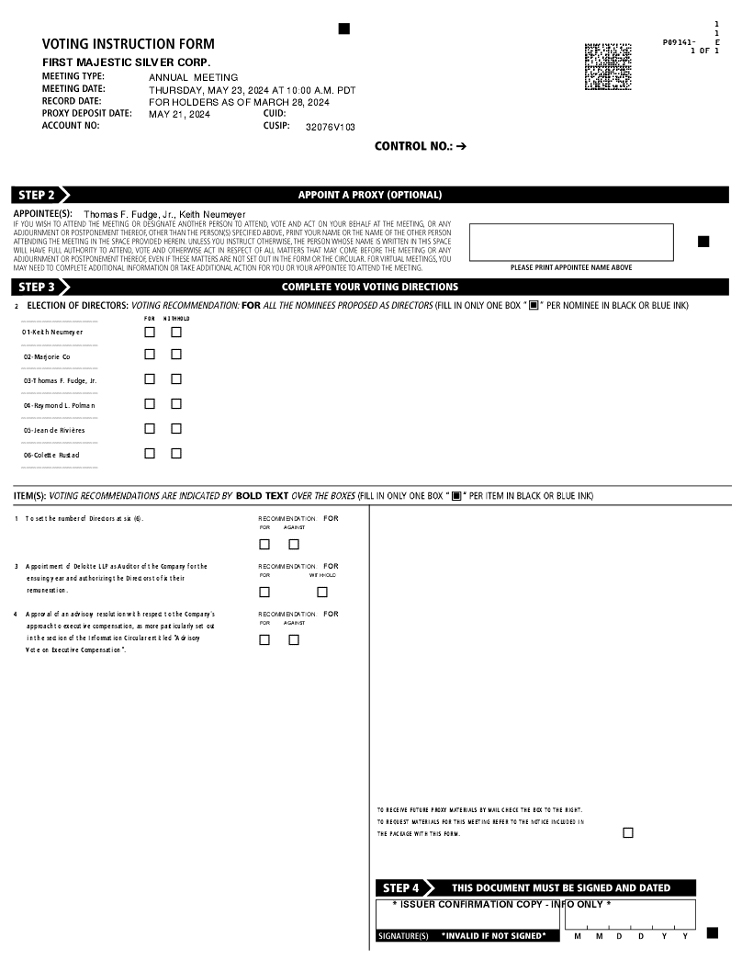

| 99.5 | Voting Instruction Form | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. | ||||||

| Date: April 15, 2024 | ||||||

| By: | /s/ Samir Patel |

|||||

| Name: | Samir Patel | |||||

| Title: | General Counsel & Corporate Secretary | |||||

2

Exhibit 99.1

|

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Date: Thursday, May 23, 2024

Time: 10:00 a.m. (Pacific Time)

The Sutton Place Hotel, 845 Burrard Street,

Record Date: March 28, 2024 |

NOTICE is hereby given that the Annual General Meeting (the “Meeting”) of the shareholders of First Majestic Silver Corp. (“First Majestic” or the “Company”) will be held at The Sutton Place Hotel, 845 Burrard Street, Vancouver, British Columbia V6Z 2K6 on Thursday, May 23, 2024 at 10:00 a.m. (Pacific Time). At the Meeting, the shareholders will receive the financial statements for the year ended December 31, 2023, together with the auditor’s report thereon, receive and consider the report of the directors, and consider resolutions:

1. To set the number of directors of the Company at six.

2. To elect the directors of the Company to serve until the next annual general meeting of shareholders.

3. To appoint Deloitte LLP, Independent Registered Public Accounting Firm, as auditors for the Company to hold office until the next annual general meeting of shareholders of the Company and to authorize the directors to fix the remuneration to be paid to the auditors.

4. To vote on an advisory resolution with respect to the Company’s approach to executive compensation.

5. To transact such other business as may properly come before the Meeting or any adjournment or adjournments thereof.

The record date for notice and for voting at the Meeting is March 28, 2024. Only registered shareholders at the close of business on March 28, 2024, will be entitled to vote at the Meeting.

If you are a registered shareholder of the Company and are unable to attend the Meeting, please read, sign and date the form of proxy for the Meeting (the “Proxy”) and deposit it with Computershare Investor Services Inc. (“Computershare”) by courier or mail at 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, Attention: Proxy Department, or by facsimile at 1-866-249-7775 (toll-free in North America) or 1-416-263-9524 (international) by 10:00 a.m. (Pacific Time) on Tuesday, May 21, 2024 or at least 48 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting). Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy.

If you are a non-registered shareholder of the Company, please complete and return the voting instruction form (or other accompanying form) in accordance with the instructions for completion and deposit.

All shareholders may attend the Meeting but must follow the instructions set out in the accompanying information circular if they wish to vote at the Meeting.

The Company has adopted the notice and access model (“Notice and Access”) provided for under National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer for the delivery of the Notice of Meeting, information circular, financial statements and management’s discussion and analysis for the year ended December 31, 2023 (collectively, the “Meeting Materials”) to shareholders for the Meeting. Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a Notice and Access notification containing details of the Meeting date, location and purpose, as well as information on how they can access the Meeting Materials electronically. Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials.

Other shareholders wishing to receive a printed copy of the Meeting Materials should follow the instructions set out in the Notice and Access notification.

DATED at Vancouver, British Columbia, this 11th day of April, 2024.

ON BEHALF OF THE BOARD OF DIRECTORS OF FIRST MAJESTIC SILVER CORP.

(signed) “Keith Neumeyer”

Keith Neumeyer President & Chief Executive Officer |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com. To obtain current information about voting your First Majestic common shares, please visit www.FirstMajesticAGM.com.

Exhibit 99.2

NOTICE AND ACCESS NOTIFICATION TO SHAREHOLDERS

Annual General Meeting of Shareholders

to be held on May 23, 2024

You are receiving this notification as First Majestic Silver Corp. (“First Majestic,” the “Company”, “we”, “us” or “our”) is using the notice and access model (“Notice and Access”) for the delivery of meeting materials to our shareholders for the annual general meeting of our shareholders that will be held on Thursday, May 23, 2024 (the “Meeting”).

Under Notice and Access, instead of receiving printed copies of the Company’s management information circular (the “Information Circular”) for the Meeting and, if requested, the audited consolidated financial statements of the Company for the year ended December 31, 2023 and management’s discussion and analysis thereon (collectively with the Information Circular, the “Meeting Materials”), our shareholders are receiving this notification containing information on how to access the Meeting Materials electronically. However, together with this notification, shareholders continue to receive a proxy or voting instruction form, as applicable, enabling them to vote at the Meeting.

First Majestic uses Notice and Access as an alternative means of delivery of the Meeting Materials to our shareholders in a more environmentally friendly and sustainable way that helps reduce paper usage and our carbon footprint, and that reduces our printing and mailing costs.

| First Majestic has retained Kingsdale Advisors (“Kingsdale”) to assist in the solicitation of proxies for the Meeting. Shareholders may contact Kingsdale for assistance with voting by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com. |

|

|

| You can access the Meeting Materials and get assistance in voting your First Majestic common shares by scanning the QR code to the right with your smartphone. |

Meeting Date and Location:

| When: | Thursday, May 23, 2024 | Where: | The Sutton Place Hotel | |||

| 10:00 a.m. (Vancouver time) | 845 Burrard Street | |||||

| Vancouver, British Columbia V6Z 2K6 |

Business of the Meeting:

| 1. | Financial Statements: Receive our audited consolidated annual financial statements for the financial year ended December 31, 2023 and the auditor’s report on those statements (see the section entitled “Part Two: Business of the Meeting – Receiving the Consolidated Financial Statements” on page 9 of the Information Circular). |

925 West Georgia Street, Suite 1800, Vancouver, B.C. Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873 | Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com

| 2. | Set the number of Directors and elect our Directors: Set the number of directors at six and elect six directors to our Board to hold office for the ensuing year (see the sections entitled “Part Two: Business of the Meeting – Setting the Number of Directors” and “Part Two: Business of the Meeting – Election of Directors”, both on page 9 of the Information Circular). |

| 3. | Appoint our Auditor: Re-appoint Deloitte LLP, Independent Registered Public Accounting Firm, as our independent auditor for the ensuing year and authorize our directors to set the auditor’s pay (see the section entitled “Part Two: Business of the Meeting – Appointment of Auditor” on page 18 of the Information Circular). |

| 4. | Advisory Resolution on Executive Compensation: Vote on an advisory resolution with respect to First Majestic’s approach to executive compensation (see the section entitled “Part Two: Business of the Meeting – Advisory Vote on Executive Compensation” on page 19 of the Information Circular). |

| 5. | Conduct such other business properly brought before the Meeting or any adjournment or postponement of the Meeting (see the section entitled “Part Two: Business of the Meeting – Other Business” on page 20 of the Information Circular). |

First Majestic reminds shareholders that it is important that they review the Information Circular before voting. See the remainder of this notice for instructions on how to view the Information Circular, and how to vote.

Accessing the Meeting Materials Online

Shareholders can view the Meeting Materials online under our SEDAR+ profile at www.sedarplus.ca, or on our website at www.FirstMajesticAGM.com.

How to Request Printed Meeting Materials

Requests for paper copies of the Meeting Materials must be received by May 9, 2024 in order to receive the materials in advance of the proxy deposit deadline for the Meeting. Shareholders who wish to receive paper copies of the Meeting Materials may request these from the Company by calling toll free 1-866-529-2807. Meeting Materials will be sent to shareholders within three business days of their request if such requests are made before the Meeting. Shareholders with existing instructions on their account to receive a paper copies will receive a paper copy of the Meeting Materials with this notification.

In addition, shareholders may request paper copies of the Meeting Materials be sent to them by postal delivery at no cost to them for up to one year from the date the Information Circular was filed on SEDAR+. These requests should be made by email to corporate@firstmajestic.com, or by contacting the General Counsel & Corporate Secretary at 1-866-529-2807 (toll-free). Meeting Materials will be sent to shareholders within ten calendar days of their request if such requests are made after the Meeting.

925 West Georgia Street, Suite 1800, Vancouver, B.C. Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873 | Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com

Voting

This notice is accompanied by either a form of proxy (for registered shareholders) or a voting instruction form (for non-registered shareholders).

Registered shareholders are asked to return their proxies using the following methods by 10:00 a.m. (Vancouver time) on Tuesday, May 21, 2024 or at least 48 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting:

| INTERNET: | www.investorvote.com

Follow the instructions using the 15-digit control number noted on your proxy. |

MAIL: | Computershare Investor Services Inc. Attention: Proxy

Department |

|||

| TELEPHONE: | 1.866.732.8683 (North America) 1.312.588.4290 (if outside North America)

You will need the 15-digit control number noted on your proxy. |

|||||

Non-registered shareholders are asked to return their voting instructions using the methods set out on their voting instruction form or business reply envelope, or as set out below, at least one business day in advance of the proxy deposit date noted on your voting instruction form:

| CANADA | UNITED STATES | |||||

|

|

|

|||||

| INTERNET: | www.proxyvote.com

Follow the instructions using the 16-digit control number from your voting instruction form. |

INTERNET: | www.proxyvote.com

Follow the instructions using the 16-digit control number from your voting instruction form. |

|||

| TELEPHONE: | 1.800.474.7493 (for English) 1.800.474.7501 (for French)

You will need the 16-digit control number noted on your voting instruction form. |

TELEPHONE: | 1.800.454.8683

You will need the 16-digit control number noted on your voting instruction form. |

|||

| MAIL: | Data Processing Centre P.O. Box 3700, STN Industrial Park Markham, Ontario L3R 9Z9 Canada |

MAIL: | Proxy Services P.O. Box 9104 Farmingdale, New York 11735-9533, USA |

|||

925 West Georgia Street, Suite 1800, Vancouver, B.C. Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873 | Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com

Any shareholder who needs assistance with voting their shares should contact

Kingsdale, the Company’s proxy solicitation agent for the Meeting, by telephone at

1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled

outside North America), or by email at contactus@kingsdaleadvisors.com.

QUESTIONS

Shareholders with questions about Notice and Access can contact the Company’s General Counsel &

Corporate Secretary at 1-866-529-2807 (toll-free) or by e-mail to by email to corporate@firstmajestic.com.

| To obtain current information about voting your First Majestic common shares, please visit www.FirstMajesticAGM.com.

You can also access the Meeting Materials and get assistance in voting your First Majestic common shares by scanning the QR code to the right with your smartphone. |

|

Dated at Vancouver, British Columbia this 11th day of April, 2024.

BY ORDER OF THE BOARD OF DIRECTORS.

(signed) “Keith Neumeyer”

Keith Neumeyer

President & Chief Executive Officer, and Director

925 West Georgia Street, Suite 1800, Vancouver, B.C. Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873 | Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com

Exhibit 99.3

|

FROM THE CHAIR

Thomas F. Fudge, Jr. Chair of the Board |

TO OUR SHAREHOLDERS

You are invited to participate in the annual general meeting of shareholders of First Majestic Silver Corp. to be held at 10:00 a.m. (Pacific Time) on Thursday, May 23, 2024.

The business to be considered at the annual general meeting is described in the accompanying Notice of Meeting and Management Information Circular which contains important information about the meeting, voting, the nominees for election as directors, our governance practices and how we compensate our executives and directors.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor, by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

Your vote is important. We encourage you to participate in this process by voting your First Majestic shares.

Thank you for your support as shareholders and I hope you can join us on May 23, 2024.

(signed) "Thomas F. Fudge, Jr."

Thomas F. Fudge, Jr. Chair of the Board

You can access the materials for the annual general meeting and get assistance in voting your First Majestic common shares by scanning the following QR code:

|

|

FROM THE PRESIDENT & CEO

Keith Neumeyer President & CEO |

TO OUR SHAREHOLDERS

20 Years – Steadfast in Our Vision

It’s been quite a journey through First Majestic’s first 20 years. These two decades have proved gratifying and successful, but also challenging at times with difficult markets and setbacks. We enjoyed profits. We endured losses. We grew into a substantial enterprise in a relatively short amount of time.

From day one, our dream was to build one of the world’s top silver mining companies. We achieved that goal, and we continue to build towards our vision of becoming the world’s largest primary silver producer.

Common themes across our 20 years have included dedication to our vision, operating with persistence, teamwork and creativity in the face of challenges. First Majestic has been fortunate to have hired talented, supportive people in all positions, working as a family through the good times and the bad.

We made fruitful and timely acquisitions along the way. We made mistakes that cost us. We let go of older and/or smaller mines. We acquired larger, more efficient operations that would further our vision. We innovated with technology and strove to be leaders in modern mining and social practices. We were early ESG adopters and supported our communities. We protected local environments and improved lives.

We made a major, grassroots discovery at the Santa Elena mine that will provide significant revenue for years to come. We continued to invest heavily in exploration to make more discoveries across our large and prospective land packages.

2023 – Challenges and High Points

Looking at 2023, the year proved to be one of the most challenging in our history. We faced significant setbacks at the Jerritt Canyon mine, water issues at La Encantada and political headwinds in Mexico. But there was plenty of good news to carry us into what looks to be a better year in 2024.

We met our revised production guidance in 2023, highlighted by record silver equivalent production at Santa Elena of 9.6 million ounces. We completed the sale of the La Guitarra and La Parrilla silver mines to Sierra Madre Gold & Silver Ltd. and Silver Storm Mining Ltd., respectively. We also moved the ISO 9001:2015 certified Central Lab from Durango to Santa Elena, providing greater efficiency for assaying and analysis.

First Mint – a Better Way to Sell Our Silver

I’m very excited about launching First Mint, our fully-owned minting facility, in Las Vegas, Nevada. First Mint will expand upon First Majestic’s existing bullion sales by vertically integrating the production of investment-grade fine silver bullion. The mint will allow us to sell a substantially greater portion of our silver production directly to our shareholders and bullion customers through our Bullion Store, while earning higher margins on our mined silver.

The mint provides us with higher margins on our doré silver sales, and we are the only mining company tapping into this aspect of silver. Ultimately, we hope to sell all our mined silver to the mint. |

| Jerritt Canyon’s Impact on Revenues and Earnings

Revenues for 2023 totaled $573.8 million, 8% lower than 2022, due primarily to the temporary suspension of mining activities at Jerritt Canyon in March 2023. As a result, we realized a 10% decrease in the total number of payable AgEq ounces sold, offset partly by an increase in payable AgEq ounces produced at Santa Elena and a 4% increase in the average realized silver price.

The Jerritt Canyon suspension, resulting in an impairment charge of $125.2 million and a one-time standby cost of $13.4 million, was the primary catalyst in our net loss of $135.1 million.

Strengthening the First Majestic Family

Since suffering high turnover following the pandemic, we have built a new and younger team, one with fresh ideas and enthusiasm for achieving First Majestic’s vision. I’m gratified at how this group has gelled and come together; I know they will provide the skills and innovation to carry us into a successful third decade.

2024 – Treasury Growth and Exploration

Looking ahead to 2024, we’re focused on treasury growth and strengthening our balance sheet through efficient operations. We have reduced our workforce from nearly 6,000 to around 3,800. We expect no significant capital expenditures this year besides exploration, for which we’ve budgeted $35 million – the highest in our history.

We will continue our search for a suitable, silver-dominant acquisition, focusing on safe and dependable jurisdictions. We have grown First Majestic primarily through M&A activity, but we adhere to high standards. Great silver projects are rare, and we have succeeded in finding them.

In closing, I take great satisfaction in seeing First Majestic reach this 20-year milestone. Credit goes to the First Majestic family, both past and current, who worked tirelessly through good times and bad. I’m grateful for your contributions, and I know we can all look forward to a successful third decade.

(signed) "Keith Neumeyer"

Keith Neumeyer President & CEO

|

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 27 | ||||

| 27 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com. To obtain current information about voting your First Majestic common shares, please visit www.FirstMajesticAGM.com.

This summary highlights information contained in this Management Information Circular (the “Information Circular”). The summary does not contain all of the information that you should consider. Shareholders are encouraged to read the entire Information Circular carefully prior to voting.

Annual General Meeting Details

|

|

Date Thursday, May 23, 2024 |

|

Location The Sutton Place Hotel, 845 Burrard Street Vancouver, British |

|

Time 10:00 a.m. (Pacific Time) |

| Matter to be Voted on

|

Management’s

|

Reference

|

||

| Set the Number of Directors at Six (6) |

FOR |

Page 9 |

||

| Election of Directors |

FOR each nominee |

Page 9 |

||

| Appointment and Remuneration of Auditors |

FOR |

Page 18 |

||

| Advisory Vote on Executive Compensation |

FOR |

Page 19 |

||

First Majestic has retained Kingsdale Advisors (“Kingsdale”) to assist in the solicitation of proxies for the Meeting. Shareholders may contact Kingsdale for assistance with voting by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| You can access the materials for the annual general meeting and get assistance in voting your First Majestic common shares by scanning the QR code to the right with your smartphone. |

|

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 1 |

Proxy Summary

Shareholders will be asked to elect six directors to act as members of the Board until the next annual general meeting of shareholders unless an office is earlier vacated. The following chart provides summary information about each director nominee. Additional information regarding the nominees may be found beginning at page 10 of this Information Circular.

| Name |

Principal Occupation |

Year First Appointed |

Independent |

Committee Participation |

||||||||||

| Audit |

Corporate |

Compensation |

Environmental, |

|||||||||||

| Keith Neumeyer |

President & Chief Executive Officer of the Company |

1998 | No | |||||||||||

| Marjorie Co |

Business Development Professional/ Lawyer |

2017 | Yes | ● | Chair | ● | ||||||||

| Thomas F. Fudge, Jr. |

Semi-retired Consultant |

2021 | Yes | ● | Chair | |||||||||

| Raymond L. Polman |

Retired/Finance Consultant |

2022 | No | ● | ||||||||||

| Jean des Rivières |

Retired Executive/ Geologist |

2021 | Yes | ● | ● | ● | Chair | |||||||

| Colette Rustad |

Consultant | 2021 | Yes | Chair | ● | |||||||||

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 2 |

|

VOTING INFORMATION

|

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 3 |

Part One

This Information Circular is furnished in connection with the solicitation of proxies by the management of First Majestic Silver Corp. (“First Majestic” or the “Company”). The accompanying form of proxy (the “Proxy”) is for use at the Annual General Meeting of shareholders of the Company (the “Meeting”) to be held on May 23, 2024, for the purposes set forth in the accompanying Notice of Meeting and at any adjournment thereof. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors and employees of the Company (for no additional compensation). The Company may retain other persons or companies to solicit proxies on behalf of management, in which event customary fees for such services will be paid. All costs of solicitation will be borne by the Company.

First Majestic has retained Kingsdale Advisors to provide the Company with a broad array of strategic advisory, governance, strategic communications, digital and investor campaign services on a global retainer basis in addition to certain fees accrued during the life of the engagement upon the discretion and direction of First Majestic. Shareholders may contact Kingsdale Advisors by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

Unless otherwise indicated, all references in this Information Circular to “$” refer to United States dollars, unless Canadian dollars (C$) are indicated. Unless otherwise indicated, any United States dollar amounts which have been converted from Canadian dollars have been converted at an exchange rate of C$1.00 = US$0.7561, being the exchange rate quoted by the Bank of Canada on December 31, 2023.

This Information Circular is dated April 11, 2024. Unless otherwise stated, information in this Information Circular is as of March 28, 2024.

The Company has adopted the notice and access model (“Notice and Access”) provided for under National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of the Notice of Meeting, this Information Circular, financial statements and management’s discussion and analysis for the year ended December 31, 2023 (collectively, the “Meeting Materials”) to shareholders for the Meeting. The Company has adopted this alternative means of delivery in order to further its commitment to environmental sustainability and to reduce its printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a Notice and Access notification containing the Meeting date, location and purpose, as well as information on how they can access the Meeting Materials electronically. Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials.

Shareholders who receive a Notice and Access notification can request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date of the filing of this Information Circular on SEDAR+. Shareholders with questions about the Notice and Access system, or who would like to request printed copies of the Meeting Materials, should contact the Company’s General Counsel & Corporate Secretary, toll-free, at 1-866-529-2807. A request for printed copies which are required in advance of the Meeting should be made no later than May 9, 2024, in order to allow sufficient time for mailing.

Registered shareholders are persons who hold common shares of the Company that are registered directly in their names. Registered shareholders may vote by participating in the Meeting, by appointing proxyholders, by telephone or by voting online.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 4 |

Part One

Registered shareholders that wish to participate in the Meeting do not need to complete and deposit the form of proxy (the “Proxy”) and should register with the scrutineer at the Meeting.

Registered shareholders that wish to appoint a proxyholder to vote at the Meeting may complete the Proxy. The Proxy names a director and/or officer of the Company as a proxyholder/alternate proxyholder (the “Management Designees”). Shareholders have the right to appoint a person or entity (who need not be a shareholder) to attend and act for them on their behalf at the meeting other than the persons named in the enclosed instrument of Proxy. Registered shareholders that wish to appoint another person (who need not be a shareholder) to serve as proxyholder/alternate proxyholder at the Meeting may do so by striking out the names of the Management Designees and inserting the name(s) of the desired proxyholder/alternate proxyholder in the blank space provided in the Proxy.

Registered shareholders may direct the manner in which their common shares are to be voted or withheld from voting at the Meeting by marking their instructions on the Proxy. Any common shares represented by the Proxy will be voted or withheld from voting by the Management Designees/proxyholder/alternate proxyholder in accordance with the instructions of the registered shareholder contained in the Proxy. If there are no instructions, those common shares will be voted “for” each matter set out in the Notice of Meeting. The Proxy grants the proxyholder discretion to vote as such person sees fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting.

At the time of printing of this Information Circular, management knows of no other matters which may come before the Meeting other than those referred to in the Notice of Meeting. No person who is a director of the Company has informed Management that he intends to oppose any action to be taken by Management at the Meeting.

Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on their Proxy.

To be valid, a completed Proxy must be deposited with or telephonic/online votes must be received by Computershare Investor Services Inc. (“Computershare”) by 10:00 a.m. (Pacific Time) on May 21, 2024, or at least 48 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

A Proxy may be revoked by:

(a) completing a Proxy with a later date and depositing it by the time and at the place noted above;

(b) signing and dating a written notice of revocation and delivering it to Computershare at the address indicated on the accompanying Notice, or by transmitting a revocation by telephonic or electronic means, to Computershare, at any time up to and including the last business day preceding the day of the Meeting, or any postponement or adjournment, at which the Proxy is to be used, or delivering a written notice of revocation and delivering it to the Chair of the Meeting on the day of the Meeting or any postponement or adjournment of the Meeting, or by delivering the written notice of revocation by any other manner permitted by law; or

(c) attending the Meeting or any postponement or adjournment and registering with the scrutineer as a shareholder present in person.

Shareholders who would like assistance with voting their First Majestic shares may contact Kingsdale Advisors (“Kingsdale”) by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com. To obtain current information about voting your First Majestic common shares, please visit www.FirstMajesticAGM.com.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 5 |

Part One

Non-registered shareholders are persons who hold common shares that are registered in the name of an intermediary (such as a broker, bank, trust company, securities dealer, trustees or administrators of RRSPs, RRIFs, RESPs or similar plans) or clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust Company). Non-registered shareholders may participate in the Meeting (either themselves or through a proxyholder) or through intermediaries using the voting instruction form (or other accompanying form). Alternatively, some non-registered shareholders may be able to vote by telephone or online and should refer to the voting instruction form (or other accompanying form) for further details and instructions.

If a non-registered shareholder wishes to participate (either in person or through a nominee) and vote at the Meeting, it is critical to follow the required procedures for appointing proxyholders given that the Company does not have unrestricted access to the names of the Company’s non-registered shareholders and accordingly would not otherwise have any record of a non-registered shareholder’s entitlement to vote at the Meeting.

Non-registered shareholders may appoint themselves or nominees as proxyholders using one of the following procedures:

(a) carefully following the instructions for appointing a proxyholder contained in the voting instruction form (or other accompanying form) and ensuring that such request is communicated to the appropriate person well in advance of the Meeting and in accordance with such instructions; or

(b) unless prohibited by applicable corporate law, submitting any other document in writing to the Company requesting the non-registered shareholder or its nominee be given authority to attend, vote and otherwise act for and on behalf of the registered shareholder in respect of all matters that may come before the Meeting or any postponement or adjournment by 10:00 a.m. (Pacific Time) on May 20, 2024 or at least 72 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting.

Non-registered shareholders who have appointed themselves as proxyholders and who wish to attend the Meeting and vote in person should not complete the voting section of their voting instruction form. Such non-registered shareholders should register with Computershare upon arrival at the Meeting, and may be asked to present valid picture identification and proof of share ownership to gain admission to the Meeting.

Non-registered shareholders who have submitted their voting instructions to their Intermediary, but nonetheless wish to attend the Meeting are welcome to do so. Such non-registered shareholders should register with Computershare upon arrival at the Meeting, and may be asked to present valid picture identification and proof of share ownership to gain admission to the Meeting. Such shareholders should not complete and sign any ballot that may be called for at the Meeting as their voting instructions will already have been followed.

Non-registered shareholders that wish to vote through their intermediaries using the voting instruction form (or other form) accompanying the Notice and Access notification should carefully follow the instructions contained in the voting instruction form (or other form) accompanying the Notice and Access notification and should ensure that such instructions are communicated to the appropriate person well in advance of the Meeting.

Non-registered shareholders should refer to the voting instruction form (or other form) accompanying the Notice and Access notification to determine if telephonic or online voting is available. If you are a non-registered shareholder, your Intermediary must receive your voting instructions in sufficient time for your Intermediary to act on them. The Company strongly encourages all non-registered shareholders to submit their voting instructions to their Intermediary online at www.proxyvote.com well in advance of the cut-off time of 10:00 a.m. (Pacific Time) on May 20, 2024 (or well in advance of 72 hours (excluding Saturdays, Sundays and holidays) before any postponement or adjournment of the Meeting).

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 6 |

Part One

Non-registered shareholders that wish to change their voting instructions or to appoint a proxyholder after delivering voting instructions in accordance with the instructions on a voting instruction form (or other form) accompanying the Notice and Access notification should contact the Company’s General Counsel & Corporate Secretary toll-free, at 1-866-529-2807, to discuss whether this is possible and what procedures must be followed.

Non-registered shareholders who do not object to their name being made known to the Company (“NOBOs”) may be contacted by Kingsdale to assist in conveniently voting their shares of First Majestic directly by telephone. First Majestic may also utilize the Broadridge QuickVoteTM service to assist such shareholders with voting their First Majestic shares.

Shareholders may contact Kingsdale by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

Distribution to Non-Registered Shareholders

Non-registered shareholders fall into two categories: those who object to their identity being known to the Company (“OBOs”) and NOBOs.

In accordance with applicable securities law requirements, the Company has distributed copies of the Notice and Access notification, the Meeting Materials and the form of proxy to the Intermediaries and clearing agencies for distribution to non-registered shareholders. Intermediaries are required to forward the Notice and Access notification to non-registered shareholders unless a non-registered shareholder has requested paper copies (in which case the Intermediary will forward the Meeting Materials to the non-registered shareholder). Intermediaries often use service companies to forward the Notice and Access notification and Meeting Materials to non-registered shareholders.

The Company will assume the costs of delivery of proxy-related materials for the Meeting to OBOs.

Electronic Delivery of Meeting Materials

Non-registered shareholders are asked to consider signing up for electronic delivery (“E-delivery”) of the Meeting materials. E-delivery has become a convenient way to make distribution of materials more efficient and is an environmentally responsible alternative by eliminating the use of printed paper and the carbon footprint of the associated mail delivery process. Signing up is quick and easy: go to www.proxyvote.com and sign in with your control number, submit your vote in respect of the resolutions for the Meeting and, following your vote confirmation, you will be able to select the E-delivery box and provide your email address. Once you have registered for E-delivery, going forward you will receive your Meeting materials by email and will be able to vote on your device by simply following a link in the email sent by your financial intermediary, provided your intermediary supports this service.

Voting Securities and Principal Holders Thereof

The authorized share structure of the Company consists of an unlimited number of common shares without par value. As of March 28, 2024 (the “Record Date”), there were 287,246,185 common shares without par value issued and outstanding.

Each shareholder is entitled to one vote for each common share held as of the Record Date. The failure of any shareholder to receive the Notice of Meeting does not deprive such shareholder of his or her entitlement to vote at the Meeting.

To the knowledge of the directors and senior officers of the Company, as of the Record Date, there are no persons or companies who beneficially own or exercise control or direction, directly or indirectly, over common shares carrying more than 10% of the voting rights attached to all outstanding common shares of the Company.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 7 |

|

|

|

|

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 8 |

Part Two

The Meeting will address the following matters:

| 1. | Receiving the Company’s audited consolidated financial statements for the year ended December 31, 2023, together with the auditor’s report thereon. |

| 2. | Setting the number of directors at six. |

| 3. | Electing the directors who will serve until the next annual general meeting of shareholders. |

| 4. | Appointing the auditors that will serve until the next annual general meeting of shareholders and authorizing the board of directors of the Company (the “Board” or “Board of Directors”) to set the auditors’ remuneration. |

| 5. | Voting on an advisory resolution with respect to the Company’s approach to executive compensation. |

| 6. | Transacting any such other business as may properly be brought before the Meeting. |

Receiving the Consolidated Financial Statements

The audited financial statements of the Company for the year ended December 31, 2023, together with the auditor’s report on those statements (the “Financial Statements”), will be presented to the shareholders at the Meeting. The Financial Statements are available at www.FirstMajesticAGM.com or under the Company’s profile at www.sedarplus.ca. A paper copy may be requested, at no charge to the shareholder, by calling the General Counsel & Corporate Secretary of the Company toll-free at 1-866-529-2807.

Setting the Number of Directors

The Company’s Board currently consists of six directors, and at the Meeting, shareholders will be asked to set the number of directors of the Company for the ensuing year at six. In the absence of instructions to the contrary, all Proxies will be voted “FOR” setting the number of directors of the Company at six for the ensuing year.

The term of office of each of the present directors expires at the close of the Meeting. Management proposes to nominate the persons listed below in “Nominees for Election of Directors” for election as directors at the Meeting and the Management Designees named in the Proxy intend to vote for the election of these nominees. In the absence of instructions to the contrary, all Proxies will be voted “FOR” the nominees herein listed. Each director elected at the Meeting will hold office until the Company’s next annual general meeting, unless his or her office is earlier vacated. Management does not contemplate that any of the nominees will be unable to serve as a director. In the event that prior to the Meeting any of the listed nominees withdraws or for any other reason will not stand for election at the Meeting, it is intended that discretionary authority shall be exercised by the Management Designees or other proxyholder/alternate proxyholder, as the case may be, named in the Proxy as nominee to vote the shares represented by the Proxy for the election of any other person or persons nominated by the Company to stand for election as directors, unless the shareholder has specified in his, her or its Proxy that the shareholder’s shares are to be withheld from voting on the election of directors.

On May 20, 2016, the Board adopted a policy (the “Majority Voting Policy”) which requires that any nominee for director for which there are a greater number of votes “withheld” than votes “for” his or her election will be required to tender his or her resignation as a director of the Company. The Majority Voting Policy was amended on February 19, 2021, and applies only to uncontested elections, which are elections in which the number of nominees for election as director is equal to the number of positions available on the Board. If a nominee for director is required under the Majority Voting Policy to tender his or her resignation, the Board will refer the

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 9 |

Part Two

resignation to the Corporate Governance & Nominating Committee (except in certain circumstances, in which case the Board will review the resignation without reference to the Corporate Governance & Nominating Committee) which will consider the director’s resignation and will recommend to the Board whether or not to accept it. The Corporate Governance and Nominating Committee will generally be expected to recommend accepting the resignation, except in situations where extraordinary circumstances would warrant the applicable director to continue to serve on the Board. The Board will act on the Corporate Governance & Nominating Committee’s recommendation within 90 days following the certification by the scrutineer of the voting results of the applicable annual meeting and will promptly disclose by press release its decision whether to accept the director’s resignation, including the reasons for rejecting the resignation, if applicable. A director who tenders his or her resignation pursuant to the Majority Voting Policy will not participate in any meeting of the Board or the Corporate Governance & Nominating Committee at which the resignation is considered.

Pursuant to the advance notice policy (the “Advance Notice Policy”) adopted by the Board of Directors on April 11, 2013, as subsequently amended, any additional director nominations for the Meeting must be received by the Company in compliance with the Advance Notice Policy no later than the close of business on April 17, 2024. No such nominations have been received by the Company as of the date hereof.

On December 3, 2015, the Board adopted a policy to ensure appropriate and ongoing renewal of the Board of Directors in order to sustain Board performance and maintain Board expertise (the “Director Tenure Policy”). The Director Tenure Policy. Pursuant to the Director Tenure Policy, subject to receiving strong annual performance assessments and being annually re-elected by shareholders, non-management members of the Board may serve on the Board for the following terms:

| • | For a maximum of 15 years if such member joined the Board prior to January 1, 2015; or |

| • | For a maximum of 10 years if such member joined the Board on or after January 1, 2015. |

The Board may extend the term of a non-management director who joined the Board on or after January 1, 2015, for a subsequent five-year period.

Nominees for Election as Directors

The tables below set out the names of each of the nominees for election as directors, the municipality and province or state and country in which each is ordinarily resident, all offices of the Company now held by each of them, each nominee’s principal occupation, business or employment, the period of time for which each nominee has served as a director of the Company and the number of securities of the Company beneficially owned by each nominee, directly or indirectly, or over which each nominee exercised control or direction as at the Record Date (March 28, 2024), and as at December 31, 2023 and 2022. All of the proposed nominees were duly elected as directors at the last Annual General Meeting of shareholders held on May 25, 2023.

The Board recommends that shareholders vote FOR the director nominees.

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 10 |

Part Two

|

|

KEITH N. NEUMEYER(1) Zug, Switzerland

Age: 64

Director since

Not Independent

Principal Occupation: |

Mr. Neumeyer has worked in the investment community for over 35 years. Mr. Neumeyer began his career at a number of Canadian national brokerage firms and moved on to work with several publicly traded companies in the resource and high technology sectors. His roles have included senior management positions and directorships in the areas of finance, business development, strategic planning and corporate restructuring. Mr. Neumeyer was the original and founding President of First Quantum Minerals Ltd. (Toronto Stock Exchange-FM). Mr. Neumeyer founded First Majestic in 2002. Mr. Neumeyer has also listed a number of companies on the Toronto Stock Exchange (“TSX”) and as such has extensive experience dealing with the financial, regulatory, legal and accounting issues that are relevant in the investment community. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Operations Industry Expertise Risk Management Human Resources Government and Community Relations

|

Vancouver Resource Investment Conference Stansberry Research Gold Stock Analyst (GSA) Investor Day BMO Capital Markets Global Metals & Mining Conference Gold Forum Europe 2023 The Rule Symposium on Natural Resource Investing Gold Forum Americas 121 Mining & Energy Investing Swiss Mining Institute Conference National Bank CEO Mining Conference Soar Financial First Mint, LLC site visit Board Corporate Governance Education Session (CLE BC) Board Education Session (UBC Sauder School of Business) Prospectors & Developers Association of Canada (PDAC) Conference |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 97.19% |

2.81% |

|||

|

Board and Committee Membership

|

Attendance |

|||

| Board |

11 / 11 100% |

|||

| Other Reporting Issuer Directorships |

||||

| First Mining Gold Corp. (Chair of Board) |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved?(2) |

Common Shares |

Options | RSUs | PSUs | ||||

|

Yes |

4,137,255 | 1,044,414 | 376,046 | 215,850 | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Mr. Neumeyer. |

| (2) | See the section entitled “Executive Share Ownership Requirement” on page 58 of this Information Circular for details regarding the requirements that apply to officers under the Company’s Share Ownership Guidelines. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 11 |

Part Two

|

|

THOMAS F. FUDGE, JR., P.E., P.Eng. (ret)(1) Grand Junction, Colorado,

Age: 69

Director since

Independent

Principal Occupation: Semi-retired Executive |

Mr. Fudge brings over 40 years of professional mining experience, having previously worked with companies including Tahoe Resources Inc., Alexco Resources Corp., Hecla Mining Company, and Sunshine Precious Metals.

Mr. Fudge holds a Bachelor of Science degree in Mining Engineering from Michigan Technological University and has overseen numerous major mining construction projects in the United States, Mexico, Venezuela, Yukon Territory, Guatemala, and Peru. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Operations Industry Expertise Risk Management Government and Community Relations Environment & Sustainability

|

Board Corporate Governance Education Session (CLE BC) Board Education Session (UBC Sauder School of Business) Shareholder Engagement Issues, Trends and Implications for Directors Getting it Right from the Start Canadian Coalition for Good Governance: Executive Compensation Principles ESG Risks 2023 The Essential Link Between ESG Targets and Financial Performance |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 92.52% |

7.48% |

|||

|

Board and Committee Membership |

Attendance

|

|||

| Board |

11 / 11 100% |

|||

| Compensation |

4 / 4 100% |

|||

| Corporate Governance & Nominating |

2 / 2 100% |

|||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved?(2) |

Common Shares |

Options | RSUs | DSUs | ||||

|

Yes |

2,981 | NIL | 13,816 | 52,774(3) | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Mr. Fudge, Jr. |

| (2) | Mr. Fudge, Jr. became a director on February 17, 2021 and has five years from the date of his appointment to comply with the Company’s Share Ownership Guidelines. See the section entitled “Director Share Ownership Requirement” on page 40 of this Information Circular for details regarding the requirements that apply to directors under the Company’s Share Ownership Guidelines. |

| (3) | Comprises 10,932 DSUs that can be settled in Common Shares, and 41,842 DSUs that can only be settled in cash. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 12 |

Part Two

|

|

MARJORIE CO, B.Sc., British Columbia, Canada

Age: 54

Director since

Independent

Principal Occupation: Business Development Professional/Lawyer |

Ms. Co brings over 25 years of legal, business and corporate development experience. She currently provides business development and legal advice for technology-focused organizations and start-up companies. Her previous roles have included being the Director of Strategic Relations at Westport Innovations Inc. and Chief Development Officer at The PROOF Centre of Excellence. Ms. Co was called to the British Columbia Bar in 1996 and is a Member of the Law Society of British Columbia. Ms. Co obtained her Master of Business Administration and Bachelor of Laws degrees from the University of British Columbia, and her Bachelor of Science degree from Simon Fraser University. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers & Acquisitions Corporate Finance Industry Expertise Accounting Risk Management Human Resources Environment & Sustainability

|

Proxy Season Preview Global Mining Group PDAC Tech Savvy Boards: Perspectives and Insights on Technology Workplace Investigations New Climate Disclosure Standards: Impact on Boardrooms Board Corporate Governance Education Session (CLE BC) Board Education Session (UBC Sauder School of Business) ESG Issues in a Changing World A Principled Approach to Navigating Rising Expectations for Boards Corporate Director—Canadian, US and Global Economic Outlook, PwC Director’s Survey Litigation Update for M&A Counsel The Contract Speaks for Itself |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 94.08% |

5.92% |

|||

|

Board and Committee Membership |

Attendance

|

|||

| Board |

11 / 11 100% |

|||

| Corporate Governance & Nominating |

2 / 2 100% |

|||

| Audit |

5 / 5 100% |

|||

| Environmental, Social, Health & Safety |

1 / 1 100% |

|||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved?(2) |

Common Shares |

Options | RSUs | DSUs | ||||

|

Yes |

13,821 | 17,232 | 14,041 | 29,203(3) | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Ms. Co. |

| (2) | See the section entitled “Director Share Ownership Requirement” on page 40 of this Information Circular for details regarding the requirements that apply to directors under the Company’s Share Ownership Guidelines. |

| (3) | Comprises 11,017 DSUs that can be settled in Common Shares, and 18,186 DSUs that can only be settled in cash. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 13 |

Part Two

|

|

RAYMOND L. POLMAN, B.Sc. (Econ), CPA, CA, ICD.D.(1) British Columbia, Canada

Age: 64

Director since May 2022

Not Independent

Principal Occupation: Retired Chief Financial Officer |

Mr. Polman has over 35 years of public accounting and corporate finance experience in the Canadian and US financial markets and was the Chief Financial Officer of the Company from February 2007 to December 2021. Prior to First Majestic, Mr. Polman had been a Chief Financial Officer for six years with a number of publicly-traded high technology companies, prior to which he served several years as the Director of Finance for Rescan Environmental Services Ltd., a large privately owned company serving the global mining community. Mr. Polman has a Bachelor of Science (Economics) Degree from the University of Victoria and he is a member of the Institute of Chartered Professional Accountants of British Columbia. Mr. Polman also brings eight years of prior public accounting experience with Deloitte, LLP, and he has completed the ICD-Rotman Directors Education Program. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers and Acquisitions Corporate Finance Industry Expertise Accounting Risk Management Information Technology

|

ICD-Rotman Directors Education Program ICD.D Designation achieved January 29, 2024 |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 93.83% |

6.17% |

|||

| Board and Committee Membership |

Attendance

|

|||

| Board |

11 / 11 100% |

|||

| Environmental, Social, Health & Safety |

1 / 1 100% |

|||

| Other Reporting Issuer Directorships |

||||

| First Mining Gold Corp. |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved?(2) |

Common Shares |

Options | RSUs | DSUs | ||||

|

Yes |

129,667 | NIL | 11,079 | 22,930(3) | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Mr. Polman. |

| (2) | See the section entitled “Director Share Ownership Requirement” on page 40 of this Information Circular for details regarding the requirements that apply to directors under the Company’s Share Ownership Guidelines. |

| (3) | These DSUs may only be settled in cash. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 14 |

Part Two

|

|

JEAN DES RIVIÈRES, P.Geo, M.Sc.A., B.Sc.(1) Québec, Canada

Age: 63

Director since March 2021

Independent

Principal Occupation: Retired Executive/Geologist |

Mr. des Rivières offers global diversified knowledge in the exploration and mining industry gained in more than 50 countries over a 35-year period. He occupied managerial and technical positions with companies such as BHP Group Limited, Rio Algom Ltd. and Noranda Inc. In his latest role as Vice President of Metals Exploration for BHP, he developed the global strategies that guided the teams to the discovery of the Oak Dam West iron oxide copper gold deposit in South Australia. His participation in the Minerals Americas Leadership team allowed him to contribute to the copper mining assets. Further, he chaired the Inclusion and Diversity committee of BHP. Prior to the vice presidency, he assumed global roles such as Ag-Pb-Zn global search leader, global copper commodity specialist and Resource Development Manager in the Business Development team. In this latter role, he helped to develop the strategies guiding the brownfield exploration programs for copper and Ag-Pb-Zn for BHP which resulted in the discoveries at Escondida Sur. He received his Bachelor or Science in Geology from the Université du Québec à Montréal in 1983 and his Master’s of Applied Science in Geology from L’Ecole Polytechnique de Montreal from the University of Montreal in 1985. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers and Acquisitions Operations Industry Expertise Accounting Risk Management Human Resources Government & Community Relations and Environment & Sustainability

|

Board Corporate Governance Education Session (CLE BC) Board Education Session (UBC Sauder School of Business) Oversight of Climate Change |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 93.81% |

6.19% |

|||

|

|

||||

| Board and Committee Membership

|

Attendance

|

|||

| Board |

11 / 11 100% | |||

| Compensation |

4 / 4 100% | |||

| Corporate Governance & Nominating |

2 / 2 100% | |||

| Audit (2) |

N/A N/A | |||

| Environmental, Social, Health & Safety |

1 / 1 100% | |||

| Other Reporting Issuer Directorships |

||||

| Midland Exploration Inc. |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved?(3) |

Common Shares |

Options | RSUs | DSUs | ||||

|

Yes |

11,989 | NIL | 11,066 | 27,609(4) | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Mr. des Rivières. |

| (2) | Mr. des Rivières joined the Audit Committee subsequent to the year-ended December 31, 2023. |

| (3) | Mr. des Rivières became a director on March 31, 2021 and has five years from the date of his appointment to comply with the Company’s Share Ownership Guidelines. See the section entitled “Director Share Ownership Requirement” on page 40 of this Information Circular for details regarding the requirements that apply to directors under the Company’s Share Ownership Guidelines. |

| (4) | Comprises 9,423 DSUs that can be settled in Common Shares, and 18,186 DSUs that can only be settled in cash. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 15 |

Part Two

|

|

COLETTE RUSTAD, CPA, CA, ICD.D.(1) British Columbia, Canada

Age: 58

Director since July 2021

Independent

Audit Committee financial expert Principal Occupation: Consultant |

Ms. Rustad is an international financial expert with over 30 years of diverse financial and operational experience, including mergers and acquisitions, project construction, risk management and advisory expertise in the mining, financial services, energy and technology sectors. She currently serves as a director of the Sanford Housing Society, previously served as a director for Terrane Metals Corp. and held executive positions at Barrick Africa (Vice-President & Chief Financial Officer); Goldcorp Inc, (Senior Vice-President, Treasurer and Controller); Ernst & Young Toronto (Senior Manager), and Alio Gold (Executive Vice-President & Chief Financial Officer). Ms. Rustad is a Chartered Professional Accountant (CPA)(CA) with a Bachelor of Commerce from the University of Calgary, and she has completed the Advanced Management Program from the Wharton Graduate School of Business, University of Pennsylvania and the ICD-Rotman Directors Education Program. |

| Primary Skills and Expertise |

2023 Continuing Education |

|||

| Strategic Leadership International Business Mergers & Acquisitions Corporate Finance Operations Industry Expertise Accounting Risk Management Human Resources Information Technology Government & Community Relations Environment & Sustainability

|

ICD-Rotman Directors Education Program Industry Audit Committee Roundtables Deloitte 360 Climate week Economic Outlook 2023 Seminar Board Corporate Governance Education Session (CLE BC) Board Education Session (UBC Sauder School of Business) ICD.D Designation achieved March 26, 2024 |

|||

| Voting Results of 2023 Annual General & Special Meeting |

||||

| For |

Withheld |

|||

| 98.45% |

1.55% |

|||

| Board and Committee Membership |

Attendance

|

|||

| Board |

11 / 11 100% |

|||

| Audit |

5 / 5 100% |

|||

| Compensation (2) |

N/A N/A |

|||

| Other Reporting Issuer Directorships |

||||

| None |

||||

| Securityholdings (as at March 28, 2024) |

||||||||

| Share Ownership Requirement Achieved(3) |

Common Shares |

Options | RSUs | DSUs | ||||

|

Yes |

2,037 | NIL | 13,491 | 26,398(4) | ||||

| (1) | Information regarding the biography, skills and expertise, continuing education and security holdings in this table has been furnished by Ms. Rustad. |

| (2) | Ms. Rustad joined the Compensation Committee subsequent to the year-ended December 31, 2023. |

| (3) | Ms. Rustad became a director on July 1, 2021 and has five years from the date of her appointment to comply with the Company’s Share Ownership Guidelines. See the section entitled “Director Share Ownership Requirement” on page 40 of this Information Circular for details regarding the requirements that apply to directors under the Company’s Share Ownership Guidelines. |

| (4) | Comprises 8,212 DSUs that can be settled in Common Shares, and 18,186 DSUs that can only be settled in cash. |

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 16 |

Part Two

The information as to the municipality and province, state or country of residence, principal occupation, or business or employment and the number of shares beneficially owned by each nominee or over which each nominee exercises control or direction set out above has been furnished by the individual nominees as at March 28, 2024.

No director or proposed director of the Company is, or within the ten years prior to the date of this Information Circular has been a director, chief executive officer or chief financial officer of any company, including the Company, that while that person was acting in that capacity:

| (a) | was the subject of a cease trade order, similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; |

| (b) | was subject to an order issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (c) | within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

No director or proposed director of the Company has, within the ten years prior to the date of this Information Circular, become bankrupt or made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

As discussed below under “Statement of Corporate Governance Practices—Assessments”, the Board of Directors has adopted an annual formal director assessment process. As a part of this process the Board of Directors assesses the skills and expertise necessary to provide effective oversight of the business of the Company. Following is a summary of the skills and expertise possessed by each of the director nominees named in this Information Circular. The lack of a specifically identified area of expertise does not mean that the person in question does not possess the applicable skill or expertise. Rather, a specifically identified area of expertise indicates that the Board of Directors currently relies upon that person for the skill or expertise.

| Keith Neumeyer |

Marjorie Co |

Thomas F. Fudge, Jr. |

Raymond L. Polman |

Jean des Rivières |

Colette Rustad |

|||||||||||

| Strategic Leadership - Experience guiding strategic direction and growth of an organization, preferably including the management of multiple significant projects and experience with corporate governance. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| International Business - Experience working in a major organization that carries on business in one or more international jurisdictions, preferably in countries or regions where the Company has or expects to be developing operations. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Mergers and Acquisitions - Experience with significant mergers and acquisitions and/or investment banking. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Corporate Finance - Experience in the field of finance, specifically in corporate lending/borrowing transactions and public market transactions. |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Operations - Senior level experience with a major resource company with mineral reserves, exploration and operations expertise, and particular experience developing and implementing strong safety, environmental and operational standards. |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

| Industry Expertise - Experience in the mining industry, market and international regulatory environment. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

Shareholders may contact Kingsdale Advisors, the Company’s strategic advisor by telephone at 1-866-851-3214 (toll-free in North America) or 1-647-577-3635 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

| 2024 MANAGEMENT INFORMATION CIRCULAR |

Page 17 |

Part Two

| Keith Neumeyer |

Marjorie Co |

Thomas F. Fudge, Jr. |

Raymond L. Polman |

Jean des Rivières |

Colette Rustad |

|||||||||||

| Accounting - Experience as a professional accountant, a chief financial officer or a chief executive officer or member of the Audit Committee of a reporting issuer; strong understanding of the financial side of an organization, including familiarity with financial reports, internal financial controls and other financial requirements. |

✓ | ✓ | ✓ | ✓ | ||||||||||||

| Risk Management - Experience implementing best practices for risk management, including assessing and addressing potential risks of a major organization. |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

| Human Resources - Experience as a board compensation committee member or senior officer responsible for the oversight of compensation and benefit programs, having particular experience with executive compensation programs. |

✓ | ✓ | ✓ | ✓ | ||||||||||||

| Information Technology - Experience developing and implementing leading information technology practices, including information security, at a major organization. |

✓ | ✓ | ||||||||||||||

| Government and Community Relations - Experience with and fulsome understanding of governmental and public policy and experience developing strong community relations and working relationships with communities and mining regulators in the jurisdictions where the Company operates. |

✓ | ✓ | ✓ | ✓ | ||||||||||||

| Environment and Sustainability - Experience with and an understanding of environmental, health and safety issues and sustainable development practices in the mining industry. |

✓ | ✓ | ✓ | ✓ | ||||||||||||